EFX 10K 2014.12.31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________

FORM 10-K

|

| |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

OR

|

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-06605

____________________________________

EQUIFAX INC.

(Exact name of registrant as specified in its charter) |

| | |

Georgia | | 58-0401110 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

1550 Peachtree Street, N.W. | | |

Atlanta, Georgia | | 30309 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: 404-885-8000

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of each class | | Name of each exchange on which registered |

Common Stock, $1.25 par value per share | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None.

____________________________________

Indicate by check mark if Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Exchange Act (“Act”). x YES ¨ NO

Indicate by check mark if Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ YES x NO

Indicate by check mark whether Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x YES ¨ NO

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). YES x NO ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | |

x Large accelerated filer | | ¨ Accelerated filer | | ¨ Non-accelerated filer | | ¨ Smaller reporting company |

| | | (Do not check if a smaller reporting company) | |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). ¨ YES x NO

As of June 30, 2014, the aggregate market value of Registrant’s common stock held by non-affiliates of Registrant was approximately $8,833,129,063 based on the closing sale price as reported on the New York Stock Exchange. At January 31, 2015, there were 119,486,858 shares of Registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of Registrant’s definitive proxy statement for its 2015 annual meeting of shareholders are incorporated by reference in Part III of this Form 10-K.

TABLE OF CONTENTS

PART I

ITEM 1. BUSINESS

OVERVIEW

Equifax Inc. is a leading global provider of information solutions and human resources business process outsourcing services for businesses, governments and consumers. We have a large and diversified group of clients, including financial institutions, corporations, governments and individuals. Our products and services are based on comprehensive databases of consumer and business information derived from numerous types of credit, financial assets, telecommunications and utility payment, employment, income, public record, demographic and marketing data. We use advanced statistical techniques and proprietary software tools to analyze all available data, creating customized insights, decision-making solutions and processing services for our clients. We help consumers understand, manage and protect their personal information and make more informed financial decisions. We also provide information, technology and services to support debt collections and recovery management. Additionally, we are a leading provider of payroll-related and human resource management business process outsourcing services in the United States of America, or U.S.

We currently operate in three global regions: North America (U.S. and Canada), Europe (the United Kingdom, or U.K., Spain and Portugal) and Latin America (Argentina, Chile, Costa Rica, Ecuador, El Salvador, Honduras, Mexico, Paraguay, Peru and Uruguay). We also maintain support operations in the Republic of Ireland. We offer credit services in Russia and India through joint ventures and have an investment in the second largest consumer and commercial credit information company in Brazil.

Equifax was originally incorporated under the laws of the State of Georgia in 1913, and its predecessor company dates back to 1899. As used herein, the terms Equifax, the Company, we, our and us refer to Equifax Inc., a Georgia corporation, and its consolidated subsidiaries as a combined entity, except where it is clear that the terms mean only Equifax Inc.

We are organized and report our business results in four operating segments, as follows:

| |

• | U.S. Information Solutions (USIS) — provides consumer and commercial information solutions to businesses in the U.S. including online information, decisioning technology solutions, fraud and identity management services, portfolio management services, mortgage reporting and financial marketing services. |

| |

• | International — includes our Canada, Europe and Latin America business units. Products and services offered are similar to those available in the USIS and North America Personal Solutions operating segments but vary by geographic region. In Europe and Latin America, we also provide information, technology and services to support debt collections and recovery management. |

| |

• | Workforce Solutions — provides services enabling clients to verify income and employment (Verification Services) as well as outsource and automate the performance of certain payroll-related and human resources management business processes, including social security number verification and employment-related tax management (Employer Services). |

| |

• | North America Personal Solutions — provides products to consumers enabling them to understand and monitor their credit and monitor and help protect their identity. |

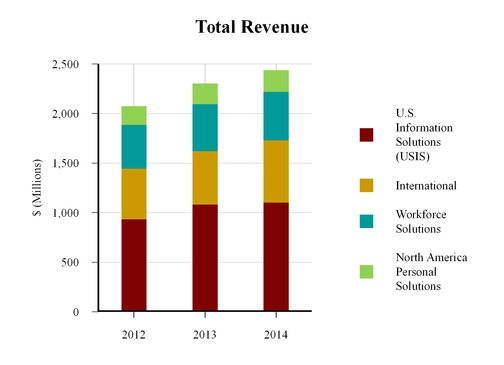

Our revenue base and business mix are diversified among our four segments as depicted in the chart below.

OUR BUSINESS STRATEGY

Our strategic objective is to be the global leader in information solutions that creates unparalleled insights to solve customer challenges. Data is at the core of our value proposition. Leveraging our extensive resources, we deliver differentiated decisions through a broad and diverse set of data assets, sophisticated analytics and proprietary decisioning technology. Our comprehensive set of data assets can provide an in-depth view of the consumer’s financial potential and opportunity including their propensity, ability and capacity to pay. Our long-term corporate growth strategy is driven by the following initiatives:

| |

• | Increase penetration of our clients’ information solutions needs. We seek to increase our share of clients’ spend on information-related services through developing and introducing new products, pricing our services in accordance with the value they represent to our customers, increasing the range of current services utilized by our clients, and improving the quality and effectiveness of our sales organization and client support interactions with consumers. We are also helping clients address increased requirements to comply with emerging regulations and rules. |

| |

• | Deploy decisioning technologies and analytics globally. We continue to invest in and develop new technology to enhance the functionality, cost-effectiveness and security of the services we offer and further differentiate our products from those offered by our competitors. In addition to custom products for large clients, we develop off-the-shelf, decisioning technology platforms that are more cost effective for medium and smaller-sized clients. We also develop predictive scores and analytics, some of which leverage multiple data assets, to help clients acquire new customers and manage their existing customer relationships. We develop a broad array of industry, risk management, cross-sell and account acquisition models to enhance the precision of our clients’ decisioning activities. We also develop custom and generic solutions that enable customers to more effectively manage their debt collection and recovery portfolios. |

| |

• | Invest in unique data sources. We continue to invest in and acquire unique sources of credit and non-credit information to enhance the variety and quality of our services while increasing clients’ confidence in information-based business decisions. Areas of focus for investment in new sources of data include, among others, positive payment data, real estate data and new commercial business data. We also have developed unique capabilities to integrate customer and third-party data into our solution offerings to further enhance the decisioning solutions we develop for our customers. |

| |

• | Pursue new vertical markets and expand into emerging markets. We believe there are many opportunities to expand into emerging markets both in the U.S. and internationally. In the U.S., we have increased and broadened resources in key markets, including auto, insurance, telecommunications, and government, and we are delivering services ranging from identity authentication and management to risk management. We continue to invest in growing our ventures in Russia and India and continue to leverage our newer product offerings across all of our geographical business units and periodically enter new country markets through acquisitions or start up operations. |

| |

• | Serve as a trusted steward and advocate for our customers and consumers. This includes continuously improving the customer and consumer experience in our consumer and commercial offerings, anticipating and executing on regulatory initiatives, while simultaneously delivering security for our services. |

MARKETS AND CLIENTS

Our products and services serve clients across a wide range of verticals, including financial services, mortgage, human resources, consumer, commercial, telecommunications, retail, automotive, utilities, brokerage, healthcare and insurance industries, as well as state and federal governments. We also serve consumers directly. Our revenue stream is highly diversified with our largest client providing only 2% of total revenue. The following table summarizes the various end-user markets we serve:

| |

(1) | Predominantly sold to companies who serve the direct to consumer market and includes other small end user markets. |

| |

(2) | Other includes revenue from marketing services, insurance, healthcare and other miscellaneous end user markets. |

We market our products and services primarily through our own direct sales organization that is organized around sales teams that focus on client segments typically aligned by vertical markets and geography. Sales groups are based in our headquarters in Atlanta, Georgia, and field offices located in the U.S. and in the countries where we have operations. We also market our products and services through indirect channels, including alliance partners, joint ventures and other resellers. In addition, we sell through direct mail and various websites, such as www.equifax.com.

Our largest geographic market segments are North America (the U.S. and Canada); Europe (the U.K., Spain and Portugal); and Latin America (Argentina, Chile, Costa Rica, Ecuador, El Salvador, Honduras, Mexico, Paraguay, Peru and Uruguay). We also maintain support operations in the Republic of Ireland. We offer consumer credit services in Russia and India through joint ventures and have an investment in the second largest consumer and commercial credit information company in Brazil.

Revenue from international clients, including end users and resellers, amounted to 26% of our total revenue in 2014, 23% of our total revenue in 2013 and 24% of our total revenue in 2012.

PRODUCTS AND SERVICES

Our products and services help our clients make better decisions with higher levels of confidence by leveraging a broad array of data assets. Analytics are used to derive insights from the data that are most relevant for the client’s decisioning needs. The data and insights are then processed through proprietary software and transmitted to the client’s operating system to execute the decision.

The following chart summarizes the key products and services offered by each of the business units within our segments:

|

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | North America Personal Solutions | |

| USIS | | International | | Workforce Solutions | | |

| Online Information Solutions | | Financial Marketing Services | | Mortgage Services | | Canada | | Europe | | Latin America | | Verification Services | | Employer Services | | |

Online data | X | | | | X | | X | | X | | X | | X | | | | X | |

Portfolio management services | X | | X | | X | | X | | X | | X | | X | | | | | |

Analytical services | X | | X | | X | | X | | X | | X | | X | | X | | X | |

Technology services | X | | | | X | | X | | X | | X | | | | | | | |

Identity management and fraud | X | | | | | | X | | X | | X | | X | | | | X | |

Marketing Services | | | X | | X | | X | | X | | X | | | | | | | |

Direct to consumer credit monitoring | X | | | | | | X | | X | | | | | | | | X | |

Employment and income verification services | | | | | | | | | | | | | X | | | | | |

Business process outsourcing (BPO) | | | | | | | | | | | | | X | | X | | | |

Debt collection software, services and analytics | | | | | | | | | X | | X | | | | | | | |

Each of our operating segments is described more fully below.

USIS

USIS provides consumer information solutions to businesses in the U.S. through three product and service lines, as follows:

Online Information Solutions. Online Information Solutions’ products are derived from multiple large and comprehensive databases of consumer and commercial information that we maintain about individual consumers and businesses, including credit history, current credit status, payment history and address information. Our clients utilize the information and analytical insights we provide to make decisions for a broad range of financial and business purposes, such as whether, and on what terms, to approve auto loans or credit card applications, and whether to allow a consumer or a business to open a new utility or telephone account. In addition, this information is used by our clients for cross selling additional products to existing customers, improving their underwriting and risk management decisions, and authenticating and verifying consumer and business identities. We also sell consumer and credit information to resellers who combine our information with other information to provide services to the mortgage, fraud and identity management, direct to consumer monitoring and other end-user markets. Our software platforms and analytical capabilities can integrate all types of information, including third-party and client information, to enhance the insights and decisioning process to help further mitigate the risk of granting credit, predict the risk of bankruptcy, indicate the applicant’s risk potential for account delinquency, ensure the identity of the consumer, and reduce exposure to fraud. These risk management services enable our clients to monitor risks and opportunities and proactively manage their portfolios.

Online Information Solutions’ clients access products through a full range of electronic distribution mechanisms, including direct real-time access, which facilitates instant decisions. We also develop and host customized applications that enhance the decision-making process for our clients. These decisioning technology applications assist with a wide variety of decisioning activities, including determining pre-approved offers, cross-selling of various products, determining deposit amounts for telephone and utility companies, and verifying the identity of their customers. We have also compiled commercial databases regarding businesses in the U.S., which include loan, credit card, public records and leasing history data, trade accounts receivable performance, and Secretary of State and Securities and Exchange Commission registration information. We offer scoring and analytical services that provide additional information to help mitigate the credit risk assumed by our clients.

Mortgage Solutions. Our Mortgage Solutions products, offered in the U.S., consist of specialized credit reports that combine information from the three major consumer credit reporting agencies (Equifax, Experian Group and TransUnion LLC) into a single “merged” credit report in an online format, commonly referred to as a tri-merge report. Mortgage lenders use these tri-merge reports in making their mortgage underwriting decisions. Additionally, we offer various “triggering” services designed to alert lenders to changes in a consumer’s credit status during the underwriting period and securitized portfolio risk assessment services for evaluating inherent portfolio risk.

Financial Marketing Services. Our Financial Marketing Services products utilize consumer and commercial financial information enabling our clients to more effectively manage their marketing efforts, including targeting and segmentation; to identify and acquire new clients for their products and services; to develop portfolio strategies to minimize risk and maximize profitability; and to realize additional revenue from existing customers through more effective cross selling and upselling of additional products and services. These products utilize information derived from consumer and commercial information, including credit, income, asset, liquidity, net worth and spending activity, which also support many of our Online Information Solutions’ products. These data assets broaden the understanding of consumer and business financial potential and opportunity which can further drive high value decisioning and targeting solutions for our clients. We also provide account review services, which assist our clients in managing their existing customers and prescreen services that help our clients identify new opportunities with their customers. Clients for these products primarily include institutions in the banking, brokerage, retail, insurance and mortgage industries as well as companies primarily focused on digital and interactive marketing.

International

The International operating segment includes our Canada, Europe and Latin America business units. These business units offer products that are similar to those available in the USIS and Personal Solutions operating segments, although, in some jurisdictions, data sources tend to rely more heavily on government agencies than in the U.S. We also offer specialized services that help our customers better manage risk in their consumer portfolios. This operating segment’s products and services generate revenue in Argentina, Canada, Chile, Costa Rica, Ecuador, El Salvador, Honduras, Mexico, Paraguay, Peru, Portugal, Spain, the U.K. and Uruguay. We also maintain support operations in the Republic of Ireland, Chile and Costa Rica. We offer consumer credit services in Russia and India through our investment in joint ventures and have an investment in the second largest consumer and commercial credit information company in Brazil. We also provide information, technology and services to support debt collections and recovery management in Europe and Latin America.

Canada. Similar to Online Information Solutions, Mortgage Solutions and Financial Marketing Services business units, Canada offers products derived from the credit information that we maintain about individual consumers and businesses. We offer many products in Canada, including credit reporting and scoring, consumer and commercial marketing, risk management, fraud detection and modeling services, identity management and authentication services, together with certain of our decisioning products that facilitate pre-approved offers of credit and automate a variety of credit decisions.

Europe. Our European operation provides information solutions, marketing and personal solutions products. Information solutions and personal solutions products are generated from information that we maintain and include credit reporting and scoring, asset information, risk management, identity management and authentication services, fraud detection and modeling services. Most of these products are sold in the U.K. with a more limited set of information solutions products sold in Portugal and Spain. Our commercial products, such as business credit reporting and commercial risk management services, are available mostly in the U.K, with a more limited set of information solutions products sold in Portugal and Spain. Marketing products, which are similar to those offered in our Financial Marketing Services business unit, are primarily available in the U.K. and, to a lesser extent, in Spain. Beginning in 2014, we also provide information, technology and services to support debt collections and recovery management.

Latin America. Our Latin American operation provides consumer and commercial information solutions products, marketing products and personal solutions products. We offer a full range of products, generated from credit records that we maintain, including credit reporting and scoring, decisioning technology, risk management, identity management, authentication and fraud detection services. Our consumer products are the primary source of revenue in each of the countries in which we operate. We also offer various commercial products, which include credit reporting, decisioning tools and risk management services, in the countries we serve. Beginning in 2013, we also provide information, technology and services to support debt collections and recovery management. Additionally, we provide a variety of consumer and commercial marketing products generated from our credit information databases, including business profile analysis, business prospect lists and database management. The countries in which we operate include Argentina, Chile, Costa Rica, Ecuador, El Salvador, Honduras, Mexico, Paraguay, Peru and Uruguay.

Workforce Solutions

Workforce Solutions operates in the U.S. through two business units:

Verification Services. Verification Services include employment, income and social security number verification services. Our online verification services enable direct third-party verifiers including various governmental agencies, mortgage originators, credit card and automotive lenders and pre-employment screeners to verify the employee’s employment status and income information. We also offer an offline research verification service, which expands employment verification to locate data outside our existing automated database. Our services also include IRS income verifications using the IncomeChek ® product as well as identity verification through a secure, web-based portal using the DirectChek ® product.

The Work Number is our key repository of employment and income data serving our verifier business and enabling employer human resource services. We rely on payroll data received from over 4,300 organizations, including almost three quarters of Fortune 500 companies, to regularly update the database. The updates occur as employers transmit data electronically to Equifax from their payroll systems. Employers contract to provide this data for specified periods under the terms of contracts which range from one to five years. We use this data to provide automated employment and income verification services to third-party verifiers as well as enabling employer services such as unemployment claims, I-9 and eVerify transactions and employer tax credits opportunities.

The fees we charge for these services are generally on a per transaction basis. After the expiration of the applicable contract, absent renewal by mutual agreement of the parties, we generally do not have any further right to use the employment data we obtained pursuant to the contract. We have not experienced significant turnover in the employer contributors to the database because we generally do not charge them to add their employment data to the database and the verification service we offer relieves them of the administrative burden and expense of responding to third-party employment verification requests. The database contained approximately 255 million current and historic employment records at December 31, 2014.

Employer Services. These services are aimed at reducing the cost to the human resources function of businesses through a broad suite of services including assisting with employment tax matters designed to reduce the cost of unemployment claims through effective claims representation and management and efficient processing and to better manage the tax rate that employers are assessed for unemployment taxes; comprehensive services designed to research the availability of employment-related tax credits (e.g., the federal work opportunity and welfare to work tax credits and state tax credits), process the necessary filings and assist the client in obtaining the tax credit; W-2 management services (which include initial distribution, reissue and correction of W-2 forms); paperless pay services that enable employees to electronically receive pay statement information as well as review and change direct deposit account or W-4 information; integrated electronic time capture and reporting services; paperless new-hire services to bring new workers on board using electronic forms; I-9 management services designed to help clients electronically comply with the immigration laws that require employers to complete an I-9 form for each new hire; and onboarding services using online forms to complete the new hire process for employees of corporate and government agencies. We also offer analytical services enabling our customers to better understand the demographic profile and key statistical metrics of their workforce. In addition we provide software and services to employers to assist in compliance with the Affordable Care Act ("ACA") through partnerships with government agencies.

North America Personal Solutions

Our Personal Solutions products give consumers information to enable them to understand and monitor their credit and monitor and help protect their identity primarily through our Equifax Complete, ID Patrol, Credit Watch and Score Watch monitoring products. Consumers can obtain credit file information about them and Equifax or FICO credit scores. Equifax products also offer monitoring features for consumers who are concerned about identity theft and data breaches, including credit report monitoring from all three bureaus, internet and bank account monitoring, lost wallet support, and the ability to lock and unlock the Equifax credit file. Our products are available to consumers in the United States and Canada directly primarily over the internet and indirectly through relationships with business partners who distribute our products or provide these services to their employees or customers.

COMPETITION

The market for our products and services is highly competitive and is subject to constant change. Our competitors vary widely in size and the nature of the products and services they offer. Sources of competition are numerous and include the following:

| |

• | Competition for our consumer information solutions and personal solutions products varies by both application and industry, but generally includes two global consumer credit reporting companies, Experian Group and TransUnion LLC, both of which offer a product suite similar to our credit reporting solutions, and LifeLock, a national provider of personal identity theft protection products, as well as emerging competitors offering free credit scores including Credit Karma. There are also a large number of competitors who offer competing products in specialized areas (such as fraud prevention, risk management and application processing and decisioning solutions) and software companies offering credit modeling services or analytical tools. We believe that our products offer our clients an advantage over those of our competitors because of the depth and breadth of our consumer information files, which we believe to be superior in terms of accuracy, coverage and availability. Other differentiators include our decisioning technology and the features and functionality of our analytical services. Our competitive strategy is to emphasize improved decision-making and product quality while remaining competitive on price. Our marketing services products also compete with the foregoing companies and others who offer demographic information products, including Acxiom Corporation, Harte-Hanks, Inc. and infoGROUP, Inc. We also compete with Fair Isaac Corporation with respect to certain of our analytical tools. |

| |

• | Competition for our commercial solutions products primarily includes Experian, The Dun & Bradstreet Corporation and Cortera, Inc., and providers of these services in the international markets we serve. We believe our access to and knowledge of U.S. small business loan information from financial institutions combined with our consumer credit information in the case of small business owners enables more efficient and effective decision-making for the small business segment of that market. |

| |

• | Competition for our employment and income verification services includes large employers who serve their own needs through in-house systems to manage verification as well as regional online verification companies, such as Verify Jobs and First Advantage, who offer verification services along with other human resources and tax services. Competition for Employer Services includes payroll processors such as Automatic Data Processing, Inc., or ADP, Paychex, Inc. and Ceridian Corporation. Competitors of our Tax Management Services include in-house management of this function primarily by large employers, ADP, and a number of smaller regional firms that offer tax management services (including Barnett Associates, Thomas & Thorngren, and UC Advantage). |

| |

• | Competition for our debt collection and recovery management software, services and analytics is similar to the competition for our consumer information solutions and personal solutions products. We believe that the breadth and depth of our data assets enable our clients to develop a more current and comprehensive view of consumers. In the category of platforms and analytics, we compete to some extent with entities that deploy collections platforms, account management systems or recovery solutions. |

While we believe that none of our competitors offers the same mix of products and services as we do, certain competitors may have a larger share of particular geographic or product markets or operate in geographic areas where we do not currently have a presence.

We assess the principal competitive factors affecting our markets to include: product attributes such as quality, depth, coverage, adaptability, scalability, interoperability, functionality and ease of use; product price; technical performance; access to unique proprietary databases; availability in application service provider, or ASP, format; quickness of response, flexibility and client services and support; effectiveness of sales and marketing efforts; existing market penetration; new product innovation; and our reputation as a trusted steward of information.

TECHNOLOGY AND INTELLECTUAL PROPERTY

We generally seek protection under federal, state and foreign laws for strategic or financially important intellectual property developed in connection with our business. Certain intellectual property, where appropriate, is protected by registration under applicable trademark laws or by prosecution of patent applications. We own a number of patents registered in the U.S. and several in foreign countries. We also have certain registered trademarks, service marks, logos and internet URLs in the U.S. and in many foreign countries, the most important of which are “Equifax,” "Decision360," “The Work Number” and variations thereof. These marks are used in connection with many of our product lines and services. We believe that, in the aggregate, the rights under our patents and trademarks are generally important to our operations and competitive position, but we do not regard any of our businesses as being dependent upon any single patent or group of patents or trademark. However, certain Company trademarks, which contribute to our identity and the recognition of our products and services, including but not limited to the “Equifax” trademark, are an integral part of our business, and their loss could have a material adverse effect on us. We also protect certain of our confidential intellectual property and technology in compliance with trade secret laws and through the use of nondisclosure agreements.

We license other companies to use certain data, software, and other technology and intellectual property rights we own or control, primarily as core components of our products and services, on terms that are consistent with customary industry standards and that are designed to protect our interest in our intellectual property. Other companies license us to use certain data, technology and other intellectual property rights they own or control. For example, we license credit-scoring algorithms and the right to sell credit scores derived from those algorithms from third parties for a fee. We do not hold any franchises or concessions that are material to our business or results of operations.

GOVERNMENTAL REGULATION

We are subject to a number of U.S. federal, state, local and foreign laws and regulations that involve matters central to our business. These laws and regulations may involve privacy, data protection, intellectual property, competition, consumer protection, anti-corruption, anti-bribery, anti-money laundering, employment, health, taxation or other subjects. In particular, we are subject to federal, state and foreign laws regarding the collection, protection, dissemination and use of non-public personal information we have in our possession and to consumer financial protection. Foreign data and consumer protection, privacy and other laws and regulations are often more restrictive than those in the U.S. Failure to satisfy those legal and regulatory requirements, or the adoption of new laws or regulations, could have a material adverse effect on our results of operations, financial condition or liquidity.

U.S. federal and state and foreign laws and regulations are evolving and can be subject to significant change. In addition, the application and interpretation of these laws and regulations are often uncertain. These laws are enforced by federal, state and local regulatory agencies in the jurisdictions where we operate, and in some instances also through private civil litigation. There are also a number of legislative proposals pending before the U.S. Congress, various state legislative bodies, and foreign governments concerning consumer and data protection which could affect us.

Summary of U.S. Regulation Relating to Consumer and Data Protection

Our U.S. operations are subject to numerous laws and regulations governing the collection, protection and use of consumer credit and other information, and imposing sanctions for the misuse of such information or unauthorized access to data. Many of these provisions also affect our customers’ use of consumer credit or other data we furnish.

Examples of the most significant of these laws include, but are not limited to, the following:

Federal Laws and Regulation

| |

• | Under Title X of the Dodd-Frank Act, the Consumer Financial Protection Bureau (“CFPB”) has broad powers to promulgate, administer and enforce consumer financial regulations, including those applicable to us and to many of our customers. The CFPB has oversight of the Fair Credit Reporting Act, as amended (“FCRA”), the federal regulation most directly impacting our U.S. operations. The CFPB is also charged with defining “unfair, deceptive or abusive acts and practices”, known as “UDAAP”. It conducts examinations for purposes of assessing compliance with federal consumer financial protection laws; has been requesting information about the business activities affecting consumers and compliance systems or procedures; and it has devoted resources to detecting and assessing risks to consumers and to markets for consumer financial products and services. |

The CFPB may pursue administrative proceedings or litigation to enforce these laws and rules. In these proceedings, the CFPB can obtain cease and desist orders, which can include orders for restitution to consumers or rescission of contracts, as well as other kinds of affirmative relief, and monetary penalties ranging from $5,000 per day for ordinary violations of federal consumer financial laws to $25,000 per day for reckless violations, and $1 million per day for knowing violations. Also, where a company has violated Title X of the Dodd-Frank Act, or CFPB regulations under Title X, the Dodd-Frank Act empowers state attorneys general and state regulators to bring civil actions for the kind of cease and desist orders available to the CFPB (but not for civil penalties).

Under UDAAP, the CFPB has exercised its broad powers to examine the acts and practices of entities subject to its jurisdiction and declare those acts or practices to be unfair, deceptive or abusive.

If the CFPB or one or more state officials believe that we have committed a violation of the foregoing laws, they could exercise their enforcement powers in a manner that would have material adverse effect on us. We are currently the subject of investigations by state attorneys general and the CFPB as more fully described under Item 3. Legal Proceedings in this Form 10-K. At this time, we cannot predict the extent to which the Dodd-Frank Act, the resulting rules and regulations, including those of the CFPB, or exercise of its or other enforcement powers will impact our operational results, financial condition, or liquidity.

The CFPB examinations may include the filing of reports, reviewing materials we use to offer products and services and our compliance management systems and procedures. Our CFPB examinations to date have covered our regulatory compliance management system, the U.S. portion of our North America Personal Solutions business unit (direct-to-consumer), our consumer dispute handling process, and our data accuracy. We are continuing to constructively engage with the CFPB on the results of all examinations.

| |

• | The Federal Trade Commission Act (“FTC Act”) prohibits unfair methods of competition and unfair or deceptive acts or practices. We must comply with the FTC Act when we market our services, such as consumer credit monitoring services offered through our Personal Solutions unit. The security measures we employ to safeguard the personal data of consumers could also be subject to the FTC Act, and failure to safeguard data adequately may subject us to regulatory scrutiny or enforcement action. There is no private right of action under the FTC Act. |

| |

• | The FCRA regulates consumer reporting agencies, including us, as well as data furnishers and users of consumer reports such as banks and other companies. FCRA provisions govern the accuracy, fairness and privacy of information in the files of consumer reporting agencies (“CRAs”) that engage in the practice of assembling or evaluating certain information relating to consumers for certain specified purposes. The FCRA limits the type of information that may be reported by CRAs, limits the distribution and use of consumer reports and establishes customer rights to access and dispute their credit files. CRAs are required to follow reasonable procedures to assure maximum possible accuracy of the information concerning the individual about whom the report relates and if a consumer disputes the accuracy of any information in the consumer’s file to conduct a reasonable reinvestigation. CRAs are required to make available to consumers a free annual credit report. The FCRA imposes many other requirements on CRAs, data furnishers and users of consumer report information. Violation of the FCRA can result in civil and criminal penalties. The FCRA contains an attorney fee shifting provision to provide an incentive for consumers to bring individual or class action lawsuits against a CRA for violations of the FCRA. Regulatory enforcement of the FCRA is by the Federal Trade Commission (“FTC”), the CFPB, and the State Attorneys General, acting alone or in concert with one another. |

| |

• | The Financial Services Modernization Act of 1999, or Gramm-Leach-Bliley Act (“GLB Act”), regulates, among other things, the use of non-public personal financial information of consumers that is held by financial institutions, including us. We are subject to various GLB Act provisions, including rules relating to the use or disclosure of the underlying data and rules relating to the physical, administrative and technological protection of non-public personal financial information. Breach of the GLB Act can result in civil and/or criminal liability and sanctions by regulatory authorities, such as fines of up to $100,000 per violation and up to five years imprisonment for individuals. Regulatory enforcement of the GLB Act is under the purview of the FTC and State Attorneys General, acting alone or in concert with each other. |

| |

• | The Credit Repair Organizations Act (“CROA”) regulates companies that claim to be able to assist consumers in improving their credit standing. There have been efforts to apply the CROA to credit monitoring services offered by consumer reporting agencies and others. CROA allows for a private right of action and permits consumers to recover all money paid for alleged “credit repair” services in the event of violation. |

State Laws and Regulation Relating to Consumer and Data Protection

| |

• | A number of states have enacted requirements similar to the federal FCRA. Some of these state laws impose additional, or more stringent, requirements than the FCRA, especially in connection with the investigations and responses to reported inaccuracies in consumer reports. The FCRA preempts some of these state laws, but the scope of preemption continues to be defined by the courts. The state of Vermont is grandfathered under the original FCRA requirements and thus we are subject to additional requirements to comply with Vermont law. |

| |

• | Most states and the District of Columbia have passed laws that give consumers the right to place a security freeze on their credit reports to prevent others from opening new accounts or obtaining new credit in their name. These laws place differing requirements on credit reporting agencies with respect to how and when to respond to such credit file freeze requests and in the fees, if any, the agencies may charge for freeze-related actions. |

| |

• | A majority of states have adopted versions of data security breach laws that require notification of affected consumers in the event of a breach of personal information. Some of these laws require additional data protection measures which exceed the GLB Act data safeguarding requirements. If data within our system is compromised by a breach, we may be subject to provisions of various state security breach laws. |

Summary of International Regulation Relating to Consumer and Data Protection

We are subject to various data protection, privacy and consumer credit laws and regulations in the foreign countries where we operate including among others the following:

| |

• | In the U.K., we are subject to a regulatory framework which provides for primary regulation by the Financial Conduct Authority (the “FCA”). The FCA focuses on consumer protection and market regulation as well as prudential supervision of all other regulated financial institutions. The FCA has significant powers, including the power to regulate conduct related to the marketing of financial products, specify minimum standards and to place requirements on products, impose unlimited fines, and to investigate organizations and individuals. In addition, the FCA is able to ban financial products for up to a year while considering an indefinite ban; it has the power to instruct firms to immediately retract or modify promotions which it finds to be misleading, and to publish such decisions. Our core credit reporting (“credit reference”) and debt collections services and recovery management businesses in the U.K. are subject to FCA supervision and we will require certain corporate and “approved person” authorizations from the FCA to carry on such businesses. The FCA has fixed the dates by which credit reference agencies and collection businesses must apply for this authorization: credit reference agencies must apply by March 31, 2016 and debt collections services businesses must apply by June 30, 2015. We are preparing to submit a license application for our collection business (TDX) by June 30, 2015. Although we do not currently anticipate any issues in receiving authorization, to the extent applicable approvals are not obtained in a timely manner, or at all, we may not conduct these businesses in the U.K. |

| |

• | In Europe, we are subject to the European Union (“EU”) data protection regulations, including the comprehensive 1995 European Union Data Protection Directive. The EU regulations establish several obligations that organizations must follow with respect to use of personal data, including a prohibition on the transfer of personal information from the EU to other countries whose laws do not protect personal data to an “adequate” level of privacy or security. The EU standard for adequacy is generally stricter and more comprehensive than that of the U.S. and most other countries where Equifax operates. In the U.K., in addition to the EU Directive on Data Protection, the Data Protection Act of 1998 regulates the manner in which we can use third-party data. In addition, regulatory limitations affect our use of the Electoral Roll, one of our key data sources in the U.K. Generally, the data underlying the products offered by our U.K. Information Services and Personal Solutions product lines, excluding our Commercial Services products, are subject to these regulations. In Spain and Portugal, the privacy laws which are subject to the EU Directive on Data Protection regulate all credit bureau and personal solutions activities. Regulation relating to the 1995 EU Data Protection Directive was proposed in 2012 by the European Commission and is currently being considered by European legislative bodies that among other things, could tighten data protection requirements and make enforcement more rigorous, for example, by streamlining enforcement at a European level, introducing data breach notification requirements and increasing penalties for non-compliance. |

| |

• | In Canada, federal and provincial laws govern how we collect, use or disclose personal information in the course of our commercial activities. The federal Personal Information Protection and Electronic Documents Act of 2000 gives individuals the right to access and request correction of their personal information collected by us, and requires compliance with the Canadian Standard Association Model Code for the Protection of Personal Information covering accountability and identifying purposes, consent, collection, use, disclosure, retention, accuracy, safeguards, individual access and compliance. The federal and provincial privacy regulators have powers of investigation and intervention, and provisions of Canadian law regarding civil liability apply in the event of unlawful processing which is prejudicial to the persons concerned. The European Union, or EU, recognizes Canada as having adequate levels of protection for personal data transfers and processing. |

| |

• | In Latin America, consumer reporting, data protection and privacy laws and regulations exist in various forms in Argentina, Chile, Costa Rica, Ecuador, El Salvador, Paraguay, Peru and Uruguay. Argentina and Uruguay generally follow the EU data protection model, and the EU recognizes Argentina’s laws as providing adequate levels of protection for personal data transfers and processing. Among other protections, laws in all of these countries generally allow individuals to access and request corrections of personal data. |

| |

• | Constitutional laws in Argentina, Chile, Ecuador, Peru and Uruguay also establish specific privacy rights, and judicial proceedings may be used to enforce them. The Chilean government has indicated that it will introduce a new comprehensive data protection bill in 2015, and a separate bill that would create a publicly-managed consumer credit registry remains before the legislature. Each of these bills would introduce a new framework to allow the government to regulate the collection and use of personal data, including credit data. Ecuador’s National Assembly approved a law to replace private sector credit bureaus with a state-run registry which when implemented would materially impact our local credit reporting operations in Ecuador. Ecuador, however, represented less than three percent of our 2014 revenue and operating profit for our International business unit and is not material to our consolidated results of operations. The law originally provided a transition period throughout 2013 for the development and introduction of the new registry, the transition period was then extended through 2014. In late 2014, the law was amended again to remove the fixed deadline, allowing private sector credit bureaus to continue operating until the financial sector regulatory board determines that the new registry is operational. Legislation has also been proposed in Argentina and Uruguay that would amend existing credit reporting laws by prohibiting the use of certain data for credit reference purposes, shorten the period during which data may be used and create new access and notification rights for data subjects. The Argentinean legislation has not proceeded beyond the introductory debate stage. Legislation has been proposed in El Salvador to reduce the period of time during which credit information may be reported, to prohibit including consumer addresses in credit reports, and to regulate scoring. The impact of the proposals is unlikely to have a material impact on our overall International operations, but could significantly restrict operations in the local market. Costa Rica is finalizing regulations that will be issued under its data protection legislation. While the potential impact of the foregoing regulatory changes is unlikely to be material in the aggregate to the results of our International operations, if the market opportunity were to be restricted significantly in Argentina or Chile, and/or in a combination of the smaller Latin American countries in which we operate, the impact on our International operating results could be material. |

| |

• | In India, various legislation including the Information Technology Act 2000 and the Credit Information Companies Regulation Act of 2005 establishes a federal data protection framework. Entities that collect and maintain personal credit information must ensure that it is complete, accurate and safeguarded, and must adopt certain privacy principles with respect to collecting, processing, preserving, sharing and using such credit information. The Indian parliament has passed legislation that would allow individuals to sue for damages in the case of a data breach, if the entity negligently failed to implement reasonable security practices and procedures to protect personal data. Our Indian joint venture is subject to regulation by the Reserve Bank of India, which is the Indian central bank. |

| |

• | In Russia, credit reporting activities are governed by the Federal Law on Credit Histories No.218-fz, dated December 30, 2004. The law regulates the contents of credit files, consent, who may submit data to a credit bureau and how credit reports may be used. |

Tax Management Services

The Tax Management Services business within our Workforce Solutions segment is potentially impacted by changes in renewal or non-renewal of U.S. tax laws or interpretations, for example, those pertaining to work opportunity tax credits and unemployment compensation claims.

PERSONNEL

Equifax employed approximately 7,500 employees in 20 countries as of December 31, 2014. None of our U.S. employees are subject to a collective bargaining agreement and no work stoppages have been experienced. Pursuant to local laws, certain of our employees in Argentina and Spain are covered under government-mandated collective bargaining regulations that govern general salary and compensation matters, basic benefits and hours of work. In some of our non-U.S. subsidiaries, certain of our employees are represented by workers’ councils or statutory labor unions.

EXECUTIVE OFFICERS OF EQUIFAX

The executive officers of Equifax and their ages and titles are set forth below. Business experience and other information is provided in accordance with SEC rules.

Richard F. Smith (55) has been Chairman and Chief Executive Officer since December 2005. He was named Chairman-Elect and Chief Executive Officer effective September 2005. Prior to that, Mr. Smith served as Chief Operating Officer, GE Insurance Solutions, from 2004 to September 2005 and President and Chief Executive Officer of GE Property and Casualty Reinsurance from 2003 to 2004.

John W. Gamble, Jr. (52) was elected to his current position effective May 21, 2014. Mr. Gamble was Executive Vice President and CFO of Lexmark International, Inc., a global provider of document solutions, enterprise content management software and services, printers and multifunction printers, from September 2005 until May 2014.

John J. Kelley III (54) was elected to his current position in January 2013. Responsibilities include legal services, global sourcing, security and compliance, government and legislative relations, corporate governance and privacy functions. Mr. Kelley was a senior partner in the Corporate Practice Group of the law firm of King & Spalding LLP from January 1993 to December 2012.

Coretha M. Rushing (58) has been Corporate Vice President and Chief Human Resources Officer since 2006. Prior to joining Equifax, she served as an executive coach and HR Consultant with Atlanta-based Cameron Wesley LLC. Prior thereto, she was Senior Vice President of Human Resources at The Coca-Cola Company, where she was employed from 1996 until 2004.

David C. Webb (59) became Chief Information Officer in January 2010. Prior thereto, he served as Chief Operations Officer for SVB Financial Corp. from 2008, and from 2004 to 2008 was Chief Information Officer. Mr. Webb was Vice President, Investment Banking Division at Goldman Sachs, a leading global investment banking, securities and investment management firm, from 1999 to 2004. He was Chief Information Officer at Bank One from 1997 to 1999.

Rodolfo O. Ploder (54) has been President, U.S. Information Solutions since April 2010. Prior thereto, he served as President, International from January 2007 to April 2010. Prior thereto, he was Group Executive, Latin America from February 2004 to January 2007.

J. Dann Adams (57) has been President, Workforce Solutions, since July 2010. Prior thereto, he served as President, U.S. Information Solutions from 2007 to June 2010. Prior thereto, he served as Group Executive, North America Information Services from November 2003 until December 2006.

Paulino R. Barros (58) has been President, International since July 2010. Prior thereto, he served as President of PB&C Global Investments, LLC, an international consulting and investment firm. Prior thereto, he was President of Global Operations for AT&T.

Joseph M. Loughran, III (47) has been President, North America Personal Solutions since January 4, 2010. Prior thereto, he was Senior Vice President - Corporate Development from April 2006 to December 2009. Prior to joining Equifax, he held various executive roles at BellSouth Corporation from May 2001 to April 2006, including most recently Managing Director-Corporate Strategy and Planning from May 2005 to April 2006.

Nuala M. King (61) has been Senior Vice President and Controller since May 2006. Prior thereto, she was Vice President and Corporate Controller from March 2004 to April 2006. Prior to joining Equifax, Ms. King served as Corporate Controller for UPS Capital from March 2001 until March 2004.

FORWARD-LOOKING STATEMENTS

This report contains information that may constitute “forward-looking statements.” Generally, the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “will” and similar expressions identify forward-looking statements, which generally are not historical in nature. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future are forward-looking statements. Management believes that these forward-looking statements are reasonable as and when made. However, forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our Company’s historical experience and our present expectations or projections, including without limitation our expectations regarding the Company’s outlook, long-term organic and inorganic growth, and customer acceptance of our business solutions referenced above under “Business” and below under “Business Environment and Company Outlook.” These risks and uncertainties include, but are not limited to, those described below in Item 1A. Risk Factors, and elsewhere in this report and those described from time to time in our future reports filed with the United States Securities and Exchange Commission, or SEC. As a result of such risks and uncertainties, we urge you not to place undue reliance on any such forward-looking statements. Forward-looking statements speak only as of the date when made. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

AVAILABLE INFORMATION

Detailed information about us is contained in our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and other reports, and amendments to those reports, that we file with, or furnish to, the SEC. These reports are available free of charge at our website, www.equifax.com, as soon as reasonably practicable after we electronically file such reports with or furnish such reports to the SEC. However, our website and any contents thereof should not be considered to be incorporated by reference into this document. We will furnish copies of such reports free of charge upon written request to Corporate Secretary, Equifax Inc., P.O. Box 4081, Atlanta, Georgia, 30302.

ITEM 1A. RISK FACTORS

All of the risks and uncertainties described below and the other information included in this Form 10-K should be considered and read carefully. The risks described below are not the only ones facing us. The occurrence of any of the following risks or additional risks and uncertainties not presently known to us or that we currently believe to be immaterial could materially and adversely affect our business, financial condition or results of operations. This Form 10-K also contains forward-looking statements and estimates that involve risks and uncertainties. Our actual results could differ materially from those anticipated in the forward-looking statements as a result of specific factors, including the risks and uncertainties described below.

Uncertain general economic conditions could materially adversely affect us.

Although there has been some improvement in overall global macroeconomic conditions in 2014, we and our customers continue to be sensitive to negative changes in general economic conditions, both inside and outside the U.S. Business customers use our credit information and related analytical services and data to process applications for new credit cards, automobile loans, home and equity loans and other consumer loans, and to manage their existing credit relationships. Bank and other lenders’ willingness to extend credit is adversely affected by elevated consumer delinquency and loan losses in a weak economy. Consumer demand for credit (i.e., rates of spending and levels of indebtedness) also tends to grow more slowly or decline during periods of economic contraction or slow economic growth. High or rising rates of unemployment and interest, declines in income, home prices, or investment values, lower consumer confidence and reduced access to credit adversely affect demand for our products and services, and consequently our revenue, as consumers may continue to postpone or reduce their spending and use of credit, and lenders may reduce the amount of credit offered or available.

The loss of access to credit, employment, financial and other data from external sources could harm our ability to provide our products and services.

We rely extensively upon data from external sources to maintain our proprietary and non-proprietary databases, including data received from customers, strategic partners and various government and public record sources. This data includes the widespread and voluntary contribution of credit data from most lenders in the U.S and many other markets as well as the contribution of data under proprietary contractual agreements, such as employers’ contribution of employment and income data to The Work Number, financial institutions’ contribution of individual financial data to IXI, telecommunications, cable and utility companies’ contribution of payment and fraud data to the National Cable, Telecommunications and Utility Exchange, and financial institutions’ contribution of small business borrowing information to the Small Business Financial Exchange. Although historically we have not experienced material issues in this regard, our data sources could withdraw, delay receipt of or increase the cost of their data provided to us for a variety of reasons, including legislatively or judicially imposed restrictions on use, security breaches or competitive reasons. Where we currently have exclusive use of data, the providers of the data sources could elect to make the information available to competitors. We also compete with several of our third-party data suppliers. If a substantial number of data sources or certain key data sources were to withdraw or be unable to provide their data, if we were to lose access to data due to government regulation, if we lose exclusive right to the use of data, or if the collection of data becomes uneconomical, our ability to provide products and services to our clients could be materially adversely impacted, which could result in decreased revenue, net income and earnings per share. There can be no assurance that we would be able to obtain data from alternative sources if our current sources become unavailable.

Our markets are highly competitive and new product introductions and pricing strategies being offered by our competitors could decrease our sales and market share or require us to enhance our products and services or reduce our prices in a manner that reduces our operating margins.

We operate in a number of geographic, product and service markets that are highly competitive. Competitors may develop products and services that are superior to or that achieve greater market acceptance than our products and services. The size of our competitors varies across market segments, as do the resources we have allocated to the segments we target. Therefore, some of our competitors may have significantly greater financial, technical, marketing or other resources than we do in one or more of our market segments, or overall. As a result, our competitors may be in a position to respond more quickly than we can to new or emerging technologies and changes in customer requirements, or may devote greater resources than we can to the development, enhancement, promotion, sale and support of products and services. Moreover, new competitors or alliances among our competitors may emerge and potentially reduce our market share, revenue or margins.

We also sell our information to competing firms, and buy information from certain of our competitors, in order to sell “tri-bureau” and other products, most notably into the mortgage and direct to consumer markets. Changes in prices between competitors for this information and/or changes in the design or sale of tri-bureau versus single bureau product offerings may affect our revenue or profitability.

Some of our competitors may choose to sell products competitive to ours at lower prices by accepting lower margins and profitability, or may be able to sell products competitive to ours at lower prices given proprietary ownership of data, technological superiority or economies of scale. Price reductions by our competitors could negatively impact our margins and results of operations and could also harm our ability to obtain new customers on favorable terms. Historically, certain of our key products have experienced declines in per unit pricing due to competitive factors and customer demand. Since a significant portion of our operating expenses is relatively fixed in nature due to sales, information technology and development and other costs, if we were unable to respond quickly enough to changes in competition or customer demand, we could experience further reductions in our operating margins.

If we do not introduce successful new products, services and analytical capabilities in a timely manner, our competitiveness and operating results will suffer.

We generally sell our products in industries that are characterized by rapid technological changes, frequent new product and service introductions and changing industry standards. In addition, certain of the markets in which we operate are seasonal and cyclical. Without the timely introduction of new products, services and enhancements, our products and services will become technologically or commercially obsolete over time, in which case our revenue and operating results would suffer. The success of our new products and services will depend on several factors, including our ability to properly identify customer needs; innovate and develop new technologies, services and applications; successfully commercialize new technologies in a timely manner; produce and deliver our products in sufficient volumes on time; differentiate our offerings from competitor offerings; price our products competitively; anticipate our competitors’ development of new products, services or technological innovations; and control product quality in our product development process.

Security breaches and other disruptions to our information technology infrastructure could interfere with our operations, and could compromise Company, customer and consumer information, exposing us to liability which could cause our business and reputation to suffer.

In the ordinary course of business, we rely upon information technology networks and systems, some of which are managed by third parties, to process, transmit and store electronic information, and to manage or support a variety of business processes and activities, including business-to-business and business-to-consumer electronic commerce and internal accounting and financial reporting systems. Additionally, we collect and store sensitive data, including intellectual property, proprietary business information and personally identifiable information of our customers, employees, consumers and suppliers, in data centers and on information technology networks. The secure and uninterrupted operation of these networks and systems, and of the processing and maintenance of this information, is critical to our business operations and strategy.

Despite our substantial investment in physical and technological security measures, employee training, contractual precautions and business continuity plans, our information technology networks and infrastructure or those of our third-party vendors and other service providers could be vulnerable to damage, disruptions, shutdowns, or breaches of confidential information due to criminal conduct, denial of service or other advanced persistent attacks by hackers, breaches due to employee error or malfeasance, or other disruptions during the process of upgrading or replacing computer software or hardware, power outages, computer viruses, telecommunication or utility failures or natural disasters or other catastrophic events.

We are regularly the target of attempted cyber and other security threats and must continuously monitor and develop our information technology networks and infrastructure to prevent, detect, address and mitigate the risk of unauthorized access, misuse, computer viruses and other events that could have a security impact. Although we have not experienced any material breach of cybersecurity, if one or more of such events occur, this potentially could compromise our networks and the information stored there could be accessed, publicly disclosed, lost or stolen. Any such access, disclosure or other loss of information could subject us to litigation, significant losses, regulatory fines, penalties or reputational damage, any of which could have a material effect on our cash flows, competitive position, financial condition or results of operations. Our property and business interruption insurance may not be adequate to compensate us for all losses or failures that may occur. Also, our third-party insurance coverage will vary from time to time in both type and amount depending on availability, cost and our decisions with respect to risk retention.

Our customers and we are subject to various current governmental regulations, and could be affected by new laws or regulations, compliance with which may cause us to incur significant expenses and change our business practices, and if we fail to maintain satisfactory compliance with certain regulations, we could be subject to civil or criminal penalties.

We are subject to a number of U.S. and state and foreign laws and regulations relating to consumer privacy, data and financial protection. The Fair Credit Reporting Act (FCRA) regulates the disclosure of consumer credit reports by consumer reporting agencies and the use of consumer report information by banks and other companies. These regulations are complex, change frequently, have tended to become more stringent over time, and are subject to administrative interpretation and judicial construction in ways that could harm our business. Foreign data protection, privacy, consumer protection and other laws and regulations are often more restrictive than those in the U.S. There are also a number of legislative proposals pending before the U.S. Congress, various state legislative bodies and foreign governments concerning data protection that could affect us. For example, new data protection regulations currently being considered by the European Union (“EU”) legislative bodies propose more stringent operational requirements for entities processing personal information, such as stronger safeguards for data transfers to non-EU countries, reliance on express consent from data subjects (as opposed to assumed or implied consent), a right to require data processors to delete personal data, and stronger enforcement authorities and mechanisms.

Under Title X of the Dodd-Frank Act, the Consumer Financial Protection Bureau (“CFPB”) has broad powers to promulgate, administer and enforce consumer financial regulations, including those applicable to us and to many of our customers. The CFPB has oversight of the Fair Credit Reporting Act, as amended (“FCRA”), the federal regulation most directly impacting U.S. operations. The CFPB is also charged with defining “unfair, deceptive or abusive acts and practices”, known as “UDAAP”. Also, where a company has violated Title X of the Dodd-Frank Act, or CFPB regulations under Title X, the Dodd-Frank Act empowers state attorneys general and state regulators to bring civil actions for the kind of cease and desist orders available to the CFPB (but not for civil penalties). During 2014, the CFPB announced more than 23 enforcement actions and imposed more than $112.6 million in civil penalties and nearly $1.8 billion in restitution. We are currently the subject of investigations by state attorneys general and the CFPB as more fully described under Item. 3 Legal Proceedings in this Form 10-K.

In the U.K., we are subject to a regulatory framework which provides for primary regulation by the Financial Conduct Authority (the “FCA”). The FCA focuses on consumer protection and market regulation as well as prudential supervision of all other regulated financial institutions. The FCA has significant powers, including the power to regulate conduct related to the marketing of financial products, specify minimum standards and to place requirements on products, impose unlimited fines, and to investigate organizations and individuals. In addition, the FCA is able to ban financial products for up to a year while considering an indefinite ban; it has the power to instruct firms to immediately retract or modify promotions which it finds to be misleading, and to publish such decisions. Our core credit reporting (“credit reference”) and debt collections services businesses in the U.K. are subject to FCA supervision and we will require certain corporate and “approved person” authorizations from the FCA to carry on such businesses. The FCA has fixed the dates by which credit reference agencies and collection businesses must apply for this authorization: credit reference agencies must apply by March 31, 2016 and debt collections services businesses must apply by June 30, 2015. We are preparing to submit a license application for our collection business (TDX) by June 30, 2015. Although we do not currently anticipate any issues in receiving authorization, to the extent applicable approvals are not obtained in a timely manner, or at all, we may not conduct these businesses in the U.K.

We are devoting substantial compliance, legal and operational business resources to facilitate compliance with applicable regulations and requirements. Additionally, we cooperate with CFPB supervisory examinations and respond to other state and federal investigations of our business practices. Any failure by us to comply with, or remedy any violations of, applicable laws and regulations could result in the curtailment of certain of our operations, the imposition of fines and penalties, and restrictions on our ability to carry on or expand our operations. In addition, because many of our products are regulated or sold to customers in various industries, we must comply with additional regulations in marketing our products. We cannot predict the ultimate impact on our business of new or proposed CFPB, FCA or other rules, supervisory examinations or government investigations or enforcement actions.

These laws and regulations (as well as actions that may be taken by legislatures and regulatory bodies in other countries) and the consequences of any violation could limit our ability to pursue business opportunities we might otherwise consider engaging in, impose additional costs on us, result in significant loss of revenue, result in significant restitution and fines, impact the value of assets we hold, or otherwise significantly adversely affect our business. See “Item 1. Business – Government Regulation” in this Form 10-K.

We are regularly involved in claims, suits, government investigations, supervisory examinations and other proceedings that may result in adverse outcomes.

We are regularly involved in claims, suits, government investigations, supervisory examinations and regulatory proceedings arising from the ordinary course of our business, including actions with respect to consumer protection and data protection, including purported class action lawsuits. Such claims, suits, government investigations, and proceedings are inherently uncertain and their results cannot be predicted with certainty. Regardless of their outcome, such legal proceedings can have an adverse impact on us because of legal costs, diversion of management and other personnel, and other factors. In addition, it is possible that a resolution of one or more such proceedings could result in reputational harm, liability, penalties, or sanctions, as well as judgments, consent decrees, or orders preventing us from offering certain features, functionalities, products, or services, or requiring a change in our business practices, products or technologies, which could in the future materially and adversely affect our business, operating results, and financial condition. The FCRA contains an attorney fee shifting provision to provide an incentive for consumers to bring individual and class action lawsuits against a CRA for violation of the FCRA, and the number of consumer lawsuits against us alleging a violation of FCRA and our resulting costs associated with resolving these lawsuits have increased substantially over the past several years.