Preliminary Offering Circular: September 22, 2017

An offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular was filed may be obtained.

VISKASE COMPANIES, INC.

333 East Butterfield Road, Suite 400

Lombard, Illinois 60148-5679

Up to [·] Shares of Common Stock

Issuable Upon Exercise of Rights to Subscribe for Such Shares at $[·] per Share

We are distributing at no charge to the holders of our common stock on [·], which we refer to as the record date, non-transferable rights to purchase up to an aggregate of [·] new shares of our common stock. We will distribute to you, a rights holder, one non-transferable right for every share of our common stock that you own on the record date. Each right entitles the holder to purchase [·] shares of our common stock, which we refer to as the subscription right, at the subscription price of $[·] per whole share of common stock, which we refer to as the subscription price. Rights holders who fully exercise their subscription rights will be entitled to subscribe for additional shares of our common stock that remain unsubscribed as a result of any unexercised subscription rights, which we refer to as the over-subscription right. The over-subscription right entitles holders of subscription rights who exercise their subscription right in full to purchase, at the subscription price, any shares that our other subscription rights holders do not purchase under their subscription privilege. We refer to the subscription rights and over-subscription rights collectively as rights. Rights may only be exercised in the aggregate for whole numbers of shares of our common stock; no fractional shares of our common stock will be issued in this offering.

|

|

|

Price to Public |

|

Underwriting |

|

Proceeds to |

| |||

|

Per Share |

|

$ |

[·] |

|

$ |

0 |

|

$ |

[·] |

|

|

Total Maximum |

|

$ |

50,000,000 |

|

$ |

0 |

|

$ |

50,000,000 |

|

(1) There is no underwriter for this offering.

(2) The Company expects that the amount of expenses of the offering that it will pay will be approximately $225,000.

The rights will expire at 5:00 p.m., New York City time, on [·], which we refer to as the expiration date, unless extended as described herein. You may not rescind your subscriptions after receipt of your payment for the subscription price except as described in this offering circular. Rights that are not exercised prior to the expiration date will expire and have no value. There is no minimum number of shares of our common stock that we must sell in order to complete this offering.

Our common stock has been traded in the over-the-counter market on the “pink sheets” under the symbol “VKSC” and trading on such market is highly illiquid and volatile. The closing price of our shares of common stock on

September [·], 2017 was $[·] per share. The rights are non-transferable and will not be listed for trading on any securities exchange or automated quotation system.

This offering is being made directly by us without the services of an underwriter or selling agent. We have engaged American Stock Transfer and Trust Company, LLC to serve as our subscription agent for this offering. The subscription agent will hold in escrow the funds we receive from subscribers until we complete or cancel this offering.

You should carefully consider whether or not to exercise your subscription rights and in doing so you should consider all of the information about us and this offering contained in this offering circular. Our Board of Directors is not making any recommendation as to whether or not you should exercise or let lapse your subscription rights.

An investment in our common stock involves risks. See “Risk Factors” beginning on page 18 of this offering circular. As a result of the terms of this offering, stockholders who do not fully exercise their rights will own, upon completion of this offering, a smaller proportional interest in us than otherwise would be the case had they fully exercised their rights.

The United States Securities and Exchange Commission does not pass upon the merits or give its approval of any securities offered or the terms of the offering, nor does it pass upon the accuracy or completeness of any offering circular or other solicitation materials. These securities are offered pursuant to an exemption from registration with the Commission; however, the Commission has not made an independent determination that the securities offered are exempt from registration.

Generally no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

The company is following the “Offering Circular” format of disclosure under Regulation A.

If you have any questions or need further information about this offering, please call American Stock Transfer and Trust Company, LLC, our subscription agent for this offering, at [·] (toll-free).

It is anticipated that delivery of the common stock purchased in this offering will be made on or about [·].

The date of this Offering Circular is [·]

|

1 | |

|

2 | |

|

5 | |

|

11 | |

|

18 | |

|

26 | |

|

27 | |

|

28 | |

|

29 | |

|

30 | |

|

31 | |

|

32 | |

|

34 | |

|

35 | |

|

36 | |

|

37 | |

|

41 | |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

43 |

|

57 | |

|

Security Ownership of Management and Certain Securityholders |

64 |

|

65 | |

|

66 | |

|

69 | |

|

70 | |

|

F-1 |

This summary highlights certain information that we believe is especially important concerning our business and this offering. It does not contain all of the information that may be important to you and to your investment decision. You should carefully read the entire offering circular and should consider, among other things, the matters set forth in the section entitled “Risk Factors” before deciding to participate in the offering. As used herein, Viskase Companies, Inc. and its subsidiaries are referred to as “Viskase” or the “Company,” as well as “we,” “us” and “our”.

Our Company

The Company operates in the casing product segment of the food industry. Viskase is a worldwide leader in the production and sale of cellulosic, fibrous and plastic casings for the processed meat and poultry industry. Viskase currently operates eleven manufacturing facilities and six distribution centers throughout North America, Europe, South America and Asia. Viskase provides value-added support services relating to these products for some of the world’s largest global consumer products companies. Viskase is one of the two largest worldwide producers of non-edible cellulosic casings for processed meats and one of the three largest manufacturers of non-edible fibrous casings.

Viskase’s business strategy is to continue to improve operational efficiencies, product quality and throughput by upgrading existing production facilities and adding resources in high growth markets through new capital investments. Viskase has been successful in implementing production cost-savings initiatives and will continue to pursue similar opportunities that enhance its profitability and competitive positioning as a leader in the casing market. The Company is focused on reducing extrusion, shirring and printing waste through equipment upgrades and an ongoing effort to redefine product mix. As part of the Company’s long-term corporate goal of increasing stockholder value, the Company regularly considers alternatives to enhance stockholder value, including strategic acquisitions and business combinations, and the Company intends to continue to consider alternatives to enhance stockholder value.

The Company is a Delaware corporation. Our principal executive offices are located at 333 East Butterfield Road, Suite 400, Lombard, IL 60148-5679, and our telephone number is (630) 874-0700. Our website is www.viskase.com. Our website and the information included therein are not part of this offering circular.

SUMMARY OF THE RIGHTS OFFERING

|

Issuer |

|

Viskase Companies, Inc. |

|

|

|

|

|

Subscription Agent |

|

American Stock Transfer and Trust Company, LLC |

|

|

|

|

|

Subscription Rights |

|

We are issuing to each holder of our common stock one non-transferable subscription rights for each share of common stock held of record as of the record date. An aggregate of 36,523,999 subscription rights will be issued pursuant to the rights offering. Each subscription right entitles the holder to purchase [·] shares of common stock for the subscription price. The subscription rights being issued in this offering are exercisable for an aggregate subscription price of $50,000,000. |

|

|

|

|

|

Subscription Price |

|

The subscription price is $[·] per share of common stock subscribed for pursuant to the subscription rights, payable in cash. |

|

|

|

|

|

Shares of Common Stock Issued and Outstanding Before the Rights Offering |

|

36,523,999 shares of our common stock were issued and outstanding as of September [·], 2017. |

|

|

|

|

|

Shares of Common Stock Issued and Outstanding after the Rights Offering |

|

Assuming full subscription of the offering, there will be [·] shares of common stock issued and outstanding upon completion of the rights offering. |

|

|

|

|

|

Transferability of Subscription Rights |

|

The subscription rights are not transferable. |

|

|

|

|

|

Record Date |

|

The record date is 5:00 p.m. New York City time, on [·]. |

|

|

|

|

|

Expiration Date |

|

The subscription rights expire as of 5:00 p.m. New York City time, [·], which date and time is referred to as the expiration date, unless we, in our sole discretion, extend the rights offering and postpone the expiration date to a later date and time. In no event will the expiration date be later than [·]. |

|

|

|

|

|

Procedure to Exercise Subscription Rights |

|

In order to exercise subscription rights, each holder must: (i) return a duly completed and executed subscription rights certificate to the subscription agent so that such certificate is actually received by the subscription agent on or before the expiration date; and (ii) pay to the subscription agent on or before the expiration date the aggregate subscription price for all of the common stock to be purchased pursuant to the holder’s exercise of the subscription rights in accordance with the subscription instructions. If, on or prior to the expiration date, the subscription agent for any reason does not receive from you a duly completed subscription rights certificate and full payment in an amount equal to the aggregate subscription price of the subscription rights you desire to exercise, your subscription rights for which we have not received such certificate and payment will be deemed to be unexercised, terminate and become null and void. Once you exercise your subscription rights, you may not revoke your exercise, even if there is a decline in the price of our common stock. In addition, because we may terminate or withdraw the rights offering at our discretion, and because we may close the rights offering even if it is less than fully subscribed, your participation in the rights offering is not assured. |

|

Over-Subscription Privilege |

|

If you exercise your subscription rights in full, you, together with other stockholders that exercise their subscription rights in full, will also be entitled to an over-subscription privilege to purchase shares not purchased by other stockholders under their subscription rights. The subscription price per share that applies to the over-subscription privilege is the same subscription price per share that applies to the subscription privilege. |

|

|

|

|

|

Persons Holding Shares, or Wishing to Exercise Subscription Rights, Through Others |

|

If you hold our common stock through a broker, custodian bank or other nominee, we will ask your broker, custodian bank or other nominee to notify you of the rights offering. If you wish to exercise your subscription rights, you will need to have your broker, custodian bank or other nominee act for you. To indicate your decision, you should complete and return to your broker, custodian bank or other nominee the form entitled “Beneficial Holder Election Form.” You should receive this form from your broker, custodian bank or other nominee along with the other rights offering materials. |

|

|

|

|

|

No Revocation |

|

Once you send in your subscription rights certificate and payment, you cannot revoke the exercise of your subscription rights. However, if we cancel or terminate the rights offering prior to the expiration date, we will return any subscription price paid by you, but without the payment of any interest thereon. |

|

|

|

|

|

Offering Type |

|

The offering of common stock pursuant to the subscription rights is being conducted as a Tier 2 offering pursuant to Regulation A under the Securities Act of 1933, as amended. |

|

|

|

|

|

Limitations on Investment |

|

Generally, no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or your net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, the Company encourages you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, the Company encourages you to refer to www.investor.gov. |

|

|

|

|

|

Trading Symbol |

|

“VKSC” |

|

|

|

|

|

Issuance of Common Stock |

|

As soon as practicable after the completion of the rights offering, shares of common stock subscribed for and issued pursuant to exercise of the subscription rights will be delivered to subscribers. Such shares will be issued in the same form, certificated or book-entry, as the shares of common stock already held by the subscriber exercising subscription rights for such shares. |

|

|

|

|

|

Material Federal Income Tax Consequences |

|

The issuance of subscription rights to you pursuant to this rights offering should not be taxable to you. See “Material U.S. Federal Income Tax Consequences.” |

|

|

|

|

|

Use of Proceeds |

|

We will use all of the net proceeds of the rights offering to replenish working capital used for the acquisitions of Walsroder and Darmex and for other general corporate purposes, including acquisitions and planned capital expenditures. |

|

|

|

|

|

No Recommendation to Holders of Subscription Rights |

|

Neither we nor our Board of Directors are making any recommendations as to whether or not you should subscribe for shares of our common stock. You should decide whether to subscribe for shares based upon your own assessment of your best interests. |

|

Fees and Expenses |

|

We will bear the fees and expenses relating to the rights offering. |

|

|

|

|

|

Charter Amendment |

|

We expect to amend our certificate of incorporation prior to the expiration date to increase the number of shares of common stock that we are authorized to issue from 50,000,000 to 100,000,000. The completion of the rights offering is conditioned on the adoption of this amendment to our certificate of incorporation. |

|

|

|

|

|

Risk Factors |

|

An investment in our common stock involves certain risks. You should carefully consider the risks described under “Risk Factors” beginning on page 18 of this offering circular, as well as other information included in this offering circular, including our financial statements and notes thereto, before making an investment decision. |

QUESTIONS AND ANSWERS ABOUT THE RIGHTS OFFERING

The following are examples of what we anticipate will be common questions about this offering. The following questions and answers do not contain all of the information that may be important to you and may not address all of the questions that you may have about this offering. This offering circular contains more detailed descriptions of the terms and conditions of this offering and provide additional information about us and our business, including potential risks related to our business, this offering and our common stock.

What is this offering?

We are issuing to the holders of our common stock as of the record date non-transferable rights to subscribe for an aggregate of up to [·] shares of our common stock. Each holder, who we refer to as a rights holder or you, is being issued one non-transferable right for each share of our common stock owned on the record date. Each right entitles you to purchase [·] shares of our common stock, which we refer to as the subscription right, at a price of $[·] per whole share, which we refer to as the subscription price. The number of shares shall be subject to adjustment for fractional shares. Fractional shares will be rounded to the nearest whole number, with such adjustments as may be necessary to ensure that we offer no more than [·] shares of common stock in the rights offering.

What is the over-subscription privilege?

If you exercise your subscription rights in full, you, together with other stockholders that exercise their subscription rights in full, will also be entitled to an over-subscription privilege to purchase shares not purchased by other stockholders under their subscription rights. The subscription price per share that applies to the over-subscription privilege is the same subscription price per share that applies to the subscription privilege.

What are the limitations on the over-subscription privilege?

We will be able to satisfy your exercise of over-subscription privilege only if other stockholders do not elect to purchase all of the shares offered under their subscription rights. We will honor over-subscription requests in full to the extent sufficient shares are available following the exercise of rights under the subscription privilege; provided that we will not issue more than [·] shares upon the exercise of subscription rights and, if applicable, the exercise of over-subscription rights. If over-subscription requests exceed shares available, we will allocate the available shares pro rata to over-subscribing stockholders based on the number of shares each such stockholder purchased under the subscription privilege. Any excess subscription payments will be returned, without interest or penalty, as soon as practicable after the completion of this rights offering.

Why are we conducting this offering?

We have recently completed two acquisitions and believe that other attractive acquisition opportunities exist in our industry. We used existing cash to complete the prior acquisitions. We are conducting this offering in order to replenish the working capital used for the prior acquisitions and to improve and strengthen our balance sheet and liquidity position. We also intend to use the proceeds of this offering for general corporate purposes, including acquisitions and capital expenditures.

Our Board considered and evaluated a number of factors relating to this offering, including:

· our current capital resources and our future need for additional liquidity and capital;

· our need for increased financial flexibility in order to enable us to implement our business strategy and achieve our business plan;

· the size and timing of this offering;

· the potential dilution to our current stockholders if they choose not to participate in this offering;

· alternatives available for raising capital, including debt and other forms of equity raises;

· the potential impact of this offering on the public float for our common stock; and

· the fact that existing stockholders would have the opportunity to participate on a pro rata basis to purchase additional shares of our common stock, subject to certain restrictions.

Am I required to exercise the rights I receive in this offering?

No. You may exercise any number of your rights or you may choose not to exercise any of your rights. However, if you choose not to exercise your rights or you exercise less than your full amount of rights and other stockholders fully exercise their rights, the percentage of our common stock owned by other stockholders will likely increase relative to your ownership percentage, in which case your voting and other rights in our Company would be diluted.

What are the rights?

The rights give holders the opportunity to purchase [·] shares of our common stock for every right held at a subscription price of $[·] per whole share, provided that (1) rights may be exercised in aggregate only to purchase whole shares of our common stock and (2) the total subscription price payable upon any exercise of rights will be rounded to the nearest whole cent. You will receive one right for each share of common stock owned as of 5:00 p.m., New York City time, on the record date. For example, if you own 100 shares of our common stock as of 5:00 p.m., New York City time, on the record date, your rights would entitle you to purchase a total of [·] shares of our common stock for a total subscription price of $[·]. Subject to the limitations described in this offering circular, you may exercise some or all of your rights, or you may choose not to exercise any rights at all. In addition, stockholders who exercise their subscription rights in full will be entitled to an over-subscription privilege as described elsewhere in this offering circular.

May I sell, transfer or assign my rights?

No. You may not transfer, sell or assign any of the rights distributed to you. The rights are non-transferable and we do not intend to list the rights on any securities exchange or include them in any automated quotation system. Therefore, there will be no market for the rights.

Are there any limitations on my ability to exercise my rights?

Yes. No sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

How do I exercise my rights if my shares of the Company’s common stock are held by me directly and not through a broker, custodian bank or other nominee?

If you hold your shares of our common stock in your name and you wish to participate in this offering, you must deliver a properly completed and duly executed rights certificate to the subscription agent and deliver all other required subscription documents, together with payment of the full subscription price, to the subscription agent before 5:00 p.m., New York City time, on the expiration date.

If you send an uncertified check, payment will not be deemed to have been delivered to the subscription agent until the check has cleared. In certain cases, you may be required to provide signature guarantees.

Please follow the delivery instructions on the rights certificate. Do not deliver documents to us. You are solely responsible for completing delivery to the subscription agent of your rights certificate, all other required subscription documents and the subscription payment. You should allow sufficient time for delivery of your subscription materials to the subscription agent so that the subscription agent receives them by 5:00 p.m., New York City time, on the expiration date. See “—To whom should I send my forms and payment?” below.

If you send a payment that is insufficient to purchase the number of shares of our common stock you requested, or if the number of shares of our common stock you requested is not specified in the forms, the payment received will be applied to exercise your rights to the fullest extent possible based on the amount of the payment received pursuant to your rights. Any payment that is received but not so applied will be refunded to you without interest (subject to the rounding of the amount so applied to the nearest whole cent).

What form of payment is required to purchase shares of the Company’s common stock?

As described in the instructions accompanying the rights certificate, payments submitted to the subscription agent must be made in U.S. currency. Checks or bank drafts drawn on U.S. banks should be payable to “[·], as subscription agent for Viskase Corporation”.

Payments will be deemed to have been received upon clearance of any uncertified check. Please note that funds paid by uncertified check may take five or more business days to clear. Accordingly, rights holders who wish to pay the subscription price by means of uncertified check are urged to make payment sufficiently in advance of the expiration time to ensure that such payment is received and clears by such date. If you hold your shares of our common stock in the name of a broker, dealer, custodian bank or other nominee, separate payment instructions apply. Please contact your nominee, if applicable, for further payment instructions. See “How do I exercise my rights if my shares of the Company’s common stock are held in the name of a broker, dealer, custodian bank or other nominee?”

How do I exercise my rights if my shares of the Company’s common stock are held in the name of a broker, custodian bank or other nominee?

If you hold shares of our common stock through a broker, custodian bank or other nominee, we will ask your broker, custodian bank or other nominee to notify you of the rights offering. If you wish to exercise your rights, you will need to have your broker, custodian bank or other nominee act for you. To indicate your decision, you should complete and return to your broker, custodian bank or other nominee the form entitled “Beneficial Holder Election Form.” You should receive this form from your broker, custodian bank or other nominee with the other rights offering materials. You should contact your broker, custodian bank or other nominee if you believe you are entitled to participate in the rights offering but you have not received this form.

How soon must I act to exercise my subscription rights?

If your shares of our common stock are registered in your name and you elect to exercise any or all of your rights, the subscription agent must receive your properly completed and duly executed rights certificate, all other required subscription documents and full subscription payment, including final clearance of any uncertified check, before this offering expires at 5:00 p.m., New York City time, on the expiration date, which is [·]. If you hold your shares in the name of a broker, custodian bank or other nominee, your nominee may establish an earlier deadline before the expiration of this offering by which time you must provide the nominee with your instructions and payment to exercise your rights. Although our Board may extend the expiration date, it currently does not intend to do so.

Although we will make reasonable attempts to provide this offering circular to our stockholders to whom rights are distributed, this offering and all rights will expire at 5:00 p.m., New York City time, on the expiration date, whether or not we have been able to locate and deliver this offering circular to all such stockholders.

After I exercise my rights, can I change my mind?

No. Once you have exercised your rights, you may not revoke such exercise in whole or in part. Accordingly, any exercise of rights will constitute a binding commitment to purchase and pay for the shares of our common stock issuable upon such exercise, regardless of any changes in the value of such shares, in our business, financial condition, results of operations or future prospects or in your individual circumstances.

Can this offering be cancelled or extended?

Yes. Our Board reserves the right to withdraw, terminate or extend this offering. If we withdraw or terminate this offering, neither we nor the subscription agent will have any obligation with respect to rights that have been exercised except to return, without interest or deduction, any subscription payments the subscription agent received from you. If we were to cancel this offering, any money received from subscribing stockholders would be returned promptly, without interest or penalty, and we would not be obligated to issue shares of common stock to holders who have exercised their rights prior to termination. In addition, we may extend the period for exercising the rights.

How was the subscription price determined?

The $[·] subscription price was set by our Board considering, among other things, our need for equity capital and evaluation of sources of equity financing, feedback from our majority stockholder, Icahn Enterprises, regarding the terms on which it would be willing to make an additional equity investment in the Company and a survey of the discount from market price associated with the subscription price of other rights offerings. The factors considered by our Board and the process our Board undertook to review, consider and approve the subscription price are discussed in “The Rights Offering—Reasons for the Rights Offering” and “—Determination of the Subscription Price.”

Has our Board made a recommendation to our stockholders regarding the exercise of rights under this offering?

No. Our Board has not made, nor will it make, any recommendation to stockholders regarding the exercise of rights in this offering. We cannot predict the price at which our shares of common stock will trade after this offering. You should make an independent investment decision about whether or not to exercise your rights. Stockholders who exercise rights risk investment loss on new money invested. We cannot assure you that the market price for our common stock will trade at any specified market price or that anyone purchasing shares at the subscription price will be able to sell those shares in the future at the same price or a higher price. If you do not exercise your rights in full, your percentage ownership interest and related rights in our Company will likely be diluted.

Are there any risks associated with this offering?

Stockholders who exercise their rights will incur investment risk on new money invested. The stock market and, in particular, our common stock price, may experience volatility and the market for our stock is illiquid. As a result, the market price for our common stock may be volatile. This offering will increase the number of outstanding shares of our common stock (assuming the exercise of the rights in full) by approximately [·]% and the trading volume in our common stock may fluctuate more than usual and cause significant price variations to occur. The market price of our common stock will depend on many factors, which may change from time to time, including our financial condition, performance, creditworthiness and prospects, future sales of our securities and other factors. Volatility in the market price of our common stock may prevent you from being able to sell our common stock when you want or at prices you find attractive. You should make your decision based on your assessment of our business and financial condition, our prospects for the future, the terms of this offering and the information contained in this offering circular. You should carefully consider the risks, among other things, described under the heading “Risk Factors” contained in this offering circular before exercising your rights and investing in shares of our common stock.

Will the directors and executive officers participate in this offering?

To the extent they hold common stock as of the record date, our directors and executive officers are entitled to participate in this offering on the same terms and conditions applicable to all other stockholders. While some or all of our directors and executive officers may participate in this offering, they are not required to do so. See “The Rights Offering—Effect of This Offering on Existing Stockholders; Interests of Certain Stockholders, Directors and Officers”.

Will Carl C. Icahn or any of its affiliates participate in this offering?

As of September 14, 2017, Carl C. Icahn, through his affiliates Icahn Enterprises L.P. (“Icahn Enterprises”) and Icahn Enterprises Holdings L.P. (“IEH”) beneficially owned 27,261,917 shares of our common stock, constituting approximately 74.6% of our outstanding common stock. Icahn Enterprises is entitled to participate in this offering on the same terms and conditions applicable to all rights holders. Icahn Enterprises has advised us that it intends to exercise its subscription rights in full and to over-subscribe with respect to any unexercised rights, although it is not required to do so.

If after the rights offering is consummated, Icahn Enterprises becomes the beneficial owner of more than 80% of our outstanding common stock, the Company would become a member of the consolidated group of a corporate subsidiary of Icahn Enterprises for U.S. federal income tax purposes and thereafter the Company’s net operating losses, if any, and other tax attributes may be available to offset the income tax liability of such consolidated group, in which case, the Company would expect to receive compensation to the extent set forth in the tax allocation agreement. See “Certain Relationships and Related Transactions-Tax Allocation Agreement.”

When will I receive my shares of the Company’s common stock?

Stockholders whose shares are held of record by Cede & Co., or Cede, the nominee of Depository Trust Company, or by any other depository or nominee on their behalf, will have any shares that they acquire credited to the account of Cede or such other depository or nominee. With respect to all other stockholders, stock certificates for all shares acquired will be mailed promptly after the expiration date.

Is there a backstop purchaser?

No. There is no backstop purchaser in this offering.

What effects will this offering have on our outstanding common stock?

After giving effect to this offering, assuming that it is fully subscribed, we will have approximately [·] shares of common stock outstanding, representing an increase of approximately [·]% from the number of our outstanding shares as of the record date. If you fully exercise the rights that we distribute to you and the offering is subscribed in full, your proportional interest in us will remain the same. If you do not exercise any rights, or you exercise less than all of your rights, your interest in us will likely be diluted, as you will likely own a smaller proportional interest in us compared to your interest prior to this offering.

As of September 14, 2017, Icahn Enterprises beneficially owned approximately 74.6% of our common stock. Icahn Enterprises will have the right to subscribe for and purchase shares of our common stock in this offering and has advised us that it intends to exercise its subscription rights in full and to over-subscribe with respect to any unexercised rights, although it is not required to do so.

If all of our stockholders, including Icahn Enterprises, exercise the subscription rights issued to them and this offering is therefore fully subscribed, the beneficial ownership percentage of Icahn Enterprises will not change. All ownership percentages described in this paragraph are based upon our outstanding common stock and the beneficial ownership of Icahn Enterprises as of September 14, 2017.

How much will we receive from this offering and how will such proceeds be used?

We estimate that the net proceeds from this offering will be approximately $50,000,000, before deducting expenses related to this offering.

We intend to use the net proceeds from this offering to replenish working capital used for the acquisitions of Walsroder and Darmex and for other general corporate purposes, including acquisitions and capital expenditures.

If my exercise of rights is not valid or if this offering is not completed, will my subscription payment be refunded to me?

Yes. The subscription agent will hold all funds it receives in a segregated bank account until the completion of this offering. If your exercise of rights is deemed not to be valid or this offering is not completed, all subscription payments received by the subscription agent will be returned as soon as practicable following the expiration of this offering, without interest or penalty. If you own shares through a nominee, it may take longer for you to receive your subscription payments because the subscription agent will return payments through the record holder of your shares.

What fees or charges apply if I purchase shares in this offering?

We are not charging any fee or sales commission to issue rights to you or to issue shares of our common stock to you if you exercise your rights. If you exercise your rights through a broker, custodian bank or other nominee, you are responsible for paying any fees your nominee may charge you.

What are the U.S. federal income tax consequences of exercising my rights?

For U.S. federal income tax purposes, a U.S. holder should not recognize income or loss in connection with the receipt or exercise of rights in this offering. You should consult your tax advisor as to your particular tax consequences resulting from this offering. For a summary of certain U.S. federal income tax consequences of this offering, see “Material U.S. Federal Income Tax Considerations.”

To whom should I send my forms and payment?

If your shares of our common stock are held in the name of a broker, custodian bank or other nominee, then you should deliver all required subscription documents and subscription payments pursuant to the instructions provided by your nominee. If your shares of our common stock are held in your name, then you should send all required subscription documents and subscription payments by mail, hand delivery or overnight courier to the appropriate address listed below:

If delivering by regular mail:

[·]

If delivering by hand or overnight courier:

[·]

You and, if applicable, your nominee are solely responsible for completing delivery to the subscription agent of your rights certificate and all other required subscription documents and payments. You should allow sufficient time for delivery of your subscription materials to the subscription agent and clearance of payments before the expiration of this offering. If you hold your common stock through a broker, custodian bank or other nominee, your nominee may establish an earlier deadline before the expiration date of this offering.

Whom should I contact if I have other questions?

If you have any questions regarding this offering, completion of the rights certificate or any other subscription documents or submitting payment in this offering, please contact the subscription agent toll-free at: [·].

Before deciding whether to exercise your subscription rights, you should carefully read this offering circular, including the information set forth under the heading “Risk Factors” and other information about the terms of the offering.

Reasons for the Rights Offering

We have recently completed two acquisitions and believe that other attractive acquisition opportunities exist in our industry. We used existing cash to complete the prior acquisitions. We are conducting this offering in order to replenish the working capital used for the prior acquisitions and to improve and strengthen our balance sheet and liquidity position. We also intend to use the proceeds of this offering for general corporate purposes, including acquisitions and capital expenditures. This offering would allow us to raise equity capital in a cost-effective manner that allows all of our stockholders the opportunity to participate in the transaction on a pro-rata basis, and if all stockholders exercise their rights, our stockholders may avoid dilution of their ownership interest in the Company, subject to the treatment of fractional shares.

Our Board considered various factors in evaluating this offering and related transactions, including:

· our current capital resources and our future need for additional liquidity and capital;

· our need for increased financial flexibility in order to enable us to implement our business strategy and achieve our business plan;

· the size and timing of this offering;

· the potential dilution to our current stockholders if they choose not to participate in this offering;

· alternatives available for raising capital, including debt and other forms of equity raises;

· the potential impact of this offering on the public float for our common stock; and

· the fact that existing stockholders would have the opportunity to participate on a pro rata basis to purchase additional shares of our common stock, subject to certain restriction.

Terms of the Offer

We are issuing to our stockholders as of the record date non-transferable rights to subscribe for an aggregate of up to [·] shares of our common stock. Each stockholder as of the record date is being issued one non-transferable right for each share of our common stock owned as of 5:00 p.m., New York City time, on the record date.

Each right entitles the holder to purchase [·] shares of our common stock, at a price of $[·] per whole share, which we refer to as the subscription price. Rights may only be exercised in aggregate for whole numbers of shares of our common stock; no fractional shares of our common stock will be issued in this offering.

Rights holders who fully exercise their rights will be entitled to subscribe for additional shares of our common stock that remain unsubscribed as a result of any unexercised subscription rights, which we refer to as the remaining shares. We refer to the right to subscribe for remaining shares as the over-subscription privilege. If sufficient remaining shares of our common stock are available, all over-subscription requests will be honored in full. The over-subscription privilege is subject to certain limitations and pro rata allocations. See “Over-Subscription Privilege” below.

We refer to the subscription rights and over-subscription privileges collectively as rights. Rights may be exercised at any time during the subscription period, which commences on [·], and ends at 5:00 p.m., New York City time, on [·], the expiration date, unless extended by us.

The rights will be evidenced by subscription certificates which will be mailed to stockholders, except as discussed below under “Foreign Stockholders.”

For purposes of determining the number of shares a rights holder may acquire in this offering, broker-dealers, trust companies, banks or others whose shares are held of record by Cede or by any other depository or nominee will be deemed to be the holders of the rights that are issued to Cede or the other depository or nominee on their behalf.

There is no minimum number of rights which must be exercised in order for this offering to close.

Over-Subscription Privilege

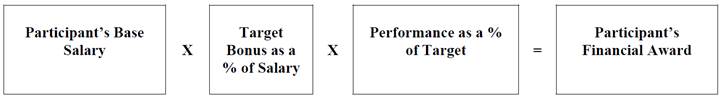

The over-subscription privilege allows rights holders who have exercised their subscription rights in full to subscribe for additional shares of our common stock available as a result of the failure of one or more holders to exercise his or her subscription rights in full. Rights holders should indicate on the subscription certificate that they submit with respect to the exercise of the rights issued to them how many additional shares of our common stock they are willing to acquire pursuant to the over-subscription privilege. If sufficient shares of our common stock are available, we will seek to honor over-subscription requests in full. If requests for shares of our common stock pursuant to the over-subscription privilege exceed the remaining shares available, the available remaining shares will be allocated pro-rata among rights holders who over-subscribe based on the subscription rights exercised. The percentage of remaining shares each over-subscribing rights holder may acquire will be rounded down to result in delivery of whole shares. The allocation process may involve a series of allocations to assure that the total number of remaining shares available for over-subscriptions is distributed on a pro-rata basis. The formula to be used in allocating the available excess shares is as follows:

|

Rights Holder’s Subscription |

|

X |

|

Shares Available for |

|

Total Subscription Rights Exercised |

|

|

|

Banks, brokers, trustees and other nominee holders of rights will be required to certify to the subscription agent, before any over-subscription privilege may be exercised with respect to any particular beneficial owner, as to the aggregate number of rights exercised pursuant to the subscription right and the number of shares subscribed for pursuant to the over-subscription privilege by such beneficial owner.

As of September 14, 2017, Icahn Enterprises beneficially owned 27,261,917 shares of our common stock, constituting approximately 74.6% of our outstanding common stock. Icahn Enterprises is entitled to participate in the rights offering on the same terms and conditions applicable to all rights holders. Icahn Enterprises has advised us that it intends to exercise its subscription rights in full and to over-subscribe with respect to any unexercised rights, although it is not required to do so.

We will not offer or sell in connection with this offering any shares of common stock that are not subscribed for pursuant to the subscription rights or the over-subscription rights.

Expiration of this Offer

This offering will expire at 5:00 p.m., New York City time, on [·], unless extended by us, and rights may not be exercised thereafter.

Any extension of this offering will be followed as promptly as practicable by announcement thereof, and in no event later than 9:00 a.m., New York City time, on the next business day following the previously scheduled expiration date. Without limiting the manner in which we may choose to make such announcement, we will not, unless otherwise required by law, have any obligation to publish, advertise or otherwise communicate any such announcement other than by issuing a press release or such other means of announcement as we deem appropriate.

Determination of the Subscription Price

The $[·] subscription price was set by our Board considering, among other things, our need for equity capital and evaluation of sources of equity financing, feedback from our majority stockholder, Icahn Enterprises, regarding the

terms on which it would be willing to make an additional equity investment in the Company and a survey of the discount from market price associated with the subscription price of other rights offerings. In approving the subscription price, our Board considered, among other things, the following factors:

· the historical and current market price of our common stock, including that the subscription price represents a discount of [·]% to the closing price of our common stock of $ [·] per share on [·] (the date our Board approved the subscription price);

· the fact that holders of rights will have an over-subscription privilege (See “Over-Subscription Privilege” above);

· the level of execution risk of raising of capital in this offering;

· the terms and expenses of this offering relative to other alternatives for raising capital and our ability to access capital through such alternatives;

· comparable precedent transactions, including the range of discounts to the market value (on an actual basis and a pro forma basis taking into account the subscription price and size of this offering) represented by the subscription prices in other rights offerings;

· the size of this offering; and

· the general condition of the securities markets.

In establishing the $[·] subscription price, our Board was aware that Icahn Enterprises uses the indicative net asset value of its subsidiaries, including the Company, as an additional method for considering the value of its assets, and Icahn Enterprises believes that this information can be helpful to its investors. Icahn Enterprises publicly reports the indicative net asset value of its subsidiaries, but cautions that such indicative net asset values do not represent the market price at which such subsidiaries trade and accordingly, data regarding indicative net asset value is of limited use and should not be considered in isolation. As of June 30, 2017, Icahn Enterprises reported the indicative net asset value of its control position in the Company at approximately $164 million or $6.00 per share. The indicative net asset value of Icahn Enterprises’ control interest in the Company was determined based on market comparables, due to the lack of material trading values in the common stock. Based on such comparables, Icahn Enterprises values its control interest at 9.0x Adjusted EBITDA of the Company’s Adjusted EBITDA as estimated by Icahn Enterprises for the twelve months ended June 30, 2017.

Subscription Agent

American Stock Transfer and Trust Company, LLC (“AST”) will act as the subscription agent in connection with this offering. AST will receive fees for its administrative, processing, invoicing and other services, plus reimbursement for all out-of-pocket expenses related to this offering.

Completed subscription certificates with full payment of the subscription price for all whole shares subscribed for through the exercise of the subscription right and the over-subscription privilege must be delivered to the subscription agent by one of the methods described below. We will accept only properly completed and duly executed subscription certificates actually received at any of the addresses listed below, at or prior to 5:00 p.m., New York City time, on the expiration date of this offering or by the close of business on the third business day after the expiration date of this offering following timely receipt of a notice of guaranteed delivery. See “Payment for Shares” below. In this offering circular, close of business means 5:00 p.m., New York City time, on the relevant date.

|

Subscription Certificate Delivery Method |

|

Address/Number |

|

By Notice of Guaranteed Delivery: |

|

Contact an Eligible Guarantor Institution, which may include a commercial bank or trust company, a member firm of a domestic stock exchange or a savings bank or credit union, to notify us of your intent to exercise the rights. |

|

|

|

|

|

By Hand or Overnight Courier: |

|

[·] |

|

By Regular Mail: |

|

[·] |

Delivery to an address other than one of the addresses listed above may not constitute valid delivery and, accordingly, may be rejected by us.

Any questions or requests for assistance concerning the method of subscribing for shares or for additional copies of this offering circular or subscription certificates or notices of guaranteed delivery may be directed to the subscription agent at its telephone number and address listed below:

[·]

Stockholders may also contact their broker-dealers or nominees for information with respect to this offering.

Methods for Exercising Rights

Exercise of the Subscription Right

Rights are evidenced by subscription certificates that, except as described below under “Foreign Stockholders,” will be mailed to record date stockholders or, if a record date stockholder’s shares are held by a depository or nominee on his, her or its behalf, to such depository or nominee. Rights may be exercised by completing and signing the subscription certificate that accompanies this offering circular and mailing it in the envelope provided, or otherwise delivering the completed and duly executed subscription certificate to the subscription agent, together with payment in full for the shares at the subscription price by the expiration date of this offering. Rights may also be exercised by contacting your broker, trustee or other nominee, who can arrange, on your behalf, to guarantee delivery of payment and delivery of a properly completed and duly executed subscription certificate, pursuant to a notice of guaranteed delivery, by the close of business on the third business day after the expiration date. A fee may be charged by your broker, trustee or other nominee for this service. Completed subscription certificates and related payments must be received by the subscription agent prior to 5:00 p.m., New York City time, on or before the expiration date (unless payment is effected by means of a notice of guaranteed delivery as described below under “Payment for Shares”) at the offices of the subscription agent at the address set forth above. All exercises of subscription rights are irrevocable.

Exercise of the Over-Subscription Privilege

Rights holders who fully exercise all rights issued to them may participate in the over-subscription privilege by indicating on their subscription certificate the number of shares of our common stock they are willing to acquire. If sufficient remaining shares of our common stock are available after the primary subscription, we will seek to honor over-subscription requests in full; otherwise remaining shares of our common stock will be allocated on a pro rata basis as described under “Over-Subscription Privilege” above. All exercises of over-subscription privilege are irrevocable.

Record Date Stockholders Whose Shares are Held by a Nominee

Record date stockholders whose shares are held by a nominee, such as a bank, broker-dealer or trustee, must contact that nominee to exercise their rights. In that case, the nominee will complete the subscription certificate on behalf of the record date stockholder and arrange for proper payment by one of the methods set forth under “Payment for Shares” below.

Nominees

Nominees, such as brokers, trustees or depositories for securities, who hold shares for the account of others, should notify the respective beneficial owners of the shares as soon as possible to ascertain the beneficial owners’ intentions and to obtain instructions with respect to the rights. If the beneficial owner so instructs, the nominee should complete the subscription certificate and submit it to the subscription agent with the proper payment as described under “Payment for Shares” below.

General

All questions as to the validity, form, eligibility (including times of receipt and matters pertaining to beneficial ownership) and the acceptance of subscription forms and the subscription price will be determined by us, which determinations will be final and binding. No alternative, conditional or contingent subscriptions will be accepted. We reserve the right to reject any or all subscriptions not properly submitted or the acceptance of which would, in the opinion of our counsel, be unlawful.

We reserve the right to reject any exercise of subscription rights if such exercise is not in accordance with the terms of this offering or not in proper form or if the acceptance thereof or the issuance of shares of our common stock thereto could be deemed unlawful. We reserve the right to waive any deficiency or irregularity with respect to any subscription certificate. Subscriptions will not be deemed to have been received or accepted until all irregularities have been waived or cured within such time as we determine in our sole discretion. We will not be under any duty to give notification of any defect or irregularity in connection with the submission of subscription certificates or incur any liability for failure to give such notification.

The Rights are Not Transferable

The rights are non-transferable and we do not intend to list the rights on any securities exchange or include them in any automated quotation system. Therefore, there will be no market for the rights.

Foreign Stockholders

Subscription certificates will not be mailed to foreign stockholders. Foreign stockholders will receive written notice of this offering. The subscription agent will hold the rights to which those subscription certificates relate for these stockholders’ accounts until instructions are received to exercise the rights, subject to applicable law.

Payment for Shares

Participating rights holders may choose between the following methods of payment:

(1) A participating rights holder may deliver the subscription certificate, together with payment for the shares subscribed for and any additional shares subscribed for pursuant to the over-subscription right, to the subscription agent at one of the subscription agent’s offices set forth above (see “—Subscription Agent”), at or prior to 5:00 p.m., New York City time, on the expiration date.

(2) A participating rights holder may request an Eligible Guarantor Institution as that term is defined in Rule 17Ad-15 under the Exchange Act to send a notice of guaranteed delivery or otherwise guaranteeing delivery of (i) payment of the full subscription price for the whole shares subscribed for and any additional shares subscribed for pursuant to the over-subscription right and (ii) a properly completed and duly executed subscription certificate. The subscription agent will not honor a notice of guaranteed delivery unless a properly completed and duly executed subscription certificate and full payment for the shares is received by the subscription agent at or prior to 5:00 p.m., New York City time, on [·], unless this offering is extended by us.

All payments by a participating rights holder must be in U.S. dollars by money order or check or bank draft drawn on a bank or branch located in the United States and payable to [·]. Payment also may be made by wire transfer to [·] with reference to the rights holder’s name. The subscription agent will deposit all funds received by it prior to the final payment date into a segregated account pending pro-ration and distribution of the shares.

The method of delivery of subscription certificates and payment of the subscription price to us will be at the election and risk of the participating rights holders, but if sent by mail it is recommended that such certificates and payments be sent by registered mail, properly insured, with return receipt requested, and that a sufficient number of days be allowed to ensure delivery to the subscription agent and clearance of payment prior to 5:00 p.m., New York City time, on the expiration date or the date guaranteed payments are due under a notice of guaranteed delivery (as applicable). Because uncertified personal checks may take at least five business days to clear, you are strongly urged to pay, or arrange for payment, by means of certified or cashier’s check or money order.

Whichever of the two methods described above is used, issuance of the shares purchased is subject to collection of checks and actual payment. If a participating rights holder who subscribes for shares as part of the subscription right or over-subscription right does not make payment of any amounts due by the expiration date or the date guaranteed payments are due under a notice of guaranteed delivery, as applicable, the subscription agent reserves the right to take any or all of the following actions: (i) reallocate the shares to other participating rights holders in accordance with the over-subscription right; (ii) apply any payment actually received by it from the participating rights holder toward the purchase of the greatest whole number of shares which could be acquired by such participating rights holder upon exercise of the primary subscription and/or the over-subscription right; and/or (iii) exercise any and all other rights or remedies to which it may be entitled, including the right to set off against payments actually received by it with respect to such subscribed for shares.

All questions concerning the timeliness, validity, form and eligibility of any exercise of rights will be determined by us, whose determinations will be final and binding. We may waive any defect or irregularity, or permit a defect or irregularity to be corrected within such time as we may determine, or reject the purported exercise of any right. Subscriptions will not be deemed to have been received or accepted until all irregularities have been waived or cured within such time as we determine. The subscription agent will not be under any duty to give notification of any defect or irregularity in connection with the submission of subscription certificates or incur any liability for failure to give such notification.

Participating rights holders will have no right to rescind their subscription after receipt of their payment for shares.

Delivery of Shares

Stockholders whose shares are held of record by Cede or by any other depository or nominee on their behalf or their broker-dealers’ behalf will have any shares that they acquire credited to the account of Cede or the other depository or nominee. With respect to all other stockholders, stock certificates for all shares acquired will be mailed as soon as practicable after the expiration date.

Termination

This offering may be terminated by our Board at any time. If this offering is terminated, all rights will expire without value and we will promptly arrange for the refund, without interest or penalty, of all funds received from rights holders. All monies received by the subscription agent in connection with this offering will be held by the subscription agent, on our behalf, in a segregated account. Any interest with respect thereto shall be payable to us even if we determine to terminate this offering and return your subscription payment.

No Recommendation to Stockholders

Our Board has not made, nor will it make, any recommendation to stockholders regarding the exercise of rights under this offering. We cannot predict the price at which our shares of common stock will trade after this offering. You should consult with your legal, tax and financial advisors prior to making your independent investment decision about whether or not to exercise your rights.

Stockholders who exercise rights risk investment loss on new money invested. We cannot assure you that the market price for our common stock will trade at any specified market price or that anyone purchasing shares at the subscription price will be able to sell those shares in the future at the same price or a higher price. If you do not exercise your rights in full, your percentage ownership interest in the Company will likely be diluted. For more information on the risks of participating in this offering, see the section of this offering circular entitled “Risk Factors.”

Effect of This Offering on Existing Stockholders; Interests of Certain Stockholders, Directors and Officers

After giving effect to this offering, assuming that it is fully subscribed, we would have approximately [·] shares of common stock outstanding, representing an increase of approximately [·]% from the number of our outstanding shares as of the record date. If you fully exercise the rights that we distribute to you and the offering is subscribed in

full, your proportional interest in us will remain the same. If you do not exercise any rights, or you exercise less than all of your rights, your interest in us will likely be diluted, as you will likely own a smaller proportional interest in us compared to your interest prior to this offering.

As of September 14, 2017, Icahn Enterprises beneficially owned approximately 74.6% of our common stock. Icahn Enterprises is entitled to participate in the rights offering on the same terms and conditions applicable to all rights holders. Icahn Enterprises has advised us that it intends to exercise its subscription rights in full and to over-subscribe with respect to any unexercised rights, although it is not required to do so.

If all of our stockholders, including Icahn Enterprises, exercise the subscription rights issued to them and this offering is therefore fully subscribed, the beneficial ownership percentage of Icahn Enterprises will not change. All ownership percentages described in this paragraph are based upon out outstanding common stock and the beneficial ownership of Icahn Enterprises as of the record date.

Material U.S. Federal Income Tax Treatment of Rights Distribution

The receipt and exercise of subscription rights by stockholders should generally not be taxable for U.S. federal income tax purposes. You should seek specific tax advice from your tax advisor in light of your particular circumstances and as to the applicability and effect of any other tax laws. See “Material U.S. Federal Income Tax Consequences.”

Charter Amendment

We expect to amend our certificate of incorporation prior to the expiration date to increase the number of shares of common stock that we are authorized to issue from 50,000,000 to 100,000,000. The completion of the rights offering is conditioned on the adoption of this amendment to our certificate of incorporation.

Shares of Our Common Stock Outstanding After this Offering

As of the September 14, 2017, 36,523,999 shares of our common stock were issued and outstanding. Assuming no additional shares of common stock have been or will be issued by the Company after the record date and prior to consummation of this offering and assuming it is fully subscribed, we expect approximately [·] shares of our common stock will be outstanding immediately after completion of this offering.

Other Matters

We are not making this offering in any state or other jurisdiction in which it is unlawful to do so, nor are we distributing or accepting any offers to purchase any shares of our common stock from subscription rights holders who are residents of those states or other jurisdictions or who are otherwise prohibited by federal or state laws or regulations to accept or exercise the subscription rights. We may delay the commencement of this offering in those states or other jurisdictions, or change the terms of this offering, in whole or in part, in order to comply with the securities laws or other legal requirements of those states or other jurisdictions. Subject to state securities laws and regulations, we also have the discretion to delay allocation and distribution of any shares you may elect to purchase by exercise of your subscription rights in order to comply with state securities laws. We may decline to make modifications to the terms of this offering requested by those states or other jurisdictions, in which case, if you are a resident in those states or jurisdictions or if you are otherwise prohibited by federal or state laws or regulations from accepting or exercising the subscription rights, you will not be eligible to participate in this offering. However, we are not currently aware of any states or jurisdictions that would preclude participation in this offering.

You should carefully consider the risk factors set forth below as well as the other information contained in this offering circular before exercising your subscription rights and investing in our common stock. The risks described below are not the only risks facing us. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect our business operations. Any of the following risks could materially adversely affect our business, financial condition or results of operations. In such case, you may lose all or part of your investment.

Risks Related to our Business

We face competitors that are better capitalized, and the continuous-flow nature of the casings manufacturing process forces competitors to compete based on price in order to maintain volume, which could adversely affect our revenues and results.

We face competition in the United States and internationally from competitors that may have substantially greater financial resources than we have. Currently, our primary competitors include Viscofan, S.A., Kalle GmbH and Visko Teepak, although new competitors could enter the market or competing products could be introduced. The continuous-flow nature of the casings manufacturing process has historically provided an incentive to competitors in our industry to compete based on price in order to maintain volume, which could result in lower pricing. Viskase believes the current and planned cellulose production capacity in its industry exceeds global demand and will continue to do so in the near term. We attempt to differentiate our products on the basis of product quality and performance, product development, service, sales and distribution, but these efforts may not be sufficient to offset price competition. If prices decline, it may materially adversely affect our profitability, whereas certain of our competitors who are better capitalized may be positioned to absorb such price declines. Any of these factors could result in a material reduction of our revenue, gross profit margins and operating results.

We receive our raw materials from a limited number of suppliers, and problems with their supply could impair our ability to meet our customer’s product demands.

Our principal raw materials, paper, pulp, polyamide resins and key chemicals, namely sodium hydroxide, carbon disulfide and sulfuric acid, constitute an important aspect and cost factor of our operations. We generally purchase our paper and pulp from a single source or a small number of suppliers, and purchase sodium hydroxide and carbon disulfide from a few sources. Any inability of our suppliers to timely deliver raw materials or any unanticipated adverse change in our suppliers could be disruptive and costly to us. Our inability to obtain raw materials from our suppliers would require us to seek alternative sources. These alternative sources may not be adequate for all of our raw material needs, nor may adequate raw material substitutes exist in a form that our processes could be modified to use. These risks could materially and adversely impact our sales volume, revenues, costs of goods sold and, ultimately, profit margins.

Our failure to efficiently respond to industry changes in casings technology could jeopardize our ability to retain our customers and maintain our market share.

We and other participants in our industry have considered alternatives to cellulosic casings for many years. As resin technology improves or other technologies develop, alternative casings or other manufacturing methods have been developed and may continue to be improved that threaten the long-term sustainability and profitability of cellulosic casings, our core product, and our fibrous casings. Our failure to anticipate, develop or efficiently and timely integrate new technologies that provide viable alternatives to cellulosic casings, including collagen, plastics and film alternatives, may cause us to lose customers and market share to competitors integrating such technologies, which, in turn, would negatively impact our revenues and operating results.

Sales of our products could be negatively affected by problems or concerns with the safety and quality of food products.

We could be adversely affected if consumers in the food markets were to lose confidence in the safety and quality of meat products, particularly with respect to processed meat products for which casings are used, such as hot dogs and

sausages. Outbreaks of, or even adverse publicity about the possibility of, diseases such as avian influenza and “mad cow disease,” food-borne pathogens such as E. coli and listeria and any other food safety problems or concerns relating to meat products, may discourage consumers from buying meat products. These risks could also result in additional governmental regulations and/or cause production and delivery disruptions or product recalls. Each of these risks could adversely affect the demand for our products and consequently our sales volumes and revenues.

Changing dietary trends and consumer preferences could weaken the demand for our products.

Various medical studies detailing the health-related attributes of particular foods, including meat products, affect the purchase patterns, dietary trends and consumption preferences of consumers. These patterns, trends and preferences are routinely changing. For example, general dietary concerns about meat products, such as the cholesterol, calorie, sodium and fat content of such products, could result in reduced demand for such products, which would, in turn, cause a reduction in the demand for our products and a decrease in our sales volume and revenue.

Our facilities are capital intensive, and we may not be able to obtain financing to fund necessary capital expenditures.

Our business is capital intensive. We operate eleven manufacturing facilities and six distribution centers as part of our business. We are required to make substantial capital expenditures and substantial repair and maintenance expenditures to maintain, repair, upgrade and expand existing equipment and facilities to keep pace with competitive developments. In addition, we are required to invest in technological advances to maintain compliance with safety standards and environmental laws or regulations. If we need to obtain additional funds to finance such capital expenditures, we may not be able to do so on terms favorable to us, or at all, which would ultimately negatively affect our production and operating results.

Business interruptions at any of our production facilities could increase our operating costs, decrease our sales or cause us to lose customers.

The reliability of our production facilities is critical to the success of our business. In recent years, we have streamlined our productive capacity to be better aligned with our sale volumes. We generally seek to operate our facilities at levels that leave little or no excess production capacity for certain products. If the operations of any of our manufacturing facilities were interrupted or significantly delayed for any reason, including labor stoppages, we may be unable to shift production to another facility without incurring a significant drop in production. Such a drop in production would negatively affect our sales and our relationships with our customers.

We are subject to significant minimum contribution requirements and market exposure with respect to our defined benefit plan, both of which could adversely affect our cash flow.

While we have frozen participation in our defined benefit plan, we are subject to substantial minimum contribution requirements with respect to our pension plan. Although the amount fluctuates, our aggregate minimum funding contribution requirement from 2017 through 2021 is approximately $19.7 million. This amount could increase or decrease due to market factors, including expected returns on plan assets and the discount rate used to measure accounting liabilities, among other factors. Our unfunded pension plan liabilities with respect to our United States employees were projected to be $45.8 million as of June 30, 2017. The funds in our defined benefit plan are subject to market risks, including fluctuating discount rates, interest rates and asset returns.

Our foreign operations expose us to risks that may materially adversely affect our financial condition, results of operations, liquidity and cash flows.

We currently have manufacturing facilities, distribution centers and service centers in eight foreign countries, including Brazil, Canada, France, Germany, Italy, Mexico, the Philippines and Poland. A significant portion of our annual revenues are generated outside the U.S. Operating in many different countries exposes us to varying risks, which include: (i) multiple, and sometimes conflicting, foreign regulatory requirements and laws that are subject to change and are often much different than the domestic laws in the U.S., including laws relating to taxes, consumer privacy, data security, employment matters, import and export controls and the protection of our trademarks and