UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

☒ |

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended February 29, 2020

OR

|

☐ |

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from __________ to __________

Commission File Number 1-5807

ENNIS, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Texas |

|

75-0256410 |

|

(State or Other Jurisdiction of Incorporation or Organization) |

|

(I.R.S. Employer Identification No.) |

|

2441 Presidential Pkwy., Midlothian, Texas |

|

76065 |

|

(Address of Principal Executive Offices) |

|

(Zip code) |

(Registrant’s Telephone Number, Including Area Code) (972) 775-9801

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

Common Stock, par value $2.50 per share |

|

EBF |

|

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated Filer |

☐ |

|

|

Accelerated filer |

☒ |

|

Non-accelerated filer |

☐ |

|

|

Smaller reporting company |

☐ |

|

Emerging growth company. |

☐ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of voting stock held by non-affiliates of the Registrant as of August 31, 2019 was approximately $507 million. Shares of voting stock held by executive officers, directors and holders of more than 10% of the outstanding voting stock have been excluded from this calculation because such persons may be deemed to be affiliates. Exclusion of such shares should not be construed to indicate that any of such persons possesses the power, direct or indirect, to control the Registrant, or that any such person is controlled by or under common control with the Registrant.

The number of shares of the Registrant’s Common Stock, par value $2.50, outstanding at April 27, 2020 was 26,099,594.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Proxy Statement for the 2020 Annual Meeting of Shareholders are incorporated by reference into Part III of this Report.

FORM 10-K

FOR THE PERIOD ENDED FEBRUARY 29, 2020

TABLE OF CONTENTS

|

|

|

|

|

Item 1 |

4 |

|

|

Item 1A |

7 |

|

|

Item 1B |

12 |

|

|

Item 2 |

12 |

|

|

Item 3 |

14 |

|

|

Item 4 |

14 |

|

|

|

|

|

|

|

|

|

|

Item 5 |

14 |

|

|

Item 6 |

16 |

|

|

Item 7 |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

17 |

|

Item 7A |

27 |

|

|

Item 8 |

27 |

|

|

Item 9 |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

27 |

|

Item 9A |

27 |

|

|

Item 9B |

28 |

|

|

|

|

|

|

|

|

|

|

Item 10 |

29 |

|

|

Item 11 |

29 |

|

|

Item 12 |

Security Ownership of Certain Beneficial Owners and Management and Related |

29 |

|

Item 13 |

Certain Relationships and Related Transactions, and Director Independence |

29 |

|

Item 14 |

29 |

|

|

|

|

|

|

|

|

|

|

Item 15 |

30 |

|

|

|

32 |

2

Cautionary Statements Regarding Forward-Looking Statements

All of the statements in this Annual Report on Form 10-K, other than historical facts, are forward-looking statements, including, without limitation, the statements made in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” particularly under the caption “Overview.” As a general matter, forward-looking statements are those focused upon anticipated events or trends, expectations, and beliefs relating to matters that are not historical in nature. The words “could,” “should,” “feel,” “anticipate,” “aim,” “preliminary,” “expect,” “believe,” “estimate,” “intend,” “intent,” “plan,” “will,” “foresee,” “project,” “forecast,” or the negative thereof or variations thereon, and similar expressions identify forward-looking statements.

The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for these forward-looking statements. In order to comply with the terms of the safe harbor, Ennis, Inc. notes that forward-looking statements are subject to known and unknown risks, uncertainties and other factors relating to its operations and business environment, all of which are difficult to predict and many of which are beyond the control of Ennis, Inc. These known and unknown risks, uncertainties and other factors could cause actual results to differ materially from those matters expressed in, anticipated by or implied by such forward-looking statements.

These statements reflect the current views and assumptions of management with respect to future events. Ennis, Inc. does not undertake, and hereby disclaims, any duty to update these forward-looking statements, even though its situation and circumstances may change in the future. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date of this report. The inclusion of any statement in this report does not constitute an admission by Ennis, Inc. or any other person that the events or circumstances described in such statement are material.

We believe these forward-looking statements are based upon reasonable assumptions. All such statements involve risks and uncertainties, and as a result, actual results could differ materially from those projected, anticipated or implied by these statements. Such forward-looking statements involve known and unknown risks, including but not limited to, general economic, business and labor conditions and the potential impact on our operations; our ability to implement our strategic initiatives and control our operational costs; dependence on a limited number of key suppliers; our ability to recover the rising cost of raw materials and other costs (including energy, freight, labor, and benefit costs) in markets that are highly price competitive and volatile; the impact of the novel coronavirus (COVID-19) pandemic or future pandemics on the U.S. and local economies, our business operations, our workforce, our supply chain and our customer base; our ability to timely or adequately respond to technological changes in the industry; the impact of the Internet and other electronic media on the demand for forms and printed materials; the impact of foreign competition, tariffs, trade regulations and import restrictions; customer credit risk; competitors’ pricing strategies; a decline in business volume and profitability could result in an impairment in our reported goodwill negatively impacting our operational results; our ability to retain key management personnel; our ability to identify, manage or integrate acquisitions; and changes in government regulations including measures intended to minimize the impact of COVID-19.

3

Overview

Ennis, Inc. (formerly Ennis Business Forms, Inc.) (collectively with its subsidiaries, the “Company,” “Registrant,” “Ennis,” or “we,” “us,” or “our”) was organized under the laws of Texas in 1909. We and our subsidiaries print and manufacture a broad line of business forms and other business products. We distribute business products and forms throughout the United States primarily through independent distributors. This distributor channel encompasses independent print distributors, commercial printers, direct mail, fulfillment companies, payroll and accounts payable software companies, and advertising agencies, among others. We also sell products to many of our competitors to satisfy their customers’ needs.

Business Overview

Our management believes we are the largest provider of business forms, pressure-seal forms, labels, tags, envelopes, and presentation folders to independent distributors in the United States.

We are in the business of manufacturing, designing and selling business forms and other printed business products primarily to distributors located in the United States. We operate 61 manufacturing plants throughout the United States in 21 strategically located states as one reportable segment. Approximately 95% of the business products we manufacture are custom and semi-custom products, constructed in a wide variety of sizes, colors, number of parts and quantities on an individual job basis, depending upon the customers’ specifications.

The products we sell include snap sets, continuous forms, laser cut sheets, tags, labels, envelopes, integrated products, jumbo rolls and pressure sensitive products in short, medium and long runs under the following labels: Ennis®, Royal Business Forms®, Block Graphics®, Specialized Printed Forms®, 360º Custom LabelsSM, ColorWorx®, Enfusion®, Uncompromised Check Solutions®, VersaSeal®, Ad ConceptsSM, FormSource LimitedSM, Star Award Ribbon Company®, Witt Printing®, B&D Litho®, Genforms®, PrintGraphics®, Calibrated Forms®, PrintXcel®, Printegra®, Falcon Business FormsSM, Forms ManufacturersSM, Mutual Graphics®, TRI-C Business FormsSM, Major Business SystemsSM, Independent PrintingSM, Hoosier Data Forms®, Hayes Graphics®, Wright Business GraphicsSM, Wright 360SM, Integrated Print & GraphicsSM, the Flesh CompanySM, Impressions DirectSM, and Ace FormsSM. We also sell the Adams McClure® brand (which provides Point of Purchase advertising for large franchise and fast food chains as well as kitting and fulfillment); the Admore®, Folder Express® and Independent Folders® brands (which provide presentation folders and document folders); Ennis Tag & LabelSM (which provides custom printed, high performance labels and custom and stock tags); Allen-Bailey Tag & LabelSM, Atlas Tag & Label®, Kay Toledo Tag®, and Special Service Partners® (SSP) (which provides custom and stock tags and labels); Trade Envelopes®, Block Graphics®, Wisco®, and National Imprint Corporation® (which provide custom and imprinted envelopes) and Northstar® and General Financial Supply® (which provide financial and security documents).

We sell predominantly through independent distributors, as well as to many of our competitors. Northstar Computer Forms, Inc., one of our wholly-owned subsidiaries, also sells direct to a small number of customers, generally large banking organizations (where a distributor is not acceptable or available to the end-user). Adams McClure, LP, a wholly-owned subsidiary, also sells direct to a small number of customers, where sales are generally through advertising agencies.

The printing industry generally sells its products either predominantly to end users, a market dominated by a few large manufacturers, such as R.R. Donnelley and Sons, Staples, Inc., Standard Register Co. (a subsidiary of Taylor Corporation), and Cenveo, Inc., or, like the Company, through a variety of independent distributors and distributor groups. While it is not possible, because of the lack of adequate public statistical information, to determine the Company’s share of the total business products market, management believes the Company is the largest producer of business forms, pressure-seal forms, labels, tags, envelopes, and presentation folders in the United States distributing primarily through independent distributors.

4

There are a number of competitors that operate in this segment, ranging in size from single employee-owned operations to multi-plant organizations. We believe our strategic locations and buying power permit us to compete on a favorable basis within the distributor market on competitive factors, such as service, quality, and price.

Distribution of business forms and other business products throughout the United States is primarily done through independent distributors, including business forms distributors, resellers, direct mail, commercial printers, payroll and accounts payable software companies, and advertising agencies.

Raw materials principally consist of a wide variety of weights, widths, colors, sizes, and qualities of paper for business products purchased primarily from one major supplier at favorable prices based on the volume of business.

Business products usage in the printing industry is generally not seasonal. General economic conditions and contraction of the traditional business forms industry are the predominant factors in quarterly volume fluctuations.

Recent Acquisitions

We have completed a number of acquisitions in recent years. On July 15, 2019, we acquired all the outstanding stock of The Flesh Company (“Flesh”) for approximately $9.9 million (which includes potential earn-out consideration of up to $500,000) plus the assumption of trade payables, subject to final working capital and certain other adjustments. The earn-out consideration is capped at $500,000 and is payable over the four years following the closing if certain minimum operating income levels are achieved. We recorded intangible assets with definite lives of approximately $1.2 million in connection with the transaction. Flesh, together with its wholly owned subsidiary, Impressions Direct, Inc. (“Impressions Direct”), is a printing company with two locations, with the St. Louis location containing Flesh’s corporate office and the direct mail operations of Impressions Direct, and the Parsons, Kansas location containing Flesh’s main manufacturing facility and warehouse. The acquisition of Flesh, which prior to the acquisition generated approximately $31.0 million in sales for its fiscal year ended September 30, 2018, expands our operations with respect to business forms, checks, direct mail services, integrated products and labels.

On March 16, 2019, we acquired the assets of Integrated Print & Graphics (“Integrated”), which is based in South Elgin, Illinois, for $8.9 million in cash plus the assumption of trade payables, subject to certain adjustments. Goodwill of $893,000 recognized as a part of the acquisition is deductible for tax purposes. We also recorded intangible assets with definite lives of approximately $1.8 million in connection with the transaction. The acquisition of Integrated, which prior to the acquisition generated approximately $20.0 million in sales for its fiscal year ended December 31, 2018, creates additional capabilities within our high color commercial print product line.

On July 31, 2018, we acquired, by way of a merger, all of the outstanding equity interests of Wright Business Forms, Inc., d/b/a Wright Business Graphics (“Wright”), a printing company headquartered in Portland, Oregon with additional locations in Washington and California. As partial consideration for the acquisition, we issued an aggregate of 829,126 shares of our common stock to the stockholders of Wright, valued at approximately $16.2 million at the time of issuance under the merger agreement. An additional $19.7 million in cash was paid to the stockholders of Wright, subject to a final working capital adjustment, and $2.6 million was paid to extinguish outstanding debt. The goodwill recognized as a part of the transaction is not deductible for tax purposes. Wright produces forms, pressure seal, packaging, direct mail, checks, statement processing and commercial printing and sells mainly through distributors and resellers. Wright, prior to the acquisition, generated approximately $58.0 million in sales for its fiscal year ended March 31, 2018 and continues to operate under its brand names.

On April 30, 2018, we acquired the assets of Allen-Bailey Tag & Label (“ABTL”), a tag and label operation located in New York for $4.7 million in cash plus the assumption of trade payables, subject to a working capital adjustment. In addition, contingent consideration of up to $500,000 is payable to the sellers if certain sales levels are maintained over the next three years. Prior to the acquisition, ABTL generated approximately $12.0 million in sales for the twelve months ended December 31, 2017. On July 7, 2017, we acquired the assets of a separate tag operation located in Ohio for $1.4 million in cash plus the assumption of certain accrued liabilities. Management considers both of these acquisitions immaterial.

5

Patents, Licenses, Franchises and Concessions

Other than the patent for our VersaSeal® product, we do not have any significant patents, licenses, franchises, or concessions.

Intellectual Property

We market our products under a number of trademarks and trade names. The protection of our trademarks is important to our business. We believe that our registered and common law trademarks have significant value and these trademarks are important to our ability to create and sustain demand for our products. We have registered trademarks in the United States for Ennis®, EnnisOnlineSM, B&D Litho of AZ®, B&D Litho®, ACR®, Block Graphics®, Enfusion®, 360º Custom LabelsSM, Admore®, CashManagementSupply.comSM, Securestar®, Northstar®, MICRLink®, MICR ConnectionTM, Ennisstores.comTM, General Financial Supply®, Calibrated Forms®, PrintXcelSM, Printegra®, Trade Envelopes®, Witt Printing®, Genforms®, Royal Business Forms®, Crabar/GBFSM, BF&SSM, Adams McClure®, Advertising ConceptsTM, ColorWorx®, Allen-Bailey Tag & LabelSM, Atlas Tag & Label®, PrintgraphicsSM, Uncompromised Check Solutions®, VersaSeal®, VersaSeal SecureX®, Folder Express®, Wisco®, National Imprint Corporation®, Star Award Ribbon®, Kay Toledo Tag®, Falcon Business FormsSM, Forms ManufacturersSM, Mutual Graphics®, TRI-C Business FormsSM, SSP®, EOSTouchpoint®, Printersmall®, Check Guard®, Envirofolder®, Independent®, Independent Checks®, Independent Folders®, Independent Large Format Solutions®, Wright Business GraphicsSM, Wright 360SM, Integrated Print & GraphicsSM, the Flesh CompanySM, Impressions DirectSM, Ace FormsSM, MegaformSM, Safe®, and variations of these brands as well as other trademarks. We have similar trademark registrations internationally.

Customers

No single customer accounts for as much as five percent of our consolidated net sales or accounts receivable.

Backlog

At February 29, 2020, our backlog of firm orders was approximately $21.8 million, compared to approximately $22.5 million at February 28, 2019. Due to the impact of COVID-19 on all businesses, our backlog as of April 30, 2020 was $17.5 million.

Research and Development

While we seek new products to sell through our distribution channel, there have been no material amounts spent on research and development in fiscal years 2020, 2019 or 2018.

Environment

We are subject to various federal, state, and local environmental laws and regulations concerning, among other things, wastewater discharges, air emissions and solid waste disposal. Our manufacturing processes do not emit substantial foreign substances into the environment. We do not believe that our compliance with federal, state, or local statutes or regulations relating to the protection of the environment has any material effect upon capital expenditures, earnings or our competitive position. There can be no assurance, however, that future changes in federal, state, or local regulations, interpretations of existing regulations or the discovery of currently unknown problems or conditions will not require substantial additional expenditures. Similarly, the extent of our liability, if any, for past failures to comply with laws, regulations, and permits applicable to our operations cannot be determined.

Employees

At February 29, 2020, we had 2,505 employees. 242 employees are represented by labor unions under collective bargaining agreements, which are subject to periodic negotiations. We believe we have a good working relationship with all of the unions that represent our employees.

Available Information

Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities and Exchange Act of 1934 are

6

available free of charge under the Investors Relations page on our website, www.ennis.com, as soon as reasonably practicable after such reports are electronically filed with, or furnished to, the Securities and Exchange Commission (“SEC”). Information on our website is not included as a part of, or incorporated by reference into, this report. Our SEC filings are also available through the SEC’s website, www.sec.gov.

You should carefully consider the risks described below, as well as the other information included or incorporated by reference in this Annual Report on Form 10-K, before making an investment in our common stock. The risks described below are not the only ones we face in our business. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may also impair our business operations. If any of the following risks occur, our business, financial condition or operating results could be materially harmed. In such an event, our common stock could decline in price and you may lose all or part of your investment.

Our business may be adversely affected by the ongoing COVID-19 pandemic.

In December 2019, a novel strain of coronavirus (COVID-19) was reported in Wuhan, China, and by early 2020, the virus had spread to other countries, including the United States. The COVID-19 pandemic is a significant threat to the health and economic wellbeing affecting our customers, suppliers and workforce. Federal, state and local authorities have recommended social distancing and have imposed, or are considering, quarantine and isolation measures on large portions of the population, including mandatory closures of businesses deemed “non-essential” in certain jurisdictions. As of the date of this Annual Report on Form 10-K, our plants are deemed “essential,” largely due to our business’s support of many important sectors of the economy, including healthcare, government, food and beverage and banking, and thus most of our plants are currently operating at close-to-normal utilization levels. As the virus continues to evolve, however, authorities could take new steps to control the outbreak, which could result in the determination that our plants are no longer “essential” and therefore must close, among other outcomes. Even if our plants are not forced to close by government regulation, the virus, in addition to prolonged stay-at-home orders or other related regulations, could depress consumer demand or disrupt our supply chain. Depending on these developments and others, we may deem it necessary to close plants, furlough or lay off employees or take other cost-cutting measures.

The extent of the impact of COVID-19 on our business and financial results will depend on future developments, including the duration and spread of the outbreak within the markets in which we operate, the related impact on our customers and suppliers and the possibility of an economic recession after the virus has subsided, all of which are highly uncertain and ever-changing. Any of these factors could materially increase our costs, negatively impact our sales and damage our results of operations and liquidity. The severity and duration of any such impacts, including after the virus has subsided, cannot be predicted.

Our results and financial condition are affected by global and local market conditions, and competitors’ pricing strategies, which can adversely affect our sales, margins, and net income.

Our results of operations can be affected by local, national and worldwide market conditions. The consequences of domestic and international economic uncertainty or instability, volatility in commodity markets, and domestic or international policy uncertainty, all of which we have seen in the past, can all impact economic activity. Unfavorable conditions can depress the demand for our products and thus sales in a given market and may prompt competitor’s pricing strategies that adversely affect our margins or constrain our operating flexibility. Certain macroeconomic events, such as the past crisis in the financial markets, could have a more wide-ranging and prolonged impact on the general business environment, which could also adversely affect us. In particular, the ongoing COVID-19 pandemic has negatively impacted local, national and worldwide economies, introduced extreme market volatility and, depending on severity and duration, may potentially trigger a prolonged nationwide or global recession. Whether we can manage these risks effectively depends on several factors, including (i) our ability to manage movements in commodity prices and the impact of government actions to manage national economic conditions such as consumer spending, inflation rates and unemployment levels, particularly given the past volatility in the global financial markets, (ii) the impact on our margins of labor costs given our labor-intensive business model, the trend toward higher wages in both mature and developing markets and the potential impact of union organizing efforts on day-to-day operations of our manufacturing facilities and (iii) other factors, which may be beyond our control.

7

The terms and conditions of our credit facility impose certain restrictions on our operations. We may not be able to raise additional capital, if needed, for proposed expansion projects.

The terms and conditions of our credit facility impose certain restrictions on our ability to incur additional debt, make capital expenditures, acquisitions and asset dispositions, as well as impose other customary covenants, such as requiring that our fixed charge coverage ratio not be less than 1.25:1.00 and our total leverage ratio not exceed 3.00:1:00. Our ability to comply with the covenants may be affected by events beyond our control, such as distressed and volatile financial and/or consumer markets, including due to the impact of the ongoing COVID-19 pandemic. A breach of any of these covenants could result in a default under our credit facility. In the event of a default, the bank could elect to declare the outstanding principal amount of our credit facility, all interest thereon, and all other amounts payable under our credit facility to be immediately due and payable. As of February 29, 2020, we were in compliance with all terms and conditions of our credit facility, which matures on November 11, 2021.

Challenging financial market conditions and continued decline in long-term interest rates could adversely impact the funded status of our pension plan.

We maintain a noncontributory defined benefit retirement plan (the “Pension Plan”) covering approximately 16% of our employees. Included in our financial results are Pension Plan costs that are measured using actuarial valuations. The actuarial assumptions used may differ from actual results. In addition, as our Pension Plan assets are invested in marketable securities, severe fluctuations in market values could potentially negatively impact our funded status, recorded pension liability, and future required minimum contribution levels. A decline in long-term debt interest rates puts downward pressure on the discount rate used by plan sponsors to determine their pension liabilities. Each 10 basis point change in the discount rate impacts our computed pension liability by about $930,000. Similar to fluctuations in market values, a drop in the discount rate could potentially negatively impact our funded status, recorded pension liability and future contribution levels. Also, continued changes in the mortality tables could potentially impact our funded status. As of February 29, 2020, the Pension Plan was 87.2% funded on a projected benefit obligation (PBO) basis and 95.7% on an accumulated benefit obligation (ABO) basis.

We may be unable to identify or to complete acquisitions or to successfully integrate the businesses we acquire.

We have evaluated, and may continue to evaluate, potential acquisition transactions. We attempt to address the potential risks inherent in assessing the attractiveness of acquisition candidates, as well as other challenges such as retaining the employees and integrating the operations of the businesses we acquire. Integrating acquired operations involves significant risks and uncertainties, including maintenance of uniform standards, controls, policies and procedures; diversion of management’s attention from normal business operations during the integration process; unplanned expenses associated with integration efforts; and unidentified issues not discovered in due diligence, including legal contingencies. Due to these risks and others, there can be no guarantee that the businesses we acquire will lead to the cost savings or increases in net sales that we expect or desire. Additionally, there can be no assurance that suitable acquisition opportunities will be available in the future, which could harm our strategic business plan as acquisitions are part of our strategy to offset normal print attrition.

We may be required to write down goodwill and other intangible assets, which could cause our financial condition and results of operations to be negatively affected in the future.

When we acquire a business, a portion of the purchase price may be allocated to goodwill and other identifiable intangible assets. The amount of the purchase price which is allocated to goodwill and other intangible assets is the excess of the purchase price over the net identifiable tangible assets acquired. The annual impairment test is based on several factors requiring judgment. An impairment may be caused by any number of factors outside our control, such as a decline in market conditions, including due to the COVID-19 pandemic, another pandemic or some other event, protracted recovery from poor market conditions, or other factors that may be tied to such negative economic events, including changes to a competitor’s pricing strategies. To date, we have not been required to take an impairment charge relating to our existing business, but continued sale-side pressures due to technology transference, competitor pricing pressures, and economic uncertainties could result in a determination that a portion of the recorded value of goodwill and intangible assets may be required to be written down. Although such a charge impairment charge relating to our existing business, but continued sale-side pressures due to technology would be a noncash expense, it would impact our reported operating results and financial position. The Company has mitigated some of this risk by changing from indefinite lives to definite lives accounting for all intangibles assets.

8

Under definite lives accounting, the value of intangible assets is gradually amortized over time, instead of being left on the Company’s books in full and only being written down when an impairment event is deemed to have occurred. At February 29, 2020, our consolidated goodwill and other intangible assets were approximately $82.5 million and $56.6 million, respectively.

Digital technologies will continue to erode the demand for our printed business documents.

The increasing sophistication of software, internet technologies, and digital equipment combined with our customers’ general preference, as well as governmental influences for paperless business environments will continue to reduce the number of traditional printed documents sold. Moreover, the documents that will continue to coexist with software applications will likely contain less value-added print content.

Many of our custom-printed documents help companies control their internal business processes and facilitate the flow of information. These applications will increasingly be conducted over the internet or through other electronic payment systems. The predominant method of our customers’ communication to their customers is by printed information. As their customers become more accepting of internet communications, our clients may increasingly opt for what is perceived to be less costly electronic option, which would reduce our revenue. The pace of these trends is difficult to predict. These factors will tend to reduce the industry-wide demand for printed documents and require us to gain market share to maintain or increase our current level of print-based revenue which could place pressure on our operating margins.

In response to the gradual obsolescence of our standardized forms business, we continue to develop our capability to provide custom and full-color products. If new printing capabilities and new product introductions do not continue to offset the obsolescence of our standardized business forms products, and we are unable to increase our market share, our sales and profits will be affected. Decreases in sales of our standardized business forms and products due to obsolescence could also reduce our gross margins or impact the value of our recorded goodwill and intangible assets. This reduction could in turn adversely impact our profits, unless we are able to offset the reduction through the introduction of new high margin products and services or realize cost savings in other areas.

Our distributor customers may be acquired by other manufacturers who redirect business within their plants.

Some of our customers are being absorbed by the distribution channels of some of our manufacturing competitors. However, we do not believe this will significantly impact our business model. We have continued to sell to some of these customers even after they were absorbed by our competition because of the breadth of our product line and our geographic diversity.

Our distributors face increased competition from various sources, such as office supply superstores. Increased competition may require us to reduce prices or to offer other incentives in order to enable our distributors to attract new customers and retain existing customers.

Low price, high value office supply chain stores offer standardized business forms, checks and related products. Because of their size, these superstores have the buying power to offer many of these products at competitive prices. These superstores also offer the convenience of “one-stop” shopping for a broad array of office supplies that our distributors do not offer. In addition, superstores have the financial strength to reduce prices or increase promotional discounts to expand market share. This could result in us reducing our prices or offering incentives in order to enable our distributors to attract new customers and retain existing customers, which could reduce our profits.

Technological improvements may reduce our competitive advantage over some of our competitors, which could reduce our profits.

Improvements in the cost and quality of digital print technology is enabling some of our competitors to gain access to products of complex design and functionality at competitive costs. Increased competition from these competitors could force us to reduce our prices in order to attract and retain customers, which could reduce our profits.

We could experience labor disputes that could disrupt our business in the future.

As of February 29, 2020, approximately 10% of our employees are represented by labor unions under collective bargaining agreements, which are subject to periodic negotiations. While we believe we have a good working

9

relationship with all of the unions, there can be no assurance that any future labor negotiations will prove successful, which may result in a significant increase in the cost of labor, or may break down and result in the disruption of our business or operations.

We obtain our raw materials from a limited number of suppliers, and any disruption in our relationships with these suppliers, or any substantial increase in the price of raw materials or material shortages could have a material adverse effect on us.

We currently purchase the majority of our paper products from one major supplier at favorable costs based on the volume of business, and traditionally we have purchased our paper products from a limited number of suppliers, all of which must meet stringent quality and on-time delivery standards under long-term contracts. Fluctuations in the quality of our paper, unexpected price changes or other factors that relate to our suppliers could have a material adverse effect on our operating results. In particular, the ongoing COVID-19 pandemic may make it more expensive or more difficult to source raw materials for our products, whether from our existing suppliers or new suppliers, and these challenges could negatively impact the cost or availability of our raw materials.

Paper is a commodity that is subject to frequent increases or decreases in price, and these fluctuations are sometimes significant. Domestic paper prices have increased and decreased in recent years due to global market conditions. There is no effective market of derivative instruments to insulate us against unexpected changes in price of paper in a cost-effective manner, and negotiated purchase contracts provide only limited protection against price increases. Generally, when paper prices increase, we attempt to recover the higher costs by raising the prices of our products to our customers. In the price-competitive marketplaces in which we operate, however, we may not always be able to pass through any or all of the higher costs. As such, any significant increase in the price of paper or shortage in its availability, whether due to the COVID-19 pandemic, the strength of the U.S. dollar, changes in mill ownership or other factors, could have a material adverse effect on our results of operations.

We face intense competition to gain market share, which may lead some competitors to sell substantial amounts of goods at prices against which we cannot profitably compete.

Our marketing strategy is to differentiate ourselves by providing quality service and quality products to our customers. Even if this strategy is successful, the results may be offset by reductions in demand or price declines due to competitors’ pricing strategies or other micro or macro-economic factors. We face the risk of our competition following a strategy of selling its products at or below cost in order to cover some amount of fixed costs, especially in stressed economic times.

Environmental regulations may impact our future operating results.

We are subject to extensive and changing federal, state and foreign laws and regulations establishing health and environmental quality standards, concerning, among other things, wastewater discharges, air emissions and solid waste disposal, and may be subject to liability or penalties for violations of those standards. We are also subject to laws and regulations governing remediation of contamination at facilities currently or formerly owned or operated by us or to which we have sent hazardous substances or wastes for treatment, recycling or disposal. We may be subject to future liabilities or obligations as a result of new or more stringent interpretations of existing laws and regulations. In addition, we may have liabilities or obligations in the future if we discover any environmental contamination or liability at any of our facilities, or at facilities we may acquire.

We are subject to taxation related risks.

Tax laws are dynamic and subject to change as new laws are passed and new interpretations of the law are applied. On December 22, 2017, the U.S. government enacted the Tax Cuts and Jobs Act (the "Tax Act"). The Tax Act includes significant changes to the U.S. corporate income tax system including, among other things, a federal corporate rate reduction from 35% to 21%; limitations on the deductibility of interest expense and executive compensation and the transition of U.S. international taxation from a worldwide tax system to a modified territorial tax system. In the future, we may be subject to increased taxes under the Tax Act, including due to the aforementioned limitations on deductions. Also, we may be required to make material adjustments to provisional items recorded. There can be no assurance that U.S. tax laws, including the corporate income tax rate, which the Tax Act lowered to 21%, would not undergo additional changes in the future. The final impact of the Tax Act on

10

the Company may differ from the estimates previously reported, possibly materially, due to such factors as changes in interpretations and assumptions made, additional guidance that may be issued, and actions taken by the Company as a result of the Tax Act, among other factors. All of these factors and uncertainties may adversely affect our results of operations, financial position and cash flows.

We are exposed to the risk of non-payment by our customers on a significant amount of our sales.

Our extension of credit involves considerable judgment and is based on an evaluation of each customer’s financial condition and payment history. We monitor our credit risk exposure by periodically obtaining credit reports and updated financials on our customers. We generally see a heightened amount of bankruptcies by our customers during economic downturns. In particular, the COVID-19 pandemic, and its impact on our customers, could have a negative impact on our collection efforts. While we maintain an allowance for doubtful receivables for potential credit losses based upon our historical trends and other available information, in times of economic turmoil, there is heightened risk that our historical indicators may prove to be inaccurate. The inability to collect on sales to significant customers or a group of customers could have a material adverse effect on our results of operations.

Our business incurs significant freight and transportation costs.

We incur transportation expenses to ship our products to our customers. Significant increases in the costs of freight and transportation could have a material adverse effect on our results of operations, as there can be no assurance that we could pass on these increased costs to our customers. Government regulations can and has impacted the availability of drivers, which will be a significant challenge to the industry. Costs to employ drivers have increased and transportation shortages have become more prevalent.

We depend upon the talents and contributions of a limited number of individuals, many of whom would be difficult to replace.

The loss or interruption of the services of our Chief Executive Officer, Executive Vice President or Chief Financial Officer could have a material adverse effect on our business, financial condition or results of operations. Although we maintain employment agreements with these individuals, it cannot be assured that the services of such individuals will continue.

If our internal controls are found to be ineffective, our financial results or our stock price could be adversely affected.

We believe that we currently have adequate internal control procedures in place. However, increased risk of internal control breakdowns generally exists in a business environment that is decentralized. In addition, if our internal control over financial reporting is found to be ineffective, investors may lose confidence in the reliability of our financial statements, which may adversely affect our stock price.

Our services depend on the reliability of computer systems we and our vendors maintain. If these systems fail, our operations may be adversely affected.

We depend on information technology and data processing systems to operate our business, and a significant malfunction or disruption in the operation of our systems may disrupt our business and adversely affect our ability to operate and compete in the markets we serve. These systems include systems that we own and operate, as well as systems of our vendors. Such systems are susceptible to malfunctions and interruptions. We also periodically upgrade and install new systems, which if installed or programmed incorrectly, may cause significant disruptions. The disruptions could interrupt our operations and adversely affect our results of operations, financial condition and cash flows.

11

We may suffer a data breach of sensitive information, which may result in significant costs to investigate and remediate the breach, litigation expenses and government enforcement actions and penalties, all of which could have an adverse effect on our operations and reputation.

It is critically important for us to maintain the confidentiality, integrity and availability of our systems, software and solutions. Many of our clients provide us with information they consider confidential or sensitive, and many of our client’s industries have established standards for safeguarding the confidentiality, integrity and availability of information relating to their businesses and customers. Confidential and sensitive information stored in our systems or available through web portals are susceptible to cybercrime or intentional disruption, which generally have increased across all industries in terms of sophistication and frequency. Disclosure of confidential information maintained on our systems or available through web portals due to human error, breach of our systems through cybercrime, a leak of confidential information due to employee misconduct or similar events may damage our reputation, subject us to regulatory enforcement action and cause significant reputational harm for our clients. Any of these outcomes may adversely affect our results of operations, financial condition and cash flows.

Increases in the cost of employee benefits could impact our financial results and cash flow.

Our expenses relating to employee health benefits are significant. Unfavorable changes in the cost of such benefits could impact our financial results and cash flow. Healthcare costs have risen significantly in recent years, and recent legislative and private sector initiatives regarding healthcare reform could result in significant changes to the U.S. healthcare system. Additionally, the ongoing COVID-19 pandemic may result in temporary or permanent healthcare reform measures, would could result in significant cost increases and other negative impacts to our business. While the Company has various cost controls measures in place and employs an outside oversight review on larger claims, employee health benefits have been and are expected to continue to be a significant cost to the Company. At the beginning of the 2017 calendar year, the Company made significant changes to its medical reimbursement program to address unexpected cost increases. Even with these remedial measures, which have been successful thus far, medical costs will continue to be a significant expense to the Company and may increase due to factors outside the Company’s control.

ITEM 1B. UNRESOLVED STAFF COMMENTS

There are no unresolved SEC staff comments.

Our corporate headquarters are located in Midlothian, Texas, and we operate manufacturing facilities throughout the United States. See the table below for additional information regarding our locations.

All of our properties are used for the production, warehousing and shipping of business products, including the following: business forms, flexographic printing, advertising specialties and Post-it® Notes (Wolfe City, Texas); presentation products (Macomb, Michigan; De Pere, Wisconsin and Columbus, Kansas); printed and electronic promotional media (Denver, Colorado); envelopes (Portland, Oregon; Columbus, Kansas; Tullahoma, Tennessee and Claysburg, Pennsylvania); financial forms (Minneapolis/St. Paul, Minnesota; Nevada, Iowa and Bridgewater, Virginia); and pressure seal products (Visalia, California; Chino, California and Clarksville, Tennessee).

Our plants are operated at production levels required to meet our forecasted customer demands. Production levels fluctuate with market demands and depend upon the product mix at any given point in time. Equipment is added as existing machinery becomes obsolete or not repairable, and as new equipment becomes necessary to meet market demands; however, at any given time, these additions and replacements are not considered to be material additions to property, plant and equipment, although such additions or replacements may increase a plant’s efficiency or capacity.

All of our facilities are believed to be in good condition. We do not anticipate that substantial expansion, refurbishing, or re-equipping of our facilities will be required in the near future.

All of our rented property is held under leases with original terms of one or more years, expiring at various times through February 2027. Presently, we believe we will be able to maintain or renew leases as they expire without significant difficulty.

12

|

|

|

|

Approximate Square Footage |

|

||||||

|

Location |

|

General Use |

|

Owned |

|

|

Leased |

|

||

|

Ennis, Texas |

|

Three Manufacturing Facilities * |

|

|

325,118 |

|

|

|

— |

|

|

Chatham, Virginia |

|

Two Manufacturing Facilities |

|

|

127,956 |

|

|

|

— |

|

|

Paso Robles, California |

|

Manufacturing |

|

|

94,120 |

|

|

|

— |

|

|

DeWitt, Iowa |

|

Two Manufacturing Facilities |

|

|

95,000 |

|

|

|

— |

|

|

Ft. Scott, Kansas |

|

Manufacturing |

|

|

86,660 |

|

|

|

— |

|

|

Portland, Oregon |

|

Two Manufacturing Facilities |

|

|

— |

|

|

|

261,765 |

|

|

Wolfe City, Texas |

|

Two Manufacturing Facilities |

|

|

119,259 |

|

|

|

— |

|

|

Coshocton, Ohio |

|

Manufacturing |

|

|

24,750 |

|

|

|

— |

|

|

Macomb, Michigan |

|

Manufacturing |

|

|

56,350 |

|

|

|

— |

|

|

Denver, Colorado |

|

Four Manufacturing Facilities |

|

|

60,000 |

|

|

|

117,575 |

|

|

Brooklyn Park, Minnesota |

|

Manufacturing |

|

|

94,800 |

|

|

|

— |

|

|

Coon Rapids, Minnesota |

|

Warehouse |

|

|

— |

|

|

|

4,800 |

|

|

Roseville, Minnesota |

|

Manufacturing |

|

|

— |

|

|

|

41,300 |

|

|

Nevada, Iowa |

|

Two Manufacturing Facilities |

|

|

232,000 |

|

|

|

— |

|

|

Nevada, Iowa |

|

Held for Sale |

|

|

58,752 |

|

|

|

— |

|

|

Bridgewater, Virginia |

|

Manufacturing |

|

|

— |

|

|

|

27,000 |

|

|

Columbus, Kansas |

|

Two Manufacturing Facilities and Warehouse |

|

|

174,089 |

|

|

|

— |

|

|

El Dorado Springs, Missouri |

|

Manufacturing |

|

|

70,894 |

|

|

|

— |

|

|

Princeton, Illinois |

|

Manufacturing |

|

|

— |

|

|

|

44,190 |

|

|

Arlington, Texas |

|

Two Manufacturing Facilities |

|

|

69,935 |

|

|

|

— |

|

|

Tullahoma, Tennessee |

|

Two Manufacturing Facilities |

|

|

142,061 |

|

|

|

— |

|

|

Caledonia, New York |

|

Manufacturing |

|

|

191,730 |

|

|

|

— |

|

|

Sun City, California |

|

Two Manufacturing Facilities |

|

|

52,617 |

|

|

|

— |

|

|

Livermore, California |

|

Sales Office |

|

|

— |

|

|

|

650 |

|

|

Chino, California |

|

Manufacturing |

|

|

— |

|

|

|

63,016 |

|

|

Neenah, Wisconsin |

|

Two Manufacturing Facilities & One Warehouse |

|

|

72,354 |

|

|

|

97,161 |

|

|

Claysburg, Pennsylvania |

|

Manufacturing |

|

|

— |

|

|

|

69,000 |

|

|

Vandalia, Ohio |

|

Held for Sale |

|

|

47,820 |

|

|

|

— |

|

|

Fairport, New York |

|

Two Manufacturing Facilities |

|

|

— |

|

|

|

40,800 |

|

|

Indianapolis, Indiana |

|

Two Manufacturing Facilities |

|

|

— |

|

|

|

38,000 |

|

|

Smyrna, Georgia |

|

Manufacturing |

|

|

— |

|

|

|

65,000 |

|

|

Clarksville, Tennessee |

|

Manufacturing |

|

|

51,900 |

|

|

|

— |

|

|

Fairhope, Alabama |

|

Manufacturing |

|

|

65,000 |

|

|

|

— |

|

|

Toledo, Ohio |

|

Three Manufacturing Facilities |

|

|

120,947 |

|

|

|

— |

|

|

Visalia, California |

|

Manufacturing |

|

|

— |

|

|

|

56,000 |

|

|

Corsicana, Texas |

|

Manufacturing |

|

|

39,685 |

|

|

|

— |

|

|

Girard, Kansas |

|

Manufacturing |

|

|

69,474 |

|

|

|

— |

|

|

Powell, Tennessee |

|

Manufacturing |

|

|

43,968 |

|

|

|

— |

|

|

Houston, Texas |

|

Manufacturing |

|

|

— |

|

|

|

29,668 |

|

|

DePere, Wisconsin |

|

Manufacturing & One Warehouse |

|

|

— |

|

|

|

142,347 |

|

|

Mosinee, Wisconsin |

|

Manufacturing & One Warehouse |

|

|

— |

|

|

|

5,700 |

|

|

Kent, Washington |

|

Manufacturing |

|

|

— |

|

|

|

48,789 |

|

|

South Elgin, Illinois |

|

Manufacturing |

|

|

— |

|

|

|

70,500 |

|

|

Parsons, Kansas |

|

Manufacturing & One Warehouse |

|

|

122,740 |

|

|

|

40,000 |

|

|

Fenton, Missouri |

|

Manufacturing** |

|

|

— |

|

|

|

26,847 |

|

|

|

|

|

|

|

2,709,979 |

|

|

|

1,290,108 |

|

|

Corporate Offices |

|

|

|

|

|

|

|

|

|

|

|

Ennis, Texas |

|

Administrative Offices |

|

|

9,300 |

|

|

|

— |

|

|

Midlothian, Texas |

|

Executive and Administrative Offices |

|

|

28,000 |

|

|

|

— |

|

|

|

|

|

|

|

37,300 |

|

|

|

— |

|

|

|

|

Totals |

|

|

2,747,279 |

|

|

|

1,290,108 |

|

|

* |

22,000 square feet of Ennis, Texas location leased |

|

** |

21,477 square feet of Fenton, Missouri location leased |

13

From time to time we are involved in various litigation matters arising in the ordinary course of our business. We do not believe the disposition of any current matter will have a material adverse effect on our consolidated financial position or results of operations.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock is traded on the New York Stock Exchange (“NYSE”) under the trading symbol “EBF”. The following table sets forth the high and low sales prices, the common stock trading volume as reported by the NYSE and dividends per share paid by the Company for the periods indicated:

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

|

|

Dividends |

|

||

|

|

|

|

|

|

|

|

|

|

|

Trading Volume |

|

|

per share of |

|

||

|

|

|

Common Stock Price Range |

|

|

(number of shares |

|

|

Common |

|

|||||||

|

|

|

High |

|

|

Low |

|

|

in thousands) |

|

|

Stock |

|

||||

|

Fiscal Year Ended February 29, 2020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Quarter |

|

$ |

21.99 |

|

|

$ |

18.30 |

|

|

|

1,989 |

|

|

$ |

0.225 |

|

|

Second Quarter |

|

|

21.10 |

|

|

|

18.48 |

|

|

|

2,220 |

|

|

$ |

0.225 |

|

|

Third Quarter |

|

|

21.49 |

|

|

|

18.66 |

|

|

|

2,135 |

|

|

$ |

0.225 |

|

|

Fourth Quarter |

|

|

22.20 |

|

|

|

19.83 |

|

|

|

2,655 |

|

|

$ |

0.225 |

|

|

Fiscal Year Ended February 28, 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Quarter |

|

$ |

20.70 |

|

|

$ |

17.65 |

|

|

|

1,116 |

|

|

$ |

0.200 |

|

|

Second Quarter |

|

|

22.95 |

|

|

|

18.20 |

|

|

|

1,552 |

|

|

$ |

0.225 |

|

|

Third Quarter |

|

|

21.90 |

|

|

|

18.55 |

|

|

|

2,153 |

|

|

$ |

0.225 |

|

|

Fourth Quarter |

|

|

21.36 |

|

|

|

17.36 |

|

|

|

2,422 |

|

|

$ |

0.225 |

|

On April 27, 2020, the last reported sale price of our common stock on the NYSE was $17.82, and there were approximately 718 shareholders of record.

Cash dividends may be paid, or repurchases of our common stock may be made, from time to time as our Board of Directors (“Board”) deems appropriate, after considering our growth rate, operating results, financial condition, cash requirements, restrictive lending covenants, and such other factors as the Board may deem appropriate.

A dividend of $0.225 per share of common stock was paid in each quarter of fiscal year 2020. A dividend of $0.20 per share was paid in the first quarter of fiscal year 2019, and a dividend of $0.225 per share was paid in each subsequent quarter of fiscal year 2019.

Our Board has authorized the repurchase of the Company’s outstanding common stock through a stock repurchase program, which authorized amount is currently up to $40.0 million in the aggregate. Under the repurchase program, purchases may be made from time to time in the open market or through privately-negotiated transactions, depending on market conditions, share price, trading volume and other factors. Repurchases may be commenced or suspended at any time or from time to time without prior notice, provided that any purchases must be made in accordance with applicable insider trading rules and securities laws and regulations. Since the program’s inception in October 2008, we have repurchased 1,816,354 common shares under the program at an average price of $15.91 per share. During our fiscal year 2020, we repurchased 126,330 shares of common stock at an average price of $19.56 per share. As of February 29, 2020, $11.1 million remained available to repurchase shares of common stock under the program. No additional shares of common stock were repurchased under the program in the three months ended February 29, 2020.

14

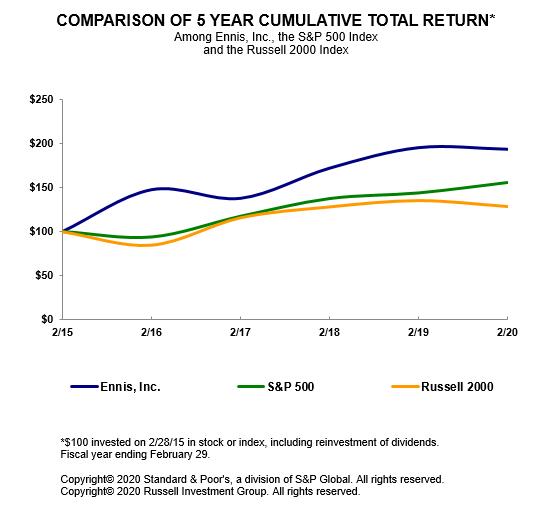

The graph below matches our cumulative 5-year total shareholder return on common stock with the cumulative total returns of the S&P 500 Index and the Russell 2000 Index. The graph tracks the performance of a $100 investment in our common stock and in each of the indexes (with the reinvestment of all dividends) from February 28, 2015 to February 29, 2020.

|

|

|

|

2015 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2018 |

|

|

|

2019 |

|

|

|

2020 |

|

|

Ennis, Inc. |

|

$ |

100.00 |

|

|

$ |

147.47 |

|

|

$ |

137.68 |

|

|

$ |

171.90 |

|

|

$ |

195.21 |

|

|

$ |

193.42 |

|

|

S&P 500 |

|

|

100.00 |

|

|

|

93.81 |

|

|

|

117.24 |

|

|

|

137.29 |

|

|

|

143.71 |

|

|

|

155.49 |

|

|

Russell 2000 |

|

|

100.00 |

|

|

|

85.03 |

|

|

|

115.73 |

|

|

|

127.89 |

|

|

|

135.03 |

|

|

|

128.38 |

|

The stock price performance included in this graph is not necessarily indicative of future stock price performance.

15

ITEM 6. SELECTED FINANCIAL DATA

The following tables set forth key operating metrics as of and for the periods indicated and have been derived from our audited historical consolidated financial statements for the five years ended February 29, 2020. Our consolidated financial statements and notes thereto as of February 29, 2020, February 28, 2019, and for the three years in the period ended February 29, 2020, and the reports of Grant Thornton LLP are included in Item 15 of this Report. The selected financial data should be read in conjunction with Item 7 — “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and notes thereto included in Item 15 of this Report.

|

|

|

Fiscal Years Ended |

|

|||||||||||||||||

|

|

|

2020 |

|

|

2019 |

|

|

2018 |

|

|

2017 |

|

|

2016 |

|

|||||

|

|

|

(Dollars and shares in thousands, except per share and ratio amounts) |

|

|||||||||||||||||

|

Operating results: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

438,412 |

|

|

$ |

400,782 |

|

|

$ |

370,171 |

|

|

$ |

356,888 |

|

|

$ |

385,946 |

|

|

Gross profit margin |

|

|

128,924 |

|

|

|

123,360 |

|

|

|

117,202 |

|

|

|

104,730 |

|

|

|

116,829 |

|

|

Selling, general and administrative expenses |

|

|

78,173 |

|

|

|

73,490 |

|

|

|

69,222 |

|

|

|

62,537 |

|

|

|

65,356 |

|

|

Earnings from continuing operations |

|

|

38,292 |

|

|

|

37,437 |

|

|

|

32,758 |

|

|

|

26,417 |

|

|

|

32,258 |

|

|

Earnings (loss) from discontinued operations, net of tax |

|

|

— |

|

|

|

— |

|

|

|

147 |

|

|

|

(24,637 |

) |

|

|

3,478 |

|

|

Net earnings (loss) |

|

$ |

38,292 |

|

|

$ |

37,437 |

|

|

$ |

32,905 |

|

|

$ |

1,780 |

|

|

$ |

35,736 |

|

|

Earnings (loss) and dividends per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and Diluted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Continuing operations |

|

$ |

1.47 |

|

|

$ |

1.45 |

|

|

$ |

1.29 |

|

|

$ |

1.03 |

|

|

$ |

1.25 |

|

|

Discontinued operations |

|

|

— |

|

|

|

— |

|

|

|

0.01 |

|

|

|

(0.96 |

) |

|

|

0.14 |

|

|

Net earnings (loss) |

|

$ |

1.47 |

|

|

$ |

1.45 |

|

|

$ |

1.30 |

|

|

$ |

0.07 |

|

|

$ |

1.39 |

|

|

Dividends |

|

$ |

0.90 |

|

|

$ |

0.875 |

|

|

$ |

0.875 |

|

(1) |

$ |

2.20 |

|

(1) |

$ |

0.70 |

|

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

26,036 |

|

|

|

25,830 |

|

|

|

25,392 |

|

|

|

25,735 |

|

|

|

25,688 |

|

|

Diluted |

|

|

26,036 |

|

|

|

25,842 |

|

|

|

25,417 |

|

|

|

25,749 |

|

|

|

25,722 |

|

|

Financial Position: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Working capital |

|

$ |

111,915 |

|

|

$ |

134,542 |

|

|

$ |

133,773 |

|

|

$ |

119,282 |

|

|

$ |

135,441 |

|

|

Current assets |

|

|

149,884 |

|

|

|

166,165 |

|

|

|

163,344 |

|

|

|

149,250 |

|

|

|

175,841 |

|

|

Total assets |

|

|

365,699 |

|

|

|

363,085 |

|

|

|

329,439 |

|

|

|

324,285 |

|

|

|

390,044 |

|

|

Current liabilities |

|

|

37,969 |

|

|

|

31,623 |

|

|

|

29,571 |

|

|

|

29,968 |

|

|

|

40,400 |

|

|

Long-term debt |

|

|

— |

|

|

|

30,000 |

|

|

|

30,000 |

|

|

|

30,000 |

|

|

|

40,000 |

|

|

Total liabilities |

|

|

71,370 |

|

|

|

73,958 |

|

|

|

67,735 |

|

|

|

72,930 |

|

|

|

91,498 |

|

|

Shareholders' equity |

|

|

294,329 |

|

|

|

289,127 |

|

|

|

261,704 |

|

|

|

251,355 |

|

|

|

298,546 |

|

|

Current ratio |

|

3.95 to 1.0 |

|

|

5.25 to 1.0 |

|

|

5.52 to 1.0 |

|

|

4.98 to 1.0 |

|

|

4.35 to 1.0 |

|

|||||

|

Long-term debt to equity ratio |

|

000 to 1.0 |

|

|

0.10 to 1.0 |

|

|

0.11 to 1.0 |

|

|

0.12 to 1.0 |

|

|

0.13 to 1.0 |

|

|||||

(1) Fiscal year 2018 included a special one-time cash dividend of $0.10 per share of common stock in response to the signing of the Tax Act. Fiscal year 2017 included a special one-time cash dividend of $1.50 per share of common stock as a result of the Company’s sale of its apparel business, consisting of Alstyle Apparel, LLC and its subsidiaries, in May 2016.

16

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

This Management’s Discussion and Analysis provides material historical and prospective disclosures intended to enable investors and other users to assess our financial condition and results of operations. Statements that are not historical are forward-looking and involve risk and uncertainties, including those discussed under the caption “Risk Factors” in Item 1A of this Annual Report on Form 10-K and elsewhere in this Report. You should read this discussion and analysis in conjunction with our Consolidated Financial Statements and the related notes appearing elsewhere in this Report. The words “anticipate,” “preliminary,” “expect,” “believe,” “intend” and similar expressions identify forward-looking statements. We believe these forward-looking statements are based upon reasonable assumptions. All such statements involve risks and uncertainties, and as a result, actual results could differ materially from those projected, anticipated, or implied by these statements.

In view of such uncertainties, investors should not place undue reliance on our forward-looking statements since such statements may prove to be inaccurate and speak only as of the date when made. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

This Management’s Discussion and Analysis covers the continuing operations of the Company, which are comprised of the production and sale of business forms and other business products, and excludes the discontinued operations of the Company, consisting of Alstyle Apparel, LLC and its subsidiaries (the “Apparel Segment”), which the Company sold in May 2016. This Management’s Discussion and Analysis includes the following sections:

|

|

• |

Overview – An overall discussion regarding our Company, the business challenges and opportunities we believe are key to our success, and our plans for facing these challenges relating to our continuing operations. |

|

|

• |

Critical Accounting Policies and Estimates – A discussion of the accounting policies that require our most critical judgments and estimates relating to our continuing operations. This discussion provides insight into the level of subjectivity, quality, and variability involved in these judgments and estimates. This section also provides a summary of recently adopted and recently issued accounting pronouncements that have or may materially affect our business. |

|

|

• |

Results of Operations – An analysis of our consolidated results of operations and segment results for the three years presented in our consolidated financial statements. This analysis discusses material trends within our continuing business and provides important information necessary for an understanding of our continuing operating results. |

|

|

• |

Liquidity and Capital Resources - An analysis of our cash flows and a discussion of our financial condition and contractual obligations. This section provides information necessary to evaluate our ability to generate cash and to meet existing and known future cash requirements over both the short and long term. |

References to 2020, 2019 and 2018 refer to the fiscal years ended February 29, 2020, February 28, 2019 and February 28, 2018, respectively.

Overview

The Company – Our management believes we are the largest provider of business forms, pressure-seal forms, labels, tags, envelopes, and presentation folders to independent distributors in the United States.

Our Business Challenges – Our industry is currently experiencing consolidation of traditional supply channels, product obsolescence, paper supplier capacity adjustments, and increased pricing and potential supply allocations due to demand/supply curve imbalance. Technology advances have made electronic distribution of documents, internet hosting, digital printing and print-on-demand valid, cost-effective alternatives to traditional custom-printed documents and customer communications. Improved equipment has become more accessible to our competitors due to the continued low interest rate environment. We face highly competitive conditions throughout our supply chain in an already over-supplied, price-competitive print industry. In addition to the risk factors discussed under the

17

caption “Risk Factors” in Item 1A of this Annual Report, some of the key challenges of our business include the following:

COVID-19 Pandemic – In December 2019, a novel strain of coronavirus (COVID-19) was reported in Wuhan, China, and by early 2020, the virus had spread to other countries, including the United States. This pandemic has significantly impacted health and economic conditions throughout the United States and the world, including the markets in which we operate.