UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington DC 20549

FORM 10-K

(Mark One)

☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended May 31, 2016

or

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 000-09061

ELECTRO RENT CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

CALIFORNIA | 95-2412961 | |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |

6060 Sepulveda Boulevard

Van Nuys, California 91411-2512

(Address of Principal Executive Offices and Zip Code)

(818) 786-2525

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Stock without par value | The NASDAQ Stock Market LLC | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer | ☐ | Accelerated Filer | ☒ | |||

Non-Accelerated Filer | ☐ | (Do not check if a smaller reporting company) | Smaller Reporting Company | ☐ | ||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the registrant’s common stock held by non-affiliates, computed on the basis of the closing price as reported on the Nasdaq market as of November 30, 2015, was $159,711,978. Shares of common stock held by executive officers, directors and by persons who own 10% or more of the outstanding common stock of the registrant have been excluded for purposes of the foregoing calculation. This does not reflect a determination that such persons are affiliates for any other purpose.

Number of shares of the registrant’s common stock outstanding as of August 8, 2016: 24,200,660.

EXPLANATORY NOTE

Unless otherwise noted, (1) the terms “we”, “us” and “our” refer to Electro Rent Corporation and its subsidiaries, and (2) the terms “Common Stock” and “shareholder(s)” refer to our common stock and the holders of that stock, respectively.

On June 23, 2016, we entered into an Amended and Restated Agreement and Plan of Merger (the “Restated Merger Agreement”) with Elecor Intermediate Holding II Corporation, a Delaware corporation (“Parent”), and Elecor Merger Corporation, a California corporation and a wholly owned subsidiary of Parent (“Merger Sub”), pursuant to which, subject to the satisfaction or waiver of the conditions set forth therein, Merger Sub will be merged with and into us, and we will survive the merger as a wholly-owned subsidiary of Parent (the “Merger”). Parent and Merger Sub are affiliates of Platinum Equity, a Beverly Hills-based private equity firm (“Platinum Equity”).

Our board of directors, in accordance with and upon the unanimous recommendation of a special committee of independent directors, has approved the Merger Agreement and the transactions contemplated thereby, including the Merger. The Merger was approved by our shareholders at a special meeting held on August 5, 2016. We expect the Merger and the transactions contemplated thereby to close by the end of August 2016.

If the Merger closes, each outstanding share of our Common Stock (other than shares held by any person who properly asserts dissenters’ rights under California law) will be converted into the right to receive an amount in cash equal to $15.50 per share (the “Merger Consideration”). Our existing shareholders will no longer have an equity ownership in our company and will no longer participate in our future earnings or growth. After the closing of the Merger, our Common Stock will no longer be listed on the NASDAQ Global Select Market and will be deregistered under the Securities Exchange Act of 1934, as amended and we will no longer file periodic reports with the SEC.

SPECIAL NOTE ABOUT FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. You can find many (but not all) of these statements by looking for words such as “approximates,” “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “would,” “may” or other similar expressions in this report. We claim the protection of the safe harbor contained in the Private Securities Litigation Reform Act of 1995. We caution investors that any forward-looking statements presented in this report, or that we may make orally or in writing from time to time, reflect our good faith estimations based on information currently available to us. Such statements are based on assumptions, and the actual outcome will be affected by known and unknown risks, trends, uncertainties and factors that are beyond our control or ability to predict. Although we believe that our assumptions are reasonable, they are not guarantees of future performance and some will inevitably prove to be incorrect. As a result, our actual future results can be expected to differ from our expectations, and those differences may be material.

Some of the risks and uncertainties that may cause our actual results, performance or achievements to differ materially from those expressed or implied by forward-looking statements include the following: statements concerning our expectation that the Merger will close, Common Stock price fluctuations, fluctuations in operating results (including as a result of changing economic conditions), risks associated with technology changes, risks associated with customer solvency, competition, risks associated with international operations, risks associated with our manufacturers and suppliers, dependence on key personnel, control by management and others, risks associated with possible acquisitions and new business ventures and anti-takeover provisions. For further discussion of these and other factors that may impact our future operations, see Item 1A. “Risk Factors”; Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations”; and Item 7A. “Quantitative and Qualitative Disclosure about Interest Rates and Currency Rates,” in this report, and our other filings with the Securities and Exchange Commission.

This Annual Report on Form 10-K and all subsequent written and oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. We do not undertake any obligation to update our forward-looking statements to reflect events or circumstances after the date of this report, except as required by law.

2

PART I

Item 1. Business.

We are a global organization devoted to the rental, lease and sale of new and used electronic test and measurement (“T&M”) equipment. We purchase T&M equipment from leading manufacturers such as Keysight Technologies, Inc. (formerly Agilent Technologies, Inc., “Keysight”), Anritsu, Inc. ("Anritsu"), Rohde & Schwarz Gmbh & Co. KG ("Rohde & Schwarz") and Tektronix Inc ("Tektronix"). Our customers rent, lease and buy our T&M equipment, and use that equipment primarily in the aerospace and defense, telecommunications, electronics, industrial and semiconductor markets.

In addition, we purchase personal computers from manufacturers including Dell, HP, IBM, Toshiba and Apple for our Data Products ("DP") division.

The Electro Rent Approach. For the most part, customers who rent, purchase, or lease equipment from us place orders through our inside sales force, which has access to our proprietary computer system that we update in real time for equipment availability and pricing. In the case of rentals and some leases, we use a pool of equipment we have previously purchased for that purpose, or we may add equipment to that pool to fill a lease or rental order if the addition makes economic sense. Our equipment fulfillment team typically can arrange delivery of equipment from our pool to our customers within one or two days of a request. Most of our equipment is technically complex and must be tested and serviced when returned to us. We do most of that testing in house, using a team of experienced technicians and our state of the art calibration laboratory.

Although our customers respond to equipment pricing and availability in making their decisions to choose to work with us, we believe that our success also depends on other factors:

• | Customer Service. Our customer service responsiveness and expert technical staff provide us with a key competitive advantage. Our resale channel for T&M equipment in the United States and Canada has enabled us to substantially expand the number and technical expertise of our T&M sales force which, at approximately 100 persons worldwide, is already the largest among our principal competitors. |

• | Trusted Brand. We believe our management team is the most experienced and stable in the industry, with our executive officers averaging 30 years at Electro Rent. In 2008, 2009 and 2014, Forbes magazine named us as one of the “100 Most Trustworthy Companies” out of more than 8,000 publicly traded companies for “transparent and conservative accounting practices and solid corporate governance and management.” We were also honored as a Frost & Sullivan 2012 Company of the Year. |

• | Global Platform. We have locations in North America, Asia and Europe. Our size and reach may appeal to multinational customers and assists us in maximizing our equipment utilization and equipment pool management across different geographic markets. The majority of our rental equipment not out on rent is located at our Van Nuys, California warehouse and service center that is compliant with ISO9001:2008 (DEKRA certification), ISO17025:2005 (A2LA accreditation) and ANSI/NCSLI Z540.3-2006 (A2LA accreditation). We also service our customers through sales offices and calibration and service centers in the United States, Canada, China and Belgium, which are linked by a proprietary computer system. These centers also function as depots for the sale of used equipment. |

• | Multichannel Offerings. Our business offers customers a single source for their equipment needs, whether they want to rent, lease or buy new or used equipment. We believe that we offer the greatest breadth of acquisition options in the industry, allowing our customers to match the appropriate option to their usage and capital needs, budget and other factors, such as accounting rules and regulatory requirements. In addition, spreading costs over multiple channels allows us to maintain the largest sales force among our principal competitors, which in turn broadens and deepens our customer contacts and provides them more technical strength and assistance. |

• | Equipment Management. To maximize our overall profit, we manage our equipment pool on an on-going basis by controlling the timing, pricing and mix of our purchases and sales of equipment. We acquire new and used equipment to meet current and anticipated customer demand and stay abreast of current technical standards. We sell our used equipment when we believe that is the most lucrative option. We employ a complex equipment management strategy and our proprietary PERFECT software to adjust our equipment pool and pricing in order to maximize equipment availability, utilization and profitability. Our PERFECT software is designed to provide real time pricing and availability on our global equipment pool, ensure rapid order fulfillment and improve overall customer service. |

Our Sales Strategy. We have a focused sales strategy, using a direct sales force to meet our customers’ needs in our T&M equipment rental, lease and sales business. We have an experienced, highly technical sales force that specializes in all the products and services offered by our company. Our sales force identifies potential customers through coordinated efforts with our marketing organization, which is staffed by professionals with many years of industry-related experience. As our customers

3

have a wide range of requirements for equipment, our sales force is able to leverage our extensive knowledge of the T&M and DP equipment environment to determine the right product to rent, lease or sell to the customer to meet the customer’s specific needs.

We sell new T&M equipment and sales of new T&M equipment represented approximately 33.7%, 66.8% and 63.5% of our sales of equipment and other revenues for fiscal 2016, 2015 and 2014, respectively. Substantially all of our new equipment sales for the years ended May 31, 2015 and 2014 were generated through our reseller agreement with Keysight where we were an authorized reseller of certain Keysight T&M products and services to small and medium size customers in the United States and Canada. Our reseller agreement with Keysight expired on May 31, 2015. The expiration of the Keysight reseller agreement materially affected our revenues and net profits and will continue to do so in the future. Please see the risk factor in PART I-Section 1A, below, for further discussion about the risks related to the expiration of the Keysight reseller agreement.

In fiscal 2016, we entered into agreements with other manufacturers of equipment, which we could not represent while we operated under the Keysight reseller agreement, including Anritsu, Rohde & Schwarz and ART-Fi SAS.

Competition. We face different competition based on industry sector and geography. For T&M equipment, the North American market generates in excess of $300 million of rental and lease revenue annually. The market is characterized by intense competition from several competitors, and no single competitor holds a dominant market share in North America. Globally, our primary competitors in this market include McGrath RentCorp, Continental Resources, Inc., Test Equity LLC, and Microlease plc. These entities also compete with us in leasing T&M equipment, as do banks, vendors and other financing sources. In selling used equipment, we may also compete with sales of new equipment by our suppliers, including Keysight, Rohde & Schwarz, Tektronix and Anritsu, and their other distributors.

For our DP division, the market for the lease and rental of computers is highly fragmented. Our principal competitors in this area include SmartSource Rentals ("SmartSource"), Rentex Inc. ("Rentex"), Rentfusion Corporation ("Rentfusion") and Vernon Computer Source. The computer rental market has been characterized by intense competition that has led to industry consolidation in recent years. SmartSource, our largest competitor in this market, has expanded primarily due to its numerous acquisitions. While we have focused on the rental of large quantities of computers to unique customers, SmartSource concentrates more on audio visual and trade show technology rentals.

Competition in our industry is concentrated on price. Our competitors engage in aggressive pricing for both rentals and sales. In order to maintain or increase our market share, we may choose to lower our prices, resulting in lower revenues and decreased profitability. In addition to price, we compete on the breadth of our product offerings, extensive sales channels, experienced customer and technical support and proprietary equipment management systems as outlined under “The Electro Rent Approach” above.

Our Backlog. At May 31, 2016, we had a sales order backlog for new T&M equipment of $1.3 million, compared to $12.4 million at May 31, 2015 and $10.7 million at May 31, 2014. The decrease in backlog is primarily due to the expiration of the Keysight agreement on May 31, 2015. The majority of the backlog is expected to be delivered to customers within the next six months.

Backlog represents the cumulative balance, at a given point in time, of recorded customer sales orders that have not yet been shipped or recognized as sales. Backlog increases when an order is received, and declines when we recognize sales. Although backlog consists of firm orders for which goods and services are yet to be provided, customers can, and sometimes do, terminate or modify these orders. Backlog, on any particular date, while indicative of short-term revenue performance, is not necessarily a reliable indicator of medium or long-term revenue performance.

International Operations. We conduct rental, leasing and sales activity in foreign countries, which in the aggregate accounted for approximately 19.3% of our revenues in 2016, 15.9% in 2015 and 15.5% in 2014. Selected financial information regarding our international operations is presented below:

Fiscal Year ended May 31, (in thousands) | 2016 | 2015 | 2014 | ||||||||

Revenues: 1 | |||||||||||

U.S. | $ | 141,535 | $ | 200,323 | $ | 203,806 | |||||

Other 2 | 33,798 | 38,006 | 37,331 | ||||||||

Total | $ | 175,333 | $ | 238,329 | $ | 241,137 | |||||

4

As of May 31, (in thousands) | 2016 | 2015 | 2014 | ||||||||

Net Long Lived Assets: 3 | |||||||||||

U.S. | $ | 168,331 | $ | 197,514 | $ | 188,343 | |||||

Other 2 | 43,583 | 47,277 | 46,667 | ||||||||

Total | $ | 211,914 | $ | 244,791 | $ | 235,010 | |||||

1 | Revenues by country are based on the shipping destination. |

2 | Other consists of countries other than the U.S. Each foreign country individually accounts for less than 10% of the total consolidated revenues and net long-lived assets. |

3 | Net long-lived assets include rental and lease equipment and other property, net of accumulated depreciation and amortization. |

For risks relating to our international operations, see “Item 1A. Risk Factors – Risks Associated with International Operations.”

Segment Information. The following table shows, for each of the last three fiscal years, revenues from rentals and leases and sales of equipment and other revenues for our T&M and DP operating segments:

Fiscal Year ended May 31, (in thousands) | T&M | DP | Total | ||||||||

2016 | |||||||||||

Rentals and leases | $ | 105,850 | $ | 17,935 | $ | 123,785 | |||||

Sales of equipment and other revenues | 49,518 | 2,030 | 51,548 | ||||||||

Segment and consolidated total | $ | 155,368 | $ | 19,965 | $ | 175,333 | |||||

2015 | |||||||||||

Rentals and leases | $ | 111,327 | $ | 17,928 | $ | 129,255 | |||||

Sales of equipment and other revenues | 107,270 | 1,804 | 109,074 | ||||||||

Segment and consolidated total | $ | 218,597 | $ | 19,732 | $ | 238,329 | |||||

2014 | |||||||||||

Rentals and leases | $ | 120,629 | $ | 16,788 | $ | 137,417 | |||||

Sales of equipment and other revenues | 101,898 | 1,822 | 103,720 | ||||||||

Segment and consolidated total | $ | 222,527 | $ | 18,610 | $ | 241,137 | |||||

Depreciation of rental and lease equipment for these operating segments was as follows for the fiscal year ended May 31:

2016 | 2015 | 2014 | |||||||||

T&M | $ | 51,669 | $ | 52,278 | $ | 52,652 | |||||

DP | 4,262 | 4,167 | 4,382 | ||||||||

Segment and consolidated total | $ | 55,931 | $ | 56,445 | $ | 57,034 | |||||

Amortization expense is not material and is included in SG&A expenses.

5

We consider the marginal contribution as our measure of segment profit or loss. The marginal contribution is calculated as operating revenue less operating costs and direct and allocated SG&A expenses. Marginal contribution for these operating segments was as follows for the fiscal year ended May 31:

2016 | 2015 | 2014 | |||||||||

T&M | $ | 38,527 | $ | 50,410 | $ | 58,924 | |||||

DP | 6,695 | 6,914 | 5,962 | ||||||||

Total marginal contribution of operating segments | 45,222 | 57,324 | 64,886 | ||||||||

Deduct: | |||||||||||

Unallocated SG&A expenses | 37,139 | 34,396 | 32,747 | ||||||||

Add: | |||||||||||

Interest income, net | (329 | ) | 332 | 387 | |||||||

Other income | 33 | 1,390 | — | ||||||||

Consolidated income before income taxes | $ | 7,787 | $ | 24,650 | $ | 32,526 | |||||

For additional financial information about our segments, see Note 13 to our consolidated financial statements included in this Annual Report on Form 10-K.

Seasonality. Regardless of the overall economic outlook domestically and globally, December, January and February typically reflect lower rental activity. In addition, because February is a short month, revenue in that month is reduced. The seasonal spending patterns of our customers are also affected by factors such as weather, holiday and vacation considerations, and fiscal budgetary cycles.

Other Information. During fiscal 2016, 2015 and 2014, Keysight equipment accounted for 56.0%, 70.7% and 65.6%, respectively, of our new equipment purchases. Anritsu equipment purchases during fiscal 2016 accounted for 12.3% of our new equipment purchases while Anritsu equipment purchases during fiscal 2015 and fiscal 2014 were below 10%. No other vendor accounted for more than 10% of such purchases.

No single customer accounted for more than 10% of our total revenues during fiscal 2016, 2015 or 2014.

We do not derive any significant portion of our revenues from direct United States government contracts.

We have no material patents, trademarks, licenses, franchises or concessions.

At May 31, 2016, we employed approximately 386 individuals. None of our employees are members of a labor union or are subject to collective bargaining agreements. We believe that our employee relations are satisfactory.

Electro Rent Corporation was incorporated in California in 1965 and became a publicly held corporation in 1980.

Additional Information. Our Internet address is www.electrorent.com. Copies of our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 are available free of charge on our website via links to the Securities and Exchange Commission’s website as soon as reasonably practicable after we electronically file those materials with the Securities and Exchange Commission. We provide paper copies of these reports to shareholders upon written request to Shareholder Relations, Electro Rent Corporation, 6060 Sepulveda Boulevard, Van Nuys, California 91411-2512.

Item 1A. Risk Factors.

Please carefully consider the following discussion of various risks and uncertainties, as well as the other information in this report and in other reports and documents that we file with the Securities and Exchange Commission, when evaluating our business and future prospects. We believe that the following risk factors are the most relevant to our business, but they are not the only risk factors that we face. Additional risks and uncertainties, not presently known to us, or that we currently see as immaterial, may also occur. Our business, financial condition and results of operations could be seriously harmed if any of these risks or uncertainties actually occur or materialize. In that event, the market price for our Common Stock could decline, and our shareholders may lose all or part of their investment.

6

MERGER AGREEMENT WITH PLATINUM EQUITY

We have entered into a merger agreement with affiliates of Platinum Equity. If the merger closes as planned, each share of our outstanding Common Stock (other than shares held by any person who property asserts dissenters’ rights under California law) will be entitled to receive a cash payment of $15.50 per share, and our existing shareholders will no longer have an equity interest in our company and will not participate in our future earnings or growth.

On June 23, 2016, we entered into an Amended and Restated Agreement and Plan of Merger (the “Restated Merger Agreement”) with Elecor Intermediate Holding II Corporation, a Delaware corporation (“Parent”), and Elecor Merger Corporation, a California corporation and a wholly owned subsidiary of Parent (“Merger Sub”), pursuant to which, subject to the satisfaction or waiver of the conditions set forth therein, Merger Sub will be merged with and into us, and we will survive the merger as a wholly-owned subsidiary of Parent (the “Merger”). Parent and Merger Sub are affiliates of Platinum Equity, a Beverly Hills-based private equity firm (“Platinum Equity”).

Our board of directors (“Board”), in accordance with and upon the unanimous recommendation of a special committee of independent directors, has approved the Merger Agreement and the transactions contemplated thereby, including the Merger. The Merger was approved by our shareholders at a special meeting held on August 5, 2016. We expect the Merger and the transactions contemplated thereby to close by the end of August 2016.

If the Merger closes, each outstanding share of our common stock (other than shares held by any person who properly asserts dissenters’ rights under California law) will be converted into the right to receive an amount in cash equal to $15.50 per share (the “Merger Consideration”). Our existing shareholders will no longer have an equity ownership in our company and will no longer participate in our long term profits or operations. After the closing of the Merger, ELRC common stock will no longer be listed on the NASDAQ Global Select Market and will be deregistered under the Securities Exchange Act of 1934, as amended and we will no longer file periodic reports with the SEC.

COMMON STOCK PRICE FLUCTUATIONS

The price of our Common Stock has fluctuated significantly in the past and may continue to do so in the future.

General Factors. We believe some of the reasons for past fluctuations in the price of our Common Stock have included:

• | announcements of developments related to our business; |

• | announcements concerning new products or enhancements in the equipment that we rent, or developments in our relationships with our customers; |

• | announcements regarding the expiration of the Keysight reseller agreement and the establishment of new reseller or sales agent arrangements; |

• | variations in our revenues, gross margins, earnings or other financial results from investors’ expectations; and |

• | fluctuations in results of our operations and general conditions in the economy, our market, and the markets served by our customers. |

In addition, prices in the stock market in general have been volatile in recent years. In many cases, the fluctuations have been unrelated to the operating performance of the affected companies. As a result, the price of our Common Stock could fluctuate in the future without regard to our operating performance.

Future Sales of our Common Stock. Sales of our Common Stock by our officers, directors and employees could adversely and unpredictably affect the price of our shares. Additionally, the price could be affected by even the potential for sales by these persons. In addition to the 24,200,660 shares outstanding as of August 8, 2016, as of such date, up to 559,032 shares of Common Stock may be issued upon conversion of our vested and unvested restricted stock units previously granted under our Equity Incentive Plan.

We cannot predict the effect that any future sales of our Common Stock, or the potential for those sales, will have on the share price for our Common Stock.

FLUCTUATIONS IN OPERATING RESULTS

Historically, our operating results have fluctuated from period to period, and we expect that fluctuations could continue in the future. The fluctuations in our past results have resulted from many factors, some of which are beyond our control. In the future, these or other factors could have a material impact on our operating results and the price of our Common Stock.

7

Timing of Equipment Purchases and Sales and Equipment Pool Management. The profitability of our business depends in part on controlling the timing, pricing and mix of purchases and sales of equipment and on managing our equipment pool. We seek to acquire new and used equipment at attractive prices, from which we feel we can make a profit as a result of a combination of renting, leasing and selling that equipment. We base expenditures for equipment purchases, sales and marketing and other items on our expectations of future customer demand. In order to maximize overall profit from the rental, leasing, and sales of equipment, we manage our equipment pool on an on-going basis by analyzing our product strategy for equipment in light of historical and projected lifecycles. In doing so, we compare our estimate of potential profit from rental with the potential profit from the product’s immediate sale and replacement with new or other equipment.

Our overall equipment management is complex and our equipment strategy can change during the equipment’s lifetime based upon numerous factors, including the U.S. and global economy, interest rates and new product launches. Our strategic equipment decisions are based on the following fundamentals:

• | our acquisition cost; |

• | our estimates of current and future market demand for rentals; |

• | our estimates of current and future supply of equipment; |

• | the book value of the equipment after depreciation and other impairment; |

• | our estimates of the effect of interest rates on rental and leasing fees as well as capital financing; and |

• | our estimates of the potential current and future sale prices of equipment. |

However, historical trends are not necessarily indicative of future trends. If our assumptions prove to be wrong, not only may our revenues fall short of our expectations, but we may not be able to adjust our equipment quickly enough to compensate for lower demand for one or more products in our equipment pool. In addition, as demand for a product falls, we may have difficulty in selling any of our excess equipment at a favorable price or at all. Both of these factors can compound the impact of any revenue shortfall and further affect our operating results and the price of our Common Stock.

Economic Conditions. Demand for our rental products depends on continued business activity. In recent years, our financial results have been impacted by competitive pressure on rental rates. Our customers historically have reduced their expenditures for T&M and DP equipment during economic downturns. Accordingly, when the domestic and/or international economy weakens, demand for our products declines. A large part of our equipment pool is rented or leased to customers in the aerospace and defense, telecommunications, electronics, industrial and semiconductor markets. Uncertainty in U.S. or global economy, or in one or more of specific markets we serve, may result in lower demand and increased pressure on prices and gross profit.

While the U.S. economy has emerged from the recession, if the economy experiences another recession, reduced demand for our rental products could increase price competition and could have a material adverse effect on our revenue and profitability.

We continue to focus on remaining profitable in the current conditions, as well as being prepared for the possibility that recessionary trends may return in future periods.

Other Factors. Our quarterly operating results are subject to fluctuation based on a wide variety of factors. Other factors that may affect our operating results from one quarter to another include:

• | changes in customer demands and/or requirements; |

• | changes in pricing or maintenance policies of equipment manufacturers; |

• | price competition from other rental, leasing and finance companies; |

• | the timing of new product announcements and launches; |

• | mix of rental versus resale revenues; |

• | changes in interest rates; |

• | changes in product delivery dates; |

• | currency fluctuations and other risks of international operations; and |

• | changes and reductions to government spending that could negatively impact our customers in the aerospace and defense industry. |

8

All or any of these factors and similar factors could result in our operating results differing substantially from our expectations, as well as the expectations of public market analysts and investors, which would likely have a material adverse impact on our stock price.

RISKS ASSOCIATED WITH TECHNOLOGY CHANGES

We serve customers that operate in markets that are characterized by technological change, and accordingly must anticipate and respond to changes in technology in order to maintain competitiveness and successful operations.

Technological Advancements. We must anticipate and keep pace with the introduction of new hardware, software and networking technologies and acquire equipment that will be marketable to our current and prospective customers. The equipment that we acquire for our equipment pool can be subject to technological change, evolving customer demands and frequent new product announcements and enhancements. If we fail to adequately anticipate or adapt to new technological developments or to recognize changing market conditions, our operating results and stock price could be materially and adversely affected.

Expenses Resulting from Technological Advancements. As a result of technology developments, we may have to make substantial and unanticipated expenditures to acquire new equipment or invest in further staff education on operating and servicing the equipment we deliver to our customers. Further, we may not adequately anticipate or respond successfully to technological changes for many reasons, including misjudging the impact of technological changes as well as financial, technological or other constraints. If we do not adequately anticipate or respond to changes in technological advancements or customer preferences, it would likely have a material adverse impact on our operating results and stock price.

Introduction of New Products and Services. The markets in which we operate are characterized by changing technology, evolving industry standards and declining prices of certain products. Our operating results will depend to a significant extent on our ability to continue to introduce new products and services and to control and/or reduce costs. Whether we succeed in our new offerings depends on several factors such as:

• | proper identification of customer needs; |

• | appropriate control of costs; |

• | timely completion and introduction of products and services as compared to our competitors; |

• | our ability to differentiate our equipment and services from our competitors; and |

• | appropriate pricing and market acceptance of our solutions. |

RISKS ASSOCIATED WITH CUSTOMER SOLVENCY

Our customers may face liquidity issues and, if we make poor credit decisions or are unable to collect on contracts with customers, it could have a material adverse effect on our operating results and stock price.

One of the reasons some of our customers find it more attractive to rent or lease electronic equipment instead of owning that equipment is because renting or leasing enables them to deploy their capital elsewhere. However, some of our customers may have liquidity issues and ultimately may not be able to fulfill the terms of their agreements with us. If we are not able to manage credit risk issues, or if a large number of customers have financial difficulties at the same time, our credit losses would increase above historical levels and may become material.

COMPETITION

If we do not compete effectively, we may lose market share and our revenues and profitability may decline.

The equipment rental, leasing and sales business is characterized by intense competition from several large competitors, some of which have access to greater financial and other resources. We face competition from both established entities and new entries in the market. Our global competitors in T&M rental area include McGrath RentCorp, Continental Resources, Inc., Test Equity LLC and Microlease plc. These entities also compete with us in leasing T&M equipment, as do banks, vendors and other financing sources. In equipment sales, we also compete with sales by our suppliers, including Keysight, Anritsu, Rohde and Schwarz and Tektronix, and their distributors. The market for the lease and rental of computers is highly fragmented, and our principal competitors include SmartSource, Rentex, Rentfusion and Vernon Computer Source.

Our competitors engage in aggressive pricing for both rentals and sales. In order to maintain or increase our market share, we may choose, or be compelled, to lower our prices, resulting in decreased revenues and profitability, which could materially and adversely affect our stock price.

9

RISKS ASSOCIATED WITH INTERNATIONAL OPERATIONS

Our international operations will continue to be a meaningful portion of our overall revenues and operations in the future. There are risks that are inherent to our international operations and, if we fail to manage them appropriately, we may not meet our revenue expectations or may incur unanticipated expenses, either of which would adversely affect our operations.

Currency Risks. We generated 19.3% of our revenues from activity in foreign countries in fiscal 2016. Our contracts to supply equipment outside of the U.S. are generally priced in local currency. However, our consolidated financial statements are prepared in U.S. dollars. Consequently, changes in exchange rates can unpredictably and adversely affect our consolidated operating results, and could result in exchange losses. Although we use foreign currency forward contracts to mitigate the risks associated with fluctuations in exchange rates, we may not be able to reduce the impact of foreign currency fluctuations flowing through our operating results. Thus, exchange rate fluctuations could have a material adverse impact on our operating results and stock price.

Other Risks Associated with International Operations. Additionally, our financial results may be adversely affected by other international risks, such as:

• | international political and economic conditions; |

• | changes in government regulation in various countries; |

• | trade barriers; |

• | difficulty in staffing our foreign sales and service centers, and in training and retaining foreign employees; |

• | issues relating to the repatriation of any profits; |

• | adverse tax consequences; and |

• | costs associated with expansion into new territories. |

We expect that our international operations and the revenues we derive from these activities will continue to be a meaningful portion of our total revenues. If we do not anticipate and respond to the risks associated with international operations, it could have a material adverse effect on our operating results and stock price.

RISKS ASSOCIATED WITH OUR MANUFACTURERS AND SUPPLIERS

Our business is dependent on our ability to purchase equipment for our equipment pool from third party manufacturers and suppliers at prices and on terms that allow us to meet our customers’ requirements. Any significant change in availability, pricing or terms for equipment from our manufacturers could have a substantial impact on our results of operations.

About 93% of our equipment portfolio at acquisition cost consists of general purpose T&M instruments purchased from leading manufacturers such as Keysight, Rohde & Schwarz, Anritsu, and Tektronix. The remainder of our equipment pool consists of personal computers, workstations and tablets from Dell, Apple, IBM, Toshiba and HP. We depend on these manufacturers and suppliers for our equipment. If, in the future, we are not able to purchase necessary equipment from one or more of these suppliers on favorable terms, we may not be able to meet our customers’ demands in a timely manner or for a price that generates a profit. Depending on the equipment required, or the customer’s specific requirements, there may not be suitable alternatives from other suppliers. Any inability to acquire equipment would adversely impact our revenues. Similarly, if we cannot increase our pricing commensurate with pricing changes from our customers, our gross profit and income from operations will be adversely impacted.

The expiration of the Keysight reseller agreement on May 31, 2015 negatively impacted our revenue and net profits. There is no assurance that we will be able to replace the Keysight reseller arrangement with other reseller arrangements or that we will retain our key sales employees.

Sales of new Keysight equipment represented approximately 6.8%, 29.5% and 26.5% of our gross revenue in fiscal 2016, 2015 and 2014, respectively. On March 3, 2015, we announced that our reseller agreement with Keysight would not be renewed after its May 31, 2015 expiration date. The expiration of the Keysight reseller agreement has negatively impacted our revenue and net profits. In the first quarter of fiscal 2016, we entered into agreements with other manufacturers of equipment, including Anritsu, Rodhe & Schwarz and ART-Fi SAS, so that we can replace some of the revenue associated with our Keysight reseller agreement. There can be no assurance that we will replace all or a significant portion of the revenue from the Keysight reseller agreement with relationships with other manufacturers. There is also no assurance that we will be able to retain our key sales personnel, the loss of which may impact our ability to support agreements with other equipment manufacturers. If we are

10

unable to effectively manage the arrangements with other equipment manufacturers or retain our key sales employees, our operating results and stock price may be further materially and adversely affected.

DEPENDENCE ON KEY PERSONNEL

If we are unable to recruit and retain qualified personnel, it could have a material adverse effect on our operating results and stock price.

Our success depends in large part on the continued services of our executive officers, our senior managers and other key personnel. T&M equipment and solutions can be highly technical and complex, and typically require customizations to meet specific customer applications and needs. The quality of our customer service and the knowledge of our personnel is a key competitive factor for our business. It is very important that we attract highly skilled personnel to accommodate growth and to replace personnel who leave. Competition for qualified personnel can be intense, especially in technology industries, and there is a limited number of people with the requisite knowledge and experience to market, sell and service our equipment. We must retain and recruit qualified personnel in order to maintain and grow our business.

CONTROL BY MANAGEMENT AND OTHERS

Senior management has significant influence over our policies and affairs and may be in a position to determine the outcome of corporate actions.

As of August 8, 2016, our executive officers and directors collectively owned approximately 20.3% of our Common Stock.

As of that date, (i) Mr. Daniel Greenberg, our director, beneficially owned approximately 19.0% of our outstanding shares of Common Stock, and (ii) one other shareholder controlled 13.8% of our outstanding shares of Common Stock. As long as these shareholders own a significant percentage of our Common Stock, they will be able to exert significant influence over our policies and affairs and may be in a position to determine the outcome of corporate actions requiring shareholder approval. These may include, for example, the election of directors, the adoption of amendments to our corporate documents and the approval of mergers and sales of our assets.

RISKS ASSOCIATED WITH POSSIBLE ACQUISITIONS AND NEW BUSINESS VENTURES

If we fail to accurately assess and successfully integrate any recent or future acquisitions or new business ventures, we may not achieve the anticipated benefits, which could result in lower revenues, unanticipated operating expenses, reduced profitability and dilution of our book value per share.

We could decide to pursue one or more opportunities by acquisition or internal development. Acquisitions and new business ventures, both domestic and foreign, involve many risks, including:

• | the difficulty of integrating acquired operations and personnel with our existing operations; |

• | the difficulty of developing and marketing new products and services; |

• | the diversion of our management’s attention as a result of evaluating, negotiating and integrating acquisitions or new business ventures; |

• | our exposure to unforeseen liabilities of acquired companies; and |

• | the loss of key employees of an acquired operation. |

In addition, an acquisition or new business venture could adversely impact cash flows and/or operating results, and dilute shareholder interests, for many reasons, including:

• | charges to our income to reflect the impairment of acquired intangible assets, including goodwill; |

• | interest costs and debt service requirements for any debt incurred in connection with an acquisition or new business venture; and |

• | any issuance of securities in connection with an acquisition or new business venture that dilutes or lessens the rights of our current shareholders. |

We have implemented various new business ventures in the past, and not all of such ventures have been successful. The risks associated with acquisitions and new business ventures could have a material adverse impact on our operating results and stock price.

11

RISKS ASSOCIATED WITH FLUCTUATING INTEREST RATES

Interest rate fluctuations could have a material adverse effect on our operating results and stock price.

Our leasing yields tend to correlate with market interest rates. When interest rates are higher, our leasing terms incorporate a higher financing charge. However, in times of relatively lower interest rates our financing charges also decrease, and some of our customers choose to purchase new equipment, rather than to lease. Lower leasing yields result in lower rental and lease revenues, which could have a material adverse impact on our operating results and stock price.

RISKS ASSOCIATED WITH CHANGES IN GOVERNMENT SPENDING

We have customers in the aerospace and defense industry that derive a significant amount of revenue from the U.S. government. If the U.S. government were to substantially curtail spending for the aerospace and defense industry, it would have a significant negative effect on our revenues and profitability.

The U.S. federal government has implemented significant changes and reductions to government defense spending. In addition, uncertainty resulting from previously announced defense spending reductions and the potential future additional reductions have impacted, and are likely to continue to impact, the manner in which our customers in the aerospace and defense industry make procurement decisions, resulting in reduced demand by such customers in our rental services and resale business. A shift in government priorities to government programs in which our customers do not participate and/or reductions in funding for or the termination of government programs in which our customers do participate, unless offset by other programs and opportunities, could have a material adverse effect on the demand of our services and products and, as a consequence, our revenues, operating results and stock price.

RISKS ASSOCIATED WITH COMPLIANCE WITH RULES AND REGULATIONS

Failure to comply with internal control attestation requirements could lead to loss of public confidence in our financial statements and negatively impact our stock price.

As a public reporting company, we are required to comply with the Sarbanes-Oxley Act of 2002, including Section 404, and the related rules and regulations of the SEC. Compliance with Section 404 and other related requirements has increased our costs and will continue to require additional management resources. We may need to continue to implement additional finance and accounting procedures and controls to satisfy new reporting requirements. While our management concluded that our internal control over financial reporting as of May 31, 2016 was effective, there is no assurance that future assessments of the adequacy of our internal controls over financial reporting will be favorable. If we are unable to obtain future unqualified reports as to the effectiveness of our internal control over financial reporting, investors could lose confidence in the reliability of our internal control over financial reporting, which could adversely affect our stock price.

ANTI-TAKEOVER PROVISIONS

The anti-takeover provisions contained in our Articles of Incorporation and Bylaws and in California law could materially and adversely impact the value of our Common Stock.

Certain provisions of our Articles of Incorporation, our Bylaws and California law could, together or separately, discourage, delay or prevent a third party from acquiring us, even if doing so might benefit our shareholders. This may adversely impact the interests of our shareholders with respect to a potential acquisition and may also affect the price investors would receive for their shares of Common Stock. Some examples of these provisions in our Articles of Incorporation and Bylaws are:

• | the right of our board of directors to issue preferred stock with rights and privileges that are senior to the Common Stock, without prior shareholder approval; and |

• | certain limitations of the rights of shareholders to call a special meeting of shareholders. |

Item 1B: Unresolved Staff Comments.

None.

Item 2. Properties.

We own a building that houses our corporate headquarters and Los Angeles sales office located at 6060 Sepulveda Boulevard, Van Nuys, California. The building contains approximately 84,500 square feet of office space. Approximately 16,000 square feet are currently leased to others and approximately 25,000 square feet are available for lease. Current tenant arrangements provide for all of the leased property to be available for our future needs.

12

We own a building at 15385 Oxnard Street, Van Nuys, California, which contains approximately 68,200 square feet. We use all of this space, except for 1,000 square feet that are currently being leased to others. This building houses our California warehouse and equipment calibration center.

We own a facility in Wood Dale, Illinois, containing approximately 30,750 square feet. This facility houses our Illinois warehouse and service center.

As of May 31, 2016, we had sales offices and/or service centers in Los Angeles, Atlanta, Chicago, Dallas, Houston, New York/Newark, San Francisco, Charlotte, Orlando, Seattle and Washington/Baltimore. We have foreign sales offices and warehouses in Toronto, Canada; Mechelen, Belgium; London, United Kingdom; and Beijing and Shanghai, China.

Our facilities aggregate approximately 280,000 square feet as of May 31, 2016. Except for the corporate headquarters, the Wood Dale, Illinois facilities and the Oxnard Street building, each of which we own, all of our facilities are rented pursuant to leases for up to seven years for aggregate annual rentals of approximately $0.9 million in fiscal 2016. Most of our leases provide us with the option of renewing our leases at the end of the initial lease term, at the then-existing fair rental value, for periods of up to five years. We do not consider any rented facility essential to our operations. We consider our facilities to be in good condition, well maintained and adequate for our needs.

Item 3. Legal Proceedings.

We are subject to legal proceedings and business disputes involving ordinary routine legal matters and claims incidental to our business. The ultimate legal and financial liability with respect to such matters generally cannot be estimated with certainty and requires the use of estimates in recording liabilities for potential litigation settlements or awards against us. Estimates for losses from litigation are made after consultation with outside counsel. If estimates of potential losses increase or the related facts and circumstances change in the future, we may be required to record either more or less litigation expense. At May 31, 2016 we are not involved in any pending or threatened legal proceedings that we believe could reasonably be expected to have a material adverse effect on our financial condition, results of operations or cash flows, except as follows:

On June 8, 2016, following the announcement of the Merger, a shareholder class action lawsuit, entitled Chaklos, et al. v. Electro Rent Corp., et al., was filed in the Superior Court of the State of California, Los Angeles County, against ELRC, our directors, Phillip A. Greenberg, Platinum Equity, Parent and Merger Sub. The lawsuit asserts that defendants variously breached, or aided and abetted others in breaching, state law fiduciary duties in connection with their consideration and approval of the merger. The lawsuit seeks rescission of the merger agreement, an injunction barring consummation of the merger, imposition of a constructive trust of “benefits improperly received by defendants” as a result of any breaches of duty and costs and disbursements of the action.

On June 20, 2016, following the announcement of the merger, a shareholder class action lawsuit, entitled Wadsworth v. Electro Rent Corp., et al., was filed in the United States District Court for the Central District of California, against ELRC, its directors, Platinum Equity, Parent and Merger Sub. The lawsuit asserts that defendants variously breached, or aided and abetted others in breaching, state law fiduciary duties in connection with their consideration and approval of the merger. The lawsuit further asserts that the defendants violated securities law in connection with an assortment of alleged material omissions from the preliminary proxy statement. The lawsuit seeks rescission of the merger agreement, an injunction barring consummation of the merger, imposition of a constructive trust of “benefits improperly received by defendants” as a result of any breaches of duty and costs and disbursements of the action.

Item 4. Mine Safety Disclosures.

Not applicable.

PART II

Item 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market for Common Stock.

Our Common Stock is quoted on the NASDAQ stock market under the symbol ELRC. The following table sets forth, for the periods shown, the high and low sale prices of our Common Stock as reported by NASDAQ.

13

Fiscal Year 2016 | Fiscal Year 2015 | ||||||||||||||

High | Low | High | Low | ||||||||||||

First Quarter | $ | 11.71 | $ | 9.72 | $ | 17.37 | $ | 14.85 | |||||||

Second Quarter | 11.67 | 9.78 | 15.53 | 13.27 | |||||||||||

Third Quarter | 10.80 | 7.30 | 14.97 | 12.52 | |||||||||||

Fourth Quarter | 13.13 | 8.26 | 13.11 | 9.97 | |||||||||||

Holders.

There were 315 shareholders of record of our Common Stock at August 8, 2016.

Sales of Unregistered Securities.

We did not make any unregistered sales of our securities in fiscal 2016.

Securities Authorized for Issuance Under Equity Compensation Plans.

The following table provides information as of May 31, 2016 with respect to shares of our Common Stock that may be issued under our 2005 Equity Incentive Plan, as amended and restated, all of which were approved by our shareholders:

EQUITY COMPENSATION PLAN INFORMATION

Number of shares of Common Stock to be issued upon exercise of outstanding options, warrants and rights (a) | Weighted-average exercise price of outstanding options, warrants and rights (b) | Number of shares of Common Stock remaining available for future issuance under equity compensation plans (excluding shares reflected in column (a)) (c) | ||

— | — | 238,720 | ||

Stock Repurchases.

We have from time to time repurchased shares of our Common Stock under an authorization from our Board of Directors. Shares repurchased by us are retired and returned to the status of authorized but unissued stock. We did not repurchase any shares during fiscal 2016, 2015 or 2014. We may choose to make additional open market or other purchases of our Common Stock in the future, but we have no commitment to do so.

Dividends.

Since 2007, we have been paying quarterly dividends each January, April, July and October. We paid total dividends of $0.50 and $0.80 per common share for fiscal 2016 and 2015 amounting to an aggregate of $12.3 million and $19.7 million, respectively. In fiscal 2014, we paid dividends of $0.80 per common share amounting to an aggregate amount of $19.7 million. Payment of future dividends is at the discretion of our Board of Directors and depends on sales, profitability and other performance metrics of the Company, subject to compliance with applicable law.

14

Performance Graph.

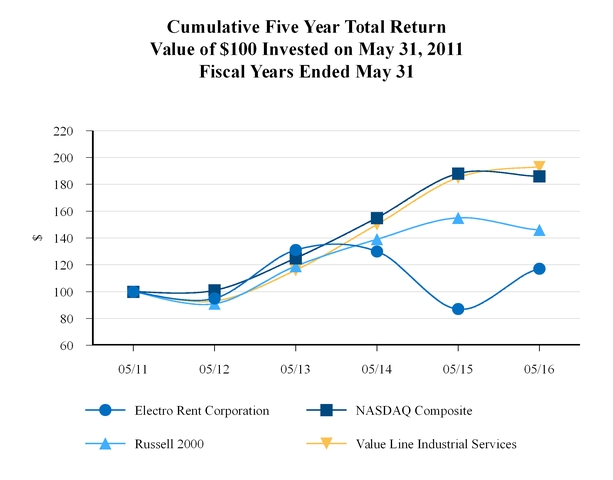

The graph below compares our total shareholder return with (1) the NASDAQ Composite Index, (2) the Russell 2000 Index, and (3) the composite prices of the companies listed by Value Line, Inc. in its Industrial Services Industry Group. Our Common Stock is listed in both the Russell 2000 Index and the Industrial Services Industry Group. The comparison is over a five year period, beginning May 31, 2011 and ending May 31, 2016. The total shareholder return assumes $100 invested at the beginning of the period in our Common Stock and in each index. It also assumes reinvestment of all dividends.

2011 | 2012 | 2013 | 2014 | 2015 | 2016 | ||||||||||||

Electro Rent Corporation | 100 | 95 | 131 | 130 | 87 | 117 | |||||||||||

NASDAQ Composite | 100 | 101 | 125 | 155 | 188 | 186 | |||||||||||

Russell 2000 | 100 | 91 | 119 | 139 | 155 | 146 | |||||||||||

Value Line Industrial Services | 100 | 93 | 116 | 150 | 185 | 193 | |||||||||||

Item 6. Selected Financial Data.

(in thousands, except per share amounts)

The following selected consolidated financial data should be read in conjunction with our audited consolidated financial statements and the accompanying notes included in “Item 8. Financial Statements and Supplementary Data” below and other financial and statistical information included in this Annual Report on Form 10-K.

15

Fiscal year ended May 31, | |||||||||||||||||||

2016 | 2015 | 2014 | 2013 | 2012 (1) | |||||||||||||||

Operations data: | |||||||||||||||||||

Revenues | $ | 175,333 | $ | 238,329 | $ | 241,137 | $ | 248,731 | $ | 248,554 | |||||||||

Costs of revenues and depreciation | 107,096 | 156,088 | 150,078 | 155,477 | 159,218 | ||||||||||||||

Selling, general and administrative expenses | 60,154 | 59,313 | 58,920 | 56,543 | 53,250 | ||||||||||||||

Operating profit | 8,083 | 22,928 | 32,139 | 36,711 | 36,086 | ||||||||||||||

Bargain purchase gain, net (2) | — | — | — | — | 3,435 | ||||||||||||||

Interest income/(expense), net | (329 | ) | 332 | 387 | 402 | 484 | |||||||||||||

Other income | 33 | 1,390 | — | — | — | ||||||||||||||

Income before income taxes | 7,787 | 24,650 | 32,526 | 37,113 | 40,005 | ||||||||||||||

Income tax provision | 3,003 | 9,218 | 12,118 | 14,359 | 14,233 | ||||||||||||||

Net income | $ | 4,784 | $ | 15,432 | $ | 20,408 | $ | 22,754 | $ | 25,772 | |||||||||

Earnings per share: | |||||||||||||||||||

Basic | $ | 0.20 | $ | 0.63 | $ | 0.84 | $ | 0.94 | $ | 1.07 | |||||||||

Diluted | $ | 0.20 | $ | 0.63 | $ | 0.84 | $ | 0.94 | $ | 1.07 | |||||||||

Shares used in per share calculation: | |||||||||||||||||||

Basic | 24,414 | 24,360 | 24,325 | 24,226 | 23,983 | ||||||||||||||

Diluted | 24,429 | 24,378 | 24,357 | 24,269 | 24,152 | ||||||||||||||

Balance sheet data (at end of year): | |||||||||||||||||||

Total assets | $ | 284,577 | $ | 300,314 | $ | 302,058 | $ | 318,926 | $ | 329,831 | |||||||||

Bank borrowings | $ | — | $ | 2,387 | $ | — | $ | 10,000 | $ | — | |||||||||

Shareholders’ equity | $ | 221,499 | $ | 227,978 | $ | 230,958 | $ | 228,549 | $ | 248,131 | |||||||||

Shareholders’ equity per common share | $ | 9.15 | $ | 9.46 | $ | 9.62 | $ | 9.52 | $ | 10.34 | |||||||||

Cash dividends declared per common share | $ | 0.50 | $ | 0.80 | $ | 0.80 | $ | 1.80 | $ | 0.80 | |||||||||

(1) | Includes the post-acquisition operating results and year-end balance sheet information for the assets acquired from Equipment Management Technology, Inc. ("EMT") on August 24, 2011. |

(2) | The estimated fair value of the net assets acquired from EMT in fiscal 2012 exceeded the acquisition cost, resulting in bargain purchase gains with respect to that transaction. |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion addresses our (a) financial condition as of May 31, 2016 and 2015, (b) the results of our operations for the fiscal years ended May 31, 2016, 2015 and 2014, and (c) cash flows for the fiscal years ended May 31, 2016, 2015 and 2014. This discussion should be read in conjunction with the consolidated financial statements and the notes thereto and the other financial and statistical information appearing elsewhere in this Annual Report on Form 10-K.

Statements in the following discussion and throughout this report that are not historical in nature are “forward-looking statements.” Please see “Special Note Regarding Forward Looking Statements” at the beginning of this report.

OVERVIEW

We are a large global organization devoted to the rental, lease and sale of new and used electronic test and measurement (“T&M”) equipment. We purchase T&M equipment from leading manufacturers such as Keysight Technologies, Inc. (formerly Agilent Technologies, Inc., “Keysight”), Anritsu, Inc., Rohde & Schwarz Gmbh & Co. KG and Tektronix Inc. Our customers rent, lease and buy our T&M equipment, and use that equipment primarily in the aerospace and defense, telecommunications, electronics, industrial and semiconductor markets.

In addition, although it represented only approximately 11.4% of our revenues in fiscal 2016, our Data Products ("DP") segment offers our customer an option to rent/lease personal computers from manufacturers including Dell, HP, IBM, Toshiba and Apple.

16

Our Businesses

Our businesses are as follows:

• | Rental and Lease Business. We rent and lease state-of-the-art electronic equipment. We maintain an equipment portfolio comprising T&M and DP equipment purchased from leading manufacturers, which we warehouse in various locations around the world to enable us to serve rental and lease customers. |

• | Used Equipment Sales. We sell used T&M and DP equipment that we previously held for rent and lease. Used equipment is sold at substantial discounts compared to new equipment, and provides an economic advantage for customers seeking ownership of used equipment. All of our used equipment has been maintained and serviced by our professional maintenance team, and our customers have confidence in the quality of the used equipment purchased from us. |

• | New Equipment Sales. We sell new T&M equipment. We were, through May 31, 2015, an authorized reseller of certain new Keysight (formerly Agilent) T&M products and services to small and medium size customers in the United States and Canada. Substantially all of our new equipment sales were through our Keysight reseller agreement. |

Our reseller agreement with Keysight expired on May 31, 2015. The expiration of the Keysight reseller agreement materially affected our revenues and net profits and is expected to do so in the future. Please see the risk factor in PART I-Section 1A, above, for further discussion about the risks related to the expiration of the Keysight reseller agreement. In fiscal 2016, we entered into agreements with other manufacturers of equipment, including Anritsu, Rohde & Schwarz and ART-Fi SAS.

Our Sales Strategy

We have a focused sales strategy, using a direct sales force to meet our customers’ needs in our T&M and DP equipment rental, lease and sales business. We have an experienced, highly technical sales force that specializes in all the products and services offered by our company. Our sales force identifies potential customers through coordinated efforts with our marketing organization, which is staffed by professionals with many years of industry-related experience. As our customers have a wide range of requirements for equipment, our sales force is able to leverage our extensive knowledge of the T&M and DP equipment to determine the right product to rent, lease or sell to the customer to meet the customer’s specific needs.

Our sales force also specializes in configuring new equipment to sell to our customers that is tailored to the customer’s need. These configurations typically start with a base model, which is frequently upgraded through an extensive list of options in order to perform the customer’s specific test or measurement. Once the configuration is determined, it serves as the basis for our orders to the manufacturer, who builds the product accordingly. We order equipment from the manufacturer once the customer had placed an order with us. Equipment is typically shipped directly to the customer by the manufacturer at our request. Occasionally, equipment is shipped to our warehouse prior to delivery to the customer. Inventory held for sale is immaterial and is therefore included in other assets in our consolidated balance sheets. Each order and sales invoice is subject to our standard sales terms and conditions, which include provisions covering equipment delivery delays and warranty services.

Our Equipment Management Strategy

To maximize our overall profitability from the rental, leasing, and sales of equipment, we manage our equipment pool on an on-going basis by controlling the timing, pricing and mix of our purchases and sales of equipment. We acquire new and used equipment for our rental pool to meet current technological standards and current and anticipated customer demand, and we sell our used equipment where we believe that is the most lucrative option. We employ a complex equipment management strategy utilizing our proprietary PERFECT software to adjust our equipment pool and pricing on a dynamic basis in order to maximize equipment availability, utilization and profitability. We manage each specific equipment class based on a separate assessment of that equipment’s historical and projected life cycle and numerous other factors, including the U.S. and global economy, interest rates and new product launches. If we do not accurately predict market trends, or if demand for the equipment we supply declines, we can be left with equipment that we are unable to rent or sell for a profit. We assess the carrying value of the equipment pool on an annual basis or more frequently when factors indicating potential impairment are present.

Foreign Operations and Hedging

Due to our foreign operations, we have revenue, expenses, assets and liabilities in foreign currencies, primarily the euro, Canadian dollar and Chinese yuan. We only enter into forward contracts to hedge against unfavorable currency fluctuations in our monetary assets and liabilities in our European and Canadian operations. Fluctuations in the Chinese yuan have not been significant. As a result of these forward contracts, we were able to reduce the impact of foreign currency fluctuations flowing through our operating results during fiscal 2016, 2015 and 2014. Please see "Item 7A-Quantitative and Qualitative Disclosures

17

about Market Risk-Changes in Foreign Currencies" for additional information about our exposure to foreign currency exchange risk.

Profitability and Key Business Trends

Following is a summary of certain financial metrics comparing fiscal 2016 to 2015 that our management deems important indicators of the performance of the Company:

• | our rental and lease revenues decreased by 4.2% to $123.8 million from $129.3 million primarily due to decreases in rental/lease rates as a result of a negative effect of a decline in foreign exchange rates and competition and, to a lesser degree, lower demand in certain industries we serve; |

• | our sales of equipment and other revenues decreased by 52.7% to $51.5 million from $109.1 million primarily due to a decrease in new equipment sales as a result of the expiration of the Keysight reseller agreement on May 31, 2015; |

• | our operating profit decreased 64.7% to $8.1 million from $22.9 million primarily due to the decrease in sales of new equipment revenues without a commensurate decrease in SG&A expenses; |

• | our net income decreased by 69% to $4.8 million from $15.4 million; |

• | our net income per diluted common share (EPS) decreased 68.3% to $0.20 from $0.63; |

• | our net income as a percentage of average assets declined to 1.6% from 5.1%; and |

• | our net income as a percentage of average equity declined to 2.1% from 6.7%. |

Following is a summary of certain financial metrics comparing fiscal 2015 to 2014 that our management deems important indicators of the performance of the Company:

• | our rental and lease revenues decreased by 5.9% to $129.3 million from $137.4 million primarily due to decreases in average T&M equipment on rent and lease and decreases in rates due to competition, changes in product mix and the negative effect of fluctuations in foreign exchange rates; |

• | our sales of equipment and other revenues increased by 5.2% to $109.1 million from $103.7 million primarily due to an increase in new equipment sales as a result of increased demand; |

• | our operating profit decreased 28.7% to $22.9 million from $32.1 million primarily due to the decrease in rental and lease revenues and changes in product mix; |

• | our net income decreased by 24.4% to $15.4 million from $20.4 million; |

• | our net income per diluted common share (EPS) decreased 25.0% to $0.63 from $0.84; |

• | our net income as a percentage of average assets declined to 5.1% from 6.5%; and |

• | our net income as a percentage of average equity declined to 6.7% from 8.8%. |

As of May 31, 2016, we had a sales order backlog for new T&M equipment of $1.3 million, compared to $12.4 million as of May 31, 2015 and $10.7 million as of May 31, 2014. The decrease in backlog is primarily due to the expiration of the Keysight agreement on May 31, 2015.

RESULTS OF OPERATIONS

Fiscal 2016 Compared with Fiscal 2015

Revenues

Total revenues for fiscal 2016 and 2015 were $175.3 million and $238.3 million, respectively. The 26.4% decrease in total revenues was due to a 4.2% decrease in rental and lease revenues and a 52.7% decrease in sales of equipment and other revenues.

18

Rental and Lease Revenues

Rental and lease revenues for fiscal 2016 were $123.8 million, compared to $129.3 million for fiscal 2015 as follows:

Fiscal Year | |||||||

2016 | 2015 | ||||||

T&M rental and lease revenue | $ | 105,850 | $ | 111,327 | |||

DP rental and lease revenue | 17,935 | 17,928 | |||||

$ | 123,785 | $ | 129,255 | ||||

Our T&M rental and lease revenues decreased by $5.5 million due to a decrease in rental and lease rates and the effect of decreases in foreign exchange rates. The decrease in rental and lease rates was primarily driven by competition and a change in product mix and included the effect of a decrease in foreign exchange rates of $2.1 million affecting our European and Canadian operations.

DP rental and lease revenues remained comparable to fiscal 2015.

Sales of Equipment and Other Revenues

Sales of equipment and other revenues decreased to $51.5 million in fiscal 2016 from $109.1 million in fiscal 2015 in as follows:

Fiscal Year | |||||||

2016 | 2015 | ||||||

Sales of new equipment | $ | 17,385 | $ | 72,846 | |||

Sales of used equipment and other revenues | 34,163 | 36,228 | |||||

$ | 51,548 | $ | 109,074 | ||||

The decrease in sales and other revenues in fiscal 2016 was primarily the result of a decrease in sales of new equipment. Sales of new equipment decreased by $55.5 million, or 76.1%, as a result of the expiration of the Keysight reseller agreement. Sales of used equipment and other revenue decreased by $2.1 million, as compared to prior period, which was impacted by a negative effect a $1.3 million non-recurring, out-of-the-period adjustment to other revenue in fiscal 2015. The expiration of the Keysight reseller agreement is expected to continue to materially affect our sales of new equipment.

Operating Expenses

Depreciation expense in fiscal 2016 decreased to $55.9 million from $56.4 million in fiscal 2015. However, the depreciation ratio, as a percentage of rental and lease revenues, increased to 45.2% in fiscal 2016 from 43.7% in fiscal 2015 as rental and lease revenues decreased.

Costs of rentals and leases, excluding depreciation, which primarily include labor related costs of our operations personnel, supplies, repairs, equipment subrentals, insurance and warehousing costs, decreased to $17.5 million in fiscal 2016 from $18.1 million in fiscal 2015. This expense generally remains consistent as our existing infrastructure is capable of handling moderate changes in rental and lease activity.

Costs of sales of equipment and other revenues, which primarily include the cost of equipment sales, decreased to $33.7 million in fiscal 2016 from $81.6 million in fiscal 2015, which is in line with the decrease in sales revenues. Costs of sales of equipment and other revenues, as a percentage of sales of equipment and other revenues, decreased to 65.4% in fiscal 2016 from 74.8% in fiscal 2015. This decrease was primarily due to a shift in sales mix favoring used T&M equipment sales, which generally result in higher margins than new equipment sales. Our sales margin percentage is expected to fluctuate depending on the mix of used and new equipment sales and is impacted by competition.

SG&A expenses increased to $60.2 million in fiscal 2016 compared to $59.3 million in fiscal 2015 primarily due to merger-related expenses and contractual obligations related to the retirement of Mr. Greenberg, our Chief Executive Officer, effective July 2016. As a percentage of total revenues, SG&A expenses increased to 34.3% in fiscal 2016 from 24.9% in fiscal 2015, due to a decrease in our revenues without a commensurate decrease in SG&A expenses.

Operating Profit

Our operating profit decreased 64.7%, or $14.8 million, from $22.9 million for fiscal 2015 to $8.1 million for fiscal 2016.

19

As compared to fiscal 2015, our rental and lease business contributed $4.4 million less to operating profit, resulting from a) a $5.5 million, or 4.2%, decrease in rental and lease revenues, b) a decrease in our costs of rentals and leases, excluding depreciation of $0.6 million and c) a $0.5 million decrease in depreciation expense.

As compared to fiscal 2015, operating profit from sales of equipment and other revenues decreased by $9.6 million as our sales of equipment and other revenues decreased by $57.5 million, or 52.7%, while the related costs decreased by $47.9 million, or 58.7%.

Our SG&A expenses increased $0.8 million, or 1.4%, to $60.2 million the fiscal 2016 from $59.3 million for fiscal 2015.

Average Acquisition Cost of Equipment

The following table sets forth the average acquisition cost of our equipment on rent and lease:

Fiscal Year | ||||||||||

Average acquisition cost of equipment on rent and lease (in millions) | 2016 | 2015 | Change | |||||||

T&M | $ | 257.7 | $ | 257.6 | — | % | ||||

DP | $ | 12.7 | $ | 13.0 | (2.3 | )% | ||||

Average T&M acquisition cost of equipment on rent and lease for fiscal 2016 remained comparable to fiscal 2015. Average DP acquisition cost of equipment on rent and lease decreased by 2.3% due to a slowdown in demand for DP products.

Average Rental and Lease Rates

Average T&M rental and lease rates decreased by 4.8% while the average DP rental and lease rates increased by 2.0% in fiscal 2016 as compared to the prior fiscal year. The decrease in T&M rates was due to the negative effect of exchange rates on our European and Canadian operations, a shift to markets where we generally experience lower rates and, to a lesser degree, competition in the marketplace. The increase in DP rates is the result of a change in product mix in fiscal 2016 as compared to fiscal 2015.

Average Utilization