| Inst | Fidelity International Real Estate Fund | ||||||||||||||||||||||||||||||||||||||

| Fund Summary Fund/Class: Fidelity® International Real Estate Fund/Fidelity Advisor® International Real Estate Fund Institutional |

||||||||||||||||||||||||||||||||||||||

| Investment Objective | ||||||||||||||||||||||||||||||||||||||

| The fund seeks capital appreciation. | ||||||||||||||||||||||||||||||||||||||

| Fee Table | ||||||||||||||||||||||||||||||||||||||

| The following table describes the fees and expenses that may be incurred when you buy and hold shares of the fund. | ||||||||||||||||||||||||||||||||||||||

| Shareholder fees (fees paid directly from your investment) |

||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||

| Annual class operating expenses (expenses that you pay each year as a % of the value of your investment) |

||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||

| This example helps compare the cost of investing in the fund with the cost of investing in other funds. Let's say, hypothetically, that the annual return for shares of the fund is 5% and that your shareholder fees and the annual operating expenses for shares of the fund are exactly as described in the fee table. This example illustrates the effect of fees and expenses, but is not meant to suggest actual or expected fees and expenses or returns, all of which may vary. For every $10,000 you invested, here's how much you would pay in total expenses if you sell all of your shares at the end of each time period indicated: |

||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||

| Portfolio Turnover | ||||||||||||||||||||||||||||||||||||||

| The fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual operating expenses or in the example, affect the fund's performance. During the most recent fiscal year, the fund's portfolio turnover rate was 78% of the average value of its portfolio. | ||||||||||||||||||||||||||||||||||||||

| Principal Investment Strategies | ||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||

| Principal Investment Risks | ||||||||||||||||||||||||||||||||||||||

An investment in the fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. You could lose money by investing in the fund. |

||||||||||||||||||||||||||||||||||||||

| Performance | ||||||||||||||||||||||||||||||||||||||

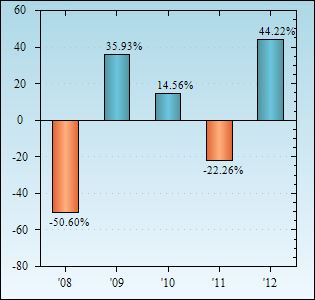

| The following information is intended to help you understand the risks of investing in the fund. The information illustrates the changes in the performance of the fund's shares from year to year and compares the performance of the fund's shares to the performance of a securities market index and an additional index over various periods of time. The indexes have characteristics relevant to the fund's investment strategies. Index descriptions appear in the Additional Index Information section of the prospectus. Past performance (before and after taxes) is not an indication of future performance. Visit www.advisor.fidelity.com for updated return information. |

||||||||||||||||||||||||||||||||||||||

| Year-by-Year Returns Calendar Years |

||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||

| Average Annual Returns | ||||||||||||||||||||||||||||||||||||||

| After-tax returns are calculated using the historical highest individual federal marginal income tax rates, but do not reflect the impact of state or local taxes. Actual after-tax returns may differ depending on your individual circumstances. The after-tax returns shown are not relevant if you hold your shares in a retirement account or in another tax-deferred arrangement. Return After Taxes on Distributions and Sale of Fund Shares may be higher than other returns for the same period due to a tax benefit of realizing a capital loss upon the sale of fund shares. For the periods ended December 31, 2012 |

||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||