UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3114

Fidelity Select Portfolios

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Marc Bryant, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

|

Date of fiscal year end: |

February 28 |

|

|

|

|

Date of reporting period: |

February 28, 2014 |

Item 1. Reports to Stockholders

Fidelity®

Select Portfolios®

Health Care Sector

Biotechnology Portfolio

Health Care Portfolio

Medical Delivery Portfolio

Medical Equipment and Systems Portfolio

Pharmaceuticals Portfolio

Annual Report

February 28, 2014

(Fidelity Cover Art)

Contents

|

Shareholder Expense Example |

|

|

|

Biotechnology Portfolio |

Performance |

|

|

|

Management's Discussion |

|

|

|

Investment Changes |

|

|

|

Investments |

|

|

|

Financial Statements |

|

|

Health Care Portfolio |

Performance |

|

|

|

Management's Discussion |

|

|

|

Investment Changes |

|

|

|

Investments |

|

|

|

Financial Statements |

|

|

Medical Delivery Portfolio |

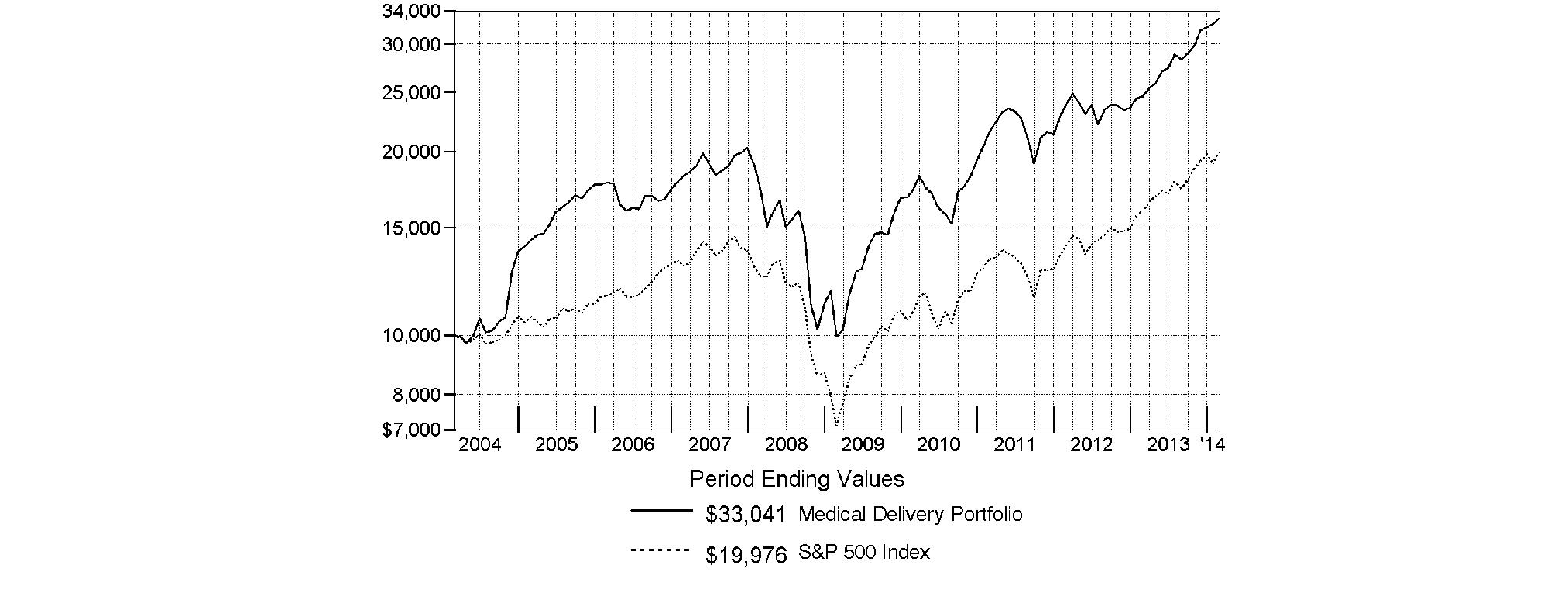

Performance |

|

|

|

Management's Discussion |

|

|

|

Investment Changes |

|

|

|

Investments |

|

|

|

Financial Statements |

|

|

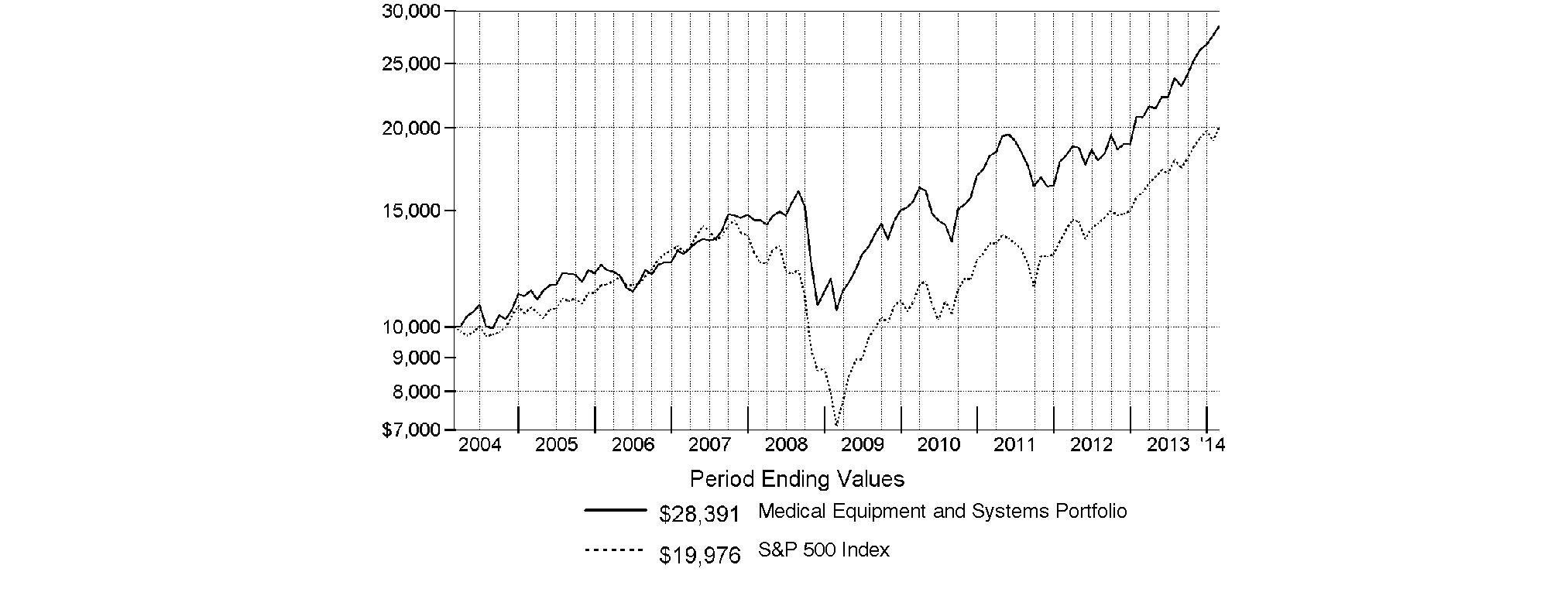

Medical Equipment and Systems Portfolio |

Performance |

|

|

|

Management's Discussion |

|

|

|

Investment Changes |

|

|

|

Investments |

|

|

|

Financial Statements |

|

|

Pharmaceuticals Portfolio |

Performance |

|

|

|

Management's Discussion |

|

|

|

Investment Changes |

|

|

|

Investments |

|

|

|

Financial Statements |

|

|

Notes to Financial Statements |

|

|

|

Report of Independent Registered Public Accounting Firm |

|

|

|

Trustees and Officers |

|

|

|

Distributions |

|

|

|

Proxy Voting Results |

|

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2014 FMR LLC. All rights reserved.

Annual Report

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the funds nor Fidelity Distributors Corporation is a bank.

Annual Report

Shareholder Expense Example

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs including redemption fees and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (September 1, 2013 to February 28, 2014).

Actual Expenses

The first line of the accompanying table for each fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, each Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each fund provides information about hypothetical account values and hypothetical expenses based on a fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, each Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

|

|

Annualized |

Beginning |

Ending |

Expenses Paid |

|

Biotechnology Portfolio |

.75% |

|

|

|

|

Actual |

|

$ 1,000.00 |

$ 1,377.20 |

$ 4.42 |

|

Hypothetical A |

|

$ 1,000.00 |

$ 1,021.08 |

$ 3.76 |

|

Health Care Portfolio |

.76% |

|

|

|

|

Actual |

|

$ 1,000.00 |

$ 1,370.20 |

$ 4.47 |

|

Hypothetical A |

|

$ 1,000.00 |

$ 1,021.03 |

$ 3.81 |

|

Medical Delivery Portfolio |

.81% |

|

|

|

|

Actual |

|

$ 1,000.00 |

$ 1,170.20 |

$ 4.36 |

|

Hypothetical A |

|

$ 1,000.00 |

$ 1,020.78 |

$ 4.06 |

|

Medical Equipment and Systems Portfolio |

.79% |

|

|

|

|

Actual |

|

$ 1,000.00 |

$ 1,230.90 |

$ 4.37 |

|

Hypothetical A |

|

$ 1,000.00 |

$ 1,020.88 |

$ 3.96 |

|

Pharmaceuticals Portfolio |

.80% |

|

|

|

|

Actual |

|

$ 1,000.00 |

$ 1,294.30 |

$ 4.55 |

|

Hypothetical A |

|

$ 1,000.00 |

$ 1,020.83 |

$ 4.01 |

A 5% return per year before expenses

B Annualized expense ratio reflects expenses net of applicable fee waivers.

* Expenses are equal to each Fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). The fees and expenses of the underlying Fidelity Central Funds in which the Fund invests are not included in the Fund's annualized expense ratio.

Annual Report

Biotechnology Portfolio

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

|

Periods ended February 28, 2014 |

Past 1 |

Past 5 |

Past 10 |

|

Biotechnology Portfolio |

84.25% |

34.20% |

15.68% |

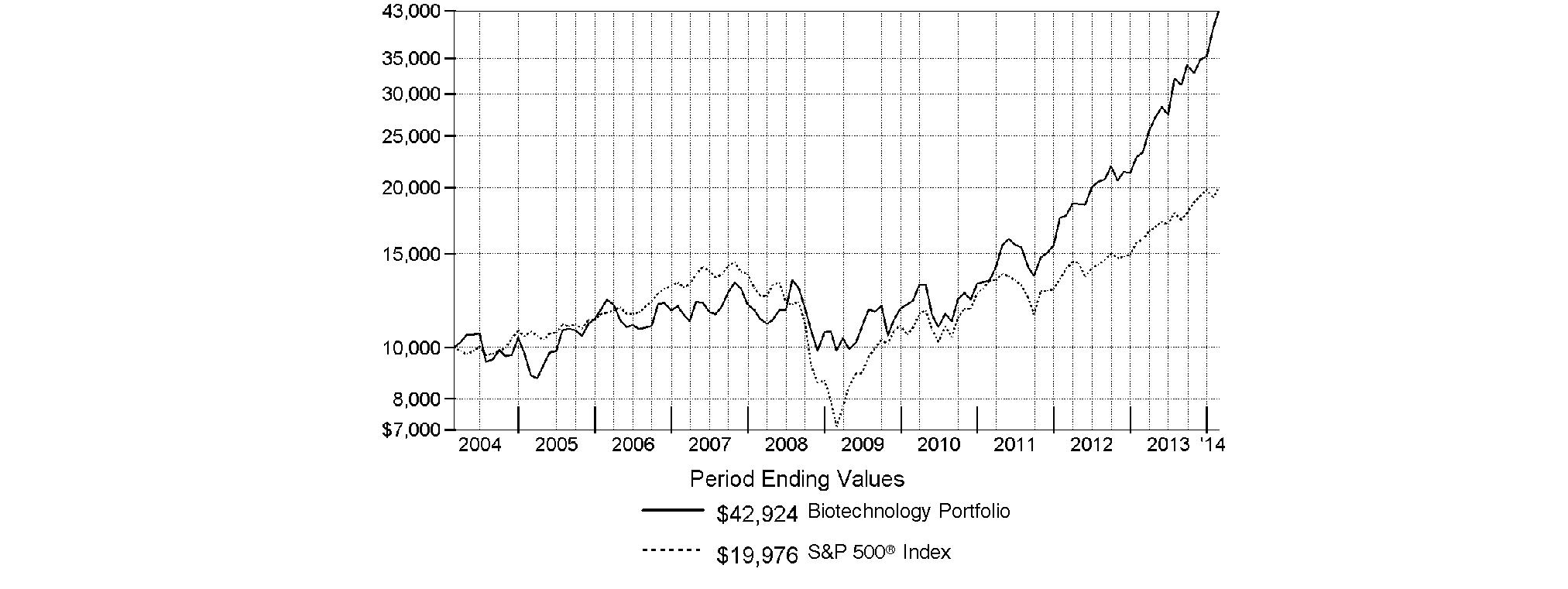

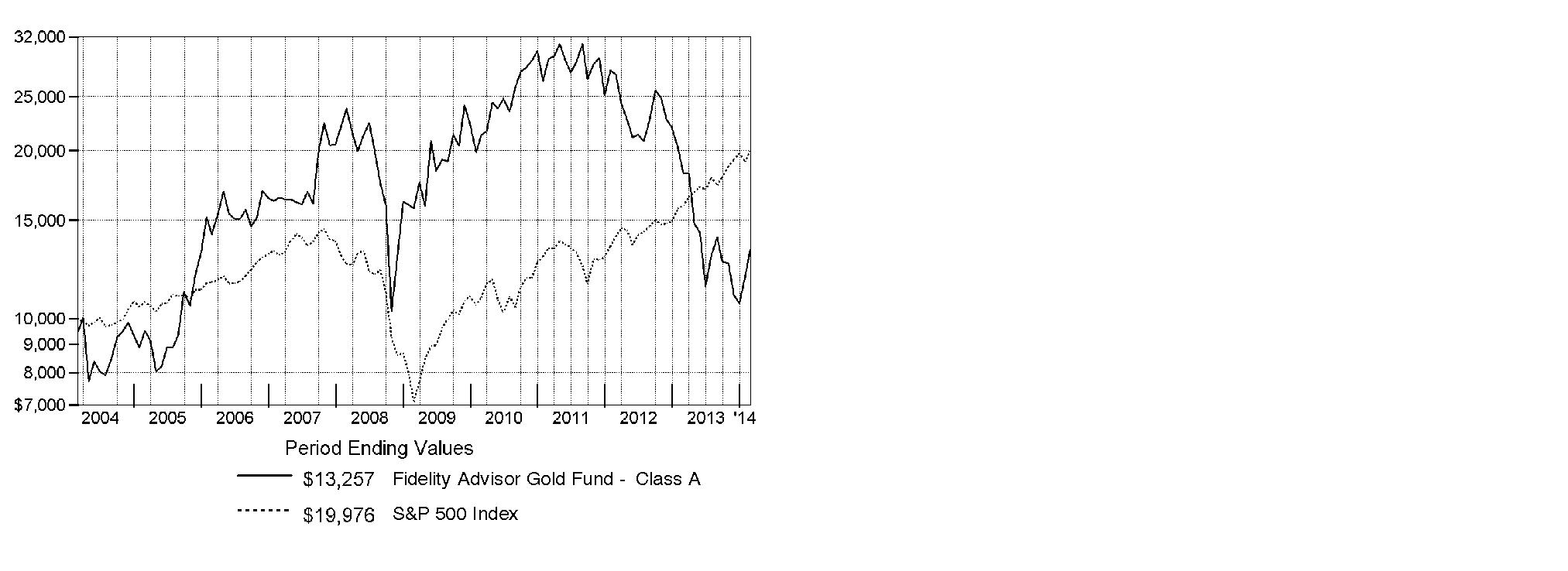

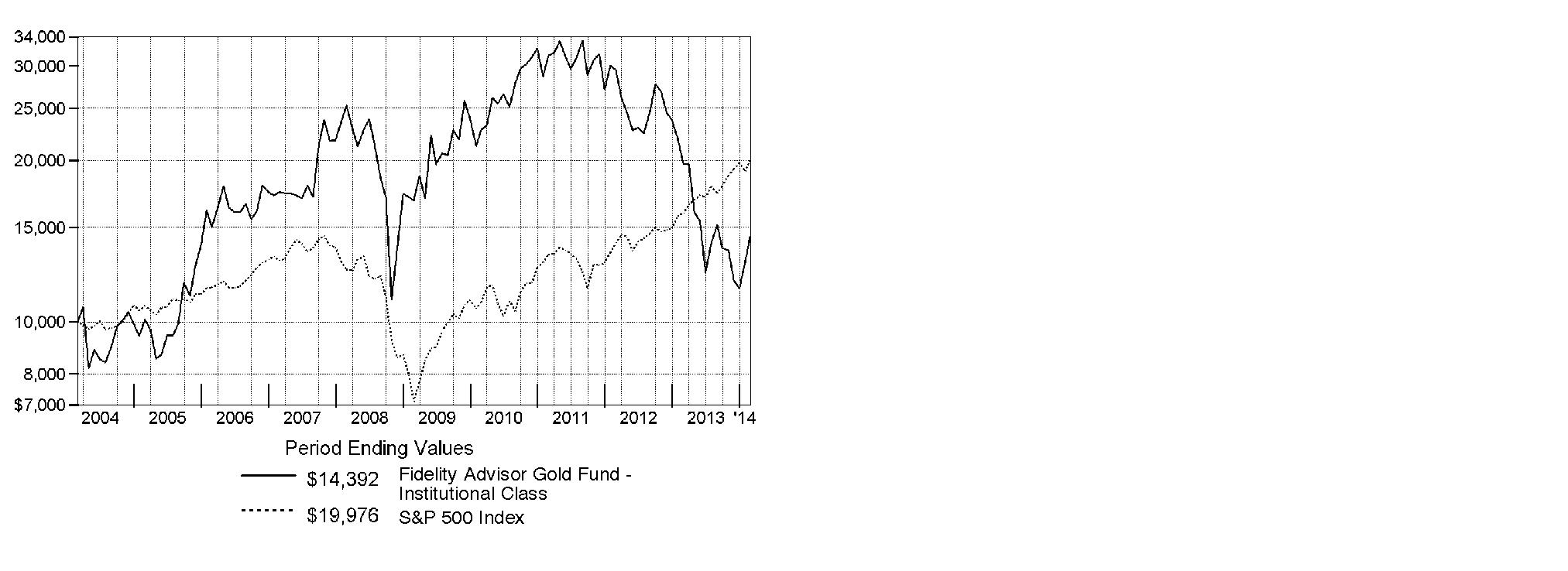

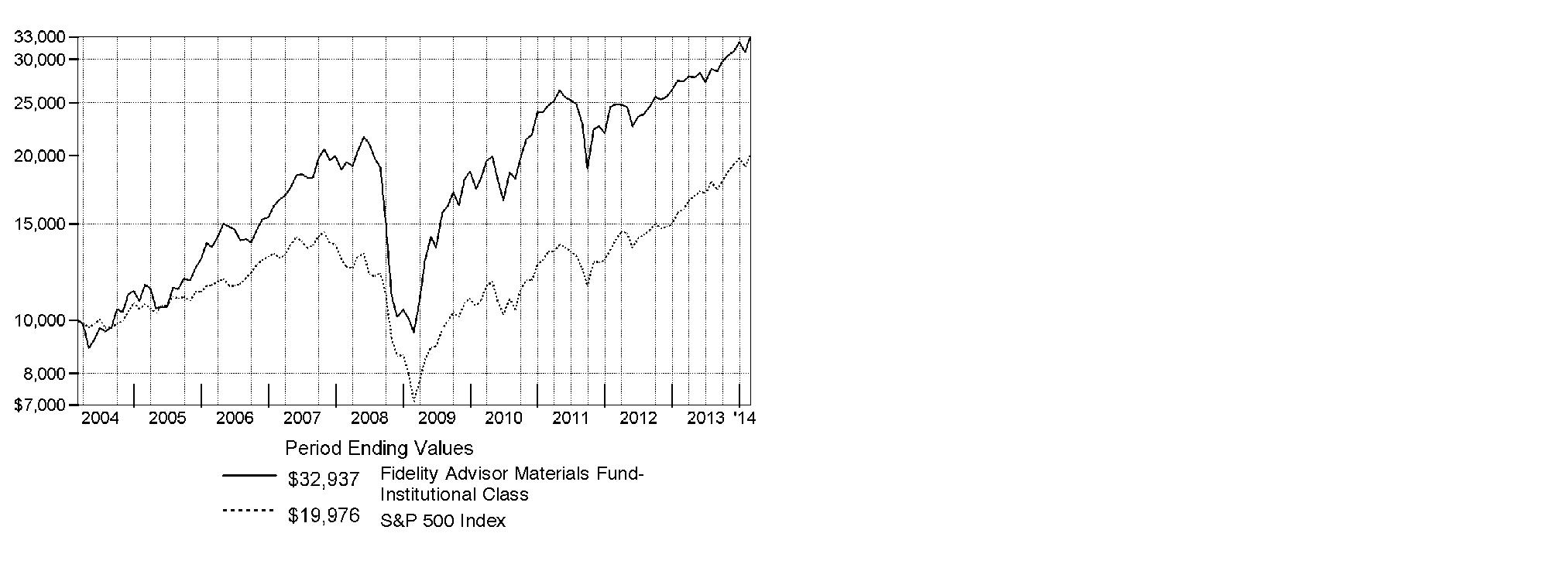

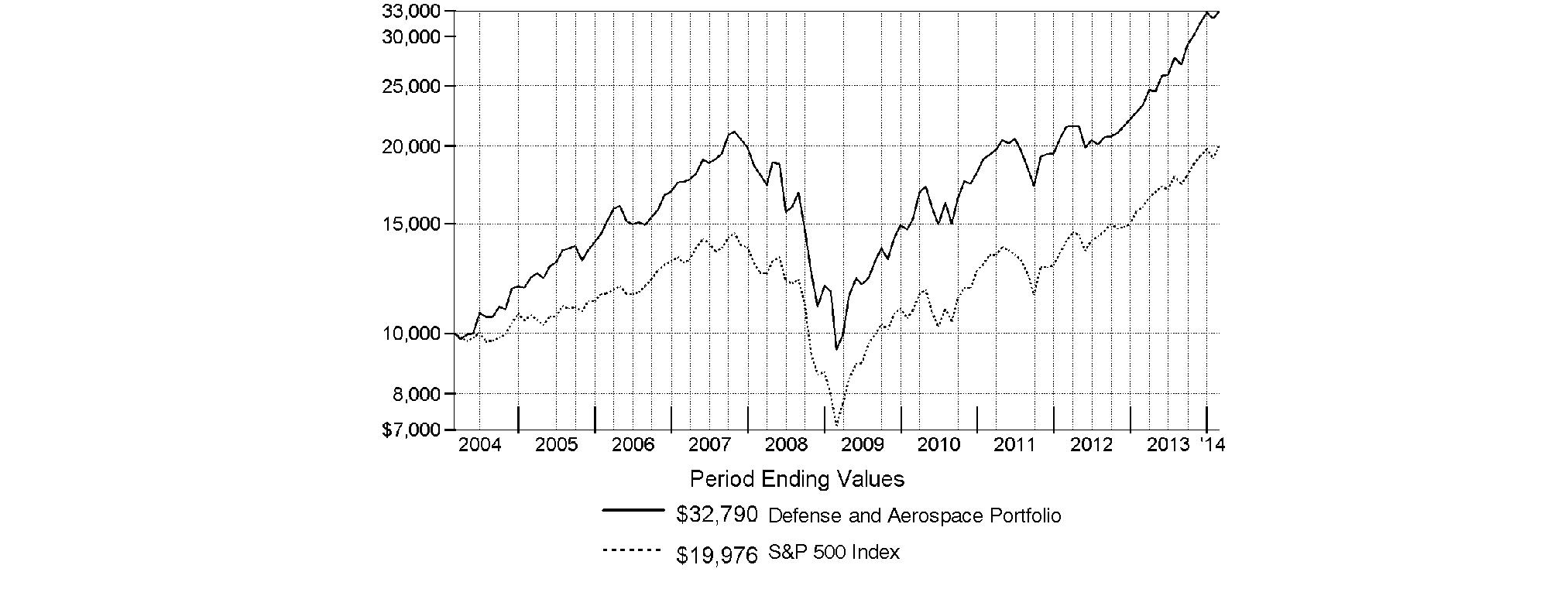

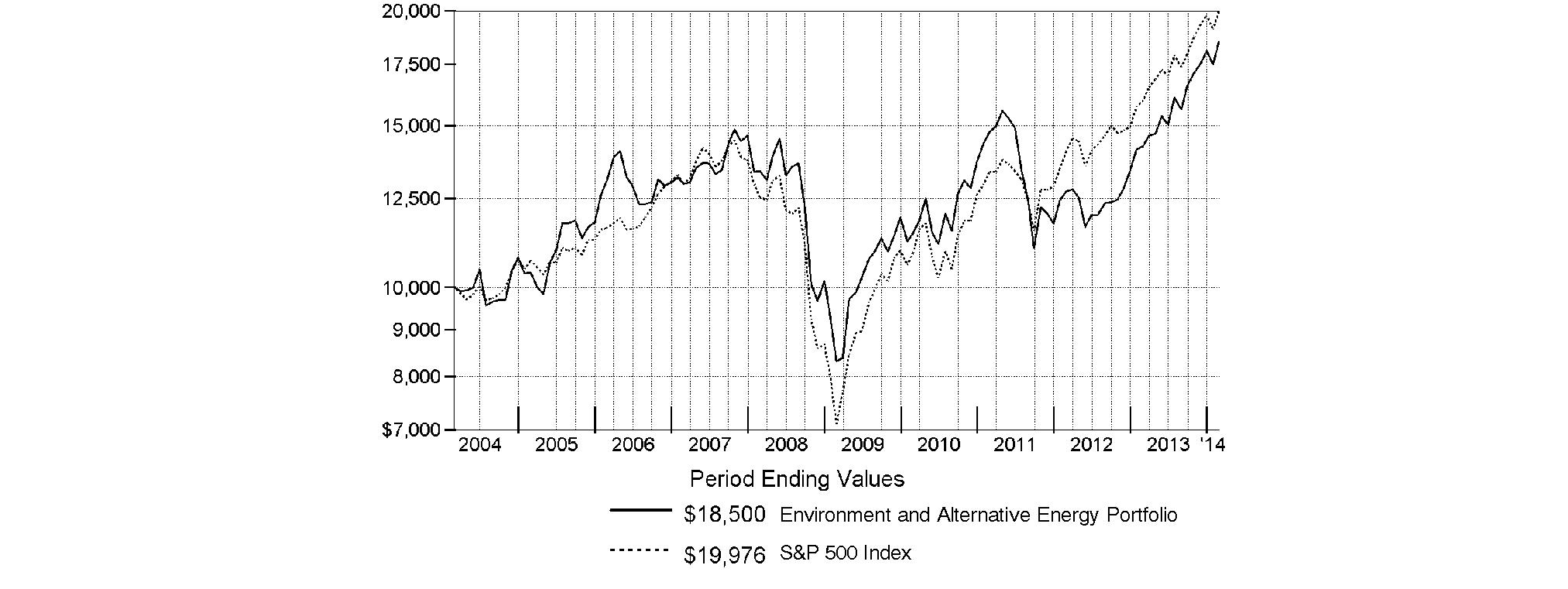

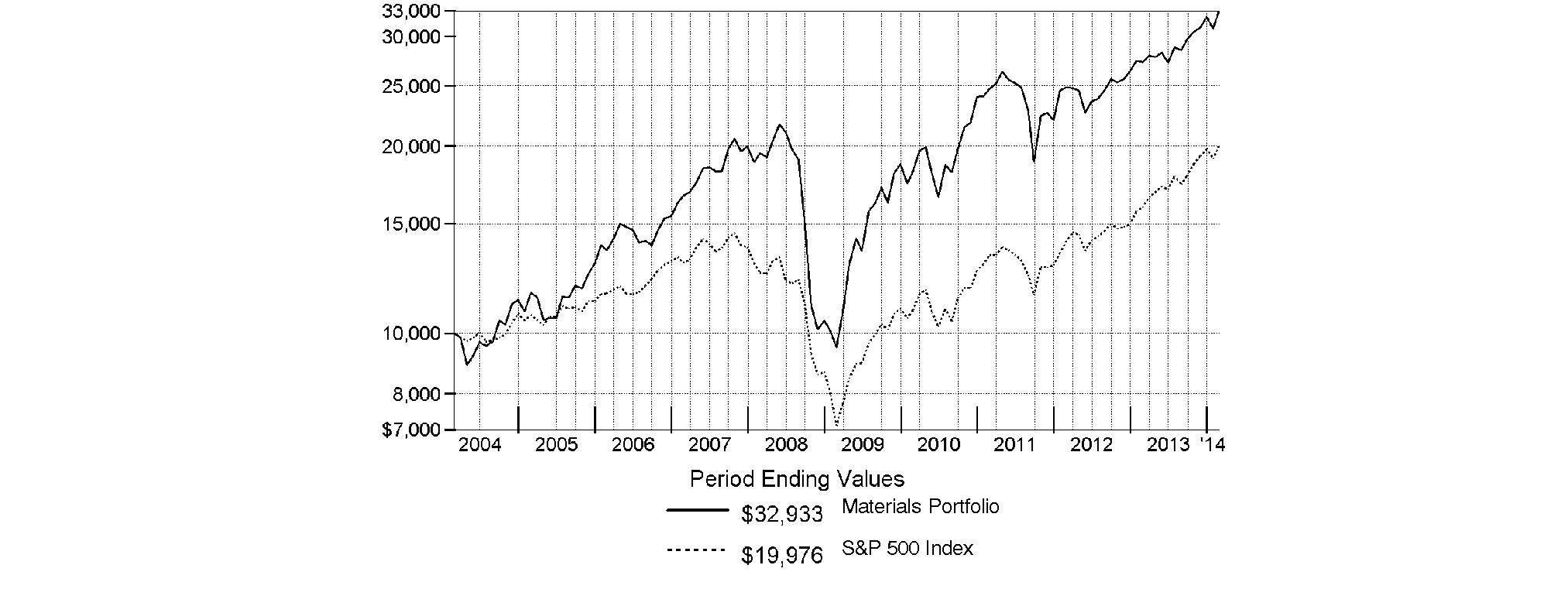

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Biotechnology Portfolio on February 29, 2004. The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period.

Annual Report

Biotechnology Portfolio

Management's Discussion of Fund Performance

Market Recap: Stocks overcame fears of higher interest rates - not to mention their worst January in four years - to finish sharply higher for the 12 months ending February 28, 2014. The broad S&P 500® Index and the blue-chip Dow Jones Industrial AverageSM gained 25.37% and 19.01%, respectively, amid generally favorable earnings reports and accommodative monetary policies worldwide. Performance generally increased along the risk spectrum, with smaller-cap and growth strategies leading the way. An ebullient market helped the growth-oriented Nasdaq Composite Index® to a 38.10% period gain, for example. On the other hand, both cyclical and defensive stocks had representation in the top-performing industry sectors: returns were highest in health care and consumer discretionary; lowest in utilities and telecommunication services. From a macroeconomic perspective, data still points to slow but steady improvement in the U.S., and Europe's recession may well be over. Reports from China have disappointed, but continue to suggest a relatively soft landing there. Mixed signals from the U.S. Federal Reserve as to when it might curtail its stimulative bond buying kept markets in flux during the spring and summer. Stocks regained momentum in October despite a federal budget impasse and brief government shutdown, and lower volatility prevailed through year-end. Shedding new-year concerns about China's economy, an emerging-markets sell-off and confirmation (at last) of Fed tapering - alongside confirmation of a presumably dovish Janet Yellen as new Fed chair - February saw stocks back in record territory, bearing down on the five-year anniversary of the market's bottom.

Comments from Rajiv Kaul, Portfolio Manager of Biotechnology Portfolio: For the year, the fund returned 84.25%, topping the 78.72% gain of its industry benchmark, the MSCI U.S. IMI Biotechnology 25-50 Index, and more than tripling the return of the broadly based S&P 500®. As a group, biotechnology stocks delivered outstanding performance, spurred by favorable product stories and investors' preference for companies with earnings growth that was less dependent on the broader U.S. economy. Compared with the MSCI industry index, stock selection in the small-cap area had the most favorable impact on the fund's performance. The top relative contributor by far was Intercept Pharmaceuticals. This stock rocketed higher in January, after the firm announced successful results from a study of obeticholic acid, or OCA, as a treatment for a form of chronic liver disease. I aggressively added to the fund's stake here, making Intercept the fund's fourth-largest holding by period end. Also lifting the fund's results was ACADIA Pharmaceuticals. In this case, the stock had been moving higher since November 2012, following the announcement of positive phase three clinical data on pimavanserin, a treatment for Parkinson's disease psychosis. Elsewhere, a takeover bid from biotech heavyweight Amgen at the beginning of July significantly lifted the share price of Onyx Pharmaceuticals and made the latter a meaningful contributor as well. I sold Onyx in August to lock in profits. I'll also mention a non-index position in Karyopharm Therapeutics, a stock that debuted in November and more than doubled in value by period end. Conversely, overweighting Ironwood Pharmaceuticals worked against us, as expectations for its recently launched drug LINZESS®, a treatment for irritable bowel syndrome, got ahead of sales, which were reasonably strong but not what the market had been hoping for. Also hampering performance was overweighted exposure to Spectrum Pharmaceuticals.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Biotechnology Portfolio

Investment Changes (Unaudited)

|

Top Ten Stocks as of February 28, 2014 |

||

|

|

% of fund's |

% of fund's net assets |

|

Gilead Sciences, Inc. |

13.3 |

14.7 |

|

Amgen, Inc. |

9.2 |

13.4 |

|

Biogen Idec, Inc. |

6.7 |

6.2 |

|

Intercept Pharmaceuticals, Inc. |

4.9 |

0.5 |

|

Alexion Pharmaceuticals, Inc. |

4.5 |

4.0 |

|

Celgene Corp. |

4.2 |

7.3 |

|

Regeneron Pharmaceuticals, Inc. |

3.8 |

3.6 |

|

Vertex Pharmaceuticals, Inc. |

3.0 |

3.3 |

|

BioMarin Pharmaceutical, Inc. |

1.7 |

1.7 |

|

Pharmacyclics, Inc. |

1.7 |

2.4 |

|

|

53.0 |

|

|

Top Industries (% of fund's net assets) |

|||

|

As of February 28, 2014 |

|||

|

Biotechnology |

95.7% |

|

|

Pharmaceuticals |

3.9% |

|

|

Life Sciences Tools & Services |

0.1% |

|

|

Health Care Equipment & Supplies |

0.0%† |

|

|

Personal Products |

0.0%† |

|

|

All Others* |

0.3% |

|

|

As of August 31, 2013 |

|||

|

Biotechnology |

97.6% |

|

|

Pharmaceuticals |

2.1% |

|

|

Health Care Providers & Services |

0.1% |

|

|

Life Sciences Tools & Services |

0.1% |

|

|

Health Care Equipment & Supplies |

0.0%† |

|

|

All Others* |

0.1% |

|

|

* Includes short-term investments and net other assets (liabilities). |

|

† Amount represents less than 0.1% |

Annual Report

Biotechnology Portfolio

Investments February 28, 2014

Showing Percentage of Net Assets

|

Common Stocks - 99.3% |

|||

|

Shares |

Value |

||

|

BIOTECHNOLOGY - 95.5% |

|||

|

Biotechnology - 95.5% |

|||

|

ACADIA Pharmaceuticals, Inc. (a)(d) |

4,205,963 |

$ 119,028,753 |

|

|

Acceleron Pharma, Inc. (d)(e) |

2,164,269 |

101,569,144 |

|

|

Acorda Therapeutics, Inc. (a)(e) |

2,317,115 |

84,899,094 |

|

|

ADMA Biologics, Inc. |

399,700 |

3,401,447 |

|

|

Aegerion Pharmaceuticals, Inc. (a)(d)(e) |

2,173,495 |

119,020,586 |

|

|

Agenus, Inc. (a)(d) |

150,089 |

733,935 |

|

|

Agenus, Inc. warrants 1/9/18 (a)(g) |

1,548,000 |

228,732 |

|

|

Agios Pharmaceuticals, Inc. (d) |

68,333 |

2,136,090 |

|

|

Agios Pharmaceuticals, Inc. (f) |

83,457 |

2,608,866 |

|

|

Alexion Pharmaceuticals, Inc. (a) |

2,781,842 |

491,829,666 |

|

|

Alkermes PLC (a) |

2,082,594 |

101,359,850 |

|

|

Alnylam Pharmaceuticals, Inc. (a) |

1,595,818 |

129,644,254 |

|

|

AMAG Pharmaceuticals, Inc. (a)(d) |

739,909 |

15,338,314 |

|

|

Ambit Biosciences Corp. |

806,137 |

8,794,955 |

|

|

Amgen, Inc. |

8,147,681 |

1,010,475,398 |

|

|

Anacor Pharmaceuticals, Inc. (a) |

152,715 |

2,901,585 |

|

|

Arena Pharmaceuticals, Inc. (a)(d) |

53,045 |

345,323 |

|

|

ARIAD Pharmaceuticals, Inc. (a)(d) |

9,117,251 |

79,228,911 |

|

|

ArQule, Inc. (a) |

8,342 |

18,770 |

|

|

Array BioPharma, Inc. (a) |

3,855,096 |

18,581,563 |

|

|

Arrowhead Research Corp. (a)(d)(e) |

3,109,885 |

60,456,164 |

|

|

Auspex Pharmaceuticals, Inc. |

356,180 |

8,797,646 |

|

|

Biogen Idec, Inc. (a) |

2,168,789 |

738,863,037 |

|

|

BioMarin Pharmaceutical, Inc. (a) |

2,294,144 |

185,825,664 |

|

|

Bionovo, Inc. warrants 2/2/16 (a) |

1,043,150 |

9,086 |

|

|

Bluebird Bio, Inc. |

181,419 |

4,626,185 |

|

|

Cara Therapeutics, Inc. |

610,950 |

11,534,736 |

|

|

Catalyst Pharmaceutical Partners, Inc.: |

|

|

|

|

warrants 5/2/17 (a) |

141,443 |

138,072 |

|

|

warrants 5/30/17 (a) |

282,100 |

347,254 |

|

|

Celgene Corp. (a) |

2,875,102 |

462,172,647 |

|

|

Cell Therapeutics, Inc. (a)(d) |

3,168,223 |

12,197,659 |

|

|

Cell Therapeutics, Inc. warrants 7/6/16 (a) |

835,596 |

155,613 |

|

|

Celldex Therapeutics, Inc. (a)(d) |

3,017,584 |

88,173,804 |

|

|

Cellectar Biosciences, Inc. (a) |

2,334,890 |

912,942 |

|

|

Cepheid, Inc. (a)(d) |

638,300 |

34,251,178 |

|

|

Chimerix, Inc. |

134,308 |

2,686,160 |

|

|

Clovis Oncology, Inc. (a) |

928,369 |

73,916,740 |

|

|

Cubist Pharmaceuticals, Inc. (a) |

1,542,419 |

122,653,159 |

|

|

Curis, Inc. (a)(d) |

3,562,162 |

10,864,594 |

|

|

Cytokinetics, Inc. (a) |

1,063,466 |

10,475,140 |

|

|

Cytokinetics, Inc. warrants 6/25/17 (a) |

3,828,480 |

1,813,283 |

|

|

Dendreon Corp. (a)(d) |

887,140 |

2,554,963 |

|

|

Dicerna Pharmaceuticals, Inc. |

98,900 |

3,631,608 |

|

|

Dyax Corp. (a)(e) |

10,144,763 |

98,099,858 |

|

|

Dynavax Technologies Corp. (a) |

53,843 |

100,148 |

|

|

Eleven Biotherapeutics, Inc. |

639,460 |

10,359,252 |

|

|

Emergent BioSolutions, Inc. (a) |

292,700 |

7,241,398 |

|

|

|

|||

|

Shares |

Value |

||

|

Enanta Pharmaceuticals, Inc. (e) |

999,266 |

$ 36,812,959 |

|

|

Epizyme, Inc. (d)(e) |

3,064,650 |

91,633,035 |

|

|

Esperion Therapeutics, Inc. (d) |

78,392 |

1,218,996 |

|

|

Exact Sciences Corp. (a)(d) |

1,393,802 |

18,746,637 |

|

|

Exelixis, Inc. (a)(d) |

1,849,687 |

13,058,790 |

|

|

Fate Therapeutics, Inc. |

1,381,284 |

8,913,426 |

|

|

Fibrocell Science, Inc. (a)(d)(e) |

3,326,640 |

18,928,582 |

|

|

Genmab A/S (a) |

855,776 |

38,653,565 |

|

|

Genocea Biosciences, Inc. |

470,400 |

6,900,768 |

|

|

Genomic Health, Inc. (a) |

558,528 |

14,750,724 |

|

|

Geron Corp. (a)(e) |

15,448,486 |

73,457,551 |

|

|

Gilead Sciences, Inc. (a) |

17,774,703 |

1,471,567,659 |

|

|

Halozyme Therapeutics, Inc. (a)(d) |

3,025,923 |

42,635,255 |

|

|

Heron Therapeutics, Inc. (a) |

254,266 |

3,567,352 |

|

|

Hyperion Therapeutics, Inc. (a)(d)(e) |

1,999,059 |

61,970,829 |

|

|

Idenix Pharmaceuticals, Inc. (a)(d) |

179,922 |

1,227,068 |

|

|

Ignyta, Inc. |

43,400 |

388,430 |

|

|

ImmunoGen, Inc. (a)(d) |

1,586,457 |

26,017,895 |

|

|

Immunomedics, Inc. (a)(d) |

3,014,504 |

14,288,749 |

|

|

Incyte Corp. (a) |

2,536,251 |

162,979,489 |

|

|

Infinity Pharmaceuticals, Inc. (a) |

1,434,533 |

22,493,477 |

|

|

Insys Therapeutics, Inc. (a) |

540,319 |

36,352,662 |

|

|

Intercept Pharmaceuticals, Inc. (a)(e) |

1,315,567 |

540,040,254 |

|

|

InterMune, Inc. (a)(d)(e) |

4,548,064 |

136,623,843 |

|

|

Intrexon Corp. (d) |

300,349 |

7,803,067 |

|

|

Ironwood Pharmaceuticals, Inc. Class A (a)(d) |

4,692,810 |

68,092,673 |

|

|

Isis Pharmaceuticals, Inc. (a)(d) |

2,326,787 |

118,666,137 |

|

|

KaloBios Pharmaceuticals, Inc. |

1,512,664 |

4,916,158 |

|

|

Karyopharm Therapeutics, Inc. (d)(e) |

2,055,682 |

82,515,075 |

|

|

Keryx Biopharmaceuticals, Inc. (a)(d) |

2,473,263 |

39,695,871 |

|

|

Kindred Biosciences, Inc. |

119,650 |

2,699,304 |

|

|

KYTHERA Biopharmaceuticals, Inc. (a)(d)(e) |

1,304,079 |

65,164,828 |

|

|

Lexicon Pharmaceuticals, Inc. (a) |

10,295,323 |

18,428,628 |

|

|

Ligand Pharmaceuticals, Inc. Class B (a)(e) |

1,497,001 |

104,415,820 |

|

|

Macrogenics, Inc. |

1,171,880 |

41,015,800 |

|

|

MannKind Corp. (a)(d) |

8,724,206 |

54,002,835 |

|

|

Medivation, Inc. (a) |

2,394,585 |

172,194,607 |

|

|

Merrimack Pharmaceuticals, Inc. (a)(d) |

422,049 |

2,101,804 |

|

|

MiMedx Group, Inc. (a) |

1,088,864 |

7,785,378 |

|

|

Mirati Therapeutics, Inc. (a) |

198,700 |

4,834,371 |

|

|

Momenta Pharmaceuticals, Inc. (a) |

1,149,777 |

17,016,700 |

|

|

Myriad Genetics, Inc. (a)(d) |

1,978,943 |

71,657,526 |

|

|

Neurocrine Biosciences, Inc. (a) |

2,981,368 |

52,561,518 |

|

|

NewLink Genetics Corp. (a)(d)(e) |

1,791,947 |

79,204,057 |

|

|

Novavax, Inc. (a)(d)(e) |

15,593,121 |

99,795,974 |

|

|

Novelos Therapeutics, Inc. warrants 12/6/16 (a) |

2,362,400 |

425 |

|

|

NPS Pharmaceuticals, Inc. (a) |

2,457,213 |

85,953,311 |

|

|

OncoMed Pharmaceuticals, Inc. (d) |

175,400 |

6,054,808 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value |

||

|

BIOTECHNOLOGY - CONTINUED |

|||

|

Biotechnology - continued |

|||

|

Onconova Therapeutics, Inc. (d) |

430,114 |

$ 3,655,969 |

|

|

Ophthotech Corp. (d)(e) |

1,898,926 |

63,936,838 |

|

|

Opko Health, Inc. (a)(d) |

3,977,909 |

37,869,694 |

|

|

Oragenics, Inc. (a)(e) |

2,616,358 |

9,785,179 |

|

|

Orexigen Therapeutics, Inc. (a)(d)(e) |

6,034,709 |

41,880,880 |

|

|

Organovo Holdings, Inc. (a)(d) |

1,753,017 |

18,021,015 |

|

|

Osiris Therapeutics, Inc. (a)(d)(e) |

2,020,095 |

30,846,851 |

|

|

OvaScience, Inc. (a) |

212,300 |

2,290,717 |

|

|

PDL BioPharma, Inc. (d) |

260,333 |

2,231,054 |

|

|

Pharmacyclics, Inc. (a) |

1,321,213 |

183,199,395 |

|

|

PolyMedix, Inc. (a)(e) |

115,509 |

3,003 |

|

|

PolyMedix, Inc. warrants 4/10/16 (a)(e) |

2,961,167 |

30 |

|

|

Portola Pharmaceuticals, Inc. |

1,502,087 |

36,635,902 |

|

|

Prana Biotechnology Ltd. ADR (a)(d) |

914,134 |

10,338,856 |

|

|

Progenics Pharmaceuticals, Inc. (a)(e) |

3,852,060 |

17,989,120 |

|

|

Prosensa Holding BV (a) |

205,163 |

1,347,921 |

|

|

Protalix BioTherapeutics, Inc. (a)(d) |

1,055,842 |

5,099,717 |

|

|

Prothena Corp. PLC (a) |

371,132 |

13,364,463 |

|

|

PTC Therapeutics, Inc. (a)(d)(e) |

1,556,944 |

48,825,764 |

|

|

Puma Biotechnology, Inc. (a) |

970,866 |

112,872,881 |

|

|

Raptor Pharmaceutical Corp. (a)(d)(e) |

3,086,957 |

48,866,529 |

|

|

Receptos, Inc. (e) |

1,328,183 |

61,607,768 |

|

|

Regeneron Pharmaceuticals, Inc. (a) |

1,262,849 |

419,897,293 |

|

|

Regulus Therapeutics, Inc. (a)(d) |

1,600,001 |

17,968,011 |

|

|

Rigel Pharmaceuticals, Inc. (a) |

15,551 |

53,495 |

|

|

Sangamo Biosciences, Inc. (a)(d)(e) |

4,581,918 |

83,390,908 |

|

|

Sarepta Therapeutics, Inc. (a)(d) |

947,632 |

27,509,757 |

|

|

Seattle Genetics, Inc. (a)(d) |

1,983,060 |

104,289,125 |

|

|

Sophiris Bio, Inc. (a)(e) |

1,289,615 |

5,264,210 |

|

|

Sorrento Therapeutics, Inc. (a)(g) |

471,200 |

5,428,224 |

|

|

Sorrento Therapeutics, Inc. (a) |

133,000 |

1,532,160 |

|

|

Spectrum Pharmaceuticals, Inc. (a)(d)(e) |

4,223,900 |

35,269,565 |

|

|

Stemline Therapeutics, Inc. (e) |

1,243,399 |

32,154,298 |

|

|

Sunesis Pharmaceuticals, Inc. (a)(d) |

2,824,764 |

18,502,204 |

|

|

Synageva BioPharma Corp. (a)(d) |

508,324 |

58,289,513 |

|

|

Synergy Pharmaceuticals, Inc. (a)(d) |

2,411,172 |

14,635,814 |

|

|

Synergy Pharmaceuticals, Inc. warrants 11/14/16 (a) |

354,400 |

1,045,480 |

|

|

Synta Pharmaceuticals Corp. (a)(d) |

3,520,817 |

21,758,649 |

|

|

Synthetic Biologics, Inc. (a) |

900 |

2,430 |

|

|

TESARO, Inc. (a) |

1,160,015 |

38,292,095 |

|

|

Theravance, Inc. (a)(d) |

1,287,856 |

47,650,672 |

|

|

Threshold Pharmaceuticals, Inc. (a) |

1,262,685 |

6,313,425 |

|

|

Threshold Pharmaceuticals, Inc. warrants 3/16/16 (a) |

631,520 |

1,713,244 |

|

|

UniQure B.V. |

201,114 |

3,318,381 |

|

|

United Therapeutics Corp. (a) |

1,155,709 |

117,212,007 |

|

|

Verastem, Inc. (a)(d)(e) |

1,453,933 |

19,439,084 |

|

|

Vertex Pharmaceuticals, Inc. (a) |

4,075,800 |

329,569,188 |

|

|

|

|||

|

Shares |

Value |

||

|

Vical, Inc. (a)(e) |

6,407,245 |

$ 9,739,012 |

|

|

Xencor, Inc. |

1,494,900 |

16,802,676 |

|

|

XOMA Corp. (a) |

4,689,019 |

39,200,199 |

|

|

ZIOPHARM Oncology, Inc. (a)(d) |

3,811,792 |

16,238,234 |

|

|

|

10,537,956,795 |

||

|

HEALTH CARE EQUIPMENT & SUPPLIES - 0.0% |

|||

|

Health Care Equipment - 0.0% |

|||

|

Alsius Corp. (a) |

314,300 |

3 |

|

|

Aradigm Corp. (a) |

6,398,160 |

1,727,503 |

|

|

InVivo Therapeutics Holdings Corp. (a) |

1,004,700 |

2,612,220 |

|

|

|

4,339,726 |

||

|

LIFE SCIENCES TOOLS & SERVICES - 0.1% |

|||

|

Life Sciences Tools & Services - 0.1% |

|||

|

BG Medicine, Inc. (a)(d) |

1,177,641 |

1,530,933 |

|

|

ChromaDex, Inc. (a)(d) |

2,195,100 |

3,775,572 |

|

|

Transgenomic, Inc. (a)(g) |

236,500 |

1,217,975 |

|

|

Transgenomic, Inc. (a) |

46,240 |

238,136 |

|

|

Transgenomic, Inc. warrants 2/3/17 (a)(g) |

1,419,000 |

14 |

|

|

|

6,762,630 |

||

|

PERSONAL PRODUCTS - 0.0% |

|||

|

Personal Products - 0.0% |

|||

|

MYOS Corp. (a)(g) |

33,334 |

296,673 |

|

|

PHARMACEUTICALS - 3.7% |

|||

|

Pharmaceuticals - 3.7% |

|||

|

AcelRx Pharmaceuticals, Inc. (a)(d) |

654,629 |

7,482,409 |

|

|

Auxilium Pharmaceuticals, Inc. (a) |

1,087,121 |

33,428,971 |

|

|

AVANIR Pharmaceuticals Class A (a)(e) |

10,558,013 |

43,921,334 |

|

|

ContraVir Pharmaceuticals, Inc. (a)(d) |

237,733 |

370,863 |

|

|

Egalet Corp. |

697,800 |

8,980,686 |

|

|

Horizon Pharma, Inc. (a)(d)(e) |

3,430,767 |

41,923,973 |

|

|

Horizon Pharma, Inc.: |

|

|

|

|

warrants 2/28/17 (a)(e) |

319,539 |

2,561,134 |

|

|

warrants 9/25/17 (a)(e) |

759,050 |

5,935,680 |

|

|

Intra-Cellular Therapies, Inc. (e) |

1,536,950 |

24,944,699 |

|

|

Jazz Pharmaceuticals PLC (a) |

319,665 |

48,571,498 |

|

|

NeurogesX, Inc. (a)(e) |

3,131,785 |

31,318 |

|

|

Pacira Pharmaceuticals, Inc. (a) |

1,026,533 |

80,315,942 |

|

|

Perrigo Co. PLC |

549 |

90,278 |

|

|

Relypsa, Inc. |

1,154,961 |

45,574,761 |

|

|

Repros Therapeutics, Inc. (a)(d) |

776,100 |

15,172,755 |

|

|

TherapeuticsMD, Inc. (a) |

1,330,507 |

9,140,583 |

|

|

Zogenix, Inc. (a)(e) |

9,804,706 |

42,650,471 |

|

|

Zogenix, Inc. warrants 7/27/17 (a)(e) |

498,465 |

433,839 |

|

|

|

411,531,194 |

||

|

TOTAL COMMON STOCKS (Cost $6,078,386,625) |

|

||

|

Preferred Stocks - 0.4% |

|||

|

Shares |

Value |

||

|

Convertible Preferred Stocks - 0.3% |

|||

|

BIOTECHNOLOGY - 0.1% |

|||

|

Biotechnology - 0.1% |

|||

|

Versartis, Inc. Series E (g) |

7,746,596 |

$ 8,738,160 |

|

|

Xenon Pharmaceuticals, Inc. Series E (a)(g) |

981,626 |

4,476,215 |

|

|

|

13,214,375 |

||

|

PHARMACEUTICALS - 0.2% |

|||

|

Pharmaceuticals - 0.2% |

|||

|

aTyr Pharma, Inc. 8.00% (g) |

3,455,296 |

8,738,444 |

|

|

Zafgen, Inc. Series E (g) |

5,172,990 |

11,238,321 |

|

|

|

19,976,765 |

||

|

TOTAL CONVERTIBLE PREFERRED STOCKS |

33,191,140 |

||

|

Nonconvertible Preferred Stocks - 0.1% |

|||

|

BIOTECHNOLOGY - 0.1% |

|||

|

Biotechnology - 0.1% |

|||

|

Moderna LLC Series D, 8.00% (g) |

207,494 |

4,425,847 |

|

|

PHARMACEUTICALS - 0.0% |

|||

|

Pharmaceuticals - 0.0% |

|||

|

Equilibrate Asia Therapeutics Series D (g) |

3,661,108 |

59,749 |

|

|

Equilibrate Worldwide Therapeutics Series D (g) |

3,661,108 |

147,067 |

|

|

Neuropathic Worldwide Therapeutics Series D (g) |

3,661,108 |

27,568 |

|

|

Oculus Worldwide Therapeutics Series D (g) |

3,661,108 |

45,947 |

|

|

Orchestrate U.S. Therapeutics, Inc. Series D (g) |

3,661,108 |

64,326 |

|

|

Orchestrate Worldwide Therapeutics Series D (g) |

3,661,108 |

114,886 |

|

|

|

459,543 |

||

|

TOTAL NONCONVERTIBLE PREFERRED STOCKS |

4,885,390 |

||

|

TOTAL PREFERRED STOCKS (Cost $40,324,452) |

|

||

|

Money Market Funds - 7.3% |

|||

|

Shares |

Value |

||

|

Fidelity Cash Central Fund, 0.10% (b) |

69,750,874 |

$ 69,750,874 |

|

|

Fidelity Securities Lending Cash Central Fund, 0.09% (b)(c) |

739,482,057 |

739,482,057 |

|

|

TOTAL MONEY MARKET FUNDS (Cost $809,232,931) |

|

||

|

TOTAL INVESTMENT PORTFOLIO - 107.0% (Cost $6,927,944,008) |

11,808,196,479 |

||

|

NET OTHER ASSETS (LIABILITIES) - (7.0)% |

(774,883,763) |

||

|

NET ASSETS - 100% |

$ 11,033,312,716 |

||

|

Legend |

|

(a) Non-income producing |

|

(b) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

|

(c) Investment made with cash collateral received from securities on loan. |

|

(d) Security or a portion of the security is on loan at period end. |

|

(e) Affiliated company |

|

(f) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $2,608,866 or 0.0% of net assets. |

|

(g) Restricted securities - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $45,248,148 or 0.4% of net assets. |

|

Additional information on each restricted holding is as follows: |

|

Security |

Acquisition Date |

Acquisition Cost |

|

Agenus, Inc. warrants 1/9/18 |

1/9/08 |

$ 1,930,622 |

|

aTyr Pharma, Inc. 8.00% |

4/8/13 - 5/17/13 |

$ 8,738,444 |

|

Equilibrate Asia Therapeutics Series D |

5/17/13 |

$ 59,749 |

|

Equilibrate Worldwide Therapeutics Series D |

5/17/13 |

$ 147,067 |

|

Moderna LLC Series D, 8.00% |

11/6/13 |

$ 4,425,847 |

|

MYOS Corp. |

7/2/12 |

$ 416,675 |

|

Security |

Acquisition Date |

Acquisition Cost |

|

Neuropathic Worldwide Therapeutics Series D |

5/17/13 |

$ 27,568 |

|

Oculus Worldwide Therapeutics Series D |

5/17/13 |

$ 45,947 |

|

Orchestrate U.S. Therapeutics, Inc. Series D |

5/17/13 |

$ 64,326 |

|

Orchestrate Worldwide Therapeutics Series D |

5/17/13 |

$ 114,886 |

|

Sorrento Therapeutics, Inc. |

5/15/12 |

$ 1,884,800 |

|

Transgenomic, Inc. |

2/3/12 |

$ 2,828,200 |

|

Transgenomic, Inc. warrants 2/3/17 |

2/3/12 |

$ 9,800 |

|

Versartis, Inc. Series E |

2/14/14 |

$ 8,738,160 |

|

Xenon Pharmaceuticals, Inc. Series E |

3/23/01 |

$ 6,724,138 |

|

Zafgen, Inc. Series E |

11/25/13 |

$ 11,238,321 |

|

Affiliated Central Funds |

|

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

|

Fund |

Income earned |

|

Fidelity Cash Central Fund |

$ 43,216 |

|

Fidelity Securities Lending Cash Central Fund |

12,562,635 |

|

Total |

$ 12,605,851 |

|

Other Affiliated Issuers |

|

An affiliated company is a company in which the Fund has ownership of at least 5% of the voting securities. Fiscal year to date transactions with companies which are or were affiliates are as follows: |

|

Affiliate |

Value, |

Purchases |

Sales |

Dividend |

Value, |

|

Acceleron Pharma, Inc. |

$ - |

$ 61,220,714 |

$ - |

$ - |

$ 101,569,144 |

|

Acorda Therapeutics, Inc. |

42,491,985 |

30,030,450 |

- |

- |

84,899,094 |

|

Aegerion Pharmaceuticals, Inc. |

59,281,220 |

57,064,799 |

51,857,257 |

- |

119,020,586 |

|

Agenus, Inc. |

642,381 |

- |

- |

- |

- |

|

Agenus, Inc. warrants 1/9/18 |

78,596 |

- |

- |

- |

- |

|

Arrowhead Research Corp. |

- |

51,296,146 |

- |

- |

60,456,164 |

|

AVANIR Pharmaceuticals Class A |

13,567,786 |

19,987,853 |

- |

- |

43,921,334 |

|

Cell Therapeutics, Inc. |

8,945,719 |

- |

9,356,172 |

- |

- |

|

Cell Therapeutics, Inc. warrants 7/6/16 |

20,931 |

- |

- |

- |

- |

|

Coronado Biosciences, Inc. |

- |

18,641,698 |

4,602,336 |

- |

- |

|

Cytokinetics, Inc. |

6,368,038 |

- |

- |

- |

- |

|

Cytokinetics, Inc. warrants 6/25/17 |

393,737 |

- |

- |

- |

- |

|

Dyax Corp. |

12,120,655 |

53,384,996 |

7,463,884 |

- |

98,099,858 |

|

Enanta Pharmaceuticals, Inc. |

- |

39,985,297 |

3,549,927 |

- |

36,812,959 |

|

Epizyme, Inc. |

- |

78,891,646 |

- |

- |

91,633,035 |

|

Fibrocell Science, Inc. |

9,272,915 |

3,667,040 |

- |

- |

18,928,582 |

|

Geron Corp. |

8,274,163 |

58,294,010 |

7,955,186 |

- |

73,457,551 |

|

Horizon Pharma, Inc. |

3,392,458 |

12,207,223 |

- |

- |

41,923,973 |

|

Horizon Pharma, Inc. warrants 2/28/17 |

15 |

- |

- |

- |

2,561,134 |

|

Horizon Pharma, Inc. warrants 9/25/17 |

36 |

- |

- |

- |

5,935,680 |

|

Hyperion Therapeutics, Inc. |

- |

46,879,521 |

- |

- |

61,970,829 |

|

Intercept Pharmaceuticals, Inc. |

4,597,883 |

58,319,907 |

- |

- |

540,040,254 |

|

InterMune, Inc. |

28,143,738 |

40,670,212 |

- |

- |

136,623,843 |

|

Intra-Cellular Therapies, Inc. |

- |

16,539,723 |

- |

- |

24,944,699 |

|

Karyopharm Therapeutics, Inc. |

- |

37,058,073 |

- |

- |

82,515,075 |

|

KYTHERA Biopharmaceuticals, Inc. |

- |

51,350,080 |

- |

- |

65,164,828 |

|

Affiliate |

Value, |

Purchases |

Sales |

Dividend |

Value, |

|

Ligand Pharmaceuticals, Inc. Class B |

$ 9,019,689 |

$ 37,667,095 |

$ - |

$ - |

$ 104,415,820 |

|

NeurogesX, Inc. |

845,582 |

- |

- |

- |

31,318 |

|

NewLink Genetics Corp. |

8,314,975 |

29,474,174 |

- |

- |

79,204,057 |

|

Novavax, Inc. |

13,380,647 |

38,710,067 |

- |

- |

99,795,974 |

|

Novelos Therapeutics, Inc. |

1,144,096 |

- |

- |

- |

- |

|

Novelos Therapeutics, Inc. warrants 12/6/16 |

23,713 |

- |

- |

- |

- |

|

Ophthotech Corp. |

- |

52,319,211 |

- |

- |

63,936,838 |

|

Oragenics, Inc. |

5,390,881 |

2,645,750 |

- |

- |

9,785,179 |

|

Orexigen Therapeutics, Inc. |

15,372,407 |

41,444,885 |

14,245,482 |

- |

41,880,880 |

|

Osiris Therapeutics, Inc. |

2,851,890 |

28,257,412 |

- |

- |

30,846,851 |

|

PolyMedix, Inc. |

698,828 |

- |

- |

- |

3,003 |

|

PolyMedix, Inc. warrants 4/10/16 |

4,541 |

- |

- |

- |

30 |

|

Progenics Pharmaceuticals, Inc. |

11,847,515 |

14,774,742 |

18,654,358 |

- |

17,989,120 |

|

PTC Therapeutics, Inc. |

- |

37,754,122 |

7,077,168 |

- |

48,825,764 |

|

Raptor Pharmaceutical Corp. |

7,318,718 |

9,155,046 |

- |

- |

48,866,529 |

|

Receptos, Inc. |

- |

49,555,966 |

5,743,638 |

- |

61,607,768 |

|

Sangamo Biosciences, Inc. |

19,381,686 |

38,195,740 |

2,264,477 |

- |

83,390,908 |

|

Sophiris Bio, Inc. |

- |

6,305,000 |

88,563 |

- |

5,264,210 |

|

Spectrum Pharmaceuticals, Inc. |

39,774,600 |

7,913,424 |

2,109,435 |

- |

35,269,565 |

|

Stemline Therapeutics, Inc. |

5,884,230 |

14,212,900 |

- |

- |

32,154,298 |

|

Targacept, Inc. |

5,509,566 |

4,261,692 |

10,108,560 |

- |

- |

|

Verastem, Inc. |

898,357 |

19,740,622 |

- |

- |

19,439,084 |

|

Vical, Inc. |

12,922,016 |

8,780,477 |

- |

- |

9,739,012 |

|

Zogenix, Inc. |

2,701,510 |

15,232,983 |

217,706 |

- |

42,650,471 |

|

Zogenix, Inc. warrants 7/27/17 |

5,428 |

- |

- |

- |

433,839 |

|

Total |

$ 360,883,131 |

$ 1,191,890,696 |

$ 145,294,149 |

$ - |

$ 2,526,009,140 |

|

Other Information |

|

The following is a summary of the inputs used, as of February 28, 2014, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements. |

|

Valuation Inputs at Reporting Date: |

||||

|

Description |

Total |

Level 1 |

Level 2 |

Level 3 |

|

Investments in Securities: |

||||

|

Common Stocks |

$ 10,960,887,018 |

$ 10,933,372,973 |

$ 22,249,832 |

$ 5,264,213 |

|

Preferred Stocks |

38,076,530 |

- |

- |

38,076,530 |

|

Money Market Funds |

809,232,931 |

809,232,931 |

- |

- |

|

Total Investments in Securities: |

$ 11,808,196,479 |

$ 11,742,605,904 |

$ 22,249,832 |

$ 43,340,743 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Biotechnology Portfolio

Financial Statements

Statement of Assets and Liabilities

|

|

February 28, 2014 |

|

|

|

|

|

|

Assets |

|

|

|

Investment in securities, at value (including securities loaned of $689,922,272) - See accompanying schedule: Unaffiliated issuers (cost $4,745,657,233) |

$ 8,472,954,408 |

|

|

Fidelity Central Funds (cost $809,232,931) |

809,232,931 |

|

|

Other affiliated issuers (cost $1,373,053,844) |

2,526,009,140 |

|

|

Total Investments (cost $6,927,944,008) |

|

$ 11,808,196,479 |

|

Receivable for investments sold |

|

42,414,295 |

|

Receivable for fund shares sold |

|

68,303,938 |

|

Dividends receivable |

|

4,544,413 |

|

Distributions receivable from Fidelity Central Funds |

|

1,502,243 |

|

Prepaid expenses |

|

33,279 |

|

Other receivables |

|

168,539 |

|

Total assets |

|

11,925,163,186 |

|

|

|

|

|

Liabilities |

|

|

|

Payable for investments purchased |

$ 122,711,748 |

|

|

Payable for fund shares redeemed |

23,330,902 |

|

|

Accrued management fee |

4,727,650 |

|

|

Other affiliated payables |

1,298,656 |

|

|

Other payables and accrued expenses |

299,457 |

|

|

Collateral on securities loaned, at value |

739,482,057 |

|

|

Total liabilities |

|

891,850,470 |

|

|

|

|

|

Net Assets |

|

$ 11,033,312,716 |

|

Net Assets consist of: |

|

|

|

Paid in capital |

|

$ 6,197,551,101 |

|

Accumulated net investment loss |

|

(2,984,590) |

|

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions |

|

(41,506,266) |

|

Net unrealized appreciation (depreciation) on investments |

|

4,880,252,471 |

|

Net Assets, for 49,823,663 shares outstanding |

|

$ 11,033,312,716 |

|

Net Asset Value, offering price and redemption price per share ($11,033,312,716 ÷ 49,823,663 shares) |

|

$ 221.45 |

Statement of Operations

|

|

Year ended February 28, 2014 |

|

|

|

|

|

|

Investment Income |

|

|

|

Dividends |

|

$ 16,098,759 |

|

Interest |

|

29,593 |

|

Income from Fidelity Central Funds (including $12,562,635 from security lending) |

|

12,605,851 |

|

Total income |

|

28,734,203 |

|

|

|

|

|

Expenses |

|

|

|

Management fee |

$ 36,804,051 |

|

|

Transfer agent fees |

11,290,960 |

|

|

Accounting and security lending fees |

1,246,798 |

|

|

Custodian fees and expenses |

71,384 |

|

|

Independent trustees' compensation |

128,844 |

|

|

Registration fees |

719,349 |

|

|

Audit |

53,055 |

|

|

Legal |

92,077 |

|

|

Interest |

9,813 |

|

|

Miscellaneous |

57,674 |

|

|

Total expenses before reductions |

50,474,005 |

|

|

Expense reductions |

(383,166) |

50,090,839 |

|

Net investment income (loss) |

|

(21,356,636) |

|

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: |

|

|

|

Investment securities: |

|

|

|

Unaffiliated issuers |

14,130,956 |

|

|

Other affiliated issuers |

(8,037,870) |

|

|

Foreign currency transactions |

(18,781) |

|

|

Total net realized gain (loss) |

|

6,074,305 |

|

Change in net unrealized appreciation (depreciation) on investment securities |

|

4,047,853,105 |

|

Net gain (loss) |

|

4,053,927,410 |

|

Net increase (decrease) in net assets resulting from operations |

|

$ 4,032,570,774 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Changes in Net Assets

|

|

Year ended |

Year ended |

|

Increase (Decrease) in Net Assets |

|

|

|

Operations |

|

|

|

Net investment income (loss) |

$ (21,356,636) |

$ (3,565,629) |

|

Net realized gain (loss) |

6,074,305 |

28,880,064 |

|

Change in net unrealized appreciation (depreciation) |

4,047,853,105 |

605,920,510 |

|

Net increase (decrease) in net assets resulting from operations |

4,032,570,774 |

631,234,945 |

|

Distributions to shareholders from net realized gain |

(19,359,860) |

(122,210,105) |

|

Share transactions |

6,286,734,102 |

2,048,861,225 |

|

Reinvestment of distributions |

18,562,365 |

115,347,882 |

|

Cost of shares redeemed |

(2,736,980,053) |

(964,521,211) |

|

Net increase (decrease) in net assets resulting from share transactions |

3,568,316,414 |

1,199,687,896 |

|

Redemption fees |

1,059,947 |

182,621 |

|

Total increase (decrease) in net assets |

7,582,587,275 |

1,708,895,357 |

|

|

|

|

|

Net Assets |

|

|

|

Beginning of period |

3,450,725,441 |

1,741,830,084 |

|

End of period (including accumulated net investment loss of $2,984,590 and accumulated net investment loss of $1,465, respectively) |

$ 11,033,312,716 |

$ 3,450,725,441 |

|

Other Information Shares |

|

|

|

Sold |

37,746,580 |

18,573,347 |

|

Issued in reinvestment of distributions |

106,764 |

1,211,311 |

|

Redeemed |

(16,664,868) |

(8,962,811) |

|

Net increase (decrease) |

21,188,476 |

10,821,847 |

Financial Highlights

|

Years ended February 28, |

2014 |

2013 |

2012 H |

2011 |

2010 |

|

Selected Per-Share Data |

|

|

|

|

|

|

Net asset value, beginning of period |

$ 120.51 |

$ 97.78 |

$ 74.01 |

$ 67.83 |

$ 54.62 |

|

Income from Investment Operations |

|

|

|

|

|

|

Net investment income (loss) B |

(.54) |

(.16) |

(.23) |

(.41) E |

(.39) F |

|

Net realized and unrealized gain (loss) |

101.91 |

29.36 |

24.11 |

6.59 |

13.60 |

|

Total from investment operations |

101.37 |

29.20 |

23.88 |

6.18 |

13.21 |

|

Distributions from net realized gain |

(.46) |

(6.48) |

(.12) |

- |

- |

|

Redemption fees added to paid in capital B |

.03 |

.01 |

.01 |

- I |

- I |

|

Net asset value, end of period |

$ 221.45 |

$ 120.51 |

$ 97.78 |

$ 74.01 |

$ 67.83 |

|

Total Return A |

84.25% |

31.78% |

32.31% |

9.11% |

24.19% |

|

Ratios to Average Net Assets C, G |

|

|

|

|

|

|

Expenses before reductions |

.76% |

.81% |

.83% |

.87% |

.91% |

|

Expenses net of fee waivers, if any |

.76% |

.80% |

.83% |

.87% |

.91% |

|

Expenses net of all reductions |

.75% |

.79% |

.83% |

.86% |

.91% |

|

Net investment income (loss) |

(.32)% |

(.15)% |

(.27)% |

(.59)% E |

(.64)% F |

|

Supplemental Data |

|

|

|

|

|

|

Net assets, end of period (000 omitted) |

$ 11,033,313 |

$ 3,450,725 |

$ 1,741,830 |

$ 1,012,907 |

$ 1,068,656 |

|

Portfolio turnover rate D |

35% |

42% |

106% |

119% |

109% |

A Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

B Calculated based on average shares outstanding during the period.

C Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

D Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

E Investment income per share reflects a large, non-recurring dividend which amounted to $.11 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been (.75)%.

F Investment income per share reflects a large, non-recurring dividend which amounted to $.09 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been (.78)%.

G Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund.

H For the year ended February 29.

I Amount represents less than $.01 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Health Care Portfolio

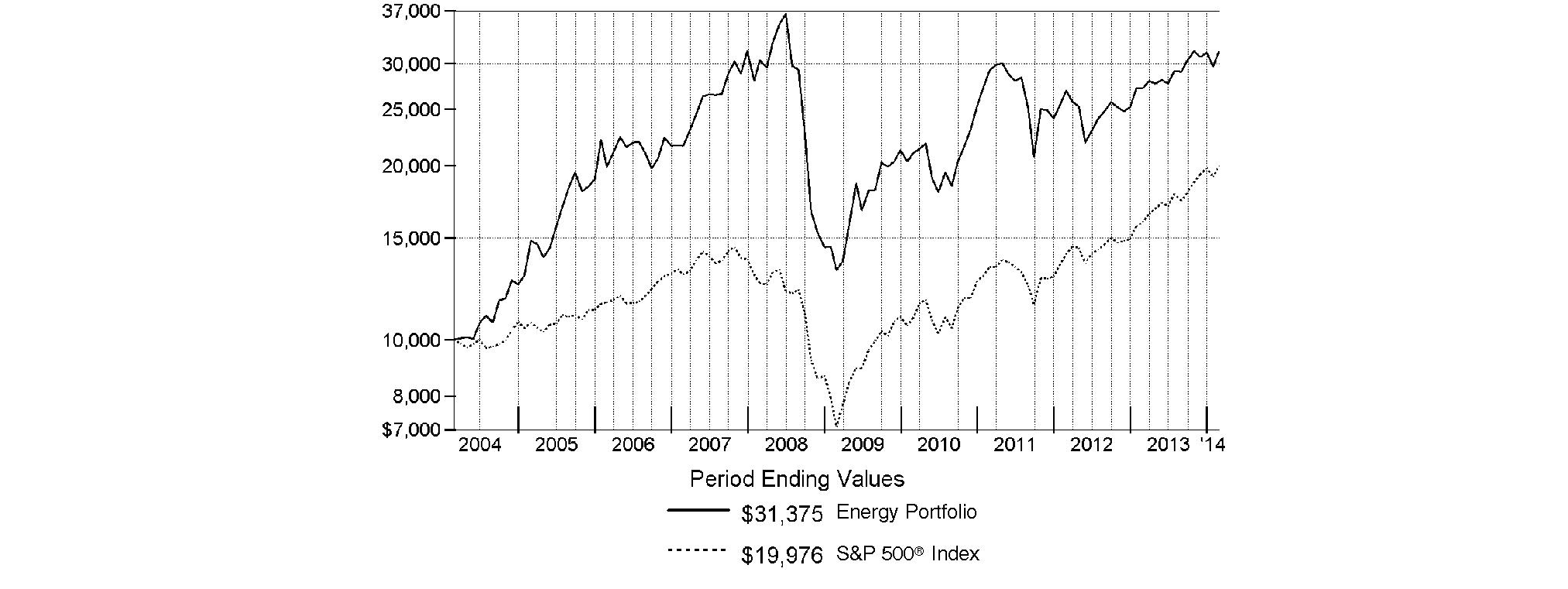

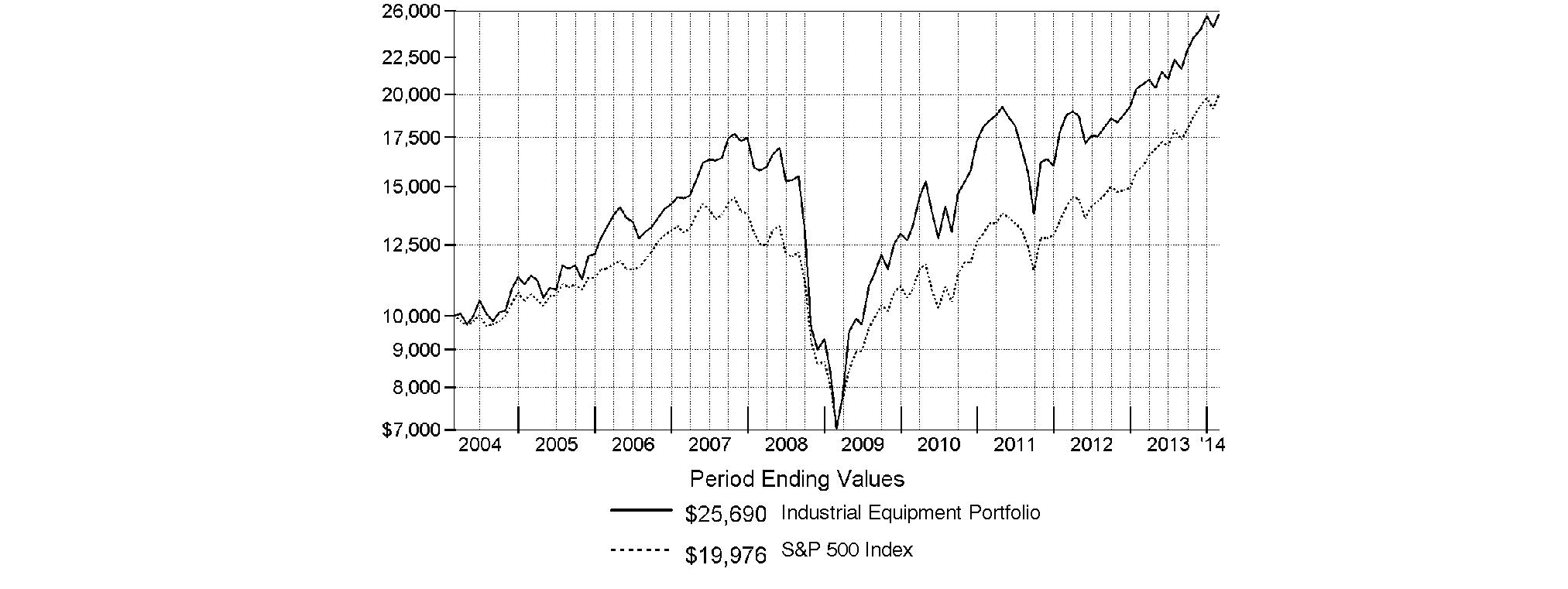

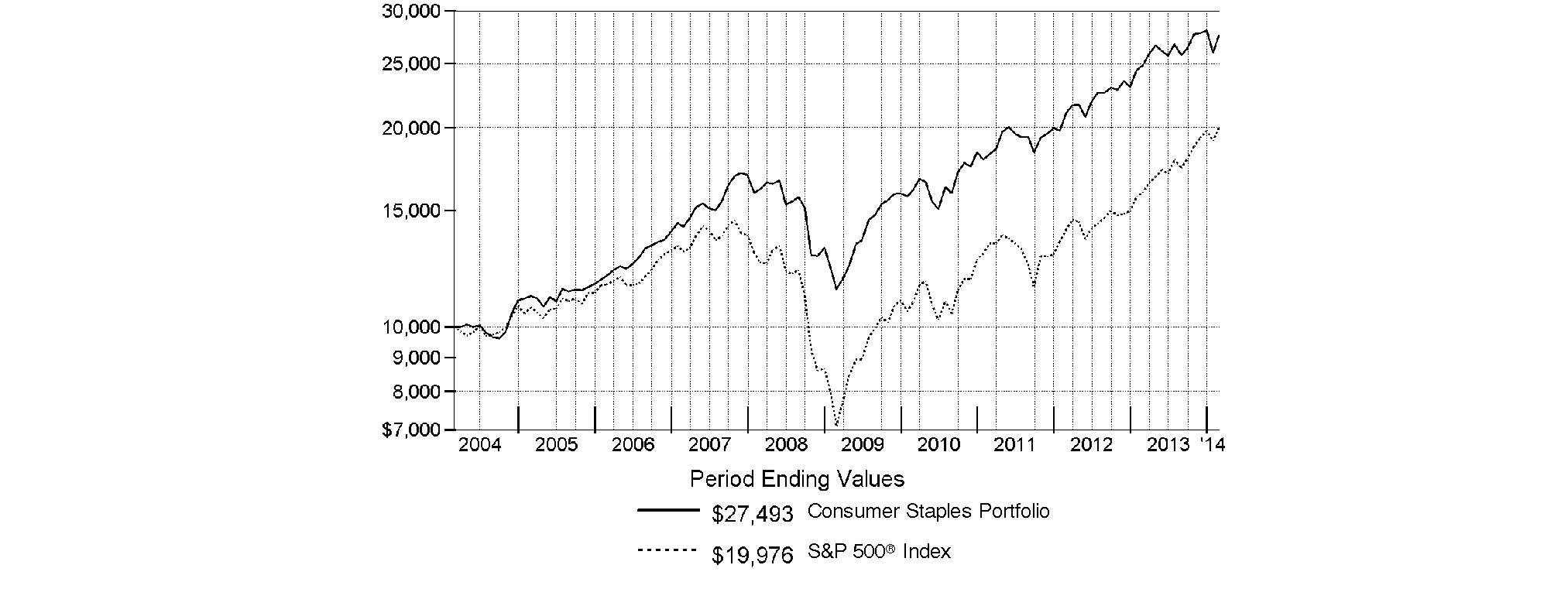

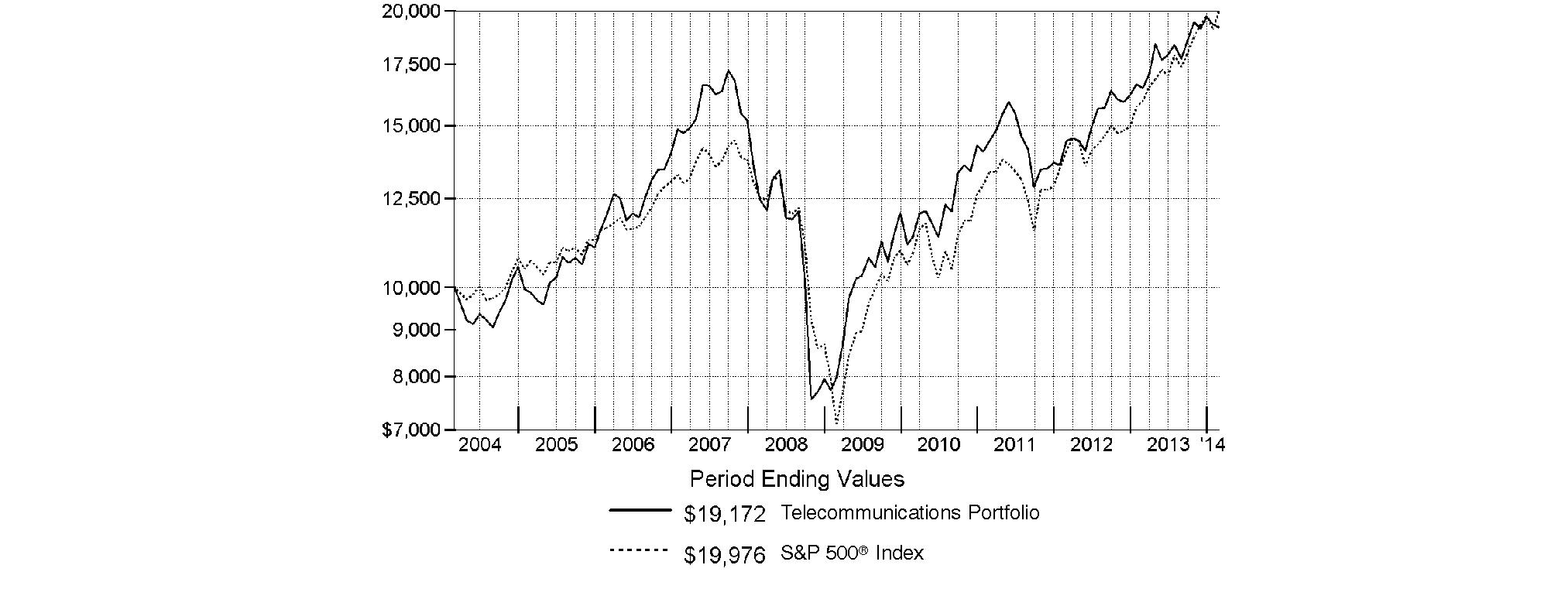

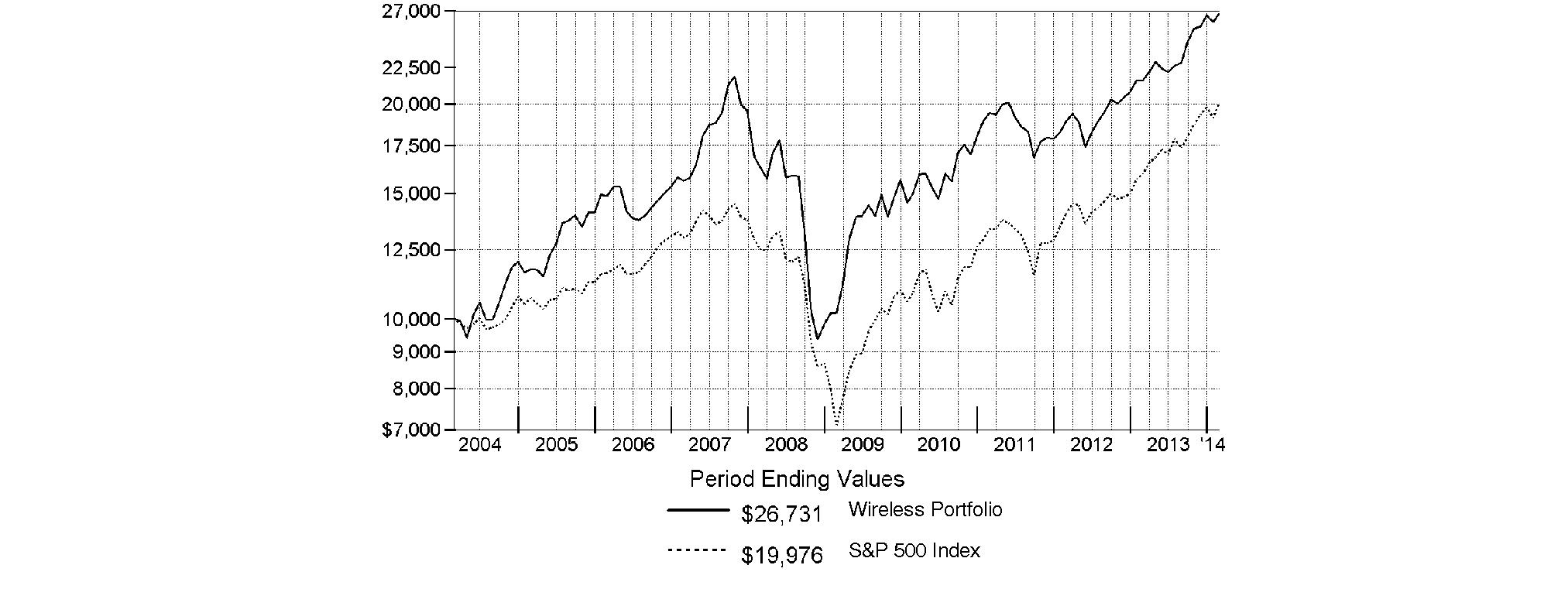

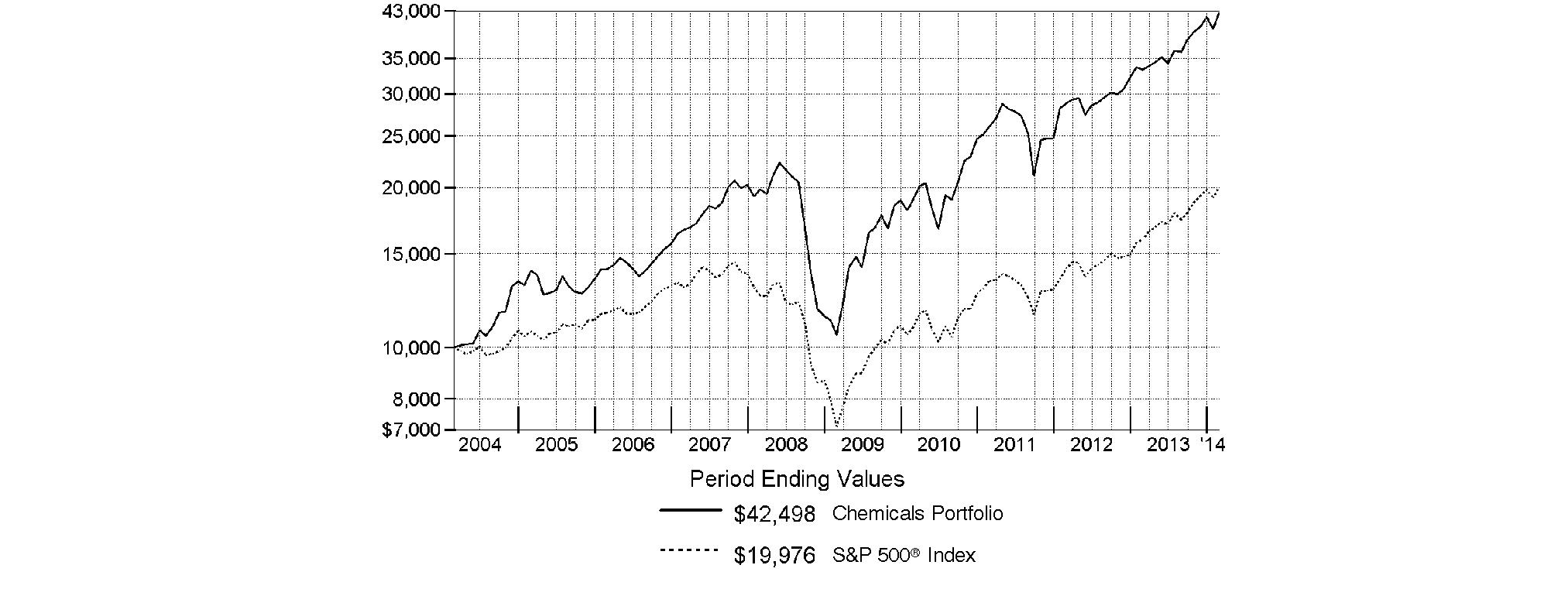

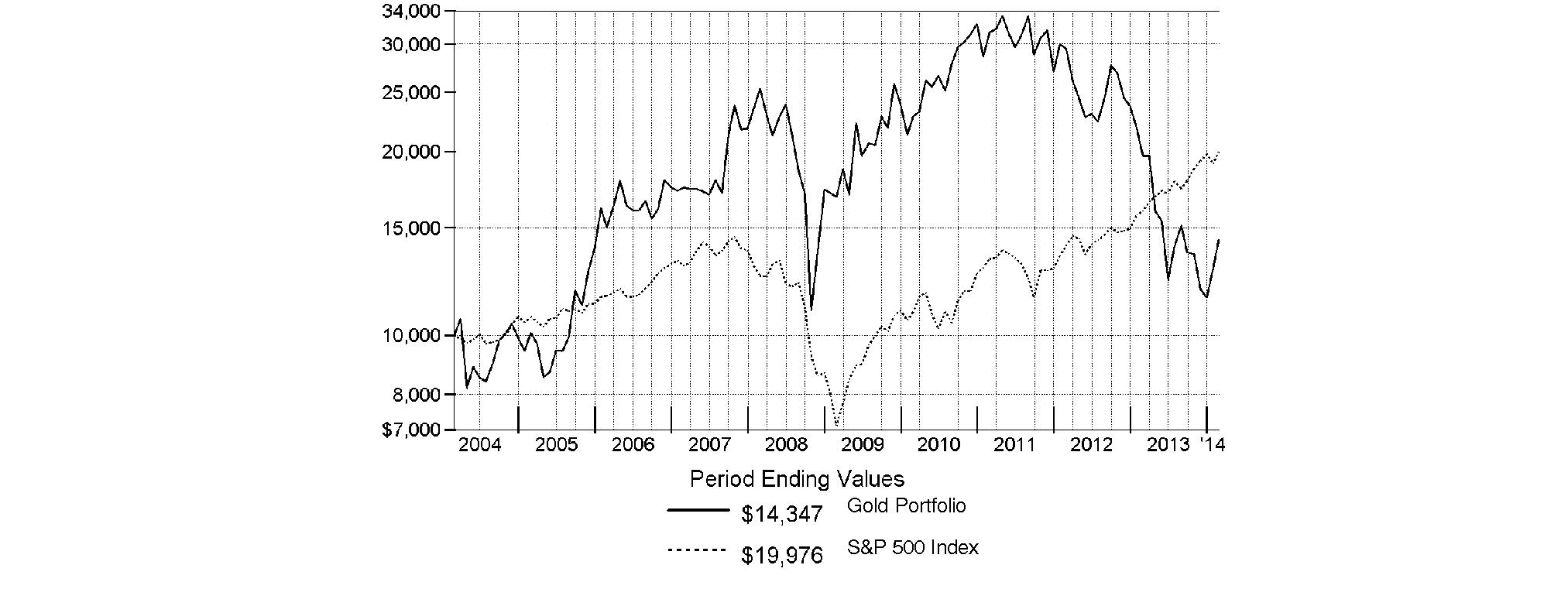

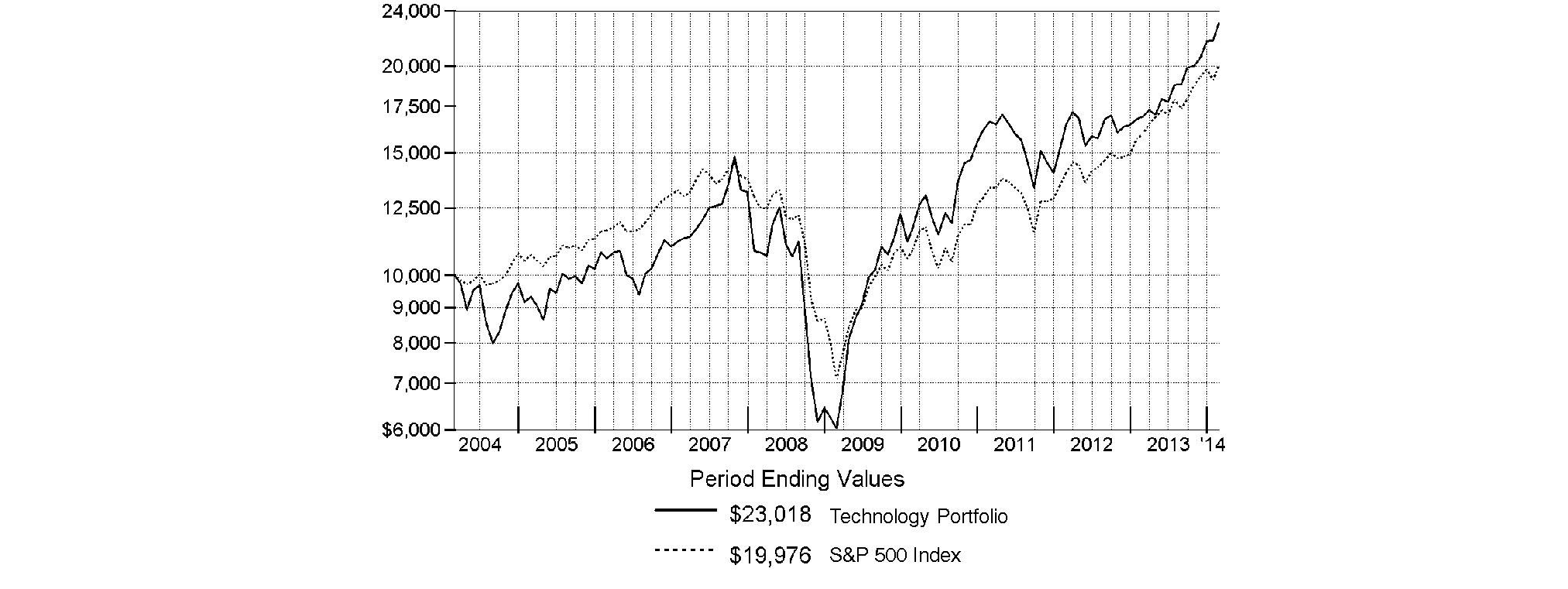

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

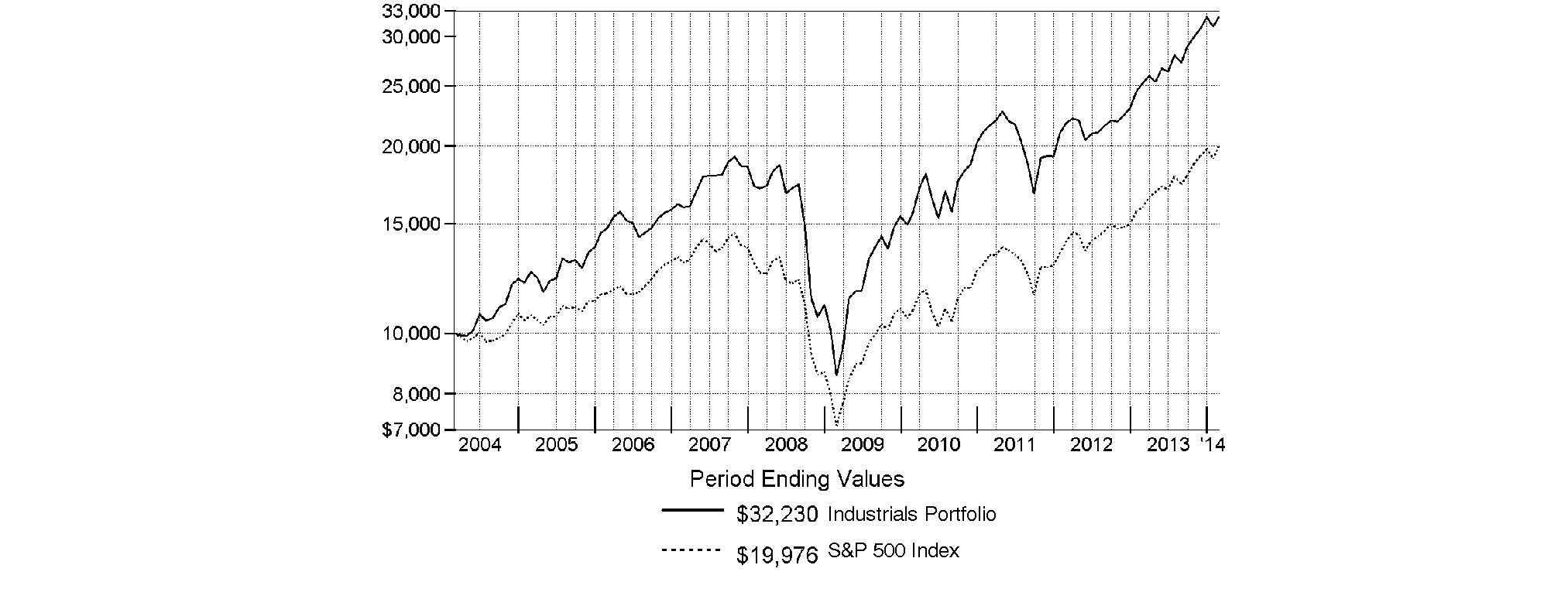

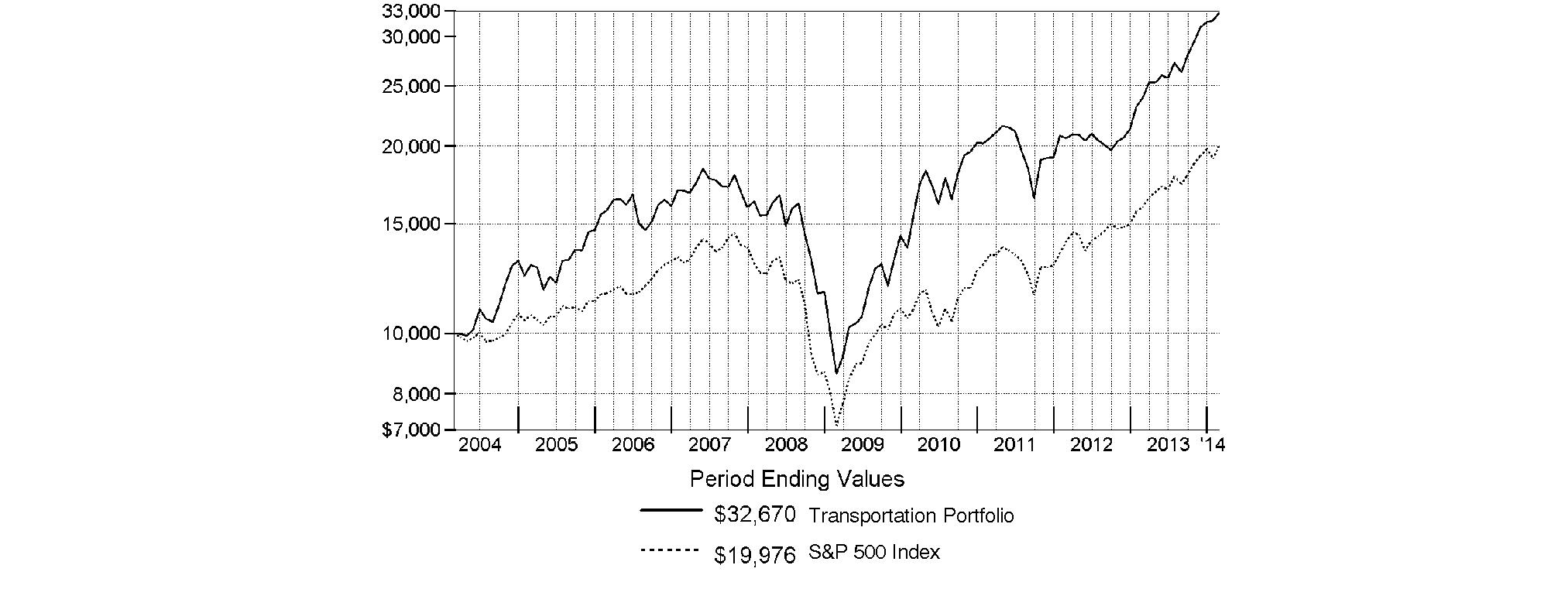

Average Annual Total Returns

|

Periods ended February 28, 2014 |

Past 1 |

Past 5 |

Past 10 |

|

Health Care Portfolio |

67.13% |

31.94% |

13.42% |

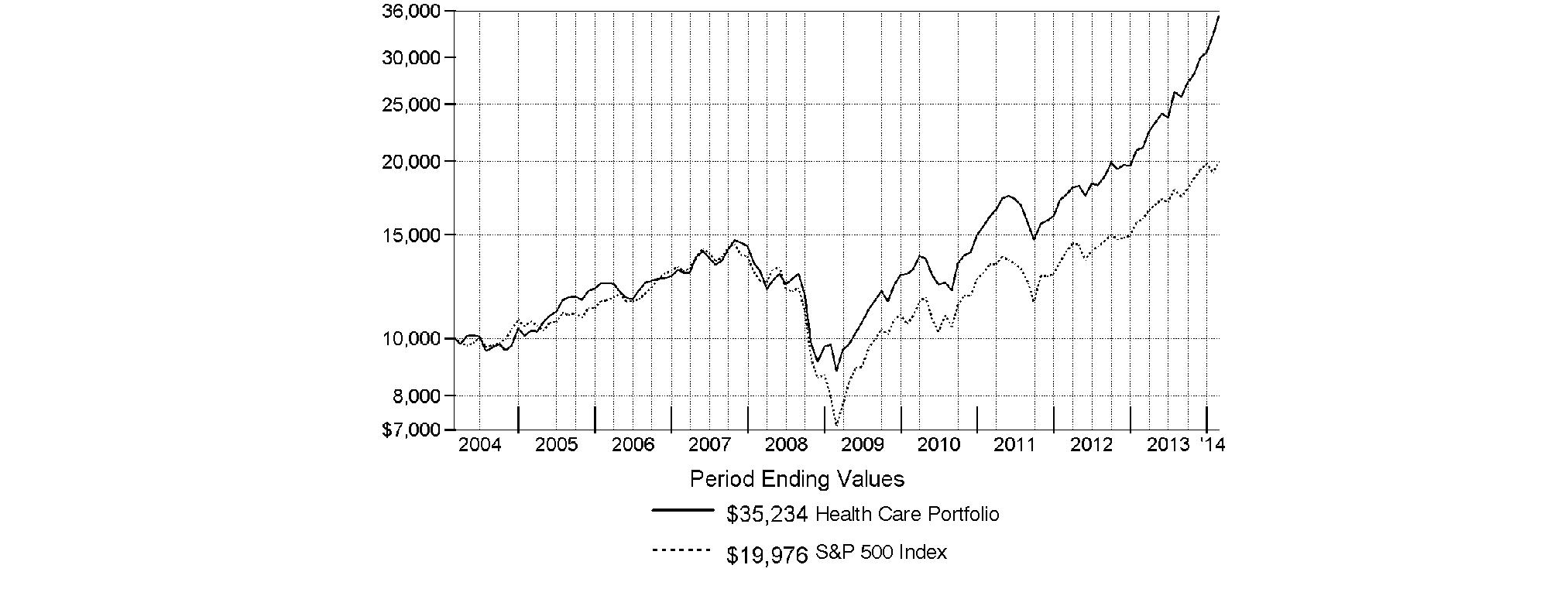

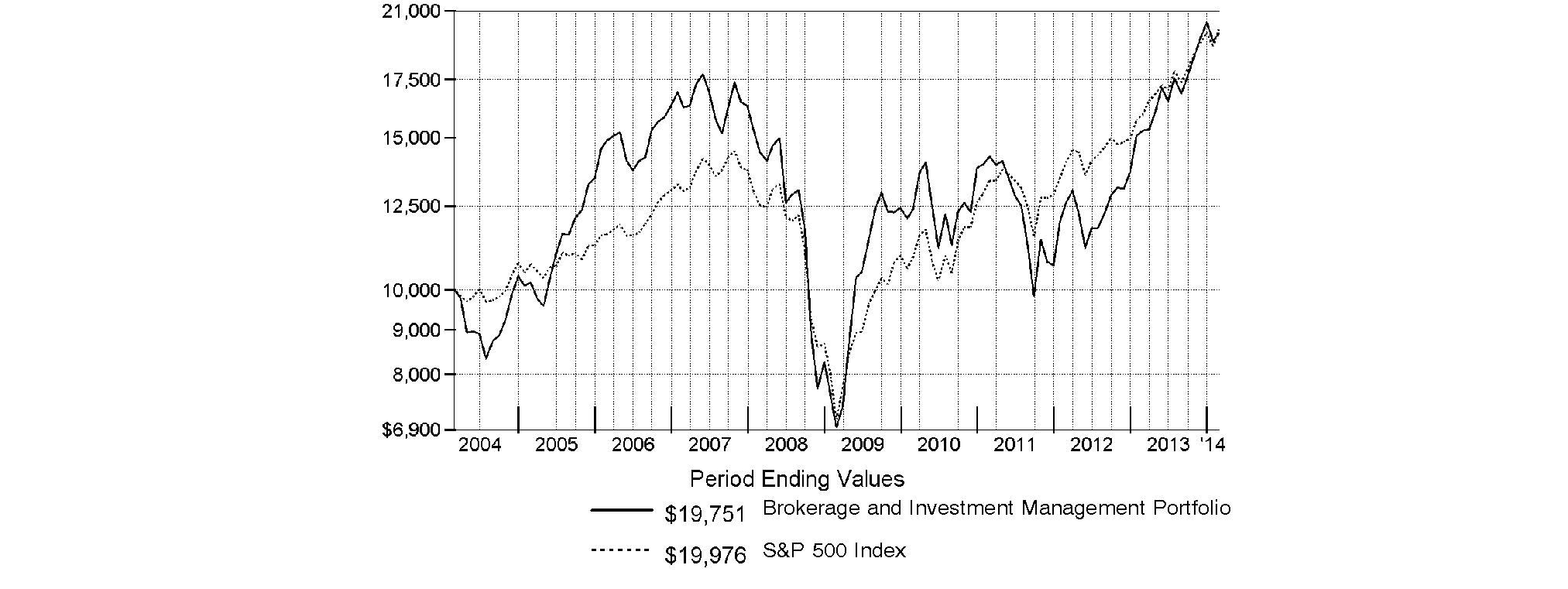

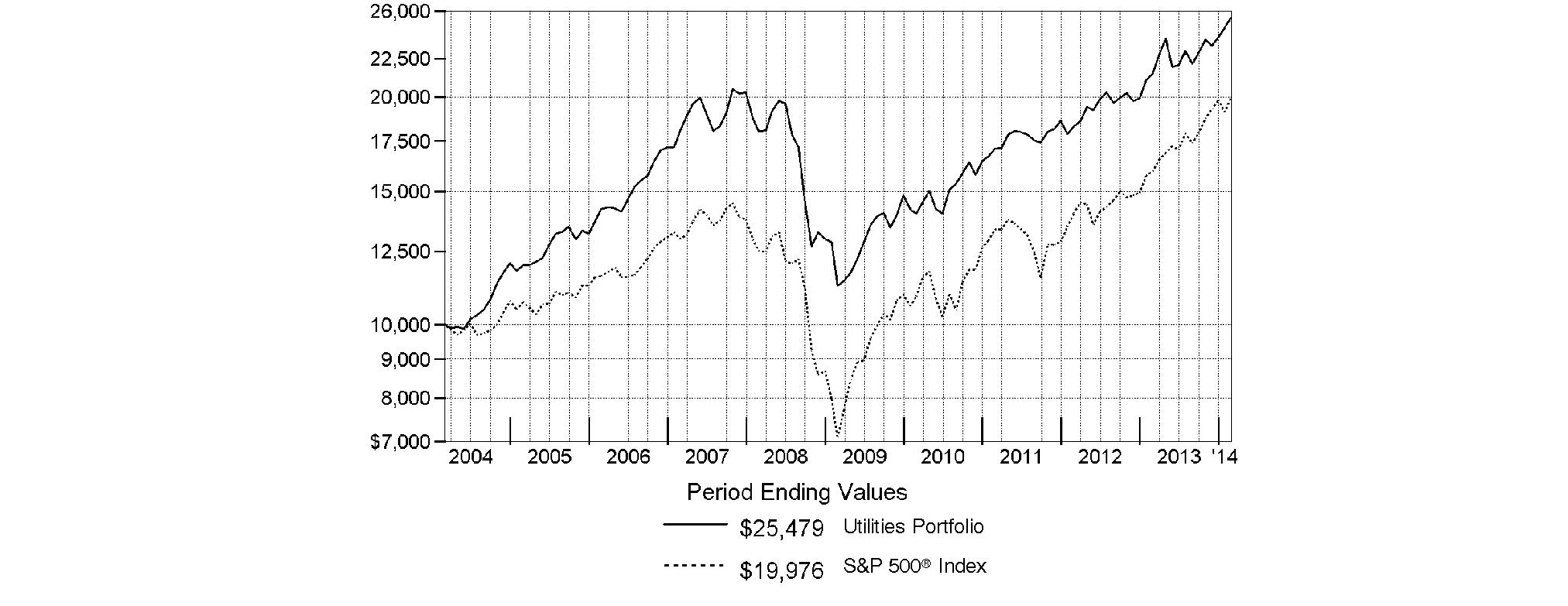

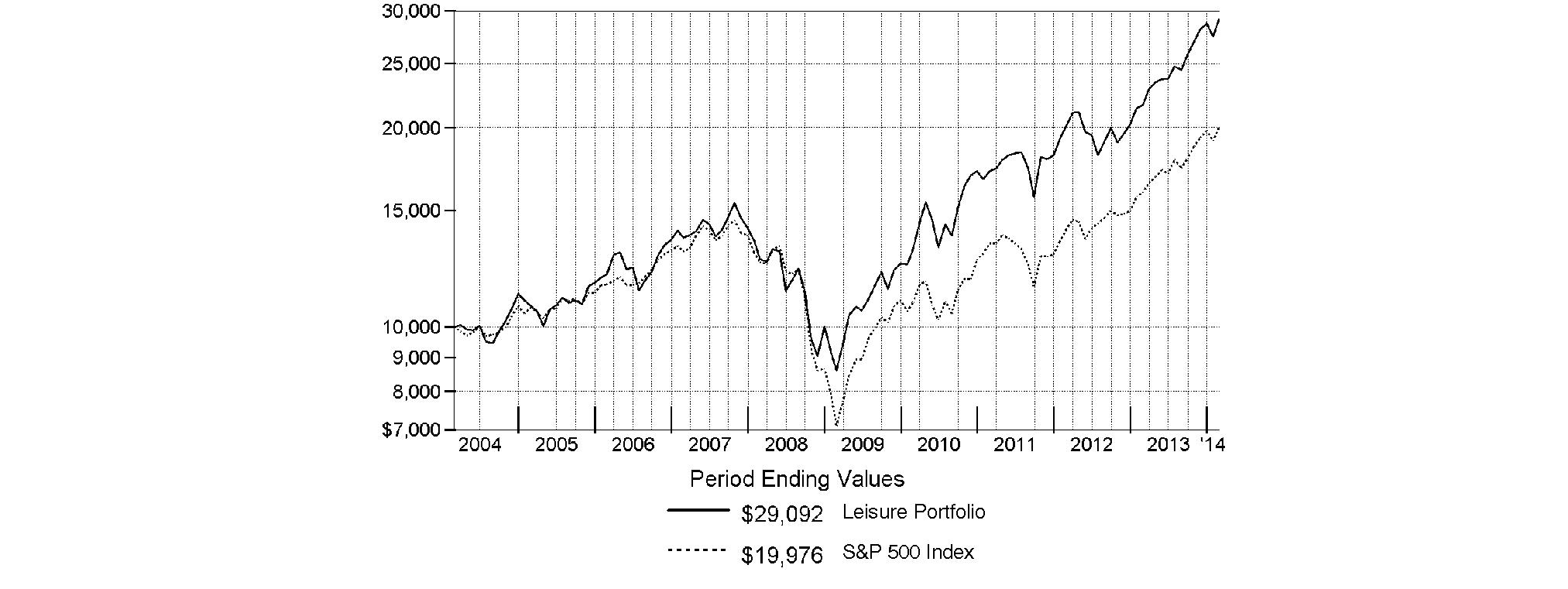

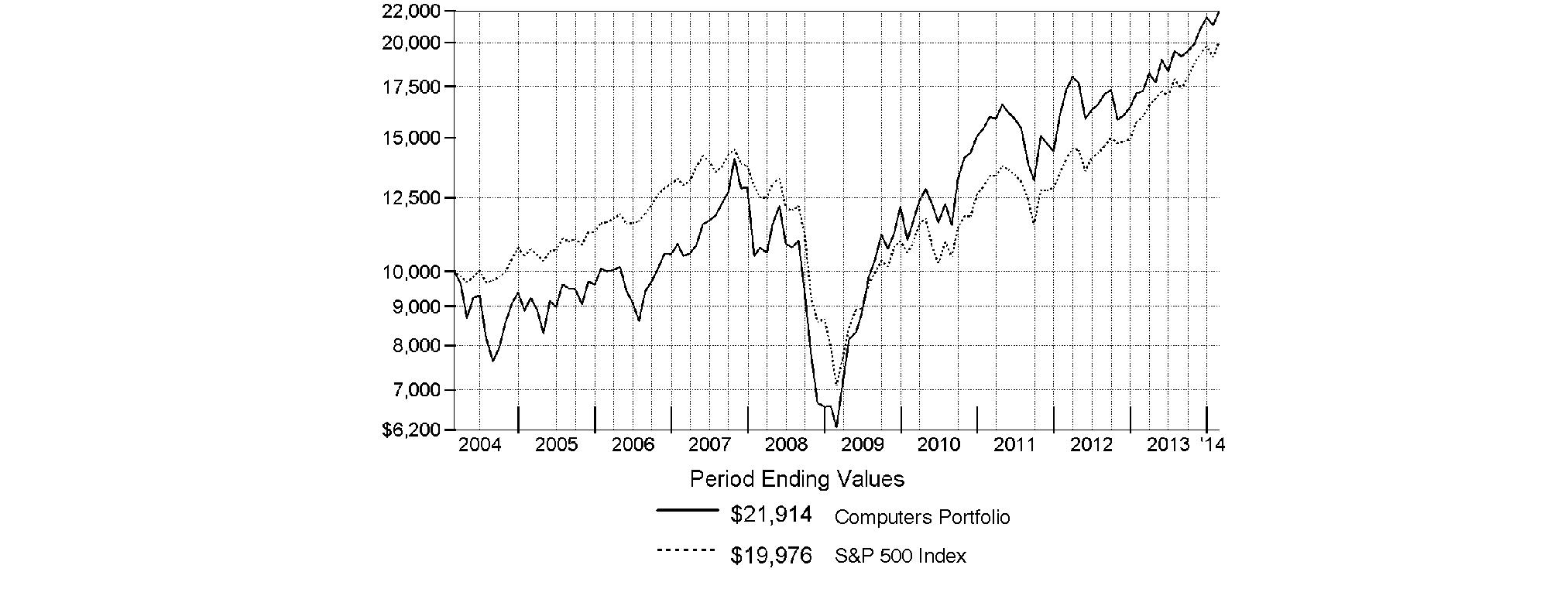

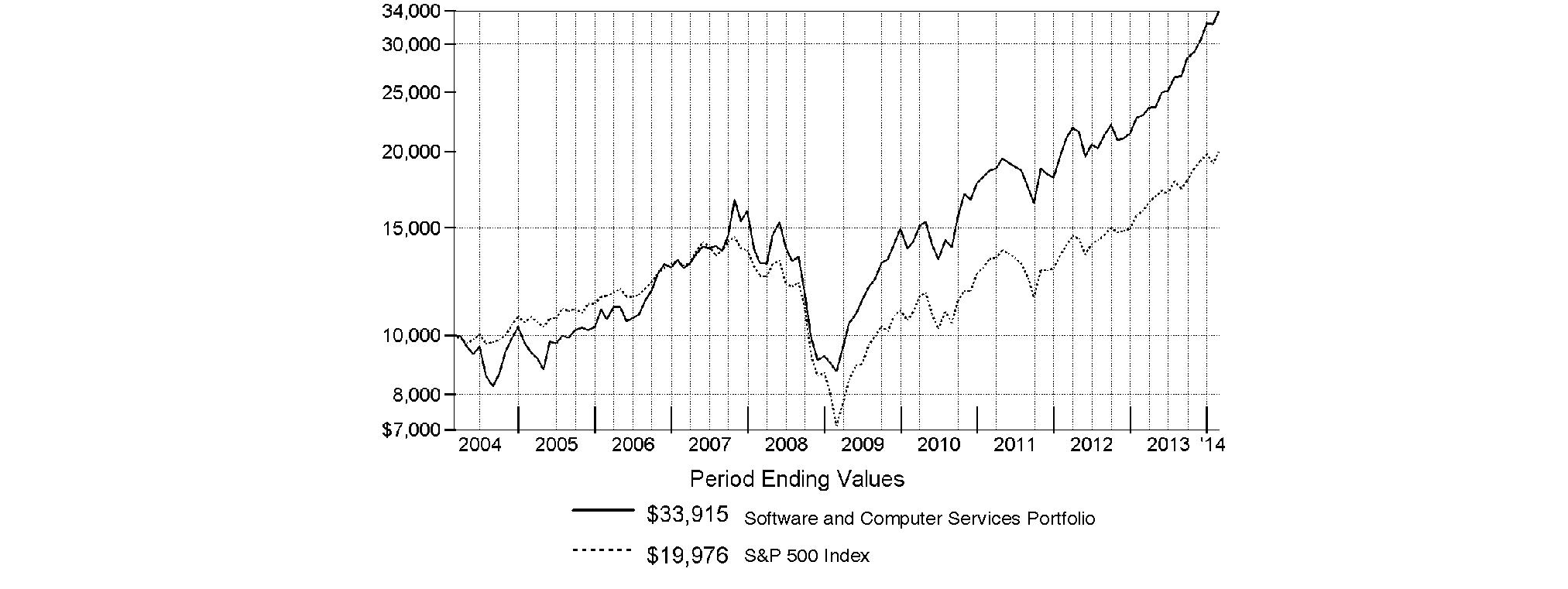

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Health Care Portfolio on February 29, 2004. The chart shows how the value of your investment would have changed, and also shows how the S&P 500 Index performed over the same period.

Annual Report

Health Care Portfolio

Management's Discussion of Fund Performance

Market Recap: Stocks overcame fears of higher interest rates - not to mention their worst January in four years - to finish sharply higher for the 12 months ending February 28, 2014. The broad S&P 500® Index and the blue-chip Dow Jones Industrial AverageSM gained 25.37% and 19.01%, respectively, amid generally favorable earnings reports and accommodative monetary policies worldwide. Performance generally increased along the risk spectrum, with smaller-cap and growth strategies leading the way. An ebullient market helped the growth-oriented Nasdaq Composite Index® to a 38.10% period gain, for example. On the other hand, both cyclical and defensive stocks had representation in the top-performing industry sectors: returns were highest in health care and consumer discretionary; lowest in utilities and telecommunication services. From a macroeconomic perspective, data still points to slow but steady improvement in the U.S., and Europe's recession may well be over. Reports from China have disappointed, but continue to suggest a relatively soft landing there. Mixed signals from the U.S. Federal Reserve as to when it might curtail its stimulative bond buying kept markets in flux during the spring and summer. Stocks regained momentum in October despite a federal budget impasse and brief government shutdown, and lower volatility prevailed through year-end. Shedding new-year concerns about China's economy, an emerging-markets sell-off and confirmation (at last) of Fed tapering - alongside confirmation of a presumably dovish Janet Yellen as new Fed chair - February saw stocks back in record territory, bearing down on the five-year anniversary of the market's bottom.

Comments from Edward Yoon, Portfolio Manager of Health Care Portfolio: For the year, the fund gained 67.13%, beating the 41.64% advance of the MSCI® U.S. IMI Health Care 25-50 Index, as well as the S&P 500®. Health care was the best-performing sector of the broader market over the past 12 months. Investors flocked to its stability early in the period amid a broader move into more-defensive areas, largely driven by ongoing weakness in the global economy. The sector was attractive later in the year as well, as it's less sensitive to overall economic activity and provides the potential for growth, possibly with less volatility than investing in the broad market. Outsized returns from biotechnology stocks helped the sector's strong return, as did an aging global population that continues to fuel demand for medical products and services. Versus the sector benchmark, exceptional stock picking drove the fund's return. We did well with life science tools & services companies, where a top relative contributor was genetic analysis-tool maker Illumina. Elsewhere, stock positions in pharmaceuticals by and large helped the most, especially heavily underweighting and eventually selling large-cap firm Johnson & Johnson. Positioning in biotech also helped, but I did reduce exposure to parts of this market during the period, namely the small-cap segment, where valuations have become more expensive on a risk-adjusted basis versus earlier in 2013. Notable relative detractors were hard to come by this period. The only really noteworthy blow came from stock picking in health care services. Here, I'll mention our non-index stake in Canada-based pharmacy benefit manager (PBM) Catamaran. Near-term uncertainty and decelerating growth weighed on this volatile stock.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Health Care Portfolio

Investment Changes (Unaudited)

|

Top Ten Stocks as of February 28, 2014 |

||

|

|

% of fund's |

% of fund's net assets |

|

Actavis PLC |

5.2 |

4.4 |

|

Amgen, Inc. |

4.8 |

6.1 |

|

Alexion Pharmaceuticals, Inc. |

4.5 |

3.6 |

|

Gilead Sciences, Inc. |

4.1 |

7.6 |

|

Biogen Idec, Inc. |

3.8 |

4.2 |

|

McKesson Corp. |

3.7 |

3.3 |

|

Boston Scientific Corp. |

3.5 |

3.6 |

|

Illumina, Inc. |

3.3 |

2.2 |

|

Merck & Co., Inc. |

3.3 |

2.4 |

|

Bristol-Myers Squibb Co. |

2.9 |

0.5 |

|

|

39.1 |

|

|

Top Industries (% of fund's net assets) |

|||

|

As of February 28, 2014 |

|||

|

Biotechnology |

30.0% |

|

|

Pharmaceuticals |

28.3% |

|

|

Health Care Equipment & Supplies |

14.4% |

|

|

Health Care Providers & Services |

11.8% |

|

|

Life Sciences Tools & Services |

7.6% |

|

|

All Others* |

7.9% |

|

|

As of August 31, 2013 |

|||

|

Biotechnology |

33.2% |

|

|

Pharmaceuticals |

25.8% |

|

|

Health Care Providers & Services |

16.8% |

|

|

Health Care Equipment & Supplies |

12.4% |

|

|

Health Care Technology |

5.0% |

|

|

All Others* |

6.8% |

|

|

* Includes short-term investments and net other assets (liabilities). |

Annual Report

Health Care Portfolio

Investments February 28, 2014

Showing Percentage of Net Assets

|

Common Stocks - 98.1% |

|||

|

Shares |

Value |

||

|

BIOTECHNOLOGY - 29.9% |

|||

|

Biotechnology - 29.9% |

|||

|

Actelion Ltd. |

280,000 |

$ 29,687,322 |

|

|

Aegerion Pharmaceuticals, Inc. (a) |

355,500 |

19,467,180 |

|

|

Alexion Pharmaceuticals, Inc. (a) |

1,580,000 |

279,344,000 |

|

|

Alnylam Pharmaceuticals, Inc. (a) |

79,800 |

6,482,952 |

|

|

Amgen, Inc. |

2,400,000 |

297,648,000 |

|

|

Array BioPharma, Inc. (a) |

3,000,000 |

14,460,000 |

|

|

Arrowhead Research Corp. (a) |

700,000 |

13,608,000 |

|

|

BioCryst Pharmaceuticals, Inc. (a) |

1,100,000 |

12,859,000 |

|

|

Biogen Idec, Inc. (a) |

690,000 |

235,069,200 |

|

|

Cubist Pharmaceuticals, Inc. (a) |

950,000 |

75,544,000 |

|

|

Discovery Laboratories, Inc. (a) |

3,600,000 |

9,504,000 |

|

|

Dyax Corp. (a) |

1,280,000 |

12,377,600 |

|

|

Genomic Health, Inc. (a) |

750,000 |

19,807,500 |

|

|

Gilead Sciences, Inc. (a) |

3,060,000 |

253,337,400 |

|

|

Grifols SA ADR |

1,400,000 |

58,912,000 |

|

|

Innate Pharma SA (a) |

1,100,000 |

15,942,465 |

|

|

Insmed, Inc. (a) |

807,500 |

16,158,075 |

|

|

Intercept Pharmaceuticals, Inc. (a) |

220,000 |

90,310,000 |

|

|

InterMune, Inc. (a) |

2,000,000 |

60,080,000 |

|

|

Kindred Biosciences, Inc. |

700,000 |

15,792,000 |

|

|

Medivation, Inc. (a) |

840,000 |

60,404,400 |

|

|

Myriad Genetics, Inc. (a) |

300,000 |

10,863,000 |

|

|

Neurocrine Biosciences, Inc. (a) |

1,750,000 |

30,852,500 |

|

|

NewLink Genetics Corp. (a) |

280,000 |

12,376,000 |

|

|

Novavax, Inc. (a) |

2,000,000 |

12,800,000 |

|

|

NPS Pharmaceuticals, Inc. (a) |

400,000 |

13,992,000 |

|

|

Pharmacyclics, Inc. (a) |

300,000 |

41,598,000 |

|

|

PTC Therapeutics, Inc. (a) |

500,000 |

15,680,000 |

|

|

Puma Biotechnology, Inc. (a) |

260,000 |

30,227,600 |

|

|

Regeneron Pharmaceuticals, Inc. (a) |

65,000 |

21,612,500 |

|

|

Swedish Orphan Biovitrum AB (a) |

1,100,000 |

14,582,830 |

|

|

Vanda Pharmaceuticals, Inc. (a)(d) |

1,600,000 |

24,208,000 |

|

|

Vertex Pharmaceuticals, Inc. (a) |

150,000 |

12,129,000 |

|

|

ZIOPHARM Oncology, Inc. (a)(d) |

2,000,000 |

8,520,000 |

|

|

|

1,846,236,524 |

||

|

DIVERSIFIED CONSUMER SERVICES - 0.3% |

|||

|

Specialized Consumer Services - 0.3% |

|||

|

Carriage Services, Inc. |

850,000 |

17,365,500 |

|

|

HEALTH CARE EQUIPMENT & SUPPLIES - 14.4% |

|||

|

Health Care Equipment - 13.0% |

|||

|

Accuray, Inc. (a) |

1,000,000 |

9,380,000 |

|

|

Boston Scientific Corp. (a) |

16,400,000 |

214,840,000 |

|

|

Cardiovascular Systems, Inc. (a) |

500,000 |

17,500,000 |

|

|

CONMED Corp. |

990,000 |

46,153,800 |

|

|

Covidien PLC |

700,000 |

50,365,000 |

|

|

Edwards Lifesciences Corp. (a) |

760,000 |

53,017,600 |

|

|

Genmark Diagnostics, Inc. (a) |

2,026,880 |

25,254,925 |

|

|

HeartWare International, Inc. (a) |

325,000 |

31,209,750 |

|

|

Insulet Corp. (a) |

400,000 |

18,964,000 |

|

|

|

|||

|

Shares |

Value |

||

|

Intuitive Surgical, Inc. (a) |

205,000 |

$ 91,190,150 |

|

|

Lumenis Ltd. Class B |

800,000 |

9,760,000 |

|

|

Masimo Corp. (a) |

1,600,000 |

40,880,000 |

|

|

Smith & Nephew PLC sponsored ADR |

500,000 |

39,820,000 |

|

|

Steris Corp. |

739,644 |

34,134,571 |

|

|

Stryker Corp. |

800,000 |

64,192,000 |

|

|

Volcano Corp. (a) |

1,800,000 |

38,628,000 |

|

|

Zeltiq Aesthetics, Inc. (a) |

900,000 |

17,091,000 |

|

|

|

802,380,796 |

||

|

Health Care Supplies - 1.4% |

|||

|

Derma Sciences, Inc. (a) |

1,000,000 |

14,690,000 |

|

|

The Cooper Companies, Inc. |

570,000 |

73,079,700 |

|

|

|

87,769,700 |

||

|

TOTAL HEALTH CARE EQUIPMENT & SUPPLIES |

890,150,496 |

||

|

HEALTH CARE PROVIDERS & SERVICES - 11.8% |

|||

|

Health Care Distributors & Services - 4.3% |

|||

|

Amplifon SpA |

3,000,000 |

18,344,187 |

|

|

EBOS Group Ltd. |

2,200,000 |

18,463,245 |

|

|

McKesson Corp. |

1,290,000 |

228,394,500 |

|

|

|

265,201,932 |

||

|

Health Care Facilities - 2.0% |

|||

|

Emeritus Corp. (a) |

1,200,000 |

37,836,000 |

|

|

NMC Health PLC |

1,700,000 |

13,237,318 |

|

|

Ramsay Health Care Ltd. |

350,000 |

15,069,561 |

|

|

Surgical Care Affiliates, Inc. |

650,000 |

19,773,000 |

|

|

Universal Health Services, Inc. Class B |

440,000 |

35,323,200 |

|

|

|

121,239,079 |

||

|

Health Care Services - 2.2% |

|||

|

Air Methods Corp. (a) |

600,000 |

32,412,000 |

|

|

Catamaran Corp. (a) |

1,000,000 |

45,028,448 |

|

|

MEDNAX, Inc. (a) |

1,000,000 |

60,820,000 |

|

|

|

138,260,448 |

||

|

Managed Health Care - 3.3% |

|||

|

Cigna Corp. |

1,000,000 |

79,590,000 |

|

|

Humana, Inc. |

650,000 |

73,099,000 |

|

|

UnitedHealth Group, Inc. |

700,000 |

54,089,000 |

|

|

|

206,778,000 |

||

|

TOTAL HEALTH CARE PROVIDERS & SERVICES |

731,479,459 |

||

|

HEALTH CARE TECHNOLOGY - 3.0% |

|||

|

Health Care Technology - 3.0% |

|||

|

Cerner Corp. (a) |

2,300,000 |

141,151,000 |

|

|

HealthStream, Inc. (a) |

460,000 |

13,257,200 |

|

|

Medidata Solutions, Inc. (a) |

511,270 |

32,772,407 |

|

|

|

187,180,607 |

||

|

INDUSTRIAL CONGLOMERATES - 1.5% |

|||

|

Industrial Conglomerates - 1.5% |

|||

|

Danaher Corp. |

1,170,000 |

89,493,300 |

|

|

Common Stocks - continued |

|||

|

Shares |

Value |

||

|

IT SERVICES - 0.3% |

|||

|

Data Processing & Outsourced Services - 0.3% |

|||

|

Maximus, Inc. |

411,100 |

$ 19,646,469 |

|

|

LIFE SCIENCES TOOLS & SERVICES - 7.6% |

|||

|

Life Sciences Tools & Services - 7.6% |

|||

|

Agilent Technologies, Inc. |

1,800,000 |

102,474,000 |

|

|

Bruker BioSciences Corp. (a) |

1,100,000 |

25,014,000 |

|

|

Illumina, Inc. (a)(d) |

1,200,000 |

205,788,000 |

|

|

Thermo Fisher Scientific, Inc. |

1,100,000 |

136,994,000 |

|

|

|

470,270,000 |

||

|

PHARMACEUTICALS - 28.3% |

|||

|

Pharmaceuticals - 28.3% |

|||

|

AbbVie, Inc. |

1,000,000 |

50,910,000 |

|

|

Actavis PLC (a) |

1,450,000 |

320,188,998 |

|

|

Bristol-Myers Squibb Co. |

3,300,000 |

177,441,000 |

|

|

Dechra Pharmaceuticals PLC |

1,700,000 |

19,998,313 |

|

|

Forest Laboratories, Inc. (a) |

1,280,000 |

124,889,600 |

|

|

Impax Laboratories, Inc. (a) |

600,000 |

15,462,000 |

|

|

Jazz Pharmaceuticals PLC (a) |

170,000 |

25,830,650 |

|

|

Merck & Co., Inc. |

3,600,000 |

205,164,000 |

|

|

Mylan, Inc. (a) |

550,000 |

30,563,500 |

|

|

Orexo AB (a)(d) |

803,352 |

21,237,617 |

|

|

Pacira Pharmaceuticals, Inc. (a) |

350,000 |

27,384,000 |

|

|

Perrigo Co. PLC |

1,070,000 |

175,950,800 |

|

|

Prestige Brands Holdings, Inc. (a) |

956,458 |

27,249,488 |

|

|

Salix Pharmaceuticals Ltd. (a) |

1,410,230 |

152,192,022 |

|

|

Shire PLC sponsored ADR |

650,000 |

107,347,500 |

|

|

Teva Pharmaceutical Industries Ltd. sponsored ADR |

2,000,000 |

99,780,000 |

|

|

The Medicines Company (a) |

1,200,000 |

36,660,000 |

|

|

TherapeuticsMD, Inc. (a) |

1,065,029 |

7,316,749 |

|

|

UCB SA |

400,000 |

32,105,778 |

|

|

Valeant Pharmaceuticals International (Canada) (a) |

660,000 |

94,210,783 |

|

|

|

1,751,882,798 |

||

|

PROFESSIONAL SERVICES - 1.0% |

|||

|

Human Resource & Employment Services - 1.0% |

|||

|

Towers Watson & Co. |

320,599 |

34,977,351 |

|

|

WageWorks, Inc. (a) |

400,000 |

23,660,000 |

|

|

|

58,637,351 |

||

|

TOTAL COMMON STOCKS (Cost $4,103,997,933) |

|

||

|

Convertible Preferred Stocks - 0.3% |

|||

|

|

|

|

|

|

BIOTECHNOLOGY - 0.1% |

|||

|

Biotechnology - 0.1% |

|||

|

Ariosa Diagnostics (a)(e) |

496,689 |

3,000,002 |

|

|

|

|||

|

Shares |

Value |

||

|

HEALTH CARE TECHNOLOGY - 0.2% |

|||

|

Health Care Technology - 0.2% |

|||

|

Castlight Health, Inc.: |

|

|

|

|

Series C (a)(e) |

90,850 |

$ 735,885 |

|

|

Series D (a)(e) |