UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3114

Fidelity Select Portfolios

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Scott C. Goebel, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

|

Date of fiscal year end: |

February 28 |

|

|

|

|

Date of reporting period: |

February 28, 2013 |

Item 1. Reports to Stockholders

Fidelity®

Select Portfolios®

Consumer Discretionary Sector

Automotive Portfolio

Construction and Housing Portfolio

Consumer Discretionary Portfolio

Leisure Portfolio

Multimedia Portfolio

Retailing Portfolio

Annual Report

February 28, 2013

(Fidelity Cover Art)

Contents

|

Shareholder Expense Example |

|

|

|

Automotive Portfolio |

Performance |

|

|

|

Management's Discussion |

|

|

|

Investment Changes |

|

|

|

Investments |

|

|

|

Financial Statements |

|

|

Construction and Housing Portfolio |

Performance |

|

|

|

Management's Discussion |

|

|

|

Investment Changes |

|

|

|

Investments |

|

|

|

Financial Statements |

|

|

Consumer Discretionary Portfolio |

Performance |

|

|

|

Management's Discussion |

|

|

|

Investment Changes |

|

|

|

Investments |

|

|

|

Financial Statements |

|

|

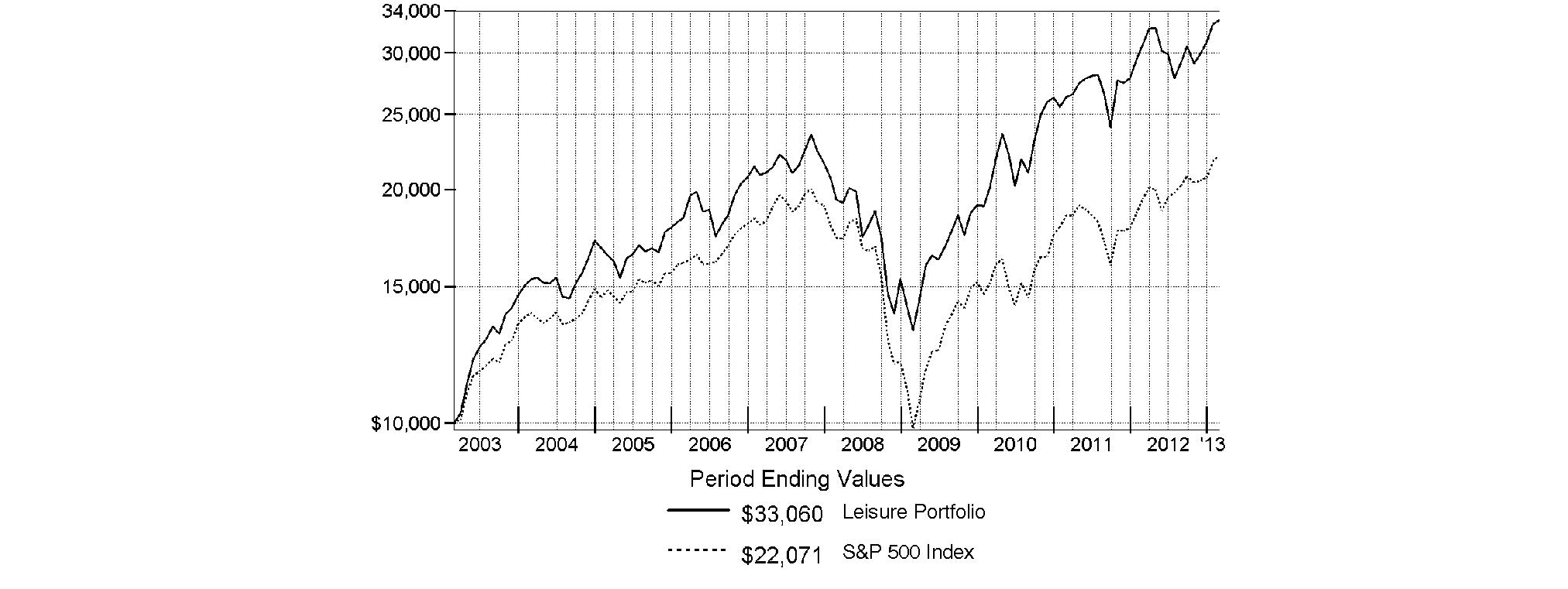

Leisure Portfolio |

Performance |

|

|

|

Management's Discussion |

|

|

|

Investment Changes |

|

|

|

Investments |

|

|

|

Financial Statements |

|

|

Multimedia Portfolio |

Performance |

|

|

|

Management's Discussion |

|

|

|

Investment Changes |

|

|

|

Investments |

|

|

|

Financial Statements |

|

|

Retailing Portfolio |

Performance |

|

|

|

Management's Discussion |

|

|

|

Investment Changes |

|

|

|

Investments |

|

|

|

Financial Statements |

|

|

Notes to Financial Statements |

|

|

|

Report of Independent Registered Public Accounting Firm |

|

|

|

Trustees and Officers |

|

|

|

Distributions |

|

|

|

Board Approval of Investment Advisory Contracts and Management Fees |

|

Annual Report

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2013 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the funds nor Fidelity Distributors Corporation is a bank.

Annual Report

Shareholder Expense Example

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including redemption fees and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (September 1, 2012 to February 28, 2013).

Actual Expenses

The first line of the accompanying table for each fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, each Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each fund provides information about hypothetical account values and hypothetical expenses based on a fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, each Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

|

|

Annualized Expense Ratio |

Beginning |

Ending |

Expenses Paid |

|

Automotive Portfolio |

.89% |

|

|

|

|

Actual |

|

$ 1,000.00 |

$ 1,222.20 |

$ 4.90 |

|

HypotheticalA |

|

$ 1,000.00 |

$ 1,020.38 |

$ 4.46 |

|

Construction and Housing Portfolio |

.84% |

|

|

|

|

Actual |

|

$ 1,000.00 |

$ 1,199.80 |

$ 4.58 |

|

HypotheticalA |

|

$ 1,000.00 |

$ 1,020.63 |

$ 4.21 |

|

Consumer Discretionary Portfolio |

.85% |

|

|

|

|

Actual |

|

$ 1,000.00 |

$ 1,106.90 |

$ 4.44 |

|

HypotheticalA |

|

$ 1,000.00 |

$ 1,020.58 |

$ 4.26 |

|

Leisure Portfolio |

.84% |

|

|

|

|

Actual |

|

$ 1,000.00 |

$ 1,130.80 |

$ 4.44 |

|

HypotheticalA |

|

$ 1,000.00 |

$ 1,020.63 |

$ 4.21 |

|

Multimedia Portfolio |

.87% |

|

|

|

|

Actual |

|

$ 1,000.00 |

$ 1,156.50 |

$ 4.65 |

|

HypotheticalA |

|

$ 1,000.00 |

$ 1,020.48 |

$ 4.36 |

|

Retailing Portfolio |

.85% |

|

|

|

|

Actual |

|

$ 1,000.00 |

$ 1,092.90 |

$ 4.41 |

|

HypotheticalA |

|

$ 1,000.00 |

$ 1,020.58 |

$ 4.26 |

A 5% return per year before expenses

* Expenses are equal to each Fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

Annual Report

Automotive Portfolio

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

|

Periods ended February 28, 2013 |

Past 1 |

Past 5 |

Past 10 |

|

Automotive Portfolio |

7.64% |

5.97% |

8.35% |

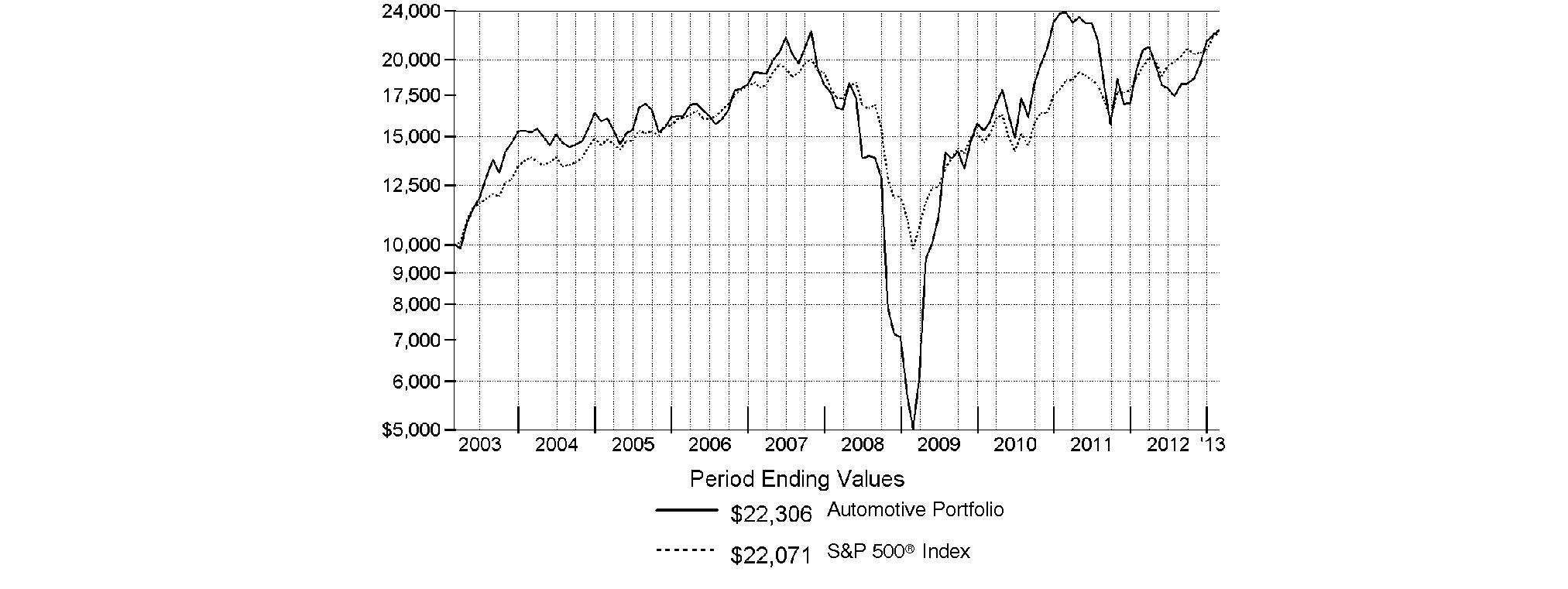

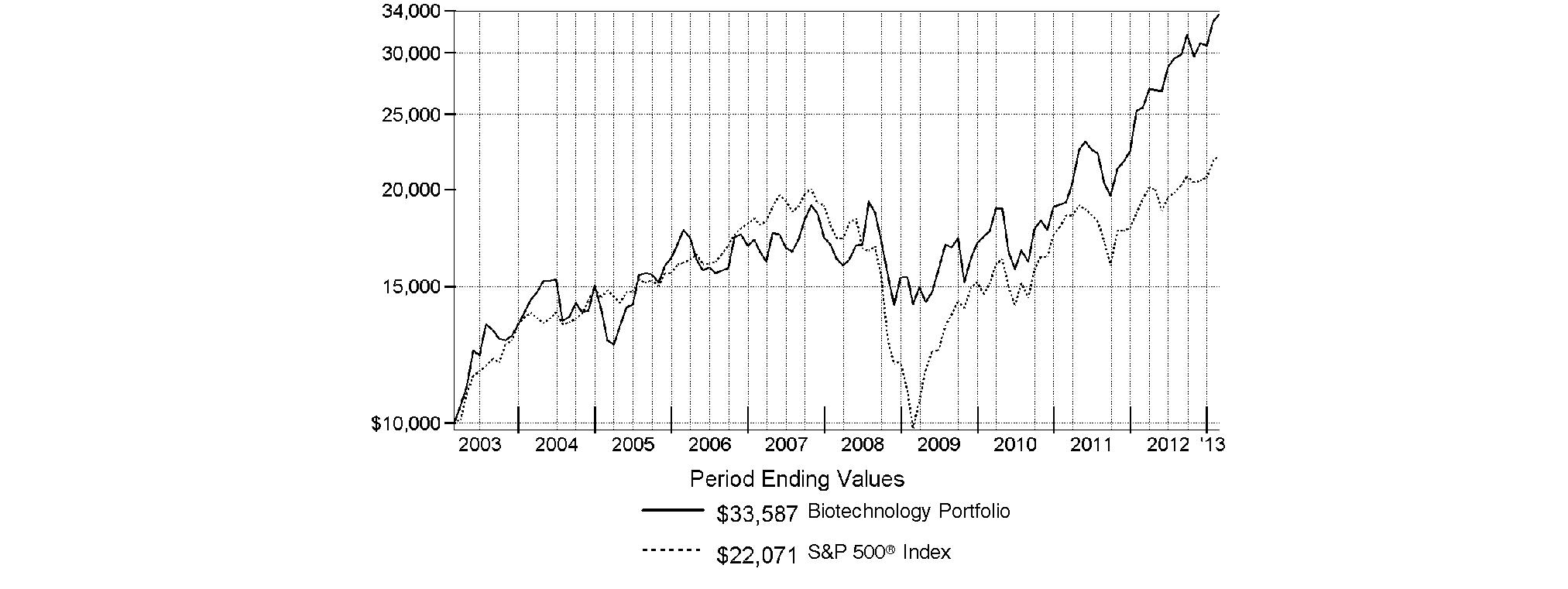

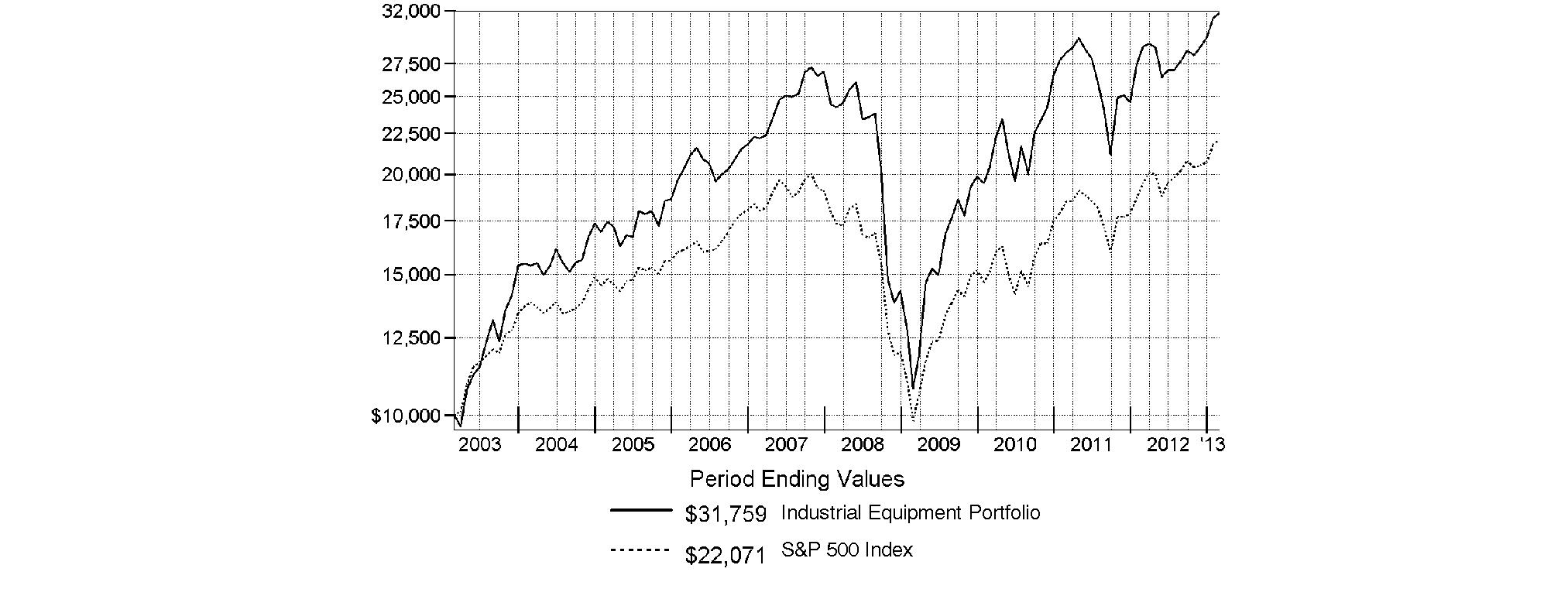

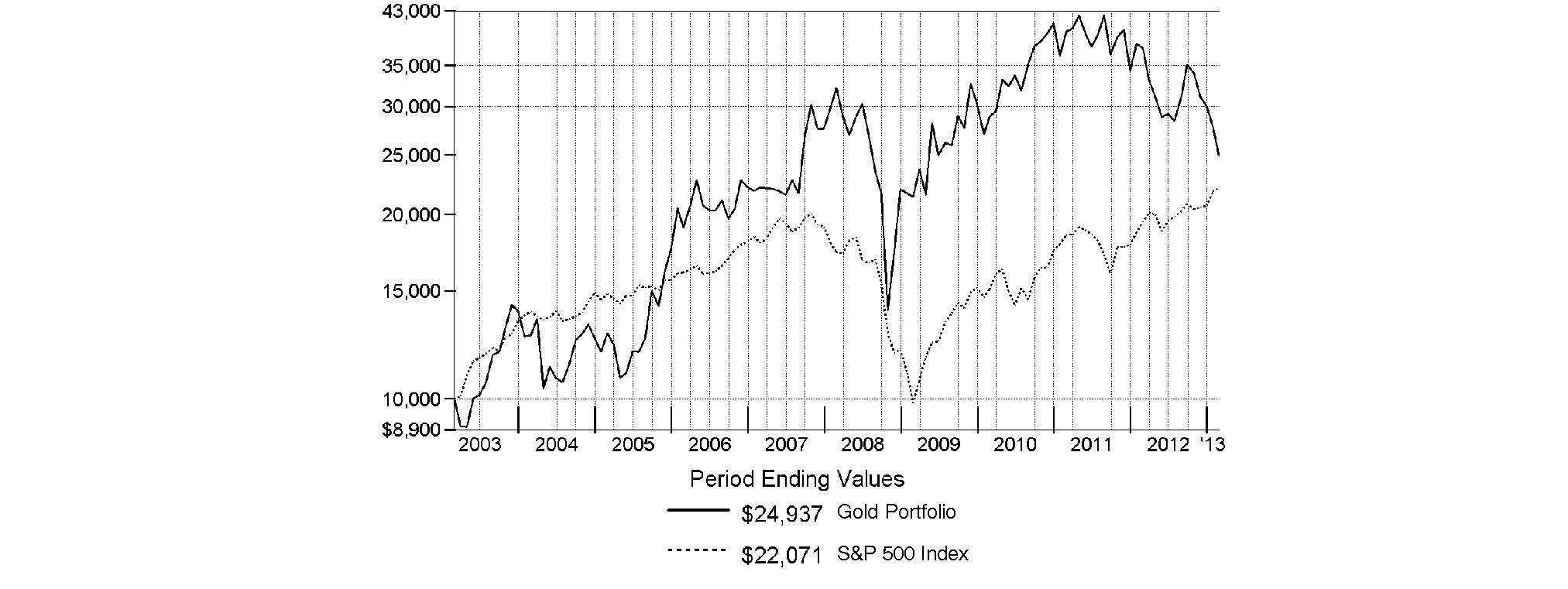

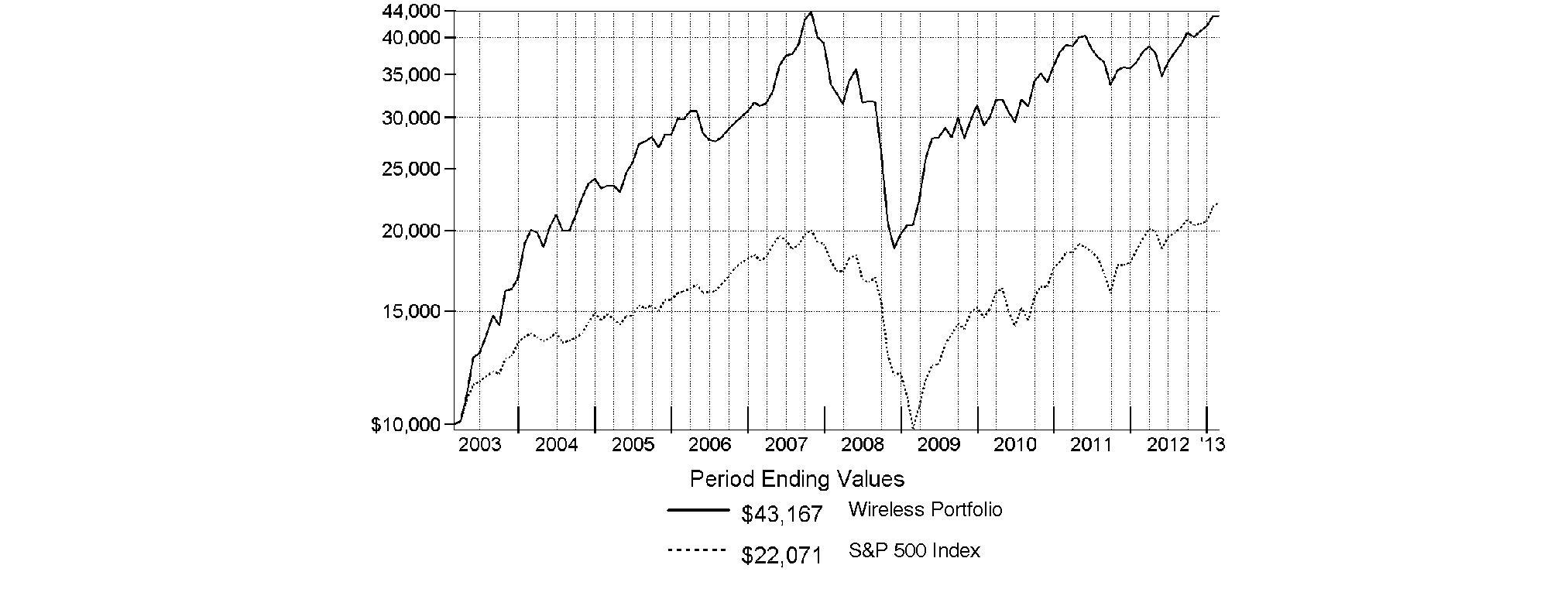

$10,000 Over 10 Years

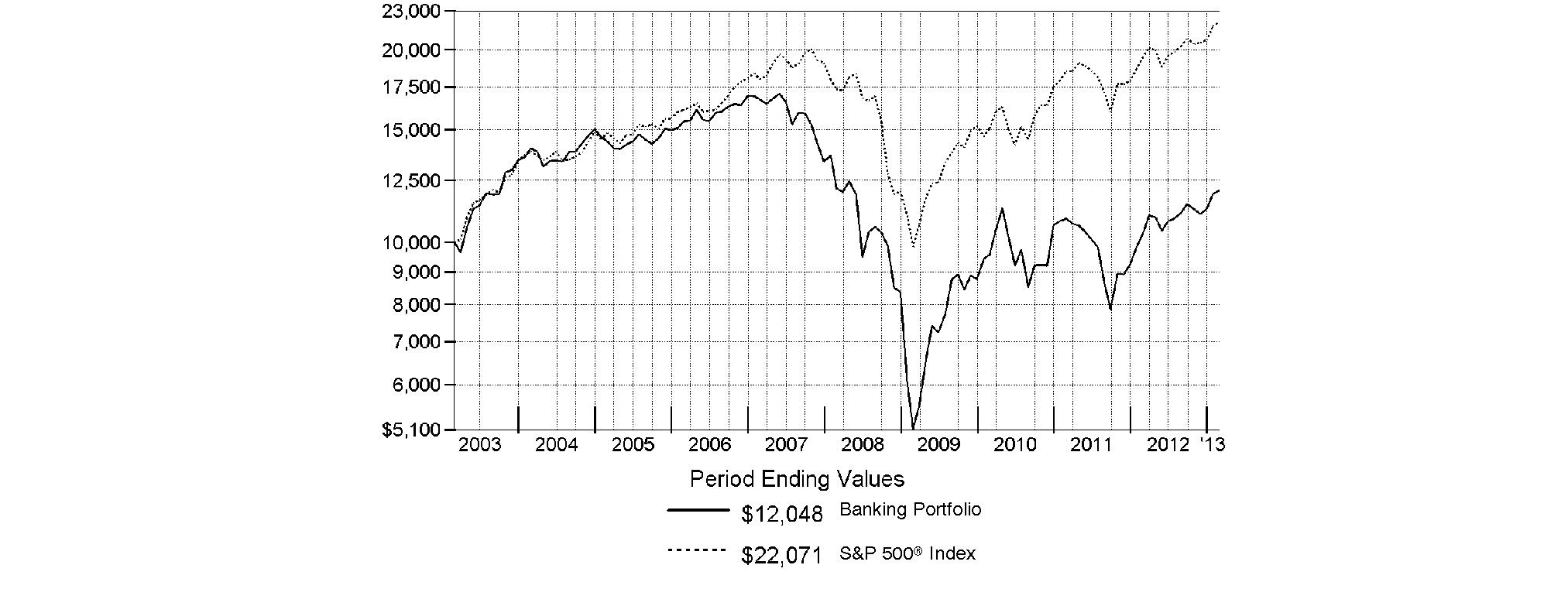

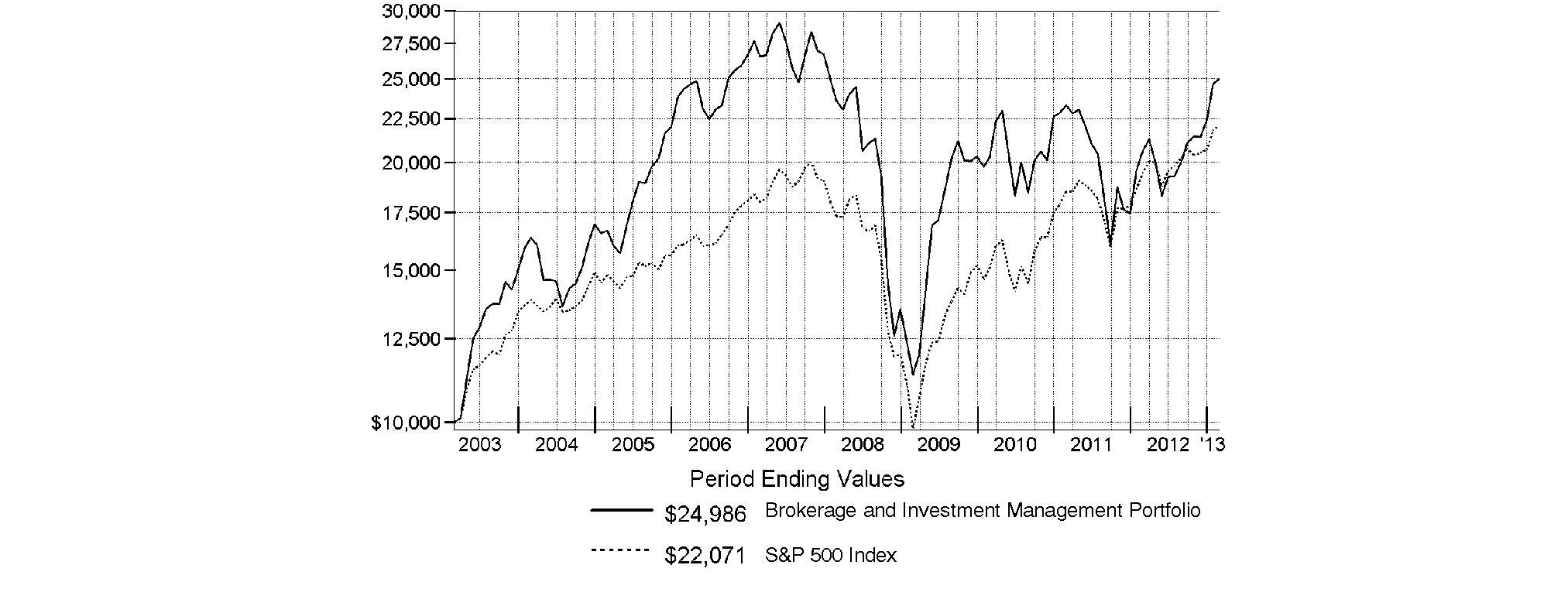

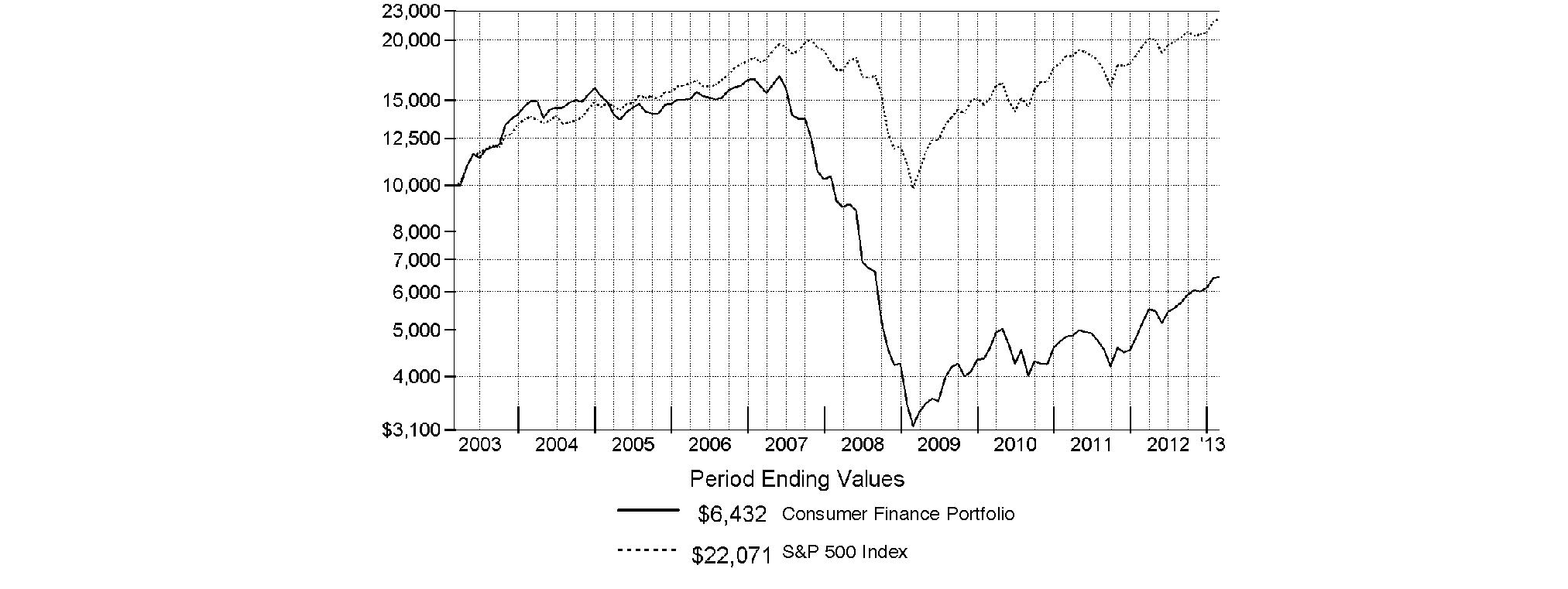

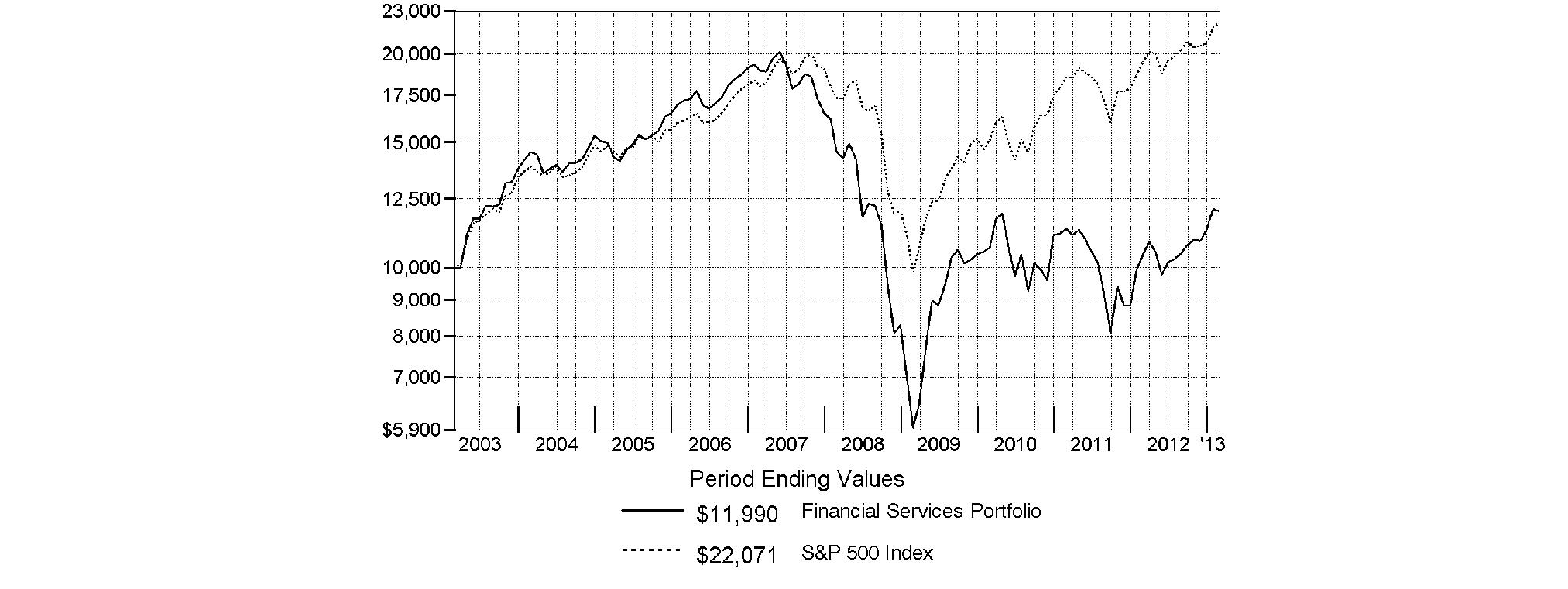

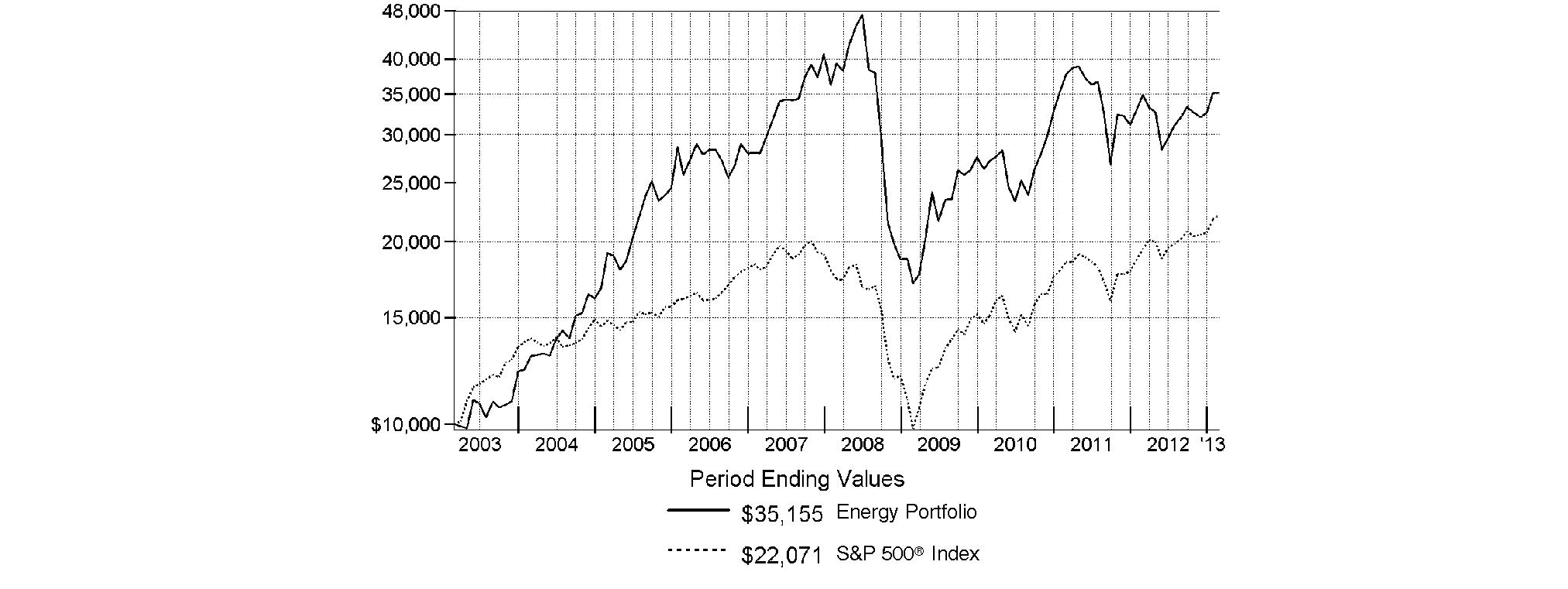

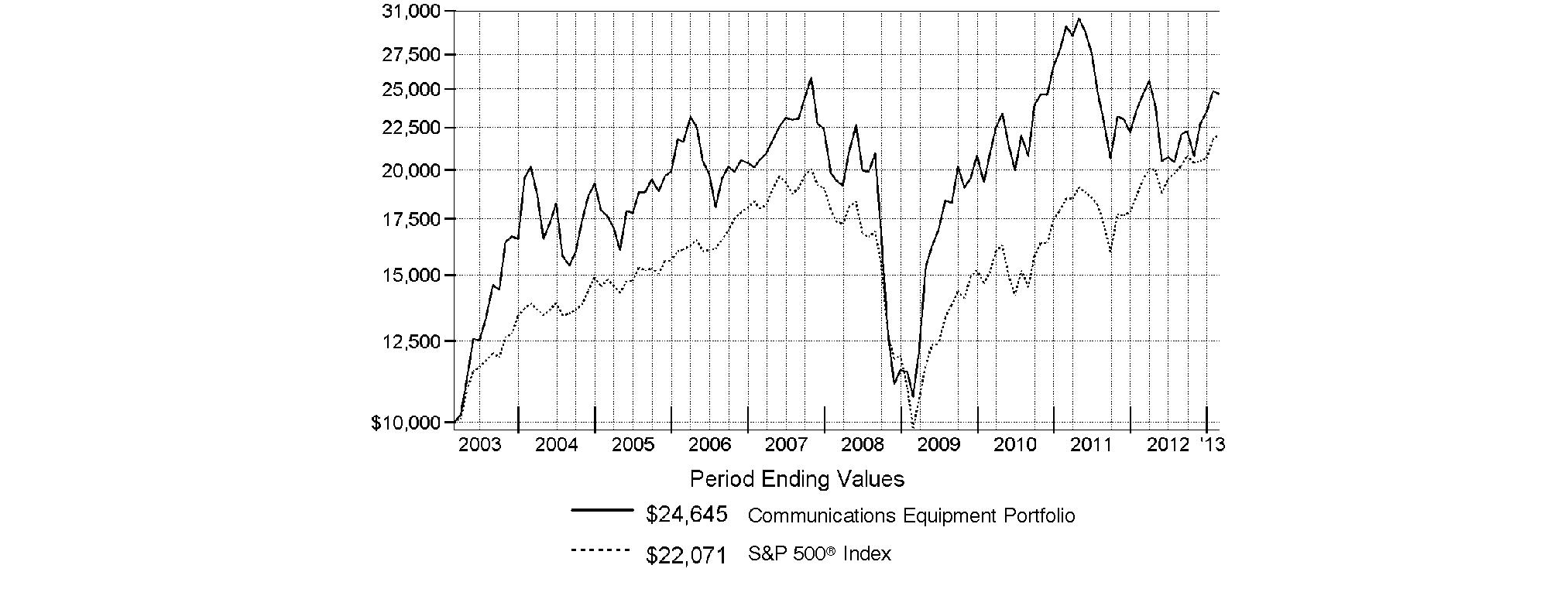

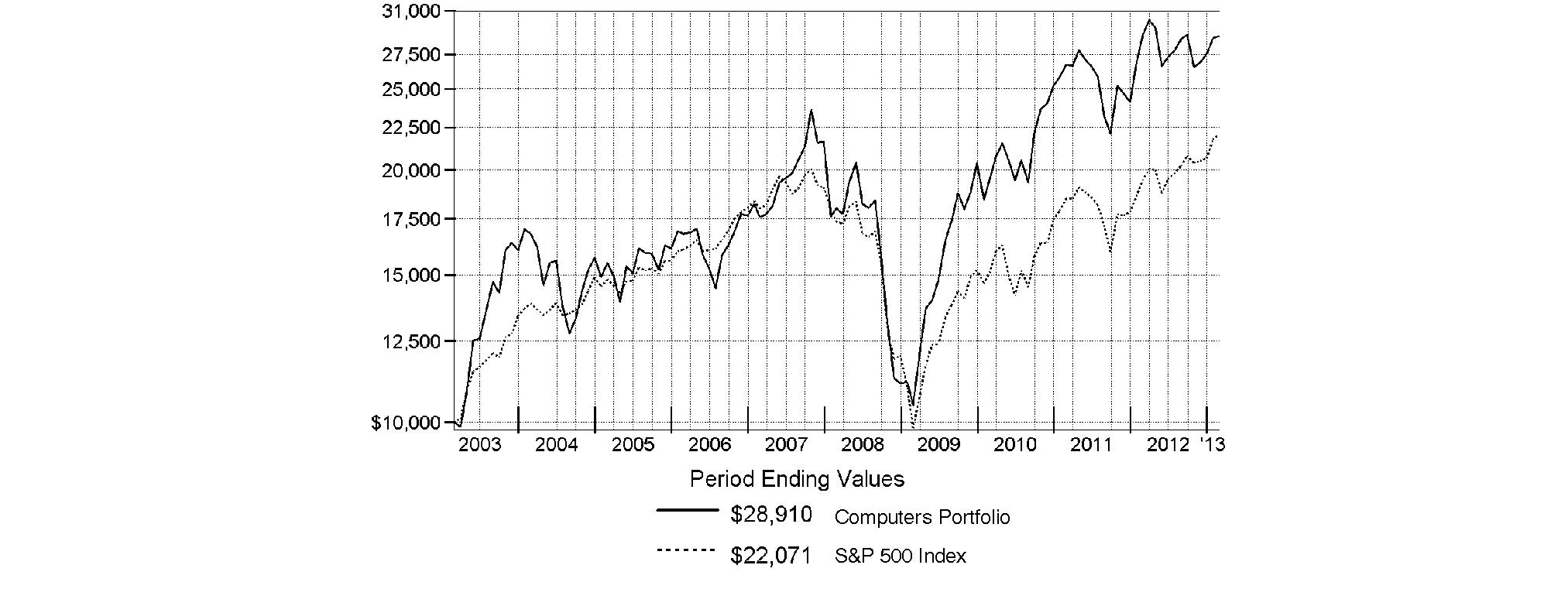

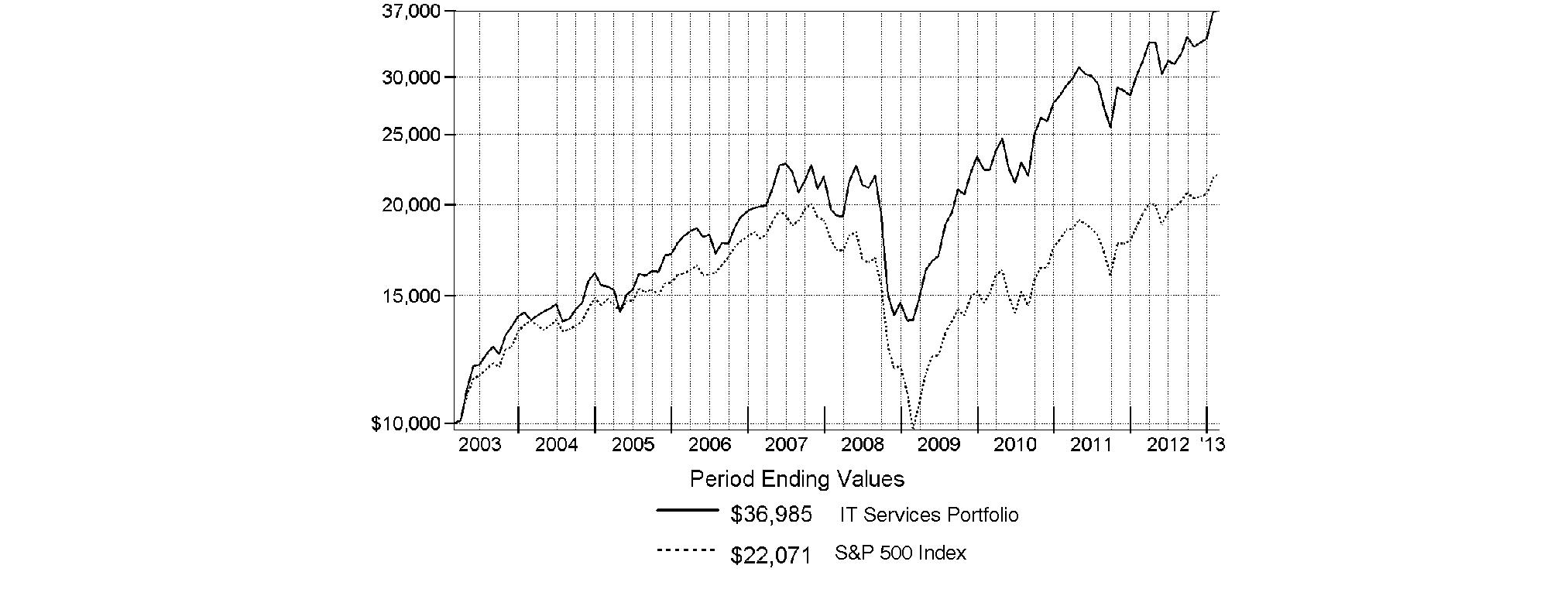

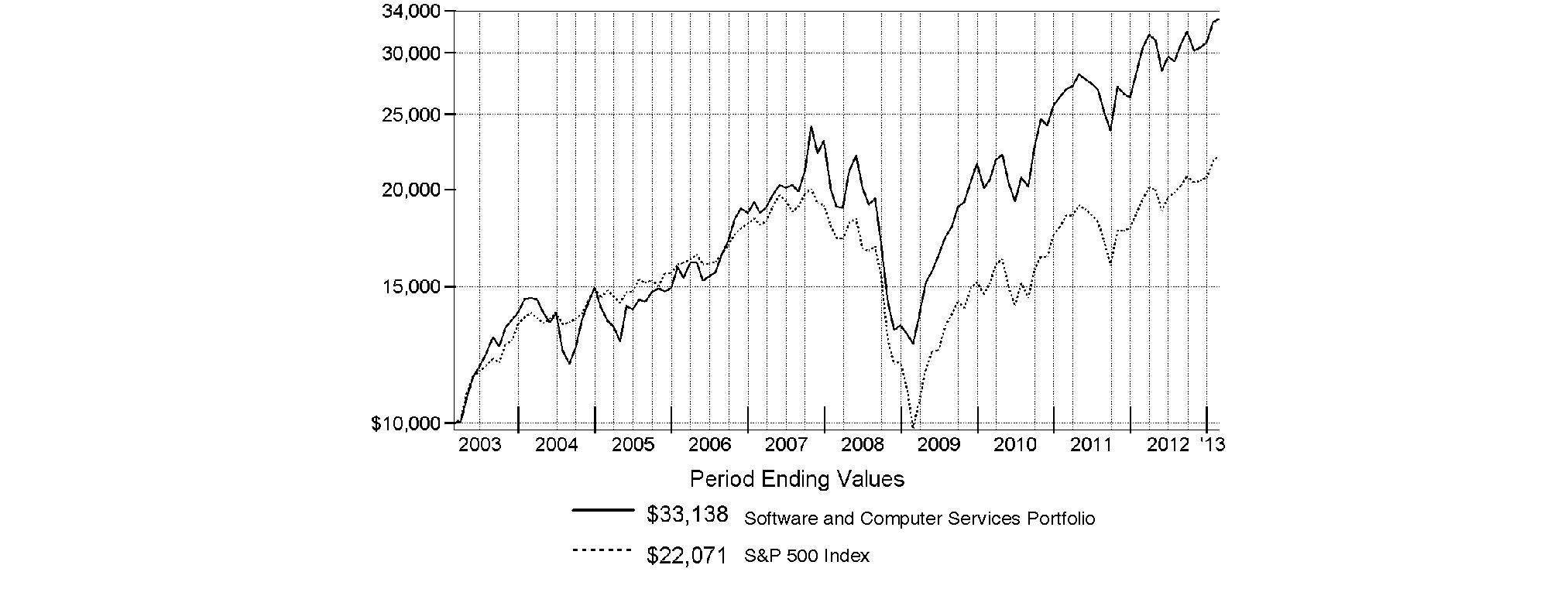

Let's say hypothetically that $10,000 was invested in Automotive Portfolio on February 28, 2003. The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period.

Annual Report

Automotive Portfolio

Management's Discussion of Fund Performance

Market Recap: U.S. stocks posted solid gains for the year ending February 28, 2013, sparked by a late-period rally that pushed major equity benchmarks to multiyear highs. Improvement in the global economy and more monetary stimulus from the U.S. Federal Reserve kept markets on the upswing for much of the year, shrugging off an early decline brought on by debt woes in Europe, and another dip later in the period amid Congressional gridlock on the federal budget. Renewed optimism over employment, the housing market, corporate earnings and record dividends made stocks a favorite with investors during the 12 months, which helped push the broad-based S&P 500® Index across the milestone 1,500 mark at the end of January. The S&P 500® finished the period up 13.46%. Seven of the 10 major market sectors tracked by MSCI U.S. IMI 25-50 classifications produced double-digit gains, led by health care and financials, while information technology, energy and materials trailed the broad equity market with only modest advances.

Comments from Michael Weaver, Portfolio Manager of Automotive Portfolio: For the year, the fund returned 7.64%, lagging the 8.04% result of the S&P® Custom Automobiles & Components Index and the S&P 500. The automotive industry rallied briskly during the second half of the period, climbing higher amid improvements in the global equity markets, as investors' became less pessimistic about some of the macroeconomic issues that previously challenged the markets. The fund's underperformance of the industry benchmark was due, in part, to its modest position in cash. Also of note, currency fluctuations hindered performance given the fund's investments in foreign stocks. Slightly underweighting the automakers, tire and rubber, and motorcycle manufacturers groups detracted as well. In particular, maintaining an underweighting, on average, in Japanese automaker Toyota Motor, one of the auto industry's best-performing stocks, was the biggest detractor. We also missed with Ford Motor and General Motors, the big U.S. automakers, because we held lighter-than-benchmark stakes during the fall months of 2012, when each stock made a sharp advance. An early-period overweighting in auto parts maker Tenneco hurt as well. On the upside, the fund's relative performance was bolstered by security selection in the auto parts and equipment industry, where the fund's emphasis on companies helping to limit emissions, increase fuel economy and enhance vehicle safety proved beneficial. Two of the fund's core holdings - Delphi Automotive and TRW Automotive Holdings - benefited from those themes and were top contributors. The fund also got an unexpected boost from a residual interest in a bond holding received during the restructuring of General Motors.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Automotive Portfolio

Investment Changes (Unaudited)

|

Top Ten Stocks as of February 28, 2013 |

||

|

|

% of fund's |

% of fund's net assets |

|

Toyota Motor Corp. sponsored ADR |

17.2 |

15.8 |

|

Honda Motor Co. Ltd. sponsored ADR |

11.5 |

11.1 |

|

Ford Motor Co. |

9.7 |

8.3 |

|

Delphi Automotive PLC |

6.2 |

4.7 |

|

General Motors Co. |

5.3 |

4.7 |

|

Johnson Controls, Inc. |

4.4 |

5.5 |

|

Harley-Davidson, Inc. |

4.3 |

3.7 |

|

Magna International, Inc. Class A (sub. vtg.) |

4.2 |

3.1 |

|

TRW Automotive Holdings Corp. |

4.0 |

4.9 |

|

Tenneco, Inc. |

3.6 |

2.9 |

|

|

70.4 |

|

|

Top Industries (% of fund's net assets) |

|||

|

As of February 28, 2013 |

|||

|

Automobiles |

49.5% |

|

|

Auto Components |

47.8% |

|

|

Machinery |

1.3% |

|

|

All Others* |

1.4% |

|

|

As of August 31, 2012 |

|||

|

Auto Components |

47.8% |

|

|

Automobiles |

45.2% |

|

|

Machinery |

1.9% |

|

|

All Others* |

5.1% |

|

|

* Includes short-term investments and net other assets. |

Annual Report

Automotive Portfolio

Investments February 28, 2013

Showing Percentage of Net Assets

|

Common Stocks - 98.6% |

|||

|

Shares |

Value |

||

|

AUTO COMPONENTS - 47.8% |

|||

|

Auto Parts & Equipment - 44.9% |

|||

|

American Axle & Manufacturing Holdings, Inc. (a) |

104,800 |

$ 1,325,720 |

|

|

Autoliv, Inc. (e) |

58,455 |

3,810,097 |

|

|

BorgWarner, Inc. (a) |

66,500 |

4,948,265 |

|

|

Dana Holding Corp. |

169,700 |

2,839,081 |

|

|

Delphi Automotive PLC |

211,678 |

8,858,724 |

|

|

Dorman Products, Inc. |

31,300 |

1,094,248 |

|

|

Drew Industries, Inc. |

37,900 |

1,378,802 |

|

|

Exide Technologies (a) |

166,200 |

445,416 |

|

|

Federal-Mogul Corp. Class A (a) |

56,924 |

459,946 |

|

|

Fuel Systems Solutions, Inc. (a) |

25,000 |

347,250 |

|

|

Gentex Corp. |

127,000 |

2,381,250 |

|

|

Gentherm, Inc. (a) |

30,600 |

471,240 |

|

|

Johnson Controls, Inc. |

201,970 |

6,355,996 |

|

|

Lear Corp. |

84,200 |

4,497,964 |

|

|

Linamar Corp. |

50,700 |

1,265,964 |

|

|

Magna International, Inc. Class A (sub. vtg.) |

113,184 |

6,020,017 |

|

|

Martinrea International, Inc. (a) |

99,300 |

856,989 |

|

|

Modine Manufacturing Co. (a) |

73,100 |

602,344 |

|

|

Motorcar Parts of America, Inc. (a) |

54,200 |

296,474 |

|

|

Spartan Motors, Inc. |

88,400 |

467,636 |

|

|

Standard Motor Products, Inc. |

28,000 |

692,440 |

|

|

Stoneridge, Inc. (a) |

58,289 |

375,964 |

|

|

Tenneco, Inc. (a) |

144,446 |

5,117,722 |

|

|

Tower International, Inc. (a) |

87,800 |

1,057,112 |

|

|

TRW Automotive Holdings Corp. (a) |

98,500 |

5,780,965 |

|

|

Visteon Corp. (a) |

41,900 |

2,441,932 |

|

|

|

64,189,558 |

||

|

Tires & Rubber - 2.9% |

|||

|

Cooper Tire & Rubber Co. |

65,200 |

1,648,256 |

|

|

The Goodyear Tire & Rubber Co. (a) |

190,426 |

2,471,729 |

|

|

|

4,119,985 |

||

|

TOTAL AUTO COMPONENTS |

68,309,543 |

||

|

AUTOMOBILES - 49.5% |

|||

|

Automobile Manufacturers - 45.2% |

|||

|

Ford Motor Co. |

1,098,861 |

13,856,637 |

|

|

General Motors Co. (a) |

279,544 |

7,589,620 |

|

|

Honda Motor Co. Ltd. sponsored ADR (e) |

440,900 |

16,507,296 |

|

|

Thor Industries, Inc. |

33,600 |

1,263,024 |

|

|

Toyota Motor Corp. sponsored ADR (e) |

239,300 |

24,552,180 |

|

|

Winnebago Industries, Inc. (a) |

45,700 |

885,666 |

|

|

|

64,654,423 |

||

|

|

|||

|

Shares |

Value |

||

|

Motorcycle Manufacturers - 4.3% |

|||

|

Harley-Davidson, Inc. |

115,600 |

$ 6,084,028 |

|

|

TOTAL AUTOMOBILES |

70,738,451 |

||

|

MACHINERY - 1.3% |

|||

|

Construction & Farm Machinery & Heavy Trucks - 1.3% |

|||

|

Meritor, Inc. (a) |

100,800 |

443,520 |

|

|

Westport Innovations, Inc. (a)(e) |

50,600 |

1,464,364 |

|

|

|

1,907,884 |

||

|

TOTAL COMMON STOCKS (Cost $107,448,098) |

|

||

|

Nonconvertible Bonds - 0.0% |

||||

|

|

Principal Amount |

|

||

|

AUTOMOBILES - 0.0% |

||||

|

Automobile Manufacturers - 0.0% |

||||

|

General Motors Corp. 6.75% 5/1/28 (d) |

|

$ 31,005,000 |

|

|

|

Money Market Funds - 18.3% |

|||

|

Shares |

|

||

|

Fidelity Cash Central Fund, 0.16% (b) |

2,900,231 |

2,900,231 |

|

|

Fidelity Securities Lending Cash Central Fund, 0.16% (b)(c) |

23,259,799 |

23,259,799 |

|

|

TOTAL MONEY MARKET FUNDS (Cost $26,160,030) |

|

||

|

TOTAL INVESTMENT PORTFOLIO - 116.9% (Cost $133,892,484) |

167,115,911 |

||

|

NET OTHER ASSETS (LIABILITIES) - (16.9)% |

(24,157,280) |

||

|

NET ASSETS - 100% |

$ 142,958,631 |

||

|

Legend |

|

(a) Non-income producing |

|

(b) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

|

(c) Investment made with cash collateral received from securities on loan. |

|

(d) Non-income producing - Security is in default. |

|

(e) Security or a portion of the security is on loan at period end. |

|

Affiliated Central Funds |

|

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

|

Fund |

Income earned |

|

Fidelity Cash Central Fund |

$ 9,561 |

|

Fidelity Securities Lending Cash Central Fund |

207,741 |

|

Total |

$ 217,302 |

|

Other Information |

|

The following is a summary of the inputs used, as of February 28, 2013, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements. |

|

Valuation Inputs at Reporting Date: |

||||

|

Description |

Total |

Level 1 |

Level 2 |

Level 3 |

|

Investments in Securities: |

||||

|

Common Stocks |

$ 140,955,878 |

$ 140,955,878 |

$ - |

$ - |

|

Nonconvertible Bonds |

3 |

- |

- |

3 |

|

Money Market Funds |

26,160,030 |

26,160,030 |

- |

- |

|

Total Investments in Securities: |

$ 167,115,911 |

$ 167,115,908 |

$ - |

$ 3 |

|

Distribution of investments by country or territory of incorporation, as a percentage of total net assets, is as follows. (Unaudited) |

|

United States of America |

58.4% |

|

Japan |

28.7% |

|

Canada |

6.7% |

|

Bailiwick of Jersey |

6.2% |

|

|

100.0% |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Automotive Portfolio

Financial Statements

Statement of Assets and Liabilities

|

|

February 28, 2013 |

|

|

|

|

|

|

Assets |

|

|

|

Investment in securities, at value (including securities loaned of $22,926,781) - See accompanying schedule: Unaffiliated issuers (cost $107,732,454) |

$ 140,955,881 |

|

|

Fidelity Central Funds (cost $26,160,030) |

26,160,030 |

|

|

Total Investments (cost $133,892,484) |

|

$ 167,115,911 |

|

Receivable for fund shares sold |

|

186,192 |

|

Dividends receivable |

|

247,709 |

|

Distributions receivable from Fidelity Central Funds |

|

32,684 |

|

Prepaid expenses |

|

113 |

|

Receivable from investment adviser for expense reductions |

|

64 |

|

Other receivables |

|

9,520 |

|

Total assets |

|

167,592,193 |

|

|

|

|

|

Liabilities |

|

|

|

Payable for fund shares redeemed |

$ 1,240,027 |

|

|

Accrued management fee |

70,738 |

|

|

Other affiliated payables |

31,875 |

|

|

Other payables and accrued expenses |

31,123 |

|

|

Collateral on securities loaned, at value |

23,259,799 |

|

|

Total liabilities |

|

24,633,562 |

|

|

|

|

|

Net Assets |

|

$ 142,958,631 |

|

Net Assets consist of: |

|

|

|

Paid in capital |

|

$ 114,592,016 |

|

Accumulated net investment loss |

|

(89) |

|

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions |

|

(4,855,875) |

|

Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies |

|

33,222,579 |

|

Net Assets, for 3,516,444 shares outstanding |

|

$ 142,958,631 |

|

Net Asset Value, offering price and redemption price per share ($142,958,631 ÷ 3,516,444 shares) |

|

$ 40.65 |

Statement of Operations

|

|

Year ended February 28, 2013 |

|

|

|

|

|

|

Investment Income |

|

|

|

Dividends |

|

$ 1,660,529 |

|

Income from Fidelity Central Funds (including $207,741 from security lending) |

|

217,302 |

|

Total income |

|

1,877,831 |

|

|

|

|

|

Expenses |

|

|

|

Management fee |

$ 677,842 |

|

|

Transfer agent fees |

296,108 |

|

|

Accounting and security lending fees |

50,118 |

|

|

Custodian fees and expenses |

9,107 |

|

|

Independent trustees' compensation |

811 |

|

|

Registration fees |

30,233 |

|

|

Audit |

38,186 |

|

|

Legal |

475 |

|

|

Miscellaneous |

1,239 |

|

|

Total expenses before reductions |

1,104,119 |

|

|

Expense reductions |

(21,599) |

1,082,520 |

|

Net investment income (loss) |

|

795,311 |

|

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: |

|

|

|

Investment securities: |

|

|

|

Unaffiliated issuers |

266,592 |

|

|

Foreign currency transactions |

(1,506) |

|

|

Total net realized gain (loss) |

|

265,086 |

|

Change in net unrealized appreciation (depreciation) on: Investment securities |

1,979,102 |

|

|

Assets and liabilities in foreign currencies |

(360) |

|

|

Total change in net unrealized appreciation (depreciation) |

|

1,978,742 |

|

Net gain (loss) |

|

2,243,828 |

|

Net increase (decrease) in net assets resulting from operations |

|

$ 3,039,139 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Automotive Portfolio

Financial Statements - continued

Statement of Changes in Net Assets

|

|

Year ended |

Year ended |

|

Increase (Decrease) in Net Assets |

|

|

|

Operations |

|

|

|

Net investment income (loss) |

$ 795,311 |

$ 119,923 |

|

Net realized gain (loss) |

265,086 |

4,447,404 |

|

Change in net unrealized appreciation (depreciation) |

1,978,742 |

(41,641,844) |

|

Net increase (decrease) in net assets resulting from operations |

3,039,139 |

(37,074,517) |

|

Distributions to shareholders from net investment income |

(740,892) |

(45,425) |

|

Distributions to shareholders from net realized gain |

(99,972) |

(9,238,375) |

|

Total distributions |

(840,864) |

(9,283,800) |

|

Share transactions |

113,289,906 |

130,281,367 |

|

Reinvestment of distributions |

802,629 |

8,936,839 |

|

Cost of shares redeemed |

(143,364,154) |

(296,538,707) |

|

Net increase (decrease) in net assets resulting from share transactions |

(29,271,619) |

(157,320,501) |

|

Redemption fees |

16,206 |

62,990 |

|

Total increase (decrease) in net assets |

(27,057,138) |

(203,615,828) |

|

|

|

|

|

Net Assets |

|

|

|

Beginning of period |

170,015,769 |

373,631,597 |

|

End of period (including accumulated net investment loss of $89 and distributions in excess of net investment income of $77, respectively) |

$ 142,958,631 |

$ 170,015,769 |

|

Other Information Shares |

|

|

|

Sold |

2,953,140 |

3,433,091 |

|

Issued in reinvestment of distributions |

21,299 |

246,291 |

|

Redeemed |

(3,926,750) |

(7,183,045) |

|

Net increase (decrease) |

(952,311) |

(3,503,663) |

Financial Highlights

|

Years ended February 28, |

2013 |

2012 F |

2011 |

2010 |

2009 |

|

Selected Per-Share Data |

|

|

|

|

|

|

Net asset value, beginning of period |

$ 38.05 |

$ 46.87 |

$ 31.63 |

$ 10.07 |

$ 34.23 |

|

Income from Investment Operations |

|

|

|

|

|

|

Net investment income (loss) B |

.24 |

.03 |

(.08) |

(.06) |

.42 |

|

Net realized and unrealized gain (loss) |

2.65 |

(6.45) |

15.94 |

21.67 |

(24.30) |

|

Total from investment operations |

2.89 |

(6.42) |

15.86 |

21.61 |

(23.88) |

|

Distributions from net investment income |

(.26) |

(.02) |

- |

(.07) |

(.28) |

|

Distributions from net realized gain |

(.02) |

(2.41) |

(.63) |

- |

(.01) |

|

Total distributions |

(.29) I |

(2.42) H |

(.63) |

(.07) |

(.29) |

|

Redemption fees added to paid in capital B |

- G |

.02 |

.01 |

.02 |

.01 |

|

Net asset value, end of period |

$ 40.65 |

$ 38.05 |

$ 46.87 |

$ 31.63 |

$ 10.07 |

|

Total Return A |

7.64% |

(13.06)% |

50.90% |

215.39% |

(69.99)% |

|

Ratios to Average Net Assets C, E |

|

|

|

|

|

|

Expenses before reductions |

.91% |

.90% |

.91% |

.99% |

1.47% |

|

Expenses net of fee waivers, if any |

.91% |

.90% |

.91% |

.99% |

1.15% |

|

Expenses net of all reductions |

.89% |

.90% |

.91% |

.97% |

1.15% |

|

Net investment income (loss) |

.66% |

.08% |

(.19)% |

(.23)% |

1.73% |

|

Supplemental Data |

|

|

|

|

|

|

Net assets, end of period (000 omitted) |

$ 142,959 |

$ 170,016 |

$ 373,632 |

$ 146,023 |

$ 7,581 |

|

Portfolio turnover rate D |

72% |

49% |

91% |

156% |

156% |

|

A Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown. B Calculated based on average shares outstanding during the period. C Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. D Amount does not include the portfolio activity of any underlying Fidelity Central Funds. E Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund. F For the year ended February 29. G Amount represents less than $.01 per share. H Total distributions of $2.42 per share is comprised of distributions from net investment income of $0.015 and distributions from net realized gain of $2.408 per share. I Total distributions of $.29 per share is comprised of distributions from net investment income of $0.261 and distributions from net realized gain of $0.024 per share. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Construction and Housing Portfolio

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

|

Periods ended February 28, 2013 |

Past 1 |

Past 5 |

Past 10 |

|

Construction and Housing Portfolio |

31.79% |

11.05% |

12.71% |

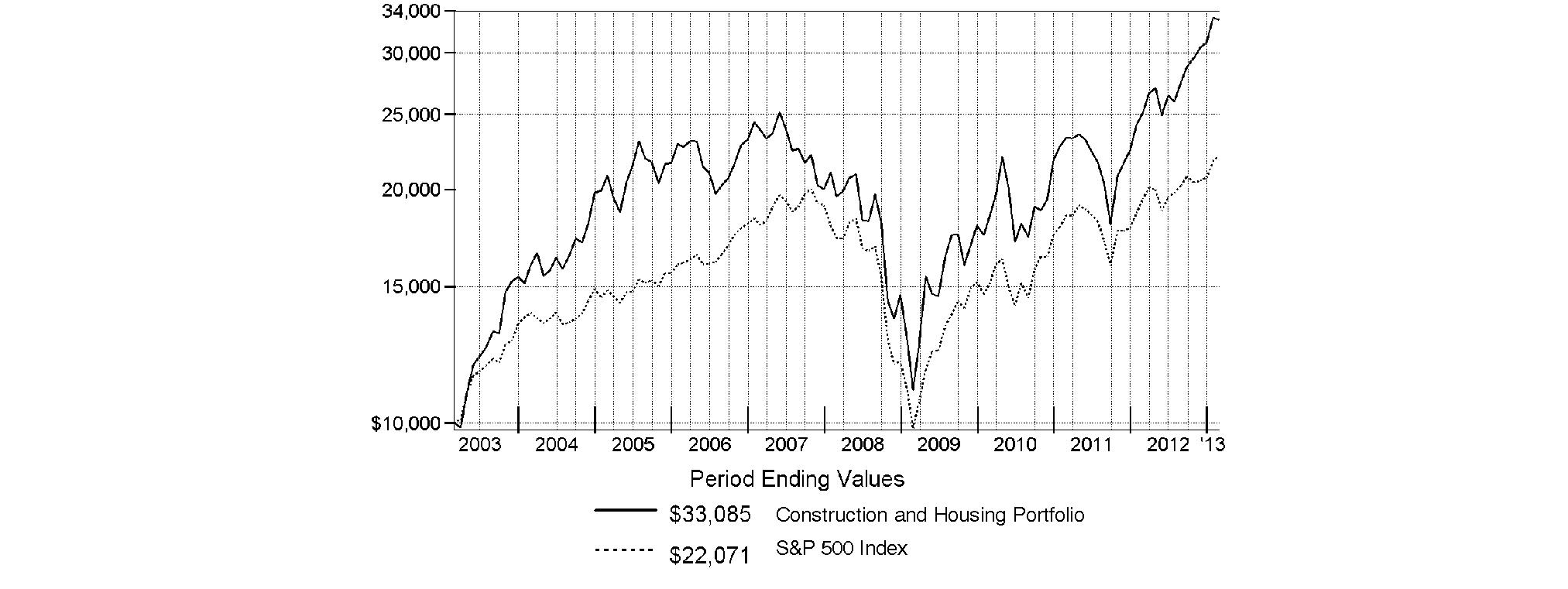

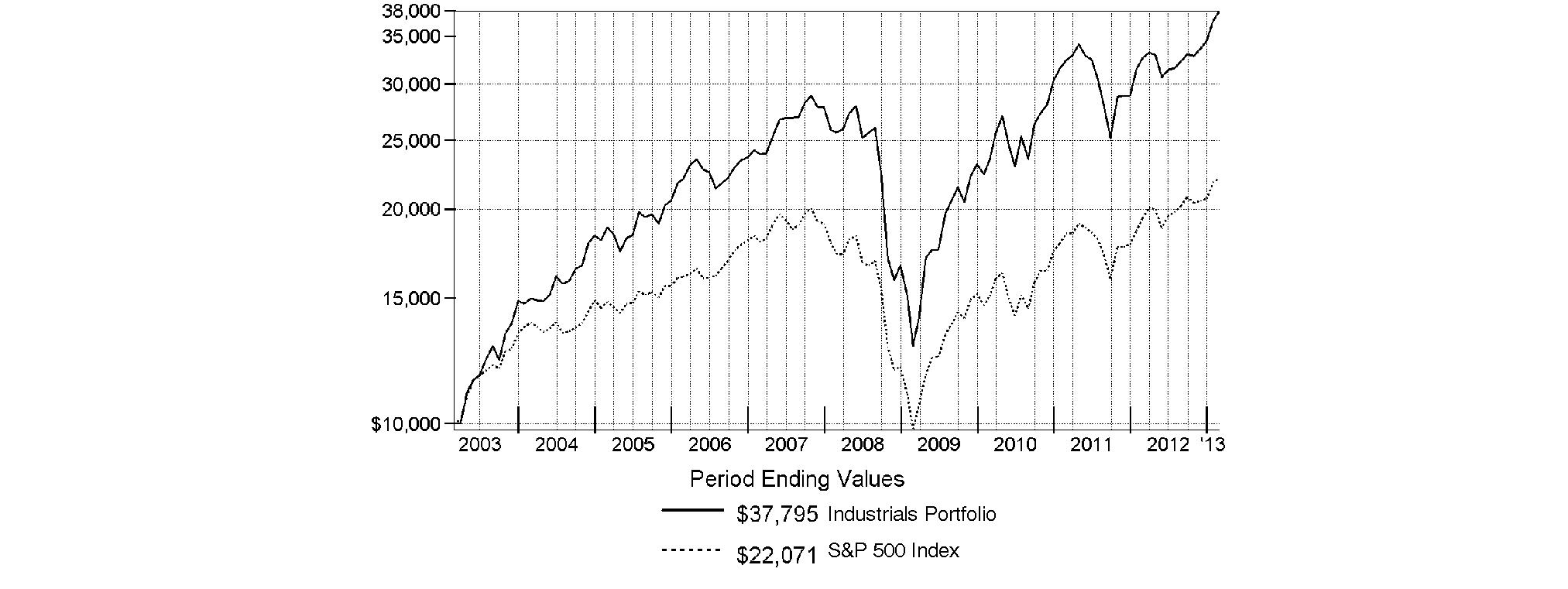

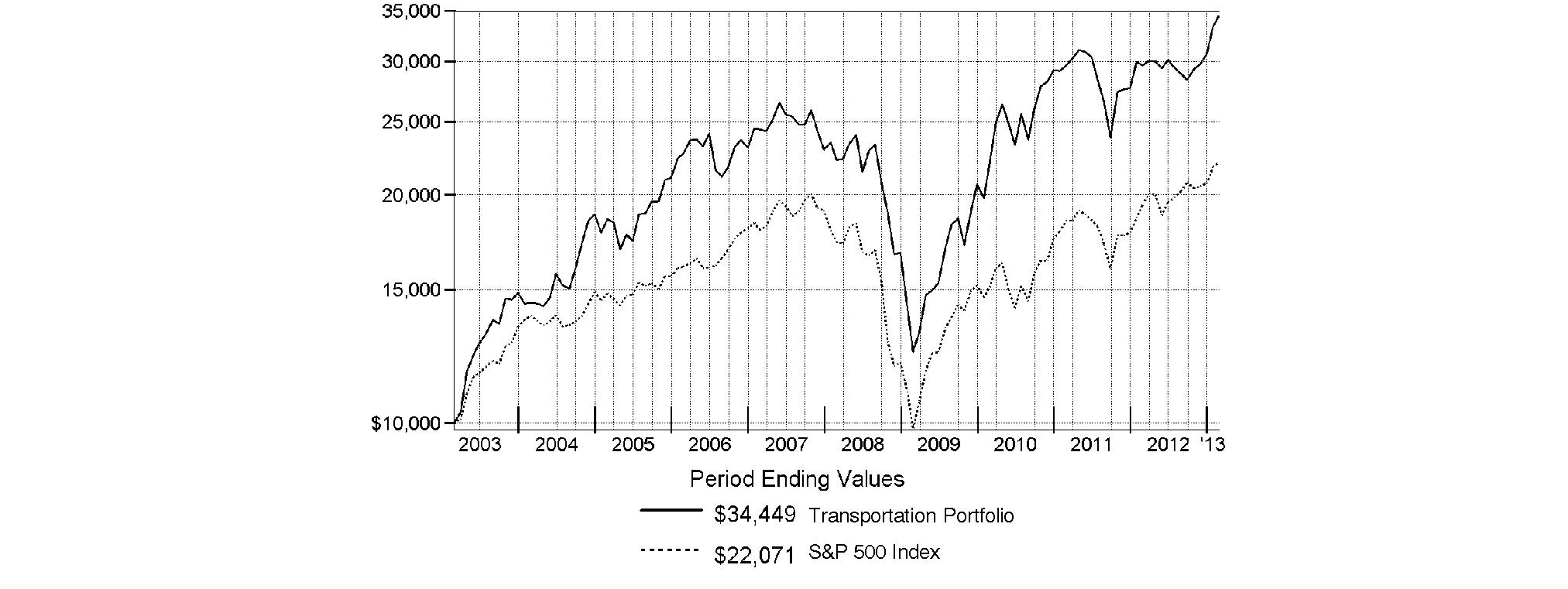

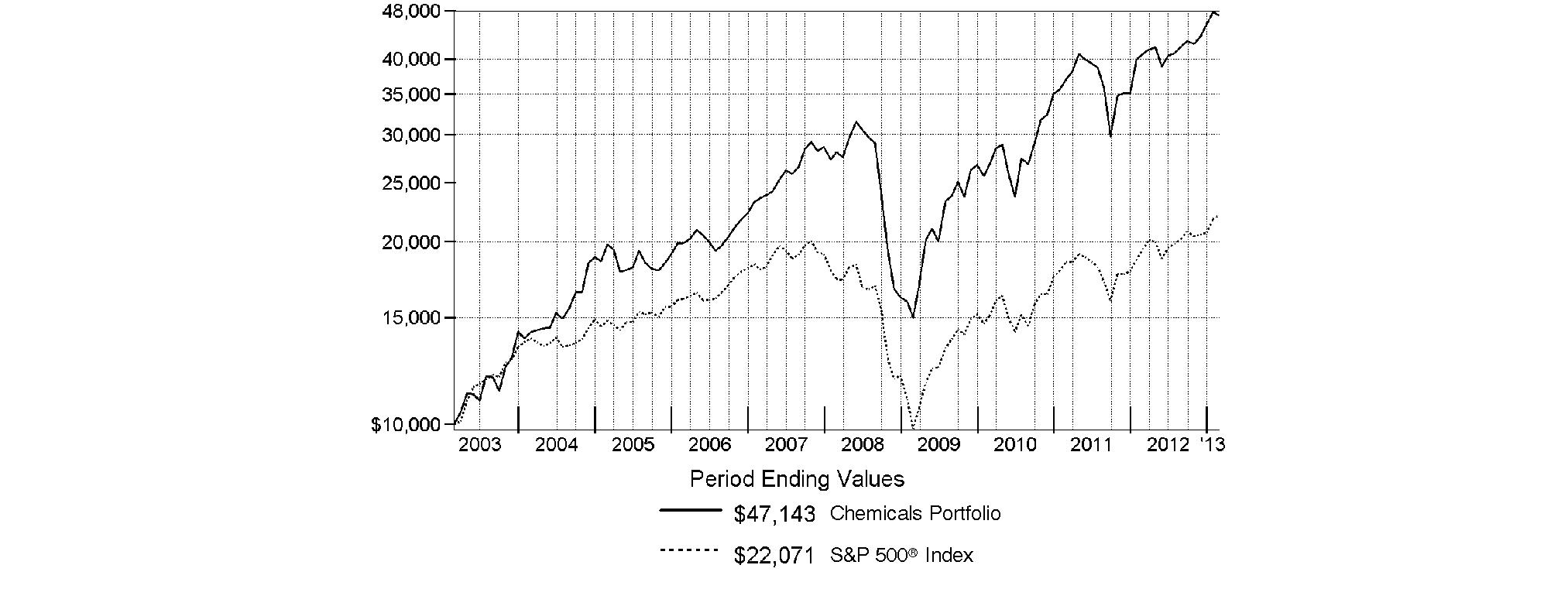

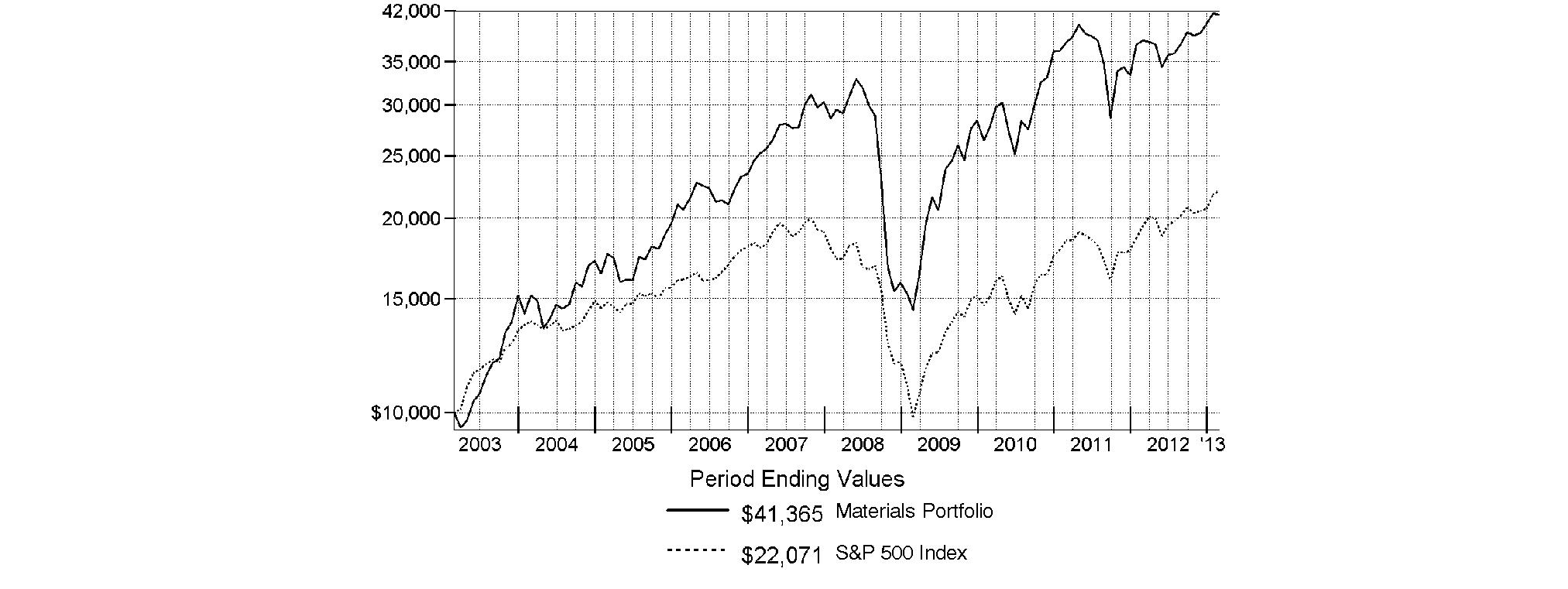

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Construction and Housing Portfolio on February 28, 2003. The chart shows how the value of your investment would have changed, and also shows how the S&P 500 Index performed over the same period.

Annual Report

Construction and Housing Portfolio

Management's Discussion of Fund Performance

Market Recap: U.S. stocks posted solid gains for the year ending February 28, 2013, sparked by a late-period rally that pushed major equity benchmarks to multiyear highs. Improvement in the global economy and more monetary stimulus from the U.S. Federal Reserve kept markets on the upswing for much of the year, shrugging off an early decline brought on by debt woes in Europe, and another dip later in the period amid Congressional gridlock on the federal budget. Renewed optimism over employment, the housing market, corporate earnings and record dividends made stocks a favorite with investors during the 12 months, which helped push the broad-based S&P 500® Index across the milestone 1,500 mark at the end of January. The S&P 500® finished the period up 13.46%. Seven of the 10 major market sectors tracked by MSCI U.S. IMI 25-50 classifications produced double-digit gains, led by health care and financials, while information technology, energy and materials trailed the broad equity market with only modest advances.

Comments from Holger Boerner, who became sole Portfolio Manager of Construction and Housing Portfolio on October 1, 2012, after serving as Co-Manager: For the year, the fund returned 31.79%, beating the 30.25% gain of the MSCI® U.S. IMI Custom Construction & Housing 25-50 Index, and well ahead of the S&P 500®. Record-low interest rates, rising demand and constrained housing supply led to a pickup in new home construction and home values, benefiting the industry. Versus the index, an underweighting in lagging residential real estate investment trusts (REITs) and an overweighting in homebuilding helped the most, while stock picks in home improvement retail, an underweighting in the strong-performing building products group and a modest overweighting in construction/engineering detracted. Individual standouts included national homebuilders Ryland Group, D.R. Horton and Toll Brothers, whose sharp gains were driven by accelerated order growth, high profit margins and positive earnings surprises. In the residential REITs segment, sizable underweightings in UDR and AvalonBay Communities worked well, as decelerating revenue growth and rising costs pressured the group. On the downside, construction/engineering firm Fluor hurt due to an overweighting early on when slowing global economic growth hampered the business and the stock fell. Similarly, in home improvement retail, an early-period overweighting in Lowe's Companies and underweighting in Home Depot had a negative impact. Not owning home improvement retailer Lumber Liquidators Holdings and building products company Fortune Brands Home & Security for most of the period detracted, as the housing recovery fueled steep gains in the stocks of both index components. UDR, Lumber Liquidators and Fortune Brands were not in the fund at period end.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Construction and Housing Portfolio

Investment Changes (Unaudited)

|

Top Ten Stocks as of February 28, 2013 |

||

|

|

% of fund's |

% of fund's net assets |

|

Home Depot, Inc. |

23.5 |

23.2 |

|

Lowe's Companies, Inc. |

12.2 |

10.7 |

|

Fluor Corp. |

3.4 |

4.5 |

|

Toll Brothers, Inc. |

2.7 |

4.2 |

|

Vulcan Materials Co. |

2.6 |

2.5 |

|

Jacobs Engineering Group, Inc. |

2.4 |

2.9 |

|

Quanta Services, Inc. |

2.4 |

3.2 |

|

Apartment Investment & Management Co. Class A |

2.4 |

2.2 |

|

Lennar Corp. Class A |

2.4 |

2.8 |

|

AvalonBay Communities, Inc. |

2.3 |

2.0 |

|

|

56.3 |

|

|

Top Industries (% of fund's net assets) |

|||

|

As of February 28, 2013 |

|||

|

Specialty Retail |

35.7% |

|

|

Real Estate Investment Trusts |

15.9% |

|

|

Household Durables |

14.3% |

|

|

Construction & Engineering |

13.4% |

|

|

Construction Materials |

8.4% |

|

|

All Others* |

12.3% |

|

|

As of August 31, 2012 |

|||

|

Specialty Retail |

33.9% |

|

|

Real Estate Investment Trusts |

21.7% |

|

|

Construction & Engineering |

15.8% |

|

|

Household Durables |

13.6% |

|

|

Building Products |

5.4% |

|

|

All Others* |

9.6% |

|

|

* Includes short-term investments and net other assets. |

Annual Report

Construction and Housing Portfolio

Investments February 28, 2013

Showing Percentage of Net Assets

|

Common Stocks - 98.8% |

|||

|

Shares |

Value |

||

|

BUILDING PRODUCTS - 5.2% |

|||

|

Building Products - 5.2% |

|||

|

American Woodmark Corp. (a) |

239,068 |

$ 7,674,083 |

|

|

Armstrong World Industries, Inc. |

156,650 |

8,009,515 |

|

|

Gibraltar Industries, Inc. (a) |

87,400 |

1,498,910 |

|

|

Masco Corp. |

416,400 |

8,019,864 |

|

|

Owens Corning (a) |

101,669 |

3,945,774 |

|

|

USG Corp. (a)(d) |

410,000 |

11,570,200 |

|

|

|

40,718,346 |

||

|

COMMERCIAL SERVICES & SUPPLIES - 0.3% |

|||

|

Office Services & Supplies - 0.3% |

|||

|

Interface, Inc. |

152,480 |

2,791,909 |

|

|

CONSTRUCTION & ENGINEERING - 13.4% |

|||

|

Construction & Engineering - 13.4% |

|||

|

Dycom Industries, Inc. (a) |

476,000 |

9,972,200 |

|

|

Fluor Corp. |

422,300 |

26,140,370 |

|

|

Furmanite Corp. (a) |

882,689 |

5,269,653 |

|

|

Granite Construction, Inc. |

297,400 |

9,246,166 |

|

|

Jacobs Engineering Group, Inc. (a) |

390,250 |

19,059,810 |

|

|

MasTec, Inc. (a) |

321,000 |

9,658,890 |

|

|

Quanta Services, Inc. (a) |

670,800 |

19,050,720 |

|

|

Tutor Perini Corp. (a) |

366,890 |

6,240,799 |

|

|

|

104,638,608 |

||

|

CONSTRUCTION MATERIALS - 8.4% |

|||

|

Construction Materials - 8.4% |

|||

|

Eagle Materials, Inc. |

210,500 |

13,537,255 |

|

|

Headwaters, Inc. (a) |

1,095,354 |

10,307,281 |

|

|

James Hardie Industries PLC CDI |

272,998 |

2,732,767 |

|

|

Lafarge SA (Bearer) |

98,200 |

6,620,507 |

|

|

Martin Marietta Materials, Inc. (d) |

132,750 |

12,894,008 |

|

|

Vulcan Materials Co. |

391,460 |

19,937,058 |

|

|

|

66,028,876 |

||

|

CONTAINERS & PACKAGING - 1.2% |

|||

|

Paper Packaging - 1.2% |

|||

|

Rock-Tenn Co. Class A |

103,900 |

9,189,955 |

|

|

ELECTRICAL EQUIPMENT - 0.4% |

|||

|

Electrical Components & Equipment - 0.4% |

|||

|

Generac Holdings, Inc. |

94,400 |

3,252,080 |

|

|

ENERGY EQUIPMENT & SERVICES - 1.2% |

|||

|

Oil & Gas Equipment & Services - 1.2% |

|||

|

McDermott International, Inc. (a) |

720,500 |

9,164,760 |

|

|

HOUSEHOLD DURABLES - 14.1% |

|||

|

Homebuilding - 13.1% |

|||

|

D.R. Horton, Inc. |

805,137 |

17,954,555 |

|

|

KB Home (d) |

594,600 |

11,113,074 |

|

|

Lennar Corp. Class A (d) |

484,078 |

18,680,570 |

|

|

M.D.C. Holdings, Inc. |

170,292 |

6,544,322 |

|

|

|

|||

|

Shares |

Value |

||

|

M/I Homes, Inc. (a) |

478,350 |

$ 10,954,215 |

|

|

PulteGroup, Inc. (a) |

295,583 |

5,669,282 |

|

|

Ryland Group, Inc. |

294,070 |

10,504,180 |

|

|

Toll Brothers, Inc. (a) |

604,714 |

20,632,842 |

|

|

|

102,053,040 |

||

|

Household Appliances - 1.0% |

|||

|

Whirlpool Corp. |

70,000 |

7,906,500 |

|

|

TOTAL HOUSEHOLD DURABLES |

109,959,540 |

||

|

REAL ESTATE INVESTMENT TRUSTS - 15.9% |

|||

|

Residential REITs - 14.9% |

|||

|

Apartment Investment & Management Co. Class A |

642,271 |

19,024,067 |

|

|

AvalonBay Communities, Inc. |

145,759 |

18,195,096 |

|

|

BRE Properties, Inc. |

248,900 |

12,099,029 |

|

|

Camden Property Trust (SBI) |

212,600 |

14,699,164 |

|

|

Equity Residential (SBI) |

311,192 |

17,128,008 |

|

|

Essex Property Trust, Inc. |

116,300 |

17,327,537 |

|

|

Home Properties, Inc. |

225,600 |

14,081,952 |

|

|

Sun Communities, Inc. |

76,059 |

3,539,025 |

|

|

|

116,093,878 |

||

|

Retail REITs - 1.0% |

|||

|

CBL & Associates Properties, Inc. |

347,200 |

7,895,328 |

|

|

TOTAL REAL ESTATE INVESTMENT TRUSTS |

123,989,206 |

||

|

REAL ESTATE MANAGEMENT & DEVELOPMENT - 1.5% |

|||

|

Real Estate Operating Companies - 1.5% |

|||

|

Forest City Enterprises, Inc. Class A (a) |

599,600 |

9,617,584 |

|

|

LEG Immobilien AG |

37,775 |

2,168,475 |

|

|

|

11,786,059 |

||

|

SPECIALTY RETAIL - 35.7% |

|||

|

Home Improvement Retail - 35.7% |

|||

|

Home Depot, Inc. |

2,678,261 |

183,460,877 |

|

|

Lowe's Companies, Inc. |

2,498,734 |

95,326,702 |

|

|

|

278,787,579 |

||

|

THRIFTS & MORTGAGE FINANCE - 0.6% |

|||

|

Thrifts & Mortgage Finance - 0.6% |

|||

|

Radian Group, Inc. |

50,900 |

448,429 |

|

|

Walker & Dunlop, Inc. (a) |

194,161 |

4,116,213 |

|

|

|

4,564,642 |

||

|

TRADING COMPANIES & DISTRIBUTORS - 0.9% |

|||

|

Trading Companies & Distributors - 0.9% |

|||

|

Watsco, Inc. |

86,600 |

6,743,542 |

|

|

TOTAL COMMON STOCKS (Cost $679,090,305) |

|

||

|

Nonconvertible Preferred Stocks - 0.2% |

|||

|

Shares |

Value |

||

|

HOUSEHOLD DURABLES - 0.2% |

|||

|

Homebuilding - 0.2% |

|||

|

M/I Homes, Inc. Series A, 9.75% (a) |

69,778 |

$ 1,751,428 |

|

|

Money Market Funds - 4.9% |

|||

|

|

|

|

|

|

Fidelity Cash Central Fund, 0.16% (b) |

3,710,749 |

3,710,749 |

|

|

Fidelity Securities Lending Cash Central Fund, 0.16% (b)(c) |

34,324,380 |

34,324,380 |

|

|

TOTAL MONEY MARKET FUNDS (Cost $38,035,129) |

|

||

|

TOTAL INVESTMENT PORTFOLIO - 103.9% (Cost $718,575,839) |

811,401,659 |

||

|

NET OTHER ASSETS (LIABILITIES) - (3.9)% |

(30,394,632) |

||

|

NET ASSETS - 100% |

$ 781,007,027 |

||

|

Legend |

|

(a) Non-income producing |

|

(b) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

|

(c) Investment made with cash collateral received from securities on loan. |

|

(d) Security or a portion of the security is on loan at period end. |

|

Affiliated Central Funds |

|

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

|

Fund |

Income earned |

|

Fidelity Cash Central Fund |

$ 14,783 |

|

Fidelity Securities Lending Cash Central Fund |

53,623 |

|

Total |

$ 68,406 |

|

Other Information |

|

All investments are categorized as Level 1 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Construction and Housing Portfolio

Financial Statements

Statement of Assets and Liabilities

|

|

February 28, 2013 |

|

|

|

|

|

|

Assets |

|

|

|

Investment in securities, at value (including securities loaned of $33,169,257) - See accompanying schedule: Unaffiliated issuers (cost $680,540,710) |

$ 773,366,530 |

|

|

Fidelity Central Funds (cost $38,035,129) |

38,035,129 |

|

|

Total Investments (cost $718,575,839) |

|

$ 811,401,659 |

|

Receivable for investments sold |

|

14,345,020 |

|

Receivable for fund shares sold |

|

3,389,300 |

|

Dividends receivable |

|

159,522 |

|

Distributions receivable from Fidelity Central Funds |

|

9,025 |

|

Prepaid expenses |

|

637 |

|

Receivable from investment adviser for expense reductions |

|

288 |

|

Other receivables |

|

18,052 |

|

Total assets |

|

829,323,503 |

|

|

|

|

|

Liabilities |

|

|

|

Payable for investments purchased |

$ 11,722,400 |

|

|

Payable for fund shares redeemed |

1,733,274 |

|

|

Accrued management fee |

354,473 |

|

|

Other affiliated payables |

126,718 |

|

|

Other payables and accrued expenses |

55,231 |

|

|

Collateral on securities loaned, at value |

34,324,380 |

|

|

Total liabilities |

|

48,316,476 |

|

|

|

|

|

Net Assets |

|

$ 781,007,027 |

|

Net Assets consist of: |

|

|

|

Paid in capital |

|

$ 688,369,076 |

|

Undistributed net investment income |

|

139,301 |

|

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions |

|

(328,354) |

|

Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies |

|

92,827,004 |

|

Net Assets, for 15,017,726 shares outstanding |

|

$ 781,007,027 |

|

Net Asset Value, offering price and redemption price per share ($781,007,027 ÷ 15,017,726 shares) |

|

$ 52.01 |

Statement of Operations

|

|

Year ended February 28, 2013 |

|

|

|

|

|

|

Investment Income |

|

|

|

Dividends |

|

$ 4,232,133 |

|

Income from Fidelity Central Funds (including $53,623 from security lending) |

|

68,406 |

|

Total income |

|

4,300,539 |

|

|

|

|

|

Expenses |

|

|

|

Management fee |

$ 1,897,905 |

|

|

Transfer agent fees |

725,801 |

|

|

Accounting and security lending fees |

131,615 |

|

|

Custodian fees and expenses |

17,420 |

|

|

Independent trustees' compensation |

1,906 |

|

|

Registration fees |

94,114 |

|

|

Audit |

38,080 |

|

|

Legal |

928 |

|

|

Miscellaneous |

1,507 |

|

|

Total expenses before reductions |

2,909,276 |

|

|

Expense reductions |

(31,182) |

2,878,094 |

|

Net investment income (loss) |

|

1,422,445 |

|

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: |

|

|

|

Investment securities: |

|

|

|

Unaffiliated issuers |

13,161,826 |

|

|

Foreign currency transactions |

6,772 |

|

|

Total net realized gain (loss) |

|

13,168,598 |

|

Change in net unrealized appreciation (depreciation) on: Investment securities |

77,121,102 |

|

|

Assets and liabilities in foreign currencies |

1,184 |

|

|

Total change in net unrealized appreciation (depreciation) |

|

77,122,286 |

|

Net gain (loss) |

|

90,290,884 |

|

Net increase (decrease) in net assets resulting from operations |

|

$ 91,713,329 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Construction and Housing Portfolio

Financial Statements - continued

Statement of Changes in Net Assets

|

|

Year ended |

Year ended |

|

Increase (Decrease) in Net Assets |

|

|

|

Operations |

|

|

|

Net investment income (loss) |

$ 1,422,445 |

$ 595,248 |

|

Net realized gain (loss) |

13,168,598 |

5,605,883 |

|

Change in net unrealized appreciation (depreciation) |

77,122,286 |

5,586,759 |

|

Net increase (decrease) in net assets resulting from operations |

91,713,329 |

11,787,890 |

|

Distributions to shareholders from net investment income |

(1,172,487) |

(636,876) |

|

Distributions to shareholders from net realized gain |

(4,637,838) |

- |

|

Total distributions |

(5,810,325) |

(636,876) |

|

Share transactions |

698,619,193 |

114,698,637 |

|

Reinvestment of distributions |

5,599,926 |

621,770 |

|

Cost of shares redeemed |

(180,705,745) |

(67,163,181) |

|

Net increase (decrease) in net assets resulting from share transactions |

523,513,374 |

48,157,226 |

|

Redemption fees |

76,720 |

5,297 |

|

Total increase (decrease) in net assets |

609,493,098 |

59,313,537 |

|

|

|

|

|

Net Assets |

|

|

|

Beginning of period |

171,513,929 |

112,200,392 |

|

End of period (including undistributed net investment income of $139,301 and distributions in excess of net investment income of $52,526, respectively) |

$ 781,007,027 |

$ 171,513,929 |

|

Other Information Shares |

|

|

|

Sold |

14,575,583 |

3,099,736 |

|

Issued in reinvestment of distributions |

115,773 |

17,775 |

|

Redeemed |

(3,960,211) |

(1,828,259) |

|

Net increase (decrease) |

10,731,145 |

1,289,252 |

Financial Highlights

|

Years ended February 28, |

2013 |

2012 F |

2011 |

2010 |

2009 |

|

Selected Per-Share Data |

|

|

|

|

|

|

Net asset value, beginning of period |

$ 40.01 |

$ 37.43 |

$ 29.89 |

$ 18.01 |

$ 33.19 |

|

Income from Investment Operations |

|

|

|

|

|

|

Net investment income (loss) B |

.19 |

.21 |

.18 |

.22 |

.31 |

|

Net realized and unrealized gain (loss) |

12.47 |

2.62 |

7.63 |

11.91 |

(14.35) |

|

Total from investment operations |

12.66 |

2.83 |

7.81 |

12.13 |

(14.04) |

|

Distributions from net investment income |

(.14) |

(.25) |

(.28) |

(.25) |

(.30) |

|

Distributions from net realized gain |

(.53) |

- |

- |

- |

(.85) |

|

Total distributions |

(.67) |

(.25) |

(.28) |

(.25) |

(1.15) |

|

Redemption fees added to paid in capital B |

.01 |

- G |

.01 |

- G |

.01 |

|

Net asset value, end of period |

$ 52.01 |

$ 40.01 |

$ 37.43 |

$ 29.89 |

$ 18.01 |

|

Total Return A |

31.79% |

7.65% |

26.24% |

67.46% |

(43.68)% |

|

Ratios to Average Net Assets C, E |

|

|

|

|

|

|

Expenses before reductions |

.86% |

.96% |

.98% |

1.01% |

1.03% |

|

Expenses net of fee waivers, if any |

.86% |

.96% |

.98% |

1.01% |

1.03% |

|

Expenses net of all reductions |

.86% |

.96% |

.98% |

1.01% |

1.02% |

|

Net investment income (loss) |

.42% |

.59% |

.55% |

.84% |

1.14% |

|

Supplemental Data |

|

|

|

|

|

|

Net assets, end of period (000 omitted) |

$ 781,007 |

$ 171,514 |

$ 112,200 |

$ 99,562 |

$ 82,219 |

|

Portfolio turnover rate D |

47% |

81% |

101% |

82% |

85% |

|

A Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown. B Calculated based on average shares outstanding during the period. C Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. D Amount does not include the portfolio activity of any underlying Fidelity Central Funds. E Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund. F For the year ended February 29. G Amount represents less than $.01 per share. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Consumer Discretionary Portfolio

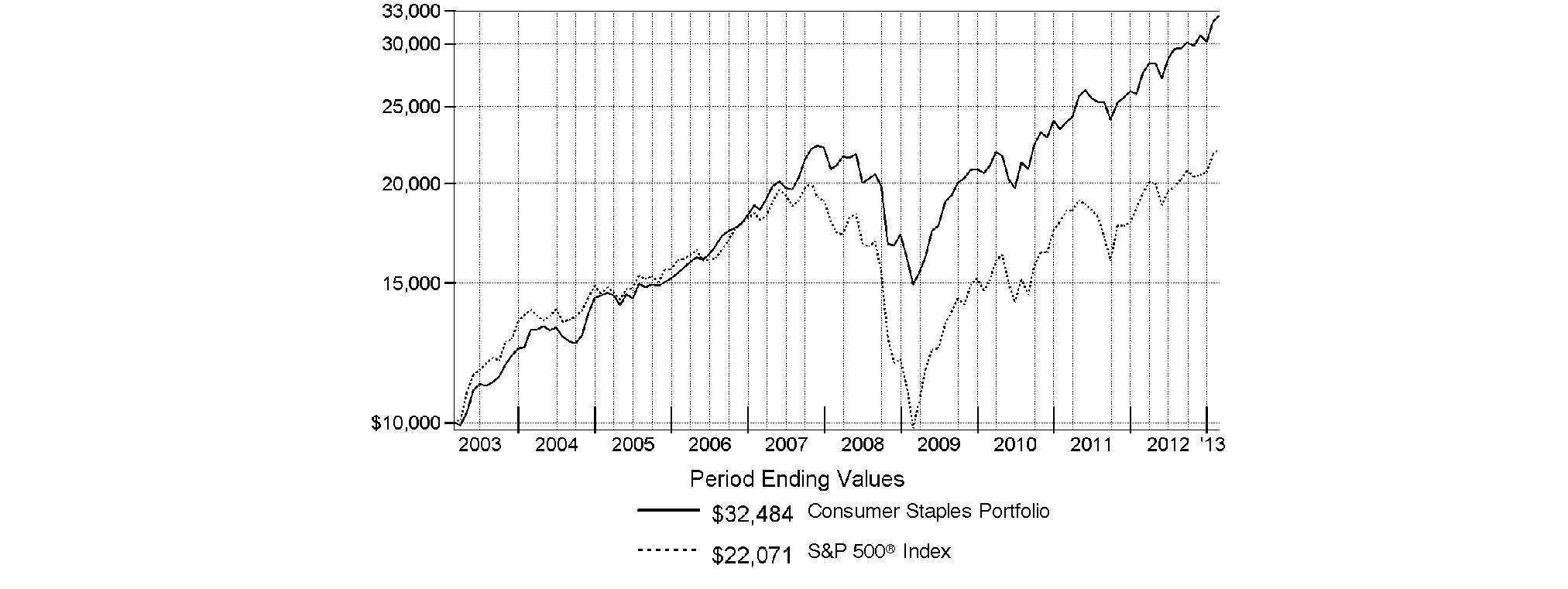

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

|

Periods ended February 28, 2013 |

Past 1 |

Past 5 |

Past 10 |

|

Consumer Discretionary Portfolio A |

15.38% |

10.07% |

8.64% |

A Prior to October 1, 2006, Consumer Discretionary Portfolio operated under certain different investment policies. The historical performance for the fund may not represent its current investment policies.

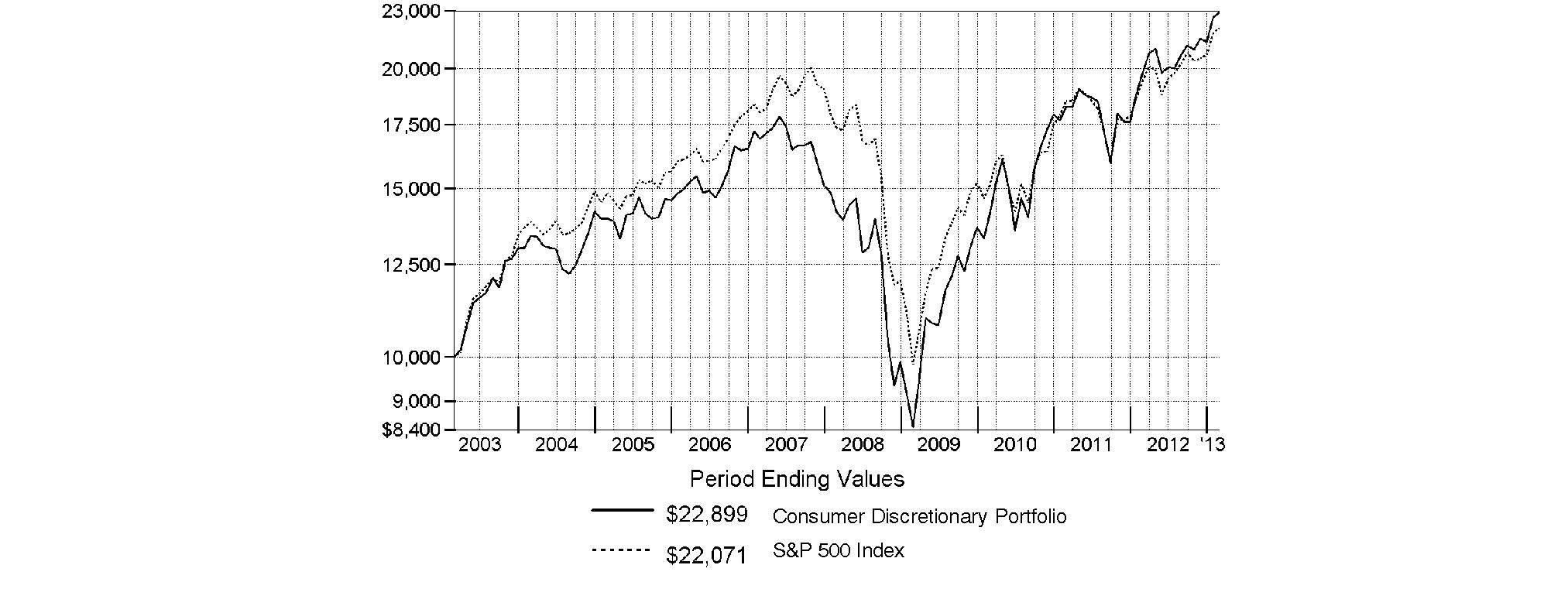

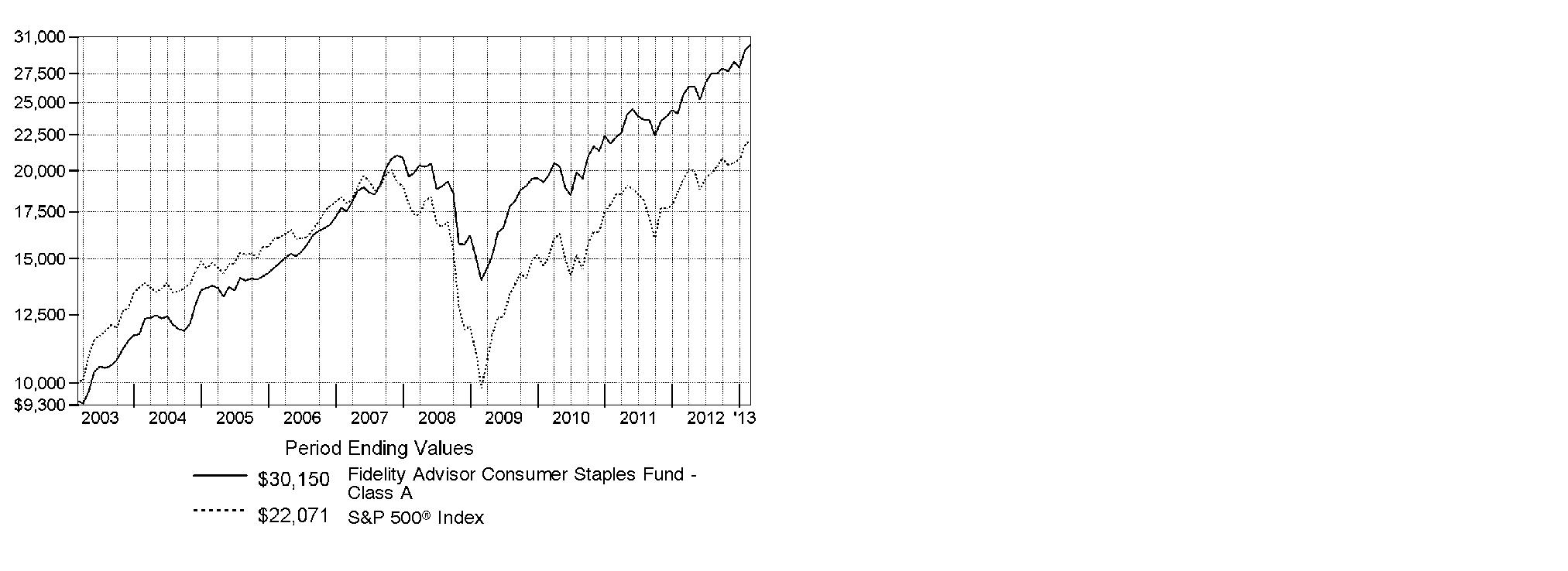

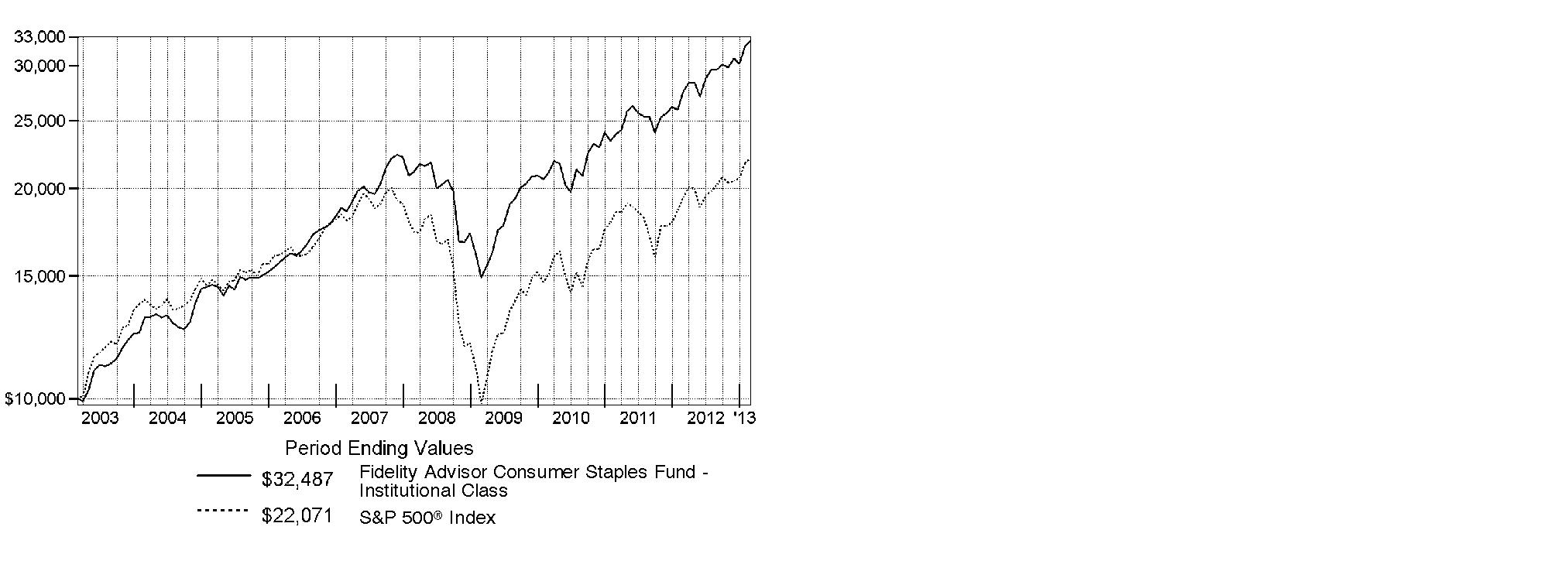

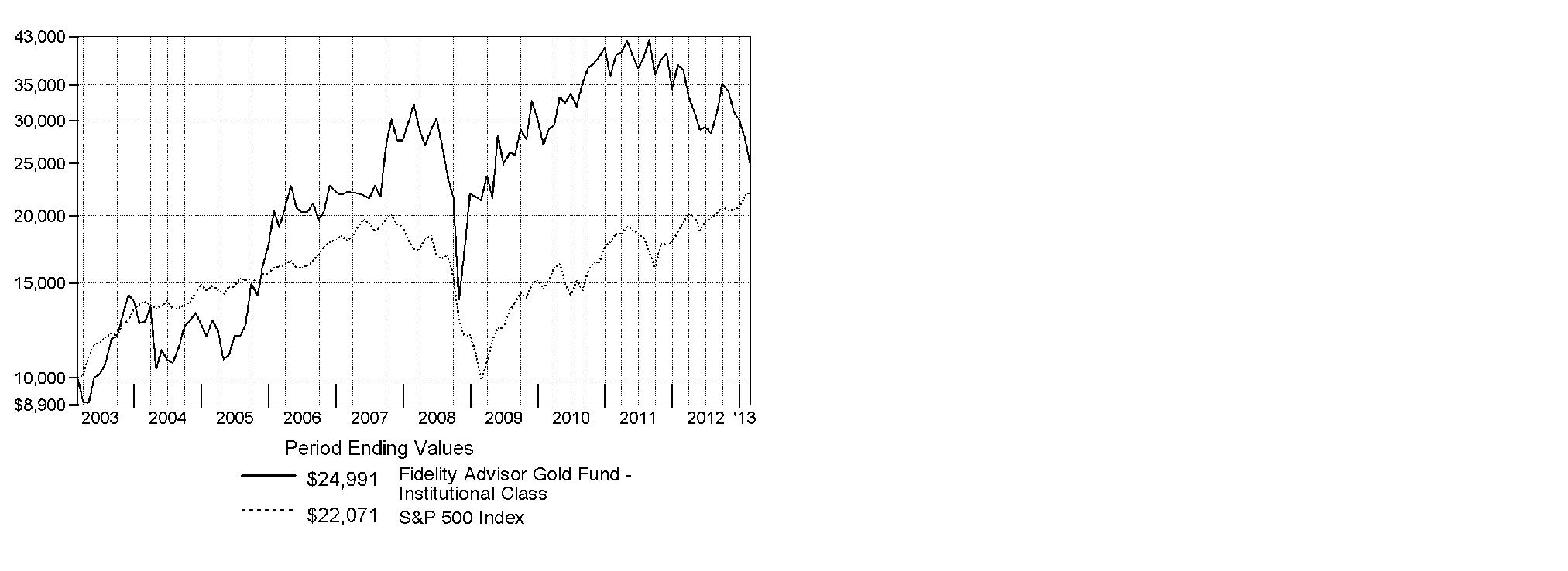

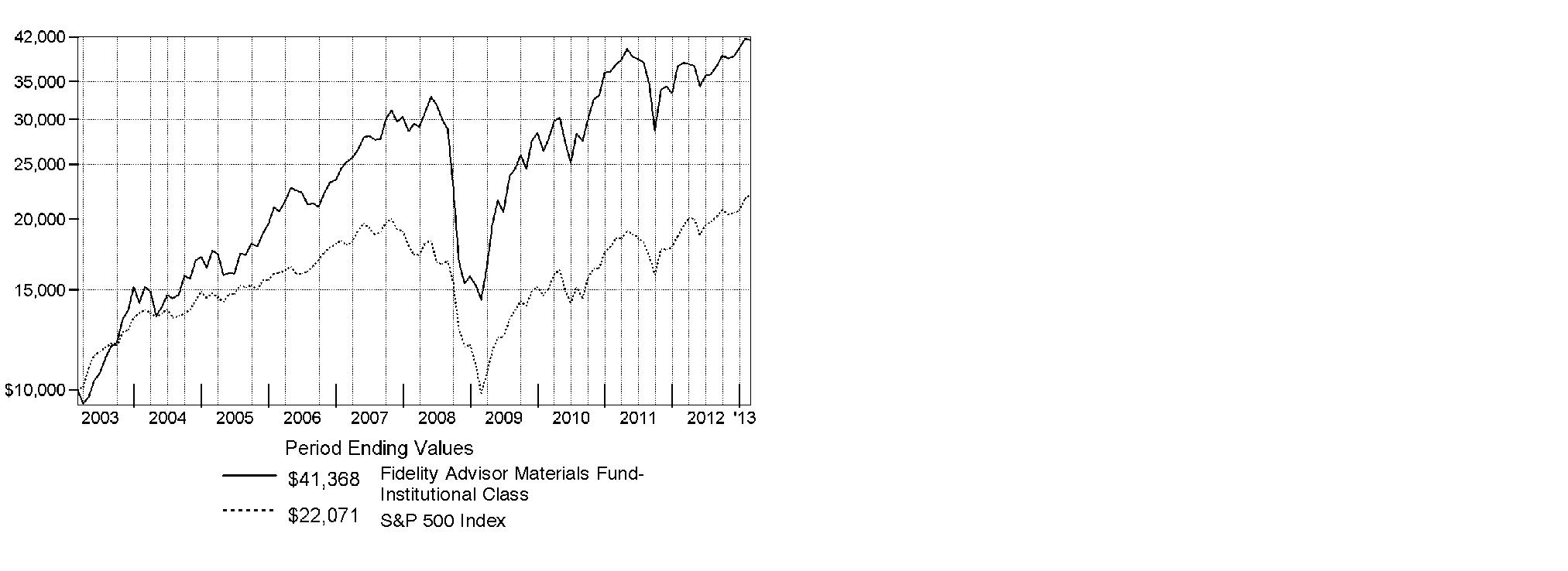

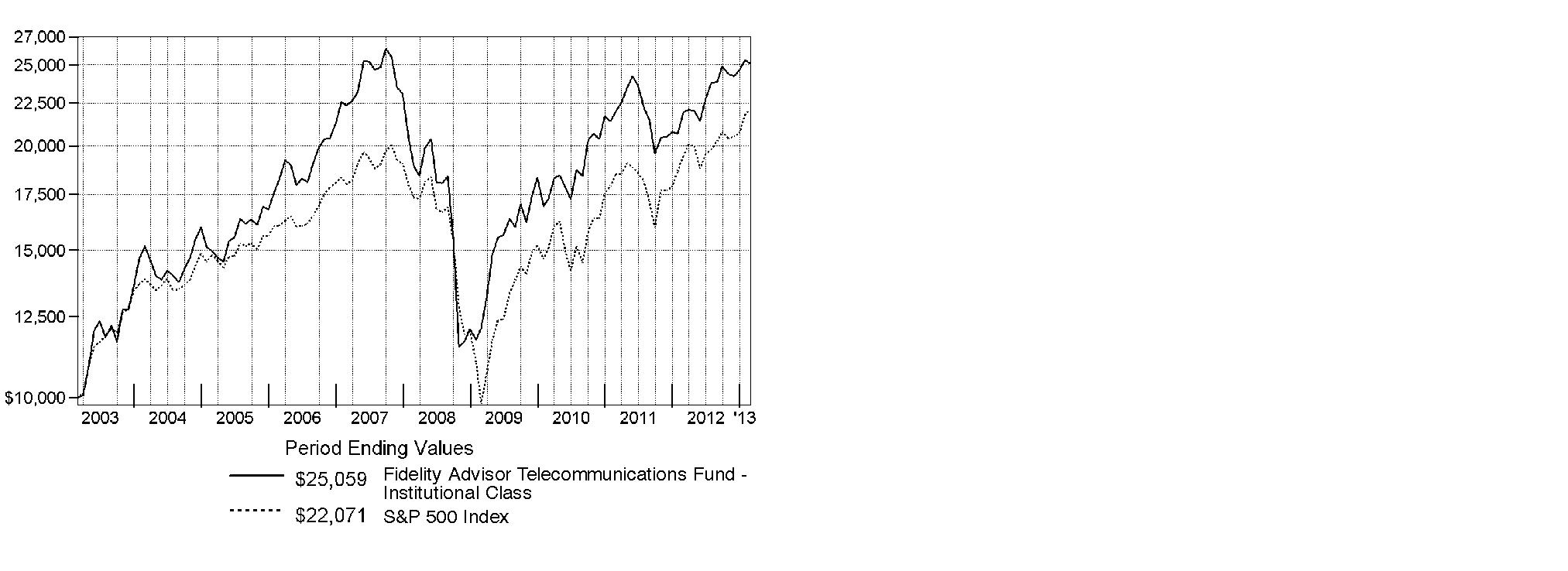

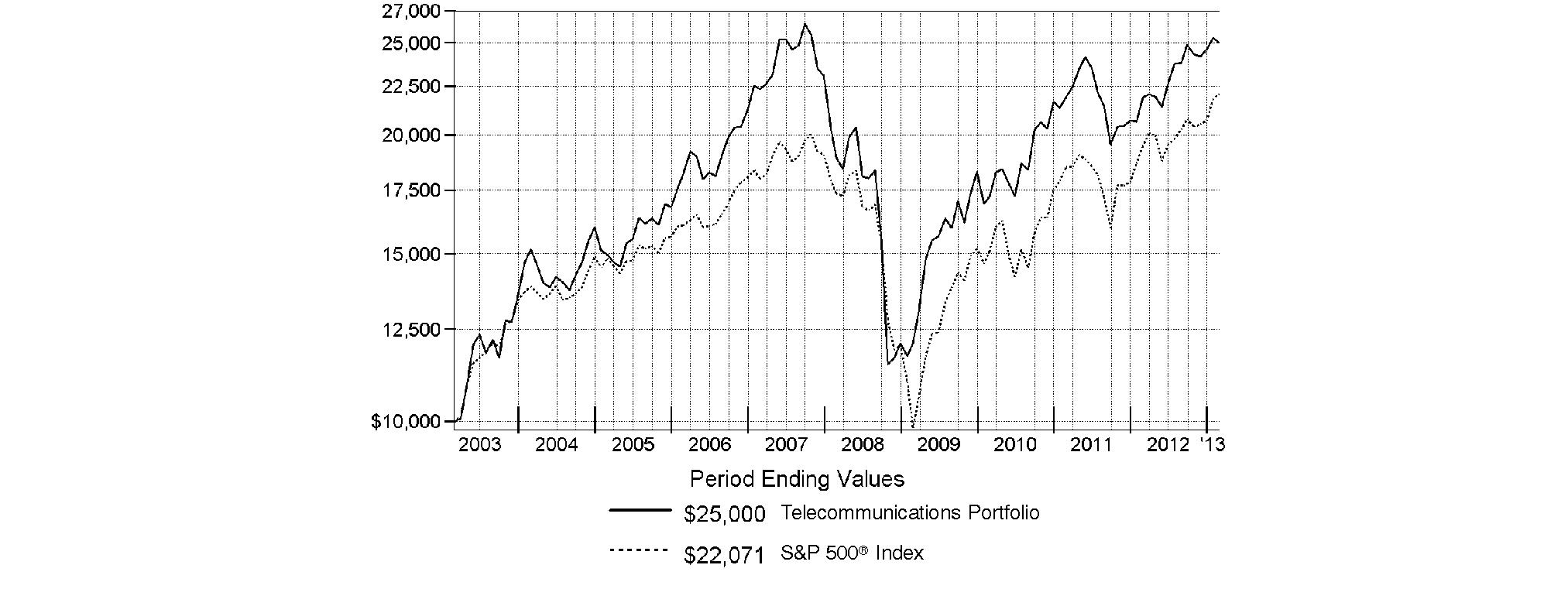

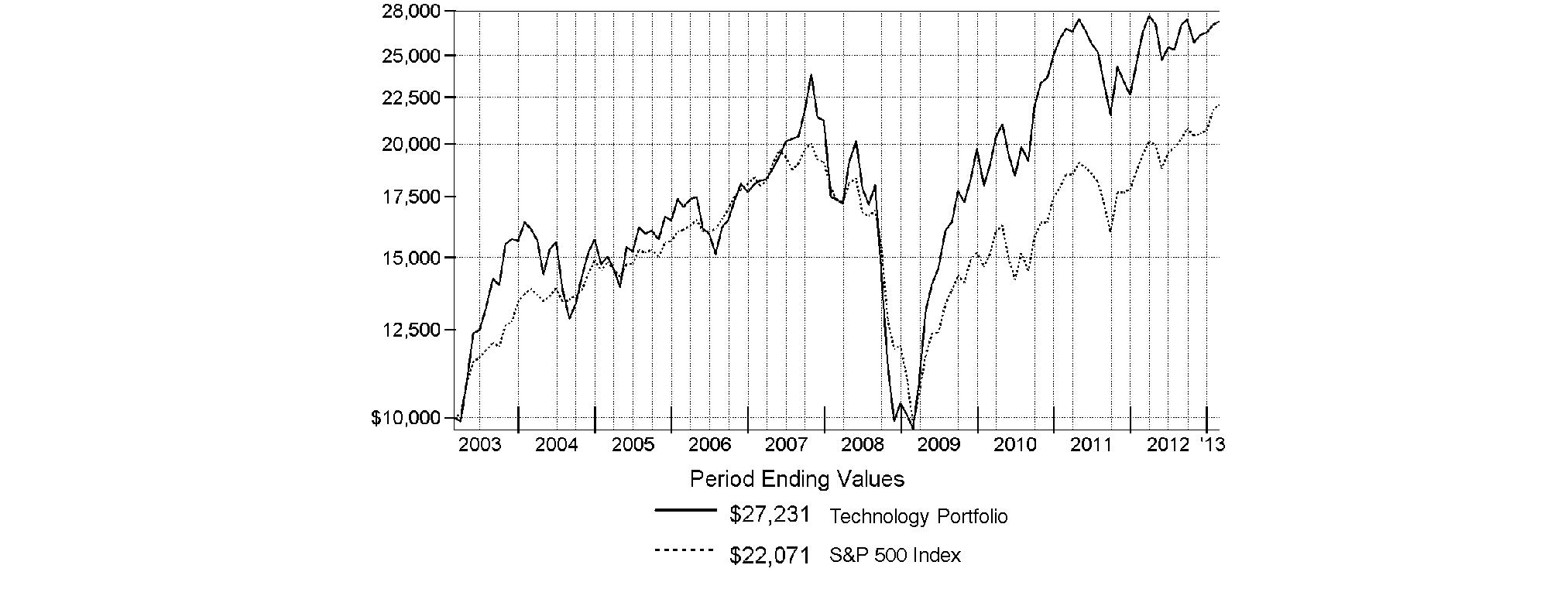

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Consumer Discretionary Portfolio on February 28, 2003. The chart shows how the value of your investment would have changed, and also shows how the S&P 500 Index performed over the same period.

Annual Report

Consumer Discretionary Portfolio

Management's Discussion of Fund Performance

Market Recap: U.S. stocks posted solid gains for the year ending February 28, 2013, sparked by a late-period rally that pushed major equity benchmarks to multiyear highs. Improvement in the global economy and more monetary stimulus from the U.S. Federal Reserve kept markets on the upswing for much of the year, shrugging off an early decline brought on by debt woes in Europe, and another dip later in the period amid Congressional gridlock on the federal budget. Renewed optimism over employment, the housing market, corporate earnings and record dividends made stocks a favorite with investors during the 12 months, which helped push the broad-based S&P 500® Index across the milestone 1,500 mark at the end of January. The S&P 500® finished the period up 13.46%. Seven of the 10 major market sectors tracked by MSCI U.S. IMI 25-50 classifications produced double-digit gains, led by health care and financials, while information technology, energy and materials trailed the broad equity market with only modest advances.

Comments from Gordon Scott, who became Portfolio Manager of Consumer Discretionary Portfolio on May 1, 2012: The fund did well on an absolute basis, posting a 15.38% return for the year. Its relative performance versus the sector benchmark was disappointing, however, as the MSCI® U.S. IMI Consumer Discretionary 25-50 Index advanced 18.69%, but it outpaced the S&P 500®. The consumer discretionary sector was one of the market's stronger performers during the past year, buoyed by rising consumer confidence and a favorable shift in investor sentiment toward a more pro-cyclical, global-recovery market environment. From a broad perspective, the fund's overall bias toward domestic growth stocks was a bit of a headwind, as globally oriented value stocks tended to be more in favor, especially during the second half of the period. Within that context, the fund's relative underperformance was mostly due to inopportune industry positioning. In particular, the fund had significantly greater exposure than the index to general merchandise stores and specialty stores, industries that struggled later in the reporting period. An overweighting in restaurants, on average, also hurt, as did security selection in such areas as home furnishings and apparel retail. In terms of individual stocks, the fund's biggest detractor from relative performance was an overweighted position in Tempur-Pedic International, which makes premium mattresses and pillows. The stock performed poorly, in part due to competitive pressures on profit margins, and the fund's position was sold. An overweighting in fast-food chain operator Yum! Brands detracted, as investors were spooked by declining same-store sales in China, where the company derives a sizable portion of its revenues. The fund's positions in two off-price retailers, Dollar Tree and Ross Stores, also hurt. I added or added to these stocks in hopes of benefiting from potential growth in demand from value-conscious consumers, but, later in the reporting period, both traded down as the companies' earning growth slowed, partially due to greater competition in the off-price space. On the upside, relative performance was bolstered by opportune stock picking in the leisure products industry, as well as by underweighting certain stocks in the underperforming apparel, accessories and luxury goods category. The fund's strongest contributor was its significantly overweighted stake in cable giant Comcast, whose stock rose on solid increases in revenue and operating income. Brunswick, a leader in the marine, fitness, and bowling and billiards industries, and global consumer products conglomerate Jarden also buoyed the fund's relative results, as investors rewarded both companies for their strong earnings and free cash flow generation.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Consumer Discretionary Portfolio

Investment Changes (Unaudited)

|

Top Ten Stocks as of February 28, 2013 |

||

|

|

% of fund's |

% of fund's net assets |

|

Comcast Corp. Class A |

8.0 |

7.5 |

|

The Walt Disney Co. |

5.5 |

6.0 |

|

News Corp. Class A |

4.5 |

4.4 |

|

Lowe's Companies, Inc. |

4.1 |

2.1 |

|

Time Warner, Inc. |

3.6 |

2.7 |

|

Home Depot, Inc. |

2.9 |

0.0 |

|

NIKE, Inc. Class B |

2.5 |

0.5 |

|

Yum! Brands, Inc. |

2.4 |

3.4 |

|

O'Reilly Automotive, Inc. |

2.3 |

1.4 |

|

Starbucks Corp. |

2.2 |

2.4 |

|

|

38.0 |

|

|

Top Industries (% of fund's net assets) |

|||

|

As of February 28, 2013 |

|||

|

Specialty Retail |

33.3% |

|

|

Media |

25.5% |

|

|

Hotels, Restaurants & Leisure |

10.2% |

|

|

Textiles, Apparel & Luxury Goods |

9.4% |

|

|

Internet & Catalog Retail |

5.1% |

|

|

All Others* |

16.5% |

|

|

As of August 31, 2012 |

|||

|

Media |

29.2% |

|

|

Specialty Retail |

26.8% |

|

|

Hotels, Restaurants & Leisure |

13.4% |

|

|

Multiline Retail |

7.9% |

|

|

Textiles, Apparel & Luxury Goods |

5.2% |

|

|

All Others* |

17.5% |

|

|

* Includes short-term investments and net other assets. |

Annual Report

Consumer Discretionary Portfolio

Investments February 28, 2013

Showing Percentage of Net Assets

|

Common Stocks - 98.4% |

|||

|

Shares |

Value |

||

|

AUTO COMPONENTS - 3.2% |

|||

|

Auto Parts & Equipment - 3.2% |

|||

|

BorgWarner, Inc. (a) |

51,542 |

$ 3,835,240 |

|

|

Delphi Automotive PLC |

119,631 |

5,006,557 |

|

|

Lear Corp. |

36,292 |

1,938,719 |

|

|

Tenneco, Inc. (a) |

53,700 |

1,902,591 |

|

|

|

12,683,107 |

||

|

COMMERCIAL SERVICES & SUPPLIES - 0.8% |

|||

|

Office Services & Supplies - 0.8% |

|||

|

Interface, Inc. |

184,900 |

3,385,519 |

|

|

DISTRIBUTORS - 1.6% |

|||

|

Distributors - 1.6% |

|||

|

LKQ Corp. (a) |

299,386 |

6,343,989 |

|

|

DIVERSIFIED CONSUMER SERVICES - 0.2% |

|||

|

Specialized Consumer Services - 0.2% |

|||

|

Ascent Capital Group, Inc. (a) |

13,072 |

896,608 |

|

|

HOTELS, RESTAURANTS & LEISURE - 10.2% |

|||

|

Casinos & Gaming - 1.4% |

|||

|

Las Vegas Sands Corp. |

103,809 |

5,345,125 |

|

|

Hotels, Resorts & Cruise Lines - 1.2% |

|||

|

Wyndham Worldwide Corp. |

81,640 |

4,917,994 |

|

|

Restaurants - 7.6% |

|||

|

Buffalo Wild Wings, Inc. (a) |

31,800 |

2,502,342 |

|

|

Chipotle Mexican Grill, Inc. (a) |

11,326 |

3,587,964 |

|

|

Domino's Pizza, Inc. |

124,100 |

5,909,642 |

|

|

Starbucks Corp. |

161,618 |

8,859,899 |

|

|

Yum! Brands, Inc. |

141,839 |

9,287,618 |

|

|

|

30,147,465 |

||

|

TOTAL HOTELS, RESTAURANTS & LEISURE |

40,410,584 |

||

|

HOUSEHOLD DURABLES - 3.0% |

|||

|

Homebuilding - 0.5% |

|||

|

Lennar Corp. Class A |

55,800 |

2,153,322 |

|

|

Housewares & Specialties - 2.5% |

|||

|

Jarden Corp. |

99,649 |

6,189,199 |

|

|

Tupperware Brands Corp. |

45,500 |

3,559,465 |

|

|

|

9,748,664 |

||

|

TOTAL HOUSEHOLD DURABLES |

11,901,986 |

||

|

INTERNET & CATALOG RETAIL - 5.1% |

|||

|

Catalog Retail - 2.0% |

|||

|

Liberty Media Corp. Interactive Series A (a) |

369,297 |

7,710,921 |

|

|

|

|||

|

Shares |

Value |

||

|

Internet Retail - 3.1% |

|||

|

Amazon.com, Inc. (a) |

17,868 |

$ 4,721,976 |

|

|

priceline.com, Inc. (a) |

11,273 |

7,751,089 |

|

|

|

12,473,065 |

||

|

TOTAL INTERNET & CATALOG RETAIL |

20,183,986 |

||

|

LEISURE EQUIPMENT & PRODUCTS - 1.8% |

|||

|

Leisure Products - 1.8% |

|||

|

Brunswick Corp. |

201,932 |

7,358,402 |

|

|

MACHINERY - 0.3% |

|||

|

Industrial Machinery - 0.3% |

|||

|

Stanley Black & Decker, Inc. |

14,400 |

1,133,280 |

|

|

MEDIA - 25.5% |

|||

|

Broadcasting - 1.5% |

|||

|

Discovery Communications, Inc. (a) |

84,400 |

6,189,052 |

|

|

Cable & Satellite - 10.4% |

|||

|

Comcast Corp. Class A |

802,360 |

31,925,905 |

|

|

DIRECTV (a) |

85,954 |

4,140,404 |

|

|

Sirius XM Radio, Inc. (d) |

1,666,577 |

5,166,389 |

|

|

|

41,232,698 |

||

|

Movies & Entertainment - 13.6% |

|||

|

News Corp. Class A |

618,969 |

17,826,307 |

|

|

The Walt Disney Co. |

398,858 |

21,773,658 |

|

|

Time Warner, Inc. |

272,027 |

14,463,676 |

|

|

|

54,063,641 |

||

|

TOTAL MEDIA |

101,485,391 |

||

|

MULTILINE RETAIL - 3.6% |

|||

|

General Merchandise Stores - 3.6% |

|||

|

Dollar General Corp. (a) |

160,038 |

7,416,161 |

|

|

Dollar Tree, Inc. (a) |

154,427 |

6,977,784 |

|

|

|

14,393,945 |

||

|

PROFESSIONAL SERVICES - 0.4% |

|||

|

Research & Consulting Services - 0.4% |

|||

|

Nielsen Holdings B.V. |

43,500 |

1,465,515 |

|

|

SPECIALTY RETAIL - 33.3% |

|||

|

Apparel Retail - 6.5% |

|||

|

Abercrombie & Fitch Co. Class A |

77,180 |

3,598,903 |

|

|

American Eagle Outfitters, Inc. |

173,860 |

3,595,425 |

|

|

Ascena Retail Group, Inc. (a) |

89,179 |

1,497,315 |

|

|

Limited Brands, Inc. |

86,898 |

3,955,597 |

|

|

Ross Stores, Inc. |

103,320 |

5,988,427 |

|

|

TJX Companies, Inc. |

160,261 |

7,206,937 |

|

|

|

25,842,604 |

||

|

Automotive Retail - 4.1% |

|||

|

CarMax, Inc. (a) |

184,563 |

7,089,065 |

|

|

O'Reilly Automotive, Inc. (a) |

91,070 |

9,265,462 |

|

|

|

16,354,527 |

||

|

Common Stocks - continued |

|||

|

Shares |

Value |

||

|

SPECIALTY RETAIL - CONTINUED |

|||

|

Home Improvement Retail - 7.0% |

|||

|

Home Depot, Inc. |

167,562 |

$ 11,477,997 |

|

|

Lowe's Companies, Inc. |

425,235 |

16,222,715 |

|

|

|

27,700,712 |

||

|

Homefurnishing Retail - 2.4% |

|||

|

Bed Bath & Beyond, Inc. (a) |

84,324 |

4,785,387 |

|

|

Williams-Sonoma, Inc. |

105,617 |

4,795,012 |

|

|

|

9,580,399 |

||

|

Specialty Stores - 13.3% |

|||

|

Cabela's, Inc. Class A (a) |

106,700 |

5,397,953 |

|

|

Dick's Sporting Goods, Inc. |

109,228 |

5,461,400 |

|

|

Hibbett Sports, Inc. (a) |

58,700 |

3,101,708 |

|

|

PetSmart, Inc. |

89,800 |

5,846,878 |

|

|

Sally Beauty Holdings, Inc. (a) |

177,090 |

4,912,477 |

|

|

Signet Jewelers Ltd. |

116,400 |

7,126,008 |

|

|

Staples, Inc. |

223,000 |

2,939,140 |

|

|

Tiffany & Co., Inc. (d) |

75,154 |

5,047,343 |

|

|

Tractor Supply Co. |

65,239 |

6,784,204 |

|

|

Ulta Salon, Cosmetics & Fragrance, Inc. |

44,385 |

3,930,736 |

|

|

Vitamin Shoppe, Inc. (a) |

48,200 |

2,532,910 |

|

|

|

53,080,757 |

||

|

TOTAL SPECIALTY RETAIL |

132,558,999 |

||

|

TEXTILES, APPAREL & LUXURY GOODS - 9.4% |

|||

|

Apparel, Accessories & Luxury Goods - 5.8% |

|||

|

Hanesbrands, Inc. (a) |

135,100 |

5,355,364 |

|

|

Michael Kors Holdings Ltd. (a) |

20,600 |

1,221,168 |

|

|

PVH Corp. |

66,485 |

8,101,197 |

|

|

Ralph Lauren Corp. |

15,955 |

2,767,714 |

|

|

VF Corp. |

35,985 |

5,802,941 |

|