0000320335--12-312020Q1FALSE00003203352020-01-012020-03-31xbrli:shares00003203352020-04-29iso4217:USD00003203352020-03-3100003203352019-12-310000320335srt:PartnershipInterestMembergl:PartnershipInterestFairValueOptionMember2020-03-310000320335srt:PartnershipInterestMembergl:PartnershipInterestFairValueOptionMember2019-12-31iso4217:USDxbrli:shares0000320335us-gaap:LifeInsuranceSegmentMember2020-01-012020-03-310000320335us-gaap:LifeInsuranceSegmentMember2019-01-012019-03-310000320335us-gaap:HealthInsuranceProductLineMember2020-01-012020-03-310000320335us-gaap:HealthInsuranceProductLineMember2019-01-012019-03-3100003203352019-01-012019-03-310000320335gl:SecuritiesMember2020-01-012020-03-310000320335gl:SecuritiesMember2019-01-012019-03-310000320335us-gaap:OtherInvestmentsMember2020-01-012020-03-310000320335us-gaap:OtherInvestmentsMember2019-01-012019-03-310000320335us-gaap:PreferredStockMember2019-12-310000320335us-gaap:CommonStockMember2019-12-310000320335us-gaap:AdditionalPaidInCapitalMember2019-12-310000320335us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310000320335us-gaap:RetainedEarningsMember2019-12-310000320335us-gaap:TreasuryStockMember2019-12-310000320335us-gaap:AccountingStandardsUpdate201613Memberus-gaap:RetainedEarningsMember2019-12-310000320335us-gaap:AccountingStandardsUpdate201613Member2019-12-310000320335us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-03-310000320335us-gaap:RetainedEarningsMember2020-01-012020-03-310000320335us-gaap:TreasuryStockMember2020-01-012020-03-310000320335us-gaap:AdditionalPaidInCapitalMember2020-01-012020-03-310000320335us-gaap:PreferredStockMember2020-03-310000320335us-gaap:CommonStockMember2020-03-310000320335us-gaap:AdditionalPaidInCapitalMember2020-03-310000320335us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-03-310000320335us-gaap:RetainedEarningsMember2020-03-310000320335us-gaap:TreasuryStockMember2020-03-310000320335us-gaap:PreferredStockMember2018-12-310000320335us-gaap:CommonStockMember2018-12-310000320335us-gaap:AdditionalPaidInCapitalMember2018-12-310000320335us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-310000320335us-gaap:RetainedEarningsMember2018-12-310000320335us-gaap:TreasuryStockMember2018-12-3100003203352018-12-310000320335us-gaap:AccountingStandardsUpdate201602Memberus-gaap:RetainedEarningsMember2018-12-310000320335us-gaap:AccountingStandardsUpdate201602Member2018-12-310000320335us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-03-310000320335us-gaap:RetainedEarningsMember2019-01-012019-03-310000320335us-gaap:TreasuryStockMember2019-01-012019-03-310000320335us-gaap:AdditionalPaidInCapitalMember2019-01-012019-03-310000320335us-gaap:PreferredStockMember2019-03-310000320335us-gaap:CommonStockMember2019-03-310000320335us-gaap:AdditionalPaidInCapitalMember2019-03-310000320335us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-03-310000320335us-gaap:RetainedEarningsMember2019-03-310000320335us-gaap:TreasuryStockMember2019-03-3100003203352019-03-31gl:numberOfSegments0000320335gl:AccountingStandardsUpdate201613AdjustmentForCommercialLoanParticipationsMemberus-gaap:RetainedEarningsMember2019-12-310000320335gl:AccountingStandardsUpdate201613AdjustmentForAgentDebitBalancesMemberus-gaap:RetainedEarningsMember2019-12-310000320335us-gaap:ParticipatingMortgagesMember2019-12-310000320335gl:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:ParticipatingMortgagesMember2020-01-010000320335gl:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:ParticipatingMortgagesMember2020-01-010000320335gl:CumulativeEffectPeriodOfAdoptionAdjustmentMember2020-01-010000320335gl:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2020-01-010000320335us-gaap:ParticipatingMortgagesMember2020-03-310000320335us-gaap:UnfundedLoanCommitmentMemberus-gaap:ParticipatingMortgagesMember2020-03-310000320335us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2019-12-310000320335gl:DeferredAcquisitionCostsMember2019-12-310000320335us-gaap:AccumulatedTranslationAdjustmentMember2019-12-310000320335us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-12-310000320335us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2020-01-012020-03-310000320335gl:DeferredAcquisitionCostsMember2020-01-012020-03-310000320335us-gaap:AccumulatedTranslationAdjustmentMember2020-01-012020-03-310000320335us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-01-012020-03-310000320335us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2020-03-310000320335gl:DeferredAcquisitionCostsMember2020-03-310000320335us-gaap:AccumulatedTranslationAdjustmentMember2020-03-310000320335us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-03-310000320335us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2018-12-310000320335gl:DeferredAcquisitionCostsMember2018-12-310000320335us-gaap:AccumulatedTranslationAdjustmentMember2018-12-310000320335us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2018-12-310000320335us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2019-01-012019-03-310000320335gl:DeferredAcquisitionCostsMember2019-01-012019-03-310000320335us-gaap:AccumulatedTranslationAdjustmentMember2019-01-012019-03-310000320335us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-01-012019-03-310000320335us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2019-03-310000320335gl:DeferredAcquisitionCostsMember2019-03-310000320335us-gaap:AccumulatedTranslationAdjustmentMember2019-03-310000320335us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-03-310000320335us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2020-01-012020-03-310000320335us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2019-01-012019-03-310000320335us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember2020-01-012020-03-310000320335us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember2019-01-012019-03-310000320335us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-01-012020-03-310000320335us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2019-01-012019-03-310000320335us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-01-012020-03-310000320335us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-01-012019-03-310000320335us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-01-012020-03-310000320335us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2019-01-012019-03-310000320335us-gaap:FixedMaturitiesMembergl:USGovernmentDirectGuaranteedAndGovernmentSponsoredEnterprisesMember2020-03-31xbrli:pure0000320335us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FixedMaturitiesMember2020-03-310000320335us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FixedMaturitiesMember2020-03-310000320335gl:FinancialMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMember2020-03-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMembergl:UtilitiesMember2020-03-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMembergl:EnergyMember2020-03-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMembergl:OtherCorporateSectorsMember2020-03-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMember2020-03-310000320335us-gaap:CollateralizedDebtObligationsMemberus-gaap:FixedMaturitiesMember2020-03-310000320335us-gaap:FixedMaturitiesMembergl:OtherAssetBackedSecuritiesMember2020-03-310000320335us-gaap:FixedMaturitiesMember2020-03-310000320335us-gaap:FixedMaturitiesMembergl:USGovernmentDirectGuaranteedAndGovernmentSponsoredEnterprisesMember2019-12-310000320335us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FixedMaturitiesMember2019-12-310000320335us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FixedMaturitiesMember2019-12-310000320335gl:FinancialMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMember2019-12-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMembergl:UtilitiesMember2019-12-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMembergl:EnergyMember2019-12-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMembergl:OtherCorporateSectorsMember2019-12-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMember2019-12-310000320335us-gaap:CollateralizedDebtObligationsMemberus-gaap:FixedMaturitiesMember2019-12-310000320335us-gaap:FixedMaturitiesMembergl:OtherAssetBackedSecuritiesMember2019-12-310000320335us-gaap:FixedMaturitiesMember2019-12-310000320335us-gaap:FixedMaturitiesMember2020-01-012020-03-310000320335us-gaap:FixedMaturitiesMember2019-01-012019-03-310000320335us-gaap:PolicyLoansMember2020-01-012020-03-310000320335us-gaap:PolicyLoansMember2019-01-012019-03-310000320335us-gaap:OtherLongTermInvestmentsMember2020-01-012020-03-310000320335us-gaap:OtherLongTermInvestmentsMember2019-01-012019-03-310000320335us-gaap:ShortTermInvestmentsMember2020-01-012020-03-310000320335us-gaap:ShortTermInvestmentsMember2019-01-012019-03-310000320335us-gaap:FairValueOptionOtherEligibleItemsMember2020-01-012020-03-310000320335us-gaap:FairValueOptionOtherEligibleItemsMember2019-01-012019-03-310000320335us-gaap:FixedMaturitiesMembergl:USGovernmentDirectGuaranteedAndGovernmentSponsoredEnterprisesMemberus-gaap:FairValueInputsLevel1Member2020-03-310000320335us-gaap:FairValueInputsLevel2Memberus-gaap:FixedMaturitiesMembergl:USGovernmentDirectGuaranteedAndGovernmentSponsoredEnterprisesMember2020-03-310000320335us-gaap:FixedMaturitiesMembergl:USGovernmentDirectGuaranteedAndGovernmentSponsoredEnterprisesMemberus-gaap:FairValueInputsLevel3Member2020-03-310000320335us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel1Member2020-03-310000320335us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FixedMaturitiesMember2020-03-310000320335us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel3Member2020-03-310000320335us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel1Member2020-03-310000320335us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FixedMaturitiesMember2020-03-310000320335us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel3Member2020-03-310000320335gl:FinancialMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel1Member2020-03-310000320335us-gaap:FairValueInputsLevel2Membergl:FinancialMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMember2020-03-310000320335gl:FinancialMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel3Member2020-03-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMembergl:UtilitiesMemberus-gaap:FairValueInputsLevel1Member2020-03-310000320335us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMembergl:UtilitiesMember2020-03-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel3Membergl:UtilitiesMember2020-03-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMembergl:EnergyMemberus-gaap:FairValueInputsLevel1Member2020-03-310000320335us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMembergl:EnergyMember2020-03-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel3Membergl:EnergyMember2020-03-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMembergl:OtherCorporateSectorsMemberus-gaap:FairValueInputsLevel1Member2020-03-310000320335us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMembergl:OtherCorporateSectorsMember2020-03-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel3Membergl:OtherCorporateSectorsMember2020-03-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel1Member2020-03-310000320335us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMember2020-03-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel3Member2020-03-310000320335us-gaap:CollateralizedDebtObligationsMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel1Member2020-03-310000320335us-gaap:FairValueInputsLevel2Memberus-gaap:CollateralizedDebtObligationsMemberus-gaap:FixedMaturitiesMember2020-03-310000320335us-gaap:CollateralizedDebtObligationsMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel3Member2020-03-310000320335us-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel1Membergl:OtherAssetBackedSecuritiesMember2020-03-310000320335us-gaap:FairValueInputsLevel2Memberus-gaap:FixedMaturitiesMembergl:OtherAssetBackedSecuritiesMember2020-03-310000320335us-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel3Membergl:OtherAssetBackedSecuritiesMember2020-03-310000320335us-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel1Member2020-03-310000320335us-gaap:FairValueInputsLevel2Memberus-gaap:FixedMaturitiesMember2020-03-310000320335us-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel3Member2020-03-310000320335us-gaap:FixedMaturitiesMembergl:USGovernmentDirectGuaranteedAndGovernmentSponsoredEnterprisesMemberus-gaap:FairValueInputsLevel1Member2019-12-310000320335us-gaap:FairValueInputsLevel2Memberus-gaap:FixedMaturitiesMembergl:USGovernmentDirectGuaranteedAndGovernmentSponsoredEnterprisesMember2019-12-310000320335us-gaap:FixedMaturitiesMembergl:USGovernmentDirectGuaranteedAndGovernmentSponsoredEnterprisesMemberus-gaap:FairValueInputsLevel3Member2019-12-310000320335us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel1Member2019-12-310000320335us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FixedMaturitiesMember2019-12-310000320335us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel3Member2019-12-310000320335us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel1Member2019-12-310000320335us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FixedMaturitiesMember2019-12-310000320335us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel3Member2019-12-310000320335gl:FinancialMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel1Member2019-12-310000320335us-gaap:FairValueInputsLevel2Membergl:FinancialMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMember2019-12-310000320335gl:FinancialMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel3Member2019-12-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMembergl:UtilitiesMemberus-gaap:FairValueInputsLevel1Member2019-12-310000320335us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMembergl:UtilitiesMember2019-12-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel3Membergl:UtilitiesMember2019-12-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMembergl:EnergyMemberus-gaap:FairValueInputsLevel1Member2019-12-310000320335us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMembergl:EnergyMember2019-12-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel3Membergl:EnergyMember2019-12-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMembergl:OtherCorporateSectorsMemberus-gaap:FairValueInputsLevel1Member2019-12-310000320335us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMembergl:OtherCorporateSectorsMember2019-12-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel3Membergl:OtherCorporateSectorsMember2019-12-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel1Member2019-12-310000320335us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMember2019-12-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel3Member2019-12-310000320335us-gaap:CollateralizedDebtObligationsMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel1Member2019-12-310000320335us-gaap:FairValueInputsLevel2Memberus-gaap:CollateralizedDebtObligationsMemberus-gaap:FixedMaturitiesMember2019-12-310000320335us-gaap:CollateralizedDebtObligationsMemberus-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel3Member2019-12-310000320335us-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel1Membergl:OtherAssetBackedSecuritiesMember2019-12-310000320335us-gaap:FairValueInputsLevel2Memberus-gaap:FixedMaturitiesMembergl:OtherAssetBackedSecuritiesMember2019-12-310000320335us-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel3Membergl:OtherAssetBackedSecuritiesMember2019-12-310000320335us-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel1Member2019-12-310000320335us-gaap:FairValueInputsLevel2Memberus-gaap:FixedMaturitiesMember2019-12-310000320335us-gaap:FixedMaturitiesMemberus-gaap:FairValueInputsLevel3Member2019-12-310000320335us-gaap:AssetBackedSecuritiesMember2019-12-310000320335us-gaap:CollateralizedDebtObligationsMember2019-12-310000320335us-gaap:CorporateDebtSecuritiesMember2019-12-310000320335us-gaap:AssetBackedSecuritiesMember2020-01-012020-03-310000320335us-gaap:CollateralizedDebtObligationsMember2020-01-012020-03-310000320335us-gaap:CorporateDebtSecuritiesMember2020-01-012020-03-310000320335us-gaap:AssetBackedSecuritiesMember2020-03-310000320335us-gaap:CollateralizedDebtObligationsMember2020-03-310000320335us-gaap:CorporateDebtSecuritiesMember2020-03-310000320335us-gaap:AssetBackedSecuritiesMember2018-12-310000320335us-gaap:CollateralizedDebtObligationsMember2018-12-310000320335us-gaap:CorporateDebtSecuritiesMember2018-12-310000320335us-gaap:AssetBackedSecuritiesMember2019-01-012019-03-310000320335us-gaap:CollateralizedDebtObligationsMember2019-01-012019-03-310000320335us-gaap:CorporateDebtSecuritiesMember2019-01-012019-03-310000320335us-gaap:AssetBackedSecuritiesMember2019-03-310000320335us-gaap:CollateralizedDebtObligationsMember2019-03-310000320335us-gaap:CorporateDebtSecuritiesMember2019-03-31gl:Issue0000320335us-gaap:ExternalCreditRatingInvestmentGradeMembergl:USGovernmentDirectGuaranteedAndGovernmentSponsoredEnterprisesMember2020-03-310000320335us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:ExternalCreditRatingInvestmentGradeMember2020-03-310000320335us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:ExternalCreditRatingInvestmentGradeMember2020-03-310000320335gl:FinancialMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:ExternalCreditRatingInvestmentGradeMember2020-03-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:ExternalCreditRatingInvestmentGradeMembergl:UtilitiesMember2020-03-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:ExternalCreditRatingInvestmentGradeMembergl:EnergyMember2020-03-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:ExternalCreditRatingInvestmentGradeMembergl:OtherCorporateSectorsMember2020-03-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:ExternalCreditRatingInvestmentGradeMember2020-03-310000320335us-gaap:ExternalCreditRatingInvestmentGradeMembergl:OtherAssetBackedSecuritiesMember2020-03-310000320335us-gaap:ExternalCreditRatingInvestmentGradeMember2020-03-310000320335us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:ExternalCreditRatingNonInvestmentGradeMember2020-03-310000320335gl:FinancialMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:ExternalCreditRatingNonInvestmentGradeMember2020-03-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:ExternalCreditRatingNonInvestmentGradeMembergl:UtilitiesMember2020-03-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:ExternalCreditRatingNonInvestmentGradeMembergl:EnergyMember2020-03-310000320335us-gaap:CorporateDebtSecuritiesMembergl:OtherCorporateSectorsMemberus-gaap:ExternalCreditRatingNonInvestmentGradeMember2020-03-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:ExternalCreditRatingNonInvestmentGradeMember2020-03-310000320335us-gaap:CollateralizedDebtObligationsMemberus-gaap:ExternalCreditRatingNonInvestmentGradeMember2020-03-310000320335us-gaap:ExternalCreditRatingNonInvestmentGradeMembergl:OtherAssetBackedSecuritiesMember2020-03-310000320335us-gaap:ExternalCreditRatingNonInvestmentGradeMember2020-03-310000320335us-gaap:ExternalCreditRatingInvestmentGradeMembergl:USGovernmentDirectGuaranteedAndGovernmentSponsoredEnterprisesMember2019-12-310000320335us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:ExternalCreditRatingInvestmentGradeMember2019-12-310000320335us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:ExternalCreditRatingInvestmentGradeMember2019-12-310000320335gl:FinancialMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:ExternalCreditRatingInvestmentGradeMember2019-12-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:ExternalCreditRatingInvestmentGradeMembergl:UtilitiesMember2019-12-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:ExternalCreditRatingInvestmentGradeMembergl:EnergyMember2019-12-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:ExternalCreditRatingInvestmentGradeMembergl:OtherCorporateSectorsMember2019-12-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:ExternalCreditRatingInvestmentGradeMember2019-12-310000320335us-gaap:ExternalCreditRatingInvestmentGradeMembergl:OtherAssetBackedSecuritiesMember2019-12-310000320335us-gaap:ExternalCreditRatingInvestmentGradeMember2019-12-310000320335us-gaap:USStatesAndPoliticalSubdivisionsMemberus-gaap:ExternalCreditRatingNonInvestmentGradeMember2019-12-310000320335gl:FinancialMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:ExternalCreditRatingNonInvestmentGradeMember2019-12-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:ExternalCreditRatingNonInvestmentGradeMembergl:UtilitiesMember2019-12-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:ExternalCreditRatingNonInvestmentGradeMembergl:EnergyMember2019-12-310000320335us-gaap:CorporateDebtSecuritiesMembergl:OtherCorporateSectorsMemberus-gaap:ExternalCreditRatingNonInvestmentGradeMember2019-12-310000320335us-gaap:CorporateDebtSecuritiesMemberus-gaap:ExternalCreditRatingNonInvestmentGradeMember2019-12-310000320335us-gaap:CollateralizedDebtObligationsMemberus-gaap:ExternalCreditRatingNonInvestmentGradeMember2019-12-310000320335us-gaap:ExternalCreditRatingNonInvestmentGradeMembergl:OtherAssetBackedSecuritiesMember2019-12-310000320335us-gaap:ExternalCreditRatingNonInvestmentGradeMember2019-12-310000320335us-gaap:OtherInvestmentsMember2020-03-310000320335us-gaap:OtherInvestmentsMember2019-12-310000320335srt:PartnershipInterestMembersrt:MinimumMember2020-01-012020-03-310000320335srt:PartnershipInterestMembersrt:MaximumMember2020-01-012020-03-310000320335srt:OfficeBuildingMemberus-gaap:ParticipatingMortgagesMember2020-03-310000320335srt:OfficeBuildingMemberus-gaap:ParticipatingMortgagesMember2019-12-310000320335gl:MixedUseMemberus-gaap:ParticipatingMortgagesMember2020-03-310000320335gl:MixedUseMemberus-gaap:ParticipatingMortgagesMember2019-12-310000320335gl:HospitalityMemberus-gaap:ParticipatingMortgagesMember2020-03-310000320335gl:HospitalityMemberus-gaap:ParticipatingMortgagesMember2019-12-310000320335us-gaap:ParticipatingMortgagesMembersrt:IndustrialPropertyMember2020-03-310000320335us-gaap:ParticipatingMortgagesMembersrt:IndustrialPropertyMember2019-12-310000320335gl:RetailPropertyMemberus-gaap:ParticipatingMortgagesMember2020-03-310000320335gl:RetailPropertyMemberus-gaap:ParticipatingMortgagesMember2019-12-310000320335srt:MultifamilyMemberus-gaap:ParticipatingMortgagesMember2020-03-310000320335srt:MultifamilyMemberus-gaap:ParticipatingMortgagesMember2019-12-310000320335gl:SouthAtlanticMemberus-gaap:ParticipatingMortgagesMember2020-03-310000320335gl:SouthAtlanticMemberus-gaap:ParticipatingMortgagesMember2019-12-310000320335gl:PacificMemberus-gaap:ParticipatingMortgagesMember2020-03-310000320335gl:PacificMemberus-gaap:ParticipatingMortgagesMember2019-12-310000320335gl:MiddleAtlanticMemberus-gaap:ParticipatingMortgagesMember2020-03-310000320335gl:MiddleAtlanticMemberus-gaap:ParticipatingMortgagesMember2019-12-310000320335gl:EastNorthCentralMemberus-gaap:ParticipatingMortgagesMember2020-03-310000320335gl:EastNorthCentralMemberus-gaap:ParticipatingMortgagesMember2019-12-310000320335gl:WestSouthCentralMemberus-gaap:ParticipatingMortgagesMember2020-03-310000320335gl:WestSouthCentralMemberus-gaap:ParticipatingMortgagesMember2019-12-310000320335gl:EastSouthCentralMemberus-gaap:ParticipatingMortgagesMember2020-03-310000320335gl:EastSouthCentralMemberus-gaap:ParticipatingMortgagesMember2019-12-310000320335gl:WestNorthCentralMemberus-gaap:ParticipatingMortgagesMember2020-03-310000320335gl:WestNorthCentralMemberus-gaap:ParticipatingMortgagesMember2019-12-310000320335gl:NewEnglandMemberus-gaap:ParticipatingMortgagesMember2020-03-310000320335gl:NewEnglandMemberus-gaap:ParticipatingMortgagesMember2019-12-31gl:loan0000320335gl:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:ParticipatingMortgagesMember2019-12-310000320335us-gaap:ParticipatingMortgagesMember2020-01-012020-03-310000320335gl:DebtServiceCoverageRatioLessThan1.00xMembergl:LTVLessThan70PercentMemberus-gaap:ParticipatingMortgagesMember2020-03-310000320335gl:DebtServiceCoverageRatio1.00x1.20xMembergl:LTVLessThan70PercentMemberus-gaap:ParticipatingMortgagesMember2020-03-310000320335gl:DebtServiceCoverageRatioGreaterThan1.20xMembergl:LTVLessThan70PercentMemberus-gaap:ParticipatingMortgagesMember2020-03-310000320335gl:LTVLessThan70PercentMemberus-gaap:ParticipatingMortgagesMember2020-03-310000320335gl:DebtServiceCoverageRatioLessThan1.00xMemberus-gaap:ParticipatingMortgagesMembergl:LTV70PercentTo80PercentMember2020-03-310000320335gl:DebtServiceCoverageRatio1.00x1.20xMemberus-gaap:ParticipatingMortgagesMembergl:LTV70PercentTo80PercentMember2020-03-310000320335gl:DebtServiceCoverageRatioGreaterThan1.20xMemberus-gaap:ParticipatingMortgagesMembergl:LTV70PercentTo80PercentMember2020-03-310000320335us-gaap:ParticipatingMortgagesMembergl:LTV70PercentTo80PercentMember2020-03-310000320335gl:LTV81PercentTo90PercentMembergl:DebtServiceCoverageRatioLessThan1.00xMemberus-gaap:ParticipatingMortgagesMember2020-03-310000320335gl:LTV81PercentTo90PercentMembergl:DebtServiceCoverageRatio1.00x1.20xMemberus-gaap:ParticipatingMortgagesMember2020-03-310000320335gl:LTV81PercentTo90PercentMembergl:DebtServiceCoverageRatioGreaterThan1.20xMemberus-gaap:ParticipatingMortgagesMember2020-03-310000320335gl:LTV81PercentTo90PercentMemberus-gaap:ParticipatingMortgagesMember2020-03-310000320335gl:DebtServiceCoverageRatioLessThan1.00xMembergl:LTVGreaterThan90PercentMemberus-gaap:ParticipatingMortgagesMember2020-03-310000320335gl:DebtServiceCoverageRatio1.00x1.20xMembergl:LTVGreaterThan90PercentMemberus-gaap:ParticipatingMortgagesMember2020-03-310000320335gl:DebtServiceCoverageRatioGreaterThan1.20xMembergl:LTVGreaterThan90PercentMemberus-gaap:ParticipatingMortgagesMember2020-03-310000320335gl:LTVGreaterThan90PercentMemberus-gaap:ParticipatingMortgagesMember2020-03-310000320335gl:DebtServiceCoverageRatioLessThan1.00xMemberus-gaap:ParticipatingMortgagesMember2020-03-310000320335gl:DebtServiceCoverageRatio1.00x1.20xMemberus-gaap:ParticipatingMortgagesMember2020-03-310000320335gl:DebtServiceCoverageRatioGreaterThan1.20xMemberus-gaap:ParticipatingMortgagesMember2020-03-310000320335gl:DebtServiceCoverageRatioLessThan1.00xMembergl:LTVLessThan70PercentMemberus-gaap:ParticipatingMortgagesMember2019-12-310000320335gl:DebtServiceCoverageRatio1.00x1.20xMembergl:LTVLessThan70PercentMemberus-gaap:ParticipatingMortgagesMember2019-12-310000320335gl:DebtServiceCoverageRatioGreaterThan1.20xMembergl:LTVLessThan70PercentMemberus-gaap:ParticipatingMortgagesMember2019-12-310000320335gl:LTVLessThan70PercentMemberus-gaap:ParticipatingMortgagesMember2019-12-310000320335gl:DebtServiceCoverageRatioLessThan1.00xMemberus-gaap:ParticipatingMortgagesMembergl:LTV70PercentTo80PercentMember2019-12-310000320335gl:DebtServiceCoverageRatio1.00x1.20xMemberus-gaap:ParticipatingMortgagesMembergl:LTV70PercentTo80PercentMember2019-12-310000320335gl:DebtServiceCoverageRatioGreaterThan1.20xMemberus-gaap:ParticipatingMortgagesMembergl:LTV70PercentTo80PercentMember2019-12-310000320335us-gaap:ParticipatingMortgagesMembergl:LTV70PercentTo80PercentMember2019-12-310000320335gl:LTV81PercentTo90PercentMembergl:DebtServiceCoverageRatioLessThan1.00xMemberus-gaap:ParticipatingMortgagesMember2019-12-310000320335gl:LTV81PercentTo90PercentMembergl:DebtServiceCoverageRatio1.00x1.20xMemberus-gaap:ParticipatingMortgagesMember2019-12-310000320335gl:LTV81PercentTo90PercentMembergl:DebtServiceCoverageRatioGreaterThan1.20xMemberus-gaap:ParticipatingMortgagesMember2019-12-310000320335gl:LTV81PercentTo90PercentMemberus-gaap:ParticipatingMortgagesMember2019-12-310000320335gl:DebtServiceCoverageRatioLessThan1.00xMembergl:LTVGreaterThan90PercentMemberus-gaap:ParticipatingMortgagesMember2019-12-310000320335gl:DebtServiceCoverageRatio1.00x1.20xMembergl:LTVGreaterThan90PercentMemberus-gaap:ParticipatingMortgagesMember2019-12-310000320335gl:DebtServiceCoverageRatioGreaterThan1.20xMembergl:LTVGreaterThan90PercentMemberus-gaap:ParticipatingMortgagesMember2019-12-310000320335gl:LTVGreaterThan90PercentMemberus-gaap:ParticipatingMortgagesMember2019-12-310000320335gl:DebtServiceCoverageRatioLessThan1.00xMemberus-gaap:ParticipatingMortgagesMember2019-12-310000320335gl:DebtServiceCoverageRatio1.00x1.20xMemberus-gaap:ParticipatingMortgagesMember2019-12-310000320335gl:DebtServiceCoverageRatioGreaterThan1.20xMemberus-gaap:ParticipatingMortgagesMember2019-12-310000320335us-gaap:LetterOfCreditMember2020-03-3100003203352019-04-020000320335us-gaap:HealthInsuranceProductLineMember2019-12-310000320335us-gaap:HealthInsuranceProductLineMember2018-12-310000320335us-gaap:HealthInsuranceProductLineMember2020-03-310000320335us-gaap:HealthInsuranceProductLineMember2019-03-310000320335us-gaap:LifeInsuranceSegmentMember2020-03-310000320335us-gaap:LifeInsuranceSegmentMember2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Membergl:CorporateBondSecuritiesFinancialMember2020-03-310000320335us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMembergl:CorporateBondSecuritiesFinancialMember2020-03-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Membergl:CorporateBondSecuritiesFinancialMember2020-03-310000320335us-gaap:PensionPlansDefinedBenefitMembergl:CorporateBondSecuritiesFinancialMember2020-03-310000320335gl:CorporateBondSecuritiesUtilitiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2020-03-310000320335us-gaap:FairValueInputsLevel2Membergl:CorporateBondSecuritiesUtilitiesMemberus-gaap:PensionPlansDefinedBenefitMember2020-03-310000320335gl:CorporateBondSecuritiesUtilitiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2020-03-310000320335gl:CorporateBondSecuritiesUtilitiesMemberus-gaap:PensionPlansDefinedBenefitMember2020-03-310000320335gl:CorporateBondSecuritiesEnergyMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2020-03-310000320335us-gaap:FairValueInputsLevel2Membergl:CorporateBondSecuritiesEnergyMemberus-gaap:PensionPlansDefinedBenefitMember2020-03-310000320335gl:CorporateBondSecuritiesEnergyMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2020-03-310000320335gl:CorporateBondSecuritiesEnergyMemberus-gaap:PensionPlansDefinedBenefitMember2020-03-310000320335us-gaap:PensionPlansDefinedBenefitMembergl:CorporateBondSecuritiesOtherMemberus-gaap:FairValueInputsLevel1Member2020-03-310000320335us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMembergl:CorporateBondSecuritiesOtherMember2020-03-310000320335us-gaap:PensionPlansDefinedBenefitMembergl:CorporateBondSecuritiesOtherMemberus-gaap:FairValueInputsLevel3Member2020-03-310000320335us-gaap:PensionPlansDefinedBenefitMembergl:CorporateBondSecuritiesOtherMember2020-03-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueInputsLevel1Member2020-03-310000320335us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateBondSecuritiesMember2020-03-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueInputsLevel3Member2020-03-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateBondSecuritiesMember2020-03-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ExchangeTradedFundsMemberus-gaap:FairValueInputsLevel1Member2020-03-310000320335us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ExchangeTradedFundsMember2020-03-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ExchangeTradedFundsMember2020-03-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ExchangeTradedFundsMember2020-03-310000320335us-gaap:PensionPlansDefinedBenefitMembergl:OtherBondsMemberus-gaap:FairValueInputsLevel1Member2020-03-310000320335us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMembergl:OtherBondsMember2020-03-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Membergl:OtherBondsMember2020-03-310000320335us-gaap:PensionPlansDefinedBenefitMembergl:OtherBondsMember2020-03-310000320335gl:GuaranteedAnnuityContractMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2020-03-310000320335us-gaap:FairValueInputsLevel2Membergl:GuaranteedAnnuityContractMemberus-gaap:PensionPlansDefinedBenefitMember2020-03-310000320335gl:GuaranteedAnnuityContractMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2020-03-310000320335gl:GuaranteedAnnuityContractMemberus-gaap:PensionPlansDefinedBenefitMember2020-03-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel1Member2020-03-310000320335us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ShortTermInvestmentsMember2020-03-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ShortTermInvestmentsMember2020-03-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ShortTermInvestmentsMember2020-03-310000320335gl:OtherMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2020-03-310000320335us-gaap:FairValueInputsLevel2Membergl:OtherMemberus-gaap:PensionPlansDefinedBenefitMember2020-03-310000320335gl:OtherMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2020-03-310000320335gl:OtherMemberus-gaap:PensionPlansDefinedBenefitMember2020-03-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2020-03-310000320335us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2020-03-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2020-03-310000320335us-gaap:FairValueInputsLevel12And3Memberus-gaap:PensionPlansDefinedBenefitMember2020-03-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2020-03-310000320335us-gaap:PensionPlansDefinedBenefitMember2020-03-310000320335us-gaap:PensionPlansDefinedBenefitMember2020-01-012020-03-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Membergl:CorporateBondSecuritiesFinancialMember2019-12-310000320335us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMembergl:CorporateBondSecuritiesFinancialMember2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Membergl:CorporateBondSecuritiesFinancialMember2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMembergl:CorporateBondSecuritiesFinancialMember2019-12-310000320335gl:CorporateBondSecuritiesUtilitiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2019-12-310000320335us-gaap:FairValueInputsLevel2Membergl:CorporateBondSecuritiesUtilitiesMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310000320335gl:CorporateBondSecuritiesUtilitiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2019-12-310000320335gl:CorporateBondSecuritiesUtilitiesMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310000320335gl:CorporateBondSecuritiesEnergyMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2019-12-310000320335us-gaap:FairValueInputsLevel2Membergl:CorporateBondSecuritiesEnergyMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310000320335gl:CorporateBondSecuritiesEnergyMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2019-12-310000320335gl:CorporateBondSecuritiesEnergyMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMembergl:CorporateBondSecuritiesOtherMemberus-gaap:FairValueInputsLevel1Member2019-12-310000320335us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMembergl:CorporateBondSecuritiesOtherMember2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMembergl:CorporateBondSecuritiesOtherMemberus-gaap:FairValueInputsLevel3Member2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMembergl:CorporateBondSecuritiesOtherMember2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueInputsLevel1Member2019-12-310000320335us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateBondSecuritiesMember2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueInputsLevel3Member2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateBondSecuritiesMember2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ExchangeTradedFundsMemberus-gaap:FairValueInputsLevel1Member2019-12-310000320335us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ExchangeTradedFundsMember2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ExchangeTradedFundsMember2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ExchangeTradedFundsMember2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMembergl:OtherBondsMemberus-gaap:FairValueInputsLevel1Member2019-12-310000320335us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMembergl:OtherBondsMember2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Membergl:OtherBondsMember2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMembergl:OtherBondsMember2019-12-310000320335gl:GuaranteedAnnuityContractMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2019-12-310000320335us-gaap:FairValueInputsLevel2Membergl:GuaranteedAnnuityContractMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310000320335gl:GuaranteedAnnuityContractMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2019-12-310000320335gl:GuaranteedAnnuityContractMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel1Member2019-12-310000320335us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ShortTermInvestmentsMember2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ShortTermInvestmentsMember2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ShortTermInvestmentsMember2019-12-310000320335gl:OtherMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2019-12-310000320335us-gaap:FairValueInputsLevel2Membergl:OtherMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310000320335gl:OtherMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2019-12-310000320335gl:OtherMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2019-12-310000320335us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2019-12-310000320335us-gaap:FairValueInputsLevel12And3Memberus-gaap:PensionPlansDefinedBenefitMember2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMember2019-12-310000320335us-gaap:PensionPlansDefinedBenefitMember2019-01-012019-12-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:QualifiedPlanMemberus-gaap:FundedPlanMember2020-03-310000320335us-gaap:PensionPlansDefinedBenefitMemberus-gaap:QualifiedPlanMemberus-gaap:FundedPlanMember2019-12-310000320335us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMemberus-gaap:NonqualifiedPlanMember2020-03-310000320335us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMemberus-gaap:NonqualifiedPlanMember2019-12-310000320335gl:AmericanIncomeExclusiveMembergl:LifeSegmentMember2020-01-012020-03-310000320335gl:AmericanIncomeExclusiveMembergl:HealthSegmentMember2020-01-012020-03-310000320335gl:AmericanIncomeExclusiveMember2020-01-012020-03-310000320335gl:DirectResponseMembergl:LifeSegmentMember2020-01-012020-03-310000320335gl:DirectResponseMembergl:HealthSegmentMember2020-01-012020-03-310000320335gl:DirectResponseMember2020-01-012020-03-310000320335gl:LifeSegmentMembergl:LibertyNationalExclusiveMember2020-01-012020-03-310000320335gl:HealthSegmentMembergl:LibertyNationalExclusiveMember2020-01-012020-03-310000320335gl:LibertyNationalExclusiveMember2020-01-012020-03-310000320335gl:UnitedAmericanIndependentMembergl:LifeSegmentMember2020-01-012020-03-310000320335gl:HealthSegmentMembergl:UnitedAmericanIndependentMember2020-01-012020-03-310000320335gl:UnitedAmericanIndependentMember2020-01-012020-03-310000320335gl:FamilyHeritageMembergl:LifeSegmentMember2020-01-012020-03-310000320335gl:FamilyHeritageMembergl:HealthSegmentMember2020-01-012020-03-310000320335gl:FamilyHeritageMember2020-01-012020-03-310000320335gl:DistributionChannelOtherMembergl:LifeSegmentMember2020-01-012020-03-310000320335gl:DistributionChannelOtherMember2020-01-012020-03-310000320335gl:LifeSegmentMember2020-01-012020-03-310000320335gl:HealthSegmentMember2020-01-012020-03-310000320335gl:AmericanIncomeExclusiveMembergl:LifeSegmentMember2019-01-012019-03-310000320335gl:AmericanIncomeExclusiveMembergl:HealthSegmentMember2019-01-012019-03-310000320335gl:AmericanIncomeExclusiveMember2019-01-012019-03-310000320335gl:DirectResponseMembergl:LifeSegmentMember2019-01-012019-03-310000320335gl:DirectResponseMembergl:HealthSegmentMember2019-01-012019-03-310000320335gl:DirectResponseMember2019-01-012019-03-310000320335gl:LifeSegmentMembergl:LibertyNationalExclusiveMember2019-01-012019-03-310000320335gl:HealthSegmentMembergl:LibertyNationalExclusiveMember2019-01-012019-03-310000320335gl:LibertyNationalExclusiveMember2019-01-012019-03-310000320335gl:UnitedAmericanIndependentMembergl:LifeSegmentMember2019-01-012019-03-310000320335gl:HealthSegmentMembergl:UnitedAmericanIndependentMember2019-01-012019-03-310000320335gl:UnitedAmericanIndependentMember2019-01-012019-03-310000320335gl:FamilyHeritageMembergl:LifeSegmentMember2019-01-012019-03-310000320335gl:FamilyHeritageMembergl:HealthSegmentMember2019-01-012019-03-310000320335gl:FamilyHeritageMember2019-01-012019-03-310000320335gl:DistributionChannelOtherMembergl:LifeSegmentMember2019-01-012019-03-310000320335gl:DistributionChannelOtherMember2019-01-012019-03-310000320335gl:LifeSegmentMember2019-01-012019-03-310000320335gl:HealthSegmentMember2019-01-012019-03-310000320335us-gaap:OperatingSegmentsMembergl:LifeSegmentMember2020-01-012020-03-310000320335us-gaap:OperatingSegmentsMembergl:HealthSegmentMember2020-01-012020-03-310000320335us-gaap:OperatingSegmentsMembergl:AnnuitySegmentMember2020-01-012020-03-310000320335gl:InvestmentSegmentMemberus-gaap:OperatingSegmentsMember2020-01-012020-03-310000320335us-gaap:CorporateNonSegmentMember2020-01-012020-03-310000320335us-gaap:MaterialReconcilingItemsMember2020-01-012020-03-310000320335us-gaap:OperatingSegmentsMembergl:LifeSegmentMember2019-01-012019-03-310000320335us-gaap:OperatingSegmentsMembergl:HealthSegmentMember2019-01-012019-03-310000320335us-gaap:OperatingSegmentsMembergl:AnnuitySegmentMember2019-01-012019-03-310000320335gl:InvestmentSegmentMemberus-gaap:OperatingSegmentsMember2019-01-012019-03-310000320335us-gaap:CorporateNonSegmentMember2019-01-012019-03-310000320335us-gaap:MaterialReconcilingItemsMember2019-01-012019-03-310000320335us-gaap:SubsequentEventMember2020-04-092020-04-090000320335us-gaap:SubsequentEventMember2020-04-090000320335us-gaap:SubsequentEventMember2020-04-152020-04-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark one)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2020

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to ________

Commission File Number: 001-08052

GLOBE LIFE INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 63-0780404 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

3700 South Stonebridge Drive, McKinney, Texas 75070

(Address of principal executive offices) (Zip Code)

(972) 569-4000

(Registrant’s telephone number, including area code)

NONE

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $1.00 par value per share | GL | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ☒ | | Accelerated filer | | ☐ |

| Non-accelerated filer | | ☐ | | Smaller reporting company | | ☐ |

| | | | Emerging growth company | | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | | | | | | ☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate the number of shares outstanding for each of the issuer’s classes of common stock, as of the last practicable date.

| | | | | | | | |

| Class | | Outstanding at April 29, 2020 |

| Common Stock, $1.00 Par Value | | 106,438,018 |

Globe Life Inc.

Table of Contents

| | | | | | | | | | | |

| | | Page |

PART I. FINANCIAL INFORMATION | | | |

| Item 1. | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Item 2. | | |

| | | |

| Item 3. | | |

| | | |

| Item 4. | | |

| | | |

PART II. OTHER INFORMATION | | | |

| | | |

| Item 1. | | |

| | | |

| Item 1A. | | |

| | | |

| Item 2. | | |

| | | |

| Item 6. | | |

| | | |

| | | |

As used in this Form 10-Q, “Globe Life,” the “Company,” “we,” “our” and “us” refer to Globe Life Inc., a Delaware corporation incorporated in 1979, its subsidiaries and affiliates.

PART I—FINANCIAL INFORMATION

Item 1. Condensed Consolidated Financial Statements

Globe Life Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

(Dollar amounts in thousands, except per share data)

| | | | | | | | | | | |

| | | |

| March 31, 2020 | | December 31, 2019 |

| Assets: | | | |

| Investments: | | | |

Fixed maturities—available for sale, at fair value (amortized cost: 2020—$16,371,944; 2019—$16,415,776, allowance for credit losses: 2020— $31,854; 2019— $0) | $ | 17,879,541 | | | $ | 18,907,147 | |

| Policy loans | 579,133 | | | 575,492 | |

Other long-term investments (includes: 2020—$211,791; 2019—$185,851 under the fair value option) | 377,239 | | | 326,347 | |

| Short-term investments | 272,601 | | | 38,285 | |

| Total investments | 19,108,514 | | | 19,847,271 | |

| Cash | 90,370 | | | 75,933 | |

| Accrued investment income | 258,437 | | | 245,129 | |

| Other receivables | 441,740 | | | 441,662 | |

| Deferred acquisition costs | 4,386,478 | | | 4,341,941 | |

| Goodwill | 441,591 | | | 441,591 | |

| Other assets | 624,784 | | | 583,933 | |

| | | |

| Total assets | $ | 25,351,914 | | | $ | 25,977,460 | |

| Liabilities: | | | |

| Future policy benefits | $ | 14,617,072 | | | $ | 14,508,134 | |

| Unearned and advance premium | 67,868 | | | 63,709 | |

| Policy claims and other benefits payable | 364,276 | | | 365,402 | |

| Other policyholders' funds | 96,525 | | | 96,282 | |

| Total policy liabilities | 15,145,741 | | | 15,033,527 | |

| Current and deferred income taxes | 1,295,024 | | | 1,476,832 | |

| Short-term debt | 458,127 | | | 298,738 | |

Long-term debt (estimated fair value: 2020—$1,386,511; 2019—$1,473,364) | 1,346,795 | | | 1,348,988 | |

| Other liabilities | 585,945 | | | 525,068 | |

| | | |

| Total liabilities | 18,831,632 | | | 18,683,153 | |

| Commitments and Contingencies (Note 5) | | | |

| Shareholders' equity: | | | |

Preferred stock, par value $1 per share—5,000,000 shares authorized; outstanding: 0 in 2020 and 2019 | — | | | — | |

Common stock, par value $1 per share—320,000,000 shares authorized; outstanding: (2020—117,218,183 issued; 2019— 117,218,183 issued) | 117,218 | | | 117,218 | |

| Additional paid-in-capital | 519,428 | | | 531,554 | |

| Accumulated other comprehensive income (loss) | 1,066,247 | | | 1,844,830 | |

| Retained earnings | 5,686,431 | | | 5,551,329 | |

Treasury stock, at cost: (2020—10,783,915 shares; 2019—9,497,940 shares) | (869,042) | | | (750,624) | |

| Total shareholders' equity | 6,520,282 | | | 7,294,307 | |

| Total liabilities and shareholders' equity | $ | 25,351,914 | | | $ | 25,977,460 | |

See accompanying Notes to Condensed Consolidated Financial Statements.

Globe Life Inc.

Condensed Consolidated Statements of Operations

(Unaudited)

(Dollar amounts in thousands, except per share data)

| | | | | | | | | | | | | | | |

| | | | | Three Months Ended

March 31, | | |

| | | | | 2020 | | 2019 |

| Revenue: | | | | | | | | |

| Life premium | | | | | | $ | 649,630 | | | $ | 624,289 | |

| Health premium | | | | | | 280,205 | | | 266,684 | |

| | | | | | | |

| Total premium | | | | | | 929,835 | | | 890,973 | |

| Net investment income | | | | | | 228,991 | | | 226,673 | |

| Realized gains (losses) | | | | | | (26,097) | | | 1,329 | |

| | | | | | | |

| Other income | | | | | | 325 | | | 241 | |

| Total revenue | | | | | | 1,133,054 | | | 1,119,216 | |

| | | | | | | |

| Benefits and expenses: | | | | | | | | |

| Life policyholder benefits | | | | | | 421,670 | | | 409,692 | |

| Health policyholder benefits | | | | | | 178,711 | | | 170,017 | |

| Other policyholder benefits | | | | | | 7,588 | | | 8,048 | |

| Total policyholder benefits | | | | | | 607,969 | | | 587,757 | |

| | | | | | | |

| Amortization of deferred acquisition costs | | | | | | 143,837 | | | 135,822 | |

| Commissions, premium taxes, and non-deferred acquisition costs | | | | | | 78,937 | | | 73,465 | |

| Other operating expense | | | | | | 78,582 | | | 72,793 | |

| Interest expense | | | | | | 20,808 | | | 21,278 | |

| Total benefits and expenses | | | | | | 930,133 | | | 891,115 | |

| | | | | | | |

| Income before income taxes | | | | | | 202,921 | | | 228,101 | |

| Income tax benefit (expense) | | | | | | (37,381) | | | (42,707) | |

| Income from continuing operations | | | | | | 165,540 | | | 185,394 | |

| | | | | | | |

| Income (loss) from discontinued operations, net of tax | | | | | | — | | | (49) | |

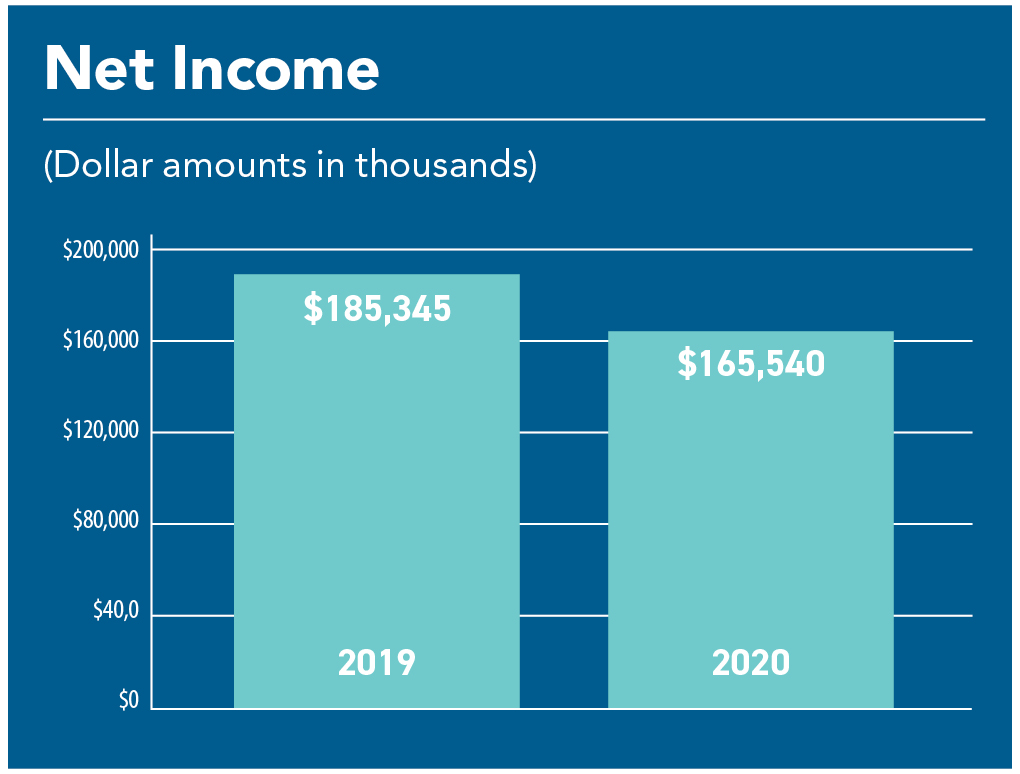

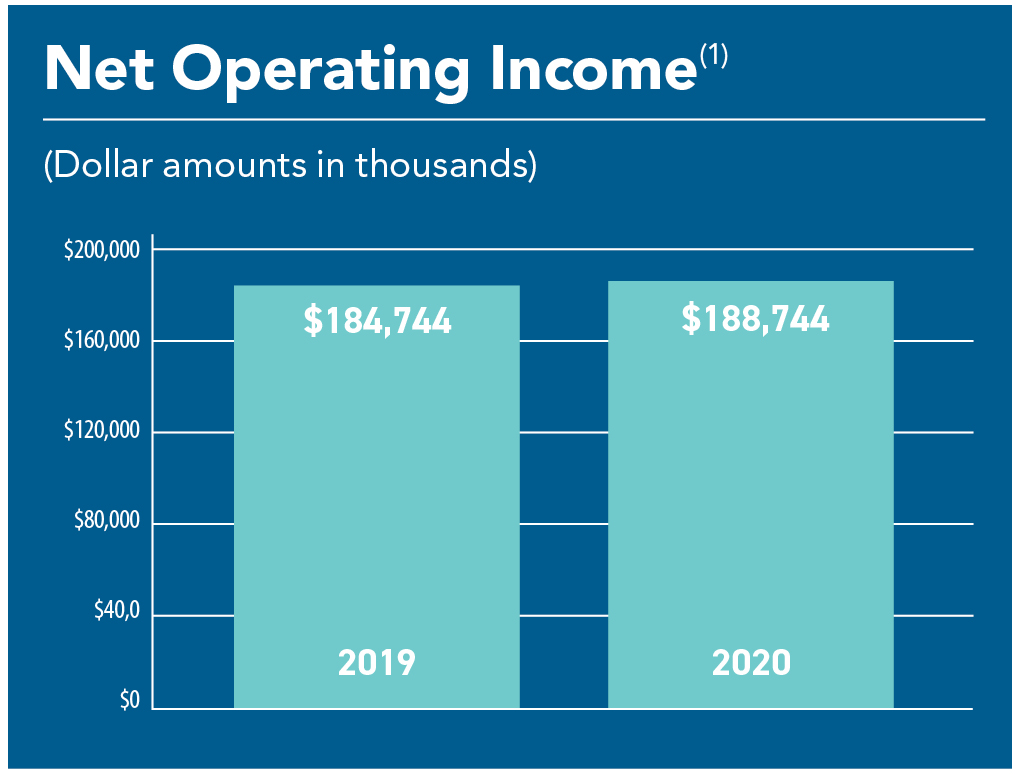

Net income | | | | | $ | 165,540 | | | $ | 185,345 | |

| | | | | | | |

| Basic net income (loss) per common share: | | | | | | | | |

| Continuing operations | | | | | | $ | 1.54 | | | $ | 1.68 | |

| Discontinued operations | | | | | | — | | | — | |

Total basic net income per common share | | | | | $ | 1.54 | | | $ | 1.68 | |

| | | | | | | |

| Diluted net income (loss) per common share: | | | | | | | | |

| Continuing operations | | | | | | $ | 1.52 | | | $ | 1.65 | |

| Discontinued operations | | | | | | — | | | — | |

Total diluted net income per common share | | | | | $ | 1.52 | | | $ | 1.65 | |

See accompanying Notes to Condensed Consolidated Financial Statements.

Globe Life Inc.

Condensed Consolidated Statements of Comprehensive Income (Loss)

(Unaudited)

(Dollar amounts in thousands)

| | | | | | | | | | | | | | | |

| | | | | Three Months Ended

March 31, | | |

| | | | | 2020 | | 2019 |

Net income | | | | | $ | 165,540 | | | $ | 185,345 | |

| | | | | | | |

| Other comprehensive income (loss): | | | | | | | |

| | | | | | | |

| Investments: | | | | | | | |

| Unrealized gains (losses) on securities: | | | | | | | |

| Unrealized holding gains (losses) arising during period | | | | | (977,936) | | | 693,482 | |

| | | | | | | |

| Other reclassification adjustments included in net income | | | | | 28,412 | | | | (2,444) | |

| Foreign exchange adjustment on securities recorded at fair value | | | | | (2,397) | | | | (142) | |

| Unrealized gains (losses) on securities | | | | | (951,921) | | | 690,896 | |

| | | | | | | |

| Unrealized gains (losses) on other investments | | | | | (10,720) | | | | 4,043 | |

| Total unrealized investment gains (losses) | | | | | (962,641) | | | 694,939 | |

| Less applicable tax (expense) benefit | | | | | 202,150 | | | | (145,936) | |

| Unrealized gains (losses) on investments, net of tax | | | | | (760,491) | | | 549,003 | |

| | | | | | | |

| Deferred acquisition costs: | | | | | | | |

| Unrealized gains (losses) attributable to deferred acquisition costs | | | | | 383 | | | | (3,199) | |

| Less applicable tax (expense) benefit | | | | | (80) | | | | 671 | |

| Unrealized gains (losses) attributable to deferred acquisition costs, net of tax | | | | | 303 | | | (2,528) | |

| | | | | | | |

| Foreign exchange translation: | | | | | | | |

| Foreign exchange translation adjustments, other than securities | | | | | (27,442) | | | | 3,089 | |

| Less applicable tax (expense) benefit | | | | | 5,763 | | | | (647) | |

| Foreign exchange translation adjustments, other than securities, net of tax | | | | | (21,679) | | | 2,442 | |

| | | | | | | |

| Pension: | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Pension adjustments | | | | | 4,157 | | | 2,120 | |

| Less applicable tax (expense) benefit | | | | | (873) | | | | (445) | |

| Pension adjustments, net of tax | | | | | 3,284 | | | 1,675 | |

| | | | | | | |

| Other comprehensive income (loss) | | | | | (778,583) | | | 550,592 | |

Comprehensive income (loss) | | | | | $ | (613,043) | | | $ | 735,937 | |

See accompanying Notes to Condensed Consolidated Financial Statements.

Globe Life Inc.

Condensed Consolidated Statements of Shareholders' Equity

(Unaudited)

(Dollar amounts in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Preferred Stock | | Common Stock | | Additional Paid-In Capital | | Accumulated Other Comprehensive Income (Loss) | | Retained Earnings | | Treasury Stock | | Total Shareholders' Equity |

Balance at December 31, 2019 | $ | — | | | $ | 117,218 | | | $ | 531,554 | | | $ | 1,844,830 | | | $ | 5,551,329 | | | $ | (750,624) | | | $ | 7,294,307 | |

Cumulative effect of change in accounting principles, net of tax(1) | — | | | — | | | — | | | — | | | (454) | | | — | | | (454) | |

Balance at January 1, 2020 | — | | | 117,218 | | | 531,554 | | | 1,844,830 | | | 5,550,875 | | | (750,624) | | | 7,293,853 | |

| Comprehensive income (loss) | — | | | — | | | — | | | (778,583) | | | 165,540 | | | — | | | (613,043) | |

Common dividends declared ($0.1875 per share) | — | | | — | | | — | | | — | | | (19,963) | | | — | | | (19,963) | |

| Acquisition of treasury stock | — | | | — | | | — | | | — | | | — | | | (166,729) | | | (166,729) | |

| Stock-based compensation | — | | | — | | | (12,126) | | | — | | | (482) | | | 21,964 | | | 9,356 | |

| Exercise of stock options | — | | | — | | | — | | | — | | | (9,539) | | | 26,347 | | | 16,808 | |

| | | | | | | | | | | | | |

Balance at March 31, 2020 | $ | — | | | $ | 117,218 | | | $ | 519,428 | | | $ | 1,066,247 | | | $ | 5,686,431 | | | $ | (869,042) | | | $ | 6,520,282 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

(1)Adoption of Accounting Standard Update (ASU) 2016-13, Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments, on January 1, 2020. See more information in Note 2, New Accounting Standards.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Preferred Stock | | Common Stock | | Additional Paid-In Capital | | Accumulated Other Comprehensive Income (Loss) | | Retained Earnings | | Treasury Stock | | Total Shareholders' Equity |

| | | | | | | | | | | | | |

Balance at December 31, 2018 | $ | — | | | $ | 121,218 | | | $ | 524,414 | | | $ | 319,475 | | | $ | 5,213,468 | | | $ | (763,398) | | | $ | 5,415,177 | |

Cumulative effect of change in accounting principles, net of tax(1) | — | | | — | | | — | | | — | | | (497) | | | — | | | (497) | |

Balance at January 1, 2019 | — | | | 121,218 | | | 524,414 | | | 319,475 | | | 5,212,971 | | | (763,398) | | | 5,414,680 | |

| Comprehensive income (loss) | — | | | — | | | — | | | 550,592 | | | 185,345 | | | — | | | 735,937 | |

Common dividends declared ($0.1725 per share) | — | | | — | | | — | | | — | | | (18,943) | | | — | | | (18,943) | |

| Acquisition of treasury stock | — | | | — | | | — | | | — | | | — | | | (110,896) | | | (110,896) | |

| Stock-based compensation | — | | | — | | | (5,885) | | | — | | | (6,817) | | | 23,261 | | | 10,559 | |

| Exercise of stock options | — | | | — | | | — | | | — | | | (7,736) | | | 19,825 | | | 12,089 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Balance at March 31, 2019 | $ | — | | | $ | 121,218 | | | $ | 518,529 | | | $ | 870,067 | | | $ | 5,364,820 | | | $ | (831,208) | | | $ | 6,043,426 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

(1)Adoption of ASU 2016-02, Leases (Topic 842), on January 1, 2019.

See accompanying Notes to Condensed Consolidated Financial Statements.

Globe Life Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited)

(Dollar amounts in thousands)

| | | | | | | | | | | |

| Three Months Ended

March 31, | | |

| 2020 | | 2019 |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Cash provided from (used for) operating activities | $ | 343,554 | | | $ | 423,285 | |

| | | |

| Cash provided from (used for) investing activities: | | | |

| Investments sold or matured: | | | |

| Fixed maturities available for sale—sold | 50,360 | | | 34,997 | |

| Fixed maturities available for sale—matured or other redemptions | 167,387 | | | 188,253 | |

| Other long-term investments | 231 | | | — | |

| Total investments sold or matured | 217,978 | | | 223,250 | |

| Acquisition of investments: | | | |

| Fixed maturities—available for sale | (211,754) | | | (421,111) | |

| Other long-term investments | (49,896) | | | (22,971) | |

| Total investments acquired | (261,650) | | | (444,082) | |

| Net (increase) decrease in policy loans | (3,641) | | | (5,390) | |

| Net (increase) decrease in short-term investments | (234,316) | | | (62,471) | |

| Additions to properties | (9,316) | | | (7,015) | |

| Sale of other assets | 13 | | | — | |

| Investments in low-income housing interests | (20,743) | | | (10,054) | |

Cash provided from (used for) investing activities | (311,675) | | | (305,762) | |

| | | |

| Cash provided from (used for) financing activities: | | | |

| Issuance of common stock | 16,808 | | | 11,592 | |

| Cash dividends paid to shareholders | (18,588) | | | (17,696) | |

| Repayment of debt | (1,875) | | | (1,250) | |

| | | |

| | | |

| Net borrowing (repayment) of commercial paper | 158,764 | | | (14,095) | |

| Acquisition of treasury stock | (166,729) | | | (110,896) | |

| Net receipts (payments) from deposit-type products | (19,651) | | | (37,136) | |

Cash provided from (used for) financing activities | (31,271) | | | (169,481) | |

| | | |

| Effect of foreign exchange rate changes on cash | 13,829 | | | (1,726) | |

| Net increase (decrease) in cash | 14,437 | | | (53,684) | |

| Cash at beginning of year | 75,933 | | | 121,026 | |

| Cash at end of period | $ | 90,370 | | | $ | 67,342 | |

See accompanying Notes to Condensed Consolidated Financial Statements.

Globe Life Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

(Dollar amounts in thousands, except per share data)

Note 1—Significant Accounting Policies

Business: "Globe Life" and the "Company" refer to Globe Life Inc., an insurance holding company incorporated in Delaware in 1979, and Globe Life Inc. subsidiaries and affiliates. Globe Life Inc.'s primary subsidiaries are Globe Life And Accident Insurance Company, American Income Life Insurance Company, Liberty National Life Insurance Company, Family Heritage Life Insurance Company of America, and United American Insurance Company.

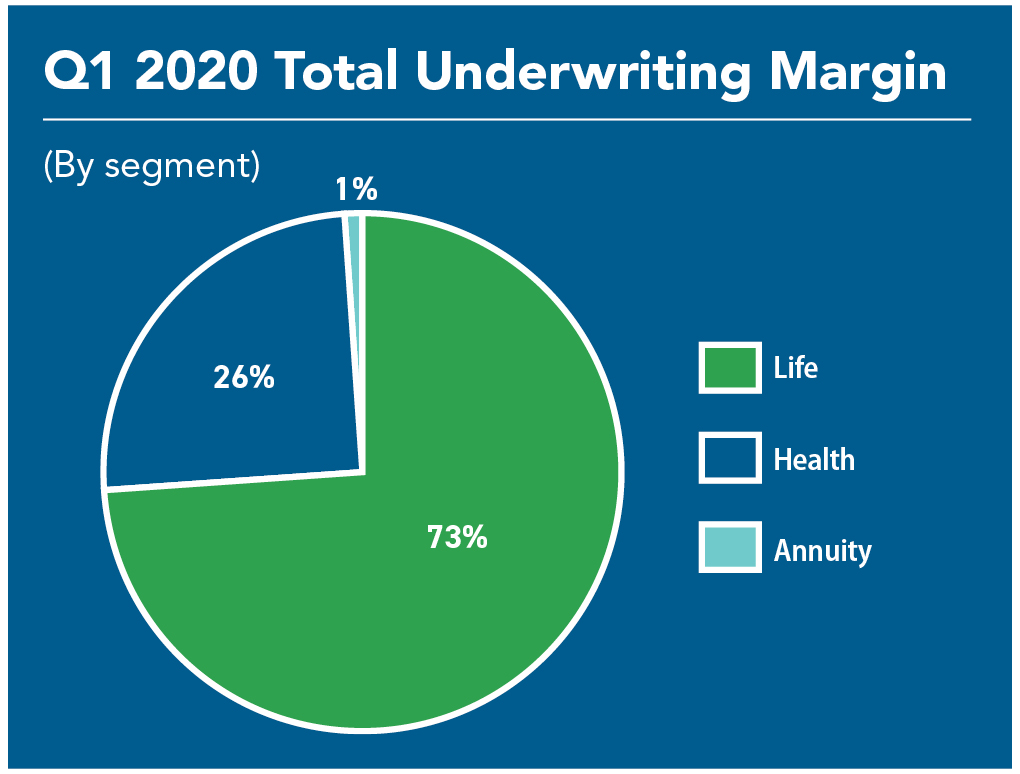

Globe Life provides a variety of life and supplemental health insurance products and annuities to a broad base of customers. The Company is organized into four reportable segments: life insurance, supplemental health insurance, annuities, and investments.

Basis of Presentation: The accompanying condensed consolidated financial statements of Globe Life have been prepared in accordance with the instructions to Form 10-Q. Therefore, they do not include all of the disclosures required by accounting principles generally accepted in the United States of America (GAAP) for annual financial statements. However, in the opinion of management, these statements include all adjustments, consisting of normal recurring adjustments, which are necessary for a fair presentation of the condensed consolidated financial position at March 31, 2020, and the condensed consolidated results of operations, comprehensive income, and cash flows for the periods ended March 31, 2020 and 2019. The interim period condensed consolidated financial statements should be read in conjunction with the Consolidated Financial Statements that are included in the Form 10-K filed with the Securities Exchange Commission (SEC) on February 27, 2020.

Significant Accounting Policies: The following accounting policies were updated since the 2019 Form 10-K due to the adoption of ASU 2016-13 Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments (ASU 2016-13.)

On January 1, 2020, the Company adopted ASU 2016-13, replacing the GAAP "incurred loss" model with a new methodology referred to as current expected credit losses (CECL). The previous methodology delayed recognition of credit losses until it was probable that a loss had incurred, ultimately resulting in fewer instances of losses being recorded in earnings. The new CECL methodology is forward looking—encompassing relevant information about historical experience, current conditions, as well as reasonable and supportable forecasts that affect the collectability of a reported amount.

The measurement of expected credit losses under the CECL methodology is applicable to financial assets measured at amortized cost, including loan receivables. The standard affected the Company's commercial mortgage loan participations (Other long-term investments) and agent debit balances (Other receivables). The Company adopted the standard using the modified retrospective method for the commercial mortgage loan participations and agent debit balances.

The Company recorded a cumulative effect adjustment of $454 thousand to retained earnings, consisting of $265 thousand, net of tax and $189 thousand, net of tax for commercial mortgage loan participations and agent debit balances, respectively. Refer to the table below and Note 4 for additional details. | | | | | | | | | | | | | | | | | | | | |

| | As reported on December 31, 2019 | | Pre-tax impact of adoption | | As reported on January 1, 2020 |

| Assets: | | | | | | |

| | | | | | |

| | | | | | |

| Commercial mortgage loan participations | | $ | 137,692 | | | $ | (335) | | | | $ | 137,357 | |

| Agent debit balances | | 423,877 | | | (240) | | | | 423,637 | |

Globe Life Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

(Dollar amounts in thousands, except per share data)

In addition, the standard made changes to the accounting for available-for-sale debt securities through the removal of "other-than-temporary-impairment" (OTTI) write downs and replaced it with allowances for credit losses. The new methodology will allow the Company to record reversals of credit losses in situations where the estimate of credit losses declines through current period net income (Realized gains (losses)).

The Company adopted the standard using the prospective transition approach for available-for-sale fixed maturities for which other-than-temporary impairment had been recognized prior to January 1, 2020. As a result, the amortized cost basis and the effective interest rate remain unchanged after the adoption of ASU 2016-13. Amortized cost will now be reflected as "amortized cost, net of allowance for credit losses" or "amortized cost, net." The Company has not elected the fair value option for any financial assets recorded at amortized cost that would be in scope of this standard.

Investments, Available-For-Sale Fixed Maturities: Globe Life classifies all of its fixed maturity investments as available for sale. Investments classified as available for sale are carried at fair value with unrealized gains and losses, net of taxes reflected directly in Accumulated other comprehensive income ("AOCI").

Income from investments is recorded in net investment income on the Consolidated Statements of Operations. Gains and losses from sales, maturities, or other redemptions of investments are recorded in Realized gains (losses). Interest income and prepayment fees are recognized when earned. Premiums and discounts are amortized using the interest method. When amortized cost of a callable debt security exceeds the first call price, the premium is amortized to the earliest call date. Otherwise, the period of amortization or accretion generally extends from the purchase date to the maturity date.

Accrued investment income consists of interest income or dividends earned on the investment portfolio, but which are yet to be received as of the balance sheet date. The Company will write-off accrued investment income that is deemed to be uncollectible related to the fixed maturities. As a practical expedient, the Company excludes the accrued investment income from the amortized cost basis of the fixed maturity and separately reports it in another financial statement line item, Accrued Investment Income. Additionally, the amount will be excluded from disclosures within Note 4.

Investments, Allowance For Credit Losses For Available-For-Sale Fixed Maturities: At the onset of the evaluation, the Company individually assesses each fixed maturity to determine whether it intends to sell, or it is more likely than not that it will be required to sell the security before recovery of its amortized cost basis. If either of the criteria are met, the Company will write down the fixed maturity's amortized cost basis to fair value through Realized gains (losses).

If neither of the aforementioned criteria are met, the Company will evaluate whether the decline in fair value has resulted from a credit event. The Company will evaluate many factors, as further described below, to determine the present value of the expected cash flows. A credit loss occurs when the present value of the expected cash flows is less than the amortized cost basis. This will result in the recording of an allowance for credit losses as a contra asset account to the amortized cost basis with an offsetting provision for credit losses in Realized gains (losses) on the Condensed Consolidated Statement of Operations. Additionally, the CECL methodology includes a fair value floor where the allowance for credit loss for a security cannot exceed the difference between fair value and amortized cost. When it is determined that there is not a credit loss, the decline in fair value is recognized in Other comprehensive income.

All changes in the allowance for credit losses are recorded as provision for (or reversal of) credit loss expense. Losses recorded to the allowance for credit losses are management's best estimate of the uncollectibility of principal and interest of a fixed maturity.

Globe Life Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

(Dollar amounts in thousands, except per share data)

The evaluation of Globe Life's securities for credit losses is a process that is undertaken at least quarterly and is overseen by a team of investment and accounting professionals. The process for making this determination is highly subjective and involves the careful consideration of many factors. The factors considered include, but are not limited to:

•The Company’s ability and intent to hold the security until anticipated recovery

•The reason(s) for the impairment

•The financial condition of the issuer and the prospects for recovery in fair value of the security

•Expected future cash flows

The relative weight given to each of these factors can change over time as facts and circumstances change. In many cases, management believes it is appropriate to give more consideration to prospective factors than to retrospective factors. Prospective factors that are given more weight include prospects for recovery, the Company’s ability and intent to hold the security until anticipated recovery, and expected future cash flows.

Among the facts and information considered in the process are:

•Financial statements of the issuer

•Changes in credit ratings of the issuer

•The value of underlying collateral

•News and information included in press releases issued by the issuer

•News and information reported in the media concerning the issuer

•News and information published by or otherwise provided by securities, economic, or research analysts

•The nature and amount of recent and expected future sources and uses of cash

•Default on a required payment

•Issuer bankruptcy filings

The expected cash flows are determined using judgment and the best information available to the Company. Inputs used to derive expected cash flows generally include expected default rates, current levels of subordination, and estimated recovery rate. The discount rate utilized in the discounted cash flows is the effective interest rate, which is the rate of return implicit in the asset at acquisition.

Investments, Commercial Mortgage Loan Participations (Commercial Mortgage Loans): Commercial mortgage loans, a type of investment where the commercial mortgage loan is shared among investors, are accounted for as financing receivables. The commercial mortgage loans are managed by a third-party. The Company purchased the legal rights to interests in commercial mortgage loans that are secured by properties such as hotels, retail, multiple family, or offices. The commercial mortgage loans typically have a term of three years with an option to extend up to two years.

The commercial mortgage loans are recorded at unpaid principal balance, net of unamortized origination fees and net of allowance for loan losses. Interest income, net of the amortization of origination fees, is recorded in Net investment income under the effective yield method. Accrued investment income on the Condensed Consolidated Balance Sheets consists of interest income earned on the commercial mortgage loan portfolio, but are yet to be received as of the balance sheet date. Accrued investment income that is deemed to be uncollectible will be written off. As a practical expedient, the Company excludes the accrued investment income from the amortized cost basis of the commercial mortgage loans and separately reports it in another financial statement line item, Accrued investment income. Additionally, the amount will be excluded from disclosures within Note 4. As of March 31, 2020, the accrued interest receivable for commercial mortgage loans was $454 thousand. Commercial mortgage loans generally pay interest monthly, therefore accrued interest is typically for a period of 30 days or less. The unfunded commitment balance was $87 million as of March 31, 2020.

The Company evaluates the performance and credit quality of the commercial mortgage loan portfolio at least on a quarterly basis, or as needed, by utilizing common metrics such as loan-to-value and debt service coverage ratios

Globe Life Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

(Dollar amounts in thousands, except per share data)