Maryland | | | 7373 | | | 52-0880974 |

(State or other jurisdiction of incorporation or organization) | | | (Primary Standard Industrial Classification Code Number) | | | (I.R.S. Employer Identification Number) |

Christopher R. Johnson Scott R. Wilson Miles & Stockbridge P.C. 100 Light Street Baltimore, Maryland 21202 (410) 727-6464 | | | Jefferson V. Wright Executive Vice President and General Counsel 19866 Ashburn Road Ashburn, Virginia 20147 (703) 726-2704 | | | Jonathan H. Talcott Gary M. Brown E. Peter Strand Nelson Mullins Riley & Scarborough LLP 101 Constitution Avenue, NW Suite 900 Washington, D.C. 20001 (202) 689-2800 |

Large accelerated filer ☐ | | | Accelerated filer ☐ |

Non-accelerated filer ☒ | | | Smaller reporting company ☐ |

| | | Emerging growth company ☒ |

Title of Each Class of Securities to be Registered | | | Proposed Maximum Aggregate Offering Price(1)(2) | | | Amount of Registration Fee |

Common Stock, par value $0.001 per share | | | $241,500,000 | | | $26,348 |

(1) | Includes shares of Common Stock issuable upon the exercise of the underwriters’ option to purchase additional shares. See “Underwriting.” |

(2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) of the Securities Act of 1933, as amended. |

| | | Per Share | | | Total | |

Initial public offering price | | | $ | | | $ |

Underwriting discounts and commissions(1) | | | $ | | | $ |

Proceeds, before expenses, to us | | | $ | | | $ |

(1) | We refer you to the section titled “Underwriting” beginning on page 70 for additional information regarding underwriting compensation. |

B. Riley Securities | | | BMO Capital Markets | | | Needham & Company |

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | |

• | Cybersecurity – We help our customers ensure the ongoing security, integrity, and compliance of their on-premises and related cloud-based systems, reducing threats and vulnerabilities in order to foil cyber adversaries before they can attack. Our consultants assess our customers’ security environments and then design, engineer, and operate the systems they need to strengthen their cybersecurity posture. |

• | Cloud Security – The cloud as an organizational resource is more than two decades old, yet the needs of cloud users are constantly changing. We offer the specialized skills and experience needed to help our customers plan, engineer, and execute secure cloud migration strategies and then ensure ongoing management and security in keeping with the leading standards for cloud-based systems and workloads. |

• | Enterprise Security – Securing the enterprise means protecting the essential and timeless elements common to every organization: its people and processes, its supply chain and inventories, its finances and facilities, and its information and communications. As ICT and operational technology (“OT”) have become part of the organizational make-up, we have offered solutions that ensure personnel can work securely and productively across and beyond the enterprise. |

• | Heavy dependence on information and operational technologies. Organizations are increasingly dependent on technology, including mobile and wireless applications, cloud-based resources, industrial internet of things (“IoT”), incident command system (“ICS”), supervisory control and data acquisition (“SCADA”), and others. |

• | Digital transformation and accelerating migration to the cloud. Enterprises and government agencies are accelerating the migration of applications, storage, and ICT/OT infrastructure to hosted and cloud environments. More organizations – including highly security-conscious agencies within the U.S. government and commercial entities – are gaining comfort and confidence in the cloud, taking advantage of the rapid application development, greater flexibility, and strategic agility that the cloud offers. |

• | Ability to work across and beyond the enterprise. Organizations are no longer defined by or confined by real estate, geography, or personnel rosters. Information and applications are now accessible in the cloud. Mobile devices free personnel to work wherever their mission takes them. Employees, contractors, and partners collaborate in the physical and digital domains, trusting that they can rely on the integrity and trustworthiness of their people and their systems. |

• | Turbulent technology environment due to COVID-19. The COVID-19 pandemic has accelerated the growth of the remote workforce and thus, cyber risk. Existing technologies for mobility are being stretched to the limit, and enterprises are facing dramatic growth in cyber-attack risk as a result of personnel and systems that are still adjusting to an increasing number of workers accessing systems remotely. Ransomware, phishing attempts, and inadequate virtual private networks (“VPNs”) all contribute to a significant increase in threats and vulnerabilities. |

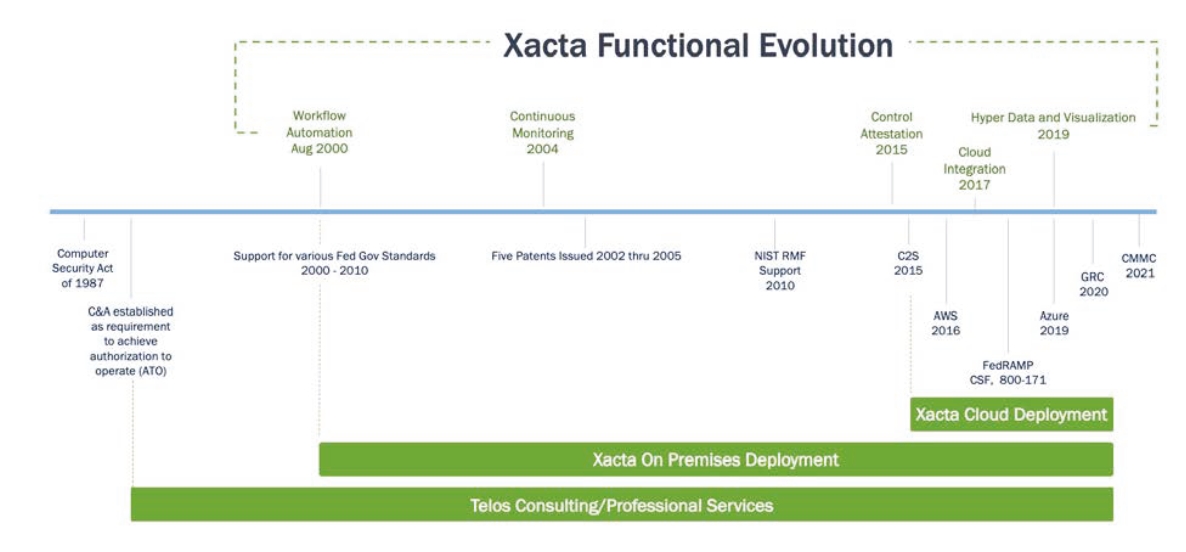

• | Information Assurance / Xacta: a premier platform for enterprise cyber risk management and security compliance automation, delivering security awareness for systems in the cloud, on-premises, and in hybrid and multi-cloud environments. Xacta delivers automated cyber risk and compliance management solutions to large commercial and government enterprises. Across the U.S. federal government, Xacta is the de facto commercial cyber risk and compliance management solution. |

• | Secure Communications: |

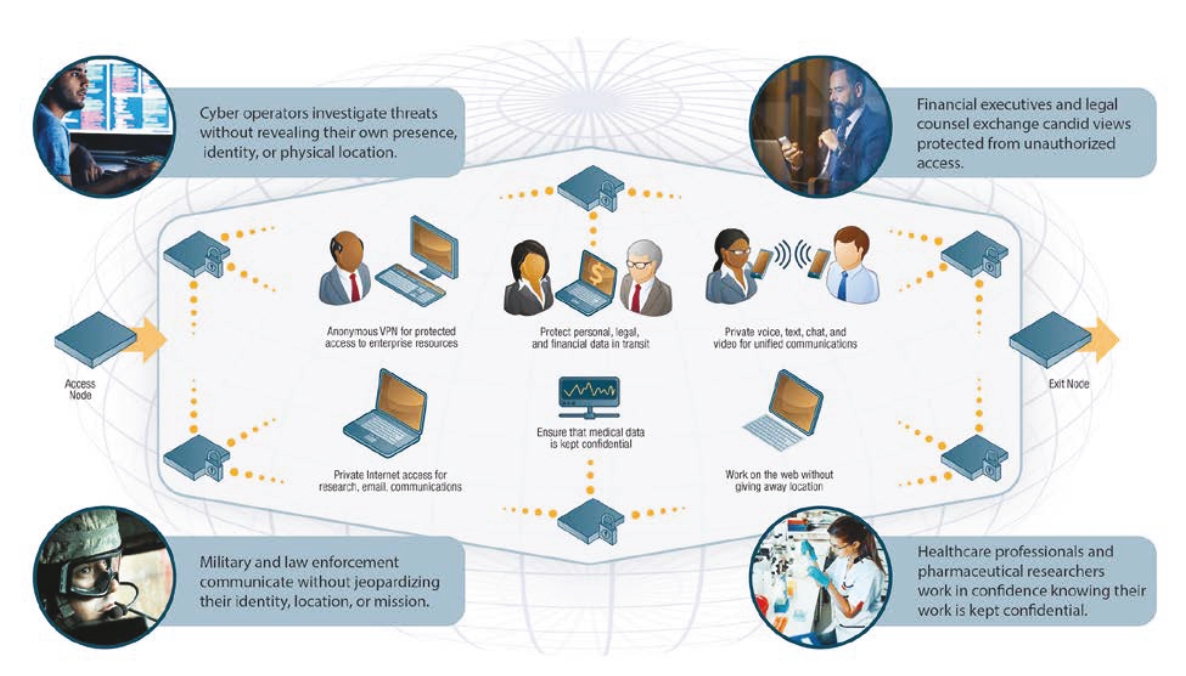

○ | Telos Ghost: a virtual obfuscation network-as-a-service with encryption and managed attribution capabilities to ensure the safety and privacy of people, information, and resources on the network. Telos Ghost seeks to eliminate cyber-attack surfaces by obfuscating and encrypting data, masking user identity and location, and hiding network resources. It provides the additional layers of security and privacy needed for intelligence gathering, cyber threat protection, securing critical infrastructure, and protecting communications and applications when operations, property, and even lives can be jeopardized by a single error in security. |

○ | Telos Automated Message Handling System (“AMHS”): web-based organizational message distribution and management for mission-critical communications; the recognized gold standard for organizational messaging in the U.S. government. Telos AMHS is used by military field operatives for critical communications on the battlefield and is the only web-based solution for assured messaging and directory services using the Defense Information System Agency’s (“DISA”) Organizational Messaging Service and its specialized communications protocols. |

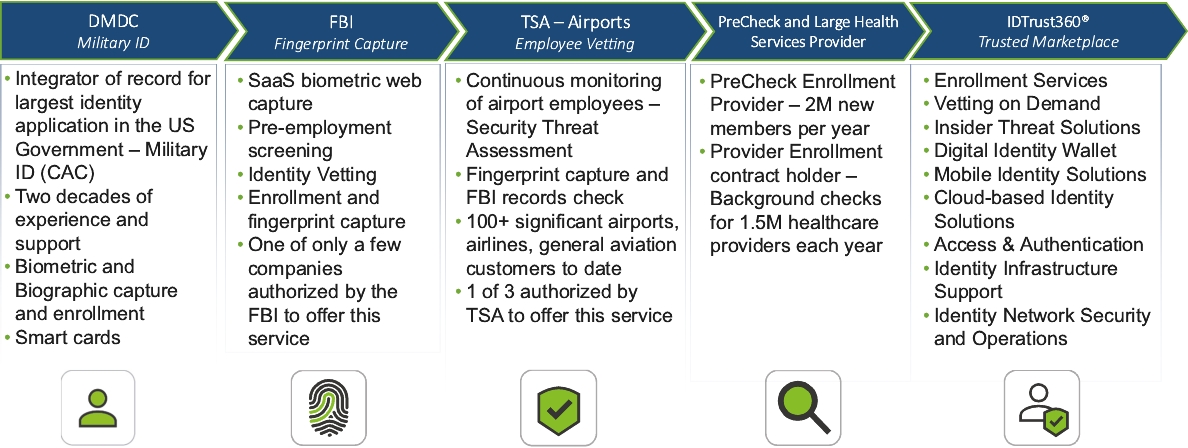

• | Telos ID: offering Identity Trust and Digital Services through IDTrust360® – an enterprise-class digital identity risk platform for extending software-as-a-service (“SaaS”) and custom digital identity services that mitigate threats through the integration of advanced technologies that fuse biometrics, credentials, and other identity-centric data used to continuously monitor trust. We maintain government certifications and designations that distinguish Telos ID, including TSA PreCheck™ enrollment provider, Designated Aviation Channeling provider, FBI-approved Channeler, and the Financial Industry Regulatory Authority (“FINRA”) Electronic Fingerprint Submission provider. We are the only commercial entity in our industry designated as a Secure Flight Services provider for terrorist watchlist checks. |

• | Secure Mobility: solutions for business and government that enable remote work and minimize concern across and beyond the enterprise. Our secure mobility team brings credentials to every engagement, supplying deep expertise and experience as well as highly desirable clearances and industry recognized certifications for network engineering, mobility, and security. |

• | Network Management and Defense: services for operating, administrating, and defending complex enterprise networks and defensive cyber operations. Our diverse portfolio of capabilities addresses common and uncommon requirements in many industries and disciplines, ranging from the military and government agencies to Fortune 500 companies. |

• | Leading cybersecurity company with a long history of providing security solutions to the most sophisticated security customers. We have been providing secure solutions, specializing in the area of cybersecurity, since 1995. Our customers include some of the most security-conscious organizations in the world, including the IC. For example, we believe that our award-winning Xacta offering is the dominant commercial risk management solution in the federal government space and is increasingly being adopted in the commercial sphere, notably by leading cloud providers such as Amazon Web Services, Inc. (“AWS”) and Microsoft Azure. Additionally, Telos Ghost gives organizations and individuals the ability to hide in plain sight, eliminating attack vectors from hackers through obfuscation and mis-attribution. And, we believe our Telos ID identity offerings are market disruptors, which present large opportunities for growth. |

• | Superior secure solutions and capabilities. Our solutions are designed for both government and commercial industries and are configured to operate in highly sensitive, highly classified environments, serving some of the most demanding, security-conscious organizations in the world. Our solutions are flexible, and can be deployed in various ways, including on premises, in the cloud, or in hybrid or multi-cloud environments. |

• | Proven ability to win and retain large contracts and enterprise-level deals, providing clear visibility into future revenue and profitability. We have over 20 active acquisition contracts and vehicles and thousands of active contracts and purchase orders. These contracts and vehicles present a solid platform for growth. For example, we have provided IT security support to the Defense Manpower Data Center (“DMDC”) under a variety of contract vehicles since 1995 and this program accounts for annual revenue at a historical average of approximately $28 million over the last five years. We also have proven our ability to deploy our security solutions at the enterprise level for both federal and commercial organizations. These long-term contract relationships provide predictable, recurring revenue at attractive margins. |

• | Our substantial investments into technology and automation can be expanded beyond our core market. Our solutions are built to help our customers be more secure, more efficient, and more effective. We have made investments across the company to take advantage of efficiencies and automation through scalable security solutions that are market driven and market proven. In contrast to traditional cybersecurity businesses with a focus on government customers, we own the intellectual property developed through our R&D initiatives and can deploy our technology solutions across our entire public and private sector customer set. The ability to offer our solutions beyond the U.S. federal government sphere is a key enabler of our strategy to grow and expand our relationships with commercial customers. |

• | Strong relationships with our customers. We are a customer-centric organization and pride ourselves on our close customer relationships. We have longstanding relationships with DoD, civilian agencies of the federal government, and the IC that date back more than two decades. Since 1995, our security solutions have been adopted by many defense, intelligence, civilian agency, and commercial customers, and we believe that the Telos brand has become synonymous with trust. Because of the quality of our relationships, we believe we are well-positioned for continued growth, as well as new and follow on contract opportunities. |

• | Respected, experienced management team. Our executive officers have an average tenure at Telos of approximately 21 years. The team is comprised of personnel with extensive military, federal government, and commercial backgrounds who are directly familiar with customer needs. Our management team also includes senior professionals who are experienced in developing commercial software solutions and leading technical teams throughout the development process. |

• | COVID-resistant business. We support mission critical operations. Because of this and the growth of remote workforces as a result of the COVID-19 pandemic, we believe, based upon our 2020 financial performance to date, that our business is relatively COVID resistant. Additionally, the automation provided by our solutions can help customers do more with less as they are forced to downsize their staffs because of the pandemic. Automation is now even more critical to efficiently manage a business, including with respect to cyber risk and regulatory compliance, which should result in additional demand for our security solutions. |

• | Leverage our diverse security solutions to expand our presence in commercial markets. Our offerings are designed to have broad application and include security risk and compliance, secure messaging, identity vetting, and managed attribution and obfuscation. We believe that we are well-positioned to sell our capabilities into a dynamic and growing commercial opportunity set and to innovate to address emerging and unique requirements. For example, we have leveraged core Xacta functionality to meet the needs of large financial services and customer relationship management (“CRM”) firms. We have also leveraged our U.S. federal government identity management qualifications to improve the speed and accuracy of vetting results for nearly 100 airports, air carriers, and general aviation across the country. We intend to continue to innovate and are developing additional offerings for cloud, mobile, and IoT devices. |

• | Grow our revenue and expand margins by building robust sales channels. In recent years, we have formed an inside sales organization that serves as both the direct channel to a wider account universe and an effective and efficient training program to grow our field sales organization. We plan to expand our partner program to include a variety of channels, including resellers, integrators, and contract partners to help us more quickly gain access to new markets, particularly commercial and international. For example, both Telos Ghost and Xacta are now available through various AWS and Microsoft Azure marketplaces, serving regions around the world and markets requiring varying levels of security. We plan to deploy a portion of the proceeds from this offering to grow our direct sales team and to accelerate the expansion of these channel partner initiatives, which we anticipate will drive revenue growth and material gross margin expansion. |

• | Target and replace inefficient legacy products. Recognizing the limitations of their legacy systems, organizations are replacing existing systems and processes with our solutions. For example, Telos AMHS is a web-centric system that replaced legacy capabilities like communications centers for the purpose of executing operational orders (through organizational messaging) across the U.S. federal government and around the world. Xacta has disrupted the cyber risk and compliance management business across the U.S. federal government, replacing manual activity with automation and delivering that automation to meet our customer’s needs flexibly on premises, in hybrid environments, in the cloud, and across multi-cloud infrastructures. |

• | Broaden reach within the U.S. federal government. We have historically focused on the U.S. federal government and believe that we are an established leader in providing security solutions to federal agencies, including DoD and the IC. Nonetheless, we believe the U.S. federal government represents a significant growth opportunity, and we expect to continue to invest in products to serve additional customers in this vertical. As an illustration, Xacta is included on the DHS Continuous Diagnostics and Mitigation (“CDM”) Approved Products List to provide federal agencies with innovative security tools, which we believe presents us with an excellent opportunity to pursue contracts with additional federal agencies. In addition, our platform is available for use in the AWS GovCloud (US) and Azure Government. |

• | Expand our international footprint. We are expanding our international operations and intend to invest globally to broaden our international footprint. We are currently working with countries such as Canada, Singapore, Australia, and Bahrain to offer Xacta to address cyber risk and compliance management capabilities. We are also working to expand AMHS to all North Atlantic Treaty Organization (“NATO”) countries and to offer Telos Ghost internationally. We intend to grow our international customer base by increasing our investments in overseas operations, establishing channel partners, and adding personnel in Europe, the Middle East, and Asia-Pacific. |

• | Pursue strategic acquisition opportunities. We believe that our markets remain fragmented, with many niche players providing limited product solutions targeting narrow customer segments. Given the breadth of our solution set and our customer end markets, we believe that we are well-positioned to opportunistically acquire smaller companies and incorporate their technology or deploy their solutions across a larger customer set. We believe that a targeted and opportunistic acquisition strategy will complement our significant organic growth opportunity. |

• | We are subject to the seasonality of U.S. government purchasing. |

• | We depend on computing infrastructure operated by AWS, Microsoft, and other third parties to support some of our solutions and customers, and any errors, disruption, performance problems, or failure in their or our operational infrastructure could adversely affect our business, financial condition, and results of operations. |

• | We depend on the U.S. government for a significant portion of our sales and a significant decline in U.S. government defense and intelligence community spending, or a reallocation of spending to other priorities, could have a material impact on our financial condition and results of operations. |

• | We will face risks associated with the growth of our business in new commercial markets, with new customer verticals and through channel partner relationships, and we may neither be able to continue our organic growth nor have the necessary resources to dedicate to the overall growth of our business. |

• | Our U.S. government contracts are subject to competitive bidding, lack of funding, fixed-price structures, the performance of third-party contractors, lengthy sales and implementation cycles, and the availability of termination for convenience provisions. |

• | Our business is subject to complex and evolving U.S. and non-U.S. laws and regulations regarding privacy, data protection and security, technology protection, and other matters. Many of these laws and regulations are subject to change and uncertain interpretation, and could result in claims, changes to our business practices, monetary penalties, increased cost of operations, or otherwise harm our business. |

• | Real or perceived errors, failures, defects or bugs in our solutions could adversely affect our results of operations and growth prospects. |

• | COVID-19 may adversely affect our future operations, financial condition and our ability to execute on business or contract opportunities, including the TSA PreCheckTM enrollment program. |

• | There has been no prior market for our common stock, the market price for our common stock may be volatile or may decline regardless of our operating performance, an active public trading market may not develop or be sustained following this offering, and you may not be able to resell our common stock at or above the initial public offering price. |

• | We are an “emerging growth company” and that status may make our common stock less attractive to investors. |

• | Our quarterly operating results fluctuate and may fall short of prior periods, our projections or the expectations of securities analysts or investors, which could materially adversely affect our stock price. |

• | You will incur immediate dilution in the net tangible book value of the shares you purchase in this offering. |

• | The issuance of additional shares of our common stock in connection with financings, acquisitions, investments, our share incentive plans or otherwise will dilute all existing stockholders. |

• | We have broad discretion to determine how to use the funds raised in this offering, and we may use them in ways that may not enhance our operating results or the price of our common stock. |

• | Our directors, executive officers and principal stockholders and their respective affiliates will continue to have substantial influence over us after this offering and could delay or prevent a change in corporate control. Our principal stockholders may have interests that conflict with your interests as an investor in our common stock. |

• | Future sales, or the perception of future sales, by us or our existing stockholders in the public market following this offering could cause the market price for our common stock to decline. |

• | Provisions in our organizational documents and agreements with third parties could delay or prevent a change of control. |

• | Our board of directors will be authorized to issue and designate shares of our preferred stock in additional series without stockholder approval. |

• | we are not required to engage an auditor attestation to report on our internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002; |

• | we are not required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board, or the PCAOB, regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and financial statements (i.e., an auditor discussion and analysis) and compliance with new or revised accounting standards until they are made applicable to us; and |

• | we are not required to comply with certain disclosure requirements related to executive compensation, such as the requirement to disclose the correlation between executive compensation and performance and the requirement to present a comparison of our Chief Executive Officer’s compensation to our median employee compensation. |

• | gives effect to the consummation of this offering; |

• | gives effect to a [•]-for-1 stock split with respect to our common stock, which will occur prior to the effective date of the registration statement of which this prospectus is a part; |

• | excludes [•] shares of common stock reserved for issuance under our 2016 Omnibus Long-Term Incentive Plan (“2016 Plan”); and |

• | assumes no exercise by the underwriters of their overallotment option. |

| | | Year Ended December 31, | | | Six Months Ended June 30, (Unaudited) | ||||||||||

| | | 2017 | | | 2018 | | | 2019 | | | 2019 | | | 2020 | |

| | | (in thousands, except per share data) | |||||||||||||

Consolidated Statement of Operations Data: | | | | | | | | | | | |||||

Revenue | | | $107,727 | | | $138,016 | | | $159,218 | | | $67,214 | | | $87,589 |

Cost of sales | | | 67,161 | | | 84,954 | | | 106,874 | | | 48,223 | | | 57,774 |

Gross profit | | | 40,566 | | | 53,062 | | | 52,344 | | | 18,991 | | | 29,815 |

Selling, general and administrative expenses | | | 40,152 | | | 44,048 | | | 47,319 | | | 20,795 | | | 24,346 |

Operating income (loss) | | | 414 | | | 9,014 | | | 5,025 | | | (1,804) | | | 5,469 |

Other income | | | 11 | | | 12 | | | 201 | | | 193 | | | 12 |

Interest expense | | | (6,690) | | | (7,258) | | | (7,467) | | | (3,500) | | | (4,013) |

Income (loss) before minority interest and income taxes | | | (6,265) | | | 1,768 | | | (2,241) | | | (5,111) | | | 1,468 |

Income tax benefit (provision) | | | 2,767 | | | (31) | | | 104 | | | 177 | | | 144 |

Net income (loss) | | | $(3,498) | | | $1,737 | | | $(2,137) | | | $(4,934) | | | $1,612 |

Less: Income attributable to non-controlling interest | | | (2,335) | | | (3,377) | | | (4,264) | | | (220) | | | (3,590) |

Net income (loss) attributable to Telos | | | $(5,833) | | | $(1,640) | | | $(6,401) | | | $(5,154) | | | $(1,978) |

Per Share Data: | | | | | | | | | | | |||||

Net loss per share attributable to Telos, basic and diluted | | | $(0.13) | | | $(0.04) | | | $(0.13) | | | $(0.11) | | | $(0.04) |

Weighted-average shares of common stock outstanding, basic and diluted | | | 45,079 | | | 46,323 | | | 47,542 | | | 47,102 | | | 48,297 |

Pro forma net loss per share, basic and diluted(1) | | | | | | | | | | | |||||

Pro forma weighted-average shares of common stock outstanding, basic and diluted | | | | | | | | | | | |||||

Other Financial Data (Unaudited): | | | | | | | | | | | |||||

Free Cash Flow(2) | | | $(2,820) | | | $2,154 | | | $5,284 | | | $2,229 | | | $(2,652) |

Adjusted EBITDA(3) | | | $139 | | | $8,677 | | | $5,934 | | | $510 | | | $4,625 |

Pro Forma net loss per share, basic and diluted, as adjusted(4) | | | | | | | | | | | |||||

(1) | See Note 1 to our consolidated financial statements appearing at the end of this prospectus for further details on the calculations of pro forma basic and diluted net income (loss) per share attributable to Telos. |

(2) | We define Free Cash Flow as net cash provided by operating activities less cash used for purchases of property and equipment and capitalized software development costs. A reconciliation to net cash provided by operating activities is set forth below. |

(3) | We define Adjusted EBITDA as net income (loss), adjusted for interest expense, loss on extinguishment of debt, (benefit) provision for income taxes, depreciation and amortization, stock-based compensation expense, acquisition related expense and other (income) expense, net. A reconciliation to net loss is set forth below. |

(4) | The pro forma basic and diluted net loss per share as adjusted has been computed in the following table to give effect to (a) net proceeds to us from this offering of $[•] from the sale of [•] shares of common stock, (b) $[•] paid, and [•] shares of common stock issued, to the holders of Exchangeable Redeemable Preferred Stock in connection with the ERPS Conversion, (c) $[•] paid, and [•] shares of common stock issued, to Hoya in connection with the Telos ID Purchase, and (d) approximately $[•] for the repayment of outstanding senior and subordinated debt. |

Net loss attributable to Telos | | | |

Pro forma adjustment to remove the dividends from preferred stock recorded as interest expense | | | |

Pro forma adjustment to remove the interest expense related to the offering proceeds used to repay debt(1) | | | |

Pro forma adjustment to reflect the payment of cash in connection with the Telos ID Purchase | | | |

Pro forma net loss as adjusted | | | |

Pro forma adjustment to give effect to the conversion of our outstanding Class A and Class B common shares into shares of common stock | | | |

Pro forma adjustment to reflect the issuance of common stock in connection with the ERPS Conversion(2) | | | |

Pro forma adjustment to reflect the payment of cash in connection with the ERPS Conversion | | | |

Pro forma adjustment to reflect the shares issued in connection with the Telos ID Purchase(3) | | | |

Pro forma weighted-average shares outstanding used in computing pro forma net loss per share, basic and diluted as adjusted | | | |

Pro forma net loss per share, basic and diluted as adjusted | | |

(1) | Computed by amortizing the unamortized discount over the period January 1, 2020 to June 30, 2020 using the effective interest method. |

(2) | Computed as the number of shares of common stock (valued at the initial offering price to the public) equal to the ERPS Liquidation Value, multiplied by 0.90, multiplied by 0.15. |

(3) | Computed as the number of shares of our common stock equal to [•] percent ([•]%) of the total estimated number of shares of common stock that are issued and outstanding following (i) the issuance of such shares of common stock to Hoya or its members and (ii) the closing of the offering described in this prospectus. |

| | | Year Ended December 31, | | | June 30, 2020 | | | Pro Forma June 30, 2020(1) | |||||||

| | | 2017 | | | 2018 | | | 2019 | | ||||||

| | | (in thousands) | |||||||||||||

Consolidated Balance Sheet Data: | | | | | | | | | | | |||||

Cash and cash equivalents | | | $600 | | | $72 | | | $6,751 | | | $2,405 | | | |

Working Capital(2) | | | (4,075) | | | 2,129 | | | 2,942 | | | (12,762) | | | |

Total Assets | | | 74,421 | | | 74,489 | | | 77,692 | | | 85,390 | | | |

Contract Liabilities (Deferred Revenue) | | | 10,073 | | | 5,232 | | | 6,337 | | | 6,682 | | | |

Senior term loan, net of unamortized discount and issuance costs, including current portion | | | 10,786 | | | 10,984 | | | 16,335 | | | 16,688 | | | |

Subordinated Debt | | | 2,289 | | | 2,597 | | | 2,927 | | | 3,102 | | | |

Total stockholders’ equity (deficit) | | | (136,037) | | | (132,103) | | | (136,662) | | | (136,009) | | | |

(1) | Gives effect to (a) net proceeds to us from this offering of $[•] from the sale of [•] shares of common stock, (b) $[•] paid, and [•] shares of common stock issued, to the holders of Exchangeable Redeemable Preferred Stock in connection with the ERPS Conversion, (c) $[•] paid, and [•] shares of common stock issued, to Hoya in connection with the Telos ID Purchase, and (d) approximately $[•] for the repayment of outstanding senior and subordinated debt. |

(2) | We define working capital as current assets less current liabilities. |

| | | Year Ended December 31, | | | Six Months Ended June 30, | ||||||||||

| | | 2017 | | | 2018 | | | 2019 | | | 2019 | | | 2020 | |

| | | (in thousands) | |||||||||||||

Net cash provided by (used in) operating activities | | | $(591) | | | $6,268 | | | $11,816 | | | $5,926 | | | $839 |

Less: | | | | | | | | | | | |||||

Purchases of property and equipment | | | (748) | | | (2,465) | | | (4,090) | | | (2,410) | | | (332) |

Capitalized software development costs | | | (1,481) | | | (1,649) | | | (2,442) | | | (1,287) | | | (3,159) |

Free Cash Flow | | | $(2,820) | | | $2,154 | | | $5,284 | | | $2,229 | | | $(2,652) |

Net cash used in investing activities | | | $(2,229) | | | $(4,114) | | | $(6,532) | | | $(3,697) | | | $(3,491) |

Net cash provided by (used in) financing activities | | | $2,761 | | | $(2,682) | | | $1,395 | | | $(1,525) | | | $(1,694) |

Cash paid for interest | | | $(2,395) | | | $(2,483) | | | $(3,299) | | | $(1,428) | | | $(1,474) |

| | | Year Ended December 31, | | | Six Months Ended June 30, | ||||||||||

| | | 2017 | | | 2018 | | | 2019 | | | 2019 | | | 2020 | |

| | | (in thousands) | |||||||||||||

Net income (loss) attributable to Telos Corporation | | | $(5,833) | | | $(1,640) | | | $(6,401) | | | $(5,154) | | | $(1,978) |

Interest expense | | | 6,690 | | | 7,258 | | | 7,467 | | | 3,500 | | | 4,013 |

(Benefit) provision for income taxes | | | (2,767) | | | 31 | | | (104) | | | (177) | | | (144) |

Depreciation and amortization | | | 1,999 | | | 3,028 | | | 4,972 | | | 2,341 | | | 2,734 |

Stock-based compensation expense | | | 50 | | | — | | | — | | | — | | | — |

Adjusted EBITDA | | | $139 | | | $8,677 | | | $5,934 | | | $510 | | | $4,625 |

• | competition in our industry and our ability to compete effectively; |

• | our ability to keep pace with rapid developments and changes in our industry and provide new products and services; |

• | liability and reputation damage from unauthorized disclosure, destruction or modification of data or disruption of our services; |

• | technical, operational and regulatory risks related to our information technology systems and third-party providers’ systems; |

• | reliance on third parties for significant services; |

• | our ability to successfully identify potential acquisition targets, and to complete and effectively integrate those acquisitions into our services; |

• | potential degradation of the quality of our products, services and support; |

• | our ability to retain clients; |

• | our ability to successfully manage our intellectual property; |

• | our ability to attract, recruit, retain and develop key personnel and qualified employees; |

• | risks related to laws, regulations and industry standards; |

• | our indebtedness and potential increases in our indebtedness; |

• | operating and financial restrictions imposed by the terms of our indebtedness; and |

• | the other factors described in “Risk Factors.” |

• | delaying, deferring or preventing a change in corporate control; |

• | impeding a merger, consolidation, takeover or other business combination involving us; or |

• | discouraging a potential acquirer from making a tender offer or otherwise attempting to obtain control of us. |

• | the seasonality of U.S. government purchasing; |

• | our dependence on the U.S. government for a significant portion of our sales and related negative effects associated with a change in U.S. government spending; |

• | our dependence on various third parties and their infrastructure when providing our services and solutions; |

• | statements regarding our U.S. government contracts and their various bidding processes and sales and implementation cycles; |

• | statements regarding our compliance with various privacy regulations; |

• | risks associated with the growth of our business in new commercial markets and other channels; |

• | real or perceived errors, failures, defects or bugs in our solutions; |

• | the effect of COVID-19 on our future operations, financial condition and our ability to execute on business or contract opportunities, including the TSA PreCheck™ enrollment program; |

• | the lack of a historical or potential lack of development of a future public trading market for our common stock; |

• | our status as an emerging growth company and its related effects; |

• | the fluctuation of our quarterly results; |

• | immediate dilution of our common stock; |

• | future issuances of shares of our common stock; |

• | our plans related to the use of funds from the offering; |

• | conflicts of interests among our Board of Directors, executive officers and significant stockholders; |

• | future sales of our common stock on the public market; |

• | provisions in our organizational documents and agreements with third parties could delay or prevent a change of control; |

• | our Board of Directors’ ability to issue additional shares of our preferred stock without stockholder approval; and |

• | other factors set forth in this prospectus in “Risk Factors,” any amendments thereto, and in our other public filings that are incorporated by reference herein. |

• | on an actual basis; |

• | on a pro forma basis to reflect the ERPS Conversion upon the closing of this offering, the Telos ID Purchase, the conversion of our Class A and Class B common stock into common stock, and our [•]-for-1 reverse stock split; and |

• | on a pro forma as adjusted basis, to give further effect to the sale by us of [•] shares of common stock in this offering at an assumed initial public offering price of $[•] per share, the midpoint of the price range set forth on the cover page of this prospectus, after deducting underwriting discounts and commissions and estimated offering expenses payable by us, and the application of the net proceeds from this offering as described under “Use of Proceeds.” |

| | | As of June 30, 2020 | |||||||

| | | Actual (Unaudited) | | | Pro Forma | | | Pro Forma As Adjusted | |

| | | (in thousands) | |||||||

Cash and cash equivalents | | | $2,405 | | | | | ||

Senior term loan, net of unamortized discount and issuance costs | | | $16,688 | | | | | ||

Subordinated debt | | | $3,102 | | | | | ||

Public preferred stock | | | $141,121 | | | | | ||

Common stock | | | | | | | |||

Additional paid-in capital | | | $4,310 | | | | | ||

Accumulated other comprehensive income | | | $7 | | | | | ||

Accumulated deficit | | | $(147,508) | | | | | ||

Total Telos stockholders’ deficit | | | $(143,191) | | | | | ||

Non-controlling interest in subsidiary | | | $7,104 | | | | | ||

Total stockholders’ deficit | | | $(136,087) | | | | | ||

Total capitalization | | | $24,824 | | | | | ||

Assumed initial public offering price per share | | | | | $[•] | |

Pro forma net tangible book value per share as of June 30, 2020 | | | $[•] | | | |

Increase in pro forma net tangible book value per share attributable to new investors in this offering | | | [•] | | | |

Pro forma as adjusted net tangible book value per share after this offering | | | | | [•] | |

Dilution in net tangible book value per share to new investors in this offering | | | | | $[•] |

• | the total consideration paid to us by our existing shareholders and by new investors purchasing common stock in this offering, assuming an initial public offering price of $[•] per share, which is the midpoint of the price range set forth on the cover page of this prospectus, before deducting underwriting discounts and commissions and estimated offering expenses payable by us in connection with this offering; and |

• | the average price per share paid by existing shareholders and by new investors purchasing shares in this offering. |

| | | Shares Purchased | | | Total Consideration | | | Average Price | |||||||

| | | Number | | | Percent | | | Amount | | | Percent | | | Per Share | |

Existing shareholders | | | | | % | | | $ | | | % | | | $ | |

New investors | | | | | % | | | | | % | | | |||

Total | | | | | 100.0% | | | $ | | | 100.0% | | | $ | |

• | Cybersecurity – We help our customers ensure the ongoing security, integrity, and compliance of their on-premises and related cloud-based systems, reducing threats and vulnerabilities in order to foil cyber adversaries before they can attack. Our consultants assess our customers’ security environments and then design, engineer, and operate the systems they need to strengthen their cybersecurity posture. |

• | Cloud Security – The cloud as an organizational resource is more than two decades old, yet the needs of cloud users are constantly changing. We offer the specialized skills and experience needed to help our customers plan, engineer, and execute secure cloud migration strategies and then ensure ongoing management and security in keeping with the leading standards for cloud-based systems and workloads. |

• | Enterprise Security – Securing the enterprise means protecting the essential and timeless elements common to every organization: its people and processes, its supply chain and inventories, its finances and facilities, and its information and communications. As ICT and OT have become part of the organizational make-up, we have offered solutions that ensure personnel can work securely and productively across and beyond the enterprise. |

• | Heavy dependence on information and operational technologies. Organizations are increasingly dependent on technology, including mobile and wireless applications, cloud-based resources, industrial IoT, ICS, SCADA, and others. Data and applications are hosted on-premises, in the cloud, and in hybrid environments. Further, the growing integration of ICT with OT offers greater control over operational systems – but also expands the overall attack surface of the enterprise. |

• | Digital transformation and accelerating migration to the cloud. One of the most salient aspects of the current technology environment is the cloud. Enterprises and government agencies are accelerating the migration of applications, storage, and ICT/OT infrastructure to hosted and cloud environments. More organizations – including highly security-conscious agencies within the U.S. government and commercial entities – are gaining comfort and confidence in the cloud, taking advantage of the rapid application development, greater flexibility, and strategic agility that the cloud offers. |

• | Ability to work across and beyond the enterprise. Organizations are no longer defined by or confined by real estate, geography, or personnel rosters. Information and applications are now accessible in the cloud. Mobile devices free personnel to work wherever their mission takes them. Employees, contractors, and partners collaborate in the physical and digital domains, trusting that they can rely on the integrity and trustworthiness of their people and their systems. |

• | Turbulent technology environment due to COVID-19. The COVID-19 pandemic has accelerated the growth of the remote workforce and, thus, cyber risk. The pandemic has upended nearly every organization’s established way of working. Existing technologies for mobility are being stretched to the limit, and enterprises are facing dramatic growth in cyber-attack risk as a result of personnel and systems that are still adjusting to an increasing number of workers accessing systems remotely. Ransomware, phishing attempts, and inadequate VPNs all contribute to a significant increase in threats and vulnerabilities. |

• | Information Assurance / Xacta: a premier platform for enterprise cyber risk management and security compliance automation, delivering security awareness for systems in the cloud, on-premises, in hybrid and multi-cloud environments. |

• | Secure Communications: |

○ | Telos Ghost: a virtual obfuscation network-as-a-service with encryption and managed attribution capabilities to ensure the safety and privacy of people, information, and resources on the network. |

○ | Telos Automated Message Handling System (“AMHS”): web-based organizational message distribution and management for mission-critical communications; the recognized gold standard for organizational messaging in the U.S. government. |

• | Telos ID: offering Identity Trust and Digital Services through IDTrust360® – an enterprise-class digital identity risk platform for extending SaaS and custom digital identity services that mitigate threats through the integration of advanced technologies that fuse biometrics, credentials, and other identity-centric data used to continuously monitor trust. |

• | Secure Mobility: solutions for business and government that enable remote work and minimize concern across and beyond the enterprise. |

• | Network Management and Defense: services for operating, administrating, and defending complex enterprise networks and defensive cyber operations. |

• | Automated asset inventory – helps quickly define IT boundary/parameters and establish audit/test plans. |

• | Automated control validation – reduces manual test efforts. |

• | Automated continuous control monitoring – offers ongoing assurance of compliance. |

• | Vulnerability management functionality – understand vulnerabilities that apply to IT environments. |

• | Remediation management – workflow to help organizations prioritize risk, establish remediation plans, and track remediation progress to closure. |

• | Automated regulatory report generation – reduces manual effort needed to create regulatory reports (bi-product of the workflow process). |

• | Cloud integration – allows Xacta to manage cloud-based resources (multi-cloud environments) as well as on-premises assets. |

• | Cloud deployment – allows Xacta to be deployed as a SaaS, Amazon Machine Image, Virtual Machine Image (“VMI”), as well as on-premises. |

• | Intelligent workflow – Artificial Intelligence (“AI”)-like functionality reduces the need for manual intervention. |

• | Predictive control mapping – AI-like functionality helps reduce redundant control testing and manual control mapping effort to help address audit fatigue. |

• | Automated control inheritance – allows organizations to share common compliance information – cloud providers share common controls with customers as per the shared responsibility model of cloud security – which greatly reduces manual effort and enables rapid cloud adoption. |

• | Visualization and reporting – reduces dependency on third-party business intelligence products. |

• | End-to-end workflow capabilities – support for complex system authorization processes like FedRAMP and the NIST Risk Management Framework, dramatically reducing time, cost, and effort. |

• | Evidence of security posture compliance – designed to provide the body of evidence needed for regulatory or legal proceedings and insurance claims to verify security posture compliance with industry best practices at the time of an event. |

• | obscures and varies network pathways to prevent adversaries from tracking users and information. |

• | uses multiple layers of encryption to protect information and remove source and destination IP addresses, eliminating network paths back to the source. |

• | enables users to manage their technical and non-technical persona to disguise their identity and location. |

• | hides critical network resources using cloaked capabilities for email, storage, unified communications, and other applications. |

• | Private Web Access: Secure anonymous Internet access. Telos Ghost disguises the identity and location of personnel when using the public web for cyber threat intelligence and competitive research. It provides users with dynamic access for every session and assures that traffic securely traverses the virtual private lines of Telos Ghost. Scalable and flexible, Telos Ghost Private Web Access feature allows users multiple points of international or domestic egress to the public internet based on customer requirements. Traffic mixing and misdirection techniques are designed to ensure that activity remains anonymous, obscure and private. |

• | Private Network Access: Leased-line security with VPN flexibility. This capability is designed to allow authorized users to work with mission-critical enterprise information without being seen or discovered. It enables the establishment of sustainable cybersecurity infrastructure, providing multi-layered secure tunnels for data traffic and obscuring the correlation between the entry doorways and the client cloud from external observers. Software and system agnostic and accessible from nearly any device and location, the Telos Ghost Private Network Access feature is designed to provide a full security solution while maintaining existing encryption and software services. |

• | Cloaked Services: Hidden unified mobile communications, storage, and applications. Telos Ghost also provides remote users with the ability to securely talk, text, email, store information, and use video and applications over nearly any mobile device. These abilities include fully encrypted geo-masked hidden mobile communications for device-agnostic voice, video, chat, and data; hidden storage to store, analyze, and collaborate privately and securely within Telos Ghost; and hidden email and applications that cloaks the servers for access only by Telos Ghost users. |

• | Cyber threat research. Telos Ghost provides members of a U.S. government organization with an isolated networking infrastructure that enables red team members to operate securely and privately without attracting unwanted attention. |

• | Open source intelligence. A U.S. government organization uses Telos Ghost to securely conduct open source cyber threat intelligence analysis. |

• | Supply chain security vulnerability assessment. A security company that vets the vulnerability of supply chains in the Defense Industrial Base uses Telos Ghost to inspect the digital connections of the supply chain online, safe from observation by adversaries that might otherwise evade discovery. |

• | Worldwide investigative and recovery services. A commercial firm uses Telos Ghost for cloaked online research and voice communications over mobile devices to enable secure, privatized communications as they track and recover property from nefarious actors. |

• | Provides anonymity of open-source VPN access with many additional security and privacy capabilities. |

• | Remotes and isolates users’ browser activity away from their desktops when operating on a Virtual Desktop Interface connected to Telos Ghost. |

• | Deceives potential cyber adversaries by allowing the user to select and change their point of presence, manage their attribution, and collect data on potential threats and targets. |

• | Enables organizations to quickly take down or destroy networks and rebuild them in a new location. |

• | Military command and control; |

• | Cross-border authorizations; |

• | Exchanges between military forces of sovereign nations; |

• | High-level policy, procedure, or directives; and |

• | Response to legal, sensitive, or personnel matters. |

• | U.S. Military ID. For more than 25 years, Telos ID’s identity trust services have provided access to health care, commissary services, and critical defense resources for more than 2,000,000 military members, their dependents, and civilian employees through use of the Common Access Card (“CAC”). We operate more than 250,000 components that comprise 7,000 end-user systems deployed around the world to nearly 2,000 military installations. We provide near real-time data collection support on personnel movement and location information for operating forces, government civil servants, and government contractors in specified operational theaters. This system has captured over 636,000,000 scans of government, U.S. military, and contractor personnel since its inception. Our logistics infrastructure provides responsive 24-hour delivery of components to our warfighters deployed across the globe, and we custom-build our identity, credentialing, and access management solutions to function effectively in austere environments that demand reliability and performance at all times. |

• | TSA Airport Employee Vetting. Historically, more than 300,000,000 airline passengers’ travel experiences have been handled by more than 1,500,000 aviation workers who are screened through Telos ID’s aviation channeling service. As one of only two authorized aviation channeling providers in the market, we offer our aviation partners innovative biometric, identity trust, and customer service technologies that are critical to the operation of more than half of the largest airports in the nation. We actively support nearly 100 commercial airports, airlines, and general aviation customers, and our Independent Secure Flight Vetting technology provides a secure vetting service for non-travelers who need to access secure areas of an airport. We were the first commercial company in the United States to implement the FBI’s Rap Back service, enabling our aviation partners to perform continuous monitoring for insider threat detection. |

• | U.S. Census Bureau Enumerator Screening. For the 2020 U.S. Census, we have processed more than 1,000,000 enumerators through our 1,100 identity service centers. Telos ID extends digital identity verification, fingerprinting, and photo services across the nation in support of 2020 Census hiring initiatives. We custom designed and deployed more than 1,300 desktop, kiosk, and mobile workstations that are operated by thousands of Census-cleared staff members. At the peak, Telos ID’s managed service supported more than 30,000 appointments per day, and our customer call center handled more than 35,000 daily calls at the peak. |

• | TSA PreCheck™ Enrollment Screening. Telos ID’s recent award of a 10-year contract to provide enrollment services in support of the TSA PreCheck™ Enrollment Program presents a large, high-profile opportunity for us, and we are preparing to launch services under this program in early 2021. The TSA PreCheck™ contract is an important example of a government-sponsored, consumer facing opportunity, in which we provide PreCheck™ enrollment services to individual, fee-paying applicants. Telos ID’s service will engage with the world’s leading airline, hospitality, credit card, ride share, and other Fortune 500 businesses to provide consumer marketing and loyalty program tie-ins to promote the PreCheck™ program. In addition, this program is expected to feature an omni-channel market approach that leverages advanced digital services to reach our customers across several market segments. |

• | CMS Healthcare Provider Screening. Telos ID was recently awarded a 10-year contract to provide technology and service solutions that detect, prevent, and proactively deter fraud, waste and abuse in the Medicare and Medicaid programs. Telos ID’s digital identity trust platform and digital services is expected to offer critical technology necessary to identify and mitigate fraud across the United States. Each year, approximately 1,500,000 health care providers are required to undergo FBI-based non-criminal history checks requiring identity trust services, including identity verification, fingerprinting, and continuous monitoring. |

• | Manage the security risks of doing business in a globally connected world. Our solutions help our customers identify threats in order to manage risks. Our solutions make our customers’ personnel and systems virtually invisible while working over the network, and help monitor user and event behavior inside the organization. |

• | Know that personnel can work securely no matter where their mission takes them. Mobile technology has freed personnel from the constraints of a physical workstation and empowered workers to perform their work virtually anywhere. However, it has also increased the threat surface and multiplied the risk of network breaches. Our solutions support mobile work over nearly any communications medium, while helping to ensure that data and information are safe. |

• | Trust the identity and integrity of the people who work for them and with them. Employees, contractors, and partner personnel turn over in today’s organizations with increasing fluidity. We provide the intelligence our customers need to protect their organizations from potential insider threats. |

• | Ensure that their own customers and partners feel safe doing business with them. Every new headline about a breach or data loss puts doubts in the minds of those who do business with today’s enterprises. We help our customers ease the concerns their own customers and partners might have about their security posture. |

• | Reduce their legal and financial exposure in today’s digital business environment. Should a security incident occur, our solutions and services are designed to provide the evidence needed for regulatory or legal proceedings and insurance claims that verify security posture compliance with industry best practices at the time of the event. |

• | Leading cybersecurity company with a long history of providing security solutions to the most sophisticated customers. We have been providing secure solutions, specializing in the area of cybersecurity, since 1995. Our customers include some of the most security-conscious organizations in the world, including the IC. For example, we believe that our award-winning Xacta offering is the dominant commercial risk management solution in the federal government space and is increasingly being adopted in the commercial sphere, notably by leading cloud providers such as AWS and Microsoft Azure. Additionally, Telos Ghost gives organizations and individuals the ability to hide in plain sight, eliminating attack vectors from hackers through obfuscation and mis-attribution. And, we believe our Telos ID identity offerings are market disruptors which present large opportunities for growth. |

• | Superior secure solutions and capabilities. Our solutions are designed for both government and commercial industries and are configured to operate in highly sensitive, highly classified environments, serving some of the most demanding, secure organizations in the world. Our solutions are flexible, and can be deployed in various ways, including on premises, in the cloud, or in hybrid or multi-cloud environments. |

• | Proven ability to win and retain large contracts and enterprise-level deals, providing clear visibility into future revenue and profitability. We have over 20 active acquisition contracts and vehicles, thousands of active contracts and purchase orders, and more than 350 customers in each of the last three years. These contracts, vehicles and customers present a solid platform for growth. As but one example, we have provided IT security support to the Defense Manpower Data Center (“DMDC”) under a variety of contract vehicles since 1995, and this program accounts for annual revenue at a |

• | Our substantial investments into technology and automation can be expanded beyond our core market. Our solutions are built to help our customers be more secure, more efficient, and more effective. We have made investments across the company to take advantage of efficiencies and automation through scalable security solutions that are market driven and market proven. In contrast to traditional cybersecurity businesses with a focus on government customers, we own the intellectual property developed through our R&D initiatives and can deploy our technology solutions across our entire public and private sector customer set. The ability to offer our solutions beyond the U.S. federal government sphere is a key enabler of our strategy to grow and expand our relationships with commercial customers. |

• | Strong relationships with our customers. We are a customer-centric organization and pride ourselves on our close customer relationships. We have longstanding relationships with DoD, civilian agencies of the federal government, and the IC that date back more than two decades. Since 1995, our security solutions have been adopted by many defense, intelligence, civilian agency, and commercial customers, and we believe that the Telos brand has become synonymous with trust. Because of the quality of our relationships, we believe we are well-positioned for accelerating growth, as well as new and follow on contract opportunities. |

• | Respected, experienced management team. Our executive officers have an average tenure at Telos of approximately 21 years. The team is comprised of personnel with extensive military, federal government, and commercial backgrounds who are directly familiar with customer needs. Our management team also includes senior professionals who are experienced in developing commercial software solutions and leading technical teams throughout the development process. |

• | COVID-resistant business. We support mission critical operations. Because of this and the growth of remote workforces as a result of the COVID-19 pandemic, we believe, based upon our 2020 financial performance to date, that our business is relatively COVID resistant. Additionally, the automation provided by our solutions can help customers do more with less as they are forced to downsize their staffs because of the pandemic. Automation is now even more critical to efficiently manage a business, including with respect to cyber risk and regulatory compliance, which should result in additional demand for our security solutions. |

• | Leverage our diverse security solutions to expand our presence in commercial markets. Our offerings are designed to have broad application and include security risk and compliance, secure messaging, identity vetting, and managed attribution and obfuscation. We believe that we are well-positioned to sell our capabilities into a dynamic and growing commercial opportunity set and to innovate to address emerging and unique requirements. For example, we have leveraged core Xacta functionality to meet the needs of large financial services and CRM firms. We have also leveraged our U.S. federal government identity management qualifications to improve the speed and accuracy of vetting results for nearly 100 airports, air carriers, and general aviation across the country. We intend to continue to innovate and are developing additional offerings for cloud, mobile, and IoT devices. |

• | Grow our revenue and expand margins by building robust sales channels. In recent years, we have formed an inside sales organization that serves as both the direct channel to a wider account universe and an effective and efficient training program to grow our field sales organization. We plan to expand our partner program to include a variety of channels, including resellers, integrators, and contract partners to help us more quickly gain access to new markets, particularly commercial and international. For example, both Telos Ghost and Xacta are now available through various AWS and Microsoft Azure |

• | Target and replace inefficient legacy products. Recognizing the limitations of their legacy systems, organizations are replacing existing systems and processes with our solutions. For example, Telos AMHS is a web-centric system that replaced legacy capabilities like communications centers for the purpose of executing operational orders (through organizational messaging) across the U.S. federal government and around the world. Xacta has disrupted the cyber risk and compliance management business across the U.S. federal government, replacing tedious manual activity with automation and delivering that automation to meet our customer’s needs flexibly on premises, in hybrid environments, in the cloud, and across multi-cloud infrastructures. |

• | Broaden reach within the U.S. federal government. We have historically focused on the U.S. federal government and believe that we are an established leader in providing security solutions to federal agencies, including DoD and the IC. Nonetheless, we believe the U.S. federal government represents a significant growth opportunity, and we expect to continue to invest in products to serve additional customers in this vertical. For example, Xacta is included on DHS’s CDM Approved Products List to provide federal agencies with innovative security tools, which we believe presents us with an excellent opportunity to pursue contracts with additional federal agencies. In addition, our platform is available for use in the AWS GovCloud (US) and Azure Government. |

• | Expand our international footprint. We are expanding our international operations and intend to invest globally to broaden our international footprint. We are currently working with countries such as Canada, Singapore, Australia, and Bahrain to offer Xacta to address cyber risk and compliance management capabilities. We are also working to expand AMHS to all NATO countries and to offer Telos Ghost internationally. We intend to grow our international customer base by increasing our investments in overseas operations, establishing channel partners, and adding personnel in Europe, the Middle East, and Asia-Pacific. |

• | Pursue strategic acquisition opportunities. We believe that our markets remain fragmented, with many niche players providing limited product solutions targeting narrow customer segments. Given the breadth of our solution set and our customer end markets, we believe that we are well-positioned to opportunistically acquire smaller companies and incorporate their technology or deploy their solutions across a larger customer set. We believe that a targeted and opportunistic acquisition strategy will complement our significant organic growth opportunity. |

• | Build trusted relationships, |

• | Work hard together, |

• | Design and deliver superior solutions, and |

• | Have fun doing it. |

Name | | | Age | | | Position(s) |

Executive Officers: | | | | | ||

John B. Wood | | | 57 | | | President, Chief Executive Officer, Director |

Michele Nakazawa | | | 63 | | | Executive Vice President, Chief Financial Officer |

Edward L. Williams | | | 60 | | | Executive Vice President, Chief Operating Officer |

Jefferson V. Wright | | | 65 | | | Executive Vice President, General Counsel |

Emmett J. Wood | | | 49 | | | Executive Vice President, Marketing & Strategy |

Brendan D. Malloy | | | 54 | | | Senior Vice President, General Manager, Information Assurance/Xacta |

Richard P. Tracy | | | 59 | | | Senior Vice President, Chief Security Officer |

Kenneth F. Fagan, Jr. | | | 66 | | | Vice President, Secure Communications |

Rinaldi Pisani | | | 51 | | | Senior Vice President, Sales & Alliance |

David S. Easley | | | 49 | | | Vice President, Finance and Controller |

Mark Griffin | | | 60 | | | President, General Manager, Telos ID |

| | | | | |||

Non-Employee Directors: | | | | | ||

Bernard C. Bailey | | | 67 | | | Director |

David Borland | | | 72 | | | Director |

Bonnie Carroll | | | 63 | | | Director |

Lieutenant General Bruce R. Harris (USA, Ret.) | | | 86 | | | Director |

Major General John W. Maluda (USAF, Ret.) | | | 66 | | | Director |

Robert J. Marino | | | 83 | | | Director |

| | | | | |||

Class D Directors(1) | | | | | ||

William H. Alderman | | | 57 | | | Director |

Andrew R. Siegel | | | 51 | | | Director |

(1) | Upon the completion of the offering described in this prospectus and the conversion of the Exchangeable Redeemable Preferred Stock into the right to receive shares of common stock and cash, William H. Alderman and Andrew R. Siegel will be automatically removed from the Board of Directors and from their positions as Class D Directors and the size of the Board of Directors will automatically decrease to seven. |

• | Providing counsel and advice as may be requested from time to time. |

• | Providing opinions to assist the Company in identifying and, in coordination with the Company’s management team, pursuing opportunities related to potential sales, technical issues, product development, marketing, strategic direction, and other matters. |

• | Keeping the Company updated of technological, competitive and other changes and developments pertinent to the business of the Company. |

• | Contributing to support the Company’s objectives. |

• | each person known by us to be the beneficial owner of 5% or more of our outstanding common stock; |

• | each of our directors; |

• | each of our named executive officers; and |

• | all of our directors and executive officers as a group. |

| | | Shares of Common Stock Beneficially Owned | | | Percentage of Shares Outstanding | ||||

| | | Before Offering | | | After Offering | ||||

5% or Greater Stockholders: | | | | | | | |||

Toxford Corporation Place de Saint Gervais 1 1211 Geneva, Switzerland | | | [•] (A) | | | [•]% | | | [•]% |

| | | | | | | ||||

Named Executive Officers and Directors: | | | | | | | |||

John B. Wood | | | [•](B) | | | [•]% | | | [•]% |

Edward L. Williams | | | [•](B) | | | [•]% | | | [•]% |

Michele Nakazawa | | | [•](B) | | | [•]% | | | [•]% |

Brendan D. Malloy | | | [•](B) | | | [•]% | | | [•]% |

Jefferson V. Wright | | | [•](B) | | | [•]% | | | [•]% |

Robert J. Marino | | | [•] | | | [•]% | | | [•]% |

Barnard C. Bailey | | | [•] | | | [•]% | | | [•]% |

David Borland | | | [•] | | | [•]% | | | [•]% |

Bonnie Carroll | | | [•] | | | [•]% | | | [•]% |

Bruce R. Harris | | | [•] | | | [•]% | | | [•]% |

John W. Maluda | | | [•] | | | [•]% | | | [•]% |

All executive officers and directors as a group (17 persons) | | | [•](C) | | | [•]% | | | [•]% |

(A) | Includes [•] shares held directly by Toxford Corporation and [•] shares held directly by Mr. John R.C. Porter, Chalet Ty Fano, 2 Chemin d’Amon, 1936 Verbier, Switzerland. Mr. Porter is the sole stockholder of Toxford Corporation. |

(B) | Includes [•],[•],[•],[•], and [•] shares of Common Stock held for the benefit of Messrs. John Wood, Malloy, Williams, and Wright and Ms. Nakazawa, respectively, by the Telos Corporation Shared Savings Plan. |

(C) | Includes [•] shares of Common Stock held for the benefit of the executive officers by the Telos Corporation Shared Savings Plan. |

• | 1% of the number of shares of our common stock then outstanding, which will equal approximately [•] shares immediately after this offering, assuming no exercise of the underwriters’ option to purchase additional shares; or |

• | the average weekly trading volume of our common stock during the four calendar weeks preceding the filing of a notice on Form 144 with respect to that sale, |

Underwriters | | | Number of Shares |

B. Riley Securities, Inc. | | | |

BMO Capital Markets Corp. | | | |

Needham & Company, LLC | | | |

Total | | |

• | the information set forth in this prospectus and otherwise available to the representative; |

• | our prospects and the history and prospects for the industry in which we compete; |

• | an assessment of our management; |

• | our prospects for future earnings; |

• | the general condition of the securities markets at the time of this offering; |

• | the recent market prices of, and demand for, publicly traded common stock of generally comparable companies; and |

• | other factors deemed relevant by the underwriters and us. |

| | | Per Share | | | Total Without Over- Allotment | | | With Over-Allotment | |

Underwriting discounts and commissions paid by us | | | $ | | | $ | | | $ |

Proceeds, before expenses, to us | | | $ | | | $ | | | $ |

• | Stabilizing transactions permit bids or purchases for the purpose of pegging, fixing or maintaining the price of the common stock, so long as stabilizing bids do not exceed a specified maximum. |

• | Over-allotment involves sales by the underwriters of securities in excess of the number of securities the underwriters are obligated to purchase, which creates a short position. The short position may be either a covered short position or a naked short position. In a covered short position, the number of shares of common stock over-allotted by the underwriters is not greater than the number of shares of common stock that they may purchase in the over-allotment option. In a naked short position, the number of shares of common stock involved is greater than the number of shares in the over-allotment option. The underwriters may close out any covered short position by either exercising their over-allotment option or purchasing shares of our common stock in the open market. |

• | Covering transactions involve the purchase of securities in the open market after the distribution has been completed in order to cover short positions. In determining the source of securities to close out the short position, the underwriters will consider, among other things, the price of securities available for purchase in the open market as compared to the price at which they may purchase securities through the over-allotment option. If the underwriters sell more shares of common stock than could be covered by the over-allotment option, creating a naked short position, the position can only be closed out by buying securities in the open market. A naked short position is more likely to be created if the underwriters are concerned that there could be downward pressure on the price of the securities in the open market after pricing that could adversely affect investors who purchase in this offering. |

• | Penalty bids permit the underwriters to reclaim a selling concession from a selected dealer when the securities originally sold by the selected dealer are purchased in a stabilizing or syndicate covering transaction. |

• | to any legal entity that is a qualified investor as defined in the Prospectus Regulation; |

• | to fewer than 150 natural or legal persons (other than qualified investors as defined in the Prospectus Regulation), subject to obtaining the prior consent of the relevant representative or representatives nominated by us for any such offer; or |

• | in any other circumstances falling within Article 1(4) of the Prospectus Regulation, |

• | our Annual Report on Form 10-K for the fiscal year ended December 31, 2019 (including information specifically incorporated by reference from our Definitive Proxy Statement on Schedule 14A filed with the SEC on April 20, 2020) (SEC File No. 001-08443) filed with the SEC on April 13, 2020; |

• | our Amendment No. 1 on Form 10-K/A for the fiscal year ended December 31, 2019 (SEC File No. 001-08443) filed with the SEC on May 12, 2020; |

• | our Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2020 (SEC File No. 001-08443) filed with the SEC on May 15, 2020; |

• | our Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2020 (SEC File No. 001-08443) filed with the SEC on August 13, 2020; |

• | our definitive proxy statement on Schedule 14A (SEC File No. 001-08443) filed with the SEC on April 20, 2020; |

• |

• | our Current Reports on Form 8-K dated March 30, 2020, May 13, 2020, September 20, 2020 and October 6, 2020 (filed with the SEC on March 30, 2020, May 15, 2020, September 24, 2020 and October 6, 2020, respectively). |

| | | Page | |

Financial Statements for the Years Ended December 31, 2019, and 2018 | | | |

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

Unaudited Interim Financial Statements for the Three and Six Months Ended June 30, 2020, and 2019 | | | |

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | |

| | | Years Ended December 31, | |||||||

| | 2019 | | | 2018 | | | 2017 | ||

Revenue (Note 5) | | | | | | | |||

Services | | | $143,581 | | | $120,990 | | | $81,606 |

Products | | | 15,637 | | | 17,026 | | | 26,121 |

| | | 159,218 | | | 138,016 | | | 107,727 | |

Costs and expenses | | | | | | | |||

Cost of sales – Services | | | 98,772 | | | 76,857 | | | 49,965 |

Cost of sales – Products | | | 8,102 | | | 8,097 | | | 17,196 |

| | | 106,874 | | | 84,954 | | | 67,161 | |

Selling, general and administrative expenses | | | 47,319 | | | 44,048 | | | 40,152 |

| | | | | | | ||||

Operating income | | | 5,025 | | | 9,014 | | | 414 |

Other income (expenses) | | | | | | | |||

Non-operating income | | | 201 | | | 12 | | | 11 |

Interest expense | | | (7,467) | | | (7,258) | | | (6,690) |

(Loss) income before income taxes | | | (2,241) | | | 1,768 | | | (6,265) |

Benefit (provision) for income taxes (Note 9) | | | 104 | | | (31) | | | 2,767 |

Net (loss) income | | | (2,137) | | | 1,737 | | | (3,498) |

Less: Net income attributable to non-controlling interest (Note 2) | | | (4,264) | | | (3,377) | | | (2,335) |

Net loss attributable to Telos Corporation | | | $(6,401) | | | $(1,640) | | | $(5,833) |

Net loss per share attributable to Telos Corporation, Common A, basic and diluted | | | $(0.13) | | | $(0.04) | | | $(0.13) |

Net loss per share attributable to Telos Corporation, Common B, basic and diluted | | | $(0.13) | | | $(0.04) | | | $(0.13) |

Weighted-average shares of Common A stock outstanding, basic and diluted | | | 43,504 | | | 42,285 | | | 41,041 |

Weighted-average shares of Common B stock outstanding, basic and diluted | | | 4,038 | | | 4,038 | | | 4,038 |

Pro forma net earnings (loss) per share attributable to Telos Corporation, basic and diluted (unaudited) | | | | | | | |||

Pro forma weighted-average shares of common stock outstanding, basic and diluted (unaudited) | | | | | | | |||

| | | Years Ended December 31, | |||||||

| | | 2019 | | | 2018 | | | 2017 | |

Net (loss) income | | | $(2,137) | | | $1,737 | | | $(3,498) |

Other comprehensive (loss) income, net of tax: | | | | | | | |||

Foreign currency translation adjustments | | | (11) | | | (15) | | | 7 |

Comprehensive income attributable to non-controlling interest | | | (4,264) | | | (3,377) | | | (2,335) |

Comprehensive loss attributable to Telos Corporation | | | $(6,412) | | | $(1,655) | | | $(5,826) |

| | | December 31, | ||||

| | | 2019 | | | 2018 | |

Current assets | | | | | ||

Cash and cash equivalents | | | $6,751 | | | $72 |

Accounts receivable, net of reserve of $720 and $306, respectively (Note 5) | | | 27,942 | | | 34,542 |

Inventories, net of obsolescence reserve of $860 and $520, respectively (Note 1) | | | 1,965 | | | 4,389 |

Deferred program expenses | | | 673 | | | 244 |

Other current assets | | | 2,914 | | | 1,985 |

Total current assets | | | 40,245 | | | 41,232 |

| | | | | |||

Property and equipment (Note 1) | | | | | ||

Furniture and equipment | | | 18,709 | | | 12,756 |

Leasehold improvements | | | 2,536 | | | 2,503 |

Property and equipment under finance leases | | | 30,792 | | | 30,832 |

| | | 52,037 | | | 46,091 | |

Accumulated depreciation and amortization | | | (32,470) | | | (28,665) |

| | | 19,567 | | | 17,426 | |

| | | | | |||

Operating lease right-of-use assets | | | 1,979 | | | — |

Goodwill (Note 3) | | | 14,916 | | | 14,916 |

Other assets | | | 985 | | | 915 |

Total assets | | | $77,692 | | | $74,489 |

| | | December 31, | ||||

| | | 2019 | | | 2018 | |

Current liabilities | | | | | ||

Accounts payable and other accrued liabilities (Note 6) | | | $15,050 | | | $21,779 |

Accrued compensation and benefits | | | 12,187 | | | 9,082 |

Contract liabilities | | | 6,337 | | | 5,232 |

Finance lease obligations – short-term (Note 10) | | | 1,224 | | | 1,115 |

Other current liabilities | | | 2,505 | | | 1,895 |

Total current liabilities | | | 37,303 | | | 39,103 |

Senior term loan, net of unamortized discount and issuance costs (Note 6) | | | 16,335 | | | 10,984 |