UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the Quarterly Period Ended March 31, 2024

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the Transition Period from __________________ to _________________________

Commission File Number 001-33650

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||

| (Address of principal executive offices) | (zip code) | ||||

Registrant’s telephone number, including area code: 908 -842-0100

| Securities registered pursuant to Section 12(b) of the Act: | ||||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

The | ||||||||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||||||||||

| ☒ | Smaller reporting company | |||||||||||||

| Emerging growth company | ||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date.

| Class | Outstanding as of May 9, 2024 | |||||||

| Common stock, $0.001 par value per share | shares | |||||||

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This quarterly report (this “Quarterly Report”) contains “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, as well as historical information. When used in this Quarterly Report, statements that are not statements of current or historical fact may be deemed to be forward-looking statements, including, without limitation, all statements related to any expectations of revenues, expenses, cash flows, earnings or losses from operations, cash required to maintain current and planned operations, capital or other financial items; any statements of the plans, strategies and objectives of management for future operations; any plans or expectations with respect to product research, development and commercialization, including regulatory approvals; any other statements of expectations, plans, intentions or beliefs; and any statements of assumptions underlying any of the foregoing. Without limiting the foregoing, the words “plan,” “project,” “forecast,” “outlook,” “intend,” “may,” “will,” “expect,” “anticipate,” “likely,” “believe,” “could,” “anticipate,” “estimate,” “continue,” “target” or similar expressions or other variations or comparable terminology are intended to identify such forward-looking statements, although some forward-looking statements are expressed differently. We remind readers that forward-looking statements are merely predictions and therefore inherently subject to uncertainties and other factors and involve known and unknown risks that could cause the actual results, performance, levels of activity or our achievements or industry results, to be materially different from any future results, performance, levels of activity or our achievements or industry results expressed or implied by such forward-looking statements. Factors that could cause our actual results to differ materially from anticipated results expressed or implied by forward-looking statements include, among others:

•our ability to obtain sufficient capital or strategic business arrangements to fund our operations and expansion plans, including collecting amounts owed to us under various licensing and other strategic arrangements, meeting our financial obligations under various licensing and other strategic arrangements, the funding of our clinical trials for product candidates, and the commercialization of the relevant technology;

•our ability to build and maintain the management and human resources infrastructure necessary to support the operation and/or growth of our business;

•whether a market is established for our products and our ability to capture a meaningful share of this market;

•scientific, regulatory and medical developments beyond our control;

•our ability to obtain and maintain, as applicable, appropriate governmental licenses, accreditations or certifications or to comply with healthcare laws and regulations or any other adverse effect or limitations caused by government regulation of our business;

•whether any of our current or future patent applications result in issued patents, the scope of those patents and our ability to obtain and maintain other rights to technology required or desirable for the conduct of our business, and our ability to commercialize products without infringing upon the claims of third-party patents;

•whether any potential strategic or financial benefits of various licensing agreements will be realized;

•our ability to diversify our pipeline of development product candidates, which could include an acquisition, merger, business combination, in-license or other strategic transaction, and whether any of such efforts will result in us entering into or completing any transaction or that any such transaction, if completed, will add to shareholder value;

•the results of our development activities;

•our ability to complete our other planned clinical trials (or initiate other trials) in accordance with our estimated timelines due to delays associated with enrolling patients due to the novelty of the treatment, the size of the patient population, competition with other clinical trials for similar subjects, patient and/or investigator site availability and accessibility due to external macroenvironmental factors and the need of patients to meet the inclusion criteria of the trial or otherwise;

•the extent to which any future public health crisis and their long-term effects may impact, directly or indirectly, our business, including our clinical trials and financial condition; and

•other factors discussed in “Risk Factors” in our Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”) on February 29, 2024 (our “2023 Form 10-K”).

The factors discussed herein, including those risks described in “Item 1A. Risk Factors” and elsewhere in our 2023 Form 10-K and in our other periodic filings with the SEC, which are available for review at www.sec.gov, could cause actual results and developments to be materially different from those expressed or implied by such statements. All forward-looking statements attributable to us are expressly qualified in their entirety by these and other factors. Readers are cautioned not to place undue

2

reliance on these forward-looking statements, which speak only as of the date they were made. Except as required by law, we undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

3

TABLE OF CONTENTS

PART I- FINANCIAL INFORMATION | Page No. | |||||||

Item 1. | ||||||||

Notes to Unaudited Consolidated Financial Statements | ||||||||

Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |||||||

Item 3. | Quantitative and Qualitative Disclosures About Market Risk | |||||||

Item 4. | Controls and Procedures | |||||||

PART II- OTHER INFORMATION | ||||||||

Item 1. | Legal Proceedings | |||||||

Item 1A. | Risk Factors | |||||||

Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | |||||||

Item 3. | Defaults Upon Senior Securities | |||||||

Item 4. | Mine Safety Disclosures | |||||||

Item 5. | Other Information | |||||||

Item 6. | Exhibits | |||||||

Signatures | ||||||||

4

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

LISATA THERAPEUTICS, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(In thousands, except share data)

| March 31, 2024 | December 31, 2023 | ||||||||||

| ASSETS | (Unaudited) | ||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

Marketable securities | |||||||||||

| Prepaid and other current assets | |||||||||||

| Total current assets | |||||||||||

| Property and equipment, net | |||||||||||

| Acquired license - intangible, net | |||||||||||

| Other assets | |||||||||||

| Total assets | $ | $ | |||||||||

| LIABILITIES, NON-CONTROLLING INTERESTS AND STOCKHOLDERS' EQUITY | |||||||||||

| Liabilities | |||||||||||

| Accounts payable | $ | $ | |||||||||

| Accrued liabilities | |||||||||||

| Total current liabilities | |||||||||||

| Other long-term liabilities | |||||||||||

| Total liabilities | |||||||||||

| Commitments and Contingencies (Note 13) | |||||||||||

| Stockholders' Equity | |||||||||||

Common stock, $ and outstanding, respectively | |||||||||||

| Additional paid-in capital | |||||||||||

Treasury stock, at cost; | ( | ( | |||||||||

| Accumulated deficit | ( | ( | |||||||||

| Accumulated other comprehensive loss | ( | ( | |||||||||

| Total Lisata Therapeutics, Inc. stockholders' equity | |||||||||||

| Non-controlling interests | ( | ( | |||||||||

| Total equity | |||||||||||

| Total liabilities, non-controlling interests and stockholders' equity | $ | $ | |||||||||

See accompanying notes to consolidated financial statements.

5

LISATA THERAPEUTICS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(In thousands, except per share data)

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| Operating Expenses: | |||||||||||

| Research and development | $ | $ | |||||||||

| General and administrative | |||||||||||

| Total operating expenses | |||||||||||

| Operating loss | ( | ( | |||||||||

| Other income (expense): | |||||||||||

| Investment income, net | |||||||||||

| Other expense, net | ( | ( | |||||||||

| Total other income | |||||||||||

| Net loss before benefit from income taxes and noncontrolling interests | ( | ( | |||||||||

| Benefit from income taxes | ( | ||||||||||

| Net loss | $ | ( | $ | ( | |||||||

| Less - net income (loss) attributable to noncontrolling interests | |||||||||||

| Net loss attributable to Lisata Therapeutics, Inc. common stockholders | $ | ( | $ | ( | |||||||

| Basic and diluted loss per share | |||||||||||

| Lisata Therapeutics, Inc. common stockholders | $ | ( | $ | ( | |||||||

Weighted average common shares outstanding | |||||||||||

Basic and diluted shares | |||||||||||

See accompanying notes to consolidated financial statements.

6

LISATA THERAPEUTICS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(Unaudited)

(In thousands)

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| Net loss | $ | ( | $ | ( | |||||||

| Other comprehensive loss: | |||||||||||

| Available for sale securities - net unrealized loss | ( | ( | |||||||||

| Cumulative translation adjustment arising during the period | ( | ( | |||||||||

| Total other comprehensive loss | ( | ( | |||||||||

| Comprehensive loss attributable to Lisata Therapeutics, Inc. common stockholders | $ | ( | $ | ( | |||||||

See accompanying notes to consolidated financial statements.

7

LISATA THERAPEUTICS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF EQUITY

(Unaudited)

(In thousands)

| Common Stock | Additional Paid-in Capital | Accumulated Other Comprehensive Loss | Accumulated Deficit | Treasury Stock | Total Lisata Therapeutics, Inc. Stockholders' Equity | Non- Controlling Interest in Subsidiary | Total Equity | |||||||||||||||||||||||||||||||||||||||||||||||||

| Shares | Amount | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at December 31, 2022 | $ | $ | $ | ( | $ | ( | $ | ( | $ | $ | ( | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | — | ( | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||

| Share-based compensation | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Unrealized loss on marketable securities | — | — | — | ( | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||

| Foreign currency translation adjustment | — | — | — | ( | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||

| Balance at March 31, 2023 | $ | $ | $ | ( | $ | ( | $ | ( | $ | $ | ( | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Common Stock | Additional Paid-in Capital | Accumulated Other Comprehensive Loss | Accumulated Deficit | Treasury Stock | Total Lisata Therapeutics, Inc. Stockholders' Equity | Non- Controlling Interest in Subsidiary | Total Equity | |||||||||||||||||||||||||||||||||||||||||||||||||

| Shares | Amount | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at December 31, 2023 | $ | $ | $ | ( | $ | ( | $ | ( | $ | $ | ( | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | — | ( | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||

| Share-based compensation | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Unrealized loss on marketable securities | — | — | — | ( | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||

| Foreign currency translation adjustment | — | — | — | ( | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||

| Balance at March 31, 2024 | $ | $ | $ | ( | $ | ( | $ | ( | $ | $ | ( | $ | ||||||||||||||||||||||||||||||||||||||||||||

See accompanying notes to consolidated financial statements.

8

LISATA THERAPEUTICS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(In thousands)

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| Cash flows from operating activities: | |||||||||||

| Net loss | $ | ( | $ | ( | |||||||

| Adjustments to reconcile net loss to net cash used in operating activities: | |||||||||||

| Share-based compensation | |||||||||||

| Depreciation and amortization | |||||||||||

| Loss on disposal of fixed assets | |||||||||||

| Loss from equity method investment | |||||||||||

| Amortization/accretion on marketable securities | ( | ( | |||||||||

| Changes in operating assets and liabilities: | |||||||||||

| Prepaid and other current assets | ( | ( | |||||||||

| Other assets | |||||||||||

| Accounts payable, accrued liabilities and other liabilities | ( | ( | |||||||||

| Net cash used in operating activities | ( | ( | |||||||||

| Cash flows from investing activities: | |||||||||||

| Purchase of marketable securities | ( | ( | |||||||||

| Sale of marketable securities | |||||||||||

| Investment in Impilo Therapeutics | ( | ||||||||||

| Net cash provided by investing activities | |||||||||||

| Cash flows from financing activities: | |||||||||||

| Tax withholding payments on net share settlement equity awards | ( | ( | |||||||||

| Net cash used in financing activities | ( | ( | |||||||||

| Effect of exchange rate changes on cash | ( | ( | |||||||||

| Net decrease in cash and cash equivalents | ( | ( | |||||||||

| Cash and cash equivalents at beginning of period | |||||||||||

| Cash and cash equivalents at end of period | $ | $ | |||||||||

See accompanying notes to consolidated financial statements.

9

LISATA THERAPEUTICS, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

Note 1 – The Business

Overview

Lisata Therapeutics, Inc. (together with its subsidiaries, the “Company”) is a clinical-stage pharmaceutical company dedicated to the discovery, development, and commercialization of innovative therapies for the treatment of solid tumors and other major diseases. The Company's lead investigational product candidate, certepetide (LSTA1), is designed to activate a novel uptake pathway that allows co-administered or tethered (i.e., molecularly bound) anti-cancer drugs to target and penetrate solid tumors more effectively. Certepetide actuates this active transport system in a tumor-specific manner, resulting in systemically co-administered anti-cancer drugs more efficiently penetrating and accumulating in the tumor, while normal tissues are expected to be unaffected. Certepetide also has been shown to modify the tumor microenvironment (“TME”), thereby making tumors more susceptible to immunotherapies and inhibiting the metastasis cascade (i.e., the spread of cancer to other parts of the body). The Company and its collaborators have amassed significant non-clinical data demonstrating enhanced delivery of a range of existing and emerging anti-cancer therapies, including chemotherapeutics, immunotherapies, and RNA-based therapeutics. To date, certepetide has also demonstrated favorable safety, tolerability and activity in completed and ongoing clinical trials designed to enhance delivery of standard-of-care chemotherapy for pancreatic cancer. The Company is exploring certepetide as a means to enable a variety of treatment modalities to treat a range of solid tumors more effectively. Currently, certepetide, is the subject of several Phase 2 clinical studies being conducted globally in a variety of solid tumor types, including metastatic pancreatic ductal adenocarcinoma (mPDAC), cholangiocarcinoma, appendiceal cancer, colon cancer and glioblastoma multiforme in combination with a variety of anti-cancer regimens.

The Company's leadership team has decades of collective biopharmaceutical and pharmaceutical product development experience across a variety of therapeutic categories and at all stages of development from preclinical through to product registration and launch. The Company's goal is to develop and commercialize products that address important unmet medical needs.

Basis of Presentation

The accompanying unaudited Consolidated Financial Statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X of the SEC for interim financial information. Accordingly, they do not include all of the information and footnotes required by generally accepted accounting principles for complete financial statements. In the opinion of management, the accompanying Consolidated Financial Statements of the Company and its subsidiaries, which are unaudited, include all normal and recurring adjustments considered necessary to present fairly the Company’s financial position as of March 31, 2024, and the results of its operations and its cash flows for the periods presented. The unaudited consolidated financial statements herein should be read together with the historical consolidated financial statements of the Company for the years ended December 31, 2023 and 2022 included in our 2023 Form 10-K. Operating results for the three months ended March 31, 2024 are not necessarily indicative of the results that may be expected for the year ending December 31, 2024.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements. Estimates also affect the reported amounts of expenses during the reporting period. The Company bases its estimates on historical experience and other assumptions believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources. The Company makes critical estimates and assumptions in determining stock-based awards values. Accordingly, actual results could differ from those estimates and assumptions.

Principles of Consolidation

10

Foreign Currency Remeasurement

The Company’s reporting currency is the U.S. Dollar. The functional currency of Lisata Therapeutics Australia Pty Ltd., which is a foreign subsidiary of the Company, is the Australian Dollar. The assets and liabilities of Lisata Therapeutics Australia Pty Ltd. are translated into U.S. Dollars at the exchange rates in effect at each balance sheet date, and the results of operations are translated using the average exchange rates prevailing throughout the reporting period. Adjustments resulting from translating foreign functional currency financial statements into U.S. Dollars are included in the foreign currency translation adjustment, a component of accumulated other comprehensive income (loss) in stockholders' equity.

Note 2 – Summary of Significant Accounting Policies

Cash and Cash Equivalents

Concentration of Risks

The Company is subject to credit risk from its portfolio of cash, cash equivalents and marketable securities. Under its investment policy, the Company limits amounts invested in such securities by credit rating, maturity, industry group, investment type and issuer, except for securities issued by the U.S. government. Cash is held at major banks in the United States and may exceed federally insured limits. The goals of the Company's investment policy, in order of priority, are as follows: safety and preservation of principal and diversification of risk, liquidity of investments sufficient to meet cash flow requirements, and a competitive after-tax rate of return.

Marketable Securities

The Company determines the appropriate classification of its marketable securities at the time of purchase and reevaluates such designation at each balance sheet date. All of the Company's marketable securities are considered as available-for-sale and carried at estimated fair values and reported in cash equivalents and marketable securities. Unrealized gains and losses on available-for-sale securities are excluded from net income and reported in accumulated other comprehensive income (loss) as a separate component of stockholders' equity. Other income (expense), net, includes interest, dividends, amortization of purchase premiums and discounts, realized gains and losses on sales of securities and other-than-temporary declines in the fair value of securities, if any. The cost of securities sold is based on the specific identification method. The Company regularly reviews all of its investments for other-than-temporary declines in fair value. The Company's review includes the consideration of the cause of the impairment, including the creditworthiness of the security issuers, the number of securities in an unrealized loss position, the severity and duration of the unrealized losses, whether the Company has the intent to sell the securities and whether it is more likely than not that it will be required to sell the securities before the recovery of their amortized cost basis. When the Company determines that the decline in fair value of an investment is below its accounting basis and this decline is other-than-temporary, it reduces the carrying value of the security it holds and records a loss for the amount of such decline.

Property and Equipment

| Furniture and fixtures | |||||

| Computer equipment | |||||

| Software | |||||

| Leasehold improvements | Life of lease | ||||

Long-lived Assets

Long-lived assets consist of property and equipment. The assets are amortized on a straight line basis over their respective useful lives. The Company reviews long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset exceeds the fair value of the asset. If other events or changes in circumstances indicate that the carrying amount of an asset that the Company expects to hold and use may not be recoverable, the Company will estimate the undiscounted future cash flows expected to result from the use of the asset and/or its eventual disposition, and recognize an impairment loss, if any. The impairment loss, if determined to be necessary, would be measured as the amount by which the carrying amount of the assets exceeds the fair value of the assets.

11

Share-Based Compensation

Loss Per Share

Treasury Stock

Treasury stock purchases are accounted for under the cost method whereby the entire cost of the acquired stock is recorded as treasury stock. Gains or losses on the subsequent reissuance of shares are credited or charged to additional paid in capital.

Research and Development Costs

Research and development (“R&D”) expenses include salaries, benefits, and other headcount related costs, clinical trial and related clinical manufacturing costs, contract and other outside service fees including sponsored research agreements, and facilities and overhead costs. The Company expenses the costs associated with research and development activities when incurred.

To further drive the Company’s initiatives, the Company will continue targeting key governmental agencies, congressional committees and not-for-profit organizations to contribute funds for the Company’s research and development programs. The Company accounts for such grants as a deduction to the related expense in research and development operating expenses when earned.

In-process Research and Development Expense

Upfront payments that relate to the acquisition of a new drug compound, as well as pre-commercial milestone payments, are immediately expensed as IPR&D in the period in which they are incurred, provided that the new drug compound did not also include processes or activities that would constitute a “business” as defined under U.S. GAAP, the drug has not achieved regulatory approval for marketing and, absent obtaining such approval, has no established alternative future use. The Company accounts for contingent consideration payable upon achievement of certain regulatory, development or sales milestones in such asset acquisitions when the underlying contingency is probable and estimable. Milestone payments made to third parties subsequent to regulatory approval will be capitalized as intangible assets and amortized over the estimated remaining useful life of the related product.

Intangible Asset

The Company’s intangible asset consists of a single asset, a license agreement with Qilu Pharmaceutical, Co., Ltd. (“Qilu”) acquired in the Company's acquisition of Cend Therapeutics, Inc (the “Cend Merger”), with a value of $0.4 million. The intangible asset is stated at fair value and is amortized using the straight-line method over its estimated useful life of 5 years. Amortization expense was $17 thousand for the three months ended March 31, 2024 and $18 thousand for the three months ended March 31, 2023. The intangible asset is reviewed for potential impairment when events or circumstances indicate that carrying amounts may not be recoverable. The projected amortization expense is $71

12

Revenue Recognition

The Company evaluates license and collaboration arrangements to determine whether units of account within the arrangement exhibit the characteristics of a vendor and customer relationship. For arrangements and units of account where a customer relationship exists, the Company applies the revenue recognition guidance. The Company recognizes revenue upon the transfer of promised goods or services to customers in an amount that reflects the consideration to which the Company expects to be entitled in exchange for those goods or services. To determine revenue recognition for contracts with customers the Company performs the following five steps: (i) identify the contract(s) with a customer; (ii) identify the performance obligations in the contract; (iii) determine the transaction price; (iv) allocate the transaction price to the performance obligations in the contract; and (v) recognize revenue when (or as) the Company satisfies the performance obligations. At contract inception, the Company assesses the goods or services promised within each contract and assesses whether each promised good or service is distinct and determines those that are performance obligations. The Company then recognizes as revenue the amount of the transaction price that is allocated to the respective performance obligation when (or as) the performance obligation is satisfied. Taxes imposed by governmental authorities on the Company's revenue, such as sales taxes and withholding taxes, are excluded from net revenue.

Milestones

At the inception of each arrangement that includes milestone payments (variable consideration), the Company evaluates whether the milestones are considered probable of being reached and estimates the amount to be included in the transaction price using the most likely amount method. If it is probable that a significant revenue reversal would not occur, the associated milestone value is included in the transaction price. Milestone payments that are not within the Company or the Company’s collaboration partner’s control, such as regulatory approvals, are generally not considered probable of being achieved until those approvals are received. The transaction price is then allocated to each performance obligation on a relative stand-alone selling price basis, for which the Company recognizes revenue as or when the performance obligations under the contract are satisfied. At the end of each subsequent reporting period, the Company re-evaluates the probability of achievement of such milestones and any related constraint, and if necessary, adjusts the Company’s estimate of the overall transaction price. Any such adjustments are allocated on a cumulative catch-up basis to satisfied and partially satisfied performance obligations, with the consideration allocated to an ongoing performance obligation being recognized over the period of performance. For the three months ended March 31, 2024 and March 31, 2023, the Company has not

Royalties

For arrangements that include sales-based royalties, including milestone payments based on the level of sales, and for which the license is deemed to be the predominant item to which the royalties relate, the Company recognizes revenue at the later of (i) when the related sales occur, or (ii) when the performance obligation to which some or all of the royalty has been allocated has been satisfied (or partially satisfied). To date, the Company has not recognized any royalty revenue from any collaborative arrangement.

13

Note 3 – Available-for-Sale-Securities

The following table is a summary of available-for-sale securities recorded in cash and cash equivalents or marketable securities in our Consolidated Balance Sheets (in thousands):

| March 31, 2024 | December 31, 2023 | ||||||||||||||||||||||||||||||||||||||||||||||

| Cost | Gross Unrealized Gains | Gross Unrealized Losses | Estimated Fair Value | Cost | Gross Unrealized Gains | Gross Unrealized Losses | Estimated Fair Value | ||||||||||||||||||||||||||||||||||||||||

| Corporate debt securities | $ | $ | $ | ( | $ | $ | $ | $ | ( | $ | |||||||||||||||||||||||||||||||||||||

| Commercial paper | |||||||||||||||||||||||||||||||||||||||||||||||

| Money market funds | |||||||||||||||||||||||||||||||||||||||||||||||

| Municipal debt securities | |||||||||||||||||||||||||||||||||||||||||||||||

| Total | $ | $ | $ | ( | $ | $ | $ | $ | ( | $ | |||||||||||||||||||||||||||||||||||||

Estimated fair values of available-for-sale securities are generally based on prices obtained from commercial pricing services. The following table summarizes the classification of the available-for-sale securities in the Company's Consolidated Balance Sheets (in thousands):

| March 31, 2024 | December 31, 2023 | ||||||||||

| Cash equivalents | $ | $ | |||||||||

| Marketable securities | |||||||||||

| Total | $ | $ | |||||||||

The following table summarizes our portfolio of available-for-sale securities by contractual maturity (in thousands):

| March 31, 2024 | |||||||||||

| Amortized Cost | Estimated Fair Value | ||||||||||

| Less than one year | $ | $ | |||||||||

| Greater than one year | |||||||||||

| Total | $ | $ | |||||||||

Note 4 – Property and Equipment

Property and equipment consisted of the following (in thousands):

| March 31, 2024 | December 31, 2023 | ||||||||||

| Computer equipment | |||||||||||

| Leasehold improvements | |||||||||||

| Property and equipment, gross | |||||||||||

| Accumulated depreciation | ( | ( | |||||||||

| Property and equipment, net | $ | $ | |||||||||

The Company’s results included depreciation expense of approximately $29 thousand and $30 thousand for the three months ended March 31, 2024 and 2023, respectively.

14

Note 5 – Income (Loss) Per Share

For the three months ended March 31, 2024 and 2023, the Company incurred net losses and therefore no common stock equivalents were utilized in the calculation of diluted loss per share as they are anti-dilutive in the periods presented. At March 31, 2024 and 2023, the Company excluded the following potentially dilutive securities (in thousands):

| March 31 | |||||||||||

| 2024 | 2023 | ||||||||||

| Stock options | |||||||||||

| Warrants | |||||||||||

| Restricted stock units | |||||||||||

Note 6 – Fair Value Measurements

Fair value of financial assets and liabilities that are being measured and reported are defined as the exchange price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants in the principal market at the measurement date (exit price). The Company is required to classify fair value measurements in one of the following categories:

Level 1 inputs are defined as quoted prices (unadjusted) in active markets for identical assets or liabilities that the reporting entity has the ability to access at the measurement date.

Level 2 inputs are defined as inputs other than quoted prices included within Level 1 that are observable for the assets or liabilities, either directly or indirectly.

Level 3 inputs are defined as unobservable inputs for the assets or liabilities.

Financial assets and liabilities are classified based on the lowest level of input that is significant to the fair value measurement. The Company’s assessment of the significance of a particular input to the fair value measurement requires judgment and may affect the valuation of the fair value of assets and liabilities and their placement within the fair value hierarchy levels.

The Company's financial assets and liabilities that were accounted for at fair value on a recurring basis as of March 31, 2024 and December 31, 2023 were as follows (in thousands):

| March 31, 2024 | December 31, 2023 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Level 1 | Level 2 | Level 3 | Total | Level 1 | Level 2 | Level 3 | Total | |||||||||||||||||||||||||||||||||||||||||||

| Assets: | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash equivalents | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||

| Marketable securities - available for sale | ||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||||||

The carrying values of accounts payable and accrued expenses approximate fair value as of March 31, 2024 and December 31, 2023, due to the short maturity nature of these items.

15

Note 7 – Accrued Liabilities

Accrued liabilities as of March 31, 2024 and December 31, 2023 were as follows (in thousands):

| March 31, 2024 | December 31, 2023 | ||||||||||

| Salaries, employee benefits and related taxes | $ | $ | |||||||||

| Clinical and R&D related liabilities | |||||||||||

| Accounting & tax consulting liabilities | |||||||||||

| Legal settlement | |||||||||||

| Operating lease liabilities — current | |||||||||||

| Other | |||||||||||

| Total | $ | $ | |||||||||

Note 8 – Operating Leases

The Company has an operating lease for one office which expires in 2025. The Company estimates its incremental borrowing rate at lease commencement to determine the present value of lease payments as most of the Company's leases do not provide an implicit rate of return. The Company recognizes lease expense on a straight-line basis over the lease term. For lease agreements entered into or reassessed after the adoption of Topic 842, the Company elected to account for non-lease components associated with its leases and lease components as a single lease component. The Company's lease includes an option for the Company to extend the lease term and/or sub-lease space in whole or in part.

16

Operating lease liabilities and right-of-use assets were recorded in the following captions of our balance sheet as follows (in thousands):

| March 31, 2024 | December 31, 2023 | ||||||||||

| Right-of-Use Assets: | |||||||||||

| $ | $ | ||||||||||

| Total Right-of-Use Asset | $ | $ | |||||||||

| Operating Lease Liabilities: | |||||||||||

| $ | $ | ||||||||||

| Total Operating Lease Liabilities | $ | $ | |||||||||

As of March 31, 2024, the weighted average remaining lease term for our operating lease was 1.5 years, and the weighted average discount rate for our operating lease was 9.625 %. As of December 31, 2023, the weighted average remaining lease term for our operating leases was 1.75 years, and the weighted average discount rate for our operating leases was 9.625 %.

Future minimum lease payments under the lease agreement as of March 31, 2024 were as follows (in thousands):

| Years ended | Operating Leases | ||||

| 2024 | |||||

| 2025 | |||||

| Total lease payments | |||||

| Less: Amounts representing interest | ( | ||||

| Present value of lease liabilities | $ | ||||

Note 9 – Stockholders' Equity

Equity Issuances

At The Market Offering Agreement

On June 4, 2021, the Company entered into an At The Market Offering Agreement (the “ATM Agreement”) with H.C. Wainwright & Co., LLC, as sales agent, in connection with an “at the market offering” under which the Company from time to time may offer and sell shares of its common stock, having an aggregate offering price of up to $50.0 million. As of the date of this filing and so long as the Company’s public float remains below $75.0 million, the Company is subject to limitations pursuant to General Instruction I.B.6 of Form S-3 (the “Baby Shelf Limitation”), which limits the amount the Company can offer to up to one-third of its public float during any trailing 12-month period. Subsequent to the filing of the Company's Registration Statement on Form S-3 (File No. 333-279034) on May 1, 2024, the aggregate market value of its outstanding common stock held by non-affiliates was approximately $26.7 million. Pursuant to the Baby Shelf Limitation, since the aggregate market value of the Company's outstanding common stock held by non-affiliates was below $75.0 million at the time of such S-3 filing, the aggregate amount of securities that the Company is permitted to offer and sell is now $8,915,094 , which is equal to one-third of the aggregate market value of our common stock held by non-affiliates as of March 21, 2024. If the Company’s public float exceeds $75.0 million on a future measurement date, it will no longer be subject to the Baby Shelf Limitation. There were no issuances of common stock under the ATM Agreement for the three months ended March 31, 2024. Since inception, the Company has issued 64,394 shares of common stock under the ATM Agreement for net proceeds of $270,774 .

17

Stock Options and Warrants

| Stock Options | Warrants | |||||||||||||||||||||||||||||||||||||||||||||||||

| Shares | Weighted Average Exercise Price | Weighted Average Remaining Contractual Term (Years) | Aggregate Intrinsic Value (In Thousands) | Shares | Weighted Average Exercise Price | Weighted Average Remaining Contractual Term (Years) | Aggregate Intrinsic Value (In Thousands) | |||||||||||||||||||||||||||||||||||||||||||

| Outstanding at December 31, 2023 | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||

| Changes during the period: | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Granted | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Exercised | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Forfeited | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Expired | ( | |||||||||||||||||||||||||||||||||||||||||||||||||

| Outstanding at March 31, 2024 | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||

| Vested at March 31, 2024 or expected to vest in the future | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||

| Vested at March 31, 2024 | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||

Restricted Stock

During the three months ended March 31, 2024 and 2023, the Company issued restricted stock for services as follows (in thousands, except share data):

| Three Months Ended March 31, | ||||||||||||||

| 2024 | 2023 | |||||||||||||

| Number of restricted stock issued | ||||||||||||||

| Value of restricted stock issued | $ | $ | ||||||||||||

The vesting terms of restricted stock issuances are generally between and four years .

The following is a summary of the changes in non-vested restricted stock for the three months ended March 31, 2024:

| Restricted Stock Shares | Weighted Average Grant-Date Fair Value | ||||||||||

| Non-vested at December 31, 2023 | $ | ||||||||||

| Changes during the Year: | |||||||||||

| Granted | $ | ||||||||||

| Vested | ( | $ | |||||||||

| Forfeited | $ | ||||||||||

| Non-vested at March 31, 2024 | $ | ||||||||||

18

Restricted Stock Units

During the three months ended March 31, 2024 and 2023, the Company issued restricted stock units for services as follows (in thousands, except share data):

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| Number of restricted stock units issued | |||||||||||

| Value of restricted stock units issued | $ | $ | |||||||||

The weighted average estimated fair value of restricted stock units issued for services in the three months ended March 31, 2024 and 2023 was $3.08 and $3.00 per share, respectively. The fair value of the restricted stock units was determined using the Company’s closing stock price on the date of issuance. The vesting terms of restricted stock unit issuances are generally one year , or upon the achievement of performance-based milestones.

The following is a summary of the changes in non-vested restricted stock units for the three months ended March 31, 2024:

| Restricted Stock Units | Weighted Average Grant-Date Fair Value | ||||||||||

| Non-vested at December 31, 2023 | $ | ||||||||||

| Changes during the Year: | |||||||||||

| Granted | $ | ||||||||||

| Vested | ( | $ | |||||||||

| Forfeited | $ | ||||||||||

| Non-vested at March 31, 2024 | $ | ||||||||||

Note 10 – Share-Based Compensation

Share-Based Compensation

The Company utilizes share-based compensation in the form of stock options, restricted stock, and restricted stock units. The following table summarizes the components of share-based compensation expense for the three months ended March 31, 2024 and 2023 (in thousands):

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| Research and development | $ | $ | |||||||||

| General and administrative | |||||||||||

| Total share-based compensation expense | $ | $ | |||||||||

Total compensation cost related to unvested awards not yet recognized and the weighted-average periods over which the awards were expected to be recognized at March 31, 2024 were as follows (in thousands):

| Stock Options | Restricted Stock Units | Restricted Stock | |||||||||||||||

| Unrecognized compensation cost | $ | $ | $ | ||||||||||||||

| Expected weighted-average period in years of compensation cost to be recognized | |||||||||||||||||

19

Total fair value of shares vested and the weighted average estimated fair values of shares granted for the three months ended March 31, 2024 and 2023 were as follows (in thousands):

| Stock Options | |||||||||||

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| Total fair value of shares vested | $ | $ | |||||||||

| Weighted average estimated fair value of shares granted | $ | $ | |||||||||

Valuation Assumptions

The fair value of stock options at the date of grant was estimated using the Black-Scholes option pricing model. The expected volatility is based upon historical volatility of the Company’s stock. The expected term for the options is based upon observation of actual time elapsed between date of grant and exercise of options for all employees. The expected term for the warrants is based upon the contractual term of the warrants.

Note 11 – Income Taxes

In assessing the realizability of deferred tax assets, including the net operating loss carryforwards (NOLs), the Company assesses the available positive and negative evidence to estimate if sufficient future taxable income will be generated to utilize its existing deferred tax assets. Based on its assessment, the Company has provided a full valuation allowance against its net deferred tax assets as their future utilization remains uncertain at this time.

As of December 31, 2023 and 2022, the Company had approximately $43.7 million and $33.7 million respectively, of Federal NOLs available to offset future taxable income expiring from 2030 through 2036. The Company performed an analysis and determined that they had an ownership change of greater than 50% on September 15, 2022. As a result of the ownership change, $88.2 million of Federal NOLs will expire unutilized. The Company wrote off that portion of the deferred tax asset and reduced the corresponding valuation allowance resulting in approximately $34.0 million of remaining Federal NOLs as of December 31, 2022. The write off of the deferred tax asset and the corresponding reduction in valuation allowance has no impact to the balance sheet or income statement. Losses incurred before the ownership change on September 15, 2022 will be subject to an annual limitation of zero while losses incurred after September 15, 2022 will not be subject to limitations.

As of December 31, 2022, Cend Therapeutics, Inc. (“Cend”) had approximately $3.6 million of Federal NOLs available to offset future taxable income. The Company performed an analysis and determined that there was an ownership change of greater than 50% on September 15, 2022. As of September 15, 2022 Cend has approximately $3.1 million of Federal and $4.3 million of state NOLs. The state NOLs will expire from the 2036 through 2042 tax years. Using a fair market value of $36.1 million and applying an applicable federal rate of 2.54 % Cend will have an annual limitation of approximately $917 thousand each year. The Federal NOL of $459 thousand incurred in the post-acquisition period September 15, 2022 to December 31, 2022 is not subject to limitation and does not expire. As of December 31, 2023 and 2022, Cend’s wholly owned Australian subsidiary had approximately $2.4 million and $1.8 million, respectively, of NOLs which will be carried forward and do not expire. There is a full valuation allowance against the NOLs.

As of December 31, 2023, the Company had federal research and development credit carryforwards of $0.5 million expiring from 2027 through 2034 if unutilized, and state research and development credit carryforwards of $0.1 million, which carryforward indefinitely. Utilization of these credits may be subject to an annual limitation based on changes in ownership.

As of December 31, 2023 and 2022, the Company had State NOLs available in New Jersey of $19.4 million and $35.5 million, respectively, California of $9.2 million and $9.2 million, respectively, and New York City of $1.9 million and $1.9 million, respectively, to offset future taxable income expiring from 2032 through 2043. The usage of the Company’s NOLs is limited given the change in ownership.

The Company applies the FASB’s provisions for uncertain tax positions. The Company utilizes the two-step process to determine the amount of recognized tax benefit. For tax positions meeting the more-likely-than-not threshold, the amount recognized in the consolidated financial statements is the largest benefit that has a greater than 50% likelihood of being realized upon ultimate settlement with the relevant taxing authority. The Company recognizes interest and penalties associated with certain tax positions as a component of income tax expense.

As of December 31, 2023 and 2022, the Company’s uncertain tax positions were $344 thousand and $344 thousand, respectively. The uncertain tax positions are due to the acquisition of Cend related to Federal and state credits and certain state

20

NOLs. The Company will continue to evaluate its uncertain tax positions in future periods. The Company does not believe there will be any material changes in its unrecognized tax positions over the next year.

For years prior to 2020, the federal statute of limitations is closed for assessing tax. The Company’s state tax returns remain open to examination for a period of three to four years from the date of the tax return filing.

On March 4, 2024, the Company received final approval from the New Jersey Economic Development Authority (“NJEDA”) under the Technology Business Tax Certificate Transfer Program (“Program”) to sell $8.9 million of its New Jersey net operating losses (“NJ NOLs”), which were subsequently sold to a qualifying and approved buyer pursuant to the Program for net proceeds of $0.7 million. The sale of NJ NOLs resulted in a $0.8 million deferred income tax benefit and a loss on sale of $0.1 million recorded in other income (expense) in the consolidated financial statements.

Note 12 – Australia Research and Development Tax Incentive

Note 13 – Contingencies

Contingencies

From time to time, the Company is subject to legal proceedings and claims, either asserted or unasserted, that arise in the ordinary course of business. While the outcome of pending claims cannot be predicted with certainty, the Company does not believe that the outcome of any pending claims will have a material adverse effect on the Company's financial condition or operating results. The Company has elected to recognize expense for legal fees as incurred when the legal services are provided.

In May 2021, Cend received a written threat of litigation on behalf of a Chinese entity called Lingmed Limited (“Lingmed”) claiming Lingmed was entitled to a success fee based on Cend’s Collaboration and License Agreement with Qilu Pharmaceuticals. Cend responded by denying that Lingmed is entitled to a success fee under the terms of their agreement. In May 2022, Cend was served with a complaint filed by Lingmed in the San Diego County Superior Court, alleging claims for breach of contract, fraud and declaratory relief. Cend’s response to the complaint was filed on June 6, 2022 and denied all of Lingmed’s material allegations. Lingmed filed an answer to Cend’s response on July 11, 2022, denying all of the Company’s material allegations. On March 25, 2024 the Company entered into a settlement agreement whereby the Company is required to pay Lingmed $0.5 million within 30 days of the effective date and the Company effected payment on April 4, 2024. Lingmed is also entitled to 5.0 % of any future milestone payments received by the Company under the license agreement with Qilu in addition to a sum of $250 thousand with respect to the first future milestone received by the Company. On April 9, 2024, pursuant to the parties’ joint request, the Court entered a dismissal with prejudice of the entire action as to all parties and all claims and the matter was settled.

Note 14 – Technology Transfer Agreement

Impilo Therapeutics

In July 2023, the Company entered into a technology transfer agreement with Impilo Therapeutics (“Impilo”) under which the Company transferred its rights to its tumor penetrating nanocomplex (TPN) platform to Impilo. As consideration for the technology transfer, Impilo issued a total of 766,000 shares of its pre-seed preferred stock to the Company. On October 3, 2023

21

in connection with the Sanford Burnham Prebys license agreement (Note 15) Impilo cancelled the original stock certificate for 766,000 shares and reissued 574,500 shares of its pre-seed preferred stock to the Company.

On March 15, 2024, the Company purchased a Simple Agreement for Future Equity ("SAFE") from Impilo for $100,000 . As of March 31, 2024 and December 31, 2023 the Company owned 38.6 30.0 million and an 80 % discount rate.

Note 15 – License Agreements

Sanford Burnham Prebys

In December 2015, Cend entered into a license agreement with Sanford Burnham Prebys (“SBP”) under which Cend was granted an exclusive, worldwide, royalty-bearing license to certain patent rights and know-how controlled by SBP related to the development of certepetide. At the time the license agreement was entered into, Cend’s founding shareholder was an executive at SBP. The agreement provides the Company with the rights to grant and authorize sublicenses to use, sell, and otherwise exploit the patent rights. As consideration for the license, Cend issued a total of 382,030 shares of common stock, as adjusted for the Reverse Stock Split and Exchange Ratio. The Company is required to pay an annual license maintenance fee of $10,000 increasing to $20,000 on year seven of the agreement. The Company could also be required to make milestone payments to SBP upon completion of certain regulatory and commercial milestones. The aggregate potential milestone payments are approximately $10.6 million. The Company has also agreed to pay SBP royalties of 4 % of net sales of products sold by the Company, or through a sublicense, subject to certain reductions. Additionally, the Company is obligated to pay SBP 25 % of any sublicensing income, which, pursuant to the technology transfer agreement with Impilo, resulted in SBP receiving 191,500 shares of the Company’s pre-seed preferred stock in Impilo on October 3, 2023.

The agreement will expire upon the later of (i) the final abandonment of all pending patent applications within the licensed patents or (ii) the expiration of the last to expire patent within the licensed patents. The agreement may be terminated in its entirety by the Company at any time by giving SBP sixty days’ prior written notice. The agreement may be terminated in its entirety by SBP if the Company, at any time, defaults in the payment of any sum when due and fails to make such payment within thirty days after receipt of written notice. The agreement may be terminated in its entirety by either SBP or the Company (i) in the event of an uncured material breach by the other party, or (ii) in the event the other party (a) files for, or is involuntarily petitioned with, bankruptcy (other than dissolution or winding up for the purposes of reconstruction or amalgamation), (b) makes an assignment of all or substantially all of its assets for the benefit of creditors, or (c) has a receiver or trustee is appointed and is unable to secure a dismissal, stay or other suspension of such proceedings within thirty days. Upon termination of the agreement for any reason, all rights and obligations of the Company with respect to the patents and patent applications shall terminate and revert to SBP.

SBP did no t own shares of the Company’s common stock as of March 31, 2024.

Note 16 – Research Collaboration and License Agreement

Exclusive License and Collaboration Agreement

In February 2021, Cend entered into an Exclusive License and Collaboration Agreement (the “Qilu Agreement”) in which Cend granted an exclusive license to Qilu for the development and commercialization of certepetide in the Territory (defined as the Greater Area of China including China, Macau, Hong Kong, and Taiwan). Under the terms of the agreement, Qilu is solely responsible for the development of certepetide in its Territory. In consideration for the license, Qilu made an upfront payment of $10.0 million to Cend, which was recognized as revenue by Cend prior to the Company's acquisition of Cend on September 15, 2022 (the “Cend Merger”). In addition, Cend received and recognized as revenue a $5.0 million development milestone prior to the Cend Merger. The Company is eligible to receive additional developmental and commercial milestone payments up to $96.0 million and $125.0 million, respectively, tiered royalties on net sales ranging from 10 % to 15 %, and tiered sublicensing revenues ranging from 12 % to 35 %.

On March 25, 2024 the Company entered into a settlement agreement with Lingmed whereby Lingmed is entitled to 5.0 % of any future milestone payments received by the Company under the Qilu Agreement, in addition, Lingmed is also entitled to a sum of $250 thousand with respect to the first future milestone received by the Company.

Unless terminated early, the Qilu Agreement will continue in effect until the expiration of all Qilu payment obligations. Either party may terminate the Qilu Agreement if an undisputed material breach by the other party is not cured within a defined

22

period of time, or upon notice for insolvency-related events of the other party that are not discharged within a defined time period. Qilu may terminate the Qilu Agreement in its entirety, at any time with at least sixty days written notice. All rights and obligations of Qilu with respect to such licensed patents and patent applications would terminate simultaneously.

Note 17 – Subsequent Events

23

ITEM 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including those set forth under “Cautionary Note Regarding Forward-Looking Statements” herein and under “Risk Factors” in our 2023 Form 10-K. The following discussion should be read in conjunction with our consolidated financial statements and related notes thereto included elsewhere in this Quarterly Report and in our 2023 Form 10-K.

Overview

We are a clinical-stage pharmaceutical company dedicated to the discovery, development, and commercialization of innovative therapies for the treatment of solid tumors and other major diseases. Our lead investigational product candidate, certepetide (LSTA1), is designed to activate a novel uptake pathway that allows co-administered or tethered (i.e., molecularly bound) anti-cancer drugs to target and penetrate solid tumors more effectively. Certepetide actuates this active transport system in a tumor-specific manner, resulting in systemically co-administered anti-cancer drugs more efficiently penetrating and accumulating in the tumor, while normal tissues are expected to be unaffected. Certepetide also has been shown to modify the tumor microenvironment (“TME”), thereby making tumors more susceptible to immunotherapies and inhibiting the metastasis cascade (i.e., the spread of cancer to other parts of the body). We and our collaborators have amassed significant non-clinical data demonstrating enhanced delivery of a range of existing and emerging anti-cancer therapies, including chemotherapeutics, immunotherapies, and RNA-based therapeutics. To date, certepetide has also demonstrated favorable safety, tolerability and activity in completed and ongoing clinical trials designed to enhance delivery of standard-of-care chemotherapy for pancreatic cancer. We are exploring certepetide as a means to enable a variety of treatment modalities to treat a range of solid tumors more effectively. Currently, certepetide, is the subject of several Phase 2 clinical studies being conducted globally in a variety of solid tumor types, including metastatic pancreatic ductal adenocarcinoma (mPDAC), cholangiocarcinoma, appendiceal cancer, colon cancer and glioblastoma multiforme in combination with a variety of anti-cancer regimens.

Our leadership team has decades of collective biopharmaceutical and pharmaceutical product development experience across a variety of therapeutic categories and at all stages of development from preclinical through to product registration and launch. Our goal is to develop and commercialize products that address important unmet medical needs.

Targeted Solid Tumor Penetration via CendR Active Transport

Many solid tumor cancers, including pancreatic ductal adenocarcinoma (“PDAC”), and cholangiocarcinoma, are surrounded by dense fibrotic tissue, or stroma. This stroma often limits the efficacy of current chemotherapies for these cancers. Emerging immunotherapies including but not limited to checkpoint inhibitors and adoptive cell therapies (e.g., chimeric antigen receptor T cells (CAR-Ts)) also face challenges in penetrating solid tumors. Many tumors also exhibit an immunosuppressive TME, which suppresses patients’ immune systems and can thus limit the effectiveness of immunotherapies and/or contribute to metastases. These factors negatively impact the ability of many therapeutic agents to effectively treat these cancers.

To address the tumor stroma’s role as a primary impediment to effective treatment, our approach is to activate the C-end rule (“CendR”), or CendR system, a naturally occurring active transport system. Our lead investigational drug, certepetide (a specific internalizing R-G-D or iRGD peptide), activates this transport system in a tumor-specific manner (Sugahara, Science, 2010). Certepetide enables more selective and efficient uptake of systemically administered anti-cancer drugs resulting in more intratumoral drug accumulation. The overall expected result is enhanced anticancer activity without an increase in adverse side effects. While it is possible to couple/tether or conjugate some anticancer drugs to certepetide, we believe that the co-administration of certepetide with anti-cancer therapies is advantageous. Co-administration does not create a new chemical entity with its attendant development and regulatory hurdles, thereby providing an anticipated faster-to-clinic and faster-to-market product opportunity for a range of co-administration therapies.

Certepetide has demonstrated favorable safety, tolerability, and activity to date in clinical trials enhancing the delivery of standard-of-care chemotherapies for mPDAC. Certepetide’s cancer-targeted delivery may enable such emerging treatment modalities to treat a range of solid tumors potentially more effectively.

Certepetide as a treatment for solid tumor cancers in combination with other anti-cancer agents

Certepetide is an investigational drug that actuates the CendR active transport mechanism. Certepetide has been shown to modify the TME, making it less immunosuppressive and thereby making the tumor more susceptible to attack by the immune system while also inhibiting the metastasis cascade. It targets tumor vasculature, endothelial cells, tumor cells and some intratumoral immunosuppressive cells by its selective affinity for alpha-v beta-3 and beta-5 integrins that are upregulated on these cells. Certepetide is a nine amino acid cyclic internalizing RGD (“iRGD”) peptide that, once bound to these integrins, is

24

cleaved by proteases expressed in tumors to release a linear peptide fragment, called a CendR peptide fragment. The CendR peptide fragment then binds to an adjacent receptor, called neuropilin-1, also upregulated in solid tumors, to activate a novel uptake pathway that allows circulating anticancer drugs to more selectively and effectively penetrate solid tumors. The ability of certepetide and iRGD peptides to modify the TME to enhance delivery and efficacy of co-administered drugs has been demonstrated in many preclinical models in a range of solid tumors. Lisata, its collaborators, and research groups around the world have published over 350 related scientific papers in this regard.

Clinically, certepetide was the subject of a completed Phase 1b/2a trial inclusive of 31 first-line mPDAC patients, of which 29 were evaluable. Results from the trial showed that the safety profile of the certepetide combination regimen was similar to standard of care (“SoC”) alone with certepetide being well-tolerated with no-dose limiting toxicities. An Objective Response Rate (“ORR”) of 59% was observed, compared to the 23% ORR observed in the “MPACT” clinical trial that served as the basis for approval of nab-paclitaxel for use in combination with gemcitabine for the treatment of first line, mPDAC (Von Hoff, et al. 2013). A Disease Control Rate (“DCR”) (partial and complete responses plus stable disease) of over 79% was also observed in comparison to a DCR of 48% observed in the MPACT trial. Reduction in the level of circulating tumor biomarker CA19-9 was observed in 96% of patients versus 61% in the MPACT trial. Importantly, median progression-free survival and median overall survival of nearly ten months and over thirteen months were observed versus less than six months and less than nine months, respectively, in the MPACT trial. These results have been published in The Lancet Gastroenterology and Hepatology (Dean, et al. 2022).

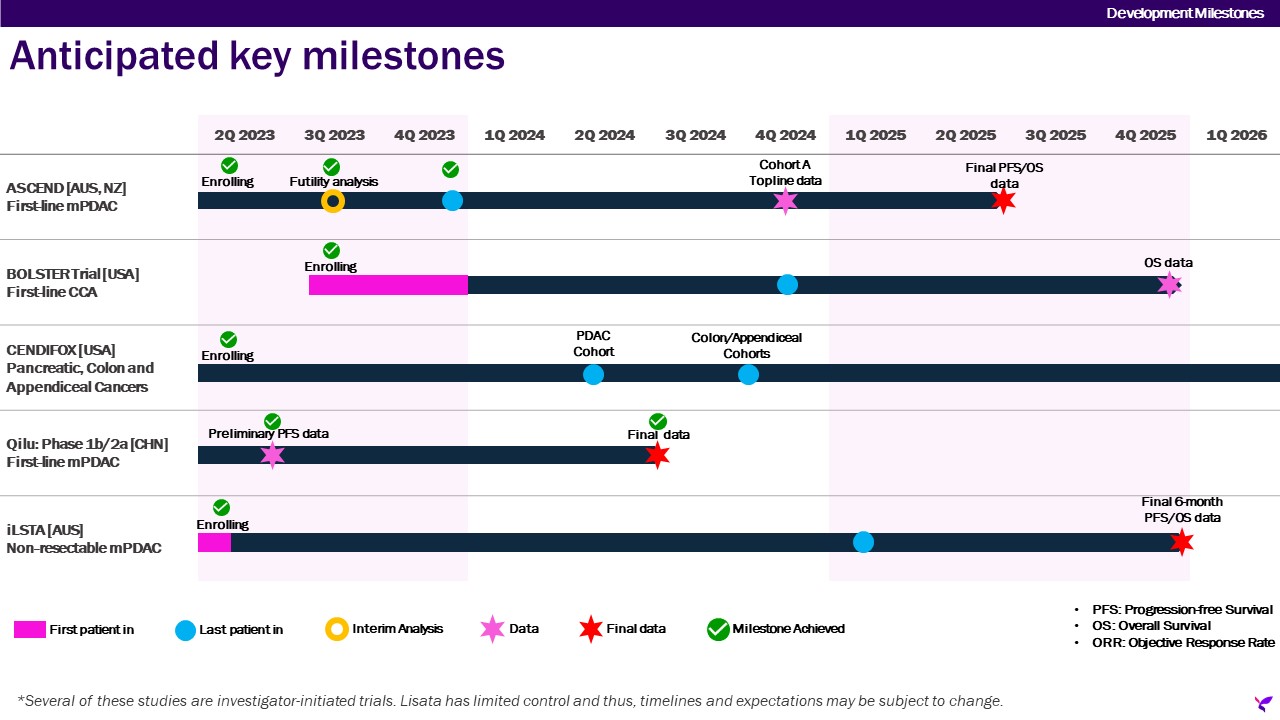

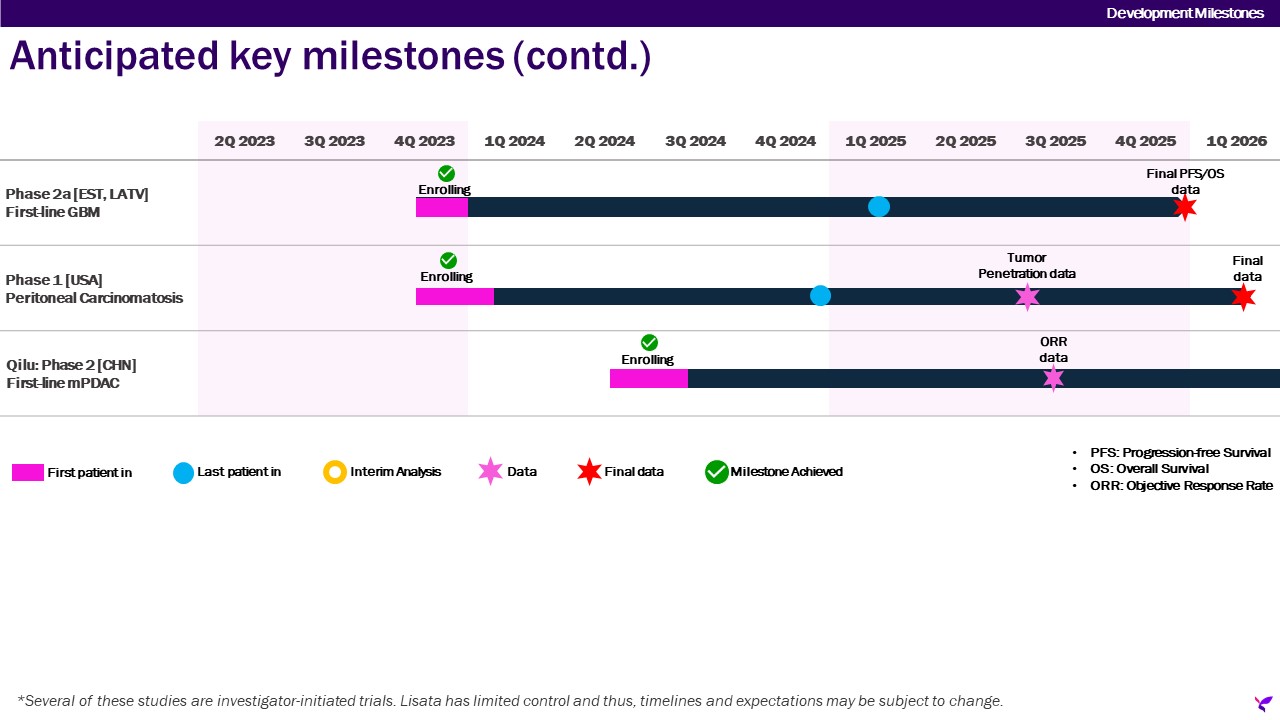

Additionally, certepetide is currently the subject of multiple ongoing and planned clinical trials being conducted globally in a variety of solid tumor types and in combination with several chemotherapy and immunotherapy anti-cancer regimens. The following diagram summarizes these studies.

25

Additional Out-licensing Opportunities

Our broad intellectual property portfolio of assets includes notable programs available for out-licensing in order to augment or continue their clinical development. Our current long-term strategy focuses on advancing our therapies through development with the ultimate objective of obtaining market authorizations and entering commercialization, either alone or with partners, to provide treatment options to patients suffering from life-threatening medical conditions. We believe that we are well-positioned to realize potentially meaningful value increases within our own proprietary pipeline if we are successful in advancing our product candidates to their next significant development milestones.

26

Results of Operations

Three Months Ended March 31, 2024 Compared to Three Months Ended March 31, 2023

The following table summarizes our results of operations for the three months ended March 31, 2024 and March 31, 2023 (in thousands):

| Three Months Ended March 31, | |||||||||||||||||

| 2024 | 2023 | Change | |||||||||||||||

| Operating Expenses: | |||||||||||||||||

| Research and development | $ | 3,241 | $ | 3,179 | $ | 62 | |||||||||||

| General and administrative | 3,360 | 3,665 | (305) | ||||||||||||||

| Total operating expenses | 6,601 | 6,844 | (243) | ||||||||||||||

| Loss from operations | (6,601) | (6,844) | 243 | ||||||||||||||

| Total other income | 402 | 657 | (255) | ||||||||||||||

| Benefit from income taxes | (798) | — | 798 | ||||||||||||||

| Net loss | $ | (5,401) | $ | (6,187) | $ | 786 | |||||||||||

Overall, net losses were $5.4 million for the three months ended March 31, 2024, compared to $6.2 million for the three months ended March 31, 2023.

Operating Expenses

For the three months ended March 31, 2024, operating expenses totaled $6.6 million, compared to $6.8 million for the three months ended March 31, 2023, representing a decrease of $0.2 million or 3.6%. Operating expenses comprised the following:

•Research and development expenses were approximately $3.2 million for the three months ended March 31, 2024, compared to $3.2 million for the three months ended March 31, 2023, representing an increase of $62.0 thousand or 2.0%. This was primarily due to an increase in expenses associated with our enrollment activities in the current year for our certepetide Phase 2a proof-of-concept Bolster trial partially offset by a reduction in expenses associated with the Phase 2b ASCEND trial which completed enrollment in the prior year.

•General and administrative expenses were approximately $3.4 million for the three months ended March 31, 2024, compared to $3.7 million for the three months ended March 31, 2023, representing a decrease of $0.3 million or 8.3%. This was primarily due to a decrease in staffing costs associated with the elimination of the Chief Business Officer position on May 1, 2023, a reduction in option assumption equity expense in connection with the Cend Merger, a decrease in directors and officers insurance premiums, and a reduction in spend on consulting and legal fees partially offset by one-off settlement related costs.

Historically, to minimize our use of cash, we have used a variety of equity instruments to compensate employees, consultants and other service providers. The use of these instruments has resulted in charges to the results of operations, which have been significant in the past.

Other Income (Expense)

Total other income (expense) is comprised primarily of investment income from cash, cash equivalents and marketable securities for the three months ended March 31, 2024 and 2023, with the current year period also including a loss on sale related to the sale of our New Jersey net operating losses (“NJ NOLs”) and an investment in Impilo Therapeutics, Inc which was fully expensed under the equity method of accounting.

Income Tax Benefit

In March 2024, we received final approval from the New Jersey Economic Development Authority (“NJEDA”) under the Technology Business Tax Certificate Transfer Program (the “Program”) to sell a percentage of our NJ NOLs, which were subsequently sold to a qualifying and approved buyer pursuant to the Program for net proceeds of $0.7 million. The $0.8

27

million of our NJ NOL tax benefits have been recorded as a benefit from income taxes and the loss on sale of $0.1 million recorded in other income (expense).

28

Analysis of Liquidity and Capital Resources

As of March 31, 2024, we had cash, cash equivalents and marketable securities of approximately $43.3 million, working capital of approximately $42.2 million, and stockholders’ equity of approximately $43.0 million.

During the three months ended March 31, 2024, we met our immediate cash requirements through existing cash balances. Additionally, we used equity and equity-linked instruments to pay for services and compensation.

Net cash (used in) or provided by, operating, investing and financing activities were as follows (in thousands):

| Three Months Ended March 31, | |||||||||||

| 2024 | 2023 | ||||||||||

| Net cash used in operating activities | $ | (7,027) | $ | (8,196) | |||||||

| Net cash provided by investing activities | 6,436 | 4,289 | |||||||||

| Net cash used in financing activities | (142) | (85) | |||||||||

Operating Activities

Our cash used in operating activities during the three months ended March 31, 2024 was $7.0 million, which is comprised of (i) our net loss of $5.4 million, adjusted for non-cash expenses totaling $0.4 million (which includes adjustments for equity-based compensation, depreciation and amortization, loss from equity method investment, and amortization/accretion of marketable securities), and (ii) changes in operating assets and liabilities using approximately $2.1 million.

Our cash used in operating activities during the three months ended March 31, 2023 was $8.2 million, which is comprised of (i) our net loss of $6.2 million, adjusted for non-cash expenses totaling $0.6 million (which includes adjustments for equity-based compensation, depreciation and amortization, a loss on disposal of fixed assets, and amortization/accretion of marketable securities) and (ii) changes in operating assets and liabilities using approximately $2.6 million.

Investing Activities

Our cash provided by investing activities during the three months ended March 31, 2024 totaled $6.4 million and was primarily due to net sales of marketable securities (net of purchases of marketable securities) partially offset by an investment of $0.1 million in Impilo Therapeutics.

Our cash provided by investing activities during the three months ended March 31, 2023 totaled $4.3 million and was primarily due to net sales of marketable securities (net of purchases of marketable securities).

Financing Activities

Our cash used in financing activities during the three months ended March 31, 2024 totaled $0.1 million and consisted of tax withholding-related payments on net share settlement equity awards to employees.

Our cash used in financing activities during the three months ended March 31, 2023 totaled $0.1 million and consisted of tax withholding-related payments on net share settlement equity awards to employees.

Liquidity and Capital Requirements Outlook

To meet our short and long-term liquidity needs, we expect to use existing cash balances, marketable securities and a variety of other means. Other sources of liquidity could include additional potential issuances of debt or equity securities in public or private financings, partnerships and/or collaborations and/or sale of assets. Our history of operating losses and liquidity challenges may make it difficult for us to raise capital on acceptable terms or at all. The demand for the equity and debt of pharmaceutical companies like ours is dependent upon many factors, including the general state of the financial markets. During times of extreme market volatility, capital may not be available on favorable terms, if at all. Our inability to obtain such additional capital could materially and adversely affect our business operations. We will also continue to seek, as appropriate, grants for scientific and clinical studies from various governmental agencies and foundations, and other sources of non-dilutive funding. We believe that our cash on hand and marketable securities will enable us to fund operating expenses for at least the next 12 months following the issuance of our financial statements. Our future capital requirements are difficult to forecast and will depend on many factors including the timing and nature of any other strategic transactions that we undertake; and our ability to establish and maintain collaboration partnerships, in-license/out-license or other similar arrangements and the financial terms of such agreements.

29

On June 4, 2021, we entered into an At The Market Offering Agreement (the “ATM Agreement”) with H.C. Wainwright & Co., LLC as sales agent, in connection with an “at the market offering” under which we from time to time may offer and sell shares of our common stock having an aggregate offering price of up to $50.0 million. As of the date of this filing and so long as our public float remains below $75.0 million, we are subject to limitations pursuant to General Instruction I.B.6 of Form S-3 (the “Baby Shelf Limitation”), which limits the amount we can offer to up to one-third of our public float during any trailing 12-month period. Subsequent to the filing of our Registration Statement on Form S-3 (File No. 333-279034) on May 1, 2024, the aggregate market value of our outstanding common stock held by non-affiliates was approximately $26.7 million. Pursuant to the Baby Shelf Limitation, since the aggregate market value of our outstanding common stock held by non-affiliates was below $75.0 million at the time of such S-3 filing, the aggregate amount of securities that we are permitted to offer and sell is now $8,915,094, which was equal to one-third of the aggregate market value of our common stock held by non-affiliates as of March 21, 2024. If our public float exceeds $75.0 million on a future measurement date, the Company will no longer be subject to the Baby Shelf Limitation. There were no issuances of common stock under the ATM Agreement for the three months ended March 31, 2024. Since inception we have issued 64,394 shares of common stock under the ATM Agreement for net proceeds of $270,774.