Investor Update January 23, 2018 Exhibit 99.1

Safe Harbor Statement Certain statements included in this presentation are forward-looking and thus reflect our current expectations and beliefs with respect to certain current and future events and anticipated financial and operating performance. Such forward-looking statements are and will be subject to many risks and uncertainties relating to our operations and business environment that may cause actual results to differ materially from any future results expressed or implied in such forward-looking statements. Words such as “expects,” “will,” “plans,” “anticipates,” “indicates,” “believes,” “forecast,” “guidance,” “outlook,” “goals” and similar expressions are intended to identify forward-looking statements. Additionally, forward-looking statements include statements that do not relate solely to historical facts, such as statements which identify uncertainties or trends, discuss the possible future effects of current known trends or uncertainties, or which indicate that the future effects of known trends or uncertainties cannot be predicted, guaranteed or assured. All forward-looking statements in this presentation are based upon information available to us on the date of this presentation. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, changed circumstances or otherwise, except as required by applicable law. Our actual results could differ materially from these forward-looking statements due to numerous factors including, without limitation, the following: our ability to comply with the terms of our various financing arrangements; the costs and availability of financing; our ability to maintain adequate liquidity; our ability to execute our operational plans and revenue-generating initiatives, including optimizing our revenue; our ability to control our costs, including realizing benefits from our resource optimization efforts, cost reduction initiatives and fleet replacement programs; costs associated with any modification or termination of our aircraft orders; our ability to utilize our net operating losses; our ability to attract and retain customers; potential reputational or other impact from adverse events in our operations; demand for transportation in the markets in which we operate; an outbreak of a disease that affects travel demand or travel behavior; demand for travel and the impact that global economic and political conditions have on customer travel patterns; excessive taxation and the inability to offset future taxable income; general economic conditions (including interest rates, foreign currency exchange rates, investment or credit market conditions, crude oil prices, costs of aircraft fuel and energy refining capacity in relevant markets); economic and political instability and other risks of doing business globally; our ability to cost-effectively hedge against increases in the price of aircraft fuel if we decide to do so; any potential realized or unrealized gains or losses related to fuel or currency hedging programs; the effects of any hostilities, act of war or terrorist attack; the ability of other air carriers with whom we have alliances or partnerships to provide the services contemplated by the respective arrangements with such carriers; the effects of any technology failures or cybersecurity breaches; disruptions to our regional network; the costs and availability of aviation and other insurance; industry consolidation or changes in airline alliances; the success of our investments in airlines in other parts of the world; competitive pressures on pricing and on demand; our capacity decisions and the capacity decisions of our competitors; U.S. or foreign governmental legislation, regulation and other actions (including Open Skies agreements and environmental regulations); the impact of regulatory, investigative and legal proceedings and legal compliance risks; the impact of any management changes; labor costs; our ability to maintain satisfactory labor relations and the results of any collective bargaining agreement process with our union groups; any disruptions to operations due to any potential actions by our labor groups; weather conditions; and other risks and uncertainties set forth under Part I, Item 1A., “Risk Factors,” of our Annual Report on Form 10-K for the fiscal year ended December 31, 2016, as well as other risks and uncertainties set forth from time to time in the reports we file with the U.S. Securities and Exchange Commission.

Chief Executive Officer Oscar Munoz

Agenda Fourth-quarter and full-year 2017 results 2018 priorities United’s network and commercial strategy Financial update including full-year 2018 EPS and long-term EPS guidance Greater accountability and transparency

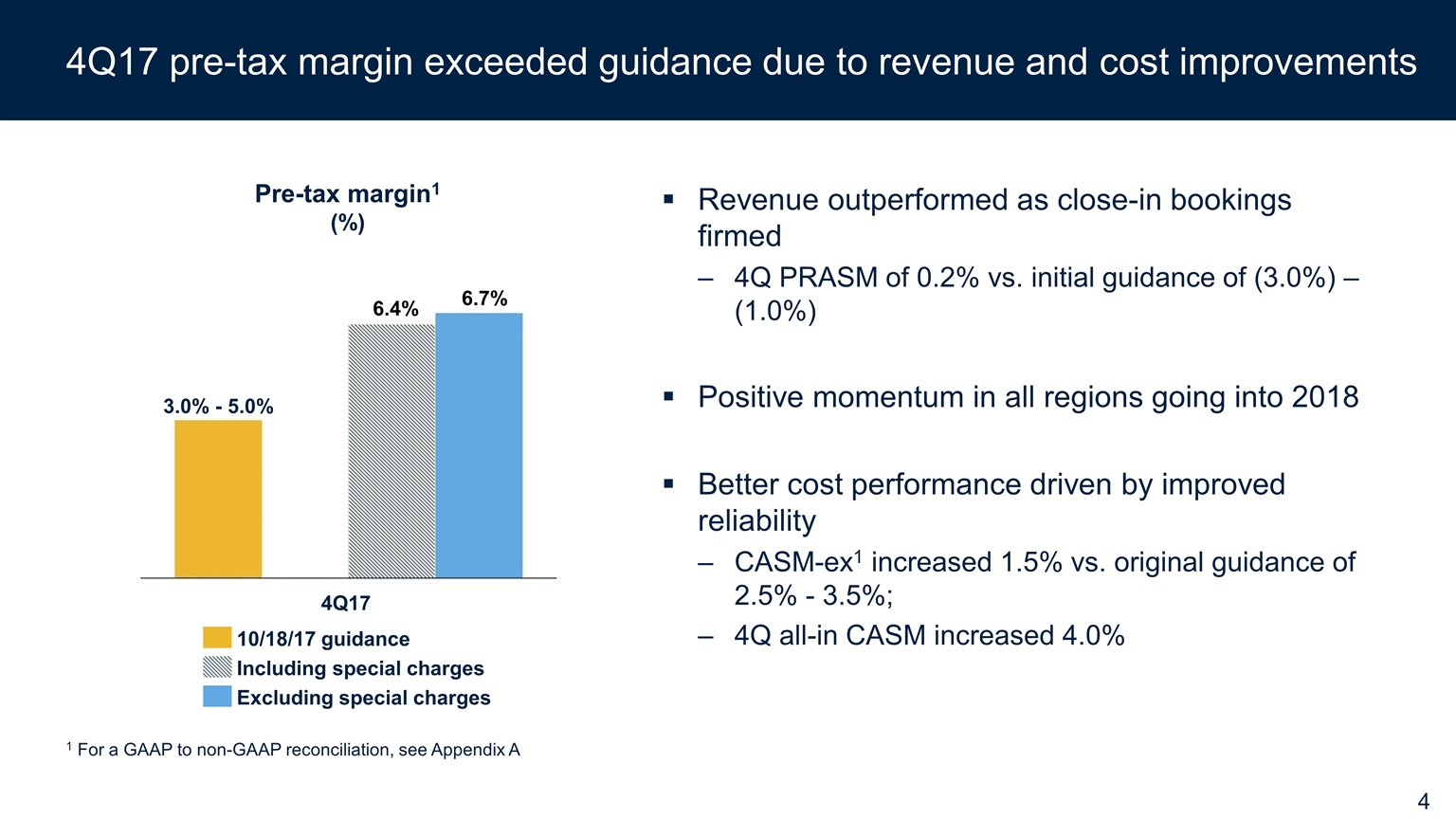

4Q17 pre-tax margin exceeded guidance due to revenue and cost improvements Pre-tax margin1 (%) Revenue outperformed as close-in bookings firmed 4Q PRASM of 0.2% vs. initial guidance of (3.0%) – (1.0%) Positive momentum in all regions going into 2018 Better cost performance driven by improved reliability CASM-ex1 increased 1.5% vs. original guidance of 2.5% - 3.5%; 4Q all-in CASM increased 4.0% 1 For a GAAP to non-GAAP reconciliation, see Appendix A 3.0% - 5.0% 6.7% 6.4%

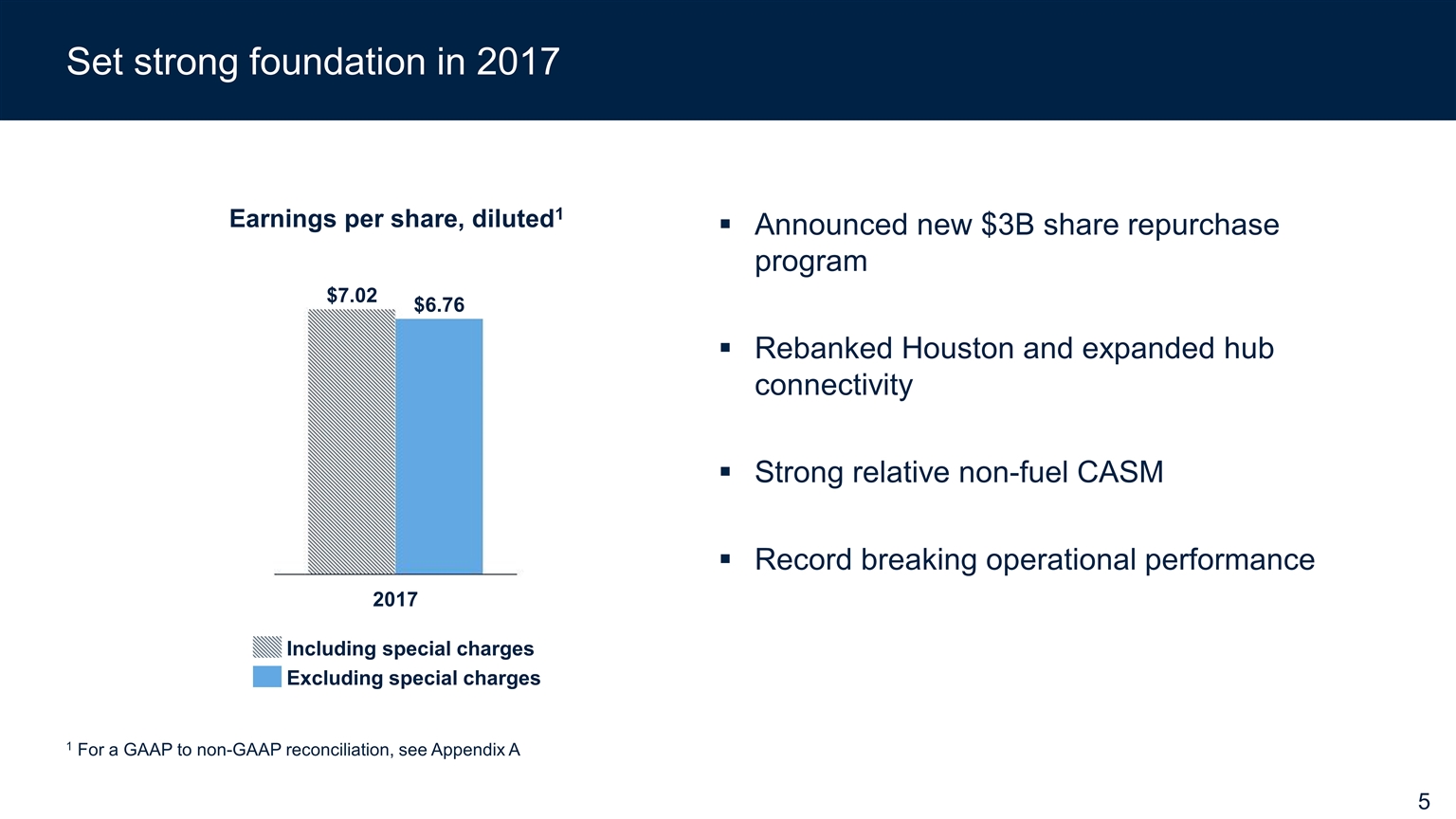

Set strong foundation in 2017 Announced new $3B share repurchase program Rebanked Houston and expanded hub connectivity Strong relative non-fuel CASM Record breaking operational performance Earnings per share, diluted1 1 For a GAAP to non-GAAP reconciliation, see Appendix A

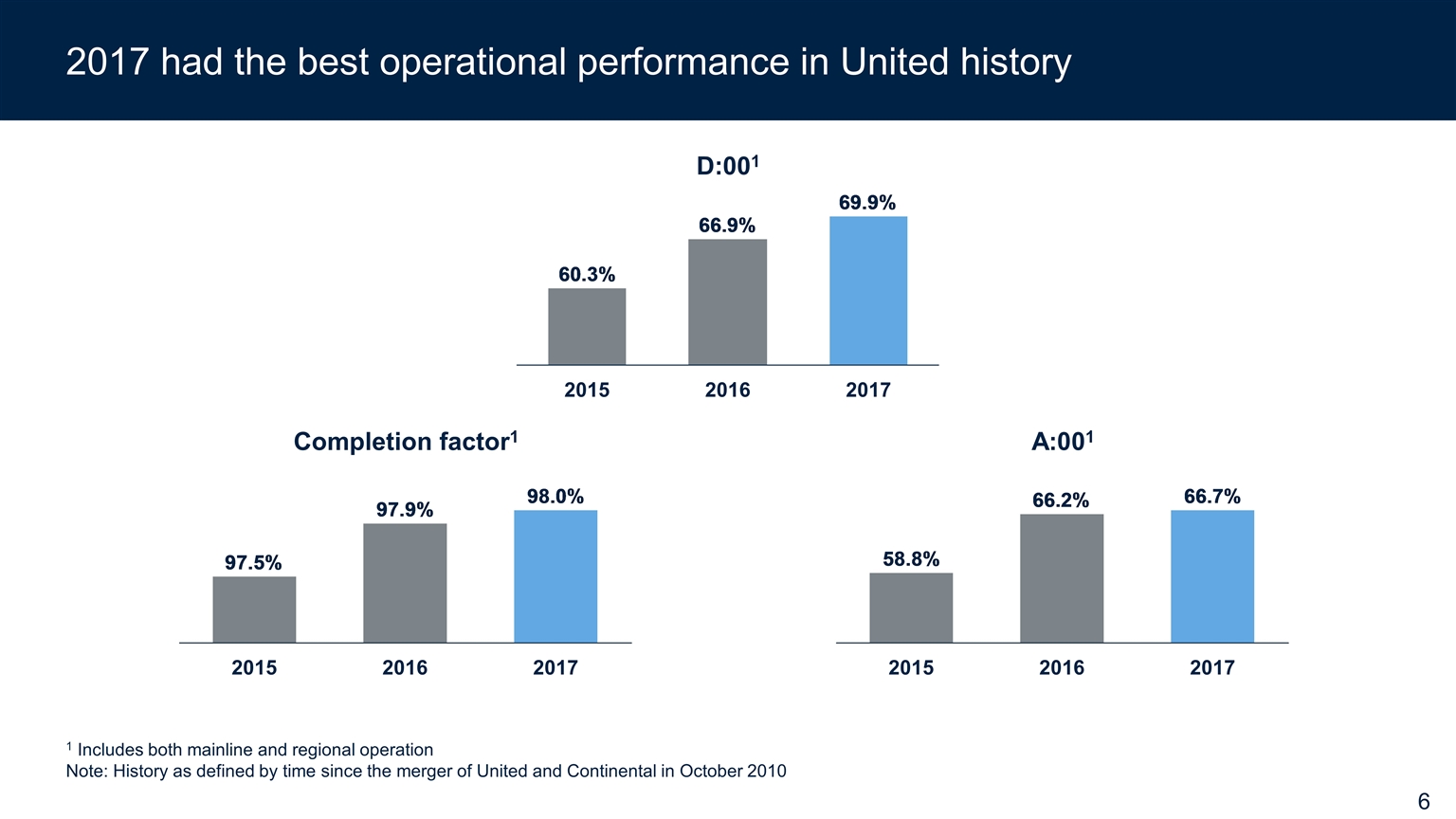

2017 had the best operational performance in United history D:001 Completion factor1 1 Includes both mainline and regional operation Note: History as defined by time since the merger of United and Continental in October 2010 A:001

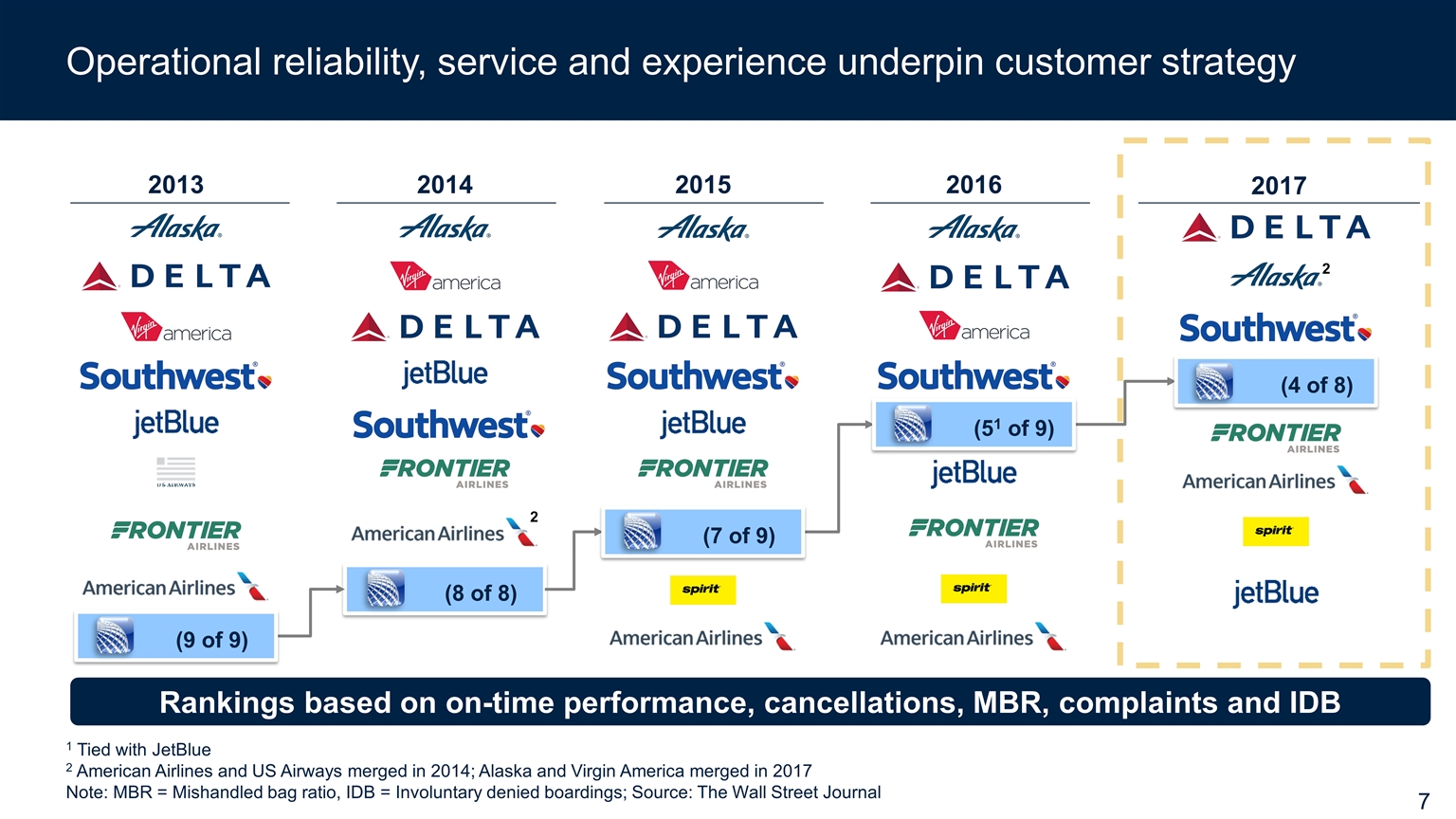

2014 (8 of 8) 2017 2015 (7 of 9) 2016 (51 of 9) Operational reliability, service and experience underpin customer strategy Rankings based on on-time performance, cancellations, MBR, complaints and IDB 1 Tied with JetBlue 2 American Airlines and US Airways merged in 2014; Alaska and Virgin America merged in 2017 Note: MBR = Mishandled bag ratio, IDB = Involuntary denied boardings; Source: The Wall Street Journal (4 of 8) 2 2013 (9 of 9) 2

2018 priorities – continued top-tier operational reliability is the foundation Strengthening our domestic network through growth Driving efficiency and productivity Continue investing in people, product and technology Our strategy drives sustainably higher profits and margins

President Scott Kirby

Network strategy – outlook Network is our foundation Leverage our strengths “Uniquely United” opportunities Our network has tremendous potential – capitalizing on our strengths and improving our hub quality Other commercial elements require a strong network to succeed Overall strategy returns United to profitable growth Our international gateways are a structural advantage that we will continue to grow and enhance Enhance and improve our alliances and JVs Geographic position of our hubs Grow our domestic network to strengthen our mid-continent hubs Greater scale at our hubs reinforces our relevance and value proposition to customers Continue to improve connectivity at our hubs

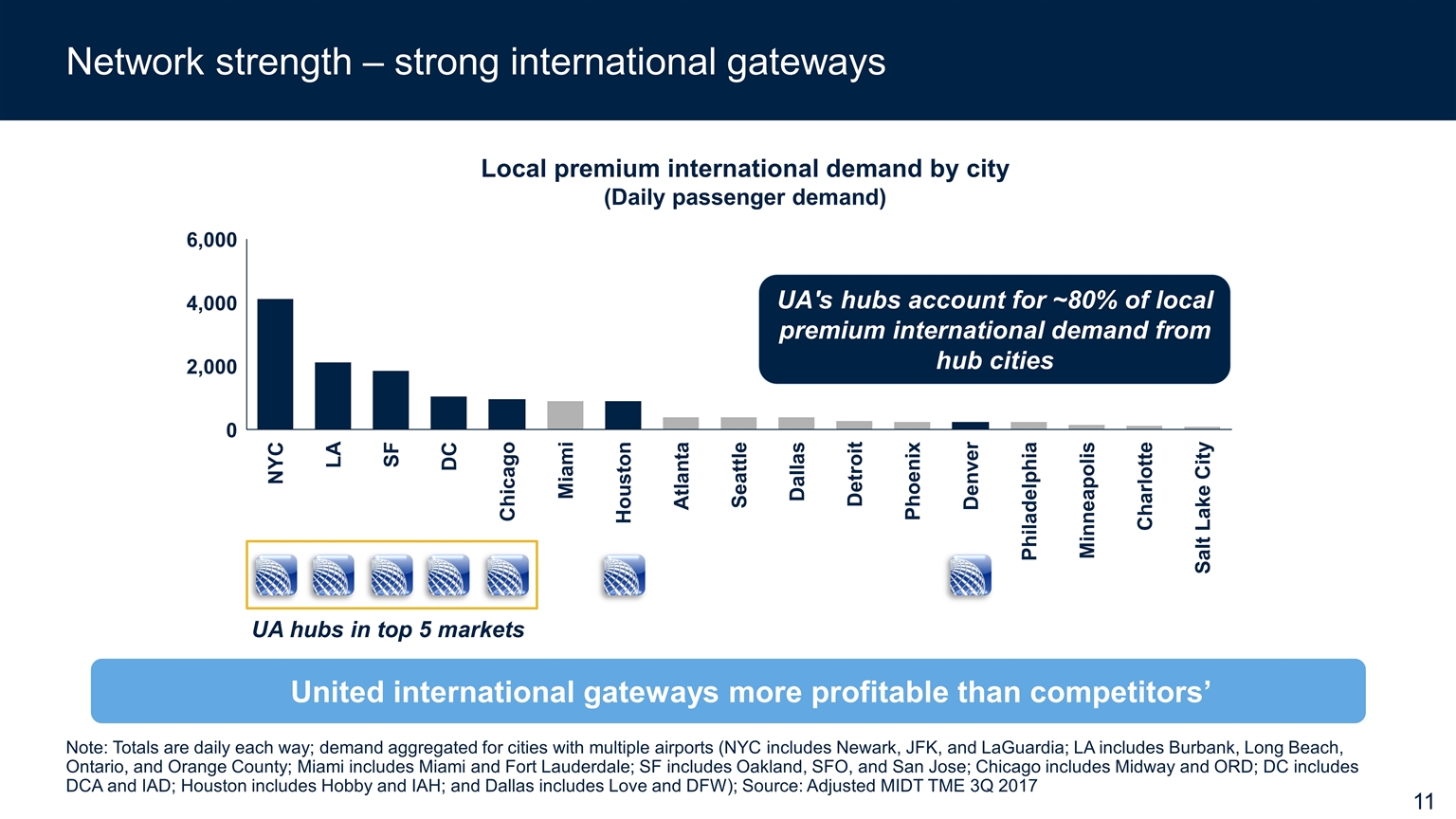

Network strength – strong international gateways Note: Totals are daily each way; demand aggregated for cities with multiple airports (NYC includes Newark, JFK, and LaGuardia; LA includes Burbank, Long Beach, Ontario, and Orange County; Miami includes Miami and Fort Lauderdale; SF includes Oakland, SFO, and San Jose; Chicago includes Midway and ORD; DC includes DCA and IAD; Houston includes Hobby and IAH; and Dallas includes Love and DFW); Source: Adjusted MIDT TME 3Q 2017 UA hubs in top 5 markets Local premium international demand by city (Daily passenger demand) UA's hubs account for ~80% of local premium international demand from hub cities United international gateways more profitable than competitors’

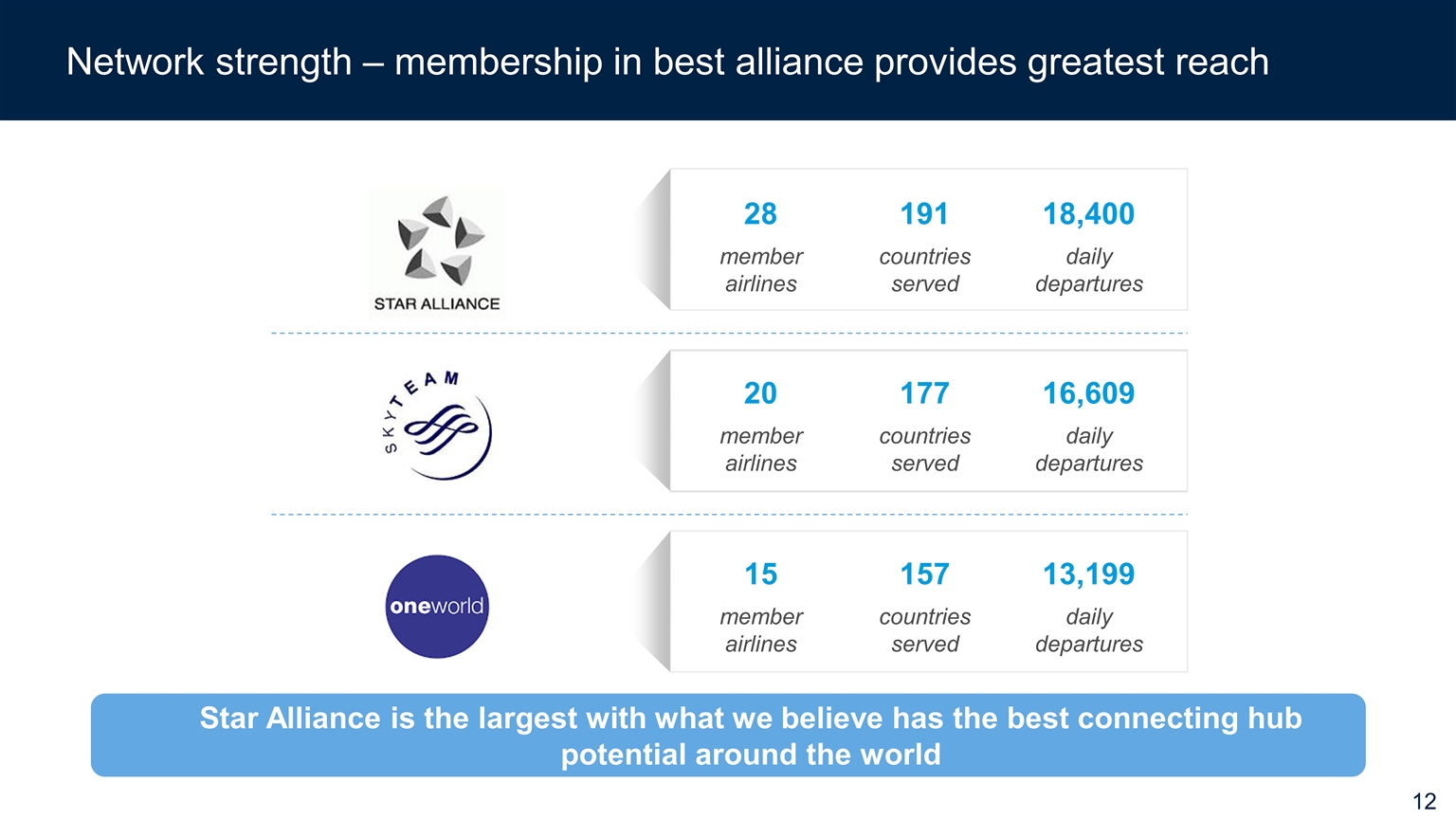

Network strength – membership in best alliance provides greatest reach 28 191 18,400 member airlines countries served daily departures 20 177 16,609 member airlines countries served daily departures 15 157 13,199 member airlines countries served daily departures Star Alliance is the largest with what we believe has the best connecting hub potential around the world

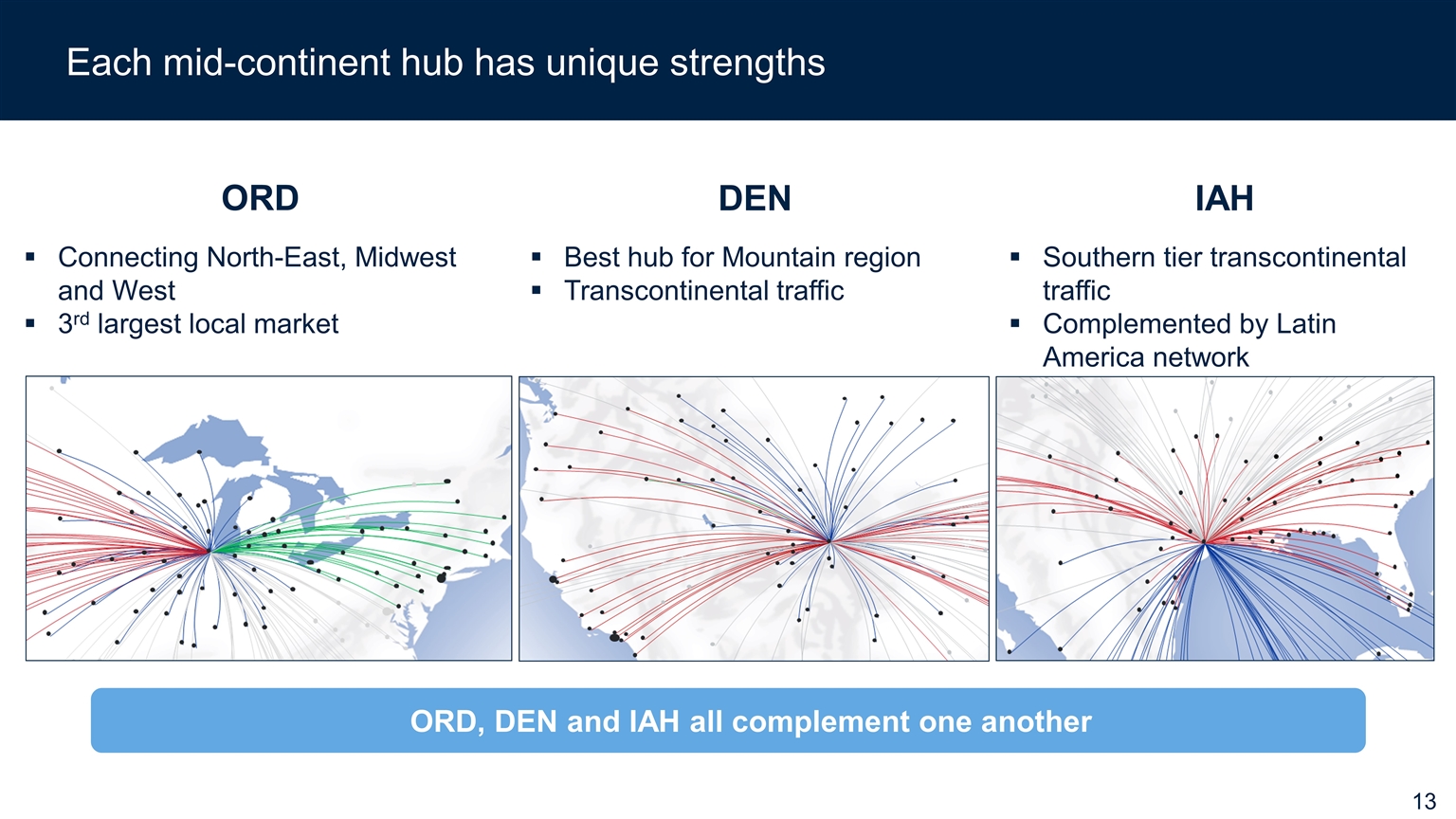

Each mid-continent hub has unique strengths ORD IAH DEN Connecting North-East, Midwest and West 3rd largest local market Southern tier transcontinental traffic Complemented by Latin America network Best hub for Mountain region Transcontinental traffic ORD, DEN and IAH all complement one another

Opportunity – mid-continent hubs not yet fulfilling their potential Hub scale UA hubs have lower connectivity than peers Hub profitability directly correlated with hub connectivity and is the most important element of a hub’s success Connectivity UA shrank without reducing fixed costs Asset efficiency UA shrank and became less exposed to high yield flow markets Revenue quality UA domestic scale/share is low versus competitors

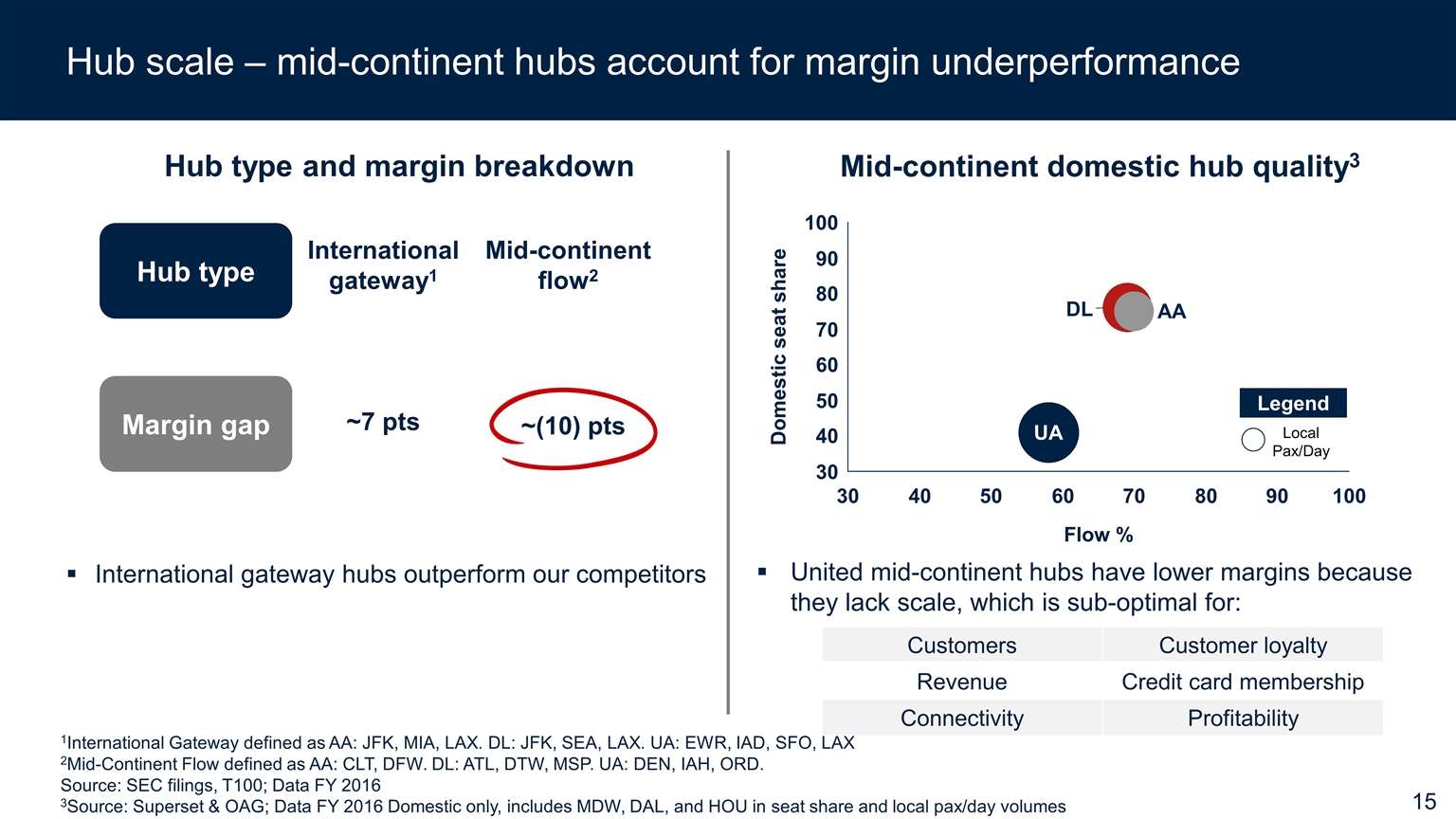

International gateway hubs outperform our competitors Hub type Margin gap International gateway1 ~7 pts Hub type and margin breakdown Mid-continent domestic hub quality3 Mid-continent flow2 ~(10) pts Hub scale – mid-continent hubs account for margin underperformance United mid-continent hubs have lower margins because they lack scale, which is sub-optimal for: Local Pax/Day Legend Customers Customer loyalty Revenue Credit card membership Connectivity Profitability 1International Gateway defined as AA: JFK, MIA, LAX. DL: JFK, SEA, LAX. UA: EWR, IAD, SFO, LAX 2Mid-Continent Flow defined as AA: CLT, DFW. DL: ATL, DTW, MSP. UA: DEN, IAH, ORD. Source: SEC filings, T100; Data FY 2016 3Source: Superset & OAG; Data FY 2016 Domestic only, includes MDW, DAL, and HOU in seat share and local pax/day volumes

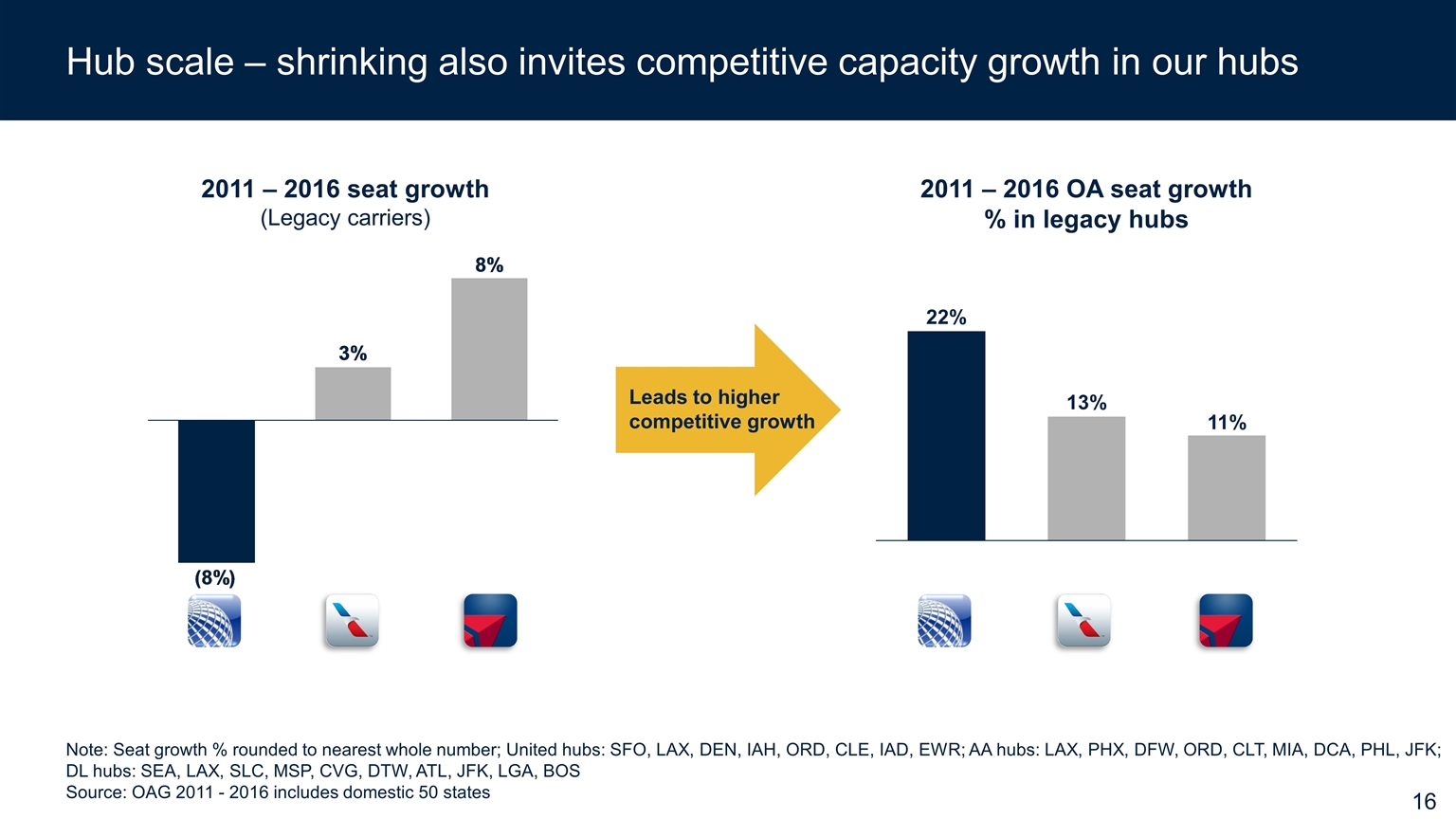

Hub scale – shrinking also invites competitive capacity growth in our hubs 2011 – 2016 seat growth (Legacy carriers) Note: Seat growth % rounded to nearest whole number; United hubs: SFO, LAX, DEN, IAH, ORD, CLE, IAD, EWR; AA hubs: LAX, PHX, DFW, ORD, CLT, MIA, DCA, PHL, JFK; DL hubs: SEA, LAX, SLC, MSP, CVG, DTW, ATL, JFK, LGA, BOS Source: OAG 2011 - 2016 includes domestic 50 states Leads to higher competitive growth 2011 – 2016 OA seat growth % in legacy hubs

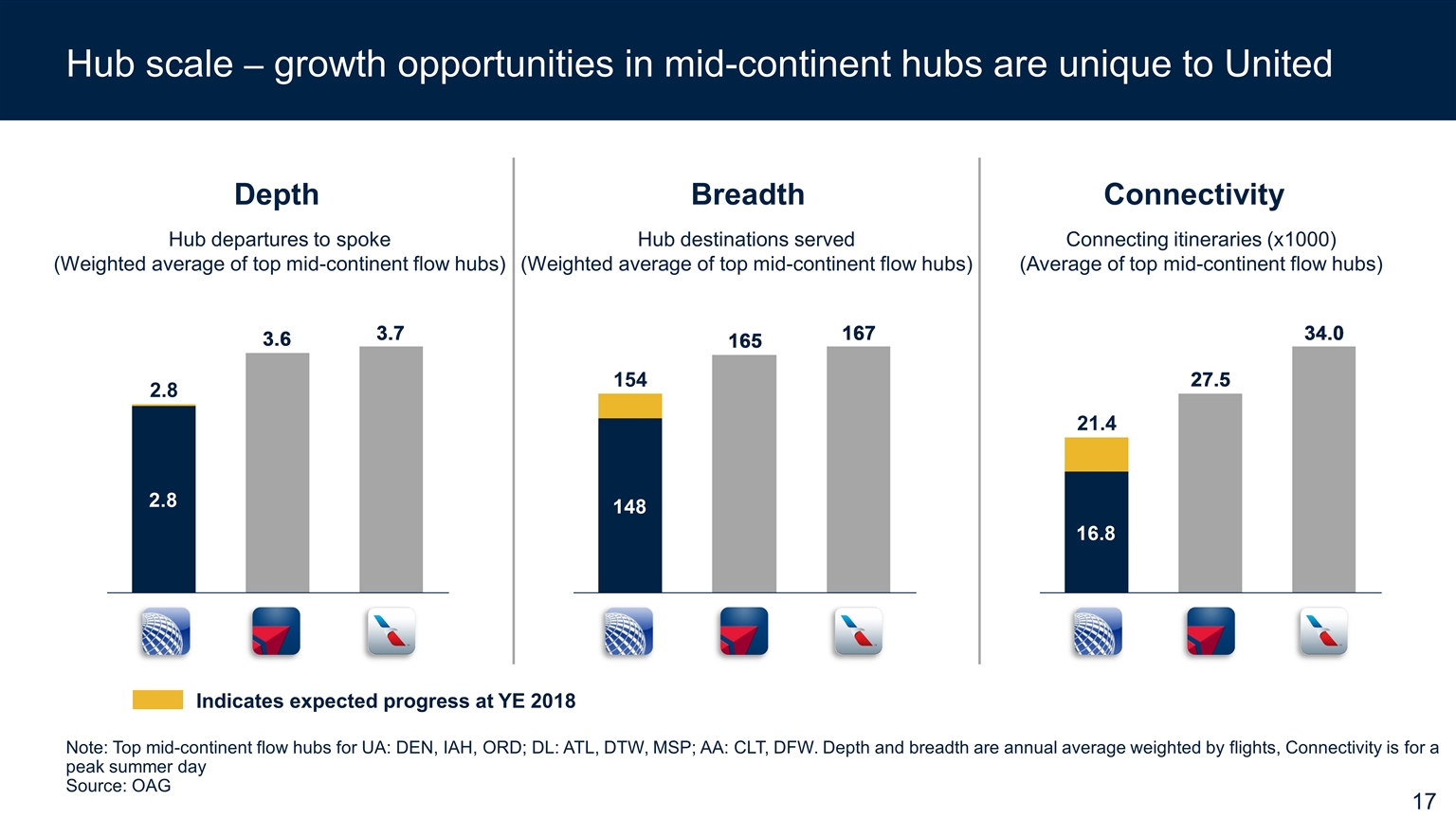

Connecting itineraries (x1000) (Average of top mid-continent flow hubs) Hub destinations served (Weighted average of top mid-continent flow hubs) Hub departures to spoke (Weighted average of top mid-continent flow hubs) Depth Breadth Connectivity 16.8 Hub scale – growth opportunities in mid-continent hubs are unique to United Indicates expected progress at YE 2018 Note: Top mid-continent flow hubs for UA: DEN, IAH, ORD; DL: ATL, DTW, MSP; AA: CLT, DFW. Depth and breadth are annual average weighted by flights, Connectivity is for a peak summer day Source: OAG

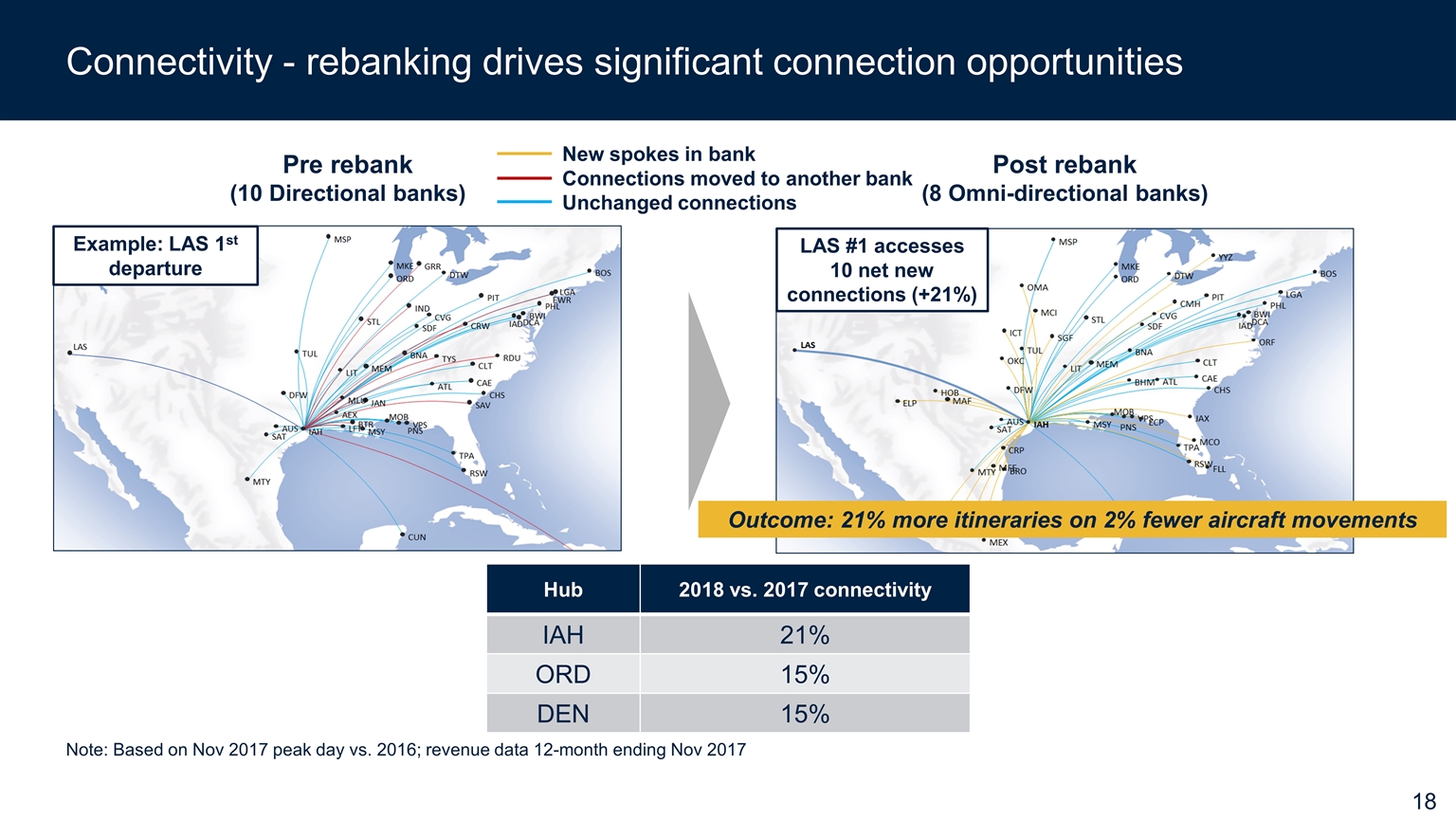

Connectivity - rebanking drives significant connection opportunities Pre rebank (10 Directional banks) Post rebank (8 Omni-directional banks) LAS #1 accesses 10 net new connections (+21%) Example: LAS 1st departure New spokes in bank Connections moved to another bank Unchanged connections Hub 2018 vs. 2017 connectivity IAH 21% ORD 15% DEN 15% Outcome: 21% more itineraries on 2% fewer aircraft movements Note: Based on Nov 2017 peak day vs. 2016; revenue data 12-month ending Nov 2017

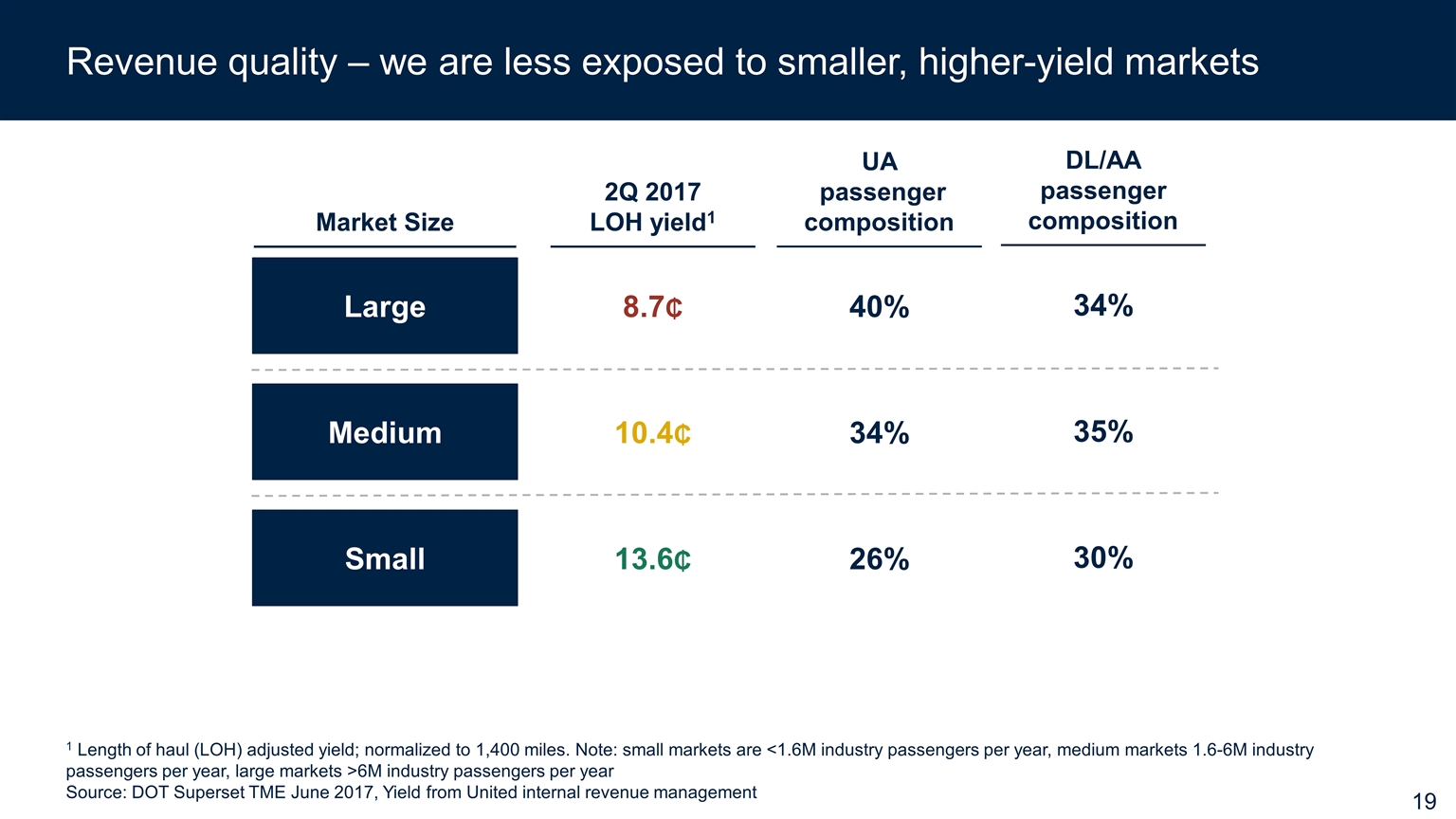

Revenue quality – we are less exposed to smaller, higher-yield markets 1 Length of haul (LOH) adjusted yield; normalized to 1,400 miles. Note: small markets are <1.6M industry passengers per year, medium markets 1.6-6M industry passengers per year, large markets >6M industry passengers per year Source: DOT Superset TME June 2017, Yield from United internal revenue management Large Medium Small 2Q 2017 LOH yield1 UA passenger composition Market Size 8.7 10.4 13.6 40% 34% 26% DL/AA passenger composition 34% 35% 30%

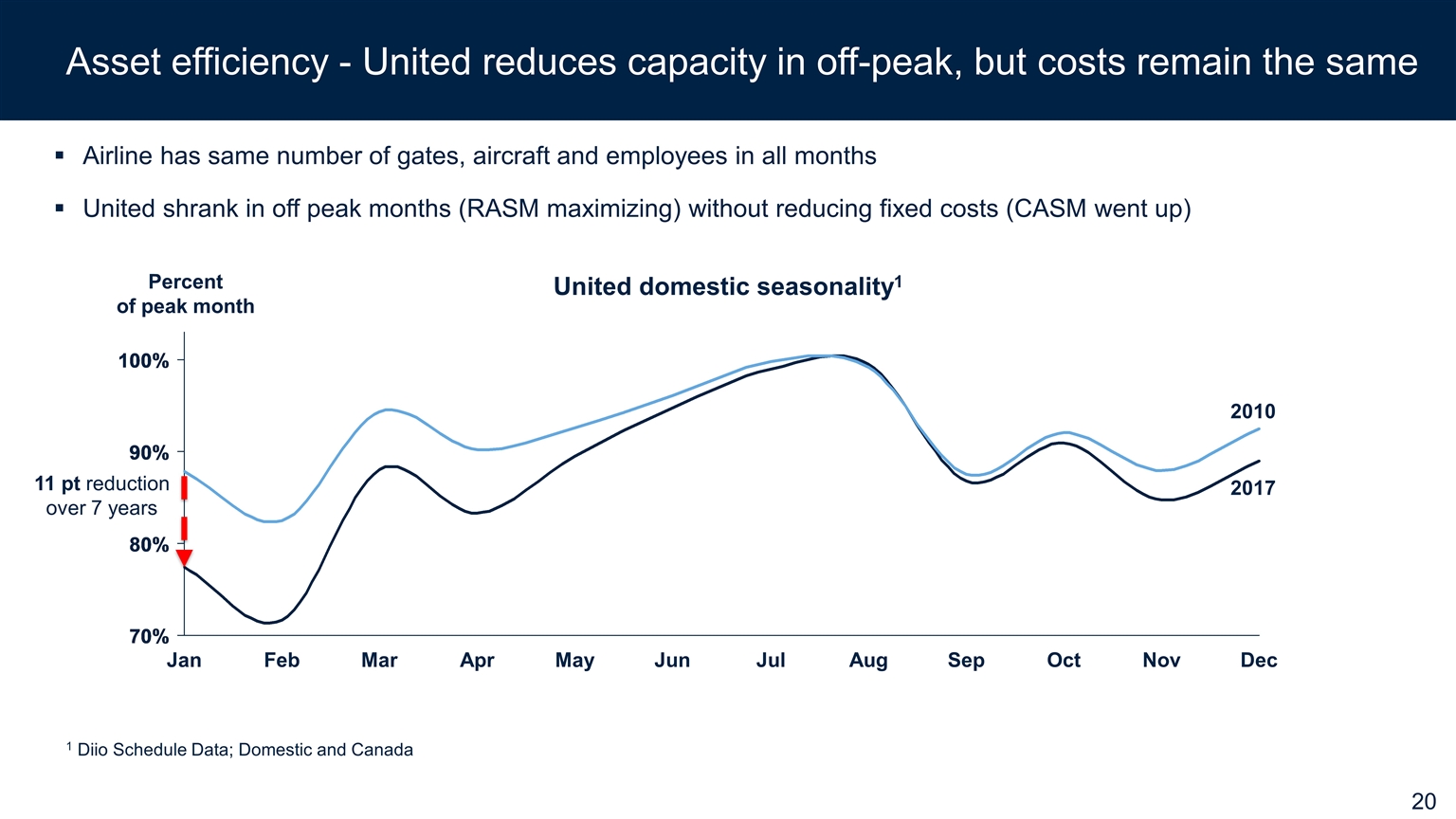

Asset efficiency - United reduces capacity in off-peak, but costs remain the same 1 Diio Schedule Data; Domestic and Canada United domestic seasonality1 Percent of peak month Airline has same number of gates, aircraft and employees in all months United shrank in off peak months (RASM maximizing) without reducing fixed costs (CASM went up) 2010 2017 11 pt reduction over 7 years

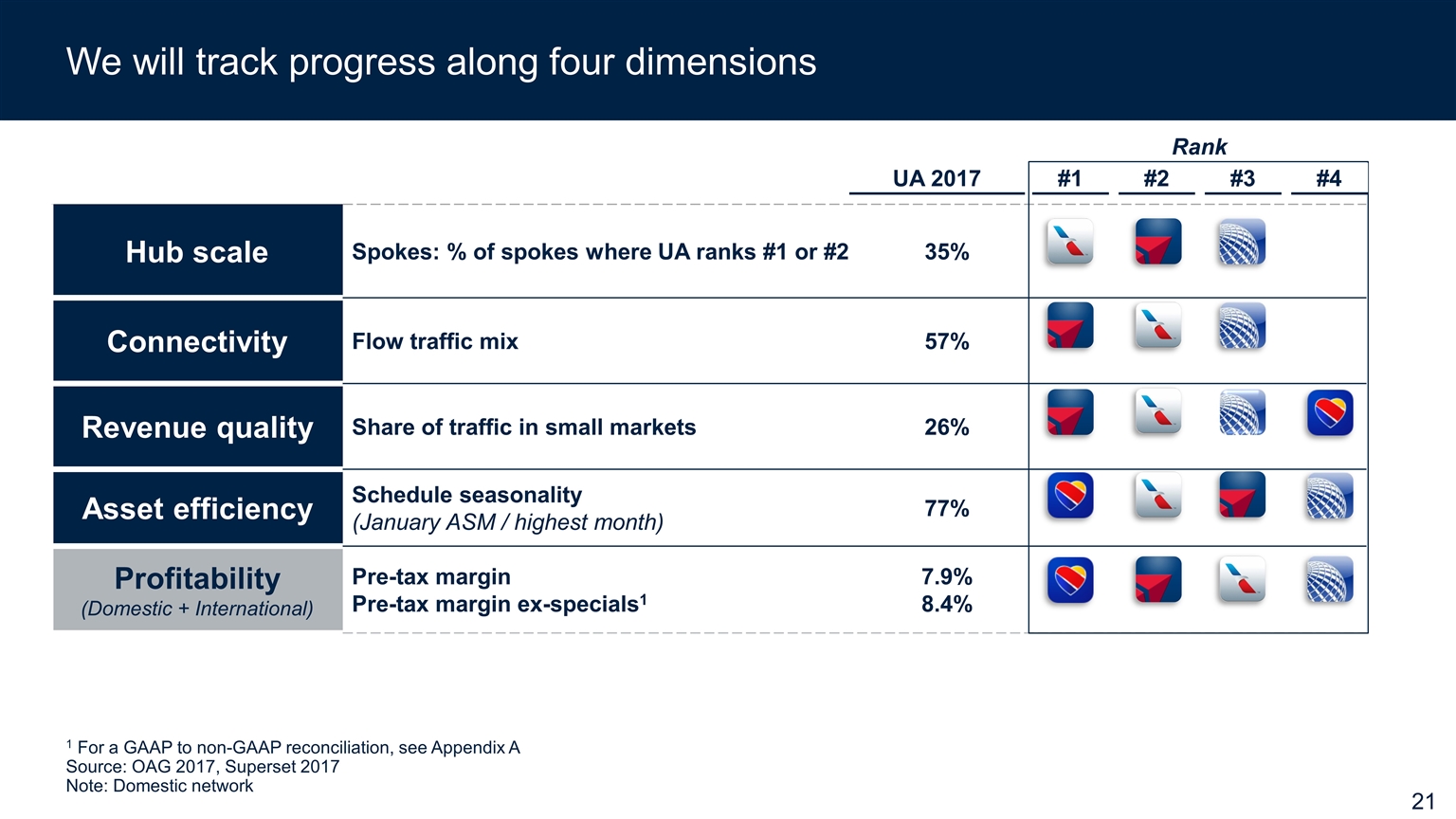

Hub scale Spokes: % of spokes where UA ranks #1 or #2 35% Connectivity Flow traffic mix 57% Revenue quality Share of traffic in small markets 26% Asset efficiency Schedule seasonality (January ASM / highest month) 77% Profitability (Domestic + International) Pre-tax margin Pre-tax margin ex-specials1 7.9% 8.4% UA 2017 #1 #2 #3 #4 Rank 1 For a GAAP to non-GAAP reconciliation, see Appendix A Source: OAG 2017, Superset 2017 Note: Domestic network We will track progress along four dimensions

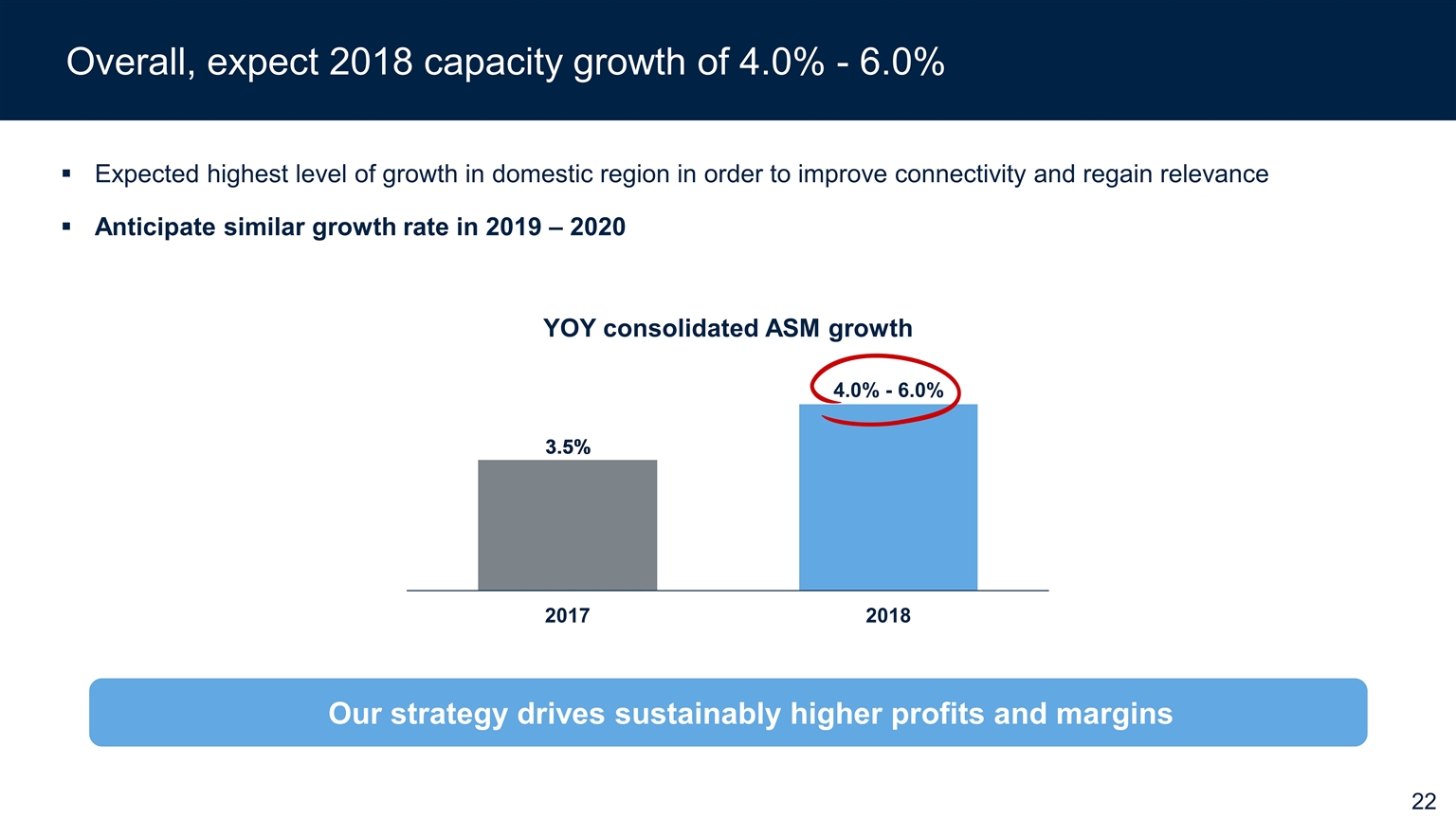

Our strategy drives sustainably higher profits and margins Overall, expect 2018 capacity growth of 4.0% - 6.0% Expected highest level of growth in domestic region in order to improve connectivity and regain relevance Anticipate similar growth rate in 2019 – 2020 4.0% - 6.0% YOY consolidated ASM growth

Executive Vice President and Chief Commercial Officer Andrew Nocella

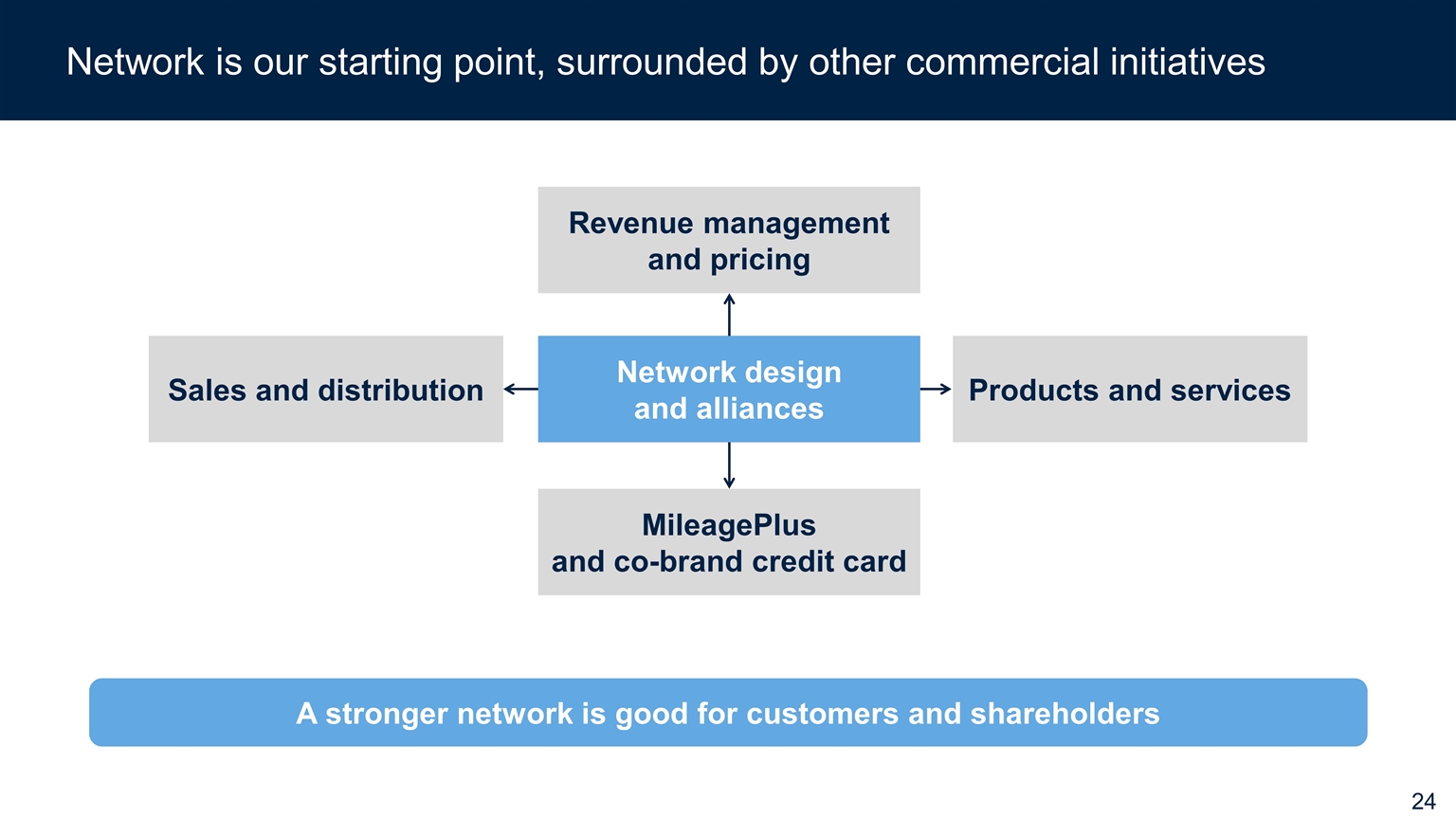

Network is our starting point, surrounded by other commercial initiatives A stronger network is good for customers and shareholders Network design and alliances Revenue management and pricing Sales and distribution Products and services MileagePlus and co-brand credit card

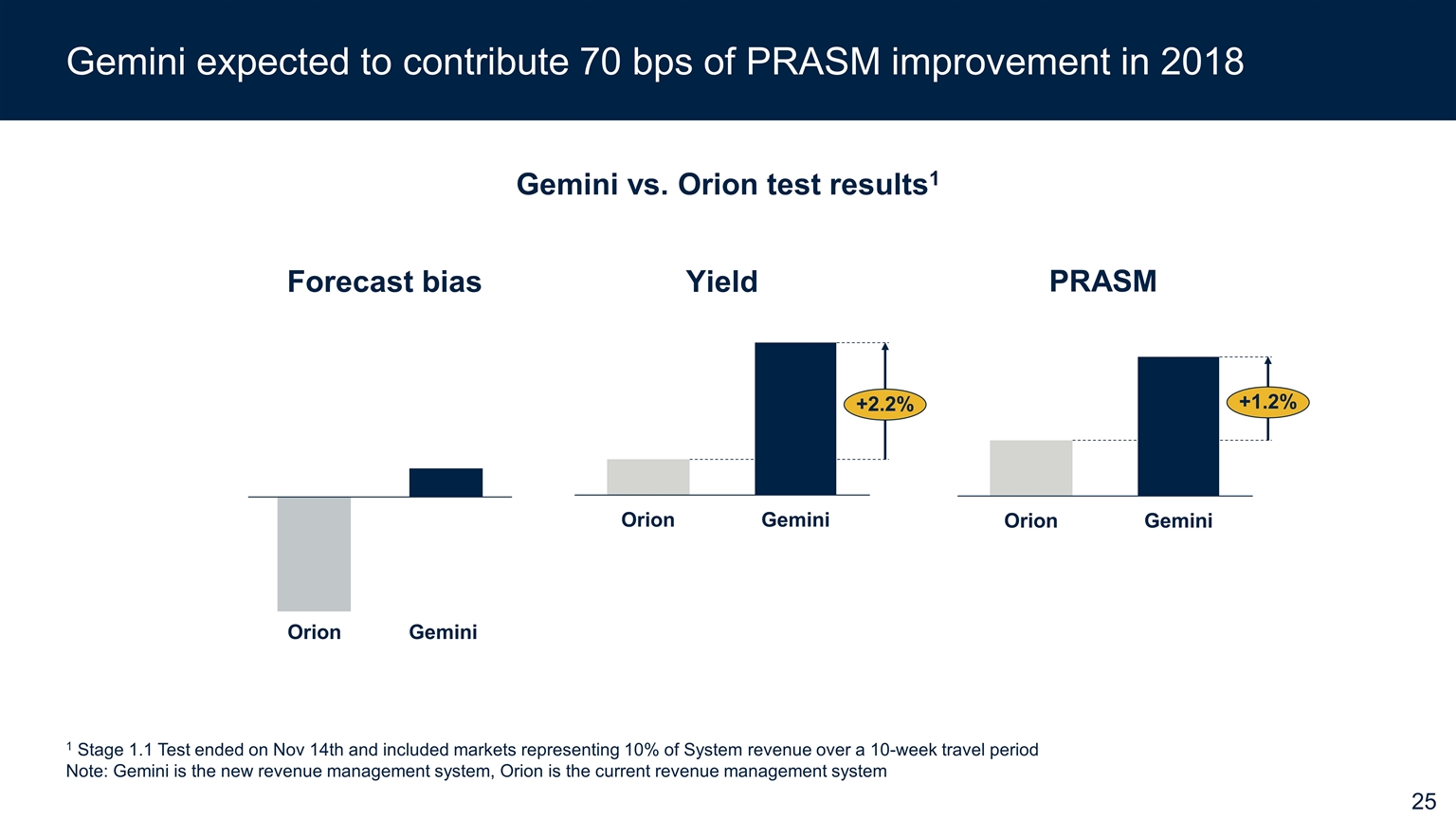

UA System Q3 YOY Gross RASM by YOY Capacity Growth Gemini expected to contribute 70 bps of PRASM improvement in 2018 Gemini vs. Orion test results1 Yield PRASM 1 Stage 1.1 Test ended on Nov 14th and included markets representing 10% of System revenue over a 10-week travel period Note: Gemini is the new revenue management system, Orion is the current revenue management system Forecast bias

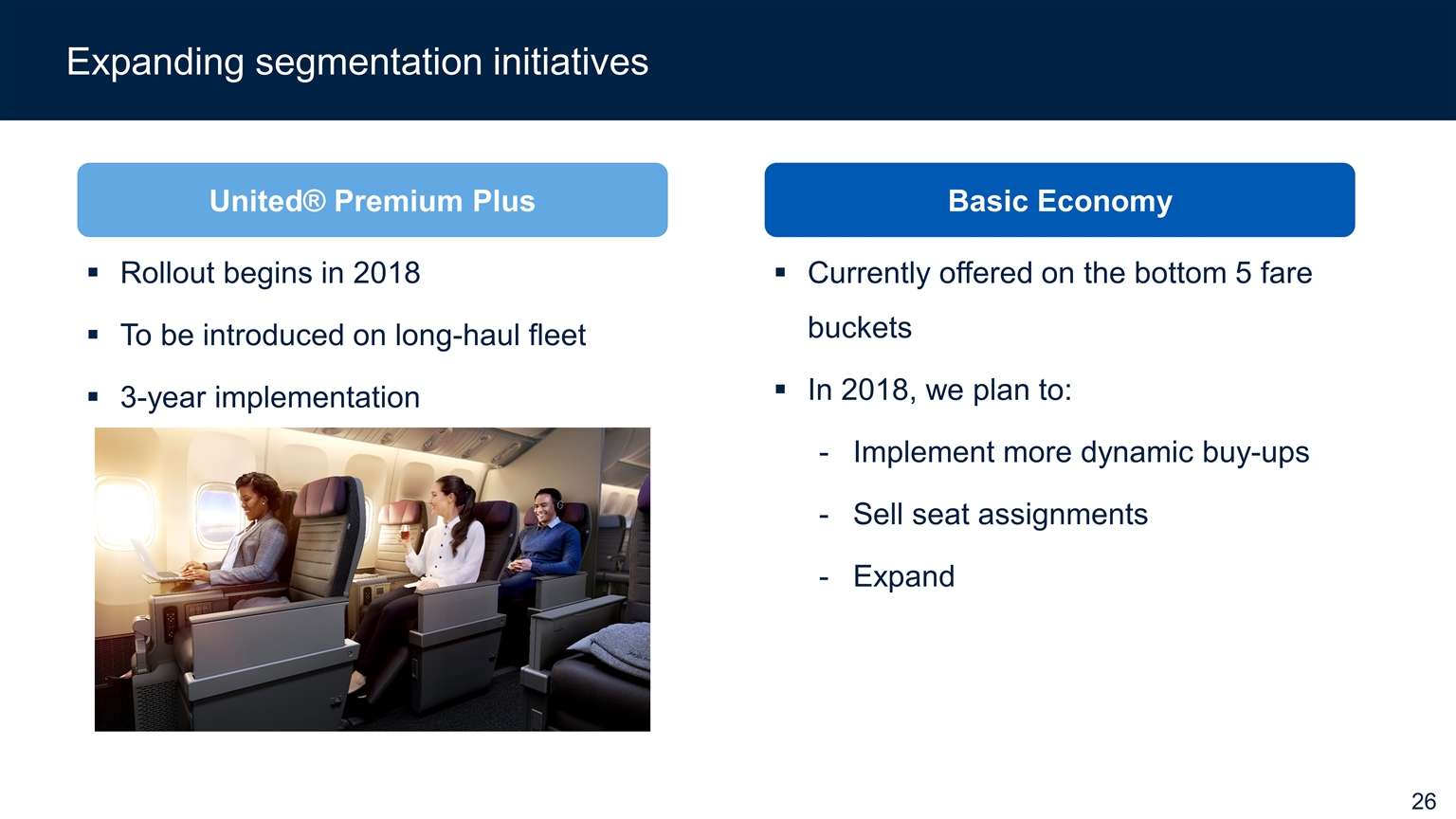

United® Premium Plus Basic Economy Currently offered on the bottom 5 fare buckets In 2018, we plan to: Implement more dynamic buy-ups Sell seat assignments Expand Rollout begins in 2018 To be introduced on long-haul fleet 3-year implementation Expanding segmentation initiatives

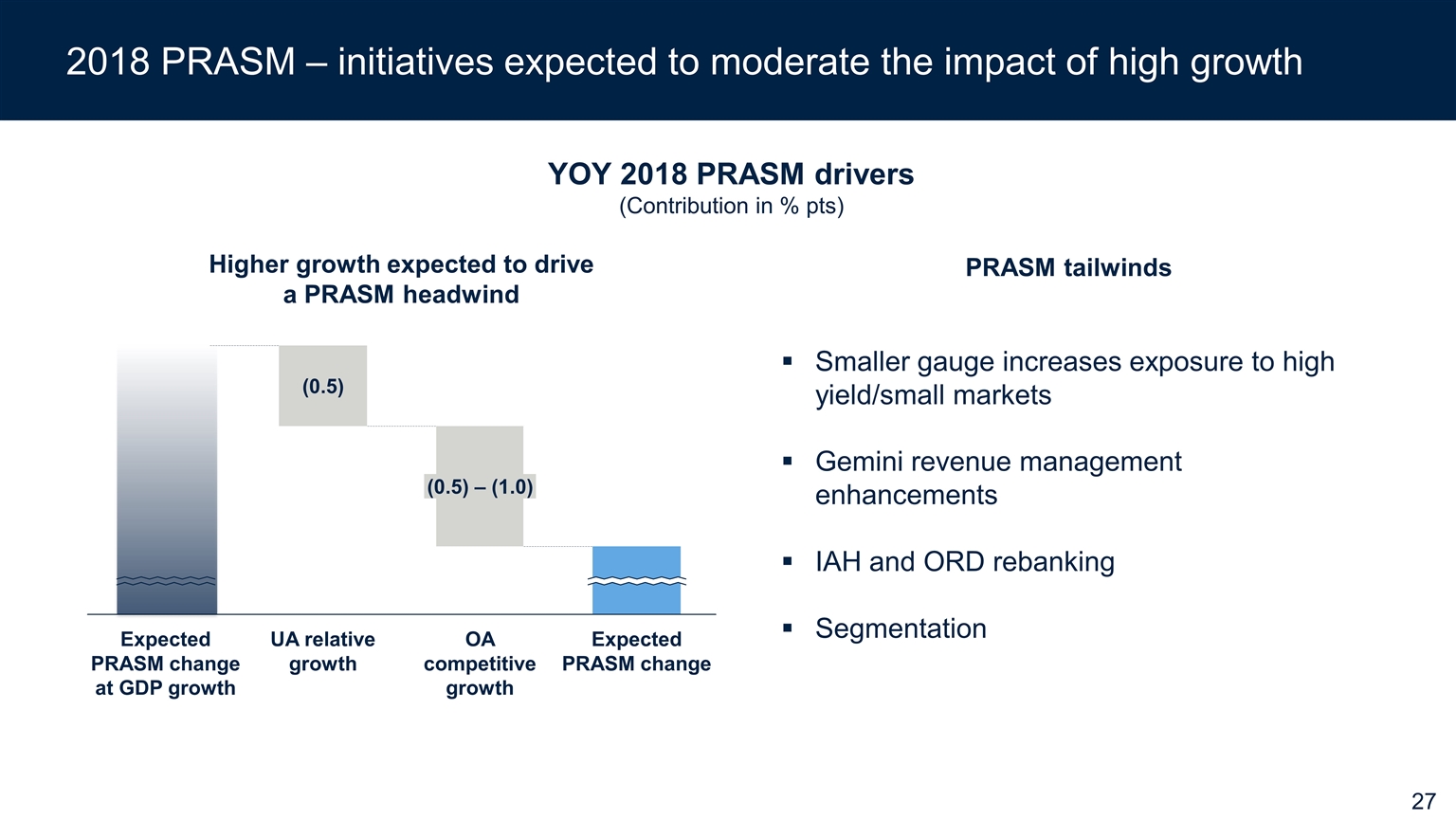

YOY 2018 Gross PRASM at +1.0% YOY 2018 PRASM drivers (Contribution in % pts) 2018 PRASM – initiatives expected to moderate the impact of high growth (0.5) – (1.0) OA competitive growth UA relative growth Higher growth expected to drive a PRASM headwind Smaller gauge increases exposure to high yield/small markets Gemini revenue management enhancements IAH and ORD rebanking Segmentation PRASM tailwinds

Executive Vice President and Chief Financial Officer Andrew Levy

Improving profitability while growing the network Improve efficiency and productivity Provide long-term CASM-ex1 guidance Accountable for higher profitability Focus on CASM Introduce 2018 EPS guidance Introduce 2020 EPS target A strong balance sheet is the foundation – maintaining $5B - $6B of liquidity 1 Non-fuel CASM (operating expense per available seat mile) excludes fuel, profit sharing, third-party business expenses and special charges, the nature and amount of which are not determinable at this time

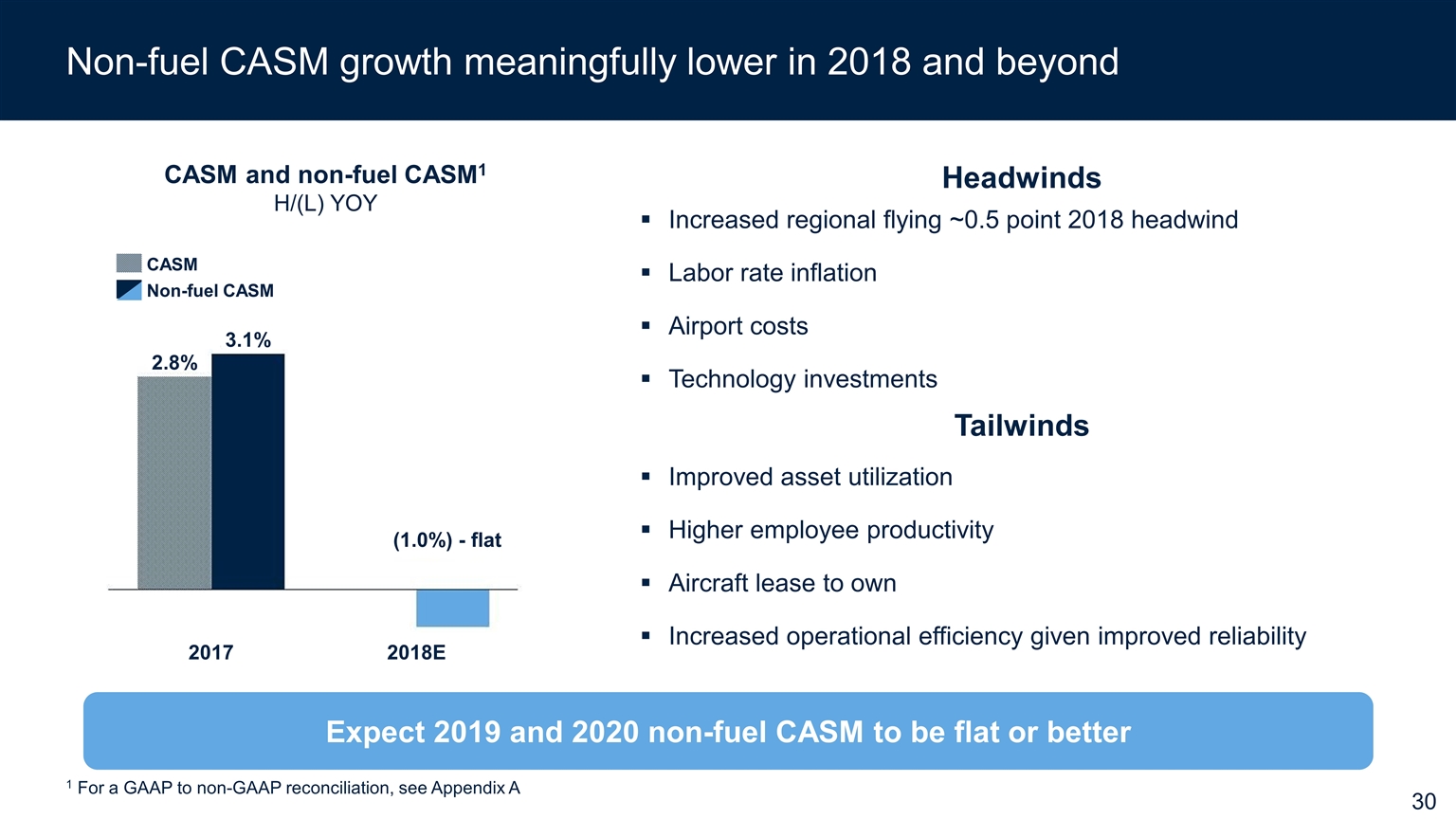

Improved asset utilization Higher employee productivity Aircraft lease to own Increased operational efficiency given improved reliability CASM and non-fuel CASM1 H/(L) YOY Non-fuel CASM growth meaningfully lower in 2018 and beyond Headwinds Tailwinds 1 For a GAAP to non-GAAP reconciliation, see Appendix A (1.0%) - flat Increased regional flying ~0.5 point 2018 headwind Labor rate inflation Airport costs Technology investments Expect 2019 and 2020 non-fuel CASM to be flat or better

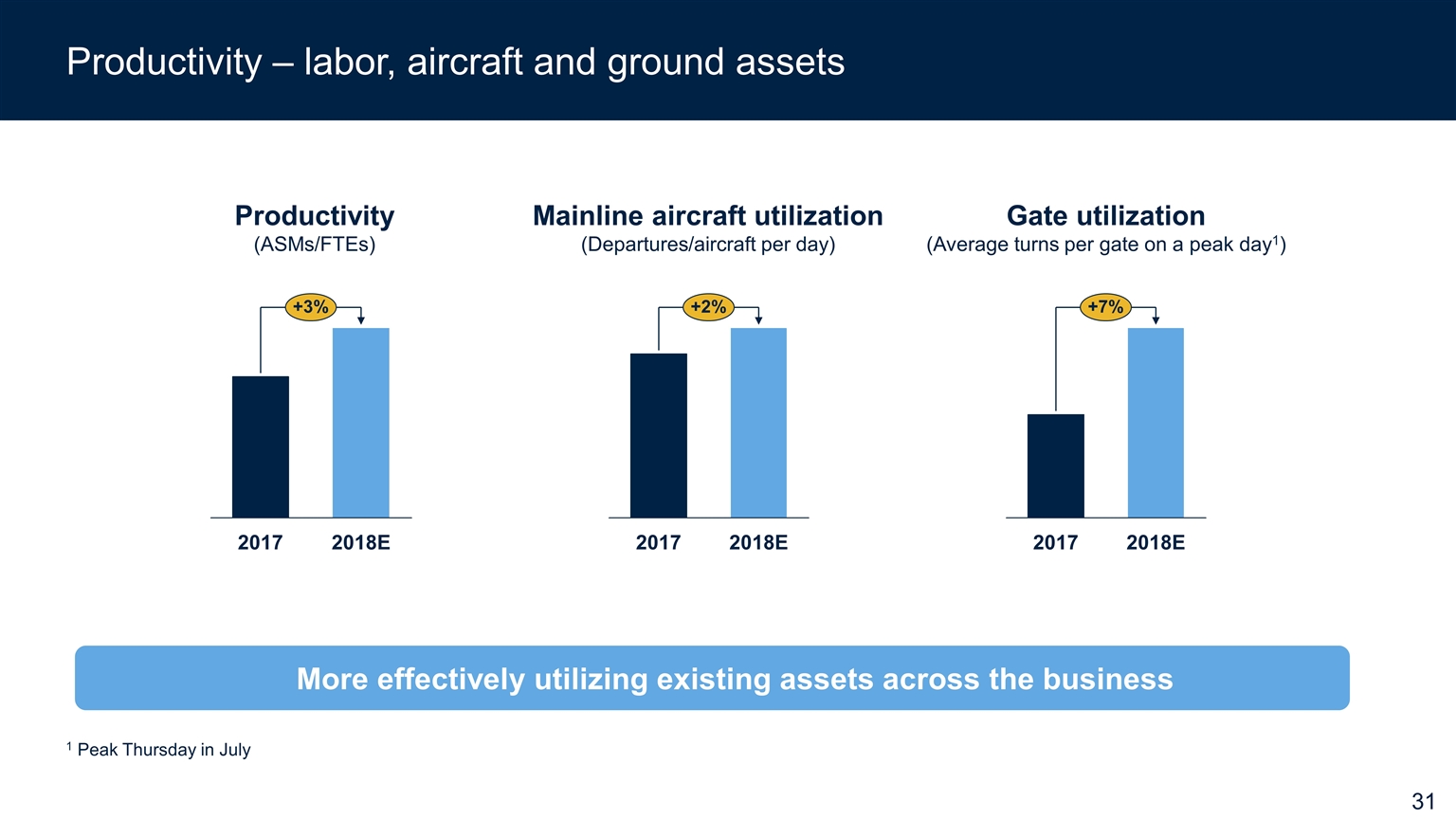

Productivity – labor, aircraft and ground assets Productivity (ASMs/FTEs) Mainline aircraft utilization (Departures/aircraft per day) Gate utilization (Average turns per gate on a peak day1) 1 Peak Thursday in July More effectively utilizing existing assets across the business

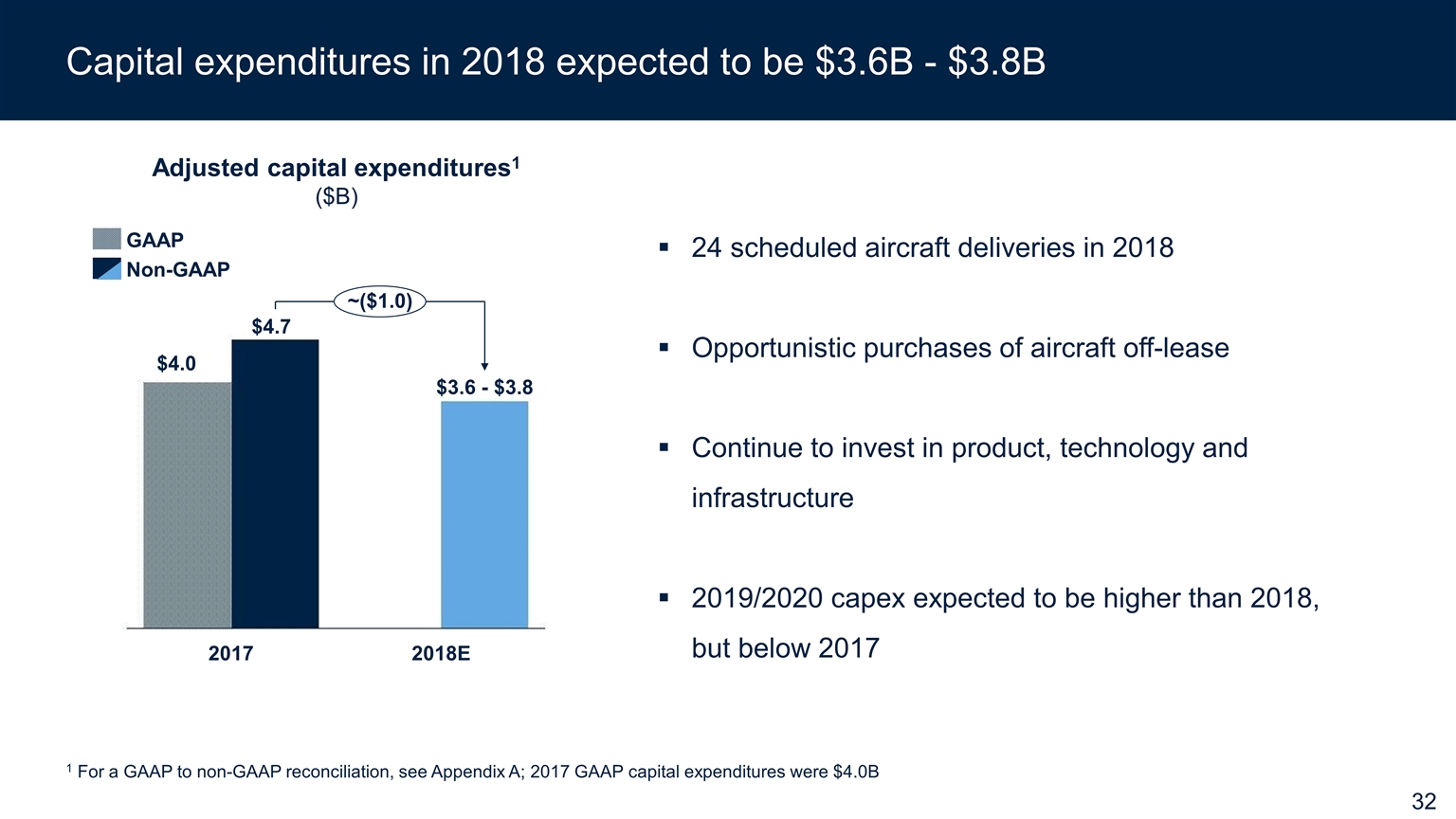

Capital expenditures in 2018 expected to be $3.6B - $3.8B 24 scheduled aircraft deliveries in 2018 Opportunistic purchases of aircraft off-lease Continue to invest in product, technology and infrastructure 2019/2020 capex expected to be higher than 2018, but below 2017 Adjusted capital expenditures1 ($B) $3.6 - $3.8 ~($1.0) 1 For a GAAP to non-GAAP reconciliation, see Appendix A; 2017 GAAP capital expenditures were $4.0B $4.0 $4.7

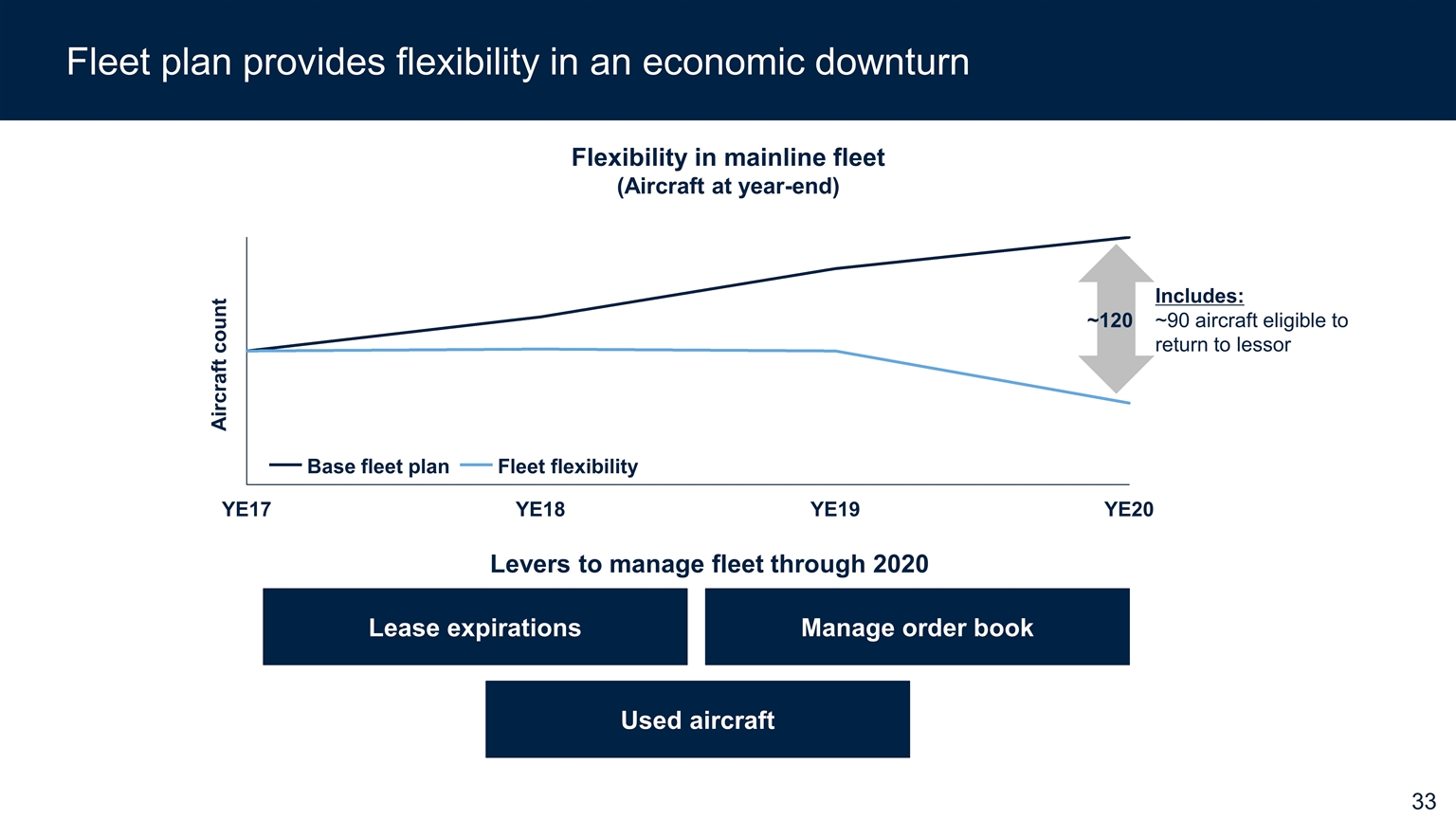

Fleet plan provides flexibility in an economic downturn Aircraft count Flexibility in mainline fleet (Aircraft at year-end) Levers to manage fleet through 2020 ~120 Includes: ~90 aircraft eligible to return to lessor Lease expirations Used aircraft Manage order book

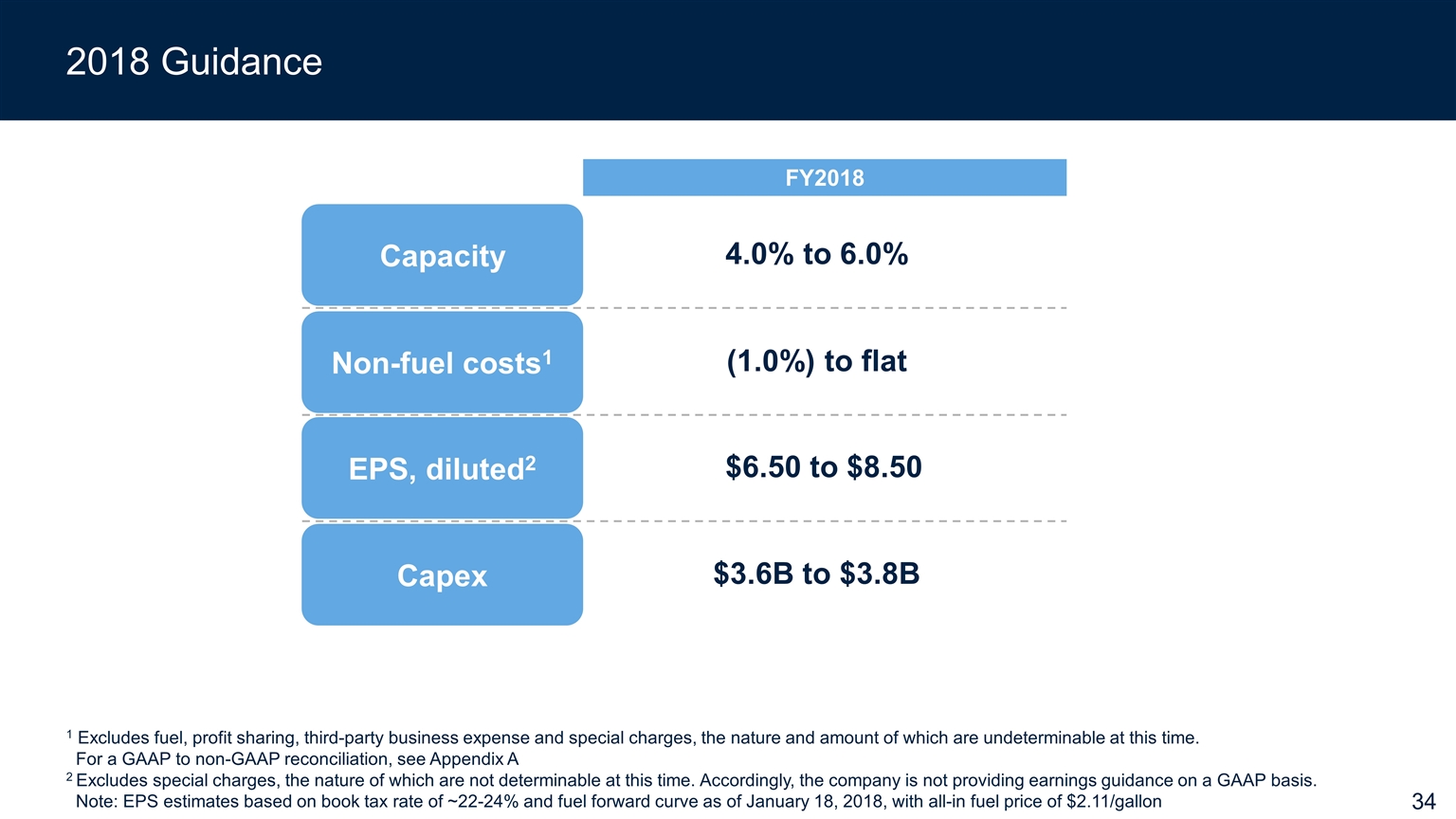

2018 Guidance Non-fuel costs1 EPS, diluted2 Capex 4.0% to 6.0% (1.0%) to flat $6.50 to $8.50 $3.6B to $3.8B Capacity 1 Excludes fuel, profit sharing, third-party business expense and special charges, the nature and amount of which are undeterminable at this time. For a GAAP to non-GAAP reconciliation, see Appendix A 2 Excludes special charges, the nature of which are not determinable at this time. Accordingly, the company is not providing earnings guidance on a GAAP basis. Note: EPS estimates based on book tax rate of ~22-24% and fuel forward curve as of January 18, 2018, with all-in fuel price of $2.11/gallon FY2018

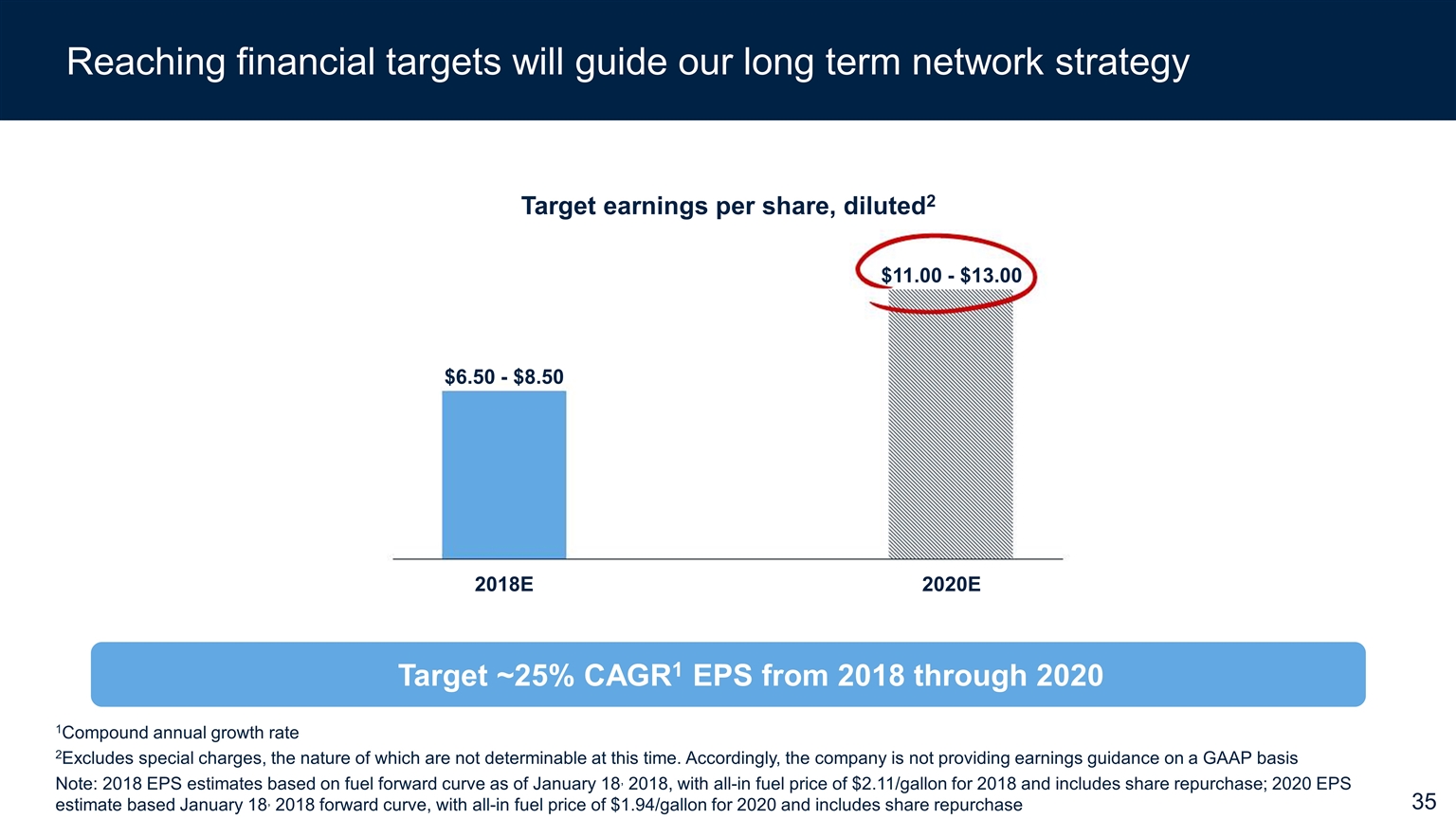

Reaching financial targets will guide our long term network strategy $11.00 - $13.00 $6.50 - $8.50 Target earnings per share, diluted2 1Compound annual growth rate 2Excludes special charges, the nature of which are not determinable at this time. Accordingly, the company is not providing earnings guidance on a GAAP basis Note: 2018 EPS estimates based on fuel forward curve as of January 18, 2018, with all-in fuel price of $2.11/gallon for 2018 and includes share repurchase; 2020 EPS estimate based January 18, 2018 forward curve, with all-in fuel price of $1.94/gallon for 2020 and includes share repurchase Target ~25% CAGR1 EPS from 2018 through 2020

Chief Executive Officer Oscar Munoz

Closing Strengthening our hubs is a critical foundation to maximize profitability Driving revenue improvements from all areas of business Improving efficiency and productivity Greater accountability and transparency Moving to annual guidance with 2018 EPS range Providing multi-year network growth strategy, underpinned by commitments on long-term costs and 2020 EPS target Our strategy drives sustainably higher profits and margins

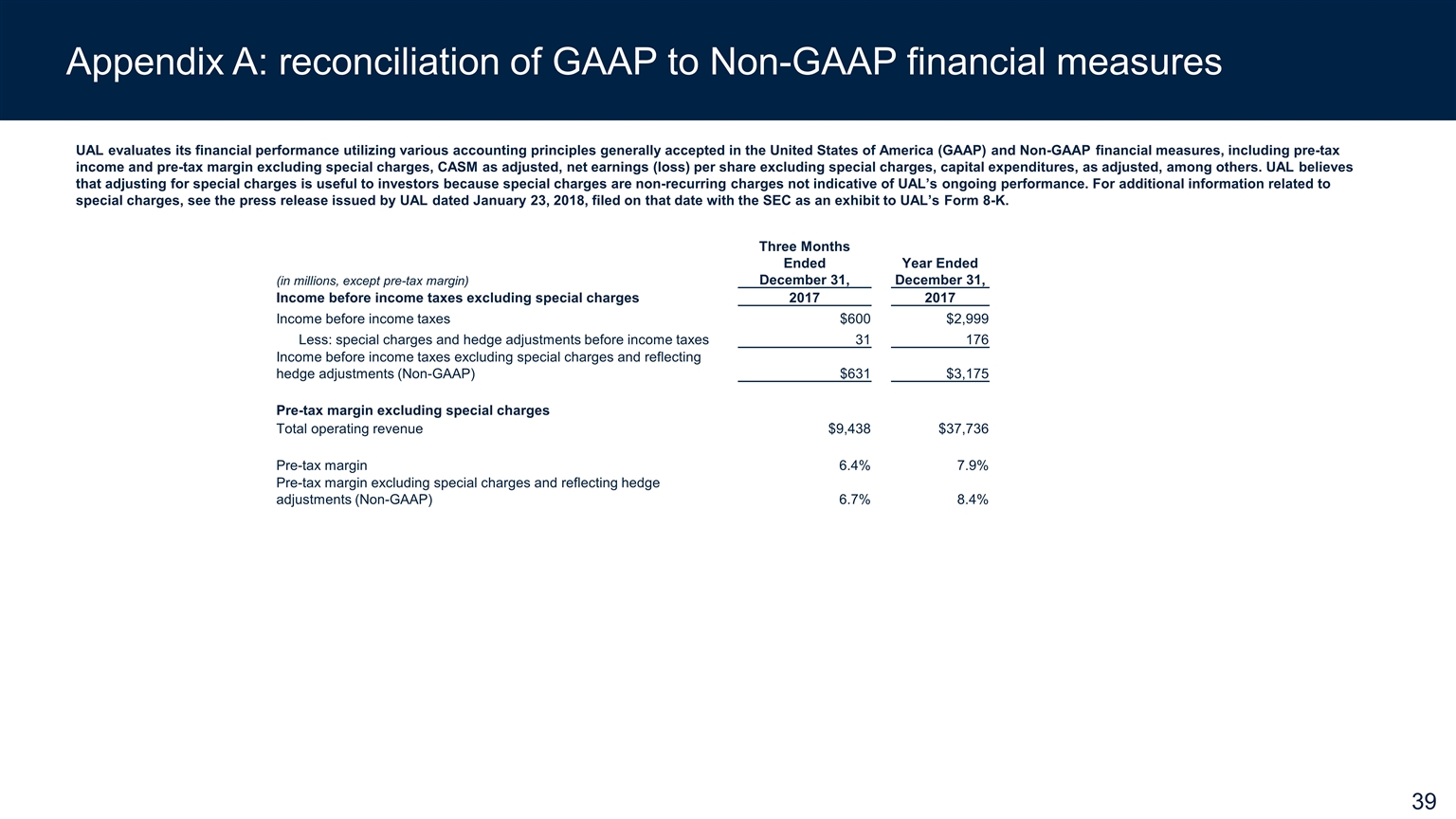

Appendix A: reconciliation of GAAP to Non-GAAP financial measures UAL evaluates its financial performance utilizing various accounting principles generally accepted in the United States of America (GAAP) and Non-GAAP financial measures, including pre-tax income and pre-tax margin excluding special charges, CASM as adjusted, net earnings (loss) per share excluding special charges, capital expenditures, as adjusted, among others. UAL believes that adjusting for special charges is useful to investors because special charges are non-recurring charges not indicative of UAL’s ongoing performance. For additional information related to special charges, see the press release issued by UAL dated January 23, 2018, filed on that date with the SEC as an exhibit to UAL’s Form 8-K. (in millions, except pre-tax margin) Three Months Ended December 31, Year Ended December 31, Income before income taxes excluding special charges 2017 2017 Income before income taxes $600 $2,999 Less: special charges and hedge adjustments before income taxes 31 176 Income before income taxes excluding special charges and reflecting hedge adjustments (Non-GAAP) $631 $3,175 Pre-tax margin excluding special charges Total operating revenue $9,438 $37,736 Pre-tax margin 6.4% 7.9% Pre-tax margin excluding special charges and reflecting hedge adjustments (Non-GAAP) 6.7% 8.4%

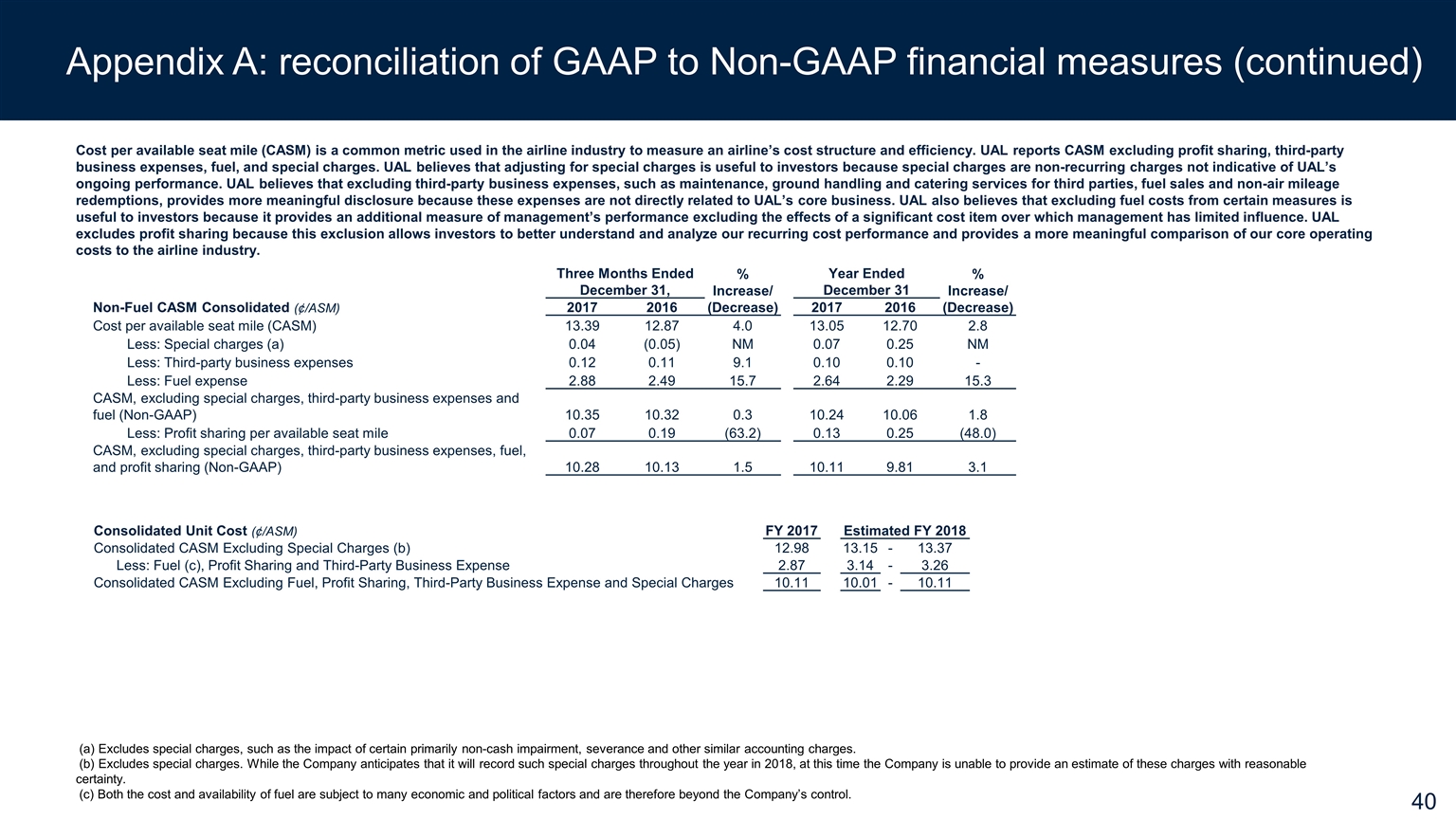

Appendix A: reconciliation of GAAP to Non-GAAP financial measures (continued) Cost per available seat mile (CASM) is a common metric used in the airline industry to measure an airline’s cost structure and efficiency. UAL reports CASM excluding profit sharing, third-party business expenses, fuel, and special charges. UAL believes that adjusting for special charges is useful to investors because special charges are non-recurring charges not indicative of UAL’s ongoing performance. UAL believes that excluding third-party business expenses, such as maintenance, ground handling and catering services for third parties, fuel sales and non-air mileage redemptions, provides more meaningful disclosure because these expenses are not directly related to UAL’s core business. UAL also believes that excluding fuel costs from certain measures is useful to investors because it provides an additional measure of management’s performance excluding the effects of a significant cost item over which management has limited influence. UAL excludes profit sharing because this exclusion allows investors to better understand and analyze our recurring cost performance and provides a more meaningful comparison of our core operating costs to the airline industry. Three Months Ended December 31, % Increase/ (Decrease) Year Ended December 31 % Increase/ (Decrease) Non-Fuel CASM Consolidated (¢/ASM) 2017 2016 2017 2016 Cost per available seat mile (CASM) 13.39 12.87 4.0 13.05 12.70 2.8 Less: Special charges (a) 0.04 (0.05) NM 0.07 0.25 NM Less: Third-party business expenses 0.12 0.11 9.1 0.10 0.10 - Less: Fuel expense 2.88 2.49 15.7 2.64 2.29 15.3 CASM, excluding special charges, third-party business expenses and fuel (Non-GAAP) 10.35 10.32 0.3 10.24 10.06 1.8 Less: Profit sharing per available seat mile 0.07 0.19 (63.2) 0.13 0.25 (48.0) CASM, excluding special charges, third-party business expenses, fuel, and profit sharing (Non-GAAP) 10.28 10.13 1.5 10.11 9.81 3.1 (a) Excludes special charges, such as the impact of certain primarily non-cash impairment, severance and other similar accounting charges. (b) Excludes special charges. While the Company anticipates that it will record such special charges throughout the year in 2018, at this time the Company is unable to provide an estimate of these charges with reasonable certainty. (c) Both the cost and availability of fuel are subject to many economic and political factors and are therefore beyond the Company’s control. Consolidated Unit Cost (¢/ASM) FY 2017 Estimated FY 2018 Consolidated CASM Excluding Special Charges (b) 12.98 13.15 - 13.37 Less: Fuel (c), Profit Sharing and Third-Party Business Expense 2.87 3.14 - 3.26 Consolidated CASM Excluding Fuel, Profit Sharing, Third-Party Business Expense and Special Charges 10.11 10.01 - 10.11

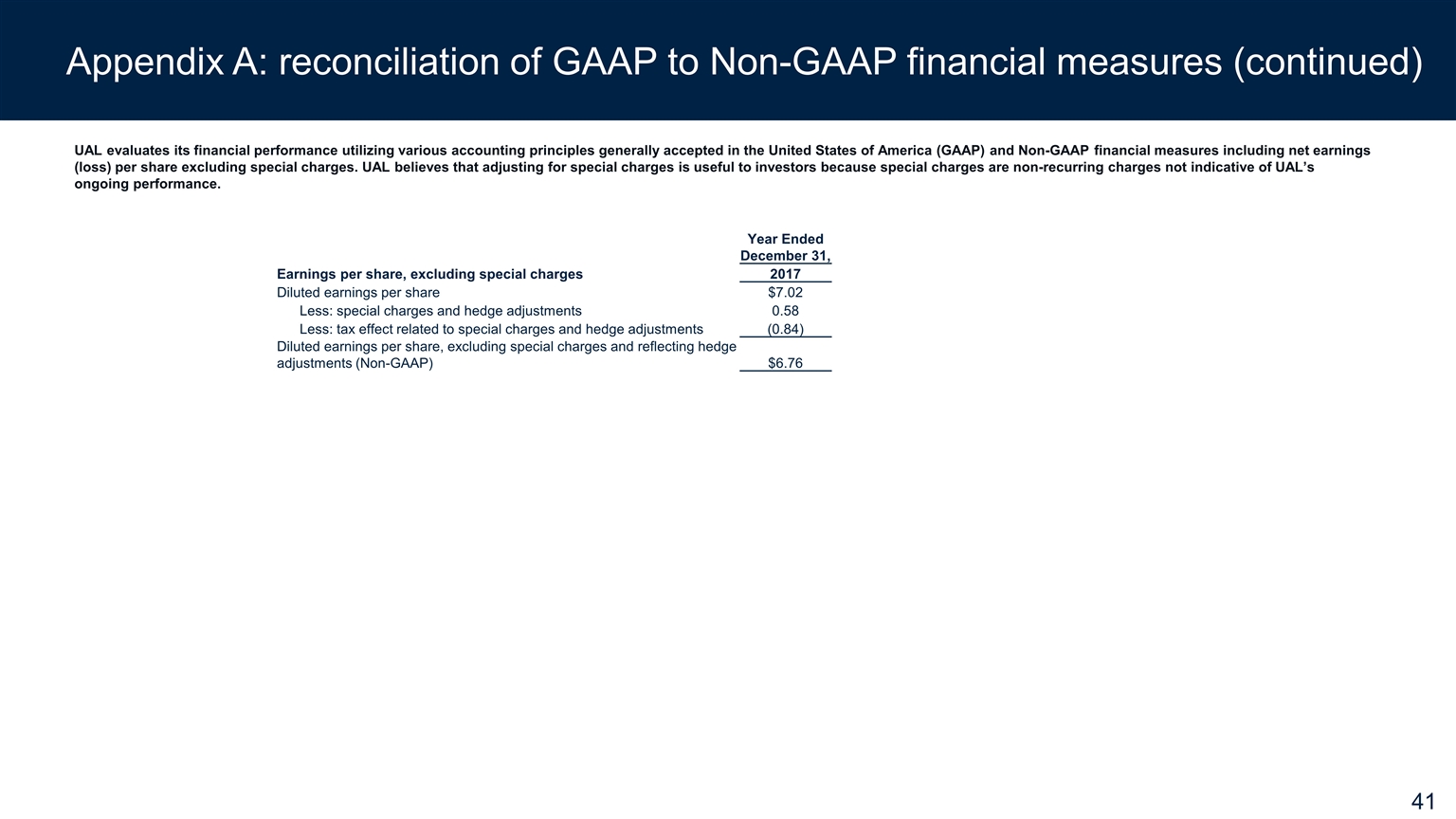

Appendix A: reconciliation of GAAP to Non-GAAP financial measures (continued) Year Ended December 31, Earnings per share, excluding special charges 2017 Diluted earnings per share $7.02 Less: special charges and hedge adjustments 0.58 Less: tax effect related to special charges and hedge adjustments (0.84) Diluted earnings per share, excluding special charges and reflecting hedge adjustments (Non-GAAP) $6.76 UAL evaluates its financial performance utilizing various accounting principles generally accepted in the United States of America (GAAP) and Non-GAAP financial measures including net earnings (loss) per share excluding special charges. UAL believes that adjusting for special charges is useful to investors because special charges are non-recurring charges not indicative of UAL’s ongoing performance.

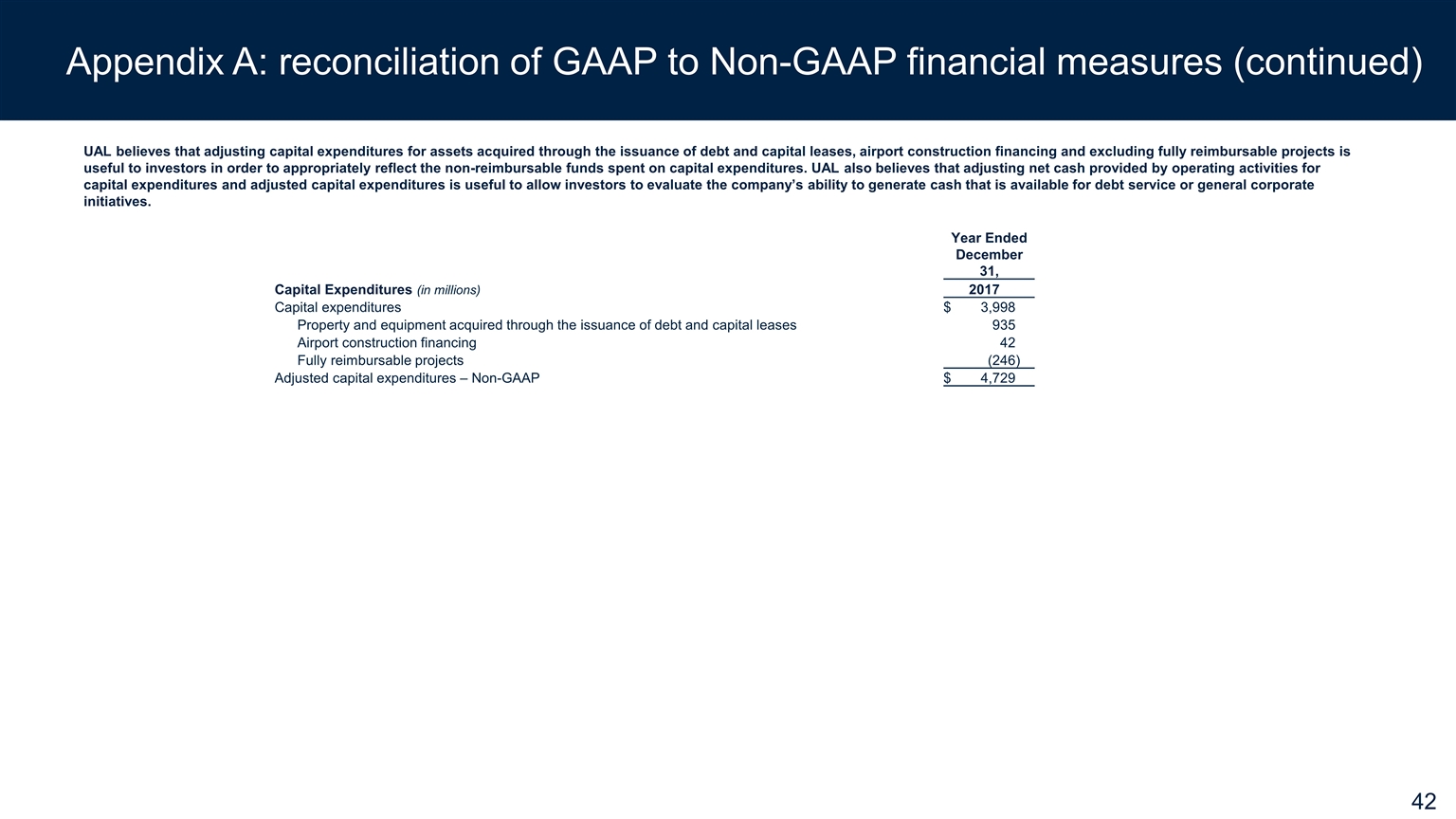

Appendix A: reconciliation of GAAP to Non-GAAP financial measures (continued) UAL believes that adjusting capital expenditures for assets acquired through the issuance of debt and capital leases, airport construction financing and excluding fully reimbursable projects is useful to investors in order to appropriately reflect the non-reimbursable funds spent on capital expenditures. UAL also believes that adjusting net cash provided by operating activities for capital expenditures and adjusted capital expenditures is useful to allow investors to evaluate the company’s ability to generate cash that is available for debt service or general corporate initiatives. Year Ended December 31, Capital Expenditures (in millions) 2017 Capital expenditures $ 3,998 Property and equipment acquired through the issuance of debt and capital leases 935 Airport construction financing 42 Fully reimbursable projects (246 ) Adjusted capital expenditures – Non-GAAP $ 4,729