| | | |

Page

|

| |||

| | | | | S-4 | | | |

| | | | | S-4 | | | |

| | | | | S-5 | | | |

| | | | | S-7 | | | |

| | | | | S-9 | | | |

| | | | | S-10 | | | |

| | | | | S-16 | | | |

| | | | | S-18 | | | |

| | | | | S-19 | | | |

| | | | | S-19 | | | |

| | | | | S-24 | | | |

| | | | | S-24 | | | |

| | | | | S-25 | | | |

| | | | | S-25 | | | |

| | | | | S-25 | | | |

| | | | | S-26 | | | |

| | | | | S-27 | | | |

| | | | | S-29 | | | |

| | | | | S-29 | | | |

| | | | | S-31 | | | |

| | | | | S-31 | | | |

| | | | | S-32 | | | |

| | | | | S-32 | | | |

| | | | | S-34 | | | |

| | | | | S-35 | | | |

| | | | | S-35 | | | |

| | | | | S-35 | | | |

| | | | | S-38 | | | |

| | | | | S-38 | | | |

| | | | | S-38 | | | |

| | | | | S-41 | | | |

| | | | | S-41 | | | |

| | | | | S-43 | | | |

| | | | | S-44 | | | |

| | | | | S-45 | | | |

| | | | | S-45 | | | |

| | | | | S-47 | | | |

| | | | | S-47 | | | |

| | | | | S-50 | | | |

| | | | | S-50 | | | |

| | | | | S-51 | | | |

| | | | | S-51 | | | |

| | | |

Page

|

| |||

| | | | | S-52 | | | |

| | | | | S-52 | | | |

| | | | | S-52 | | | |

| | | | | S-54 | | | |

| | | | | S-56 | | | |

| | | | | S-56 | | | |

| | | | | S-56 | | | |

| | | | | S-56 | | | |

| | | | | S-57 | | | |

| | | | | S-58 | | | |

| | | | | S-58 | | | |

| | | | | S-58 | | | |

| | | | | S-59 | | | |

| | | | | S-60 | | | |

| | | | | S-61 | | | |

| | | | | S-61 | | | |

| | | | | S-66 | | | |

| | | | | S-66 | | | |

| | | | | S-66 | | | |

| | | | | S-67 | | | |

| | | | | S-68 | | | |

| | | | | S-68 | | | |

| | | | | S-68 | | | |

| | | | | S-68 | | | |

| | | | | S-69 | | | |

| | | | | S-70 | | | |

| | | | | S-70 | | | |

| | | | | S-70 | | | |

| | | | | S-71 | | | |

| | | | | S-72 | | | |

| | | | | S-73 | | | |

| Underwriting | | | | | S-75 | | |

| | | | | S-77 | | | |

| | | | | S-80 | | | |

| Experts | | | | | S-80 | | |

| | | | | S-81 | | | |

| | | | | I-1 | | | |

| | | | | II-1 | | | |

| | | | | III-1 | | | |

| | | | | | 1 | | | |

| | | | | | 2 | | | |

| | | | | | 2 | | | |

| | | | | | 4 | | | |

| | | | | | 4 | | | |

| | | | | | 4 | | | |

| | | | | | 4 | | | |

| | | | | | 6 | | | |

| | Experts | | | | | 6 | | |

| | | |

Class AA Certificates

|

| |

Class A Certificates

|

|

|

Aggregate Face Amount

|

| |

$969,187,000

|

| |

$385,470,000

|

|

|

Interest Rate

|

| |

%

|

| |

%

|

|

|

Initial Loan to Aircraft Value (cumulative)(1)(2)

|

| |

44.0%

|

| |

61.5%

|

|

|

Highest Loan to Aircraft Value (cumulative)(2)

|

| |

44.4%

|

| |

62.0%

|

|

|

Expected Principal Distribution Window (in years)

|

| |

0.5 – 12.5

|

| |

0.5 – 12.5

|

|

|

Initial Average Life (in years from Issuance Date)

|

| |

8.5

|

| |

8.5

|

|

|

Regular Distribution Dates

|

| |

February 15 and August 15

|

| |

February 15 and August 15

|

|

|

Final Expected Distribution Date

|

| |

February 15, 2037

|

| |

February 15, 2037

|

|

|

Final Maturity Date

|

| |

August 15, 2038

|

| |

August 15, 2038

|

|

|

Minimum Denomination

|

| |

$1,000

|

| |

$1,000

|

|

|

Section 1110 Protection

|

| |

Yes

|

| |

Yes

|

|

|

Liquidity Facility Coverage

|

| |

Three semiannual interest payments

|

| |

Three semiannual interest payments

|

|

|

Aircraft Model

|

| |

Registration

Number(1) |

| |

Manufacturer’s

Serial Number(1) |

| |

Manufacturer’s

Delivery Month(1) |

| |

Principal

Amount of Series AA Equipment Notes |

| |

Principal

Amount of Series A Equipment Notes |

| |

Appraised

Value(2) |

| |||||||||||||||

|

737 MAX 8

|

| | | | N27290 | | | | | | 44309 | | | |

June 2023

|

| | | $ | 22,584,000 | | | | | $ | 8,982,000 | | | | | $ | 51,328,182 | | |

|

737 MAX 8

|

| | | | N17312 | | | | | | 64609 | | | |

July 2023

|

| | | | 22,934,000 | | | | | | 9,121,000 | | | | | | 52,122,275 | | |

|

737 MAX 8

|

| | | | N37307 | | | | | | 64608 | | | |

August 2023

|

| | | | 22,934,000 | | | | | | 9,121,000 | | | | | | 52,122,275 | | |

|

737 MAX 8

|

| | | | N37324 | | | | | | 67604 | | | |

December 2023

|

| | | | 23,338,000 | | | | | | 9,282,000 | | | | | | 53,040,000 | | |

|

737 MAX 8

|

| | | | N47330 | | | | | | 67588 | | | |

December 2023

|

| | | | 23,338,000 | | | | | | 9,282,000 | | | | | | 53,040,000 | | |

|

737 MAX 9

|

| | | | N37560 | | | | | | 67184 | | | |

May 2023

|

| | | | 22,880,000 | | | | | | 9,100,000 | | | | | | 52,000,000 | | |

|

737 MAX 9

|

| | | | N37561 | | | | | | 67590 | | | |

May 2023

|

| | | | 22,880,000 | | | | | | 9,100,000 | | | | | | 52,000,000 | | |

|

737 MAX 9

|

| | | | N37562 | | | | | | 67591 | | | |

June 2023

|

| | | | 23,008,000 | | | | | | 9,151,000 | | | | | | 52,290,000 | | |

|

737 MAX 9

|

| | | | N37563 | | | | | | 67187 | | | |

June 2023

|

| | | | 23,008,000 | | | | | | 9,151,000 | | | | | | 52,290,000 | | |

|

737 MAX 9

|

| | | | N17565 | | | | | | 67186 | | | |

June 2023

|

| | | | 23,008,000 | | | | | | 9,151,000 | | | | | | 52,290,000 | | |

|

737 MAX 9

|

| | | | N17564 | | | | | | 67188 | | | |

June 2023

|

| | | | 23,008,000 | | | | | | 9,151,000 | | | | | | 52,290,000 | | |

|

737 MAX 9

|

| | | | N77573 | | | | | | 67603 | | | |

August 2023

|

| | | | 23,263,000 | | | | | | 9,252,000 | | | | | | 52,870,000 | | |

|

737 MAX 9

|

| | | | N77571 | | | | | | 67193 | | | |

August 2023

|

| | | | 23,263,000 | | | | | | 9,252,000 | | | | | | 52,870,000 | | |

|

737 MAX 9

|

| | | | N77575 | | | | | | 67609 | | | |

August 2023

|

| | | | 23,263,000 | | | | | | 9,252,000 | | | | | | 52,870,000 | | |

|

737 MAX 9

|

| | | | N77576 | | | | | | 67610 | | | |

September 2023

|

| | | | 23,390,000 | | | | | | 9,303,000 | | | | | | 53,160,000 | | |

|

737 MAX 9

|

| | | | N37577 | | | | | | 67615 | | | |

September 2023

|

| | | | 23,390,000 | | | | | | 9,303,000 | | | | | | 53,160,000 | | |

|

737-800

|

| | | | N76528 | | | | | | 31663 | | | |

October 2010

|

| | | | 6,893,000 | | | | | | 2,741,000 | | | | | | 15,665,389 | | |

|

737-800

|

| | | | N76529 | | | | | | 31652 | | | |

December 2010

|

| | | | 6,640,000 | | | | | | 2,641,000 | | | | | | 15,091,839 | | |

|

737-800

|

| | | | N77530 | | | | | | 39998 | | | |

March 2011

|

| | | | 11,838,000 | | | | | | 4,708,000 | | | | | | 26,904,943 | | |

|

737-800

|

| | | | N87531 | | | | | | 39999 | | | |

March 2011

|

| | | | 8,361,000 | | | | | | 3,325,000 | | | | | | 19,001,251 | | |

|

737-900ER

|

| | | | N38443 | | | | | | 31655 | | | |

December 2010

|

| | | | 6,292,000 | | | | | | 2,503,000 | | | | | | 14,300,000 | | |

|

737-900ER

|

| | | | N36444 | | | | | | 31643 | | | |

December 2010

|

| | | | 6,200,000 | | | | | | 2,466,000 | | | | | | 14,090,000 | | |

|

737-900ER

|

| | | | N73445 | | | | | | 40000 | | | |

April 2011

|

| | | | 6,626,000 | | | | | | 2,636,000 | | | | | | 15,060,000 | | |

|

737-900ER

|

| | | | N38446 | | | | | | 31661 | | | |

January 2012

|

| | | | 7,313,000 | | | | | | 2,909,000 | | | | | | 16,620,000 | | |

|

737-900ER

|

| | | | N36447 | | | | | | 31650 | | | |

February 2012

|

| | | | 7,902,000 | | | | | | 3,143,000 | | | | | | 17,960,000 | | |

|

737-900ER

|

| | | | N78448 | | | | | | 40003 | | | |

March 2012

|

| | | | 7,247,000 | | | | | | 2,882,000 | | | | | | 16,470,000 | | |

|

737-900ER

|

| | | | N81449 | | | | | | 31651 | | | |

March 2012

|

| | | | 8,158,000 | | | | | | 3,245,000 | | | | | | 18,540,000 | | |

|

737-900ER

|

| | | | N39450 | | | | | | 40004 | | | |

April 2012

|

| | | | 10,168,000 | | | | | | 4,044,000 | | | | | | 23,110,000 | | |

|

737-900ER

|

| | | | N38451 | | | | | | 31646 | | | |

April 2012

|

| | | | 7,476,000 | | | | | | 2,973,000 | | | | | | 16,990,000 | | |

|

737-900ER

|

| | | | N68452 | | | | | | 40005 | | | |

May 2012

|

| | | | 7,968,000 | | | | | | 3,169,000 | | | | | | 18,110,000 | | |

|

737-900ER

|

| | | | N68453 | | | | | | 41742 | | | |

May 2012

|

| | | | 7,801,000 | | | | | | 3,103,000 | | | | | | 17,730,000 | | |

|

737-900ER

|

| | | | N38454 | | | | | | 31640 | | | |

June 2012

|

| | | | 7,894,000 | | | | | | 3,140,000 | | | | | | 17,940,000 | | |

|

Aircraft Model

|

| |

Registration

Number(1) |

| |

Manufacturer’s

Serial Number(1) |

| |

Manufacturer’s

Delivery Month(1) |

| |

Principal

Amount of Series AA Equipment Notes |

| |

Principal

Amount of Series A Equipment Notes |

| |

Appraised

Value(2) |

| |||||||||||||||

|

737-900ER

|

| | | | N34455 | | | | | | 41743 | | | |

June 2012

|

| | | | 7,652,000 | | | | | | 3,043,000 | | | | | | 17,390,000 | | |

|

737-900ER

|

| | | | N37456 | | | | | | 37205 | | | |

September 2012

|

| | | | 6,987,000 | | | | | | 2,779,000 | | | | | | 15,880,000 | | |

|

737-900ER

|

| | | | N28457 | | | | | | 41744 | | | |

September 2012

|

| | | | 6,926,000 | | | | | | 2,755,000 | | | | | | 15,740,000 | | |

|

737-900ER

|

| | | | N38458 | | | | | | 37199 | | | |

September 2012

|

| | | | 6,992,000 | | | | | | 2,781,000 | | | | | | 15,890,000 | | |

|

737-900ER

|

| | | | N38459 | | | | | | 37206 | | | |

October 2012

|

| | | | 7,203,000 | | | | | | 2,865,000 | | | | | | 16,370,934 | | |

|

737-900ER

|

| | | | N34460 | | | | | | 37200 | | | |

November 2012

|

| | | | 7,414,000 | | | | | | 2,949,000 | | | | | | 16,850,000 | | |

|

737-900ER

|

| | | | N68811 | | | | | | 42175 | | | |

January 2014

|

| | | | 8,964,000 | | | | | | 3,565,000 | | | | | | 20,372,669 | | |

|

737-900ER

|

| | | | N61882 | | | | | | 42201 | | | |

May 2015

|

| | | | 10,450,000 | | | | | | 4,156,000 | | | | | | 23,750,053 | | |

|

737-900ER

|

| | | | N62883 | | | | | | 42202 | | | |

June 2015

|

| | | | 10,518,000 | | | | | | 4,183,000 | | | | | | 23,903,830 | | |

|

777-300ER

|

| | | | N2251U | | | | | | 66591 | | | |

January 2020

|

| | | | 42,175,000 | | | | | | 16,774,000 | | | | | | 95,851,509 | | |

|

777-300ER

|

| | | | N2352U | | | | | | 66592 | | | |

March 2020

|

| | | | 42,515,000 | | | | | | 16,909,000 | | | | | | 96,624,406 | | |

|

787-10

|

| | | | N14019 | | | | | | 66988 | | | |

November 2022

|

| | | | 63,422,000 | | | | | | 25,224,000 | | | | | | 144,139,979 | | |

|

787-10

|

| | | | N13018 | | | | | | 66987 | | | |

November 2022

|

| | | | 63,422,000 | | | | | | 25,224,000 | | | | | | 144,139,979 | | |

|

787-10

|

| | | | N12020 | | | | | | 66989 | | | |

December 2022

|

| | | | 63,427,000 | | | | | | 25,227,000 | | | | | | 144,153,233 | | |

|

787-10

|

| | | | N12021 | | | | | | 66990 | | | |

December 2022

|

| | | | 63,427,000 | | | | | | 25,227,000 | | | | | | 144,153,233 | | |

|

787-10

|

| | | | N14016 | | | | | | 66985 | | | |

December 2022

|

| | | | 63,427,000 | | | | | | 25,227,000 | | | | | | 144,153,233 | | |

|

Regular Distribution Date

|

| |

Assumed

Aggregate Aircraft Value(1) |

| |

Outstanding Balance(2)

|

| |

LTV(3)

|

| |||||||||||||||||||||

| |

Class AA

Certificates |

| |

Class A

Certificates |

| |

Class AA

Certificates |

| |

Class A

Certificates |

| ||||||||||||||||||||

|

At Issuance

|

| | | $ | 2,202,689,212 | | | | | $ | 969,187,000 | | | | | $ | 385,470,000 | | | | | | 44.0% | | | | | | 61.5% | | |

|

February 15, 2025

|

| | | | 2,164,316,388 | | | | | | 960,752,622 | | | | | | 382,115,410 | | | | | | 44.4% | | | | | | 62.0% | | |

|

August 15, 2025

|

| | | | 2,125,943,563 | | | | | | 935,770,847 | | | | | | 372,179,519 | | | | | | 44.0% | | | | | | 61.5% | | |

|

February 15, 2026

|

| | | | 2,087,435,692 | | | | | | 910,789,072 | | | | | | 362,243,628 | | | | | | 43.6% | | | | | | 61.0% | | |

|

August 15, 2026

|

| | | | 2,048,050,106 | | | | | | 885,807,297 | | | | | | 352,307,738 | | | | | | 43.3% | | | | | | 60.5% | | |

|

February 15, 2027

|

| | | | 2,008,664,520 | | | | | | 860,825,523 | | | | | | 342,371,847 | | | | | | 42.9% | | | | | | 59.9% | | |

|

August 15, 2027

|

| | | | 1,968,401,414 | | | | | | 835,843,748 | | | | | | 332,435,956 | | | | | | 42.5% | | | | | | 59.4% | | |

|

February 15, 2028

|

| | | | 1,926,951,582 | | | | | | 810,861,973 | | | | | | 322,500,066 | | | | | | 42.1% | | | | | | 58.8% | | |

|

August 15, 2028

|

| | | | 1,885,501,751 | | | | | | 785,880,198 | | | | | | 312,564,175 | | | | | | 41.7% | | | | | | 58.3% | | |

|

February 15, 2029

|

| | | | 1,844,051,919 | | | | | | 760,898,423 | | | | | | 302,628,284 | | | | | | 41.3% | | | | | | 57.7% | | |

|

August 15, 2029

|

| | | | 1,802,453,381 | | | | | | 735,916,648 | | | | | | 292,692,394 | | | | | | 40.8% | | | | | | 57.1% | | |

|

February 15, 2030

|

| | | | 1,760,854,844 | | | | | | 710,934,873 | | | | | | 282,756,503 | | | | | | 40.4% | | | | | | 56.4% | | |

|

August 15, 2030

|

| | | | 1,719,256,306 | | | | | | 685,953,098 | | | | | | 272,820,612 | | | | | | 39.9% | | | | | | 55.8% | | |

|

February 15, 2031

|

| | | | 1,677,196,326 | | | | | | 660,971,323 | | | | | | 262,884,721 | | | | | | 39.4% | | | | | | 55.1% | | |

|

August 15, 2031

|

| | | | 1,398,219,780 | | | | | | 540,727,624 | | | | | | 215,059,984 | | | | | | 38.7% | | | | | | 54.1% | | |

|

February 15, 2032

|

| | | | 1,369,197,697 | | | | | | 521,578,212 | | | | | | 207,443,819 | | | | | | 38.1% | | | | | | 53.2% | | |

|

August 15, 2032

|

| | | | 1,340,175,614 | | | | | | 502,428,800 | | | | | | 199,827,653 | | | | | | 37.5% | | | | | | 52.4% | | |

|

February 15, 2033

|

| | | | 1,311,153,530 | | | | | | 483,279,387 | | | | | | 192,211,488 | | | | | | 36.9% | | | | | | 51.5% | | |

|

August 15, 2033

|

| | | | 1,282,131,447 | | | | | | 464,129,975 | | | | | | 184,595,323 | | | | | | 36.2% | | | | | | 50.6% | | |

|

February 15, 2034

|

| | | | 1,253,109,364 | | | | | | 444,980,563 | | | | | | 176,979,157 | | | | | | 35.5% | | | | | | 49.6% | | |

|

August 15, 2034

|

| | | | 1,198,628,357 | | | | | | 416,082,869 | | | | | | 165,486,088 | | | | | | 34.7% | | | | | | 48.5% | | |

|

February 15, 2035

|

| | | | 1,170,911,860 | | | | | | 397,494,443 | | | | | | 158,093,028 | | | | | | 33.9% | | | | | | 47.4% | | |

|

August 15, 2035

|

| | | | 1,142,082,785 | | | | | | 378,906,017 | | | | | | 150,699,967 | | | | | | 33.2% | | | | | | 46.4% | | |

|

February 15, 2036

|

| | | | 1,113,253,710 | | | | | | 360,317,590 | | | | | | 143,306,907 | | | | | | 32.4% | | | | | | 45.2% | | |

|

August 15, 2036

|

| | | | 1,084,424,635 | | | | | | 341,729,164 | | | | | | 135,913,846 | | | | | | 31.5% | | | | | | 44.0% | | |

|

February 15, 2037

|

| | | | 1,055,595,561 | | | | | | 0 | | | | | | 0 | | | | | | 0.0% | | | | | | 0.0% | | |

![[MISSING IMAGE: fc_cashflow-bw.jpg]](fc_cashflow-bw.jpg)

Considerations

| | | | | | |

S&P

|

| |

Moody’s

|

|

| Threshold Rating for the Liquidity Provider for the Class AA Trust | | | Long Term | | |

A-

|

| |

Baa2

|

|

| Threshold Rating for the Liquidity Provider for the Class A Trust | | | Long Term | | |

BBB

|

| |

Baa2

|

|

|

Liquidity Provider Rating

|

| | The Liquidity Provider meets the Liquidity Threshold Rating requirements. | | ||||||

| | | |

Six Months Ended June 30,

|

| |

Year Ended December 31,

|

| ||||||||||||||||||||||||

| | | |

2024

|

| |

2023

|

| |

2023

|

| |

2022

|

| |

2021

|

| |||||||||||||||

| Statement of Operations Data(1) (in millions): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Operating revenue

|

| | | $ | 27,525 | | | | | $ | 25,607 | | | | | $ | 53,717 | | | | | $ | 44,955 | | | | | $ | 24,634 | | |

|

Operating expenses

|

| | | | 25,496 | | | | | | 24,132 | | | | | | 49,503 | | | | | | 42,616 | | | | | | 25,654 | | |

|

Operating income (loss)

|

| | | | 2,029 | | | | | | 1,475 | | | | | | 4,214 | | | | | | 2,339 | | | | | | (1,020) | | |

|

Net income (loss)

|

| | | | 1,200 | | | | | | 881 | | | | | | 2,620 | | | | | | 739 | | | | | | (1,962) | | |

| | | |

As of June 30,

|

| |

As of December 31,

|

| ||||||||||||

| | | |

2024

|

| |

2023

|

| |

2022

|

| |||||||||

| Balance Sheet Data (in millions): | | | | | | | | | | | | | | | | | | | |

|

Unrestricted cash, cash equivalents and short-term investments

|

| | | $ | 15,248 | | | | | $ | 14,388 | | | | | $ | 16,414 | | |

|

Total assets

|

| | | | 73,254 | | | | | | 71,104 | | | | | | 67,329 | | |

|

Debt and finance leases(2)

|

| | | | 26,619 | | | | | | 29,338 | | | | | | 31,413 | | |

|

Stockholder’s equity

|

| | | | 10,495 | | | | | | 9,294 | | | | | | 6,865 | | |

| | | |

Six Months Ended June 30,

|

| |

Year Ended December 31,

|

| ||||||||||||||||||||||||

| | | |

2024

|

| |

2023

|

| |

2023

|

| |

2022

|

| |

2021

|

| |||||||||||||||

| Special Charges (credits) (in millions): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Labor contract ratification bonuses

|

| | | $ | ― | | | | | $ | 813 | | | | | $ | 814 | | | | | $ | ― | | | | | $ | ― | | |

|

CARES Act grant credit(3)

|

| | | | ― | | | | | | ― | | | | | | ― | | | | | | ― | | | | | | (4,021) | | |

|

Severance and benefit costs

|

| | | | ― | | | | | | ― | | | | | | ― | | | | | | ― | | | | | | 438 | | |

|

Impairment of assets

|

| | | | ― | | | | | | ― | | | | | | ― | | | | | | ― | | | | | | 97 | | |

|

(Gains) losses on sale of assets and other special charges

|

| | | | 49 | | | | | | 60 | | | | | | 135 | | | | | | 140 | | | | | | 119 | | |

|

Nonoperating special charges and unrealized (gains) losses on investments:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Debt extinguishment and modification fees

|

| | | | 35 | | | | | | 11 | | | | | | 11 | | | | | | 7 | | | | | | 50 | | |

|

Special termination benefits and settlement losses

|

| | | | ― | | | | | | ― | | | | | | ― | | | | | | ― | | | | | | 31 | | |

|

Unrealized (gains) losses on investments

|

| | | | 70 | | | | | | (108) | | | | | | (27) | | | | | | (20) | | | | | | 34 | | |

|

Credit loss on BRW term loan and guarantee

|

| | | | ― | | | | | | ― | | | | | | ― | | | | | | ― | | | | | | ― | | |

|

Income tax expense (benefit), net of valuation allowance related to special charges (credits)

|

| | | | (19) | | | | | | (197) | | | | | | (214) | | | | | | (33) | | | | | | 728 | | |

| | | |

Six Months Ended June 30,

|

| |

Year Ended December 31,

|

| ||||||||||||||||||||||||

| | | |

2024

|

| |

2023

|

| |

2023

|

| |

2022

|

| |

2021

|

| |||||||||||||||

| Consolidated Operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Passengers (thousands)(1)

|

| | | | 83,700 | | | | | | 78,767 | | | | | | 164,927 | | | | | | 144,300 | | | | | | 104,082 | | |

|

Revenue passenger miles (millions)(2)

|

| | | | 124,491 | | | | | | 116,073 | | | | | | 244,435 | | | | | | 206,791 | | | | | | 128,979 | | |

|

Available seat miles (millions)(3)

|

| | | | 151,346 | | | | | | 139,258 | | | | | | 291,333 | | | | | | 247,858 | | | | | | 178,684 | | |

| Passenger load factor:(4) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Consolidated

|

| | | | 82.3% | | | | | | 83.4% | | | | | | 83.9% | | | | | | 83.4% | | | | | | 72.2% | | |

|

Domestic

|

| | | | 85.1% | | | | | | 84.1% | | | | | | 85.1% | | | | | | 85.5% | | | | | | 79.9% | | |

|

International

|

| | | | 79.0% | | | | | | 82.4% | | | | | | 82.4% | | | | | | 80.5% | | | | | | 59.0% | | |

|

Passenger revenue per available seat mile

(cents) |

| | | | 16.51 | | | | | | 16.71 | | | | | | 16.84 | | | | | | 16.15 | | | | | | 11.30 | | |

|

Total revenue per available seat mile (cents)

|

| | | | 18.19 | | | | | | 18.39 | | | | | | 18.44 | | | | | | 18.14 | | | | | | 13.79 | | |

|

Average yield per revenue passenger mile (cents)(5)

|

| | | | 20.08 | | | | | | 20.05 | | | | | | 20.07 | | | | | | 19.36 | | | | | | 15.66 | | |

|

Cargo revenue ton miles (millions)(6)

|

| | | | 1,742 | | | | | | 1,499 | | | | | | 3,159 | | | | | | 3,041 | | | | | | 3,285 | | |

|

Aircraft in fleet at end of period

|

| | | | 1,369 | | | | | | 1,325 | | | | | | 1,358 | | | | | | 1,338 | | | | | | 1,344 | | |

|

Average stage length (miles)(7)

|

| | | | 1,500 | | | | | | 1,465 | | | | | | 1,479 | | | | | | 1,437 | | | | | | 1,315 | | |

|

Approximate employee headcount at end of period (thousands)

|

| | | | 106.0 | | | | | | 99.8 | | | | | | 103.3 | | | | | | 92.8 | | | | | | 84.1 | | |

|

Cost per available seat mile (cents)(8)

|

| | | | 16.85 | | | | | | 17.33 | | | | | | 16.99 | | | | | | 17.19 | | | | | | 14.36 | | |

|

Average fuel price per gallon

|

| | | $ | 2.82 | | | | | $ | 2.98 | | | | | $ | 3.01 | | | | | $ | 3.63 | | | | | $ | 2.11 | | |

|

Fuel gallons consumed (millions)

|

| | | | 2,159 | | | | | | 2,014 | | | | | | 4,205 | | | | | | 3,608 | | | | | | 2,729 | | |

| | | |

Class AA

|

| |

Class A

|

| ||||||||||||||||||

|

Date

|

| |

Scheduled Principal

Payments |

| |

Expected

Pool Factor |

| |

Scheduled Principal

Payments |

| |

Expected

Pool Factor |

| ||||||||||||

|

At Issuance

|

| | | $ | 0.00 | | | | | | 1.0000000 | | | | | $ | 0.00 | | | | | | 1.0000000 | | |

|

February 15, 2025

|

| | | | 8,434,377.58 | | | | | | 0.9912975 | | | | | | 3,354,590.38 | | | | | | 0.9912974 | | |

|

August 15, 2025

|

| | | | 24,981,774.98 | | | | | | 0.9655215 | | | | | | 9,935,890.68 | | | | | | 0.9655214 | | |

|

February 15, 2026

|

| | | | 24,981,774.98 | | | | | | 0.9397454 | | | | | | 9,935,890.68 | | | | | | 0.9397453 | | |

|

August 15, 2026

|

| | | | 24,981,774.98 | | | | | | 0.9139694 | | | | | | 9,935,890.68 | | | | | | 0.9139693 | | |

|

February 15, 2027

|

| | | | 24,981,774.98 | | | | | | 0.8881934 | | | | | | 9,935,890.68 | | | | | | 0.8881932 | | |

|

August 15, 2027

|

| | | | 24,981,774.98 | | | | | | 0.8624174 | | | | | | 9,935,890.68 | | | | | | 0.8624172 | | |

|

February 15, 2028

|

| | | | 24,981,774.98 | | | | | | 0.8366414 | | | | | | 9,935,890.68 | | | | | | 0.8366412 | | |

|

August 15, 2028

|

| | | | 24,981,774.98 | | | | | | 0.8108654 | | | | | | 9,935,890.68 | | | | | | 0.8108651 | | |

|

February 15, 2029

|

| | | | 24,981,774.98 | | | | | | 0.7850894 | | | | | | 9,935,890.68 | | | | | | 0.7850891 | | |

|

August 15, 2029

|

| | | | 24,981,774.98 | | | | | | 0.7593134 | | | | | | 9,935,890.68 | | | | | | 0.7593130 | | |

|

February 15, 2030

|

| | | | 24,981,774.98 | | | | | | 0.7335374 | | | | | | 9,935,890.68 | | | | | | 0.7335370 | | |

|

August 15, 2030

|

| | | | 24,981,774.98 | | | | | | 0.7077613 | | | | | | 9,935,890.68 | | | | | | 0.7077609 | | |

|

February 15, 2031

|

| | | | 24,981,774.98 | | | | | | 0.6819853 | | | | | | 9,935,890.68 | | | | | | 0.6819849 | | |

|

August 15, 2031

|

| | | | 120,243,698.30 | | | | | | 0.5579188 | | | | | | 47,824,737.18 | | | | | | 0.5579163 | | |

|

February 15, 2032

|

| | | | 19,149,412.36 | | | | | | 0.5381606 | | | | | | 7,616,165.43 | | | | | | 0.5381581 | | |

|

August 15, 2032

|

| | | | 19,149,412.36 | | | | | | 0.5184023 | | | | | | 7,616,165.43 | | | | | | 0.5184000 | | |

|

February 15, 2033

|

| | | | 19,149,412.36 | | | | | | 0.4986441 | | | | | | 7,616,165.43 | | | | | | 0.4986419 | | |

|

August 15, 2033

|

| | | | 19,149,412.36 | | | | | | 0.4788859 | | | | | | 7,616,165.43 | | | | | | 0.4788838 | | |

|

February 15, 2034

|

| | | | 19,149,412.36 | | | | | | 0.4591277 | | | | | | 7,616,165.43 | | | | | | 0.4591256 | | |

|

August 15, 2034

|

| | | | 28,897,693.16 | | | | | | 0.4293112 | | | | | | 11,493,068.83 | | | | | | 0.4293099 | | |

|

February 15, 2035

|

| | | | 18,588,426.40 | | | | | | 0.4101318 | | | | | | 7,393,060.60 | | | | | | 0.4101306 | | |

|

August 15, 2035

|

| | | | 18,588,426.40 | | | | | | 0.3909524 | | | | | | 7,393,060.60 | | | | | | 0.3909512 | | |

|

February 15, 2036

|

| | | | 18,588,426.40 | | | | | | 0.3717730 | | | | | | 7,393,060.60 | | | | | | 0.3717719 | | |

|

August 15, 2036

|

| | | | 18,588,426.40 | | | | | | 0.3525936 | | | | | | 7,393,060.60 | | | | | | 0.3525925 | | |

|

February 15, 2037

|

| | | | 341,729,163.80 | | | | | | 0.0000000 | | | | | | 135,913,845.90 | | | | | | 0.0000000 | | |

|

Aircraft Type

|

| |

Registration

Number(1) |

| |

Manufacturer’s

Serial Number(1) |

| |

Manufacturer

Delivery Month(1) |

| |

Appraiser’s Valuations

|

| |

Appraised

Value(2) |

| ||||||||||||||||||||||||

| |

ASG

|

| |

BK

|

| |

MBA

|

| ||||||||||||||||||||||||||||||||

|

737 MAX 8

|

| | | | N27290 | | | | | | 44309 | | | |

June 2023

|

| | | $ | 51,328,182 | | | | | $ | 54,485,353 | | | | | $ | 51,220,000 | | | | | $ | 51,328,182 | | |

|

737 MAX 8

|

| | | | N17312 | | | | | | 64609 | | | |

July 2023

|

| | | | 52,122,275 | | | | | | 54,587,543 | | | | | | 51,530,000 | | | | | | 52,122,275 | | |

|

737 MAX 8

|

| | | | N37307 | | | | | | 64608 | | | |

August 2023

|

| | | | 52,122,275 | | | | | | 54,689,733 | | | | | | 51,830,000 | | | | | | 52,122,275 | | |

|

737 MAX 8

|

| | | | N37324 | | | | | | 67604 | | | |

December 2023

|

| | | | 52,921,723 | | | | | | 55,098,492 | | | | | | 53,040,000 | | | | | | 53,040,000 | | |

|

737 MAX 8

|

| | | | N47330 | | | | | | 67588 | | | |

December 2023

|

| | | | 52,921,723 | | | | | | 55,098,492 | | | | | | 53,040,000 | | | | | | 53,040,000 | | |

|

737 MAX 9

|

| | | | N37560 | | | | | | 67184 | | | |

May 2023

|

| | | | 51,700,000 | | | | | | 55,858,811 | | | | | | 52,000,000 | | | | | | 52,000,000 | | |

|

737 MAX 9

|

| | | | N37561 | | | | | | 67590 | | | |

May 2023

|

| | | | 51,700,000 | | | | | | 55,858,811 | | | | | | 52,000,000 | | | | | | 52,000,000 | | |

|

737 MAX 9

|

| | | | N37562 | | | | | | 67591 | | | |

June 2023

|

| | | | 51,700,000 | | | | | | 55,966,351 | | | | | | 52,290,000 | | | | | | 52,290,000 | | |

|

737 MAX 9

|

| | | | N37563 | | | | | | 67187 | | | |

June 2023

|

| | | | 51,700,000 | | | | | | 55,966,351 | | | | | | 52,290,000 | | | | | | 52,290,000 | | |

|

737 MAX 9

|

| | | | N17565 | | | | | | 67186 | | | |

June 2023

|

| | | | 51,700,000 | | | | | | 55,966,351 | | | | | | 52,290,000 | | | | | | 52,290,000 | | |

|

737 MAX 9

|

| | | | N17564 | | | | | | 67188 | | | |

June 2023

|

| | | | 51,700,000 | | | | | | 55,966,351 | | | | | | 52,290,000 | | | | | | 52,290,000 | | |

|

737 MAX 9

|

| | | | N77573 | | | | | | 67603 | | | |

August 2023

|

| | | | 52,800,000 | | | | | | 56,181,432 | | | | | | 52,870,000 | | | | | | 52,870,000 | | |

|

737 MAX 9

|

| | | | N77571 | | | | | | 67193 | | | |

August 2023

|

| | | | 52,800,000 | | | | | | 56,181,432 | | | | | | 52,870,000 | | | | | | 52,870,000 | | |

|

737 MAX 9

|

| | | | N77575 | | | | | | 67609 | | | |

August 2023

|

| | | | 52,800,000 | | | | | | 56,181,432 | | | | | | 52,870,000 | | | | | | 52,870,000 | | |

|

737 MAX 9

|

| | | | N77576 | | | | | | 67610 | | | |

September 2023

|

| | | | 52,800,000 | | | | | | 56,288,972 | | | | | | 53,160,000 | | | | | | 53,160,000 | | |

|

737 MAX 9

|

| | | | N37577 | | | | | | 67615 | | | |

September 2023

|

| | | | 52,800,000 | | | | | | 56,288,972 | | | | | | 53,160,000 | | | | | | 53,160,000 | | |

|

737-800

|

| | | | N76528 | | | | | | 31663 | | | |

October 2010

|

| | | | 15,665,389 | | | | | | 16,788,044 | | | | | | 14,680,000 | | | | | | 15,665,389 | | |

|

737-800

|

| | | | N76529 | | | | | | 31652 | | | |

December 2010

|

| | | | 15,091,839 | | | | | | 16,215,238 | | | | | | 14,220,000 | | | | | | 15,091,839 | | |

|

737-800

|

| | | | N77530 | | | | | | 39998 | | | |

March 2011

|

| | | | 27,169,977 | | | | | | 27,394,853 | | | | | | 26,150,000 | | | | | | 26,904,943 | | |

|

737-800

|

| | | | N87531 | | | | | | 39999 | | | |

March 2011

|

| | | | 19,001,251 | | | | | | 19,913,175 | | | | | | 18,690,000 | | | | | | 19,001,251 | | |

|

737-900ER

|

| | | | N38443 | | | | | | 31655 | | | |

December 2010

|

| | | | 13,936,313 | | | | | | 16,230,112 | | | | | | 14,300,000 | | | | | | 14,300,000 | | |

|

737-900ER

|

| | | | N36444 | | | | | | 31643 | | | |

December 2010

|

| | | | 13,635,783 | | | | | | 16,089,010 | | | | | | 14,090,000 | | | | | | 14,090,000 | | |

|

737-900ER

|

| | | | N73445 | | | | | | 40000 | | | |

April 2011

|

| | | | 14,574,282 | | | | | | 16,711,759 | | | | | | 15,060,000 | | | | | | 15,060,000 | | |

|

737-900ER

|

| | | | N38446 | | | | | | 31661 | | | |

January 2012

|

| | | | 16,525,239 | | | | | | 18,767,647 | | | | | | 16,620,000 | | | | | | 16,620,000 | | |

|

737-900ER

|

| | | | N36447 | | | | | | 31650 | | | |

February 2012

|

| | | | 16,881,718 | | | | | | 19,421,276 | | | | | | 17,960,000 | | | | | | 17,960,000 | | |

|

737-900ER

|

| | | | N78448 | | | | | | 40003 | | | |

March 2012

|

| | | | 16,175,033 | | | | | | 18,727,482 | | | | | | 16,470,000 | | | | | | 16,470,000 | | |

|

737-900ER

|

| | | | N81449 | | | | | | 31651 | | | |

March 2012

|

| | | | 18,237,354 | | | | | | 20,462,655 | | | | | | 18,540,000 | | | | | | 18,540,000 | | |

|

737-900ER

|

| | | | N39450 | | | | | | 40004 | | | |

April 2012

|

| | | | 23,078,644 | | | | | | 24,811,129 | | | | | | 23,110,000 | | | | | | 23,110,000 | | |

|

737-900ER

|

| | | | N38451 | | | | | | 31646 | | | |

April 2012

|

| | | | 16,960,515 | | | | | | 19,199,256 | | | | | | 16,990,000 | | | | | | 16,990,000 | | |

|

737-900ER

|

| | | | N68452 | | | | | | 40005 | | | |

May 2012

|

| | | | 17,659,581 | | | | | | 19,975,027 | | | | | | 18,110,000 | | | | | | 18,110,000 | | |

|

737-900ER

|

| | | | N68453 | | | | | | 41742 | | | |

May 2012

|

| | | | 17,576,871 | | | | | | 19,871,525 | | | | | | 17,730,000 | | | | | | 17,730,000 | | |

|

737-900ER

|

| | | | N38454 | | | | | | 31640 | | | |

June 2012

|

| | | | 17,651,108 | | | | | | 20,079,825 | | | | | | 17,940,000 | | | | | | 17,940,000 | | |

|

737-900ER

|

| | | | N34455 | | | | | | 41743 | | | |

June 2012

|

| | | | 17,103,288 | | | | | | 19,622,423 | | | | | | 17,390,000 | | | | | | 17,390,000 | | |

|

737-900ER

|

| | | | N37456 | | | | | | 37205 | | | |

September 2012

|

| | | | 15,781,983 | | | | | | 18,902,471 | | | | | | 15,880,000 | | | | | | 15,880,000 | | |

|

737-900ER

|

| | | | N28457 | | | | | | 41744 | | | |

September 2012

|

| | | | 15,676,020 | | | | | | 18,787,874 | | | | | | 15,740,000 | | | | | | 15,740,000 | | |

|

737-900ER

|

| | | | N38458 | | | | | | 37199 | | | |

September 2012

|

| | | | 15,828,964 | | | | | | 18,913,487 | | | | | | 15,890,000 | | | | | | 15,890,000 | | |

|

737-900ER

|

| | | | N38459 | | | | | | 37206 | | | |

October 2012

|

| | | | 16,370,934 | | | | | | 19,100,039 | | | | | | 16,110,000 | | | | | | 16,370,934 | | |

|

737-900ER

|

| | | | N34460 | | | | | | 37200 | | | |

November 2012

|

| | | | 16,668,490 | | | | | | 19,466,913 | | | | | | 16,850,000 | | | | | | 16,850,000 | | |

|

737-900ER

|

| | | | N68811 | | | | | | 42175 | | | |

January 2014

|

| | | | 20,372,669 | | | | | | 21,751,854 | | | | | | 20,220,000 | | | | | | 20,372,669 | | |

|

737-900ER

|

| | | | N61882 | | | | | | 42201 | | | |

May 2015

|

| | | | 23,750,053 | | | | | | 24,362,509 | | | | | | 23,570,000 | | | | | | 23,750,053 | | |

|

737-900ER

|

| | | | N62883 | | | | | | 42202 | | | |

June 2015

|

| | | | 23,212,209 | | | | | | 24,099,281 | | | | | | 24,400,000 | | | | | | 23,903,830 | | |

|

777-300ER

|

| | | | N2251U | | | | | | 66591 | | | |

January 2020

|

| | | | 107,406,020 | | | | | | 83,788,505 | | | | | | 96,360,000 | | | | | | 95,851,509 | | |

|

777-300ER

|

| | | | N2352U | | | | | | 66592 | | | |

March 2020

|

| | | | 107,406,020 | | | | | | 84,607,199 | | | | | | 97,860,000 | | | | | | 96,624,406 | | |

|

787-10

|

| | | | N14019 | | | | | | 66988 | | | |

November 2022

|

| | | | 144,153,233 | | | | | | 149,036,706 | | | | | | 139,230,000 | | | | | | 144,139,979 | | |

|

787-10

|

| | | | N13018 | | | | | | 66987 | | | |

November 2022

|

| | | | 144,153,233 | | | | | | 149,036,706 | | | | | | 139,230,000 | | | | | | 144,139,979 | | |

|

Aircraft Type

|

| |

Registration

Number(1) |

| |

Manufacturer’s

Serial Number(1) |

| |

Manufacturer

Delivery Month(1) |

| |

Appraiser’s Valuations

|

| |

Appraised

Value(2) |

| ||||||||||||||||||||||||

| |

ASG

|

| |

BK

|

| |

MBA

|

| ||||||||||||||||||||||||||||||||

|

787-10

|

| | | | N12020 | | | | | | 66989 | | | |

December 2022

|

| | | | 144,153,233 | | | | | | 149,227,976 | | | | | | 140,110,000 | | | | | | 144,153,233 | | |

|

787-10

|

| | | | N12021 | | | | | | 66990 | | | |

December 2022

|

| | | | 144,153,233 | | | | | | 149,227,976 | | | | | | 140,110,000 | | | | | | 144,153,233 | | |

|

787-10

|

| | | | N14016 | | | | | | 66985 | | | |

December 2022

|

| | | | 144,153,233 | | | | | | 149,227,976 | | | | | | 140,110,000 | | | | | | 144,153,233 | | |

| | | |

Make-Whole

Spread |

| |||

|

Series AA Equipment Notes

|

| | | | % | | |

|

Series A Equipment Notes

|

| | | | % | | |

|

Underwriter

|

| |

Face Amount of

Class AA Certificates |

| |

Face Amount of

Class A Certificates |

| ||||||

|

Goldman Sachs & Co. LLC

|

| | | $ | | | | | $ | | | ||

|

Morgan Stanley & Co. LLC

|

| | | | | | | | | | | | |

|

Citigroup Global Markets Inc.

|

| | | | | | | | | | | | |

|

Deutsche Bank Securities Inc.

|

| | | | | | | | | | | | |

|

BofA Securities, Inc.

|

| | | | | | | | | | | | |

|

Barclays Capital Inc.

|

| | | | | | | | | | | | |

|

BNP Paribas Securities Corp.

|

| | | | | | | | | | | | |

|

J.P. Morgan Securities LLC

|

| | | | | | | | | | | | |

|

Mizuho Securities USA LLC

|

| | | | | | | | | | | | |

|

MUFG Securities Americas Inc.

|

| | | | | | | | | | | | |

|

NatWest Markets Securities Inc.

|

| | | | | | | | | | | | |

|

SMBC Nikko Securities America, Inc.

|

| | | | | | | | | | | | |

|

Credit Agricole Securities (USA) Inc.

|

| | | | | | | | | | | | |

|

Loop Capital Markets LLC

|

| | | | | | | | | | | | |

|

Natixis Securities Americas LLC

|

| | | | | | | | | | | | |

|

Raymond James & Associates, Inc.

|

| | | | | | | | | | | | |

|

Academy Securities, Inc.

|

| | | | | | | | | | | | |

|

AmeriVet Securities, Inc.

|

| | | | | | | | | | | | |

|

Total

|

| | | $ | 969,187,000 | | | | | $ | 385,470,000 | | |

|

Pass Through Certificates

|

| |

Concession To Selling

Group Members |

| |

Discount To

Broker/Dealers |

| ||||||

|

2024-1AA

|

| | | | % | | | | | | % | | |

|

2024-1A

|

| | | | % | | | | | | % | | |

|

Filing

|

| |

Date Filed

|

|

| | |

February 29, 2024

|

| |

| | |

April 17, 2024

|

| |

| | |

July 18, 2024

|

| |

| | |

February 22, 2024

|

| |

| | |

March 4, 2024

|

| |

| | |

July 2, 2024

|

|

| |

60-Day Period

|

| | | | S-31 | | |

| |

Actual Disposition Event

|

| | | | S-50 | | |

| |

Additional Equipment Notes

|

| | | | S-66 | | |

| |

Additional Junior Certificates

|

| | | | S-66 | | |

| |

Additional Trust

|

| | | | S-66 | | |

| |

Additional Trustee

|

| | | | S-66 | | |

| |

Administration Expenses

|

| | | | S-47 | | |

| |

Aircraft

|

| | | | S-52 | | |

| |

Airframe

|

| | | | S-52 | | |

| |

Appraisal

|

| | | | S-47 | | |

| |

Appraised Current Market Value

|

| | | | S-47 | | |

| |

Appraisers

|

| | | | S-52 | | |

| |

ASG

|

| | | | S-52 | | |

| |

Assumed Amortization Schedule

|

| | | | S-28 | | |

| |

Average Life Date

|

| | | | S-58 | | |

| |

Base Rate

|

| | | | S-42 | | |

| |

Basic Agreement

|

| | | | S-25 | | |

| |

BK

|

| | | | S-52 | | |

| |

Boeing

|

| | | | S-52 | | |

| |

Business Day

|

| | | | S-27 | | |

| |

Cape Town Treaty

|

| | | | S-61 | | |

| |

CARES Act

|

| | | | S-17 | | |

| |

Cash Collateral Account

|

| | | | S-39 | | |

| |

Cede

|

| | | | S-35 | | |

| |

Certificate Account

|

| | | | S-27 | | |

| |

Certificate Buyout Event

|

| | | | S-31 | | |

| |

Certificate Owner

|

| | | | S-35 | | |

| |

Certificateholders

|

| | | | S-26 | | |

| |

Certificates

|

| | | | S-25 | | |

| |

citizen of the United States

|

| | | | S-32 | | |

| |

Class A Adjusted Interest

|

| | | | S-49 | | |

| |

Class A Certificates

|

| | | | S-25 | | |

| |

Class A Trust

|

| | | | S-25 | | |

| |

Class A Trustee

|

| | | | S-25 | | |

| |

Class AA Certificates

|

| | | | S-25 | | |

| |

Class AA Trust

|

| | | | S-25 | | |

| |

Class AA Trustee

|

| | | | S-25 | | |

| |

Class B Certificates

|

| | | | S-66 | | |

| |

Class C Certificates

|

| | | | S-66 | | |

| |

Class Exemptions

|

| | | | S-73 | | |

| |

clearing agency

|

| | | | S-36 | | |

| |

clearing corporation

|

| | | | S-35 | | |

| |

Code

|

| | | | S-33 | | |

| |

Commission

|

| | | | S-1 | | |

| |

Company

|

| | | | S-19 | | |

| |

Controlling Party

|

| | | | S-45 | | |

| |

Convention

|

| | | | S-61 | | |

| |

Current Distribution Date

|

| | | | S-49 | | |

| |

Debt Balance

|

| | | | S-62 | | |

| |

Deemed Disposition Event

|

| | | | S-50 | | |

| |

default

|

| | | | S-30 | | |

| |

disqualified persons

|

| | | | S-73 | | |

| |

Distribution Date

|

| | | | S-47 | | |

| |

Downgrade Drawing

|

| | | | S-39 | | |

| |

Downgrade Event

|

| | | | S-39 | | |

| |

Draft Securitization RTS

|

| | | | S-22 | | |

| |

DTC

|

| | | | S-35 | | |

| |

DTC Participants

|

| | | | S-35 | | |

| |

EEA

|

| | | | S-77 | | |

| |

Engines

|

| | | | S-52 | | |

| |

Equipment

|

| | | | S-60 | | |

| |

Equipment Note Special Payment

|

| | | | S-47 | | |

| |

Equipment Notes

|

| | | | S-56 | | |

| |

ERISA

|

| | | | S-73 | | |

| |

ERISA Plans

|

| | | | S-73 | | |

| |

EU Securitization Laws

|

| | | | S-22 | | |

| |

EU Securitization Regulation

|

| | | | S-22 | | |

| |

EUWA

|

| | | | S-77 | | |

| |

Event of Loss

|

| | | | S-64 | | |

| |

Exchange Act

|

| | | | S-35 | | |

| |

Expected Distributions

|

| | | | S-49 | | |

| |

FATCA

|

| | | | S-70 | | |

| |

Final Distributions

|

| | | | S-46 | | |

| |

Final Drawing

|

| | | | S-41 | | |

| |

Final Maturity Date

|

| | | | S-26 | | |

| |

Financial Promotion Order

|

| | | | S-77 | | |

| |

FinSA

|

| | | | S-79 | | |

| |

Form 10-K

|

| | | | S-16 | | |

| |

Form 10-Q

|

| | | | S-16 | | |

| |

H.15 Page

|

| | | | S-57 | | |

| |

Indenture

|

| | | | S-35 | | |

| |

Indenture Defaults

|

| | | | S-58 | | |

| |

Indirect DTC Participants

|

| | | | S-35 | | |

| |

Insurance Distribution Directive

|

| | | | S-77 | | |

| |

Intercreditor Agreement

|

| | | | S-45 | | |

| |

Interest Drawing

|

| | | | S-38 | | |

| |

Investment Company Act

|

| | | | S-1 | | |

| |

IRS

|

| | | | S-68 | | |

| |

Issuance Date

|

| | | | S-22 | | |

| |

Liquidity Event of Default

|

| | | | S-43 | | |

| |

Liquidity Expenses

|

| | | | S-49 | | |

| |

Liquidity Facility

|

| | | | S-38 | | |

| |

Liquidity Obligations

|

| | | | S-49 | | |

| |

Liquidity Provider

|

| | | | S-38 | | |

| |

Liquidity Threshold Rating

|

| | | | S-40 | | |

| |

Loan Trustee

|

| | | | S-56 | | |

| |

Long-Term Rating

|

| | | | S-40 | | |

| |

LTVs

|

| | | | S-7 | | |

| |

Make-Whole Premium

|

| | | | S-57 | | |

| |

Make-Whole Spread

|

| | | | S-57 | | |

| |

Maximum Available Commitment

|

| | | | S-38 | | |

| |

Maximum Commitment

|

| | | | S-38 | | |

| |

MBA

|

| | | | S-52 | | |

| |

MiFID II

|

| | | | S-77 | | |

| |

Minimum Sale Price

|

| | | | S-46 | | |

| |

Moody’s

|

| | | | S-40 | | |

| |

most recent H.15 Page

|

| | | | S-58 | | |

| |

Non-Extension Drawing

|

| | | | S-40 | | |

| |

non-U.S. Certificateholder

|

| | | | S-70 | | |

| |

Note Holders

|

| | | | S-59 | | |

| |

Note Purchase Agreement

|

| | | | S-34 | | |

| |

Offering

|

| | | | S-66 | | |

| |

Participation Agreement

|

| | | | S-35 | | |

| |

parties in interest

|

| | | | S-73 | | |

| |

Pass Through Trust Agreements

|

| | | | S-25 | | |

| |

Performing Equipment Note

|

| | | | S-39 | | |

| |

Plan Asset Regulation

|

| | | | S-73 | | |

| |

Plan Fiduciary

|

| | | | S-74 | | |

| |

Plans

|

| | | | S-73 | | |

| |

Pool Balance

|

| | | | S-27 | | |

| |

Pool Factor

|

| | | | S-28 | | |

| |

Post Default Appraisals

|

| | | | S-47 | | |

| |

Preferred A Pool Balance

|

| | | | S-49 | | |

| |

PRIIPs Regulation

|

| | | | S-77 | | |

| |

Prospectus Regulation

|

| | | | S-77 | | |

| |

PSP2 and PSP3 Agreements

|

| | | | S-17 | | |

| |

PTC Event of Default

|

| | | | S-31 | | |

| |

PTCE

|

| | | | S-73 | | |

| |

qualifying income

|

| | | | S-68 | | |

| |

Rating Agencies

|

| | | | S-39 | | |

| |

Refinancing Certificates

|

| | | | S-67 | | |

| |

Refinancing Equipment Notes

|

| | | | S-66 | | |

| |

Refinancing Trust

|

| | | | S-67 | | |

| |

Regular Distribution Dates

|

| | | | S-26 | | |

| |

relevant persons

|

| | | | S-77 | | |

| |

Remaining Weighted Average Life

|

| | | | S-58 | | |

| |

Replacement Facility

|

| | | | S-41 | | |

| |

Required Amount

|

| | | | S-38 | | |

| |

S&P

|

| | | | S-40 | | |

| |

Scheduled Payments

|

| | | | S-26 | | |

| |

Section 1110

|

| | | | S-59 | | |

| |

Section 2.4 Fraction

|

| | | | S-49 | | |

| |

Series A Equipment Notes

|

| | | | S-56 | | |

| |

Series AA Equipment Notes

|

| | | | S-56 | | |

| |

SFA

|

| | | | S-79 | | |

| |

Similar Law Plans

|

| | | | S-73 | | |

| |

SOFR

|

| | | | S-42 | | |

| |

Special Distribution Date

|

| | | | S-27 | | |

| |

Special Payment

|

| | | | S-26 | | |

| |

Special Payments Account

|

| | | | S-27 | | |

| |

Special Termination Drawing

|

| | | | S-40 | | |

| |

Special Termination Notice

|

| | | | S-40 | | |

| |

Stated Interest Rates

|

| | | | S-38 | | |

| |

Subordination Agent

|

| | | | S-45 | | |

| |

Substitute Aircraft

|

| | | | S-54 | | |

| |

Term SOFR

|

| | | | S-42 | | |

| |

Term SOFR Administrator

|

| | | | S-42 | | |

| |

Term SOFR Reference Rate

|

| | | | S-42 | | |

| |

Termination Notice

|

| | | | S-43 | | |

| |

Transportation Code

|

| | | | S-32 | | |

| |

Treasury

|

| | | | S-17 | | |

| |

Treasury Yield

|

| | | | S-57 | | |

| |

Triggering Event

|

| | | | S-27 | | |

| |

Trust Indenture Act

|

| | | | S-33 | | |

| |

Trust Property

|

| | | | S-25 | | |

| |

Trust Supplement

|

| | | | S-25 | | |

| |

Trustee

|

| | | | S-25 | | |

| |

Trusts

|

| | | | S-25 | | |

| |

U.S. Certificateholders

|

| | | | S-68 | | |

| |

U.S. Government Securities Business Day

|

| | | | S-42 | | |

| |

U.S. Persons

|

| | | | S-68 | | |

| |

UAL

|

| | | | S-19 | | |

| |

UK

|

| | | | S-77 | | |

| |

UK PRIIPs Regulation

|

| | | | S-78 | | |

| |

UK Securitization Laws

|

| | | | S-22 | | |

| |

Underwriters

|

| | | | S-75 | | |

| |

Underwriting Agreement

|

| | | | S-75 | | |

| |

United

|

| | | | S-19 | | |

| |

United Bankruptcy Event

|

| | | | S-46 | | |

APPENDIX II — APPRAISAL LETTERS

Adjusted Desktop Valuation Report

Aviation Specialists Group, Inc. (“ASG”) has been engaged by United Airlines, Inc. (“Client”) to provide an adjusted desktop valuation setting forth ASG’s opinions as to halflife halftime and Adjusted Base and Current Market Values for those 48 Boeing jetliners described in the Aircraft Descriptions and Values table later in this report. In reaching its value opinions, ASG has relied upon data provided to it by Client.

This report contains the following sections:

| 4 | Adjusted Desktop Valuation Assumptions | |

| 4 | Value Definitions and Explanations | |

| 4 | Aircraft Values | |

| 4 | Covenants |

| Adjusted Desktop Valuation Assumptions |

In an adjusted desktop valuation, the appraiser neither sees the subject aircraft nor reviews its specifications and technical documents. Instead, the appraiser is furnished with certain maintenance status information by the client or aircraft operator. In preparing its value opinions, ASG relies on that data and, unless specifically stated otherwise, makes the following assumptions about the aircraft itself:

| 4 | It is of average specification for its type and age and has no special equipment or characteristics which would materially affect its value. | |

| 4 | Its utilization in terms of hours and cycles is average for its type and age. | |

| 4 | It is in passenger or freighter configuration as appropriate. | |

| 4 | It is certificated and operated under the aegis of a major airworthiness authority such as the FAA or EASA. | |

| 4 | It is in average physical condition and its maintenance records and documents comply with all applicable regulations and good industry practices. Required back to birth records are on hand and in good order and only original equipment manufacturer parts are in use in the aircraft and engines. | |

| 4 | It has no history of major damage. | |

| 4 | It complies with applicable Airworthiness Directives and mandatory Service Bulletins. |

ASG first develops the subject aircraft’s Base and/or Current Market Value assuming that the airframe, engines, engine life limited parts, landing gears and other major life- and time-limited components are in halflife, halftime condition. ASG then uses the maintenance data provided to it to adjust for the aircraft’s variance from that status. For example, if the aircraft has had a recent heavy check or engine shop visit, ASG will add to the halflife value.

Regarding Adjusted Base/Market Values, ASG uses the following value convention. A new aircraft is considered to be factory new with 100% life remaining on all components, that is, it is full life. The aircraft then ages based on typical utilization for its type until it becomes mature and reaches halflife condition. ASG’s unadjusted values for mature aircraft assume them to be in halflife condition. Time to reach mature halflife status depends on the aircraft and engine combination and typical utilization for that aircraft type. For many (but not all) jetliners, mature halflife status is reached when they are 4-5 years old. For aircraft between factory new and mature, ASG’s Current Market and Base Values already assume the aircraft to be in better than halflife condition and therefore no further adjustments are needed to their values. Adjustments are shown in the Aircraft Descriptions and Values table below.

In developing its values, ASG also makes two further assumptions:

United Airlines, Inc.

| June 21, 2024 |

1

II-1

| 4 | that the aircraft has been bought and will be sold as a single unit or as part of a small lot. It is not part of a launch purchase nor will it be the subject of a fleet sale which could result in a price discount. | |

| 4 | that the aircraft is not subject to an existing lease. ASG’s opinion of values excludes the effects of attached lease rental streams and tax benefits, either of which can have a material effect on an aircraft’s actual purchase price. |

| Value Definitions and Explanations |

ASG uses the following ISTAT definitions:

| 4 | Base Value is the Appraiser’s opinion of the value of an aircraft (or other aviation-related asset) in a stable market with a reasonable balance of supply and demand. The Base Value of a tangible asset typically assumes its physical condition is average for an asset of its type and age, and its maintenance status is as described. Base Value assumes that the value is for an unencumbered single-unit transaction valued for the asset’s highest and best use (as defined by the Appraiser), that the parties to the potential sale would be willing, able, prudent and knowledgeable, and under no unusual pressure for a prompt sale, and that the transaction would be negotiated in an open and unrestricted market on an arm’s-length basis, for cash or equivalent consideration, and given an adequate amount of time for effective exposure to prospective buyers. | |

| 4 | Market Value or Fair Market Value (or Current Market Value or Current Fair Market Value, if the value pertains to the time of the analysis) is the Appraiser’s opinion of the most likely trading price that may be generated for an aircraft (or other aviation-related asset) under the market circumstances perceived to exist at the time in question. Market Value assumes that the value is for an unencumbered single-unit transaction valued for the asset’s highest and best use (as defined by the Appraiser), that the parties to the potential sale would be willing, able, prudent and knowledgeable, and under no unusual pressure for a prompt sale, and that the transaction would be negotiated in an open and unrestricted market on an arm’s-length basis, for cash or equivalent consideration, and given an adequate amount of time for effective exposure to prospective buyers. | |

| 4 | Full-life/Full-time describes a maintenance status where all scheduled maintenance events are at zero-time (100% time remaining) and all life-limited components have their full lives remaining. | |

| 4 | Halflife/Halftime (historically also known as Mid-life/Mid-time) describes a maintenance status where all scheduled maintenance events are at mid-point of their scheduled or estimated interval (50% time remaining) and all life-limited components are at the mid-point of their assigned lives. |

ASG also uses the term Adjusted Market/Base Value to indicate that it has adjusted Current Market/Base Value to reflect the data which it has regarding the aircraft’s maintenance status.

| Aircraft Values |

ASG’s value opinions for the subject aircraft are set forth in millions of U.S. dollars in the Aircraft Descriptions and Values table below. Maintenance adjustments to halflife halftime values are set forth in the MX Adjustments column of the table. Detailed adjustments to specific aircraft values are available on request.

United Airlines, Inc.

| June 21, 2024 |

2

II-2

Aircraft Descriptions and Values (US$ millions), 01 June 2024

| MSN | Type | DOM | Registration | Engine | ESN1 | ESN2 | OH

Crew Rests |

Unadj

Current Mkt Value |

Unadj

Base Value |

MX Adjustmt |

Adj

Cur Mkt Val |

Adj

Base Val |

| 44309 | 737 MAX 8 | Jun-23 | N27290 | LEAP 1B-28 | 603741 | 603756 | n/a | $52.5 | $51.3 | $0.0 | $52.5 | $51.3 |

| 64609 | 737 MAX 8 | Jul-23 | N17312 | LEAP 1B-28 | 602765 | 602821 | n/a | $53.2 | $52.1 | $0.0 | $53.2 | $52.1 |

| 64608 | 737 MAX 8 | Aug-23 | N37307 | LEAP 1B-28 | 602846 | 602843 | n/a | $53.2 | $52.1 | $0.0 | $53.2 | $52.1 |

| 67604 | 737 MAX 8 | Dec-23 | N37324 | LEAP 1B-28 | 603967 | 60B013 | n/a | $54.0 | $52.9 | $0.0 | $54.0 | $52.9 |

| 67588 | 737 MAX 8 | Dec-23 | N47330 | LEAP 1B-28 | 60A132 | 60A488 | n/a | $54.0 | $52.9 | $0.0 | $54.0 | $52.9 |

| 67184 | 737 MAX 9 | May-23 | N37560 | LEAP 1B-28 | 603421 | 60A463 | n/a | $52.9 | $51.7 | $0.0 | $52.9 | $51.7 |

| 67590 | 737 MAX 9 | May-23 | N37561 | LEAP 1B-28 | 603202 | 603353 | n/a | $52.9 | $51.7 | $0.0 | $52.9 | $51.7 |

| 67591 | 737 MAX 9 | Jun-23 | N37562 | LEAP 1B-28 | 603227 | 603861 | n/a | $52.9 | $51.7 | $0.0 | $52.9 | $51.7 |

| 67187 | 737 MAX 9 | Jun-23 | N37563 | LEAP 1B-28 | 60B229 | 60B235 | n/a | $52.9 | $51.7 | $0.0 | $52.9 | $51.7 |

| 67186 | 737 MAX 9 | Jun-23 | N17565 | LEAP 1B-28 | 60B287 | 60B292 | n/a | $52.9 | $51.7 | $0.0 | $52.9 | $51.7 |

| 67188 | 737 MAX 9 | Jun-23 | N17564 | LEAP 1B-28 | 603288 | 603568 | n/a | $52.9 | $51.7 | $0.0 | $52.9 | $51.7 |

| 67603 | 737 MAX 9 | Aug-23 | N77573 | LEAP 1B-28 | 60A367 | 603602 | n/a | $54.0 | $52.8 | $0.0 | $54.0 | $52.8 |

| 67193 | 737 MAX 9 | Aug-23 | N77571 | LEAP 1B-28 | 60B352 | 60B375 | n/a | $54.0 | $52.8 | $0.0 | $54.0 | $52.8 |

| 67609 | 737 MAX 9 | Aug-23 | N77575 | LEAP 1B-28 | 603120 | 60A674 | n/a | $54.0 | $52.8 | $0.0 | $54.0 | $52.8 |

| 67610 | 737 MAX 9 | Sep-23 | N77576 | LEAP 1B-28 | 60B443 | 60B473 | n/a | $54.0 | $52.8 | $0.0 | $54.0 | $52.8 |

| 67615 | 737 MAX 9 | Sep-23 | N37577 | LEAP 1B-28 | 60B472 | 60B475 | n/a | $54.0 | $52.8 | $0.0 | $54.0 | $52.8 |

| 31663 | B737-800 | Oct-10 | N76528 | CFM56-7B26 | 805240 | 804292 | n/a | $20.8 | $20.2 | ($4.6) | $16.2 | $15.7 |

| 31652 | B737-800 | Dec-10 | N76529 | CFM56-7B26 | 804586 | 805596 | n/a | $20.8 | $20.2 | ($5.1) | $15.6 | $15.1 |

| 39998 | B737-800 | Mar-11 | N77530 | CFM56-7B26 | 804678 | 804677 | n/a | $21.1 | $20.6 | $6.6 | $27.7 | $27.2 |

| 39999 | B737-800 | Mar-11 | N87531 | CFM56-7B26 | 804509 | 804545 | n/a | $21.1 | $20.6 | ($1.6) | $19.5 | $19.0 |

| 31655 | B737-900ER | Dec-10 | N38443 | CFM56-7B26 | 804398 | 804401 | n/a | $17.9 | $18.7 | ($4.8) | $13.1 | $13.9 |

| 31643 | B737-900ER | Dec-10 | N36444 | CFM56-7B26 | 804446 | 804447 | n/a | $17.9 | $18.7 | ($5.1) | $12.8 | $13.6 |

| 40000 | B737-900ER | Apr-11 | N73445 | CFM56-7B26 | 804866 | 804869 | n/a | $18.6 | $19.5 | ($4.9) | $13.7 | $14.6 |

| 31661 | B737-900ER | Jan-12 | N38446 | CFM56-7B26 | 960530 | 960540 | n/a | $19.7 | $20.8 | ($4.2) | $15.5 | $16.5 |

| 31650 | B737-900ER | Feb-12 | N36447 | CFM56-7B26 | 960603 | 960604 | n/a | $19.7 | $20.8 | ($3.9) | $15.8 | $16.9 |

| 40003 | B737-900ER | Mar-12 | N78448 | CFM56-7B26 | 960637 | 960645 | n/a | $19.7 | $20.8 | ($4.6) | $15.1 | $16.2 |

United Airlines, Inc.

| June 21, 2024 |

3

II-3

| MSN | Type | DOM | Registration | Engine | ESN1 | ESN2 | OH

Crew Rests |

Unadj

Current Mkt Value |

Unadj

Base Value |

MX Adjustmt |

Adj

Cur Mkt Val |

Adj

Base Val |

| 31651 | B737-900ER | Mar-12 | N81449 | CFM56-7B26 | 960715 | 960716 | n/a | $19.7 | $20.8 | ($2.5) | $17.2 | $18.2 |

| 40004 | B737-900ER | Apr-12 | N39450 | CFM56-7B26 | 960735 | 961746 | n/a | $20.1 | $21.2 | $1.9 | $22.0 | $23.1 |

| 31646 | B737-900ER | Apr-12 | N38451 | CFM56-7B26 | 960742 | 961747 | n/a | $20.1 | $21.2 | ($4.2) | $15.9 | $17.0 |

| 40005 | B737-900ER | May-12 | N68452 | CFM56-7B26 | 960831 | 960839 | n/a | $20.1 | $21.2 | ($3.5) | $16.6 | $17.7 |

| 41742 | B737-900ER | May-12 | N68453 | CFM56-7B26 | 960869 | 960871 | n/a | $20.1 | $21.2 | ($3.6) | $16.5 | $17.6 |

| 31640 | B737-900ER | Jun-12 | N38454 | CFM56-7B26 | 960904 | 961908 | n/a | $20.1 | $21.2 | ($3.5) | $16.5 | $17.7 |

| 41743 | B737-900ER | Jun-12 | N34455 | CFM56-7B26 | 960936 | 960943 | n/a | $20.1 | $21.2 | ($4.1) | $16.0 | $17.1 |

| 37205 | B737-900ER | Sep-12 | N37456 | CFM56-7B26 | 962201 | 963202 | n/a | $20.5 | $21.6 | ($5.8) | $14.6 | $15.8 |

| 41744 | B737-900ER | Sep-12 | N28457 | CFM56-7B26 | 962231 | 962234 | n/a | $20.5 | $21.6 | ($5.9) | $14.5 | $15.7 |

| 37199 | B737-900ER | Sep-12 | N38458 | CFM56-7B26 | 962248 | 962252 | n/a | $20.5 | $21.6 | ($5.8) | $14.7 | $15.8 |

| 37206 | B737-900ER | Oct-12 | N38459 | CFM56-7B26 | 962312 | 962318 | n/a | $20.9 | $22.0 | ($5.7) | $15.2 | $16.4 |

| 37200 | B737-900ER | Nov-12 | N34460 | CFM56-7B26 | 962316 | 962330 | n/a | $20.9 | $22.0 | ($5.4) | $15.5 | $16.7 |

| 42175 | B737-900ER | Jan-14 | N68811 | CFM56-7B26 | 658490 | 658505 | n/a | $22.9 | $24.3 | ($3.9) | $18.9 | $20.4 |

| 42201 | B737-900ER | May-15 | N61882 | CFM56-7B26 | 862112 | 862113 | n/a | $25.0 | $26.8 | ($3.1) | $22.0 | $23.8 |

| 42202 | B737-900ER | Jun-15 | N62883 | CFM56-7B26 | 862193 | 862210 | n/a | $25.0 | $26.8 | ($3.6) | $21.4 | $23.2 |

| 66591 | 777-300ER | Jan-20 | N2251U | GE90-115B | 901497 | 901498 | Pilot / FA | $84.1 | $107.4 | $0.0 | $84.1 | $107.4 |

| 66592 | 777-300ER | Mar-20 | N2352U | GE90-115B | 901507 | 901508 | Pilot / FA | $84.1 | $107.4 | $0.0 | $84.1 | $107.4 |

| 66988 | 787-10 | Nov-22 | N14019 | GEnx-1B70 | 958735 | 958792 | Pilot / FA | $144.1 | $144.2 | $0.0 | $144.1 | $144.2 |

| 66987 | 787-10 | Nov-22 | N13018 | GEnx-1B70 | 958798 | 958799 | Pilot / FA | $144.1 | $144.2 | $0.0 | $144.1 | $144.2 |

| 66989 | 787-10 | Dec-22 | N12020 | GEnx-1B70 | 958806 | 958807 | Pilot / FA | $144.1 | $144.2 | $0.0 | $144.1 | $144.2 |

| 66990 | 787-10 | Dec-22 | N12021 | GEnx-1B70 | 958809 | 958810 | Pilot / FA | $144.1 | $144.2 | $0.0 | $144.1 | $144.2 |

| 66985 | 787-10 | Dec-22 | N14016 | GEnx-1B70 | 958780 | 958782 | Pilot / FA | $144.1 | $144.2 | $0.0 | $144.1 | $144.2 |

United Airlines, Inc.

| June 21, 2024 |

4

II-4

| Covenants |

In accordance with ISTAT’s Principles of Appraisal Practice and Code of Ethics, this report has been prepared for the exclusive use of Client; ASG will not provide it to any other party without the express consent of Client. ASG has no present or contemplated interest in the subject equipment or any similar equipment, it has no current, past or contemplated interest in Client or any companies related to Client nor does it have any other interest which might tend to prevent it making a fair and unbiased appraisal.

This report fairly represents ASG’s opinion of the subject equipment’s value. In reaching its value opinions, ASG has relied upon information provided by Client. ASG does not assume responsibility or legal liability for any actions taken, or not taken, by Client or other parties with regard to the equipment. By accepting this report, all parties agree that ASG shall bear no such responsibility or legal liability including liability for special or consequential damages.

For Aviation Specialists Group, Inc.

Fred J. Klein

ISTAT-certified Senior Appraiser Fellow

International Society of Transport Aircraft Trading

United Airlines, Inc.

| June 21, 2024 |

5

II-5

VALUATION OF A 48 AIRCRAFT PORTFOLIO

As of June 1, 2024 Client: United Airlines, Inc.

Report Date: July 2, 2024

7315 Wisconsin Ave, Ste 800W Bethesda, MD 20814

II-6

Table of Contents

| VALUATION SUMMARY | 2 | |

| DEFINITIONS | 3 | |

| ASSUMPTIONS | 4 | |

| MARKET OUTLOOK | 5 | |

| AIRCRAFT MARKET ANALYTICS | 9 | |

| VALUATION METHODOLOGY | 12 | |

| DISCLAIMER | 14 |

1

II-7

I. VALUATION SUMMARY

BK Associates, Inc. (“BK”) has been engaged by United Airlines, Inc. (“Client”) to provide a desktop valuation, setting forth BK’s opinions of current half-life base values (BV) for 23 aircraft and maintenance-adjusted BVs for 25 aircraft, as of June 1, 2024.

AIRCRAFT DESCRIPTION

The Portfolio aircraft are identified by type, serial number, date of manufacture and engine model/variant in the attached Figure 1. Figure 1 reflects the current half-life and maintenance-adjusted BVs in millions.

PURPOSE OF THE VALUATION ENGAGEMENT

It is understood by BK that the Conclusion of Value will be used by Client for potential financing. This report was prepared solely for the purposes described herein and, accordingly, should not be used for any other purpose. In addition, this report should not be distributed to any party other than Client, without the express knowledge and written consent of the Client or BK.

RELEVANT DATES

BK was engaged to value the subject aircraft as of the Valuation Date, June 1, 2024. In this valuation, BK considered only circumstances that existed as of and events that occurred up to the Valuation Date.

PREMISE OF VALUE

The valuation premise may be either in-use (i.e., going concern) or liquidation. The determining factor being the highest and best use as considered from a market participant’s perspective. The values issued in this report are based on an in-use valuation premise, which assumes that the aircraft will continue to operate.

CONCLUSIONS

Based upon BK’s knowledge of these various aircraft types, BK’s knowledge of the capabilities and uses to which they have been put in various parts of the world, BK’s knowledge of the marketing of used aircraft, and BK’s knowledge of aircraft in general, it is BK’s opinion that the values are in 2024 U.S. dollars as found in the attached Figure 1.

2

II-8

II. DEFINITIONS

According to the International Society of Transport Aircraft Trading's (ISTAT) definition of Base Value to which BK Associates subscribes, the base value is the Appraiser's opinion of the underlying economic value of an aircraft in an open, unrestricted, stable market environment with a reasonable balance of supply and demand, and assumes full consideration of its "highest and best use". An aircraft's base value is founded in the historical trend of values and in the projection of future value trends and presumes an arm's length, cash transaction between willing, able and knowledgeable parties, acting prudently, with an absence of duress and with a reasonable period of time available for marketing. The base value normally refers to a transaction involving a single aircraft. When multiple aircraft are acquired in the same transaction, the trading price of each unit may be discounted.

BK’s stated values include assumed half-life and maintenance adjusted values. For comparison purposes, it is the convention to assign “half-time, half-life” values to aircraft or engines, which represent the value of an aircraft or engine that is halfway between the expense major maintenance events. As a starting point, the base value of a tangible asset typically assumes its maintenance status is at half-life/half-time, or benefiting from an above half-life/half-time maintenance status if the asset is new or young.

The maintenance adjusted values include appropriate financial adjustments applied to the half-time value, these adjustments are based on BK’s interpretation of the maintenance summary and fleet utilization data provided. The adjustments are approximate, based on industry average costs, and include an adjustment for the time remaining to a “C” check, time remaining to a “D” check, time remaining to landing gear overhaul, time since new or time since the most recent heavy shop visit on engines and life remaining on engine life-limited parts.

3

II-9

III. ASSUMPTIONS

BK has made the following assumptions and determinations with respect to these aircraft in preparing this valuation:

| 1. | The aircraft are in good physical condition. |

| 2. | The historical maintenance documentation has been maintained to acceptable international standards. |

| 3. | The specifications of the aircraft are those most common for aircraft of their type and vintage. |

| 4. | The aircraft are in standard passenger configurations, unless specifically stated otherwise. |

| 5. | The aircraft are current as to all Airworthiness Directives and Service Bulletins. |

| 6. | Their modification statuses are comparable to those of aircraft of their type and vintage. |

| 7. | They are operated under an appropriate civil airworthiness authority. |

| 8. | Their utilization is comparable to industry averages. |

| 9. | There is no history of accident or incident damage that BK is aware of. |

4

II-10

IV. MARKET OUTLOOK

The performance and value of any aircraft is affected to varying degrees by conditions in the global economy. Some of the key influences include gross domestic product, fuel price, and the lending environment. This section of the report will analyze what the current outlook is for each.

GROSS DOMESTIC PRODUCT (GDP) 1

|

||

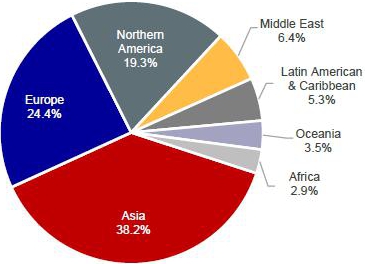

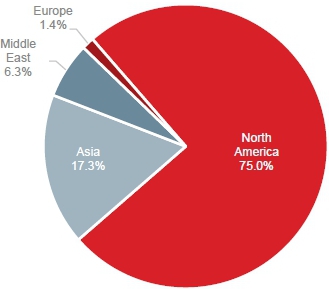

| Source: IATA.org |

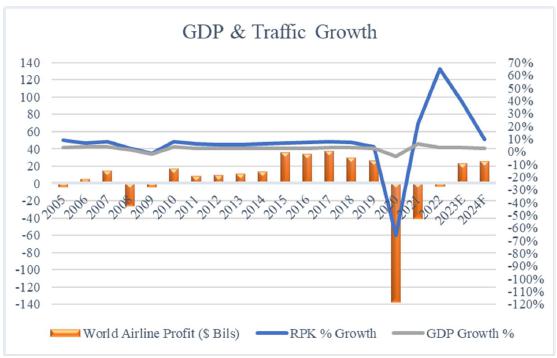

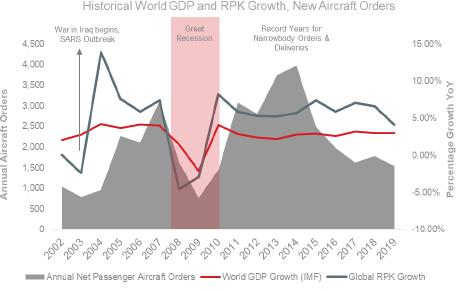

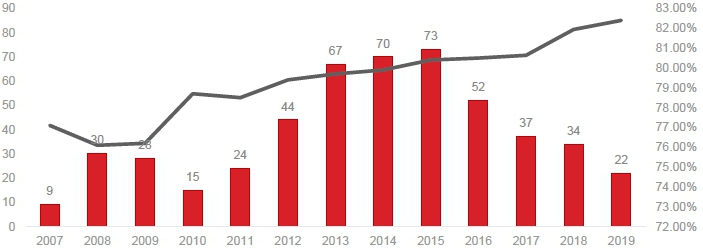

Aviation is a highly cyclical industry, marked with high highs and low lows. Historically, GDP and traffic have been good indicators of the health of the industry, as they are highly correlated. Economic prosperity leads to an increase in disposable income and subsequently an increase in demand for air travel. An increase in demand for air travel means an increase in demand for aircraft and related equipment.

The aviation industry, along with the global economy at large, were severely impacted by the COVID-19 pandemic. As a result of travel restrictions and broader economic downturns, both traffic and GDP sharply dropped. However, access to the COVID-19 vaccine brought down caseloads, easing travel restrictions and brightened economic prospects for advanced economies. While 2022 saw tremendous GDP growth compared to 2021, this is likely to slow down due to global inflation. According to the IMF, global growth was 3.2 percent in 2023 and projected to be the same in 2024 and 2025. Advanced economies grew by 1.6% in 2023, and increase to 1.7% and 1.8% in 2024 and 2025, respectively. Developing economies had and are estimated to have stronger growth, relative to advanced economies, with 4.3% in 2023, and projected to grow 4.2% in both 2024 and 2025. In addition, there are more difficult near-term prospects due in part to tight

1 https://www.imf.org/en/Publications/WEO/Issues/2024/04/16/world-economic-outlook-april-2024

5

II-11

monetary policy tackling inflation, the impacts of the war in Ukraine, and the supply chain disruptions within manufacturing countries.

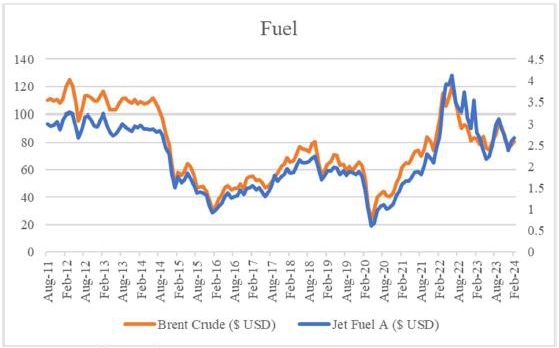

FUEL ENVIRONMENT 2 3 4 5 6 7 8

|

||

| Source: Indexmundi.com |