| | | |

Page

|

| |||

| | | | | S-4 | | | |

| | | | | S-4 | | | |

| | | | | S-5 | | | |

| | | | | S-7 | | | |

| | | | | S-8 | | | |

| | | | | S-9 | | | |

| | | | | S-15 | | | |

| | | | | S-17 | | | |

| | | | | S-18 | | | |

| | | | | S-18 | | | |

| | | | | S-21 | | | |

| | | | | S-21 | | | |

| | | | | S-22 | | | |

| | | | | S-22 | | | |

| | | | | S-22 | | | |

| | | | | S-22 | | | |

| | | | | S-24 | | | |

| | | | | S-25 | | | |

| | | | | S-26 | | | |

| | | | | S-27 | | | |

| | | | | S-28 | | | |

| | | | | S-28 | | | |

| | | | | S-29 | | | |

| | | | | S-31 | | | |

| | | | | S-31 | | | |

| | | | | S-31 | | | |

| | | | | S-31 | | | |

| | | | | S-35 | | | |

| | | | | S-35 | | | |

| | | | | S-35 | | | |

| | | | | S-38 | | | |

| | | | | S-38 | | | |

| | | | | S-40 | | | |

| | | | | S-40 | | | |

| | | | | S-41 | | | |

| | | | | S-41 | | | |

| | | | | S-43 | | | |

| | | | | S-43 | | | |

| | | | | S-46 | | | |

| | | | | S-46 | | | |

| | | |

Page

|

| |||

| | | | | S-46 | | | |

| | | | | S-47 | | | |

| | | | | S-48 | | | |

| | | | | S-48 | | | |

| | | | | S-48 | | | |

| | | | | S-49 | | | |

| | | | | S-51 | | | |

| | | | | S-51 | | | |

| | | | | S-51 | | | |

| | | | | S-51 | | | |

| | | | | S-52 | | | |

| | | | | S-52 | | | |

| | | | | S-53 | | | |

| | | | | S-53 | | | |

| | | | | S-54 | | | |

| | | | | S-55 | | | |

| | | | | S-55 | | | |

| | | | | S-55 | | | |

| | | | | S-61 | | | |

| | | | | S-61 | | | |

| | | | | S-61 | | | |

| | | | | S-62 | | | |

| | | | | S-63 | | | |

| | | | | S-63 | | | |

| | | | | S-63 | | | |

| | | | | S-63 | | | |

| | | | | S-64 | | | |

| | | | | S-64 | | | |

| | | | | S-64 | | | |

| | | | | S-65 | | | |

| | | | | S-66 | | | |

| | | | | S-67 | | | |

| | | | | S-69 | | | |

| | | | | S-70 | | | |

| | | | | S-74 | | | |

| | | | | S-74 | | | |

| | | | | S-75 | | | |

| | | | | Appendix I | | | |

| | | | | Appendix II | | | |

| | | | | Appendix III | | | |

| | | |

Page

|

| |||

| | | | | 1 | | | |

| | | | | 2 | | | |

| | | | | 2 | | | |

| | | | | 5 | | | |

| | | | | 5 | | | |

| | | | | 5 | | | |

| | | | | 5 | | | |

| | | | | 7 | | | |

| | | | | 7 | | | |

| |

Aggregate Face Amount

|

| |

$1,320,110,000

|

|

| |

Interest Rate

|

| |

%

|

|

| |

Initial Loan to Aircraft Value (cumulative)(1)(2)

|

| |

62.5%

|

|

| |

Highest Loan to Aircraft Value (cumulative)(2)

|

| |

63.5%

|

|

| |

Expected Principal Distribution Window (in years)

|

| |

1.1 – 12.6

|

|

| |

Initial Average Life (in years from Issuance Date)

|

| |

9.5

|

|

| |

Regular Distribution Dates

|

| |

January 15 and July 15

|

|

| |

Final Expected Distribution Date

|

| |

January 15, 2036

|

|

| |

Final Maturity Date

|

| |

July 15, 2037

|

|

| |

Minimum Denomination

|

| |

$1,000

|

|

| |

Section 1110 Protection

|

| |

Yes

|

|

| |

Liquidity Facility Coverage

|

| |

Three semiannual interest payments

|

|

|

Aircraft Model

|

| |

Registration

Number(1) |

| |

Manufacturer’s

Serial Number(1) |

| |

Manufacturer

Delivery Month(1) |

| |

Principal

Amount of Equipment Notes |

| |

Appraised

Value(2) |

| ||||||||||||

|

737 MAX 8

|

| | | | N27268 | | | | | | 67523 | | | |

August 2022

|

| | | $ | 33,000,000 | | | | | $ | 52,800,000 | | |

|

737 MAX 8

|

| | | | N27271 | | | | | | 67526 | | | |

September 2022

|

| | | | 33,158,000 | | | | | | 53,053,028 | | |

|

737 MAX 8

|

| | | | N27269 | | | | | | 67524 | | | |

September 2022

|

| | | | 33,158,000 | | | | | | 53,053,028 | | |

|

737 MAX 8

|

| | | | N47275 | | | | | | 64610 | | | |

September 2022

|

| | | | 33,158,000 | | | | | | 53,053,028 | | |

|

737 MAX 8

|

| | | | N27270 | | | | | | 67525 | | | |

September 2022

|

| | | | 33,158,000 | | | | | | 53,053,028 | | |

|

737 MAX 8

|

| | | | N27267 | | | | | | 67522 | | | |

September 2022

|

| | | | 33,158,000 | | | | | | 53,053,028 | | |

|

737 MAX 8

|

| | | | N17272 | | | | | | 67527 | | | |

September 2022

|

| | | | 33,158,000 | | | | | | 53,053,028 | | |

|

737 MAX 8

|

| | | | N27273 | | | | | | 67528 | | | |

October 2022

|

| | | | 33,344,000 | | | | | | 53,350,000 | | |

|

737 MAX 8

|

| | | | N47281 | | | | | | 62535 | | | |

October 2022

|

| | | | 33,344,000 | | | | | | 53,350,000 | | |

|

737 MAX 8

|

| | | | N27277 | | | | | | 64612 | | | |

November 2022

|

| | | | 33,513,000 | | | | | | 53,620,000 | | |

|

737 MAX 8

|

| | | | N47282 | | | | | | 61861 | | | |

December 2022

|

| | | | 33,681,000 | | | | | | 53,890,000 | | |

|

737 MAX 8

|

| | | | N47284 | | | | | | 61863 | | | |

December 2022

|

| | | | 33,681,000 | | | | | | 53,890,000 | | |

|

737 MAX 8

|

| | | | N17279 | | | | | | 64613 | | | |

December 2022

|

| | | | 33,681,000 | | | | | | 53,890,000 | | |

|

737 MAX 8

|

| | | | N27276 | | | | | | 64611 | | | |

December 2022

|

| | | | 33,681,000 | | | | | | 53,890,000 | | |

|

737 MAX 8

|

| | | | N17285 | | | | | | 61853 | | | |

December 2022

|

| | | | 33,681,000 | | | | | | 53,890,000 | | |

|

737 MAX 8

|

| | | | N57286 | | | | | | 61854 | | | |

February 2023

|

| | | | 33,894,000 | | | | | | 54,230,000 | | |

|

737 MAX 8

|

| | | | N47280 | | | | | | 64614 | | | |

February 2023

|

| | | | 33,894,000 | | | | | | 54,230,000 | | |

|

737 MAX 8

|

| | | | N37278 | | | | | | 61859 | | | |

February 2023

|

| | | | 33,894,000 | | | | | | 54,230,000 | | |

|

737 MAX 8

|

| | | | N47288 | | | | | | 61856 | | | |

March 2023

|

| | | | 33,925,000 | | | | | | 54,280,000 | | |

|

737 MAX 8

|

| | | | N27287 | | | | | | 60709 | | | |

March 2023

|

| | | | 33,925,000 | | | | | | 54,280,000 | | |

|

737 MAX 8

|

| | | | N27283 | | | | | | 61857 | | | |

April 2023

|

| | | | 33,950,000 | | | | | | 54,320,000 | | |

|

737 MAX 8

|

| | | | N17289 | | | | | | 60712 | | | |

April 2023

|

| | | | 33,950,000 | | | | | | 54,320,000 | | |

|

737 MAX 9

|

| | | | N27539 | | | | | | 64468 | | | |

October 2022

|

| | | | 33,863,000 | | | | | | 54,181,568 | | |

|

737 MAX 9

|

| | | | N37542 | | | | | | 64470 | | | |

November 2022

|

| | | | 33,985,000 | | | | | | 54,375,704 | | |

|

737 MAX 9

|

| | | | N37541 | | | | | | 64469 | | | |

November 2022

|

| | | | 33,985,000 | | | | | | 54,375,704 | | |

|

737 MAX 9

|

| | | | N37538 | | | | | | 64467 | | | |

November 2022

|

| | | | 33,985,000 | | | | | | 54,375,704 | | |

|

737 MAX 9

|

| | | | N77543 | | | | | | 64474 | | | |

December 2022

|

| | | | 34,108,000 | | | | | | 54,573,174 | | |

|

737 MAX 9

|

| | | | N77544 | | | | | | 64473 | | | |

December 2022

|

| | | | 34,108,000 | | | | | | 54,573,174 | | |

|

737 MAX 9

|

| | | | N37545 | | | | | | 64472 | | | |

December 2022

|

| | | | 34,108,000 | | | | | | 54,573,174 | | |

|

737 MAX 9

|

| | | | N27546 | | | | | | 64478 | | | |

December 2022

|

| | | | 34,108,000 | | | | | | 54,573,174 | | |

|

737 MAX 9

|

| | | | N37547 | | | | | | 64477 | | | |

December 2022

|

| | | | 34,108,000 | | | | | | 54,573,174 | | |

|

737 MAX 9

|

| | | | N37548 | | | | | | 64476 | | | |

December 2022

|

| | | | 34,108,000 | | | | | | 54,573,174 | | |

|

737 MAX 9

|

| | | | N37554 | | | | | | 67578 | | | |

February 2023

|

| | | | 34,488,000 | | | | | | 55,180,000 | | |

|

737 MAX 9

|

| | | | N37551 | | | | | | 67181 | | | |

March 2023

|

| | | | 34,519,000 | | | | | | 55,230,000 | | |

|

737 MAX 9

|

| | | | N37553 | | | | | | 67180 | | | |

March 2023

|

| | | | 34,519,000 | | | | | | 55,230,000 | | |

|

737 MAX 9

|

| | | | N77552 | | | | | | 67179 | | | |

March 2023

|

| | | | 34,519,000 | | | | | | 55,230,000 | | |

|

737 MAX 9

|

| | | | N37555 | | | | | | 67182 | | | |

March 2023

|

| | | | 34,519,000 | | | | | | 55,230,000 | | |

|

737 MAX 9

|

| | | | N37556 | | | | | | 67579 | | | |

March 2023

|

| | | | 34,519,000 | | | | | | 55,230,000 | | |

|

737 MAX 9

|

| | | | N17557 | | | | | | 67584 | | | |

May 2023

|

| | | | 34,575,000 | | | | | | 55,320,000 | | |

|

Regular Distribution Date

|

| |

Assumed Aggregate

Aircraft Value(1) |

| |

Outstanding Balance(2)

|

| |

LTV(3)

|

| |||||||||

|

At Issuance

|

| | | $ | 2,112,175,896 | | | | | $ | 1,320,110,000 | | | | | | 62.5% | | |

|

January 15, 2024

|

| | | | 2,080,123,495 | | | | | | 1,320,110,000 | | | | | | 63.5% | | |

|

July 15, 2024

|

| | | | 2,048,071,095 | | | | | | 1,290,614,789 | | | | | | 63.0% | | |

|

January 15, 2025

|

| | | | 2,016,018,694 | | | | | | 1,261,119,578 | | | | | | 62.6% | | |

|

July 15, 2025

|

| | | | 1,983,966,294 | | | | | | 1,231,624,367 | | | | | | 62.1% | | |

|

January 15, 2026

|

| | | | 1,951,913,893 | | | | | | 1,202,129,156 | | | | | | 61.6% | | |

|

July 15, 2026

|

| | | | 1,919,861,493 | | | | | | 1,172,633,945 | | | | | | 61.1% | | |

|

January 15, 2027

|

| | | | 1,887,809,092 | | | | | | 1,143,138,734 | | | | | | 60.6% | | |

|

July 15, 2027

|

| | | | 1,855,756,692 | | | | | | 1,113,643,523 | | | | | | 60.0% | | |

|

January 15, 2028

|

| | | | 1,823,704,292 | | | | | | 1,084,148,312 | | | | | | 59.4% | | |

|

July 15, 2028

|

| | | | 1,791,651,891 | | | | | | 1,054,653,101 | | | | | | 58.9% | | |

|

January 15, 2029

|

| | | | 1,759,599,491 | | | | | | 1,025,157,890 | | | | | | 58.3% | | |

|

July 15, 2029

|

| | | | 1,727,547,090 | | | | | | 995,662,679 | | | | | | 57.6% | | |

|

January 15, 2030

|

| | | | 1,695,494,690 | | | | | | 966,167,468 | | | | | | 57.0% | | |

|

July 15, 2030

|

| | | | 1,663,442,289 | | | | | | 936,672,257 | | | | | | 56.3% | | |

|

January 15, 2031

|

| | | | 1,631,389,889 | | | | | | 907,177,046 | | | | | | 55.6% | | |

|

July 15, 2031

|

| | | | 1,599,337,488 | | | | | | 877,681,835 | | | | | | 54.9% | | |

|

January 15, 2032

|

| | | | 1,567,285,088 | | | | | | 848,186,624 | | | | | | 54.1% | | |

|

July 15, 2032

|

| | | | 1,535,232,688 | | | | | | 818,691,413 | | | | | | 53.3% | | |

|

January 15, 2033

|

| | | | 1,503,180,287 | | | | | | 789,196,202 | | | | | | 52.5% | | |

|

July 15, 2033

|

| | | | 1,471,127,887 | | | | | | 759,700,991 | | | | | | 51.6% | | |

|

January 15, 2034

|

| | | | 1,439,075,486 | | | | | | 730,205,780 | | | | | | 50.7% | | |

|

July 15, 2034

|

| | | | 1,407,023,086 | | | | | | 700,710,569 | | | | | | 49.8% | | |

|

January 15, 2035

|

| | | | 1,374,970,685 | | | | | | 671,215,358 | | | | | | 48.8% | | |

|

July 15, 2035

|

| | | | 1,342,918,285 | | | | | | 641,720,147 | | | | | | 47.8% | | |

|

January 15, 2036

|

| | | | 1,310,865,885 | | | | | | 0 | | | | | | 0.0% | | |

![[MISSING IMAGE: fc_cash-bw.jpg]](fc_cash-bw.jpg)

Notes

Consequences

| | | | | | | | | |

S&P

|

| |

Moody’s

|

| |||

|

Threshold Rating for the Liquidity Provider

|

| |

Long Term

|

| | | | | BBB | | | | | Baa2 | | |

| | | |

Three Months Ended

March 31, |

| |

Year Ended December 31,

|

| ||||||||||||||||||||||||

| | | |

2023

|

| |

2022

|

| |

2022

|

| |

2021

|

| |

2020

|

| |||||||||||||||

| Statement of Operations Data(1) (in millions): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Operating revenue

|

| | | $ | 11,429 | | | | | $ | 7,566 | | | | | $ | 44,955 | | | | | $ | 24,634 | | | | | $ | 15,355 | | |

|

Operating expenses

|

| | | | 11,472 | | | | | | 8,941 | | | | | | 42,616 | | | | | | 25,654 | | | | | | 21,712 | | |

|

Operating income (loss)

|

| | | | (43) | | | | | | (1,375) | | | | | | 2,339 | | | | | | (1,020) | | | | | | (6,357) | | |

|

Net income (loss)

|

| | | | (194) | | | | | | (1,377) | | | | | | 739 | | | | | | (1,962) | | | | | | (7,067) | | |

| | | |

As of March 31,

|

| |

As of December 31,

|

| ||||||||||||

| | | |

2023

|

| |

2022

|

| |

2021

|

| |||||||||

| Balance Sheet Data (in millions): | | | | | | | | | | | | | | | | | | | |

|

Unrestricted cash, cash equivalents and short-term investments

|

| | | $ | 17,156 | | | | | $ | 16,414 | | | | | $ | 18,406 | | |

|

Total assets

|

| | | | 70,388 | | | | | | 67,329 | | | | | | 68,147 | | |

|

Debt and finance leases(2)

|

| | | | 30,846 | | | | | | 31,413 | | | | | | 33,658 | | |

|

Stockholder’s equity

|

| | | | 6,636 | | | | | | 6,865 | | | | | | 4,998 | | |

| | | |

Three Months Ended

March 31, |

| |

Year Ended December 31,

|

| ||||||||||||||||||||||||

| | | |

2023

|

| |

2022

|

| |

2022

|

| |

2021

|

| |

2020

|

| |||||||||||||||

| Special Charges (credits) (in millions): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

CARES Act grant credit(3)

|

| | | $ | — | | | | | $ | — | | | | | $ | — | | | | | $ | (4,021) | | | | | $ | (3,536) | | |

|

Severance and benefit costs

|

| | | | — | | | | | | — | | | | | | — | | | | | | 438 | | | | | | 575 | | |

|

Impairment of assets

|

| | | | — | | | | | | — | | | | | | — | | | | | | 97 | | | | | | 318 | | |

|

(Gains) losses on sale of assets and other special charges

|

| | | | 14 | | | | | | (8) | | | | | | 140 | | | | | | 119 | | | | | | 27 | | |

|

Nonoperating special charges and unrealized (gains) losses on investments:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Debt extinguishment and modification fees

|

| | | | — | | | | | | 7 | | | | | | 7 | | | | | | 50 | | | | | | — | | |

|

Special termination benefits and settlement losses

|

| | | | — | | | | | | — | | | | | | — | | | | | | 31 | | | | | | 687 | | |

|

Unrealized (gains) losses on investments

|

| | | | (24) | | | | | | — | | | | | | (20) | | | | | | 34 | | | | | | 194 | | |

|

Credit loss on BRW term loan and guarantee

|

| | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | 697 | | |

|

Income tax expense (benefit), net of valuation allowance related to special charges (credits)

|

| | | | (3) | | | | | | — | | | | | | (33) | | | | | | 728 | | | | | | 404 | | |

| | | |

Three Months Ended

March 31, |

| |

Year Ended December 31,

|

| ||||||||||||||||||||||||

| | | |

2023

|

| |

2022

|

| |

2022

|

| |

2021

|

| |

2020

|

| |||||||||||||||

| Consolidated Operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Passengers (thousands)(1)

|

| | | | 36,822 | | | | | | 29,333 | | | | | | 144,300 | | | | | | 104,082 | | | | | | 57,761 | | |

|

Revenue passenger miles (millions)(2)

|

| | | | 52,532 | | | | | | 38,644 | | | | | | 206,791 | | | | | | 128,979 | | | | | | 73,883 | | |

|

Available seat miles (millions)(3)

|

| | | | 65,720 | | | | | | 53,264 | | | | | | 247,858 | | | | | | 178,684 | | | | | | 122,804 | | |

| Passenger load factor:(4) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Consolidated

|

| | | | 79.9% | | | | | | 72.6% | | | | | | 83.4% | | | | | | 72.2% | | | | | | 60.2% | | |

|

Domestic

|

| | | | 80.9% | | | | | | 77.5% | | | | | | 85.5% | | | | | | 79.9% | | | | | | 63.2% | | |

|

International

|

| | | | 78.5% | | | | | | 64.3% | | | | | | 80.5% | | | | | | 59.0% | | | | | | 55.1% | | |

|

Passenger revenue per available seat mile (cents)

|

| | | | 15.63 | | | | | | 11.92 | | | | | | 16.15 | | | | | | 11.30 | | | | | | 9.61 | | |

|

Total revenue per available seat mile (cents)

|

| | | | 17.39 | | | | | | 14.20 | | | | | | 18.14 | | | | | | 13.79 | | | | | | 12.50 | | |

|

Average yield per revenue passenger mile (cents)(5)

|

| | | | 19.56 | | | | | | 16.43 | | | | | | 19.36 | | | | | | 15.66 | | | | | | 15.98 | | |

|

Cargo revenue ton miles (millions)(6)

|

| | | | 731 | | | | | | 791 | | | | | | 3,041 | | | | | | 3,285 | | | | | | 2,711 | | |

|

Aircraft in fleet at end of period

|

| | | | 1,337 | | | | | | 1,343 | | | | | | 1,338 | | | | | | 1,344 | | | | | | 1,287 | | |

|

Average stage length (miles)(7)

|

| | | | 1,432 | | | | | | 1,370 | | | | | | 1,437 | | | | | | 1,315 | | | | | | 1,307 | | |

|

Approximate employee headcount at end of period (thousands)

|

| | | | 96.3 | | | | | | 87.4 | | | | | | 92.8 | | | | | | 84.1 | | | | | | 74.4 | | |

|

Cost per available seat mile (cents)(8)

|

| | | | 17.46 | | | | | | 16.79 | | | | | | 17.19 | | | | | | 14.36 | | | | | | 17.68 | | |

|

Average fuel price per gallon

|

| | | $ | 3.33 | | | | | $ | 2.88 | | | | | $ | 3.63 | | | | | $ | 2.11 | | | | | $ | 1.57 | | |

|

Fuel gallons consumed (millions)

|

| | | | 952 | | | | | | 775 | | | | | | 3,608 | | | | | | 2,729 | | | | | | 2,004 | | |

|

Date

|

| |

Scheduled Principal

Payments |

| |

Expected Pool

Factor |

| ||||||

|

At Issuance

|

| | | $ | 0.00 | | | | | | 1.0000000 | | |

|

January 15, 2024

|

| | | | 0.00 | | | | | | 1.0000000 | | |

|

July 15, 2024

|

| | | | 29,495,211.02 | | | | | | 0.9776570 | | |

|

January 15, 2025

|

| | | | 29,495,211.02 | | | | | | 0.9553140 | | |

|

July 15, 2025

|

| | | | 29,495,211.02 | | | | | | 0.9329710 | | |

|

January 15, 2026

|

| | | | 29,495,211.02 | | | | | | 0.9106280 | | |

|

July 15, 2026

|

| | | | 29,495,211.02 | | | | | | 0.8882850 | | |

|

January 15, 2027

|

| | | | 29,495,211.02 | | | | | | 0.8659420 | | |

|

July 15, 2027

|

| | | | 29,495,211.02 | | | | | | 0.8435990 | | |

|

January 15, 2028

|

| | | | 29,495,211.02 | | | | | | 0.8212560 | | |

|

July 15, 2028

|

| | | | 29,495,211.02 | | | | | | 0.7989130 | | |

|

January 15, 2029

|

| | | | 29,495,211.02 | | | | | | 0.7765701 | | |

|

July 15, 2029

|

| | | | 29,495,211.02 | | | | | | 0.7542271 | | |

|

January 15, 2030

|

| | | | 29,495,211.02 | | | | | | 0.7318841 | | |

|

July 15, 2030

|

| | | | 29,495,211.02 | | | | | | 0.7095411 | | |

|

January 15, 2031

|

| | | | 29,495,211.02 | | | | | | 0.6871981 | | |

|

July 15, 2031

|

| | | | 29,495,211.02 | | | | | | 0.6648551 | | |

|

January 15, 2032

|

| | | | 29,495,211.02 | | | | | | 0.6425121 | | |

|

July 15, 2032

|

| | | | 29,495,211.02 | | | | | | 0.6201691 | | |

|

January 15, 2033

|

| | | | 29,495,211.02 | | | | | | 0.5978261 | | |

|

July 15, 2033

|

| | | | 29,495,211.02 | | | | | | 0.5754831 | | |

|

January 15, 2034

|

| | | | 29,495,211.02 | | | | | | 0.5531401 | | |

|

July 15, 2034

|

| | | | 29,495,211.02 | | | | | | 0.5307971 | | |

|

January 15, 2035

|

| | | | 29,495,211.02 | | | | | | 0.5084541 | | |

|

July 15, 2035

|

| | | | 29,495,211.02 | | | | | | 0.4861111 | | |

|

January 15, 2036

|

| | | | 641,720,146.54 | | | | | | 0.0000000 | | |

|

Aircraft Type

|

| |

Registration

Number(1) |

| |

Manufacturer’s

Serial Number(1) |

| |

Manufacturer

Delivery Month(1) |

| |

Appraiser’s Valuations

|

| |

Appraised

Value(2) |

| ||||||||||||||||||||||||

| |

ASG

|

| |

BK

|

| |

MBA

|

| ||||||||||||||||||||||||||||||||

|

737 MAX 8

|

| | | | N27268 | | | | | | 67523 | | | |

August 2022

|

| | | $ | 51,288,214 | | | | | $ | 54,484,212 | | | | | $ | 52,800,000 | | | | | $ | 52,800,000 | | |

|

737 MAX 8

|

| | | | N27271 | | | | | | 67526 | | | |

September 2022

|

| | | | 51,288,214 | | | | | | 54,790,871 | | | | | | 53,080,000 | | | | | | 53,053,028 | | |

|

737 MAX 8

|

| | | | N27269 | | | | | | 67524 | | | |

September 2022

|

| | | | 51,288,214 | | | | | | 54,790,871 | | | | | | 53,080,000 | | | | | | 53,053,028 | | |

|

737 MAX 8

|

| | | | N47275 | | | | | | 64610 | | | |

September 2022

|

| | | | 51,288,214 | | | | | | 54,790,871 | | | | | | 53,080,000 | | | | | | 53,053,028 | | |

|

737 MAX 8

|

| | | | N27270 | | | | | | 67525 | | | |

September 2022

|

| | | | 51,288,214 | | | | | | 54,790,871 | | | | | | 53,080,000 | | | | | | 53,053,028 | | |

|

737 MAX 8

|

| | | | N27267 | | | | | | 67522 | | | |

September 2022

|

| | | | 51,288,214 | | | | | | 54,790,871 | | | | | | 53,080,000 | | | | | | 53,053,028 | | |

|

737 MAX 8

|

| | | | N17272 | | | | | | 67527 | | | |

September 2022

|

| | | | 51,288,214 | | | | | | 54,790,871 | | | | | | 53,080,000 | | | | | | 53,053,028 | | |

|

737 MAX 8

|

| | | | N27273 | | | | | | 67528 | | | |

October 2022

|

| | | | 52,071,024 | | | | | | 55,097,530 | | | | | | 53,350,000 | | | | | | 53,350,000 | | |

|

737 MAX 8

|

| | | | N47281 | | | | | | 62535 | | | |

October 2022

|

| | | | 52,071,024 | | | | | | 55,097,530 | | | | | | 53,350,000 | | | | | | 53,350,000 | | |

|

737 MAX 8

|

| | | | N27277 | | | | | | 64612 | | | |

November 2022

|

| | | | 52,071,024 | | | | | | 55,404,189 | | | | | | 53,620,000 | | | | | | 53,620,000 | | |

|

737 MAX 8

|

| | | | N47282 | | | | | | 61861 | | | |

December 2022

|

| | | | 52,071,024 | | | | | | 55,710,848 | | | | | | 53,890,000 | | | | | | 53,890,000 | | |

|

737 MAX 8

|

| | | | N47284 | | | | | | 61863 | | | |

December 2022

|

| | | | 52,071,024 | | | | | | 55,710,848 | | | | | | 53,890,000 | | | | | | 53,890,000 | | |

|

737 MAX 8

|

| | | | N17279 | | | | | | 64613 | | | |

December 2022

|

| | | | 52,071,024 | | | | | | 55,710,848 | | | | | | 53,890,000 | | | | | | 53,890,000 | | |

|

737 MAX 8

|

| | | | N27276 | | | | | | 64611 | | | |

December 2022

|

| | | | 52,071,024 | | | | | | 55,710,848 | | | | | | 53,890,000 | | | | | | 53,890,000 | | |

|

737 MAX 8

|

| | | | N17285 | | | | | | 61853 | | | |

December 2022

|

| | | | 52,071,024 | | | | | | 55,710,848 | | | | | | 53,890,000 | | | | | | 53,890,000 | | |

|

737 MAX 8

|

| | | | N57286 | | | | | | 61854 | | | |

February 2023

|

| | | | 52,870,050 | | | | | | 57,770,937 | | | | | | 54,230,000 | | | | | | 54,230,000 | | |

|

737 MAX 8

|

| | | | N47280 | | | | | | 64614 | | | |

February 2023

|

| | | | 52,870,050 | | | | | | 57,770,937 | | | | | | 54,230,000 | | | | | | 54,230,000 | | |

|

737 MAX 8

|

| | | | N37278 | | | | | | 61859 | | | |

February 2023

|

| | | | 52,870,050 | | | | | | 57,770,937 | | | | | | 54,230,000 | | | | | | 54,230,000 | | |

|

737 MAX 8

|

| | | | N47288 | | | | | | 61856 | | | |

March 2023

|

| | | | 52,870,050 | | | | | | 58,077,596 | | | | | | 54,280,000 | | | | | | 54,280,000 | | |

|

737 MAX 8

|

| | | | N27287 | | | | | | 60709 | | | |

March 2023

|

| | | | 52,870,050 | | | | | | 58,077,596 | | | | | | 54,280,000 | | | | | | 54,280,000 | | |

|

737 MAX 8

|

| | | | N27283 | | | | | | 61857 | | | |

April 2023

|

| | | | 53,063,500 | | | | | | 58,247,380 | | | | | | 54,320,000 | | | | | | 54,320,000 | | |

|

737 MAX 8

|

| | | | N17289 | | | | | | 60712 | | | |

April 2023

|

| | | | 53,063,500 | | | | | | 58,247,380 | | | | | | 54,320,000 | | | | | | 54,320,000 | | |

|

737 MAX 9

|

| | | | N27539 | | | | | | 64468 | | | |

October 2022

|

| | | | 53,195,780 | | | | | | 55,068,924 | | | | | | 54,280,000 | | | | | | 54,181,568 | | |

|

737 MAX 9

|

| | | | N37542 | | | | | | 64470 | | | |

November 2022

|

| | | | 53,195,780 | | | | | | 55,381,333 | | | | | | 54,550,000 | | | | | | 54,375,704 | | |

|

737 MAX 9

|

| | | | N37541 | | | | | | 64469 | | | |

November 2022

|

| | | | 53,195,780 | | | | | | 55,381,333 | | | | | | 54,550,000 | | | | | | 54,375,704 | | |

|

737 MAX 9

|

| | | | N37538 | | | | | | 64467 | | | |

November 2022

|

| | | | 53,195,780 | | | | | | 55,381,333 | | | | | | 54,550,000 | | | | | | 54,375,704 | | |

|

737 MAX 9

|

| | | | N77543 | | | | | | 64474 | | | |

December 2022

|

| | | | 53,195,780 | | | | | | 55,693,743 | | | | | | 54,830,000 | | | | | | 54,573,174 | | |

|

Aircraft Type

|

| |

Registration

Number(1) |

| |

Manufacturer’s

Serial Number(1) |

| |

Manufacturer

Delivery Month(1) |

| |

Appraiser’s Valuations

|

| |

Appraised

Value(2) |

| ||||||||||||||||||||||||

| |

ASG

|

| |

BK

|

| |

MBA

|

| ||||||||||||||||||||||||||||||||

|

737 MAX 9

|

| | | | N77544 | | | | | | 64473 | | | |

December 2022

|

| | | | 53,195,780 | | | | | | 55,693,743 | | | | | | 54,830,000 | | | | | | 54,573,174 | | |

|

737 MAX 9

|

| | | | N37545 | | | | | | 64472 | | | |

December 2022

|

| | | | 53,195,780 | | | | | | 55,693,743 | | | | | | 54,830,000 | | | | | | 54,573,174 | | |

|

737 MAX 9

|

| | | | N27546 | | | | | | 64478 | | | |

December 2022

|

| | | | 53,195,780 | | | | | | 55,693,743 | | | | | | 54,830,000 | | | | | | 54,573,174 | | |

|

737 MAX 9

|

| | | | N37547 | | | | | | 64477 | | | |

December 2022

|

| | | | 53,195,780 | | | | | | 55,693,743 | | | | | | 54,830,000 | | | | | | 54,573,174 | | |

|

737 MAX 9

|

| | | | N37548 | | | | | | 64476 | | | |

December 2022

|

| | | | 53,195,780 | | | | | | 55,693,743 | | | | | | 54,830,000 | | | | | | 54,573,174 | | |

|

737 MAX 9

|

| | | | N37554 | | | | | | 67578 | | | |

February 2023

|

| | | | 54,302,999 | | | | | | 58,287,589 | | | | | | 55,180,000 | | | | | | 55,180,000 | | |

|

737 MAX 9

|

| | | | N37551 | | | | | | 67181 | | | |

March 2023

|

| | | | 54,302,999 | | | | | | 58,599,999 | | | | | | 55,230,000 | | | | | | 55,230,000 | | |

|

737 MAX 9

|

| | | | N37553 | | | | | | 67180 | | | |

March 2023

|

| | | | 54,302,999 | | | | | | 58,599,999 | | | | | | 55,230,000 | | | | | | 55,230,000 | | |

|

737 MAX 9

|

| | | | N77552 | | | | | | 67179 | | | |

March 2023

|

| | | | 54,302,999 | | | | | | 58,599,999 | | | | | | 55,230,000 | | | | | | 55,230,000 | | |

|

737 MAX 9

|

| | | | N37555 | | | | | | 67182 | | | |

March 2023

|

| | | | 54,302,999 | | | | | | 58,599,999 | | | | | | 55,230,000 | | | | | | 55,230,000 | | |

|

737 MAX 9

|

| | | | N37556 | | | | | | 67579 | | | |

March 2023

|

| | | | 54,302,999 | | | | | | 58,599,999 | | | | | | 55,230,000 | | | | | | 55,230,000 | | |

|

737 MAX 9

|

| | | | N17557 | | | | | | 67584 | | | |

May 2023

|

| | | | 54,505,500 | | | | | | 58,950,234 | | | | | | 55,320,000 | | | | | | 55,320,000 | | |

|

Underwriter

|

| |

Face Amount of

Certificates |

| |||

|

Citigroup Global Markets Inc.

|

| | | $ | | | |

|

Credit Suisse Securities (USA) LLC

|

| | | | | | |

|

Deutsche Bank Securities Inc.

|

| | | | | | |

|

Goldman Sachs & Co. LLC

|

| | | | | | |

|

BofA Securities, Inc.

|

| | | | | | |

|

Barclays Capital Inc.

|

| | | | | | |

|

J.P. Morgan Securities LLC

|

| | | | | | |

|

Morgan Stanley & Co. LLC

|

| | | | | | |

|

BNP Paribas Securities Corp.

|

| | | | | | |

|

Credit Agricole Securities (USA) Inc.

|

| | | | | | |

|

Natixis Securities Americas LLC

|

| | | | | | |

|

Academy Securities, Inc.

|

| | | | | | |

|

AmeriVet Securities, Inc.

|

| | | | | | |

|

Loop Capital Markets LLC

|

| | | | | | |

|

Total

|

| | | $ | 1,320,110,000 | | |

|

Pass Through Certificates

|

| |

Concession To

Selling Group Members |

| |

Discount To

Broker/Dealers |

|

|

2023-1A

|

| |

%

|

| |

%

|

|

|

Filing

|

| |

Date Filed

|

|

| | | | ||

| | | | ||

| | | |

| | | |

Page

|

| |||

|

60-Day Period

|

| | | | S-28 | | |

|

Actual Disposition Event

|

| | | | S-46 | | |

|

Additional Equipment Notes

|

| | | | S-61 | | |

|

Additional Junior Certificates

|

| | | | S-61 | | |

|

Additional Trust

|

| | | | S-61 | | |

|

Additional Trustee

|

| | | | S-61 | | |

|

Adjusted Interest

|

| | | | S-61 | | |

|

Administration Expenses

|

| | | | S-43 | | |

|

Aircraft

|

| | | | S-48 | | |

|

Airframe

|

| | | | S-48 | | |

|

Appraisal

|

| | | | S-43 | | |

|

Appraised Current Market Value

|

| | | | S-43 | | |

|

Appraisers

|

| | | | S-48 | | |

|

ASG

|

| | | | S-48 | | |

|

Assumed Amortization Schedule

|

| | | | S-24 | | |

|

Average Life Date

|

| | | | S-52 | | |

|

Base Rate

|

| | | | S-39 | | |

|

Basic Agreement

|

| | | | S-22 | | |

|

BK

|

| | | | S-48 | | |

|

Boeing

|

| | | | S-18 | | |

|

Business Day

|

| | | | S-24 | | |

|

Cape Town Treaty

|

| | | | S-56 | | |

|

CARES Act

|

| | | | S-16 | | |

|

Cash Collateral Account

|

| | | | S-36 | | |

|

Cede

|

| | | | S-31 | | |

|

Certificate Account

|

| | | | S-24 | | |

|

Certificate Buyout Event

|

| | | | S-28 | | |

|

Certificate Owner

|

| | | | S-32 | | |

|

Certificateholders

|

| | | | S-22 | | |

|

Certificates

|

| | | | S-22 | | |

|

citizen of the United States

|

| | | | S-28 | | |

|

Class B Certificates

|

| | | | S-61 | | |

|

Class C Certificates

|

| | | | S-61 | | |

|

Class Exemptions

|

| | | | S-67 | | |

|

clearing agency

|

| | | | S-32 | | |

|

clearing corporation

|

| | | | S-32 | | |

|

Code

|

| | | | S-29 | | |

|

Commission

|

| | | | S-1 | | |

|

Company

|

| | | | S-18 | | |

|

Controlling Party

|

| | | | S-41 | | |

|

Convention

|

| | | | S-56 | | |

|

Current Distribution Date

|

| | | | S-44 | | |

|

Debt Balance

|

| | | | S-57 | | |

|

Deemed Disposition Event

|

| | | | S-46 | | |

|

default

|

| | | | S-27 | | |

|

disqualified persons

|

| | | | S-67 | | |

|

Distribution Date

|

| | | | S-43 | | |

|

Downgrade Drawing

|

| | | | S-36 | | |

| | | |

Page

|

| |||

|

Downgrade Event

|

| | | | S-36 | | |

|

Draft Securitization RTS

|

| | | | S-19 | | |

|

DTC

|

| | | | S-31 | | |

|

DTC Participants

|

| | | | S-31 | | |

|

EEA

|

| | | | S-71 | | |

|

Engines

|

| | | | S-48 | | |

|

Equipment

|

| | | | S-54 | | |

|

Equipment Note Special Payment

|

| | | | S-43 | | |

|

Equipment Notes

|

| | | | S-51 | | |

|

ERISA

|

| | | | S-67 | | |

|

ERISA Plans

|

| | | | S-67 | | |

|

EU Securitization Laws

|

| | | | S-19 | | |

|

EU Securitization Regulation

|

| | | | S-19 | | |

|

EUWA

|

| | | | S-71 | | |

|

Event of Loss

|

| | | | S-58 | | |

|

Exchange Act

|

| | | | S-32 | | |

|

Expected Distributions

|

| | | | S-44 | | |

|

FATCA

|

| | | | S-65 | | |

|

Final Distributions

|

| | | | S-41 | | |

|

Final Drawing

|

| | | | S-37 | | |

|

Final Maturity Date

|

| | | | S-23 | | |

|

Financial Promotion Order

|

| | | | S-71 | | |

|

FinSA

|

| | | | S-73 | | |

|

Form 10-K

|

| | | | S-15 | | |

|

Form 10-Q

|

| | | | S-15 | | |

|

H.15 Page

|

| | | | S-52 | | |

|

Indenture

|

| | | | S-31 | | |

|

Indenture Defaults

|

| | | | S-53 | | |

|

Indirect DTC Participants

|

| | | | S-32 | | |

|

Insurance Distribution Directive

|

| | | | S-71 | | |

|

Intercreditor Agreement

|

| | | | S-41 | | |

|

Interest Drawing

|

| | | | S-35 | | |

|

Investment Company Act

|

| | | | S-1 | | |

|

IRS

|

| | | | S-63 | | |

|

Issuance Date

|

| | | | S-20 | | |

|

Liquidity Event of Default

|

| | | | S-40 | | |

|

Liquidity Expenses

|

| | | | S-44 | | |

|

Liquidity Facility

|

| | | | S-35 | | |

|

Liquidity Obligations

|

| | | | S-44 | | |

|

Liquidity Provider

|

| | | | S-35 | | |

|

Liquidity Threshold Rating

|

| | | | S-36 | | |

|

Loan Trustee

|

| | | | S-51 | | |

|

Long-Term Rating

|

| | | | S-37 | | |

|

LTVs

|

| | | | S-7 | | |

|

Make-Whole Premium

|

| | | | S-52 | | |

|

Make-Whole Spread

|

| | | | S-52 | | |

|

Maximum Available Commitment

|

| | | | S-35 | | |

|

Maximum Commitment

|

| | | | S-35 | | |

| | | |

Page

|

| |||

|

MBA

|

| | | | S-48 | | |

|

MiFID II

|

| | | | S-71 | | |

|

Minimum Sale Price

|

| | | | S-42 | | |

|

Moody’s

|

| | | | S-36 | | |

|

most recent H.15 Page

|

| | | | S-52 | | |

|

Non-Extension Drawing

|

| | | | S-37 | | |

|

non-U.S. Certificateholder

|

| | | | S-64 | | |

|

Note Holders

|

| | | | S-53 | | |

|

Note Purchase Agreement

|

| | | | S-31 | | |

|

Offering

|

| | | | S-61 | | |

|

Participation Agreement

|

| | | | S-31 | | |

|

parties in interest

|

| | | | S-67 | | |

|

Pass Through Trust Agreement

|

| | | | S-22 | | |

|

Performing Equipment Note

|

| | | | S-36 | | |

|

Plan Asset Regulation

|

| | | | S-67 | | |

|

Plan Fiduciary

|

| | | | S-68 | | |

|

Plans

|

| | | | S-67 | | |

|

Pool Balance

|

| | | | S-24 | | |

|

Pool Factor

|

| | | | S-24 | | |

|

Post Default Appraisals

|

| | | | S-43 | | |

|

Preferred Pool Balance

|

| | | | S-45 | | |

|

PRIIPs Regulation

|

| | | | S-71 | | |

|

Prospectus Regulation

|

| | | | S-71 | | |

|

PSP2 and PSP3 Agreements

|

| | | | S-16 | | |

|

PTC Event of Default

|

| | | | S-28 | | |

|

PTCE

|

| | | | S-67 | | |

|

qualifying income

|

| | | | S-63 | | |

|

Rating Agencies

|

| | | | S-36 | | |

|

Refinancing Certificates

|

| | | | S-61 | | |

|

Refinancing Equipment Notes

|

| | | | S-61 | | |

|

Refinancing Trust

|

| | | | S-61 | | |

|

Regular Distribution Dates

|

| | | | S-23 | | |

|

relevant persons

|

| | | | S-71 | | |

|

Remaining Weighted Average Life

|

| | | | S-52 | | |

|

Replacement Facility

|

| | | | S-38 | | |

|

Required Amount

|

| | | | S-35 | | |

|

S&P

|

| | | | S-36 | | |

|

Scheduled Payments

|

| | | | S-23 | | |

| | | |

Page

|

| |||

|

Section 1110

|

| | | | S-54 | | |

|

Section 2.4 Fraction

|

| | | | S-44 | | |

|

SFA

|

| | | | S-72 | | |

|

Similar Law Plans

|

| | | | S-67 | | |

|

SOFR

|

| | | | S-39 | | |

|

Special Distribution Date

|

| | | | S-23 | | |

|

Special Payment

|

| | | | S-23 | | |

|

Special Payments Account

|

| | | | S-24 | | |

|

Special Termination Drawing

|

| | | | S-37 | | |

|

Special Termination Notice

|

| | | | S-37 | | |

|

Stated Interest Rate

|

| | | | S-35 | | |

|

Subordination Agent

|

| | | | S-41 | | |

|

Substitute Aircraft

|

| | | | S-49 | | |

|

Term SOFR

|

| | | | S-39 | | |

|

Term SOFR Administrator

|

| | | | S-39 | | |

|

Term SOFR Reference Rate

|

| | | | S-39 | | |

|

Termination Notice

|

| | | | S-40 | | |

|

Transportation Code

|

| | | | S-28 | | |

|

Treasury

|

| | | | S-16 | | |

|

Treasury Yield

|

| | | | S-52 | | |

|

Triggering Event

|

| | | | S-23 | | |

|

Trust

|

| | | | S-22 | | |

|

Trust Indenture Act

|

| | | | S-29 | | |

|

Trust Property

|

| | | | S-22 | | |

|

Trust Supplement

|

| | | | S-22 | | |

|

Trustee

|

| | | | S-22 | | |

|

U.S. Certificateholders

|

| | | | S-63 | | |

|

U.S. Government Securities Business Day

|

| | | | S-39 | | |

|

U.S. Persons

|

| | | | S-63 | | |

|

UAL

|

| | | | S-18 | | |

|

UK

|

| | | | S-71 | | |

|

UK PRIIPs Regulation

|

| | | | S-72 | | |

|

UK Securitization Laws

|

| | | | S-20 | | |

|

Underwriters

|

| | | | S-69 | | |

|

Underwriting Agreement

|

| | | | S-69 | | |

|

United

|

| | | | S-18 | | |

|

United Bankruptcy Event

|

| | | | S-42 | | |

Adjusted Desktop Valuation Report

Aviation Specialists Group, Inc. (“ASG”) has been engaged by United Airlines, Inc. (“Client”) to provide an adjusted desktop valuation setting forth ASG’s opinions of unadjusted and adjusted Base Values for those 39 Boeing 737 MAX aircraft which are described in further detail in the Aircraft Values section below. In reaching its value opinions, ASG has relied upon data provided to it by Client.

This valuation report contains the following sections:

| 4 | Adjusted Desktop Valuation Assumptions | 4 | Aircraft Values |

| 4 | Value Definition and Explanations | 4 | Covenants |

| Adjusted Desktop Valuation Assumptions |

In an adjusted desktop valuation, the appraiser neither sees the subject aircraft nor reviews its specifications and technical documents. Instead, the appraiser is furnished with certain maintenance status information by the client or aircraft operator. In preparing its value opinions, ASG relies on that data and, unless specifically stated otherwise, makes the following assumptions about the aircraft itself:

| 4 | It is of average specification for its type and age and has no special equipment or characteristics which would materially affect its value. |

| 4 | Its utilization in terms of hours and cycles is average for its type and age. |

| 4 | It is in passenger or freighter configuration as appropriate. |

| 4 | It is certificated and operated under the aegis of a major airworthiness authority such as the FAA or EASA. |

| 4 | It is in average physical condition and its maintenance records and documents comply with all applicable regulations and good industry practices. Required back to birth records are on hand and in good order and only original equipment manufacturer parts are in use in the aircraft and engines. |

| 4 | It has no history of major damage. |

| 4 | It complies with applicable Airworthiness Directives and mandatory Service Bulletins. |

ASG first develops the subject aircraft’s Base and/or Current Market Value assuming that the airframe, engines, engine life limited parts, landing gears and other major life- and time-limited components are in halflife, halftime condition. ASG then uses the maintenance data provided to it to adjust for the aircraft’s variance from that status. For example, if the aircraft has had a recent heavy check or engine shop visit, ASG will add to the halflife value.

Regarding adjusted Base/Market Values, ASG uses the following value convention. A new aircraft is considered to be factory new with 100% life remaining on all components, that is, it is full life. The aircraft then ages based on typical utilization for its type until it becomes mature and reaches halflife condition. ASG’s unadjusted values for mature aircraft assume them to be in halflife condition. Time to reach mature halflife status depends on the aircraft and engine combination and typical utilization for that aircraft type. For many (but not all) jetliners, mature halflife status is reached when they are 4-5 years old. For aircraft between factory new and mature, ASG’s Current Market and Base Values already assume the aircraft to be in better than halflife condition and therefore no further adjustments are needed to their values. All of the subject aircraft in this report are young and none have reached mature halflife status. Accordingly, no maintenance status adjustments are required for any of them and unadjusted Base Values equal adjusted Base Values.

In developing its values, ASG also makes two further assumptions:

United Airlines, Inc.

| March 31, 2023 |

1

II-1

| 4 | that the aircraft has been bought and will be sold as a single unit or as part of a small lot. It is not part of a launch purchase nor will it be the subject of a fleet sale which could result in a price discount. |

| 4 | that the aircraft is not subject to an existing lease. ASG’s opinion of values excludes the effects of attached lease rental streams and tax benefits, either of which can have a material effect on an aircraft’s actual purchase price. |

| Value Definition and Explanations |

ASG uses the ISTAT definitions for Base Value which is:

| 4 | Base Value is an appraiser’s opinion of the underlying economic value of an aircraft in an open, unrestricted, stable market environment with a reasonable balance of supply and demand, and assumes full consideration of its “highest and best use”. An aircraft’s Base Value is founded in the historical trend of values and in the projection of value trends and presumes an arm’s length, cash transaction between willing, able and knowledgeable parties, acting prudently, with an absence of duress and with a reasonable period of time available for marketing. In most cases, the Base Value of an aircraft assumes its physical condition is average for an aircraft of its type and age, and its maintenance time status is at mid-life, mid-time (or benefitting from an above average maintenance status if it is new or nearly new, as the case may be). |

ASG also uses the term adjusted Base Value to indicate that it has adjusted Base Value to reflect the data which it has regarding the aircraft’s maintenance status.

| Aircraft Values |

ASG’s value opinions for the subject aircraft are set forth in millions of U.S. dollars in the following table. As noted above, all of the subject aircraft are young, not yet mature, and therefore adjusted Base Values are the same as unadjusted values.

United Airlines, Inc.

| March 31, 2023 |

2

II-2

Aircraft Descriptions and Values (US$ millions), March 2023

| Serial # | Type | FAA # | Mfr. Date | Engine Type | MTOW (lbs.) | Unadj

Base Value |

Adjustments | Adjusted Base Val |

| 67523 | 737 MAX 8 | N27268 | 08/23/22 | LEAP-1B28 | 182,200 | $51.3 | $0.0 | $51.3 |

| 67526 | 737 MAX 8 | N27271 | 09/19/22 | LEAP-1B28 | 182,200 | $51.3 | $0.0 | $51.3 |

| 67524 | 737 MAX 8 | N27269 | 09/26/22 | LEAP-1B28 | 182,200 | $51.3 | $0.0 | $51.3 |

| 64610 | 737 MAX 8 | N47275 | 09/27/22 | LEAP-1B28 | 182,200 | $51.3 | $0.0 | $51.3 |

| 67525 | 737 MAX 8 | N27270 | 09/28/22 | LEAP-1B28 | 182,200 | $51.3 | $0.0 | $51.3 |

| 67522 | 737 MAX 8 | N27267 | 09/29/22 | LEAP-1B28 | 182,200 | $51.3 | $0.0 | $51.3 |

| 67527 | 737 MAX 8 | N17272 | 09/29/22 | LEAP-1B28 | 182,200 | $51.3 | $0.0 | $51.3 |

| 67528 | 737 MAX 8 | N27273 | 10/12/22 | LEAP-1B28 | 182,200 | $52.1 | $0.0 | $52.1 |

| 62535 | 737 MAX 8 | N47281 | 10/18/22 | LEAP-1B28 | 182,200 | $52.1 | $0.0 | $52.1 |

| 64612 | 737 MAX 8 | N27277 | 11/28/22 | LEAP-1B28 | 182,200 | $52.1 | $0.0 | $52.1 |

| 61861 | 737 MAX 8 | N47282 | 12/13/22 | LEAP-1B28 | 182,200 | $52.1 | $0.0 | $52.1 |

| 61863 | 737 MAX 8 | N47284 | 12/15/22 | LEAP-1B28 | 182,200 | $52.1 | $0.0 | $52.1 |

| 64613 | 737 MAX 8 | N17279 | 12/28/22 | LEAP-1B28 | 182,200 | $52.1 | $0.0 | $52.1 |

| 64611 | 737 MAX 8 | N27276 | 12/29/22 | LEAP-1B28 | 182,200 | $52.1 | $0.0 | $52.1 |

| 61853 | 737 MAX 8 | N17285 | 12/29/22 | LEAP-1B28 | 182,200 | $52.1 | $0.0 | $52.1 |

| 61854 | 737 MAX 8 | N57286 | 02/13/23 | LEAP-1B28 | 182,200 | $52.9 | $0.0 | $52.9 |

| 64614 | 737 MAX 8 | N47280 | 02/20/23 | LEAP-1B28 | 182,200 | $52.9 | $0.0 | $52.9 |

| 61859 | 737 MAX 8 | N37278 | 02/24/23 | LEAP-1B28 | 182,200 | $52.9 | $0.0 | $52.9 |

| 61856 | 737 MAX 8 | N47288 | 03/27/23 | LEAP-1B28 | 182,200 | $52.9 | $0.0 | $52.9 |

| 60709 | 737 MAX 8 | N27287 | 03/31/23 | LEAP-1B28 | 182,200 | $52.9 | $0.0 | $52.9 |

| 61857 | 737 MAX 8 | N27283 | 04/01/23 | LEAP-1B28 | 182,200 | $53.1 | $0.0 | $53.1 |

United Airlines, Inc.

| March 31, 2023 |

3

II-3

| Serial # | Type | FAA # | Mfr. Date | Engine Type | MTOW (lbs.) | Unadj

Base Value |

Adjustments | Adjusted Base Val |

| 60712 | 737 MAX 8 | N17289 | 04/01/23 | LEAP-1B28 | 182,200 | $53.1 | $0.0 | $53.1 |

| 64468 | 737 MAX 9 | N27539 | 10/24/22 | LEAP-1B28 | 194,700 | $53.2 | $0.0 | $53.2 |

| 64470 | 737 MAX 9 | N37542 | 11/01/22 | LEAP-1B28 | 194,700 | $53.2 | $0.0 | $53.2 |

| 64469 | 737 MAX 9 | N37541 | 11/15/22 | LEAP-1B28 | 194,700 | $53.2 | $0.0 | $53.2 |

| 64467 | 737 MAX 9 | N37538 | 11/17/22 | LEAP-1B28 | 194,700 | $53.2 | $0.0 | $53.2 |

| 64474 | 737 MAX 9 | N77543 | 12/06/22 | LEAP-1B28 | 194,700 | $53.2 | $0.0 | $53.2 |

| 64473 | 737 MAX 9 | N77544 | 12/15/22 | LEAP-1B28 | 194,700 | $53.2 | $0.0 | $53.2 |

| 64472 | 737 MAX 9 | N37545 | 12/23/22 | LEAP-1B28 | 194,700 | $53.2 | $0.0 | $53.2 |

| 64478 | 737 MAX 9 | N27546 | 12/23/22 | LEAP-1B28 | 194,700 | $53.2 | $0.0 | $53.2 |

| 64477 | 737 MAX 9 | N37547 | 12/28/22 | LEAP-1B28 | 194,700 | $53.2 | $0.0 | $53.2 |

| 64476 | 737 MAX 9 | N37548 | 12/28/22 | LEAP-1B28 | 194,700 | $53.2 | $0.0 | $53.2 |

| 67578 | 737 MAX 9 | N37554 | 02/24/23 | LEAP-1B28 | 194,700 | $54.3 | $0.0 | $54.3 |

| 67181 | 737 MAX 9 | N37551 | 03/06/23 | LEAP-1B28 | 194,700 | $54.3 | $0.0 | $54.3 |

| 67180 | 737 MAX 9 | N37553 | 03/15/23 | LEAP-1B28 | 194,700 | $54.3 | $0.0 | $54.3 |

| 67179 | 737 MAX 9 | N77552 | 03/23/23 | LEAP-1B28 | 194,700 | $54.3 | $0.0 | $54.3 |

| 67182 | 737 MAX 9 | N37555 | 03/24/23 | LEAP-1B28 | 194,700 | $54.3 | $0.0 | $54.3 |

| 67579 | 737 MAX 9 | N37556 | 03/30/23 | LEAP-1B28 | 194,700 | $54.3 | $0.0 | $54.3 |

| 67584 | 737 MAX 9 | N17557 | 05/05/23 | LEAP-1B28 | 194,700 | $54.5 | $0.0 | $54.5 |

United Airlines, Inc.

| March 31, 2023 |

4

II-4

| Covenants |

In accordance with ISTAT’s Principles of Appraisal Practice and Code of Ethics, this report has been prepared for the exclusive use of Client; ASG will not provide it to any other party without the express consent of Client. ASG has no present or contemplated interest in the subject equipment or any similar equipment, it has no current, past or contemplated interest in Client or any companies related to Client nor does it have any other interest which might tend to prevent it making a fair and unbiased appraisal.

This report fairly represents ASG’s opinion of the subject equipment’s value. In reaching its value opinions, ASG has relied upon information provided by Client. ASG does not assume responsibility or legal liability for any actions taken, or not taken, by Client or other parties with regard to the equipment. By accepting this report, all parties agree that ASG shall bear no such responsibility or legal liability including liability for special or consequential damages.

For Aviation Specialists Group, Inc.

Fred J. Klein

ISTAT-certified Senior Appraiser Fellow

International Society of Transport Aircraft Trading

United Airlines, Inc.

| March 31, 2023 |

5

II-5

VALUATION OF A 39 AIRCRAFT PORTFOLIO

As of March 31, 2023 Client: United Airlines, Inc.

Report Date: May 9, 2023

7315 Wisconsin Ave, Ste 800W Bethesda, MD 20814

II-6

Table of Contents

| VALUATION SUMMARY | 2 |

| DEFINITIONS | 3 |

| ASSUMPTIONS | 4 |

| MARKET OUTLOOK | 5 |

| AIRCRAFT MARKET ANALYTICS | 9 |

| COVID-19 IMPACT & RECOVERY | 12 |

| VALUATION METHODOLOGY | 14 |

| DISCLAIMER | 16 |

| APPENDIX | 17 |

1

II-7

I. VALUATION SUMMARY

BK Associates, Inc. (“BK”) has been engaged by United Airlines, Inc. (“Client”) to provide a desktop valuation, setting forth BK’s opinions of current base values (BV) for a portfolio of 39 aircraft, as of March 31, 2023.

AIRCRAFT DESCRIPTION

The Portfolio aircraft are identified by type, registration number, serial number, date of manufacture, engine model/variant, and maximum takeoff weight (MTOW) in the attached figure. The figure reflects the current BVs in millions, as of March 31, 2023.

PURPOSE OF THE VALUATION ENGAGEMENT

It is understood by BK that the Conclusion of Value will be used by Client to present to potential investors in this portfolio of aircraft. This report was prepared solely for the purposes described herein and, accordingly, should not be used for any other purpose. In addition, this report should not be distributed to any party other than client, without the express knowledge and written consent of the client or BK.

RELEVANT DATES

BK was engaged to value the subject aircraft as of the Valuation Date, March 31, 2023. In this valuation, BK considered only circumstances that existed as of and events that occurred up to the Valuation Date. However, events occurring after the Valuation Date but before the date of this report (i.e., subsequent events) were taken into account to the extent that they were indicative of conditions that were known or knowable as of the Valuation Date.

PREMISE OF VALUE

The valuation premise may be either in-use (i.e., going concern) or liquidation. The determining factor being the highest and best use as considered from a market participant’s perspective. The values issued in this report are based on an in-use valuation premise, which assumes that the aircraft will continue to operate.

CONCLUSIONS

Based upon our knowledge of these various aircraft types, our knowledge of the capabilities and uses to which they have been put in various parts of the world, our knowledge of the marketing of used aircraft, and our knowledge of aircraft in general, it is our opinion that the values are in 2023 U.S. dollars as found in the attached figure. These values reflect the impact of COVID-19, which will be discussed in more detail later in the report. The values provided in this report and figure are subject to change after BK finalizes its 2023 values update. BK valued 2022 and 2023 vintages, assuming typical utilization.

2

II-8

II. DEFINITIONS

According to the International Society of Transport Aircraft Trading's (ISTAT) definition of Base Value, to which BK Associates subscribes, the base value is the Appraiser's opinion of the underlying economic value of an aircraft in an open, unrestricted, stable market environment with a reasonable balance of supply and demand, and assumes full consideration of its "highest and best use". An aircraft's base value is founded in the historical trend of values and in the projection of future value trends and presumes an arm's length, cash transaction between willing, able and knowledgeable parties, acting prudently, with an absence of duress and with a reasonable period of time available for marketing. The base value normally refers to a transaction involving a single aircraft. When multiple aircraft are acquired in the same transaction, the trading price of each unit may be discounted.

For comparison purposes, it is the convention to assign “half-time, half-life” values to aircraft or engines, which represent the value of an aircraft or engine that is halfway between the expense major maintenance events. As a starting point the base value of a tangible asset typically assumes its maintenance status is at half-life/half-time, or benefiting from an above half-life/half-time maintenance status if the asset is new or young.

3

II-9

III. ASSUMPTIONS

We have made the following assumptions and determinations with respect to these aircraft, in preparing this valuation:

| 1. | The aircraft are in good physical condition. |

| 2. | The historical maintenance documentation has been maintained to acceptable international standards. |

| 3. | The specifications of the aircraft are those most common for aircraft of their type and vintage. |

| 4. | The aircraft are in standard passenger configurations, unless specifically stated otherwise. |

| 5. | The aircraft are current as to all Airworthiness Directives and Service Bulletins. |

| 6. | Their modification statuses are comparable to those of aircraft of their type and vintage. |

| 7. | They are operated under an appropriate civil airworthiness authority. |

| 8. | Their utilization is comparable to industry averages. |

| 9. | There is no history of accident or incident damage we are aware of. |

4

II-10

IV. MARKET OUTLOOK

The performance and value of any aircraft or engine is affected to varying degrees by conditions in the global economy. Some of the key influences include gross domestic product, fuel price, and the lending environment. This section of the report will analyze what the current outlook is for each.

GROSS DOMESTIC PRODUCT (GDP) 1

Source: IATA.org

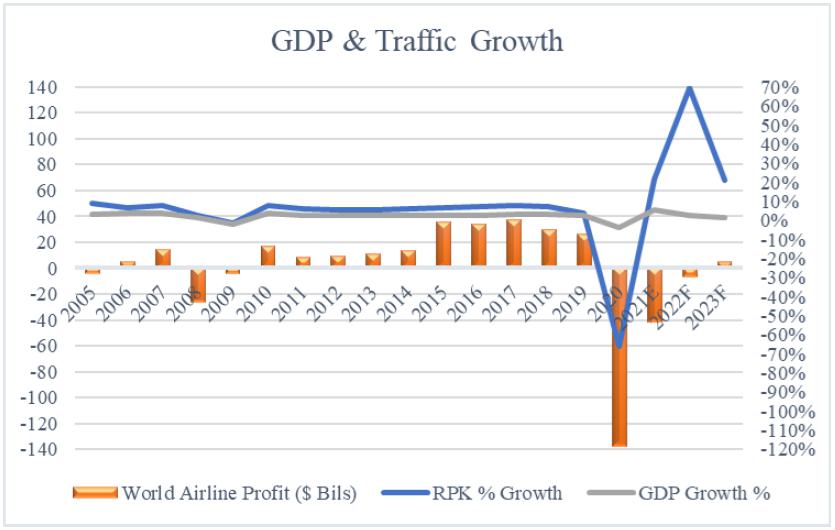

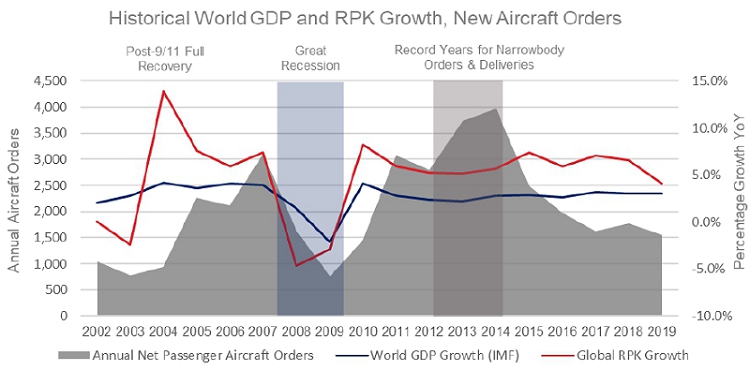

Aviation is a highly cyclical industry, marked with high highs and low lows. Historically, GDP and traffic have been good indicators of the health of the industry, as they are highly correlated. Economic prosperity leads to an increase in disposable income and subsequently an increase in demand for air travel. An increase in demand for air travel means an increase in demand for aircraft and related equipment.

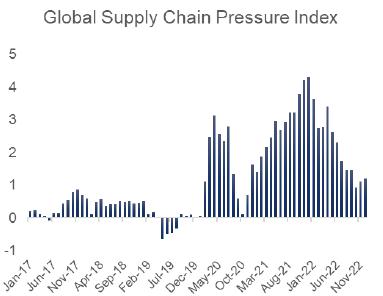

The aviation industry, along with the global economy at large, has been severely impacted by the COVID-19 pandemic. As a result of travel restrictions and broader economic downturns, both traffic and GDP sharply dropped. However, access to the COVID-19 vaccine brought down caseloads and brightened economic prospects for advanced economies. According to the IMF, global growth is forecast to fall from 3.4 percent in 2022 to 2.9 percent in 2023 and then rise to 3.1 percent in 2024 with advanced economies to moderate at 1.2% in 2023 and developing economies at 4.0%. In addition, there are more difficult near-term prospects due in part to tight monetary policy tackling inflation, the impacts of the war in Ukraine, and the supply chain disruptions within manufacturing countries.

1 https://www.imf.org/en/Publications/WEO/Issues/2023/01/31/world-economic-outlook-update-january-2023

5

II-11

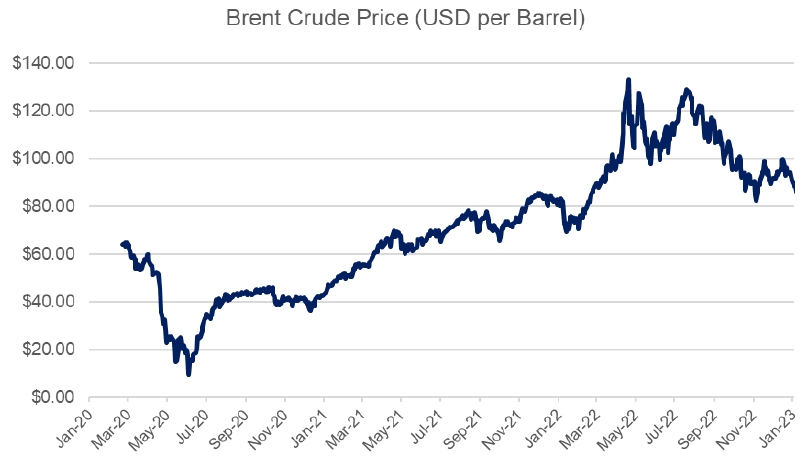

FUEL ENVIRONMENT 2 3 4 5 6 7

Source: Indexmundi.com

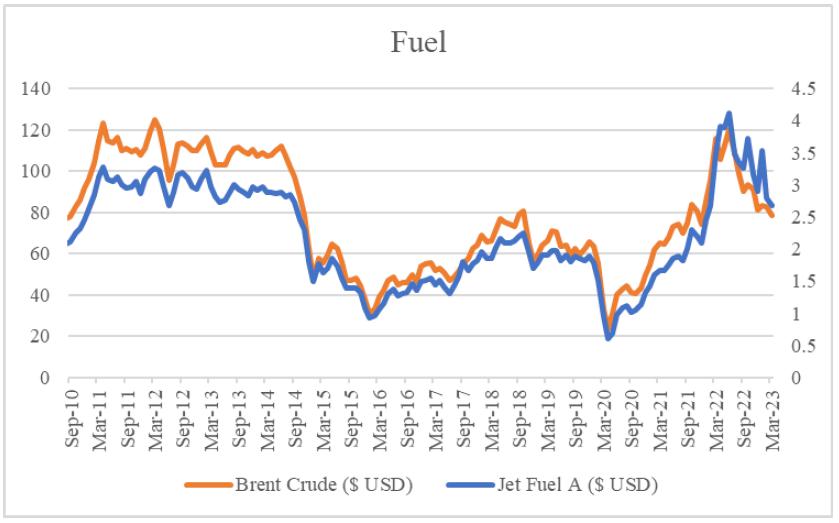

The chart above shows the volatility in the fuel market over the last decade. Brent crude has a strong correlation with Jet Fuel A prices. After a period of high prices, crude oil began to decline in the fall of 2014. Prices remained low through early 2016 and then steadily rose until reaching a four-year high in October 2018. Following a sharp price drop in November 2018, crude oil prices remained relatively stable through January 2020, averaging around $63 per barrel. As a result of the COVID-19 pandemic, along with the price war between Russia and Saudi Arabia, both Brent Crude and Jet Fuel A saw severe drops in price in early 2020. Crude and Fuel hit the lowest points in April 2020, and both have begun recovery. From April 2020 to March 2023, Jet Fuel A had a compound monthly growth rate (CMGR) of 4.20% and Brent Crude had a CMGR of 3.43%. According to Airlines for America’s U.S. Jet Fuel Index, fuel was trading at $2.55 per gallon as of April 13, 2023.

According to the Department of Energy’s short-term outlook, crude oil prices are expected to remain high in 2023, averaging $83 per barrel, which is an 18% decline from 2022’s drastic increase in prices.

Historically, jet fuel and airline profitability have had an inverse relationship. Higher fuel means higher fares, worse profitability and in turn, lower demand. As of the valuation date, oil prices are high and expected to remain high as we head further into a recession.

2 https://www.ft.com/content/bc938195-82d3-43eb-b031-740028451382

3 https://www.bloomberg.com/news/articles/2020-04-01/saudi-arabia-resists-trump-s-attempt-to-broker-an-oil-war-truce

4 https://www.airlines.org/argus-us-jet-fuel-index/

5 https://www.nbcnews.com/politics/politics-news/us-ban-russian-oil-imports-rcna19119

6 https://apnews.com/article/gas-prices-record-high-russia-ukraine-ac7fcc350ad1f1c71db4185b99fef112

7 https://www.eia.gov/outlooks/steo/

6

II-12

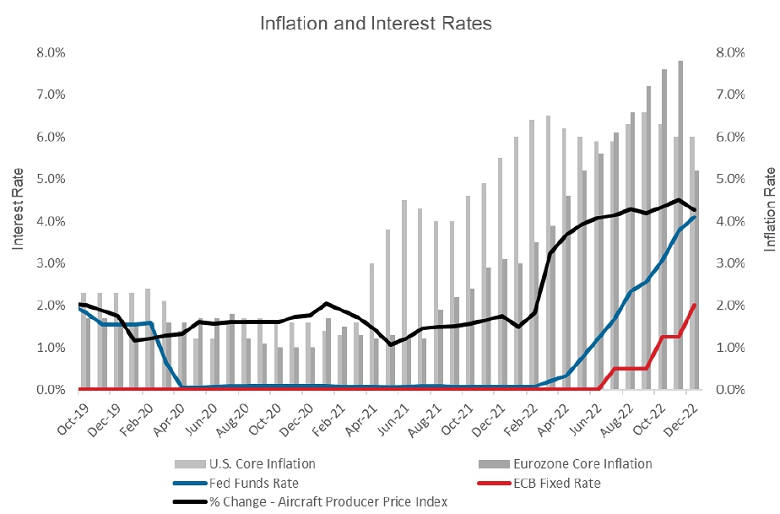

LENDING LANDSCAPE 8 9 10 11 12 13 14 15 16

The lending environment is also a material consideration when evaluating the current market. The last 10 years have been marked with historically low interest rates. However, while, indicators of economic activity and employment have continued to strengthen, inflation remains elevated. This reflects pandemic-related supply and demand imbalances, higher energy prices, and broader price pressures.

In March of 2022, the Federal Reserve raised interest rates for the first time since 2018. On June 1, 2022, the Fed began reducing its holdings of Treasury securities and agency mortgage-backed securities. As of March 22, 2023, the Committee announced its plan to continue to reduce its holding of Treasury securities. For Treasury securities, a $30 billion per month cap will be set for the first three months and $60 billion per month after. The decline under this cap will include Treasury coupon securities and Treasury bills. For agency mortgage-backed securities, the cap is $17.5 billion per month for the first three months, which will increase to $35 billion per month after that. In doing this, they hope to support the flow of credit to households and businesses.

Over the past year, rates have risen faster than originally anticipated. On March 22, 2023, the Federal Reserve’s policy-making arm, the Federal Open Market Committee (FOMC), again raised rates, bringing the federal funds rate to a range of 4.75% to 5%. The Fed has further indicated that they anticipate another quarter point hike to a peak range of between 5% to 5.25%. As of now, the FOMC projects rates to fall to 4.3%, but this is an increase from the previous estimate for 2024.

The Fed has signaled its continuous pursuit of maximum employment and inflation at 2% over the longer run and it is achievable with appropriate and firm monetary policies. The Fed has acknowledged that inflation has risen above predictions throughout 2021. As of March 2023, the median FOMC inflation projection for year-end 2022 has gone from 3.1% to 3.3%. Additionally, the FOMC projects the median PCE inflation to be 3.6% in 2023 and 2.6% in 2024.

One factor that may weigh on the Fed’s decision to continue raising rates is that a few banks have collapsed. Silicon Valley Bank and Signature Bank are two banks that have collapsed in March 2023. As of March 2023, banks have borrowed almost $153 billion from the Fed, far surpassing the previous record of when the Fed handed out $112 billion

8 https://www.federalreserve.gov/newsevents/speech/powell20220321a.htm

9 https://www.federalreserve.gov/newsevents/pressreleases/monetary20220504a.htm

10 https://www.federalreserve.gov/newsevents/pressreleases/monetary20220504b.htm

11 https://www.wsj.com/articles/fed-raises-interest-rates-for-first-time-since-2018-11647453603?mod=trending_now_news_5

12 https://www.federalreserve.gov/newsevents/pressreleases/monetary20230322a.htm

13 https://www.cnbc.com/2023/03/22/the-fed-projections-call-for-just-one-more-rate-hike-this-year.html?&doc=107213115

14 https://www.federalreserve.gov/monetarypolicy/fomcprojtabl20220921.htm

15 https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20230322.pdf

16 https://www.cnn.com/2023/03/17/business/global-banking-crisis-explained/index.html

7

II-13

during the crisis of 2008. Goldman Sachs announced that the growing stress in the banking sector has increased the probability of an American economy recession to 35% likelihood within the year. This is increased from 25% likelihood, prior to the collapse of the banking sector.

8

II-14

V. AIRCRAFT MARKET ANALYTICS

AIRCRAFT DEMAND 17

Source: Boeing.com; Airbus.com

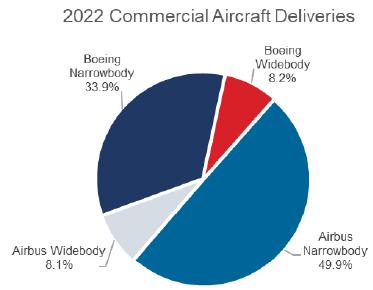

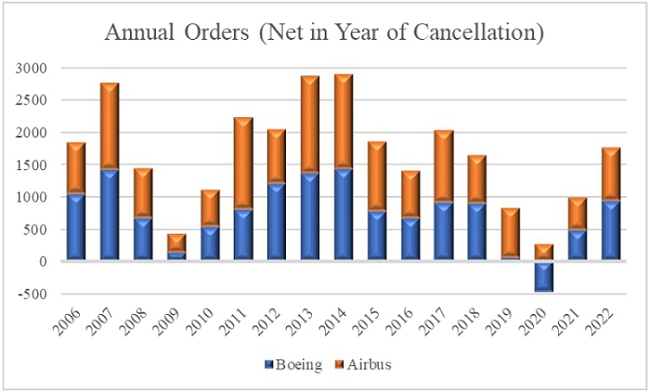

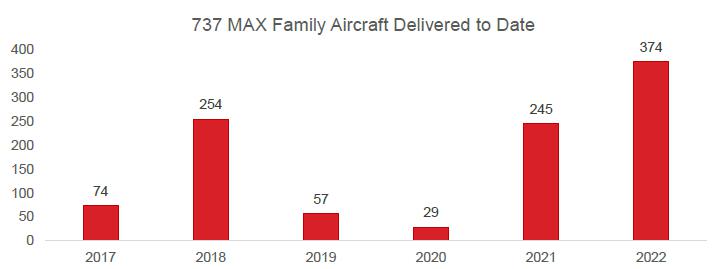

The number of orders placed in a given year is a good indicator of where we are in the cycle. An aircraft type launched in the right business cycle can lead to a large order stream and ultimately, a strong residual value. In 2022, the number of orders placed increased compared to 2021. In 2022, Airbus delivered a total of 663 aircraft and received 820 new orders (net in year of cancellation). Most of its orders were for the Airbus 321Neo, followed by the Airbus 320Neo aircraft. Of the orders Airbus had in 2022, its largest was with China Eastern Airlines for 32 Airbus 320Neos and 68 Airbus 321Neos. By comparison, Boeing delivered 480 aircraft, which is 41% more than their 2021 amount. Net orders for Boeing were positive again this year, with 935 annual gross orders.

According to IATA, aircraft demand remained strong in 2022 across multiple regions. Deliveries increased in North America by 40% and in Latin America by 30%. New airlines in Latin America, such as Arajet, emphasize the positive recovery in the region. Aircraft deliveries continued to grow in Europe, remained stable in Africa but slowed in the Asia Pacific region.

17 https://www.iata.org/en/iata-repository/publications/economic-reports/airlines-financial-monitor---april-2020/

9

II-15

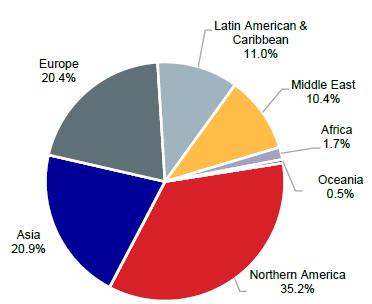

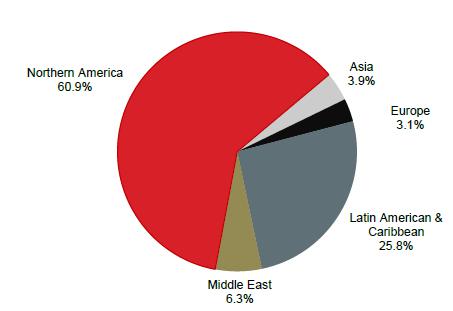

GEOGRAPHIC DIVERSITY

Source: JetInventory.com

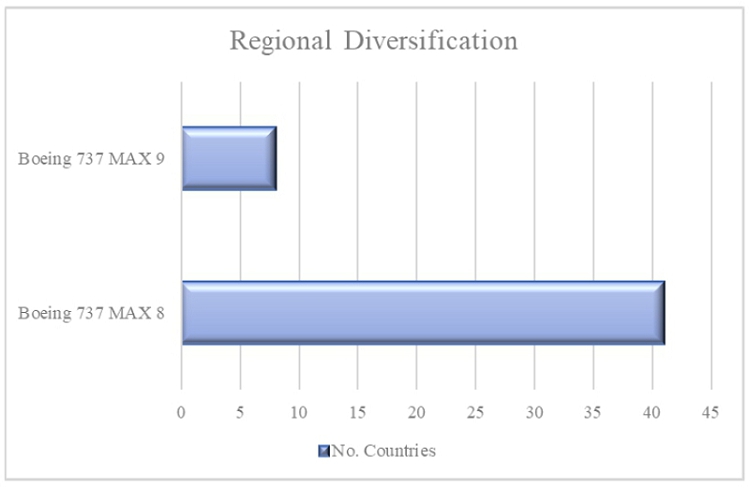

The aircraft in this portfolio are popular all over the world with a dominance in Asia and North America, on a regional level. The Boeing 737 MAX 8 is in 41 countries and the Boeing 737 MAX 9 is in 8 countries. The United States has the most Boeing 737 MAX 8 and Boeing 737 MAX 9 aircraft with 173 and 70 of them, respectively. Regional diversification is also a major influence on value. The more diverse the operation of the aircraft, the easier it is to remarket it.

10

II-16

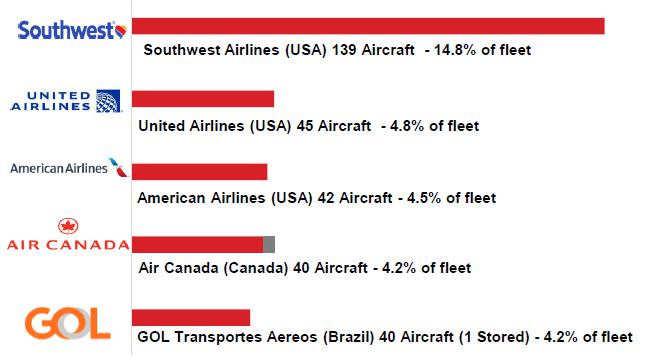

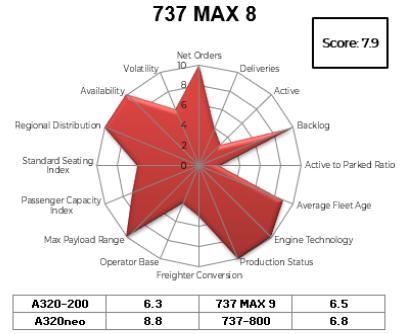

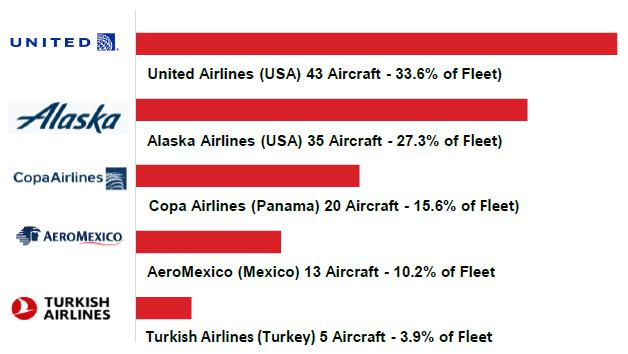

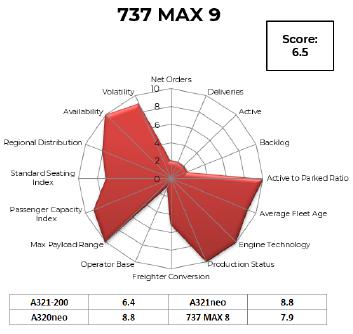

OPERATOR BASE

Source: JetInventory.com

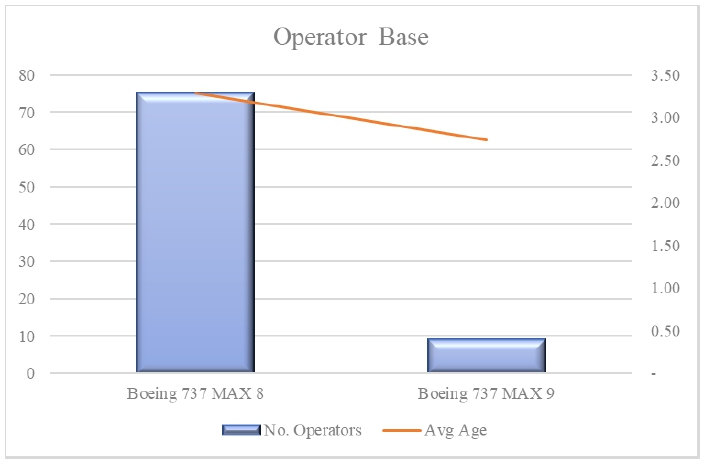

The graph above illustrates the operator base of each aircraft type compared with the age of the global fleet. Airbus 320s and Boeing 737-800s are typically viewed as the most liquid aircraft types, in terms of ability to convert to cash. The Boeing 737 MAX 8 has 75 operators and the Boeing 737 MAX 9 has 9 operators. The largest operator of Boeing 737 MAX 8 aircraft is Southwest Airlines with 101 of them. The largest operator of Boeing 737 MAX 9 aircraft is United Airlines with 37 of them. Operator base, like region diversification, is an important influence on value. The more operators there are, the easier it is to remarket the aircraft.

11

II-17

VI. COVID-19 IMPACT & RECOVERY

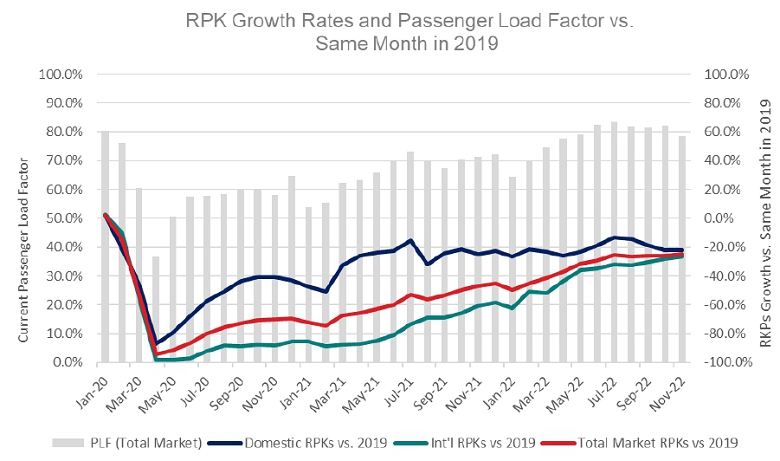

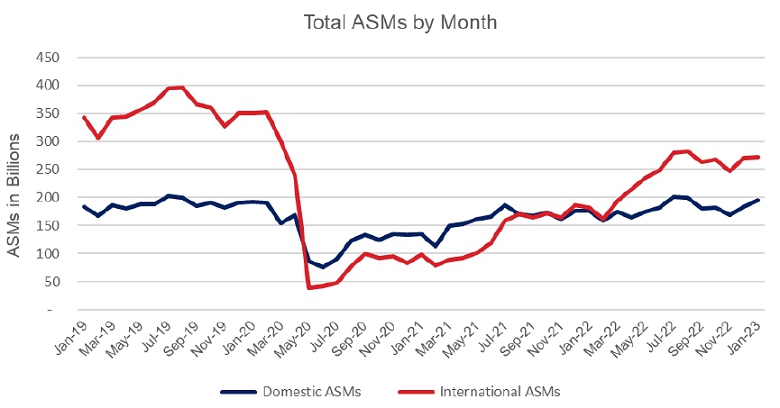

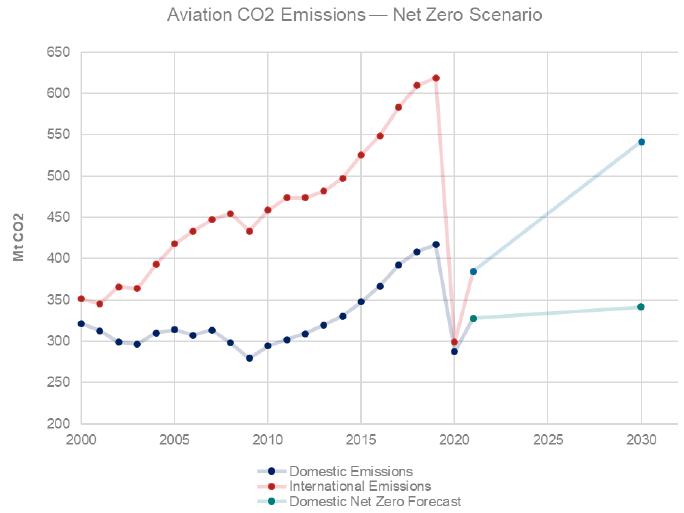

INDUSTRY OVERVIEW 18 19 20 21

The global economic shock resulting from the COVID-19 pandemic has dramatically impacted the aviation industry. Airlines around the world saw financial positions deteriorate as passenger revenues for the industry fell more than 60% during 2020, while net losses exceeded $118 billion. As airlines faced substantial levels of cash burn, many carriers were forced to cease operations or declare bankruptcy. Carriers that survived generally did so through some combination of debt, emergency cost reductions, and governmental support. The story in the cargo market has been quite different. While industry-wide cargo demand, as measured by cargo tonne kilometers (CTKs), fell 10% in 2020, overall, the recovery has been much more robust.

In February 2021, pharmaceutical companies Pfizer-BioNTech, Moderna, Oxford-AstraZeneca began to rollout vaccines and as a result, travel recovery began. As of January 2023, 199 countries have adopted the easing of travel restrictions, only requiring proof of vaccination for travel, while 10 countries remain closed to international travelers. As of November 2022, global RPKs increased by 41.3% year-over-year and has recovered to 75.3% of November 2019 levels. Airline net loss is forecasted to be $9.7 billion with North America being the only region to actually break a profit at $8.8 billion. Additionally, North American demand (RPKs) is projected to be 95% of 2019 levels with capacity at 99.5%.

While there are some new variants and subvariants around the world, both domestic and international travel have recovered significantly and COVID-19 has become less of a concern.

AIRCRAFT AND ENGINE MARKET 22 23

In addition to COVID-19’s direct impacts on traffic and demand, the pandemic has also led to deferrals and cancellations of new equipment deliveries and storage of existing fleets. At the low point of the pandemic in April 2020, IATA reported that roughly 2/3 of the global commercial fleet was grounded and that deliveries of new aircraft were practically non-existent. Since then, many future deliveries have been cancelled or delayed, but more of the fleet is starting to come back into service as demand slowly recovers.

All of these factors have impaired the marketability of commercial aircraft and engines. Given our knowledge of previous crises such as 9-11, SARS, and the 2008 recession, as well as the data currently available, BK has developed a position of the impact of COVID-

| 18 | https://www.iata.org/contentassets/c81222d96c9a4e0bb4ff6ced0126f0bb/annual-review-2022.pdf | |

| 19 | https://www.iata.org/en/pressroom/2022-releases/2022-06-20-02/ | |

| 20 | https://www.kayak.com/travel-restrictions? | |

| 21 | https://www.iata.org/en/pressroom/2023-releases/2023-01-09-02/ | |

| 22 | https://www.iata.org/en/iata-repository/publications/economic-reports/air-passenger-monthly-analysis---august-2020/ | |

| 23 | https://www.iata.org/en/iata-repository/publications/economic-reports/airlines-financial-monitor-july-2020/ |

12

II-18

19 on the current market values (CMV) of the world’s fleets of commercial aircraft and engines. Specifically, we have reduced our CMVs by 5% to 25%, depending on the age, type, and production status of the asset.

The CMVs have been reduced more severely for widebody aircraft than for narrowbody and regional aircraft. Older or out of production aircraft have been reduced more severely. We have not impaired the marketability of freighter aircraft that are in production, but we have impaired marketability for those out of production. For engines, the CMVs have been cut in proportion to the haircut applied to the host aircraft type, albeit by a lesser percentage.

In addition to the reductions made to the CMVs, we have also reduced the base values (BV) for certain aircraft types, including the Boeing 777-200s, Boeing 777-200ERs, Boeing 777-300ERs, Airbus 330-300s, Airbus 330-200s, Embraer 190s, Embraer 195s, and Airbus 380s. Based on early retirements and falling activity rates, we believe these aircraft types have had permanent impairment to their BVs. Please note that these changes to our BVs also reflect the typical updates we make to our value tables throughout the year. The reductions should not be interpreted as solely being a result of COVID-19. With the Boeing 737 MAX returning to service, we have also raised the CMVs for that aircraft type. As trading begins to pick up again, we will continue to monitor the values of various aircraft and engine types and adjust as needed.

13

II-19

VII. VALUATION METHODOLOGY

Current values are normally based on comparison to recent sales of comparable aircraft. Unfortunately, there have been few recent transactions involving comparable aircraft for which the price was divulged. Since the 1990s, the major airlines and other aviation industry entities in the United States have claimed, with support of the government and the courts that the realizations in their aircraft sales should be kept confidential. Prior to that, all transactions were reported to the government and the prices were available to the public. Now, we are only aware of transactions that are occasionally reported in the press, when we are involved in the transaction or when our clients sometimes share the prices of recent transactions. Equipment manufacturers also share with us confidential cost data related to their products. We are aware of some sales of similar aircraft to those subject of this appraisal.

In the absence of more recent sales data, alternative methodologies must be used. One approach is to determine the base value or what the value should be in a balanced market and then adjust that base value to reflect the impact of current market conditions.

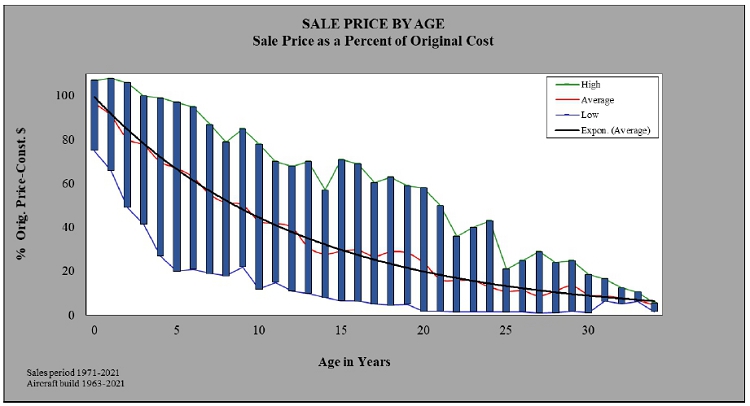

As the definition implies, the base value is determined from long-term historical trends. BK Associates has accumulated a database of over 13,000 data points of aircraft sales that occurred since 1970. From analysis of these data we know, for example, what the average aircraft should sell for as a percentage of its new price, as well as the high and low values that have occurred in strong and weak markets.

Based on these data, we have developed relationships between aircraft age and sale price for wide-bodies, narrow-bodies, large turboprops and, more recently, regional jet and freighter aircraft. Within these groups we have developed further refinements for such things as derivative aircraft, aircraft still in production versus no longer in production, and aircraft early in the production run versus later models. Within each group variations are determined by the performance capabilities of each aircraft relative to the others. We now track some 150 different variations of aircraft types and models and determine current and forecast base values. These relationships are verified, and changed or updated if necessary, when actual sales data becomes available.