Table of Contents

August 24, 2018

By Overnight Delivery, Email & EDGAR Filed

United States Securities and Exchange Commission

100 F. Street, N.E.

Washington, D.C. 20549

Attn: Rufus Decker, Accounting Branch Chief

RE: Fuse Medical, Inc.

Form 10-K for Fiscal Year Ended December 31, 2017

Filed April 6, 2018

File No. 000-10093

Dear Mr. Decker:

On behalf of Fuse Medical, Inc., a Delaware corporation (“Fuse” or the “Registrant”), we hereby submit the Registrant’s response to the comments of the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) set forth in the Staff’s letters, dated April 27, 2018 and May 23, 2018 (the “Staff’s Letters”), and communicated to Fuse in subsequent telephone calls on August 7, 2018, August 9, 2018, and August 14, 2018, with the Staff, with respect to Fuse’s responses to the Staff’s comments with respect to the above-referenced Annual Report on Form 10-K (the “2017 Form 10-K”).

We appreciate the comments of the Staff and the opportunity to respond. For the convenience of the Staff, the Staff’s comments are included and followed by the corresponding response of the registrant. Unless the context indicates otherwise, references in this letter to “we” and “our” refer to the Registrant. Any terms capitalized herein but not otherwise defined have the meaning ascribed to them in the 2017 Form 10-K.

1565 North Central Expressway, Suite 220

Richardson, TX 75080

Office: 469.862.3030 Facimile: 469.862.3035

www.fusemedical.com

Table of Contents

Form 10-K for Fiscal Year Ended December 31, 2017

| A. | Previously Addressed Questions and Responses from the Staff’s Letters. |

Item 9A. Controls and Procedures, page 25

| 1. | Staff Comment: We read your responses to comments 1 and 2 and note that you state you cannot reach a conclusion at this time. We further note that in the Form 10-Q filed on May 15, 2018, you were able to conclude your controls were not effective as of March 31, 2018. Considering that you were able to reach a conclusion as of March 31, 2018, please revise to provide your conclusion as to the effectiveness of both your disclosure controls and your internal control over financial reporting as of December 31, 2017. |

Fuse Response: The Registrant intends to file an amendment to the 2017 Form 10-K as soon as reasonably practicable following the completion of all comments from the Staff to reflect the above-requested revisions.

Changes in Internal Control of Financial Reporting, page 25

| 2. | Staff Comment: We read your response to comment 3. Please disclose the changes noted in your response in your amended filing. |

Fuse Response: The Registrant intends to file an amendment to the 2017 Form 10-K as soon as reasonably practicable following the completion of all comments from the Staff to reflect the above-requested revisions.

| B. | Additional Responses Requested by the Staff |

We are providing the following information and background on the 2016 and 2017 transactions to provide clarity. Although Fuse has filed the majority of the below information in its public filings, we believe it would be helpful to the Staff to re-present this information in this response.

| 1. | Summary of Fuse’s 2016 Transactions. Through a series of transactions in 2016 (the “2016 Transactions”), Mr. Mark Brooks and Mr. Christopher Reeg acquired control of our company through entities owned and controlled by Messrs. Brooks and Reeg, respectively. At December 31, 2016, Mr. Brooks held ultimate beneficial ownership of 40% and Mr. Reeg held ultimate beneficial ownership of 29% of the outstanding common stock, par |

2

Table of Contents

| value $0.01, of Fuse (“Common Stock”). As part of a December 19, 2016, purchase agreement pursuant to which Mr. Brooks and Mr. Reeg acquired control of our company, as disclosed in Fuse’s Current Report on Form 8-K filed with the Commission on December 23, 2016 (the “December 2016 Form 8-K”), which is herein incorporated by reference, certain stockholders executed that certain Voting Agreement, dated December 19, 2016, by and among Fuse, Christopher C. Pratt, Robert H. Donehew, Reeg Medical Industries, Inc., a Texas corporation controlled by Mr. Reeg (“RMI”), and NC 143 Family Holdings, LP, a Texas limited partnership controlled by Mr. Brooks (“NC 143” and such agreement, the “Voting Agreement”), which is filed as Exhibit 4.1 to the December 2016 Form 8-K, providing that Messrs. Brooks and Reeg would have the right to appoint or remove a majority of the members of Fuse’s board of directors (the “Board”) and therefore, control of us and our operations. We believe that the Voting Agreement constitutes contemporaneous written evidence of the intent and ability of Messrs. Brooks and Reeg to control our company jointly. When combined with the long history of Messrs. Brooks and Reeg engaging in joint business operations with common interests, we do not believe that any conclusion other than the existence of common control following the 2016 Transactions would be warranted. Additionally, in our Annual Report on Form 10-K for the fiscal year ended December 31, 2016, filed with the Commission on March 20, 2017 (the “2016 Form 10-K”) and subsequent interim reporting, the 2016 Transactions were consistently referred to as a change in control. |

| 2. | Acquisition of CPM Medical Consultants, LLC. Fuse’s acquisition of CPM Medical Consultants, LLC (“CPM”), closed on December 29, 2017, and was effective on December 31, 2017, the (“CPM Acquisition”), as disclosed on Fuse’s Current Report on Form 8-K filed with the Commission on January 5, 2018, which is herein incorporated by reference, including a discussion of (a) additional supporting material from ValueScope regarding the fair value of Common Stock, in connection with the CPM Acquisition; (b) an analysis with respect to the contingent consideration to be paid in connection with the CPM Acquisition; (c) the fairness opinion (the “Fairness Opinion”) of ValueScope, Inc. (“ValueScope”) with respect to the CPM Acquisition; and (d) an analysis of common control issues in connection with the CPM Acquisition. The CPM Acquisition was approved by an independent special committee of the Board on December 13, 2017, as described in Fuse’s Current Report on Form 8-K, filed with the Commission on December 20, 2017, which is herein incorporated by reference. |

| a. | Additional Valuation Support and Analysis. We engaged ValueScope to prepare a valuation and fairness opinion for the CPM Acquisition. ValueScope’s response provides further detail with respect to the $0.20 per share valuation of Fuse as reflected in the Fairness Opinion. The additional analysis is attached hereto as Exhibit A and is herein incorporated by reference. |

| b. | Analysis of Contingent Consideration. An analysis of the accounting treatment with respect to the contingent consideration in the CPM Acquisition is attached hereto as Exhibit B and is herein incorporated by reference. |

3

Table of Contents

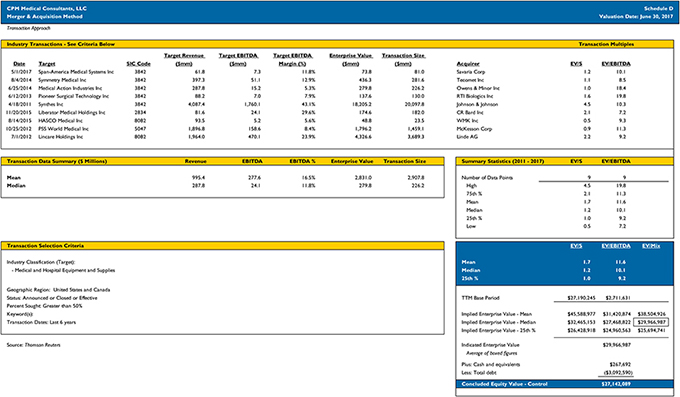

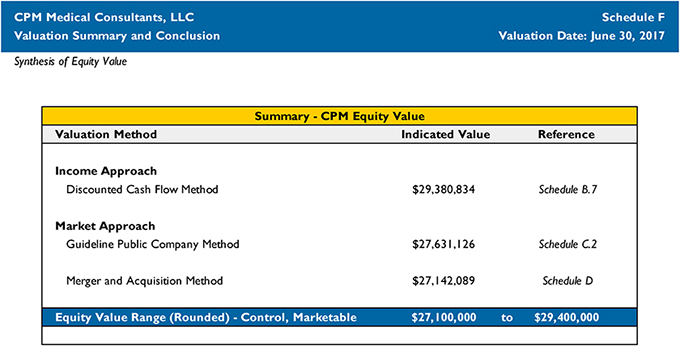

| c. | Fairness Opinion and Valuation Report. The CPM Acquisition was, for accounting purposes, treated as a reverse merger under common control. The Fairness Opinion of ValueScope is attached hereto as Exhibit C and is herein incorporated by reference. The valuation report of ValueScope supporting the value of CPM in connection with such transaction is attached hereto as Exhibit D and is herein incorporated by reference. |

| d. | Analysis of Common Control Issues. We note that the Staff’s guidance contained within EITF 02-5 provides that common control among a group of shareholders exist where “a group of shareholders holds more than 50 percent of the voting ownership interest of each entity, and contemporaneous written evidence [emphasis added] of an agreement to vote a majority of the entities’ shares in concert exists.” In connection with the acquisition of shares representing 61% of the beneficial ownership interests of Fuse by NC 143 and RMI (together with NC 143, the “Investors”) in December 19, 2016, the Investors entered into the Voting Agreement under which the parties thereto were bound to vote collectively on the matters set forth in the Voting Agreement. |

The matters set forth in the Voting Agreement include (i) the right to appoint a majority of the members of Board and (ii) the right to remove a majority of the members of our Board of directors. Section 3 of the Voting Agreement provides that all determinations to be made by the Investors under the Voting Agreement will be made pursuant to the determination of the holders of a majority of all of the shares of Common Stock held by the Investors. At the time of the execution of the Voting Agreement, NC 143 beneficially owned approximately 57.5% of the issued and outstanding shares of Common Stock held by the Investors. Consequently, NC 143 held complete control over the appointment or removal of a majority of the members of the Board. The Board, in turn, holds complete control over the business and affairs of the Registrant. We note that at all relevant times NC 143 held control over CPM.

As a threshold matter, the Registrant does not interpret the applicable guidance to require that NC 143 and RMI be required to vote in concert on “all significant issues with regard to Fuse Medical, Inc.” The applicable guidance merely requires that the Investors (and by extension NC 143) agreed to vote a majority of the Registrant’s shares in concert. There is no more significant “control” issue upon which stockholders are entitled to vote than election of a majority of the Board, as the Board directs all material policies and decisions of the Registrant. As a result, the Registrant believes that even if there were no other agreements or understandings between NC 143 and RMI, the Voting Agreement itself is sufficient to support the position of common control.

4

Table of Contents

The Registrant further notes that the applicable guidance does not require that there be a written agreement requiring that a majority of the Registrant’s shares be voted in concert. Rather, the applicable guidance requires written evidence of an agreement to vote a majority of the Registrant’s shares in concert. The Registrant’s determination that common control existed is based upon statements by Messrs. Reeg and Brooks that they intended and agreed to vote together on all significant issues relating to the Registrant. The Voting Agreement and the right of NC 143 to control a majority of the Board, while not specifically embodying such agreement to vote in concert on all significant issues relating to the Registrant, does go to provide evidence of such agreement. The existence of such an agreement is supported by the following additional circumstantial factors, as noted previously:

| (i) | Messrs. Brooks and Mr. Reeg are invested in multiple ventures outside of the Registrant and have generally worked together to further their economic interests in a collaborative manner in a relationship that spans over twenty years; |

| (ii) | Mr. Reeg was appointed the chief executive officer of Fuse immediately following the 2016 Transactions, indicating that Messrs. Brooks and Reeg would continue to work in their common interests; |

| (iii) | The December 2016 Form 8-K filing associated with the 2016 Transactions noted that there was a change in control and this conclusion is also noted in the 2016 Form 10-K and Fuse’s subsequent filings of Quarterly Reports on Form 10-Q; and |

| (iv) | The stock purchases made by Mr. Brooks through NC 143 and Mr. Reeg through RMI were contemporaneous, indicating that the Investors worked together. |

To summarize, the Registrant believes that the Voting Agreement by its terms constitutes sufficient basis to determine that common control existed between the Registrant and CPM in accordance with existing guidance. Further, even if the Voting Agreement by its terms was not so sufficient, the Registrant believes that the Voting Agreement constitutes sufficient evidence of an agreement between NC 143 and RMI to provide for common control between the Registrant and CPM.

5

Table of Contents

In addition to our response to the Staff’s comments, we acknowledge that:

| • | The Registrant is responsible for the adequacy and accuracy of the disclosure in the filing; |

| • | Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| • | The Registrant may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

If you have any additional questions, please do not hesitate to contact Christopher C. Reeg, our Chief Executive Officer, at (972) 331-5883 or at ChrisReeg@fusemedical.com.

| Sincerely, |

| Fuse Medical, Inc. |

| /s/ Christopher C. Reeg |

| Christopher C. Reeg |

| Chief Executive Officer |

CC: William E. McLaughlin, III

6

Table of Contents

EXHIBIT A

ADDITIONAL VALUATION SUPPORT AND ANALYSIS OF VALUESCOPE

(attached)

A-1

Table of Contents

| Additional Valuation Support and Analysis of ValueScope | EXHIBIT A |

The Registrant engaged ValueScope, Inc., to prepare a valuation of CPM as well as a fairness opinion to assist in the reverse acquisition transaction with CPM (the “2017 Reverse Acquisition”). The SEC’s point of inquiry pertains to the special committee comprised of independent Board of Director’s (“Special Committee”) negotiated and agreed upon Fuse common stock share price of $0.20, in conjunction with the fact that the Registrant’s shares were trading at $1.50 as of December 29, 2017 (the “Closing Date”).

ValueScope’s findings indicated that the Registrant was part of an inactive and inefficient market, and the trading share price was not based on the fundamentals of the Registrant and did not represent the true intrinsic value of Fuse. ValueScope’s conclusion was based on the following factors: 1,2,3,4

| 1. | the Registrant was traded on what is commonly known to be the most speculative tier of the three (3) over-the-counter(“OTC”) marketplaces; |

| 2. | the Registrant maintained historically very low net asset value; |

| 3. | the Registrant historically has had a small number of shareholders; |

| 4. | the Registrant’s stock historically has had a large bid-ask spread; |

| 5. | historically there was a low daily dollar volume of trades of the Registrant’s stock; |

| 6. | the Registrant’s stock has not had any published investment research or analysis; |

| 7. | no reporting institutions or institutional investors have been active in acquiring shares. |

A summary of these individual factors listed above is presented in the following section of this report. Next, a portion of the Accounting Standards Codification; Number 820 “Fair Value Measurement” (“ASC 820”) is analyzed and discussed. Following the discussion of ASC 820, ValueScope presents its own valuation of the Registrant’s stock price that was included in the Fairness Opinion Related to the Acquisition of CPM by Fuse as filed with the SEC on Current Report Form 8-K on December 20, 2017. Lastly, the report discusses relevant court case decisions and their findings on market efficiencies.

Summary of Findings

| 1. | The Registrant is listed on the OTC Exchange |

As of the Closing Date, the Registrant’s shares were traded on the OTC Pink marketplace, the most speculative tier of the three (3) OTC marketplaces.

| 2. | The Registrant Maintained Historically Very Low Net Asset Value |

Prior to the transfer of assets after the Closing Date of the 2017 Reverse Acquisition, the Registrant held few assets. For a two-year period prior to the 2017 Reverse Acquisition, Fuse had very few net assets valued under $500,000 (and negative for various periods). This indicates the Registrant had little, if any, operations prior to the 2017 Reverse Acquisition with CPM, which is consistent with the Statement of Operations. In fact, over that two-year period, Fuse’s going-concern status was heightened, as auditors considered whether the Registrant had the ability to continue as a going concern. The Registrant’s annual report on Form 10-K for the fiscal year ended December 31,

| 1 | https://www.marketwatch.com/story/thinly-traded-stocks-proceed-with-caution |

| 2 | https://www.investopedia.com/terms/t/thinly-traded.asp |

| 3 | https://tradingsim.com/blog/5-challenges-trading-thinly-traded-stocks/ |

| 4 | Empirical Analysis of Liquidity Demographics and Market Quality for Thinly-Traded NMS Stocks, Office of Analytics and Research, Division of Trading and Markets, U.S. Securities and Exchange Commission, April 10, 2018. |

A-2

Table of Contents

2016 (“2016 Annual Report”) stated that Fuse’s ability to continue as a going concern depended on obtaining adequate new debt or equity financing and achieving sufficient sales and profitability. Furthermore, the auditor’s report regarding Fuse’s financial statements, filed on March 20, 2017, stated the following:

“The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the consolidated financial statements, the Company incurred a significant net loss and negative cash flows from operations during the year ended December 31, 2016. These matters raise substantial doubt about the Company’s ability to continue as a going concern.”5

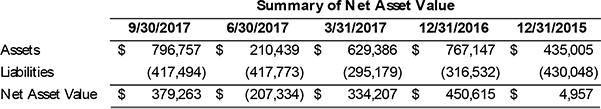

The table below (“Figure 1”) presents Fuse’s net asset value from December 31, 2015 to September 30, 2017.

Summary of N et Asset Value 9/30/2017 6/30/2017 3/31/2017 12/31/2016 12/31/2015 Assets $ 796,757 $ 210,439 $ 629,386 $ 767,147 $ 435,005 Liabilities (417,494) (417,773) (295,179) (316,532) (430,048) Net Asset Value $ 379,263 $ (207,334) $ 334,207 $ 450,615 $ 4,957

| 3. | The Registrant Historically has had a Small Number of Shareholders |

As of the Closing Date, the Registrant had 18,215,808 shares outstanding with a total of 349 unique shareholders. Bloomberg reported Fuse to have had a float estimated to be around one (1) million shares. Immediately prior to the 2017 Reverse Acquisition the number of shares held by the Cede & Co. account was 301,603.6 This is considered an extremely small number of shares available for active trading and represented less than 2% of the total outstanding shares at that time. This evidence further supports the conclusion that Fuse’s stock has been operating in an inactive and inefficient market, highly volatile, and susceptible to speculative price swings.

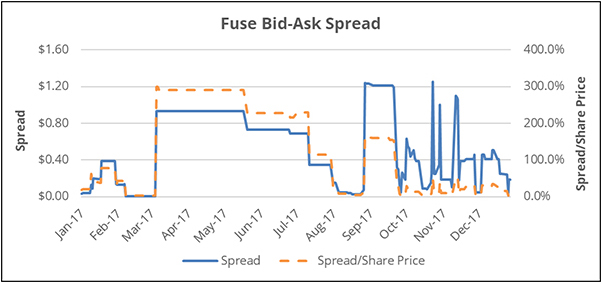

| 4. | Historically the Registrant had a Large Bid-Ask Spread |

The difference between the bid and ask price is usually indicative of a security’s liquidity. Inactive securities have a wider bid-ask spread than liquid securities. For the fiscal year 2017, the Registrant had an average bid-ask spread of $0.5265 with a maximum of $1.25. In fact, for various extended periods, the bid-ask spread was over two (2) times as large as Fuse’s actual share price. Assets considered less liquid typically have spreads equivalent to 1%-2% of the asset’s stock price.7 This indicates that the Registrant participates in an inactive and inefficient market and is susceptible to speculative price swings.

The following chart (Figure 2) presents Fuse’s bid-ask spread over the 2017 calendar year.

| 5 | Fuse Medical, Inc. Form 10-K for the Fiscal Year Ended December 31, 2016, filed March 20, 2017, pg. F-2. |

| 6 | AST, List of Shareholders – Fuse Medical, Inc. (18988), dated December 29, 2017 |

| 7 | https://www.investopedia.com/terms/b/bid-askspread.asp |

A-3

Table of Contents

A-4

Table of Contents

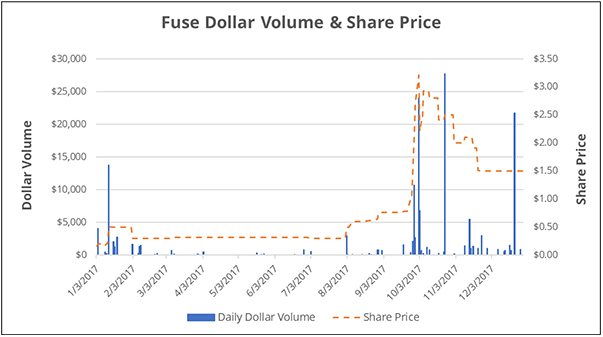

| 5. | Historically there was a Low Daily Dollar Volume of Trades of Fuse Stock |

The Registrant had an abnormally lower daily dollar volume of trades. From January 2, 2017 to the Closing Date, The Registrant averaged $643 in trades per day (251 total trading days). In fact, the majority of the available trading days (189 days) had no trades occur at all. We noted that only on three (3) days did the dollar volume go above $20,000. These trends indicated that Fuse was not part of an actively traded market with significant investor interest. The indicators of the inefficient market do not support that trades were being executed due to newly available or disseminated corporate information.

The chart below (Figure 3) presents Fuse’s daily dollar volume of trades and share price.

| 6. | The Registrant’s Stock Has Not Had Any Published Research or Analysis |

ValueScope searched Bloomberg and S&P Capital IQ but was unable to identify any published reports containing research or analysis performed on Fuse prior to the Closing Date The lack of analytical research indicates that trades occurring prior to the Closing Date were speculative and leads to the conclusion that the trades were not based on the fundamentals of the Registrant.

| 7. | No Reporting Institutions or Institutional Investors were Acquiring the Registrant’s Stock |

Trades of Fuse stock prior to the transaction were made by individual, speculative investors. ValueScope found no evidence that reporting institutions or institutional investors were buying the Registrant’s stock.

A-5

Table of Contents

ASC 820 -Fair Value Measurement

ValueScope considered ASC 820 for guidance on inactive markets. ASC 820-10-35-54C through 35-54H addresses valuations in markets that are inactive in the current reporting period.8

The fair value standards provided additional factors to consider in measuring fair value when there is little market activity for an asset or a liability and quoted prices are associated with transactions that are not orderly. For those measurements, pricing inputs that are considered not orderly for referenced transactions may be less relevant. A reporting entity should determine if a pricing input for an inactive security was “orderly” and representative of fair value by assessing if it has the information to determine that the transaction is not forced or distressed. If it cannot make that determination, additional factors should be considered.

ASC 820 outlines a list of factors to consider in determining whether the volume or level of activity is in relation to normal market activity. The factors that an entity should evaluate include (but are not limited to) the following:

| 1. | There is an absence of a market for new issues (that is, a primary market) for that asset or liability or similar assets or liabilities. |

| ◾ | Fuse was not traded on a primary market. |

| 2. | There are few orderly transactions. |

| ◾ | Fuse had no, or very few, orderly transactions. |

| 3. | Price quotations are not developed using relevant or current information. |

| ◾ | Fuse had issued no relevant or current information that could have been used to develop a price quotation. |

| 4. | Price quotations vary substantially either over time or among market makers (for example, some brokered markets). |

| ◾ | Fuse had no market makers or brokered markets. |

| 5. | There is a large bid-ask spread or significant increases in the bid-ask spread. |

| ◾ | Large bid-asked spreads were the norm for Fuse. |

| 6. | Little information is publicly available (for example, a principal-to-principal market). |

| ◾ | There were no principal-to-principal markets for Fuse or any other publicly available information prior to the 2017 Reverse Acquisition. |

If a reporting entity concludes that the volume or level of activity in the market for an asset or liability is low, the reporting entity should perform further analysis of the transactions or quoted prices observed in that market. Further analysis is required because the transactions or quoted prices may not be determinative of fair value, and significant adjustments may be necessary when using the information in estimating fair value. ValueScope performed this analysis as presented above in the Summary of Findings Items 1 through 7.

The fair value standards do not prescribe a methodology for making significant adjustments to transactions or quoted prices when estimating fair value. Instead of applying a prescriptive approach, reporting entities should consider indications of fair value.

| 8 | Language in this section was paraphrased from PwC’s Fair Value Measurements Guide, dated August 2015. |

A-6

Table of Contents

For example, a reporting entity may use indications of fair value developed from both a market approach and a present value technique in its estimate of fair value. When using multiple indications of fair value, the reporting entity should consider the reasonableness of the range of fair value indications. The objective is to determine the point that is most representative of fair value under current market conditions.

In inactive markets, market capitalization may not be representative of fair value and other valuation methods may be required to measure the fair value of an entity. Use of a value other than market capitalization will require other evidence and documentation that clearly support that the quoted market prices are not the best indication of fair value. This guidance is set out in ASC 820-10-35.

ValueScope Valuation of Fuse Pre-Reverse Acquisition Share Price

ValueScope reviewed Fuse’s historical trading history and share prices. As a publicly traded company, the share price of the Registrant as of the Closing Date was not a reliable indicator of the true value the Registrant’s stock.

Historical Fuse share prices are presented in the table below (Figure 4).

| Date |

Share Price |

|||

| March 31, 2016 |

$ | 0.15 | ||

| June 30, 2016 |

$ | 0.13 | ||

| September 30, 2016 |

$ | 0.11 | ||

| December 30, 2016 |

$ | 0.32 | ||

| March 31, 2017 |

$ | 0.32 | ||

| June 30, 2017 |

$ | 0.32 | ||

| September 29, 2017 |

$ | 2.70 | ||

| December 29, 2017 |

$ | 1.50 | ||

A-7

Table of Contents

The Registrant’s share prices increased by more than five (5) times from June 30, 2017 to the Closing Date while the operations of the Registrant had not improved, and the future expectations had not changed, aside from the anticipated 2017 Reverse Acquisition with CPM, which at the time was not public information. This indicated that the share price of $1.50 was not based on the intrinsic value of Fuse. Therefore, ValueScope performed its own analysis to determine the true fair market value of Fuse’s pre-transaction equity as of the Closing Date.

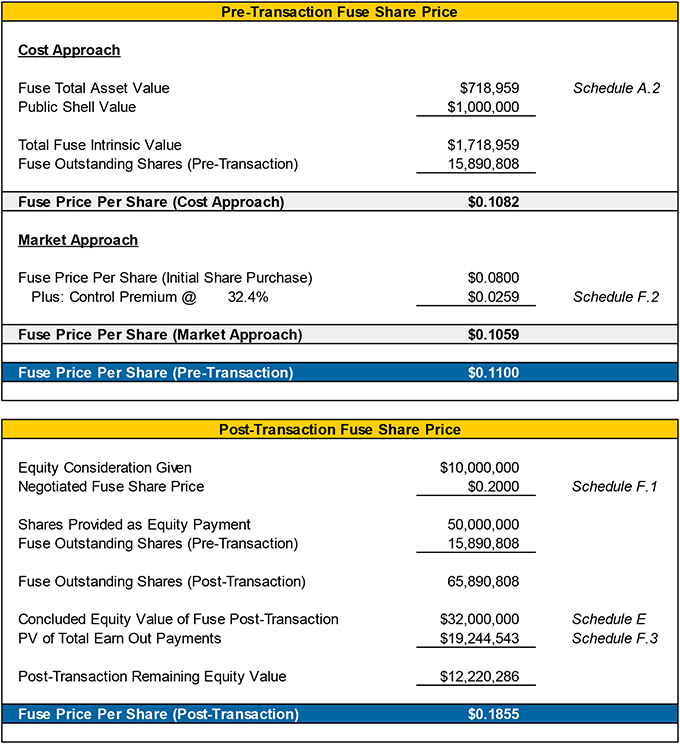

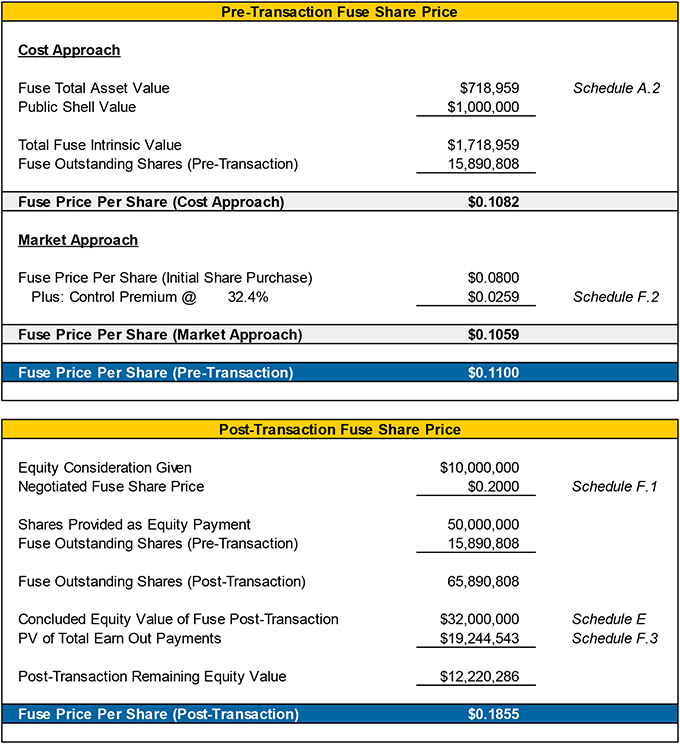

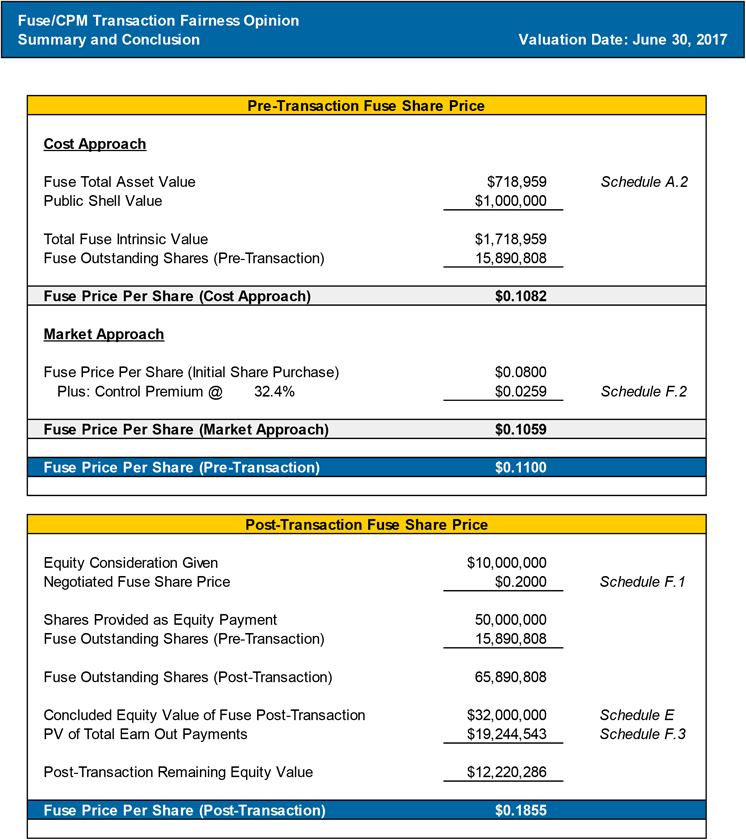

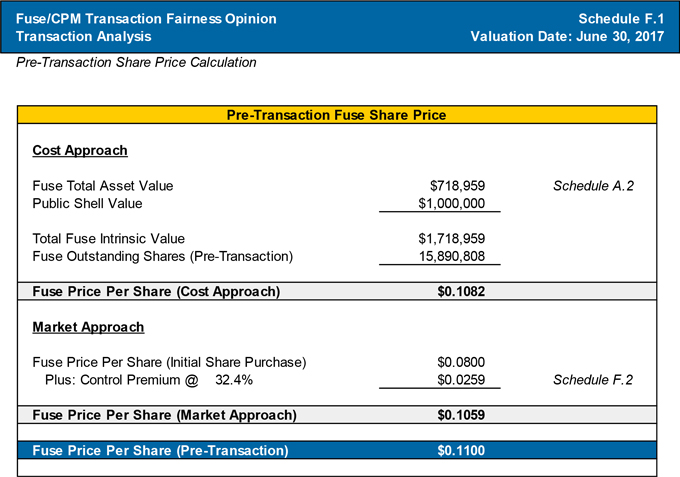

Under the cost approach, ValueScope determined the Registrant’s equity value by analyzing the costs associated with recreating Fuse’s assets. ValueScope then added the cost of a public shell. Prices for public shells often range from $100,000 to $500,000, plus all the due diligence and legal costs associated with acquiring them. Conservatively, ValueScope estimated the cost of Fuse’s public shell to be $1.0 million.9 The conclusion of Fuse’s intrinsic value was calculated to be $1.719 million. With 15,890,808 shares outstanding, it was concluded that Fuse’s pre-transaction value per share was calculated to be $0.1082.

ValueScope also utilized the market approach to determine another indication of value per share for the Registrant by relying on an actual purchase agreement for Fuse shares. According to the stock purchase agreement by and among Fuse, Reeg Medical Industries, Inc., and NC 143 Family Holdings, LP, dated December 19, 2016 (“Stock Purchase Agreement”), the Registrant was authorized to sell shares at $0.08 per share. This was an arm-length price as it was determined and set by Fuse’s independent Board. The Stock Purchase Agreement provided the buying entities collective control of the Registrant.

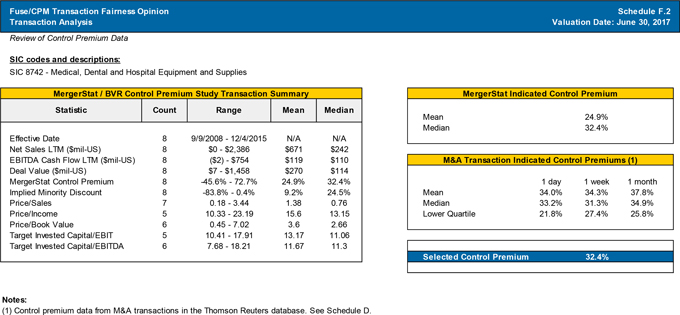

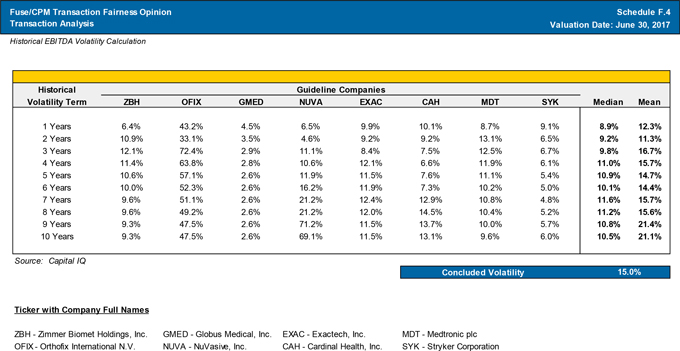

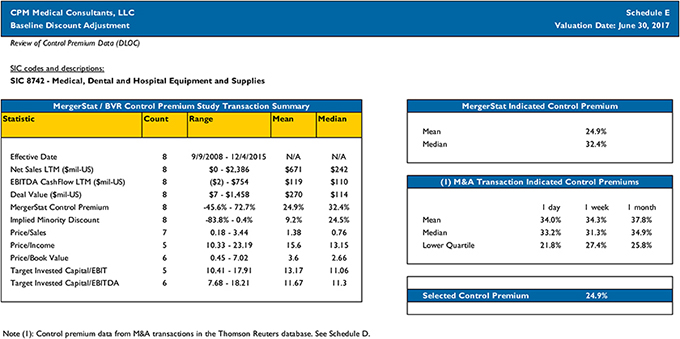

To facilitate the 2017 Reverse Acquisition with CPM, effective December 31, 2017, the Registrant created a special committee of the Board comprised entirely of Independent Directors; who were charged with due diligence and the negotiation of the proposed 2017 Reverse Acquisition transaction. To calculate the per share value of the 2017 Reverse Acquisition on a controlling interest basis for a single entity buyer, ValueScope applied a control premium of 32.4%.10 A control premium is an amount that a buyer is willing to pay over the current market price of a company in order to acquire a controlling share in that company.

If the market perceives that a public company’s profit and cash flow is not being maximized, capital structure is not optimal, or other factors that can be changed are impacting the company’s share price, an acquirer may be willing to offer a premium over the price currently established by other market participants. The pre-transaction price per share calculated under the market approach was calculated as $0.1059 per share.

Based on the separate valuation approaches described above, it was concluded a Fuse pre-transaction price per share of $0.11. The Registrant’s Independent Committee of the Board negotiated a price per share of $0.20. ValueScope valuation of Fuse’s stock was the most indicative measure of intrinsic value and affirmed that the $0.20 negotiated share price of Fuse was fair.

| 9 | Go Public Institute and Stag Financial Group |

| 10 | A 32.4% control premium is based median control premium from the Mergerstat database for SIC 8742 – Medical, Dental, and Hospital Equipment and Supplies. |

A-8

Table of Contents

Relevant Court Cases

Cammer v. Bloom

In the Cammer v. Bloom opinion, five factors are presented that determine whether the market for a security is efficient. These include the following:

| 1. | Trading volume; |

| 2. | Coverage by securities analysts; |

| 3. | Number of market makers; |

| 4. | Eligibility for S-3 registration; and |

| 5. | Empirical evidence that the security price reacts to new, company-specific information |

In the case of Fuse, none of these factors were present, indicating that the market for the Registrant’s stock was inefficient.

Krogman v. Sterritt

The Krogman v. Sterritt case identified three additional factors that are also indicative of market efficiency (these factors have since been considered by other courts, including in the Second Circuit regarding Petrobras). These include the following:

| 1. | The company’s market capitalization; |

| 2. | The security’s float; and |

| 3. | The typical bid-ask spread for the security |

As discussed previously, the Registrant had a small market capitalization and float and a large bid-ask spread. This also indicated that the market for Fuse’s security was inefficient.

A-9

Table of Contents

Conclusion

ValueScope reviewed the value characteristics of Fuse prior to the 2017 Reverse Acquisition and concluded that the trading price was not indicative of the fundamentals of the Registrant. Fuse was part of an inactive and inefficient market with no orderly transactions, and the share price did not represent an accurate intrinsic value of the Registrant.

ValueScope found the following factors led to this conclusion:

| 1. | the Registrant was traded on what is commonly known to be the most speculative tier of the three (3) over-the-counter(“OTC”) marketplaces; |

| 2. | the Registrant maintained historically very low net asset value; |

| 3. | the Registrant historically has had a small number of shareholders; |

| 4. | the Registrant’s stock historically has had a large bid-ask spread; |

| 5. | historically there was a low daily dollar volume of trades of the Registrant’s stock; |

| 6. | the Registrant’s stock has not had any published research or analysis; |

| 7. | no reporting institutions or institutional investors have been active in acquiring shares. |

ASC 820-10-35-54C through 35-54H support ValueScope’s conclusion that Fuse did not have an active trading market prior to the Closing Date. Furthermore, relevant court cases such as Cammer v. Bloom and Krogman v. Sterritt provide their own factors for market efficiency. Fuse’s stock, as of the Closing Date of the 2017 Reverse Acquisition of CPM, met none of these factors, thereby backing up our own findings. The Registrant’s Independent Committee of the Board negotiated a price per share of $0.20. ValueScope’s valuation of Fuse’s stock was deemed the most indicative measure of intrinsic value and affirmed that the $0.20 negotiated share price of Fuse was fair.

A-10

Table of Contents

EXHIBIT B

ANALYSIS OF CONTINGENT CONSIDERATION IN CONNECTION WITH THE CPM ACQUISITION

(attached)

B-1

Table of Contents

EXHIBIT B

ANALYSIS OF CONTINGENT CONSIDERATION IN CONNECTION WITH THE CPM ACQUISITION

In analyzing the contingent consideration treatment of the CPM Acquisition, we have relied upon ASC 505-55-24 & 25, “Arrangements for Contingent Payments to Employees or Selling Shareholders”

I. ASC 505-55-24: Whether arrangements for contingent payments to employees or selling shareholders are contingent consideration in the business combination or are separate transactions depends on the nature of the arrangements. Understanding the reasons why the acquisition agreement includes a provision for contingent payments, who initiated the arrangement, and when the parties entered into the arrangement may be helpful in assessing the nature of the arrangement.

Fuse Response: Our objective for structuring the CPM Acquisition as it was structured was to provide a mechanism that allowed payment of the full value (if such full value was indeed realized) over time while avoiding high interest cost associated with long-term debt and the correlating impact to working capital. We considered a traditional seller note payable and concluded such structure would likely overly-burden the successor entity with a high interest expense along with constraints on liquidity. As such, the negotiated substance and intent of the earn-out arrangement is to defer a portion of the purchase price and tie such deferred payment to continued performance.

I. ASC 505-55-25: If it is not clear whether an arrangement for payments to employees or selling shareholders is part of the exchange for the acquiree or is a transaction separate from the business combination, the acquirer should consider the following indicators:

a. Continuing employment. The terms of continuing employment by the selling shareholders who become key employees may be an indicator of the substance of a contingent consideration arrangement. The relevant terms of continuing employment may be included in an employment agreement, acquisition agreement, or some other document. A contingent consideration arrangement in which the payments are automatically forfeited if employment terminates is compensation for post combination services. Arrangements in which the contingent payments are not affected by employment termination may indicate that the contingent payments are additional consideration rather than compensation.

Fuse Response: The payment of earn-out liability is not subject to the continued employment of Mr. Brooks, and thus the earn-out payout, when made in future periods, should not be accounted as compensation payments but, as payment of contingent consideration. Mr. Brooks employment is independent upon earn-out payments and not contingent on continued employment.

B-2

Table of Contents

b. Duration of continuing employment. If the period of required employment coincides with or is longer than the contingent payment period, that fact may indicate that the contingent payments are, in substance, compensation. Fuse Response: This is not applicable.

Fuse Response: The payments required under the earn-out arrangement are not predicated upon the continued employment of Mr. Brooks by the Registrant as further evidenced by the lack of an employment agreement between Mr. Brooks and the Registrant. The earn-out payments become due when Earnings Before Interest, Taxes, Depreciation, and Amortization (“EBITDA”) for year prior to the CPM Acquisition is met or exceeded in future years, irrespective of whether Mr. Brooks is an employee of the Registrant or not. We believe this fact supports our accounting treatment conclusion that the earn-out arrangement is appropriate to be considered as a part of the purchase price associated with the Reverse Acquisition of CPM under common control.

c. Level of compensation. Situations in which employee compensation other than the contingent payments is at a reasonable level in comparison to that of other key employees in the combined entity may indicate that the contingent payments are additional consideration rather than compensation.

Fuse Response: We evaluated Mr. Brooks’ base compensation before earn-out payments and concluded it is commensurate with his business experience and expertise, customer relationships and his overall skillsets. Since Mr. Brooks’ compensation is at a reasonable level in comparison to other key employees, the earn-out payments represent consideration associated with the CPM Acquisition rather than compensation for services.

d. Incremental payments to employees. If selling shareholders who do not become employees receive lower contingent payments on a per-share basis than the selling shareholders who become employees of the combined entity, that fact may indicate that the incremental amount of contingent payments to the selling shareholders who become employees is compensation.

Fuse Response: We do not believe that this subsection of the accounting standards codification is applicable in determining the accounting treatment for the earn-out arrangement because Mr. Brooks was the sole owner of CPM, and as such, there were no other selling shareholders in the transaction.

e. Number of shares owned. The relative number of shares owned by the selling shareholders who remain as key employees may be an indicator of the substance of the contingent consideration arrangement. For example, if the selling shareholders who owned substantially all the shares in the acquiree continue as key employees, that fact may indicate that the arrangement is, in substance, a profit-sharing arrangement intended to provide compensation for post combination services. Alternatively, if selling shareholders who continue as key employees owned only a small number of shares of the acquiree and all selling shareholders receive the same amount of contingent consideration on a per-share basis, that fact may indicate that the contingent payments are additional consideration. The pre-acquisition ownership interests held by parties related to selling shareholders who continue as key employees, such as family members, also should be considered.

B-3

Table of Contents

Fuse Response: We have concluded this subsection of the accounting standards codification is not applicable in determining the accounting treatment for the earn-out arrangement because Mr. Brooks was the sole owner of CPM and therefore no other selling shareholders participated in the transaction. There are no other selling shareholders.

f. Linkage to the valuation. If the initial consideration transferred at the acquisition date is based on the low end of a range established in the valuation of the acquiree and the contingent formula relates to that valuation approach, that fact may suggest that the contingent payments are additional consideration. Alternatively, if the contingent payment formula is consistent with prior profit-sharing arrangements, that fact may suggest that the substance of the arrangement is to provide compensation.

Fuse Response: The CPM purchase consideration consisted of the issuance of Fuse’s Company stock ($10,000,000 (50 million shares at $0.20)) which is the initial consideration. The initial consideration is deemed to be at the low end of the range of the valuation. The remainder consideration to be paid-out in future years depending on subsequent earnings ($16 million initial earn-out + $10 million bonus earn-out) is a maximum of $26 million of undiscounted payments. This indicates that the earn-out payments are additional purchase consideration based on the value of CPM.

Fuse Response: No, as no other history of profit sharing arrangements. Further, a long-term consideration payout structure is consistent with management’s objective to provide for long-term successful results.

g. Formula for determining consideration. The formula used to determine the contingent payment may be helpful in assessing the substance of the arrangement. For example, if a contingent payment is determined on the basis of a multiple of earnings, that might suggest that the obligation is contingent consideration in the business combination and that the formula is intended to establish or verify the fair value of the acquiree. In contrast, a contingent payment that is a specified percentage of earnings might suggest that the obligation to employees is a profit-sharing arrangement to compensate employees for services rendered.

Fuse Response: The consideration, which includes the contingent consideration, was based on an independent valuation that utilized both an income approach and market approach in determining the fair value of CPM.

Fuse Response: The amounts payable under the earn-out arrangement are based on the financial performance of the Registrant in the period after the acquisition. The earn-out arrangement is wholly contingent and therefore, potentially no amounts will be paid out under the earn-out arrangement if the agreed upon financial and other targets specified in the related agreement are not met.

B-4

Table of Contents

Fuse Response: The Registrant’s significant objective for structuring the acquisition of CPM, was to provide characteristics of purchase price pay-outs, which closely align with the Registrant’s projected liquidity, results of operations. This structure would also minimize high interest cost associated with long-term debt, and the correlating impact to working capital. We considered a traditional seller note payable and concluded such structure would likely overly-burden the successor entity with a high interest expense along with constraints on liquidity. As such, the negotiated substance and intent of the earn-out arrangement is to defer a portion of the purchase price.

B-5

Table of Contents

h. Other agreements and issues. The terms of other arrangements with selling shareholders (such as noncompete agreements) and the income tax treatment of contingent payments may indicate that contingent payments are attributable to something other than consideration for the acquiree. For example, in connection with the acquisition, the acquirer might enter into a property lease arrangement with a significant selling shareholder. If the lease payments specified in the lease contract are significantly below market, some or all the contingent payments to the lessor (the selling shareholder) required by a separate arrangement for contingent payments might be, in substance, payments for the use of the leased property that the acquirer should recognize separately in its post combination financial statements. In contrast, if the lease contract specifies lease payments that are consistent with market terms for the leased property, the arrangement for contingent payments to the selling shareholder may be contingent consideration in the business combination.

Fuse Response: There are no noncompete agreements, executory contracts or consulting contracts. The real property lease agreement was evaluated to be on market terms. While we have and continue to have business transactions with entities owned and controlled by Mr. Brooks, as disclosed in our related party transactions footnote at Note 11 to the consolidated financial statements for the years ended December 31, 2017 and 2016. We believe these transactions have been and will continue to be conducted on terms and conditions substantially commensurate with market conditions. Therefore, we concluded these arrangements between the Registrant and Mr. Brooks are not below market terms and therefore not indicative that the contingent earn-out payments are a component of other arrangements disclosed in Note 11 to the financial statements.

B-6

Table of Contents

EXHIBIT C

FAIRNESS OPINION OF VALUESCOPE

(attached)

C-1

Table of Contents

EXHIBIT C

FAIRNESS OPINION

RELATED TO THE ACQUISITION OF

CPM MEDICAL CONSULTANTS, LLC BY

FUSE MEDICAL, INC.

DECEMBER 12, 2017

Prepared for:

Board of Directors

Fuse Medical, Inc.

C-2

Table of Contents

December 12, 2017

Board of Directors

Fuse Medical, Inc.

1565 North Central Expressway

Suite 220

Richardson, TX 75080

Dear Members of the Board:

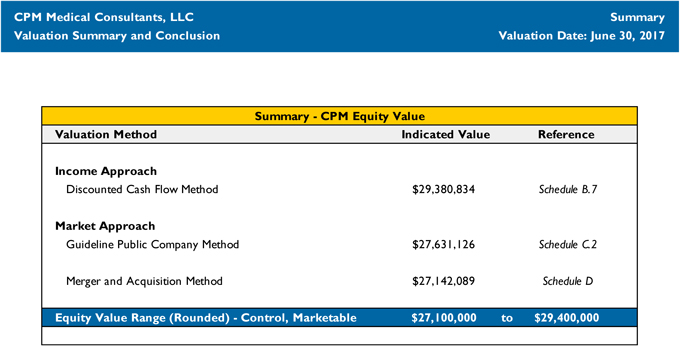

ValueScope, Inc. has been engaged to advise Fuse Medical, Inc. (“Fuse”) and its Board of Directors as to the fairness of the consideration to be paid by Fuse for the purchase of all of the stock of CPM Medical Consultants, LLC (“CPM”) as outlined in Fuse’s Purchase Agreement (the “Purchase Agreement”) dated December 11, 2017. Our analysis is based on available financial information as of June 30, 2017 (the “Valuation Date”).

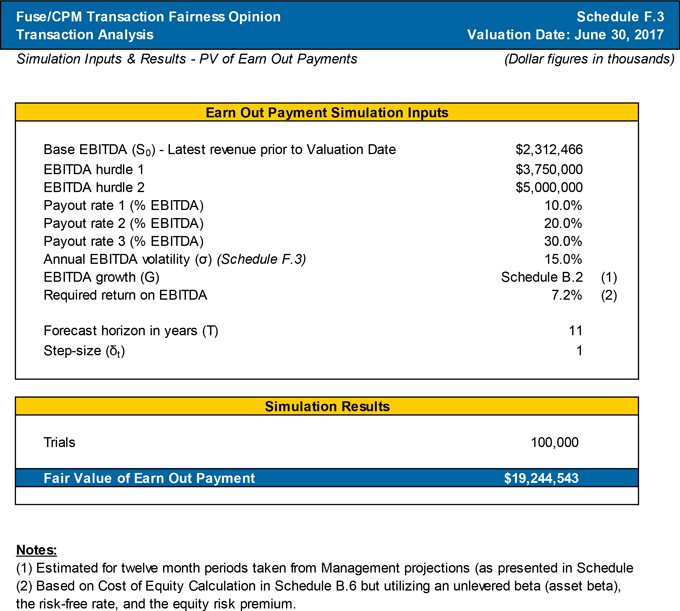

Based on a review of the Purchase Agreement, it is our understanding that the total possible consideration for the transaction is equal to $36,000,000 over multiple future payments. These payments will consist of $10,000,000 worth of Fuse membership interests at closing (the “Equity Consideration”), ten possible earn out payments of $1,600,000 beginning on March 31, 2019 (the “Initial Earn Out Payments”), and ten potential bonus earn out payments equal up to $10,000,000 total (the “Bonus Earn Out Payments”).

Our opinion is based on a review of publicly available business and financial information relating to Fuse. We have also reviewed internal financial and operating information related to CPM, including financial forecasts prepared by CPM’s management (the “Management”).

This opinion is based on financial analyses prepared in accordance with generally accepted valuation standards. These procedures included substantive valuation tests that we considered necessary and appropriate under the circumstances.

We are not acting as the financial advisor to CPM or to Fuse or its shareholders in connection with this acquisition. It is understood that this letter is for the use of the Board of Directors and shareholders of Fuse and may be quoted, referred to, in whole or in part, in Fuse’s proxy statement. We understand that this letter may be filed with the Securities and Exchange Commission (SEC) by Fuse as part of Fuse’s Information Statement. This letter is not to be used with any other document in connection with the proposed merger, without the express written consent of ValueScope, Inc.

| VALUESCOPE | C-3 |

Table of Contents

Our analyses included, but were not necessarily limited to, the following procedures:

| • | A review of the Purchase Ageement dated December 11, 2017 to purchase all of the Membership Units of CPM Medical Consultants, LLC from NC 143 Family Holdings, LP by Fuse Medical, Inc. |

| • | A review of Fuse’s publicly available financial statements for the fiscal years ended December 31, 2013 through December 31, 2016 and the trailing twelve-month period ended June 30, 2017. |

| • | A review of Management’s projected income statements for CPM for the period 2017 through 2021. |

| • | A review of information relating to CPM’s industry and similar companies. |

| • | Discussions with Management regarding the historical and projected operating performance of CPM. |

| • | Discussions with Management regarding CPM’s industry with respect to guideline companies and transactions. |

| • | A review of publicly available historical and financial information related to Fuse. |

| • | A review of Fuse’s recent trading activity on the Over-the-Counter Bulletin Board quotation service. |

| • | A review of pricing data of comparable guideline companies and industry transactions existing as of the Valuation Date. |

| • | A review of the Fuse’s capital table. |

We have not independently verified any of the foregoing information and have relied upon its completeness and accuracy in all material aspects. With respect to the financial forecasts, we have assumed that they have been reasonably prepared on a basis reflecting the best currently available estimates of Management as to the expected financial performance of CPM.

Based upon and subject to the foregoing, including the various assumptions and limitations as set forth herein, it is our opinion that the consideration to be paid by Fuse for the outstanding stock of CPM as outlined in the Purchase Agreement is FAIR to the shareholders of Fuse from a financial point of view.

| VALUESCOPE | C-4 |

Table of Contents

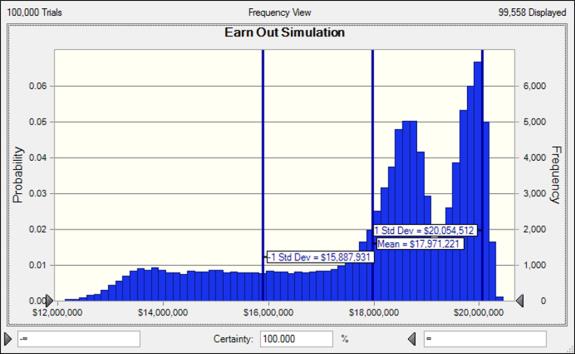

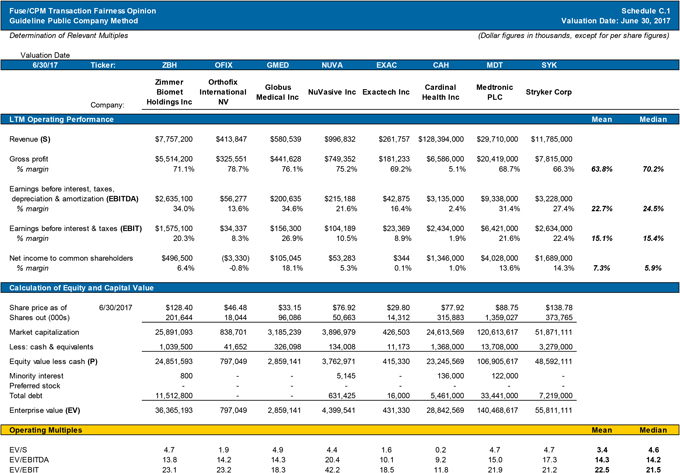

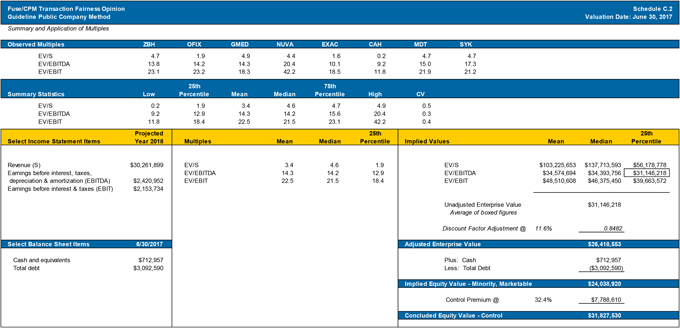

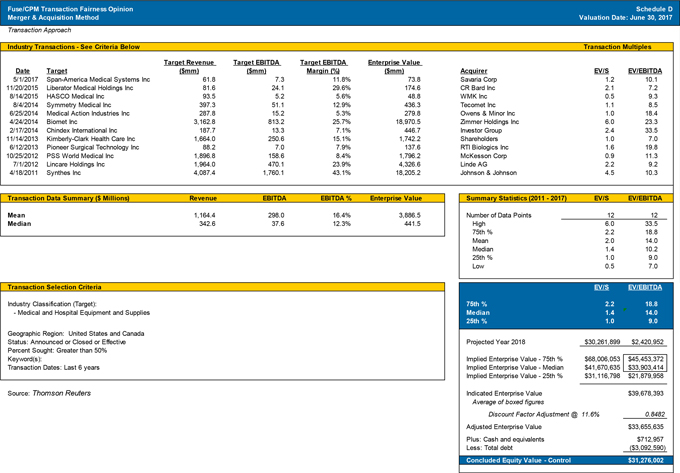

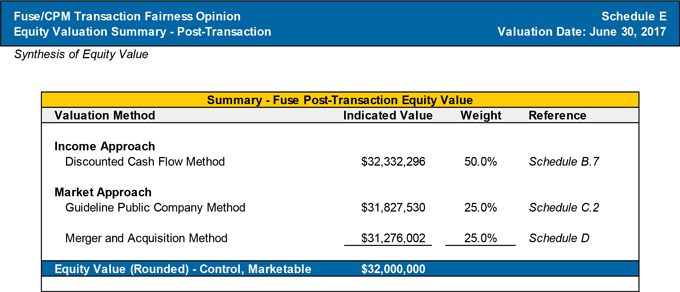

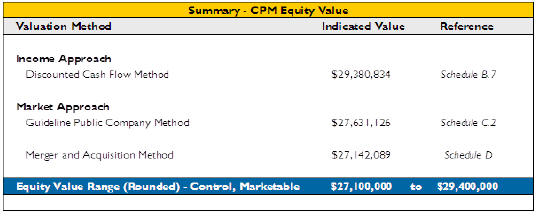

Our value calculations are presented in the Summary Schedule and in the tables below.

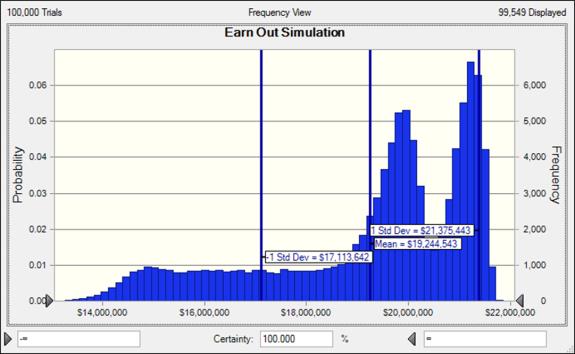

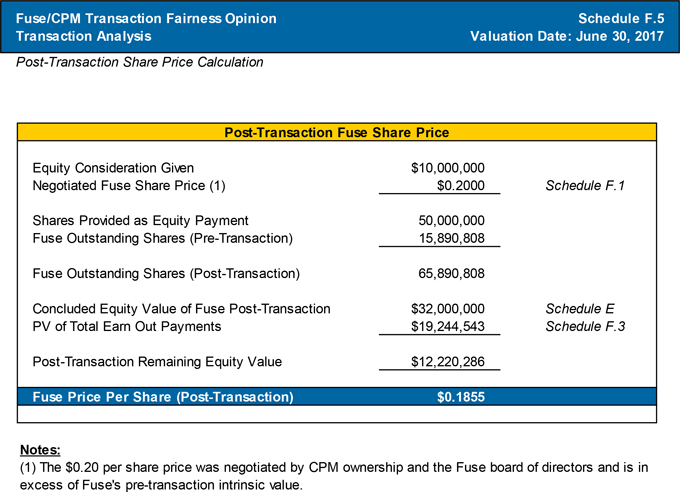

Pre-Transaction Fuse Share Price Cost Approach Fuse Total Asset Value $718,959 Schedule A.2 Public Shell Value $1,000,000 Total Fuse Intrinsic Value $1,718,959 Fuse Outstanding Shares (Pre-Transaction) 15,890,808 Fuse Price Per Share (Cost Approach) $0.1082 Market Approach Fuse Price Per Share (Initial Share Purchase) $0.0800 Plus: Control Premium @ 32.4% $0.0259 Schedule F.2 Fuse Price Per Share (Market Approach) $0.1059 Fuse Price Per Share (Pre-Transaction) $0.1100 Post-Transaction Fuse Share Price Equity Consideration Given $10,000,000 Negotiated Fuse Share Price $0.2000 Schedule F.1 Shares Provided as Equity Payment 50,000,000 Fuse Outstanding Shares (Pre-Transaction) 15,890,808 Fuse Outstanding Shares (Post-Transaction) 65,890,808 Concluded Equity Value of Fuse Post-Transaction $32,000,000 Schedule E PV of Total Earn Out Payments $19,244,543 Schedule F.3 Post-Transaction Remaining Equity Value $12,220,286 Fuse Price Per Share (Post-Transaction) $0.1855

| VALUESCOPE | C-5 |

Table of Contents

We are independent of Fuse and CPM and have no current or prospective economic interest in Fuse’s shares that are the subject of this opinion. Our fee for this opinion was in no way influenced by our conclusion.

Respectfully submitted,

ValueScope, Inc.

Steven C. Hastings, CPA/ABV/CFF, CGMA, ASA, CVA

Principal

| VALUESCOPE | C-6 |

Table of Contents

APPENDIX A—FUSE OFFER

Purchase Price

Fuse Medical, Inc. (the “Buyer”) will purchase the membership interest units (the “Securities”) of CPM from NC 143 Family Holdings, LP (the “Seller”) in the amount of $10,000,000 to be paid in membership interests (“Membership Interest”) and up to $26,000,000 based on the future financial performance of the Buyer and Seller following the closing of the transaction (the “Transaction”).

Equity Component

The purchase price for the Securities of CPM would be paid in part by issuance of $10,000,000 worth of Membership Interests valued at $0.20 per Membership Interest at the closing of the Transaction (the “Closing Date Purchase Price”). The $0.20 price was negotiated by CPM’s ownership and the Buyer and is in excess of Fuse’s pre-transaction intrinsic value.

Proposed Structure of the Earn Outs

Additionally, the Seller is entitled to receive additional consideration based on the future earnings before interest, taxes, depreciation and amortization and adjusted for charges to earnings taken as a result of compensation expense for equity issuances (“Adjusted EBITDA”) of the buyer and seller or an earn out payment. There are two structured earn outs as part of the sales price of the Transaction.

Initial Earn Out

The Seller shall receive an earn out payment equal to $16,000,000 (“Initial Earn Out Amount”) if Adjusted EBITDA for the 2018 calendar year is equal to or greater than the 2017 calendar year Adjusted EBITDA (“2017 Adjusted EBITDA Hurdle”), which if earned, shall be paid in ten equal payments beginning March 31, 2019.

If the 2017 Adjusted EBITDA Hurdle is not met in the calendar year 2018 or if the 2019 calendar year Adjusted EBITDA is equal to or greater than the 2017 Adjusted EBITDA Hurdle, Seller shall receive a payment equal to $15,000,000, which if earned, shall be paid in nine equal installments.

The Seller will be able to earn a reducing share of the Initial Earn out Amount. If not earned in the prior year, each year thereafter upon meeting or exceeding the 2017 EBITDA Hurdle. This is provided that each year that elapses, the Initial Earn Out Amount shall be decreased by $1,000,000.

| VALUESCOPE | C-7 |

Table of Contents

Bonus Earn Out

The Seller shall also receive earn out payment(s) based on hurdles from 2018 through and including 2034 up to an amount equal to $10,000,000 (“Bonus Earn Out”). Based on the following structure:

(i) If the combined Adjusted EBITDA of the Buyer and Seller is less than three million, seven hundred fifty thousand dollars ($3,750,000) from January 1 of each year through that December 31 (for all years 2018 through and including 2034), each earn out payment will be equal to ten percent (10%) of the Adjusted EBITDA amount.

(ii) If the combined Adjusted EBITDA of Buyer and Seller is equal to or greater than three million, seven hundred fifty thousand dollars ($3,750,000) from January 1 of each year through that December 31 (for all years 2018 through and including 2034), each earn out payment will be equal to twenty percent (20%) of the Adjusted EBITDA amount.

(iii) If the combined Adjusted EBITDA of Buyer and Seller is equal to or greater than five million dollars ($5,000,000) from January 1 of each year through that December 31 (for all years 2018 through and including 2034), Seller shall receive an amount equal to thirty percent (30%) of the EBITDA Amount up to the Earn Out Amount, not to exceed the Earn Out Amount.

Items (i), (ii), (iii) are summarized below:

| Hurdle EBITDA |

Earn Out Payments | |||

| < $3,750,000 |

10% of EBITDA | |||

| ³ $3,750,000 and < $5,000,000 |

20% of EBITDA | |||

| ³ $5,000,000 |

30% of EBITDA | |||

Change of Control

A “Change of Control” shall mean at any time that Mark Brooks (or his affiliate) does not beneficially own at least 50% of the common stock of Buyer. In the event of a Change of Control, Buyer shall grant to Seller a promissory note bearing interest at a rate of 3% per annum, payable in equal monthly installments over a term of ten years as follows:

| VALUESCOPE | C-8 |

Table of Contents

Initial Earnout Amount plus the prorated Bonus Earnout Amount minus all earn out payments paid to Seller prior to the Change of Control.

The Pro-Rated Bonus Earnout Amount shall be calculated as follows:

| = |

Buyer Enterprise Value on a Change of Control - $30,000,000 |

|||

| $20,000,000 |

Buyer Enterprise Value on a Change of Control shall be calculated as follows:

= EBITDA as of most recent fiscal year end ×10

| VALUESCOPE | C-9 |

Table of Contents

Buyer has calculated the Closing Date Purchase Price on the basis of information currently known to Buyer and on the assumptions that:

| • | Working capital at the closing of the Transaction is $100,000, calculated in accordance with GAAP consistently applied. The Closing Date Purchase Price payable at closing would be increased or decreased based on changes in the Company’s working capital, on a dollar-for-dollar basis; and |

| • | No material negative information will arise in the course of due diligence. |

Buyer and Seller shall mutually agree on the allocation of the Closing Date Purchase Price, provided, however, Seller shall determine the allocation between personal goodwill and corporate goodwill and the allocation to any non-competition provision shall be $50,000.

Working Capital Adjustment

Working capital at the closing of the Transaction is $100,000, calculated in accordance with GAAP consistently applied. The Closing Date Purchase Price payable at closing would be increased or decreased based on changes in the Company’s working capital, on a dollar-for-dollar basis

Additional Consideration

Buyer and Seller shall mutually agree on the allocation of the Closing Date Purchase Price, provided, however, Seller shall determine the allocation between personal goodwill and corporate goodwill and the allocation to any non-competition provision shall be $50,000.

| VALUESCOPE | C-10 |

Table of Contents

APPENDIX B—VALUATION ANALYSIS

Description of the Transaction

In the Purchase Agreement (the “Purchase Agreement”) dated December 11, 2017, Fuse Medical, Inc. (“Fuse”) offered to acquire CPM Medical Consultants, LLC in exchange for a total possible consideration equal to $36,000,000 over multiple future payments. These payments will consist of $10,000,000 worth of Fuse shares at closing (the “Equity Consideration”), ten possible earn out payments of totaling a maximum of $16,000,000 (the “Initial Earn Out Payments”), and potential bonus earn out payments equal up to $10,000,000 total (the “Bonus Earn Out Payments”).

CPM Medical Consultants, LLC (“CPM”)

CPM Medical Consultants, LLC is a Texas limited liability company and was founded by and wholly owned by Mark Brooks. CPM is believed to be the largest U.S. privately-held stocking distributor of orthopedic implants for spines, total joints, sports medicine, trauma, and feet and ankles. CPM also provides an array of related surgical products which include regenerative tissue to support orthopedic surgeries and wound care.

CPM primarily operates as a stocking distributor, whereby CPM purchases product directly from manufacturers pursuant to contracts that are volume based. Certain manufacturer contracts contain exclusivity provisions allowing for CPM to be the sole distributor for the manufacturer in certain hospitals, counties, or states. CPM is a Food & Drug Administration (“FDA”) approved tissue storage and shipping facility. Headquartered in Richardson, Texas, CPM has customers and distributors in over 16 states.

Fuse Medical, Inc. (“Fuse”)3

Fuse Medical, Inc., together with its subsidiaries, distributes healthcare products and supplies to ambulatory surgical centers and hospitals, and physicians primarily in the United States. It offers plates and screws for internal fixation of small bone fractures; human allografts of bone chips and tendons; regenerative amniotic tissues and fluids; osteobiologics; and other related surgical products for use in various surgical procedures.

Fuse was founded in 2012 and is headquartered in Fort Worth, Texas.

| 3 | Fuse business description provided by Capital IQ |

| VALUESCOPE | C-11 |

Table of Contents

Overview of the U.S. Economy

According to the third estimate released by the Bureau of Economic Analysis (BEA), the U.S. economy increased in the second quarter of 2017, with real gross domestic product (GDP) increasing at an annual rate of 3.1%. In the first quarter, real GDP increased by 1.2%. The increase in real GDP in the second quarter reflected positive contributions from PCE, nonresidential fixed investment, exports, federal government spending, and private inventory investment that were partly offset by negative contributions from residential fixed investment and state and local government spending. Imports, which are a subtraction in the calculation of GDP, increased.4

Forecasters surveyed by the Federal Reserve Bank of Philadelphia projected a 2.6% annual real growth rate for this quarter and 2.3% next quarter. The forecasters predict that real GDP will grow 2.1% in 2017, 2.4% in 2018, 2.2% in 2019, and 2.0% in 2020. The forecasts for 2017, 2018, and 2020 are lower than previous estimates while the forecast for 2019 is higher than previous estimates.5

Employment

Nonfarm payroll employment, according to the Bureau of Labor Statistics (BLS), rose by 156,000 in August 2017. The unemployment rate in August 2017 was 4.4%. The BLS reported job gains in manufacturing, construction, professional services, health care, and mining.6

Forecasters surveyed by the Federal Reserve Bank of Philadelphia predicted that the unemployment rate will average 4.4% in 2017, 4.2% in 2018, 4.3% in 2019, and 4.3% in 2020.7

| 4 | U.S. Department of Commerce, Bureau of Economic Analysis, Gross Domestic Product: Second Quarter 2017 (Third Estimate), September 28, 2017 |

| 5 | Federal Reserve Bank of Philadelphia, Third Quarter 2017 Survey of Professional Forecasters, August 11, 2017 |

| 6 | United States Department of Labor, Bureau of Labor Statistics, The Employment Situation: August 2017, September 1, 2017 |

| 7 | Federal Reserve Bank of Philadelphia, Third Quarter 2017 Survey of Professional Forecasters, August 11, 2017 |

| VALUESCOPE | C-12 |

Table of Contents

Inflation

According to the BLS, inflation, as measured by changes in the Consumer Price Index for All Urban Consumers (CPI-U), increased 0.4% in August 2017 on a seasonally adjusted basis. Over the previous 12 months, the all items index increased 1.9% before seasonal adjustment. August’s increase was a larger rise than the 1.7% increase for the twelve months ending July 2017. The index for all items less food and energy remained at 1.7% for the fourth month in a row. The energy index rose 6.4% over the last year, while the food index increased 1.1%.8

According to forecasters surveyed by the Federal Reserve Bank of Philadelphia, inflation is expected to average 1.7% in 2017, 2.2% in 2018, and 2.3% in 2019. Over the next ten years, forecasters expect CPI inflation to average 2.25% annually.9

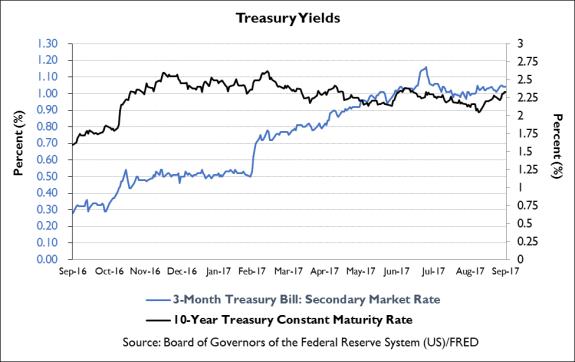

Interest Rates

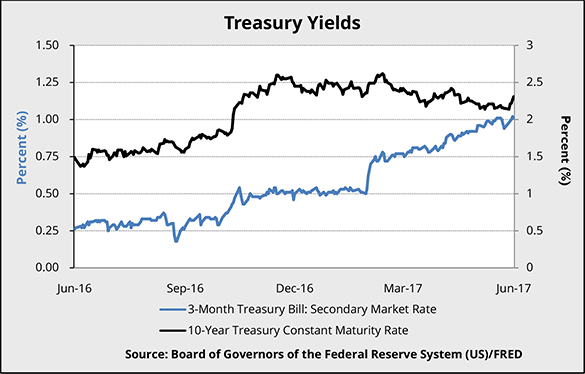

The interest rate on the three-month Treasury bill increased from 0.26% as of June 30, 2016 to 1.01% as of June 30, 2017.10 The interest rate on the ten-year Treasury note increased from 1.49% as of June 30, 2016 to 2.31% as of June 30, 2017.11

Source: Federal Reserve Economic Data

As of September 30, 2017, the yields on Moody’s Aaa-rated corporate bonds and Baa-rated corporate bonds were 3.62% and 4.33%, respectively.12

| 8 | United States Department of Labor, Bureau of Labor Statistics, Consumer Price Index: August 2017, September 14, 2017 |

| 9 | Federal Reserve Bank of Philadelphia, Third Quarter 2017 Survey of Professional Forecasters, August 11, 2017 |

| 10 | Federal Reserve Bank of St. Louis, Federal Reserve Economic Data, Series: DTB3, 3-Month Treasury Bill: Secondary Market Rate, last accessed October 31, 2017 |

| 11 | Federal Reserve Bank of St. Louis, Federal Reserve Economic Data, Series: DGS10, 10-Year Treasury Constant Maturity Rate, last accessed October 31, 2017 |

| 12 | Federal Reserve Bank of St. Louis, Federal Reserve Economic Data, Series: DAAA, Moody’s Seasoned Aaa Corporate Bond Yield©, Series: DBAA, Moody’s Seasoned Baa Corporate Bond Yield©, last accessed October 31, 2017 |

| VALUESCOPE | C-13 |

Table of Contents

Corporate Profits

According to the BEA, profits from current production (corporate profits with inventory valuation and capital consumption adjustments) increased $14.4 billion in the second quarter, in contrast to a decrease of $46.2 billion in the first quarter.13

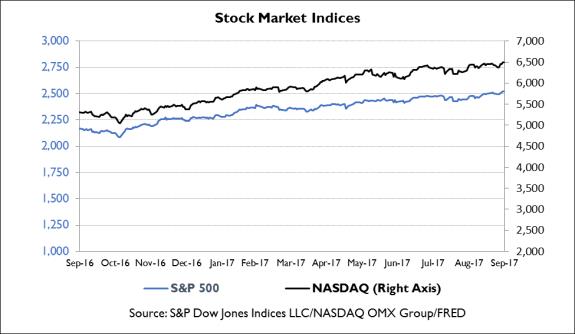

Stock Markets

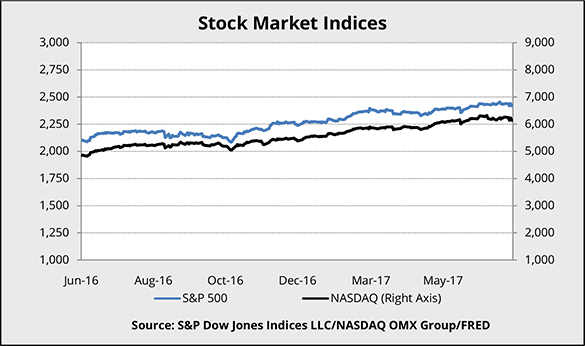

The S&P 500 opened at 2,168.27 on September 30, 2016 and closed higher at 2,519.36 on September 29, 2017. The NASDAQ Composite index opened at 5,312.00 on September 30, 2016 and closed higher at 6,495.96 on September 29, 2017. 14

Source: Federal Reserve Economic Data

Consumer Confidence

The Conference Board reported that the Consumer Confidence Index increased in September 2017 to 120.6.15 The index is based on a survey of consumer perceptions of present economic conditions and expectations of future conditions. The survey is based on a representative sample of 5,000 U.S. households and is considered a leading indicator of future consumer expenditures and economic activity.

| 13 | U.S. Department of Commerce, Bureau of Economic Analysis, Corporate Profits: Second Quarter 2017 (Revised Estimate), September 28, 2017 |

| 14 | Federal Reserve Bank of St. Louis, Federal Reserve Economic Data, Series: SP500, S&P500©, and NASDAQCOM, NASDAQ Composite Index©, last accessed July 14, 2017 |

| 15 | The Conference Board, Consumer Confidence Index, October 31, 2017 |

| VALUESCOPE | C-14 |

Table of Contents

Industry Review16

The medical supplies wholesaling industry (the “Industry”) distributes dental and medical supplies and equipment intended to improve or maintain health. Demand for wholesale activities associated with these products is highly correlated with demand for the products themselves. The median age of the population has risen over the past five years; as a result, the number of age-related nonelective procedures performed in the United States increased as well. Accordingly, the Industry revenue has increased steadily over the five years to 2017.

In particular, demand for medical devices used in elderly care has increased over this period and is expected to continue rising over the next five years. Rising product prices have also supported industry growth. Over the five years to 2017, Industry revenue is expected to increase at an annualized rate of 1.9% to total $193.8 billion, including a 2.3% increase in 2017. Revenue growth began to slow down as the Patient Protection and Affordable Care Act took effect and further regulated the Industry. In addition, as a result of consolidation among medical device manufacturers, wholesalers must take on most increases in input costs, thus limiting their profit margins. However, due to only slight increases in commodity prices, profit margins have grown over the past five years to 6.8% in 2017.

Over the five years to 2022, Industry revenue is projected to grow at an annualized rate of 3.0% to $224.2 billion. Revenue is projected to rise as healthcare providers continue to invest in new equipment to keep up with growing demand for healthcare services. New product development by medical device manufacturers will also contribute to Industry growth by offering new solutions to health issues. Mergers and acquisitions among medical device manufacturers will cause wholesalers to consolidate to maintain negotiating power and meet demands of newly expanded customers. Consolidation will help Industry operators reduce costs, therefore leading to a rise in profit margins.

Products & Markets

Sales of high-priced medical instruments fluctuate substantially from year to year, principally as providers replace aging equipment with newer technologies. However, newly developed high technology electromedical, interventional cardiology and

| 16 | Information for this section taken from IBISWorld Industry Report 42345 – Medical Supplies Wholesaling in the U.S., dated October 2017. |

| VALUESCOPE | C-15 |

Table of Contents

orthopedic products have consistently helped boost growth shipments of wholesale medical devices. These high-technology products have increased as a percentage of total Industry sales due to increased demand by doctors and patients for less-invasive, innovative products that improve the quality of patients’ lives and disease diagnosis and treatment. However, while advanced technology can fluctuate in price, the rest of the Industry is made up of less advanced products. Demand for these types of goods is fairly constant from year to year, because their prices are indirectly determined by patients. Prices for these goods are responsive to patient demographics and major population trends.

Major Markets

The overall healthcare market is characterized by healthcare providers that are consolidating into larger and more sophisticated entities to lower their total costs. Many of these providers have sought to lower total costs by taking advantage of value-added services offered by medical and surgical supply wholesalers. This trend has in turn driven consolidation within the Iindustry due to the competitive advantages that larger operators experience. Such economies of scale include the ability to serve nationwide customers, negotiate prices, buy inventory in large volumes and develop sophisticated technology platforms.

Competitive Structure Benchmarks

Profit

Operating profit, defined as earnings before interest and taxes, represents 6.8% of revenue for the average Industry wholesaler. Over the five years to 2017, profit has increased as a result of rising product prices and mounting demand. However, the 2.3% medical excise tax has cut into margins somewhat, and volume growth has been slightly offset by the negative impact of commodity price fluctuation on the cost of products sold. Despite this, increased healthcare spending has resulted in increased demand for Industry products.

Purchases

As is the case in most wholesaling industries, purchases account for the largest share of an average company’s revenue. The input costs for a particular company depend on the effect of supplier price changes and the impact of changes in inventory mix, but on average, purchases account for 73.3% of Industry revenue. A company’s ability to sustain gross margins partially depends on favorable terms and incentives from suppliers and suppliers’ continuing use of third-party distributors to sell and deliver their products. As an Industry company refines their supplier relationships, the percentage of revenue dedicated to purchases will decrease slightly. Industry operators can also keep

| VALUESCOPE | C-16 |

Table of Contents

purchasing costs down by entering into agreements with group purchasing organizations that negotiate distribution contracts on behalf of their members. Nonetheless, Industry purchase costs have gone up in recent years, due in part to the Patient Protection and Affordable Care Act’s imposition of an excise tax on some Industry-wholesaled medical devices; some upstream manufacturers have incorporated this new cost into the price of their products, thus increasing purchase costs for Industry wholesalers.

Wages

Labor costs account for an estimated 11.7% of revenue. Over the five years to 2017, wage costs have risen as the Industry has increasingly distributed more high-tech products, which require more advanced storage and transportation solutions. To offer wholesaling solutions that cater to these products, Industry operators have hired more highly paid engineers and other specialists to design storage and transport systems to handle these new products.

Other costs

Most Industry participants incur minimal marketing expenses, relying heavily on existing arrangements with suppliers and customers. However, to win new business and retain current clients, participants perform promotional activities such as distributing reminder gifts, note pads and pens. Additionally, Industry operators are increasingly advertising and selling via the internet, reducing the costs spent on other advertising forms. Depreciation expenses account for 0.8% of revenue. As the Industry continues to improve technologically, wholesale operators will look to implement more advanced machinery and equipment and capital costs will likely increase accordingly. Other Industry costs include insurance, repairs and legal fees.

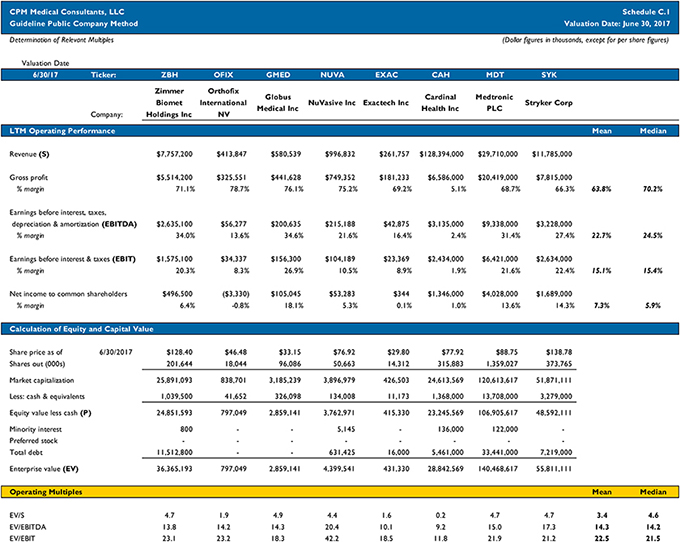

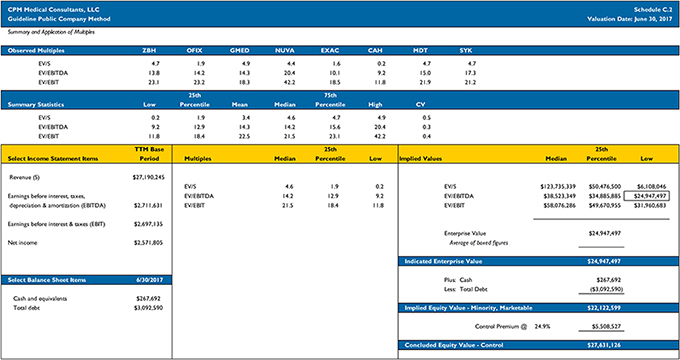

Valuation Methodology

There are three conceptually distinct methodologies that can be applied to determine the fair market value of a business or asset: (a) the income approach, (b) the market approach, and (c) the cost approach. Each of these generally accepted valuation methodologies are considered in the appraisal process and are more or less relevant given the nature of the business and the observable data used to apply the method.

The income and market approaches were utilized to arrive at a conclusion of value for Fuse’s post-transaction equity. The market and cost approaches were utilized to determine the conclusion of a pre-transaction value for Fuse’s equity on a per share basis. The income approach directly measures the value of a company by estimating the expected cash flows derived from the business. The market approach provides an indication of value by observing the market value of guideline companies based on various pricing measures or transactions. The cost approach estimates the value based on consideration of the contribution to value by all the operating assets (tangible and intangible) of the business.

| VALUESCOPE | C-17 |

Table of Contents

Summary of Supporting Schedules

Historical Financial Review of Fuse

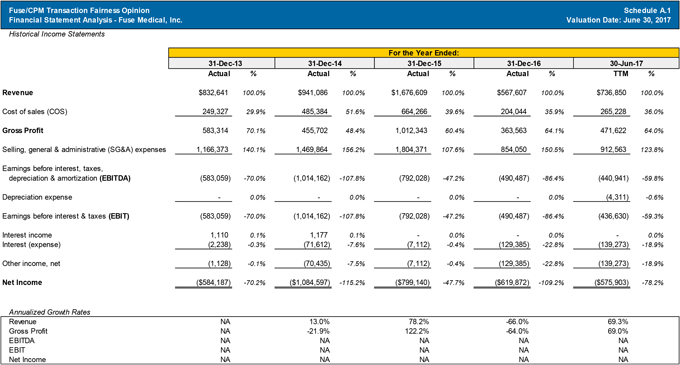

The historical financial information for Fuse for the fiscal years ended December 31, 2013 through December 31, 2016 and the trailing twelve-month period (TTM) ended June 30, 2017 (collectively, the “Review Period”) is presented in Schedules A.1 through A.3. Schedule A.1 presents Fuse’s income statements for the Review Period, as issued in public filings with the Securities and Exchange Commission (SEC).

Fuse’s total revenue increased from $0.833 million at the end of fiscal year 2013 to $1.677 million reported at the end of fiscal year 2015. Fuse’s revenue then decreased to $0.737 million by TTM ending June 30, 2017. Fuse’s SEC filings reported cost of sales of $0.249 million fiscal 2013 and $0.265 million for the TTM 2017. Cost of sales as a percentage of revenue as presented in the SEC filings ranged from 29.9% to 51.6% during the Review Period. Selling, general and administrative expenses (SG&A) decreased during the Review Period, from $1.166 million in 2013 to $0.913 million by TTM 2017. SG&A expense as a percentage of revenue fluctuated between 107.6% and 156.2% during the Review Period.

Fuse reported earnings before interest, taxes, depreciation and amortization (EBITDA) of -$0.583 million in 2013, -$1.014 million in 2014, -$0.792 million in 2015, -$0.490 million in 2016, and -$0.441 million in the TTM 2017. Fuse’s historical income statements are presented in Schedule A.1

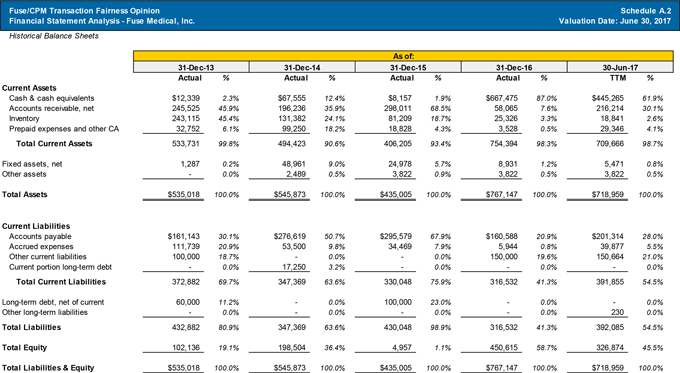

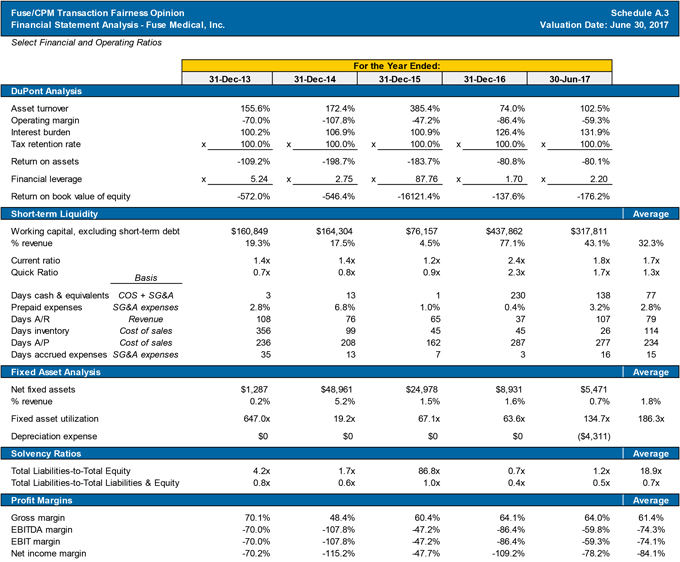

Fuse’s total assets increased from $0.535 million as of December 31, 2013 to $0.719 million as of June 30, 2017. Current assets increased along with total assets from $0.534 million as of December 31, 2013 to $0.710 million as of June 30, 2017. Fuse’s total liabilities stayed relatively flat during the Review Period, ranging from $0.317 million to $0.433 million. Shareholders’ equity increased from $0.102 million as of December 31, 2013 to $0.327 million as of June 30, 2017. Fuse’s historical balance sheets are presented in Schedule A.2. Select financial and operating ratios are presented in Schedule A.3.

Historical Financial Review of CPM

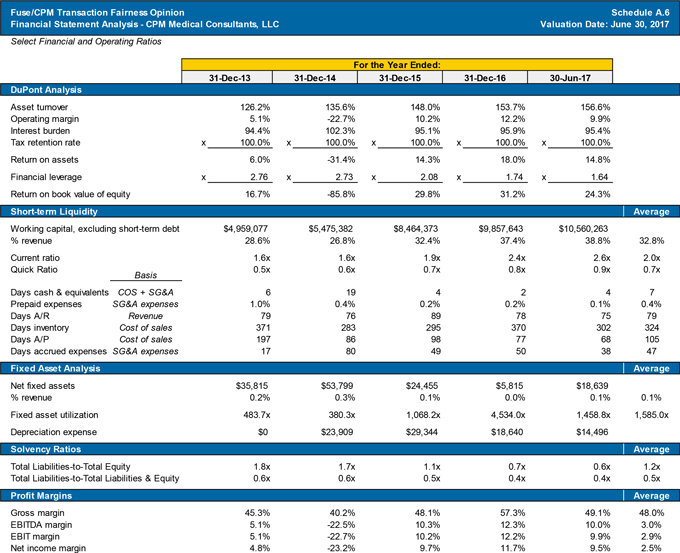

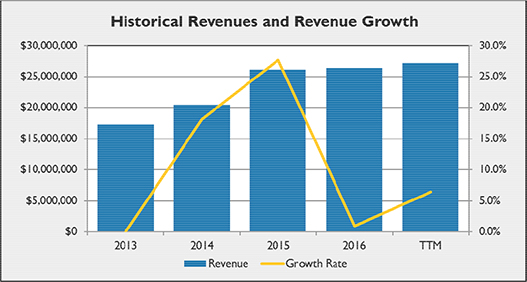

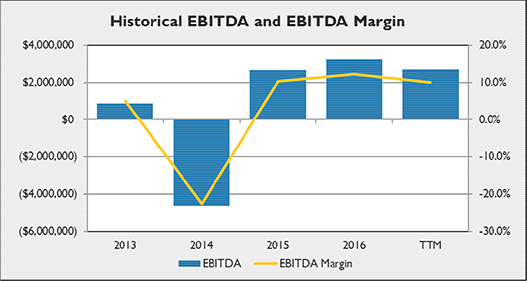

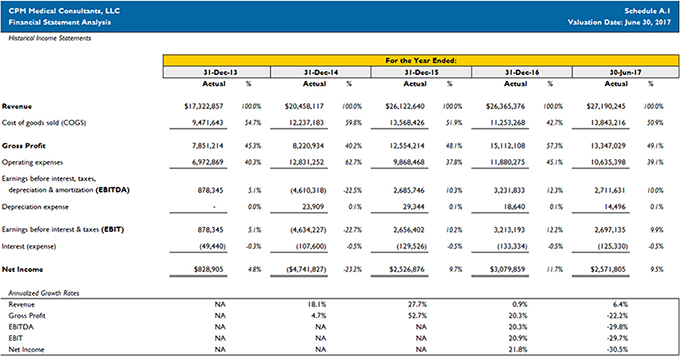

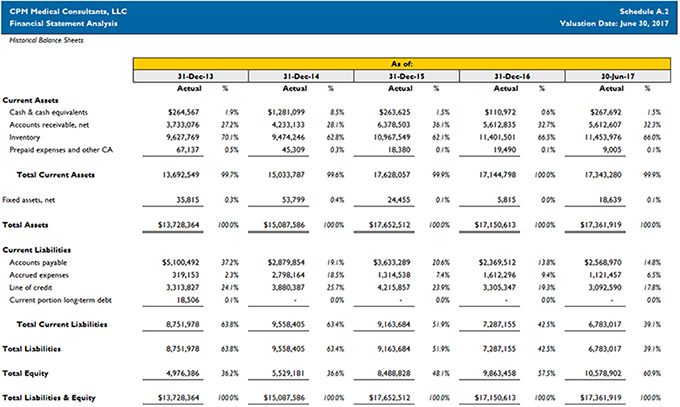

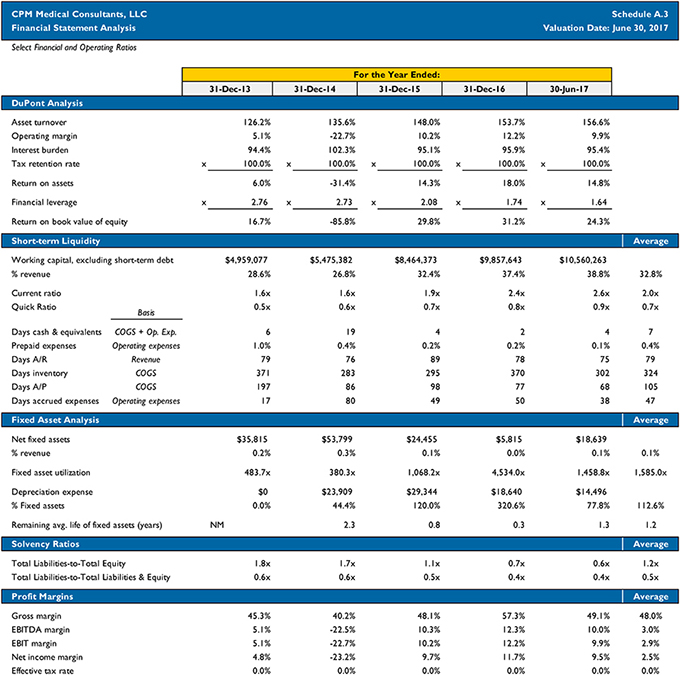

The historical financial information for CPM for the fiscal years ended December 31, 2013 through December 31, 2016 and the trailing twelve-month period (TTM) ended June 30, 2017 (collectively, the “Review Period”) is presented in Schedules A.4 through A.6.

| VALUESCOPE | C-18 |

Table of Contents

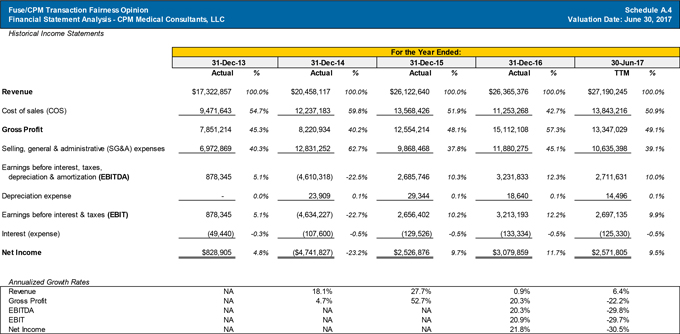

CPM’s total revenue increased during the Review Period, from $17.323 million at the end of fiscal year 2013 to $27.190 million in TTM 2017. CPM’s cost of sales moved with revenues, increasing from $9.472 million in 2013 to $13.843 million by TTM 2017. Cost of sales as a percentage of revenue ranged from 42.7% to 59.8% during the Review Period. Selling, general and administrative expenses (SG&A) increased overall during the Review Period, from $6.973 million in 2013 to $10.635 million by TTM 2017. SG&A expense as a percentage of revenue fluctuated between 37.8% and 62.7% during the Review Period.

CPM reported earnings before interest, taxes, depreciation and amortization (EBITDA) of $0.878 million in 2013, -$4.610 million in 2014, $2.686 million in 2015, $3.232 million in 2016, and $2.712 million in the TTM 2017. CPM’s historical income statements are presented in Schedule A.4.

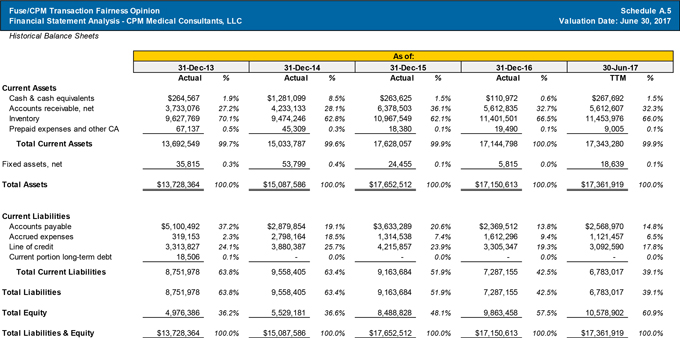

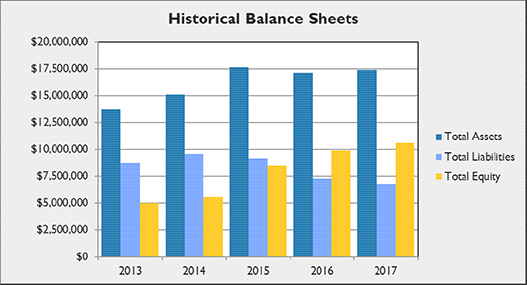

CPM’s total assets increased from $13.728 million as of December 31, 2013 to $17.362 million as of June 30, 2017. Current assets accounted for almost all of total asset throughout the Review Period. CPM’s total liabilities consisted of current liabilities and decreased during the Review Period, from $8.752 million as of December 31, 2013 to $6.783 million as of June 30, 2017. Shareholders’ equity increased from $4.976 million as of December 31, 2013 to $10.579 million as of June 30, 2017. CPM’s historical balance sheets are presented in Schedule A.5. Select financial and operating ratios are presented in Schedule A.6.

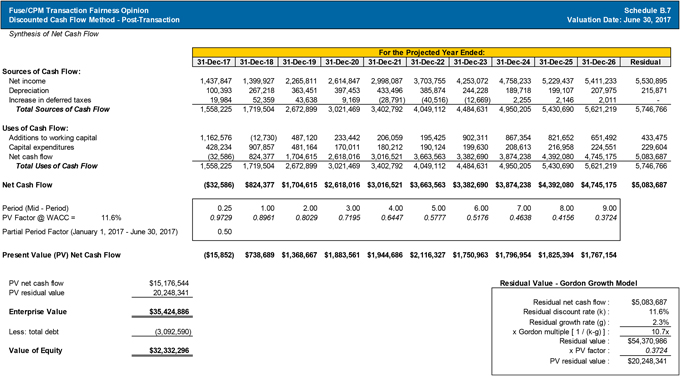

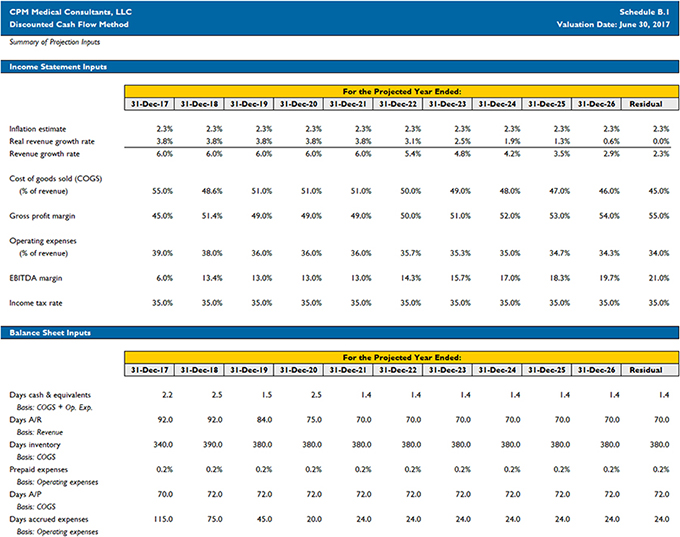

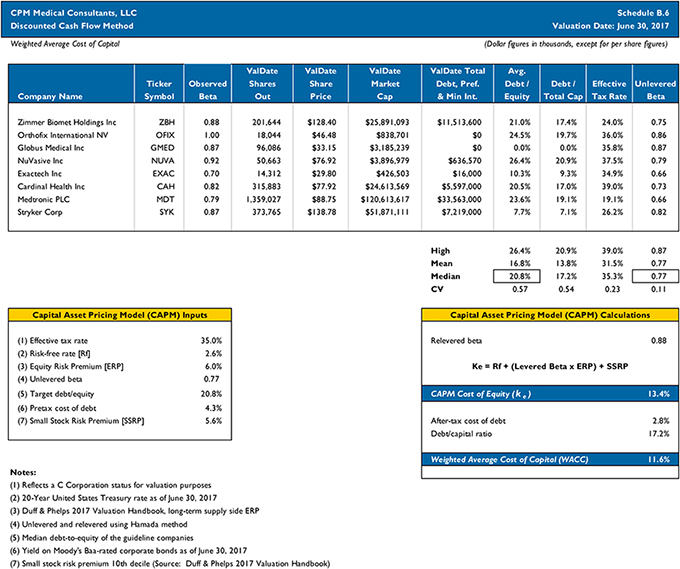

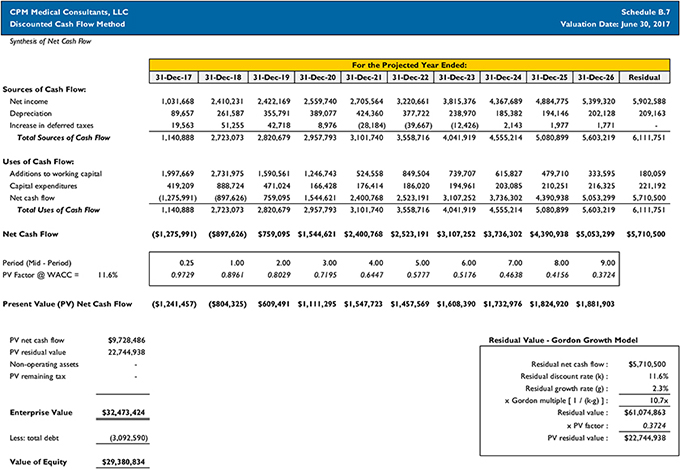

Income Approach – Discounted Cash Flow Model

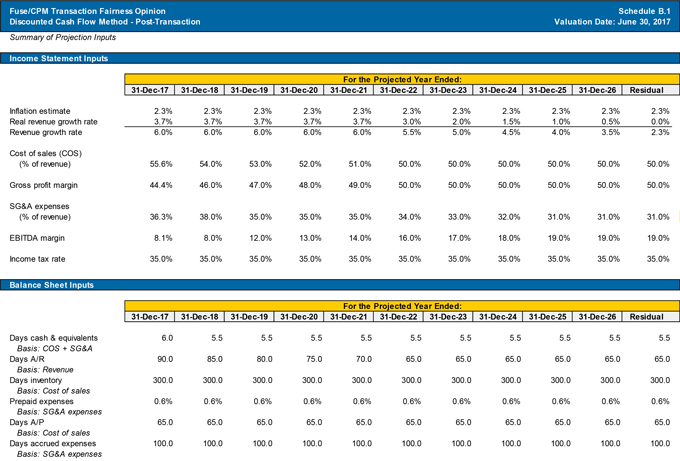

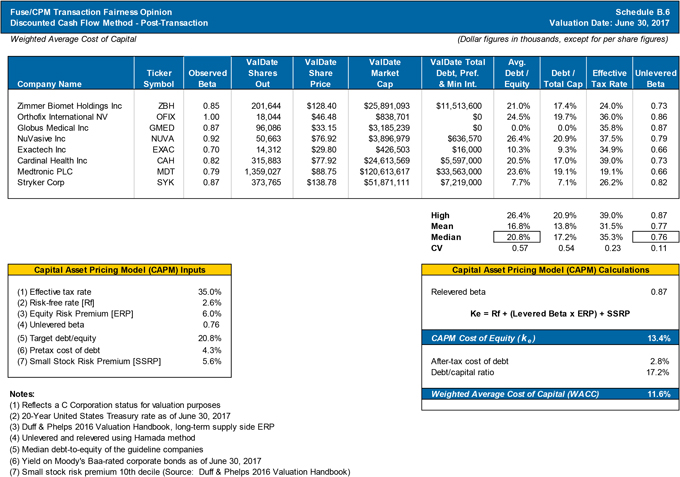

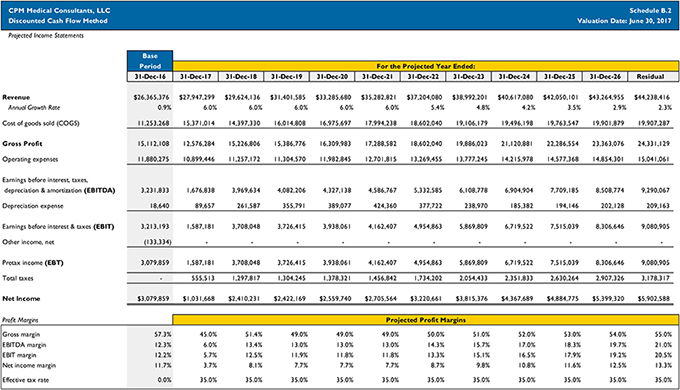

The projected revenue and expenses in the discounted cash flow (DCF) model were based on a review of Management’s projected income statements for the fiscal years ending December 31, 2017 through December 31, 2021 and discussions with Management regarding long-term growth. The nominal growth rate consists of a long-term inflation estimate of 2.25% and a real revenue growth rate. Management’s projected income statement implies nominal revenue growth of 6.0% year-over-year from 2017 to 2021.

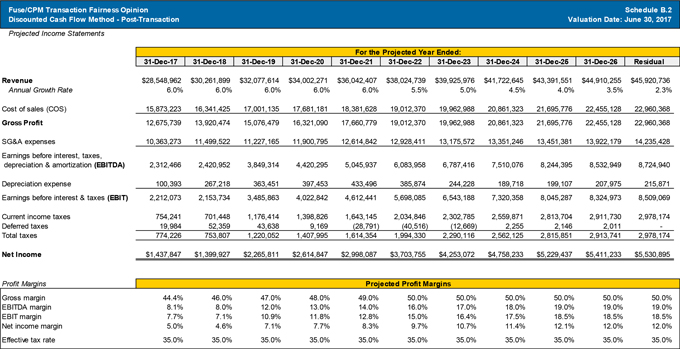

The projected cost of sales as a percentage of revenue is based on Management projections and decreases from 55.6% of revenue in 2017 to 51.0% of revenue in 2021. Projected cost of sales is then estimated to equal 50.0% of revenue through the rest of the projection period. Projected SG&A expenses are based on Management projections and are expected to decrease from 36.3% of revenue in 2017 to 35.0% of revenue in 2021. Operating efficiencies and economies of scale are expected to drop SG&A to 31.0% of revenue by the residual period. The projected revenue and expenses are presented in Schedule B.1 and the projected income statements are presented in Schedule B.2.

| VALUESCOPE | C-19 |

Table of Contents

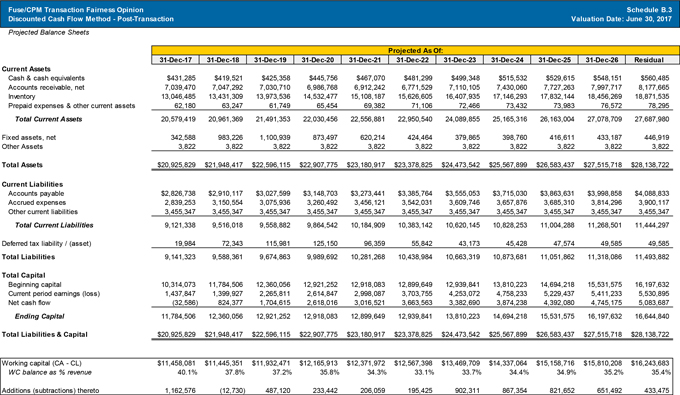

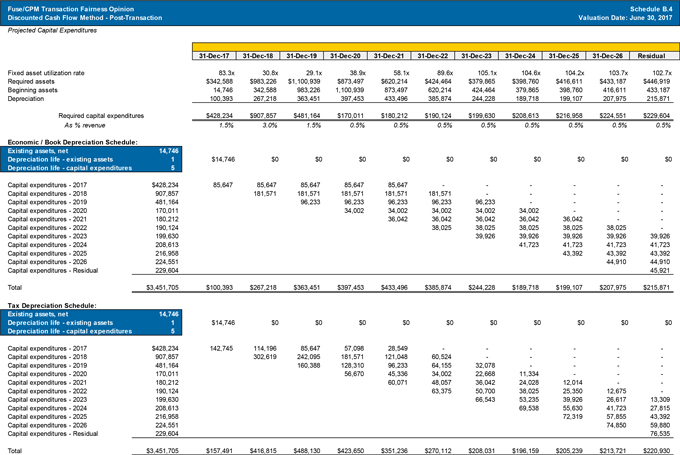

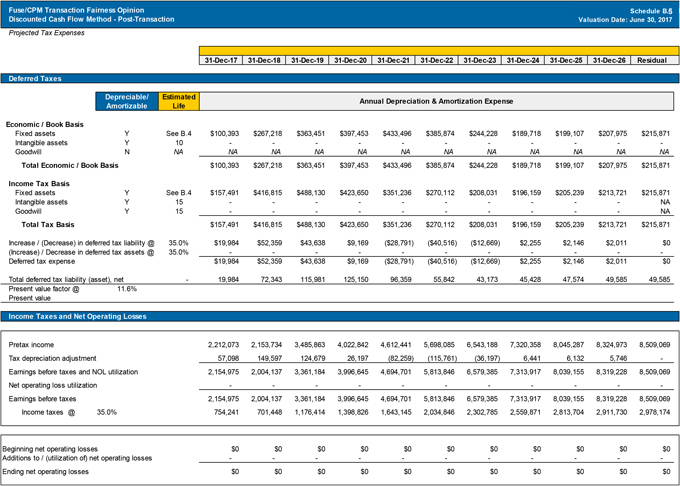

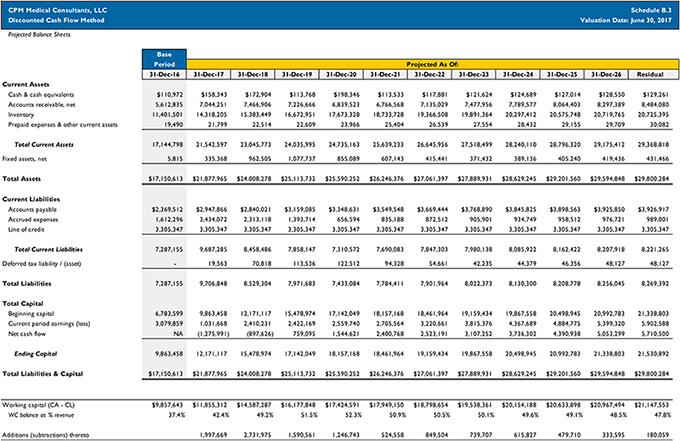

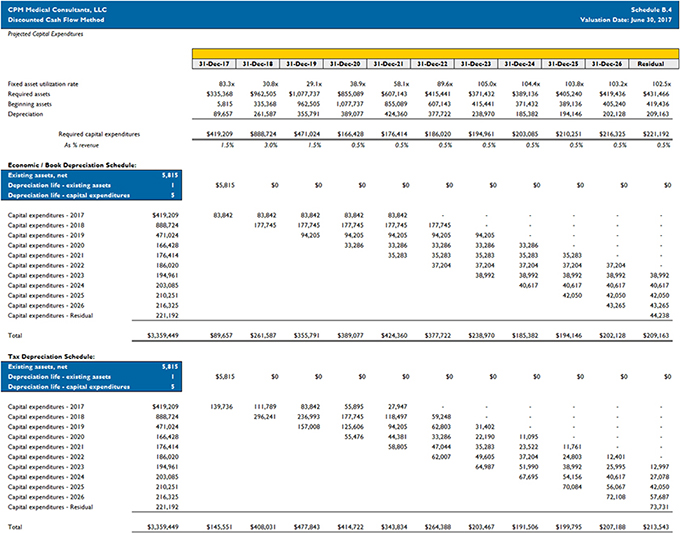

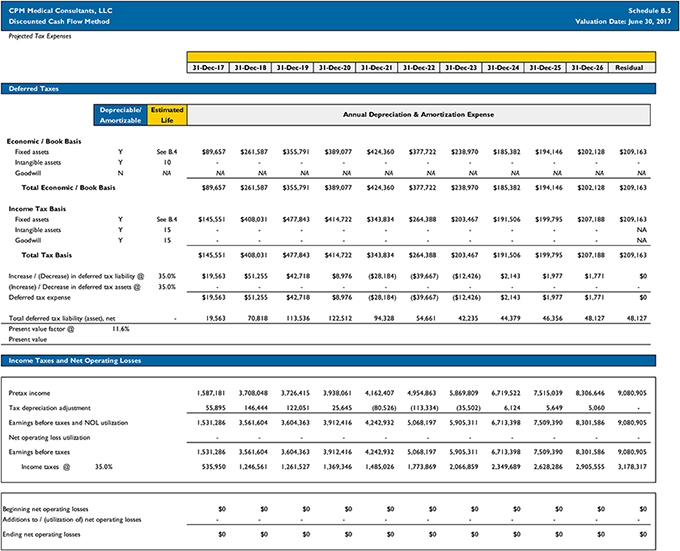

The projected balance sheets (Schedule B.3) and capital expenditures (Schedule B.4) were determined based on historical financial information and ratios with input from Management.