Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended May 31, 2012

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-08604

TEAM, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 74-1765729 | |

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |

| 200 Hermann Drive, Alvin, Texas | 77511 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

(281) 331-6154

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, $.30 par value |

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

(Check one): Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of the completion of the most recent second quarter:

| Voting common stock (November 30, 2011) |

$ | 373,336,366 |

For purposes for the foregoing calculation only, all directors, executive officers, the Team, Inc. Salary Deferral Plan and Trust and known 5% or greater beneficial owners have been deemed affiliates.

The Registrant had 19,956,096 shares of common stock, par value $0.30, outstanding and 89,569 shares of treasury stock as of July 27, 2012.

Documents Incorporated by Reference

Portions of our definitive proxy statement for the 2012 Annual Meeting of Stockholders are incorporated by reference into Part III of this report. These will be filed no later than September 28, 2012.

Table of Contents

Table of Contents

Certain items required in Part III of this Form 10-K can be found in our 2012 Proxy Statement and are incorporated herein by reference. A copy of the 2012 Proxy Statement will be provided, without charge, to any person who receives a copy of this Form 10-K and submits a written request to Team, Inc., Attn: Corporate Secretary, 200 Hermann Drive, Alvin, Texas, 77511.

| ITEM 1. | BUSINESS |

Introduction. Unless otherwise indicated, the terms “Team, Inc.,” “Team,” “the Company,” “we,” “our” and “us” are used in this report to refer to Team, Inc., to one or more of our consolidated subsidiaries or to all of them taken as a whole. We are incorporated in the State of Delaware and our company website can be found at www.teamindustrialservices.com. Our corporate headquarters is located at 200 Hermann Drive, Alvin, Texas, 77511 and our telephone number is (281) 331-6154. Our stock is traded on the New York Stock Exchange (“NYSE”) under the symbol “TISI” and our fiscal year ends on May 31 of each calendar year.

We are a leading provider of specialty industrial services, including inspection and assessment, required in maintaining high temperature and high pressure piping systems and vessels that are utilized extensively in the refining, petrochemical, power, pipeline and other heavy industries. We offer an array of complementary services including:

| • | Inspection and Assessment |

| • | Field Heat Treating |

| • | Leak Repair |

| • | Fugitive Emissions Control |

| • | Hot Tapping |

| • | Field Machining |

| • | Technical Bolting |

| • | Field Valve Repair |

We offer these services in over 100 locations throughout the world. Our industrial services are available 24 hours a day, 7 days a week, 365 days a year. We market our services to companies in a diverse array of heavy industries which include the petrochemical, refining, power, pipeline, steel, pulp and paper industries, as well as municipalities, shipbuilding, original equipment manufacturers (“OEMs”), distributors, and some of the world’s largest engineering and construction firms. Our services are also provided across a broad geographic reach.

Narrative Description of Business

Inspection and Assessment Services. We offer inspection and evaluation of piping, piping components and equipment to determine the present condition and predict remaining operability. Our inspection services use all the common methods of non-destructive testing, including radiography, ultrasound, magnetic particle and dye penetrate, higher end robotic and newly developed advanced technology systems. Many of the visual inspection programs we provide require specialized training to industry and regulatory standards. Inspection services are marketed to our traditional industrial customer base, and customers outside our traditional customer base, such as the aerospace and automotive industries. Inspection services frequently require industry recognized training and certification processes. We maintain training and certification programs which are designed to meet or exceed industry standards.

1

Table of Contents

Field Heat Treating Services. Our field heat treating services include electric resistance and gas-fired combustion, primarily utilized by industrial users to enhance the metallurgical properties of their process piping and equipment. Electric resistance heating is the transfer of high energy power sources through attached heaters to the plant component to preheat weld joints, to remove contaminates and moisture prior to welding and post-weld heat treatments to relieve metal thermal stresses induced by the welding process. Specialty heat treating processes are performed using gas-fired combustion on large pressure vessels for stress relieving, to bake specialty paint coatings and controlled drying of abrasion and temperature resistant refractories. Special high frequency heating, commonly called induction heating, is used to expand metal parts for assembly or disassembly, expansion of large bolting for industrial turbines and stress relieving projects which is cost prohibitive for electric resistance or gas-fired combustion.

Leak Repair Services. Our leak repair services consist of on-stream repairs of leaks in pipes, valves, flanges and other parts of piping systems and related equipment. Our on-stream repairs utilize both standard and custom-designed clamps and enclosures for piping systems. We use specially developed techniques, sealants and equipment for repairs. Many of our repairs are furnished as interim measures which allow plant systems to continue operating until more permanent repairs can be made during plant shut downs. Our leak repair services involve inspection of the leak by our field crew who records pertinent information about the faulty part of the system and transmits the information to our engineering department for determination of appropriate repair techniques. Repair materials such as clamps and enclosures are custom designed and manufactured at our ISO-9001 certified manufacturing centers and delivered to the job site. We maintain an inventory of raw materials and semi-finished clamps and enclosures to reduce the time required to manufacture the finished product.

Fugitive Emissions Control Services. We provide fugitive volatile organic chemical (“VOC”) emission leak detection services that include identification, monitoring, data management and reporting primarily for the chemical, refining and natural gas processing industries. These services are designed to monitor and record VOC emissions from specific process equipment and piping components as required by environmental regulations and customer requests, typically assisting the customer in enhancing an ongoing maintenance program and/or complying with present and/or future environmental regulations. We provide specialty trained technicians in the use of portable organic chemical analyzers and data loggers to measure potential leaks at designated plant components maintained in customer or our proprietary databases. The measured data is used to prepare standard reports in compliance with the U.S. Environmental Protection Agency (“EPA”) and local regulatory requirements. We also provide enhanced custom-designed reports to customer specifications.

Hot Tapping Services. Our hot tapping services consist of providing a full range of hot tapping, Line-stop® and Freeze-stop® services with capabilities for up to 48” diameter pipelines. Hot tapping services involve utilizing special equipment to cut a hole in a pressurized pipeline so that a new branch pipe can be connected onto the existing pipeline without interrupting operations. Line-stop® services permit the line to be depressurized downstream so that maintenance work can be performed on the piping system. We typically perform these services by mechanically cutting into the pipeline similar to a hot tap and installing a special plugging device to stop the process flow. The Hi-stop® is a proprietary and patented procedure that allows stopping of the process flow in extreme pressures and temperatures. In some cases, we may use a line freezing procedure by injecting liquid nitrogen into installed special external chambers around the pipe to stop the process flow.

Field Machining Services and Technical Bolting Services. We use portable machining equipment to repair or modify machinery, equipment, vessels and piping systems not easily removed from a permanent location. As opposed to conventional machining processes where the work piece rotates and the cutting tool is fixed, in field machining, the work piece remains fixed in position and the cutting tool rotates. Other common descriptions for this service are on-site or in-place machining. Field machining services include flange facing, pipe cutting, line boring, journal turning, drilling and milling. We provide customers technical bolting as a complimentary service to field machining during plant shut downs or maintenance activities. These services involve the use of hydraulic or pneumatic equipment with industry standard bolt tightening techniques to achieve

2

Table of Contents

reliable and leak-free connections following plant maintenance or expansion projects. Additional services include bolt disassembly and hot bolting, which is a process to remove and replace a bolt as the process is operating.

Field Valve Repair Services. We perform on-site repairs to manual and control valves, pressure and safety relief valves as well as specialty valve actuator diagnostics and repair. We are certified and authorized to perform testing and repairs to pressure and safety relief valves by The National Board of Boiler and Pressure Vessel Inspectors. This certification requires specific procedures, testing and documentation to maintain the safe operation of these essential plant valves. We provide special transportable trailers to the plant site which contain specialty machines to manufacture valve components without removing the valve from the piping system. In addition, we provide preventive maintenance programs for VOC specific valves and valve data management programs.

Description of Segment and Divisions

We operate in only one segment—the industrial services segment. Within the industrial services segment, we are organized as two divisions. Our TCM division provides the services of inspection and assessments and field heat treating. Our TMS division provides the services of leak repair, fugitive emissions control, hot tapping, field machining, technical bolting and field valve repair. Each division has goodwill relating to past acquisitions and we assess goodwill for impairment at the lower TCM and TMS divisional level. Both divisions derive their revenues from providing specialized labor intensive industrial services and the market for their services is principally dictated by the population of process piping systems in industrial plants and facilities. Services provided by both the TCM and TMS divisions are provided through a network of field branch locations in proximity to industrial plants. The structure of those branch locations is similar, with locations overseen by a branch/regional manager, one or more sales representatives and a cadre of technicians to service the business requirements of our customers. Both divisions share the same chief operating decision maker and both divisions are supported by common and often centralized technical and commercial support staffs, quality assurance, training, finance, legal, human resources and health and safety departments.

In fiscal year 2012, we completed two small acquisitions for a total of $19.4 million. Both acquisitions were financed through borrowings on our banking credit facility. These small acquisitions resulted in the creation of an insignificant amount of intangible assets. We perform preliminary purchase price allocations based on our most current assessments of fair value of the assets acquired and the liabilities assumed. During the process of completing certain post acquisition procedures, including valuation of some intangible assets and other items, finalizing the assessments of fair value may affect the final allocation of the purchase price. As such, the purchase price allocations related to these small acquisitions are subject to change as the procedures are completed. Based upon our preliminary purchase price allocation associated with both of these transactions, we have recorded an increase of $1.1 million in net working capital, fixed assets of $3.0 million, $6.3 million in intangible assets classified as customer relationships and $8.9 million in goodwill. We expect a final valuation report of intangibles and goodwill associated with these transactions to be completed by an independent specialist in early fiscal year 2013.

On November 3, 2010, we purchased Quest Integrity Group, LLC (“Quest”), a privately held advanced inspection services and engineering assessment company. We effectively purchased 95% of Quest for a total consideration paid to Quest shareholders of $41.7 million, consisting of a cash payment of $39.1 million and the issuance of our restricted common stock with a fair value of $2.6 million (approximately 186,000 shares). Additionally, we also assumed debt, net of cash on hand, with a value of $2.3 million. We repaid the debt upon consummation of the purchase. In connection with this transaction, we borrowed $41.4 million under our banking credit facility (our “Credit Facility”) which was used to fund the cash portion of the purchase price, including the retirement of Quest debt. We expect to purchase the remaining 5% in fiscal year 2015 for a purchase consideration based upon the future financial performance of Quest as defined in the purchase

3

Table of Contents

agreement. Future consideration would be payable in unregistered shares of our common stock for an aggregate value of no less than $2.4 million, provided the aggregate value of the consideration does not exceed 20% of our outstanding common stock. Our valuation of the remaining 5% equity of Quest at the date of acquisition was $4.9 million, which is reflected in the shareholders’ equity section of the Consolidated Balance Sheet as “Non-controlling interest.”

Headquartered near Seattle, Washington, Quest has leading technical capabilities related to the measurement and assessment of facility and pipeline mechanical integrity. Quest has developed several proprietary tools for advanced tube and pipeline inspection and measurement. Supporting and augmenting these proprietary inspection tools, Quest has an advanced technical team that provides specialized engineering assessments of facility conditions and serviceability. Quest maintains operations in Seattle, Boulder, and New Zealand, and has service locations in Houston, Calgary, Australia, The Netherlands, and the Middle East. The results of Quest are reflected in our TCM division.

Our industrial services are marketed principally by personnel based at our service locations. We believe that these service locations are situated to facilitate timely responses to customer needs with on-call expertise, which is an important feature of selling and providing our services. Our array of integrated services also allows us to benefit from the procurement trends of many of our customers who are seeking reductions in the number of contractors and vendors in their facilities. No single customer accounted for 10% or more of consolidated revenues during any of the last three fiscal years.

Generally, customers are billed on a time and materials basis, although some work may be performed pursuant to a fixed-price bid. Services are usually performed pursuant to purchase orders issued under written customer agreements. While most purchase orders provide for the performance of a single job, some provide for services to be performed on a run and maintain basis. Substantially all our agreements and contracts may be terminated by either party on short notice. The agreements generally specify the range of services to be performed and the hourly rates for labor. While many contracts cover specific plants or locations, we also enter into multiple-site regional or national contracts which cover multiple plants or locations.

We experience some seasonal fluctuations. Historically, the refining industry has scheduled plant shutdowns (commonly referred to as “turnarounds”) for the fall and spring seasons. Large turnarounds can significantly impact our revenues.

At May 31, 2012, we had approximately 3,800 employees in our worldwide operations. Our employees in the U.S. are predominantly not unionized. Our Canadian employees and certain employees outside of North America, primarily Europe, are unionized. There have been no employee work stoppages to date and we believe our relations with our employees and their representative organizations are good.

A significant portion of our business activities are subject to foreign, federal, state and local laws and regulations. These regulations are administered by various foreign, federal, state and local health and safety and environmental agencies and authorities, including the Occupational Safety and Health Administration of the U.S. Department of Labor and the EPA. Failure to comply with these laws and regulations may involve civil and

4

Table of Contents

criminal liability. From time to time, we are also subject to a wide range of reporting requirements, certifications and compliance as prescribed by various federal and state governmental agencies that include, but are not limited to, the EPA, the Nuclear Regulatory Commission, Chemical Safety Board, Department of Transportation and Federal Aviation Administration. Expenditures relating to such regulations are made in the normal course of our business and are neither material nor place us at any competitive disadvantage. We do not currently expect that compliance with such laws and regulations will require us to make material expenditures.

From time to time, in the operation of our environmental consulting and engineering services, the assets of which were sold in 1996, we handled small quantities of certain hazardous wastes or other substances generated by our customers. Under the Comprehensive Environmental Response, Compensation and Liability Act of 1980 (the “Superfund Act”), the EPA is authorized to take administrative and judicial action to either cause parties who are responsible under the Superfund Act for cleaning up any unauthorized release of hazardous substances to do so, or to clean up such hazardous substances and to seek reimbursement of the costs thereof from the responsible parties, who are jointly and severally liable for such costs under the Superfund Act. The EPA may also bring suit for treble damages from responsible parties who unreasonably refuse to voluntarily participate in such a clean-up or funding thereof. Responsible parties include anyone who owns or operates the facility where the release occurred (either currently and/or at the time such hazardous substances were disposed of), or who by contract arranges for disposal, treatment, transportation for disposal or treatment of a hazardous substance, or who accepts hazardous substances for transport to disposal or treatment facilities selected by such person from which there is a release. We believe that our risk of liability is minimized since our handling consisted solely of maintaining and storing small samples of materials for laboratory analysis that are classified as hazardous. Due to its prohibitive costs, we accordingly do not currently carry insurance to cover liabilities which we may incur under the Superfund Act or similar environmental statutes.

We are the holder of various patents, trademarks, trade secrets and licenses, which have not historically been material to our consolidated business operations. However, our recently acquired subsidiary, Quest, has significant trade secrets and intellectual property pertaining to its in-line inspection tool technologies. This subsidiary was acquired in fiscal year 2011 and a significant amount of the purchase price was allocated to these intangible assets. (See Note 2 to our audited consolidated financial statements).

In general, competition stems from a large number of other outside service contractors. More than 100 different competitors are currently active in our markets. We believe we have a competitive advantage over most service contractors due to the quality, training and experience of our technicians, our nationwide and increasingly international service capability, our broad range of services, and our technical support and manufacturing capabilities supporting the service network. However, there are other competitors that may offer a similar range of coverage or services and include, but are not limited to, Acuren Group, Inc., Furmanite Corporation, Guardian Compliance, Mistras Group, Inc. and T.D. Williamson, Inc.

As a public company, we are required to file periodic reports with the Securities and Exchange Commission (the “SEC”) within established deadlines. Any document we file with the SEC may be viewed or copied at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Additional information regarding the Public Reference Room can be obtained by calling the SEC at (800) SEC-0330. Our SEC filings are also available to the public through the SEC’s website located at www.sec.gov.

Our internet website address is www.teamindustrialservices.com. Information contained on our website is not part of this report on Form 10-K. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, Proxy

5

Table of Contents

Statements and current reports on Form 8-K filed with (or furnished to) the SEC are available on our website, free of charge, as soon as reasonably practicable after we file or furnish such material. We also post our code of ethical conduct, our governance principles, our social responsibility policy and the charters of our Board of Directors’ (the “Board”) committees on our website. Our governance documents are available in print to any stockholder that submits a written request to Team, Inc., Attn: Corporate Secretary, 200 Hermann Drive, Alvin, Texas, 77511.

| ITEM 1A. | RISK FACTORS |

Past financial performance is not necessarily a reliable indicator of future performance, and investors in our common stock should not use historical performance to anticipate results or future period trends. Investing in our common stock involves a high degree of risk. The risk factors described below should be carefully considered in addition to other information contained or incorporated by reference herein. We operate in a continually changing business environment and new risk factors emerge from time to time. We cannot predict such risk factors, nor can we assess the impact, if any, of such risk factors on our business or the extent to which any factors may cause actual results to differ materially from those projected. The following risks and uncertainties should be considered in evaluating our outlook of future Company performance.

The current economic environment may affect our customers’ demand for our services. The ongoing economic uncertainty has reduced the availability of liquidity and credit and, in many cases, reduced demand for our customers’ products. Continued disruption of the credit markets could also adversely affect our customers’ ability to finance on-going maintenance and new projects, resulting in contract cancellations or suspensions, and project delays. An extended or deepening recession may result in further plant closures or other contractions in our customer base. These factors may also adversely affect our ability to collect payment for work we have previously performed. Furthermore, our ability to expand our business could be limited if, in the future, we are unable to increase our credit capacity under favorable terms or at all. Such disruptions, should they occur, could materially impact our results of operations, financial position or cash flows.

Our revenues are heavily dependent on certain industries. Sales of our services are dependent on customers in certain industries, particularly the refining and petrochemical industries. As experienced in the past, and as expected to occur in the future, downturns characterized by diminished demand for services in these industries could have a material impact on our results of operations, financial position or cash flows.

We sell our services in highly competitive markets, which places pressure on our profit margins and limits our ability to maintain or increase the market share of our services. Our competition generally stems from other outside service contractors, many of whom offer a similar range of services. The ongoing economic uncertainty has generally reduced demand for industrial services and thus created a more competitive bidding environment for new and existing work. No assurances can be made that we will continue to maintain our pricing model and our profit margins or increase our market share.

No assurances can be made that we will be successful in maintaining or renewing our contracts with our customers. A significant portion of our contracts and agreements with customers may be terminated by either party on short notice. Although we actively pursue the renewal of our contracts, we cannot assure that we will be able to renew these contracts or that the terms of the renewed contracts will be as favorable as the existing contracts. If we are unable to renew or replace these contracts, or if we renew on less favorable terms, we may suffer a material reduction in revenue and earnings.

No assurances can be made that we will be successful in hiring or retaining members of a skilled technical workforce. We have a skilled technical workforce and an industry recognized technician training program for each of our service lines that prepares new employees as well as further trains our existing employees. The competition for these individuals is intense. The loss of the services of a number of these individuals, or failure to attract new employees, could adversely affect our ability to perform our obligations on our customers’ projects or maintenance and consequently could negatively impact the demand for our products and services.

6

Table of Contents

Unsatisfactory safety performance can affect customer relationships, result in higher operating costs and negatively impact our ability to hire and retain a skilled technical workforce. Our workers are subject to the normal hazards associated with providing services at industrial facilities. Even with proper safety precautions, these hazards can lead to personal injury, loss of life, destruction of property, plant and equipment, lower employee morale and environmental damage. We are intensely focused on maintaining a strong safety environment and reducing the risk of accidents to the lowest possible level. Poor safety performance may limit or eliminate potential revenue streams from many of our largest customers and may materially increase our future insurance and other operating costs. Although we maintain insurance coverage, such coverage may be inadequate to protect us from all expenses related to these risks.

Our operations and properties are subject to extensive governmental regulation under environmental laws. Environmental laws and regulations can impose substantial sanctions for violations or operational changes that may limit our services. We must conform our operations to applicable regulatory requirements and adapt to changes in such requirements in all locations in which we operate. These actions may increase the overall costs of providing our services. Some of our services involve handling or monitoring highly regulated materials, including volatile organic compounds or hazardous wastes. Environmental laws and regulations generally impose limitations and standards for regulated materials and require us to obtain permits and comply with various other requirements. The improper characterization, handling, disposal or monitoring of regulated materials or any other failure by us to comply with increasingly complex and strictly enforced federal, state and local environmental laws and regulations or associated environmental permits could subject us to the assessment of administrative, civil and criminal penalties, the imposition of investigatory or remedial obligations, or the issuance of injunctions that could restrict or prevent our ability to operate our business and complete contracted services. A defect in our services or faulty workmanship could result in an environmental liability if, as a result of the defect or faulty workmanship, a contaminate is released into the environment.

We currently maintain liability insurance to limit any potential loss, but there can be no assurance that our insurance will fully protect us against a claim or loss. We perform services in hazardous environments on or around high-pressure, high temperature systems and our employees are exposed to a number of hazards, including exposure to hazardous materials, explosion hazards and fire hazards. Incidents that occur at these large industrial facilities or systems, regardless of fault, may be catastrophic and adversely impact our employees and third parties by causing serious personal injury, loss of life, damage to property or the environment, and interruption of operations. Our contracts typically require us to indemnify our customers for injury, damage or loss arising out of our presence at our customers’ location, regardless of fault, or the performance of our services and provide for warranties for materials and workmanship. We may also be required to name the customer as an additional insured under our insurance policies. We maintain insurance coverage against these and other risks associated with our business. Due to the high cost of general liability coverage, we maintain insurance with a self-insured retention of $3 million per occurrence. This insurance may not protect us against liability for certain events, including events involving pollution, product or professional liability, losses resulting from business interruption or acts of terrorism or damages from breach of contract by the Company. We cannot assure you that our insurance will be adequate in risk coverage or policy limits to cover all losses or liabilities that we may incur. Moreover, in the future, we cannot assure that we will be able to maintain insurance at levels of risk coverage or policy limits that we deem adequate. Any future damages caused by our products or services that are not covered by insurance or are in excess of policy limits could have a material adverse effect on our results of operations, financial position or cash flows.

We are involved and are likely to continue to be involved in legal proceedings, which will increase our costs and, if adversely determined, could have a material effect on our results of operations, financial position or cash flows. We are currently a defendant in legal proceedings arising from the operation of our business and it is reasonable to expect that we will be named in future actions. Most of the legal proceedings against us arise out of the normal course of performing services at customer facilities, and include claims for workers’ compensation, personal injury and property damage. Legal proceedings can be expensive to defend and can divert the attention of management and other personnel for significant periods of time, regardless of the ultimate

7

Table of Contents

outcome. An unsuccessful defense of a liability claim could have an adverse effect on our business, results of operations, financial position or cash flows.

Economic, political and other risks associated with international operations could adversely affect our business. A significant portion of our operations are conducted and located outside the United States and, accordingly, our business is subject to risks associated with doing business internationally, including changes in foreign currency exchange rates, instability in political or economic conditions, difficulty in repatriating cash proceeds, differing employee relations, differing regulatory environments, trade protection measures, and difficulty in administering and enforcing corporate policies which may be different than the normal business practices of local cultures. In many foreign countries, particularly in those with developing economies, it is common to engage in business practices that are prohibited by U.S. and foreign anti-corruption regulations applicable to us such as the U.S. Foreign Corrupt Practices Act (“FCPA”) and the United Kingdom Bribery Act. Our international business operations may include projects in countries where corruption is prevalent. Although we have, and continue to, implement policies and procedures designed to ensure compliance with these laws, there can be no assurance that all of our employees, contractors or agents, including those representing us in countries where practices which violate such anti-corruption laws may be customary, will not take actions in violation of our policies and procedures. Any violation of foreign or U.S. laws by our employees, contractors or agents, even if such violation is prohibited by our policies and procedures, could have a material adverse effect on our results of operations, financial position or cash flows.

Our growth strategy entails risk for investors. We intend to continue to pursue acquisitions in, or complementary to, the specialty maintenance and construction services industry to complement and diversify our existing business. We may not be able to continue to expand our market presence through attractive acquisitions, and any future acquisitions may present unforeseen integration difficulties or costs. From time to time, we make acquisitions of other businesses that enhance our services or the geographic scope. No assurances can be made that we will realize the cost savings, synergies or revenue enhancements that we may anticipate from any acquisition, or that we will realize such benefits within the time frame that we expect. If we are not able to address the challenges associated with acquisitions and successfully integrate acquired businesses, or if our integrated product and service offerings fail to achieve market acceptance, our business could be adversely affected. The consideration paid in connection with an acquisition may also affect our share price or future financial results depending on the structure of such consideration. To the extent we issue stock or other rights to purchase stock, including options or other rights, existing shareholders may be diluted and earnings per share may decrease. In addition, acquisitions may result in the incurrence of additional debt.

The price of our outstanding securities may be volatile. It is possible that in some future quarter or quarters our revenues, operating results or other measures of financial performance will not meet the expectations of public stock market analysts or investors, which could cause the price of our outstanding securities to decline or be volatile. Historically, our quarterly and annual sales and operating results have fluctuated. We expect fluctuations to continue in the future. In addition to general economic and political conditions, the following factors may affect our sales and operating results: the timing of significant customer orders, the timing of planned maintenance projects at customer facilities, changes in competitive pricing, wide variations in profitability by product line, variations in operating expenses, rapid increases in raw material and labor costs, the timing of announcements or introductions of new products or services by us, our competitors or our respective customers, the acceptance of those services, our ability to adequately meet staffing requirements with qualified personnel, relative variations in manufacturing efficiencies and costs, and the relative strength or weakness of international markets. Since our quarterly and annual revenues and operating results vary, we believe that period-to-period comparisons are not necessarily meaningful and should not be relied upon as indicators of our future performance.

Our business may be adversely impacted by work stoppages, staffing shortages and other labor matters. At May 31, 2012, we had approximately 3,800 employees and contractors, approximately 700 of whom were located in Canada and Europe where employees predominantly are represented by unions. Although we believe that our relations with our employees are good and we have had no strikes or work stoppages, no

8

Table of Contents

assurances can be made that we will not experience these and other types of conflicts with labor unions, works councils, other groups representing employees, or our employees in general, or that any future negotiations with our labor unions will not result in significant increases in the cost of labor.

Climate change legislation or regulations restricting emissions of “greenhouse gases” could result in reduced demand for our services and products. Recent scientific studies have suggested that emissions of certain gases, commonly referred to as “greenhouse gases” may be contributing to warming of the earth’s atmosphere. As a result, there have been a variety of regulatory developments, proposals or requirements and legislative initiatives that have been introduced in the United States (and other parts of the world) that are focused on restricting the emission of carbon dioxide, methane and other greenhouse gases. The adoption and implementation of any regulations which impose limiting emissions of carbon dioxide and other greenhouse gases from customers for whom we provide repair and maintenance services could affect demand for our products and services.

Interruptions in the proper functioning of our information systems could disrupt operations and cause increases in costs and/or decreases in revenues. The proper functioning of our information systems is critical to the successful operation of our business. Although our information systems are protected through physical and software safeguards, our information systems are still vulnerable to natural disasters, power losses, telecommunication failures and other problems. If critical information systems fail or are otherwise unavailable, our business operations could be adversely affected.

Other risk factors. Other risk factors may include interruption of our operations, or the operations of our customers due to fire, hurricanes, earthquakes, power loss, telecommunications failure, terrorist attacks, labor disruptions, health epidemics and other events beyond our control.

Any one of these factors, or a combination of these factors, could materially affect our future results of operations, financial position or cash flows and whether any forward-looking statements in this Form 10-K ultimately prove to be accurate.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

| ITEM 2. | PROPERTIES |

We own several facilities used in our operations. Our 88,000 square foot facility in Alvin, Texas consists of our corporate office, primary training facility and ISO-9001 certified manufacturing facility for clamps, enclosures, and sealants. Additionally, we own a 30,000 square foot manufacturing facility in Houston, Texas and an 11,000 square foot equipment distribution facility in Pearland, Texas. We also own offices for our branch service locations in the following areas:

| • | Beaumont, Texas (27,000 square feet) |

| • | Pasadena, Texas (27,000 square feet) |

| • | Edmonton, Alberta (17,000 square feet) |

| • | Milwaukee, Wisconsin (10,000 square feet) |

All other facilities used in our operations are provided through operating leases.

Included in assets held for sale is $5.8 million pertaining to land in or around Houston. This primarily consists of $5.2 million attributable to 50 acres purchased in October 2007 on which we had previously planned

9

Table of Contents

to construct future facilities in Pearland, Texas. During the fourth quarter of fiscal year 2012, we decided not to proceed with construction of the future facilities at this location and recognized a $1.7 million asset writedown of pre-construction building costs and capitalized interest.

We believe that our property and equipment are adequate for our current needs, although additional investments are expected to be made in property and equipment for expansion, replacement of assets at the end of their useful lives and in connection with corporate development activities.

| ITEM 3. | LEGAL PROCEEDINGS |

We have, from time to time, provided temporary leak repair services for the steam operations of Consolidated Edison of New York (“Con Ed”) located in New York City. In July 2007, a Con Ed steam main located in midtown Manhattan ruptured causing one death and other injuries and property damage. As of May 31, 2012, one hundred and six lawsuits have been filed against Con Ed, the City of New York and Team in the Supreme Courts of New York located in Kings, New York and Bronx County, alleging that our temporary leak repair services may have contributed to the cause of the rupture. The lawsuits seek generally unspecified compensatory damages for personal injury, property damage and business interruption. Additionally, on March 31, 2008, we received a letter from Con Ed alleging that our contract with Con Ed requires us to indemnify and defend Con Ed for additional claims filed against Con Ed as a result of the rupture. Con Ed filed an action to join Team and the City of New York as defendants in all lawsuits filed against Con Ed that did not include Team and the City of New York as direct defendants. We are vigorously defending the lawsuits and Con Ed’s claim for indemnification. We are unable to estimate the amount of liability to us, if any, associated with these lawsuits and the claim for indemnification. We maintain insurance coverage, subject to a deductible limit of $250,000, which we believe should cover these claims. We have not accrued any liability in excess of the deductible limit for the lawsuits. We do not believe the ultimate outcome of these matters will have a material adverse effect on our financial position, results of operations, or cash flows.

In June 2010, we received a grand jury subpoena from the United States Attorney for the Northern District of Texas requesting documents related to fugitive emissions monitoring services provided to customers from our Borger, Texas branch office. Our internal investigation determined that on specific occasions, certain employees failed to follow EPA protocols while conducting emissions monitoring and one supervisor, along with another employee, altered the customer’s emissions monitoring database to falsely represent monitoring events. The falsification of emissions monitoring protocols and data resulted in the generation of false representations and certifications in records and reports which our customer submitted to the EPA and Texas Commission on Environmental Quality.

In July 2012, we negotiated a plea agreement and pled guilty to a single misdemeanor violation of a section of the Clean Air Act. In the plea agreement, we agreed to develop and implement an Environmental Compliance Plan for our emissions monitoring services to enhance our compliance with the Clean Air Act.

The maximum penalty for this misdemeanor violation is a term of probation of not more than five years and a fine not to exceed $200,000, or twice any gross gain to us or loss to the victim(s). While the actual penalty has not yet been determined, we do not believe the ultimate outcome of this matter will have a material adverse effect on our financial position, results of operations, or cash flows.

We are involved in various other lawsuits and are subject to various claims and proceedings encountered in the normal conduct of business. In our opinion, any uninsured losses that might arise from these lawsuits and proceedings will not have a materially adverse effect on our consolidated financial statements.

| ITEM 4. | MINE SAFETY DISCLOSURES |

Not applicable.

10

Table of Contents

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Information

Prior to January 3, 2012, our stock was traded on the NASDAQ under the symbol “TISI”. Beginning January 3, 2012, our stock is now traded on the NYSE under the same symbol. The table below reflects the high and low sales prices of our common stock by quarter for the fiscal years ended May 31, 2012 and 2011, respectively.

| Sales Price | ||||||||

| High | Low | |||||||

| 2012 |

||||||||

| Quarter ended: |

||||||||

| August 31, 2011 |

$ | 27.48 | $ | 20.27 | ||||

| November 30, 2011 |

$ | 27.43 | $ | 19.98 | ||||

| February 29, 2012 |

$ | 32.50 | $ | 26.39 | ||||

| May 31, 2012 |

$ | 33.50 | $ | 24.95 | ||||

| 2011 |

||||||||

| Quarter ended: |

||||||||

| August 31, 2010 |

$ | 16.26 | $ | 12.64 | ||||

| November 30, 2010 |

$ | 21.88 | $ | 14.70 | ||||

| February 28, 2011 |

$ | 28.71 | $ | 20.36 | ||||

| May 31, 2011 |

$ | 28.42 | $ | 21.31 | ||||

11

Table of Contents

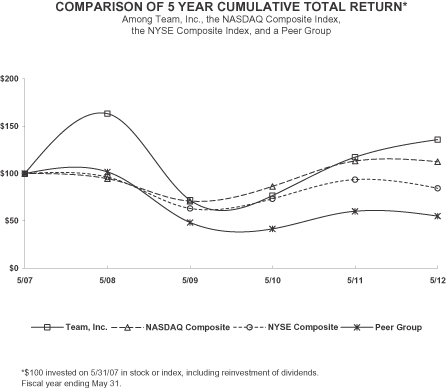

Performance Graph

The following performance graph compares the performance of our common stock to the NASDAQ Composite Index, the NYSE Composite Index and a Peer Group Index. The comparison assumes $100 was invested on May 31, 2007 in our common stock, the NASDAQ Composite Index, the NYSE Composite Index and a Peer Group Index. The values of each investment are based on share price appreciation, with reinvestment of all dividends, assuming any were paid. For each graph, the investments are assumed to have occurred at the beginning of each period presented. The following companies are included in our peer group index used in the graph: Furmanite Corporation, Matrix Service Company, Englobal Corporation and Mistras Group, Inc.

| 5/07 | 5/08 | 5/09 | 5/10 | 5/11 | 5/12 | |||||||||||||||||||

| Team, Inc. |

100.00 | 163.51 | 72.21 | 76.75 | 117.38 | 136.16 | ||||||||||||||||||

| NASDAQ Composite |

100.00 | 94.87 | 70.94 | 86.49 | 113.35 | 112.60 | ||||||||||||||||||

| NYSE Composite |

100.00 | 96.41 | 63.46 | 73.49 | 93.80 | 84.77 | ||||||||||||||||||

| Peer Group |

100.00 | 101.96 | 48.58 | 41.76 | 60.43 | 55.16 | ||||||||||||||||||

Notes: The above information was provided by Research Data Group, Inc.

Holders

There were 210 holders of record of our common stock as of July 27, 2012 excluding beneficial owners of stock held in street name.

Dividends

No cash dividends were declared or paid during the fiscal years ended May 31, 2012, 2011 and 2010. We are not permitted to pay cash dividends without the consent of our bank syndicate. Accordingly, we have no present intention to pay cash dividends in the foreseeable future. Additionally, any future dividend payments will continue to depend on our financial condition, market conditions and other matters deemed relevant by the Board.

12

Table of Contents

Securities Authorized for Issuance Under Equity Compensation Plans

This information has been omitted from this report on Form 10-K as we intend to file such information in our definitive proxy statement no later than 120 days following the close of our fiscal year ended May 31, 2012. The information required regarding equity compensation plans is hereby incorporated by reference.

13

Table of Contents

| ITEM 6. | SELECTED FINANCIAL DATA |

The following is a summary of selected financial information for the five years ended May 31, 2012 (in thousands, except per share data):

| 2012 | 2011 | 2010 | 2009 | 2008 | ||||||||||||||||

| Revenues |

$ | 623,740 | $ | 508,020 | $ | 453,869 | $ | 497,559 | $ | 478,475 | ||||||||||

| Operating income |

$ | 56,497 | $ | 42,475 | $ | 24,777 | $ | 41,271 | $ | 45,873 | ||||||||||

| Net income available to Team shareholders |

$ | 32,911 | $ | 26,585 | $ | 12,275 | $ | 22,911 | $ | 23,623 | ||||||||||

| Net income per share |

||||||||||||||||||||

| Basic |

$ | 1.67 | $ | 1.38 | $ | 0.65 | $ | 1.22 | $ | 1.30 | ||||||||||

| Diluted |

$ | 1.59 | $ | 1.32 | $ | 0.63 | $ | 1.16 | $ | 1.20 | ||||||||||

| Weighted-average shares outstanding |

||||||||||||||||||||

| Basic |

19,667 | 19,206 | 18,923 | 18,793 | 18,226 | |||||||||||||||

| Diluted |

20,660 | 20,083 | 19,510 | 19,725 | 19,676 | |||||||||||||||

| Cash dividend declared, per common share |

$ | 0.00 | $ | 0.00 | $ | 0.00 | $ | 0.00 | $ | 0.00 | ||||||||||

| Depreciation and amortization |

$ | 17,469 | $ | 14,584 | $ | 12,509 | $ | 12,116 | $ | 11,285 | ||||||||||

| Share-based compensation |

$ | 4,386 | $ | 4,993 | $ | 5,009 | $ | 4,761 | $ | 3,329 | ||||||||||

| Capital expenditures |

$ | 23,924 | $ | 13,158 | $ | 7,711 | $ | 16,383 | $ | 25,612 | ||||||||||

| Balance sheet data: |

||||||||||||||||||||

| Total assets |

$ | 403,788 | $ | 355,486 | $ | 264,989 | $ | 275,921 | $ | 280,461 | ||||||||||

| Long-term debt and other long-term liabilities |

$ | 97,131 | $ | 86,299 | $ | 56,795 | $ | 82,628 | $ | 102,955 | ||||||||||

| Stockholders’ equity |

$ | 245,001 | $ | 209,446 | $ | 165,192 | $ | 146,501 | $ | 120,762 | ||||||||||

| Working capital |

$ | 157,019 | $ | 130,533 | $ | 107,343 | $ | 109,845 | $ | 100,470 | ||||||||||

| Non-controlling interest |

$ | 5,097 | $ | 4,983 | $ | 0 | $ | 0 | $ | 0 | ||||||||||

14

Table of Contents

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following review of our results of operations and financial condition should be read in conjunction with Item 1 “Business,” Item 1A “Risk Factors,” Item 2 “Properties,” and Item 8 “Consolidated Financial Statements and Supplementary Data,” included in this Form 10-K.

CAUTIONARY STATEMENT FOR THE PURPOSE OF

SAFE HARBOR PROVISIONS OF THE

PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

This report includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. In addition, other written or oral statements that constitute forward-looking statements may be made by us or on behalf of the Company in other materials we release to the public including all statements, other than statements of historical facts, included or incorporated by reference in this Form 10-K, that address activities, events or developments which we expect or anticipate will or may occur in the future. You can generally identify our forward-looking statements by the words “anticipate,” “believe,” “expect,” “plan,” “intend,” “estimate,” “project,” “projection,” “predict,” “budget,” “forecast,” “goal,” “guidance,” “target,” “will,” “could,” “should,” “may” and similar expressions.

We based our forward-looking statements on our reasonable beliefs and assumptions, and our current expectations, estimates and projections about ourselves and our industry. We caution that these statements are not guarantees of future performance and involve risks, uncertainties and assumptions that we cannot predict. In addition, we based many of these forward-looking statements on assumptions about future events that may prove to be inaccurate. We wish to ensure that such statements are accompanied by meaningful cautionary statements, so as to obtain the protections of the safe harbor established in the Private Securities Litigation Reform Act of 1995. New risk factors emerge from time to time and it is not possible for us to predict all such risk factors, nor can we assess the impact of all such risk factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Accordingly, forward-looking statements cannot be relied upon as a guarantee of future results and involve a number of risks and uncertainties that could cause actual results to differ materially from those projected in the statements, including, but not limited to the statements under “Risk Factors.” We undertake no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

This Management’s Discussion and Analysis of Financial Condition and Results of Operations is provided as a supplement to the accompanying consolidated financial statements and notes to help provide an understanding of our financial condition, changes in financial condition, and results of operations.

General Information

We are a leading provider of specialty maintenance and construction services required in maintaining high temperature and high pressure piping systems and vessels that are utilized extensively in heavy industries. We offer an array of complementary services including:

| • | Inspection and Assessment |

| • | Field Heat Treating |

| • | Leak Repair |

| • | Fugitive Emissions Control |

| • | Hot Tapping |

15

Table of Contents

| • | Field Machining |

| • | Technical Bolting |

| • | Field Valve Repair |

We offer these services in over 100 locations throughout the world. Our industrial services are available 24 hours a day, 7 days a week, 365 days a year. We market our services to companies in a diverse array of heavy industries which include the petrochemical, refining, power, pipeline, steel, pulp and paper industries, as well as municipalities, shipbuilding, OEMs, distributors, and some of the world’s largest engineering and construction firms. Our services are also provided across a broad geographic reach.

Year Ended May 31, 2012 Compared to Year Ended May 31, 2011

The following table sets forth the components of revenue and operating income from our operations for fiscal year 2012 and 2011 (in thousands):

| Year Ended May 31, 2012 |

Year Ended May 31, 2011 |

Increase (Decrease) |

||||||||||||||

| $ | % | |||||||||||||||

| Revenues: |

||||||||||||||||

| TCM division |

$ | 354,830 | $ | 284,616 | $ | 70,214 | 25 | % | ||||||||

| TMS division |

268,910 | 223,404 | 45,506 | 20 | % | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenues |

623,740 | 508,020 | 115,720 | 23 | % | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross margin |

195,051 | 157,143 | 37,908 | 24 | % | |||||||||||

| SG&A expenses: |

||||||||||||||||

| Field operations |

117,044 | 95,806 | 21,238 | 22 | % | |||||||||||

| Corporate costs |

21,893 | 19,260 | 2,633 | 14 | % | |||||||||||

| Non-routine acquisition costs |

— | 632 | (632 | ) | (100 | )% | ||||||||||

| Non-routine legal settlement |

800 | — | 800 | 100 | % | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total SG&A expenses |

139,737 | 115,698 | 24,039 | 21 | % | |||||||||||

| Earnings from unconsolidated affiliates |

1,183 | 1,030 | 153 | 15 | % | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating income |

$ | 56,497 | $ | 42,475 | $ | 14,022 | 33 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Revenues. Our revenues for the year ended May 31, 2012 were $623.7 million compared to $508.0 million for the year ended May 31, 2011, an increase of $115.7 million or 23%. Revenues for our TCM division for the year ended May 31, 2012 were $354.8 million compared to $284.6 million for the year ended May 31, 2011, an increase of $70.2 million or 25%. Revenues for our TMS division for the year ended May 31, 2012 were $268.9 million compared to $223.4 million for the year ended May 31, 2011, an increase of $45.5 million or 20%. Organic revenue growth was approximately $100 million or 20% for the year ended May 31, 2012. Overall revenue growth was broad based across services lines, geography and customers and was a result of strong service performance, beginning the year with a strong tailwind as it relates to turnaround projects, expansion of new services lines and capabilities, and long term procurement consolidation trends by our customers.

Gross margin. Our gross margin for the year ended May 31, 2012 was $195.1 million compared to $157.1 million for the year ended May 31, 2011, an increase of $37.9 million or 24%. Gross margin as a percentage of revenue was 31% for the year ended May 31, 2012 and 2011. Gross margin for our TCM division for the year ended May 31, 2012 was $110.2 million compared to $87.6 million for the year ended May 31, 2011, an increase of $22.6 million or 26%. TCM division gross margin as a percentage of revenue was 31% for the year ended May 31, 2012 and 2011. Gross margin for our TMS division was $84.9 million for the year ended May 31, 2012

16

Table of Contents

compared to $69.6 million for the year ended May 31, 2011, an increase of $15.3 million or 22%. TMS division gross margin as a percentage of revenue was 32% for the year ended May 31, 2012 and 31% for the year ended May 31, 2011. Gross margins for both divisions reflect relatively flat year over year job margins. Fluctuations in gross margins are primarily impacted by service line mix.

Selling, general and administrative expenses. Our SG&A expenses for the year ended May 31, 2012 were $139.7 million compared to $115.7 million for the year ended May 31, 2011, an increase of $24.0 million or 21%. SG&A expenses for the current year ended May 31, 2012 includes a non-routine $0.8 million pre-tax legal settlement related to the resolution of a long outstanding personal injury matter and in the prior year included $0.6 million of non-routine expense related to the Quest acquisition. Excluding these non-routine charges, SG&A expenses for the year ended May 31, 2012 were $138.9 million, an increase of $23.9 million or 21%. SG&A expenses as a percentage of revenue, adjusted to exclude the non-routine charges, was 22% for the year ended May 31, 2012 compared to 23% for the year ended May 31, 2011. The increase in SG&A expenses primarily was related to compensation related costs within field operations supporting organic growth. Also included in SG&A expenses were approximately $2.7 million in unusually elevated expenses in the year. First, we incurred $2.0 million in increased medical costs accruals. We accrue medical costs based on our actuarial expectation of claims. Due to an unusual number of major claims that hit during the fiscal year, our actual costs exceeded our accruals, thus requiring the additional expense. Second, we incurred about $0.7 million in outside legal and professional services expenses related to two recently completed acquisitions as well as significant efforts on unsuccessful transaction activities.

Earnings from unconsolidated affiliates. Our earnings from unconsolidated affiliates consists entirely of our joint venture (50% ownership) formed in May 2008, to perform non-destructive testing and inspection services in Alaska. Revenues of the joint venture not reflected in our consolidated revenues for the year ended May 31, 2012 and 2011 were $12.3 million and $9.9 million, respectively. As a result of the higher revenue levels in the joint venture, and leverage of fixed costs of the joint venture, our share of the earnings from the joint venture were $1.2 million, an increase of $0.2 million or 15%.

Interest. Interest expense was $2.4 million for the year ended May 31, 2012 compared to $2.2 million for the year ended May 31, 2011. The increase is a result of higher interest rates applied to increased outstanding borrowings.

Foreign currency (gain) loss. There were no significant currency transaction gains or losses for the year ended May 31, 2012 and 2011, respectively.

Taxes. The provision for income tax for fiscal year 2012 was $19.4 million on pre-tax income of $52.5 million, compared to the provision for income tax for fiscal year 2011 of $13.5 million on pre-tax income of $40.2 million. During the third quarter of fiscal year 2011, we identified and corrected accounting errors relating to the effect of share-based compensation on tax provisions for fiscal years 2007-2010. During those periods, reported earnings were understated because effective tax rates were overstated as a result of the previously undetected errors in the tax provision calculation. No restatement of previously issued financial statements was required because the effect on those statements was immaterial. The cumulative effect of the errors in the tax provision calculation was a tax benefit consisting of $1.8 million associated with the prior years. Our effective tax rate for the fiscal year 2012 was 37% compared to 38% for the fiscal year 2011 which excludes the effect of the $1.8 million portion of the cumulative adjustments related to prior years (see Note 8 to our audited consolidated financial statements).

17

Table of Contents

Year Ended May 31, 2011 Compared to Year Ended May 31, 2010

The following table sets forth the components of revenue and operating income from our operations for fiscal year 2011 and 2010 (in thousands):

| Year Ended May 31, 2011 |

Year Ended May 31, 2010 |

Increase (Decrease) |

||||||||||||||

| $ | % | |||||||||||||||

| Revenues: |

||||||||||||||||

| TCM division |

$ | 284,616 | $ | 259,227 | $ | 25,389 | 10 | % | ||||||||

| TMS division |

223,404 | 194,642 | 28,762 | 15 | % | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenues |

508,020 | 453,869 | 54,151 | 12 | % | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross margin |

157,143 | 136,005 | 21,138 | 16 | % | |||||||||||

| SG&A expenses: |

||||||||||||||||

| Field operations |

95,806 | 89,104 | 6,702 | 8 | % | |||||||||||

| Corporate costs |

19,260 | 18,944 | 316 | 2 | % | |||||||||||

| Non-routine acquisition costs |

632 | — | 632 | 100 | % | |||||||||||

| Severance charges |

— | 662 | (662 | ) | (100 | )% | ||||||||||

| Non-routine investigation costs |

— | 3,153 | (3,153 | ) | (100 | )% | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total SG&A expenses |

115,698 | 111,863 | 3,835 | 3 | % | |||||||||||

| Earnings from unconsolidated affiliates |

1,030 | 635 | 395 | 62 | % | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating income |

$ | 42,475 | $ | 24,777 | $ | 17,698 | 71 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Revenues. Our revenues for the year ended May 31, 2011 were $508.0 million compared to $453.9 million for the year ended May 31, 2010, an increase of $54.2 million or 12%. Revenues for our TCM division (inclusive of Quest) for the year ended May 31, 2011 were $284.6 million compared to $259.2 million for the year ended May 31, 2010, an increase of $25.4 million or 10%. Team’s recent acquisition, Quest, contributed $15.8 million during the year ended May 31, 2011 (Quest was acquired on November 3, 2010). Organic revenue growth for the TCM division, excluding Quest, was $9.6 million or 4%. Revenues for our TMS division for the year ended May 31, 2011 were $223.4 million compared to $194.6 million for the year ended May 31, 2010, an increase of $28.8 million or 15%. Overall, organic revenue growth was geographically broad based as most regions benefitted from a return of previously deferred maintenance activities.

Gross margin. Our gross margin for the year ended May 31, 2011 was $157.1 million compared to $136.0 million for the year ended May 31, 2010, an increase of $21.1 million or 16%. Gross margin as a percentage of revenue was 31% for the year ended May 31, 2011 compared to 30% for the year ended May 31, 2010. Gross margin for our TCM division for the year ended May 31, 2011 was $87.6 million compared to $76.3 million for the year ended May 31, 2010, an increase of $11.2 million or 15%. TCM division gross margin as a percentage of revenue was 31% for the year ended May 31, 2011 and 29% for the year ended May 31, 2010. Gross margin for our TMS division was $69.6 million for the year ended May 31, 2011 compared to $59.7 million for the year ended May 31, 2010, an increase of $9.9 million or 17%. TMS division gross margin as a percentage of revenue was 31% for the year ended May 31, 2011 and 31% for the year ended May 31, 2010. Pricing pressures that negatively impact gross margin as a percentage of revenues were mitigated by demand for value-add technology solutions in our inspection business (part of the TCM division), and volume related leverage in our TMS division where most regions saw a return of previously deferred maintenance activities.

Selling, general and administrative expenses. Our SG&A expenses for the year ended May 31, 2011 were $115.7 million compared to $111.9 million for the year ended May 31, 2010, an increase of $3.8 million or

18

Table of Contents

3%. SG&A expenses for the current year ended May 31, 2011 include $0.6 million of non-routine acquisition costs related to our recent acquisition of Quest. SG&A expenses for the prior year ended May 31, 2010 included $0.7 million of severance charges related to staff reductions and $3.2 million of professional fees related to investigation costs. Excluding these non-routine charges, SG&A expenses for the year ended May 31, 2011 were $115.1 million, an increase of $7.0 million or 6%. Substantially all of the increase is related to field operations and associated with support of increased revenues. SG&A expenses as a percentage of revenue, adjusted to exclude the non-routine charges, was 23% for the year ended May 31, 2011 compared to 24% for the year ended May 31, 2010.

Earnings from unconsolidated affiliates. Our earnings from unconsolidated affiliates consists entirely of our joint venture (50% ownership) formed in May 2008, to perform non-destructive testing and inspection services in Alaska. Revenues of the joint venture not reflected in our consolidated revenues for the year ended May 31, 2011 and 2010 were $9.9 million and $7.5 million, respectively. As a result of the higher revenue levels in the joint venture, and leverage of fixed costs of the joint venture, our share of the earnings from the joint venture were $1.0 million, an increase of $0.4 million or 62%.

Interest. Interest expense was $2.2 million for the year ended May 31, 2011 compared to $2.8 million for the year ended May 31, 2010. This decrease is the result of lower interest rates applied to outstanding borrowings.

Foreign currency (gain) loss. There were no significant currency transaction gains or losses for the year ended May 31, 2011. Foreign currency transaction losses were $1.6 million for the year ended May 31, 2010. Currency transaction losses were primarily due to fluctuations between the Venezuelan Bolivar and the U.S. Dollar. Team operates a small service location in Punta Fijo, Venezuela, whose annual revenues have historically been less than one percent of Team’s consolidated revenues for all periods presented. Venezuela is accounted for as a hyperinflationary economy (see Note 16 to our audited consolidated financial statements).

Taxes. The provision for income tax for fiscal year 2011 was $13.5 million on pre-tax income of $40.2 million, compared to the provision for income tax for fiscal year 2010 which was $8.2 million on pre-tax income of $20.4 million. During the third quarter of fiscal year 2011, we identified and corrected accounting errors relating to the effect of share-based compensation on tax provisions for fiscal years 2007-2010. During those periods, reported earnings were understated because effective tax rates were overstated as a result of the previously undetected errors in the tax provision calculation. No restatement of previously issued financial statements was required because the effect on those statements was immaterial. The cumulative effect of the errors in the tax provision calculation was a tax benefit consisting of $1.8 million associated with the prior years. Excluding the effect of the $1.8 million portion of the cumulative adjustments related to prior years, our effective tax rate for the fiscal year 2011 was 38% compared to 40% for the fiscal year 2010 (see Note 8 to our audited consolidated financial statements).

Liquidity and Capital Resources

Financing for our operations consists primarily of vendor financing and leasing arrangements, our bank facility and cash flows attributable to our operations, which we believe are sufficient to fund our business needs. At May 31, 2012, we had $22.5 million of cash on hand and approximately $50.6 million of available borrowing capacity through our banking syndicate.

19

Table of Contents

Bank facility. In fiscal year 2012, we renewed our Credit Facility (the “New Credit Facility”). The New Credit Facility has borrowing capacity of up to $150 million in multiple currencies, is secured by virtually all of our domestic assets and a majority of the stock of our foreign subsidiaries and matures in July of 2016. In connection with the renewal, we capitalized $0.8 million of associated debt issuance costs which will be amortized over the life of the New Credit Facility. The New Credit Facility bears interest at LIBOR plus 1.75% and has commitment fees of 0.30% on unused borrowing capacity. At May 31, 2012, we were in compliance with all financial covenants of the New Credit Facility.

Future maturities of long-term debt, reflecting the maturities under the New Credit Facility, are as follows (in thousands):

| 2013 |

$ | — | ||

| 2014 |

— | |||

| 2015 |

— | |||

| 2016 |

— | |||

| 2017 |

85,872 | |||

| Thereafter |

— | |||

|

|

|

|||

| $ | 85,872 | |||

|

|

|

In order to secure our insurance programs we are required to post letters of credit generally issued by a bank as collateral. A letter of credit commits the issuer to remit specified amounts to the holder, if the holder demonstrates that we failed to meet our obligations under the letter of credit. If this were to occur, we would be obligated to reimburse the issuer for any payments the issuer was required to remit to the holder of the letter of credit. At May 31, 2012 and May 31, 2011, we were contingently liable for outstanding stand-by letters of credit totaling $13.5 million and $8.8 million, respectively. Outstanding letters of credit reduce amounts available under our New Credit Facility and are considered as having been funded for purposes of calculating our financial covenants under the New Credit Facility.

On February 12, 2008, we borrowed €12.3 million under the Credit Facility to serve as an economic hedge of our net investment in our European operations as fluctuations in the fair value of the borrowing attributable to the U.S. Dollar/Euro spot rate offset translation gains or losses attributable to our investment in our European operations. At May 31, 2012, the €12.3 million borrowing had a U.S. Dollar value of $15.3 million.

Leasing arrangements. We enter into operating leases to rent facilities and obtain vehicles and equipment for our field operations. Our contractual obligations under non-cancellable operating leases, primarily consisting of facility and auto leases, were approximately $36.1 million at May 31, 2012 and are as follows (in thousands):

| Twelve Months Ended May 31, |

Operating Leases |

|||

| 2013 |

$ | 11,288 | ||

| 2014 |

8,700 | |||

| 2015 |

6,598 | |||

| 2016 |

4,168 | |||

| 2017 |

1,991 | |||

| Thereafter |

3,376 | |||

|

|

|

|||

| Total |

$ | 36,121 | ||

|

|

|

|||

Total rent expense resulting from operating leases for the twelve months ended May 31, 2012, 2011 and 2010 was $20.5 million, $18.8 million and $19.4 million, respectively. Subsequent to year end, we entered into an agreement to lease 22,000 square feet of office space in Sugar Land, Texas where we will relocate our corporate administrative functions. The additional lease commitment will total approximately $3.0 million over the next 5 years.

20

Table of Contents

A summary of long-term debt and other contractual obligations as of May 31, 2012 and May 31, 2011 is as follows (in thousands):

| May 31, | ||||||||

| 2012 | 2011 | |||||||

| Credit Facility |

$ | 85,872 | $ | 75,848 | ||||

| Vendor financing and other |

— | 232 | ||||||

|

|

|

|

|

|||||

| 85,872 | 76,080 | |||||||

| Current maturities |

— | (212 | ) | |||||

|

|

|

|

|

|||||

| Long-term debt, excluding current maturities |

$ | 85,872 | $ | 75,868 | ||||

|

|

|

|

|

|||||

| Outstanding letters of credit |

$ | 13,548 | $ | 8,793 | ||||

|

|

|

|

|

|||||

| Leasing arrangements |

$ | 36,121 | $ | 27,684 | ||||

|

|

|

|

|

|||||

Restrictions on cash. Included in our cash and cash equivalents at May 31, 2012, is $8.2 million of cash in Europe and $0.9 million of cash in Venezuela. Any repatriation of cash from Europe, if deemed to be a dividend from our European subsidiary for tax purposes, would result in adverse tax consequences of $0.7 million. While not legally restricted from repatriating this cash, we consider all earnings of our European subsidiary to be indefinitely reinvested and access to cash in Europe to be limited. Similarly, the uncertain economic and political environment in Venezuela makes it very difficult to repatriate cash flows of our Venezuelan subsidiary.

Cash flows attributable to our operating activities. For the year ended May 31, 2012, cash provided by operating activities was $36.7 million. Positive operating cash flow was primarily attributable to net income of $33.1 million, depreciation and amortization of $17.5 million, and non-cash compensation cost of $4.4 million offset by a $18.3 million increase in working capital.

Cash flows attributable to our investing activities. For the year ended May 31, 2012, cash used in investing activities was $42.3 million, consisting primarily of $23.9 million of capital expenditures and $19.4 million related to business acquisitions. Capital expenditures can vary depending upon specific customer needs that may arise unexpectedly.

Cash flows attributable to our financing activities. For the year ended May 31, 2012, cash provided by financing activities was $15.3 million consisting primarily of $12.7 million of cash provided by our New Credit Facility.