Schedule 14A Information

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| x | Definitive Proxy Statement – 2007 Annual Meeting of Shareholders | |||||

| ¨ | Definitive Additional Materials | |||||

| ¨ | Soliciting Material Pursuant to § 240.14a-11(c) or § 240.14a-12 | |||||

TEAM, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

TEAM, INC.

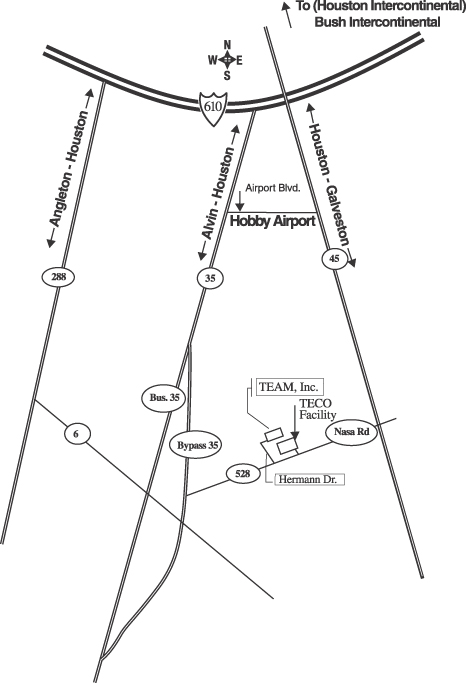

200 Hermann Drive

Alvin, Texas 77511

(281) 331-6154

Notice of 2007 Annual Meeting of Shareholders

To Be Held on Thursday, September 27, 2007

To the Shareholders of Team, Inc.:

The 2007 Annual Meeting of Shareholders of Team, Inc. (the “Company”) will be held on Thursday, September 27, 2007 at 3:00 p.m. at the Company’s offices, 200 Hermann Drive, Alvin, Texas 77511 for the following purposes:

1. To elect two persons to serve as Class III Directors to hold office until the 2010 Annual Meeting of Shareholders.

2. To approve an increase of the number of authorized shares under the First Amended and Restated Team, Inc. 2006 Stock Incentive Plan.

3. To approve the Team, Inc. Executive Incentive Compensation Plan.

4. To transact such other business as may properly come before the meeting and all adjournments thereof.

Further information regarding the meeting and the above proposals is set forth in the accompanying Proxy Statement. The Board of Directors has fixed the close of business on August 10, 2007, as the record date for determination of shareholders who are entitled to notice of and to vote either in person or by proxy at the 2007 Annual Meeting of Shareholders and any adjournment thereof.

All shareholders are cordially invited to attend the meeting in person. Even if you plan to attend the meeting, YOU ARE REQUESTED TO SIGN, DATE AND RETURN THE ACCOMPANYING PROXY AS SOON AS POSSIBLE.

| By Order of the Board of Directors |

|

| Philip J. Hawk |

| Chairman of the Board of Directors and Chief Executive Officer |

August 27, 2007

YOUR VOTE IS IMPORTANT.

PLEASE SIGN, DATE AND RETURN THE ACCOMPANYING PROXY CARD PROMPTLY.

TEAM, INC.

200 Hermann Drive

Alvin, Texas 77511

(281) 331-6154

PROXY STATEMENT

GENERAL

This Proxy Statement and the accompanying proxy card are furnished in connection with the solicitation of proxies by the Board of Directors of Team, Inc., a Texas corporation (the “Company”), for use at the 2007 Annual Meeting of Shareholders and at any adjournment thereof (such meeting or adjournment(s) thereof referred to as the “2007 Annual Meeting”), to be held at the time and place and for the purposes set forth in the accompanying Notice of 2007 Annual Meeting of Shareholders. This Proxy Statement and accompanying proxy card are being mailed to shareholders beginning on August 27, 2007.

The Company will bear the costs of soliciting proxies in the accompanying form. In addition to the solicitation made hereby, proxies may also be solicited by telephone, telegram or personal interview by officers and employees of the Company. The Company will reimburse brokers or other persons holding stock in their names or in the names of their nominees for their reasonable expenses in forwarding proxy material to beneficial owners of stock.

All duly executed proxies received prior to the 2007 Annual Meeting will be voted in accordance with the choices specified thereon, unless revoked as described below. As to any matter for which no choice has been specified in a proxy, the shares represented thereby will be voted by the persons named in the proxy: FOR the election of the two nominees named herein for Class III Directors to hold office until the 2010 Annual Meeting of Shareholders; FOR the approval of an increase of authorized shares under the First Amended and Restated Team, Inc. 2006 Stock Incentive Plan; FOR the approval of the Team, Inc. Executive Incentive Compensation Plan; and in the discretion of such person in connection with any other business that may properly come before the meeting. Shareholders may revoke their proxy at any time prior to the exercise thereof by (i) written notice to Mr. Ted W. Owen of the Company at the above address of the Company, (ii) the execution and delivery of a later dated proxy or (iii) voting in person at the 2007 Annual Meeting. However, a proxy will not be revoked simply by attending the 2007 Annual Meeting and not voting. Proxy cards that are not signed or that are not returned have no effect for any purpose.

VOTING SECURITIES

General

As of the close of business on August 10, 2007, the record date for determining shareholders entitled to vote at the 2007 Annual Meeting, the Company had 9,006,143 shares of common stock, $0.30 par value per share (“Common Stock”), outstanding and entitled to vote. Each share of Common Stock is entitled to one vote with respect to each matter to be acted upon at the 2007 Annual Meeting. The holders of a majority of the total shares of Common Stock of the Company issued and outstanding as of August 10, 2007, whether present in person or represented by proxy, will constitute a quorum for the transaction of business at the meeting. Any abstentions, and any “withholds” in the election of directors, are counted for purposes of determining the presence or absence of a quorum while broker non-votes are not counted. Additionally, abstentions and/or withholds are counted as shares at the meeting in tabulations of the votes cast on proposals presented to shareholders, whereas broker non-votes are not counted as shares at the meeting for purposes of determining whether a proposal has been approved.

1

Stock Split effective August 29, 2007

The Board of Directors previously announced a stock split to be effected in the form of a stock dividend payable on August 29, 2007 in which each shareholder will receive one additional common share for each share owned. After such stock split, all references in this proxy statement to the number of shares of common stock outstanding, held by a particular person or available pursuant to a plan will be double the amount stated. Further, all references in this proxy statement to stock prices will be one-half the amount stated. For example, after the stock split, the number of shares outstanding and entitled to vote will be 18,012,286.

2

PROPOSAL ONE—ELECTION OF DIRECTORS

General

The Company’s Restated Articles of Incorporation and Bylaws provide that the Company’s Board of Directors will consist of not less than six nor more than nine persons, the exact number to be fixed from time-to-time by the Board of Directors. The Board of Directors has fixed the current number of directors at seven. The Company’s directors are divided into three classes designated as Class I, Class II and Class III. Each class consists, as nearly as possible, of one-third of the total number of directors constituting the entire Board of Directors. The Class I directors serve for a term expiring at the 2008 Annual Meeting, Class II directors serve for a term expiring at the 2009 Annual Meeting and the Class III directors serve for a term expiring at the 2007 Annual Meeting. At each annual meeting of shareholders successors to the class of directors whose term expires at that annual meeting shall be elected for a term expiring at the third succeeding annual meeting. Each director holds office until the annual meeting for the year in which his term expires and until his successor has been elected and qualified.

The Board of Directors has nominated two persons for election as Class III Directors to serve a three-year term expiring on the date of the Company’s 2010 Annual Meeting, and until their successors are duly elected and qualified. Messrs. Sidney B. Williams and Emmett J. Lescroart have been nominated by the Board of Directors to stand for election as such Class III Directors.

Directors will be elected by a plurality of votes cast at the 2007 Annual Meeting. Shareholders may not cumulate their votes for the election of directors. Unless contrary instructions are set forth in the proxies, the persons with full power of attorney to act as proxies at the 2007 Annual Meeting will vote all shares represented by such proxies for the election of the nominees named therein as directors. Should any of the nominees become unable or unwilling to accept nomination or election, it is intended that the persons acting under the proxy will vote for the election, in the nominee’s stead, of such other persons as the Board of Directors of the Company may recommend. The Company’s management has no reason to believe that any of the nominees will be unable or unwilling to stand for election or to serve if elected.

Nominees

The Board of Directors unanimously recommends a vote FOR the election of the nominees listed below.

Set forth below is certain information as of August 10, 2007 concerning the nominees for election at the 2007 Annual Meeting as Class III directors, including the business experience of each nominee for at least the past five years:

| Name |

Age | Present Position With the Company |

Director Since | |||

| Sidney B. Williams |

73 | Director | 1973 | |||

| Emmett J. Lescroart |

56 | Director | 2004 |

Mr. Williams is the sole shareholder of a professional corporation which is a partner in the law firm of Chamberlain, Hrdlicka, White, Williams & Martin in Houston, Texas. He has been a partner in that firm for more than the past five years.

Mr. Lescroart is a Managing Director of Chapman Associates, a private investment banking firm. He is also an independent private investor managing his personal investments and has done this since 1996. He owned and operated EJL Capital, LLC, a private investment banking firm before joining Chapman Associates in 2005. For twenty years prior to 1996, he was employed with Cooperheat Company in positions of increased responsibility

3

and authority, becoming chief executive officer in 1983 and remaining in that position until resigning in 1996 to pursue his personal investments business. In August 2004, certain of the assets of a successor to the Cooperheat entity were acquired by the Company.

Directors Continuing in Office

Set forth below is certain information concerning the five directors continuing in office until the expiration of their respective terms, including the business experience of each director for at least the past five years:

| Name |

Age | Present Position With the Company |

Director Since |

Class | Expiration of Present Term | |||||

| Philip J. Hawk |

53 | Chairman & CEO | 1998 | Class I | 2008 | |||||

| Louis A. Waters |

69 | Director | 1998 | Class I | 2008 | |||||

| Jack M. Johnson, Jr. |

69 | Director | 1992 | Class II | 2009 | |||||

| Vincent D. Foster |

50 | Director | 2005 | Class II | 2009 | |||||

| Robert A. Peiser |

59 | Director | 2006 | Class II | 2009 |

Mr. Hawk was appointed Chairman of the Board and Chief Executive Officer of the Company in November 1998. Mr. Hawk is also a director of NCI Building Systems, Inc.

Mr. Waters presently manages the Waters Group, a family investment company. He was the Founding Chairman of Browning-Ferris Industries, Inc. (NYSE) and served that company from its inception in 1969 until his retirement in March 1997. Mr. Waters was also the Founding Chairman of Tyler Corp (NYSE) serving that company from September 1997 until he retired in March 2002. Mr. Waters also serves as the Lead Director of the Company’s Board of Directors.

Mr. Johnson has been Managing General Partner of Wintermann & Company, a partnership that manages approximately 25,000 acres of real estate in Texas used in farming, ranching and oil and gas exploration activities, for more than the past five years. Mr. Johnson is also President of Winco Agriproducts, an agricultural products company that primarily processes rice for seed and commercial sale. Mr. Johnson is also a director of Security State Bank in Anahuac, Texas.

Mr. Foster is a Principal and Senior Managing Director of Main Street Capital Partners, LLC, Main Street Mezzanine Fund, LP and Main Street Capital II, LP. The fund is third in a series of funds co-founded by Mr. Foster since 1997. Prior to co-founding Main Street Merchant Partners, Mr. Foster, a CPA, spent 19 years with Andersen Worldwide and Arthur Andersen LLP (“Andersen”) where he was a partner from 1988-1997. Mr. Foster was the Director of Andersen’s Corporate Finance and Mergers and Acquisitions practices for the Southwest United States and specialized in working with companies involved in consolidating their respective industries. Mr. Foster currently serves as a Director of Quanta Services, Inc., after being the non-executive Chairman through May 2002. He also serves as the non-executive Chairman of the Board of Directors of U.S. Concrete, Inc. and a Director of Carriage Services, Inc. Mr. Foster also serves as the Chairman of the Audit Committee.

Mr. Peiser is the President and CEO of Imperial Sugar Company, a publicly traded refiner and marketer of sugar products. He has been in that position since April 2002 and also serves on its Board of Directors. From 1999 until joining Imperial Sugar, Mr. Peiser was the Chairman and CEO of Vitality Beverages, Inc., a privately owned beverage packaging and distribution company based in Tampa, Florida.

Meetings and Committees of the Board

The Board of Directors held eight meetings during the fiscal year ended May 31, 2007. No director attended fewer than 75% of the meetings held during the period for which he served as a member of the Board and the

4

Committees on which he served. The Company does not have a formal policy regarding director attendance at annual meetings of shareholders; however, it does encourage all directors to attend all meetings of shareholders. All directors, except for Mr. Waters, were in attendance at the 2006 Annual Meeting of Shareholders.

The Board of Directors has an Executive Committee, an Audit Committee, a Compensation Committee, and a Corporate Governance and Nominating Committee. The Executive Committee is composed of Messrs. Hawk, Williams and Waters. The Executive Committee is responsible for assisting with the general management of the business and affairs of the Company as needed during intervals between meetings of the Board of Directors. The Executive Committee had one formal meeting during fiscal 2007.

Audit Committee

The Audit Committee, which met twelve times during fiscal 2007, is charged with the duties of recommending the appointment of the independent certified public accountants; reviewing their fees; ensuring that proper guidelines are established for the dissemination of financial information to the Company’s shareholders; meeting periodically with the independent certified public accountants, the Board of Directors and certain officers of the Company and its subsidiaries to ensure the adequacy of internal controls and reporting; reviewing consolidated financial statements; providing oversight to the Company’s internal audit function established in June 2007; and performing any other duties or functions deemed appropriate by the Board. The Board has determined that Vincent D. Foster and Robert A. Peiser are audit committee financial experts within the meaning of SEC regulations. In addition, the Board of Directors has determined that each member of the Audit Committee is independent, as defined by the applicable listing requirements of the NASDAQ Global Select Stock Market. The Audit Committee is established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended. Mr. Foster is Chairman of the Audit Committee and serves with Messrs. Peiser and Johnson.

Compensation Committee

The Compensation Committee, which met seven times during fiscal 2007, reviews management performance and makes recommendations to the Board of Directors concerning management compensation and other employment benefits. Mr. Johnson is the Chairman of the Compensation Committee and serves with Messrs. Lescroart, Waters and Williams.

Corporate Governance and Nominating Committee

The Corporate Governance and Nominating Committee, which met one time during fiscal 2007, is charged with recommending director nominees to the Board of Directors; evaluating the contribution and performance of members and committees of the Board; developing appropriate corporate governance principles for the Company; and ensuring the processes of the Board are sufficient and consistent with its oversight role of the Company. Each member of the Corporate Governance and Nominating Committee is independent, as defined by the applicable listing requirements of the NASDAQ Global Select Stock Market. The Board of Directors has adopted a written charter for the Corporate Governance and Nominating Committee, a copy of which is posted on the Company’s website at www.teamindustrialservices.com on the “Investors” page under “Governance.” Mr. Williams is Chairman of the Corporate Governance and Nominating Committee and serves with Messrs. Peiser and Waters.

The Corporate Governance and Nominating Committee will consider director nominees who the committee believes have demonstrated a high level of personal and professional integrity and exceptional ability and judgment. The committee will examine whether a director nominee is likely to be effective, in conjunction with other nominees and the continuing directors, in serving the long-term interest of the Company’s shareholders. The committee will also examine other qualifications of a director nominee, including experience in formulating policy in areas relevant to the Company’s activities as well as skills and business experience that complement the other directors on the Board.

5

The Corporate Governance and Nominating Committee and Board of Directors will consider nominees for the Board of Directors that are recommended by any shareholder entitled to vote for the election of directors. A nominating shareholder must submit any recommendation in writing to the Corporate Governance and Nominating Committee, c/o the Company’s Secretary, 200 Hermann Drive, Alvin, Texas 77511, by May 31 each year for consideration for the next annual meeting of shareholders. Such recommendation must be accompanied by a description of each nominee’s qualifications, experience and background, as well as a statement signed by each such nominee consenting to being nominated and, if elected, to serving as director. The committee evaluates nominees recommended by shareholders in the same manner it does other nominees, as described above.

Lead Director

The Board of Directors acting on the recommendation of the Corporate Governance and Nominating Committee has established the position of Lead Director. As duties and responsibilities, the Lead Director will (i) preside at all meetings of the board at which the Chairman is not present including executive sessions of the independent directors; (ii) respond directly to shareholder and other stakeholder questions and comments that are directed to the Lead Director or to the independent directors as a group, with such consultation with the Chairman or other directors as the Lead Director may deem appropriate; (iii) review meeting agendas and schedules for the Board; (iv) ensure personal availability for consultation and communication with independent directors and with the Chairman, as appropriate; and (v) call special meetings of the independent directors in accordance with the Company’s by-laws, as the Lead Director may deem to be appropriate. The General Counsel and the Corporate Secretary’s Office will provide support to the Lead Director in fulfilling the Lead Director role. Louis A. Waters has been elected Lead Director by the Board of Directors.

Director Independence

The Board has determined that, except for Mr. Hawk, all the director nominees and directors not standing for election are “independent” as that term is defined in the applicable rules of The NASDAQ Global Select Market. In making this determination, the Board considered transactions and relationships between each director or his or her immediate family and the Company and its subsidiaries, including those reported under “Compensation Committee Interlocks and Insider Participation” and “Certain Transactions” below. The purpose of this review was to determine whether any such relationships or transactions were material and, therefore, inconsistent with a determination that the director is independent. There are no family relationships between any nominees, directors and executive officers. Mr. Hawk is not independent because of his employment as chief executives officer of the Company.

During this review of director independence, the Board specifically considered the relationship between the Company and Chamberlain, Hrdlicka, White, Williams and Martin of Houston, Texas, of which Mr. Sidney B. Williams is the sole shareholder of a professional corporation that is a partner in such law firm. Chamberlain, Hrdlicka, White, Williams and Martin is a law firm that has provided legal services to the Company for many years. The Company’s fee arrangement with Chamberlain, Hrdlicka, White, Williams and Martin is negotiated on the same basis as arrangements with other outside legal counsel and is subject to the same terms and conditions. The fees the Company pays to Chamberlain, Hrdlicka, White, Williams and Martin are comparable to those the Company pays to other law firms for similar services. The fees paid by the Company to Chamberlain, Hrdlicka, White, Williams and Martin in fiscal 2007 were approximately $50,000. Mr. Williams is compensated by Chamberlain, Hrdlicka, White, Williams and Martin on a fixed fee arrangement. While the relationship between the Company and Chamberlain, Hrdlicka, White, Williams and Martin was not required to be disclosed in the “Certain Transactions” section below, the Board still considered this relationship in connection with its analysis of director independence. Based on its review, the Board concluded that this relationship (i) was not material to the Company or Mr. Williams, (ii) does not interfere with the exercise of Mr. Williams’ independent judgment, and (iii) did not adversely impact the Board’s determination that Mr. Williams is independent.

The Board also considered its relationship with Emmett J. Lescroart. The Company and Mr. Lescroart were parties to a Consulting Agreement effective July 30, 2004 under which Mr. Lescroart was to provide assistance to

6

the Company officers in operating the Company’s heat treating business from time to time as requested by Company management for base fees of $900 per day. The Company and Mr. Lescroart terminated this Consulting Agreement in August 2006. In fiscal year 2007, no compensation was paid to Mr. Lescroart under the Consulting Agreement. While the relationship between the Company and Mr. Lescroart was not required to be disclosed in the “Certain Transactions” section below, the Board still considered this relationship in connection with its analysis of director independence. Based on its review, the Board concluded that this relationship (i) was not material to the Company or Mr. Lescroart, (ii) does not interfere with the exercise of Mr. Lescroart’s independent judgment, and (iii) did not adversely impact the Board’s determination that Mr. Lescroart is independent.

Compensation of Directors

In fiscal 2007, all non-employee directors received an annual fee of $30,000, of which two-thirds ($20,000) was paid in cash in four equal quarterly installments. The remaining $10,000 was paid in the form of Common Stock. The stock payments are made July 1 of each year with the number of shares determined by dividing $10,000 by the closing price per share on the preceding business day. 222 shares were issued to each non-employee director on July 2, 2007. In addition, the Chairman of the Audit Committee is paid an additional $10,000 fee in cash per year.

In August 2007, the Board increased the cash portion of the fee for non-employee directors (other than Audit Committee members) to $30,000 per year. The cash fee for Audit Committee members, other than the Chairman, was increased by an additional $5,000 per year to $35,000 per year. The annual cash fee to the Audit Committee Chairman was increased to $40,000, which continues to be $10,000 more per year than non-audit committee directors.

In December 1991, the Company adopted the Non-Employee Directors Stock Option Plan (the “Non-Employee Director Plan”). The Non-Employee Director Plan authorizes the award of stock options for an aggregate of 610,000 shares of Common Stock to non-employee directors of the Company. The purpose of the Non-Employee Director Plan is to attract and retain the services of experienced and knowledgeable independent individuals as directors, to extend to them the opportunity to acquire a proprietary interest in the Company so that they will apply their best efforts for the benefit of the Company, and to provide such individuals with an additional incentive to continue in their positions.

7

Pursuant to the Non-Employee Director Plan, each non-employee director receives an automatic grant of stock options upon such director’s appointment, reappointment, election or reelection to the Board of Directors equal to the product obtained by multiplying 5,000 by the number of years, or any part of any year, that such director is appointed or elected to serve on the Board of Directors. The exercise price of the options is equal to the fair market value of the Company’s Common Stock on the date of grant, and the options expire ten years after the date of grant. Options to purchase 5,000 shares vest on the date of grant and each anniversary thereafter until all of the options granted are fully vested. During fiscal 2007, Messrs. Johnson, Foster, and Peiser were granted options to purchase 15,000 shares, 15,000 shares, and 15,000 shares, respectively, with an exercise price of $25.26 per share, pursuant to their election to the Board of Directors at the 2006 Annual Meeting. See Director Compensation table below.

The following table sets forth director compensation for fiscal 2007.

Director Compensation

| Name |

Fees Earned ($) |

Stock Awards ($) |

Option ($) |

Total ($) |

Total Options Outstanding at May 31, 2007 (#) | |||||||||

| Philip J. Hawk (1) |

— | — | — | — | — | |||||||||

| Louis A. Waters |

$ | 20,000 | $ | 10,000 | — | $ | 30,000 | 50,000 | ||||||

| Jack M. Johnson, Jr. |

$ | 20,000 | $ | 10,000 | $ | 196,200 | $ | 226,200 | 45,000 | |||||

| Vincent D. Foster |

$ | 30,000 | $ | 10,000 | $ | 196,200 | $ | 236,200 | 20,000 | |||||

| E. Theodore Laborde (2) |

$ | 5,000 | $ | 10,000 | — | $ | 15,000 | — | ||||||

| Robert A. Peiser (2) |

$ | 15,000 | — | $ | 196,200 | $ | 211,200 | 15,000 | ||||||

| Sidney B. Williams |

$ | 20,000 | $ | 10,000 | — | $ | 30,000 | 45,000 | ||||||

| Emmett J. Lescroart |

$ | 20,000 | $ | 10,000 | — | $ | 30,000 | 35,000 | ||||||

| (1) | Mr. Hawk is a Named Executive and as such all of his stock options are reported in the Outstanding Equity Awards at Fiscal Year-End table. |

| (2) | On August 14, 2006, the Company was informed that one of its Class II directors, Mr. E. Theodore Laborde, would not stand for reelection at the Company’s 2006 annual shareholders meeting on September 28, 2006 (the “2006 Annual Meeting”). Accordingly, at a Board meeting held on August 14, 2006, the Board nominated Mr. Robert A. Peiser to stand for election as a Class II director whereby he was duly elected at the 2006 Annual Meeting. As a result of the change in directors during the year, both Mr. Laborde and Peiser received compensation for their respective service as directors during fiscal year 2007. |

8

COMPENSATION DISCUSSION AND ANALYSIS

Overview

The Company’s executive compensation policies are designed to provide aggregate compensation opportunities for our executives that are competitive in the business marketplace and that are based upon Company and individual performance. Our foremost objectives are to:

| • | align executive pay and benefits with the performance of the Company; and |

| • | attract, motivate, reward, and retain the broad-based management talent required to achieve our corporate directives. |

Role of the Compensation Committee

The Compensation Committee of the Board of Directors, which is composed entirely of non-employee directors, reviews the executive compensation program of the Company to ensure that it is adequate to attract, motivate, and retain well-qualified executive officers and that it is directly and materially related to the short-term and long-term objectives of the Company and its stockholders as well as the operating performance of the Company. To carry out its role, among other things, the Compensation Committee:

| • | reviews the Company’s major compensation and benefit practices, policies, and programs with respect to executive officers; |

| • | reviews appropriate criteria for establishing performance targets for executive compensation; |

| • | determines appropriate levels of executive compensation by annually conducting a thorough competitive evaluation, reviewing proprietary and proxy information; and |

| • | ensures that the Company’s executive stock plans are administered in accordance with compensation objectives. |

The Compensation Committee is authorized to act on behalf of the Board on all issues pertaining to the compensation of, and the grant of options to, the executive officers. However, it is the practice of the Compensation Committee to fully review its activities and recommendations with the full Board.

Compensation Philosophy and Process

The Company’s compensation philosophy as implemented through the Compensation Committee is to match executive compensation with the performance of the Company and the individual by using several compensation components for the Company’s executives. The Compensation Committee endeavors to support the Company’s commitment to generating increases in shareholder value. The compensation and related programs are designed to reward and motivate executives for the accomplishment of the Company’s commitment to its shareholders. The components of the compensation program for the Company’s executives consist of:

| • | annual base salaries; |

| • | annual performance-based incentives paid in cash; |

| • | long-term performance-based incentives delivered in stock options pursuant to the Company’s stock options programs; |

Unlike many other companies its size, the Company offers no other executive perquisites other than a car allowance. The Company does not provide supplemental executive retirement plans, deferred compensation programs, special allowances, special medical or insurance plans. While committed to maintaining a competitive overall program, the Committee prefers this streamlined approach with minimal special executive benefits.

9

The Company’s overall compensation philosophy is to target its direct compensation for executives at the market median of the comparison group as discussed below, with opportunities to exceed the targeted median compensation levels through annual performance-based incentives paid in cash and through long-term performance-based incentives. The Company believes these targeted levels are appropriate in order to motivate, reward, and retain its executives, each of whom has leadership talents and expertise that make him or her attractive to other companies.

Compensation decisions are made by the Compensation Committee, based in part on detailed compensation tally sheets for each of the Company’s senior executives received from the Company’s management. These tally sheets included all components of compensation, including salaries, annual bonuses, stock options, restricted stock, other perquisites, retirement programs, and severance programs, for each of the last three fiscal years.

From time to time, the Compensation Committee has retained third party independent consultants to provide advice as to market levels of compensation and compensation trends, executive benefit programs such as executive life insurance benefits, and deferred compensation arrangements. Most recently, the Compensation Committee commissioned a related study by Watson Wyatt that was completed in the fall of 2006.

Benchmarking Tools

In reviewing the appropriate range of overall compensation and the appropriate ranges of the components of compensation, the Compensation Committee must ensure that compensation is competitive to attract and retain highly qualified executives. To facilitate this objective, the Compensation Committee, as a rule, considers various compensation surveys and proxy statement compensation information for companies of comparable size and complexity to the Company and with whom the Company competes for talent.

Annual Base Salaries

The annual base salary of the Company’s Chief Executive Officer is decided solely by the Compensation Committee. The annual base salaries of other Named Executive Officers are decided by the Compensation Committee with input or recommendations from the CEO. None of the Named Executive Officers have employment agreements. The Compensation Committee believes that salary levels should generally be targeted at the median level for the competitive market, because the Company believes that level is appropriate to motivate and retain its Named Executive Officers.

Fiscal 2007 Salary Decisions

In determining fiscal 2007 salary levels, the Compensation Committee recognized the expansion of the Company’s business achieved during fiscal 2006 reflected in 35% revenue growth and 122% growth in net income. The total shareholder return for the year, reflecting appreciation in stock price, was 64%. The Compensation Committee also noted the five-year average annual shareholder return of greater than 35%. With this strong performance as a context, the Compensation Committee granted an average 13% salary increase to each officer for fiscal 2007. The increase for each officer reflected the Compensation Committee’s assessment of the officer’s level of responsibility, experience and performance.

Annual Performance-Based Incentives Paid in Cash

The Company uses annual performance-based incentives paid in cash to focus its executive officers on financial and operational objectives that the Compensation Committee believes are primary drivers of the Common Stock price over time. The Compensation Committee believes that overall levels of annual performance-based incentives paid in cash should be consistent with the overall performance of the Company.

10

Historically, including fiscal 2007, the Company has had a discretionary performance-based incentives plan for senior executives. The Chief Executive Officer provided the Committee with performance-based incentives recommendations for each officer as well as a proposed total performance-based incentives pool for all Company employees. The Committee assessed the performance recommendations for all officers and determined the appropriate performance incentives recommendation for the Chief Executive Officer in view of overall Company performance, individual performance, and the resulting size of the overall performance-based incentives pool relative to Company earnings.

Fiscal 2007 Performance-Based Incentives Paid in Cash

For fiscal 2007, the Committee established a bonus program, 80% of which was based on quantitative measures and 20% of which was discretionary. The quantitative measure used was “fully diluted earnings per share,” or FDEPS, because the Committee currently believes it is the best measure reflecting appropriate growth of the Company and it directly affects the Company’s stock price performance. Target bonuses were set for the Named Executive Officers if the Company’s fiscal 2007 FDEPS reached $1.43. Further, the Named Executive Officers were entitled to receive 50% or more of their targeted bonus if the Company’s FDEPS equaled or exceeded $1.25, and were entitled to receive 200% of their targeted bonus if the Company’s FDEPS equaled or exceeded $2.35. The Company’s actual fiscal 2007 FDEPS was $1.64, so each of the Named Executive Officers received 123% of their targeted bonus pursuant to the quantitative measure of the Company’s incentive plan.

For the discretionary portion of the bonus, the Committee awarded bonuses at the target amount for each of the Named Executive Officers. The Committee was pleased with the operational and strategic progress of the Company during the year and believed that the leadership by the Named Executive Officers was a key contributor to this performance.

Proposal Three in this proxy statement seeks shareholder approval of the Company’s Executive Incentive Compensation Plan, pursuant to which the Company intends to pay cash incentives to its executive officers. Please see “Proposal Three—Approval of the Team, Inc. Executive Incentive Compensation Plan”

Long-Term Incentive Compensation

Regarding long-term incentives, the Committee has determined that the use of stock options is the appropriate vehicle for the Company. In previous years, the Committee explored the greater use of restricted stock and other approaches, but concluded that stock options provide the appropriate incentive that is fully aligned with shareholders to continue to increase the value of the Company. The shareholders approved the 2006 Stock Incentive Plan at the 2006 Annual Meeting that allows the Committee greater flexibility in the structure of specific awards. Going forward, the Committee intends to emphasize non-qualified stock options. The Committee has announced that it intends to maintain an average annual maximum “burn” rate (annual stock option awards as a percentage of total outstanding shares) of approximately three percent. The Compensation Committee makes grants of stock options during the spring of each year and following the annual meeting of shareholders, each with an exercise price equal to the closing market price on the date prior to the grant. Pursuant to the decisions to exclusively utilize stock options, there were no awards of restricted stock made to any Named Executive Officer during the fiscal year ended May 31, 2007 under the Company’s 2006 Stock Option and Award Plan.

Fiscal 2007 Long-Term Incentive Awards

In October 2006, we awarded grants of stock options to Named Executive Officers as set forth in the “Option Grants” table under “Executive Compensation and Other Matters” below.

11

Section 162(m) of the Internal Revenue Code

The Committee considers the accounting treatment and tax treatment of its compensation decisions, which is one of the reasons the Executive Incentive Compensation Plan is included as a proposal for shareholder approval in this proxy statement. Please see “Proposal Three—Approval of the Team, Inc. Executive Incentive Compensation Plan”.

Employment Agreements

None of the Named Executive Officers have employment agreements. Please see “Executive Compensation and Other Matters—Senior Management Compensation and Benefit Continuation Policy” and “—Potential Payments Upon Termination” for a discussion of severance and change of control benefits pursuant to the Company’s policies.

On October 9, 2006 Mr. Hawk and the Board of Directors mutually agreed to cancel his employment agreement. This action was initiated by Mr. Hawk for the sole purpose of aligning future compensation arrangements in a manner similar to that currently used for the Company’s other officers. There are no plans to change or alter Mr. Hawk’s current role, title or responsibilities. Mr. Hawk’s employment agreement is the only such employment agreement the Company had entered into with any of its employees. Among other things, the cancellation of the employment agreement has the effect of nullifying 295,000 future stock option grants that would have been issued no later than January 31, 2008, the date of the original expiration of the employment agreement. The Company neither paid any consideration nor incurred any early termination penalties related to the cancellation of the employment agreement.

Retirement Plans

Unlike many other companies its size, the Company does not provide supplemental executive retirement plans. The Company offers a 401(k) plan to its employees, including the Named Executive Officers, which currently provides a Company match of 3% of 6% of the employee’s contribution.

Perquisites and Personal Benefits

The Company offers no executive perquisites other than a car allowance, which is less than $10,000 per year. The Company offers medical benefits and life and disability insurance to its employees, including the Named Executive Officers. Personal benefit amounts are not considered annual salary for bonus purposes, deferred compensation purposes, or 401(k) contribution purposes.

12

COMPENSATION COMMITTEE REPORT

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis with management. Based on such review and discussions, the Compensation Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this proxy statement.

The Board of Directors has adopted a written charter for the committee, a copy of which is posted on the Company’s website at www.teamindustrialservices.com on the “Investors” page under “Governance.”

Jack M. Johnson, Jr., Chairman

Emmett J. Lescroart

Louis A. Waters

Sidney B. Williams

13

EXECUTIVE COMPENSATION AND OTHER MATTERS

The following table sets forth compensation information for the fiscal year ended May 31, 2007 for the Chief Executive Officer, the Chief Financial Officer, and the three next most highly compensated executive officers of the Company during the Company’s 2007 fiscal year (the “Named Executive Officers”):

Summary Compensation Table

| Name and Principal Position |

Fiscal Year |

Salary ($) | Bonus ($) (1) |

Stock Awards ($) (2) |

Option Awards ($) (3) |

Non-Equity ($) |

All Other Compensation ($) (4) |

Total ($) | ||||||||||||||

| Philip J. Hawk, Chairman of the Board and Chief Executive Officer |

2007 | $ | 439,423 | $ | 345,261 | — | $ | 962,400 | — | $ | 20,865 | $ | 1,767,949 | |||||||||

| Kenneth M. Tholan, President and Chief Operating Officer (5) |

2007 | $ | 296,154 | $ | 212,832 | $ | 125,000 | — | — | $ | 16,820 | $ | 650,806 | |||||||||

| Ted W. Owen, Senior Vice President and Chief Financial Officer and Treasurer |

2007 | $ | 248,077 | $ | 124,152 | — | $ | 160,400 | — | $ | 15,051 | $ | 547,680 | |||||||||

| John P. Kearns, Senior Vice President |

2007 | $ | 190,385 | $ | 124,152 | — | $ | 160,400 | — | $ | 13,026 | $ | 487,963 | |||||||||

| Gregory T. Sangalis, Senior Vice President—Law & Administration and Secretary (6) |

2007 | $ | 230,577 | $ | 124,152 | — | $ | 160,400 | — | $ | 11,163 | $ | 526,292 | |||||||||

| (1) | Represents the bonus earned for fiscal 2007. The bonuses are paid subsequent to year end based on the final results for the year. |

| (2) | The amounts represent the dollar amount expensed for financial accounting statement purposes with respect to the 2007 fiscal year for the fair value of restricted stock awards granted to each named executive officer in accordance with SFAS No. 123R, “Share Based Payments.” Pursuant to the SEC rules, the amounts shown exclude the impact of estimated forfeitures related to service-based vesting conditions. Refer to the Grants of Plan-Based Awards table for the full fair value of stock awards granted in fiscal 2007. These amounts reflect our accounting expense for these awards and do not correspond to the actual value, if any, that may be received by the named executive from these awards. |

| (3) | Represents the grant date fair value of options awarded in fiscal 2007 years. These amounts reflect our accounting expense for these awards and do not correspond to the actual value, if any, that may be received by the Named Executive Officers for these awards. The fair value was determined in accordance with SFAS No. 123R on the date of grant using the Black-Scholes option-pricing model. The assumptions used to determine the fair value are presented in Note 9 to the audited financial statement included in our Form 10-K Annual Report for the fiscal year ended May 31, 2007. |

| (4) | Represents vehicle allowances and the employer contribution to the 401(k) plan. |

| (5) | Mr. Tholan resigned as an officer of the Company effective May 31, 2007 and retired from the Company subsequent to May 31, 2007. As such no additional options were awarded for fiscal 2007. |

| (6) | Mr. Sangalis resigned his position as an officer of the Company effective June 22, 2007. |

14

Grants of Plan-Based Awards

The following table sets forth additional information relating to stock and option awards and equity and non-equity incentive plan awards granted to the named Executive Officers during the fiscal year ended May 31, 2007.

| Estimated Future Payouts Under Non-Equity Incentive Plan Awards (1) |

All Other Stock Awards: Number of Securities Underlying Options (#) |

Exercise or Base Price of Option Awards ($/Sh) (1) | ||||||||||||||

| Name |

Threshold ($) |

Target ($) |

Maximum ($) |

Grant Date |

||||||||||||

| Philip J. Hawk |

$ | 146,000 | $ | 292,000 | $ | 584,000 | 10/17/06 | 60,000 | $ | 30.53 | ||||||

| Kenneth M. Tholan (2) |

$ | 90,000 | $ | 180,000 | $ | 360,000 | None | — | — | |||||||

| Ted W. Owen |

$ | 52,500 | $ | 105,000 | $ | 210,000 | 10/17/06 | 10,000 | $ | 30.53 | ||||||

| John P. Kearns |

$ | 52,500 | $ | 105,000 | $ | 210,000 | 10/17/06 | 10,000 | $ | 30.53 | ||||||

| Gregory T. Sangalis (3) |

$ | 52,500 | $ | 105,000 | $ | 210,000 | 10/17/06 | 10,000 | $ | 30.53 | ||||||

| (1) | 2007 cash incentive plan was based upon achievement of diluted earnings per share in a range of $1.25 to $2.35, with a target of $1.43. At the threshold earnings level, payouts would generally be 50% of target and at the maximum earnings level, payouts would generally be 200% of target. |

| (2) | Mr. Tholan resigned as an officer of the Company effective May 31, 2007 and retired from the Company subsequent to May 31, 2007. As such, there are no estimated future payouts under non-equity incentive plans or options awards for the October 17, 2006 grant. |

| (3) | Mr. Sangalis resigned his position as an officer of the Company effective June 22, 2007. As such, there are no estimated future payouts under non-equity incentive plans. |

15

Outstanding Equity Awards at Fiscal Year-End

The following table summarizes the equity awards we have made to our Named Executive Officers which are outstanding as of May 31, 2007.

| Options Awards | |||||||||

| Name |

Number of (#) Exercisable |

Number of Unexercisable (3) |

Option ($) |

Option Expiration Date | |||||

| Philip J. Hawk |

115,934 | — | $ | 3.63 | 11/02/08 | ||||

| 50,000 | — | $ | 5.30 | 10/01/11 | |||||

| 2,500 | 2,500 | $ | 19.38 | 5/11/15 | |||||

| 2,500 | 2,500 | $ | 19.13 | 5/12/15 | |||||

| 1,000 | 1,000 | $ | 18.85 | 5/13/15 | |||||

| 5,000 | 15,000 | $ | 18.45 | 8/12/15 | |||||

| 5,750 | 17,250 | $ | 19.25 | 8/17/15 | |||||

| 12,500 | 37,500 | $ | 26.55 | 1/17/16 | |||||

| — | 60,000 | $ | 30.53 | 10/17/16 | |||||

| Kenneth M. Tholan (1) |

— | 5,000 | $ | 13.90 | 7/15/14 | ||||

| — | 5,000 | $ | 18.45 | 8/12/15 | |||||

| Ted W. Owen |

15,000 | — | $ | 3.90 | 7/20/11 | ||||

| 7,000 | — | $ | 9.00 | 6/27/12 | |||||

| 4,000 | — | $ | 9.25 | 6/26/13 | |||||

| 6,000 | 6,000 | $ | 15.67 | 6/24/14 | |||||

| 2,500 | 2,500 | $ | 16.56 | 9/23/14 | |||||

| 4,250 | 12,750 | $ | 18.45 | 8/12/15 | |||||

| — | 10,000 | $ | 30.53 | 10/17/16 | |||||

| John P. Kearns |

18,750 | — | $ | 3.50 | 6/08/09 | ||||

| 8,000 | — | $ | 1.94 | 6/29/10 | |||||

| 15,000 | — | $ | 3.90 | 7/20/11 | |||||

| 2,000 | — | $ | 9.00 | 6/27/12 | |||||

| 4,000 | — | $ | 8.25 | 6/26/13 | |||||

| 4,000 | 4,000 | $ | 15.67 | 6/24/14 | |||||

| 3,750 | 11,250 | $ | 18.45 | 8/12/15 | |||||

| — | 10,000 | $ | 30.53 | 10/17/16 | |||||

| Gregory T. Sangalis (2) |

19,069 | 25,000 | $ | 16.86 | 1/28/15 | ||||

| 1,250 | 3,750 | $ | 18.45 | 8/12/15 | |||||

| — | 10,000 | $ | 30.53 | 10/17/16 | |||||

| (1) | Mr. Tholan resigned as an officer of the Company effective May 31, 2007 and retired from the Company subsequent to May 31, 2007. As such, there are no estimated future payouts under non-equity incentive plans. |

| (2) | Mr. Sangalis resigned his position as an officer of the Company effective June 22, 2007. As such, any awards not vested by that date were forfeited. |

| (3) | All unvested options at May 31, 2007, with the exception of Mr. Tholan’s, vest ratably over 4 years on the anniversary date of the grant. Mr. Tholan’s options vested one-third upon grant and then one-third on the anniversary date of the grant in each of the two subsequent years. |

16

Option Exercises and Stock Vested

The following table provides additional information about the value realized by our Named Executive Officers on option award exercises and stock award vesting during the fiscal year ended May 31, 2007.

| Option Awards | Stock Awards | |||||||||

| Name |

Number of (#) |

Value ($) |

Number of (#) |

Value ($) | ||||||

| Philip J. Hawk |

84,066 | $ | 2,327,924 | — | — | |||||

| Kenneth M. Tholan |

32,500 | $ | 800,621 | 5,000 | $ | 195,950 | ||||

| Ted W. Owen |

15,486 | $ | 421,659 | — | — | |||||

| John P. Kearns |

13,750 | $ | 384,369 | — | — | |||||

| Gregory T. Sangalis |

— | — | — | |||||||

Executive and Other Officers

The following table sets forth information regarding the current executive officers of the Company as of August 10, 2007:

| Name of Director or Officer |

Age | Officer Since |

Position with Company | |||

| Philip J. Hawk |

53 | 1998 | Chairman of the Board and Chief Executive Officer | |||

| Ted W. Owen |

55 | 1998 | Senior Vice President, Chief Financial Officer and Treasurer | |||

| John P. Kearns |

50 | 1998 | Senior Vice President | |||

| David C. Palmore |

51 | 2007 | Senior Vice President | |||

| Arthur F. Victorson |

45 | 2007 | Senior Vice President | |||

| Peter W. Wallace |

44 | 2007 | Senior Vice President |

Information concerning the business experience of Mr. Hawk is provided under the section entitled “Directors Continuing in Office.”

Mr. Owen joined the Company in February 1998 and in April 1998 was elected Vice President, Chief Financial Officer and Treasurer. He was promoted to Senior Vice President in 2003.

Mr. Kearns joined the Company in 1980 as a design engineer and assumed the position of Vice President of Engineering and Manufacturing in 1996. He was promoted to Senior Vice President in 1998. Throughout his career with the Company, Mr. Kearns has been involved with the Company’s engineering, manufacturing and research and development functions.

Mr. Palmore joined the Company in 1996 as a Regional Manager. Since 2004, he has served as the Group Vice President—TMS Division. He was promoted to Senior Vice President, TMS Division in June 2007.

Mr. Victorson joined the Company at the time of the acquisition of the assets of Cooperheat-MQS, Inc. by the Company in 2004. He had been with that company since 1997. From 2001—2004 he was a Regional Manager. In 2004, he became a Vice President and General Manager of the Midwest & Great Lakes Region. In 2006, he began serving as the Group Vice President—TCM Division. He was promoted to Senior Vice President, TCM Division in June 2007.

Mr. Wallace joined the Company in 1987 as an Operations Supervisor. From 1989 to 1996 he was a Branch Manager, from 1997 to 2000 he was the Managing Director S.E. Asia, and from 2001 to 2004, he was a Regional Manager. From 2005 until June 2007, Mr. Wallace served as a Vice President and General Manager of the Southeast Region of the TMS Division. In June 2007, Mr. Wallace was promoted to Senior Vice President, Commercial Support and Business Development.

17

Senior Management Compensation and Benefit Continuation Policy

In August 2007, the Board adopted a Senior Management Compensation and Benefits Continuation Policy that recognizes the leadership roles that are critical to the Company’s success and provides our senior management with reasonable assurances of continued compensation in the event of a separation from the Company for any reason other than “for cause.” The terms of the policy provide upon (i) involuntary termination by the Company without cause and (ii) employee voluntary termination for good reason, the terminated senior executive would receive:

| • | a continued salary for a stated period (18 months for the CEO, 12 months for Senior Vice Presidents and 6 months for Vice Presidents); |

| • | continued medical benefits, life insurance, and long-term disability for the same period; and |

| • | access to outplacement assistance paid by the Company. |

In exchange for such benefits, the executive must enter into a one-year non-competition agreement.

Severance benefits are also triggered when an involuntary termination without cause or voluntary termination for good reason occurs within 90 days before or within 360 days after a change of control. In such event, the terminated senior executive would receive:

| • | a supplemental salary payment of the employee’s current level at the time of termination for a stated period (36 months for CEO, 24 months for Senior Vice Presidents, and 12 months for Vice Presidents), payable within 60 days of termination; |

| • | a supplemental compensation payment related to foregone annual and incentive or bonus for the period of salary continuation, calculated as the higher of the most recent year’s paid bonus or the average bonus for the last three years, payable within 60 days of termination; |

| • | continued medical benefits, life insurance and long-term disability for the same length of time as salary continuation; |

| • | continued perquisites for the salary continuation period; and |

| • | access to outplacement assistance paid by the Company. |

18

Potential Payments Upon Termination

As of May 31, 2007, the Company had no severance or termination policy for its senior management. As discussed above under “—Senior Management Compensation and Benefit Continuation Policy,” in August 2007, the Board adopted a policy that recognizes the leadership roles that are critical to the Company’s success and provides senior management with reasonable assurances of compensation in the event of a separation from the Company for any reason other than “for cause.” Based on the terms of such policy, the amount of compensation payable to each Named Executive Officer in each situation is listed below. The following information assumes the Senior Management Compensation and Benefit Continuation Policy was in effect at May 31, 2007. Mr. Tholan resigned as an officer of the Company effective May 31, 2007 and retired subsequent to May 31, 2007, and as such has not been included in table below. Mr. Sangalis resigned from the Company effective June 22, 2007, and as such has not been included in the table below.

| Philip J. Hawk: Benefits Payable Upon Termination as of 5/31/07 |

Salary | Incentive Bonus |

Outstanding Unvested Options (1) |

Healthcare/ Life |

Total | ||||||||||

| Involuntary Termination by Company Without Cause/Voluntary Termination by Employee for Good Reason |

$ | 750,000 | $ | — | $ | — | $ | 27,321 | $ | 777,321 | |||||

| Change of Control and Involuntary Termination by Company Without Cause or Voluntary Termination by Employee for Good Reason |

$ | 1,500,000 | $ | 1,035,783 | $ | 1,768,680 | $ | 54,642 | $ | 4,359,105 | |||||

| Ted W. Owen: Benefits Payable Upon Termination as of 5/31/07 |

Salary | Incentive Bonus |

Outstanding Unvested Options (1) |

Healthcare/ Life |

Total | ||||||||||

| Involuntary Termination by Company Without Cause/Voluntary Termination by Employee for Good Reason |

$ | 250,000 | $ | — | $ | — | $ | 7,464 | $ | 257,464 | |||||

| Change of Control and Involuntary Termination by Company Without Cause or Voluntary Termination by Employee for Good Reason |

$ | 500,000 | $ | 248,304 | $ | 548,730 | $ | 14,928 | $ | 1,311,962 | |||||

| John P. Kearns: Benefits Payable Upon Termination as of 5/31/07 |

Salary | Incentive Bonus |

Outstanding Unvested Options (1) |

Healthcare/ Life |

Total | ||||||||||

| Involuntary Termination by Company Without Cause/Voluntary Termination by Employee for Good Reason |

$ | 195,000 | $ | — | $ | — | $ | 7,464 | $ | 202,464 | |||||

| Change of Control and Involuntary Termination by Company Without Cause or Voluntary Termination by Employee for Good Reason |

$ | 390,000 | $ | 248,304 | $ | 414,005 | $ | 14,928 | $ | 1,067,237 | |||||

| (1) | All options vest upon a change in control. This amount represents the net realizable value of the unvested options at May 31, 2007. This amount is calculated assuming the unvested options are exercised at the May 31, 2007 close price of $39.19. |

19

COMPARISON OF TOTAL SHAREHOLDER RETURN

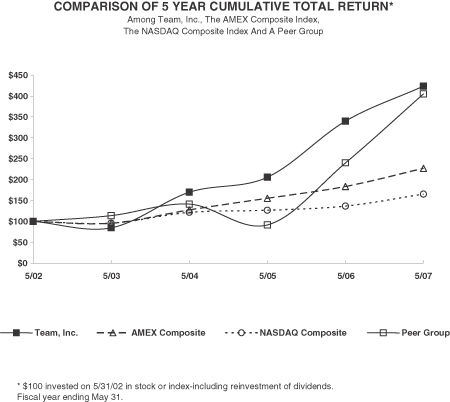

The following graph compares the Company’s cumulative total shareholder return on its Common Stock for a five-year period (May 31, 2002 to May 31, 2007), with the cumulative total return of the American Stock Exchange Market Value Index (“ASEMVI”) and the NASDAQ Composite Index, and a peer group of companies selected by the Company. The “Peer Group” is described in more detail below. The graph assumes that the value of the investment in the Company’s Common Stock and each index was $100 at May 31, 2002 and that all dividends were reinvested. Total returns are based on market capitalization. The following graph is based on historical data and is not necessarily indicative of future performance.

The peer group is composed of four companies which provide industrial and/or leak repair services. The returns of each company have been weighted according to their respective market capitalization for purposes of arriving at a peer group average. The members of the peer group are T-3 Energy Services, Inc., Furmanite Corporation, Matrix Service Company and Versar, Inc.

20

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of the Company’s Common Stock (the only class of voting securities of the Company) as of August 1, 2007 of (a) each person known by the Company to be the beneficial owner of more than 5% of the outstanding Common Stock, (b) each director or nominee for director of the Company, (c) the Named Executive Officers and (d) all executive officers and directors of the Company as a group. The information shown assumes the exercise by each person (or all directors and officers as a group) of the stock options owned by such person that are currently exercisable or exercisable within 60 days of August 1, 2007. Unless otherwise indicated, the address of each person named below is the address of the Company at 200 Hermann Drive, Alvin, Texas 77511.

| Name and Address of Beneficial Owner |

Number of Shares Beneficially Owned (1) |

Percentage of Outstanding Common Stock |

||||

| Philip J. Hawk |

361,316 | (2) | 3.8 | % | ||

| Kenneth M. Tholan |

62,822 | (3) | * | |||

| Ted W. Owen |

59,291 | (4) | * | |||

| John P. Kearns |

89,214 | (5) | * | |||

| Gregory T. Sangalis |

16,114 | (6) | * | |||

| Sidney B. Williams |

141,324 | (7) | 1.5 | % | ||

| Jack M. Johnson, Jr. |

103,918 | (8) | 1.1 | % | ||

| Louis A. Waters |

365,941 | (9) | 3.9 | % | ||

| Emmett J. Lescroart |

117,221 | (10) | 1.2 | % | ||

| Vincent D. Foster |

11,086 | (11) | * | |||

| Robert A. Peiser |

5,222 | (12) | * | |||

| All directors, nominees and executive officers as a group (11 persons) |

1,333,469 | (13) | 14.1 | % | ||

| FMR Corp. 82 Devonshire Street Boston, MA 02109 |

1,035,216 | (14) | 11.0 | % |

| * | Less than 1% of outstanding Common Stock. |

| (1) | The information as to beneficial ownership of Common Stock has been furnished, respectively, by the persons and entities listed, except as indicated below. Each individual or entity has sole power to vote and dispose of all shares listed opposite his or its name except as indicated below. |

| (2) | Includes 205,934 shares which may be acquired pursuant to the exercise of stock options currently exercisable or exercisable within 60 days of August 1, 2007. |

| (3) | Includes 5,000 shares which may be acquired pursuant to the exercise of stock options currently exercisable or exercisable within 60 days of August 1, 2007. |

| (4) | Includes 47,250 shares which may be acquired pursuant to the exercise of stock options currently exercisable or exercisable within 60 days of August 1, 2007 and 1,027 shares held in an employee benefit plan. |

| (5) | Includes 61,250 shares which may be acquired pursuant to the exercise of stock options currently exercisable or exercisable within 60 days of August 1, 2007 and 8,964 shares held in an employee benefit plan. |

| (6) | Includes 7,069 shares which may be acquired pursuant to the exercise of stock options currently exercisable or exercisable within 60 days of August 1, 2007 and 114 shares held in an employee benefit plan. |

| (7) | Includes 2,685 shares owned by Nancy Williams, Mr. Williams’ wife and 4,000 shares held by Mr. Williams’ adult children. Mr. Williams disclaims any economic interest in these shares. Also includes 45,000 shares which may be acquired pursuant to the exercise of stock options currently exercisable or exercisable within 60 days of August 1, 2007. |

| (8) | Includes 35,000 shares which may be acquired pursuant to the exercise of stock options currently exercisable or exercisable within 60 days of August 1, 2007. |

21

| (9) | Includes 45,000 shares which may be acquired pursuant to the exercise of stock options currently exercisable or exercisable within 60 days of August 1, 2007. Includes the impact of 14,258 shares sold on August 2, 2007. |

| (10) | Includes 30,000 shares which may be acquired pursuant to the exercise of stock options currently exercisable or exercisable within 60 days of August 1, 2007. |

| (11) | Includes 10,000 shares which may be acquired pursuant to the exercise of stock options currently exercisable or exercisable within 60 days of August 1, 2007. |

| (12) | Includes 5,000 shares which may be acquired pursuant to the exercise of stock options currently exercisable or exercisable within 60 days of August 1, 2007. |

| (13) | Includes 496,503 shares which may be acquired pursuant to the exercise of stock options currently exercisable or exercisable within 60 days of August 1, 2007. |

| (14) | Based on NASDAQ report on institutional holders dated August 10, 2007. |

The Company does not know of any arrangement that may at a subsequent date result in a change of control of the Company.

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee of the Board of Directors of the Company was, during fiscal 2007, an officer or employee of the Company or any of its subsidiaries, or was formerly an officer of the Company or any of its subsidiaries or had any relationship requiring disclosure by the Company. During fiscal 2007, no executive officer of the Company served as (i) a member of the compensation committee (or other board committee performing equivalent functions) of another entity, one of whose executive officers served on the Compensation Committee of the Board of Directors, (ii) a director of another entity, one of whose executive officers served on the Compensation Committee of the Board of Directors, or (iii) a member of the compensation committee (or other board committee performing equivalent functions) of another entity, one of whose executive officers served as a director of the Company.

Stockholder Communications with the Board of Directors

The Board of Directors welcomes communications from its shareholders and has adopted a procedure for receiving and addressing those communications. The process for shareholders to communicate with the Board of Directors is to send such communications in writing to Philip J. Hawk, Chairman of the Board, Team, Inc., 200 Hermann Drive, Alvin, Texas 77511.

Section 16(a) Beneficial Ownership Reporting Compliance

During fiscal year 2007, the following person failed to file timely reports required under Section 16(a) of the Exchange Act (the number of late reports and transactions involved is contained in the parenthesis after his name): Vincent D. Foster (1:1), Emmett J. Lescroart (1:1), Sidney B. Williams (1:1), Jack M. Johnson, Jr. (1:1), E. Theodore Laborde (1:1), Louis A. Waters (1:1), Philip J. Hawk (1:4), and Kenneth M. Tholan (1:4). Mr. Foster, Mr. Lescroart, Mr. Williams, Mr. Johnson, Mr. Laborde, and Mr. Waters were late filing Form 4s disclosing the shares of common stock each received as director compensation. Mr. Hawk and Mr. Tholan were tardy in their filing Form 4s disclosing the acquisition and disposition of common stock.

Code of Ethical Conduct

The Company has adopted a code of ethics that applies to all employees and directors of the Company. A copy of such code, entitled “Team, Inc. Code of Ethical Conduct”, has been filed with the Securities and Exchange Commission as an exhibit to the Company’s 10-K Report for the fiscal year ended May 31, 2003. Also, a copy of this Code is posted on the Company’s website at www.teamindustrialservices.com on the “Investors” page under “Governance.” The Company intends to disclose on its website any waivers or amendments to its Code of Ethical Conduct within five business days of such action.

22

CERTAIN TRANSACTIONS

The Company’s legal staff annually reviews the transactions of each director and executive officer to determine if there are any circumstances that would require disclosure as a related person transaction in the Company’s public filings. In addition, the Directors and Corporate Governance Committee is responsible for annually reviewing the independence of each director and the appropriateness of any potential related person transactions and related issues.

23

AUDIT COMMITTEE REPORT

The Audit Committee consists of the three members of the Company’s Board of Directors identified above. Each committee member is independent, as defined by the applicable listing requirements of the NASDAQ Global Select Stock Market. The duties and responsibilities of the Audit Committee are set forth in a written charter adopted by the Board of Directors.

The Audit Committee has reviewed and discussed the audited financial statements for the fiscal year ended May 31, 2007 with management and has discussed with KPMG LLP, the independent auditors for the Company, the matters required to be discussed by Statement on Accounting Standards (“SAS”) No. 61, Communication with Audit Committees, as amended by SAS No. 90, Audit Committee Communications.

The Audit Committee has also received the written disclosures and the letter from the independent accountants required by Independence Standards Board Standard No. 1 (Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees), and has discussed the auditors’ independence with KPMG.

The Board of Directors has adopted a written charter for the Audit Committee, a copy of which is posted on the Company’s website at www.teamindustrialservices.com on the “Investors” page under “Governance.”

Based on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended May 31, 2007 filed with the Securities and Exchange Commission.

Vincent D. Foster, Chairman

Jack M. Johnson, Jr.

Robert A. Peiser

24

INFORMATION ON INDEPENDENT PUBLIC ACCOUNTANTS

A representative of KPMG LLP is expected to attend the 2007 Annual Meeting with the opportunity to make a statement if such representative desires to do so and to respond to appropriate questions presented at the meeting.

Principal Accountant Fees and Services

The following table sets forth the fees billed by KPMG LLP in each of the past two fiscal years:

| FY 2007 | FY 2006 | |||||

| Audit Fees |

$ | 985,000 | $ | 945,750 | ||

| Audit-Related Fees |

$ | 35,000 | $ | 30,000 | ||

| Tax Fees |

$ | 1,250 | $ | 25,525 | ||

| All Other Fees |

$ | — | $ | — | ||

Audit-related fees consist of fees associated with the audit of the Company’s 401(k) Plan. Tax fees consist of fees associated with the preparation of the Company’s Federal and state income tax returns for the subject years.

The Audit Committee meets annually to pre-approve audit and tax fees for the ensuing year. In June 2006, the Audit Committee authorized Mr. Owen to engage KPMG on matters not exceeding $10,000; provided that KPMG is more efficient or uniquely qualified to perform the work for which it is engaged and that such engagement is reported to the full Audit Committee in a timely manner. More than 90% of fees paid to KPMG pertaining to fiscal 2007 were pre-approved by the Audit Committee.

25

PROPOSAL TWO—APPROVAL OF AN INCREASE IN THE NUMBER OF AUTHORIZED SHARES UNDER THE FIRST AMENDED AND RESTATED TEAM, INC. 2006 STOCK INCENTIVE PLAN

The Board of Directors of the Company has approved, and proposed that the shareholders approve at the Annual Meeting, an increase in the total number of shares authorized to be issued under the First Amended and Restated Team, Inc. 2006 Stock Incentive Plan (the “Plan”) by 350,000 shares (700,000 shares post-split) to 2,700,000 shares (5,400,000 shares post-split). Currently, there are 2,350,000 shares (4,700,000 shares post-split) authorized under the Plan, a copy of which is attached hereto as Appendix A.

It is anticipated that the additional 350,000 shares (700,000 shares post-split) proposed to be authorized under the Plan will enable the Company to provide sufficient grants of awards for the next year. The Company’s intention is to maintain an average annual “burn rate” of approximately three percent for all employees, excluding initial option awards that may be associated with new employees joining the Company through acquisitions.

Description of the Plan

Awards under the Plan consist of the Company’s authorized common stock, par value $0.30 per share. The fair market value of the Company’s common stock as of August 10, 2007 was $43.35 per share ($21.68 per share post-split). The Plan provides for the grant of incentive stock options, nonstatutory stock options, shares of restricted stock, stock appreciation rights (“SARs”), stock units and performance share awards. Awards under the Plan may be made to employees, including officers and directors who may be employees, and non-employee directors, consultants and advisors. Currently all employees of the Company are eligible to receive awards under the Plan, however, historically approximately 75 employees receive awards and, additionally, as deem appropriate, consultants and advisors to the Company are eligible to receive awards under the Plan. As amended, an aggregate of 2,700,000 shares (5,400,000 shares post-split) of Common Stock will be reserved for issuance under the Plan. No eligible individual may be granted options or rights under the Plan in any single fiscal year of the Company, the total number of shares subject to which exceeds 250,000 shares (500,000 shares post-split) (the “Maximum Award Limit”).

The Plan is administered by the Board of Directors or by the Compensation Committee (referred to herein as the “Committee”). The Committee has full authority, subject to the terms of the Plan, to determine the individuals to whom awards are made, the number of shares of common stock represented by each award, the time or times at which options are granted and exercisable, the exercise price of options, and the time or times at which shares of restricted stock, SARs, stock units or performance shares will be issued, vested or exercisable.

The Plan may be amended by the Board of Directors. However, the Plan may not be amended without the consent of the holders of a majority of the shares of stock then outstanding to increase the aggregate number of shares of stock that may be issued under the Plan or the Maximum Award Limit.

Description of Stock Options under the Plan

The Plan authorizes the award of both incentive stock options, for which option holders may receive favorable tax treatment under the Code, and nonstatutory stock options, for which option holders do not receive special tax treatment. For further information regarding the tax treatment of options granted under the Plan, see “Tax Treatment of Awards” below.

Incentive stock options may be granted only to employees. Non-qualified stock options may be granted to employees, directors, consultants and advisors. The exercise price of each option shall be determined by the Committee, and must be equal to or greater than the fair market value of the stock on the date of grant of the option; provided that the exercise price of an incentive stock option granted to an employee who owns more than 10% of the Company’s common stock may not be less than 110% of the fair market value of the underlying shares of common stock on the date of grant.

26

The optionee may pay the exercise price:

| (1) | in cash; |

| (2) | with the approval of the Committee, by delivering or attesting to the ownership of shares of common stock having a fair market value on the date of exercise equal to the exercise price of the option; or |

| (3) | by such other method as the Committee shall approve, including payment through a broker in accordance with cashless exercise procedures permitted by Regulation T of the Federal Reserve Board. |

Options vest according to the terms and conditions determined by the Committee and specified in the option agreement. The Committee will determine the term of each option up to a maximum of ten years from the date of grant; provided that the term of an incentive stock option granted to an employee who owns more than 10% of the common stock may not exceed five years from the date of grant. The Committee may accelerate the exercisability of any or all outstanding options at any time for any reason.

Description of Restricted Stock

Restricted stock awards are grants of common stock subject to a required period of employment or service following the award, referred to as the restricted period, and any other conditions established by the Committee. A recipient of a restricted stock award will become the holder of shares of restricted stock free of all restrictions if he or she completes the restricted period and satisfies any other conditions; otherwise, the shares will be forfeited. Under the Plan, the restricted period may not be more than ten years. The recipient of the restricted stock will have the right to vote the shares of restricted stock and, unless the Committee determines otherwise, will have the right to receive dividends on the shares during the restricted period. The recipient of the restricted stock may not sell, pledge or otherwise encumber or dispose of restricted stock until the conditions imposed by the Committee have been satisfied. The Committee may accelerate the termination of the restricted period or waive any other conditions with respect to any restricted stock.

Description of Stock Units and SARs