Exhibit (c)(1)

Goldman Sachs

Presentation to Special Committee of Francis

Goldman, Sachs & Co.

12-Aug-2008

Goldman Sachs

Table of Contents

I. Situational Summary

II. Overview of Francis

III. Overview of James

IV. Financial Analysis

V. Transaction Analysis

VI. Key Considerations and Next Steps

Appendix A: Weighted Average Cost of Capital Analysis

Appendix B: Outlook for CHF / USD

Appendix C: Precedent Case Studies

Goldman Sachs

I. Situational Summary

Situational Summary 1

Goldman Sachs

Summary of the James Proposal

? James has offered to acquire all publicly -held shares of Francis for $89.00 per share in cash

— Total payment of $43.7 billion to equity holders other than James

— Transaction expected to be financed through its own funds and debt financing

— One day premium of 8.8% to Francis’ closing price of $81.82 on 18-Jul-2008 and a one month premium of 19.0% to Francis’ closing price of $74.76 on 20-Jun-2008

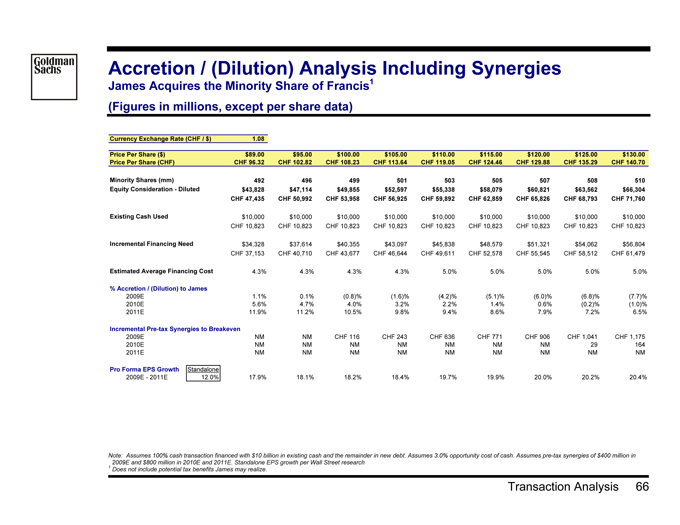

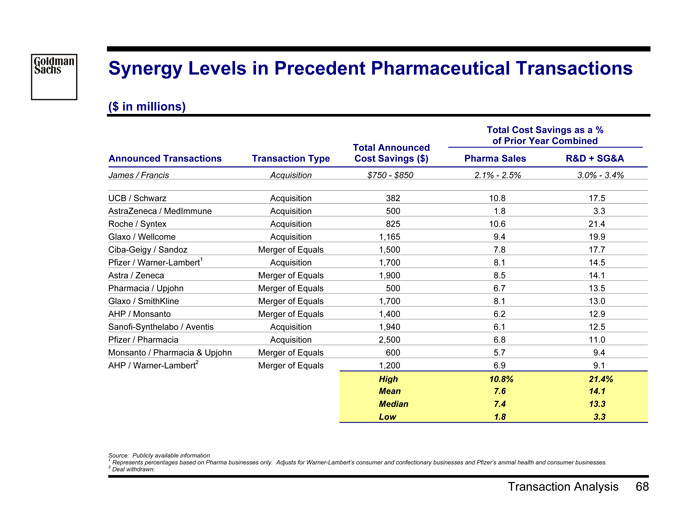

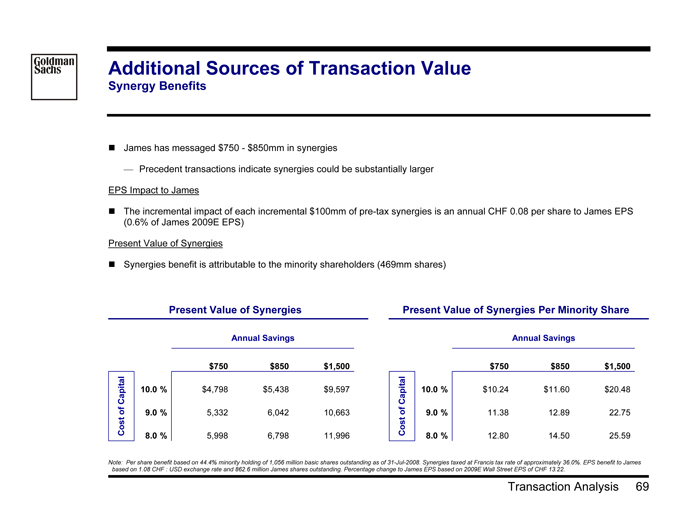

? Expected to deliver pre-tax cost synergies of $750 million to $850 million

— Achieving substantial scale benefits, operational synergies and cost avoidance

? Publicly stated transaction rationale:

— Enhanced ability to innovate

— Greater operational efficiency

— Stronger competitive position and scale in the U.S.

? Proposes that Francis operate as an independent research and early development center within James from its existing campus in South San Francisco

? Proposed transaction expected to be accretive to James’ earnings per share in the first year after closing

? Proposed transaction not expected to impact James’ sales and Core1 EPS targets for 2008

1 James defines Core EPS as excluding amortization and impairment of intangible assets.

Situational Summary 2

Goldman Sachs

Selected Initial Market Reaction to James’ Announcement

James’ Message 1

? Combination to enhance innovation by allowing for diversity of research approaches while also encouraging sharing of IP, technologies, partnerships and other key assets

? Francis’ unique research culture to be maintained; South San Francisco site to operate as an independent research and early development center and become headquarters of combined U.S. commercial operations

? Improved operational efficiency to result from reduced complexity, elimination of duplications and increased scale in the U.S.

? Transaction to deliver annual pre-tax synergies of U.S.$750—$850 million; Expected to be EPS accretive in the first year after closing

? Offer represents a one day premium to Francis shareholders of 8.8% and a one month premium of 19.0%

Market Commentary

? “We applaud the proposed acquisition of Francis, which would: 1) allow U.S. cost reduction to offset the negative revenue trends that we have previously highlighted; 2) reduce R&D redundancy under the current James group structure; 3) enhance James’ pipeline post-2015, after which James’ current agreement with Francis is due to expire; and 4) increase gearing to Avastin adjuvant call options. Loss of

Francis scientific talent would be a manageable risk, we believe. “ (Steven Harr, Morgan Stanley, 22-Jul-2008)

? “If we are reading the tea leaves correctly, the few clues that James has given about its plans indicate Basel is reaching even farther, aiming to remake its U.S. operations in Francis’ image.” (Stacy Lawrence and Aaron Bouchie, BioCentury, 28-Jul-2008)

? “The proposed consolidation would weaken the fabric of the Francis culture that has taken decades to build and is the primary driver behind the most productive biotechnology organization in history. “

(Joel Sendek, Lazard, 21-Jul-2008)

? “While synergies look modest at $750mm+ and were not a driving force behind the proposed transaction according to James, we estimate the Swiss company could pay up to $110/share without risking earnings dilution. “ (Societe Generale, 22-Jul-2008)

? “It’s an inadequate offer and they know it. Anything below $100 isn’t going to happen. “ (Sven Borho, OrbiMed Advisors, 28-Jul-2008)

Source: 1 Wall Street Research and Factiva From James press release dated 21-Jul-2008.

Situational Summary 3

Goldman Sachs

The Market Does Not Expect a Transaction at $89/Share

Market Tracker Since Announcement

Change Since

8-Aug-2008 18-Jul-2008 1 Week 1 Month 3 Month YTD Francis $96.95 $0.06 0.1 % 18.5 % 1.7 % 24.4 % 41.9 % 43.8 % BTK 857.86 23.11 2.8 7.8 1.0 11.2 14.7 8.9 S&P 500 1,296.32 30.25 2.4 2.8 2.9 1.8 (7.3) (10.4) AMEX Pharmaceutical Index 317.76 6.03 1.9 3.7 4.9 4.0 5.9 (5.6)

James CHF189.60 CHF3.20 1.7 % 5.6 % (2.4)% 4.9 % 12.3 % (1.3)% Swiss Exchange 7,262.10 80.03 1.1 6.4 1.7 7.0 (4.3) (12.7) FTSE 350 Pharma & Biotech 8,204.40 102.40 1.3 8.3 6.9 5.5 14.2 3.3 James (ADR) $87.50 $0.20 0.2 (0.7) (4.4) 0.2 9.4 1.3

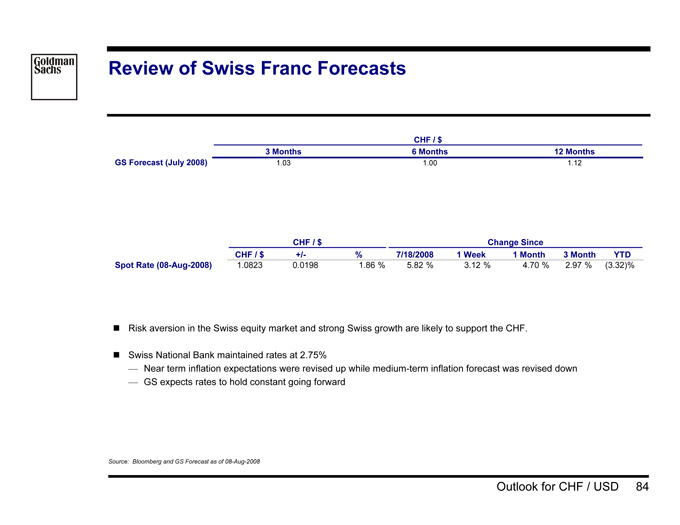

Currency Exchange Rate (CHF / $) 1.0823 0.0198 1.86 % 5.82 % 3.12 % 4.70 % 2.97 % (3.32)%

James announced bid to James Francis

125% acquire Francis for $89 Offer Price Francis Trading Volume 50 120% 18.5%

40 (mm)

115%

Francis announced that it has formed a Special $89/share 30

Price 110% Volume

Committee to evaluate 5.6% James’ offer

105%

Indexed 20 100% Trading

3 Month Avg Vol: 4.7mm 10

95% Daily

90% 0 18-Jul-2008 23-Jul-2008 28-Jul-2008 31-Jul-2008 5-Aug-2008 8-Aug-2008

Source: FactSet as of 08-Aug-2008

Situational Summary 4

Goldman Sachs

II. Overview of Francis

Overview of Francis 5

Goldman Sachs

Stock Price Performance History

Francis

Last Five Years

300%

157.2%

250%

200%

Price

Indexed 81.7%

150%

32.6% 27.4%

100%

50%

Aug-2003 Aug-2004 Aug-2005 Aug-2006 Aug-2007 Aug-2008

Daily from 8-Aug-2003 to 8-Aug-2008

Francis Large Cap Biotech Selected Pharma S&P 500

Source: FactSet as of 08-Aug-2008

Note: Large Cap Biotech includes Amgen, Biogen Idec, Celgene, Genzyme and Gilead. Selected Pharma includes Bristol-Myers Squibb, Merck KGaA, Novartis, Novo Nordisk, Schering -Plough

Overview of Francis 6

Goldman Sachs

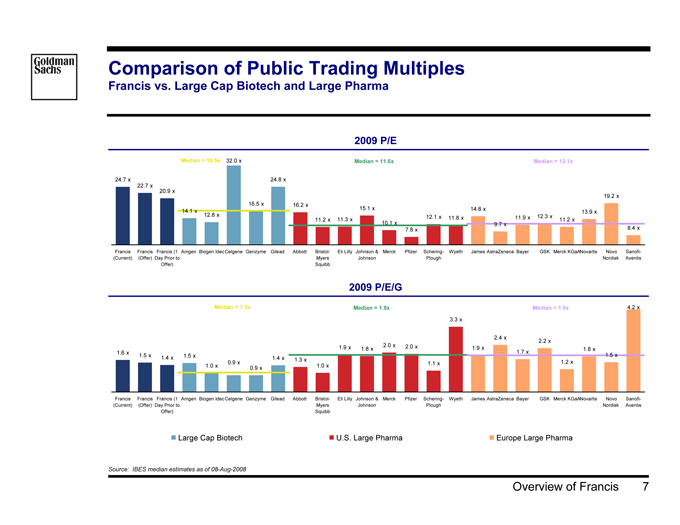

Comparison of Public Trading Multiples

Francis vs. Large Cap Biotech and Large Pharma

2009 P/E

Median = 16.5x 32.0 xMedian = 11.6xMedian = 12.1x

24.7 x24.8 x

22.7 x

20.9 x

19.2 x

16.5 x16.2 x15.1 x14.8 x

14.1 x13.9 x

12.8 x11.2 x11.3 x12.1 x11.8 x11.9 x12.3 x 11.2 x

10.1 x9.7 x

7.8 x8.4 x

FrancisFrancis Francis (1 Amgen Biogen IdecCelgene GenzymeGileadAbbottBristol-Eli Lilly Johnson &MerckPfizerSchering-WyethJames AstraZeneca BayerGSK Merck KGaANovartisNovoSanofi-

(Current)(Offer) Day Prior toMyersJohnsonPloughNordiskAventis

Offer)Squibb

2009 P/E/G

Median = 1.0xMedian = 1.9xMedian = 1.9x4.2 x

3.3 x

2.4 x2.2 x

1.9 x 1.8 x2.0 x2.0 x1.9 x1.8 x

1.6 x1.7 x

1.5 x 1.4 x 1.5 x1.4 x1.3 x1.5 x

1.0 x 0.9 x1.0 x1.1 x1.2 x

0.9 x

FrancisFrancis Francis (1 Amgen Biogen IdecCelgene GenzymeGileadAbbottBristol-Eli Lilly Johnson &MerckPfizerSchering-WyethJames AstraZeneca BayerGSK Merck KGaANovartisNovoSanofi-

(Current)(Offer) Day Prior toMyersJohnsonPloughNordiskAventis

Offer)Squibb

Large Cap BiotechU.S. Large PharmaEurope Large Pharma

Source: IBES median estimates as of 08-Aug-2008

Overview of Francis 7

Goldman Sachs

Evolution of Analyst Estimates

Francis

Last Five Years

$7.00 $110

$100 $6.00 $96.95

$5.43 2012E $90

$5.00 $4.96

2011E $4.45

$80

USD) 2010E

(USD) (in $4.00 $3.92 2009E

$3.46 $70 Price

Estimate $3.00 2008E $2.94 $60 Closing

EPS 2007A $2.23

$2.00 2006A $50

$1.28 2005A

$1.00

$0.83 $40 2004A $0.60 2003A

$0.00 $30 Aug-2003 Aug-2004 Aug-2005 Aug-2006 Aug-2007 Aug-2008

Monthly from Aug-2003 to Aug-2008

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Francis

Source: FactSet and IBES median estimates as of 08-Aug-2008.

Note: IBES median estimates exclude stock based compensation expense

Overview of Francis 8

Goldman Sachs

Next Twelve Months P/E Multiples

Francis vs. Selected Comparables Last Five Years

120x Average Multiple As of 2009 P/E 5-Year¹ 3-Year¹ 1-Year¹ 18-Jul-2008 Current Current Francis 41.5x 32.4x 21.3x 21.9x 26.2x 24.7x Amgen 18.5 15.6 11.2 12.1 14.7 14.1 100x Biogen Idec 24.4 20.0 19.3 17.6 13.5 12.8 Celgene 55.9 49.8 36.9 35.9 40.8 32.0 Genzyme 23.2 20.7 17.5 17.7 27.0 16.5 Gilead 28.6 25.8 24.4 23.1 18.6 24.8 80x

Multiples 60x PE NTM

40x 40.8x 27.0x 26.2x 20x 18.6x 14.7x 13.5x

0x

Aug-2003 Feb-2004 Aug-2004 Feb-2005 Aug-2005 Feb-2006 Aug-2006 Feb-2007 Aug-2007 Feb-2008 Aug-2008

Daily from 08-Aug-2003 to 08-Aug-2008

Francis Amgen Biogen Idec Celgene Gilead Genzyme

Source: 1 FactSet as of 08-Aug-2008

Average multiple excludes period after undisturbed date of 18-Jul-2008.

Overview of Francis 9

Goldman Sachs

Next Twelve Months P/E Multiples

Francis vs. Selected Comparables 08-Aug-2006 to Present

60x Average Multiple As of 2009 P/E 2-Year¹ 1-Year¹ 18-Jul-2008 Current Current Francis 25.2x 21.3x 21.9x 26.2x 24.7x Amgen 13.1 11.2 12.1 14.7 14.1 Biogen Idec 19.1 19.3 17.6 13.5 12.8 50x Celgene 42.5 36.9 35.9 40.8 32.0 Genzyme 25.1 17.5 17.7 27.0 16.5 Gilead 18.7 24.4 23.1 18.6 24.8

40.8x 40x

Multiples 30x

PE 27.0x NTM 26.2x 20x 18.6x 14.7x 10x 13.5x

0x

Aug-2006 Nov-2006 Feb-2007 May-2007 Aug-2007 Nov-2007 Feb-2008 May-2008 Aug-2008

Daily from 08-Aug-2006 to 08-Aug-2008

Francis Amgen Biogen Idec Celgene Gilead Genzyme

1 Source: FactSet as of 08-Aug-2008

Average multiple excludes period after undisturbed date of 18-Jul-2008.

Overview of Francis 10

Goldman Sachs

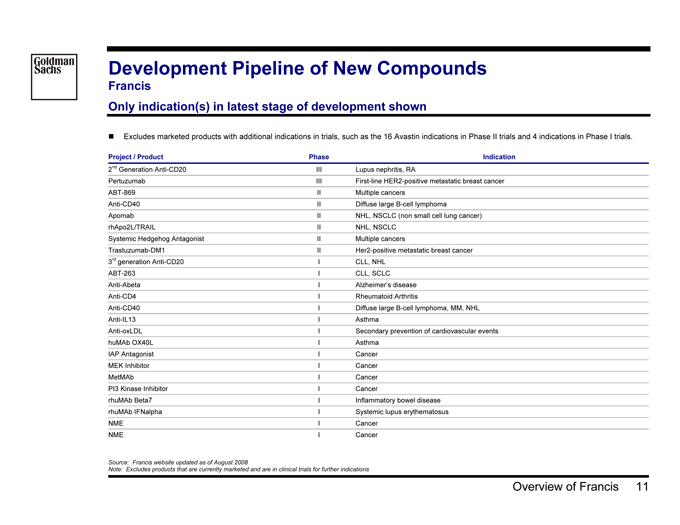

Development Pipeline of New Compounds

Francis

Only indication(s) in latest stage of development shown

? Excludes marketed products with additional indications in trials, such as the 16 Avastin indications in Phase II trials and 4 indications in Phase I trials.

Project / Product Phase

2nd Generation Anti-CD20 III Pertuzumab III ABT-869 II Anti-CD40 II Apomab II rhApo2L/TRAIL II Systemic Hedgehog Antagonist II Trastuzumab -DM1 II 3rd generation Anti-CD20 I ABT-263 I Anti-Abeta I Anti-CD4 I Anti-CD40 I Anti-IL13 I Anti-oxLDL I huMAb OX40L I IAP Antagonist I MEK Inhibitor I MetMAb I PI3 Kinase Inhibitor I rhuMAb Beta7 I rhuMAb IFNalpha I NME I NME I

Indication

Lupus nephritis, RA

First-line HER2-positive metastatic breast cancer Multiple cancers Diffuse large B-cell lymphoma NHL, NSCLC (non small cell lung cancer) NHL, NSCLC

Multiple cancers

Her2-positive metastatic breast cancer CLL, NHL

CLL, SCLC

Alzheimer’s disease Rheumatoid Arthritis

Diffuse large B-cell lymphoma, MM, NHL Asthma Secondary prevention of cardiovascular events Asthma Cancer Cancer Cancer Cancer Inflammatory bowel disease Systemic lupus erythematosus Cancer Cancer

Source: Francis website updated as of August 2008

Note: Excludes products that are currently marketed and are in clinical trials for further indications

Overview of Francis 11

Goldman Sachs

Shares Traded at Various Prices

Francis

As of 08-Aug-2008

1 Month

140,000 100%

100% 90% 120,000

74% 80% 100,000 70% (000) 80,000 60%

Cumulative

50% 60,000 40%

Volume 26% 26% 26% 30% 40,000 19%Shares

20,000 20% (%) 19% 7%

10%

0 0% 75.39 79.70 84.01 88.33 92.64 to to to to to 79.69 84.00 88.32 92.63 96.95

Daily from 08-Jul-2008 to 08-Aug-2008

WASP: $90.62

Shares Traded as % of Outstanding: 16.11%

6 Months

260,000 100%

100%

90% 210,000 36% 80%

62% 78% 78% 70%

(000) 160,000 26% 60%

50% Cumulative 22%

110,000 40%

Volume 16% Shares 30% (%)

60,000 26% 20% 10% 10,000 0% 67.24 73.18 79.12 85.07 91.01 to to to to to 73.17 79.11 85.06 91.00 96.95

Daily from 11-Feb-2008 to 08-Aug-2008

WASP: $79.36

Shares Traded as % of Outstanding: 54.76%

1 Year

470,000 100%

40% 100%

420,000 90% 370,000 88% 88% 80%

33% 70% 320,000 73% (000) 60% Cumulative

270,000 50% Volume 220,000 40%

33% 30% Shares 15%

170,000 12% 20% (%)

120,000 10% 70,000 0% 66.27 72.41 78.54 84.68 90.81 to to to to to 72.40 78.53 84.67 90.80 96.95

Daily from 20-Jul-2007 to 18-Jul-2008

WASP: $76.27

Shares Traded as % of Outstanding: 100.12%

3 Years

1,070,000 100% 970,000 100% 90%

34%

32% 91%

870,000 80% 770,000 80% 70% (000) 670,000 60%

Cumulative

570,000 50% 470,000 46% 40%

Volume 370,000 14% 30% Shares 11%

270,000 9% 20% (%) 170,000 14% 10% 70,000 0% 66.27 72.95 79.63 86.30 92.98 to to to to to 72.94 79.62 86.29 92.97 99.66

Daily from 09-Aug-2005 to 08-Aug-2008

WASP: $80.61

Shares Traded as % of Outstanding: 259.89%

Source: FactSet as of 08-Aug-2008

Overview of Francis 12

Goldman Sachs

Recent Shareholder Momentum Analysis

Top 25 Francis Shareholders As of 07-Aug-2008

Position Position % Non-James

# Institution Name 18-Jul-2008 05-Aug-2008 Change % O/S Holdings Avg Cost

1 Fidelity Mgmt. & Research 44,589,431 44,589,431—4.22% 9.52% $60.02

2 Marsico Capital 28,248,512 28,248,512—2.68 6.03 41.00

3 Capital Guardian Trust 21,263,293 20,563,293 (700,000) 1.95 4.39 78.24

4 T. Rowe Price 17,784,494 17,784,494—1.68 3.8 74.79

5 Capital Research & Mgmt. 17,500,000 17,500,000—1.66 3.74 65.05

6 AllianceBerstein 16,030,000 16,030,000—1.52 3.42 68.21

7 Wellington Mgmt. 15,892,746 15,892,746—1.51 3.39 63.32

8 Barclays Global 15,306,210 15,306,210—1.45 3.27 54.51

9 Jennison Associates 10,821,503 10,821,503—1.03 2.31 66.39

10 ClearBridge Advisors 9,981,191 9,981,191—0.95 2.13 33.14

11 Vanguard Group 9,056,406 9,056,406—0.86 1.93 59.11

12 Delaware Inv. Advisors 9,147,746 8,647,746 (500,000) 0.82 1.85 78.18

13 TIAA-CREF Asset Mgmt. 7,342,446 7,342,446—0.70 1.57 65.24

14 Sands Capital Mgmt. 7,071,391 7,071,391—0.67 1.51 51.55

15 Janus Capital Mgmt. 6,755,964 6,755,964—0.64 1.44 44.95

16 State Street Global Advisors 6,431,203 6,431,203—0.61 1.37 45.43

17 TCW Asset Mgmt. 5,343,048 5,343,048—0.51 1.14 39.65

18 Goldman Sachs Asset Mgmt. 7,844,682 4,844,682 (3,000,000) 0.46 1.03 73.67

19 Victory Capital Mgmt. 5,350,299 4,350,299 (1,000,000) 0.41 0.93 74.77

20 CalPERS 4,116,863 4,116,863—0.39 0.88 48.53

21 Credit Suisse Asset Mgmt. 4,095,333 4,095,333—0.39 0.87 79.32

22 Walter Scott & Partners 3,951,407 3,951,407—0.37 0.84 69.62

23 GE Asset Management 3,788,047 3,788,047—0.36 0.81 76.17

24 Thornburg Investment Mgmt. 6,447,184 3,447,184 (3,000,000) 0.33 0.74 73.43

25 Bellevue Asset Mgmt. 3,192,536 3,192,536—0.30 0.68 81.66 Total 287,351,935 279,151,935 (8,200,000) 26.47% 59.59%

Source: Francis investor relations as of 07-Aug-2008

Overview of Francis 13

Goldman Sachs

Francis Research Analyst Price Targets

Before and After James Proposal

Price Target Before

Date Updated Bank Analyst Announcement Current Price Target Deal Price Speculation

15-Jul-2008 Goldman Sachs Ho $88 N/A N/A 15-Jul-2008 JP Morgan Meacham 100 N/A $100+ 15-Jul-2008 Merrill Lynch Berena 84 No Opinion No Opinion 15-Jul-2008 Morgan Stanley Harr 94 N/A N/A 15-Jul-2008 Thomas Weisel Partners Somaiya 81 N/A N/A 21-Jul-2008 Baird Raymond 87 95 95 21-Jul-2008 BMO Capital Zhang 82 104 104 21-Jul-2008 Bank of America Kim 95 100 100 21-Jul-2008 Credit Suisse Aberman 82 98 98 21-Jul-2008 Jefferies Walsh 78 95 95 21-Jul-2008 Lazard Sendek 90 97 95-100 21-Jul-2008 Lehman Birchenough 75 105 105 21-Jul-2008 Natixis To 76 95 95 21-Jul-2008 Oppenheimer1 Holley 88 88 102-110 21-Jul-2008 Rodman & Renshaw King 90 N/A 95-113 22-Jul-2008 Piper Jaffray Wei 94 96 96 22-Jul-2008 RBC Capital Kantor 84 95 95-100 08-Aug-2008 UBS Shenouda / Amusa 92 105 115-135 11-Aug-2008 Bernstein Research Porges 86 101 105-130

High $100 $105 $135 Mean 87 98 103 Median 87 97 100 Low 75 88 95

Source 1 Latest available Wall Street research

Oppenheimer has not updated its target price to reflect the offer by James to buy remaining the outstanding shares in Francis. Not included in summary statistics.

Overview of Francis 14

Goldman Sachs

Research Price Targets and Key Themes

Francis Research Analysts’ Views Prior To Announcement

Broker Date Price Target 1 Key Themes

Jefferies & Co. 15-Jul-2008 $78.00 ? We continue to harbor concerns regarding long-term EPS growth potential for Francis, and a successful NSABP -C08 trial (Avastin for adjuvant CRC) outcome is key to changing our view. We believe this trial’s outcome remains pivotal to accelerating EPS growth beyond our 5-year 13% CAGR estimate. The next interim analysis will occur in 4Q08 and then every 6 months thereafter. We are less optimistic than the Street that the recently approved Avastin metastatic breast cancer (mBC) indication can re-accelerate the Avastin franchise in a meaningful way, leading to sustained EPS outperformance.

Rodman & Renshaw 15-Jul-2008 $90.00 ? Francis has multiple value drivers in 2008. In our view, the most important driver is the uptake of Avastin use in the mBC and NSCLC settings. Based on today’s results, we are maintaining our Q08 growth estimates for Avastin in mBC and raising our Q08 Rituxan numbers in RA and NHL by 1-2%. Additionally, we are marginally raising the growth of the legacy products, Lucentis and Xolair. Finally, we are raising Rituxan numbers FY08 and beyond. We see a sustained upside going into 2009 for Francis in mBC with the expected data release of the RIBBON -I trial during 2H08. Furthermore, in the lung cancer setting the SATURN and the BETA Lung trials may potentially further define Tarceva and Avastin’s role in first line maintenance and second line setting in NSCLC respectively, consequently promoting market share gains for both products during 2H08 and beyond Deutsche Bank 14-Jul-2008 $85.00 ? We believe investors would be willing to assign a premium PE to Francis shares ahead of the Phase 3 data on Avastin in the adjuvant colon cancer setting. If the trial is successful, we believe the upside could be significant (40%+) . If negative, we see the downside risk as 10%-15%. We do not include any Avastin adjuvant sales in our forecasts. Our one year price target of $85 is derived by applying a 22x PE to our 2009 estimate (in line with the biotech group 20-22x current year P/E). Thus, our price target likely understates the true potential upside should the trial succeed.

Credit Suisse 14-Jul-2008 $82.00 ? Expectations had risen following strong IMS data, but Francis delivered with Avastin and Rituxan sales that were higher than consensus. Although EPS was slightly light, if one were to remove non-recurring items such as (1) a failed manufacturing run and (2) a tax bill from 2007, pro-forma EPS was actually ahead of The Street. Further, Francis was able to increase its full year guidance. Given the difficult economic environment investors are currently facing, we think these results can support further rotation into the large cap biotech space as a defensive position. That said, our prior survey work suggests that Avastin expectations may be high for the second half and we expect Rituxan sales growth to taper off in 2H08. As such, we are again reminded that Francis long term performance is highly dependent on the results of the adjuvant data, which we do not expect until 2009.

Source: 1 Wall Street Research Price target reflects estimates that are not based on transaction in context of James offer.

Overview of Francis 15

Goldman Sachs

Research Price Targets and Key Themes

Francis Research Analysts’ Views Following Announcement

Broker Date Price Target 1 Key Themes

Bernstein Research 11-Aug-2008 $101.00 ? Sum of the parts analysis estimating total value of $124 per share (when additional pipeline opportunities and label expansion programs are included) comprised of:

— Approved products and indications (worth $55-$60/share)

— The potential of Francis’ late stage label expansion programs for currently approved products (worth $25-$30/share)

— Phase II oncology pipeline – assumes 50% probability of success (worth $17/share)

— Early stage R&D assets and capabilities (worth $5/share)

— Option value of access to the companies future innovations beyond 2015 (currently outside James’ rights) (estimated at $8 per share)

— Value of the $750-850mm in cost saving synergies James has identified (worth $9/share) UBS 08-Aug-2008 $105.00 ? Sum of the parts analysis estimating total value of up to $129 per share

— Evaluates per share standalone value plus cost synergies ($84 per share plus $12 per share in synergies)

— Considers additional long-term benefits from tax benefits ($14 per share); elimination of the opt-in ($9 per share)

— Considers Avastin adjuvant value greater than $20 per share, assuming 50% probability Piper Jaffray 22-Jul-2008 $96.00 ? Discounted cash flow analysis with cost synergies

— Free cash flow estimates through 2012

— Terminal growth in free cash flow generation from the base business of 4%-5% per year

— $850mm in cost synergies ($4/share)

— 80% probability of significant erosion of Lucentis franchise (negative $2/share)

— 65% probability of positive data for Avastin in adjuvant colon, lung and breast studies ($19/share)

— 64% return on future R&D spending, consistent with 10 year historical return ($23/share)

Bank of America 21-Jul-2008 $100.00 ? Applies a 1.2 PEG multiple to the 5 year estimated CAGR of 20% and 2009 EPS estimate of 3.92, to which a buyout premium of $5/share is added.

Lazard 21-Jul-2008 $97.00 ? New target on historical trading range and average trailing PE ratio over past 2 years

— Applies historic average multiple to LTM EPS of $3.08/share

? Notes “no possibility for competing outside buyers to potentially drive the price higher”

Source: 1 Wall Street Research Price target reflects estimates based on transaction in context of James offer.

Overview of Francis 16

Goldman Sachs

Research Price Targets and Key Themes

Francis Research Analysts’ Views Following Announcement

Broker Date Price Target 1 Key Themes

Rodman & Renshaw 21-Jul-2008 $95.00—$113.00 ? 2 step analysis to determine range of $95.00—$113.00 sum of the parts analysis and deal comparison

? Sum of the parts analysis: $95.00 ($91.00 without adjusting for current cash and debt)

— Sales estimates for each marketed product through 2015 and subsequent growth rate of 3%-5%

— Flat sales after patent expiration

— 9.6% discount rate

? Comparable Transaction Analysis: $113.00

— Applies historical average and median acquisition premiums from large cap biotech/pharma deals

— Sensitivity analysis by assuming different acquisition premiums ranging from 20%-50% Bernstein Research 21-Jul-2008 $101.00 ? Discounted cash flow valuation of $107.00 per share (including synergies)

? Discounted cash flow valuation of $95.00 (stand-alone basis) and $107.00 with $750-850mm in synergies

— Excludes most of the value of incremental opportunities from Avastin

— Excludes upside of earlier phase III programs including Herceptin

— Excludes upside from emerging phase II programs, including trastuzumab DM1, pretuzumab, Hedgehog antagonist, 2nd and 3rd generation versions of Rituxan, rhApo2L/Trail, Apomab and ABT-869

? Price target of $101.00 based on 80% probability of a deal with transaction value of $105.00 and 20% probability of no transaction occurring with stock price returning to $86.00

Source: 1 Wall Street Research Price target reflects estimates based on transaction in context of James offer.

Overview of Francis 17

Goldman Sachs

III. Overview of James

Goldman Sachs

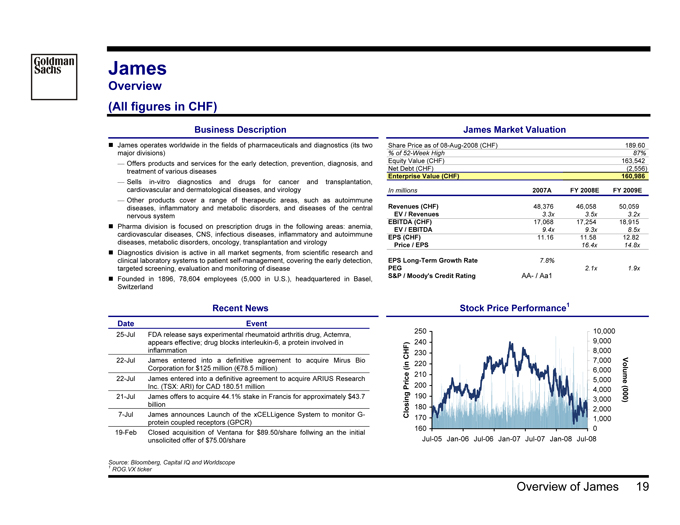

James

Overview

(All figures in CHF)

Business Description

? James operates worldwide in the fields of pharmaceuticals and diagnostics (its two major divisions)

— Offers products and services for the early detection, prevention, diagnosis, and treatment of various diseases

— Sells in-vitro diagnostics and drugs for cancer and transplantation, cardiovascular and dermatological diseases, and virology

— Other products cover a range of therapeutic areas, such as autoimmune diseases, inflammatory and metabolic disorders, and diseases of the central nervous system

? Pharma division is focused on prescription drugs in the following areas: anemia, cardiovascular diseases, CNS, infectious diseases, inflammatory and autoimmune diseases, metabolic disorders, oncology, transplantation and virology

? Diagnostics division is active in all market segments, from scientific research and clinical laboratory systems to patient self-management, covering the early detection, targeted screening, evaluation and monitoring of disease

? Founded in 1896, 78,604 employees (5,000 in U.S.), headquartered in Basel, Switzerland

Recent News Date Event

25-Jul FDA release says experimental rheumatoid arthritis drug, Actemra, appears effective; drug blocks interleukin -6, a protein involved in inflammation 22-Jul James entered into a definitive agreement to acquire Mirus Bio Corporation for $125 million (€78.5 million) 22-Jul James entered into a definitive agreement to acquire ARIUS Research Inc. (TSX: ARI) for CAD 180.51 million 21-Jul James offers to acquire 44.1% stake in Francis for approximately $43.7 billion 7-Jul James announces Launch of the xCELLigence System to monitor G-protein coupled receptors (GPCR) 19-Feb Closed acquisition of Ventana for $89.50/share follwing an the initial unsolicited offer of $75.00/share

James Market Valuation

Share Price as of 08-Aug-2008 (CHF) 189.60

% of 52-Week High 87%

Equity Value (CHF) 163,542 Net Debt (CHF) (2,556)

Enterprise Value (CHF) 160,986

In millions 2007A FY 2008E FY 2009E

Revenues (CHF) 48,376 46,058 50,059

EV / Revenues 3.3 x 3.5x 3.2x

EBITDA (CHF) 17,068 17,254 18,915

EV / EBITDA 9.4x 9.3x 8.5x

EPS (CHF) 11.16 11.58 12.82

Price / EPS 16.4 x 14.8x

EPS Long-Term Growth Rate 7.8%

PEG 2.1 x 1.9x

S&P / Moody’s Credit Rating AA- / Aa1

Stock Price Performance 1

250 10,000 240 9,000 CHF) 230 8,000 (in 220 7,000 210 6,000 5,000 Volume Price 200 190 4,000 3,000 (000) Closing 180 2,000 170 1,000 160 0 Jul-05 Jan-06 Jul-06 Jan-07 Jul-07 Jan-08 Jul-08

1 Source: Bloomberg, Capital IQ and Worldscope ROG.VX ticker

Overview of James 19

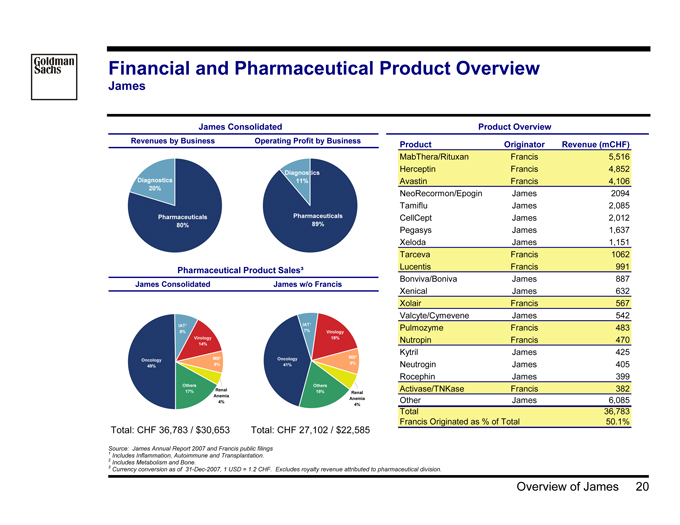

Goldman Sachs

Financial and Pharmaceutical Product Overview

James

James Consolidated Revenues by Business Operating Profit by Business

Diagnostics Diagnostics 11% 20%

Pharmaceuticals Pharmaceuticals

80% 89%

Pharmaceutical Product Sales³ James Consolidated James w/o Francis

IAT¹ IAT¹

8% 7% Virology Virology 18% 14%

MB² Oncology MB² Oncology

8% 41% 9% 49%

Others Others 17% Renal 19%

Renal Anemia Anemia 4% 4%

Total: CHF 36,783 / $30,653 Total: CHF 27,102 / $22,585

Product Overview

Product Originator Revenue (mCHF)

MabThera/Rituxan Francis 5,516 Herceptin Francis 4,852 Avastin Francis 4,106 NeoRecormon/Epogin James 2094 Tamiflu James 2,085 CellCept James 2,012 Pegasys James 1,637 Xeloda James 1,151 Tarceva Francis 1062 Lucentis Francis 991 Bonviva/Boniva James 887 Xenical James 632 Xolair Francis 567 Valcyte/Cymevene James 542 Pulmozyme Francis 483 Nutropin Francis 470 Kytril James 425 Neutrogin James 405 Rocephin James 399 Activase/TNKase Francis 382 Other James 6,085 Total 36,783 Francis Originated as % of Total 50.1%

Source: James Annual Report 2007 and Francis public filings 1 Includes Inflammation, Autoimmune and Transplantation. 2 Includes Metabolism and Bone.

3 Currency conversion as of 31-Dec-2007, 1 USD = 1.2 CHF. Excludes royalty revenue attributed to pharmaceutical division.

Overview of James 20

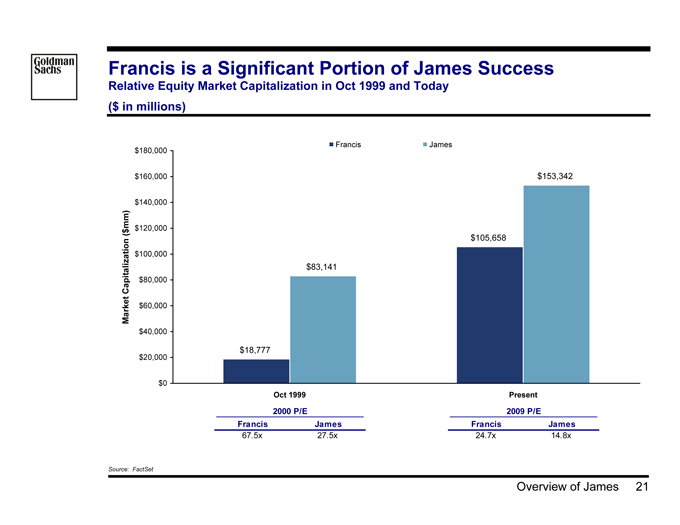

Goldman Sachs

Francis is a Significant Portion of James Success

Relative Equity Market Capitalization in Oct 1999 and Today ($ in millions)

Francis James

$180,000 $160,000 $153,342

$140,000 $ mm) $120,000

( $105,658 $100,000

$83,141

Capitalization $80,000

Market $60,000 $40,000

$20,000 $18,777

$0

Oct 1999 Present

2000 P/E Francis James

67.5x 27.5x

2009 P/E Francis James

24.7x 14.8x

Source: FactSet

Overview of James 21

Goldman Sachs

Francis Compounds Comprise a Large Portion of James Compounds in Development

NME’s Only

40

36

35

James With Other Partners

9

30 James Originated

25 Francis Originated

NMEs 20 17 18

15 6

10

6

4

5 10

6 2

0 2

Phase I Phase II Phase III

Source: Francis website. Includes opt-in opportunities as displayed on Francis website.

Overview of James 22

Goldman Sachs

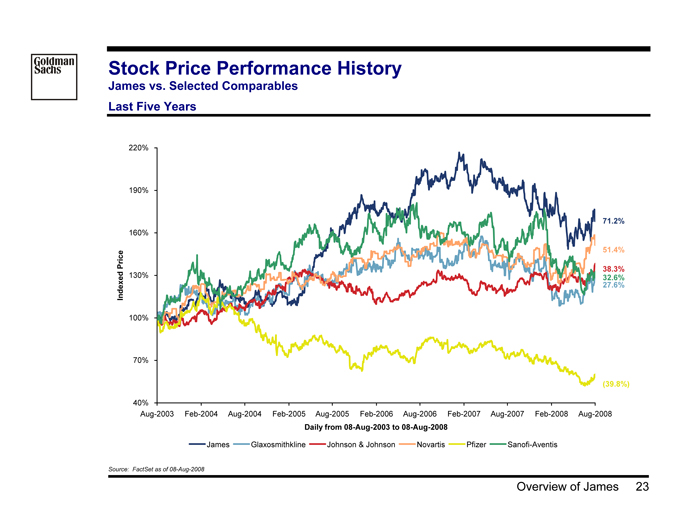

Stock Price Performance History

James vs. Selected Comparables Last Five Years

220%

190%

71.2%

160%

51.4% Price 38.3% 130% 32.6% Indexed 27.6%

100%

70%

(39.8%)

40%

Aug-2003 Feb-2004 Aug-2004 Feb-2005 Aug-2005 Feb-2006 Aug-2006 Feb-2007 Aug-2007 Feb-2008 Aug-2008

Daily from 08-Aug-2003 to 08-Aug-2008

James Glaxosmithkline Johnson & Johnson Novartis Pfizer Sanofi-Aventis

Source: FactSet as of 08-Aug-2008

Overview of James 23

Goldman Sachs

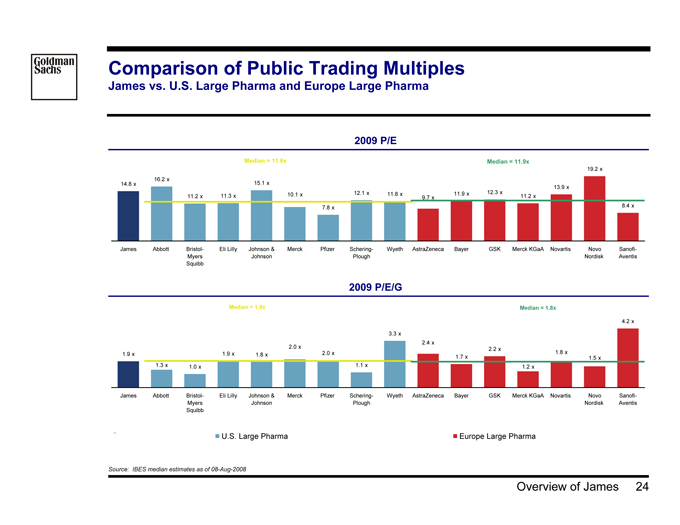

Comparison of Public Trading Multiples

James vs. U.S. Large Pharma and Europe Large Pharma

2009 P/E

Median = 11.6x Median = 11.9x

19.2 x 16.2 x 14.8 x 15.1 x 12.3 x 13.9 x 10.1 x 12.1 x 11.8 x 11.9 x 11.2 x 11.3 x 9.7 x 11.2 x

7.8 x 8.4 x

James Abbott Bristol- Eli Lilly Johnson & Merck Pfizer Schering—Wyeth AstraZeneca Bayer GSK Merck KGaA Novartis Novo Sanofi-Myers Johnson Plough Nordisk Aventis Squibb

2009 P/E/G

Median = 1.9x Median = 1.8x

4.2 x

3.3 x

2.4 x

2.0 x 2.2 x 1.8 x 1.9 x 1.9 x 1.8 x 2.0 x

1.7 x 1.5 x 1.3 x 1.0 x 1.1 x 1.2 x

James Abbott Bristol- Eli Lilly Johnson & Merck Pfizer Schering—Wyeth AstraZeneca Bayer GSK Merck KGaA Novartis Novo Sanofi-Myers Johnson Plough Nordisk Aventis Squibb

U.S. Large Pharma Europe Large Pharma

Source: IBES median estimates as of 08-Aug-2008

Overview of James 24

Goldman Sachs

Evolution of Analyst Estimates

James

Last Five Years

22.00

240 20.00

220 18.00 16.84

2012E 15.87

16.00 2011E 200

CHF) CHF189.60

14.65

(in 14.00 2010E 180

12.82

2009E(CHF) Estimate 12.00 11.58

2008E 160 Price EPS 11.36

10.00 2007A

9.22

2006A 140 Closing

8.00

6.86

120

6.00 2005A 5.396 3.68 2004A

4.00 2003A 100

Aug-2003 Aug-2004 Aug-2005 Aug-2006 Aug-2007 Aug-2008

Monthly from Aug-2003 to Aug-2008

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 James

Overview of James 25

Goldman Sachs

Next Twelve Months P/E Multiples

James vs. Selected Comparables Last Five Years

Average Multiple As of 2009 P/E 31x 5-Year¹ 3-Year¹ 1-Year¹ 18-Jul-2008 Current Current James 21.2x 19.9x 15.6x 14.4x 15.4x 14.8x GlaxoSmithKline 14.1 13.6 11.5 11.5 12.1 12.3 Johnson & Johnson 16.8 15.8 14.9 14.9 15.7 15.1 28x Novartis 17.1 16.2 14.2 14.1 14.9 13.9 Pfizer 12.7 11.3 9.4 7.5 8.1 7.8 Sanofi -Aventis 13.9 12.4 10.0 8.4 8.9 8.4 25x

Multiples 22x

19x

PE

15.7x NTM 16x 15.4x 14.9x

13x

12.1x

10x

8.9x

8.1x

7x

Aug-2003 Apr-2004 Jan-2005 Sep-2005 Jun-2006 Mar-2007 Nov-2007 Aug-2008

Daily from 8-Aug-2003 to 8-Aug-2008

James GlaxoSmithKline Johnson & Johnson Novartis Pfizer Sanofi -Aventis

Source: FactSet as of 08-Aug-2008

Overview of James 26

Goldman Sachs

Shares Traded at Various Prices

James

As of 08-Aug-2008

1 Month

25,000 100% 100%

84% 90% 20,000 29% 80%

31% 70%

(000) 15,000 53% 60%

Cumulative

50% Volume 10,000 16% 16% 40%

37% 30% Shares

8%

5,000 20% (%) 10%

0 8% 0% 171.00 175.90 180.80 185.70 190.60 to to to to to 175.89 180.79 185.69 190.59 195.50

Daily from 09-Jul-2008 to 08-Aug-2008

WASP: 184.02 CHF

Shares Traded as % of Outstanding: 9.37%

1 Year

250,000 100%

30% 100%

230,000 80% 90% 210,000 80% 70% 190,000 60% (000) 60% 170,000 21% 50% Cumulative

150,000 20% 17% 40%

Volume 130,000

30% Shares

110,000 13% 30% 20% (%) 90,000 10%

13%

70,000 0% 164.60 175.34 186.08 196.82 207.56 to to to to to 175.33 186.07 196.81 207.55 218.30

Daily from 09-Aug-2007 to 08-Aug-2008

WASP: 193.25 CHF

Shares Traded as % of Outstanding: 109.10%

6 Months

135,000 100%

100%

81% 90% 115,000 31% 95% 80% 70% 95,000

28%

(000) 60% 75,000 22% 50% Cumulative 53%

40%

Volume 55,000 14%

30% Shares

20% 35,000 22% (%) 10% 15,000 5% 0% 164.60 173.40 182.20 191.00 199.80 to to to to to 173.39 182.19 190.99 199.79 208.60

Daily from 11-Feb-2008 to 08-Aug-2008

WASP: 182.46 CHF

Shares Traded as % of Outstanding: 52.09%

3 Years

550,000 28%

28% 100% 95% 500,000 25% 92% 85% 450,000

64% 75% 400,000

(000) 65% 350,000 55% Cumulative

300,000 45% Volume 250,000 35%

11% 39% Shares

200,000

8% 25% (%)

150,000 11% 15% 100,000 5% 164.60 179.70 194.80 209.90 225.00 to to to to to 179.69 194.79 209.89 224.99 240.10

Daily from 09-Aug-2005 to 08-Aug-2008

WASP: 201.46 CHF

Shares Traded as % of Outstanding: 264.75%

Source: FactSet as of 08-Aug-2008

Overview of James 27

Goldman Sachs

Overview of James Ownership Structure

Economic Ownership

Bearer Shares

Novartis 6.2%

Families 9.3%

Other 3.1%

NES Total 81.4%

Bearer Total 18.6%

James

862.7mm Shares Outstanding

Bearer Shares

160,000,000 Shares

Ticker: RO.SW

Non-voting Equity Shares

(Genussschein)

702,562,700 Shares

Ticker:ROG.VX

Novartis

53,332,863 Shares

(33.3%)

Families

80,020,000 Shares

(50.0%)

Other

26,647137 Shares

(16.7%)

ADRs

US$

(2 ADRs:1 NES)

Ticker:RHHBY

Comments

? James has two forms of shares

— 160,000,000 Bearer shares with full voting rights

The families, through shares held within the “Other” category, own a majority of the bearer shares

— 702,562,700 Non-voting Equity Securities not part of the share capital and confer no voting rights, but have the same rights to participate in available earnings and proceeds from liquidation as Bearer shares

? James’ ADR (American Depositary Receipt) is traded in U.S. Dollars with two James ADRs representing one underlying non-voting equity security

— The James ADR program was initiated in 1992, obtained securities manual listing by Standard & Poor’s Standard Corporation Records in 2006 and was upgraded to OTCQX International PremierQX in 2007

Source: James public filings and website

Overview of James 28

Goldman Sachs

James Trading Activity (NES Shares / Genussschein)

As of 08-Aug-2008

Ordinary Shares Tickers Exchange Day’s Volume Currency

ROG VX SWX Europe 2,586,987 CHF ROG XB OTC Composite 69,872 CHF ROCG IX Chi-X Alt TS 39,852 CHF RH05 GR Germany 12,419 EUR RH05 GY Germany 10,827 EUR RH05 GF Germany 1,392 EUR RH05 GB Germany EUR RH05 GD Germany EUR RH05 GH Germany EUR RH05 GM Germany EUR RH05 GS Germany EUR RHHVF US U.S. 115 USD RHHVF UV U.S. 115 USD

Bearer Shares

RO.SW SWX 7,001 CHF

ADR Tickers (2:1)

RHHBY US U.S. 273,127 USD RHHBY UV U.S. 273,127 USD RHHBY PQ U.S.—USD RHHBYN MM Mexico—MXN RH06 GR Germany—EUR RH06 GF Germany—EUR RH06 GY Germany—EUR

Note: Highlighted shares represent tickers with the greatest volume of shares traded.

Overview of James 29

Goldman Sachs

James Ownership

Top 25 Institutional Investors – ROG.VX Shares

Rank Investor Name Position % O/S % O/S of Francis

1 Capital Research Global Investors 39,455,934 5.62 1.66

2 Capital World Investors 35,448,720 5.05 0.71

3 UBS Global Asset Management 10,081,923 1.44 -

4 Fidelity Management & Research 9,875,416 1.41 4.22

5 Fidelity International Limited 7,619,891 1.08 -

6 MFS Investment Management 6,317,050 0.90 -

7 Norges Bank 6,063,122 0.86 -

8 Wellington Management Company, LLP 5,618,392 0.80 1.51

9 Janus Capital Management LLC 5,606,545 0.80 0.64

10 Thornburg Investment Management, Inc. 4,557,902 0.65 0.33

11 PRIMECAP Management Company 4,286,500 0.61 0.14

12 Credit Suisse Asset Management 4,143,527 0.59 0.39

13 OppenheimerFunds, Inc. 4,103,719 0.58 -

14 Allianz Global Investors 3,681,678 0.52 -

15 Barclays Global Investors, N.A. 3,340,461 0.48 1.45

16 Schroder Investment Management Ltd. 3,260,764 0.46 -

17 Vanguard Group, Inc. 2,988,639 0.43 0.86

18 Pictet Asset Management Ltd. 2,937,432 0.42 -

19 Pioneer Investment Management Ltd. 2,900,784 0.41 -

20 Artisan Partners Limited Partnership 2,709,550 0.39 -

21 T. Rowe Price Associates, Inc. 2,566,268 0.37 1.68

22 Swisscanto Asset Management AG 2,357,348 0.34 -

23 AllianceBernstein L.P. 2,251,869 0.32 1.52

24 William Blair & Company, L.L.C. 2,108,543 0.30 0.17

25 Northern Cross Investments Limited 2,080,510 0.30 -

Top 25 Shareholders 176,362,487 25.13 15.28

Source: Thomson Research as of 08-Aug-2008

Overview of James 30

Goldman Sachs

James Research Analyst Price Targets

CHF 189.60 per share as of 08-Aug-2008

Date Updated Bank Analyst Current Price Target Speculated Deal Price

21-Jul-2008 Goldman Sachs Murphy CHF 220 NA 21-Jul-2008 Lehman Brothers Walton 218 <= $105 21-Jul-2008 Natixis Lanone 220 NA 21-Jul-2008 Societe Generale Miemietz 208 <= 110 22-Jul-2008 Deutsche Bank Leuchten 209 92—102 22-Jul-2008 HSBC Scotcher 220 NA 22-Jul-2008 JPMorgan Hauber 230 NA 22-Jul-2008 Merrill Lynch Jain 210 <= 100 22-Jul-2008 Morgan Stanley Baum 228 NA 22-Jul-2008 Vontobel Weiss N/A NA 24-Jul-2008 Credit Suisse Holford 212 NA 08-Aug-2008 UBS Shenouda / Amusa 200 115—135

High CHF 230 Mean 216 Median 218 Low 200

Source: Latest available Wall Street research

Overview of James 31

Goldman Sachs

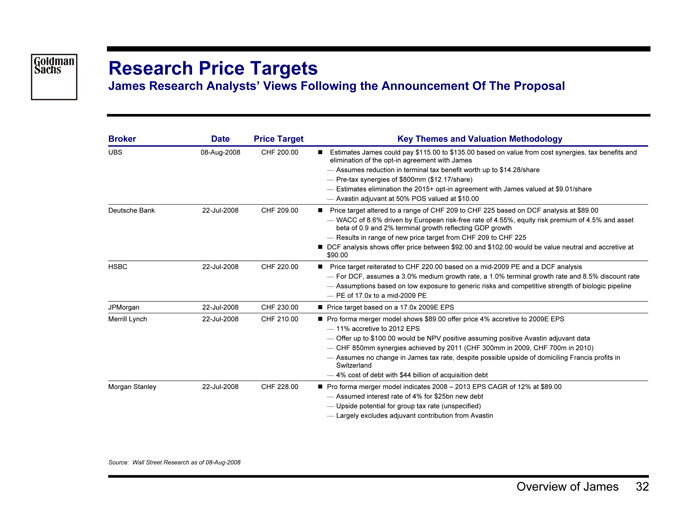

Research Price Targets

James Research Analysts’ Views Following the Announcement Of The Proposal

Broker Date Price Target 1 Key Themes and Valuation Methodology

UBS 08-Aug-2008 CHF 200.00 ? Estimates James could pay $115.00 to $135.00 based on value from cost synergies, tax benefits and elimination of the opt-in agreement with James

— Assumes reduction in terminal tax benefit worth up to $14.28/share

— Pre-tax synergies of $800mm ($12.17/share)

— Estimates elimination the 2015+ opt-in agreement with James valued at $9.01/share

— Avastin adjuvant at 50% POS valued at $10.00

Deutsche Bank 22-Jul-2008 CHF 209.00 ? Price target altered to a range of CHF 209 to CHF 225 based on DCF analysis at $89.00

— WACC of 8.6% driven by European risk-free rate of 4.55%, equity risk premium of 4.5% and asset beta of 0.9 and 2% terminal growth reflecting GDP growth

— Results in range of new price target from CHF 209 to CHF 225

? DCF analysis shows offer price between $92.00 and $102.00 would be value neutral and accretive at $90.00 HSBC 22-Jul-2008 CHF 220.00 ? Price target reiterated to CHF 220.00 based on a mid-2009 PE and a DCF analysis

— For DCF, assumes a 3.0% medium growth rate, a 1.0% terminal growth rate and 8.5% discount rate

— Assumptions based on low exposure to generic risks and competitive strength of biologic pipeline

— PE of 17.0x to a mid-2009 PE

JPMorgan 22-Jul-2008 CHF 230.00 ? Price target based on a 17.0x 2009E EPS

Merrill Lynch 22-Jul-2008 CHF 210.00 ? Pro forma merger model shows $89.00 offer price 4% accretive to 2009E EPS

— 11% accretive to 2012 EPS

— Offer up to $100.00 would be NPV positive assuming positive Avastin adjuvant data

— CHF 850mm synergies achieved by 2011 (CHF 300mm in 2009, CHF 700m in 2010)

— Assumes no change in James tax rate, despite possible upside of domiciling Francis profits in Switzerland

— 4% cost of debt with $44 billion of acquisition debt

Morgan Stanley 22-Jul-2008 CHF 228.00 ? Pro forma merger model indicates 2008 – 2013 EPS CAGR of 12% at $89.00

— Assumed interest rate of 4% for $25bn new debt

— Upside potential for group tax rate (unspecified)

— Largely excludes adjuvant contribution from Avastin

Source: 1 Wall Street Research as of 08-Aug-2008 Price target reflects estimates based on change of control

Overview of James 32

Goldman Sachs

Analyst Commentary

James

Before Transaction Announcement

? “Both Rituxan and Avastin franchises are equally important value drivers for James non-U.S. business. In James forthcoming press release, we will be focusing on continued growth on James’ monoclonal antibody franchise. Given Francis’ robust product revenue growth and its strong royalty stream, we reiterate our Buy recommendation and PT of CHF 233 ahead of the publication of 1H08 results. “ (Vontobel, 16-Jul- 2008)

? “We value James using DCF valuation (WACC 8.4% driven by a European risk-free rate of 4.3%, an equity risk premium of 4.5%, an asset beta of 0.9 and a 2% terminal growth reflecting real GDP growth) . We believe this most appropriately captures the company’s growth prospects as

General well as its differentiation from European pharma peers. This yields our price target of CHF225. Downside risks include long-term threats to the Avastin, Rituxan and Herceptin franchises, the potential introduction of biologic follow-on compounds, pricing, development and political risks.” (Deutsche Bank, 9-Jul-2008)

? “After a deluge of new clinical data from the new drug pipeline, we believe only Avastin in its adjuvant colorectal setting is near enough or big enough to move the needle and enhance James’s premium valuation vs. its peers.” (HSBC, 17-Jun-2008)

After Transaction Announcement

? “We believe this will help secure James future beyond 2015 removing the need for renegotiation of opt-in rights for Francis pipeline, will help remove operational complexity and offers upside potential from Avastin adjuvant. “ (JPMorgan, 21-Jul-2008)

? “We view this as a sensible proposed use of cash (in particular at current FX rates) . . . and see major long-term EPS benefits from the deal.

This deal proposal gives James the perfect opportunity to address its U.S. infrastructure (e.g.; no longer run duplicate U.S. businesses), including closing the Palo Alto site and restructuring the Nutley site, essentially leaving Francis to drive the R&D function. “ (GS, 21-Jul-2008)

Transaction ? “We applaud the proposed acquisition of Francis , which would: 1) allow U.S. cost reduction to offset the negative revenue trends that we a have previously highlighted; 2) reduce R&D redundancy under the current James group structure; 3) enhance James’ pipeline post-2015, after to which James current agreement with Francis is due to expire; and 4) increase gearing to Avastin adjuvant call options. Loss of Francis scientific talent would be a manageable risk, we believe. “ (Morgan Stanley, 22-Jul-2008)

? “Francis is, by general consensus, the premier R&D organization in the entire pharmaceutical industry. Beyond the phase II pipeline, we believe a very important part of Francis’ value is in soft assets – the world leading scientists, the business processes and management

Benefits judgment, the culture, the single site, the values and history. James is also buying the option on the future potential of Francis R&D organization .” (Bernstein Research, 11-Aug-2008)

Source: Wall Street research as of 8-Aug-2008

Overview of James 33

Goldman Sachs

Analyst Commentary (cont’d)

James After Announcement

? “While at face value, the Francis deal appears to offer value to James shareholders through enhanced synergies and an attractive acquisition price, we believe that key concerns will be retaining senior talent at Francis and the final acquisition price payable …James has often cited this one

(potential loss of senior talent) as one of the reasons not to acquire the company. “ (Merrill Lynch, 21-Jul-2008)

? “If the acquisition occurs, James plans to operate Francis as an independent research and early development centre. James has always allowed Francis to operate at arm’s length and this has been a key part of Francis’ success story in our view. Though James purports to be doing exactly this in term of R&D going forward, it is possible that the new structure may not suit all key R&D employees of Francis. In the near term,

Concerns James may be able to provide financial incentives to retain Francis personnel, but the long-term impact is unclear. “ (Goldman Sachs, 21-Jul-2008) ? “We expect the market to have a mixed reaction .as there are a number of uncertainties. First retaining top talent at Francis will be crucial. Key James has often cited this as one of the reasons not to acquire the company. Second is whether they can actually get Francis at this price

($89/share) . The price is only a 19% premium to the 1-month average price, which Francis shareholders may view inadequately compensates for the multiple pipeline opportunities that exist (e.g., Avastin adjuvant CRC). However, our first pass estimate is that the deal would become NPV dilutive, on our existing pipeline assumptions (e.g., no Avastin adjuvant), at an acquisition price above ~$95/share. “ (Merrill Lynch, 21-Jul-2008)

? “We anticipate that a $95.81 valuation for Francis, which incorporates only the value of $12.17ps in cost synergies could go up to $129.10 (roughly $135 in 6 months) if James is willing to value 1) Avastin adjuvant with some probability (James management already communicated the view of >50% probability of success for Avastin adjuvant), 2) potential long-term tax benefits, as well as 3) the value of the elimination of the opt-in beyond 2015. Because James would want to capture some of the value of synergies, we see a $115-$135 bid range (6 month prices) as reasonable.

Another benefit from an acquisition is the elimination of the need to pay royalties and other costs to minority shareholders in Francis. We believe that the expiry of the current opt-in agreement could lead to higher royalties than the 15% James often pays currently. We believe the rate could go as high as 25% in less well-negotiated scenarios. Assuming that new opt-in products start to launch in 2023, we see the value on eliminating the opt-in royalties, assuming they would have persisted durably, would be worth $9.01. Note that we allocate all per share value to minorities since the minorities are the shares that James has to “convince” in order to access the $5.7bn in aggregate cost synergies value. Because James is not currently able to rationalize Francis’s cost base, despite its majority share control, we believe it appropriate that James pay for certain synergies, i.e. pay for a form of control. “ (UBS, 8-Aug-2008)

Commentary ? “The true potential of the realizable synergies, should this transaction be successful, is impossible to second -guess at this point but it is safe to assume that the true synergy potential is significantly above the suggested amount no matter how much James stresses that the proposed transaction is not a cost-cutting story.” (Deutsche, 22-Jul-2008) Price ? “We question whether Francis can be bought for $89 as the value of Avastin adjuvant alone could be worth $20 per share.” (UBS, 21-Jul-2008)

? “The lengthy relationship and the absence of a white knight for Francis make the ultimate acquisition plausible, in our view. At $89 per share, we calculate that the transaction could be 8-10% EPS accretive by 2010.” (Morgan Stanley, 22-Jul-2008)

? “On our estimates, if we assume positive Avastin adjuvant data, Francis valuation could increase $11 to $100 per share. A valuation assuming 50% probability of success would therefore yield $95. Although this suggests Francis minority shareholders could demand a higher price than the initial $89 per share, the current share price more than factors this in.” (Merrill Lynch, 22-Jul-2008)

Source: Wall Street research as of 8-Aug-2008

Overview of James 34

Goldman Sachs

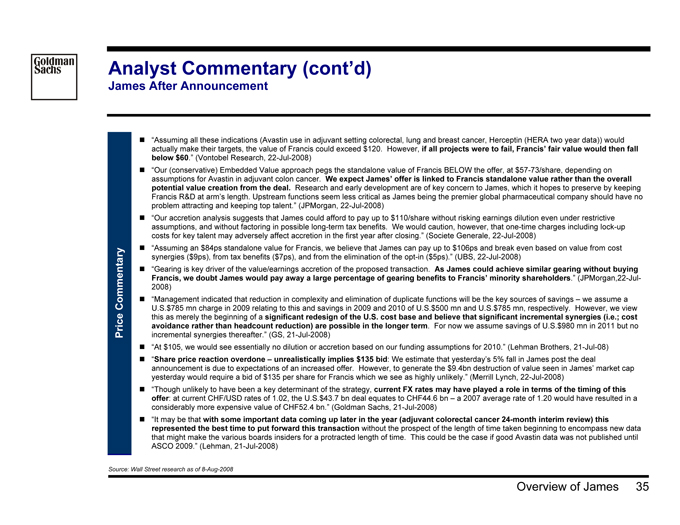

Analyst Commentary (cont’d)

James After Announcement

? “Assuming all these indications (Avastin use in adjuvant setting colorectal, lung and breast cancer, Herceptin (HERA two year data)) would actually make their targets, the value of Francis could exceed $120. However, if all projects were to fail, Francis’ fair value would then fall below $60.” (Vontobel Research, 22-Jul-2008)

? “Our (conservative) Embedded Value approach pegs the standalone value of Francis BELOW the offer, at $57-73/share, depending on assumptions for Avastin in adjuvant colon cancer. We expect James’ offer is linked to Francis standalone value rather than the overall potential value creation from the deal. Research and early development are of key concern to James, which it hopes to preserve by keeping Francis R&D at arm’s length. Upstream functions seem less critical as James being the premier global pharmaceutical company should have no problem attracting and keeping top talent.” (JPMorgan, 22-Jul-2008)

? “Our accretion analysis suggests that James could afford to pay up to $110/share without risking earnings dilution even under restrictive assumptions, and without factoring in possible long-term tax benefits. We would caution, however, that one-time charges including lock-up costs for key talent may adversely affect accretion in the first year after closing. “ (Societe Generale, 22-Jul-2008) ? “Assuming an $84ps standalone value for Francis, we believe that James can pay up to $106ps and break even based on value from cost synergies ($9ps), from tax benefits ($7ps), and from the elimination of the opt-in ($5ps).” (UBS, 22-Jul-2008)

? “Gearing is key driver of the value/earnings accretion of the proposed transaction. As James could achieve similar gearing without buying Francis, we doubt James would pay away a large percentage of gearing benefits to Francis’ minority shareholders .” (JPMorgan,22 -Jul-2008) Commentary ? “Management indicated that reduction in complexity and elimination of duplicate functions will be the key sources of savings – we assume a U.S.$785 mn charge in 2009 relating to this and savings in 2009 and 2010 of U.S.$500 mn and U.S.$785 mn, respectively. However, we view this as merely the beginning of a significant redesign of the U.S. cost base and believe that significant incremental synergies (i.e.; cost avoidance rather than headcount reduction) are possible in the longer term. For now we assume savings of U.S.$980 mn in 2011 but no

Price incremental synergies thereafter. “ (GS, 21-Jul-2008)

? “At $105, we would see essentially no dilution or accretion based on our funding assumptions for 2010.” (Lehman Brothers, 21-Jul-08)

? “Share price reaction overdone – unrealistically implies $135 bid: We estimate that yesterday’s 5% fall in James post the deal announcement is due to expectations of an increased offer. However, to generate the $9.4bn destruction of value seen in James’ market cap yesterday would require a bid of $135 per share for Francis which we see as highly unlikely. “ (Merrill Lynch, 22-Jul-2008)

? “Though unlikely to have been a key determinant of the strategy, current FX rates may have played a role in terms of the timing of this offer: at current CHF/USD rates of 1.02, the U.S.$43.7 bn deal equates to CHF44.6 bn – a 2007 average rate of 1.20 would have resulted in a considerably more expensive value of CHF52.4 bn.” (Goldman Sachs, 21-Jul-2008)

? “It may be that with some important data coming up later in the year (adjuvant colorectal cancer 24-month interim review) this represented the best time to put forward this transaction without the prospect of the length of time taken beginning to encompass new data that might make the various boards insiders for a protracted length of time. This could be the case if good Avastin data was not published until ASCO 2009.” (Lehman, 21-Jul-2008)

Source: Wall Street research as of 8-Aug-2008

Overview of James 35

Goldman Sachs

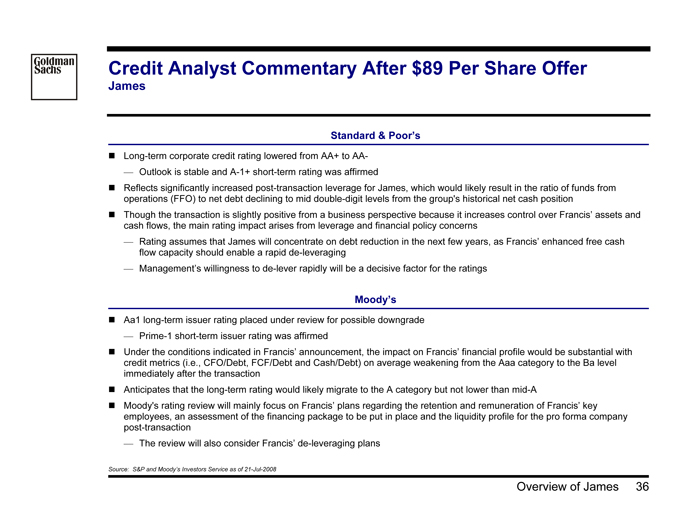

Credit Analyst Commentary After $89 Per Share Offer

James

Standard & Poor’s

? Long-term corporate credit rating lowered from AA+ to AA-

— Outlook is stable and A-1+ short-term rating was affirmed

? Reflects significantly increased post-transaction leverage for James, which would likely result in the ratio of funds from operations (FFO) to net debt declining to mid double-digit levels from the group’s historical net cash position

? Though the transaction is slightly positive from a business perspective because it increases control over Francis’ assets and cash flows, the main rating impact arises from leverage and financial policy concerns

— Rating assumes that James will concentrate on debt reduction in the next few years, as Francis’ enhanced free cash flow capacity should enable a rapid de-leveraging

— Management’s willingness to de-lever rapidly will be a decisive factor for the ratings

Moody’s

? Aa1 long-term issuer rating placed under review for possible downgrade

— Prime-1 short-term issuer rating was affirmed

? Under the conditions indicated in Francis’ announcement, the impact on Francis’ financial profile would be substantial with credit metrics (i.e., CFO/Debt, FCF/Debt and Cash/Debt) on average weakening from the Aaa category to the Ba level immediately after the transaction

? Anticipates that the long-term rating would likely migrate to the A category but not lower than mid-A

? Moody’s rating review will mainly focus on Francis’ plans regarding the retention and remuneration of Francis’ key employees, an assessment of the financing package to be put in place and the liquidity profile for the pro forma company post-transaction

— The review will also consider Francis’ de-leveraging plans

Source: S&P and Moody’s Investors Service as of 21-Jul-2008

Overview of James 36

Goldman Sachs

IV. Financial Analysis

Financial Analysis 37

Goldman Sachs

Key Assumptions to Francis Management Projections

Near-term

? Avastin adjuvant CRC trial (C-08)

— Base case 65% PTS in Q2 2009

— Upside case Q4 ‘08 interim look is positive with positive PTS adjustments to other adjuvant trials

— Downside case Q2 ‘09 trial end is negative with negative PTS adjustments to other adjuvant trials

? Price / reimbursement impacts

— Base case assume 3% annual price increases

? 2015 James commercial agreement expiration

— Assumes status quo type of terms

— Management expects more favorable market terms than current (modeled separately)

? Tax rate assumptions

— Base case assumes off-shore manufacturing tax benefits trend tax-rate to approximately 30%

? FOB Assumptions

— Assumptions assume number of entrants, physician acceptance and price discounts by product

? Unnamed product PTS and market opportunity

— Assumes large and small molecule NMEs

— Launch to Filing PTS of 23% and 11% respectively

— Market opportunity of $1bn per NME indication plus two line extensions Upside case of $2.3bn total market opportunity Long-term Downside case of $500mm total market opportunity

Source: Francis management

Financial Analysis 38

Goldman Sachs

Comparison of Management Projections to Wall Street Estimates

($ in billions)

Revenue

$18.0 $17.4 $17.0 $15.7 $15.8 $16.0 $16.0 $16.0 $14.2 $14.6 $15.3 $15.2 $15.0 $15.0 $14.2 $13.8 $14.3 $14.2 $14.0 $13.4 $13.6 $13.0 $12.0 $11.0 $10.0

2009E 2010E 2011E

Operating Income

$9.0 $8.4 $8.0 $7.3 $7.2 $6.6 $6.1 $6.6 $7.0 $7.0 $7.1 $5.8 $6.1 $6.3 $6.3 $6.7 $6.0 $6.2 $6.4 $6.0 $5.0

$4.0

$3.0

2009E 2010E 2011E

LRP 2007 April Update Management Case IBES High IBES Mean IBES Low

Source: Financial projections per Francis management and Wall Street estimates as of 05-Aug-2008 Note: 2011E IBES mean based on selected composite from Wall Street research

Financial Analysis 39

Goldman Sachs

Comparison of Management Projections to Wall Street Estimates (cont’d)

($ in billions, except per share data)

Net Income

$7.0 $6.5 $6.1 $6.0 $5.2 $5.2 $4.4 $5.0 $4.2 $5.0 $4.8 $5.0 $4.2 $4.8 $4.2 $4.5 $3.8 $4.0 $4.6 $4.0 $4.1 $4.1 $3.7 $3.0

$2.0

$1.0

2009E 2010E 2011E

Cash EPS

$6.50 $6.20 $5.97 $5.50 $5.22 $4.39 $4.91 $4.79 $4.76 $4.15 $4.76 $4.94 $4.50 $3.87 $4.01 $3.94 $4.23 $4.44 $3.66 $3.95 $3.92 $3.50 $3.69

$2.50

$1.50

2009E 2010E 2011E

LRP 2007 April Update Management Case ¹ Management Case (No Share Repurchase) ² IBES High IBES Mean IBES Low

Source: Financial projections per Francis management and Wall Street estimates as of 05-Aug-2008. Cash EPS due to exclusion of stock based compensation Note: 1 2011E IBES mean based on selected composite from Wall Street research 2 Includes after-tax interest income of $200mm ($0.19 per share), $304mm ($0.30 per share) and $369mm ($0.38 per share) in 2009E, 2010E and 2011E, respectively. Includes interest income of $0.19, $0.44 and $0.76 per share in 2009E, 2010E and 2011E, respectively.

Financial Analysis 40

Goldman Sachs

Review of Francis Annual Long Range Plan Estimates

($ in millions)

$30,000 $26,992 2006 LRP $25,210 2005 LRP

$25,000 $24,630 Mgmt Plan $22,240 2004 LRP

$20,000 millions) $20,666 2007 LRP in $ ( $16,530

$15,000 2003 LRP

Estimate $14,467

Sales 2002 LRP . $10,000 . S $10,743

U

2001 LRP

$7,666 2000 LRP $5,000

$0

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

2000 LRP 2001 LRP 2002 LRP 2003 LRP 2004 LRP 2005 LRP 2006 LRP 2007 LRP Management Case Actual

Source: Francis management

Financial Analysis 41

Goldman Sachs

Francis Forecasted Product Sales Breakdown

($ in millions)

Avastin Rituxan Herceptin Lucentis Other Marketed Named Product Pipeline Unnamed Non-Product

$35,000 $33,244

$31,055

$28,356

$26,025

$25,185

$30,000

$24,955

$24,194

$21,404

$25,000 $19,441

$18,427

$17,533 20,080 4,155 17,152

$16,223 6,397

14,169

$14,923 8,790

$20,000 2,283 11,411

$13,989 587 1,150 2,825 275 2,184

$12,645 102 1,029 1,563

16 547 3,483

$11,325 85 208

$15,000 25 3,812 3,707

4,136 3,943 3,780 3,990

17 4,139 2,814

4,071 1,558 1,638 4,198

3,796 1,230 1,339 1,456 4,485

- 1,115 1,325 4,554

3,250 1,752 1,867 1,945 2,696 4,548 1,110 1,735 1,804

$10,000 2,762 1,728 1,852

1,290 1,132 967 917 2,599 1,156 1,753 1,977 1,488 881

964 2,369 1,558 2,529 2,476

1,787 2,498 1,999 1,778 735 1,603 2,489 811 1,343 683 663 1,254 646 2,426 1,201 1,156 $5,000 2,608 759 2,584 9,008 725 699 677 7,849 8,249 8,619 8,257 6,484 7,290 6,482 4,665 5,420 5,040 4,574 3,852 4,371 4,205 3,413

$0 (15) (21) (51) (48) (50) (49) (51) (51) (53) (58) (60) (62) (60) (67) 2009E 2010E 2011E 2012E 2013E 2014E 2015E 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E

($5,000)

Source: Francis management projections

Financial Analysis 42

Goldman Sachs

Growth Trends in Management Projections

Francis

16.0%

Net Income

Earnings Before Interest After Tax 14.0% 14.1% 13.1% Rate 12.0% 11.6%

Growth 10.8%

10.0%

9.1% 9.2%

Annual 8.7% 8.6% 8.0% 7.4%

7.4% 7.4% 7.2%

6.5%

6.6%

Compounded 6.0% 6.1% 6.8%

5.7% 4.4%

3.9% 4.3% 4.0% 3.7% 3.1%

2.0%

2009E 2010E 2011E 2012E 2013E 2014E 2015E 2016E 2017E 2018E 2019E

5yr Forward CAGR Yearly From 2009—2019

Source: Francis Management Projections

Financial Analysis 43

Goldman Sachs

Discounted Cash Flow Analysis of Francis

Key Assumptions

? Projections from 2009 to 2024 provided by Francis Management as of 01-Aug-2008

— Projections by product were provided for Avastin, Rituxan, Herceptin, Lucentis as well as for the pipeline

? Assumes 1,056mm basic shares outstanding, as of 07-Aug-2008

— Current options outstanding included in share count by the treasury stock method

— Options schedule provided by Francis management as of 07-Aug-2008

? Financial Sensitivity Analysis:

— Discount rates evaluated using a range of 8.0%—10.0% based on WACC analysis

— Terminal value evaluated using perpetuity growth rate method using a range of 2.0%—4.0%

Implied P/E terminal multiple also evaluated

? Total debt of $2,475mm, total cash and investments of $6,337mm as of 30-Jun-2008 per latest public filings

? Assumes capital expenditures of $818mm and depreciation and amortization of $867mm in 2024 terminal year, per Company management

? Assumes tax rate trends from 36% in 2009 to 31% in 2024 terminal year per management forecast

? Assumes cash flows discounted back to 01-Jan-2009

? Analysis includes impact of:

— Future employee stock options expense

Assumes $328mm in after-tax ESO expense in 2009 with a six percent annual growth rate

— Changes to James / Francis marketing agreement post 2015 per management guidance on expected market rate terms

“Marked to market” 2015 opt-in value derived from discounting projected product royalties from large and small molecules in the unnamed pipeline beginning in 2016, with a three percent perpetuity growth rate

Financial Analysis 44

Goldman Sachs

Summary Management Forecast

2009E – 2015E

($ in millions, except per share data)\

2009E—2014E 2009E—2015E 2009E 2010E 2011E 2012E 2013E 2014E 2015E CAGR CAGR

Revenues:

Avastin $3,413 $3,852 $4,665 $5,420 $6,484 $7,290 $7,849 16.4% 14.9% Rituxan 2,584 2,608 2,426 2,489 2,498 2,369 1,977 (1.7)% (4.4)% Herceptin 1,603 1,778 1,787 1,753 1,728 1,735 1,752 1.6% 1.5% Lucentis 964 1,156 1,290 1,110 1,115 1,230 1,339 5.0% 5.6% Other Named Products 2,762 3,266 3,821 4,156 4,347 4,683 4,972 11.1% 10.3% Unnamed—— 16 102 275 587 Non-Product (0) (15) 0 (21) (51) (48) (50) Product Sales $11,325 $12,645 $13,989 $14,923 $16,223 $17,533 $18,427 Royalties 2,563 2,653 2,811 2,873 2,966 3,136 2,976 Contract & Other 351 410 638 767 838 879 850

Total Revenue $14,239 $15,708 $17,439 $18,562 $20,026 $21,549 $22,253 8.6% 7.7% Cost and Expenses:

Cost of Sales $1,547 $1,693 $1,656 $1,696 $1,816 $1,885 $1,804 R&D 2,848 3,142 3,488 3,712 4,005 4,310 4,451 MSG&A 2,167 2,177 2,279 2,429 2,490 2,721 2,925 Profit Sharing 1,352 1,496 1,657 1,695 1,548 1,594 1,513

Total Cost & Exp. $7,914 $8,508 $9,080 $9,532 $9,858 $10,510 $10,692

Operating Income $6,326 $7,201 $8,359 $9,030 $10,168 $11,038 $11,560 11.8% 10.6% EBITDA $6,996 $7,884 $9,083 $9,771 $10,924 $11,817 $12,347 11.1% 9.9% Other Income, Net 281 403 494 524 590 618 796

Earnings (Pre-Tax) $6,607 $7,604 $8,853 $9,554 $10,757 $11,656 $12,357 12.0% 11.0% Taxes 2,380 2,585 2,773 2,892 3,214 3,472 3,672

Net Income $4,227 $5,019 $6,080 $6,662 $7,543 $8,185 $8,684 14.1% 12.7% WASO 1,053 1,022 981 941 898 864 851

EPS $4.01 $4.91 $6.20 $7.08 $8.40 $9.47 $10.21 18.7% 16.8% Growth and Margins Analysis

Revenue Growth—10.3 % 11.0 % 6.4 % 7.9 % 7.6 % 3.3 % R&D as % of Revenue 20.0 20.0 20.0 20.0 20.0 20.0 20.0 MSG&A as % of Revenue 15.2 13.9 13.1 13.1 12.4 12.6 13.1 EBIT Margin 44.4 45.8 47.9 48.6 50.8 51.2 52.0 EBITDA Margin 49.1 50.2 52.1 52.6 54.6 54.8 55.5 EPS Growth—22.4 26.1 14.3 18.5 12.8 7.7

Selected Balance Sheet Metrics

Cash & Equivalents ¹ $6,237 $6,444 $6,932 $7,534 $8,082 $11,473 $18,299 Total Debt 2,345 1,656 1,640 1,623 1,603 1,581 556

Selected Cash Flow Metrics

Depreciation & Amortization $670 $683 $724 $740 $757 $779 $786 Capital Expenditures (739) (812) (791) (615) (605) (626) (648) (Increase) / Decrease in Working Capital (66) (221) (161) (155) (252) (163) (106)

Source: 1 Company management projections as of 01-Aug-2008 Includes short-term investments

Financial Analysis 45

Goldman Sachs

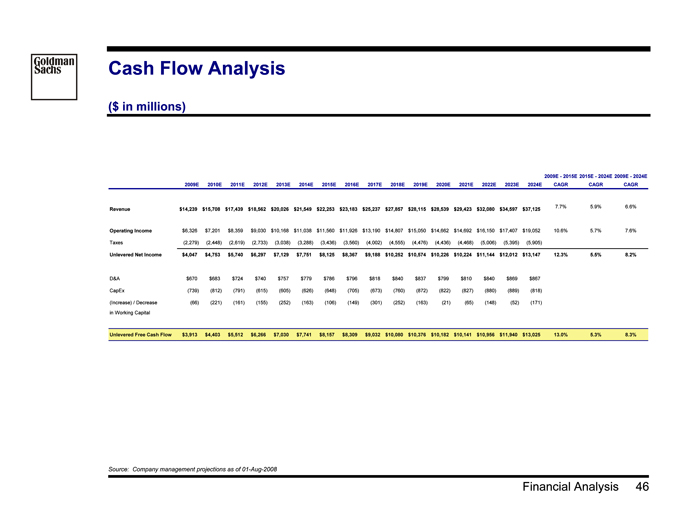

Cash Flow Analysis

($ in millions)

2009E—2015E 2015E—2024E 2009E—2024E 2009E 2010E 2011E 2012E 2013E 2014E 2015E 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E CAGR CAGR CAGR

7.7% 5.9% 6.6%

Revenue $14,239 $15,708 $17,439 $18,562 $20,026 $21,549 $22,253 $23,183 $25,237 $27,857 $28,115 $28,539 $29,423 $32,080 $34,597 $37,125

Operating Income $6,326 $7,201 $8,359 $9,030 $10,168 $11,038 $11,560 $11,926 $13,190 $14,807 $15,050 $14,662 $14,692 $16,150 $17,407 $19,052 10.6% 5.7% 7.6%

Taxes (2,279) (2,448) (2,619) (2,733) (3,038) (3,288) (3,436) (3,560) (4,002) (4,555) (4,476) (4,436) (4,468) (5,006) (5,395) (5,905)

Unlevered Net Income $4,047 $4,753 $5,740 $6,297 $7,129 $7,751 $8,125 $8,367 $9,188 $10,252 $10,574 $10,226 $10,224 $11,144 $12,012 $13,147 12.3% 5.5% 8.2%

D&A $670 $683 $724 $740 $757 $779 $786 $796 $818 $840 $837 $799 $810 $840 $869 $867

CapEx (739) (812) (791) (615) (605) (626) (648) (705) (673) (760) (872) (822) (827) (880) (889) (818)

(Increase) / Decrease (66) (221) (161) (155) (252) (163) (106) (149) (301) (252) (163) (21) (65) (148) (52) (171) in Working Capital

Unlevered Free Cash Flow $3,913 $4,403 $5,512 $6,266 $7,030 $7,741 $8,157 $8,309 $9,032 $10,080 $10,376 $10,182 $10,141 $10,956 $11,940 $13,025 13.0% 5.3% 8.3%

Source: Company management projections as of 01-Aug-2008

Financial Analysis 46

Goldman Sachs

Discounted Cash Flow Analysis of Francis

Financial Sensitivities 2024 Terminal Year

Enterprise Value

Perpetuity Growth Rate

# ##### 2.0 % 2.5 % 3.0 % 3.5 % 4.0 %

10.0 % $88,539 $91,137 $94,107 $97,533 $101,531 Rate 9.5 % 95,338 98,518 102,186 106,467 111,525 Discount 9.0 % 102,993 106,923 111,507 116,925 123,427 8.5 % 111,571 116,483 122,288 129,253 137,767

8.0 % 121,004 127,225 134,691 143,815 155,221

% of Enterprise Value in Terminal Value

Perpetuity Growth Rate $ 50.5 2.0 % 2.5 % 3.0 % 3.5 % 4.0 %

10.0 % 40.8 % 42.5 % 44.3 % 46.3 % 48.4 % Rate 9.5 % 43.5 45.3 47.3 49.4 51.7 Discount 9.0 % 46.4 48.4 50.5 52.8 55.3 8.5 % 49.7 51.8 54.1 56.6 59.2

8.0 % 53.4 55.7 58.1 60.8 63.7

Equity Value Per Share

Perpetuity Growth Rate

$ 105.8 2.0 % 2.5 % 3.0 % 3.5 % 4.0 %

10.0 % $85.66 $87.95 $90.56 $93.57 $97.08 Rate 9.5 % 91.64 94.43 97.66 101.42 105.86 Discount 9.0 % 98.37 101.82 105.85 110.61 116.33 8.5 % 105.91 110.22 115.33 121.45 128.94

8.0 % 114.20 119.67 126.24 134.26 144.30

Implied 2024 P/E1

Perpetuity Growth Rate

$ 13.1 2.0 % 2.5 % 3.0 % 3.5 % 4.0 %

10.0 % 9.7 x 10.4 x 11.2 x 12.2 x 13.2 x Rate 9.5 % 10.4 11.2 12.1 13.2 14.4 Discount 9.0 % 11.1 12.0 13.1 14.4 15.9 8.5 % 12.0 13.1 14.3 15.8 17.7

8.0 % 13.0 14.2 15.7 17.6 19.9

Source: Financial projections and scenarios per Francis management as of 01-Aug-2008

Note: Includes capitalized ESO expense and “marked to market” 2015 opt-in value. Assumes 1,056mm basic shares outstanding, as of 07-Aug-2008, and net cash of $3,862 million, as of 30-Jun-2008.

1 Assumes cash flows discounted to 01-Jan-2009 P/E as implied by Earnings Before Interest, After-tax

Financial Analysis

47

Goldman Sachs

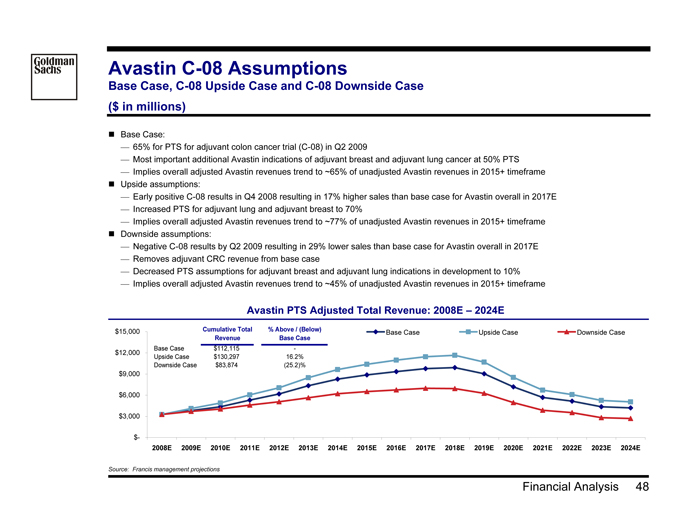

Avastin C-08 Assumptions

Base Case, C-08 Upside Case and C-08 Downside Case ($ in millions)

? Base Case:

— 65% for PTS for adjuvant colon cancer trial (C-08) in Q2 2009

— Most important additional Avastin indications of adjuvant breast and adjuvant lung cancer at 50% PTS

— Implies overall adjusted Avastin revenues trend to ~65% of unadjusted Avastin revenues in 2015+ timeframe

? Upside assumptions:

— Early positive C-08 results in Q4 2008 resulting in 17% higher sales than base case for Avastin overall in 2017E

— Increased PTS for adjuvant lung and adjuvant breast to 70%

— Implies overall adjusted Avastin revenues trend to ~77% of unadjusted Avastin revenues in 2015+ timeframe

? Downside assumptions:

— Negative C-08 results by Q2 2009 resulting in 29% lower sales than base case for Avastin overall in 2017E

— Removes adjuvant CRC revenue from base case

— Decreased PTS assumptions for adjuvant breast and adjuvant lung indications in development to 10%

— Implies overall adjusted Avastin revenues trend to ~45% of unadjusted Avastin revenues in 2015+ timeframe

Source: Francis management projections

Financial Analysis 48

Avastin PTS Adjusted Total Revenue: 2008E – 2024E

$15,000 Cumulative Total % Above / (Below) Base Case Upside Case Downside Case

Revenue Base Case

Base Case $112,115 -$12,000 Upside Case $130,297 16.2% Downside Case $83,874 (25.2)% $9,000

$6,000

$3,000

$-

2008E 2009E 2010E 2011E 2012E 2013E 2014E 2015E 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E

Goldman Sachs

Avastin Case Discounted Cash Flow Analysis

Base Case, C-08 Upside Case and C-08 Downside Case 2024 Terminal Year

Avastin Impact on Whole -Co. – Equity Value Per Share

C-08 Downside Case Base Case C-08 Upside Case

Perpetuity Growth Rate Perpetuity Growth Rate Perpetuity Growth Rate $ 95.2 2.0 % 2.5 % 3.0 % 3.5 % 4.0 % $ 105.8 2.0 % 2.5 % 3.0 % 3.5 % 4.0 % $ 112.4 2.0 % 2.5 % 3.0 % 3.5 % 4.0 %

10.0 % $76.68 $78.86 $81.31 $84.14 $87.39 10.0 % $85.66 $87.95 $90.56 $93.57 $97.08 10.0 % $91.17 $93.55 $96.27 $99.41 $103.07 Rate 9.5 % 82.16 84.78 87.76 91.25 95.36 Rate 9.5 % 91.64 94.43 97.66 101.42 105.86 Rate 9.5 % 97.50 100.41 103.77 107.69 112.32 Discount 9.0 % 88.23 91.43 95.16 99.57 104.86 Discount 9.0 % 98.37 101.82 105.85 110.61 116.33 Discount 9.0 % 104.62 108.22 112.42 117.38 123.34 8.5 % 94.99 98.98 103.71 109.38 116.31 8.5 % 105.91 110.22 115.33 121.45 128.94 8.5 % 112.61 117.11 122.43 128.81 136.61

8.0 % 102.37 107.44 113.52 120.95 130.24 8.0 % 114.20 119.67 126.24 134.26 144.30 8.0 % 121.43 127.12 133.96 142.33 152.78

Incremental Impact on Whole-Co. – Equity Value Per Share

C-08 Downside Case C-08 Upside Case

Perpetuity Growth Rate $ 95.2 2.0 % 2.5 % 3.0 % 3.5 % 4.0 %

10.0 % ($8.98) ($9.08) ($9.24) ($9.43) ($9.69) Rate 9.5 % (9.48) (9.66) (9.89) (10.17) (10.50) Discount 9.0 % (10.13) (10.39) (10.69) (11.04) (11.47) 8.5 % (10.92) (11.24) (11.62) (12.08) (12.63)

8.0 % (11.83) (12.23) (12.72) (13.32) (14.06)

Perpetuity Growth Rate

$ 112.4 2.0 % 2.5 % 3.0 % 3.5 % 4.0 %

10.0 % $5.51 $5.61 $5.72 $5.84 $5.99 Rate 9.5 % 5.86 5.98 6.11 6.27 6.45 Discount 9.0 % 6.26 6.40 6.57 6.77 7.01 8.5 % 6.71 6.89 7.10 7.36 7.67

8.0 % 7.23 7.45 7.73 8.06 8.48

Source: Francis management projections

Financial Analysis 49

Goldman Sachs

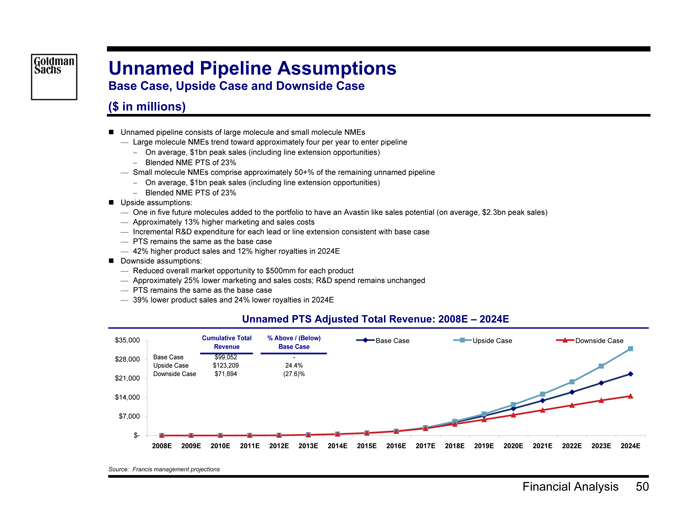

Unnamed Pipeline Assumptions

Base Case, Upside Case and Downside Case ($ in millions)

? Unnamed pipeline consists of large molecule and small molecule NMEs

— Large molecule NMEs trend toward approximately four per year to enter pipeline

On average, $1bn peak sales (including line extension opportunities)

Blended NME PTS of 23%

— Small molecule NMEs comprise approximately 50+% of the remaining unnamed pipeline

On average, $1bn peak sales (including line extension opportunities)

Blended NME PTS of 23%

? Upside assumptions:

— One in five future molecules added to the portfolio to have an Avastin like sales potential (on average, $2.3bn peak sales)

— Approximately 13% higher marketing and sales costs

— Incremental R&D expenditure for each lead or line extension consistent with base case

— PTS remains the same as the base case

— 42% higher product sales and 12% higher royalties in 2024E

? Downside assumptions:

— Reduced overall market opportunity to $500mm for each product

— Approximately 25% lower marketing and sales costs; R&D spend remains unchanged

— PTS remains the same as the base case

— 39% lower product sales and 24% lower royalties in 2024E

Unnamed PTS Adjusted Total Revenue: 2008E – 2024E

$35,000 Cumulative Total % Above / (Below) Base Case Upside Case Downside Case

Revenue Base Case $28,000 Base Case $99,052 -Upside Case $123,209 24.4% Downside Case $71,694 (27.6)% $21,000

$14,000

$7,000

$-

2008E 2009E 2010E 2011E 2012E 2013E 2014E 2015E 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E

Source: Francis management projections

Financial Analysis 50

Goldman Sachs

Unnamed Products Case Discounted Cash Flow Analysis

Base Case, Upside Case and Downside Case 2024 Terminal Year

Unnamed Product Impact on Whole-Co. – Equity Value Per Share

Downside Case Base Case Upside Case

Perpetuity Growth Rate Perpetuity Growth Rate Perpetuity Growth Rate $ 87.1 2.0 % 2.5 % 3.0 % 3.5 % 4.0 % $ 105.8 2.0 % 2.5 % 3.0 % 3.5 % 4.0 % $ 117.3 2.0 % 2.5 % 3.0 % 3.5 % 4.0 %

10.0 % $72.62 $74.25 $76.12 $78.26 $80.70 10.0 % $85.66 $87.95 $90.56 $93.57 $97.08 10.0 % $93.17 $95.94 $99.12 $102.78 $107.05 Rate 9.5 % 77.12 79.09 81.33 83.93 86.98 Rate 9.5 % 91.64 94.43 97.66 101.42 105.86 Rate 9.5 % 100.21 103.61 107.53 112.11 117.52 Discount 9.0 % 81.99 84.38 87.14 90.40 94.31 Discount 9.0 % 98.37 101.82 105.85 110.61 116.33 Discount 9.0 % 108.20 112.40 117.31 123.10 130.06 8.5 % 87.23 90.19 93.68 97.87 102.99 8.5 % 105.91 110.22 115.33 121.45 128.94 8.5 % 117.26 122.51 128.72 136.17 145.28

8.0 % 92.73 96.48 100.97 106.46 113.33 8.0 % 114.20 119.67 126.24 134.26 144.30 8.0 % 127.38 134.03 142.02 151.78 163.99

Incremental Impact on Whole-Co. – Equity Value Per Share

Downside Case Upside Case

Perpetuity Growth Rate $ 87.1 2.0 % 2.5 % 3.0 % 3.5 % 4.0 %

10.0 % ($13.04) ($13.69) ($14.44) ($15.31) ($16.38) Rate 9.5 % (14.52) (15.34) (16.33) (17.48) (18.88) Discount 9.0 % (16.38) (17.44) (18.71) (20.22) (22.02) 8.5 % (18.67) (20.04) (21.65) (23.59) (25.95)

8.0 % (21.46) (23.19) (25.27) (27.80) (30.97)

Perpetuity Growth Rate

$ 117.3 2.0 % 2.5 % 3.0 % 3.5 % 4.0 %

10.0 % $7.51 $8.00 $8.56 $9.21 $9.97 Rate 9.5 % 8.57 9.18 9.87 10.69 11.65 Discount 9.0 % 9.84 10.59 11.46 12.49 13.73 8.5 % 11.35 12.29 13.39 14.72 16.34

8.0 % 13.18 14.36 15.78 17.52 19.69

Source: Francis management projections

Financial Analysis 51

Goldman Sachs

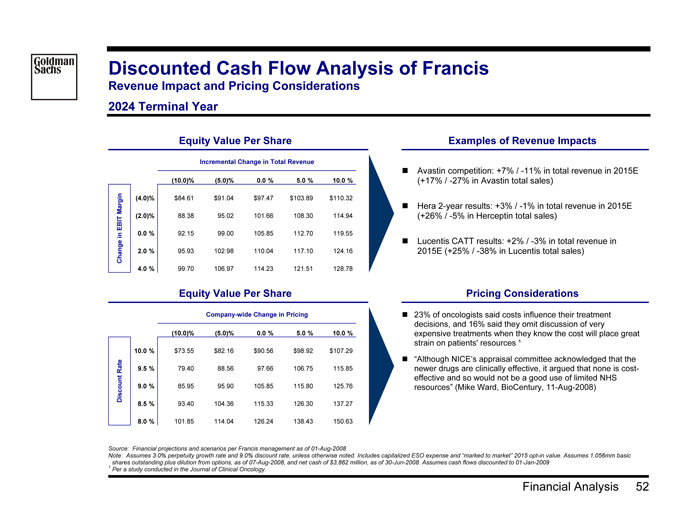

Discounted Cash Flow Analysis of Francis

Revenue Impact and Pricing Considerations 2024 Terminal Year

Equity Value Per Share

Incremental Change in Total Revenue

(10.0)% (5.0)% 0.0 % 5.0 % 10.0 %

Margin (4.0)% $84.61 $91.04 $97.47 $103.89 $110.32 EBIT (2.0)% 88.38 95.02 101.66 108.30 114.94 in 0.0 % 92.15 99.00 105.85 112.70 119.55 Change 2.0 % 95.93 102.98 110.04 117.10 124.16 4.0 % 99.70 106.97 114.23 121.51 128.78

Equity Value Per Share

Company -wide Change in Pricing

(10.0)% (5.0)% 0.0 % 5.0 % 10.0 %

10.0 % $73.55 $82.16 $90.56 $98.92 $107.29 Rate 9.5 % 79.40 88.56 97.66 106.75 115.85 Discount 9.0 % 85.95 95.90 105.85 115.80 125.76 8.5 % 93.40 104.36 115.33 126.30 137.27

8.0 % 101.85 114.04 126.24 138.43 150.63

Examples of Revenue Impacts

? Avastin competition: +7% / -11% in total revenue in 2015E (+17% / -27% in Avastin total sales)

? Hera 2-year results: +3% / -1% in total revenue in 2015E (+26% / -5% in Herceptin total sales)

? Lucentis CATT results: +2% / -3% in total revenue in 2015E (+25% / -38% in Lucentis total sales)

Pricing Considerations

? 23% of oncologists said costs influence their treatment decisions, and 16% said they omit discussion of very expensive treatments when they know the cost will place great strain on patients’ resources ¹

? “Although NICE’s appraisal committee acknowledged that the newer drugs are clinically effective, it argued that none is cost-effective and so would not be a good use of limited NHS resources” (Mike Ward, BioCentury, 11-Aug-2008)

Source: Financial projections and scenarios per Francis management as of 01-Aug-2008

Note: Assumes 3.0% perpetuity growth rate and 9.0% discount rate, unless otherwise noted. Includes capitalized ESO expense and “marked to market” 2015 opt-in value. Assumes 1,056mm basic 1 shares outstanding plus dilution from options, as of 07-Aug-2008, and net cash of $3,862 million, as of 30-Jun-2008. Assumes cash flows discounted to 01-Jan-2009 Per a study conducted in the Journal of Clinical Oncology.

Financial Analysis 52

Goldman Sachs

Discounted Cash Flow Analysis of Francis

Tax and Follow -on Biologic Considerations 2024 Terminal Year

Equity Value Per Share

Terminal Year Tax Rate

36.0 % 33.5 % 31.0 % 28.5 % 26.0 %

10.0 % $87.69 $89.12 $90.56 $91.99 $93.42 Rate 9.5 % 94.35 96.01 97.66 99.31 100.96 Discount 9.0 % 102.02 103.93 105.85 107.77 109.68 8.5 % 110.85 113.09 115.33 117.57 119.81

8.0 % 120.95 123.60 126.24 128.88 131.52

Equity Value Per Share

Incremental Follow -on Biologic Erosion for Top 4 Products ¹

(20.0)% (10.0)% 0.0 % 10.0 % 20.0 %

10.0 % $87.63 $89.09 $90.56 $92.02 $93.48 Rate 9.5 % 94.33 95.99 97.66 99.32 100.98 Discount 9.0 % 102.05 103.95 105.85 107.75 109.65 8.5 % 110.95 113.14 115.33 117.52 119.71

8.0 % 121.15 123.69 126.24 128.78 131.32

Tax Considerations

? U.S. tax system may eventually shift to tax worldwide income, thus reducing offshore tax benefits