Exhibit (c)(6)

Goldman Sachs Confidential Discussion Materials for Francis Special Committee Goldman, Sachs & Co. 13-Feb-2009

Goldman Sachs Confidential Table of Contents I. Summary Overview II. Update on Public Market Perspectives III. Updated Financial Analysis A. Present Value of Future Stock Price Analysis B. Discounted Cash Flow Analysis C. Transaction-Related Financial Analysis IV. Credit Market Considerations and Transaction Analysis A. Credit Market Considerations B. Transaction Analysis Appendix A: Supplementary Materials

Goldman Sachs Confidential I. Summary Overview Summary Overview 1

Goldman Sachs Confidential Project Nobel Market Tracker Change from 1 Day Prior Change Since 10-Feb-2009 18-Jul-2008 1 Week 1 Month 3 Month 2-Jan-2008 Francis $82.69 ($0.01) (0.0)% 1.1 % (0.3)% (4.2)% 2.2 % 22.7 % BTK 827.16 113.94 16.0 4.0 22.7 29.8 29.5 5.0 S&P 500 693.06 (176.83) (20.3) (45.0) (17.3) (22.2) (22.9) (52.1) AMEX Pharmaceutical Index 259.80 (7.66) (2.9) (15.2) (2.9) (3.9) (1.1) (22.8) James CHF147.00 (CHF1.60) (1.1)% (18.2)% (9.6)% (14.5)% (12.3)% (23.4)% Swiss Exchange 5,144.69 (13.81) (0.3) (24.6) (1.4) (9.7) (12.5) (38.2) FTSE 350 Pharma & Biotech 8,218.64 86.94 1.1 8.5 (1.9) (3.4) 0.8 4.6 James (ADR) $31.40 ($0.47) (1.5) (28.7) (12.0) (18.2) (10.7) (27.3) Currency Exchange Rate (CHF / $) 1.1568 (0.0073) (0.63)% 13.10 % 1.24 % 3.83 % (2.61)% 3.33 % James Francis Francis Trading Volume James announced bid to Offer Price Tender Price 100 acquire Francis for $89 $89/share 120% James announced 90 confidence in ability $86.5/share 80 to secure financing James announced talks James files tender 3 Month Avg Vol: 3.8mm at healthcare 70 110% of acquisition are in conference in progress James announces intent to 60 Volume Price London tender 50 100% 1.1% Francis announced that James’ $89 40 Trading Francis announced that it has Indexed proposal substantially undervalues the formed a Special Committee 30 company to evaluate James’ offer Daily 90% 20 10 (18.2%) 80% 0 18-Jul-2008 28-Aug-2008 9-Oct-2008 19-Nov-2008 2-Jan-2009 Source: FactSet as of 10-Feb-2009 Summary Overview 2

Goldman Sachs Confidential II. Update on Public Market Perspectives Update on Public Market Perspectives 3

Goldman Sachs Confidential 5 Years 310% 280% 250% Price 220% 137.4% 190% 160% 69.7% Indexed 130% 100% 4.0% 70% (27.8%) 40% Feb- Oct- Jul- Mar- Dec- Aug- May- Jan-2004 2004 2005 2006 2006 2007 2008 2009 Daily from 10-Feb-2004 to 10-Feb-2009 6 Months 110% 100% (11.8%) Price 90% 80% (12.5%) (15.5%) Indexed 70% 60% (36.6%) 50% 11-Aug- 6-Sep- 2-Oct- 28-Oct- 23-Nov- 19-Dec- 14-Jan- 9-Feb-2008 2008 2008 2008 2008 2008 2009 2009 Daily from 11-Aug-2008 to 10-Feb-2009 Francis Large Cap Biotech ¹ 1 Year 160% 140% 120% Price 18.5% 100% 0.2% Indexed 80% (8.0%) 60% (37.9%) 40% Feb- Mar- May- Jul- Sep- Oct- Dec- Feb-2008 2008 2008 2008 2008 2008 2008 2009 Daily from 08-Feb-2008 to 10-Feb-2009 Since Offer 130% 120% 110% 1.1% Price 100% 90% (9.3%) (9.4%) Indexed 80% 70% 60% (34.4%) 50% 18-Jul- 16-Aug- 14-Sep- 13-Oct- 11-Nov- 10-Dec- 8-Jan- 6-Feb-2008 2008 2008 2008 2008 2008 2009 2009 Daily from 18-Jul-2008 to 10-Feb-2009 Large Pharma ² S&P 500 Index Source: 1 FactSet as of 10-Feb-2009 2 Large Cap Biotech Composite includes: Amgen, Biogen Idec, Celgene, Genzyme and Gilead. Large Pharma Composite includes: Abbott, AstraZeneca, Bayer, Bristol-Myers Squibb, Eli Lilly, GSK, JNJ, Merck, Novartis, Novo Nordisk, Pfizer, Sanofi-Aventis, Schering-Plough and Wyeth. Update on Public Market Perspectives 4

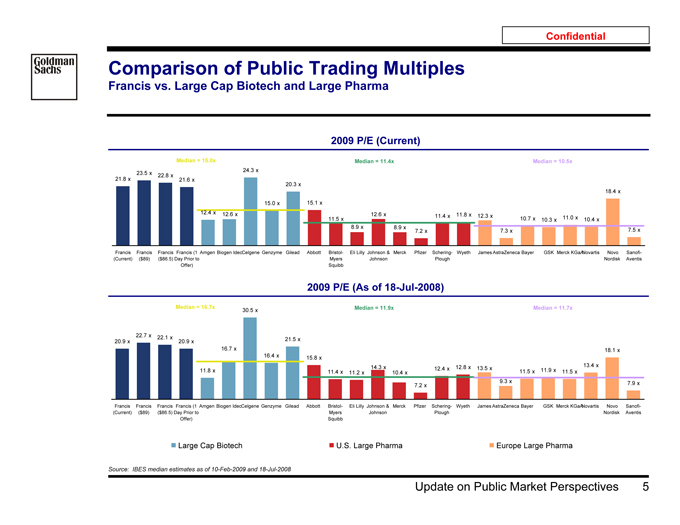

Goldman Sachs Confidential Comparison of Public Trading Multiples Francis vs. Large Cap Biotech and Large Pharma 2009 P/E (Current) Median = 15.0x Median = 11.4x Median = 10.5x 24.3 x 23.5 x 22.8 x 21.8 x 21.6 x 20.3 x 18.4 x 15.0 x 15.1 x 12.4 x 12.6 x 12.6 x 11.8 x 11.4 x 12.3 x 11.0 x 11.5 x 10.7 x 10.3 x 10.4 x 8.9 x 8.9 x 7.2 x 7.3 x 7.5 x Francis Francis Francis Francis (1 Amgen Biogen IdecCelgene Genzyme Gilead Abbott Bristol- Eli Lilly Johnson & Merck Pfizer Schering- Wyeth James AstraZeneca Bayer GSK Merck KGaANovartis Novo Sanofi-(Current) ($89) ($86.5) Day Prior to Myers Johnson Plough Nordisk Aventis Offer) Squibb 2009 P/E (As of 18-Jul-2008) Median = 16.7x Median = 11.9x Median = 11.7x 30.5 x 22.7 x 22.1 x 20.9 x 20.9 x 21.5 x 16.7 x 18.1 x 16.4 x 15.8 x 14.3 x 12.8 x 13.4 x 11.8 x 12.4 x 13.5 x 11.9 x 11.4 x 11.2 x 10.4 x 11.5 x 11.5 x 9.3 x 7.9 x 7.2 x Francis Francis Francis Francis (1 Amgen Biogen IdecCelgene Genzyme Gilead Abbott Bristol- Eli Lilly Johnson & Merck Pfizer Schering- Wyeth James AstraZeneca Bayer GSK Merck KGaANovartis Novo Sanofi-(Current) ($89) ($86.5) Day Prior to Myers Johnson Plough Nordisk Aventis Offer) Squibb Large Cap Biotech U.S. Large Pharma Europe Large Pharma Source: IBES median estimates as of 10-Feb-2009 and 18-Jul-2008 Update on Public Market Perspectives 5

Goldman Sachs Confidential Comparison of Public Trading Multiples Francis vs. Large Cap Biotech and Large Pharma 2009 P/E (Current) Median = 15.0x Median = 11.4x Median = 10.5x 24.3 x 23.5 x 22.8 x 21.8 x 21.6 x 20.3 x 18.4 x 15.0 x 15.1 x 12.4 x 12.6 x 12.6 x 11.8 x 11.4 x 12.3 x 11.0 x 11.5 x 10.7 x 10.3 x 10.4 x 8.9 x 8.9 x 7.2 x 7.3 x 7.5 x Francis Francis Francis Francis (1 Amgen Biogen IdecCelgene Genzyme Gilead Abbott Bristol- Eli Lilly Johnson & Merck Pfizer Schering- Wyeth James AstraZeneca Bayer GSK Merck KGaANovartis Novo Sanofi-(Current) ($89) ($86.5) Day Prior to Myers Johnson Plough Nordisk Aventis Offer) Squibb 2009 P/E (As of 10-Dec-2008 Meeting) 22.7 x 22.1 x Median = 13.8x 23.5 x Median = 9.5x Median = 10.2x 20.9 x 20.0 x 19.0 x 17.6 x 12.2 x 14.3 x 13.8 x 12.5 x 12.7 x 11.2 x 11.3 x 11.1 x 10.6 x 9.6 x 9.3 x 8.1 x 9.3 x 9.2 x 7.1 x 7.5 x 7.6 x 6.6 x Francis Francis Francis Francis (1 Amgen Biogen IdecCelgene Genzyme Gilead Abbott Bristol- Eli Lilly Johnson & Merck Pfizer Schering- Wyeth James AstraZeneca Bayer GSK Merck KGaANovartis Novo Sanofi-(Current) ($89) ($86.5) Day Prior to Myers Johnson Plough Nordisk Aventis Offer) Squibb Large Cap Biotech U.S. Large Pharma Europe Large Pharma Source: IBES median estimates as of 10-Feb-2009 and 05-Dec-2008 Update on Public Market Perspectives 6

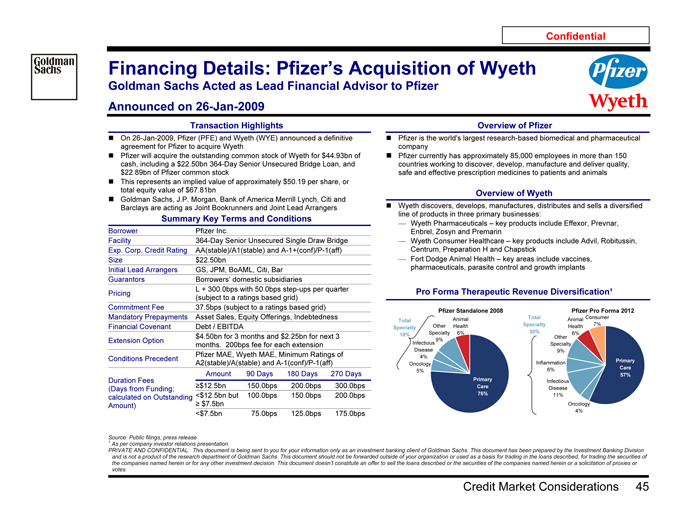

Goldman Sachs Confidential Pfizer’s Acquisition of Wyeth Goldman Sachs Acted as Lead Financial Advisor to Pfizer Announced on 26-Jan-2009 pfizer Wyeth Transaction Highlights ? On 26-Jan-2009, Pfizer (PFE) and Wyeth (WYE) announced a definitive agreement for Pfizer to acquire Wyeth ? Pfizer will acquire the outstanding common stock of Wyeth for $33.00 in cash and 0.985 of a share of Pfizer common stock per Wyeth share ? This represents an implied value of approximately $50 per share, or total equity value of $68bn / enterprise value of $64bn — A premium of 29% to the undisturbed Wyeth closing price of $38.83 on 22-Jan-2009 — A premium of 41% to the average Wyeth closing price for 90 calendar days preceding 22-Jan-2009 ? This is the second largest U.S. healthcare deal ever ? Goldman Sachs, Bank of America Merrill Lynch, and J.P. Morgan advised Pfizer; Morgan Stanley and Evercore advised Wyeth Strategic Rationale ? The transaction creates a premier global biopharmaceutical company that is one of the most diversified in the healthcare industry — The deal represents a unique opportunity for Pfizer to diversify its business and acquire attractive strategic assets, with approximately 40% of 2012E revenues generated from outside of small molecules ? The acquisition establishes a company with leadership in: — Human, Animal and Consumer Health — Primary and Specialty Care — Vaccines, Biologics and Small Molecules — Developed and Developing Markets Transaction Statistics Transaction Value $64bn Consideration Type 66% Cash / 34% Stock Transaction Value / 2009E IBES Revenue 2.8x Overview of Pfizer ? Pfizer is the world’s largest research-based biomedical and pharmaceutical company ? Pfizer currently has approximately 85,000 employees in more than 150 countries working to discover, develop, manufacture and deliver quality, safe and effective prescription medicines to patients and animals Overview of Wyeth ? Wyeth discovers, develops, manufactures, distributes and sells a diversified line of products in three primary businesses: — Wyeth Pharmaceuticals – key products include Effexor, Prevnar, Enbrel, Zosyn and Premarin — Wyeth Consumer Healthcare – key products include Advil, Robitussin, Centrum, Preparation H and Chapstick — Fort Dodge Animal Health – key areas include vaccines, pharmaceuticals, parasite control and growth implants Pro Forma Therapeutic Revenue Diversification¹ Pfizer Standalone 2008 Pfizer Pro Forma 2012 Animal Total Animal Consumer Total Other Health Specialty Health 7% Specialty Specialty 6% 30% 6% 18% 9% Other Infectious Specialty Disease 9% 4% Inflammation Primary Oncology 6% Care 5% Primary 57% Infectious Care Disease 76% 11% Oncology 4% Source: Public filings, press release 1 As per company investor relations presentation. PRIVATE AND CONFIDENTIAL. This document is being sent to you for your information only as an investment banking client of Goldman Sachs and should not be forwarded outside of your organization and should not be used as a basis for trading in the securities described. This document does not constitute an offer to sell the securities described or a solicitation of proxies or votes. Update on Public Market Perspectives 7

Goldman Sachs Confidential Evolution of Analyst Estimates Francis Last Five Years 27-Feb-04 6-May-05 17-Jul-06 25-Sep-07 $7.00 $120.00 $6.00 2013E $6.00 $5.48 2012E $90.00 $5.00 $4.86 2011E $4.35 2010E EPS $4.00 $3.79 2009E Price $60.00 $3.00 $2.94 $3.42 Stock Estimated 2007A 2008A $2.23 $2.00 2006A $30.00 $1.28 $1.00 2005A $0.83 2004A $0.00 $0.00 27-Feb-04 31-Dec-04 31-Oct-05 31-Aug-06 29-Jun-07 30-Apr-08 10-Feb-09 Monthly from 27-Feb-2004 to 10-Feb-2009 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Price Source: FactSet and IBES median estimates as of 10-Feb-2009 Note: IBES median estimates exclude stock based compensation expense. Closing price of $82.69 as of 10-Feb-2009. Update on Public Market Perspectives 8

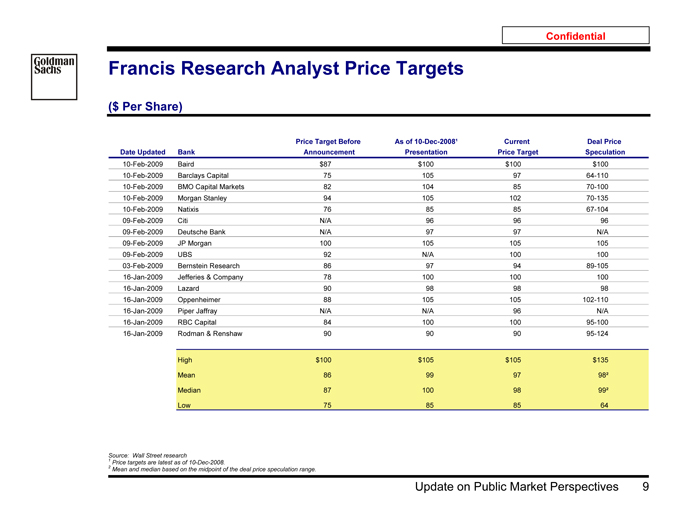

Goldman Sachs Confidential Francis Research Analyst Price Targets ($ Per Share) Price Target Before As of 10-Dec-2008¹ Current Deal Price Date Updated Bank Announcement Presentation Price Target Speculation 10-Feb-2009 Baird $87 $100 $100 $100 10-Feb-2009 Barclays Capital 75 105 97 64-110 10-Feb-2009 BMO Capital Markets 82 104 85 70-100 10-Feb-2009 Morgan Stanley 94 105 102 70-135 10-Feb-2009 Natixis 76 85 85 67-104 09-Feb-2009 Citi N/A 96 96 96 09-Feb-2009 Deutsche Bank N/A 97 97 N/A 09-Feb-2009 JP Morgan 100 105 105 105 09-Feb-2009 UBS 92 N/A 100 100 03-Feb-2009 Bernstein Research 86 97 94 89-105 16-Jan-2009 Jefferies & Company 78 100 100 100 16-Jan-2009 Lazard 90 98 98 98 16-Jan-2009 Oppenheimer 88 105 105 102-110 16-Jan-2009 Piper Jaffray N/A N/A 96 N/A 16-Jan-2009 RBC Capital 84 100 100 95-100 16-Jan-2009 Rodman & Renshaw 90 90 90 95-124 High $100 $105 $105 $135 Mean 86 99 97 98² Median 87 100 98 99² Low 75 85 85 64 Source: Wall Street research 1 Price targets are latest as of 10-Dec-2008. 2 Mean and median based on the midpoint of the deal price speculation range. Update on Public Market Perspectives 9

Goldman Sachs Confidential Selected Analyst Commentary Regarding Tender Offer Francis Broker Date Commentary Cowen 10-Feb-2009 ? “This official offer is about a week early, which reflects James’ eagerness to close this deal before the results of the Avastin C-08 study in April, and take advantage of current market conditions.” Morgan Stanley 10-Feb-2009 ? “We found several aspects of James’ proxy interesting, most supporting our view that: 1) investors will likely demand a higher price to complete this deal in front of adjuvant Avastin data; and 2) the bid may not fall significantly if the trial fails (although there may be periods of uncertainty).” Citi 09-Feb-2009 ? “We do not believe the majority of investors will surrender their shares at $86.50 before adjuvant CRC data is released. However, we believe James will continue to extend the tender offer past the March 12 midnight deadline and sweeten the deal along the way. Thus, this game could continue to play out until adjuvant CRC data is released in mid-April, unless James sweetens the price enough to incite investors not to wait for the data release.” BMO 09-Feb-2009 ? “We do not believe that a majority of remaining shareholders will tender their shares at the current offer because the offer simply does not provide sufficient premium.” JP Morgan 09-Feb-2009 ? “While the documents do provide clarity on the events thus far in the process, there is little in the filing that changes our view that the tender at $86.50 is likely to fail and that Francis’ shares should fetch a price significantly higher than the current tender offer should the C-08 trial be successful.” Natixis 30-Jan-2009 ? “We see very little chance that James will obtain the 22.5% of the outstanding James shares through this tender, because, after the previous offer, the board committee representing minority shareholders insisted that Francis has value substantially higher than $89, and we believe most of the minority shareholders think that the buyout price should be higher. In another sign that James does not fully believe it will succeed at this iteration, it did not even announce that it had pre-arranged financing for the tender and rather made the tender contingent upon successfully obtaining financing after the fact.” Source: Wall Street research Update on Public Market Perspectives 10

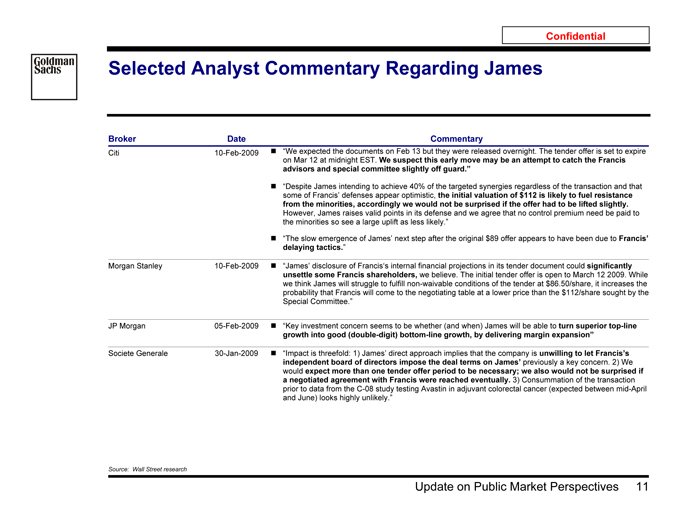

Goldman Sachs Confidential Selected Analyst Commentary Regarding James Broker Date Commentary Citi 10-Feb-2009 ? “We expected the documents on Feb 13 but they were released overnight. The tender offer is set to expire on Mar 12 at midnight EST. We suspect this early move may be an attempt to catch the Francis advisors and special committee slightly off guard.” ? “Despite James intending to achieve 40% of the targeted synergies regardless of the transaction and that some of Francis’ defenses appear optimistic, the initial valuation of $112 is likely to fuel resistance from the minorities, accordingly we would not be surprised if the offer had to be lifted slightly. However, James raises valid points in its defense and we agree that no control premium need be paid to the minorities so see a large uplift as less likely.” ? “The slow emergence of James’ next step after the original $89 offer appears to have been due to Francis’ delaying tactics.” Morgan Stanley 10-Feb-2009 ? “James’ disclosure of Francis’s internal financial projections in its tender document could significantly unsettle some Francis shareholders, we believe. The initial tender offer is open to March 12 2009. While we think James will struggle to fulfill non-waivable conditions of the tender at $86.50/share, it increases the probability that Francis will come to the negotiating table at a lower price than the $112/share sought by the Special Committee.” JP Morgan 05-Feb-2009 ? “Key investment concern seems to be whether (and when) James will be able to turn superior top-line growth into good (double-digit) bottom-line growth, by delivering margin expansion” Societe Generale 30-Jan-2009 ? “Impact is threefold: 1) James’ direct approach implies that the company is unwilling to let Francis’s independent board of directors impose the deal terms on James’ previously a key concern. 2) We would expect more than one tender offer period to be necessary; we also would not be surprised if a negotiated agreement with Francis were reached eventually. 3) Consummation of the transaction prior to data from the C-08 study testing Avastin in adjuvant colorectal cancer (expected between mid-April and June) looks highly unlikely.” Source: Wall Street research Update on Public Market Perspectives 11

Goldman Sachs Confidential Research Price Targets and Key Themes Francis Broker Date Price Target Price and Valuation Commentary Morgan Stanley 10-Feb-2008 $102.00 ??”Our sum of the parts and risk-adjusted cash flow analysis demonstrates fair-value for Francis is in the $102+/share range and we continue to expect James to raise its current $86.50 offer.” — “Bull case valuation of $135 | Fair-value based on merger analysis: Deal closes after positive Avastin data in adjuvant CRC. We believe adjuvant cancer represents a significant opportunity for Avastin, with $1bn+ in colorectal. In addition, the market will need to markedly increase the probability of success of Avastin in adjuvant breast cancer, a $5bn potential market in the US alone. These sales would significantly increase Francis’ fair value.” — “Base Case $102 | Fair value based on merger analysis: Deal closes at our estimated fair value of current business: Given both our sum of the parts and DCF analyses, we believe fair value is in the $100+ range (without adjuvant Avastin data available) and we doubt investors take any offer <$100 seriously” — “Bear case valuation of $94 | DCF-based intrinsic value: Deal fails to close: Our bear case models failure of the deal to close…Our $94 bear case is a one-year fair value based on our DCF analysis, which assumes Avastin growth in breast cancer in the near-term drives EPS growth and has risk- adjusted growth estimates for Avastin (assume grows from combination of adjuvant, prostate, and / or ovarian).” — “Ultra bear case valuation of $65 | DCF-based intrinsic value: Deal fails, adjuvant fails, and both Avastin sales fall short of expectations… Furthermore, Avastin label does not expand into any other large cancers (data in 2010).” Source: Wall Street research Update on Public Market Perspectives 12

Goldman Sachs Confidential Research Price Targets and Key Themes Francis Broker Date Price Target Price and Valuation Commentary Barclays 10-Feb-2009 $97.00 ? “We arrive at our price target by applying a 26x multiple to 2009 EPS estimate of $3.73. We believe that the 26x multiple at a 30% premium to peers more adequately reflects the aggregate upside potential from product growth, upcoming clinical trials and potential price bump from James.” Citi 09-Feb-2009 $96.00 ? “Our $96 target price is based on 22x our fully-taxed non-GAAP 2010 EPS estimate of $4.37. We believe Francis deserves a premium to the current group average of 17x due to higher ‘09/’10 growth (18% vs. 15%), numerous upcoming catalysts that could unlock growth opportunities that are rare in the large cap-biotech space and support from a potential James acquisition.” ? “We apply a 2009 forward multiple to our 2010 estimates because in 12 months investors should be willing to attribute a similar multiple to 2009 earnings.” JP Morgan 09-Feb-2009 $105.00 ? “Our target is based on a multiple of 27x our 2009 EPS estimate of $3.92. Our target P/E is at a premium to peers at 19x, given a high likelihood for a raised bid from James as well as upside from several positive label expansion opportunities that are not reflected in estimates.” UBS 09-Feb-2009 $100.00 ? “Using a calculation of our original, standalone PT & James’s synergies, terminal tax benefits & elimination of opt-in cost, we calculate a base case for a James’s acquisition valuation of $100/share, our new price target (was $105).” Source: Wall Street research Update on Public Market Perspectives 13

Goldman Sachs Confidential Research Price Targets and Key Themes Francis Broker Date Price Target Price and Valuation Commentary Baird 10-Feb-2009 $100.00 ? “We place an Outperform rating on Francis shares. Large-cap biotech multiples have compressed in the last few quarters from a traditional range of 30-40X current-year EPS expectations. In that we acknowledge the compressing multiples in the biotech industry (the group currently trades near 17X 2009E EPS), we apply a 26 multiple to our 2009 EPS estimate of $3.85 to derive our 12-month price target of $100.” BMO 10-Feb-2009 $85.00 ? “We do not believe that a majority of remaining shareholders will tender their shares at the current offer because the offer simply does not provide sufficient premium. We believe there is a 50% probability that Francis shares could be worth $100 if the Avastin C-08 study is positive. On the downside, we estimate a floor of $70 for Francis shares based on a high probability of a follow-up James offer post a negative C-08 outcome.” ? “Probability adjusted value of $85 based on 50% C-08 success ($100) and 75% probability of a James offer at 15% premium of worse case price ($63).” Natixis 10-Feb-2009 $85.00 ? “Given Francis stock is currently in merger arbitrage, our valuation is as follows: If the adjuvant colorectal trial fails in mid-April, our current 2010 EPS estimate of $4.28 will remain. Applying a 12x multiple leads to $51.00 per share. Giving a 30% takeover premium leads to a potential buyout price of $67.00 per share. However, if the Avastin trial succeeds, we anticipate off- label use beginning in mid-2009. After factoring in increased Avastin sales, our 2010 EPS estimate would be $4.54. Applying a 20x multiple leads to a valuation of $91.00 per share. Then adding a 15% premium gives a potential buyout price of $104.00 per share. Therefore, our $85.00 risk- adjusted target price remains as a probability adjusted arbitrage valuation. We maintain our target price of $85.00 and HOLD rating.” Source: Wall Street research Update on Public Market Perspectives 14

Goldman Sachs Confidential Research Price Targets and Key Themes Francis Broker Date Price Target Price and Valuation Commentary Bernstein 03-Feb-2009 $94.00 ? “Our $94 target price for Francis is based on the high likelihood we place on a deal between James and Francis being completed ($94 is the probability weighted average of our acquisition scenarios). We now assign a 15% probability to no deal, and the value a year from now being $78, 15% to the deal closing at James’s original bid price of $89, 30% to James raising their bid to $97 in Q1 09, 25% to James having to pay $105 after a positive C08 trial result in May and 15% to James paying $89 in May after a negative result to the C08 trial. Our $94 target price is most easily calculated by applying a 21x multiple to our 2010 EPS estimate of $4.42.” Rodman & Renshaw 30-Jan-2009 $90.001 ? “We reiterate our Market Outperform rating and $90 price target. We reach our target price using a Discounted Cash Flow (DCF) valuation. This valuation method is more conservative than sum-of-parts valuation since it takes into account future CapEx and working capital expenses. We forecast sales and individual expenses until 2015 to calculate the free cash flow in each year. Assuming a conservative terminal growth rate of 3% to calculate the terminal value, we discount the numbers to 2009 by using the Weighted Average Cost of Capital (WACC) of 9.8% to achieve the value of the firm. Subtracting the long-term debt of $2.48bil and adding back cash, we derive the value of equity. Dividing by the outstanding shares, we reach out target price of approximately $90. Our Sum-of-Parts valuation method gives us a price target of approximately $95 on a stand-along basis. Adjusting for the average and median historical acquisition premiums gives us an acquisition target price range of $116 to $124 per share. However, we believe the James acquisition could occur at a revised bid in the range of $95 to $100 per share.” Source: Wall Street research 1 Represents price target for standalone Francis. Update on Public Market Perspectives 15

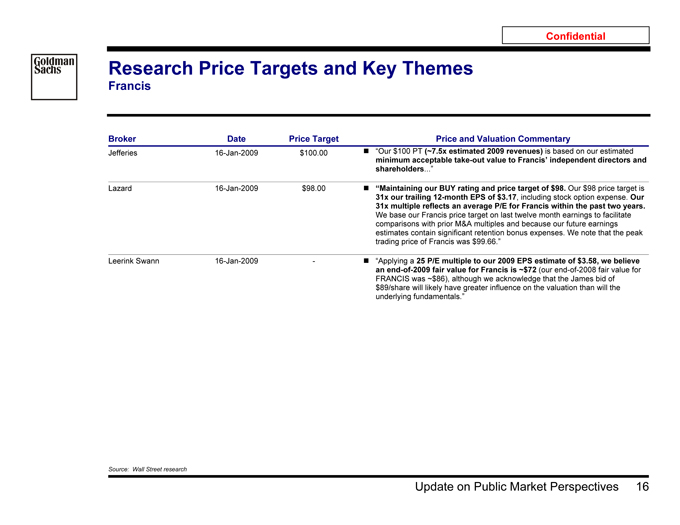

Goldman Sachs Confidential Research Price Targets and Key Themes Francis Broker Date Price Target Price and Valuation Commentary Jefferies 16-Jan-2009 $100.00 ? “Our $100 PT (~7.5x estimated 2009 revenues) is based on our estimated minimum acceptable take-out value to Francis’ independent directors and shareholders “ Lazard 16-Jan-2009 $98.00 ? “Maintaining our BUY rating and price target of $98. Our $98 price target is 31x our trailing 12-month EPS of $3.17, including stock option expense. Our 31x multiple reflects an average P/E for Francis within the past two years. We base our Francis price target on last twelve month earnings to facilitate comparisons with prior M&A multiples and because our future earnings estimates contain significant retention bonus expenses. We note that the peak trading price of Francis was $99.66.” Leerink Swann 16-Jan-2009—? “Applying a 25 P/E multiple to our 2009 EPS estimate of $3.58, we believe an end-of-2009 fair value for Francis is ~$72 (our end-of-2008 fair value for FRANCIS was ~$86), although we acknowledge that the James bid of $89/share will likely have greater influence on the valuation than will the underlying fundamentals.” Source: Wall Street research Update on Public Market Perspectives 16

Goldman Sachs Confidential Research Price Targets and Key Themes Francis Broker Date Price Target Price and Valuation Commentary Oppenheimer 16-Jan-2009 $105.00 ? “Our $105 price target for Francis is based on consensus EPS and P/Es for large-cap biotechnology companies in 2009, and our assessment of a fair takeover premium for the company. We calculated P/E ratios for each comparable company using recent closing prices and our 2009 EPS estimates. The resulting average P/E ratio for large-cap biotechs is 17.2x. We believe a premium 22.9x P/E multiple is appropriate for Francis given the growth prospects for Avastin and our estimate of a 14.6% 2009-2011E EPS CAGR for Francis’ current base business. By applying this multiple to our 2009 diluted EPS estimate of $3.84, we arrive at an $88 valuation for Francis, not factoring in any takeover premium for the company Based on historical premiums of 25-30% for comparable transactions, we believe fair takeover value for Francis is in the $102 to $110 per share range. Taking near the midpoint of this range, we arrive at our $105 price target for Francis.” Piper Jaffray 16-Jan-2009 $96.001 ? “…our 2009 EPS changes from $3.85 to $3.73 and our 2010 EPS from $4.44 to $4.49. Our price target remain s unchanged at $96 based on a sum-of-the- parts DCF analysis (base business $52 + Avastin adjuvant $18 + cost synergies $4 + pipeline $24—erosion of Lucentis $2).” RBC 16-Jan-2009 $100.00 ? “Our price target is $100, assuming a James acquisition or positive Avastin data. Our $100 target is 25x our 2009E EPS. We believe an acquisition in the $95-100 range is reasonable given it is a 7-12% premium to the original bid of $89/share, and a 13—18% premium to the current market price. Francis also has an all time-high price of $99 (November 2005).” Source: Wall Street research 1 Represents price target for standalone Francis. Update on Public Market Perspectives 17

Goldman Sachs Confidential Francis Top Institutional Shareholders Composition As of 31-Jan-2009 % O/S As of 30-Jan-2009 % O/S of Minority James Holdings 587,189,380 55.76% Hedge Fund / Arb 9.00% Non-James Holding 465,784,657 44.24% Non-Hedge Fund / Arb 91.00% Shares Outstanding 1,052,974,037 Top Shareholders (Sorted by “Current Position”) Position 18-Jul-2008 Current Current (Based on 30-Jun-2008 Position Current Position Change vs. Change vs. %O/S of %O/S of Rank Institution Name 13F Filings) 23-Jan-2009 30-Jan-2009 23-Jan-2009 18-Jul-2008 Avg. Cost Total Minority 1 Fidelity Mgmt. & Research 41,806,660 52,365,067 52,365,067 0 10,558,407 $66.05 4.97% 11.24% 2 Marsico Capital 27,214,792 26,632,703 26,632,703 0 (582,089) 43.59 2.53 5.72 3 AllianceBerstein (AXA) 17,112,145 22,083,000 23,083,000 1,000,000 5,970,855 75.29 2.19 4.96 4 T. Rowe Price 17,256,456 18,332,149 18,332,149 0 1,075,693 76.22 1.74 3.94 5 Barclays Global 15,306,210 14,219,787 14,219,787 0 (1,086,423) 54.51 1.35 3.05 6 Capital Guardian Trust 19,376,837 13,024,240 13,024,240 0 (6,352,597) 78.21 1.24 2.80 7 Jennison Associates 10,779,817 12,179,817 12,179,817 0 1,400,000 68.79 1.16 2.61 8 Vanguard Group 9,056,406 9,808,157 9,808,157 0 751,751 59.28 0.93 2.11 9 Capital Research & Mgmt. 15,350,000 6,021,900 8,021,900 2,000,000 (7,328,100) 65.05 0.76 1.72 10 Waddell & Reed 2,382,370 7,511,504 7,511,504 0 5,129,134 85.73 0.71 1.61 11 State Street Global Advisors 6,597,198 7,196,948 7,196,948 0 599,750 49.72 0.68 1.55 12 Delaware Inv. Advisors 9,135,610 6,919,756 6,919,756 0 (2,215,854) 78.18 0.66 1.49 13 ClearBridge Advisors 9,712,089 6,120,773 6,120,773 0 (3,591,316) 33.14 0.58 1.31 14 Goldman Sachs Asset Mgmt. 7,215,425 5,485,325 5,485,325 0 (1,730,100) 78.19 0.52 1.18 15 TIAA-CREF Asset Mgmt. 7,281,457 5,465,793 5,466,143 350 (1,815,314) 65.24 0.52 1.17 16 PRIMECAP Management 2,949,486 4,348,586 4,348,586 0 1,399,100 73.73 0.41 0.93 17 TCW Asset Mgmt. 4,703,902 4,001,837 4,001,837 0 (702,065) 39.65 0.38 0.86 18 Walter Scott & Partners 4,070,591 3,689,052 3,689,052 0 (381,539) 69.76 0.35 0.79 19 GE Asset Management 3,788,047 3,501,946 3,501,946 0 (286,101) 76.95 0.33 0.75 20 Franklin Advisors 2,965,748 3,458,615 3,458,615 0 492,867 59.21 0.33 0.74 21 Orbimed Advisors 2,716,480 3,280,680 3,280,680 0 564,200 53.54 0.31 0.70 22 RCM Capital Mgmt. 3,060,596 3,260,596 3,260,596 0 200,000 68.72 0.31 0.70 23 Citigroup Global Markets (US) 1,806,259 3,145,282 3,145,282 0 1,339,023 89.38 0.30 0.68 24 Columbia Mgmt. (BofA) 4,147,081 2,854,404 2,854,404 0 (1,292,677) 72.30 0.27 0.61 25 Victory Capital (Keybank Ntl.) 5,392,495 2,839,812 2,839,812 0 (2,552,683) 74.68 0.27 0.61 Top 25 Institutional Shareholders 251,184,157 247,747,729 250,748,079 3,000,350 (436,078) $66.20 23.81% 53.83% Source: Bloom Partners Note: Capital Research Global and Capital World Investors have been combined. Walter Scott & Partners is Scotland-based investment firm. Update on Public Market Perspectives 18

Goldman Sachs Confidential III. Updated Financial Analysis Updated Financial Analysis 19

Goldman Sachs Confidential Financial Analysis Overview Summary ($ Per Share) Methodology Equity Value Per Diluted Share Comments Current Stock Price Current Offer Price $82.69 $86.50 52-Week Trading Range $67 $99 ? 52-Week High: $99.05 ? 52-Week Low: $66.80 Wall Street Equity Research ? Wall Street High Target Price: $135.00 $64 $135 Deal Price Speculation ? Wall Street Low Target Price: $64.00 ? Forward earnings multiple of 16 – 24x on 2009E EPS Comparable Companies (2009E P/E) – $61 $93 ? Management base case 2009E EPS of $3.86 Management and IBES EPS Estimates ? IBES median 2009E EPS of $3.79 ? Forward earnings multiple of 16 – 24x on EPS Present Value of Future Stock Price – P/E – ? 9.0% cost of equity Management Base Case $65 $112 ? Management base case 2010E and 2011E EPS of $4.44 and $5.54 Present Value of Future Stock Price – P/E – ? Forward earnings multiple of 16 – 24x on EPS IBES $64 $98 ? 9.0% cost of equity ? IBES median 2010E and 2011E EPS of $4.35 and $4.86 ? 2 – 4% perpetuity growth rate Whole Co DCF – Base Case (2024) $97 $147 ? 8 – 10% discount rate ? Includes 2015 opt-in value and ESO expense ? 2 – 4% perpetuity growth rate Whole Co DCF – Base Case (2018) $91 $141 ? 8 – 10% discount rate ? Includes 2015 opt-in value and ESO expense $50.00 $70.00 $90.00 $110.00 $130.00 $150.00 Source: Francis management projections, Wall Street research and FactSet as of 10-Feb-2009 Updated Financial Analysis 20

Goldman Sachs Confidential A. Present Value of Future Stock Price Analysis Present Value of Future Stock Price Analysis 21

Goldman Sachs Confidential Present Value of Future Stock Price Analysis Management Case, Adjusted for Share Repurchases at One Year Forward at 20.0x P/E1 ($ Per Share) Future Stock Price (Undiscounted) Present Value at 9.0% Cost of Equity 16.0x 20.0x 24.0x 16.0x 20.0x 24.0x $140 $132.92 $140 $120 $120 $111.88 $106.55 $110.77 $100 $100 $97.76 $93.23 $92.65 $88.80 $88.61 $92.65 $81.46 $80 $80 $74.59 $77.21 $77.21 $71.04 $60 $60 $65.17 $61.77 $61.77 $40 $40 2009E 2010E 2011E 2009E 2010E 2011E 2009E 2010E 2011E 2008E—2011E CAGR ² EPS (Mgmt Forecast)¹ $ 3.86 $ 4.44 $ 5.54 17.0% IBES $ 3.79 $ 4.35 $ 4.86 12.0% Source: Francis management projections and IBES 1 Assumes cash of $3.6bn, $7.2bn and $5.5bn for 2009E-2011E, respectively, used to repurchase shares based on management projections. Price of share repurchase assumed to be 20.0x one year 2 forward EPS per Management Case ($88.80, $110.77 and $133.43 for 2009E-2011E, respectively). 2008E EPS per Francis management. Present Value of Future Stock Price Analysis 22

Goldman Sachs Confidential B. Discounted Cash Flow Analysis Discounted Cash Flow Analysis 23

Goldman Sachs Confidential Key Assumptions to Francis Management Projections Near-term ? Avastin adjuvant CRC trial (C-08) — Base case: 61% PTS in Q2 2009 ? Price / reimbursement impacts — Base case assumes 3% annual price increases excluding Avastin and Lucentis — Avastin price increase contingent upon breast trial outcome ? 2015 James commercial agreement expiration — Assumes status quo type of terms — Management expects more favorable market terms than current (modeled separately) ? Tax rate assumptions — Base case assumes off-shore manufacturing tax benefits trend tax-rate to approximately 29% ? FOB Assumptions — Assumptions factor in number of entrants, physician acceptance and price discounts by product ? Unnamed product PTS and market opportunity — Assumes large and small molecule NMEs — Launch to filing PTS of 20% and 11%, respectively — Market opportunity of $1bn per NME indication (including two line extensions) Long-term Source: Francis management Discounted Cash Flow Analysis 24

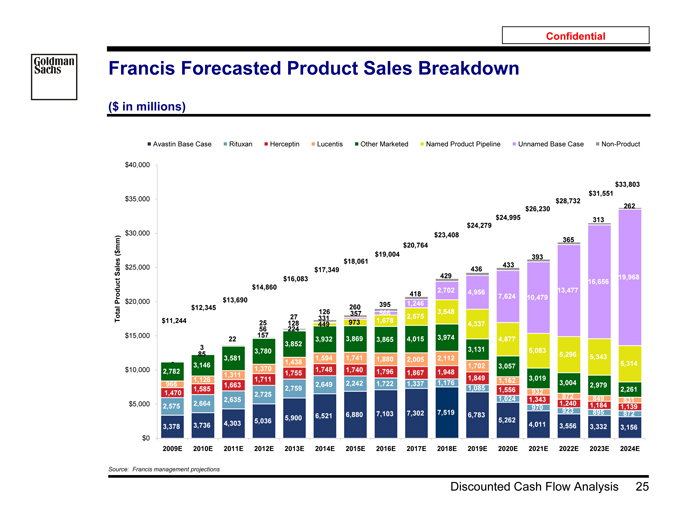

Goldman Sachs Confidential Francis Forecasted Product Sales Breakdown ($ in millions) Avastin Base Case Rituxan Herceptin Lucentis Other Marketed Named Product Pipeline Unnamed Base Case Non-Product $40,000 $33,803 $31,551 $35,000 $28,732 $26,230 262 $24,995 313 $24,279 $30,000 $23,408 365 mm) $20,764 ( $ $19,004 393 $18,061 $25,000 433 Sales $17,349 436 $16,083 429 16,656 19,968 $14,860 2,702 13,477 418 4,956 7,624 10,479 Product $20,000 $13,690 395 1,246 $12,345 260 126 357 566 3,548 Total 27 331 2,575 $11,244 25 128 973 1,678 449 4,337 157 56 224 $15,000 3,974 22 3,932 3,869 3,865 4,015 4,877 3,852 3 3,131 5,083 85 3,780 5,296 5,343 3,581 1,594 1,741 1,880 2,005 2,112—1,438 5,314 3,146 1,702 3,057 $10,000 2,782 1,370 1,748 1,740 1,796 1,311 1,755 1,867 1,948 1,849 3,019 1,126 1,711 1,162 966 1,663 2,649 2,242 1,722 1,337 1,176 3,004 2,979 1,585 2,759 1,085 1,556 2,261 1,470 2,725 932 1,024 872 849 2,635 1,343 831 $5,000 2,575 2,664 1,240 1,184 970 1,139 7,302 7,519 923 895 872 6,521 6,880 7,103 6,783 5,036 5,900 5,262 3,736 4,303 4,011 3,556 3,378 3,332 3,156 $0 2009E 2010E 2011E 2012E 2013E 2014E 2015E 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E Source: Francis management projections Discounted Cash Flow Analysis 25

Goldman Sachs Confidential Discounted Cash Flow Analysis of Francis Key Assumptions ? Discounted Cash Flow analysis provides a framework to evaluate the ongoing performance of the business, but should be considered in a broader context of approaches (e.g., comparable transaction and trading multiples) ? Projections from 2009 to 2024 provided by Francis Management as of 16-Nov-2008 and provided to James and Greenhill — Projections by product were provided for Avastin, Rituxan, Herceptin, Lucentis as well as for the unnamed pipeline ? Assumes 1,052mm basic shares outstanding, as of 31-Oct-2008 — Current options outstanding included in share count by the treasury stock method — Options schedule provided by Francis management as of 14-Nov-2008 ? Financial Sensitivity Analysis: — Discount rates evaluated using a range of 8.0%—10.0% based on WACC analysis — Terminal value evaluated using perpetuity growth rate method using a range of 2.0%—4.0% Implied P/E terminal multiple also evaluated ? Assumes 31-Mar-2009 estimated net cash of $7.7 billion ? Assumes capital expenditures of $820mm and depreciation of $661mm in 2024 terminal year, per Company management (assumes normalization in the terminal year) ? Assumes an adjusted tax rate applied to operating income that trends from 36% in 2009 to 29% in 2024 terminal year per management forecast ? Assumes cash flows discounted back to 31-Mar-2009 using mid-year convention ? Analysis includes impact of: — Future employee stock options expense: Assumes $328mm in after-tax ESO expense in 2009 with a 3.0% inflation rate and a range of 2.0%—4.0% of growth in headcount into perpetuity — Changes to James / Francis marketing agreement post 2015 per management guidance on expected market rate terms: “Marked to market” 2015 opt-in value derived from discounting projected product royalties from large and small molecules in the unnamed pipeline beginning in 2016, with a range of 2.0%—4.0% perpetuity growth rate Discounted Cash Flow Analysis 26

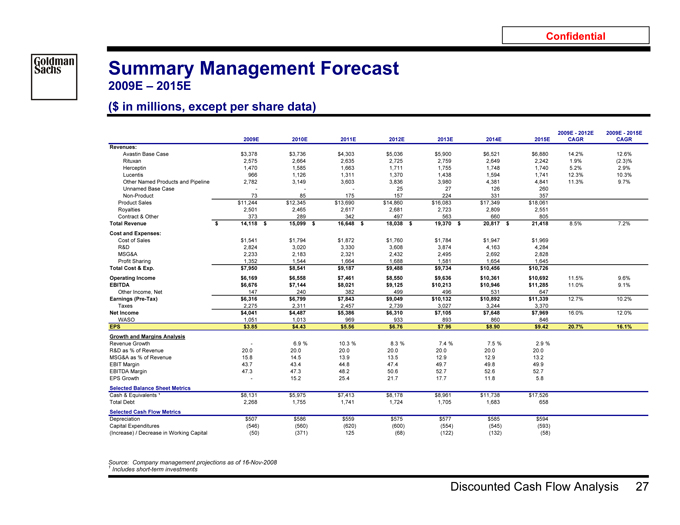

Goldman Sachs Confidential Summary Management Forecast 2009E – 2015E ($ in millions, except per share data) 2009E—2012E 2009E—2015E 2009E 2010E 2011E 2012E 2013E 2014E 2015E CAGR CAGR Revenues: Avastin Base Case $3,378 $3,736 $4,303 $5,036 $5,900 $6,521 $6,880 14.2% 12.6% Rituxan 2,575 2,664 2,635 2,725 2,759 2,649 2,242 1.9% (2.3)% Herceptin 1,470 1,585 1,663 1,711 1,755 1,748 1,740 5.2% 2.9% Lucentis 966 1,126 1,311 1,370 1,438 1,594 1,741 12.3% 10.3% Other Named Products and Pipeline 2,782 3,149 3,603 3,836 3,980 4,381 4,841 11.3% 9.7% Unnamed Base Case—— 25 27 126 260 Non-Product 73 85 175 157 224 331 357 Product Sales $11,244 $12,345 $13,690 $14,860 $16,083 $17,349 $18,061 Royalties 2,501 2,465 2,617 2,681 2,723 2,809 2,551 Contract & Other 373 289 342 497 563 660 805 Total Revenue $ 14,118 $ 15,099 $ 16,648 $ 18,038 $ 19,370 $ 20,817 $ 21,418 8.5% 7.2% Cost and Expenses: Cost of Sales $1,541 $1,794 $1,872 $1,760 $1,784 $1,947 $1,969 R&D 2,824 3,020 3,330 3,608 3,874 4,163 4,284 MSG&A 2,233 2,183 2,321 2,432 2,495 2,692 2,828 Profit Sharing 1,352 1,544 1,664 1,688 1,581 1,654 1,645 Total Cost & Exp. $7,950 $8,541 $9,187 $9,488 $9,734 $10,456 $10,726 Operating Income $6,169 $6,558 $7,461 $8,550 $9,636 $10,361 $10,692 11.5% 9.6% EBITDA $6,676 $7,144 $8,021 $9,125 $10,213 $10,946 $11,285 11.0% 9.1% Other Income, Net 147 240 382 499 496 531 647 Earnings (Pre-Tax) $6,316 $6,799 $7,843 $9,049 $10,132 $10,892 $11,339 12.7% 10.2% Taxes 2,275 2,311 2,457 2,739 3,027 3,244 3,370 Net Income $4,041 $4,487 $5,386 $6,310 $7,105 $7,648 $7,969 16.0% 12.0% WASO 1,051 1,013 969 933 893 860 846 EPS $3.85 $4.43 $5.56 $6.76 $7.96 $8.90 $9.42 20.7% 16.1% Growth and Margins Analysis Revenue Growth—6.9 % 10.3 % 8.3 % 7.4 % 7.5 % 2.9 % R&D as % of Revenue 20.0 20.0 20.0 20.0 20.0 20.0 20.0 MSG&A as % of Revenue 15.8 14.5 13.9 13.5 12.9 12.9 13.2 EBIT Margin 43.7 43.4 44.8 47.4 49.7 49.8 49.9 EBITDA Margin 47.3 47.3 48.2 50.6 52.7 52.6 52.7 EPS Growth—15.2 25.4 21.7 17.7 11.8 5.8 Selected Balance Sheet Metrics Cash & Equivalents ¹ $8,131 $5,975 $7,413 $8,178 $8,961 $11,738 $17,526 Total Debt 2,268 1,755 1,741 1,724 1,705 1,683 658 Selected Cash Flow Metrics Depreciation $507 $586 $559 $575 $577 $585 $594 Capital Expenditures (546) (560) (620) (600) (554) (545) (593) (Increase) / Decrease in Working Capital (50) (371) 125 (68) (122) (132) (58) 1 Source: Company management projections as of 16-Nov-2008 Includes short-term investments Discounted Cash Flow Analysis 27

Goldman Sachs Confidential Cash Flow Analysis ($ in millions) ‘09E—‘15E ‘15E—‘24E ‘09E—‘24E 2009E 2010E 2011E 2012E 2013E 2014E 2015E 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E CAGR CAGR CAGR Revenue $14,118 $15,099 $16,648 $18,038 $19,370 $20,817 $21,418 $22,273 $24,171 $26,897 $27,542 $28,398 $29,883 $32,825 $36,099 $38,764 7.2% 6.8% 7.0% Operating Income $6,169 $6,558 $7,461 $8,550 $9,636 $10,361 $10,692 $11,173 $12,414 $14,148 $14,450 $14,217 $14,609 $16,182 $17,970 $19,604 9.6% 7.0% 8.0% Taxes (2,219) (2,220) (2,311) (2,548) (2,838) (3,041) (3,121) (3,252) (3,662) (4,223) (4,116) (4,095) (4,203) (4,756) (5,269) (5,732) Unlevered Net Income $3,950 $4,339 $5,150 $6,002 $6,798 $7,320 $7,570 $7,920 $8,752 $9,925 $10,334 $10,122 $10,406 $11,426 $12,701 $13,872 11.5% 7.0% 8.7% Depreciation $507 $586 $559 $575 $577 $585 $594 $593 $594 $606 $613 $638 $625 $622 $635 $661 CapEx (546) (560) (620) (600) (554) (545) (593) (647) (640) (716) (688) (722) (782) (808) (833) (820) (Increase) / Decrease (50) (371) 125 (68) (122) (132) (58) (91) (222) (228) (126) 7 (197) (231) (397) (746) in Working Capital Unlevered Free Cash Flow $3,861 $3,994 $5,214 $5,909 $6,699 $7,228 $7,513 $7,776 $8,483 $9,588 $10,133 $10,044 $10,052 $11,010 $12,105 $12,968 11.7% 6.3% 8.4% EBITDA 6,676 7,144 8,021 9,125 10,213 10,946 11,285 11,766 13,007 14,754 15,063 14,855 15,234 16,804 18,605 20,266 9.1% 6.7% 7.7% Adjusted Tax Rate 36.0% 33.8% 31.0% 29.8% 29.4% 29.3% 29.2% 29.1% 29.5% 29.8% 28.5% 28.8% 28.8% 29.4% 29.3% 29.2% Source: Company management projections as of 16-Nov-2008 Discounted Cash Flow Analysis 28

Goldman Sachs Confidential Illustrative Components of Discounted Cash Flow Analysis Base Case: Assumes 3.0% Perpetuity Growth Rate and 9.0% Discount Rate ($ Per Share) $140 $121.00 ($10.35) $120 $7.69 $118.34 $100 Share $80 Per Value $60 $40 $20 $0 Base Case DCF Capitalized ESO Expense 2015 Opt-In Value Total Value Source: Financial projections and scenarios per Francis management as of 16-Nov-2008 Note: Assumes 1,052mm basic shares outstanding, as of 31-Oct-2008. Fully diluted shares outstanding calculated using treasury stock method based on options schedule provided by Francis management. Assumes net cash of $7.7 billion and cash flows discounted to 31-Mar-2009 using mid-year convention. Discounted Cash Flow Analysis 29

Goldman Sachs Confidential Discounted Cash Flow Analysis of Francis Financial Sensitivities 2024 Terminal Year Enterprise Value Perpetuity Growth Rate # ##### 2.0 % 2.5 % 3.0 % 3.5 % 4.0 % 10.0 % $97,327 $99,467 $101,834 $104,446 $107,299 Rate 9.5 % 105,295 107,891 110,766 113,925 117,319 Discount 9.0 % 114,467 117,628 121,120 124,905 128,791 8.5 % 125,100 128,954 133,166 137,562 141,470 8.0 % 137,512 142,191 147,144 151,729 153,327 % of Enterprise Value in Terminal Value Perpetuity Growth Rate $ 50.0 2.0 % 2.5 % 3.0 % 3.5 % 4.0 % 10.0 % 40.2 % 42.2 % 44.3 % 46.8 % 49.6 % Rate 9.5 % 42.5 44.6 47.1 49.8 53.0 Discount 9.0 % 44.9 47.3 50.0 53.1 57.0 8.5 % 47.5 50.1 53.2 56.9 61.8 8.0 % 50.2 53.2 56.8 61.5 68.8 Equity Value Per Share Perpetuity Growth Rate $ 118.3 2.0 % 2.5 % 3.0 % 3.5 % 4.0 % 10.0 % $97.28 $99.18 $101.27 $103.58 $106.11 Rate 9.5 % 104.34 106.63 109.18 111.97 114.98 Discount 9.0 % 112.45 115.25 118.34 121.69 125.13 8.5 % 121.87 125.28 129.01 132.90 136.36 8.0 % 132.85 137.00 141.38 145.44 146.85 Implied 2024 P/E1 Perpetuity Growth Rate $ 14.3 2.0 % 2.5 % 3.0 % 3.5 % 4.0 % 10.0 % 10.6 x 11.4 x 12.3 x 13.3 x 14.5 x Rate 9.5 % 11.3 12.2 13.2 14.4 15.7 Discount 9.0 % 12.1 13.1 14.3 15.6 17.3 8.5 % 13.0 14.2 15.5 17.2 19.2 8.0 % 14.1 15.4 17.0 19.0 21.5 Source: Financial projections and scenarios per Francis management as of 16-Nov-2008 Note: Includes capitalized ESO expense and “marked to market” 2015 opt-in value. Assumes 1,052mm basic shares outstanding, as of 31-Oct-2008. Fully diluted shares outstanding calculated using 1 treasury stock method based on options schedule provided by Francis management. Assumes net cash of $7.7 billion and cash flows discounted to 31-Mar-2009 using mid-year convention P/E as implied by net income per Francis management projections Discounted Cash Flow Analysis 30

Goldman Sachs Confidential Discounted Cash Flow Analysis of Francis Financial Sensitivities 2018 Terminal Year Enterprise Value Perpetuity Growth Rate # ##### 2.0 % 2.5 % 3.0 % 3.5 % 4.0 % 10.0 % $89,767 $92,775 $96,134 $99,891 $104,080 Rate 9.5 % 96,725 100,258 104,215 108,637 113,523 Discount 9.0 % 104,705 108,875 113,545 118,722 124,277 8.5 % 113,921 118,855 124,344 130,271 136,051 8.0 % 124,630 130,453 136,780 143,043 146,739 % of Enterprise Value in Terminal Value Perpetuity Growth Rate $ 66.1 2.0 % 2.5 % 3.0 % 3.5 % 4.0 % 10.0 % 57.0 % 59.2 % 61.5 % 64.0 % 66.9 % Rate 9.5 % 58.9 61.2 63.7 66.5 69.8 Discount 9.0 % 60.8 63.3 66.1 69.3 73.1 8.5 % 62.8 65.5 68.7 72.4 77.5 8.0 % 64.9 68.0 71.7 76.5 84.3 Equity Value Per Share Perpetuity Growth Rate $ 111.6 2.0 % 2.5 % 3.0 % 3.5 % 4.0 % 10.0 % $90.59 $93.25 $96.23 $99.55 $103.26 Rate 9.5 % 96.75 99.88 103.38 107.29 111.62 Discount 9.0 % 103.81 107.50 111.64 116.22 121.14 8.5 % 111.97 116.34 121.20 126.44 131.56 8.0 % 121.45 126.61 132.21 137.75 141.02 Implied 2018 P/E1 Perpetuity Growth Rate $ 16.0 2.0 % 2.5 % 3.0 % 3.5 % 4.0 % 10.0 % 11.9 x 12.8 x 13.8 x 14.9 x 16.2 x Rate 9.5 % 12.7 13.7 14.8 16.1 17.6 Discount 9.0 % 13.6 14.7 16.0 17.5 19.3 8.5 % 14.6 15.9 17.4 19.2 21.4 8.0 % 15.7 17.3 19.1 21.3 24.1 Source: Financial projections and scenarios per Francis management as of 16-Nov-2008 Note: Includes capitalized ESO expense and “marked to market” 2015 opt-in value. Assumes 1,052mm basic shares outstanding, as of 31-Oct-2008. Fully diluted shares outstanding calculated using 1 treasury stock method based on options schedule provided by Francis management. Assumes net cash of $7.7 billion and cash flows discounted to 31-Mar-2009 using mid-year convention P/E as implied by net income per Francis management projections Discounted Cash Flow Analysis 31

Goldman Sachs Confidential 2015 Opt-In Valuation Assumptions Key Assumptions ? Management forecast assumes current James / Francis royalty arrangement remains in place post 2015 with ~15% royalty rate ? Incremental value assumes a market royalty rate of 20% to 30% less the existing 15% royalty rate assumed in the management forecast ? $500M peak for lead indication and $250M peak sales for each line extension — Ex-U.S. sales equal to 100% of U.S. sales ? 35% marginal tax rate applied to post-2015 royalty revenues ? NMEs per year from 2015-2025 consistent with the management base case ? NMEs post 2025 held constant at 13 NMEs per year — Sensitivity analysis varies the 13 base case NMEs per year +/- 2 NMEs per year ? Revenues projected to 2060 (beginning in 2022) and discounted to 31-Mar-2009 using mid-year convention — Discount rate of 8.0 to 10.0% Incremental Value Per Share Royalty Rate 20% 23% 25% 28% 30% 10.0 % $2.74 $4.10 $5.47 $6.84 $8.21 Rate 9.5 % 3.23 4.85 6.47 8.08 9.70 Discount 9.0 % 3.85 5.77 7.69 9.62 11.54 8.5 % 4.61 6.92 9.22 11.53 13.83 8.0 % 5.58 8.37 11.16 13.95 16.74 Incremental Value Per Share Incremental Slots (2.0) (1.0) 0.0 1.0 2.0 10.0 % $3.26 $4.36 $5.47 $7.41 $9.35 Rate 9.5 % 3.86 5.15 6.47 8.66 10.86 Discount 9.0 % 4.61 6.14 7.69 10.20 12.71 8.5 % 5.53 7.36 9.22 12.11 14.99 8.0 % 6.71 8.92 11.16 14.50 17.85 Source: Company management Note: Assumes 1,052mm basic shares outstanding, as of 31-Oct-2008. Fully diluted shares outstanding calculated using treasury stock method based on options schedule provided by Francis management. Discounted Cash Flow Analysis 32

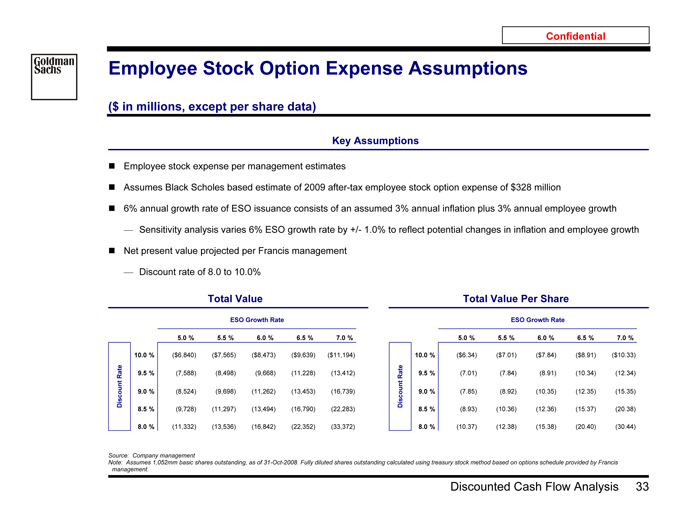

Goldman Sachs Confidential Employee Stock Option Expense Assumptions ($ in millions, except per share data) Key Assumptions ? Employee stock expense per management estimates ? Assumes Black Scholes based estimate of 2009 after-tax employee stock option expense of $328 million ? 6% annual growth rate of ESO issuance consists of an assumed 3% annual inflation plus 3% annual employee growth — Sensitivity analysis varies 6% ESO growth rate by +/- 1.0% to reflect potential changes in inflation and employee growth ? Net present value projected per Francis management — Discount rate of 8.0 to 10.0% Total Value ESO Growth Rate ####### 5.0 % 5.5 % 6.0 % 6.5 % 7.0 % 10.0 % ($6,840) ($7,565) ($8,473) ($9,639) ($11,194) Rate 9.5 % (7,588) (8,498) (9,668) (11,228) (13,412) Discount 9.0 % (8,524) (9,698) (11,262) (13,453) (16,739) 8.5 % (9,728) (11,297) (13,494) (16,790) (22,283) 8.0 % (11,332) (13,536) (16,842) (22,352) (33,372) Total Value Per Share ESO Growth Rate $(10.4) 5.0 % 5.5 % 6.0 % 6.5 % 7.0 % 10.0 % ($6.34) ($7.01) ($7.84) ($8.91) ($10.33) Rate 9.5 % (7.01) (7.84) (8.91) (10.34) (12.34) Discount 9.0 % (7.85) (8.92) (10.35) (12.35) (15.35) 8.5 % (8.93) (10.36) (12.36) (15.37) (20.38) 8.0 % (10.37) (12.38) (15.38) (20.40) (30.44) Source: Company management Note: Assumes 1,052mm basic shares outstanding, as of 31-Oct-2008. Fully diluted shares outstanding calculated using treasury stock method based on options schedule provided by Francis management. Discounted Cash Flow Analysis 33

Goldman Sachs Confidential Illustrative Review of Financial Analysis Sensitivity Analysis ($ Per Share) Item Methodology Equity Value Per Diluted Share $118 Range of 8% to 10% discount rate and 2% to 4% perpetuity Base Case growth rate ($21) +$29 Scenarios¹ 70% PTS for adjuvant lung and breast indications; early Adjuvant Upside positive C-08 results in Q2 2009 +$6 Adjuvant Downside 10% PTS for adjuvant lung and breast indications; negative C-08 results by Q2 2009 ($11) Unnamed Pipeline Greater market opportunity – one in five future molecules Upside added to portfolio have an Avastin like sales potential (~$2.3 +$15 billion peak sales) Unnamed Pipeline Reduced overall market opportunity to $750 million for each Downside product ($4) -10% to +10% incremental change in volume / total revenue Volume ($15) +$15 (constant margins) -10% to +10% incremental change in pricing Pricing ($23) +$23 (no change in costs) Follow-on Biologic -20% to +20% incremental follow-on biologic erosion for top 4 products (constant margins) ($4) +$4 $85 $95 $105 $115 $125 $135 $145 $155 Source: Francis management projections 1 Assumes 3.0% perpetuity growth rate and 9.0% discount rate Discounted Cash Flow Analysis 34

Goldman Sachs Confidential C. Transaction-Related Financial Analysis Transaction-Related Financial Analysis 35

Goldman Sachs Confidential Transaction-Related Source of Value ? Synergies to James — James publicly acknowledges $750 to $850 million in synergy opportunity Precedent transactions show this estimate to be conservative when measured as a percentage of sales and operating expenses ? Tax Benefits — Inter-company loan: James acknowledges using inter-company tax strategies in recent acquisitions to reduce tax leakage — Long-term tax strategies: Under James’ ownership, Francis can gradually lower the tax rate by moving existing IP and housing new IP in foreign jurisdictions as well as expanding Francis’ current plan to offshore manufacturing activities ? The Intangibles – Control versus Ownership — “Be very careful — we control, but we don’t own. And there is, as Bill or Severin pointed out, there is no free exchange of information, of know-how, of intellectual property; all that is today not possible. We are running two parallel organizations. We are running programs that are parallel and perhaps should not be parallel. We are developing the same drugs on the one hand in the United States through an organization; on the other hand, outside of the States through an organization. More and more large company overlaps are being created.” -— Franz Humer, Investor Conference, 22-Jul-2008 ? Cash Flow Control Transaction-Related Financial Analysis 36

Goldman Sachs Confidential Illustrative Benefits Related to Inter-Company Loan ($ in billions, except per share data) Potential Inter-Company Loan Benefit ? James Swiss parent raises debt in non-U.S. jurisdictions ? James parent loans proceeds to its U.S. subsidiary at an arm’s-length rate (e.g., 8%) to fund the buyout consideration (the “inter-company loan”) ? The inter-company loan creates tax deductions in the U.S. which enhances after-tax cash flow from Francis’ operations — Interest on inter-company loan is generally deductible for U.S. tax purposes provided aggregate interest expense does not exceed 50% of taxable EBITDA — Interest payments should not be subject to U.S. withholding tax under U.S.-Swiss tax treaty ? Need to determine whether and at what rate the interest income would be taxable in Switzerland — Generally, Swiss companies would be subject to tax on interest income at 25% tax rate, although there may be structures to reduce tax liability in Switzerland ? Illustrative tax shield assuming $30 billion in new debt: — ($30bn debt * 8% interest rate * 39% marginal tax rate) = $936mm annual benefit — If Swiss tax rate on interest income is 25%, net tax savings of $336mm; net benefit even greater if interest income is subject to even lower tax rate in Switzerland or the Netherlands NPV Benefit of Inter-Company Loan at Various Swiss Tax Rates Per Total Share Inter-Company Loan Amount ($bn) $ 9.6 $10.0 $20.0 $30.0 $40.0 $50.0 25 % $1.14 $2.29 $3.43 $4.58 $5.72 Rate 20 % 1.55 3.11 4.66 6.21 7.77 Tax 15 % 1.96 3.92 5.89 7.85 9.81 10 % 2.37 4.74 7.11 9.48 11.85 Swiss 5 % 2.78 5.56 8.34 11.12 13.90 0 % 3.19 6.38 9.57 12.75 15.94 Per Minority Share Inter-Company Loan Amount ($bn) $ 20.8 $10.0 $20.0 $30.0 $40.0 $50.0 25 % $2.49 $4.98 $7.47 $9.95 $12.44 Rate 20 % 3.38 6.75 10.13 13.51 16.89 Tax 15 % 4.27 8.53 12.80 17.06 21.33 10 % 5.16 10.31 15.47 20.62 25.78 Swiss 5 % 6.04 12.09 18.13 24.18 30.22 0 % 6.93 13.87 20.80 27.73 34.66 Note: Assumes 1,087 mm diluted shares outstanding. Assumes James owns 587mm shares and the remainder held by minority shareholders. Assumes 9.0% cost of capital. Assumes James will not pay down transaction debt and U.S. marginal tax rate of 39%. Transaction-Related Financial Analysis 37

Goldman Sachs Confidential Illustrative Benefits Related to Long-Term Tax Strategies ? Over time James may be able to offshore Francis IP to achieve a lower overall tax rate — Immediate movement of IP offshore would generate a large one-time tax bill ? In addition, due to global operations, James may be able to accelerate and/or maintain offshore manufacturing tax benefits for a longer period ? The long term benefit of a tax rate that approximates James’ current tax rate could contribute significant long-term value ? The table below shows the net value that could be created by trending to a 26% terminal year tax rate vs. a 29% tax rate Present Value of Long-term Tax Strategies Per Total Share Perpetuity Growth Rate # ##### 2.0 % 2.5 % 3.0 % 3.5 % 4.0 % 10.0 % $0.77 $0.89 $1.03 $1.19 $1.37 Rate 9.5 % 1.01 1.15 1.32 1.52 1.76 Discount 9.0 % 1.29 1.47 1.68 1.93 2.23 8.5 % 1.63 1.86 2.12 2.44 2.83 8.0 % 2.04 2.33 2.67 3.09 3.61 Per Minority Share Perpetuity Growth Rate # ##### 2.0 % 2.5 % 3.0 % 3.5 % 4.0 % 10.0 % $1.74 $2.02 $2.33 $2.69 $3.10 Rate 9.5 % 2.28 2.61 3.00 3.44 3.97 Discount 9.0 % 2.92 3.33 3.81 4.37 5.05 8.5 % 3.69 4.20 4.80 5.53 6.41 8.0 % 4.62 5.27 6.04 6.98 8.16 Note: Assumes 1,052mm basic shares outstanding, as of 31-Oct-2008. Fully diluted shares outstanding calculated using treasury stock method based on options schedule provided by Francis management. Assumes 44.2% minority holdings. Assumes James will not pay down transaction debt. Potential tax withholding related to interest income to parent entity is not included in analysis. Transaction-Related Financial Analysis 38

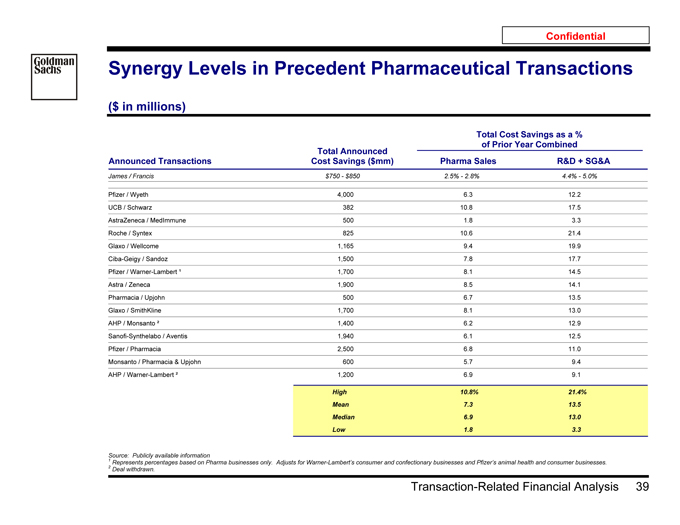

Goldman Sachs Confidential Synergy Levels in Precedent Pharmaceutical Transactions ($ in millions) Total Cost Savings as a % of Prior Year Combined Total Announced Announced Transactions Cost Savings ($mm) Pharma Sales R&D + SG&A James / Francis $750—$850 2.5%—2.8% 4.4%—5.0% Pfizer / Wyeth 4,000 6.3 12.2 UCB / Schwarz 382 10.8 17.5 AstraZeneca / MedImmune 500 1.8 3.3 Roche / Syntex 825 10.6 21.4 Glaxo / Wellcome 1,165 9.4 19.9 Ciba-Geigy / Sandoz 1,500 7.8 17.7 Pfizer / Warner-Lambert ¹ 1,700 8.1 14.5 Astra / Zeneca 1,900 8.5 14.1 Pharmacia / Upjohn 500 6.7 13.5 Glaxo / SmithKline 1,700 8.1 13.0 AHP / Monsanto ² 1,400 6.2 12.9 Sanofi-Synthelabo / Aventis 1,940 6.1 12.5 Pfizer / Pharmacia 2,500 6.8 11.0 Monsanto / Pharmacia & Upjohn 600 5.7 9.4 AHP / Warner-Lambert ² 1,200 6.9 9.1 High 10.8% 21.4% Mean 7.3 13.5 Median 6.9 13.0 Low 1.8 3.3 Source: Publicly available information 1 Represents percentages based on Pharma businesses only. Adjusts for Warner-Lambert’s consumer and confectionary businesses and Pfizer’s animal health and consumer businesses. 2 Deal withdrawn. Transaction-Related Financial Analysis 39

Goldman Sachs Confidential Illustrative Benefits Related to Incremental Synergy Benefits ? James has messaged $750—$850mm in synergies — Precedent transactions indicate synergies could be substantially larger EPS Impact to James ? The incremental impact of $100mm of pre-tax synergies is an annual CHF 0.11 per share to James EPS (0.8% of James 2009E EPS) Present Value of Synergies ? Discounted by 8.0%—10.0%, assuming no growth rate Present Value of Synergies Per Total Share Annual Savings 4.903757 $750 $850 $1,500 $2,250 Capital 10.0 % $4.41 $5.00 $8.83 $13.24 of 9.0 % 4.90 5.56 9.81 14.71 Cost 8.0 % 5.52 6.25 11.03 16.55 Per Minority Share Annual Savings 10.66202 $750 $850 $1,500 $2,250 Capital 10.0 % $9.60 $10.88 $19.19 $28.79 of 9.0 % 10.66 12.08 21.32 31.99 Cost 8.0 % 11.99 13.59 23.99 35.98 Note: Assumes 1,087 mm diluted shares outstanding. Assumes James owns 587mm shares and the remainder held by minority shareholders. Synergies taxed at Francis tax rate of approximately 36.0%. EPS benefit to James based on 1.22 CHF : USD exchange rate and 862.6 million James shares outstanding. Percentage change to James EPS based on 2009E Wall Street EPS of CHF 13.23. Transaction-Related Financial Analysis 40

Goldman Sachs Confidential Selected Quotes Regarding James Financing Quotes from James: “Credit spreads have widened noticeable, even for high grade issuers such as James, and financing terms have become more onerous. For example, to finance its acquisition of Wyeth, Pfizer had to pay 7% to 9% on one-year bank debt and agree to an unusual provision allowing banks and “out” if Pfizer’s rating declines past certain thresholds” — Greenhill Presentation to James, 07-Feb-2009 “We are very confident that we can get financing in place as soon as we need, It will be a mixture of various tools such as bonds, cash on hand, commercial paper, bank financing, and we would approach first the bond markets,” — Severin Schwan, 06-Feb-2009 “As soon as the tender offer stands, we will launch bonds which will serve as a base for further talks on financing the deal.” — Severin Schwan, 04-Feb-2009 Quotes from Analysts and Press: “James is to hold a European roadshow next week for a bond issue to help fund its planned buyout of Francis, three sources familiar with the situation said on Thursday… One source familiar with the situation said James was likely to be looking for around $10 billion from the bond market and a $25 billion loan from a syndicate of 12 banks — supplemented by $7 billion of its own cash — to pay for Francis. The availability of funding for two such bumper acquisitions (Pfizer / Wyeth and James / Francis) indicates that debt markets for cash-rich drugmakers are far from dead, although sources said the richly priced Pfizer loan could vacuum up cash and make financing more tricky for James.” — Reuters, 12-Feb-2009 “Here’s an interesting story about James’ lack of financing for the deal. Apparently, it’s currently looking for a $27 billion bridge commitment which it will then turn around and float off as bonds. Layoffs will follow like night follows day as James cuts expenses to make those payments” — BNET, 10-Feb-2009 “Although James may wait for meaningful improvement in credit market to lower cost of capital, we continue to believe James will be able to obtain financing, and needs to do so before adjuvant data read-out. We expect upside in Francis as credit markets ease and financing appears more feasible.” — Morgan Stanley, 10-Feb-2009 “The acquisition of Wyeth shows that mega-deals are possible in times of troubled financial markets, so we still expect James to succeed in the planned takeover of Francis” — DZ Bank, 30-Jan-2009 “Banks are checking if there is internal capital to do the deal, quite honestly, I think it will be difficult. The question is — is there enough capital for a deal of that size,” — CNN, 30-Jan-2009 Source: Wall Street research, Factiva Transaction-Related Financial Analysis 41

Goldman Sachs Confidential IV. Credit Market Considerations and Transaction Analysis Credit Market Considerations and Transaction Analysis 42

Goldman Sachs Confidential A. Credit Market Considerations Credit Market Considerations 43

Goldman Sachs Confidential Current Credit Market Considerations ? Financing markets are showing signs of improvement for high quality, investment grade issuers — Pfizer/Wyeth bridge loan for $22.5 billion is a positive development, although lenders negotiated unusual funding conditions and sizeable up-front fees — Novartis successfully placed $5 billion in bonds during its initial US public bond offering — Investment grade new issue volume year to date has been strong More than $80bn of new corporate issuance year-to-date in 2009, including 10 offerings larger than $3bn ? Reduced bank capacity continues to create size constraints for completing large transactions — Commitments are very expensive — Pfizer loan arguably decreases capacity ? Uncertainty around government sponsored bank relief programs adds to near term lending hesitancy ? However, James and Francis are considered stable, creditworthy companies, which makes it difficult to completely dismiss the ability to finance a deal — Generate significant cash flow — Low existing leverage levels — Healthcare considered a relatively stable sector during economic downturns Credit Market Considerations 44

Goldman Sachs Confidential Financing Details: Pfizer’s Acquisition of Wyeth Goldman Sachs Acted as Lead Financial Advisor to Pfizer Announced on 26-Jan-2009 Pfizer Wyeth Transaction Highlights ? On 26-Jan-2009, Pfizer (PFE) and Wyeth (WYE) announced a definitive agreement for Pfizer to acquire Wyeth ? Pfizer will acquire the outstanding common stock of Wyeth for $44.93bn of cash, including a $22.50bn 364-Day Senior Unsecured Bridge Loan, and $22.89bn of Pfizer common stock ? This represents an implied value of approximately $50.19 per share, or total equity value of $67.81bn ? Goldman Sachs, J.P. Morgan, Bank of America Merrill Lynch, Citi and Barclays are acting as Joint Bookrunners and Joint Lead Arrangers Summary Key Terms and Conditions Borrower Pfizer Inc. Facility 364-Day Senior Unsecured Single Draw Bridge Exp. Corp. Credit Rating AA(stable)/A1(stable) and A-1+(conf)/P-1(aff) Size $22.50bn Initial Lead Arrangers GS, JPM, BoAML, Citi, Bar Guarantors Borrowers’ domestic subsidiaries L + 300.0bps with 50.0bps step-ups per quarter Pricing (subject to a ratings based grid) Commitment Fee 37.5bps (subject to a ratings based grid) Mandatory Prepayments Asset Sales, Equity Offerings, Indebtedness Financial Covenant Debt / EBITDA $4.50bn for 3 months and $2.25bn for next 3 Extension Option months. 200bps fee for each extension Pfizer MAE, Wyeth MAE, Minimum Ratings of Conditions Precedent A2(stable)/A(stable) and A-1(conf)/P-1(aff) Duration Fees Amount 90 Days 180 Days 270 Days (Days from Funding; $12.5bn 150.0bps 200.0bps 300.0bps calculated on Outstanding <$12.5bn but 100.0bps 150.0bps 200.0bps Amount) $7.5bn <$7.5bn 75.0bps 125.0bps 175.0bps Overview of Pfizer ? Pfizer is the world’s largest research-based biomedical and pharmaceutical company ? Pfizer currently has approximately 85,000 employees in more than 150 countries working to discover, develop, manufacture and deliver quality, safe and effective prescription medicines to patients and animals Overview of Wyeth ? Wyeth discovers, develops, manufactures, distributes and sells a diversified line of products in three primary businesses: — Wyeth Pharmaceuticals – key products include Effexor, Prevnar, Enbrel, Zosyn and Premarin — Wyeth Consumer Healthcare – key products include Advil, Robitussin, Centrum, Preparation H and Chapstick — Fort Dodge Animal Health – key areas include vaccines, pharmaceuticals, parasite control and growth implants Pro Forma Therapeutic Revenue Diversification¹ Pfizer Standalone 2008 Pfizer Pro Forma 2012 Animal Total Animal Consumer Total Other Health Specialty Health 7% Specialty Specialty 6% 30% 6% 18% 9% Other Infectious Specialty Disease 9% 4% Inflammation Primary Oncology 6% Care 5% Primary 57% Infectious Care Disease 76% 11% Oncology 4% Source: Public filings, press release 1 As per company investor relations presentation. PRIVATE AND CONFIDENTIAL: This document is being sent to you for your information only as an investment banking client of Goldman Sachs. This document has been prepared by the Investment Banking Division and is not a product of the research department of Goldman Sachs. This document should not be forwarded outside of your organization or used as a basis for trading in the loans described, for trading the securities of the companies named herein or for any other investment decision. This document doesn’t constitute an offer to sell the loans described or the securities of the companies named herein or a solicitation of proxies or votes. Credit Market Considerations 45

Goldman Sachs Confidential Novartis AG $5.0bn Inaugural 5 & 10yr Bond Offering Case Study Goldman Sachs Acted as One of Four Bookrunners Transaction Details Issuer Novartis Capital (5 Year), Novartis Securities Investment (10 Year) Issue Rating Aa2/AA- (Moody’s/S&P) Pricing Date 04th February 2009 Settlement Date 10th February 2009 Bookrunners Goldman Sachs & Co, Banc of America Securities, Citigroup, JPMorgan Form of Instrument Inaugural USD bond offering Use of Proceeds General corporate purposes (possible purchase of remaining Nestle stake in Alcon) 5 Year 10 Year Deal Size $2,000m $3,000m Maturity 2th February 2014 2th February 2019 Coupon 4.125% 5.125% Re-offer Yield 4.148% 5.148% Re-offer Spread T+225 T+225 Re-offer Price 99.897 99.822 Investor Breakdown – by Allocated Number of Accounts 5 Year 10 Year Investor Type 3% 4% 1% 3% 5% 2% 15% 18% 73% 76% Asset Manager Pension/Insurance Bank Hedge Funds Other Geography 4% 5% 9% 6% 5% 85% 86% US UK Swiss Other Transaction Overview and Highlights Successful US transaction debut for issuer ? Transaction marks the inaugural dollar deal for Novartis and has been documented under the Company’s newly established US debt shelf ? Order book was oversubscribed, with a slightly bigger investor focus on the 10yr vs. the 5yr maturity ? This strong and very diversified investor demand allowed the Company to price the transaction at 225bps across both maturities, i.e. the bottom end of the initial price guidance of 225-237.5bps ? This pricing was in line with where Novartis – after swap – could have issued in other benchmark currencies ? The bond performed strongly in the secondary market, establishing attractive pricing reference points for future Novartis transactions Company Overview ? Novartis (Aa2/AA-) is a world leader in pharmaceutical and consumer healthcare products with a market cap of ~CHF129bn/USD112bn (as of 12-Feb-2009) ? Novartis is organised in four divisions — The Pharmaceuticals Division develops and markets patent-protected prescription drugs for important health needs in major therapeutical areas (cardiovascular and metabolism, oncology and hematology, neuroscience, respiratory, immunology and infectious diseases) — Vaccines and Diagnostics provides products to fight more than 20 vaccine-preventable viral and bacterial diseases as well as sophisticated blood-testing equipment — Sandoz is the generic pharmaceuticals division of Novartis — Consumer Health divisions focuses on three business units (over-the-counter, animal health, CIBA Vision) ? In April 2008 Novartis agreed to acquire 24.85% stake in Alcon from Nestle for $10.59 billion. Under the terms of the transaction from January 2010 until July 2011, Novartis will have a call option to acquire Nestlé’s remaining majority shareholding in Alcon, currently worth approx. $14bn PRIVATE AND CONFIDENTIAL. This document is being sent to you for your information only as an investment banking client of Goldman Sachs and should not be forwarded outside of your organization and should not be used as a basis for trading in the securities described. This document does not constitute an offer to sell the securities described or a solicitation of proxies or votes. Credit Market Considerations 46

Goldman Sachs Confidential New Investment Grade Bridge Market Dynamics Issues for Consideration ? Given substantial market dislocation in the bank market, bridge terms for Investment Grade companies continue to evolve over recent months ? In light of bank concerns related to holding large funded bridges on balance sheet for extended periods of time, provisions almost never seen in Investment Grade bridges have become common in “today’s market.” Items include: — Funding fees to incent borrowers to pre-fund acquisitions in the capital markets — Duration fees and coupon step-ups to incent borrowers to reduce commitments post funding — Flex provisions to ensure a successful syndication Interest rate and structural flex ? Coupon of bridge loan representative of actual credit risk, not necessarily existing credit lines Bridge Facility Fee Components Type Stage Payable Commitment Fee ? At time of commitment Closing / Funding Fee ? Incents borrowers to pre-fund acquisitions in the capital markets ? At closing and generally on amount funded at Close Duration Fees ? Paid at the end of each 3 month interval ? Can be considered as part of the overall bridge compensation to lenders ? Incents borrowers to reduce commitments post funding Credit Market Considerations 47

Goldman Sachs Confidential Reduce Reliance on the Bank Market Investment Grade Bank Market Remains Pressured Despite Some Relief in Banks’ Cost of Funds, Balance Sheets Remain Dear As Banks’ Funding Costs Have Risen, Bank Facility Pricing and Terms Have Evolved 600 500 400 (bps) CDX IG Financials Index Spread 300 200 CDX IG Index 100 0 Jan-07 Jul-07 Jan-08 Jul-08 Jan-09 Where We Were ? Description — Bank balance sheets had massive amounts of liquidity with limited balance sheet constraints — Investment grade lending commoditized — Very aggressive lending competition ? Pricing / Fees — Below market drawn spreads which did not reflect borrowers’ true cost of capital — Limited to no upfront fees — Below lenders’ own cost of capital ? Tenor: 3-5 years ? Terms: Unsecured with single covenant Where We Are ? Description — Bank balance sheets very constrained — Investment grade lending very challenging and in some cases, not available — Decreased number of market participants coupled with very limited liquidity ? Pricing / Fees — Market based drawn spreads including CDS/CDX based pricing, known as Relative Value Pricing (RVP) — Upfront fees which reflect cost of capital allocation — Pricing above lenders’ cost of capital and emergence of lender-based drawn spreads ? Tenor: 364-day ? Terms: Unsecured with one or two covenants; case-specific security Where Are We Going? ? Description — Bank balance sheets begin to repair themselves — Government equity investments help strengthen Tier 1 capital and ultimately will be taken out entirely — Liquidity comes back to IG lending ? Pricing / Fees — Continuation of use of RVP — Upfront fees which reflect cost of capital allocation — Continued use of lender based drawn spreads to account for high cost of obtaining capital ? Tenor: 364-day-3 years ? Terms: Unsecured with one or two covenants; case-specific security Source: GS Internal Credit Market Considerations 48

Goldman Sachs Confidential Rate and Spread Environment in Context Flight to Quality May Limit Rise in Rates 12 5yr UST (Mean: 5.40; Curr: 1.88; Q409 GS Forecast: 2.20) 10yr UST (Mean: 5.79; Curr: 2.90; Q409 GS Forecast: 3.20) 10 30yr UST (Mean: 6.17; Curr: 3.63; Q409 GS Forecast: 3.80) 8 (%) Rate 6 4 2 0 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 Despite Recent Improvement, Spreads Remain High… 500 5yr A Spread (Mean: 98.19; Curr: 310.80) 450 10yr A Spread (Mean: 116.44; Curr: 302.40) 400 30yr A Spread (Mean: 158.22; Curr: 307.35) (bps) 350 UST 300 to 250 200 Spread 150 100 50 0 2004 2005 2006 2007 2008 2009 The Yield Curve Should Remain Moderately Steep 1988—1992 10 1992—1998 (%) 9 1998—2002 8 2002—2005 Rate 7 2005—2009 6 Current Curve Treasury 5 30Y 4 3 2 -1 -0.5 0 0.5 1 1.5 2 2.5 3 30Y Treasury Rate—5Y Treasury Rate (%) But All-In Yields are Attractive for Corporate Issuers 9 5yr A Yield (Mean: 4.83; Curr: 4.83) 10yr A Yield (Mean: 5.45; Curr: 5.85) 8 30yr A Yield (Mean: 6.27; Curr: 6.74) 7 (%) 6 Rate 5 4 3 2 2004 2005 2006 2007 2008 2009 Source: GS Internal. Levels as of 29-Jan-2009. Credit Market Considerations 49

Goldman Sachs Confidential Flight to Quality – Even Within IG – To Continue Ratings Downgrades Expected to Rise, Pressuring Lower-Rated Spreads Credit Downgrades Likely to Spike As In Past Recessionary Periods… 8% 12 Month Trailing Downgrade Rate (IG to HY) GS Forecast Baseline Scenario GS Forecast Benign Scenario GS Forecast Deep Recession Scenario 7% 6% HY to IG from 5% Rate Downgrade 4% Trailing 3% Month 12 2% Shading indicates 1% recessionary periods 0% 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 With Credit Spreads Further Differentiating the Strong from the Weak 800 A-Rated iBoxx Bond Index (left axis) 300 BBB-Rated iBoxx Bond Index (left axis) Difference (right axis) 250 (bps) 600 Index Bond (bps) 200 Shading indicates iBoxx UST recessionary periods to Rated—400 150 BBB Spread and Index Rated A -Bond 100 Between 200 50 Difference 0 0 99 00 01 02 03 04 05 06 07 08 09 Source: GS Research Credit Market Considerations 50

Goldman Sachs Confidential Investment Grade Bond Market Off to a Strong Start in 2009 2009 Non-Government-Guaranteed Investment Grade Issuance Exceeds $80 billion 50 Max Min Avg Curr 600 . 5 HVOL Index 600 201 370 458 550 45 . 4 43 . 6 CDX IG Index 283 81 156 198 . 1 40 39 500 40 38 4 1 . . 450 bn) 35 . 3 34 34 ( $ 31 400 7 2 . 30 . 27 350 26 . 8 4 2 . 25 . 7 23 23 300 Volume 22 . 2 . Spread 8 0 20 . 9 . 8 20 . . 5 19 250 16 2 1 17 . 18 Issue . . 16 . 6 8 1 15 200 (bps) . 8 14 14 2 . 7 7 15 . 13 New 11 . 11 12 . . 10 10 10 6 4 150 7 0 . 3 9 . 8 . . 5 . IG 10 . 3 8 . 3 8 8 7 6 . 8 7 8 7 9 . . . 7 . 7 2 8 . . 6 6 6 100 6 . 6 1 . 8 0 . 5 4 . 3 5 5 8 4 . 4 3 3 . 4 . 2 1 7 . . . 4 50 0 1 1 0 . 0 0 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb 2008 2008 2008 2008 2008 2008 2008 2008 2008 2008 2008 2008 2009 2009 Weekly New Issue Volume HVOL Index CDX IG Index Credit Crunch in Perspective : Credit Spreads and Investment Grade New Issue Volume, 1990 to Present 150,000 Late ‘98: ‘00—‘02: ‘07—‘08: 1200 LTCM Collapse Dot-Com Bubble Credit Crunch 120,000 1000 (bps) Volume 90,000 800 mm) 600 ( $ 60,000 400 Spread Issuance 30,000 200 UST 0 0 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 Non-Financials Financials AA Index Spread A Index Spread BBB Index Spread BB Index Spread Source: GS Internal. Updated through 30-Jan-2009 Credit Market Considerations 51

Goldman Sachs Confidential B. Transaction Analysis Transaction Analysis 52

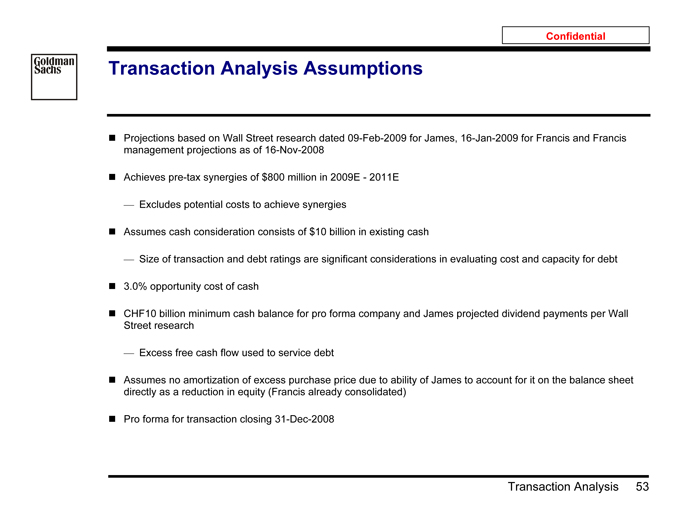

Goldman Sachs Confidential Transaction Analysis Assumptions ? Projections based on Wall Street research dated 09-Feb-2009 for James, 16-Jan-2009 for Francis and Francis management projections as of 16-Nov-2008 ? Achieves pre-tax synergies of $800 million in 2009E—2011E — Excludes potential costs to achieve synergies ? Assumes cash consideration consists of $10 billion in existing cash — Size of transaction and debt ratings are significant considerations in evaluating cost and capacity for debt ? 3.0% opportunity cost of cash ? CHF10 billion minimum cash balance for pro forma company and James projected dividend payments per Wall Street research — Excess free cash flow used to service debt ? Assumes no amortization of excess purchase price due to ability of James to account for it on the balance sheet directly as a reduction in equity (Francis already consolidated) ? Pro forma for transaction closing 31-Dec-2008 Transaction Analysis 53

Goldman Sachs Confidential Leverage Analysis for James Pro Forma for the Acquisition of Francis (Figures in millions, except per share data) Currency Exchange Rate (CHF / $) 1.16 Price Per Share ($) $86.50 $89.00 $95.00 $100.00 $105.00 $110.00 $115.00 $120.00 $125.00 Price Per Share (CHF) CHF 100.56 CHF 103.47 CHF 110.44 CHF 116.26 CHF 122.07 CHF 127.88 CHF 133.69 CHF 139.51 CHF 145.32 Minority Shares (mm) 486 488 491 494 496 498 500 502 503 Equity Consideration—Diluted $42,044 $43,397 $46,648 $49,360 $52,072 $54,785 $57,497 $60,210 $62,923 CHF 48,879 CHF 50,451 CHF 54,231 CHF 57,384 CHF 60,537 CHF 63,691 CHF 66,844 CHF 69,998 CHF 73,151 Existing Cash Used $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 CHF 11,626 CHF 11,626 CHF 11,626 CHF 11,626 CHF 11,626 CHF 11,626 CHF 11,626 CHF 11,626 CHF 11,626 Incremental Financing Need $32,544 $33,897 $37,148 $39,860 $42,572 $45,285 $47,997 $50,710 $53,423 CHF 37,834 CHF 39,407 CHF 43,187 CHF 46,339 CHF 49,493 CHF 52,646 CHF 55,800 CHF 58,953 CHF 62,107 Estimated Average Financing Cost 3.0% 3.1% 3.3% 3.8% 3.9% 4.0% 6.5% 6.5% 6.5% 2008A Pro Forma Credit Profile (CHF mn) EBITDA CHF 16,645 CHF 16,645 CHF 16,645 CHF 16,645 CHF 16,645 CHF 16,645 CHF 16,645 CHF 16,645 CHF 16,645 CapEx 3,139 3,139 3,139 3,139 3,139 3,139 3,139 3,139 3,139 Total Debt 41,923 43,496 47,276 50,428 53,582 56,735 59,889 63,042 66,196 Total Debt / EBITDA 2.5 x 2.6 x 2.8 x 3.0 x 3.2 x 3.4 x 3.6 x 3.8 x 4.0 x Total Debt / (EBITDA—CapEx) 3.1 3.2 3.5 3.7 4.0 4.2 4.4 4.7 4.9 Net Debt 30,252 31,824 35,604 38,757 41,910 45,064 48,217 51,371 54,524 Net Debt / EBITDA 1.8 x 1.9 x 2.1 x 2.3 x 2.5 x 2.7 x 2.9 x 3.1 x 3.3 x Net Debt / (EBITDA—CapEx) 2.2 2.4 2.6 2.9 3.1 3.3 3.6 3.8 4.0 Total Cash 11,672 11,672 11,672 11,672 11,672 11,672 11,672 11,672 11,672 2009E Pro Forma Credit Profile (CHF mn) EBITDA CHF 19,304 CHF 19,304 CHF 19,304 CHF 19,304 CHF 19,304 CHF 19,304 CHF 19,304 CHF 19,304 CHF 19,304 CapEx 2,898 2,898 2,898 2,898 2,898 2,898 2,898 2,898 2,898 Total Debt 33,364 34,937 38,717 41,869 45,023 48,176 51,330 54,484 57,637 Total Debt / EBITDA 1.7 x 1.8 x 2.0 x 2.2 x 2.3 x 2.5 x 2.7 x 2.8 x 3.0 x Total Debt / (EBITDA—CapEx) 2.0 2.1 2.4 2.6 2.7 2.9 3.1 3.3 3.5 Net Debt 23,364 24,937 28,717 31,869 35,023 38,176 41,330 44,484 47,637 Net Debt / EBITDA 1.2 x 1.3 x 1.5 x 1.7 x 1.8 x 2.0 x 2.1 x 2.3 x 2.5 x Net Debt / (EBITDA—CapEx) 1.4 1.5 1.8 1.9 2.1 2.3 2.5 2.7 2.9 Total Cash 10,000 10,000 10,000 10,000 10,000 10,000 10,000 10,000 10,000 Preliminary Long-term Credit Rating AA- / A1 AA- / A1 AA-,A+ / A1,A2 A+ / A2 A / A3 upside potential A / A3 A- / Baa1 A- / Baa1 Potential Notch Downgrade ¹ 0 / 3 0 / 3 1 / 4 1 / 4 2 / 5 2 / 5 3 / 6 3 / 6 Preliminary Short-term Credit Rating A-1+ / P-1 A-1+ / P-1 A-1+,A-1 / P-1 A-1 / P-1 <--— A-1 stable / P-1 at risk --—> A-2 / P-2 A-2 / P-2 A-2 / P-2 Estimated Bank Loan Capacity ² $2,456 $1,103—————Source: Francis management projections Note: Assumes debt paydown beginning in 2009 with a minimum CHF10,000 mn cash balance 1 Assumes current Moody’s long-term rating of Aa1, which is under review for possible downgrade. Transaction Analysis 54