UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2020

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period from _____ to _____

Commission File Number 000-09341

SECURITY NATIONAL FINANCIAL CORPORATION

(Exact name of registrant as specified in its charter)

UTAH | 87-0345941 | ||

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||

121 West Election Road, Draper, Utah | 84020 | ||

(Address of principal executive offices) | (Zip Code) | ||

|

| ||

Registrant’s telephone number, including area code: | (801) 264-1060 | ||

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading symbol | Name of exchange on which registered |

Class A Common Stock | SNFCA | The Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act of 1933, as amended (“Securities Act”).

[ ] Yes [X] No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Act.

[ ] Yes [X] No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended (“Exchange Act”) during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

[X] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

[X] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] Accelerated filer [ ]

Non-accelerated filer [ ]Smaller reporting company [X]

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

[ ] Yes [X] No

As of June 30, 2020, the aggregate market value of the registrant’s Class A common stock held by non-affiliates of the registrant was approximately $50,000,000 based on the $6.58 closing sale price of the Class A common stock as reported on The Nasdaq Global Select Market.

As of March 23, 2021, there were outstanding 16,621,147 shares of Class A common stock, $2.00 par value per share, and 2,679,603 shares of Class C common stock, $2.00 par value per share.

Documents Incorporated by Reference

None.

Security National Financial Corporation

Form 10-K

For the Fiscal Year Ended December 31, 2020

TABLE OF CONTENTS

|

| Page |

| Part I |

|

|

|

|

Item 1. | 4 | |

Item 2. | 12 | |

Item 3. | 15 | |

Item 4. | 16 | |

|

|

|

| Part II |

|

|

|

|

Item 5. | 17 | |

Item 6. | 19 | |

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 19 |

Item 7A. | 32 | |

Item 8. | 33 | |

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 114 |

Item 9A. | 114 | |

Item 9B. | 115 | |

|

|

|

| Part III |

|

|

|

|

Item 10. | 116 | |

Item 11. | 120 | |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 131 |

Item 13. | Certain Relationships and Related Transactions, and Director Independence | 133 |

Item 14. | 134 | |

|

|

|

| Part IV |

|

|

|

|

Item 15. | 134 |

PART I

Security National Financial Corporation (the “Company”) operates in three reportable business segments: life insurance, cemetery and mortuary, and mortgages. The life insurance segment is engaged in the business of selling and servicing selected lines of life insurance, annuity products, and accident and health insurance. These products are marketed in 40 states through a commissioned sales force of independent licensed insurance agents who may also sell insurance products of other companies. The cemetery and mortuary segment consists of eight mortuaries and five cemeteries in the state of Utah and one cemetery in the state of California. The Company also engages in pre-need selling of funeral, cemetery, mortuary, and cremation services through its Utah and California operations. Many of the insurance agents also sell pre-need funeral, cemetery, and cremation services. The mortgage segment originates and underwrites or otherwise purchases residential and commercial loans for new construction, existing homes, and other real estate projects. The mortgage segment operates through 98 retail offices in 23 states, and is an approved mortgage lender in several other states.

The Company’s design and structure are that each business segment is related to the other business segments and contributes to the profitability of the other segments. The Company’s cemetery and mortuary segment provides a level of public awareness that assists in the sales and marketing of insurance and pre-need cemetery and funeral products. The Company’s insurance segment invests their assets (including, in part, pre-need funeral products and services) in investments authorized by the respective insurance departments of their states of domicile. The Company also pursues growth through acquisitions. The Company’s mortgage segment provides mortgage loans and other real estate investment opportunities.

The Company was organized as a holding company in 1979 when Security National Life Insurance Company (“Security National Life”) became a wholly owned subsidiary of the Company and the former stockholders of Security National Life became stockholders of the Company. Security National Life was formed in 1965 and has acquired or purchased significant blocks of business which include Capital Investors Life Insurance Company (1994), Civil Service Employees Life Insurance Company (1995), Southern Security Life Insurance Company (1998), Menlo Life Insurance Company (1999), Acadian Life Insurance Company (2002), Paramount Security Life Insurance Company (2004), Memorial Insurance Company of America (2005), Capital Reserve Life Insurance Company (2007), Southern Security Life Insurance Company, Inc. (2008), North America Life Insurance Company (2011, 2015), Trans-Western Life Insurance Company (2012), Mothe Life Insurance Company (2012), DLE Life Insurance Company (2012), American Republic Insurance Company (2015), First Guaranty Insurance Company (2016), and Kilpatrick Life Insurance Company (2019).

The cemetery and mortuary operations have also grown through the acquisition of other cemetery and mortuary companies. The cemetery and mortuary companies that the Company has acquired are Holladay Memorial Park, Inc. (1991), Cottonwood Mortuary, Inc. (1991), Deseret Memorial, Inc. (1991), Probst Family Funerals and Cremations L.L.C. (2019), and Heber Valley Funeral Home, Inc. (2019).

In 1993, the Company formed SecurityNational Mortgage Company (“SecurityNational Mortgage”) to originate and refinance residential mortgage loans. In 2012, the Company formed Green Street Mortgage Services, Inc. (now known as EverLEND Mortgage Company) (“EverLEND Mortgage”) also to originate and refinance residential mortgage loans.

See Note 15 of the Notes to Consolidated Financial Statements for additional information regarding business segments of the Company.

Life Insurance

Products

The Company, through Security National Life, First Guaranty Insurance Company (“First Guaranty”), and Kilpatrick Life Insurance Company (“Kilpatrick”), issues and distributes selected lines of life insurance and annuities. The Company’s life insurance business includes funeral plans and interest-sensitive life insurance, as well as other traditional life, accident, and health insurance products. The Company places specific marketing emphasis on funeral

4

plans through pre-need planning. The Company’s insurance subsidiaries, Memorial Insurance Company of America (“Memorial Insurance”), Southern Security Life Insurance Company, Inc. (“Southern Security”), Trans-Western Life Insurance Company (“Trans-Western”), First Guaranty, and Kilpatrick, service and maintain policies that were purchased prior to their acquisition by Security National Life.

A funeral plan is a small face value life insurance policy that generally has face coverage of up to $25,000. The Company believes that funeral plans represent a marketing niche that has lower competition because most insurance companies do not offer similar coverage. The purpose of the funeral plan policy is to pay the costs and expenses incurred at the time of a person’s death. On a per thousand-dollar cost of insurance basis, these policies can be more expensive to the policyholder than many types of non-burial insurance due to their low face amount, requiring the fixed cost of the policy administration to be distributed over a smaller policy size, and the simplified underwriting practices that result in higher mortality costs.

Markets and Distribution

The Company is licensed to sell insurance in 40 states. The Company, in marketing its life insurance products, seeks to locate, develop and service specific niche markets. The Company’s funeral plan policies are sold primarily to persons who range in age from 45 to 85 and have low to moderate income. A majority of the Company’s funeral plan premiums come from the states of Arkansas, California, Florida, Georgia, Louisiana, Mississippi, Texas, and Utah.

The Company sells its life insurance products through direct agents, brokers, and independent licensed agents who may also sell insurance products of other companies. The commissions on life insurance products range from approximately 50% to 120% of first year premiums. In those cases, where the Company utilizes its direct agents in selling such policies, those agents customarily receive advances against future commissions.

In some instances, funeral plan insurance is marketed in conjunction with the Company’s cemetery and mortuary sales force. When it is marketed by that group, the beneficiary is usually the Company’s cemeteries and mortuaries. Thus, death benefits that become payable under the policy are paid to the Company’s cemetery and mortuary subsidiaries to the extent of services performed and products purchased.

In marketing funeral plan insurance, the Company also seeks and obtains third-party endorsements from other cemeteries and mortuaries within its marketing areas. Typically, these cemeteries and mortuaries will provide letters of endorsement and may share in mailing and other lead-generating costs since these businesses are usually made the beneficiary of the policy. The following table summarizes the life insurance business for the five years ended December 31, 2020:

| 2020 |

| 2019 |

| 2018 |

| 2017 |

| 2016 |

|

Life Insurance |

|

|

|

|

|

|

|

|

|

|

Policy/Cert Count as of December 31 | 659,237 |

| 669,064 | (1) | 531,831 |

| 533,065 |

| 531,775 | (2) |

Insurance in force as of December 31 (omitted 000) | $2,890,791 |

| $2,877,402 | (1) | $1,838,488 |

| $1,759,148 |

| $1,672,081 | (2) |

Premiums Collected (omitted 000) | $92,058 |

| $78,253 | (1) | $74,965 |

| $69,565 |

| $65,220 | (2) |

_____________

(1)Includes the acquisition of Kilpatrick

(2)Includes the acquisition of First Guaranty and the termination of the reinsurance assumed from Servicemembers’ Group Life Insurance (“SGLI”)

5

Underwriting

The factors considered in evaluating an application for ordinary life insurance coverage can include the applicant’s age, occupation, general health, and medical history. Upon receipt of a satisfactory (non-funeral plan insurance) application, which contains pertinent medical questions, the Company issues insurance based upon its medical limits and requirements subject to the following general non-medical limits:

Age Nearest |

|

| Non-Medical |

0-50 |

| $ | 100,000 |

51-up |

|

| Medical information |

|

|

| required (APS or exam) |

When underwriting life insurance, the Company will sometimes issue policies with higher premium rates for substandard risks.

The Company’s funeral plan insurance is written on a simplified medical application with underwriting requirements being a completed application, a phone inspection on the applicant, and an intelliscript prescription history inquiry. There are several underwriting classes in which an applicant can be placed.

Annuities

Products

The Company’s annuity business includes single premium deferred annuities, flexible premium deferred annuities, and immediate annuities. A single premium deferred annuity is a contract where the individual remits a sum of money to the Company, which is retained on deposit until such time as the individual may wish to annuitize or surrender the contract for cash. A flexible premium deferred annuity gives the contract holder the right to make premium payments of varying amounts or to make no further premium payments after his initial payment. These single and flexible premium deferred annuities can have initial surrender charges. The surrender charges act as a deterrent to individuals who may wish to prematurely surrender their annuity contracts. An immediate annuity is a contract in which the individual remits a sum of money to the Company in return for the Company’s obligation to pay a series of payments on a periodic basis over a designated period of time, such as an individual’s life, or for such other period as may be designated.

Annuities have guaranteed interest rates that range from 1% to 6.5% per annum. Rates above the guaranteed interest rate credited are periodically modified by the Board of Directors at its discretion. In order for the Company to realize a profit on an annuity product, the Company must maintain an interest rate spread between its investment income and the interest rate credited to the annuities. Commissions, issuance expenses, and general and administrative expenses are deducted from this interest rate spread.

Markets and Distribution

The general market for the Company’s annuities is middle to older age individuals. A major source of annuity sales come from direct agents and are sold in conjunction with other insurance sales. If an individual does not qualify for a funeral plan, the agent will often sell that individual an annuity to fund final expenses.

The following table summarizes the annuity business for the five years ended December 31, 2020:

| 2020 |

| 2019 |

| 2018 |

| 2017 |

| 2016 |

|

Annuities Policy/Cert Count as of December 31 | 25,476 |

| 26,565 | (1) | 22,313 |

| 22,729 |

| 21,364 | (2) |

Deposits Collected (omitted 000) | $9,637 |

| $10,400 | (1) | $9,644 |

| $10,353 |

| $11,019 | (2) |

____________

(1)Includes the acquisition of Kilpatrick

(2)Includes the acquisition of First Guaranty

6

Accident and Health

Products

With the acquisition of Capital Investors in 1994, the Company acquired a small block of accident and health policies. Since 1999, the Company has offered a low-cost comprehensive diver’s accident policy that provides worldwide coverage for medical expense reimbursement in the event of a diving accident. With the acquisition of Kilpatrick in 2019, the Company also acquired a block of accident and health policies.

Markets and Distribution

The Company currently markets its diver’s accident policies through the internet.

The following table summarizes the accident and health insurance business for the five years ended December 31, 2020:

| 2020 |

| 2019 |

| 2018 |

| 2017 |

| 2016 |

Accident and Health Policy/Cert Count as of December 31 | 13,735 |

| 15,133 | (1) | 3,763 |

| 4,069 |

| 4,761 |

Premiums Collected (omitted 000) | $296 |

| $110 | (1) | $98 |

| $104 |

| $113 |

____________

(1)Includes the acquisition of Kilpatrick

Reinsurance

The primary purpose of reinsurance is to enable an insurance company to issue an insurance policy in an amount larger than the risk the insurance company is willing to assume for itself. The insurance company remains obligated for the amounts reinsured (ceded) in the event the reinsurers do not meet their obligations.

The Company currently cedes and assumes certain risks with various authorized unaffiliated reinsurers pursuant to reinsurance treaties, which are generally renewed annually. The premiums paid by the Company are based on a number of factors, primarily including the age of the insured and the risk ceded to the reinsurer.

It is the Company’s policy to retain no more than $100,000 of ordinary insurance per insured life, with the excess risk being reinsured. The total amount of life insurance reinsured by other companies as of December 31, 2020, was $377,138,000, which represents approximately 13.0% of the Company’s life insurance in force on that date.

See “Management’s Discussion and Analysis of Results of Operations and Financial Condition” and “Notes to Consolidated Financial Statements” for additional disclosure and discussion regarding reinsurance.

Investments

The investments that support the Company’s life insurance and annuity obligations are determined by the investment committees of the Company’s subsidiaries and ratified by the full Board of Directors of the respective subsidiaries. A significant portion of the Company’s investments must meet statutory requirements governing the nature and quality of permitted investments by its insurance subsidiaries. The Company maintains a diversified investment portfolio consisting of common stocks, preferred stocks, municipal bonds, corporate bonds, mortgage loans, real estate, and other securities and investments.

See “Management’s Discussion and Analysis of Results of Operations and Financial Condition” and “Notes to Consolidated Financial Statements” for additional disclosure and discussion regarding investments.

7

Cemetery and Mortuary

Products

Through its cemetery and mortuary segment, the Company markets a variety of products and services both on a pre-need basis (prior to death) and an at-need basis (at the time of death). The products include: plots, interment vaults, mausoleum crypts, markers, caskets, urns and other death care related products. These services include: professional services of funeral directors, opening and closing of graves, use of chapels and viewing rooms, and use of automobiles and clothing. The Company has a mortuary at each of its cemeteries, other than Holladay Memorial Park and Singing Hills Memorial Park, and has six separate stand-alone mortuary facilities.

Markets and Distribution

The Company’s pre-need cemetery and mortuary sales are marketed to persons of all ages but are generally purchased by persons 45 years of age and older. The Company is limited in its geographic distribution of these products to areas lying within an approximate 20-mile radius of its mortuaries and cemeteries. The Company’s at-need sales are similarly limited in geographic area.

The Company actively seeks to sell its cemetery and funeral products to customers on a pre-need basis. The Company employs cemetery sales representatives on a commission basis to sell these products. Many of these pre-need cemetery and mortuary sales representatives are also licensed insurance salesmen and sell funeral plan insurance. In some instances, the Company’s cemetery and mortuary facilities are the named beneficiaries of the funeral plan policies.

Potential customers are located via telephone sales prospecting, responses to letters mailed by the pre-planning consultants, newspaper inserts, referrals, and door-to-door canvassing. The Company trains its sales representatives and helps generate leads for them.

Mortgage Loans

Products

The Company, through its wholly owned subsidiaries, SecurityNational Mortgage and EverLEND Mortgage, are active in the residential real estate market. SecurityNational Mortgage is approved by the U.S. Department of Housing and Urban Development (HUD), the Federal National Mortgage Association (Fannie Mae), and other secondary market investors, to originate a variety of residential mortgage loan products, which are subsequently sold to investors. EverLEND Mortgage is approved by the U.S. Department of Housing and Urban Development (HUD), and other secondary market investors, to originate a variety of residential mortgage loan products, which are subsequently sold to investors. The Company uses internal and external funding sources to fund mortgage loans.

Security National Life originates and funds commercial real estate loans, residential construction loans, and land development loans for internal investment.

Markets and Distribution

The Company’s residential mortgage lending services are marketed primarily to real estate brokers, builders and directly with consumers. The Company has a strong retail origination presence in the Utah, Florida, Texas, Nevada and Arizona markets and is experiencing rapid growth with sales representatives in these and many other states across the country. See “Management’s Discussion and Analysis of Results of Operations and Financial Condition” and “Notes to Consolidated Financial Statements” for additional disclosure and discussion regarding mortgage loans.

8

Recent Acquisitions and Other Business Activities

Acquisitions

Acquisition of Kilpatrick Life Insurance Company

On December 13, 2019, the Company, through its wholly-owned subsidiary, Security National Life, completed a stock purchase transaction with Kilpatrick, a Louisiana domiciled insurance company, and Kilpatrick’s shareholders, to purchase all the outstanding shares of common stock of Kilpatrick.

Under the terms of the transaction, as set forth in the Stock Purchase Agreement, dated October 11, 2019, the Company paid purchase consideration at the closing of the transaction equal to $23,779,940 subject to a $1,400,000 holdback that was deposited into an interest bearing escrow account to be held for a period of eighteen months from the closing date. The current amount that is available to be disbursed to the prior owners is $598,949.

Acquisition of Probst Family Funerals and Cremations and Heber Valley Funeral Home

On February 15, 2019, the Company, through its wholly-owned subsidiary, Memorial Mortuary Inc., completed an asset purchase transaction with Probst Family Funerals and Cremations, LLC. (“Probst Family Funerals”) and Heber Valley Funeral Home, Inc. (“Heber Valley Funeral Home”). These funeral homes are both located in Heber Valley, a community situated about 45 miles southeast of Salt Lake City.

Under the terms of the transaction, as set forth in the Asset Purchase Agreement, dated February 15, 2019, the Company paid the net purchase price of $3,315,647 for the business and assets of Probst Family Funerals and Heber Valley Funeral Home, subject to a $150,000 holdback. In August 2019, this escrow account was settled and $137,550 was paid to the prior owners.

Real Estate Development

The Company is capitalizing on the opportunity to develop commercial and residential assets on its existing properties. The cost to acquire existing for-sale assets currently exceeds the replacement costs, thus creating the opportunity for development and redevelopment of the land that the Company currently owns. The Company has developed, or is in the process of developing, assets that have an initial development cost exceeding $100,000,000. The Company plans to continue its development endeavors as the market demands.

Center53 Development

In 2015, the Company broke ground and commenced development on the first phase of its new corporate campus. The anticipated project, comprising nearly 20 acres of land that is currently owned by the Company in the central valley of Salt Lake City, is envisioned to be a multi-year, phased development. At full development, the project will include nearly one million square-feet in five buildings, ranging from four to ten stories, and will be serviced by three parking structures with about 4,000 stalls. The first phase of the project includes a building and a parking garage consisting of nearly 200,000 square feet of office space with 748 parking stalls. This phase of the campus was completed in July 2017 and is currently 96% occupied. The second phase of the project began in March 2020 and includes a six story building of nearly 218,000 square feet and a parking garage with approximately 870 stalls. The Company will occupy half of the building as its corporate headquarters, and has leased the remainder of the building. It is anticipated that the Company will occupy the building in September 2021.

Regulation

The Company’s insurance subsidiaries are subject to comprehensive regulation in the jurisdictions in which they do business under statutes and regulations administered by state insurance commissioners. Such regulation relates to, among other things, prior approval of the acquisition of a controlling interest in an insurance company; standards of solvency which must be met and maintained; licensing of insurers and their agents; nature of and limitations on investments; deposits of securities for the benefit of policyholders; approval of policy forms and premium rates; periodic examinations of the affairs of insurance companies; annual and other reports required to be filed on the financial condition of insurers or for other purposes; and requirements regarding aggregate reserves for life policies

9

and annuity contracts, policy claims, unearned premiums, and other matters. The Company’s insurance subsidiaries are subject to this type of regulation in any state in which they are licensed to do business. Such regulation could involve additional costs, restrict operations, or delay implementation of the Company’s business plans.

The Company’s life insurance subsidiaries are currently subject to regulation in Utah, Arkansas, Louisiana, Mississippi and Texas under insurance holding company legislation, and other states where applicable. Generally, intercompany transfers of assets and dividend payments from insurance subsidiaries are subject to prior notice of approval from the state insurance department, if they are deemed “extraordinary” under these statutes. The insurance subsidiaries are required, under state insurance laws, to file detailed annual reports with the supervisory agencies in each of the states in which they do business. Their business and accounts are also subject to examination by these agencies. The Company was notified that all of its life insurance subsidiaries have been selected for examination for the year ended December 31, 2020 and periods since their last examination. The Company was last examined in 2016 (First Guaranty Insurance), 2017 (Security National Life) and 2019 (Kilpatrick Life). The Texas Department of Banking also audits pre-need insurance policies that are issued in the state of Texas. Pre-need policies are life and annuity products sold as the funding mechanism for funeral plans through funeral homes by Security National agents. The Company is required to send the Texas Department of Banking an annual report that summarizes the number of policies in force and the face amount or death benefit for each policy. This annual report also indicates the number of new policies issued for that year, all death claims paid that year, and all premiums received.

The Company’s cemetery and mortuary subsidiaries are subject to the Federal Trade Commission’s comprehensive funeral industry rules and to state regulations in the various states where such operations are domiciled. The morticians must be licensed by the respective state in which they provide their services. Similarly, the mortuaries and cemeteries are governed and licensed by state statutes and city ordinances in Utah and California. Reports are required to be kept on file on a yearly basis which include financial information concerning the number of spaces sold and, where applicable, funds provided to the Endowment Care Trust Fund. Licenses are issued annually on the basis of such reports. The cemeteries maintain city or county licenses where they conduct business.

The Company’s mortgage subsidiaries are subject to the rules and regulations of the U.S. Department of Housing and Urban Development (HUD), and to various state licensing acts and regulations and the Consumer Financial Protection Bureau (CFPB). These regulations, among other things, specify minimum capital requirements, procedures for loan origination and underwriting, licensing of brokers and loan officers, quality review audits and the fees that can be charged to borrowers. Each year, the Company is required to have an audit completed for each mortgage subsidiary by an independent registered public accounting firm to verify compliance under some of these regulations. In addition to the government regulations, the Company must meet loan requirements, and underwriting guidelines of various investors who purchase the loans.

Income Taxes

The Company’s insurance subsidiaries, Security National Life, First Guaranty and Kilpatrick, are taxed under the Life Insurance Company Tax Act of 1984. Under the act, life insurance companies are taxed at standard corporate rates on life insurance company taxable income. Life insurance company taxable income is gross income less general business deductions and reserves for future policyholder benefits (with modifications). The Company may be subject to the corporate Alternative Minimum Tax (AMT) for tax years ending prior to January 1, 2018. The Tax Cuts and Jobs Act (the “Tax Act”) repealed the corporate AMT for tax years beginning after December 31, 2017. Also, under the Tax Act, December 31, 2017 policyholder surplus account balances result in taxable income over a period of eight years.

Security National Life, First Guaranty and Kilpatrick calculate their life insurance taxable income after establishing a provision representing a portion of the costs of acquisition of such life insurance business. The effect of the provision is that a certain percentage of the Company’s premium income is characterized as deferred expenses and recognized over a five or ten-year period. The Tax Act changed this recognition period for amounts deferred after December 31, 2017 to a five or fifteen-year period.

The Company’s non-life insurance company subsidiaries are taxed in general under the regular corporate tax provisions. The following subsidiaries are regulated as life insurance companies but do not meet the Internal Revenue Code definition of a life insurance company, so they are taxed as insurance companies other than life insurance companies: Memorial Insurance, Southern Security, and Trans-Western.

10

Competition

The life insurance industry is highly competitive. There are approximately 800 legal reserve life insurance companies in business in the United States. These insurance companies differentiate themselves through marketing techniques, product features, price, and customer service. The Company’s insurance subsidiaries compete with a large number of insurance companies, many of which have greater financial resources, a longer business history, and more diversified line of insurance products than the Company. In addition, such companies generally have a larger sales force. Further, the Company competes with mutual insurance companies which may have a competitive advantage because all profits accrue to policyholders. Because the Company is smaller by industry standards and lacks broad diversification of risk, it may be more vulnerable to losses than larger, better-established companies. The Company believes that its policies and rates for the markets it serves are generally competitive.

The cemetery and mortuary industry is also highly competitive. In the Utah and California markets where the Company competes, there are a number of cemeteries and mortuaries which have longer business histories, more established positions in the community, and stronger financial positions than the Company. In addition, some of the cemeteries with which the Company must compete for sales are owned by municipalities and, as a result, can offer lower prices than can the Company. The Company bears the cost of a pre-need sales program that is not incurred by those competitors which do not have a pre-need sales force. The Company believes that its products and prices are generally competitive with those in the industry.

The mortgage industry is highly competitive with a large number of mortgage companies and banks in the same geographic area in which the Company is operating. The mortgage industry in general is sensitive to changes in interest rates and the refinancing market is particularly vulnerable to changes in interest rates.

Employees

As of December 31, 2020, the Company had 1,511 full-time and 197 part-time employees.

11

The following table sets forth the location of the Company’s office facilities and certain other information relating to these properties.

Street | City | State | Function | Owned / Leased | Approximate Square Footage | Lease | Expiration | ||

121 W. Election Rd., Suite 100 | Draper | UT | Corporate Headquarters | Owned | 14,145 | N/A |

|

| N/A |

5201 S. Green St. | Salt Lake City | UT | Mortgage and Insurance Operations | Owned | 28,448 | N/A |

|

| N/A |

1044 River Oaks Dr. | Flowood | MS | Insurance Operations | Owned | 5,522 | N/A |

|

| N/A |

1818 Marshall St. | Shreveport | LA | Insurance Operations | Owned | 12,274 | N/A |

|

| N/A |

812 Sheppard St. | Minden | LA | Insurance Sales | Owned | 1,560 | N/A |

|

| N/A |

909 Foisy Ave. | Alexandria | LA | Insurance Sales | Owned | 8,059 | N/A |

|

| N/A |

1550 N. Third St. | Jena | LA | Insurance Sales | Owned | 1,737 | N/A |

|

| N/A |

4455 South 700 East | Salt Lake City | UT | Insurance Operations | Leased | 16,134 | $ 23,196 | / | mo | 6/30/2021 |

1 Sanctuary Blvd. Suite 302A | Mandeville | LA | Insurance Sales | Leased | 1,337 | $ 2,196 | / | mo | 6/30/2023 |

79 E. Main Street | Midway | UT | Funeral Service Sales | Leased | 4,476 | $ 5,304 | / | mo | 10/31/2022 |

200 Market Way | Rainbow City | AL | Fast Funding Operations | Leased | 12,850 | $ 10,490 | / | mo | 1/31/2025 |

6000 Pelham Rd. | Greenville | SC | Fast Funding Operations | Leased | 4,483 | $ 4,233 | / | mo | 8/31/2022 |

199 Deauville Dr. | Maumelle | AR | Mortgage Sales | Leased | 50 | $ 100 |

| mo | month to month |

1819 S. Dobson Rd., Suite 202/203 | Mesa | AZ | Mortgage Sales | Leased | 2,397 | $ 1,633 | / | mo | 7/31/2021 |

17015 N. Scottsdale Rd., Suite 125 | Scottsdale | AZ | Mortgage Sales | Leased | 6,070 | $ 7,130 | / | mo | 7/31/2023 |

4725 N. 19th Ave. | Phoenix | AZ | Mortgage Sales | Leased | 1,480 | $ 1,700 | / | mo | month to month |

5100 N. 99th Ave., Suite 101/103 | Phoenix | AZ | Mortgage Sales | Sub-Leased | 3,940 | $ 5,348 | / | mo | month to month |

5100 N. 99th Ave., Suite 111 | Phoenix | AZ | Mortgage Sales | Sub-Leased | 720 | $ 1,023 | / | mo | 8/31/2022 |

10609 N. Hayden Rd., Suite 100 | Scottsdale | AZ | Mortgage Sales | Leased | 3,585 | $ 8,500 | / | mo | month to month |

11225 N. 28th Dr., #C-200 | Phoenix | AZ | Mortgage Sales | Leased | 1,031 | $ 2,000 | / | mo | month to month |

1819 Dobson Rd., Suite 202 | Mesa | AZ | Mortgage Sales | Leased | 890 | $ 964 | / | mo | 7/31/2021 |

2828 N. Central Ave., Suite 1100A | Phoenix | AZ | Mortgage Sales | Sub-Leased | 1,691 | $ 4,859 | / | mo | month to month |

2777 S. Arizona Ave., Suite 3169 | Chandler | AZ | Mortgage Sales | Leased | 100 | $ 100 | / | mo | month to month |

1490 S. Price Road, Suite 318 | Chandler | AZ | Mortgage Sales | Leased | 1,600 | $ 3,050 | / | mo | 8/31/2021 |

2436 E. 4th St., Suite 920 | Long Beach | CA | Mortgage Sales | Leased | 100 | $ 100 | / | mo | month to month |

40977 Oak Dr. | Forest Falls | CA | Mortgage Sales | Leased | 250 | $ - | / | mo | month to month |

2934 E. Garvey Ave. South, Suite 250 | West Covina | CA | Mortgage Sales | Leased | 500 | $ 712 | / | mo | month to month |

1910 Union St., Suite 2020 | Anaheim | CA | Mortgage Sales | Sub-Leased | 100 | $ 100 | / | mo | month to month |

573 Chouinard Cir. | Claremont | CA | Mortgage Sales | Leased | 100 | $ 50 | / | mo | month to month |

7398 Fox Trail Unit B | Yucca Valley | CA | Mortgage Sales | Leased | 900 | $ 550 | / | mo | month to month |

26511 Silver Spring | Lake Forest | CA | Mortgage Sales | Leased | 100 | $ 50 | / | mo | month to month |

18647 Marimba St. | Rowland Heights | CA | Mortgage Sales | Leased | 100 | $ 50 | / | mo | month to month |

2325 El Empino | La Habra Heights | CA | Mortgage Sales | Leased | 100 | $ 50 | / | mo | month to month |

445 W. University Ave., Apt. A | San Deigo | CA | Mortgage Sales | Leased | 120 | $ - | / | mo | month to month |

5475 Tech Center Dr., Suite 100 | Colorado Springs | CO | Mortgage Sales | Leased | 3,424 | $ 4,565 | / | mo | 9/30/2023 |

8480 E. Orchard Rd., Suite 4200 | Greenwood Village | CO | Mortgage Sales | Leased | 4,631 | $ 10,227 | / | mo | 5/31/2021 |

1120 W. 122nd Ave., Suite 104 | Denver | CO | Mortgage Sales | Leased | 2,088 | $ 3,828 | / | mo | 10/31/2021 |

27 Main St., Suite C-104B | Edwards | CO | Mortgage Sales | Leased | 680 | $ 1,600 | / | mo | month to month |

4501 Mohawk Dr. | Larkspur | CO | Mortgage Sales | Leased | 250 | $ 50 | / | mo | month to month |

7800 E. Union Ave., Suite 550 | Denver | CO | Mortgage Sales | Sub-Leased | 4,656 | $ 9,312 | / | mo | 9/30/2022 |

1145 Town Park Ave., Suite 2215 | Lake Mary | FL | Mortgage Sales | Leased | 5,901 | $ 12,835 | / | mo | 2/28/2023 |

8191 College Parkway, Suite 201 | Ft Myers | FL | Mortgage Sales | Leased | 4,676 | $ 4,006 | / | mo | 8/21/2021 |

1545 S. Belcher Rd., Suite B | Clearwater | FL | Mortgage Sales | Leased | 100 | $ 1,573 | / | mo | month to month |

3180 Curlew Rd. Unit 107 | Oldsmar | FL | Mortgage Sales | Leased | 1,705 | $ 2,707 | / | mo | 2/14/2023 |

113th St. N. and 82nd Ave. N. | Seminole | FL | Mortgage Sales | Leased | 1,400 | $ 1,692 | / | mo | 8/31/2023 |

136 Parliament Loop | Lake Mary | FL | Mortgage Sales | Leased | 1,527 | $ 3,100 | / | mo | 11/30/2022 |

6456 Cypressdale Dr., Unit 102 | Riverview | FL | Mortgage Sales | Leased | 50 | $ - | / | mo | month to month |

800 Avalon Blvd., Suite 100 | Alpharetta | GA | Mortgage Sales | Sub-Leased | 1,000 | $ 841 | / | mo | month to month |

106 A Adamson Square | Carrolton | GA | Mortgage Sales | Leased | 1,000 | $ 1,550 | / | mo | 10/31/2021 |

4370 Kukui Grove St., Suite 201 | Lihue | HI | Mortgage Sales | Leased | 864 | $ 1,412 | / | mo | 2/28/2022 |

1001 Kamokila Blvd. | Kapolei | HI | Mortgage Sales | Leased | 737 | $ 1,708 | / | mo | 12/31/2022 |

116 N. 3rd St., Suite 12 | Mccall | ID | Mortgage Sales | Leased | 480 | $ 466 | / | mo | month to month |

9963 Crosspoint Blvd Suites 101/102 | Indianapolis | IN | Mortgage Sales | Leased | 1,350 | $ 1,570 | / | mo | month to month |

1739 E. Michigan St. | Indianapolis | IN | Mortgage Sales | Leased | 200 | $ 100 | / | mo | month to month |

568 Greenluster Dr. | Covington | LA | Mortgage Sales | Leased | 150 | $ 750 | / | mo | month to month |

3828 Veterans Blvd., Suite 101 | Metairie | LA | Mortgage Sales | Sub-Leased | 80 | $ 350 | / | mo | 6/30/2021 |

8530 Veterans Hwy | Millersville | MD | Mortgage Sales | Leased | 4,000 | $ 6,000 | / | mo | 4/30/2021 |

4987 Fall Creek Rd. Suite 1 | Branson | MO | Mortgage Sales | Leased | 700 | $ 1,000 | / | mo | month to month |

330 Camp Rd., Suite B-39 | Charlotte | NC | Mortgage Sales | Leased | N/A | $ 650 | / | mo | month to month |

1980 Festival Plaza Dr., Suite 850 | Las Vegas | NV | Mortgage Sales | Leased | 12,866 | $ 44,902 | / | mo | 10/31/2021 |

12

Item 2. Properties (Continued)

Street | City | State | Function | Owned / Leased | Approximate Square Footage | Lease | Expiration | ||

840 Pinnacle Ct., Suite 3 | Mesquite | NV | Mortgage Sales | Leased | 900 | $ 720 | / | mo | 3/12/2022 |

2635 St. Rose Pkwy, Suites D 100, 110, 120 | Hendeson | NV | Mortgage Sales | Leased | 5,788 | $ 11,576 | / | mo | 9/30/2025 |

8720 Orion Place, Suite 160 | Colombus | OH | Mortgage Sales | Leased | 1,973 | $ 1,809 | / | mo | 6/30/2023 |

4294 Martin Dr. | North Olmstead | OH | Mortgage Sales | Leased | 100 | $ - | / | mo | month to month |

3311 NE MLK Jr Blvd., Suite 203 | Portland | OR | Mortgage Sales | Leased | 1,400 | $ 875 | / | mo | month to month |

10365 SE Sunnyside Rd., Suite 310 | Clackamus | OR | Mortgage Sales | Leased | 1,288 | $ 2,653 | / | mo | 11/30/2022 |

11104 SE Stark St., Suite S | Portland | OR | Mortgage Sales | Sub-Leased | 506 | $ 600 | / | mo | month to month |

8285 SW Numbus, Suite 160 | Beaverton | OR | Mortgage Sales | Sub-Leased | 800 | $ 888 | / | mo | month to month |

13 Park Shore Dr. North | Columbia | SC | Mortgage Sales | Leased | 50 | $ 100 | / | mo | month to month |

6263 Poplar Ave., Suite 900 | Memphis | TN | Mortgage Sales | Leased | 1,680 | $ 1,921 | / | mo | 3/31/2022 |

144 Alf Taylor Rd. | Johnson City | TN | Mortgage Sales | Sub-Leased | 1,521 | $ 800 | / | mo | month to month |

347 Main St., Suite 200 | Franklin | TN | Mortgage Sales | Leased | 2,444 | $ 5,703 | / | mo | 8/31/2025 |

3027 Marina Bay Dr., Suite 200 | League City | TX | Mortgage Sales | Leased | 1,225 | $ 2,246 | / | mo | 4/30/2023 |

11550 Fuqua, Suite 200 | Houston | TX | Mortgage Sales | Leased | 1,865 | $ 3,575 | / | mo | 4/30/2021 |

1848 Norwood Plaza, Suite 213 | Hurst | TX | Mortgage Sales | Sub-Leased | 1,596 | $ 1,031 | / | mo | month to month |

17347 Village Green Dr., Suite 102 | Houston | TX | Mortgage Sales | Sub-Leased | 3,300 | $ 8,970 | / | mo | 12/1/2024 |

1626 Lee Trevino, Suite A | El Paso | TX | Mortgage Sales | Leased | 4,200 | $ 7,853 | / | mo | 12/31/2022 |

9737 Great Hills Trail, Suites 150, 200, 220 | Austin | TX | Mortgage Sales | Leased | 19,891 | $ 37,710 | / | mo | 8/31/2024 |

1213 East Alton Gloor Blvd., Suite H | Brownsville | TX | Mortgage Sales | Leased | 2,000 | $ 2,200 | / | mo | 2/28/2022 |

7920 Belt Line Rd., Suite 720 | Dallas | TX | Mortgage Sales | Sub-Leased | 1,714 | $ 2,428 | / | mo | month to month |

5020 Collinwood Ave., Suite 100 | Fort Worth | TX | Mortgage Sales | Leased | 2,687 | $ 5,300 | / | mo | 1/31/2025 |

3000 Joe DiMaggio Blvd., Bldg 12 Suite 42 | Round Rock | TX | Mortgage Sales | Leased | 920 | $ 1,750 | / | mo | 5/15/2021 |

2408 Jacaman Road, Suite F | Laredo | TX | Mortgage Sales | Leased | N/A | $ 900 | / | mo | 6/1/2022 |

1900 Country Club Dr., Suite 150 | Mansfield | TX | Mortgage Sales | Leased | 175 | $ 325 | / | mo | month to month |

3220 Gus Thomasson Rd. | Mesquite | TX | Mortgage Sales | Sub-Leased | 130 | $ 1,000 | / | mo | month to month |

722 Kiowa Dr. West | Lake Kiowa | TX | Mortgage Sales | Leased | 150 | $ 495 | / | mo | month to month |

1785 Preston Rd., Suite 550 | Dallas | TX | Mortgage Sales | Leased | 200 | $ 657 | / | mo | 8/31/2021 |

6860 N. Dallas Pkwy | Plano | TX | Mortgage Sales | Leased | 200 | $ 582 | / | mo | 2/28/2021 |

2102 Jitterbug Ln. | Katy | TX | Mortgage Sales | Leased | 100 | $ 100 | / | mo | month to month |

124 N. Main St. | Mansfield | TX | Mortgage Sales | Sub-Leased | 100 | $ 3,000 | / | mo | month to month |

4411 W. Illinois, Suite B-4 | Midland | TX | Mortgage Sales | Sub-Leased | 100 | $ 1,700 | / | mo | month to month |

590 W. State Street | Pleasant Grove | UT | Mortgage Sales | Leased | 250 | $ 500 | / | mo | month to month |

5965 S. Redwood Rd. | Taylorsville | UT | Mortgage Sales | Leased | 1,000 | $ 1,400 | / | mo | month to month |

6575 S. Redwood Rd. | Taylorsville | UT | Mortgage Sales | Leased | 3,323 | $ 5,491 | / | mo | 12/31/2022 |

126 W. Sego Lily Dr., Suite 260 | Sandy | UT | Mortgage Sales | Leased | 2,794 | $ 5,944 | / | mo | 8/31/2021 |

75 Towne Ridge Parkway, Suite 100 | Sandy | UT | Mortgage Sales | Leased | 6,867 | $ 16,695 | / | mo | 8/31/2023 |

1133 North Main St., Suite 150 | Layton | UT | Mortgage Sales | Sub-Leased | 300 | $ 1,000 | / | mo | month to month |

497 S. Main | Ephraim | UT | Mortgage Sales | Leased | 1,884 | $ 1,600 | / | mo | 4/30/2025 |

6965 S. Union Park, Suites 100, 190, 260, 300, 460, 470, & 480 | Midvale | UT | Mortgage Sales | Leased | 39,649 | $ 82,465 | / | mo | 6/30/2021 |

11240 S. River Heights Dr. | South Jordan | UT | Mortgage Sales | Leased | 3,403 | $ 7,740 | / | mo | 11/30/2024 |

500 East Village Blvd. | Stansbury Park | UT | Mortgage Sales | Leased | 1,950 | $ 3,180 | / | mo | 10/31/2024 |

833 N. 900 W. | Orem | UT | Mortgage Sales | Leased | 2,391 | $ 3,104 | / | mo | 1/31/2023 |

1350 E. 300 S. 3rd Floor | Lehi | UT | Mortgage Sales | Leased | 15,446 | $ 35,140 | / | mo | 12/22/2026 |

2455 E. Parleys Way, Suites 120 & 150 | Salt Lake City | UT | Mortgage Sales | Leased | 5,256 | $ 8,322 | / | mo | 7/31/2030 |

859 W. South Jordan Pkwy, Suite 101 | South Jordan | UT | Mortgage Sales | Leased | 3,376 | $ 5,751 | / | mo | 3/22/2022 |

558 E. Riverside Dr., Suite 204 | St. George | UT | Mortgage Sales | Leased | 1,685 | $ 2,106 | / | mo | 8/31/2023 |

21430 Cedar Dr., Suite 200-202 | Sterling | VA | Mortgage Sales | Leased | 6,850 | $ 12,984 | / | mo | 3/9/2023 |

15640 NE Fourth Plain Blvd., Suite 220/221 | Vancouver | WA | Mortgage Sales | Leased | 360 | $ 425 | / | mo | 9/30/2021 |

2701 Currant St. | Lynden | WA | Mortgage Sales | Leased | 1,500 | $ 50 | / | mo | month to month |

1508 24th Ave., Suite 23 | Kenosha | WI | Mortgage Sales | Leased | 250 | $ 150 | / | mo | month to month |

27903 99th St. | Trevor | WI | Mortgage Sales | Leased | 300 | $ 150 | / | mo | month to month |

219 W. Washington St. | Charlestown | WV | Mortgage Sales | Leased | N/A | $ 1,700 | / | mo | 4/14/2023 |

The Company believes the office facilities it occupies are in good operating condition and adequate for current operations. The Company will enter into additional leases or modify existing leases to meet market demand. Those leases will be month to month where possible. As leases expire, the Company will either renew or find comparable leases or acquire additional office space.

13

Item 2. Properties (Continued)

The following table summarizes the location and acreage of the six Company owned cemeteries, each of which includes one or more mausoleums:

|

|

|

| Net Saleable Acreage | ||

Name of Cemetery | Location | Date Acquired | Developed Acreage (1) | Total Acreage (1) | Acres Sold as Cemetery Spaces (2) | Total Available Acreage (1) |

Memorial Estates, Inc. |

|

|

|

|

| |

Lakeview Cemetery | 1640 East Lakeview Drive | 1973 | 9 | 39 | 7 | 32 |

|

|

|

|

|

|

|

Mountain View Cemetery | 3115 East 7800 South | 1973 | 26 | 54 | 20 | 34 |

|

|

|

|

|

|

|

Redwood Cemetery (3) | 6500 South Redwood Road | 1973 | 28 | 71 | 35 | 36 |

|

|

|

|

|

|

|

Deseret Memorial Inc. |

|

|

|

|

| |

Lake Hills Cemetery | 10055 South State Street | 1991 | 9 | 28 | 6 | 22 |

|

|

|

|

|

|

|

Holladay Memorial Park, Inc. |

|

|

|

|

| |

Holladay Memorial Park (3) | 4900 South Memory Lane | 1991 | 12 | 14 | 7 | 7 |

|

|

|

|

|

|

|

California Memorial Estates, Inc. |

|

|

|

|

| |

Singing Hills Memorial Park (4) | 2800 Dehesa Road | 1995 | 8 | 97 | 6 | 91 |

______________

(1)The acreage represents estimates of acres that are based upon survey reports, title reports, appraisal reports, or the Company’s inspection of the cemeteries. The Company estimates that there are approximately 1,200 spaces per developed acre.

(2)Includes both reserved and occupied spaces.

(3)Includes two granite mausoleums.

(4)Includes an open easement.

14

Item 2. Properties (Continued)

The following table summarizes the location, square footage and the number of viewing rooms and chapels of the eight Company owned mortuaries:

|

| Date | Viewing |

| Square |

Name of Mortuary | Location | Acquired | Room(s) | Chapel(s) | Footage |

Memorial Mortuary, Inc. |

|

|

|

|

|

Memorial Mortuary | 5850 South 900 East |

|

|

|

|

| Murray, Utah | 1973 | 3 | 1 | 20,000 |

|

|

|

|

|

|

Affordable Funerals and | 157 East Riverside Dr., No. 3A | 2016 | 1 | 1 | 2,360 |

| St. George, Utah |

|

|

|

|

|

|

|

|

|

|

Memorial Estates, Inc. |

|

|

|

|

|

Redwood Mortuary (1) | 6500 South Redwood Rd. |

|

|

|

|

| West Jordan, Utah | 1973 | 2 | 1 | 10,000 |

|

|

|

|

|

|

Mountain View Mortuary (1) | 3115 East 7800 South |

|

|

|

|

| Salt Lake City, Utah | 1973 | 2 | 1 | 16,000 |

|

|

|

|

|

|

Lakeview Mortuary (1) | 1640 East Lakeview Dr. |

|

|

|

|

| Bountiful, Utah | 1973 | 0 | 1 | 5,500 |

|

|

|

|

|

|

Lakehills Mortuary (1) | 10055 South State St. |

|

|

|

|

| Sandy, Utah | 1991 | 2 | 1 | 18,000 |

|

|

|

|

|

|

Cottonwood Mortuary, Inc. |

|

|

|

|

|

Cottonwood Mortuary (1) | 4670 South Highland Dr. |

|

|

|

|

| Holladay, Utah | 1991 | 2 | 1 | 14,500 |

|

|

|

|

|

|

SN Probst LLC |

|

|

|

|

|

Heber Valley Funeral Home | 288 North Main St. |

|

|

|

|

| Heber City, Utah | 2019 | 1 | 1 | 5,900 |

__________

(1)These funeral homes also provide burial niches at their respective locations.

Item 3. Legal Proceedings

Settlement Agreement and Mutual Release with Lehman Brothers Holdings Inc.

From 2004 to early 2008, SecurityNational Mortgage Company (“SecurityNational Mortgage”), a wholly owned subsidiary of the Company, originated “limited documentation” or “reduced documentation” loans which were sold to certain affiliates of Lehman Brothers Holdings Inc. (“Lehman Holdings”). Certain of these loans became the subject of disputes between SecurityNational Mortgage and Lehman Holdings and certain Lehman Holdings affiliates. Lehman Holdings filed a Petition for Relief under Chapter 11 of the United States Bankruptcy Code in 2008. In May of 2011, SecurityNational Mortgage filed a complaint in U.S. District Court against certain Lehman Holdings affiliates. In June of 2011, Lehman Holdings filed a complaint in Federal District Court against SecurityNational Mortgage, both of which were later resolved. In 2016, certain other pending loan disputes between SecurityNational Mortgage and Lehman Holdings became the subject of an unsuccessful, non-binding alternate dispute resolution mediation proceeding.

Thereafter, in 2016, Lehman Holdings filed an adversary proceeding complaint against approximately 150 mortgage loan originators, including SecurityNational Mortgage, in the U.S. Bankruptcy Court of the Southern District of New York, which included seeking damages relating to the alleged obligations of the defendants under indemnification provisions of alleged agreements, in amounts to be determined at trial, including interest, attorneys’

15

fees and costs incurred by Lehman Holdings in enforcing the obligations of the defendants. The complaint was later amended with the latest amended complaint filed against SecurityNational Mortgage on December 27, 2016, seeking damages to be determined at trial, including interest, attorneys’ fees and costs. This complaint involved approximately 135 mortgage loans, there being millions of dollars allegedly in dispute. These claims against SecurityNational Mortgage were asserted as a result of Lehman Holdings’ earlier settlements with the Federal National Mortgage Association (“Fannie Mae”) and the Federal Home Loan Corporation (“Freddie Mac”).

In 2018, Lehman Holdings filed a separate adversary proceeding complaint against SecurityNational Mortgage. This adversary proceeding allegedly involved approximately 577 mortgage loans relative to private securitization trusts (“RMBS Loans”) and millions of dollars in damages. Thereafter, Lehman Holdings made a filing that effectively reduced the number of RMBS Loans to 248. This proceeding was in addition to the above-referenced proceeding involving the Fannie Mae and Freddie Mac mortgage loans. As with the above-referenced proceeding, damages were sought including interest, costs, and attorneys’ fees.

SecurityNational Mortgage, as well as other defendants, have been involved in written discovery, and production of documents relative to the cases, and the filing of motions. The deposition phase of the cases was yet to begin, as well as the later expert witness phase. Those phases would require substantial expenditures of legal fees and costs.

On February 1, 2021, SecurityNational Mortgage executed a settlement agreement with Lehman Holdings in relation to these two adversary proceedings wherein all mortgage loan related claims were resolved, thereby ending all liabilities asserted by Lehman Holdings and conclusively ending all proceedings between SecurityNational Mortgage and Lehman Holdings. In accordance with GAAP, the full amount of SecurityNational Mortgage’s settlement payment has been accounted for in the Company’s loan loss reserve as of December 31, 2020.

Item 4. Mine Safety Disclosures

Not applicable.

16

PART II

Item 5. Market for the Registrant’s Common Stock, Related Stockholder Matters, and Issuer Purchases of Equity Securities

The Company’s Class A common stock trades on The Nasdaq Global Select Market under the symbol “SNFCA.” As of March 23, 2021, the closing stock price of the Class A common stock was $9.69 per share. The following were the high and low market closing stock prices for the Class A common stock by quarter as reported by NASDAQ since January 1, 2019:

|

| Price Range (1) | ||

|

| High |

| Low |

Period (Calendar Year) |

|

|

|

|

2019 |

|

|

|

|

First Quarter |

| $5.21 |

| $4.39 |

Second Quarter |

| $5.25 |

| $4.42 |

Third Quarter |

| $5.07 |

| $4.44 |

Fourth Quarter |

| $5.60 |

| $4.47 |

|

|

|

|

|

2020 |

|

|

|

|

First Quarter |

| $6.10 |

| $3.67 |

Second Quarter |

| $7.32 |

| $4.01 |

Third Quarter |

| $6.98 |

| $5.55 |

Fourth Quarter |

| $8.91 |

| $6.42 |

|

|

|

|

|

2021 |

|

|

|

|

First Quarter (through March 23, 2021) |

| $10.54 |

| $8.48 |

_____________

(1)Stock prices have been adjusted retroactively for the effect of annual stock dividends.

The Class C common stock is not registered or traded on a national exchange. See Note 12 of the Notes to Consolidated Financial Statements.

The Company has never paid a cash dividend on its Class A or Class C common stock. The Company currently anticipates that all of its earnings will be retained for use in the operation and expansion of its business and does not intend to pay any cash dividends on its Class A or Class C common stock in the foreseeable future. Any future determination as to cash dividends will depend upon the earnings and financial position of the Company and such other factors as the Board of Directors may deem appropriate. A 5% stock dividend on Class A and Class C common stock has been paid each year from 1990 through 2019 and a 7.5% stock dividend was paid for year 2020.

On September 7, 2018, the Board of Directors of the Company approved a Stock Repurchase Plan that authorized the repurchase of 300,000 shares of the Company's Class A Common Stock in the open market. The Stock Repurchase Plan was amended on December 4, 2020. The amendment authorized the repurchase of a total of 1,000,000 shares of the Company’s Class A Common Stock in the open market. The repurchased shares of Class A common stock will be held as treasury shares to be used as the Company's employer matching contribution to the Employee 401(k) Retirement Savings Plan and for shares held in the Deferred Compensation Plan. The following table shows the Company’s repurchase activity of its common stock during the three months ended December 31, 2020 under its Stock Repurchase Plan.

17

Period | (a) Total Number of Class A Shares Purchased |

| (b) Average Price Paid per Class A Share |

| (c) Total Number of Class A Shares Purchased as Part of Publicly Announced Plan or Program |

| (d) Maximum Number of Class A Shares that May Yet Be Purchased Under the Plan or Program |

10/1/2020-10/31/2020 | 8,630 |

| $ 6.46 |

| - |

| 80,488 |

11/1/2020-11/30/2020 | 9,960 |

| $ 7.55 |

| - |

| 70,528 |

12/1/2020-12/31/2020 | 19,551 |

| $ 8.36 |

| - |

| 750,977 |

|

|

|

|

|

|

|

|

Total | 38,141 |

| $ 7.79 |

| - |

| 750,977 |

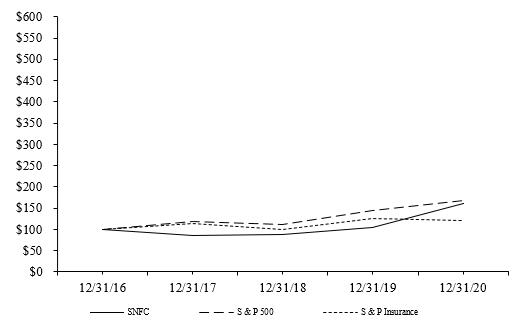

The graph below compares the cumulative total stockholder return of the Company’s Class A common stock with the cumulative total return on the Standard & Poor’s 500 Stock Index and the Standard & Poor’s Insurance Index for the period from December 31, 2016 through December 31, 2020. The graph assumes that the value of the investment in the Company’s Class A common stock and in each of the indexes was $100 at December 31, 2016 and that all dividends were reinvested.

The comparisons in the graph below are based on historical data and are not intended to forecast the possible future performance of the Company’s Class A common stock.

| 12/31/16 | 12/31/17 | 12/31/18 | 12/31/19 | 12/31/20 |

SNFC | 100 | 85 | 88 | 104 | 160 |

S & P 500 | 100 | 119 | 112 | 144 | 168 |

S & P Insurance | 100 | 114 | 99 | 125 | 121 |

The stock performance graph set forth above is required by the Securities and Exchange Commission and shall not be deemed to be incorporated by reference by any general statement incorporating by reference this Form 10-K into any filing under the Securities Act of 1933, as amended, or under the Securities Exchange Act of 1934, as amended, except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed soliciting material or filed under such acts.

18

Item 6. Selected Financial Data

As a smaller reporting company, the Company is not required to provide information typically disclosed under this item.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Overview

The Company’s operations over the last several years generally reflect three trends or events which the Company expects to continue: (i) increased attention to “niche” insurance products, such as the Company’s funeral plan policies and traditional whole life products; (ii) emphasis on cemetery and mortuary business; and (iii) capitalizing on an improving housing market by originating mortgage loans. The Company has adjusted its operations and sales approach to respond to the changing economic circumstances resulting from the COVID-19 pandemic.

Insurance Operations

The following table shows the condensed financial results for the Company’s insurance operations for the years ended December 31, 2020 and 2019. See Note 15 of the Notes to Consolidated Financial Statements.

| Years ended December 31 | ||||

| 2020 |

| 2019 |

| 2020 vs 2019 % Increase (Decrease) |

Revenues from external customers: |

|

|

|

|

|

Insurance premiums | $ 93,021 |

| $ 81,861 |

| 14% |

Net investment income | 54,811 |

| 41,611 |

| 32% |

Gains (losses) on investments and other assets | 2,089 |

| 138 |

| 1414% |

Other than temporary impairments | (371) |

| - |

| (100)% |

Other | 1,492 |

| 2,129 |

| (30%) |

Total | $ 151,042 |

| $ 125,739 |

| 20% |

Intersegment revenue | $ 8,023 |

| $ 4,455 |

| 80% |

Earnings before income taxes | $ 11,923 |

| $ 6,565 |

| 82% |

Intersegment revenues for the Company’s insurance operations were primarily interest income from the warehouse lines provided to its mortgage lending affiliates to fund loans held for sale. Profitability in 2020 increased due to a $13,201,000 increase in net investment income, a $11,160,000 increase in insurance premiums and other considerations, a $3,567,000 increase in intersegment revenue, a $1,950,000 increase in gains on investments and other assets primarily due to a decrease in impairment losses on commercial real estate, a $581,000 decrease in amortization of deferred policy acquisition costs, and a $453,000 decrease in interest expense. This increase was partially offset by a $17,930,000 increase in death, surrenders and other policy benefits ($6,239,000 for COVID-19 related deaths), a $6,449,000 increase in selling, general and administrative expenses, and a $637,000 decrease in other revenues. The Company acquired Kilpatrick Life Insurance Company (“Kilpatrick Life”) in December 2019. See Note 15 to the condensed consolidated financial statements. This acquisition is the primary reason for the increases in insurance premiums, net investment income, death, surrenders and other policy benefits, and selling, general and administrative expenses.

In response to the COVID-19 pandemic, the life insurance sales force has transitioned to virtual and tele sales processes and transitioned approximately 95% of office staff to work remotely.

19

Cemetery and Mortuary Operations

The following table shows the condensed financial results for the Company’s cemetery and mortuary operations for the years ended December 31, 2020 and 2019. See Note 15 of the Notes to Consolidated Financial Statements.

| Years ended December 31 | ||||

| 2020 |

| 2019 |

| 2020 vs 2019 % Increase (Decrease) |

Revenues from external customers: |

|

|

|

|

|

Mortuary revenues | $ 7,854 |

| $ 6,541 |

| 20% |

Cemetery revenues | 12,454 |

| 8,755 |

| 42% |

Net investment income | 808 |

| 580 |

| 39% |

Gains on investments and other assets | (163) |

| 530 |

| (131%) |

Other | 94 |

| 95 |

| (1%) |

Total | $ 21,047 |

| $ 16,501 |

| 28% |

Earnings before income taxes | $ 4,399 |

| $ 2,660 |

| 65% |

Profitability in 2020 has increased due to a $2,133,000 increase in cemetery pre-need sales, a $1,566,000 increase in cemetery at-need sales, a $1,312,000 increase in mortuary at-need sales, and a $228,000 increase in net investment income. This increase was partially offset by a $2,178,000 increase in selling, general and administrative expenses, a $693,000 decrease in gains on investments and other assets primarily attributable to a $621,000 decrease in gains on real estate sales and a $72,000 decrease in the fair value of equity securities classified as restricted assets and cemetery perpetual care trust investments due to the recent downturn of the economy caused by the COVID-19 pandemic, and a $374,000 increase in costs of goods sold.

As a result of the COVID-19 pandemic, the Company has seen a decrease in its average case size as funeral services have been limited. The Company has transitioned its pre-need sales force to virtual selling and has done in home sales as local regulations permit.

Mortgage Operations

The Company’s wholly owned subsidiaries, SecurityNational Mortgage and EverLEND Mortgage Company, are mortgage lenders incorporated under the laws of the State of Utah and approved and regulated by the Federal Housing Administration (FHA), a department of the U.S. Department of Housing and Urban Development (HUD), which originate mortgage loans that qualify for government insurance in the event of default by the borrower, in addition to various conventional mortgage loan products. SecurityNational Mortgage and EverLEND Mortgage originate and refinance mortgage loans on a retail basis. Mortgage loans originated or refinanced by the Company’s mortgage subsidiaries are funded through loan purchase agreements with Security National Life, Kilpatrick Life and unaffiliated financial institutions.

The Company’s mortgage subsidiaries receive fees from borrowers that are involved in mortgage loan originations and refinancings, and secondary fees earned from third party investors that purchase the mortgage loans originated by the mortgage subsidiaries. Mortgage loans originated by the mortgage subsidiaries are generally sold with mortgage servicing rights released to third-party investors or retained by SecurityNational Mortgage. SecurityNational Mortgage currently retains the mortgage servicing rights on approximately 67% of its loan origination volume. These mortgage loans are serviced by either SecurityNational Mortgage or an approved third-party sub-servicer.

For the twelve months ended December 31, 2020 and 2019, SecurityNational Mortgage originated 21,206 loans ($5,472,503,000 total volume) and 10,885 loans ($2,534,399,000 total volume), respectively. For the twelve months ended December 31, 2020 and 2019, EverLEND Mortgage originated 511 loans ($154,511,000 total volume) and 275 loans ($72,440,000 total volume), respectively.

During the COVID-19 pandemic, the demand for mortgage loans has increased. The Company has seen most markets increase their demand for new homes and refinances on existing homes. The Company has transitioned 90% of its processes to a remote work environment.

20

The following table shows the condensed financial results for the Company’s mortgage operations for the years ended 2020 and 2019. See Note 15 of the Notes to Consolidated Financial Statements.

| Years ended December 31 | ||||

| 2020 |

| 2019 |

| 2020 vs 2019 % Increase (Decrease) |

Revenues from external customers: |

|

|

|

|

|

Income from loan originations | $ 67,174 |

| $ 38,394 |

| 75% |

Secondary gains from investors | 231,759 |

| 93,582 |

| 148% |

Net investment income | 711 |

| 829 |

| (14%) |

Gains on investments and other assets | 0 |

| 60 |

| (100%) |

Other | 9,732 |

| 7,956 |

| 22% |

Total | $ 309,376 |

| $ 140,821 |

| 120% |

Earnings before income taxes | $ 55,128 |

| $ 4,718 |

| 1068% |

Included in other revenues is service fee income. The increase in revenues for the Company’s mortgage operations for the twelve months ended December 31, 2020 as compared to December 31, 2019 was due to an increase in mortgage loan originations and refinancings, and subsequent sales of mortgage loans into the secondary market.

Mortgage Loan Loss Settlements

Future loan losses can be extremely difficult to estimate. However, management believes that the Company’s reserve methodology and its current practice of property preservation allow it to estimate potential losses on mortgage loans sold. The estimated liability for indemnification losses is included in other liabilities and accrued expenses and, as of December 31, 2020 and 2019, the balances were $20,584,000 and $4,046,000, respectively.

Mortgage Loan Loss Litigation

For a description of the litigation involving SecurityNational Mortgage and Lehman Brothers Holdings, see Part I, Item 3. Legal Proceedings.

Significant Accounting Policies

The following is a brief summary of the Company’s significant accounting policies and a review of the Company’s most critical accounting estimates. See Note 1 of the Notes to Consolidated Financial Statements.

Insurance Operations

In accordance with generally accepted accounting principles in the United States of America (“GAAP”), premiums and other considerations received for interest sensitive products are reflected as increases in liabilities for policyholder account balances and not as revenues. Revenues reported for these products consist of policy charges for the cost of insurance, administration charges, amortization of policy initiation fees and surrender charges assessed against policyholder account balances. Surrender benefits paid relating to these products are reflected as decreases in liabilities for policyholder account balances and not as expenses.

The Company receives investment income earned from the funds deposited into account balances, a portion of which is passed through to the policyholders in the form of interest credited. Interest credited to policyholder account balances and benefit claims in excess of policyholder account balances are reported as expenses in the consolidated financial statements.

Premiums and other considerations received for traditional life insurance products are recognized as revenues when due. Future policy benefits are recognized as expenses over the life of the policy by means of the provision for future policy benefits.

The costs related to acquiring new business, including certain costs of issuing policies and other variable selling expenses (principally commissions), defined as deferred policy acquisition costs, are capitalized and amortized into expense. For nonparticipating traditional life products, these costs are amortized over the premium paying period of

21

the related policies, in proportion to the ratio of annual premium revenues to total anticipated premium revenues. Such anticipated premium revenues are estimated using the same assumptions used for computing liabilities for future policy benefits and are generally “locked in” at the date the policies are issued. For interest sensitive products, these costs are amortized generally in proportion to expected gross profits from surrender charges and investment, mortality and expense margins. This amortization is adjusted when the Company revises the estimate of current or future gross profits or margins. For example, deferred policy acquisition costs are amortized earlier than originally estimated when policy terminations are higher than originally estimated or when investments backing the related policyholder liabilities are sold at a gain prior to their anticipated maturity.

Death and other policyholder benefits reflect exposure to mortality risk and fluctuate from year to year on the level of claims incurred under insurance retention limits. The profitability of the Company is primarily affected by fluctuations in mortality, other policyholder benefits, expense levels, interest spreads (i.e., the difference between interest earned on investments and interest credited to policyholders) and persistency. The Company has the ability to mitigate adverse experience through sound underwriting, asset and liability duration matching, sound actuarial practices, adjustments to credited interest rates, policyholder dividends and cost of insurance charges.

Cemetery and Mortuary Operations

Pre-need sales of funeral services and caskets, including revenue and costs associated with the sales of pre-need funeral services and caskets, are deferred until the services are performed or the caskets are delivered.

Pre-need sales of cemetery interment rights (cemetery burial property), including revenue and costs associated with the sales of pre-need cemetery interment rights, are recognized in accordance with the retail land sales provisions of GAAP. Under GAAP, recognition of revenue and associated costs from constructed cemetery property must be deferred until a minimum percentage of the sales price has been collected. Revenues related to the pre-need sale of unconstructed cemetery property will be deferred until such property is constructed and meets the criteria of GAAP, described above.

Pre-need sales of cemetery merchandise (primarily markers and vaults), including revenue and costs associated with the sales of pre-need cemetery merchandise, are deferred until the merchandise is delivered, fulfilling the performance obligation.

Pre-need sales of cemetery services (primarily merchandise delivery and installation fees and burial opening and closing fees), including revenue and costs associated with the sales of pre-need cemetery services, are deferred until the services are performed.

Prearranged funeral and pre-need cemetery customer obtaining costs, including costs incurred related to obtaining new pre-need cemetery and prearranged funeral business are accounted for under the guidance of the provisions of GAAP. Obtaining costs, which include only costs that vary with and are primarily related to the acquisition of new pre-need cemetery and prearranged funeral business, are deferred until the merchandise is delivered or services are performed.

Revenues and costs for at-need sales are recorded when a valid contract exists, the services are performed, collection is reasonably assured, and there are no significant company obligations remaining.

Mortgage Operations

Mortgage fee income consists of origination fees, processing fees, interest income and certain other income related to the origination and sale of mortgage loans. The Company has elected to use fair value accounting for all mortgage loans that are held for sale. Accordingly, all revenues and costs are now recognized when the mortgage loan is funded and any changes in fair value are shown as a component of mortgage fee income.

22

The Company, through its mortgage subsidiaries, sells mortgage loans to third-party investors without recourse, unless defects are identified in the representations and warranties made at loan sale. It may be required, however, to repurchase a loan or pay a fee instead of repurchase under certain events, which include the following:

·Failure to deliver original documents specified by the investor,

·The existence of misrepresentation or fraud in the origination of the loan,

·The loan becomes delinquent due to nonpayment during the first several months after it is sold,

·Early pay-off of a loan, as defined by the agreements,

·Excessive time to settle a loan,

·Investor declines purchase, and

·Discontinued product and expired commitment.

Loan purchase commitments generally specify a date 30 to 45 days after delivery upon which the underlying loans should be settled. Depending on market conditions, these commitment settlement dates can be extended at a cost to the Company.

It is the Company’s policy to cure any documentation problems regarding such loans at a minimal cost for up to a six-month time period and to pursue efforts to enforce loan purchase commitments from third-party investors concerning the loans. The Company believes that six months allows adequate time to remedy any documentation issues, to enforce purchase commitments, and to exhaust other alternatives. Remedial methods include the following:

·Research reasons for rejection,

·Provide additional documents,

·Request investor exceptions,

·Appeal rejection decision to purchase committee, and

·Commit to secondary investors.