|

UTAH

|

87-0345941

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

123 West Election Road, Draper, Utah

|

84020

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Registrant’s telephone number, including area code:

|

(801) 264-1060

|

|

Title of each class

|

Trading symbol

|

Name of exchange on which registered

|

|

Class A Common Stock

|

SNFCA

|

The Nasdaq Global Select Market

|

|

Large accelerated filer [ ]

|

Accelerated filer [ ]

|

|

Non-accelerated filer [ ]

|

Smaller reporting company [X]

|

|

Emerging growth company [ ]

|

|

Page

|

||

|

Part I

|

||

|

Item 1.

|

Business

|

3

|

|

Item 2.

|

Properties

|

11

|

|

Item 3.

|

Legal Proceedings

|

13

|

|

Item 4.

|

Mine Safety Disclosures

|

15

|

|

Part II

|

||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

16

|

|

Item 6.

|

Selected Financial Data

|

18

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

18

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

29

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

30

|

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

110

|

|

Item 9A.

|

Controls and Procedures

|

110

|

|

Item 9B.

|

Other Information

|

111

|

|

Part III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

112

|

|

Item 11.

|

Executive Compensation

|

116

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

126

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

128

|

|

Item 14.

|

Principal Accounting Fees and Services

|

129

|

|

Part IV

|

||

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

129

|

|

2019

|

2018

|

2017

|

2016

|

2015

|

||||||||||||||||||||

|

Life Insurance

|

||||||||||||||||||||||||

|

Policy/Cert Count as of December 31

|

669,064

|

(1

|

)

|

531,831

|

533,065

|

531,775

|

(2

|

)

|

509,058

|

|||||||||||||||

|

Insurance in force as of December 31 (omitted 000)

|

$

|

2,877,402

|

(1

|

)

|

$

|

1,838,488

|

$

|

1,759,148

|

$

|

1,672,081

|

(2

|

)

|

$

|

2,862,803

|

||||||||||

|

Premiums Collected (omitted 000)

|

$

|

78,253

|

(1

|

)

|

$

|

74,965

|

$

|

69,565

|

$

|

65,220

|

(2

|

)

|

$

|

55,780

|

||||||||||

|

(1)

|

Includes the acquisition of Kilpatrick

|

|

(2)

|

Includes the acquisition of First Guaranty and the termination of the reinsurance assumed from Servicemembers’ Group Life Insurance (“SGLI”)

|

|

Age Nearest

|

Non‑Medical

|

|||

|

Birthday

|

Limits

|

|||

|

0‑50

|

$

|

100,000

|

||

|

51‑up

|

Medical information

|

|||

|

required (APS or exam)

|

||||

|

2019

|

2018

|

2017

|

2016

|

2015

|

||||||||||||||||||||

|

Annuities Policy/Cert Count as of December 31

|

26,565

|

(1

|

)

|

22,313

|

22,729

|

21,364

|

(2

|

)

|

12,022

|

|||||||||||||||

|

Deposits Collected (omitted 000)

|

$

|

10,400

|

(1

|

)

|

$

|

9,644

|

$

|

10,353

|

$

|

11,019

|

(2

|

)

|

$

|

8,069

|

||||||||||

|

(1)

|

Includes the acquisition of Kilpatrick

|

|

(2)

|

Includes the acquisition of First Guaranty

|

|

2019

|

2018

|

2017

|

2016

|

2015

|

||||||||||||||||||

|

Accident and Health Policy/Cert Count as of December 31

|

15,133

|

(1

|

)

|

3,763

|

4,069

|

4,761

|

5,185

|

|||||||||||||||

|

Premiums Collected (omitted 000)

|

$

|

110

|

(1

|

)

|

$

|

98

|

$

|

104

|

$

|

113

|

$

|

119

|

||||||||||

|

(1)

|

Includes the acquisition of Kilpatrick

|

|

Street

|

City

|

State

|

Function

|

Owned / Leased

|

Approximate

Square

Footage |

Lease

Amount |

Expiration

|

|||||||||||||

|

121 W. Election Rd., Suite 100

|

Draper

|

UT

|

Corporate Headquarters (1)

|

Owned

|

14,145

|

N/A

|

N/A

|

|||||||||||||

|

5300 S. 360 W.

|

Salt Lake City

|

UT

|

Corporate Headquarters (1)

|

Owned

|

36,000

|

N/A

|

N/A

|

|||||||||||||

|

5201 S. Green St.

|

Salt Lake City

|

UT

|

Mortgage and Insurance Operations

|

Owned

|

28,448

|

N/A

|

N/A

|

|||||||||||||

|

1044 River Oaks Dr.

|

Flowood

|

MS

|

Insurance Operations

|

Owned

|

5,522

|

N/A

|

N/A

|

|||||||||||||

|

5239 Greenpine Dr.

|

Murray

|

UT

|

Funeral Service Operations

|

Owned

|

1,642

|

N/A

|

N/A

|

|||||||||||||

|

1818 Marshall St.

|

Shreveport

|

LA

|

Insurance Operations

|

Owned

|

12,274

|

N/A

|

N/A

|

|||||||||||||

|

812 Sheppard St.

|

Minden

|

LA

|

Insurance Sales

|

Owned

|

1,560

|

N/A

|

N/A

|

|||||||||||||

|

909 Foisy Ave.

|

Alexandria

|

LA

|

Insurance Sales

|

Owned

|

8,059

|

N/A

|

N/A

|

|||||||||||||

|

1550 N. Third St.

|

Jena

|

LA

|

Insurance Sales

|

Owned

|

1,737

|

N/A

|

N/A

|

|||||||||||||

|

4455 South 700 East

|

Salt Lake City

|

UT

|

Insurance Operations

|

Leased

|

16,134

|

$

|

22,520

|

/

|

mo

|

6/30/2021

|

||||||||||

|

1 Sanctuary Blvd. Suite 302A

|

Mandeville

|

LA

|

Insurance Sales

|

Leased

|

867

|

$

|

1,382

|

/

|

mo

|

6/30/2020

|

||||||||||

|

79 E. Main Street

|

Midway

|

UT

|

Funeral Service Sales

|

Leased

|

4,476

|

$

|

3,460

|

/

|

mo

|

10/31/2022

|

||||||||||

|

200 Market Way

|

Rainbow City

|

AL

|

Fast Funding Operations

|

Leased

|

12,850

|

$

|

10,490

|

/

|

mo

|

12/31/2025

|

||||||||||

|

6000 Pelham Rd.

|

Greenville

|

SC

|

Fast Funding Operations

|

Leased

|

4,483

|

$

|

4,109

|

/

|

mo

|

8/31/2022

|

||||||||||

|

4007 Seaboard Court, Suite 1

|

Portsmouth

|

VA

|

Fast Funding Operations

|

Leased

|

N/A

|

$

|

3,000

|

/

|

mo

|

5/31/2020

|

||||||||||

|

1819 S. Dobson Rd., Suite 202/203

|

Mesa

|

AZ

|

Mortgage Sales

|

Leased

|

2,397

|

$

|

2,447

|

/

|

mo

|

7/31/2021

|

||||||||||

|

17015 N. Scottsdale Rd., Suite 125

|

Scottsdale

|

AZ

|

Mortgage Sales

|

Leased

|

6,070

|

$

|

13,415

|

/

|

mo

|

4/30/2020

|

||||||||||

|

1930 S Alma School Rd., Suite B-201

|

Mesa

|

AZ

|

Mortgage Sales

|

Leased

|

1,762

|

$

|

1,909

|

/

|

mo

|

9/14/2020

|

||||||||||

|

4725 N. 19th Ave.

|

Phoenix

|

AZ

|

Mortgage Sales

|

Leased

|

600

|

$

|

250

|

/

|

mo

|

month to month

|

||||||||||

|

77 E. Weldon Ave., Suite 220

|

Phoenix

|

AZ

|

Mortgage Sales

|

Leased

|

1,500

|

$

|

2,000

|

/

|

mo

|

month to month

|

||||||||||

|

5100 N. 99th Ave., Suite 101/103

|

Phoenix

|

AZ

|

Mortgage Sales

|

Leased

|

2,540

|

$

|

3,175

|

/

|

mo

|

month to month

|

||||||||||

|

2828 N. Central Ave., Suite 1006/1018

|

Phoenix

|

AZ

|

Mortgage Sales

|

Leased

|

245

|

$

|

2,075

|

/

|

mo

|

month to month

|

||||||||||

|

2999 Douglas Blvd.

|

Roseville

|

CA

|

Mortgage Sales

|

Leased

|

1,515

|

$

|

3,485

|

/

|

mo

|

6/30/2020

|

||||||||||

|

1855 Gladys Ave., Suite 2

|

Signal Hill

|

CA

|

Mortgage Sales

|

Leased

|

200

|

$

|

100

|

/

|

mo

|

month to month

|

||||||||||

|

22775 Pine Lake Dr.

|

Colfax

|

CA

|

Mortgage Sales

|

Leased

|

200

|

$

|

20

|

/

|

mo

|

month to month

|

||||||||||

|

40977 Oak Dr.

|

Forest Falls

|

CA

|

Mortgage Sales

|

Leased

|

250

|

$

|

-

|

/

|

mo

|

month to month

|

||||||||||

|

5475 Tech Center Dr., Suite 100

|

Colorado Springs

|

CO

|

Mortgage Sales

|

Leased

|

3,424

|

$

|

3,852

|

/

|

mo

|

7/31/2020

|

||||||||||

|

8480 E. Orchard Rd., Suite 4200

|

Greenwood Village

|

CO

|

Mortgage Sales

|

Leased

|

4,631

|

$

|

9,841

|

/

|

mo

|

5/31/2021

|

||||||||||

|

1120 W. 122nd Ave., Suite 104

|

Denver

|

CO

|

Mortgage Sales

|

Leased

|

2,088

|

$

|

3,654

|

/

|

mo

|

10/31/2021

|

||||||||||

|

27 Main St., Suite C-104B

|

Edwards

|

CO

|

Mortgage Sales

|

Leased

|

680

|

$

|

1,600

|

/

|

mo

|

month to month

|

||||||||||

|

1145 Town Park Ave., Suite 2215

|

Lake Mary

|

FL

|

Mortgage Sales

|

Leased

|

9,390

|

$

|

19,829

|

/

|

mo

|

2/29/2020

|

||||||||||

|

8191 College Parkway, Suite 201

|

Ft Myers

|

FL

|

Mortgage Sales

|

Leased

|

4,676

|

$

|

3,917

|

/

|

mo

|

8/21/2021

|

||||||||||

|

1545 S. Belcher Rd., Suite B

|

Clearwater

|

FL

|

Mortgage Sales

|

Leased

|

N/A

|

$

|

3,073

|

/

|

mo

|

month to month

|

||||||||||

|

3689 Tampa Rd., Suite 324

|

Oldsmar

|

FL

|

Mortgage Sales

|

Leased

|

2,553

|

$

|

2,708

|

/

|

mo

|

2/28/2020

|

||||||||||

|

113th St. N. and 82nd Ave. N.

|

Seminole

|

FL

|

Mortgage Sales

|

Leased

|

N/A

|

$

|

2,100

|

/

|

mo

|

8/30/2020

|

||||||||||

|

136 Parliament Loop

|

Lake Mary

|

FL

|

Mortgage Sales

|

Leased

|

1,527

|

$

|

3,100

|

/

|

mo

|

11/30/2022

|

||||||||||

|

4370 Kukui Grove St., Suite 201

|

Lihue

|

HI

|

Mortgage Sales

|

Leased

|

864

|

$

|

1,331

|

/

|

mo

|

2/28/2020

|

||||||||||

|

116 N. 3rd St., Suite 12

|

Mccall

|

ID

|

Mortgage Sales

|

Leased

|

480

|

$

|

400

|

/

|

mo

|

month to month

|

||||||||||

|

7225-27 West Madison St.

|

Forest Park

|

IL

|

Mortgage Sales

|

Leased

|

1,800

|

$

|

2,200

|

/

|

mo

|

6/30/2020

|

||||||||||

|

9963 Crosspoint Blvd Suites 101/102

|

Indianapolis

|

IN

|

Mortgage Sales

|

Leased

|

N/A

|

$

|

1,350

|

/

|

mo

|

month to month

|

||||||||||

|

568 Greenluster Dr.

|

Covington

|

LA

|

Mortgage Sales

|

Leased

|

150

|

$

|

750

|

/

|

mo

|

month to month

|

||||||||||

|

4987 Fall Creek Rd. Suite 1

|

Branson

|

MO

|

Mortgage Sales

|

Leased

|

700

|

$

|

1,000

|

/

|

mo

|

month to month

|

||||||||||

|

7930 West Kenton Circle

|

Huntersville

|

NC

|

Mortgage Sales

|

Sub-Leased

|

951

|

$

|

1,918

|

/

|

mo

|

2/29/2020

|

||||||||||

|

801 Cascade Pointe Lane, Suite 101

|

Raleigh

|

NC

|

Mortgage Sales

|

Sub-Leased

|

2,000

|

$

|

2,961

|

/

|

mo

|

4/30/2020

|

||||||||||

|

1980 Festival Plaza Dr., Suite 850

|

Las Vegas

|

NV

|

Mortgage Sales

|

Leased

|

12,866

|

$

|

43,615

|

/

|

mo

|

5/31/2021

|

||||||||||

|

2370 Corporate Circle, Suite 200/270

|

Henderson

|

NV

|

Mortgage Sales

|

Leased

|

10,261

|

$

|

18,297

|

/

|

mo

|

4/30/2020

|

||||||||||

|

8720 Orion Place, Suite 160

|

Colombus

|

OH

|

Mortgage Sales

|

Leased

|

1,973

|

$

|

1,726

|

/

|

mo

|

6/30/2023

|

||||||||||

|

10610 SE Washington

|

Portland

|

OR

|

Mortgage Sales

|

Leased

|

506

|

$

|

600

|

/

|

mo

|

month to month

|

||||||||||

|

3311 NE MLK Jr Blvd., Suite 203

|

Portland

|

OR

|

Mortgage Sales

|

Leased

|

1,400

|

$

|

875

|

/

|

mo

|

month to month

|

||||||||||

|

10365 SE Sunnyside Rd., Suite 310

|

Clackamus

|

OR

|

Mortgage Sales

|

Leased

|

1,288

|

$

|

2,420

|

/

|

mo

|

11/30/2022

|

||||||||||

|

213 E. Butler, Suite E-1

|

Mauldin

|

SC

|

Mortgage Sales

|

Leased

|

250

|

$

|

-

|

/

|

mo

|

month to month

|

||||||||||

|

6263 Poplar Ave., Suite 900

|

Memphis

|

TN

|

Mortgage Sales

|

Leased

|

1,680

|

$

|

2,476

|

/

|

mo

|

3/31/2020

|

||||||||||

|

6640 Carothers Parkway, Suite 150

|

Franklin

|

TN

|

Mortgage Sales

|

Leased

|

3,229

|

$

|

8,199

|

/

|

mo

|

3/31/2020

|

||||||||||

|

208 Sunset Dr., Suites 403/404

|

Knoxville

|

TN

|

Mortgage Sales

|

Leased

|

2,476

|

$

|

3,817

|

/

|

mo

|

10/31/2022

|

||||||||||

|

6640 Carothers Parkway, Suite 110

|

Franklin

|

TN

|

Mortgage Sales

|

Leased

|

2,102

|

$

|

4,668

|

/

|

mo

|

4/30/2020

|

||||||||||

|

602 S Main St., Suite 200

|

Weatherford

|

TX

|

Mortgage Sales

|

Leased

|

1,000

|

$

|

1,865

|

/

|

mo

|

3/1/2020

|

||||||||||

|

52 Sugar Creek Center, Suite 150

|

Sugarland

|

TX

|

Mortgage Sales

|

Leased

|

1,788

|

$

|

3,994

|

/

|

mo

|

3/31/2020

|

||||||||||

|

1 Chisholm Trail Rd., Suite 210

|

Round Rock

|

TX

|

Mortgage Sales

|

Leased

|

3,402

|

$

|

4,961

|

/

|

mo

|

12/31/2020

|

||||||||||

|

3027 Marina Bay Dr., Suite 200

|

League City

|

TX

|

Mortgage Sales

|

Leased

|

1,225

|

$

|

2,118

|

/

|

mo

|

3/31/2020

|

||||||||||

|

11550 Fuqua, Suite 200

|

Houston

|

TX

|

Mortgage Sales

|

Leased

|

1,865

|

$

|

3,341

|

/

|

mo

|

4/30/2020

|

||||||||||

|

24668 Kingsland Blvd.

|

Katy

|

TX

|

Mortgage Sales

|

Leased

|

144

|

$

|

500

|

/

|

mo

|

month to month

|

||||||||||

|

1848 Norwood Plaza, Suite 213

|

Hurst

|

TX

|

Mortgage Sales

|

Leased

|

1,596

|

$

|

1,031

|

/

|

mo

|

month to month

|

||||||||||

|

17347 Village Green Dr., Suite 102

|

Houston

|

TX

|

Mortgage Sales

|

Leased

|

4,395

|

$

|

8,970

|

/

|

mo

|

12/1/2024

|

||||||||||

|

4100 Alpha Rd., Suite 650

|

Farmers Branch

|

TX

|

Mortgage Sales

|

Leased

|

2,935

|

$

|

4,158

|

/

|

mo

|

3/31/2020

|

||||||||||

|

1626 Lee Trevino, Suite A

|

El Paso

|

TX

|

Mortgage Sales

|

Leased

|

4,200

|

$

|

7,799

|

/

|

mo

|

12/31/2022

|

||||||||||

|

9737 Great Hills Trail, Suites 150, 200, 220

|

Austin

|

TX

|

Mortgage Sales

|

Sub-Leased

|

19,891

|

$

|

36,052

|

/

|

mo

|

8/31/2024

|

||||||||||

|

1213 East Alton Gloor Blvd., Suite H

|

Brownsville

|

TX

|

Mortgage Sales

|

Leased

|

2,000

|

$

|

2,200

|

/

|

mo

|

3/31/2020

|

||||||||||

|

7920 Belt Line Rd., Suite 720

|

Dallas

|

TX

|

Mortgage Sales

|

Leased

|

1,714

|

$

|

2,143

|

/

|

mo

|

month to month

|

||||||||||

|

5020 Collinwood Ave., Suite 100

|

Fort Worth

|

TX

|

Mortgage Sales

|

Leased

|

2,687

|

$

|

5,150

|

/

|

mo

|

1/31/2021

|

||||||||||

|

240 North Adams St., Suite 4

|

Eagle Pass

|

TX

|

Mortgage Sales

|

Leased

|

275

|

$

|

1,015

|

/

|

mo

|

12/31/2020

|

||||||||||

|

3000 Joe DiMaggio Blvd., Bldg 12 Suite 42

|

Round Rock

|

TX

|

Mortgage Sales

|

Leased

|

920

|

$

|

1,750

|

/

|

mo

|

5/15/2021

|

||||||||||

|

2408 Jacaman Road, Suite F

|

Laredo

|

TX

|

Mortgage Sales

|

Leased

|

N/A

|

$

|

900

|

/

|

mo

|

6/1/2020

|

||||||||||

|

1900 Country Club Dr., Suite 150

|

Mansfield

|

TX

|

Mortgage Sales

|

Leased

|

175

|

$

|

325

|

/

|

mo

|

month to month

|

||||||||||

|

3220 Gus Thomasson Rd.

|

Mesquite

|

TX

|

Mortgage Sales

|

Leased

|

130

|

$

|

1,000

|

/

|

mo

|

month to month

|

||||||||||

|

722 Kiowa Dr. West

|

Lake Kiowa

|

TX

|

Mortgage Sales

|

Leased

|

150

|

$

|

-

|

/

|

mo

|

month to month

|

||||||||||

|

1224 S. River Rd., Suites E3/B4

|

Saint George

|

UT

|

Mortgage Sales

|

Leased

|

1,900

|

$

|

1,869

|

/

|

mo

|

5/31/2020

|

||||||||||

|

1111 Brickyard Rd., Suite 107

|

Salt Lake City

|

UT

|

Mortgage Sales

|

Leased

|

4,857

|

$

|

4,408

|

/

|

mo

|

1/31/2020

|

||||||||||

|

170 S Interstate Plaza, Suite 230

|

Lehi

|

UT

|

Mortgage Sales

|

Leased

|

1,927

|

$

|

3,453

|

/

|

mo

|

7/31/2021

|

||||||||||

|

590 W. State Street

|

Pleasant Grove

|

UT

|

Mortgage Sales

|

Leased

|

250

|

$

|

500

|

/

|

mo

|

month to month

|

||||||||||

|

5965 S. Redwood Rd.

|

Taylorsville

|

UT

|

Mortgage Sales

|

Leased

|

2,000

|

$

|

600

|

/

|

mo

|

month to month

|

||||||||||

|

6575 S. Redwood Rd.

|

Taylorsville

|

UT

|

Mortgage Sales

|

Leased

|

3,323

|

$

|

5,221

|

/

|

mo

|

12/31/2022

|

||||||||||

|

126 W. Sego Lily Dr., Suite 260

|

Sandy

|

UT

|

Mortgage Sales

|

Leased

|

2,794

|

$

|

5,672

|

/

|

mo

|

8/31/2020

|

||||||||||

|

75 Towne Ridge Parkway, Suite 100

|

Sandy

|

UT

|

Mortgage Sales

|

Leased

|

6,867

|

$

|

15,737

|

/

|

mo

|

8/31/2023

|

||||||||||

|

1145 S. 800 E.

|

Orem

|

UT

|

Mortgage Sales

|

Leased

|

2,581

|

$

|

4,431

|

/

|

mo

|

1/31/2020

|

||||||||||

|

1133 North Main St., Suite 150

|

Layton

|

UT

|

Mortgage Sales

|

Sub-Leased

|

300

|

$

|

1,000

|

/

|

mo

|

month to month

|

||||||||||

|

497 S. Main

|

Ephraim

|

UT

|

Mortgage Sales

|

Leased

|

953

|

$

|

765

|

/

|

mo

|

9/30/2021

|

||||||||||

|

6965 S. Union Park, Suites 100, 190, 260, 300, 460, 470, & 480

|

Midvale

|

UT

|

Mortgage Sales

|

Leased

|

39,649

|

$

|

77,726

|

/

|

mo

|

6/30/2021

|

||||||||||

|

11240 S. River Heights Dr.

|

South Jordan

|

UT

|

Mortgage Sales

|

Leased

|

3,403

|

$

|

7,515

|

/

|

mo

|

11/30/2024

|

||||||||||

|

500 East Village Blvd.

|

Stansbury Park

|

UT

|

Mortgage Sales

|

Leased

|

1,950

|

$

|

3,088

|

/

|

mo

|

10/31/2024

|

||||||||||

|

1350 E. 300 S. 3rd Floor

|

Lehi

|

UT

|

Mortgage Sales

|

Leased

|

15,446

|

$

|

34,110

|

/

|

mo

|

12/22/2026

|

||||||||||

|

21430 Cedar Dr., Suite 200-202

|

Sterling

|

VA

|

Mortgage Sales

|

Leased

|

4,000

|

$

|

7,700

|

/

|

mo

|

10/31/2022

|

||||||||||

|

15640 NE Fourth Plain Blvd., Suite 220/221

|

Vancouver

|

WA

|

Mortgage Sales

|

Leased

|

360

|

$

|

425

|

/

|

mo

|

9/30/2020

|

||||||||||

|

5816 Ledgemont Ct.

|

Fitchburg

|

WI

|

Mortgage Sales

|

Leased

|

200

|

$

|

250

|

/

|

mo

|

month to month

|

||||||||||

|

1508 24th Ave., Suite 23

|

Kenosha

|

WI

|

Mortgage Sales

|

Leased

|

250

|

$

|

150

|

/

|

mo

|

month to month

|

||||||||||

|

27903 99th St.

|

Trevor

|

WI

|

Mortgage Sales

|

Leased

|

300

|

$

|

150

|

/

|

mo

|

month to month

|

||||||||||

|

(1)

|

The Company temporarily relocated its Corporate Headquarters from 5300 South 360 West, Salt Lake City, Utah to 121 W. Election Rd., Draper, Utah. The building at 5300 South 360 West was demolished in March

2020 as part of the second phase of the Center53 corporate campus development. The existing land will be used as the site to construct a building, which the Company anticipates occupying a part of the building in June 2021 as its new

Corporate Headquarters.

|

|

Net Saleable Acreage

|

||||||

|

Name of Cemetery

|

Location

|

Date Acquired

|

Developed

Acreage (1)

|

Total Acreage (1)

|

Acres Sold

as Cemetery

Spaces (2)

|

Total Available

Acreage (1)

|

|

Memorial Estates, Inc.

|

||||||

|

Lakeview Cemetery

|

1640 East Lakeview Drive

Bountiful, Utah |

1973

|

9

|

39

|

7

|

32

|

|

Mountain View Cemetery

|

3115 East 7800 South

Salt Lake City, Utah |

1973

|

26

|

54

|

20

|

34

|

|

Redwood Cemetery (3)

|

6500 South Redwood Road

West Jordan, Utah |

1973

|

28

|

71

|

35

|

36

|

|

Deseret Memorial Inc.

Lake Hills Cemetery (3)(6) |

||||||

|

Lake Hills Cemetery

|

10055 South State Street

Sandy, Utah |

1991

|

9

|

28

|

6

|

22

|

|

Holladay Memorial Park, Inc.

|

||||||

|

Holladay Memorial Park (3)

|

4900 South Memory Lane

Holladay, Utah |

1991

|

12

|

14

|

7

|

7

|

|

California Memorial Estates, Inc.

|

||||||

|

Singing Hills Memorial Park (4)

|

2800 Dehesa Road

El Cajon, California |

1995

|

8

|

97

|

6

|

91

|

|

The acreage represents estimates of acres that are based upon survey reports, title reports, appraisal reports, or the Company’s inspection of the cemeteries. The Company estimates that there are approximately

1,200 spaces per developed acre.

|

|

|

(2)

|

Includes both reserved and occupied spaces.

|

|

(3)

|

Includes two granite mausoleums.

|

|

Includes an open easement.

|

|

Date

|

Viewing

|

Square

|

|||

|

Name of Mortuary

|

Location

|

Acquired

|

Room(s)

|

Chapel(s)

|

Footage

|

|

Memorial Mortuary, Inc.

|

|||||

|

Memorial Mortuary

|

5850 South 900 East

|

||||

|

Murray, Utah

|

1973

|

3

|

1

|

20,000

|

|

|

Affordable Funerals and Cremations, St. George

|

157 East Riverside Dr., No. 3A

|

2016

|

1

|

1

|

2,360

|

|

St. George, Utah

|

|||||

|

Memorial Estates, Inc.

|

|||||

|

Redwood Mortuary (1)

|

6500 South Redwood Rd.

|

||||

|

West Jordan, Utah

|

1973

|

2

|

1

|

10,000

|

|

|

Mountain View Mortuary (1)

|

3115 East 7800 South

|

||||

|

Salt Lake City, Utah

|

1973

|

2

|

1

|

16,000

|

|

|

Lakeview Mortuary (1)

|

1640 East Lakeview Dr.

|

||||

|

Bountiful, Utah

|

1973

|

0

|

1

|

5,500

|

|

|

Lakehills Mortuary (1)

|

10055 South State St.

|

||||

|

Sandy, Utah

|

1991

|

2

|

1

|

18,000

|

|

|

Cottonwood Mortuary, Inc.

|

|||||

|

Cottonwood Mortuary (1)

|

4670 South Highland Dr.

|

||||

|

Holladay, Utah

|

1991

|

2

|

1

|

14,500

|

|

|

SN Probst LLC

|

|||||

|

Heber Valley Funeral Home

|

288 North Main St.

|

||||

|

Heber City, Utah

|

2019

|

1

|

1

|

5,900

|

|

(1)

|

These funeral homes also provide burial niches at their respective locations.

|

|

Price Range (1)

|

||||||||

|

High

|

Low

|

|||||||

|

Period (Calendar Year)

|

||||||||

|

2018

|

||||||||

|

First Quarter

|

$

|

4.90

|

$

|

3.92

|

||||

|

Second Quarter

|

$

|

4.99

|

$

|

4.67

|

||||

|

Third Quarter

|

$

|

5.03

|

$

|

4.58

|

||||

|

Fourth Quarter

|

$

|

5.35

|

$

|

4.68

|

||||

|

2019

|

||||||||

|

First Quarter

|

$

|

5.34

|

$

|

4.50

|

||||

|

Second Quarter

|

$

|

5.38

|

$

|

4.53

|

||||

|

Third Quarter

|

$

|

5.20

|

$

|

4.55

|

||||

|

Fourth Quarter

|

$

|

5.74

|

$

|

4.58

|

||||

|

2020

|

||||||||

|

First Quarter (through March 27, 2020)

|

$

|

6.25

|

$

|

3.77

|

||||

|

(1)

|

Stock prices have been adjusted retroactively for the effect of annual 5% stock dividends.

|

|

Period

|

(a) Total

Number of

Class A

Shares

Purchased

|

(b) Average

Price Paid

per Class

A Share

|

(c) Total

Number of

Class A Shares Purchased as Part of Publicly Announced Plan or Program |

(d) Maximum

Number of Class A Shares that May Yet Be Purchased Under the Plan or Program |

||||||||||||

|

10/1/2019-10/31/2019

|

8,790

|

$

|

5.01

|

-

|

182,007

|

|||||||||||

|

11/1/2019-11/30/2019

|

10,000

|

$

|

5.36

|

-

|

172,007

|

|||||||||||

|

12/1/2019-12/31/2019

|

10,000

|

$

|

5.73

|

-

|

162,007

|

|||||||||||

|

Total

|

28,790

|

$

|

5.41

|

-

|

162,007

|

|||||||||||

|

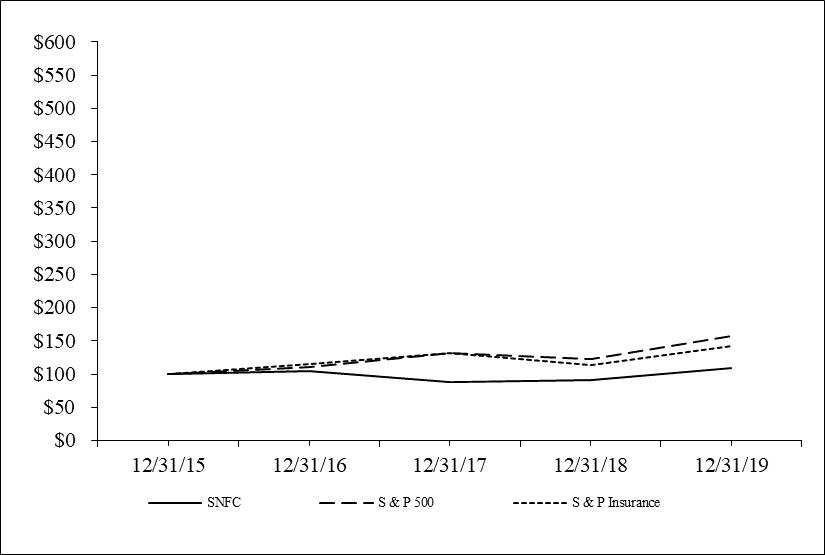

12/31/15

|

12/31/16

|

12/31/17

|

12/31/18

|

12/31/19

|

|

|

SNFC

|

100

|

104

|

88

|

91

|

109

|

|

S & P 500

|

100

|

110

|

131

|

123

|

158

|

|

S & P Insurance

|

100

|

115

|

131

|

113

|

143

|

|

Years ended December 31

(in thousands of dollars) |

||||||||||||

|

2019

|

2018

|

2019 vs 2018 % Increase (Decrease)

|

||||||||||

|

Revenues from external customers:

|

||||||||||||

|

Insurance premiums

|

$

|

81,861

|

$

|

75,929

|

8

|

%

|

||||||

|

Net investment income

|

41,611

|

38,720

|

7

|

%

|

||||||||

|

Gains (losses) on investments and other assets

|

138

|

21,396

|

(99

|

%)

|

||||||||

|

Other

|

2,129

|

1,637

|

30

|

%

|

||||||||

|

Total

|

$

|

125,739

|

$

|

137,682

|

(9

|

%)

|

||||||

|

Intersegment revenue

|

$

|

4,455

|

$

|

3,973

|

12

|

%

|

||||||

|

Earnings before income taxes

|

$

|

6,565

|

$

|

30,124

|

(78

|

%)

|

||||||

|

Years ended December 31

(in thousands of dollars) |

||||||||||||

|

2019

|

2018

|

2019 vs 2018 % Increase (Decrease)

|

||||||||||

|

Revenues from external customers:

|

||||||||||||

|

Mortuary revenues

|

$

|

6,541

|

$

|

5,514

|

19

|

%

|

||||||

|

Cemetery revenues

|

8,755

|

8,213

|

7

|

%

|

||||||||

|

Net investment income

|

580

|

283

|

105

|

%

|

||||||||

|

Gains on investments and other assets

|

530

|

2,301

|

(77

|

%)

|

||||||||

|

Other

|

95

|

129

|

(26

|

%)

|

||||||||

|

Total

|

$

|

16,501

|

$

|

16,440

|

0

|

%

|

||||||

|

Earnings before income taxes

|

$

|

2,660

|

$

|

3,916

|

(32

|

%)

|

||||||

|

Years ended December 31

(in thousands of dollars) |

||||||||||||

|

2019

|

2018

|

2019 vs 2018 % Increase (Decrease)

|

||||||||||

|

Revenues from external customers:

|

||||||||||||

|

Income from loan originations

|

$

|

38,394

|

$

|

35,769

|

7

|

%

|

||||||

|

Secondary gains from investors

|

93,582

|

80,417

|

16

|

%

|

||||||||

|

Net investment income

|

829

|

910

|

(9

|

%)

|

||||||||

|

Gains on investments and other assets

|

60

|

243

|

(75

|

%)

|

||||||||

|

Other

|

7,956

|

8,157

|

(2

|

%)

|

||||||||

|

Total

|

$

|

140,821

|

$

|

125,496

|

12

|

%

|

||||||

|

Earnings before income taxes

|

$

|

4,718

|

$

|

(7,860

|

)

|

160

|

%

|

|||||

|

•

|

Failure to deliver original documents specified by the investor,

|

|

•

|

The existence of misrepresentation or fraud in the origination of the loan,

|

|

•

|

The loan becomes delinquent due to nonpayment during the first several months after it is sold,

|

|

•

|

Early pay-off of a loan, as defined by the agreements,

|

|

•

|

Excessive time to settle a loan,

|

|

•

|

Investor declines purchase, and

|

|

•

|

Discontinued product and expired commitment.

|

|

•

|

Research reasons for rejection,

|

|

•

|

Provide additional documents,

|

|

•

|

Request investor exceptions,

|

|

•

|

Appeal rejection decision to purchase committee, and

|

|

•

|

Commit to secondary investors.

|

|

•

|

For loans that are committed, the Company uses the commitment price.

|

|

•

|

For loans that are non-committed that have an active market, the Company uses the market price.

|

|

•

|

For loans that are non-committed where there is no market but there is a similar product, the Company uses the market value for the similar product.

|

|

•

|

For loans that are non-committed where no active market exists, the Company determines that the unpaid principal balance best approximates the market value, after considering the fair value of the underlying

real estate collateral, estimated future cash flows, and loan interest rate.

|

|

-200 bps

|

-100 bps

|

+100 bps | +200 bps | |||||||||||||

|

Change in Fair Value (in thousands)

|

$

|

52,282

|

$

|

23,017

|

$

|

(14,014

|

)

|

$

|

4,386

|

|||||||

|

Less than

1 year |

1-3 years

|

4-5 years

|

over

5 years |

Total

|

||||||||||||||||

|

Bank and other loans payable

|

192,985,602

|

5,408,387

|

2,466,203

|

16,712,420

|

217,572,612

|

|||||||||||||||

|

Non-cancelable operating leases

|

4,241,547

|

4,712,587

|

2,445,058

|

2,919,074

|

14,318,266

|

|||||||||||||||

|

Future policy benefits (1)

|

8,630,570

|

36,211,003

|

50,924,810

|

718,220,779

|

813,987,162

|

|||||||||||||||

|

$

|

205,857,719

|

$

|

46,331,977

|

$

|

55,836,071

|

$

|

737,852,273

|

$

|

1,045,878,040

|

|||||||||||

|

(1)

|

Amounts represent the present value of future policy benefits, net of estimated future premiums.

|

|

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

|

||

|

Page No.

|

||

|

Financial Statements:

|

||

|

Report of Independent Registered Public Accounting Firm

|

31

|

|

|

Consolidated Balance Sheets, December 31, 2019 and 2018

|

32

|

|

|

Consolidated Statements of Earnings for the Years Ended December 31, 2019 and 2018

|

34

|

|

|

Consolidated Statements of Comprehensive Income for the Years Ended December 31, 2019 and 2018

|

35

|

|

|

Consolidated Statements of Stockholders’ Equity for the Years Ended December 31, 2019 and 2018

|

36

|

|

|

Consolidated Statements of Cash Flows for the Years Ended December 31, 2019 and 2018

|

37

|

|

|

Notes to Consolidated Financial Statements

|

39

|

|

March 30, 2020

|

December 31

|

||||||||

|

Assets

|

2019

|

2018

|

||||||

|

Investments:

|

||||||||

|

Fixed maturity securities, available for sale, at estimated fair value

|

$

|

355,977,820

|

$

|

-

|

||||

|

Fixed maturity securities, held to maturity, at amortized cost

|

-

|

232,078,723

|

||||||

|

Equity securities, available for sale, at estimated fair value

|

7,271,165

|

5,558,611

|

||||||

|

Mortgage loans held for investment (net of allowances for loan losses of $1,453,037 and $1,347,972 for 2019 and 2018)

|

236,694,546

|

186,465,069

|

||||||

|

Real estate held for investment (net of accumulated depreciation of $12,788,739 and $16,739,578 for 2019 and 2018)

|

102,756,946

|

121,558,222

|

||||||

|

Real estate held for sale

|

14,097,627

|

-

|

||||||

|

Other investments and policy loans (net of allowances for doubtful accounts of $1,448,026 and $1,092,528 for 2019 and 2018)

|

60,245,269

|

46,617,655

|

||||||

|

Accrued investment income

|

4,833,232

|

3,566,146

|

||||||

|

Total investments

|

781,876,605

|

595,844,426

|

||||||

|

Cash and cash equivalents

|

127,754,719

|

142,199,942

|

||||||

|

Loans held for sale at estimated fair value

|

213,457,632

|

136,210,853

|

||||||

|

Receivables (net of allowances for doubtful accounts of $1,724,156 and $1,519,842 for 2019 and 2018)

|

9,236,330

|

8,935,343

|

||||||

|

Restricted assets (including $2,985,347 and $744,673 for 2019 and 2018 at estimated fair value)

|

13,935,317

|

10,981,562

|

||||||

|

Cemetery perpetual care trust investments (including $2,581,124 and $483,353 for 2019 and 2018 at estimated fair value)

|

4,411,864

|

4,335,869

|

||||||

|

Receivable from reinsurers

|

15,747,768

|

10,820,102

|

||||||

|

Cemetery land and improvements

|

9,519,950

|

9,878,427

|

||||||

|

Deferred policy and pre-need contract acquisition costs

|

94,701,920

|

89,362,096

|

||||||

|

Mortgage servicing rights, net

|

17,155,529

|

20,016,822

|

||||||

|

Property and equipment, net

|

14,600,394

|

7,010,778

|

||||||

|

Value of business acquired

|

9,876,647

|

5,765,190

|

||||||

|

Goodwill

|

3,519,588

|

2,765,570

|

||||||

|

Other

|

18,649,812

|

6,684,143

|

||||||

|

Total Assets

|

$

|

1,334,444,075

|

$

|

1,050,811,123

|

||||

|

December 31

|

||||||||

|

Liabilities and Stockholders' Equity

|

2019

|

2018

|

||||||

|

Liabilities

|

||||||||

|

Future policy benefits and unpaid claims

|

$

|

825,600,918

|

$

|

620,399,714

|

||||

|

Unearned premium reserve

|

3,621,697

|

3,920,473

|

||||||

|

Bank and other loans payable

|

217,572,612

|

187,521,188

|

||||||

|

Deferred pre-need cemetery and mortuary contract revenues

|

12,607,978

|

12,508,625

|

||||||

|

Cemetery perpetual care obligation

|

3,933,719

|

3,821,979

|

||||||

|

Accounts payable

|

5,056,983

|

2,883,349

|

||||||

|

Other liabilities and accrued expenses

|

50,652,591

|

31,821,624

|

||||||

|

Income taxes

|

18,686,972

|

16,122,998

|

||||||

|

Total liabilities

|

1,137,733,470

|

878,999,950

|

||||||

|

Stockholders’ Equity

|

||||||||

|

Preferred Stock:

|

||||||||

|

Preferred stock - non-voting-$1.00 par value; 5,000,000 shares authorized; none issued or outstanding

|

-

|

-

|

||||||

|

Common Stock:

|

||||||||

|

Class A: common stock - $2.00 par value; 20,000,000 shares authorized; issued 16,107,779 shares in 2019 and 15,304,798 shares in 2018

|

32,215,558

|

30,609,596

|

||||||

|

Class B: non-voting common stock - $1.00 par value; 5,000,000 shares authorized; none issued or outstanding

|

-

|

-

|

||||||

|

Class C: convertible common stock - $2.00 par value; 3,000,000 shares authorized; issued 2,500,887 shares in 2019 and 2,193,643 shares in 2018

|

5,001,774

|

4,387,286

|

||||||

|

Additional paid-in capital

|

46,091,112

|

41,821,778

|

||||||

|

Accumulated other comprehensive income, net of taxes

|

13,726,514

|

(2,823

|

)

|

|||||

|

Retained earnings

|

101,256,229

|

95,201,732

|

||||||

|

Treasury stock, at cost - 490,823 Class A shares and -0- Class C shares in 2019; 302,541 Class A shares and -0- Class C shares in 2018

|

(1,580,582

|

)

|

(206,396

|

)

|

||||

|

Total stockholders’ equity

|

196,710,605

|

171,811,173

|

||||||

|

Total Liabilities and Stockholders’ Equity

|

$

|

1,334,444,075

|

$

|

1,050,811,123

|

||||

|

Years Ended

December 31

|

||||||||

|

2019

|

2018

|

|||||||

|

Revenues:

|

||||||||

|

Insurance premiums and other considerations

|

$

|

81,860,610

|

$

|

75,928,910

|

||||

|

Net investment income

|

43,019,473

|

39,913,267

|

||||||

|

Net mortuary and cemetery sales

|

15,296,235

|

13,726,518

|

||||||

|

Gains on investments and other assets

|

728,367

|

23,941,179

|

||||||

|

Mortgage fee income

|

131,976,082

|

116,185,853

|

||||||

|

Other

|

10,180,163

|

9,923,000

|

||||||

|

Total revenues

|

283,060,930

|

279,618,727

|

||||||

|

Benefits and expenses:

|

||||||||

|

Death benefits

|

41,591,057

|

36,298,789

|

||||||

|

Surrenders and other policy benefits

|

3,320,748

|

2,886,298

|

||||||

|

Increase in future policy benefits

|

23,568,497

|

24,332,088

|

||||||

|

Amortization of deferred policy and pre-need acquisition costs and value of business acquired

|

14,634,577

|

11,631,346

|

||||||

|

Selling, general and administrative expenses:

|

||||||||

|

Commissions

|

56,762,891

|

50,291,352

|

||||||

|

Personnel

|

64,221,270

|

67,368,952

|

||||||

|

Advertising

|

4,784,558

|

4,602,591

|

||||||

|

Rent and rent related

|

7,055,456

|

7,605,375

|

||||||

|

Depreciation on property and equipment

|

1,711,369

|

1,867,001

|

||||||

|

Costs related to funding mortgage loans

|

6,278,954

|

6,423,944

|

||||||

|

Other

|

34,922,761

|

31,014,999

|

||||||

|

Interest expense

|

7,386,688

|

6,956,707

|

||||||

|

Cost of goods and services sold – cemeteries and mortuaries

|

2,878,169

|

2,158,895

|

||||||

|

Total benefits and expenses

|

269,116,995

|

253,438,337

|

||||||

|

Earnings before income taxes

|

13,943,935

|

26,180,390

|

||||||

|

Income tax expense

|

(3,050,416

|

)

|

(4,494,311

|

)

|

||||

|

Net earnings

|

$

|

10,893,519

|

$

|

21,686,079

|

||||

|

Net earnings per Class A equivalent common share (1)

|

$

|

0.60

|

$

|

1.21

|

||||

|

Net earnings per Class A equivalent common share - assuming dilution (1)

|

$

|

0.60

|

$

|

1.19

|

||||

|

Weighted average Class A equivalent common shares outstanding (1)

|

18,104,681

|

17,968,062

|

||||||

|

Weighted average Class A equivalent common shares outstanding-assuming dilution (1)

|

18,229,116

|

18,188,665

|

||||||

|

(1)

|

Earnings per share amounts have been adjusted retroactively for the effect of annual stock dividends. The weighted-average shares outstanding includes the weighted-average Class A common shares and the

weighted-average Class C common shares determined on an equivalent Class A common stock basis. Net earnings per common share represent net earnings per equivalent Class A common share.

|

|

Years Ended

December 31

|

||||||||

|

2019

|

2018

|

|||||||

|

Net earnings

|

$

|

10,893,519

|

$

|

21,686,079

|

||||

|

Other comprehensive income:

|

||||||||

|

Unrealized gains on fixed maturity securities available for sale

|

17,315,770

|

-

|

||||||

|

Unrealized gains on restricted assets

|

35,550

|

-

|

||||||

|

Unrealized gains on cemetery perpetual care trust investments

|

29,904

|

|||||||

|

Foreign currency translation adjustments

|

972

|

(3,761

|

)

|

|||||

|

Other comprehensive income, before income tax

|

17,382,196

|

(3,761

|

)

|

|||||

|

Income tax benefit (expense)

|

(3,652,859

|

)

|

938

|

|||||

|

Other comprehensive income (loss), net of income tax

|

13,729,337

|

(2,823

|

)

|

|||||

|

Comprehensive income

|

$

|

24,622,856

|

$

|

21,683,256

|

||||

|

Class A

Common Stock

|

Class C

Common Stock

|

Additional

Paid-in

Capital

|

Accumulated

Other

Comprehensive

Income (Loss)

|

Retained

Earnings |

Treasury

Stock |

Total

|

||||||||||||||||||||||

|

Balance at December 31, 2017

|

29,071,154

|

4,178,748

|

38,125,042

|

603,170

|

77,520,951

|

(931,075

|

)

|

148,567,990

|

||||||||||||||||||||

|

Cumulative effect adjustment upon adoption of new accounting standard (ASU 2016-01)

|

(603,170

|

)

|

603,170

|

-

|

||||||||||||||||||||||||

|

Net earnings

|

-

|

-

|

-

|

-

|

21,686,079

|

-

|

21,686,079

|

|||||||||||||||||||||

|

Other comprehensive loss

|

-

|

-

|

-

|

(2,823

|

)

|

-

|

-

|

(2,823

|

)

|

|||||||||||||||||||

|

Stock based compensation expense

|

-

|

-

|

237,123

|

-

|

-

|

-

|

237,123

|

|||||||||||||||||||||

|

Exercise of stock options

|

76,946

|

-

|

(19,534

|

)

|

-

|

-

|

-

|

57,412

|

||||||||||||||||||||

|

Sale of treasury stock

|

-

|

-

|

540,713

|

-

|

-

|

940,200

|

1,480,913

|

|||||||||||||||||||||

|

Purchase of treasury stock

|

-

|

-

|

-

|

-

|

-

|

(215,521

|

)

|

(215,521

|

)

|

|||||||||||||||||||

|

Stock dividends

|

1,461,120

|

208,914

|

2,938,434

|

-

|

(4,608,468

|

)

|

-

|

-

|

||||||||||||||||||||

|

Conversion Class C to Class A

|

376

|

(376

|

)

|

-

|

-

|

-

|

-

|

-

|

||||||||||||||||||||

|

Balance at December 31, 2018

|

30,609,596

|

4,387,286

|

41,821,778

|

(2,823

|

)

|

95,201,732

|

(206,396

|

)

|

171,811,173

|

|||||||||||||||||||

|

Net earnings

|

-

|

-

|

-

|

-

|

10,893,519

|

-

|

10,893,519

|

|||||||||||||||||||||

|

Other comprehensive income

|

-

|

-

|

-

|

13,729,337

|

-

|

-

|

13,729,337

|

|||||||||||||||||||||

|

Stock based compensation expense

|

-

|

-

|

256,996

|

-

|

-

|

-

|

256,996

|

|||||||||||||||||||||

|

Exercise of stock options

|

65,034

|

382,886

|

415,990

|

-

|

-

|

-

|

863,910

|

|||||||||||||||||||||

|

Sale of treasury stock

|

-

|

-

|

529,858

|

-

|

-

|

165,702

|

695,560

|

|||||||||||||||||||||

|

Purchase of treasury stock

|

-

|

-

|

-

|

-

|

-

|

(1,539,888

|

)

|

(1,539,888

|

)

|

|||||||||||||||||||

|

Stock dividends

|

1,534,356

|

238,174

|

3,066,490

|

-

|

(4,839,022

|

)

|

-

|

(2

|

)

|

|||||||||||||||||||

|

Conversion Class C to Class A

|

6,572

|

(6,572

|

)

|

-

|

-

|

-

|

-

|

-

|

||||||||||||||||||||

|

Balance at December 31, 2019

|

$

|

32,215,558

|

$

|

5,001,774

|

$

|

46,091,112

|

$

|

13,726,514

|

$

|

101,256,229

|

$

|

(1,580,582

|

)

|

$

|

196,710,605

|

|||||||||||||

|

Years Ended

December 31

|

||||||||

|

2019

|

2018

|

|||||||

|

Cash flows from operating activities:

|

||||||||

|

Net earnings

|

$

|

10,893,519

|

$

|

21,686,079

|

||||

|

Adjustments to reconcile net earnings to net cash provided by (used in) operating activities:

|

||||||||

|

Gains on investments and other assets

|

(728,367

|

)

|

(23,941,179

|

)

|

||||

|

Depreciation

|

5,183,658

|

5,456,185

|

||||||

|

Provision for loan losses and doubtful accounts

|

1,202,688

|

377,683

|

||||||

|

Net amortization of deferred fees and costs, premiums and discounts

|

(887,605

|

)

|

(1,110,363

|

)

|

||||

|

Provision for deferred income taxes

|

(1,857,897

|

)

|

(2,605,401

|

)

|

||||

|

Policy and pre-need acquisition costs deferred

|

(19,176,531

|

)

|

(19,544,569

|

)

|

||||

|

Policy and pre-need acquisition costs amortized

|

13,787,037

|

10,807,777

|

||||||

|

Value of business acquired amortized

|

847,540

|

823,569

|

||||||

|

Mortgage servicing rights, additions

|

(4,194,502

|

)

|

(3,922,816

|

)

|

||||

|

Amortization of mortgage servicing rights

|

7,055,795

|

5,282,931

|

||||||

|

Stock based compensation expense

|

256,996

|

237,123

|

||||||

|

Benefit plans funded with treasury stock

|

695,560

|

1,480,913

|

||||||

|

Net change in fair value of loans held for sale

|

(2,498,097

|

)

|

(3,736,209

|

)

|

||||

|

Originations of loans held for sale

|

(2,606,839,175

|

)

|

(2,194,607,543

|

)

|

||||

|

Proceeds from sales of loans held for sale

|

2,580,875,055

|

2,259,145,473

|

||||||

|

Net gains on sales of loans held for sale

|

(80,666,413

|

)

|

(74,426,183

|

)

|

||||

|

Change in assets and liabilities:

|

||||||||

|

Land and improvements held for sale

|

358,477

|

64,506

|

||||||

|

Future policy benefits and unpaid claims

|

18,394,928

|

21,710,347

|

||||||

|

Other operating assets and liabilities

|

1,695,259

|

3,830,947

|

||||||

|

Net cash provided by (used in) operating activities

|

(75,602,075

|

)

|

7,009,270

|

|||||

|

Cash flows from investing activities:

|

||||||||

|

Purchases of fixed maturity securities

|

(110,601,438

|

)

|

(37,488,774

|

)

|

||||

|

Calls and maturities of fixed maturity securities

|

26,624,182

|

32,993,161

|

||||||

|

Purchase of equity securities

|

(3,264,028

|

)

|

(3,354,274

|

)

|

||||

|

Sales of equity securities

|

2,639,729

|

2,886,492

|

||||||

|

Net changes in restricted assets

|

(1,254,991

|

)

|

(241,665

|

)

|

||||

|

Net changes in cemetery perpetual care trust investments

|

299,897

|

1,207,622

|

||||||

|

Mortgage loans held for investment, other investments and policy loans made

|

(572,171,590

|

)

|

(505,060,464

|

)

|

||||

|

Payments received for mortgage loans held for investment, other investments and policy loans

|

556,352,676

|

535,354,544

|

||||||

|

Purchases of property and equipment

|

(1,839,293

|

)

|

(1,282,704

|

)

|

||||

|

Sales of property and equipment

|

54,496

|

2,016,156

|

||||||

|

Purchases of real estate held for investment

|

(8,572,556

|

)

|

(29,193,332

|

)

|

||||

|

Sales of real estate held for investment

|

11,614,927

|

68,875,269

|

||||||

|

Cash received for reinsurance assumed

|

158,358,594

|

-

|

||||||

|

Cash paid for purchase of subsidiaries, net of cash acquired

|

(20,141,074

|

)

|

(3,405,783

|

)

|

||||

|

Net cash provided by investing activities

|

38,099,531

|

63,306,248

|

||||||

|

Years Ended

December 31

|

||||||||

|

2019

|

2018

|

|||||||

|

Cash flows from financing activities:

|

||||||||

|

Investment contract receipts

|

$

|

12,141,627

|

$

|

11,571,551

|

||||

|

Investment contract withdrawals

|

(16,911,841

|

)

|

(15,356,571

|

)

|

||||

|

Proceeds from stock options exercised

|

863,910

|

57,412

|

||||||

|

Purchase of treasury stock

|

(1,539,888

|

)

|

(215,521

|

)

|

||||

|

Repayment of bank loans

|

(236,790,722

|

)

|

(133,123,024

|

)

|

||||

|

Proceeds from bank borrowings

|

196,610,127

|

162,653,177

|

||||||

|

Net change in warehouse line borrowings for loans held for sale

|

69,928,331

|

(717,792

|

)

|

|||||

|

Net change in line of credit borrowings

|

-

|

1,250,000

|

||||||

|

Net cash provided by financing activities

|

24,301,544

|

26,119,232

|

||||||

|

Net change in cash, cash equivalents, restricted cash and restricted cash equivalents

|

(13,201,000

|

)

|

96,434,750

|

|||||

|

Cash, cash equivalents, restricted cash and restricted cash equivalents at beginning of year

|

150,936,673

|

54,501,923

|

||||||

|

Cash, cash equivalents, restricted cash and restricted cash equivalents at end of year

|

$

|

137,735,673

|

$

|

150,936,673

|

||||

|

Supplemental Disclosure of Cash Flow Information:

|

||||||||

|

Cash paid during the year for:

|

||||||||

|

Interest (net of amount capitalized)

|

$

|

7,284,078

|

$

|

6,878,048

|

||||

|

Income taxes

|

4,861,318

|

5,701,565

|

||||||

|

Non Cash Investing and Financing Activities:

|

||||||||

|

Transfer of loans held for sale to mortgage loans held for investment

|

$

|

31,881,851

|

$

|

10,827,797

|

||||

|

Right-of-use assets obtained in exchange for operating lease liabilities

|

16,544,406

|

-

|

||||||

|

Transfer of real estate held for investment to property and equipment

|

3,261,259

|

-

|

||||||

|

Mortgage loans held for investment foreclosed into real estate held for investment

|

1,704,015

|

670,601

|

||||||

|

Accrued real estate construction costs and retainage

|

590,256

|

214,200

|

||||||

|

Right-of-use assets obtained in exchange for finance lease liabilities

|

252,763

|

-

|

||||||

|

Mortgage loans held for investment foreclosed into receivables

|

155,347

|

-

|

||||||

|

Years Ended

December 31

|

||||||||

|

2019

|

2018

|

|||||||

|

Cash and cash equivalents

|

$

|

127,754,719

|

$

|

142,199,942

|

||||

|

Restricted assets

|

8,674,214

|

7,179,225

|

||||||

|

Cemetery perpetual care trust investments

|

1,306,740

|

1,557,506

|

||||||

|

Total cash, cash equivalents, restricted cash and restricted cash equivalents

|

$

|

137,735,673

|

$

|

150,936,673

|

||||

|

•

|

Failure to deliver original documents specified by the investor,

|

|

•

|

The existence of misrepresentation or fraud in the origination of the loan,

|

|

•

|

The loan becomes delinquent due to nonpayment during the first several months after it is sold,

|

|

•

|