PGIM

INVESTMENTS | Bringing you the investment managers of Prudential Financial, Inc.

PGIM

Jennison Small Company Fund

| A: PGOAX | C: PSCCX | R: JSCRX | Z: PSCZX | R2: PSCHX | R4: PSCJX | R6: PJSQX |

SUMMARY PROSPECTUS

| November 27, 2020

Before you invest, you may want

to review the Fund's Prospectus, which contains more information about the Fund and its risks. You can find the Fund's Prospectus, Statement of Additional Information (SAI), Annual Report and other information

about the Fund online at pgim.com/investments. You can also get this information at no cost by calling 1-800-225-1852 or by sending an e-mail to: prospectus@pgim.com. The Fund's Prospectus and SAI, both dated November

27, 2020, as supplemented and amended from time to time, and the Fund's Annual Report, dated September 30, 2020, are all incorporated by reference into (legally made a part of) this Summary Prospectus.

IMPORTANT INFORMATION

Beginning on January 1, 2021, as permitted by

regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies

of the reports. Instead, the reports will be made available on the Fund’s website (www.pgim.com/investments), and you will be notified by mail each time a report is posted and provided with a website link to

access the report.

If you already elected to receive

shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime

by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 1-800-225-1852 or by sending an e-mail request to PGIM Investments at

shareholderreports@pgim.com.

You may elect to receive all future

reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to elect to continue to receive paper copies of your shareholder reports. If you invest

directly with the Fund, you can call 1-800-225-1852 or send an email request to shareholderreports@pgim.com to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election

to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the fund complex if you invest directly with the Fund.

INVESTMENT OBJECTIVE

The investment objective of the Fund is capital growth.

FUND FEES AND EXPENSES

The tables below describe the sales charges, fees

and expenses that you may pay if you buy and hold shares of the Fund. You may be required to pay commissions to a broker for transactions in Class Z shares, which are not reflected in the table or the example below.

You may qualify for sales charge discounts if you and an eligible group of related investors purchase, or agree to purchase in the future, $25,000 or more in shares of the Fund or other funds in the PGIM Funds family.

More information about these discounts as well as other waivers or discounts is available from your financial professional and is explained in Reducing or Waiving Class A's and Class C’s Sales Charges on page 23 of the Fund's Prospectus, Appendix A: Waivers and Discounts Available From Certain Financial Intermediaries on page 47 of the Fund's Prospectus and in Rights of Accumulation on page 50 of the Fund's Statement of Additional Information (SAI).

| Shareholder Fees (fees paid directly from your investment) | |||||||

| Class A | Class C | Class R | Class Z | Class R2 | Class R4 | Class R6 | |

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | 5.50% | None | None | None | None | None | None |

| Maximum deferred sales charge (load) (as a percentage of the lower of the original purchase price or the net asset value at redemption) | 1.00%** | 1.00%*** | None | None | None | None | None |

| Maximum sales charge (load) imposed on reinvested dividends and other distributions | None | None | None | None | None | None | None |

| Redemption fee | None | None | None | None | None | None | None |

| Exchange fee | None | None | None | None | None | None | None |

| Shareholder Fees (fees paid directly from your investment) | |||||||

| Class A | Class C | Class R | Class Z | Class R2 | Class R4 | Class R6 | |

| Maximum account fee (accounts under $10,000) | $15 | $15 | None | None* | None | None | None |

*Direct Transfer Agent

Accounts holding under $10,000 of Class Z shares are subject to the $15 fee.

**Investors who purchase $1 million or more of Class A shares and sell these shares within 12 months of purchase are subject to a 1.00% CDSC, although they are not subject to an initial sales charge. The CDSC is waived for purchases by certain retirement and/or benefit plans.

***Class C shares are sold with a CDSC of 1% on sales made within 12 months of purchase.

**Investors who purchase $1 million or more of Class A shares and sell these shares within 12 months of purchase are subject to a 1.00% CDSC, although they are not subject to an initial sales charge. The CDSC is waived for purchases by certain retirement and/or benefit plans.

***Class C shares are sold with a CDSC of 1% on sales made within 12 months of purchase.

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||||

| Class A | Class C | Class R | Class Z | Class R2 | Class R4 | Class R6 | |

| Management fee | 0.68% | 0.68% | 0.68% | 0.68% | 0.68% | 0.68% | 0.68% |

| Distribution or distribution and service (12b-1) fees | 0.30% | 1.00% | 0.75% | None | 0.25% | None | None |

| Other expenses: | 0.20% | 0.21% | 0.17% | 0.14% | 0.46% | 0.93% | 0.02% |

| Shareholder service fee | None | None | None | None | 0.10%(1) | 0.10%(1) | None |

| Remainder of other expenses | 0.20% | 0.21% | 0.17% | 0.14% | 0.36% | 0.83% | 0.02% |

| Total annual Fund operating expenses | 1.18% | 1.89% | 1.60% | 0.82% | 1.39% | 1.61% | 0.70% |

| Fee waiver and/or expense reimbursement | None | None | (0.25)% | None | (0.21)% | (0.68)% | None |

| Total annual Fund operating expenses after fee waiver and/or expense reimbursement(2,3) | 1.18% | 1.89% | 1.35% | 0.82% | 1.18% | 0.93% | 0.70% |

(1) “Shareholder service fee” reflects maximum allowable fees under a shareholder services plan.

(2) PGIM Investments LLC (PGIM Investments) has contractually agreed, through January 31, 2022, to limit transfer agency, shareholder servicing, sub-transfer agency, and blue sky

fees, as applicable, to the extent that such fees cause the Total Annual Fund Operating Expenses to exceed 1.18% of average daily net assets for Class R2 shares, or 0.93% of average daily net assets for Class R4

shares. This contractual expense limitation excludes interest, brokerage, taxes (such as income and foreign withholding taxes, stamp duty and deferred tax expenses), acquired fund fees and expenses, extraordinary

expenses, and certain other Fund expenses such as dividend and interest expense and broker charges on short sales. Where applicable, PGIM Investments agrees to waive management fees or shared operating expenses on any

share class to the same extent that it waives such expenses on any other share class. In addition, Total Annual Fund Operating Expenses for Class R6 shares will not exceed Total Annual Fund Operating Expenses for

Class Z shares. Fees and/or expenses waived and/or reimbursed by PGIM Investments may be recouped by PGIM Investments within the same fiscal year during which such waiver and/or reimbursement is made if such

recoupment can be realized without exceeding the expense limit in effect at the time of the recoupment for that fiscal year. This expense limitation may not be terminated prior to January 31, 2022 without the prior

approval of the Fund’s Board of Directors.

(3) The distributor of the Fund has contractually agreed through January 31, 2022 to reduce its distribution and service (12b-1) fees applicable to Class R shares to 0.50% of the

average daily net assets of Class R shares. This waiver may not be terminated prior to January 31, 2022 without the prior approval of the Fund’s Board of Directors.

Example. The following hypothetical example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. It assumes that you invest $10,000 in

the Fund for the time periods indicated and then, except as indicated, redeem all your shares at the end of those periods. It assumes a 5% return on your investment each year, that the Fund's operating expenses remain

the same (except that fee waivers or reimbursements, if any, are only reflected in the 1-Year figures) and that all dividends and distributions are reinvested. Your actual costs may be higher or lower.

| If Shares Are Redeemed | If Shares Are Not Redeemed | |||||||

| Share Class | 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years |

| Class A | $664 | $904 | $1,163 | $1,903 | $664 | $904 | $1,163 | $1,903 |

| Class C | $292 | $594 | $1,021 | $2,212 | $192 | $594 | $1,021 | $2,212 |

| Class R | $137 | $481 | $847 | $1,879 | $137 | $481 | $847 | $1,879 |

| Class Z | $84 | $262 | $455 | $1,014 | $84 | $262 | $455 | $1,014 |

| Class R2 | $120 | $419 | $741 | $1,650 | $120 | $419 | $741 | $1,650 |

| Class R4 | $95 | $441 | $812 | $1,854 | $95 | $441 | $812 | $1,854 |

| Class R6 | $72 | $224 | $390 | $871 | $72 | $224 | $390 | $871 |

Portfolio Turnover. The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher

transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance.

During the Fund's most recent fiscal year, the Fund's portfolio turnover rate was 58% of the average value of its portfolio.

INVESTMENTS, RISKS AND

PERFORMANCE

Principal Investment Strategies. The subadviser seeks investments whose price will increase over time. The subadviser normally invests at least 80% of the Fund’s investable assets in equity and equity-related

securities of small, less well-known companies that the subadviser believes are relatively undervalued. In deciding which stocks to buy, the subadviser uses a blend of both value and growth styles. The subadviser

looks for stocks in a variety of different industries and sectors that the subadviser believes have attractive valuations, and should experience superior earnings growth on an intermediate term basis. The subadviser

generally bases its belief on its proprietary forecasts of each company’s potential earnings growth for

periods greater than one year. “Investable

assets” consist of the Fund's net assets plus any borrowings for investment purposes. The Fund's investable assets will be less than its total assets to the extent that it has borrowed money for non-investment

purposes, such as to meet anticipated redemptions.

The subadviser currently considers

small companies to be those with a market capitalization less than the largest market capitalization of the Russell 2500 Index at the time of investment. The market capitalization within the index will vary, but as of

September 30, 2020, the median market capitalization was approximately $1.03 billion and the largest company by market capitalization was approximately $23.0 billion. The Fund’s portfolio is diversified and

typically will include stocks representing all of the sectors in the Russell 2500 Index.

Principal Risks

All investments have risks to some

degree. The value of your investment in the Fund, as well as the amount of return you receive on your investment, may fluctuate significantly from day to day and over time.

You may lose part or all of your

investment in the Fund or your investment may not perform as well as other similar investments.

An investment in the Fund is not

guaranteed to achieve its investment objective; is not a deposit with a bank; and is not insured, endorsed or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The following is a

summary description of principal risks of investing in the Fund. The order of the below risk factors does not indicate the significance of any particular risk factor.

Blend Style Risk. The Fund's blend investment style may subject the Fund to risks of both value and growth investing. The portion of the Fund's portfolio that makes investments pursuant to a growth strategy

may be subject to above-average fluctuations as a result of seeking higher than average capital growth. The portion of the Fund's portfolio that makes investments pursuant to a value strategy may be subject to the

risk that the market may not recognize a security's intrinsic value for a long time or that a stock judged to be undervalued may actually be appropriately priced. Issuers of value stocks may have experienced adverse

business developments or may be subject to special risks that have caused the stock to be out of favor. Historically, growth stocks have performed best during later stages of economic expansion and value stocks have

performed best during periods of economic recovery. Therefore, both styles may over time go in and out of favor with the markets. At times when a style is out of favor, that portion of the portfolio may lag the other

portion of the portfolio, which may cause the Fund to underperform the market in general, its benchmark and other mutual funds. Growth and value stocks have historically produced similar long-term results, though each

category has periods when it outperforms the other.

Economic and Market Events Risk. Events in the US and global financial markets, including actions taken by the US Federal Reserve or foreign central banks to stimulate or stabilize economic growth or the functioning of

the securities markets, may at times result in unusually high market volatility, which could negatively impact performance. Relatively reduced liquidity in credit and fixed income markets could adversely affect

issuers worldwide.

Equity and Equity-Related Securities

Risk. The value of a particular security could go down and you could lose money. In addition to an individual security losing value, the value of the equity markets or a sector in which the Fund

invests could go down. The Fund's holdings can vary significantly from broad market indices and the performance of the Fund can deviate from the performance of these indices. Different parts of a market can react

differently to adverse issuer, market, regulatory, political and economic developments.

Increase in Expenses Risk. Your actual cost of investing in the Fund may be higher than the expenses shown in the expense table for a variety of reasons. For example, expense ratios may be higher than those shown if

average net assets decrease. Net assets are more likely to decrease and Fund expense ratios are more likely to increase when markets are volatile. Active and frequent trading of Fund securities can increase

expenses.

Large Shareholder and Large Scale

Redemption Risk. Certain individuals, accounts, funds (including funds affiliated with the Manager) or institutions, including the Manager and its affiliates, may from time to time own or control a

substantial amount of the Fund’s shares. There is no requirement that these entities maintain their investment in the Fund. There is a risk that such large shareholders or that the Fund’s shareholders

generally may redeem all or a substantial portion of their investments in the Fund in a short period of time, which could have a significant negative impact on the Fund’s NAV, liquidity, and brokerage costs.

Large redemptions could also result in tax consequences to shareholders and impact the Fund’s ability to implement its investment strategy. The Fund’s ability to pursue its investment objective after one

or more large scale redemptions may be impaired and, as a result, the Fund may invest a larger portion of its assets in cash or cash equivalents.

Management Risk. The value of your investment may decrease if judgments by the subadviser about the attractiveness, value or market trends affecting a particular security, industry or sector or about market

movements are incorrect.

Market Disruption and Geopolitical

Risks. International wars or conflicts and geopolitical developments in foreign countries, along with instability in regions such as Asia, Eastern Europe, and the Middle East, possible terrorist

attacks in the United States or around the world, public health epidemics such as the outbreak of infectious diseases like the recent outbreak of coronavirus globally or the 2014–2016 outbreak in West Africa of

the Ebola virus, and other similar events could adversely affect the U.S. and foreign financial markets, including increases in market volatility, reduced liquidity in the securities

markets and government intervention, and may cause

further long-term economic uncertainties in the United States and worldwide generally. The coronavirus pandemic and the related governmental and public responses have had and may continue to have an impact on the

Fund’s investments and net asset value and have led and may continue to lead to increased market volatility and the potential for illiquidity in certain classes of securities and sectors of the market.

Preventative or protective actions that governments may take in respect of pandemic or epidemic diseases may result in periods of business disruption, business closures, inability to obtain raw materials, supplies and

component parts, and reduced or disrupted operations for the issuers in which the Fund invests. Government intervention in markets may impact interest rates, market volatility and security pricing. The occurrence,

reoccurrence and pendency of such diseases could adversely affect the economies (including through changes in business activity and increased unemployment) and financial markets either in specific countries or

worldwide.

Market Risk. Securities markets may be volatile and the market prices of the Fund’s securities may decline. Securities fluctuate in price based on changes in an issuer’s financial condition

and overall market and economic conditions. If the market prices of the securities owned by the Fund fall, the value of your investment in the Fund will decline.

Small Company Risk. Small company stocks present above-average risks in comparison to larger companies. Small companies usually offer a smaller range of products and services than larger companies. Smaller

companies may also have limited financial resources and may lack management depth. As a result, stocks issued by smaller companies may be comparatively less liquid and fluctuate in value more than the stocks of

larger, more established companies.

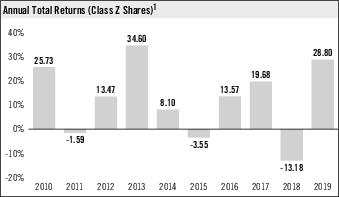

Performance. The following bar chart shows the Fund's performance for Class Z shares for each full calendar year of operations or for the last 10 calendar years, whichever is shorter. The

following table shows the Fund's average annual returns and also compares the Fund’s performance with the average annual total returns of an index or other benchmark. The bar chart and table demonstrate the risk

of investing in the Fund by showing how returns can change from year to year.

Past performance (before and after

taxes) does not mean that the Fund will achieve similar results in the future. Updated Fund performance information is available online at www.pgim.com/investments.

1 The total return for Class Z shares from January 1, 2020 to September 30, 2020 was -1.93%.

| Average Annual Total Returns % (including sales charges) (as of 12-31-19) | ||||

| Return Before Taxes | One Year | Five Years | Ten Years | Since Inception |

| Class A shares | 21.24% | 6.42% | 10.66% | - |

| Class C shares | 26.55% | 6.91% | 10.52% | - |

| Class R shares | 28.19% | 7.44% | 11.08% | - |

| Class R2 shares | 28.30% | N/A | N/A | 5.88% (11/28/17) |

| Class R4 shares | 28.69% | N/A | N/A | 6.21% (11/28/17) |

| Class R6 shares | 28.99% | 8.15% | N/A | 10.77% (11/29/10) |

| Class Z Shares % (as of 12-31-19) | ||||

| Return Before Taxes | 28.80% | 7.95% | 11.59% | - |

| Return After Taxes on Distributions | 26.41% | 5.33% | 9.60% | - |

| Return After Taxes on Distributions and Sale of Fund Shares | 18.66% | 5.76% | 9.20% | - |

° After-tax

returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation

and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. After-tax

returns are shown only for Class Z shares. After-tax returns for other classes will vary due to differing sales charges and expenses.

| Index % (reflects no deduction for fees, expenses or taxes) (as of 12-31-19) | ||||

| Russell 2500 Index | 27.77% | 8.93% | 12.58% | - |

| S&P SmallCap 600 Index | 22.78% | 9.56% | 13.35% | - |

MANAGEMENT OF THE FUND

| Investment Manager | Subadviser | Portfolio Managers | Title | Service Date |

| PGIM Investments LLC | Jennison Associates LLC | Jonathan M. Shapiro | Managing Director | July 2018 |

| Jason M. Swiatek, CFA | Managing Director | November 2013 |

BUYING AND SELLING FUND

SHARES

| Class A* | Class C* | Class R* | Class Z* | Class R2 | Class R4 | Class R6 | |

| Minimum initial investment | $1,000 | $1,000 | None | None | None | None | None |

| Minimum subsequent investment | $100 | $100 | None | None | None | None | None |

* Certain share classes are

generally closed to investments by new group retirement plans. Please see “How to Buy, Sell and Exchange Fund Shares—Closure of Certain Share Classes to New Group Retirement Plans” in the Prospectus

for more information.

For Class A and Class C shares, the

minimum initial and subsequent investment for Automatic Investment Plan purchases is $50. Class R, Class R2, Class R4 and Class R6 shares are generally not available for purchase by individuals. Class Z shares may be

purchased by certain individuals, subject to certain requirements. Please see “How to Buy, Sell and Exchange Fund Shares—How to Buy Shares—Qualifying for Class R Shares,”

“—Qualifying for Class Z Shares,” “—Qualifying for Class R2 and Class R4 Shares,” and “—Qualifying for Class R6 Shares” in the Prospectus for purchase eligibility

requirements.

Your financial intermediary may

impose different investment minimums. You can purchase or redeem shares on any business day that the Fund is open through the Fund's transfer agent or through servicing agents, including brokers, dealers and other

financial intermediaries appointed by the distributor to receive purchase and redemption orders. Current shareholders may also purchase or redeem shares through the Fund's website or by calling (800) 225-1852.

TAX INFORMATION

Dividends, Capital Gains and Taxes. The Fund's dividends and distributions are taxable and will be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan

or an individual retirement account. Such tax-deferred arrangements may be taxed later upon withdrawal of monies from those arrangements.

PAYMENTS TO FINANCIAL

INTERMEDIaries

If you purchase Fund shares through a financial

intermediary such as a broker-dealer, bank, retirement recordkeeper or other financial services firm, the Fund or its affiliates may pay the financial intermediary for the sale of Fund shares and/or for services to

shareholders. This may create a conflict of interest by influencing the financial intermediary or its representatives to recommend the Fund over another investment. Ask your financial intermediary or representative or

visit your financial intermediary’s website for more information.

Notes

Notes

| ||

| By Mail: | Prudential Mutual Fund Services LLC, PO Box 9658, Providence, RI 02940 | |

| By Telephone: | 800-225-1852 or 973-367-3529 (outside the US) | |

| On the Internet: | www.pgim.com/investments |

MF109A