UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number: | 811-03084 | |

| Exact name of registrant as specified in charter: | Prudential Jennison Small Company Fund, Inc. | |

| Address of principal executive offices: | 655 Broad Street, 6th Floor | |

| Newark, New Jersey 07102 | ||

| Name and address of agent for service: | Andrew R. French | |

| 655 Broad Street, 6th Floor | ||

| Newark, New Jersey 07102 | ||

| Registrant’s telephone number, including area code: | 800-225-1852 | |

| Date of fiscal year end: | 9/30/2023 | |

| Date of reporting period: | 9/30/2023 | |

Item 1 – Reports to Stockholders

PGIM JENNISON SMALL COMPANY FUND

ANNUAL REPORT

SEPTEMBER 30, 2023

To enroll in e-delivery, go to pgim.com/investments/resource/edelivery

| 3 | ||||

| 4 | ||||

| 5 | ||||

| 8 | ||||

| 12 | ||||

| 15 | ||||

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

Mutual funds are distributed by Prudential Investment Management Services LLC, member SIPC. Jennison Associates LLC is a registered investment adviser. Both are Prudential Financial companies. © 2023 Prudential Financial, Inc. and its related entities. Jennison Associates, Jennison, PGIM, and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

2 Visit our website at pgim.com/investments

|

|

Dear Shareholder:

We hope you find the annual report for the PGIM Jennison Small Company Fund informative and useful. The report covers performance for the 12-month period that ended September 30, 2023.

Although central banks raised interest rates aggressively to tame surging inflation during the period, the global economy and financial markets demonstrated resilience. Employers continued hiring, consumers continued spending, home prices rose, and recession fears receded. |

Early in the period, stocks began a rally that eventually ended a bear market and continued to rise globally for much of 2023 as inflation cooled and the Federal Reserve (the Fed) slowed the pace of its rate hikes. However, stocks declined in September when the Fed signaled that rates may remain elevated longer than investors had expected. For the entire period, equities in both US and international markets posted gains.

Bond markets benefited during the period as the Fed moderated its rate-hiking cycle, and the higher level of interest rates offered investors an additional cushion from fixed income volatility. US and global investment-grade bonds posted small gains for the overall period, while US high yield corporate bonds and emerging-market debt rose by double digits.

Regarding your investments with PGIM, we believe it is important to maintain a diversified portfolio of funds consistent with your tolerance for risk, time horizon, and financial goals. Your financial advisor can help you create a diversified investment plan that may include funds covering all the basic asset classes and that reflects your personal investor profile and risk tolerance. However, diversification and asset allocation strategies do not assure a profit or protect against loss in declining markets.

At PGIM Investments, we provide access to active investment strategies across the global markets in the pursuit of consistent outperformance for investors. PGIM is the world’s 14th-largest investment manager with more than $1.3 trillion in assets under management. Our scale and investment expertise allow us to deliver a diversified suite of actively managed solutions across a broad spectrum of asset classes and investment styles.

Thank you for choosing our family of funds.

Sincerely,

Stuart S. Parker, President

PGIM Jennison Small Company Fund

November 15, 2023

PGIM Jennison Small Company Fund 3

Your Fund’s Performance (unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at pgim.com/investments or by calling (800) 225-1852.

| Average Annual Total Returns as of 9/30/2023 | ||||||||

| One Year (%) | Five Years (%) | Ten Years (%) | Since Inception (%) | |||||

| Class A |

||||||||

| (with sales charges) |

1.05 | 5.11 | 7.63 | — | ||||

| (without sales charges) |

6.93 | 6.31 | 8.24 | — | ||||

| Class C |

||||||||

| (with sales charges) |

5.04 | 5.57 | 7.47 | — | ||||

| (without sales charges) |

6.04 | 5.57 | 7.47 | — | ||||

| Class R |

||||||||

| (without sales charges) |

6.67 | 6.11 | 8.03 | — | ||||

| Class Z |

||||||||

| (without sales charges) |

7.28 | 6.68 | 8.57 | — | ||||

| Class R2 |

||||||||

| (without sales charges) |

6.87 | 6.35 | N/A | 6.96 (11/28/2017) | ||||

| Class R4 |

||||||||

| (without sales charges) |

7.13 | 6.55 | N/A | 7.24 (11/28/2017) | ||||

| Class R6 |

||||||||

| (without sales charges) |

7.38 | 6.80 | 8.74 | — | ||||

| Russell 2500 Index |

||||||||

| 11.28 | 4.55 | 7.90 | — | |||||

| S&P SmallCap 600 Index |

||||||||

| 10.08 | 3.21 | 8.15 | — | |||||

| Average Annual Total Returns as of 9/30/2023 Since Inception (%) | ||||||||

| Class R2, Class R4 | ||||||||

| (11/28/2017) | ||||||||

| Russell 2500 Index |

5.72 | |||||||

| S&P SmallCap 600 Index |

5.07 | |||||||

Since Inception returns are provided for any share class with less than 10 fiscal years of returns. Since Inception returns for the Indexes are measured from the closest month-end to the class’s inception date.

4 Visit our website at pgim.com/investments

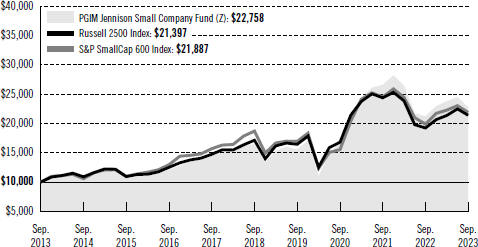

Growth of a $10,000 Investment (unaudited)

The graph compares a $10,000 investment in the Fund’s Class Z shares with a similar investment in the Russell 2500 Index and the S&P SmallCap 600 Index by portraying the initial account values at the beginning of the 10-year period (September 30, 2013) and the account values at the end of the current fiscal year (September 30, 2023), as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted and (b) all dividends and distributions were reinvested. The line graph provides information for Class Z shares only. As indicated in the tables provided earlier, performance for other share classes will vary due to the differing fees and expenses applicable to each share class (as indicated in the following paragraphs). Without waiver of fees and/or expense reimbursements, if any, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

PGIM Jennison Small Company Fund 5

Your Fund’s Performance (continued)

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. The average annual total returns take into account applicable sales charges, which are described for each share class in the table below.

| Class A | Class C | Class R | Class Z | Class R2 | Class R4 | Class R6 | ||||||||

| Maximum initial sales charge | 5.50% of the public offering price | None | None | None | None | None | None | |||||||

| Contingent deferred sales charge (CDSC) (as a percentage of the lower of the original purchase price or the net asset value at redemption) | 1.00% on sales of $1 million or more made within 12 months of purchase | 1.00% on sales made within 12 months of purchase | None | None | None | None | None | |||||||

| Annual distribution or distribution and service (12b-1) fees (shown as a percentage of average daily net assets) | 0.30% | 1.00% | 0.75% (0.50% currently) | None | 0.25% | None | None | |||||||

| Shareholder service fees | None | None | None | None | 0.10%* | 0.10%* | None | |||||||

*Shareholder service fee reflects maximum allowable fees under a shareholder services plan.

6 Visit our website at pgim.com/investments

Benchmark Definitions

Russell 2500 Index—The Russell 2500 Index is an unmanaged index that measures the performance of the 2,500 smallest companies in the Russell 3000 Index, which represents approximately 20% of the total market capitalization of the Russell 3000 Index.

S&P SmallCap 600 Index*—The S&P SmallCap 600 Index is an unmanaged, capital-weighted index of 600 smaller company US common stocks that cover all industry sectors. It gives a broad look at how US small-cap stock prices have performed.

*The S&P SmallCap 600 Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by PGIM, Inc. and/or its affiliates. Copyright © 2023 S&P Dow Jones Indices LLC, a division of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of S&P Global and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC.

Investors cannot invest directly in an index. The returns for the Indexes would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes that may be paid by an investor.

Presentation of Fund Holdings as of 9/30/23

|

Ten Largest Holdings |

Line of Business |

% of Net Assets | ||

| Targa Resources Corp. |

Oil, Gas & Consumable Fuels | 2.7% | ||

| Gaming & Leisure Properties, Inc. |

Specialized REITs | 2.3% | ||

| Universal Display Corp. |

Semiconductors & Semiconductor Equipment | 2.1% | ||

| Trinity Industries, Inc. |

Machinery | 2.0% | ||

| Kirby Corp. |

Marine Transportation | 2.0% | ||

| Performance Food Group Co. |

Consumer Staples Distribution & Retail | 1.8% | ||

| Constellium SE |

Metals & Mining | 1.8% | ||

| Chord Energy Corp. |

Oil, Gas & Consumable Fuels | 1.7% | ||

| WEX, Inc. |

Financial Services | 1.7% | ||

| Axis Capital Holdings Ltd. |

Insurance | 1.7% | ||

Holdings reflect only long-term investments and are subject to change.

PGIM Jennison Small Company Fund 7

Strategy and Performance Overview* (unaudited)

How did the Fund perform?

The PGIM Jennison Small Company Fund’s Class Z shares returned 7.28% in the 12-month reporting period that ended September 30, 2023, underperforming the 11.28% return of the Russell 2500 Index (the Index).

What were the market conditions?

| · | The investment backdrop during the reporting period can be divided into three sections. In the last three months of 2022, investors remained uncertain about inflationary pressures and US Federal Reserve (Fed) policy, heightened geopolitical tension, war in Ukraine, and expectations that US economic growth would slow and could enter a recession. |

| · | In the first six months of 2023, the economy delivered better-than-feared results, with continued—albeit moderating—growth led by resilient consumer spending amid ongoing labor market strength. As inflationary pressures eased, the Fed slowed the pace of monetary tightening, which encouraged investors, as did stronger-than-expected earnings reports. Investors appeared to be surprised that many companies were able to effectively cut their costs and reduce their head counts, enabling them to exceed Wall Street expectations. Growth companies, led by technology, rose sharply. |

| · | However, during the third quarter of 2023, macroeconomic and political developments stoked investor unease. Threats of a federal government shutdown, strikes at several US automakers, and tensions with China made the path to slower growth and a soft landing appear less smooth or likely. Oil prices moved higher on the back of coordinated supply restraints imposed by the OPEC+ oil-producing nations and a subsequent rebound in gasoline prices. US consumer confidence ticked down, while employment and home prices held firm. The US economy’s ongoing resilience, coupled with higher interest rates, reinvigorated the value of the US dollar, which closed the period near its early-2023 levels. |

| · | The collapse in March 2023 of Silicon Valley Bank, the 16th-largest US bank by assets, was largely contained. Regulators closed several ailing banks—none of which were held by the Fund—and provided additional bank borrowing facilities and deposit guarantees. However, the underlying issue of asset/liability mismatch on many banks’ balance sheets remained unresolved. |

| · | Interest in artificial intelligence (AI)—catalyzed by the launch of ChatGPT in late November 2022—continued to grow through the first half of 2023. Investors expressed the greatest enthusiasm for companies supplying the foundational components to design, build, and run AI and machine-learning capabilities. |

| · | Small-cap stocks underperformed their large- and mid-cap counterparts during the period. Within the Index, the energy and industrials sectors saw the greatest gains. The largest declines were seen in the healthcare and utilities sectors. |

8 Visit our website at pgim.com/investments

What worked?

| · | From a sector perspective, stock selection in financials and energy added the most value relative to the Index during the reporting period. Security selection within consumer discretionary was also positive. |

| · | Individual positions that performed well were diversified across several different sectors, with top performers including Targa Resources Corp., Horizon Therapeutics plc, Performance Food Group Co., Saia, Inc., and Toll Brothers, Inc. |

| · | Targa Resources owns a portfolio of integrated midstream energy assets across the natural gas and natural gas liquids (NGLs) value chain. In addition to an attractive business model, strong balance sheet, and industry-leading free cash flow generation, management continues to execute well. A strong earnings report and the stock’s inclusion in the S&P 500 Index were two of several positive data points for the company during the period. |

| · | Biopharmaceutical company Horizon Therapeutics focuses on researching, developing, and commercializing medicines that address unmet treatment needs for rare and rheumatic diseases. Shares benefited from strong sales of key treatments, especially Krystexxa and Uplinza, as well as stabilization of Tepezza sales. The position was eliminated during the reporting period as Jennison found limited additional upside. |

| · | Performance Food Group, a foodservice distributor leader headquartered in Richmond, Virginia, operates a nationwide network of over 100 distribution centers. The company gained share and is poised, in Jennison’s view, to achieve higher synergies from recent acquisitions. |

| · | American trucking company Saia benefited from good cost controls and volume momentum. Jennison views the company’s network expansion—both in the Northeast and within the company’s legacy footprint—as a key driver of growth going forward. |

| · | Toll Brothers designs, builds, markets, sells, and arranges financing for residential and commercial properties in the US. The company is executing very well and benefiting from both supply and demand dynamics. Despite a challenging environment for new home sales, Toll Brothers and other builders have made sufficient changes to their business models since the recession of 2008-2009 to better weather economic downturns. |

What didn’t work?

| · | Stock selection in the healthcare, information technology, and industrials sectors detracted the most from relative results. |

| · | Underweights to the information technology and materials sectors also weighed on relative returns. |

| · | Individual positions that detracted the most were diversified across several different sectors and included Tower Semiconductor Ltd., ZoomInfo Technologies, Inc., TELUS International (Cda), Inc., Etsy, Inc., and Apellis Pharmaceuticals, Inc. |

PGIM Jennison Small Company Fund 9

Strategy and Performance Overview* (continued)

| · | Shares in integrated circuits manufacturer Tower Semiconductor were weak due to a broad, industry-wide inventory correction, as well as the termination of Intel’s planned acquisition of the company. With the cash gained from the deal’s end, Jennison believes Tower is well-positioned to fuel organic growth. |

| · | Jennison eliminated the Fund’s position in ZoomInfo following the release of disappointing organic bookings growth and lowered expectations for 2023. |

| · | E-commerce website Etsy specializes in handmade or vintage items and craft supplies. While results during the period were mostly solid, there are some concerns about macroeconomic headwinds and discretionary spending prospects. Etsy operates in a niche, differentiated, and fast-growing segment of retail as a scaled, global, two-sided marketplace for unique and creative goods. In Jennison’s view, Etsy provides opportunity for durable high margins and increasing returns at scale in a capital-light model with higher profitability than its e-commerce peers. |

| · | Canadian technology company TELUS International provides IT services and multilingual customer service to global clients. The company lowered 2023 guidance due to softening demand, which weighed heavily on shares. While Jennison’s expectations were lowered, the resulting valuation appeared very attractive. As of the end of the period, the position was under evaluation by Jennison. |

| · | Biotech company Apellis Pharmaceuticals focuses on complement therapeutics, with a growing pipeline of drugs targeting rare diseases, ophthalmology, and neurology. Shares were down because of reports of inflammation following administration of the company’s ocular medication, Syfovre. Jennison believes these side effects likely resulted from the way the drug was administered, rather than the drug itself; however, Jennison is closely monitoring the situation. |

Current outlook

| · | Sentiment in the near term is clouded by uncertainties due to—but not limited to—repeated threats of a government shutdown, auto strikes, the restart of student loan repayments, and the lagged effect on financing costs and spending intentions of interest rates at 15-year highs. These impediments will likely weigh on economic growth into year-end and deepen the deceleration that Jennison has been anticipating since 2023 began. |

| · | US consumers, with less robust prospects overall, are beginning to show stress—primarily at lower income levels. Overall, a healthy employment backdrop and residential real estate strength, which bolsters net worth, are variables that point to a moderate slowdown. |

| · | From a forward-looking perspective, small-cap stocks appear very attractively valued on an absolute and relative basis relative to large-cap stocks. |

| · | Jennison remains optimistic that Fund holdings are well-positioned to navigate the prevailing complex macroeconomic and market landscape. From a positioning perspective, the Fund remains prudently diversified and is balanced relative to the index. |

10 Visit our website at pgim.com/investments

*This strategy and performance overview, which discusses what strategies or holdings (including derivatives, if applicable) affected the Fund’s performance, is compiled based on how the Fund performed relative to the Fund’s benchmark index and is viewed for performance attribution purposes at the aggregate Fund level, which in most instances will not directly correlate to the amounts disclosed in the Statement of Operations which conform to US generally accepted accounting principles.

PGIM Jennison Small Company Fund 11

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 held through the six-month period ended September 30, 2023. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of PGIM funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information

12 Visit our website at pgim.com/investments

provided in the expense table. Additional fees have the effect of reducing investment returns.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| PGIM Jennison Small Company Fund |

Beginning Account Value April 1, 2023 |

Ending Account Value September 30, 2023 |

Annualized Expense Ratio Based on the Six-Month Period |

Expenses Paid During the Six-Month Period* | ||||||

| Class A |

Actual | $1,000.00 | $ 956.30 | 1.15% | $ 5.64 | |||||

| Hypothetical | $1,000.00 | $1,019.30 | 1.15% | $ 5.82 | ||||||

| Class C |

Actual | $1,000.00 | $ 952.60 | 1.98% | $ 9.69 | |||||

| Hypothetical | $1,000.00 | $1,015.14 | 1.98% | $10.00 | ||||||

| Class R |

Actual | $1,000.00 | $ 955.00 | 1.34% | $ 6.57 | |||||

| Hypothetical | $1,000.00 | $1,018.35 | 1.34% | $ 6.78 | ||||||

| Class Z |

Actual | $1,000.00 | $ 957.90 | 0.80% | $ 3.93 | |||||

| Hypothetical | $1,000.00 | $1,021.06 | 0.80% | $ 4.05 | ||||||

| Class R2 |

Actual | $1,000.00 | $ 956.30 | 1.18% | $ 5.79 | |||||

| Hypothetical | $1,000.00 | $1,019.15 | 1.18% | $ 5.97 | ||||||

| Class R4 |

Actual | $1,000.00 | $ 957.10 | 0.93% | $ 4.56 | |||||

| Hypothetical | $1,000.00 | $1,020.41 | 0.93% | $ 4.71 | ||||||

| Class R6 |

Actual | $1,000.00 | $ 958.20 | 0.69% | $ 3.39 | |||||

| Hypothetical | $1,000.00 | $1,021.61 | 0.69% | $ 3.50 | ||||||

*Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 183 days in the six-month period ended September 30, 2023, and divided by the 365 days in the Fund’s fiscal year ended September 30, 2023 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

PGIM Jennison Small Company Fund 13

as of September 30, 2023

| Description | Shares | Value | ||||||

| LONG-TERM INVESTMENTS 97.5% |

||||||||

| COMMON STOCKS |

||||||||

| Aerospace & Defense 1.3% |

||||||||

| Hexcel Corp. |

548,331 | $ | 35,718,281 | |||||

| Automobiles 0.0% |

||||||||

| Electric Last Mile Solutions, Inc.* |

760,000 | 53,200 | ||||||

| Banks 5.8% |

||||||||

| BankUnited, Inc. |

421,773 | 9,574,247 | ||||||

| Brookline Bancorp, Inc. |

1,421,847 | 12,953,026 | ||||||

| East West Bancorp, Inc. |

598,938 | 31,570,022 | ||||||

| Eastern Bankshares, Inc. |

1,338,272 | 16,781,931 | ||||||

| First Bancorp |

65,761 | 1,850,514 | ||||||

| First Interstate BancSystem, Inc. (Class A Stock)(a) |

595,003 | 14,839,375 | ||||||

| Hilltop Holdings, Inc. |

476,480 | 13,512,973 | ||||||

| Pinnacle Financial Partners, Inc. |

579,745 | 38,866,105 | ||||||

| Western Alliance Bancorp |

262,166 | 12,051,771 | ||||||

| WSFS Financial Corp.(a) |

152,562 | 5,568,513 | ||||||

|

|

|

|||||||

| 157,568,477 | ||||||||

| Biotechnology 3.1% |

||||||||

| Apellis Pharmaceuticals, Inc.*(a) |

660,484 | 25,124,811 | ||||||

| Arcutis Biotherapeutics, Inc.*(a) |

778,196 | 4,132,221 | ||||||

| Argenx SE (Netherlands), ADR* |

37,045 | 18,212,433 | ||||||

| Avid Bioservices, Inc.* |

1,037,779 | 9,796,634 | ||||||

| Syndax Pharmaceuticals, Inc.* |

656,761 | 9,536,170 | ||||||

| Vaxcyte, Inc.* |

326,250 | 16,632,225 | ||||||

|

|

|

|||||||

| 83,434,494 | ||||||||

| Broadline Retail 0.7% |

||||||||

| Etsy, Inc.*(a) |

280,777 | 18,132,579 | ||||||

| Building Products 1.3% |

||||||||

| Armstrong World Industries, Inc. |

81,375 | 5,859,000 | ||||||

| Hayward Holdings, Inc.*(a) |

2,148,594 | 30,295,175 | ||||||

|

|

|

|||||||

| 36,154,175 | ||||||||

| Capital Markets 1.6% |

||||||||

| AssetMark Financial Holdings, Inc.* |

930,025 | 23,325,027 | ||||||

See Notes to Financial Statements.

PGIM Jennison Small Company Fund 15

Schedule of Investments (continued)

as of September 30, 2023

| Description | Shares | Value | ||||||

| COMMON STOCKS (Continued) |

||||||||

| Capital Markets (cont’d.) |

||||||||

| Bridge Investment Group Holdings, Inc. (Class A Stock) |

1,391,366 | $ | 12,800,567 | |||||

| Houlihan Lokey, Inc. |

60,903 | 6,523,930 | ||||||

|

|

|

|||||||

| 42,649,524 | ||||||||

| Chemicals 0.8% |

||||||||

| Avient Corp. |

586,054 | 20,699,427 | ||||||

| Commercial Services & Supplies 1.1% |

||||||||

| ACV Auctions, Inc. (Class A Stock)*(a) |

1,269,603 | 19,272,573 | ||||||

| VSE Corp.(a) |

204,568 | 10,318,410 | ||||||

|

|

|

|||||||

| 29,590,983 | ||||||||

| Construction & Engineering 1.5% |

||||||||

| Great Lakes Dredge & Dock Corp.* |

1,259,513 | 10,038,319 | ||||||

| WillScot Mobile Mini Holdings Corp.* |

729,595 | 30,343,856 | ||||||

|

|

|

|||||||

| 40,382,175 | ||||||||

| Construction Materials 0.5% |

||||||||

| Summit Materials, Inc. (Class A Stock)* |

477,093 | 14,856,676 | ||||||

| Consumer Staples Distribution & Retail 2.2% |

||||||||

| Chefs’ Warehouse, Inc. (The)* |

491,794 | 10,416,197 | ||||||

| Performance Food Group Co.* |

818,397 | 48,170,847 | ||||||

|

|

|

|||||||

| 58,587,044 | ||||||||

| Diversified Telecommunication Services 0.3% |

||||||||

| Cogent Communications Holdings, Inc. |

126,107 | 7,806,023 | ||||||

| Electrical Equipment 1.4% |

||||||||

| Regal Rexnord Corp. |

271,027 | 38,724,338 | ||||||

| Electronic Equipment, Instruments & Components 0.4% |

||||||||

| Cognex Corp. |

260,121 | 11,039,535 | ||||||

| Energy Equipment & Services 1.4% |

||||||||

| Weatherford International PLC* |

408,802 | 36,927,085 | ||||||

See Notes to Financial Statements.

16

| Description | Shares | Value | ||||||

| COMMON STOCKS (Continued) |

||||||||

| Financial Services 3.2% |

||||||||

| Shift4 Payments, Inc. (Class A Stock)*(a) |

710,608 | $ | 39,346,365 | |||||

| WEX, Inc.* |

248,326 | 46,707,637 | ||||||

|

|

|

|||||||

| 86,054,002 | ||||||||

| Food Products 2.6% |

||||||||

| Adecoagro SA (Brazil) |

2,557,367 | 29,895,620 | ||||||

| Darling Ingredients, Inc.* |

538,168 | 28,092,370 | ||||||

| Freshpet, Inc.* |

65,339 | 4,304,533 | ||||||

| Lamb Weston Holdings, Inc. |

88,796 | 8,210,078 | ||||||

|

|

|

|||||||

| 70,502,601 | ||||||||

| Ground Transportation 1.3% |

||||||||

| Saia, Inc.* |

90,371 | 36,026,399 | ||||||

| Health Care Equipment & Supplies 0.3% |

||||||||

| Shockwave Medical, Inc.* |

38,908 | 7,746,583 | ||||||

| Health Care Providers & Services 5.2% |

||||||||

| Acadia Healthcare Co., Inc.* |

449,774 | 31,623,610 | ||||||

| Guardant Health, Inc.* |

647,665 | 19,196,791 | ||||||

| Molina Healthcare, Inc.* |

138,880 | 45,537,363 | ||||||

| Option Care Health, Inc.* |

412,500 | 13,344,375 | ||||||

| Progyny, Inc.*(a) |

921,107 | 31,336,060 | ||||||

|

|

|

|||||||

| 141,038,199 | ||||||||

| Health Care Technology 0.4% |

||||||||

| Phreesia, Inc.* |

611,103 | 11,415,404 | ||||||

| Hotel & Resort REITs 0.6% |

||||||||

| Summit Hotel Properties, Inc. |

2,823,664 | 16,377,251 | ||||||

| Hotels, Restaurants & Leisure 4.1% |

||||||||

| Bloomin’ Brands, Inc.(a) |

1,336,670 | 32,868,715 | ||||||

| Boyd Gaming Corp. |

391,581 | 23,819,872 | ||||||

| Cava Group, Inc.*(a) |

457,593 | 14,016,074 | ||||||

| Churchill Downs, Inc. |

344,030 | 39,921,241 | ||||||

|

|

|

|||||||

| 110,625,902 | ||||||||

See Notes to Financial Statements.

PGIM Jennison Small Company Fund 17

Schedule of Investments (continued)

as of September 30, 2023

| Description | Shares | Value | ||||||

| COMMON STOCKS (Continued) |

||||||||

| Household Durables 2.2% |

||||||||

| Century Communities, Inc. |

431,806 | $ | 28,836,005 | |||||

| Toll Brothers, Inc. |

423,688 | 31,335,964 | ||||||

|

|

|

|||||||

| 60,171,969 | ||||||||

| Independent Power & Renewable Electricity Producers 0.4% |

||||||||

| NextEra Energy Partners LP |

361,900 | 10,748,430 | ||||||

| Industrial REITs 1.1% |

||||||||

| Plymouth Industrial REIT, Inc. |

1,368,014 | 28,659,893 | ||||||

| Insurance 5.8% |

||||||||

| Axis Capital Holdings Ltd. |

828,227 | 46,687,156 | ||||||

| James River Group Holdings Ltd. |

435,582 | 6,686,184 | ||||||

| Markel Group, Inc.* |

17,828 | 26,251,552 | ||||||

| RenaissanceRe Holdings Ltd. (Bermuda) |

168,573 | 33,363,968 | ||||||

| Ryan Specialty Holdings, Inc.* |

581,348 | 28,137,243 | ||||||

| Skyward Specialty Insurance Group, Inc.* |

635,337 | 17,382,820 | ||||||

|

|

|

|||||||

| 158,508,923 | ||||||||

| IT Services 0.8% |

||||||||

| Globant SA*(a) |

115,242 | 22,800,630 | ||||||

| Leisure Products 0.6% |

||||||||

| Brunswick Corp. |

207,221 | 16,370,459 | ||||||

| Life Sciences Tools & Services 0.2% |

||||||||

| Olink Holding AB (Sweden), ADR* |

369,165 | 5,445,184 | ||||||

| Machinery 4.5% |

||||||||

| Energy Recovery, Inc.* |

680,941 | 14,442,759 | ||||||

| Enerpac Tool Group Corp. |

1,231,448 | 32,547,171 | ||||||

| EnPro Industries, Inc. |

171,155 | 20,742,274 | ||||||

| Trinity Industries, Inc. |

2,241,417 | 54,578,504 | ||||||

|

|

|

|||||||

| 122,310,708 | ||||||||

| Marine Transportation 1.9% |

||||||||

| Kirby Corp.* |

639,125 | 52,919,550 | ||||||

| Metals & Mining 3.1% |

||||||||

| B2Gold Corp. (Canada) |

2,944,981 | 8,510,995 | ||||||

| Constellium SE* |

2,646,639 | 48,168,830 | ||||||

See Notes to Financial Statements.

18

| Description | Shares | Value | ||||||

| COMMON STOCKS (Continued) |

||||||||

| Metals & Mining (cont’d.) |

||||||||

| ERO Copper Corp. (Brazil)* |

1,103,979 | $ | 19,035,662 | |||||

| Materion Corp. |

74,494 | 7,591,684 | ||||||

|

|

|

|||||||

| 83,307,171 | ||||||||

| Mortgage Real Estate Investment Trusts (REITs) 1.0% |

||||||||

| Ladder Capital Corp. |

2,539,116 | 26,051,330 | ||||||

| Multi-Utilities 2.4% |

||||||||

| CenterPoint Energy, Inc. |

1,048,593 | 28,154,722 | ||||||

| NiSource, Inc. |

1,491,489 | 36,809,949 | ||||||

|

|

|

|||||||

| 64,964,671 | ||||||||

| Office REITs 0.2% |

||||||||

| Cousins Properties, Inc. |

315,710 | 6,431,013 | ||||||

| Oil, Gas & Consumable Fuels 5.6% |

||||||||

| Chord Energy Corp.(a) |

291,088 | 47,176,632 | ||||||

| Permian Resources Corp.(a) |

2,325,824 | 32,468,503 | ||||||

| Targa Resources Corp. |

851,675 | 73,005,581 | ||||||

|

|

|

|||||||

| 152,650,716 | ||||||||

| Passenger Airlines 0.4% |

||||||||

| Sun Country Airlines Holdings, Inc.* |

708,170 | 10,509,243 | ||||||

| Personal Care Products 0.2% |

||||||||

| elf Beauty, Inc.* |

48,707 | 5,349,490 | ||||||

| Pharmaceuticals 2.0% |

||||||||

| Cymabay Therapeutics, Inc.* |

513,408 | 7,654,913 | ||||||

| Jazz Pharmaceuticals PLC* |

262,133 | 33,930,496 | ||||||

| Pacira BioSciences, Inc.*(a) |

256,009 | 7,854,356 | ||||||

| Revance Therapeutics, Inc.* |

435,357 | 4,993,545 | ||||||

|

|

|

|||||||

| 54,433,310 | ||||||||

| Professional Services 5.0% |

||||||||

| ASGN, Inc.* |

100,382 | 8,199,202 | ||||||

| HireRight Holdings Corp.*(a) |

489,832 | 4,658,302 | ||||||

| Huron Consulting Group, Inc.* |

404,980 | 42,182,717 | ||||||

| KBR, Inc.(a) |

708,545 | 41,761,642 | ||||||

See Notes to Financial Statements.

PGIM Jennison Small Company Fund 19

Schedule of Investments (continued)

as of September 30, 2023

| Description | Shares | Value | ||||||

| COMMON STOCKS (Continued) |

||||||||

| Professional Services (cont’d.) |

||||||||

| Paycom Software, Inc. |

149,379 | $ | 38,729,493 | |||||

| TELUS International CDA, Inc. (Philippines)* |

40,057 | 305,235 | ||||||

|

|

|

|||||||

| 135,836,591 | ||||||||

| Real Estate Management & Development 1.0% |

||||||||

| Howard Hughes Holdings, Inc.* |

381,250 | 28,262,063 | ||||||

| Residential REITs 0.6% |

||||||||

| Independence Realty Trust, Inc. |

1,088,829 | 15,319,824 | ||||||

| Retail REITs 0.5% |

||||||||

| Retail Opportunity Investments Corp. |

1,080,302 | 13,374,139 | ||||||

| Semiconductors & Semiconductor Equipment 3.0% |

||||||||

| Entegris, Inc. |

84,026 | 7,890,882 | ||||||

| Tower Semiconductor Ltd. (Israel)* |

678,917 | 16,674,201 | ||||||

| Universal Display Corp. |

357,028 | 56,049,826 | ||||||

|

|

|

|||||||

| 80,614,909 | ||||||||

| Software 5.5% |

||||||||

| Clear Secure, Inc. (Class A Stock)(a) |

1,083,901 | 20,637,475 | ||||||

| CyberArk Software Ltd.* |

149,184 | 24,431,864 | ||||||

| Descartes Systems Group, Inc. (The) (Canada)* |

124,861 | 9,162,300 | ||||||

| DoubleVerify Holdings, Inc.* |

163,391 | 4,566,779 | ||||||

| EngageSmart, Inc.* |

316,361 | 5,691,334 | ||||||

| Intapp, Inc.* |

423,773 | 14,204,871 | ||||||

| PTC, Inc.* |

121,243 | 17,177,708 | ||||||

| Q2 Holdings, Inc.* |

342,227 | 11,043,665 | ||||||

| Sprout Social, Inc. (Class A Stock)*(a) |

863,434 | 43,068,088 | ||||||

|

|

|

|||||||

| 149,984,084 | ||||||||

| Specialized REITs 2.8% |

||||||||

| Gaming & Leisure Properties, Inc. |

1,386,872 | 63,172,018 | ||||||

| National Storage Affiliates Trust |

442,090 | 14,031,937 | ||||||

|

|

|

|||||||

| 77,203,955 | ||||||||

| Specialty Retail 1.4% |

||||||||

| Boot Barn Holdings, Inc.* |

122,897 | 9,978,007 | ||||||

See Notes to Financial Statements.

20

| Description | Shares | Value | ||||||

| COMMON STOCKS (Continued) |

||||||||

| Specialty Retail (cont’d.) |

||||||||

| Burlington Stores, Inc.* |

146,435 | $ | 19,812,656 | |||||

| Foot Locker, Inc.(a) |

407,778 | 7,074,948 | ||||||

|

|

|

|||||||

| 36,865,611 | ||||||||

| Textiles, Apparel & Luxury Goods 3.3% |

||||||||

| Kontoor Brands, Inc.(a) |

221,112 | 9,709,028 | ||||||

| On Holding AG (Switzerland) (Class A Stock)* |

1,503,091 | 41,815,992 | ||||||

| Ralph Lauren Corp.(a) |

323,261 | 37,527,369 | ||||||

|

|

|

|||||||

| 89,052,389 | ||||||||

| Trading Companies & Distributors 0.9% |

||||||||

| Herc Holdings, Inc.(a) |

196,533 | 23,375,635 | ||||||

|

|

|

|||||||

| TOTAL LONG-TERM INVESTMENTS |

2,643,632,247 | |||||||

|

|

|

|||||||

| SHORT-TERM INVESTMENTS 13.4% |

||||||||

| AFFILIATED MUTUAL FUNDS |

||||||||

| PGIM Core Government Money Market Fund(wb) |

73,971,470 | 73,971,470 | ||||||

| PGIM Institutional Money Market Fund |

288,808,265 | 288,634,980 | ||||||

|

|

|

|||||||

| TOTAL SHORT-TERM INVESTMENTS |

362,606,450 | |||||||

|

|

|

|||||||

| TOTAL INVESTMENTS 110.9% |

3,006,238,697 | |||||||

| Liabilities in excess of other assets (10.9)% |

(295,370,572 | ) | ||||||

|

|

|

|||||||

| NET ASSETS 100.0% |

$ | 2,710,868,125 | ||||||

|

|

|

|||||||

Below is a list of the abbreviation(s) used in the annual report:

ADR—American Depositary Receipt

LP—Limited Partnership

REITs—Real Estate Investment Trust

SOFR—Secured Overnight Financing Rate

| * | Non-income producing security. |

See Notes to Financial Statements.

PGIM Jennison Small Company Fund 21

Schedule of Investments (continued)

as of September 30, 2023

| (a) | All or a portion of security is on loan. The aggregate market value of such securities, including those sold and pending settlement, is $279,446,726; cash collateral of $287,305,921 (included in liabilities) was received with which the Fund purchased highly liquid short-term investments. In the event of significant appreciation in value of securities on loan on the last business day of the reporting period, the Fund may reflect a collateral value that is less than the market value of the loaned securities and such shortfall is remedied the following business day. |

| (b) | Represents security, or portion thereof, purchased with cash collateral received for securities on loan and includes dividend reinvestment. |

| (wb) | Represents an investment in a Fund affiliated with the Manager. |

Fair Value Measurements:

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

Level 1—unadjusted quoted prices generally in active markets for identical securities.

Level 2—quoted prices for similar securities, interest rates and yield curves, prepayment speeds, foreign currency exchange rates and other observable inputs.

Level 3—unobservable inputs for securities valued in accordance with Board approved fair valuation procedures.

The following is a summary of the inputs used as of September 30, 2023 in valuing such portfolio securities:

| Level 1 | Level 2 |

Level 3 |

||||||||||||||||||||||||||||||

| Investments in Securities |

||||||||||||||||||||||||||||||||

| Assets |

||||||||||||||||||||||||||||||||

| Long-Term Investments |

||||||||||||||||||||||||||||||||

| Common Stocks |

||||||||||||||||||||||||||||||||

| Aerospace & Defense |

$ | 35,718,281 | $ | — | $ | — | ||||||||||||||||||||||||||

| Automobiles |

53,200 | — | — | |||||||||||||||||||||||||||||

| Banks |

157,568,477 | — | — | |||||||||||||||||||||||||||||

| Biotechnology |

83,434,494 | — | — | |||||||||||||||||||||||||||||

| Broadline Retail |

18,132,579 | — | — | |||||||||||||||||||||||||||||

| Building Products |

36,154,175 | — | — | |||||||||||||||||||||||||||||

| Capital Markets |

42,649,524 | — | — | |||||||||||||||||||||||||||||

| Chemicals |

20,699,427 | — | — | |||||||||||||||||||||||||||||

| Commercial Services & Supplies |

29,590,983 | — | — | |||||||||||||||||||||||||||||

| Construction & Engineering |

40,382,175 | — | — | |||||||||||||||||||||||||||||

| Construction Materials |

14,856,676 | — | — | |||||||||||||||||||||||||||||

| Consumer Staples Distribution & Retail |

58,587,044 | — | — | |||||||||||||||||||||||||||||

| Diversified Telecommunication Services |

7,806,023 | — | — | |||||||||||||||||||||||||||||

| Electrical Equipment |

38,724,338 | — | — | |||||||||||||||||||||||||||||

| Electronic Equipment, Instruments & Components |

11,039,535 | — | — | |||||||||||||||||||||||||||||

| Energy Equipment & Services |

36,927,085 | — | — | |||||||||||||||||||||||||||||

| Financial Services |

86,054,002 | — | — | |||||||||||||||||||||||||||||

| Food Products |

70,502,601 | — | — | |||||||||||||||||||||||||||||

| Ground Transportation |

36,026,399 | — | — | |||||||||||||||||||||||||||||

| Health Care Equipment & Supplies |

7,746,583 | — | — | |||||||||||||||||||||||||||||

| Health Care Providers & Services |

141,038,199 | — | — | |||||||||||||||||||||||||||||

| Health Care Technology |

11,415,404 | — | — | |||||||||||||||||||||||||||||

| Hotel & Resort REITs |

16,377,251 | — | — | |||||||||||||||||||||||||||||

| Hotels, Restaurants & Leisure |

110,625,902 | — | — | |||||||||||||||||||||||||||||

See Notes to Financial Statements.

22

| Level 1 | Level 2 |

Level 3 |

||||||||||||||||||||||||||||||

| Investments in Securities (continued) |

||||||||||||||||||||||||||||||||

| Assets (continued) |

||||||||||||||||||||||||||||||||

| Long-Term Investments (continued) |

||||||||||||||||||||||||||||||||

| Common Stocks (continued) |

||||||||||||||||||||||||||||||||

| Household Durables |

$ | 60,171,969 | $ | — | $ | — | ||||||||||||||||||||||||||

| Independent Power & Renewable Electricity Producers |

10,748,430 | — | — | |||||||||||||||||||||||||||||

| Industrial REITs |

28,659,893 | — | — | |||||||||||||||||||||||||||||

| Insurance |

158,508,923 | — | — | |||||||||||||||||||||||||||||

| IT Services |

22,800,630 | — | — | |||||||||||||||||||||||||||||

| Leisure Products |

16,370,459 | — | — | |||||||||||||||||||||||||||||

| Life Sciences Tools & Services |

5,445,184 | — | — | |||||||||||||||||||||||||||||

| Machinery |

122,310,708 | — | — | |||||||||||||||||||||||||||||

| Marine Transportation |

52,919,550 | — | — | |||||||||||||||||||||||||||||

| Metals & Mining |

83,307,171 | — | — | |||||||||||||||||||||||||||||

| Mortgage Real Estate Investment Trusts (REITs) |

26,051,330 | — | — | |||||||||||||||||||||||||||||

| Multi-Utilities |

64,964,671 | — | — | |||||||||||||||||||||||||||||

| Office REITs |

6,431,013 | — | — | |||||||||||||||||||||||||||||

| Oil, Gas & Consumable Fuels |

152,650,716 | — | — | |||||||||||||||||||||||||||||

| Passenger Airlines |

10,509,243 | — | — | |||||||||||||||||||||||||||||

| Personal Care Products |

5,349,490 | — | — | |||||||||||||||||||||||||||||

| Pharmaceuticals |

54,433,310 | — | — | |||||||||||||||||||||||||||||

| Professional Services |

135,836,591 | — | — | |||||||||||||||||||||||||||||

| Real Estate Management & Development |

28,262,063 | — | — | |||||||||||||||||||||||||||||

| Residential REITs |

15,319,824 | — | — | |||||||||||||||||||||||||||||

| Retail REITs |

13,374,139 | — | — | |||||||||||||||||||||||||||||

| Semiconductors & Semiconductor Equipment |

80,614,909 | — | — | |||||||||||||||||||||||||||||

| Software |

149,984,084 | — | — | |||||||||||||||||||||||||||||

| Specialized REITs |

77,203,955 | — | — | |||||||||||||||||||||||||||||

| Specialty Retail |

36,865,611 | — | — | |||||||||||||||||||||||||||||

| Textiles, Apparel & Luxury Goods |

89,052,389 | — | — | |||||||||||||||||||||||||||||

| Trading Companies & Distributors |

23,375,635 | — | — | |||||||||||||||||||||||||||||

| Short-Term Investments |

||||||||||||||||||||||||||||||||

| Affiliated Mutual Funds |

362,606,450 | — | — | |||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

| Total |

$ | 3,006,238,697 | $ | — | $ | — | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

Industry Classification:

The industry classification of investments and liabilities in excess of other assets shown as a percentage of net assets as of September 30, 2023 were as follows:

| Affiliated Mutual Funds (10.6% represents investments purchased with collateral from securities on loan) |

13.4 | % | ||

| Insurance |

5.8 | |||

| Banks |

5.8 | |||

| Oil, Gas & Consumable Fuels |

5.6 | |||

| Software |

5.5 |

| Health Care Providers & Services |

5.2 | % | ||

| Professional Services |

5.0 | |||

| Machinery |

4.5 | |||

| Hotels, Restaurants & Leisure |

4.1 | |||

| Textiles, Apparel & Luxury Goods |

3.3 | |||

| Financial Services |

3.2 | |||

| Biotechnology |

3.1 |

See Notes to Financial Statements.

PGIM Jennison Small Company Fund 23

Schedule of Investments (continued)

as of September 30, 2023

Industry Classification (continued):

| Metals & Mining |

3.1 | % | ||

| Semiconductors & Semiconductor Equipment |

3.0 | |||

| Specialized REITs |

2.8 | |||

| Food Products |

2.6 | |||

| Multi-Utilities |

2.4 | |||

| Household Durables |

2.2 | |||

| Consumer Staples Distribution & Retail |

2.2 | |||

| Pharmaceuticals |

2.0 | |||

| Marine Transportation |

1.9 | |||

| Capital Markets |

1.6 | |||

| Construction & Engineering |

1.5 | |||

| Electrical Equipment |

1.4 | |||

| Energy Equipment & Services |

1.4 | |||

| Specialty Retail |

1.4 | |||

| Building Products |

1.3 | |||

| Ground Transportation |

1.3 | |||

| Aerospace & Defense |

1.3 | |||

| Commercial Services & Supplies |

1.1 | |||

| Industrial REITs |

1.1 | |||

| Real Estate Management & Development |

1.0 | |||

| Mortgage Real Estate Investment Trusts (REITs) |

1.0 | |||

| Trading Companies & Distributors |

0.9 | |||

| IT Services |

0.8 | |||

| Chemicals |

0.8 | |||

| Broadline Retail |

0.7 |

| Hotel & Resort REITs |

0.6 | % | ||

| Leisure Products |

0.6 | |||

| Residential REITs |

0.6 | |||

| Construction Materials |

0.5 | |||

| Retail REITs |

0.5 | |||

| Health Care Technology |

0.4 | |||

| Electronic Equipment, Instruments & Components |

0.4 | |||

| Independent Power & Renewable Electricity Producers |

0.4 | |||

| Passenger Airlines |

0.4 | |||

| Diversified Telecommunication Services |

0.3 | |||

| Health Care Equipment & Supplies |

0.3 | |||

| Office REITs |

0.2 | |||

| Life Sciences Tools & Services |

0.2 | |||

| Personal Care Products |

0.2 | |||

| Automobiles |

0.0 | * | ||

|

|

|

|||

| 110.9 | ||||

| Liabilities in excess of other assets |

(10.9 | ) | ||

|

|

|

|||

| 100.0 | % | |||

|

|

|

|||

| * | Less than 0.05% |

Financial Instruments/Transactions—Summary of Offsetting and Netting Arrangements:

The Fund entered into financial instruments/transactions during the reporting period that are either offset in accordance with current requirements or are subject to enforceable master netting arrangements or similar agreements that permit offsetting. The information about offsetting and related netting arrangements for financial instruments/transactions where the legal right to set-off exists is presented in the summary below.

Offsetting of financial instrument/transaction assets and liabilities:

| Description | Gross Market Value of Recognized Assets/(Liabilities) |

Collateral Pledged/(Received)(1) |

Net Amount | |||

| Securities on Loan | $279,446,726 | $(279,446,726) | $— | |||

| (1) | Collateral amount disclosed by the Fund is limited to the market value of financial instruments/transactions. |

See Notes to Financial Statements.

24

Statement of Assets and Liabilities

as of September 30, 2023

| Assets |

||||

| Investments at value, including securities on loan of $279,446,726: |

||||

| Unaffiliated investments (cost $2,514,339,625) |

$ | 2,643,632,247 | ||

| Affiliated investments (cost $362,494,211) |

362,606,450 | |||

| Receivable for investments sold |

22,922,970 | |||

| Receivable for Fund shares sold |

3,086,689 | |||

| Dividends receivable |

2,239,105 | |||

| Tax reclaim receivable |

46,038 | |||

| Prepaid expenses |

13,366 | |||

|

|

|

|||

| Total Assets |

3,034,546,865 | |||

|

|

|

|||

| Liabilities |

||||

| Payable to broker for collateral for securities on loan |

287,305,921 | |||

| Payable for Fund shares purchased |

20,761,262 | |||

| Payable for investments purchased |

12,355,463 | |||

| Management fee payable |

1,534,573 | |||

| Accrued expenses and other liabilities |

1,497,401 | |||

| Distribution fee payable |

163,003 | |||

| Affiliated transfer agent fee payable |

61,117 | |||

|

|

|

|||

| Total Liabilities |

323,678,740 | |||

|

|

|

|||

| Net Assets |

$ | 2,710,868,125 | ||

|

|

|

|||

| Net assets were comprised of: |

||||

| Common stock, at par |

$ | 1,432,636 | ||

| Paid-in capital in excess of par |

2,603,154,810 | |||

| Total distributable earnings (loss) |

106,280,679 | |||

|

|

|

|||

| Net assets, September 30, 2023 |

$ | 2,710,868,125 | ||

|

|

|

|||

See Notes to Financial Statements.

PGIM Jennison Small Company Fund 25

Statement of Assets and Liabilities

as of September 30, 2023

| Class A |

||||||||

| Net asset value and redemption price per share, ($411,857,860 ÷ 24,459,607 shares of common stock issued and outstanding) |

$ | 16.84 | ||||||

| Maximum sales charge (5.50% of offering price) |

0.98 | |||||||

|

|

|

|||||||

| Maximum offering price to public |

$ | 17.82 | ||||||

|

|

|

|||||||

| Class C |

||||||||

| Net asset value, offering price and redemption price per share, ($10,333,977 ÷ 459,156 shares of common stock issued and outstanding) |

$ | 22.51 | ||||||

|

|

|

|||||||

| Class R |

||||||||

| Net asset value, offering price and redemption price per share, ($108,533,934 ÷ 6,911,612 shares of common stock issued and outstanding) |

$ | 15.70 | ||||||

|

|

|

|||||||

| Class Z |

||||||||

| Net asset value, offering price and redemption price per share, ($363,372,564 ÷ 18,169,917 shares of common stock issued and outstanding) |

$ | 20.00 | ||||||

|

|

|

|||||||

| Class R2 |

||||||||

| Net asset value, offering price and redemption price per share, ($12,746,213 ÷ 676,666 shares of common stock issued and outstanding) |

$ | 18.84 | ||||||

|

|

|

|||||||

| Class R4 |

||||||||

| Net asset value, offering price and redemption price per share, ($2,045,662 ÷ 106,708 shares of common stock issued and outstanding) |

$ | 19.17 | ||||||

|

|

|

|||||||

| Class R6 |

||||||||

| Net asset value, offering price and redemption price per share, ($1,801,977,915 ÷ 92,479,965 shares of common stock issued and outstanding) |

$ | 19.49 | ||||||

|

|

|

|||||||

See Notes to Financial Statements.

26

Statement of Operations

Year Ended September 30, 2023

| Net Investment Income (Loss) |

||||

| Income |

||||

| Unaffiliated dividend income (net of $200,424 foreign withholding tax) |

$ | 40,788,500 | ||

| Affiliated dividend income |

2,953,574 | |||

| Income from securities lending, net (including affiliated income of $967,131) |

1,063,073 | |||

|

|

|

|||

| Total income |

44,805,147 | |||

|

|

|

|||

| Expenses |

||||

| Management fee |

18,979,459 | |||

| Distribution fee(a) |

2,387,596 | |||

| Shareholder servicing fees(a) |

11,195 | |||

| Transfer agent’s fees and expenses (including affiliated expense of $335,491)(a) |

1,435,987 | |||

| Custodian and accounting fees |

165,645 | |||

| Registration fees(a) |

109,757 | |||

| Shareholders’ reports |

99,411 | |||

| Professional fees |

54,507 | |||

| Directors’ fees |

50,996 | |||

| Audit fee |

25,440 | |||

| Miscellaneous |

63,696 | |||

|

|

|

|||

| Total expenses |

23,383,689 | |||

| Less: Fee waiver and/or expense reimbursement(a) |

(26,790 | ) | ||

| Distribution fee waiver(a) |

(292,782 | ) | ||

|

|

|

|||

| Net expenses |

23,064,117 | |||

|

|

|

|||

| Net investment income (loss) |

21,741,030 | |||

|

|

|

|||

| Realized And Unrealized Gain (Loss) On Investment And Foreign Currency Transactions |

||||

| Net realized gain (loss) on: |

||||

| Investment transactions (including affiliated of $16,427) |

(25,104,518 | ) | ||

| Foreign currency transactions |

10,583 | |||

|

|

|

|||

| (25,093,935 | ) | |||

|

|

|

|||

| Net change in unrealized appreciation (depreciation) on investments (including affiliated of $17,530) |

192,672,577 | |||

|

|

|

|||

| Net gain (loss) on investment and foreign currency transactions |

167,578,642 | |||

|

|

|

|||

| Net Increase (Decrease) In Net Assets Resulting From Operations |

$ | 189,319,672 | ||

|

|

|

|||

| (a) | Class specific expenses and waivers were as follows: |

| Class A | Class C | Class R | Class Z | Class R2 | Class R4 | Class R6 | ||||||||||||||||||||||

| Distribution fee |

1,359,702 | 126,518 | 878,345 | — | 23,031 | — | — | |||||||||||||||||||||

| Shareholder servicing fees |

— | — | — | — | 9,213 | 1,982 | — | |||||||||||||||||||||

| Transfer agent’s fees and expenses |

731,070 | 22,042 | 170,578 | 456,707 | 26,935 | 3,578 | 25,077 | |||||||||||||||||||||

| Registration fees |

17,922 | 14,300 | 6,584 | 27,159 | 6,584 | 6,054 | 31,154 | |||||||||||||||||||||

| Fee waiver and/or expense reimbursement |

— | — | — | — | (20,059 | ) | (6,731 | ) | — | |||||||||||||||||||

| Distribution fee waiver |

— | — | (292,782 | ) | — | — | — | — | ||||||||||||||||||||

See Notes to Financial Statements.

PGIM Jennison Small Company Fund 27

Statements of Changes in Net Assets

| Year Ended September 30, |

||||||||||

|

|

|

|||||||||

| 2023 | 2022 | |||||||||

| Increase (Decrease) in Net Assets |

||||||||||

| Operations |

||||||||||

| Net investment income (loss) |

$ | 21,741,030 | $ | 6,645,235 | ||||||

| Net realized gain (loss) on investment and foreign currency transactions |

(25,093,935 | ) | 103,901,575 | |||||||

| Net change in unrealized appreciation (depreciation) on investments |

192,672,577 | (626,497,716 | ) | |||||||

|

|

|

|

|

|||||||

| Net increase (decrease) in net assets resulting from operations |

189,319,672 | (515,950,906 | ) | |||||||

|

|

|

|

|

|||||||

| Dividends and Distributions |

||||||||||

| Distributions from distributable earnings |

||||||||||

| Class A |

(18,142,082 | ) | (174,559,455 | ) | ||||||

| Class C |

(395,179 | ) | (4,769,099 | ) | ||||||

| Class R |

(4,996,511 | ) | (47,410,255 | ) | ||||||

| Class Z |

(13,913,313 | ) | (121,470,127 | ) | ||||||

| Class R2 |

(190,361 | ) | (1,393,766 | ) | ||||||

| Class R4 |

(31,240 | ) | (179,466 | ) | ||||||

| Class R6 |

(66,802,691 | ) | (241,822,838 | ) | ||||||

|

|

|

|

|

|||||||

| (104,471,377 | ) | (591,605,006 | ) | |||||||

|

|

|

|

|

|||||||

| Fund share transactions (Net of share conversions) |

||||||||||

| Net proceeds from shares sold |

529,726,720 | 1,418,226,831 | ||||||||

| Net asset value of shares issued in reinvestment of dividends and distributions |

102,069,673 | 566,459,157 | ||||||||

| Cost of shares purchased |

(593,103,253 | ) | (490,693,967 | ) | ||||||

|

|

|

|

|

|||||||

| Net increase (decrease) in net assets from Fund share transactions |

38,693,140 | 1,493,992,021 | ||||||||

|

|

|

|

|

|||||||

| Total increase (decrease) |

123,541,435 | 386,436,109 | ||||||||

| Net Assets: |

||||||||||

| Beginning of year |

2,587,326,690 | 2,200,890,581 | ||||||||

|

|

|

|

|

|||||||

| End of year |

$ | 2,710,868,125 | $ | 2,587,326,690 | ||||||

|

|

|

|

|

|||||||

See Notes to Financial Statements.

28

Financial Highlights

|

Class A Shares |

| |||||||||||||||||||

| Year Ended September 30, | ||||||||||||||||||||

| 2023 | 2022 | 2021 | 2020 | 2019 | ||||||||||||||||

| Per Share Operating Performance(a): |

||||||||||||||||||||

| Net Asset Value, Beginning of Year |

$16.38 | $28.33 | $20.68 | $21.08 | $26.83 | |||||||||||||||

| Income (loss) from investment operations: |

||||||||||||||||||||

| Net investment income (loss) |

0.08 | 0.01 | (0.10 | ) | (0.04 | )(b) | (0.06 | ) | ||||||||||||

| Net realized and unrealized gain (loss) on investment and foreign currency transactions | 1.08 | (3.78 | ) | 11.23 | 1.55 | (1.94 | ) | |||||||||||||

| Total from investment operations |

1.16 | (3.77 | ) | 11.13 | 1.51 | (2.00 | ) | |||||||||||||

| Less Dividends and Distributions: |

||||||||||||||||||||

| Dividends from net investment income |

- | (0.08 | ) | - | - | (0.05 | ) | |||||||||||||

| Distributions from net realized gains |

(0.70 | ) | (8.10 | ) | (3.48 | ) | (1.91 | ) | (3.70 | ) | ||||||||||

| Total dividends and distributions |

(0.70 | ) | (8.18 | ) | (3.48 | ) | (1.91 | ) | (3.75 | ) | ||||||||||

| Net asset value, end of year |

$16.84 | $16.38 | $28.33 | $20.68 | $21.08 | |||||||||||||||

| Total Return(c): |

6.93 | % | (20.52 | )% | 58.28 | % | 7.29 | % | (5.91 | )% | ||||||||||

|

Ratios/Supplemental Data: |

||||||||||||||||||||

| Net assets, end of year (000) |

$411,858 | $438,659 | $616,160 | $447,491 | $520,351 | |||||||||||||||

| Average net assets (000) |

$453,234 | $553,509 | $575,482 | $449,980 | $577,174 | |||||||||||||||

| Ratios to average net assets(d): |

||||||||||||||||||||

| Expenses after waivers and/or expense reimbursement |

1.15 | % | 1.14 | % | 1.13 | % | 1.18 | % | 1.17 | % | ||||||||||

| Expenses before waivers and/or expense reimbursement |

1.15 | % | 1.14 | % | 1.13 | % | 1.18 | % | 1.17 | % | ||||||||||

| Net investment income (loss) |

0.43 | % | 0.07 | % | (0.38 | )% | (0.21 | )% | (0.27 | )% | ||||||||||

| Portfolio turnover rate(e) |

59 | % | 53 | % | 64 | % | 58 | % | 30 | % | ||||||||||

| (a) | Calculated based on average shares outstanding during the year. |

| (b) | The per share amount of net investment income (loss) does not directly correlate to the amounts reported in the Statement of Operations due to class specific expenses. |

| (c) | Total return does not consider the effects of sales loads. Total return is calculated assuming a purchase of a share on the first day and a sale on the last day of each year reported and includes reinvestment of dividends and distributions, if any. Total returns may reflect adjustments to conform to GAAP. |

| (d) | Does not include expenses of the underlying funds in which the Fund invests. |

| (e) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short-term investments, certain derivatives and in-kind transactions (if any). If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

See Notes to Financial Statements.

PGIM Jennison Small Company Fund 29

Financial Highlights (continued)

|

Class C Shares |

| |||||||||||||||||||

| Year Ended September 30, | ||||||||||||||||||||

| 2023 | 2022(a) | 2021(a) | 2020(a) | 2019(a) | ||||||||||||||||

| Per Share Operating Performance(b): |

||||||||||||||||||||

| Net Asset Value, Beginning of Year |

$21.86 | $35.44 | $33.72 | $38.88 | $59.08 | |||||||||||||||

| Income (loss) from investment operations: |

||||||||||||||||||||

| Net investment income (loss) |

(0.09 | )(c) | (0.20 | )(c) | (0.36 | ) | (0.28 | )(c) | (0.44 | ) | ||||||||||

| Net realized and unrealized gain (loss) on investment and foreign currency transactions | 1.44 | (5.20 | ) | 16.00 | 2.76 | (4.92 | ) | |||||||||||||

| Total from investment operations |

1.35 | (5.40 | ) | 15.64 | 2.48 | (5.36 | ) | |||||||||||||

| Less Dividends and Distributions: |

||||||||||||||||||||

| Dividends from net investment income |

- | (0.08 | ) | - | - | (0.04 | ) | |||||||||||||

| Distributions from net realized gains |

(0.70 | ) | (8.10 | ) | (13.92 | ) | (7.64 | ) | (14.80 | ) | ||||||||||

| Total dividends and distributions |

(0.70 | ) | (8.18 | ) | (13.92 | ) | (7.64 | ) | (14.84 | ) | ||||||||||

| Net asset value, end of year |

$22.51 | $21.86 | $35.44 | $33.72 | $38.88 | |||||||||||||||

| Total Return(d): |

6.04 | % | (21.10 | )% | 57.01 | % | 6.54 | % | (6.32 | )% | ||||||||||

|

Ratios/Supplemental Data: |

||||||||||||||||||||

| Net assets, end of year (000) |

$10,334 | $13,646 | $21,421 | $21,468 | $34,527 | |||||||||||||||

| Average net assets (000) |

$12,652 | $18,021 | $23,032 | $26,313 | $51,231 | |||||||||||||||

| Ratios to average net assets(e): |

||||||||||||||||||||

| Expenses after waivers and/or expense reimbursement |

1.97 | % | 1.91 | % | 1.88 | % | 1.89 | % | 1.86 | % | ||||||||||

| Expenses before waivers and/or expense reimbursement |

1.97 | % | 1.91 | % | 1.88 | % | 1.89 | % | 1.86 | % | ||||||||||

| Net investment income (loss) |

(0.38 | )% | (0.72 | )% | (1.11 | )% | (0.89 | )% | (1.03 | )% | ||||||||||

| Portfolio turnover rate(f) |

59 | % | 53 | % | 64 | % | 58 | % | 30 | % | ||||||||||

| (a) | The Fund had a 4 to 1 reverse stock split effective December 27, 2021. Prior year net asset values and per share amounts have been restated to reflect the impact of the reverse stock split (see Note 7 in the Notes to Financial Statements). The net asset value reported at the original dates prior to the reverse stock split were $8.86, $8.43 and $9.72 for the years ended September 30, 2021, 2020 and 2019, respectively. |

| (b) | Calculated based on average shares outstanding during the year. |

| (c) | The per share amount of net investment income (loss) does not directly correlate to the amounts reported in the Statement of Operations due to class specific expenses. |

| (d) | Total return does not consider the effects of sales loads. Total return is calculated assuming a purchase of a share on the first day and a sale on the last day of each year reported and includes reinvestment of dividends and distributions, if any. Total returns may reflect adjustments to conform to GAAP. |

| (e) | Does not include expenses of the underlying funds in which the Fund invests. |

| (f) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short-term investments, certain derivatives and in-kind transactions (if any). If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

See Notes to Financial Statements.

30

|

Class R Shares |

| |||||||||||||||||||

| Year Ended September 30, | ||||||||||||||||||||

| 2023 | 2022 | 2021 | 2020 | 2019 | ||||||||||||||||

| Per Share Operating Performance(a): |

||||||||||||||||||||

| Net Asset Value, Beginning of Year |

$15.35 | $27.07 | $19.92 | $20.40 | $26.10 | |||||||||||||||

| Income (loss) from investment operations: |

||||||||||||||||||||

| Net investment income (loss) |

0.04 | (0.03 | )(b) | (0.14 | ) | (0.08 | )(b) | (0.09 | ) | |||||||||||

| Net realized and unrealized gain (loss) on investment and foreign currency transactions | 1.01 | (3.51 | ) | 10.77 | 1.51 | (1.90 | ) | |||||||||||||

| Total from investment operations |

1.05 | (3.54 | ) | 10.63 | 1.43 | (1.99 | ) | |||||||||||||

| Less Dividends and Distributions: |

||||||||||||||||||||

| Dividends from net investment income |

- | (0.08 | ) | - | - | (0.01 | ) | |||||||||||||

| Distributions from net realized gains |

(0.70 | ) | (8.10 | ) | (3.48 | ) | (1.91 | ) | (3.70 | ) | ||||||||||

| Total dividends and distributions |

(0.70 | ) | (8.18 | ) | (3.48 | ) | (1.91 | ) | (3.71 | ) | ||||||||||

| Net asset value, end of year |

$15.70 | $15.35 | $27.07 | $19.92 | $20.40 | |||||||||||||||

| Total Return(c): |

6.67 | % | (20.65 | )% | 57.95 | % | 7.12 | % | (6.07 | )% | ||||||||||

|

Ratios/Supplemental Data: |

||||||||||||||||||||

| Net assets, end of year (000) |

$108,534 | $111,936 | $161,790 | $135,920 | $138,754 | |||||||||||||||

| Average net assets (000) |

$117,113 | $142,659 | $164,085 | $133,107 | $149,385 | |||||||||||||||

| Ratios to average net assets(d): |

||||||||||||||||||||

| Expenses after waivers and/or expense reimbursement |

1.33 | % | 1.33 | % | 1.33 | % | 1.35 | % | 1.34 | % | ||||||||||

| Expenses before waivers and/or expense reimbursement |

1.58 | % | 1.58 | % | 1.58 | % | 1.60 | % | 1.59 | % | ||||||||||

| Net investment income (loss) |

0.24 | % | (0.13 | )% | (0.58 | )% | (0.43 | )% | (0.46 | )% | ||||||||||

| Portfolio turnover rate(e) |

59 | % | 53 | % | 64 | % | 58 | % | 30 | % | ||||||||||

| (a) | Calculated based on average shares outstanding during the year. |

| (b) | The per share amount of net investment income (loss) does not directly correlate to the amounts reported in the Statement of Operations due to class specific expenses. |

| (c) | Total return is calculated assuming a purchase of a share on the first day and a sale on the last day of each year reported and includes reinvestment of dividends and distributions, if any. Total returns may reflect adjustments to conform to GAAP. |

| (d) | Does not include expenses of the underlying funds in which the Fund invests. |

| (e) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short-term investments, certain derivatives and in-kind transactions (if any). If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

See Notes to Financial Statements.

PGIM Jennison Small Company Fund 31

Financial Highlights (continued)

|

Class Z Shares |

| |||||||||||||||||||

| Year Ended September 30, | ||||||||||||||||||||

| 2023 | 2022 | 2021 | 2020 | 2019 | ||||||||||||||||

| Per Share Operating Performance(a): |

||||||||||||||||||||

| Net Asset Value, Beginning of Year |

$19.31 | $31.93 | $22.88 | $23.05 | $28.94 | |||||||||||||||

| Income (loss) from investment operations: |

||||||||||||||||||||

| Net investment income (loss) |

0.16 | 0.10 | (0.01 | ) | 0.04 | - | (b) | |||||||||||||

| Net realized and unrealized gain (loss) on investment and foreign currency transactions | 1.27 | (4.54 | ) | 12.54 | 1.70 | (2.06 | ) | |||||||||||||

| Total from investment operations |

1.43 | (4.44 | ) | 12.53 | 1.74 | (2.06 | ) | |||||||||||||

| Less Dividends and Distributions: |

||||||||||||||||||||

| Dividends from net investment income |

(0.04 | ) | (0.08 | ) | - | - | (0.13 | ) | ||||||||||||

| Distributions from net realized gains |

(0.70 | ) | (8.10 | ) | (3.48 | ) | (1.91 | ) | (3.70 | ) | ||||||||||

| Total dividends and distributions |

(0.74 | ) | (8.18 | ) | (3.48 | ) | (1.91 | ) | (3.83 | ) | ||||||||||

| Net asset value, end of year |

$20.00 | $19.31 | $31.93 | $22.88 | $23.05 | |||||||||||||||

| Total Return(c): |

7.28 | % | (20.23 | )% | 58.79 | % | 7.69 | % | (5.58 | )% | ||||||||||

|

Ratios/Supplemental Data: |

||||||||||||||||||||

| Net assets, end of year (000) |

$363,373 | $371,658 | $480,732 | $493,395 | $775,200 | |||||||||||||||

| Average net assets (000) |

$398,223 | $450,927 | $527,437 | $589,620 | $1,156,293 | |||||||||||||||

| Ratios to average net assets(d): |

||||||||||||||||||||

| Expenses after waivers and/or expense reimbursement |

0.81 | % | 0.81 | % | 0.81 | % | 0.82 | % | 0.82 | % | ||||||||||

| Expenses before waivers and/or expense reimbursement |

0.81 | % | 0.81 | % | 0.81 | % | 0.82 | % | 0.82 | % | ||||||||||

| Net investment income (loss) |

0.78 | % | 0.41 | % | (0.05 | )% | 0.18 | % | 0.02 | % | ||||||||||

| Portfolio turnover rate(e) |

59 | % | 53 | % | 64 | % | 58 | % | 30 | % | ||||||||||

| (a) | Calculated based on average shares outstanding during the year. |

| (b) | Amount rounds to zero. |

| (c) | Total return is calculated assuming a purchase of a share on the first day and a sale on the last day of each year reported and includes reinvestment of dividends and distributions, if any. Total returns may reflect adjustments to conform to GAAP. |

| (d) | Does not include expenses of the underlying funds in which the Fund invests. |

| (e) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short-term investments, certain derivatives and in-kind transactions (if any). If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

See Notes to Financial Statements.

32

|

Class R2 Shares |

| |||||||||||||||||||

| Year Ended September 30, | ||||||||||||||||||||

| 2023 | 2022 | 2021 | 2020 | 2019 | ||||||||||||||||

| Per Share Operating Performance(a): |

||||||||||||||||||||

| Net Asset Value, Beginning of Year |

$18.26 | $30.70 | $22.18 | $22.48 | $28.24 | |||||||||||||||

| Income (loss) from investment operations: |

||||||||||||||||||||

| Net investment income (loss) |

0.07 | 0.01 | (0.12 | ) | (0.03 | )(b) | (0.06 | ) | ||||||||||||

| Net realized and unrealized gain (loss) on investment and foreign currency transactions | 1.21 | (4.27 | ) | 12.12 | 1.64 | (1.97 | ) | |||||||||||||

| Total from investment operations |

1.28 | (4.26 | ) | 12.00 | 1.61 | (2.03 | ) | |||||||||||||

| Less Dividends and Distributions: |

||||||||||||||||||||

| Dividends from net investment income |

- | (0.08 | ) | - | - | (0.03 | ) | |||||||||||||

| Distributions from net realized gains |

(0.70 | ) | (8.10 | ) | (3.48 | ) | (1.91 | ) | (3.70 | ) | ||||||||||