As filed with the Securities and Exchange Commission on November 23, 2016

Securities Act Registration No. 002-68723

Investment Company Act Registration No. 811-03084

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-1A

REGISTRATION STATEMENT UNDER THE

SECURITIES ACT OF 1933

PRE-EFFECTIVE AMENDMENT NO.

POST-EFFECTIVE AMENDMENT NO. 62 (X)

and/or

REGISTRATION STATEMENT UNDER THE

INVESTMENT COMPANY ACT OF 1940

POST-EFFECTIVE AMENDMENT NO. 63 (X)

Check appropriate box or boxes

Prudential Jennison Small Company

Fund, Inc.

Exact name of registrant as specified in charter

655 Broad Street

Newark, New Jersey 07102

Address of Principal Executive Offices including Zip Code

(973) 367-7521

Registrant’s Telephone Number, Including Area Code

Deborah A. Docs

655 Broad Street, 17th floor

Newark, New Jersey 07102

Name and Address of Agent for Service

It is proposed that this filing will become effective:

__ immediately upon filing pursuant to paragraph (b)

X_ on November 28, 2016 pursuant to paragraph (b)

__ 60 days after filing pursuant to paragraph (a)(1)

__ on (____) pursuant to paragraph (a)(1)

__ 75 days after filing pursuant to paragraph (a)(2)

__ on (date) pursuant to paragraph (a)(2) of Rule 485

If appropriate, check the following box:

__ this post-effective amendment designates a new effective date for a previously filed post-effective amendment.

| PROSPECTUS | November 28, 2016 |

| Shareholder Fees (fees paid directly from your investment) | ||||||

| Class A | Class B | Class C | Class Q | Class R | Class Z | |

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | 5.50% | None | None | None | None | None |

| Maximum deferred sales charge (load) (as a percentage of the lower of original purchase price or net asset value at redemption) | 1% | 5% | 1% | None | None | None |

| Maximum sales charge (load) imposed on reinvested dividends and other distributions | None | None | None | None | None | None |

| Redemption fee | None | None | None | None | None | None |

| Exchange fee | None | None | None | None | None | None |

| Maximum account fee (accounts under $10,000) | $15 | $15 | $15 | None | None | None |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | ||||||

| Class A | Class B | Class C | Class Q | Class R | Class Z | |

| Management fees | .67% | .67% | .67% | .67% | .67% | .67% |

| + Distribution and service (12b-1) fees | .30% | 1.00% | 1.00% | None | .75% | None |

| + Other expenses | .17% | .17% | .17% | .02% | .17% | .17% |

| = Total annual Fund operating expenses | 1.14% | 1.84% | 1.84% | .69% | 1.59% | .84% |

| – Fee waiver and/or expense reimbursement | None | None | None | None | (.25)% | None |

| = Total annual Fund operating expenses after fee waiver and/or expense reimbursement(1) | 1.14% | 1.84% | 1.84% | .69% | 1.34% | .84% |

| If Shares Are Redeemed | If Shares Are Not Redeemed | |||||||

| Share Class | 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years |

| Class A | $660 | $892 | $1,143 | $1,860 | $660 | $892 | $1,143 | $1,860 |

| Class B | $687 | $879 | $1,095 | $1,889 | $187 | $579 | $995 | $1,889 |

| Class C | $287 | $579 | $995 | $2,159 | $187 | $579 | $995 | $2,159 |

| Class Q | $70 | $221 | $384 | $859 | $70 | $221 | $384 | $859 |

| Class R | $136 | $477 | $842 | $1,868 | $136 | $477 | $842 | $1,868 |

| Class Z | $86 | $268 | $466 | $1,037 | $86 | $268 | $466 | $1,037 |

| Visit our website at www.prudentialfunds.com | 3 |

| 4 | Prudential Jennison Small Company Fund, Inc. |

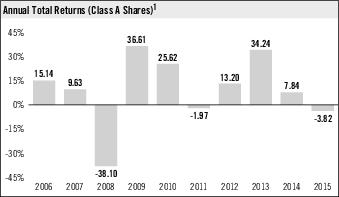

| Average Annual Total Returns % (including sales charges) (as of 12-31-15) | ||||

| Return Before Taxes | One Year | Five Years | Ten Years | Since Inception |

| Class B shares | -8.33% | 8.19% | 6.68% | - |

| Class C shares | -5.34% | 8.32% | 6.76% | - |

| Class Q shares | -3.30% | 9.28% | N/A | 10.43% (11/29/10) |

| Class R shares | -3.95% | 8.89% | 7.30% | - |

| Class Z shares | -3.55% | 9.40% | 7.79% | - |

| Class A Shares % (including sales charges) | ||||

| Return Before Taxes | -9.11% | 7.86% | 6.95% | - |

| Return After Taxes on Distributions | -12.03% | 5.93% | 5.64% | - |

| Visit our website at www.prudentialfunds.com | 5 |

| Class A Shares % (including sales charges) | ||||

| Return After Taxes on Distribution and Sale of Fund Shares | -2.92% | 6.16% | 5.51% | - |

| Index % (reflects no deduction for fees, expenses or taxes) | ||||

| Russell 2500 Index | -2.90% | 10.32% | 7.56% | - |

| S&P SmallCap 600 Index | -1.97% | 11.48% | 8.01% | - |

| Lipper Average % (reflects no deduction for sales charges or taxes) | ||||

| Lipper Small-Cap Growth Funds Average* | -2.17% | 9.54% | 7.05% | - |

| Lipper Small-Cap Core Funds Average* | -5.14% | 8.32% | 6.36% | - |

| Investment Manager | Subadviser | Portfolio Managers | Title | Service Date |

| Prudential Investments LLC | Jennison Associates LLC | John P. Mullman, CFA | Managing Director | May 2000 |

| Jason M. Swiatek, CFA | Managing Director | November 2013 |

| Minimum Initial Investment | Minimum Subsequent Investment | |

| Fund shares (most cases)* | $2,500 | $100 |

| Retirement accounts and custodial accounts for minors | $1,000 | $100 |

| Automatic Investment Plan (AIP) | $50 | $50 |

| 6 | Prudential Jennison Small Company Fund, Inc. |

| Visit our website at www.prudentialfunds.com | 7 |

| 8 | Prudential Jennison Small Company Fund, Inc. |

| Principal & Non-Principal Strategies |

| ■ Equity & equity-related securities of small companies: At least 80% of investable assets■ Common stocks of larger companies: Up to 20% of investable assets ■ Securities of Real Estate Investment Trusts (REITs): Percentage varies ■ Foreign securities: Up to 35% of investable assets ■ Short Sales: Up to 25% of net assets (short sales “against the box” are not subject to this limit) ■ Illiquid Securities: Up to 15% of net assets ■ Money market instruments: up to 100% on temporary basis |

| Visit our website at www.prudentialfunds.com | 9 |

| 10 | Prudential Jennison Small Company Fund, Inc. |

| Visit our website at www.prudentialfunds.com | 11 |

655 Broad Street

Newark, NJ 07102-4410

| 12 | Prudential Jennison Small Company Fund, Inc. |

| Visit our website at www.prudentialfunds.com | 13 |

| 14 | Prudential Jennison Small Company Fund, Inc. |

| Visit our website at www.prudentialfunds.com | 15 |

| Expected Distribution Schedule* | |

| Dividends | Annually |

| Short-Term Capital Gains | Annually |

| Long-Term Capital Gains | Annually |

| 16 | Prudential Jennison Small Company Fund, Inc. |

| Visit our website at www.prudentialfunds.com | 17 |

| 18 | Prudential Jennison Small Company Fund, Inc. |

P.O. Box 9658

Providence, RI 02940

| Share Class | Eligibility |

| Class A | Individual investors |

| Class B | Individual investors* |

| Class C | Individual investors |

| Class Q | Certain group retirement plans, institutional investors and certain other investors |

| Class R | Certain group retirement plans |

| Class Z | Certain group retirement plans, institutional investors and certain other investors |

| ■ | Class A shares purchased in amounts of less than $1 million require you to pay a sales charge at the time of purchase, but the operating expenses of Class A shares are lower than the operating expenses of Class C shares. Investors who purchase $1 million or more of Class A shares and sell these shares within 12 months of purchase are also subject to a contingent deferred sales charge (CDSC) of 1%. The CDSC is waived for certain retirement and/or benefit plans. |

| Visit our website at www.prudentialfunds.com | 19 |

| ■ | Class C shares do not require you to pay a sales charge at the time of purchase, but do require you to pay a contingent deferred sales charge (CDSC) if you sell your shares within 12 months of purchase. The operating expenses of Class C shares are higher than the operating expenses of Class A shares. |

| ■ | The amount of your investment and any previous or planned future investments, which may qualify you for reduced sales charges for Class A shares under Rights of Accumulation or a Letter of Intent. |

| ■ | The length of time you expect to hold the shares and the impact of varying distribution fees. Over time, these fees will increase the cost of your investment and may cost you more than paying other types of sales charges. For this reason, Class C shares are generally appropriate only for investors who plan to hold their shares for no more than 3 years. |

| ■ | The different sales charges that apply to each share class—Class A's front-end sales charge (and, in certain instances, CDSC) vs. Class C's CDSC. |

| ■ | Class C shares purchased in single amounts greater than $1 million are generally less advantageous than purchasing Class A shares. Purchase orders for Class C shares above this amount generally will not be accepted. |

| ■ | Because Class Z shares have lower operating expenses than Class A or Class C shares, as applicable, you should consider whether you are eligible to purchase Class Z shares. |

| Class A | Class B* | Class C | Class Q | Class R | Class Z | |

| Minimum purchase amount | $2,500 | $2,500 | $2,500 | None | None | None |

| Minimum amount for subsequent purchases |

$100 | $100 | $100 | None | None | None |

| Maximum initial sales charge | 5.5% of the public offering price |

None | None | None | None | None |

| Contingent Deferred Sales Charge (CDSC) (as a percentage of the lower of original purchase price or net asset value at redemption) | 1% on sales of $1 million or more made within 12 months of purchase | 5%(Yr.1) 4%(Yr.2) 3%(Yr.3) 2%(Yr.4) 1%(Yr.5) 1%(Yr.6) 0%(Yr.7) |

1% on sales made within 12 months of purchase |

None | None | None |

| Annual distribution and service (12b-1) fees (shown as a percentage of average daily net assets) |

.30% | 1% | 1% | None | .75% (.50% currently) |

None |

| 20 | Prudential Jennison Small Company Fund, Inc. |

| Amount of Purchase | Sales Charge as a % of Offering Price* |

Sales Charge as a % of Amount Invested* |

Dealer Reallowance |

| Less than $25,000 | 5.50% | 5.82% | 5.00% |

| $25,000 to $49,999 | 5.00% | 5.26% | 4.50% |

| $50,000 to $99,999 | 4.50% | 4.71% | 4.00% |

| $100,000 to $249,999 | 3.75% | 3.90% | 3.25% |

| $250,000 to $499,999 | 2.75% | 2.83% | 2.50% |

| $500,000 to $999,999 | 2.00% | 2.04% | 1.75% |

| Visit our website at www.prudentialfunds.com | 21 |

| Amount of Purchase | Sales Charge as a % of Offering Price* |

Sales Charge as a % of Amount Invested* |

Dealer Reallowance |

| $1 million to $4,999,999** | None | None | 1.00% |

| $5 million to $9,999,999** | None | None | 0.50% |

| $10 million and over** | None | None | 0.25% |

| ■ | Use your Rights of Accumulation, which allow you or an eligible group of related investors to combine (1) the current value of Class A, Class B and Class C Prudential Investments mutual fund shares you or the group already own, (2) the value of money market shares (other than Direct Purchase money market shares) you or an eligible group of related investors have received for shares of other Prudential Investments mutual funds in an exchange transaction, and (3) the value of the shares you or an eligible group of related investors are purchasing; or |

| ■ | Sign a Letter of Intent, stating in writing that you or an eligible group of related investors will purchase a certain amount of shares in the Fund and other Prudential Investments mutual funds within 13 months. |

| ■ | Purchases made prior to the effective date of the Letter of Intent will be applied toward the satisfaction of the Letter of Intent to determine the level of sales charge that will be paid pursuant to the Letter of Intent, but will not result in any reduction in the amount of any previously paid sales charge. |

| ■ | All accounts held in your name (alone or with other account holders) and taxpayer identification number (TIN); |

| ■ | Accounts held in your spouse's name (alone or with other account holders) and TIN (see definition of spouse below); |

| ■ | Accounts for your children or your spouse's children, including children for whom you and/or your spouse are legal guardian(s) (e.g., UGMAs and UTMAs); |

| ■ | Accounts in the name and TINs of your parents; |

| ■ | Trusts with you, your spouse, your children, your spouse's children and/or your parents as the beneficiaries; |

| ■ | With limited exclusions, accounts with the same address (exclusions include, but are not limited to, addresses for brokerage firms and other intermediaries and Post Office boxes); and |

| ■ | Accounts held in the name of a company controlled by you (a person, entity or group that holds 25% or more of the outstanding voting securities of a company will be deemed to control the company, and a partnership will be deemed to be controlled by each of its general partners), including employee benefit plans of the company where the accounts are held in the plan's TIN. |

| ■ | The person to whom you are legally married. We also consider your spouse to include the following: |

| ■ | An individual of the same gender with whom you have been joined in a civil union, or legal contract similar to marriage; |

| ■ | A domestic partner, who is an individual (including one of the same gender) with whom you have shared a primary residence for at least six months, in a relationship as a couple where you, your domestic partner or both provide for the personal or financial welfare of the other without a fee, to whom you are not related by blood; or |

| ■ | An individual with whom you have a common law marriage, which is a marriage in a state where such marriages are recognized between a man and a woman arising from the fact that the two live together and hold themselves out as being married. |

| 22 | Prudential Jennison Small Company Fund, Inc. |

| ■ | Mutual fund “wrap” or asset allocation programs, where the sponsor places fund trades, links its clients' accounts to a master account in the sponsor's name and charges its clients a management, consulting or other fee for its services; or |

| ■ | Mutual fund “supermarket” programs, where the sponsor links its clients' accounts to a master account in the sponsor's name and the sponsor charges a fee for its services. |

| ■ | Certain directors, officers, current employees (including their spouses, children and parents) and former employees (including their spouses, children and parents) of Prudential and its affiliates, the Prudential Investments mutual funds, and the investment subadvisers of the Prudential Investments mutual funds; former employees must have an existing investment in the Fund; |

| ■ | Persons who have retired directly from active service with Prudential or one of its subsidiaries; |

| Visit our website at www.prudentialfunds.com | 23 |

| ■ | Registered representatives and employees of broker-dealers (including their spouses, children and parents) that have entered into dealer agreements with the Distributor; |

| ■ | Investors in IRAs, provided that: (a) the purchase is made either from a directed rollover to such IRA or with the proceeds of a tax-free rollover of assets from a Benefit Plan for which Prudential Retirement (the institutional Benefit Plan recordkeeping entity of Prudential) provides administrative or recordkeeping services, in each case provided that such purchase is made within 60 days of receipt of the Benefit Plan distribution, and (b) the IRA is established through Prudential Retirement as part of its “Rollover IRA” program (regardless of whether or not the purchase consists of proceeds of a tax-free rollover of assets from a Benefit Plan described above); and |

| ■ | Clients of financial intermediaries, who (i) have entered into an agreement with the principal underwriter to offer Class A shares through a no-load network or platform, (ii) charge clients an ongoing fee for advisory, investment, consulting or similar services, or (iii) offer self-directed brokerage accounts that may or may not charge transaction fees to customers. |

| 24 | Prudential Jennison Small Company Fund, Inc. |

| ■ | Mutual fund “wrap” or asset allocation programs where the sponsor places fund trades, links its clients' accounts to a master account in the sponsor's name and charges its clients a management, consulting or other fee for its services; or |

| ■ | Mutual fund “supermarket” programs where the sponsor links its clients' accounts to a master account in the sponsor's name and the sponsor charges a fee for its services. |

| Visit our website at www.prudentialfunds.com | 25 |

| ■ | Certain participants in the MEDLEY Program (group variable annuity contracts) sponsored by Prudential for whom Class Z shares of the Prudential mutual funds are an available option; |

| ■ | Current and former Directors/Trustees of mutual funds managed by PI or any other affiliate of Prudential; |

| ■ | Current and former employees (including their spouses, children and parents) of Prudential and its affiliates; former employees must have an existing investment in the Fund; |

| ■ | Prudential; |

| ■ | Prudential funds, including Prudential funds-of-funds; |

| ■ | Qualified state tuition programs (529 plans); and |

| ■ | Investors working with fee-based consultants for investment selection and allocations. |

| 26 | Prudential Jennison Small Company Fund, Inc. |

| Visit our website at www.prudentialfunds.com | 27 |

| 28 | Prudential Jennison Small Company Fund, Inc. |

| Visit our website at www.prudentialfunds.com | 29 |

P.O. Box 9658

Providence, RI 02940

| 30 | Prudential Jennison Small Company Fund, Inc. |

P.O. Box 9658

Providence, RI 02940

| ■ | You are selling more than $100,000 of shares; |

| ■ | You want the redemption proceeds made payable to someone that is not in our records; |

| ■ | You want the redemption proceeds sent to some place that is not in our records; |

| ■ | You are a business or a trust; or |

| ■ | You are redeeming due to the death of the shareholder or on behalf of the shareholder. |

| ■ | Amounts representing shares you purchased with reinvested dividends and distributions, |

| ■ | Amounts representing the increase in NAV above the total amount of payments for shares made during the past 12 months for Class A shares (in certain cases), six years for Class B shares, and 12 months for Class C shares, and |

| Visit our website at www.prudentialfunds.com | 31 |

| ■ | Amounts representing the cost of shares held beyond the CDSC period (12 months for Class A shares (in certain cases), six years for Class B shares, and 12 months for Class C shares). |

| ■ | After a shareholder is deceased or permanently disabled (or, in the case of a trust account, after the death or permanent disability of the grantor). This waiver applies to individual shareholders, as well as shares held in joint tenancy, provided the shares were purchased before the death or permanent disability; |

| ■ | To provide for certain distributions—made without IRS penalty—from a qualified or tax-deferred retirement plan, benefit plan, IRA or Section 403(b) custodial account; and |

| ■ | To withdraw excess contributions from a qualified or tax-deferred retirement plan, IRA or Section 403(b) custodial account. |

| ■ | After a shareholder is deceased or permanently disabled (or, in the case of a trust account, after the death or permanent disability of the grantor). This waiver applies to individual shareholders, as well as shares held in joint tenancy, provided the shares were purchased before the death or permanent disability; |

| ■ | To provide for certain distributions—made without IRS penalty—from a qualified or tax-deferred retirement plan, benefit plan, IRA or Section 403(b) custodial account; |

| ■ | To withdraw excess contributions from a qualified or tax-deferred retirement plan, IRA or Section 403(b) custodial account; and |

| ■ | On certain redemptions effected through a Systematic Withdrawal Plan. |

| ■ | After a shareholder is deceased or permanently disabled (or, in the case of a trust account, after the death or permanent disability of the grantor). This waiver applies to individual shareholders, as well as shares held in joint tenancy, provided the shares were purchased before the death or permanent disability; |

| ■ | To provide for certain distributions—made without IRS penalty—from a qualified or tax-deferred retirement plan, benefit plan, IRA or Section 403(b) custodial account; and |

| ■ | To withdraw excess contributions from a qualified or tax-deferred retirement plan, IRA or Section 403(b) custodial account. |

| 32 | Prudential Jennison Small Company Fund, Inc. |

| Visit our website at www.prudentialfunds.com | 33 |

P.O. Box 9658

Providence, RI 02940

| 34 | Prudential Jennison Small Company Fund, Inc. |

| Visit our website at www.prudentialfunds.com | 35 |

| 36 | Prudential Jennison Small Company Fund, Inc. |

| Visit our website at www.prudentialfunds.com | 37 |

| Class A Shares | |||||

| Year Ended September 30, | |||||

| 2016 | 2015 | 2014 | 2013 | 2012 | |

| Per Share Operating Performance(a): | |||||

| Net Asset Value, Beginning Of Year | $23.76 | $28.09 | $27.95 | $21.81 | $17.39 |

| Income (loss) from investment operations: | |||||

| Net investment income (loss) | .09 | .07 | .07 | .12 | .06 |

| Net realized and unrealized gain (loss) on investment transactions | 1.96 | (.19) | 2.72 | 6.12 | 4.36 |

| Total from investment operations | 2.05 | (.12) | 2.79 | 6.24 | 4.42 |

| Less Dividends and Distributions: | |||||

| Dividends from net investment income | (.03) | (.06) | (.09) | (.10) | – |

| Distributions from net realized gains | (3.13) | (4.15) | (2.56) | – | – |

| Total dividends and distributions | (3.16) | (4.21) | (2.65) | (.10) | – |

| Net asset value, end of year | $22.65 | $23.76 | $28.09 | $27.95 | $21.81 |

| Total Return(b): | 9.82% | (1.16)% | 10.55% | 28.76% | 25.42% |

| Ratios/Supplemental Data: | |||||

| Net assets, end of year (000) | $791,197 | $830,116 | $971,441 | $1,109,515 | $989,346 |

| Average net assets (000) | $796,776 | $944,315 | $1,059,916 | $1,034,609 | $1,014,383 |

| Ratios to average net assets(c): | |||||

| Expenses after waivers and/or expense reimbursement | 1.14% | 1.13% | 1.14% | 1.15% | 1.17% |

| Expenses before waivers and/or expense reimbursement | 1.14% | 1.13% | 1.14% | 1.15% | 1.17% |

| Net investment income (loss) | .42% | .27% | .25% | .48% | .29% |

| Portfolio turnover rate | 37% | 52% | 41% | 50% | 47% |

| 38 | Prudential Jennison Small Company Fund, Inc. |

| Class B Shares | |||||

| Year Ended September 30, | |||||

| 2016 | 2015 | 2014 | 2013 | 2012 | |

| Per Share Operating Performance(a): | |||||

| Net Asset Value, Beginning Of Year | $15.65 | $19.95 | $20.60 | $16.13 | $12.98 |

| Income (loss) from investment operations: | |||||

| Net investment income (loss) | (.04) | (.08) | (.09) | (.03) | (.07) |

| Net realized and unrealized gain (loss) on investment transactions | 1.19 | (.07) | 2.00 | 4.52 | 3.22 |

| Total from investment operations | 1.15 | (.15) | 1.91 | 4.49 | 3.15 |

| Less Dividends and Distributions: | |||||

| Dividends from net investment income | – | – | – | (.02) | – |

| Distributions from net realized gains | (3.13) | (4.15) | (2.56) | – | – |

| Total dividends and distributions | (3.13) | (4.15) | (2.56) | (.02) | – |

| Net asset value, end of year | $13.67 | $15.65 | $19.95 | $20.60 | $16.13 |

| Total Return(b): | 8.98% | (1.90)% | 9.97% | 27.88% | 24.27% |

| Ratios/Supplemental Data: | |||||

| Net assets, end of year (000) | $9,143 | $11,566 | $14,556 | $18,250 | $18,965 |

| Average net assets (000) | $10,434 | $14,015 | $17,001 | $18,899 | $20,997 |

| Ratios to average net assets(c): | |||||

| Expenses after waivers and/or expense reimbursement | 1.84% | 1.83% | 1.84% | 1.85% | 1.87% |

| Expenses before waivers and/or expense reimbursement | 1.84% | 1.83% | 1.84% | 1.85% | 1.87% |

| Net investment income (loss) | (.30)% | (.43)% | (.44)% | (.19)% | (.42)% |

| Portfolio turnover rate | 37% | 52% | 41% | 50% | 47% |

| Visit our website at www.prudentialfunds.com | 39 |

| Class C Shares | |||||

| Year Ended September 30, | |||||

| 2016 | 2015 | 2014 | 2013 | 2012 | |

| Per Share Operating Performance(a): | |||||

| Net Asset Value, Beginning Of Year | $15.82 | $20.12 | $20.79 | $16.29 | $13.08 |

| Income (loss) from investment operations: | |||||

| Net investment income (loss) | (.04) | (.08) | (.09) | (.04) | (.06) |

| Net realized and unrealized gain (loss) on investment transactions | 1.20 | (.07) | 1.98 | 4.56 | 3.27 |

| Total from investment operations | 1.16 | (.15) | 1.89 | 4.52 | 3.21 |

| Less Dividends and Distributions: | |||||

| Dividends from net investment income | – | – | – | (.02) | – |

| Distributions from net realized gains | (3.13) | (4.15) | (2.56) | – | – |

| Total dividends and distributions | (3.13) | (4.15) | (2.56) | (.02) | – |

| Net asset value, end of year | $13.85 | $15.82 | $20.12 | $20.79 | $16.29 |

| Total Return(b): | 8.94% | (1.88)% | 9.77% | 27.79% | 24.54% |

| Ratios/Supplemental Data: | |||||

| Net assets, end of year (000) | $108,219 | $128,022 | $123,856 | $119,436 | $92,886 |

| Average net assets (000) | $114,415 | $135,406 | $124,252 | $105,977 | $94,960 |

| Ratios to average net assets(c): | |||||

| Expenses after waivers and/or expense reimbursement | 1.84% | 1.83% | 1.84% | 1.85% | 1.87% |

| Expenses before waivers and/or expense reimbursement | 1.84% | 1.83% | 1.84% | 1.85% | 1.87% |

| Net investment income (loss) | (.30)% | (.43)% | (.45)% | (.24)% | (.41)% |

| Portfolio turnover rate | 37% | 52% | 41% | 50% | 47% |

| 40 | Prudential Jennison Small Company Fund, Inc. |

| Class Q Shares | |||||

| Year Ended September 30, | |||||

| 2016 | 2015 | 2014 | 2013 | 2012 | |

| Per Share Operating Performance(a): | |||||

| Net Asset Value, Beginning Of Year | $24.87 | $29.22 | $28.95 | $22.60 | $17.97 |

| Income (loss) from investment operations: | |||||

| Net investment income (loss) | .20 | .20 | .20 | .24 | .17 |

| Net realized and unrealized gain (loss) on investment transactions | 2.08 | (.21) | 2.83 | 6.31 | 4.54 |

| Total from investment operations | 2.28 | (.01) | 3.03 | 6.55 | 4.71 |

| Less Dividends and Distributions: | |||||

| Dividends from net investment income | (.15) | (.19) | (.20) | (.20) | (.08) |

| Distributions from net realized gains | (3.13) | (4.15) | (2.56) | – | – |

| Total dividends and distributions | (3.28) | (4.34) | (2.76) | (.20) | (.08) |

| Net asset value, end of year | $23.87 | $24.87 | $29.22 | $28.95 | $22.60 |

| Total Return(b): | 10.36% | (.73)% | 11.10% | 29.27% | 26.29% |

| Ratios/Supplemental Data: | |||||

| Net assets, end of year (000) | $748,480 | $546,771 | $429,165 | $293,225 | $240,377 |

| Average net assets (000) | $667,511 | $531,193 | $427,179 | $259,446 | $189,399 |

| Ratios to average net assets(c): | |||||

| Expenses after waivers and/or expense reimbursement | .69% | .69% | .69% | .70% | .70% |

| Expenses before waivers and/or expense reimbursement | .69% | .69% | .69% | .70% | .70% |

| Net investment income (loss) | .88% | .71% | .70% | .94% | .78% |

| Portfolio turnover rate | 37% | 52% | 41% | 50% | 47% |

| Visit our website at www.prudentialfunds.com | 41 |

| Class R Shares | |||||

| Year Ended September 30, | |||||

| 2016 | 2015 | 2014 | 2013 | 2012 | |

| Per Share Operating Performance(a): | |||||

| Net Asset Value, Beginning Of Year | $23.31 | $27.63 | $27.53 | $21.50 | $17.17 |

| Income (loss) from investment operations: | |||||

| Net investment income (loss) | .05 | .04 | .02 | .07 | .02 |

| Net realized and unrealized gain (loss) on investment transactions | 1.91 | (.20) | 2.68 | 6.02 | 4.31 |

| Total from investment operations | 1.96 | (.16) | 2.70 | 6.09 | 4.33 |

| Less Dividends and Distributions: | |||||

| Dividends from net investment income | – | (.01) | (.04) | (.06) | – |

| Distributions from net realized gains | (3.13) | (4.15) | (2.56) | – | – |

| Total dividends and distributions | (3.13) | (4.16) | (2.60) | (.06) | – |

| Net asset value, end of year | $22.14 | $23.31 | $27.63 | $27.53 | $21.50 |

| Total Return(b): | 9.57% | (1.35)% | 10.36% | 28.42% | 25.22% |

| Ratios/Supplemental Data: | |||||

| Net assets, end of year (000) | $166,550 | $153,606 | $47,538 | $59,157 | $50,449 |

| Average net assets (000) | $159,631 | $86,446 | $56,323 | $54,213 | $48,728 |

| Ratios to average net assets(c): | |||||

| Expenses after waivers and/or expense reimbursement | 1.34% | 1.33% | 1.34% | 1.35% | 1.37% |

| Expenses before waivers and/or expense reimbursement | 1.59% | 1.58% | 1.59% | 1.60% | 1.62% |

| Net investment income (loss) | .23% | .14% | .06% | .28% | .10% |

| Portfolio turnover rate | 37% | 52% | 41% | 50% | 47% |

| 42 | Prudential Jennison Small Company Fund, Inc. |

| Class Z Shares | |||||

| Year Ended September 30, | |||||

| 2016 | 2015 | 2014 | 2013 | 2012 | |

| Per Share Operating Performance(a): | |||||

| Net Asset Value, Beginning Of Year | $25.19 | $29.56 | $29.27 | $22.85 | $18.22 |

| Income (loss) from investment operations: | |||||

| Net investment income (loss) | .17 | .16 | .16 | .20 | .13 |

| Net realized and unrealized gain (loss) on investment transactions | 2.09 | (.23) | 2.85 | 6.38 | 4.55 |

| Total from investment operations | 2.26 | (.07) | 3.01 | 6.58 | 4.68 |

| Less Dividends and Distributions: | |||||

| Dividends from net investment income | (.11) | (.15) | (.16) | (.16) | (.05) |

| Distributions from net realized gains | (3.13) | (4.15) | (2.56) | – | – |

| Total dividends and distributions | (3.24) | (4.30) | (2.72) | (.16) | (.05) |

| Net asset value, end of year | $24.21 | $25.19 | $29.56 | $29.27 | $22.85 |

| Total Return(b): | 10.14% | (.95)% | 10.89% | 29.04% | 25.73% |

| Ratios/Supplemental Data: | |||||

| Net assets, end of year (000) | $1,484,823 | $1,602,437 | $1,514,147 | $1,603,451 | $1,359,627 |

| Average net assets (000) | $1,498,820 | $1,715,343 | $1,545,618 | $1,428,455 | $1,332,921 |

| Ratios to average net assets(c): | |||||

| Expenses after waivers and/or expense reimbursement | .84% | .83% | .84% | .85% | .87% |

| Expenses before waivers and/or expense reimbursement | .84% | .83% | .84% | .85% | .87% |

| Net investment income | .72% | .57% | .55% | .77% | .60% |

| Portfolio turnover rate | 37% | 52% | 41% | 50% | 47% |

| Visit our website at www.prudentialfunds.com | 43 |

| 44 | Prudential Jennison Small Company Fund, Inc. |

| FOR MORE INFORMATION Please read this Prospectus before you invest in the Fund and keep it for future reference. For information or shareholder questions contact: | |

| ■ MAIL Prudential Mutual Fund Services LLC PO Box 9658 Providence, RI 02940■ WEBSITE www.prudentialfunds.com |

■ TELEPHONE (800) 225-1852 (973) 367-3529 (from outside the US) |

| ■ E-DELIVERY To receive your mutual fund documents on-line, go to www.prudentialfunds.com/edelivery and enroll. Instead of receiving printed documents by mail, you will receive notification via email when new materials are available. You can cancel your enrollment or change your email address at any time by visiting the website address above. |

| The Annual and Semi-Annual Reports and the SAI contain additional information about the Fund. Shareholders may obtain free copies of the SAI, Annual Report and Semi-Annual Report as well as other information about the Fund and may make other shareholder inquiries through the telephone number, address and website listed above. | |

| ■ STATEMENT OF ADDITIONAL INFORMATION (SAI) (incorporated by reference into this Prospectus) ■ SEMI-ANNUAL REPORT |

■ ANNUAL REPORT (contains a discussion of the market conditions and investment strategies that significantly affected the Fund's performance during the last fiscal year) |

| You can also obtain copies of Fund documents, including the SAI, from the Securities and Exchange Commission as follows (the SEC charges a fee to copy documents): | |

| ■ MAIL Securities and Exchange Commission Public Reference Section 100 F Street, NE Washington, DC 20549-1520■ ELECTRONIC REQUEST publicinfo@sec.gov |

■ IN PERSON Public Reference Room located at 100 F Street, NE in Washington, DC For hours of operation, call (202) 551-8090■ VIA THE INTERNET on the EDGAR Database at www.sec.gov |

| Prudential Jennison Small Company Fund, Inc. | ||||||

| Share Class | A | B | C | Q | R | Z |

| NASDAQ | PGOAX | CHNDX | PSCCX | PJSQX | JSCRX | PSCZX |

| CUSIP | 74441N101 | 74441N200 | 74441N309 | 74441N887 | 74441N507 | 74441N408 |

| MF109STAT | The Fund's Investment Company Act File No. 811-03084 |

| STATEMENT OF ADDITIONAL INFORMATION | November 28, 2016 |

| Term | Definition |

| ADR | American Depositary Receipt |

| ADS | American Depositary Share |

| Board | Fund’s Board of Directors or Trustees |

| Board Member | A trustee or director of the Fund’s Board |

| CEA | Commodity Exchange Act, as amended |

| CFTC | US Commodity Futures Trading Commission |

| Code | Internal Revenue Code of 1986, as amended |

| CMO | Collateralized Mortgage Obligation |

| ETF | Exchange-Traded Fund |

| EDR | European Depositary Receipt |

| Fannie Mae | Federal National Mortgage Association |

| FDIC | Federal Deposit Insurance Corporation |

| Fitch | Fitch Ratings, Inc. |

| Freddie Mac | Federal Home Loan Mortgage Corporation |

| GDR | Global Depositary Receipt |

| Ginnie Mae | Government National Mortgage Association |

| IPO | Initial Public Offering |

| IRS | Internal Revenue Service |

| 1933 Act | Securities Act of 1933, as amended |

| 1934 Act | Securities Exchange Act of 1934, as amended |

| 1940 Act | Investment Company Act of 1940, as amended |

| 1940 Act Laws, Interpretations and Exemptions | Exemptive order, SEC release, no-action letter or similar relief or interpretations, collectively |

| LIBOR | London Interbank Offered Rate |

| Manager or PI | Prudential Investments LLC |

| Moody’s | Moody’s Investor Services, Inc. |

| NASDAQ | National Association of Securities Dealers Automated Quotations System |

| NAV | Net Asset Value |

| NRSRO | Nationally Recognized Statistical Rating Organization |

| NYSE | New York Stock Exchange |

| OTC | Over the Counter |

| Prudential | Prudential Financial, Inc. |

| PMFS | Prudential Mutual Fund Services LLC |

| REIT | Real Estate Investment Trust |

| RIC | Regulated Investment Company, as the term is used in the Internal Revenue Code of 1986, as amended |

| S&P | Standard & Poor’s Corporation |

| SEC | US Securities & Exchange Commission |

| Term | Definition |

| World Bank | International Bank for Reconstruction and Development |

| ■ | The Fund will not purchase portfolio securities when borrowings exceed 5% of the value of its total assets unless this policy is changed by the Board. |

| ■ | The aggregate value of the securities underlying call options and the obligations underlying put options (as of the date the options are sold) will not exceed 25% of the Fund's net assets. In addition, the Fund will not enter into futures contracts or related options if the aggregate initial margin and premiums exceed 5% of the market value of the Fund's total assets, taking into account unrealized profits and losses on such contracts; provided, however, that in the case of an option that is in-the-money, the in-the-money amount may be excluded in computing such 5%. The above restriction does not apply to the purchase or sale of futures contracts and related options for bona fide hedging purposes, within the meaning of regulations of the CFTC. The Fund does not intend to purchase options on equity securities or securities indexes if the aggregate premiums paid for such outstanding options would exceed 10% of the Fund's total assets. |

| ■ | When the Fund writes a call option on a broadly-based stock market index, the Fund will segregate with its custodian, or pledge to a broker as collateral for the option, cash or other liquid assets, with a market value at the time the option is written of not less than 100% of the current index value times the multiplier times the number of contracts. |

| ■ | If the Fund has written an option on an industry or market segment index, it will segregate with its custodian, or pledge to a broker as collateral for the option, at least ten “qualified securities,” all of which are stocks of issuers in such industry or market segment, and that, in the judgment of the investment subadviser, substantially replicate the movement of the index with a market value at the time the option is written of not less than 100% of the current index value times the multiplier times the number of contracts. Such stocks will include stocks which represent at least 50% of the weighting of the industry or market segment index and will represent at least 50% of the Fund's holdings in that industry or market segment. No individual security will represent more than 15% of the amount so segregated or pledged in the case of broadly-based stock market index options or 25% of such amount in the case of industry or market segment index options. |

| ■ | If at the close of business on any day the market value of such qualified securities so segregated or pledged falls below 100% of the current index value times the multiplier times the number of contracts, the Fund will so segregate or pledge an amount in cash or other liquid assets equal in value to the difference. In addition, when the Fund writes a call on an index which is in-the-money at the time the call is written, the Fund will segregate with its custodian or pledge to the broker as collateral cash or other liquid assets equal in value to the amount by which the call is in-the-money times the multiplier times the number of contracts. Any amount segregated pursuant to the foregoing sentence may be applied to the Fund's obligation to segregate additional amounts in the event that the market value of the qualified securities falls below 100% of the current index value times the multiplier times the number of contracts. A “qualified security” is an equity security which is listed on a national securities exchange or listed on NASDAQ against which the Fund has not written a stock call option and which has not been hedged by the Fund by the sale of stock index futures. However, if the Fund holds a call on the same index as the call written where the exercise price of the call held is equal to or less than the exercise price of the call written or greater than the exercise price of the call written if the difference is maintained by the Fund in cash or other liquid assets segregated with its custodian, it will not be subject to the requirements described in this paragraph. |

| ■ | The Fund may invest up to 25% of its net assets in derivatives. |

| Independent Board Members(1) | ||

| Name, Address, Age Position(s) Portfolios Overseen |

Principal Occupation(s) During Past Five Years | Other Directorships Held During Past Five Years |

| Ellen S. Alberding (58) Board Member Portfolios Overseen: 67 |

President and Board Member, The Joyce Foundation (charitable foundation) (since 2002); Vice Chair, City Colleges of Chicago (community college system) (since 2011); Trustee, Skills for America’s Future (national initiative to connect employers to community colleges) (since 2011); Trustee, National Park Foundation (charitable foundation for national park system) (since 2009); Trustee, Economic Club of Chicago (since 2009). | None. |

| Kevin J. Bannon (64) Board Member Portfolios Overseen: 67 |

Managing Director (April 2008-May 2015) and Chief Investment Officer (October 2008-November 2013) of Highmount Capital LLC (registered investment adviser); formerly Executive Vice President and Chief Investment Officer (April 1993-August 2007) of Bank of New York Company; President (May 2003-May 2007) of BNY Hamilton Family of Mutual Funds. | Director of Urstadt Biddle Properties (equity real estate investment trust) (since September 2008). |

| Linda W. Bynoe (64) Board Member Portfolios Overseen: 67 |

President and Chief Executive Officer (since March 1995) and formerly Chief Operating Officer (December 1989-February 1995) of Telemat Ltd. (management consulting); formerly Vice President (January 1985-June 1989) at Morgan Stanley & Co. (broker-dealer). | Director of Simon Property Group, Inc. (retail real estate) (May 2003-May 2012); Director of Anixter International, Inc. (communication products distributor) (since January 2006); Director of Northern Trust Corporation (financial services) (since April 2006); Trustee of Equity Residential (residential real estate) (since December 2009). |

| Keith F. Hartstein (60) Board Member Portfolios Overseen: 67 |

Retired; Member (since November 2014) of the Governing Council of the Independent Directors Council (organization of independent mutual fund directors); formerly President and Chief Executive Officer (2005-2012), Senior Vice President (2004-2005), Senior Vice President of Sales and Marketing (1997-2004), and various executive management positions (1990-1997), John Hancock Funds, LLC (asset management); Chairman, Investment Company Institute’s Sales Force Marketing Committee (2003-2008). | None. |

| Independent Board Members(1) | ||

| Name, Address, Age Position(s) Portfolios Overseen |

Principal Occupation(s) During Past Five Years | Other Directorships Held During Past Five Years |

| Michael S. Hyland, CFA (71) Board Member Portfolios Overseen: 67 |

Retired (since February 2005); formerly Senior Managing Director (July 2001-February 2005) of Bear Stearns & Co, Inc.; Global Partner, INVESCO (1999-2001); Managing Director and President of Salomon Brothers Asset Management (1989-1999). | None. |

| Richard A. Redeker (73) Board Member & Independent Chair Portfolios Overseen: 67 |

Retired Mutual Fund Senior Executive (47 years); Management Consultant; Director, Mutual Fund Directors Forum (since 2014); Independent Directors Council (organization of independent mutual fund directors)-Executive Committee, Chair of Policy Steering Committee, Governing Council. | None. |

| Stephen G. Stoneburn (73) Board Member Portfolios Overseen: 67 |

Chairman (since July 2011), President and Chief Executive Officer (since June 1996) of Quadrant Media Corp. (publishing company); formerly President (June 1995-June 1996) of Argus Integrated Media, Inc.; Senior Vice President and Managing Director (January 1993-1995) of Cowles Business Media; Senior Vice President of Fairchild Publications, Inc. (1975-1989). | None. |

| Interested Board Members(1) | ||

| Name, Address, Age Position(s) Portfolios Overseen |

Principal Occupation(s) During Past Five Years | Other Directorships Held During Past Five Years |

| Stuart S. Parker (54) Board Member & President Portfolios Overseen: 67 |

President of Prudential Investments LLC (since January 2012); Executive Vice President of Prudential Investment Management Services LLC (since December 2012); Executive Vice President of Jennison Associates LLC and Head of Retail Distribution of Prudential Investments LLC (June 2005-December 2011). | None. |

| Scott E. Benjamin (43) Board Member & Vice President Portfolios Overseen: 67 |

Executive Vice President (since June 2009) of Prudential Investments LLC; Executive Vice President (June 2009-June 2012) and Vice President (since June 2012) of Prudential Investment Management Services LLC; Executive Vice President (since September 2009) of AST Investment Services, Inc.; Senior Vice President of Product Development and Marketing, Prudential Investments (since February 2006); Vice President of Product Development and Product Management, Prudential Investments (2003-2006). | None. |

| Grace C. Torres* (57) Board Member Portfolios Overseen: 65 |

Retired; formerly Treasurer and Principal Financial and Accounting Officer of the Prudential Investments Funds, Target Funds, Advanced Series Trust, Prudential Variable Contract Accounts and The Prudential Series Fund (1998-June 2014); Assistant Treasurer (March 1999-June 2014) and Senior Vice President (September 1999-June 2014) of Prudential Investments LLC; Assistant Treasurer (May 2003-June 2014) and Vice President (June 2005-June 2014) of AST Investment Services, Inc.; Senior Vice President and Assistant Treasurer (May 2003-June 2014) of Prudential Annuities Advisory Services, Inc. | Director (since July 2015) of Sun Bancorp, Inc. N.A. |

| Fund Officers(a) | ||

| Name, Address and Age Position with Fund |

Principal Occupation(s) During Past Five Years | Length of Service as Fund Officer |

| Raymond A. O’Hara (61) Chief Legal Officer |

Vice President and Corporate Counsel (since July 2010) of Prudential Insurance Company of America (Prudential); Vice President (March 2011-Present) of Pruco Life Insurance Company and Pruco Life Insurance Company of New Jersey; Vice President and Corporate Counsel (March 2011-Present) of Prudential Annuities Life Assurance Corporation; Chief Legal Officer of Prudential Investments LLC (since June 2012); Chief Legal Officer of Prudential Mutual Fund Services LLC (since June 2012) and Corporate Counsel of AST Investment Services, Inc. (since June 2012); formerly Assistant Vice President and Corporate Counsel (September 2008-July 2010) of The Hartford Financial Services Group, Inc.; formerly Associate (September 1980-December 1987) and Partner (January 1988–August 2008) of Blazzard & Hasenauer, P.C. (formerly, Blazzard, Grodd & Hasenauer, P.C.). | Since 2012 |

| Chad A. Earnst (41) Chief Compliance Officer |

Chief Compliance Officer (September 2014-Present) of Prudential Investments LLC; Chief Compliance Officer (September 2014-Present) of the Prudential Investments Funds, Target Funds, Advanced Series Trust, The Prudential Series Fund, Prudential's Gibraltar Fund, Inc., Prudential Global Short Duration High Yield Income Fund, Inc., Prudential Short Duration High Yield Fund, Inc. and Prudential Jennison MLP Income Fund, Inc.; formerly Assistant Director (March 2010-August 2014) of the Asset Management Unit, Division of Enforcement, US Securities & Exchange Commission; Assistant Regional Director (January 2010-August 2014), Branch Chief (June 2006–December 2009) and Senior Counsel (April 2003-May 2006) of the Miami Regional Office, Division of Enforcement, US Securities & Exchange Commission. | Since 2014 |

| Deborah A. Docs (58) Secretary |

Vice President and Corporate Counsel (since January 2001) of Prudential; Vice President (since December 1996) and Assistant Secretary (since March 1999) of Prudential Investments LLC; formerly Vice President and Assistant Secretary (May 2003-June 2005) of AST Investment Services, Inc. | Since 2004 |

| Jonathan D. Shain (58) Assistant Secretary |

Vice President and Corporate Counsel (since August 1998) of Prudential; Vice President and Assistant Secretary (since May 2001) of Prudential Investments LLC; Vice President and Assistant Secretary (since February 2001) of Prudential Mutual Fund Services LLC; formerly Vice President and Assistant Secretary (May 2003-June 2005) of AST Investment Services, Inc. | Since 2005 |

| Claudia DiGiacomo (42) Assistant Secretary |

Vice President and Corporate Counsel (since January 2005) of Prudential; Vice President and Assistant Secretary of Prudential Investments LLC (since December 2005); Associate at Sidley Austin Brown & Wood LLP (1999-2004). | Since 2005 |

| Andrew R. French (53) Assistant Secretary |

Vice President and Corporate Counsel (since February 2010) of Prudential; formerly Director and Corporate Counsel (2006-2010) of Prudential; Vice President and Assistant Secretary (since January 2007) of Prudential Investments LLC; Vice President and Assistant Secretary (since January 2007) of Prudential Mutual Fund Services LLC. | Since 2006 |

| Theresa C. Thompson (54) Deputy Chief Compliance Officer |

Vice President, Compliance, Prudential Investments LLC (since April 2004); and Director, Compliance, Prudential Investments LLC (2001-2004). | Since 2008 |

| Richard W. Kinville (48) Anti-Money Laundering Compliance Officer |

Vice President, Corporate Compliance, Anti-Money Laundering Unit (since January 2005) of Prudential; committee member of the American Council of Life Insurers Anti-Money Laundering and Critical Infrastructure Committee (since January 2007); formerly Investigator and Supervisor in the Special Investigations Unit for the New York Central Mutual Fire Insurance Company (August 1994-January 1999); Investigator in AXA Financial's Internal Audit Department and Manager in AXA's Anti-Money Laundering Office (January 1999-January 2005); first chair of the American Council of Life Insurers Anti-Money Laundering and Critical Infrastructure Committee (June 2007-December 2009). | Since 2011 |

| M. Sadiq Peshimam (52) Treasurer and Principal Financial and Accounting Officer |

Vice President (since 2005) of Prudential Investments LLC; formerly Assistant Treasurer of funds in the Prudential Mutual Fund Complex (2006-2014). | Since 2006 |

| Peter Parrella (58) Assistant Treasurer |

Vice President (since 2007) and Director (2004-2007) within Prudential Mutual Fund Administration; formerly Tax Manager at SSB Citi Fund Management LLC (1997-2004). | Since 2007 |

| Lana Lomuti (49) Assistant Treasurer |

Vice President (since 2007) and Director (2005-2007), within Prudential Mutual Fund Administration; formerly Assistant Treasurer (December 2007-February 2014) of The Greater China Fund, Inc. | Since 2014 |

| Linda McMullin (55) Assistant Treasurer |

Vice President (since 2011) and Director (2008-2011) within Prudential Mutual Fund Administration. | Since 2014 |

| Kelly A. Coyne (48) Assistant Treasurer |

Director, Investment Operations of Prudential Mutual Fund Services LLC (since 2010). | Since 2015 |

| ■ | Board Members are deemed to be “Interested,” as defined in the 1940 Act, by reason of their affiliation with Prudential Investments LLC and/or an affiliate of Prudential Investments LLC. |

| ■ | Unless otherwise noted, the address of all Board Members and Officers is c/o Prudential Investments LLC, 655 Broad Street, Newark, New Jersey 07102-4410. |

| ■ | There is no set term of office for Board Members or Officers. The Board Members have adopted a retirement policy, which calls for the retirement of Board Members on December 31 of the year in which they reach the age of 75. |

| ■ | “Other Directorships Held” includes only directorships of companies required to register or file reports with the SEC under the 1934 Act (that is, “public companies”) or other investment companies registered under the 1940 Act. |

| ■ | “Portfolios Overseen” includes all investment companies managed by Prudential Investments LLC. The investment companies for which Prudential Investments LLC serves as manager include the Prudential Investments Mutual Funds, The Prudential Variable Contract Accounts, Target Mutual Funds, Prudential Short Duration High Yield Fund, Inc., Prudential Global Short Duration High Yield Fund, Inc., The Prudential Series Fund, Prudential's Gibraltar Fund, Inc. and the Advanced Series Trust. |

| Name | Aggregate Fiscal Year Compensation from Funds |

Pension or Retirement Benefits Accrued as Part of Fund Expenses |

Estimated Annual Benefits Upon Retirement |

Total Compensation from Funds and Fund Complex for Most Recent Calendar Year |

| Compensation Received by Independent Board Members | ||||

| Ellen S. Alberding | $7,540 | None | None | $220,000 (32/67)* |

| Kevin J. Bannon | $7,730 | None | None | $220,750 (32/67)* |

| Linda W. Bynoe** | $7,260 | None | None | $218,000 (32/67)* |

| Keith F. Hartstein** | $7,440 | None | None | $220,000 (32/67)* |

| Michael S. Hyland | $7,730 | None | None | $229,000 (32/67)* |

| Richard A. Redeker** | $10,220 | None | None | $283,000 (32/67)* |

| Stephen G. Stoneburn** | $7,260 | None | None | $218,000 (32/67)* |

| Compensation Received by Non-Management Interested Board Member | ||||

| Grace C. Torres‡ | $6,355 | None | None | $199,505 (30/65)* |

Kevin J. Bannon (Chair)

Ellen S. Alberding

Linda W. Bynoe

Richard A. Redeker (ex-officio)

Michael S. Hyland, CFA (Chair)

Stephen G. Stoneburn

Keith F. Hartstein

Richard A. Redeker (ex-officio)

Gibraltar Investment Committee

Keith F. Hartstein (Chair)

Richard A. Redeker

Stephen G. Stoneburn

Linda W. Bynoe

Ellen S. Alberding (Chair)

Kevin J. Bannon

Michael S. Hyland, CFA

Grace C. Torres

| Board Committee Meetings (for most recently completed fiscal year) | ||

| Audit Committee | Nominating & Governance Committee | Gibraltar Investment Committee |

| 4 | 4 | 3 |

| Name | Dollar Range of Equity Securities in the Fund |

Aggregate Dollar Range of Equity Securities in All Registered Investment Companies Overseen by Board Member in Fund Complex |

| Board Member Share Ownership: Independent Board Members | ||

| Ellen S. Alberding | None | Over $100,000 |

| Kevin J. Bannon | Over $100,000 | Over $100,000 |

| Linda W. Bynoe | None | Over $100,000 |

| Keith F. Hartstein | None | Over $100,000 |

| Michael S. Hyland | None | Over $100,000 |

| Richard A. Redeker | None | Over $100,000 |

| Stephen G. Stoneburn | None | Over $100,000 |

| Board Member Share Ownership: Interested Board Members | ||

| Stuart S. Parker | None | Over $100,000 |

| Scott E. Benjamin | $50,001-$100,000 | Over $100,000 |

| Grace C. Torres | None | Over $100,000 |

| ■ | the salaries and expenses of all of its and the Fund's personnel except the fees and expenses of Independent Board Members and Non-Management Interested Board Members; |

| ■ | all expenses incurred by the Manager or the Fund in connection with managing the ordinary course of a Fund’s business, other than those assumed by the Fund as described below; and |

| ■ | the fees, costs and expenses payable to any investment subadviser pursuant to a subadvisory agreement between PI and such investment subadviser. |

| ■ | the fees and expenses incurred by the Fund in connection with the management of the investment and reinvestment of the Fund's assets payable to the Manager; |

| ■ | the fees and expenses of Independent Board Members and Non-Management Interested Board Members; |

| ■ | the fees and certain expenses of the Custodian and transfer and dividend disbursing agent, including the cost of providing records to the Manager in connection with its obligation of maintaining required records of the Fund and of pricing the Fund's shares; |

| ■ | the charges and expenses of the Fund's legal counsel and independent auditors and of legal counsel to the Independent Board Members; |

| ■ | brokerage commissions and any issue or transfer taxes chargeable to the Fund in connection with securities (and futures, if applicable) transactions; |

| ■ | all taxes and corporate fees payable by the Fund to governmental agencies; |

| ■ | the fees of any trade associations of which the Fund may be a member; |

| ■ | the cost of share certificates representing, and/or non-negotiable share deposit receipts evidencing, shares of the Fund; |

| ■ | the cost of fidelity, directors and officers and errors and omissions insurance; |

| ■ | the fees and expenses involved in registering and maintaining registration of the Fund and of Fund shares with the SEC and paying notice filing fees under state securities laws, including the preparation and printing of the Fund's registration statements and prospectuses for such purposes; allocable communications expenses with respect to investor services and all expenses of shareholders' and Board meetings and of preparing, printing and mailing reports and notices to shareholders; and |

| ■ | litigation and indemnification expenses and other extraordinary expenses not incurred in the ordinary course of the Fund's business and distribution and service (12b-1) fees. |

| Management Fees Paid by the Fund | |||

| 2016 | 2015 | 2014 | |

| $21,609,224 | $22,774,249 | $21,497,231 |

| Subadvisory Fees Paid by PI | |||

| 2016 | 2015 | 2014 | |

| $14,776,225 | $15,591,493 | $14,698,062 |

| Information About Other Accounts Managed by the Portfolio Managers | ||||

| Portfolio Managers | Registered Investment Companies |

Other Pooled Investment Vehicles |

Other Accounts* | Ownership of Fund Securities** |

| John P. Mullman | 4/$8,636,093 | 5/$739,126 | 12/$1,980,407 | $100,001 - $500,000 |

| Jason M. Swiatek | 1/$312,265 | 4/$721,661 | 12/$1,980,407 | Over $1,000,000 |

| ■ | One, three, five- year and longer term pre-tax investment performance of groupings of accounts managed by the portfolio manager in the same strategy (composite) relative to market conditions, pre-determined passive indices, and industry peer group data for the product strategy (e.g., large cap growth, large cap value) for which the portfolio manager is responsible; |

| ■ | Performance for the composite of accounts that includes the Fund managed by Mr. Swiatek and Mr. Mullman is measured against the Russell 2500 Index. |

| ■ | The quality of the portfolio manager’s investment ideas and consistency of the portfolio manager’s judgment; |

| ■ | Historical and long-term business potential of the product strategies; |

| ■ | Qualitative factors such as teamwork and responsiveness; and |

| ■ | Individual factors such as years of experience and responsibilities specific to the individual’s role such as being a team leader or supervisor are also factored into the determination of an investment professional’s total compensation. |

| ■ | Long only accounts/long-short accounts: Jennison manages accounts in strategies that only hold long securities positions as well as accounts in strategies that are permitted to sell securities short. Jennison may hold a long position in a security in some client accounts while selling the same security short in other client accounts. For example, Jennison permits quantitatively hedged strategies to short securities that are held long in other strategies. Additionally, Jennison permits securities that are held long in quantitatively derived strategies to be shorted by other strategies. The strategies that sell a security short held long by another strategy could lower the price for the security held long. Similarly, if a strategy is purchasing a security that is held short in other strategies, the strategies purchasing the security could increase the price of the security held short. |

| ■ | Multiple strategies: Jennison may buy or sell, or may direct or recommend that one client buy or sell, securities of the same kind or class that are purchased or sold for another client at prices that may be different. Jennison may also, at any time, execute trades of securities of the same kind or class in one direction for an account and in the opposite direction for another account, due to differences in investment strategy or client direction. Different strategies effecting trading in the same securities or types of securities may appear as inconsistencies in Jennison’s management of multiple accounts side-by-side. |

| ■ | Affiliated accounts/unaffiliated accounts and seeded/nonseeded accounts and accounts receiving asset allocation assets from affiliated investment advisers: Jennison manages accounts for its affiliates and accounts in which it has an interest alongside unaffiliated accounts. Jennison could have an incentive to favor its affiliated accounts over unaffiliated accounts. Additionally, Jennison’s affiliates may provide initial funding or otherwise invest in vehicles managed by Jennison. When an affiliate provides “seed capital” or other capital for a fund or account, it may do so with the intention of redeeming all or part of its interest at a particular future point in time or when it deems that sufficient additional capital has been invested in that fund or account. Jennison typically requests seed capital to start a track record for a new strategy or product. Managing “seeded” accounts alongside “non-seeded” accounts can create an incentive to favor the “seeded” accounts to establish a track record for a new strategy or product. Additionally, Jennison’s affiliated investment advisers could allocate their asset allocation clients’ assets to Jennison. Jennison could favor accounts used by its affiliate for their asset allocation clients to receive more assets from the affiliate. |

| ■ | Non-discretionary accounts or models: Jennison provides non-discretionary model portfolios to some clients and manages other portfolios on a discretionary basis. Recommendations for some non-discretionary models that are derived from discretionary portfolios are communicated after the discretionary portfolio has traded. The non-discretionary clients could be disadvantaged if Jennison delivers the model investment portfolio to them after Jennison initiates trading for the discretionary clients, or vice versa. |

| ■ | Higher fee paying accounts or products or strategies: Jennison receives more revenues from (1) larger accounts or client relationships than smaller accounts or client relationships and from (2) managing discretionary accounts than advising nondiscretionary models and from (3) non-wrap fee accounts than from wrap fee accounts and from (4) charging higher fees for some strategies than others. The differences in revenue that Jennison receives could create an incentive for Jennison to favor the higher fee paying or higher revenue generating account or product or strategy over another. |

| ■ | Personal interests: The performance of one or more accounts managed by Jennison’s investment professionals is taken into consideration in determining their compensation. Jennison also manages accounts that are investment options in its employee benefit plans such as its defined contribution plans or deferred compensation arrangements and where its employees may have personally invested alongside other accounts where there is no personal interest. These factors could create an incentive for Jennison to favor the accounts where it has a personal interest over accounts where Jennison does not have a personal interest. |

| ■ | Jennison has adopted trade aggregation and allocation procedures that seek to treat all clients (including affiliated accounts) fairly and equitably. These policies and procedures address the allocation of limited investment opportunities, such as initial public offerings (IPOs) and new issues, the allocation of transactions across multiple accounts, and the timing of transactions between its non-wrap accounts and its wrap fee accounts. |

| ■ | Jennison has policies that limit the ability to short securities in portfolios that primarily rely on its fundamental research and investment processes (fundamental portfolios) if the security is held long in other fundamental portfolios. |

| ■ | Jennison has adopted procedures to review allocations or performance dispersion between accounts with performance fees and non-performance fee based accounts and to review overlapping long and short positions among long accounts and long-short accounts. |

| ■ | Jennison has adopted a code of ethics and policies relating to personal trading. |

| ■ | Jennison provides disclosure of these conflicts as described in its Form ADV. |

| Compensation Received by the Agent for Securities Lending | |||

| 2016 | 2015 | 2014 | |

| $655,400 | $355,800 | $471,500 |

| Fees Paid to PMFS | |

| Fund Name | Amount |

| Prudential Jennison Small Company Fund, Inc. | $686,800 |

| Payments Received by the Distributor | |

| CLASS A CONTINGENT DEFERRED SALES CHARGES (CDSC) | $2,060 |

| CLASS A DISTRIBUTION AND SERVICE (12B-1) FEES | $2,390,290 |

| CLASS A INITIAL SALES CHARGES | $428,689 |

| CLASS B CONTINGENT DEFERRED SALES CHARGES (CDSC) | $7,007 |

| CLASS B DISTRIBUTION AND SERVICE (12B-1) FEES | $104,336 |

| CLASS C CONTINGENT DEFERRED SALES CHARGES (CDSC) | $8,497 |

| CLASS C DISTRIBUTION AND SERVICE (12B-1) FEES | $1,144,109 |

| CLASS R DISTRIBUTION AND SERVICE (12B-1) FEES | $798,147 |

| Amounts Spent by the Distributor | ||||

| Share Class | Printing & Mailing Prospectuses to Other than Current Shareholders |

Compensation to Broker/Dealers for Commissions to Representatives & Other Expenses* |

Overhead Costs** | Total Amount Spent |

| CLASS A | None | $1,795,017 | $1,005,856 | $2,800,873 |

| CLASS B | None | $26,041 | $10,636 | $36,677 |

| CLASS C | None | $927,378 | $116,137 | $1,043,515 |

| CLASS R | None | $124,680 | $436,542 | $561,222 |

** Including sales promotion expenses.

| ■ | Prudential Retirement |

| ■ | Wells Fargo Advisors, LLC |

| ■ | Ameriprise Financial Services Inc. |

| ■ | Merrill Lynch Pierce Fenner & Smith Inc. |

| ■ | Raymond James |

| ■ | Morgan Stanley Smith Barney |

| ■ | Fidelity |

| ■ | UBS Financial Services Inc. |

| ■ | GWFS Equities, Inc. |

| ■ | Principal Life Insurance Company |

| ■ | LPL Financial |

| ■ | Matrix Financial Solutions |

| ■ | Massachusetts Mutual |

| ■ | Cetera |

| ■ | Charles Schwab & Co., Inc. |

| ■ | ADP Broker-Dealer, Inc. |

| ■ | Nationwide Financial Services Inc. |

| ■ | Commonwealth Financial Network |

| ■ | American United Life Insurance Company |

| ■ | AIG Advisor Group |

| ■ | Voya Financial |

| ■ | Ascensus |

| ■ | NYLIFE Distributors LLC |

| ■ | Vanguard Group, Inc. |

| ■ | Reliance Trust Company |

| ■ | Lincoln Retirement Services Company LLC |

| ■ | Hewitt Associates LLC |

| ■ | MidAtlantic Capital Corp. |

| ■ | TIAA Cref |

| ■ | Transamerica |

| ■ | John Hancock USA |

| ■ | Hartford Life |

| ■ | TD Ameritrade Trust Company |

| ■ | Standard Insurance Company |

| ■ | T. Rowe Price Retirement Plan Services |

| ■ | Cambridge |

| ■ | The Ohio National Life Insurance Company |

| ■ | Securities America, Inc. |

| ■ | RBC Capital Markets Corporation |

| ■ | VALIC Retirement Services Company |

| ■ | Northwestern |

| ■ | Security Benefit Life Insurance Company |

| ■ | Janney Montgomery & Scott, Inc. |

| ■ | Mercer HR Services, LLC |

| ■ | 1st Global Capital Corp. |

| ■ | Citigroup |

| ■ | Sammons Retirement Solutions, Inc. |

| ■ | Newport Retirement Plan Services, Inc. |

| ■ | Genworth |

| ■ | ExpertPlan, Inc. |

| ■ | Triad Advisors Inc. |

| ■ | Northern Trust |

| ■ | Oppenheimer & Co. |

| Offering Price Per Share | |

| Class A | |

| NAV and redemption price per Class A share | $22.65 |

| Maximum initial sales charge (5.50% of offering price) | $1.32 |

| Maximum offering price to public | $23.97 |

| Class B | |

| NAV, offering price and redemption price per Class B share | $13.67 |

| Class C | |

| NAV, offering price and redemption price per Class C share | $13.85 |

| Class Q | |

| NAV, offering price and redemption price per Class Q share | $23.87 |

| Class R | |

| NAV, offering price and redemption price per Class R share | $22.14 |

| Class Z | |

| NAV, offering price and redemption price per Class Z share | $24.21 |

| Brokerage Commissions Paid by the Fund | |||

| 2016 | 2015 | 2014 | |

| Total brokerage commissions paid by the Fund | $2,202,494 | $2,587,847 | $2,584,954 |

| Broker-Dealer Securities Holdings ($) (as of most recently completed fiscal year) | ||

| Broker/Dealer Name | Equity or Debt | Amount |

| None | None | None |

Class B: 75 million authorized shares

Class C: 100 million authorized shares

Class M: 25 million authorized shares

Class Q: 225 million authorized shares

Class R: 225 million authorized shares

Class (New) X: 25 million authorized shares

Class Z: 275 million authorized shares

| Principal Fund Shareholders as of November 10, 2016 | |||

| Shareholder Name | Address | Share Class |

No. of Shares / % of Class |

| Special Custody Account For The Exclusive Benefit Of Customers |

2801 Market Street Saint Louis, MO 63103 |

A | 4,233,314 / 12.34% |

| National Financial Services LLC For Exclusive Benefit Of Our Customers Attn: Mutual Funds Dept |

499 Washington Blvd, 4th Fl Jersey City, NJ 07310 |

A | 3,063,574 / 8.93% |

| Merrill Lynch, Pierce, Fenner & Smith For The Sole Benefit Of Its Customers |

4800 Deer Lake Dr E Jacksonville, Fl 32246 |

A | 2,190,837 / 6.39% |

| Charles Schwab Co | 211 Main Street San Francisco, CA 94105 |

A | 2,129,853 / 6.21% |

| DCGT As TTEE And/Or Cust FBO PLIC Various Retirement Plans Omnibus Attn: NPIO Trade Desk |

711 High Street Des Moines, IA 50303 |

A | 1,868,947 / 5.45% |

| National Financial Services LLC For Exclusive Benefit Of Our Customers Attn: Mutual Funds Dept |

499 Washington Blvd, 4th Fl Jersey City, NJ 07310 |

B | 155,837 / 23.70% |

| Special Custody Account For The Exclusive Benefit Of Customers |

2801 Market Street Saint Louis, MO 63103 |

B | 95,479 / 14.52% |

| Pershing LLC | 1 Pershing Plaza Jersey City, NJ 07399 |

B | 41,894 / 6.37% |

| Merrill Lynch, Pierce, Fenner & Smith For The Sole Benefit Of Its Customers |

4800 Deer Lake Dr E Jacksonville, Fl 32246 |

B | 41,851 / 6.37% |

| Raymond James Omnibus For Mutual Funds House Account Firm Attn: Courtney Waller |

880 Carillon Parkway St Petersburg, Fl 33716 |

C | 1,849,575 / 25.18% |

| Merrill Lynch, Pierce, Fenner & Smith For The Sole Benefit Of Its Customers |

4800 Deer Lake Dr E Jacksonville, Fl 32246 |

C | 1,031,121 / 14.04% |

| Special Custody Account For The Exclusive Benefit Of Customers |

2801 Market Street Saint Louis, MO 63103 |

C | 847,126 / 11.53% |

| Morgan Stanley & Co | Harborside Financial Center Plaza II, 3rd Floor Jersey City, NJ 07311 |

C | 845,913 / 11.52% |

| Pershing LLC | 1 Pershing Plaza Jersey City, NJ 07399 |

C | 564,913 / 7.69% |

| Principal Fund Shareholders as of November 10, 2016 | |||

| Shareholder Name | Address | Share Class |

No. of Shares / % of Class |

| National Financial Services LLC For Exclusive Benefit Of Our Customers Attn: Mutual Funds Dept |

499 Washington Blvd, 4th Fl Jersey City, NJ 07310 |

C | 417,522 / 5.69% |

| Fidelity Invest Institutional Operations Company, Inc (FIIOC) As Agent For Certain Employee Benefit Plan |

100 Magellan Way # KW1C Covington, KY 41015 |

Q | 8,140,914 / 25.35% |

| TIAA-CREF Trust Co Cust/TTEE FBO Retirement Plans Which TIAA Acts As Recordkeeper Attn: Trade Operations |

211 North Broadway, Suite 1000 St Louis, MO 63102 |

Q | 4,205,164 / 13.09% |

| Charles Schwab Co | 211 Main Street San Francisco, CA 94105 |

Q | 2,956,830 / 9.21% |

| Merrill Lynch, Pierce, Fenner & Smith For The Sole Benefit Of Its Customers |

4800 Deer Lake Dr E Jacksonville, Fl 32246 |

Q | 2,847,644 / 8.87% |

| National Financial Services LLC For Exclusive Benefit Of Our Customers Attn: Mutual Funds Dept |

499 Washington Blvd, 4th Fl Jersey City, NJ 07310 |

Q | 2,773,027 / 8.64% |

| Pims/Prudential Retirement As Nominee For The TTEE/Cust Prudential SmartSolutions IRA |

280 Trumbull St Hartford, CT 06103 |

R | 6,051,015 / 80.82% |

| DCGT As TTEE And/Or Cust FBO PLIC Various Retirement Plans Omnibus Attn: NPIO Trade Desk |

711 High Street Des Moines, IA 50303 |

R | 597,760 / 7.98% |

| Charles Schwab Co | 211 Main Street San Francisco, CA 94105 |

Z | 10,452,579 / 16.85% |

| National Financial Services LLC For Exclusive Benefit Of Our Customers Attn: Mutual Funds Dept |

499 Washington Blvd, 4th Fl Jersey City, NJ 07310 |

Z | 5,908,325 / 9.53% |

| Vanguard Fiduciary Trust Company | PO Box 2600 VM 613 Attn: Outside Funds Valley Forge, PA 19482 |

Z | 4,776,840 / 7.70% |

| Fidelity Invest Institutional Operations Company, Inc (FIIOC) As Agent For Certain Employee Pl |

100 Magellan Way # KW1C Covington, KY 41015 |

Z | 3,920,242 / 6.32% |

| Merrill Lynch, Pierce, Fenner & Smith For The Sole Benefit Of Its Customers |

4800 Deer Lake Dr E Jacksonville, Fl 32246 |

Z | 3,764,086 / 6.07% |

| Wells Fargo Bank FBO Various Retirement Plans |

1525 West WT Harris Blvd Charlotte, NC 28288 |

Z | 3,746,318 / 6.04% |

| Raymond James Omnibus For Mutual Funds House Account Firm Attn: Courtney Waller |

880 Carillon Parkway St Petersburg, Fl 33716 |

Z | 3,495,636 / 5.64% |

| ■ | After a shareholder is deceased or permanently disabled (or, in the case of a trust account, after the death or disability of the grantor). This waiver applies to individual shareholders as well as shares held in joint tenancy, provided the shares were purchased before the death or permanent disability, |

| ■ | To provide for certain distributions—made without IRS penalty—from a qualified or tax-deferred retirement plan, benefit plan, IRA or Section 403(b) custodial account, |

| ■ | To withdraw excess contributions from a qualified or tax-deferred retirement plan, IRA or Section 403(b) custodial account, and |

| ■ | On certain redemptions effected through a Systematic Withdrawal Plan (Class B shares only). |

| ■ | A request for release of portfolio holdings shall be prepared setting forth a legitimate business purpose for such release which shall specify the Fund(s), the terms of such release, and frequency (e.g., level of detail, staleness). Such request shall address whether there are any conflicts of interest between the Fund and the investment adviser, subadviser, principal underwriter or any affiliated person thereof and how such conflicts shall be dealt with to demonstrate that the disclosure is in the best interest of the shareholders of the Fund(s). |

| ■ | The request shall be forwarded to PI’s Product Development Group and to the Chief Compliance Officer or his delegate for review and approval. |

| ■ | A confidentiality agreement in the form approved by a Fund officer must be executed by the recipient of the portfolio holdings. |

| ■ | A Fund officer shall approve the release and the agreement. Copies of the release and agreement shall be sent to PI’s Law Department. |

| ■ | Written notification of the approval shall be sent by such officer to PI’s Fund Administration Group to arrange the release of portfolio holdings. |

| ■ | PI’s Fund Administration Group shall arrange the release by the Custodian Bank. |

| ■ | Full holdings on a daily basis to Institutional Shareholder Services (ISS), Broadridge and Glass, Lewis & Co. (proxy voting administrator/agents) at the end of each day; |

| ■ | Full holdings on a daily basis to ISS (securities class action claims administrator) at the end of each day; |

| ■ | Full holdings on a daily basis to a Fund's Subadviser(s), Custodian Bank, sub-custodian (if any) and accounting agents (which includes the Custodian Bank and any other accounting agent that may be appointed) at the end of each day. When a Fund has more than one Subadviser, each Subadviser receives holdings information only with respect to the “sleeve” or segment of the Fund for which the Subadviser has responsibility; |

| ■ | Full holdings to a Fund's independent registered public accounting firm as soon as practicable following the Fund's fiscal year-end or on an as-needed basis; and |

| ■ | Full holdings to financial printers as soon as practicable following the end of a Fund's quarterly, semi-annual and annual period-ends. |

| ■ | Fund trades on a quarterly basis to Abel/Noser Corp. (an agency-only broker and transaction cost analysis company) as soon as practicable following a Fund's fiscal quarter-end; |

| ■ | Full holdings on a daily basis to FactSet Research Systems, Inc. (investment research provider) at the end of each day; |

| ■ | Full holdings on a daily basis to FT Interactive Data (a fair value information service) at the end of each day; |

| ■ | Full holdings on a quarterly basis to Frank Russell Company (investment research provider) when made available ; |