0000318300DEF 14AFALSE00003183002022-01-012022-12-31iso4217:USDiso4217:USDxbrli:shares00003183002021-01-012021-12-3100003183002020-01-012020-12-310000318300ecd:PeoMemberpebo:AdjustmentEquityAwardsReportedValueMember2022-01-012022-12-310000318300ecd:PeoMemberpebo:AdjustmentEquityAwardAdjustmentsMember2022-01-012022-12-310000318300ecd:PeoMemberpebo:AdjustmentPensionBenefitsReportedChangeMember2022-01-012022-12-310000318300ecd:PeoMemberpebo:AdjustmentPensionBenefitAdjustmentsMember2022-01-012022-12-310000318300ecd:PeoMemberpebo:AdjustmentEquityAwardsReportedValueMember2021-01-012021-12-310000318300ecd:PeoMemberpebo:AdjustmentEquityAwardAdjustmentsMember2021-01-012021-12-310000318300ecd:PeoMemberpebo:AdjustmentPensionBenefitsReportedChangeMember2021-01-012021-12-310000318300ecd:PeoMemberpebo:AdjustmentPensionBenefitAdjustmentsMember2021-01-012021-12-310000318300ecd:PeoMemberpebo:AdjustmentEquityAwardsReportedValueMember2020-01-012020-12-310000318300ecd:PeoMemberpebo:AdjustmentEquityAwardAdjustmentsMember2020-01-012020-12-310000318300ecd:PeoMemberpebo:AdjustmentPensionBenefitsReportedChangeMember2020-01-012020-12-310000318300ecd:PeoMemberpebo:AdjustmentPensionBenefitAdjustmentsMember2020-01-012020-12-310000318300pebo:AdjustmentEquityAwardsReportedValueMemberecd:NonPeoNeoMember2022-01-012022-12-310000318300pebo:AdjustmentEquityAwardAdjustmentsMemberecd:NonPeoNeoMember2022-01-012022-12-310000318300pebo:AdjustmentPensionBenefitsReportedChangeMemberecd:NonPeoNeoMember2022-01-012022-12-310000318300pebo:AdjustmentPensionBenefitAdjustmentsMemberecd:NonPeoNeoMember2022-01-012022-12-310000318300pebo:AdjustmentEquityAwardsReportedValueMemberecd:NonPeoNeoMember2021-01-012021-12-310000318300pebo:AdjustmentEquityAwardAdjustmentsMemberecd:NonPeoNeoMember2021-01-012021-12-310000318300pebo:AdjustmentPensionBenefitsReportedChangeMemberecd:NonPeoNeoMember2021-01-012021-12-310000318300pebo:AdjustmentPensionBenefitAdjustmentsMemberecd:NonPeoNeoMember2021-01-012021-12-310000318300pebo:AdjustmentEquityAwardsReportedValueMemberecd:NonPeoNeoMember2020-01-012020-12-310000318300pebo:AdjustmentEquityAwardAdjustmentsMemberecd:NonPeoNeoMember2020-01-012020-12-310000318300pebo:AdjustmentPensionBenefitsReportedChangeMemberecd:NonPeoNeoMember2020-01-012020-12-310000318300pebo:AdjustmentPensionBenefitAdjustmentsMemberecd:NonPeoNeoMember2020-01-012020-12-31000031830012022-01-012022-12-31000031830022022-01-012022-12-31000031830032022-01-012022-12-31000031830042022-01-012022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant þ

Filed by a party other than the Registrant o

Check the appropriate box: | | | | | | | | |

o | | Preliminary Proxy Statement |

o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

þ | | Definitive Proxy Statement |

o | | Definitive Additional Materials |

o | | Soliciting Material under §240.14a-12 |

Peoples Bancorp Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply): | | | | | | | | | | | |

þ | | No fee required | |

o | | Fee paid previously with preliminary materials |

o | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |

| | | | | | | | |

| | 138 Putnam Street P.O. Box 738 Marietta, OH 45750-0738 |

|

| Telephone: (740) 374-6136 |

| www.peoplesbancorp.com |

Notice of Annual Meeting of Shareholders

Peoples Bancorp Inc.

| | | | | | | | | | | | | | | | | | | | |

Date Thursday, April 27, 2023 | | Time 10:00 a.m. (Eastern Daylight Saving Time) | | Place Via Live Webcast at www.proxydocs.com/pebo | | Record Date February 27, 2023 |

The Annual Meeting of Shareholders (the “Annual Meeting”) of Peoples Bancorp Inc. (“Peoples”) will be held for the following purposes:

| | | | | | | | | | | | | | | | | |

| 1. | | To elect twelve directors nominated by the Peoples Board of Directors, each to serve for a term of one year expiring at the 2024 Annual Meeting of Shareholders. |

| | | | | |

| 2. | | To consider and vote upon a proposal to approve a non-binding advisory resolution to approve the compensation of Peoples’ named executive officers as disclosed in the accompanying Proxy Statement for the Annual Meeting. |

| | | | | |

| 3. | | To consider and vote upon a proposal to approve the Peoples Bancorp Inc. Fourth Amended and Restated 2006 Equity Plan. |

| | | | | |

| 4. | | To consider and vote upon a proposal to ratify the appointment of Ernst & Young LLP as Peoples’ independent registered public accounting firm for the fiscal year ending December 31, 2023. |

| | | | | |

| 5. | | To transact any other business that properly comes before the Annual Meeting. Peoples’ Board of Directors is not aware of any other business to come before the Annual Meeting. |

If you were a holder of record of common shares of Peoples at the close of business on February 27, 2023, you will be entitled to vote at the Annual Meeting.

We have elected to take advantage of Securities and Exchange Commission (“SEC”) rules that allow us to furnish proxy materials to certain shareholders over the internet. On or about the date of this Notice of Annual Meeting of Shareholders, we began mailing a notice of internet availability of proxy materials (the “Notice of Internet Availability”) to shareholders of record at the close of business on February 27, 2023. The Notice of Internet Availability contains information on how to access the Proxy Statement (which describes in detail each of the matters to be considered at the Annual Meeting), Peoples’ 2022 Annual Report to Shareholders and the form of proxy over the internet, as well as instructions on how to request a paper copy of the proxy materials. At the same time, we provided shareholders of record with access to our online proxy materials and filed our proxy materials with the SEC. We believe furnishing proxy materials to our shareholders over the internet allows us to provide our shareholders with the information they need, while lowering the costs of delivery and reducing the environmental impact of the Annual Meeting. If you have received the Notice of Internet Availability, you will not receive a printed copy of the proxy materials unless you request it by following the instructions for requesting such proxy materials contained in the Notice of Internet Availability and summarized on the following page.

It is important that your common shares be represented at the Annual Meeting whether or not you are personally able to participate. Accordingly, after reading the accompanying Proxy Statement, please promptly submit your proxy by telephone, over the internet or by mail as described in the Proxy Statement.

YOUR VOTE IS IMPORTANT

Your common shares may be voted by one of the following methods:

Submitting your proxy over the internet, by telephone or by mail does not deprive you of the right to participate in the Annual Meeting live via the internet and to vote your common shares online in the manner described in the accompanying Proxy Statement.

To obtain instructions as to how to participate in the Annual Meeting virtually, please call Investor Relations at 740-374-6136.

| | |

| By Order of the Board of Directors, |

|

M. Ryan Kirkham Corporate Secretary March 16, 2023 |

|

YOUR VOTE IS IMPORTANT

| | | | | |

Before you vote, access the proxy materials in one of the following ways prior to the Annual Meeting: |

|

To view Online: Visit www.proxydocs.com/pebo 24 hours a day, seven days a week, until the polls close during the Annual Meeting. With your Notice of Internet Availability handy, follow the instructions to log in, and view copies. |

|

| To request and receive a PAPER or E-MAIL copy: |

|

You MUST REQUEST a paper or e-mail copy of the proxy materials. There is NO charge for requesting a copy. Please choose one of the following methods to make your request: |

|

| (1) Over the Internet: | www.proxydocs.com/pebo |

| (2) By Telephone: | 1-866-870-3684 |

| (3) By E-Mail*: | paper@investorelections.com |

| |

*If you request proxy materials by e-mail, please send a blank e-mail with “PEBO Materials Request” included in the subject line. The e-mail must include: (i) the 11-digit control # located in the box in the upper right hand corner on the front of your Notice of Internet Availability; (ii) your preference to receive printed proxy materials via mail or to receive an e-mail with links to the electronic proxy materials; (iii) if you choose e-mail delivery, the e-mail address to which the links to the electronic proxy materials is to be sent; and (iv) if you would like this election to apply to the delivery of materials for all future meetings, write the word “Permanent” and include the last 4 digits of your Social Security Number or Tax Identification Number in the e-mail. Requests, instructions and other inquiries sent to this e-mail address will NOT be forwarded to your investment advisor. Please make the request as instructed above on or before April 13, 2023 to facilitate timely delivery of the proxy materials. |

Peoples Bancorp Inc.

Proxy Statement for the Annual Meeting of Shareholders

To Be Held April 27, 2023

| | | | | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Corporate Governance and Board Matters | |

| |

| |

| |

Environmental, Social and Governance Matters | |

| Associates | |

| Communities | |

| Clients | |

| Shareholders | |

| |

| |

| |

| |

| |

| |

| |

| Board Skills | |

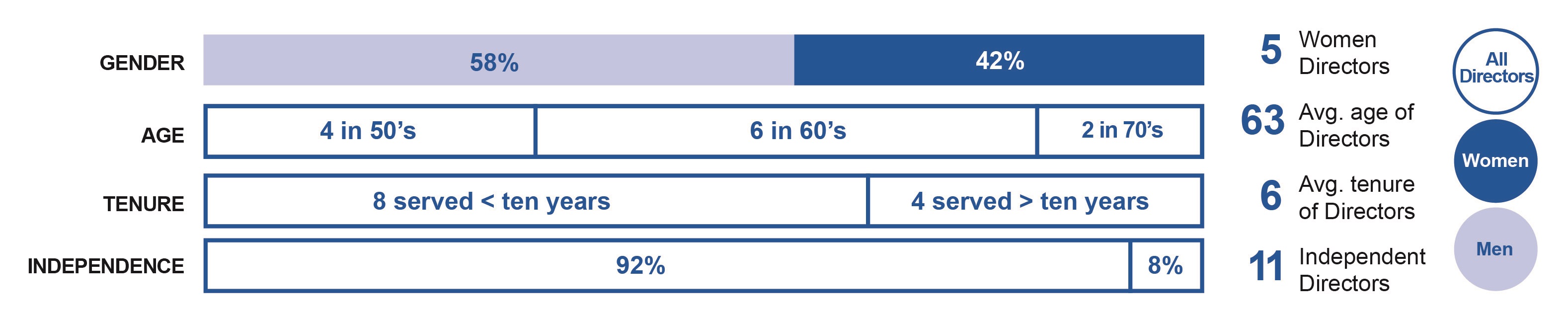

| Board Diversity | |

| |

| |

| | |

| | |

| | |

| | |

| | |

| |

| |

| | |

| | |

| |

| |

| |

| |

| | | | | | | | |

| |

| |

| |

| |

| |

| |

| 2022 Business Highlights | |

| Goals for 2022 Incentive Awards | |

| 2022 Actual Results vs. Performance Goals | |

| 2022 Compensation Actions | |

| Notable Pay Practices | |

| Total Shareholder Return | |

| Pay for Performance | |

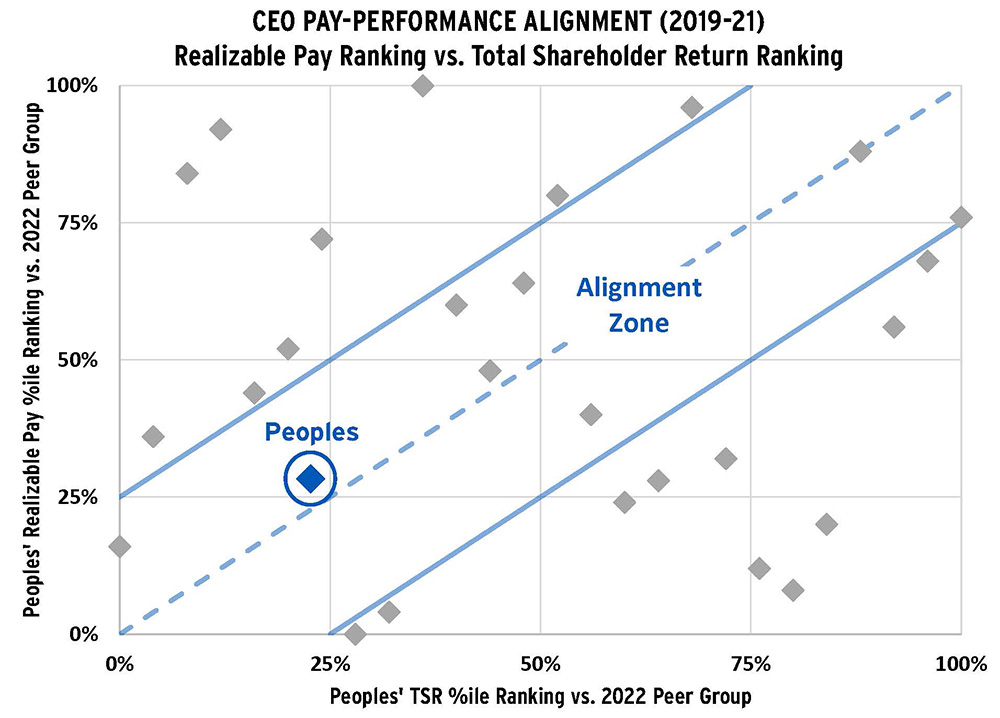

| Pay for Performance – Realizable Pay Analysis | |

| Pay for Performance – Our Key Compensation Decisions | |

| Advisory Vote of Shareholders | |

| |

| |

| |

| |

| | |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| |

| | |

| | |

| |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| Pay Versus Performance | |

| Financial Performance Measures | |

| Analysis of Information Presented in the Pay versus Performance Table | |

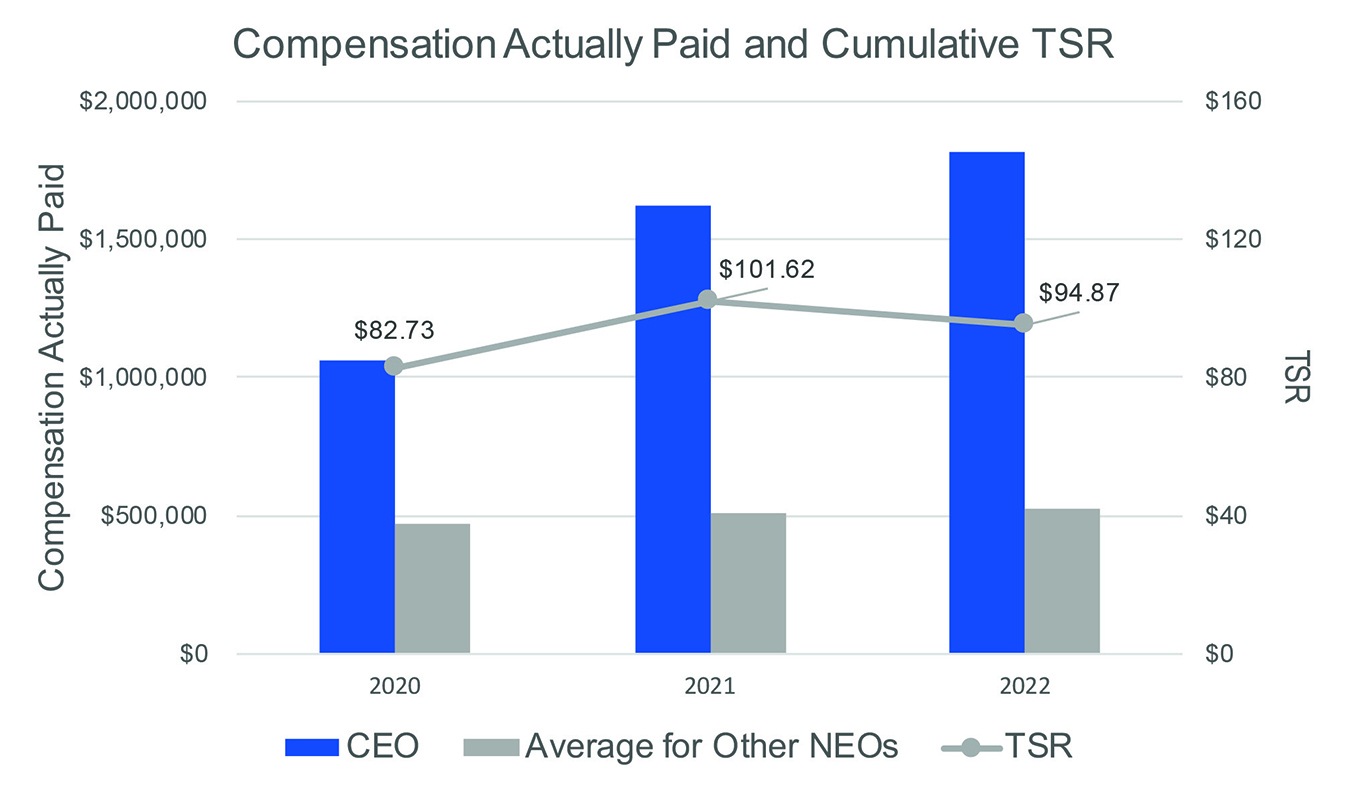

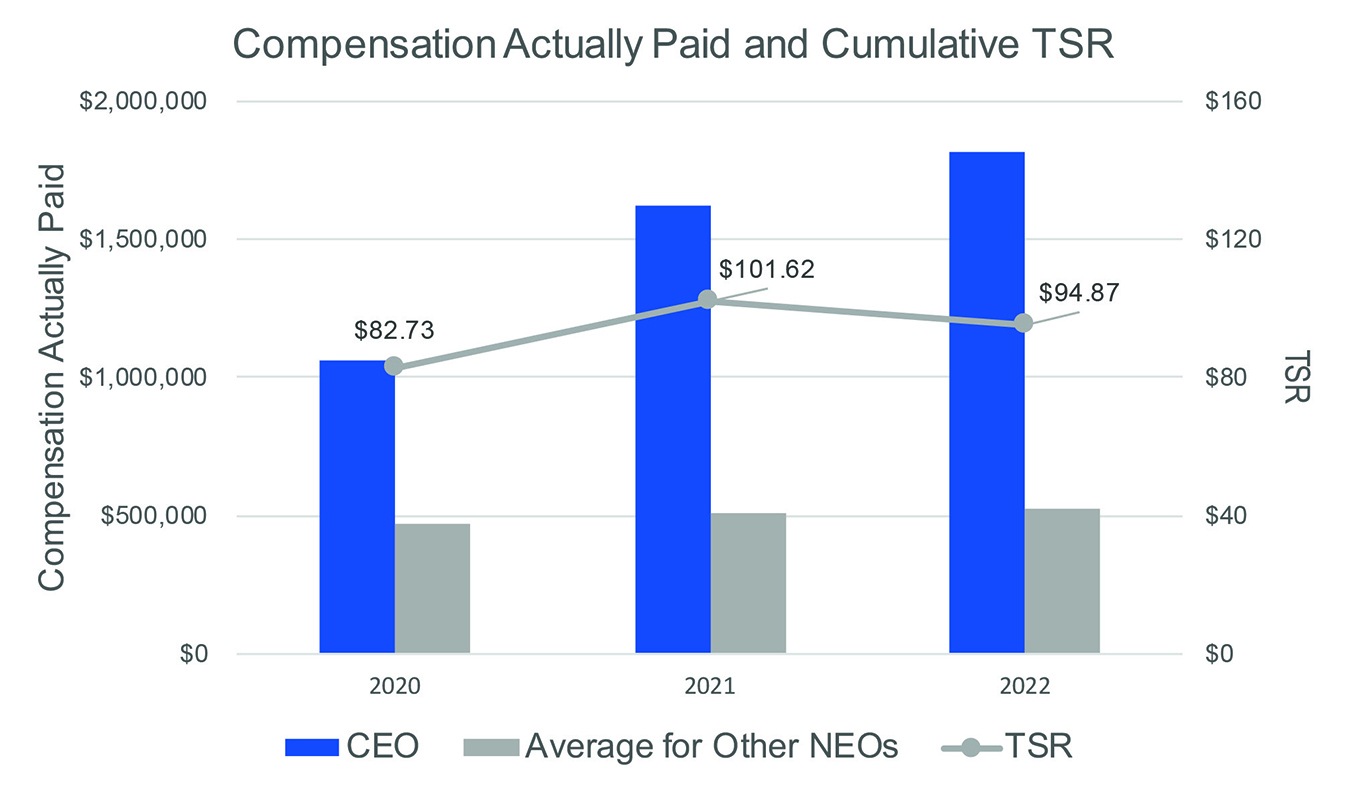

| Compensation Actually Paid and Cumulative TSR | |

| Compensation Actually Paid and Net Income | |

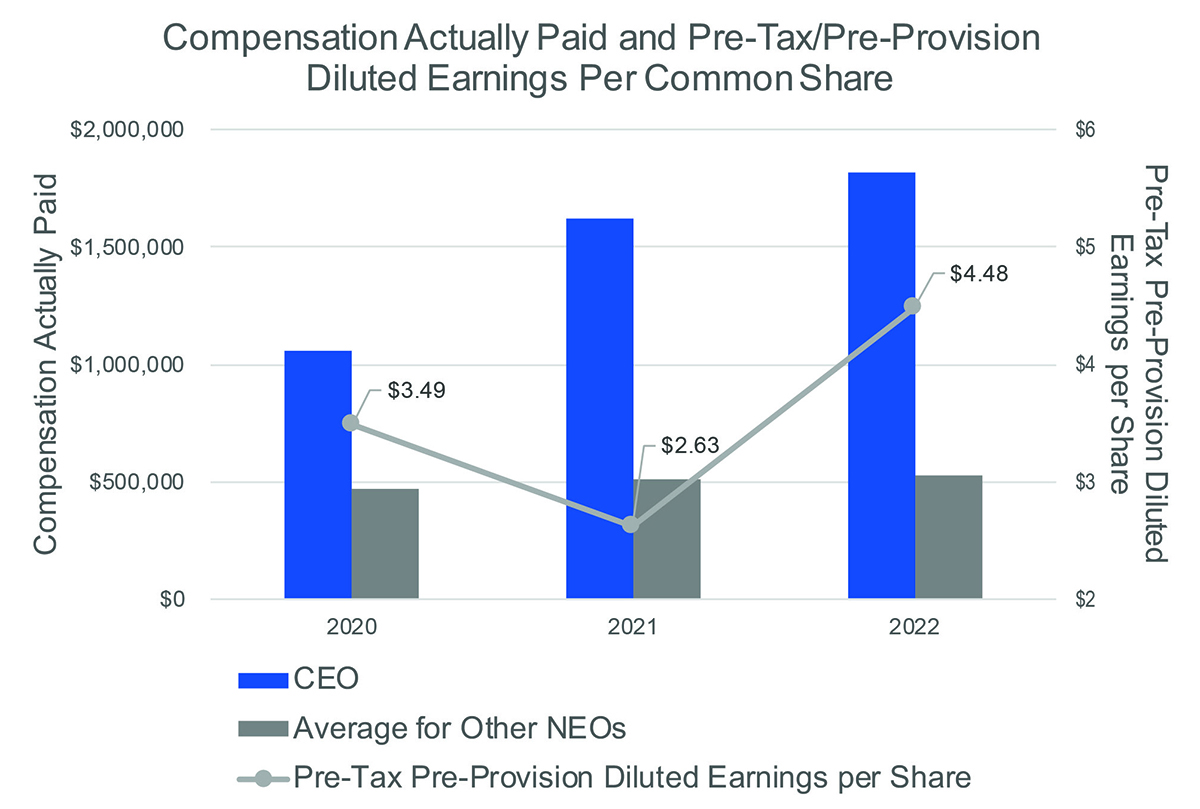

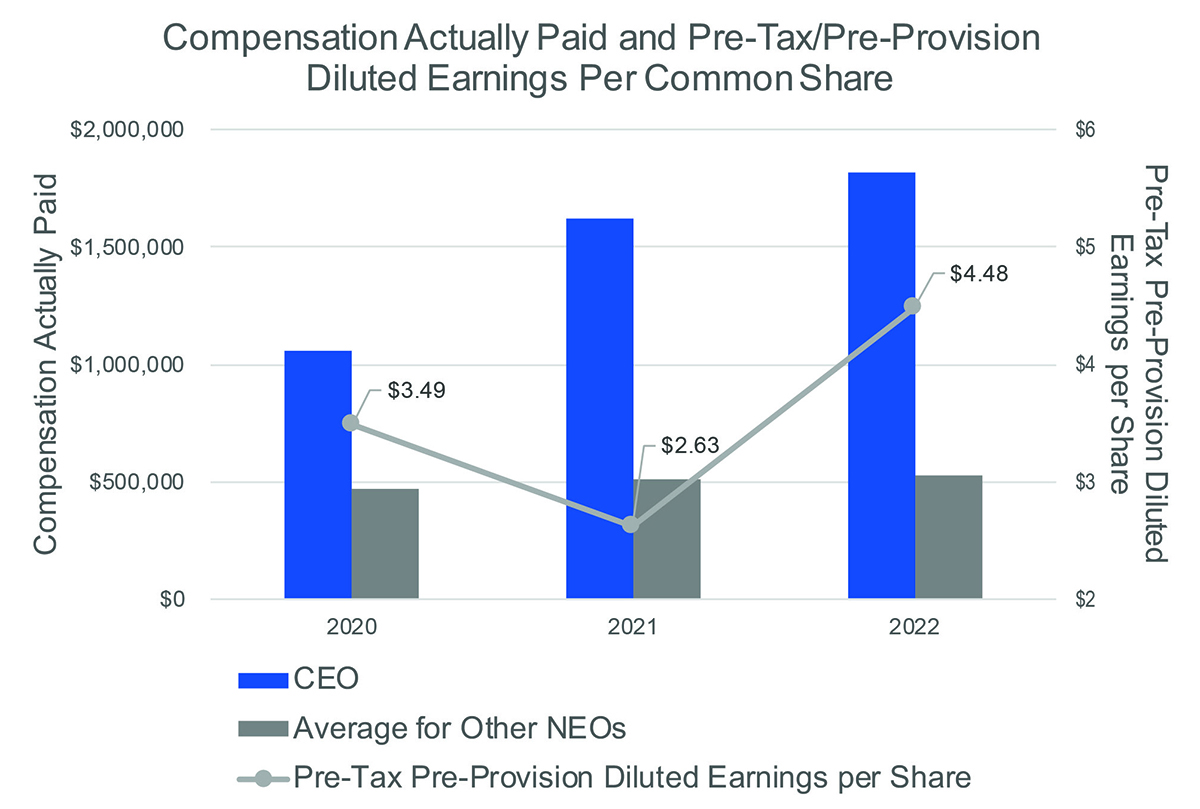

| Compensation Actually Paid and Pre-Tax/Pre-Provision Diluted Earnings Per Common Share | |

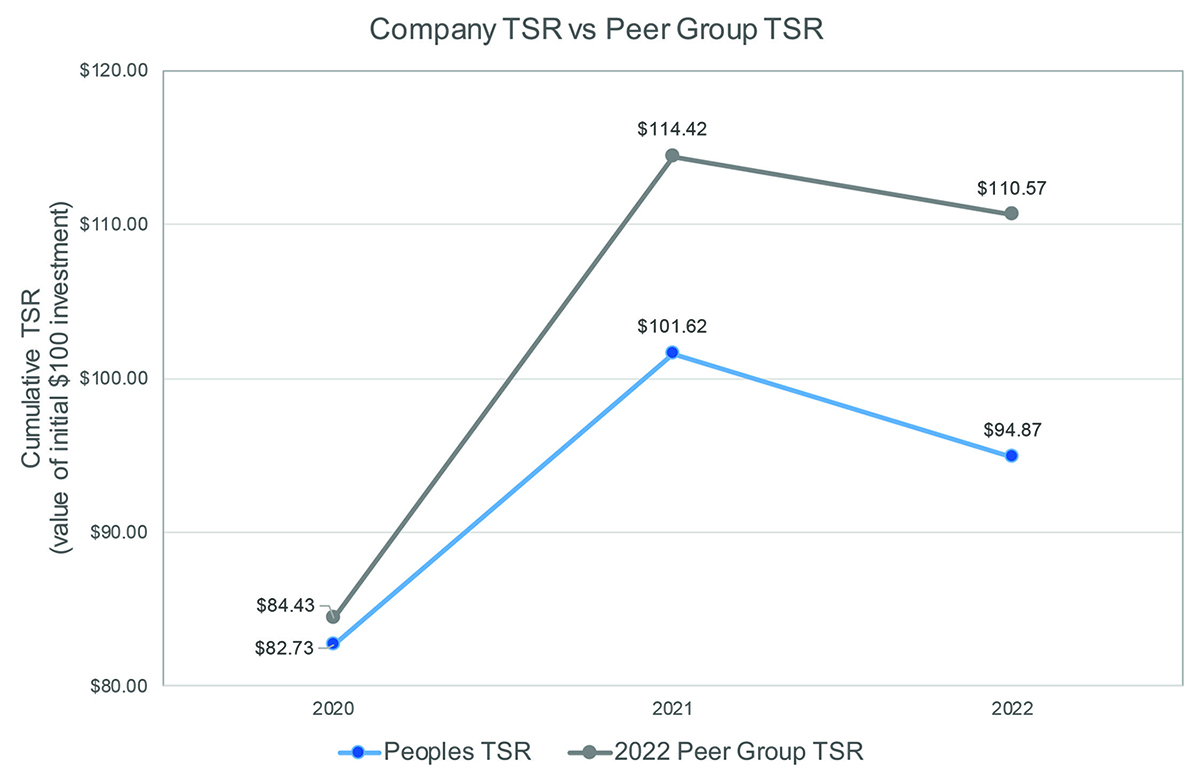

| Cumulative TSR of Peoples and Cumulative TSR of the 2022 Peer Group | |

| |

| |

| | |

| | |

| | |

| Equity Compensation Plan Information | |

| |

| |

| General | |

| | | | | | | | |

| Purpose | |

| Effective Date and Expiration of the Fourth A&R 2006 Plan | |

| Administration of the Fourth A&R 2006 Plan | |

| Eligibility and Participation | |

| Plan Benefits | |

| Common Shares Available Under the Fourth A&R 2006 Plan | |

| Limitation on Awards | |

| Options | |

| SARs | |

| Restricted Stock and Restricted Performance Stock | |

| Unrestricted Common Shares | |

| Performance Units | |

| General Performance Goals | |

| Change in Control | |

| Tax Withholding | |

| Termination | |

| Adjustments | |

| Clawback | |

| Limitations on Transferability of Awards | |

| Amendment, Suspension and Termination of the Fourth A&R 2006 Plan | |

| U.S. Federal Income Tax Consequences | |

| Incentive Stock Options | |

| Nonqualified Stock Options | |

| SARs | |

| Restricted Stock | |

| Restricted Performance Stock and Performance Units | |

| Unrestricted Common Shares | |

| Section 162(m) of the Internal Revenue Code | |

| Sections 280G and 4999 of the Internal Revenue Code | |

| Section 409A of the Internal Revenue Code | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Appendix A - Peoples Bancorp Inc. Fourth Amended and Restated 2006 Equity Plan | |

PEOPLES BANCORP INC.

138 Putnam Street

P.O. Box 738

Marietta, Ohio 45750-0738

(740) 374-6136

www.peoplesbancorp.com

Proxy Statement for the Annual Meeting of Shareholders

To Be Held on April 27, 2023

GENERAL INFORMATION

This Proxy Statement is furnished in connection with the solicitation of proxies on behalf of the Board of Directors (the “Board”) of Peoples Bancorp Inc. (“Peoples”) for use at the Annual Meeting of Shareholders, to be held on Thursday, April 27, 2023, at 10:00 a.m., Eastern Daylight Saving Time (the “2023 Annual Meeting” or the “Annual Meeting”). This Proxy Statement summarizes the information that you will need in order to vote. The Annual Meeting will be held solely over the internet in a virtual-only format, which means that you will be able to participate in the Annual Meeting, vote and submit your questions during the Annual Meeting via live webcast by visiting www.proxydocs.com/pebo. Because the Annual Meeting will be held in a virtual-only format, you will not be able to attend the Annual Meeting in person at a physical location.

Peoples has three wholly-owned operating subsidiaries: Peoples Bank, Peoples Investment Company, and Peoples Risk Management, Inc., and Peoples holds all of the common securities of NB&T Statutory Trust III and FNB Capital Trust One. Peoples Bank’s operating subsidiaries include an insurance agency, Peoples Insurance Agency, LLC; and an equipment leasing company, Vantage Financial, LLC. In 2003, Peoples established Peoples Bank Foundation, Inc. as an independent charitable foundation to provide financial assistance and grants to local organizations within Peoples’ market area.

Mailing

On or about March 16, 2023, we began mailing a notice of internet availability of proxy materials (the “Notice of Internet Availability”) to all registered shareholders entitled to vote their common shares at the Annual Meeting. The Notice of Internet Availability contains instructions on how to access the Notice of Annual Meeting of Shareholders, this Proxy Statement, the form of proxy and Peoples’ 2022 Annual Report to Shareholders, which includes the Annual Report of Peoples on Form 10-K for the fiscal year ended December 31, 2022 (the “2022 Annual Report”), over the internet.

Copies of the 2022 Annual Report may be obtained, without charge, by sending a written request to: M. Ryan Kirkham, Corporate Secretary, Peoples Bancorp Inc., 138 Putnam Street, P.O. Box 738, Marietta, Ohio 45750-0738. A copy of the 2022 Annual Report can be obtained through the “SEC Filings – Annual Reports” section of the “Investor Relations” page of Peoples’ website at www.peoplesbancorp.com and is also on file with the Securities and Exchange Commission (the “SEC”) and available on the SEC’s website at www.sec.gov.

SHAREHOLDER PROPOSALS FOR 2024 ANNUAL MEETING

Proposals by shareholders intended to be presented at the 2024 Annual Meeting of Shareholders (the “2024 Annual Meeting”) must be received by the Corporate Secretary of Peoples no later than November 17, 2023 to be eligible for inclusion in Peoples’ form of proxy, Notice of Annual Meeting of Shareholders, Proxy Statement and Notice of Internet Availability, as applicable, relating to the 2024 Annual Meeting. Peoples will not be required to include in its form of

proxy, Notice of Annual Meeting of Shareholders, Proxy Statement or Notice of Internet Availability, as applicable, a shareholder proposal that is received after that date or that otherwise fails to meet the requirements for shareholder proposals established by the applicable SEC rules. In addition, in order to comply with the universal proxy rules, shareholders who intend to solicit proxies for the 2024 Annual Meeting in support of director nominees other than Peoples' nominees must provide notice to Peoples that sets forth the information required by Rule 14a-19 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), no later than February 28, 2024.

The SEC has promulgated rules relating to the exercise of discretionary voting authority under proxies solicited by the Board. If a shareholder intends to present a proposal at the 2024 Annual Meeting without inclusion of that proposal in Peoples’ proxy materials, and does not notify the Corporate Secretary of Peoples of the proposal by January 31, 2024, or if Peoples meets other requirements of the applicable SEC rules, the proxies solicited by the Board for use at the 2024 Annual Meeting will confer discretionary authority to vote on the proposal should it then be raised at the 2024 Annual Meeting.

In each case, written notice must be given to Peoples’ Corporate Secretary, at the following address: Peoples Bancorp Inc., 138 Putnam Street, P.O. Box 738, Marietta, Ohio 45750-0738, Attention: Corporate Secretary.

Shareholders desiring to nominate candidates for election as directors at the 2023 Annual Meeting must follow the procedures described in the section captioned “CORPORATE GOVERNANCE AND BOARD MATTERS - Nominating Procedures.”

VOTING INFORMATION

Who can vote at the Annual Meeting?

Only holders of common shares of record at the close of business on February 27, 2023, are entitled to receive notice of and to vote at the Annual Meeting. At the close of business on February 27, 2023, there were 28,471,767 common shares outstanding and entitled to vote. Other than the common shares, there are no voting securities of Peoples outstanding. All voting at the Annual Meeting will be governed by our Amended Articles of Incorporation, our Code of Regulations and the General Corporation Law of the State of Ohio.

Each common share entitles the holder thereof to one vote on each matter to be voted upon at the Annual Meeting. There is no cumulative voting with respect to the election of directors.

How do I attend and participate in the Annual Meeting?

We will be hosting the Annual Meeting live via the internet. You will not be able to attend the Annual Meeting in person. Any shareholder can listen to and participate in the Annual Meeting live via the internet at www.proxydocs.com/pebo. The webcast will start at 10:00 a.m., Eastern Daylight Saving Time, on April 27, 2023. Shareholders of record (also known as registered shareholders) may vote and submit questions while connected to the Annual Meeting on the internet.

Instructions on how to register for and participate in the Annual Meeting, including how to demonstrate proof of ownership of Peoples common shares, are posted at www.proxydocs.com/pebo.

We recommend that you register at least one hour before the Annual Meeting to ensure ample time to complete the registration procedures and receive your unique link to the virtual meeting via confirmation e-mail. A replay of the Annual Meeting audio webcast will be available on our website for approximately one year following the Annual Meeting.

You do not need to attend the Annual Meeting to vote. Even if you plan to attend the Annual Meeting, please submit your vote in advance as instructed in this Proxy Statement.

What is a Notice of Internet Availability?

In accordance with rules adopted by the SEC, instead of mailing a printed copy of our proxy materials to each shareholder of record, we are permitted to furnish our proxy materials, including the Notice of Annual Meeting of Shareholders, this Proxy Statement, the form of proxy and our 2023 Annual Report, by providing access to such

documents over the internet. Generally, shareholders will not receive printed copies of the proxy materials unless they request them.

A Notice of Internet Availability that provides instructions for accessing our proxy materials over the internet was mailed directly to registered shareholders. The Notice of Internet Availability also provides instructions regarding how registered shareholders may vote their common shares over the internet. Registered shareholders who prefer to receive a paper or e-mail copy of our proxy materials must follow the instructions provided in the Notice of Internet Availability for requesting such materials.

The Notice of Internet Availability only identifies the items to be voted on at the Annual Meeting. You cannot vote by marking the Notice of Internet Availability and returning it. The Notice of Internet Availability provides instructions on how to cast your vote.

A notice that directs beneficial owners of our common shares to the website where they can access our proxy materials will be forwarded to each beneficial shareholder by the brokerage firm, bank or other shareholder of record that is considered the registered shareholder with respect to the common shares of the beneficial shareholder. Such brokerage firm, bank or other shareholder of record will also provide each beneficial owner of our common shares with instructions on how the beneficial shareholder may request a paper or e-mail copy of our proxy materials.

What is the difference between holding common shares as a registered shareholder and as a beneficial owner?

If, at the close of business on February 27, 2023, your common shares were registered directly in your name with our transfer agent, Shareowner Services, you are considered a registered shareholder with respect to those common shares, and the Notice of Internet Availability or proxy materials were sent directly to you. As a registered shareholder, you may vote your common shares electronically at the Annual Meeting or by proxy.

If, at the close of business on February 27, 2023, your common shares were held in an account at a brokerage firm, bank or other similar organization, then you are the beneficial owner of common shares held in “street name” and a notice directing you to the website where you can access our proxy materials is being forwarded to you by that organization. The organization holding your account is considered the registered shareholder for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct that organization how to vote the common shares in your account. If that organization is not given specific direction, common shares held in the name of that organization may not be voted and will not be considered as present and entitled to vote on any matter to be considered at the Annual Meeting other than the ratification of the appointment of Peoples’ independent registered public accounting firm. Please direct your broker how to vote your common shares following the instructions provided by your broker.

How do I vote my common shares?

If you are a registered shareholder (i.e., you hold your common shares of record), you may vote your common shares using one of the following methods (please also see the information provided above and below concerning the difference in how to vote if you hold common shares beneficially through a brokerage firm, bank or other nominee, instead of as the registered shareholder ‒ beneficial holders should follow the voting instructions provided by their respective nominees):

•Vote over the internet.

◦Before the Date of the Annual Meeting: Go to www.proxypush.com/pebo.

◦You can use the internet 24 hours a day, seven days a week, to transmit your voting instructions and for electronic delivery of information until the polls close during the Annual Meeting. Have your Notice of Internet Availability or your Proxy Card (if you requested a printed copy of our proxy materials) in hand when you access the website and follow the instructions to obtain your records and create an electronic voting instruction form.

•During the Annual Meeting: Go to www.proxydocs.com/pebo.

◦You may attend the Annual Meeting via the internet and vote during the Annual Meeting. Have the information printed in the designated box at the top of your Notice of Internet Availability or your Proxy Card (if you requested a printed copy of our proxy materials) available and follow the instructions.

•Vote by Telephone. Call 1-866-883-3382.

◦You can use any touch-tone telephone to transmit your voting instructions until the polls close during the Annual Meeting. Have your Notice of Internet Availability or your Proxy Card (if you requested a printed copy of our proxy materials) available when you call and follow the instructions.

•By mail. If you received a printed copy of our proxy materials, you may submit your vote by completing, signing and dating your Proxy Card and returning it in the postage-paid envelope to Shareowner Services, P.O. Box 64945, St. Paul, Minnesota 55164-0945. Sign your name exactly as it appears on the Proxy Card. Proxy Cards submitted by mail must be received no later than April 26, 2023 to be voted at the Annual Meeting.

If, prior to the Annual Meeting, you vote via the internet or by telephone, your electronic vote authorizes the named proxy holders in the same manner as if you signed, dated and returned a Proxy Card. If, prior to the Annual Meeting, you vote via the internet or by telephone, do not return a Proxy Card unless you intend to revoke your previously submitted proxy.

If I am a shareholder holding common shares in “street name,” how do I vote?

If you hold your common shares in “street name,” you should have received a notice of internet availability of proxy materials or voting instructions from the brokerage firm, bank or other nominee holding your common shares. You should follow the instructions in the notice of internet availability of proxy materials or voting instructions provided by your broker or other nominee in order to instruct your broker or other nominee on how to vote your common shares. The availability of telephone and internet voting will depend on the voting process of your broker or other nominee.

How do I vote if my common shares are held through the Peoples Bancorp Inc. Retirement Savings Plan?

If you participate in the Peoples Bancorp Inc. Retirement Savings Plan (the “Retirement Savings Plan”), you will be entitled to instruct the trustee of the Retirement Savings Plan how to vote common shares that have been allocated to your account. If you are such a participant, you will receive a Notice of Internet Availability that provides instructions for accessing our proxy materials over the internet for the common shares allocated to your account in the Retirement Savings Plan. The Notice of Internet Availability also provides instructions on how you may request a paper or e-mail copy of our proxy materials. You may vote the common shares allocated to your account by following the instructions stated on your Notice of Internet Availability or on your Proxy Card (if you requested a paper copy of our proxy materials). If you do not provide voting instructions to the trustee of the Retirement Savings Plan by 11:59 p.m., Central Saving Time, on April 23, 2023, the trustee will not vote the common shares allocated to your account.

How will my common shares be voted?

Those common shares represented by properly-authenticated internet or telephone voting instructions that are submitted prior to the deadline for doing so or a properly-executed Proxy Card (if you requested a paper copy of our proxy materials) that is received no later than April 26, 2023, and not subsequently revoked, will be voted in accordance with your instructions by your “proxies” (the individuals named in the voting instructions or on your Proxy Card). If you timely submit a valid Proxy Card prior to the Annual Meeting, or timely submit your voting instructions via the internet or by telephone, but do not complete the Proxy Card or voting instructions, your proxies will vote your common shares as recommended by the Board, except in the case of broker non-votes, where applicable, as follows:

•“FOR” the election as Peoples directors of the nominees listed on pages 22 through 26 under “PROPOSAL NUMBER 1: ELECTION OF DIRECTORS”;

•“FOR” the approval of the non-binding advisory resolution to approve the compensation of Peoples’ named executive officers as disclosed in this Proxy Statement;

•“FOR” the approval of the Peoples Bancorp Inc. Fourth Amended and Restated 2006 Equity Plan; and

•“FOR” the ratification of the appointment of Ernst & Young LLP as Peoples’ independent registered public accounting firm for the fiscal year ending December 31, 2023.

No appraisal or dissenters’ rights exist for any action proposed to be taken at the Annual Meeting. If any other matters are properly presented for voting at the Annual Meeting, the individuals appointed as proxies will vote on those matters, to the extent permitted by applicable law, in accordance with their best judgment.

How do I revoke or change my vote after submitting my proxy?

Registered shareholders who submit proxies retain the right to revoke them at any time before they are exercised. Unless revoked, the common shares represented by such proxies will be voted at the Annual Meeting. If you are a registered shareholder, you may revoke or change your vote at any time before the closing of the polls during the Annual Meeting by:

•filing a written notice of revocation with the Corporate Secretary of Peoples at 138 Putnam Street, P.O. Box 738, Marietta, Ohio 45750-0738, which must be received no later than April 26, 2023;

•executing and returning a new Proxy Card (if you requested a paper copy of our proxy materials) with a later date – only your latest completed, signed and dated Proxy Card received prior to April 26, 2023, will be counted;

•submitting a later-dated vote by telephone or via the internet ‒ only your latest telephone or internet voting instructions received prior to the closing of the polls during the Annual Meeting, will be counted; or

•participating in the Annual Meeting live via the internet and voting again.

Participation in the virtual Annual Meeting will not, by itself, revoke your proxy. The last-dated form of proxy or Proxy Card or voting instructions you submit (by any means) will supersede all previously-submitted proxies and voting instructions. If you hold your common shares in “street name” and instructed your brokerage firm, bank or other nominee to vote your common shares and you would like to revoke or change your vote, then you must follow the instructions received from your nominee to revoke or change your vote.

If I vote in advance, can I still participate in the Annual Meeting?

Yes. You are encouraged to vote promptly, by submitting your voting instructions via the internet before or during the Annual Meeting, or by telephone, or by returning your Proxy Card (if you requested a paper copy of our proxy materials), so that your common shares will be represented at the Annual Meeting. However, appointing a proxy or submitting voting instructions does not affect your right to participate in the Annual Meeting and vote your common shares if you are a shareholder of record.

What constitutes a quorum and what is the vote required with respect to the proposals to be considered at the Annual Meeting?

Under Peoples’ Code of Regulations, a quorum is a majority of the voting shares of Peoples then outstanding and entitled to vote at the Annual Meeting. Other than the common shares, there are no voting shares outstanding. Common shares may be voted online during the Annual Meeting or represented by proxy at the Annual Meeting. Both abstentions and broker non-votes are counted as being present for purposes of determining the presence of a quorum. There were 28,471,767 common shares outstanding and entitled to vote on February 27, 2023, the record date for the Annual Meeting. A majority of the outstanding common shares, or 14,235,884 common shares, voted online before or during the Annual Meeting or represented by proxy, will constitute a quorum. A quorum must exist to conduct business at the Annual Meeting.

If a proposal is routine, a broker holding common shares for a beneficial owner in street name may vote on the proposal without receiving instructions from the beneficial owner. If a proposal is non-routine, a broker may vote on the proposal only if the beneficial owner has provided voting instructions. A “broker non-vote” occurs when a broker

holding common shares for a beneficial owner is unable to vote on a proposal because the proposal is non-routine and the beneficial owner has not provided any voting instructions.

The ratification of the appointment of Peoples’ independent registered public accounting firm is the only routine proposal. Each of the other proposals is a non-routine proposal on which a broker may vote only if the beneficial owner has provided voting instructions.

The following table sets forth the votes required, and the impact of abstentions and broker non-votes, if any, on the three proposals:

| | | | | | | | | | | | | | |

| Item | | Vote Required | | Impact of Abstentions and Broker Non-Votes, if any |

| | | | |

| Election of Directors | | Under Ohio law and Peoples’ Code of

Regulations, the twelve nominees for

election as directors of Peoples receiving the greatest number of votes “FOR” their election will be elected as directors of Peoples. | | •Common shares as to which the

authority to vote is withheld will be

counted for quorum purposes, but will not affect whether a nominee has received sufficient votes to be elected as a director. However, common shares to which the authority to vote is withheld will be treated as a vote against the nominee for the purpose of the majority vote standard provisions in our Corporate Governance Guidelines.

•Broker non-votes will not count as a vote on the proposal and will not

affect the outcome of the vote. |

| | | | |

Approval of Non-Binding

Advisory Resolution to

Approve Compensation of

Peoples’ Named Executive

Officers | | The affirmative vote of a majority of the common shares represented at the Annual Meeting, in person or by proxy, and entitled to vote on the proposal, is required to approve the non-binding advisory resolution to approve the compensation of Peoples’ named executive officers as disclosed in this Proxy Statement. | | •Abstentions have the same effect as a vote “AGAINST” the proposal.

•Broker non-votes will not be counted in determining whether the proposal has been approved. |

| | | | |

| Approval of the Peoples Bancorp Inc. Fourth Amended and Restated 2006 Equity Plan | | The affirmative vote of a majority of the common shares represented at the Annual Meeting, in person or by proxy, and entitled to vote on the proposal, is required to approve the Peoples Bancorp Inc. Fourth Amended and Restated 2006 Equity Plan. | | •Abstentions have the same effect as a vote “AGAINST” the proposal.

•Broker non-votes will not be counted in determining whether the proposal has been approved. |

| |

| | | | |

Ratification of Appointment

of Independent Registered

Public Accounting Firm | | The affirmative vote of a majority of the common shares represented at the Annual Meeting, in person or by proxy, and entitled to vote on the proposal, is required to ratify the appointment of Ernst & Young LLP as Peoples’ independent registered public accounting firm for the fiscal year ending December 31, 2023. | | •Abstentions have the same effect as a vote “AGAINST” the proposal. |

Peoples’ policy is to maintain confidentiality with respect to Proxy Cards, ballots, voting instructions submitted electronically and telephonically and voting tabulations that identify individual shareholders. However, exceptions to this policy may be necessary in some instances to comply with applicable legal requirements and, in the case of any

contested proxy solicitation, to verify the validity of proxies presented by any person and the results of the voting. Inspectors of election and any employees associated with processing Proxy Cards or ballots, reviewing voting instructions submitted electronically and telephonically and tabulating the vote must acknowledge their responsibility to comply with this policy of confidentiality.

Who pays the costs of proxy solicitation?

This solicitation of proxies is being made on behalf of the Board. Peoples will pay the costs of soliciting proxies on behalf of the Board, other than the internet access or telephone usage fees, which may be charged to shareholders when voting electronically or by telephone. In addition to mailing the Notice of Internet Availability (or, if applicable, paper copies of the proxy materials) to registered shareholders as of the close of business on February 27, 2023, the brokerage firms, banks and other nominees holding our common shares for beneficial owners of such common shares must provide a notice as to where the beneficial owners can access our proxy materials in order that such common shares may be voted. Solicitation may also be made by directors, officers and employees of Peoples and our subsidiaries by further mailings, telephone, electronic mail, facsimile, or personal contact. Directors, officers and employees who help us in the solicitation will not be specifically compensated for those services, but they may be reimbursed for their out-of-pocket expenses incurred in connection with the solicitation. Peoples will reimburse its transfer agent, as well as brokerage firms, banks and other nominees, for their reasonable out-of-pocket expenses in forwarding the proxy materials to the beneficial owners.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of February 27, 2023 (except as otherwise noted), information concerning the beneficial ownership of common shares by the only persons known by Peoples to be the beneficial owners of more than 5% of Peoples’ outstanding common shares:

| | | | | | | | | | | | | | |

Name and Address of

Beneficial Owner | | Amount and Nature of

Beneficial Ownership | Percent of Class (1) |

Dimensional Fund Advisors LP

Building One

6300 Bee Cave Road

Austin, TX 78746 | | 2,288,855 | (2) | 8.04% |

BlackRock, Inc.

55 East 52nd Street

New York, NY 10055 | | 2,238,767 | (3) | 7.86% |

| Franklin Mutual Advisers, LLC 101 John F. Kennedy Parkway Short Hills, NJ 07078 | | 1,534,762 | (4) | 5.39% |

| The Vanguard Group 100 Vanguard Blvd. Malvern, PA 19355 | | 1,426,216 | (5) | 5.01% |

(1)The “Percent of Class” computation is based on 28,471,767 common shares outstanding and entitled to vote on February 27, 2023.

(2)Based on information contained in a Schedule 13G/A, dated February 14, 2023 and filed with the SEC on February 10, 2023, on behalf of Dimensional Fund Advisors LP, a registered investment adviser, to report its beneficial ownership of common shares of Peoples as of December 30, 2022, and consequently, the beneficial ownership of Dimensional Fund Advisors LP may have changed prior to the printing of this Proxy Statement. The Schedule 13G/A reported that Dimensional Fund Advisors LP had sole voting power as to 2,251,825 common shares and sole investment power as to 2,288,855 common shares, all of which common shares were held in portfolios of four registered investment companies to which Dimensional Fund Advisors LP or one of its subsidiaries furnishes investment advice and of certain other commingled funds, group trusts and separate accounts for which Dimensional Fund Advisors LP or one of its subsidiaries serves as investment manager or sub-adviser. The common shares reported were owned by the investment companies, commingled funds, group trusts and separate accounts. Dimensional Fund Advisors LP disclaimed beneficial ownership of the reported common shares.

(3)Based on information contained in a Schedule 13G/A, dated February 3, 2023 and filed with the SEC on the same date, on behalf of BlackRock, Inc., to report the beneficial ownership by its subsidiaries (BlackRock Advisors, LLC; Aperio Group, LLC; BlackRock Investment Management (UK) Limited; BlackRock Asset Management Canada Limited; BlackRock (Luxembourg) S.A.; BlackRock (Netherlands) B.V.; BlackRock Fund Advisors; BlackRock Asset Management Ireland Limited; BlackRock Institutional Trust Company, National Association; BlackRock Financial Management, Inc.; BlackRock Fund Managers Ltd; BlackRock Asset Management Schweiz AG; and BlackRock Investment Management, LLC) of common shares of Peoples as of December 31, 2022, and, consequently, the beneficial ownership of BlackRock, Inc. may have changed prior to the printing of this Proxy Statement. The Schedule 13G/A reported that BlackRock, Inc., through its subsidiaries, had sole voting power as to 2,173,217 common shares and sole investment power as to 2,238,767 common shares.

(4)Based on information contained in a Schedule 13G/A, dated January 24, 2023 and filed with the SEC on January 31, 2023, on behalf of Franklin Mutual Advisers, LLC, a registered investment adviser, to report its beneficial ownership of common shares of Peoples as of December 31, 2022, and, consequently, the beneficial ownership of Franklin Mutual Advisers, LLC may have changed prior to the printing of this Proxy Statement. The Schedule 13G/A reported that Franklin Mutual Advisers, LLC had sole voting power as to 1,453,961 common shares and sole investment power as to 1,534,762 common shares. The common shares reported were beneficially owned by one or more open-end investment companies or other managed accounts that are investment management clients of Franklin Mutual Advisers, LLC.

(5)Based on information contained in a Schedule 13G, dated February 9, 2023 and filed with the SEC on the same date, on behalf of The Vanguard Group, to report its beneficial ownership of common shares of Peoples as of December 30, 2022, and consequently, the beneficial ownership of The Vanguard Group may have changed prior to the printing of this Proxy Statement. The Schedule 13G reported that The Vanguard Group had shared voting power as to 30,927 common shares, sole investment power as to 1,371,152 common shares, and shared investment power as to 55,064 common shares.

The table below sets forth, as of February 27, 2023, certain information with respect to the common shares beneficially owned by each current director of Peoples (each of whom is also a nominee for election as a director at the Annual Meeting), by each executive officer named in the “SUMMARY COMPENSATION TABLE FOR 2022” on page 65 and by all current executive officers and directors of Peoples as a group. The table also sets forth additional share interests not reportable as beneficially owned. | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amount and Nature of Beneficial Ownership (1) |

| Name of Beneficial Owner | Common Shares

Presently Held | | Percent of Class (2) | | Additional Share Interests (3) | | Total Share

Interests |

| Tara M. Abraham | 25 | | (4) | | (5) | | 21,899 | | | 21,924 | |

| Kathryn M. Bailey (6) | 28,822 | | (7) | | (5) | | — | | | 28,822 | |

| S. Craig Beam | 24,820 | | (8) | | (5) | | — | | | 24,820 | |

| George W. Broughton | 123,033 | | (9) | | (5) | | 2,260 | | | 125,293 | |

| David F. Dierker | 16,874 | | (10) | | (5) | | 18,936 | | | 35,810 | |

| Jason M. Eakle (6) | 15,324 | | (11) | | (5) | | — | | | 15,324 | |

| James S. Huggins | 12,690 | | (12) | | (5) | | 8,059 | | | 20,749 | |

| Brooke W. James | 232,386 | | (13) | | (5) | | — | | | 232,386 | |

| Susan D. Rector | 19,238 | | (14) | | (5) | | 10,814 | | | 30,052 | |

| Kevin R. Reeves | 6,516 | | (15) | | (5) | | — | | | 6,516 | |

| Carol A. Schneeberger | 52,039 | | (16) | | (5) | | — | | | 52,039 | |

| Frances A. Skinner | 2,434 | | (17) | | (5) | | 4,006 | | | 6,440 | |

| Dwight E. Smith | 200 | | (18) | | (5) | | — | | | 200 | |

| Charles W. Sulerzyski (6) | 85,632 | | (19) | | (5) | | — | | | 85,632 | |

| Michael N. Vittorio | 4,966 | | (20) | | (5) | | — | | | 4,966 | |

| Tyler J. Wilcox (6) | 24,002 | | (21) | | (5) | | — | | | 24,002 | |

| Douglas V. Wyatt (6) | 16,631 | | (22) | | (5) | | — | | | 16,631 | |

| All current directors and executive officers as a group (numbering 18) | 672,268 | | (23) | | 2.36% | | 65,974 | | | 738,242 | |

(1)Unless otherwise indicated in the footnotes to this table, the beneficial owner has sole voting and investment power with respect to all of the common shares reflected in the table. All fractional common shares have been rounded down to the nearest whole common share. The mailing address of each of the current executive officers and directors of Peoples is 138 Putnam Street, P.O. Box 738, Marietta, Ohio 45750-0738.

(2)The “Percent of Class” computation is based on 28,471,767 common shares outstanding and entitled to vote on February 27, 2023.

(3)Represents common shares accrued to the bookkeeping accounts of directors participating in the Third Amended and Restated Deferred Compensation Plan for Directors of Peoples Bancorp Inc. and Subsidiaries (the “Deferred Compensation Plan for Directors”). The participating directors have vested ownership interests but do not have voting power or investment power with respect to such common shares, or the right to acquire such common shares within 60 days of February 27, 2023.

(4)Does not include 21,899 common shares accrued to Tara M. Abraham’s bookkeeping account under the Deferred Compensation Plan for Directors, as to which Ms. Abraham has no voting or investment power, or the right to acquire such common shares within 60 days of February 27, 2023.

(5)Reflects beneficial ownership of less than 1% of the outstanding common shares.

(6)Executive officer of Peoples during the 2022 fiscal year and named in the “SUMMARY COMPENSATION TABLE FOR 2022” on page 65. (7)Includes 3,252 common shares held by Kathryn M. Bailey in the Peoples Bancorp Inc. Employee Stock Purchase Plan (the “ESPP”), as to which Ms. Bailey exercises sole voting and investment power. Also includes (i) 10,000 unvested restricted common shares which were granted to Ms. Bailey on October 1, 2020 and will vest as described in footnote (5) to the table under “OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END 2022;” (ii) 952 unvested restricted common shares which were granted to Ms. Bailey on February 9, 2021 and will vest as described in footnote (2) to the table under “OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END 2022;” (iii) 3,104 unvested restricted common shares which were granted to Ms. Bailey on February 9, 2022 and will vest as described in footnote (3) to the table under “OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END 2022;" and (iv) 3,795 unvested restricted common shares which were granted to Ms. Bailey on February 8, 2023 and will vest as described in footnote (4) to the table under “OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END 2022." Ms. Bailey has voting power with respect to all of the reported restricted common shares and the right to receive dividends paid with respect to the underlying common shares at the same level as dividends paid to other shareholders of Peoples; however, the dividends will be accrued and paid to Ms. Bailey at the same time as the underlying restricted common shares vest, if at all.

(8)Includes 7,391 common shares held in an investment account by S. Craig Beam, as to which Mr. Beam exercises sole voting and investment power. Also includes 8,709 common shares held jointly by Mr. Beam and his wife, as to which Mr. Beam exercises shared voting and investment power. Does not include 1,997 common shares held of record and beneficially owned by Mr. Beam’s wife, as to which Mr. Beam has no voting or investment power and disclaims beneficial ownership.

(9)Includes 2,475 common shares held in an investment account by Peoples Bank as custodian, as to which George W. Broughton exercises sole voting and investment power. Does not include 13,553 common shares held of record and beneficially owned by Mr. Broughton’s wife, as to which Mr. Broughton has no voting or investment power and disclaims beneficial ownership. Does not include 2,260 common shares accrued to Mr. Broughton’s bookkeeping account under the Deferred Compensation Plan for Directors, as to which Mr. Broughton has no voting or investment power, or the right to acquire such common shares within 60 days of February 27, 2023.

(10)Includes 12,500 common shares held in an investment account by David F. Dierker, as to which Mr. Dierker exercises sole voting and investment power. Does not include 18,936 common shares accrued to Mr. Dierker’s bookkeeping account under the Deferred Compensation Plan for Directors, as to which Mr. Dierker has no voting or investment power, or the right to acquire such common shares within 60 days of February 27, 2023.

(11)Includes 108 common shares held by Jason M. Eakle in the ESPP, as to which Mr. Eakle exercises sole voting and investment power. Also includes (i) 5,000 unvested restricted common shares which were granted to Mr. Eakle on October 1, 2020 and will vest as described in footnote (5) to the table under “OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END 2022;” (ii) 952 unvested restricted common shares which were granted to Mr. Eakle on February 9, 2021 and will vest as described in footnote (2) to the table under “OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END 2022;” (iii) 2,281 unvested restricted common shares which were granted to Mr. Eakle on February 9, 2022 and will vest as described in footnote (3) to the table under "OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END 2022;” and (iv) 2,970 unvested restricted common shares which were granted to Mr. Eakle on February 8, 2023 and will vest as described in footnote (4) to the table under "OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END 2022.” Mr. Eakle has voting power with respect to all of the reported restricted common shares and the right to receive dividends paid with respect to the underlying common shares at the same level as dividends paid to other shareholders of Peoples; however, the dividends will be accrued and paid to Mr. Eakle at the same time as the underlying restricted common shares vest, if at all.

(12)Includes 144 common shares held jointly by James S. Huggins and his wife, as to which Mr. Huggins exercises shared voting and investment power. Also includes 1,306 common shares held jointly in an investment account by Mr. Huggins and his wife, as to which Mr. Huggins exercises shared voting and investment power. Does not include 8,059 common shares accrued to Mr. Huggins’ bookkeeping account under the Deferred Compensation Plan for Directors, as to which Mr. Huggins has no voting or investment power, or the right to acquire such common shares within 60 days of February 27, 2023.

(13)Includes 16,886 common shares held by Brooke W. James as custodian, as to which Ms. James exercises sole voting and investment power.

(14)Includes 4,189 common shares held in an investment account by Susan D. Rector, as to which Ms. Rector exercises sole voting and investment power. Does not include 10,814 common shares accrued to Ms. Rector’s bookkeeping account under the Deferred Compensation Plan for Directors, as to which Ms. Rector has no voting or investment power, or the right to acquire such common shares within 60 days of February 27, 2023.

(15)Includes 5,000 common shares held in an investment account by Kevin R. Reeves, as to which Mr. Reeves exercises sole voting and investment power.

(16)Includes 32,736 common shares held by Carol A. Schneeberger as co-trustee of a trust account, as to which Ms. Schneeberger exercises shared voting and investment power.

(17)Includes 2,366 shares held in an investment account by Frances A. Skinner, as to which Ms. Skinner exercises sole voting and investment power. Does not include 4,006 common shares accrued to Ms. Skinner's bookkeeping account under the Deferred Compensation Plan for Directors, as to which Ms. Skinner has no voting or investment power, or the right to acquire such common shares within 60 days of February 27, 2023.

(18)Includes 200 shares held in an investment account by Dwight E. Smith, as to which Mr. Smith exercises sole voting and investment power.

(19)Includes 32,501 common shares held in an investment account by Charles W. Sulerzyski, as to which Mr. Sulerzyski exercises sole voting and investment power. Includes 8,171 common shares held by Mr. Sulerzyski in the ESPP. Also includes (i) 7,210 unvested restricted common shares which were granted to Mr. Sulerzyski on February 9, 2021 and will vest as described in footnote (2) to the table under “OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END 2022;” (ii) 14,576 unvested restricted common shares which were granted to Mr. Sulerzyski on February 9, 2022 and will vest as described in footnote (3) to the table under "OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END 2022;” and (iii) 18,943 unvested restricted common shares which were granted to Mr. Sulerzyski on February 8, 2023 and will vest as described in footnote (4) to the table under "OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END 2022.” Mr. Sulerzyski has voting power with respect to all of the reported restricted common shares and the right to receive dividends paid with respect to the underlying common shares at the same level as dividends paid to other shareholders of Peoples; however, the dividends will be accrued and paid to Mr. Sulerzyski at the same time as the underlying restricted common shares vest, if at all.

(20)Includes 2,010 common shares held in an investment account by Michael J. Vittorio, as to which Mr. Vittorio exercises sole voting and investment power.

(21)Includes 900 common shares held by Tyler J. Wilcox in the ESPP as to which Mr. Wilcox exercises sole voting and investment power. Also includes (i) 5,000 unvested restricted common shares which were granted to Mr. Wilcox on October 1, 2020 and will vest as described in footnote (5) to the table under “OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END 2022;” (ii) 1,270 unvested restricted common shares which were granted to Mr. Wilcox on February 9, 2021 and will vest as described in footnote (2) to the table under “OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END 2022;” (iii) 3,104 unvested restricted common shares which were granted to Mr. Wilcox on February 9, 2022 and will vest as described in footnote (3) to the table under "OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END 2022;” and (iv) 3,630 unvested restricted common shares which were granted to Mr. Sulerzyski on February 8, 2023 and will vest as described in footnote (4) to the table under "OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END 2022.” Mr. Wilcox has voting power with respect to all of the reported restricted common shares and the right to receive dividends paid with respect to the underlying common shares at the same level as dividends paid to other shareholders of Peoples; however, the dividends will be accrued and paid to Mr. Wilcox at the same time as the underlying restricted common shares vest, if at all.

(22)Includes (i) 1,588 unvested restricted common shares which were granted to Mr. Wyatt on February 9, 2021 and will vest as described in footnote (2) to the table under “OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END 2022;” (ii) 2,949 unvested restricted common shares which were granted to Mr. Wyatt on February 9, 2022 and will vest as described in footnote (3) to the table under "OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END 2022;” (iii) 3,630 unvested restricted common shares which were granted to Mr. Wyatt on February 8, 2023 and will vest as described in footnote (4) to the table under "OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END 2022.” Mr. Wyatt has voting power with respect to all of the reported restricted common shares and the right to receive dividends paid with respect to the underlying common shares at the same level as dividends paid to other shareholders of Peoples; however, the dividends will be accrued and paid to Mr. Wyatt at the same time as the underlying restricted common shares vest, if at all.

(23)Includes common shares held jointly by current directors and executive officers with other persons. See notes (4) and (7) through (22) above.

DELINQUENT SECTION 16(a) REPORTS

(Section 16(a) Beneficial Ownership Reporting Compliance)

Section 16(a) of the Exchange Act requires that Peoples’ directors and executive officers, and any persons beneficially owning more than 10 percent of Peoples’ outstanding common shares, file statements (also referred to as reports) with the SEC reporting their initial beneficial ownership of common shares and any subsequent changes in their beneficial ownership. Peoples is required to disclose in this Proxy Statement any late reports, if any reports were not filed within the time periods mandated by the SEC. Based solely on Peoples’ review of (i) Section 16(a) reports filed electronically with the SEC on behalf of these persons for their transactions during Peoples’ 2022 fiscal year and (ii) written representations received from these persons that no other Section 16(a) reports were required to be filed by them for transactions during Peoples’ 2022 fiscal year (including no Form 5), Peoples believes that all Section 16(a) filing requirements applicable to Peoples’ executive officers and directors, and persons holding more than 10 percent of Peoples’ outstanding common shares, were complied with, except:

•Tara M. Abraham, a Peoples director, filed late a Form 4 reporting the transfer of an aggregate of 6,190 common shares in a series of 25 transactions (reflecting different prices), all of which occurred May 5, 2022 pursuant to a divorce decree, and was reported on June 29, 2022.

TRANSACTIONS WITH RELATED PERSONS

During the 2022 fiscal year, Peoples Bank entered into banking transactions (including deposit, trust or other banking services and/or loans and loan commitments) with certain executive officers and directors of Peoples, with members of their respective immediate families and with corporations or organizations as to which directors of Peoples serve as executive officers or beneficially own more than 10% of the equity securities. These transactions were in the ordinary course of their respective businesses and in compliance with applicable federal and state laws and regulations. It is expected that similar banking transactions will be entered into in the future. Any loans to these persons (i) were made in the ordinary course of business, (ii) were made on substantially the same terms, including interest rates charged and collateral required, as those prevailing at the time for comparable loans with persons not related to Peoples or Peoples Bank, and (iii) did not involve more than the normal risk of collectability or present other unfavorable features to Peoples or Peoples Bank. As of the date of this Proxy Statement, none of the loans described in this paragraph is or would be disclosed as past due, nonaccrual or a troubled debt restructuring in Peoples’ consolidated financial statements and each loan was performing in accordance with its original terms.

The loans described in the immediately preceding paragraph were subject to Peoples Bank’s written policies, procedures and standard underwriting criteria applicable to loans generally, and were made in accordance with the Federal Reserve Board’s Regulation O (“Regulation O”) requiring loans to executive officers and directors of Peoples Bank in excess of $500,000 to be approved by the full Board of Directors of Peoples Bank.

The Board has adopted the Peoples Bancorp Inc. Related Person Transaction Policy (the “Related Person Transaction Policy”), a copy of which is posted under the “Corporate Overview – Governance Documents” tab on the “Investor Relations” page of Peoples’ website at www.peoplesbancorp.com. The purpose of the Related Person Transaction Policy is to set forth the guidelines and procedures under which certain related person transactions must be reviewed and approved or ratified by the Audit Committee, as appropriate.

A “related person transaction” is any transaction, arrangement or relationship, or any series of similar transactions, arrangements or relationships, in which: (1) Peoples or one of our subsidiaries was, is or will be a party or participant, or had, has or will have a direct or indirect interest; (2) the amount involved exceeds or is expected to exceed $120,000, or if the limitations prescribed by Regulation O apply, such lesser amount, if any, as may be prescribed by Regulation O; and (3) a related person had, has or will have a direct or indirect interest. A “related person” is a person who is or was a director, an executive officer, or a nominee for election as a director at any time since the beginning of Peoples’ last fiscal year or a five percent shareholder of Peoples at the time of the occurrence or at any time during the existence of the transaction, and their respective immediate family members. Related person transactions deemed pre-approved or ratified, as appropriate, include:

•any transaction where the related person’s interest arises solely from the ownership of common shares if all shareholders receive the same benefit;

•any transaction involving compensation to an executive officer of Peoples if the executive officer is not an immediate family member of another executive officer or of a director of Peoples and the compensation has been approved by the Compensation Committee or the Board;

•any transaction involving compensation to Peoples’ directors if the compensation is required to be reported pursuant to Item 402(k) of SEC Regulation S-K;

•any extension of credit by Peoples Bank to an immediate family member of a related person, or extension of credit in respect of which an immediate family member of a related person has an interest, if the extension of credit is not subject to Regulation O and meets certain terms specified in the Related Person Transaction Policy;

•any transaction where the related person’s interest derives solely from the related person’s position as a director of another corporation or organization that is a party to the transaction;

•any transaction where the related person’s interest derives solely from the related person’s direct or indirect ownership of less than 10% of the equity interest in another person (other than a partnership) which is a party to the transaction or ownership of a limited partner interest of less than 10% of the partnership and the related person is not a general partner and does not hold another position in the partnership, with the determination of whether the ownership threshold is exceeded made in accordance with the terms of the Related Person Transaction Policy;

•any transaction involving a related person where the rates or charges involved in the transaction are determined by competitive bids; and

•any transaction with a related person involving services by Peoples Bank as a bank depository of funds, transfer agent, registrar, trustee under a trust indenture, or similar services provided in the ordinary course of the business of Peoples Bank and on substantially the same terms as then prevailing for comparable services provided to persons not related to Peoples Bank.

Under the Related Person Transaction Policy, all related person transactions not otherwise pre-approved are referred to the Audit Committee for review and approval or disapproval. The Audit Committee may approve or ratify a related person transaction only if the Audit Committee determines that the related person transaction is in the best interest of Peoples and our subsidiaries. In making this determination, the Audit Committee will review and consider all information available to it, which the Audit Committee deems relevant, including:

•the related person’s interest in the transaction;

•the approximate dollar value of the amount involved in the transaction;

•the approximate dollar value of the amount of the related person’s interest in the transaction computed without regard to the amount of any profit or loss;

•whether the transaction was undertaken in the ordinary course of business of Peoples or the applicable subsidiary of Peoples;

•whether the transaction is on terms no less favorable to Peoples or the applicable subsidiary of Peoples than terms that could have been reached with an unrelated third party;

•the purpose of, and the potential benefits to Peoples or the applicable subsidiary of Peoples of, the transaction;

•the impact of the transaction on the related person’s independence; and

•any other information regarding the transaction or the related person in the context of the proposed transaction that would be material to investors in light of the circumstances of the particular transaction.

CORPORATE GOVERNANCE AND BOARD MATTERS

Independence of Directors

The rules (the “Nasdaq Rules”) of The Nasdaq Stock Market (“Nasdaq”) require that a majority of the members of the Board be independent directors. The definition of an independent director for purposes of the Nasdaq Rules includes a series of objective criteria, which the Board has used in determining whether its members are independent.

Peoples is led by Charles W. Sulerzyski, who serves as President and Chief Executive Officer and as a director, and Susan D. Rector, an independent director who serves as non-executive Chairman of the Board, a position she has held since October 2020. George W. Broughton, an independent director, serves as non-executive Vice Chairman of the Board, a position he has held since July 2013. The Board is comprised of Mr. Sulerzyski and twelve non-management directors, all of whom are independent as of the date of this Proxy Statement except Carol A. Schneeberger, who will become independent as of March 31, 2023, three years after her retirement as an executive officer and employee of Peoples and Peoples Bank. Peoples believes that the independent directors provide objective oversight of management performance as a key component of efficient corporate governance and overall risk management. The Board has determined that the most effective leadership structure for Peoples is for a different person to serve as each of the Chief Executive Officer and the Chairman of the Board, coupled with independent chairs of each of the Audit Committee, the Compensation Committee, the Governance and Nominating Committee and the Risk Committee. The Board regularly deliberates and discusses what it believes is the appropriate leadership structure based upon the needs of Peoples in order to provide effective oversight of management.

In addition to considering the objective criteria, as required by the Nasdaq Rules, the Board has made a subjective determination as to each independent director that no relationships exist, which, in the opinion of the Board, would interfere with such individual’s exercise of independent judgment in carrying out the responsibilities of a director. In making these independence determinations, the Board has reviewed, considered and discussed each director’s business and personal relationships, both direct and indirect, if any, with Peoples and our subsidiaries, and the compensation and other payments each director and such director’s immediate family members have, both directly and indirectly, received from or made to Peoples and our subsidiaries and presently expect to receive from or make to Peoples and our subsidiaries. Based on that review, consideration and discussion, the Board has determined that at least a majority of its members qualify as independent directors.

The Board has further determined that each of the following current directors has no financial or personal ties, either directly or indirectly, with Peoples or our subsidiaries (other than compensation received in the individual’s capacity as a director of Peoples and our subsidiaries, non-preferential banking relationships in the ordinary course of business with Peoples Bank and ownership of common shares of Peoples as described in this Proxy Statement) and thus qualifies as independent: Tara M. Abraham; S. Craig Beam; George W. Broughton; David F. Dierker; James S. Huggins; Brooke W. James; Susan D. Rector; Kevin R. Reeves; Frances A. Skinner; Dwight E. Smith; and Michael N. Vittorio. The Board has also determined that, during his period of service with Peoples and Peoples Bank as director, Douglas V. Reynolds had no financial or personal ties, either directly or indirectly, with Peoples or our subsidiaries (other than compensation received in his capacity as a director of Peoples and our subsidiaries, non-preferential banking relationships in the original course of business with Peoples Bank and ownership of common shares of Peoples and described in this Proxy Statement) and thus qualified as independent during his period of service.

Charles W. Sulerzyski does not qualify as an independent director, because he serves as an executive officer of Peoples and Peoples Bank. Carol A. Schneeberger will not qualify as an independent director until March 31, 2023, three years after she retired as an executive officer and employee of Peoples and Peoples Bank.

Executive Sessions

In accordance with applicable Nasdaq Rules, the independent directors were given the opportunity to meet in executive session during each meeting of the Board and at such other times as the independent directors deemed necessary. Each executive session is presided over by the Chairman of the Board.

Meetings of the Board and Attendance at Annual Meetings of Shareholders

The Board held 11 meetings during the 2022 fiscal year. Each incumbent director attended 94% or more of the aggregate of the total number of meetings held by the Board and the total number of meetings held by all committees of the Board on which he or she served, in each case during his or her period of service during the 2022 fiscal year.

Peoples encourages all director nominees to attend each annual meeting of shareholders. All of the then incumbent directors participated in Peoples’ last annual meeting of shareholders held virtually on April 28,2022.

Environmental, Social and Governance Matters

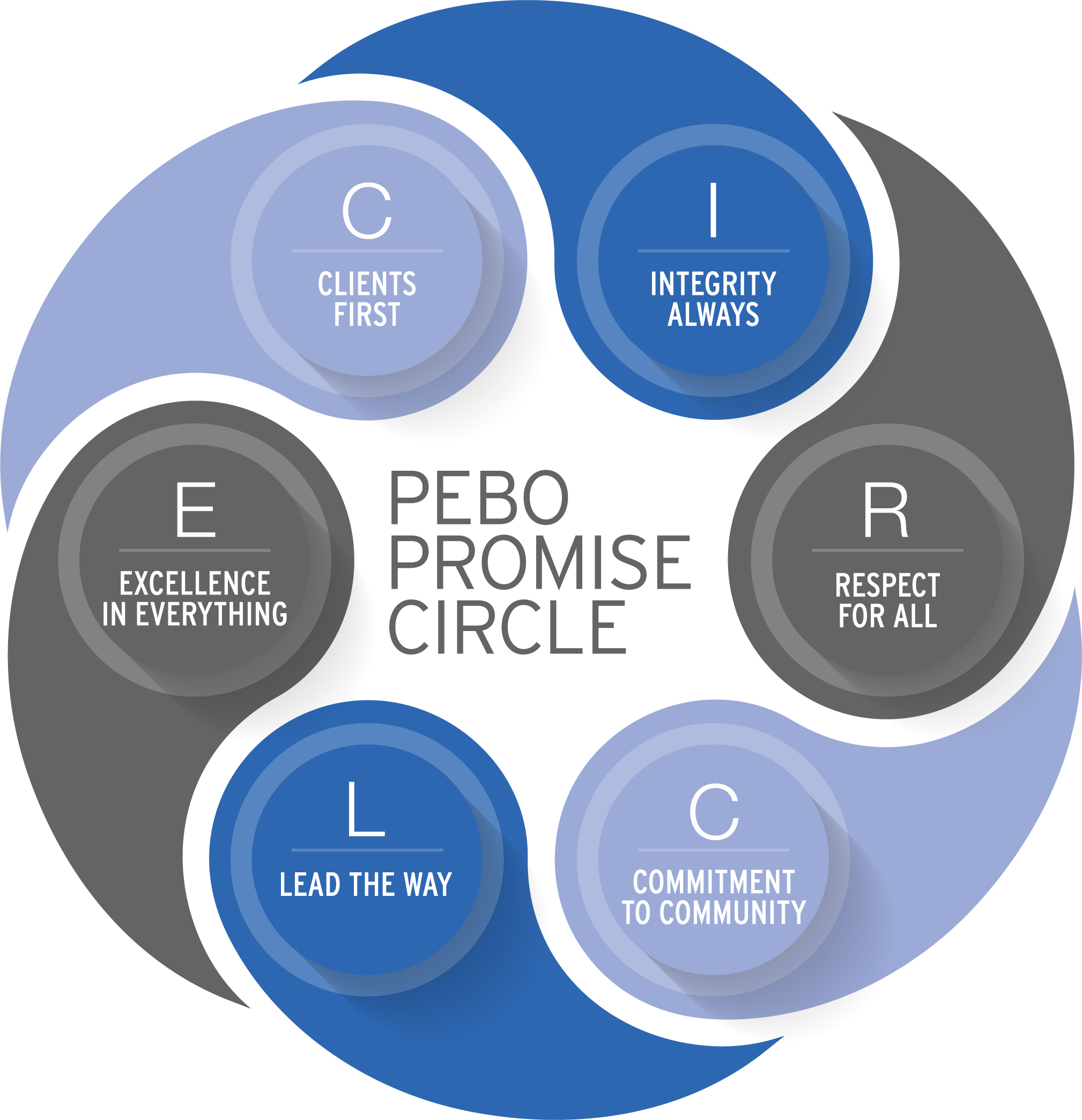

Our vision at Peoples is to be the "Best Community Bank in America." We are committed to conducting our business in a way that ensures that Peoples will be around for many years to come. Our actions are guided by our core values represented by the Promise Circle, which embodies how we do business, and our never-ending pursuit of creating value for our employees, or as we also often refer to them, our associates, our communities, our clients and our shareholders. Being true to these core values in the decisions we make and in our business practices is essential to driving sustainable long-term growth.

| | | | | | | | |

The Board’s Governance and Nominating Committee provides oversight of Peoples’ practices and reporting with respect to environmental, social and governance (“ESG”) matters, and the Board’s Risk Committee is responsible for oversight of ESG-related risks. In 2022, we continued to build upon and improve our ESG oversight framework and to further evolve our sustainability strategy. Our executive leadership team and the Board recognize the importance of these responsibilities, and we have an established internal cross-functional working group tasked with driving additional progress in the initiatives to promote sustainability and further transparency. We believe in focusing our efforts where we can have the most impact. Our ESG areas of focus are organized around our associates, our communities, our clients and our shareholders. | | |

✓ 2nd Consecutive Year: American Banker “Best Banks to Work For”

✓ Commitment to culture of diversity and inclusion

✓ Comprehensive and competitive compensation and benefits package, including $15/hour minimum wage

✓ Scholarship program for children of our associates, offering four scholarships per year

✓ Over $1 million contributed in 2022 in donations and sponsorships to charitable causes

✓ Each associate provided 8 hours of paid time off to be used for community service

✓ CRA rating of “Outstanding” for meeting the credit needs of our communities

✓ Associates have contributed over $336,000 from their own pockets to local area food banks since April 2020

✓ Newsweek "America’s Best Banks 2023, Best Small Bank in Ohio”

✓ Culture of only delivering to clients what they want and need – we are not product pushers

✓ Effective Risk Committee and risk management framework

✓ Strong dedication to information security and data privacy

✓ Pay-for-performance alignment

✓ Executive Incentive Compensation Clawback Policy

✓ Commitment to a fair, ethical and responsible corporate governance program

✓ 92% of Board comprised of independent directors

✓ 58% of Board is diverse in terms of gender or race/ethnicity

✓ Directors elected annually to be more responsive to shareholders

Furthermore, at Peoples, our culture places a very high importance on our operating model and investment rationale:

•Unique community banking model

•Strong, diverse businesses earning non-interest income

•Capacity to grow our franchise

•Commitment to disciplined execution

•Attractive dividend opportunity

In 2023 and beyond, we are committed to continuing to conduct our business in a manner that aligns with our values, our ESG areas of focus, and our investment rationale.o Sustainability

Associates

AssociatesColleagues

We are devoted to fostering the physical and mental well-being of our workforce and are proud to have been recognized by American Banker as one of the top 90 banks to work for in the United States in 2022. We provide a comprehensive and competitive benefits package that supports the health and financial wellness of our people. Some common features offered to our associates include the following:

•Medical, dental and vision benefits for associates, spouse and dependents

•Flexible spending and health savings accounts for both healthcare and dependent care

•Wellness program with incentives for participants who meet certain criteria

•Company-paid life insurance for associates

•Short-term and long-term disability insurance for associates

•Paid time off for full-time and part-time associates

•Paid maternity and parental leave

•401(k) retirement savings program with company matching contributions of up to 6%

•Employee stock purchase program allowing for the purchase of Peoples common shares at a 15% discount

•Student loan pay down program that pays up to $200 per month towards the associate’s student loan

•Tuition assistance program for associates

•Scholarship program for children of our associates, for college, community college or trade school

•Associate hardship and disaster relief fund to provide financial support to associates in need

•Employee Assistance Program providing free counseling services

We are also committed to pay equity, and we regularly review our compensation model to ensure fair and inclusive pay practices across our businesses. Some of our recent workforce investment highlights include establishing a company-wide minimum wage of $15 per hour and adding parental leave in 2022. We also added two additional scholarships - bringing the total to four scholarships offered to children of associates - with a focus on technical or trade training for the two new scholarships, which we will begin to award in 2023. We provide educational offerings to colleagues believed to be suited for leadership roles within Peoples. We survey our associates twice per year to gauge their satisfaction and to solicit feedback, and management thoroughly reviews the results. Management addresses issues raised by the surveys in a timely manner and provides regular progress updates as the survey results are used to continually improve the workplace for associates. In addition, the Peoples Professional Development Associate Program provides a unique opportunity for recent college graduates to immerse themselves in the financial industry and gain valuable real-world experience.

Diversity & Inclusion

We are committed to providing equal employment opportunities for training, compensation, transfer, promotion and other aspects of employment for all qualified applicants and associates without regard to sex, race, color, religion, national origin, age, disability, sexual orientation or veteran status. A diverse and inclusive workplace begins with our core value of “Respect for All” – treating all associates and clients with respect. Our goal is to attract, retain and develop a workforce that is diverse in background, knowledge, skill and experience. As of December 31, 2022, women represented 71% of Peoples’ workforce.

Communities

CommunitiesAt Peoples, we continually strive to use our knowledge, talents and resources to improve the quality of life in our communities. We are committed to making a positive and meaningful difference in the neighborhoods where we work and live. Therefore, we measure success not only in financial terms, but also in our ongoing actions such as fundraising efforts, educational sponsorship, community development, food drives, and partnerships with local universities. Our charitable giving occurs in two distinct areas: financial contributions and volunteerism, both of which are of equal importance and emphasis within our organization.

Financial Contributions