INVESTOR PRESENTATION 3RD QUARTER 2020 NASDAQ: PEBO

NASDAQ: PEBO SAFE HARBOR STATEMENT Statements in this presentation which are not historical are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These forward-looking statements may include discussions of the strategic plans and objectives or anticipated future performance and events of Peoples Bancorp Inc. (“Peoples”). The information contained in this presentation should be read in conjunction with Peoples’ Annual Report on Form 10-K for the fiscal year ended December 31, 2019 (the “2019 Form 10-K”), and the Quarterly Report on Form 10-Q for the quarter ended September 30, 2020, each of which is available on the Securities and Exchange Commission’s (“SEC”) website (www.sec.gov) or at Peoples’ website (www.peoplesbancorp.com). Investors are cautioned that forward-looking statements, which are not historical fact, involve risks and uncertainties, including those detailed in Peoples’ 2019 Form 10-K under the section, “Risk Factors” in Part I, Item 1A and “Risk Factors” in Part II of Peoples’ Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2020. As such, actual results could differ materially from those contemplated by forward-looking statements made in this presentation. Management believes that the expectations in these forward-looking statements are based upon reasonable assumptions within the bounds of management's knowledge of Peoples’ business and operations. Peoples disclaims any responsibility to update these forward-looking statements to reflect events or circumstances after the date of this presentation. 2

NASDAQ: PEBO TABLE OF CONTENTS PAGE 5 PROFILE, INVESTMENT RATIONALE, WORKINGCULTURE AND STRATEGY PAGE 10 COVID-19 CREDIT IMPACT, CAPITAL & LIQUIDITY PAGE 30 TOGETHERQ3 & YTD 2020 FINANCIAL INSIGHTS PAGE 45 BUILDINGQ3 & YTD 2020 APPENDIX ® SUCCESS3 WORKING TOGETHER. BUILDING SUCCESS.

PROFILENASDAQ: PEBO INVESTMENT PROFILE, INVESTMENT RATIONALE, RATIONALECULTURE AND STRATEGY CULTURE ® STRATEGY4 WORKING TOGETHER. BUILDING SUCCESS.

PEBO PROFILE NASDAQ: PEBO PEBO MARKET INSIGHT PEBO GEOGRAPHIC FOOTPRINT • Strongest deposit market share positions in more rural markets where we can affect pricing Clelevveelandland PA • Presence near larger cities puts us in a position to capture lending opportunities in more urban markets (e.g. Cincinnati, Cleveland and Columbus) OH • Snapshot as of September 30, 2020 Loans: $3.5 billion / Assets: $4.9 billion Columbusolumbuus Deposits: $4.0 billion IN MD Market Cap: $376.5 million MarietMarietttaa Cincinnatincinnaatti DEMOGRAPHICS Median Income: $54,013 CharlestCharlerlrlestoonn WV Key Industries: Health Care, Lumber, Manufacturing, Oil/Gas/Coal, Tourism LeLexxingtingtotonn VA Unemployment: OH 8.40% WV 8.60% KY 5.60% US 7.90% KY PEBO FOOTPRINT COUNTIES WHERE PEBO HAS TOP 3 MARKET SHARE* COUNTIES WHERE PEBO HAS OVER $100 MILLION OF DEPOSITS AND IS NOT IN TOP 3 MARKET SHARE* ® SUCCESS. *According to FDIC annual summary of deposits as of September 30. 2020. WORKING TOGETHER. BUILDING 5 Unemployment data from www.bls.gov/lau as of June 2020.

INVESTMENT RATIONALE NASDAQ: PEBO UNIQUE COMMUNITY BANKING MODEL • Greater revenue diversity (non-interest income, excluding gains and losses, as a percent of total revenue was 31% year-to-date) than the average $1 - 10 billion bank • Strong community reputation and active involvement • 16 local market teams capable of out-maneuvering larger banks • More sophistication and product breadth than smaller banks (insurance, retirement plans, swaps, premium financing, etc.) STRONG, DIVERSE BUSINESSES EARNING NON-INTEREST INCOME • 20th largest bank-owned insurance agency, with expertise in commercial, personal, life and health • Wealth management – $2.5 billion in assets under administration and management, including brokerage, trust and retirement planning CAPACITY TO GROW OUR FRANCHISE • Strong capital and fundamentals to support M&A strategy • Proven integration capabilities and scalable infrastructure COMMITTED TO DISCIPLINED EXECUTION • Strong, integrated enterprise risk management process • Dedicated to delivering positive operating leverage • Focused on business line performance and contribution, operating efficiency and credit quality ATTRACTIVE DIVIDEND OPPORTUNITY • Targeting 40% to 50% payout ratio under normal operating environment • Dividend paid increased from $0.15 per share for Q1 2016 to $0.35 in the most recent quarter • Consistently evaluate dividend and adjust accordingly – annualized dividend yield at September 30, 2020 was 6.46% ® 6 WORKING TOGETHER. BUILDING SUCCESS.

CORPORATE CULTURE NASDAQ: PEBO OUR VISION CIRCLE Our vision is to be THE BEST COMMUNITY BANK IN AMERICA. OUR MISSION CLIENTS INTEGRITY FIRST ALWAYS We will work side by side to overcome challenges and seize opportunities. We listen and work with you. Together, we will build and execute thoughtful plans and actions, blending our experience and expertise, to move you toward your goals. Our PEBO core difference is providing you peace of mind, confidence and EXCELLENCE Promise RESPECT OUR clarity in your financial life. IN EVERYTHING CIRCLE FOR ALL VALUESOUR VALUES Our promise CIRCLE embodies values that strengthen relationships. LEAD THE WAY COMMITMENT TO COMMUNITY PROMISE CIRCLE Peoples' Employee Promise Circle represents how we do business and our never-ending pursuit of creating value for our clients. Our strategies to serve clients and enhance shareholder value often change, but our values remain constant. 15 ® ���������� �������� ������� �������� ������� �����7 WORKING TOGETHER. BUILDING SUCCESS.���������� ������� ��

STRATEGIC ROAD MAP NASDAQ: PEBO STRATEGIC ROAD MAP FOR BEST COMMUNITY BANK IN AMERICA • Commitment to Superior Shareholder Returns • Great Place to Work • Clients’ 1st Choice for Banking, Investing and Insurance • Meaningful Impact on Our Communities RESPONSIBLE EXTRAORDINARY PROFITABLE FIRST CLASS RISK MANAGEMENT CLIENT EXPERIENCE REVENUE GROWTH WORKPLACE • Embrace Risk Management • Delight the Client • Acquire, Grow and • Hire for Values • Know the Risks: Strategic, • Deliver Expert Advice Retain Clients • Strive for Excellence Reputation, Credit, Market, and Solutions • Earn Client Referrals • Invest in Each Other Liquidity, Operational, • Provide a Consistent • Understand Client Compliance • Promote a Culture Client Experience Needs and Concerns of Learning • Do Things Right the • Lead Meaningful • Live the Sales and • Coach in Every Direction First Time Client Reviews Service Processes • Raise Your Hand • Recognize and Reward • Evolve the Mobile • Value Our Skills and Performance • Discover the Root Cause Experience Expertise • Balance Work and Life • Excel at Change • DWYSYWD • Operate Efficiently • Cultivate Diversity Management • Execute Thoughtful Mergers and Acquisitions • Spread Goodness ® 8 WORKING TOGETHER. BUILDING SUCCESS.

COVID-19NASDAQ: PEBO CREDITCOVID-19 CREDIT IMPACT, CAPITAL IMPACT & LIQUIDITY CAPITAL ® &9 LIQUIDITYWORKING TOGETHER. BUILDING SUCCESS.

OUR RESPONSE TO COVID-19 NASDAQ: PEBO THE CHANGES THAT THE PANDEMIC HAS HAD ON OUR INDUSTRY HAVE BEEN WIDESPREAD AND SWEEPING. • It changed the way we provide our products and services, which is now more digital. • Enabled remote work capabilities for associates as appropriate. • Temporarily moved to lobby access by appointment while redesigning lobbies to enable social distancing. Branches reopened lobbies June 22. • Remained nimble and provided relief for clients, including setting up administration of new programs like SBA Paycheck Protection Program (PPP). CLIENTS COMMUNITIES ASSOCIATES • We frequently call our clients to • Made $250,000 donation to local • Created assistance programs for check in on them and are being charities with majority going to associates including paying for accommodating in their time of fight hunger. unexpected childcare and/or elder need by providing loan modifications, care, paying for associates that need payment deferrals and fee waivers. • Associates donated additional to quarantine or are not feeling well $75,000 to local food banks and for an extended period of time Modified $529 million in loans as • pantries as of September 30, 2020. of June 30. • Made donation of $100,000 to our employee assistance program • Peoples Bank had the highest PPP loan production as a percentage of total loan • Associates at the level of Assistant balances in phase 1 (through April 16, Vice President and below received 2020) for all banks in Ohio, Kentucky $500 stock award and West Virginia. ® 10 Unless specified otherwise, data as of September 30, 2020. WORKING TOGETHER. BUILDING SUCCESS.

COMMUNITY RELATIONS DURING COVID-19 NASDAQ: PEBO SOCIAL MEDIA POSTS RECOGNIZING PEOPLES BANK 4.1 M Followers 441 K Followers / 250K Views / Over 10K Likes & Retweets Jobs Ohio provided a 90% guarantee on the first $25 million of increased exposure to small businesses. Clients were able to obtain up to $200,000 in additional financing on terms that were favorable to the clients, subject to certain eligibility requirements. The program concluded in October. 244 K Followers ® 11 WORKING TOGETHER. BUILDING SUCCESS.

CREDIT RISK MANAGEMENT PROCESS NASDAQ: PEBO LOAN PORTFOLIO COMPOSITION MANAGEMENT & MONITORING • Robust concentration management process focused on portfolio • Clear segregation of duties between sales & credit functions risk diversification • Signature approval process with Credit Administration representation • Relationship based lending • Centralized risk rating, borrowing base monitoring, • CRE and C&I are balanced with Consumer covenant tracking and testing • CRE financing for "A" tier developers only • Consistent documentation and loan funding process centrally • Very limited out of market lending managed by Credit Administration with second review Growing consumer portfolios organically and through acquisitions • • Experienced workout team dedicated to proactive rehabilitation or exit $4.9 billion bank with $25mm guideline for maximum loan exposure • • Construction loan monitoring and funding process independently per relationship managed by Credit Administration staff POLICY / UNDERWRITING STANDARDS OVERSIGHT • Experienced, independent commercial and consumer underwriters • Board approval required for loan relationships > $25.0mm • Comprehensive commercial underwriting package includes • External loan review by large accounting and advisory firm standardized loan covenant language, sensitivity analysis, • Quarterly Criticized Asset Review (CAR) meetings for loans > $500m and industry research • Quarterly review of Systemically Important Relationships (SIRs) • Risk appropriate CRE policy standards that vary by asset class • Monthly Loan Quality Committee meetings • Established limits on policy exceptions; volume and trends monitored monthly • Use of government guarantee programs when appropriate • Abbreviated approval process for loan exposures < $1.0mm • Use of automated underwriting systems to evaluate all residential loan requests (e.g. Fannie Mae Desktop Underwriter) ® 12 WORKING TOGETHER. BUILDING SUCCESS.

COVID-19 RELATED LOAN PAYMENT DEFERRALS NASDAQ: PEBO COVID-19 RELATED LOAN PAYMENT DEFERRALS* ���� ������� ��������� $3.0B �� $2.9B • At June 30, 2020, consumer and commercial loan modifications totaled $529 million, made up of $485 million in commercial loans and $44 million in consumer loans. �� • As of September 30, 2020, consumer and commercial loan modifications totaled $14 million, made up of $9 $ BILLIONS �� million in commercial loans and $5 million of consumer $529M loans. Loan modifications represented 0.45% of the $14M** loan portfolio (excluding PPP loans). �� ���� ���� • 7 commercial clients had pending requests as of September 30, 2020 for additional relief, accounting for $24 million. TOTAL EXPOSURE • $14 million were hotel operators TOTAL DEFERMENT * Excludes SBA Paycheck Protection Program loans. ** Does not include $33 million pending as of September 30, 2020. ® 13 WORKING TOGETHER. BUILDING SUCCESS.

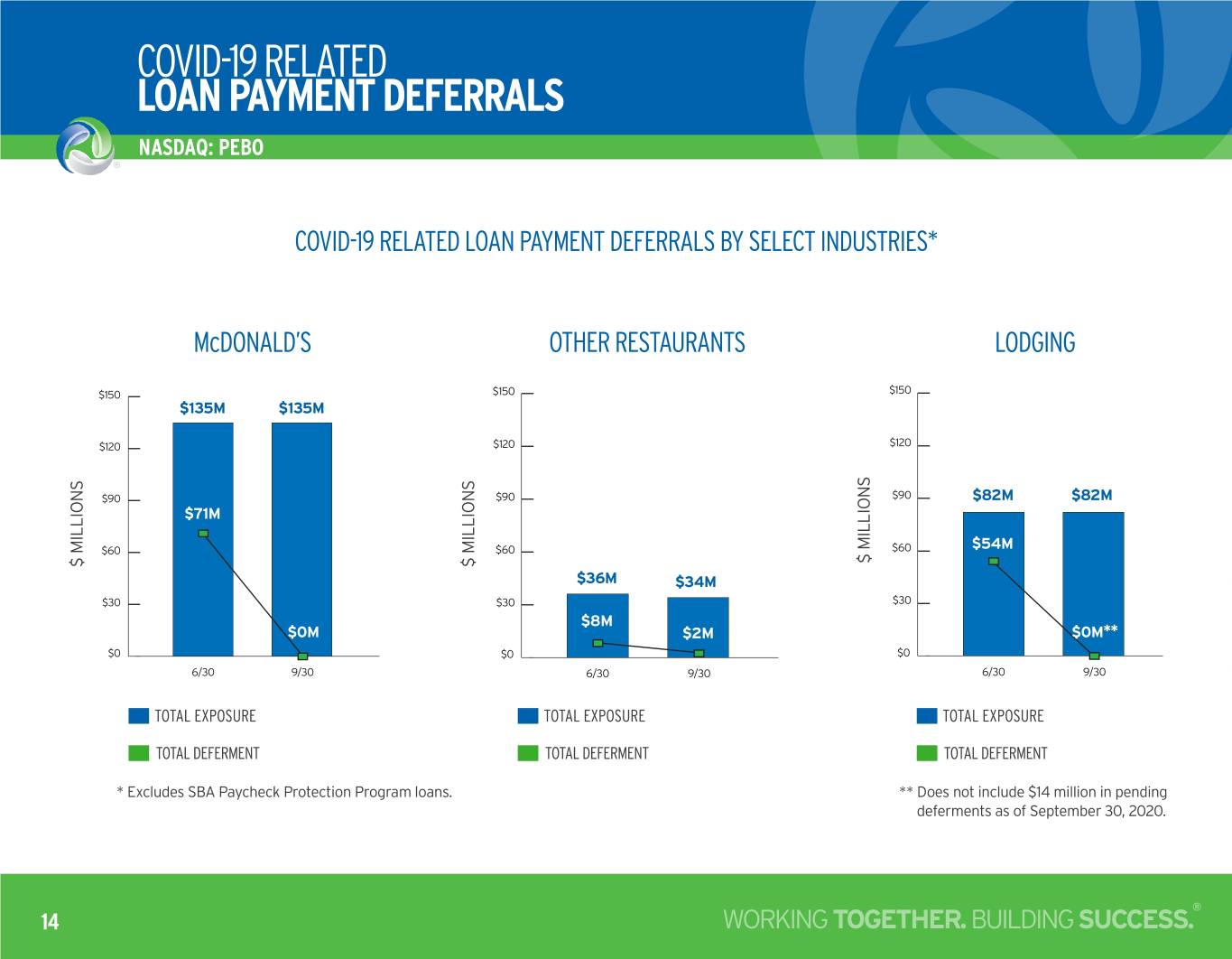

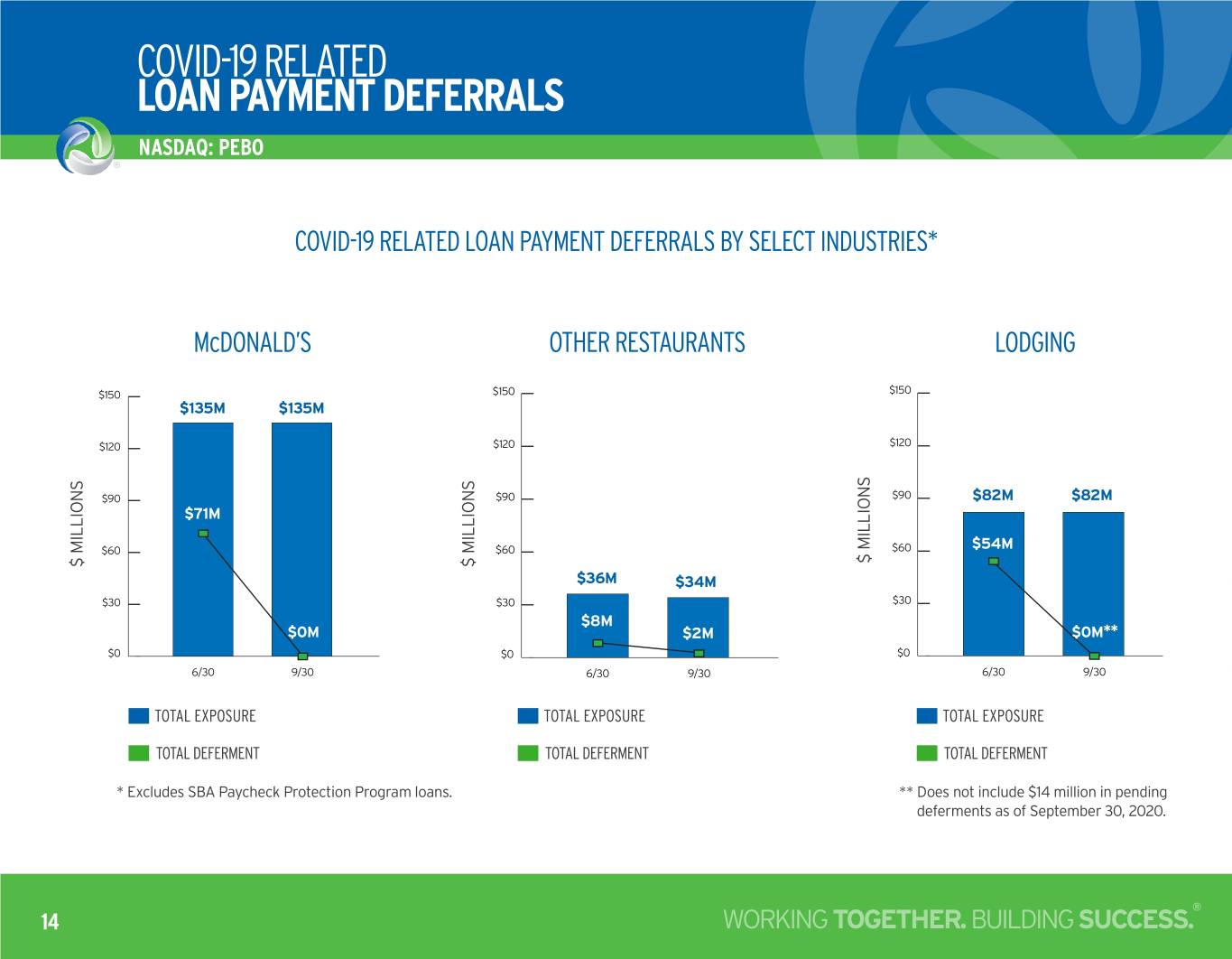

COVID-19 RELATED LOAN PAYMENT DEFERRALS NASDAQ: PEBO COVID-19 RELATED LOAN PAYMENT DEFERRALS BY SELECT INDUSTRIES* McDONALD’S����������������������������� OTHER RESTAURANTSO���� R������������������������������ LODGING��������������������������� ���� 150% ���� 150% ���� 150% $135M $135M 120% ���� 120% ���� 120% ���� 90% ��� 90% ��� 90% ��� $82M $82M $71M ��� ��� ��� $54M 60% 60% 60% $ MILLIONS $ MILLIONS $ MILLIONS $36M $34M 30% ��� 30% ��� 30% ��� $8M $0M $2M $0M** 0% �� 0% �� 0% �� ���� ���� ���� ���� ���� ���� TOTAL EXPOSURE TOTAL EXPOSURE TOTAL EXPOSURE TOTAL DEFERMENT TOTAL DEFERMENT TOTAL DEFERMENT * Excludes SBA Paycheck Protection Program loans. ** Does not include $14 million in pending deferments as of September 30, 2020. ® 14 WORKING TOGETHER. BUILDING SUCCESS.

ASSET QUALITY NASDAQ: PEBO OUR DELINQUENCY AND NET CHARGE-OFF TRENDS HAVE REMAINED STABLE TO IMPROVING FOR FOUR PLUS YEARS. Percentage���������� of �� Loans����� � �������Considered�� ������ “Current”� Percentage of Net Charge-Offs to Average Loans Annualized ������ O��� ���������� ���� ������ 99.2% 98.6% 98.5% 98.5% 98.0% ������ ��� ������ 0.15% 0.15% 0.09% 0.04% 0.04% ��� ������ �������� �������� �������� �������� �������� ���� ���� ���� ���� �������� ® 15 WORKING TOGETHER. BUILDING SUCCESS.

ASSET QUALITY ����� ������� � N���������� NASDAQ: PEBO ���� NPAS AS A PERCENTAGE OF TOTAL ASSETS HAVE CONSISTENTLY BEEN SUPERIOR TO MIDWEST BANKS WITH $1 TO $10 BILLION IN TOTAL ASSETS. ���� ���� ���� 0.60% 0.57% 0.56% ���� 0.54% 0.49% 0.50% 0.50% 0.48% 0.49% 0.48% 0.46% 0.46% 0.45% 0.47% ���� NPAS / ASSETS NPAS ���� ���� ����� ����� ����� ����� ����� ����� ����� ����� ����� ����� ����� ����� ����� ����� ����� $1 TO $10 BILLION MIDWEST BANKS PEBO The new accounting for purchased credit deteriorated loans under ASU 2016-13 resulted in the movement of $3.9 million of loans from the 90+ days past due and accruing category to the nonaccrual category on March 31, 2020. As of December 31, 2019, these loans were presented as 90+ days past due and accruing, although they were not accruing interest income, because they were accreting income from the discount that was recognized due to acquisition accounting. Source: S&P Global Market Intelligence. Nonperforming assets include loans 90+ days past due and accruing, renegotiated loans, nonaccrual loans, and other real estate owned. ® 16 WORKING TOGETHER. BUILDING SUCCESS.

ASSET QUALITY NASDAQ: PEBO NPA Composition NPAS AT 9/30/20 WERE PRIMARILY COMPOSED OF WELL-COLLATERALIZED COMMERCIAL REAL ESTATE AND RESIDENTIAL REAL ESTATE LOANS. INCREASE DURING Q3 2020 WAS MAINLY DUE TO THE PANDEMIC.* ��� ��� ��� ��� $ MILLIONS ��� �� �� ����� ����� ����� ����� ����� ����� ����� ����� ����� ����� ����� ����� ����� ����� ����� ����� ����� ����� ����� CRE RESIDENTIAL C&I HELOC CONSUMER * The new accounting for purchased credit deteriorated loans under ASU 2016-13 resulted in the movement of $3.9 million of loans from the 90+ days past due and accruing catego- ry to the nonaccrual category on March 31, 2020. As of December 31, 2019, these loans were presented as 90+ days past due and accruing, although they were not accruing interest income, because they were accreting income from the discount that was recognized due to acquisition accounting. ® 17 WORKING TOGETHER. BUILDING SUCCESS.

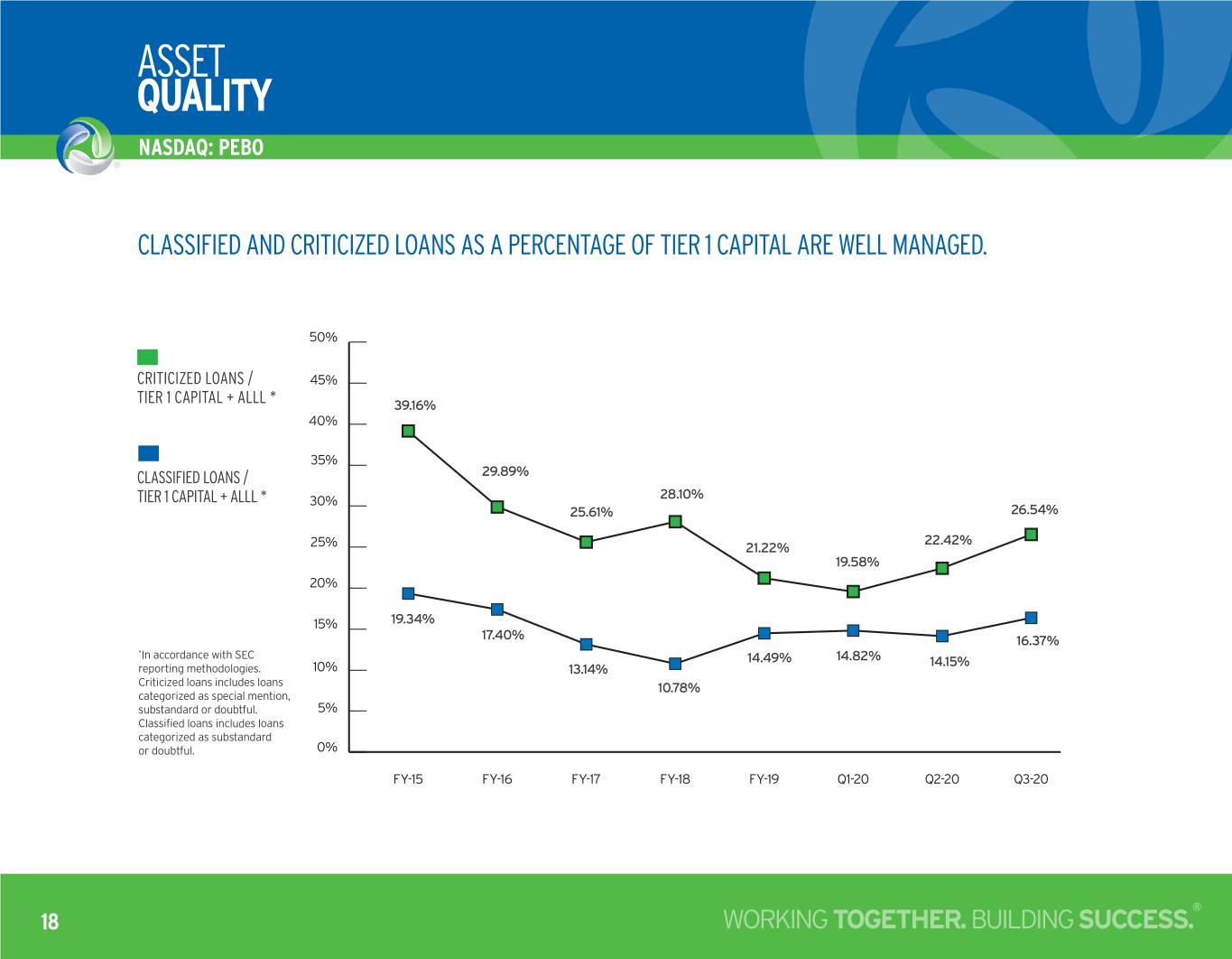

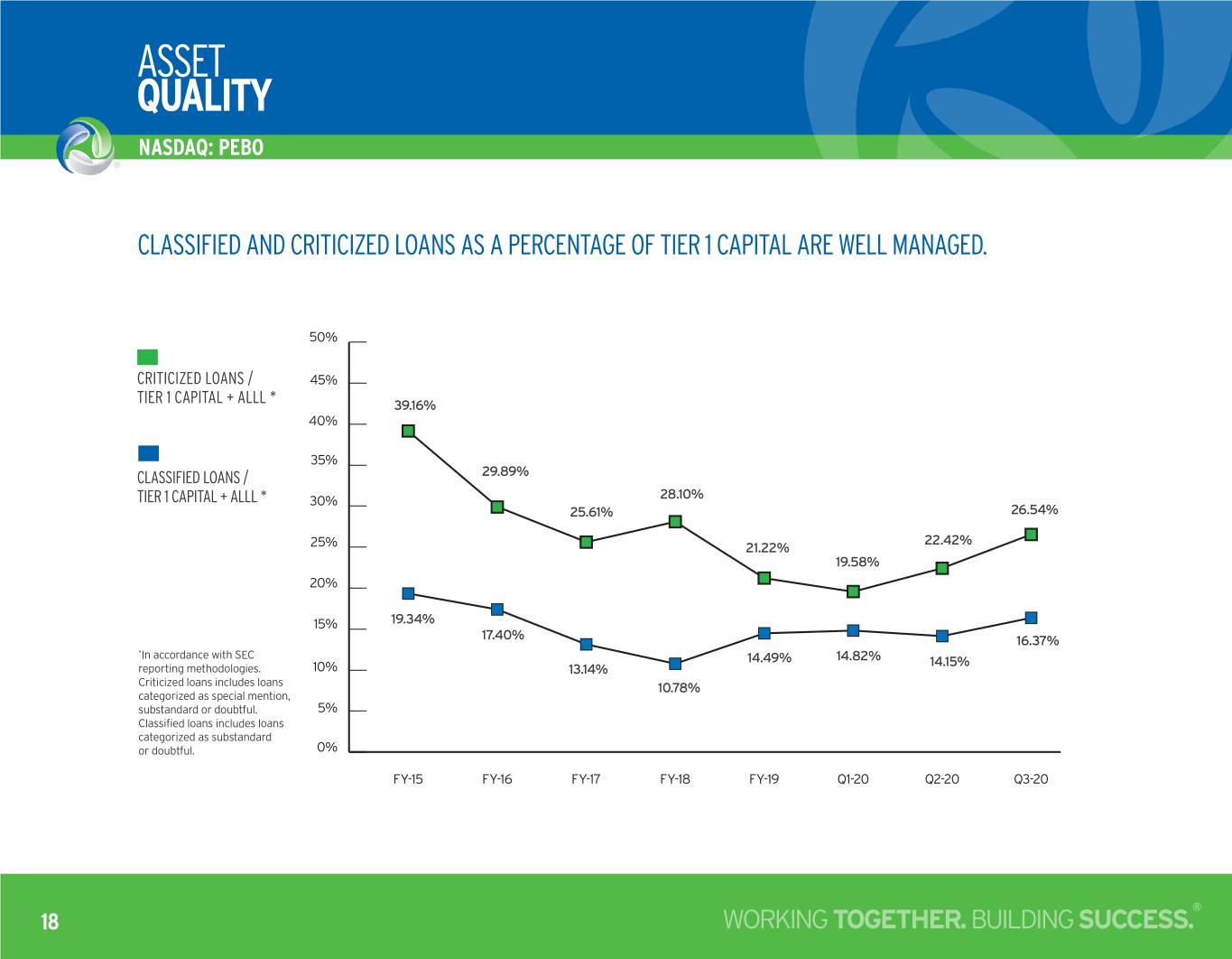

ASSET QUALITY NASDAQ: PEBO CLASSIFIED AND CRITICIZED LOANS AS A PERCENTAGEAsset OF TIER �ualit 1 CAPITALy ARE WELL MANAGED. ��� CRITICIZED LOANS / ��� TIER 1 CAPITAL + ALLL * 39.16% ��� ��� CLASSIFIED LOANS / 29.89% 28.10% TIER 1 CAPITAL + ALLL * ��� 25.61% 26.54% 22.42% ��� 21.22% 19.58% ��� ��� 19.34% 17.40% 16.37% *In accordance with SEC 14.49% 14.82% 14.15% reporting methodologies. ��� 13.14% Criticized loans includes loans 10.78% categorized as special mention, substandard or doubtful. �� Classified loans includes loans categorized as substandard or doubtful. �� ����� ����� ����� ����� ����� ����� ����� ����� ® 18 WORKING TOGETHER. BUILDING SUCCESS.

CRE CONCENTRATION ANALYSIS NASDAQ: PEBO CRE Concentration Analysis CRE EXPOSURE IS WELL BELOW SUPERVISORY CRITERIA ESTABLISHED TO IDENTIFY INSTITUTIONS WITH HEIGHTENED CRE CONCENTRATION RISK. ���� • Exposure levels also compare favorably to peer institution concentration levels. ���� PEER BANK SUBS – CRE LOANS / RISK-BASED CAPITAL ���� 300% IS THE LEVEL CONSIDERED HEIGHTENED ���� 220% CRE CONCENTRATION RISK ���� PER SUPERVISORY GUIDANCE ���� 126% ���� ��� �� STBA PFC TSC SMMF CCNE TMP FCF SYBT Universe CHCO LKFN FISI FRME GABC HBNC CTBI NWBI PRK THFF FMNB PEBO SRCE ������ B Source: S&P Global Market Intelligence, Commercial Bank Call Report Data as of 6/30/20. Per April 2013 OCC-FRB Guidance. CLD Loans defined as total loans for construction, land and land development. CRE Loans defined as total non-owner-occupied CRE loans (including CLD). The Proxy Peer Group is used above for comparative purposes. Note: For the following peers, 6/30/20 data was not required to be reported for banks less than $3.0 billion, so the data above represents the most recent that is available for these peers: SMMF, FMNB. ® 19 WORKING TOGETHER. BUILDING SUCCESS.

CRE CONCENTRATION ANALYSIS NASDAQ: PEBO PEER BANK SUBS – CONSTRUCTION, LANDCRE AND Conc LANDentr DEVELOPMENTation Analysis LOANS / RISK-BASED CAPITAL ���� ���� ��� 100% IS THE LEVEL CONSIDERED HEIGHTENED CONSTRUCTION, ��� LAND AND LAND DEVELOPMENT CONCENTRATION RISK PER ��� SUPERVISORY GUIDANCE ��� ��� 45% ��� ��� 25% ��� ��� �� ��� �I�I LK�N ��B� ��N� ��� �B�� ���� �R�� ���� U������� �RK G�B� �BN� ��� ��� ��NB ��BI ��BO NWBI �R�� ���O ������ B Source: S&P Global Market Intelligence, Commercial Bank Call Report Data as of 6/30/20. Per April 2013 OCC-FRB Guidance. CLD Loans defined as total loans for construction, land and land development. CRE Loans defined as total non-owner-occupied CRE loans (including CLD). The Proxy Peer Group is used above for comparative purposes. Note: For the following peers, 6/30/20 data was not required to be reported for banks less than $3.0 billion, so the data above represents the most recent that is available for these peers: SMMF, FMNB. ® 20 WORKING TOGETHER. BUILDING SUCCESS.

LOAN COMPOSITION NASDAQ: PEBO LOAN COMPOSITION REFLECTS HEALTHY RISK DIVERSITY. TOTAL LOAN PORTFOLIO* = $3.0Lo BILLION,an Composition WHICH EXCLUDES $460 MILLION OF PPP LOANS TOTAL CRE PORTFOLIO** = $0.9 BILLION Commercial Real Estate Portfolio Loan Portfolio �Excluding Deposit Overdrafts� Commercial Real Estate Portfolio 6 7 8 1 5 12 2 11 4 1 10 3 9 4 3 5 8 6 2 7 1 COMMERCIAL REAL ESTATE (CRE) 30% 5 CONSUMER, INDIRECT 16% 1 APARTMENT 12% 7 RETAIL 10% 2 COMMERCIAL & INDUSTRIAL 20% 6 CONSUMER, DIRECT 3% 2 MIXED USE 10% 8 LODGING 6% 3 RESIDENTIAL REAL ESTATE 20% 7 PREMIUM FINANCE LOANS 3% 3 LIGHT INDUSTRIAL 8% 9 WAREHOUSE 7% 4 HOME EQUITY LINES OF CREDIT 4% 8 CONSTRUCTION 4% 4 AGRICULTURE 2% 10 ASSISTED LIVING 7% 5 GAS STATION 2% 11 EDUCATION SERVICES 4% 6 OFFICE BUILDINGS 15% 12 OTHER 17% Data as of September 30, 2020. *Excludes deposit overdrafts. **Total CRE includes commercial real estate and construction loans, and exposure includes commitments. ® 21 WORKING TOGETHER. BUILDING SUCCESS.

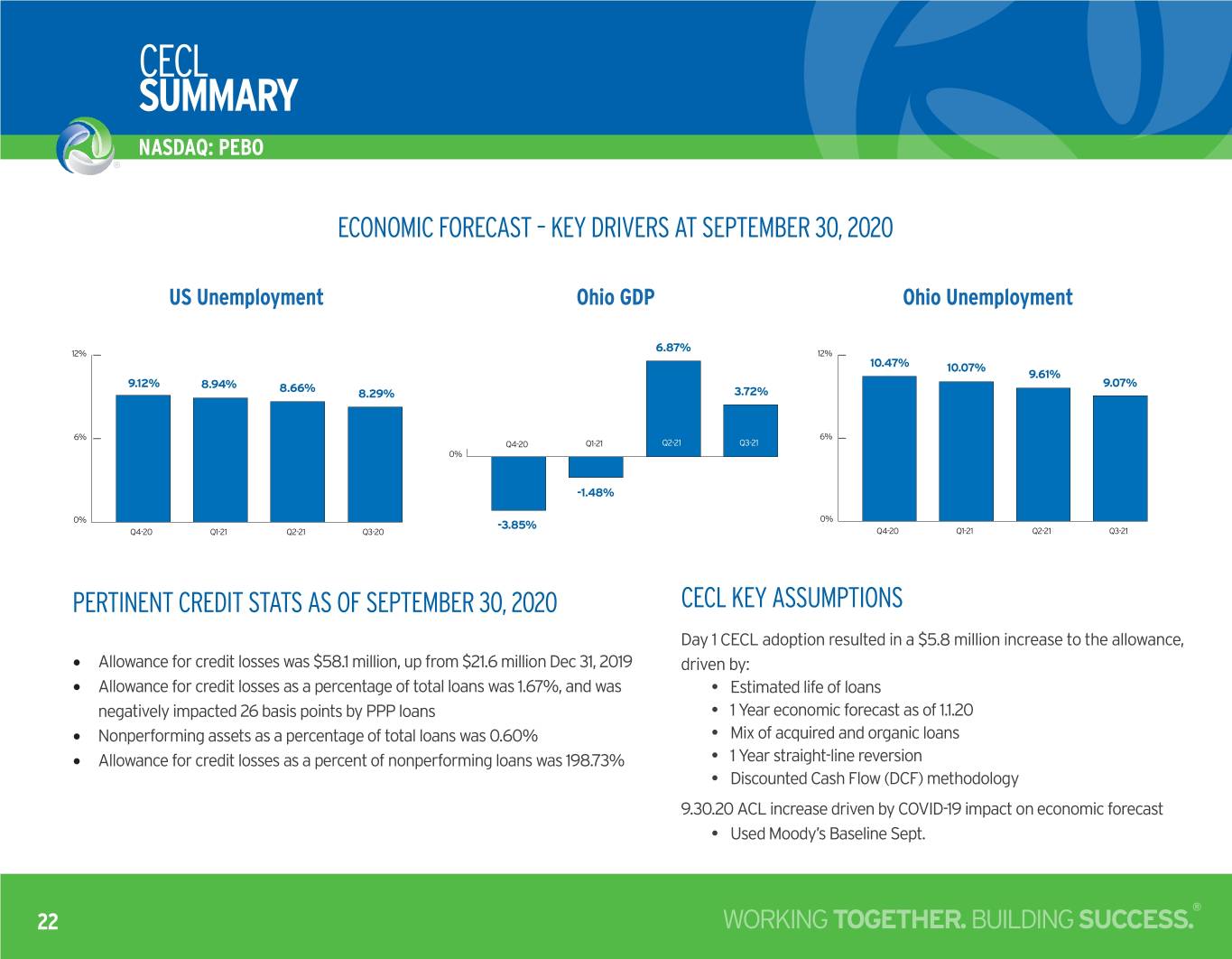

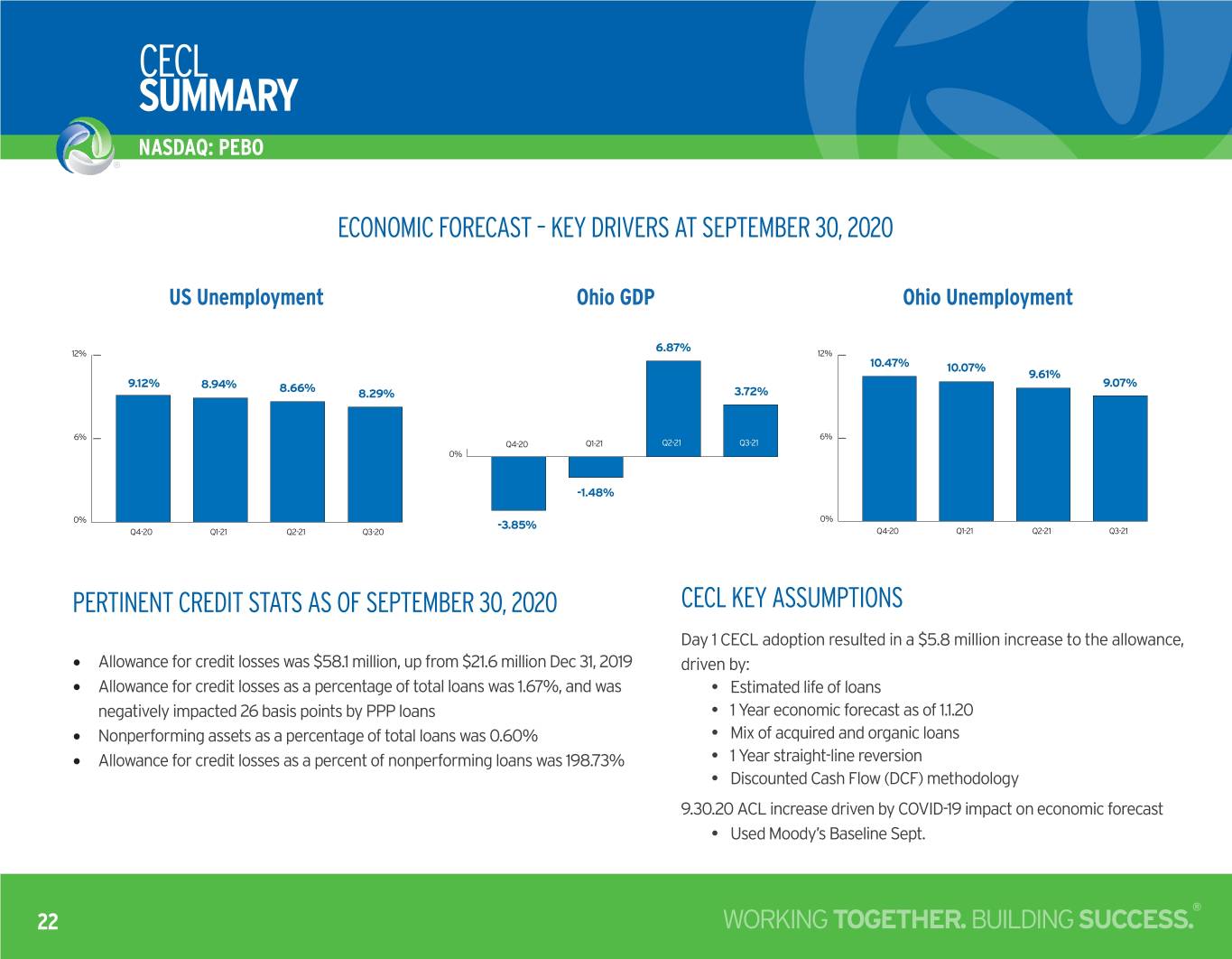

CECL SUMMARY NASDAQ: PEBO ECONOMIC FORECAST – KEY DRIVERS AT SEPTEMBER 30, 2020 Percentage of Loans considered Current US Unemployment ��� Ohio GDP Ohio Unemployment Percentage of Loans considered Current Percentage of Loans considered Current 6.87% ��� ��� 10.47% 10.07% �� 9.61% 9.12% 8.94% 9.07% 8.66% 8.29% 3.72% �� �� ����� ����� ����� ����� �� -1.48% �� �� -3.85% ����� ����� ����� ����� ����� ����� ����� ����� PERTINENT CREDIT STATS AS OF SEPTEMBER 30, 2020 CECL KEY ASSUMPTIONS Day 1 CECL adoption resulted in a $5.8 million increase to the allowance, • Allowance for credit losses was $58.1 million, up from $21.6 million Dec 31, 2019 driven by: • Allowance for credit losses as a percentage of total loans was 1.67%, and was • Estimated life of loans negatively impacted 26 basis points by PPP loans • 1 Year economic forecast as of 1.1.20 • Nonperforming assets as a percentage of total loans was 0.60% • Mix of acquired and organic loans • Allowance for credit losses as a percent of nonperforming loans was 198.73% • 1 Year straight-line reversion • Discounted Cash Flow (DCF) methodology 9.30.20 ACL increase driven by COVID-19 impact on economic forecast • Used Moody’s Baseline Sept. ® 22 WORKING TOGETHER. BUILDING SUCCESS.

RESERVES TO ASSETS CRE Concentration Analysis NASDAQ: PEBO PEBO IS MEANINGFULLY ABOVE ITS PEERS IN TERMS OF RESERVES TO TOTAL ASSETS AS OF JUNE 2020. 3.00% RESERVES AS A % OF LOANS 2.25% 1.50% 0.75% 0.00% SRCE PFC PEBO STBA HBNC SYBT FISI CTBI LKFN FRME GABC NWBI SMMF FCF PRK TMP THFF CCNE FMNB CHCO TSC $1–$10 B Source: S&P Global Market Intelligence, Commercial Bank Call Report Data as of 6/30/2020. Peer financial institutions are used in this presentation for comparative purposes and are referred to as the “Proxy Peer Group”. The parent holding companies of these financial institutions did not comprise the peer group of financial institution holding companies used by Peoples’ Compensation Committee in analyzing and setting executive compensation for 2020. ® 23 WORKING TOGETHER. BUILDING SUCCESS.

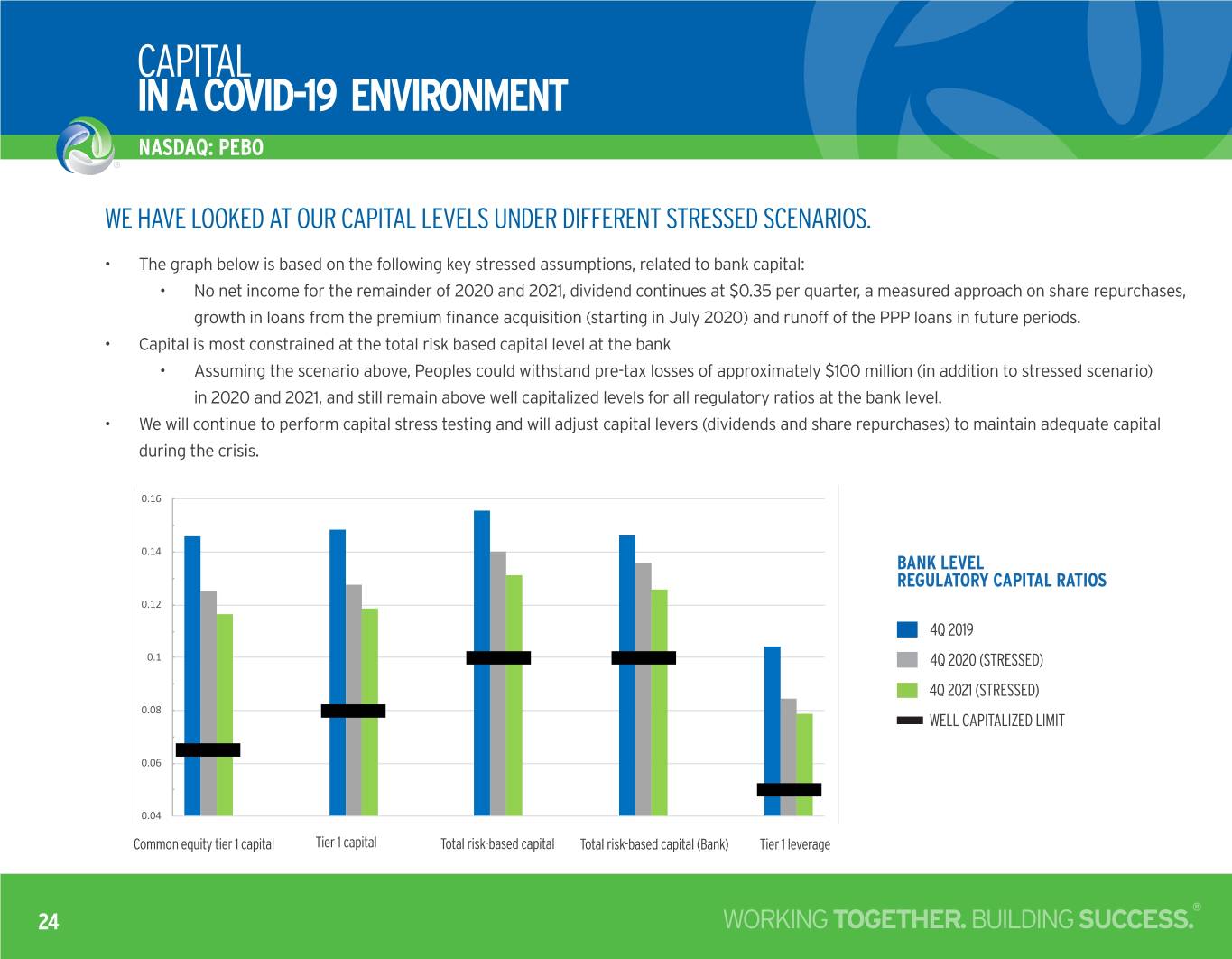

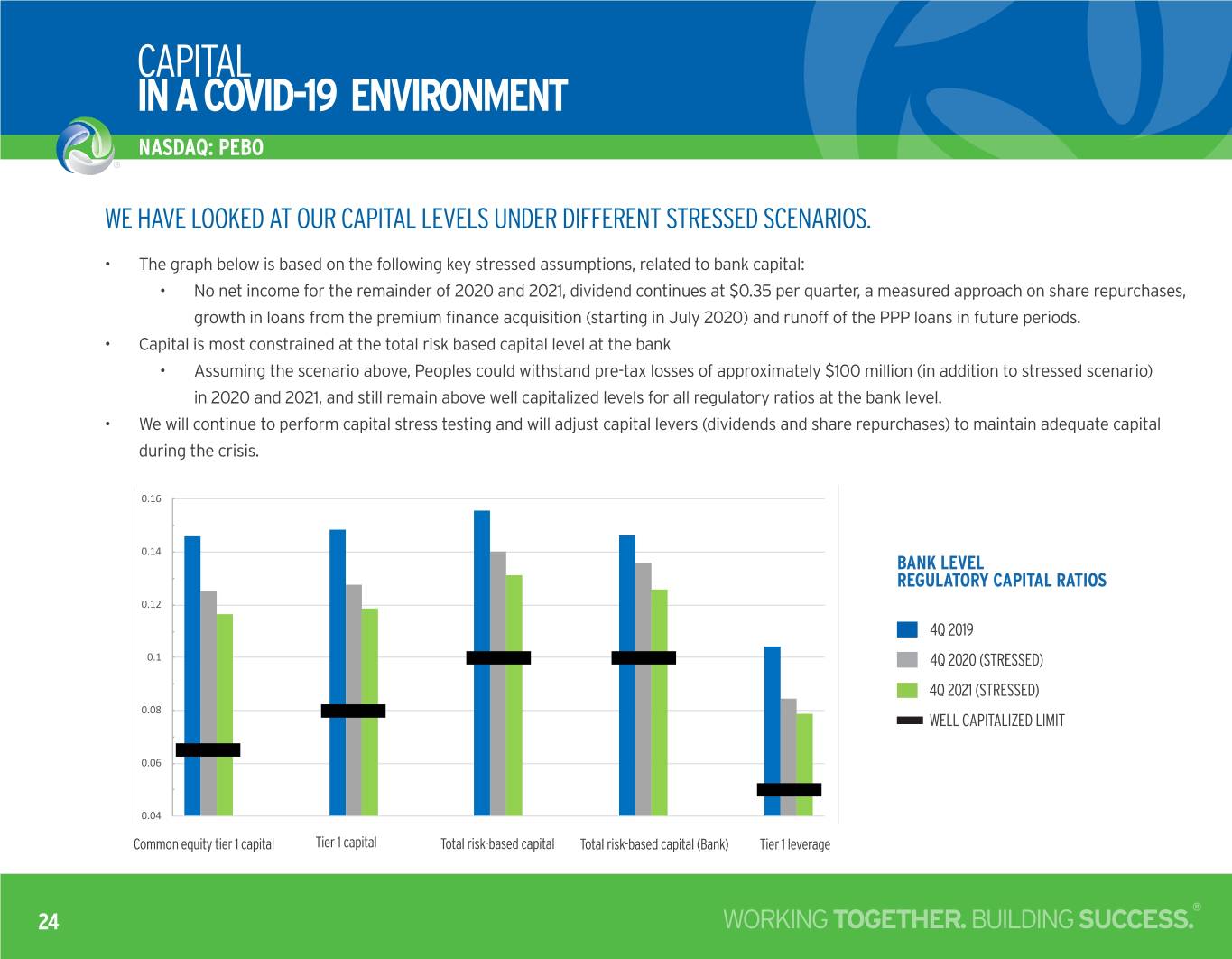

CAPITAL IN A COVID-19 ENVIRONMENT NASDAQ: PEBO WE HAVE LOOKED AT OUR CAPITAL LEVELS UNDER DIFFERENT STRESSED SCENARIOS. • The graph below is based on the following key stressed assumptions, related to bank capital: • No net income for the remainder of 2020 and 2021, dividend continues at $0.35 per quarter, a measured approach on share repurchases, growth in loans from the premium finance acquisition (starting in July 2020) and runoff of the PPP loans in future periods. • Capital is most constrained at the total risk based capital level at the bank • Assuming the scenario above, Peoples could withstand pre-tax losses of approximately $100 million (in addition to stressed scenario) in 2020 and 2021, and still remain above well capitalized levels for all regulatory ratios at the bank level. • We will continue to perform capital stress testing and will adjust capital levers (dividends and share repurchases) to maintain adequate capital during the crisis. Regulatory Capital Ratios 4Q 2019 4Q 2020 (S) 4Q 2021 (S) Well Capitalized Limit 0.16 0.14 BANK LEVEL REGULATORY CAPITAL RATIOS 0.12 4Q 2019 0.1 4Q 2020 (STRESSED) 4Q 2021 (STRESSED) 0.08 WELL CAPITALIZED LIMIT 0.06 0.04 Common Tier 1 capital Total risk- Total risk- Tier 1 leverage Common Equityequity Tier tier 1 1 capital Tier 1 capital Total risk-basedbased capital capital Total risk-basedbased capital capital (Bank) Tier 1 leverage capital (Bank) ® 24 WORKING TOGETHER. BUILDING SUCCESS.

PRUDENT USE OF CAPITAL NASDAQ: PEBO ACQUISITIONS • Bank acquisitions completed in 2014 (3), 2015 (1), 2018 (1), and 2019 (1) • Insurance acquisitions completed in 2014 (1), 2015 (1), 2017 (2), and 2020 (1) • One investment acquisition was completed in 2016 • One premium finance acquisition effective July 1, 2020 CAPITAL PRIORITIES • Organic growth • Dividends • Acquisition activities • Share repurchases DIVIDENDS • Dividend paid increased from $0.15 per share for Q1 2016 to $0.35 in the most recent quarter • Consistently evaluate dividend and adjust accordingly – annualized dividend yield at September 30, 2020 was 6.46%. SHARE REPURCHASES • Prudent repurchase of shares • Repurchased shares in all four quarters of 2020 ® 25 WORKING TOGETHER. BUILDING SUCCESS.

LIQUIDITY IN A COVID-19 ENVIRONMENT NASDAQ: PEBO WE ARE WELL POSITIONED FROM A LIQUIDITY PERSPECTIVE • We had a loan-to-deposit ratio of 88% at September 30, 2020, which enables us to be flexible and grow loans when it is prudent. • We can leverage our investment securities to gain liquidity through sales or pledging. • Our loans give us the ability to increase borrowing capacity by pledging loans to provide liquidity to meet the borrowing needs of our customers. • As needed, we will utilize the Federal Reserve’s program to pledge the SBA PPP loans as collateral for our borrowings. • In the second quarter, we saw an increase in our deposits, as we experienced inflows from stimulus money to consumers, and the majority of PPP money was deposited within the bank. • We realize that these inflows will likely diminish over time and will remain focused on maintaining a high level of borrowing capacity at the Federal Reserve Bank, the FHLB of Cincinnati and other funding sources. • Over the long run, we anticipate funding the premium finance portfolio through a combination of security liquidations and shorter term wholesale funding. ® 26 WORKING TOGETHER. BUILDING SUCCESS.

DEPOSIT FRANCHISE IN A COVID-19 ENVIRONMENT NASDAQ: PEBO AS OF JUNE 2020, OUR LOAN-TO-DEPOSIT RATIO WAS LOW COMPARED TO PEER GROUP, WHICH POSITIONS US WELL FROM A LIQUIDITY PERSPECTIVE. 105% 100% 95% 90% UNIV. $1- $10 B AVERAGE: 88.74% 85% NOT TO SCALE TO NOT 80% 75% 70% MEDIAN ���� ���� ���� ��� ���� ���� ���� ��� ���� ���� ��� ���� ���� ��� ��� ���� ���� ���� ���� ���� ���� The Proxy Peer Group is used above for comparative purposes. Source: S&P Global Market Intelligence ® 27 Data as of June 30, 2020 WORKING TOGETHER. BUILDING SUCCESS.

COST OF DEPOSITS CRE Concentration Analysis NASDAQ: PEBO PEBO IS MEANINGFULLY BELOW THE $1 - $10 BILLION BANK UNIVERSE 1.00% IN TERMS OF COST OF DEPOSITS AS OF JUNE 30, 2020. TOTAL DEPOSIT COST (%) 0.75% 0.60% 0.50% 0.30% 0.25% 0.00% ��� ���� ���� ���� ���� ���� ���� ���� ���� ��� ���� ���� ���� ���� ���� ���� ���� ���� ��� ��� ���� ��� $1–$10 B Source: S&P Global Market Intelligence, Commercial Bank Call Report Data as of 6/30/2020. Peer financial institutions are used in this presentation for comparative purposes and are referred to as the “Proxy Peer Group”. The parent holding companies of these financial institutions did not comprise the peer group of financial institution holding companies used by Peoples’ Compensation Committee in analyzing and setting executive compensation for 2020. ® 28 WORKING TOGETHER. BUILDING SUCCESS.

NASDAQ: PEBO Q3 & YTD 2020 FINANCIAL INSIGHTS ® 29 WORKING TOGETHER. BUILDING SUCCESS.

PEOPLES PREMIUM FINANCE NASDAQ: PEBO Effective July 1, 2020, Peoples closed on the asset purchase agreement under which Peoples Bank acquired the operations and assets of Triumph Premium Finance (“TPF”), a division of TBK Bank, SSB. Based in Kansas City, Missouri, Peoples Premium Finance will continue to provide premium finance services for customers to purchase property and casualty insurance products through its growing network of independent insurance agency partners nationwide. Peoples Bank acquired $84.8 million in loans at acquisition date, after preliminary fair value adjustments. As of September 30, 2020, Peoples Premium Finance loans had grown to $104.1 million. Former Senior Vice President of TPF, John Binaggio, manages the insurance premium financing operations for Peoples Bank, now called Peoples Premium Finance. For the client, premium financing is typically done with a 15 - 20% down payment, followed by 9 - 10 monthly payments. Premium financing is typically done with a 15 - 20% down payment, followed by 9 - 10 monthly payments. ® 30 WORKING TOGETHER. BUILDING SUCCESS.

Q3 & YTD 2020 HIGHLIGHTS & KEY IMPACTS NASDAQ: PEBO FINANCIAL: • Recorded net income of $10.2 million for the third quarter of 2020, representing earnings per diluted common share of $0.51. • Net interest income was $35.1 million for the third quarter of 2020, an increase of $259,000, or 1%, compared to the second quarter of 2020. • Non-interest income, excluding gains and losses, as a percent of total revenue was 31% year-to-date. • Our total non-interest expense increased by 8% compared to the second quarter of 2020. • Asset quality metrics were generally stable during the quarter. • Loans considered current comprised 99.2% of the loan portfolio at September 30, 2020, compared to 99.0% at June 30, 2020. • Our net charge-off rate was $735,000, or 0.08% of average total loans annualized, for the third quarter of 2020. • Period-end total deposit balances at September 30, 2020 decreased $72.9, or 2%, compared to June 30, 2020. 1 • Period-end total loan balances at September 30, 2020 increased $111.1 million, or 3%, compared to June 30, 2020. • Growth of period-end loan balances compared to June 30, 2020 was driven by loans acquired with the Peoples Premium2 Finance acquisition, which are included in commercial and industrial loans, and an increase in consumer indirect loans. • Average loan balances increased for the quarter, compared to the linked quarter, and were driven by mortgage loan production, indirect loan originations, the Peoples Premium Finance acquisition and a full-quarter impact from PPP loans. ® 31 WORKING TOGETHER. BUILDING SUCCESS.

Q3 & YTD 2020 HIGHLIGHTS & KEY IMPACTS NASDAQ: PEBO RECOGNITION: • Peoples Bank was recognized as the number one bank in West Virginia as part of Forbes’ annual list of America’s Best-In-State Banks and Credit Unions 2020. • For the 2nd year in a row, Peoples Bank has been recognized as a Top Workplace by cleveland.com and the Cleveland Plain Dealer. • Peoples Bank received the Marietta Times Readers Choice Awards for Best Bank and Best Mortgage. Peoples Bank finished as runner up for Best Insurance Agency and Best Employer. • Peoples Bank became the first bank in Ohio to get a USDA B&I CARES Act Loan approved. • Peoples Bank received a 2019 Top 10 Lender of the Year award from the U.S. Small Business Administration (SBA) Columbus District Office. • Peoples Bank received the Huntington (WV) Herald Dispatch Readers Best Bank award for Boyd County, KY and Lawrence County, OH. ® 32 WORKING TOGETHER. BUILDING SUCCESS.

Q3 & YTD 2020 HIGHLIGHTS & KEY IMPACTS NASDAQ: PEBO PEOPLES BANK CONTINUES TO ADD TECHNOLOGY THAT CLIENTS CARE ABOUT • Contactless debit cards • Cardless cash (ability to use ATM via mobile app without debit card) • Card Controls (ability to lock/unlock debit card) • Transaction alerts • Ability to setup PayPal using debit card • Zelle® - (Send & Receive money) • Mobile check deposit • Stand alone Insurance App • Stand alone Retirement App Increase in mobile deposit 24% monthly users (Sep vs. Jan 2020) Increase in card control 17% active users Increase in active 64% Zelle© users ® 33 WORKING TOGETHER. BUILDING SUCCESS.

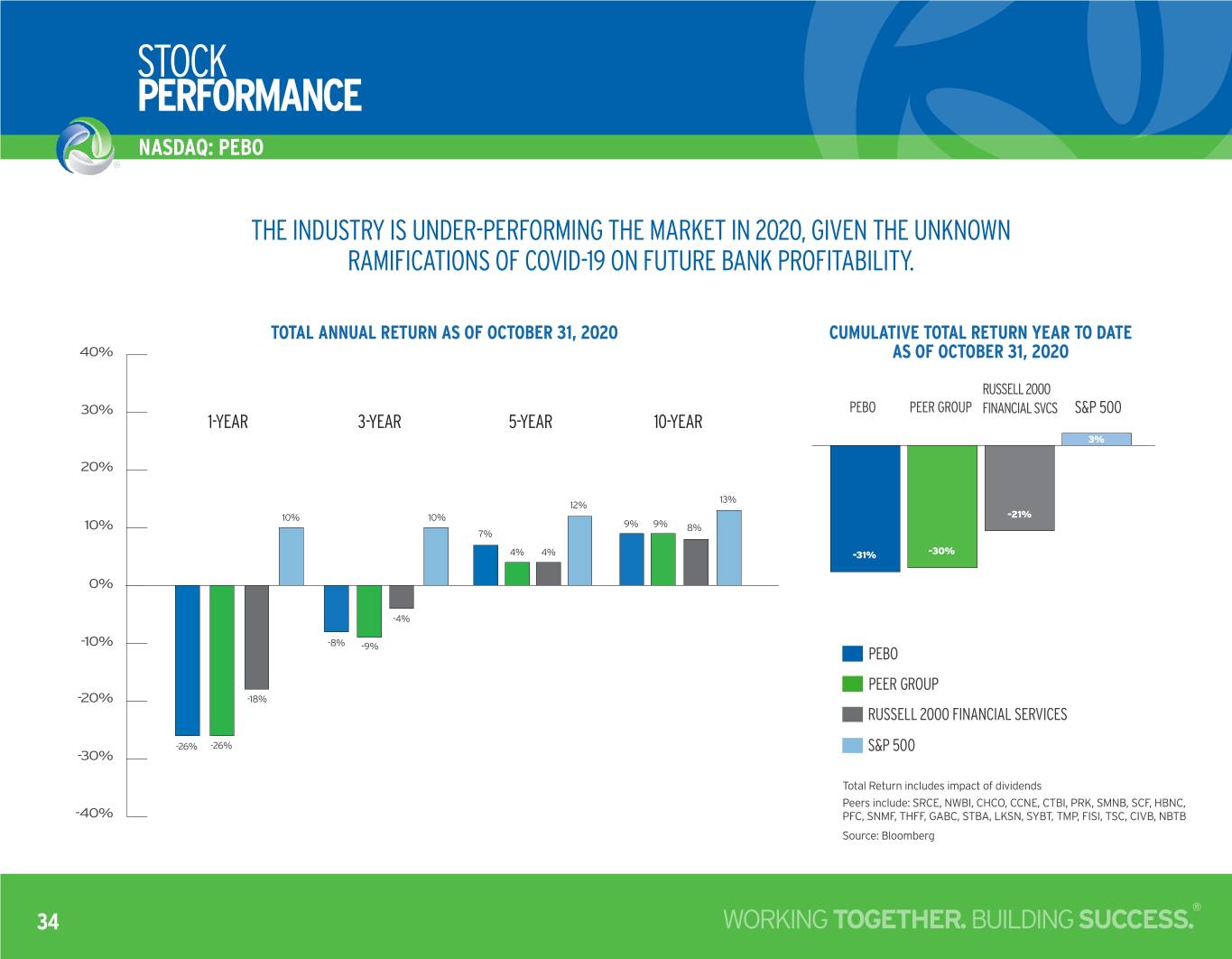

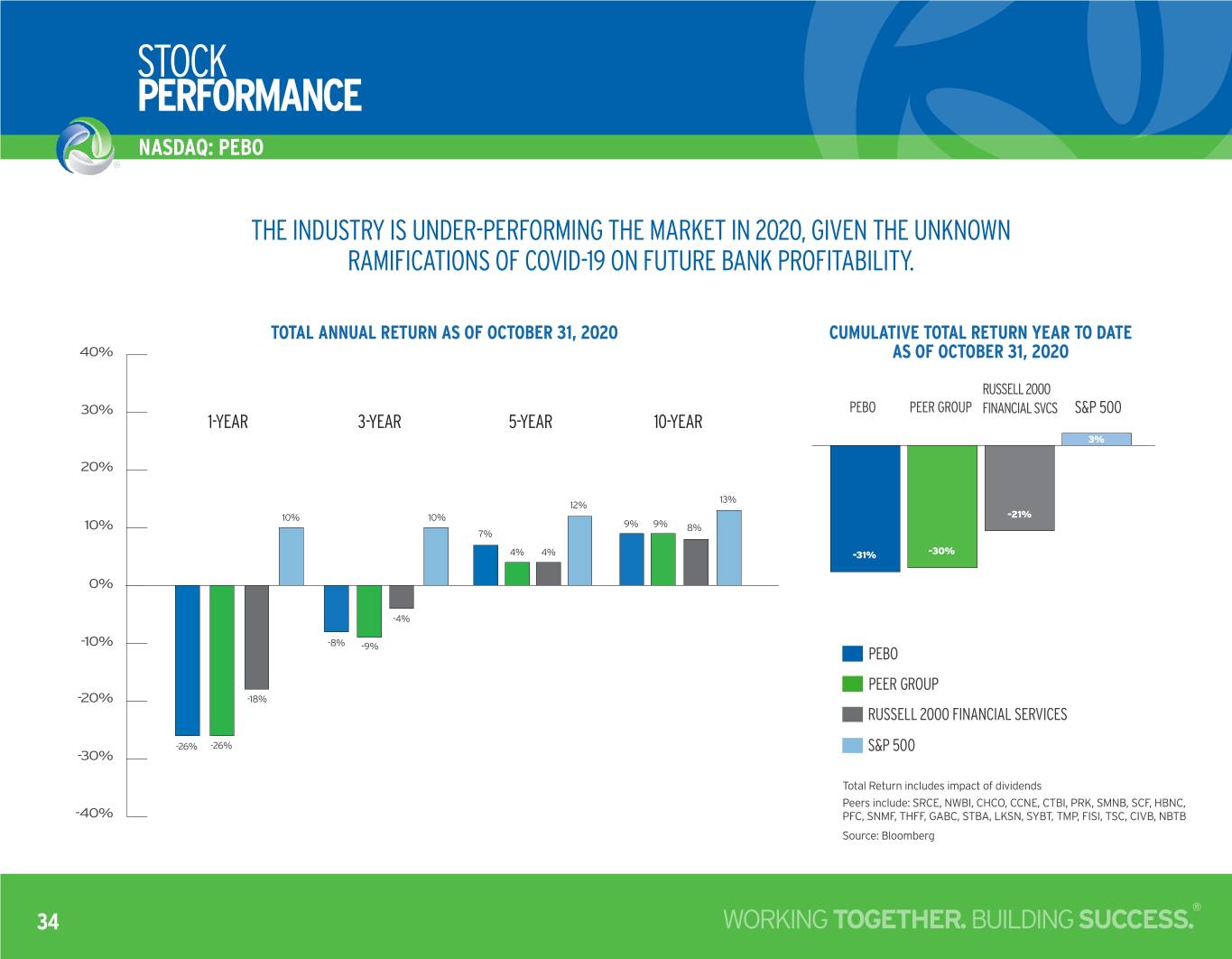

STOCK PERFORMANCE NASDAQ: PEBO THE INDUSTRY IS UNDER-PERFORMING THE MARKET IN 2020, GIVEN THE UNKNOWN RAMIFICATIONS OF COVID-19 ON FUTURE BANK PROFITABILITY. TOTAL ANNUAL RETURN AS OF OCTOBER 31, 2020 CUMULATIVE TOTAL RETURN YEAR TO DATE ��� AS OF OCTOBER 31, 2020 RUSSELL 2000 ��� PEBO PEER GROUP FINANCIAL SVCS S&P 500 1-YEAR 3-YEAR 5-YEAR 10-YEAR 3% 0 ��� -10 13% 12% 10% 10% -21% ��� 9% 9% 8% -20 7% 4% 4% -31% -30% -30 �� -4% ���� -8% -9% PEBO PEER GROUP ���� -18% RUSSELL 2000 FINANCIAL SERVICES -26% -26% S&P 500 ���� Total Return includes impact of dividends Peers include: SRCE, NWBI, CHCO, CCNE, CTBI, PRK, SMNB, SCF, HBNC, ���� PFC, SNMF, THFF, GABC, STBA, LKSN, SYBT, TMP, FISI, TSC, CIVB, NBTB Source: Bloomberg ® 34 WORKING TOGETHER. BUILDING SUCCESS.

TOTAL REVENUE NASDAQ: PEBO TOTAL REVENUE OF $150 MILLION FOR FIRST NINE MONTHS OF 2020. REVENUE IN FOURTH QUARTER OF 2020 WILL BENEFIT FROM PPP AND PREMIUM FINANCE ACQUISITION. COVID-19 AND INTEREST RATE ENVIRONMENT WILL MUTE YEAR OVER YEAR ORGANIC GROWTH. ������� Beginning in the second quarter of 2018, Peoples benefited from the ������� acquisition of ASB $64,892 Financial Corp. $57,234 Additionally, beginning in the second quarter of $52,653 ������� 2019, Peoples benefited $51,070 $47,025 $47,441 from the acquisition $140,838 $129,612 of First Prestonsburg Bancshares Inc., and ������� $113,377 $104,865 $104,615 in the third quarter of ($ THOUSANDS) $97,612 2020 Peoples benefited from the acquisition of Triumph Premium ������ Finance. �� ����� ����� ����� ����� ����� ��D��� NET INTEREST INCOME NON-INTEREST INCOME, EXCLUDING GAINS AND LOSSES ® 35 WORKING TOGETHER. BUILDING SUCCESS.

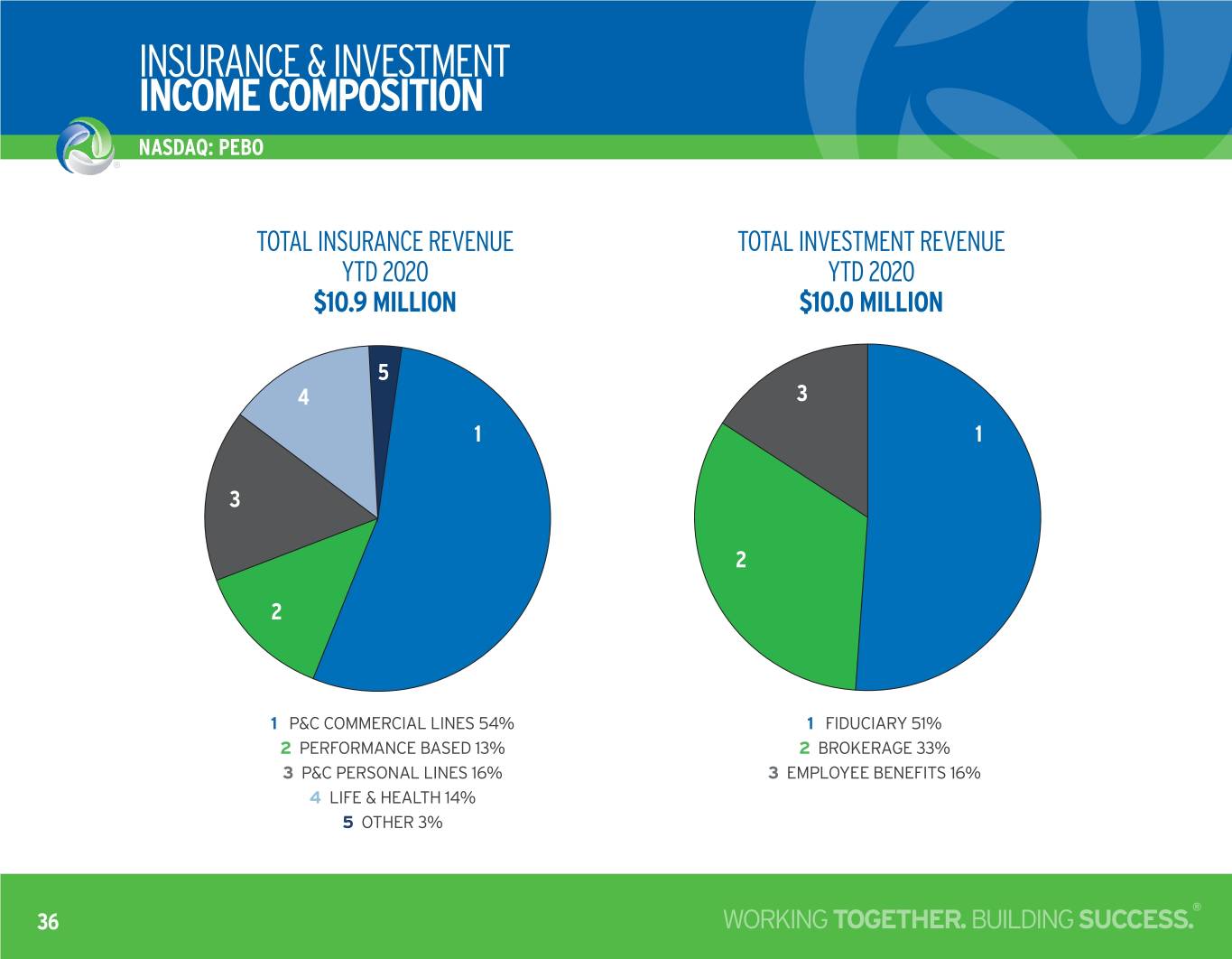

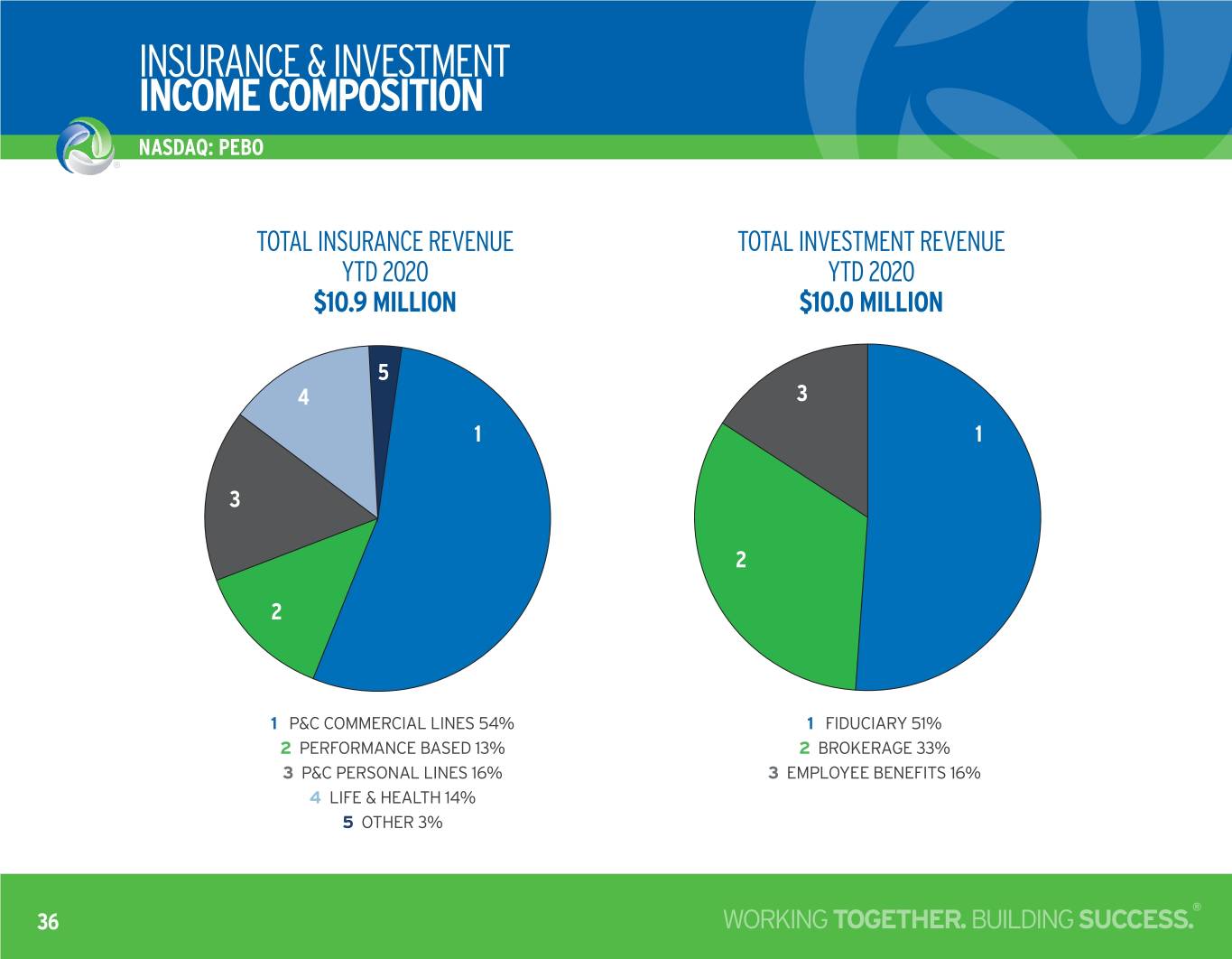

nue� Reve tment ves INSURANCE & INVESTMENTIn INCOME COMPOSITION NASDAQ: PEBO estment Income Composition v estment Income Composition Income estment v In and e anc Insur e and In TOTAL INSURANCE REVENUE TOTAL INVESTMENT REVENUE anc YTD 2020 YTD 2020 $10.9 MILLION � $10.0nue Reve MILLIONtment ves In enue� Rev e anc Insur Insur enue� 5 4 3 e Rev anc 1 1 Insur 3 2 2 1 P&C COMMERCIAL LINES 54% 1 FIDUCIARY 51% 2 PERFORMANCE BASED 13% 2 BROKERAGE 33% 3 P&C PERSONAL LINES 16% 3 EMPLOYEE BENEFITS 16% 4 LIFE & HEALTH 14% 5 OTHER 3% ® 36 WORKING TOGETHER. BUILDING SUCCESS.

CORE NON-INTEREST EXPENSE* NASDAQ: PEBO THE RECENT ESCALATION IN EXPENSES WAS DUE TO ACQUISITIONS, OUR MOVE TO A $15 MINIMUM WAGE, AND AN INCREASE IN FTE’S FOR GROWTHCo ANDre TECHNOLOGYNon-Interest INVESTMENTS. Expense� COVID-19 IS NOT EXPECTED TO CAUSE A MATERIAL INCREASE IN EXPENSES. ������� ������� CORE NON-INTEREST EXPENSES* EXPENSES RESULTING FROM ACQUISITIONS** ������� ������ $1.3M ($ THOUSANDS) NOT TO SCALE TO NOT ($ THOUSANDS) ������ ������ �Y-15 �Y-16 �Y-17 �Y-18�� �Y-19�� YTD-20 * Non-US GAAP financial measure. See Appendix. **2014, 2015, 2018 and 2019 included a partial quarter of expenses resulting from the Midwest Bancshares, Inc. (2014), Ohio Heritage Bancorp, Inc. (2014), North Akron Savings Bank (2014), National Bank and Trust (2015), American Savings Bank (2018), and First Prestonsburg (2019) and Triumph Premium Finance (2020) acquisitions, respectively, such as salaries and occupancy expenses. ® 37 WORKING TOGETHER. BUILDING SUCCESS.

EFFICIENCY RATIO ADJUSTED FOR NON-CORE ITEMS* NASDAQ: PEBO COVID-19 ANDEff iciencREDUCEDy R NETatio INTEREST Ad�usted MARGIN for Non-C HAVE orIMPACTEDe Items � THE EFFICIENCY RATIO IN THE FIRST NINE MONTHS OF 2020 �������� ��� ��� 69.55% �������� ��� ��� ������� ��� 67.49% ��� ������� ��� 64.30% NOT TO SCALE TO NOT ��� 61.85% 61.78% 61.32% 61.09% ��� ������� ��� ��� ������� ����� ����� ����� ����� ����� ��D��� ������� ������� ����� ����� ������� ��D����� *The efficiency ratio adjusted for non-core items is defined as core non-interest expense (less amortization of other intangible assets) as a percentage of fully tax-equivalent net interest income plus core non-interest income excluding all gains and losses. This amount represents a non-US GAAP financial measure since it excludes the impact of all gains and/or losses, acquisition-related expenses, COVID-19-related expenses, pension settlement charges, amortization of other intangible assets and uses fully tax-equivalent net interest income. See Appendix. ® 38 WORKING TOGETHER. BUILDING SUCCESS.

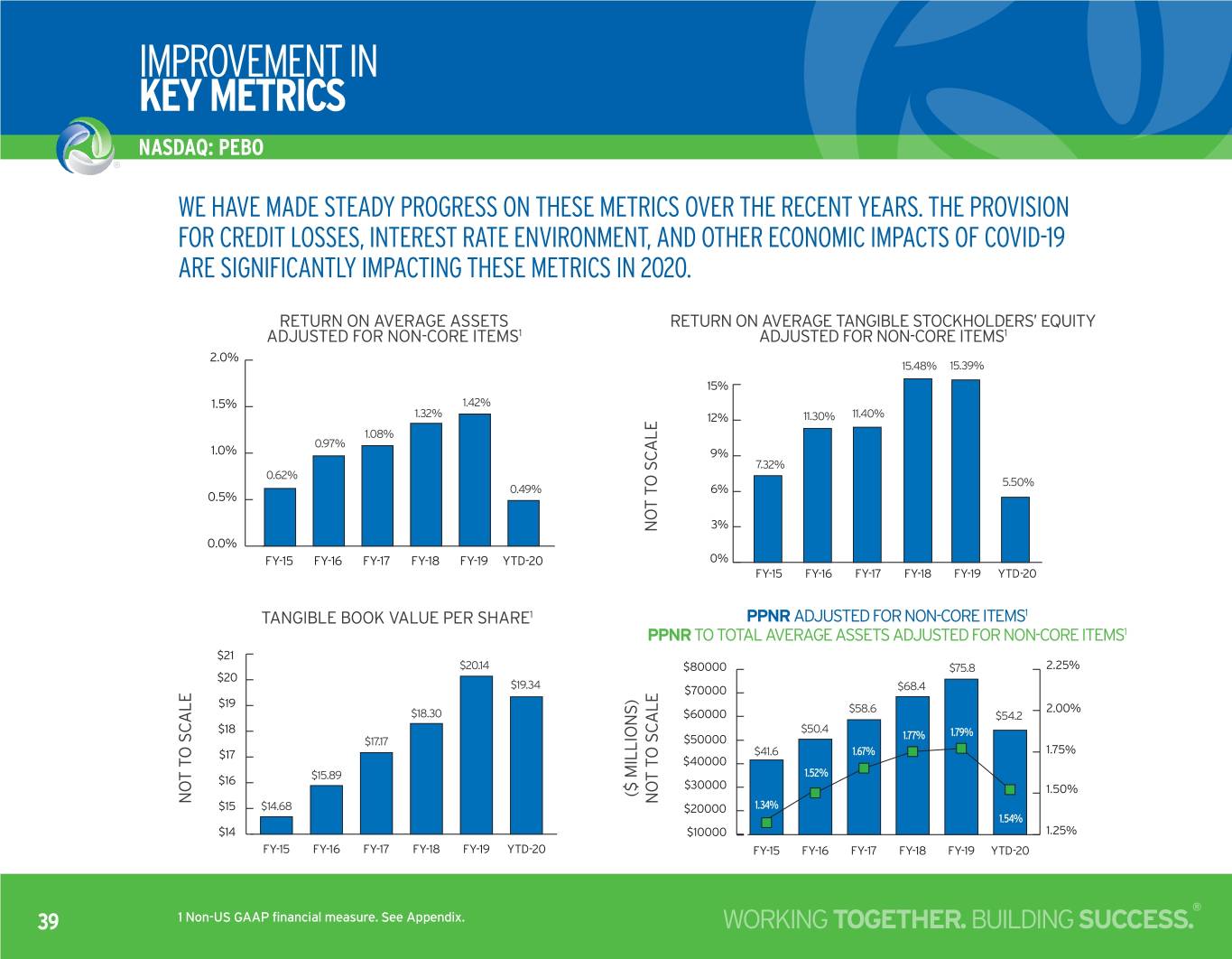

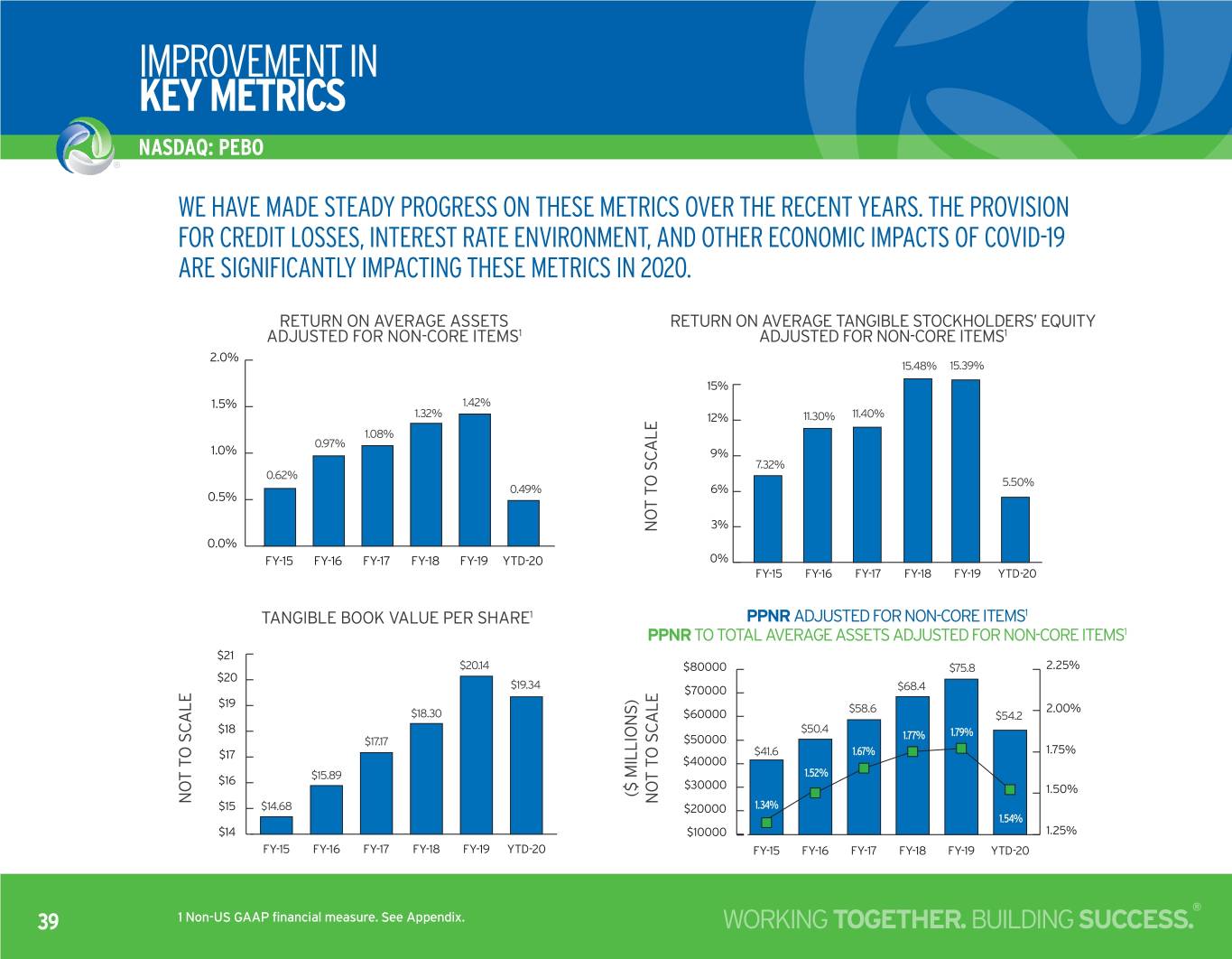

IMPROVEMENT IN KEY METRICS NASDAQ: PEBO WE HAVE MADE STEADY PROGRESS ON THESE METRICS OVER THE RECENT YEARS. THE PROVISION FOR CREDIT LOSSES, INTEREST RATE ENVIRONMENT, AND OTHER ECONOMIC IMPACTS OF COVID-19 Improvement In Key Metrics ARE SIGNIFICANTLY IMPACTING THESEImpr METRICSovement IN 2020. In Key Metrics ImprovImprementov ementIn Key InMetric Key sMetrics Return on Average Assets Ad�usted for Non-Core Items Return on Average Tangible Stockholders� RETURN ON AVERAGE ASSETS RETURNE� uiONty AVERAGEAd�usted f orTANGIBLE Non-Cor STOCKHOLDERS’e Items EQUITY ReturnADJUSTED on Aver FORage Assets NON-CORE Ad�ust ITEMSed for 1Non-Core Items ReturnADJUSTED on Aver ageFOR T NON-COREangible Stockholde ITEMS1rs� Return���� on RAveturnerage on Assets Average Ad�ust Assetsed foArd�ust Non-edCo forer Non-ItemsCore Items Return onR AveturnE�eruiagety on A T d�ustangibleAveredage fSt orTangibleockholde Non-C orStrseockholde �It ems rs� ��� 15.48% 15.39% E�uity Ad�ustE�uiedty fAord�ust Non-Ced orfore Non-CItemsore Items ���� ��� ���� ��� ���� ���� 1.42% ��� ��� 1.32% ��� 11.30% 11.40% ���� 1.08% ����� ��� ���� ����0.97% ���� �� �� 7. 32% 0.62%���� �� �� 5.50% ���� ���� 0.49% �� ���� ���� �� ���� �� ���� ���� SCALE TO NOT ���� ���� �� ��������� ����� ����� ����� ����� ��D��� ����� ����� ����� ����� ����� ��D��� ���� ���� ����� ����� ����� ����� ����� ��D��� �� �� ����� ����� ����� ����� ����� ��D��� ����� ������������������������������������������ D�������� ��D��� ����� ������� ��� ������� ��� ������� ��� ������� �����D�������� ��D��� TANGIBLETangible BOOK Book VALUE Value PER Per SHAREShare 1 PPNR ADJUSTED FOR NON-CORE ITEMS1 ��� Tangible Book Value Per Share ����� 1 ��� Tangible BookTangible Value Book Per VSharaluee Per Share ������PPNR TO TOTAL AVERAGE ASSETS ADJUSTED FOR NON-CORE ITEMS ��� ������ ����� ��� ��� ��� $20.14 ������������ ����� ����� ������������ $75.8 ������ ��� ����� ��� $19.34 ������������ $68.4 ������������ ����� ������ ��� ����� ��� $18.30 ������������ ������ $58.6 ����� ������ $54.2 ��� $50.4 ����� ��� ��� ������������ 1.77% 1.79% ����� ��� $17.17 ������������ $41.6 1.67% ����� ����� ������ ��� ������������ ��� ������������ ����� $15.89 1.52% ����� ��� ��� ������ ��� ��� ������ ������������ ����� ����� ($ MILLIONS) NOT TO SCALE TO NOT ��� $14.68 ������ SCALE TO NOT 1.34% ��� ������ ������ ����� ����� ��� ��� ������ 1.54% ����� ��� ����� ����������� ���������� ���������� ���������� ����D���� ��D��� ������ ����������� ���������� ���������� ���������� ���������� �������D�����D��� ����� ����� ������� ��� ������� ��� ������� ��� ������� �����D�������� ��D��� ����� ������� ��� ������� ��� ������� ��� ������� �����D�������� ��D��� ® 39 1 Non-US GAAP financial measure. See Appendix. WORKING TOGETHER. BUILDING SUCCESS.

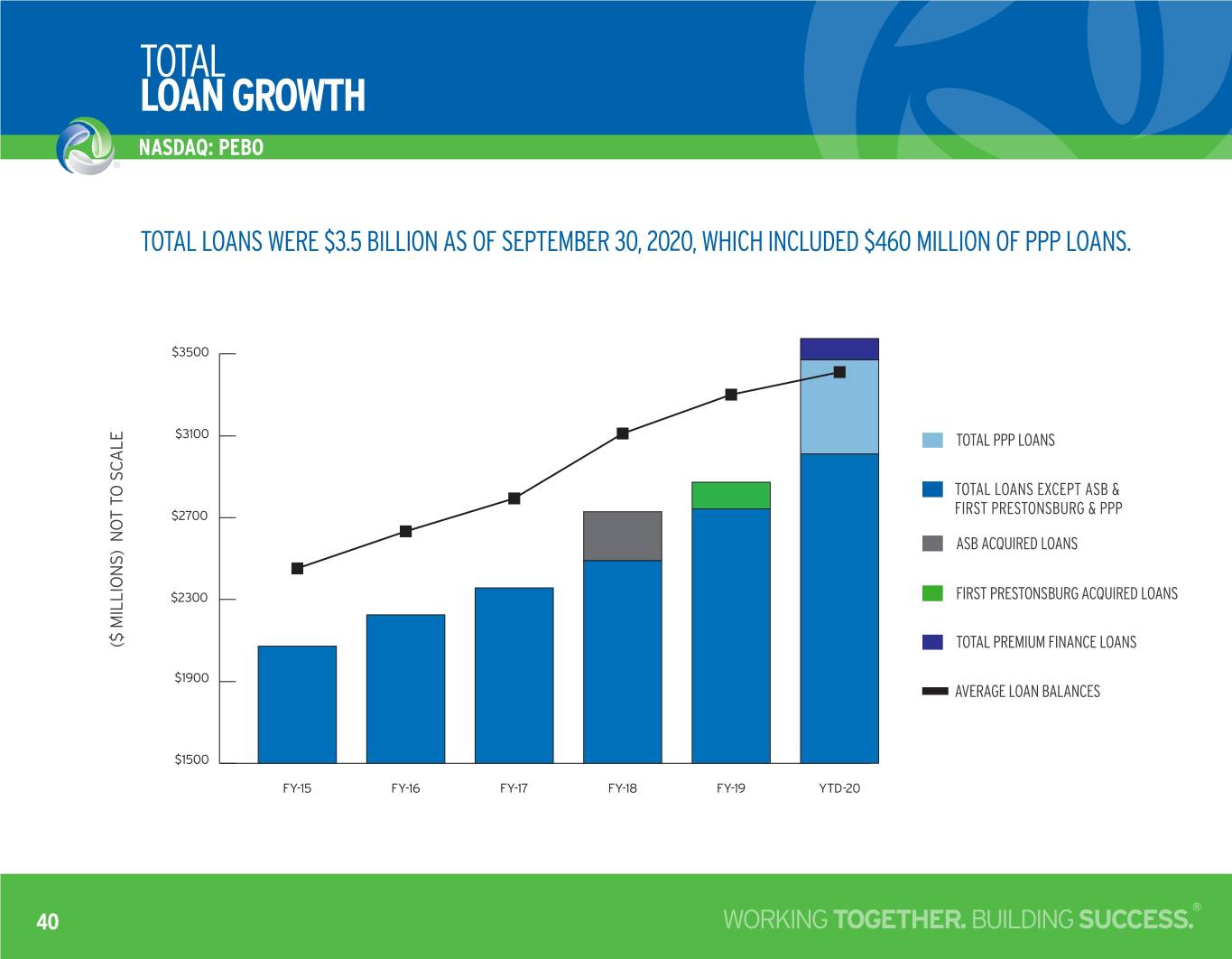

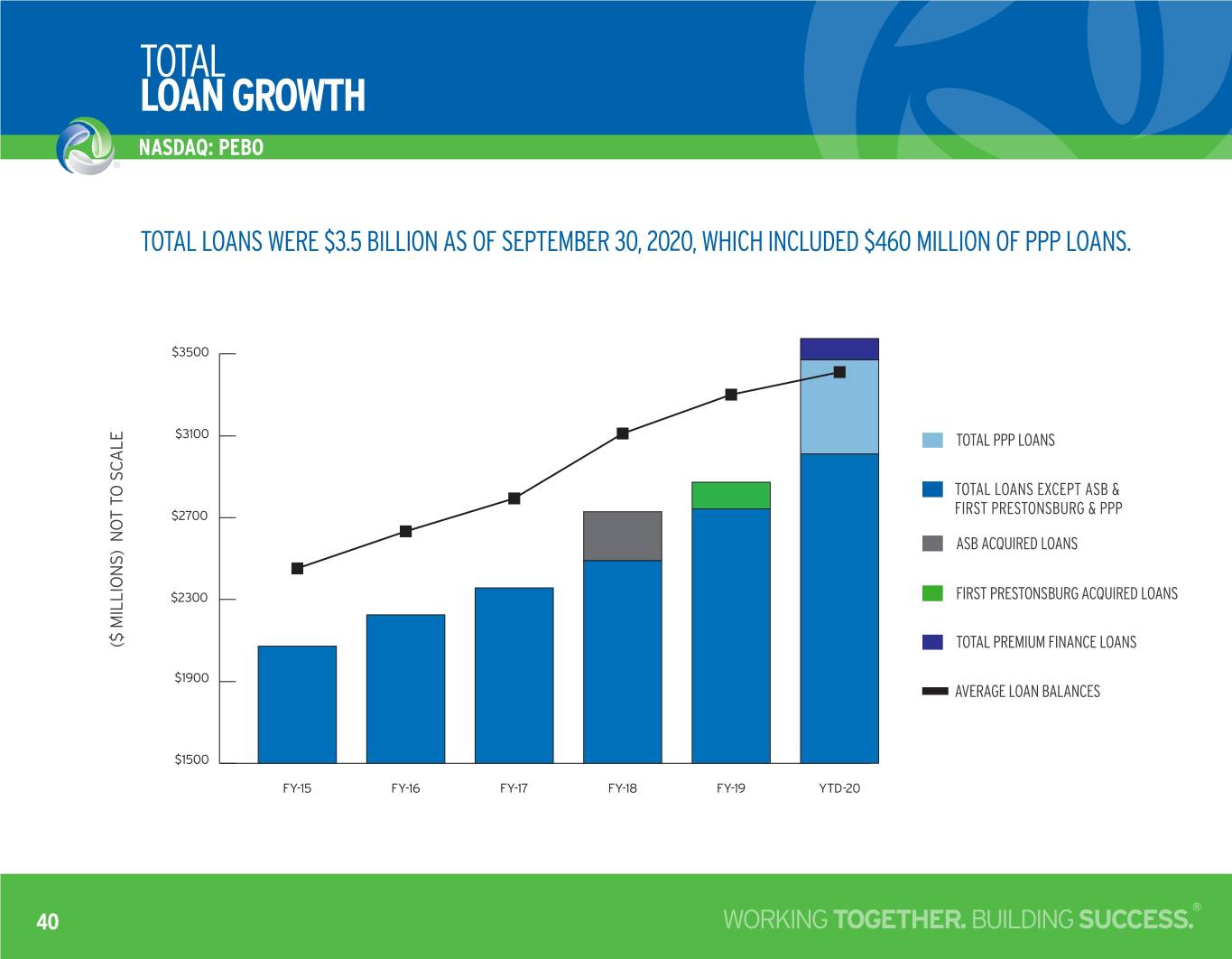

TOTAL LOAN GROWTH NASDAQ: PEBO TOTAL LOANS WERE $3.5 BILLION ASTo tOFal SEPTEMBERLoan Growth 30, 2020, WHICH INCLUDED $460 MILLION OF PPP LOANS. ����� ����� TOTAL PPP LOANS TOTAL LOANS EXCEPT ASB & ����� FIRST PRESTONSBURG & PPP ASB ACQUIRED LOANS ����� FIRST PRESTONSBURG ACQUIRED LOANS ($ MILLIONS) NOT TO SCALE TO NOT ($ MILLIONS) TOTAL PREMIUM FINANCE LOANS ����� AVERAGE LOAN BALANCES ����� ����� ����� ����� ����� ����� ��D��� ® 40 WORKING TOGETHER. BUILDING SUCCESS.

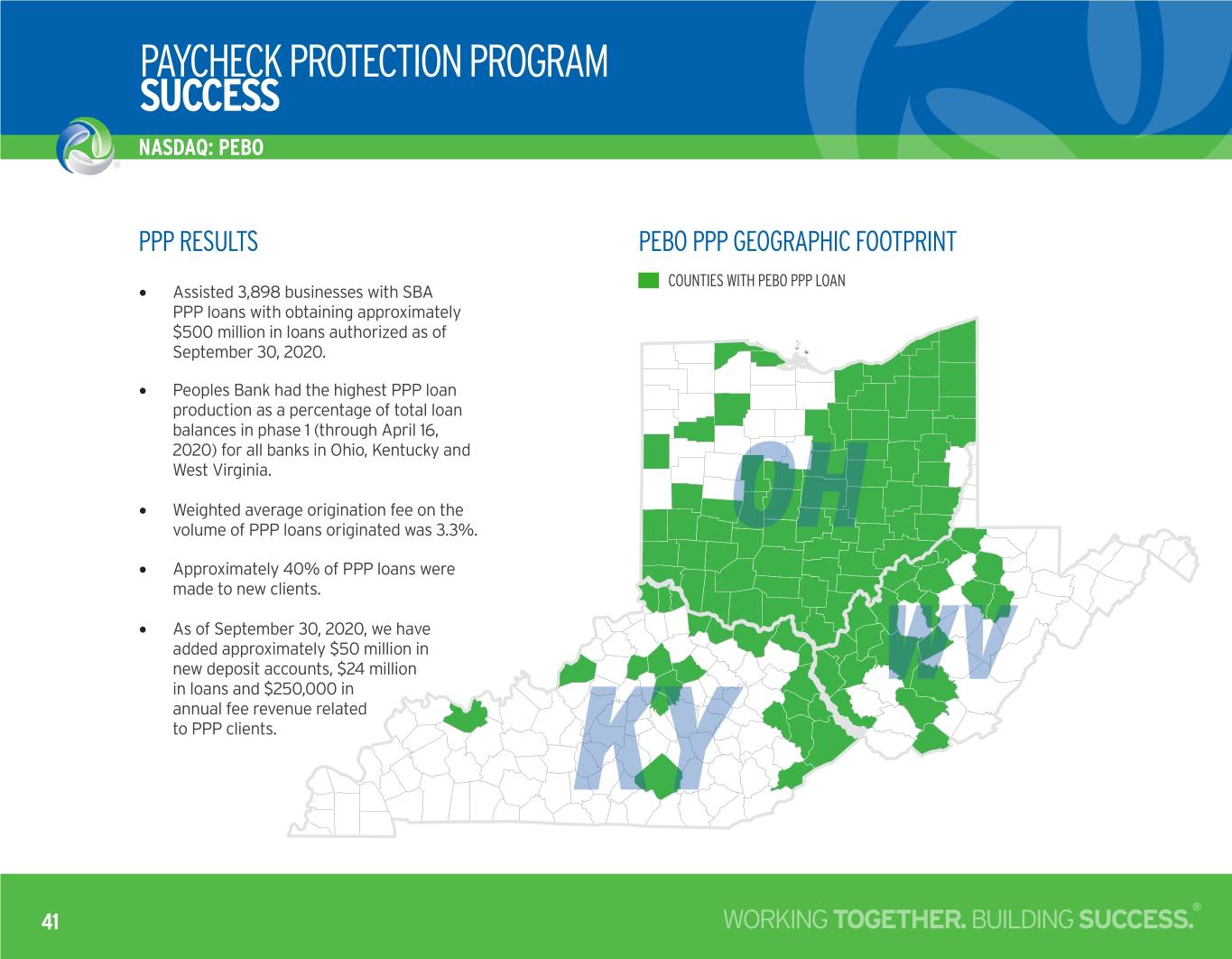

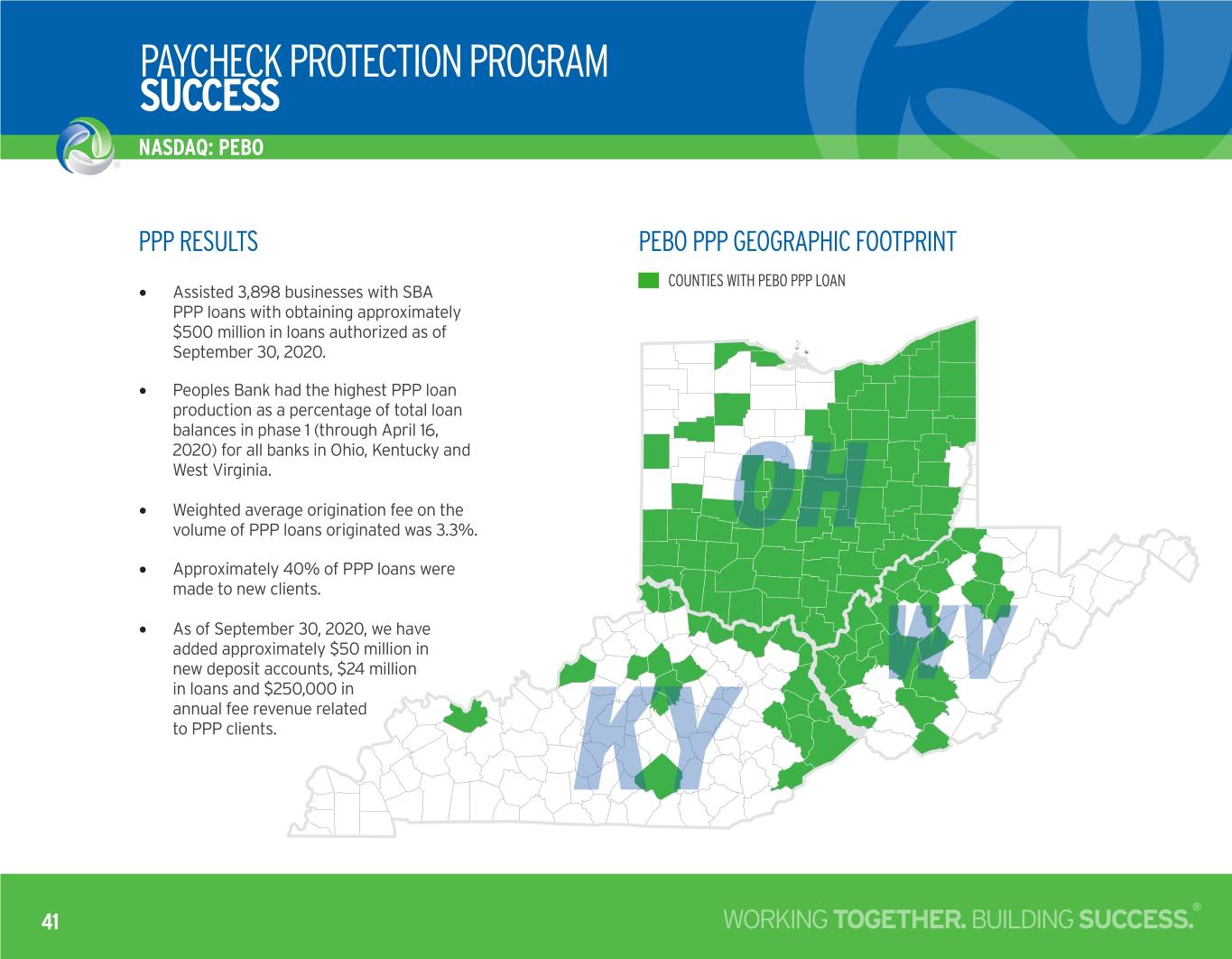

PAYCHECK PROTECTION PROGRAM SUCCESS NASDAQ: PEBO PPP RESULTS PEBO PPP GEOGRAPHIC FOOTPRINT COUNTIES WITH PEBO PPP LOAN • Assisted 3,898 businesses with SBA PPP loans with obtaining approximately $500 million in loans authorized as of September 30, 2020. • Peoples Bank had the highest PPP loan production as a percentage of total loan balances in phase 1 (through April 16, 2020) for all banks in Ohio, Kentucky and West Virginia. • Weighted average origination fee on the volume of PPP loans originated was 3.3%. OH • Approximately 40% of PPP loans were made to new clients. • As of September 30, 2020, we have added approximately $50 million in new deposit accounts, $24 million in loans and $250,000 in WV annual fee revenue related to PPP clients. KY ® 41 WORKING TOGETHER. BUILDING SUCCESS.

EARNING ASSET MIX NASDAQ: PEBO FROM 2013 TO 2018, THE PERCENTAGE OF EARNING ASSETS COMPOSED OF INVESTMENTS DECREASED. IN 2020, THE INCREASE IN LOANS AS A EPERCENTAGEarning Asset OF EARNINGMix ASSETS WAS DUE TO PPP LOANS. ���� 79% ��� 76% 73% 74% 72% 78% PERCENTAGE OF TOTAL EARNING ASSETS ���� 70% ��� ���� ���� ��� ���� ��� ���� (IN $BILLIONS) ���� ��� TOTAL EARNING ASSETS EARNING ASSETS TOTAL ���� ��� ���� 30% 28% 27% 21% 26% 24% ���� ��� ����� ����� ����� ����� ����� ��D��� INVESTMENTS LOANS INVESTMENTS % LOANS % ® 42 WORKING TOGETHER. BUILDING SUCCESS.

DEPOSIT GROWTH NASDAQ: PEBO TOTAL DEPOSIT BALANCES AT SEPTEMBER 30, 2020 INCREASED 20% COMPARED TO DECEMBER 31, 2019. DEPOSIT BALANCES BENEFITED FROMDeposit PPP LOAN Gro PROCEEDSwth AND FISCAL STIMULUS FOR CONSUMERS AND COMMERCIAL CLIENTS. $3,952 ����� BROKERED CERTIFICATES OF DEPOSIT GOVERNMENTAL DEPOSIT ACCOUNTS $3,291 ����� MONEY MARKET DEPOSIT ACCOUNTS $2,955 RETAIL CERTIFICATES OF DEPOSIT $2,730 SAVINGS ACCOUNTS ����� $2,536 $2,510 INTEREST-BEARING DDAS* NON-INTEREST-BEARING DDAS* ����� ($ MILLIONS) NOT TO SCALE TO NOT ($ MILLIONS) ����� 42% ���� DDAs ���� ����� ����� ����� ����� ����� ��D��� *DDAs stands for demand deposit accounts and represents interest-bearing and non-interest bearing transaction accounts. ® 43 WORKING TOGETHER. BUILDING SUCCESS.

Q3NASDAQ: PEBO & YTD 2020Q3 & YTD 2020 APPENDIX ® 44 WORKING TOGETHER. BUILDING SUCCESS.

APPENDIX NON-US GAAP MEASURES NASDAQ: PEBO PRE-PROVISION NET REVENUE Pre-provision net revenue (PPNR) has become a key financial measure used by federal bank regulatory agencies when assessing the capital adequacy of financial institutions. PPNR is defined as net interest income plus total non-interest income (excluding all gains and losses) minus total non-interest expense and, therefore, excludes the provision for loan losses and all gains and/or losses included in earnings. As a result, PPNR represents the earnings capacity that can be either retained in order to build capital or used to absorb unexpected losses and preserve existing capital. ($ in Thousands) FY-14 FY-15 FY-16 FY-17 FY-18 FY-19 YTD-20 Income before income taxes $ 24,178 $ 14,816 $ 45,282 $ 57,203 $ 54,941 $ 65,358 $ 17,810 Add: Provision for loan/credit losses 339 14,097 3,539 3,772 5,448 2,504 33,531 Add: Loss on debt extinguishment – – 707 – – – – Add: Loss on OREO 68 530 34 116 35 98 17 Add: Loss on securities – – 1 – 147 – – Add: Loss on other assets 430 696 427 – 469 692 258 Add: Loss on other transactions – 43 – – 76 – – Less: Gain on OREO – – – – 14 – 16 Less: Gains on securities 398 729 931 2,983 1 164 383 Less: Gains on other assets – – 35 28 76 8 – Less: Gains on other transactions 67 – – 25 168 – 22 Pre-provision net revenue $ 24,550 $ 29,453 $ 49,024 $ 58,055 $ 60,857 $ 68,480 $ 51,195 Average assets (in millions) $ 2,241 $ 3,112 $ 3,320 $ 3,510 $ 3,872 $ 4,222 $ 4,706 Pre-provision net revenue to average assets 1.10% 0.95% 1.48% 1.65% 1.57% 1.62% 1.45% (a) Presented on an annualized basis 45

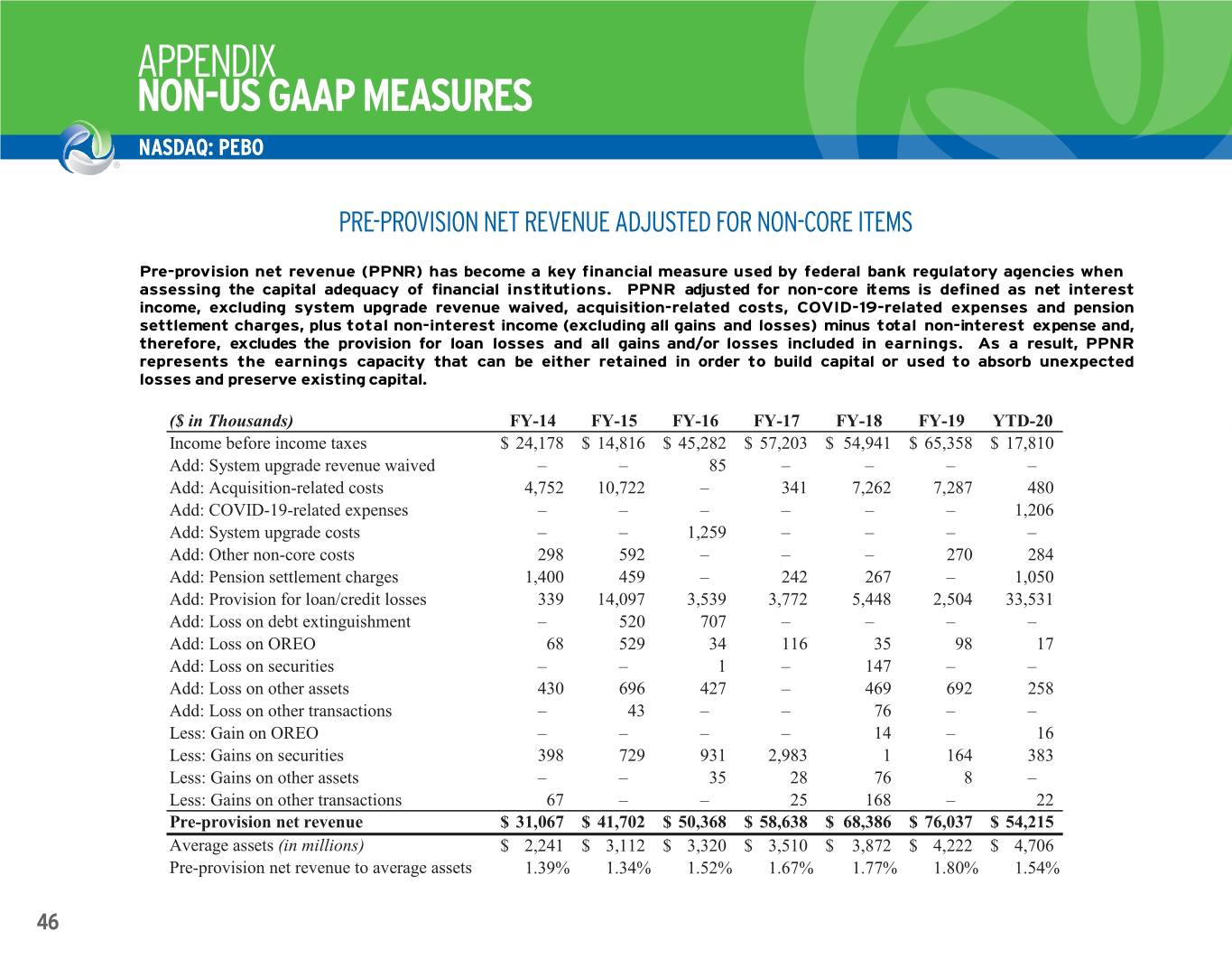

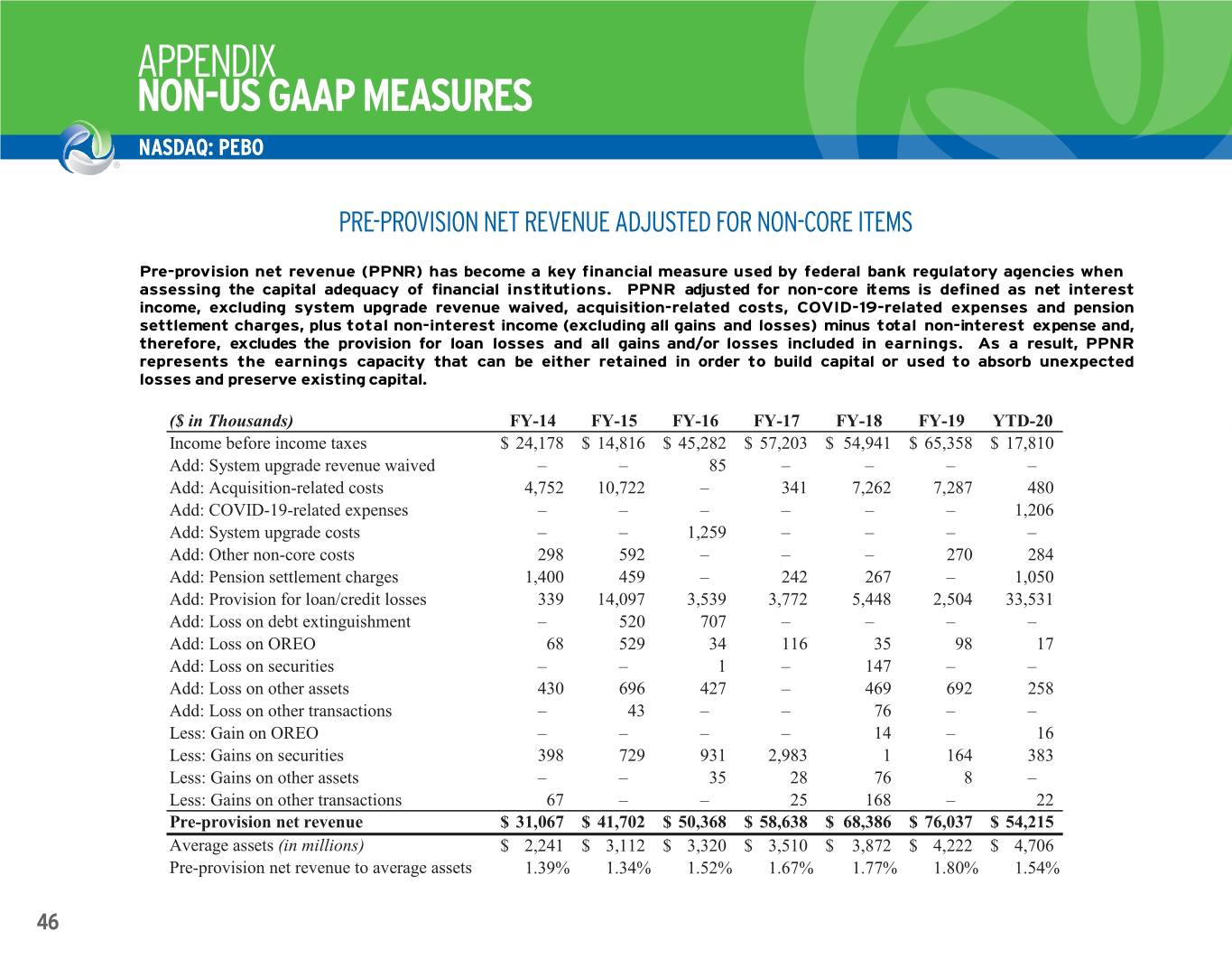

APPENDIX NON-US GAAP MEASURES NASDAQ: PEBO PRE-PROVISION NET REVENUE ADJUSTED FOR NON-CORE ITEMS PRE-PROVISION NET REVENUE ADJUSTED FOR NON-CORE ITEMS Pre-provision net revenue (PPNR) has become a key financial measure used by federal bank regulatory agencies when assessing the capital adequacy of financial institutions. PPNR adjusted for non-core items is defined as net interest income, excluding system upgrade revenue waived, acquisition-related costs, COVID-19-related expenses and pension settlement charges, plus total non-interest income (excluding all gains and losses) minus total non-interest expense and, therefore, excludes the provision for loan losses and all gains and/or losses included in earnings. As a result, PPNR represents the earnings capacity that can be either retained in order to build capital or used to absorb unexpected losses and preserve existing capital. ($ in Thousands) FY-14 FY-15 FY-16 FY-17 FY-18 FY-19 YTD-20 Income before income taxes $ 24,178 $ 14,816 $ 45,282 $ 57,203 $ 54,941 $ 65,358 $ 17,810 Add: System upgrade revenue waived – – 85 – – – – Add: Acquisition-related costs 4,752 10,722 – 341 7,262 7,287 480 Add: COVID-19-related expenses – – – – – – 1,206 Add: System upgrade costs – – 1,259 – – – – Add: Other non-core costs 298 592 – – – 270 284 Add: Pension settlement charges 1,400 459 – 242 267 – 1,050 Add: Provision for loan/credit losses 339 14,097 3,539 3,772 5,448 2,504 33,531 Add: Loss on debt extinguishment – 520 707 – – – – Add: Loss on OREO 68 529 34 116 35 98 17 Add: Loss on securities – – 1 – 147 – – Add: Loss on other assets 430 696 427 – 469 692 258 Add: Loss on other transactions – 43 – – 76 – – Less: Gain on OREO – – – – 14 – 16 Less: Gains on securities 398 729 931 2,983 1 164 383 Less: Gains on other assets – – 35 28 76 8 – Less: Gains on other transactions 67 – – 25 168 – 22 Pre-provision net revenue $ 31,067 $ 41,702 $ 50,368 $ 58,638 $ 68,386 $ 76,037 $ 54,215 Average assets (in millions) $ 2,241 $ 3,112 $ 3,320 $ 3,510 $ 3,872 $ 4,222 $ 4,706 (a)Pre-provision Presented on an annualizednet revenue basis to average assets 1.39% 1.34% 1.52% 1.67% 1.77% 1.80% 1.54% 46 C:\Users\NSlatter\AppData\Local\Temp\notesDE4CD4\Appendix for investor book Appendix 2

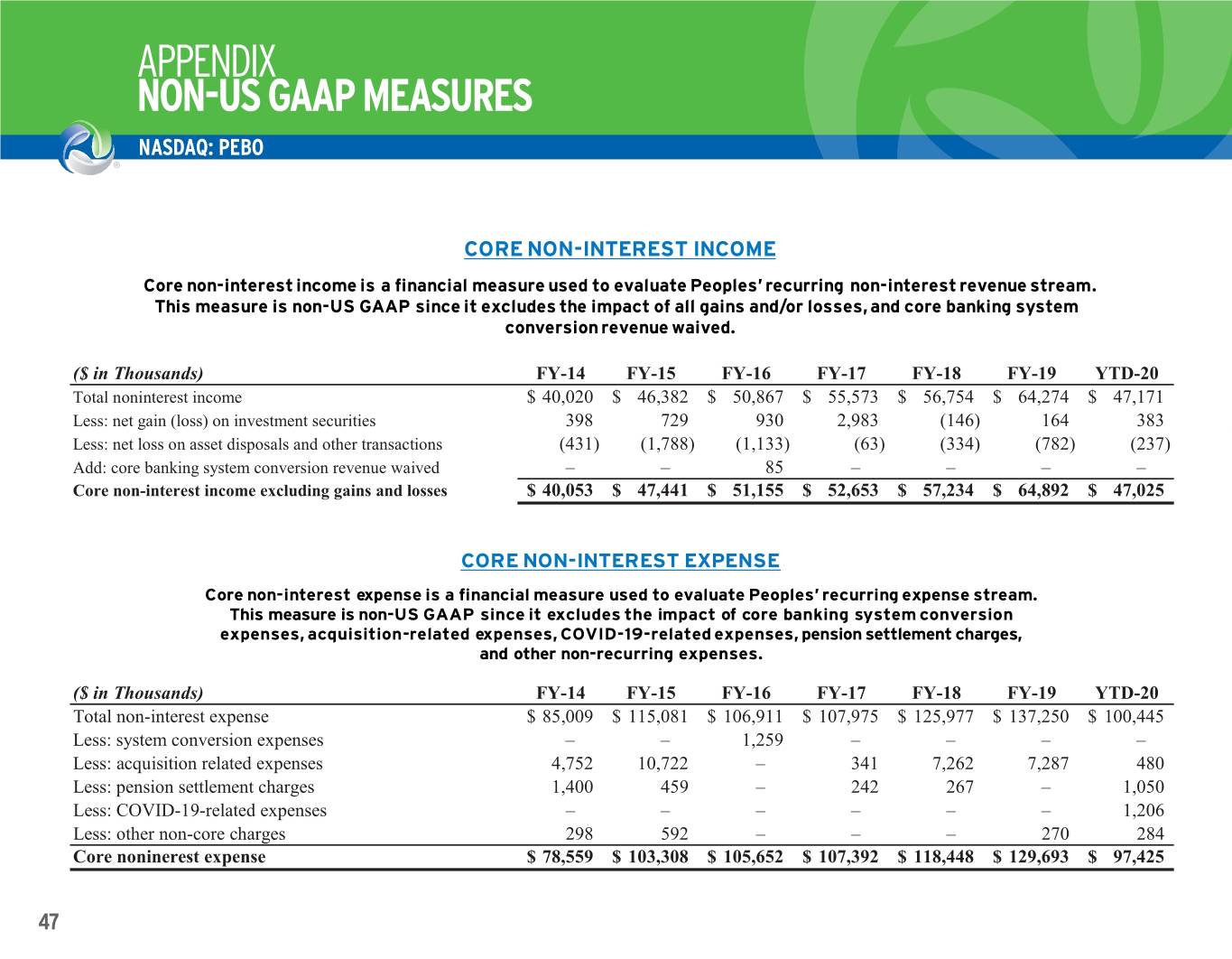

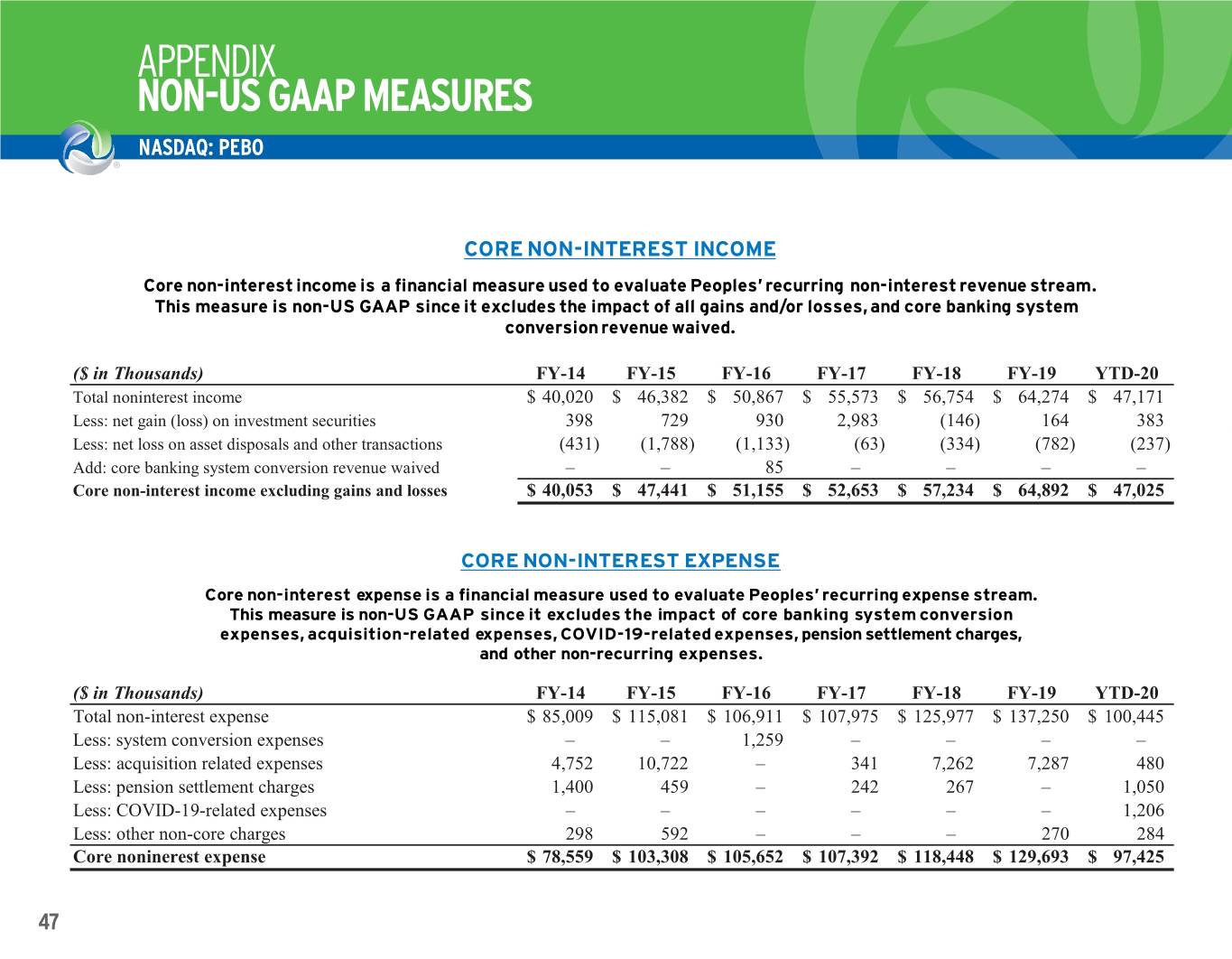

APPENDIX NON-US GAAP MEASURES NASDAQ: PEBO CORE NON-INTEREST INCOME Core non-interest income is a financial measure used to evaluate Peoples’ recurring non-interest revenue stream. This measure is non-US GAAP since it excludes the impact of all gains and/or losses, and core banking system CORE NON-INTEREST INCOME conversion revenue waived. Core non-interest income is a financial measure used to evaluate Peoples’ recurring non-interest revenue stream. ($ in Thousands) This measure is non-US GAAP since it excludesFY-14 the impactFY-15 of all gainsFY-16 and/or losses,FY-17 and core bankingFY-18 systemFY-19 YTD-20 conversion revenue waived. Total noninterest income $ 40,020 $ 46,382 $ 50,867 $ 55,573 $ 56,754 $ 64,274 $ 47,171 Less: net gain (loss) on investment securities 398 729 930 2,983 (146) 164 383 Less: net loss on asset disposals and other transactions (431) (1,788) (1,133) (63) (334) (782) (237) Add:($ in coreThousands) banking system conversion revenue waived FY-14 – FY-15 – FY-16 85 FY-17 – FY-18 – FY-19 – YTD-20 – CoreTotal noninterestnon-interest income income excluding gains and losses $ 40,02040,053 $ 47,44146,382 $ 51,15550,867 $ 52,65355,573 $ 57,23456,754 $ 64,89264,274 $ 47,02547,171 Less: net gain (loss) on investment securities 398 729 930 2,983 (146) 164 383 Less: net loss on asset disposals and other transactionsCORE NON (431) -INTEREST (1,788) EXP (1,133)ENSE (63) (334) (782) (237) Add: core bankingCore non system-interest conversion expense revenue waived is a financialCORE measureNON –-INTEREST used to – evaluateEXP ENSE 85Peoples’ recurring – expense – stream. – – Core non-interest income excluding gains and losses $ 40,053 $ 47,441 $ 51,155 $ 52,653 $ 57,234 $ 64,892 $ 47,025 ThisCore measure non-interest is non -UexpenseS GAAP is a financialsince it measureexcludes used the to impact evaluate of Peoples’ core banking recurring system expense conversion stream. ($ in Thousands)expenses,This acquisitionmeasure is non-r-UelatedS GAAP expenses, since itFY-14 e COVID-19-relatedxcludes theFY-15 impact oFY-16 expenses,f core bankingFY-17 pension system settlementFY-18 conversion charges,FY-19 YTD-20 Total non-interest expenseexpenses, acquisition-relatedand expenses, other$ 85,009 non COVID-19-related-recurring$ 115,081 expenses.$ expenses, 106,911 pension$ 107,975 settlement$ 125,977 charges,$ 137,250 $ 100,445 Less: system conversion expenses and other non – -recurring – expenses. 1,259 – – – – Less: acquisition related expenses 4,752 10,722 – 341 7,262 7,287 480 ($Less: in Thousands)pension settlement charges FY-14 1,400 FY-15 459 FY-16 – FY-17 242 FY-18 267 FY-19 – YTD-20 1,050 TotalLess: COVID-19-relatednon-interest expense expenses $ 85,009 – $ 115,081 – $ 106,911 – $ 107,975 – $ 125,977 – $ 137,250 – $ 100,445 1,206 Less: systemother non-core conversion charges expenses –298 –592 1,259 – – – –270 –284 Less:Core acquisitionnoninerest relatedexpense expenses $ 78,559 4,752 $ 103,308 10,722 $ 105,652 – $ 107,392 341 $ 118,448 7,262 $ 129,693 7,287 $ 97,425 480 Less: pension settlement charges 1,400 459 – 242 267 – 1,050 Less: COVID-19-related expenses – – – – – – 1,206 Less: other non-core charges 298 592 – – – 270 284 Core noninerest expense $ 78,559 $ 103,308 $ 105,652 $ 107,392 $ 118,448 $ 129,693 $ 97,425 47 C:\Users\NSlatter\AppData\Local\Temp\notesDE4CD4\Appendix for investor book Appendix 3 C:\Users\NSlatter\AppData\Local\Temp\notesDE4CD4\Appendix for investor book Appendix 3

APPENDIX NON-US GAAP MEASURES NASDAQ: PEBO EFFICIENCY RATIO The efficiency ratio is a key financial measure used to monitor performance. The efficiency ratio is calculated as total non-interest expense (less amo rtization of other intangible assets) as a percentage of fully tax-equivalent net interest income plus total non-interest income excluding all gains and all losses. This measure is non-US GAAP since it excludes amortization of other intangible assets, system upgrade revenue waived and all gains and/or losses included in earnings, and uses fully tax-equivalent net interest income. The efficiency ratio adjusted for non-core items is non-US GAAP since it excludes amortization of other intangible assets, non-core expenses and all gains and/or losses included in earnings, and uses fully tax-equivalent net interest income. ($ in Thousands) FY-14 FY-15 FY-16 FY-17 FY-18 FY-19 YTD-20 Total noninterest expense $ 85,009 $ 115,081 $ 106,911 $ 107,975 $ 125,977 $ 137,250 $ 100,445 Less: amortization on other intangible assets 1,428 4,077 4,030 3,516 3,338 3,359 2,314 Adjusted total non-interest expense 83,581 111,004 102,881 104,459 122,639 133,891 98,131 Total non-interest income excluding net gains and losses 40,053 47,441 51,155 52,653 57,234 64,892 47,025 Net interest income 69,506 97,612 104,865 113,377 129,612 140,838 104,615 Add: fully taxable equivalent adjustment 1,335 1,978 2,027 1,912 881 1,068 803 Net interest income on a fully taxable equivalent basis 70,841 99,590 106,892 115,289 130,493 141,906 105,418 Adjusted revenue $ 110,894 $ 147,031 $ 158,047 $ 167,942 $ 187,727 $ 206,798 $ 152,443 Efficiency ratio 75.37% 75.50% 65.10% 62.20% 65.33% 64.74% 64.37% Core non-interest expense $ 78,559 $ 103,308 $ 105,652 $ 107,392 $ 118,448 $ 129,693 $ 96,493 Less: amortization on other intangible assets 1,428 4,077 4,030 3,516 3,338 3,359 2,314 77,131 99,231 101,622 103,876 115,110 126,334 94,179 Core non-interest income excluding gains and losses 40,053 47,441 51,155 52,653 57,234 64,892 47,025 Net interest income on a fully taxable equivalent basis 70,841 99,590 106,892 115,289 130,493 141,906 105,418 Adjusted core revenue 110,894 147,031 158,047 167,942 187,727 206,798 152,443 Efficiency ratio adjusted for non-core items 69.55% 67.49% 64.30% 61.85% 61.32% 61.09% 61.78% 48 C:\Users\NSlatter\AppData\Local\Temp\notesDE4CD4\Appendix for investor book Appendix 4

APPENDIX NON-US GAAP MEASURES NASDAQ: PEBO TANGIBLE EQUITY TO TANGIBLE ASSETS AND TANGIBLE BOOK VALUE PER SHARE Peoples uses tangible capital measures to evaluate the adequacy of Peoples’ stockholders’ equity. Such ratios represent non-US GAAP financial measures since the calculation removes the impact of goodwill and other intangible assets acquired through acquisitions on both total stockholders' equity and total assets. Management believes this information is useful to investors since it facilitates the comparison of Peoples’ operating performance, financial condition and trends to peers, especially those without a level of intangible assets similar to that of Peoples. The following table reconciles the calculation of these non-US GAAP financial measures to amounts reported in Peoples’ consolidated financial statements. ($ in Thousands) FY-14 FY-15 FY-16 FY-17 FY-18 FY-19 YTD-20 Tangible equity Total stockholders equity $ 340,118 $ 419,789 $ 435,261 $ 458,592 $ 520,140 $ 594,393 $ 566,856 Less: goodwill and other intangible assets 109,158 149,617 146,018 144,576 162,085 177,503 185,397 Tangible equity 230,960 270,172 289,243 314,016 358,055 416,890 381,459 Tangible assets Total assets $ 2,567,769 $ 3,258,970 $ 3,432,348 $ 3,581,686 $ 3,991,454 $ 4,354,165 $ 4,911,807 Less: goodwill and other intangible assets 109,158 149,617 146,018 144,576 162,085 177,503 185,397 Tangible assets 2,458,611 3,109,353 3,286,330 3,437,110 3,829,369 4,176,662 4,726,410 Tangible equity to tangible assets 9.39% 8.69% 8.80% 9.14% 9.35% 9.98% 8.07% Tangible book value per share Tangible equity $ 230,960 $ 270,172 $ 289,243 $ 314,016 $ 358,055 $ 416,890 $ 381,459 Common shares outstanding 14,836,727 18,404,864 18,200,067 18,287,449 19,565,029 20,698,941 19,721,783 Tangible book value per share $ 15.57 $ 14.68 $ 15.89 $ 17.17 $ 18.30 $ 20.14 $ 19.34 49

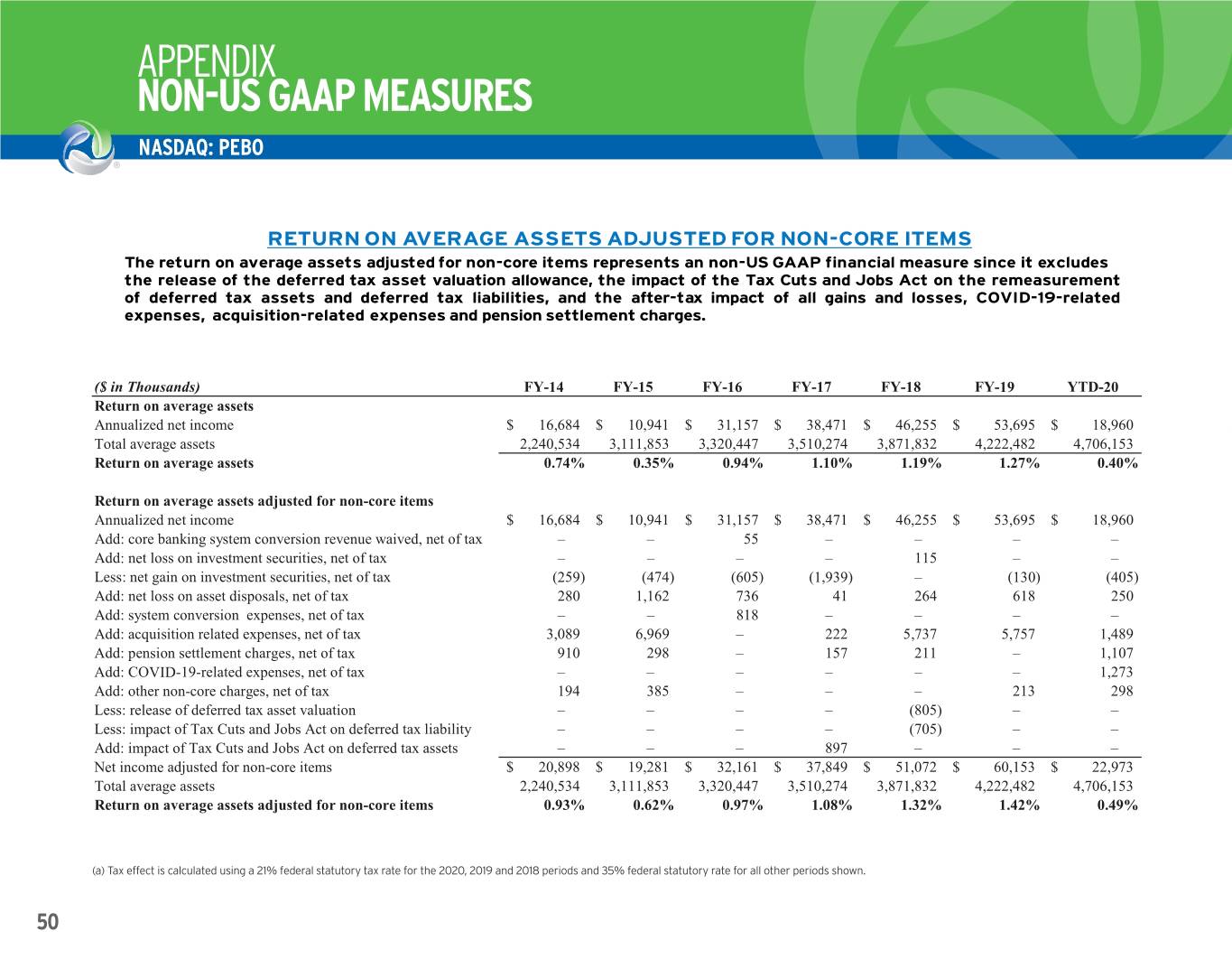

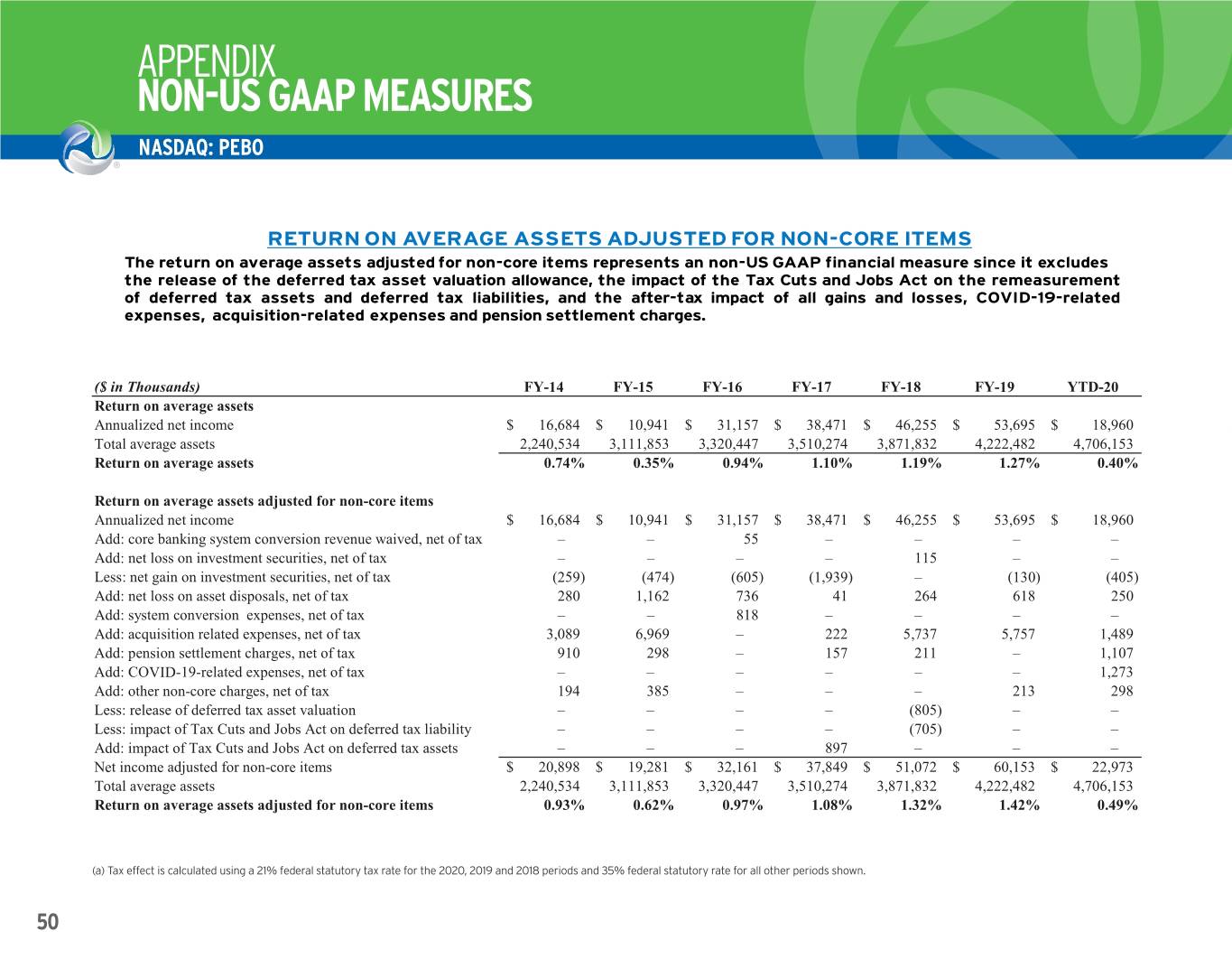

APPENDIX NON-US GAAP MEASURES NASDAQ: PEBO RETURN ON AVERAGE ASSETS ADJUSTED FOR NON-CORE ITEMS The return on average assets adjusted for non-core items represents an non-US GAAP financial measure since it excludes the release of the deferred tax asset valuation allowance, the impact of the Tax Cuts and Jobs Act on the remeasurement of deferred tax assets and deferred tax liabilities, and the after-tax impact of all gains and losses, COVID-19-related expenses, acquisition-related expenses and pension settlement charges. ($ in Thousands) FY-14 FY-15 FY-16 FY-17 FY-18 FY-19 YTD-20 Return on average assets Annualized net income $ 16,684 $ 10,941 $ 31,157 $ 38,471 $ 46,255 $ 53,695 $ 18,960 Total average assets 2,240,534 3,111,853 3,320,447 3,510,274 3,871,832 4,222,482 4,706,153 Return on average assets 0.74% 0.35% 0.94% 1.10% 1.19% 1.27% 0.40% Return on average assets adjusted for non-core items Annualized net income $ 16,684 $ 10,941 $ 31,157 $ 38,471 $ 46,255 $ 53,695 $ 18,960 Add: core banking system conversion revenue waived, net of tax – – 55 – – – – Add: net loss on investment securities, net of tax – – – – 115 – – Less: net gain on investment securities, net of tax (259) (474) (605) (1,939) – (130) (405) Add: net loss on asset disposals, net of tax 280 1,162 736 41 264 618 250 Add: system conversion expenses, net of tax – – 818 – – – – Add: acquisition related expenses, net of tax 3,089 6,969 – 222 5,737 5,757 1,489 Add: pension settlement charges, net of tax 910 298 – 157 211 – 1,107 Add: COVID-19-related expenses, net of tax – – – – – – 1,273 Add: other non-core charges, net of tax 194 385 – – – 213 298 Less: release of deferred tax asset valuation – – – – (805) – – Less: impact of Tax Cuts and Jobs Act on deferred tax liability – – – – (705) – – Add: impact of Tax Cuts and Jobs Act on deferred tax assets – – – 897 – – – Net income adjusted for non-core items $ 20,898 $ 19,281 $ 32,161 $ 37,849 $ 51,072 $ 60,153 $ 22,973 Total average assets 2,240,534 3,111,853 3,320,447 3,510,274 3,871,832 4,222,482 4,706,153 Return on ave(a)rage Tax effectasse ists calculated adjusted using fo ar 21% no n-corefederal statutory itemstax 0.93% 0.62% 0.97% 1.08% 1.32% 1.42% 0.49% rate for the 2018 periods and 35% for the 2017 period. (a) Tax effect is calculated using a 21% federal statutory tax rate for the 2020, 2019 and 2018 periods and 35% federal statutory rate for all other periods shown. 50

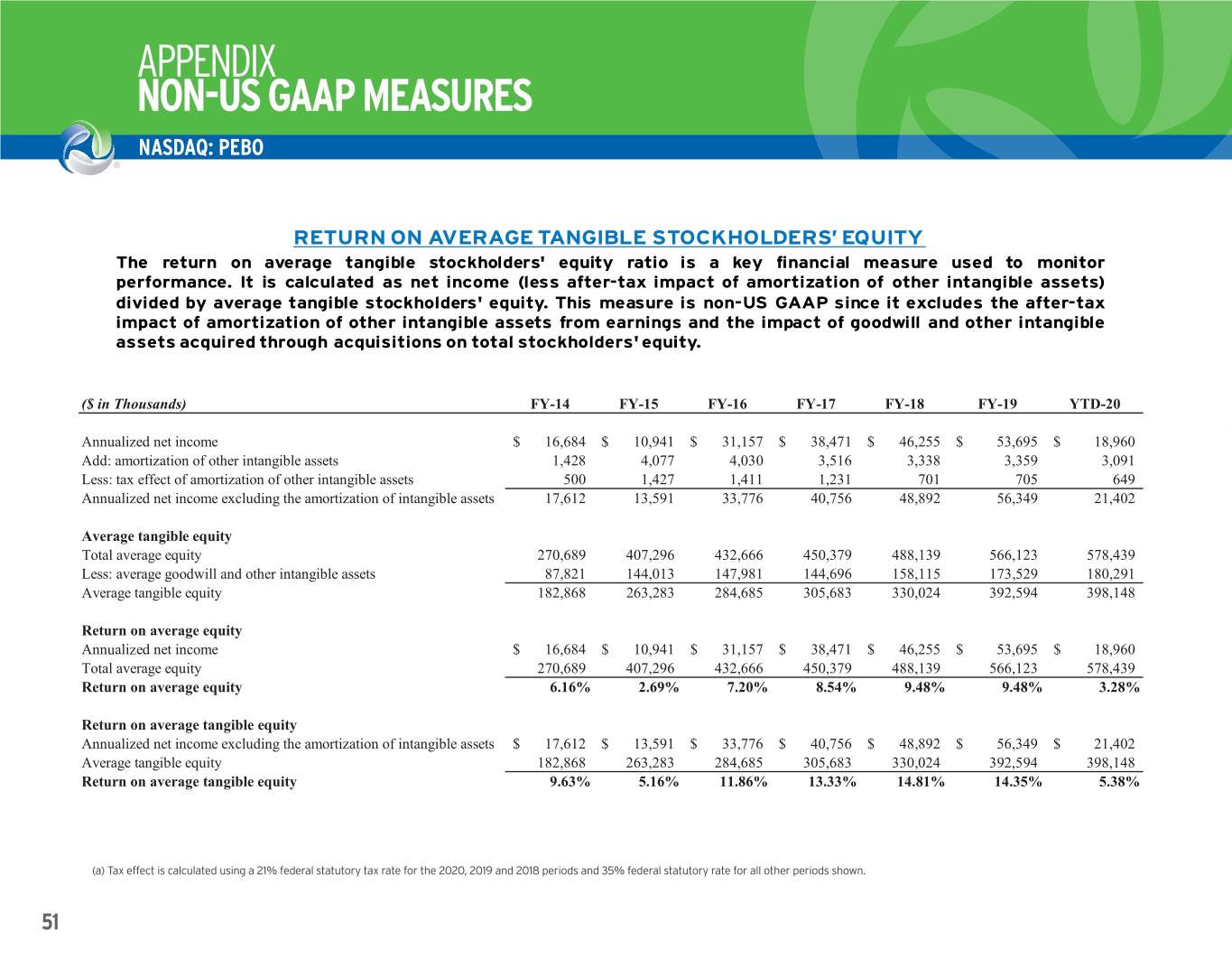

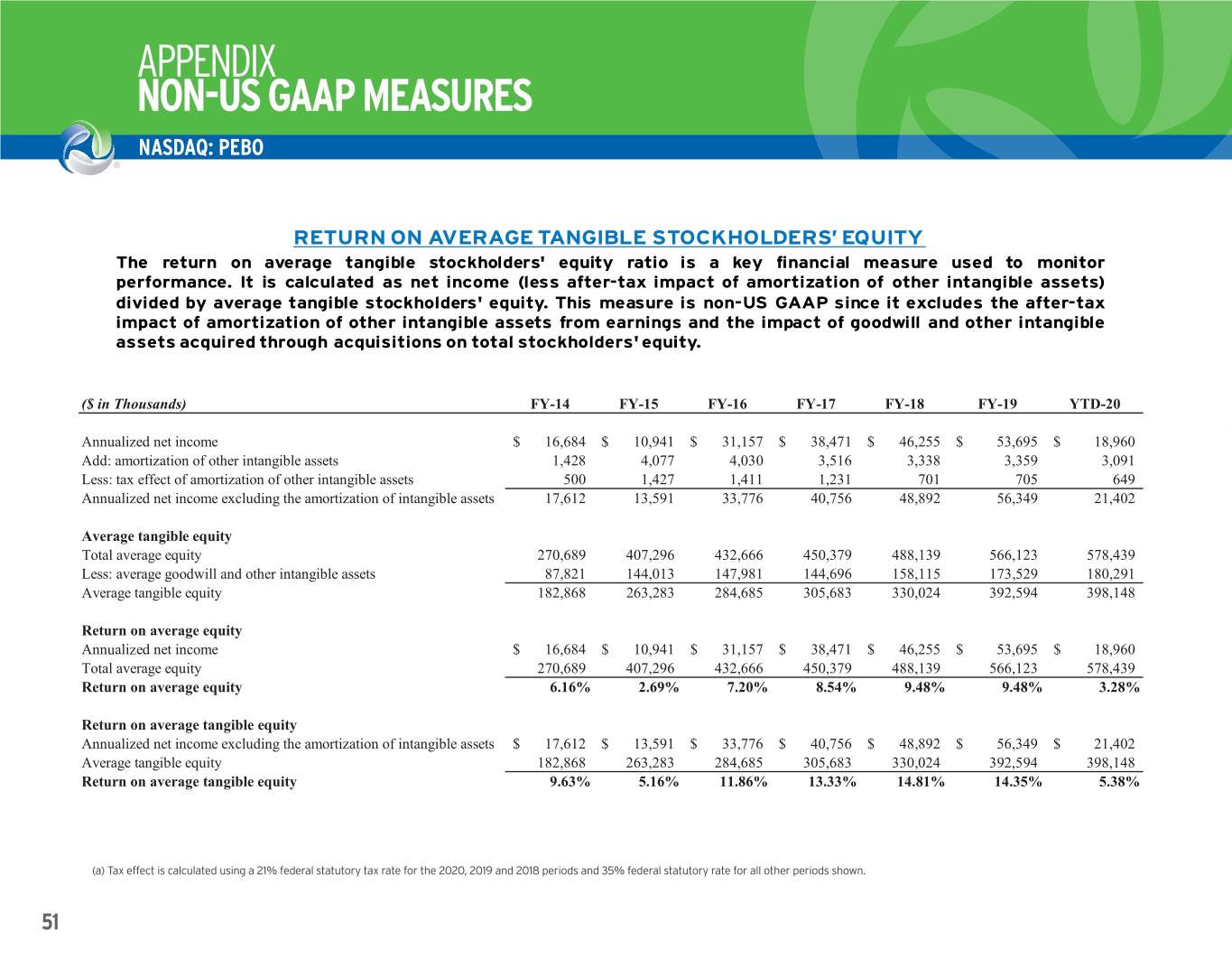

APPENDIX NON-US GAAP MEASURES NASDAQ: PEBO RETURN ON AVERAGE TANGIBLE STOCKHOLDERS’ EQUITY The return on average tangible stockholders' equity ratio is a key financial measure used to monitor performance. It is calculated as net income (less after-tax impact of amortization of other intangible assets) divided by average tangible stockholders' equity. This measure is non-US GAAP since it excludes the after-tax impact of amortization of other intangible assets from earnings and the impact of goodwill and other intangible assets acquired through acquisitions on total stockholders'equity. ($ in Thousands) FY-14 FY-15 FY-16 FY-17 FY-18 FY-19 YTD-20 Annualized net income $ 16,684 $ 10,941 $ 31,157 $ 38,471 $ 46,255 $ 53,695 $ 18,960 Add: amortization of other intangible assets 1,428 4,077 4,030 3,516 3,338 3,359 3,091 Less: tax effect of amortization of other intangible assets 500 1,427 1,411 1,231 701 705 649 Annualized net income excluding the amortization of intangible assets 17,612 13,591 33,776 40,756 48,892 56,349 21,402 Average tangible equity Total average equity 270,689 407,296 432,666 450,379 488,139 566,123 578,439 Less: average goodwill and other intangible assets 87,821 144,013 147,981 144,696 158,115 173,529 180,291 Average tangible equity 182,868 263,283 284,685 305,683 330,024 392,594 398,148 Return on average equity Annualized net income $ 16,684 $ 10,941 $ 31,157 $ 38,471 $ 46,255 $ 53,695 $ 18,960 Total average equity 270,689 407,296 432,666 450,379 488,139 566,123 578,439 Return on average equity 6.16% 2.69% 7.20% 8.54% 9.48% 9.48% 3.28% Return on average tangible equity Annualized net income excluding the amortization of intangible assets $ 17,612 $ 13,591 $ 33,776 $ 40,756 $ 48,892 $ 56,349 $ 21,402 Average tangible equity 182,868 263,283 284,685 305,683 330,024 392,594 398,148 Return on average tangible equity 9.63% 5.16% 11.86% 13.33% 14.81% 14.35% 5.38% ($ in Thousands)(a) T ax effect is calculated using a 21% federal statutory tax rate for the 2019 and 2018 periodsFY-14, and a 35% federalFY-15 statutory tax rateFY-16 for all other periodsFY-17 shown. FY-18 FY-19 YTD-20 Return on average equity adjusted for non-core items Annualized net income $ 16,684 $ 10,941 $ 31,157 $ 38,471 $ 46,255 $ 53,695 $ 18,960 Add(a) :Tax core effect banking is calculated system using conversion a 21% federal re statutoryvenue w taxaived, rate fornet the of 2020, tax 2019 and 2018 periods – and 35% federal – statutory rate for 55 all other periods – shown. – – – Add: net loss on investment securities, net of tax – – – – 115 – – 51 Less: net gain on investment securities, net of tax (259) (474) (605) (1,939) – 130 (405) Add: net loss on asset disposals, net of tax 280 1,162 736 41 264 618 250 Add: system conversion expenses, net of tax – – 818 – – – – Add: acquisition related expenses, net of tax 3,089 6,969 – 222 5,737 5,757 434 Add: pension settlement charges, net of tax 910 298 – 157 211 – 1,107 Add: COVID-19-related expenses – – – – – – 1,273 Add: other non-core charges, net of tax 194 385 – – – 213 298 Less: release of deferred tax asset valuation – – – – (805) – – Less: impact of Tax Cuts and Jobs Act on deferred tax liability – – – – (705) – – Add: impact of Tax Cuts and Jobs Act on deferred tax assets – – – 897 – – – Net income adjusted for non-core items $ 20,898 $ 19,281 $ 32,161 $ 37,849 $ 51,072 $ 60,413 $ 21,917 Average tangible equity 270,689 407,296 432,666 450,379 488,139 566,123 578,439 Return on average equity adjusted for non-core items 7.72% 4.73% 7.43% 8.40% 10.46% 10.67% 3.79% Return on average tangible equity adjusted for non-core items Net income adjusted for non-core items $ 20,898 $ 19,281 $ 32,161 $ 37,849 $ 51,072 $ 60,413 $ 21,917 Average tangible equity 182,868 263,283 284,685 305,683 330,024 392,594 398,148 Return on average tangible equity adjusted for non-core items 11.43% 7.32% 11.30% 12.38% 15.48% 15.39% 5.50% C:\Users\NSlatter\AppData\Local\Temp\notesDE4CD4\Spreadsheet data for investor deck Q3.2020 Appendix 7

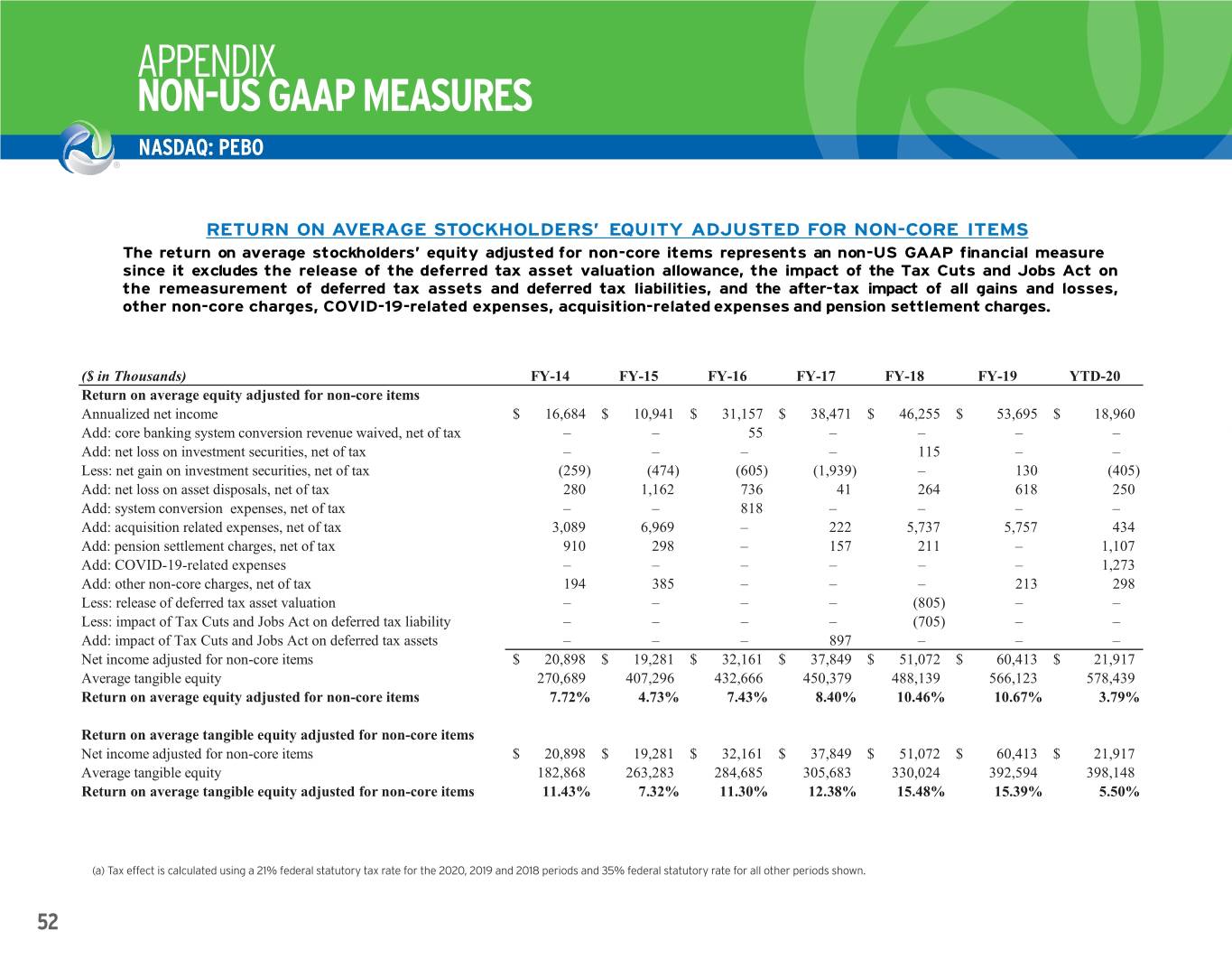

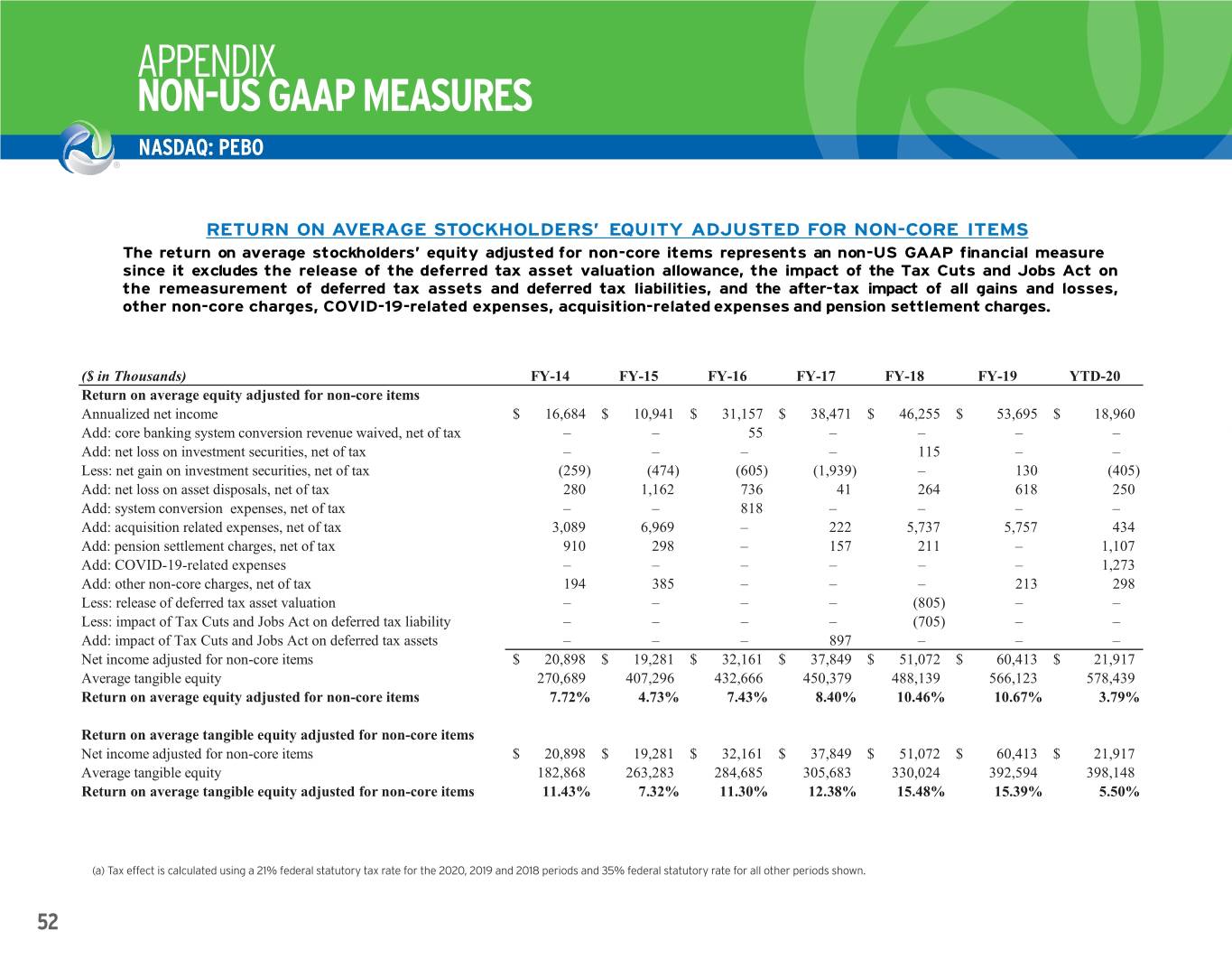

($ in Thousands) FY-14 FY-15 FY-16 FY-17 FY-18 FY-19 YTD-20 Annualized net income $ 16,684 $ 10,941 $ 31,157 $ 38,471 $ 46,255 $ 53,695 $ 18,960 Add: amortization of other intangible assets 1,428 4,077 4,030 3,516 3,338 3,359 3,091 Less: tax effect of amortization of other intangible assets 500 1,427 1,411 1,231 701 705 649 AnnualizedAPPENDIX net income excluding the amortization of intangible assets 17,612 13,591 33,776 40,756 48,892 56,349 21,402 Average tangible equity Total averageNON-US equity GAAP MEASURES 270,689 407,296 432,666 450,379 488,139 566,123 578,439 Less: average goodwill and other intangible assets 87,821 144,013 147,981 144,696 158,115 173,529 180,291 Average tangibleNASDAQ: equity PEBO 182,868 263,283 284,685 305,683 330,024 392,594 398,148 Return on average equity Annualized net income $ 16,684 $ 10,941 $ 31,157 $ 38,471 $ 46,255 $ 53,695 $ 18,960 Total average equity RETURN ON AVERAGE STOCKHOLDERS’ 270,689 EQUITY 407,296 ADJUSTED 432,666 450,379FOR NON 488,139-CORE ITEMS 566,123 578,439 Return on average equity 6.16% 2.69% 7.20% 8.54% 9.48% 9.48% 3.28% The return on average stockholders’ equity adjusted for non-core items represents an non-US GAAP financial measure since it excludes the release of the deferred tax asset valuation allowance, the impact of the Tax Cuts and Jobs Act on Returnthe on average remeasurement tangible equity of deferred tax assets and deferred tax liabilities, and the after-tax impact of all gains and losses, Annualizedother net non-coreincome excluding charges, the amortization COVID-19-related of intangible assets expenses,$ 17,612 acquisition$ 13,591-related$ expenses 33,776 $ and 40,756 pension$ settlement 48,892 $ charges 56,349 . $ 21,402 Average tangible equity 182,868 263,283 284,685 305,683 330,024 392,594 398,148 Return on average tangible equity 9.63% 5.16% 11.86% 13.33% 14.81% 14.35% 5.38% ($ in Thousands) FY-14 FY-15 FY-16 FY-17 FY-18 FY-19 YTD-20 Return on average equity adjusted for non-core items Annualized net income $ 16,684 $ 10,941 $ 31,157 $ 38,471 $ 46,255 $ 53,695 $ 18,960 Add: core banking system conversion revenue waived, net of tax – – 55 – – – – Add: net loss on investment securities, net of tax – – – – 115 – – Less: net gain on investment securities, net of tax (259) (474) (605) (1,939) – 130 (405) Add: net loss on asset disposals, net of tax 280 1,162 736 41 264 618 250 Add: system conversion expenses, net of tax – – 818 – – – – Add: acquisition related expenses, net of tax 3,089 6,969 – 222 5,737 5,757 434 Add: pension settlement charges, net of tax 910 298 – 157 211 – 1,107 Add: COVID-19-related expenses – – – – – – 1,273 Add: other non-core charges, net of tax 194 385 – – – 213 298 Less: release of deferred tax asset valuation – – – – (805) – – Less: impact of Tax Cuts and Jobs Act on deferred tax liability – – – – (705) – – Add: impact of Tax Cuts and Jobs Act on deferred tax assets – – – 897 – – – Net income adjusted for non-core items $ 20,898 $ 19,281 $ 32,161 $ 37,849 $ 51,072 $ 60,413 $ 21,917 Average tangible equity 270,689 407,296 432,666 450,379 488,139 566,123 578,439 Return on average equity adjusted for non-core items 7.72% 4.73% 7.43% 8.40% 10.46% 10.67% 3.79% Return on average tangible equity adjusted for non-core items Net income adjusted for non-core items $ 20,898 $ 19,281 $ 32,161 $ 37,849 $ 51,072 $ 60,413 $ 21,917 Average tangible equity 182,868 263,283 284,685 305,683 330,024 392,594 398,148 Return on average tangible equity adjusted for non-core items 11.43% 7.32% 11.30% 12.38% 15.48% 15.39% 5.50% (a) Tax effect is calculated using a 21% federal statutory tax rate for the 2019and 2018 periods and 35% for the 2017 period. C:\Users\NSlatter\AppData\Local\Temp\notesDE4CD4\Spreadsheet data for investor deck Q3.2020 Appendix 7 (a) Tax effect is calculated using a 21% federal statutory tax rate for the 2020, 2019 and 2018 periods and 35% federal statutory rate for all other periods shown. 52

NASDAQ: PEBO CHUCK SULERZYSKI President and Chief Executive Officer P: 740.374.6163 Chuck.Sulerzyski@pebo.com KATIE BAILEY Executive Vice President Chief Financial Officer and Treasurer P: 740.376.7138 Kathryn.Bailey@pebo.com Peoples Bancorp® is a federally registered service mark of Peoples Bancorp Inc. The three arched ribbons logo and Working Together. Building Success.® are federally registered services marks of Peoples Bank. peoplesbancorp.com ® 53531 WORKING TOGETHER. BUILDING SUCCESS.