Exhibit

Peoples Bancorp Inc. [PEBO]

Fourth-Quarter 2016 Earnings Conference Call

Friday, January 27, 2017, 10:00 AM ET

Company Representatives:

Chuck Sulerzyski; President & CEO

John Rogers; EVP, CFO & Treasurer

Analysts:

Scott Siefers; Sandler O'Neill + Partners

Kevin Fitzsimmons; Hovde Group

Michael Perito; Keefe, Bruyette & Woods

Daniel Cardenas; Raymond James & Associates

Presentation

Operator: Good morning, and welcome to Peoples Bancorp conference call. My name is Daniel and I will be your conference facilitator today. Today's call will cover a discussion of the results of operations for the quarter and fiscal year ended December 31, 2016.

(Operator Instructions)

This call is also being recorded. If you object to the recording, please disconnect at this time.

Please be advised that the commentary in this call will contain projections or other forward-looking statements regarding Peoples' future financial performance or future events. These statements are based on Management's current expectations. The statements in this call which are not historical fact are forward-looking statements and involve a number of risks and uncertainties detailed in Peoples' Securities and Exchange Commission filings.

These include, but are not limited to, Peoples' ability to leverage the system upgrade without complications or difficulties; the success, impact and timing of the implementation of Peoples' business strategies, including the system upgrade; the successful integration of acquisitions; and the expansion of consumer lending activity; the competitive nature of the financial services industry; changes in the interest rate environment; uncertainty regarding the nature, timing, and effect of federal and/or state banking, insurance and tax regulations; and changes in economic conditions and/or activities.

Management believes the forward-looking statements made during this call are based on reasonable assumptions within the bounds of their knowledge of Peoples' business and operation. However, it is possible actual results may differ materially from these forward-looking statements.

Peoples disclaims any responsibility to update these forward-looking statements after this call except as may be required by applicable legal requirements. Peoples' fourth-quarter 2016 earnings release was issued this morning and is available at peoplesbancorp.com under the Investor Relations tab.

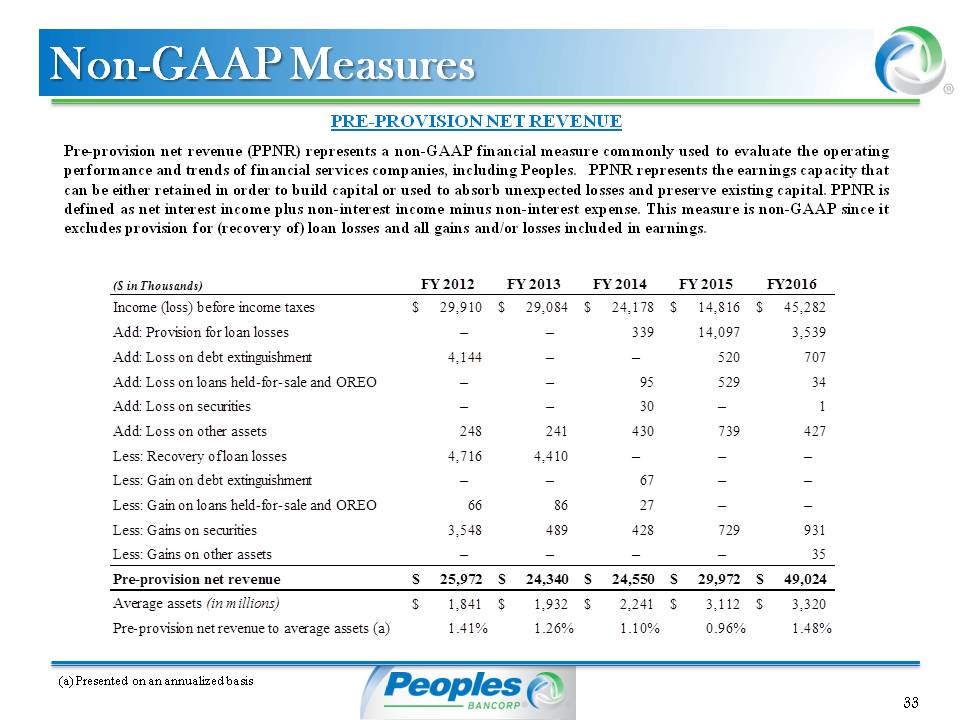

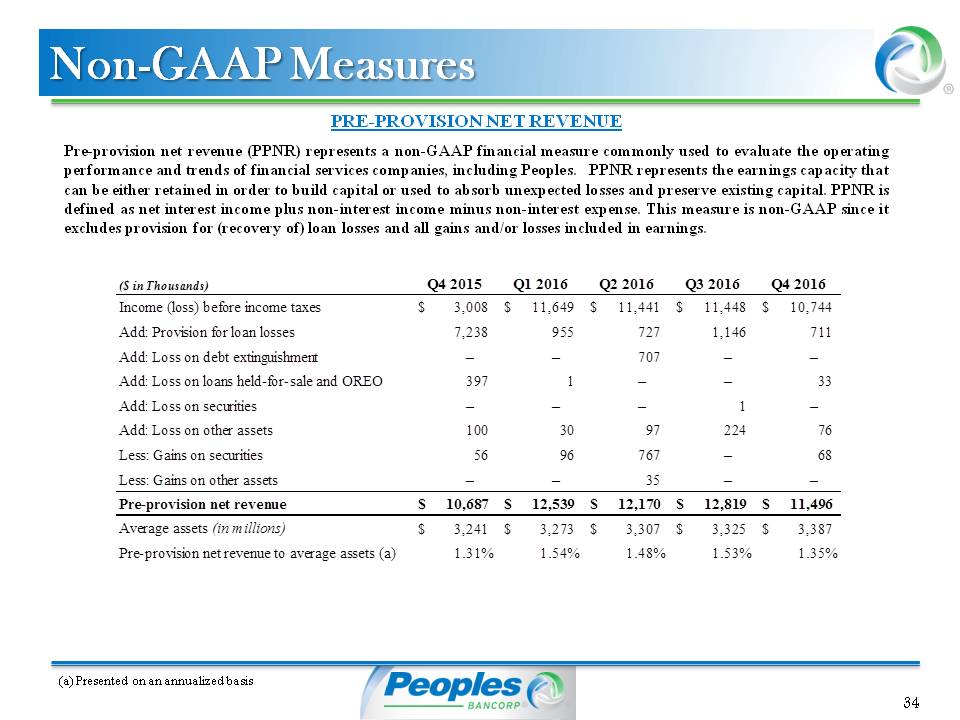

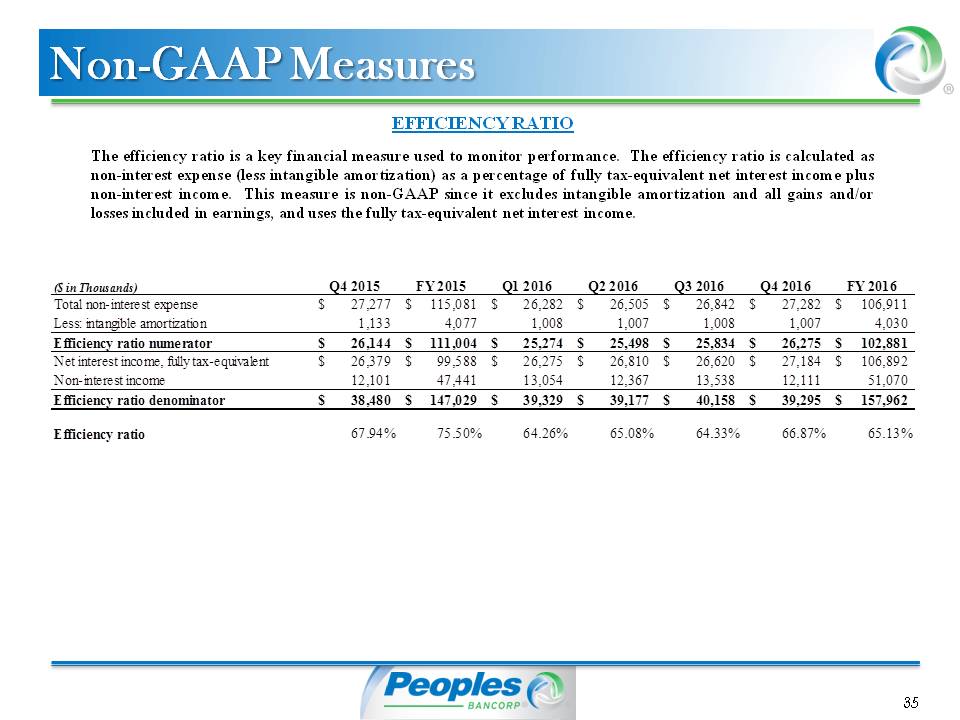

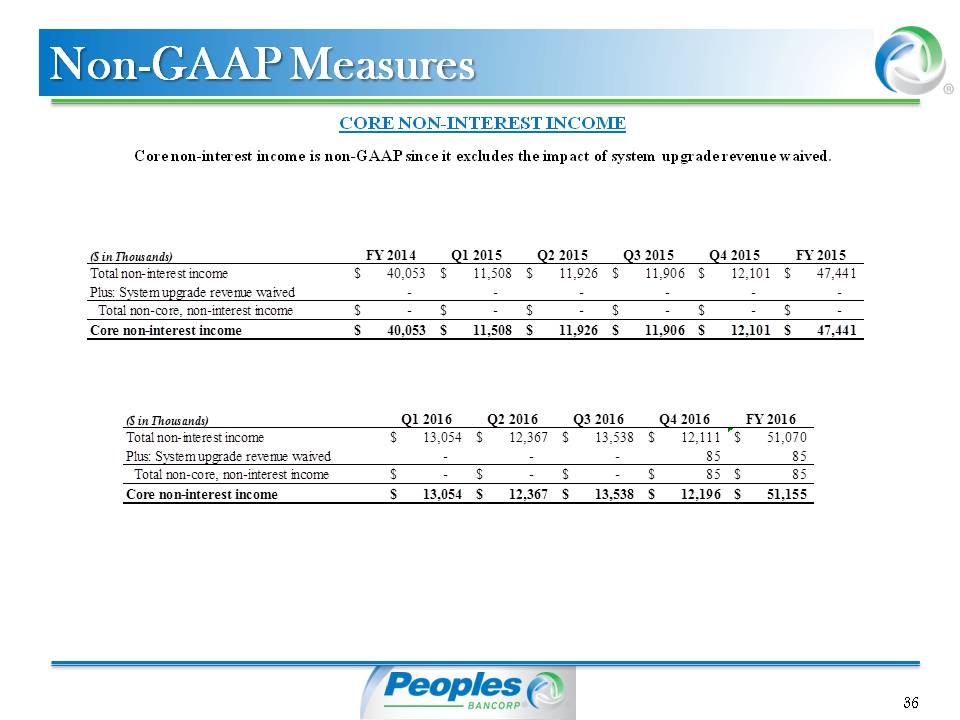

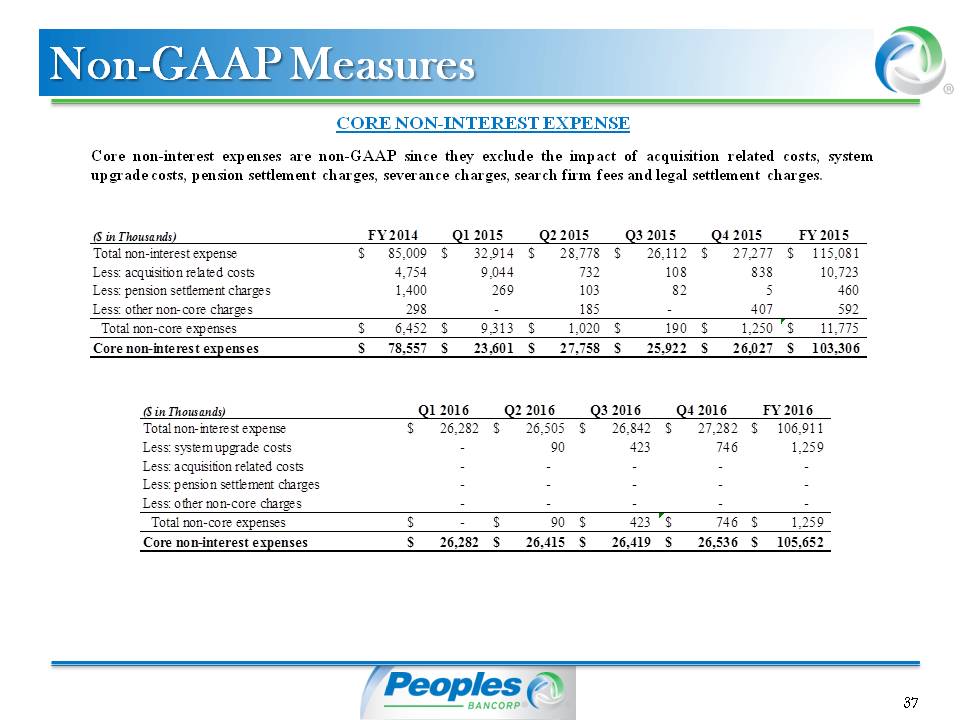

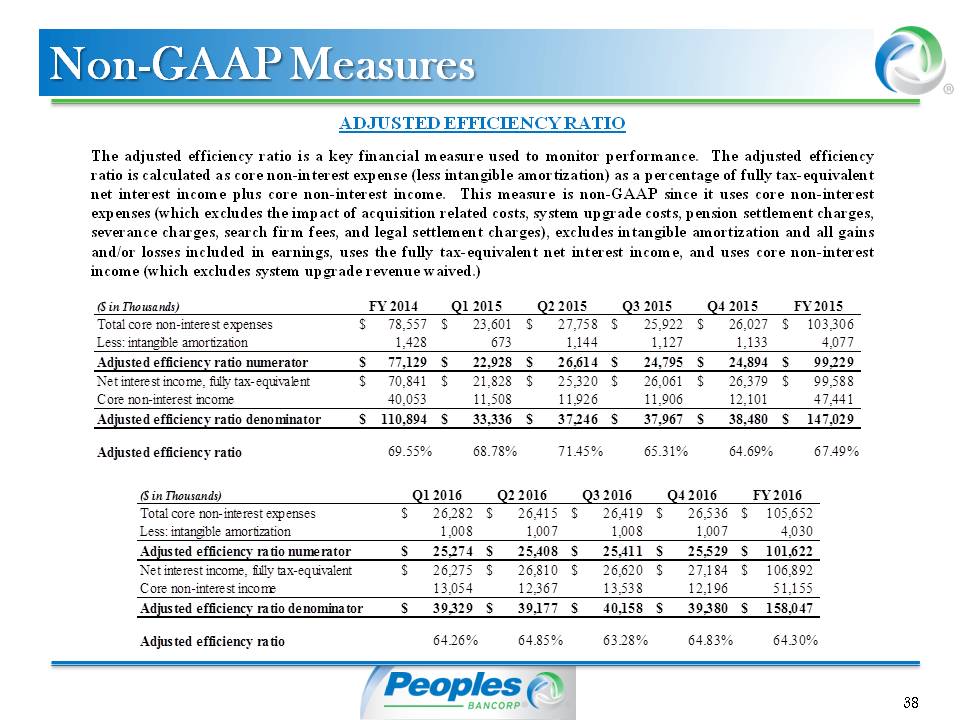

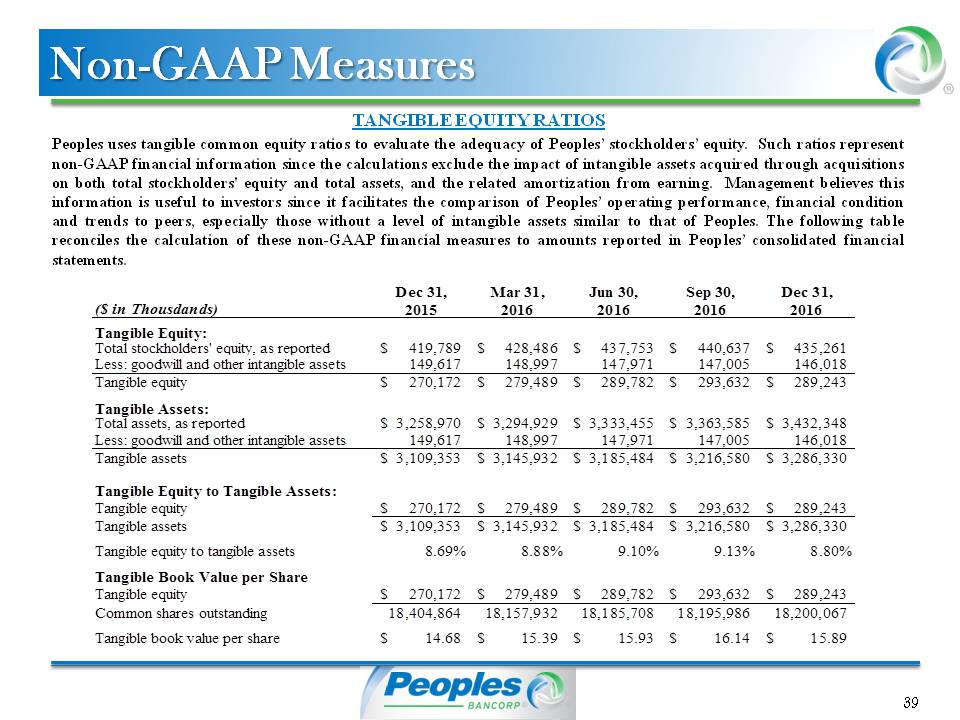

A reconciliation of the non-GAAP financial measures discussed during this call to the most directly comparable GAAP financial measures is included at the end of the earnings release.

This call will include about 15 to 20 minutes of prepared commentary followed by a question-and-answer period, which I will facilitate. An archived webcast of this call will be available on peoplesbancorp.com in the Investor Relations section for one year.

Participants in today's call will be Chuck Sulerzyski, President and Chief Executive Officer, and John Rogers, Chief Financial Officer and Treasurer, and each will be available for questions following opening statements. Mr. Sulerzyski, you may please begin your conference.

Chuck Sulerzyski:

Thank you, Daniel. Good morning and thanks for joining us for a review of our fourth-quarter and full-year 2016 results.

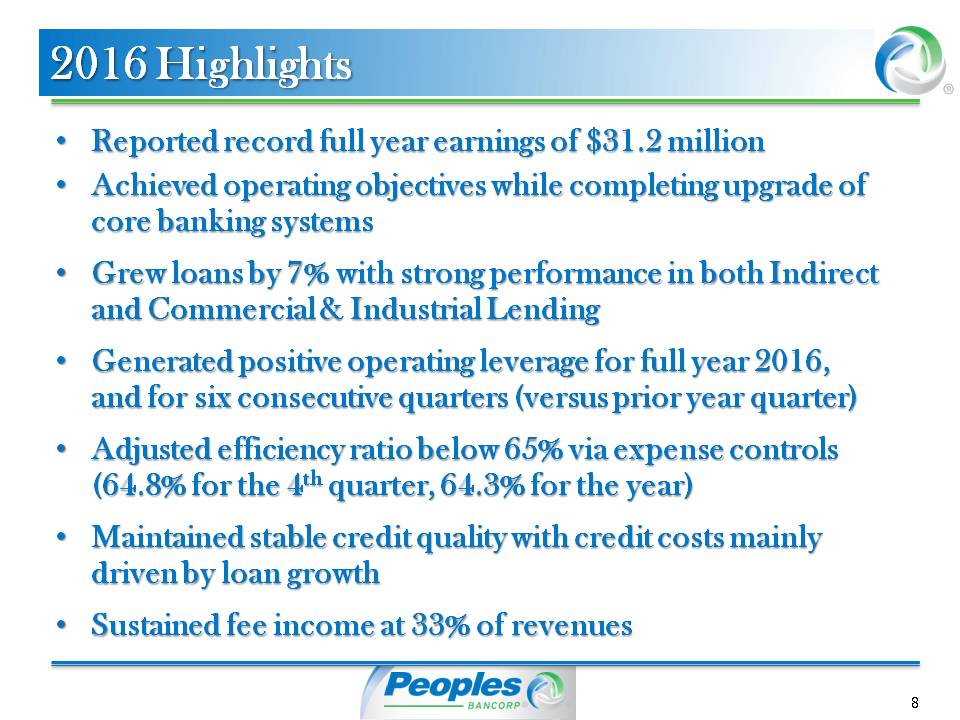

Earlier this morning we released our fourth-quarter 2016 results and our quarterly dividend, which we were pleased to increase to $0.20 per share. During the quarter we completed the planned system upgrade of our core banking system. As anticipated, the quarter was impacted by one-time system upgrade items which were in line with our previous projections. The majority of the impact was in non-interest expense. However, we did waive some account services charges in November which impacted non-interest income. We believe substantially all of the associated one-time costs have been recorded and any upgrade cost in the future periods should be minimal.

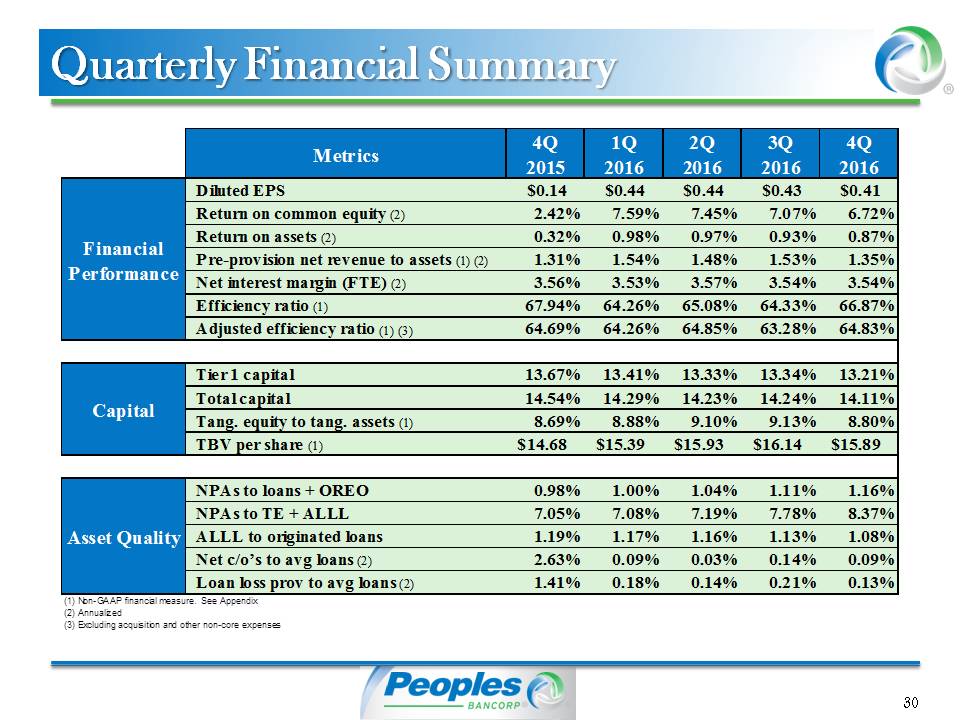

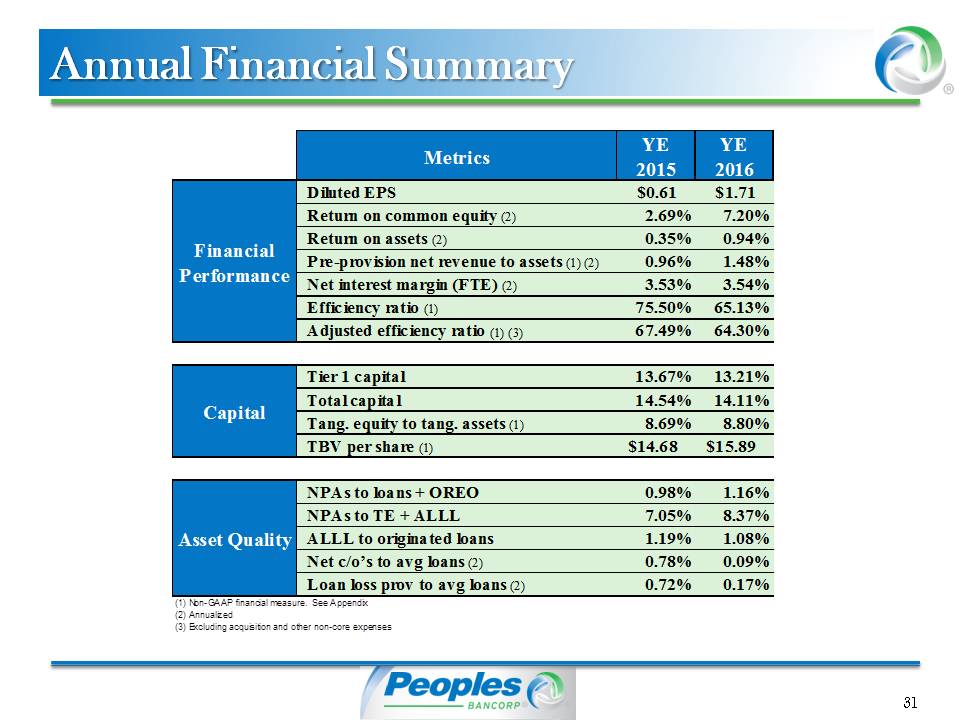

Net income for the fourth quarter of 2016 was $0.41 per diluted share compared to $0.43 per diluted share in the third quarter. The decrease was largely due to one-time system upgrade costs, coupled with a decline in non-interest income. System upgrade impacts for the quarter totaled $831,000 and $1.3 million for 2016, and were up $408,000 from the prior quarter. For the full year of 2016, net income was $1.71 per diluted share compared to $0.61 per diluted share during 2015. Net income per diluted share adjusted for non-core items was $0.44 for the fourth quarter of 2016 compared to $0.45 for the third quarter of 2016 and $0.18 for the fourth quarter of 2015. For the full year of 2016 net income per diluted share adjusted for non-core items was $1.76 in 2016 compared to $1.04 in 2015.

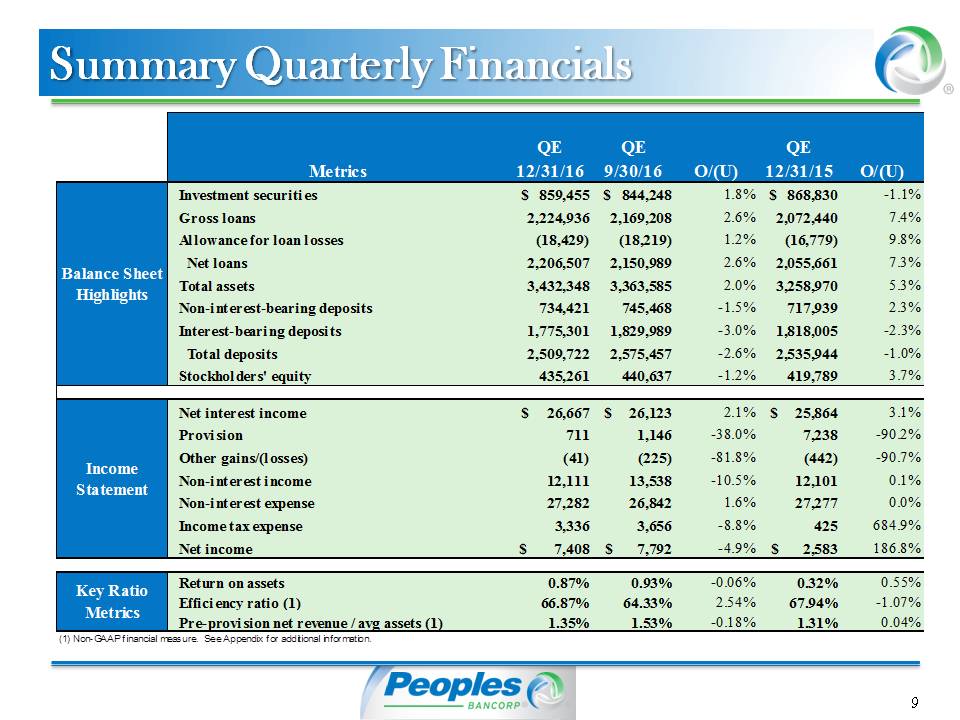

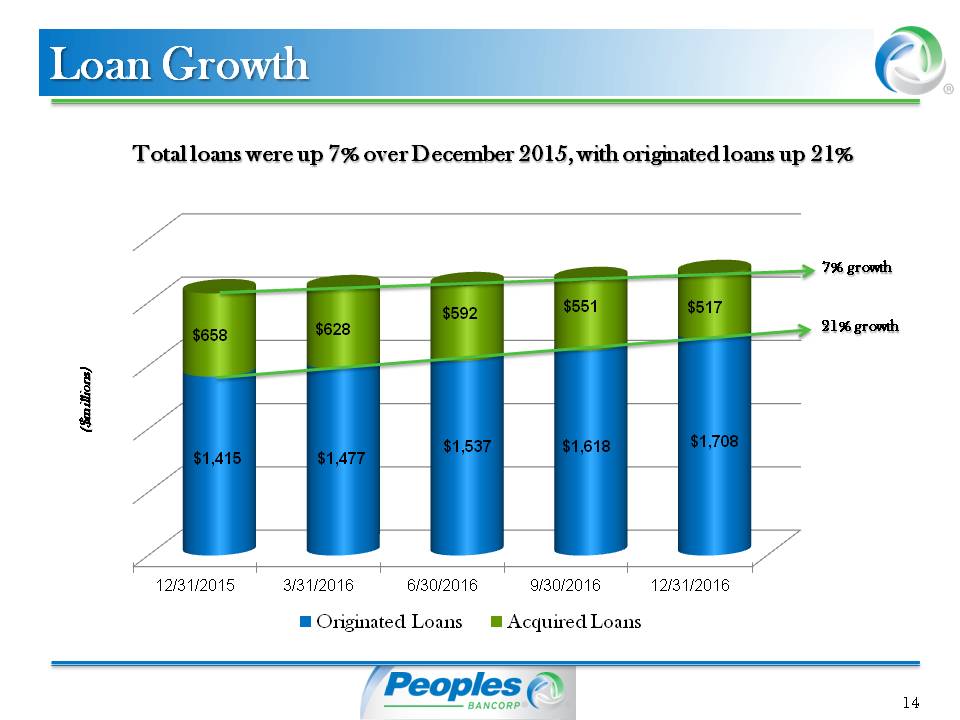

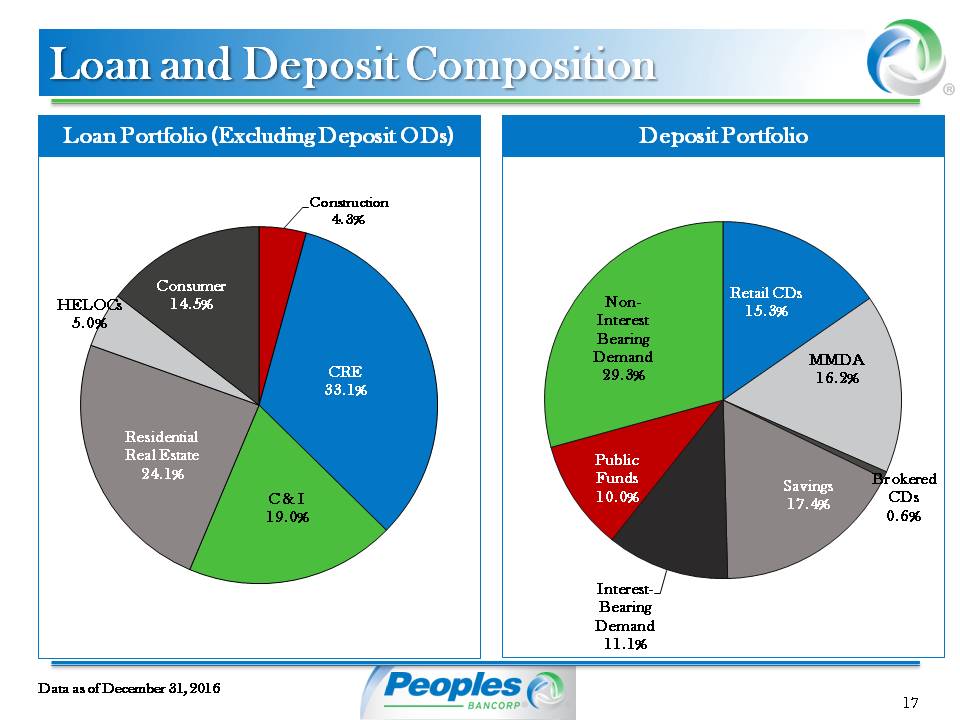

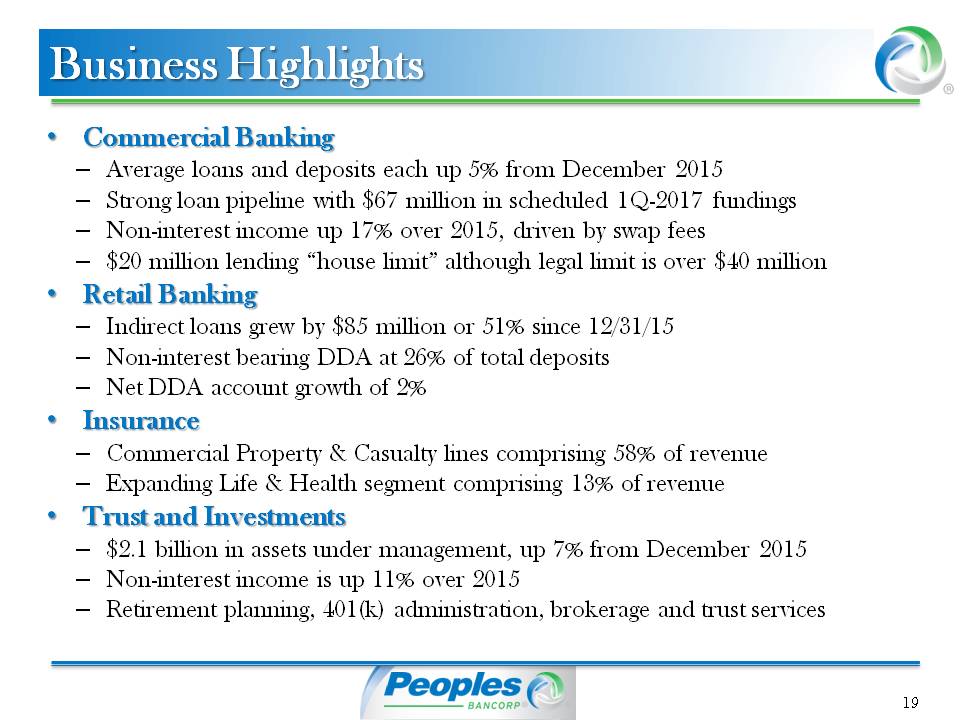

Loan growth during the fourth quarter of 2016 was 10% annualized. This increase contributed to the 7% growth for the full year, which was higher than we expected. Commercial loans provided $43 million of growth during the fourth quarter, while consumer loans provided $13 million.

Our indirect lending business continued to provide significant growth, generating $23 million during the fourth quarter. The growth was partially offset by declines in residential real estate loans. Our mix of loans has been relatively stable. At December 31, 2016, commercial loans comprised 56% of total portfolio, while consumer loans comprised 44%. We expect indirect lending continue to grow in 2017, just not at the same pace as 2016.

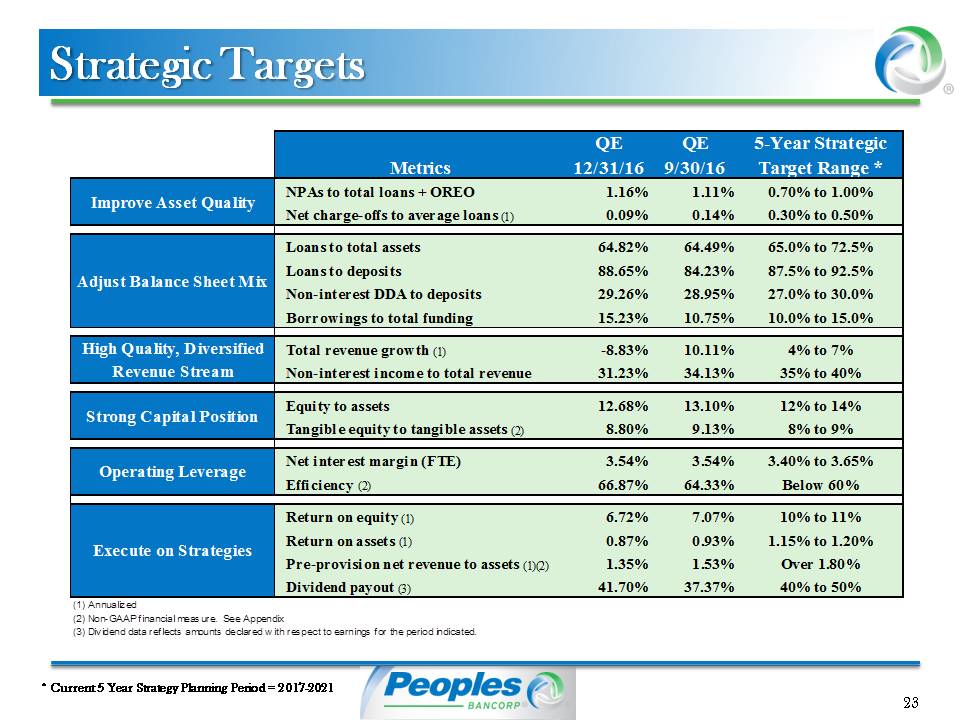

Net charge-offs declined 35% compared to the third quarter. Net charge-offs have been primarily driven by consumer loans and deposit accounts overdrafts in recent quarters. For 2016 net charge-offs totaled $1.9 million and were 9 basis points as a percent of average loans. In 2015 net charge-offs, excluding the $13.1 million charge-off on one large commercial relationship, were $2.1 million, or 11 basis points as a percent of average loans.

Loans 90-plus days past due and accruing decreased $0.4 million during the quarter. Nonaccrual loans increased $2 million compared to the third quarter. The fluctuation in these categories was related to several small loans and not one specific credit.

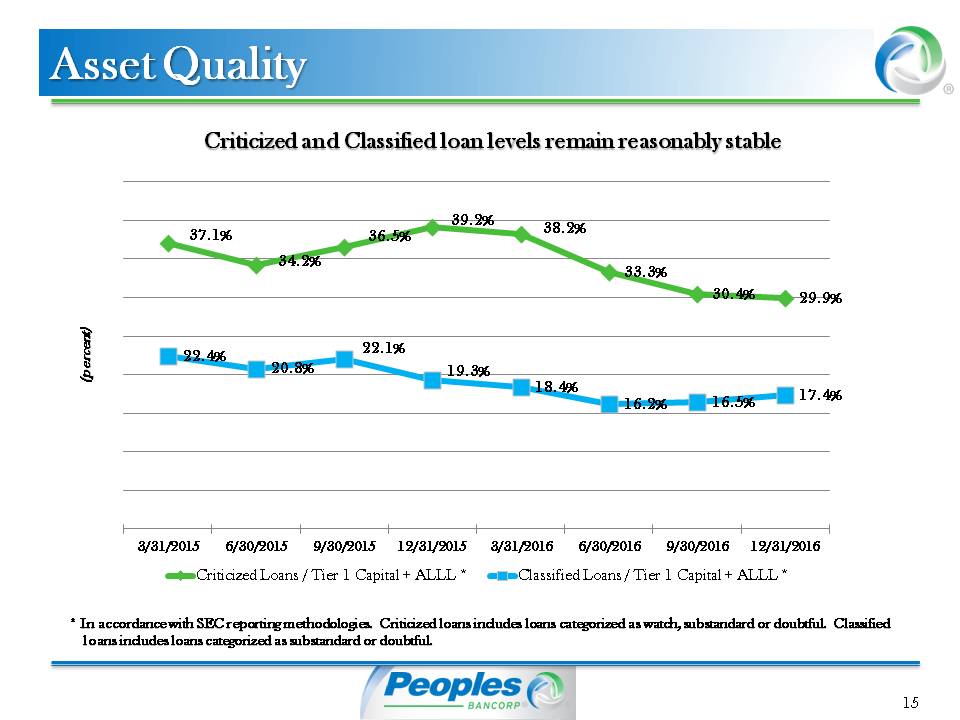

Criticized loans were relatively flat compared to the third quarter, while classified assets increased $4 million, mostly due to one commercial loan relationship.

Provision for loan losses declined during the quarter as net charge-off rates remained low. The allowance for loan losses as a percent of originated loans, net of deferred fees and costs, declined slightly to 1.08% compared to 1.13% at September 30, 2016. However, we did add $1.7 million to the allowance over the course of 2016, increasing our total reserves to $18.4 million at December 31, 2016.

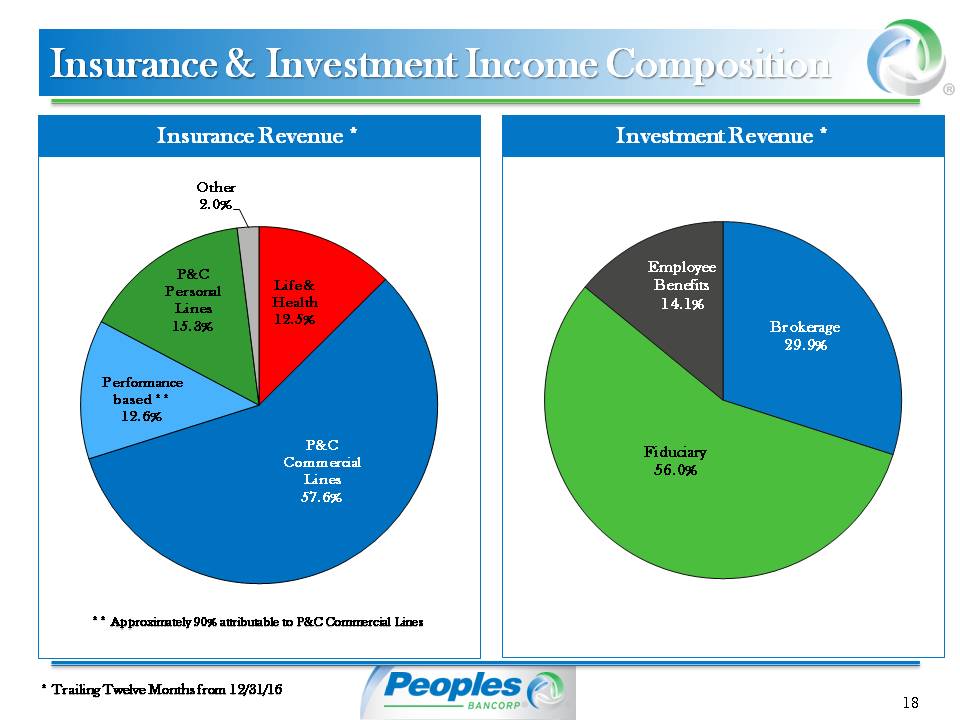

As expected, we were not able to sustain our recent non-interest income growth, as our commercial loan swap fee income slowed during the fourth quarter. We also experienced declines in electronic banking income, insurance income, and deposit account service charges compared to the third quarter. We have historically recognized a drop in insurance and deposit account service charge income during the fourth quarter compared to the third quarter. Compared to the fourth quarter of 2015 non-interest income was flat.

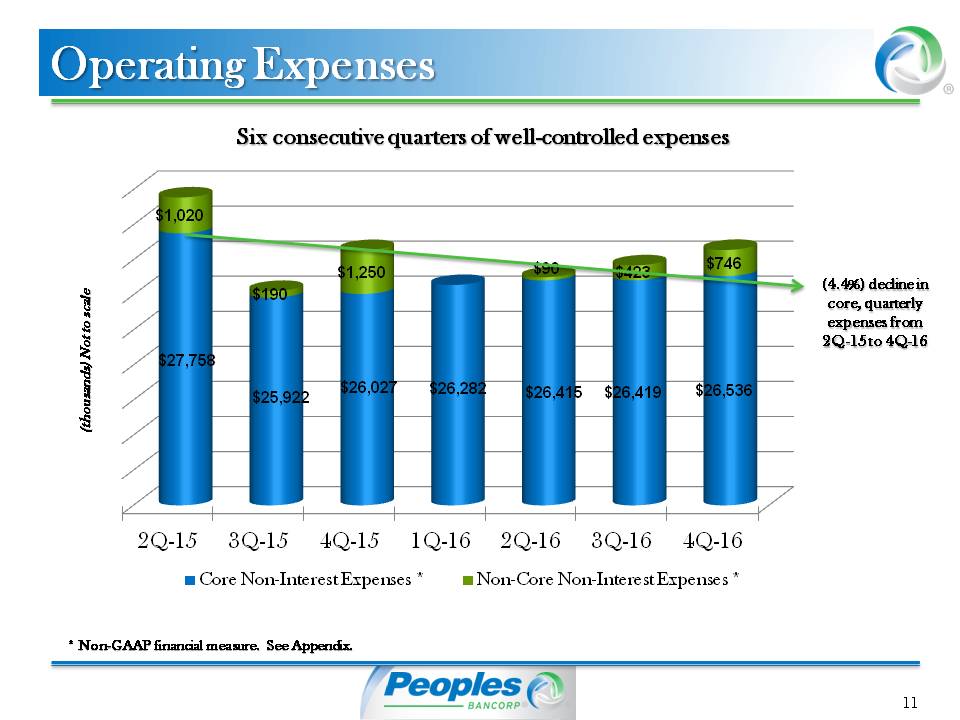

Non-interest expenses were up 2% in the fourth quarter compared to the prior quarter. The increase was due mainly to the system upgrade costs recognized in the fourth quarter compared to the prior quarter. These costs were mostly recognized as a data processing and software expense in professional fee line items. FDIC insurance expense declined in the fourth quarter. The decrease was the result of the FDIC Insurance Fund's reserve ratio reaching 1.15% effective June 30. Reaching the ratio resulted in reducing FDIC insurance expense for us.

Compared to the fourth quarter of 2015, non-interest expenses were flat. Increased salary and employee benefits were largely due to incentive compensation which is directly tied to corporate earnings and performance.

Professional fees and data processing and software expense were higher because of the system upgrade costs incurred in the fourth quarter of 2016. These increases offset reductions in other non-interest expense -- FDIC insurance, net occupancy and equipment and marketing expenses.

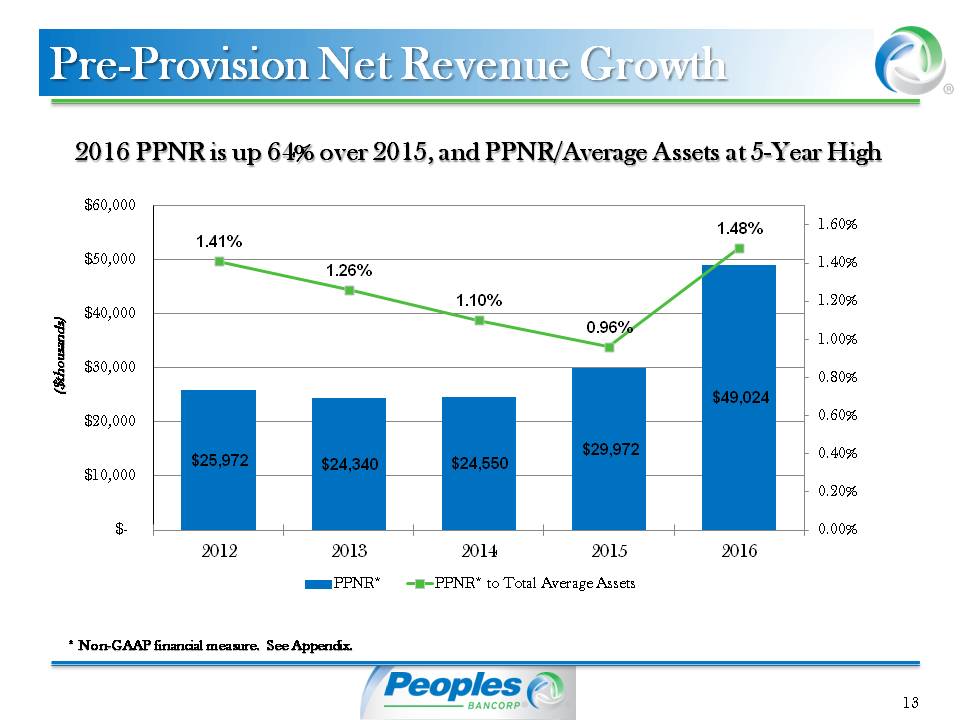

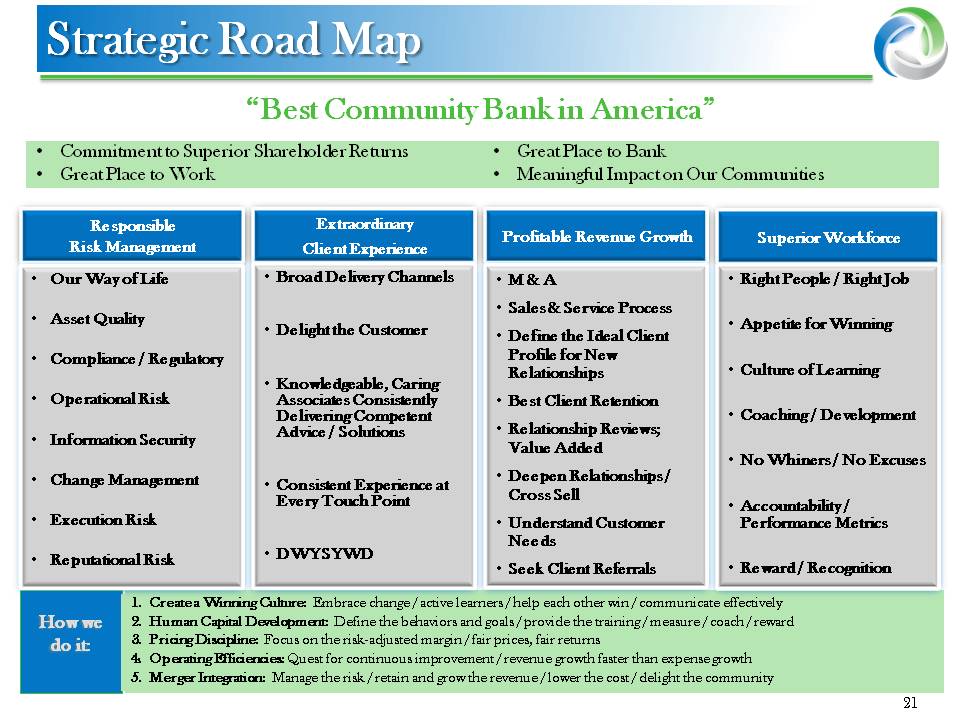

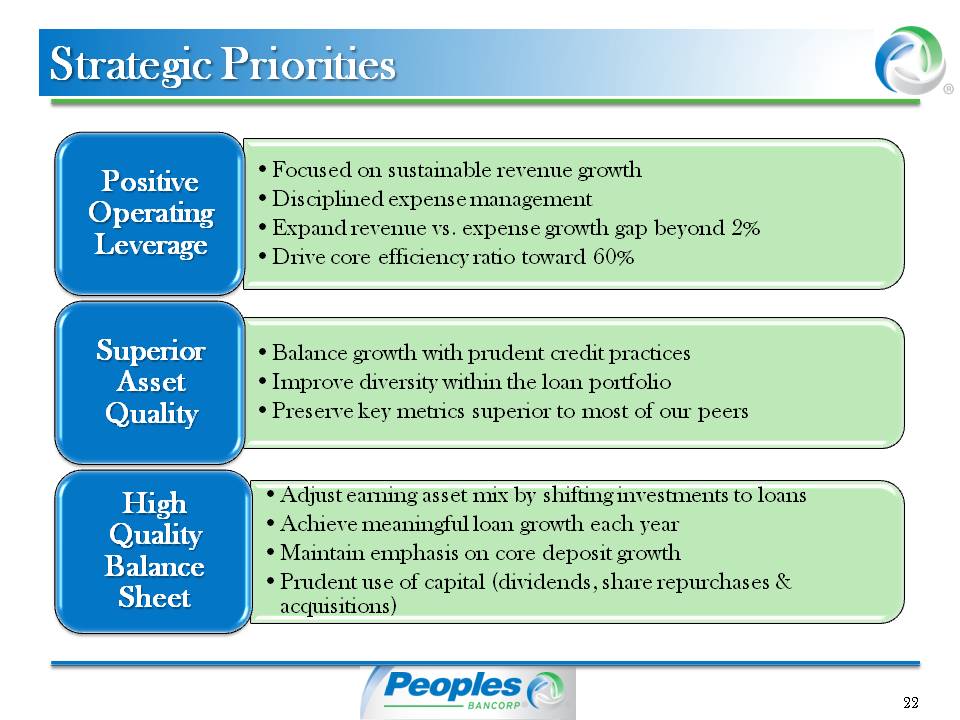

As expected, we generated positive operating leverage for full year of 2016. The fourth quarter of 2016 was our sixth consecutive quarter of generating year-over-year positive operating leverage.

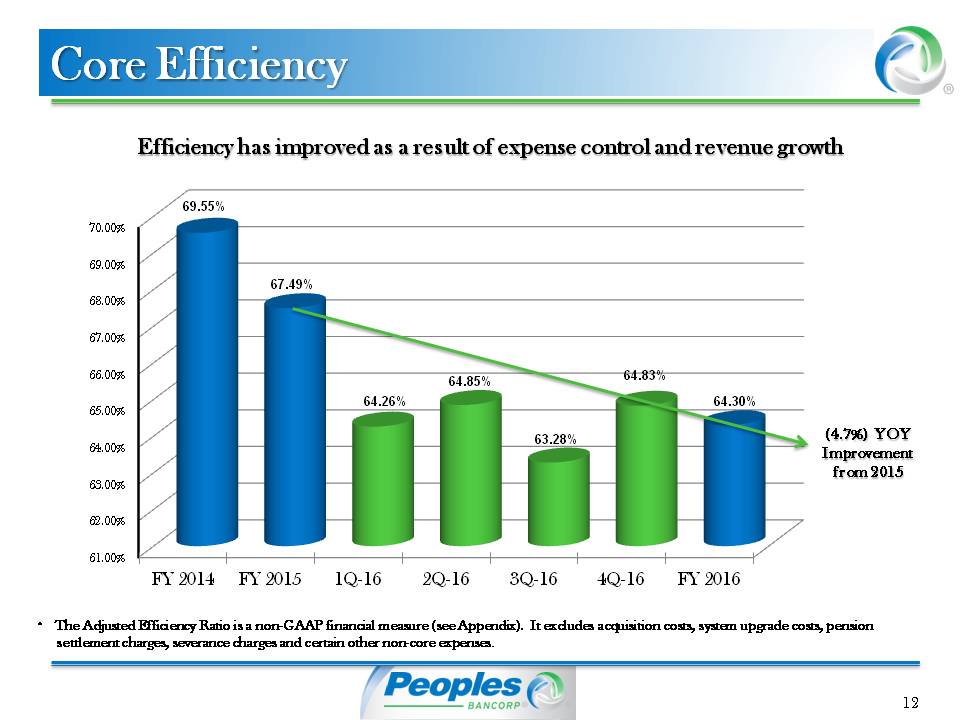

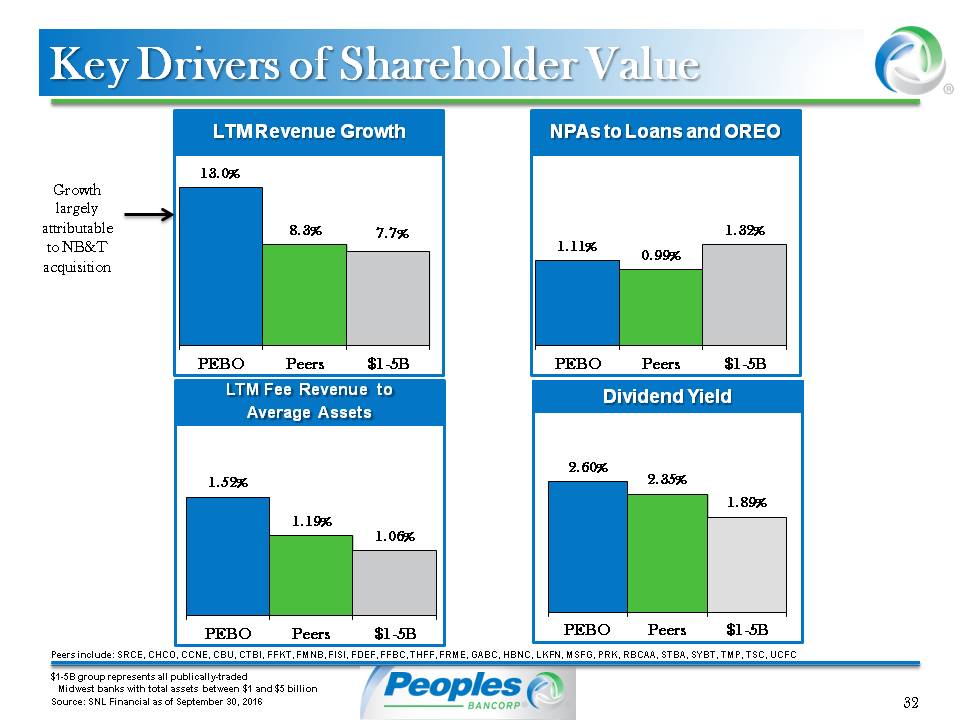

During the fourth quarter of 2016 the efficiency ratio was 66.9% compared to 64.3% in the third quarter and 67.9% in the fourth quarter of 2015. For the full year of 2016 the efficiency ratio was 65.1%, a decrease from 75.5% for 2015. The decline during 2016 was largely due to the costs associated with the NB&T acquisition completed in 2015.

The efficiency ratio adjusted for non-core items was 64.8% in the fourth quarter of 2016 compared to 63.3% in the linked quarter and 64.7% in the fourth quarter of 2015. Over the past eight quarters full-time-equivalent employees have decreased from 847 to 782. For 2016 the efficiency ratio adjusted for non-core charges was 64.3% compared to 67.5% in 2015.

On December 30, 2016 we closed the two branches that we discussed during the call last quarter. At the end of the first quarter we will close four additional branches and convert one of those into an insurance facility. For the most part these locations are relatively close to other branches and we expect minimal impact to customers. We continually evaluate our branch structure in an effort to optimize our efficiency.

I will now turn the call over to John to provide additional details around net interest income and margin and non-interest income, the balance sheet, and capital activities.

John Rogers:

Thanks, Chuck.

During the fourth quarter net interest income grew 2% and was up 7% for the full year. Compared to the fourth quarter of 2015 net interest income increased 3%. Loan growth during the year has been the main driver of our higher net interest income. Average loan balances increased $50 million, or 2%, in the fourth quarter compared to the third quarter and were up approximately $180 million, or 9%, compared to the full year of 2015.

Net interest margin remained fairly stable and was flat compared to the third quarter of 2016, while it declined only 2 basis points from the fourth quarter of 2015. For the full year of 2016 it expanded 1 basis point compared to 2015. Our ability to grow net interest income and maintain net interest margin during the year was the result of sustained shift in the mix on the balance sheet for both assets and liabilities coupled with restructuring of certain borrowings during the second quarter of 2016.

The increase in interest rates by the Federal Reserve in December is expected to provide an additional $0.02 to $0.03 increase in EPS for the full year of 2017.

Accretion income, net of net amortization expense from acquisitions, increased to $874,000 during the fourth quarter, adding 11 basis points to net interest margin compared to $801,000 and 10 basis points in the third quarter. The increase during the fourth quarter compared to the third quarter was mainly due to payoffs in the commercial loan portfolio and the related discounts associated with those loans which is recorded as additional income.

For the full year accretion income added 11 basis points to net interest margin and was $3.5 million compared to $4.8 million and 17 basis points in 2015. As expected, we continue to see liquidations in these portfolios, which causes some variability in the amount of income recorded on a quarterly basis.

Non-interest income declined to 31% of total revenue for the fourth quarter and was 33% of total revenue for 2016. We have continued to see declines in this ratio as growth in net interest income due to loan growth is out-pacing growth in non-interest income.

During the fourth quarter non-interest income declined 11%. We have had a lot of success during the year with our commercial loan swap fee income, especially in the third quarter. However, we anticipated that the fourth quarter would not keep pace with the prior quarter. During the fourth quarter insurance income and deposit account service

charges decreased. The decline in deposit account service charges was primarily driven by certain account service charges that were granted to customers during the system upgrade, as previously mentioned by Chuck. Electronic banking income was impacted by third-party annual volume incentive revenue that was received in the third quarter.

Compared to the fourth quarter of 2015 non-interest income was flat. Trust investment income increased 10% while bank-owned life insurance income almost tripled. These increases were offset by lower commercial loan swap fee income, other non-interest income, and deposit account service charges.

For the year, non-interest income grew 8% with notable increases in most categories. Electronic banking income and trust investment income increased significantly, which was due to higher consumer customer activity and sales, coupled with the recognition of a full year of the NB&T acquisition. Bank-owned life insurance income more than doubled during 2016, due to additional investments made during the second quarter. Commercial loan swap fee income was up compared to the full year 2015, given the increased likelihood of rates rising in future periods.

The investment securities portfolio continued to comprise 25% of total assets at December 31, 2016. Overall, the portfolio grew 2% from September 30, 2016. The growth was mostly from purchases out-pacing principal pay-downs and the decline in the market value of the portfolio due to rising rates. The investment securities yield increased slightly compared to the prior quarter, but was down only 4 basis points for the year compared to 2015.

Period-end core deposits, which exclude $401 million of CDs, decreased $43 million from the linked quarter. Most of the reduction was from declines in governmental deposits, which is a seasonal occurrence. We typically see governmental deposits increase in the first quarter. Compared to the prior year, core deposits increased 3%, or $56 million. Non-interest-bearing deposits remained at 29% of total deposits at December 31, 2016, which was the same as the prior-quarter end.

During the fourth quarter our short-term FHLB borrowings increased $140 million as loan growth outpaced deposit growth. We've been able to reduce our overnight borrowing position in the first quarter through the addition of $50 million for shorter-duration term FHLB borrowings.

Our capital position remained strong, although we had a slight decline from the third quarter. The decline was mostly due to decreases in the market value of investment securities. Our tangible asset ratio declined to 8.8%, a 33-basis-point decrease compared to the third quarter, but still 11 basis points higher than last year.

Our tangible book value per share was $15.89 at December 31, 2016, a decrease from the prior quarter and an 8% improvement over the prior year.

We continue to maintain regulatory capital level higher than well-capitalized status. Our capital ratios have declined from September 30, 2016, mainly due to an increase in our net risk-weighted assets, mainly from loan growth. At December 31, 2016 our common equity Tier 1 capital ratio was 12.84%. Our Tier 1 capital ratio was 13.13%. And our total risk-based capital ratio was 14.04%.

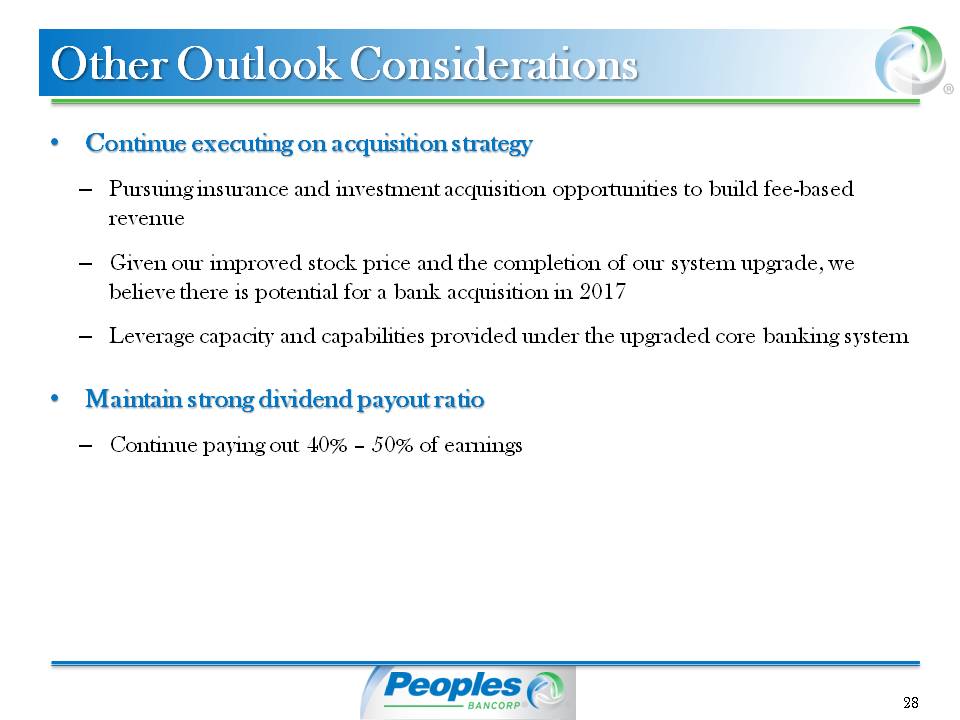

As our capital position strengthens from improved earnings, we are continually evaluating methods of effectively deploying excess capital. As our stock price has increased, our appetite to repurchase shares has diminished. As Chuck mentioned, earlier this morning we were pleased to announce another increase to our dividend rate, which is now at $0.20 per share and a 33% increase over a year ago. We will continue to monitor our dividend rate quarterly and are targeting a 40% to 50% dividend payout ratio based upon our capital position. This is an increase from our prior benchmark of 32.5% to 42.5%.

I will now turn the call back to Chuck for his final comments.

Chuck Sulerzyski:

Thanks, John.

On Monday we announced that Dan McGill, our Chief Commercial Banking Officer, will retire at the end of March. Dan has been leading the commercial banking business line since he joined us in 2009. Dan has played an important role in our success and growth and we wish him well in his retirement. We have also announced his replacement, Doug Wyatt, who joined us in April of 2016 and has been serving as Executive Vice President -

Commercial Banking. We feel that Doug's experience and leadership will facilitate the continued success in our commercial banking business line and ensure a smooth transition.

As mentioned earlier, we recently completed our system upgrade and our associates and clients have been using the new system for a couple of months. We had minimal disruption to our clients and have been getting positive feedback from them about the new system's capabilities.

While the system upgrade has been a time-consuming endeavor, we now have increased system capacity and capability for expansion. We now have the ability to provide an even better service to our current customers while we remain focused on growing our business. This project sidelined our ability to execute bank acquisitions during 2016. However, in 2017 we expect to give greater consideration to a bank acquisition than we did in 2016.

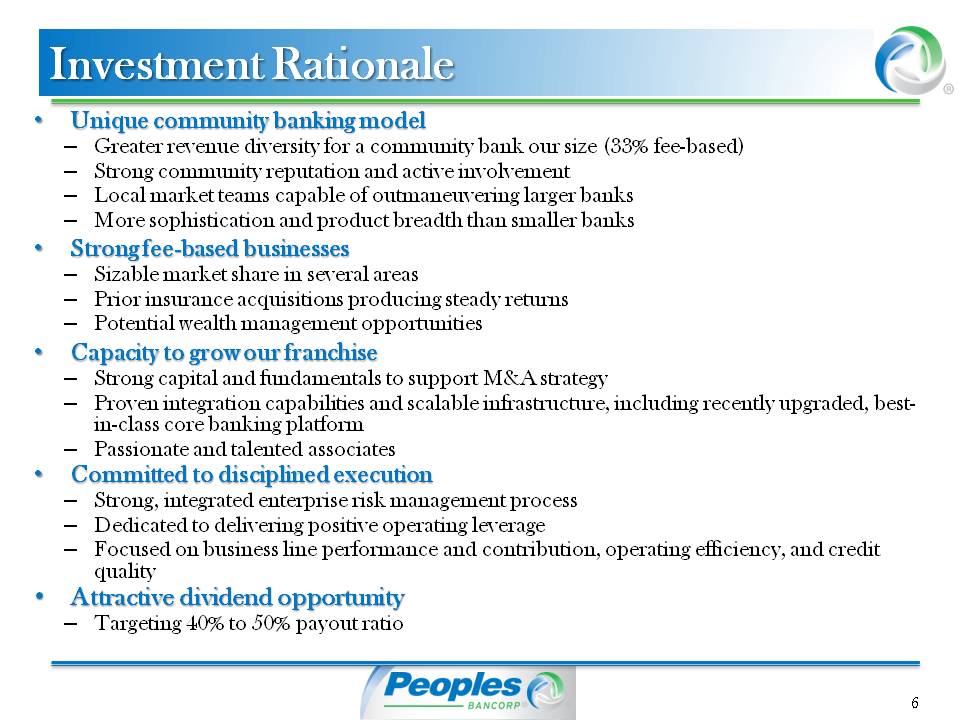

When I look at 2016 I see several accomplishments in our organization. We reported record earnings in 2016 with net income of $31.2 million. Additionally, we have been able to:

| |

• | successfully control expenses, |

| |

• | generate quality loan growth, |

| |

• | increase net interest margin by 1 basis point, |

| |

• | grow fee income by 10% compared to 2015, and |

| |

• | effectively manage our credit costs and quality with only 9 basis points of net charge-offs for the year. |

With the closing of 2016 I think it's appropriate to review some five-year trends that have been purposefully pursued:

| |

• | The period-end non-interest-bearing deposits have increased to 29% of total deposits at December 31, 2016 from 18% of total deposits at December 31, 2011. |

| |

• | Our loan portfolio has become more balanced. Period-end consumer loans have increased to 44% of total loans versus 38% five years ago. |

| |

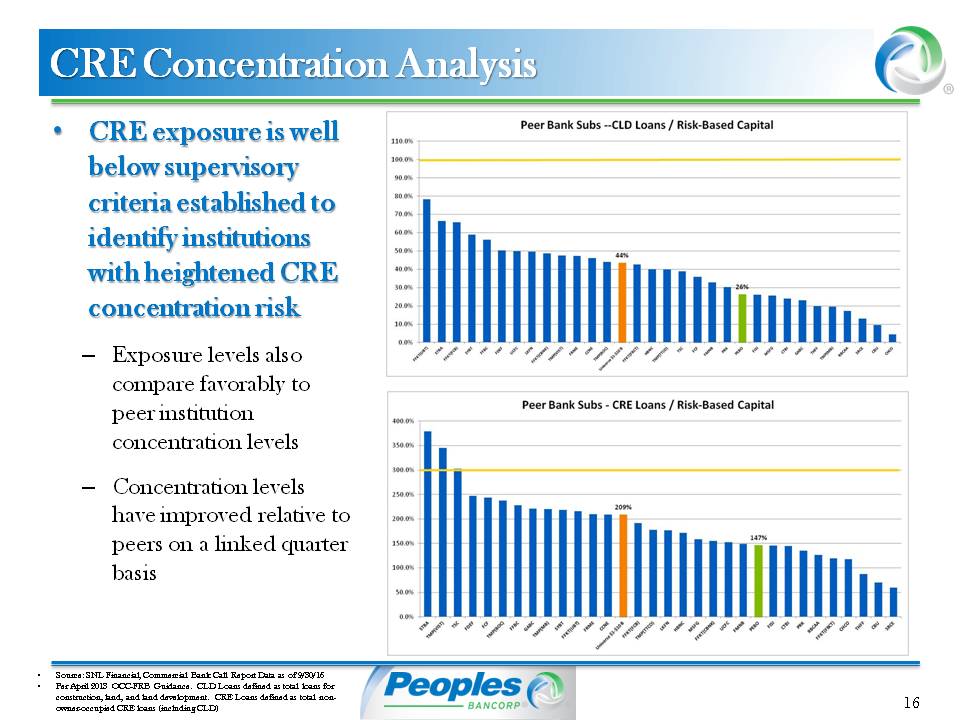

• | Period-end commercial real estate loans have decreased to 66% of commercial loans and 38% of total loans. Five years ago CRE's represented 75% of commercial loans and 47% of total loans. As a percent of total stockholders' equity, CRE was 191% at December 31, 2016 versus 213% five years ago. |

| |

• | Period-end commercial and industrial loans increased 20% in 2016 and now represent 34% of commercial loans, up from 25% five years ago. |

| |

• | Net interest margin expanded to 3.54% from 3.43% five years ago. |

| |

• | The efficiency ratio has improved to 65% compared to 69% five years ago. |

| |

• | Our stock price more than doubled and was $32.46 at December 31, 2016 compared to $14.81 at December 31, 2011. |

| |

• | Finally, our market capitalization has increased to $591 million at December 31, 2016 from $156 million on December 31, 2011. |

We believe continued emphasis on low-cost deposits and appropriate portfolio management will lead to meaningful shareholder benefits.

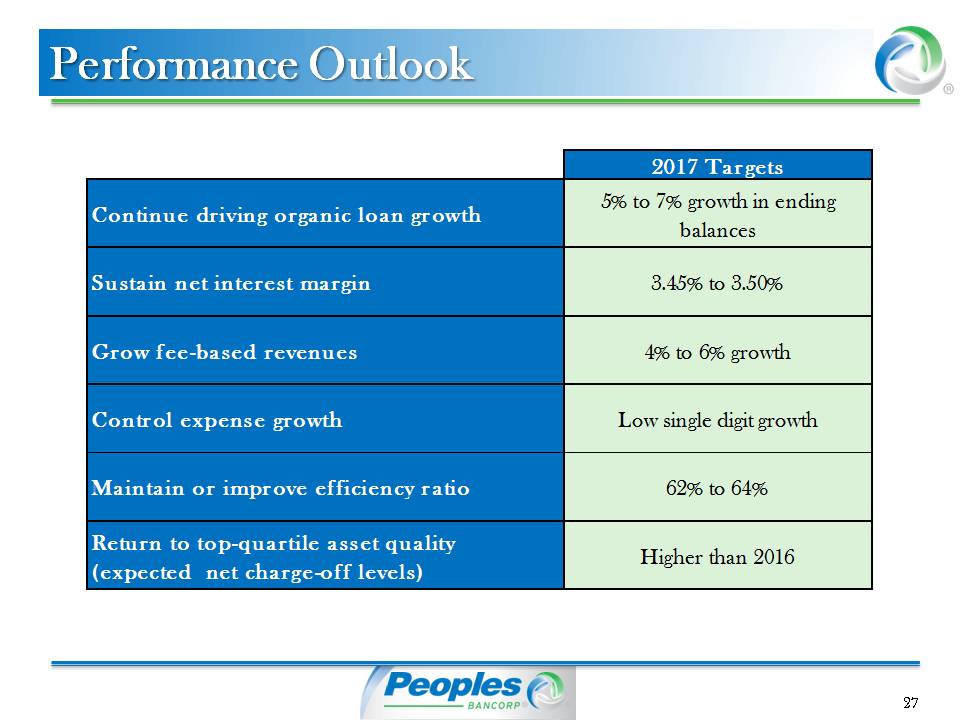

During 2017 we expect to achieve:

| |

• | point-to-point loan growth of 5% to 7%. |

| |

• | We expect higher credit costs as we do not expect to continue with single-digit net charge-off rates. |

| |

• | We believe net interest margin will decline slightly and we will be in the 3.45% to 3.50% range. |

| |

• | Our fee-based revenue growth is expected to be between 4% and 6%. |

| |

• | We plan to generate positive operating leverage for the full year of 2017. We expect the reported expense growth to be in the low-single digits. We are targeting an efficiency ratio of 62% to 64%. |

These expectations are consistent with our prior guidance for 2017.

We are committed to building long-term shareholder value and we are pleased with the recent increase in our stock price, as well as our ability to increase the dividend. We are pleased with the improvement in our performance during 2016 and have better positioned ourselves to generate the returns expected by our shareholders.

While we are all unsure about what regulatory and market impacts and new leadership in Washington, DC may bring, we believe we can actively manage our own position and react to those changes accordingly.

This concludes our commentary and we will open the call for questions. Once again, this is Chuck Sulerzyski and joining me for the Q&A session is John Rogers, Chief Financial Officer. I will now turn the call back to the hands of our call facilitator.

Questions & Answers

Operator: Thank you. We will now begin the question-and-answer session. (Operator Instructions) Scott Siefers; Sandler O'Neill.

Scott Siefers: Appreciate the guidance for 2017. Just a couple of question, first on fees. I know there were sort of some aberrations in the fourth quarter. Just curious basically when you sort of wade through the noise, how the underlying trends felt to you, Chuck, versus what you might have anticipated. And then if you could just sort of go through in the expectations for 4% to 6% fee growth in 2016 what do you see as the main drivers.

Chuck Sulerzyski: Sure. Our fee growth obviously went down. We did have the core conversion. We waived some fees. We had extraordinary swap income in the third quarter. We didn't see as much of that in the fourth quarter. I think we may see a little bit more of it in the first quarter.

So all total, I think that you're not going to see the first, second quarter be as abnormal or down as the first quarter was. When we talk about 4% to 6% fee income growth, we for multiple years now have had double-digit growth in our investment businesses. We expect that to continue. You'll see growth in the insurance business so we expect to see more swap income. I think we have the possibility potentially for more mortgage income than we've had in the past and just kind of across the board, the electronic banking fees that we see, is how I would see it.

Scott Siefers: Okay. All right, that's perfect. Thank you. And then just so I'm clear on the guidance for both fees and expenses, are those all off the reported numbers for full-year 2016, so specifically the fee income of 4% to 6% growth off the $51.1 million in 2016 and then expenses growth off of $106.9 million?

Chuck Sulerzyski: Yes.

John Rogers: Yes.

Scott Siefers: Okay, perfect. Thank you very much.

Operator: Kevin Fitzsimmons; Hovde Group.

Kevin Fitzsimmons: Was just wondering. You've said for a couple quarters now, Chuck, about the indirect auto probably continuing to grow but at a slower pace. What kind of slowdown are you expecting in that space? It's been very strong. Are we expecting it just to ratchet down a little or to be cut in half, the pace of growth --

Chuck Sulerzyski: Oh, no, no, no. We will continue doing what it is that we are doing, which is basically getting a little bit more penetration across our footprint and getting deeper business with the dealers. But as a percentage growth, the percentage growth will begin to slow because the denominator is getting bigger.

You know, you bring up indirect and we're just very excited about the growth that we've had. In the fourth quarter our average FICO score was 735, which is the best that we've had. And for the year we averaged 725, where that's up from 695 four years ago. And it's kind of headed in the right direction.

So we're comfortable with the volume. We're comfortable with where it fits in our portfolio. And we think the dollars will continue to grow.

Kevin Fitzsimmons: Okay. So it's really not about you guys downshifting. It's more about it's just getting bigger --

Chuck Sulerzyski: Yes.

Kevin Fitzsimmons: -- and growing less as a bigger piece. Okay.

John Rogers: The percentage of growth will continue to decline a little bit.

Kevin Fitzsimmons: Got it. Just if I could ask -- appreciate the comments on acquisitions being something you may focus more on in 2017 than 2016. If you can just remind us what your appetite would be in terms of in an ideal world what kind of geography, what kind of size bank you would look at. And then maybe if you could touch on non-banks as well. I know that's an area you've continued to look at. Thanks.

Chuck Sulerzyski: Yes, we continue to look at things that will round out our insurance business on the non-bank side. I'll start there first. I think you'll see some minor deals being done in the upcoming months. Anything that gives us more geographic coverage in the things that we do we would be excited about in both insurance and investments. And things that add to our capabilities excite us also. The insurance business in particular, meaningful business.

In terms of bank acquisitions, the ideal situation would be something in market where we'd have the cost takeout and the market share gain, or, secondary to that, adjacent markets. Probably the only market expansion that I think we'd be up for considering would be going to Louisville. There's a lot of opportunities there. We think it's a good, strong market. But obviously there'd be a lot of competitors for deals there as kind of witnessed in some of the recent transactions.

John Rogers: Yes. And I'd add, Kevin, on size, our preference probably is $0.5 billion to $1 billion. But following our core conversion our preference still probably is to do something on the smaller end initially. But you can't always dictate exactly what you do. You're subject to what the market gives you from that perspective.

Kevin Fitzsimmons: Is there a certain amount of time you want to get past that systems conversion before you think about doing something? Is it six months, a year?

Chuck Sulerzyski: No, I think we're fine to go now. I'm not saying that we're going to do anything, but in terms of where we are with that system conversion, there's nothing in it that would prevent us from doing a deal if we had the right opportunity today.

Kevin Fitzsimmons: And, Chuck, just post-election with this surge we've seen in stock prices, what's your sense on does that make it more likely that there will be sellers? Does it make it less likely? We've heard for years the rationale for M&A was that it's such an awful environment that sellers were going to look to get out and throw in the towel. Is it possible that some are going to say: Well, everything's great. Rates are going up and we're getting more of a spread and we'll stay in. What's your sense?

Chuck Sulerzyski: Well, I think the fundamentals on the economy may change. But we certainly aren't seeing any great change. I mean, I think the GDP number came out today, back to the modest growth numbers that we were seeing. It's still pretty tough to grow revenue. And I think for a lot of smaller banks getting sustained long-term positive operating leverage is pretty much a challenge.

So I don't think, particularly for smaller banks that are maybe not publicly traded or don't have much float that aren't taking advantage of this uptick, I think they've got to look at trading into a more robust currency. So I don't think much will change. It's still an emotional item, trying to figure out whether to sell, whether to go along. So I think if I had to guess you'll see a slight uptick in the number of deals in 2017 versus 2016, but not a great uptick in the number of deals.

Kevin Fitzsimmons: Great. Thanks.

Operator: Michael Perito; KBW.

Michael Perito: I apologize if I missed anything. I've had a few calls that all happened to happen at the exact same time. But wanted to touch on the margin guidance. I think it was 3.45% to 3.50% was the range that you provided. Curious if you can give any color on kind of what the interest rate backdrop that you're assuming is behind that, and maybe just an updated comment to start the new year here on just reaction, how you feel you're positioned for higher rates.

John Rogers: Yes. I think in that guidance we assumed one rate increase in the middle of the year. So if there's additional increases that would be somewhat beneficial to us. I do think we are just slightly asset sensitive. We've been that way for a while now, and might look at that a little bit as we move forward. But there is some benefit, like I

mentioned, in the guidance, $0.02 to $0.03 for the one that was in December. And that's kind of where we're positioned at this point in time.

Michael Perito: Okay. And as you piece through all the guidance you kind of get to a certain number. But, Chuck, curious what your thoughts are as we look at the profitability profile of the Bank, which obviously improved dramatically in 2016, back to levels more similar with 2013, 2014 on the ROA and ROTCE. Any kind of thoughts as M&A seems to be coming back into the cycle here for you, is the hope to expand that organically and then M&A could be juice on top of that? Any kind of thoughts on longer-term targets that you think are realistic?

Chuck Sulerzyski: Well, in terms of targets that are realistic, you don't mean institutions I'm assuming, but --

Michael Perito: No, profitability targets. I'm sorry.

Chuck Sulerzyski: No. I mean, we're pretty excited about where we are. Six quarters in a row of positive operating leverage is good. You heard that we're saying low-single digit expense growth. And we've been growing our revenues organically over the last few years, you know, 7%, 8%. And if we can continue to do that we're going to continue to move up from an ROA standpoint and continue to deliver better earnings for the shareholder.

So we're enthusiastic about what it is that we can do. We continue -- 10% annualized loan growth in the fourth quarter was pretty sweet. We feel good with where we are right now at the end of January with what we're seeing in the loan portfolio. So I would say that we're optimistic.

Michael Perito: Okay. Great. Thank you. I think actually that's all the questions I had. Appreciate the time. Thank you.

Operator: (Operator Instructions) Daniel Cardenas; Raymond James.

Daniel Cardenas: Just a quick question here. Given the loan growth that we saw in the fourth quarter, and given your guidance of 5% to 7% for 2017, could your local economy support growth beyond that range that you've given us for 2017?

Chuck Sulerzyski: Well, I don't think the environment is really changing. I think that ours is about taking the business away from the guy across the street. So we've been growing that loan portfolio in that high double-digit and occasionally low single-digit area for 4 years now. And it's certainly not in the growth in what's in our footprint. It's from taking the business away from the guy across the street. And that's kind of what we're about. We don't expect that to change.

If the consumer gets more enthusiastic, we see some wage growth, consumers controlling 70%, 68% of the economy, yes, the economy could begin to pick up and we would love that. But we are prepared if that does not happen. We're not -- if we get some wind in our sails, wind at our back, that's only icing on the cake from our perspective.

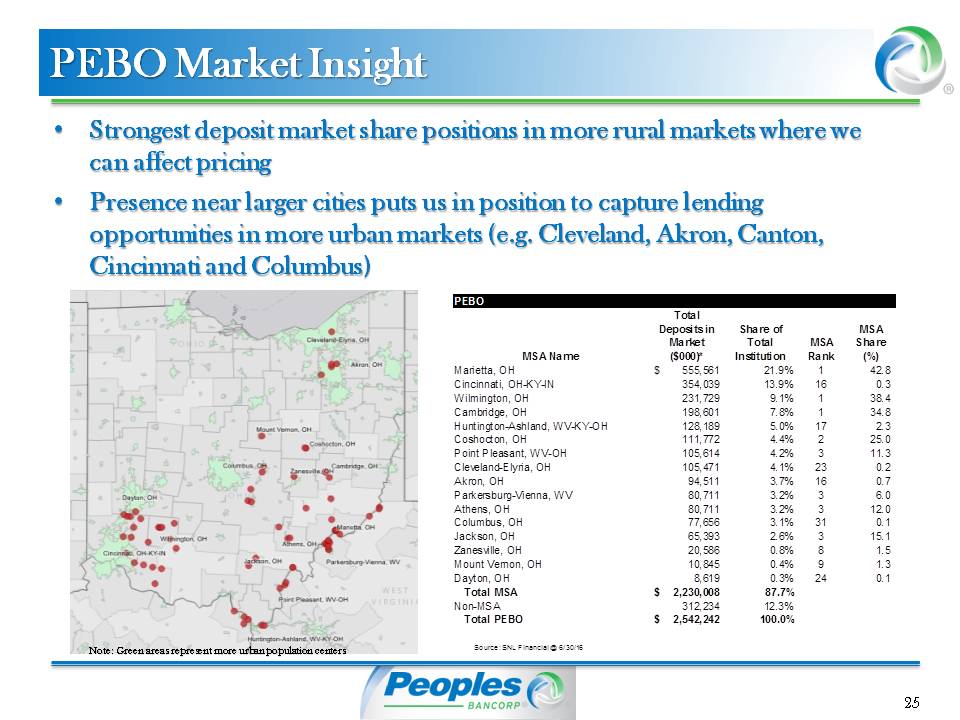

Daniel Cardenas: Okay. Good. And then, geographically is there any one area that you expect to see more loan growth coming out of?

Chuck Sulerzyski: You know, we've been pretty fortunate. We've done well up in the Northeast recently in the Akron/Cleveland area. A little market disruption with Huntington and FirstMerit -- we've added some talent. We've had some major wins in the southwestern portion of Ohio, some consistent good performance in our core West Virginia, Ohio, Southeast Ohio market. So it's been more balanced. Some years it hasn't been. Some years we've had five of our markets be relatively lackluster and one booming. That's not the case. It's been pretty consistent.

Daniel Cardenas: Okay. And then just kind of jumping to credit quality quickly, what are your watch list trends looking like right now? And maybe some quick comments on how good of a predictive indicator your 30-to-89-day past-due levels have been.

Chuck Sulerzyski: I'll just make some general comments about the credit quality. Our NPAs have ticked up for four quarters in a row. I actually thought that would be the first question you guys asked. But it's only $25 million.

When we look at that NPA slug, a third of it is one credit, which we've talked about previously, the nursing home, the little group of three nursing homes. When we first started talking about that with you, the census for that was in the kind of mid-to-high 50s. Today the census for those nursing homes are in the 80s, one of them is at 90, and continue to increase. So it's cash flowing today. We hope in the first or second quarter that we get a government guarantee on that credit, SBA or HUD, and that will help us. If that does not occur, we anticipate that credit selling in the calendar year and we do not expect to have a loss on that of any significance.

If we look at the remaining $17 million of the NPAs, it's extremely granular. Very few of them are north of $1 million. We expect to be able to get out about $7 million to $10 million of that during the year. And we think that you'll see some of that in the first quarter. We think you'll see more of it in Q3, 4, and -- Q2, 3, and 4. I almost gave you a fifth quarter.

None of that -- we're not aware of anything that's heading that way, but there always will be things that are heading that way. But right now we're not aware of anything. So even though our trend is not pretty, from an absolute standpoint it's fine.

You talked about the delinquencies. I think those numbers are reasonable. I think that in terms of total criticized loans we are optimistic that we will see those numbers move down meaningfully in the first half of the year. We have a couple of big relationships that are either going to move out of criticize because of improved performance or move out of criticized because they're going to take the business elsewhere.

So we believe that in the fourth quarter -- when we're doing this call next year at this time we believe our credit statistics will be meaningfully better.

Daniel Cardenas: Great. All right, thanks. Good quarter.

Operator: Scott Siefers; Sandler O'Neill.

Scott Siefers: Just trying to square the margin guidance. I know it's the same thing that you had said last quarter, but just given that you're up at a 3.54% currently, the core of 3.43% should be advancing, presumably. And you're getting still kind of low double-digits accretion from purchase accounting benefits. What would be sort of the trajectory of the margins that you're expecting? Why wouldn't the margin on a reported basis come in even higher than the top end of the range for the full year 2017?

Chuck Sulerzyski: Well, we would certainly welcome that. And I would say that looks more like a possibility each passing day. But I would say in general we'd like to under-promise and over-deliver. John, I don't know if you want to --?

John Rogers: Yes. I mean, Scott, we had 11 basis points of accretion helped us. It was 17, I think, the prior year. I'd expect that to be lower next year and that would continue to come down probably more into the high single-digits range. So that will drop somewhat there. And perhaps we're being a tad bit conservative, but we think it will still take time to -- we'll still be hurt a little bit on the investment securities. We only have so much that matures to kind of buy into these rates. We still have some higher-rate securities out there that will be maturing.

So maybe a little bit at the higher end of that range, maybe more practical or possible, but as we saw it as we pulled everything together and that's where we were at.

Scott Siefers: Okay. All right. That makes sense. Thanks a lot for taking the follow-up.

Operator: Michael Perito; KBW.

Michael Perito: Thanks for taking the follow-up. Chuck, just one quickly -- the dividend raised to $0.20, pretty material. Obviously this past year was pretty active. You raised the dividend on a couple of separate occasions. Just as we kind of think about the capital return it sounds like M&A is obviously more in focus than it's been. Is this dividend kind of -- I guess how should we be thinking about further dividend increases? And what is the Board's latest kind of overall view of the dividend policy and the kind of targets that they're setting?

Chuck Sulerzyski: The target that we're setting is a payout ratio in the 40% to 50% range. And that's a little higher than where we were. I think we were at 32.5% to 42.5% most recently. If you go back a few years ago we were

saying 25% to 40%. Some of that reflects the capital levels that we have. So some of that reflects some interest -- you know, some investors. I don't see us increasing our dividend payout ratio higher than it is at this point in time. And obviously increasing the dividend is going to come out of increasing earnings. And we're pretty confident that we can drive the earnings.

John, anything you want to add to that?

John Rogers: Yes. I think we did some capital planning later in the year and looked at where we were headed and looked at peer groups, et cetera, and kind of their payout ratios and what we've done in the past. So I think there were some comments on the call that our numbers were kind of turning back to 2013, 2014. And we looked back to where our payout ratios were a number of years ago. And we think that the 40% to 50% range makes sense. The payout on reported earnings is at the higher end of that range. But, if you back out the one-time items and noncore items, we're kind of in the middle of that range today.

So we think it makes sense. And we don't expect to make less. We expect to make more. So we think it's a reasonable point at this point in time to be at.

Daniel Cardenas: All right, great. Thank you.

Operator: At this time there are no further questions. Sir, do you have any closing remarks?

Chuck Sulerzyski: Yes. I want to thank everyone for participating. Please remember that our earnings release and a webcast of this call will be archived on peoplesbancorp.com under the Investor Relations section. Thanks for your time and have a good day and a nice weekend.

Operator: The conference has now concluded. Thank you for attending today's presentation. You may now disconnect.