Exhibit 99.1 July 2012 Transcript

PEOPLES BANCORP INC. (Nasdaq: PEBO)

TELECONFERENCE CALL TO DISCUSS SECOND QUARTER 2012 EARNINGS

Tuesday, July 24, 2012 11:00 am local time

Facilitator: Good morning, and welcome to Peoples Bancorp's conference call. My name is Amy, and I will be your conference facilitator today. Today's call will cover Peoples Bancorp's discussion of results of operations for the quarter ended June 30, 2012.

Please be advised all lines have been placed on mute to prevent any background noise. After the speakers' remarks, there will be a question and answer period. [Facilitator Instructions.]

This call is also being recorded. If you object to the recording, please disconnect at this time.

Please be advised that the commentary in this call may contain projections or other forward-looking statements regarding future events or Peoples Bancorp's future financial performance. These statements are based on management's current expectations. The statements in this call which are not historical fact are forward-looking statements and involve a number of risks and uncertainties, including, but not limited to, the interest rate environment; the effect of federal and/or state banking, insurance, and tax regulations; the effect of technological changes; the effect of economic conditions; the impact of competitive products and pricing; and other risks detailed in Peoples Bancorp's Securities and Exchange Commission filings. Although management believes that the expectations in these forward-looking statements are based on reasonable assumptions within the bounds of management's knowledge of Peoples' business and operations, it is possible that actual results may differ materially from these projections. Peoples Bancorp disclaims any responsibility to update these forward-looking statements.

Peoples Bancorp's 2nd quarter 2012 earnings release was issued this morning and is available at peoplesbancorp.com.

This call will include about 15 minutes of prepared commentary, followed by a question and answer period, which I will facilitate. An archived webcast of this call will be available on peoplesbancorp.com.

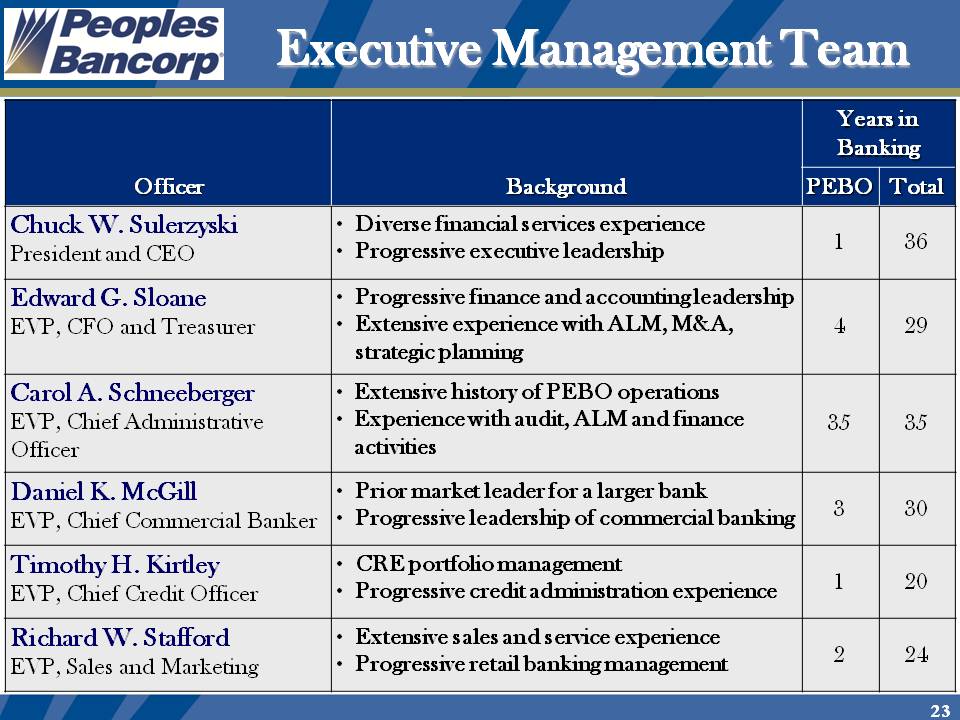

Peoples Bancorp's participants in today's call will be Chuck Sulerzyski, President and Chief Executive Officer, and Ed Sloane, Chief Financial Officer and Treasurer, and each will be available for questions following opening statements.

Mr. Sulerzyski, you may begin your conference.

Chuck Sulerzyski: Thank you, Amy. Good morning and welcome to our call.

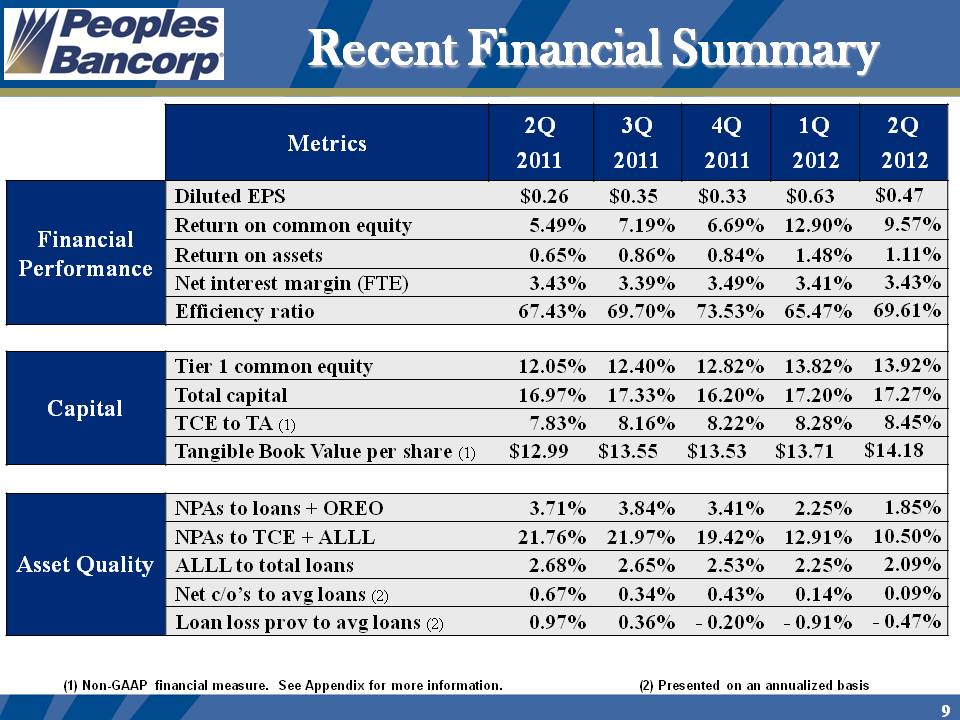

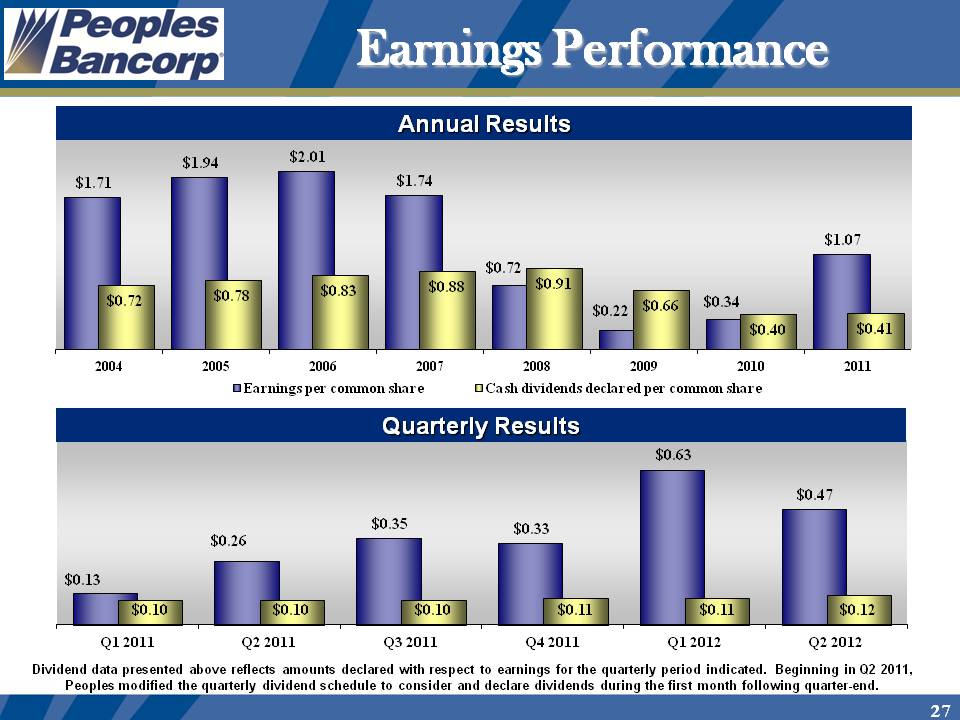

Early today, Peoples Bancorp reported net earnings of $5.0 million or 47 cents per common share for the second quarter. Both of these amounts were significantly higher than the $2.7 million and 26 cents earned in last year's second quarter. Through six months, our earnings per common share were $1.10 versus $0.38 a year ago.

2012 results continue to be stronger than last year due to improved performance in our core businesses. We also are benefiting from the continuation of favorable credit trends. During the second quarter, we released $1.1 million of our allowance for loan losses, bringing the year-to-date release to $3.3 million. Last year, we recorded $7.6 million of provision expense through the end of June.

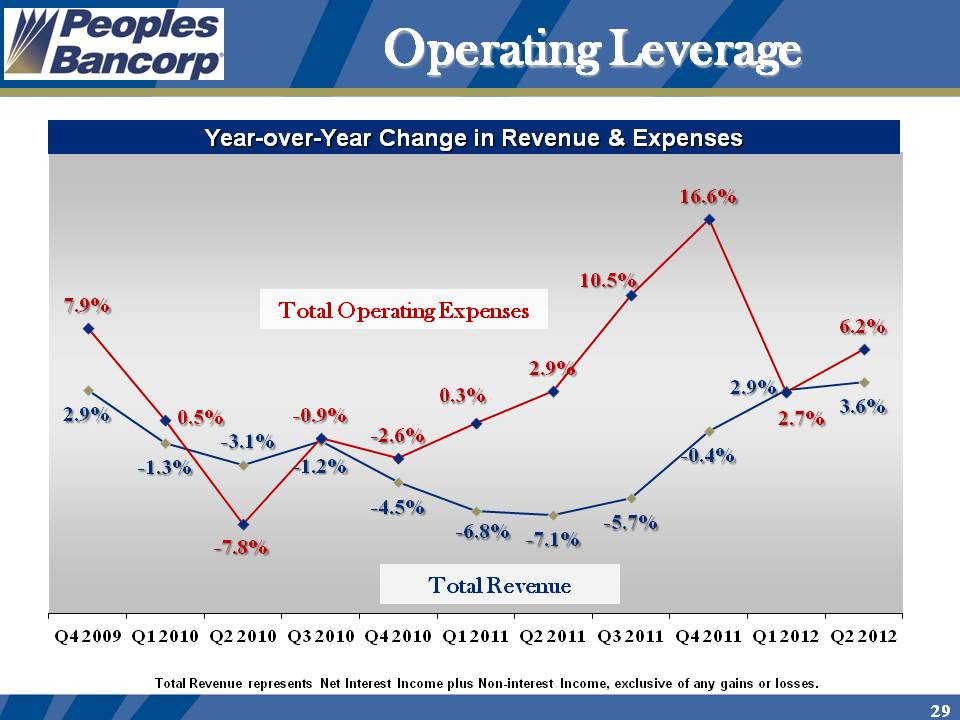

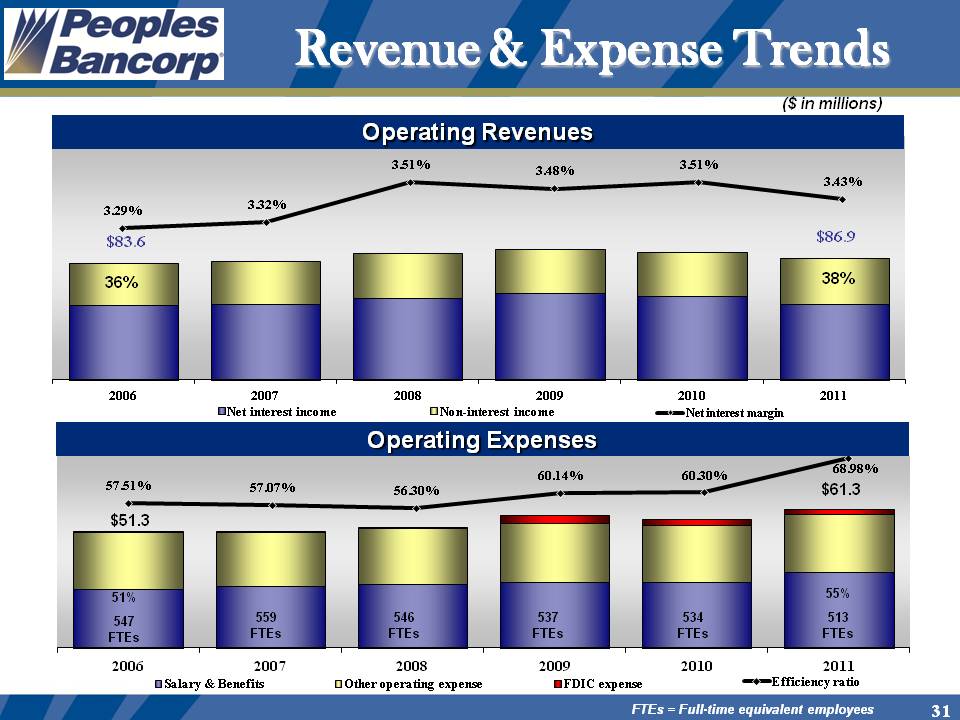

Our focus on positive operating leverage is producing higher pre-provision net revenue in 2012. This growth is taking place even though we incurred $660,000, or 4 cents after-tax, of merger and other non-core expenses during the second quarter. Absent these expenses, operating costs would have been up only slightly year-over-year, while total revenue grew 4%. We are comfortable with the higher expenses in the first half of 2012 given the level of revenue growth that has occurred.

In contrast, second quarter 2012 earnings were lower than the linked quarter because of the smaller reserve release and the nearly $1 million of annual insurance contingent income recognized in the first quarter.

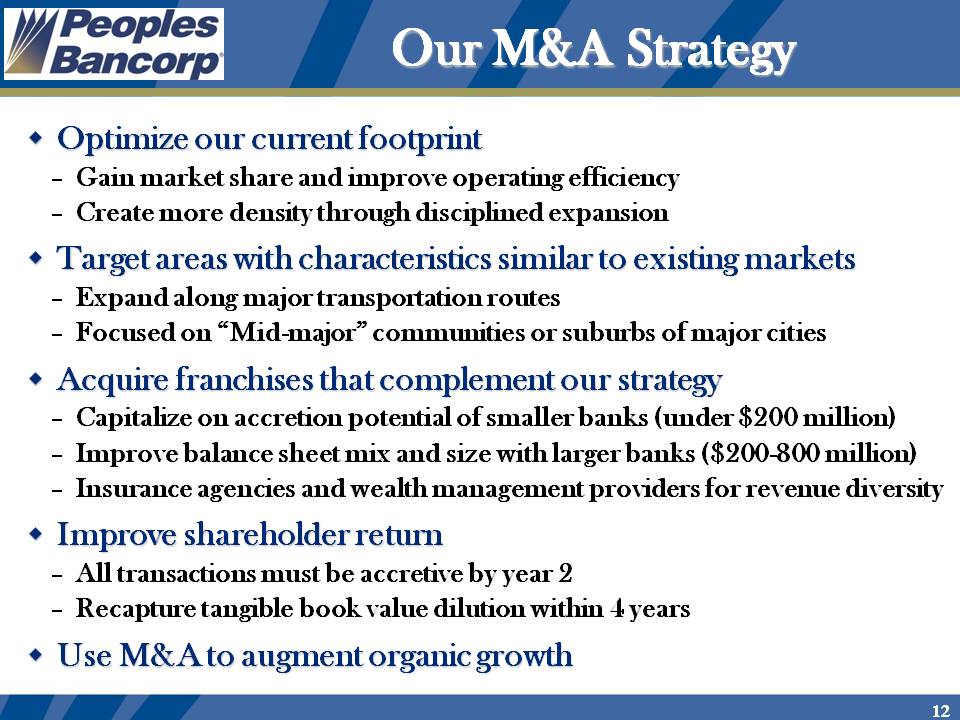

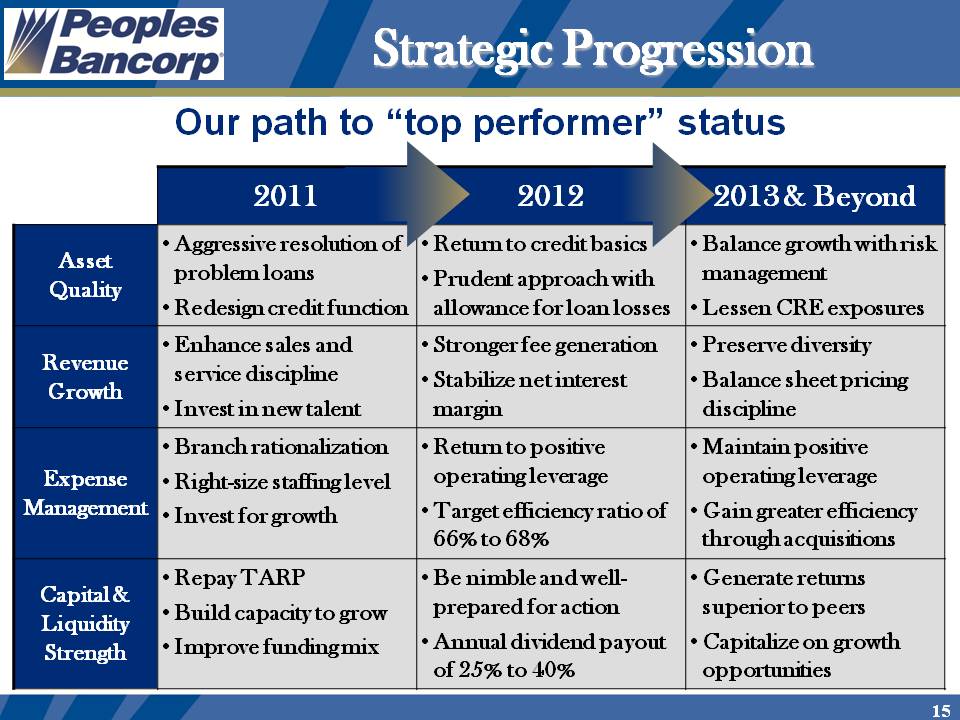

As we have discussed in recent calls, improving our business line performance is a key strategic goal. We are also looking to supplement this growth with acquisitions given our capital strength. Many smaller banks are finding it harder to survive as operating conditions become even more challenging. As a result, we are seeing more opportunities emerge within our footprint.

Along these lines, we are being more aggressive with acquisition opportunities in each of our three lines of business - banking, wealth management and insurance. During the second quarter, we made progress in two of these areas and ended a 6-year hiatus from acquisitions.

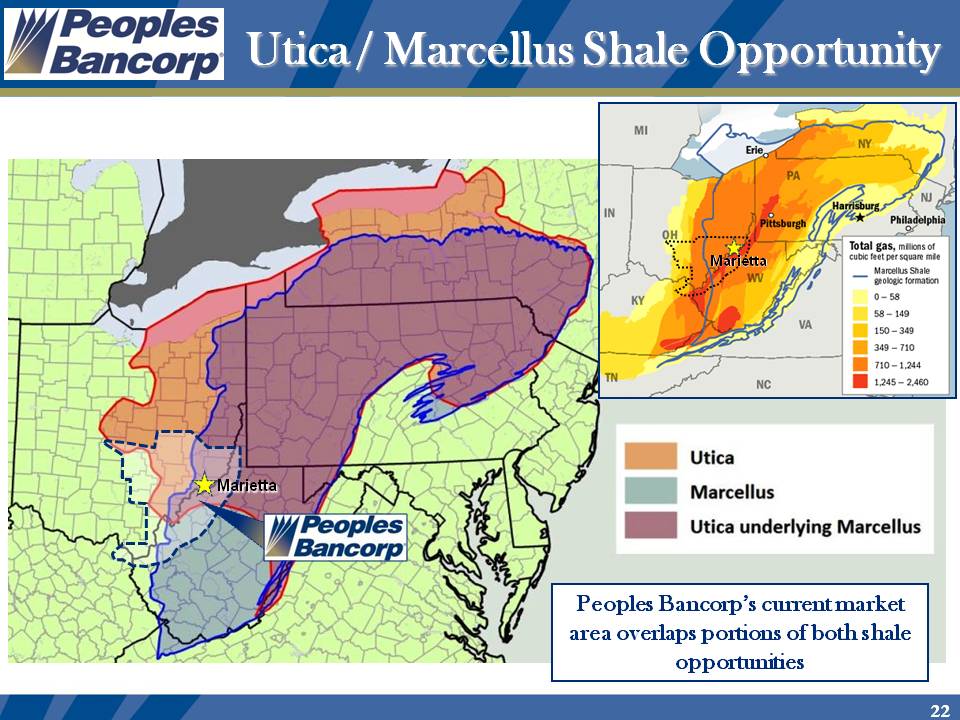

We began the mid-quarter purchase of a small wealth management book in Parkersburg, West Virginia region. Although not significant from a net earnings perspective, this transaction is consistent with our goal of growing our fee-based businesses. It also helps lay the foundation for our new Vienna office which is scheduled to open late in the year.

We then followed-up in early June with our announced plans to acquire Sistersville Bancorp. This transaction is consistent with our strategy to capitalize on the earnings accretion potential of smaller banks. We remain on schedule and anticipate finalizing this transaction in mid-September.

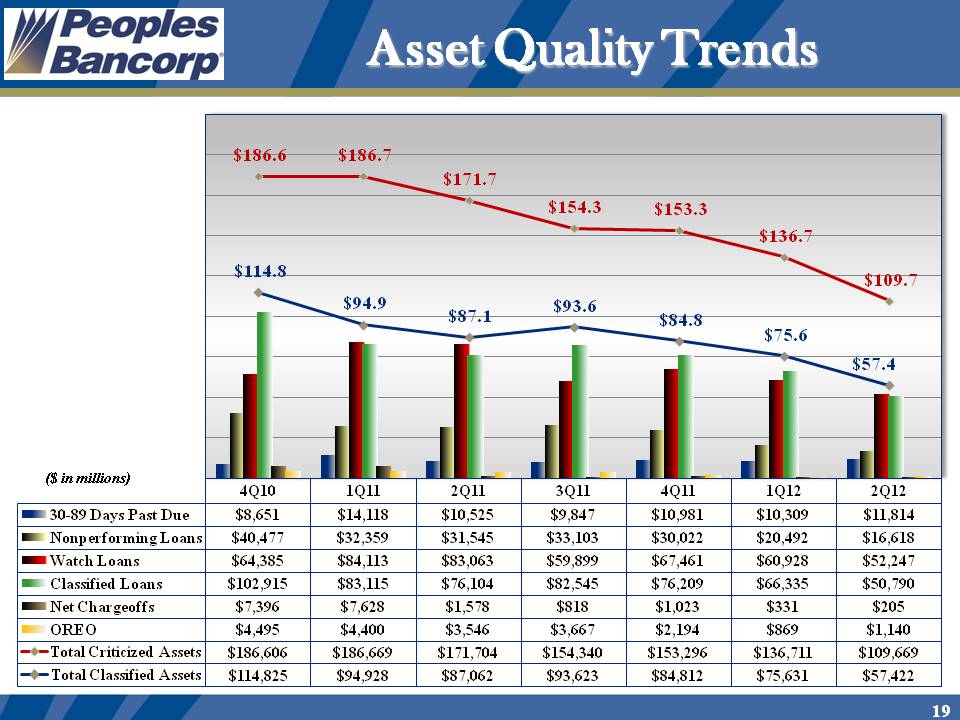

Turning back to our credit trends, we are pleased with the continued progress made in the second quarter towards restoring our asset quality. Both criticized and nonperforming assets were down for the third straight quarter. At the same time, our net charge-off rate remained lower than our long-term historic level. These conditions were key drivers of our decision to release additional reserves in the second quarter.

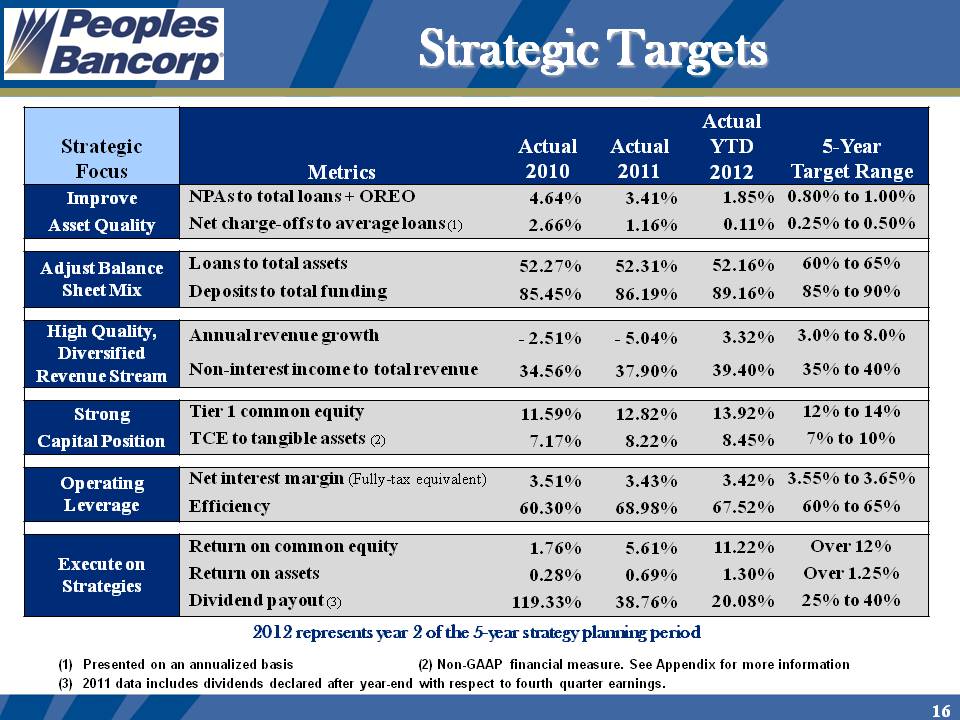

At June 30, nonperforming assets stood at 1.85% of loans and OREO versus 3.41% at year-end 2011. This represents a $14 million or 45% reduction over this period. We also have seen a $43 million or 28% decrease in criticized assets. Much of these improvements were due to principal paydowns and upgrades. Net charge-offs through six months of 2012 were minimal at 11 basis points on an annualized basis compared to nearly 2% a year ago.

Our allowance remains strong at 2.09% of total loans and 120% of nonperforming loans at June 30. We continue to believe asset quality trends will remain favorable in the coming quarters. As we move forward, our evaluation of the appropriate reserve level will continue to be based largely on net charge-offs, changes in nonperforming assets and overall credit quality migration trends.

Overall, our success in the first half of 2012 reflects our unrelenting focus on the “levers of success”: asset quality, expense management and revenue growth.

I will now turn the call over to Ed to further discuss our second quarter results.

Ed Sloane: Thanks Chuck.

During the second quarter, we achieved positive results in several key areas, including revenue growth, higher loan balances and good expense management. We also had to deal with several ongoing challenges facing the entire banking industry.

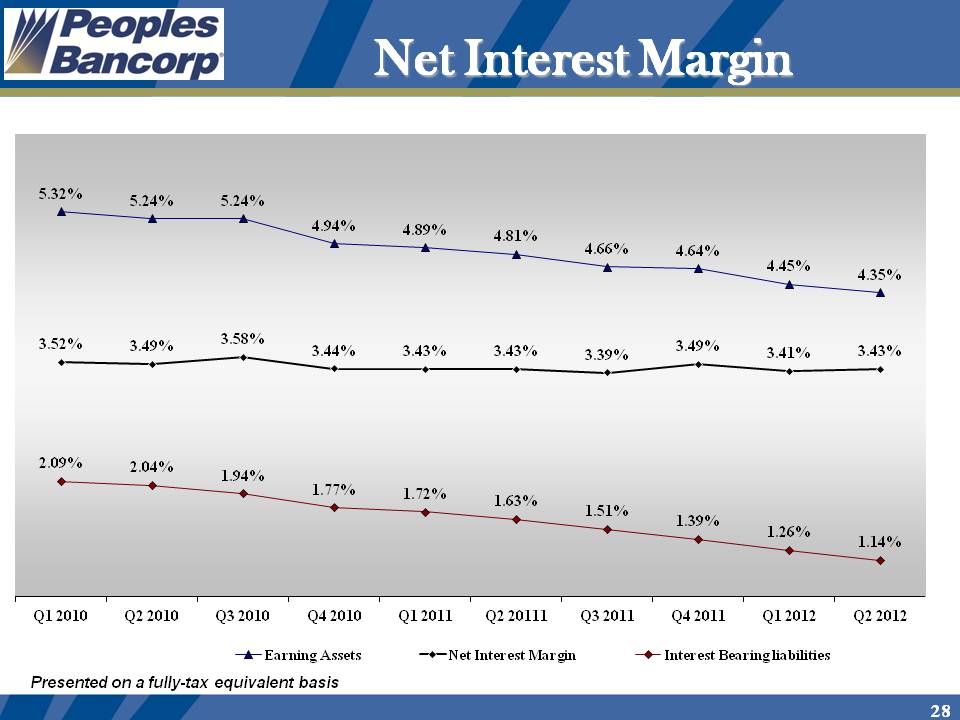

Most notably, the yield curve flattened substantially in response to renewed economic concerns in both the US and Europe. The resulting lower long-term rates intensified the downward pressure on our net interest margin.

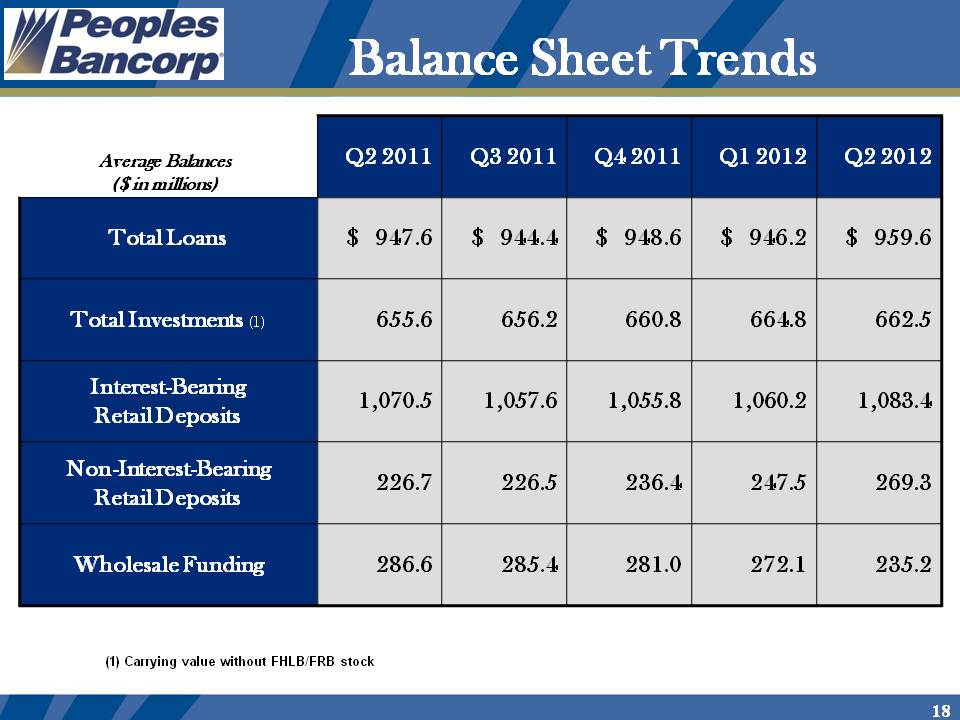

We are pleased to have maintained a stable net interest margin in the second quarter given the tougher interest rate conditions. This success reflects our disciplined balance sheet management and pricing. Our margin also benefited from higher average loan balances - both sequentially and year-over-year.

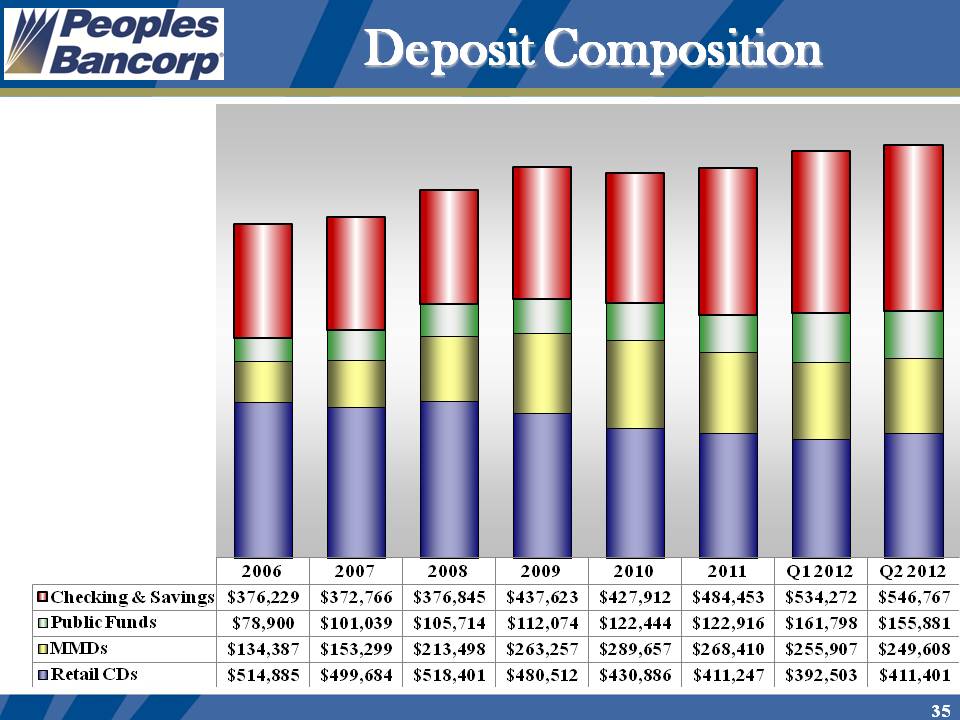

During the quarter, total funding costs fell 12 basis points from 1.06% last quarter and were 45 basis points lower than last year's second quarter. This improvement is being driven by the continued mix shift from higher-cost funding to low-cost core deposits. Second quarter 2012 funding costs also reflect a full quarter's impact of debt restructuring we completed mid-first quarter.

On the asset side of the balance sheet, our asset yields are being impacted by higher principal runoff from the investment portfolio due to the lower interest rates. In the second quarter, our monthly cash flow exceeded $12 million, 13% higher than the prior quarter and up over 30% from a year ago. We also are losing at least 1% in yield on the reinvestment of these funds.

On the other hand, modest loan growth occurred during the second quarter which helped to stabilize asset yields. Period-end balances were up $11 million while average balances were $13 million higher than the prior quarter.

For the second half of 2012, improving loan mix and quality will be equally as important as growing total loan balances. On the funding side, we will continue to seek opportunities to reduce funding costs, although our options remain limited. Absent meaningful loan growth or yield curve steepening, we anticipate a third quarter margin in the high 330's with similar compression in the fourth quarter.

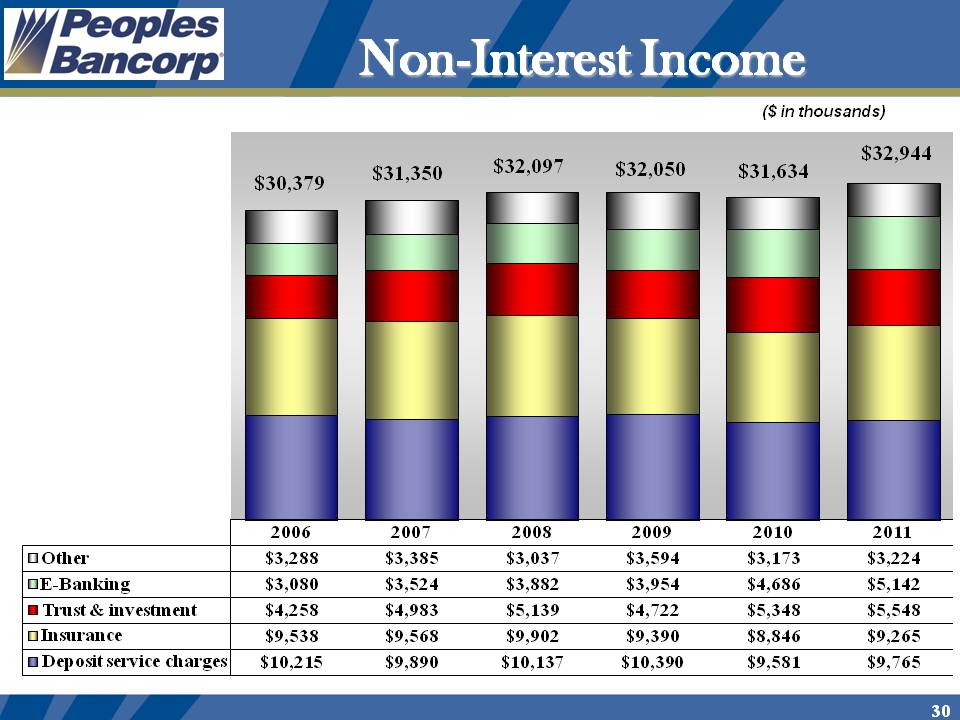

Turning back to revenue growth, during the second quarter, we made further progress towards our goal of double-digit growth in our wealth management and insurance revenues. Both of these areas are up 8% on a year-to-date basis. In addition, our mortgage and electronic banking activities continue to be strong drivers of revenue growth in 2012.

We are fortunate to have a growing, diversified revenue stream where nearly 40% comes from fee-based businesses. As a result, we are less dependent on net interest income than most banks our size.

However, increases in our fee-based revenue also has a direct impact on our operating expenses. Specifically, our sales and incentive-based compensation was up $355,000, or 30%, for the quarter and $795,000, or 38%, on a year-to-date basis.

Second quarter operating expenses also were higher than both the linked and prior year quarters due to the additional expenses Chuck mentioned earlier. These expenses caused our second quarter efficiency ratio to be outside our target range of 66% to 68% for 2012. We remain confident with our ability to manage expenses within this range, absent acquisition activities.

Taking a closer look at the second quarter acquisition expenses, included in this amount was $104,000 of legal and other professional fees for the two acquisitions discussed. We also incurred another $103,000 of acquisition-related costs where we ultimately decided to walk away based on our due diligence process. This action reflects the disciplined approach we are taking with acquisitions.

I will now turn the call back to Chuck for his final comments.

Chuck Sulerzyski: Thanks Ed.

In the second quarter, we made positive progress along several key fronts. Our diversified revenue stream is growing faster than expected. Operating expenses are being held in check. Loan balances are increasing while asset quality continues to improve.

We have also achieved a major milestone with the successful negotiation of two acquisitions during the quarter.

As discussed in our year-end call, our expectations for 2012 are for modest total revenue growth and operating expenses lower than 2011 absent acquisitions. Thus far in 2012, revenue growth is exceeding our expectations while operating expenses are trending higher than expected.

Looking to the second half of the year, we believe revenue generation will remain strong while operating expenses could end the year modestly higher than 2011. Our focus on expense management will result in meaningful stronger operating leverage during the final two quarters compared to the first half of 2012. This result reflects our commitment to grow revenue while holding the line on expenses. Further, we will look to reduce expenses in the event revenue levels show signs of weakening.

Another strategic goal for 2012 and beyond is to build a loan portfolio with better risk dynamics and greater diversity. Overall, we are pleased with the progress made thus far. Our credit quality is improving at a faster pace than expected. In addition, C&I loans are up 11% higher than one year ago, while consumer balances are up 5%. At the same time, CRE balances have decreased 5% as we have exited several problems loans.

Looking over the next 12 to 18 months, we expect to see C&I and consumer loans become even larger segments of the portfolio. Within our CRE portfolio, ongoing efforts to replace C-tier credits with A and B-tier credits will create a higher quality portfolio going forward. Overall, we believe current origination volumes are capable of generating 5 to 10% annualized loan growth once our credit metrics stabilize and the outflow of troubled loans slow.

Along these lines, I am pleased to report the hiring of an experienced consumer lender during the second quarter. Tom Frawely joined our management team in early June. Tom comes to Peoples with over 25 years of banking experience, most of it in consumer lending. Most recently, Tom served as the head of consumer leading for a larger bank located within our footprint. We are excited to have a professional with Tom's depth of experience on board to lead our consumer lending activities.

We are committed to sustaining the current earnings momentum in the coming quarters. I am confident we will succeed through disciplined execution of our strategies and partnership with our clients and communities.

We are pleased to report another quarter of solid performance. This accomplishment reflects our commitment to profitable growth of the company and building long-term shareholder value.

This concludes our commentary, and we will open the call for questions. Once again, this is Chuck Sulerzyski and joining me for the Q and A session is Ed Sloane, Chief Financial Officer. I will now turn the call back to Amy, our facilitator. Thank you.

Question and Answer Session

Facilitator: Thank you. We will now begin the question-and-answer session. [Facilitator Instructions.] Our first question is from Scott Siefers with Sandler O'Neill. Go ahead please.

Scott Siefers: Good morning guys. Let's see, I guess I wanted to start with Chuck, maybe just hear your thoughts at a top level on overall loan growth-just in the press release you cited some paydowns that will make growth in the second half of the year kind of challenging. I just want to get your overall thoughts on loan growth. Is that - are you feeling kind of more conservative or is it simply paydowns but no - really no change in customer demand? How are you thinking about those dynamics?

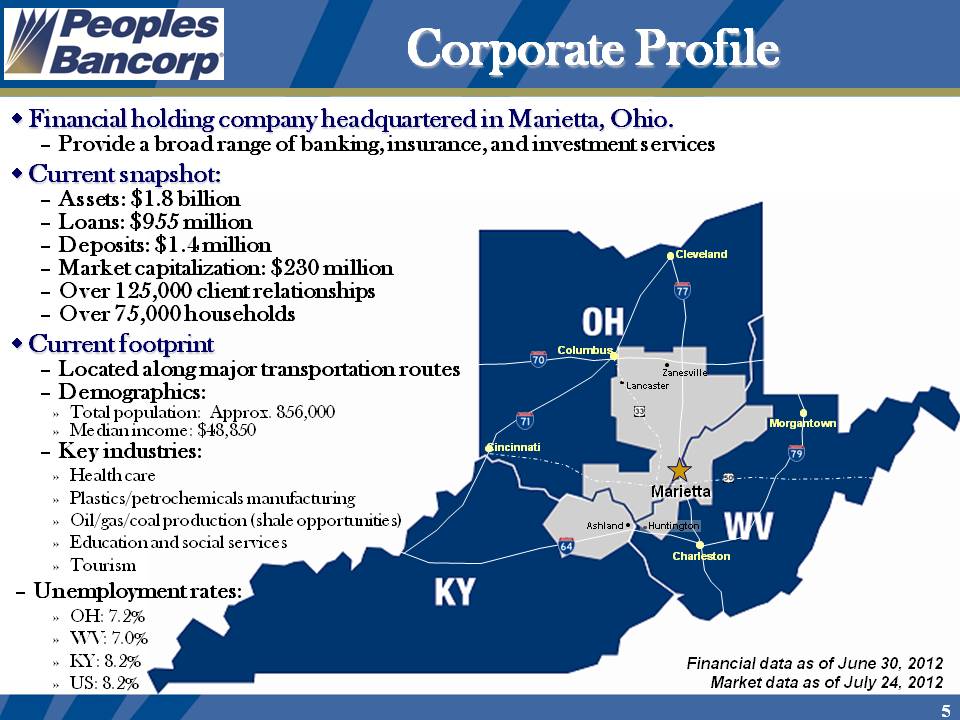

Chuck Sulerzyski: Well, a couple of comments Scott, first on the macro environment. There's a lot in the press about the economy slowing down. We're not seeing it in our footprint and - for example, the unemployment rate in Ohio is 7.2%, 1% less than the national average. And I suspect the last time it was 1% difference, I doubt you were actually in the business-you have to go back decades. So we're seeing a fair amount of growth.We feel pretty optimistic about loan demand. We have put a lot of effort into cleaning up the portfolio. Our origination volumes the last four quarters have been strong. The reason why the portfolio has not grown is because of stuff that we have been flushing out. I see that slowing down in the next four quarters. I see our origination volume staying at least as good as it has been, perhaps even better. So I think we will see more loan growth in the next four quarters than we have in the last four quarters. I also feel strongly about that because of the investments that we've made in the consumer lending talent. So I'm more optimistic today. We've spent a lot of time in the last four or five quarters

really working defensively to improve the portfolio. We've changed our underwriting practices. We've changed some of the systems that we've used. And that's behind us and is kind of becoming a set of operating norms within the lending community that we have here. So I'm more optimistic today than I've been since I've been here.

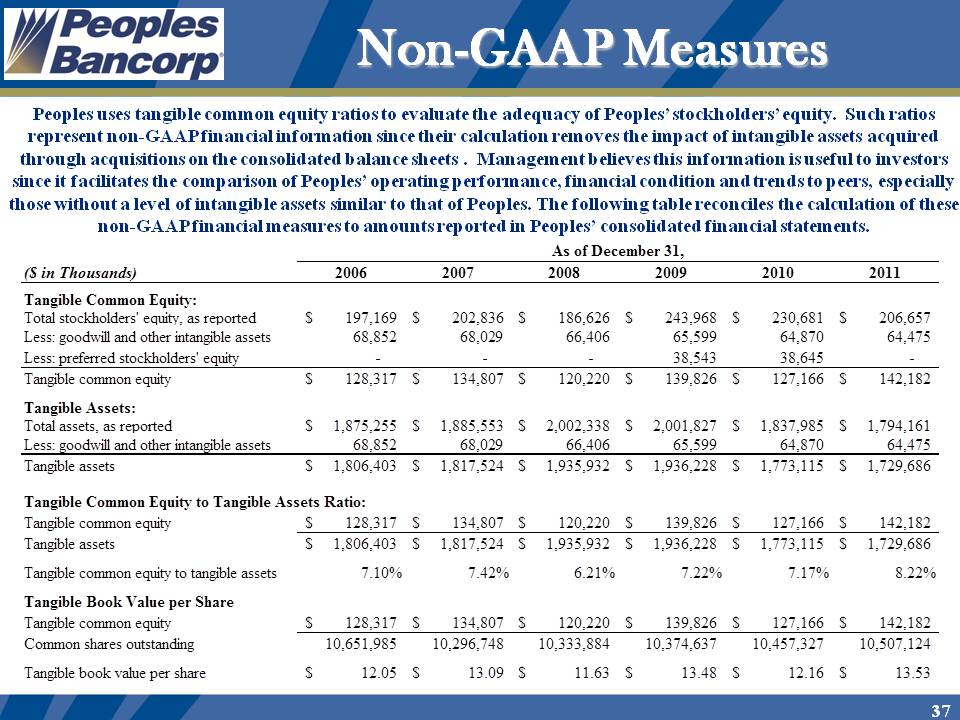

Scott Siefers: Okay. That's very helpful. I appreciate it. And then, Ed, I wanted to ask you a question or two on the margin. So it sounds like maybe about five basis points of compression per quarter in the last half of the year. Just curious about any additional levers you might have to pull maybe, i.e., prepaying some borrowings and things like that. You guys are building tangible book at a pretty quick clip. So, I think you could probably tolerate any prepayment penalties, things like that. Just curious what sort of optionality there is in there?

Ed Sloane: Not really seeing anything right now, Scott, on prepayment penalties in the borrowings side. I would have to say the levers that we have to pull really tie back to what Chuck just commented on in terms of the loan portfolio. The expectation there and the focus has been around growth in the loan portfolio for the next - for the coming quarters and consumer lending to help fortify that, continue growth in C&I type lending in the commercial portfolio. And then I think if you go to the other side of the balance sheet and look at the deposit base and we've had very good success at remixing our deposits into lower-cost core deposits, almost 20% increase in non-interest-bearing DDA over the past year. And we're expecting to see some continued remix in that area. But to your point, there will be some pressure on investment portfolio yields, and it's critical that we continue to focus on loan growth and strong pricing discipline in our loan portfolio.

Scott Siefers: Okay. Perfect. And then just a final question I had, so expense guidance is a little higher than you had been saying previously. If I'm understanding it correctly, that's largely just a function of the fact that revenues are coming in significantly higher or at least higher than you guys had been anticipating previously. And that it sounds like you're still pretty confident on the positive operating leverage side. But within the expense guidance, does that take into account the fact that you had some unusual expenses here in the first half? Are those embedded into that guidance? Or maybe a simpler way of asking it is that you've been right around this $15 million quarterly run rate. Is that something that we should expect to grow off of or can you kind of hold the line at this $15 million level, absent acquisitions?

Ed Sloane: I think up slightly on that, Scott, for the reason that you outlined. There is a sales compensation component to it. And as we've seen very strong revenue growth, 4% in revenue growth so far this year, it's exceeding our expectations and 8% of that coming from fee-based businesses. That's going to drive some of that sales compensation up. So we would expect it to add to it.

Chuck Sulerzyski: Also, Scott, the Sistersville acquisition closes in mid-September and gives us a little bit more expense in the second half of the year than we anticipated. I think that our second half 2012 expenses will be very, very close to our second half 2011 expenses.

Scott Siefers: Okay, perfect. That's very helpful. Thanks a lot.

Facilitator: [Facilitator Instructions] And our next question is from Daniel Cardenas with Raymond James. Go ahead, please.

Dan Cardenas: Good morning, guys.

Chuck Sulerzyski: Hi, Dan.

Ed Sloane: Hi, Dan.

Dan Cardenas: Quick question then. With the hiring of a new consumer head, are - what are the thoughts of hiring additional consumer lenders over the next year?

Chuck Sulerzyski: Well, first off, that search that we just completed took us almost a year to complete and we're

real excited about it. If you look at our company over the last decade, consumer lending was clearly undernourished and it was viewed as a undesirable business. I think consumer lending has more opportunity than the company has taken advantage of. I don't see us adding much in the way of talent. In addition, we will add a person - a salesperson in the indirect business. And then the normal underwriting, collection functions and other components will grow as volume grows, but I don't anticipate us adding many FTE in the next six to nine months in that area at all. So, I think there's a tremendous amount of upside here in terms of leveraging some of the embedded investments or scale that we have. And I think that we're - our loan book is roughly two-thirds commercial to one-third consumer. And five years from now, I'd like to see that closer to 50/50.

Dan Cardenas: All right. And then, I think you had mentioned - maybe Ed mentioned in the call that there is about $300,000 of expenses related to an acquisition that you took a look at and walked away from. Was that a bank transaction or was that one of your other business lines?

Chuck Sulerzyski: It was a bank transaction primarily.

Dan Cardenas: Okay. And are you seeing a pick up or a substantial pick up in conversations that you're having with other financial institutions in your footprint?

Chuck Sulerzyski: Unlike what you read in the press, we've had the opportunity to do several due diligences over the last couple of quarters. So we're getting kind of to the point of having conversations and having agreements on pricings. When you get under the covers and you see what's there, that has made us walk away more often than we've gone forward. So, we are having conversations. I think that the small banks, in particular, are overwhelmed. And I think it's opportunity for us.

Ed Sloane: Yeah. The only thing that I would add to that, Dan, is we do have looks at other lines of business as well, the wealth management and insurance. We've taken several looks at some smaller agencies in those areas. So that's just as big of a focus to us as whole banks are.

Chuck Sulerzyski: I mean we would like to keep the proportion of our earnings coming from insurance and investments if we were to double the size of the bank over a four or five year period through acquisitions. The smaller banks are not going to bring us the insurance and the investment business.

Dan Cardenas: Got it. Okay. Good. Thank you.

Chuck. Sulerzyski: Thank you.

Ed Sloane: Thank you.

Facilitator: [Facilitator Instructions] At this time, there are no further questions. Sir, do you have any closing remarks?

Chuck Sulerzyski: I'd just like to thank everybody for being with us this morning. And please remember that our earnings release and webcast of this call will be archived on peoplesbancorp.com under the Investor Relations section. Thanks a bunch and have a good day.

Facilitator: This will conclude today's conference call. Please disconnect your lines.

END