UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANY

811-03074

(Investment Company Act file number)

Northeast Investors Growth Fund

(Exact name of registrant as specified in charter)

100 High Street

Boston, MA 02110

Boston, MA 02110

(Address of principal executive offices) (Zip code)

(617) 523-3588

(Registrant’s telephone number, including area code)

Robert Kane

100 High Street

Boston, MA 02110

100 High Street

Boston, MA 02110

(Name and address of agent for service)

December 31

Date of fiscal year end

January 1, 2015 - June 30, 2015

Date of reporting period

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

|

TABLE OF CONTENTS

|

|

Shareholder Letter

|

1

|

|

Portfolio Update

|

3

|

|

Disclosure of Fund Expenses

|

7

|

|

Schedule of Investments

|

8

|

|

Statement of Assets and Liabilities

|

12

|

|

Statement of Operations

|

13

|

|

Statements of Changes in Net Assets

|

14

|

|

Financial Highlights

|

16

|

|

Notes to Financial Statements

|

18

|

|

Additional Information

|

23

|

|

Board Approval of Investment Advisory Contract

|

24

|

|

Northeast Investors Growth Fund

|

Shareholder Letter

|

Dear Fellow Shareholders:

In the first six months of 2015, the Northeast Investors Growth Fund performed well vs. our benchmark, returning +4.83% compared to just +1.23% for the S&P 500. U.S. large cap stocks rode into January with the momentum of six consecutive positive-returning calendar years – five of which were in double-digits. During this time period from the lows in the spring of 2009, the S&P 500 more than tripled to reach a price-to-earnings multiple just above a long-term historical average. Many believed this market was due for some digestion and that is just what we have received through June.

Domestic equity markets sold off to begin the year as a continuing rally in the U.S. dollar and further weakening commodity prices weighed on many multinational corporations comprising the benchmark indexes. The Federal Reserve also gave strong indications that the long-awaited initial interest rate hike would indeed come sometime during the year. The European Central Bank, on the other hand, began an easing package of their own after watching the results of our own quantitative easing for years.

This uncertain investing environment led to far lower equity correlations and greater sector divergences than we had seen for many years. Health care stocks continued to drive the broad markets higher on both further innovative therapy developments and a faster-acting FDA. Consumer discretionary companies also led during the first half of the year, primarily those more domestically-focused and insulated from the strong dollar headwinds. Prolonged low commodity prices and anticipated higher interest rates weighed heavily on names with these sensitivities. Thus, the utilities, energy, and industrials sectors led on the downside.

The outperformance of our Fund was primarily due to stock selection, although we benefitted also from maintaining an underweight in energy and no exposure to utility stocks. The greatest individual positive contributors to our performance came from Manhattan Associates (+46% return), NXP Semiconductor (+29%), Gilead Sciences (+25%) and Under Armour (+23%). Manhattan’s supply chain management software solutions continue to help retailers combat downward margin pressure from the likes of Amazon. NXP’s success has been driven by recent design wins in iPhones and Samsung devices as well as the rollout of chip and PIN bank cards in both the U.S. and China. And Gilead continues to surpass expectations in the fight against Hepatitis C with their drugs Sovaldi and Harvoni, which effectively cure the disease over an eight or twelve week regimen. Lastly, Under Armour is benefitting from the growing trend of “athleisure” apparel and capitalizing on recent successes of its major endorsement athletes.

The Fund portfolio was not without some disappointments for the first half of the year, however. Railroad operator Union Pacific had been a star performer for the past few years for our Fund but declined 19% in this time period due to West Coast port commercial disruptions and lower commodity volumes. Chinese e-commerce leader Alibaba declined 18% before it’s elimination from the portfolio. Consumer staples giant Procter & Gamble (-13%) felt the effects of the strong dollar crimping its overseas sales and Pioneer Natural Resources (-12%) sold off further as oil prices continued their slide.

|

Semi-Annual Report | June 30, 2015

|

1 |

|

Northeast Investors Growth Fund

|

Shareholder Letter

|

As of mid-summer, we are optimistically looking forward to the remainder of the year. We acknowledge the Federal Reserve needs to begin raising rates sooner than later to return to a more normalized interest rate environment. Greece appears to have successfully kicked the can for another few months and China’s government has stepped in to reduce the volatility of their own equity markets. The nuclear deal with Iran may lead to a greater supply and demand gap in the global crude markets. Mindful of all of these factors, we are confident our trusted holdings can navigate the choppy waters ahead.

We welcome and encourage you to contact us with any questions, concerns or comments. Please call us directly at 617-523-3588 or visit our website, www.northeastinvestorsgrowthfund.com, where you can view the Fund’s closing price, composition, and historical performance. If you follow your investments online, the ticker symbol for the Fund is NTHFX. Our lines of communication are always open to our most important partners – you, our fellow shareholders. We continue to appreciate your support.

William A. Oates, Jr.

August, 2015

| 2 |

www.northeastinvestorsgrowthfund.com

|

|

Northeast Investors Growth Fund

|

Portfolio Update

|

|

June 30, 2015 (Unaudited)

|

Average Annual Total Return (For the Period Ended June 30, 2015)

|

1 Year

|

5 Year

|

10 Year

|

Expense Ratio

|

|

|

Northeast Investors Growth Fund

|

10.62%

|

12.68%

|

5.79%

|

1.25%*

|

|

S&P 500® Total Return Index

|

7.42%

|

17.34%

|

7.89%

|

| * | As stated in the Fund’s most recent prospectus. |

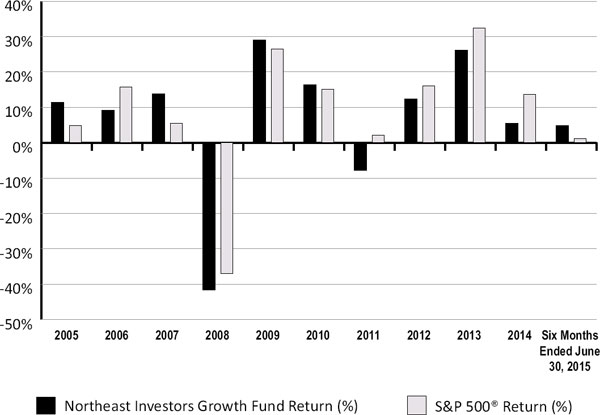

Performance Graph

The following graph compares the cumulative total shareholder return on the Northeast Investors Growth Fund shares to the cumulative total return on the S&P 500® Total Return Index, assuming an investment of $10,000 in both at their closing prices on December 31, 2004 and reinvestment of dividends and capital gains. The graph does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Keep in mind that past performance does not guarantee future returns, and an investment in the Fund is not guaranteed. For management’s discussion of the Fund’s performance for the period ended June 30, 2015, including strategies and market conditions which influenced such performance, see the Shareholder Letter.

|

2005

|

2006

|

2007

|

2008

|

2009

|

2010

|

2011

|

2012

|

2013

|

2014

|

Six

Months

Ended

June 30,

2015

|

||||||||||||||||||||||||||||||||||

|

Northeast Investors Growth Fund

|

$

|

11,138

|

$

|

12,167

|

$

|

13,858

|

$

|

8,092

|

$

|

10,442

|

$

|

12,152

|

$

|

11,200

|

$

|

12,590

|

$

|

15,878

|

$

|

16,746

|

$

|

17,555

|

||||||||||||||||||||||

|

S&P 500® Total Return Index

|

$

|

10,491

|

$

|

12,148

|

$

|

12,816

|

$

|

8,074

|

$

|

10,211

|

$

|

11,749

|

$

|

11,997

|

$

|

13,917

|

$

|

18,425

|

$

|

20,947

|

$

|

21,206

|

||||||||||||||||||||||

|

Semi-Annual Report | June 30, 2015

|

3 |

|

Northeast Investors Growth Fund

|

Portfolio Update

|

|

June 30, 2015 (Unaudited)

|

Returns and Per Share Data

|

2005

|

2006

|

2007

|

2008

|

2009

|

2010

|

2011

|

2012

|

2013

|

2014

|

Six

Months

Ended

June 30,

2015

|

||||||||||||||||||||||||||||||||||

|

Net Asset Value

|

18.40

|

20.10

|

20.19

|

11.74

|

15.15

|

17.60

|

16.22

|

16.67

|

17.26

|

16.58

|

17.38

|

|||||||||||||||||||||||||||||||||

|

Dividend Dist.

|

0.00

|

0.00

|

0.04

|

0.05

|

0.00

|

0.03

|

0.00

|

0.10

|

0.08

|

0.00

|

0.00

|

|||||||||||||||||||||||||||||||||

|

Capital Gains Dist.

|

0.00

|

0.00

|

2.60

|

0.00

|

0.00

|

0.00

|

0.00

|

1.47

|

3.60

|

1.64

|

0.00

|

|||||||||||||||||||||||||||||||||

|

Northeast Investors Growth Fund Return (%)

|

11.38

|

%

|

9.24

|

%

|

13.90

|

%

|

-41.61

|

%

|

29.05

|

%

|

16.38

|

%

|

-7.84

|

%

|

12.42

|

%

|

26.11

|

%

|

5.47

|

%

|

4.83

|

%

|

||||||||||||||||||||||

|

S&P 500® Return (%)

|

4.91

|

%

|

15.79

|

%

|

5.49

|

%

|

-37.00

|

%

|

26.46

|

%

|

15.06

|

%

|

2.11

|

%

|

16.00

|

%

|

32.39

|

%

|

13.69

|

%

|

1.23

|

%

|

||||||||||||||||||||||

| 4 |

www.northeastinvestorsgrowthfund.com

|

|

Northeast Investors Growth Fund

|

Portfolio Update

|

|

June 30, 2015 (Unaudited)

|

|

Ten Largest Investment Holdings

|

||||||||

|

Market Value

|

Percent of Net Assets

|

|||||||

|

Apple, Inc.

|

$

|

3,072,913

|

4.99

|

%

|

||||

|

Honeywell International, Inc.

|

2,263,734

|

3.67

|

%

|

|||||

|

Visa, Inc., Class A

|

2,249,525

|

3.65

|

%

|

|||||

|

Facebook, Inc., Class A

|

2,229,890

|

3.62

|

%

|

|||||

|

Gilead Sciences, Inc.

|

2,189,396

|

3.55

|

%

|

|||||

|

Goldman Sachs Group, Inc.

|

1,983,505

|

3.22

|

%

|

|||||

|

Akamai Technologies, Inc.

|

1,906,086

|

3.09

|

%

|

|||||

|

Manhattan Associates, Inc.

|

1,753,710

|

2.85

|

%

|

|||||

|

Celgene Corp.

|

1,736,025

|

2.82

|

%

|

|||||

|

CVS Health Corp.

|

1,730,520

|

2.81

|

%

|

|||||

Summary of Sector Weightings as a Percentage of Net Assets

|

Percent of Net Assets

|

||||

|

Consumer, Non‐Cyclical

|

22.87

|

%

|

||

|

Financial

|

17.02

|

%

|

||

|

Consumer, Cyclical

|

16.41

|

%

|

||

|

Technology

|

14.62

|

%

|

||

|

Industrial

|

11.30

|

%

|

||

|

Communications

|

10.06

|

%

|

||

|

Energy

|

6.74

|

%

|

||

|

Other Assets in Excess of Liabilities

|

0.98

|

%

|

||

|

Total

|

100.00

|

%

|

||

|

Semi-Annual Report | June 30, 2015

|

5

|

|

Northeast Investors Growth Fund

|

Portfolio Update

|

|

June 30, 2015 (Unaudited)

|

Summary of Net Assets by Industry

|

Market Value

|

% of Net Assets

|

|||||||

|

Common Stocks

|

||||||||

|

Aerospace/Defense

|

$

|

1,308,974

|

2.12

|

%

|

||||

|

Apparel

|

4,133,090

|

6.71

|

%

|

|||||

|

Auto Parts & Equipment

|

1,559,302

|

2.53

|

%

|

|||||

|

Banks

|

5,292,170

|

8.59

|

%

|

|||||

|

Beverages

|

774,722

|

1.26

|

%

|

|||||

|

Biotechnology

|

4,728,513

|

7.68

|

%

|

|||||

|

Computers

|

4,826,623

|

7.84

|

%

|

|||||

|

Cosmetics/Personal Care

|

711,984

|

1.16

|

%

|

|||||

|

Diversified Financial Services

|

2,664,701

|

4.32

|

%

|

|||||

|

Electronics

|

2,263,734

|

3.67

|

%

|

|||||

|

Food

|

1,199,231

|

1.95

|

%

|

|||||

|

Household Products/Wares

|

1,040,200

|

1.69

|

%

|

|||||

|

Insurance

|

1,646,560

|

2.67

|

%

|

|||||

|

Internet

|

4,111,493

|

6.68

|

%

|

|||||

|

Media

|

1,597,960

|

2.59

|

%

|

|||||

|

Miscellaneous Manufacturing

|

1,779,721

|

2.89

|

%

|

|||||

|

Oil & Gas

|

3,765,573

|

6.12

|

%

|

|||||

|

Pharmaceuticals

|

5,626,497

|

9.13

|

%

|

|||||

|

Pipelines

|

383,900

|

0.62

|

%

|

|||||

|

Real Estate Investment Trusts

|

886,255

|

1.44

|

%

|

|||||

|

Retail

|

4,415,748

|

7.17

|

%

|

|||||

|

Semiconductors

|

1,512,280

|

2.46

|

%

|

|||||

|

Software

|

2,665,466

|

4.32

|

%

|

|||||

|

Telecommunications

|

489,405

|

0.79

|

%

|

|||||

|

Transportation

|

1,611,753

|

2.62

|

%

|

|||||

|

Total Common Stocks

|

60,995,855

|

99.02

|

%

|

|||||

|

Other Assets in Excess of Liabilities

|

605,610

|

0.98

|

%

|

|||||

|

Total Net Assets

|

61,601,465

|

100.00

|

%

|

|||||

|

6

|

www.northeastinvestorsgrowthfund.com

|

|

Northeast Investors Growth Fund

|

Disclosure of Fund Expenses

|

|

June 30, 2015 (Unaudited)

|

As a shareholder of the Northeast Investors Growth Fund (the “Fund”), you will incur ongoing costs, including management fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on January 1, 2015 and held until June 30, 2015.

Actual Expenses. The first line of each table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. The expenses shown in the table are meant to highlight ongoing Fund costs. Therefore, the second line of each table below is useful in comparing ongoing costs only, and may not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

|

Net

|

Beginning

|

Ending

|

||||||||||||

|

Expense

|

Account Value

|

Account Value

|

Expenses Paid

|

|||||||||||

|

Ratios

|

January 1, 2015

|

June 30, 2015

|

During Period(a)

|

|||||||||||

|

Northeast Investors Growth Fund

|

||||||||||||||

|

Actual Return

|

1.31%

|

$

|

1,000.00

|

$

|

1,048.30

|

$

|

6.65

|

|||||||

| Hypothetical Return | ||||||||||||||

|

(5% return before expenses)

|

1.31%

|

$

|

1,000.00

|

$

|

1,018.30

|

$

|

6.56

|

|||||||

|

(a)

|

Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (181), divided by 365.

|

|

Semi-Annual Report | June 30, 2015

|

7

|

|

Northeast Investors Growth Fund

|

Schedule of Investments

|

|

June 30, 2015 (Unaudited)

|

|

Description

|

Shares

|

$ Value

|

||||||

|

COMMON STOCKS ‐ 99.02%

|

||||||||

|

Communications ‐ 10.06%

|

||||||||

|

Internet ‐ 6.68%

|

||||||||

|

Amazon.com, Inc.(a)

|

1,100

|

$

|

477,499

|

|||||

|

Facebook, Inc., Class A(a)

|

26,000

|

2,229,890

|

||||||

|

Google, Inc., Class A(a)

|

2,600

|

1,404,104

|

||||||

|

4,111,493

|

||||||||

|

Media ‐ 2.59%

|

||||||||

|

Walt Disney Co.

|

14,000

|

1,597,960

|

||||||

|

Telecommunications ‐ 0.79%

|

||||||||

|

Verizon Communications, Inc.

|

10,500

|

489,405

|

||||||

|

Total Communications

|

6,198,858

|

|||||||

|

Consumer, Cyclical ‐ 16.41%

|

||||||||

|

Apparel ‐ 6.71%

|

||||||||

|

NIKE, Inc., Class B

|

14,200

|

1,533,884

|

||||||

|

Under Armour, Inc., Class A(a)

|

19,700

|

1,643,768

|

||||||

|

VF Corp.

|

13,700

|

955,438

|

||||||

|

4,133,090

|

||||||||

|

Auto Parts & Equipment ‐ 2.53%

|

||||||||

|

Magna International, Inc.

|

27,800

|

1,559,302

|

||||||

|

Retail ‐ 7.17%

|

||||||||

|

Costco Wholesale Corp.

|

10,300

|

1,391,118

|

||||||

|

CVS Health Corp.

|

16,500

|

1,730,520

|

||||||

|

Lowe’s Cos., Inc.

|

14,200

|

950,974

|

||||||

|

Starbucks Corp.

|

6,400

|

343,136

|

||||||

|

4,415,748

|

||||||||

|

Total Consumer, Cyclical

|

10,108,140

|

|||||||

|

Consumer, Non‐Cyclical ‐ 22.87%

|

||||||||

|

Beverages ‐ 1.26%

|

||||||||

|

PepsiCo, Inc.

|

8,300

|

774,722

|

||||||

|

Biotechnology ‐ 7.68%

|

||||||||

|

Amgen, Inc.

|

2,600

|

399,152

|

||||||

|

Biogen, Inc.(a)

|

1,000

|

403,940

|

||||||

|

Celgene Corp.(a)

|

15,000

|

1,736,025

|

||||||

|

See accompanying notes which are an integral part of these financial statements.

|

|

|

8

|

www.northeastinvestorsgrowthfund.com

|

|

Northeast Investors Growth Fund

|

Schedule of Investments

|

|

June 30, 2015 (Unaudited)

|

|

Description

|

Shares

|

$ Value

|

||||||

|

Consumer, Non‐Cyclical ‐ 22.87% (continued)

|

||||||||

|

Gilead Sciences, Inc.

|

18,700

|

$

|

2,189,396

|

|||||

|

4,728,513

|

||||||||

|

Cosmetics/Personal Care ‐ 1.16%

|

||||||||

|

Procter & Gamble Co.

|

9,100

|

711,984

|

||||||

|

Food ‐ 1.95%

|

||||||||

|

Mondelez International, Inc., Class A

|

29,150

|

1,199,231

|

||||||

|

Household Products/Wares ‐ 1.69%

|

||||||||

|

Clorox Co.

|

10,000

|

1,040,200

|

||||||

|

Pharmaceuticals ‐ 9.13%

|

||||||||

|

Alkermes PLC(a)

|

5,500

|

353,870

|

||||||

|

Bristol‐Myers Squibb Co.

|

19,700

|

1,310,838

|

||||||

|

Johnson & Johnson

|

16,840

|

1,641,226

|

||||||

|

Merck & Co., Inc.

|

8,000

|

455,440

|

||||||

|

Perrigo Co. PLC

|

6,100

|

1,127,463

|

||||||

|

Pfizer, Inc.

|

22,000

|

737,660

|

||||||

|

5,626,497

|

||||||||

|

Total Consumer, Non‐Cyclical

|

14,081,147

|

|||||||

|

Energy ‐ 6.74%

|

||||||||

|

Oil & Gas ‐ 6.12%

|

||||||||

|

Chevron Corp.

|

5,200

|

501,644

|

||||||

|

ConocoPhillips

|

6,500

|

399,165

|

||||||

|

EOG Resources, Inc.

|

7,800

|

682,890

|

||||||

|

Exxon Mobil Corp.

|

12,300

|

1,023,360

|

||||||

|

Occidental Petroleum Corp.

|

12,400

|

964,348

|

||||||

|

Pioneer Natural Resources Co.

|

1,400

|

194,166

|

||||||

|

3,765,573

|

||||||||

|

Pipelines ‐ 0.62%

|

||||||||

|

Kinder Morgan, Inc.

|

10,000

|

383,900

|

||||||

|

Total Energy

|

4,149,473

|

|||||||

|

Financial ‐ 17.02%

|

||||||||

|

Banks ‐ 8.59%

|

||||||||

|

Bank of America Corp.

|

39,200

|

667,184

|

||||||

|

Citigroup Inc

|

5,300

|

292,772

|

||||||

|

First Republic Bank

|

4,700

|

296,241

|

||||||

|

Goldman Sachs Group, Inc.

|

9,500

|

1,983,505

|

||||||

|

See accompanying notes which are an integral part of these financial statements.

|

|

|

Semi-Annual Report | June 30, 2015

|

9

|

|

Northeast Investors Growth Fund

|

Schedule of Investments

|

|

June 30, 2015 (Unaudited)

|

|

Description

|

Shares

|

$ Value

|

||||||

|

Financial ‐ 17.02% (continued)

|

||||||||

|

JPMorgan Chase & Co.

|

13,400

|

$

|

907,984

|

|||||

|

Wells Fargo & Co.

|

20,350

|

1,144,484

|

||||||

|

5,292,170

|

||||||||

|

Diversified Financial Services ‐ 4.32%

|

||||||||

|

BlackRock, Inc.

|

1,200

|

415,176

|

||||||

|

Visa, Inc., Class A

|

33,500

|

2,249,525

|

||||||

|

2,664,701

|

||||||||

|

Insurance ‐ 2.67%

|

||||||||

|

American International Group, Inc.

|

7,700

|

476,014

|

||||||

|

Berkshire Hathaway, Inc., Class B(a)

|

8,600

|

1,170,546

|

||||||

|

1,646,560

|

||||||||

|

Real Estate Investment Trusts ‐ 1.44%

|

||||||||

|

American Tower Corp.

|

9,500

|

886,255

|

||||||

|

Total Financial

|

10,489,686

|

|||||||

|

Industrial ‐ 11.30%

|

||||||||

|

Aerospace/Defense ‐ 2.12%

|

||||||||

|

United Technologies Corp.

|

11,800

|

1,308,974

|

||||||

|

Electronics ‐ 3.67%

|

||||||||

|

Honeywell International, Inc.

|

22,200

|

2,263,734

|

||||||

|

Miscellaneous Manufacturing ‐ 2.89%

|

||||||||

|

3M Co.

|

5,800

|

894,940

|

||||||

|

General Electric Co.

|

33,300

|

884,781

|

||||||

|

1,779,721

|

||||||||

|

Transportation ‐ 2.62%

|

||||||||

|

Union Pacific Corp.

|

16,900

|

1,611,753

|

||||||

|

Total Industrial

|

6,964,182

|

|||||||

|

Technology ‐ 14.62%

|

||||||||

|

Computers ‐ 7.84%

|

||||||||

|

Apple, Inc.

|

24,500

|

3,072,913

|

||||||

|

Manhattan Associates, Inc.(a)

|

29,400

|

1,753,710

|

||||||

|

4,826,623

|

||||||||

|

Semiconductors ‐ 2.46%

|

||||||||

|

NXP Semiconductors N.V.(a)

|

15,400

|

1,512,280

|

||||||

|

See accompanying notes which are an integral part of these financial statements.

|

|

|

10

|

www.northeastinvestorsgrowthfund.com

|

|

Northeast Investors Growth Fund

|

Schedule of Investments

|

|

June 30, 2015 (Unaudited)

|

|

Description

|

Shares

|

$ Value

|

||||||

|

Technology ‐ 14.62% (continued)

|

||||||||

|

Software ‐ 4.32%

|

||||||||

|

Akamai Technologies, Inc.(a)

|

27,300

|

$

|

1,906,086

|

|||||

|

Microsoft Corp.

|

17,200

|

759,380

|

||||||

|

2,665,466

|

||||||||

|

Total Technology

|

9,004,369

|

|||||||

|

Total Common Stocks

|

||||||||

|

(Cost $47,349,638)

|

60,995,855

|

|||||||

|

Total Investments ‐ 99.02%

|

||||||||

|

(Cost $47,349,638)

|

60,995,855

|

|||||||

|

Other Assets in Excess of Liabilities ‐ 0.98%

|

605,610

|

|||||||

|

Total Net Assets ‐ 100.00%

|

$

|

61,601,465

|

||||||

|

(a)

|

Non-income producing security. Includes securities which did not pay at least one dividend in the year preceding the date of this statement.

|

Common Abbreviations:

(N.V.) Naamloze Vennootschap is the Dutch term for a public limited liability corporation.

(PLC) Public Limited Company.

|

See accompanying notes which are an integral part of these financial statements.

|

|

|

Semi-Annual Report | June 30, 2015

|

11

|

|

Northeast Investors Growth Fund

|

Statement of Assets and Liabilities

|

|

June 30, 2015 (Unaudited)

|

|

ASSETS:

|

||||

|

Investments, at market value (Cost $47,349,638)

|

$

|

60,995,855

|

||

|

Cash

|

702,320

|

|||

|

Dividends receivable

|

33,088

|

|||

|

Other assets

|

16,442

|

|||

|

Total Assets

|

61,747,705

|

|||

|

LIABILITIES:

|

||||

|

Accrued investment advisory fee

|

34,077

|

|||

|

Accrued insurance

|

28,635

|

|||

|

Accrued audit and tax expense

|

27,749

|

|||

|

Accrued legal fees

|

15,869

|

|||

|

Accrued printing fees

|

12,412

|

|||

|

Accrued administration fees

|

8,380

|

|||

|

Payable for shares redeemed

|

4,511

|

|||

|

Accrued other expenses

|

14,607

|

|||

|

Total Liabilities

|

146,240

|

|||

|

NET ASSETS

|

$

|

61,601,465

|

||

|

NET ASSETS CONSISTS OF:

|

||||

|

Paid‐in capital

|

$

|

41,049,473

|

||

|

Undistributed net investment income

|

57,215

|

|||

|

Accumulated net realized gain

|

6,848,560

|

|||

|

Net unrealized appreciation on investments

|

13,646,217

|

|||

|

NET ASSETS

|

$

|

61,601,465

|

||

|

Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized)

|

3,544,659

|

|||

|

Net Asset Value, offering and redemption price per share

|

$

|

17.38

|

|

See accompanying notes which are an integral part of these financial statements.

|

|

|

12

|

www.northeastinvestorsgrowthfund.com

|

|

Northeast Investors Growth Fund

|

Statement of Operations

|

|

For the Six Months Ended June 30, 2015 (Unaudited)

|

|

INVESTMENT INCOME:

|

||||

|

Dividends, (net of foreign withholding taxes of $1,835)

|

$

|

473,198

|

||

|

Total Investment Income

|

473,198

|

|||

|

EXPENSES:

|

||||

|

Investment advisory fee (Note D)

|

208,606

|

|||

|

Administrative fees (Note C)

|

49,882

|

|||

|

Transfer agent fees (Note C)

|

44,170

|

|||

|

Audit and tax fees

|

22,486

|

|||

|

Legal fees

|

20,640

|

|||

|

Insurance

|

16,115

|

|||

|

Registration and filing fees

|

15,194

|

|||

|

Trustee fees

|

15,070

|

|||

|

Printing fees

|

10,779

|

|||

|

Custodian fees

|

5,379

|

|||

|

Miscellaneous fees

|

7,662

|

|||

|

Total Expenses

|

415,983

|

|||

|

Net Investment Income

|

57,215

|

|||

|

REALIZED AND UNREALIZED GAIN ON INVESTMENTS:

|

||||

|

Net realized gain on investment transactions

|

6,875,697

|

|||

|

Net change in unrealized depreciation on investments

|

(3,827,682

|

)

|

||

|

Net Gain on Investments

|

3,048,015

|

|||

|

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS

|

$

|

3,105,230

|

||

|

See accompanying notes which are an integral part of these financial statements.

|

|

|

Semi-Annual Report | June 30, 2015

|

13

|

|

Northeast Investors Growth Fund

|

Statements of Changes in Net Assets

|

|

Six Months Ended

|

||||||||

|

June 30, 2015

|

Year Ended

|

|||||||

|

(Unaudited)

|

December 31, 2014

|

|||||||

|

INCREASE IN NET ASSETS FROM OPERATIONS:

|

|

|

|

|

||||

|

Net investment income/(loss)

|

$

|

57,215

|

$

|

(203,262

|

)

|

|||

|

Net realized gain on investment transactions

|

6,875,697

|

5,751,819

|

||||||

|

Net change in unrealized depreciation on investments

|

(3,827,682

|

)

|

(2,173,381

|

)

|

||||

|

Net Increase in Net Assets Resulting from Operations

|

3,105,230

|

3,375,176

|

||||||

|

DISTRIBUTIONS TO SHAREHOLDERS:

|

||||||||

|

From net realized gains on investments

|

–

|

(6,039,228

|

)

|

|||||

|

Net Decrease in Net Assets from Distributions

|

–

|

(6,039,228

|

)

|

|||||

|

FUND SHARE TRANSACTIONS:

|

||||||||

|

Proceeds from sale of shares

|

2,108,383

|

608,934

|

||||||

|

Reinvestment of distributions

|

–

|

5,439,311

|

||||||

|

Cost of shares redeemed

|

(9,593,198

|

)

|

(13,457,354

|

)

|

||||

|

Net Decrease in Net Assets from Fund Share Transactions

|

(7,484,815

|

)

|

(7,409,109

|

)

|

||||

|

Net Decrease in Net Assets

|

(4,379,585

|

)

|

(10,073,161

|

)

|

||||

|

NET ASSETS:

|

||||||||

|

Beginning of period

|

65,981,050

|

76,054,211

|

||||||

|

End of period*

|

$

|

61,601,465

|

$

|

65,981,050

|

||||

|

*Includes accumulated undistributed net investment income:

|

$

|

57,215

|

$

|

–

|

||||

|

See accompanying notes which are an integral part of these financial statements.

|

|

|

14

|

www.northeastinvestorsgrowthfund.com

|

Intentionally Left Blank

|

Northeast Investors Growth Fund

|

|

NET ASSET VALUE, BEGINNING OF PERIOD

|

|

INVESTMENT OPERATIONS:

|

|

Net investment income/(loss)(a)

|

|

Net realized and unrealized gain/(loss) on investments

|

|

Total from Investment Operations

|

|

LESS DISTRIBUTIONS TO SHAREHOLDERS

|

|

From net investment income

|

|

From net realized gains

|

|

Total Distributions

|

|

NET ASSET VALUE, END OF PERIOD

|

|

TOTAL RETURN(c)

|

|

RATIOS AND SUPPLEMENTAL DATA:

|

|

Net assets, end of period (in 000s)

|

|

Ratio to average daily net assets:

|

|

Expenses

|

|

Net investment income/(loss)

|

|

PORTFOLIO TURNOVER RATE

|

|

(a)

|

Average share method used to calculate per share data.

|

|

(b)

|

Less than $0.005 per share.

|

|

(c)

|

Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends.

|

|

(d)

|

Annualized.

|

|

See accompanying notes which are an integral part of these financial statements.

|

|

|

16

|

www.northeastinvestorsgrowthfund.com

|

|

Financial Highlights

|

|

For a share outstanding through the periods presented

|

|

Six Months

|

||||||||||||||||||||||

|

Ended

|

Year Ended

|

Year Ended

|

Year Ended

|

Year Ended

|

Year Ended

|

|||||||||||||||||

|

June 30, 2015

|

December 31,

|

December 31,

|

December 31,

|

December 31,

|

December 31,

|

|||||||||||||||||

|

(Unaudited)

|

2014

|

2013

|

2012

|

2011

|

2010

|

|||||||||||||||||

|

$

|

16.58

|

$

|

17.26

|

$

|

16.67

|

$

|

16.22

|

$

|

17.60

|

$

|

15.15

|

|||||||||||

|

0.00

|

(b)

|

(0.05

|

)

|

0.04

|

0.08

|

0.02

|

0.01

|

|||||||||||||||

|

0.80

|

1.01

|

4.23

|

1.94

|

(1.40

|

)

|

2.47

|

||||||||||||||||

|

0.80

|

0.96

|

4.27

|

2.02

|

(1.38

|

)

|

2.48

|

||||||||||||||||

|

–

|

–

|

(0.08

|

)

|

(0.10

|

)

|

–

|

(0.03

|

)

|

||||||||||||||

|

–

|

(1.64

|

)

|

(3.60

|

)

|

(1.47

|

)

|

–

|

–

|

||||||||||||||

|

–

|

(1.64

|

)

|

(3.68

|

)

|

(1.57

|

)

|

–

|

(0.03

|

)

|

|||||||||||||

|

$

|

17.38

|

$

|

16.58

|

$

|

17.26

|

$

|

16.67

|

$

|

16.22

|

$

|

17.60

|

|||||||||||

|

4.83

|

%

|

5.47

|

%

|

26.11

|

%

|

12.42

|

%

|

(7.84

|

)%

|

16.38

|

%

|

|||||||||||

|

$

|

61,601

|

$

|

65,981

|

$

|

76,054

|

$

|

73,016

|

$

|

76,191

|

$

|

93,264

|

|||||||||||

|

1.31

|

%(d)

|

1.25

|

%

|

1.23

|

%

|

1.38

|

%

|

1.40

|

%

|

1.39

|

%

|

|||||||||||

|

0.18

|

%(d)

|

(0.29

|

)%

|

0.22

|

%

|

0.44

|

%

|

0.14

|

%

|

0.03

|

%

|

|||||||||||

|

23

|

%

|

58

|

%

|

82

|

%

|

36

|

%

|

49

|

%

|

15

|

%

|

|||||||||||

|

Semi-Annual Report | June 30, 2015

|

17

|

|

Northeast Investors Growth Fund

|

Notes to Financial Statements

|

|

June 30, 2015 (Unaudited)

|

|

NOTE A–ORGANIZATION

|

Northeast Investors Growth Fund (the “Fund”) is a diversified, no-load, open-end, series-type management investment company registered under the Investment Company Act of 1940, as amended. The Fund presently consists of one portfolio and is organized as a Massachusetts business trust.

The Fund’s objective is to produce long-term capital appreciation for its shareholders. The Fund maintains a flexible investment policy which primarily targets common stocks of large domestic companies. The Fund emphasizes well-known companies which it believes to have strong management, solid financial fundamentals and which are established leaders in their industries. The Fund generally invests in companies with market capitalizations in excess of $10 billion.

|

NOTE B–SIGNIFICANT ACCOUNTING POLICIES

|

The Fund is considered an investment company for financial reporting purposes under accounting principles generally accepted in the United States of America (“U.S. GAAP”). Significant accounting policies of the Fund, which are in conformity with U.S. GAAP are as follows:

Use of Estimates: The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Valuation of Investments: Investments in securities traded on national securities exchanges are valued based upon closing prices on the exchanges or last sales price. Securities traded in the over-the-counter market and listed securities with no sales on the date of valuation are valued at closing bid prices. Other short-term investments, when held by the Fund, are valued at cost plus earned discount or interest which approximates market value.

Securities and other assets for which market quotations are not readily available or are deemed unreliable (including restricted securities, if any) are valued at their fair value as determined in good faith under consistently applied procedures approved by the Board of Trustees. Methodologies and factors used to determine fair value of securities may include, but are not limited to, contractual restrictions, information of any recent sales, the analysis of the company’s financial statements, quotations or evaluated prices from broker-dealers and/or pricing services and information obtained from analysts. The Fund may use fair value pricing for foreign securities if a material event occurs that may effect the price of a security after the close of the foreign market or exchange (or on days the foreign market is closed) but before the Fund prices its portfolio, generally at 4:00 p.m. EST. Fair value pricing may also be used for securities acquired as a result of corporate restructurings or reorganizations as reliable market quotations for such issues may not be readily available. At June 30, 2015, there were no securities priced at fair value as determined in good faith.

Investment Transactions: Investment transactions are accounted for as of trade date. Realized gains and losses on investment transactions are determined on the identified cost basis.

|

18

|

www.northeastinvestorsgrowthfund.com

|

|

Northeast Investors Growth Fund

|

Notes to Financial Statements

|

|

June 30, 2015 (Unaudited)

|

Investment Income: Interest income is recognized on an accrual basis. Dividend income is recorded on the ex-dividend date, net of applicable withholding taxes.

Federal Income Taxes: No provision for federal income taxes is necessary since the Fund has elected to qualify under subchapter M of the Internal Revenue Code of 1986, as amended, and its policy is to distribute substantially all of its taxable income, including net realized capital gains, within the prescribed time periods.

As of and during the six months ended June 30, 2015, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognized interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the six months ended, the Fund did not incur any interest or penalties. The Fund is subject to examination by U.S. federal tax authorities for tax years 2011 through 2014.

Dividends and Distributions to Shareholders: Income and capital gain distributions are determined in accordance with income tax regulations which may differ from U.S. GAAP. Permanent book and tax differences relating to shareholder distributions will result in reclassifications to paid-in capital. The Fund’s distributions and dividend income are recorded on the ex-dividend date.

Indemnification: In the normal course of business, the Fund may enter into contracts that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims against the Fund that have not yet occurred. Based on experience, the Fund expects the risk of loss to be remote.

Net Asset Value: In determining the net asset value per share, rounding adjustments are made for fractions of a cent to the next higher cent.

Concentration of Credit Risk: The Fund places its cash with one banking institution, which is insured by Federal Deposit Insurance Corporation (FDIC). The FDIC limit is $250,000. At various times throughout the year, the amount on deposit may exceed the FDIC limit and subject the Fund to a credit risk. The Fund does not believe that such deposits are subject to any unusual risk associated with investment activities.

Subsequent Events: In accordance with U.S. GAAP, management has evaluated subsequent events through the date these financial statements were issued. All subsequent events determined to be relevant and material to these financial statements as a whole have been accordingly disclosed.

|

NOTE C–FUND ADMINISTRATION, ACCOUNTING, TRANSFER AGENCY, SHAREHOLDER SERVICING AND OTHER AGREEMENTS

|

ALPS Fund Services, Inc. (“ALPS”) serves as Fund administrator for which it is compensated by the Fund. ALPS also serves as fund accountant, transfer agent and shareholder servicing agent. ALPS carries out all functions related to the maintenance of shareholder accounts, acquisition and redemption of shares and mailings to shareholders. ALPS also determines the Fund’s Net

Asset Value.

Asset Value.

Union Bank serves as custodian of portfolio securities and other assets.

|

Semi-Annual Report | June 30, 2015

|

19

|

|

Northeast Investors Growth Fund

|

Notes to Financial Statements

|

|

June 30, 2015 (Unaudited)

|

|

NOTE D–INVESTMENT ADVISORY AND SERVICE CONTRACT

|

Northeast Management & Research Company, Inc. (“NMR”) provides the Fund with the services of a Chief Compliance Officer and anti-money laundering officer. The Fund has an investment advisory and service contract with NMR (the “Advisor”). Under the contract, the Fund pays the Advisor an annual fee at a maximum rate of 1.00% of the first $10,000,000 of the Fund’s average daily net assets, 3/4 of 1.00% of the next $20,000,000 and 1/2 of 1.00% of the average daily net assets in excess of $30,000,000, in monthly installments on the basis of the average daily net assets during the month preceding payment.

Under the Fund’s Investment Advisory Agreement (the “Agreement”), personnel of the Advisor provide the Fund with advice and assistance in the choice of investments and the execution of securities transactions, and otherwise maintain the Fund’s organization. Compensation to officers of the Fund or Advisor for services rendered to the Fund or to the Advisor are paid by the Advisor. Messrs. John C. Emery, Michael Baldwin, and F. Washington Jarvis, the Fund’s disinterested Trustees, are not officers or directors of the Advisor. The compensation of all disinterested Trustees of the Fund is borne by the Fund.

|

NOTE E–PURCHASES AND SALES OF INVESTMENTS

|

|

NOTE F–FUND SHARE TRANSACTIONS

|

Transactions in shares of beneficial interest for the periods ended were as follows:

|

6/30/2015

|

||||||||

|

(Unaudited)

|

12/31/2014

|

|||||||

|

Shares sold

|

121,492

|

36,045

|

||||||

|

Shares reinvested

|

–

|

325,122

|

||||||

|

Shares redeemed

|

(558,418

|

)

|

(787,376

|

)

|

||||

|

Net decrease in shares outstanding

|

(436,926

|

)

|

(426,209

|

)

|

||||

|

NOTE G–TAX BASIS INFORMATION

|

Tax Distributions: The amounts and characteristics of tax distributions and composition of distributable earnings/ (accumulated losses) are finalized at year end: accordingly, tax basis balances have not been determined as of June 30, 2015.

The tax character of distributions paid for the year ended December 31, 2014 were as follows:

|

Distributions Paid From:

|

2014

|

|||

|

Ordinary Income

|

$ | – | ||

|

Long Term Capital Gains

|

6,039,228

|

|||

|

Total

|

$

|

6,039,228

|

||

|

20

|

www.northeastinvestorsgrowthfund.com

|

|

Northeast Investors Growth Fund

|

Notes to Financial Statements

|

|

June 30, 2015 (Unaudited)

|

At June 30, 2015 the Fund’s aggregate security unrealized gains and losses based on cost for U.S. federal income tax purposes was as follows:

|

Cost of investments for income tax purposes

|

$

|

47,349,638

|

||

|

Aggregate gross appreciation

|

$

|

14,426,250

|

||

|

Aggregate gross depreciation

|

(780,033

|

)

|

||

|

Net unrealized appreciation

|

$

|

13,646,217

|

||

The Fund elects to defer to the fiscal year ending December 31, 2015, capital losses recognized during the period from November 1, 2014 to December 31, 2014 in the amount of $27,137.

|

NOTE H–FAIR VALUE MEASUREMENTS

|

Accounting Standards Codification 820 (“ASC 820”), “Fair Value Measurements and Disclosures” established a fair value hierarchy that distinguishes between market data obtained from independent sources (observable inputs) and the Fund’s own market assumptions (unobservable inputs). The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The various inputs that may be used to determine the value of the Fund’s investments are summarized in the following fair

value hierarchy:

value hierarchy:

| Level 1 - | Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date; |

| Level 2 - | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or input other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

| Level 3 - | Significant unobservable prices or inputs (including a Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

An investment level within the fair value hierarchy is based on the lowest level input, individually or in the aggregate, that is significant to fair value measurement. The valuation techniques used by the Fund to measure fair value during the six months ended June 30, 2015, maximized the use of observable inputs and minimized the use of unobservable inputs.

|

Semi-Annual Report | June 30, 2015

|

21

|

|

Northeast Investors Growth Fund

|

Notes to Financial Statements

|

|

June 30, 2015 (Unaudited)

|

The following table summarizes the Fund’s investments as of June 30, 2015, based on the inputs used to value them.

|

Level 1

|

Level 2

|

Level 3

|

Total

|

|||||||||||||

|

Common Stocks

|

$

|

60,995,855

|

$

|

–

|

$

|

–

|

$

|

60,995,855

|

||||||||

|

TOTAL

|

$

|

60,995,855

|

$

|

–

|

$

|

–

|

$

|

60,995,855

|

||||||||

For the six months ended June 30, 2015, there have been no significant changes to the Fund’s fair value methodologies. Additionally, there were no transfers into or out of assigned levels during the six months ended June 30, 2015. It is the Fund’s policy to recognize transfers at the end of the reporting period.

For the six months ended June 30, 2015, the Fund did not have significant unobservable inputs (Level 3) used in determining fair value.

|

22

|

www.northeastinvestorsgrowthfund.com

|

|

Northeast Investors Growth Fund

|

Additional Information

|

|

|

June 30, 2015 (Unaudited)

|

|

1. PROXY VOTING POLICIES AND VOTING RECORD

|

A description of the policies and procedures that the Fund uses to vote proxies relating to portfolio securities is available without charge upon request by calling toll-free 1-855-755-6344, on the Fund’s website at www.northeastinvestorsgrowthfund.com or on the Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30th is available without charge upon request by calling toll-free 1-855-755-6344, or on the SEC’s website at http://www.sec.gov.

|

2. QUARTERLY PORTFOLIO HOLDINGS

|

The Fund files a complete listing of portfolio holdings with the SEC as of the first and third quarters of each fiscal year on Form N-Q. The filings are available upon request by calling 1-855-755-6344. Furthermore, you may obtain a copy of the filing on the SEC’s website at http://www.sec.gov. The Fund’s Form N-Q may also be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C., and information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

|

Semi-Annual Report | June 30, 2015

|

23

|

|

Northeast Investors Growth Fund

|

Board Approval of Investment

Advisory Contract

|

|

|

June 30, 2015 (Unaudited)

|

At its meeting held on May 19, 2015, the Board of Trustees of the Fund, including the Independent Trustees voting separately, voted to approve a one year renewal of the Fund’s investment advisory and service contract with Northeast Management & Research Company, Inc. (the “Investment Advisor”).

In reaching its decision, the Board considered information furnished to the Board at prior Board meetings, as well as information prepared specifically in connection with the annual contract review process. The Board also observed that there is a range of investment options available to shareholders of the Fund, including other mutual funds, and that the Fund’s shareholders have chosen to invest in the Fund. The Board also observed that the Fund has been managed in accordance with its investment objective and principal investment strategies, as disclosed in its prospectus. The Board reviewed and evaluated all information and factors they believed, with the advice of independent legal counsel and through the exercise of their own business judgment, to be relevant and appropriate and necessary to make an informed decision about the renewal. The Board’s decision to renew the contract was not based on any single factor and certain Trustees may have weighed certain factors differently.

The Investment Advisor provided detailed information to the Board. Such information included (i) information about the financial condition of the Investment Advisor and the Investment Advisor’s profitability derived from its relationship with the Fund; (ii) a description of the personnel and services provided by the Investment Advisor, including its investment process used for the Fund; and (iii) comparative information on investment performance, fees and expenses.

The Board reviewed and considered the nature, extent and quality of services provided to the Fund by the Investment Advisor. The Board took into account information furnished at meetings throughout the year as well as the materials furnished specifically in connection with the annual contract review process. The Board reviewed the background and experience of the Investment Advisor’s management team, and considered favorably steps taken during the prior year to further strengthen the investment process, enhance compliance and improve the shareholder service experience. The Board also reviewed and considered the qualifications of the portfolio managers for the Fund, including their history managing investments generally and growth oriented investments in particular, as well as the background and expertise of other key personnel and their roles in providing services to the Fund. The Board concluded, in light of the particular requirements of the Fund, it was satisfied with the professional qualifications and overall commitment to the Fund of the portfolio management team and other advisory personnel, and overall, was generally satisfied with the nature, extent and quality of investment advisory services provided to the Fund by the Investment Advisor.

The Board reviewed and considered the historical investment performance for the year-to-date, 1-year, 3-year, 5-year and 10-year periods, including comparative information against indexes and peer funds as determined by a third party. The Board concluded that while the Fund had underperformed relative to the index and peer measures, the differences were explainable based on the Investment Advisor’s investment approach and the Fund’s investment strategy. The Board determined that in light of the information taken as a whole and the nature of the investment program of the Fund, the investment performance was reasonable.

|

24

|

www.northeastinvestorsgrowthfund.com

|

|

Northeast Investors Growth Fund

|

Board Approval of Investment

Advisory Contract

|

|

|

June 30, 2015 (Unaudited)

|

The Board reviewed and considered information provided by the Investment Advisor about fees, income and expenses, and the Investment Advisor’s profitability derived from its relationship with the Fund. The Board determined that the Investment Advisor is solvent and in a position to perform the ongoing responsibilities to the Fund, and that the profitability to the Investment Advisor under the agreement was not unreasonable.

The Board reviewed and considered the total advisory fees and the effective investment advisory fee rate paid by the Fund in the context of potential economies of scale that might be realized by the Fund and noted the current advisory fee schedule contains breakpoints and that the current asset level does not justify implementation of additional breakpoints at this time.

The Board reviewed and considered the investment advisory fees or other payments received by the Investment Advisor from the Fund and the Fund’s expense ratio. The Board reviewed and considered the aggregate fees paid during the prior year by the Fund to the Investment Advisor, as well as comparative fee information for other funds in its peer group, as determined by a third party. The Board observed that the management fee rate was below the median of the Fund’s peer group and the Fund’s net expense ratio was in line with the peer median. After carefully considering the information provided and the factors noted above, the Board concluded that, in light of the services provided, the Fund’s fees paid to the Investment Advisor were fair.

|

Semi-Annual Report | June 30, 2015

|

25

|

|

TRUSTEES

William A. Oates, Jr.

Michael Baldwin

John C. Emery

F. Washington Jarvis

OFFICERS

William A. Oates, Jr., President

Robert B. Minturn, Vice President, Clerk & Chief Legal Officer

John F. Francini, Jr., Vice President & Chief Financial Officer

Richard G. Manoogian, Vice President & Chief Compliance Officer

Nancy M. Mulligan, Vice President

Robert M. Kane, Vice President

INVESTMENT ADVISOR

Northeast Management & Research Company, Inc.

100 High Street

Boston, Massachusetts 02110

CUSTODIAN

Union Bank

350 California Street, 6th Floor

San Francisco, CA 94104

LEGAL COUNSEL

Wilmer Cutler Pickering Hale and Dorr LLP

60 State Street

Boston, Massachusetts 02109

TRANSFER AGENT

ALPS Fund Services, Inc.

1290 Broadway Suite 1100

Denver, Colorado 80203

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Grant Thornton LLP

75 State Street

Boston, MA 02109

|

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus. Past performance is not predictive of future results. You may lose money by investing in the Fund. The information in this letter should not be construed as a recommendation to purchase or sell a particular security, and there is no assurance the securities described remain part of the Fund’s portfolio today.

Shares of the Fund are sold to investors at net asset value by

Northeast Investors Growth Fund

100 High Street

Boston, Massachusetts 02110

855-755-NEIG (6344)

www.northeastinvestorsgrowthfund.com

|

|

|

|

Must be preceded or accompanied by a prospectus.

|

|

Item 2. Code of Ethics.

Not applicable to semi-annual report.

Item 3. Audit Committee Financial Expert.

Not applicable to semi-annual report.

Item 4. Principal Accountant Fees and Services.

Not applicable to semi-annual report.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

| (a) | Schedule of Investments in securities of unaffiliated issuers as of the close of the reporting period is included as part of the Reports to Stockholders filed under Item 1 of Form N-CSR. |

| (b) | Not applicable. |

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

There have been no material changes to the procedures by which the shareholders may recommend nominees to the registrant’s board of directors, where those changes were implemented after the registrant last provided disclosure in response to the requirements of Item 407(c)(2)(iv) of Regulation S-K (17 CFR 229.407) (as required by Item 22(b)(15) of Schedule 14A (17 CFR 240.14a-101)), or this Item.

Item 11. Controls and Procedures.

| (a) | The registrant’s principal executive and principal financial officers, or persons performing similar functions, have concluded that the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Act (17 CFR 270.30a-3(c))) are effective, as of a date within 90 days of the filing date of the report that includes the disclosure required by this paragraph, based on their evaluation of these controls and procedures required by Rule 30a-3(b) under the Act (17 CFR 270.30a-3(b)) and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934, as amended (17 CFR 240.13a-15(b) or 240.15d-15(b)). |

| (b) | No changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Act (17 CFR 270.30a-3(d)) occurred during the registrant’s second fiscal quarter of the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting. |

Item 12. Exhibits.

|

(a)(1)

|

Not applicable to semi-annual report.

|

| (a)(2) | Certifications pursuant to Rule 30a-2(a) under the 1940 Act and Section 302 of the Sarbanes-Oxley Act of 2002 are attached hereto Exhibits 99.302(i) CERT. |

| (a)(3) | Not applicable. |

| (b) | Certifications pursuant to Rule 30a-2(b) under the 1940 Act and Section 906 of the Sarbanes-Oxley Act of 2002 are attached hereto Exhibit 99.906CERT. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Northeast Investors Growth Fund | ||

|

By:

|

/s/ William A. Oates, Jr.

|

|

|

William A. Oates, Jr., President

|

||

|

(principal executive officer)

|

||

|

Date:

|

September 4, 2015

|

|

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, as amended, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

By:

|

/s/ William A. Oates, Jr.

|

|

|

William A. Oates, Jr., President

|

||

|

(principal executive officer)

|

||

|

Date:

|

September 4, 2015

|

|

By:

|

/s/ John F. Francini, Jr.

|

|

|

John F. Francini, Jr., Chief Financial Officer

|

||

|

(principal financial officer)

|

||

|

Date:

|

September 4, 2015

|