Table of Contents

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement. |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)). |

| x | Definitive Proxy Statement. |

| ¨ | Definitive Additional Materials. |

| ¨ | Soliciting Material Pursuant to §240.14a-12. |

TELLABS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

Table of Contents

Tellabs, Inc., 1415 West Diehl Road, Naperville, Illinois 60563-2359

Notice of Annual Meeting of Stockholders

| Date: | May 1, 2013 | |

| Time: | 2:00 p.m., Central Daylight Savings Time | |

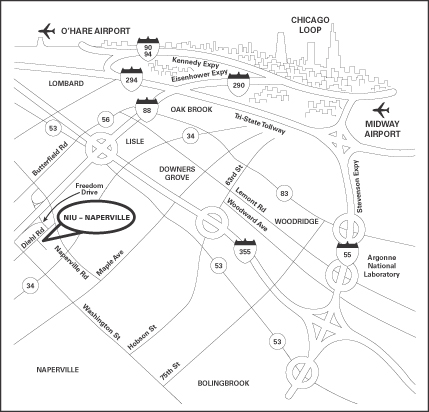

| Place: | Northern Illinois University — Naperville Campus 1120 East Diehl Road Naperville, IL 60563-9347 |

Purposes of the Annual Meeting:

| 1. | To elect four directors to serve until the 2016 Annual Meeting of Stockholders; |

| 2. | To amend the Tellabs Inc. Restated Certificate of Incorporation to declassify the Board of Directors; |

| 3. | To approve, on an advisory basis, named executive officer compensation; |

| 4. | To reapprove performance criteria under the Tellabs, Inc. Amended and Restated 2004 Incentive Compensation Plan; |

| 5. | To ratify the appointment of the Tellabs, Inc. independent registered auditor for fiscal year 2013; |

| 6. | To transact such other business as may properly, in accordance with the Tellabs, Inc. bylaws, come before the Annual Meeting of Stockholders or any adjournment thereof. |

Proxy voting:

Whether or not you plan to attend, you can be sure your shares are represented at the Annual Meeting of Stockholders by promptly voting and submitting your proxy by phone, Internet, or completing, signing, dating and mailing your proxy card in the enclosed envelope.

Who may attend the Annual Meeting of Stockholders:

The Board of Directors has fixed the close of business on March 4, 2013, as the record date for the Annual Meeting of Stockholders. Only stockholders of Tellabs, Inc. as of the record date are entitled to notice of, to vote at and to attend the Annual Meeting of Stockholders.

Conduct of the Meeting:

For security reasons, personal items such as backpacks, briefcases, banners, cameras and other recording devices are not allowed in the Annual Meeting of Stockholders. Please leave them at home or lock them in your car. Tellabs, Inc. has established an agenda for the meeting. At the conclusion of the presentations by the Chairman and the CEO there will be a question and answer period. Please hold all questions and comments until the moderator asks for stockholder questions.

Directions to the Annual Meeting of Stockholders:

For a map and directions to the Annual Meeting of Stockholders, please refer to the back page of this Proxy Statement.

By Order of the Board of Directors,

James M. Sheehan

Secretary

March 28, 2013

This Proxy Statement and the accompanying form of proxy are first being sent to stockholders on March 28, 2013.

WE URGE YOU TO VOTE YOUR SHARES AS PROMPTLY AS POSSIBLE BY (1) CALLING THE TOLL-FREE NUMBER (1.800.690.6903), (2) ACCESSING THE INTERNET WEB SITE AT www.proxyvote.com OR (3) COMPLETING, SIGNING, DATING AND MAILING THE ENCLOSED PROXY CARD.

Tellabs, Inc., One Tellabs Center, 1415 West Diehl Road, Naperville, Illinois 60563-2359

Table of Contents

| 1 | ||||

| 1 | ||||

| 3 | ||||

| 3 | ||||

| 8 | ||||

| PROPOSAL 3 — ADVISORY RESOLUTION TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION |

8 | |||

| 9 | ||||

| 11 | ||||

| 11 | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 13 | ||||

| 13 | ||||

| 13 | ||||

| 14 | ||||

| 14 | ||||

| 14 | ||||

| 14 | ||||

| 15 | ||||

| 16 | ||||

| 16 | ||||

| 16 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| 29 | ||||

| 30 | ||||

| 32 | ||||

| 33 | ||||

| 35 | ||||

| 35 | ||||

| 36 | ||||

| 40 | ||||

| 41 | ||||

| 41 | ||||

| 41 | ||||

| POLICIES AND PROCEDURES FOR REVIEW AND APPROVAL OF RELATED-PERSON TRANSACTIONS |

42 | |||

| 42 | ||||

| 44 | ||||

| FUTURE STOCKHOLDER PROPOSALS, DIRECTOR NOMINATIONS AND STOCKHOLDER COMMUNICATIONS |

44 | |||

| 45 | ||||

| EXHIBIT A — RESTATED CERTIFICATE OF INCORPORATION OF TELLABS, INC. ARTICLE SIXTH |

A-1 | |||

| EXHIBIT B — TELLABS, INC. AMENDED AND RESTATED 2004 INCENTIVE COMPENSATION PLAN |

B-i | |||

| DIRECTIONS TO THE 2013 ANNUAL MEETING OF STOCKHOLDERS |

B-14 |

Table of Contents

Tellabs, Inc.

One Tellabs Center

1415 West Diehl Road

Naperville, Illinois 60563-2359

The enclosed proxy is solicited by the Board of Directors (the Board) of Tellabs, Inc., a Delaware corporation (the Company), for use at the Company’s 2013 Annual Meeting of Stockholders (the Annual Meeting) to be held at 2:00 p.m. Central Daylight Savings Time on Wednesday, May 1, 2013. To ensure that your vote is recorded promptly, please vote as soon as possible, even if you plan to attend the Annual Meeting in person. This Proxy Statement and the accompanying form of proxy are first being sent to stockholders on March 28, 2013.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be Held on May 1, 2013: the Company’s Proxy Statement and 2012 Annual Report on Form 10-K (Proxy Materials) are available at: www.tellabs.com/investors.

Who can vote?

Only stockholders of record as of the close of business on March 4, 2013, are entitled to notice of, to vote at, and to attend the Annual Meeting. At the close of business on that date, the Company had 357,445,780 shares of Common Stock outstanding.

For ten days prior to the Annual Meeting, a list of registered stockholders entitled to vote at the Annual Meeting will be available for inspection at the Company’s principal executive offices, 1415 West Diehl Road, Naperville, Illinois 60563-2359. If you would like to view the stockholder of record list, please call the Investor Relations department at 630.798.3602 to schedule an appointment.

How do I vote?

Stockholders are entitled to one vote for each share held. Stockholders may revoke a proxy at any time before it is voted by filing a written revocation notice with the Secretary of the Company or by duly executing a proxy bearing a later date. Proxies may also be revoked by any stockholder present at the Annual Meeting who expresses a desire to vote his or her shares in person.

If you are a beneficial owner, you must give instructions to your bank, broker or other holder of record to vote your shares. You should follow the voting instructions on the information you receive from your bank, broker or other holder of record. Without instructions, your broker or nominee is permitted to use its discretion and vote your shares only on certain routine matters. The vote to ratify the Company’s independent registered auditor is the only routine matter being considered at the Annual Meeting. None of the other proposals are considered routine matters and brokers will not be permitted to vote your shares. Accordingly, it is important for you to give voting instructions to your broker for voting your shares on these other matters. If you hold shares through a bank or brokerage firm, you must contact that firm to revoke any prior voting instructions.

Subject to any such revocation, all shares represented by properly executed proxies that are received prior to the Annual Meeting will be voted in accordance with the directions on the proxy. If no direction is made, the proxy will be voted FOR the election of each of the four nominees for director, FOR amending the Company’s Certificate of Incorporation to declassify the Board of Directors, FOR approval, on an advisory basis, of the Company’s named executive officer compensation, FOR reapproval of performance

Page 1

Table of Contents

criteria under the Company’s Amended and Restated 2004 Incentive Compensation Plan, and FOR the ratification of the Company’s independent registered auditor for fiscal year 2013. The inspectors of election will tabulate votes cast in person or by proxy at the Annual Meeting and will determine whether a quorum (a majority of the shares entitled to be voted) is present at the meeting.

What constitutes a valid quorum for the Annual Meeting?

The presence of the holders of a majority of the outstanding shares of common stock entitled to vote at the Annual Meeting, whether in person or represented by proxy, is necessary to constitute a quorum. Abstentions and “broker non-votes” are counted as present and entitled to vote for purposes of determining a quorum. A “broker non-vote” occurs when a bank, broker or other holder of record holding shares for a beneficial owner does not vote on a particular proposal because that holder does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner.

How many votes are needed for each proposal and how are the votes counted?

Election of Directors. A majority of the votes cast is required for the election of each director nominee in an uncontested election. An uncontested election generally means an election where the number of nominees for director equals the number of directors to be elected. A “majority of the votes cast” means that the number of shares voted “for” a director must exceed the number of votes cast “against” the director with abstentions and broker non-votes not counted as a vote “for” or “against.” You should note that brokers are not permitted to vote shares in the election of directors without instructions from you. You should review the information from your broker on how to provide your broker voting instructions.

The election of directors at the Annual Meeting is an uncontested election. The Company’s Corporate Governance Guidelines, described later in this Proxy Statement, set forth procedures to follow if any nominee for director does not receive a majority of the votes cast in this uncontested election. Any nominee for director who does not receive a majority of votes cast is required to tender his or her resignation. The Nominating and Governance Committee would then be required to make a recommendation to the Board with respect to whether to accept any such letter of resignation. The Board is required to take action with respect to this recommendation and to disclose its decision-making process and final decision.

Declassification of the Board. The affirmative vote of holders of 75% or more of the voting power of the outstanding shares of capital stock of the Company entitled to vote generally is required to approve the amendment to the Company’s Restated Certificate of Incorporation. Abstentions and broker non-votes will have the effect of a vote against on this proposal.

All Other Proposals. The affirmative vote of the holders of a majority of the shares of the Company’s Common Stock present or represented at the Annual Meeting and entitled to vote thereon is required for approval of the other proposals. Abstentions and shares not voted by stockholders of record present or represented at the Annual Meeting and entitled to vote will have the same effect as a vote cast against approval of the other proposals. Broker non-votes will have no effect on the approval of the other proposals.

How do I vote if I am a Tellabs 401(k) Plan participant?

A Notice of Annual Meeting of Stockholders, Proxy Statement and form of proxy will be provided to each participant in the Tellabs 401(k) Plan who holds the Company’s shares as an investment within the Plan. Pursuant to the Tellabs 401(k) Plan, each participant is entitled to direct the trustee of the Tellabs 401(k) Plan with respect to voting (i) the shares of Common Stock allocated to the participant’s accounts; (ii) a proportion of the shares allocated to accounts of participants who do not return voting instructions to the trustee; and (iii) a proportion of all unallocated shares. Subject to its fiduciary duties, the trustee will vote allocated shares in accordance with the instructions received and will vote shares with respect to which no instructions are received and all unallocated shares in the same proportion as the shares with respect to which instructions are received. Tellabs 401(k) Plan participants should return the proxy as provided therein. Pursuant to the Tellabs 401(k) Plan, the trustee will not disclose the directions set forth on any individual proxy to the Company or its directors or officers, except as may otherwise be required by law.

Page 2

Table of Contents

What is householding and how can I request it?

The SEC has adopted rules that permit companies and other intermediaries, such as brokers and banks, to satisfy the delivery requirements for proxy materials with respect to two or more stockholders sharing the same address by delivering a single copy of the applicable proxy materials addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially means extra convenience for stockholders and cost savings for companies.

A single proxy statement will be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker that they will be householding communications to your address, householding will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in householding and would prefer to receive separate proxy materials, please notify your broker, direct your written request to Tellabs Investor Relations, 1415 W. Diehl Road, Naperville, IL 60563 or contact the Company at 630.798.8800. Stockholders who currently receive multiple copies of the proxy materials at their address and would like to request householding of their communications should contact their brokers.

Who pays for this proxy solicitation?

This proxy is solicited by the Board, and the cost of solicitation will be paid by the Company. Additional solicitation may be made by mail, personal interview, telephone or facsimile by Company personnel, who will not be additionally compensated for such effort. The cost of any such additional solicitation will be borne by the Company.

Where can I obtain additional information?

A copy of the Company’s 2012 Annual Report accompanies this Proxy Statement. More information about the Company, including electronic copies of the Company’s 2012 Annual Report on Form 10-K and this Proxy Statement, is available on the Company’s Web site at www.tellabs.com/investors.

Proposal 1 — Election of Directors

The Company has three classes of directors with staggered terms. Members of each class serve a three-year term. At the 2013 Annual Meeting, the terms of the Class III directors will expire.

The Nominating and Governance Committee conducts an annual review of the Board, each Board Committee and the Chairman of the Board based on input received from the Board and members of the Company’s management. Each Board Committee reviews the applicable results of these evaluations. The Board has adopted a set of Corporate Governance Guidelines, which the Nominating and Governance Committee is responsible for overseeing. A copy of the Nominating and Governance Committee’s current charter and the Company’s Corporate Governance Guidelines are available on the Company’s Web site at www.tellabs.com/investors.

In accordance with the Corporate Governance Guidelines, the Nominating and Governance Committee of the Board reviews the performance and qualifications of the members of the Board. Each director’s experience is evaluated in a matrix on whether he or she has some, moderate or extensive expertise in three main categories. These categories are Business Experience and Expertise; Industry and Technology Experience; and Related Experience. The Business Experience and Expertise category includes subcategories related to the skills needed to run a business ranging from profit and loss responsibility to corporate communication. The Industry and Technology Experience category focuses on technical knowledge and customer perspective. The Related Experience category includes other business, civic and philanthropic experience. The Board utilizes these categories to ensure that the Board composition is diverse in that a broad spectrum of relevant experience is represented. There are subcategories in each of

Page 3

Table of Contents

these categories, so each Board member and potential candidate is evaluated based on twenty-one different criteria. All nominees and current directors have extensive experience in business management and profit and loss responsibility as well as strategic planning and perspective.

Several directors have extensive experience in optical technology, wireless networks, network architectures, telecom customers or broadband/access networks. A number of the directors have international experience. Additional information on each individual director or nominee, including: age, current employment, public company directorships for the past five years, the year such person joined the Tellabs Board, and other information concerning their specific experience, qualifications, attributes or skills relevant to their service on the Board is set forth below.

For your consideration and election, the Board has nominated the following four individuals as Class III directors: Alex Mashinsky, Gregory J. Rossmann, Vincent H. Tobkin and Mikel H. Williams.

As previously announced, the Company has entered into an agreement with the Company’s largest stockholder, Third Avenue Management LLC (Third Avenue) pursuant to which the Company agreed to nominate Mr. Mashinsky as a Class III director for the vacancy caused by Mr. Birck’s retirement. The Company also agreed, subject to any limitations in its corporate documents, to amend its bylaws prior to the 2013 Annual Meeting to limit the size of the Board to a maximum of 10 directors. Also, pursuant to the previously announced agreement with Dialectic Capital Partners, LP (Dialectic) the Board agreed to nominate both Mr. Williams and Mr. Rossmann as Class III directors.

If elected, the nominees for Class III directors will serve a term that expires at the Company’s 2016 Annual Meeting (or until their successors are elected and qualified). Unless otherwise instructed by you as a stockholder, it is intended that your shares represented by the enclosed proxy will be voted for these nominees, each of whom has been selected by the Board. All Class I and Class II directors plan to continue in office for the remainder of their terms or until their successors are elected and qualified.

The Company is not aware of any other proposed nominees for directors. The Company anticipates that all of the nominees will be able to serve. However, if any nominee is unable to serve at the time of the Annual Meeting, your proxy will be voted for a substitute candidate nominated by the Nominating and Governance Committee of the Board and approved for nomination by the Board.

THE BOARD RECOMMENDS A VOTE FOR ALEX MASHINSKY, GREGORY J. ROSSMANN, VINCENT H. TOBKIN AND MIKEL H. WILLIAMS AS CLASS III DIRECTORS TO HOLD OFFICE UNTIL THE 2016 ANNUAL MEETING OR UNTIL THEIR SUCCESSORS ARE ELECTED.

Page 4

Table of Contents

Class III Nominees for Director Whose Terms Will Expire in 2016 if Elected

|

|

|

| |||

|

Alex Mashinsky, 47, managing partner of Governing Dynamics since 2004. CEO of Name.Space, Inc. 2011-2012. Founder and CEO of Groundlink 2005-2011. Founder of Transit Wireless 2002. Founder of Elematics 2000. Founder of Arbinet 1996. Director, Migo Software, Inc. Attended Tel Aviv University and Israel Open University.

Mr. Mashinsky has experience in the technology industry including innovative hardware and software ideas and founding successful businesses based on such technology. This experience will assist the Company with developing strategy initiatives. In addition to his current public company directorship, he previously served on the board of Arbinet. |

Gregory J. Rossmann, 51, senior managing director of GJR Capital Management since 2009. Managing director of The Carlyle Group 2007-2009. Managing director at Pequot Capital Management, Inc. 2000-2007. Managing director and partner at Broadview International 1994-2000. Manager of new business development at Dynatech Corporation 1991-1994. Product line management and engineering roles at Advanced Micro Devices, Inc. and National Semiconductor Corporation prior to 1994. Director, NETGEAR, Inc. M.B.A., Santa Clara University; B.S., University of Cincinnati. Tellabs director since 2012.

Mr. Rossmann’s extensive technology, private equity, and investment banking experience will enable him to provide the Company with expertise on global markets, corporate development and strategy initiatives. He serves on several private boards in addition to his current public company directorship. |

Mikel H. Williams, 56, president and CEO of DDi Corp. 2005 until its acquisition in 2012. Sole member Constellation Management Group, LLC 2004. COO LNG Holdings 2002-2003. Various executive positions with Global Telesystems, Inc. prior to 2002. Director, Iteris, Inc., Lightbridge Communications Corporation and IPC electronics industry association. M.B.A., Georgetown University; B.S., University of Maryland. Tellabs director since 2012.

Mr. Williams has been a CEO and has extensive international, management and financial experience as well as several years of experience in the telecom field. In addition to his current public company directorship, he also served on the board of DDi Corp. while CEO. |

Vincent H. Tobkin, 61, senior advisor, retired director and global telecom/technology practice leader of Bain & Company 1992-2009. General partner and a founder of Sierra Ventures 1984-1992. Partner and consultant with McKinsey and Company 1976-1984. Director, Radisys Corp. J.D. and M.B.A., Harvard University; S.B. and S.M., Massachusetts Institute of Technology. Tellabs director since 2010 and lead director since 2012.

Mr. Tobkin brings a vast knowledge of the telecommunications industry and business practices to assist the Board and management to focus on executing strategy. In addition to his current public company directorship, he has public company board experience and has advised public companies and their executives throughout most of his career. | |||

Page 5

Table of Contents

Class I Directors Continuing in Office Until 2014

|

|

| ||

| Frank Ianna, 63, chief executive officer of Attila Technologies LLC since 2007. President of AT&T Network Services 1998-2003; various executive and senior management positions at AT&T 1990-1998; various management and staff positions at AT&T 1972-1998. Director, Sprint Nextel. M.S.E.E., Massachusetts Institute of Technology; B.E.E.E., Stevens Institute of Technology. Tellabs director since 2004.

Mr. Ianna brings expertise in the area of communications technology as well as many years of experience as an executive of one of the largest telecom providers in the United States. He served at AT&T for more than 30 years, beginning as a member of the technical staff at Bell Telephone Laboratories. In addition to his current directorship, Mr. Ianna also has extensive experience as a public company director, most recently at Clearwire Corporation from 2008 through 2011. |

Stephanie Pace Marshall, Ph.D., 67, retired. Founding president and president emerita of Illinois Mathematics and Science Academy since 1986. Ph.D., Loyola University; M.A., University of Chicago; B.A., Queens College. Tellabs director since 1996.

Dr. Marshall contributes significant expertise and experience in building a successful organization, organizational cultures, and innovative thinking with regards to leadership, training, and the importance of innovating with science and technology. She has extensive private board experience and has served in CEO, senior leadership and management positions throughout her career. Dr. Marshall also has beneficial philanthropic experience including as a Trustee for the Society for Science and the Public, a Fellow of the Royal Society for the encouragement of Arts, Manufactures and Commerce, and a Trustee at the Lincoln Academy of Illinois. |

Vincent D. Kelly, 53, president and chief executive officer of USA Mobility, Inc. since 2004 when USA Mobility was formed through the merger of Metrocall, Inc. and Arch Wireless, Inc. President and chief executive officer at Metrocall 2003-2004; chief operating officer, chief financial officer and executive vice president at various times 1987-2003; and treasurer 1990-1996. Prior to joining Metrocall in 1987, Mr. Kelly worked as a Certified Public Accountant. B.S., George Mason University. Tellabs director since 2012.

Mr. Kelly has been involved with the wireless and telecommunications industry for over 25 years with extensive experience in strategic planning, M&A, regulatory and financial matters. In addition to his current directorships, his recent public company director experience includes Penton Media, Inc. from 2003 through 2007. | ||

Page 6

Table of Contents

Class II Directors Continuing in Office Until 2015

|

|

|

| |||

|

Bo Hedfors, 69, retired. President of Hedfone Consulting, Inc. (telecom and Internet consulting) 2002-2009. President of Motorola Networks 1998-2002. President and chief executive officer of Ericsson, Inc. 1994-1998; chief technology officer of LM Ericsson 1990-1993. Chairman, Kineto Wireless, Inc. Director, Firetide, Inc., Lemko Corporation and E-Band Communications Inc. M.S.E.E., Chalmers University of Technology. Tellabs director since 2003.

Mr. Hedfors brings an international viewpoint to the Board as well as previous executive experience with other large public communications equipment suppliers. He has served on several public and private boards during his career. In addition to his current directorship, his recent public company director experience includes Openwave Systems, Inc. from 2002 through 2008 and Switchcore AB from 2002 through 2007. |

Michael E. Lavin, 67,

Mr. Lavin’s background in |

Jan H. Suwinski, 71,

Mr. Suwinski has |

Dennis (Denny) F. Strigl,

Mr. Strigl has extensive |

| Retiring Chairman

| ||

|

Michael J. Birck, 75, chairman and co-founder of Tellabs. Chairman since 2000; chief executive officer 2002-2004; president and chief executive officer 1975-2000. Director, Molex Incorporated. M.S.E.E., New York University; B.S.E.E., Purdue University. Tellabs Director since 1975.

As a co-founder and former CEO of Tellabs, Mr. Birck brings unparalleled knowledge of Tellabs’ business and technology. He has significant experience in the communications industry and has received a number of awards for innovation and entrepreneurship. Mr. Birck also has extensive public company director experience. In addition to his current directorship, his recent public company director experience includes Illinois Tool Works, Inc. from 1996 to 2008. Mr. Birck is retiring from the Board after over 35 years of service as a Tellabs director and executive. | |

Page 7

Table of Contents

Proposal 2 — To Amend the Company’s Restated Certificate of Incorporation to Declassify the Board of Directors

In 2011, the Company received a request from a stockholder to include in the Company’s proxy statement, for consideration at the 2012 Annual Meeting, a proposal eliminating the Company’s classified board structure. Following a dialogue with the stockholder, the Company agreed to submit to stockholders, for consideration at this Annual Meeting, a proposal to eliminate the Company’s classified Board structure pursuant to an amendment to the Company’s Restated Certificate of Incorporation. After careful consideration, the Board has adopted a proposed amendment to the Company’s Restated Certificate of Incorporation to provide for the annual election of directors on a phase-out basis beginning with the 2014 Annual Meeting and the elimination of the classified board structure following the 2016 Annual Meeting.

Article Sixth of the Company’s Restated Certificate of Incorporation currently provides that directors are divided into three classes, with the term of office of one class expiring each year and the directors in each class serving three-year terms. If the proposed amendments are adopted and become effective, the Board will remain classified through the 2016 Annual Meeting, and directors elected at or before this Annual Meeting will serve out their three-year terms, but directors elected by stockholders after this Annual Meeting will be elected to one-year terms. Beginning at the 2016 Annual Meeting, the classified board structure would be eliminated and all directors would be subject to annual election for one-year terms.

Delaware corporate law provides that members of a board that is classified may be removed only for cause. At present, because the Board is classified, the Company’s Restated Certificate of Incorporation provides that directors are removable only for cause. If this item is approved by stockholders, Article Sixth would be amended to provide that, once the Board has become declassified following the 2016 Annual Meeting, directors may be removed with or without cause.

Article Sixth would be further amended to provide that, following the elimination of the classified Board structure in 2016, a director appointed to a vacancy or new directorship would serve for a term expiring at the next Annual Meeting following his or her appointment.

The proposed changes to Sections of Article Sixth are set forth in their entirety in Exhibit A.

In accordance with Delaware law, the Board of Directors has adopted resolutions approving and declaring advisable these proposed amendments and is recommending them to stockholders for approval.

Information about the voting standard for this proposal appears on page 2. If the proposed amendments are adopted and become effective, the Board will adopt conforming amendments to the Company’s Amended and Restated By-Laws.

THE BOARD RECOMMENDS A VOTE FOR DECLASSIFICATION OF THE BOARD.

Proposal 3 — Advisory Resolution to Approve Named Executive Officer Compensation

The Company is asking its stockholders to indicate approval of its named executive officer (NEO) compensation as described in this Proxy Statement. This proposal, commonly known as a “say-on-pay” proposal, gives stockholders the opportunity to express their views on the Company’s NEO compensation as required by Section 14A of the Securities Exchange Act of 1934. This vote is not intended to address any specific item of compensation, but rather the overall compensation of NEOs as described in this Proxy Statement. Accordingly, the Company asks the stockholders to vote FOR the following resolution:

“RESOLVED, that the Company’s stockholders approve, on an advisory basis, the compensation of the named executive officers, as disclosed in the Company’s Proxy Statement for the 2013 Annual Meeting of

Page 8

Table of Contents

Stockholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, the 2012 Summary Compensation Table and the other related tables and disclosure.”

As described in detail under the heading Compensation Discussion and Analysis, the Company’s executive compensation program is designed to attract, motivate, and retain NEOs who are critical to the Company’s success. This program does so by compensating the NEOs for performance as evidenced by the Company’s financial performance, the Company’s achievement of strategic objectives and individual performance. Please read the Compensation Discussion and Analysis for additional details about the Company’s executive compensation program, including information about the fiscal year 2012 compensation of the Company’s NEOs.

The say-on-pay vote is advisory, and therefore not binding on the Company, the Compensation Committee or the Board. The vote will provide the Board and Compensation Committee with information relating to the opinions of the stockholders which the Compensation Committee will consider as it makes determinations with respect to future action.

THE BOARD RECOMMENDS A VOTE FOR APPROVAL OF THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS, AS DISCLOSED IN THIS PROXY STATEMENT PURSUANT TO THE COMPENSATION DISCLOSURE RULES OF THE SECURITIES AND EXCHANGE COMMISSION.

Proposal 4 — Reapproval of Performance Criteria Under the Company’s Amended & Restated 2004 Incentive Compensation Plan

The Board is asking the stockholders of the Company to reapprove the performance criteria that apply to certain performance awards granted under the Tellabs, Inc. Amended & Restated 2004 Incentive Compensation Plan (the “Incentive Compensation Plan”). Stockholders are not being asked to approve an increase in the number of shares issuable under the Incentive Compensation Plan or any other amendment to the Incentive Compensation Plan.

Section 162(m) of the Internal Revenue Code of 1986, as amended (“Section 162(m)”) disallows federal income tax deductions for certain compensation in excess of $1,000,000 per year paid to each of the Company’s chief executive officer and its other three highest compensated officers (other than the chief financial officer). These individuals are referred to as “covered employees” for purposes of Section 162(m). Under Section 162(m), compensation that qualifies as “performance-based compensation” is not subject to the $1,000,000 deduction limit.

Performance awards granted under the Incentive Compensation Plan are intended to be eligible to qualify as performance-based compensation. One of the conditions to qualify as performance-based compensation is that the compensation payable under the performance award (other than stock options and SARs, which are treated as “performance-based compensation”) must be subject to one or more performance goals established by the Compensation Committee and which goals are based upon performance criteria which have been disclosed to, and approved by, the stockholders of the Company. Under Section 162(m), such performance criteria must be reapproved by the stockholders every five years. Because the Incentive Compensation Plan, including the performance criteria, was last approved by stockholders at the 2008 Annual Meeting, the Board is seeking reapproval of the performance criteria at this time. If reapproval is not obtained, performance awards (other than stock options and SARs) granted under the Incentive Compensation Plan which might otherwise have been intended to qualify as “performance-based compensation” will be subject to the $1,000,000 deduction limit under Section 162(m), which could result in greater tax costs for the Company. While reapproval of the

Page 9

Table of Contents

performance criteria is required for performance awards to qualify as performance-based compensation, not all awards under the Incentive Compensation Plan or other compensation approved by the Committee are intended to qualify, or if intended to qualify, will qualify, as “performance-based compensation” or otherwise be deductible.

Performance Criteria Under the Incentive Compensation Plan

Performance awards may be granted under the Incentive Compensation Plan to covered employees and other employees, directors and consultants of the Company or any subsidiary of the Company. Performance awards may be in the form of an annual incentive award, performance shares or performance units (which may be denominated or settled in cash, shares of stock [either fully vested or subject to vesting]), cash awards and other incentive awards, or a combination thereof. For a performance award to qualify as performance-based compensation under Section 162(m), the award must specify a predetermined amount of cash or shares that may be earned by the covered employee to the extent that predetermined performance goals based upon one or more of the following performance criteria are attained within a predetermined performance period: total stockholder return, earnings, earnings per share, net income, gross margin, earnings before interest, taxes, depreciation and/or amortization, revenues, expenses, cash flow, indebtedness, market share, return on assets, return on equity, economic value added, assets, fair market value of the common stock, value of assets, regulatory compliance, satisfactory internal or external audits, improvement of financial ratings, achievement of balance sheet or income statement objectives or other financial, accounting or quantitative objectives established by the Committee. The performance goals and objectives may be absolute in their terms or measured against, or in relationship to, other companies comparably and may be particular to a line of business, subsidiary or other unit of the Company generally. The performance goals may include or exclude extraordinary charges, losses from discontinued operations, restatements and accounting changes and other unplanned special charges, such as restructuring expenses, acquisitions and acquisition expenses, including expenses related to goodwill and other intangible assets, stock offerings and stock repurchases.

To qualify, the specific goals and objectives must be established by the Committee not later than 90 days after the applicable performance period has commenced (or if the performance period is less than a year, not later than the date on which 25% of the period has elapsed) and at the end of each performance period, the Committee must determine and certify the extent to which the performance goal established for the performance period has been achieved and determine the amount to be paid, vested or delivered as a result. The Committee may, in its sole discretion, reduce or eliminate such amount to the extent permitted under the Incentive Compensation Plan and applicable law.

The above summary of the material terms of the performance criteria under the Plan is qualified in its entirety by the specific language of the Incentive Compensation Plan, which is included as Exhibit B to this proxy statement and which is available to any stockholder upon request.

Maximum Number of Shares and Amount of Compensation Payable Under Awards

The Incentive Compensation Plan contains an annual limit of $3,000,000 on the amount any one individual may earn under an annual incentive award for any calendar year and an annual limit of $3,000,000 on the amount any one individual may earn under a cash or other incentive award for any calendar year. For purposes of this limitation, any award earned over a period greater than one year is deemed to have been earned ratably over the full and partial calendar years in such period. The Incentive Compensation Plan also includes an annual limit of 1,000,000 shares of common stock as the maximum number of shares that may be subject to awards made to any one individual for any calendar year.

Vote Required and Board of Directors’ Recommendation

If a quorum is present, a majority of the stock having voting power present in person or represented by proxy is required for approval of this proposal. Abstentions and “broker non-votes” will each be counted as present for purposes of determining the presence of a quorum, but will have no effect on the outcome of the vote.

Page 10

Table of Contents

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR REAPPROVAL OF THE PERFORMANCE CRITERIA UNDER THE TELLABS, INC. AMENDED & RESTATED 2004 INCENTIVE COMPENSATION PLAN.

Proposal 5 — To Ratify Appointment of the Company’s Independent Registered Auditor for Fiscal Year 2013

The Audit and Ethics Committee has selected Ernst & Young LLP (Ernst & Young), independent registered auditor, as the Company’s independent registered auditor for fiscal year 2013, as it has done since 1997.

Before making its determination on appointment, the Audit and Ethics Committee carefully considers the qualifications and competence of candidates for the independent registered public accounting firm. For Ernst & Young, this has included a review of its performance in prior years, its independence and processes for maintaining independence, the results of the most recent internal quality control review or Public Company Accounting Oversight Board (PCAOB) inspection, the key members of the audit engagement team, the firm’s approach to resolving significant accounting and auditing matters including consultation with the firm’s national office, as well as its reputation for integrity and competence in the fields of accounting and auditing.

Although action by the stockholders in this matter is not required, the Audit and Ethics Committee believes that it is appropriate to seek stockholder ratification of this appointment in light of the critical role played by independent registered auditors in maintaining the integrity of Company financial controls and reporting, and the Audit and Ethics Committee will seriously consider stockholder input on this issue. A representative of Ernst & Young is expected to be present at the Annual Meeting to answer appropriate questions and, if the representative so desires, to make a statement.

The following proposal will be presented for action at the Annual Meeting by direction of the Board:

“RESOLVED, that action by the Audit and Ethics Committee appointing Ernst & Young as the Company’s independent registered auditor to conduct the annual audit of the Company’s consolidated financial statements and management’s assessment of internal controls over financial reporting for the current fiscal year is hereby ratified, confirmed and approved.”

THE BOARD RECOMMENDS A VOTE FOR THE RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG AS THE COMPANY’S INDEPENDENT REGISTERED AUDITOR.

Corporate Governance Guidelines

As noted above, the Company has adopted Corporate Governance Guidelines. The primary purpose of the guidelines is to document the role of the Board and management, its composition and leadership, Board operations, Board committees, and the Board and management evaluations. Each director and the Board are expected to promote the best interests of the stockholders in terms of corporate governance, fiduciary responsibilities, compliance with applicable laws and regulations, and maintenance of accounting, financial and other controls. The Board’s primary responsibility is to provide effective guidance of the affairs of the Company for the benefit of its stockholders and other constituencies. This guidance includes overseeing the conduct of the Company’s business, financial objectives, major corporate plans, strategies and related risks. In addition, the Board selects the Company’s President and Chief Executive Officer (CEO); delegates to the President and CEO the authority and responsibility to manage the Company’s operations; acts as an advisor and counselor to the President and CEO and senior management; and evaluates the President and CEO’s performance.

Page 11

Table of Contents

When Mr. Birck originally stepped down as President and CEO in 2000, the Company separated the position of Chairman from the CEO position. Mr. Birck has served as an executive officer in his role as Chairman and is retiring after the Annual Meeting. In 2012, the Board has established a lead director position in which the lead director will serve until such time as his/her term is up or another lead director is appointed to the Board. The appointment will be reaffirmed every two years by majority vote of the Board. The Company believes that this separation of responsibilities provides a balanced approach to managing the Board and overseeing the Company. The Nominating and Governance Committee oversees the process for selecting the lead director, annually evaluating his/her performance and recommending any changes in roles and responsibilities deemed appropriate, including changes in compensation. Any changes in the lead director role or responsibilities must be approved by the Board.

In addition, the Nominating and Governance Committee, which is comprised entirely of independent directors, holds significant governance responsibilities. The primary duties and responsibilities of the Nominating and Governance Committee include:

| • | Working with the Chairman of the Board to ensure that the Board and the committees of the Board have the appropriate size, composition, skills, experience, orientation and training to support the needs of the Company; |

| • | Providing oversight to ensure that the Board and the Board Committees, as appropriate, have adequate operational structure and accountability in the key areas of strategic planning, financial control, succession planning, executive compensation, risk oversight, compliance and corporate governance (including any conflict of interest); |

| • | Establishing processes for evaluating the performance of the Board, the Committees of the Board and the Chairman of the Board; |

| • | Reviewing and making recommendations regarding the Company’s compensation philosophy for Board members and reviewing and making recommendations to the Board regarding the amount and form of compensation to be paid to the Board; |

| • | Making recommendations to the Board of Directors regarding corporate governance practices; and |

| • | Reviewing, discussing with management and approving disclosures to be made with respect to the Board of Directors and the Committees; |

The Board, lead director (on behalf of the independent directors) and each Committee are authorized to directly engage outside consultants and legal counsel to assist and advise the Board, lead director and each Committee as each believes useful or necessary. The Compensation Committee and the Nominating and Governance Committee use the services of an independent compensation consultant, Pearl Meyer & Partners, as an outside advisor (the Compensation Consultant). The Compensation Committee assessed the independence of the Compensation Consultant, determined that the Compensation Consultant does not perform other services for the Company and concluded that no conflict of interest exists that would prevent the Compensation Consultant from serving as an independent consultant to the Compensation Committee.

The Company offers industry, market, corporate governance and financial education opportunities for its Board members. Each Board member is required to participate in educational programs (both internal and external) as deemed appropriate by each Board member. The Nominating and Governance Committee monitors each Board member’s educational activities.

Page 12

Table of Contents

Each of the Company’s directors, other than Mr. Birck qualifies as “independent” in accordance with the applicable NASDAQ listing standards. In addition, as further required by the NASDAQ rules, the Board has made a subjective determination as to each independent director that no relationships exists that, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Meetings Held in 2012 and Attendance

During 2012, 22 meetings of the Board, 9 meetings of the Audit and Ethics Committee, 8 meetings of the Compensation Committee, 10 meetings of the Nominating and Governance Committee, 1 meeting of the Ad Hoc Strategy Advisory Committee and 1 meeting of the Ad Hoc President and Chief Executive Officer Search Committee were held. Each director attended at least 75% of the total number of meetings of the Board and of the Committees on which such director served during 2012. All of the directors except for one attended the 2012 Annual Meeting of Stockholders. Each Board member is expected to attend the Annual Meeting unless extraordinary circumstances prevent him or her from doing so.

Executive Sessions of Independent Directors

The independent directors meet following the regular Board meetings; unscheduled meetings (in person or telephone) may be called upon appropriate notice at any time to address specific needs of the Company. The Executive sessions are run by the Lead director without the Chairman or the President and CEO.

Risk oversight is an important function of the Board. The Board oversees the enterprise-wide approach to risk management that the Company’s management team has designed to support the achievement of organizational objectives, including strategic objectives, to improve long-term organizational performance, minimize the Company’s overall risk profile and enhance stockholder value. The Board recognizes that a fundamental part of risk oversight is not only understanding the risks the Company faces and what steps the management team is taking to manage those risks, but also determining with management the level of risk appropriate for the business. The involvement of the Board in guiding the Company’s business strategy is a key part of setting an appropriate level of risk for the Company’s business.

While the Board has overall responsibility for risk oversight, the Board has made the Audit and Ethics Committee primarily responsible for risk oversight related to financial reporting and ensuring the Board has an appropriate overall risk oversight process.

Additionally, on an annual basis, the management team provides the Board with a report on risk management including the status of management’s efforts to mitigate identified risks.

Compensation Risk Assessment

The Compensation Committee aims to establish company-wide compensation policies and practices that reward contributions to long-term stockholder value and do not promote unnecessary or excessive risk-taking. In furtherance of the Company’s risk management program in 2012, the Committee reviewed the Company’s compensation policies and practices. As a result of its review the Compensation Committee noted that:

| • | The performance measures and goals for incentive-based compensation were tied to the Company’s strategic objectives and financial performance, thereby aligning the incentives with the Company’s risk profile. |

| • | The Company’s incentive plans do not provide an incentive to pursue short-term financial performance at the expense of long-term stockholder value. A significant portion of variable compensation is delivered in equity (stock options, restricted stock units [RSUs] and performance stock units [PSUs]) and is subject to multi-year vesting. The Compensation Committee believes that these equity awards reduce short-term focus in favor of emphasizing long-term value creation. |

Page 13

Table of Contents

Because a significant portion of the compensation of the NEOs is tied to quantifiable measurements of actual Company performance and the actual level of achievement of each NEO’s personal performance goals, the Compensation Committee believes the Company’s executive compensation plans are appropriately structured and are not reasonably likely to result in a material adverse effect on the Company.

The Company has formalized an annual process for reviewing and updating the Company’s long term planning, business framework and strategy. Members of the management team coordinate with their teams the planning calendar, the accomplishment of the tasks and meeting of the deadlines and the progress on each strategic initiative. The outputs of this annual process, including the Company strategy and business framework are presented to the Board and refreshed, as necessary, during the year. The annual planning process provides the Board an opportunity to interact extensively with the Company’s senior leadership team and assists the Board in its succession planning responsibilities. Throughout the year, significant corporate strategy decisions are brought to the Board for review, discussion and direction.

Compensation Committee Interlocks and Insider Participation

During 2012, the following Board members served on the Company’s Compensation Committee: Bo Hedfors, Michael E. Lavin, Stephanie Pace Marshall, Jan H. Suwinski, and Vincent H. Tobkin. All decisions regarding the compensation of the executive officers were made by the Compensation Committee of the Board, which is composed entirely of non-employee, independent members of the Board. Although the Chairman or the President and CEO made recommendations to the Compensation Committee with regard to the compensation of the other executive officers, including the NEOs, they did not participate in the Compensation Committee’s deliberations with respect to their own compensation.

The Board has three standing committees: the Audit and Ethics Committee, the Compensation Committee, and the Nominating and Governance Committee. The current members of the committees as of December 28, 2012, are identified below in the table.

| Director | Audit and Ethics Committee |

Compensation Committee |

Nominating and Governance Committee | |||

| Bo Hedfors |

ü | ü | ||||

| Frank Ianna |

ü | ü | ||||

| Vincent D. Kelly |

ü | |||||

| Michael E. Lavin |

Chair | ü | ||||

| Stephanie Pace Marshall |

ü | Chair | ||||

| Gregory J. Rossmann |

ü | |||||

| Dennis F. Strigl |

||||||

| Jan H. Suwinski |

ü | Chair | ||||

| Vincent H. Tobkin |

ü | ü | ||||

| Mikel H. Williams |

The Audit and Ethics Committee assists the Board in its general oversight of the Company’s financial reporting and disclosures, internal controls and audit functions. The Audit and Ethics Committee is directly responsible for the reappointment, retention, compensation and oversight of the work of the

Page 14

Table of Contents

Company’s independent registered auditor. The Board has also made the Audit and Ethics Committee responsible for reviewing any related-person transactions involving the Company’s officers or directors for potential conflicts of interest. To monitor compliance with applicable laws, rules and regulations, the Audit and Ethics Committee has adopted the Tellabs Integrity Policy (Integrity Policy), a code of ethics applicable to all directors, officers and employees. The Integrity Policy provides for prompt and consistent enforcement of the code of conduct, protection for persons reporting questionable behavior, clear and objective standards for compliance and a fair process by which to determine violations. A copy of the Integrity Policy, as well as the Audit and Ethics Committee’s current charter, is available on the Company’s Web site at www.tellabs.com/investors. For additional discussion regarding the Company’s policies and procedures concerning related-person transactions, please see the section below entitled Policies and Procedures for Review and Approval of Related-Person Transactions.

The Board has determined that each member of the Audit and Ethics Committee is independent as defined by NASDAQ listing standards and has sufficient knowledge in reading and understanding the Company’s financial statements to serve on the Audit and Ethics Committee. The Board has determined that Mr. Ianna, Mr. Kelly, Mr. Lavin and Mr. Rossmann meet the qualifications of an audit committee financial expert, as defined by SEC guidelines and as required by the applicable NASDAQ listing standards. Stockholders should understand that the financial expert designation is a disclosure requirement of the SEC, and does not impose on Mr. Ianna, Mr. Kelly, Mr. Lavin and Mr. Rossmann any duties, obligations or liabilities that are greater than those that are generally imposed on them as Audit and Ethics Committee members or members of the Board. The Audit and Ethics Committee’s report is included later in this Proxy Statement.

The Compensation Committee is responsible for reviewing performance and executive succession planning, determining compensation for the executive officers of the Company and administering the Company’s equity-based compensation plans. The Committee also has risk oversight responsibility with respect to compensation policies and practices. The Board has determined that each member of the Compensation Committee is independent as defined by NASDAQ listing standards. The Committee’s report on executive compensation is included in the Compensation Discussion and Analysis section of this Proxy Statement. A copy of the Compensation Committee’s current charter is available on the Company’s Web site at www.tellabs.com/investors.

As mentioned previously, the Compensation Committee uses the services of the Compensation Consultant. The Compensation Consultant’s role is to provide independent, third-party advice to assist the Compensation Committee in evaluation and design of the Company’s policies and programs on executive compensation and with other compensation decisions. While the Compensation Consultant reports directly to the Compensation Committee, there is interaction between the Compensation Consultant and Company management as part of the process of providing market and Company data regarding executive compensation to the Compensation Committee.

Compensation Committee meetings are held once per quarter. Teleconferences and ad hoc meetings are held as needed. Agendas are based on a pre-determined schedule of activities as set by the Compensation Committee, and other agenda items are added on an as needed basis. The Compensation Committee’s charter authorizes the Compensation Committee to delegate duties to standing and ad hoc subcommittees as it deems necessary or advisable.

At the request of the Compensation Committee, the Vice President, Human Resources, develops recommendations on executive compensation matters prior to each meeting, in consultation with the CEO, other members of the management team and the Compensation Consultant. Management team members do not provide input on their own compensation.

Generally, the Vice President, Human Resources, attends Compensation Committee meetings to present the management views and recommendations. The Compensation Committee requests that the CEO

Page 15

Table of Contents

attend certain portions of the meetings to discuss the performance and present compensation recommendations for his direct reports. Additionally, the Committee requests the CEO’s perspective on the executive succession planning process and the overall compensation philosophy.

Nominating and Governance Committee

The Nominating and Governance Committee is responsible for evaluating Board composition, performance and compensation; soliciting, evaluating and making recommendations for candidates to the Board, including candidates recommended by stockholders; making recommendations regarding corporate governance matters and practices; and providing oversight of the Board’s operational structure and accountability. The Nominating and Governance Committee also conducts an annual review of the Board, each Board Committee and the Chairman based on input received from the Board and members of the Company’s management. Each committee reviews the applicable results of these evaluations. The Board has adopted a set of Corporate Governance Guidelines, which the Nominating and Governance Committee is responsible for overseeing. A copy of the Nominating and Governance Committee’s current charter and the Company’s Corporate Governance Guidelines are available on the Company’s Web site at www.tellabs.com/investors.

The Board has determined that each member of the Nominating and Governance Committee is independent as defined by NASDAQ listing standards. Stockholders who wish to communicate with the Nominating and Governance Committee concerning nomination of director candidates may do so by corresponding with the Secretary of the Company. These communications should include the name, biographical data and any other relevant information about the individual who is the subject of the communication and other information as required by the Company’s bylaws. In evaluating director candidates, the Nominating and Governance Committee considers a variety of factors including independence, diversity of business experience and expertise, industry and technical knowledge, and other related experience and knowledge.

From time to time the Board will establish ad hoc or special committees for a specific purpose, such as the Ad Hoc Strategy Advisory Committee and the Ad Hoc President and Chief Executive Officer Search Committee, which each met once in 2012.

The Nominating and Governance Committee is responsible for reviewing and making recommendations to the Board on compensation of the independent directors.

The Nominating and Governance Committee utilizes a combination of cash and equity as a way to attract and retain qualified directors. In 2012, the compensation program for independent directors included the following elements of compensation:

| • | A cash retainer for annual service on the Board; |

| • | Additional cash retainers for annual Committee service; and |

| • | An annual restricted stock unit and stock option grant. |

Compensation

In 2012, each independent director earned an annual cash retainer of $50,000, in addition to their cash retainers for serving on committees. The Audit and Ethics Committee member retainer was $10,000, the Compensation Committee member retainer was $8,000, the Nominating and Governance Committee

Page 16

Table of Contents

member retainer was $6,000, and the Ad Hoc Strategy Advisory Committee member retainer was $6,000. In addition to the committee member retainer, the chair of the Audit and Ethics Committee earned an annual retainer of $12,000, the chair of the Compensation Committee earned an annual retainer of $10,000, the chair of the Nominating and Governance Committee earned an annual retainer of $6,000, and the chair of the Ad Hoc Strategy Advisory Committee earned an annual retainer of $6,000. The Lead Director retainer is $15,000. No other retainers for committee members were earned during 2012. All retainers are paid in arrears for service rendered the previous year. In addition, the Company reimburses its directors for reasonable expenses in connection with attendance at Board and Committee meetings and the Company’s Annual Meeting.

In 2012, each independent director received approximately $30,000 in stock options and approximately $75,000 in RSUs calculated based on the closing price of the stock on the date of grant. Independent director equity grants are made annually on the last trading day of April and fully vest one year from the date of the grant. Mr. Kelly and Mr. Rossmann joined the Board effective as of the end of the Annual Meeting so they received stock grants on May 2, 2012.

In 2013, the Nominating and Governance Committee reviewed independent director compensation and recommended to the Board that the annual cash retainer be lowered to $45,000 in recognition of the Company’s cost-cutting initiatives. The Nominating and Governance Committee also recommended that equity grants in 2013 be 100% RSUs to align with stockholder interests. The Board approved these changes effective for 2013.

If a director ceases to be a director of the Company for any reason other than retirement, death or disability, options held by such director may be exercised, subject to the expiration date of the options, for three months after such termination, but only to the extent such options were exercisable on the date of termination. If a director has attained age 55 or older and is terminating due to retirement as stated in the Incentive Compensation Plan, options held by such director may be exercised, subject to the expiration date of the options, for up to three years after such termination. If a directorship is terminated because of disability, the option may be exercised, subject to the expiration date of the option, for up to three years (depending on the plan and award agreement governing that option) after such termination, but only to the extent the option was exercisable on the date of disability. In the event a directorship is terminated due to the death of a director, the option may be exercised, subject to the expiration date of the option, for up to one year after such termination, and such director’s unvested options shall fully vest. Options granted to non-employee directors under the Incentive Compensation Plan are not transferable.

Director Stock Ownership Guidelines

The Nominating and Governance Committee is responsible for establishing stock ownership guidelines for the independent directors. In October 2005, the Nominating and Governance Committee adopted guidelines that require each independent director to own stock valued at four times the annual retainer paid to the independent directors. The stock ownership guideline is to be met within five years after October 2005 or a director’s election to the Board if initially elected after October 2005. As of year-end 2012, each director has met or is on target to meet the ownership guidelines within the applicable five-year compliance window.

Page 17

Table of Contents

Director Compensation Table for 2012

The following table summarizes the total compensation earned by each member of the Company’s Board for service as a director during the fiscal year ended December 28, 2012. All equity awards were made under the Company’s stockholder approved plans. Since Messrs. Birck and Pullen were compensated as officers of the Company, they were not entitled to additional compensation as directors.

| Name | Fees Earned or Paid in Cash |

Stock Awards(1) |

Option Awards(1) |

Total | ||||

| Michael J. Birck(2) |

– | – | – | – | ||||

| Bo Hedfors(3) |

$64,000 | $74,999 | $30,000 | $168,999 | ||||

| Frank Ianna(4) |

$66,000 | $74,999 | $30,000 | $170,999 | ||||

| Linda Wells Kahangi(5) |

$85,000 | – | – | $85,000 | ||||

| Vincent D. Kelly(6) |

$45,000 | $75,000 | $29,999 | $149,999 | ||||

| Michael E. Lavin(7) |

$80,000 | $74,999 | $30,000 | $184,999 | ||||

| Stephanie Pace Marshall(8) |

$70,000 | $74,999 | $30,000 | $174,999 | ||||

| Robert W. Pullen(9) |

– | – | – | – | ||||

| Gregory J. Rossmann(10) |

$45,000 | $75,000 | $29,999 | $149,999 | ||||

| William F. Souders(11) |

$36,500 | – | – | $36,500 | ||||

| Dennis F. Strigl(12) |

– | – | – | – | ||||

| Jan H. Suwinski(13) |

$75,500 | $74,999 | $30,000 | $180,499 | ||||

| Vincent H. Tobkin(14) |

$73,250 | $74,999 | $30,000 | $178,249 | ||||

| Mikel H. Williams(15) |

– | – | – | – |

| (1) | Represents fair value of the award on the grant date, computed in accordance with Accounting Standards Codification (ASC) 718. A discussion of the assumptions used in calculating these values may be found in Note 8 to the 2012 audited financial statements on pages 67 through 70 of the Company’s 2012 Annual Report on Form 10-K which accompanies this Proxy Statement. |

| (2) | Mr. Birck also serves as the Company’s Chairman, which is an executive officer position. At the July Board meeting, in recognition of the Company’s cost cutting initiatives, Mr. Birck recommended and the Compensation Committee agreed to lower his base salary by 50% for the balance of 2012. As a result, in 2012, Mr. Birck earned a salary of $412,000 as compensation for serving as Chairman. At his request, he did not receive equity awards in 2012. He is also entitled to other benefits that are available to the general employee population. Since Mr. Birck is paid as an employee of the Company, he does not receive compensation as a director. Mr. Birck will be retiring as Chairman following the Annual Meeting. |

| (3) | At fiscal year-end 2012, Mr. Hedfors had 129,924 stock options outstanding and 19,920 RSU awards outstanding. |

| (4) | At fiscal year-end 2012, Mr. Ianna had 129,924 stock options outstanding and 19,920 RSU awards outstanding. |

| (5) | Ms. Kahangi retired from the Board after the 2012 Annual Meeting and was paid director fees for the remainder of the year. |

| (6) | At fiscal year-end 2012, Mr. Kelly had 24,123 stock options outstanding and 19,685 RSU awards outstanding. |

| (7) | At fiscal year-end 2012, Mr. Lavin had 129,924 stock options outstanding and 19,920 RSU awards outstanding. |

| (8) | At fiscal year-end 2012, Dr. Marshall had 104,924 stock options outstanding and 19,920 RSU awards outstanding. |

| (9) | Mr. Pullen served as the Company’s President and CEO until July 2012. His compensation is reflected in the Summary Compensation Table below. Mr. Pullen was paid as an employee of the Company and he did not receive compensation as a director. |

| (10) | At fiscal year-end 2012, Mr. Rossmann had 24,123 stock options outstanding and 19,685 RSU awards outstanding. |

| (11) | At fiscal year-end 2012, Mr. Souders had 105,717 stock options outstanding. Mr. Souders retired from the Board after the 2012 Annual Meeting and was paid a pro rata portion of his director fees. |

| (12) | Mr. Strigl joined the Board in December 2012 and as such did not receive compensation for service as a director in fiscal year 2012. |

| (13) | At fiscal year-end 2012, Mr. Suwinski had 129,924 stock options outstanding and 19,920 RSU awards outstanding. |

| (14) | At fiscal year-end 2012, Mr. Tobkin had 50,503 stock options outstanding and 19,920 RSU awards outstanding. |

| (15) | Mr. Williams joined the Board in December 2012 and as such did not receive compensation for service as a director in fiscal year 2012. |

Compensation Discussion and Analysis

| 1. | Executive Summary |

This Compensation Discussion and Analysis section describes the Company’s executive compensation program and objectives as they relate to the Named Executive Officers (NEOs). It also explains why the Company decided to pay each element of 2012 compensation shown in the Summary Compensation Table on page 30. This discussion depicts the compensation for the following individuals:

| • | Daniel P. Kelly, President and Chief Executive Officer since November 29, 2012, acting President and CEO since June 27, 2012, and Executive Vice President, Global Products, for the remainder of the year; |

Page 18

Table of Contents

| • | Andrew B. Szafran, Executive Vice President and Chief Financial Officer (CFO) since April 16, 2012; |

| • | Roger J. Heinz, Executive Vice President, Global Sales and Service; |

| • | James M. Sheehan, Executive Vice President, Chief Administrative Officer and General Counsel; and |

| • | John M. Brots, Executive Vice President, Global Operations. |

In addition, in accordance with SEC rules, information with respect to three executives who served for a portion of fiscal year 2012 is also included:

| • | Robert W. Pullen, who served as President and CEO until his death in July 2012; |

| • | Thomas P. Minichiello, who served as interim CFO until Mr. Szafran’s appointment in April 2012; and |

| • | Dr. Vikram R. Saksena, who served as Executive Vice President and Chief Technology Officer until his retirement in July 2012. |

These individuals are the NEOs for 2012. The subsections which follow describe the major elements of compensation awarded to the NEOs. They also explain how and why the Company arrived at the material compensation decisions in the context of the Company’s performance.

Company Performance in 2012

In recent years, Tellabs has acquired technology and invested in research and development for new products to drive profitable, sustainable revenue growth. Despite these efforts, total revenue has not grown since 2010, resulting in losses in each of the last two years. As a result, in 2012, the Company fell short of financial performance expectations for the year. The Company returned $396.9 million of capital to stockholders through the payment of quarterly cash dividends and a special one-time dividend and also resumed a stock repurchase program of up to $224.6 million.

NEO Compensation Actions for 2012

| • | Base Salaries: No annual increases were made to base salaries with the exception of Mr. Kelly who received a salary increase when he was promoted to President and CEO. |

As a result of the year’s performance:

| • | Annual Incentive Awards: No bonuses were awarded to the NEOs for 2012 under the Annual Incentive Plan (AIP). |

| • | Long-Term Incentive Awards: Equity awards were a blend of 25% stock options, 25% RSUs and 50% PSUs. This reflects a change from past practice as a greater percentage of equity awards were made in the form of PSUs compared to prior years. |

| • | Other Awards: As a result of certain transitions in the management team, special awards were made that are not part of the regular ongoing program. A special retention award in the form of 150,000 RSUs was made to Mr. Kelly upon him becoming Acting President and CEO in July 2012. This grant was in recognition of his increased responsibilities and to ensure continuity until a permanent successor to Mr. Pullen was named. In addition, Mr. Szafran, the Company’s newly appointed CFO, received a sign-on grant of 100,000 stock options, 40,000 RSUs and 61,141 PSUs. |

Page 19

Table of Contents

Good Governance Practices and Policies

The Company strives to maintain good governance practices for the compensation of NEOs. Such practices include:

| • | Stock Ownership Guidelines: Target stock ownership levels are set for the CEO at the lesser of 200,000 shares or four times base salary and for the other NEOs at the lesser of 50,000 shares or three times the respective officer’s individual salary. Each NEO has met or is on track to timely meet the applicable stock ownership requirements. |

| • | Minimal Perquisites: The Company provides minimal perquisites to NEOs. |

| • | No Employment Agreements: NEOs do not have individual agreements with the Company. NEOs participate in the Company’s general salaried severance plan and are also covered by the Executive Continuity and Protection Plan in the event of a change in control. |

| • | No SERP or Defined Benefit Pension Plan: The Company does not maintain any defined benefit retirement arrangements or SERP for NEOs. |

| • | Independent Consultant Benchmarking: The Company works with an outside independent consultant in annually assessing executive compensation programs. |

| • | Stockholder Approved Equity Plan: Equity awards to the NEOs are granted pursuant to the terms of the Incentive Compensation Plan which was approved by Company stockholders in 2008. |

| • | Securities Trading Guidelines: A policy is in place preventing buying or selling of securities of the Company or engaging in any other action to take advantage of, or pass on to others, any material, non-public information. |

| • | Risk Mitigation: Compensation programs are reviewed with the Compensation Consultant on an annual basis to ensure plans do not create incentives that would put the Company at excessive risk. |

| • | Balanced Compensation Programs: Compensation programs are balanced to create a focus on short and long term results through a mix of fixed and variable pay. |

| • | Annual Incentives are Capped: The overall bonus is limited to 1.5 times the target amount, even in the event that performance would exceed the ranges established at the beginning of the year. |

Say on Pay Vote

The Company has adopted an annual advisory say on pay vote, consistent with the preference of the Company’s stockholders. In 2011 and 2012, the Company received majority support in favor of the plans at levels of 92% and 75%, respectively. The Company’s 2012 executive compensation approach was in line with the 2011 approach approved by stockholders.

Pay for Performance

Tellabs’ executive compensation philosophy is pay for performance, and therefore is tied to the achievement of Company goals. As discussed throughout this proxy, total realizable pay is less than market competitive when company results are below long-term performance goals pay is considered competitive at levels of performance consistent with long-term goals and can exceed market median levels when performance is greater than those goals. Since the Company is currently in a period of financial performance expectations that are below the long-term goals, performance consistent with near-term operating plans will result in below market median pay levels.

| 2. | Summary — Elements of the Executive Compensation Program and Governance Practices |

Executive Compensation Program