two thousand twenty four 2024 Proxy Statement corporation

☐ |

Preliminary Proxy Statement | |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

☒ |

Definitive Proxy Statement | |

☐ |

Definitive Additional Materials | |

☐ |

Soliciting Material under §240.14a-12 | |

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

two thousand twenty four 2024 Proxy Statement corporation

April 5, 2024

Dear Fellow Stockholders,

We cordially invite you to attend our 2024 Annual Meeting of Stockholders to be held on Thursday, May 23, 2024, at 11:00 a.m. Central Time. The annual meeting will be held via the internet at www.proxydocs.com/SCHW. Please follow the registration instructions as outlined in this proxy statement to attend the meeting virtually via the internet.

At the annual meeting, we will conduct the items of business outlined in this proxy statement. We also will report on our corporate performance in 2023 and answer questions.

Your vote is important. We encourage you to read this proxy statement carefully and to vote your shares as soon as possible, even if you plan to attend the meeting. Voting instructions are contained on the proxy card or voting instruction form that you received with this proxy statement.

We look forward to your participation.

Sincerely,

|

| |

| CHARLES R. SCHWAB | WALTER W. BETTINGER II | |

| CO-CHAIRMAN | CO-CHAIRMAN AND CHIEF EXECUTIVE OFFICER |

Table of Contents

| THE CHARLES SCHWAB CORPORATION 2024 PROXY STATEMENT |

|

NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS |

Notice of 2024 Annual Meeting of Stockholders

|

|

| ||

| Date May 23, 2024 |

Time 11:00 a.m. Central Time |

Location www.proxydocs.com/SCHW | ||

Agenda

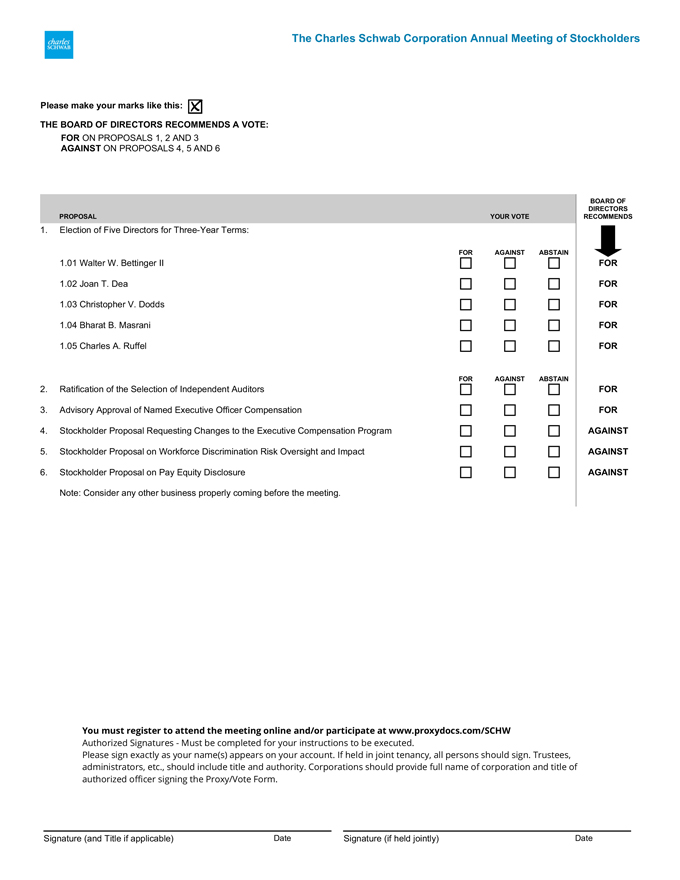

| 1. Elect five directors for three-year terms; |

| 2. Vote to ratify the selection of independent auditors; |

| 3. Vote for the approval, on an advisory basis, of compensation of named executive officers; |

| 4. Vote on three stockholder proposals, if properly presented; and |

| 5. Consider any other business properly coming before the meeting. |

Stockholders who owned shares of our voting common stock at the close of business on March 25, 2024 are entitled to attend and vote at the meeting and any adjournment or postponement of the meeting. A complete list of registered stockholders will be available during the 10 days prior to the meeting at our principal executive offices at 3000 Schwab Way, Westlake, Texas 76262.

By Order of the Board of Directors,

PETER J. MORGAN III

Managing Director, General Counsel and Corporate Secretary

IMPORTANT NOTICE

Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be Held on May 23, 2024. The proxy statement and annual report to security holders are available in the “Investor Relations” section of our website at www.aboutschwab.com.

| THE CHARLES SCHWAB CORPORATION 2024 PROXY STATEMENT | i |

Proxy Statement Summary

The Board of Directors (the board) of The Charles Schwab Corporation (the company) is making the solicitation for proxies to be voted at the 2024 Annual Meeting of Stockholders to be held on May 23, 2024 (the annual meeting). These proxy materials were first made available to stockholders on or about April 5, 2024.

This summary highlights information contained in the proxy statement. This summary does not contain all of the information that you should consider, and you should review all of the information contained in the proxy statement before voting.

Annual Meeting of Stockholders

|

|

Date & Time May 23, 2024 at 11 a.m. CT |

|

Record Date March 25, 2024 |

|

Location www.proxydocs.com/SCHW | |||||||||||||

| Voting Stockholders as of the record date are entitled to vote. Each share of voting common stock is entitled to one vote.* Attending the Meeting Please follow the meeting attendance instructions contained in the proxy statement on page 86. |

* Unless otherwise specified, references to “common stock” in this proxy statement do not include non-voting common stock. | |||||||||||||||||

Voting Proposals

| Board Recommendation | Page | |||

| Election of Directors |

||||

| Walter W. Bettinger II |

FOR | 16 | ||

| Joan T. Dea |

FOR | 18 | ||

| Christopher V. Dodds |

FOR | 19 | ||

| Bharat B. Masrani |

FOR | 24 | ||

| Charles A. Ruffel |

FOR | 26 | ||

| Ratification of Independent Auditors |

FOR | 36 | ||

| Advisory Approval of Named Executive Officer (NEO) Compensation |

FOR | 39 | ||

| Stockholder Proposal Requesting Changes to the Executive Compensation Program |

AGAINST | 76 | ||

| Stockholder Proposal on Workforce Discrimination Risk Oversight and Impact |

AGAINST | 79 | ||

| Stockholder Proposal on Pay Equity Disclosure |

AGAINST | 82 | ||

HOW TO VOTE

|

Internet |

Telephone |

|

During the Meeting | |||

| Visit www.proxydocs.com/ SCHW and follow the instructions on the website. |

Call (866) 485-0358 and follow the instructions on your proxy card or your voting instruction form. | Sign, date and mail your proxy card or your voting instruction form. | While we encourage you to vote before the meeting, stockholders may vote online during the meeting by following the instructions on page 87. | |||

| THE CHARLES SCHWAB CORPORATION 2024 PROXY STATEMENT | 1 |

PROXY STATEMENT SUMMARY

Director Nominees

We ask that you vote for the election of Walter W. Bettinger II, Joan T. Dea, Christopher V. Dodds, Bharat B. Masrani and Charles A. Ruffel. The following table provides summary information on these nominees. Complete biographical information is contained in the proxy statement.

| Name |

Age | Director Since | Occupation | Skills | Independent | Committees | ||||||

| Walter W. Bettinger II |

63 | 2008 | Co-Chairman and Chief Executive Officer, The Charles Schwab Corporation | Financial services expertise and leadership experience | ||||||||

| Joan T. Dea |

60 | 2017 | Founder and Managing Director, Beckwith Investments LLC | Investment and consulting expertise, strategic planning, and leadership experience |

|

Compensation, Nominating | ||||||

| Christopher V. Dodds |

64 | 2014 | Co-Founder and Managing Member, Crown Oak Advisors LLC | Leadership skills, knowledge of the financial service industry, and financial and accounting experience |

|

Risk | ||||||

| Bharat B. Masrani |

67 | 2020 | Group President and Chief Executive Officer, The Toronto-Dominion Bank | Financial services expertise and international business and leadership experience | Risk | |||||||

| Charles A. Ruffel |

68 | 2018 | Managing Partner, Kudu Investment Management, LLC | Financial services and asset management expertise and leadership experience |

|

Risk | ||||||

| 2 | THE CHARLES SCHWAB CORPORATION 2024 PROXY STATEMENT |

PROXY STATEMENT SUMMARY

Independent Auditors

We ask that you ratify the appointment of Deloitte & Touche LLP and the member firms of Deloitte Touche Tohmatsu Limited (collectively referred to as Deloitte) as the company’s independent registered public accounting firm for the 2024 fiscal year. While the Audit Committee has the sole authority to retain the independent auditors, we are asking for your ratification as part of the Audit Committee’s evaluation process of the independent registered public accounting firm for the next fiscal year.

Fees for services provided by Deloitte in the last two fiscal years were:

| 2023 | 2022 | |||

| Audit Fees |

$11,532,307 | $11,172,248 | ||

| Audit-Related Fees |

4,342,211 | 4,175,673 | ||

| Tax Fees |

45,400 | 109,179 | ||

| All Other Fees |

— | — | ||

| Total |

$15,919,918 | $15,457,100 | ||

Executive Compensation

We ask that you approve, on an advisory basis, the compensation of our NEOs. The NEOs are those executive officers listed in the 2023 Summary Compensation Table (the 2023 SCT). The advisory approval of NEO compensation is required by federal law, and while the vote is not binding, the Compensation Committee considers the vote as part of its evaluation of executive compensation programs.

The executive compensation program supports the company’s strategic objectives through the following design principles:

| Pay for Performance |

Stockholder Value Creation |

Risk Management | ||||||

| ◾ Link executives’ pay with company financial and stock price performance. ◾ Reward executives for individual performance. |

◾ Promote profitable growth that delivers on the annual and long-term operating plan. ◾ Attract, retain, and reward talented executives.

|

◾ Create appropriate balance of risk and reward. ◾ Ensure effective governance and risk management practices are in place. | ||||||

The Compensation Committee is dedicated to delivering a robust and balanced executive compensation program, in support of a strong link between executive pay and the company’s financial performance. The executive compensation program uses three compensation elements: base salary, annual cash incentives, and long-term equity-based incentives (LTIs).

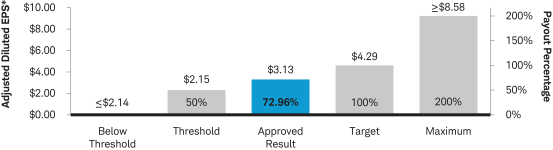

Given the company’s financial performance in 2023, the Compensation Committee approved funding at 72.96% of the target award for the NEOs for annual cash incentives. The performance goal for performance-based restricted stock units (PBRSUs) granted in 2023 was set at Return on Tangible Common Equity (ROTCE) exceeding the Cost of Equity (COE); this aligns the executives’ incentives with the long-term interests of stockholders. The PBRSUs have cliff-vesting based on a three-year performance period.

| THE CHARLES SCHWAB CORPORATION 2024 PROXY STATEMENT | 3 |

PROXY STATEMENT SUMMARY

Summary compensation information for the NEOs is contained in the following table. As discussed in the proxy statement, these amounts are presented in accordance with accounting assumptions and Securities and Exchange Commission (SEC) rules, and the amount that the executive actually receives may vary from what is reported in the equity columns of the table.

2023 Summary Compensation

| Name and Principal Position | Salary ($) |

Bonus ($) |

Stock Awards ($) |

Option Awards ($) |

Non-Equity Incentive Plan Compensation ($) |

All Other Compensation ($) |

Total ($) | |||||||

| Walter W. Bettinger II Chief Executive Officer and Co-Chairman |

1,500,000 | — | 10,950,019 | 7,300,015 | 4,104,000 | 17,710 | 23,871,744 | |||||||

| Peter B. Crawford Managing Director and Chief Financial Officer |

721,154 | — | 1,920,002 | 1,280,010 | 1,052,308 | 17,465 | 4,990,939 | |||||||

| Joseph R. Martinetto Managing Director and Chief Operating Officer |

921,154 | — | 3,720,042 | 2,480,020 | 2,016,222 | 17,614 | 9,155,052 | |||||||

| Richard A. Wurster President |

984,615 | — | 4,800,004 | 3,200,004 | 2,155,126 | 17,614 | 11,157,363 | |||||||

| Charles R. Schwab Co-Chairman |

884,616 | — | 3,000,041 | 2,000,016 | 1,613,539 | 17,518 | 7,515,730 | |||||||

Stockholder Proposals

There are three stockholder proposals to vote on that are described in the proxy statement.

| 4 | THE CHARLES SCHWAB CORPORATION 2024 PROXY STATEMENT |

Corporate Governance

Company Overview

The Charles Schwab Corporation is a savings and loan holding company that engages, through its subsidiaries, in wealth management, securities brokerage, banking, asset management, custody, and financial advisory services. As of December 31, 2023, the company had $8.52 trillion in client assets, 34.8 million active brokerage accounts, 5.2 million workplace plan participant accounts, and 1.8 million banking accounts.

The company was founded on the belief that all Americans deserve access to a better investing experience. Although

much has changed in the intervening years, our purpose remains clear – to champion every client’s goals with passion and integrity. Guided by this purpose and our vision of being the most trusted leader in investment services, management has adopted a strategy described as “Through Clients’ Eyes.”

The Board of Directors

The board is committed to the company’s vision of being the most trusted leader in investment services and believes that good corporate governance and high ethical standards are duties that we owe to our investors, customers, and employees, and are key to our long-term success and the creation of long-term stockholder value. The board has the responsibility to hold management accountable for carrying out the company’s daily operations consistent with its strategic vision while navigating changes in the financial services industry, effectively managing risks, and responding to competitive pressures, new technologies, and an evolving regulatory environment.

Our practices to maintain board effectiveness include the following:

Board Leadership

Our Corporate Governance Guidelines provide that the roles of Chairman or Co-Chairman of the board and Chief Executive Officer may be separated or combined, and our board exercises its discretion in combining or separating these positions as it deems appropriate in light of prevailing circumstances. Currently, Mr. Schwab and Mr. Bettinger serve as Co-Chairmen of the board, and Mr. Bettinger also serves as Chief Executive Officer. The board has carefully considered its leadership structure and determined that leveraging our founder, in the case of Mr. Schwab, and Chief Executive Officer, in the case of Mr. Bettinger, together as Co-Chairmen of the board currently serves the best

| THE CHARLES SCHWAB CORPORATION 2024 PROXY STATEMENT | 5 |

CORPORATE GOVERNANCE

interests of the company and its stockholders. Specifically, the board believes that Mr. Schwab and Mr. Bettinger are best situated to serve as Co-Chairmen given their deep knowledge of our business and strategy as the founder and Chief Executive Officer of the company, respectively, and their ability to draw on that experience in order to provide leadership to the board. This structure also reflects Mr. Schwab’s and the board’s intention to ensure strategic and leadership continuity for the company by following a thoughtful and long-term succession plan.

As provided in our Corporate Governance Guidelines, non-management directors meet regularly in executive session without management and independent directors meet at least annually in executive session with only independent directors. The Chair of the Nominating and Corporate Governance Committee, Mr. Herringer, presides over these sessions. Through the independence of the board’s committees and the regular use of executive sessions led by Mr. Herringer, the board is able to maintain independent oversight of our business strategy, annual operating plan, and other corporate activities. These features ensure a full and free discussion of issues that are important to the company and its stockholders. At the same time, the board is able to take advantage of the unique blend of leadership, experience, and knowledge of our industry and business that Mr. Schwab and Mr. Bettinger bring to the roles of Co-Chairmen.

The board has four standing committees (Audit, Compensation, Nominating and Corporate Governance, and Risk). Given the role and scope of authority of these committees, and that over 76% of the directors are independent, the board believes that its leadership structure, with the Co-Chairmen of the board leading board discussions, and the Chair of the Nominating and Corporate Governance Committee leading executive sessions, is appropriate.

Director Independence

We have considered the independence of each director in accordance with New York Stock Exchange (NYSE) corporate governance standards. To assist us in our determination, we have general guidelines for independence. The guidelines for independence are available on the company’s website at www.aboutschwab.com/governance.

Based on our guidelines and NYSE corporate governance standards, we have determined that each of the company’s directors, except Mr. Schwab, Mr. Bettinger, Mr. Masrani, and Ms. Schwab-Pomerantz, is independent.

In determining independence, the board considers broadly all relevant facts and circumstances regarding a director’s relationships with the company. All non-employee directors receive compensation from the company for their service as directors, as disclosed in the “Director Compensation” section of this proxy statement, and are entitled to receive reimbursement for their expenses in traveling to and participating in board and committee meetings. As disclosed in the “Transactions with Related Persons” section of this proxy statement, some directors and entities with which they are affiliated have credit transactions with the company’s banking and brokerage subsidiaries, such as mortgage loans, revolving lines of credit, or other extensions of credit. These transactions with directors and their affiliates are made in the ordinary course of business and as permitted by the Sarbanes-Oxley Act of 2002. Such transactions are on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with persons not related to the lender and do not involve more than the normal risk of collectability or present other unfavorable features.

In addition to the relationships outlined above and in “Transactions with Related Persons” the board considered the following as part of its determination of independence:

| ◾ | Marianne C. Brown serves as a director of technology companies to which, or to the parent company of which, the company has made payments for products and services. |

| 6 | THE CHARLES SCHWAB CORPORATION 2024 PROXY STATEMENT |

| ◾ | Joan T. Dea’s spouse serves as a trustee of a nonprofit organization to which the company, its affiliates, or its charitable foundation have made donations. |

| ◾ | Mark A. Goldfarb serves as a member of an advisory council of a nonprofit organization to which the company, its affiliates, or its charitable foundation have made donations. |

| ◾ | Frank C. Herringer’s spouse serves as a trustee of a nonprofit organization to which the company, its affiliates, or its charitable foundation have made donations. |

| ◾ | Todd M. Ricketts serves as a director of a professional baseball organization to which the company has made payments in connection with sponsorship and advertising. |

| ◾ | Arun Sarin serves as a director of a consulting firm to which the company has made payments for consulting services. |

Board Structure and Committees

The authorized number of directors is currently 17, and the company has 17 directors. There are five nominees for election this year and 11 directors will continue to serve the terms described in their biographies. Mr. Goldfarb’s term is expiring at the annual meeting, and he is not standing for re-election as a director, and accordingly, the authorized number of directors will be reduced from 17 to 16 effective at the annual meeting.

Directors currently serve staggered terms. Each director who is elected at an annual meeting of stockholders serves a three-year term, and the directors are divided into three classes.

The board held eight meetings in 2023. Each director attended at least 75% of applicable board and committee meetings during 2023. As provided in our Corporate Governance Guidelines, we expect directors to attend the annual meeting of stockholders. In 2023, all of the then-serving directors attended the annual meeting, which was held virtually.

Risk Oversight

We believe a fundamental commitment to strong and effective risk management is integral to achieving the company’s vision and executing on its strategy to be the most trusted leader in investment services. As part of its oversight functions, the board is responsible for oversight of risk management at the company and for holding senior management accountable for implementing the board’s approved risk tolerance. The board exercises this oversight both directly and indirectly through its standing committees, each of which is delegated responsibility for specific risks and keeps the board informed of its oversight efforts through regular reports by each committee Chair. The Risk Committee assists the board in fulfilling its oversight responsibilities with respect to the company’s risk management program and provides reports to the board and the Audit Committee. Among other responsibilities, the Risk Committee reviews the company’s overall risk governance and approves the enterprise-wide risk management framework. In addition, the Risk Committee has oversight of independent risk management, liquidity, market risk, and capital adequacy and credit-related and other key policies. The Audit Committee reviews reports from management and the Risk Committee concerning the company’s risk assessment and major risk exposures and the steps management has taken to monitor and control such exposures. The Compensation Committee oversees incentive compensation risk and reviews the compensation program with respect to the potential impact of risk taking by employees. For further discussion of risk management at the company, please see Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Risk Management” of the company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

| THE CHARLES SCHWAB CORPORATION 2024 PROXY STATEMENT | 7 |

Committees

Each of our four standing committees is chaired by an independent director. The Audit, Compensation, and Nominating and Corporate Governance Committees are composed entirely of independent directors as determined by the board in accordance with its independence guidelines and NYSE corporate governance standards, and the Risk Committee is chaired by an independent director. In addition to these standing committees, the board may from time to time establish ad hoc committees to assist in various matters.

The board and its committees are currently composed of the following individuals:

| Committee Memberships | ||||||||||

| Name | Independent | AC | CC | NCGC | RC | |||||

| Charles R. Schwab |

||||||||||

| Walter W. Bettinger II |

||||||||||

| John K. Adams, Jr. |

✓ | C | ||||||||

| Marianne C. Brown |

✓ | C | ||||||||

| Joan T. Dea |

✓ | • | • | |||||||

| Christopher V. Dodds |

✓ | • | ||||||||

| Stephen A. Ellis |

✓ | • | • | |||||||

| Mark A. Goldfarb |

✓ | • | ||||||||

| Frank C. Herringer |

✓ | • | C | |||||||

| Brian M. Levitt |

✓ | VC | ||||||||

| Gerri K. Martin-Flickinger |

✓ | • | ||||||||

| Bharat B. Masrani |

• | |||||||||

| Todd M. Ricketts |

✓ | • | ||||||||

| Charles A. Ruffel |

✓ | • | ||||||||

| Arun Sarin |

✓ | • | • | |||||||

| Carolyn Schwab-Pomerantz |

• | |||||||||

| Paula A. Sneed |

✓ | C | ||||||||

| AC CC |

Audit Committee Compensation Committee |

NCGC | Nominating and Corporate Governance Committee | RC | Risk Committee | Committee Member • Committee Chair C Committee Vice Chair VC |

| 8 | THE CHARLES SCHWAB CORPORATION 2024 PROXY STATEMENT |

CORPORATE GOVERNANCE

| Audit Committee | The Audit Committee held 13 meetings in 2023 | |

| None of the directors on the Audit Committee is or, during the past three years, has been an employee of the company or any of its subsidiaries. None of the Audit Committee members simultaneously serves on the audit committees of more than three public companies, including ours. The board has determined that all the members of the Audit Committee are financially literate in accordance with NYSE listing standards, and Mr. Adams, Mr. Ellis, and Mr. Goldfarb are Audit Committee financial experts in accordance with SEC rules. | ||

| Primary responsibilities: | ||

|

|

| |

|

|

|

|

| ||||

| John K. Adams, Jr. (Chair) |

Stephen A. Ellis |

Mark A. Goldfarb |

Gerri K. Martin-Flickinger |

Todd M. Ricketts |

| Compensation Committee | The Compensation Committee held six meetings in 2023 | |

| Primary responsibilities: | ||

|

|

| |

|

|

|

| |||

| Paula A. Sneed (Chair) |

Brian M. Levitt (Vice Chair) |

Joan T. Dea |

Frank C. Herringer |

| THE CHARLES SCHWAB CORPORATION 2024 PROXY STATEMENT | 9 |

CORPORATE GOVERNANCE

| Nominating and Corporate Governance Committee | The Nominating and Corporate Governance Committee held four meetings in 2023 | |

| Primary responsibilities: | ||

|

|

| |

|

|

|

| |||

| Frank C. Herringer (Chair) |

Joan T. Dea | Stephen A. Ellis |

Arun Sarin |

| Risk Committee | The Risk Committee held five meetings in 2023 | |

| Primary responsibilities: | ||

|

|

| |

|

|

|

|

|

| |||||

| Marrianne C. Brown (Chair) |

Christopher V. Dodds |

Bharat B. Masrani |

Charles A. Ruffel |

Arun Sarin | Carolyn Schwab-Pomerantz |

Each standing committee has a written charter. You may find a copy of these charters, as well as our Corporate Governance Guidelines and Code of Business Conduct and Ethics, on the company’s website at www.aboutschwab.com/governance. You also may request and obtain a paper copy of these items, without charge, from:

The Charles Schwab Corporation

Attn: Office of the Corporate Secretary

3000 Schwab Way

Westlake, Texas 76262

SchwabCorporateSecretary@Schwab.com

| 10 | THE CHARLES SCHWAB CORPORATION 2024 PROXY STATEMENT |

CORPORATE GOVERNANCE

Board Qualifications and Composition

The Nominating and Corporate Governance Committee regularly assesses the board’s composition in light of our business operations, complexity, asset size, and risk profile to assure appropriate succession, and our Corporate Governance Guidelines provide that the board should be composed of directors who have the qualifications necessary for effective service as determined in this assessment.

Director Qualifications

The qualifications for directors are described in our Corporate Governance Guidelines, which are available on the company’s website at www.aboutschwab.com/governance. In addition, the Nominating and Corporate Governance Committee believes that the following specific, minimum qualifications must be met by any director nominee:

| ◾ | ability to work together with other directors, with full and open discussion and debate, as an effective group; |

| ◾ | current knowledge of and experience in the company’s business or operations, or contacts in the communities in which the company does business or the industries relevant to the company’s business, or substantial business, financial, or industry-related experience commensurate with the business operations, complexity, asset size, and risk profile of the company; and |

| ◾ | willingness and ability to devote adequate time to the company’s business. |

The Nominating and Corporate Governance Committee also considers the following qualities and skills when making its determination whether a nominee is qualified for the position of director:

| ◾ | relationships that may affect the independence of the director or conflicts of interest that may affect the director’s ability to discharge the director’s duties; |

| ◾ | diversity of experience, including the need for financial, business, academic, public sector, and other expertise on the board or board committees; |

| ◾ | diversity of background, including race, ethnicity, and gender; and |

| ◾ | the fit of the individual’s skills and experience with those of the other directors and potential directors in comparison to the needs of the company. |

When evaluating a candidate for nomination, the committee does not assign specific weight to any of these factors or believe that all of the criteria need apply to every candidate.

Diversity

The Nominating and Corporate Governance Committee considers the qualifications and experience represented on the board when identifying director nominees and assessing the composition of the board. The board recognizes that a variety of viewpoints is vital to effective decision-making, constructive dialogue, and a healthy boardroom culture. As discussed in the “Director Qualifications” section above, the board’s evaluation encompasses the diversity of experience and background of directors. This consideration includes diversity of skill sets and experience as well as background, including race, ethnicity, and gender.

The Nominating and Corporate Governance Committee considers these qualifications and regularly assesses the overall effectiveness of the board in maintaining a balance of perspectives important to the company’s business. To this end, the Nominating and Corporate Governance Committee has acted repeatedly in recent years to increase board diversity. Since July 2020, three women directors and one underrepresented minority director have been added to the board, furthering board diversity.

| THE CHARLES SCHWAB CORPORATION 2024 PROXY STATEMENT | 11 |

CORPORATE GOVERNANCE

Skills and Competencies

Set forth below are some of the experience, skills, and competencies that the Nominating and Corporate Governance Committee views as important for the board as a whole to possess in light of the board’s areas of oversight of management.

For simplicity, each qualification is assigned to one category of oversight, even though some qualifications may pertain to multiple areas.

| Board Oversight of Management |

Related Qualifications and Experience | |

| Carrying out the company’s daily operations consistent with its strategic vision |

◾ Financial Services ◾ Banking ◾ Asset Management ◾ Brokerage/Investment Banking ◾ Business Operations ◾ ESG ◾ Ethnic and Gender Diversity | |

| Navigating changes in the financial services industry and responding to competitive pressures |

◾ Strategic Planning ◾ Information Technology/Cybersecurity ◾ Marketing ◾ Academia | |

| Overseeing the integrity of the company’s financial statements and financial reporting process |

◾ Finance ◾ Accounting ◾ Public Company Executive Experience ◾ Public Company Board Experience | |

| Ensuring compliance with legal and regulatory requirements |

◾ Regulatory ◾ Government Service ◾ International Business | |

| Implementing the board’s approved risk tolerance, maintaining the company’s risk |

◾ Risk Management | |

| 12 | THE CHARLES SCHWAB CORPORATION 2024 PROXY STATEMENT |

CORPORATE GOVERNANCE

The following matrix highlights the qualifications and experience represented by our director nominees and continuing directors:

| Qualifications and Experience |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||

| Public Company Executive Experience |

• | • | • | • | • | • | • | • | • | • | • | |||||||||||||||||||||

| Public Company Board Experience |

• | • | • | • | • | • | • | • | • | • | • | • | • | |||||||||||||||||||

| Financial Services |

• | • | • | • | • | • | • | • | • | • | • | • | ||||||||||||||||||||

| Banking |

• | • | • | • | • | • | • | • | • | |||||||||||||||||||||||

| Asset Management |

• | • | • | • | • | • | • | • | • | • | ||||||||||||||||||||||

| Brokerage/Investment Banking |

• | • | • | • | • | • | • | • | • | • | ||||||||||||||||||||||

| Strategic Planning |

• | • | • | • | • | • | • | • | • | • | • | • | • | • | ||||||||||||||||||

| Finance |

• | • | • | • | • | • | • | • | • | • | • | • | • | • | • | |||||||||||||||||

| Business Operations |

• | • | • | • | • | • | • | • | • | • | • | |||||||||||||||||||||

| Information Technology/Cybersecurity |

• | • | • | • | • | |||||||||||||||||||||||||||

| Marketing |

• | • | • | • | • | • | • | • | • | |||||||||||||||||||||||

| Regulatory |

• | • | • | • | • | • | • | • | • | |||||||||||||||||||||||

| Accounting |

• | • | • | |||||||||||||||||||||||||||||

| Risk Management |

• | • | • | • | • | • | • | • | • | • | ||||||||||||||||||||||

| Government Service |

• | • | • | |||||||||||||||||||||||||||||

| International Business |

• | • | • | • | • | • | • | • | • | • | ||||||||||||||||||||||

| Academia |

• | |||||||||||||||||||||||||||||||

| Environmental, Social, and Governance |

• | • | • | • | • | • | • | • | • | • | • | • | • | |||||||||||||||||||

| Additional Qualifications and Information |

||||||||||||||||||||||||||||||||

| Audit Committee Financial Expert |

• | • | ||||||||||||||||||||||||||||||

| Other Current Public Boards |

3 | 1 | 1 | 2 | ||||||||||||||||||||||||||||

| Board Tenure, Age and Diversity |

||||||||||||||||||||||||||||||||

| Tenure |

9 | 16 | 4 | 7 | 10 | 12 | 28 | 4 | 4 | 4 | 4 | 6 | 15 | 38 | 2 | 22 | ||||||||||||||||

| Age |

68 | 63 | 65 | 60 | 64 | 61 | 81 | 76 | 61 | 67 | 54 | 68 | 69 | 86 | 64 | 76 | ||||||||||||||||

| Racial/Ethnic Diversity |

||||||||||||||||||||||||||||||||

| Asian |

• | • | ||||||||||||||||||||||||||||||

| Black or African American |

• | |||||||||||||||||||||||||||||||

| Hispanic or Latino |

||||||||||||||||||||||||||||||||

| American Indian or Alaskan Native |

||||||||||||||||||||||||||||||||

| Native Hawaiian or Pacific Islander |

||||||||||||||||||||||||||||||||

| White/Caucasian |

• | • | • | • | • | • | • | • | • | • | • | • | • | |||||||||||||||||||

| Gender |

M | M | F | F | M | M | M | M | F | M | M | M | M | M | F | F | ||||||||||||||||

| THE CHARLES SCHWAB CORPORATION 2024 PROXY STATEMENT | 13 |

CORPORATE GOVERNANCE

Succession Planning and Refreshment

The board views the annual nomination process conducted by the Nominating and Corporate Governance Committee, including its review of the skills and competencies represented on the board and the self-assessment process, as critical elements in planning for board succession. In addition, the Chair of the Nominating and Corporate Governance Committee discusses with each board member the member’s perspective on succession planning, including overall size and composition, tenure, and the effectiveness of the board and board committees. The Chair of the Nominating and Corporate Governance Committee also speaks with the Chairs of the Audit Committee, Compensation Committee, and Risk Committee about any particular succession issues that may affect their committees. As part of the succession planning process, the Nominating and Corporate Governance Committee considers the contributions made by directors with deep knowledge and experience with the company and its business through continued service over the years, as well as the need to refresh the board with new insights and perspectives. The board has demonstrated its commitment to refreshment by adding six new directors, including three women and one underrepresented minority, since the beginning of 2020.

As part of board succession planning, the Nominating and Corporate Governance Committee plans for anticipated vacancies, including those due to directors’ plans for retirement or expected changes in status. The Nominating and Corporate Governance Committee evaluates potential needs for skills and experience due to anticipated departures.

Board and Committee Evaluations

The Nominating and Corporate Governance Committee leads the board in its annual self-evaluation of the performance of the board and its committees to determine whether they are functioning effectively. The charters of each committee require an annual performance evaluation. Committee self-evaluations are conducted by the Chair of each committee and are reported to the full board by the respective Chairs. The Chair of the Nominating and Corporate Governance Committee reviews any issues arising from the committee self-evaluations with the Chairs of the other board committees. The Chair of the Nominating and Corporate Governance Committee also discusses the results of the board self-evaluation with the full board. The respective committee or the full board, as appropriate, will take such steps as are necessary or advisable to address weaknesses or deficiencies identified as part of the performance evaluation process.

Environmental, Social, and Governance Practices

The company is invested in the success of its clients, employees, and communities. We describe certain of our ESG initiatives more fully on the “Citizenship” section of our website and in our Environmental, Social, and Governance Report, which is available at www.aboutschwab.com/citizenship. Information available on or through the company’s website is not incorporated by reference into and is not part of this proxy statement, and any references to the website are intended to be inactive textual references only.

| 14 | THE CHARLES SCHWAB CORPORATION 2024 PROXY STATEMENT |

|

PROPOSAL ONE: ELECTION OF DIRECTORS |

Proposal One: Election of Directors

Nominees for directors this year are:

|

|

|

|

|

| ||||

| Walter W. Bettinger II |

Joan T. Dea |

Christopher V. Dodds |

Bharat B. Masrani |

Charles A. Ruffel |

Each nominee has consented to serve a three-year term and is presently a director of the company. Biographical information about each of the company’s director nominees and continuing directors is contained in the following section.

Mark A. Goldfarb, who is a current director and whose term is expiring at the annual meeting, is not standing for re-election as a director, and accordingly, the size of the board will be reduced from 17 directors to 16 directors effective at the annual meeting. We would like to thank Mr. Goldfarb for his service on the board since 2012 and his important contributions to the company in that time.

Director Nominees and Continuing Directors

|

DIRECTOR SINCE 2015

AGE AT ANNUAL MEETING: 68

INDEPENDENT DIRECTOR

COMMITTEES Audit |

John K. Adams, Jr. | |||

| Mr. Adams is a former Managing Director in the Financial Institutions Group at UBS Investment Bank (UBS), a financial services firm, where he served from 2002 until 2013. Prior to joining UBS, Mr. Adams was with Credit Suisse’s Financial Institutions Group from 1985 until 2002. He has served as a member of the Board of Directors of Charles Schwab Bank, SSB (CSB), since 2015. He served as a member of the Board of Directors of Navient Corporation, a financial services company that services and collects student loans, from 2014 to 2018. Mr. Adams’ term expires in 2025.

Mr. Adams has significant experience with respect to the financial services industry, investment banking, capital markets, and mergers and acquisitions, having served as head of UBS’ North American banks practice and in Credit Suisse’s Financial Institutions Group.

| ||||

| CAREER EXPERIENCE UBS Investment Bank Managing Director (2002-2013) Credit Suisse Financial Institutions Group (1985-2002) |

QUALIFICATIONS Public Company Board Financial Services Banking Asset Management Brokerage/Investment Banking Strategic Planning Finance Regulatory Environmental, Social, and Governance | |||

| THE CHARLES SCHWAB CORPORATION 2024 PROXY STATEMENT | 15 |

PROPOSAL ONE: ELECTION OF DIRECTORS

|

DIRECTOR SINCE 2008

AGE AT ANNUAL MEETING: 63 |

Walter W. Bettinger II | |||

| Mr. Bettinger has served as Chief Executive Officer of the company and a member of the board since 2008. He has served as Co-Chairman since 2022 and served as President of the company from 2008 until 2021. He also serves as Co-Chairman of CSB and as a trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Laudus Trust, and Schwab Strategic Trust, all registered investment companies managed by an affiliate of the company. He also served as Chief Operating Officer from 2007 until 2008, Executive Vice President and President – Schwab Investor Services from 2005 until 2007, Executive Vice President and Chief Operating Officer – Individual Investor Enterprise from 2004 until 2005, Executive Vice President and President – Corporate Services from 2002 until 2004, and Executive Vice President and President – Retirement Plan Services from 2000 until 2002. Mr. Bettinger joined the company in 1995 as part of the acquisition of The Hampton Company, which he founded in 1983. Mr. Bettinger is a nominee for election this year.

Mr. Bettinger has significant financial services experience, having served in a senior executive role overseeing sales, service, marketing, and operations for more than 40 years. As Chief Executive Officer of the company, Mr. Bettinger works closely with the board in evaluating and enhancing the strategic position of the company.

| ||||

|

CAREER EXPERIENCE The Charles Schwab Corporation Co-Chairman (2022-present) Chief Executive Officer (2008-present) President (2008-2021) Chief Operating Officer (2007-2008) Multiple Executive Vice President positions (2000-2007) |

QUALIFICATIONS Public Company Executive Financial Services Banking Asset Management Brokerage/Investment Banking Strategic Planning Finance Business Operations Marketing Regulatory Accounting Risk Management International Business Environmental, Social, and Governance | |||

| 16 | THE CHARLES SCHWAB CORPORATION 2024 PROXY STATEMENT |

PROPOSAL ONE: ELECTION OF DIRECTORS

|

DIRECTOR SINCE 2020

AGE AT ANNUAL MEETING: 65

INDEPENDENT DIRECTOR

COMMITTEES Risk |

Marianne C. Brown | |||

| Ms. Brown is the former Co-Chief Operating Officer of Fidelity National Information Services, Inc. (FIS), a financial services technology company, where she served from 2018 to 2019. She served as Chief Operating Officer, Institutional and Wholesale Business, of FIS from 2015, when it acquired SunGard Financial Systems LLC (SunGard), a software and IT services provider, to 2018. She served as the Chief Operating Officer of SunGard Financial Systems from 2014 to 2015. Prior to that, Ms. Brown was the Chief Executive Officer and President of Omgeo LLC, a financial services technology company, from 2006 to 2014. Before joining Omgeo LLC, she was the Chief Executive Officer of the Securities Industry Automation Corporation, a technical services company and subsidiary of the NYSE. Ms. Brown began her career at Automatic Data Processing, where she last served as general manager of Brokerage Processing Services, which spun off to become part of Broadridge Financial Services. Ms. Brown has served as a member of the Board of Directors of CSB since 2021. She has served as a member of the Boards of Directors of Northrop Grumman Corporation, an aerospace and defense technology company, since 2015, and Akamai Technologies, Inc., a cybersecurity company, since 2020. Ms. Brown also served on the Board of Directors of VMware, Inc. (VMware), a software and cloud computing company, from 2019 to November 2023, when VMware was acquired by Broadcom Inc. She has served on the Board of Directors of International Business Machines Corporation (IBM), a global technology company, since December 2023. Ms. Brown’s term expires in 2026.

Ms. Brown brings financial technology expertise and significant public company board experience to the board, having served as an executive at several financial technology companies and as a director of other public company boards.

| ||||

|

CAREER EXPERIENCE Fidelity National Information Services, Inc. Co-Chief Operating Officer (2018-2019) Chief Operating Officer (2015-2018) SunGard Financial Systems, LLC Chief Operating Officer (2014-2015) Omgeo LLC President and Chief Executive Officer (2006-2014) |

QUALIFICATIONS Public Company Executive Public Company Board Financial Services Banking Asset Management Brokerage/Investment Banking Strategic Planning Business Operations Information Technology/Cybersecurity Risk Management International Business | |||

| THE CHARLES SCHWAB CORPORATION 2024 PROXY STATEMENT | 17 |

PROPOSAL ONE: ELECTION OF DIRECTORS

|

DIRECTOR SINCE 2017

AGE AT ANNUAL MEETING: 60

INDEPENDENT DIRECTOR

COMMITTEES Compensation Nominating and Corporate Governance |

Joan T. Dea | |||

| Ms. Dea is the founder of Beckwith Investments LLC, a private investment and consulting firm, and has served as Managing Director since 2008. She served on the Executive Committee of BMO Financial Group from 2003 to 2008, most recently as Executive Vice President, Strategic Management and Corporate Marketing. She was previously a partner and director at Boston Consulting Group from 1994 to 2003, where she was a leader in the global financial services practice. She has served as a member of the Board of Directors of CSB since 2011 and Cineplex Inc., a diversified media company, since 2006. She served as a member of the Board of Directors of Performance Sports Group, a sports equipment and apparel company, from 2015 to 2017 and Torstar Corporation, a media company, from 2009 to 2015. Ms. Dea is a nominee for election this year.

Ms. Dea brings public company, leadership, strategy, governance, and financial services experience to the board, having served in a variety of executive leadership positions at BMO Financial Group and Boston Consulting Group.

| ||||

|

CAREER EXPERIENCE Beckwith Investments LLC Managing Director (2008-present) BMO Financial Group Executive Committee (2003-2008) Boston Consulting Group Partner and Director (1994-2003) |

QUALIFICATIONS Public Company Executive Public Company Board Financial Services Banking Asset Management Brokerage/Investment Banking Strategic Planning Finance Marketing International Business Environmental, Social, and Governance | |||

| 18 | THE CHARLES SCHWAB CORPORATION 2024 PROXY STATEMENT |

PROPOSAL ONE: ELECTION OF DIRECTORS

|

DIRECTOR SINCE 2014

AGE AT ANNUAL MEETING: 64

INDEPENDENT DIRECTOR

COMMITTEES Risk |

Christopher V. Dodds | |||

| Mr. Dodds has served as the Co-Founder and Managing Member of Crown Oak Advisors LLC, a registered investment advisor, since 2020. Mr. Dodds has also served as a senior advisor at The Cynosure Group, a private equity firm, since 2018. He served as a senior advisor at The Carlyle Group, a private equity firm, from 2008 to 2018. From 1986 to 2007, Mr. Dodds held several key positions at the company, including Executive Vice President and Chief Financial Officer. He has served as a member of the Board of Directors of CSB since 2007. He served as a member of the Board of Directors of Investment Technology Group, Inc., a brokerage and financial markets technology company, from 2008 to 2015. Mr. Dodds is a nominee for election this year.

Mr. Dodds brings leadership skills, knowledge of the financial services industry, and financial and accounting experience. He has deep knowledge of the company and its business, having served as its Chief Financial Officer from 1999 until 2007, and as a member of the Board of Directors of CSB since 2007.

| ||||

|

CAREER EXPERIENCE Crown Oak Advisors, LLC Managing Member (2020-present) The Cynosure Group Senior Advisor (2018-present) The Carlyle Group Senior Advisor (2008-2018) The Charles Schwab Corporation Chief Financial Officer (1999-2007) |

QUALIFICATIONS Public Company Executive Public Company Board Financial Services Banking Asset Management Brokerage/Investment Banking Strategic Planning Finance Regulatory Accounting Risk Management | |||

| THE CHARLES SCHWAB CORPORATION 2024 PROXY STATEMENT | 19 |

PROPOSAL ONE: ELECTION OF DIRECTORS

|

DIRECTOR SINCE 2012

AGE AT ANNUAL MEETING: 61

INDEPENDENT DIRECTOR

COMMITTEES Audit Nominating and Corporate Governance |

Stephen A. Ellis | |||

| Mr. Ellis is a Managing Partner at TPG, a private equity and alternative investment firm, where he co-leads The Rise Fund, the firm’s impact investing platform. Prior to joining TPG in 2015, he served as Chief Executive Officer of Asurion, LLC (Asurion), a provider of consumer technology protection services, from 2012 through 2015. Prior to Asurion, Mr. Ellis served as Worldwide Managing Director of Bain & Company (Bain), a management consulting firm, from 2005 until 2012, and as Managing Partner for Bain’s West Coast offices from 1999 through 2004. Mr. Ellis joined Bain in 1993. Mr. Ellis served as a member of the Board of Directors of e.l.f. Beauty, Inc., a cosmetics company, in 2019. Mr. Ellis’ term expires in 2025.

Mr. Ellis brings leadership and management skills, investment expertise, and experience in global management consulting to the board, having served as Worldwide Managing Director of Bain, Chief Executive Officer of Asurion, and as a Managing Partner at TPG.

| ||||

|

CAREER EXPERIENCE TPG Managing Partner (2015-present) Asurion, LLC Chief Executive Officer (2012-2015) Bain & Company Worldwide Managing Director (2005-2012) |

QUALIFICATIONS Public Company Board Financial Services Asset Management Strategic Planning Finance Business Operations International Business Academia Environmental, Social, and Governance | |||

| 20 | THE CHARLES SCHWAB CORPORATION 2024 PROXY STATEMENT |

PROPOSAL ONE: ELECTION OF DIRECTORS

|

DIRECTOR SINCE 1996

AGE AT ANNUAL MEETING: 81

INDEPENDENT DIRECTOR

COMMITTEES Compensation Nominating and Corporate Governance |

Frank C. Herringer | |||

| Mr. Herringer is the former Chairman of the Board and Chief Executive Officer of Transamerica, a financial services company. He served as Chairman of the Board of Transamerica from 1996 until 2015, Chief Executive Officer from 1991 until 1999 and President from 1986 until 1999, when Transamerica was acquired by AEGON N.V. (AEGON). From the date of the acquisition until 2000, Mr. Herringer served on the Executive Board of AEGON and as Chairman of the Board of AEGON USA, Inc. Mr. Herringer served as a member of the Board of Directors of Transamerica from 1986 to 2018. Mr. Herringer served as a member of the Boards of Directors of Amgen Inc. from 2004 to 2019, Cardax Pharmaceuticals, Inc. from 2006 to 2015, and Safeway, Inc. from 2008 to 2015. Mr. Herringer’s term expires in 2026.

Mr. Herringer brings public company knowledge and leadership experience to the board, having served as Chief Executive Officer of Transamerica, and his service at Transamerica and AEGON contributes to his knowledge of the financial services industry. Mr. Herringer brings insights to the board from his service on other public company boards.

| ||||

|

CAREER EXPERIENCE Transamerica Corporation Chairman of the Board (1996-2015) Chief Executive Officer (1991-1999) |

QUALIFICATIONS Public Company Executive Public Company Board Financial Services Strategic Planning Business Operations Finance Regulatory Risk Management Government Service Environmental, Social, and Governance | |||

| THE CHARLES SCHWAB CORPORATION 2024 PROXY STATEMENT | 21 |

PROPOSAL ONE: ELECTION OF DIRECTORS

|

DIRECTOR SINCE 2020

AGE AT ANNUAL MEETING: 76

INDEPENDENT DIRECTOR

COMMITTEES Compensation |

Brian M. Levitt | |||

| Mr. Levitt served as the Board Chair of The Toronto-Dominion Bank (TD Bank), a Canadian chartered bank, from 2011 to February 2024, and has been a director since 2008. Mr. Levitt has announced his retirement from the Board of Directors of TD Bank effective as of April 18, 2024. He also served as a member of the Board of Directors of TD Ameritrade Holding Corporation (TD Ameritrade) from 2016 to 2020. Mr. Levitt previously served as President and then Chief Executive Officer of Imasco Limited, a consumer products and services company, from 1991 to 2000, and served in various executive and non-executive leadership positions at the law firm Osler, Hoskin & Harcourt LLP from 2001 to 2015, where he most recently served as Vice-Chair. Mr. Levitt has served as a member of the Board of Directors of Xebec Adsorption Inc., a clean energy company, since 2021. He also served as a member of the Board of Directors of Domtar Corporation, a paper manufacturing company, from 2007 to 2021, Stelco Holdings, Inc., a primary steel producer, from 2017 to 2019, and Talisman Energy Inc., an oil and gas producer, from 2013 to 2015. Mr. Levitt’s term expires in 2025.

Mr. Levitt is one of the two directors currently designated by TD Bank. He brings significant strategy, governance, financial services, and public company board experience to the board.

| ||||

|

CAREER EXPERIENCE The Toronto-Dominion Bank Board Chair (2011-2024) Osler, Hoskin & Harcourt LLP Partner (2001-2015) Imasco Limited President and Chief Executive Officer (1991-2000) |

QUALIFICATIONS Public Company Executive Public Company Board Financial Services Banking Strategic Planning Finance Business Operations Regulatory Risk Management International Business Environmental, Social, and Governance | |||

| 22 | THE CHARLES SCHWAB CORPORATION 2024 PROXY STATEMENT |

PROPOSAL ONE: ELECTION OF DIRECTORS

|

DIRECTOR SINCE 2020

AGE AT ANNUAL MEETING: 61

INDEPENDENT DIRECTOR

COMMITTEES Audit |

Gerri K. Martin-Flickinger | |||

| Ms. Martin-Flickinger is a former Executive Vice President and Chief Technology Officer of Starbucks Corporation (Starbucks), a coffeehouse chain and coffee roasting company, where she served from 2015 to 2021. Prior to joining Starbucks in 2015, Ms. Martin-Flickinger served as Senior Vice President and Chief Information Officer of Adobe Inc. (Adobe), a computer software company, from 2006 to 2015, where she led portions of Adobe’s technology transformation to a cloud-based, subscription services business. She has previously served as Chief Information Officer at VeriSign, Inc. (VeriSign), Network Associates, Inc. (Network Associates), and McAfee Associates, Inc. (McAfee). She began her career at Chevron Corporation, where she held several senior positions. Ms. Martin-Flickinger served as a member of the Board of Directors of Tableau Software, Inc., a computer software company, from 2018 to 2019. Ms. Martin-Flickinger’s term expires in 2026.

Ms. Martin-Flickinger brings consumer retail and customer-digital knowledge and executive leadership experience to the board, having served as Executive Vice President and the Chief Technology Officer of Starbucks. She brings technology company industry insight and cybersecurity experience having served as Chief Information Officer of Adobe, Verisign, Network Associates, and McAfee, and public company board experience with Tableau Software.

| ||||

|

CAREER EXPERIENCE Starbucks Corporation Executive Vice President and Chief Technology Officer (2015-2021) Adobe Inc. Senior Vice President and Chief Information Officer (2006-2015) |

QUALIFICATIONS Public Company Executive Public Company Board Strategic Planning Finance Information Technology/Cybersecurity Marketing Risk Management International Business | |||

| THE CHARLES SCHWAB CORPORATION 2024 PROXY STATEMENT | 23 |

PROPOSAL ONE: ELECTION OF DIRECTORS

|

DIRECTOR SINCE 2020

AGE AT ANNUAL MEETING: 67

COMMITTEES Risk |

Bharat B. Masrani | |||

| Mr. Masrani has served as Group President and Chief Executive Officer of TD Bank since 2014. He served as Chief Operating Officer of TD Bank from 2013 to 2014. He served as Group Head, U.S. Personal and Commercial Banking, of TD Bank and President and Chief Executive Officer of TD Bank US Holding Company and TD Bank, N.A., subsidiaries of TD Bank, from 2008 until 2013. In 2006, Mr. Masrani became the President of TD Banknorth and, in 2007, President and CEO. From 2003 to 2006, he served as Vice Chair and Chief Risk Officer of TD Bank. Mr. Masrani began his banking career with TD Bank in 1987. From 2013 to 2020, Mr. Masrani served as member of the Board of Directors of TD Ameritrade. Mr. Masrani has served as a member of the Board of Directors of TD Bank since 2014. He has served as a member of the Board of Directors of The Clearing House since 2014 and the Bank Policy Institute since 2018. Mr. Masrani is a nominee for election this year.

Mr. Masrani is one of the two directors currently designated by TD Bank. He brings leadership and risk management skills, knowledge of the banking and the financial services industry, and international experience to the board, having served as Chief Executive Officer of TD Bank.

| ||||

|

CAREER EXPERIENCE The Toronto-Dominion Bank Group President and Chief Executive Officer (2014-present) Chief Operating Officer (2013-2014) Group Head, U.S. Personal and Commercial Banking (2008-2013) |

QUALIFICATIONS Public Company Executive Public Company Board Financial Services Banking Asset Management Brokerage/Investment Banking Strategic Planning Finance Business Operations Marketing Regulatory Accounting Risk Management International Business Environmental, Social, and Governance | |||

| 24 | THE CHARLES SCHWAB CORPORATION 2024 PROXY STATEMENT |

PROPOSAL ONE: ELECTION OF DIRECTORS

|

DIRECTOR SINCE 2020

AGE AT ANNUAL MEETING: 54

INDEPENDENT DIRECTOR

COMMITTEES Audit |

Todd M. Ricketts | |||

| Mr. Ricketts served as a member of the Board of Directors of TD Ameritrade, a registered broker-dealer and investment advisory firm, from 2011 to 2020. He has managed his personal investment portfolio since 2001. Mr. Ricketts previously served as Corporate Secretary and Director of Business Development for TD Ameritrade. Mr. Ricketts has served as a member of the Board of Directors of CSB since 2023. Mr. Ricketts has also served as a member of the Board of Directors of the parent company of the Chicago Cubs, Chicago Baseball Holdings, LLC, since 2009. Mr. Ricketts’ term expires in 2026.

He brings business management and financial experience to the board through his entrepreneurial and financial services industry experience.

| ||||

|

CAREER EXPERIENCE Chicago Baseball Holdings, LLC Director (2009-present) TD Ameritrade Holding Corporation Director (2011-2020) |

QUALIFICATIONS Public Company Board Financial Services Brokerage/Investment Banking Finance Business Operations Information Technology/Cybersecurity Environmental, Social, and Governance | |||

| THE CHARLES SCHWAB CORPORATION 2024 PROXY STATEMENT | 25 |

PROPOSAL ONE: ELECTION OF DIRECTORS

|

DIRECTOR SINCE 2018

AGE AT ANNUAL MEETING: 68

INDEPENDENT DIRECTOR

COMMITTEES Risk |

Charles A. Ruffel | |||

| Mr. Ruffel is the founder and Managing Partner of Kudu Investment Management, LLC, a private equity firm. He served as Chief Executive Officer and Managing Partner of Kudu Advisors, LLC, an investment banking company, from 2009 to 2015. He was the founder and Chief Executive Officer of Asset International, Inc., an information provider in the field of asset management, retirement, and bank services, from 1989 to 2010. He served as a trustee of Schwab Strategic Trust from 2009 to 2018 and as a trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust and Schwab Annuity Portfolios, Laudus Trust, and Laudus Institutional Trust from 2015 to 2018. He has served as a member of the Board of Directors of CSB since 2018. Mr. Ruffel served as a member of the Board of Directors of Aspire Financial Services, LLC, a financial services and retirement planning company, from 2012 to 2019. Mr. Ruffel is a nominee for election this year.

Mr. Ruffel brings financial and leadership experience to the board, having served as Chief Executive Officer of Kudu Advisors, LLC and Asset International, Inc. He brings insight to the board from his service as a trustee of numerous asset management funds of the company.

| ||||

|

CAREER EXPERIENCE Kudu Investment Management, LLC Managing Partner (2015-present) Kudu Advisors, LLC Managing Partner (2009-2015) Asset International, Inc. Chief Executive Officer (1998-2010) |

QUALIFICATIONS Asset Management Brokerage/Investment Banking Strategic Planning Finance Business Operations Information Technology/Cybersecurity Marketing Regulatory Risk Management International Business Environmental, Social, and Governance | |||

| 26 | THE CHARLES SCHWAB CORPORATION 2024 PROXY STATEMENT |

PROPOSAL ONE: ELECTION OF DIRECTORS

|

DIRECTOR SINCE 2009

AGE AT ANNUAL MEETING: 69

INDEPENDENT DIRECTOR

COMMITTEES Nominating and Corporate Governance Risk |

Arun Sarin | |||

| Mr. Sarin served as Chief Executive Officer of Vodafone Group Plc (Vodafone), a mobile telecommunications company, from 2003 until his retirement in 2008. Beginning in 1984, he held a variety of management positions with Pacific Telesis Group, a telecommunications company, and AirTouch Communications, Inc. (AirTouch), a wireless telecommunications company, which was spun off from Pacific Telesis Group in 1994. He was appointed President and Chief Operating Officer of AirTouch in 1997. In 1999, Mr. Sarin was appointed Chief Executive Officer of Vodafone’s US/AsiaPacific region. He left Vodafone in 2000 to become Chief Executive Officer of Infospace, Inc., an information technology company. From 2002 until 2003, he served as Chief Executive Officer of Accel-KKR Telecom, a private equity firm. He served as a non-executive director of the Court of the Bank of England from 2005 until 2009. He served as a member of the Board of Directors of Blackhawk Network Holdings, Inc. from 2009 to 2018, Safeway, Inc. from 2009 to 2015, and Cisco Systems, Inc. from 2009 to 2020, and Chairman of the Board of Trepont Acquisition Corp I, a special purpose acquisition company, from 2020 to 2022. Mr. Sarin has served as a member of the Board of Directors of Accenture PLC, a consulting and information technology services company, since 2015. He has served as Chairman of the Board of Cerence Inc., an automotive software company, and as a member of the Board of Directors of Ola Electric Mobility Limited, an electric vehicle company, since 2019. Mr. Sarin’s term expires in 2025.

Mr. Sarin brings public company knowledge, information technology/cybersecurity experience, and leadership experience to the board, having served as President and Chief Operating Officer of AirTouch and Chief Executive Officer of Vodafone. He brings insights to the board from his service on other public company boards.

| ||||

|

CAREER EXPERIENCE Trepont Acquisition Corp I Chairman (2020-2022) Vodafone Group Plc Chief Executive Officer (2003-2008) Accel-KKR Telecom Chief Executive Officer (2001-2003) Infospace, Inc. Chief Executive Officer (2000-2001) |

QUALIFICATIONS Public Company Executive Public Company Board Strategic Planning Finance Business Operations Information Technology/Cybersecurity Marketing Regulatory Risk Management International Business Environmental, Social, and Governance | |||

| THE CHARLES SCHWAB CORPORATION 2024 PROXY STATEMENT | 27 |

PROPOSAL ONE: ELECTION OF DIRECTORS

|

DIRECTOR SINCE 1986

AGE AT ANNUAL MEETING: 86 |

Charles R. Schwab | |||

| Mr. Schwab has served as a director of the company since its incorporation in 1986, having served as Co-Chairman since 2022 and as Chairman from 1986 to 2022. Mr. Schwab served as Chief Executive Officer of the company from 1986 to 1997 and from 2004 until 2008. He served as Co-Chief Executive Officer of the company from 1998 to 2003. Mr. Schwab was a founder of Charles Schwab & Co., Inc. (CS&Co) in 1971 and served as its Chief Executive Officer from 2004 until 2008. Mr. Schwab served as Chairman and trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, and Laudus Trust, all registered investment companies, through 2015. Mr. Schwab is the father of Carolyn Schwab-Pomerantz, a member of the Company’s board. Mr. Schwab’s term expires in 2025.

Mr. Schwab is the founder of the company, was the Chief Executive Officer of the company, and has been the Chairman or Co-Chairman since its inception. His vision continues to drive the company’s growth.

| ||||

|

CAREER EXPERIENCE The Charles Schwab Corporation Co-Chairman (2022-present) Chairman (1986-2022) Chief Executive Officer (1986-1997; 2004-2008) Co-Chief Executive Officer (1998-2003) Charles Schwab & Co. Inc. Chief Executive Officer (2004-2008) |

QUALIFICATIONS Public Company Executive Public Company Board Financial Services Banking Asset Management Brokerage/Investment Banking Strategic Planning Finance Business Operations Marketing Regulatory International Business Environmental, Social, and Governance | |||

| 28 | THE CHARLES SCHWAB CORPORATION 2024 PROXY STATEMENT |

PROPOSAL ONE: ELECTION OF DIRECTORS

|

DIRECTOR SINCE 2022

AGE AT ANNUAL MEETING: 64

COMMITTEES Risk |

Carolyn Schwab-Pomerantz | |||

| Ms. Schwab-Pomerantz was employed by CS&Co for 40 years. She served as Managing Director, Consumer Education of CS&Co from 2022 to 2023 and served as Senior Vice President, Consumer Education of CS&Co from 2005 to 2022. Ms. Schwab-Pomerantz also served as President of Charles Schwab Foundation, the Company’s charitable foundation, from 2002 to 2023, and as Chair of Charles Schwab Foundation from 2014 to 2023. She also served as Chair of Schwab Charitable Fund, a donor-advised fund, from 2012 to 2023, and as Chair of the Board of Governors for Boys & Girls Clubs of America, a nonprofit corporation, from 2021 to 2022 (and has served as Chair Emeritus since 2023). Ms. Schwab-Pomerantz is the daughter of the company’s Co-Chairman and founder Charles R. Schwab. Ms. Schwab-Pomerantz’s term expires in 2026.

Ms. Schwab-Pomerantz has significant financial services and environmental, social, and governance experience, having served in a senior role overseeing consumer education with the company from 2005 to 2023 and including through her roles with Charles Schwab Foundation, Schwab Charitable Fund, and Boys & Girls Clubs of America.

| ||||

|

CAREER EXPERIENCE Charles Schwab Foundation Chair (2004-2023) President (2002-2023) Charles Schwab & Co., Inc. Managing Director – Consumer Education (2022-2023) Senior Vice President – Consumer Education (2005-2022) |

QUALIFICATIONS Financial Services Brokerage/Investment Banking Strategic Planning Finance Marketing Risk Management Government Service Environmental, Social, and Governance | |||

| THE CHARLES SCHWAB CORPORATION 2024 PROXY STATEMENT | 29 |

PROPOSAL ONE: ELECTION OF DIRECTORS

|

DIRECTOR SINCE 2002

AGE AT ANNUAL MEETING: 76

INDEPENDENT DIRECTOR

COMMITTEES Compensation |

Paula A. Sneed | |||

| Ms. Sneed is Chairman and Chief Executive Officer of Phelps Prescott Group, LLC (Phelps Prescott), a strategy and management consulting firm. She served as Executive Vice President, Global Marketing Resources and Initiatives, of Kraft Foods, Inc. (Kraft), a global food and beverage company, from 2005 until her retirement in 2006; Senior Vice President, Global Marketing Resources and Initiatives from 2004 to 2005; and Group Vice President and President of E-Commerce and Marketing Services for Kraft Foods North America, part of Kraft, from 2000 until 2004. She joined General Foods Corporation (which later merged with Kraft) in 1977 and held a variety of senior executive positions, including Chief Marketing Officer, Executive Vice President and President eCommerce division, Executive Vice President and President Desserts division, and Senior Vice President and President Food Service division. Ms. Sneed served as a member of the Board of Directors of Berry Global Group, Inc., a package manufacturing company, from 2018 to 2022; as a member of the Board of Directors of TE Connectivity, Ltd., a manufacturer of engineered electronic components, network solutions, and telecommunications systems, from 2007 to 2020; and as a member of the Board of Directors of Airgas, Inc. from 1999 to 2016. Ms. Sneed’s term expires in 2025.

Ms. Sneed brings marketing skills and general management and executive leadership experience to the board, having served in a variety of senior executive positions at Kraft, and as Chairman and Chief Executive Officer of Phelps Prescott. She brings insights to the board through her service on other public company boards.

| ||||

|

CAREER EXPERIENCE Phelps Prescott Group, LLC Chairman and Chief Executive Officer (2007-present) Kraft Foods, Inc. Executive Vice President (2005-2006) Senior Vice President (2004-2005) Kraft Foods North America Executive Vice President (2000-2004) |

QUALIFICATIONS Public Company Executive Public Company Board Strategic Planning Business Operations Marketing Environmental, Social, and Governance | |||

| 30 | THE CHARLES SCHWAB CORPORATION 2024 PROXY STATEMENT |

PROPOSAL ONE: ELECTION OF DIRECTORS

Director Nominations

The Nominating and Corporate Governance Committee recommended all of the nominees for election included in this year’s proxy statement.

The committee has a policy to consider candidates recommended by stockholders. The policy requires written stockholder recommendations that include the following information: (i) the name, address, and contact information of the recommending stockholder; (ii) proof of the stockholder’s share ownership; (iii) a resume or statement of the candidate’s qualifications; and (iv) a statement of the stockholder’s relationship with the proposed candidate or interest in the proposed candidacy. The written recommendation must be addressed to the Office of the Corporate Secretary at the address provided in the “Corporate Governance” section of this proxy statement, or by email to SchwabCorporateSecretary@Schwab.com.

Identifying and Evaluating Candidates for Director

The Nominating and Corporate Governance Committee reviews the appropriate skills and characteristics required of board members in the context of the current composition of the board, as well as director qualifications as determined by the board. The committee evaluates attributes and capabilities valuable to the company’s business and commensurate with the size, complexity, and risk profile of the company and, as needed, to bring fresh perspective to the board. Candidates considered for nomination to the board may come from several sources, including current and former directors, professional search firms, and stockholder recommendations. Nominees for director are evaluated, in consultation with the company’s Co-Chairmen, by the Nominating and Corporate Governance Committee, which may retain the services of a professional search firm to assist it in identifying or evaluating potential candidates.

Communications With the Board of Directors

If you wish to communicate with the board, the Chair of the Nominating and Corporate Governance Committee, or the independent directors as a group, you may send your communication in writing to the Office of the Corporate Secretary at the address provided in the “Corporate Governance” section of this proxy statement or by email to SchwabCorporateSecretary@Schwab.com. You must include your name and address in the written communication and indicate whether you are a stockholder of the company.

The Office of the Corporate Secretary will compile all communications, summarize lengthy, repetitive, or duplicative communications, and forward them to the appropriate director or directors. The Office of the Corporate Secretary will not forward non-substantive communications or communications that pertain to personal grievances, but instead will forward them to the appropriate department within the company for resolution. In such cases, the Office of the Corporate Secretary will retain a copy of such communication for review by any director upon the director’s request.

Director Compensation

The Compensation Committee reviews, approves, and establishes guidelines for the compensation of directors, including appropriate levels of compensation for service on board committees. In 2023, the Compensation Committee conducted a review of non-employee director compensation with input from its outside consultant, Semler Brossy Consulting Group LLC (Semler Brossy). This review included a comparison to the company’s peer group. Based on this review and upon recommendation by the Compensation Committee, the board did not approve any changes to either the annual cash or annual equity retainers for committee Chairs and members. Mr. Schwab and Mr. Bettinger, who are employed by the company, receive no additional compensation for their service as directors, and Ms. Schwab-Pomerantz received no additional compensation for her service as director during the period in which she was employed by the company.

| THE CHARLES SCHWAB CORPORATION 2024 PROXY STATEMENT | 31 |

PROPOSAL ONE: ELECTION OF DIRECTORS

Cash Retainers

For 2023, each non-employee director received an annual cash retainer in the amount of $100,000. In addition, the Chairs of the Audit Committee and the Risk Committee each received an annual cash retainer of $50,000, and the other members of the Audit Committee and the Risk Committee each received an annual cash retainer of $20,000. The Chairs of the Compensation Committee and the Nominating and Corporate Governance Committee each received an annual cash retainer of $50,000, and the other members of the Compensation Committee and the Nominating and Corporate Governance Committee each received an annual cash retainer of $15,000.

There are no fees for attendance at board or committee meetings, but the board retains the discretion to establish special committees and to pay a special retainer to the Chair and the members of any special committee.

Equity Grants

For 2023, each non-employee director received an annual equity grant under the 2022 Stock Incentive Plan, with an aggregate value of $215,000. This equity grant was awarded 60% in restricted stock units (RSUs) and 40% in stock options.

Terms and Conditions

Non-employee directors receive annual RSU and option grants on the second business day after the annual meeting of stockholders. In the event a new non-employee director is elected to the board during the year, the company grants that individual a pro rata amount of cash retainers and equity awards for the first calendar year in lieu of the full amount. The non-employee director equity grants are subject to the following terms and conditions:

| ◾ | the annual grants of RSUs and options vest over the three-year period following the grant date, with 25% vesting on each of the first and second anniversary of the grant date and the remaining 50% on the third anniversary of the grant date. The RSUs and options become 100% vested in the event of the non-employee director’s death, disability, or retirement; |

| ◾ | the number of RSUs for the 2023 annual grant was determined by dividing 60% of the aggregate value of the annual equity grant by the average of the high and low market price of the company’s common stock on the grant date; |

| ◾ | the number of options for the 2023 annual grant of stock options was determined by dividing 40% of the aggregate value of the annual equity grant by the fair value of an option on the grant date; |

| ◾ | each stock option is designated as a nonqualified stock option and has an exercise price equal to the fair market value of common stock on the grant date; and |

| ◾ | each stock option expires on the earliest of (i) the date ten years after the grant date, (ii) the date three months after termination of service for any reason other than death, disability, or retirement, or (iii) the date one year after termination of service because of death or disability. |

The board has adopted stock ownership guidelines to promote significant equity ownership by non-employee directors and further align their long-term financial interests with those of stockholders. Under the guidelines, each non-employee director is expected to maintain an investment position in the company’s common stock with a fair market value equal to at least $400,000. A new director is expected to reach this target level upon completing five years of service. Once this target level is reached, the director is deemed to meet this target so long as he or she continues to hold an equivalent number of shares as on the date the target level was met. Shares owned outright, deferred shares, and RSUs are included in determining ownership levels, but stock options are not. As of December 31, 2023, all directors complied with the stock ownership guidelines.

| 32 | THE CHARLES SCHWAB CORPORATION 2024 PROXY STATEMENT |

PROPOSAL ONE: ELECTION OF DIRECTORS

Directors’ Deferred Compensation Plan

Non-employee directors also may participate in the Directors’ Deferred Compensation Plan II (the DCP2). This plan allows them to defer receipt of all or a portion of their cash retainers and, at their election, to receive:

| (1) | stock options that: |

| ◾ | have a fair value equal to the amounts deferred (as determined under the valuation method used by the company to value stock options at the time of the deferral); |

| ◾ | have an option exercise price equal to the closing price of common stock on the date the deferred amount would have been paid; and |

| ◾ | vest immediately upon grant and generally expire ten years after the grant date; |

– or –