Table of Contents

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ |

Preliminary Proxy Statement | ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| x |

Definitive Proxy Statement | |||||

| ¨ |

Definitive Additional Materials | |||||

| ¨ |

Soliciting Material Pursuant to Section 240.14a-12 |

The Charles Schwab Corporation

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee previously paid with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

March 30, 2012

Dear Fellow Stockholders,

We cordially invite you to attend our 2012 Annual Meeting of Stockholders to be held on Thursday, May 17, 2012, at 2:00 p.m. Pacific Time. We are pleased to host the meeting as a virtual event at www.schwabevents.com/corporation. You also may attend the meeting in person at 211 Main Street, San Francisco, California. If you plan to attend the meeting virtually via the internet or in person, please follow the registration instructions as outlined in this proxy statement.

At the annual meeting, we will conduct the items of business outlined in this proxy statement. We also will report on our corporate performance in 2011 and answer your questions.

Your vote is important. We encourage you to read this proxy statement carefully and to vote your shares as soon as possible, even if you plan to attend the meeting. Voting instructions are contained on the proxy card or voting instruction form that you received with this proxy statement.

We look forward to your participation.

Sincerely,

|

|

| |

| CHARLES R. SCHWAB | WALTER W. BETTINGER II | |

| CHAIRMAN | PRESIDENT AND CHIEF EXECUTIVE OFFICER | |

Table of Contents

i

Table of Contents

This summary highlights information contained elsewhere in the proxy statement. This summary does not contain all of the information that you should consider, and you should review all of the information contained in the proxy statement before voting.

ANNUAL MEETING OF STOCKHOLDERS

| Date: |

Thursday, May 17, 2012 | |

| Time: |

2:00 p.m., Pacific Time | |

| Location: |

www.schwabevents.com/corporation or | |

| 211 Main Street, San Francisco, California | ||

| Record Date: |

March 19, 2012 | |

| Voting: |

Stockholders as of the record date are entitled to vote. Each share of common stock is entitled to one vote. | |

| Registration: |

Please follow the advance registration instructions contained in the proxy statement on page 1. |

VOTING PROPOSALS

| Board Recommendation | Page | |||||

| Election of Directors |

||||||

| Nancy H. Bechtle |

For | 2 | ||||

| Walter W. Bettinger II |

For | 2 | ||||

| C. Preston Butcher |

For | 2 | ||||

| Ratification of Independent Auditors |

For | 13 | ||||

| Advisory Approval of Named Executive Officer Compensation |

For | 16 | ||||

| Proposal to amend Certificate of Incorporation and Bylaws to Declassify the Board |

For | 46 | ||||

| Stockholder Proposal on Political Contributions |

Against | 51 | ||||

| Stockholder Proposal to amend Bylaws regarding Proxy Access |

Against | 52 | ||||

DIRECTOR NOMINEES

We ask that you vote for the election of Nancy H. Bechtle, Walter W. Bettinger II, and C. Preston Butcher. The following table provides summary information on these nominees; complete biographical information is contained in the proxy statement.

| Name | Age | Director Since |

Occupation | Skills | Independent | Committees | ||||||||||||

| Nancy H. Bechtle |

74 | 1992 | Chairman, Sugar Bowl Corporation | Finance Leadership |

X | Nominating Compensation | ||||||||||||

| Walter W. Bettinger II |

51 | 2008 | President and Chief Executive Officer, The Charles Schwab Corporation | Financial Services Leadership Strategic |

||||||||||||||

| C. Preston Butcher |

73 | 1988 | Chairman and Chief Executive Officer, Legacy Partners | Finance Leadership |

X | Nominating Audit | ||||||||||||

ii

Table of Contents

INDEPENDENT AUDITORS

We ask that you ratify the appointment of Deloitte & Touche LLP and the member firms of Deloitte Touche Tohmatsu (collectively referred to as “Deloitte”) as the company’s independent registered public accounting firm for the 2012 fiscal year. While the Audit Committee has the sole authority to retain the independent auditors, we are asking for your ratification as part of the Audit Committee’s evaluation process of the independent registered public accounting firm for the next fiscal year.

Fees for services provided by Deloitte in the last two fiscal years were:

| 2011 | 2010 | |||||||

| (amounts in millions) | ||||||||

| Audit Fees |

$ | 5.2 | $ | 4.4 | ||||

| Audit-Related Fees |

1.8 | 1.8 | ||||||

| Tax Fees |

0.1 | 0.1 | ||||||

| All Other Fees |

None | None | ||||||

| Total |

$ | 7.1 | $ | 6.3 | ||||

EXECUTIVE COMPENSATION

We ask you to approve on an advisory basis the compensation of our named executive officers, i.e., the Chief Executive Officer, the Chief Financial Officer, and the next three most highly compensated executive officers. The advisory approval of named executive officer compensation is required by federal law, and while the vote is not binding, the Compensation Committee considers the vote as part of its evaluation of executive compensation programs.

2011 Executive Compensation Highlights

In 2011, our management team continued to position the company for future growth, invest in clients, and sustain expense discipline, which resulted in a pretax profit margin of 29.7% and return on stockholders’ equity of 12%.

iii

Table of Contents

The company’s compensation programs are designed to link pay to the long-term performance of the company. Key elements of compensation include:

| Element | Form | Terms | Objectives | |||

| Base Salary |

· Cash |

· Reviewed annually |

· Attract, motivate and retain executives | |||

| Annual Incentives |

· Cash |

· Subject to satisfaction of performance criteria |

· Attract, motivate and retain executives

· Link pay with individual performance

· Link pay with company financial performance | |||

| Long-Term Incentives |

· Performance-based restricted stock units

|

· Restricted stock units vest 25% per year subject to satisfaction of performance criteria |

· Attract, motivate and retain executives

· Link pay with individual performance | |||

| · Stock options

|

· Stock options generally vest 25% per year and have a 10 year term |

· Link pay with company financial performance

· Align with long-term interests of stockholders | ||||

In 2011, the target for annual incentive compensation was set at earnings per share levels achieved prior to the onset of the financial crisis. Financial performance in 2011 supported a payout below this aggressive target, at 78% of the target award. The performance goal for performance-based restricted stock units was set as return on equity exceeding the cost of equity to align the executives’ interests with long-term interests of stockholders. These units vest only if the performance goals are satisfied for the annual performance period or the cumulative four-year performance period.

iv

Table of Contents

Summary compensation information for the named executive officers in 2011 is contained in the following table. As discussed in the proxy statement, these amounts are presented in accordance with accounting assumptions and Securities and Exchange Commission rules, and the amount that the executive actually receives may vary substantially from what is reported in the equity columns of the table.

2011 SUMMARY COMPENSATION

| Name and Principal Position |

Salary ($) |

Stock Awards ($) |

Option Awards ($) |

Non-Equity Incentive Plan Compensation ($) |

All Other Compensation ($) |

Total ($) |

||||||||||||||||||

| Walter W. Bettinger II PRESIDENT AND CHIEF |

900,000 | 1,950,000 | 4,550,000 | 2,632,500 | 71,877 | 10,104,377 | ||||||||||||||||||

| Joseph R. Martinetto CHIEF FINANCIAL OFFICER |

497,667 | 390,000 | 910,000 | 582,269 | 19,564 | 2,399,500 | ||||||||||||||||||

| Benjamin L. Brigeman EXECUTIVE VICE PRESIDENT – |

543,500 | 450,000 | 1,050,000 | 741,877 | 21,627 | 2,807,004 | ||||||||||||||||||

| James D. McCool EXECUTIVE VICE PRESIDENT – |

522,667 | 420,000 | 980,000 | 713,440 | 47,462 | 2,683,569 | ||||||||||||||||||

| Charles R. Schwab CHAIRMAN |

500,000 | 900,000 | 2,100,000 | 975,000 | 42,979 | 4,517,979 | ||||||||||||||||||

OTHER PROPOSALS

For a description of our proposal regarding declassification of the Board of Directors and the two stockholder proposals, and our reasons for our recommendation on each proposal, please see the information contained within the proxy statement.

v

Table of Contents

NOTICE OF 2012 ANNUAL MEETING OF STOCKHOLDERS

The 2012 Annual Meeting of Stockholders of The Charles Schwab Corporation will be held as a virtual event on Thursday, May 17, 2012, at 2:00 p.m. Pacific Time, at www.schwabevents.com/corporation. You also may attend in person at 211 Main Street, San Francisco, California. At the annual meeting, we will conduct the following items of business:

| · | elect three directors for three-year terms, |

| · | vote to ratify the selection of independent auditors, |

| · | vote for the approval, on an advisory basis, of compensation of named executive officers, |

| · | vote to amend the certificate of incorporation and bylaws to declassify the board, |

| · | vote on two stockholder proposals, and |

| · | consider any other business properly coming before the meeting. |

Stockholders who owned shares of our common stock at the close of business on March 19, 2012 are entitled to attend and vote at the meeting and any adjournment or postponement of the meeting. A complete list of registered stockholders will be available prior to the meeting at our principal executive offices at 211 Main Street, San Francisco, California 94105.

| By Order of the Board of Directors, |

|

| CARRIE E. DWYER |

| EXECUTIVE VICE PRESIDENT, |

| GENERAL COUNSEL AND |

| CORPORATE SECRETARY |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of

Stockholders to be Held on May 17, 2012. The proxy statement and annual report to

security holders are available in the “Investor Relations” section of our web site at

www.aboutschwab.com.

Your Vote is Important

Please vote as promptly as possible by following the instructions on your proxy card or voting

instruction form. If you plan to attend the meeting virtually via the internet or in person, you must

register by following the instructions contained in the “Information about the Annual Meeting”

section of this proxy statement.

vi

Table of Contents

INFORMATION ABOUT THE ANNUAL MEETING

The Board of Directors is sending these proxy materials to you on or about March 30, 2012. Stockholders who owned the company’s common stock at the close of business on March 19, 2012 may attend and vote at the annual meeting. Each share is entitled to one vote. There were 1,272,811,091 shares of common stock outstanding on March 19, 2012.

How do I register for the annual meeting?

You must register in advance to attend the annual meeting in person or virtually via the internet. While you may watch the webcast without registering, you will not be able to access the area of the website where you can ask questions and vote if you do not register.

To register to attend the annual meeting in person or virtually via the internet, please go to:

www.schwabevents.com/corporation.

You will be asked to provide your name, complete mailing address, email address and proof that you own Schwab shares (such as the Schwab account number in which you hold the shares, or the name of the broker and number of shares that you hold in an account outside of Schwab).

You also may write the Assistant Corporate Secretary at the address in the “Corporate Governance Information” section of this proxy statement or call the Assistant Corporate Secretary at (415) 667-9979 if you plan to attend the in-person meeting.

How may I vote shares at the annual meeting?

If you plan to vote at the annual meeting and your shares are held in “street name” (e.g., through a bank or broker), you will need a legal proxy to vote your shares at the annual meeting. You may obtain a legal proxy from your bank or broker. If you plan to vote at the virtual meeting, please send your legal proxy to our transfer agent, Wells Fargo Bank, N.A., by fax to (651) 450-4026 or email to wfssproxyteam@wellsfargo.com. If you plan to vote at the in-person meeting, you may bring the legal proxy with you.

If you hold shares registered in your name (e.g., in certificate form), you will not need a legal proxy to vote your shares.

How do I access the virtual annual meeting?

To access the virtual annual meeting, please go to:

www.schwabevents.com/corporation.

If you register in advance to attend the annual meeting, we will email you information on how to access the area of the virtual meeting where you will be able to submit questions and vote.

How do I attend the in-person meeting?

If you plan to attend the in-person meeting, in accordance with our security procedures, you will be asked to present picture identification to enter the meeting. Attendance at the annual meeting is limited to stockholders or one named representative of a stockholder. Seating is limited and, therefore, admission to the annual meeting is on a first-come, first-served basis. If you will be naming a representative to attend the meeting on your behalf, the name, address and telephone number of that individual must also be provided.

1

Table of Contents

ELECTION OF DIRECTORS

Nominees for directors this year are:

| · | Nancy H. Bechtle |

| · | Walter W. Bettinger II |

| · | C. Preston Butcher |

Each nominee is presently a director of the company and has consented to serve a three-year term. Biographical information about each of the nominees is contained in the following section.

MEMBERS OF THE BOARD OF DIRECTORS

NANCY H. BECHTLE

DIRECTOR SINCE 1992

Ms. Bechtle, age 74, served as President and Chief Executive Officer of the San Francisco Symphony from 1987 until 2001 and has served as a member of the San Francisco Symphony Board of Governors since 1984. She was a director and Chief Financial Officer of J.R. Bechtle & Co., an international consulting firm, from 1979 to 1998. Ms. Bechtle has served as Chairman and a director of Sugar Bowl Corporation, a ski resort operator, since 1998. She was appointed a director of the Presidio Trust in 2008 and currently serves as its Chairman. She also served as a director of the National Park Foundation from 2002 until 2008 and was its Vice Chairman from 2005 until 2008. Ms. Bechtle is a nominee for election this year.

Ms. Bechtle brings leadership skills and financial experience to the board, having served as Chief Financial Officer of J.R. Bechtle & Co., Chairman of Sugar Bowl Corporation and Chief Executive Officer of the San Francisco Symphony. She has deep knowledge of the company and its business, having served on our board since 1992.

WALTER W. BETTINGER II

DIRECTOR SINCE 2008

Mr. Bettinger, age 51, has served as President and Chief Executive Officer of The Charles Schwab Corporation and a member of the Board of Directors since 2008. He also serves as Chief Executive Officer and a member of the Board of Directors of Charles Schwab Bank and Charles Schwab & Co., Inc., and as a trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Laudus Trust, Laudus Institutional Trust, and Schwab Strategic Trust, all registered investment companies. Prior to assuming his current role, he served as President and Chief Operating Officer of the company. He also served as Executive Vice President and President – Schwab Investor Services from 2005 until 2007, Executive Vice President and Chief Operating Officer – Individual Investor Enterprise from 2004 until 2005, Executive Vice President and President – Corporate Services from 2002 until 2004 and Executive Vice President and President – Retirement Plan Services from 2000 until 2002. Mr. Bettinger joined the company in 1995 as part of the acquisition of The Hampton Company, which he founded in 1983. Mr. Bettinger is a nominee for election this year.

Mr. Bettinger has significant financial services experience, having served in a senior executive role overseeing sales, service, marketing and operations. As Chief Executive Officer of the company, Mr. Bettinger works closely with the board in evaluating and enhancing the strategic position of the company.

2

Table of Contents

C. PRESTON BUTCHER

DIRECTOR SINCE 1988

Mr. Butcher, age 73, has been Chairman and Chief Executive Officer of Legacy Partners (formerly Lincoln Property Company N.C., Inc.), a real estate development and management firm, since 1998 and Chairman of the Board, Chief Executive Officer and Director of KBS Legacy Partners Apartment REIT, Inc., a real estate investment trust, since 2009. Mr. Butcher served as President, Chief Executive Officer and Regional Partner of Lincoln Property Company N.C., Inc. from 1967 until 1998. He is a director of Northstar Realty Finance Corp. Mr. Butcher is a nominee for election this year.

Mr. Butcher brings leadership skills and experience in complex financial transactions to the board as Chairman and Chief Executive Officer of Legacy Partners. He has deep knowledge of the company and its business, having served on our board since 1988.

FRANK C. HERRINGER

DIRECTOR SINCE 1996

Mr. Herringer, age 69, has been Chairman of the Board of Transamerica Corporation, a financial services company, since 1996. He served as Chief Executive Officer of Transamerica from 1991 to 1999 and President from 1986 to 1999, when Transamerica was acquired by AEGON N.V. From the date of the acquisition until 2000, Mr. Herringer served on the Executive Board of AEGON N.V. and as Chairman of the Board of AEGON USA, Inc. Mr. Herringer is also a director of AEGON U.S. Corporation, the holding company for AEGON N.V.’s operations in the United States, Amgen Inc., a biotechnology company, Safeway, Inc., a food and drug retailer, and Cardax Pharmaceuticals, a biotechnology company. Mr. Herringer’s term expires in 2014.

Mr. Herringer brings public company knowledge and leadership experience to the board, having served as Chief Executive Officer of Transamerica, and his service at Transamerica and AEGON contribute to his knowledge of the financial services industry. Mr. Herringer brings insights to our board from his service on other public company boards.

STEPHEN T. MCLIN

DIRECTOR SINCE 1988

Mr. McLin, age 65, has been Chairman and Chief Executive Officer of STM Holdings LLC, which offers merger and acquisition advice, since 1998. From 1987 until 1998, he was President and Chief Executive Officer of America First Financial Corporation, a finance and investment banking firm, and parent of EurekaBank. Before that, he was an Executive Vice President of Bank of America. Mr. McLin is an advisory director of Headwaters MB, a merchant bank, and Financial Technology Ventures, a private equity fund. Mr. McLin’s term expires in 2014.

Mr. McLin brings leadership experience to the board, having served as Chief Executive Officer of America First Financial Corporation and having extensive knowledge of the financial services industry through his experience at STM Holdings, LLC, America First Financial Corporation and Bank of America. His financial expertise is critical for his role as Audit Committee Chairman.

ARUN SARIN

DIRECTOR SINCE 2009

Mr. Sarin, age 57, served as Chief Executive Officer of Vodafone Group Plc, a mobile telecommunications company, from 2003 until his retirement in 2008. Beginning in 1984, he held a variety of management positions with Pacific

3

Table of Contents

Telesis Group, a telecommunications company, and AirTouch Communications, Inc., a wireless telecommunications company, which was spun off from Pacific Telesis Group in 1994. He was appointed President and Chief Operating Officer of AirTouch in 1997. In 1999, Mr. Sarin was appointed Chief Executive Officer of Vodafone’s US/AsiaPacific region. He left Vodafone in 2000 to become Chief Executive Officer of Infospace, Inc., an information technology company. From 2002 until 2003, he served as Chief Executive Officer of Accel-KKR Telecom, a private equity firm. He served as a non-executive director of the Court of the Bank of England from 2005 until May 2009. He currently serves as senior advisor for KKR. Mr. Sarin is a director of Cisco Systems, Inc., a networking and communications technology company, and Safeway, Inc., a food and drug retailer. Mr. Sarin’s term expires in 2013.

Mr. Sarin brings public company knowledge and leadership experience to the board, having served as President and Chief Operating Officer of AirTouch Communications, Inc. and Chief Executive Officer of Vodafone Group Plc. He brings insights to our board from his service on other public company boards.

CHARLES R. SCHWAB

DIRECTOR SINCE 1986

Mr. Schwab, age 74, has been Chairman and a director of The Charles Schwab Corporation since its incorporation in 1986. Mr. Schwab served as Chief Executive Officer of the company from 1986 to 1997 and from 2004 until 2008. He served as Co-Chief Executive Officer of the company from 1998 to 2003. Mr. Schwab was a founder of Charles Schwab & Co., Inc. in 1971, has been its Chairman since 1978, and served as its Chief Executive Officer from 2004 until 2008. Mr. Schwab is Chairman of Charles Schwab Bank and Chairman and trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Laudus Trust and Laudus Institutional Trust, all registered investment companies. Mr. Schwab’s term expires in 2013.

Mr. Schwab is the founder of the company, was the Chief Executive Officer of the company, and has been the Chairman since its inception. His vision continues to drive the company’s growth.

PAULA A. SNEED

DIRECTOR SINCE 2002

Ms. Sneed, age 64, is Chairman and Chief Executive Officer of Phelps Prescott Group, LLC, a strategy and management consulting firm. She served as Executive Vice President, Global Marketing Resources and Initiatives, of Kraft Foods, Inc., a global food and beverage company, from 2005 until her retirement in 2006; Senior Vice President, Global Marketing Resources and Initiatives from 2004 to 2005; and Group Vice President and President of E-Commerce and Marketing Services for Kraft Foods North America, part of Kraft Foods, Inc., from 2000 until 2004. She joined General Foods Corporation (which later merged with Kraft Foods) in 1977 and held a variety of management positions, including Chief Marketing Officer, Executive Vice President and President Desserts division, and Executive Vice President and President eCommerce division. Ms. Sneed is a director of Airgas, Inc., a national distributor of industrial, medical and specialty gases and related equipment, and TE Connectivity, Ltd., a manufacturer of engineered electronic components, network solutions, wireless systems and telecommunications systems. Ms. Sneed’s term expires in 2013.

Ms. Sneed brings marketing skills and general management and leadership experience to the board, having served as Executive Vice President, Global Marketing Resources and Initiatives, of Kraft Foods, her other management positions at Kraft, and as Chairman and Chief Executive Officer of Phelps Prescott Group. She brings insights to our board through her service on other public company boards.

4

Table of Contents

ROGER O. WALTHER

DIRECTOR SINCE 1989

Mr. Walther, age 76, has served as Chairman and Chief Executive Officer of Tusker Corporation, a real estate and business management company, since 1997. He served as Chairman and Chief Executive Officer of ELS Educational Services, Inc., a provider in the United States and internationally of courses in English as a second language, between 1992 and 1997. Mr. Walther was President, Chief Executive Officer and a director of AIFS, Inc., which designs and markets educational and cultural programs internationally, from 1964 to 1993. Mr. Walther served as Chairman and a director of First Republic Bank from 1985 until 2007. Mr. Walther’s term expires in 2014.

Mr. Walther brings public company knowledge, leadership, and financial services industry experience to the board, having served as Chairman and Chief Executive Officer of Tusker Corporation, Chairman and a director of First Republic Bank, Chief Executive Officer of ELS Educational Services, Inc. and Chief Executive Officer of AIFS, Inc.

ROBERT N. WILSON

DIRECTOR SINCE 2003

Mr. Wilson, age 71, is Chairman of MEVION Medical Systems (formerly Still River Systems), a medical device company. Mr. Wilson was Chairman of Caxton Health Holdings, LLC, a healthcare-focused investment firm, from 2004 through 2007, and was Vice Chairman of the board of directors of Johnson & Johnson, a manufacturer of health care products, from 1989 until 2003. Mr. Wilson joined Johnson & Johnson in 1964. Mr. Wilson is also a director of Hess Corporation, an integrated oil and gas company, and Synta Pharmaceuticals Corporation, a bio-pharmaceutical company. Mr. Wilson’s term expires in 2014.

Mr. Wilson brings public company knowledge and leadership experience to the board, having served as Vice Chairman of Johnson & Johnson, Chairman of MEVION Medical Systems, and Chairman of Caxton Health Holdings. He brings insights to our board as a director of other public company boards.

We have considered the independence of each member of the board in accordance with New York Stock Exchange corporate governance standards. To assist us in our determination, we also adopted general guidelines for independence. The guidelines for independence are available on the company’s website at www.aboutschwab.com/governance.

Based on our guidelines and New York Stock Exchange corporate governance standards, we have determined that the following directors are independent: Nancy H. Bechtle, C. Preston Butcher, Frank C. Herringer, Stephen T. McLin, Arun Sarin, Paula A. Sneed, Roger O. Walther, and Robert N. Wilson.

In determining independence, the Board of Directors considers broadly all relevant facts and circumstances regarding a director’s relationships with the company. All non-employee directors receive compensation from the company for their service as a director, as disclosed in the section “Director Compensation,” and are entitled to receive reimbursement for their expenses in traveling to and participating in board and committee meetings. As disclosed in the “Transactions with Related Persons” section of this proxy statement, some directors and entities with which they are affiliated have credit transactions with the company’s banking and brokerage subsidiaries, such as mortgage loans, revolving lines of credit, or other extensions of credit. These transactions with directors and their affiliates are made in the ordinary course of business and to the extent permitted by the Sarbanes-Oxley Act of 2002. Such transactions are on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with persons not related to the lender and do not involve more than the normal risk of collectability or present other unfavorable features.

5

Table of Contents

In addition to the relationships outlined above, the board considered the following types of relationships for the following directors:

| · | Nancy H. Bechtle: The director serves as a director of a nonprofit organization to which the company, its affiliates or its charitable foundation have made donations. |

| · | C. Preston Butcher: The director’s spouse serves as a director of a nonprofit organization to which the company, its affiliates or its charitable foundation have made donations. |

| · | Frank C. Herringer: The director’s spouse serves as a director of a nonprofit organization to which the company, its affiliates or its charitable foundation have made donations. |

| · | Stephen T. McLin: The director’s son is employed by the company in a non-executive officer, non-managerial capacity. |

| · | Paula A. Sneed: The director serves as a director of a nonprofit organization to which the company, its affiliates or its charitable foundation have made donations. |

CORPORATE GOVERNANCE INFORMATION

Board Leadership

The Chairman of the Board is Charles R. Schwab. The Chairman and Chief Executive Officer roles are split, and Mr. Bettinger serves as Chief Executive Officer. The Chairman of the Board approves the agenda for board meetings and leads the board in its discussions. Mr. Schwab and Mr. Bettinger, as the only two management directors, do not participate in sessions of non-management directors. As provided in our Corporate Governance Guidelines, non-management directors meet regularly in executive session without management. The Chairman of the Nominating and Corporate Governance Committee presides over the executive sessions of non-management directors. Mr. Herringer, as chairman of the Nominating and Corporate Governance Committee in 2011, led the non-management directors in executive session.

The board has three standing committees (Audit, Compensation, and Nominating and Corporate Governance) that are composed entirely of independent directors and are chaired by independent directors. Given the role and scope of authority of these committees, and that 80% of the board is composed of independent directors, the board believes that its leadership structure, with the Chairman of the Board leading board discussions, and the Chairman of the Nominating and Corporate Governance Committee leading non-management executive sessions, is appropriate.

Risk Oversight

As part of its oversight functions, the Board of Directors is responsible for oversight of risk management at the company. Responsibility for oversight of risk management is delegated to the Audit Committee, which reviews with management the company’s major risk exposures and the steps management has taken to monitor and control such exposures, including the company’s risk assessment and risk management policies. The Compensation Committee, as described in the Compensation Discussion and Analysis, separately reviews the compensation program with respect to incentives for risk-taking by employees. For further discussion of risk management at the company, please see “Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations – Risk Management” of the company’s Form 10-K for the period ended December 31, 2011.

Board Structure and Committees

The authorized number of directors is currently ten and the company has ten directors. Three directors are nominees for election this year and seven directors will continue to serve the terms described in their biographies.

6

Table of Contents

Directors currently serve staggered terms. Each director who is elected at an annual meeting of stockholders serves a three-year term, and the directors are divided into three classes.

The board held seven meetings in 2011. Each director attended at least 75% of all board and applicable committee meetings during 2011. As provided in our Corporate Governance Guidelines, we expect directors to attend the annual meeting of stockholders. In 2011, nine directors attended the annual meeting.

We have an Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee. Each of these committees is composed entirely of “independent directors” as determined by the Board of Directors in accordance with its independence guidelines and New York Stock Exchange corporate governance standards. In addition to those standing committees, the board may from time to time establish ad hoc committees to assist in various matters.

The Audit Committee held twelve meetings in 2011 and is composed of the following members: Stephen T. McLin (Chairman), C. Preston Butcher, and Arun Sarin. None of the directors on the Audit Committee is or has been an employee of The Charles Schwab Corporation or any of its subsidiaries. None of the Audit Committee members simultaneously serves on the audit committees of more than three public companies, including ours. The board has determined that all of the members of the Audit Committee are financially literate in accordance with New York Stock Exchange listing standards and that Stephen T. McLin is an Audit Committee financial expert in accordance with Securities and Exchange Commission rules.

The Audit Committee:

| · | reviews and discusses with management and the independent auditors the company’s annual and quarterly financial statements and the integrity of the financial reporting process, |

| · | reviews the qualifications and independence of the independent auditors and performance of the company’s internal and independent auditors, |

| · | reviews reports from management regarding major risk exposures and steps management has taken to address such exposures, and |

| · | reviews compliance with legal and regulatory requirements. |

The Compensation Committee held seven meetings in 2011 and is composed of the following members: Roger O. Walther (Chairman), Nancy H. Bechtle, Frank C. Herringer, Paula A. Sneed, and Robert N. Wilson. The Compensation Committee:

| · | annually reviews and approves corporate goals and objectives relating to compensation of executive officers and other senior officers, |

| · | evaluates the performance of executive officers and other senior officers and determines their compensation levels, |

| · | reviews and approves compensatory arrangements for executive officers and other senior officers, and |

| · | approves long-term awards for executive officers and other senior officers. |

The Nominating and Corporate Governance Committee held two meetings in 2011 and is composed of the following members: Frank C. Herringer (Chairman), Nancy H. Bechtle, C. Preston Butcher, Stephen T. McLin, Arun Sarin, Paula A. Sneed, Roger O. Walther, and Robert N. Wilson. The Nominating and Corporate Governance Committee:

| · | identifies and evaluates individuals qualified to serve on the board, |

| · | recommends nominees to fill vacancies on the board and each board committee and recommends a slate of nominees for election or re-election as directors by the stockholders, |

7

Table of Contents

| · | makes recommendations regarding succession planning for the Chief Executive Officer and executive management, and |

| · | assesses the performance of the board and its committees and recommends corporate governance principles for adoption by the board. |

The Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee have written charters. You may find a copy of these charters, as well as our Corporate Governance Guidelines and Code of Business Conduct and Ethics, on the company’s website at www.aboutschwab.com/governance. You also may obtain a paper copy of these items, without charge, from:

Assistant Corporate Secretary

The Charles Schwab Corporation

Mailstop SF211MN-05

211 Main Street

San Francisco, California 94105

The following table shows compensation paid to each of our non-employee directors during 2011. The company does not provide any non-equity incentive plans, defined benefit and actuarial pension plans, or other defined contribution retirement plans for non-employee directors. The company does not offer above-market or preferential earnings under its nonqualified deferred compensation plans for directors.

2011 Director Compensation Table

| Name | Fees Earned or Paid in Cash ($) | |||||||||||||||||||||||

| Paid in ($) |

Deferred

into ($) |

Stock ($) |

Option ($) |

All Other ($) |

Total ($) |

|||||||||||||||||||

| Nancy H. Bechtle |

85,500 | — | 62,500 | 62,500 | 1,891 | 212,391 | ||||||||||||||||||

| C. Preston Butcher |

— | 90,500 | 62,500 | 62,500 | 1,891 | 217,391 | ||||||||||||||||||

| Frank C. Herringer |

— | 100,000 | 62,500 | 62,500 | 1,891 | 226,891 | ||||||||||||||||||

| Stephen T. McLin |

79,000 | 110,500 | 82,500 | 62,500 | 2,496 | 336,996 | ||||||||||||||||||

| Arun Sarin |

90,000 | — | 62,500 | 62,500 | 1,293 | 216,293 | ||||||||||||||||||

| Paula A. Sneed |

85,000 | — | 62,500 | 62,500 | 1,891 | 211,891 | ||||||||||||||||||

| Roger O. Walther |

100,000 | — | 62,500 | 62,500 | 1,891 | 226,891 | ||||||||||||||||||

| Robert N. Wilson |

85,000 | — | 62,500 | 62,500 | 1,891 | 211,891 | ||||||||||||||||||

| (1) | This column shows amounts paid in cash for retainers and meeting fees. For Mr. McLin, the amount in this column represents his cash retainer and fees for service on the Charles Schwab Bank board of directors. |

| (2) | This column shows the dollar amount of retainers and meeting fees deferred into restricted stock units or options under the Directors’ Deferred Compensation Plan II. The corresponding restricted stock units or options were as follows: 21,605 stock options for Mr. Butcher, 26,385 stock options for Mr. McLin, and 6,564 restricted stock units for Mr. Herringer. |

8

Table of Contents

| (3) | The amounts shown in this column represent the grant date fair value of the restricted stock unit award. In 2011, all non-employee directors received an automatic grant of restricted stock units with a grant date fair value of $62,500. In addition, Mr. McLin received a grant of restricted stock units with a grant date fair value of $20,000 for his service on the Charles Schwab Bank board. |

| (4) | The amounts shown in this column represent the grant date fair value of the option award. In 2011, all non-employee directors received an automatic grant of stock options with a grant date fair value of $62,500. |

| (5) | This column shows the dollar amount of cash dividends on unvested restricted shares and dividend equivalents on unvested restricted stock units. |

| (6) | The following table shows the aggregate number of outstanding restricted stock, stock option and restricted stock unit awards granted to the non-employee directors as of December 31, 2011: |

| Name | Restricted Stock Awards |

Stock Option Awards |

Restricted Stock Unit Awards |

|||||||||

| Nancy H. Bechtle |

1,780 | 93,901 | 6,832 | |||||||||

| C. Preston Butcher |

1,780 | 278,721 | 33,708 | |||||||||

| Frank C. Herringer |

1,780 | 92,669 | 87,612 | |||||||||

| Stephen T. McLin |

2,350 | 166,615 | 38,144 | |||||||||

| Arun Sarin |

— | 24,000 | 6,562 | |||||||||

| Paula A. Sneed |

1,780 | 90,463 | 49,964 | |||||||||

| Roger O. Walther |

1,780 | 76,843 | 33,872 | |||||||||

| Robert N. Wilson |

1,780 | 91,559 | 54,386 | |||||||||

During 2011, Mr. Schwab and Mr. Bettinger received no additional compensation for their service as directors. Non-employee directors received the following retainers in 2011:

Cash Retainers

Each non-employee director received an annual cash retainer in the amount of $85,000. In addition, the Chair of the Audit Committee received an annual cash retainer of $25,000, and each other member of the Audit Committee received an annual cash retainer of $5,000. The Chair of the Compensation Committee and the Chair of the Nominating and Corporate Governance Committee each received an annual cash retainer of $15,000. There are no fees for attendance at board or committee meetings, but the board retains the discretion to establish special committees and to pay a special retainer to the Chair and the members of any special committee. The board has authorized meeting fees for service on a special committee by Ms. Bechtle, Mr. Butcher and Mr. McLin. The meeting fees for that special committee consisted of $500 per meeting held on the same day as a board meeting and $2,000 per meeting held on a day other than a board meeting.

Equity Grants

Each non-employee director received an annual equity grant under the 2004 Stock Incentive Plan with an aggregate value of $125,000. Non-employee directors received the equity grant 50 percent in stock options and 50 percent in restricted stock units.

9

Table of Contents

Terms and Conditions

Non-employee directors received the annual grants of options and restricted stock units on the second business day after the annual meeting of stockholders. In the event a new non-employee director is elected to the board during the year, a pro-rata amount of cash retainers and equity awards will be granted to that individual for the first calendar year in lieu of the full amount. The non-employee director equity grants are subject to the following terms and conditions:

| · | Annual grants of options and restricted stock units vest over the three-year period following the grant date, with 25% vesting on each of the first and second anniversary of the grant date and the remaining 50% on the third anniversary of the grant date. The options and restricted stock units become 100% vested in the event of the non-employee director’s death, disability or retirement. |

| · | The number of shares for the annual grant of restricted stock units is determined by dividing $62,500 by the average of the high and low market price of the company’s common stock on the grant date. |

| · | The number of options for the annual grant of stock options is determined by dividing $62,500 by the fair value of an option on the grant date. |

| · | Each stock option is designated as a nonqualified stock option and has an exercise price equal to the fair market value of common stock on the grant date. |

| · | Each stock option expires on the earliest of (1) the date ten years after the grant date, (2) the date three months after termination of service for any reason other than death, disability or retirement, (3) the date one year after termination of service because of death or disability, or (4) the date two years after termination of service because of retirement. |

The company also has stock ownership guidelines for non-employee directors. Under our guidelines, each non-employee director should own company stock with a fair market value equal to or exceeding $250,000. A new director should reach this target level upon completing five years of service. Once this target level is reached, the director is deemed to meet this target so long as he or she continues to hold an equivalent number of shares as on the date the target level was met. Shares owned outright, deferred shares and restricted stock and stock units are counted in determining the threshold under our stock ownership guidelines, but stock options are not.

Directors’ Deferred Compensation Plan

Non-employee directors also may participate in the Directors’ Deferred Compensation Plan II. This plan allows them to defer receipt of all or a portion of their retainers and, at their election, either to:

(1) receive stock options that:

| · | have a fair value equal to the amounts deferred (as determined under the valuation method used by the company to value stock options at the time of the deferral), |

| · | have an option exercise price equal to the closing price of common stock on the date the deferred amount would have been paid, and |

| · | vest immediately upon grant and generally expire ten years after the grant date, |

– or –

(2) receive restricted stock units that are funded by an equivalent number of shares of common stock to be held in a “rabbi” trust and distributed to the director when he or she ceases to be a director.

10

Table of Contents

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

No member of the Compensation Committee is or has been an officer or employee of the company or any of its subsidiaries. There were no Compensation Committee interlocks as defined under Securities and Exchange Commission rules during 2011.

The Nominating and Corporate Governance Committee recommended all of the nominees for election included in this year’s proxy statement.

The Nominating and Corporate Governance Committee has a policy to consider candidates recommended by stockholders. The policy provides that stockholder recommendations must be in writing and include the following information: (i) the name, address and contact information of the recommending stockholder; (ii) proof of the stockholder’s share ownership; (iii) a resume or statement of the candidate’s qualifications; and (iv) a statement of the stockholder’s relationship with the proposed candidate or interest in the proposed candidacy. The written recommendation must be addressed to the Assistant Corporate Secretary at the address provided in the “Corporate Governance Information” section of this proxy statement.

Diversity

When identifying director nominees, the board considers the qualifications and skills represented on the board. As discussed in the “Director Qualifications” section below, one of the considerations evaluated by the board is the diversity of experience and background of directors. This consideration is broad, is consistent with our company’s non-discrimination policies, and includes diversity of skill sets and experience as well as background, including race and gender.

The Nominating and Corporate Governance Committee annually reviews the structure and size of the board to assure that the proper skills are represented on the board. This assessment includes the effectiveness of board composition, including the qualifications, skills, and diversity represented on the board.

Director Qualifications

The qualifications for directors are described in our Corporate Governance Guidelines, which are available on the company’s website at www.aboutschwab.com/governance. In addition, the committee believes that the following specific, minimum qualifications must be met by a nominee for the position of director:

| · | the ability to work together with other directors, with full and open discussion and debate as an effective group, |

| · | current knowledge and experience in the company’s business or operations, or contacts in the community in which the company does business and in the industries relevant to the company’s business, or substantial business, financial or industry-related experience, and |

| · | the willingness and ability to devote adequate time to the company’s business. |

The committee also considers the following qualities and skills when making its determination whether a nominee is qualified for the position of director:

| · | relationships that may affect the independence of the director or conflicts of interest that may affect the director’s ability to discharge his or her duties, |

11

Table of Contents

| · | diversity of experience and background, including the need for financial, business, academic, public sector and other expertise on the board or board committees, and |

| · | the fit of the individual’s skills and experience with those of the other directors and potential directors in comparison to the needs of the company. |

When evaluating a candidate for nomination, the committee does not assign specific weight to any of these factors or believe that all of the criteria necessarily apply to every candidate.

Identifying and Evaluating Candidates for Director

The Nominating and Corporate Governance Committee reviews the appropriate skills and characteristics required of board members in the context of the current composition of the board. Candidates considered for nomination to the Board of Directors may come from several sources, including current and former directors, professional search firms and stockholder recommendations. Nominees for director are evaluated, in consultation with the company’s Chairman, by the committee, which may retain the services of a professional search firm to assist it in identifying or evaluating potential candidates.

COMMUNICATIONS WITH THE BOARD OF DIRECTORS

If you wish to communicate with the board, the chairman of the Nominating and Corporate Governance Committee, or with the independent directors as a group, you may send your communication in writing to the Assistant Corporate Secretary at the address provided in the “Corporate Governance Information” section of this proxy statement. You must include your name and address in the written communication and indicate whether you are a stockholder of the company.

The Assistant Corporate Secretary will compile all communications, summarize lengthy, repetitive or duplicative communications and forward them to the appropriate director or directors. The Assistant Corporate Secretary will not forward non-substantive communications or communications that pertain to personal grievances, but instead will forward them to the appropriate department within the company for resolution. In such cases, the Assistant Corporate Secretary will retain a copy of such communication for review by any director upon his or her request.

12

Table of Contents

RATIFICATION OF THE SELECTION OF INDEPENDENT AUDITORS

The Audit Committee has selected Deloitte & Touche LLP and the member firms of Deloitte Touche Tohmatsu (collectively referred to as “Deloitte”) as the company’s independent registered public accounting firm for the 2012 fiscal year. Deloitte has served in this capacity since the company’s inception. We expect representatives of Deloitte to attend the annual meeting of stockholders, where they will respond to appropriate questions from stockholders and have the opportunity to make a statement.

As required by federal law, the Audit Committee has the sole authority to retain the independent auditors. Although we are not required to submit the selection of the independent auditors to stockholders, we are asking for your ratification as part of the Audit Committee’s evaluation process of the independent registered public accounting firm for the next fiscal year.

Fees for services provided by Deloitte in the last two fiscal years were:

| 2011 | 2010 | |||||||

| (amounts in millions) | ||||||||

| Audit Fees1 |

$ | 5.2 | $ | 4.4 | ||||

| Audit-Related Fees2 |

1.8 | 1.8 | ||||||

| Tax Fees3 |

0.1 | 0.1 | ||||||

| All Other Fees4 |

None | None | ||||||

| Total |

$ | 7.1 | $ | 6.3 | ||||

| (1) | Audit fees are the aggregate fees for professional services billed by Deloitte in connection with their audits of the consolidated annual financial statements and management’s assessment of the effectiveness of internal control over financial reporting, and reviews of the consolidated financial statements included in quarterly reports on Form 10-Q. |

| (2) | Audit-Related fees include assurance and related services, such as reports on internal controls, review of Securities and Exchange Commission filings, merger and acquisition due diligence and related services. |

| (3) | Tax fees are limited by the Audit Committee to services by Deloitte for tax return review, preparation and compliance. |

| (4) | All other fees represent fees not included in “audit fees,” “audit-related fees,” and “tax fees.” |

In addition to the services listed above, Deloitte provides audit services to certain unconsolidated affiliated mutual funds and foundations. The fees for such audit services are included in the expenses of the mutual funds and foundations and borne by the stockholders of the funds and foundations. Amounts billed by Deloitte for these services were $0.1 million in both 2011 and 2010. These amounts are not included in the expenses of The Charles Schwab Corporation.

13

Table of Contents

Non-Audit Services Policies and Procedures

The Audit Committee has adopted a policy regarding non-audit services performed by Deloitte. The Audit Committee’s policy prohibits engaging Deloitte to perform the following services:

| · | any contingent fee arrangement, |

| · | bookkeeping or other services relating to accounting records or financial statements of the audit client, |

| · | broker-dealer services, |

| · | actuarial services, |

| · | management and human resource functions (including executive search services), |

| · | legal services and expert services unrelated to the audit, |

| · | appraisal and valuation services, fairness opinions or contribution-in-kind reports, |

| · | internal audit outsourcing, |

| · | financial information systems design and implementation, |

| · | tax consulting or advice or a tax opinion on an “aggressive” tax position or on a “listed transaction” or a “confidential transaction” as defined by U.S. Department of Treasury regulations, and |

| · | tax services to employees who have a financial reporting oversight role. |

The policy requires the pre-approval of the Audit Committee for other non-audit services performed by Deloitte. The policy divides non-audit services into three separate categories, which the Audit Committee has pre-approved subject to an annual aggregate dollar limit for each category. Once the dollar limit in each of these three categories is reached, the Audit Committee will decide whether to establish an additional spending limit for the category or specifically pre-approve each additional service in the category for the remainder of the year. The three categories are:

| · | accounting theory consultation (includes services such as guidance on the application of Generally Accepted Accounting Principles to various transactions and guidance on the effects of new accounting pronouncements), |

| · | assurance and due diligence (includes services such as certain reports on internal controls, review of Securities and Exchange Commission filings, merger and acquisition due diligence, employee benefit plan audits, and foreign statutory audits and regulatory reports), and |

| · | tax return review, preparation and compliance. |

Services not subject to pre-approval limits in one of the three categories above require specific pre-approval from the Audit Committee. Fees related to services requiring specific pre-approval are limited, on an annual basis, to 50% of the combination of audit fees, audit-related fees and tax fees.

The policy permits the Audit Committee to delegate pre-approval authority to one or more members of the Audit Committee, provided that the member or members report to the entire Audit Committee pre-approval actions taken since the last Audit Committee meeting. The policy expressly prohibits delegation of pre-approval authority to management.

In fiscal years 2011 and 2010, the Audit Committee pre-approved 100% of the services performed by Deloitte relating to “audit-related fees” and “tax fees.”

14

Table of Contents

|

The Audit Committee has met and held discussions with management and the company’s independent registered public accounting firm. As part of this process, the committee has:

· reviewed and discussed the audited financial statements with management,

· discussed with the independent registered public accounting firm the matters required to be discussed pertaining to Public Company Accounting Oversight Board AU 380 (Communication with Audit Committees), and

· received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the audit committee concerning independence, and has discussed with the independent registered public accounting firm its independence.

Based on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2011, for filing with the SEC.

AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

Stephen T. McLin, Chairman C. Preston Butcher Arun Sarin

|

15

Table of Contents

ADVISORY APPROVAL OF NAMED EXECUTIVE OFFICER COMPENSATION

This proxy statement contains detailed information in the Compensation Discussion and Analysis and executive compensation tables regarding compensation of the named executive officers. The “named executive officers” are those executive officers who are listed in the Summary Compensation Table. We ask that you provide an advisory vote to approve the following, non-binding resolution on named executive officer compensation:

RESOLVED, that the stockholders of The Charles Schwab Corporation approve the compensation paid to the named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and related footnotes, and narrative disclosures.

The advisory approval of named executive officer compensation is required by federal law. Although the vote is not binding on the Board of Directors or the Compensation Committee, the Compensation Committee intends to consider the vote as part of its evaluation of executive compensation programs.

COMPENSATION DISCUSSION AND ANALYSIS

Executive Summary

This Compensation Discussion and Analysis describes the company’s compensation strategy, policies, program and practices for the named executive officers identified in the Summary Compensation Table. Our executive compensation program is designed to support the company’s objectives of achieving sustainable growth and long-term stockholder value by focusing on our clients and their needs across our diversified businesses of securities brokerage services, banking, asset management and related financial services. In 2011, in the face of the weak economic environment that has persisted over multiple years and posed challenges particular to the financial services industry, the company remained solidly profitable and continued to pursue its objectives and position itself, both strategically and operationally, for future growth.

Our management team’s performance includes its success in navigating a difficult economic environment and its focus on building the long-term strength of our franchise by executing on our business strategy. In 2011, business results demonstrating this success included:

| · | Core net new client assets of $82.3 billion, an increase of 5% year-over-year (core net new assets are net new client assets excluding significant one-time flows relating to certain mutual fund clearing services clients and the acquisition of optionsXpress Holdings, Inc. (“optionsXpress”)); |

| · | New brokerage accounts of 1.1 million, an increase of 7% year-over-year; |

| · | Total client assets of $1.68 trillion, representing a ten-year compound annual growth rate of 9%; and |

| · | Accounts in retail advisory solutions or under the guidance of independent investment advisors of 2.4 million, an increase of 6% year-over-year. |

Our business strategy is to meet the financial services needs of investors, advisors, and employers. Execution on our business strategy focuses on building client loyalty, innovating in ways that benefit clients, operating in a disciplined manner, and leveraging strengths through shared core processes and technology platforms. In 2011, examples of management’s execution on our strategy included: completion of the integration of Windhaven Investment Management, Inc., an investment advisory firm that manages diversified investment portfolios comprised primarily of exchange-traded funds; and the acquisition of optionsXpress, an online brokerage firm primarily focused on equity options securities and futures. A more thorough discussion of our business and business strategy is provided in our Annual Report on Form 10-K.

16

Table of Contents

While management performed well in a difficult economic environment, the majority of their compensation is linked to the company’s financial performance. In 2011, our executive compensation program rewarded executives based on financial performance as measured by earnings per share, revenue growth, pre-tax profit margin, and return on equity.

| · | Earnings per share was used for the annual cash incentive program because it focuses executives on operating performance and capital management. |

| · | Revenue growth, pre-tax profit margin, and return on equity were used for the long-term incentive awards to focus management on earnings growth and the creation of stockholder value over the longer term. |

Our reported year-over-year results on key financial metrics demonstrate our performance despite the weak economic environment.

| Fiscal Year End 12/31 |

||||||||

| 2011 | 2010 | |||||||

| Net revenues (in millions) |

$ | 4,691 | $ | 4,248 | ||||

| Net income (in millions) |

$ | 864 | $ | 454 | ||||

| Diluted earnings per share (“EPS”) |

$ | 0.70 | $ | 0.38 | ||||

| Revenue Growth |

10% | 1% | ||||||

| Pre-tax profit margin |

29.7% | 18.3% | ||||||

| Return on equity (“ROE”) |

12% | 8% | ||||||

The Compensation Committee balances various incentives to motivate and reward executive officers for effectively evaluating business opportunities and taking appropriate risks to grow the company and generate long-term value for stockholders. Our compensation program uses three key elements – base salary, annual cash incentives and long-term incentive awards (“LTI”) in the form of stock options and performance-based restricted stock units to:

| · | attract, motivate and retain executive officers, |

| · | link annual executive pay with individual performance (through target levels) and company financial performance (through actual payouts), and |

| · | align the interests of the executive officers with the long-term interests of the company and its stockholders and link executive pay with longer-term performance. |

We consider annual cash incentives, stock options and performance-based restricted stock units performance-based because they are valuable to the recipient only if performance goals are achieved or share price improves. In 2011, 90% of the total compensation opportunity for the Chief Executive Officer and an average of 82% for the other named executive officers was delivered in these performance-based incentives.

17

Table of Contents

| * | Pay Mix is based on amounts in the Summary Compensation Table |

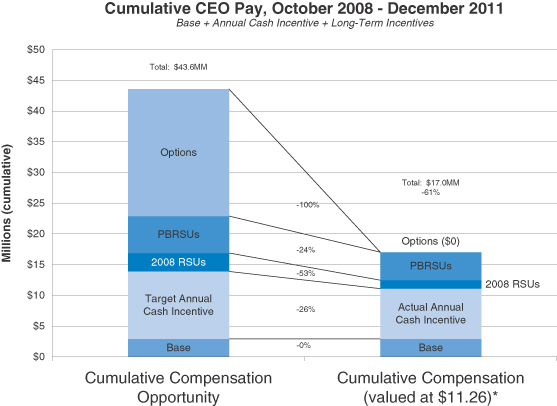

The link between executive pay and the company’s financial performance is illustrated by the decline in value of compensation awarded to our Chief Executive Officer, Walt Bettinger, since his promotion to President and Chief Executive Officer on October 1, 2008. Upon his promotion, Mr. Bettinger was awarded an annual base salary of $900,000, a bonus target of 375% of base salary, and long-term incentive awards (which consist of stock options and restricted stock) with a grant date fair value of $10 million. As of December 31, 2011, Mr. Bettinger’s base salary and bonus target had not increased since his promotion. Starting in 2009, he also received annual long-term incentive awards with a grant date fair value of $6.5 million. Since October 1, 2008, the cumulative value of his compensation opportunity (including base salary, target annual cash incentive amounts and the grant date fair value of long-term incentive awards of restricted stock, performance-based restricted stock units, and stock options) was $43.6 million. As shown in the following chart, the value (based on the company’s December 30th stock price of $11.26) of the compensation awarded to Mr. Bettinger since he became Chief Executive Officer was $17 million, 61% less than the grant date fair value of that compensation. This decline in value includes actual cash payments of base salary and annual cash incentives for this period.

18

Table of Contents

| * | For restricted stock units (“RSUs”) and performance-based restricted stock units (“PBRSUs”), value reflects the total number of shares granted times $11.26, the company’s stock price on December 30, 2011. For options, value reflects the total number of options granted times the difference between $11.26 and the exercise price (if lower). As of December 31, 2011, Mr. Bettinger had not exercised any of the options granted since 2008. |

This example illustrates that the grant date fair value disclosed in the Summary Compensation Table and Grants of Plan Based Awards Table does not reflect the amount that may be realized, which depends on stock price performance. Comparing Mr. Bettinger’s cumulative compensation opportunity to the value on December 31, 2011 illustrates the link between our compensation program and the company’s financial and stock price performance over this period.

The compensation of the other named executive officers has followed a pattern similar to Mr. Bettinger’s. Upon Mr. Bettinger’s promotion to Chief Executive Officer, Mr. Schwab’s compensation was reduced, and his base salary, bonus target and long-term incentive award have not increased since 2009. The Compensation Committee has approved some increases to base salary, bonus targets and long-term incentive awards for certain named executive officers because of changes in their responsibilities, pay relative to internal peers, individual performance, and pay relative to external compensation data. These adjustments have been reported in prior proxy statements. In 2011, after the review described below in “The Decision Making Process”, the Compensation Committee approved the increases in base salary, bonus targets and long-term incentive awards for certain named executive officers, as described in the respective sections below.

19

Table of Contents

In 2011, the company continued to demonstrate its commitment to pay for performance by making the following decisions:

| · | Setting performance targets for the annual cash incentive at earnings per share levels last achieved prior to the financial crisis even though the company’s financial plan did not anticipate reaching these levels, so that annual cash incentives pay at target only when stockholders benefit from an increase in earnings per share over pre-crisis levels. |

| · | Paying annual cash incentives below target based on the company’s financial performance. Since 2008, annual cash incentives have paid out between 70% and 78% of target. |

| · | Establishing performance targets for the performance-based restricted stock units that will reward executives only when financial performance and long-term value has been delivered to stockholders. |

| · | Vesting portions of the performance-based equity awards granted from 2007-2010 only upon certification that financial goals set for revenue growth, pre-tax profit margin and return on equity were achieved for the performance period ended September 30, 2011. |

Elements of Compensation Awarded in 2011 and How They Support Our Objectives

Base salary, annual cash incentives and long-term incentives are the key compensation elements for achieving the objectives below.

Base Salary

In 2011 after a review of the factors outlined below in “The Decision Making Process”, the Compensation Committee increased base salaries for Mr. Brigeman 7.6%, Mr. McCool 2.7%, and Mr. Martinetto 2.9%, based on their responsibilities and individual performance.

In January 2012, the Compensation Committee approved a $100,000 increase in base salary for Mr. Bettinger to reward and recognize his accomplishments as Chief Executive Officer and encourage his continuing leadership. The Compensation Committee believes that Mr. Bettinger’s leadership has been a key factor in managing through a

20

Table of Contents

difficult economic environment while continuing to build the long-term strength of our franchise by focusing on serving our clients, operating in a disciplined manner and building a leadership team for the future. This raise is the first base salary increase for Mr. Bettinger since his promotion in October 2008 and is effective as of March 1, 2012.

Annual Cash Incentives

Annual cash incentive awards in 2011 for the named executive officers were made pursuant to the Corporate Executive Bonus Plan. In the first quarter of the year, the Compensation Committee established the performance criteria and set performance goals and a bonus target for each executive officer, expressed as a percentage of base salary. After a review of the factors outlined below in “The Decision Making Process”, the Compensation Committee set the bonus target for each executive officer and increased bonus targets for Mr. Brigeman and Mr. McCool to 175% of base salary based on their responsibilities and individual performance. The performance goals for the company were based on overall corporate financial performance as measured by earnings per share and were the same for all individual executive officers.

The Compensation Committee selected earnings per share to focus executives on operating performance and capital management. The Compensation Committee believes earnings per share provides a comprehensive measure of the company’s profitability, and is an appropriate performance criterion for short-term cash awards. For purposes of the Corporate Executive Bonus Plan, earnings per share is calculated as fully diluted earnings per share in accordance with U.S. generally accepted accounting principles, excluding losses from discontinued operations, extraordinary losses, unusual losses, the cumulative negative effect of changes in accounting principles, losses on acquisitions or divestitures, losses from foreign exchange transactions, and any unusual non-recurring losses. When reviewing whether the performance goals have been achieved, the Compensation Committee reviews unusual gains and losses and may exercise discretion to reduce payouts. Earnings per share amounts were set forth in a matrix, with an annual cash incentive payout percentage assigned to each amount of earnings per share. Award payouts under the matrix could range from 0% to 200% of the target award, with a 100% payout assigned to the earnings per share goal set by the Compensation Committee. Achieving earnings per share of less than the goal would result in a payout of between 0% and 100%, and achieving earnings per share of more than the goal would result in a payout of between 100% and 200% of the target.

In 2011, the goal for earnings per share was set at $0.90, consistent with earnings per share levels last achieved prior to the financial crisis. The Compensation Committee set this target even though the company’s financial plan reviewed by the board did not anticipate reaching $0.90 because the company believes that annual cash incentives should pay out at target only when stockholders benefit from an increase in earnings per share over pre-crisis levels.

For purposes of determining payouts under the Corporate Executive Bonus Plan for 2011, earnings per share was $0.70. The Compensation Committee reserves discretion to reduce payouts. For 2011, it approved payouts based on earnings per share of $0.70 per share, which supported a payout of 78% of the target award. The Compensation Committee determined that the company achieved these results while maintaining a low credit risk profile and remaining within its risk parameters for interest rate risk. The Compensation Committee did not exercise discretion to reduce the cash incentive award for any individual named executive officer and approved funding at 78% of target for each of the named executive officers.

In the first quarter of 2012, the Compensation Committee considered performance criteria for 2012 annual cash incentive awards under the Corporate Executive Bonus Plan. The Compensation Committee selected overall corporate performance as measured by earnings per share.

21

Table of Contents

Long-Term Incentives

At its January 2011 meeting, the Compensation Committee granted equity awards of stock options and performance-based restricted stock units to the named executive officers based on its review of the factors outlined below in “The Decision Making Process”. The Compensation Committee increased the value of the awards granted to Mr. Brigeman by $50,000 and Mr. Martinetto by $100,000 in recognition of their responsibilities and individual performance.

The Compensation Committee granted long-term equity awards to the named executive officers in the form of 70% stock options and 30% performance-based restricted stock units.

Stock Options

At its January 2011 meeting, the Compensation Committee approved stock options to be granted in three equal installments on the following predetermined dates: March 1, August 1, and November 1, 2011, with 25% vesting annually over four years. This approach essentially “dollar cost averages” the granting of stock options, which mitigates the risk that the exercise price of awards granted on a single day might be exceptionally high or low due to unusual market conditions on the grant date.

Performance-Based Restricted Stock Units

At its January 2011 meeting, the Compensation Committee also approved the grant of performance-based restricted stock units with a grant date of November 1, 2011. The performance-based restricted stock units have four one-year performance periods ending September 30, 2012, 2013, 2014 and 2015, and vest in installments of 25% after each performance period if the Compensation Committee certifies that the performance goal for that period has been met. Any units that do not vest at the conclusion of the corresponding one-year performance period may vest at the conclusion of the fourth one-year period (September 30, 2015) if the performance goal for the four-year period ending on September 30, 2015 has been met (the “second vesting opportunity”). The second vesting opportunity has been added to encourage stable performance and reduce the risk that a potential forfeiture may encourage inappropriate risk-taking. The Compensation Committee also granted accumulated dividend equivalent payments on the performance-based restricted stock units. The dividend equivalent payments are cash payments equal to the dividends paid on a share of company stock. These payments vest, if at all, at the same time as the underlying units. If the performance goals for the units are not met, the dividend equivalent payments are forfeited.

The Compensation Committee set the performance goal for each of the four one-year performance periods of the 2011 performance-based restricted stock units and for the second 25% tranche of the 2010 performance-based restricted stock units as cumulative return on equity exceeds cumulative cost of equity capital. The Compensation Committee approved this performance goal because it reflects the creation of financial value for stockholders in all phases of the business cycle and measures the earnings power of the company. Return on equity is calculated in accordance with U.S. generally accepted accounting principles, excluding losses from discontinued operations, extraordinary losses, unusual losses, the cumulative negative effects of changes in accounting principles and laws, losses on acquisitions or divestitures, losses on foreign exchange transactions, and any unusual, non-recurring losses. When reviewing whether the performance goals have been achieved, the Compensation Committee reviews unusual gains and losses and may exercise discretion to reduce payouts. If the Compensation Committee certifies that the goal has been met for each performance period, then the portion of the restricted stock unit award that is due to vest for that performance period (25% of the total grant) will vest. If the goal has not been met, then the restricted stock units due to vest for that one-year performance period will remain outstanding subject to the second vesting opportunity.