UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant o

Filed by a Party other than the Registrant x

Check the appropriate box:

o Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2))

¨ Definitive Proxy Statement

x Definitive Additional Materials

o Soliciting Material Under Rule 14a-12

|

ENZO BIOCHEM, INC.

|

|

(Name of Registrant as Specified in Its Charter)

|

|

LONE STAR VALUE INVESTORS, LP

LONE STAR VALUE INVESTORS GP, LLC

LONE STAR VALUE MANAGEMENT, LLC

JEFFREY E. EBERWEIN

DIMITRIOS J. ANGELIS

JOHN M. CLIMACO

|

|

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

¨ Fee paid previously with preliminary materials:

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

(1) Amount previously paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

Lone Star Value Management, LLC, together with the other participants named herein (collectively, “Lone Star Value”), has made a definitive filing with the Securities and Exchange Commission of a proxy statement and an accompanying GOLD proxy card to be used to solicit votes for the election of Lone Star Value’s slate of two highly-qualified director nominees to the Board of Directors of Enzo Biochem, Inc., a New York corporation (the “Company”), at the Company’s upcoming 2015 annual meeting of shareholders, or any other meeting of shareholders held in lieu thereof, and any adjournments, postponements, reschedulings or continuations thereof.

On December 22, 2015, Lone Star Value issued a press release, which is set forth in full below:

LONE STAR VALUE ISSUES OPEN LETTER TO SHAREHOLDERS OF ENZO BIOCHEM, INC.

Letter Sets Forth Lone Star’s Serious Concerns with the Company’s Poor Performance and Disregard for Shareholder Rights

Urges Shareholders to Complete and Return Lone Star’s GOLD Proxy Card to Replace Two Incumbent Directors with Lone Star’s Highly-Qualified Nominees

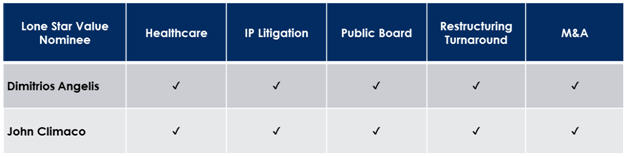

Lone Star’s Two Nominees Have the Relevant Experience, Qualifications, and Commitment Necessary to Improve the Company’s Performance and Maximize Shareholder Value

NEW YORK, December 22, 2015 – Lone Star Value Management, LLC who, together with its affiliates and the other participants in its solicitation (collectively, “Lone Star Value”, “LSV”, “us”, or “we”), owns approximately 600,000 shares common stock of Enzo Biochem, Inc. (“Enzo” or the “Company”) (NYSE: ENZ), issued an open letter to Enzo shareholders today to set forth its concerns with the Company’s poor performance and to urge shareholders to vote for LSV’s two highly-qualified director nominees. The full text of the letter is included below:

December 22, 2015

Dear Fellow Enzo Biochem Shareholders:

It is Time for Change at Enzo Biochem

Vote the Enclosed GOLD Proxy Card to Significantly Improve Enzo Biochem’s Board

Lone Star Value Management, LLC together with its affiliates and the other participants in its solicitation, (collectively, “Lone Star Value”, “LSV”, “us”, or “we”), owns approximately 600,000 shares of Enzo Biochem, Inc. (“Enzo” or the “Company”). We are a long-term shareholder who has been engaged with Enzo since 2013 and we are dedicated to maximizing shareholder value and improving shareholder rights at Enzo. We believe the first step to achieving this goal is enhancing the composition of Enzo’s board of directors (the “Board”) by electing our two nominees.

Over the last 10 years, Enzo’s stock price has declined by approximately 67% and the Company has been unprofitable every year since 2005. Enzo’s stock price has substantially underperformed all relevant peer groups and market indices over the last 1, 3, 5, and 10 years.

We, the shareholders of Enzo, deserve change. We are seeking to replace two incumbent directors, Dov Perlysky and Gregory Bortz, who lack healthcare and intellectual property (IP) experience. In their place, we seek to elect two highly-qualified candidates with proven turnaround and IP experience that Enzo needs: Dimitrios Angelis and John Climaco. Our two candidates, if elected, will be dedicated to improving shareholder value and shareholder rights and will represent ALL shareholders. We encourage our fellow Enzo shareholders to read our detailed presentation available here:

http://www.sec.gov/Archives/edgar/data/316253/000092189515002814/ex1todfan14a09482023_121715.pdf

We believe change at Enzo is warranted and necessary as a result of:

|

1.

|

Chronic stock price underperformance:

|

|

|

·

|

Over the past 10 fiscal years, Enzo’s Total Shareholder Return (TSR) is -67%. Enzo has drastically underperformed all relevant peer groups and market indices over the last 1, 3, 5, and 10 years.

|

|

2.

|

Sustained lack of profitability:

|

|

|

·

|

Enzo has failed to generate positive net income or free cash flow in any year since 2005.

|

|

|

·

|

Nothing in the Board’s current rhetoric gives us any confidence that things will change under the leadership of the incumbent Board or that focus will ever shift to the shareholders of Enzo.

|

|

3.

|

Poor corporate governance and disregard for shareholder rights:

|

|

|

·

|

Enzo maintains almost every possible entrenchment mechanism, including a classified board, a combined Chair and CEO position, and two insiders on a five-member Board. While providing the incumbent directors with all of these protections, Enzo also severely limits shareholder rights, including prohibiting shareholders from calling a special meeting or feasibly acting by written consent, and imposing supermajority voting policies for transaction approvals.

|

|

|

·

|

ISS has given Enzo a corporate governance “QuickScore” rating of 10, which is the worst possible corporate governance rating that a company can receive by ISS.

|

|

4.

|

Conflicted Board, dominated by insiders and not truly representative of public shareholders:

|

|

|

·

|

Enzo has engaged in interested party transactions for more than 25 years, paying in excess of $29mm, or 50% above the local “market rate”1, to a management company owned by Chairman and CEO, Dr. Elazar Rabbani; President, CFO, and director, Barry Weiner (and his wife); and the CEO’s brother and former executive officer, Shahram Rabbani.

|

|

5.

|

LSV’s nominees, Angelis and Climaco, have the experience Enzo desperately needs:

|

|

|

·

|

We believe our two nominees, if elected, will immediately add relevant expertise to the Company’s core healthcare business and its IP litigation process and monetization strategy to enhance value for ALL shareholders.

|

|

|

·

|

Enzo’s two incumbents, Perlysky and Bortz, lack healthcare experience and have no IP litigation experience.

|

LSV is very disappointed by the current Board’s dismissal of our concerns and refusal to engage with us constructively. We made every attempt to initiate a constructive dialogue by privately voicing our concerns with Enzo’s Board and management team for over two years. Unfortunately, the Board disregarded our input and left us no choice but to run a proxy contest in order to align the Company’s Board with the best interests of ALL Enzo shareholders.

Chronic Stock Price Underperformance

As seen in the table below, Enzo’s stock has produced a negative 67%2 return over the last 10 years and has significantly underperformed its self-selected peer groups and other relevant benchmarks over the past 1-,3-,5-, and 10-year periods.

|

Peer Group Average Returns3vb

|

||||

|

Peer Group

|

1-Yr Return

|

3-Yr Return

|

5-Yr Return

|

10-Yr Return

|

|

Enzo’s 2014 Proxy Peer Group Avg.

|

13.8%

|

161.5%

|

195.7%

|

354.0%

|

|

Enzo’s 2015 Proxy Peer Group Avg.

|

-2.6%

|

89.8%

|

86.6%

|

372.1%

|

|

Enzo’s Dec. 2015 Proxy Contest Peer Group Avg.

|

19.0%

|

74.1%

|

136.5%

|

606.6%

|

|

Enzo’s ISS Peer Group

|

2.7%

|

140.6%

|

193.7%

|

454.5%

|

|

Russell 3000 Index

|

2.6%

|

56.1%

|

93.7%

|

107.6%

|

|

MSCI Life Science Tools & Services

|

7.0%

|

109.3%

|

130.2%

|

N/A

|

|

Enzo (ENZ)

|

0.2%

|

64.9%

|

3.4%

|

-66.6%

|

Enzo’s shareholders deserve better, but we believe the incumbent Board members up for re-election, Mr. Perlysky and Mr. Bortz, lack the experience and expertise to help Enzo unlock its value.

Sustained Lack of Profitability

Enzo has continuously failed to generate a profit every year since 2005, an almost unfathomable 10 consecutive years of unprofitability. From 2005 until plateauing in 2010, Enzo experienced significant revenue growth; however, the Company remained unprofitable each and every year after 2005. In fact, Enzo has reported a net loss of approximately $168mm during this time, which clearly demonstrates the Board and management team’s inability to control costs.

|

Poor Financial Performance4

|

|||||||||||

|

2005

|

2006

|

2007

|

2008

|

2009

|

2010

|

2011

|

2012

|

2013

|

2014

|

2015

|

|

|

Revenue ($mm)

|

$43.4

|

$39.8

|

$52.9

|

$77.8

|

$89.6

|

$97.1

|

$102.0

|

$103.1

|

$93.7

|

$95.95

|

$97.6

|

|

Gross Margin

|

66.0%

|

59.6%

|

56.1%

|

48.3%

|

40.8%

|

46.3%

|

47.3%

|

45.7%

|

41.5%

|

43.4%

|

43.9%

|

|

Net Income ($mm)

|

$3.0

|

$(15.7)

|

$(13.3)

|

$(10.7)

|

$(23.6)

|

$(22.2)

|

$(13.0)

|

$(39.3)

|

$(18.2)

|

$(10.0)5

|

$(2.3)6

|

|

Free Cash Flow ($mm)

|

$11.6

|

$(14.4)

|

$(5.2)

|

$(11.8)

|

$(14.2)

|

$(16.7)

|

$(9.5)

|

$(7.3)

|

$(11.0)

|

$(2.5)

|

$(5.5)

|

Tellingly, this is not the first time a shareholder has raised concerns with the Company’s continued underperformance. Shahram Rabbani, a co-founder, former officer and director, and the current CEO’s brother, initiated proxy contests at both the 2009 and 2010 annual meetings of shareholders, seeking the election of a new independent director and noting in his proxy statement:

“In recent years, Mr. Rabbani grew increasingly frustrated with the lack of a strategic direction within the Company, the performance of the management team, and the failure by the Board of Directors to implement any strategic or management changes to reverse the tide of increasing annual losses…The board of directors has failed in any way to hold management accountable for the Company’s performance and has failed to act with any regard to the interests of stockholders and the actual performance of the Company.”7

Unfortunately, no meaningful changes were made to the Company as a result of Mr. Rabbani’s proxy campaigns.

Poor Corporate Governance

Enzo’s corporate governance policies serve to entrench the incumbent Board and severely restrict shareholder rights. In fact, as a result of the anti-shareholder provisions Enzo’s incumbent Board supports, ISS assigned Enzo the worst possible corporate governance “QuickScore” of 10 (on a scale of 1 to 10 where 1 indicates low risk and 10 maximum governance risk)8. Enzo’s incumbent Board continues to support the following poor corporate governance policies:

|

|

·

|

Classified Board: Directors are only subject to re-election by shareholders once every three years, impeding shareholders from acting upon directors’ performance on an annual basis.

|

|

|

·

|

Shareholders are prohibited from calling special meetings: Further, Enzo requires unanimous approval to act by written consent.

|

|

|

·

|

The Company has supermajority voting requirements: Certain provisions of the Company’s Certificate of Incorporation may only be amended by a supermajority vote of 80% of the shares outstanding. Business combinations (mergers or acquisitions) may only be approved by a supermajority vote of two-thirds of the shares outstanding.

|

|

|

·

|

Combined Chairman and CEO position: Concentration of control and power creates an inherent conflict and undermines the Board’s ability to effectively oversee management.

|

|

|

·

|

Two of five Board members are the Company’s CEO and CFO: This leaves only three “independent” Board members, and one of the “independent” Board member’s family has a 35+ year relationship with Enzo’s management.

|

In LSV’s conversations with Enzo’s CFO, Barry Weiner, in response to our call for Enzo to hold a shareholder vote to declassify the Board, Mr. Weiner responded that “shareholders don’t understand the benefits of a classified board and that shareholders don’t have enough information to make a fully informed decision”.9 Mr. Weiner’s comments show a blatant lack of respect for shareholders and a paternalistic attitude. Furthermore, when asked about Enzo’s extremely poor ISS score, Mr. Weiner exclaimed it was because “Enzo does not subscribe to or pay for ISS’ services”10, demonstrating the Company’s flippancy toward its shareholder-unfriendly corporate governance policies.

Conflicted Board Dominated by Insiders with Questionable Family Ties that are NOT Representative of the Interests of Public Shareholders

Enzo’s CEO and CFO comprise 40% of Company’s current Board. The CEO is also the Chairman, further solidifying management’s grasp and control over the Board.

The family of one of Enzo’s incumbent directors up for re-election, Dov Perlysky, has had a close relationship with Enzo’s management for 35+ years. Mr. Perlysky was recommended to Enzo due to his family and its now defunct brokerage firm, D.H. Blair that served as the lead underwriter for Enzo’s IPO in 1980. J. Morton Davis, who founded D.H. Blair, is Mr. Perlysky’s father-in-law. D.H. Blair later ceased operations under the weight of an impending FBI and SEC investigation into various securities-related controversies. D.H. Blair and 15 of the firm’s top executives were later indicted on 173 counts of securities fraud. Two of Mr. Davis’ other sons-in-law (Alan Stahler and Kalman Renov) pled guilty to multiple counts of securities fraud in connection with their employment at D.H. Blair. Given the 35+ year relationship between Mr. Perlysky’s family and Enzo’s management team, we question whether Mr. Perlysky is truly “independent” and his values are aligned with the interests of ALL shareholders.

Enzo’s related party transactions raise further questions over the insiders’ priorities. A subsidiary of the Company, leases a facility in Farmingdale, New York from Pari Management Corporation (“Pari”), which is owned equally by Dr. Elazar Rabbani, Barry Weiner (and his wife), and former officer and director Shahram Rabbani (the current CEO’s brother). The parties purchased the Farmingdale property in December 1989 for $2.75 million and, shortly thereafter, Enzo Labs entered into a lease agreement with Pari (which has been guaranteed and renewed every 10-12 years by the Company).

Between FY 1990 and FY 2015, Enzo Labs has made lease payments to Pari in excess of $29mm11. When accounting for the total lease payments to date made by Enzo Labs, Pari has managed to earn a nearly 950% return on its initial investment of $2.75mm, which was paid off in under 6 years. This raises questions as to why Enzo did not purchase the facility outright from the beginning. The Company has claimed they did not have the capital to purchase the facility in December 1989, despite Enzo having more than $27mm in cash at the end of FY 1989, and the fact that they committed to spend more than $7mm on renovations for the facility in the following year.

Our Two Nominees, Angelis and Climaco, Have the Relevant Experience, Qualifications, and Commitment Necessary to Maximize and Unlock Value for Shareholders

LSV has carefully and thoroughly considered the key potential sources of value for Enzo today, and in the future, and the director candidates who can best position the Company to maximize this value. We based our evaluation of Bortz and Perlysky not only on their responsibility for the Company’s underperformance, but also on whether they have the relevant experience and track record to meet the needs of the Company going forward. We have concluded that Enzo’s incumbents, Bortz and Perlysky, lack significant experience in the life sciences and biotechnology industry, and have NO experience in IP litigation and monetization, which has become a key source of potential value for Enzo’s shareholders. We are also concerned by their poor track record serving on other “public company” boards or lack of public board experience altogether (Mr. Perlysky – PBSV, NWCM, OTED, EXGI, HSBK; Mr. Bortz – no other public company boards).

These concerns are why we propose to replace the incumbent directors with Messrs. Angelis and Climaco, two highly-qualified independent directors with complementary skill sets, who together bring significant healthcare, IP, public board, turnaround management, and transaction experience that is directly relevant to Enzo.

|

|

·

|

Dimitrios Angelis has over a decade of experience as an accomplished negotiator and general counsel to public and private companies, prior experience within the pharmaceutical and medical device industries, and experience with patent portfolios that will enable him to bring valuable strategic, legal, and business acumen to the Board.

|

|

|

·

|

John Climaco has significant executive experience, including nine years as the CEO of a company developing genetic and diagnostic tests and operating a clinical laboratory, as well as his experience raising capital, engineering strategic alliances, building executive teams, and managing complex business operations and legal strategies, will make him a valuable addition to the Board.

|

Lone Star Value’s Nominees are:

Dimitrios J. Angelis currently serves as Executive Counsel at Life Sciences Law Group, which provides daily legal counseling for biotech, medical device, and pharmaceutical companies. He also currently serves as a director of Digirad Corporation, a medical imaging company, and AMERI Holdings, Inc., a technology management solutions company. Mr. Angelis has held multiple positions related to the biotechnology and life sciences industry, including: (i) General Counsel of Wockhardt Inc., a biologics and pharmaceutical company; (ii) senior counsel at Dr. Reddy’s Laboratories, Ltd., a publicly traded pharmaceutical company; and, (iii) Chief Legal Officer and Corporate Secretary of Osteotech, Inc., a medical device company, where he was responsible for managing the patent portfolio of approximately 42 patents. We believe Mr. Angelis’ prior experience within the pharmaceutical and medical device industries, and experience with patent portfolios will enable him to bring a wealth of strategic, legal and business acumen to the Board.

John M. Climaco is the Executive Vice President of Perma-Fix Medical S.A., a company involved in the research, development and manufacturing of medical radioisotopes. Mr. Climaco also currently serves as a director of Digirad Corporation, a medical imaging company, and Perma-Fix Environmental Solutions, Inc., an environmental solutions business. He previously served as the President, Chief Executive Officer and a director of Axial Biotech, Inc., a venture-backed molecular diagnostics and clinical laboratory company he co-founded specializing in the genetics of spine disorders. Mr. Climaco also previously served as a director of InfuSystem Holdings Inc., a medical device and services company. We believe that Mr. Climaco’s significant executive experience, including nine years as the CEO of a company developing genetic tests and operating a clinical laboratory, as well as his experience raising capital, engineering strategic alliances, building executive teams and managing complex business operations and legal strategies, will make him a valuable addition to the Board.

________________________

Enzo’s shareholders have grown impatient with the Company’s unacceptable financial performance, poor total shareholder returns, and broken promises by the incumbent Board and management team and its lack of a sense of urgency. It is now up to us, Enzo’s shareholders, to choose the best individuals to represent us and enhance value for ALL shareholders. We ask you to review the qualifications of our two respective director nominees and determine for yourself who you believe is most qualified to represent your interests on the Board of Enzo, create shareholder value, and improve corporate governance. As a significant shareholder of Enzo, we believe the choice is clear.

VOTE FOR CHANGE AT ENZO BIOCHEM

PLEASE SIGN, DATE, AND MAIL THE ENCLOSED GOLD PROXY CARD TODAY

We look forward to your support at the January 2016 Annual Meeting.

Best Regards,

/s/ Jeffrey E. Eberwein

Jeffrey E. Eberwein

Lone Star Value Management, LLC

If you have any questions, or require assistance with your vote, please contact InvestorCom toll- free at 877-972-0090 or email: info@investor-com.com.

About Lone Star Value Management:

Lone Star Value Management, LLC (“Lone Star Value”) is an investment firm that invests in undervalued securities and engages with its portfolio companies in a constructive way to help maximize value for all shareholders. Lone Star Value was founded by Jeff Eberwein who was formerly a Portfolio Manager at Soros Fund Management and Viking Global Investors. Lone Star Value is based in Old Greenwich, CT.

Investor Contact:

John Glenn Grau

InvestorCom

(203) 972-9300 ext. 11

If you have any questions, require assistance with submitting your GOLD proxy card or need additional copies of the proxy materials, please contact InvestorCom at (877) 972-0090.

1 Source: Jones, Lang, Lasalle, Inc. and CoStarRealty Information, Inc. Based on general analysis of triple net leases within the area including the following considerations/estimates: (i) type of usage (Lab/R&D space rental = ~$21psf, Warehouse space rental ~$8.00, Office Space rental = ~$13-14psf given limited demand); (ii)current market (active on warehouse/flex side with less demand for office space); (iii) property taxes (assuming $2psf estimate); (iv) insurance (assuming $.25psf estimate); (v) Common Area Maintenance (assuming $.75psf estimate); and (vi) cleaning(assuming $1.25psf estimate). Separately metered utilities were not included as an accurate estimate requires further information.

2 Calculated using Bloomberg’s Custom Total Return function for the holding period from November 30, 2005 to November 30, 2015.

4 Source: Bloomberg as of November 30, 2015.

5 Adjusted FY2014 non-GAAP net income figure as reported in Enzo’s Q4 2014 Earnings Press Release as adjusted for legal settlements and legal fees associated with settlements was $(11.22).

6 Adjusted FY2015 non-GAAP net income figure as reported in Enzo’s Q4 2015 Earnings Press Release as adjusted for legal settlements and legal fees associated with settlements was $(13.45).