UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

[X] Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the Fiscal Year Ended December 31, 2018

[ ] Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Commission File Number

001-09071

BBX Capital Corporation

(Exact name of registrant as specified in its charter)

|

Florida |

|

59‑2022148 |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S Employer Identification No.) |

|

401 East Las Olas Boulevard, Suite 800 |

|

|

|

Fort Lauderdale, Florida |

|

33301 |

|

(Address of principal executive office) |

|

(Zip Code) |

|

|

|

(954) 940-4900 |

|

(Registrant's telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

None.

Securities registered pursuant to Section 12(g) of the Act:

|

|

|

|

|

Class A Common Stock, $.01 par Value |

|

|

|

Class B Common Stock, $.01 par Value

Preferred Share Purchase Rights |

|

(Title of Class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.YES [ ] NO [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES [ ] NO [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES [X] NO [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ]Accelerated filer [X]Non-accelerated filer [ ] Smaller reporting company [ ]

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).YES [ ] NO [X]

On June 30, 2018, the aggregate market value of the registrant’s voting common equity held by non-affiliates was $562.2 million computed by reference to the closing price of the registrant’s Class A Common Stock and Class B Common Stock on such date. The registrant does not have any non-voting common equity.

The number of shares outstanding of each of the registrant’s classes of common stock as of March 1, 2019 is as follows:

Class A Common Stock of $.01 par value, 78,379,530 shares outstanding.

Class B Common Stock of $.01 par value, 19,384,830 shares outstanding.

Documents Incorporated by Reference

Portions of the registrant’s Definitive Proxy Statement on Schedule 14A relating to the registrant’s 2019 Annual Meeting of Shareholders are incorporated by reference into Part III of this Form 10-K.

|

|

||

|

|

||

|

BBX Capital Corporation Annual Report on Form 10-K for the Year Ended December 31, 2018 |

||

|

|

||

|

TABLE OF CONTENTS |

||

|

|

||

|

|

PART I |

Page |

|

|

||

|

Item 1. |

1 | |

|

|

||

|

Item 1A |

30 | |

|

|

||

|

Item 1B |

50 | |

|

|

||

|

Item 2 |

50 | |

|

|

||

|

Item 3 |

51 | |

|

|

||

|

Item 4 |

54 | |

|

|

||

|

|

PART II |

|

|

|

||

|

Item 5 |

54 | |

|

|

||

|

Item 6 |

57 | |

|

|

||

|

Item 7 |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

60 |

|

|

||

|

Item 7A |

89 | |

|

|

||

|

Item 8 |

F-1 to F-66 |

|

|

|

||

|

Item 9 |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

|

|

|

||

|

Item 9A |

||

|

|

||

|

Item 9B |

||

|

|

||

|

|

PART III |

|

|

|

||

|

Item 10 |

||

|

|

||

|

Item 11 |

||

|

|

||

|

Item 12 |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

|

|

||

|

Item 13 |

Certain Relationships and Related Transactions, and Director Independence |

|

|

|

||

|

Item 14 |

||

|

|

||

|

|

PART IV |

|

|

|

||

|

Item 15 |

||

|

|

||

|

|

||

PART I

Overview

History

BBX Capital Corporation (referred to in this report together with its subsidiaries as the “Company,” “we,” “us,” or “our,” and without its subsidiaries as “BBX Capital”) is a Florida-based diversified holding company whose principal investments are Bluegreen Vacations Corporation (“Bluegreen Vacations” or “Bluegreen”), BBX Capital Real Estate LLC (“BBX Capital Real Estate” or “BBXRE”), Renin Holdings, LLC (“Renin”), and IT’SUGAR, LLC (“IT’SUGAR”). In addition to its principal investments, the Company has other investments in various operating businesses, including restaurant locations throughout Florida and companies in the confectionery industry.

The Company’s Class A Common Stock trades on the New York Stock Exchange (“NYSE”) under the ticker symbol “BBX,” and its Class B Common Stock trades on the OTCQX Best Market under the ticker symbol “BBXTB.”

In December 2016, BBX Capital completed the acquisition of all the outstanding shares of the former BBX Capital Corporation (“BCC”) not previously owned by it, and following the transaction, BBX Capital changed its name from BFC Financial Corporation to BBX Capital Corporation. Prior to the acquisition, BBX Capital had an 82% equity interest in BCC and a direct 54% equity interest in Woodbridge Holdings Corporation (“Woodbridge”), the parent company of Bluegreen, and BCC held the remaining 46% interest in Woodbridge. As a result of the acquisition, BCC, Woodbridge, and Bluegreen became wholly-owned subsidiaries of the Company.

During the fourth quarter of 2017, Bluegreen completed an initial public offering (“IPO”) of its common stock in which Bluegreen sold to the public 3,736,723 shares of its common stock and Woodbridge, as a selling shareholder, sold to the public 3,736,722 shares of Bluegreen’s common stock. In addition, during the fourth quarter of 2018, Bluegreen repurchased and retired 288,532 shares of its common stock for $4.0 million. As a result of Bluegreen’s IPO and subsequent share repurchases, BBX Capital currently owns approximately 90.3% of Bluegreen’s common stock through Woodbridge. In March 2019, BBX Capital announced its intention to take Bluegreen private through a short-form merger under Florida law pursuant to which BBX Capital will acquire all of the outstanding shares of Bluegreen’s common stock not currently owned by BBX Capital. If the proposed merger is completed, Bluegreen will become a wholly-owned subsidiary of BBX Capital, and each share of Bluegreen’s common stock outstanding at the effective time of the merger, other than shares beneficially owned by BBX Capital and shareholders who duly exercise and perfect appraisal rights in accordance with Florida law, will be converted into the right to receive $16.00 per share in cash. The total merger consideration is estimated to be approximately $115.0 million. The merger is expected to be completed 30 days after the Schedule 13E-3 filed with the SEC relating to the merger is first mailed to Bluegreen's shareholders, or as soon as practicable thereafter. However, the merger may be terminated at any time before it becomes effective, and there is no assurance that the merger will be consummated on the contemplated terms, or at all.

Prior to July 2012, BCC’s principal investment was BankAtlantic and its subsidiaries (“BankAtlantic”), a federal savings bank headquartered in Fort Lauderdale, Florida. In July 2012, BCC sold all of the issued and outstanding shares of BankAtlantic’s capital stock to BB&T Corporation (“BB&T”) (the stock sale and related transactions described herein are collectively referred to as the “BankAtlantic Sale”). Prior to the closing of the BankAtlantic Sale, BankAtlantic transferred certain non-performing loans receivable, real estate properties, and previously charged off loans to BCC.

Principal Investments

BBX Capital’s principal investments are as follows:

|

· |

Bluegreen Vacations: Founded in 1966 and headquartered in Boca Raton, Florida, Bluegreen is a leading vacation ownership company that markets and sells vacation ownership interests (“VOIs”) and manages resorts in top leisure and urban destinations. Bluegreen’s resort network includes 45 Club Resorts (resorts in which owners in the Bluegreen Vacation Club (the “Vacation Club”) have the right to use most of the units in connection with their VOI ownership) and 24 Club Associate Resorts (resorts in which owners in Bluegreen’s

1

|

Vacation Club have the right to use a limited number of units in connection with their VOI ownership). Bluegreen’s Club Resorts and Club Associate Resorts are primarily located in popular, high-volume, “drive-to” vacation locations, including Orlando, Las Vegas, Myrtle Beach and Charleston, among others. Through Bluegreen’s points-based system, the approximately 216,000 owners in its Vacation Club have the flexibility to stay at units available at any of its resorts and have access to over 11,000 other hotels and resorts through partnerships and exchange networks. Bluegreen has a robust sales and marketing platform supported by exclusive marketing relationships with nationally-recognized consumer brands, such as Bass Pro and Choice Hotels. These marketing relationships drive sales within its core demographic. Bluegreen also provides third-party developers with sales and marketing services and resorts and resort developers with other fee-based services, including resort management, mortgage servicing, title services, and construction management. In addition, Bluegreen offers financing to qualified VOI purchasers. Bluegreen had total assets of approximately $1.3 billion as of December 31, 2018. |

|

· |

BBX Capital Real Estate: BBXRE is engaged in the acquisition, development, construction, ownership, financing, and management of real estate and investments in real estate joint ventures. BBXRE had total assets of approximately $165.1 million as of December 31, 2018, including investments, directly and indirectly through joint ventures, in multifamily apartment and townhome communities, single-family master-planned communities, and commercial properties located primarily in Florida. In addition, BBXRE owns a 50% equity interest in The Altman Companies, LLC (the “Altman Companies”), a developer and manager of multifamily apartment communities. |

|

· |

Renin: Renin is engaged in the design, manufacture, and distribution of sliding doors, door systems and hardware, and home décor products and operates through its headquarters in Canada and two manufacturing and distribution facilities in Canada and the United States. In addition to its own manufacturing, Renin also sources various products and materials from China. Renin had total assets of approximately $32.4 million as of December 31, 2018. |

Other Investments

In addition to its principal investments, the Company has investments in other operating businesses that are in various stages of development and currently generate operating losses. These investments include various companies in the confectionery industry, including Hoffman’s Chocolates, a manufacturer and retailer of gourmet chocolates with retail locations in South Florida, and other manufacturers/wholesalers of confectionery products. In addition, the Company has entered into area development and franchise agreements pursuant to which the Company has the opportunity to develop up to approximately 60 MOD Super Fast Pizza (“MOD Pizza”) franchised restaurant locations throughout Florida over the next several years. The Company currently operates nine MOD Pizza restaurant locations and is evaluating their performance to determine the rate at which it will open new restaurant locations in the future.

Our Strategies and Objectives

The Company’s goal is to build long-term shareholder value. Since many of the Company’s assets do not generate income on a regular or predictable basis, the Company’s objective continues to be long-term growth as measured by increases in book value and intrinsic value over time.

In addition, our goal is to streamline our business verticals so that our business model can be more easily analyzed and followed by the marketplace.

The Company regularly reviews the performance of its investments and, based upon economic, market, and other relevant factors, considers transactions involving the sale or disposition of all or a portion of its assets, investments, or subsidiaries. These include, among other alternatives, a sale or spin-off of its assets, investments, or subsidiaries or transactions involving public or private issuances of debt or equity securities which decrease or dilute the Company’s ownership interest in such investments.

2

Additional Information

The Company’s corporate website is www.bbxcapital.com. The Company’s annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports are available free of charge through its website as soon as reasonably practicable after such material is electronically filed with, or furnished to, the Securities and Exchange Commission (“SEC”). The Company’s website and the information contained on or connected to it are not incorporated into this Annual Report on Form 10-K.

Cautionary Note Regarding Forward-Looking Statements

This document contains forward-looking statements based largely on current expectations of the Company that involve a number of risks and uncertainties. All opinions, forecasts, projections, future plans or other statements, other than statements of historical fact, are forward-looking statements and can be identified by the use of words or phrases such as “plans,” “believes,” “will,” “expects,” “anticipates,” “intends,” “estimates,” “our view,” “we see,” “would” and words and phrases of similar import. The forward-looking statements in this document are also forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and involve substantial risks and uncertainties. We can give no assurance that such expectations will prove to be correct. Actual results, performance, or achievements could differ materially from those contemplated, expressed, or implied by the forward-looking statements contained herein. Forward-looking statements are based largely on our expectations and are subject to a number of risks and uncertainties that are subject to change based on factors which are, in many instances, beyond our control. When considering forward-looking statements, the reader should keep in mind the risks, uncertainties and other cautionary statements made in this report. The reader should not place undue reliance on any forward-looking statement, which speaks only as of the date made. This document also contains information regarding the past performance of the Company and its respective investments and operations. The reader should note that prior or current performance is not a guarantee or indication of future performance. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, and all such information should only be viewed as historical data. Future results could differ materially as a result of a variety of risks and uncertainties.

Some factors which may affect the accuracy of the forward-looking statements apply generally to the industries in which the Company operates, including the resort development and vacation ownership industries in which Bluegreen operates, the real estate development and construction industry in which BBX Capital Real Estate operates, the home improvement industry in which Renin operates, and the confectionery industry in which IT’SUGAR and the Company’s other confectionery businesses operate.

These risks and uncertainties include, but are not limited to:

|

· |

BBX Capital has limited sources of cash and is dependent upon dividends from Bluegreen to fund its operations; Bluegreen may not be in a position to pay dividends or its board of directors may determine not to pay dividends; and dividend payments may be subject to restrictions, including restrictions contained in debt instruments; |

|

· |

Risks associated with the Company’s indebtedness, including that the Company will be required to utilize cash flow to service its indebtedness, that indebtedness may make the Company more vulnerable to economic downturns, that indebtedness subjects the Company to covenants and restrictions on its operations and activities and on BBX Capital’s ability to pay dividends, and, with respect to the $80.0 million loan that BBX Capital received from a subsidiary of Bluegreen during April 2015, that BBX Capital may be required to prepay the loan to the extent necessary for Bluegreen or its subsidiaries to remain in compliance with covenants under their outstanding indebtedness; |

|

· |

Risks associated with BBX Capital’s current business strategy, including the risk that BBX Capital will not be successful in simplifying its business structure or in pursuing the sale or disposal of businesses or investments, that it will not be in a position to provide strategic support to or make additional investments in its subsidiaries or joint ventures, or that it may not achieve or maintain in the future the benefits anticipated to be realized from such support or additional investments; |

|

· |

BBX Capital’s shareholders’ interests will be diluted to the extent additional shares of its common stock are issued; |

|

· |

The risk that BBX Capital may not pay dividends on its Class A Common Stock or Class B Common Stock in the amount anticipated, when anticipated, or at all; |

|

· |

Risks associated with BBX Capital’s recently announced plan to take Bluegreen private pursuant to a statutory short-form merger under Florida law; |

|

· |

The impact of economic conditions on the Company, the price and liquidity of BBX Capital’s Class A Common Stock and Class B Common Stock, and BBX Capital’s ability to obtain additional capital, including the risk

3

|

that if BBX Capital needs or otherwise believes it is advisable to issue debt or equity securities or to incur indebtedness in order to fund the Company’s operations or investments, it may not be possible to issue any such securities or obtain such indebtedness on favorable terms, or at all; |

|

· |

The impact on liquidity of BBX Capital’s Class A Common Stock of not maintaining compliance with the listing requirements of the NYSE, which includes, among other things, a minimum average closing price, share volume, and market capitalization; |

|

· |

The risk that creditors of BBX Capital’s subsidiaries or other third-parties may seek to recover distributions or dividends made by such subsidiaries to BBX Capital or other amounts owed by such subsidiaries to such creditors or third-parties; |

|

· |

The performance of entities in which BBX Capital has made investments may not be profitable or achieve anticipated results; |

|

· |

Risks related to potential business expansion that the Company may pursue, including that the Company may not pursue such expansion when or to the extent anticipated or at all, and any such expansion may involve significant costs and the incurrence of significant indebtedness and may not be successful; |

|

· |

Risks and uncertainties affecting the Company and its results, operations, markets, products, services and business strategies, and the risks and uncertainties associated with its ability to successfully implement its currently anticipated plans, and its ability to generate earnings under the current business strategy; |

|

· |

Risks associated with acquisitions, asset or subsidiary dispositions, or debt or equity financings which the Company may consider or pursue from time to time; |

|

· |

Adverse conditions in the stock market, the public debt market, and other capital markets and the impact of such conditions on the activities of the Company; |

|

· |

Risks of cybersecurity threats, including the potential misappropriation of assets or confidential information, corruption of data or operational disruptions; |

|

· |

Updating of, and developments with respect to, technology, including the cost involved in updating our technology and the impact that any failure to keep pace with developments in technology could have on our operations or competitive position and our information technology expenditures may not result in the expected benefits; |

|

· |

The Company’s ability to compete effectively in the highly competitive industries in which it operates; |

|

· |

The Company’s ability to maintain the integrity of internal or customer data, the failure of which could result in damage to our reputation and/or subject us to costs, fines or lawsuits; |

|

· |

Risks associated with, and the impact of, regulatory examinations or audits of the Company’s operations, and the costs associated with regulatory compliance; |

|

· |

Risks associated with legal and other regulatory proceedings, including claims of noncompliance with applicable regulations or for development related defects, and the impact they may have on the Company’s financial condition and operating results; |

|

· |

Audits of the Company’s federal or state tax returns, including that they may result in the imposition of additional taxes; |

|

· |

Environmental liabilities, including claims with respect to mold or hazardous or toxic substances, and their impact on the Company’s financial condition and operating results; |

|

· |

The impact on the Company’s consolidated financial statements and internal control over financial reporting of the adoption of new accounting standards, including the new standard for accounting for leases which the Company adopted on January 1, 2019; |

|

· |

Risks that the impact of hurricanes and other natural disasters may adversely impact the Company’s financial condition and operating results; and |

|

· |

The preparation of financial statements in accordance with U.S. generally accepted accounting principles (“GAAP”) involves making estimates, judgments and assumptions, and any changes in estimates, judgments and assumptions used could have a material adverse impact on the financial condition and operating results of the Company or its subsidiaries. |

With respect to Bluegreen, the risks and uncertainties include, but are not limited to:

|

· |

Adverse trends or disruptions in the vacation ownership, vacation rental, and travel industries; |

|

· |

Adverse changes to, or interruptions in, business relationships, including changes in or the expiration or termination of Bluegreen’s management contracts, exchange networks, or strategic marketing alliances; |

|

· |

Risks of the real estate market and the risks associated with real estate development, including a decline in real estate values and a deterioration of other conditions relating to the real estate market and real estate development; |

|

· |

Bluegreen’s ability to maintain inventory of VOIs for sale; |

|

· |

Decreased demand from prospective purchasers of VOIs; |

4

|

· |

Adverse events or trends in vacation destinations and regions where the resorts in Bluegreen’s network are located, including weather-related events; |

|

· |

The availability of financing and Bluegreen’s ability to sell, securitize, or borrow against its VOI notes receivable; |

|

· |

The ratings of third-party rating agencies, including the impact of any downgrade on Bluegreen’s ability to obtain, renew or extend credit facilities, or otherwise raise funds; |

|

· |

Bluegreen’s indebtedness and the terms of its indebtedness may limit, among other things, its activities and ability to pay dividends, and Bluegreen may not comply with the terms of its indebtedness; |

|

· |

The loss of the services of Bluegreen’s key management and personnel could adversely affect its business; |

|

· |

Bluegreen’s ability to comply with applicable regulations to the vacation ownership industry currently as adopted or as may be adopted in the future and the costs of compliance efforts or a failure to comply; |

|

· |

Bluegreen’s ability to successfully implement its growth strategy or maintain or expand its capital-light business relationships or activities; |

|

· |

Bluegreen’s customers’ compliance with their payment obligations under financing provided by Bluegreen, and the impact of defaults on Bluegreen’s operating results and liquidity position; |

|

· |

Changes in Bluegreen’s business model and marketing efforts, plans or strategies, may cause marketing expenses to increase or adversely impact its revenue, operating results and financial condition and such expenses as well as investments in new and expanded sales offices may not achieve the desired results; |

|

· |

The impact of the resale market for VOIs on Bluegreen’s business, operating results and financial condition; |

|

· |

Risks associated with Bluegreen’s relationships with third-party developers, including that third-party developers who provide VOIs to be sold pursuant to fee-based services or just-in-time arrangements may not provide VOIs when planned and that third-party developers may not fulfill their obligations to Bluegreen or to the homeowners associations that maintain the resorts they developed; and |

|

· |

Calculation of payments and reimbursements due under Bluegreen’s marketing agreement with Bass Pro and the parties’ ability to resolve the issue with respect thereto. |

With respect to BBX Capital Real Estate, the risks and uncertainties include, but are not limited to:

|

· |

The impact of economic, competitive, and other factors affecting BBX Capital Real Estate and its assets, including the impact of a decline in real estate values on BBX Capital Real Estate’s business and the value of BBX Capital Real Estate’s assets; |

|

· |

Risks that the recent investment in the Altman Companies may not realize the anticipated benefits and will increase the Company’s exposure to risks associated with the multifamily real estate development and construction industry; |

|

· |

The risk of additional impairments of real estate assets; |

|

· |

The risks associated with investments in real estate developments and joint ventures include: |

|

o |

exposure to downturns in the real estate and housing markets; |

|

o |

exposure to risks associated with real estate development activities, including severe weather conditions increasing costs, delaying construction, causing uninsured losses or reducing demand for homes; |

|

o |

risks associated with obtaining necessary zoning and entitlements; |

|

o |

risks that joint venture partners may not fulfill their obligations and concentration risks associated with entering into numerous joint ventures with the same joint venture partner; |

|

o |

risks relating to reliance on third-party developers or joint venture partners to complete real estate projects; |

|

o |

risk associated with increasing interest rates, as the majority of the development costs and sales of residential communities is financed; |

|

o |

risks associated with not finding tenants for multifamily apartments or buyers for single-family homes and townhomes; |

|

o |

risk associated with finding equity partners, securing financing, and selling newly built multifamily apartments; |

|

o risk that the projects will not be developed as anticipated or be profitable; and |

|

o risk associated with customers or vendors not performing on their contractual obligations. |

With respect to IT’SUGAR and Renin, the risks and uncertainties include, but are not limited to:

|

· |

Risks that the Company’s investments will not achieve the returns anticipated; |

|

· |

Risks that their business plans, including IT’SUGAR’s plans for opening new stores in high profile locations, will not be successful; |

|

· |

Risks that market demand for their products could decline; |

5

|

· |

Risks associated with increased commodity costs or a limited availability of commodities; |

|

· |

Risks associated with product recalls or product liability claims; |

|

· |

The risk of losses associated with excess and obsolete inventory and the risks of additional required reserves for lower of cost or market value losses in inventory; |

|

· |

For Renin, the risk of trade receivable losses and the risks of charge-offs and required increases in the allowance for bad debts; |

|

· |

Risks associated with the performance of vendors, commodity price volatility and the impact of tariffs on goods imported from Canada and Asia, particularly with respect to Renin; |

|

· |

For Renin, risks associated with exposure to foreign currency exchange risk of the U.S. dollar compared to the Canadian dollar; |

|

· |

The amount and terms of indebtedness associated with the operations and capital expenditures may impact their financial condition and results of operations and limit their activities; |

|

· |

Requirements for operating and capital expenditures may require BBX Capital to make capital contributions or advances; and |

|

· |

The risk that a decline in IT’SUGAR’s profitability or cash flows may result in impairment losses associated with IT’SUGAR’s intangible and long-lived assets. |

With respect to the Company’s other investments in operating businesses, in addition to the above risks relevant to these businesses, the risks and uncertainties include, but are not limited to:

|

· |

Risks that the reorganization of the confectionery businesses and operations may not achieve anticipated operating efficiencies and reduction in operating losses and that the implementation of strategic alternatives, including the sale or disposal of certain operations, will result in additional losses; |

|

· |

Continued operating losses and the failure of these businesses to meet financial metrics may necessitate BBX Capital making further capital contributions or advances to the businesses or a decision not to support underperforming businesses; |

|

· |

The risk of impairment losses associated with declines in the value of the Company’s investments in these operating businesses or the Company’s inability to recover its investments; and |

|

· |

Risks associated with the Company’s ongoing compliance with its franchise agreements or area development agreements, including the impact of noncompliance with the development schedule to open MOD Pizza restaurant locations. |

These and other risks and uncertainties disclosed in this Annual Report on Form 10-K are not necessarily all of the important factors that could cause the Company’s actual results to differ materially from those expressed in any of the forward-looking statements. Other unknown or unpredictable factors could cause the Company’s actual results to differ materially from those expressed in any of the forward-looking statements.

Given these uncertainties, you are cautioned not to place undue reliance on forward-looking statements, and you should read this Annual Report on Form 10-K with the understanding that actual future results, levels of activity, performance, and events and circumstances may be materially different from what the Company expects. The Company qualifies all forward-looking statements by these cautionary statements.

Forward-looking statements speak only as of the date of this Annual Report on Form 10-K.

In addition to the risks and factors identified above, reference is also made to the other risks and factors detailed in this report and the other reports filed by the Company with the SEC. The Company cautions that the foregoing factors are not exclusive.

6

Principal Investments

The Company’s principal investments are Bluegreen, BBX Capital Real Estate, Renin, and IT’SUGAR.

Bluegreen

Strategies

Bluegreen’s core operating and growth strategies are focused on:

|

· |

Utilizing Bluegreen’s sales and marketing platform to increase VOI sales growth through the maintenance and expansion of existing marketing alliances, continued development of new marketing programs, and generation of additional VOI sales to existing Vacation Club owners; |

|

· |

Continuing to enhance Bluegreen’s Vacation Club experience by offering owners exceptional value through the addition of new destinations, the expansion of exchange programs, and the addition of new partnerships to offer increased vacation options; |

|

· |

Continuing to grow Bluegreen’s higher-margin, cash-generating businesses, including resort management, title services, and loan servicing; |

|

· |

Increasing sales and operating efficiencies across all customer touch-points; |

|

· |

Maintaining operational flexibility and continuing to pursue growth through a balanced mix of capital-light sales vs. developed VOI sales, sales to new customers vs. sales to existing Vacation Club owners, and cash sales vs. financed sales; and |

|

· |

Pursuing strategic transactions, including acquisitions of other VOI companies, resort assets, sales and marketing platforms, management companies and contracts, and other assets, properties and businesses. |

Market and Industry Data

Market and industry data used in this Annual Report on Form 10-K have been obtained from Bluegreen’s internal surveys, industry publications, unpublished industry data and estimates, discussions with industry sources and other currently available information. The sources for this data include, without limitation, the American Resort Development Association. Industry publications generally state that the information contained therein has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of such information. Bluegreen has not independently verified such data. Similarly, Bluegreen’s internal surveys, while believed to be reliable, have not been verified by any independent sources. Accordingly, such data may not prove to be accurate. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements contained in this Annual Report on Form 10-K, as described above.

Trademarks, Service Marks and Trade Names

Bluegreen owns or has rights to use a number of registered and common law trademarks, trade names and service marks in connection with its business, including, but not limited to, Bluegreen, Bluegreen Resorts, Bluegreen Vacations, Bluegreen Traveler Plus, Bluegreen Vacation Club, Bluegreen Wilderness Club at Big Cedar, and the Bluegreen Logo. This Annual Report on Form 10-K also refers to trademarks, trade names and service marks of other organizations. Without limiting the generality of the preceding sentence, World Golf Village is registered by World Golf Foundation, Inc.; Big Cedar and Bass Pro Shops are registered by Bass Pro Trademarks, LP; Ascend, Ascend Hotel Collection, Ascend Resort Collection, Choice Privileges, Comfort Inn, Comfort Suites, Quality, Sleep Inn, Clarion, Cambria, MainStay Suites, Econo Lodge and Rodeway Inn are registered by Choice Hotels International, Inc.; and Suburban Extended Stay Hotel is registered by Suburban Franchise Systems, Inc. All trademarks, service marks or trade names referred to in this Annual Report on Form 10-K are the property of their respective holders. Solely for convenience, the trademarks, trade names and service marks referred to in this Annual Report on Form 10-K appear without the ® and ™ symbols, but such references are not intended to indicate in any way that Bluegreen or the owner will not assert, to the fullest extent under applicable law, all rights to such trademarks, trade names and service marks.

Business

Bluegreen is a leading vacation ownership company that markets and sells VOIs and manages resorts in top leisure and urban destinations. Bluegreen’s resort network includes 45 Club Resorts (resorts in which owners in the Vacation Club have the right to use most of the units in connection with their VOI ownership) and 24 Club Associate Resorts (resorts in which owners in the Vacation Club have the right to use a limited number of units in connection with their VOI ownership). Bluegreen’s Club Resorts and Club Associate Resorts are primarily located in popular, high-volume, “drive-

7

to” vacation locations, including Orlando, Las Vegas, Myrtle Beach and Charleston, among others. Through Bluegreen’s points-based system, the approximately 216,000 owners in its Vacation Club have the flexibility to stay at units available at any of its resorts and have access to over 11,000 other hotels and resorts through partnerships and exchange networks. Bluegreen has a robust sales and marketing platform supported by exclusive marketing relationships with nationally-recognized consumer brands, such as Bass Pro and Choice Hotels. These marketing relationships drive sales within its core demographic, which is described below.

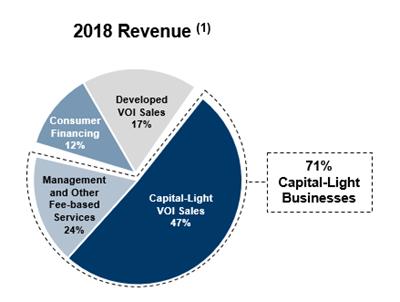

Prior to 2009, Bluegreen’s vacation ownership business consisted solely of the sale of VOIs in resorts that it had developed or acquired (“developed VOI sales”). While Bluegreen continues to conduct such sales and development activities, Bluegreen now also derives a significant portion of its revenue from its capital-light business model, which utilizes Bluegreen’s expertise and infrastructure to generate both VOI sales and recurring revenue from third parties without the significant capital investment generally associated with the development and acquisition of resorts. Bluegreen’s capital-light business activities include sales of VOIs owned by third-party developers pursuant to which Bluegreen is paid a commission (“fee-based sales”) and sales of VOIs that Bluegreen purchases under just-in-time (“JIT”) arrangements with third-party developers or from secondary market sources. In addition, Bluegreen provides resorts and resort developers with other fee-based services, including resort management, mortgage servicing, title services, and construction management. Bluegreen also offers financing to qualified VOI purchasers, which generates significant interest income.

|

(1) |

Excludes “Other Income, Net.” |

Bluegreen’s Vacation Club has grown from approximately 170,000 owners as of December 31, 2012 to approximately 216,000 owners as of December 31, 2018. Bluegreen primarily serves a demographic that it considers underpenetrated within the vacation ownership industry, as the typical Vacation Club owner has an average annual household income of approximately $77,000 as compared to an industry average of $86,000. According to U.S. census data, households with an annual income of $50,000 to $100,000 represent the largest percentage of the total population (approximately 29%). Bluegreen believes that its ability to effectively scale the transaction size to suit its customer, as well as high-quality, conveniently-located, “drive-to” resorts, are attractive to its core target demographic.

Products and Services

Vacation Ownership Interests

Since entering the vacation ownership industry in 1994, Bluegreen has generated over 669,000 VOI sales transactions, including over 147,000 fee-based sales transactions. Bluegreen’s Vacation Club owners receive an annual or biennial allotment of “points” in perpetuity (supported by an underlying deeded VOI held in trust for the owner) that may be used to stay at any of Bluegreen’s 45 Club Resorts and 24 Club Associate Resorts. Vacation Club owners can use their points to stay in resorts for varying lengths of time, starting at a minimum of two nights. The number of points required for a stay at a resort varies depending on a variety of factors, including resort location, size of the unit, vacation season, and the days of the week. Under this system, Vacation Club owners can select vacations according to their schedules, space needs and available points. Subject to certain restrictions and fees, Vacation Club owners are typically allowed to carry over any unused points for one year and to “borrow” points from the next year. Vacation Club owners may also

8

take advantage of various other lodging and vacation opportunities available to them as described under “Value Proposition” below.

Each of Bluegreen’s Club Resorts and Club Associate Resorts is managed by a homeowners association (“HOA”), which is governed by a board of directors or trustees. This board hires a management company to which it delegates many of the rights and responsibilities of the HOA, including landscaping, security, housekeeping, garbage collection, utilities, insurance procurement, laundry and repairs and maintenance. Vacation Club owners pay annual maintenance fees which cover the costs of operating all the resorts in the Vacation Club system, including fees for real estate taxes and reserves for capital improvements. If a Vacation Club owner does not pay such charges, his or her use rights may be suspended and ultimately terminated, subject to the applicable lender’s first mortgage lien, if any, on such owner’s VOI. Bluegreen provides management services to 49 resorts and the Vacation Club through contractual arrangements with HOAs. Bluegreen has a 100% renewal rate on management contracts from its Club Resorts.

“Value Proposition”

Bluegreen Vacation Club’s points-based platform offers owners significant flexibility. As reflected in the chart below, basic Vacation Club ownership entitles owners to use their points to stay at any of Bluegreen’s 45 Club Resorts and 24 Club Associate Resorts, as well as to access more than 4,300 resorts available through the Resort Condominiums International, LLC (“RCI”) exchange network. For a nominal annual fee and transaction fees, Vacation Club owners can join and utilize Bluegreen’s Traveler Plus program, which enables them to use their points to access an additional 48 direct exchange resorts and other vacation experiences, such as cruises. Vacation Club owners can convert their Vacation Club points into Choice Privileges points. Choice Privileges points can be used for stays in Choice Hotels. In addition, Traveler Plus members can directly use their Vacation Club points for stays in Choice Hotels’ Ascend Hotel Collection properties, a network of historic and boutique hotels in the United States, Canada, Scandinavia and Latin America. Overall, there are approximately 6,900 hotels in the Choice Hotels network, located in more than 40 countries and territories, and Choice Hotels’ brands include the Ascend Hotel Collection, Comfort Inn, Comfort Suites, Quality, Sleep Inn, Clarion, Cambria Hotels and Suites, MainStay Suites, Suburban Extended Stay Hotel, Econo Lodge and Rodeway Inn. Bluegreen continuously seeks new ways to add value for its Vacation Club owners, including enhanced product offerings, new resort locations, broader vacation experiences, and further technological innovation, all of which are designed to increase guest satisfaction.

Approximately 66% of Vacation Club owners are enrolled in Traveler Plus. During the year ended December 31, 2018, approximately 8% of Vacation Club owners utilized the RCI exchange network.

9

Vacation Club Resort Locations and Amenities

As shown in the map below, Bluegreen’s Vacation Club resorts are primarily located on the U.S. East Coast and Midwest. The 48 direct-exchange resorts available to Traveler Plus members are concentrated along the West Coast and Hawaii. Together, this provides a broad offering across the United States and the Caribbean.

Vacation Club resorts are primarily “drive-to” resort destinations, and approximately 89% of Bluegreen’s Vacation Club owners live within a four-hour drive of at least one of Bluegreen’s resorts. Bluegreen’s resorts are located in popular vacation destinations, such as Florida, South Carolina, North Carolina, Tennessee, Virginia, Texas, Louisiana and Nevada, and represent a diverse mix of resort and urban destinations, allowing Vacation Club owners the ability to customize their vacation experience. In addition, Bluegreen offers its Vacation Club owners access to Caribbean locations, including Aruba.

Bluegreen’s resort network offers a diverse mix of experiences and accommodations. Unlike some of Bluegreen’s competitors that maintain static brand design standards across resorts and geographies, Bluegreen seeks to design resorts that capture the uniqueness of a particular location. Bluegreen’s distinctive resorts are designed to create an authentic experience and connection to their unique and varied locations.

Bluegreen’s resorts typically feature condominium-style accommodations with amenities such as fully equipped kitchens, entertainment centers, and in-room laundry facilities. Many resorts feature a clubhouse (including a pool, game room, and lounge), hotel-type staff, and concierge services.

Bluegreen also owns a 51% interest in Bluegreen/Big Cedar Vacations, which develops, markets, and sells VOIs at three premier wilderness-themed resorts adjacent to Table Rock Lake near Branson, Missouri: The Bluegreen Wilderness Club at Big Cedar, The Cliffs at Long Creek, and Paradise Point. The remaining 49% interest in Bluegreen/Big Cedar Vacations is held by Big Cedar, LLC, (“BC LLC”), an affiliate of Bass Pro. As a result of Bluegreen’s controlling interest in Bluegreen/Big Cedar Vacations, the Company’s consolidated financial statements include the results of operations and financial condition of Bluegreen/Big Cedar Vacations.

Located next to the Big Cedar Lodge, The Bluegreen Wilderness Club is a 40-acre resort overlooking Table Rock Lake with sprawling views of the surrounding Ozarks. Vacation Club owners enjoy a variety of amenities, including a 9,000 square foot clubhouse, lazy river, and rock-climbing wall, in addition to full access to the amenities and activities of Big

10

Cedar Lodge. The Cliffs at Long Creek offers fully furnished homes that can accommodate up to 13 people and other vacation villas while providing access to a clubhouse and amenities at The Bluegreen Wilderness Club. Paradise Point offers spacious vacation villas with direct access to Table Rock Lake and the Bass Pro Long Creek Marina.

Vacation Club Resorts

|

|

|||||||||

|

|

Club Resorts |

Location |

Total |

Managed by Bluegreen (2) |

Fee-Based |

Sales |

|||

| 1 |

Cibola Vista Resort and Spa |

Peoria, Arizona |

315 |

✓ |

✓ |

✓ |

|||

| 2 |

La Cabana Beach Resort & Casino(4) |

Oranjestad, Aruba |

449 | ||||||

| 3 |

The Club at Big Bear Village |

Big Bear Lake, California |

38 |

✓ |

✓ |

||||

| 4 |

The Innsbruck Aspen |

Aspen, Colorado |

17 |

✓ |

|||||

| 5 |

Via Roma Beach Resort |

Bradenton Beach, Florida |

28 |

✓ |

|||||

| 6 |

Daytona SeaBreeze |

Daytona Beach Shores, Florida |

78 |

✓ |

✓ |

||||

| 7 |

Resort Sixty-Six |

Holmes Beach, Florida |

28 |

✓ |

|||||

| 8 |

The Hammocks at Marathon |

Marathon, Florida |

58 |

✓ |

|||||

| 9 |

The Fountains, Lake Eve and Oasis Lakes |

Orlando, Florida |

745 |

✓ |

✓ |

✓ |

|||

| 10 |

Orlando’s Sunshine Resort I & II |

Orlando, Florida |

84 |

✓ |

|||||

| 11 |

Casa del Mar Beach Resort |

Ormond Beach, Florida |

118 |

✓ |

|||||

| 12 |

Grande Villas at World Golf Village & |

St. Augustine, Florida |

214 |

✓ |

✓ |

||||

| 13 |

Bluegreen at Tradewinds |

St. Pete Beach, Florida |

160 |

✓ |

✓ |

✓ |

|||

| 14 |

Solara Surfside |

Surfside, Florida |

60 |

✓ |

✓ |

||||

| 15 |

Studio Homes at Ellis Square |

Savannah, Georgia |

28 |

✓ |

✓ |

✓ |

|||

| 16 |

The Hotel Blake |

Chicago, Illinois |

160 |

✓ |

✓ |

✓ |

|||

| 17 |

Bluegreen Club La Pension |

New Orleans, Louisiana |

64 |

✓ |

✓ |

||||

| 18 |

Marquee(8) |

New Orleans, Louisiana |

94 |

✓ |

✓ |

✓ |

|||

| 19 |

The Soundings Seaside Resort |

Dennis Port, Massachusetts |

69 |

✓ |

✓ |

||||

| 20 |

Mountain Run at Boyne |

Boyne Falls, Michigan |

205 |

✓ |

✓ |

||||

| 21 |

The Falls Village |

Branson, Missouri |

293 |

✓ |

✓ |

||||

| 22 |

Paradise Point Resort(5) |

Hollister, Missouri |

150 |

✓ |

|||||

| 23 |

Bluegreen Wilderness Club at Big Cedar(5) |

Ridgedale, Missouri |

427 |

✓ |

✓ |

||||

| 24 |

The Cliffs at Long Creek(5) |

Ridgedale, Missouri |

106 |

✓ |

|||||

| 25 |

Bluegreen Club 36 |

Las Vegas, Nevada |

476 |

✓ |

✓ |

||||

| 26 |

South Mountain Resort |

Lincoln, New Hampshire |

116 |

✓ |

✓ |

✓ |

|||

| 27 |

Blue Ridge Village I,II and III |

Banner Elk, North Carolina |

132 |

✓ |

|||||

| 28 |

Club Lodges at Trillium |

Cashiers, North Carolina |

36 |

✓ |

✓ |

||||

| 29 |

The Suites at Hershey |

Hershey, Pennsylvania |

78 |

✓ |

|||||

| 30 |

The Lodge Alley Inn |

Charleston, South Carolina |

90 |

✓ |

✓ |

||||

| 31 |

King 583 |

Charleston, South Carolina |

50 |

✓ |

✓ |

||||

| 32 |

Carolina Grande |

Myrtle Beach, South Carolina |

118 |

✓ |

✓ |

||||

| 33 |

Harbour Lights |

Myrtle Beach, South Carolina |

324 |

✓ |

✓ |

||||

| 34 |

Horizon at 77th |

Myrtle Beach, South Carolina |

88 |

✓ |

✓ |

||||

| 35 |

SeaGlass Tower |

Myrtle Beach, South Carolina |

136 |

✓ |

|||||

| 36 |

Shore Crest Vacation Villas I & II |

North Myrtle Beach, South Carolina |

240 |

✓ |

✓ |

||||

| 37 |

MountainLoft I & II |

Gatlinburg, Tennessee |

394 |

✓ |

✓ |

||||

| 38 |

Laurel Crest |

Pigeon Forge, Tennessee |

298 |

✓ |

✓ |

||||

| 39 |

Eilan Hotel and Spa |

San Antonio, Texas |

163 |

✓ |

✓ |

||||

| 40 |

Shenandoah Crossing |

Gordonsville, Virginia |

136 |

✓ |

✓ |

||||

| 41 |

Bluegreen Wilderness Traveler at Shenandoah |

Gordonsville, Virginia |

146 |

✓ |

|||||

| 42 |

BG Patrick Henry Square |

Williamsburg, Virginia |

130 |

✓ |

✓ |

✓ |

|||

| 43 |

Parkside Williamsburg Resort |

Williamsburg, Virginia |

107 |

✓ |

✓ |

||||

| 44 |

Bluegreen Odyssey Dells |

Wisconsin Dells, Wisconsin |

92 |

✓ |

|||||

| 45 |

Christmas Mountain Village |

Wisconsin Dells, Wisconsin |

381 |

✓ |

✓ |

||||

|

|

Total Units |

7,719 |

11

|

|

|||||||

|

|

Club Associate Resorts |

Location |

Managed |

Fee-Based |

|||

|

1 |

Paradise Isle Resort |

Gulf Shores, Alabama |

|||||

|

2 |

Shoreline Towers Resort |

Gulf Shores, Alabama |

|||||

|

3 |

Dolphin Beach Club |

Daytona Beach Shores, Florida |

✓ |

||||

|

4 |

Fantasy Island Resort II |

Daytona Beach Shores, Florida |

✓ |

||||

|

5 |

Mariner’s Boathouse and Beach Resort |

Fort Myers Beach, Florida |

|||||

|

6 |

Tropical Sands Resort |

Fort Myers Beach, Florida |

|||||

|

7 |

Windward Passage Resort |

Fort Myers Beach, Florida |

|||||

|

8 |

Gulfstream Manor |

Gulfstream, Florida |

✓ |

||||

|

9 |

Outrigger Beach Club |

Ormond Beach, Florida |

|||||

|

10 |

Landmark Holiday Beach Resort |

Panama City Beach, Florida |

|||||

|

11 |

Ocean Towers Beach Club |

Panama City Beach, Florida |

|||||

|

12 |

Panama City Resort & Club |

Panama City Beach, Florida |

|||||

|

13 |

Surfrider Beach Club |

Sanibel Island, Florida |

|||||

|

14 |

Petit Crest Villas and Golf Club Villas at Big Canoe |

Marble Hill, Georgia |

|||||

|

15 |

Pono Kai Resort |

Kapaa (Kauai), Hawaii |

|||||

|

16 |

The Breakers |

Dennis Port, Massachusetts |

✓ |

✓ |

|||

|

17 |

Lake Condominiums at Big Sky |

Big Sky, Montana |

|||||

|

18 |

Foxrun Townhouses |

Lake Lure, North Carolina |

|||||

|

19 |

Sandcastle Village II |

New Bern, North Carolina |

|||||

|

20 |

Waterwood Townhouses |

New Bern, North Carolina |

|||||

|

21 |

Bluegreen at Atlantic Palace |

Atlantic City, New Jersey |

|||||

|

22 |

The Manhattan Club |

New York, New York |

✓ |

||||

|

23 |

Players Club |

Hilton Head Island, South Carolina |

|||||

|

24 |

Blue Water Resort at Cable Beach(6) |

Nassau, Bahamas |

✓ |

✓ |

|

(1) |

Represents the total number of units at the Club Resort. Owners in the Vacation Club have the right to use most of the units at each Club Resort in connection with their VOI ownership. |

|

(2) |

This resort is managed by Bluegreen Resorts Management, Inc. (“Bluegreen Resorts Management”), Bluegreen’s wholly-owned subsidiary. |

|

(3) |

This resort, or a portion thereof, was developed by third-parties, and Bluegreen has sold VOIs on their behalf or have arrangements to acquire such VOIs as part of Bluegreen’s capital-light business strategy. |

|

(4) |

This resort is managed by Casa Grande Cooperative Association I, which has contracted with Bluegreen Resorts Management to provide management consulting services to the resort. The services provided by Bluegreen Resorts Management to this resort pursuant to such agreement are similar in nature to, but less extensive than, the services provided by Bluegreen or its subsidiaries to the other resorts listed in the table as “Managed by Bluegreen.” |

|

(5) |

This resort is developed, marketed and sold by Bluegreen/Big Cedar Vacations. |

|

(6) |

This resort is currently closed due to hurricane damage. |

|

(7) |

In addition to the sales centers listed in the table, Bluegreen also operates an additional sales center in Memphis, Tennessee. |

|

(8) |

The Marquee is expected to be open for guests in June 2019. |

Marketing and Sale of Inventory

VOI sales are typically generated by attracting prospective customers to tour a resort and attend a sales presentation. Bluegreen’s sales and marketing platform utilizes a variety of methods to generate new owner prospects, drive tour flow and sell VOIs in its Vacation Club. Bluegreen utilizes marketing alliances with nationally-recognized brands, which provide exclusive access to venues which target consumers generally matching Bluegreen’s core demographic. In addition, Bluegreen sources sales prospects through programs which generate leads at high-traffic venues and in high-density tourist locations and events, as well as from telemarketing and referrals from existing owners and exchangers and renters staying at Bluegreen’s properties.

Many of Bluegreen’s programs involve the sale of a discounted vacation package that typically includes a two to three night stay in close proximity to one of Bluegreen’s resort sales offices and requires participation in a sales presentation (a sales tour). Vacation packages are typically sold either in retail establishments, such as Bass Pro stores and outlet malls, or via telemarketing. During the year ended December 31, 2018, Bluegreen sold over 227,000 vacation packages, and 48% of Bluegreen’s VOI sales were derived from vacation packages. As of December 31, 2018, Bluegreen had a pipeline of over 185,000 vacation packages sold, which typically convert to tours at a rate of 55%.

Bluegreen has an exclusive marketing agreement with Bass Pro, a nationally-recognized retailer of fishing, marine, hunting, camping and sports gear, that provides Bluegreen with the right to market and sell vacation packages at kiosks in each of Bass Pro’s retail locations. As of December 31, 2018, Bluegreen sold vacation packages in 69 of Bass Pro’s stores. Bass Pro has a loyal customer base that strongly matches Bluegreen’s core demographic. Under the agreement, Bluegreen also has the right to market VOIs in Bass Pro catalogs and on its website and to access Bass Pro’s customer

12

database. In exchange, Bluegreen compensates Bass Pro based on VOI sales generated through the program. No compensation is paid to Bass Pro under the agreement on sales made at Bluegreen/Big Cedar Vacations’ resorts. During the years ended December 31, 2018, 2017 and 2016, VOI sales to prospects and leads generated by the agreement with Bass Pro accounted for approximately 14%, 15% and 16%, respectively, of Bluegreen’s VOI sales volume. Bluegreen’s marketing alliance with Bass Pro originated in 2000, has been renewed twice, and currently runs through 2025. Bluegreen has continued to meet with Bass Pro’s leadership in an effort to resolve the issues which arose between the parties in 2017 and 2018. While there is no assurance that a resolution will be reached, Bluegreen remains optimistic that it will achieve a resolution of the outstanding issues. Bluegreen is hopeful that the resolution will address the timing of entry into the Cabela’s stores and an extension of the parties’ agreements. If reached, the resolution may include a restructuring of the amount and timing of compensation paid to Bass Pro. In the meantime, Bluegreen continues to execute its vacation package marketing strategy under the current agreement with Bass Pro. While Bluegreen does not believe that any material additional amounts are due to Bass Pro, Bluegreen’s future results would be impacted if the issues are not resolved and by any change in the compensation payable to Bass Pro or the calculation of payments or reimbursements utilized pursuant to the agreements.

Bluegreen also has an exclusive strategic relationship with Choice Hotels that covers several areas of its business, including a sales and marketing alliance that enables it to leverage Choice Hotels’ brands, customer relationships, and marketing channels to sell vacation packages. Vacation packages are sold through customer reservation calls transferred to Bluegreen from Choice and through outbound telemarketing methods utilizing Choice’s customer database. In addition, 37 of Bluegreen’s resorts are part of Choice’s Ascend Hotel Collection, which provides Bluegreen with the opportunity to market to Choice Hotel guests staying at its resorts. Bluegreen’s strategic relationship with Choice Hotels originated in 2013 and was extended in August 2017 for a term of 15 years, with an additional 15-year renewal term thereafter unless either party elects not to renew the arrangement.

In addition, Bluegreen generates leads and sells vacation packages through its relationships with various other retail operators and entertainment providers. As of December 31, 2018, Bluegreen had kiosks in 21 outlet malls, strategically selected based on proximity to major vacation destinations and strong foot traffic of consumers matching its core target demographic. Bluegreen generates vacation package sales from these kiosks. Bluegreen also generates leads at malls, outlets and high-density locations or events, where contact information for sales prospects is obtained through raffles, giveaways and other attractions. Bluegreen then seeks to sell vacation packages to such prospects, including through telemarketing efforts by Bluegreen or third-party vendors. As of December 31, 2018, Bluegreen had lead generation operations in over 460 locations.

Bluegreen believes that its diverse strategic marketing alliances (including those with Bass Pro, Choice Hotels and other retail operators and entertainment providers) deliver a strategic advantage over certain competitors that rely primarily on relationships with their affiliated hotel brands to drive lead generation and new owner growth. Bluegreen’s goal is to identify marketing partners with brands that attract Bluegreen’s targeted owner demographic and to build successful marketing relationships with those partners. Bluegreen also attempts to structure its marketing alliances to compensate its partners with success-based payments, rather than flat fees, for the use of their brand or facilities for lead generation. Bluegreen believes that the variety in its marketing relationships has facilitated a healthy mix of new owner sales vs. existing owner sales that compare favorably to its competitors. During the year ended December 31, 2018, approximately 48% of Bluegreen’s VOI sales were to new owners.

In addition to attracting new customers, Bluegreen also seeks to sell additional VOI points to its existing Vacation Club owners. These sales generally have lower marketing costs and result in higher operating margins than sales generated through other marketing channels. During the years ended December 31, 2018, 2017 and 2016, sales to existing Vacation Club owners accounted for 52%, 49% and 46%, respectively, of Bluegreen’s system-wide sales of VOIs, net. Bluegreen targets a balanced mix of new customer and existing Vacation Club owner sales to drive sustainable long-term growth. The number of owners in Bluegreen’s Vacation Club has increased at a 5% compound annual growth rate between 2012 and 2018, from approximately 170,000 owners as of December 31, 2012 to approximately 216,000 owners as of December 31, 2018.

Bluegreen operates 26 sales offices, typically located adjacent to its resorts and staffed with sales representatives and sales managers. As of December 31, 2018, Bluegreen had over 3,000 employees dedicated to VOI sales and marketing. Bluegreen utilizes a uniform sales process, offers ongoing training for its sales personnel, and maintains strict quality control policies. During the year ended December 31, 2018, 91% of Bluegreen’s sales were generated from 17 of its sales offices, which focus on both new customer and existing Vacation Club owner sales. Bluegreen’s remaining 9 sales offices are primarily focused on sales to existing Vacation Club owners staying at the respective resort. In addition, Bluegreen utilizes its telesales operations to sell additional VOIs to Vacation Club owners.

13

Flexible Business Model

Bluegreen’s business model is designed to give it flexibility to capitalize on opportunities and adapt to changing market environments. Bluegreen has the ability to adjust its targeted mix of capital-light vs. developed VOI sales, sales to new customers vs. existing Vacation Club owners, and cash vs. financed sales. While Bluegreen may pursue opportunities that impact its short-term results, Bluegreen’s long-term goal is to achieve sustained growth while maximizing earnings and cash flow.

Note: Cash sales represent the portion of Bluegreen’s system-wide sales of VOIs, net that is received from the customer in cash within 30 days of purchase.

VOI Sales Mix

Bluegreen’s VOI sales include:

|

· |

Fee-based sales of VOIs owned by third-party developers pursuant to which Bluegreen is paid a commission; |

|

· |

JIT sales of VOIs Bluegreen acquires from third-party developers in close proximity to when Bluegreen intends to sell such VOIs; |

|

· |

Secondary market sales of VOIs Bluegreen acquires from HOAs or other owners; and |

|

· |

Developed VOI sales, or sales of VOIs in resorts that Bluegreen develops or acquires (excluding inventory acquired pursuant to JIT and secondary market arrangements). |

14

Fee-Based Sales

Bluegreen offers sales and marketing services to third-party developers for a commission. Under these fee-based sales arrangements, which are typically entered into on a non-committed basis, Bluegreen sells the third-party developers’ VOIs as Vacation Club interests through its sales and marketing platform. Bluegreen also provides third-party developers with administrative services, periodic reporting, and analytics through its proprietary software platform. Bluegreen seeks to structure the fee for these services to cover selling and marketing costs, plus an operating profit. Historically, Bluegreen has targeted a commission rate of 65% to 75% of the VOI sales price. Notes receivable originated in connection with fee-based sales are held by the third-party developer and, in certain cases, are serviced by Bluegreen for an additional fee. In connection with fee-based sales, Bluegreen is not at risk for development financing and has no capital requirements, thereby increasing its return on invested capital. Bluegreen also typically holds the HOA management contract associated with these resorts.

Just-In-Time (JIT) Sales

Bluegreen enters into JIT inventory acquisition agreements with third-party developers that allow Bluegreen to buy VOI inventory in close proximity to when Bluegreen intends to sell such VOIs. While Bluegreen typically enters into such arrangements on a non-committed basis, Bluegreen may engage in committed arrangements under certain circumstances. Similar to fee-based sales, JIT sales do not expose Bluegreen to risks for development financing. However, unlike fee-based sales, Bluegreen holds the consumer finance receivables originated in connection with JIT sales. While JIT sales accounted for only 5% of system-wide sales of VOIs, net for the year ended December 31, 2018, JIT arrangements are often entered into in connection with fee-based sales arrangements. Bluegreen also typically holds the HOA management contract associated with these resorts.

Secondary Market Sales

Bluegreen acquires VOI inventory from HOAs and other owners generally on a non-committed basis. These VOIs are typically obtained by the applicable HOA through foreclosure or termination in connection with HOA maintenance fee defaults. Accordingly, Bluegreen generally purchases VOIs from secondary market sources at a greater discount to retail price compared to developed VOI sales and JIT sales. During the year ended December 31, 2018, secondary market sales accounted for 19% of Bluegreen’s system-wide sales of VOIs, net.

Developed VOI Sales

Developed VOI sales are sales of VOIs in resorts that Bluegreen has developed or acquired (excluding inventory acquired pursuant to JIT and secondary market arrangements). During the year ended December 31, 2018, developed VOI sales accounted for 25% of Bluegreen’s system-wide sales of VOIs, net. Bluegreen holds the notes receivable originated in connection with developed VOI sales. Bluegreen also typically obtains the HOA management contract associated with these resorts.

Future VOI Sales

Completed VOI inventory increases or decreases from period to period due to the acquisition of inventory through JIT and secondary market arrangements, development of new VOI units, reacquisition of VOIs through notes receivable defaults, and changes to sales prices and completed sales. As of December 31, 2018 and 2017, Bluegreen owned completed VOI inventory (excluding units not currently being marketed as VOIs, such as model units) and had access to additional completed VOI inventory through fee-based and JIT arrangements as follows (dollars are in thousands and represent the then-estimated retail sales value):

|

|

||||||

|

|

As of December 31, |

|||||

|

Inventory Source |

2018 |

2017 |

||||

|

Owned completed VOI inventory |

$ |

759,327 |

$ |

754,961 | ||

|

Inventory accessible through fee-based |

||||||

|

and JIT arrangements |

487,391 | 401,906 | ||||

|

Total |

$ |

1,246,718 |

$ |

1,156,867 | ||

Based on current estimates and expectations, Bluegreen believes this inventory, combined with inventory being developed by Bluegreen or its third-party developer clients, and inventory that Bluegreen may reacquire in connection with mortgage and maintenance fee defaults, can support Bluegreen’s VOI sales at its current levels for over four years. Bluegreen maintains relationships with numerous third-party developers and expects additional fee-based and JIT

15

relationships to continue to provide high-quality VOI inventory to support its sales efforts. In addition, Bluegreen is focused on strategically expanding its inventory through development at three of its resorts over the next several years. Bluegreen intends to continue to strategically evaluate opportunities to develop or acquire VOI inventory in key strategic markets where Bluegreen identifies growing demand and has already established marketing and sales networks.

During the years ended December 31, 2018 and 2017, the estimated retail sales value and cash purchase price of the VOIs Bluegreen acquired through secondary market arrangements were as follows (dollars in thousands):

|

|

||||||

|

|

Years Ended December 31, |

|||||

|

|

2018 |

2017 |

||||

|

Estimated retail sales value |

|

$ |

164,390 |

|

$ |

243,084 |

|

Cash purchase price |

|

$ |

11,994 |

|

$ |

12,721 |

In addition to inventory acquired through secondary market arrangements and in connection with notes receivable defaults, Bluegreen expects to acquire inventory through five JIT arrangements during 2019, three of which provide for committed purchases for 2019, and development activities. Development activities currently consist primarily of additional VOI units being developed at The Cliffs at Long Creek and The Bluegreen Wilderness Club at Big Cedar in Ridgedale, Missouri, and at the Fountains in Orlando, Florida.

Management and Other Fee-Based Services

Bluegreen earns recurring management fees for providing services to HOAs. These management services include oversight of housekeeping services, maintenance, and certain accounting and administrative functions. Bluegreen believes its management contracts yield highly predictable cash flows that do not have the traditional risks associated with hotel management contracts that are linked to daily rate or occupancy. Bluegreen’s management contracts are typically structured as “cost-plus” management fees, which means Bluegreen generally earns fees equal to 10% to 12% of the costs to operate the applicable resort, and have an initial term of three years with automatic one-year renewals. As of December 31, 2018, Bluegreen provided management services to 49 resorts. Bluegreen also earns recurring management fees for providing services to the Vacation Club. These services include managing the reservation system and providing owner billing and collection services. Bluegreen’s management contract with the Vacation Club provides for reimbursement of its costs plus a fee equal to $10 per VOI owner. Bluegreen may seek to expand its management services business, including to provide hospitality management services to hotels for third parties.

In addition to HOA and club management services, which provide a recurring stream of revenue, Bluegreen provides other fee-based services that produce revenues without the significant capital investment generally associated with the development and acquisition of resorts. These services include, but are not limited to, title and escrow services for fees in connection with the closing of VOI sales, servicing notes receivable held by third parties, typically for a fee equal to 1.5% to 2.5% of the principal balance of the serviced portfolio, and construction management services for third-party developers, typically for fees equal to 4% of the cost of construction of the project. Bluegreen also receives revenues from retail and food and beverage outlets at certain resorts.

Customer Financing

Bluegreen generally offers qualified purchasers financing for up to 90% of the purchase price of VOIs. The typical financing provides for a term of ten years, a fixed interest rate that is determined by the FICO score of the borrower, the amount of the down payment, and existing ownership, is fully amortizing in equal installments, and may be prepaid without penalty. Purchasers may receive an additional 1% discount on the interest rate by participating in Bluegreen’s pre-authorized payment plan. As of December 31, 2018, 95% of Bluegreen’s serviced VOI notes receivable participated in Bluegreen’s pre-authorized payment plan. During the year ended December 31, 2018, the weighted-average interest rate on Bluegreen’s VOI notes receivable was 15.1%.

VOI purchasers are generally required to make a down payment of at least 10% of the sales price. As part of Bluegreen’s continued efforts to manage operating cash flows, Bluegreen incentivizes its sales associates to encourage cash sales and higher down payments on financed sales, with a target of 40-45% of the VOI sales price collected in cash. Bluegreen also promotes a point-of-sale credit card program sponsored by a third-party financial institution. As a result of these efforts, Bluegreen has increased both the percentage of sales that are fully paid in cash and the average down payment on financed sales. Including down payments received on financed sales, approximately 42% of Bluegreen’s system-wide sales of VOIs, net during the year ended December 31, 2018 were paid in cash within approximately 30 days from the contract date.

16

See “Sales/Financing of Receivables” below for additional information regarding Bluegreen’s receivable financing activities.

Loan Underwriting