Company

Presentation June 27, 2016

FILED BY RANGE RESOURCES CORPORATION PURSUANT TO RULE 425

UNDER THE SECURITIES ACT OF 1933 AND DEEMED FILED PURSUANT TO

RULE 14a-12 UNDER THE SECURITIES EXCHANGE ACT OF 1934

REGISTRATION NO. 333-211994

SUBJECT COMPANY: MEMORIAL RESOURCE DEVELOPMENT CORP. FILE NO. 001-36490 |

2 Forward-Looking Statements This communication contains certain “forward-looking statements” within the meaning of federal securities laws, including within the

meaning of the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995 that are not limited to historical facts, but reflect Range’s and MRD’s current beliefs, expectations or intentions regarding future events. Words such as “may,” “will,” “could,” “should,” “expect,” ““plan,” “project,”

“intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “pursue,” “target,” “continue,” and similar

expressions are intended to identify such forward-looking statements. The statements

in this press release that are not historical statements, including statements regarding the expected timetable for completing the proposed transaction, benefits and synergies of the proposed transaction, costs and other anticipated financial

impacts of the proposed transaction; the combined company’s plans,

objectives, future opportunities for the combined company and products, future financial performance and operating results and any other statements regarding Range’s and MRD’s future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or

performance that are not historical facts, are forward- looking

statements within the meaning of the federal securities laws. Furthermore, the statements relating to the proposed transaction are subject to numerous risks and uncertainties, many of which are beyond

Range’s or MRD’s control, which could cause actual results to

differ materially from the results expressed or implied by the statements. These risks and uncertainties include, but are not limited to: failure to obtain the required votes of Range’s or MRD’s shareholders; the timing to consummate the proposed transaction; satisfaction of the conditions to closing of

the proposed transaction may not be satisfied or that the closing of the

proposed transaction otherwise does not occur; the risk that a regulatory approval that may be required for the proposed transaction is not obtained or is obtained subject to conditions that are not anticipated; the diversion of management time on transaction-related issues; the ultimate timing, outcome

and results of integrating the operations of Range and MRD; the effects of

the business combination of Range and MRD, including the combined company’s future financial condition, results of operations, strategy and plans; potential adverse reactions or changes to business relationships resulting from the announcement or completion of the proposed transaction;

expected synergies and other benefits from the proposed transaction and the

ability of Range to realize such synergies and other benefits; expectations regarding regulatory approval of the transaction; results of litigation, settlements and investigations; and actions by third parties, including governmental agencies; changes in the demand for or price of oil and/or

natural gas can be significantly impacted by weakness in the worldwide

economy; consequences of audits and investigations by government agencies and legislative bodies and related publicity and potential adverse proceedings by such agencies; compliance with environmental laws; changes in government regulations and regulatory requirements, particularly those

related to oil and natural gas exploration; compliance with laws related to

income taxes and assumptions regarding the generation of future taxable income; weather-related issues; changes in capital spending by customers; delays or failures by customers to make payments owed to us; impairment of oil and natural gas properties; structural changes in the oil and natural gas industry; and

maintaining a highly skilled workforce.

Range’s and MRD’s respective reports on Form 10-K for the year ended December 31, 2015, Form 10-Q for the quarter ended March 31,

2016, recent Current Reports on Form 8-K, and other SEC filings discuss

some of the important risk factors identified that may affect these factors and Range’s and MRD’s respective business, results of operations and financial condition. Range and MRD undertake no obligation to revise or update publicly any forward-looking statements for any reason. Readers are

cautioned not to place undue reliance on these forward-looking

statements that speak only as of the date hereof. The SEC permits oil and gas companies, in filings made with the SEC, to disclose proved reserves, which are estimates that geological and

engineering data demonstrate with reasonable certainty to be recoverable in

future years from known reservoirs under existing economic and operating conditions as well as the option to disclose probable and possible reserves. Range has elected not to disclose the Company’s probable and possible reserves in its filings with the SEC. Range uses certain broader

terms such as "resource potential,” “unrisked resource

potential,” "unproved resource potential" or "upside" or other descriptions of volumes of resources potentially recoverable through additional drilling or recovery techniques

that may include probable and possible reserves as defined by the SEC's guidelines.

Range has not attempted to distinguish probable and possible reserves from these broader classifications. The SEC’s rules prohibit us from including in filings with the SEC these broader classifications of reserves. These

estimates are by their nature more speculative than estimates of proved,

probable and possible reserves and accordingly are subject to substantially greater risk of actually being realized. Unproved resource potential refers to Range's internal estimates of hydrocarbon quantities that may be potentially discovered through exploratory drilling or recovered with additional drilling

or recovery techniques and have not been reviewed by independent

engineers. Unproved resource potential does not constitute reserves within the meaning of the Society of Petroleum Engineer's Petroleum Resource Management System and does not include proved reserves. Area wide unproven resource potential has not been fully risked by Range's

management. “EUR,” or estimated ultimate recovery, refers

to our management’s estimates of hydrocarbon quantities that may be recovered from a well completed as a producer in the area. These quantities may not necessarily constitute or represent reserves within the meaning of the Society of Petroleum Engineer’s Petroleum Resource Management System or the

SEC’s oil and natural gas disclosure rules. Actual quantities that may

be recovered from Range's interests could differ substantially. Factors affecting ultimate recovery include the scope of Range's drilling program, which will be directly affected by the availability of capital, drilling and production costs, commodity prices, availability of drilling and completion services

and equipment, lease expirations, transportation constraints, regulatory

approvals, field spacing rules, recoveries of gas in place, length of horizontal laterals, actual drilling and completion results, including geological and mechanical factors affecting recovery rates and other factors. Estimates of resource potential may change significantly as development of

our resource plays provides additional data.

In addition, our production forecasts and expectations for future periods are dependent upon many assumptions, including estimates of production

decline rates from existing wells and the undertaking and outcome of future

drilling activity, which may be affected by significant commodity price declines or drilling cost increases. Investors are urged to consider closely the disclosure in our most recent Annual Report on Form 10-K, available from our website at www.rangeresources.com or by written request to 100

Throckmorton Street, Suite 1200, Fort Worth, Texas 76102. You can

also obtain this Form 10-K on the SEC’s website at www.sec.gov or by calling the SEC at 1-800-SEC-0330. |

3 Range’s Keys for Success • High quality, large scale acreage position containing repeatable projects with good returns improving further as costs are reduced • Low cost structure with ability to continue driving costs down • Improving capital efficiency • New takeaway capacity projected to improve realizations for natural gas, NGLs and condensate • Shallow base decline rate, 19% in 1 st year, allows a minimal level of capex to hold production flat, ~$300 million for 2017 • Low-cost takeaway capacity with built-in flexibility • Strong 2016 hedges and ample liquidity with no near-term debt maturities |

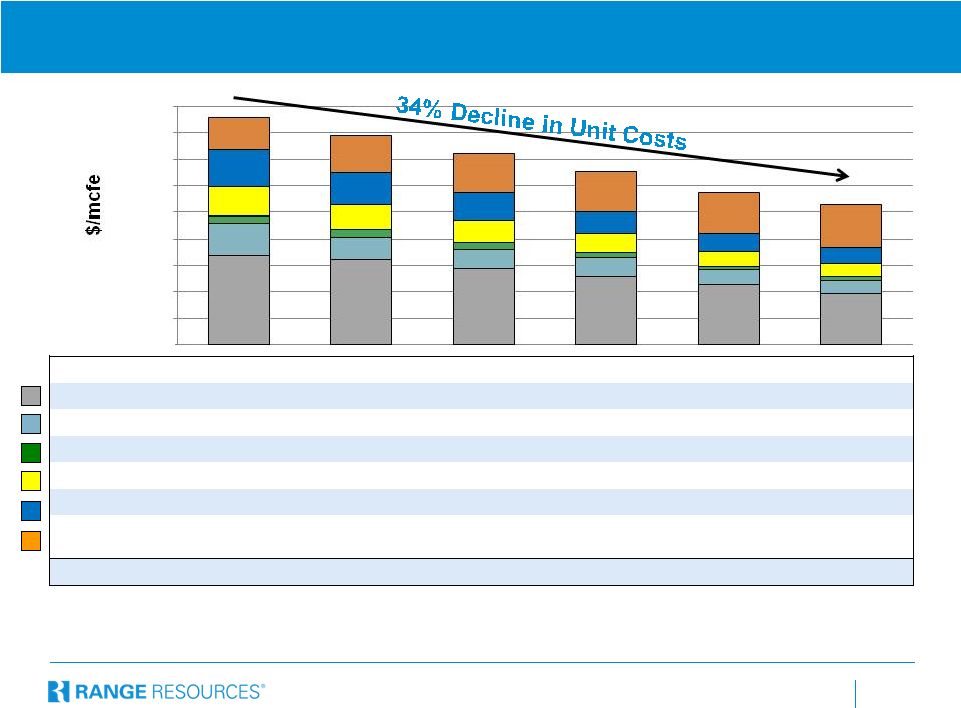

4 Driving Down Unit Costs 2011 2012 2013 2014 2015 2016E DD&A $1.69 $1.62 $1.44 $1.30 $1.14 $0.96 (2) LOE (1) $0.60 $0.41 $0.36 $0.35 $0.26 $0.23 Prod. Taxes $0.14 $0.15 $0.13 $0.10 $0.07 $0.06 G&A (1) $0.56 $0.46 $0.42 $0.35 $0.27 $0.24 Interest $0.69 $0.61 $0.51 $0.40 $0.33 $0.29 Trans. & Gathering $0.62 $0.70 $0.75 $0.76 $0.78 Total $4.30 $3.95 $3.61 $3.26 $2.85 $2.58 $0.00 (1) Excludes non-cash stock compensation (2) 1Q 2016 DD&A was $0.96 (3) Includes additional NGL & natural gas firm transport agreements. Propane transport costs were previously netted against NGL

revenue. Incremental natural gas & NGL revenue, including

additional ethane production, will more than offset the 2016 increase in transport expense (4) Expected improvement in differentials as a result of additional transportation capacity

($0.25) (4) $1.05 (3) $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $4.00 $4.50 |

5 Near-Term Price Enhancements • Range will be able to utilize a full year of Spectra’s Uniontown to Gas City project, which takes ~200 Mmcf per day of Range gas production from local Appalachia M2 to Midwest markets • Additional takeaway projects could strengthen local pricing differentials • Range is the only producer with capacity on the Mariner East project to Marcus Hook • 20,000 barrels per day of ethane transportation to fulfill contract with INEOS • 20,000 barrels per day of propane transportation with access to international propane markets • Range initiated a new marketing arrangement in 3Q15 which improved Marcellus condensate net realized prices Natural Gas Differential Natural Gas Differential NGL (Natural Gas Liquids) Differential NGL (Natural Gas Liquids) Differential Condensate Differential Condensate Differential $0.00 Midpoint Midpoint Midpoint $(0.62) $(0.42) $(0.70) $(0.60) $(0.50) $(0.40) $(0.30) $(0.20) $(0.10) 2015 2016E RRC Marcellus NG Differential to NYMEX 18% 24% 0% 5% 10% 15% 20% 25% 30% 2015 2016E RRC Corporate NGL Price as % of WTI $(14.93) $(13.50) $(15.50) $(15.00) $(14.50) $(14.00) $(13.50) $(13.00) $(12.50) 2015 2016E RRC Corporate Condensate Differential to WTI |

6 Mariner East: Opening New Lanes First Ethane Shipments – Faster Propane Loading Combined with VLGC Ships A ship waits in the harbor as another ship is being loaded. • Range is the only producer with current capacity on Mariner East • Historic first shipments of ethane from U.S. to Europe • Optionality of selling propane internationally or in local markets • Expect uplift in ethane and propane realizations in 2016 for Range Ethane loading in progress |

7 First VLGC Loading of Range Propane for Export |

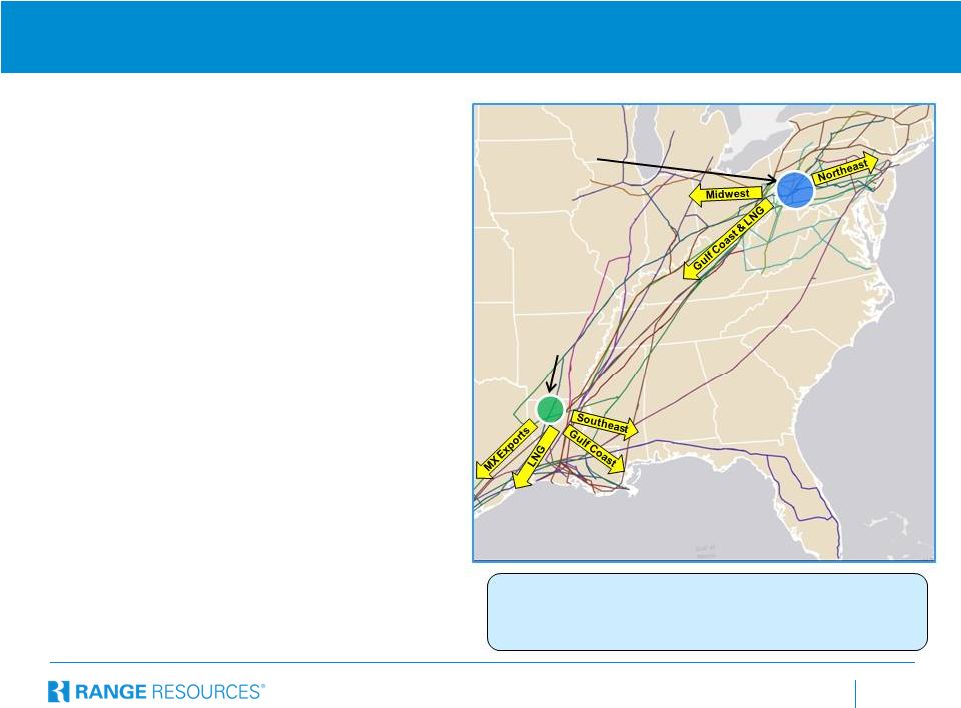

8 Regional Direction Projected Avg. 2016 Projected Avg. 2017 Mmbtu/day Transport Cost per Mmbtu Mmbtu/day Transport Cost per Mmbtu Firm Transportation Appalachia/Local 390,000 $ 0.20 325,000 $ 0.21 Gulf Coast 295,000 $ 0.30 510,000 $ 0.31 Midwest/Canada 285,000 $ 0.28 330,000 $ 0.30 Northeast 210,000 $ 0.59 210,000 $ 0.59 Total Gross Takeaway Capacity 1,180,000 $ 0.31 1,375,000 $ 0.35 Total Net Takeaway Capacity 980,000 $ 0.31 1,140,000 $ 0.35 Estimated Marcellus Differential to NYMEX ($0.40) – ($0.45) ($0.25) – ($0.35) Appalachia Gas Transportation Arrangements Transportation Portfolio additions improve Range’s differentials to NYMEX Does not include current intermediary pipeline capacity (gathering) of >650,000 Mmbtu/day and assumes full utilization. Based on pipeline operator’s anticipated project start dates. (1) Based on expected utilization of capacity and forward pricing with differentials as of April 2016

(1) |

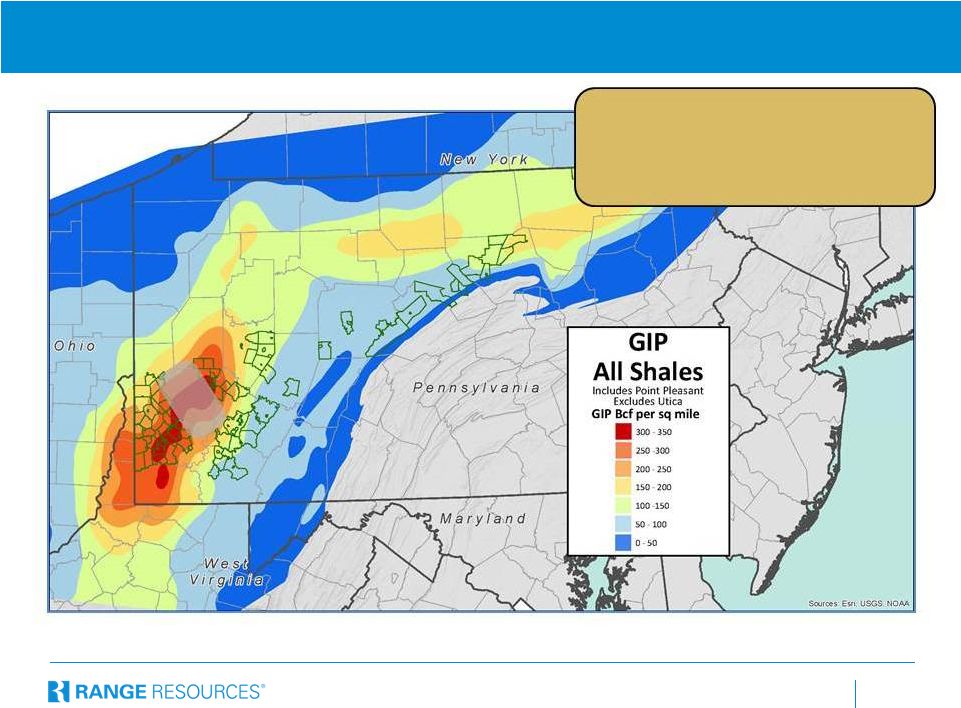

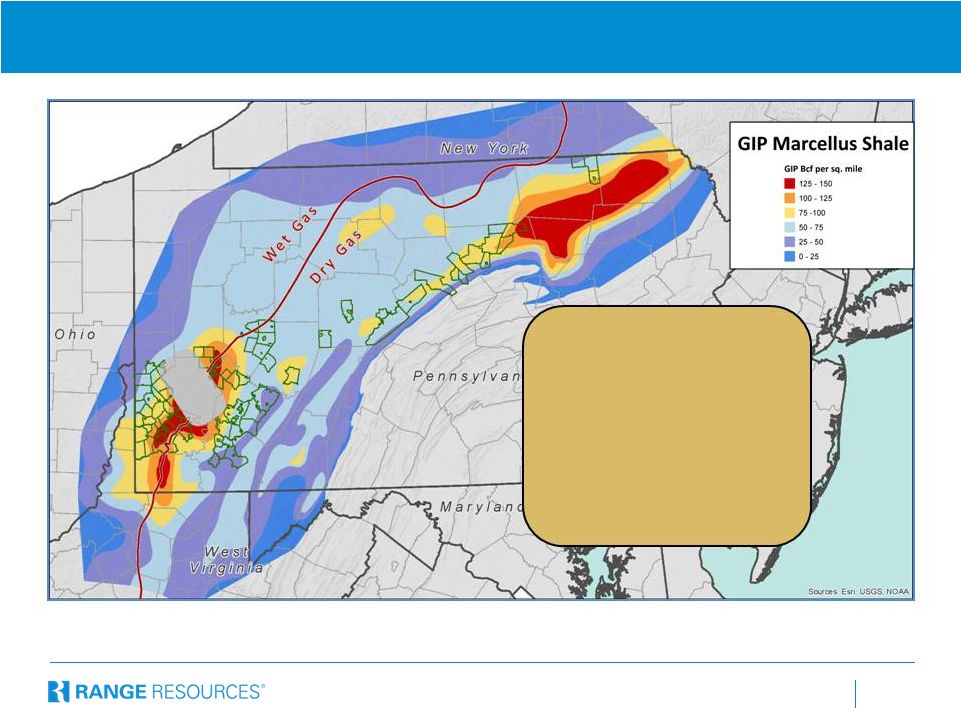

9 Gas In Place (GIP) Analysis Shows Greatest Potential in SW PA

Note: Townships where Range holds ~2,000+ acres (as of January 2016) and estimated as

prospective, are outlined green. GIP – Range

estimates. When

GIP analysis from the Marcellus, Upper Devonian and Point Pleasant are combined, the largest stacked pay resource is located in SW PA where Range has concentrated its acreage position |

10 SW/NE Pennsylvania Stacked Pays Upper Devonian 335,000 180,000 515,000 335,000 290,000 625,000 - 400,000 400,000 670,000

870,000 1,540,000

Marcellus Utica/Point Pleasant Wet Acreage Dry Acreage Total Net Acreage (1) (1) Excludes Northwest PA - 280,000 net acres, largely HBP Stacked pays allow for multiple development opportunities |

11 Over 180 Existing Pads Facilitate Future Development • 124 pads with 5 or fewer wells, 59 pads with 6 to 9 wells • Most pads designed to accommodate ~20 wells with the flexibility to drill Marcellus, Utica/Point Pleasant or Upper Devonian formations • Significant time and cost savings are realized minimal permitting required reuse of existing roads, surface facilities and gathering system |

12 Range Marcellus – 2016 Well Economic Summary See appendix for complete assumptions and data on each area SW Super-Rich SW Wet SW Dry NE Dry EUR 16.0 Bcfe 1,450 Mbbls & 7.3 Bcf 20.6 Bcfe 1,756 Mbbls & 10.1 Bcf 17.6 Bcf 14.1 Bcf EUR/1,000 ft. lateral 2.4 Bcfe 3.0 Bcfe 2.5 Bcf 2.5 Bcf EUR/stage 485 Mmcfe 589 Mmcfe 503 Mmcf 504 Mmcf Well Cost $5.9 MM $5.8 MM $5.2 MM $2.9 MM Cost/1,000 ft. lateral $881 K $832 K $743 K $518 K Stages 33 35 35 28 Lateral Length 6,660 ft. 6,970 ft. 7,000 ft. 5,660 ft. IRR - $3.00 26% 25% 54% 58% Industry leading EUR/1,000 ft. and Cost/1,000 ft. in SW Appalachia |

13 Appalachian Peers Well Cost Comparison Average Well Cost* Average Lateral Length Cost per 1,000 ft. ($000’s) (feet) (per 1,000 feet) Range $5,630 6,876 $819 K Peer A 6,300 7,000 900 Peer B 8,500 9,000 944 Peer C 6,700 7,000 957 Peer D 7,350 7,500 980 Peer E 7,100 7,700 925 Peer Average $7,195 7,640 $942 K Peer group includes AR, COG, EQT, RICE, SWN. Peer data comes from most recent presentations.

* Costs should include surface facilities. |

14 Unhedged Recycle Ratio Assumed 2017 Natural Gas price*: ~$3.00 Less: 2016 Expected Corp. differential $0.42 2016 Expected All-in cash unit costs $1.87 Adjusted Margin ~$0.71 Expected future development Cost for PUD reserves $0.40 Unhedged Recycle Ratio 1.8 Recycle Ratio: (Margin divided by F&D) * Natural gas strip price as of 4/27/16 |

15 Liquidity and Leverage Outlook (Range pre-merger) •

At March 31, 2016, Range had $1.7 billion liquidity under bank commitments, which is

currently

limited to $1.2 billion by senior subordinated note indentures • $3 billion borrowing base and $2 billion commitment amount under $4 billion credit

facility unanimously reaffirmed by bank group, next scheduled redetermination by

May 1, 2017

• No note maturities until 2021 • Bank facility subject to renewal in 2019, with annual redeterminations • Bradford County non-operated interest sold 3/28/16 for $110 million of proceeds

• Signed agreement to sell 9,200 acres in the STACK play for ~$77 million • Solid, stable coverage on debt covenants • EBITDAX to interest – minimum of 2.5x (1Q Actual 4.8x) • PV9 proved reserves value to debt – minimum of 1.5x (1Q Actual 2.4x) • Hedges on 80% of 2016 production at ~$3.24 |

16 Range’s Keys for Success – Assets, Team, Agreements & Strategy Low cost structure with ability to continue driving costs lower • High-grading asset sales lowered operating costs • Lower debt balances reduce interest expense • Headcount reduced by 31% YoY Improving capital efficiency • Longer laterals; 2016 plan average ~7,000’, 2017 plan est. to average ~8,000’ • Improved targeting and completions • Existing pad locations with facilities and gathering • 2017 maintenance capex estimated at ~$300 million Better realizations from additional takeaway capacity and sales agreements • Unique marketing arrangements coming on line • Ability to reach premium markets and deliver products outside Marcellus, including international exports Low-cost takeaway capacity with built-in flexibility • First-mover advantage allowed Range to secure capacity on low-cost expansion projects • Anticipated excess infrastructure build-out and avoided contracting for excessive firm transport Strong 2016 hedges and ample liquidity • Approximately 80% hedged on natural gas at ~$3.24 Mmbtu • At 3/31/16, only $31 million drawn on $2 billion credit facility • 2016 program expected to use cash flow and asset sales, preserving liquidity High quality, large scale acreage position containing repeatable projects with good returns • Optionality and flexibility due to quality of acreage position, gathering system, available locations on existing pads • Further improvements expected |

17 Range Resources/Memorial Resource Development Proposed Merger Announced May 16, 2016 Closing expected late 3 rd Qtr. / early 4 th Qtr. 2016 |

18 Highlights of Merger Core acreage positions in two of the most prolific high- quality natural gas plays in North America Immediately cash flow accretive and credit enhancing Combination of two low-cost gas producers with opportunities to drive costs lower, improve returns and increase cash flow Complementary assets positioned near expanding natural gas and NGL demand centers |

19 Transaction Details Consideration • Range Resources (“Range”) merges with Memorial Resource Development (“MRD”) for 0.375 shares of Range per MRD share; All-stock transaction • Implied value of $15.75 per MRD share, a 17% premium based on closing prices as of May 13, 2016 Pro Forma Ownership and Corporate Governance • MRD shareholders will own ~31% of the combined company • MRD will have the right to nominate an independent director to a seat on Range’s Board • Combined company will be led by current Range senior management team Key Conditions and Timing • Range shareholder approval and MRD shareholder approval • Customary regulatory approvals • Closing expected late 3 rd quarter or early 4 th quarter of 2016 |

20 Immediately Accretive & Credit Enhancing Annual Consensus Metrics * Existing RRC Pro Forma RRC % Change • 2016E Production 520 Bcfe 670 Bcfe +29% • 2016E Production per day 1,420 Mmcfe 1,830 Mmcfe +29% • 2016E Cash Flow $375 Million $780 Million +108% • 2016E Cash Flow per share $2.24 $3.20 +43% • 2016E Cash Margin per Mcfe $0.72 $1.17 +62% • YE 2016E Debt to EBITDAX 4.8x 3.5x +27% • YE 2016E Debt to Cap 50% 37% +26% * Using 5/13/16 Consensus estimates Significant Enhancement to both Cash Flow Per Share and Credit Metrics |

21 Marketing and Operational Efficiencies Marketing • MRD’s position gives Range a presence in the Gulf Coast in advance of additional transportation availability out of Appalachia • Opportunities to optimize Range’s transportation portfolio • Creates an expanding and improved Range customer base in or near multiple demand areas Operational • Modified drilling and targeting techniques • Capital cost reductions through leveraging service provider relationships and reducing drilling or completion times • Overhead efficiencies Marcellus Terryville Existing infrastructure connects the two acreage positions |

22 Appendix |

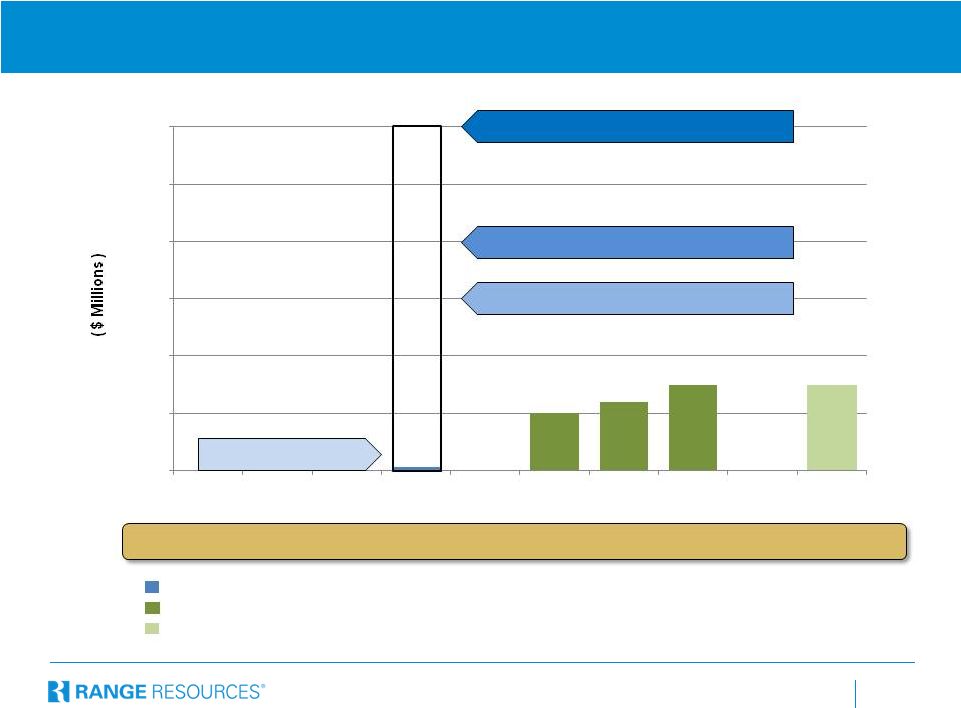

23 Sustained Growth with Improving Capital Efficiency * 2016 production estimated at midpoint of guidance with capital budget of $495 million

$ Capex per incremental mcfe Production

Production (Mmcfepd) Range has one of the most capital efficient spending programs in the sector 1,500 1,250 1,000 750 500 250 0 2011 2012 2013 2014 2015 2016E* $30 $25 $20 $15 $10 $5 $- |

24 Cost & Efficiency Improvements – SW Pennsylvania - 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 2012 2013 2014 2015 2016 E Average Lateral Length ' ' ' ' ' ' ' ' $- $500 $1,000 $1,500 $2,000 $2,500 2012 2013 2014 2015 2016 E Well Cost / Lateral Length $- $200 $400 $600 $800 $1,000 $1,200 2012 2013 2014 2015 2016 E Drilling Cost / Lateral Length (includes vertical) $- $200 $400 $600 $800 $1,000 $1,200 $1,400 2012 2013 2014 2015 2016 E Completion Cost / Lateral Length |

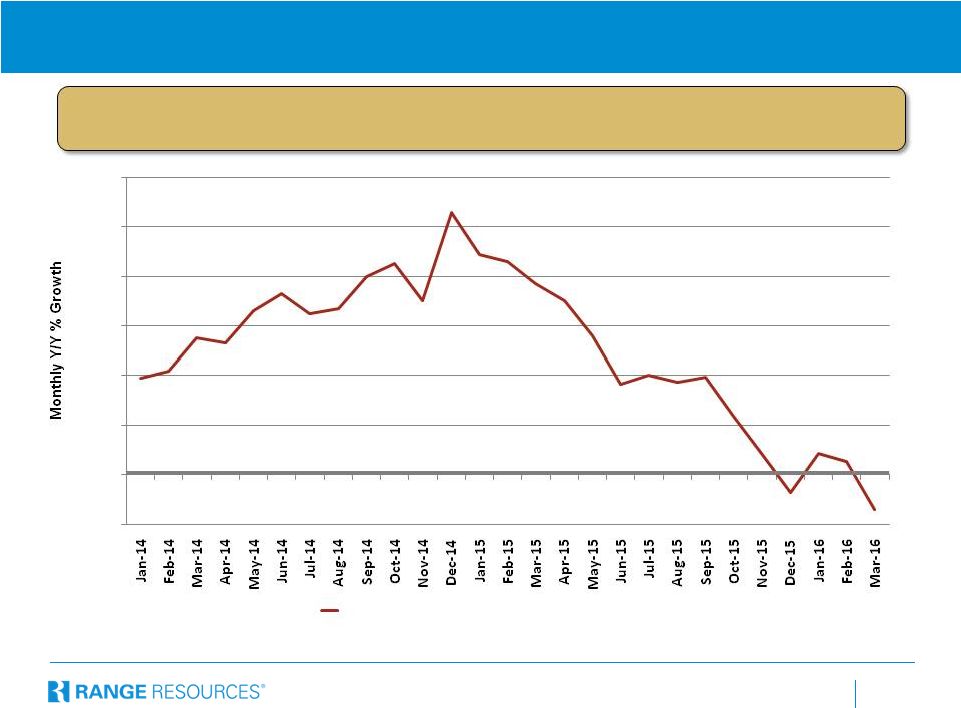

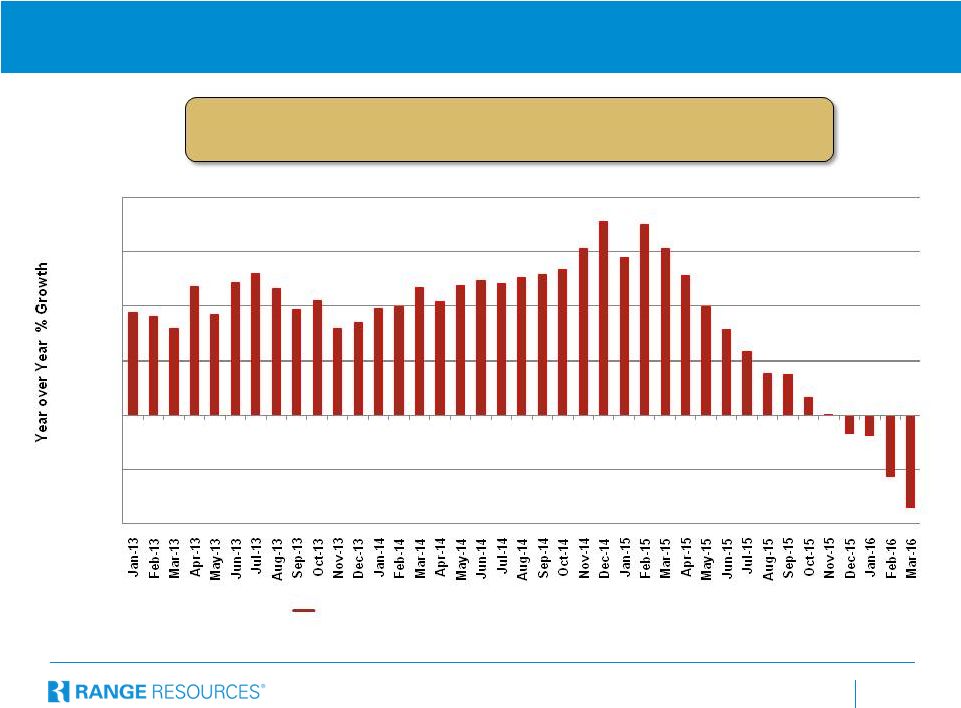

25 Source – Bentek, Jefferies as of April 2016 Monthly Y/Y % Growth – Total US Dry Gas U.S. Natural Gas Production Growth has Slowed Considerably

December 2015 marked the first Y/Y supply decrease since February 2010

December 2015 marked the first Y/Y supply decrease since February 2010

12.0% 10.0% 8.0% 6.0% 4.0% 2.0% 0.0% -2.0% |

26 Track Record of Impressive Reserve Replacement at Low Cost (1) Includes performance and price revisions, excludes SEC required PUD removal due to 5-year rule

(2) From all sources, including price, performance and SEC required PUD removal due to 5-year rule

(3) Percentages shown are compounded annual growth rate 2011 2012 2013 2014 2015 3-Year Average 5-Year Average Reserve Replacement All sources – excluding PUD removals (1) 849% 680% 745% 793% 436% 638% 669% All sources (2) 849% 680% 636% 649% 207% 469% 546% Finding Costs Drill bit only – without acreage (1) $0.76 $0.76 $0.47 $0.44 $0.37 $0.43 $0.53 Drill bit only – with acreage (1) $0.89 $0.86 $0.52 $0.51 $0.40 $0.48 $0.60 All sources – excluding PUD removals (2) $0.89 $0.86 $0.52 $0.54 $0.40 $0.50 $0.61 All sources (2) $0.89 $0.76 $0.61 $0.67 $0.84 $0.68 $0.75 26 |

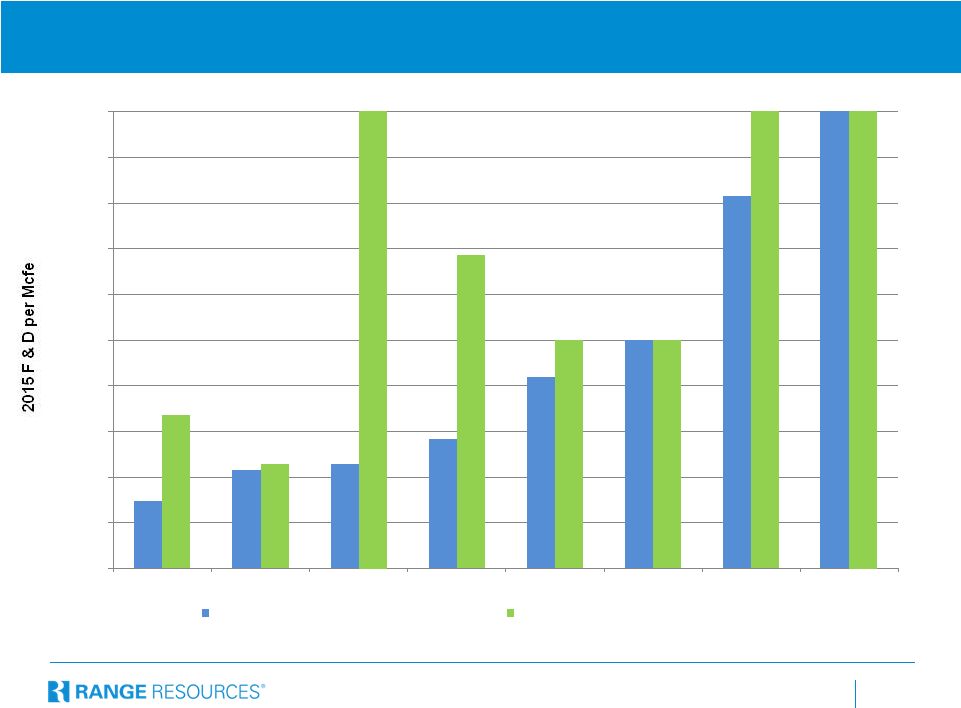

27 $0.00 $0.25 $0.50 $0.75 $1.00 $1.25 $1.50 $1.75 $2.00 $2.25 $2.50 Range Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Adds + perform + price rev into D & C Adds + all adjustments into total cost Peers included – Antero, Cabot, Consol, EQT, Gulfport, Rice & Southwestern N e g a t i v e A d d i t i o n s N e g a t i v e A d d i t i o n s N e g a t i v e A d d i t i o n s N e g a t i v e A d d i t i o n s Appalachia Producer’s 2015 F & D Costs Core Acreage Has Big Impact on Value of Reserves |

28 Range: Low-Cost, Large Scale Source: Wood Mackenzie – February 2016 0.00 0.50 1.00 1.50 2.00 2.50 3.00 3.50 4.00 4.50 5.00 5.50 0 20 40 60 80 100 120 140 160 Remaining net risked resource (tcfe) Range - Southwest Rich EQT - Southwest Rich EQT - WV Rich Southwestern - Rich Gas Core CONSOL - Southwest Rich Noble - Southwest Rich Rice - Greene Antero - WV Rich Range - Pittsburgh Rex - Pittsburgh Magnum Hunter - WV Rich CONSOL - Allegheny Mountains Noble - Allegheny Mountains Range - Rich Gas Core Range - Greene Chevron - Greene ExxonMobil - Pittsburgh Antero - WV Dry EXCO - Pittsburgh CONSOL - Rich Gas Core CONSOL - WV Rich Rice - Southwest Rich AEP - WV Rich EQT - WV Dry Chevron - Rich Gas Core Southwestern - WV Rich CONSOL - WV Dry Chevron - Allegheny Mountains ExxonMobil - WV Dry EQT - Allegheny Mountains Noble - WV Rich Southwestern - WV Dry Noble - WV Dry Chevron - Pittsburgh Wood Mackenzie 2016 Henry Hub price forecast (US$2.60/mcf) 140 tcfe in the Southwest Marcellus alone… Range has lowest breakeven price in the SW Marcellus per Wood Mackenzie Range has lowest breakeven price in the SW Marcellus per Wood Mackenzie |

29 SW PA Super-Rich Area Marcellus Projected 2016 Well Economics

• Southwestern PA – (High Btu case) • 110,000 Net Acres • EUR / 1,000 ft. – 2.40 Bcfe • EUR – 16.0 Bcfe (226 Mbbls condensate, 1,224 Mbbls NGLs & 7.3 Bcf gas) • Drill and Complete Capital – $5.87 MM

($881 K per 1,000 ft.) • Average Lateral Length – 6,660 ft. • F&D – $0.44/mcfe NYMEX Gas Price ROR Strip - 22% $3.00 - 26% Estimated Cumulative Recovery for 2016 Production Forecast Condensate (Mbbls) Residue (Mmcf) NGL w/ Ethane (Mbbls) 1 Year 48 661 111 2 Years 73 1,142 192 3 Years 92 1,555 261 5 Years 120 2,246 378 10 Years 161 3,517 591 20 Years 195 5,157 867 EUR 226 7,279 1,224 • Price includes current and expected differentials less gathering, transportation and processing costs • For flat pricing, oil price assumed to be $40/bbl for 2016, $50/bbl for 2017 then $65/bbl to life with no escalation • NGL is average price including ethane with escalation • Ethane price tied to ethane contracts plus same comparable escalation • Strip dated 12/31/15 with 10-year average $52.14/bbl and $3.25/mcf |

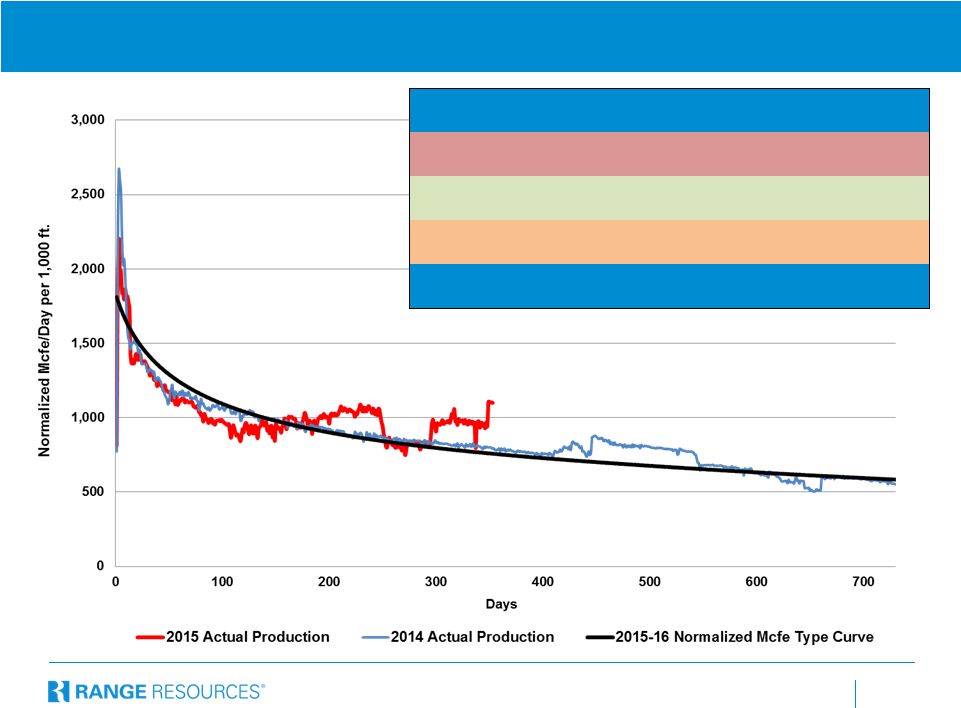

30 Southwest PA - Super-Rich Area 2016 Turn in Line Forecast Improvements Between Years EUR (Bcfe) Well Costs ($ MM) Lateral Lengths (ft.) 2015 Type Curve - TIL 12.9 $5.9 5,367 2016 Type Curve - TIL 16.0 $5.9 6,660 System designed to maximize project economics |

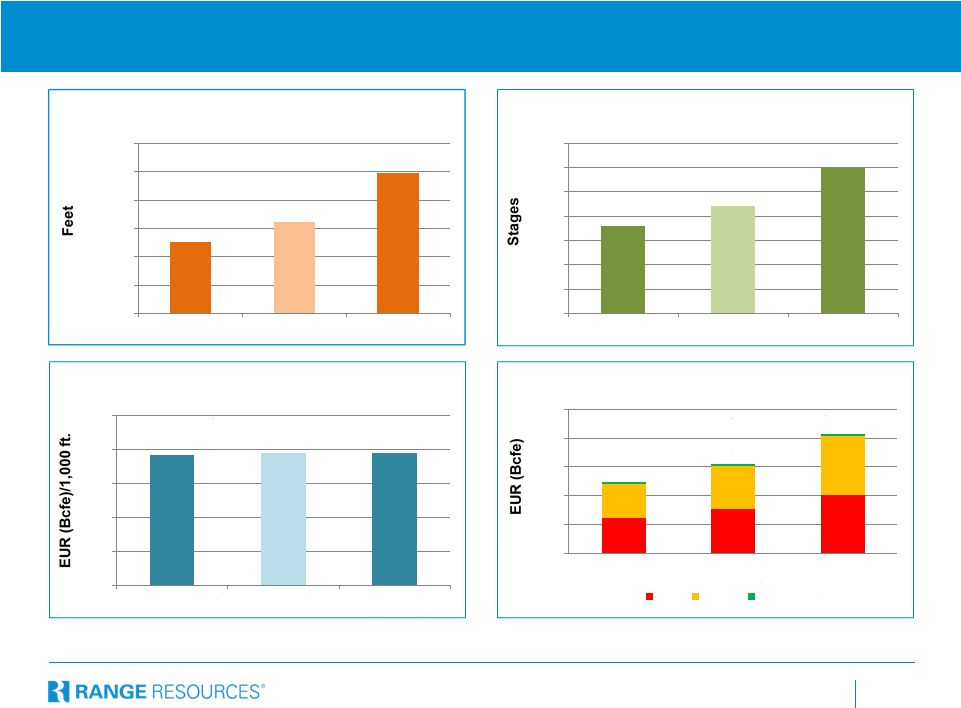

31 Southwest PA – Super-Rich Marcellus All comparisons based on Turned in Line (TIL) wells for each year 2,000 2,500 3,000 3,500 4,000 4,500 5,000 5,500 6,000 6,500 7,000 2014 2015 2016 Horizontal Length (TIL) 5 10 15 20 25 30 35 2014 2015 2016 Average Number of Stages 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 2014 2015 2016 EUR per 1,000 ft. 0.0 5.0 10.0 15.0 20.0 2014 2015 2016 EUR by Year Gas NGLs Condensate |

32 SW PA Wet Area Marcellus Projected 2016 Well Economics • Southwestern PA – (Wet Gas case) • 225,000 Net Acres • EUR / 1,000 ft. – 2.95 Bcfe • EUR – 20.6 Bcfe (56 Mbbls condensate, 1,700 Mbbls NGLs & 10.1 Bcf gas) • Drill and Complete Capital – $5.8 MM

($832 K per 1,000 ft.) • Lateral Length – 6,970 ft. • F&D – $0.34/mcfe • Price includes current and expected differentials less gathering, transportation and processing costs • For flat pricing, oil price assumed to be $40/bbl for 2016, $50/bbl for 2017 then $65/bbl to life with no escalation • NGL is average price including ethane with escalation • Ethane price tied to ethane contracts plus same comparable escalation • Strip dated 12/31/15 with 10-year average $52.14/bbl and $3.25/mcf NYMEX Gas Price ROR Strip - 20% $3.00 - 25% Estimated Cumulative Recovery for 2016 Production Forecast Condensate (Mbbls) Residue (Mmcf) NGL w/ Ethane (Mbbls) 1 Year 20 1,211 204 2 Years 30 2,014 339 3 Years 36 2,665 449 5 Years 44 3,694 622 10 Years 51 5,470 921 20 Years 55 7,654 1,289 EUR 56 10,100 1,700 |

33 Southwest PA - Wet Area 2016 Turn in Line Forecast Improvements Between Years EUR (Bcfe) Well Costs ($ MM) Lateral Lengths (ft.) 2015 Type Curve - TIL 17.6 $5.9 5,955 2016 Type Curve - TIL 20.6 $5.8 6,970 System designed to maximize project economics |

34 Southwest PA – Wet Marcellus 34 2,000 3,000 4,000 5,000 6,000 7,000 8,000 2014 2015 2016 Horizontal Length (TIL) 5 10 15 20 25 30 35 40 2014 2015 2016 Average Number of Stages 1.0 1.5 2.0 2.5 3.0 3.5 2014 2015 2016 EUR per 1,000 ft. 0.0 5.0 10.0 15.0 20.0 25.0 2014 2015 2016 EUR by Year Gas NGLs Condensate All comparisons based on Turned in Line (TIL) wells for each year |

35 • Southwestern PA – (Dry Gas case) • 180,000 Net Acres • EUR / 1,000 ft. – 2.52 Bcf • EUR – 17.6 Bcf • Drill and Complete Capital $5.2

MM ($743 K per 1,000 ft.) • Average Lateral Length – 7,000 ft. • F&D – $0.36/mcf NYMEX Gas Price ROR Strip - 41% $3.00 - 54% Estimated Cumulative Recovery for 2016 Production Forecast Residue (Mmcf) 1 Year 3,039 2 Years 4,674 3 Years 5,866 5 Years 7,609 10 Years 10,392 20 Years 13,633 EUR 17,641 • Price includes current and expected differentials less gathering and transportation costs • Strip dated 12/31/15 with 10-year average $52.14/bbl and $3.25/mcf SW PA Dry Area Marcellus Projected 2016 Well Economics Based on Washington County well data |

36 SW PA– Dry Area 2016 Turn in Line Forecast Improvements Between Years EUR (Bcf) Well Costs ($ MM) Lateral Lengths (ft.) 2015 Type Curve - TIL 17.1 $6.0 6,798 2016 Type Curve - TIL 17.6 $5.2 7,000 System designed to maximize project economics Based on Washington County well data |

37 Southwest PA– Dry Marcellus 37 Based on Washington County well data 2,000 3,000 4,000 5,000 6,000 7,000 8,000 2014 2015 2016 Horizontal Length (TIL) 5 10 15 20 25 30 35 40 2014 2015 2016 Average Number of Stages 1.0 1.5 2.0 2.5 3.0 2014 2015 2016 EUR per 1,000 ft. 0.0 5.0 10.0 15.0 20.0 2014 2015 2016 EUR by Year All comparisons based on Turned in Line (TIL) wells for each year |

38 Utica Wells – Wellhead Pressure vs. Cumulative Production Early Time Production Data (Including Flowback/Test Data) Normalized Gas Cum (Mcf/1000 ft.) RRC DMC Properties well one of the best in the Utica ~25 Mmcfd ~30 Mmcfd ~18 Mmcfd ~12 Mmcfd ~20 Mmcfd *TVD (total vertical depth) With an average pressure gradient of .85 to .95 for these wells, greater TVD equals higher cost and higher pressure 13,200’ TVD* 13,400’ TVD* 11,850’ TVD* 9,206’ TVD* |

39 Utica/Point Pleasant Update • 1 st well estimated to have 15 Bcf EUR, or 2.8 Bcf per 1,000 lateral foot • 2 nd well completed with higher sand concentration and brought online in Q3 2015 with choke management at 13 Mmcf per day • 2 nd well EUR appears to be greater than the first well • 3 rd well appears to be one of the best dry gas Utica wells in the basin • 400,000 net acres in SW PA prospective Note: Townships where Range holds ~2,000+ or more acres are shown outlined above (as January 2016) |

40 Cost & Efficiency Improvements – Northern Marcellus ' ' ' ' ' ' ' ' ' |

Normalized Production Results of Marcellus Tighter Spacing Projects

• Tighter spaced wells turned to sales in 2009 and 2010 • Average lateral length of these wells is 2,861 feet • Well performance not reflective of improved targeting and completion designs • 500 foot spaced wells produced 77% of 1,000 foot spaced wells through the life of the current production • Tighter spaced wells turned to sales in 2009 and 2010 • Average lateral length of these wells is 2,861 feet • Well performance not reflective of improved targeting and completion designs • 500 foot spaced wells produced 77% of 1,000 foot spaced wells through the life of the current production 41 |

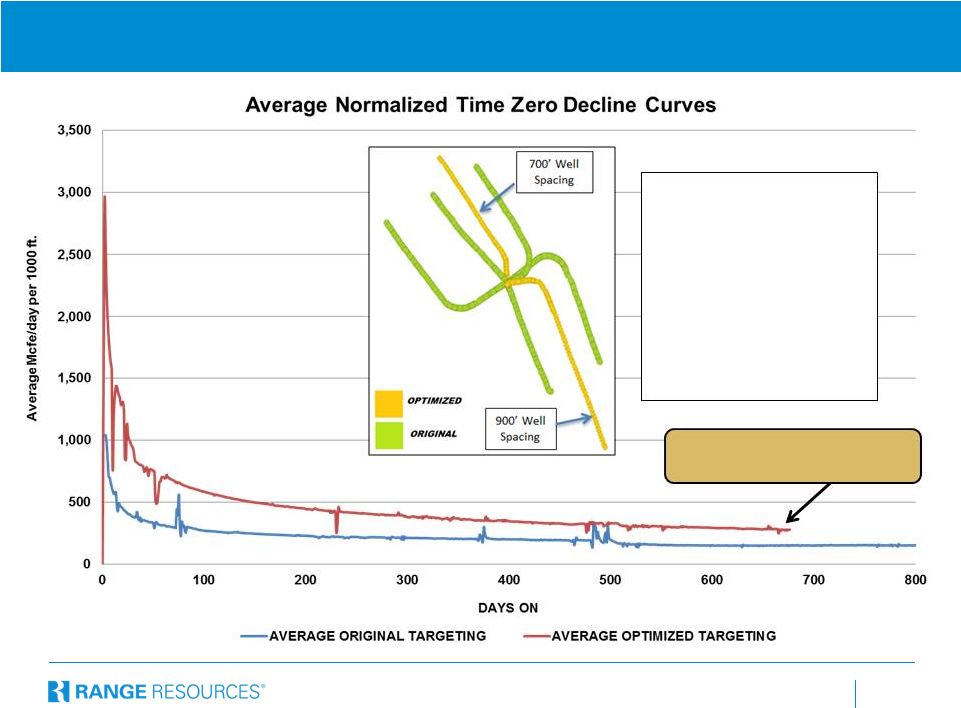

Targeting/Down Spacing Test Results Encouraging • Optimized targeting shows a ~53% increase in cumulative production after 600 days • Normalized well costs were $850,000 less than original wells • No detrimental production impact seen on the original wells Represents New Optimized Completion Method 42 |

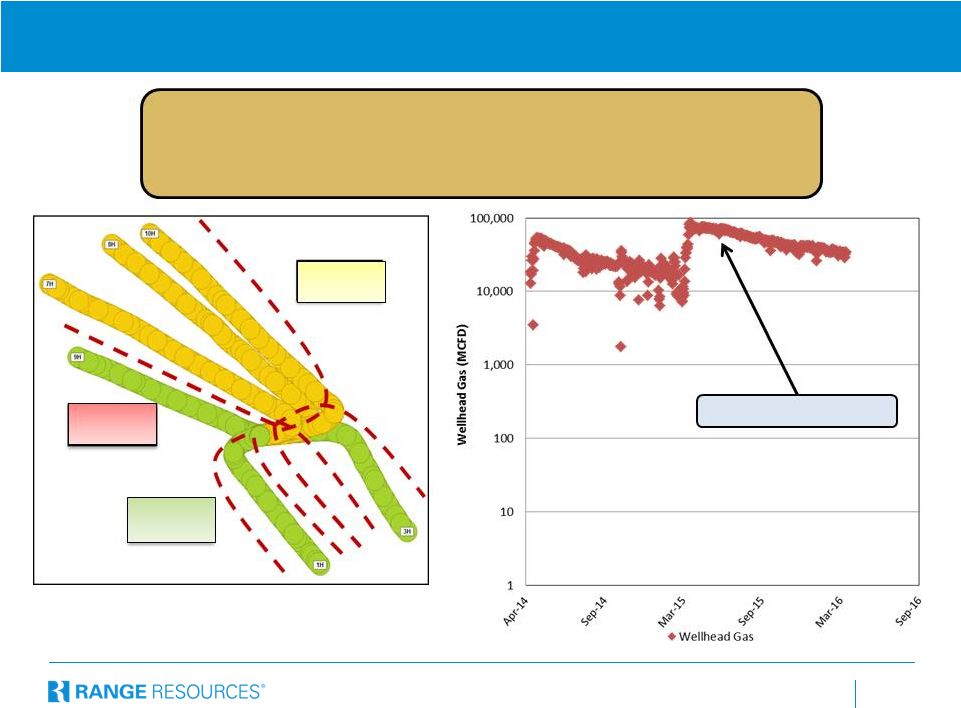

43 43 Returning to Existing Pads – SW Wet Avg EUR/1000 ft.: 3.6+ Bcfe • Ability to target our best areas with 3.6+ Bcfe/1,000 ft. • New wells have EURs 22% higher than the average wet well • Significant cost savings Drilled wells - 2015 Future Locations Additional 5 wells Drilled wells - 2010 |

44 44 Returning to Existing Pads – SW Dry Additional 3 wells Avg EUR/1000 ft.: 3.0+ Bcfe • Ability to target our best areas with 3.0+ Bcfe/1,000 ft. • New wells have EURs 20% higher than the average dry well • Significant cost savings Drilled wells - 2015 Drilled wells - 2014 Future Locations |

45 Gas In Place (GIP) – Marcellus Shale Note: Townships where Range holds ~2,000+ acres (as of January 2016) and estimated as prospective, are outlined green. GIP

– Range estimates.

• GIP is a function of pressure, temperature, thermal maturity, porosity, hydrocarbon saturation and net thickness • Two core areas have been developed in the Marcellus • Condensate and NGLs are in gaseous form in the reservoir |

46 Gas In Place (GIP) – Point Pleasant Bold, outlined portion represents the area of the highest pressure gradients in the Point Pleasant Note: Townships where Range holds ~2,000+ acres (as of January 2016) and estimated as prospective, are outlined green. GIP

– Range estimates. |

47 Gas In Place (GIP) – Upper Devonian Shale • The greatest GIP in the Upper Devonian is found in SW PA • A significant portion of the GIP in the Upper Devonian is located in the wet gas window Note: Townships where Range holds ~2,000+ acres (as of January 2016) and estimated as prospective, are outlined green. GIP

– Range estimates. |

48 Macro Section |

49 Significant Natural Gas Demand Growth Projected – Beginning in 2016 LONG TERM US NATURAL GAS DEMAND ROADMAP (BCF/D) 2016 2017 2018 2019 2020 Cumulative 2015-2020 LNG Exports Sabine Pass 1.2 1.2 0.7 3.1 Freeport 0.5 1.0 1.5 Cove Point 0.8 0.8 Cameron 1.2 0.6 1.8 Corpus Christi 0.8 0.8 1.6 LNG Sub-Total 1.2 1.6 2.6 3.1 0.8 8.9 Mexico/Canada Exports Mexico Net Exports 0.5 0.3 0.3 0.3 0.4 1.8 1.8 Canada net Exports 0.1 0.1 0.1 0.1 0.1 0.5 Mexico/Canada Sub-Total 0.6 0.4 0.4 0.4 0.5 2.3 Power Generation Coal Plant Retirements 0.4 0.3 0.1 0.0 0.3 1.1 Nuclear Retirements - - 01.1 0.1 0.2 0.4 Incremental Electricity Demand 0.1 0.1 0.1 2.0 2.0 4.3 Power Generation Sub-Total 0.5 0.4 0.4 0.3 0.7 2. 2.3 Industrial Methanol 0.3 0 0 0 0 0.4 Ethylene 0 0.4 0.1 - 0.1 0.6 Ammonia 0.5 0.1 0.2 0.1 0.1 1.0 Industrial Sub-Total 0.8 0.4 0.3 0.1 0.2 2.0 Transportation New Fueling Opportunities - - 0.1 0.1 0.1 0.3 Transportation Sub-Total - - 0.1 0.1 0.1 0.3 2016 2017 2018 2019 2020 2020 Total 3.1 2.5 3.7 4.0 2.2 15.8 Research report dated 04/08/2016 |

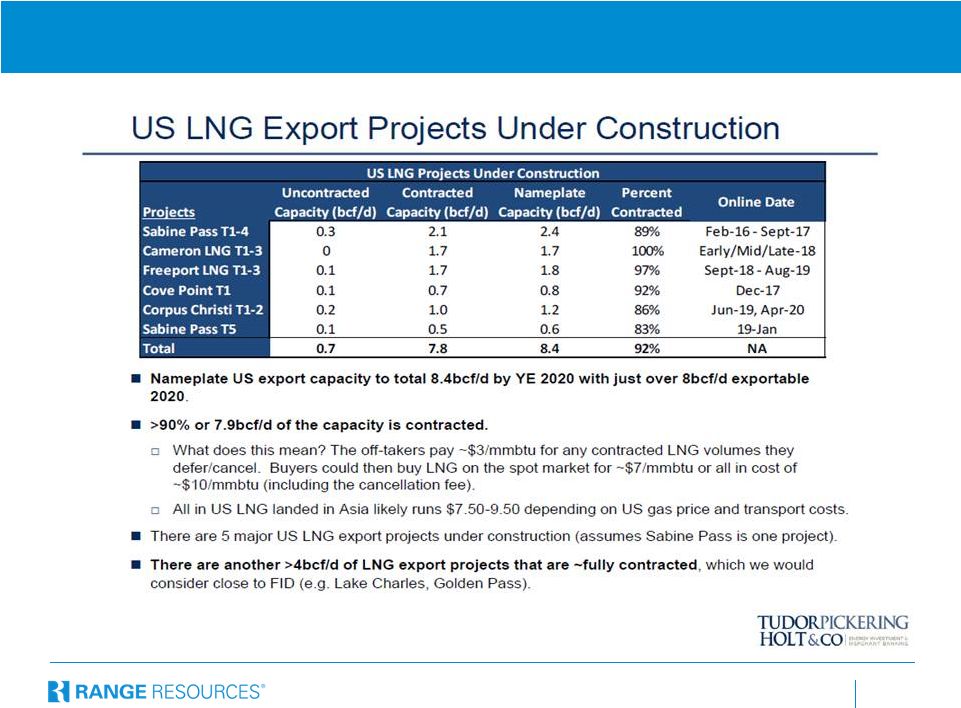

50 U.S. LNG Exports Expected to be ~8 Bcf/day by 2020 – per TPH Research report dated 10/08/2015 |

51 U.S. Natural Gas Exports to Mexico Source – PointLogic, Bloomberg Mexico exports have recently been larger than forecast, with the trend expected to continue 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Jan-13 Jan-14 Jan-15 |

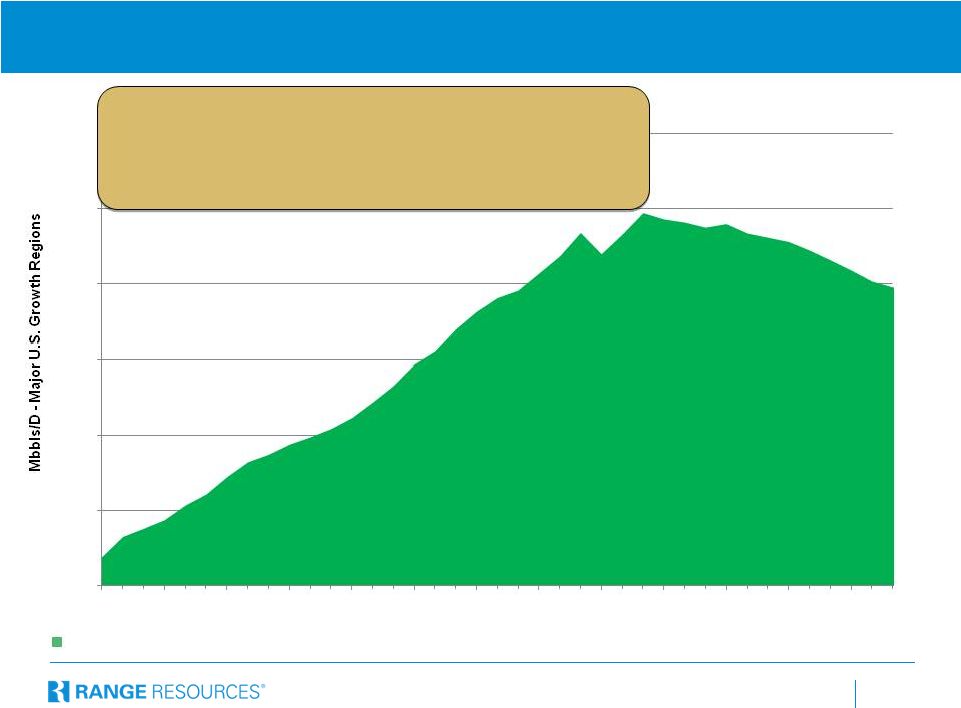

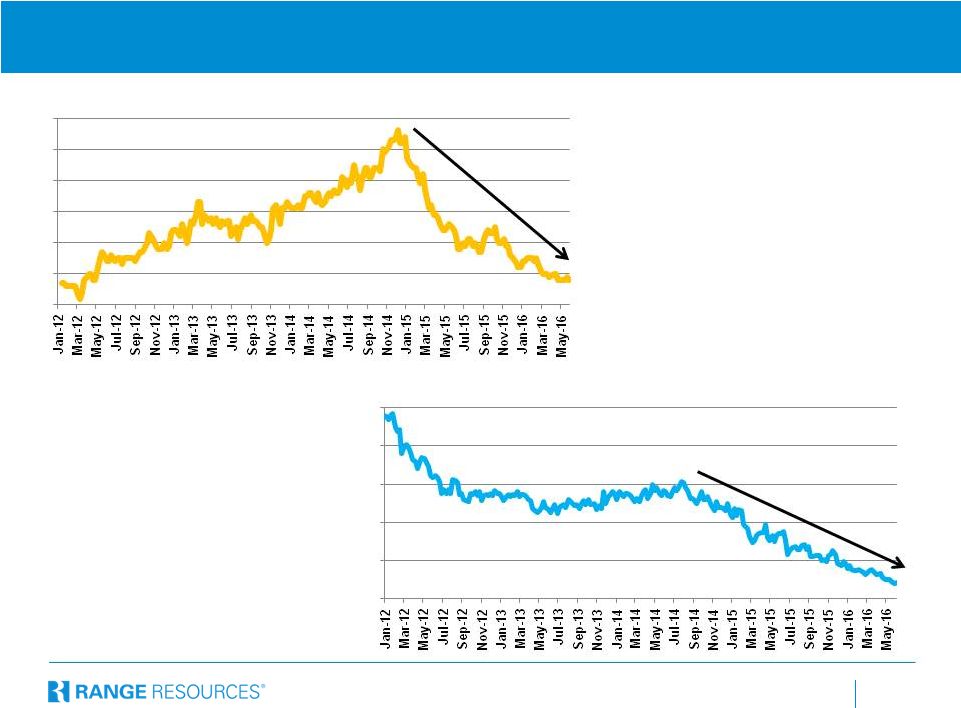

52 U.S. Domestic Oil Production Appears to Have Peaked • 7 major regions account for 95% of domestic oil production growth • Production appears to have peaked in 2 nd Qtr. 2015 • Significant reduction in capital spending in the 7 regions would suggest the trend will continue • Associated gas estimated to be 8 Bcf per day from growth in oil production. Declines in oil production are also impacting associated gas. April EIA data for the 7 Major Growth Producing Regions – Marcellus, Eagle Ford, Permian, Haynesville, Niobrara, Utica & Bakken 3,000 3,500 4,000 4,500 5,000 5,500 6,000 Jan-13 Apr-13 Jul-13 Oct-13 Jan-14 Apr-14 Jul-14 Oct-14 Jan-15 Apr-15 Jul-15 Oct-15 Jan-16 |

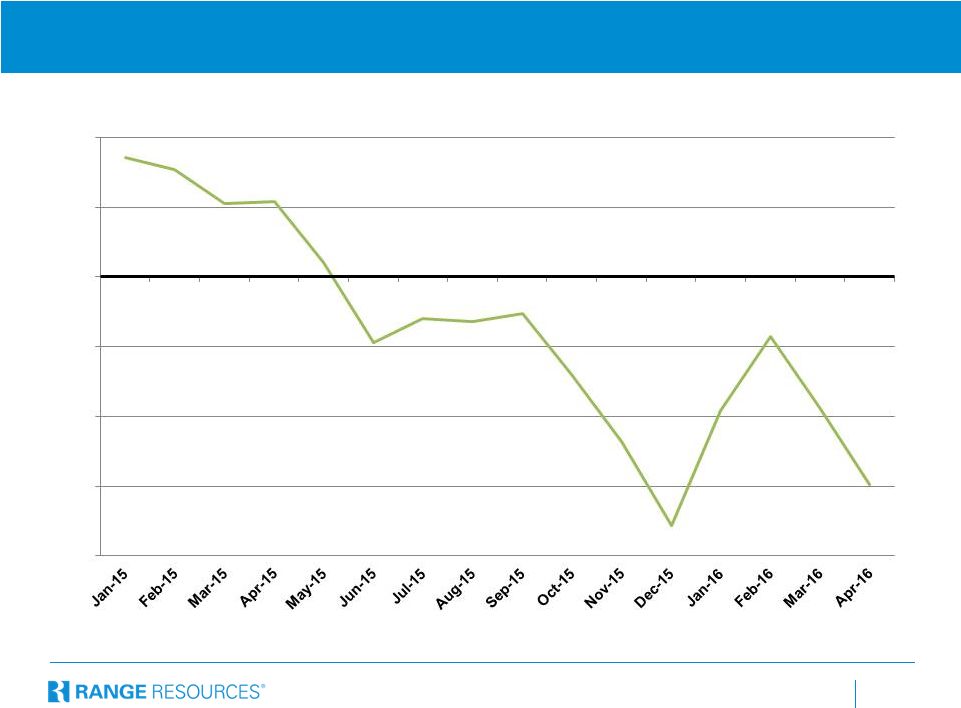

53 Associated Gas Production Source – Bentek, Jefferies as of April 2016 Monthly Y/Y % Growth – Associated US Dry Gas Gas production from ‘oil plays’ expected to continue declining in 2016 due to a lack of drilling within these plays - 10.0% -5.0% 0.0% 5.0% 10.0% 15.0% 20.0% |

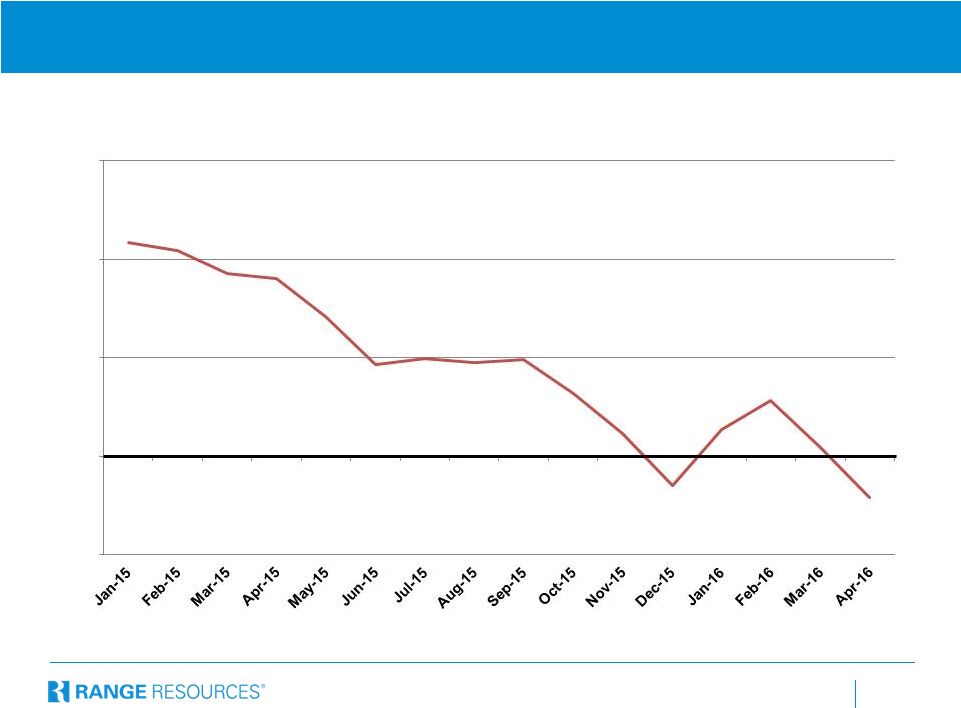

54 Source – Bentek, EIA Non-Appalachian Gas Basins Growth by Area Year over Year % Growth - 8% -6% -4% - 2% 0% 2% 4% |

55 Appalachian Pipeline Flow Data by Region (Mcf/d) Source – RS Energy Group, raw data from Ventyx Velocity Suite and Bloomberg, as of 4/19/2016

0 1,000,000 2,000,000 3,000,000 4,000,000 5,000,000 6,000,000 7,000,000 8,000,000 9,000,000 10,000,000 Jan-10 Jan-11 Jan-12 Jan-13 Jan-14 Jan-15 Jan-16 NE PA SW PA WV Utica |

56 Source – Bentek, EIA Total U.S. Natural Gas Production Growth by Area Year over Year % Growth - 4% 0% 4% 8% 12% Total Gas |

57 • Utica/Point Pleasant rig count down 86% from the peak in 2014 • Marcellus rig count down 86% from the 2014 peak Appalachian Rig Counts Declining Source – RigData as of 6/3/2016 0 10 20 30 40 50 60 Utica / Point Pleasant Rig Count 0 30 60 90 120 150 Marcellus Rig Count |

58 (1) Based on estimated NGL volumes in 1Q 2016 (2) Based on Mont Belvieu NGL prices and weighted average barrel composition for Marcellus

Marcellus NGL Pricing

Realized Marcellus NGL Prices

2015 2016 1Q 2Q 3Q 4Q 1Q NYMEX – WTI (per bbl) $48.62 $57.88 $46.61 $42.22 $33.56 Mont Belvieu Weighted Priced Equivalent $18.05 $18.32 $17.16 $17.24 $13.60 Plant Fees plus Diff. (7.16) (10.64) (11.20) (8.43) (5.30) Marcellus average price before NGL hedges $10.89 $7.71 $5.96 $8.81 $8.30 % of WTI (NGL Pre- hedge / Oil NYMEX) 22% 13% 13% 21% 25% (2) 51% 27% 3% 9% 10% Weighted Avg. Composite Barrel (1) Ethane C2 Propane C3 Iso Butane iC4 Normal Butane NC4 Natural Gasoline C5+ |

59 2015 2016 2017 2018 Appalachia Production Year End Exit Rate 20.6 22.0 24.0 26.5 Appalachia Consumption + Injections 14.4 14.4 14.9 15.4 A Appalachia Gas Surplus for Export 6.2 7.6 9.1 11.1 Takeaway Projects - Northeast (cumulative) 1.1 1.8 3.1 7.8 Takeaway Projects - Southwest (cumulative) 3.3 5.9 15.2 20.4 B Total Takeaway Projects (cumulative) 4.4 7.7 18.3 28.3 Excess Takeaway (B – A) (1.8) 0.1 9.2 17.1 Appalachian Production, Consumption & Takeaway - 2015-2018 Source: Analyst estimates • LNG exports starting in early 2016 • Appears to have sufficient takeaway capacity by 2017 Freely Flowing Overbuilt Summer Constrained 10 20 30 40 50 North East Consumption Regional Storage Injections Announced Takeaway Additions North East Production 0 |

60 Northeast PA Operator Main Line Market Start-up* Capacity – Bcf/d Fully Committed Approved or with FERC 2015 Niagara Expansion Kinder Morgan TGP Canada Q4'15 0.2 Y Y Northern Access 2015 NFG National Fuel Canada Q4'15 0.1 Y Y Leidy Southeast Williams Transco Mid-Atlantic/SE Q4'15 0.5 Y Y East Side Expansion Nisource Columbia Mid-Atlantic/SE Q4'15 0.3 Y Y 2016 SoNo Iroquois Access Dominion Iroquois Canada Q2'16 0.3 N N Algonquin AIM Spectra Algonquin NE Q4'16 0.4 Y Y 2017 Northern Access 2016 NFG National Fuel Canada H2'17 0.4 Y Y Constitution Williams Constitution NE H2'17 0.7 Y Y Atlantic Bridge Spectra Algonquin NE H2'17 0.7 N Y 2018 Atlantic Sunrise Williams Transco Mid-Atlantic/SE H1'18 1.7 Y Y Access Northeast Spectra Algonquin NE H2'18 1.0 N Y Diamond East Williams Transco NE H2'18 1.0 N N PennEast AGT NE H2‘18 1.0 Y Y Southwest Operator Main Line Market Start-up Capacity – Bcf/d Fully Committed Approved or with FERC 2015 REX Zone 3 Full Reversal Tall Grass REX Midwest Q2'15 1.2 Y Y TGP Backhaul / Broad Run Kinder Morgan TGP Gulf Coast Q4'15 0.6 Y Y TETCO OPEN Spectra TETCO Gulf Coast Q4'15 0.6 Y Y Uniontown to Gas City Spectra TETCO Midwest Q3'15 0.4 Y Y 2016 Gulf Expansion Ph1 Spectra TETCO Gulf Coast Q4'16 0.3 Y Y Clarington West Expansion Tall Grass REX Midwest Q4'16 1.6 N N Zone 3 Capacity Enhancement Tall Grass REX Midwest Q4'16 0.8 Y Y Announced Appalachian Basin Takeaway Projects – 1 of 2 Note: Data subject to change as projects are approved and built. Highlighted projects where Range is participating. * Start-up dates reflect announced operator in-service dates |

61 Southwest Operator Main Line Market Start-up* Capacity – Bcf/d Fully Committed Approved or with FERC 2017 Rover Ph1 ETP Midwest/Canada/ Gulf Coast Q2'17 1.9 Y Y Rayne/Leach Xpress Nisource Columbia Gulf Coast Q3'17 1.5 Y Y SW Louisiana Kinder Morgan TGP Gulf Coast Q3'17 0.9 Y Y Rover Ph2 ETP Midwest/Canada/ Gulf Coast Q3'17 1.3 Y Y Adair SW Spectra TETCO Gulf Coast Q4'17 0.2 Y Y Access South Spectra TETCO Gulf Coast Q4'17 0.3 Y Y Gulf Expansion Ph2 Spectra TETCO Gulf Coast Q4'17 0.4 Y Y NEXUS Spectra Midwest/Canada Q4'17 1.5 Y Y ANR Utica Transcanada ANR Midwest/Canada Q4'17 0.6 N N Cove Point LNG Dominion NE Q4'17 0.7 Y Y 2018 TGP Backhaul / Broad Run Expansion Kinder Morgan TGP Gulf Coast Q2’18 0.2 Y Y Mountain Valley NextEra/EQT Mid-Atlantic/SE Q4'18 2.0 Y Y Western Marcellus Williams Transco Mid-Atlantic/SE Q4'18 1.5 N N Atlantic Coast Duke/Dominion Mid-Atlantic/SE Q4'18 1.5 Y Y Total NE Appalachia to Canada 1.0 Total NE Appalachia to NE 4.4 Total NE Appalachia to Mid-Atlantic/SE 2.5 Total NE Appalachia Additions 7.8 Total SW Appalachia to Mid-Atlantic/SE 5.0 Total SW Appalachia to Midwest/Canada 8.2 Total SW Appalachia to Gulf Coast 6.5 Total SW Appalachia to NE 0.7 Total SW Appalachia Additions 20.4 Overall Total Additions for Appalachian Basin 28.3 Announced Appalachian Basin Takeaway Projects – 2 of 2 Note: Data subject to change as projects are approved and built. Highlighted projects where Range is participating. * Start-up dates reflect announced operator in-service dates (2015 – 2018) Existing capacity added by YE 2014 2.8 SW .6 NE 3.4 Total |

62 What Does the Future’s Strip Price Indicate for Regional Basis?

TCO Pool 2015 -$0.12 2020 -$0.21 Dom South 2015 -$1.21 2020 -$0.53 TETCO M3 2015 -$0.44 2020 $0.00 Chicago CG 2015 $0.15 2020 $0.04 CG Mainline 2015 -$0.07 2020 -$0.05 Dawn 2015 $0.30 2020 -$0.06 MichCon 2015 $0.19 2020 $0.05 Algonquin 2015 $2.24 2020 $1.05 Transco Z6 (NY) 2015 $1.01 2020 +$1.03 Transco Z4 2015 -$0.01 2020 +$0.03 Source = Bloomberg, Inside-FERC Basis (04/22/16) Prices $/Mmbtu North East anticipated takeaway projects should improve future basis in the Appalachian Basin North East anticipated takeaway projects should improve future basis in the Appalachian Basin Leidy 2015 -$1.57 2020 -$0.71 Transco Z6 (NNY) 2015 $0.51 2020 $0.31 |

63 Financial Detail Appendix |

64 Range Maintains an Orderly Debt Maturity Ladder Senior Secured Revolving Credit Facility Senior Subordinated Notes Senior Notes Interest Rate 1.8% 5.75% 5.0% 5.0% 4.875% $31 Million Drawn Borrowing Base - $3 Billion $31 $500 $600 $750 $750 0 500 1,000 1,500 2,000 2,500 3,000 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 Bond Incurrence Limit - $1.5 Billion Bank Commitment - $2 Billion |

65 Strong, Simple Balance Sheet YE 2013 YE 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 ($ in millions) Bank borrowings (1) $500 $723 $912 $364 $987 $95 $31 Sr. Notes (1) 750 750 750 750 Sr. Sub. Notes (1) 2,641 2,350 2,350 2,350 1,850 1,850 1,850 Less: Cash (0) (0) (0) (0) (0) (0) (0) Net debt 3,141 3,073 3,262 3,464 3,587 2,695 2,631 Common equity 2,414 3,456 3,490 3,381 3,085 2,760 2,672 Total capitalization $5,555 $6,529 $6,752 $6,845 $6,672 $5,455 $5,303 Debt-to capitalization 57% 47% 48% 50% 54% 49% 50% Debt/EBITDAX 2.8x 2.6x 2.9x 3.3x 3.7x 3.0x 3.3x Liquidity (2) $1,166 $1,172 $980 $1,527 $876 $1,267 (3) $1,238 (3) (1) Excludes unamortized debt issuance costs (2) Liquidity based on bank commitment amount, which excludes additional liquidity under total borrowing base

(3) Liquidity limited based on senior subordinated notes indenture provision Debt at lowest level in past 3 years |

June 2014 •Called high cost 8% notes, reducing annual interest expense by $24 million or $0.06 mcfe

•Redemption funded by an equal sized equity offering aimed at accelerating

balance sheet October

2014 •Renewed bank credit agreement with larger facility size, borrowing base, bank group and enhanced flexibility

•Annual borrowing base redeterminations and a 5-year maturity

•Ability to release collateral during transition to investment grade

March 2015 •Unanimous reaffirmation of $3 billion borrowing base and $2 billion commitments

•Elimination of debt-to-ebitdax covenant; replaced with interest coverage

test and a forward-looking asset coverage test •Announced

closure of Oklahoma City office, saving approximately $18 million annually in administrative costs May 2015 •Opportunistically accessed a strong high yield debt market issuing $750 million 10-year notes at 4.875%

•Issued senior notes continuing to lay foundation for an investment grade balance

sheet •Coupon remains the lowest of any high yield energy issuer of

any rating year-to-date August

2015 •Portion of proceeds from 4.875% senior notes offering used to redeem 6.75% senior subordinated notes due 2020

•Reduction in coupon on $500 million principal redeemed of 1.875% amounts to

annual interest savings of ~$9.4 million 2016

•Sold Nora field for $876 million on 12/30/15, paying down revolving credit

facility •Bradford county assets sold 3/28/16 for $110

million •Signed purchase and sale agreement for central Oklahoma

assets for $77 million Early, Continuous Action Taken

to Prepare for Low Prices 66

|

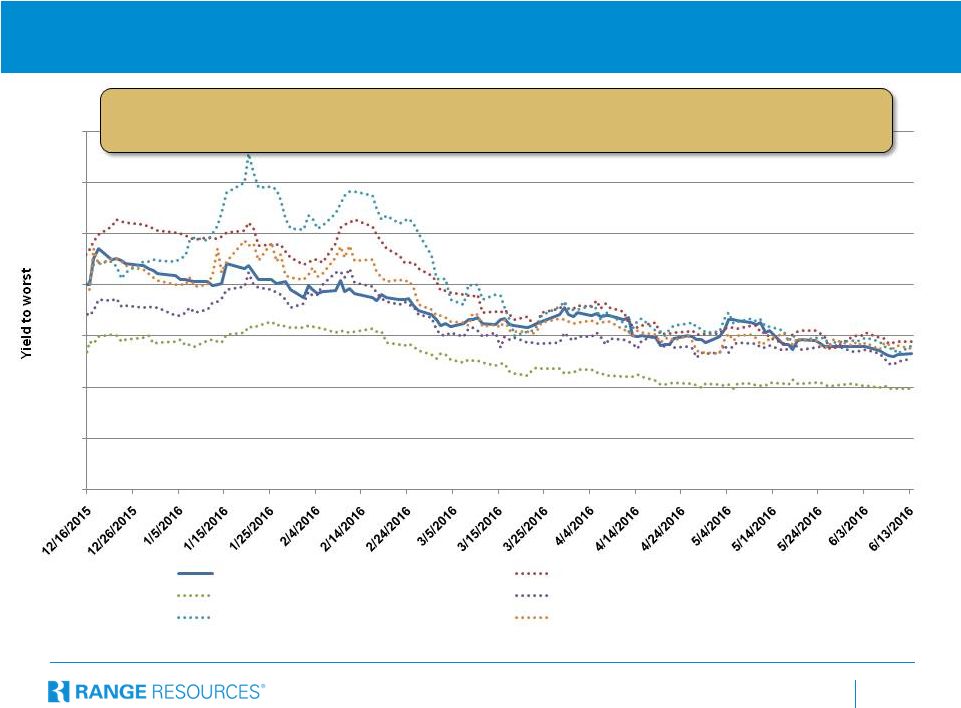

67 Range Bonds Continue to Trade Well 67 Source: Bloomberg as of 6/13/2016 Since December highs, Range bonds tightened significantly and continue to trade well

relative to a group of high quality peer bonds of similar duration

0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% Range Resources 4.875% 15-MAY-25 Antero Resources 5.625% 01-JUN-23 Cimarex 4.375% 01-JUN-24 Concho Resources 5.500% 01-APR-23 Continental Resources 3.800% 01-JUN-24 Newfield Exploration 5.625% 01-JUL-24 |

69 Period Volumes Hedged (Mmbtu/day) Average Floor Price ($/Mmbtu) Gas Hedging 2Q 2016 Swaps 3Q 2016 Swaps 4Q 2016 Swaps 760,000 760,000 760,000 $3.21 $3.22 $3.24 2017 Swaps 2018 Swaps 205,000 50,000 $2.83 $2.88 Oil Hedging 2Q 2016 Swaps 3Q 2016 Swaps 4Q 2016 Swaps 6,000 5,750 5,750 $59.21 $58.73 $58.73 2017 Swaps 1,000 $50.13 Gas and Oil Hedging Status As of 04/25/2016 – For quarterly detail of hedges, see RRC website |

70 Period Volumes Hedged (bbls/day) Hedged Price (1) ($/gal) Ethane (C2) 2H 2016 Swaps 2017 Swaps 500 1,000 $0.22 $0.25 Propane (C3) 2016 Swaps 5,500 $0.60 Normal Butane (NC4) 2Q 2016 Swaps 2H 2016 Swaps 3,918 4,000 $0.66 $0.66 Natural Gasoline (C5) 2Q 2016 Swaps 2H 2016 Swaps 2017 Swaps 3,250 3,500 1,000 $1.14 $1.11 $0.92 Natural Gas Liquids Hedging Status (1) NGL hedges have Mont Belvieu as the underlying index Conversion Factor: One barrel = 42 gallons As of 04/25/2016 – For quarterly detail of hedges, see RRC website |

71 Contact Information Range Resources Corporation 100 Throckmorton, Suite 1200 Fort Worth, Texas 76102 Laith Sando, Vice President – Investor Relations (817) 869-4267 lsando@rangeresources.com David Amend, Investor Relations Manager (817) 869-4266 damend@rangeresources.com Michael Freeman, Senior Financial Analyst (817) 869-4264 mfreeman@rangeresources.com www.rangeresources.com |

72 Important Additional Information This communication does not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities or a solicitation of any vote or approval. This communication relates to a proposed business combination between Range and MRD. In connection with the proposed transaction, Range intends to file with the SEC a registration statement on Form S-4 that will include a joint proxy statement of Range and MRD that also constitutes a prospectus of Range. Each of Range and MRD also plan to file other relevant documents with the SEC regarding the proposed transactions. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended. Any definitive joint proxy statement/prospectus(es) for Range and/or MRD (if and when available) will be mailed to shareholders of Range and/or MRD, as applicable. INVESTORS AND SECURITY HOLDERS OF RANGE AND MRD ARE URGED TO READ THE PROXY STATEMENT(S), REGISTRATION STATEMENT(S), PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS THAT MAY BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents

containing important information about Range and MRD, once such documents are filed with

the SEC through the website maintained

by the SEC at http://www.sec.gov.

Copies of the documents filed with the SEC by Range will be available free of charge on Range’s internet website at

http://www.rangeresources.com or by contacting Range’s Investor Relations Department by email at lsando@rangeresources.com,

damend@rangeresources.com, mfreeman@rangeresources.com,

or by phone at 817-869-4267. Copies of the documents filed with the SEC by MRD will be available free of charge on MRD’s internet website at

http://www.memorialrd.com

or by phone at 713-588-8339.

Range, MRD and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about the directors and executive officers of MRD is set forth in MRD’s proxy statement for its 2016 annual meeting of shareholders, which was filed with the SEC on April 1, 2016. Information about the directors and executive officers of Range is set forth in its proxy statement for its 2016 annual meeting of shareholders, which was filed with the SEC on April 8, 2016. These documents can be obtained free of charge from the sources indicated above. Other information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC when such materials become available. Investors should read the joint proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from Range or MRD using the sources indicated above. |