UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03015

Ohio National Fund, Inc.

|

(Exact name of registrant as specified in charter) | ||

| One Financial Way, Cincinnati, Ohio

|

45242

| |

|

(Address of principal executive offices)

|

(Zip Code)

| |

| CT Corporation 300 E. Lombard St., Suite 1400 Baltimore, MD 21202

| ||

|

(Name and address of agent for service) | ||

Registrant’s telephone number, including area code: 513-794-6971

Date of fiscal year end: December 31

Date of reporting period: June 30, 2019

Item 1. Reports To Stockholders.

TABLE OF CONTENTS

| 1 | ||||

| The following pages contain Performance, Comments from Adviser/Sub-Adviser, Change in Value of $10,000 Investment, Portfolio Composition, Top Holdings and Schedule of Investments (all of which are unaudited) for each of the Fund’s Portfolios: |

||||

| 3 | ||||

| 9 | ||||

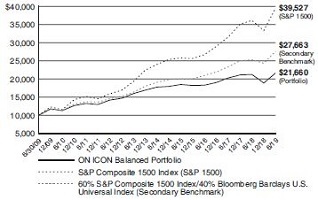

| ON BlackRock Balanced Allocation Portfolio (formerly the ON Omni Portfolio) |

15 | |||

| 24 | ||||

| 28 | ||||

| 32 | ||||

| 37 | ||||

| 40 | ||||

| 44 | ||||

| 48 | ||||

| 56 | ||||

| 59 | ||||

| 70 | ||||

| 72 | ||||

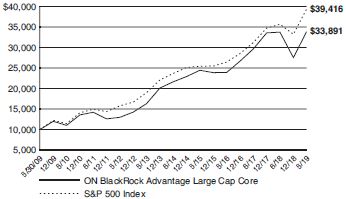

| ON BlackRock Advantage Large Cap Core Portfolio (formerly the ON Bristol Portfolio) |

76 | |||

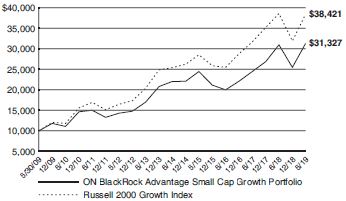

| ON BlackRock Advantage Small Cap Growth Portfolio (formerly the ON Bryton Growth Portfolio) |

82 | |||

| 90 | ||||

| 95 | ||||

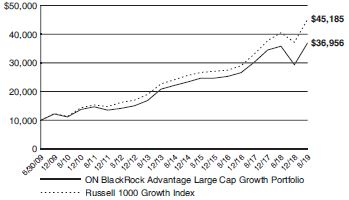

| ON BlackRock Advantage Large Cap Growth Portfolio (formerly the ON Bristol Growth Portfolio) |

102 | |||

| 108 | ||||

| 122 | ||||

| 125 | ||||

| 128 | ||||

| 131 | ||||

| 135 | ||||

| 138 | ||||

| 141 | ||||

| 144 | ||||

| 150 | ||||

| 156 | ||||

| 177 | ||||

| 182 | ||||

1

2

| Ohio National Fund, Inc. | ON Equity Portfolio (Unaudited) |

| 3 | (continued) |

| Ohio National Fund, Inc. | ON Equity Portfolio (Unaudited) (Continued) |

| 4 | (continued) |

| Ohio National Fund, Inc. | ON Equity Portfolio (Unaudited) (Continued) |

| (1) | Composition of Portfolio subject to change. |

| (2) | Short-term investments have been excluded from the list of Top 10 Portfolio Holdings. |

| (3) | Top 10 Portfolio Holdings is presented at an individual security level. Total investment exposure by issuer may be higher. |

| (4) | Sectors (Common Stocks): |

| % of Net Assets | ||||

| Information Technology |

21.5 | |||

| Health Care |

13.7 | |||

| Financials |

13.5 | |||

| Industrials |

10.0 | |||

| Consumer Discretionary |

9.7 | |||

| Communication Services |

9.1 | |||

| Consumer Staples |

6.1 | |||

| Energy |

4.2 | |||

| Real Estate |

3.7 | |||

| Utilities |

3.6 | |||

| Materials |

2.6 | |||

|

|

|

|||

| 97.7 | ||||

|

|

|

|||

5

| Ohio National Fund, Inc. | ON Equity Portfolio |

| Schedule of Investments |

June 30, 2019 (Unaudited) | |

| 6 | (continued) |

| Ohio National Fund, Inc. | ON Equity Portfolio (Continued) |

| Schedule of Investments |

June 30, 2019 (Unaudited) | |

| 7 | (continued) |

| Ohio National Fund, Inc. | ON Equity Portfolio (Continued) |

| Schedule of Investments |

June 30, 2019 (Unaudited) | |

Percentages are stated as a percent of net assets.

Abbreviations:

| ADR: | American Depositary Receipts |

Footnotes:

| (a) | Non-income producing security. |

| (b) | Rate represents the seven-day yield at June 30, 2019. |

| (c) | Represents cost for financial reporting purposes, which may differ from cost basis for federal income tax purposes. See also Note 7 of the Notes to Financial Statements. |

| (d) | Includes $233,100 of cash pledged as collateral for the futures contracts outstanding at June 30, 2019. See also the following Schedule of Open Futures Contracts. |

The accompanying notes are an integral part of these financial statements.

| Schedule of Open Futures Contracts |

June 30, 2019 (Unaudited) | |||||||||||

| Description |

Number of contracts |

Expiration Date | Notional Amount |

Value |

Unrealized |

Variation Margin | ||||||

| CME E-mini S&P 500 Index - Long |

37 | September 20, 2019 | $5,408,660 | $5,446,770 | $38,110 | $5,926 |

The accompanying notes are an integral part of these financial statements.

8

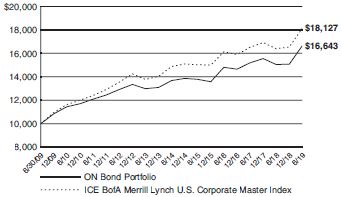

| Ohio National Fund, Inc. | ON Bond Portfolio (Unaudited) |

| 9 | (continued) |

| Ohio National Fund, Inc. | ON Bond Portfolio (Unaudited) (Continued) |

| (1) | Composition of Portfolio subject to change. |

| (2) | Short-term investments have been excluded from the list of Top 10 Portfolio Holdings. |

| (3) | Top 10 Portfolio Holdings is presented at an individual security level. Total investment exposure by issuer may be higher. |

| (4) | Sectors (Corporate Bonds, Asset-Backed Securities): |

| % of Net Assets | ||||

| Financials |

26.5 | |||

| Energy |

12.7 | |||

| Industrials |

11.2 | |||

| Materials |

10.7 | |||

| Utilities |

8.0 | |||

| Real Estate |

7.4 | |||

| Consumer Staples |

6.1 | |||

| Consumer Discretionary |

5.9 | |||

| Health Care |

3.6 | |||

| Communication Services |

3.4 | |||

| Information Technology |

1.9 | |||

|

|

|

|||

| 97.4 | ||||

|

|

|

10

| Ohio National Fund, Inc. | ON Bond Portfolio |

| Schedule of Investments |

June 30, 2019 (Unaudited) | |

| Corporate Bonds – 94.7% | Rate | Maturity | Face Amount | Value | ||||||||||||||||

| COMMUNICATION SERVICES – 3.4% |

||||||||||||||||||||

| AT&T, Inc. (Diversified Telecom. Svs.) |

QL + 118 | 06/12/2024 | $2,000,000 | $ | 2,025,146 | |||||||||||||||

| AT&T, Inc. (Diversified Telecom. Svs.) |

3.400% | 05/15/2025 | 1,000,000 | 1,027,448 | ||||||||||||||||

| AT&T, Inc. (Diversified Telecom. Svs.) |

4.900% | 08/15/2037 | 1,000,000 | 1,080,109 | ||||||||||||||||

| Discovery Communications LLC (Media) |

3.950% | 03/20/2028 | 900,000 | 927,549 | ||||||||||||||||

| Lamar Media Corp. (Media) |

5.750% | 02/01/2026 | 500,000 | 525,625 | ||||||||||||||||

| Sirius XM Radio, Inc. (Media) |

(a | ) | 5.375% | 04/15/2025 | 1,000,000 | 1,031,250 | ||||||||||||||

| Time Warner Cable LLC (Media) |

6.550% | 05/01/2037 | 850,000 | 981,324 | ||||||||||||||||

| Verizon Communications, Inc. (Diversified Telecom. Svs.) |

4.500% | 08/10/2033 | 1,000,000 | 1,125,793 | ||||||||||||||||

|

|

|

|||||||||||||||||||

| 8,724,244 | ||||||||||||||||||||

|

|

|

|||||||||||||||||||

| CONSUMER DISCRETIONARY – 5.9% |

||||||||||||||||||||

| Amazon.com, Inc. (Internet & Direct Marketing Retail) |

3.875% | 08/22/2037 | 900,000 | 992,071 | ||||||||||||||||

| Aptiv PLC (Auto Components) |

4.350% | 03/15/2029 | 1,000,000 | 1,053,398 | ||||||||||||||||

| Dollar General Corp. (Multiline Retail) |

4.125% | 05/01/2028 | 2,000,000 | 2,127,576 | ||||||||||||||||

| Expedia Group, Inc. (Internet & Direct Marketing Retail) |

5.000% | 02/15/2026 | 3,000,000 | 3,266,552 | ||||||||||||||||

| General Motors Co. (Automobiles) |

5.000% | 04/01/2035 | 900,000 | 884,057 | ||||||||||||||||

| Hasbro, Inc. (Leisure Products) |

3.500% | 09/15/2027 | 2,000,000 | 2,028,731 | ||||||||||||||||

| Lear Corp. (Auto Components) |

3.800% | 09/15/2027 | 4,000,000 | 3,957,679 | ||||||||||||||||

| Magna International, Inc. (Auto Components) |

3.625% | 06/15/2024 | 1,000,000 | 1,046,258 | ||||||||||||||||

|

|

|

|||||||||||||||||||

| 15,356,322 | ||||||||||||||||||||

|

|

|

|||||||||||||||||||

| CONSUMER STAPLES – 6.1% |

||||||||||||||||||||

| Anheuser-Busch Cos. LLC / Anheuser-Busch InBev Worldwide, Inc. (Beverages) |

4.700% | 02/01/2036 | 2,000,000 | 2,199,333 | ||||||||||||||||

| Anheuser-Busch Cos. LLC / Anheuser-Busch InBev Worldwide, Inc. (Beverages) |

4.900% | 02/01/2046 | 1,000,000 | 1,111,466 | ||||||||||||||||

| Anheuser-Busch InBev Worldwide, Inc. (Beverages) |

4.600% | 04/15/2048 | 2,000,000 | 2,147,717 | ||||||||||||||||

| B.A.T. Capital Corp. (Tobacco) |

4.390% | 08/15/2037 | 3,000,000 | 2,851,613 | ||||||||||||||||

| Campbell Soup Co. (Food Products) |

4.150% | 03/15/2028 | 2,000,000 | 2,087,008 | ||||||||||||||||

| J.M. Smucker Co. / The (Food Products) |

3.375% | 12/15/2027 | 3,000,000 | 3,064,454 | ||||||||||||||||

| Mead Johnson Nutrition Co. (Food Products) |

3.000% | 11/15/2020 | 900,000 | 907,955 | ||||||||||||||||

| Philip Morris International, Inc. (Tobacco) |

4.125% | 05/17/2021 | 1,250,000 | 1,288,654 | ||||||||||||||||

|

|

|

|||||||||||||||||||

| 15,658,200 | ||||||||||||||||||||

|

|

|

|||||||||||||||||||

| ENERGY – 12.7% |

||||||||||||||||||||

| Apache Corp. (Oil, Gas & Consumable Fuels) |

4.375% | 10/15/2028 | 1,800,000 | 1,880,123 | ||||||||||||||||

| Baker Hughes, a GE Co. LLC / Baker Hughes Co-Obligor, Inc. (Energy Equip. & Svs.) |

4.080% | 12/15/2047 | 2,000,000 | 1,936,279 | ||||||||||||||||

| BP Capital Markets America, Inc. (Oil, Gas & Consumable Fuels) |

3.017% | 01/16/2027 | 900,000 | 918,794 | ||||||||||||||||

| Buckeye Partners LP (Oil, Gas & Consumable Fuels) |

4.875% | 02/01/2021 | 1,000,000 | 1,015,777 | ||||||||||||||||

| Canadian Natural Resources Ltd. (Oil, Gas & Consumable Fuels) |

4.950% | 06/01/2047 | 3,000,000 | 3,416,114 | ||||||||||||||||

| Chevron Corp. (Oil, Gas & Consumable Fuels) |

2.895% | 03/03/2024 | 900,000 | 929,264 | ||||||||||||||||

| Columbia Pipeline Group, Inc. (Oil, Gas & Consumable Fuels) |

4.500% | 06/01/2025 | 1,000,000 | 1,074,591 | ||||||||||||||||

| Concho Resources, Inc. (Oil, Gas & Consumable Fuels) |

3.750% | 10/01/2027 | 2,000,000 | 2,071,978 | ||||||||||||||||

| Energy Transfer Operating LP (Oil, Gas & Consumable Fuels) |

4.950% | 06/15/2028 | 2,000,000 | 2,185,633 | ||||||||||||||||

| EQM Midstream Partners LP (Oil, Gas & Consumable Fuels) |

4.750% | 07/15/2023 | 900,000 | 932,796 | ||||||||||||||||

| Exxon Mobil Corp. (Oil, Gas & Consumable Fuels) |

4.114% | 03/01/2046 | 900,000 | 1,034,350 | ||||||||||||||||

| Halliburton Co. (Energy Equip. & Svs.) |

4.850% | 11/15/2035 | 900,000 | 959,021 | ||||||||||||||||

| Kinder Morgan Energy Partners LP (Oil, Gas & Consumable Fuels) |

4.150% | 03/01/2022 | 1,000,000 | 1,042,622 | ||||||||||||||||

| Kinder Morgan, Inc. (Oil, Gas & Consumable Fuels) |

5.300% | 12/01/2034 | 1,000,000 | 1,130,179 | ||||||||||||||||

| Marathon Oil Corp. (Oil, Gas & Consumable Fuels) |

3.850% | 06/01/2025 | 850,000 | 880,740 | ||||||||||||||||

| Marathon Petroleum Corp. (Oil, Gas & Consumable Fuels) |

4.750% | 09/15/2044 | 1,000,000 | 1,030,367 | ||||||||||||||||

| ONEOK, Inc. (Oil, Gas & Consumable Fuels) |

6.000% | 06/15/2035 | 1,000,000 | 1,137,011 | ||||||||||||||||

| Patterson-UTI Energy, Inc. (Energy Equip. & Svs.) |

3.950% | 02/01/2028 | 1,000,000 | 982,863 | ||||||||||||||||

| Peabody Energy Corp. (Oil, Gas & Consumable Fuels) |

(a | ) | 6.000% | 03/31/2022 | 1,800,000 | 1,842,750 | ||||||||||||||

| Shell International Finance BV (Oil, Gas & Consumable Fuels) |

4.000% | 05/10/2046 | 900,000 | 986,770 | ||||||||||||||||

| Texas Eastern Transmission LP (Oil, Gas & Consumable Fuels) |

(a | ) | 4.150% | 01/15/2048 | 1,000,000 | 1,019,380 | ||||||||||||||

| Transocean Pontus Ltd. (Energy Equip. & Svs.) |

(a | ) | 6.125% | 08/01/2025 | 1,181,250 | 1,216,688 | ||||||||||||||

| Williams Cos., Inc. / The (Oil, Gas & Consumable Fuels) |

3.350% | 08/15/2022 | 1,000,000 | 1,018,859 | ||||||||||||||||

| Williams Cos., Inc. / The (Oil, Gas & Consumable Fuels) |

3.750% | 06/15/2027 | 1,000,000 | 1,033,236 | ||||||||||||||||

| Williams Cos., Inc. / The (Oil, Gas & Consumable Fuels) |

5.400% | 03/04/2044 | 1,000,000 | 1,102,913 | ||||||||||||||||

|

|

|

|||||||||||||||||||

| 32,779,098 | ||||||||||||||||||||

|

|

|

|||||||||||||||||||

| FINANCIALS – 26.5% |

||||||||||||||||||||

| AerCap Ireland Capital DAC /AerCap Global Aviation Trust (Diversified Financial Svs.) |

3.300% | 01/23/2023 | 3,000,000 | 3,025,553 | ||||||||||||||||

| Aflac, Inc. (Insurance) |

3.625% | 06/15/2023 | 1,425,000 | 1,494,247 | ||||||||||||||||

| American Express Co. (Consumer Finance) |

QL + 75 | 08/03/2023 | 1,000,000 | 1,005,196 | ||||||||||||||||

| American International Group, Inc. (Insurance) |

3.875% | 01/15/2035 | 2,500,000 | 2,489,501 | ||||||||||||||||

| Bank of America Corp. (Banks) |

3.875% | 08/01/2025 | 850,000 | 909,200 | ||||||||||||||||

| Bank of America Corp. (Rate is fixed until 01/23/2025, at which point, the rate becomes QL + 81) (Banks) |

(b | ) | 3.366% | 01/23/2026 | 2,000,000 | 2,062,660 | ||||||||||||||

| Bank of America Corp. (Rate is fixed until 04/24/2037, at which point, the rate becomes QL + 181) (Banks) |

(b | ) | 4.244% | 04/24/2038 | 1,000,000 | 1,089,441 | ||||||||||||||

| 11 | (continued) |

| Ohio National Fund, Inc. | ON Bond Portfolio (Continued) |

| Schedule of Investments |

June 30, 2019 (Unaudited) | |

| Corporate Bonds (Continued) | Rate | Maturity | Face Amount | Value | ||||||||||||||

| FINANCIALS (continued) |

||||||||||||||||||

| Bank of Montreal (Rate is fixed until 12/15/2027, at which point, the rate becomes USSW5 + 143) (Banks) |

(b) | 3.803% | 12/15/2032 | $2,800,000 | $ | 2,839,508 | ||||||||||||

| Berkshire Hathaway, Inc. (Diversified Financial Svs.) |

3.125% | 03/15/2026 | 900,000 | 934,684 | ||||||||||||||

| Branch Banking & Trust Co. (Banks) |

3.625% | 09/16/2025 | 1,180,000 | 1,240,510 | ||||||||||||||

| Citigroup, Inc. (Banks) |

4.400% | 06/10/2025 | 2,000,000 | 2,134,421 | ||||||||||||||

| Citigroup, Inc. (Banks) |

3.700% | 01/12/2026 | 1,000,000 | 1,052,306 | ||||||||||||||

| Deutsche Bank AG (Capital Markets) |

2.700% | 07/13/2020 | 5,000,000 | 4,978,525 | ||||||||||||||

| Discover Bank (Rate is fixed until 08/09/2023, at which point, the rate becomes USSW5 + 173) (Banks) |

(b) | 4.682% | 08/09/2028 | 2,000,000 | 2,072,520 | |||||||||||||

| E*TRADE Financial Corp. (Capital Markets) |

2.950% | 08/24/2022 | 1,800,000 | 1,817,126 | ||||||||||||||

| Ford Motor Credit Co. LLC (Consumer Finance) |

3.157% | 08/04/2020 | 1,400,000 | 1,405,022 | ||||||||||||||

| Ford Motor Credit Co. LLC (Consumer Finance) |

QL + 88 | 10/12/2021 | 2,000,000 | 1,968,544 | ||||||||||||||

| General Motors Financial Co., Inc. (Consumer Finance) |

3.200% | 07/06/2021 | 2,000,000 | 2,017,016 | ||||||||||||||

| General Motors Financial Co., Inc. (Consumer Finance) |

QL + 99 | 01/05/2023 | 2,000,000 | 1,970,976 | ||||||||||||||

| General Motors Financial Co., Inc. (Consumer Finance) |

4.350% | 01/17/2027 | 1,000,000 | 1,018,224 | ||||||||||||||

| Goldman Sachs Group, Inc. / The (Capital Markets) |

3.750% | 05/22/2025 | 2,000,000 | 2,090,807 | ||||||||||||||

| Goldman Sachs Group, Inc. / The (Rate is fixed until 04/23/2028, at which point, the rate becomes QL + 116) (Capital Markets) |

(b) | 3.814% | 04/23/2029 | 2,000,000 | 2,082,779 | |||||||||||||

| Intercontinental Exchange, Inc. (Capital Markets) |

3.750% | 12/01/2025 | 1,000,000 | 1,068,416 | ||||||||||||||

| Jefferies Group LLC / Jefferies Group Capital Finance, Inc. (Diversified Financial Svs.) |

4.850% | 01/15/2027 | 1,800,000 | 1,856,475 | ||||||||||||||

| JPMorgan Chase & Co. (Banks) |

3.900% | 07/15/2025 | 2,023,000 | 2,159,079 | ||||||||||||||

| JPMorgan Chase & Co. (Banks) |

3.625% | 12/01/2027 | 1,800,000 | 1,854,054 | ||||||||||||||

| Marsh & McLennan Cos., Inc. (Insurance) |

3.500% | 06/03/2024 | 1,400,000 | 1,459,113 | ||||||||||||||

| Morgan Stanley (Capital Markets) |

QL + 140 | 10/24/2023 | 1,260,000 | 1,284,104 | ||||||||||||||

| Morgan Stanley (Capital Markets) |

3.950% | 04/23/2027 | 1,000,000 | 1,045,521 | ||||||||||||||

| Morgan Stanley (Rate is fixed until 05/06/2029, at which point, the rate becomes QL + 116) (Capital Markets) |

(b) | 4.431% | 01/23/2030 | 2,000,000 | 2,214,180 | |||||||||||||

| Nasdaq, Inc. (Capital Markets) |

3.850% | 06/30/2026 | 2,000,000 | 2,096,098 | ||||||||||||||

| Progressive Corp. /The (Insurance) |

2.450% | 01/15/2027 | 900,000 | 890,394 | ||||||||||||||

| Synchrony Financial (Consumer Finance) |

4.250% | 08/15/2024 | 1,000,000 | 1,041,428 | ||||||||||||||

| TD Ameritrade Holding Corp. (Capital Markets) |

3.300% | 04/01/2027 | 1,900,000 | 1,959,515 | ||||||||||||||

| Teachers Insurance & Annuity Association of America (Insurance) |

(a) | 4.270% | 05/15/2047 | 900,000 | 973,361 | |||||||||||||

| Wells Fargo & Co. (Banks) |

3.000% | 04/22/2026 | 900,000 | 910,089 | ||||||||||||||

| Wells Fargo & Co. (Banks) |

4.650% | 11/04/2044 | 1,000,000 | 1,112,219 | ||||||||||||||

| Wells Fargo Bank NA (Banks) |

3.550% | 08/14/2023 | 2,000,000 | 2,086,318 | ||||||||||||||

| Westpac Banking Corp. (Banks) |

QL + 57 | 01/11/2023 | 1,000,000 | 997,854 | ||||||||||||||

| Westpac Banking Corp. (Rate is fixed until 11/23/2026, at which point, the rate becomes USISDA05 + 224) (Banks) |

(b) | 4.322% | 11/23/2031 | 1,800,000 | 1,862,847 | |||||||||||||

|

|

|

|||||||||||||||||

| 68,569,831 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| HEALTH CARE – 3.6% |

||||||||||||||||||

| AbbVie, Inc. (Biotechnology) |

2.900% | 11/06/2022 | 850,000 | 855,334 | ||||||||||||||

| Bayer U.S. Finance II LLC (Pharmaceuticals) |

(a) | 4.875% | 06/25/2048 | 2,000,000 | 2,051,452 | |||||||||||||

| Celgene Corp. (Biotechnology) |

3.875% | 08/15/2025 | 2,000,000 | 2,142,453 | ||||||||||||||

| CVS Health Corp. (Health Care Providers & Svs.) |

4.100% | 03/25/2025 | 3,000,000 | 3,162,378 | ||||||||||||||

| UnitedHealth Group, Inc. (Health Care Providers & Svs.) |

3.875% | 12/15/2028 | 900,000 | 979,355 | ||||||||||||||

|

|

|

|||||||||||||||||

| 9,190,972 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| INDUSTRIALS – 8.5% |

||||||||||||||||||

| Aircastle Ltd. (Trading Companies & Distributors) |

4.125% | 05/01/2024 | 4,000,000 | 4,094,999 | ||||||||||||||

| Boeing Co. / The (Aerospace & Defense) |

3.200% | 03/01/2029 | 2,900,000 | 2,991,297 | ||||||||||||||

| Burlington Northern Santa Fe LLC (Road & Rail) |

4.550% | 09/01/2044 | 900,000 | 1,041,535 | ||||||||||||||

| FedEx Corp. (Air Freight & Logistics) |

4.900% | 01/15/2034 | 2,000,000 | 2,325,524 | ||||||||||||||

| Lockheed Martin Corp. (Aerospace & Defense) |

3.600% | 03/01/2035 | 1,000,000 | 1,042,723 | ||||||||||||||

| Northrop Grumman Corp. (Aerospace & Defense) |

2.930% | 01/15/2025 | 3,900,000 | 3,976,729 | ||||||||||||||

| Parker-Hannifin Corp. (Machinery) |

4.200% | 11/21/2034 | 1,400,000 | 1,528,772 | ||||||||||||||

| Union Pacific Corp. (Road &Rail) |

3.250% | 08/15/2025 | 1,000,000 | 1,039,649 | ||||||||||||||

| United Rentals North America, Inc. (Trading Companies & Distributors) |

5.250% | 01/15/2030 | 2,000,000 | 2,055,000 | ||||||||||||||

| Waste Connections, Inc. (Commercial Svs. & Supplies) |

4.250% | 12/01/2028 | 1,800,000 | 1,967,584 | ||||||||||||||

|

|

|

|||||||||||||||||

| 22,063,812 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| INFORMATION TECHNOLOGY – 1.9% |

||||||||||||||||||

| Apple, Inc. (Tech. Hardware, Storage & Periph.) |

3.350% | 02/09/2027 | 900,000 | 945,233 | ||||||||||||||

| Hewlett Packard Enterprise Co. (Tech. Hardware, Storage & Periph.) |

4.900% | 10/15/2025 | 850,000 | 928,742 | ||||||||||||||

| Microsoft Corp. (Software) |

4.100% | 02/06/2037 | 900,000 | 1,026,403 | ||||||||||||||

| Microsoft Corp. (Software) |

4.450% | 11/03/2045 | 900,000 | 1,078,081 | ||||||||||||||

| Seagate HDD Cayman (Tech. Hardware, Storage & Periph.) |

4.875% | 03/01/2024 | 900,000 | 923,410 | ||||||||||||||

|

|

|

|||||||||||||||||

| 4,901,869 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| 12 | (continued) |

| Ohio National Fund, Inc. | ON Bond Portfolio (Continued) |

| Schedule of Investments |

June 30, 2019 (Unaudited) | |

| Corporate Bonds (Continued) | Rate | Maturity | Face Amount | Value | ||||||||||||||

| MATERIALS – 10.7% |

||||||||||||||||||

| Anglo American Capital PLC (Metals & Mining) |

(a) | 4.750% | 04/10/2027 | $1,000,000 | $ | 1,058,752 | ||||||||||||

| Anglo American Capital PLC (Metals & Mining) |

(a) | 4.000% | 09/11/2027 | 900,000 | 903,070 | |||||||||||||

| Dow Chemical Co. / The (Chemicals) |

4.250% | 10/01/2034 | 1,900,000 | 1,972,541 | ||||||||||||||

| FMC Corp. (Chemicals) |

3.950% | 02/01/2022 | 1,000,000 | 1,030,679 | ||||||||||||||

| Kinross Gold Corp. (Metals & Mining) |

4.500% | 07/15/2027 | 2,900,000 | 2,929,000 | ||||||||||||||

| Martin Marietta Materials, Inc. (Construction Materials) |

3.500% | 12/15/2027 | 4,000,000 | 3,991,409 | ||||||||||||||

| Martin Marietta Materials, Inc. (Construction Materials) |

4.250% | 12/15/2047 | 1,000,000 | 934,793 | ||||||||||||||

| Mosaic Co. / The (Chemicals) |

4.050% | 11/15/2027 | 3,000,000 | 3,099,295 | ||||||||||||||

| Nutrien Ltd. (Chemicals) |

4.200% | 04/01/2029 | 1,900,000 | 2,050,321 | ||||||||||||||

| Packaging Corp. of America (Containers & Packaging) |

3.400% | 12/15/2027 | 2,000,000 | 2,021,704 | ||||||||||||||

| RPM International, Inc. (Chemicals) |

4.250% | 01/15/2048 | 3,000,000 | 2,733,332 | ||||||||||||||

| Syngenta Finance N.V. (Chemicals) |

(a) | 4.441% | 04/24/2023 | 1,000,000 | 1,039,147 | |||||||||||||

| Syngenta Finance N.V. (Chemicals) |

(a) | 5.182% | 04/24/2028 | 1,000,000 | 1,039,841 | |||||||||||||

| Yamana Gold, Inc. (Metals & Mining) |

4.625% | 12/15/2027 | 2,800,000 | 2,861,079 | ||||||||||||||

|

|

|

|||||||||||||||||

| 27,664,963 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| REAL ESTATE – 7.4% |

||||||||||||||||||

| Alexandria Real Estate Equities, Inc. (Equity REIT) |

3.950% | 01/15/2028 | 1,000,000 | 1,051,192 | ||||||||||||||

| Boston Properties LP (Equity REIT) |

3.125% | 09/01/2023 | 925,000 | 948,340 | ||||||||||||||

| Crown Castle International Corp. (Equity REIT) |

4.000% | 03/01/2027 | 1,800,000 | 1,888,436 | ||||||||||||||

| Federal Realty Investment Trust (Equity REIT) |

3.000% | 08/01/2022 | 1,425,000 | 1,446,978 | ||||||||||||||

| Federal Realty Investment Trust (Equity REIT) |

3.250% | 07/15/2027 | 2,000,000 | 2,040,738 | ||||||||||||||

| HCP, Inc. (Equity REIT) |

4.000% | 06/01/2025 | 1,500,000 | 1,585,258 | ||||||||||||||

| Healthcare Realty Trust, Inc. (Equity REIT) |

3.875% | 05/01/2025 | 1,400,000 | 1,445,053 | ||||||||||||||

| Healthcare Realty Trust, Inc. (Equity REIT) |

3.625% | 01/15/2028 | 1,000,000 | 1,009,170 | ||||||||||||||

| Highwoods Realty LP (Equity REIT) |

4.200% | 04/15/2029 | 1,850,000 | 1,934,571 | ||||||||||||||

| Hospitality Properties Trust (Equity REIT) |

4.250% | 02/15/2021 | 1,000,000 | 1,010,933 | ||||||||||||||

| Kilroy Realty LP (Equity REIT) |

3.450% | 12/15/2024 | 1,000,000 | 1,028,353 | ||||||||||||||

| SITE Centers Corp. (Equity REIT) |

3.625% | 02/01/2025 | 1,721,000 | 1,740,596 | ||||||||||||||

| Vornado Realty LP (Equity REIT) |

3.500% | 01/15/2025 | 1,000,000 | 1,020,162 | ||||||||||||||

| Welltower, Inc. (Equity REIT) |

4.250% | 04/01/2026 | 1,000,000 | 1,065,304 | ||||||||||||||

|

|

|

|||||||||||||||||

| 19,215,084 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| UTILITIES – 8.0% |

||||||||||||||||||

| AEP Transmission Co. LLC (Electric Utilities) |

4.000% | 12/01/2046 | 900,000 | 940,573 | ||||||||||||||

| American Water Capital Corp. (Water Utilities) |

4.300% | 12/01/2042 | 1,400,000 | 1,518,675 | ||||||||||||||

| Berkshire Hathaway Energy Co. (Multi-Utilities) |

3.250% | 04/15/2028 | 1,900,000 | 1,960,799 | ||||||||||||||

| Commonwealth Edison Co. (Electric Utilities) |

4.350% | 11/15/2045 | 900,000 | 1,019,332 | ||||||||||||||

| Connecticut Light & Power Co. / The (Electric Utilities) |

4.000% | 04/01/2048 | 900,000 | 982,727 | ||||||||||||||

| DTE Electric Co. (Electric Utilities) |

3.375% | 03/01/2025 | 1,000,000 | 1,041,475 | ||||||||||||||

| Duke Energy Corp. (Electric Utilities) |

3.750% | 09/01/2046 | 900,000 | 879,982 | ||||||||||||||

| Duke Energy Florida LLC (Electric Utilities) |

2.100% | 12/15/2019 | 500,000 | 499,166 | ||||||||||||||

| Eversource Energy (Electric Utilities) |

3.300% | 01/15/2028 | 1,000,000 | 1,020,050 | ||||||||||||||

| FirstEnergy Transmission LLC (Electric Utilities) |

(a) | 4.550% | 04/01/2049 | 1,800,000 | 1,966,220 | |||||||||||||

| Jersey Central Power & Light Co. (Electric Utilities) |

(a) | 4.300% | 01/15/2026 | 900,000 | 966,092 | |||||||||||||

| LG&E & KU Energy LLC (Electric Utilities) |

4.375% | 10/01/2021 | 1,000,000 | 1,036,153 | ||||||||||||||

| NextEra Energy Capital Holdings, Inc. (Electric Utilities) |

2.800% | 01/15/2023 | 3,000,000 | 3,019,947 | ||||||||||||||

| Public Service Electric & Gas Co. (Multi-Utilities) |

3.600% | 12/01/2047 | 1,500,000 | 1,537,003 | ||||||||||||||

| Southwest Gas Corp. (Gas Utilities) |

3.875% | 04/01/2022 | 1,000,000 | 1,023,273 | ||||||||||||||

| Virginia Electric & Power Co. (Electric Utilities) |

3.450% | 02/15/2024 | 1,255,000 | 1,306,904 | ||||||||||||||

|

|

|

|||||||||||||||||

| 20,718,371 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| Total Corporate Bonds (Cost $235,839,745) |

$ | 244,842,766 | ||||||||||||||||

|

|

|

|||||||||||||||||

| Asset-Backed Securities – 2.7% | Rate | Maturity | Face Amount | Value | ||||||||||||||

| INDUSTRIALS – 2.7% |

||||||||||||||||||

| Air Canada 2017-1 Class B Pass Through Trust |

(a) | 3.700% | 01/15/2026 | $2,377,646 | $ | 2,369,324 | ||||||||||||

| American Airlines 2015-1 Class B Pass Through Trust |

3.700% | 05/01/2023 | 3,068,398 | 3,084,354 | ||||||||||||||

| United Airlines 2016-1 Class B Pass Through Trust |

3.650% | 01/07/2026 | 1,645,833 | 1,646,261 | ||||||||||||||

|

|

|

|||||||||||||||||

| Total Asset-Backed Securities (Cost $7,094,739) |

$ | 7,099,939 | ||||||||||||||||

|

|

|

|||||||||||||||||

| Sovereign Issues – 1.2% | Rate | Maturity | Face Amount | Value | ||||||||||||||

| Mexico Government International Bond |

3.750% | 01/11/2028 | $3,000,000 | $ | 3,056,250 | |||||||||||||

|

|

|

|||||||||||||||||

| Total Sovereign Issues (Cost $2,988,734) |

$ | 3,056,250 | ||||||||||||||||

|

|

|

|||||||||||||||||

| 13 | (continued) |

| Ohio National Fund, Inc. | ON Bond Portfolio (Continued) |

| Schedule of Investments |

June 30, 2019 (Unaudited) | |

| Money Market Funds – 0.6% | Shares | Value | ||||||||||

| State Street Institutional Liquid Reserves Fund Institutional Class, 2.449% |

(c | ) | 1,468,904 | $ | 1,469,198 | |||||||

|

|

|

|||||||||||

| Total Money Market Funds (Cost $1,469,198) |

$ | 1,469,198 | ||||||||||

|

|

|

|||||||||||

| Total Investments – 99.2% (Cost $247,392,416) |

(d | ) | $ | 256,468,153 | ||||||||

| Other Assets in Excess of Liabilities – 0.8% |

1,942,397 | |||||||||||

|

|

|

|||||||||||

| Net Assets – 100.0% |

$ | 258,410,550 | ||||||||||

|

|

|

|||||||||||

Percentages are stated as a percent of net assets.

Abbreviations:

| QL: | Quarterly U.S. LIBOR Rate, 2.320% at 06/30/2019 | |

| USISDA05: | USD ICE Swap Rate 11:00am NY 5 Year, 1.758% at 06/30/2019 | |

| USSW5: | USD Swap Semi 30/360 5 Year, 1.765% at 06/30/2019 |

Footnotes:

| (a) | Security exempt from registration under Regulation D of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified buyers under Rule 144A. At June 30, 2019, the value of these securities totaled $17,477,327, or 6.8% of the Portfolio’s net assets. |

| (b) | Security is a fixed-then-variable rate instrument in which the coupon or dividend rate is fixed until a later specified date, then is adjusted periodically. Rates stated, including interest rate caps and floors, if any, are those in effect at June 30, 2019. |

| (c) | Rate represents the seven-day yield at June 30, 2019. |

| (d) | Represents cost for financial reporting purposes, which may differ from cost basis for federal income tax purposes. See also Note 7 of the Notes to Financial Statements. |

The accompanying notes are an integral part of these financial statements.

14

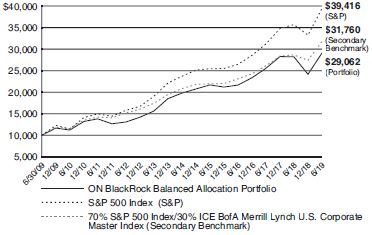

| Ohio National Fund, Inc. | ON BlackRock Balanced Allocation Portfolio (Unaudited) |

| 15 | (continued) |

| Ohio National Fund, Inc. | ON BlackRock Balanced Allocation Portfolio (Unaudited) (Continued) |

| 16 | (continued) |

| Ohio National Fund, Inc. | ON BlackRock Balanced Allocation Portfolio (Unaudited) (Continued) |

| (1) | Composition of Portfolio subject to change. |

| (2) | Short-term investments have been excluded from the list of Top 10 Portfolio Holdings. |

| (3) | Top 10 Portfolio Holdings is presented at an individual security level. Total investment exposure by issuer may be higher. |

| (4) | Sectors (Common Stocks, Corporate Bonds, Asset-Backed Securities): |

| % of Net Assets | ||||

| Financials |

18.3 | |||

| Information Technology |

16.8 | |||

| Health Care |

11.6 | |||

| Industrials |

9.5 | |||

| Consumer Discretionary |

8.6 | |||

| Communication Services |

8.3 | |||

| Energy |

7.2 | |||

| Consumer Staples |

5.4 | |||

| Utilities |

4.5 | |||

| Real Estate |

3.9 | |||

| Materials |

3.7 | |||

|

|

|

|||

| 97.8 | ||||

|

|

|

17

| Ohio National Fund, Inc. | ON BlackRock Balanced Allocation Portfolio |

| Schedule of Investments |

June 30, 2019 (Unaudited) | |

| Common Stocks – 71.7% | Shares | Value | ||||||||

| COMMUNICATION SERVICES – 7.0% |

||||||||||

| Activision Blizzard, Inc. (Entertainment) |

813 | $ | 38,374 | |||||||

| Alphabet, Inc. Class A (Interactive Media & Svs.) |

(a) | 222 | 240,381 | |||||||

| Alphabet, Inc. Class C (Interactive Media & Svs.) |

(a) | 531 | 573,963 | |||||||

| AT&T, Inc. (Diversified Telecom. Svs.) |

4,176 | 139,938 | ||||||||

| CBS Corp. Class B (Media) |

601 | 29,990 | ||||||||

| Comcast Corp. Class A (Media) |

12,774 | 540,085 | ||||||||

| Facebook, Inc. Class A (Interactive Media & Svs.) |

(a) | 4,850 | 936,050 | |||||||

| Fox Corp. Class A (Media) |

357 | 13,080 | ||||||||

| Fox Corp. Class B (Media) |

685 | 25,023 | ||||||||

| Interpublic Group of Cos., Inc. / The (Media) |

21,298 | 481,122 | ||||||||

| Netflix, Inc. (Entertainment) |

(a) | 419 | 153,907 | |||||||

| Pinterest, Inc. Class A (Interactive Media & Svs.) |

(a) | 927 | 25,233 | |||||||

| Sinclair Broadcast Group, Inc. Class A (Media) |

406 | 21,774 | ||||||||

| Verizon Communications, Inc. (Diversified Telecom. Svs.) |

13,696 | 782,452 | ||||||||

| Viacom, Inc. Class B (Entertainment) |

2,878 | 85,966 | ||||||||

|

|

|

|||||||||

| 4,087,338 | ||||||||||

|

|

|

|||||||||

| CONSUMER DISCRETIONARY – 6.9% |

||||||||||

| Advance Auto Parts, Inc. (Specialty Retail) |

517 | 79,690 | ||||||||

| Alibaba Group Holding Ltd. – ADR (Internet & Direct Marketing Retail) |

(a) | 950 | 160,977 | |||||||

| Amazon.com, Inc. (Internet & Direct Marketing Retail) |

(a) | 868 | 1,643,672 | |||||||

| AutoZone, Inc. (Specialty Retail) |

(a) | 90 | 98,952 | |||||||

| Chipotle Mexican Grill, Inc. (Hotels, Restaurants & Leisure) |

(a) | 7 | 5,130 | |||||||

| Darden Restaurants, Inc. (Hotels, Restaurants & Leisure) |

3,885 | 472,921 | ||||||||

| Domino’s Pizza, Inc. (Hotels, Restaurants & Leisure) |

256 | 71,240 | ||||||||

| Extended Stay America, Inc. (Hotels, Restaurants & Leisure) |

12,239 | 206,717 | ||||||||

| frontdoor, Inc. (Diversified Consumer Svs.) |

(a) | 558 | 24,301 | |||||||

| Home Depot, Inc. / The (Specialty Retail) |

422 | 87,763 | ||||||||

| Las Vegas Sands Corp. (Hotels, Restaurants & Leisure) |

3,497 | 206,638 | ||||||||

| Lululemon Athletica, Inc. (Textiles, Apparel & Luxury Goods) |

(a) | 708 | 127,589 | |||||||

| McDonald’s Corp. (Hotels, Restaurants & Leisure) |

1,361 | 282,625 | ||||||||

| NIKE, Inc. Class B (Textiles, Apparel & Luxury Goods) |

3,538 | 297,015 | ||||||||

| O’Reilly Automotive, Inc. (Specialty Retail) |

(a) | 104 | 38,409 | |||||||

| Royal Caribbean Cruises Ltd. (Hotels, Restaurants & Leisure) |

698 | 84,605 | ||||||||

| Target Corp. (Multiline Retail) |

2,070 | 179,283 | ||||||||

| TJX Cos., Inc. / The (Specialty Retail) |

129 | 6,822 | ||||||||

| Ulta Beauty, Inc. (Specialty Retail) |

(a) | 27 | 9,366 | |||||||

|

|

|

|||||||||

| 4,083,715 | ||||||||||

|

|

|

|||||||||

| CONSUMER STAPLES – 4.9% |

||||||||||

| Archer-Daniels-Midland Co. (Food Products) |

4,046 | 165,077 | ||||||||

| Church & Dwight Co., Inc. (Household Products) |

2,512 | 183,527 | ||||||||

| Colgate-Palmolive Co. (Household Products) |

995 | 71,312 | ||||||||

| Costco Wholesale Corp. (Food & Staples Retailing) |

890 | 235,191 | ||||||||

| Estee Lauder Cos., Inc. / The Class A (Personal Products) |

526 | 96,316 | ||||||||

| General Mills, Inc. (Food Products) |

6,462 | 339,384 | ||||||||

| Hershey Co. / The (Food Products) |

1,844 | 247,151 | ||||||||

| J.M. Smucker Co. / The (Food Products) |

477 | 54,945 | ||||||||

| McCormick & Co., Inc. (Food Products) |

517 | 80,140 | ||||||||

| Monster Beverage Corp. (Beverages) |

(a) | 1,289 | 82,277 | |||||||

| PepsiCo, Inc. (Beverages) |

3,676 | 482,034 | ||||||||

| Performance Food Group Co. (Food & Staples Retailing) |

(a) | 1,556 | 62,287 | |||||||

| Philip Morris International, Inc. (Tobacco) |

2,746 | 215,643 | ||||||||

| Procter & Gamble Co. / The (Household Products) |

3,201 | 350,990 | ||||||||

| Walmart, Inc. (Food & Staples Retailing) |

1,930 | 213,246 | ||||||||

|

|

|

|||||||||

| 2,879,520 | ||||||||||

|

|

|

|||||||||

| ENERGY – 3.2% |

||||||||||

| Antero Midstream Corp. (Oil, Gas & Consumable Fuels) |

6,922 | 79,326 | ||||||||

| Cabot Oil & Gas Corp. (Oil, Gas & Consumable Fuels) |

628 | 14,419 | ||||||||

| Chevron Corp. (Oil, Gas & Consumable Fuels) |

4,005 | 498,382 | ||||||||

| ConocoPhillips (Oil, Gas & Consumable Fuels) |

9,752 | 594,872 | ||||||||

| EOG Resources, Inc. (Oil, Gas & Consumable Fuels) |

1,925 | 179,333 | ||||||||

| Exxon Mobil Corp. (Oil, Gas & Consumable Fuels) |

1,524 | 116,784 | ||||||||

| Halliburton Co. (Energy Equip. & Svs.) |

7,538 | 171,414 | ||||||||

| Phillips 66 (Oil, Gas & Consumable Fuels) |

1,305 | 122,070 | ||||||||

| Valero Energy Corp. (Oil, Gas & Consumable Fuels) |

1,174 | 100,506 | ||||||||

| Williams Cos., Inc. / The (Oil, Gas & Consumable Fuels) |

314 | 8,805 | ||||||||

|

|

|

|||||||||

| 1,885,911 | ||||||||||

|

|

|

|||||||||

| 18 | (continued) |

| Ohio National Fund, Inc. | ON BlackRock Balanced Allocation Portfolio (Continued) |

| Schedule of Investments |

June 30, 2019 (Unaudited) | |

| Common Stocks (Continued) | Shares | Value | ||||||||

| FINANCIALS – 9.8% |

||||||||||

| Allstate Corp. / The (Insurance) |

2,354 | $ | 239,378 | |||||||

| American Express Co. (Consumer Finance) |

3,550 | 438,212 | ||||||||

| Bank of America Corp. (Banks) |

9,231 | 267,699 | ||||||||

| Berkshire Hathaway, Inc. Class B (Diversified Financial Svs.) |

(a) | 4,182 | 891,477 | |||||||

| Charles Schwab Corp. / The (Capital Markets) |

13,477 | 541,641 | ||||||||

| Cincinnati Financial Corp. (Insurance) |

448 | 46,444 | ||||||||

| Citizens Financial Group, Inc. (Banks) |

10,906 | 385,636 | ||||||||

| Discover Financial Services (Consumer Finance) |

5,251 | 407,425 | ||||||||

| First American Financial Corp. (Insurance) |

2,117 | 113,683 | ||||||||

| First Republic Bank (Banks) |

1,606 | 156,826 | ||||||||

| JPMorgan Chase & Co. (Banks) |

9,782 | 1,093,628 | ||||||||

| Lincoln National Corp. (Insurance) |

259 | 16,693 | ||||||||

| Loews Corp. (Insurance) |

664 | 36,301 | ||||||||

| MetLife, Inc. (Insurance) |

1,830 | 90,896 | ||||||||

| Morgan Stanley (Capital Markets) |

1,127 | 49,374 | ||||||||

| Prudential Financial, Inc. (Insurance) |

5,399 | 545,299 | ||||||||

| TD Ameritrade Holding Corp. (Capital Markets) |

3,049 | 152,206 | ||||||||

| Travelers Cos., Inc. / The (Insurance) |

416 | 62,200 | ||||||||

| Wells Fargo & Co. (Banks) |

4,007 | 189,611 | ||||||||

| Western Alliance Bancorp (Banks) |

(a) | 478 | 21,376 | |||||||

|

|

|

|||||||||

| 5,746,005 | ||||||||||

|

|

|

|||||||||

| HEALTH CARE – 10.3% |

||||||||||

| AbbVie, Inc. (Biotechnology) |

5,277 | 383,743 | ||||||||

| AmerisourceBergen Corp. (Health Care Providers & Svs.) |

909 | 77,501 | ||||||||

| Amgen, Inc. (Biotechnology) |

2,956 | 544,732 | ||||||||

| Anthem, Inc. (Health Care Providers & Svs.) |

500 | 141,105 | ||||||||

| Bristol-Myers Squibb Co. (Pharmaceuticals) |

6,273 | 284,480 | ||||||||

| Celgene Corp. (Biotechnology) |

(a) | 1,222 | 112,962 | |||||||

| Cigna Corp. (Health Care Providers & Svs.) |

261 | 41,121 | ||||||||

| CVS Health Corp. (Health Care Providers & Svs.) |

2,230 | 121,513 | ||||||||

| Danaher Corp. (Health Care Equip. & Supplies) |

90 | 12,863 | ||||||||

| Genomic Health, Inc. (Biotechnology) |

(a) | 17 | 989 | |||||||

| Gilead Sciences, Inc. (Biotechnology) |

8,401 | 567,572 | ||||||||

| Johnson & Johnson (Pharmaceuticals) |

7,798 | 1,086,105 | ||||||||

| McKesson Corp. (Health Care Providers & Svs.) |

261 | 35,076 | ||||||||

| Medtronic PLC (Health Care Equip. & Supplies) |

6,782 | 660,499 | ||||||||

| Merck & Co., Inc. (Pharmaceuticals) |

9,870 | 827,599 | ||||||||

| Regeneron Pharmaceuticals, Inc. (Biotechnology) |

(a) | 323 | 101,099 | |||||||

| Stryker Corp. (Health Care Equip. & Supplies) |

1,416 | 291,101 | ||||||||

| UnitedHealth Group, Inc. (Health Care Providers & Svs.) |

2,308 | 563,175 | ||||||||

| Veeva Systems, Inc. Class A (Health Care Technology) |

(a) | 1,049 | 170,053 | |||||||

| Vertex Pharmaceuticals, Inc. (Biotechnology) |

(a) | 312 | 57,215 | |||||||

|

|

|

|||||||||

| 6,080,503 | ||||||||||

|

|

|

|||||||||

| INDUSTRIALS – 7.1% |

||||||||||

| ADT, Inc. (Commercial Svs. & Supplies) |

1,343 | 8,219 | ||||||||

| Allegion PLC (Building Products) |

2,386 | 263,772 | ||||||||

| CoStar Group, Inc. (Professional Svs.) |

(a) | 191 | 105,825 | |||||||

| Crane Co. (Machinery) |

5,274 | 440,063 | ||||||||

| Curtiss-Wright Corp. (Aerospace & Defense) |

171 | 21,739 | ||||||||

| Generac Holdings, Inc. (Electrical Equip.) |

(a) | 437 | 30,332 | |||||||

| Honeywell International, Inc. (Industrial Conglomerates) |

2,199 | 383,923 | ||||||||

| Hubbell, Inc. (Electrical Equip.) |

652 | 85,021 | ||||||||

| IDEX Corp. (Machinery) |

62 | 10,673 | ||||||||

| Insperity, Inc. (Professional Svs.) |

2,822 | 344,679 | ||||||||

| L3Harris Technologies, Inc. (Aerospace & Defense) |

1,449 | 274,049 | ||||||||

| Landstar System, Inc. (Road & Rail) |

223 | 24,082 | ||||||||

| Lockheed Martin Corp. (Aerospace & Defense) |

1,483 | 539,130 | ||||||||

| Lyft, Inc. Class A (Road & Rail) |

(a) | 1,298 | 85,292 | |||||||

| Oshkosh Corp. (Machinery) |

888 | 74,139 | ||||||||

| PACCAR, Inc. (Machinery) |

7,166 | 513,516 | ||||||||

| Raytheon Co. (Aerospace & Defense) |

609 | 105,893 | ||||||||

| Rockwell Automation, Inc. (Electrical Equip.) |

2,450 | 401,384 | ||||||||

| Roper Technologies, Inc. (Industrial Conglomerates) |

93 | 34,062 | ||||||||

| Snap-on, Inc. (Machinery) |

1,460 | 241,834 | ||||||||

| TriNet Group, Inc. (Professional Svs.) |

(a) | 172 | 11,662 | |||||||

| 19 | (continued) |

| Ohio National Fund, Inc. | ON BlackRock Balanced Allocation Portfolio (Continued) |

| Schedule of Investments |

June 30, 2019 (Unaudited) | |

| Common Stocks (Continued) | Shares | Value | ||||||||

| INDUSTRIALS (continued) |

||||||||||

| Uber Technologies, Inc. (Road & Rail) |

(a) | 2,069 | $ | 95,960 | ||||||

| Waste Management, Inc. (Commercial Svs. & Supplies) |

695 | 80,182 | ||||||||

|

|

|

|||||||||

| 4,175,431 | ||||||||||

|

|

|

|||||||||

| INFORMATION TECHNOLOGY – 15.4% |

||||||||||

| Adobe, Inc. (Software) |

(a) | 1,626 | 479,101 | |||||||

| Amdocs Ltd. (IT Svs.) |

280 | 17,385 | ||||||||

| Analog Devices, Inc. (Semiconductors & Equip.) |

189 | 21,332 | ||||||||

| Apple, Inc. (Tech. Hardware, Storage & Periph.) |

5,544 | 1,097,269 | ||||||||

| Automatic Data Processing, Inc. (IT Svs.) |

3,137 | 518,640 | ||||||||

| Broadcom, Inc. (Semiconductors & Equip.) |

471 | 135,582 | ||||||||

| CDW Corp. (Electronic Equip., Instr. & Comp.) |

1,056 | 117,216 | ||||||||

| Ciena Corp. (Communications Equip.) |

(a) | 1,398 | 57,500 | |||||||

| Cirrus Logic, Inc. (Semiconductors & Equip.) |

(a) | 1,648 | 72,018 | |||||||

| Cisco Systems, Inc. (Communications Equip.) |

11,695 | 640,067 | ||||||||

| Dell Technologies, Inc. Class C (Tech. Hardware, Storage & Periph.) |

(a) | 2,380 | 120,904 | |||||||

| Fidelity National Information Services, Inc. (IT Svs.) |

3,155 | 387,055 | ||||||||

| GoDaddy, Inc. Class A (IT Svs.) |

(a) | 3,569 | 250,365 | |||||||

| HP, Inc. (Tech. Hardware, Storage & Periph.) |

8,196 | 170,395 | ||||||||

| Intel Corp. (Semiconductors & Equip.) |

6,232 | 298,326 | ||||||||

| International Business Machines Corp. (IT Svs.) |

1,306 | 180,097 | ||||||||

| Intuit, Inc. (Software) |

857 | 223,960 | ||||||||

| Mastercard, Inc. Class A (IT Svs.) |

58 | 15,343 | ||||||||

| Microsoft Corp. (Software) |

9,788 | 1,311,201 | ||||||||

| National Instruments Corp. (Electronic Equip., Instr. & Comp.) |

5,181 | 217,550 | ||||||||

| NVIDIA Corp. (Semiconductors & Equip.) |

304 | 49,926 | ||||||||

| Oracle Corp. (Software) |

2,595 | 147,837 | ||||||||

| Paychex, Inc. (IT Svs.) |

5,842 | 480,738 | ||||||||

| PayPal Holdings, Inc. (IT Svs.) |

(a) | 491 | 56,200 | |||||||

| QUALCOMM, Inc. (Semiconductors & Equip.) |

68 | 5,173 | ||||||||

| Red Hat, Inc. (Software) |

(a) | 79 | 14,833 | |||||||

| salesforce.com, Inc. (Software) |

(a) | 4,294 | 651,529 | |||||||

| ServiceNow, Inc. (Software) |

(a) | 868 | 238,327 | |||||||

| Square, Inc. Class A (IT Svs.) |

(a) | 575 | 41,705 | |||||||

| Texas Instruments, Inc. (Semiconductors & Equip.) |

1,873 | 214,945 | ||||||||

| VeriSign, Inc. (IT Svs.) |

(a) | 159 | 33,256 | |||||||

| Visa, Inc. (IT Svs.) |

3,236 | 561,608 | ||||||||

| Workday, Inc. Class A (Software) |

(a) | 169 | 34,743 | |||||||

| Xilinx, Inc. (Semiconductors & Equip.) |

1,614 | 190,323 | ||||||||

|

|

|

|||||||||

| 9,052,449 | ||||||||||

|

|

|

|||||||||

| MATERIALS – 2.0% |

||||||||||

| Air Products & Chemicals, Inc. (Chemicals) |

1,405 | 318,050 | ||||||||

| Dow, Inc. (Chemicals) |

4,246 | 209,370 | ||||||||

| Ecolab, Inc. (Chemicals) |

935 | 184,606 | ||||||||

| LyondellBasell Industries N.V. Class A (Chemicals) |

1,776 | 152,967 | ||||||||

| Westrock Co. (Containers & Packaging) |

8,714 | 317,800 | ||||||||

|

|

|

|||||||||

| 1,182,793 | ||||||||||

|

|

|

|||||||||

| REAL ESTATE – 2.4% |

||||||||||

| Equity LifeStyle Properties, Inc. (Equity REIT) |

3,637 | 441,314 | ||||||||

| Outfront Media, Inc. (Equity REIT) |

1,760 | 45,390 | ||||||||

| Park Hotels & Resorts, Inc. (Equity REIT) |

8,847 | 243,823 | ||||||||

| Prologis, Inc. (Equity REIT) |

4,973 | 398,337 | ||||||||

| Ryman Hospitality Properties, Inc. (Equity REIT) |

951 | 77,117 | ||||||||

| Simon Property Group, Inc. (Equity REIT) |

1,328 | 212,161 | ||||||||

|

|

|

|||||||||

| 1,418,142 | ||||||||||

|

|

|

|||||||||

| UTILITIES – 2.7% |

||||||||||

| Alliant Energy Corp. (Electric Utilities) |

359 | 17,620 | ||||||||

| American Water Works Co., Inc. (Water Utilities) |

4,067 | 471,772 | ||||||||

| Avista Corp. (Multi-Utilities) |

1,104 | 49,238 | ||||||||

| Black Hills Corp. (Multi-Utilities) |

1,011 | 79,030 | ||||||||

| Consolidated Edison, Inc. (Multi-Utilities) |

2,039 | 178,780 | ||||||||

| DTE Energy Co. (Multi-Utilities) |

2,671 | 341,567 | ||||||||

| Evergy, Inc. (Electric Utilities) |

1,353 | 81,383 | ||||||||

| IDACORP, Inc. (Electric Utilities) |

1,416 | 142,209 | ||||||||

| Pinnacle West Capital Corp. (Electric Utilities) |

67 | 6,304 | ||||||||

| 20 | (continued) |

| Ohio National Fund, Inc. | ON BlackRock Balanced Allocation Portfolio (Continued) |

| Schedule of Investments |

June 30, 2019 (Unaudited) | |

| Common Stocks (Continued) | Shares | Value | ||||||

| UTILITIES (continued) |

||||||||

| Southwest Gas Holdings, Inc. (Gas Utilities) |

243 | $ | 21,778 | |||||

| Xcel Energy, Inc. (Electric Utilities) |

3,582 | 213,093 | ||||||

|

|

|

|||||||

| 1,602,774 | ||||||||

|

|

|

|||||||

| Total Common Stocks (Cost $39,737,306) |

$ | 42,194,581 | ||||||

|

|

|

|||||||

| Corporate Bonds – 25.6% | Rate | Maturity | Face Amount | Value | ||||||||||||||

| COMMUNICATION SERVICES – 1.3% |

||||||||||||||||||

| AT&T, Inc. (Diversified Telecom. Svs.) |

3.400% | 05/15/2025 | $150,000 | $ | 154,117 | |||||||||||||

| Discovery Communications LLC (Media) |

3.950% | 03/20/2028 | 100,000 | 103,061 | ||||||||||||||

| Time Warner Cable LLC (Media) |

6.550% | 05/01/2037 | 150,000 | 173,175 | ||||||||||||||

| Verizon Communications, Inc. (Diversified Telecom. Svs.) |

4.500% | 08/10/2033 | 150,000 | 168,869 | ||||||||||||||

| Viacom, Inc. (Entertainment) |

4.250% | 09/01/2023 | 150,000 | 158,624 | ||||||||||||||

|

|

|

|||||||||||||||||

| 757,846 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| CONSUMER DISCRETIONARY – 1.7% |

||||||||||||||||||

| Amazon.com, Inc. (Internet & Direct Marketing Retail) |

3.875% | 08/22/2037 | 100,000 | 110,230 | ||||||||||||||

| Aptiv PLC (Auto Components) |

4.350% | 03/15/2029 | 150,000 | 158,010 | ||||||||||||||

| Booking Holdings, Inc. (Internet & Direct Marketing Retail) |

3.550% | 03/15/2028 | 200,000 | 208,358 | ||||||||||||||

| General Motors Co. (Automobiles) |

5.000% | 04/01/2035 | 100,000 | 98,228 | ||||||||||||||

| Lear Corp. (Auto Components) |

5.250% | 01/15/2025 | 222,000 | 230,332 | ||||||||||||||

| Volkswagen Group of America Finance LLC (Automobiles) |

(b) | 4.625% | 11/13/2025 | 200,000 | 217,176 | |||||||||||||

|

|

|

|||||||||||||||||

| 1,022,334 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| CONSUMER STAPLES – 0.5% |

||||||||||||||||||

| Anheuser-Busch Cos. LLC / Anheuser-Busch InBev Worldwide, Inc. (Beverages) |

4.700% | 02/01/2036 | 100,000 | 109,966 | ||||||||||||||

| Mead Johnson Nutrition Co. (Food Products) |

3.000% | 11/15/2020 | 100,000 | 100,884 | ||||||||||||||

| Philip Morris International, Inc. (Tobacco) |

3.375% | 08/11/2025 | 100,000 | 103,922 | ||||||||||||||

|

|

|

|||||||||||||||||

| 314,772 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| ENERGY – 4.0% |

||||||||||||||||||

| Apache Corp. (Oil, Gas & Consumable Fuels) |

4.375% | 10/15/2028 | 200,000 | 208,903 | ||||||||||||||

| BP Capital Markets America, Inc. (Oil, Gas & Consumable Fuels) |

3.017% | 01/16/2027 | 100,000 | 102,088 | ||||||||||||||

| Canadian Natural Resources Ltd. (Oil, Gas & Consumable Fuels) |

4.950% | 06/01/2047 | 100,000 | 113,870 | ||||||||||||||

| Chevron Corp. (Oil, Gas & Consumable Fuels) |

2.895% | 03/03/2024 | 100,000 | 103,251 | ||||||||||||||

| Columbia Pipeline Group, Inc. (Oil, Gas & Consumable Fuels) |

4.500% | 06/01/2025 | 150,000 | 161,189 | ||||||||||||||

| EOG Resources, Inc. (Oil, Gas & Consumable Fuels) |

3.150% | 04/01/2025 | 100,000 | 102,594 | ||||||||||||||

| EQM Midstream Partners LP (Oil, Gas & Consumable Fuels) |

4.750% | 07/15/2023 | 100,000 | 103,644 | ||||||||||||||

| Exxon Mobil Corp. (Oil, Gas & Consumable Fuels) |

4.114% | 03/01/2046 | 100,000 | 114,928 | ||||||||||||||

| Halliburton Co. (Energy Equip. & Svs.) |

4.850% | 11/15/2035 | 100,000 | 106,558 | ||||||||||||||

| Kinder Morgan Energy Partners LP (Oil, Gas & Consumable Fuels) |

4.150% | 03/01/2022 | 75,000 | 78,197 | ||||||||||||||

| Marathon Oil Corp. (Oil, Gas & Consumable Fuels) |

3.850% | 06/01/2025 | 150,000 | 155,425 | ||||||||||||||

| Marathon Petroleum Corp. (Oil, Gas & Consumable Fuels) |

3.800% | 04/01/2028 | 150,000 | 152,389 | ||||||||||||||

| ONEOK, Inc. (Oil, Gas & Consumable Fuels) |

4.000% | 07/13/2027 | 150,000 | 155,832 | ||||||||||||||

| Patterson-UTI Energy, Inc. (Energy Equip. & Svs.) |

3.950% | 02/01/2028 | 150,000 | 147,429 | ||||||||||||||

| Peabody Energy Corp. (Oil, Gas & Consumable Fuels) |

(b) | 6.000% | 03/31/2022 | 200,000 | 204,750 | |||||||||||||

| Shell International Finance BV (Oil, Gas & Consumable Fuels) |

4.000% | 05/10/2046 | 100,000 | 109,641 | ||||||||||||||

| Williams Cos., Inc. / The (Oil, Gas & Consumable Fuels) |

3.350% | 08/15/2022 | 109,000 | 111,056 | ||||||||||||||

| Williams Cos., Inc. / The (Oil, Gas & Consumable Fuels) |

5.400% | 03/04/2044 | 100,000 | 110,291 | ||||||||||||||

|

|

|

|||||||||||||||||

| 2,342,035 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| FINANCIALS – 8.5% |

||||||||||||||||||

| AerCap Ireland Capital DAC / AerCap Global Aviation Trust (Diversified Financial Svs.) |

3.300% | 01/23/2023 | 150,000 | 151,278 | ||||||||||||||

| Aflac, Inc. (Insurance) |

3.625% | 06/15/2023 | 75,000 | 78,645 | ||||||||||||||

| American Express Co. (Consumer Finance) |

3.000% | 10/30/2024 | 150,000 | 153,679 | ||||||||||||||

| American International Group, Inc. (Insurance) |

3.875% | 01/15/2035 | 150,000 | 149,370 | ||||||||||||||

| Bank of America Corp. (Banks) |

3.875% | 08/01/2025 | 150,000 | 160,447 | ||||||||||||||

| Bank of Montreal (Rate is fixed until 12/15/2027, at which point, the rate becomes USSW5 + 143) (Banks) |

(c) | 3.803% | 12/15/2032 | 200,000 | 202,822 | |||||||||||||

| Bank of New York Mellon Corp. / The (Capital Markets) |

3.300% | 08/23/2029 | 200,000 | 207,265 | ||||||||||||||

| Berkshire Hathaway, Inc. (Diversified Financial Svs.) |

3.125% | 03/15/2026 | 100,000 | 103,854 | ||||||||||||||

| Branch Banking & Trust Co. (Banks) |

3.625% | 09/16/2025 | 100,000 | 105,128 | ||||||||||||||

| Citigroup, Inc. (Banks) |

4.400% | 06/10/2025 | 100,000 | 106,721 | ||||||||||||||

| Comerica, Inc. (Banks) |

3.800% | 07/22/2026 | 100,000 | 104,073 | ||||||||||||||

| Deutsche Bank AG (Capital Markets) |

2.700% | 07/13/2020 | 200,000 | 199,141 | ||||||||||||||

| Discover Bank (Rate is fixed until 08/09/2023, at which point, the rate becomes USSW5 + 173) (Banks) |

(c) | 4.682% | 08/09/2028 | 250,000 | 259,065 | |||||||||||||

| E*TRADE Financial Corp. (Capital Markets) |

2.950% | 08/24/2022 | 200,000 | 201,903 | ||||||||||||||

| Ford Motor Credit Co. LLC (Consumer Finance) |

3.157% | 08/04/2020 | 100,000 | 100,359 | ||||||||||||||

| General Motors Financial Co., Inc. (Consumer Finance) |

3.200% | 07/06/2021 | 100,000 | 100,851 | ||||||||||||||

| Goldman Sachs Group, Inc. / The (Capital Markets) |

3.750% | 05/22/2025 | 150,000 | 156,811 | ||||||||||||||

| 21 | (continued) |

| Ohio National Fund, Inc. | ON BlackRock Balanced Allocation Portfolio (Continued) |

|

Schedule of Investments

|

June 30, 2019 (Unaudited)

|

| Corporate Bonds (Continued) | Rate | Maturity | Face Amount | Value | ||||||||||||

| FINANCIALS (continued) |

||||||||||||||||

| Jefferies Group LLC / Jefferies Group Capital Finance, Inc. (Diversified Financial Svs.) |

4.850% | 01/15/2027 | $200,000 | $ 206,275 | ||||||||||||

| JPMorgan Chase & Co. (Banks) |

3.250% | 09/23/2022 | 100,000 | 102,695 | ||||||||||||

| JPMorgan Chase & Co. (Banks) |

3.625% | 12/01/2027 | 200,000 | 206,006 | ||||||||||||

| Marsh & McLennan Cos., Inc. (Insurance) |

3.500% | 06/03/2024 | 100,000 | 104,222 | ||||||||||||

| Morgan Stanley (Capital Markets) |

3.950% | 04/23/2027 | 100,000 | 104,552 | ||||||||||||

| Nasdaq, Inc. (Capital Markets) |

3.850% | 06/30/2026 | 100,000 | 104,805 | ||||||||||||

| Northern Trust Corp. (Capital Markets) |

3.950% | 10/30/2025 | 200,000 | 215,785 | ||||||||||||

| PNC Bank N.A. (Banks) |

3.250% | 06/01/2025 | 195,000 | 202,071 | ||||||||||||

| Progressive Corp. / The (Insurance) |

2.450% | 01/15/2027 | 100,000 | 98,933 | ||||||||||||

| Raymond James Financial, Inc. (Capital Markets) |

3.625% | 09/15/2026 | 150,000 | 154,195 | ||||||||||||

| S&P Global, Inc. (Capital Markets) |

4.000% | 06/15/2025 | 150,000 | 162,784 | ||||||||||||

| Synchrony Financial (Consumer Finance) |

4.250% | 08/15/2024 | 150,000 | 156,214 | ||||||||||||

| TD Ameritrade Holding Corp. (Capital Markets) |

3.300% | 04/01/2027 | 150,000 | 154,698 | ||||||||||||

| Teachers Insurance & Annuity Association of America (Insurance) |

(b) | 4.270% | 05/15/2047 | 100,000 | 108,151 | |||||||||||

| Wells Fargo & Co. (Banks) |

3.500% | 03/08/2022 | 75,000 | 77,143 | ||||||||||||

| Wells Fargo & Co. (Banks) |

3.000% | 04/22/2026 | 100,000 | 101,121 | ||||||||||||

| Westpac Banking Corp. (Rate is fixed until 11/23/2026, at which point, the rate becomes USISDA05 + 224) (Banks) |

(c) | 4.322% | 11/23/2031 | 200,000 | 206,983 | |||||||||||

|

|

|

|||||||||||||||

| 5,008,045 | ||||||||||||||||

|

|

|

|||||||||||||||

| HEALTH CARE – 1.3% |

||||||||||||||||

| AbbVie, Inc. (Biotechnology) |

2.900% | 11/06/2022 | 150,000 | 150,942 | ||||||||||||

| Celgene Corp. (Biotechnology) |

3.875% | 08/15/2025 | 150,000 | 160,684 | ||||||||||||

| CVS Health Corp. (Health Care Providers & Svs.) |

4.100% | 03/25/2025 | 150,000 | 158,119 | ||||||||||||

| HCA, Inc. (Health Care Providers & Svs.) |

5.250% | 06/15/2026 | 150,000 | 166,022 | ||||||||||||

| UnitedHealth Group, Inc. (Health Care Providers & Svs.) |

3.875% | 12/15/2028 | 100,000 | 108,817 | ||||||||||||

|

|

|

|||||||||||||||

| 744,584 | ||||||||||||||||

|

|

|

|||||||||||||||

| INDUSTRIALS – 1.9% |

||||||||||||||||

| Boeing Co. / The (Aerospace & Defense) |

3.200% | 03/01/2029 | 100,000 | 103,148 | ||||||||||||

| Burlington Northern Santa Fe LLC (Road & Rail) |

4.550% | 09/01/2044 | 100,000 | 115,726 | ||||||||||||

| FedEx Corp. (Air Freight & Logistics) |

4.900% | 01/15/2034 | 150,000 | 174,414 | ||||||||||||

| Lockheed Martin Corp. (Aerospace & Defense) |

3.600% | 03/01/2035 | 100,000 | 104,272 | ||||||||||||

| Northrop Grumman Corp. (Aerospace & Defense) |

2.930% | 01/15/2025 | 100,000 | 101,968 | ||||||||||||

| Parker-Hannifin Corp. (Machinery) |

4.200% | 11/21/2034 | 100,000 | 109,198 | ||||||||||||

| Union Pacific Corp. (Road & Rail) |

3.250% | 08/15/2025 | 100,000 | 103,965 | ||||||||||||

| United Rentals North America, Inc. (Trading Companies & Distributors) |

5.250% | 01/15/2030 | 100,000 | 102,750 | ||||||||||||

| Waste Connections, Inc. (Commercial Svs. & Supplies) |

4.250% | 12/01/2028 | 200,000 | 218,621 | ||||||||||||

|

|

|

|||||||||||||||

| 1,134,062 | ||||||||||||||||

|

|

|

|||||||||||||||

| INFORMATION TECHNOLOGY – 1.4% |

||||||||||||||||

| Apple, Inc. (Tech. Hardware, Storage & Periph.) |

2.500% | 02/09/2025 | 100,000 | 100,974 | ||||||||||||

| Apple, Inc. (Tech. Hardware, Storage & Periph.) |

3.350% | 02/09/2027 | 100,000 | 105,026 | ||||||||||||

| Hewlett Packard Enterprise Co. (Tech. Hardware, Storage & Periph.) |

4.900% | 10/15/2025 | 150,000 | 163,895 | ||||||||||||

| Microsoft Corp. (Software) |

4.100% | 02/06/2037 | 100,000 | 114,045 | ||||||||||||

| Microsoft Corp. (Software) |

4.450% | 11/03/2045 | 100,000 | 119,787 | ||||||||||||

| Oracle Corp. (Software) |

4.300% | 07/08/2034 | 100,000 | 113,836 | ||||||||||||

| Seagate HDD Cayman (Tech. Hardware, Storage & Periph.) |

4.875% | 03/01/2024 | 100,000 | 102,601 | ||||||||||||

|

|

|

|||||||||||||||

| 820,164 | ||||||||||||||||

|

|

|

|||||||||||||||

| MATERIALS – 1.7% |

||||||||||||||||

| Anglo American Capital PLC (Metals & Mining) |

(b) | 4.000% | 09/11/2027 | 100,000 | 100,341 | |||||||||||

| CF Industries, Inc. (Chemicals) |

(b) | 4.500% | 12/01/2026 | 150,000 | 155,902 | |||||||||||

| Dow Chemical Co. / The (Chemicals) |

4.250% | 10/01/2034 | 100,000 | 103,818 | ||||||||||||

| Kinross Gold Corp. (Metals & Mining) |

4.500% | 07/15/2027 | 100,000 | 101,000 | ||||||||||||

| Mosaic Co. / The (Chemicals) |

4.050% | 11/15/2027 | 200,000 | 206,620 | ||||||||||||

| Nutrien Ltd. (Chemicals) |

4.200% | 04/01/2029 | 100,000 | 107,911 | ||||||||||||

| Yamana Gold, Inc. (Metals & Mining) |

4.625% | 12/15/2027 | 200,000 | 204,363 | ||||||||||||

|

|

|

|||||||||||||||

| 979,955 | ||||||||||||||||

|

|

|

|||||||||||||||

| REAL ESTATE – 1.5% |

||||||||||||||||

| Alexandria Real Estate Equities, Inc. (Equity REIT) |

3.950% | 01/15/2028 | 150,000 | 157,679 | ||||||||||||

| Boston Properties LP (Equity REIT) |

3.125% | 09/01/2023 | 75,000 | 76,892 | ||||||||||||

| Crown Castle International Corp. (Equity REIT) |

4.000% | 03/01/2027 | 200,000 | 209,826 | ||||||||||||

| Federal Realty Investment Trust (Equity REIT) |

3.000% | 08/01/2022 | 75,000 | 76,157 | ||||||||||||

| HCP, Inc. (Equity REIT) |

4.000% | 06/01/2025 | 100,000 | 105,684 | ||||||||||||

| Healthcare Realty Trust, Inc. (Equity REIT) |

3.875% | 05/01/2025 | 100,000 | 103,218 | ||||||||||||

| Highwoods Realty LP (Equity REIT) |

4.200% | 04/15/2029 | 150,000 | 156,857 | ||||||||||||

|

|

|

|||||||||||||||

| 886,313 | ||||||||||||||||

|

|

|

|||||||||||||||

| 22 | (continued) |

| Ohio National Fund, Inc. | ON BlackRock Balanced Allocation Portfolio (Continued) |

| Schedule of Investments |

June 30, 2019 (Unaudited) | |

| Corporate Bonds (Continued) | Rate | Maturity | Face Amount | Value | ||||||||||||||||

| UTILITIES – 1.8% |

||||||||||||||||||||

| AEP Transmission Co. LLC (Electric Utilities) |

4.000% | 12/01/2046 | $100,000 | $ | 104,508 | |||||||||||||||

| American Water Capital Corp. (Water Utilities) |

4.300% | 12/01/2042 | 100,000 | 108,477 | ||||||||||||||||

| Berkshire Hathaway Energy Co. (Multi-Utilities) |

3.250% | 04/15/2028 | 100,000 | 103,200 | ||||||||||||||||

| Commonwealth Edison Co. (Electric Utilities) |

4.350% | 11/15/2045 | 100,000 | 113,259 | ||||||||||||||||

| Connecticut Light & Power Co. / The (Electric Utilities) |

4.000% | 04/01/2048 | 100,000 | 109,192 | ||||||||||||||||

| Duke Energy Corp. (Electric Utilities) |

3.750% | 09/01/2046 | 100,000 | 97,776 | ||||||||||||||||

| FirstEnergy Transmission LLC (Electric Utilities) |

(b | ) | 4.550% | 04/01/2049 | 200,000 | 218,469 | ||||||||||||||

| Fortis, Inc. (Electric Utilities) |

3.055% | 10/04/2026 | 100,000 | 99,223 | ||||||||||||||||

| Jersey Central Power & Light Co. (Electric Utilities) |

(b | ) | 4.300% | 01/15/2026 | 100,000 | 107,343 | ||||||||||||||

|

|

|

|||||||||||||||||||

| 1,061,447 | ||||||||||||||||||||

|

|

|

|||||||||||||||||||

| Total Corporate Bonds (Cost $14,327,292) |

$ | 15,071,557 | ||||||||||||||||||

|

|

|

|||||||||||||||||||

| Asset-Backed Securities – 0.5% | Rate | Maturity | Face Amount | Value | ||||||||||||||||

| INDUSTRIALS – 0.5% |

||||||||||||||||||||

| American Airlines 2015-1 Class B Pass Through Trust |

3.700% | 05/01/2023 | $127,850 | $ | 128,515 | |||||||||||||||

| United Airlines 2016-1 Class B Pass Through Trust |

3.650% | 01/07/2026 | 182,870 | 182,918 | ||||||||||||||||

|

|

|

|||||||||||||||||||

| Total Asset-Backed Securities (Cost $310,746) |

$ | 311,433 | ||||||||||||||||||

|

|

|

|||||||||||||||||||

| U.S. Treasury Obligations – 0.4% | Rate | Maturity | Face Amount | Value | ||||||||||||||||

|

U.S. Treasury Note |

2.125% | 05/15/2025 | $200,000 | $ | 203,265 | |||||||||||||||

|

|

|

|||||||||||||||||||

| Total U.S. Treasury Obligations (Cost $195,856) |

$ | 203,265 | ||||||||||||||||||

|

|

|

|||||||||||||||||||

| Money Market Funds – 1.6% | Shares | Value | ||||||||||||||||||

| State Street Institutional Liquid Reserves Fund Institutional Class, 2.449% |

(d | ) | 949,424 | $ | 949,614 | |||||||||||||||

|

|

|

|||||||||||||||||||

| Total Money Market Funds (Cost $949,585) |

$ | 949,614 | ||||||||||||||||||

|

|

|

|||||||||||||||||||

| Total Investments – 99.8% (Cost $55,520,785) |

(e | ) | $ | 58,730,450 | ||||||||||||||||

| Other Assets in Excess of Liabilities – 0.2% |

(f | ) | 88,664 | |||||||||||||||||

|

|

|

|||||||||||||||||||

| Net Assets – 100.0% |

$ | 58,819,114 | ||||||||||||||||||

|

|

|

|||||||||||||||||||

Percentages are stated as a percent of net assets.

Abbreviations:

| ADR: | American Depositary Receipts | |||

| USISDA05: | USD ICE Swap Rate 11:00am NY 5 Year, 1.758% at 06/30/2019 | |||

| USSW5: | USD Swap Semi 30/360 5 Year, 1.765% at 06/30/2019 |

Footnotes:

| (a) | Non-income producing security. |

| (b) | Security exempt from registration under Regulation D of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified buyers under Rule 144A. At June 30, 2019, the value of these securities totaled $1,112,132, or 1.9% of the Portfolio’s net assets. |

| (c) | Security is a fixed-then-variable rate instrument in which the coupon or dividend rate is fixed until a later specified date, then is adjusted periodically. Rates stated, including interest rate caps and floors, if any, are those in effect at June 30, 2019. |

| (d) | Rate represents the seven-day yield at June 30, 2019. |

| (e) | Represents cost for financial reporting purposes, which may differ from cost basis for federal income tax purposes. See also Note 7 of the Notes to Financial Statements. |

| (f) | Includes $25,200 of cash pledged as collateral for the futures contracts outstanding at June 30, 2019. See also the following Schedule of Open Futures Contracts. |

The accompanying notes are an integral part of these financial statements.

| Schedule of Open Futures Contracts |

June 30, 2019 (Unaudited) | |||||||||||

| Description |

Number of contracts |

Expiration Date | Notional Amount |

Value | Unrealized Appreciation (Depreciation) |

Variation Margin Receivable (Payable) | ||||||||||

| CME E-mini S&P 500 Index - Long |

4 | September 20, 2019 | $ | 585,594 | $ | 588,840 | $3,246 | $2,660 | ||||||||

The accompanying notes are an integral part of these financial statements.

23

| Ohio National Fund, Inc. | ON Capital Appreciation Portfolio (Unaudited) |

| 24 | (continued) |

| Ohio National Fund, Inc. | ON Capital Appreciation Portfolio (Unaudited) (Continued) |

| (1) | Composition of Portfolio subject to change. |

| (2) | Short-term investments have been excluded from the list of Top 10 Portfolio Holdings. |

| (3) | Top 10 Portfolio Holdings is presented at an individual security level. Total investment exposure by issuer may be higher. |

| (4) | Sectors (Common Stocks): |

| % of Net Assets | ||||

| Industrials |

15.5 | |||

| Information Technology |

12.7 | |||

| Communication Services |

12.5 | |||

| Financials |

12.4 | |||

| Consumer Discretionary |

11.1 | |||

| Health Care |

9.4 | |||

| Materials |

8.2 | |||

| Energy |

7.1 | |||

| Consumer Staples |

5.5 | |||

| Real Estate |

3.0 | |||

|

|

|

|||

| 97.4 | ||||

|

|

|

25

| Ohio National Fund, Inc. | ON Capital Appreciation Portfolio |

| Schedule of Investments |

June 30, 2019 (Unaudited) | |

| 26 | (continued) |

| Ohio National Fund, Inc. | ON Capital Appreciation Portfolio (Continued) |

| Schedule of Investments |

June 30, 2019 (Unaudited) | |

Percentages are stated as a percent of net assets.

Abbreviations:

| ADR: | American Depositary Receipts |

Footnotes:

| (a) | Non-income producing security. |

| (b) | Security traded on a foreign exchange has been valued at an estimate of fair value that is different than the local market close price. These fair value estimates are determined by an independent fair valuation service that has been approved by the Board. These securities represent $1,956,231 or 2.0% of the Portfolio’s net assets. |

| (c) | Rate represents the seven-day yield at June 30, 2019. |

| (d) | Represents cost for financial reporting purposes, which may differ from cost basis for federal income tax purposes. See also Note 7 of the Notes to Financial Statements. |

The accompanying notes are an integral part of these financial statements.

27

| Ohio National Fund, Inc. | ON International Equity Portfolio (Unaudited) |

| 28 | (continued) |

| Ohio National Fund, Inc. | ON International Equity Portfolio (Unaudited) (Continued) |

| (1) | Composition of Portfolio subject to change. |

| (2) | Short-term investments have been excluded from the list of Top 10 Portfolio Holdings. |

| (3) | Top 10 Portfolio Holdings is presented at an individual security level. Total investment exposure by issuer may be higher. |

| (4) | Top 10 Country Weightings (Common Stocks, Preferred Securities): |

| % of Net Assets | ||||

| United Kingdom |

18.9 | |||

| France |

13.1 | |||

| Japan |

13.0 | |||

| Netherlands |

7.5 | |||

| Germany |

6.8 | |||

| Canada |

5.4 | |||

| Switzerland |

4.8 | |||

| Ireland |

3.8 | |||

| Sweden |

3.6 | |||

| Singapore |

2.7 | |||

| (5) | Sectors (Common Stocks, Preferred Securities): |

| % of Net Assets | ||||

| Financials |

18.6 | |||

| Industrials |

18.1 | |||

| Health Care |

9.8 | |||

| Consumer Staples |

9.2 | |||

| Communication Services |

7.8 | |||

| Materials |

7.5 | |||

| Information Technology |

7.3 | |||

| Consumer Discretionary |

7.1 | |||

| Energy |

6.3 | |||

| Real Estate |

2.8 | |||

| Utilities |

2.7 | |||

|

|

|

|||

| 97.2 | ||||

|

|

|

|||

29

| Ohio National Fund, Inc. | ON International Equity Portfolio |

| Schedule of Investments |

June 30, 2019 (Unaudited) | |

| 30 | (continued) |

| Ohio National Fund, Inc. | ON International Equity Portfolio (Continued) |

| Schedule of Investments |

June 30, 2019 (Unaudited) | |

Percentages are stated as a percent of net assets.

Abbreviations:

| ADR: American Depositary Receipts |

Footnotes:

| (a) | Security traded on a foreign exchange has been valued at an estimate of fair value that is different than the local market close price. These fair value estimates are determined by an independent fair valuation service that has been approved by the Board. These securities represent $392,821,268 or 82.4% of the Portfolio’s net assets. |

| (b) | Non-income producing security. |

| (c) | As discussed in Note 2 of the Notes to Financial Statements, not all investments that are traded on a foreign exchange are valued at an estimate that is different from the local close price. In some instances, the independent fair valuation service uses a stock’s local close price because the service’s measure of predictability related to their valuation model of a stock is below a chosen threshold. These securities represent $6,417,580 or 1.3% of the Portfolio’s net assets. Other Portfolio securities are not subjected to fair valuation procedures because they are traded on domestic or foreign exchanges that have close times that are consistent with the U.S. market close, normally 4:00 pm Eastern Time. |

| (d) | Payout is the rate of the company’s ordinary common stock dividend per share + 6 cents per share. |

| (e) | Rate represents the seven-day yield at June 30, 2019. |

| (f) | Represents cost for financial reporting purposes, which may differ from cost basis for federal income tax purposes. See also Note 7 of the Notes to Financial Statements. |

The accompanying notes are an integral part of these financial statements.

31

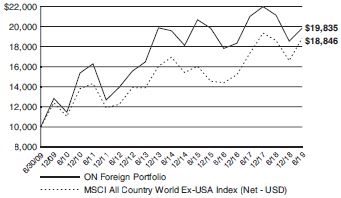

| Ohio National Fund, Inc. | ON Foreign Portfolio (Unaudited) |

| 32 | (continued) |

| Ohio National Fund, Inc. | ON Foreign Portfolio (Unaudited) (Continued) |

| 33 | (continued) |

| Ohio National Fund, Inc. | ON Foreign Portfolio (Unaudited) (Continued) |

| (1) | Composition of Portfolio subject to change. |

| (2) | Short-term investments have been excluded from the list of Top 10 Portfolio Holdings. |

| (3) | Top 10 Portfolio Holdings is presented at an individual security level. Total investment exposure by issuer may be higher. |

| (4) | Top 10 Country Weightings (Common Stocks): |

| % of Net Assets | ||||

| United Kingdom |

15.2 | |||

| Japan |

12.6 | |||

| France |

11.5 | |||

| South Korea |

10.9 | |||

| Netherlands |

8.7 | |||

| Germany |

5.5 | |||

| Switzerland |

4.7 | |||

| Canada |

4.3 | |||

| Hong Kong |

4.3 | |||

| China |

4.2 | |||

| (5) | Sectors (Common Stocks): |

| % of Net Assets | ||||

| Financials |

22.3 | |||

| Energy |

13.9 | |||

| Health Care |

13.7 | |||

| Communication Services |

10.4 | |||

| Materials |

9.0 | |||

| Information Technology |

7.9 | |||

| Industrials |

6.7 | |||

| Consumer Discretionary |

4.6 | |||

| Utilities |

3.4 | |||

| Consumer Staples |

2.5 | |||

| Real Estate |

2.2 | |||

|

|

|

|||

| 96.6 | ||||

|

|

|

|||

| 34 |

| Ohio National Fund, Inc.

|

ON Foreign Portfolio

| |

| Schedule of Investments |

June 30, 2019 (Unaudited) | |

| 35 | (continued) |

| Ohio National Fund, Inc. | ON Foreign Portfolio (Continued) |

| Schedule of Investments |

June 30, 2019 (Unaudited) | |

Percentages are stated as a percent of net assets.

Abbreviations:

| ADR: | American Depositary Receipts |

| NVDR: | Non-Voting Depository Receipts |

Footnotes:

| (a) | Security traded on a foreign exchange has been valued at an estimate of fair value that is different than the local market close price. These fair value estimates are determined by an independent fair valuation service that has been approved by the Board. These securities represent $45,537,113 or 86.5% of the Portfolio’s net assets. |

| (b) | Non-income producing security. |