UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03015

Ohio National Fund, Inc.

(Exact name of registrant as specified in charter)

| One Financial Way, Cincinnati, Ohio |

45242

| |

|

(Address of principal executive offices) |

(Zip code) |

CT Corporation 300 E. Lombard St. Suite 1400 Baltimore, MD 21202

(Name and address of agent for service)

Registrant’s telephone number, including area code: 513-794-6971

Date of fiscal year end: December 31

Date of reporting period: June 30, 2015

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports To Stockholders. |

OHIO NATIONAL FUND, INC.

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 8 | ||||

| 10 | ||||

| 15 | ||||

| 21 | ||||

| 27 | ||||

| 31 | ||||

| 37 | ||||

| 40 | ||||

| 45 | ||||

| 49 | ||||

| 56 | ||||

| 60 | ||||

| 70 | ||||

| 74 | ||||

| 78 | ||||

| 81 | ||||

| 84 | ||||

| 91 | ||||

| 95 | ||||

| 98 | ||||

| 109 | ||||

| 112 | ||||

| 115 | ||||

| 121 | ||||

| 132 | ||||

| 157 | ||||

| 159 | ||||

| Message |

|

Dear Investor:

| 1 |

Directors and Officers of Ohio National Fund, Inc.

The Statement of Additional Information of Ohio National Fund, Inc. (the “Fund”) includes additional information about the Fund’s Board of Directors (the “Board”) and is available at http://www.ohionationalfund.com or upon request, without charge, by calling 877-781-6392 (toll-free).

A description of the policies and procedures that the Fund uses in voting proxies relating to Fund securities, as well as information regarding how the Fund voted proxies during the most recent twelve-month period ended June 30, is available without charge, upon request, by calling 877-781-6392 (toll-free) and on the Securities and Exchange Commission (the “Commission”) website at http://www.sec.gov.

The Fund has filed its Schedules of Investments as of March 31 and September 30 with the Commission, as required, on Form N-Q. Form N-Q is required to be filed with the Commission for the first and third quarters of each fiscal year within sixty days after the end of each period and is available on the Commission website upon acceptance of each submission. The Fund’s Forms N-Q may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information about the Public Reference Room is available by calling 1-800-SEC-0330 (toll-free).

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus of Ohio National Fund, Inc. For a prospectus containing more complete information, including charges and expenses, please contact Ohio National Investments, Inc., One Financial Way, Cincinnati, OH 45242, telephone 877-781-6392 (toll-free).

| 2 |

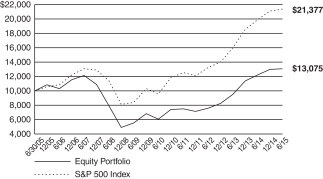

| Ohio National Fund, Inc. | Equity Portfolio |

| 3 | (continued) |

| Ohio National Fund, Inc. | Equity Portfolio (Continued) |

| 4 | (continued) |

| Ohio National Fund, Inc. | Equity Portfolio (Continued) |

| 5 | (continued) |

| Ohio National Fund, Inc. | Equity Portfolio (Continued) |

| (1) | Composition of Portfolio subject to change. |

| (2) | Short-term investments have been excluded from the list of Top 10 Portfolio Holdings. |

| (3) | Sectors (combined): |

| % of Net Assets | ||||

| Financials |

24.0 | |||

| Health Care |

16.7 | |||

| Information Technology |

16.1 | |||

| Consumer Discretionary |

13.1 | |||

| Energy |

8.3 | |||

| Industrials |

7.1 | |||

| Materials |

5.2 | |||

| Utilities |

4.9 | |||

| Consumer Staples |

3.6 | |||

|

|

|

|||

| 99.0 | ||||

|

|

|

| 6 |

| Ohio National Fund, Inc. | Equity Portfolio |

| Schedule of Investments |

June 30, 2015 (Unaudited) |

Percentages are stated as a percent of net assets.

Footnotes:

| (a) | Non-income producing security. |

| (b) | Represents cost for financial reporting purposes, which may differ from cost basis for federal income tax purposes. See also Note 7 of the Notes to Financial Statements. |

The accompanying notes are an integral part of these financial statements.

| 7 |

| Ohio National Fund, Inc. | Money Market Portfolio |

| (1) | Composition of Portfolio subject to change. |

| (2) | Sectors: |

| % of Net Assets | ||||

| Financials |

22.3 | |||

| Consumer Staples |

9.1 | |||

| Information Technology |

8.6 | |||

| Energy |

5.3 | |||

| Health Care |

4.6 | |||

| Consumer Discretionary |

4.1 | |||

|

|

|

|||

| 54.0 | ||||

|

|

|

| 8 |

| Ohio National Fund, Inc. | Money Market Portfolio |

| Schedule of Investments |

June 30, 2015 (Unaudited) |

| Commercial Paper – 54.0% | (b) Rate | Maturity | Face Amount | Amortized Cost | ||||||||||||

| CONSUMER DISCRETIONARY – 4.1% |

||||||||||||||||

| Walt Disney Co. / The (Media) |

(a) | 0.070% | 07/01/2015 | $ | 8,000,000 | $ | 8,000,000 | |||||||||

|

|

|

|||||||||||||||

| CONSUMER STAPLES – 9.1% |

||||||||||||||||

| Wal-Mart Stores, Inc. (Food & Staples Retailing) |

(a) | 0.050% | 07/06/2015 | 9,000,000 | 8,999,938 | |||||||||||

| Nestle Capital Corp. (Food Products) |

(a) | 0.060% | 07/20/2015 | 9,000,000 | 8,999,715 | |||||||||||

|

|

|

|||||||||||||||

| 17,999,653 | ||||||||||||||||

|

|

|

|||||||||||||||

| ENERGY – 5.3% |

||||||||||||||||

| Chevron Corp. (Oil, Gas & Consumable Fuels) |

(a) | 0.080% | 07/16/2015 | 1,500,000 | 1,499,950 | |||||||||||

| Exxon Mobil Corp. (Oil, Gas & Consumable Fuels) |

0.080% | 07/06/2015 | 9,000,000 | 8,999,900 | ||||||||||||

|

|

|

|||||||||||||||

| 10,499,850 | ||||||||||||||||

|

|

|

|||||||||||||||

| FINANCIALS – 22.3% |

||||||||||||||||

| U.S. Bank (Commercial Banks) |

0.050% | 07/01/2015 | 9,000,000 | 9,000,000 | ||||||||||||

| American Honda Finance Corp. (Consumer Finance) |

0.110% | 07/23/2015 | 9,000,000 | 8,999,395 | ||||||||||||

| John Deere Capital Corp. (Consumer Finance) |

(a) | 0.120% | 07/21/2015 | 8,000,000 | 7,999,466 | |||||||||||

| Toyota Motor Credit Corp. (Consumer Finance) |

0.100% | 07/13/2015 | 9,000,000 | 8,999,700 | ||||||||||||

| Prudential Funding LLC (Insurance) |

0.030% | 07/01/2015 | 9,000,000 | 9,000,000 | ||||||||||||

|

|

|

|||||||||||||||

| 43,998,561 | ||||||||||||||||

|

|

|

|||||||||||||||

| HEALTH CARE – 4.6% |

||||||||||||||||

| Johnson & Johnson (Pharmaceuticals) |

(a) | 0.050% | 07/24/2015 | 9,000,000 | 8,999,713 | |||||||||||

|

|

|

|||||||||||||||

| INFORMATION TECHNOLOGY – 8.6% |

||||||||||||||||

| International Business Machines Corp. (IT Services) |

(a) | 0.090% | 07/27/2015 | 9,000,000 | 8,999,415 | |||||||||||

| Microsoft Corp. (Software) |

(a) | 0.070% | 07/22/2015 | 8,000,000 | 7,999,673 | |||||||||||

|

|

|

|||||||||||||||

| 16,999,088 | ||||||||||||||||

|

|

|

|||||||||||||||

| Total Commercial Paper (Cost $106,496,865) |

$ | 106,496,865 | ||||||||||||||

|

|

|

|||||||||||||||

| U.S. Government Agency Issues – 4.1% | Rate | Maturity | Face Amount | Amortized Cost | ||||||||||||

| Federal Home Loan Bank |

0.030% | 07/15/2015 | $ | 8,000,000 | $ | 7,999,907 | ||||||||||

|

|

|

|||||||||||||||

| Total U.S. Government Agency Issues (Cost $7,999,907) |

$ | 7,999,907 | ||||||||||||||

|

|

|

|||||||||||||||

| Money Market Funds – 13.7% | Shares | Value | ||||||||||||||

| Federated Prime Cash Obligations Fund – Institutional Class |

0.070% | 07/01/2015 | 9,000,000 | $ | 9,000,000 | |||||||||||

| Fidelity Institutional Money Market Funds Money Market Portfolio – Class I |

0.100% | 07/01/2015 | 9,000,000 | 9,000,000 | ||||||||||||

| First American Prime Obligations Fund – Class Z |

0.030% | 07/01/2015 | 9,000,000 | 9,000,000 | ||||||||||||

|

|

|

|||||||||||||||

| Total Money Market Funds (Cost $27,000,000) |

$ | 27,000,000 | ||||||||||||||

|

|

|

|||||||||||||||

| Total Investments – 71.8% (Cost $141,496,772) |

(c) | $ | 141,496,772 | |||||||||||||

| Other Assets in Excess of Liabilities – 28.2% |

55,694,038 | |||||||||||||||

|

|

|

|||||||||||||||

| Net Assets – 100.0% |

$ | 197,190,810 | ||||||||||||||

|

|

|

|||||||||||||||

Percentages are stated as a percent of net assets.

Footnotes:

| (a) | Security exempt from registration under Section 4 (2) of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified buyers under Rule 144A. At June 30, 2015, the value of these securities totaled $61,497,870, or 31.2% of the Portfolio’s net assets. These securities were deemed liquid pursuant to procedures approved by the Board of Directors. |

| (b) | Rate presented is the effective yield at the time of purchase. |

| (c) | Represents cost for federal income tax and financial reporting purposes. See also Note 2 regarding the use of amortized cost for valuation of instruments in this Portfolio. |

The accompanying notes are an integral part of these financial statements.

| 9 |

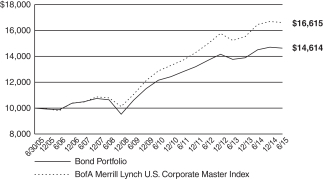

| Ohio National Fund, Inc. | Bond Portfolio |

| 10 | (continued) |

| Ohio National Fund, Inc. | Bond Portfolio (Continued) |

| (1) | Composition of Portfolio subject to change. |

| (2) | Short-term investments have been excluded from the list of Top 10 Portfolio Holdings. |

| (3) | Sectors (combined): |

| % of Net Assets | ||||

| Financials |

26.4 | |||

| Energy |

16.8 | |||

| Utilities |

12.0 | |||

| Industrials |

10.6 | |||

| Consumer Discretionary |

9.0 | |||

| Health Care |

6.1 | |||

| Information Technology |

5.7 | |||

| Materials |

5.1 | |||

| Consumer Staples |

4.1 | |||

| Telecommunication Services |

2.0 | |||

|

|

|

|||

| 97.8 | ||||

|

|

|

| 11 | (continued) |

| Ohio National Fund, Inc. | Bond Portfolio |

| Schedule of Investments |

June 30, 2015 (Unaudited) |

| Corporate Bonds – 97.2% | Rate | Maturity | Face Amount | Value | ||||||||||||

| CONSUMER DISCRETIONARY – 9.0% |

| |||||||||||||||

| Magna International, Inc. (Auto Components) |

3.625% | 06/15/2024 | $ | 1,000,000 | $ | 983,441 | ||||||||||

| General Motors Co. (Automobiles) |

5.000% | 04/01/2035 | 900,000 | 883,669 | ||||||||||||

| Darden Restaurants, Inc. (Hotels, Restaurants & Leisure) |

3.350% | 11/01/2022 | 206,000 | 193,130 | ||||||||||||

| Newell Rubbermaid, Inc. (Household Durables) |

6.250% | 04/15/2018 | 500,000 | 553,919 | ||||||||||||

| Mattel, Inc. (Leisure Products) |

2.350% | 05/06/2019 | 1,000,000 | 997,568 | ||||||||||||

| Mattel, Inc. (Leisure Products) |

3.150% | 03/15/2023 | 625,000 | 604,379 | ||||||||||||

| 21st Century Fox America, Inc. (Media) |

4.500% | 02/15/2021 | 1,250,000 | 1,351,708 | ||||||||||||

| Comcast Corp. (Media) |

4.250% | 01/15/2033 | 750,000 | 731,260 | ||||||||||||

| Discovery Communications, LLC (Media) |

4.375% | 06/15/2021 | 1,000,000 | 1,050,889 | ||||||||||||

| Discovery Communications, LLC (Media) |

3.300% | 05/15/2022 | 275,000 | 270,081 | ||||||||||||

| Time Warner Cable, Inc. (Media) |

4.500% | 09/15/2042 | 425,000 | 348,240 | ||||||||||||

| Time Warner, Inc. (Media) |

2.100% | 06/01/2019 | 1,400,000 | 1,389,786 | ||||||||||||

| Viacom, Inc. (Media) |

4.850% | 12/15/2034 | 1,500,000 | 1,383,257 | ||||||||||||

| Walt Disney Co. / The (Media) |

3.700% | 12/01/2042 | 925,000 | 846,322 | ||||||||||||

| Kohl’s Corp. (Multiline Retail) |

4.000% | 11/01/2021 | 925,000 | 978,808 | ||||||||||||

| AutoZone, Inc. (Specialty Retail) |

3.125% | 07/15/2023 | 925,000 | 895,838 | ||||||||||||

| Bed Bath & Beyond, Inc. (Specialty Retail) |

5.165% | 08/01/2044 | 900,000 | 890,363 | ||||||||||||

|

|

|

|||||||||||||||

| 14,352,658 | ||||||||||||||||

|

|

|

|||||||||||||||

| CONSUMER STAPLES – 4.1% |

| |||||||||||||||

| Anheuser-Busch Cos., LLC (Beverages) |

5.500% | 01/15/2018 | 750,000 | 824,456 | ||||||||||||

| Anheuser-Busch InBev Finance, Inc. (Beverages) |

4.000% | 01/17/2043 | 750,000 | 685,949 | ||||||||||||

| CVS Health Corp. (Food & Staples Retailing) |

5.750% | 06/01/2017 | 301,000 | 325,243 | ||||||||||||

| Kroger Co. / The (Food & Staples Retailing) |

2.950% | 11/01/2021 | 900,000 | 895,544 | ||||||||||||

| Sysco Corp. (Food & Staples Retailing) |

4.350% | 10/02/2034 | 900,000 | 909,000 | ||||||||||||

| Bunge NA Finance LP (Food Products) |

5.900% | 04/01/2017 | 1,500,000 | 1,602,162 | ||||||||||||

| Philip Morris International, Inc. (Tobacco) |

4.125% | 05/17/2021 | 1,250,000 | 1,347,329 | ||||||||||||

|

|

|

|||||||||||||||

| 6,589,683 | ||||||||||||||||

|

|

|

|||||||||||||||

| ENERGY – 16.8% |

||||||||||||||||

| Ensco PLC (Energy Equip. & Svs.) |

5.200% | 03/15/2025 | 900,000 | 889,791 | ||||||||||||

| Noble Holding International Ltd. (Energy Equip. & Svs.) |

4.000% | 03/16/2018 | 900,000 | 920,993 | ||||||||||||

| Noble Holding International Ltd. (Energy Equip. & Svs.) |

5.950% | 04/01/2025 | 1,000,000 | 984,619 | ||||||||||||

| Weatherford International Ltd. (Energy Equip. & Svs.) |

6.000% | 03/15/2018 | 1,500,000 | 1,596,049 | ||||||||||||

| Anadarko Petroleum Corp. (Oil, Gas & Consumable Fuels) |

5.950% | 09/15/2016 | 1,000,000 | 1,054,080 | ||||||||||||

| Buckeye Partners LP (Oil, Gas & Consumable Fuels) |

4.875% | 02/01/2021 | 1,000,000 | 1,041,702 | ||||||||||||

| Chesapeake Energy Corp. (Oil, Gas & Consumable Fuels) |

4.875% | 04/15/2022 | 1,000,000 | 870,000 | ||||||||||||

| Columbia Pipeline Group, Inc. (Oil, Gas & Consumable Fuels) |

(a) | 4.500% | 06/01/2025 | 900,000 | 886,496 | |||||||||||

| ConocoPhillips Co. (Oil, Gas & Consumable Fuels) |

3.350% | 05/15/2025 | 1,350,000 | 1,332,054 | ||||||||||||

| Devon Energy Corp. (Oil, Gas & Consumable Fuels) |

3.250% | 05/15/2022 | 900,000 | 888,502 | ||||||||||||

| Energy Transfer Partners LP (Oil, Gas & Consumable Fuels) |

4.750% | 01/15/2026 | 400,000 | 394,269 | ||||||||||||

| Enterprise Products Operating LLC (Oil, Gas & Consumable Fuels) |

3.900% | 02/15/2024 | 1,000,000 | 1,002,810 | ||||||||||||

| Kinder Morgan Energy Partners LP (Oil, Gas & Consumable Fuels) |

4.150% | 03/01/2022 | 1,000,000 | 1,000,510 | ||||||||||||

| Kinder Morgan, Inc. (Oil, Gas & Consumable Fuels) |

5.300% | 12/01/2034 | 1,000,000 | 921,737 | ||||||||||||

| Magellan Midstream Partners LP (Oil, Gas & Consumable Fuels) |

4.250% | 02/01/2021 | 1,000,000 | 1,062,923 | ||||||||||||

| Marathon Oil Corp. (Oil, Gas & Consumable Fuels) |

3.850% | 06/01/2025 | 850,000 | 831,792 | ||||||||||||

| Marathon Petroleum Corp. (Oil, Gas & Consumable Fuels) |

4.750% | 09/15/2044 | 1,000,000 | 909,481 | ||||||||||||

| MarkWest Energy Partners LP / MarkWest Energy Finance Corp. (Oil, Gas & Consumable Fuels) |

4.875% | 12/01/2024 | 1,000,000 | 977,500 | ||||||||||||

| Murphy Oil Corp. (Oil, Gas & Consumable Fuels) |

3.700% | 12/01/2022 | 1,400,000 | 1,279,509 | ||||||||||||

| Occidental Petroleum Corp. (Oil, Gas & Consumable Fuels) |

3.125% | 02/15/2022 | 1,000,000 | 1,001,416 | ||||||||||||

| Phillips 66 (Oil, Gas & Consumable Fuels) |

4.300% | 04/01/2022 | 1,300,000 | 1,363,059 | ||||||||||||

| Plains All American Pipeline LP / PAA Finance Corp. (Oil, Gas & Consumable Fuels) |

2.850% | 01/31/2023 | 1,000,000 | 937,367 | ||||||||||||

| Shell International Finance BV (Oil, Gas & Consumable Fuels) |

4.375% | 03/25/2020 | 1,250,000 | 1,367,314 | ||||||||||||

| Southwestern Energy Co. (Oil, Gas & Consumable Fuels) |

4.050% | 01/23/2020 | 900,000 | 924,186 | ||||||||||||

| TransCanada PipeLines Ltd. (Oil, Gas & Consumable Fuels) |

2.500% | 08/01/2022 | 1,425,000 | 1,350,129 | ||||||||||||

| Williams Cos., Inc. / The (Oil, Gas & Consumable Fuels) |

5.750% | 06/24/2044 | 1,000,000 | 925,047 | ||||||||||||

|

|

|

|||||||||||||||

| 26,713,335 | ||||||||||||||||

|

|

|

|||||||||||||||

| FINANCIALS – 26.4% |

| |||||||||||||||

| Bank of America Corp. (Banks) |

5.650% | 05/01/2018 | 1,000,000 | 1,097,966 | ||||||||||||

| Bank of America Corp. (Banks) |

4.200% | 08/26/2024 | 500,000 | 498,087 | ||||||||||||

| Citigroup, Inc. (Banks) |

4.400% | 06/10/2025 | 900,000 | 895,296 | ||||||||||||

| Comerica Bank (Banks) |

5.750% | 11/21/2016 | 1,500,000 | 1,598,994 | ||||||||||||

| Fifth Third Bancorp (Banks) |

4.500% | 06/01/2018 | 1,750,000 | 1,852,685 | ||||||||||||

| KeyCorp (Banks) |

5.100% | 03/24/2021 | 500,000 | 554,194 | ||||||||||||

| PNC Bank NA (Banks) |

3.250% | 06/01/2025 | 850,000 | 828,821 | ||||||||||||

| SunTrust Banks, Inc. (Banks) |

2.500% | 05/01/2019 | 1,400,000 | 1,406,898 | ||||||||||||

| Wells Fargo & Co. (Banks) |

4.650% | 11/04/2044 | 1,000,000 | 954,987 | ||||||||||||

| Goldman Sachs Group, Inc. / The (Capital Markets) |

3.750% | 05/22/2025 | 1,400,000 | 1,379,445 | ||||||||||||

| Janus Capital Group, Inc. (Capital Markets) |

(b) | 6.700% | 06/15/2017 | 1,500,000 | 1,632,186 | |||||||||||

| 12 | (continued) |

| Ohio National Fund, Inc. | Bond Portfolio (Continued) |

| Schedule of Investments |

June 30, 2015 (Unaudited) |

| Corporate Bonds (Continued) | Rate | Maturity | Face Amount | Value | ||||||||||||

| FINANCIALS (continued) |

||||||||||||||||

| Morgan Stanley (Capital Markets) |

3.750% | 02/25/2023 | $ | 1,250,000 | $ | 1,265,268 | ||||||||||

| Morgan Stanley (Capital Markets) |

3.950% | 04/23/2027 | 1,000,000 | 941,241 | ||||||||||||

| Northern Trust Corp. (Capital Markets) |

3.450% | 11/04/2020 | 1,000,000 | 1,057,036 | ||||||||||||

| State Street Corp. (Capital Markets) |

4.375% | 03/07/2021 | 1,250,000 | 1,375,481 | ||||||||||||

| Ally Financial, Inc. (Consumer Finance) |

5.125% | 09/30/2024 | 1,000,000 | 1,002,500 | ||||||||||||

| Capital One Financial Corp. (Consumer Finance) |

2.450% | 04/24/2019 | 925,000 | 924,441 | ||||||||||||

| Discover Financial Services (Consumer Finance) |

6.450% | 06/12/2017 | 750,000 | 814,441 | ||||||||||||

| Synchrony Financial (Consumer Finance) |

4.250% | 08/15/2024 | 900,000 | 902,614 | ||||||||||||

| General Electric Capital Corp. (Diversified Financial Svs.) |

5.625% | 05/01/2018 | 1,000,000 | 1,106,276 | ||||||||||||

| Moody’s Corp. (Diversified Financial Svs.) |

5.250% | 07/15/2044 | 1,000,000 | 1,024,593 | ||||||||||||

| Aflac, Inc. (Insurance) |

3.625% | 06/15/2023 | 1,425,000 | 1,438,184 | ||||||||||||

| Allstate Corp. / The (Insurance) |

5.200% | 01/15/2042 | 500,000 | 526,195 | ||||||||||||

| American International Group, Inc. (Insurance) |

3.875% | 01/15/2035 | 1,400,000 | 1,264,785 | ||||||||||||

| Hartford Financial Services Group, Inc. / The (Insurance) |

5.375% | 03/15/2017 | 1,500,000 | 1,593,770 | ||||||||||||

| Liberty Mutual Group, Inc. (Insurance) |

(a) | 4.850% | 08/01/2044 | 1,500,000 | 1,444,116 | |||||||||||

| Marsh & McLennan Cos., Inc. (Insurance) |

3.500% | 06/03/2024 | 1,400,000 | 1,393,564 | ||||||||||||

| Metropolitan Life Global Funding I (Insurance) |

(a) | 2.300% | 04/10/2019 | 1,500,000 | 1,508,269 | |||||||||||

| New York Life Global Funding (Insurance) |

(a) | 2.150% | 06/18/2019 | 1,000,000 | 1,001,832 | |||||||||||

| Prudential Financial, Inc. (Insurance) |

6.100% | 06/15/2017 | 1,500,000 | 1,629,681 | ||||||||||||

| Boston Properties LP (Real Estate Investment Trusts) |

3.125% | 09/01/2023 | 925,000 | 897,970 | ||||||||||||

| Camden Property Trust (Real Estate Investment Trusts) |

4.250% | 01/15/2024 | 500,000 | 513,701 | ||||||||||||

| Equity One, Inc. (Real Estate Investment Trusts) |

6.250% | 01/15/2017 | 1,250,000 | 1,332,269 | ||||||||||||

| Federal Realty Investment Trust (Real Estate Investment Trusts) |

3.000% | 08/01/2022 | 1,425,000 | 1,402,180 | ||||||||||||

| HCP, Inc. (Real Estate Investment Trusts) |

4.000% | 06/01/2025 | 1,500,000 | 1,466,262 | ||||||||||||

| Simon Property Group LP (Real Estate Investment Trusts) |

3.750% | 02/01/2024 | 1,475,000 | 1,508,888 | ||||||||||||

|

|

|

|||||||||||||||

| 42,035,116 | ||||||||||||||||

|

|

|

|||||||||||||||

| HEALTH CARE – 6.1% |

||||||||||||||||

| Amgen, Inc. (Biotechnology) |

4.100% | 06/15/2021 | 1,000,000 | 1,064,141 | ||||||||||||

| Baxalta, Inc. (Biotechnology) |

(a) | 4.000% | 06/23/2025 | 1,400,000 | 1,390,844 | |||||||||||

| Gilead Sciences, Inc. (Biotechnology) |

4.500% | 02/01/2045 | 900,000 | 893,127 | ||||||||||||

| Becton Dickinson and Co. (Health Care Equip. & Supplies) |

5.000% | 05/15/2019 | 500,000 | 546,273 | ||||||||||||

| AmerisourceBergen Corp. (Health Care Providers & Svs.) |

4.875% | 11/15/2019 | 500,000 | 550,907 | ||||||||||||

| Express Scripts Holding Co. (Health Care Providers & Svs.) |

2.250% | 06/15/2019 | 1,400,000 | 1,387,644 | ||||||||||||

| Laboratory Corp. of America Holdings (Health Care Providers & Svs.) |

3.750% | 08/23/2022 | 425,000 | 429,362 | ||||||||||||

| Quest Diagnostics, Inc. (Health Care Providers & Svs.) |

2.700% | 04/01/2019 | 1,000,000 | 1,007,561 | ||||||||||||

| AbbVie, Inc. (Pharmaceuticals) |

2.900% | 11/06/2022 | 1,425,000 | 1,378,575 | ||||||||||||

| Merck Sharp & Dohme Corp. (Pharmaceuticals) |

5.000% | 06/30/2019 | 1,000,000 | 1,112,711 | ||||||||||||

|

|

|

|||||||||||||||

| 9,761,145 | ||||||||||||||||

|

|

|

|||||||||||||||

| INDUSTRIALS – 10.0% |

||||||||||||||||

| BAE Systems Holdings, Inc. (Aerospace & Defense) |

(a) | 6.375% | 06/01/2019 | 750,000 | 854,739 | |||||||||||

| Lockheed Martin Corp. (Aerospace & Defense) |

3.350% | 09/15/2021 | 1,000,000 | 1,028,106 | ||||||||||||

| Lockheed Martin Corp. (Aerospace & Defense) |

3.600% | 03/01/2035 | 1,000,000 | 920,609 | ||||||||||||

| Raytheon Co. (Aerospace & Defense) |

4.400% | 02/15/2020 | 1,250,000 | 1,367,560 | ||||||||||||

| FedEx Corp. (Air Freight & Logistics) |

4.900% | 01/15/2034 | 1,425,000 | 1,473,055 | ||||||||||||

| American Airlines Group, Inc. (Airlines) |

(a) | 4.625% | 03/01/2020 | 1,000,000 | 967,500 | |||||||||||

| Waste Management, Inc. (Commercial Svs. & Supplies) |

6.100% | 03/15/2018 | 500,000 | 557,927 | ||||||||||||

| Deere & Co. (Machinery) |

4.375% | 10/16/2019 | 1,250,000 | 1,369,761 | ||||||||||||

| Illinois Tool Works, Inc. (Machinery) |

3.375% | 09/15/2021 | 500,000 | 521,785 | ||||||||||||

| Parker-Hannifin Corp. (Machinery) |

4.200% | 11/21/2034 | 1,400,000 | 1,391,340 | ||||||||||||

| Burlington Northern Santa Fe, LLC (Road & Rail) |

4.550% | 09/01/2044 | 900,000 | 887,522 | ||||||||||||

| CSX Corp. (Road & Rail) |

5.600% | 05/01/2017 | 1,500,000 | 1,616,664 | ||||||||||||

| Norfolk Southern Corp. (Road & Rail) |

3.000% | 04/01/2022 | 600,000 | 596,167 | ||||||||||||

| Union Pacific Corp. (Road & Rail) |

4.000% | 02/01/2021 | 1,250,000 | 1,348,208 | ||||||||||||

| Union Pacific Corp. (Road & Rail) |

3.250% | 08/15/2025 | 1,000,000 | 988,005 | ||||||||||||

|

|

|

|||||||||||||||

| 15,888,948 | ||||||||||||||||

|

|

|

|||||||||||||||

| INFORMATION TECHNOLOGY – 5.7% |

||||||||||||||||

| Harris Corp. (Communications Equip.) |

2.700% | 04/27/2020 | 900,000 | 887,724 | ||||||||||||

| QUALCOMM, Inc. (Communications Equip.) |

3.450% | 05/20/2025 | 1,000,000 | 972,959 | ||||||||||||

| Denali Borrower LLC / Denali Finance Corp. (Computers & Peripherals) |

(a) | 5.625% | 10/15/2020 | 900,000 | 946,125 | |||||||||||

| Computer Sciences Corp. (IT Svs.) |

6.500% | 03/15/2018 | 1,000,000 | 1,104,148 | ||||||||||||

| Intel Corp. (Semiconductors & Equip.) |

4.000% | 12/15/2032 | 1,500,000 | 1,433,273 | ||||||||||||

| KLA-Tencor Corp. (Semiconductors & Equip.) |

3.375% | 11/01/2019 | 900,000 | 923,756 | ||||||||||||

| Microsoft Corp. (Software) |

3.500% | 02/12/2035 | 400,000 | 364,499 | ||||||||||||

| Oracle Corp. (Software) |

4.300% | 07/08/2034 | 1,500,000 | 1,474,769 | ||||||||||||

| Apple, Inc. (Tech. Hardware, Storage & Periph.) |

2.500% | 02/09/2025 | 1,000,000 | 936,210 | ||||||||||||

|

|

|

|||||||||||||||

| 9,043,463 | ||||||||||||||||

|

|

|

|||||||||||||||

| 13 | (continued) |

| Ohio National Fund, Inc. | Bond Portfolio (Continued) |

| Schedule of Investments |

June 30, 2015 (Unaudited) |

| Corporate Bonds (Continued) | Rate | Maturity | Face Amount | Value | ||||||||||||

| MATERIALS – 5.1% |

||||||||||||||||

| Dow Chemical Co. / The (Chemicals) |

4.250% | 10/01/2034 | $ | 1,400,000 | $ | 1,311,128 | ||||||||||

| Eastman Chemical Co. (Chemicals) |

3.600% | 08/15/2022 | 1,000,000 | 1,009,683 | ||||||||||||

| FMC Corp. (Chemicals) |

3.950% | 02/01/2022 | 1,000,000 | 1,013,966 | ||||||||||||

| Praxair, Inc. (Chemicals) |

2.650% | 02/05/2025 | 1,000,000 | 954,084 | ||||||||||||

| Packaging Corp. of America (Containers & Packaging) |

4.500% | 11/01/2023 | 675,000 | 695,238 | ||||||||||||

| Freeport-McMoRan, Inc. (Metals & Mining) |

3.550% | 03/01/2022 | 925,000 | 855,266 | ||||||||||||

| Newmont Mining Corp. (Metals & Mining) |

3.500% | 03/15/2022 | 1,425,000 | 1,358,425 | ||||||||||||

| Teck Resources Ltd. (Metals & Mining) |

3.750% | 02/01/2023 | 1,000,000 | 859,159 | ||||||||||||

|

|

|

|||||||||||||||

| 8,056,949 | ||||||||||||||||

|

|

|

|||||||||||||||

| TELECOMMUNICATION SERVICES – 2.0% |

||||||||||||||||

| AT&T, Inc. (Diversified Telecom. Svs.) |

3.400% | 05/15/2025 | 900,000 | 854,528 | ||||||||||||

| Verizon Communications, Inc. (Diversified Telecom. Svs.) |

4.600% | 04/01/2021 | 1,250,000 | 1,341,921 | ||||||||||||

| Verizon Communications, Inc. (Diversified Telecom. Svs.) |

3.850% | 11/01/2042 | 425,000 | 350,014 | ||||||||||||

| Rogers Communications, Inc. (Wireless Telecom. Svs.) |

3.000% | 03/15/2023 | 700,000 | 671,505 | ||||||||||||

|

|

|

|||||||||||||||

| 3,217,968 | ||||||||||||||||

|

|

|

|||||||||||||||

| UTILITIES – 12.0% |

||||||||||||||||

| Appalachian Power Co. (Electric Utilities) |

4.600% | 03/30/2021 | 1,000,000 | 1,086,105 | ||||||||||||

| Commonwealth Edison Co. (Electric Utilities) |

5.950% | 08/15/2016 | 1,500,000 | 1,581,858 | ||||||||||||

| DTE Electric Co. (Electric Utilities) |

3.375% | 03/01/2025 | 1,000,000 | 1,010,833 | ||||||||||||

| Duke Energy Florida, Inc. (Electric Utilities) |

4.550% | 04/01/2020 | 500,000 | 549,053 | ||||||||||||

| ITC Holdings Corp. (Electric Utilities) |

3.650% | 06/15/2024 | 500,000 | 494,337 | ||||||||||||

| Kansas City Power & Light Co. (Electric Utilities) |

5.850% | 06/15/2017 | 1,500,000 | 1,624,940 | ||||||||||||

| South Carolina Electric & Gas Co. (Electric Utilities) |

4.350% | 02/01/2042 | 1,000,000 | 954,938 | ||||||||||||

| Tenaska Georgia Partners LP (Electric Utilities) |

9.500% | 02/01/2030 | 439,987 | 547,328 | ||||||||||||

| Union Electric Co. (Electric Utilities) |

6.400% | 06/15/2017 | 1,500,000 | 1,643,427 | ||||||||||||

| Westar Energy, Inc. (Electric Utilities) |

4.125% | 03/01/2042 | 500,000 | 482,569 | ||||||||||||

| Xcel Energy, Inc. (Electric Utilities) |

4.700% | 05/15/2020 | 1,000,000 | 1,089,847 | ||||||||||||

| AGL Capital Corp. (Gas Utilities) |

5.250% | 08/15/2019 | 1,000,000 | 1,104,664 | ||||||||||||

| Southwest Gas Corp. (Gas Utilities) |

3.875% | 04/01/2022 | 1,250,000 | 1,308,328 | ||||||||||||

| Spectra Energy Capital LLC (Gas Utilities) |

3.300% | 03/15/2023 | 1,425,000 | 1,305,162 | ||||||||||||

| Avista Corp. (Multi-Utilities) |

5.950% | 06/01/2018 | 1,000,000 | 1,120,865 | ||||||||||||

| LG&E and KU Energy LLC (Multi-Utilities) |

4.375% | 10/01/2021 | 1,000,000 | 1,083,465 | ||||||||||||

| Public Service Electric & Gas Co. (Multi-Utilities) |

3.950% | 05/01/2042 | 750,000 | 708,781 | ||||||||||||

| American Water Capital Corp. (Water Utilities) |

4.300% | 12/01/2042 | 1,400,000 | 1,374,097 | ||||||||||||

|

|

|

|||||||||||||||

| 19,070,597 | ||||||||||||||||

|

|

|

|||||||||||||||

| Total Corporate Bonds (Cost $152,543,352) |

$ | 154,729,862 | ||||||||||||||

|

|

|

|||||||||||||||

| Asset-Backed Securities – 0.6% | Rate | Maturity | Face Amount | Value | ||||||||||||

| INDUSTRIALS – 0.6% |

||||||||||||||||

| American Airlines 2015-1 Class B Pass Through Trust (Airlines) |

3.700% | 05/01/2023 | $ | 900,000 | $ | 882,000 | ||||||||||

|

|

|

|||||||||||||||

| Total Asset-Backed Securities (Cost $900,000) |

$ | 882,000 | ||||||||||||||

|

|

|

|||||||||||||||

| Money Market Funds – 0.7% | Shares | Value | ||||||||||||||

| Fidelity Institutional Money Market Funds |

1,186,000 | $ | 1,186,000 | |||||||||||||

|

|

|

|||||||||||||||

| Total Money Market Funds (Cost $1,186,000) |

$ | 1,186,000 | ||||||||||||||

|

|

|

|||||||||||||||

| Total Investments – 98.5% (Cost $154,629,352) |

(c) | $ | 156,797,862 | |||||||||||||

| Other Assets in Excess of Liabilities – 1.5% |

2,432,853 | |||||||||||||||

|

|

|

|||||||||||||||

| Net Assets – 100.0% |

$ | 159,230,715 | ||||||||||||||

|

|

|

|||||||||||||||

Percentages are stated as a percent of net assets.

Footnotes:

| (a) | Security exempt from registration under Regulation D of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified buyers under Rule 144A. At June 30, 2015, the value of these securities totaled $8,999,921, or 5.7% of the Portfolio’s net assets. These securities were deemed liquid pursuant to procedures approved by the Board of Directors. |

| (b) | Represents bonds that are credit sensitive. The coupon rates for these bonds are subject to adjustment based on changes in national credit rating agency ratings. |

| (c) | Represents cost for financial reporting purposes, which may differ from cost basis for federal income tax purposes. See also Note 7 of the Notes to Financial Statements. |

The accompanying notes are an integral part of these financial statements.

| 14 |

| Ohio National Fund, Inc. | Omni Portfolio |

| 15 | (continued) |

| Ohio National Fund, Inc. | Omni Portfolio (Continued) |

| (1) | Composition of Portfolio subject to change. |

| (2) | Short-term investments have been excluded from the list of Top 10 Portfolio Holdings. |

| (3) | Sectors (combined): |

| % of Net Assets | ||||

| Information Technology |

18.7 | |||

| Financials |

17.5 | |||

| Health Care |

17.2 | |||

| Consumer Discretionary |

16.2 | |||

| Industrials |

8.4 | |||

| Energy |

7.2 | |||

| Consumer Staples |

4.4 | |||

| Materials |

4.4 | |||

| Utilities |

1.9 | |||

| Telecommunication Services |

0.4 | |||

|

|

|

|||

| 96.3 | ||||

|

|

|

| 16 |

| Ohio National Fund, Inc. | Omni Portfolio |

| Schedule of Investments |

June 30, 2015 (Unaudited) |

| Common Stocks – 75.7% | Shares | Value | ||||||||

| CONSUMER DISCRETIONARY – 14.2% |

||||||||||

| Johnson Controls, Inc. (Auto Components) |

14,249 | $ | 705,753 | |||||||

| Jarden Corp. (Household Durables) |

(a) | 13,350 | 690,862 | |||||||

| Amazon.com, Inc. (Internet & Catalog Retail) |

(a) | 1,792 | 777,889 | |||||||

| CBS Corp. Class B (Media) |

13,728 | 761,904 | ||||||||

| Time Warner, Inc. (Media) |

8,501 | 743,072 | ||||||||

| Viacom, Inc. Class B (Media) |

11,531 | 745,364 | ||||||||

| Walt Disney Co. / The (Media) |

6,860 | 783,000 | ||||||||

| Lowe’s Cos., Inc. (Specialty Retail) |

11,138 | 745,912 | ||||||||

| Tiffany & Co. (Specialty Retail) |

4,844 | 444,679 | ||||||||

| PVH Corp. (Textiles, Apparel & Luxury Goods) |

6,740 | 776,448 | ||||||||

|

|

|

|||||||||

| 7,174,883 | ||||||||||

|

|

|

|||||||||

| CONSUMER STAPLES – 3.1% |

||||||||||

| Mondelez International, Inc. Class A (Food Products) |

19,005 | 781,866 | ||||||||

| Tyson Foods, Inc. Class A (Food Products) |

17,925 | 764,143 | ||||||||

|

|

|

|||||||||

| 1,546,009 | ||||||||||

|

|

|

|||||||||

| ENERGY – 3.1% |

||||||||||

| Anadarko Petroleum Corp. (Oil, Gas & Consumable Fuels) |

8,827 | 689,036 | ||||||||

| Devon Energy Corp. (Oil, Gas & Consumable Fuels) |

12,398 | 737,557 | ||||||||

| Newfield Exploration Co. (Oil, Gas & Consumable Fuels) |

(a) | 3,895 | 140,687 | |||||||

|

|

|

|||||||||

| 1,567,280 | ||||||||||

|

|

|

|||||||||

| FINANCIALS – 12.9% |

||||||||||

| Bank of America Corp. (Banks) |

45,511 | 774,597 | ||||||||

| BankUnited, Inc. (Banks) |

10,505 | 377,445 | ||||||||

| Citigroup, Inc. (Banks) |

17,200 | 950,128 | ||||||||

| JPMorgan Chase & Co. (Banks) |

12,118 | 821,116 | ||||||||

| Capital One Financial Corp. (Consumer Finance) |

8,767 | 771,233 | ||||||||

| Hartford Financial Services Group, Inc. / The (Insurance) |

17,637 | 733,170 | ||||||||

| Lincoln National Corp. (Insurance) |

5,986 | 354,491 | ||||||||

| MetLife, Inc. (Insurance) |

14,742 | 825,405 | ||||||||

| Prudential Financial, Inc. (Insurance) |

10,813 | 946,354 | ||||||||

|

|

|

|||||||||

| 6,553,939 | ||||||||||

|

|

|

|||||||||

| HEALTH CARE – 15.8% |

||||||||||

| Amgen, Inc. (Biotechnology) |

4,601 | 706,345 | ||||||||

| Celgene Corp. (Biotechnology) |

(a) | 4,022 | 465,486 | |||||||

| Receptos, Inc. (Biotechnology) |

(a) | 3,320 | 630,966 | |||||||

| St. Jude Medical, Inc. (Health Care Equip. & Supplies) |

10,094 | 737,569 | ||||||||

| Aetna, Inc. (Health Care Providers & Svs.) |

4,456 | 567,962 | ||||||||

| HCA Holdings, Inc. (Health Care Providers & Svs.) |

(a) | 8,157 | 740,003 | |||||||

| Thermo Fisher Scientific, Inc. (Life Sciences Tools & Svs.) |

6,936 | 900,015 | ||||||||

| Allergan PLC (Pharmaceuticals) |

(a) | 3,167 | 961,058 | |||||||

| Mylan NV (Pharmaceuticals) |

(a) | 13,485 | 915,092 | |||||||

| Pfizer, Inc. (Pharmaceuticals) |

18,856 | 632,242 | ||||||||

| Valeant Pharmaceuticals International, Inc. (Pharmaceuticals) |

(a) | 3,260 | 724,209 | |||||||

|

|

|

|||||||||

| 7,980,947 | ||||||||||

|

|

|

|||||||||

| INDUSTRIALS – 6.5% |

||||||||||

| Honeywell International, Inc. (Aerospace & Defense) |

7,074 | 721,336 | ||||||||

| Lockheed Martin Corp. (Aerospace & Defense) |

4,071 | 756,799 | ||||||||

| FedEx Corp. (Air Freight & Logistics) |

4,255 | 725,052 | ||||||||

| General Electric Co. (Industrial Conglomerates) |

13,160 | 349,661 | ||||||||

| Xylem, Inc. (Machinery) |

20,574 | 762,678 | ||||||||

|

|

|

|||||||||

| 3,315,526 | ||||||||||

|

|

|

|||||||||

| INFORMATION TECHNOLOGY – 16.6% |

||||||||||

| Cisco Systems, Inc. (Communications Equip.) |

26,636 | 731,424 | ||||||||

| Facebook, Inc. Class A (Internet Software & Svs.) |

(a) | 8,873 | 760,993 | |||||||

| Google, Inc. Class A (Internet Software & Svs.) |

(a) | 631 | 340,765 | |||||||

| Google, Inc. Class C (Internet Software & Svs.) |

(a) | 570 | 296,691 | |||||||

| MasterCard, Inc. Class A (IT Svs.) |

8,250 | 771,210 | ||||||||

| Avago Technologies Ltd. (Semiconductors & Equip.) |

5,737 | 762,619 | ||||||||

| Intel Corp. (Semiconductors & Equip.) |

24,452 | 743,707 | ||||||||

| Microsoft Corp. (Software) |

21,985 | 970,638 | ||||||||

| Oracle Corp. (Software) |

17,086 | 688,566 | ||||||||

| Apple, Inc. (Tech. Hardware, Storage & Periph.) |

11,822 | 1,482,774 | ||||||||

| Hewlett-Packard Co. (Tech. Hardware, Storage & Periph.) |

28,384 | 851,804 | ||||||||

|

|

|

|||||||||

| 8,401,191 | ||||||||||

|

|

|

|||||||||

| 17 | (continued) |

| Ohio National Fund, Inc. | Omni Portfolio (Continued) |

| Schedule of Investments |

June 30, 2015 (Unaudited) |

| Common Stocks (Continued) | Shares | Value | ||||||||

| MATERIALS – 3.5% |

||||||||||

| Dow Chemical Co. / The (Chemicals) |

14,553 | $ | 744,677 | |||||||

| Huntsman Corp. (Chemicals) |

30,250 | 667,618 | ||||||||

| Monsanto Co. (Chemicals) |

3,247 | 346,098 | ||||||||

|

|

|

|||||||||

| 1,758,393 | ||||||||||

|

|

|

|||||||||

| Total Common Stocks (Cost $36,832,497) |

$ | 38,298,168 | ||||||||

|

|

|

|||||||||

| Corporate Bonds – 20.4% | Rate | Maturity | Face Amount | Value | ||||||||||||

| CONSUMER DISCRETIONARY – 2.0% |

||||||||||||||||

| General Motors Co. (Automobiles) |

5.000% | 04/01/2035 | $ | 100,000 | $ | 98,185 | ||||||||||

| Darden Restaurants, Inc. (Hotels, Restaurants & Leisure) |

3.350% | 11/01/2022 | 11,000 | 10,313 | ||||||||||||

| Mattel, Inc. (Leisure Products) |

3.150% | 03/15/2023 | 75,000 | 72,525 | ||||||||||||

| 21st Century Fox America, Inc. (Media) |

4.500% | 02/15/2021 | 100,000 | 108,137 | ||||||||||||

| Comcast Corp. (Media) |

5.875% | 02/15/2018 | 75,000 | 83,189 | ||||||||||||

| Discovery Communications, LLC (Media) |

3.300% | 05/15/2022 | 75,000 | 73,659 | ||||||||||||

| Time Warner Cable, Inc. (Media) |

4.500% | 09/15/2042 | 75,000 | 61,454 | ||||||||||||

| Time Warner, Inc. (Media) |

2.100% | 06/01/2019 | 100,000 | 99,270 | ||||||||||||

| Viacom, Inc. (Media) |

4.250% | 09/01/2023 | 75,000 | 75,499 | ||||||||||||

| Walt Disney Co. / The (Media) |

3.700% | 12/01/2042 | 75,000 | 68,621 | ||||||||||||

| Kohl’s Corp. (Multiline Retail) |

4.000% | 11/01/2021 | 75,000 | 79,363 | ||||||||||||

| AutoZone, Inc. (Specialty Retail) |

3.125% | 07/15/2023 | 75,000 | 72,636 | ||||||||||||

| Bed Bath & Beyond, Inc. (Specialty Retail) |

5.165% | 08/01/2044 | 100,000 | 98,929 | ||||||||||||

|

|

|

|||||||||||||||

| 1,001,780 | ||||||||||||||||

|

|

|

|||||||||||||||

| CONSUMER STAPLES – 1.3% |

||||||||||||||||

| Anheuser-Busch Cos., LLC (Beverages) |

5.500% | 01/15/2018 | 150,000 | 164,891 | ||||||||||||

| CVS Health Corp. (Food & Staples Retailing) |

5.750% | 06/01/2017 | 45,000 | 48,624 | ||||||||||||

| Kroger Co. / The (Food & Staples Retailing) |

2.950% | 11/01/2021 | 100,000 | 99,505 | ||||||||||||

| Sysco Corp. (Food & Staples Retailing) |

4.350% | 10/02/2034 | 100,000 | 101,000 | ||||||||||||

| Bunge NA Finance LP (Food Products) |

5.900% | 04/01/2017 | 150,000 | 160,216 | ||||||||||||

| Procter & Gamble Co. / The (Household Products) |

4.700% | 02/15/2019 | 100,000 | 110,155 | ||||||||||||

|

|

|

|||||||||||||||

| 684,391 | ||||||||||||||||

|

|

|

|||||||||||||||

| ENERGY – 4.1% |

||||||||||||||||

| Ensco PLC (Energy Equip. & Svs.) |

5.200% | 03/15/2025 | 100,000 | 98,866 | ||||||||||||

| Noble Holding International Ltd. (Energy Equip. & Svs.) |

4.000% | 03/16/2018 | 100,000 | 102,332 | ||||||||||||

| Weatherford International Ltd. (Energy Equip. & Svs.) |

6.000% | 03/15/2018 | 150,000 | 159,605 | ||||||||||||

| Anadarko Petroleum Corp. (Oil, Gas & Consumable Fuels) |

5.950% | 09/15/2016 | 100,000 | 105,408 | ||||||||||||

| Boardwalk Pipelines LP (Oil, Gas & Consumable Fuels) |

5.500% | 02/01/2017 | 100,000 | 103,674 | ||||||||||||

| Columbia Pipeline Group, Inc. (Oil, Gas & Consumable Fuels) |

(b) | 4.500% | 06/01/2025 | 100,000 | 98,500 | |||||||||||

| ConocoPhillips Co. (Oil, Gas & Consumable Fuels) |

3.350% | 05/15/2025 | 150,000 | 148,006 | ||||||||||||

| Devon Energy Corp. (Oil, Gas & Consumable Fuels) |

3.250% | 05/15/2022 | 100,000 | 98,722 | ||||||||||||

| Energy Transfer Partners LP (Oil, Gas & Consumable Fuels) |

4.750% | 01/15/2026 | 100,000 | 98,567 | ||||||||||||

| Enterprise Products Operating LLC (Oil, Gas & Consumable Fuels) |

3.900% | 02/15/2024 | 100,000 | 100,281 | ||||||||||||

| EOG Resources, Inc. (Oil, Gas & Consumable Fuels) |

3.150% | 04/01/2025 | 100,000 | 97,408 | ||||||||||||

| Kinder Morgan Energy Partners LP (Oil, Gas & Consumable Fuels) |

4.150% | 03/01/2022 | 75,000 | 75,038 | ||||||||||||

| Magellan Midstream Partners LP (Oil, Gas & Consumable Fuels) |

6.400% | 07/15/2018 | 150,000 | 167,027 | ||||||||||||

| Marathon Oil Corp. (Oil, Gas & Consumable Fuels) |

3.850% | 06/01/2025 | 150,000 | 146,787 | ||||||||||||

| Murphy Oil Corp. (Oil, Gas & Consumable Fuels) |

3.700% | 12/01/2022 | 100,000 | 91,393 | ||||||||||||

| Phillips 66 (Oil, Gas & Consumable Fuels) |

4.300% | 04/01/2022 | 100,000 | 104,851 | ||||||||||||

| Shell International Finance BV (Oil, Gas & Consumable Fuels) |

3.250% | 05/11/2025 | 100,000 | 98,871 | ||||||||||||

| Southwestern Energy Co. (Oil, Gas & Consumable Fuels) |

4.050% | 01/23/2020 | 100,000 | 102,687 | ||||||||||||

| TransCanada PipeLines Ltd. (Oil, Gas & Consumable Fuels) |

2.500% | 08/01/2022 | 75,000 | 71,059 | ||||||||||||

|

|

|

|||||||||||||||

| 2,069,082 | ||||||||||||||||

|

|

|

|||||||||||||||

| FINANCIALS – 4.6% |

||||||||||||||||

| Bank of America Corp. (Banks) |

5.750% | 08/15/2016 | 75,000 | 78,530 | ||||||||||||

| Citigroup, Inc. (Banks) |

5.850% | 08/02/2016 | 75,000 | 78,690 | ||||||||||||

| Citigroup, Inc. (Banks) |

4.400% | 06/10/2025 | 100,000 | 99,477 | ||||||||||||

| Comerica, Inc. (Banks) |

3.800% | 07/22/2026 | 100,000 | 96,998 | ||||||||||||

| JPMorgan Chase & Co. (Banks) |

3.250% | 09/23/2022 | 100,000 | 99,231 | ||||||||||||

| KeyBank NA (Banks) |

5.700% | 11/01/2017 | 150,000 | 162,964 | ||||||||||||

| PNC Bank NA (Banks) |

3.250% | 06/01/2025 | 150,000 | 146,262 | ||||||||||||

| SunTrust Banks, Inc. (Banks) |

2.500% | 05/01/2019 | 100,000 | 100,493 | ||||||||||||

| Wells Fargo & Co. (Banks) |

3.500% | 03/08/2022 | 75,000 | 77,028 | ||||||||||||

| Goldman Sachs Group, Inc. / The (Capital Markets) |

3.750% | 05/22/2025 | 100,000 | 98,532 | ||||||||||||

| Mellon Funding Corp. (Capital Markets) |

5.500% | 11/15/2018 | 100,000 | 110,966 | ||||||||||||

| Morgan Stanley (Capital Markets) |

3.750% | 02/25/2023 | 75,000 | 75,916 | ||||||||||||

| Northern Trust Corp. (Capital Markets) |

3.950% | 10/30/2025 | 75,000 | 77,371 | ||||||||||||

| Capital One Financial Corp. (Consumer Finance) |

2.450% | 04/24/2019 | 75,000 | 74,955 | ||||||||||||

| 18 | (continued) |

| Ohio National Fund, Inc. | Omni Portfolio (Continued) |

| Schedule of Investments |

June 30, 2015 (Unaudited) |

| Corporate Bonds (Continued) | Rate | Maturity | Face Amount | Value | ||||||||||||

| FINANCIALS (continued) |

||||||||||||||||

| Discover Financial Services (Consumer Finance) |

6.450% | 06/12/2017 | $ | 150,000 | $ | 162,888 | ||||||||||

| Synchrony Financial (Consumer Finance) |

4.250% | 08/15/2024 | 100,000 | 100,291 | ||||||||||||

| Aflac, Inc. (Insurance) |

3.625% | 06/15/2023 | 75,000 | 75,694 | ||||||||||||

| Allstate Corp. / The (Insurance) |

3.150% | 06/15/2023 | 75,000 | 74,997 | ||||||||||||

| American International Group, Inc. (Insurance) |

3.875% | 01/15/2035 | 100,000 | 90,342 | ||||||||||||

| Marsh & McLennan Cos., Inc. (Insurance) |

3.500% | 06/03/2024 | 100,000 | 99,540 | ||||||||||||

| Boston Properties LP (Real Estate Investment Trusts) |

3.125% | 09/01/2023 | 75,000 | 72,808 | ||||||||||||

| Camden Property Trust (Real Estate Investment Trusts) |

3.500% | 09/15/2024 | 100,000 | 97,305 | ||||||||||||

| Federal Realty Investment Trust (Real Estate Investment Trusts) |

3.000% | 08/01/2022 | 75,000 | 73,799 | ||||||||||||

| Simon Property Group LP (Real Estate Investment Trusts) |

3.750% | 02/01/2024 | 75,000 | 76,723 | ||||||||||||

|

|

|

|||||||||||||||

| 2,301,800 | ||||||||||||||||

|

|

|

|||||||||||||||

| HEALTH CARE – 1.4% |

||||||||||||||||

| Baxalta, Inc. (Biotechnology) |

(b) | 4.000% | 06/23/2025 | 100,000 | 99,346 | |||||||||||

| Gilead Sciences, Inc. (Biotechnology) |

4.500% | 02/01/2045 | 100,000 | 99,236 | ||||||||||||

| Anthem, Inc. (Health Care Providers & Svs.) |

5.875% | 06/15/2017 | 150,000 | 162,865 | ||||||||||||

| Express Scripts Holding Co. (Health Care Providers & Svs.) |

2.250% | 06/15/2019 | 100,000 | 99,117 | ||||||||||||

| Laboratory Corp. of America Holdings (Health Care Providers & Svs.) |

3.750% | 08/23/2022 | 75,000 | 75,770 | ||||||||||||

| AbbVie, Inc. (Pharmaceuticals) |

2.900% | 11/06/2022 | 75,000 | 72,557 | ||||||||||||

| Hospira, Inc. (Pharmaceuticals) |

6.050% | 03/30/2017 | 75,000 | 80,686 | ||||||||||||

|

|

|

|||||||||||||||

| 689,577 | ||||||||||||||||

|

|

|

|||||||||||||||

| INDUSTRIALS – 1.7% |

||||||||||||||||

| Lockheed Martin Corp. (Aerospace & Defense) |

3.600% | 03/01/2035 | 100,000 | 92,061 | ||||||||||||

| FedEx Corp. (Air Freight & Logistics) |

4.900% | 01/15/2034 | 75,000 | 77,529 | ||||||||||||

| Waste Management, Inc. (Commercial Svs. & Supplies) |

6.100% | 03/15/2018 | 75,000 | 83,689 | ||||||||||||

| Parker-Hannifin Corp. (Machinery) |

4.200% | 11/21/2034 | 100,000 | 99,381 | ||||||||||||

| Burlington Northern Santa Fe, LLC (Road & Rail) |

4.550% | 09/01/2044 | 100,000 | 98,614 | ||||||||||||

| ERAC U.S.A. Finance LLC (Road & Rail) |

(b)(c) | 6.375% | 10/15/2017 | 150,000 | 164,862 | |||||||||||

| Norfolk Southern Corp. (Road & Rail) |

3.000% | 04/01/2022 | 75,000 | 74,521 | ||||||||||||

| Ryder System, Inc. (Road & Rail) |

2.650% | 03/02/2020 | 100,000 | 99,753 | ||||||||||||

| Union Pacific Corp. (Road & Rail) |

3.250% | 08/15/2025 | 100,000 | 98,801 | ||||||||||||

|

|

|

|||||||||||||||

| 889,211 | ||||||||||||||||

|

|

|

|||||||||||||||

| INFORMATION TECHNOLOGY – 2.1% |

||||||||||||||||

| Harris Corp. (Communications Equip.) |

2.700% | 04/27/2020 | 100,000 | 98,636 | ||||||||||||

| QUALCOMM, Inc. (Communications Equip.) |

3.450% | 05/20/2025 | 100,000 | 97,296 | ||||||||||||

| Denali Borrower LLC / Denali Finance Corp. (Computers & Peripherals) |

(b) | 5.625% | 10/15/2020 | 100,000 | 105,125 | |||||||||||

| Amphenol Corp. (Electronic Equip., Instr. & Comp.) |

3.125% | 09/15/2021 | 100,000 | 99,962 | ||||||||||||

| Computer Sciences Corp. (IT Svs.) |

6.500% | 03/15/2018 | 150,000 | 165,622 | ||||||||||||

| Intel Corp. (Semiconductors & Equip.) |

4.000% | 12/15/2032 | 100,000 | 95,552 | ||||||||||||

| KLA-Tencor Corp. (Semiconductors & Equip.) |

3.375% | 11/01/2019 | 100,000 | 102,640 | ||||||||||||

| Microsoft Corp. (Software) |

3.500% | 02/12/2035 | 100,000 | 91,125 | ||||||||||||

| Oracle Corp. (Software) |

4.300% | 07/08/2034 | 100,000 | 98,318 | ||||||||||||

| Apple, Inc. (Tech. Hardware, Storage & Periph.) |

2.500% | 02/09/2025 | 100,000 | 93,621 | ||||||||||||

|

|

|

|||||||||||||||

| 1,047,897 | ||||||||||||||||

|

|

|

|||||||||||||||

| MATERIALS – 0.9% |

||||||||||||||||

| CF Industries, Inc. (Chemicals) |

3.450% | 06/01/2023 | 75,000 | 72,521 | ||||||||||||

| Dow Chemical Co. / The (Chemicals) |

4.250% | 10/01/2034 | 100,000 | 93,652 | ||||||||||||

| Packaging Corp. of America (Containers & Packaging) |

4.500% | 11/01/2023 | 75,000 | 77,249 | ||||||||||||

| Freeport-McMoRan, Inc. (Metals & Mining) |

3.550% | 03/01/2022 | 75,000 | 69,346 | ||||||||||||

| Newmont Mining Corp. (Metals & Mining) |

3.500% | 03/15/2022 | 75,000 | 71,496 | ||||||||||||

| Teck Resources Ltd. (Metals & Mining) |

3.750% | 02/01/2023 | 75,000 | 64,437 | ||||||||||||

|

|

|

|||||||||||||||

| 448,701 | ||||||||||||||||

|

|

|

|||||||||||||||

| TELECOMMUNICATION SERVICES – 0.4% |

||||||||||||||||

| AT&T, Inc. (Diversified Telecom. Svs.) |

3.400% | 05/15/2025 | 100,000 | 94,948 | ||||||||||||

| Verizon Communications, Inc. (Diversified Telecom. Svs.) |

3.850% | 11/01/2042 | 75,000 | 61,767 | ||||||||||||

| Rogers Communications, Inc. (Wireless Telecom. Svs.) |

3.000% | 03/15/2023 | 75,000 | 71,947 | ||||||||||||

|

|

|

|||||||||||||||

| 228,662 | ||||||||||||||||

|

|

|

|||||||||||||||

| UTILITIES – 1.9% |

||||||||||||||||

| Commonwealth Edison Co. (Electric Utilities) |

5.950% | 08/15/2016 | 75,000 | 79,093 | ||||||||||||

| Kansas City Power & Light Co. (Electric Utilities) |

5.850% | 06/15/2017 | 150,000 | 162,494 | ||||||||||||

| Pennsylvania Electric Co. (Electric Utilities) |

6.050% | 09/01/2017 | 150,000 | 163,697 | ||||||||||||

| South Carolina Electric & Gas Co. (Electric Utilities) |

4.350% | 02/01/2042 | 75,000 | 71,620 | ||||||||||||

| Union Electric Co. (Electric Utilities) |

6.400% | 06/15/2017 | 150,000 | 164,343 | ||||||||||||

| Westar Energy, Inc. (Electric Utilities) |

4.125% | 03/01/2042 | 75,000 | 72,385 | ||||||||||||

| Southwest Gas Corp. (Gas Utilities) |

3.875% | 04/01/2022 | 75,000 | 78,500 | ||||||||||||

| 19 | (continued) |

| Ohio National Fund, Inc. | Omni Portfolio (Continued) |

| Schedule of Investments |

June 30, 2015 (Unaudited) |

| Corporate Bonds (Continued) | Rate | Maturity | Face Amount | Value | ||||||||||||

| UTILITIES (continued) |

||||||||||||||||

| Spectra Energy Capital LLC (Gas Utilities) |

3.300% | 03/15/2023 | $ | 75,000 | $ | 68,693 | ||||||||||

| American Water Capital Corp. (Water Utilities) |

4.300% | 12/01/2042 | 100,000 | 98,150 | ||||||||||||

|

|

|

|||||||||||||||

| 958,975 | ||||||||||||||||

|

|

|

|||||||||||||||

| Total Corporate Bonds (Cost $10,239,962) |

$ | 10,320,076 | ||||||||||||||

|

|

|

|||||||||||||||

| Asset-Backed Securities – 0.2% | Rate | Maturity | Face Amount | Value | ||||||||||||

| INDUSTRIALS – 0.2% |

||||||||||||||||

| American Airlines 2015-1 Class B Pass Through Trust (Airlines) |

3.700% | 05/01/2023 | $ | 100,000 | $ | 98,000 | ||||||||||

|

|

|

|||||||||||||||

| Total Asset-Backed Securities (Cost $100,000) |

$ | 98,000 | ||||||||||||||

|

|

|

|||||||||||||||

| U.S. Treasury Obligations – 2.4% | Rate | Maturity | Face Amount | Value | ||||||||||||

| United States Treasury Note |

1.125% | 04/30/2020 | $ | 400,000 | $ | 390,438 | ||||||||||

| United States Treasury Note |

2.125% | 06/30/2021 | 200,000 | 202,297 | ||||||||||||

| United States Treasury Note |

2.000% | 02/15/2025 | 400,000 | 388,062 | ||||||||||||

| United States Treasury Note |

2.500% | 02/15/2045 | 300,000 | 262,781 | ||||||||||||

|

|

|

|||||||||||||||

| Total U.S. Treasury Obligations (Cost $1,253,410) |

$ | 1,243,578 | ||||||||||||||

|

|

|

|||||||||||||||

| Money Market Funds – 1.1% | Shares | Value | ||||||||||||||

| Fidelity Institutional Money Market Funds |

540,000 | $ | 540,000 | |||||||||||||

|

|

|

|||||||||||||||

| Total Money Market Funds (Cost $540,000) |

$ | 540,000 | ||||||||||||||

|

|

|

|||||||||||||||

| Total Investments – 99.8% (Cost $48,965,869) |

(d) | $ | 50,499,822 | |||||||||||||

| Other Assets in Excess of Liabilities – 0.2% |

92,516 | |||||||||||||||

|

|

|

|||||||||||||||

| Net Assets – 100.0% |

$ | 50,592,338 | ||||||||||||||

|

|

|

|||||||||||||||

Percentages are stated as a percent of net assets.

Footnotes:

| (a) | Non-income producing security. |

| (b) | Security exempt from registration under Regulation D of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified buyers under Rule 144A. At June 30, 2015, the value of these securities totaled $467,833, or 0.9% of the Portfolio’s net assets. These securities were deemed liquid pursuant to procedures approved by the Board of Directors. |

| (c) | Represents bonds that are credit sensitive. The coupon rates for these bonds are subject to adjustment based on changes in national credit rating agency ratings. |

| (d) | Represents cost for financial reporting purposes, which may differ from cost basis for federal income tax purposes. See also Note 7 of the Notes to Financial Statements. |

The accompanying notes are an integral part of these financial statements.

| 20 |

| Ohio National Fund, Inc. | International Portfolio |

| 21 | (continued) |

| Ohio National Fund, Inc. | International Portfolio (Continued) |

| 22 | (continued) |

| Ohio National Fund, Inc. | International Portfolio (Continued) |

| (1) | Composition of Portfolio subject to change. |

| (2) | Short-term investments have been excluded from the list of Top 10 Portfolio Holdings. |

| (3) | Top 10 Country Weightings (combined): |

| % of Net Assets | ||||

| Japan |

28.8 | |||

| Germany |

12.2 | |||

| Sweden |

10.7 | |||

| Denmark |

9.5 | |||

| Spain |

7.4 | |||

| Taiwan |

4.8 | |||

| Ireland |

4.6 | |||

| Norway |

3.6 | |||

| Italy |

1.9 | |||

| United States |

1.3 |

| 23 |

| Ohio National Fund, Inc. | International Portfolio |

| Schedule of Investments |

June 30, 2015 (Unaudited) |

| 24 | (continued) |

| Ohio National Fund, Inc. | International Portfolio (Continued) |

| Schedule of Investments |

June 30, 2015 (Unaudited) |

Percentages are stated as a percent of net assets.

Abbreviations:

ADR: American Depositary Receipts

Footnotes:

| (a) | Non-income producing security. |

| (b) | Security exempt from registration under Regulation D of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified buyers under Rule 144A. At June 30, 2015, the value of these securities totaled $1,756,354, or 1.0% of the Portfolio’s net assets. These securities were deemed liquid pursuant to procedures approved by the Board of Directors. |

| (c) | Security traded on a foreign exchange has been valued at an estimate of fair value that is different than the local market close price. These fair value estimates are determined by an independent fair valuation service that has been approved by the Board. These securities represent $139,262,011, or 78.9% of the Portfolio’s net assets. |

| (d) | As discussed in Note 2 of the Notes to Financial Statements, not all investments that are traded on a foreign exchange are valued at an estimate that is different from the local close price. In some instances, the independent fair valuation service uses a stock’s local close price because the service’s measure of predictability related to their valuation model of a stock is below a chosen threshold. These securities represent $2,749,451, or 1.6% of the Portfolio’s net assets. |

| Other Portfolio securities are not subjected to fair valuation procedures because they are traded on domestic or foreign exchanges that have close times that are consistent with the U.S. market close, normally 4:00 pm Eastern Time. |

| (e) | Represents cost for financial reporting purposes, which may differ from cost basis for federal income tax purposes. See also Note 7 of the Notes to Financial Statements. |

| (f) | Includes $2,172,003 of cash pledged as collateral for the following futures contracts outstanding at June 30, 2015: |

| Type |

Description |

Expiration |

Number of Contracts |

Contract |

Initial Contract Amount |

Unrealized Appreciation (Depreciation) |

Variation Margin Receivable (Payable) |

|||||||||||||||

| Long |

JPX Nikkei Index 400 Future |

September 10, 2015 | 211 | $ 2,536,965 | $ | 2,602,430 | $ | (65,465 | ) | $ | 13,718 | |||||||||||

| Long |

DAX Index Future |

September 18, 2015 | 17 | $ 5,212,632 | $ | 5,354,349 | $ | (141,717 | ) | $ | (44,905 | ) | ||||||||||

| Long |

Hang Seng China Enterprises (HSCE) Index Future |

July 30, 2015 | 112 | $ 9,337,487 | $ | 9,821,230 | $ | (483,743 | ) | $ | 196,411 | |||||||||||

| Long |

OMX Stockholm 30 Index Future |

July 17, 2015 | 100 | $ 1,859,804 | $ | 1,891,228 | $ | (31,424 | ) | $ | (21,019 | ) | ||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||

| $18,946,890 | $ | 19,669,239 | $ | (722,349 | ) | $ | 144,205 | |||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||

| Details of the foreign currency contracts outstanding in the International Portfolio at June 30, 2015 are as follows: |

Contracts to buy foreign currency:

| Date of contract |

Exchange date |

Counterparty |

Currency to receive |

Currency to deliver |

Contract at value |

Unrealized Appreciation (Depreciation) |

||||||||||||||

| April 9, 2015 |

July 10, 2015 |

JPM | 98,905,000 RUB | $ | 1,835,654 | $ | 1,787,095 | $ | (48,559 | ) | ||||||||||

| April 21, 2015 |

July 27, 2015 |

MSCS | 8,739,810 CHF | $ | 9,153,550 | $ | 9,356,621 | $ | 203,071 | |||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| $ | 10,989,204 | $ | 11,143,716 | $ | 154,512 | |||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||

Contracts to sell foreign currency:

| Date of contract |

Exchange date |

Counterparty |

Currency to receive |

Currency to deliver | Contract at value |

Unrealized Appreciation (Depreciation) |

||||||||||||||

| April 21, 2015 |

July 27, 2015 |

MSCS | $ | 9,153,550 | 8,550,000 EUR | $ | 9,535,059 | $ | (381,509 | ) | ||||||||||

| June 12, 2015 |

September 15, 2015 |

CITI | $ | 19,473,299 | 17,325,000 EUR | $ | 19,334,979 | $ | 138,320 | |||||||||||

| June 12, 2015 |

September 15, 2015 |

HSBC | $ | 26,422,451 | 3,253,000,000 JPY | $ | 26,605,579 | $ | (183,128 | ) | ||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| $ | 55,049,300 | $ | 55,475,617 | $ | (426,317 | ) | ||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| Counterparties |

Currencies | |

| JPM –J.P. Morgan Chase Bank, N.A. |

RUB – Russian Ruble | |

| MSCS – Morgan Stanley Capital Services, Inc. |

CHF – Swiss Franc | |

| CITI – Citigroup Global Markets, Inc. |

EUR – Euro | |

| HSBC – HSBC Bank USA, N.A. |

JPY – Japanese Yen |

| 25 | (continued) |

| Ohio National Fund, Inc. | International Portfolio (Continued) |

| Schedule of Investments |

June 30, 2015 (Unaudited) |

Sector Classifications (Common Stocks & Preferred Stocks): (Percent of net assets)

| Consumer Discretionary |

19.9% | |||

| Financials |

18.9% | |||

| Industrials |

12.7% | |||

| Information Technology |

11.3% | |||

| Materials |

8.0% | |||

| Health Care |

7.1% | |||

| Utilities |

2.5% | |||

| Consumer Staples |

1.8% | |||

| Telecommunication Services |

1.7% | |||

| Energy |

1.4% | |||

|

|

|

|||

| 85.3% | ||||

|

|

|

The accompanying notes are an integral part of these financial statements.

| 26 |

| Ohio National Fund, Inc. | Capital Appreciation Portfolio |

| 27 | (continued) |

| Ohio National Fund, Inc. | Capital Appreciation Portfolio (Continued) |

| (1) | Composition of Portfolio subject to change. |

| (2) | Short-term investments have been excluded from the list of Top 10 Portfolio Holdings. |

| (3) | Sectors: |

| % of Net Assets | ||||

| Information Technology |

20.8 | |||

| Consumer Discretionary |

19.4 | |||

| Financials |

15.1 | |||

| Health Care |

12.2 | |||

| Industrials |

9.2 | |||

| Energy |

7.2 | |||

| Utilities |

4.9 | |||

| Materials |

4.2 | |||

| Consumer Staples |

4.1 | |||

| Telecommunication Services |

1.0 | |||

|

|

|

|||

| 98.1 | ||||

|

|

|

| 28 |

| Ohio National Fund, Inc. | Capital Appreciation Portfolio |

| Schedule of Investments |

June 30, 2015 (Unaudited) |

| 29 | (continued) |

| Ohio National Fund, Inc. | Capital Appreciation Portfolio (Continued) |

| Schedule of Investments |

June 30, 2015 (Unaudited) |

Percentages are stated as a percent of net assets.

Abbreviations:

ADR: American Depositary Receipts

Footnotes:

| (a) | Non-income producing security. |

| (b) | Security exempt from registration under Regulation D of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified buyers under Rule 144A. At June 30, 2015, the value of these securities totaled $489,429, or 0.1% of the Portfolio’s net assets. These securities were deemed liquid pursuant to procedures approved by the Board of Directors. |

| (c) | Security traded on a foreign exchange has been valued at an estimate of fair value that is different than the local market close price. These fair value estimates are determined by an independent fair valuation service that has been approved by the Board. These securities represent $7,256,421, or 1.6% of the Portfolio’s net assets. |

Other Portfolio securities are not subjected to fair value procedures because they are traded on domestic or foreign exchanges that have close times that are consistent with the U.S. market close, normally 4:00 pm Eastern Time.

| (d) | Represents cost for financial reporting purposes, which may differ from cost basis for federal income tax purposes. See also Note 7 of the Notes to Financial Statements. |

The accompanying notes are an integral part of these financial statements.

| 30 |

| Ohio National Fund, Inc. | International Small-Mid Company Portfolio |

| 31 | (continued) |

| Ohio National Fund, Inc. | International Small-Mid Company Portfolio (Continued) |

| 32 | (continued) |

| Ohio National Fund, Inc. | International Small-Mid Company Portfolio (Continued) |

| (1) | Composition of Portfolio subject to change. |

| (2) | Short-term investments have been excluded from the list of Top 10 Portfolio Holdings. |

| (3) | Top 10 Country Weightings: |

| % of Net Assets | ||||

| United Kingdom |

19.2 | |||

| Japan |

14.1 | |||

| France |

10.5 | |||

| Germany |

10.4 | |||

| Italy |

7.6 | |||

| Hong Kong |

7.4 | |||

| Canada |

4.2 | |||

| China |

3.4 | |||

| United States |

3.2 | |||

| Ireland |

2.7 |

| 33 |

| Ohio National Fund, Inc. | International Small-Mid Company Portfolio |

| Schedule of Investments |

June 30, 2015 (Unaudited) |

| 34 | (continued) |

| Ohio National Fund, Inc. | International Small-Mid Company Portfolio (Continued) |

| Schedule of Investments |

June 30, 2015 (Unaudited) |

Percentages are stated as a percent of net assets.

Abbreviations:

ADR: American Depositary Receipts

Footnotes:

| (a) | Non-income producing security. |

| (b) | Security exempt from registration under Regulation D of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified buyers under Rule 144A. At June 30, 2015, the value of these securities totaled $7,330,074, or 8.5% of the Portfolio’s net assets. These securities were deemed liquid pursuant to procedures approved by the Board of Directors. |

| (c) | A market quotation for this investment was not readily available at June 30, 2015. As discussed in Note 2 of the Notes to Financial Statements, the price for this issue was derived from an estimate of fair market value using methods determined in good faith by the Fund’s Pricing Committee under supervision of the Board. This security represents $299,028, or 0.3% of the Portfolio’s net assets. |

| (d) | A market quotation for this investment was not readily available at June 30, 2015. As discussed in Note 2 of the Notes to Financial Statements, the price for this issue was derived from an estimate of fair market value using methods determined in good faith by the Fund’s pricing policy approved by the Board. This security represents $9, or 0.0% of the Portfolio’s net assets. |

| (e) | Security traded on a foreign exchange has been valued at an estimate of fair value that is different than the local market close price. These fair value estimates are determined by an independent fair valuation service that has been approved by the Board. These securities represent $68,764,289, or 79.3% of the Portfolio’s net assets. |

| (f) | As discussed in Note 2 of the Notes to Financial Statements, not all investments that are traded on a foreign exchange are valued at an estimate that is different from the local close price. In some instances, the independent fair valuation service uses a stock’s local close price because the service’s measure of predictability related to their valuation model of a stock is below a chosen threshold. These securities represent $4,724,408, or 5.4% of the Portfolio’s net assets. |

| (g) | Represents a security deemed to be illiquid. At June 30, 2015, the value of illiquid securities in the Portfolio totaled $299,028, or 0.3% of the Portfolio’s net assets. |

| (h) | Represents cost for financial reporting purposes, which may differ from cost basis for federal income tax purposes. See also Note 7 of the Notes to Financial Statements. |

| Details of the foreign currency contracts outstanding in the International Small-Mid Company Portfolio at June 30, 2015 are as follows: |

Contracts to sell foreign currency:

| Date of contract |

Exchange date |

Counterparty |

Currency to receive |

Currency to deliver |

Contract at value |

Unrealized Depreciation |

||||||||||||||

| April 21, 2015 |

July 27, 2015 |

MSCS | $ | 8,217,845 | 7,670,000 EUR | $ | 8,553,673 | $ | (335,828 | ) | ||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| Counterparties |

Currencies | |

| MSCS - Morgan Stanley Capital Services, Inc. |

EUR – Euro |

| 35 | (continued) |

| Ohio National Fund, Inc. | International Small-Mid Company Portfolio (Continued) |

| Schedule of Investments |

June 30, 2015 (Unaudited) |

Sector Classifications (Common stocks and Rights): (Percent of net assets)

| Consumer Discretionary |

23.4% | |||

| Industrials |

22.6% | |||

| Information Technology |

15.5% | |||

| Financials |

14.0% | |||

| Health Care |

8.4% | |||

| Materials |

5.7% | |||

| Utilities |

2.9% | |||

| Energy |

1.8% | |||

| Telecommunication Services |

1.8% | |||

| Consumer Staples |

1.7% | |||

|

|

|

|||

| 97.8% | ||||

|

|

|

The accompanying notes are an integral part of these financial statements.

| 36 |

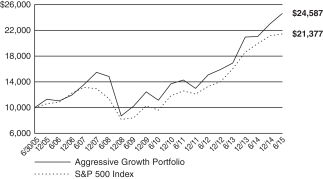

| Ohio National Fund, Inc. | Aggressive Growth Portfolio |

| 37 | (continued) |

| Ohio National Fund, Inc. | Aggressive Growth Portfolio (Continued) |

| (1) | Composition of Portfolio subject to change. |

| (2) | Short-term investments have been excluded from the list of Top 10 Portfolio Holdings. |

| (3) | Sectors: |

| % of Net Assets | ||||

| Consumer Discretionary |

28.9 | |||

| Information Technology |

23.8 | |||

| Health Care |

14.8 | |||

| Financials |

14.7 | |||

| Industrials |

10.9 | |||

| Materials |

2.2 | |||

| Energy |

1.2 | |||

|

|

|

|||

| 96.5 | ||||

|

|

|

| 38 |

| Ohio National Fund, Inc. | Aggressive Growth Portfolio |

| Schedule of Investments |

June 30, 2015 (Unaudited) |

Percentages are stated as a percent of net assets.

Abbreviations:

ADR: American Depositary Receipts

Footnotes:

| (a) | Non-income producing security. |

| (b) | Represents cost for financial reporting purposes, which may differ from cost basis for federal income tax purposes. See also Note 7 of the Notes to Financial Statements. |

The accompanying notes are an integral part of these financial statements.

| 39 |

| Ohio National Fund, Inc. | Small Cap Growth Portfolio |

| 40 | (continued) |

| Ohio National Fund, Inc. | Small Cap Growth Portfolio (Continued) |

| 41 | (continued) |

| Ohio National Fund, Inc. | Small Cap Growth Portfolio (Continued) |

| (1) | Composition of Portfolio subject to change. |

| (2) | Short-term investments have been excluded from the list of Top 10 Portfolio Holdings. |

| (3) | Sectors (combined): |

| % of Net Assets | ||||

| Information Technology |

33.4 | |||

| Health Care |

21.5 | |||

| Industrials |

18.3 | |||

| Consumer Discretionary |

12.7 | |||

| Financials |

8.7 | |||

| Materials |

2.0 | |||

| Consumer Staples |

2.0 | |||

| Energy |

1.3 | |||

|

|

|

|||

| 99.9 | ||||

|

|

|

| 42 |

| Ohio National Fund, Inc. | Small Cap Growth Portfolio |

| Schedule of Investments |

June 30, 2015 (Unaudited) |

| 43 | (continued) |

| Ohio National Fund, Inc. | Small Cap Growth Portfolio (Continued) |

| Schedule of Investments |

June 30, 2015 (Unaudited) |

Percentages are stated as a percent of net assets.

Abbreviations:

ADR: American Depositary Receipts

Footnotes:

| (a) | Non-income producing security. |

| (b) | Security traded on a foreign exchange has been valued at an estimate of fair value that is different than the local market close price. These fair value estimates are determined by an independent fair valuation service that has been approved by the Board. These securities represent $4,011,857, or 1.8% of the Portfolio’s net assets. |

Other Portfolio securities are not subjected to fair value procedures because they are traded on domestic or foreign exchanges that have close times that are consistent with the U.S. market close, normally 4:00 pm Eastern Time.

| (c) | Represents cost for financial reporting purposes, which may differ from cost basis for federal income tax purposes. See also Note 7 of the Notes to Financial Statements. |

The accompanying notes are an integral part of these financial statements.

| 44 |

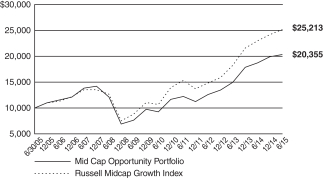

| Ohio National Fund, Inc. | Mid Cap Opportunity Portfolio |

| 45 | (continued) |

| Ohio National Fund, Inc. | Mid Cap Opportunity Portfolio (Continued) |

| (1) | Composition of Portfolio subject to change. |

| (2) | Short-term investments have been excluded from the list of Top 10 Portfolio Holdings. |

| (3) | Sectors: |

| % of Net Assets | ||||

| Consumer Discretionary |

25.2 | |||

| Information Technology |

17.5 | |||

| Health Care |

15.6 | |||

| Industrials |

14.2 | |||

| Financials |

10.5 | |||