UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03015

Ohio National Fund, Inc.

(Exact name of registrant as specified in charter)

| One Financial Way, Cincinnati, Ohio | 45242 | |

| (Address of principal executive offices) | (Zip code) |

CT Corporation 300 E. Lombard St. Suite 1400 Baltimore, MD 21202

(Name and address of agent for service)

Registrant’s telephone number, including area code: 513-794-6971

Date of fiscal year end: December 31

Date of reporting period: December 31, 2012

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports To Stockholders. |

WEALTH BUILDING OPPORTUNITY

Ohio National Fund, Inc.

Annual Report

December 31, 2012

Ohio National Fund, Inc.

OHIO NATIONAL FUND, INC.

| 1 | ||||

| 3 | ||||

| The following pages contain Performance, Management’s Comments, Change in Value of $10,000 Investment, Portfolio Composition, Top Holdings, and Schedule of Investments for each of the Fund’s Portfolios: |

||||

| 4 | ||||

| 8 | ||||

| 11 | ||||

| 16 | ||||

| 21 | ||||

| 26 | ||||

| 31 | ||||

| 34 | ||||

| 38 | ||||

| 41 | ||||

| 44 | ||||

| 48 | ||||

| 55 | ||||

| 58 | ||||

| 68 | ||||

| 72 | ||||

| 76 | ||||

| 79 | ||||

| 82 | ||||

| 85 | ||||

| 91 | ||||

| 94 | ||||

| 98 | ||||

| 101 | ||||

| 104 | ||||

| 107 | ||||

| 110 | ||||

| 116 | ||||

| 128 | ||||

| 153 | ||||

| 154 | ||||

| 162 | ||||

| Message |

|

Dear Investor:

| 1 |

| 2 |

Directors and Officers of Ohio National Fund, Inc.

The Statement of Additional Information of Ohio National Fund, Inc. (the “Fund”) includes additional information about the Fund’s Board of Directors (the “Board”) and is available at http://www.ohionationalfund.com or upon request, without charge, by calling 877-781-6392 (toll-free).

A description of the policies and procedures that the Fund uses in voting proxies relating to Fund securities, as well as information regarding how the Fund voted proxies during the most recent twelve-month period ended June 30, is available without charge, upon request, by calling 877-781-6392 (toll-free) and on the Securities and Exchange Commission (the “Commission”) website at http://www.sec.gov.

The Fund has filed its Schedules of Investments as of March 31 and September 30 with the Commission, as required, on Form N-Q. Form N-Q is required to be filed with the Commission for the first and third quarters of each fiscal year within sixty days after the end of each period and is available on the Commission website upon acceptance of each submission. The Fund’s Forms N-Q may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information about the Public Reference Room is available by calling 1-800-SEC-0330 (toll-free).

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus of Ohio National Fund, Inc. For a prospectus containing more complete information, including charges and expenses, please contact Ohio National Investments, Inc., One Financial Way, Cincinnati, OH 45242, telephone 513-794-6100.

| 3 |

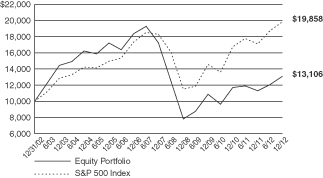

| Ohio National Fund, Inc. | Equity Portfolio |

| 4 | (continued) |

| Ohio National Fund, Inc. | Equity Portfolio (Continued) |

| 5 | (continued) |

| Ohio National Fund, Inc. | Equity Portfolio (Continued) |

| (1) | Composition of Portfolio subject to change. |

| (2) | Short-term investments have been excluded from the list of Top 10 Portfolio Holdings. |

| (3) | Sectors (combined): |

| % of Net Assets | ||||

| Financials |

21.1 | |||

| Information Technology |

20.7 | |||

| Consumer Discretionary |

15.8 | |||

| Industrials |

14.7 | |||

| Health Care |

14.1 | |||

| Energy |

8.2 | |||

| Consumer Staples |

2.1 | |||

| Materials |

2.0 | |||

|

|

|

|||

| 98.7 | ||||

|

|

|

| 6 |

| Ohio National Fund, Inc. | Equity Portfolio |

| Schedule of Investments |

December 31, 2012 |

Percentages are stated as a percent of net assets.

Abbreviations:

ADR: American Depositary Receipts

Footnotes:

| (a) | Non-income producing security. |

| (b) | This preferred stock is convertible at a 20% conversion premium until 12/01/2013. There is a mandatory conversion at 12/01/2013, at which time the conversion proceeds will be determined by the General Motors, Inc. common share price on that date. |

| (c) | Represents cost for financial reporting purposes, which may differ from cost basis for federal income tax purposes. See also Note 7 of the Notes to Financial Statements. |

The accompanying notes are an integral part of these financial statements.

| 7 |

| Ohio National Fund, Inc. | Money Market Portfolio |

| (1) | Composition of Portfolio subject to change. |

| (2) | Sectors (combined): |

| % of Net Assets | ||||

| Financials |

22.1 | |||

| Consumer Staples |

12.0 | |||

| Health Care |

11.6 | |||

| Energy |

8.5 | |||

| Consumer Discretionary |

4.6 | |||

| Information Technology |

3.9 | |||

|

|

|

|||

| 62.7 | ||||

|

|

|

| 8 |

| Ohio National Fund, Inc. | Money Market Portfolio |

| Schedule of Investments |

December 31, 2012 |

| Commercial Paper – 62.2% | (b) Rate | Maturity | Face Amount | Amortized Cost | ||||||||||||

| CONSUMER DISCRETIONARY – 4.6% |

||||||||||||||||

| Walt Disney Co. / The (Media) |

(a) | 0.120% | 03/22/2013 | $ | 2,000,000 | $ | 1,999,467 | |||||||||

| Walt Disney Co. / The (Media) |

(a) | 0.110% | 01/18/2013 | 10,000,000 | 9,999,481 | |||||||||||

|

|

|

|||||||||||||||

| 11,998,948 | ||||||||||||||||

|

|

|

|||||||||||||||

| CONSUMER STAPLES – 12.0% |

||||||||||||||||

| Coca-Cola Co. / The (Beverages) |

(a) | 0.170% | 02/08/2013 | 2,000,000 | 1,999,641 | |||||||||||

| Coca-Cola Co. / The (Beverages) |

(a) | 0.110% | 01/16/2013 | 8,000,000 | 7,999,633 | |||||||||||

| Wal-Mart Stores, Inc. (Food & Staples Retailing) |

(a) | 0.100% | 01/22/2013 | 5,000,000 | 4,999,708 | |||||||||||

| Wal-Mart Stores, Inc. (Food & Staples Retailing) |

(a) | 0.090% | 01/03/2013 | 6,000,000 | 5,999,970 | |||||||||||

| Procter & Gamble Co. / The (Household Products) |

(a) | 0.140% | 03/04/2013 | 5,000,000 | 4,998,794 | |||||||||||

| Procter & Gamble Co. / The (Household Products) |

(a) | 0.160% | 03/01/2013 | 3,000,000 | 2,999,213 | |||||||||||

| Procter & Gamble Co. / The (Household Products) |

(a) | 0.150% | 02/06/2013 | 2,000,000 | 1,999,700 | |||||||||||

|

|

|

|||||||||||||||

| 30,996,659 | ||||||||||||||||

|

|

|

|||||||||||||||

| ENERGY – 8.5% |

||||||||||||||||

| Chevron Corp. (Oil, Gas & Consumable Fuels) |

(a) | 0.100% | 01/09/2013 | 10,000,000 | 9,999,778 | |||||||||||

| Exxon Mobil Corp. (Oil, Gas & Consumable Fuels) |

0.040% | 01/17/2013 | 10,000,000 | 9,999,822 | ||||||||||||

| Exxon Mobil Corp. (Oil, Gas & Consumable Fuels) |

0.020% | 01/03/2013 | 2,000,000 | 1,999,998 | ||||||||||||

|

|

|

|||||||||||||||

| 21,999,598 | ||||||||||||||||

|

|

|

|||||||||||||||

| FINANCIALS – 21.6% |

||||||||||||||||

| U.S. Bank (Commercial Banks) |

0.050% | 01/02/2013 | 12,000,000 | 11,999,983 | ||||||||||||

| American Honda Finance Corp. (Consumer Finance) |

0.150% | 02/05/2013 | 2,000,000 | 1,999,708 | ||||||||||||

| American Honda Finance Corp. (Consumer Finance) |

0.130% | 01/09/2013 | 2,000,000 | 1,999,942 | ||||||||||||

| American Honda Finance Corp. (Consumer Finance) |

0.150% | 01/04/2013 | 6,000,000 | 5,999,925 | ||||||||||||

| Toyota Motor Credit Corp. (Consumer Finance) |

0.090% | 01/08/2013 | 10,000,000 | 9,999,825 | ||||||||||||

| General Electric Capital Corp. (Diversified Financial Services) |

0.040% | 01/14/2013 | 12,000,000 | 11,999,827 | ||||||||||||

| Prudential Funding LLC (Insurance) |

0.050% | 01/02/2013 | 12,000,000 | 11,999,983 | ||||||||||||

|

|

|

|||||||||||||||

| 55,999,193 | ||||||||||||||||

|

|

|

|||||||||||||||

| HEALTH CARE – 11.6% |

||||||||||||||||

| Merck & Co., Inc. (Pharmaceuticals) |

(a) | 0.130% | 01/07/2013 | 10,000,000 | 9,999,783 | |||||||||||

| Pfizer, Inc. (Pharmaceuticals) |

(a) | 0.060% | 01/15/2013 | 10,000,000 | 9,999,767 | |||||||||||

| Johnson & Johnson (Pharmaceuticals) |

(a) | 0.080% | 02/25/2013 | 10,000,000 | 9,998,778 | |||||||||||

|

|

|

|||||||||||||||

| 29,998,328 | ||||||||||||||||

|

|

|

|||||||||||||||

| INFORMATION TECHNOLOGY – 3.9% |

||||||||||||||||

| International Business Machines Corp. |

(a) | 0.070% | 01/04/2013 | 10,000,000 | 9,999,942 | |||||||||||

|

|

|

|||||||||||||||

| Total Commercial Paper (Cost $160,992,668) |

$ | 160,992,668 | ||||||||||||||

|

|

|

|||||||||||||||

| Asset-Backed Securities – 0.5% | Rate | Maturity | Face Amount | Amortized Cost | ||||||||||||

| FINANCIALS – 0.5% |

||||||||||||||||

| CNH Equipment Trust 2012-B, Class A1 (Consumer Finance) |

0.383% | 07/12/2013 | $ | 478,368 | $ | 478,368 | ||||||||||

| Ford Credit Auto Owner Trust 2012-C, Class A1 (Consumer Finance) |

0.272% | 08/15/2013 | 87,943 | 87,943 | ||||||||||||

| Hyundai Auto Receivables Trust 2012-C, Class A1 (Consumer Finance) |

0.230% | 10/15/2013 | 671,602 | 671,602 | ||||||||||||

|

|

|

|||||||||||||||

| Total Asset-Backed Securities (Cost $1,237,913) |

$ | 1,237,913 | ||||||||||||||

|

|

|

|||||||||||||||

| U.S. Government Agency Issues – 4.6% | Rate | Maturity | Face Amount | Amortized Cost | ||||||||||||

| Federal Home Loan Bank |

0.131% | 02/15/2013 | $ | 12,000,000 | $ | 11,998,035 | ||||||||||

|

|

|

|||||||||||||||

| Total U.S. Government Agency Issues (Cost $11,998,035) |

$ | 11,998,035 | ||||||||||||||

|

|

|

|||||||||||||||

| U.S. Treasury Obligations – 3.9% | Rate | Maturity | Face Amount | Amortized Cost | ||||||||||||

| U.S. Treasury Bill |

0.040% | 03/07/2013 | $ | 10,000,000 | $ | 9,999,278 | ||||||||||

|

|

|

|||||||||||||||

| Total U.S. Treasury Obligations (Cost $9,999,278) |

$ | 9,999,278 | ||||||||||||||

|

|

|

|||||||||||||||

| Money Market Funds – 11.6% | Shares | Value | ||||||||||||||

| Federated Prime Cash Obligations Fund – Institutional Class |

10,000,000 | $ | 10,000,000 | |||||||||||||

| Fidelity Institutional Money Market Funds Money Market Portfolio – Class I |

10,000,000 | 10,000,000 | ||||||||||||||

| First American Prime Obligations Fund – Class Z |

10,000,000 | 10,000,000 | ||||||||||||||

|

|

|

|||||||||||||||

| Total Money Market Funds (Cost $30,000,000) |

$ | 30,000,000 | ||||||||||||||

|

|

|

|||||||||||||||

| Total Investments – 82.8% (Cost $214,227,894) |

(c) |

$ | 214,227,894 | |||||||||||||

| Other Assets in Excess of Liabilities – 17.2% |

44,378,318 | |||||||||||||||

|

|

|

|||||||||||||||

| Net Assets – 100.0% |

$ | 258,606,212 | ||||||||||||||

|

|

|

|||||||||||||||

Percentages are stated as a percent of net assets.

| 9 | (continued) |

| Ohio National Fund, Inc. | Money Market Portfolio (Continued) |

| Schedule of Investments |

December 31, 2012 |

Footnotes:

| (a) | Security exempt from registration under Section 4 (2) of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified buyers under Rule 144A. At December 31, 2012, the value of these securities totaled $92,993,655, or 36.0% of the Portfolio’s net assets. These securities were deemed liquid pursuant to procedures approved by the Board of Directors. |

| (b) | Rate presented is the effective yield at the time of purchase. |

| (c) | Represents cost for federal income tax and financial reporting purposes. See also Note 2 regarding the use of amortized cost for valuation of instruments in this Portfolio. |

The accompanying notes are an integral part of these financial statements.

| 10 |

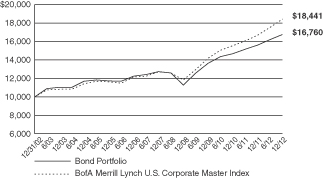

| Ohio National Fund, Inc. | Bond Portfolio |

| 11 | (continued) |

| Ohio National Fund, Inc. | Bond Portfolio (Continued) |

| (1) | Composition of Portfolio subject to change. |

| (2) | Short-term investments have been excluded from the list of Top 10 Portfolio Holdings. |

| (3) | Sectors: |

| % of Net Assets | ||||

| Financials |

26.0 | |||

| Utilities |

14.9 | |||

| Energy |

10.9 | |||

| Consumer Discretionary |

8.8 | |||

| Industrials |

8.4 | |||

| Consumer Staples |

7.5 | |||

| Health Care |

6.3 | |||

| Materials |

4.0 | |||

| Telecommunication Services |

3.8 | |||

| Information Technology |

1.2 | |||

|

|

|

|||

| 91.8 | ||||

|

|

|

| 12 |

| Ohio National Fund, Inc. | Bond Portfolio |

| Schedule of Investments |

December 31, 2012 |

| Corporate Bonds – 91.8% | Rate | Maturity | Face Amount | Value | ||||||||||||

| CONSUMER DISCRETIONARY – 8.8% |

| |||||||||||||||

| Darden Restaurants, Inc. (Hotels, Restaurants & Leisure) |

3.350% | 11/01/2022 | $ | 1,425,000 | $ | 1,380,122 | ||||||||||

| Newell Rubbermaid, Inc. (Household Durables) |

6.250% | 04/15/2018 | 500,000 | 582,836 | ||||||||||||

| Comcast Corp. (Media) |

5.875% | 02/15/2018 | 750,000 | 904,483 | ||||||||||||

| Discovery Communications LLC (Media) |

4.375% | 06/15/2021 | 1,000,000 | 1,117,373 | ||||||||||||

| Discovery Communications LLC (Media) |

3.300% | 05/15/2022 | 275,000 | 282,707 | ||||||||||||

| News America, Inc. (Media) |

4.500% | 02/15/2021 | 1,250,000 | 1,429,140 | ||||||||||||

| Time Warner Cable, Inc. (Media) |

5.850% | 05/01/2017 | 1,000,000 | 1,182,102 | ||||||||||||

| Time Warner Cable, Inc. (Media) |

4.500% | 09/15/2042 | 425,000 | 414,881 | ||||||||||||

| Time Warner, Inc. (Media) |

3.150% | 07/15/2015 | 1,250,000 | 1,322,581 | ||||||||||||

| Viacom, Inc. (Media) |

4.375% | 09/15/2014 | 1,000,000 | 1,059,953 | ||||||||||||

| Walt Disney Co. / The (Media) |

3.700% | 12/01/2042 | 925,000 | 926,977 | ||||||||||||

| Kohl’s Corp. (Multiline Retail) |

4.000% | 11/01/2021 | 1,250,000 | 1,323,045 | ||||||||||||

| Macy’s Retail Holdings, Inc. (Multiline Retail) |

5.900% | 12/01/2016 | 425,000 | 499,683 | ||||||||||||

| Target Corp. (Multiline Retail) |

2.900% | 01/15/2022 | 1,500,000 | 1,591,278 | ||||||||||||

| Lowe’s Cos., Inc. (Specialty Retail) |

3.800% | 11/15/2021 | 1,000,000 | 1,105,523 | ||||||||||||

|

|

|

|||||||||||||||

| 15,122,684 | ||||||||||||||||

|

|

|

|||||||||||||||

| CONSUMER STAPLES – 7.5% |

| |||||||||||||||

| Anheuser-Busch Cos., Inc. (Beverages) |

5.500% | 01/15/2018 | 750,000 | 899,789 | ||||||||||||

| CVS Caremark Corp. (Food & Staples Retailing) |

5.750% | 06/01/2017 | 487,000 | 582,637 | ||||||||||||

| Kroger Co. / The (Food & Staples Retailing) |

2.200% | 01/15/2017 | 1,500,000 | 1,551,139 | ||||||||||||

| Wal-Mart Stores, Inc. (Food & Staples Retailing) |

1.500% | 10/25/2015 | 1,250,000 | 1,287,365 | ||||||||||||

| Bunge NA Finance LP (Food Products) |

5.900% | 04/01/2017 | 1,500,000 | 1,704,166 | ||||||||||||

| Hillshire Brands Co. (Food Products) |

2.750% | 09/15/2015 | 1,250,000 | 1,288,526 | ||||||||||||

| Mead Johnson Nutrition Co. (Food Products) |

3.500% | 11/01/2014 | 800,000 | 836,483 | ||||||||||||

| Mondelez International, Inc. (Food Products) |

6.125% | 02/01/2018 | 1,500,000 | 1,826,545 | ||||||||||||

| Tyson Foods, Inc. (Food Products) |

(b) | 6.600% | 04/01/2016 | 1,000,000 | 1,150,674 | |||||||||||

| Procter & Gamble Co. / The (Household Products) |

4.700% | 02/15/2019 | 250,000 | 295,543 | ||||||||||||

| Philip Morris International, Inc. (Tobacco) |

4.125% | 05/17/2021 | 1,250,000 | 1,414,156 | ||||||||||||

|

|

|

|||||||||||||||

| 12,837,023 | ||||||||||||||||

|

|

|

|||||||||||||||

| ENERGY – 10.9% |

| |||||||||||||||

| Weatherford International Ltd. (Energy Equip. & Svs.) |

6.000% | 03/15/2018 | 1,500,000 | 1,715,170 | ||||||||||||

| Anadarko Petroleum Corp. (Oil, Gas & Consumable Fuels) |

5.950% | 09/15/2016 | 1,000,000 | 1,151,791 | ||||||||||||

| Apache Corp. (Oil, Gas & Consumable Fuels) |

2.625% | 01/15/2023 | 1,000,000 | 999,087 | ||||||||||||

| Buckeye Partners LP (Oil, Gas & Consumable Fuels) |

4.875% | 02/01/2021 | 1,000,000 | 1,036,438 | ||||||||||||

| Cenovus Energy, Inc. (Oil, Gas & Consumable Fuels) |

5.700% | 10/15/2019 | 1,000,000 | 1,213,426 | ||||||||||||

| Devon Energy Corp. (Oil, Gas & Consumable Fuels) |

3.250% | 05/15/2022 | 500,000 | 522,298 | ||||||||||||

| EOG Resources, Inc. (Oil, Gas & Consumable Fuels) |

2.950% | 06/01/2015 | 1,250,000 | 1,314,691 | ||||||||||||

| Kinder Morgan Energy Partners LP (Oil, Gas & Consumable Fuels) |

4.150% | 03/01/2022 | 1,000,000 | 1,084,394 | ||||||||||||

| Magellan Midstream Partners LP (Oil, Gas & Consumable Fuels) |

4.250% | 02/01/2021 | 1,000,000 | 1,105,301 | ||||||||||||

| Murphy Oil Corp. (Oil, Gas & Consumable Fuels) |

4.000% | 06/01/2022 | 1,250,000 | 1,260,999 | ||||||||||||

| Occidental Petroleum Corp. (Oil, Gas & Consumable Fuels) |

3.125% | 02/15/2022 | 1,000,000 | 1,064,595 | ||||||||||||

| ONEOK Partners LP (Oil, Gas & Consumable Fuels) |

3.250% | 02/01/2016 | 1,000,000 | 1,055,563 | ||||||||||||

| Phillips 66 (Oil, Gas & Consumable Fuels) |

(a) | 4.300% | 04/01/2022 | 1,300,000 | 1,453,878 | |||||||||||

| Plains All American Pipeline LP / PAA Finance Corp. (Oil, Gas & Consumable Fuels) |

2.850% | 01/31/2023 | 1,000,000 | 991,719 | ||||||||||||

| Shell International Finance BV (Oil, Gas & Consumable Fuels) |

4.375% | 03/25/2020 | 1,250,000 | 1,450,941 | ||||||||||||

| TransCanada PipeLines Ltd. (Oil, Gas & Consumable Fuels) |

2.500% | 08/01/2022 | 1,425,000 | 1,429,218 | ||||||||||||

|

|

|

|||||||||||||||

| 18,849,509 | ||||||||||||||||

|

|

|

|||||||||||||||

| FINANCIALS – 26.0% |

| |||||||||||||||

| Credit Suisse (Capital Markets) |

3.500% | 03/23/2015 | 1,250,000 | 1,318,807 | ||||||||||||

| Franklin Resources, Inc. (Capital Markets) |

3.125% | 05/20/2015 | 1,000,000 | 1,052,791 | ||||||||||||

| Goldman Sachs Group, Inc. / The (Capital Markets) |

6.150% | 04/01/2018 | 1,250,000 | 1,469,601 | ||||||||||||

| Janus Capital Group, Inc. (Capital Markets) |

(b) | 6.700% | 06/15/2017 | 1,500,000 | 1,715,511 | |||||||||||

| Jefferies Group, Inc. (Capital Markets) |

5.875% | 06/08/2014 | 1,000,000 | 1,057,500 | ||||||||||||

| Morgan Stanley (Capital Markets) |

4.750% | 04/01/2014 | 1,250,000 | 1,294,736 | ||||||||||||

| Northern Trust Corp. (Capital Markets) |

3.450% | 11/04/2020 | 1,000,000 | 1,079,401 | ||||||||||||

| State Street Corp. (Capital Markets) |

4.375% | 03/07/2021 | 1,250,000 | 1,453,956 | ||||||||||||

| TD Ameritrade Holding Corp. (Capital Markets) |

4.150% | 12/01/2014 | 1,000,000 | 1,066,245 | ||||||||||||

| BB&T Corp. (Commercial Banks) |

5.200% | 12/23/2015 | 1,000,000 | 1,115,545 | ||||||||||||

| Comerica Bank (Commercial Banks) |

5.750% | 11/21/2016 | 1,500,000 | 1,736,575 | ||||||||||||

| Deutsche Bank Capital Funding Trust VII (Commercial Banks) |

(a)(c) | 5.628% | Perpetual | 1,500,000 | 1,440,000 | |||||||||||

| Fifth Third Bancorp (Commercial Banks) |

4.500% | 06/01/2018 | 1,750,000 | 1,944,897 | ||||||||||||

| KeyCorp (Commercial Banks) |

5.100% | 03/24/2021 | 500,000 | 582,943 | ||||||||||||

| PNC Funding Corp. (Commercial Banks) |

5.250% | 11/15/2015 | 1,500,000 | 1,677,024 | ||||||||||||

| SunTrust Bank (Commercial Banks) |

5.000% | 09/01/2015 | 229,000 | 250,337 | ||||||||||||

| Wells Fargo & Co. (Commercial Banks) |

4.600% | 04/01/2021 | 1,250,000 | 1,438,904 | ||||||||||||

| Capital One Bank U.S.A. NA (Consumer Finance) |

5.125% | 02/15/2014 | 750,000 | 787,052 | ||||||||||||

| Discover Financial Services (Consumer Finance) |

6.450% | 06/12/2017 | 750,000 | 877,616 | ||||||||||||

| 13 | (continued) |

| Ohio National Fund, Inc. | Bond Portfolio (Continued) |

| Schedule of Investments |

December 31, 2012 |

| Corporate Bonds (Continued) | Rate | Maturity | Face Amount | Value | ||||||||||||

| FINANCIALS (continued) |

| |||||||||||||||

| Bank of America Corp. (Diversified Financial Svs.) |

5.650% | 05/01/2018 | $ | 1,000,000 | $ | 1,164,368 | ||||||||||

| Citigroup, Inc. (Diversified Financial Svs.) |

6.125% | 05/15/2018 | 1,250,000 | 1,499,206 | ||||||||||||

| General Electric Capital Corp. (Diversified Financial Svs.) |

5.625% | 05/01/2018 | 1,000,000 | 1,188,483 | ||||||||||||

| JPMorgan Chase & Co. (Diversified Financial Svs.) |

5.150% | 10/01/2015 | 1,500,000 | 1,649,658 | ||||||||||||

| National Rural Utilities Cooperative Finance Corp. (Diversified Financial Svs.) |

1.900% | 11/01/2015 | 1,000,000 | 1,032,142 | ||||||||||||

| Allstate Corp. / The (Insurance) |

5.200% | 01/15/2042 | 500,000 | 593,995 | ||||||||||||

| Assurant, Inc. (Insurance) |

5.625% | 02/15/2014 | 1,500,000 | 1,565,432 | ||||||||||||

| Axis Capital Holdings Ltd. (Insurance) |

5.750% | 12/01/2014 | 1,000,000 | 1,072,959 | ||||||||||||

| Berkshire Hathaway, Inc. (Insurance) |

3.200% | 02/11/2015 | 1,250,000 | 1,316,571 | ||||||||||||

| Hartford Financial Services Group, Inc. (Insurance) |

5.375% | 03/15/2017 | 1,500,000 | 1,695,872 | ||||||||||||

| Liberty Mutual Group, Inc. (Insurance) |

(a) | 5.750% | 03/15/2014 | 1,000,000 | 1,047,559 | |||||||||||

| Loews Corp. (Insurance) |

5.250% | 03/15/2016 | 750,000 | 836,315 | ||||||||||||

| Prudential Financial, Inc. (Insurance) |

6.100% | 06/15/2017 | 1,500,000 | 1,770,471 | ||||||||||||

| Equity One, Inc. (Real Estate Investment Trusts) |

6.250% | 01/15/2017 | 1,250,000 | 1,427,911 | ||||||||||||

| Federal Realty Investment Trust (Real Estate Investment Trusts) |

3.000% | 08/01/2022 | 1,425,000 | 1,411,847 | ||||||||||||

| HCP, Inc. (Real Estate Investment Trusts) |

5.375% | 02/01/2021 | 1,000,000 | 1,139,590 | ||||||||||||

| Mack-Cali Realty LP (Real Estate Investment Trusts) |

4.600% | 06/15/2013 | 1,000,000 | 1,015,284 | ||||||||||||

|

|

|

|||||||||||||||

| 44,787,104 | ||||||||||||||||

|

|

|

|||||||||||||||

| HEALTH CARE – 6.3% |

| |||||||||||||||

| Amgen, Inc. (Biotechnology) |

4.100% | 06/15/2021 | 1,000,000 | 1,108,721 | ||||||||||||

| Celgene Corp. (Biotechnology) |

2.450% | 10/15/2015 | 1,250,000 | 1,297,905 | ||||||||||||

| Baxter International, Inc. (Health Care Equip. & Supplies) |

1.800% | 03/15/2013 | 250,000 | 250,706 | ||||||||||||

| Becton Dickinson and Co. (Health Care Equip. & Supplies) |

5.000% | 05/15/2019 | 500,000 | 593,018 | ||||||||||||

| Covidien International Finance SA (Health Care Equip. & Supplies) |

2.800% | 06/15/2015 | 1,250,000 | 1,308,073 | ||||||||||||

| AmerisourceBergen Corp. (Health Care Providers & Svs.) |

4.875% | 11/15/2019 | 500,000 | 580,131 | ||||||||||||

| Laboratory Corp of America Holdings (Health Care Providers & Svs.) |

3.750% | 08/23/2022 | 425,000 | 451,092 | ||||||||||||

| UnitedHealth Group, Inc. (Health Care Providers & Svs.) |

6.000% | 02/15/2018 | 1,500,000 | 1,827,180 | ||||||||||||

| Thermo Fisher Scientific, Inc. (Life Sciences Tools & Svs.) |

3.250% | 11/20/2014 | 300,000 | 313,828 | ||||||||||||

| AbbVie, Inc. (Pharmaceuticals) |

(a) | 2.900% | 11/06/2022 | 1,425,000 | 1,452,554 | |||||||||||

| Merck & Co., Inc. (Pharmaceuticals) |

5.000% | 06/30/2019 | 1,000,000 | 1,204,401 | ||||||||||||

| Teva Pharmaceutical Finance II BV / Teva Pharmaceutical Finance III LLC (Pharmaceuticals) |

3.000% | 06/15/2015 | 500,000 | 525,958 | ||||||||||||

|

|

|

|||||||||||||||

| 10,913,567 | ||||||||||||||||

|

|

|

|||||||||||||||

| INDUSTRIALS – 8.4% |

| |||||||||||||||

| BAE Systems Holdings, Inc. (Aerospace & Defense) |

(a) | 6.375% | 06/01/2019 | 750,000 | 895,884 | |||||||||||

| Lockheed Martin Corp. (Aerospace & Defense) |

3.350% | 09/15/2021 | 1,000,000 | 1,057,635 | ||||||||||||

| Raytheon Co. (Aerospace & Defense) |

4.400% | 02/15/2020 | 1,250,000 | 1,431,545 | ||||||||||||

| Republic Services, Inc. (Commercial Svs. & Supplies) |

3.800% | 05/15/2018 | 1,000,000 | 1,100,299 | ||||||||||||

| Waste Management, Inc. (Commercial Svs. & Supplies) |

6.100% | 03/15/2018 | 500,000 | 603,798 | ||||||||||||

| Emerson Electric Co. (Electrical Equip.) |

4.250% | 11/15/2020 | 1,250,000 | 1,443,425 | ||||||||||||

| Caterpillar, Inc. (Machinery) |

5.700% | 08/15/2016 | 1,000,000 | 1,160,755 | ||||||||||||

| Deere & Co. (Machinery) |

4.375% | 10/16/2019 | 1,250,000 | 1,448,228 | ||||||||||||

| Illinois Tool Works, Inc. (Machinery) |

3.375% | 09/15/2021 | 500,000 | 544,416 | ||||||||||||

| CSX Corp. (Road & Rail) |

5.600% | 05/01/2017 | 1,500,000 | 1,753,373 | ||||||||||||

| Norfolk Southern Corp. (Road & Rail) |

3.000% | 04/01/2022 | 600,000 | 615,978 | ||||||||||||

| Ryder System, Inc. (Road & Rail) |

3.600% | 03/01/2016 | 1,000,000 | 1,050,358 | ||||||||||||

| Union Pacific Corp. (Road & Rail) |

4.000% | 02/01/2021 | 1,250,000 | 1,402,390 | ||||||||||||

|

|

|

|||||||||||||||

| 14,508,084 | ||||||||||||||||

|

|

|

|||||||||||||||

| INFORMATION TECHNOLOGY – 1.2% |

| |||||||||||||||

| Cisco Systems, Inc. (Communications Equip.) |

2.900% | 11/17/2014 | 300,000 | 313,250 | ||||||||||||

| Computer Sciences Corp. (IT Svs.) |

6.500% | 03/15/2018 | 1,500,000 | 1,751,028 | ||||||||||||

|

|

|

|||||||||||||||

| 2,064,278 | ||||||||||||||||

|

|

|

|||||||||||||||

| MATERIALS – 4.0% |

| |||||||||||||||

| Eastman Chemical Co. (Chemicals) |

3.600% | 08/15/2022 | 1,000,000 | 1,048,239 | ||||||||||||

| FMC Corp. (Chemicals) |

3.950% | 02/01/2022 | 1,000,000 | 1,062,434 | ||||||||||||

| Freeport-McMoRan Copper & Gold, Inc. (Metals & Mining) |

3.550% | 03/01/2022 | 1,250,000 | 1,240,778 | ||||||||||||

| Newmont Mining Corp. (Metals & Mining) |

3.500% | 03/15/2022 | 1,425,000 | 1,470,933 | ||||||||||||

| Rio Tinto Finance U.S.A. Ltd. (Metals & Mining) |

1.875% | 11/02/2015 | 1,000,000 | 1,026,929 | ||||||||||||

| Teck Resources Ltd. (Metals & Mining) |

3.750% | 02/01/2023 | 1,000,000 | 1,026,623 | ||||||||||||

|

|

|

|||||||||||||||

| 6,875,936 | ||||||||||||||||

|

|

|

|||||||||||||||

| TELECOMMUNICATION SERVICES – 3.8% |

| |||||||||||||||

| AT&T, Inc. (Diversified Telecom. Svs.) |

3.875% | 08/15/2021 | 1,000,000 | 1,115,416 | ||||||||||||

| AT&T, Inc. (Diversified Telecom. Svs.) |

3.000% | 02/15/2022 | 500,000 | 520,468 | ||||||||||||

| Telecom Italia Capital SA (Diversified Telecom. Svs.) |

5.250% | 10/01/2015 | 750,000 | 799,875 | ||||||||||||

| Verizon Communications, Inc. (Diversified Telecom. Svs.) |

4.600% | 04/01/2021 | 1,250,000 | 1,460,150 | ||||||||||||

| Verizon Communications, Inc. (Diversified Telecom. Svs.) |

3.850% | 11/01/2042 | 425,000 | 418,456 | ||||||||||||

| 14 | (continued) |

| Ohio National Fund, Inc. | Bond Portfolio (Continued) |

| Schedule of Investments |

December 31, 2012 |

| Corporate Bonds (Continued) | Rate | Maturity | Face Amount | Value | ||||||||||||

| TELECOMMUNICATION SERVICES (continued) |

| |||||||||||||||

| America Movil SAB de CV (Wireless Telecom. Svs.) |

5.750% | 01/15/2015 | $ | 1,000,000 | $ | 1,102,413 | ||||||||||

| Rogers Communications, Inc. (Wireless Telecom. Svs.) |

5.500% | 03/15/2014 | 1,000,000 | 1,058,168 | ||||||||||||

|

|

|

|||||||||||||||

| 6,474,946 | ||||||||||||||||

|

|

|

|||||||||||||||

| UTILITIES – 14.9% |

| |||||||||||||||

| Appalachian Power Co. (Electric Utilities) |

4.600% | 03/30/2021 | 1,000,000 | 1,152,683 | ||||||||||||

| Commonwealth Edison Co. (Electric Utilities) |

5.950% | 08/15/2016 | 1,500,000 | 1,749,152 | ||||||||||||

| Duke Energy Corp. (Electric Utilities) |

3.350% | 04/01/2015 | 1,250,000 | 1,321,356 | ||||||||||||

| Florida Power Corp. (Electric Utilities) |

4.550% | 04/01/2020 | 500,000 | 575,202 | ||||||||||||

| Kansas City Power & Light Co. (Electric Utilities) |

5.850% | 06/15/2017 | 1,500,000 | 1,748,244 | ||||||||||||

| Metropolitan Edison Co. (Electric Utilities) |

4.875% | 04/01/2014 | 750,000 | 786,072 | ||||||||||||

| Pepco Holdings, Inc. (Electric Utilities) |

2.700% | 10/01/2015 | 750,000 | 776,789 | ||||||||||||

| South Carolina Electric & Gas Co. (Electric Utilities) |

4.350% | 02/01/2042 | 1,000,000 | 1,056,613 | ||||||||||||

| Tenaska Georgia Partners LP (Electric Utilities) |

9.500% | 02/01/2030 | 471,240 | 562,233 | ||||||||||||

| Union Electric Co. (Electric Utilities) |

6.400% | 06/15/2017 | 1,500,000 | 1,833,425 | ||||||||||||

| Virginia Electric and Power Co. (Electric Utilities) |

5.400% | 01/15/2016 | 1,500,000 | 1,703,994 | ||||||||||||

| Westar Energy, Inc. (Electric Utilities) |

4.125% | 03/01/2042 | 500,000 | 522,330 | ||||||||||||

| Xcel Energy, Inc. (Electric Utilities) |

4.700% | 05/15/2020 | 1,000,000 | 1,170,249 | ||||||||||||

| AGL Capital Corp. (Gas Utilities) |

5.250% | 08/15/2019 | 1,000,000 | 1,192,600 | ||||||||||||

| CenterPoint Energy Resources Corp. (Gas Utilities) |

5.950% | 01/15/2014 | 500,000 | 524,979 | ||||||||||||

| Southwest Gas Corp. (Gas Utilities) |

3.875% | 04/01/2022 | 1,250,000 | 1,380,776 | ||||||||||||

| Spectra Energy Capital LLC (Gas Utilities) |

5.500% | 03/01/2014 | 750,000 | 789,158 | ||||||||||||

| Energy Future Competitive Holdings Co. (Ind. Power Prod. & Energy Traders) |

7.480% | 01/01/2017 | 393,963 | 361,924 | ||||||||||||

| Alliant Energy Corp. (Multi-Utilities) |

4.000% | 10/15/2014 | 1,000,000 | 1,054,234 | ||||||||||||

| Avista Corp. (Multi-Utilities) |

5.950% | 06/01/2018 | 1,000,000 | 1,210,227 | ||||||||||||

| Consumers Energy Co. (Multi-Utilities) |

6.000% | 02/15/2014 | 1,000,000 | 1,059,119 | ||||||||||||

| LG&E and KU Energy LLC (Multi-Utilities) |

4.375% | 10/01/2021 | 1,000,000 | 1,098,169 | ||||||||||||

| NextEra Energy Capital Holdings, Inc. (Multi-Utilities) |

2.600% | 09/01/2015 | 1,250,000 | 1,303,088 | ||||||||||||

| Public Service Electric & Gas Co. (Multi-Utilities) |

3.950% | 05/01/2042 | 750,000 | 771,373 | ||||||||||||

|

|

|

|||||||||||||||

| 25,703,989 | ||||||||||||||||

|

|

|

|||||||||||||||

| Total Corporate Bonds (Cost $143,475,815) |

$ | 158,137,120 | ||||||||||||||

|

|

|

|||||||||||||||

| U.S. Treasury Obligations – 4.7% | Rate | Maturity | Face Amount | Value | ||||||||||||

| United States Treasury Note |

2.000% | 11/15/2021 | $ | 4,000,000 | $ | 4,147,812 | ||||||||||

| United States Treasury Note |

1.625% | 08/15/2022 | 4,000,000 | 3,970,000 | ||||||||||||

|

|

|

|||||||||||||||

| Total U.S. Treasury Obligations (Cost $7,994,136) |

$ | 8,117,812 | ||||||||||||||

|

|

|

|||||||||||||||

| Money Market Funds – 2.3% | Shares | Value | ||||||||||||||

| Fidelity Institutional Money Market Funds |

3,883,000 | $ | 3,883,000 | |||||||||||||

|

|

|

|||||||||||||||

| Total Money Market Funds (Cost $3,883,000) |

$ | 3,883,000 | ||||||||||||||

|

|

|

|||||||||||||||

| Total Investments – 98.8% (Cost $155,352,951) |

(d) | $ | 170,137,932 | |||||||||||||

| Other Assets in Excess of Liabilities – 1.2% |

2,046,518 | |||||||||||||||

|

|

|

|||||||||||||||

| Net Assets – 100.0% |

$ | 172,184,450 | ||||||||||||||

|

|

|

|||||||||||||||

Percentages are stated as a percent of net assets.

Footnotes:

| (a) | Security exempt from registration under Regulation D of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified buyers under Rule 144A. At December 31, 2012, the value of these securities totaled $6,289,875, or 3.7% of the Portfolio’s net assets. These securities were deemed liquid pursuant to procedures approved by the Board of Directors. |

| (b) | These securities are credit sensitive bonds. The coupon rates are variable rates subject to adjustment based on changes in national credit rating agency ratings. |

| (c) | Fixed-to-floating rate, callable, perpetual life trust preferred security. Interest rates stated are those in effect at December 31, 2012. |

| (d) | Represents cost for financial reporting purposes, which may differ from cost basis for federal income tax purposes. See also Note 7 of the Notes to Financial Statements. |

The accompanying notes are an integral part of these financial statements.

| 15 |

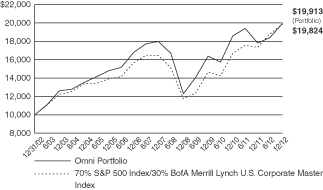

| Ohio National Fund, Inc. | Omni Portfolio |

| 16 | (continued) |

| Ohio National Fund, Inc. | Omni Portfolio (Continued) |

| (1) | Composition of Portfolio subject to change. |

| (2) | Short-term investments have been excluded from the list of Top 10 Portfolio Holdings. |

| (3) | Sectors (combined): |

| % of Net Assets | ||||

| Industrials |

18.3 | |||

| Information Technology |

17.9 | |||

| Financials |

17.4 | |||

| Consumer Discretionary |

12.6 | |||

| Energy |

8.4 | |||

| Health Care |

6.9 | |||

| Materials |

4.3 | |||

| Utilities |

4.1 | |||

| Consumer Staples |

3.1 | |||

| Telecommunication Services |

1.6 | |||

|

|

|

|||

| 94.6 | ||||

|

|

|

| 17 |

| Ohio National Fund, Inc. | Omni Portfolio |

| Schedule of Investments |

December 31, 2012 |

| Common Stocks – 72.5% | Shares | Value | ||||||||||||

| CONSUMER DISCRETIONARY – 10.8% |

| |||||||||||||

| CBS Corp. Class B (Media) |

7,500 | $ | 285,375 | |||||||||||

| Time Warner, Inc. (Media) |

10,400 | 497,432 | ||||||||||||

| Walt Disney Co. / The (Media) |

9,900 | 492,921 | ||||||||||||

| Macy’s, Inc. (Multiline Retail) |

4,300 | 167,786 | ||||||||||||

| Target Corp. (Multiline Retail) |

7,400 | 437,858 | ||||||||||||

| AutoZone, Inc. (Specialty Retail) |

(a) | 900 | 318,987 | |||||||||||

| Lowe’s Cos., Inc. (Specialty Retail) |

10,200 | 362,304 | ||||||||||||

| Hanesbrands, Inc. (Textiles, Apparel & Luxury Goods) |

(a) | 14,800 | 530,136 | |||||||||||

| Michael Kors Holdings Ltd. (Textiles, Apparel & Luxury Goods) |

(a) | 4,700 | 239,841 | |||||||||||

| Wolverine World Wide, Inc. (Textiles, Apparel & Luxury Goods) |

6,400 | 262,272 | ||||||||||||

|

|

|

|||||||||||||

| 3,594,912 | ||||||||||||||

|

|

|

|||||||||||||

| CONSUMER STAPLES – 1.4% |

| |||||||||||||

| Constellation Brands, Inc. Class A (Beverages) |

(a) | 13,500 | 477,765 | |||||||||||

|

|

|

|||||||||||||

| ENERGY – 5.7% |

| |||||||||||||

| Schlumberger Ltd. (Energy Equip. & Svs.) |

6,700 | 464,243 | ||||||||||||

| ConocoPhillips (Oil, Gas & Consumable Fuels) |

8,800 | 510,312 | ||||||||||||

| Marathon Oil Corp. (Oil, Gas & Consumable Fuels) |

16,700 | 512,022 | ||||||||||||

| Whiting Petroleum Corp. (Oil, Gas & Consumable Fuels) |

(a) | 9,700 | 420,689 | |||||||||||

|

|

|

|||||||||||||

| 1,907,266 | ||||||||||||||

|

|

|

|||||||||||||

| FINANCIALS – 11.5% |

| |||||||||||||

| PNC Financial Services Group, Inc. (Commercial Banks) |

8,400 | 489,804 | ||||||||||||

| Wells Fargo & Co. (Commercial Banks) |

13,000 | 444,340 | ||||||||||||

| Citigroup, Inc. (Diversified Financial Svs.) |

10,700 | 423,292 | ||||||||||||

| JPMorgan Chase & Co. (Diversified Financial Svs.) |

11,400 | 501,258 | ||||||||||||

| Hartford Financial Services Group, Inc. (Insurance) |

22,500 | 504,900 | ||||||||||||

| Lincoln National Corp. (Insurance) |

20,100 | 520,590 | ||||||||||||

| MetLife, Inc. (Insurance) |

14,000 | 461,160 | ||||||||||||

| Prudential Financial, Inc. (Insurance) |

8,800 | 469,304 | ||||||||||||

|

|

|

|||||||||||||

| 3,814,648 | ||||||||||||||

|

|

|

|||||||||||||

| HEALTH CARE – 5.4% |

| |||||||||||||

| Amarin Corp PLC – ADR (Biotechnology) |

(a) | 36,100 | 292,049 | |||||||||||

| Ariad Pharmaceuticals, Inc. (Biotechnology) |

(a) | 13,600 | 260,848 | |||||||||||

| Vertex Pharmaceuticals, Inc. (Biotechnology) |

(a) | 8,400 | 352,296 | |||||||||||

| UnitedHealth Group, Inc. (Health Care Providers & Svs.) |

7,400 | 401,376 | ||||||||||||

| Pfizer, Inc. (Pharmaceuticals) |

19,300 | 484,044 | ||||||||||||

|

|

|

|||||||||||||

| 1,790,613 | ||||||||||||||

|

|

|

|||||||||||||

| INDUSTRIALS – 16.7% |

| |||||||||||||

| Honeywell International, Inc. (Aerospace & Defense) |

8,400 | 533,148 | ||||||||||||

| United Technologies Corp. (Aerospace & Defense) |

5,900 | 483,859 | ||||||||||||

| FedEx Corp. (Air Freight & Logistics) |

5,500 | 504,460 | ||||||||||||

| Delta Air Lines, Inc. (Airlines) |

(a) | 41,600 | 493,792 | |||||||||||

| Quanta Services, Inc. (Construction & Engineering) |

(a) | 9,200 | 251,068 | |||||||||||

| Eaton Corp. PLC (Electrical Equip.) |

9,500 | 514,900 | ||||||||||||

| General Electric Co. (Industrial Conglomerates) |

11,200 | 235,088 | ||||||||||||

| Deere & Co. (Machinery) |

3,421 | 295,643 | ||||||||||||

| Pentair Ltd. (Machinery) |

10,000 | 491,500 | ||||||||||||

| Snap-On, Inc. (Machinery) |

6,700 | 529,233 | ||||||||||||

| Stanley Black & Decker, Inc. (Machinery) |

1,400 | 103,558 | ||||||||||||

| Xylem, Inc. (Machinery) |

19,200 | 520,320 | ||||||||||||

| Hertz Global Holdings, Inc. (Road & Rail) |

(a) | 35,200 | 572,704 | |||||||||||

|

|

|

|||||||||||||

| 5,529,273 | ||||||||||||||

|

|

|

|||||||||||||

| INFORMATION TECHNOLOGY – 17.4% |

| |||||||||||||

| QUALCOMM, Inc. (Communications Equip.) |

8,000 | 496,160 | ||||||||||||

| Apple, Inc. (Computers & Peripherals) |

1,150 | 612,984 | ||||||||||||

| EMC Corp. (Computers & Peripherals) |

(a) | 17,500 | 442,750 | |||||||||||

| eBay, Inc. (Internet Software & Svs.) |

(a) | 7,500 | 382,650 | |||||||||||

| Facebook, Inc. Class A (Internet Software & Svs.) |

(a) | 17,000 | 452,710 | |||||||||||

| Google, Inc. Class A (Internet Software & Svs.) |

(a) | 700 | 496,559 | |||||||||||

| Altera Corp. (Semiconductors & Equip.) |

14,000 | 482,160 | ||||||||||||

| Avago Technologies Ltd. (Semiconductors & Equip.) |

14,300 | 452,738 | ||||||||||||

| Xilinx, Inc. (Semiconductors & Equip.) |

13,700 | 491,830 | ||||||||||||

| Citrix Systems, Inc. (Software) |

(a) | 7,400 | 486,550 | |||||||||||

| Oracle Corp. (Software) |

14,400 | 479,808 | ||||||||||||

| TIBCO Software, Inc. (Software) |

(a) | 23,500 | 517,235 | |||||||||||

|

|

|

|||||||||||||

| 5,794,134 | ||||||||||||||

|

|

|

|||||||||||||

| 18 | (continued) |

| Ohio National Fund, Inc. | Omni Portfolio (Continued) |

| Schedule of Investments |

December 31, 2012 |

| Common Stocks (Continued) | Shares | Value | ||||||||||||||||

| MATERIALS – 3.6% |

| |||||||||||||||||

| Air Products & Chemicals, Inc. (Chemicals) |

5,700 | $ | 478,914 | |||||||||||||||

| E.I. du Pont de Nemours & Co. (Chemicals) |

5,800 | 260,826 | ||||||||||||||||

| Monsanto Co. (Chemicals) |

2,400 | 227,160 | ||||||||||||||||

| Freeport–McMoRan Copper & Gold, Inc. (Metals & Mining) |

6,200 | 212,040 | ||||||||||||||||

|

|

|

|||||||||||||||||

| 1,178,940 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| Total Common Stocks (Cost $22,894,005) |

$ | 24,087,551 | ||||||||||||||||

|

|

|

|||||||||||||||||

| Corporate Bonds – 22.1% | Rate | Maturity | Face Amount | Value | ||||||||||||||

| CONSUMER DISCRETIONARY – 1.8% |

||||||||||||||||||

| Darden Restaurants, Inc. (Hotels, Restaurants & Leisure) |

3.350% | 11/01/2022 | $ | 75,000 | $ | 72,638 | ||||||||||||

| Comcast Corp. (Media) |

5.875% | 02/15/2018 | 150,000 | 180,897 | ||||||||||||||

| Discovery Communications LLC (Media) |

3.300% | 05/15/2022 | 75,000 | 77,102 | ||||||||||||||

| Time Warner Cable, Inc. (Media) |

4.500% | 09/15/2042 | 75,000 | 73,214 | ||||||||||||||

| Walt Disney Co. / The (Media) |

3.700% | 12/01/2042 | 75,000 | 75,160 | ||||||||||||||

| Kohl’s Corp. (Multiline Retail) |

4.000% | 11/01/2021 | 75,000 | 79,383 | ||||||||||||||

| Macy’s Retail Holdings, Inc. (Multiline Retail) |

5.900% | 12/01/2016 | 42,000 | 49,380 | ||||||||||||||

|

|

|

|||||||||||||||||

| 607,774 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| CONSUMER STAPLES – 1.7% |

||||||||||||||||||

| Anheuser-Busch Cos., Inc. (Beverages) |

5.500% | 01/15/2018 | 150,000 | 179,958 | ||||||||||||||

| CVS Caremark Corp. (Food & Staples Retailing) |

5.750% | 06/01/2017 | 73,000 | 87,336 | ||||||||||||||

| Bunge NA Finance LP (Food Products) |

5.900% | 04/01/2017 | 150,000 | 170,417 | ||||||||||||||

| Procter & Gamble Co. / The (Household Products) |

4.700% | 02/15/2019 | 100,000 | 118,217 | ||||||||||||||

|

|

|

|||||||||||||||||

| 555,928 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| ENERGY – 2.7% |

||||||||||||||||||

| Weatherford International Ltd. (Energy Equip. & Svs.) |

6.000% | 03/15/2018 | 150,000 | 171,517 | ||||||||||||||

| Anadarko Petroleum Corp. (Oil, Gas & Consumable Fuels) |

5.950% | 09/15/2016 | 100,000 | 115,179 | ||||||||||||||

| Boardwalk Pipelines LP (Oil, Gas & Consumable Fuels) |

5.500% | 02/01/2017 | 100,000 | 110,541 | ||||||||||||||

| Enterprise Products Operating LLC (Oil, Gas & Consumable Fuels) |

5.000% | 03/01/2015 | 75,000 | 81,180 | ||||||||||||||

| Kinder Morgan Energy Partners LP (Oil, Gas & Consumable Fuels) |

4.150% | 03/01/2022 | 75,000 | 81,330 | ||||||||||||||

| Magellan Midstream Partners LP (Oil, Gas & Consumable Fuels) |

6.400% | 07/15/2018 | 150,000 | 183,712 | ||||||||||||||

| Murphy Oil Corp. (Oil, Gas & Consumable Fuels) |

4.000% | 06/01/2022 | 75,000 | 75,660 | ||||||||||||||

| TransCanada PipeLines Ltd. (Oil, Gas & Consumable Fuels) |

2.500% | 08/01/2022 | 75,000 | 75,222 | ||||||||||||||

|

|

|

|||||||||||||||||

| 894,341 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| FINANCIALS – 5.9% |

||||||||||||||||||

| Jefferies Group, Inc. (Capital Markets) |

5.875% | 06/08/2014 | 75,000 | 79,312 | ||||||||||||||

| Mellon Funding Corp. (Capital Markets) |

5.500% | 11/15/2018 | 100,000 | 117,531 | ||||||||||||||

| Morgan Stanley (Capital Markets) |

4.750% | 04/01/2014 | 100,000 | 103,579 | ||||||||||||||

| BB&T Corp. (Commercial Banks) |

5.200% | 12/23/2015 | 100,000 | 111,554 | ||||||||||||||

| Deutsche Bank Capital Funding Trust VII (Commercial Banks) |

(b)(c) | 5.628% | Perpetual | 100,000 | 96,000 | |||||||||||||

| KeyBank NA (Commercial Banks) |

5.700% | 11/01/2017 | 150,000 | 169,517 | ||||||||||||||

| PNC Funding Corp. (Commercial Banks) |

5.250% | 11/15/2015 | 75,000 | 83,851 | ||||||||||||||

| Wells Fargo & Co. (Commercial Banks) |

3.500% | 03/08/2022 | 75,000 | 80,068 | ||||||||||||||

| Capital One Bank U.S.A. NA (Consumer Finance) |

5.125% | 02/15/2014 | 100,000 | 104,940 | ||||||||||||||

| Discover Financial Services (Consumer Finance) |

6.450% | 06/12/2017 | 150,000 | 175,523 | ||||||||||||||

| Bank of America Corp. (Diversified Financial Svs.) |

5.750% | 08/15/2016 | 75,000 | 82,061 | ||||||||||||||

| Citigroup, Inc. (Diversified Financial Svs.) |

5.850% | 08/02/2016 | 75,000 | 85,769 | ||||||||||||||

| General Electric Capital Corp. (Diversified Financial Svs.) |

5.000% | 01/08/2016 | 100,000 | 111,155 | ||||||||||||||

| JPMorgan Chase & Co. (Diversified Financial Svs.) |

5.150% | 10/01/2015 | 100,000 | 109,977 | ||||||||||||||

| Assurant, Inc. (Insurance) |

5.625% | 02/15/2014 | 100,000 | 104,362 | ||||||||||||||

| Liberty Mutual Group, Inc. (Insurance) |

(b) | 5.750% | 03/15/2014 | 100,000 | 104,756 | |||||||||||||

| Federal Realty Investment Trust (Real Estate Investment Trusts) |

3.000% | 08/01/2022 | 75,000 | 74,308 | ||||||||||||||

| HCP, Inc. (Real Estate Investment Trusts) |

6.000% | 01/30/2017 | 150,000 | 172,420 | ||||||||||||||

|

|

|

|||||||||||||||||

| 1,966,683 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| HEALTH CARE – 1.5% |

||||||||||||||||||

| Laboratory Corp. of America Holdings (Health Care Providers & Svs.) |

3.750% | 08/23/2022 | 75,000 | 79,604 | ||||||||||||||

| WellPoint, Inc. (Health Care Providers & Svs.) |

5.875% | 06/15/2017 | 150,000 | 178,154 | ||||||||||||||

| AbbVie, Inc. (Pharmaceuticals) |

(b) | 2.900% | 11/06/2022 | 75,000 | 76,450 | |||||||||||||

| Hospira, Inc. (Pharmaceuticals) |

6.050% | 03/30/2017 | 150,000 | 174,257 | ||||||||||||||

|

|

|

|||||||||||||||||

| 508,465 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| INDUSTRIALS – 1.6% |

||||||||||||||||||

| Waste Management, Inc. (Commercial Svs. & Supplies) |

6.100% | 03/15/2018 | 75,000 | 90,570 | ||||||||||||||

| CSX Corp. (Road & Rail) |

5.600% | 05/01/2017 | 150,000 | 175,337 | ||||||||||||||

| ERAC U.S.A. Finance LLC (Road & Rail) |

(b) | 6.375% | 10/15/2017 | 150,000 | 181,550 | |||||||||||||

| 19 | (continued) |

| Ohio National Fund, Inc. | Omni Portfolio (Continued) |

| Schedule of Investments |

December 31, 2012 |

| Corporate Bonds (Continued) | Rate | Maturity | Face Amount | Value | ||||||||||||||

| INDUSTRIALS (continued) |

||||||||||||||||||

| Norfolk Southern Corp. (Road & Rail) |

3.000% | 04/01/2022 | $ | 75,000 | $ | 76,997 | ||||||||||||

|

|

|

|||||||||||||||||

| 524,454 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| INFORMATION TECHNOLOGY – 0.5% |

||||||||||||||||||

| Computer Sciences Corp. (IT Svs.) |

6.500% | 03/15/2018 | 150,000 | 175,103 | ||||||||||||||

|

|

|

|||||||||||||||||

| MATERIALS – 0.7% |

||||||||||||||||||

| Freeport-McMoRan Copper & Gold, Inc. (Metals & Mining) |

3.550% | 03/01/2022 | 75,000 | 74,447 | ||||||||||||||

| Newmont Mining Corp. (Metals & Mining) |

3.500% | 03/15/2022 | 75,000 | 77,418 | ||||||||||||||

| Teck Resources Ltd. (Metals & Mining) |

3.750% | 02/01/2023 | 75,000 | 76,997 | ||||||||||||||

|

|

|

|||||||||||||||||

| 228,862 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| TELECOMMUNICATION SERVICES – 1.6% |

||||||||||||||||||

| AT&T, Inc. (Diversified Telecom. Svs.) |

3.000% | 02/15/2022 | 75,000 | 78,070 | ||||||||||||||

| Telecom Italia Capital SA (Diversified Telecom. Svs.) |

5.250% | 10/01/2015 | 100,000 | 106,650 | ||||||||||||||

| Verizon Communications, Inc. (Diversified Telecom. Svs.) |

3.850% | 11/01/2042 | 75,000 | 73,845 | ||||||||||||||

| America Movil SAB de CV (Wireless Telecom. Svs.) |

5.750% | 01/15/2015 | 100,000 | 110,241 | ||||||||||||||

| Rogers Communications, Inc. (Wireless Telecom. Svs.) |

5.500% | 03/15/2014 | 150,000 | 158,725 | ||||||||||||||

|

|

|

|||||||||||||||||

| 527,531 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| UTILITIES – 4.1% |

||||||||||||||||||

| Commonwealth Edison Co. (Electric Utilities) |

5.950% | 08/15/2016 | 75,000 | 87,458 | ||||||||||||||

| Kansas City Power & Light Co. (Electric Utilities) |

5.850% | 06/15/2017 | 150,000 | 174,824 | ||||||||||||||

| Nevada Power Co. (Electric Utilities) |

5.950% | 03/15/2016 | 75,000 | 86,025 | ||||||||||||||

| Pennsylvania Electric Co. (Electric Utilities) |

6.050% | 09/01/2017 | 150,000 | 175,816 | ||||||||||||||

| South Carolina Electric & Gas Co. (Electric Utilities) |

4.350% | 02/01/2042 | 75,000 | 79,246 | ||||||||||||||

| Union Electric Co. (Electric Utilities) |

6.400% | 06/15/2017 | 150,000 | 183,342 | ||||||||||||||

| Westar Energy, Inc. (Electric Utilities) |

4.125% | 03/01/2042 | 75,000 | 78,349 | ||||||||||||||

| Southwest Gas Corp. (Gas Utilities) |

3.875% | 04/01/2022 | 75,000 | 82,847 | ||||||||||||||

| Spectra Energy Capital LLC (Gas Utilities) |

5.500% | 03/01/2014 | 100,000 | 105,221 | ||||||||||||||

| Southern Power Co. (Ind. Power Prod. & Energy Traders) |

4.875% | 07/15/2015 | 100,000 | 109,593 | ||||||||||||||

| American Water Capital Corp. (Water Utilities) |

6.085% | 10/15/2017 | 150,000 | 179,411 | ||||||||||||||

|

|

|

|||||||||||||||||

| 1,342,132 | ||||||||||||||||||

|

|

|

|||||||||||||||||

| Total Corporate Bonds (Cost $6,577,552) |

$ | 7,331,273 | ||||||||||||||||

|

|

|

|||||||||||||||||

| U.S. Treasury Obligations – 1.3% | Rate | Maturity | Face Amount | Value | ||||||||||||||

| United States Treasury Note |

3.375% | 11/15/2019 | $ | 300,000 | $ | 344,602 | ||||||||||||

| United States Treasury Note |

1.625% | 08/15/2022 | 100,000 | 99,250 | ||||||||||||||

|

|

|

|||||||||||||||||

| Total U.S. Treasury Obligations (Cost $409,565) |

$ | 443,852 | ||||||||||||||||

|

|

|

|||||||||||||||||

| Money Market Funds – 3.4% | Shares | Value | ||||||||||||||||

| Fidelity Institutional Money Market Funds |

1,118,000 | $ | 1,118,000 | |||||||||||||||

|

|

|

|||||||||||||||||

| Total Money Market Funds (Cost $1,118,000) |

$ | 1,118,000 | ||||||||||||||||

|

|

|

|||||||||||||||||

| Total Investments – 99.3% (Cost $30,999,122) |

(d) | $ | 32,980,676 | |||||||||||||||

| Other Assets in Excess of Liabilities – 0.7% |

224,013 | |||||||||||||||||

|

|

|

|||||||||||||||||

| Net Assets – 100.0% |

$ | 33,204,689 | ||||||||||||||||

|

|

|

|||||||||||||||||

Percentages are stated as a percent of net assets.

Abbreviations:

ADR: American Depositary Receipts

Footnotes:

| (a) | Non-income producing security. |

| (b) | Security exempt from registration under Regulation D of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified buyers under Rule 144A. At December 31, 2012, the value of these securities totaled $458,756, or 1.4% of the Portfolio’s net assets. These securities were deemed liquid pursuant to procedures approved by the Board of Directors. |

| (c) | Fixed-to-floating rate, callable, perpetual life trust preferred security. Interest rates stated are those in effect at December 31, 2012. |

| (d) | Represents cost for financial reporting purposes, which may differ from cost basis for federal income tax purposes. See also Note 7 of the Notes to Financial Statements. |

The accompanying notes are an integral part of these financial statements.

| 20 |

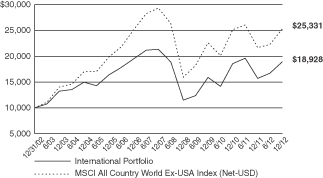

| Ohio National Fund, Inc. | International Portfolio |

| 21 | (continued) |

| Ohio National Fund, Inc. | International Portfolio (Continued) |

| 22 | (continued) |

| Ohio National Fund, Inc. | International Portfolio (Continued) |

| (1) | Composition of Portfolio subject to change. |

| (2) | Short-term investments have been excluded from the list of Top 10 Portfolio Holdings. |

| (3) | Top 10 Country Weightings (combined): |

| % of Net Assets | ||||

| Germany |

20.7 | |||

| Japan |

12.0 | |||

| South Korea |

11.4 | |||

| Norway |

11.2 | |||

| Mexico |

10.5 | |||

| Brazil |

9.2 | |||

| Denmark |

7.3 | |||

| China |

6.0 | |||

| United Kingdom |

3.9 | |||

| Hong Kong |

2.9 |

| 23 |

| Ohio National Fund, Inc. | International Portfolio |

| Schedule of Investments |

December 31, 2012 |

| 24 | (continued) |

| Ohio National Fund, Inc. | International Portfolio (Continued) |

| Schedule of Investments |

December 31, 2012 |

Percentages are stated as a percent of net assets.

Abbreviations:

ADR: American Depositary Receipts

Footnotes:

| (a) | Non-Income producing security. |

| (b) | Security traded on a foreign exchange has been valued at an estimate of fair value that is different than the local market close price. These fair value estimates are determined by an independent fair valuation service that has been approved by the Board. These securities represent $127,832,331, or 70.9% of the Portfolio’s net assets. |

| (c) | As discussed in Note 2 of the Notes to Financial Statements, not all investments that are traded on a foreign exchange are valued at an estimate that is different from the local close price. In some instances, the independent fair valuation service uses a stock’s local close price because the service’s measure of predictability related to their valuation model of a stock is below a chosen threshold. These securities represent $715,630, or 0.4% of the Portfolio’s net assets. |

Other Portfolio securities are not subjected to fair valuation procedures because they are traded on domestic or foreign exchanges that have close times that are consistent with the U.S. market close, normally 4:00 pm Eastern Time.

| (d) | Security is fully or partially pledged as collateral for the Portfolio’s futures contracts outstanding at December 31, 2012. See also Note 6 of the Notes to Financial Statements. |

| (e) | Represents cost for financial reporting purposes, which may differ from cost basis for federal income tax purposes. See also Note 7 of the Notes to Financial Statements. |

Sector Classifications (Common and preferred stocks): (Percent of net assets)

| Financials |

17.0 | % | ||

| Consumer Discretionary |

15.1 | % | ||

| Materials |

13.0 | % | ||

| Industrials |

11.4 | % | ||

| Energy |

10.3 | % | ||

| Information Technology |

8.4 | % | ||

| Consumer Staples |

8.1 | % | ||

| Health Care |

7.4 | % | ||

| Telecommunication Services |

4.1 | % | ||

| Utilities |

1.9 | % | ||

|

|

|

|||

| 96.7 | % | |||

|

|

|

The accompanying notes are an integral part of these financial statements.

| 25 |

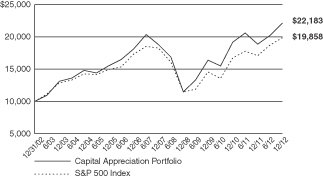

| Ohio National Fund, Inc. | Capital Appreciation Portfolio |

| 26 | (continued) |

| Ohio National Fund, Inc. | Capital Appreciation Portfolio (Continued) |

| 27 | (continued) |

| Ohio National Fund, Inc. | Capital Appreciation Portfolio (Continued) |

| (1) | Composition of Portfolio subject to change. |

| (2) | Short-term investments have been excluded from the list of Top 10 Portfolio Holdings. |

| (3) | Sectors: |

| % of Net Assets | ||||

| Consumer Discretionary |

20.2 | |||

| Information Technology |

14.5 | |||

| Energy |

11.9 | |||

| Financials |

11.3 | |||

| Industrials |

11.0 | |||

| Health Care |

10.8 | |||

| Consumer Staples |

7.7 | |||

| Materials |

4.9 | |||

| Utilities |

1.8 | |||

| Telecommunication Services |

1.7 | |||

|

|

|

|||

| 95.8 | ||||

|

|

|

| 28 |

| Ohio National Fund, Inc. | Capital Appreciation Portfolio |

| Schedule of Investments |

December 31, 2012 |

| 29 | (continued) |

| Ohio National Fund, Inc. | Capital Appreciation Portfolio (Continued) |

| Schedule of Investments |

December 31, 2012 |

Percentages are stated as a percent of net assets.

Abbreviations:

ADR: American Depositary Receipts

Footnotes:

| (a) | Non-income producing security. |

| (b) | Security traded on a foreign exchange has been valued at an estimate of fair value that is different than the local market close price. These fair value estimates are determined by an independent fair valuation service that has been approved by the Board. These securities represent $3,476,725, or 3.0% of the Portfolio’s net assets. Other Portfolio securities are not subjected to fair valuation procedures because they are traded on domestic or foreign exchanges that have close times that are consistent with the U.S. market close, normally 4:00 pm Eastern Time. |

| (c) | Represents cost for financial reporting purposes, which may differ from cost basis for federal income tax purposes. See also Note 7 of the Notes to Financial Statements. |

The accompanying notes are an integral part of these financial statements.

| 30 |

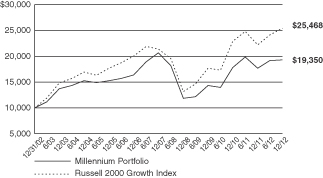

| Ohio National Fund, Inc. | Millennium Portfolio |

| 31 | (continued) |

| Ohio National Fund, Inc. | Millennium Portfolio (Continued) |

| (1) | Composition of Portfolio subject to change. |

| (2) | Short-term investments have been excluded from the list of Top 10 Portfolio Holdings. |

| (3) | Sectors: |

| % of Net Assets | ||||

| Information Technology |

25.5 | |||

| Health Care |

19.0 | |||

| Consumer Discretionary |

18.5 | |||

| Industrials |

15.8 | |||

| Financials |

6.9 | |||

| Energy |

5.3 | |||

| Consumer Staples |

4.2 | |||

| Materials |

3.6 | |||

|

|

|

|||

| 98.8 | ||||

|

|

|

| 32 |

| Ohio National Fund, Inc. | Millennium Portfolio |

| Schedule of Investments |

December 31, 2012 |

Percentages are stated as a percent of net assets.

Footnotes:

| (a) | Non-income producing security. |

| (b) | Represents cost for financial reporting purposes, which may differ from cost basis for federal income tax purposes. See also Note 7 of the Notes to Financial Statements. |

The accompanying notes are an integral part of these financial statements.

| 33 |

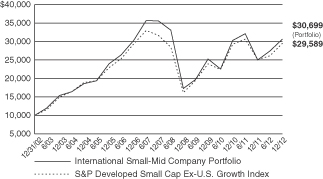

| Ohio National Fund, Inc. | International Small-Mid Company Portfolio |

| 34 | (continued) |

| Ohio National Fund, Inc. | International Small-Mid Company Portfolio (Continued) |

| (1) | Composition of Portfolio subject to change. |

| (2) | Short-term investments have been excluded from the list of Top 10 Portfolio Holdings. |

| (3) | Top 10 Country Weightings: |

| % of Net Assets | ||||

| United Kingdom |

19.3 | |||

| France |

9.3 | |||

| Japan |

9.1 | |||

| Canada |

7.1 | |||

| Germany |

7.0 | |||

| Singapore |

5.1 | |||

| Mexico |

4.1 | |||

| Sweden |

3.7 | |||

| United States |

3.0 | |||

| China |

2.5 |

| 35 |

| Ohio National Fund, Inc. | International Small-Mid Company Portfolio |

| Schedule of Investments |

December 31, 2012 |

| 36 | (continued) |

| Ohio National Fund, Inc. | International Small-Mid Company Portfolio (Continued) |

| Schedule of Investments |

December 31, 2012 |

Percentages are stated as a percent of net assets.

Abbreviations:

ADR: American Depositary Receipts

Footnotes:

| (a) | Non-Income producing security. |

| (b) | Security traded on a foreign exchange has been valued at an estimate of fair value that is different than the local market close price. These fair value estimates are determined by an independent fair valuation service that has been approved by the Board. These securities represent $46,204,976, or 71.7% of the Portfolio’s net assets. |

| (c) | As discussed in Note 2 of the Notes to Financial Statements, not all investments that are traded on a foreign exchange are valued at an estimate that is different from the local close price. In some instances, the independent fair valuation service uses a stock’s local close price because the service’s measure of predictability related to their valuation model of a stock is below a chosen threshold. These securities represent $296,368, or 0.5% of the Portfolio’s net assets. |

Other Portfolio securities are not subjected to fair valuation procedures because they are traded on domestic or foreign exchanges that have close times that are consistent with the U.S. market close, normally 4:00 pm Eastern Time.

| (d) | Represents cost for financial reporting purposes, which may differ from cost basis for federal income tax purposes. See also Note 7 of the Notes to Financial Statements. |

Sector Classifications (Common stocks): (Percent of net assets)

| Consumer Discretionary |

26.9% | |||

| Industrials |

22.9% | |||

| Materials |

12.2% | |||

| Energy |

9.9% | |||

| Financials |

7.5% | |||

| Health Care |

7.2% | |||

| Information Technology |

5.4% | |||

| Consumer Staples |

2.9% | |||

|

|

|

|||

| 94.9% | ||||

|

|

|

The accompanying notes are an integral part of these financial statements.

| 37 |

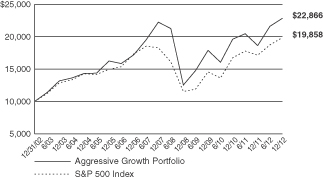

| Ohio National Fund, Inc. | Aggressive Growth Portfolio |

| 38 | (continued) |

| Ohio National Fund, Inc. | Aggressive Growth Portfolio (Continued) |

| 39 |

| Ohio National Fund, Inc. | Aggressive Growth Portfolio |

| Schedule of Investments |

December 31, 2012 |

Percentages are stated as a percent of net assets.

Footnotes:

| (a) | Non-income producing security. |

| (b) | Security traded on a foreign exchange has been valued at an estimate of fair value that is different than the local market close price. These fair value estimates are determined by an independent fair valuation service that has been approved by the Board. These securities represent $4,995,733, or 15.1% of the Portfolio’s net assets. |

| (c) | As discussed in Note 2 of the Notes to Financial Statements, not all investments that are traded on a foreign exchange are valued at an estimate that is different from the local close price. In some instances, the independent fair valuation service uses a stock’s local close price because the service’s measure of predictability related to the valuation model of a stock is below a chosen threshold. These securities represent $158,321, or 0.5% of the Portfolio’s net assets. |

Other Portfolio securities are not subjected to fair value procedures because they are traded on domestic or foreign exchanges that have close times that are consistent with the U.S. market close, normally 4:00 pm Eastern Time.

| (d) | A VVPR Strip is a coupon attached to specific ordinary common shares that offers tax advantages. The coupon entitles a holder to reduced withholding tax rates on the dividends generated from the related common shares. |

| (e) | Represents cost for financial reporting purposes, which may differ from cost basis for federal income tax purposes. See also Note 7 of the Notes to Financial Statements. |

The accompanying notes are an integral part of these financial statements.

| 40 |

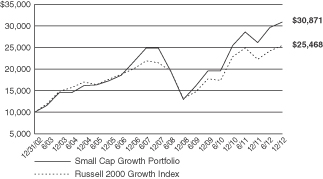

| Ohio National Fund, Inc. | Small Cap Growth Portfolio |

| 41 | (continued) |

| Ohio National Fund, Inc. | Small Cap Growth Portfolio (Continued) |

| 42 |

| Ohio National Fund, Inc. | Small Cap Growth Portfolio |

| Schedule of Investments |

December 31, 2012 |

Percentages are stated as a percent of net assets.

Footnotes:

| (a) | Non-income producing security. |

| (b) | Represents cost for financial reporting purposes, which may differ from cost basis for federal income tax purposes. See also Note 7 of the Notes to Financial Statements. |

| 43 |

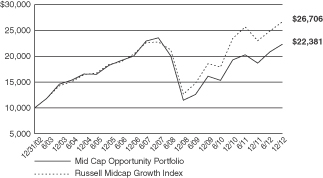

| Ohio National Fund, Inc. | Mid Cap Opportunity Portfolio |

| 44 | (continued) |

| Ohio National Fund, Inc. | Mid Cap Opportunity Portfolio (Continued) |

| (1) | Composition of Portfolio subject to change. |

| (2) | Short-term investments have been excluded from the list of Top 10 Portfolio Holdings. |

| (3) | Sectors: |

| % of Net Assets | ||||

| Information Technology |

22.6 | |||

| Consumer Discretionary |

21.5 | |||

| Health Care |

12.8 | |||

| Financials |

12.6 | |||

| Industrials |

8.1 | |||

| Telecommunication Services |

6.9 | |||

| Consumer Staples |

5.6 | |||

| Materials |

4.8 | |||

| Energy |

4.6 | |||

|

|

|

|||

| 99.5 | ||||

|

|

|

| 45 |

| Ohio National Fund, Inc. | Mid Cap Opportunity Portfolio |

| Schedule of Investments |

December 31, 2012 |

| 46 | (continued) |

| Ohio National Fund, Inc. | Mid Cap Opportunity Portfolio (Continued) |

| Schedule of Investments |

December 31, 2012 |

Percentages are stated as a percent of net assets.

Abbreviations:

ADR: American Depositary Receipts

Footnotes:

| (a) | Non-income producing security. |

| (b) | Represents cost for financial reporting purposes, which may differ from cost basis for federal income tax purposes. See also Note 7 of the Notes to Financial Statements. |

The accompanying notes are an integral part of these financial statements.

| 47 |

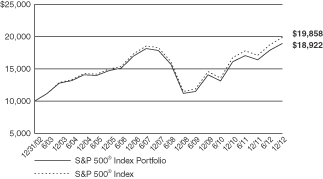

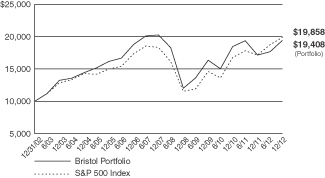

| Ohio National Fund, Inc. | S&P 500® Index Portfolio |

| 48 | (continued) |

| Ohio National Fund, Inc. | S&P 500® Index Portfolio (Continued) |

| (1) | Composition of Portfolio subject to change. |

| (2) | Short-term investments have been excluded from the list of Top 10 Portfolio Holdings. |

| (3) | Sectors: |

| % of Net Assets | ||||

| Information Technology |

18.3 | |||

| Financials |

15.0 | |||

| Health Care |

11.6 | |||

| Consumer Discretionary |

11.1 | |||

| Energy |

10.6 | |||

| Consumer Staples |

10.2 | |||

| Industrials |

9.7 | |||

| Materials |

3.5 | |||

| Utilities |

3.3 | |||

| Telecommunication Services |

2.9 | |||

|

|

|

|||

| 96.2 | ||||

|

|

|

| 49 |

| Ohio National Fund, Inc. | S&P 500® Index Portfolio |

| Schedule of Investments |

December 31, 2012 |

| 50 | (continued) |

| Ohio National Fund, Inc. | S&P 500® Index Portfolio (Continued) |

| Schedule of Investments |

December 31, 2012 |

| 51 | (continued) |

| Ohio National Fund, Inc. | S&P 500® Index Portfolio (Continued) |

| Schedule of Investments |

December 31, 2012 |

| 52 | (continued) |

| Ohio National Fund, Inc. | S&P 500® Index Portfolio (Continued) |

| Schedule of Investments |

December 31, 2012 |

| 53 | (continued) |

| Ohio National Fund, Inc. | S&P 500® Index Portfolio (Continued) |

| Schedule of Investments |

December 31, 2012 |

Percentages are stated as a percent of net assets.

Footnotes:

| (a) | Non-income producing security. |

| (b) | Represents cost for financial reporting purposes, which may differ from cost basis for federal income tax purposes. See also Note 7 of the Notes to Financial Statements. |

The accompanying notes are an integral part of these financial statements.

| 54 |

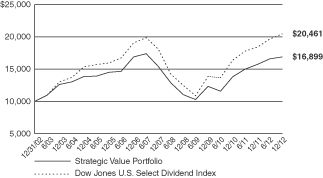

| Ohio National Fund, Inc. | Strategic Value Portfolio |

| 55 | (continued) |

| Ohio National Fund, Inc. | Strategic Value Portfolio (Continued) |

| (1) | Composition of Portfolio subject to change. |

| (2) | Short-term investments have been excluded from the list of Top 10 Portfolio Holdings. |

| (3) | Sectors: |

| % of Net Assets | ||||

| Consumer Staples |

26.0 | |||

| Health Care |

19.4 | |||

| Utilities |

19.3 | |||

| Telecommunication Services |

16.9 | |||

| Energy |

12.5 | |||

| Consumer Discretionary |

2.3 | |||

|

|

|

|||

| 96.4 | ||||

|

|

|

| 56 |

| Ohio National Fund, Inc. | Strategic Value Portfolio |

| Schedule of Investments |

December 31, 2012 |

Percentages are stated as a percent of net assets.

Abbreviations:

ADR: American Depositary Receipts

Footnotes:

| (a) | Security traded on a foreign exchange has been valued at an estimate of fair value that is different than the local market close price. These fair value estimates are determined by an independent fair valuation service that has been approved by the Board. These securities represent $64,896,335, or 24.2% of the Portfolio’s net assets. |

Other Portfolio securities are not subjected to fair value procedures because they are traded on domestic or foreign exchanges that have close times that are consistent with the U.S. market close, normally 4:00 pm Eastern Time.

| (b) | Represents cost for financial reporting purposes, which may differ from cost basis for federal income tax purposes. See also Note 7 of the Notes to Financial Statements. |

The accompanying notes are an integral part of these financial statements.

| 57 |

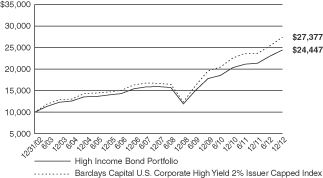

| Ohio National Fund, Inc. | High Income Bond Portfolio |

| 58 | (continued) |

| Ohio National Fund, Inc. | High Income Bond Portfolio (Continued) |

| (1) | Composition of Portfolio subject to change. |

| (2) | Short-term investments have been excluded from the list of Top 10 Portfolio Holdings. |

| (3) | Sectors (combined): |

| % of Net Assets | ||||

| Consumer Discretionary |

28.2 | |||

| Industrials |

12.1 | |||

| Energy |

11.8 | |||

| Information Technology |

10.6 | |||

| Health Care |

10.6 | |||

| Materials |

7.6 | |||

| Financials |

5.2 | |||

| Telecommunication Services |

5.2 | |||

| Consumer Staples |

5.2 | |||

| Utilities |

1.8 | |||

|

|

|

|||

| 98.3 | ||||

|

|

|

| 59 |

| Ohio National Fund, Inc. | High Income Bond Portfolio |

| Schedule of Investments |

December 31, 2012 |

| Corporate Bonds – 98.2% | Rate | Maturity | Face Amount | Value | ||||||||||||

| CONSUMER DISCRETIONARY – 28.2% |

||||||||||||||||

| Allison Transmission, Inc. (Auto Components) |

(b) | 7.125% | 05/15/2019 | $ | 600,000 | $ | 643,500 | |||||||||

| American Axle & Manufacturing, Inc. (Auto Components) |

7.750% | 11/15/2019 | 625,000 | 681,250 | ||||||||||||

| American Axle & Manufacturing, Inc. (Auto Components) |

6.625% | 10/15/2022 | 700,000 | 714,000 | ||||||||||||

| American Tire Distributors, Inc. (Auto Components) |

9.750% | 06/01/2017 | 175,000 | 186,375 | ||||||||||||

| Cooper-Standard Automotive, Inc. (Auto Components) |

8.500% | 05/01/2018 | 775,000 | 837,000 | ||||||||||||

| Exide Technologies (Auto Components) |

8.625% | 02/01/2018 | 1,400,000 | 1,193,500 | ||||||||||||

| IDQ Holdings, Inc. (Auto Components) |

(b) | 11.500% | 04/01/2017 | 600,000 | 649,500 | |||||||||||

| International Automotive Components Group SL (Auto Components) |

(b) | 9.125% | 06/01/2018 | 1,200,000 | 1,119,000 | |||||||||||

| J.B. Poindexter & Co., Inc. (Auto Components) |

(b) | 9.000% | 04/01/2022 | 825,000 | 856,969 | |||||||||||

| Pittsburgh Glass Works LLC (Auto Components) |

(b) | 8.500% | 04/15/2016 | 1,100,000 | 1,017,500 | |||||||||||

| Stoneridge, Inc. (Auto Components) |

(b) | 9.500% | 10/15/2017 | 725,000 | 775,750 | |||||||||||

| Tenneco, Inc. (Auto Components) |

7.750% | 08/15/2018 | 325,000 | 354,250 | ||||||||||||

| Tenneco, Inc. (Auto Components) |

6.875% | 12/15/2020 | 450,000 | 492,187 | ||||||||||||

| Tomkins LLC (Auto Components) |

9.000% | 10/01/2018 | 576,000 | 648,000 | ||||||||||||

| Tower Automotive Holdings U.S.A. LLC / T.A. Holdings Finance, Inc. (Auto Components) |

(b) | 10.625% | 09/01/2017 | 700,000 | 770,000 | |||||||||||

| UCI International, Inc. (Auto Components) |