Ohio National Fund, Inc.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03015

Ohio National Fund, Inc.

(Exact name of registrant as specified in charter)

|

|

|

| One Financial Way, Cincinnati, Ohio |

|

45242 |

| (Address of principal executive offices) |

|

(Zip code) |

CT Corporation 300 E. Lombard St. Suite 1400 Baltimore, MD 21202

(Name and address of agent for service)

Registrant’s telephone number, including area code: 513-794-6971

Date of fiscal year end:

December 31

Date of reporting period: December 31, 2011

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be

transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A

registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the

accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information

under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. |

Reports To Stockholders. |

WEALTH BUILDING OPPORTUNITY

Ohio National Fund, Inc.

Annual Report

December 31, 2011

Ohio National Fund, Inc.

OHIO NATIONAL FUND, INC.

TABLE OF CONTENTS

|

|

|

| President’s Message |

|

|

Dear Investor:

The year 2011 was a tale of two halves and a tale of volatility. For the first half of

the year, the markets were relatively calm and performance was good. The S&P 500® Index was up 6.0 percent,

the MSCI EAFE (Europe, Australasia and Far East) Index was up 5.3 percent, and the VIX Index averaged 18.04, several points below its ten-year average. However, as mid-year approached, storm clouds began brewing on the horizon as troubles in Europe

grew and the U.S. debt ceiling debate took center stage. A potential default in Greece caused serious concern about the fate of the European Union, and the large European banks that had lent money to Greece through the purchase of Greek sovereign

debt. These concerns sparked fears of a European recession spreading to the United States and further weakening other overextended European nations such as Italy, Portugal, Ireland and Spain.

These events caused significant changes in the second half of the year, starting with falling interest rates in the U.S., as Treasuries became the flight-to-quality asset of choice. From its high, the

yield on ten-year Treasuries fell 200 basis points, from 3.7 percent to 1.7 percent. This significant decline in yields made U.S. Treasuries the clear total return winner in 2011, as price moves inversely to yield.

Equity performance in the second half of the year was also challenging and very volatile. The S&P 500® Index was down 3.7 percent. The MSCI EAFE Index, because of its significant exposure to Europe, fared even worse and

finished down 16.2 percent. Volatility showed the most dramatic change with the VIX Index averaging 30.3 during the last six months of the year, reaching a high of 48.0 on August 8. However, by year-end, volatility had returned close to its

decade-long average, finishing December at 23.4.

Through November, volatility remained high as equity returns fluctuated widely. Returns at

the end of October

were up almost 11 percent, then November ended with slightly negative returns. What was amazing to watch through all of this was the day-to-day movement of the markets. For example, of the

twenty-one trading days in November, over 50 percent of the days had moves of 1 percent or more, one-third of the days had moves of 2 percent or more, and two days saw moves of over 3 percent.

By the end of the year, the S&P 500® Index was largely unchanged with a beginning value of 1257.6, an ending value of 1257.6 and an annual return of 2.1 percent coming entirely from dividends. 2011 truly

was a roller-coaster year that gave us a wild ride that ended where we started.

Active managers often struggle in highly

volatile markets, and the portfolio managers of the Ohio National Fund were no exception. During the first half of the year, nine of the twenty-one actively managed Portfolios (excluding the Money Market, S&P 500® Index and Nasdaq-100® Index Portfolios) outperformed their respective benchmarks and were in the top half of their respective peer groups. Five others underperformed their benchmarks, but

ranked in the top half of their peer groups, leaving only 7 of 21 underperforming both.

In the second half of the year, the story reversed

– eleven Portfolios underperformed both their respective benchmarks and their peer groups, 6 outperformed their respective peer groups but underperformed the benchmarks, and only 4 outperformed both. There was an improvement in December as

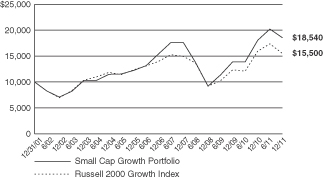

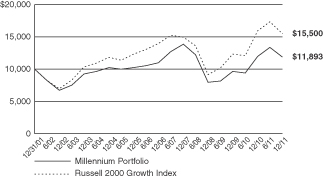

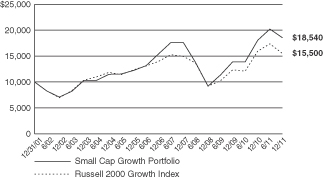

volatility declined; twelve Portfolios outperformed their respective benchmarks or peer groups for the month. Several Portfolios that performed very well during the year were the Millennium Portfolio, sub-advised by Neuberger Berman, the Small Cap

Growth Portfolio, sub-advised by Janus, and the Strategic Value Portfolio, sub-advised by Federated Investors.

As we look forward into 2012, we are left with many of the same issues from 2011: a highly contentious

political environment leading into an election year; stubbornly high but gradually improving unemployment; potential slowing growth in China; and the European debt crisis, which I see as the largest problem of the year. Unfortunately, this is an

economic problem created by politicians, and it must be solved by politicians. One of the characteristics of a political solution is that it does not happen until the absolute last moment and is usually inadequate to address the long-term problem. A

good example is the U.S. deficit reduction debate of last summer.

The center of the European debt crisis is Greece. Even though Greece is

deeply in debt and potentially on the verge of default, it is in the driver’s seat. There’s an old expression in the real estate development business that says, “If you want to be in debt to your bank, owe them a little money. If you

want your bank to be in debt to you, owe them a lot of money.” There is no doubt that Greece owes a lot of money to its banks. The European Central Bank, as well as most European commercial banks, cannot afford a Greek default. On the other

hand, Greece has a history of default. The first Greek default occurred in the fourth century B.C., and it has defaulted five times in the modern era (1826, 1843, 1860, 1894, and 1932). The Greeks

probably prefer default to the austerity measures that come with a bailout.

For these

reasons, a solution will take time to craft. This is actually good news. John Maynard Keynes said, “For as long as a bank is in a position to wait quietly for better times… there is no cause for panic.” While it may not be quiet,

waiting will give banks the time they need to de-lever their balance sheets in as orderly a fashion as possible.

On the positive side, U.S.

equity valuations are at very low levels and the value in higher quality companies is starting to be recognized. This bodes well for U.S. equity returns going forward and I am hopeful 2012 will be a better year than 2011.

Thank you for entrusting your assets to the Ohio National Fund. We look forward to serving your investment needs.

Sincerely

Christopher A. Carlson

President

Directors and Officers of Ohio National Fund, Inc.

|

| John J. Palmer, Director |

| James E. Bushman, Director |

| George M. Vredeveld, Director |

| John I. Von Lehman, Director |

|

| Christopher A. Carlson, President |

| Thomas A. Barefield, Vice President |

| Dennis R. Taney, Chief Compliance Officer |

| R. Todd Brockman, Treasurer |

| Catherine E. Gehr, Assistant Treasurer |

| Kimberly A. Plante, Secretary |

| Katherine L. Carter, Assistant Secretary |

The Statement of Additional Information of Ohio

National Fund, Inc. (the “Fund”) includes additional information about the Fund’s Board of Directors (the “Board”) and is available, without charge, upon request, by calling 877-781-6392 (toll-free).

A description of the policies and procedures that the Fund uses in voting proxies relating to Fund securities, as well as information regarding how the Fund voted

proxies during the most recent twelve-month period ended June 30, is available without charge, upon request, by calling 877-781-6392 (toll-free) and on the Securities and Exchange Commission (the “Commission”) website at

http://www.sec.gov.

The Fund has filed its Schedules of Investments as of March 31 and September 30 with the Commission, as required,

on Form N-Q. Form N-Q is required to be filed with the Commission for the first and third quarters of each fiscal year within sixty days after the end of each period and is available on the Commission website upon acceptance of each submission. The

Fund’s Forms N-Q may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information about the Public Reference Room is available by calling 1-800-SEC-0330 (toll-free).

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized

for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus of Ohio National Fund, Inc. For a prospectus containing more complete information, including charges and expenses, please contact Ohio

National Investments, Inc., One Financial Way, Cincinnati, OH 45242, telephone 513-794-6100.

|

|

|

| Ohio National Fund, Inc. |

|

Equity Portfolio |

The Equity Portfolio seeks long-term growth of capital by investing at least 80% of its assets in equity securities.

Performance as of

December 31, 2011

|

|

|

|

|

| Average Annual Total Returns: |

|

|

|

|

| One year |

|

|

-3.38% |

|

| Five years |

|

|

-9.21% |

|

| Ten years |

|

|

-0.82% |

|

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns

may be lower or higher. Total return figures include change in share price and reinvestment of dividends and capital gains. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more

or less than the original cost. To obtain performance information up to the most recent month end, call toll-free 1-877-781-6392.

The Portfolio

is not open to direct retail investment. Beneficial interest in shares is obtained solely by purchase of variable life insurance policies and variable annuity contracts. Actual performance results for variable annuity and variable universal life

contracts will be lower due to contract charges. Consult your contract for applicable charges.

For the year ended December 31, 2011, the Equity Portfolio returned -3.38% versus 2.11% for the current

benchmark, the S&P 500 Index.

Relative Portfolio underperformance was driven by both sector allocation effects and security

selection. At the sector level, the Portfolio’s relative underperformance was driven by a relative overweight position in the Financials sector, which underperformed the benchmark, and relative underweight positions in Utilities and Consumer

Staples, which outperformed the benchmark. However, a relative overweight position in Health Care contributed to the Portfolio’s performance as the sector outperformed the benchmark, and relative underweight exposure to the Materials and

Industrials sectors contributed positively to performance, as both underperformed the benchmark. At the security level, Hewlett-Packard Co., Bank of America Corp., and Citigroup, Inc. were the top three detractors from performance while UnitedHealth

Group, Inc., Aetna, Inc., and International Business Machines Corp. were the top contributors to performance during

2011.(1)

U.S. equities began the year on a strong foot, bolstered by corporate earnings and overcoming the effects of a natural disaster in Japan and foreign political turmoil. However, about halfway into the year, concerns

over a brewing European liquidity crisis coupled with a downgrade of the U.S. debt rating shook investor confidence and sent the markets sharply lower in a volatile and troubling third quarter. Stocks rebounded, however, once the S&P 500 Index

reached a level just under 1100, providing a strong fourth quarter to close out the year. All in all, the S&P 500 Index finished nearly flat for the year, with a positive return provided solely by dividends, amid uncertainty surrounding the

sovereign debt crisis, record corporate earnings, and largely consensus-beating economic indicators.

Stocks opened 2011 with the strongest first quarter

in more than a decade, as almost every major index posted gains between 5% and 10%. Investors continued to find reasons for bullishness despite political unrest in North Africa and the Middle East, as economic data indicated gathering strength in

the recovery and a turnaround in the jobs market. In mid-March, the tsunami in Japan sent the S&P 500 Index into a 3.6% dive as investors were uncertain of the disaster’s impact on the world’s third largest economy. U.S. equities

quickly recovered from this plunge until the market took a hit in April, after Standard & Poor’s ratcheted down the U.S. credit outlook to “negative” due to large budget

deficits and a politically polarized budget process. However, a strong earnings season carried stocks past this dip to post almost 3% in gains on the month. Investors saw a volatile decline throughout May and June with rising commodity prices and

emerging evidence of a slowdown in manufacturing growth in China and Europe served to deepen concerns that a global slowdown may gain momentum. Headlines in June focused on weak employment reports, falling second-quarter gross domestic product

estimates, the conclusion of QE2 (quantitative easing phase II), and the ongoing debate over the U.S. debt ceiling. Markets also became more short-term oriented and reactionary in the face of broad uncertainty surrounding the growing European

sovereign debt problems.

The market started to struggle fairly early in the third quarter and it proceeded to post a loss in each month, resulting in

the largest quarterly loss since the financial crisis in 2008. The market was rocked by events on both sides of the Atlantic including a U.S. debt ceiling show-down and escalating European sovereign debt problems. Congress squabbled right up to the

deadline date, but finally managed to reach a deal with the Administration, although not a long-term solution to the country’s structural deficits. Standard & Poor’s reacted several days later by lowering its U.S. government

sovereign debt rating from AAA to AA+ with a negative outlook. Increased uncertainty and a darkening economic outlook for Europe, which threatens to spill over into China and possibly the U.S., sent market volatility to historically high levels. In

its September 21 Federal Open Market Committee (“FOMC”) statement, the Federal Reserve described the downside risks to the U.S. economy as “significant,” producing fresh anxiety for investors and causing the market to sell

off over 6% in 2 days. In that same meeting, the FOMC introduced the widely expected “Operation Twist,” which is a $400 billion sterilized asset purchase program aimed at lowering long-term rates and improving the mortgage market.

Equities rebounded in the fourth quarter as markets continued to exhibit what is colloquially known as “risk on/risk off” behavior, reacting

to European debt crisis developments, economic indicators, and corporate earnings. European Union (“EU”) summit meetings yielded concrete steps towards containing and possibly remedying Europe’s mounting debt issues, ultimately

leading EU leaders to introduce the European Financial Stabilization Mechanism, a proposed temporary €500 billion bailout fund expected to

launch in early 2012. Additionally, leadership changes swept through some of Europe’s most debt burdened countries, which were received as generally positive developments by the market. The Federal Reserve, in a coordinated effort with the

European Central Bank, Swiss National Bank, and the Banks of England, Japan and Canada, lowered the U.S. dollar liquidity swap rate 50 basis points in an effort to “provide liquidity support” and “ease strain in financial

markets.” Many economic indicators were at better-than-feared levels and corporate earnings were again strong. Payroll numbers were revised higher for the fifth consecutive month, consumer spending expanded, retail sales were up each month

during the fourth quarter, and gross domestic product grew at an annualized rate of 1.8%. Three hundred twenty eight companies in the S&P 500 Index beat their respective estimates, while expectations were revised lower heading into 2012, but

still on pace to finish at record levels.

The S&P 500 Index ended the year at 1,257.60, just four basis points under its 2010 closing price, and

provided investors with a total return including dividends of 2.1%. The Dow Jones Industrial

Aver-

|

|

|

| Ohio National Fund, Inc. |

|

Equity Portfolio (Continued) |

age fared the best, up 8.4% on the year, while the tech-heavy Nasdaq Composite Index slipped 0.8%. In terms of size, large-cap companies prevailed in 2011, besting the losses generated by small-

and mid-cap companies. Specifically, the Russell 1000 Index climbed 1.5% compared to the Russell Midcap Index and Russell 2000 Index, which fell 1.5% and 4.2%, respectively. On the whole, growth-oriented stocks outperformed value names, as the

Russell 1000 Growth Index returned +2.6% to the Russell 1000 Value Index’s +0.4%. At a sector level, Utilities, Consumer Staples, and Health Care were primarily responsible for driving the S&P 500 Index’s gains, each up over 12.0%,

though they were weighed down by Financials and Materials stocks that were off 17.0% and 9.7%, respectively.

Hewlett-Packard Co. was

the top detractor in the Portfolio in 2011 due to a slew of disappointing announcements and news headlines. The company began the year with an investigation into the sudden departure of former CEO Mark Hurd, and newly-appointed CEO Leo Apotheker

made headlines by shaking up management in an effort to implement his new strategy for the tech giant. Hewlett-Packard Co. also came under fire on reports that Apotheker was too actively involved in selecting new board members. The stock suffered

after management lowered its quarterly and annual revenue and earnings guidance several times, most recently due to concerns over the macro outlook and its exit from the tablet market. Hewlett-Packard Co. also announced the spin-off or sale of its

PC business and said the services business will likely turn around in four to six quarters. A month later, Hewlett-Packard Co.’s Board dismissed CEO Leo Apotheker after just 11 months at the helm of the company and appointed former eBay CEO Meg

Whitman to take his place, the company’s third CEO in six years. Additionally, the company paid a stunning $10 billion to acquire British corporate search provider Autonomy, which we believe is a gross misallocation of capital. While shares

appear inexpensive at only six times fiscal 2012 consensus earnings, improvement in the services business appears to be at least four to six quarters out and the very rich Autonomy deal will depress share repurchase activity. We, therefore, chose to

exit the position halfway through the third quarter in favor of more secularly advantaged names which are trading at attractive valuations.(1)

Bank of

America Corp. shares were weighed down all year by legal battles with investors over issues related to mortgage securities, in addition to the factors affecting other financials, including regulatory uncertainty, fears of an economic slowdown, and a

lackluster housing market. The stock contributed negatively to performance through August before we swapped it for PNC Financial Services Group, Inc., a stock that subsequently became a top contributor for the year. After a review of our investment

case, we determined that much of the apparent discount in Bank of America Corp.’s valuation on tangible book value disappeared when adjusted for the capital needed to meet Basel III requirements and settle a variety of lawsuits related to its

Countrywide mortgage business. In contrast, we believed that PNC Financial Services Group, Inc. was very attractive on a tangible book basis and also had the potential to do better in more environments than Bank of America Corp. PNC Financial

Services Group, Inc. ranks among the best of the large regional banks when considering its returns on equity, underwriting strength, dilution risk, market share, and capital adequacy. Despite this, PNC Financial Services Group, Inc. trades at among

the lowest multiple of earnings and tangible book value, adjusted for Basel III and potential settlements, among its peers, belying the bank’s impressive business fundamentals.(1)

Citigroup, Inc. was another Financials position that detracted from performance as macroeconomic

uncertainty roiled banks. The stock took a major hit in August along with its financial sector peers when ratings agency Standard & Poor’s downgraded U.S. debt, spurring a substantial sell-off in equities. Investors have also grown

increasingly worried that a renewed global economic slowdown, especially in Europe where Citigroup, Inc. has exposure, might hurt banks by curbing loan demand and reducing the overall appetite for risk, among other factors. Nevertheless, we believe

Citigroup, Inc. is on firm footing, having posted seven straight profitable quarters while strengthening its balance sheet significantly and implementing a more stringent risk management process. In addition, we consider shares to be attractively

valued, as they trade at a sharp discount to tangible book value and normalized returns on equity.(1)

International Business Machines Corp. upheld its reputation as a best-in-class technology company

this year, as the stock ascended throughout the year, resilient against macro concerns and far outpacing the S&P 500 Index and its tech peer group. The stock appreciated as the company consistently beat consensus estimates for quarterly

earnings, while maintaining a steady income stream to investors. Management repurchased nearly 100 million shares and boosted the quarterly dividend by 15% mid year to provide a 1.7% dividend yield to shareholders. An additional $12 billion

remains in buyback authorizations which could retire approximately another 6% of current shares outstanding. Though the stock has performed very well the past several years, we continue to see strong upside in the position as the company repeatedly

outperforms expectations and returns capital to shareholders while trading at around ten times forward earnings

estimates.(1)

Stocks of managed-care organizations Aetna, Inc. and UnitedHealth Group, Inc. were top contributors this past year as investors’ anxiety

over the possibility of punitive health care reforms faded early in the year and as the companies posted strong quarterly earnings results. Uncertainty surrounding the outcome of health care reforms has restrained managed-care stocks for some time,

but the group has managed through the first round of reform implementation without devolving into a utility model, as some investors had feared. The pricing environment continues to be favorable for the industry, evident in consensus-beating

quarterly results from Aetna, Inc. and UnitedHealth Group, Inc. Both companies also boosted their dividends significantly and announced new share-buyback authorizations. These actions indicate intent to continue returning capital to shareholders,

which we see as a positive for the stocks heading into 2012.(1)

The tremendous volatility that shaped the market in 2011 had many sources, but none were more persistent or bedeviling than the European fiscal woes. While Europe

is far from resolved, we continue to believe that the critical element is not a comprehensive solution that fixes all problems, but time. As long as the European Union, the European Central Bank, the International Monetary Fund, and other central

banks buy European banks time to de-leverage and hedge exposures, the odds of a disastrous event diminish.

2011 rewarded “risk-off” portfolios

as investors sought income through bonds of all forms and “bond-like” equities. We foresee a significant behavioral shift towards “risk-on” returns in 2012. Stocks rebounded in the fourth quarter of 2011 and we expect investor

confidence to continue into 2012 as U.S. gross domestic product growth persists, the unemployment rate declines, and as corporations begin to utilize their cash-rich balance sheets to generate growth through

|

|

|

| Ohio National Fund, Inc. |

|

Equity Portfolio (Continued) |

both capital expenditures and acquisitions. We also believe investors will be rewarded as the global economic picture becomes clearer and macro drags on the market subside. U.S. equities are

well-positioned to capture the upside presented by current conditions as valuations remain historically low and are currently discounting little to no growth, in our opinion.

| (1) |

The Portfolio’s composition is subject to change. Holdings and weightings are as

of December 31, 2011. |

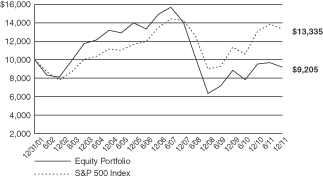

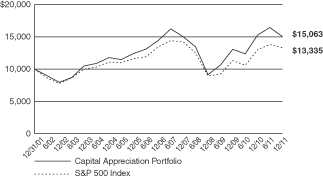

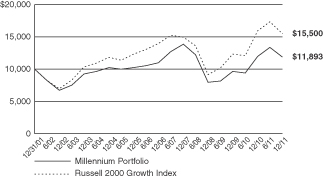

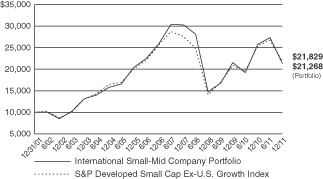

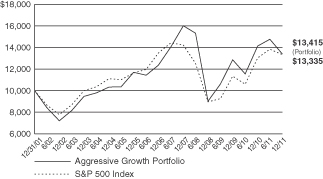

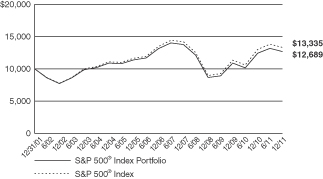

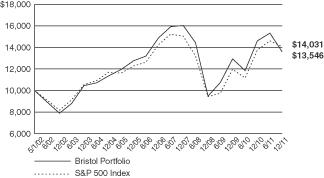

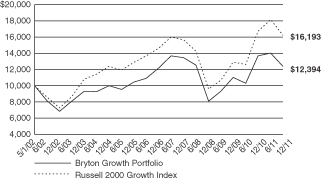

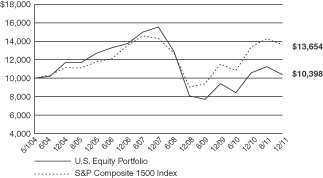

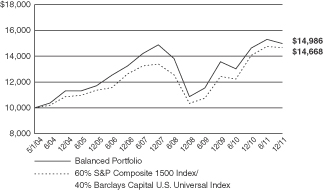

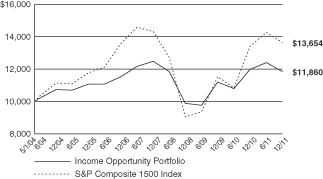

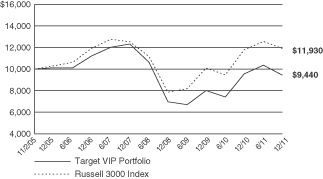

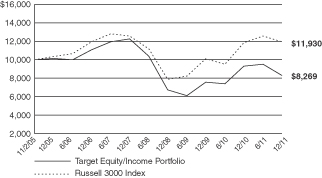

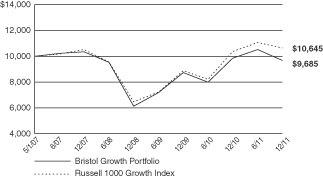

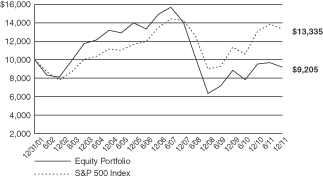

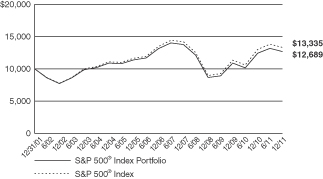

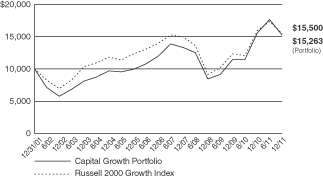

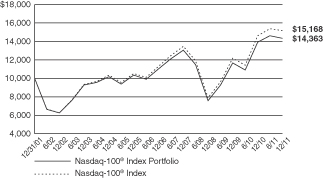

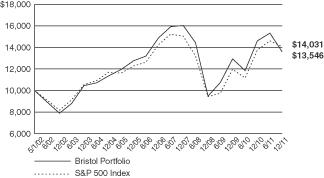

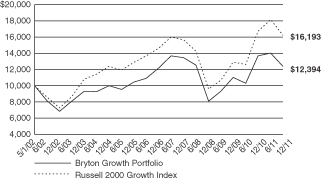

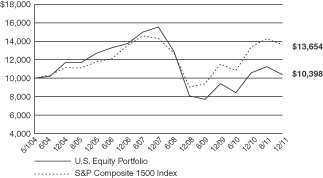

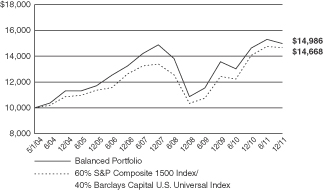

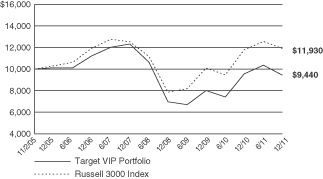

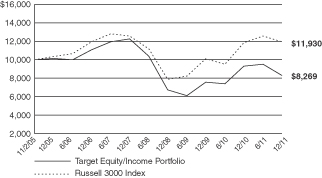

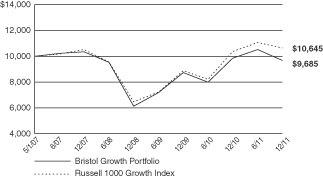

Change in Value of

$10,000 Investment

Hypothetical illustration based on past performance. Future performance will vary. The Portfolio’s returns reflect

reinvested dividends. The Portfolio’s holdings may differ significantly from the securities in the index. The index is unmanaged and therefore does not reflect the cost of portfolio management and accounting.

The S&P 500 Index is a capitalization-weighted index designed to measure performance of the broad domestic economy through changes in the aggregate market

value of 500 stocks representing all major industries. The index presented herein includes the effects of reinvested dividends.

Portfolio

Composition as of December 31, 2011 (1)

|

|

|

|

|

|

|

|

% of Net Assets |

|

| Common

Stocks (3) |

|

|

96.6 |

|

| Preferred

Stocks (3) |

|

|

1.2 |

|

| Repurchase Agreements and

Other Net Assets |

|

|

2.2 |

|

|

|

|

|

|

|

|

|

100.0 |

|

|

|

|

|

|

Top

10 Portfolio Holdings as of December 31, 2011 (1) (2)

|

|

|

|

|

|

|

|

% of Net Assets |

|

| 1. Apple, Inc. |

|

|

3.9 |

|

| 2. General Electric Co. |

|

|

3.0 |

|

| 3. Pfizer, Inc. |

|

|

2.7 |

|

| 4. MetLife, Inc. |

|

|

2.6 |

|

| 5. BlackRock, Inc. |

|

|

2.6 |

|

| 6. eBay, Inc. |

|

|

2.6 |

|

| 7. Philip Morris International, Inc. |

|

|

2.6 |

|

| 8. Microsoft Corp. |

|

|

2.5 |

|

| 9. ConocoPhillips |

|

|

2.5 |

|

| 10. PNC Financial Services Group, Inc. |

|

|

2.4 |

|

| (1) |

Composition of Portfolio subject to change.

|

| (2) |

Short-term investments have been excluded from

the list of Top 10 Portfolio Holdings. |

|

|

|

|

|

|

|

|

% of Net Assets |

|

| Information Technology |

|

|

22.6 |

|

| Financials |

|

|

19.8 |

|

| Health Care |

|

|

16.4 |

|

| Consumer Discretionary |

|

|

13.4 |

|

| Industrials |

|

|

9.7 |

|

| Consumer Staples |

|

|

9.3 |

|

| Energy |

|

|

6.6 |

|

|

|

|

|

|

|

|

|

97.8 |

|

|

|

|

|

|

|

|

|

| Ohio National Fund, Inc. |

|

Equity Portfolio |

|

|

|

| Schedule of

Investments |

|

December 31, 2011 |

|

|

|

|

|

|

|

|

|

|

|

| Common Stocks – 96.6% |

|

Shares |

|

|

Value |

|

| CONSUMER DISCRETIONARY – 12.2% |

|

|

|

|

|

|

|

|

|

|

| Ford Motor Co. (Automobiles) |

|

(a) |

|

|

319,500 |

|

|

$ |

3,437,820 |

|

| Yum! Brands, Inc. (Hotels, Restaurants & Leisure) |

|

|

|

|

48,600 |

|

|

|

2,867,886 |

|

| Amazon.com, Inc. (Internet & Catalog Retail) |

|

(a) |

|

|

20,200 |

|

|

|

3,496,620 |

|

| Groupon, Inc. (Internet & Catalog Retail) |

|

(a) |

|

|

102,800 |

|

|

|

2,120,764 |

|

| Time Warner, Inc. (Media) |

|

|

|

|

121,500 |

|

|

|

4,391,010 |

|

| Target Corp. (Multiline Retail) |

|

|

|

|

58,000 |

|

|

|

2,970,760 |

|

| Lowe’s Cos., Inc. (Specialty Retail) |

|

|

|

|

145,600 |

|

|

|

3,695,328 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22,980,188 |

|

|

|

|

|

|

|

|

|

|

|

|

| CONSUMER STAPLES – 9.3% |

|

|

|

|

|

|

|

|

|

|

| PepsiCo, Inc. (Beverages) |

|

|

|

|

66,000 |

|

|

|

4,379,100 |

|

| CVS Caremark Corp. (Food & Staples Retailing) |

|

|

|

|

104,000 |

|

|

|

4,241,120 |

|

| Procter & Gamble Co. / The (Household Products) |

|

|

|

|

61,800 |

|

|

|

4,122,678 |

|

| Philip Morris International, Inc. (Tobacco) |

|

|

|

|

61,400 |

|

|

|

4,818,672 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17,561,570 |

|

|

|

|

|

|

|

|

|

|

|

|

| ENERGY – 6.6% |

|

|

|

|

|

|

|

|

|

|

| BP PLC – ADR (Oil, Gas & Consumable Fuels) |

|

|

|

|

92,300 |

|

|

|

3,944,902 |

|

| Chevron Corp. (Oil, Gas & Consumable Fuels) |

|

|

|

|

35,100 |

|

|

|

3,734,640 |

|

| ConocoPhillips (Oil, Gas & Consumable Fuels) |

|

|

|

|

64,100 |

|

|

|

4,670,967 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12,350,509 |

|

|

|

|

|

|

|

|

|

|

|

|

| FINANCIALS – 19.8% |

|

|

|

|

|

|

|

|

|

|

| BlackRock, Inc. (Capital Markets) |

|

|

|

|

27,200 |

|

|

|

4,848,128 |

|

| Fifth Third Bancorp (Commercial Banks) |

|

|

|

|

137,500 |

|

|

|

1,749,000 |

|

| PNC Financial Services Group, Inc. (Commercial Banks) |

|

|

|

|

79,600 |

|

|

|

4,590,532 |

|

| Wells Fargo & Co. (Commercial Banks) |

|

|

|

|

159,400 |

|

|

|

4,393,064 |

|

| Citigroup, Inc. (Diversified Financial Svs.) |

|

|

|

|

141,820 |

|

|

|

3,731,284 |

|

| JPMorgan Chase & Co. (Diversified Financial Svs.) |

|

|

|

|

128,100 |

|

|

|

4,259,325 |

|

| Aflac, Inc. (Insurance) |

|

|

|

|

101,205 |

|

|

|

4,378,128 |

|

| MetLife, Inc. (Insurance) |

|

|

|

|

156,800 |

|

|

|

4,889,024 |

|

| Annaly Capital Management, Inc. (Real Estate Investment Trusts) |

|

|

|

|

269,900 |

|

|

|

4,307,604 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

37,146,089 |

|

|

|

|

|

|

|

|

|

|

|

|

| HEALTH CARE – 16.4% |

|

|

|

|

|

|

|

|

|

|

| Celgene Corp. (Biotechnology) |

|

(a) |

|

|

50,800 |

|

|

|

3,434,080 |

|

| Medtronic, Inc. (Health Care Equip. & Supplies) |

|

|

|

|

94,100 |

|

|

|

3,599,325 |

|

| Aetna, Inc. (Health Care Providers & Svs.) |

|

|

|

|

79,109 |

|

|

|

3,337,609 |

|

| UnitedHealth Group, Inc. (Health Care Providers & Svs.) |

|

|

|

|

64,900 |

|

|

|

3,289,132 |

|

| Abbott Laboratories (Pharmaceuticals) |

|

|

|

|

71,100 |

|

|

|

3,997,953 |

|

| Johnson & Johnson (Pharmaceuticals) |

|

|

|

|

59,300 |

|

|

|

3,888,894 |

|

| Pfizer, Inc. (Pharmaceuticals) |

|

|

|

|

238,000 |

|

|

|

5,150,320 |

|

| Teva Pharmaceutical Industries Ltd. – ADR (Pharmaceuticals) |

|

|

|

|

99,600 |

|

|

|

4,019,856 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30,717,169 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common Stocks (Continued) |

|

Shares |

|

|

Value |

|

| INDUSTRIALS – 9.7% |

|

|

|

|

|

|

|

|

|

|

| United Technologies Corp. (Aerospace & Defense) |

|

|

|

|

39,500 |

|

|

$ |

2,887,055 |

|

| United Continental Holdings, Inc. (Airlines) |

|

(a) |

|

|

187,400 |

|

|

|

3,536,238 |

|

| General Electric Co. (Industrial Conglomerates) |

|

|

|

|

316,500 |

|

|

|

5,668,515 |

|

| Parker Hannifin Corp. (Machinery) |

|

|

|

|

36,000 |

|

|

|

2,745,000 |

|

| Norfolk Southern Corp. (Road & Rail) |

|

|

|

|

47,200 |

|

|

|

3,438,992 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18,275,800 |

|

|

|

|

|

|

|

|

|

|

|

|

| INFORMATION TECHNOLOGY – 22.6% |

|

|

|

|

|

|

|

|

|

|

| Cisco Systems, Inc. (Communications Equip.) |

|

|

|

|

227,700 |

|

|

|

4,116,816 |

|

| QUALCOMM, Inc. (Communications Equip.) |

|

|

|

|

65,000 |

|

|

|

3,555,500 |

|

| Apple, Inc. (Computers & Peripherals) |

|

(a) |

|

|

18,050 |

|

|

|

7,310,250 |

|

| EMC Corp. (Computers & Peripherals) |

|

(a) |

|

|

172,600 |

|

|

|

3,717,804 |

|

| eBay, Inc. (Internet Software & Svs.) |

|

(a) |

|

|

158,900 |

|

|

|

4,819,437 |

|

| Google, Inc. Class A (Internet Software & Svs.) |

|

(a) |

|

|

6,475 |

|

|

|

4,182,202 |

|

| International Business Machines Corp. (IT Svs.) |

|

|

|

|

18,050 |

|

|

|

3,319,034 |

|

| Intel Corp. (Semiconductors & Equip.) |

|

|

|

|

118,050 |

|

|

|

2,862,713 |

|

| Texas Instruments, Inc. (Semiconductors & Equip.) |

|

|

|

|

135,500 |

|

|

|

3,944,405 |

|

| Microsoft Corp. (Software) |

|

|

|

|

181,000 |

|

|

|

4,698,760 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

42,526,921 |

|

|

|

|

|

|

|

|

|

|

|

|

| Total Common Stocks (Cost $166,236,540) |

|

|

|

|

|

|

|

$ |

181,558,246 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Preferred Stocks – 1.2% |

|

|

|

Shares |

|

|

Value |

|

| CONSUMER DISCRETIONARY – 1.2% |

|

|

|

|

|

|

|

|

|

|

| General Motors Co. – Series B (Automobiles) |

|

(b) |

|

|

64,000 |

|

|

$ |

2,192,000 |

|

|

|

|

|

|

|

|

|

|

|

|

| Total Preferred Stocks (Cost $2,774,111) |

|

|

|

|

|

|

|

$ |

2,192,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Repurchase Agreements – 1.8% |

|

|

|

Face

Amount |

|

|

Amortized

Cost |

|

U.S. Bank 0.010%, 01/03/2012,

Agreement Date: 12/30/11, Repurchase price $3,379,943 Collateralized by: Fannie Mae 15 yr Pool #CI-729590 (FNCI) 4.500%, Due 07/01/2018 with a value of

$3,447,693 |

|

|

|

$ |

3,379,939 |

|

|

$ |

3,379,939 |

|

|

|

|

|

|

|

|

|

|

|

|

| Total Repurchase Agreements (Cost $3,379,939) |

|

|

|

|

|

|

|

$ |

3,379,939 |

|

|

|

|

|

|

|

|

|

|

|

|

| Total Investments – 99.6% (Cost $172,390,590) |

|

(c) |

|

|

|

|

|

$ |

187,130,185 |

|

| Other Assets in Excess of Liabilities – 0.4% |

|

|

|

|

|

|

|

|

726,573 |

|

|

|

|

|

|

|

|

|

|

|

|

| Net Assets – 100.0% |

|

|

|

|

|

|

|

$ |

187,856,758 |

|

|

|

|

|

|

|

|

|

|

|

|

Percentages

are stated as a percent of net assets.

Abbreviations:

ADR: American Depositary Receipts

Footnotes:

| |

(a) |

Non-income producing security. |

| |

(b) |

This preferred stock is convertible at a 20% conversion premium until 12/01/2013. There is a mandatory conversion at 12/01/2013, at which time the conversion proceeds will be

determined by the General Motors, Inc. common share price on that date. |

| |

(c) |

Represents cost for financial reporting purposes, which may differ from cost basis for federal income tax purposes. See also Note 7 of the Notes to Financial Statements.

|

The accompanying notes are an integral part of

these financial statements.

|

|

|

| Ohio National Fund, Inc. |

|

Money Market Portfolio |

Portfolio

Composition as of December 31, 2011 (1)

|

|

|

|

|

|

|

|

% of Net Assets |

|

| Commercial Paper

(2) |

|

|

65.4 |

|

| Asset-Backed Securities

(2) |

|

|

0.8 |

|

| Repurchase Agreements and

Other Net Assets |

|

|

33.8 |

|

|

|

|

|

|

|

|

|

100.0 |

|

|

|

|

|

|

Top

10 Portfolio Holdings as of December 31, 2011 (1)

|

|

|

|

|

|

|

|

% of Net Assets |

|

| 1. U.S. Bank Repurchase Agreement

0.010%, 01/03/2012 |

|

|

4.9 |

|

| 2. Prudential Funding LLC

0.040%, 01/03/2012 |

|

|

4.9 |

|

| 3. American Express Credit Corp.

0.020%, 01/04/2012 |

|

|

4.5 |

|

| 4. Chevron Corp.

0.020%, 01/06/2012 |

|

|

4.5 |

|

| 5. Exxon Mobil Corp.

0.030%, 01/11/2012 |

|

|

4.5 |

|

| 6. Wal-Mart Stores, Inc.

0.020%, 01/23/2012 |

|

|

4.5 |

|

| 7. Abbott Laboratories

0.040%, 01/17/2012 |

|

|

4.5 |

|

| 8. General Electric Capital Corp.

0.070%, 02/06/2012 |

|

|

4.5 |

|

| 9. HSBC Finance Corp.

0.180%, 01/27/2012 |

|

|

4.5 |

|

| 10. Nestle Capital Corp.

0.030%, 01/17/2012 |

|

|

3.5 |

|

|

|

|

|

|

| (1) |

Composition of Portfolio subject to change.

|

|

|

|

|

|

|

|

|

% of Net Assets |

|

| Financials |

|

|

26.3 |

|

| Consumer Staples |

|

|

18.2 |

|

| Health Care |

|

|

12.6 |

|

| Energy |

|

|

9.1 |

|

|

|

|

|

|

|

|

|

66.2 |

|

|

|

|

|

|

|

|

|

| Ohio National Fund, Inc. |

|

Money Market Portfolio |

|

|

|

| Schedule of

Investments |

|

December 31, 2011 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commercial Paper – 65.4% |

|

|

|

Rate |

|

|

Maturity |

|

Face Amount |

|

|

Amortized Cost |

|

| CONSUMER STAPLES – 18.2% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Coca-Cola Co. / The (Beverages) |

|

(a) |

|

|

0.120% |

|

|

01/10/2012 |

|

$ |

6,000,000 |

|

|

$ |

5,999,820 |

|

| Coca-Cola Co. / The (Beverages) |

|

(a) |

|

|

0.130% |

|

|

01/10/2012 |

|

|

4,000,000 |

|

|

|

3,999,870 |

|

| Coca-Cola Co. / The (Beverages) |

|

(a) |

|

|

0.080% |

|

|

02/24/2012 |

|

|

3,000,000 |

|

|

|

2,999,640 |

|

| Wal-Mart Stores, Inc. (Food & Staples Retailing) |

|

(a) |

|

|

0.020% |

|

|

01/23/2012 |

|

|

13,000,000 |

|

|

|

12,999,841 |

|

| Nestle Capital Corp. (Food Products) |

|

(a) |

|

|

0.030% |

|

|

01/17/2012 |

|

|

10,000,000 |

|

|

|

9,999,867 |

|

| Nestle Capital Corp. (Food Products) |

|

(a) |

|

|

0.070% |

|

|

03/05/2012 |

|

|

3,000,000 |

|

|

|

2,999,627 |

|

| Procter & Gamble International Funding SCA (Household Products) |

|

(a) |

|

|

0.060% |

|

|

01/09/2012 |

|

|

8,000,000 |

|

|

|

7,999,893 |

|

| Procter & Gamble Co. / The (Household Products) |

|

(a) |

|

|

0.060% |

|

|

03/20/2012 |

|

|

3,000,000 |

|

|

|

2,999,605 |

|

| Procter & Gamble Co. / The (Household Products) |

|

(a) |

|

|

0.100% |

|

|

01/19/2012 |

|

|

2,000,000 |

|

|

|

1,999,900 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

51,998,063 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ENERGY – 9.1% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Chevron Corp. (Oil, Gas & Consumable Fuels) |

|

|

|

|

0.020% |

|

|

01/06/2012 |

|

|

13,000,000 |

|

|

|

12,999,964 |

|

| Exxon Mobil Corp. (Oil, Gas & Consumable Fuels) |

|

|

|

|

0.030% |

|

|

01/11/2012 |

|

|

13,000,000 |

|

|

|

12,999,892 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25,999,856 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FINANCIALS – 25.5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| American Express Credit Corp. (Consumer Finance) |

|

|

|

|

0.020% |

|

|

01/04/2012 |

|

|

13,000,000 |

|

|

|

12,999,978 |

|

| Toyota Motor Credit Corp. (Consumer Finance) |

|

|

|

|

0.060% |

|

|

01/09/2012 |

|

|

10,000,000 |

|

|

|

9,999,867 |

|

| American Honda Finance Corp. (Consumer Finance) |

|

|

|

|

0.250% |

|

|

03/06/2012 |

|

|

10,000,000 |

|

|

|

9,995,486 |

|

| HSBC Finance Corp. (Diversified Financial Services) |

|

|

|

|

0.180% |

|

|

01/27/2012 |

|

|

13,000,000 |

|

|

|

12,998,310 |

|

| General Electric Capital Corp. (Diversified Financial Services) |

|

|

|

|

0.070% |

|

|

02/06/2012 |

|

|

13,000,000 |

|

|

|

12,999,090 |

|

| Prudential Funding LLC (Insurance) |

|

|

|

|

0.040% |

|

|

01/03/2012 |

|

|

14,000,000 |

|

|

|

13,999,969 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

72,992,700 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| HEALTH CARE – 12.6% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Abbott Laboratories (Pharmaceuticals) |

|

(a) |

|

|

0.040% |

|

|

01/17/2012 |

|

|

13,000,000 |

|

|

|

12,999,769 |

|

| Pfizer, Inc. (Pharmaceuticals) |

|

(a) |

|

|

0.020% |

|

|

01/26/2012 |

|

|

10,000,000 |

|

|

|

9,999,861 |

|

| Johnson & Johnson (Pharmaceuticals) |

|

(a) |

|

|

0.060% |

|

|

03/21/2012 |

|

|

10,000,000 |

|

|

|

9,998,667 |

|

| Johnson & Johnson (Pharmaceuticals) |

|

(a) |

|

|

0.060% |

|

|

02/17/2012 |

|

|

3,000,000 |

|

|

|

2,999,765 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

35,998,062 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Commercial Paper (Cost $186,988,681) |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

186,988,681 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Asset-Backed Securities – 0.8% |

|

|

|

Rate |

|

|

Maturity |

|

Face Amount |

|

|

Amortized Cost |

|

| FINANCIALS – 0.8% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CNH Equipment Trust 2011-A, Class A1 (Consumer Finance) |

|

(a) |

|

|

0.336% |

|

|

05/15/2012 |

|

$ |

215,892 |

|

|

$ |

215,892 |

|

| Honda Auto Receivables Owner Trust 2011-3, Class A1 (Consumer Finance) |

|

|

|

|

0.398% |

|

|

10/22/2012 |

|

|

754,135 |

|

|

|

754,134 |

|

| Nissan Auto Receivables Owners Trust 2011-A, Class A1 (Consumer Finance) |

|

|

|

|

0.261% |

|

|

04/16/2012 |

|

|

8,371 |

|

|

|

8,371 |

|

| Nissan Auto Lease Trust 2011-B, Class A1 (Consumer Finance) |

|

|

|

|

0.350% |

|

|

10/15/2012 |

|

|

651,199 |

|

|

|

651,199 |

|

| Volkswagen Auto Lease Trust 2011-A, Class A1 (Consumer Finance) |

|

|

|

|

0.461% |

|

|

11/20/2012 |

|

|

738,744 |

|

|

|

738,744 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Asset-Backed Securities (Cost $2,386,340) |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

2,368,340 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Repurchase Agreements – 4.9% |

|

|

|

Rate |

|

|

Maturity |

|

Face Amount |

|

|

Amortized Cost |

|

| U.S. Bank, Agreement date: 12/30/11, Repurchase price $14,000,016, |

|

|

|

|

0.010% |

|

|

01/03/2012 |

|

$ |

14,000,000 |

|

|

$ |

14,000,000 |

|

| Collateralized by: Fannie Mae 15 yr. Pool #CI-254919 (FNCI) 4.000%, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Due 09/01/2018 with value of $14,280,226 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Repurchase Agreements (Cost $14,000,000) |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

14,000,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Investments – 71.1% (Cost $203,357,021) |

|

(b) |

|

|

|

|

|

|

|

|

|

|

|

$ |

203,357,021 |

|

| Other Assets in Excess of Liabilities – 28.9% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

82,831,076 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Assets – 100.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

286,188,097 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Percentages are stated as a percent of net assets.

Footnotes:

| |

(a) |

Security exempt from registration under Section 4 (2) of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally

to qualified buyers under Rule 144A. At December 31, 2011, the value of these securities totaled $88,212,017, or 30.8% of the Portfolio’s net assets. These securities were deemed liquid pursuant to procedures approved by the Board of

Directors. |

| |

(b) |

Represents cost for federal income tax and financial reporting purposes. See also Note 2 regarding the use of amortized cost for valuation of instruments in this Portfolio.

|

The accompanying notes are an integral part of

these financial statements.

|

|

|

| Ohio National Fund, Inc. |

|

Bond Portfolio |

The Bond Portfolio seeks to obtain a high level of income and opportunity for capital appreciation consistent with the preservation of capital by investing primarily in intermediate-term and long-term fixed income

securities.

Performance as of

December 31, 2011

|

|

|

|

|

| Average Annual Total Returns: |

|

|

|

|

| One year |

|

|

6.36% |

|

| Five years |

|

|

4.96% |

|

| Ten years |

|

|

5.44% |

|

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns

may be lower or higher. Total return figures include change in share price and reinvestment of dividends and capital gains. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more

or less than the original cost. To obtain performance information up to the most recent month end, call toll-free 1-877-781-6392.

The Portfolio

is not open to direct retail investment. Beneficial interest in shares is obtained solely by purchase of variable life insurance policies and variable annuity contracts. Actual performance results for variable annuity and variable universal life

contracts will be lower due to contract charges. Consult your contract for applicable charges.

For the year ended December 31, 2011, the Bond Portfolio returned 6.36% versus 7.51% for the current benchmark, the BofA Merrill

Lynch U.S. Corporate Master Index (the ”Merrill Lynch Index” or the “Index”).

Both the Merrill Lynch Index and the Portfolio had

reasonably good absolute positive total returns because U.S. Treasury rates declined significantly in 2011. For the year, the 10-year U.S. Treasury yield declined 142 basis points. U.S. Treasury yields declined because the United States, despite its

economic and political problems, became a “safe haven” for investors given all the economic and banking problems in Europe, particularly in Southern Europe. While U.S. Treasury yields declined in 2011, credit spreads widened for the year.

The credit spread for the Merrill Lynch Index widened 92 basis points during 2011, a result of a soft economy in the U.S., fears of a double-dip recession, and a demand on the part of investors for more yield due to the low absolute level of

interest rates existing in the economy during the year. The decline in U.S. Treasury yields more than offset the credit spread widening that occurred during 2011, resulting in positive price performance for bonds for the year. Of the 7.51% return of

the Merrill Lynch Index in 2011, 2.19% of the return was from price appreciation of bonds in the Index.

The Portfolio

under-performed the Merrill Lynch Index primarily because the duration of the Portfolio was shorter than the duration of the Index during a year in which interest rates declined. During 2011, the Portfolio’s duration was approximately 2.0 years

shorter than the duration of the Merrill Lynch Index. The Portfolio’s duration was positioned shorter than the Index’s duration in anticipation of an increase in Treasury yields. The expectation was for interest rates to rise as the U.S.

economy improved. This did not occur because economic growth remained sub-par and demand for U.S. Treasury securities was strong because of the problems in Europe.(1)

Several industry weightings

had an impact on relative performance during 2011. The Portfolio’s under-weighting in the banking sector benefited performance because this sector under-performed. The over-weighting in the insurance and brokerage sectors hurt

performance because these two sectors under-performed. The over-weighting in electric utilities benefited performance because this sector out-performed. The under-weighting in Telecommunication

Services hurt performance because this sector out-performed. The Portfolio was positively impacted by its holdings of U.S. Treasuries because Treasury yields declined and credit spreads widened for the year. The overall credit quality of the

Portfolio had little impact on relative performance because both the Portfolio and the Index had an average quality of A3 (Moody’s rating).(1)

Because

the U.S. economy continued to grow, albeit at a slow rate, the credit quality of most of the holdings in the Portfolio was maintained. That being said, several bonds performed poorly, and most of these were either in the Financials sector or were

domiciled in Europe. The five poorest performing bonds were Deutsche Bank Capital Funding Trust VII, Telecom Italia Capital SA, Computer Sciences Corp., Jefferies Group, Inc., and Bank of America Corp. The five best performing bonds were Verizon

Communications, Inc., Shell International Finance BV, Texas Utilities Energy Future Competitive Holdings Co., Avista Corp., and Appalachian Power Co.(1)

We expect that the growth rate

of the U.S. economy will improve over the course of the coming year, and ordinarily this would imply that the Federal Reserve would begin to remove its monetary stimulus, thus suggesting higher interest rates in 2012. However, due to the economic

problems in Europe, we do not expect U.S. interest rates to rise meaningfully this year because U.S. Treasury securities will remain a “safe haven” investment for international investors. Duration on the Portfolio will be lengthened but

not to the duration of the Merrill Lynch Index because absolute interest rates are very low and, despite our expectation for continued low interest rates, rates could rise. Because we expect credit spreads to tighten modestly in 2012 as the economy

grows, we anticipate that purchases for the Portfolio will be skewed toward BBB names, which are slightly lower in quality than the average for the Merrill Lynch Index.

| (1) |

The Portfolio’s composition is subject to change. Holdings and weightings are as of December 31, 2011. |

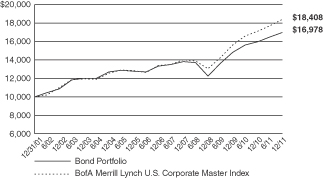

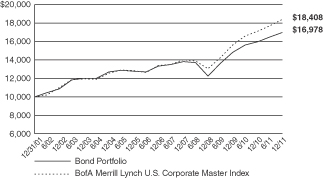

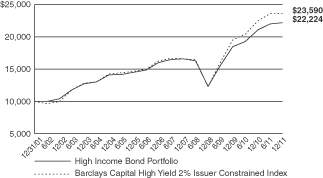

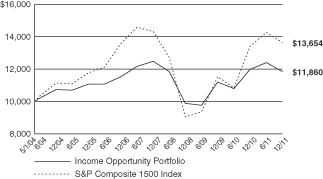

Change in Value of

$10,000 Investment

Hypothetical illustration based on past performance. Future performance will vary. The Portfolio’s returns reflect

reinvested dividends. The Portfolio’s holdings may differ significantly from the securities in the index. The index is unmanaged and therefore does not reflect the cost of portfolio management and accounting.

The BofA Merrill Lynch U.S. Corporate Master Index tracks the performance of all U.S. dollar-denominated, investment grade corporate public debt issued in the

U.S. domestic bond market. Qualifying bonds must have at least one year remaining term to maturity, a fixed coupon schedule, and a minimum amount outstanding of $250 million.

|

|

|

| Ohio National Fund, Inc. |

|

Bond Portfolio (Continued) |

Portfolio

Composition as of December 31, 2011 (1)

|

|

|

|

|

|

|

|

% of Net Assets |

|

| Corporate Bonds

(3) |

|

|

90.3 |

|

| U.S. Treasury Obligations |

|

|

2.8 |

|

| Commercial Paper |

|

|

4.3 |

|

| Repurchase Agreements and

Other Net Assets |

|

|

2.6 |

|

|

|

|

|

|

|

|

|

100.0 |

|

|

|

|

|

|

Top

10 Portfolio Holdings as of December 31, 2011 (1) (2)

|

|

|

|

|

|

|

|

% of Net Assets |

|

| 1. United States Treasury Note

3.375%, 11/15/2019 |

|

|

2.1 |

|

| 2. Union Electric Co.

6.400%, 06/15/2017 |

|

|

1.1 |

|

| 3. UnitedHealth Group, Inc.

6.000%, 02/15/2018 |

|

|

1.1 |

|

| 4. Kraft Foods, Inc.

6.125%, 02/01/2018 |

|

|

1.1 |

|

| 5. Fifth Third Bancorp

4.500%, 06/01/2018 |

|

|

1.1 |

|

| 6. Commonwealth Edison Co.

5.950%, 08/15/2016 |

|

|

1.1 |

|

| 7. Virginia Electric and Power Co.

5.400%, 01/15/2016 |

|

|

1.1 |

|

| 8. CSX Corp.

5.600%, 05/01/2017 |

|

|

1.1 |

|

| 9. Kansas City Power & Light Co.

5.850%, 06/15/2017 |

|

|

1.1 |

|

| 10. Weatherford International Ltd.

6.000%, 03/15/2018 |

|

|

1.0 |

|

|

|

|

|

|

| (1) |

Composition of Portfolio subject to change. |

| (2) |

Short-term investments have been excluded from the list of Top 10 Portfolio Holdings. |

|

|

|

|

|

|

|

|

% of Net Assets |

|

| Financials |

|

|

27.3 |

|

| Utilities |

|

|

15.2 |

|

| Industrials |

|

|

9.0 |

|

| Energy |

|

|

8.6 |

|

| Consumer Discretionary |

|

|

7.3 |

|

| Consumer Staples |

|

|

7.1 |

|

| Health Care |

|

|

6.7 |

|

| Telecommunication Services |

|

|

3.9 |

|

| Materials |

|

|

3.3 |

|

| Information Technology |

|

|

1.9 |

|

|

|

|

|

|

|

|

|

90.3 |

|

|

|

|

|

|

|

|

|

| Ohio National Fund, Inc. |

|

Bond Portfolio |

|

|

|

| Schedule of

Investments |

|

December 31,

2011 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Corporate Bonds – 90.3% |

|

|

|

Rate |

|

|

Maturity |

|

Face Amount |

|

|

Value |

|

| CONSUMER DISCRETIONARY – 7.3% |

|

| Newell Rubbermaid, Inc. (Household Durables) |

|

|

|

|

6.250% |

|

|

04/15/2018 |

|

$ |

500,000 |

|

|

$ |

569,096 |

|

| Comcast Corp. (Media) |

|

|

|

|

5.875% |

|

|

02/15/2018 |

|

|

750,000 |

|

|

|

868,333 |

|

| Discovery Communications LLC (Media) |

|

|

|

|

4.375% |

|

|

06/15/2021 |

|

|

1,000,000 |

|

|

|

1,057,639 |

|

| News America, Inc. (Media) |

|

|

|

|

4.500% |

|

|

02/15/2021 |

|

|

1,250,000 |

|

|

|

1,313,087 |

|

| Time Warner Cable, Inc. (Media) |

|

|

|

|

5.850% |

|

|

05/01/2017 |

|

|

1,000,000 |

|

|

|

1,140,148 |

|

| Time Warner, Inc. (Media) |

|

|

|

|

3.150% |

|

|

07/15/2015 |

|

|

1,250,000 |

|

|

|

1,301,236 |

|

| Viacom, Inc. (Media) |

|

|

|

|

4.375% |

|

|

09/15/2014 |

|

|

1,000,000 |

|

|

|

1,071,934 |

|

| Kohl’s Corp. (Multiline Retail) |

|

|

|

|

4.000% |

|

|

11/01/2021 |

|

|

1,250,000 |

|

|

|

1,283,220 |

|

| Macy’s Retail Holdings, Inc. (Multiline Retail) |

|

|

|

|

5.900% |

|

|

12/01/2016 |

|

|

1,000,000 |

|

|

|

1,118,674 |

|

| Home Depot, Inc. / The (Specialty Retail) |

|

|

|

|

5.250% |

|

|

12/16/2013 |

|

|

1,000,000 |

|

|

|

1,086,415 |

|

| Lowe’s Cos., Inc. (Specialty Retail) |

|

|

|

|

3.800% |

|

|

11/15/2021 |

|

|

1,000,000 |

|

|

|

1,052,035 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11,861,817 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CONSUMER STAPLES – 7.1% |

|

| Anheuser-Busch Cos. LLC (Beverages) |

|

|

|

|

5.500% |

|

|

01/15/2018 |

|

|

750,000 |

|

|

|

866,231 |

|

| CVS Caremark Corp. (Food & Staples Retailing) |

|

|

|

|

5.750% |

|

|

06/01/2017 |

|

|

1,000,000 |

|

|

|

1,168,222 |

|

| Wal-Mart Stores, Inc. (Food & Staples Retailing) |

|

|

|

|

1.500% |

|

|

10/25/2015 |

|

|

1,250,000 |

|

|

|

1,270,799 |

|

| Bunge NA Finance LP (Food Products) |

|

|

|

|

5.900% |

|

|

04/01/2017 |

|

|

1,500,000 |

|

|

|

1,639,911 |

|

| Kraft Foods, Inc. (Food Products) |

|

|

|

|

6.125% |

|

|

02/01/2018 |

|

|

1,500,000 |

|

|

|

1,760,517 |

|

| Mead Johnson Nutrition Co. (Food Products) |

|

|

|

|

3.500% |

|

|

11/01/2014 |

|

|

800,000 |

|

|

|

835,998 |

|

| Sara Lee Corp. (Food Products) |

|

|

|

|

2.750% |

|

|

09/15/2015 |

|

|

1,250,000 |

|

|

|

1,260,371 |

|

| Tyson Foods, Inc. (Food Products) |

|

(b) |

|

|

6.850% |

|

|

04/01/2016 |

|

|

1,000,000 |

|

|

|

1,102,500 |

|

| Procter & Gamble Co. / The (Household Products) |

|

|

|

|

4.700% |

|

|

02/15/2019 |

|

|

250,000 |

|

|

|

295,492 |

|

| Philip Morris International, Inc. (Tobacco) |

|

|

|

|

4.125% |

|

|

05/17/2021 |

|

|

1,250,000 |

|

|

|

1,375,024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11,575,065 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ENERGY – 8.6% |

|

| Weatherford International Ltd. (Energy Equip. & Svs.) |

|

|

|

|

6.000% |

|

|

03/15/2018 |

|

|

1,500,000 |

|

|

|

1,671,133 |

|

| Anadarko Petroleum Corp. (Oil, Gas & Consumable Fuels) |

|

|

|

|

5.950% |

|

|

09/15/2016 |

|

|

1,000,000 |

|

|

|

1,134,726 |

|

| Atlantic Richfield Co. (Oil, Gas & Consumable Fuels) |

|

|

|

|

8.550% |

|

|

03/01/2012 |

|

|

200,000 |

|

|

|

201,837 |

|

| Buckeye Partners LP (Oil, Gas & Consumable Fuels) |

|

|

|

|

4.875% |

|

|

02/01/2021 |

|

|

1,000,000 |

|

|

|

1,054,484 |

|

| Cenovus Energy, Inc. (Oil, Gas & Consumable Fuels) |

|

|

|

|

5.700% |

|

|

10/15/2019 |

|

|

1,000,000 |

|

|

|

1,174,846 |

|

| Energy Transfer Partners LP (Oil, Gas & Consumable Fuels) |

|

|

|

|

5.650% |

|

|

08/01/2012 |

|

|

1,000,000 |

|

|

|

1,021,816 |

|

| EOG Resources, Inc. (Oil, Gas & Consumable Fuels) |

|

|

|

|

2.950% |

|

|

06/01/2015 |

|

|

1,250,000 |

|

|

|

1,307,317 |

|

| Kinder Morgan Energy Partners LP (Oil, Gas & Consumable Fuels) |

|

|

|

|

4.150% |

|

|

03/01/2022 |

|

|

1,000,000 |

|

|

|

1,019,235 |

|

| Magellan Midstream Partners LP (Oil, Gas & Consumable Fuels) |

|

|

|

|

4.250% |

|

|

02/01/2021 |

|

|

1,000,000 |

|

|

|

1,050,076 |

|

| Occidental Petroleum Corp. (Oil, Gas & Consumable Fuels) |

|

|

|

|

3.125% |

|

|

02/15/2022 |

|

|

1,000,000 |

|

|

|

1,028,019 |

|

| ONEOK Partners LP (Oil, Gas & Consumable Fuels) |

|

|

|

|

3.250% |

|

|

02/01/2016 |

|

|

1,000,000 |

|

|

|

1,030,323 |

|

| Shell International Finance BV (Oil, Gas & Consumable Fuels) |

|

|

|

|