UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended October 31, 2014 or |

| ¨ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from _________ to _________. |

Commission File No. 0-9143

HURCO COMPANIES, INC.

(Exact name of registrant as specified in its charter)

| Indiana | 35-1150732 |

| (State or other jurisdiction of | (I.R.S. Employer Identification Number) |

| incorporation or organization) | |

| One Technology Way | |

| Indianapolis, Indiana | 46268 |

| (Address of principal executive offices) | (Zip code) |

| Registrant’s telephone number, including area code | (317) 293-5309 |

| Securities registered pursuant to Section 12(b) of the Act: | None |

| Securities registered pursuant to Section 12(g) of the Act: | Common Stock, No Par Value |

| (Title of Class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d).

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to the filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer x | Non-accelerated filer ¨ | Smaller reporting company ¨ |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

The aggregate market value of the registrant’s voting stock held by non-affiliates as of April 30, 2014 (the last day of our most recently completed second quarter) was $173,420,000.

The number of shares of the registrant’s common stock outstanding as of December 31, 2014 was 6,522,886.

DOCUMENTS INCORPORATED BY REFERENCE: Portions of the registrant’s Proxy Statement for its 2015 Annual Meeting of Shareholders (Part III).

Forward-looking Statements

This report contains certain statements that are forward-looking statements within the meaning of federal securities laws. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. When used in this report, the words “may”, “will”, “should”, “would” ,“could”, “anticipate”, “expect”, “plan”, “seek”, “believe”, “predict”, “estimate”, “potential”, “project”, “target”, “forecast”, “intend”, “strategy”, “future”, “opportunity”, “assume”, “guide”, and similar expressions are intended to identify forward-looking statements. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. These risks and uncertainties include, but are not limited to, the risks and other important factors under the heading “Risk Factors” in Part I, Item 1A of this report. You should understand that it is not possible to predict or identify all factors that could cause actual results to differ materially from forward-looking statements. Consequently, you should not consider any list or discussion of such factors to be a complete set of all potential risks or uncertainties. Readers of this report are cautioned not to place undue reliance on these forward-looking statements. While we believe the assumptions on which the forward-looking statements are based are reasonable, there can be no assurance that these forward-looking statements will prove to be accurate. This cautionary statement is applicable to all forward-looking statements contained in this report. We expressly disclaim any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. You are advised, however, to consult any further disclosures we make on related subjects in our Form 10-Q, 8-K and 10-K reports and our other filings with the Securities and Exchange Commission (SEC).

PART I

Item 1. BUSINESS

General

Hurco Companies, Inc. is an industrial technology company. We design, manufacture and sell computerized machine tools, consisting primarily of vertical machining centers (mills) and turning centers (lathes), to companies in the metal working industry through a worldwide sales, service and distribution network. Although our computer control systems and software products are proprietary, they predominantly use industry standard personal computer components. Our computer control systems and software products are primarily sold as integral components of our computerized machine tool products. As used in this report, the words “we”, “us”, “our”, “Hurco” and the “Company” refer to Hurco Companies, Inc. and its consolidated subsidiaries.

Since our founding in 1968, we have been a leader in the introduction of interactive computer control systems that automate manufacturing processes and improve productivity in the metal parts manufacturing industry. We pioneered the application of microprocessor technology and conversational programming software for use in machine tools. Our computer control systems can be operated by both skilled and unskilled machine tool operators and yet are capable of instructing a machine to perform complex tasks. The combination of microprocessor technology and patented interactive, conversational programming software in our computer control systems enables operators on the production floor to quickly and easily create a program for machining a particular part from a blueprint or computer aided design file and immediately begin machining that part.

Our executive offices and principal design and engineering operations are headquartered in Indianapolis, Indiana, USA. Sales, application engineering and service subsidiaries are located in China, France, Germany, India, Italy, Poland, Singapore, South Africa, the United Kingdom, and the USA. We have manufacturing operations in Taiwan, the USA, Italy and China, and distribution facilities in the USA, the Netherlands, and Taiwan. During the third quarter of fiscal 2013, we acquired the machine tools components business of an Italian designer and manufacturer of electro-mechanical components and accessories for machine tools. We are operating this business through our wholly-owned subsidiary, LCM Precision Technology S.r.l. (LCM). This acquisition supports our mission to develop advanced machine tool technologies to support our customers, that need increasingly sophisticated and versatile CNC (“Computer Numerical Control”) machine tools to stay competitive and to grow profitability.

Our strategy is to design, manufacture and sell a comprehensive line of computerized machine tools that incorporate our proprietary, interactive, computer control technology for the global metal cutting market. Our technology is designed to enhance the machine tool user's productivity through ease of operation and higher levels of machine performance (speed, accuracy and surface finish quality). We use an open system software architecture that permits our computer control systems and software to be produced and employed using standard PC hardware. We have emphasized a “user-friendly” design that employs both interactive conversational and graphical programming software. We routinely expand our product offering to meet customer needs, which has led us to design and manufacture more complex machining centers with advanced capabilities. We bring a disciplined approach to strategically enter new geographic markets, as appropriate.

| 1 |

Industry

Machine tool products are considered capital goods, which makes them part of an industry that has historically been highly cyclical.

Although industry association data for the U.S. machine tool market is available, that market only accounts for approximately 16% of worldwide consumption. Reports available for the U.S. machine tool market include:

| · | United States Machine Tool Consumption – generated by the Association for Manufacturing Technology, this report includes metal cutting machines of all types and sizes, including segments in which we do not compete |

| · | Purchasing Manager’s Index - developed by the Institute for Supply Management, this report includes activity levels in U.S. manufacturing plants that purchase machine tools |

| · | Capacity Utilization of Manufacturing Companies – issued by the Federal Reserve Board |

A limited amount of information is available for foreign markets, and different reporting methodologies are used by various countries. Machine tool consumption data published by Gardner Publications, Inc., calculates machine tool consumption annually by country. It is important to note that data for foreign countries are based on government reports that may lag 6 to 12 months and therefore are unreliable for forecasting purposes.

Demand for capital equipment can fluctuate significantly during periods of changing economic conditions. Manufacturers and suppliers of capital goods, such as our company, are often the first to experience these changes in demand. Additionally, since our typical order backlog is approximately 45 days, it is difficult to estimate demand with any reasonable certainty. Therefore, we do not have the benefit of relying on the common leading indicators other industries use for market analysis and forecasting purposes.

Products

Our core products consist of general purpose computerized machine tools for the metal cutting industry. These are, principally, vertical machining centers (mills) and turning centers (lathes), with which our proprietary software and computer control systems are fully integrated. Additionally, we produce and distribute software options, control upgrades, hardware accessories, and replacement parts for our machine tool product lines, and we provide operator training and support services to our customers. We also produce computer control systems and related software for press brake applications that are sold as retrofit units for installation on existing or new press brake machines. Through LCM, we now produce CNC rotary and tilting tables, swivel heads and electro-spindles.

| 2 |

The following table sets forth the contribution of each of our product groups and services to our total revenues during each of the past three fiscal years:

Net Sales and Service Fees by Product Category

(Dollars in thousands)

| Year Ended October 31, | ||||||||||||||||||||||||

| 2014 | 2013 | 2012 | ||||||||||||||||||||||

| Computerized Machine Tools** | $ | 193,937 | 87 | % | $ | 166,896 | 87 | % | $ | 179,337 | 88 | % | ||||||||||||

| Computer Control Systems and Software * | 3,407 | 2 | % | 3,066 | 2 | % | 2,947 | 1 | % | |||||||||||||||

| Service Parts | 17,391 | 8 | % | 16,474 | 8 | % | 15,299 | 8 | % | |||||||||||||||

| Service Fees | 7,568 | 3 | % | 6,368 | 3 | % | 5,534 | 3 | % | |||||||||||||||

| Total | $ | 222,303 | 100 | % | $ | 192,804 | 100 | % | $ | 203,117 | 100 | % | ||||||||||||

* Amounts shown do not include computer control systems sold as integrated components of computerized machine tools.

** Amounts shown include sales of LCM electro-mechanical components to third parties since the date of acquisition on July 1, 2013.

Computerized Machine Tools – Machining and Turning Centers

We design, manufacture and sell computerized machine tools equipped with a fully integrated interactive computer control system that features our proprietary WinMax® software. Our computer control system enables a machine tool operator to create complex two-dimensional or three-dimensional machining programs directly from an engineering drawing or computer aided design geometry file. An operator with little or no machine tool programming experience can successfully create a program with minimal training and begin machining the part in a short period of time. The control features an operator console with a liquid crystal display (LCD), and incorporates an upgradeable personal computer (PC) platform using a high speed processor with solid rendering graphical programming. In addition, WinMax® has a Windows®* based operating system that enables users to improve shop floor flexibility and software productivity.

Companies using computer controlled machine tools are better able to:

| • | maximize the efficiency of their human resources; | |

| • | make more advanced and complex parts from a wide range of materials using multiple processes; | |

| • | incorporate fast moving changes in technology into their operations to keep their competitive edge; and | |

| • | integrate their business into the global supply chain of their customers by supporting small to medium lot sizes for “just in time” initiatives. |

Our Windows®* based control facilitates our ability to meet these customer needs. The familiar Windows®* operating system coupled with our intuitive conversational style of program creation allows our customers’ operators to create and edit part-making programs without incurring the incremental overhead of specialized computer aided design and computer aided manufacturing programmers. With the ability to transfer most computer aided design data directly into a Hurco program, programming time can be significantly reduced.

Machine tool products today are being designed to meet the demand for machining complex parts with greater part accuracies. Our proprietary controls with WinMax® software and high speed processors efficiently handle the large amounts of data these complex part-making programs require, which enables our customers to create parts with higher accuracy at faster speeds. We continue to add technology to our control design as it becomes available. For example, UltiMotion, our patented motion control system, provides significant cycle time reductions and increases the quality of a part’s surface finish. This technology differentiates us in the marketplace and is incorporated into our control.

*Windows® is a registered trademark of Microsoft Corporation in the United States and other countries.

| 3 |

Our offering of machining centers, currently equipped with either a twin touch-screen console or a single touch-screen console, consists of the following nine product lines:

VM Product Line

The VM product line consists of moderately priced vertical machining centers for the entry-level market. Their design premise of a machining center with a large work cube and a small footprint optimizes the use of available floor space. The VM line consists of five models in four sizes with X-axis (horizontal) travels of 18, 26, 40, and 50 inches.

VMX Product Line

The VMX product line consists of higher performing vertical machining centers aimed at manufacturers that require greater part accuracy. It is our flagship series of machining centers. The VMX line consists of 20 models in seven sizes with X-axis travels of 24, 30, 42, 50, 60, 64, and 84 inches.

Five-Axis Product Line

The five-axis product line is targeted at manufacturers seeking to produce complex multi-sided parts in a single setup. Machines in this product line can yield significant productivity gains for manufacturers that previously had to process each side of a part separately. With the addition of the VMX30UHSi, VMX42HSRTi, DCX325Si, and VCX600i this year, the five-axis product line now consists of 13 models in five sizes.

HS High Speed Machining Product Line

Due to the integral, motorized spindle with a base speed of 18,000 rpm, the HS product line is desirable for the die and mold industry with particular interest in improving surface finish quality and reducing cycle time. Additionally, this product line offers us the opportunity to expand our customer base to manufacturers that produce larger batches. The HS product line consists of two models with X-axis travels of 24 and 42 inches.

HMX Horizontal Product Line

The HMX product line is beneficial to manufacturers entering production manufacturing versus small batch manufacturing. The HMX machines have expanded tool capacity, a comprehensive chip management system, a built-in pallet changer, and a box-in-box design supported at both the top and bottom to increase rigidity for long production runs and heavy cuts. The HMX product line consists of four models in three sizes with X-axis travels of 24, 32, and 41 inches.

HBMX Boring Mill Product Line

The HBMX product line is beneficial to manufacturers that build custom machinery and parts for a multitude of industries, such as packaging, pharmaceutical, automotive, energy, and medical. Additionally, boring mills are also used to repair and/or rebuild large components. The HBMX boring mill product line consists of three models with X-axis travels of 55, 79, and 94 inches.

TM/TMM Product Line

Since its introduction in fiscal 2005, we have continued to expand the TM turning center (horizontal slant-bed lathe) product line. The TM series is designed for entry-level job shops and contract manufacturers seeking efficient processing of small to medium lot sizes. There is one TM model in seven sizes: the TM6, TM8, TM10, TM12, TM18, TM18L, and TM18BB, which was introduced this year. The TM18BB big bore turning center targets the energy and aerospace industries because it has a larger chuck diameter and bigger bar capacity for larger parts. We added motorized tooling on the lathe turret to further enhance the capability of the TM turning centers and designated it as the TMM product line. These turning centers with live tooling allow our customers to complete a number of secondary milling, drilling and tapping operations while the part is still held in the chuck after the turning operations are complete, which provides significant productivity gains. The addition of the TMM12 this year expands the TMM product line to three models.

| 4 |

TMX Product Line

The TMX product line consists of high performance turning centers. There are three models in two sizes. One of the models is equipped with an additional axis and motorized live tooling, and another one of the models has an additional spindle.

DCX Product Line

The double column DCX series includes five models in three sizes. These 2-meter, 3-meter, and 4-meter machining centers are designed to facilitate production of large parts and molds often required by the aerospace, energy and custom machinery industries.

Computer Control Systems and Software

The following machine tool computer control systems and software products are sold directly to end-users and/or to original equipment manufacturers.

Autobend®

Autobend® computer control systems are applied to metal bending press brake machines that form parts from sheet metal and steel plate. They consist of a microprocessor-based computer control and back gauge (an automated gauging system that determines where the bend will be made). We have manufactured and sold the Autobend® product line since 1968. We currently market two models of our Autobend® computer control systems for press brake machines, in combination with six different back gauges as retrofit units for installation on existing or new press brake machines.

Software Products

In addition to our standard computer control features, we offer software option products for two-dimensional programming. These products are sold to users of our computerized machine tools equipped with our twin touch-screen or single touch-screen consoles featuring WinMax® control software. The options include: Swept Surface, SelectSurface Finish Quality (SFQ), DXF Transfer, UltiMonitor, UltiPocket, Conversational Part and Tool Probing, Advanced Verification Graphics, the Tool and Material Library, NC/Conversational Merge, Job List, Thread Repair, and Simultaneous Five-Axis Contouring.

Our Swept Surface software option simplifies programming of 3D contours and significantly reduces programming time.

SelectSurface Finish Quality (SFQ) lets the customer control surface finish quality and run time in one easy step.

The DXF Transfer software option increases operator productivity because it eliminates manual data entry of part features by transferring AutoCAD®* drawing files directly into our computer control or into our desktop programming software, WinMax® Desktop.

UltiMonitor is a web-based productivity, management and service tool, enabling customers to monitor, inspect and receive notifications about their Hurco machines from any location where they can access the internet. Customers can transfer part designs, receive event notifications via email or text, access diagnostic data, monitor the machine via webcam and communicate with the machine operator.

* AutoCAD® is a registered trademark of Autodesk, Inc., and/or its subsidiaries and/or affiliates in the USA and/or other countries.

| 5 |

UltiPocket automatically calculates the tool path around islands, eliminating the arduous task of plotting these shapes. Islands can also be rotated, scaled and repeated.

Conversational Part and Tool Probing options permit the computerized dimensional measurement of machined parts and the associated cutting tools. This “on-machine” technique improves the throughput of the measurement process when compared to traditional “off-machine” approaches.

The Advanced Verification Graphics feature significantly reduces both scrap and programming time because it provides customers with a three-dimensional solid rendering of the part, including dynamic rotation. This feature allows a customer to view the rendered part from any angle without needing to redraw it.

The Tool and Material Library option stores the tool and material information with the machine instead of storing it with each individual part program. The user enters the tool data and geometry one time and chooses the particular tool from the list when it is needed. Additionally, the library reads the part program and automatically locates the tool or displays an alert if the tool does not exist. In addition to saving time, the Tool and Material Library eliminates the need to enter information repeatedly, and can prevent common tool crash conditions.

NC/Conversational Merge lets the user incorporate conversational features, such as tool probing, pattern operations, and scaling, into existing G-Code programs.

Job List provides an intuitive way to group files together and run them sequentially without operator intervention, which promotes automation, lights-out machining, program stitching, file bundling, and adaptive processes.

Thread Repair is a feature for turning applications that provides an efficient way to repair existing threads, which is especially beneficial for large pipes and other parts manufactured for the oil/energy sector.

Simultaneous Five-Axis Contouring software enables a five-axis machine to command motion concurrently on all axes. This allows the user to create continuous tool-paths along complex geometries with only a single machine/part setup, providing increased productivity along with the performance benefits of using shorter cutting tools. The sale of simultaneous five-axis contouring software is subject to government export licensing requirements.

LCM Machine Tool Components and Accessories

During the third quarter of fiscal 2013, we acquired the business of an Italian designer and manufacturer of electro-mechanical components and accessories for machine tools. We are operating this business through our subsidiary in Italy, LCM. We incorporate LCM products in many of our machine tools and also sell these products to third parties.

CNC Rotary Tables

LCM has five lines of CNC rotary tables for both horizontal and vertical-horizontal positioning. Customers can choose rotary tables with either hydraulic or pneumatic clamping systems. Additionally, LCM offers CNC rotary tables powered by either a torque motor or a high-precision mechanical transmission.

CNC Tilt Tables

LCM has seven lines of CNC tilting rotary tables, of which four lines are intended specifically for 5-axis machining centers. Each of the seven lines is differentiated by the technology used for clamping (hydraulic or pneumatic) and by the type of transmission (either mechanical transmission or torque motor).

| 6 |

Swivel Heads and Electro-spindles

LCM has two primary lines of swivel heads that enable the spindle axis to be tilted with continuous motion and one line of electro-spindles (built-in motors for swivel heads). Two lines of swivel heads are differentiated by the type of transmission (either mechanical transmission or torque motor).

Parts and Service

Our service organization provides installation, warranty, operator training and customer support for our products on a worldwide basis. In the United States, our principal distributors have the primary responsibility for machine installation and warranty service and support for product sales. Our service organization also sells software options, computer control upgrades, accessories and replacement parts for our products. Our after-sales parts and service business strengthens our customer relationships and provides continuous information concerning the evolving requirements of end-users.

Manufacturing

Our computerized metal cutting machine tools are manufactured to our specifications primarily by our wholly-owned subsidiary in Taiwan, Hurco Manufacturing Limited (HML). HML conducts final assembly operations and is supported by a network of contract suppliers of components and sub-assemblies that manufacture components for our products. Our facility in Indianapolis, Indiana also conducts final assembly operations for certain VMX machines for the North American market. Our manufacturing facility in Ningbo, China, focuses on the machining of castings to support HML’s production in Taiwan and has produced VM machines specifically for the Chinese market.

The LCM line of electro-mechanical components and accessories for machine tools are designed and manufactured in Italy. We use LCM products primarily in our 5-axis machine tools and also sell them separately to third parties.

We have a contract manufacturing agreement for computer control systems with Hurco Automation, Ltd. (HAL), a Taiwanese company in which we have a 35% ownership interest. This company produces all of our computer control systems to our specifications, sources industry standard computer components and our proprietary parts, performs final assembly and conducts test operations.

We work closely with our subsidiaries, key component suppliers and HAL to ensure that their production capacity will be sufficient to meet the projected demand for our machine tool products. Many of the key components used in our machines can be sourced from multiple suppliers. However, any prolonged interruption of operations or significant reduction in the capacity or performance capability at any of our manufacturing facilities, or at any of our key component suppliers, could have a material adverse effect on our operations.

Marketing and Distribution

We sell our products through more than 100 independent agents and distributors throughout North America, Europe and Asia. Although some distributors carry competitive products, we are the primary line for the majority of our distributors globally. We also have direct sales personnel in China, France, Germany, India, Italy, Poland, Singapore, South Africa, the United Kingdom and certain parts of the United States, which are among the world's principal machine tool consuming markets.

Approximately 84% of the worldwide demand for computerized machine tools and computer control systems is outside the United States. In fiscal 2014, approximately 72% of our revenues were from overseas customers. No single end-user or distributor of our products accounted for more than 5% of our total sales and service fees.

| 7 |

The end-users of our products are precision tool, die and mold manufacturers, independent job shops, and specialized short-run production applications within large manufacturing operations. Industries served include aerospace, defense, medical equipment, energy, automotive/transportation, electronics and computer industries.

We also sell our Autobend® computer control systems to original equipment manufacturers of new metal fabrication machine tools that integrate them with their own products prior to the sale of those products to their own customers, to retrofitters of used metal fabrication machine tools that integrate them with those machines as part of the retrofitting operation, and to end-users that have an installed base of metal fabrication machine tools, either with or without related computer control systems.

Demand

We believe demand for our products is driven by advances in industrial technology and the related demand for automated process improvements.

Other factors affecting demand include:

| • | the need to continuously improve productivity and shorten cycle time; |

| • | an aging machine tool installed base that will require replacement with more advanced technology; |

| • | the industrial development of emerging markets in Asia and Eastern Europe; and |

| • | the declining supply of skilled machinists. |

Demand for our products is also highly dependent upon economic conditions and the general level of business confidence, as well as such factors as production capacity utilization and changes in governmental policies regarding tariffs, corporate taxation, fluctuations in foreign currencies, and other investment incentives.

Competition

We compete with many other machine tool producers in the United States and foreign countries. Most of our competitors are larger and have greater financial resources than our company. Major worldwide competitors include Deckel Maho Gildemeister Group (DMG), Mori Seiki Co., Ltd., Mazak, Haas Automation, Inc., Hardinge Inc., Doosan, and Okuma Machinery Works Ltd.

Through our subsidiary LCM, we compete with manufacturers of machine tool components and accessories such as IBAG, Kessler, Peron Speed, GSA Technology Co., LTD and Duplomatic Automation.

We strive to compete effectively by developing patentable software and other proprietary features that offer enhanced productivity, technological capabilities and ease of use. We offer our products in a range of prices and capabilities to target a broad potential market. We also believe that our competitiveness is aided by our reputation for reliability and quality, our strong international sales and distribution organization, and our extensive customer service organization.

Intellectual Property

We consider our products to be proprietary. Various features of our control systems and machine tools employ technologies covered by patents and trademarks that are material to our business. We also own additional patents covering new technologies that we have acquired or developed, and that we are planning to incorporate into our control systems in the future.

| 8 |

Research and Development

In the fiscal years set forth below, non-capitalized research and development expenditures for new products, significant product improvements and expenditures related to software development projects that were capitalized were as follows (in thousands):

| Fiscal Year | Non-Capitalized Research and Development | Capitalized Software Development | ||||||

| 2014 | $ | 3,400 | $ | 1,000 | ||||

| 2013 | 3,000 | 1,000 | ||||||

| 2012 | 2,600 | 1,000 | ||||||

Employees

We had approximately 617 full-time employees at the end of fiscal 2014, none of whom are covered by a collective-bargaining agreement or represented by a union. We have experienced no employee-generated work stoppages or disruptions and we consider our employee relations to be satisfactory.

Geographic Areas

Financial information about geographic areas in which we sell our products is set forth in Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and Note 15 of Notes to Consolidated Financial Statements. Some of the risks of doing business on a global basis are described in Item 1A. Risk Factors below.

Backlog

For information on orders and backlog, see Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Availability of Reports and Other Information

Our website can be found at www.hurco.com. We use this website as a means of disclosing pertinent information about us, free of charge, including:

| • | our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, proxy materials, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (Exchange Act), as soon as reasonably practicable after we electronically file that material with or furnish it to the SEC; |

| • | press releases on quarterly earnings, product announcements, legal developments and other material news that we may post from time to time; |

| • | corporate governance information including our Corporate Governance Principles, Code of Business Conduct and Ethics, information concerning our Board of Directors and its committees, including the charters of the Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee and other governance-related policies; and |

| • | opportunities to sign up for email alerts and RSS feeds to have information provided in real time. |

The information available on our website is not incorporated by reference in, or a part of, this or any other report we file with, or furnish to, the SEC.

| 9 |

Item 1A. RISK FACTORS

In this section we describe what we believe to be the material risks related to our business. The risks and uncertainties described below or elsewhere in this report are not the only ones to which we are exposed. Additional risks and uncertainties not presently known and/or risks we currently deem immaterial may also adversely affect our business and operations. If any of the developments included in the following risks were to occur, our business, financial condition, results of operations, cash flows or prospects could be materially adversely affected.

The cyclical nature of our business causes fluctuations in our operating results.

The machine tool industry is highly cyclical and changes in demand can occur abruptly in the geographic markets we serve. As a result of this cyclicality, we have experienced significant fluctuations in our sales, which, in periods of reduced demand, have adversely affected our results of operations and financial condition.

Uncertain economic conditions, particularly in Europe, may adversely affect overall demand.

We typically sell the majority of our larger high-performance VMX machines in Europe, which makes us particularly sensitive to economic and market conditions in that region. Therefore, economic uncertainty and business downturns in the European market adversely affect our results of operations and financial condition.

Our international operations pose additional risks that may adversely impact sales and earnings.

During fiscal 2014, approximately 72% of our revenues were derived from sales to customers located outside the United States. In addition, our manufacturing facilities are located outside of the United States. Our international operations are subject to a number of risks, including:

| · | trade barriers; |

| · | regional economic uncertainty; |

| · | differing labor regulation; |

| · | governmental expropriation; |

| · | domestic and foreign customs and tariffs; |

| · | current and changing regulatory environments affecting the importation and exportation of products and raw materials; |

| · | difficulty in obtaining distribution support; |

| · | difficulty in staffing and managing widespread operations; |

| · | differences in the availability and terms of financing; |

| · | political instability and unrest; and |

| · | changes in tax regulations and rates in foreign countries. |

Quotas, tariffs, taxes or other trade barriers could require us to change manufacturing sources, reduce prices, increase spending on marketing or product development, withdraw from or not enter certain markets or otherwise take actions that could be adverse to us. Also, in some foreign jurisdictions, we may be subject to laws limiting the right and ability of entities organized or operating therein to pay dividends or remit earnings to affiliated companies unless specified conditions are met. These factors may adversely affect our future operating results. The vast majority of our products are shipped from our manufacturing facility in Taiwan from the Port of Taichung to three ports of destination: Los Angeles, California, Venlo, the Netherlands, and Shanghai, China. Changes in customs requirements, as a result of national security or other constraints put upon these ports, may also have an adverse impact on our results of operations.

| 10 |

Additionally, we must comply with complex foreign and U.S. laws and regulations, such as the U.S. Foreign Corrupt Practices Act, the U.K. Bribery Act, and other foreign laws prohibiting corrupt payments to governmental officials, and anti-competition regulations. Violations of these laws and regulations could result in fines and penalties, criminal sanctions, restrictions on our business conduct and on our ability to offer our products in one or more countries, and could also materially affect our brand, our ability to attract and retain employees, our international operations, our business and our operating results. Although we have implemented policies and procedures designed to ensure compliance with these laws and regulations, there can be no assurance that our employees, contractors, or agents in foreign countries will not violate our policies.

We depend on limited sources for our products.

Our wholly-owned subsidiaries, Hurco Manufacturing Limited, Ningbo Hurco Manufacturing Limited and LCM Precision Technology S.r.l., produce our machine tools and electro-mechanical components and accessories in Taiwan, China and Italy, respectively. An unplanned interruption in manufacturing would have a material adverse effect on our results of operations and financial condition. Such an interruption could result from a change in the political environment or a natural disaster, such as an earthquake, typhoon, or tsunami. Any interruption in service by one of our key component suppliers, if prolonged, also could have a material adverse effect on our results of operations and financial condition.

Fluctuations in the exchange rates between the U.S. Dollar and any of several foreign currencies can increase our costs and decrease our revenues.

Our foreign sales, which generate approximately 72% of our revenues, are invoiced and received in several foreign currencies, primarily the Euro, Pound Sterling and Chinese Yuan. Therefore, our results of operations and financial condition are affected by fluctuations in exchange rates between these currencies and the U.S. Dollar, both for purposes of actual conversion and for financial reporting purposes. In addition, we are exposed to exchange risk associated with our purchases of materials and components for our Taiwan manufacturing operations, which are primarily made in the New Taiwan Dollar. We hedge our foreign currency exposure with the purchase of forward exchange contracts. These hedge contracts only mitigate the impact of changes in foreign currency rates that occur during the term of the related contract period and carry risks of counter-party failure. There can be no assurance that our hedges will have their intended effects.

Our competitive position and prospects for growth may be diminished if we are unable to develop and introduce new and enhanced products on a timely basis that are accepted in the market.

The machine tool industry is subject to technological change, evolving industry standards, changing customer requirements, and improvements in and expansion of product offerings. Our ability to anticipate changes in technology, industry standards, customers’ requirements and competitors’ product offerings and to develop and introduce new and enhanced products on a timely basis that are accepted in the market, are significant factors in maintaining and improving our competitive position and growth prospects. If the technologies or standards used in our products become obsolete or fail to gain widespread commercial acceptance, our business would be materially adversely affected. Although we believe that we have the technological capabilities to remain competitive, developments by others may render our products or technologies obsolete or noncompetitive.

We compete with larger companies that have greater financial resources, and our business could be harmed by competitors’ actions.

The markets in which our products are sold are extremely competitive and highly fragmented. In marketing our products, we compete with other manufacturers in terms of quality, reliability, price, value, delivery time, service and technological characteristics. We compete with a number of U.S., European and Asian competitors, most of which are larger, have substantially greater financial resources and have been supported by governmental or financial institution subsidies and, therefore, may have competitive advantages over us. While we believe our product lines compete effectively, our financial resources are limited compared to those of most of our competitors, making it challenging to remain competitive.

| 11 |

Fluctuations in the price of raw materials, especially steel and iron, could adversely affect our sales, costs and profitability.

We manufacture products with a high iron and steel content. The availability and price for these and other raw materials are subject to volatility due to worldwide supply and demand forces, speculative actions, inventory levels, exchange rates, production costs and anticipated or perceived shortages. In some cases, those cost increases can be passed on to customers in the form of price increases; in other cases they cannot. If the prices of raw materials increase and we are not able to charge our customers higher prices to compensate, our results of operations would be adversely affected.

Regulations related to “conflict minerals” may cause us to incur additional expenses and could limit the supply and increase the cost of certain metals used in manufacturing our products.

The SEC requires disclosure by public companies of specified minerals, known as conflict minerals, that are necessary to the functionality or production of products manufactured or contracted to be manufactured. The rule requires a disclosure report to be filed annually with the SEC, beginning in 2014, and requires companies to perform due diligence, disclose and report whether or not such minerals originate from the Democratic Republic of Congo or an adjoining country. The rule could affect sourcing at competitive prices and availability in sufficient quantities of certain minerals used in the manufacture of components that are incorporated into our products, including tin, tantalum, gold and tungsten. The number of suppliers that provide conflict-free minerals may be limited. In addition, there may be material costs associated with complying with the disclosure requirements, such as costs related to the due diligence process of determining the source of certain minerals used in our products, as well as costs of possible changes to products, processes, or sources of supply as a consequence of such verification activities. We may not be able to sufficiently verify the origins of the relevant minerals used in components manufactured by third parties through the due diligence procedures that we implement, which may harm our reputation. We may also encounter challenges to satisfy those customers that require that all of the components of our products be certified as conflict-free, which could place us at a competitive disadvantage if we are unable to do so.

Due to future changes in technology, changes in market demand, or changes in market expectations, portions of our inventory may become obsolete or excess.

The technology within our products changes and, generally, we bring new versions of our machines to market in three-year to five-year cycles. The phasing out of an old product involves estimating the amount of inventory to hold to satisfy the final demand for those machines and to satisfy future repair part needs. Based on changing customer demand and expectations of delivery times for repair parts, we may find that we have either obsolete or excess inventory on hand. Because of unforeseen future changes in technology, market demand or competition, we might have to write off unusable inventory, which would adversely affect our results of operations.

Acquisitions could disrupt our operations and harm our operating results.

In 2013, we acquired a machine tool component business in Italy (namely, LCM) and we may seek additional opportunities to expand our product offerings or the markets we serve by acquiring other companies, product lines, technologies and personnel. Acquisitions involve numerous risks, including the following:

| · | difficulties integrating the operations, technologies, products, and personnel of an acquired company; | |

| · | diversion of management’s attention from normal daily operations of the business; | |

| · | potential difficulties completing projects associated with in-process research and development; | |

| · | difficulties entering markets in which we have no or limited prior experience, especially when competitors in such markets have stronger market positions; |

| 12 |

| · | initial dependence on unfamiliar supply chains or relatively small supply partners; | |

| · | insufficient revenues to offset increased expenses associated with acquisitions; and | |

| · | the potential loss of key employees of the acquired companies. |

Acquisitions may also cause us to:

| · | issue common stock that would dilute our current shareholders’ percentage ownership; |

| · | assume liabilities of an acquired company; |

| · | record goodwill and non-amortizable intangible assets that will be subject to impairment testing on a regular basis and potential periodic impairment charges; |

| · | incur amortization expenses related to certain intangible assets; |

| · | incur large and immediate write-offs, and restructuring and other related expenses; and |

| · | become subject to litigation. |

Mergers and acquisitions are inherently risky. No assurance can be given that our acquisitions will be successful. Further, no assurance can be given that an acquisition will not adversely affect our business, operating results, or financial condition. Failure to manage and successfully integrate an acquisition could harm our business and operating results in a material way. Even when an acquired company has already developed and marketed products, there can be no assurance that enhancements to those products will be made in a timely manner or that pre-acquisition due diligence will identify all possible issues that might arise with respect to such products.

Risks related to new product development also apply to acquisitions. For additional information, please see the risk factor above entitled, “Due to future changes in technology, changes in market demand, or changes in market expectations, portions of our inventory may become obsolete or excess.”

Assets may become impaired, requiring us to record a significant charge to earnings.

We review our assets, including intangible assets such as goodwill, for indications of impairment when events or changes in circumstances indicate the carrying value may not be recoverable. We could be required to record a significant charge to earnings in our financial statements for the period in which any impairment of these assets is determined, which would adversely affect our results of operations for that period.

We may experience negative or unforeseen tax consequences.

We may experience negative or unforeseen tax consequences. We review the probability of the realization of our net deferred tax assets each period based on forecasts of taxable income in both the U.S. and foreign jurisdictions. This review uses historical results, projected future operating results based upon approved business plans, eligible carryforward periods, tax-planning opportunities and other relevant considerations. Adverse changes in the profitability and financial outlook in the U.S. or foreign jurisdictions may require the creation of a valuation allowance to reduce our net deferred tax assets. Such changes could result in material non-cash expenses in the period in which the changes are made and could have a material adverse impact on our results of operations and financial condition.

Our continued success depends on our ability to protect our intellectual property.

Our future success depends in part upon our ability to protect our intellectual property. We rely principally on nondisclosure agreements, other contractual arrangements, trade secret law, trademark registration and patents to protect our intellectual property. However, these measures may be inadequate to protect our intellectual property from infringement by others or prevent misappropriation of our proprietary rights. In addition, the laws of some foreign countries do not protect proprietary rights to the same extent as do U.S. laws. Our inability to protect our proprietary information and enforce our intellectual property rights through infringement proceedings could have a material adverse effect on our business, financial condition and results of operations.

| 13 |

The unanticipated loss of current members of our senior management team and other key personnel may adversely affect our operating results.

The unexpected loss of members of our senior management team or other key personnel could impair our ability to carry out our business plan. We believe that our future success will depend in part on our ability to attract and retain highly skilled and qualified personnel. The loss of senior management or other key personnel may adversely affect our operating results as we incur costs to replace the departed personnel and potentially lose opportunities in the transition of important job functions.

If our network and system security measures are breached and unauthorized access is obtained to our data, our customers’ or vendors’ data, or to our critical information technology systems, we may incur legal and financial exposure and liabilities.

As part of our business, we store our data and certain data about our customers and vendors in our information technology systems. If a third party gained unauthorized access to our data, including any data regarding our customers or vendors, the security breach could expose us to risks, including loss of business, litigation and possible liability. These security measures may be breached as a result of third-party action, including intentional misconduct by computer hackers, employee error, malfeasance or otherwise. Additionally, third parties may attempt to fraudulently induce employees or customers into disclosing sensitive information such as user names, passwords or other information to gain access to our customers' data or our data, including our intellectual property and other confidential business information, or our information technology systems. Although we work closely with industry recognized manufacturers supporting the security measures we have employed in an effort to keep our technology current with the ongoing threats, the techniques used to obtain unauthorized access, or to sabotage systems, change frequently, and therefore we may be unable to anticipate these techniques or to implement adequate preventative measures. Any security breach could result in: the unauthorized publication of our confidential business or proprietary information; the unauthorized release of customer or vendor data and payment information; a loss of confidence by our customers; damage to our reputation; a disruption to our business; litigation and legal liability; and a negative impact on our future sales. In addition, the cost and operational consequences of implementing further data protection measures could be significant.

| 14 |

Item 1B. Unresolved Staff Comments

None.

Item 2. PROPERTIES

The following table sets forth the principal use, location, and size of each of our facilities:

| Principal Uses | Locations | Square Footage | ||||

| Corporate headquarters, design and engineering, product testing, sales and marketing, application engineering and customer service. | Indianapolis, Indiana, USA (1) | 165,000 | ||||

| Manufacturing | Taichung, Taiwan | 309,900 | ||||

| Ningbo, China | 31,000 | |||||

| Castell’Alfero, Italy | 32,300 | |||||

| Sales, design engineering, product testing and customer service. | Dexter, Michigan, USA | 3,000 | ||||

| Sales, application engineering and customer service. | High Wycombe, England Benoni, South Africa | 16,000 2,500 | ||||

| Paris and Toulouse, France | 11,100 | |||||

| Munich and Verl, Germany | 20,100 | |||||

| Milan, Italy | 10,800 | |||||

| Netherlands | 9,700 | |||||

| Singapore | 3,900 | |||||

| Shanghai, Dongguan, Shenyang | ||||||

| and Beijing, China | 23,000 | |||||

| Chennai, Delhi, and Pune India | 7,200 | |||||

| Liegnitz, Poland | 2,900 | |||||

| Grand Rapids, Michigan, USA | 5,000 | |||||

| Ball Ground, Georgia, USA | 5,200 | |||||

(1) Approximately 34,000 square feet is leased to a third-party under a lease that expires April 30, 2016.

We own the Indianapolis facility and lease all other facilities. The leases have terms expiring at various dates ranging from November 2014 to March 2024. We believe that all of our facilities are well maintained and are adequate for our needs now and in the foreseeable future. We do not believe that we would experience any difficulty in replacing any of the present facilities if any of our leases were not renewed at expiration.

| 15 |

Item 3. LEGAL PROCEEDINGS

From time to time we are involved in various claims and lawsuits arising in the normal course of business. We do not expect any of these claims, individually or in the aggregate, to have a material adverse effect on our consolidated financial position or results of operations. Any claims that have been filed against us are properly reflected on our consolidated financial position and results of operations and we believe that the ultimate resolution of claims for any losses will not exceed our insurance policy coverages.

Item 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

None.

Executive Officers of the Registrant

Executive officers are elected each year by the Board of Directors following the Annual Meeting of Shareholders to serve during the ensuing year and until their respective successors are elected and qualified. There are no family relationships between any of our executive officers or between any of them and any of the members of the Board of Directors.

The following information sets forth as of October 31, 2014, the name of each executive officer and his or her age, tenure as an officer, principal occupation and business experience for the last five years:

| Name | Age | Position(s) with the Company | ||

| Michael Doar | 59 | Chairman of the Board and Chief Executive Officer | ||

| Gregory S. Volovic | 50 | President | ||

| Sonja K. McClelland | 43 | Vice President, Secretary, Treasurer and Chief Financial Officer | ||

| John P. Donlon | 57 | Executive Vice President, International Sales/Service |

Michael Doar was elected Chairman of the Board and Chief Executive Officer on November 14, 2001. Mr. Doar had held various management positions with Ingersoll Milling Machine Company from 1989 until 2001. Mr. Doar has been a director of Hurco since 2000.

Gregory S. Volovic has been employed by us since March 2005 and was elected as our President in March 2013. Mr. Volovic previously held the position of Executive Vice President, Software and Engineering until October 2009. Prior to joining us, Mr. Volovic held various positions with Thomson, Inc. including Director of E-Business, Engineering, and Information Technology. Prior to that, Mr. Volovic was employed by Unisys Corporation.

Sonja K. McClelland has been employed by us since September 1996 and was elected Vice President, Secretary, Treasurer and Chief Financial Officer in March 2014. Ms. McClelland served as Corporate Accounting Manager from September 1996 to 1999, as Division Controller for Hurco USA from September 1999 to November 2004, and as our Corporate Controller and Assistant Secretary from November 2004 to March 2014. Prior to joining us, Ms. McClelland was employed for three years by an international public accounting firm.

John P. Donlon has been employed by us since April 2010 as Executive Vice President, International Sales/Service. Prior to joining us, Mr. Donlon served as the Vice President of Sales for Yaskawa America Robotics since 2008. From 2004 to 2008, Mr. Donlon served as the Vice President of Sales and Marketing for Ansaldo STS, a worldwide supplier of automation technologies to the rail industry. Earlier in his career, Mr. Donlon held executive sales and management positions with other multi-national companies including Honeywell and ABB, and he has significant international experience in the emerging markets of China, Russia and Brazil.

| 16 |

PART II

Item 5. MARKET FOR THE REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Our common stock is traded on the Nasdaq Global Select Market under the symbol “HURC”. The following table sets forth, for the periods indicated, the high and low sale prices as reported by the Nasdaq Global Select Market and declared dividends per share of our common stock.

| 2014 | Declared | 2013 | Declared | |||||||||||||||||||||

| Fiscal Quarter Ended: | High | Low | Dividends | High | Low | Dividends | ||||||||||||||||||

| January 31 | $ | 26.91 | $ | 23.63 | $ | .05 | $ | 30.33 | $ | 21.22 | — | |||||||||||||

| April 30 | 28.52 | 24.00 | $ | .07 | 30.50 | 24.16 | — | |||||||||||||||||

| July 31 | 37.87 | 24.98 | $ | .07 | 31.61 | 26.21 | $ | .05 | ||||||||||||||||

| October 31 | 39.64 | 30.88 | $ | .07 | 30.35 | 23.52 | $ | .05 | ||||||||||||||||

On December 31, 2014, the closing price of our common stock on the Nasdaq Global Select Market was $34.09.

Holders

There were 134 holders of record of our common stock as of December 31, 2014.

Dividend Policy

We began declaring cash dividends on our common stock in the third quarter of fiscal 2013, and we expect to continue to declare dividends on a quarterly basis; however, the declaration and amount of any future cash dividends will be subject to the sole discretion of our Board of Directors and will depend upon many factors, including our results of operations, financial condition, capital requirements, regulatory and contractual restrictions, our business strategy and other factors deemed relevant by our Board of Directors.

Our payment of dividends is limited by our U.S. credit agreement, as further described in Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and in Note 5 of Notes to Consolidated Financial Statements.

Other Information

During the period covered by this report, we did not sell any equity securities that were not registered under the Securities Act of 1933, as amended.

The disclosure under the caption “Equity Compensation Plan Information” is incorporated by reference in Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

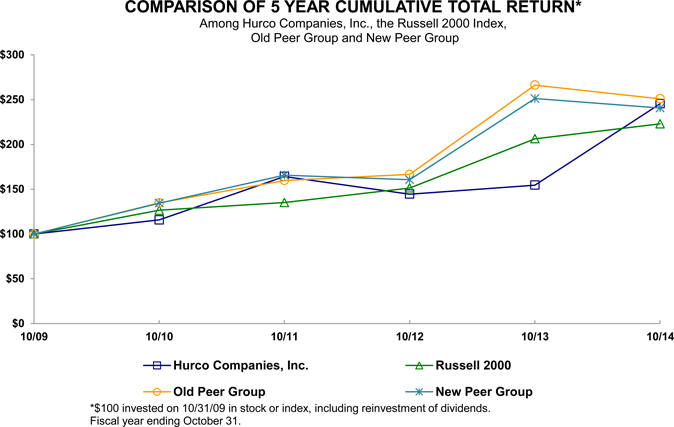

The performance graph information is included in Item 9B. Other Information.

| 17 |

Item 6. SELECTED FINANCIAL DATA

The Selected Financial Data presented below has been derived from our consolidated financial statements for the years indicated and should be read in conjunction with the consolidated financial statements and related notes set forth elsewhere herein and Management’s Discussion and Analysis of Financial Condition and Results of Operations.

| Year Ended October 31, | ||||||||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||

| Statement of Operations Data: | (In thousands, except per share amounts) | |||||||||||||||||||

| Sales and service fees | $ | 222,303 | $ | 192,804 | $ | 203,117 | $ | 180,400 | $ | 105,893 | ||||||||||

| Gross profit | 68,612 | 55,056 | 63,181 | 55,874 | 21,796 | |||||||||||||||

| Selling, general and administrative expenses | 46,615 | 41,413 | 41,160 | 38,493 | 29,837 | |||||||||||||||

| Operating income (loss) | 21,997 | 13,643 | 22,021 | 17,381 | (8,041 | ) | ||||||||||||||

| Other income (expense) | (636 | ) | (1,201 | ) | (157 | ) | (1,762 | ) | (818 | ) | ||||||||||

| Net income (loss) | 15,143 | 8,190 | 15,638 | 11,124 | (5,744 | ) | ||||||||||||||

| Earnings (loss) per common share- diluted | 2.30 | 1.25 | 2.40 | 1.71 | (0.89 | ) | ||||||||||||||

| Weighted average common shares outstanding-diluted | 6,538 | 6,497 | 6,470 | 6,472 | 6,441 | |||||||||||||||

| Dividends declared per common share. | $ | .26 | $ | .10 | — | — | — | |||||||||||||

| As of October 31, | ||||||||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||

| Balance Sheet Data: | (Dollars in thousands) | |||||||||||||||||||

| Current assets | $ | 210,754 | $ | 185,002 | $ | 173,381 | $ | 164,074 | $ | 136,208 | ||||||||||

| Current liabilities | 66,803 | 55,686 | 49,372 | 57,228 | 42,240 | |||||||||||||||

| Working capital | 143,951 | 129,316 | 124,009 | 106,846 | 93,968 | |||||||||||||||

| Current ratio | 3.2 | 3.3 | 3.5 | 2.9 | 3.2 | |||||||||||||||

| Total assets | 236,931 | 211,235 | 195,312 | 186,545 | 160,346 | |||||||||||||||

| Non-current liabilities | 5,483 | 4,058 | 2,147 | 3,105 | 3,366 | |||||||||||||||

| Total debt | 3,272 | 3,665 | 3,206 | 865 | — | |||||||||||||||

| Shareholders’ equity | 164,645 | 151,491 | 143,793 | 126,212 | 114,740 | |||||||||||||||

| 18 |

Item 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

EXECUTIVE OVERVIEW

Hurco Companies, Inc. is an industrial technology company operating in a single segment. We design and produce computerized machine tools, featuring our proprietary computer control systems and software, for sale through our own distribution network to the worldwide metal cutting market. We also provide machine tool components, software options, control upgrades, accessories and replacement parts for our products, as well as customer service and training support.

The following overview is intended to provide a brief explanation of the principal factors that have contributed to our recent financial performance. This overview is intended to be read in conjunction with the more detailed information included in our audited financial statements that appear elsewhere in this report.

The market for machine tools is international in scope. We have both significant foreign sales and significant foreign manufacturing operations. During fiscal 2014, approximately 62% of our revenues were attributable to customers in Europe, where we typically sell more of our higher-performance, higher-priced VMX series machines. Additionally, approximately 10% of our revenues were attributable to customers in Asia, where we sell more of our entry-level, lower-priced machines, but where we also encounter greater price pressures. We sell our products through more than 100 independent agents and distributors in countries throughout North America, Europe and Asia. We also have our own direct sales and service organizations in China, France, Germany, India, Italy, Poland, Singapore, South Africa, the United Kingdom and certain parts of the United States. The vast majority of our machine tools are manufactured to our specifications primarily by our wholly-owned subsidiary in Taiwan, Hurco Manufacturing Limited (HML). Machine castings and components to support HML’s production are manufactured at our facility in Ningbo, China.

During the third quarter of fiscal 2013, we acquired the machine tool component business of LCM S.r.l, an Italian designer and manufacturer of electro-mechanical components and accessories for machine tools. We are operating this business through our wholly-owned subsidiary, LCM Precision Technology S.r.l. (LCM). We have used LCM components in our SRT line of five-axis machining centers that employs LCM's direct drive spindle, swivel head, and rotary torque table to achieve superior simultaneous five-axis machining. Based in Italy, this business has been producing and selling mechanical and electro-mechanical components for machine tools since 1986.

Our sales to foreign customers are denominated, and payments by those customers are made, in the prevailing currencies—primarily the Euro, Pound Sterling and Chinese Yuan—in the countries in which those customers are located. Our product costs are incurred and paid primarily in the New Taiwan Dollar and the U.S. Dollar. Changes in currency exchange rates may have a material effect on our operating results and consolidated balance sheets as reported under U.S. Generally Accepted Accounting Principles. For example, when the U.S. Dollar weakens in value relative to a foreign currency, sales made, and expenses incurred, in that currency when translated to U.S. Dollars for reporting in our financial statements, are higher than would be the case when the U.S. Dollar is stronger. In the comparison of our period-to-period results, we discuss the effect of currency translation on those results including the increases or decreases in those results as reported in our financial statements (which reflect translation to U.S. Dollars at exchange rates prevailing during the period covered by those financial statements) and also the effect that changes in exchange rates had on those results.

Our high levels of foreign manufacturing and sales also subject us to cash flow risks due to fluctuating currency exchange rates. We seek to mitigate those risks through the use of various derivative instruments – principally foreign currency forward exchange contracts.

| 19 |

Results of Operations

The following table presents, for the fiscal years indicated, selected items from the Consolidated Statements of Income expressed as a percentage of our worldwide sales and service fees and the year-to-year percentage changes in the dollar amounts of those items.

| Percentage of Revenues | Year-to-Year % Change | |||||||||||||||||||

| 2014 | 2013 | 2012 | Increase (Decrease) | |||||||||||||||||

| ’14 vs. ’13 | ’13 vs. ’12 | |||||||||||||||||||

| Sales and service fees | 100 | % | 100 | % | 100 | % | 15 | % | (5 | )% | ||||||||||

| Gross profit | 31 | % | 29 | % | 31 | % | 25 | % | (13 | )% | ||||||||||

| Selling, general and administrative expenses | 21 | % | 21 | % | 20 | % | 13 | % | 1 | % | ||||||||||

| Operating income (loss) | 10 | % | 7 | % | 11 | % | 61 | % | (38 | )% | ||||||||||

| Net income (loss) | 7 | % | 4 | % | 8 | % | 85 | % | (48 | )% | ||||||||||

Fiscal 2014 Compared to Fiscal 2013

Sales and Service Fees. Annual sales and service fees for fiscal 2014 were $222.3 million, an increase of $29.5 million, or 15%, from fiscal 2013. The year-over-year increase included a favorable currency impact of $3.3 million, primarily due to a stronger Euro and Pound Sterling when translating foreign sales to U.S. Dollars for financial reporting purposes.

Net Sales and Service Fees by Geographic Region

The following table sets forth net sales and service fees by geographic region for the fiscal years ended October 31, 2014 and 2013 (in thousands):

| October 31, | Increase (Decrease) | |||||||||||||||||||||||

| 2014 | 2013 | Amount | % | |||||||||||||||||||||

| North America | $ | 62,142 | 28 | % | $ | 60,759 | 32 | % | $ | 1,383 | 2 | % | ||||||||||||

| Europe | 138,201 | 62 | % | 114,855 | 59 | % | 23,346 | 20 | % | |||||||||||||||

| Asia Pacific | 21,960 | 10 | % | 17,190 | 9 | % | 4,770 | 28 | % | |||||||||||||||

| Total | $ | 222,303 | 100 | % | $ | 192,804 | 100 | % | $ | 29,499 | 15 | % | ||||||||||||

Sales and service fees increased in all regions during fiscal 2014. The improvement in sales was primarily driven by an overall increase in the volume of machine tool sales and a favorable mix of higher-performance machines. During the first three quarters of fiscal 2014, sales in North America experienced some market softening in comparison to the same periods in fiscal 2013. However, following the International Manufacturing Technology Show in September 2014, sales of machine tools in North America increased due to year-end promotional activities, resulting in a 19% increase in the fourth quarter of fiscal 2014 compared to the same period in fiscal 2013. This surge in orders and shipments in the fourth quarter of fiscal 2014 resulted in a total year-over-year increase in sales and service fees in North America for fiscal 2014 of approximately 2% compared to fiscal 2013. The increased sales in Europe and Asia were attributable to improved market conditions and sales of our expanded product line of VMX machines. European sales and service fees for fiscal 2014 included $7.7 million of sales from electro-mechanical components and accessories manufactured by LCM, compared to $2.4 million in fiscal 2013.

| 20 |

Net Sales and Service Fees by Product Category

The following table sets forth net sales and service fees by product category for the years ended October 31, 2014 and 2013 (in thousands):

| October 31, | Increase (Decrease) | |||||||||||||||||||||||

| 2014 | 2013 | Amount | % | |||||||||||||||||||||

| Computerized Machine Tools | $ | 193,937 | 87 | % | $ | 166,896 | 87 | % | $ | 27,041 | 16 | % | ||||||||||||

| Service Fees, Parts and Other | 28,366 | 13 | % | 25,908 | 13 | % | 2,458 | 9 | % | |||||||||||||||

| Total | $ | 222,303 | 100 | % | $ | 192,804 | 100 | % | $ | 29,499 | 15 | % | ||||||||||||

Orders and Backlog. Orders for fiscal 2014 were $232.5 million, an increase of $34.6 million, or 17%, over fiscal 2013, and included $9.9 million of orders for LCM products compared to $5.7 million for fiscal 2013. Orders for fiscal 2014 increased in all geographic regions in comparison to fiscal 2013. Over 80% of the year-over-year increase was driven by increased orders in Europe, primarily Germany and the United Kingdom. The impact of currency translation on orders booked for fiscal 2014 was consistent with the impact on sales. Backlog was $39.8 million at October 31, 2014 and included $5.2 million of backlog for LCM products, compared to $31.3 million and $3.3 million, respectively, for LCM products, at October 31, 2013. We do not believe backlog is a useful measure of past performance or indicative of future performance. Backlog orders as of October 31, 2014 are expected to be fulfilled in fiscal 2015.

Gross Profit. Gross profit for fiscal 2014 was $68.6 million, or 31% of sales, compared to $55.1 million, or 29% of sales, for fiscal 2013. The increase in gross profit was attributable to higher sales volumes, particularly in Europe, the primary market for higher-performance machines, and increased cost efficiencies realized from higher production levels.

Operating Expenses. Selling, general and administrative expenses for fiscal 2014 were $46.6 million, or 21% of sales, compared to $41.4 million, or 21% of sales, for fiscal 2013. The year-over-year increase in selling, general and administrative expenses was primarily due to incremental operating expenses associated with the acquisition of the LCM business, increased tradeshow expenses, and increased incentive compensation expenses for employees.

Operating Income (Loss). Operating income for fiscal 2014 was $22.0 million, or 10% of sales, compared to $13.6 million, or 7% of sales, in fiscal 2013. The increase in operating income year-over-year was primarily due to the increase in sales and cost efficiencies realized from higher production levels.

Other (Income) Expense. Other expense for fiscal 2014 decreased by $0.6 million from fiscal 2013 due to lower foreign currency losses experienced in fiscal 2014.

Provision (Benefit) for Income Taxes. Our effective tax rate for fiscal 2014 was 29% in comparison to 34% for fiscal 2013. The decrease in the effective income tax rate in fiscal 2014 was due primarily to changes in the geographic mix of income or loss among tax jurisdictions.

Net Income (Loss). Net income for fiscal 2014 was $15.1 million, or $2.30 per diluted share, an increase of $7.0 million, or 85%, from fiscal 2013 net income of $8.2 million, or $1.25 per diluted share.

| 21 |

Fiscal 2013 Compared to Fiscal 2012

Sales and Service Fees. Annual sales and service fees for fiscal 2013 were $192.8 million, a decrease of $10.3 million, or 5%, from fiscal 2012. The impact of currency translation on the year-over-year comparison was not material.

The overall decline in total sales was due primarily to the adverse impact of weak market conditions in Europe, the primary market for our high-performance machine tools and continuing weakness throughout the Asia Pacific region.

Net Sales and Service Fees by Geographic Region

The following table sets forth net sales and service fees by geographic region for the fiscal years ended October 31, 2013 and 2012 (in thousands):

| October 31, | Increase (Decrease) | |||||||||||||||||||||||

| 2013 | 2012 | Amount | % | |||||||||||||||||||||

| North America | $ | 60,759 | 32 | % | $ | 60,527 | 30 | % | $ | 232 | 0 | % | ||||||||||||

| Europe | 114,855 | 59 | % | 119,359 | 59 | % | (4,504 | ) | (4 | )% | ||||||||||||||

| Asia Pacific | 17,190 | 9 | % | 23,231 | 11 | % | (6,041 | ) | (26 | )% | ||||||||||||||

| Total | $ | 192,804 | 100 | % | $ | 203,117 | 100 | % | $ | (10,313 | ) | (5 | )% | |||||||||||

European sales included $2.4 million for fiscal 2013 that was attributable to sales of LCM electro-mechanical components and accessories after July 1, 2013.

Net Sales and Service Fees by Product Category

The following table sets forth net sales and service fees by product category for the years ended October 31, 2013 and 2012 (in thousands):

| October 31, | Increase (Decrease) | |||||||||||||||||||||||

| 2013 | 2012 | Amount | % | |||||||||||||||||||||

| Computerized Machine Tools | $ | 166,896 | 87 | % | $ | 179,337 | 88 | % | $ | (12,441 | ) | (7 | )% | |||||||||||

| Service Fees, Parts and Other | 25,908 | 13 | % | 23,780 | 12 | % | 2,128 | 9 | % | |||||||||||||||

| Total | $ | 192,804 | 100 | % | $ | 203,117 | 100 | % | $ | (10,313 | ) | (5 | )% | |||||||||||

Orders and Backlog. New order bookings in fiscal 2013 were $197.9 million, which were consistent with the level of orders received during fiscal 2012, as orders for LCM products offset lower order levels for our other product lines as a result of unfavorable market conditions. The largest decrease in order activity was in Asia where machine tool demand has declined. The impact of currency translation on orders booked for the full fiscal year was not material. Backlog was $31.3 million at October 31, 2013 and included $3.3 million of backlog for LCM products, compared to $25.8 million at October 31, 2012. We do not believe backlog is a useful measure of past performance or indicative of future performance. Backlog orders as of October 31, 2013 are expected to be fulfilled in fiscal 2014.

Gross Profit. Gross profit for fiscal 2013 was $55.1 million, or 29% of sales, compared to $63.2 million, or 31% of sales for fiscal 2012. The decrease in gross profit was due primarily to lower sales and increased pricing pressures in Europe, which is the primary market for our larger, higher performance machines, as well as the adverse effect of leveraging fixed costs over lower gross sales.

| 22 |

Operating Expenses. Selling, general and administrative expenses were $41.4 million for fiscal 2013, an increase of $0.3 million, or 1%, from fiscal 2012. During fiscal 2013 we incurred approximately $0.7 million of one-time costs related to the acquisition of LCM.