☐ |

Preliminary proxy statement |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ |

Definitive proxy statement |

☐ |

Definitive additional materials |

☐ |

Soliciting material pursuant to Rule 14a-12 |

☒ |

No fee required. |

☐ |

Fee paid previously with preliminary materials. |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Table of Contents

Notice of Annual General Meeting of Shareholders

| Friday, June 21, 2024 8:30 a.m. Irish Standard Time |

70 Sir John Rogerson’s Quay Dublin 2, Ireland |

We are pleased to invite you to join the board of directors (the “Board” or the “Board of Directors”) and senior leadership at the Aon plc (“Aon” or the “Company”) annual general meeting of shareholders (the “Annual Meeting”) scheduled for Friday, June 21, 2024 at 8:30 a.m. Irish Standard Time.

Items of Business:

| 1. | By separate resolutions, to elect the 12 director nominees described in the proxy statement. |

| 2. | To approve by an advisory resolution the compensation of the Company’s named executive officers. |

| 3. | To ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm (“Ernst & Young US”) for the fiscal year ending December 31, 2024. |

| 4. | To re-appoint Ernst & Young Chartered Accountants as the Company’s statutory auditor |

| under Irish law (“Ernst & Young Ireland”), to hold office until the conclusion of the Company’s next annual general meeting. |

| 5. | To authorize the Board or the Audit Committee of the Board to determine the remuneration of Ernst & Young Ireland, in its capacity as the Company’s statutory auditor under Irish Law. |

| 6. | To authorize the Board to issue Class A Ordinary Shares under Irish Law. |

| 7. | To authorize the Board to opt-out of statutory pre-emption rights under Irish Law. |

Shareholders are strongly encouraged to vote their shares by proxy in advance of the Annual Meeting by one of the methods described on pages 77-78 of the proxy statement. Shareholders who wish to attend the Annual Meeting virtually may do so via webcast at meetnow.global/MLDMKCM, as further described on page 79 of the proxy statement. Note that attending the Annual Meeting virtually will not allow you to vote at the Annual Meeting. During the Annual Meeting, the Board will present, for consideration by the shareholders, the Company’s statutory financial statements under Irish law for the fiscal year ended December 31, 2023 (including the reports of the directors and the Irish statutory auditor thereon) and a review of the Company’s affairs. We urge you to read the attached proxy statement for additional information concerning the matters to be considered at the Annual Meeting. The proxy statement shall be deemed incorporated into this notice.

Holders of Class A Ordinary Shares at the close of business on April 12, 2024 can vote at the Annual Meeting. A shareholder of record entitled to attend and vote at the Annual Meeting may appoint one or more proxies to attend, speak, and vote on his or her behalf by any of the procedures set out below and on pages 77-78 of the proxy statement. A proxy holder need not be a shareholder of record. To be valid, a proxy must be received by the Company using one of such procedures no later than 5:00 pm (Irish Standard Time) on June 20, 2024, the proxy deadline.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held on June 21, 2024.

The proxy statement and our Annual Report for the fiscal year ended December 31, 2023 are available at www.envisionreports.com/AON. Our Irish financial statements will be mailed to shareholders of record and made available at www.envisionreports.com/AON at least 21 days prior to the Annual Meeting. This notice and proxy statement are first being mailed or made available to shareholders on or about April 29, 2024.

By Order of the Board of Directors,

Darren Zeidel

Company Secretary

April 29, 2024

Your vote is important

Only holders of Class A Ordinary Shares as of the record date April 12, 2024 can vote at the Annual Meeting. Please cast your vote as soon as possible in one of the following ways:

| Internet Online at www.envisionreports.com/AON and follow the instructions on your proxy card or notice of internet availability

|

| |

| Telephone

Call 1-800-652-VOTE (8683)

|

| |

| Mark, sign and date your proxy card or voting instruction form and return it in the postage-paid envelope

|

| |

If you are a beneficial owner, you should follow the directions provided by your broker, bank or other nominee. You may submit instructions by telephone or through the Internet to your broker, bank, or other nominee, or request and return a paper proxy card to your broker, bank, or other nominee.

Proxy Summary

Voting Matters

Shareholders are being asked to vote on the following matters at the Annual Meeting:

| Proposal | Our Board’s Recommendation | |

|

1. Resolutions Regarding the Election of Directors (page 8) The 12 nominees possess the necessary qualifications and diversity of perspectives to provide effective oversight of the Company. |

FOR each nominee | |

|

2. Advisory Resolution on Executive Compensation (page 26) The Company seeks a non-binding advisory vote to approve the compensation of its named executive officers. The Board values shareholders’ opinions, and the Organization and Compensation Committee will take into account the outcome of the advisory vote when making future executive compensation decisions.

|

FOR | |

| 3. Resolution to Ratify the Appointment of Independent Registered Public Accounting Firm (page 65) The Board believes that the continued retention of Ernst & Young US to serve as our independent registered accounting firm is in the best interests of the Company and its shareholders.

|

FOR | |

| 4. Resolution to Re-Appoint Ernst & Young Ireland as the Company’s Statutory Auditor Under Irish law (page 66) The Board believes that the continued retention of Ernst & Young Ireland to serve as our statutory auditor under Irish law from the conclusion of the Annual Meeting until the conclusion of the next annual general meeting of the Company is in the best interests of the Company and its shareholders.

|

FOR | |

| 5. Resolution to Authorize the Board or the Audit Committee of the Board to Determine the Remuneration of the Company’s Statutory Auditor Under Irish Law (page 66) We are asking our shareholders to authorize the Board or the Audit Committee to determine Ernst & Young Ireland’s remuneration as our statutory auditor under Irish law. |

FOR | |

|

6. Resolution to Authorize the Board to Issue Shares Under Irish Law (page 67) We are asking our shareholders to authorize the renewal of the Board’s authority to issue authorized but unissued shares and to grant rights to acquire such shares with the terms set forth in the proposal.

|

FOR | |

| 7. Resolution to Authorize the Board to Opt-Out of Statutory Pre-Emption Rights Under Irish Law (page 68) We are asking our shareholders to authorize the renewal of the Board’s current authority and power to opt-out of statutory pre-emption rights which are currently included in the Company’s Articles of Association. |

FOR | |

We are providing the enclosed proxy materials to you in connection with the solicitation by the board of directors (the “Board”) of Aon plc (“Aon” or the “Company”) of proxies to be voted at the annual general meeting of shareholders to be held on June 21, 2024 (the “Annual Meeting”), or any adjournment or postponement thereof. The Annual Meeting will be held at 70 Sir John Rogerson’s Quay, Dublin 2, Ireland. This proxy statement is first being mailed or made available to shareholders on or about April 29, 2024.

2024 Aon Proxy Statement 1

| Who We Are |

Aon is in the Business of Better Decisions

At Aon, we partner with our clients to help shape business decisions for the better. We give our clients the clarity and confidence to make better decisions that protect and grow their businesses.

At Aon, our values are the foundation of all we do. We are:

| • | Committed as one firm to our purpose |

| • | United through trust as one inclusive, diverse team |

| • | Passionate about making our colleagues and clients successful |

| What We Do |

Our Solutions

The end benefit of all that we do is enabling our clients to make better decisions to protect and grow their organizations.

Commercial Risk

Shifts in technology, economics and geopolitics are creating unprecedented volatility. We help clients identify, measure and manage their risk exposure.

Health

Health is declining, costs are rising and workers have vastly different needs. We help companies improve employee health and wellbeing while managing costs.

Reinsurance

Businesses, governments and communities need to become more resilient. Our expertise and insight help (re)insurers navigate uncharted territories and create more relevant solutions.

Wealth

Global business is becoming increasingly difficult to navigate. We help employers, fiduciaries and investment officers optimize results and provide a more secure future for their stakeholders.

ESG and Risk

Management of environmental, social and governance (ESG) risks is an increasingly important priority for our clients. We partner with our clients in offering solutions designed to address and manage ESG issues for our clients, including climate solutions to help assess, quantify and address risk.

As a professional services firm, Aon’s management and oversight of ESG risks is a priority. The Board (including through its committees) regularly reviews and discusses our ESG risks and opportunities, including Aon’s decarbonization and sustainability efforts and people-related risks, such as colleague satisfaction and engagement survey results, workforce diversity and inclusion, pay equity, colleague well-being and succession planning. We are committed to improving inclusion and wellbeing at Aon at all levels of our organization and have published our workforce diversity data in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023. We intend to make our EEO-1 Employer Information Summary Reports available on our website at www.aon.com. Our Board is committed to continued adherence to effective corporate governance best practices, including oversight of enterprise risk management.

2 2024 Aon Proxy Statement

2023 Highlights

In 2023, we delivered strong performance across each of our key metrics. We returned $3.2 billion of capital to shareholders through share repurchases and dividends, highlighting our strong cash flow generation and effective allocation of capital.

In assessing our performance, we focus on our performance against four non-GAAP metrics that we communicate to shareholders: organic revenue growth, adjusted operating margin, adjusted diluted earnings per share, and free cash flow. Management believes that these measures are important to make meaningful period-to-period comparisons and that this supplemental information is helpful to investors. Management also uses these measures to assess operating performance and performance for compensation. These non-GAAP metrics should be viewed in addition to, not instead of, our consolidated financial statements and notes thereto. A reconciliation of these non-GAAP metrics to the most directly comparable GAAP metrics is set forth in Appendix A to this proxy statement.

|

“Our strong performance in 2023 demonstrates how we are going further, faster with our 3x3 plan, which is an acceleration of our proven Aon United strategy.” |

| Greg Case, CEO

|

In 2023, we continued to deliver across these four metrics:

| • | Total revenue growth was 7% compared to 2022, reflecting organic revenue growth of 7%, driven by the ongoing strength of our Aon United strategy, and a 2% favorable impact from fiduciary investment income, partially offset by a 2% unfavorable impact from acquisitions, divestitures and other. |

| • | Operating margin was 28.3% and adjusted operating margin was 31.6%, driven by revenue growth outpacing expense growth and long-term investments. |

| • | Diluted earnings per share was $12.51 and adjusted diluted earnings per share was $14.14, reflecting strong operational performance and effective capital management, highlighted by $2.7 billion of share repurchases during 2023, partially offset by an unfavorable impact from higher non-cash pension expense and other non-operating expenses. |

| • | Cash flows provided by operating activities was $3.4 billion in 2023, an increase of $216 million, or 7%, from $3.2 billion in 2022, reflecting strong operating income growth and overall working capital optimization, partially offset by higher cash tax payments and a negative impact to working capital due to temporary invoicing delays associated with the implementation of a new system. Free cash flow was $3.2 billion in 2023, an increase of $160 million, or 5%, from $3.0 billion in 2022, reflecting an increase in cash flows from operations, partially offset by a $56 million increase in capital expenditures. |

2024 Aon Proxy Statement 3

Our Board of Directors

In January 2024, we announced that Jose Antonio Álvarez joined our Board effective January 24, 2024. Mr. Álvarez serves on the Audit Committee of the Board. In February 2024, we announced that Carolyn Y. Woo will be retiring from our Board effective at the Annual Meeting. Upon Dr. Woo’s retirement, our Board will be composed of 12 directors, 11 of whom are independent, including the Board Chair. It is a priority of the Governance/Nominating Committee to continue to identify candidates for the Board of Directors who have diverse backgrounds and bring fresh perspectives to the Board.

4 2024 Aon Proxy Statement

Directors

| Name | Age | Director Since |

Current Committee Membership | Other Boards† | ||||||

|

|

Lester B. Knight, Chair* | 65 | 1999 | Executive Committee - Chair Governance/Nominating Committee - Chair Inclusion & Wellbeing Sub-Committee |

— | |||||

|

|

Gregory C. Case, CEO | 61 | 2005 | Executive Committee Inclusion & Wellbeing Sub-Committee |

1 | |||||

|

|

Jose Antonio Álvarez* | 64 | 2024 | Audit Committee | 2 | |||||

|

|

Jin-Yong Cai* | 64 | 2016 | Finance Committee Organization and Compensation Committee |

2 | |||||

|

|

Jeffrey C. Campbell* | 63 | 2018 | Audit Committee - Chair Executive Committee Organization and Compensation Committee |

1 | |||||

|

|

Fulvio Conti* | 76 | 2008 | Audit Committee Executive Committee Finance Committee - Chair Governance/Nominating Committee |

1 | |||||

|

|

Cheryl A. Francis* | 70 | 2010 | Finance Committee Governance/Nominating Committee Inclusion & Wellbeing Sub-Committee - Chair Organization and Compensation Committee |

2 | |||||

|

|

Adriana Karaboutis* | 61 | 2022 | Audit Committee | 2 | |||||

|

|

Richard C. Notebaert* | 76 | 1998 | Executive Committee Finance Committee Governance/Nominating Committee Inclusion & Wellbeing Sub-Committee Organization and Compensation Committee - Chair |

— | |||||

|

|

Gloria Santona* | 73 | 2004 | Audit Committee Governance/Nominating Committee Inclusion & Wellbeing Sub-Committee |

— | |||||

|

|

Sarah E. Smith* | 65 | 2023 | Finance Committee | 1 | |||||

|

|

Byron O. Spruell* | 59 | 2020 | Audit Committee Inclusion & Wellbeing Sub-Committee Organization and Compensation Committee |

— | |||||

|

|

Carolyn Y. Woo*†† | 69 | 1998 | Audit Committee Organization and Compensation Committee |

— | |||||

* Independent Director

† Number of other public company directorships or listed business development company trusteeships

†† Dr. Woo is retiring effective at the Annual Meeting

2024 Aon Proxy Statement 5

Corporate Governance Highlights

Aon’s commitment to good corporate governance is integral to our business. Highlights of our strong corporate governance practices include:

|

Annual election of all directors

|

Separation of Board Chair and CEO

|

Strong Board oversight of risk management programs

| ||

|

12 of 13 directors are independent

|

Directors elected by a majority of votes cast in an uncontested election

|

Active shareholder engagement

| ||

|

Regular executive sessions of the Board and its committees

|

Shareholder ability to call a special meeting

|

Robust share ownership guidelines for directors and senior executives

| ||

|

Annual evaluation process for the Board, Committees, and individual directors

|

Corporate Governance Guidelines include limitations on “overboarding”

|

Comprehensive director orientation program

| ||

2023 Executive Compensation Highlights

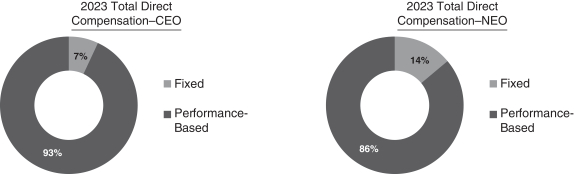

The core principle of our executive compensation program continues to be pay for performance, as we continue towards our goal of being the leading global professional services firm focused on risk, health, and wealth.

Leadership Performance Program. In early 2024, we settled performance share units (“PSUs”) granted to our NEOs in 2021 under our sixteenth LPP cycle (“LPP 16”). The settlement of those units in Class A Ordinary Shares was contingent upon achieving adjusted diluted earnings per share of at least $31.23 (threshold performance) over the performance period from January 1, 2021 to December 31, 2023, and reflects achievement of adjusted diluted earnings per share of $38.75, which exceeded the stretch performance level adjusted diluted earnings per share of $35.72. In 2023, we granted PSUs under our eighteenth LPP cycle (“LPP 18”) to each of our NEOs, which are expected to be settled in 2026 contingent upon the Company’s adjusted diluted earnings per share performance over the January 1, 2023 to December 31, 2025 performance period.

Annual Incentive Compensation. Annual incentives paid to our NEOs reflected our application of the incentive pool funding guidelines adopted by the Organization and Compensation Committee (the “Compensation Committee”), as well as the committee’s evaluation of each NEO’s contributions to our business and financial results, delivery of key strategic initiatives, and personal leadership qualities. The incentive pool funding guidelines included both a comparison of current year adjusted operating income results against the prior year and a People & Culture component, which assessed the Company’s progress on inclusion and diversity objectives. Annual incentives for 2023 were awarded to our NEOs in early 2024 following the Company’s achievement of adjusted operating income of $4,223 million. As part of the annual review process, Mr. Case proposed to the Compensation Committee that he and the other participants in the Senior Executive Incentive Compensation Plan receive annual incentives below the target amounts for fiscal 2023. Following their review of individual NEO performance and total incentive compensation outcomes, the Compensation Committee (and the independent members of the Board, in the case of Mr. Case) determined that each NEO receive 68% of his or her target annual incentive, other than Mr. Zeidel, who received an annual incentive of 96% of his target. For 2023, annual incentive awards to our NEOs were paid out entirely in PSUs, vesting on similar terms as LPP 19 awards, subject in addition to attainment of a share price hurdle, except that Mr. Zeidel received a portion ($250,000) of his earned annual incentive in cash.

6 2024 Aon Proxy Statement

Compensation-Related Best Practices

Our compensation philosophy and related governance features are complemented by several policies and practices designed to align our executive compensation program with the long-term interests of our shareholders, including the following:

|

Robust share ownership guidelines for senior executives and directors

|

Clawback and forfeiture provisions in the event of fraud or a material violation of Company policies

|

Annual say-on-pay vote for shareholders

| ||

|

Robust annual risk assessment of compensation programs, policies and practices

|

Inclusion & Diversity performance metric for determining executive annual incentives

|

Prohibition on hedging transactions by all employees and directors; prohibition on pledging by executive officers and directors

| ||

|

Pay for performance philosophy weighted towards variable at-risk performance-based compensation |

No dividends or dividend equivalents on unvested performance share awards |

Effective balance between differentiated short-term and long-term performance factors and incentives

| ||

2024 Aon Proxy Statement 7

Proposal 1 — Election of Directors

|

|

The Board of Directors unanimously recommends that shareholders vote “FOR” each nominee to serve as director. |

What am I voting on?

The current members of the Board, other than Carolyn Y. Woo, who has decided to retire from the Board, are standing for election, in each case to serve until our 2025 annual general meeting. The 12 directors who are standing for election are named below.

The Governance/Nominating Committee of the Board (the “Governance/Nominating Committee”) has recommended to the Board that each director be nominated. With respect to Mr. Case, his employment agreement provides that he will be nominated for election as a director at each annual general meeting of shareholders during the period of his employment. All nominees for director have consented to being named in this proxy statement and have agreed to serve as directors if re-elected. We have no reason to believe that any of the nominees will not be available to serve as a director. However, if any nominee should become unavailable to serve for any reason, the proxies may be voted for such substitute nominees as may be designated by the Board, or the Board may reduce its size.

The term of each director expires at the next annual general meeting of shareholders, and each director will continue in office until the election of his or her respective successor or until his or her earlier resignation or removal in accordance with the Company’s articles of association (the “Articles”) or the Irish Companies Act 2014, as amended (the “Irish Companies Act”). Consistent with the terms of the Articles, the Board currently is authorized to have up to 21 directors, and the number of directors was most recently set by the Board at 13. Carolyn Y. Woo has decided to retire from the Board effective at the Annual Meeting. Following Dr. Woo’s retirement, the Board expects to reduce the size of the Board to 12. Due to Dr. Woo’s retirement, there are fewer director nominees named in the proxy statement than the number fixed pursuant to the Company’s Articles. Proxies cannot be voted for a greater number of persons than the number of nominees named.

Our governing documents provide that a director nominee be elected by a majority of votes cast in an uncontested election. If an incumbent director nominee fails to receive a majority of the votes cast in an election that is not a contested election, the director must offer to tender a resignation, and the Board shall decide, through a process managed by the Governance/Nominating Committee, whether to accept or reject the resignation or whether other action shall be taken. In reaching its decision, the Governance/Nominating Committee and the Board may consider any factors they deem appropriate and relevant. The Board will act on the recommendation of the Governance/Nominating Committee at its next regularly scheduled meeting and will promptly disclose the rationale for its decision in a Form 8-K furnished to the SEC. A shareholder may: (i) vote for the election of a nominee; (ii) vote against the election of a nominee; or (iii) abstain from voting on a nominee. Unless an executed proxy contains instructions to the contrary, it is assumed that the proxy will be voted “FOR” the re-election of each nominee named on the following pages.

The form of shareholder resolution for this proposal is below:

|

|

RESOLVED THAT, the following individuals be, and each hereby is, by way of separate ordinary resolution, re-elected to serve as director until the election of his or her respective successor or until his or her earlier removal or resignation pursuant to the Articles or the Irish Companies Act:

|

| ||||

| Lester B. Knight

Jose Antonio Álvarez

Jin-Yong Cai

Jeffrey C. Campbell

Gregory C. Case

Fulvio Conti

|

Cheryl Francis

Adriana Karaboutis

Richard C. Notebaert

Gloria Santona

Sarah E. Smith

Byron O. Spruell

|

|||||

Aon values a number of attributes and criteria when identifying nominees to serve as a director, including professional background, expertise, reputation for integrity, business, financial and management experience, leadership capabilities, and diversity. We believe all of the nominees are individuals with a reputation for integrity, demonstrate strong leadership capabilities, and are able to work collaboratively to make contributions to the Board and management. Biographical information about the nominees and the experience, qualifications, attributes, and skills considered by our Governance/Nominating Committee and the Board in determining that the nominees should serve as a director appears below.

8 2024 Aon Proxy Statement

Director Nominee Bios

|

|

Committees: • Executive Committee (Chair) • Governance/Nominating Committee (Chair) • Inclusion & Wellbeing Sub-Committee

Director Since: 1999

Age: 65

|

|

|

Lester B. Knight

Mr. Knight is a Founding Partner of RoundTable Healthcare Partners and the former Vice Chairman and director of Cardinal Health, Inc., a diversified healthcare service company. Mr. Knight was Chairman of the Board and Chief Executive Officer of Allegiance Corporation from 1996 until February 1999, and had been with Baxter International, Inc. from 1981 until 1996, where he served as Corporate Vice President from 1990, Executive Vice President from 1992 and as a director from 1995. Mr. Knight became Chairman of the Board of Directors of Aon in August 2008. He is a life director of NorthShore University Health System and Junior Achievement of Chicago, a life Trustee of Northwestern University and a member of the Civic Committee of The Commercial Club of Chicago.

Skills & Qualifications: Mr. Knight’s experience as the founder of a private equity firm focused on investing in the healthcare industry, his executive background at several leading healthcare companies, and his financial and investment expertise provides the Board with executive leadership and oversight experience. In addition, his role in chairing our Governance/Nominating Committee and his previous leadership and Board experience at other public companies position him to effectively lead the Board. Mr. Knight provides valuable perspectives with his broad experience in corporate governance, strategic transactions, business transformation and growth and oversight. |

|

|

Committees: • Executive Committee • Inclusion & Wellbeing Sub-Committee

Director Since: 2005

Age: 61

|

|

|

Gregory C. Case

Mr. Case has served as Chief Executive Officer and a director of Aon since April 2005. Mr. Case served as Aon’s President from 2005 to 2018. Prior to joining Aon, Mr. Case was with McKinsey & Company, the global management consulting firm, for 17 years where he served on the governing Shareholders’ Council and as head of the Global Insurance and Financial Services Practice. Prior to joining McKinsey, Mr. Case was with the investment banking firm of Piper, Jaffray and Hopwood and the Federal Reserve Bank of Kansas City. Mr. Case is a director of Discover Financial Services.

Skills & Qualifications: As Chief Executive Officer of Aon, Mr. Case brings to the Board his day-to-day experiences leading Aon’s colleagues serving clients across Commercial Risk, Reinsurance, Health, and Wealth solution lines, and his intimate knowledge of Aon’s business and operations. Mr. Case’s background as a management consultant, including in the global insurance and financial services areas, brings critical industry and business development knowledge to the Board. His extensive and specific knowledge of Aon and its businesses enables him to keep the Board apprised of the most significant developments impacting the Company and to guide the Board’s discussion and review of the Company’s strategy. |

2024 Aon Proxy Statement 9

|

|

Committees: • Audit Committee

Director Since: 2024

Age: 64

|

|

|

Jose Antonio Álvarez

Mr. Álvarez is the former Chief Executive Officer of Banco Santander, S.A., a Spanish multinational financial services company, and currently serves as Vice Chair and a non-executive director of Santander. Mr. Álvarez first joined Santander in 2002 and served as Executive Vice President and Chief Financial Officer from 2004 to 2014. In 2015, Mr. Álvarez was appointed Chief Executive Officer of Santander and served in that role until his retirement in 2022.

Mr. Álvarez previously served as a member of the supervisory boards of Santander Consumer Bank AG, Santander Consumer Holding GmbH and Santander Bank Polska, S.A., and as a director of SAM Investments Holdings Limited, Santander Consumer Finance, S.A. and Santander Holdings USA, Inc. In addition, Mr. Álvarez previously served as a board member of Bolsas y Mercados Españoles, S.A. Mr. Álvarez is currently Vice Chair and a non-executive director of Banco Santander (Brasil) S.A.

Skills & Qualifications: Mr. Álvarez’s experience as former Chief Executive Officer, and previously Chief Financial Officer, of a multinational financial services company provides the Board with deep knowledge and expertise in international finance, and unique insights into emerging and global markets and investments. In addition, as a member and prior member of the board of directors of several international companies that invest globally, Mr. Álvarez brings substantive expertise in business strategy in international markets, as well as business transformation and risk management, to the Board. Mr. Álvarez’s extensive financial background and experience has led the Board to determine that he is an “audit committee financial expert” as defined by the Securities and Exchange Commission (the “SEC”). |

|

|

Committees: • Finance Committee • Organization and Compensation Committee

Director Since: 2016

Age: 64

|

|

|

Jin-Yong Cai

Mr. Cai is a Partner at Global Infrastructure Partners, a global private equity investment firm. Prior to his current position, Mr. Cai was a Partner at TPG Capital, L.P., a global private equity investment firm. From 2012 to 2016, Mr. Cai was the Chief Executive Officer of the International Finance Corporation, a member of the World Bank Group and the largest global development institution focused on private sector development. Before the International Finance Corporation, Mr. Cai worked in the financial services industry for nearly two decades, including 12 years with Goldman Sachs Group, as a Partner and its top executive in China. He began his career at the World Bank Group. Mr. Cai is a director of PetroChina Company Limited and Syngenta Group.

Skills & Qualifications: Mr. Cai’s experience in global finance and international business, particularly in the Asia-Pacific region, enhances the Board’s global perspectives. Mr. Cai’s increased level of financial literacy and extensive background with international finance and global management, including areas relating to investment banking and private equity, provide valuable perspective and knowledge relating to financial risk and risks related to the Company’s international activities and growth strategies. |

10 2024 Aon Proxy Statement

|

|

Committees: • Audit Committee (Chair) • Executive Committee • Organization and Compensation Committee

Director Since: 2018

Age: 63

|

|

|

Jeffrey C. Campbell

Mr. Campbell served as Chief Financial Officer of American Express Company, from July 2013 until August 2023, and as Vice Chairman from April 2021 to March 2024. From 2004 to 2013, Mr. Campbell served as Executive Vice President and Chief Financial Officer at McKesson Corporation, a leading healthcare services, information technology and distribution company. Prior to his time at McKesson, Mr. Campbell spent 13 years at AMR Corporation and its principal subsidiary, American Airlines, ultimately becoming its Chief Financial Officer in 2002. He serves as the Lead Director and Chair of the Audit Committee of Hexcel Corporation. Mr. Campbell is also a board member of The Julliard School and the Lincoln Center for the Performing Arts, and is the Chair of the Lincoln Center Corporate Fund.

Skills & Qualifications: Having served as chief financial officer of three multinational, publicly traded companies, Mr. Campbell adds financial expertise and risk management leadership to the Board. His significant business experience, deep financial acumen and leadership in the development of diverse talent provide the Board and its committees with valuable management perspective. He also brings to the Board substantial experience in the areas of compliance, risk oversight, corporate finance and strategy, as well as knowledge and experience relating to the financial services sector. This experience has also led the Board to determine that Mr. Campbell is an “audit committee financial expert” as defined by the SEC. |

|

|

Committees: • Finance Committee (Chair) • Audit Committee • Executive Committee • Governance/Nominating Committee

Director Since: 2008

Age: 76

|

|

|

Fulvio Conti

Mr. Conti served as Chairman of TIM SpA, a leader in the telecommunications market in Italy, from May 2018 to September 2019. He served as Chief Executive Officer and General Manager of Enel SpA, Italy’s largest power company, from May 2005 to May 2014. From 1999 until 2005, he served as Chief Financial Officer of Enel. Mr. Conti has a financial and industrial career spanning over 40 years. Prior to joining Enel, SpA, he was the Chief Financial Officer and general manager of Ferrovie dello Stato SpA and Telecom Italia SpA. From 1970 to 1990, he held many roles at Mobil Oil Corporation in Italy and other countries, including as Chief Financial Officer of Mobil Oil Europe and Chief Operating Officer of Mobil Plastics Europe. From 1991 to 1995, Mr. Conti was Chief Financial Officer of Montedison-Compart, SpA. Mr. Conti currently serves as Chairman of Innova Italy Srl, Chairman of SGI SpA (Societa’ Gasdotti ltalia SpA), and chairman of Fondo Italiano Efficienza Energetica (FIEE SGR SpA). In addition, Mr. Conti serves as a director of Take Off SpA. Mr. Conti previously served as a non-executive director of Barclays plc, RCS Mediagroup and director of the Italian Institute of Technology as well as Unidad Editorial SA. In 2009, he was appointed “Cavaliere del Lavoro” of the Italian Republic and in December of that year he became “Officier de la Légion d’Honneur” of the French Republic.

Skills & Qualifications: Mr. Conti’s background as a chief executive officer and chief financial officer of a large international energy company, his familiarity with international business and finance activities, particularly in the European Union, and his global financial and management experience bring financial expertise and global leadership to the Board. In addition, Mr. Conti’s background as a chief financial officer of a multinational utility provides a knowledgeable resource on matters relating to financial reporting and treasury. His experience has also led the Board to determine that Mr. Conti is an “audit committee financial expert” as defined by the SEC. |

2024 Aon Proxy Statement 11

|

|

Committees: • Inclusion & Wellbeing Sub-Committee (Chair) • Finance Committee • Governance/Nominating Committee • Organization and Compensation Committee

Director Since: 2010

Age: 70

|

|

|

Cheryl A. Francis

Ms. Francis served as Executive Vice President and Chief Financial Officer of R.R. Donnelley & Sons Co., a publicly traded print media company, from 1995 until 2000. Since 2000, Ms. Francis has served as a business consultant and, since August 2008, as Co-Chair of the Corporate Leadership Center. From 2002 until 2008, she served as Vice Chairman of the Corporate Leadership Center. Prior to her role at R.R. Donnelley, Ms. Francis served on the management team of FMC Corporation and its subsidiary, FMC Gold, including serving as Chief Financial Officer of FMC Gold from 1987 through 1991, and Treasurer of FMC Corporation from 1993 through 1995. She was also an adjunct professor for the University of Chicago Graduate School of Business from 1991 through 1993. Ms. Francis currently serves as a director of HNI Corporation and Morningstar, Inc., and previously served as a director of Hewitt Associates, Inc. from 2002 until the Company’s acquisition of Hewitt Associates, Inc. in 2010.

Skills & Qualifications: Ms. Francis’s background as a chief financial officer of a large publicly traded company provides the Board with an increased level of financial literacy. In addition, her role as a Board member of other public companies provides valuable perspective on matters of risk oversight, corporate governance and strategy. As Co-Founder of the Corporate Leadership Center’s CEO Perspectives and Leading Women Executives, Ms. Francis is a leading voice on inclusion and leadership development. |

|

|

Committees: • Audit Committee

Director Since: 2022

Age: 61

|

|

|

Adriana Karaboutis

From 2017 to August 2023, Ms. Karaboutis served as Chief Information and Digital Officer of National Grid PLC, one of the world’s largest public utility companies focused on transmitting and distributing electricity and gas in the UK and northeast US. She previously served as Executive Vice President, Technology, Business Solutions and Corporate Affairs at Biogen Inc., a global biotechnology company, from September 2014 to March 2017. In that role, she introduced leading digital and data science capabilities that unlocked value across the drug discovery, development, and delivery processes. From December 2015, she also oversaw global public affairs, government affairs, public policy and patient advocacy. From March 2010 to September 2014, Ms. Karaboutis was Vice President and Global Chief Information Officer of Dell, Inc., a global technology company. Ms. Karaboutis previously spent more than 20 years at General Motors Company and Ford Motor Company in various international leadership positions, including global production planning, computer-integrated manufacturing, supply chain operations and information technology. Ms. Karaboutis serves as a director of Perrigo Company plc, a global over-the-counter consumer goods and pharmaceutical company, and Savills plc, a British real estate services company. She previously served on the boards of directors of Aspen Technology, Advance Auto Parts and Blue Cross Blue Shield of Massachusetts.

Skills & Qualifications: Ms. Karaboutis’ background as a chief information officer for a public utility company and a global technology company provides the Board with valuable insight and experience in technology, cybersecurity, data privacy and data security matters. In addition, Ms. Karaboutis’ experience in developing and delivering digital solutions and data science capabilities enhances the Board’s perspective in innovative strategies. Ms. Karaboutis’ role as a current and former board member of multiple public companies provides valuable perspective on matters of risk oversight, corporate governance and executive management. |

12 2024 Aon Proxy Statement

|

|

Committees: • Organization and Compensation Committee (Chair) • Executive Committee • Finance Committee • Governance/Nominating Committee • Inclusion & Wellbeing Sub- Committee

Director Since: 1998

Age: 76

|

|

|

Richard C. Notebaert

From June 2002 until August 2007, Mr. Notebaert served as Chairman and Chief Executive Officer of Qwest Communications International Inc., a leading provider of broadband Internet-based data, voice and image communications. He previously served as President and Chief Executive Officer of Tellabs, Inc., which designs and markets equipment to providers of telecommunications services worldwide, from August 2000 to June 2002, and as a director of Tellabs from April 2000 to June 2002. He served as Chairman of the Board and Chief Executive Officer of Ameritech Corporation, a full-service communications company, from 1994 until 1999. Mr. Notebaert first joined Ameritech Communications in 1983 and served in significant positions within the Ameritech organization before his election as Vice Chairman in January 1993, President and Chief Operating Officer in June 1993 and President and Chief Executive Officer in January 1994. Mr. Notebaert is a Trustee Emeritus of the Board of Trustees of the University of Notre Dame. Mr. Notebaert previously served as a director of American Electric Power and Cardinal Health, Inc., and as Chairman of the Board of Trustees of the University of Notre Dame.

Skills & Qualifications: Mr. Notebaert’s background as a chairman and chief executive officer of several large international communications companies provides the Board with substantial management expertise, including in the areas of global operations, technology and innovation and strategic planning. In addition, Mr. Notebaert’s executive and board leadership experience provides valuable perspectives on matters of risk oversight, corporate governance and executive management. |

|

|

Committees: • Audit Committee • Governance/Nominating Committee • Inclusion & Wellbeing Sub-Committee

Director Since: 2004

Age: 73

|

|

|

Gloria Santona

Ms. Santona served as Of Counsel at Baker McKenzie, an international law firm, from 2018 to 2022. Prior to Baker McKenzie, Ms. Santona served as Executive Vice President, General Counsel and Secretary of McDonald’s Corporation from 2001 to 2017 when she retired. After joining McDonald’s in 1977, Ms. Santona held positions of increasing responsibility in the legal department, serving as U.S. General Counsel from December 1999 to June 2001 and corporate General Counsel from 2001 to 2017. She is a member of the Board of Trustees of Rush University Medical Center and former member of the Board of Directors of the American Society of Corporate Secretaries, the Association of Corporate Counsel and the Minority Corporate Counsel Association. Ms. Santona is also a former member of the Board of Trustees of the Chicago Zoological Society and the Chicago Symphony Orchestra, and the Board of Directors of The Chicago Network, the Chicago Food Depository and the National Immigrant Justice Center.

Skills & Qualifications: Ms. Santona’s legal background, including her experience serving as a general counsel and secretary of a large international corporation, brings critical perspective to the Board and enhances the Board’s global risk oversight capabilities. Ms. Santona’s diverse legal background contributes corporate governance, legal, regulatory and compliance expertise and further brings valuable perspective on long-term growth strategy planning. Under Ms. Santona’s leadership, McDonald’s legal department won numerous awards for its commitment to inclusivity and pro bono, and Ms. Santona’s continuing service and leadership at non-profit organizations deepens the Board’s expertise on social and governance priorities. |

2024 Aon Proxy Statement 13

|

|

Committees: • Finance Committee

Director Since: 2023

Age: 65

|

|

|

Sarah E. Smith

Ms. Smith is a former member of the Management Committee of The Goldman Sachs Group, Inc., a global investment banking, securities and investment management firm. Ms. Smith joined Goldman Sachs in 1996 and was named Managing Director in 1998 and Partner in 2002. During her tenure, Ms. Smith served as the Controller and Chief Accounting Officer of the firm until 2017, and subsequently as the Chief Compliance Officer from 2017 to 2020. Ms. Smith then served as Senior Advisor to Goldman Sachs from 2020 until her retirement in 2021. Prior to joining Goldman Sachs, Ms. Smith worked in the National and Audit practices of KPMG in both London and New York and held several finance positions at Bristol-Myers Squibb. Ms. Smith is a member of the Board of Trustees of the Financial Accounting Foundation since September 2020. Ms. Smith attended City of London University (Dip. Acc), and is a Fellow of the Institute of Chartered Accountants in England and Wales. Ms. Smith serves as a Trustee of the Nuveen Churchill Private Capital Income Fund and as a board member for three private companies: Klarna Bank A.B., Via Transportation and 98point6.

Skills & Qualifications: Ms. Smith’s background as a chief accounting officer and chief compliance officer provides the Board with an increased level of financial literacy and enhances the Board’s expertise in the oversight of risk management and compliance. In addition, Ms. Smith’s experience in the investment banking and asset management industries brings valuable insight to the Company’s business operations in professional and financial services. |

|

|

Committees: • Audit Committee • Organization and Compensation Committee • Inclusion & Wellbeing Sub-Committee

Director Since: 2020

Age: 59

|

|

|

Byron O. Spruell

Mr. Spruell is the President of League Operations at the National Basketball Association, a position he has held since August 2016. Prior to joining the National Basketball Association, Mr. Spruell spent 20 years at Deloitte LLP, most recently as its Vice Chairman, Central Region Marketplace Leader and Chicago Managing Principal. He serves on several non-profit boards, including the University of Notre Dame Board of Trustees, the Museum of Science and Industry, Metropolitan Family Services in Chicago and the Jackie Robinson Foundation.

Skills & Qualifications: Mr. Spruell’s background in a professional services firm and as a current executive at the National Basketball Association provides the Board with valuable experience in operations management, agility, talent development, application of analytics and innovation, business continuity and colleague health and wellness. Mr. Spruell’s experiences at Deloitte LLP and as Chair of the Audit Committee of the University of Notre Dame’s Board of Trustees further elevates the Board’s financial and accounting expertise. Additionally, Mr. Spruell’s service on non-profit boards enhances the Board’s perspectives around community engagement and social impact. |

14 2024 Aon Proxy Statement

Corporate Governance

We are committed to effective corporate governance, which we believe helps us sustain our success and build long-term value for our shareholders and other stakeholders. Aon’s Corporate Governance Guidelines provide the framework for our system of corporate governance, which, together with our committee charters and Code of Business Conduct, set forth standards of conduct for employees, officers and directors. The Board and its committees provide oversight of Aon’s overall performance, strategic direction, and executive management team performance, including management of the Company’s top risks and mitigation plans. The Board also reviews major initiatives and transactions and advises on key financial and business matters. The charter of each standing committee and sub-committee, the Corporate Governance Guidelines, and the Code of Business Conduct are available on the corporate governance section of our website at http://www.aon.com/about-aon/corporate-governance/corporate-governance.jsp. For more information about our Board’s and management’s oversight of risk, including oversight of key ESG risks, please see “Board Role in Risk Oversight” below.

| Corporate Governance Best Practices | ||

|

|

Board Independence. All of our directors are independent, with the exception of our Chief Executive Officer.

| |

|

|

Independent Chair. We have had an independent chair Board leadership structure since 2008. | |

|

|

Inclusion & Wellbeing Sub-Committee. The Inclusion & Wellbeing Sub-Committee of the Governance/Nominating Committee helps to ensure focused evaluation, oversight and management of Aon’s inclusion and wellbeing strategies and initiatives. | |

|

|

Annual Elections with Majority Voting. Directors are elected annually by a majority of votes cast in an uncontested election. | |

|

|

Robust Year-Round Shareholder Engagement Program. Aon seeks input from shareholders to better understand shareholder perspectives on long-term strategy, governance, executive compensation and other topics. | |

|

|

Annual Board, Committee and Director Peer Evaluations. Annually, Aon’s directors review and complete evaluations on Board effectiveness, committee performance and individual peer assessment. | |

|

|

Shareholder Right to Call a Special Meeting. Our shareholders owning 10% of our shares may request that the company call an extraordinary general meeting, in accordance with the requirements of the Irish Companies Act. | |

|

|

Share Ownership Guidelines. We maintain robust share ownership guidelines for our directors and senior executives. | |

|

|

Executive Sessions. Our independent directors meet regularly in executive sessions. | |

|

|

Prohibitions on Hedging and Pledging Company Shares. Our Board has adopted an insider trading policy which, among other things, specifically prohibits all employees and directors from engaging in short sales, publicly traded options, puts and calls, forward sale contracts and other swap, hedging and derivative transactions relating to our securities. The policy also specifically prohibits our executive officers and directors from holding our securities in margin accounts or pledging our securities as collateral for a loan.

| |

Board Leadership Structure

The positions of Chief Executive Officer and Chair of the Board are currently held by separate individuals. Lester Knight has served as the Non-Executive Chair of the Board since 2008. The position of Non-Executive Chair is independent from management. As Non-Executive Chair, in addition to serving as liaison between the Board and management, Mr. Knight sets the agendas for, and presides over, the Board meetings and also chairs executive sessions of the non-management directors. Our Chief Executive Officer is also a member of the Board and participates in its meetings. The Board believes the separation of the positions of Chief Executive Officer and Chair is the appropriate structure at this time as it allows our Chief Executive Officer to focus on the management of the Company and the Chair to ensure that the Board is focused on its oversight responsibilities, including independent oversight of management, and best serves the company and its shareholders. The structure facilitates robust communications between management and the Board and provides effective oversight by independent directors, including oversight of risks. The Board regularly assesses its leadership structure from time to time to ensure that the leadership structure is the most appropriate for the Company.

2024 Aon Proxy Statement 15

Board Role in Risk Oversight

Risk is inherent and evolving in every business, and how well a business manages risk can ultimately determine its success. Our enterprise risk management (“ERM”) program covers the range of material risks to Aon, including strategic, operational, financial, compliance, human capital, technology, security and ESG risks (including climate and human capital management risks). The Board oversees Aon’s risk management program and allocates certain oversight responsibilities to its committees or any sub-committee, as appropriate. Each committee regularly reports to the Board on risk matters under its purview. The Board and its committees regularly review our risk management policies, processes and controls.

Management carries out the daily processes, controls, and practices of our risk management program, many of which are embedded in our operations. In addition, as part of our ERM process, management identifies, assesses, prioritizes, and develops mitigation plans for Aon’s top risks. The Board believes that establishing the right tone at the top and maintaining full and open communication between management and the Board are essential for effective risk management and oversight. As such, the Board and the committees regularly review and discuss with management the Company’s risk landscape, ERM governance, and progress on key risk management priorities, including emerging risks associated with growth initiatives and changing geopolitical and macroeconomic conditions. Throughout the year, the Board and the committees review the Company’s management of risk, including but not limited to the areas of cybersecurity and data security, data privacy, business continuity, compliance with government regulations, errors & omissions claims, financial performance, liquidity, taxes, mergers and acquisitions, and human capital management.

In addition, members of senior management attend Board and committee meetings (including private sessions with independent directors when invited) and are available to address any questions or concerns raised by the Board related to risk management and any other matters. For more information on committee responsibilities with respect to risk oversight, please see the section titled “Board of Directors and Committees” below.

Cybersecurity, Data Security, and Data Privacy Risk Management and Board Oversight

Cybersecurity, data security, and data privacy matters are an important focus of our Board’s oversight of risk. The Company’s management, including the Chief Security Officer (CSO), regularly presents (no less than twice annually) to the Audit Committee of the Board regarding cybersecurity, data security, and data privacy matters.

Aon strives to protect the personal and confidential data of our clients and our colleagues. To do so, Aon engages in a risk-based approach to adopting and implementing appropriate technical, organizational, administrative, and physical safeguards for cybersecurity. Aon has established a Global Privacy Office led by a Chief Privacy Officer and comprised of full-time privacy professionals located around the globe, responsible for implementing Aon’s data privacy program, and designing and developing data privacy compliance solutions. In addition, Aon maintains a Global Security Services organization, led by a CSO, with dedicated security personnel responsible for protecting Aon’s people, property and information. Refer to Part I, Item 1C of Aon’s Annual Report on Form 10-K for the year ended December 31, 2023, for further information regarding Aon’s cybersecurity and risk management.

Oversight of ESG Risks and Opportunities

Our Board and management recognize that the full spectrum of ESG risks are evolving in their significance to the business, and accordingly, oversight of ESG risks is a continuing and dynamic commitment. The Board reviews Aon’s ESG and climate strategy and, more generally, the Board (including through its committees) oversees the company’s ESG risks and opportunities, including human capital management, governance, climate, executive compensation, inclusion and data security and privacy. The full Board (or its committees) regularly reviewed and discussed people-related risks and opportunities, including colleague satisfaction and engagement survey results, pay equity, colleague wellbeing, succession planning, employment law matters and ethics matters. The full Board reviewed progress against Aon’s inclusion and wellbeing strategy and initiatives. For more information on Aon’s ESG efforts, please see our latest Aon Impact Report, which can be found on the Company’s website, www.aon.com. The information in the Aon Impact Report or otherwise on the Company’s website is not incorporated by reference into, and does not form part of, this proxy statement.

16 2024 Aon Proxy Statement

Director Independence

Aon’s Corporate Governance Guidelines require that a majority of directors meet the independence requirements of NYSE. The Corporate Governance Guidelines further provide that each of the Audit Committee, Governance/Nominating Committee and Compensation Committee be composed entirely of independent directors.

The Board has affirmatively determined that each nominee for director other than Mr. Case is independent. Mr. Case is considered a management director because of his position as our Chief Executive Officer. In addition, the Board has affirmatively determined that J. Michael Losh, who retired as a director effective as of June 16, 2023, was independent during the time he served on the Board and that Dr. Woo, who will be retiring from the Board effective as of the Annual Meeting, is independent.

In determining that each of the non-management directors is independent, the Board also considered the following relationships that it deemed were immaterial to such director’s independence:

| • | With respect to Mr. Knight, Mr. Campbell, Ms. Karaboutis, and Mr. Spruell, the Board considered that, in the ordinary course of business, Aon has sold services to, or received services from, a company or other entity at which the director is (or during 2023 was) an employee and the amount that we received from or paid to the entity in any of the previous three fiscal years was below the greater of $1 million or two percent (2%) of that entity’s annual revenue; and |

| • | With respect to Mr. Knight, Mr. Álvarez, Ms. Francis, Mr. Notebaert, Ms. Santona, and Mr. Spruell, the Board considered that Aon or certain of its affiliates made charitable contributions in 2023 to organizations in which the director or the director’s spouse was an officer, director, or trustee. In each case, the amount that we contributed was below the greater of $1 million or two percent (2%) of that organization’s consolidated gross revenue. |

Board of Directors and Committees

The Board met six times in 2023. All nominees for director who served as a director in 2023 attended at least 75% of the total meetings of the Board and the standing committees and sub-committees on which they served during the period for which they served. In accordance with NYSE rules and the Governance Guidelines, non-management directors meet regularly in executive session without management. Mr. Knight, the Non-Executive Chair, chairs these executive sessions.

The Board has five standing committees: the Executive Committee, the Audit Committee, the Finance Committee, the Governance/Nominating Committee and the Compensation Committee. The Board has also established the Inclusion & Wellbeing Sub-Committee as a standing sub-committee of the Governance/Nominating Committee. The Board previously maintained a Compliance Sub-Committee of the Audit Committee. In February 2024, the Compliance Sub-Committee was dissolved, and its responsibilities reverted to the Audit Committee.

2024 Aon Proxy Statement 17

Executive Committee

When the Board is not in session, the Executive Committee is empowered to exercise the power and authority in the management of the business and affairs of Aon as would be exercised by the Board, subject to certain exceptions.

Audit Committee

The Company has a separately-designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The primary purposes of the Audit Committee are to assist the Board with the oversight of: (i) the integrity of Aon’s financial statements, financial reporting process and internal controls; (ii) Aon’s compliance with legal and regulatory requirements and compliance and ethics programs, policies and procedures; (iii) the engagement of Aon’s independent auditor and its qualifications, independence and performance; (iv) subject to the provisions of Irish law, the appointment and performance of Aon’s statutory auditor as required under Irish law; and (v) the performance of Aon’s internal audit function. The Audit Committee is authorized to retain outside counsel or other experts as it deems appropriate to carry out its duties and responsibilities.

The Board has also delegated to the Audit Committee the primary responsibility for the oversight of the Company’s risk management. The Audit Committee reviews and discusses with management Aon’s guidelines and policies with respect to risk assessment and enterprise risk management, including the major financial risk exposures facing the Company and the steps management has taken to monitor and control such exposures. The Audit Committee also has primary responsibility for oversight of cybersecurity risk and engages in regular discussion with management regarding cybersecurity risk mitigation and incident management. The Audit Committee also has general oversight responsibility for the Company’s legal, regulatory, and ethics policies and programs and annually reviews the adequacy of those policies and programs, including Aon’s Code of Business Conduct. In addition, the Audit Committee periodically reviews with management any material correspondence with, or other action by, regulators or governmental agencies.

The current members of the Audit Committee are Jeffrey C. Campbell, Jose Antonio Álvarez, Fulvio Conti, Adriana Karaboutis, Gloria Santona, Byron O. Spruell and Carolyn Y. Woo. In 2023, the Audit Committee met nine times. The Board has determined that each of the members of the Audit Committee is independent as defined by the rules of the NYSE and under the Company’s categorical independence standards, as well as Rule 10A-3 under the

Exchange Act. In addition, as required by the rules of the NYSE, the Board has determined that all of the Audit Committee members are financially literate, and that Mr. Álvarez, Mr. Campbell, and Mr. Conti are “audit committee financial experts” within the meaning of rules promulgated by the SEC.

Additional information regarding the Audit Committee’s responsibilities may be found in this proxy statement in the section captioned “Report of the Audit Committee.”

Finance Committee

The Finance Committee is responsible for assisting the Board with monitoring and overseeing Aon’s balance sheet, including Aon’s capital management strategy, capital structure, investments, returns, and related policies. The Finance Committee also reviews certain proposed mergers, acquisitions, divestitures, and strategic and passive investments. In addition, the Finance Committee oversees the financial, investment, and actuarial policies and objectives of Aon’s U.S. tax-qualified defined benefit plans, reviews the investment performance of non-U.S. benefit and retirement plans and reviews Aon’s major insurance programs.

The current members of the Finance Committee are Fulvio Conti, Jin-Yong Cai, Cheryl Francis, Richard Notebaert, and Sarah Smith. Each member of the Finance Committee is independent as defined in the independence standards of the NYSE. The Finance Committee met five times during 2023.

Governance/Nominating Committee

The Governance/Nominating Committee oversees the risks associated with Aon’s overall governance and: (i) identifies and recommends to the Board candidates for service on the Board; (ii) reviews and recommends the re-nomination of incumbent directors for each annual general meeting; (iii) reviews and recommends Board committee appointments; and (iv) leads the annual performance evaluation of the Board and its committees. In addition, the Governance/Nominating Committee develops and recommends the Governance Guidelines to the Board, reviews related person transactions, and annually reviews compliance with share ownership guidelines.

The current members of the Governance/Nominating Committee are Lester Knight, Fulvio Conti, Cheryl Francis, Richard Notebaert, and Gloria Santona. Each member of the Governance/Nominating Committee is independent as defined in the independence standards of the NYSE. The Governance/Nominating Committee met four times during 2023.

18 2024 Aon Proxy Statement

Inclusion & Wellbeing Sub-Committee

In light of the importance of the evaluation, oversight, and management of Aon’s inclusion and wellbeing strategies and initiatives, the Board formed the Inclusion & Wellbeing Sub-Committee (previously named the Inclusion & Diversity Sub-Committee), a standing sub-committee of the Governance/Nominating Committee. The primary responsibilities of the Inclusion & Wellbeing Sub-Committee are to: (i) oversee management’s inclusion and wellbeing strategy and initiatives, including the efforts of the Company’s Global Inclusive Leadership Council; (ii) periodically review and monitor the Company’s policies and practices with respect to inclusion, wellbeing, and equal employment opportunity; and (iii) perform any other duties as directed by the Governance/Nominating Committee or the Board.

The current members of the Inclusion and Wellbeing Sub-Committee are Cheryl Francis, Gregory Case, Lester Knight, Richard Notebaert, Gloria Santona, and Byron Spruell. The Inclusion & Wellbeing Sub-Committee met four times during 2023.

Compensation Committee

The Compensation Committee assists the Board in carrying out its overall responsibilities with regard to executive compensation, including oversight of the determination and administration of our compensation philosophy, policies, programs and plans for executive officers and non-management directors. The Compensation Committee annually reviews and determines the compensation of Aon’s executive officers, including our Chief Executive Officer, subject, in the case of the Chief Executive Officer, to the input of the other independent members of the Board. The Compensation Committee consults with our Chief Executive Officer on, and directly approves, the compensation of other executive officers, including special hiring and severance arrangements.

In compliance with the committee charter, the Compensation Committee may establish subcommittees

consisting of one or more members or other independent directors and may delegate to such subcommittees and management power and authority to carry out such duties as the Compensation Committee may delegate.

The Compensation Committee administers the Aon plc 2011 Incentive Plan, as amended and restated (and its predecessor plans) (the “Shareholder-Approved Plan”), including granting equity (other than awards to our Chief Executive Officer, which awards are approved by the independent members of the Board) and interpreting the Shareholder-Approved Plan, and has certain settlor responsibilities with respect to our other U.S. employee benefit programs. In addition, the Compensation Committee reviews and makes recommendations to the Board concerning non-management director compensation and certain amendments to U.S. employee benefit plans and equity plans. The Compensation Committee reviews and discusses the compensation disclosures contained in the proxy statement. As part of these duties, the Compensation Committee reviews the risks associated with Aon’s compensation practices, including an annual review of Aon’s risk assessment of its compensation policies and practices for its employees. The Compensation Committee also reviews and monitors the Company’s policies and practices with respect to diversity, wellbeing, inclusion, and equal employment opportunity, and works in coordination with the Inclusion & Wellbeing Sub-Committee.

The current members of the Compensation Committee are Richard Notebaert, Jin-Yong Cai, Jeffrey Campbell, Cheryl Francis, Byron Spruell, and Carolyn Woo. Each member of the Compensation Committee is independent as defined in the independence standards of the NYSE. The Compensation Committee met five times during 2023. Additional information regarding the Compensation Committee’s responsibilities may be found in this proxy statement in the sections captioned “Compensation Committee Report” and “Compensation Discussion and Analysis.”

Other Corporate Governance Practices

Board and Committee Evaluations

Our Board engages in ongoing self-evaluation and assessment. Annually, the directors review and complete evaluations on Board effectiveness, committee performance and peer assessment. This process is overseen by the Governance/Nominating Committee, and the Board retains an outside party to review the completed evaluations. Each of the committees and the full Board discuss their self-assessments in executive sessions at least annually. The Governance/Nominating Committee periodically reviews the form and process for Board and Committee self-evaluations. Feedback received regarding individual directors is shared with the Governance/Nominating Committee Chair and the individual directors. The Board believes that this annual evaluation process supports its effectiveness and continuous improvement.

2024 Aon Proxy Statement 19

Director Commitments

Our Corporate Governance Guidelines provide that a director must notify the Board Chair prior to accepting any invitation to serve on another public company board, and that a director may not serve on the boards of more than three other public companies, in addition to his or her service on the Board of the Company, unless otherwise approved by the Governance/Nominating Committee.

Director Education

Upon joining our Board, new directors are provided with a comprehensive orientation covering key topics including our business, strategy and governance. New directors typically participate in introductory meetings with our senior business and functional leaders. On an ongoing basis, directors receive presentations on a variety of topics related to their work on the Board and within the industry, both from senior management and from experts outside of our company. The Board also receives periodic briefings and education on core concepts and trends that impact our businesses. Directors may also enroll in continuing education programs sponsored by third parties at our expense.

CEO Succession Planning

Our Independent Board Chair oversees the Chief Executive Officer succession planning process. The Board, at least annually, discusses CEO succession planning, including emergency succession plans and processes. The Board also regularly reviews and discusses senior leadership succession planning and development.

Director Selection and Shareholder Recommendations

Consistent with the Governance Guidelines, the Governance/Nominating Committee seeks members from diverse backgrounds who combine a broad spectrum of experience and expertise with a reputation for integrity. The Governance/Nominating Committee also considers whether a potential nominee would satisfy independence standards adopted by the Board and the requirements of the NYSE.

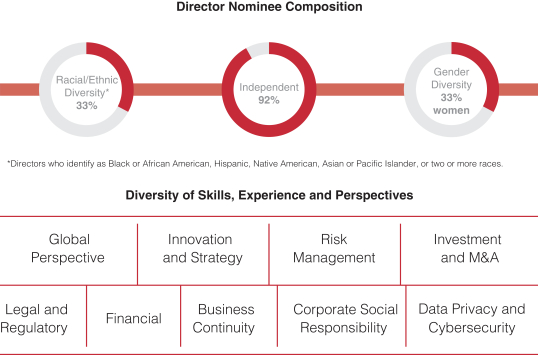

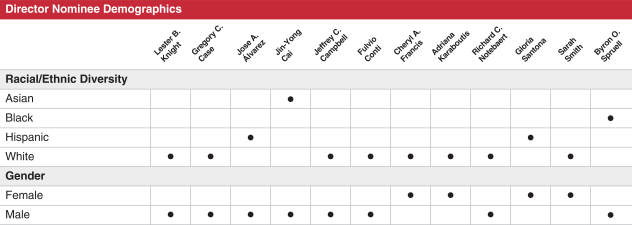

The Board values diversity as a factor in selecting nominees to serve on the Board. In selecting nominees for director, the Governance/Nominating Committee considers professional background, reputation for integrity, leadership capabilities, skills and experience in the context of the needs of the Board, diversity, including gender and racial/ethnic diversity, and international experience and perspectives. Of the 12 director nominees for election at the Annual Meeting, 4 nominees are ethnically or racially diverse, and 4 nominees are women. For more information regarding director diversity and the racial/ethnic demographics of each of our directors, see page 4 of this proxy statement. The Governance/Nominating Committee may retain third-party search firms to identify director candidates. When evaluating candidates for nomination as new directors, the Governance/Nominating Committee considers, and requests that the search firms it engages provide, a set of candidates that includes a diversity of race, ethnicity and gender.

When a vacancy exists on the Board due to the expansion of the size of the Board or the resignation or retirement of an existing director or as part of considering ongoing board succession planning, the Governance/Nominating Committee identifies and evaluates potential director nominees. The Governance/Nominating Committee has sole authority to retain and terminate any search firm to be used to identify director candidates and sole authority to approve such search firm’s fees and other retention terms. The Governance/Nominating Committee recommends potential director candidates to the full Board, which is responsible for final approval of any director candidate. This process is the same for director candidates who are recommended by our shareholders. The effectiveness of the nomination process, including the criteria used for selecting nominees for director, is evaluated by the Board each year as part of its annual self-evaluation process and by the Governance/Nominating Committee as it evaluates and identifies director candidates. Our newest director, Mr. Álvarez (who was appointed to the Board in January 2024) will stand for election at the Annual Meeting. Mr. Álvarez was identified by a third-party search firm retained by the Governance/Nominating Committee.

The Governance/Nominating Committee will consider shareholder recommendations for director nominees. Recommendations, together with the name and address of the shareholder making the recommendation, relevant biographical information regarding the proposed nominee and a description of any arrangement or understanding between the shareholder and the proposed nominee, should be sent to the Company Secretary. Shareholder recommendations for director candidates to stand for election at the 2025 annual general meeting must be submitted in writing to the Company

20 2024 Aon Proxy Statement

Secretary, Aon plc, Metropolitan Building, James Joyce Street, Dublin 1, Ireland. Recommendations will be forwarded to the Chair of the Governance/Nominating Committee for review and consideration. For information regarding compliance with the requirements applicable to shareholder nominations to the Board, see “Shareholder Proposals for 2025 Annual General Meeting” on page 76 of this proxy statement.

Communications with the Board of Directors

Shareholders and other interested parties may communicate with the Board, any committee of the Board, our independent Chair, or any of our directors by contacting the non-management directors of Aon plc, c/o the Company Secretary, Metropolitan Building, James Joyce Street, Dublin 1, Ireland. Alternatively, shareholders and other interested parties may communicate with Aon’s non-management directors or any of our directors via electronic mail to the following address: corporate.governance@aon.com.

The non-management directors have established procedures for handling communications from shareholders and other interested parties. Communications are distributed to the Chair of the Governance/Nominating Committee, the full Board, the non-management directors, or to any individual director or directors as appropriate, depending on the facts and circumstances outlined in the communication. The Company Secretary will not distribute communications that are unrelated to the duties of the Board, such as spam, junk mail, mass mailings, business solicitations, and advertisements.

Shareholder Engagement

It has been our long-standing practice to actively engage with our shareholders throughout the year so that management and the Board can better understand shareholder perspectives on long-term strategy, governance, executive compensation, and other topics. Our engagement discussions in 2023 covered, among other topics, our results and strategy, our long-term expectations and financial guidance, impacts of external factors such as industry trends and economic volatility on our clients and business, our corporate governance structure, Board composition and director refreshment and tenure, Board oversight of risks, succession planning, executive compensation, including performance based executive awards, and ESG matters. These discussions provide valuable insights into our shareholders’ views and we plan to continue to actively engage with our shareholders to better understand and consider their views.

2023 Shareholder Engagement Highlights

|

|

Who we engaged

In 2023, we reached out to our largest shareholders to engage on corporate governance, executive compensation and ESG matters, as well as our results and strategy, impacts of industry trends and economic volatility |

|

How we engaged

Shareholders representing approximately 32% of our shares accepted our invitation to meet and participated in individual conference calls |

|

What we learned

Based on our shareholder engagement and other feedback from investors throughout the year, we believe we continue to be focused on what matters to our shareholders, including:

• Creating and delivering value for our clients and shareholders, and

• Strong governance including Board oversight of risks, succession planning, executive compensation, and ESG matters

|

For more information on our shareholder engagement efforts with respect to executive compensation and consideration of last year’s say-on-pay vote, see page 33 of the Compensation Discussion and Analysis in this proxy statement.

2024 Aon Proxy Statement 21