In fiscal year 2021, the company implemented a new operating model and reporting structure. With this change, the company’s agriculture and turf operations were divided into two new segments: production and precision agriculture and small agriculture and turf.

The production and precision agriculture segment defines, develops, and delivers global equipment and technology solutions to unlock customer value for production-scale growers of large grains, small grains, cotton, and sugar. Main products include large and certain mid-size tractors, combines, cotton pickers, sugarcane harvesters and loaders, and soil preparation, seeding, application and crop care equipment.

The small agriculture and turf segment defines, develops, and delivers global equipment and technology solutions to unlock customer value for dairy and livestock producers, high-value crop producers, and turf and utility customers. The segment’s primary products include certain mid-size and small tractors, as well as hay and forage equipment, riding and commercial lawn equipment, golf course equipment, and utility vehicles.

There were no reporting changes for the construction and forestry and financial services segments. As a result, the company has four reportable segments.

Worldwide Production and Precision Agriculture Operations

(In millions of dollars) | 2021 | 2020 | % Change | ||||||

Net sales | $ | 16,509 | $ | 12,962 | +27 | ||||

Operating profit | 3,334 | 1,969 | +69 | ||||||

Operating margin | 20.2% | 15.2% | |||||||

Segment sales increased due to higher shipment volumes and price realization. Operating profit benefitted from price realization, higher shipment volumes / sales mix, and a favorable indirect tax ruling in Brazil. These items were partially offset by higher production costs. The prior year was also impacted by employee-separation program expenses (see Note 5).

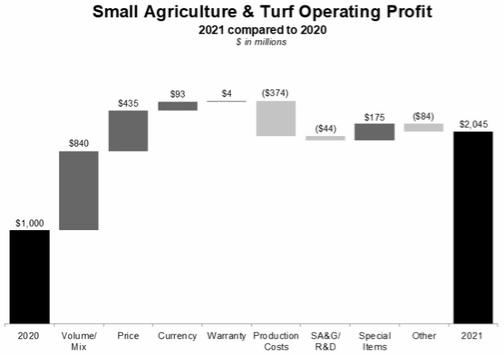

Worldwide Small Agriculture and Turf Operations

(In millions of dollars) | 2021 | 2020 | % Change | ||||||

Net sales | $ | 11,860 | $ | 9,363 | +27 | ||||

Operating profit | 2,045 | 1,000 | +105 | ||||||

Operating margin | 17.2% | 10.7% | |||||||

Segment sales and operating profit were both higher in 2021 due to higher shipment volumes / sales mix and price realization. The operating profit improvement was partially offset by higher production costs. Results for the current year were positively impacted by a gain on the sale of a factory in China, while results for the prior year were affected by impairments, closure costs, and employee-separation expenses (see Note 5).

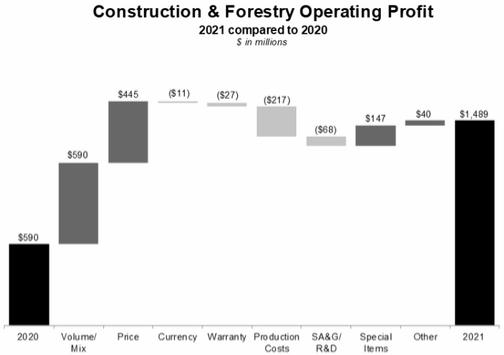

Worldwide Construction and Forestry Operations

(In millions of dollars) | 2021 | 2020 | % Change | ||||||

Net sales | $ | 11,368 | $ | 8,947 | +27 | ||||

Operating profit | 1,489 | 590 | +152 | ||||||

Operating margin | 13.1% | 6.6% | |||||||

Segment sales increased in 2021 primarily due to higher shipment volumes and price realization. Operating profit increased mainly due to positive shipment volumes / sales mix and price realization, partially offset by higher production costs. The prior year was also impacted by employee-separation program expenses and impairments in certain fixed assets and unconsolidated affiliates (see Note 5).

29