FALSE0000314808DEF 14A00003148082023-01-012023-12-310000314808val:AntonDibowitzMember2023-01-012023-12-31iso4217:USD0000314808val:TomBurkeMember2023-01-012023-12-31iso4217:USDxbrli:shares0000314808val:AntonDibowitzMember2022-01-012022-12-310000314808val:TomBurkeMember2022-01-012022-12-3100003148082022-01-012022-12-310000314808val:AntonDibowitzMember2021-01-012021-12-310000314808val:TomBurkeMember2021-01-012021-12-3100003148082021-01-012021-12-310000314808val:AntonDibowitzMember2020-01-012020-12-310000314808val:TomBurkeMember2020-01-012020-12-3100003148082020-01-012020-12-310000314808ecd:PeoMemberval:FairValueOfEquityAwardsAsOfGrantDateMemberval:AntonDibowitzMember2023-01-012023-12-310000314808val:FairValueOfEquityAwardsAsOfYearEndDateMemberecd:PeoMemberval:AntonDibowitzMember2023-01-012023-12-310000314808ecd:PeoMemberval:AntonDibowitzMemberval:ChangesInFairValueOfAwardsGrantedAndVestedMember2023-01-012023-12-310000314808ecd:PeoMemberval:ChangesInFairValueOfAwardsGrantedAndUnvestedMemberval:AntonDibowitzMember2023-01-012023-12-310000314808ecd:PeoMemberval:FairValueOfAwardsForfeitedMemberval:AntonDibowitzMember2023-01-012023-12-310000314808val:ChangeInActuarialPresentValueOfAccumulatedBenefitsMemberecd:NonPeoNeoMember2023-01-012023-12-310000314808val:FairValueOfEquityAwardsAsOfGrantDateMemberecd:NonPeoNeoMember2023-01-012023-12-310000314808val:FairValueOfEquityAwardsAsOfYearEndDateMemberecd:NonPeoNeoMember2023-01-012023-12-310000314808ecd:NonPeoNeoMemberval:ChangesInFairValueOfAwardsGrantedAndVestedMember2023-01-012023-12-310000314808val:FairValueOfEquityAwardsGrantedAndVestedMemberecd:NonPeoNeoMember2023-01-012023-12-310000314808val:ChangesInFairValueOfAwardsGrantedAndUnvestedMemberecd:NonPeoNeoMember2023-01-012023-12-310000314808val:FairValueOfAwardsForfeitedMemberecd:NonPeoNeoMember2023-01-012023-12-31000031480812023-01-012023-12-31000031480822023-01-012023-12-31000031480832023-01-012023-12-31000031480842023-01-012023-12-31000031480852023-01-012023-12-31000031480862023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the registrant þ Filed by a party other than the registrant o

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

þ Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material under §240. 14a-12

Valaris Limited

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of filing fee (Check all boxes that apply):

þ No fee required

o Fee paid previously with preliminary materials

o Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

Dear Fellow Shareholders,

The Valaris story begins 100 years ago when two brothers purchased a single steam-powered drilling rig and began contract drilling operations. Today, the Rowan brothers’ bold first step has grown into the largest offshore drilling fleet in the world. The unifying thread between these modest beginnings and Valaris’ position as an industry-leading drilling contractor is the unwavering dedication of our employees and a commitment to delivering the highest levels of service to our customers. During 2023, we continued to focus our efforts on investing in our people and fleet while innovating and continuously improving to drive our operational performance, increased earnings and long-term shareholder value.

Positioning Valaris for a multi-year upcycle

Commodity prices remain supportive for continued investment in offshore projects and growing global demand for hydrocarbons means that these resources will be needed to meet the world’s energy needs. We are seeing a growing pipeline of customer demand, with increased term and longer lead times, which is a positive sign for the strength and duration of the current upcycle.

As a result, we continued to position Valaris to capitalize on these strong market conditions by reactivating drillships VALARIS DS-8 and DS-17 for attractive contracts offshore Brazil and purchasing drillships VALARIS DS-13 and DS-14 at compelling prices, providing additional operating leverage to the upcycle.

The successful reactivation of VALARIS DS-8 marked our fifth drillship reactivation completed since early 2022 and our second in 2023. We continue to make good progress on reactivating VALARIS DS-7, and look forward to adding another drillship to the active fleet later this year for a multi-year contract offshore West Africa.

Our industry-leading ability to execute these complex projects has been an important part of our growth story and will be a key driver of the meaningful improvement expected in our financial results during 2024.

Investing in our people

Delivering safe and efficient operations to customers is key to our success and our people are critical to achieving this objective.

With the continued increase in drilling activity, we expanded our rig crews, hiring approximately 1,200 offshore employees in 2023. We also conducted approximately 530,000 hours of training, an increase of 150% compared to the prior year. Our orientation program for new hires includes the Valaris Basic Training Program - a unique, immersive program that utilizes a dedicated rig in the U.S. Gulf of Mexico to provide training for our new crew members to prepare them to work safely offshore. The Valaris Basic Training Program was recognized by the Center for Offshore Safety with its 2023 Safety Leadership Award - an honor that serves as a positive endorsement of the value this program creates for the company and its shareholders.

For our onshore employees, we launched the Onshore Leadership Engagement program, which is focused on developing leadership skills for our shore-based colleagues, and more than 150 of our senior leaders completed this training during 2023. We will continue to invest in our people as we expand our operations to meet increasing customer demand.

Delivering earnings and cash flow growth

We achieved significant commercial success in 2023, adding nearly $3 billion in new contract backlog at meaningfully improved day rates. As of February 2024, we had total contract backlog of nearly $4 billion, an industry-leading 59% increase as compared to a year prior.

This contracting success is anticipated to lead to a notable improvement in our 2024 forecasted financial results, and we expect further improvement in 2025 with more rigs expected to reprice from lower legacy day rate contracts to higher market rates as well as the benefit of a full-year of operations for VALARIS DS-7 following its reactivation.

| | | | | | | | |

| valaris.com | 2024 Proxy Statement | 1 |

Letter to Our Shareholders

Committed to returning capital to shareholders

We demonstrated our commitment to returning capital to shareholders by repurchasing $200 million of shares during 2023. In February 2024, the Valaris Board of Directors increased our share repurchase authorization from $300 million to $600 million, providing increased flexibility to opportunistically return additional capital to shareholders.

We would like to thank the entire Valaris team not only for their hard work and commitment to living

our values, but also for their many accomplishments in 2023. Looking forward, we remain confident in the strength and duration of this upcycle and the outlook for Valaris is positive. We expect to deliver significant earnings and cash flow growth over the next few years, and we intend to return all future free cash flow to shareholders unless there is a better or more value accretive use for it.

On behalf of our entire global workforce and the Board of Directors, thank you for your support.

Sincerely,

| | | | | | | | |

Elizabeth D. Leykum

Chair of the Board | | Anton Dibowitz

Director, President and Chief Executive Officer |

| | | | | | | | |

2 | Valaris Limited | valaris.com |

| | | | | | | | | | | | | | | | | |

| Date and Time June 12, 2024 8:00 a.m. Bermuda time 6:00 a.m. Houston time | | Location Verdmont Room Rosewood Bermuda 60 Tucker's Point Drive Hamilton Parish HS 02, Bermuda | | Who Can Vote Shareholders of Valaris Limited ("Valaris," "we," "us," "our" or the "Company") as of April 15, 2024 are entitled to vote. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Resolution 1 Election of Eight Director Nominees Named in the Proxy Statement | | | Resolution 2 Advisory Vote to Approve Named Executive Officer Compensation | | | Resolution 3 Approve appointment of KPMG LLP as our Independent Registered Public Accounting Firm and to authorize the Board, acting by its Audit Committee, to set KPMG LLP’s remuneration |

| | | | | | |

| “FOR” | | | | | “FOR” | | | | | “FOR” | |

each director nominee | | | | | | | | | |

| | | | | | | | | | |

Shareholders may also be asked to consider and vote on such other business as may properly come before the meeting and any adjournment or postponement thereof. The Company’s audited financial statements for the year ended December 31, 2023 will also be available at the Meeting and are included in our 2023 annual report to shareholders ("2023 annual report").

Your vote is very important. Even if you plan to attend the meeting, please submit a proxy as soon as possible to ensure that your shares are voted at the meeting in accordance with your instructions. Voting your shares will help to ensure that your interests are represented at the Meeting. Please review the proxy statement accompanying this notice for more complete information regarding the Meeting and the full text of the resolutions to be proposed at the Meeting.

By Order of the Board of Directors,

Davor Vukadin

Senior Vice President, General Counsel and Secretary

April 17, 2024

| | | | | | | | | | | | | | |

| | | | |

How to

Vote | | Internet www.proxyvote.com

Have your proxy card in hand when you access the website and follow the instructions. | | Mail Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717 so that it is received no later than 3:00 PM Eastern time on June 11, 2024, which is the voting cutoff time. |

| | |

|

Important Notice Regarding the Availability of Proxy Materials for the Annual General Meeting of Shareholders to be held on June 12, 2024. The proxy statement, our 2023 annual report and notice are available without charge at www.proxyvote.com. |

|

| | | | | | | | |

| valaris.com | 2024 Proxy Statement | 3 |

| | | | | |

Letter to Our Shareholders | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | | | | | | | |

4 | Valaris Limited | valaris.com |

| | |

|

FORWARD-LOOKING STATEMENTS Statements contained in this proxy statement that are not historical facts are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act. Forward-looking statements include words or phrases such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “likely,” “plan,” “project,” “could,” “may,” “might,” “should,” “will” and similar words. The forward-looking statements contained in this proxy statement are subject to numerous risks, uncertainties and assumptions that may cause actual results to vary materially from those indicated, and we can give no assurance that they will prove to be correct or that any plan, initiative, projection, target, goal, commitment or expectation can or will be achieved. You should also carefully read and consider “Item 1A. Risk Factors” in Part I and “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II of our most recent annual report on Form 10-K, which is available on the SEC’s website at www.sec.gov or on the Investor Relations section of our website at www.valaris.com. Each forward-looking statement speaks only as of the date of the particular statement and we undertake no obligation to update or revise any forward-looking statements, except as required by law. Standards of measurement and performance made in reference to our sustainability targets, plans and goals are based on evolving protocols and assumptions which may change or be refined. Company goals are aspirational and may change. Statements regarding the Company’s goals, including greenhouse gas emissions' reduction goals, are not guarantees or promises that they will be met. The inclusion of information regarding our sustainability initiatives and aspirations is not an indication that these contents are necessarily material to investors or required to be disclosed in our filings with the SEC. Content available on websites and in documents referenced in this proxy statement are not incorporated by reference herein and are not part of this proxy statement. |

|

| | | | | | | | |

| valaris.com | 2024 Proxy Statement | 5 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Our Purpose | | | Our Strategy Focused Building enduring presence and long-term relationships •Operate a high spec jackup and floater fleet •Build deep customer and partner relationships •Identify and commit to priority basins Value Driven Exercising financial discipline and driving efficiency •Deliver Operational Excellence •Operate an efficient and scalable cost structure •Exercise disciplined capital allocation / be returns focused Responsible Advancing our sustainability program •Decarbonize our operations •Dedication to a safety-first work culture •Be transparent on our sustainability progress •Partner with customers on their energy transition efforts •Monitor compatible opportunities within the energy transition |

To provide responsible solutions that deliver energy to the world | | |

Our Values | | |

| |

| | | | | | | |

Integrity Doing the right thing; whether or not anyone is watching | | | Respect Treating others the way we would like to be treated | | |

| | | |

| | | | | | | |

| | | | | | | |

Safety Causing no harm is always our priority | | | Ingenuity Solving problems creatively | | |

| | | | | | | |

| | | | | | | |

Excellence Delivering value to the customer while consistently raising the bar on performance | | | Stewardship Safeguarding where we work for the next generation | | |

| | | |

| | | |

| | | |

| | | |

Performance Highlights

| | | | | |

| Financial Performance •Generated net income of $866.8 million (including tax benefit of $782.6 million), Adjusted EBITDA of $141.3 million and Adjusted EBITDAR of $301.1 million, which adds back one-time reactivation costs to return rigs to a ready-to-work state from a preservation stacked state following a prolonged idle period. •Adjusted EBITDA and Adjusted EBITDAR represent non-GAAP financial measures. See Appendix A for a reconciliation of GAAP and non-GAAP financial measures. |

| |

| | | | | | | | |

6 | Valaris Limited | valaris.com |

| | | | | |

| Operational Excellence •Continued our track record of operational excellence, by delivering revenue efficiency of 96% and earned recognition by the Center for Offshore Safety with its 2023 Safety Leadership Award for the Valaris Basic Training program. •Reactivated two drillships from preservation stack for multi-year contracts and have now completed five drillship reactivations since early 2022. We also progressed the reactivation of an additional drillship, which we expect to join the active fleet in 2024. •Purchased and took delivery of our newbuild seventh-generation drillships VALARIS DS-13 and VALARIS DS-14 at highly attractive prices, creating additional operating leverage in our rig fleet. |

| | | | | |

| Contracting Success •Awarded new contracts and extensions in 2023 with associated contract backlog of nearly $3 billion. •Increased total contract backlog to nearly $4 billion as of February 15, 2024, representing a 59% increase since February 2023. |

| | | | | |

| Financial Management •Enhanced our capital structure by executing financing transactions, including refinancing our first lien senior secured notes with $700 million second lien senior secured notes, issuing $400 million in additional second lien senior secured notes and the addition of a $375 million revolving credit facility. •Repurchased $200 million of shares in 2023, representing 3 million shares or approximately 4% of the total outstanding share count, and in February 2024 increased share repurchase authorization to $600 million from $300 million. |

Sustainability Highlights

•Published our 2023 Annual Sustainability Report, which highlights the sustainability efforts that demonstrate our commitment to our purpose, values and communities. The report was prepared in accordance with the standards of the Task Force on Climate-Related Financial Disclosures (TCFD), in addition to the Sustainability Accounting Standards Board (SASB), with references to other frameworks such as the Global Reporting Initiative (GRI) and the Carbon Disclosure Project (CDP), where relevant, and report scope 1, 2 and 3 GHG emissions, among other data. In addition, we announced last year a target of reducing our emissions' intensity. Please refer to our 2022 Sustainability Report for information on the assumptions underlying our emissions’ intensity target.

•Partnered with customers on their energy transition efforts. Since 2022, six of our jackup rigs have been involved in carbon capture and storage (CCS) projects with customers, including three in 2023.

•Endeavored to support and build diversity and inclusion throughout our workforce. As our operations span the globe, we seek to bring employment for the benefit of the local communities in which we work. Employees of 74 nationalities are represented in our workforce as of December 31, 2023. In addition, all employees were assigned unconscious bias training as part of our efforts to support a more inclusive workforce.

•Continued alignment of compensation with sustainability performance by setting a spill prevention performance component for our 2023 Valaris Cash Incentive Plan. Spill prevention performance is a measure that considers the environmental impact of any substances released in the course of our operations. Consistent with prior years, safety (personal and process) was also a component of our 2023 Valaris Cash Incentive Plan.

•Invested in our employees through our BOLD leadership training for offshore supervisors which was attended by nearly 500 personnel in 2023. We also implemented an onshore leadership program in 2023, which included eight separate onshore leadership sessions, which was delivered to over 150 personnel. We also delivered over 28,700 training hours under our Behavior Based Safety program, focused on improving the safety of our operations.

•Continued our efforts to protect the biodiversity of the marine environments we operate in by preventing spills, managing discharges and cleaning hulls and jackup legs before moving geographies.

| | | | | | | | |

| valaris.com | 2024 Proxy Statement | 7 |

| | | | | | | | | | | |

|

Resolution 1 Election of Directors | | | The Board recommends a vote FOR each director nominee.  See page 11 See page 11 |

|

Board Highlights

Board Nominees

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name and Principal Occupation | Age | Independent | Director

Since | Committee Membership |

| | | | |

Anton Dibowitz President and Chief Executive Officer

of Valaris Limited | 52 | No | 2021 | | | | | ● |

Dick Fagerstal Former Executive Chairman of

Global Marine Group | 63 | Yes | 2021 | ● | | ● | | |

Joseph Goldschmid Managing Director, Oak Hill Advisors, L.P. | 38 | Yes | 2021 | | ● | | ● | ● |

Catherine J. Hughes Former Executive Vice President International at Nexen Inc. | 61 | Yes | 2022 | | ● | ● | | |

Kristian Johansen Chief Executive Officer of TGS ASA | 52 | Yes | 2023 | | | | | ● |

Elizabeth D. Leykum (Chair of the Board) Founder of Serenade Capital LLC | 45 | Yes | 2021 | ● | ● | | ● | ● |

Deepak Munganahalli Founder of Sencirc Holding Limited | 54 | Yes | 2021 | | | ● | | ● |

James W. Swent, III Former Chairman, President and

Chief Executive Officer of Southcross

Energy Partners, L.P. | 73 | Yes | 2021 | ● | ● | ● | ● | |

| | | | | | | | |

8 | Valaris Limited | valaris.com |

Current Board Skills and Experience

| | | | | | | | | | | | | | |

| | | | |

| Strategic Planning | | | Finance / Capital Allocation |

| | | | |

| Energy Industry, including oilfield services | | | Human Capital Management |

| | | | |

| Business Development / Operations | | | Risk Management |

| | | | |

| Senior Executive Leadership | | | Public Company Governance |

| | | | |

| Accounting | | | Legal / Regulatory |

| | | | |

| International Business | | | Environment and Sustainability Practices |

| | | | |

| Information Technology / Cybersecurity | | | |

| | | | |

|

Corporate Governance Highlights

| | | | | |

| Independent Chair of the Board, separate from Chief Executive Officer |

| No staggered board – all directors are elected annually |

| Fully independent Audit, Compensation, Nominating and Governance (“N&G”) and Safety and Sustainability committees |

| Regular executive sessions of non-executive directors |

| Majority vote standard for uncontested director elections |

| Director nominees reflect diversity in gender, ethnicity, experience and skills |

| Annual Board and committee evaluations guided by an independent consultant |

| Our Code of Conduct applies to all officers, directors, employees and full-time contractors, with required annual compliance training. We also expect our business partners and vendors to act consistent with our Code of Conduct |

| Director, executive officer and vice president share ownership guidelines (including at least six times (6x) base salary multiple for our Chief Executive Officer) |

| Minimum holding periods for all equity interests of the Company until share ownership guidelines are met |

| Directors and officers are not permitted to engage in transactions designed to hedge or offset the market value of our equity securities or to pledge our common shares |

| Average independent director tenure of less than three years |

| | | | | | | | |

| valaris.com | 2024 Proxy Statement | 9 |

| | | | | | | | | | | |

| | | | |

Resolution 2 Advisory Vote to Approve Named

Executive Officer Compensation | | | The Board recommends a vote FOR this resolution.  See page 37 See page 37 |

|

|

2023 Executive Compensation Highlights

| | | | | | | | |

| Element | Form | Description |

| Base Salary | Cash | •Provides a fixed, market level of base compensation |

Short-Term

Incentive Awards | Cash | •Provided under the Valaris Cash Incentive Plan (the "VCIP") •Earned based on achievement of specified annual financial, operational, sustainability (spill prevention) and safety (personal and process) and strategic team goals |

Long-Term

Incentive Awards | Shares | •Executive officer awards are provided under the Valaris 2021 Management Incentive Plan (the "MIP") through a combination of restricted share units (“RSUs”) and performance share units (“PSUs”) •RSUs generally vest over a three-year period •PSUs are earned based on the attainment of absolute total shareholder return and relative total shareholder return as compared to a peer group over a three-year performance period |

2023 Say-on-Pay Vote

98% of the votes cast at our 2023 Annual General Meeting of Shareholders were in favor of our named executive officers' compensation

| | | | | | | | | | | |

| | | |

Resolution 3 Appointment of the Independent Registered Public Accounting Firm | | | The Board recommends a vote FOR this resolution  See page 68 See page 68 |

|

|

Certain information in this summary is contained elsewhere in this proxy statement. This summary does not contain all of the information you should consider, and you should read the entire proxy statement carefully before voting. For more complete information regarding our 2023 fiscal performance, please review our 2023 annual report. The Notice of Internet Availability, or this proxy statement, our 2023 annual report and the notice are first being sent or distributed to shareholders on or about April 17, 2024 and are available, free of charge, at www.proxyvote.com.

| | | | | | | | |

10 | Valaris Limited | valaris.com |

| | | | | | | | |

|

Resolution 1: To elect each of the following as directors of the Company for a term to serve until the next Annual General Meeting of Shareholders or until their respective offices are otherwise vacated in accordance with the bye-laws of the Company. |

|

a. Anton Dibowitz | d. Catherine J. Hughes | g. Deepak Munganahalli |

b. Dick Fagerstal | e. Kristian Johansen | h. James W. Swent, III |

c. Joseph Goldschmid | f. Elizabeth D. Leykum | |

| | |

Each of the nominees is currently a director of the Company and was elected at the 2023 Annual General Meeting of Shareholders to hold office until the Meeting, or until his or her office is otherwise vacated in accordance with the bye-laws of the Company.

If elected, each nominee will serve until the next Annual General Meeting of Shareholders of the Company, which is expected to be held in 2025, or when their respective offices are otherwise vacated in accordance with the bye-laws of the Company.

In December 2021, Valaris entered into a support agreement (as amended, the “Support Agreement”) with Famatown Finance Limited and certain of its affiliates ("Famatown"). Pursuant to the Support Agreement, the Board has nominated Kristian Johansen to stand for election as a director of the Company at the Meeting. Mr. Johansen will resign as a director if, among other things, Famatown's aggregate beneficial ownership falls below the threshold set forth in the Support Agreement. Furthermore, Famatown has agreed to vote with the Board's recommendations for the Company’s resolutions set forth in this proxy statement at the Meeting.

The N&G Committee and the Board have determined that these nominees possess the appropriate mix of skills and characteristics required of Board members. The Board regularly evaluates the composition of the Board in the context of the perceived needs of the Board at a given point in time. In evaluating potential director nominees, our Board evaluates their qualifications as set forth in our Corporate Governance Policy, which is further described on page 25. | | | | | |

| |

| The Board recommends that shareholders vote FOR each nominee standing for election as director. |

|

Each of the Board nominees has been nominated by our Board for election at the Meeting. Our bye-laws require majority voting for the election of directors. A nominee seeking election will be elected if a simple majority of the votes cast are cast in favor of the resolution to elect the director nominee. In determining the number of votes cast, shares that abstain from voting or are not voted will not be treated as votes cast. Each director nominee will be considered separately. You may cast your vote for or against each nominee or abstain from voting your shares in connection with one or more of the nominees.

As a shareholder of record, if no indication is given as to how you want your shares to be voted, but your proxy is executed, the persons designated as proxies will vote the proxies received FOR each nominee.

| | | | | | | | |

| valaris.com | 2024 Proxy Statement | 11 |

Resolution 1: Election of Directors

Board Overview

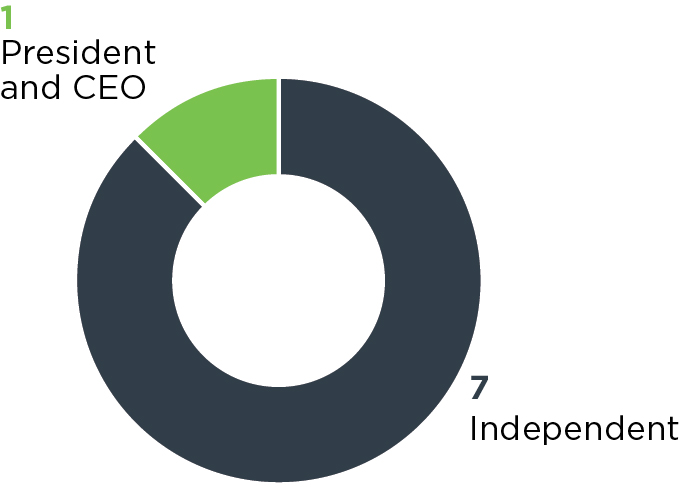

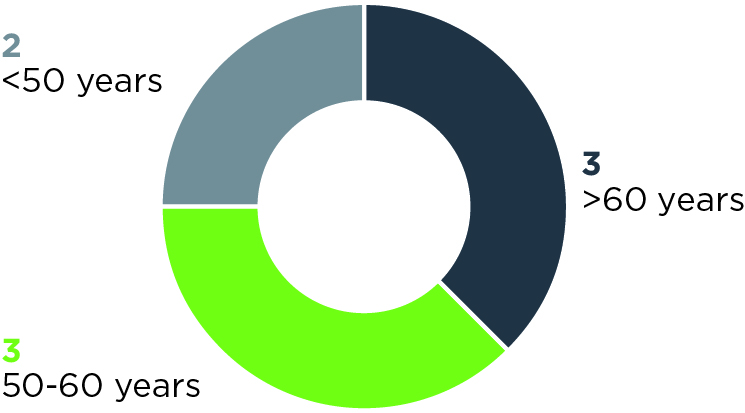

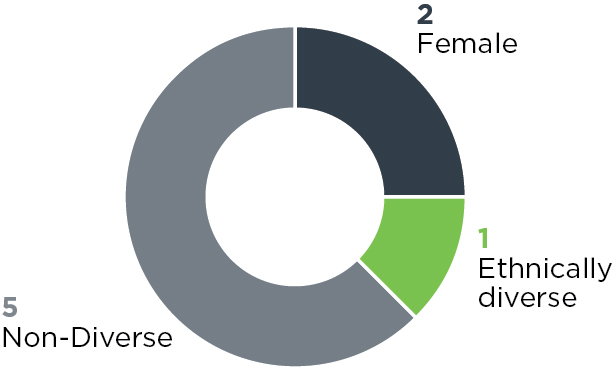

Current Board Snapshot

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Independence | | | Average Age | | | Diversity |

| | | | | | |

| | | | | | |

88 % independent | | | 55 average age | | | 38% diverse by gender or race/ethnicity |

| | | | | | |

|

| | |

|

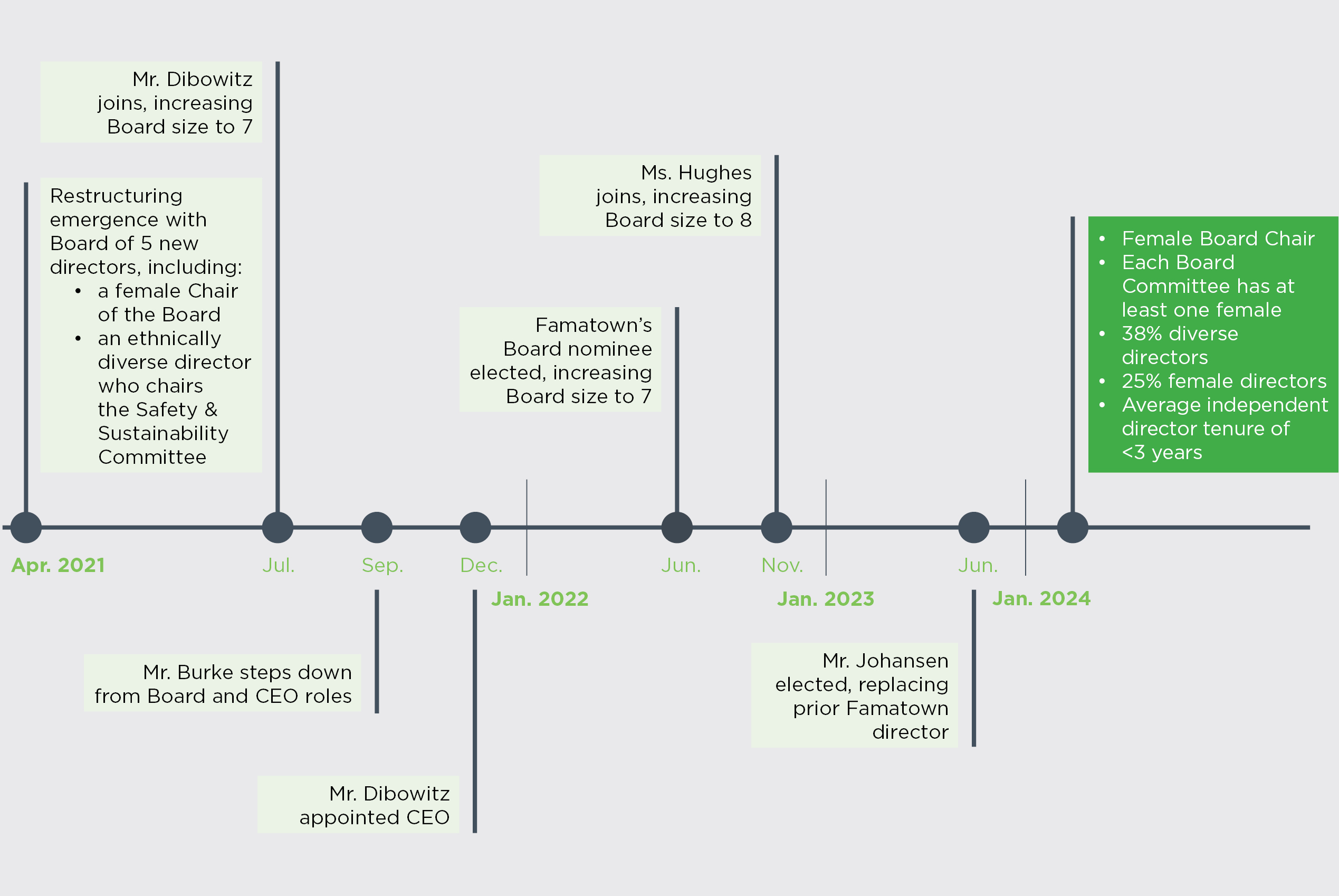

We are committed to building a diverse Board comprised of individuals from diverse backgrounds, including with respect to gender, ethnicity, age, nationality and other individual qualifications and attributes. The N&G Committee seeks opportunities to evaluate and appoint gender and ethnically diverse directors to the Board. To accomplish this, the N&G Committee endeavors to include, and requires any search firm that it engages include diverse candidates based on gender, race and/or ethnicity and other diverse attributes in the pool of possible director candidates. As part of our ongoing board refreshment and diversity efforts, in November 2022, we appointed an additional female independent director, Catherine J. Hughes, to our Board. We are further committed to maintaining an actively refreshed Board with a mix of tenures. The average tenure of our independent directors is less than three years. As described under “Director Nominations,” the N&G Committee is responsible for and has evaluated the Board’s composition and current mix of skills and characteristics to determine whether they are appropriate to support oversight of the Company’s strategy and Board responsibilities. The "Directors Skills Matrix" below reflects the Board’s mix of experiences, backgrounds and qualifications. The Board currently believes its size and composition, including its mix of experiences, skills, qualifications and tenure, provides a highly effective and well-functioning Board. While the Board does not believe an increase in the size of the Board is appropriate at this time, it continues to identify and evaluate gender diverse candidates in the event it decides to increase the size of the Board or to fill vacancies. The timeline below illustrates the evolution of our Board, including enhancements made to the diversity of the Board. |

|

| | | | | | | | |

12 | Valaris Limited | valaris.com |

Resolution 1: Election of Directors

Current Board Timeline

| | | | | | | | |

| valaris.com | 2024 Proxy Statement | 13 |

Resolution 1: Election of Directors

Directors Skills Matrix

The N&G Committee develops and recommends to the Board skills, experience, characteristics and other criteria for identifying and evaluating directors, which will inform the N&G Committee’s annual evaluation of the composition of the Board to assess whether the mix of skills, experience, characteristics and other criteria are currently represented on the Board and those that may be needed in the future.

The following chart shows how these skills and experience, characteristics and other criteria are represented among our eight Board directors.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| SKILLS AND EXPERIENCE | | | | | | | | |

| Strategic Planning

Contributes to effectively advising management on important strategic decisions | ● | ● | ● | ● | ● | ● | ● | ● |

| Risk Management

Critical to identifying the types of risks facing our organization and that there are appropriate controls and policies in place to manage such risks | ● | ● | ● | ● | ● | ● | ● | ● |

| Business Development / Operations

Informs an understanding of business opportunities and commercial relationships that are applicable to our organization | ● | ● | ● | ● | ● | ● | ● | ● |

| Energy Industry, including oilfield services

Contributes to a deeper understanding of the industry in which we operate, our business strategy and competition | ● | ● | ● | ● | ● | | ● | ● |

| Senior Executive Leadership

Demonstrates a record of corporate leadership and an understanding of organizations | ● | ● | | ● | ● | ● | ● | ● |

| International Business

Demonstrates knowledge of the overseas markets in which we operate and practical experience with a company operating in multiple countries | ● | ● | | ● | ● | ● | ● | ● |

| Finance / Capital Allocation

Contributes to our evaluation of financial strategy, capital markets and capital structure | ● | ● | ● | | ● | ● | ● | ● |

| Human Capital Management

Assists in engaging with and developing talent at our organization | ● | ● | | ● | ● | | ● | ● |

| Public Company Governance

Demonstrates an understanding of corporate governance practices and trends | ● | ● | | ● | ● | ● | | ● |

| Accounting

Assists with the Board’s role in overseeing our financial statements and financial reports | ● | ● | | | ● | ● | | ● |

| Environment and Sustainability Practices

Contributes to the Board’s understanding of Sustainability issues and how those issues interact with our business strategy | | ● | ● | ● | | | ● | |

| Information Technology / Cybersecurity

Knowledge or experience that contributes to the Board's understanding of IT and cybersecurity risks | | ● | | | | ● | | ● |

| Legal / Regulatory

Assists with navigating the complexities of the legal environments in which we operate | | | ● | | | | | |

| | | | | | | | |

14 | Valaris Limited | valaris.com |

Resolution 1: Election of Directors

Director Nominees

| | | | | | | | | | | | | | | | | | | | | | | |

| | |

Anton Dibowitz President and Chief Executive Officer of Valaris Age: 52 Director since: 2021 Committees: •Strategy (Chair) | | Career Highlights Anton Dibowitz became the President and Chief Executive Officer of Valaris in December 2021, following his service as the Company’s interim President and Chief Executive Officer since September 2021. Mr. Dibowitz joined the Valaris Board in July 2021. Prior to joining the Board, he served as an advisor of Seadrill Ltd., a global offshore drilling contractor, from November 2020 until March 2021. He served as Chief Executive Officer of Seadrill Ltd. from July 2017 until October 2020. Seadrill Ltd. filed for bankruptcy in September 2017. Prior to this, Mr. Dibowitz served as Executive Vice President of Seadrill Management from June 2016, and as Chief Commercial Officer from January 2013. He has over 20 years of drilling industry experience. Prior to joining Seadrill, Mr. Dibowitz held various positions within tax, process reengineering and marketing at Transocean Ltd. and Ernst & Young LLP. He is a Certified Public Accountant and a graduate of the University of Texas at Austin where he received a Bachelor’s degree in Business Administration, and Master’s degrees in Professional Accounting (MPA) and Business Administration (MBA). Director Qualifications The particular experience, qualifications, attributes and skills that led our Board to conclude that Mr. Dibowitz should serve as a director include his extensive managerial and industry experience, including prior Chief Executive Officer experience. |

| | | | | | | |

| | Skills and Experience: |

| | | Strategic Planning / Development | | Accounting | | Risk Management |

| | | Energy Industry, including oilfield services | | International Business | | Public Company Governance |

| | | Business Development / Operations | | Finance / Capital Allocation | | |

| | | Senior Executive Leadership | | Human Capital Management | | |

| | | | | | | |

| | |

| |

| | | | | | | | |

| valaris.com | 2024 Proxy Statement | 15 |

Resolution 1: Election of Directors

| | | | | | | | | | | | | | | | | | | | | | | |

| | |

Dick Fagerstal Former Executive Chairman of the Global Marine Group Independent Age: 63 Director since: 2021 Committees: •Audit (Chair) •Safety and Sustainability | | Career Highlights Dick Fagerstal currently serves as the Chairman of the Board of Tidewater Inc. (NYSE:TDW), in addition to serving as a member of the Audit Committee, Nomination & Governance Committee and Safety & Sustainability Committee. He has served on its board of directors since 2017. Mr. Fagerstal served as Executive Chairman of the Global Marine Group, based in Chelmsford, United Kingdom, a subsea cable installation and maintenance business operating globally in the telecoms, offshore renewables, and oil and gas sectors, from February 2020 to March 2023. Mr. Fagerstal continues to serve as a director of Global Marine Group. From 2014 to 2020 Mr. Fagerstal served as Chairman & Chief Executive Officer of Global Marine Holdings LLC, which was the prior owner of the business. He served as an Independent Director of Frontier Oil Corporation, Manila, Philippines from 2014 to 2017. Mr. Fagerstal previously held the positions of Senior Vice President, Finance & Corporate Development from 2003 to 2014 and Vice President Finance & Treasurer from 1997 to 2003 at SEACOR Holdings Inc. (NYSE: CKH). Mr. Fagerstal held the positions of Executive Vice President, Chief Financial Officer and Director of Era Group Inc. (NYSE: ERA) from 2011 to 2012 and was the Senior Vice President, Chief Financial Officer, and Director of Chiles Offshore Inc. (AMEX: COD) from 1997 to 2002. From 1986 to 1997, Mr. Fagerstal served as a senior banker at DNB ASA in New York with a focus on the maritime and energy services industries, and before he started his business career, Mr. Fagerstal served as an officer in the Special Air Service unit of the Swedish Special Forces from 1979 to 1983. Mr. Fagerstal received a B.S. in Economics and Law from the University of Gothenburg and an M.B.A. in Finance from New York University, as a Fulbright Scholar. Director Qualifications The particular experience, qualifications, attributes and skills that led our Board to conclude that Mr. Fagerstal should serve as a director include his business, finance and accounting background. In addition, his knowledge of the energy, renewables and maritime industries contributes to our Board’s ability to monitor the risks facing our company. With respect to cybersecurity qualifications, Mr. Fagerstal obtained a National Association of Corporate Directors (NACD) Cybersecurity Certification in 2021 and completed the Harvard University course "Cybersecurity: The Intersection of Policy and Technology" in 2020. Mr. Fagerstal also obtained an NACD Directorship Certification in 2023. |

| | | | | | | |

| | Skills and Experience: |

| | | Strategic Planning / Development | | Accounting | | Risk Management |

| | | Energy Industry, including oilfield services | | International Business | | Public Company Governance |

| | | Business Development / Operations | | Finance / Capital Allocation | | Environment and Sustainability Practices |

| | | Senior Executive Leadership | | Human Capital Management | | Information Technology / Cybersecurity |

| | | | | | | |

| | |

| |

| | | | | | | | |

16 | Valaris Limited | valaris.com |

Resolution 1: Election of Directors

| | | | | | | | | | | | | | | | | | | | | | | |

| | |

Joseph Goldschmid Managing Director at Oak Hill Advisors, L.P. Independent Age: 38 Director since: 2021 Committees: •Compensation (Chair) •Nomination and Governance •Strategy | | Career Highlights Joseph Goldschmid has served as a Managing Director with a primary focus on stressed, distressed and special situations investments at Oak Hill Advisors, L.P. ("OHA"), an alternative investment firm with over $60 billion under management across performing and distressed credit related investments in North America, Europe and other geographies, since November 2019. At OHA, Mr. Goldschmid covers a variety of industries including energy and renewables in addition to serving on the firm's ESG Committee. Prior to joining OHA, Mr. Goldschmid was a Director in the Distressed & Special Situations Group at Angelo Gordon, a global alternative investment manager, from January 2016 to August 2019. During his career, Mr. Goldschmid has led numerous high-profile restructuring cases and served on many official and ad hoc creditor committees. Before joining Angelo Gordon, Mr. Goldschmid worked in the Restructuring and Special Situations Group at The Blackstone Group and PJT Partners. Mr. Goldschmid began his career as an Analyst at Morgan Stanley. Mr. Goldschmid previously served on the Board of Directors for Expro Group. Mr. Goldschmid holds a B.S. degree from the Massachusetts Institute of Technology, an M.B.A. from Columbia Business School and a J.D. from Columbia Law School, where he was a James Kent Scholar. Director Qualifications The particular experience, qualifications, attributes and skills that led our Board to conclude that Mr. Goldschmid should serve as a director include his prior management and governance experience from overseeing various investments in a variety of industries, including the energy industry. |

| | | | | | | |

| | Skills and Experience: |

| | | Strategic Planning / Development | | Finance / Capital Allocation | | Environment and Sustainability Practices |

| | | Energy Industry, including oilfield services | | Risk Management | | |

| | | Business Development / Operations | | Legal / Regulatory | | |

| | | | | | | |

| | |

| |

| | | | | | | | |

| valaris.com | 2024 Proxy Statement | 17 |

Resolution 1: Election of Directors

| | | | | | | | | | | | | | | | | | | | | | | |

| | |

Catherine J. Hughes Former Executive Vice President International at Nexen Inc. Independent Age: 61 Director since: 2022 Committee: •Compensation •Safety and Sustainability | | Career Highlights Catherine J. Hughes has served as a non-executive director of Shell plc since 2017, including as Chair of the Sustainability Committee. Ms. Hughes was previously Executive Vice President International at Nexen Inc. from January 2012 until her retirement in April 2013, where she was responsible for all oil and gas activities including exploration, production, development and project activities outside Canada. Ms. Hughes joined Nexen in 2009 as Vice President Operational Services, Technology and Human Resources. Prior to joining Nexen, she was Vice President Oil Sands at Husky Oil from 2007 to 2009 and Vice President Exploration & Production Services, from 2005 to 2007. Ms. Hughes started her career with Schlumberger in 1986 and held key positions in various countries, including France, Italy, Nigeria, the UK and the USA, and was President of Schlumberger Canada Ltd for five years. Ms. Hughes has previously held non-executive director positions at SNC-Lavalin Group Inc, Statoil ASA and Precision Drilling Inc. Ms. Hughes received a B.Sc. in electrical engineering from the Institut National des Sciences Appliquées de Lyon, France. Director Qualifications The particular experience, qualifications, attributes and skills that led our Board to conclude that Ms. Hughes should serve as a director include her over 30 years of experience in the oil and natural gas industry as well as her experience working in operations as an engineer and senior human resources roles. |

| | | | | | |

| | Skills and Experience: |

| | | Strategic Planning / Development | | International Business | | Environment and Sustainability Practices |

| | | Energy Industry, including oilfield services | | Human Capital Management | | |

| | | Business Development / Operations | | Risk Management | | |

| | Senior Executive Leadership | | Public Company Governance | | |

| | | | | | | |

| | |

| |

| | | | | | | | |

18 | Valaris Limited | valaris.com |

Resolution 1: Election of Directors

| | | | | | | | | | | | | | | | | | | | | | | |

| | |

Kristian Johansen Chief Executive Officer of TGS ASA Independent Age: 52 Director since: 2023 Committee: •Strategy | | Career Highlights Kristian Johansen has served as the Chief Executive Officer of TGS ASA, a leading global energy data and intelligence company, since March 2016. He joined TGS in 2010 as the Chief Financial Officer before becoming the Chief Operating Officer in early 2015. Kristian has almost 20 years of executive experience for public companies in the construction, technology, and energy industries. Mr. Johansen also had previous professional experience from board positions of several public companies in Europe and the U.S., and industry associations such as the National Ocean Industries Association (NOIA) and EnerGeo Alliance (former IAGC). Mr. Johansen earned his undergraduate and master’s degrees in business administration from the University of New Mexico in 1998 and 1999. Director Qualifications The particular experience, qualifications, attributes and skills that led our Board to conclude that Mr. Johansen should serve as a director include his senior executive leadership experience across multiple industries, particularly within the oil and natural gas sector. |

| | | | | | |

| | Skills and Experience: |

| | | Strategic Planning / Development | | Accounting | | Risk Management |

| | | Energy Industry, including oilfield services | | International Business | | Public Company Governance |

| | | Business Development / Operations | | Finance / Capital Allocation | | |

| | Senior Executive Leadership | | Human Capital Management | | |

| | | | | | | |

| | |

| |

| | | | | | | | |

| valaris.com | 2024 Proxy Statement | 19 |

Resolution 1: Election of Directors

| | | | | | | | | | | | | | | | | | | | | | | |

| | |

Elizabeth D. Leykum Founder of Serenade Capital LLC Independent Age: 45 Director since: 2021 Committees: •Audit •Compensation •Nominating and Governance •Strategy | | Career Highlights Elizabeth D. Leykum, our Chair of the Board, has served as founder of Serenade Capital LLC, an investment firm, since May 2016. From October 2013 to April 2016, she served as a founding principal of HEG Capital LLC, a Connecticut-registered investment advisory firm. Prior to joining HEG Capital, Ms. Leykum was, from June 2012 to September 2013, a Vice President at Rand Group, an investment management services firm. Until June 2012, she was a Vice President of ESL Investments, Inc., which she joined in July 2004. From 2000 to 2002, Ms. Leykum worked in the Principal Investment Area at Goldman, Sachs & Co. She has served on the board of Lands’ End, Inc. (NASDAQ: LE) since April 2014, where she was previously Chairman of the Board, and she has served as a director of IES Holdings (NASDAQ: IESC) since April 2021. She graduated Phi Beta Kappa, magna cum laude from Harvard College and received an MBA with distinction from Harvard Business School. Director Qualifications The particular experience, qualifications, attributes and skills that led our Board to conclude that Ms. Leykum should serve includes her work in investment management, which brings to the Board an ability to analyze, assess and oversee corporate and financial performance, and her public company governance experience. With respect to cybersecurity qualifications, Ms. Leykum completed the Massachusetts Institute of Technology's course on "Cybersecurity Leadership for Non-Technical Executives" in 2023. |

| | | | | | |

| | Skills and Experience: |

| | | Strategic Planning / Development | | International Business | | Public Company Governance |

| | | | Business Development / Operations | | Finance / Capital Allocation | | Information Technology / Cybersecurity |

| | | | Senior Executive Leadership | | Risk Management | | |

| | | | | | | |

| | |

| |

| | | | | | | | |

20 | Valaris Limited | valaris.com |

Resolution 1: Election of Directors

| | | | | | | | | | | | | | | | | | | | | | | |

| | |

Deepak Munganahalli Founder of Sencirc Holding Limited Independent Age: 54 Director since: 2021 Committees: •Safety and Sustainability (Chair) •Strategy | | Career Highlights Deepak Munganahalli founded Sencirc, an investment firm that invests and partners to develop sustainable energy and fuels in the circular economy, in September 2022. He currently serves as a director of the firm. He previously served as co-founder of JOULON, an energy industry asset management services company, with a primary focus on the EfW (energy from waste) strategy, mergers, acquisitions and divestitures from 2020 to 2022. Prior to serving as co-founder, Mr. Munganahalli served as Chairman of JOULON, an asset management company established in 2016 in partnership with KKR, from 2016 to 2020. Prior to founding JOULON, Mr. Munganahalli had a 25 year career with Schlumberger and Transocean. Most recently at Transocean, Mr. Munganahalli held leadership roles as Chief Executive Officer for Caledonia Offshore Drilling and Senior Vice President roles in Innovation and Transformation, Corporate Strategy and the Asia Pacific business. He joined the industry in 1991 working on offshore rigs as an engineer trainee and has since worked in more than ten countries globally with various positions in the contract drilling business. Mr. Munganahalli is a graduate of the Indian Institute of Technology at Kanpur and the Harvard Business School General Management Program. Director Qualifications The particular experience, qualifications, attributes and skills that led our Board to conclude that Mr. Munganahalli should serve as a director include his operational and business experience in the offshore drilling industry, which contributes to his ability to assess the sustainability risks facing the Company. |

| | | | | | | |

| | Skills and Experience: |

| | | Strategic Planning / Development | | Senior Executive Leadership | | Human Capital Management |

| | | Energy Industry, including oilfield services | | International Business | | Risk Management |

| | | Business Development / Operations | | Finance / Capital Allocation | | Environment and Sustainability Practices |

| | | | | | | |

| | |

| |

| | | | | | | | |

| valaris.com | 2024 Proxy Statement | 21 |

Resolution 1: Election of Directors

| | | | | | | | | | | | | | | | | | | | | | | |

| | |

James W. Swent, III Former Chairman, President and Chief Executive Officer of Southcross Energy Partners, L.P. Independent Age: 73 Director since: 2021 Committees: •Nominating and Governance (Chair) •Audit •Compensation •Safety and Sustainability | | Career Highlights James W. Swent, III served as the President, Chief Executive Officer & Chairman of the Board of Southcross Energy Partners, GP LLC, the general partner of Southcross Energy Partners, L.P., a provider of natural gas gathering, processing, treating, compression and transportation services and NGL fractionation and transportation services, from September 2018 to June 2020. Southcross Energy Partners, L.P. filed for bankruptcy in April 2019. Previously, Mr. Swent served as Chairman of the Board, President and Chief Executive Officer of Paragon Offshore Limited from July 2017 to April 2018, a global supplier of offshore jack up contract drilling services. From July 2003 to December 2015, he was Executive Vice President and Chief Financial Officer of Ensco plc, a global provider of offshore contract drilling services, which is one of our predecessor entities. He joined Ensco in July 2003 as Senior Vice President and Chief Financial Officer and retired in December 2015. Prior to joining Ensco plc, Mr. Swent served as Co-Founder and Managing Director of Amrita Holdings, LLC. Mr. Swent previously held various financial executive positions in the information technology, telecommunications and manufacturing industries, including positions with Memorex Corporation and Nortel Networks. He served as Chief Executive Officer and Chief Financial Officer of Cyrix Corporation from 1996 to 1997 and Chief Financial Officer and Chief Executive Officer of American Pad and Paper Company from 1998 to 2000. He previously served on the boards of HGIM Corp., Energy XXI Gulf Coast Inc., Co-Chairman of American Pad & Paper Co., Cyrix Corp, and Rodime PLC. Mr. Swent holds a Bachelor of Science degree in Finance and a Master’s degree in Business Administration from the University of California at Berkeley. Director Qualifications The particular experience, qualifications, attributes and skills that led our Board to conclude that Mr. Swent should serve as a director include his experience as a senior executive, including as Chief Executive Officer and Chief Financial Officer of a public company, his finance and accounting expertise, as well as experience with mergers and acquisitions. With respect to cybersecurity qualifications, Mr. Swent was directly responsible for the Information Technology department of Ensco plc for over a decade and oversaw various cybersecurity issues during this time period. |

| | | | | | | |

| | | Skills and Experience: |

| | | | Strategic Planning / Development | | Accounting | | Risk Management |

| | | | Energy Industry, including oilfield services | | International Business | | Public Company Governance |

| | | | Business Development / Operations | | Finance / Capital Allocation | | Information Technology / Cybersecurity |

| | | Senior Executive

Leadership | | Human Capital

Management | | |

| | | | | | | |

| | |

| |

| | | | | | | | |

22 | Valaris Limited | valaris.com |

Resolution 1: Election of Directors

Determination of Independence

Our bye-laws and Corporate Governance Policy state that at least a majority of the Board shall be independent, as the term is defined by SEC rules and NYSE Corporate Governance Standards. Except with respect to their directorships, we do not have any business or other relationships with our independent directors. Only independent directors serve on the Board’s Audit, Compensation, N&G and Safety and Sustainability Committees. In this regard, our Board has determined that all director nominees and directors who served on the Board during 2023 (being Gunnar Eliassen, Mr. Fagerstal, Mr. Goldschmid, Ms. Hughes, Mr. Johansen, Ms. Leykum, Mr. Munganahalli and Mr. Swent) are independent and have no material relationship with us, with the exception of Mr. Dibowitz. Accordingly, 88% of our current Board is independent.

Our Corporate Governance Policy provides that a director who changes his or her principal occupation shall promptly notify the Board of the change and submit a pro-forma letter of resignation to the Board. Under this policy, the other directors shall then meet in executive session, determine whether the change of occupation impacts the director’s independence or creates a conflict of interest and decide whether to accept or reject the pro-forma resignation.

Director Nominations

The N&G Committee, with input from other Board members, is primarily responsible for identifying and screening candidates for nomination to Board membership. Additionally, when appropriate, we may retain the services of a third party to identify, evaluate and/or assist the N&G Committee and the Board in evaluating potential director nominees. Our Board is responsible for nominating individuals to serve on our Board.

| | | | | |

| |

Pursuant to our Corporate Governance Policy, candidates nominated for election or re-election to our Board should possess the following qualifications: |

•personal characteristics: •highest personal and professional ethics, integrity and values, •an inquiring and independent mind, and •practical wisdom and mature judgement; •experience at the policy-making level in business, government or education; •expertise that is useful to our Company and complementary to the background and experience of other Board members (e.g., previous executive and board experience, an international perspective, capital intensive cyclical business experience and knowledge of the global oil and natural gas industry are considered to be desirable); | •willingness to devote the required amount of time to perform the duties and responsibilities of Board membership; •commitment to serve on the Board over a period of several years to develop knowledge about our principal operations; •willingness to represent the best interests of all shareholders and objectively appraise management performance; and •no involvement in activities or interests that create a conflict with the director’s responsibilities to us and our shareholders. |

| |

| | | | | | | | |

| valaris.com | 2024 Proxy Statement | 23 |

Resolution 1: Election of Directors

The N&G Committee will evaluate the qualifications of each director candidate, including any nominees recommended by shareholders, against these criteria in making recommendations to our Board concerning director nominations. The N&G Committee is responsible for assessing the appropriate mix of skills and characteristics required of Board members in the context of the perceived needs of our Board at a given point in time and periodically reviews and updates the criteria listed above as deemed necessary. Diversity in background, including gender, ethnicity, age and nationality, for the Board as a whole may be taken favorably into account in considering individual candidates, and it is one of the many factors that the N&G Committee may consider when identifying individuals for Board membership. The N&G Committee recognizes the benefits of demographic and cognitive diversity, and the breadth of diverse backgrounds, skills and experiences the directors bring to the Board. The Board assesses its effectiveness in this regard as part of the annual Board evaluation process.

Our Board consists of eight members, including two women and one South Asian director. The N&G Committee may identify potential director candidates from a number of sources, including recommendations from directors, management, shareholders and executive recruiting firms retained for such purpose. The N&G Committee uses the same criteria for evaluating candidates regardless of the source of referral.

Shareholder Nominations

The N&G Committee will consider director candidates recommended by shareholders. Shareholders wishing to propose a candidate for consideration by the N&G Committee may do so by writing our Company Secretary at our principal executive offices and following the requirements of our bye-laws for director nominations referred to in the “Information for Shareholder Proposals at the 2025 Annual General Meeting of Shareholders” section of this proxy statement.

| | | | | | | | |

24 | Valaris Limited | valaris.com |

Corporate Governance Policy

We have adopted a Corporate Governance Policy, which includes governance guidelines that assist the Board and its committees in the exercise of their responsibilities under applicable law and the listing standards of the NYSE.

These governance guidelines provide a framework for the Company’s governance and the Board’s activities, covering such matters as Board membership criteria, director independence, Board meetings, Board structure, Board access to management and independent advisors, limitations on outside directorships and leadership roles on other boards of directors, conflicts of interest, director compensation, shareholder communications to the Board, director attendance at shareholder meetings, evaluation of Board and Chief Executive Officer performance, management succession planning, risk oversight, share ownership guidelines and other corporate governance practices and principles.

| | |

|

Key provisions of the Corporate Governance Policy include: •Independent directors meet at regularly scheduled executive sessions without the presence of the Chief Executive Officer and other Company personnel at each regular Board meeting. •Independent directors may convene such sessions during any Board meeting or by notice of a special Board meeting. •Independent directors have open access to management and Valaris' independent advisors, such as attorneys or auditors. •Independent directors are encouraged to suggest items for inclusion in the agenda for Board meetings and are free to raise subjects that are not on the meeting agenda. •The Chair of the Board leads executive sessions of the independent directors and serves as the interface between the independent directors and the Chief Executive Officer in communicating the matters discussed during executive sessions, including feedback to the Chief Executive Officer. The Board believes that this structure facilitates full and frank discussions among all independent directors. The Chair of the Board also: •develops an appropriate schedule of Board meetings and reviews in advance the agenda for Board meetings and Board committee meeting schedules as prepared by the Chief Executive Officer and the Secretary; •develops standards as to the quality, quantity and timeliness of the information submitted to the Board by the Company’s management; •develops the agendas for, and serves as chair of, the executive sessions of the Board’s independent directors; and •participates in recommendations regarding recruitment of new directors, management succession planning and annual Board performance and Chief Executive Officer evaluations. |

|

Our Corporate Governance Policy is available in the Governance Documents section under About on our website (www.valaris.com). Paper copies also are available upon request without charge. Such requests should be directed to Investor Relations at 5847 San Felipe, Suite 3300, Houston, Texas 77057.

| | | | | | | | |

| valaris.com | 2024 Proxy Statement | 25 |

Board and Committee Structure

Board Leadership Structure

The Board believes separation of the Chair of the Board and Chief Executive Officer currently best serves the objectives of the Board’s oversight of management, the Board’s ability to carry out its roles and responsibilities on behalf of its shareholders and the Company’s overall corporate governance.

The Board believes the separation of the Chair of the Board and Chief Executive Officer roles also allows Mr. Dibowitz to focus on managing the Company, its operations and strategic direction, allowing him to leverage the Chair of the Board’s experience and perspectives. In addition, the Board believes that this leadership structure provides an effective framework for addressing the risks facing our Company, as discussed in greater detail under “Risk Oversight.” The Board has authority to modify this structure to best address the Company’s circumstances and advance the best interests of shareholders as and when appropriate.

Our governance practices provide for strong independent leadership, independent discussion among directors, independent evaluation of, and communication with, members of management and independent oversight of the Company’s operational, fiscal and risk mitigation activities. These governance practices are reflected in our Corporate Governance Policy and the committee charters, all of which are available on our website in the Governance Documents section under About on our website (www.valaris.com).

Board Committees

Audit Committee

Members: Dick Fagerstal (Chair), Elizabeth D. Leykum and James W. Swent, III

Number of meetings in 2023: 10

•The members meet the independence criteria for audit committee members prescribed by the NYSE.

•None of the members of our Audit Committee serve on more than three public company audit committees.

•Our Board has determined that each member of the Audit Committee meets the requisite SEC criteria to qualify as audit committee financial experts, and each of the members of our Audit Committee is financially literate and has accounting or related financial management expertise as defined in the NYSE Corporate Governance Standards. In making recommendations and determinations regarding audit committee financial experts, our Board and the Audit Committee considered the relevant academic and professional experience of the Audit Committee members.

| | |

|

RESPONSIBILITIES INCLUDE: •appoint independent auditors to examine, review and audit our consolidated financial statements; •review the general scope of services to be rendered by the independent auditors; •pre-approve all services of the independent auditors and authorize payment of their associated fees; •review with management the adequacy and effectiveness of our internal controls over financial reporting; •review with management our earnings releases, quarterly financial statements and annual audited financial statements along with certain other disclosures; •review, approve and oversee related party transactions and monitor compliance with our Code of Conduct; and •provide oversight of risks associated with the Company’s financial performance, information technology and cybersecurity, internal and external audit functions, legal and tax contingencies and other exposures. |

|

| | | | | | | | |

26 | Valaris Limited | valaris.com |

Compensation Committee

Members: Joseph Goldschmid (Chair), Catherine J. Hughes, Elizabeth D. Leykum and James W. Swent, III

Number of meetings in 2023: 8

•The members of the Compensation Committee meet the independence criteria for compensation committee members prescribed by the NYSE.

•None of the members of our Compensation Committee serve on more than three public company compensation committees.

| | |

|

RESPONSIBILITIES INCLUDE: •review and approve executive compensation, including matters regarding our benefit plans, independently or in conjunction with our Board, as appropriate; •review with management and approve any significant changes to the Company’s compensation structure and benefit plans; •oversee administration of the Company’s incentive-compensation and equity-based compensation plans, including the corporate goals and objectives applied to the compensation of the Company’s executives; •oversee the administration of the Company’s clawback policy in consultation with the Audit Committee (other than with respect to the CEO and any other executive director), and review and recommend changes in the policy to the Board from time to time as appropriate; •oversee compliance with SEC rules and regulations governing executive compensation; and •evaluate appropriate compensation levels for non-executive directors. |

|

Safety and Sustainability Committee

Members: Deepak Munganahalli (Chair), Dick Fagerstal, Catherine J. Hughes and James W. Swent, III

Number of meetings in 2023: 5

This committee was previously known as the Environmental, Social and Governance ("ESG") Committee. In June 2023, the committee's charter was revised to include additional safety oversight responsibilities and to rename the committee to Safety and Sustainability Committee. The committee's revised charter is available on the Valaris website.

| | |

|

RESPONSIBILITIES INCLUDE: •assist the Board in its oversight with respect to the areas of (i) process safety and personal safety (collectively, “Safety”); and (ii) sustainability, including environmental and social matters as commonly included in environmental social governance standards and assessments (other than diversity, equity and inclusion and other matters in which oversight is managed by the Board) (collectively, “Sustainability”); •oversee the Company's policies, programs and strategies relating to Safety and Sustainability matters; •review and discuss with management the Company’s policies and programs on risk assessment and management of Safety and Sustainability related matters, including the manner in which current and emerging risks are identified, evaluated and managed that affect or could affect the Company; •review updates from management on material Safety audits and high potential incident investigations; •review updates from management regarding the Company's Safety and Sustainability activities; •oversee the establishment of appropriate Safety and Sustainability targets, including greenhouse gas reduction targets, review Safety and Sustainability targets for inclusion in the Company's bonus plans (in conjunction with the Compensation Committee) and monitor the Company's performance against those goals; •review with management the Company’s disclosures regarding Safety and Sustainability matters (in conjunction with other committees or the Board, as appropriate), including the Company’s annual Sustainability Report; and •certain social and corporate governance responsibilities set forth in the Safety and Sustainability Committee charter may also fall within the purview of other committees or may be considered by the Board. |

|

| | | | | | | | |

| valaris.com | 2024 Proxy Statement | 27 |

Nominating and Governance Committee

Members: James W. Swent, III (Chair), Joseph Goldschmid and Elizabeth D. Leykum

Number of meetings in 2023: 6

•The members of the Nominating and Governance meet the independence criteria prescribed by NYSE for service on a nominating committee.

| | |

|

RESPONSIBILITIES INCLUDE: •select, identify and screen candidates for nomination to our Board - in identifying director candidates, the Committee shall endeavor to include, and have any search firm that it engages include, women, minority and other diverse candidates in the pool from which the Committee selects director candidates; •recommend the composition of committees of our Board; •recommend our slate of officers; •oversee the Company’s shareholder engagement program and make recommendations to the Board regarding its involvement in shareholder engagement; •oversee and recommend matters of corporate governance, independently or in conjunction with our Board, as appropriate; and •involvement in succession planning both from a general standpoint and with respect to a potential emergency situation that might impact the ability of the Board and executive management to continue the performance of their respective functions and responsibilities. |

|

Strategy Committee

The Strategy Committee is responsible for assisting the Board in overseeing the Company’s strategic mergers and acquisitions (M&A) opportunities. Its members include Anton Dibowitz (Chair), Joseph Goldschmid, Kristian Johansen, Elizabeth D. Leykum and Deepak Munganahalli. The Strategy Committee meets as appropriate or when such strategic M&A opportunities are not otherwise discussed by the Board.

Director Engagement

Meetings and Attendance

The Board met 16 times during the year ended December 31, 2023. The Board has five committees, the Audit Committee, N&G Committee, Compensation Committee, Safety and Sustainability Committee and Strategy Committee. During 2023 each incumbent director attended at least 90% of the meetings held by the Board and the committees of which he or she was a member.

The independent directors conducted executive sessions without management during each of the four regular quarterly meetings of the Board and during other meetings held throughout the year. Only independent directors serve on the Board’s Audit, Compensation, N&G and Safety and Sustainability Committees.

Our Corporate Governance Policy provides that, barring extenuating circumstances, all members of the Board shall attend our annual general meetings of shareholders and also are encouraged to attend any and all other general meetings that may be duly convened. All eight incumbent directors serving on the Board attended the 2023 Annual General Meeting of Shareholders.

| | | | | | | | |

28 | Valaris Limited | valaris.com |

Director Education and Orientation Program

The Company provides an orientation process and continuing education for Board members to enable them to stay current on developments related to their Board and committee service.

New Director Orientation

When new directors join the Board, the Company provides a tailored orientation and onboarding process. Following their orientation, new directors should know key information about the Company’s business, strategy, leadership and structure and be well-informed about their responsibilities and duties as directors and have access to resources, information and contacts that will allow them to be effective directors.

Continuing Education

Our directors' continuing education has come from a combination of outside programs, presentations by customers and other key business partners, participation in management or third party-led programs and visits to operational locations. Recent topics have included industry and operational matters, various sustainability matters, cybersecurity, recent regulatory developments and other topics relevant for Board oversight. The Company’s directors are encouraged to participate in continuing education programs to enhance their effectiveness on the Company’s Board. The Company reimburses directors for continuing education programs.

Outside the Boardroom

Throughout their service, our directors have regular discussions with each other and the Company's leadership outside of regularly scheduled Board and committee meetings in order to share ideas and perspectives, build relationships and gain a deeper understanding of the Company’s business.

Board Evaluations

Board and committee evaluations play a critical role in ensuring the effective functioning of our Board. Each year, our Board conducts an evaluation in order to assess its effectiveness, review our governance practices and policies, and identify areas for enhancement. As provided in their respective charters, each of our Board’s standing committees also conducts an evaluation process annually. The N&G Committee, in consultation with our Chair, reviews and determines the overall process of our Board’s annual evaluation. The current Board and committee evaluation process involves an annual evaluation by each director of the Board as a whole and each committee on which he or she serves. Our Board’s and each committee’s evaluation includes a review of the Corporate Governance Policy and its committee charter to consider any proposed changes.

Each year, the N&G Committee, in consultation with the Chair, also considers whether to engage a third party to assist the Board in conducting its evaluation. In recent years, the Board engaged a third party to help facilitate its annual evaluation process.

The results of the evaluation process provides valuable insight regarding areas of effectiveness and opportunities for improvement. The Board and each committee discuss the findings and make changes as deemed necessary to improve director communications and the overall effectiveness of Board and committee meetings. For example, findings in previous years have led to changes in Board and committee composition and oversight responsibilities, including adding safety oversight responsibilities to the Safety and Sustainability Committee (See "Safety and Sustainability Committee" above) and areas for further director education. An overview of the Board’s evaluation process in recent years is illustrated below:

| | | | | | | | |

| valaris.com | 2024 Proxy Statement | 29 |

| | | | | | | | | | | |

| | | Board Evaluation Process |

| | | |

| | | |

| | | Board and Committee Evaluation Survey Discussion Topics Board and Committee evaluation survey discussion topics are reviewed annually, including in light of best practices and regulatory expectations, and approved by the N&G Committee and chair of each committee and sent to each director to request feedback on various topics. |

| | |

| | |

| | | |

| | | q |

| | | |

| | | One-on-One Director Discussions Individual meetings are conducted by an independent third party with each director to obtain feedback about Board and committee performance. |

| | |

| | |

| | | |

| | | q |

| | | |

| | | Board and Committee Executive Session The results are aggregated and summarized by the independent third party. The third party facilitator leads a discussion of the results of the evaluations. |

| | |

| | |

| | | |

| | | q |

| | | |

| | | Feedback Communicated and Acted Upon Opportunities for improvement are identified and addressed |

| | |

| | |

| | | |

In addition, each year, the independent directors meet in executive session to evaluate the performance of the CEO. The N&G Committee, in conjunction with the chair of the Compensation Committee, coordinates a process for the CEO annual evaluation, which has been guided by an independent third party in recent years.

Oversight by Our Board

Risk Oversight

The Board and its committees are actively involved in the oversight of risks that could impact our Company. The Board oversees the management of enterprise-wide risks, such as those related to macroeconomic and market conditions, commodity prices, strategic decisions, significant operating risks and disruptions.

| | | | | | | | |

30 | Valaris Limited | valaris.com |

| | |

|