Exhibit (13)

MANAGEMENT’S DISCUSSION & ANALYSIS

Executive Summary

The following management discussion and analysis (“MD&A”) provides information that we believe is useful in understanding our operating results, cash flows and financial condition. This discussion contains various “Non-GAAP Financial Measures” and also contains various “Forward-Looking Statements” within the meaning of the Private Securities Litigation Reform Act of 1995. We refer readers to the information on Non-GAAP Financial Measures and Forward-Looking Statements and Risk Factors found on pages 19 and 20.

In 2010, we delivered double-digit earnings growth despite continued mixed conditions in our end markets. While global hospitality markets showed improving trends and food and beverage and healthcare were generally steady, foodservice markets in the U.S. and Europe remained soft. We continued to focus on driving our sales, working to expand our market shares in all markets and regions; invest in new product development that provide outstanding results and enable customers to save labor, water and energy; make smart investments to sustain our growth in the future; and employ strategic acquisitions to bolster the current business and to develop new areas of growth.

At the same time, we also worked aggressively to improve our profitability and enhance our returns on investment. Numerous projects were undertaken to improve process efficiency, simplify and enhance our product portfolio, globalize purchasing, and optimize our business structure. The most significant of these was the new business systems installation in Europe, which will bring us an unprecedented range of tools and capabilities to unlock excess operational and structural costs in Europe and substantially improve margins there. Through these focused actions, we once again delivered for our shareholders in 2010, while building opportunity for the future. Our performance underscored the strength and long term potential of our business, our people and our strategies.

Both 2010 and 2009 results of operations included special gains and charges, as well as discrete tax items which impact the year over year comparisons.

Sales: Reported consolidated net sales increased 3% to $6.1 billion in 2010 from $5.9 billion in 2009. Net sales were slightly impacted by favorable foreign currency exchange compared to the prior year.

Gross Margin: Our reported gross margin improved to 50.5% of sales for 2010 compared to 49.5% of sales in 2009. Our 2009 gross margin was negatively impacted by restructuring charges included in cost of sales of $12.6 million, which decreased our gross margin by 0.2 percentage points.

Operating Income: Reported operating income increased 18% to $807 million in 2010 compared to $681 million in 2009. Non-GAAP adjusted operating income, excluding the impact of special gains and charges, increased 7% in 2010. See the section entitled Non-GAAP Financial Measures on page 19 for further information on our Non-GAAP measures, and the Operating Income table on page 13.

Earnings Per Share: Reported diluted earnings per share increased 28% to $2.23 in 2010 compared to $1.74 for 2009. Special gains and charges and discrete tax items had no net impact on 2010 and negatively impacted 2009 by $0.25 per share due primarily to restructuring charges. Non-GAAP adjusted earnings per share, which exclude the impact of special gains and charges, and discrete tax items, increased 12% to $2.23 in 2010 compared to $1.99 in 2009.

See the section entitled Non-GAAP Financial Measures on page 19 for further information on our Non-GAAP measures, and the Diluted Earnings Per Common Share (EPS) table on page 14.

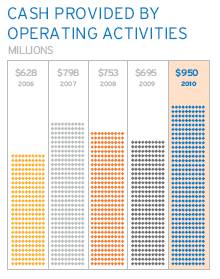

Cash Flow: Cash flow from operating activities was $950 million in 2010. We continue to generate strong cash flow from operations, allowing us to make key investments in our business, pay down debt and provide returns to our shareholders through cash dividends and share repurchases.

Balance Sheet: Our balance sheet remained within the “A” categories of the major rating agencies during 2010 and exceeded our stated objective of having an investment grade balance sheet. Our strong balance sheet has allowed us to continue to have access to capital at attractive rates.

Return on Equity: Our return on beginning shareholders’ equity (net income attributable to Ecolab divided by beginning shareholders’ equity) for 2010 was 26.5%. This was the 19th consecutive year in which we achieved our long-term financial objective of at least 20% return on beginning shareholders’ equity.

Dividends: We increased our quarterly cash dividend 13% in December 2010 to an indicated annual rate of $0.70 per share for 2011. The increase represents our 19th consecutive annual dividend rate increase and the 74th consecutive year we have paid cash dividends. Our outstanding dividend record is a result of our excellent business model, and this year’s increase reflects our solid balance sheet, our outlook for further growth and our commitment to improving shareholder returns.

Europe Transformation: Following the recent implementation of new business systems in Europe, in February 2011, subsequent to our 2010 year end, we announced we have undertaken a comprehensive plan to substantially improve the efficiency and effectiveness of our Europe business, sharpen its competitiveness and accelerate its growth and profitability. As a part of this effort, we are developing plans for an accelerated restructure of our European operations in order to more quickly realize the benefits. We expect to incur a pretax restructuring charge of approximately $150 million ($125 million after tax) over the next three years, beginning in the first quarter of 2011, as the restructuring is rolled out. The restructuring and other cost savings actions are expected to result in annualized cost savings of approximately $120 million ($100 million after tax) when fully realized. See the section entitled Subsequent Events on page 19 for more details.

CRITICAL ACCOUNTING ESTIMATES

Our consolidated financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (U.S. GAAP). We have adopted various accounting policies to prepare the consolidated financial statements in accordance with U.S. GAAP. Our most significant accounting policies are disclosed in Note 2 of the Notes to the Consolidated Financial Statements.

Preparation of our consolidated financial statements, in conformity with U.S. GAAP, requires us to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. Estimates are considered to be critical if they meet both of the following criteria: (1) the estimate requires assumptions to be made about matters that are highly uncertain at the time the accounting estimate is made, and (2) different estimates that the company reasonably could have used for the accounting estimate in the current period, or changes in the accounting estimate that are reasonably likely to occur from period to period, have a material impact on the presentation of the company’s financial condition, changes in financial condition or results of operations.

Besides estimates that meet the “critical” estimate criteria, we make many other accounting estimates in preparing our financial statements and related disclosures. All estimates, whether or not deemed critical, affect reported amounts of assets, liabilities, revenues and expenses as well as disclosures of contingent assets and liabilities. Estimates are based on experience and other information available prior to the issuance of the financial statements. Materially different results can occur as circumstances change and additional information becomes known, even from estimates not deemed critical. Our critical accounting estimates include the following:

Revenue Recognition

We recognize revenue on product sales at the time title to the product and risk of loss transfers to the customer. We recognize revenue on services as they are performed. Our sales policies do not provide for general rights of return. We record estimated reductions to revenue for customer programs and incentive offerings including pricing arrangements, promotions and other volume-based incentives at the time the sale is recorded. Depending on market conditions, we may increase customer incentive offerings, which could reduce gross profit margins at the time the incentive is offered.

Valuation Allowances and Accrued Liabilities

We estimate sales returns and allowances by analyzing historical returns and credits, and apply these trend rates to the most recent 12 months’ sales data to calculate estimated reserves for future credits. We estimate the allowance for doubtful accounts by analyzing accounts receivable balances by age and applying historical write-off trend rates. In addition, our estimates also include separately providing for specific customer balances when it is deemed probable that the balance is uncollectible. Actual results could differ from these estimates under different assumptions. Our allowance for doubtful accounts balance was $45 million and $52 million, as of December 31, 2010 and 2009, respectively. These amounts include our allowance for sales returns and credits of $7 million as of December 31, 2010 and $10 million as of December 31, 2009. Our bad debt expense as a percent of net sales was 0.3% in 2010 and 0.4% in 2009 and 2008. We believe that it is reasonably likely that future results will be consistent with historical trends and experience. However, if the financial condition of our customers were to deteriorate, resulting in an inability to make payments, or if unexpected events or significant changes in future trends were to occur, additional allowances may be required.

Estimates used to record liabilities related to pending litigation and environmental claims are based on our best estimate of probable future costs. We record the amounts that represent the points in the range of estimates that we believe are most probable or the minimum amount when no amount within the range is a better estimate than any other amount. Potential insurance reimbursements are not anticipated in our accruals for environmental liabilities or other insured losses. Expected insurance proceeds are recorded as receivables when recovery is probable. While the final resolution of litigation and environmental contingencies could result in amounts different than current accruals, and therefore have an impact on our consolidated financial results in a future reporting period, we believe the ultimate outcome will not have a significant effect on our financial position.

Actuarially Determined Liabilities

The measurement of our pension and postretirement benefit obligations are dependent on a variety of assumptions determined by management and used by our actuaries. These assumptions affect the amount and timing of future contributions and expenses.

The assumptions used in developing the required estimates include, among others, discount rate, projected salary and health care cost increases and expected return or earnings on assets. The discount rate assumption for the U.S. Plans is calculated using a bond yield curve constructed from a population of high-quality, non-callable, corporate bond issues with maturity dates of six months to thirty years. Bond issues in the population are rated no less than Aa by Moody’s Investor Services or AA by Standard & Poors. The discount rate is calculated by matching the plans’ projected cash flows to the yield curve. Projected salary and health care cost increases are based on our long-term actual experience, the near-term outlook and assumed inflation. The expected return on plan assets reflects asset allocations, investment strategies and the views of investment advisors. The effects of actual results differing from our assumptions, as well as changes in assumptions, are reflected in the unrecognized actuarial loss and amortized over future periods and, therefore, generally affect our recognized expense in future periods. Significant differences in actual experience or significant changes in assumptions may materially affect pension and other post-retirement obligations. The unrecognized actuarial loss on our U.S. qualified and non-qualified pension plans decreased from $533 million to $500 million (before tax) as of December 31, 2009 and 2010, respectively, primarily due to amortization of existing unrecognized losses, partially offset by a decrease in our discount rate. In determining our U.S. pension and postretirement obligations for 2010, our discount rate decreased to 5.41% from 5.84% at year-end 2009 and our projected salary increase was unchanged at 4.32% . Our expected return on plan assets, used for determining 2010 and 2011 expense, was 8.50% and reflects our expected long-term returns on plan assets.

The effect on 2011 expense of a decrease in the discount rate or expected return on assets assumption as of December 31, 2010 is shown below assuming no changes in benefit levels and no amortization of gains or losses for our major plans:

|

MILLIONS |

|

EFFECT ON U.S. PENSION PLAN |

| ||||

|

ASSUMPTION |

|

ASSUMPTION |

|

INCREASE IN |

|

HIGHER |

|

|

Discount rate |

|

-0.25 pts |

|

$40.0 |

|

$4.8 |

|

|

Expected return on assets |

|

-0.25 pts |

|

N/A |

|

$2.9 |

|

|

MILLIONS |

|

EFFECT ON U.S. POSTRETIREMENT |

| ||||

|

ASSUMPTION |

|

ASSUMPTION |

|

INCREASE IN |

|

HIGHER |

|

|

Discount rate |

|

-0.25 pts |

|

$4.7 |

|

$1.2 |

|

|

Expected return on assets |

|

-0.25 pts |

|

N/A |

|

$0.1 |

|

We use similar assumptions to measure our international pension obligations. However, the assumptions used vary by country based on specific local country requirements and information. See Note 15 for further discussion concerning our accounting policies, estimates, funded status, planned contributions and overall financial positions of our pension and post-retirement plan obligations.

In the U.S. we have high deductible insurance policies for workers’ compensation, general liability and automotive liability losses, subject to per occurrence and liability limitations. We are insured for losses in excess of these limitations and have recorded both a liability and an offsetting receivable for amounts in excess of these limitations. We are self-insured for health care claims for eligible participating employees, subject to certain deductibles and limitations. We determine our liabilities for claims incurred but not reported on an actuarial basis. A change in these assumptions would cause reported results to differ. Outside of the U.S., we are fully insured for losses, subject to annual insurance deductibles.

Share-Based Compensation

We measure compensation expense for share-based awards at fair value at the date of grant and recognize compensation expense over the service period for awards expected to vest. Determining the fair value of share-based awards at the grant date requires judgment, including estimating expected volatility, exercise and post-vesting cancellation behavior, expected dividends and risk-free rates of return. Additionally, the expense that is recorded is dependent on the amount of share-based awards expected to vest or be forfeited. Estimating vesting includes assessing the probability of meeting service and performance conditions. If actual vesting or forfeiture results differ significantly from these estimates, share-based compensation expense and our results of operations could be impacted. For additional information on our stock incentive and option plans, including significant assumptions used in determining fair value, see Note 10.

Income Taxes

Judgment is required to determine the annual effective income tax rate, deferred tax assets and liabilities and any valuation allowances recorded against net deferred tax assets. Our effective income tax rate is based on annual income, statutory tax rates and tax planning opportunities available in the various jurisdictions in which we operate. Our annual effective income tax rate includes the impact of reserve provisions. We recognize the largest amount of tax benefit that is greater than 50% likely of being realized upon settlement with a taxing authority. We adjust these reserves in light of changing facts and circumstances. During interim periods, this annual rate is then applied to our year-to-date operating results. In the event that there is a significant one-time item recognized in our interim operating results, the tax attributable to that item would be separately calculated and recorded in the same period as the one-time item.

Tax regulations require items to be included in our tax returns at different times than the items are reflected in our financial statements. As a result, the effective income tax rate reflected in our financial statements differs from that reported in our tax returns. Some of these differences are permanent, such as expenses that are not deductible on our tax return, and some are temporary differences, such as depreciation expense. Temporary differences create deferred tax assets and liabilities. Deferred tax assets generally represent items that can be used as a tax deduction or credit in our tax return in future years for which we have already recorded the tax benefit in our income statement. We establish valuation allowances for our deferred tax assets when the amount of expected future taxable income is not likely to support the utilization of the entire deduction or credit. Deferred tax liabilities generally represent items for which we have already taken a deduction in our tax return, but have not yet recognized that tax benefit in our financial statements. Undistributed earnings of foreign subsidiaries are considered to have been reinvested indefinitely or available for distribution with foreign tax credits available to offset the amount of applicable income tax and foreign withholding taxes that might be payable on earnings. It is impractical to determine the amount of incremental taxes that might arise if all undistributed earnings were distributed.

A number of years may elapse before a particular tax matter, for which we have established a reserve, is audited and finally resolved. The number of tax years with open tax audits varies depending on the tax jurisdiction. The Internal Revenue Service (IRS) has completed its examinations of our U.S. federal income tax returns through 2006. There are specific positions within the 1999 through 2001 examinations that are still open with the IRS. The U.S. income tax returns for the years 2007 and 2008 are currently under audit. It is reasonably possible for the specific open positions within the 1999 through 2001 examinations to be settled in the next twelve months. Settlement of any particular issue could result in offsets to other balance sheet accounts, cash payments or receipts and/or adjustments to tax expense. The majority of our tax reserves are presented in the balance sheet within other non-current liabilities. For additional information on income taxes, see Note 11.

Long-Lived, Intangible Assets and Goodwill

We periodically review our long-lived and intangible assets for impairment and assess whether significant events or changes in business circumstances indicate that the carrying value of the assets may not be recoverable. This could occur when the carrying amount of an asset exceeds the anticipated future undiscounted cash flows expected to result from the use of the asset and its eventual disposition. The amount of the impairment loss to be recorded, if any, is calculated as the excess of the asset’s carrying value over its estimated fair value. We also periodically reassess the estimated remaining useful lives of our long-lived assets.

Changes to estimated useful lives would impact the amount of depreciation and amortization expense recorded in earnings. We have experienced no significant changes in the carrying value or estimated remaining useful lives of our long-lived assets.

We test our goodwill for impairment on an annual basis during the second quarter. Our reporting units are our operating segments. If circumstances change significantly, we would also test a reporting unit for impairment during interim periods between its annual tests. Based on our testing, there has been no impairment of goodwill during the three years ending December 31, 2010. Goodwill is assessed for impairment using fair value measurement techniques. Specifically, goodwill impairment is determined using a two-step process. Both the first step of determining the fair value of a reporting unit and the second step of determining the fair value of individual assets and liabilities of a reporting unit (including unrecognized intangible assets) are judgmental in nature and often involve the use of significant estimates and assumptions. Fair values of reporting units are established using a discounted cash flow method. Where available and as appropriate, comparable market multiples are used to corroborate the results of the discounted cash flow method. These valuation methodologies use estimates and assumptions, which include projected future cash flows (including timing), discount rate reflecting the risk inherent in future cash flows, perpetual growth rate, and determination of appropriate market comparables.

During the second quarter ended June 30, 2010, we completed our annual test for goodwill impairment and we determined GCS Service required an updated fair value calculation due to soft sales and continued operating losses. We used both a discounted cash flow analysis and market valuations, including similar company market multiples and comparable transactions, to assess fair value. The estimated fair value of the GCS Service business is based on a probability weighted-average of these various measures. Based on this analysis, it was determined that the fair value of the GCS Service reporting unit would have to decline by approximately 30% to indicate the potential for an impairment of their goodwill. Therefore, we believe that the estimated fair value of the GCS Service reporting unit substantially exceeds its carrying value and no adjustment to the $43 million carrying value of goodwill is necessary. The key assumptions utilized in determining fair value are revenue growth rates, operating margins and factors that impact the company’s weighted-average cost of capital, including interest rates. Of these factors, the fair value estimate is most sensitive to changes in revenue growth rates which could be adversely impacted by continued difficult economic conditions, uncertainty in the U.S. foodservice markets and the timing of adding new customers. GCS Service is included in our U.S. Other Services reportable segment.

RESULTS OF OPERATIONS

Net Sales

|

|

|

|

|

|

PERCENT CHANGE | |||||||||||||

|

MILLIONS |

|

2010 |

2009 |

2008 |

2010 |

2009 | ||||||||||||

|

Net sales |

|

|

$ |

6,090 |

|

|

|

$ |

5,901 |

|

|

$ |

6,138 |

|

3 |

% |

(4 |

)% |

The components of the year-over-year net sales change are as follows:

|

PERCENT |

|

2010 |

2009 | ||

|

Volume |

|

2 |

% |

(3 |

)% |

|

Price changes |

|

— |

|

3 |

|

|

Acquisitions and divestitures |

|

— |

|

— |

|

|

Fixed currency sales change |

|

3 |

|

— |

|

|

Foreign currency exchange |

|

1 |

|

(4 |

) |

|

Total net sales change |

|

3 |

% |

(4 |

)% |

Note: Amounts in table above do not necessarily sum due to rounding.

Gross Margin

|

|

|

2010 |

2009 |

2008 | |||

|

Gross profit as a percent of net sales |

|

50.5 |

% |

49.5 |

% |

48.8 |

% |

Our gross profit margin (“gross margin”) (defined as the difference between net sales less cost of sales, divided by net sales) increase in 2010 over 2009 was driven by volume gains, favorable delivered product costs (includes raw materials, freight and fuel) and cost savings actions. Our 2009 gross margin was negatively impacted by restructuring charges included in cost of sales of $12.6 million, which decreased our gross margin by 0.2 percentage points.

Our gross margin increase in 2009 over 2008 was driven by pricing and cost-saving initiatives, which more than offset lower sales volume, higher delivered product costs and restructuring charges included in cost of sales.

Selling, General and Administrative Expenses

|

|

|

2010 |

2009 |

2008 | |||

|

Selling, general & administrative expenses as a percent of net sales |

|

37.1 |

% |

36.8 |

% |

36.8 |

% |

Selling, general and administrative expenses as a percentage of consolidated net sales increased to 37.1% compared to 36.8% in 2009. Investments in the business and cost increases more than offset savings from last year’s restructuring and leverage from sales gains. We continue to make key business investments that drive innovation and efficiency, through R&D and information technology systems.

Selling, general and administrative expenses as a percentage of consolidated net sales were 36.8% for both 2009 and 2008. The savings from restructuring, pricing leverage and well-managed spending were offset by a sales decline, investments and other cost increases during 2009.

Special Gains and Charges

Special gains and charges reported on the Consolidated Statement of Income included the following items:

|

MILLIONS |

|

2010 |

2009 |

2008 | ||||||||

|

Cost of sales |

|

|

|

|

|

|

|

|

|

|

| |

|

Restructuring charges |

|

$ |

— |

|

|

$ |

12.6 |

|

|

$ |

— |

|

|

Special (gains) and charges |

|

|

|

|

|

|

|

|

|

|

| |

|

Restructuring charges |

|

— |

|

|

|

59.9 |

|

|

|

— |

| |

|

Venezuela currency devaluation |

|

4.2 |

|

|

|

— |

|

|

|

— |

| |

|

Business structure and optimization |

|

10.9 |

|

|

|

2.8 |

|

|

|

25.6 |

| |

|

Business write-downs and closures |

|

(1.4 |

) |

|

|

2.4 |

|

|

|

19.1 |

| |

|

Gain on sale of plant |

|

— |

|

|

|

— |

|

|

|

(24.0 |

) | |

|

Gain on sale of businesses |

|

— |

|

|

|

— |

|

|

|

(1.7 |

) | |

|

Gain on sale of investments |

|

(5.9 |

) |

|

|

— |

|

|

|

— |

| |

|

Other items |

|

(0.3 |

) |

|

|

2.0 |

|

|

|

6.9 |

| |

|

Subtotal |

|

7.5 |

|

|

|

67.1 |

|

|

|

25.9 |

| |

|

Total |

|

$ |

7.5 |

|

|

$ |

79.7 |

|

|

$ |

25.9 |

|

Special gains and charges in 2010 include costs to optimize our organizational structure, $8.5 million of which were recorded in the fourth quarter. In the third quarter of 2010, the company sold an investment in a small U.S. business and recognized a $5.9 million gain on the sale. The investment was not material to our consolidated results of operations or financial position.

Beginning in 2010, Venezuela has been designated hyper-inflationary and as such all foreign currency fluctuations are recorded in income. On January 8, 2010 the Venezuelan government devalued its currency (Bolivar Fuerte). We are remeasuring the financial statements of our Venezuelan subsidiary using the official exchange rate of 4.30 Bolivars to U.S. dollar. As a result of the devaluation, we recorded a charge of $4.2 million in the first quarter of 2010 due to the remeasurement of the local balance sheet. We are unable to predict the ongoing currency gains and losses for the remeasurement of the balance sheet, but do not expect these gains and losses to have a material impact on our future consolidated results of operations or financial position.

In the first quarter of 2009, we announced plans to undertake restructuring and other cost-saving actions during 2009 in order to streamline operations and improve efficiency and effectiveness. The restructuring plan included a reduction of the company’s global workforce and the reduction of plant and distribution center locations. As a result of these actions, we recorded restructuring charges of $72.5 million ($52.0 million after tax) or $0.22 per diluted share during 2009. The restructuring was completed as of the end of 2009. These actions provided annualized pretax savings of approximately $75 million ($50 million after tax), with pretax savings of approximately $50 million realized in 2009. Further details related to the restructuring are included in Note 3.

2009 special gains and charges also included the write-down of our carrying value in a non-strategic business as well as costs to optimize our business structure.

Special gains and charges in 2008 included a charge of $19.1 million, recorded in the fourth quarter, for the write-down of investments in an energy management business and closure of two small non-strategic healthcare businesses as well as costs to optimize our business structure, including costs related to establishing our new European headquarters in Zurich, Switzerland. These charges were partially offset by a gain of $24.0 million from the sale of a plant in Denmark recorded in the second quarter and a $1.7 million gain related to the sale of a business in the United Kingdom (U.K.) recorded in the first quarter.

For segment reporting purposes, special gains and charges have been included in our corporate segment, which is consistent with our internal management reporting.

Operating Income

|

|

|

|

|

|

PERCENT CHANGE | |||||||||||

|

MILLIONS |

|

2010 |

2009 |

2008 |

2010 |

2009 | ||||||||||

|

Reported GAAP operating income |

|

$ |

806.8 |

|

|

$ |

681.3 |

|

|

$ |

712.8 |

|

18 |

% |

(4 |

)% |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Special gains and charges |

|

7.5 |

|

|

|

79.7 |

|

|

|

25.9 |

|

|

|

|

| |

|

Non-GAAP adjusted operating income |

|

814.3 |

|

|

|

761.0 |

|

|

|

738.7 |

|

7 |

|

3 |

| |

|

Effect of foreign currency translation |

|

2.8 |

|

|

|

10.6 |

|

|

|

(22.9 |

) |

|

|

|

| |

|

Non-GAAP adjusted fixed currency operating income |

|

$ |

817.1 |

|

|

$ |

771.6 |

|

|

$ |

715.8 |

|

6 |

% |

8 |

% |

Reported operating income increased 18% in 2010 compared to 2009. The operating income increase was impacted by the year over year decrease in special gains and charges and the favorable impact of foreign currency exchange. Excluding the impact of special gains and charges, adjusted operating income increased 7% in 2010. Excluding favorable currency exchange, adjusted fixed currency operating income increased 6% in 2010 as sales gains, favorable delivered product costs, and savings from last year’s restructuring more than offset continued investment in the business and other cost increases.

Reported operating income declined 4% in 2009 compared to 2008. The operating income decrease was impacted by the year over year comparison of special gains and charges and the unfavorable impact of foreign currency exchange. Excluding the impact of special gains and charges, adjusted operating income increased 3% in 2009. Excluding unfavorable currency exchange, adjusted fixed currency operating income increased 8% in 2009 as increased pricing and cost savings efforts more than offset increased raw material and other costs during the year.

Interest Expense, Net

Net interest expense totaled $59 million, $61 million and $62 million in 2010, 2009 and 2008, respectively. The decrease in our 2010 net interest expense compared to 2009 was due to lower commercial paper borrowing rates combined with lower borrowing amounts as well as lower interest expense related to hedging activities and higher interest income.

Provision for Income Taxes

The following table provides a summary of our reported tax rate:

|

PERCENT |

|

2010 |

2009 |

2008 | |||

|

Reported tax rate |

|

29.0 |

% |

32.5 |

% |

31.1 |

% |

|

Tax rate impact of: |

|

|

|

|

|

|

|

|

Special gains and charges |

|

(0.1 |

) |

(0.6 |

) |

0.2 |

|

|

Discrete tax items |

|

1.0 |

|

(0.2 |

) |

0.3 |

|

|

Non-GAAP adjusted effective tax rate |

|

29.9 |

% |

31.7 |

% |

31.6 |

% |

Our reported tax rate includes discrete impacts from special gains and charges and discrete tax events. Our adjusted effective tax rate decreased in 2010 compared to 2009 due primarily to increased benefits from the domestic manufacturing deduction in the U.S. Our adjusted effective tax rate in 2009 was comparable to 2008.

The 2010 reported tax rate was impacted by $8.9 million of tax items including $0.9 million of net tax benefits on special gains and charges as well as $8.0 million of discrete tax benefits. 2010 discrete tax benefits primarily include recognizing favorable settlements related to our 2002 through 2004 IRS appeals case and adjustments related to our prior year tax reserves. The discrete tax benefit for the year also includes a $6 million tax benefit from the settlement of an international tax audit recorded in the first quarter, offset by a $5 million charge also recorded in the first quarter due to the passage of the U.S. Patient Protection and Affordable Care Act which changes the tax deductibility related to federal subsidies and resulted in a reduction of the value of our deferred tax assets related to the subsidies, as well as a $2 million charge in the second quarter for the impact of international tax costs from optimizing our business structure.

The 2009 reported tax rate was impacted by $20.4 million of tax items including $21.5 million of net tax benefits on special gains and charges as well as $1.1 million of discrete tax net charges. Discrete tax items in 2009 included tax benefits of $3.4 million related to prior year reserve adjustments which were more than offset by $4.5 million of tax charges related to optimizing our business structure.

The 2008 reported tax rate was impacted by $11.0 million of tax items including $9.1 million of net tax benefits on special gains and charges as well as $1.9 million of discrete tax benefits. Discrete tax items in 2008 included $4.8 million of discrete tax benefits recorded in the first quarter due to enacted tax legislation and an international rate change. 2008 also included $2.1 million of discrete tax expense recorded in the third quarter related to recognizing adjustments from filing our 2007 U.S. federal income tax return and $0.8 million of discrete tax expense recorded in the fourth quarter.

Net Income Attributable to Ecolab

|

|

|

|

|

|

PERCENT CHANGE | |||||||||

|

MILLIONS |

|

2010 |

2009 |

2008 |

2010 |

2009 | ||||||||

|

Reported GAAP net income |

|

$ |

530.3 |

|

$ |

417.3 |

|

$ |

448.1 |

|

27 |

% |

(7 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

| |||

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

| |||

|

Special gains and charges |

|

6.6 |

|

58.2 |

|

16.8 |

|

|

|

|

| |||

|

Discrete tax expense (benefit) |

|

(8.0 |

) |

1.1 |

|

(1.9 |

) |

|

|

|

| |||

|

Non-GAAP adjusted net income |

|

$ |

528.9 |

|

$ |

476.6 |

|

$ |

463.0 |

|

11 |

% |

3 |

% |

Diluted Earnings Per Common Share (EPS)

|

|

|

|

|

|

PERCENT CHANGE | ||||||||||

|

DOLLARS |

|

2010 |

2009 |

2008 |

2010 |

2009 | |||||||||

|

Reported GAAP EPS |

|

$ |

2.23 |

|

$ |

1.74 |

|

$ |

1.80 |

|

28 |

% |

(3 |

)% | |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

| ||||

|

Special gains and charges |

|

0.03 |

|

0.24 |

|

0.07 |

|

|

|

|

| ||||

|

Discrete tax expense (benefit) |

|

(0.03 |

) |

0.00 |

|

(0.01 |

) |

|

|

|

| ||||

|

Non-GAAP adjusted EPS |

|

$ |

2.23 |

|

$ |

1.99 |

|

$ |

1.86 |

|

12 |

% |

7 |

% | |

Note: Per share amounts do not necessarily sum due to rounding.

Net income attributable to Ecolab increased 27% to $530 million in 2010 compared to 2009. On a per share basis, diluted earnings per share increased 28% to $2.23. Amounts for both 2010 and 2009 include special gains and charges and discrete tax items. Excluding these items from both years, adjusted net income attributable to Ecolab increased 11% and adjusted earnings per share increased 12%. Currency translation had a favorable impact of approximately $5 million, net of tax, or $0.02 per share for 2010 compared to 2009.

Net income attributable to Ecolab decreased 7% to $417 million in 2009 compared to 2008. On a per share basis, diluted earnings per share decreased 3% to $1.74. Amounts for both 2009 and 2008 include special gains and charges and discrete tax items. Excluding these items from both years, adjusted net income attributable to Ecolab increased 3% and adjusted earnings per share increased 7%. Currency translation had an unfavorable impact of approximately $25 million, net of tax, or $0.10 per share for 2009 compared to 2008.

Segment Performance

Our operating segments are aggregated into three reportable segments: U.S. Cleaning & Sanitizing, U.S. Other Services and International. We evaluate the performance of our International operations based on fixed rates of foreign currency exchange. Therefore, International sales and operating income totals, as well as the International financial information included in this financial discussion, are based on translation into U.S. dollars at the fixed foreign currency exchange rates used by management for 2010. The difference between actual currency exchange rates and the fixed currency exchange rates used by management is included in “Effect of foreign currency translation” within our operating segment results. All other accounting policies of the reportable segments are consistent with U.S. GAAP and the accounting policies of the company described in Note 2. Additional information about our reportable segments is included in Note 16.

Sales by Reportable Segment

|

|

|

|

|

|

PERCENT CHANGE | ||||||||||

|

MILLIONS |

|

2010 |

2009 |

2008 |

2010 |

2009 | |||||||||

|

Net sales |

|

|

|

|

|

|

|

|

|

|

| ||||

|

United States |

|

|

|

|

|

|

|

|

|

|

| ||||

|

Cleaning & Sanitizing |

|

$ |

2,722 |

|

$ |

2,663 |

|

$ |

2,661 |

|

2 |

% |

0 |

% | |

|

Other Services |

|

449 |

|

450 |

|

469 |

|

0 |

|

(4 |

) | ||||

|

Total United States |

|

3,171 |

|

3,113 |

|

3,130 |

|

2 |

|

(1 |

) | ||||

|

International |

|

3,016 |

|

2,922 |

|

2,895 |

|

3 |

|

1 |

| ||||

|

Total |

|

6,187 |

|

6,035 |

|

6,025 |

|

3 |

|

0 |

| ||||

|

Effect of foreign currency translation |

|

(97 |

) |

(134 |

) |

113 |

|

|

|

|

| ||||

|

Consolidated |

|

$ |

6,090 |

|

$ |

5,901 |

|

$ |

6,138 |

|

3 |

% |

(4 |

)% | |

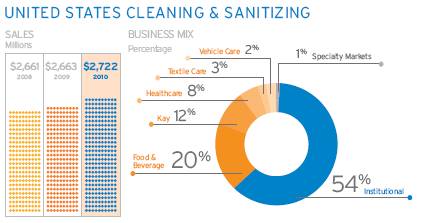

U.S. Cleaning & Sanitizing sales increased 2% in 2010 compared to 2009 and were flat in 2009 versus 2008. Sales for our largest U.S. Cleaning & Sanitizing businesses were as follows:

Institutional - Sales increased 1% in 2010 compared to 2009. 2010 sales benefited from new account gains and increased sales to distributors. We continued to experience mixed market trends in 2010 as room demand in the lodging market improved while overall foot traffic in the foodservice market continued to decline. While our markets are expected to remain soft over the near term, we remain confident in their long-term potential, and that our investments in business development and innovation will continue to deliver steady long-term growth.

Sales declined 3% in 2009 compared to 2008. New account gains, success with new products and appropriate pricing enabled us to outperform our markets in 2009 during the deep recession’s impact on the restaurant and lodging market environment. We saw strong results for our ApexTM solids warewashing line due to customer demand for energy and cost savings solutions.

Food & Beverage - Sales increased 3% in 2010 compared to 2009. Sales increased in almost all end markets, led by growth in food, beverage and agri markets, as corporate account wins and new products offset soft results in meat & poultry markets. Sales also benefited from improved water, energy and waste treatment capabilities.

Sales decreased 1% in 2009 compared to 2008 as good results for our core Food & Beverage business were offset by lower Ecovation sales. Excluding the impact of Ecovation, our core Food & Beverage business sales rose 5%. Food & Beverage enjoyed good gains in the dairy, beverage and food markets as pricing, corporate account wins and new products offset soft results in agri and meat & poultry markets. Ecovation experienced a sales decline in 2009 as the sales comparison was negatively impacted by the timing of a large Ecovation project sale in the first quarter of 2008, with the

remainder of the unfavorability driven by delays in design/build projects due to the negative economic climate in 2009 which caused customers to be reluctant to make capital investments.

Kay - Sales were strong in 2010 growing 7% compared to 2009. Sales growth was led by new food retail accounts and success with new products and programs. Sales at Kay continue to benefit from good demand from existing and new food retail and quick service accounts.

Sales increased 9% in 2009 compared to 2008. Quick service restaurant sales experienced solid growth benefiting from new accounts, new product introductions and growth at existing customers. The food retail business showed strong results due to new account growth.

Healthcare - Sales increased 2% in 2010 compared to 2009. Gains in sales of infection barriers and surgical instrument cleaning products more than offset the prior year’s spike in demand due to H1N1 virus preparations and slowing healthcare market trends in the current year, including fewer patient visits and surgical procedures.

Sales increased 11% in 2009 compared to 2008. Business acquisitions contributed 2% to the year over year sales growth. Sales growth benefited from H1N1 related sales of hand sanitizers during 2009, as well as solid growth from our infection barrier business and hand hygiene products.

U.S. Other Services sales were flat in 2010 and declined 4% in 2009. Sales for our U.S. Other Services businesses were as follows:

Pest Elimination - Sales for 2010 declined 1% compared to 2009. Sales growth in food safety management services was offset by lower pest elimination contract and non-contract services. Gains in the quick service restaurant, grocery, healthcare and food & beverage plant markets were offset by slow conditions in other major markets.

Pest Elimination experienced a 1% sales decline in 2009 versus 2008 as weakness in full service restaurants and hospitality more than offset gains in the quick service restaurant and food & beverage plant markets. Both contract and non-contract services were lower. New account gains were offset by customer cancellations as our customers focused on reducing their spending due to the very weak economy in 2009.

GCS Service - Sales increased 1% in 2010 compared to 2009. Service and installed parts sales increased in 2010, benefiting from pricing gains and new accounts, which more than offset the impact of slow foodservice market conditions. Direct parts sales continued to be soft.

Sales declined 11% in 2009 compared to 2008. The difficult economic conditions and decline in the foodservice market caused existing customers to delay repairs and maintenance, and prospective customers to delay the start of new programs. We also chose to exit some low-margin business during 2009.

We evaluate the performance of our International operations based on fixed rates of foreign currency exchange. Fixed currency International sales increased 3% and 1% in 2010 and 2009, respectively. When measured at public currency rates, International sales increased 5% and declined 7% in 2010 and 2009, respectively. Fixed currency sales changes for our International regions were as follows:

Europe, Middle East and Africa (EMEA) - Sales increased 1% in 2010 compared to 2009. Sales growth in the U.K. and Turkey were partially offset by lower sales in Italy and France. Sales in Germany were comparable to the prior year. From a divisional perspective, Europe’s Institutional sales increased due to new account gains. Food & Beverage and Pest Elimination sales increased during the year while Healthcare sales were flat compared to the prior year which included higher sales related to H1N1 virus preparations. Textile Care sales declined slightly in the current year.

Sales declined 2% in 2009 compared to 2008 as the significant slowdown in foodservice and hospitality markets in Europe more than offset sales growth in the Middle East and Africa. In Europe, sales growth in the U.K. was offset by lower sales in Germany, France and Italy as the region was negatively impacted by the global recession. From a divisional perspective, our Healthcare business showed solid growth in the region, benefiting from H1N1 related sales of hand sanitizers, while Institutional, Food & Beverage, Textile Care and Pest Elimination businesses all reported modest sales declines.

Asia Pacific - Sales increased 8% in 2010 compared to 2009 as the region showed a good recovery from last year’s low levels of business travel and tourism. Sales growth was driven by continued growth in China, Australia and New Zealand. From a division perspective, Institutional sales were strong as hotel occupancy levels improved and Asian economies recovered. Food & Beverage also continued to report strong sales growth, benefiting from increased product penetration and account gains.

Sales increased 4% in 2009 compared to the prior year. New customer account gains and increased product penetration in key markets helped overcome the impact of economic uncertainty and low levels of business travel and tourism in the region. Sales growth in the region was led by growth in Food & Beverage. From a country perspective, sales growth was driven by China, Australia and New Zealand.

Latin America - We continue to experience strong sales growth in Latin America as sales in the region increased 8% in 2010 compared to 2009. Sales were led by strong growth in Brazil, Mexico and Venezuela. Our Institutional, Food & Beverage and Pest Elimination businesses all reported increased sales growth. Sales benefited from new accounts and good demand in the beverage and brewery markets.

Sales increased 8% in 2009 compared to 2008. All businesses showed strong gains in the region against weak economic conditions. Growth was driven by new corporate account wins and increased product penetration within existing accounts. This helped to offset the economic slowdown brought about by the global recession and the initial H1N1 virus outbreak in Mexico that negatively impacted the tourism and lodging industry throughout the region. From a country perspective, sales were led by strong gains in Venezuela and Brazil.

Canada - Sales increased 4% in 2010 compared to the prior year. Sales continued to be led by strong growth from Food & Beverage and good growth from Institutional, offset partially by lower Healthcare sales as hospitals worked down their H1N1 related product inventories purchased in the prior year.

Sales increased 8% in 2009 compared to 2008. Sales growth was led by strong results from Food & Beverage, driven by new account gains and product price increases. Institutional also reported sales growth in 2009 led by pricing, success with distributor partners and new account wins during the year.

Operating Income by Reportable Segment

|

MILLIONS |

|

2010 |

2009 |

2008 | ||||||

|

Operating income |

|

|

|

|

|

|

| |||

|

United States |

|

|

|

|

|

|

| |||

|

Cleaning & Sanitizing |

|

$ |

514 |

|

$ |

495 |

|

$ |

430 |

|

|

Other Services |

|

71 |

|

66 |

|

52 |

| |||

|

Total United States |

|

585 |

|

561 |

|

482 |

| |||

|

International |

|

255 |

|

235 |

|

263 |

| |||

|

Total |

|

840 |

|

796 |

|

745 |

| |||

|

Corporate |

|

(30 |

) |

(104 |

) |

(55 |

) | |||

|

Effect of foreign currency translation |

|

(3 |

) |

(11 |

) |

23 |

| |||

|

Consolidated |

|

$ |

807 |

|

$ |

681 |

|

$ |

713 |

|

|

|

|

|

|

|

|

|

| |||

|

Operating income as a percent of net sales |

|

|

|

|

|

|

| |||

|

United States |

|

|

|

|

|

|

| |||

|

Cleaning & Sanitizing |

|

18.9 |

% |

18.6 |

% |

16.2 |

% | |||

|

Other Services |

|

15.9 |

|

14.6 |

|

11.1 |

| |||

|

Total United States |

|

18.5 |

|

18.0 |

|

15.4 |

| |||

|

International |

|

8.4 |

|

8.0 |

|

9.1 |

| |||

|

Consolidated |

|

13.2 |

% |

11.5 |

% |

11.6 |

% | |||

U.S. Cleaning & Sanitizing - Operating income increased 4% to $514 million in 2010 compared to 2009. As a percentage of net sales, operating income increased to 18.9% in 2010 from 18.6% in 2009. Sales gains and favorable delivered product costs more than offset cost increases to drive the increase in operating income.

U.S. Cleaning & Sanitizing operating income increased 15% to $495 million in 2009 compared to 2008. As a percentage of net sales, operating income increased to 18.6% in 2009 from 16.2% in 2008. Increased pricing, favorable delivered product costs and cost savings actions drove the significant operating income growth in 2009.

U.S. Other Services - Operating income increased 9% to $71 million in 2010 compared to 2009 led by continued improvement in GCS Service operating results. As a percentage of net sales, operating income increased to 15.9% in 2010 from 14.6% in 2009. Operating income growth was driven by pricing and cost savings actions which more than offset service delivery and other cost increases.

U.S. Other Services operating income increased 27% to $66 million in 2009 compared to 2008. As a percentage of net sales, operating income increased to 14.6% in 2009 from 11.1% in 2008. Operating income growth was driven by good operating income growth at Pest Elimination and significant improvement in GCS Service operating results compared to 2008. Operating income benefited from pricing, cost savings actions and well-managed spending.

International - Fixed currency operating income increased 8% to $255 million in 2010 compared to 2009. The International operating income margin was 8.4% in 2010 compared to 8.0% in 2009. Volume and pricing gains, favorable delivered product costs, and cost savings efforts more than offset continued investments in the business and increased costs. When measured at public currency rates, operating income increased 12% to $252 million in 2010 compared to 2009.

Fixed currency operating income decreased 12% in 2009 compared to 2008. The International operating income margin was 8.0% in 2009 compared to 9.1% in 2008. Pricing gains and cost savings efforts were unable to fully offset higher delivered product costs and other cost increases, and continued investment in the business. When measured at public currency rates, operating income declined 21% to $224 million in 2009 compared to 2008.

Operating income margins of our International operations are generally less than those realized for our U.S. operations. The lower International margins are due to (i) the smaller scale of International operations where many operating locations are smaller in size, (ii) the additional cost of operating in numerous and diverse foreign jurisdictions and (iii) higher costs of importing certain raw materials and finished goods in some regions. Proportionately larger investments in sales, technical support and administrative personnel are also necessary in order to facilitate the growth of our International operations.

Corporate - The corporate segment includes special gains and charges reported on the Consolidated Statement of Income of $8 million, $80 million and $26 million for 2010, 2009 and 2008, respectively. It also includes investments in the development of business systems and other corporate investments we made during the last three years as part of our ongoing efforts to improve our efficiency and returns.

FINANCIAL POSITION & LIQUIDITY

Financial Position

Significant changes in our financial position during 2010 included the following:

Total assets decreased to $4.9 billion as of December 31, 2010 from $5.0 billion at December 31, 2009. The decrease was primarily due to the impact of foreign currency exchange rates, which decreased the value of international assets on our balance sheet when translated into U.S. dollars, partially offset by an increase in cash and cash equivalents.

Total liabilities decreased to $2.7 billion at December 31, 2010 from $3.0 billion at December 31, 2009 primarily due to a decrease in our debt outstanding and a decrease in liabilities due to currency translation.

Total debt was $0.8 billion at December 31, 2010 and decreased from total debt of $1.0 billion at December 31, 2009. Our debt continued to be rated within the “A” categories by the major rating agencies during 2010. The decrease in total debt was primarily due to the paydown of our outstanding commercial paper. The ratio of total debt to capitalization (total debt divided by the sum of total equity and total debt) was 28% at year-end 2010 and 32% at year-end 2009. The debt to capitalization ratio was lower at year-end 2010 due to the decrease in debt as well as an increase in equity. We view our debt to capitalization ratio as an important indicator of our creditworthiness.

Cash Flows

Operating Activities - Cash provided by operating activities increased to $950 million in 2010 compared to $695 million in 2009. 2010 operating cash flow benefited from improved earnings, lower pension contributions and lower restructuring payments. In 2010 we made no voluntary contributions to our U.S. pension plan compared to $225 million in 2009 and $75 million in 2008. Operating cash flow in 2009 was also negatively impacted by the payment of a $35 million legal settlement and restructuring payments of $50 million. Our bad debt expense decreased to $18 million or 0.3% of net sales in 2010 from $27 million or 0.4% of net sales in 2009. We continue to monitor our receivable portfolio and the creditworthiness of our customers closely and do not expect our future cash flow to be materially impacted. Historically, we have had strong operating cash flow, and we anticipate this will continue. We expect to continue to use this cash flow to fund our ongoing operations and investments in the business, acquire new businesses and return cash to shareholders through dividend payments and share repurchases.

Investing Activities - Cash used for investing activities was $304 million in 2010 compared to $299 million in 2009. We continue to make investments in the business including merchandising equipment consisting primarily of systems used by our customers to dispense our cleaning and sanitizing products. Cash paid for acquisitions increased in 2010 due to the acquisition of the commercial laundry division of Dober Chemical in the third quarter of 2010 and final payment made on the Ecovation acquisition. The Ecovation acquisition in 2008 included an indemnification escrow agreement. As part of the agreement, we deposited $21 million into an escrow account. In 2010 the final payment on the acquisition was settled and $4 million was paid to the seller and is included in the cash paid for businesses acquired while we retained the remaining $17 million. We continue to target strategic business acquisitions which complement our growth strategy. We also expect to continue to make capital investments and acquisitions in the future to support our long-term growth.

Financing Activities - Our cash flows from financing activities reflect issuances and repayment of debt, common stock repurchases, dividend payments and proceeds from common stock issuances related to our equity incentive programs. 2010 financing activities included a $74 million paydown of our U.S. commercial paper and $349 million of share repurchases. 2009 financing activities included a $242 million paydown of our U.S. commercial paper and $69 million of share repurchases. 2008 financing activities included the issuance of $250 million 4.875% senior notes and $337 million of share repurchases. Share repurchases were funded with operating cash flows, short-term borrowing and cash from the exercise of employee stock options. Shares are repurchased for the purpose of offsetting the dilutive effect of stock options and incentives, to efficiently return capital to shareholders and for general corporate purposes. Cash proceeds and tax benefits from option exercises provide a portion of the funding for repurchase activity.

In December 2010, we increased our indicated annual dividend rate by 13%. This represents the 19th consecutive year we have increased our dividend. We have paid dividends on our common stock for 74 consecutive years. Cash dividends declared per share of common stock, by quarter, for each of the last three years were as follows:

|

|

|

FIRST |

|

SECOND |

|

THIRD |

|

FOURTH |

|

YEAR |

| |||||

|

2010 |

|

$ |

0.1550 |

|

$ |

0.1550 |

|

$ |

0.1550 |

|

$ |

0.1750 |

|

$ |

0.6400 |

|

|

2009 |

|

0.1400 |

|

0.1400 |

|

0.1400 |

|

0.1550 |

|

0.5750 |

| |||||

|

2008 |

|

0.1300 |

|

0.1300 |

|

0.1300 |

|

0.1400 |

|

0.5300 |

| |||||

Liquidity and Capital Resources

We currently expect to fund all of our cash requirements which are reasonably foreseeable for 2011, including scheduled debt repayments, new investments in the business, share repurchases, dividend payments, possible business acquisitions and pension contributions from operating cash flow, cash reserves and additional short-term and/or long-term borrowings. In the event of a significant

acquisition or other significant funding need, funding may occur through additional short and/or long-term borrowings or through the issuance of the company’s common stock.

As of December 31, 2010, we had $242 million of cash and cash equivalents on hand and expect our operating cash flow to remain strong. Additionally, we have a $600 million multi-year credit facility with a diverse group of banks which expires in June 2012. The credit facility supports our $600 million U.S. commercial paper program and our $200 million European commercial paper program. Combined borrowing under these two commercial paper programs may not exceed $600 million. Both programs are rated A-1 by Standard & Poor’s and P-1 by Moody’s.

In addition, we have other committed and uncommitted credit lines of $232 million with major international banks and financial institutions to support our general global funding needs. Approximately $200 million of these credit lines were undrawn and available for use as of our 2010 year end.

We are in compliance with all covenants and other requirements of our credit agreements and indentures.

A downgrade in our credit rating could limit or preclude our ability to issue commercial paper under our current programs. A credit rating downgrade could also adversely affect our ability to renew existing or negotiate new credit facilities in the future and could increase the cost of these facilities. Should this occur, we could seek additional sources of funding, including issuing term notes or bonds. In addition, we have the ability, at our option, to draw upon our $600 million committed credit facility prior to their termination.

A schedule of our obligations under various notes payable, long-term debt agreements, operating leases with noncancelable terms in excess of one year, interest obligations and benefit payments are summarized in the following table:

|

MILLIONS |

|

|

|

PAYMENTS DUE BY PERIOD |

| |||||||||||

|

CONTRACTUAL OBLIGATIONS |

|

TOTAL |

|

LESS |

|

2-3 |

|

4-5 |

|

MORE |

| |||||

|

Notes payable |

|

$ |

32 |

|

$ |

32 |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

|

Commercial paper |

|

— |

|

— |

|

— |

|

— |

|

— |

| |||||

|

Long-term debt |

|

796 |

|

151 |

|

165 |

|

253 |

|

227 |

| |||||

|

Capital lease obligations |

|

17 |

|

6 |

|

8 |

|

3 |

|

— |

| |||||

|

Operating leases |

|

206 |

|

67 |

|

79 |

|

35 |

|

25 |

| |||||

|

Interest* |

|

139 |

|

32 |

|

61 |

|

36 |

|

10 |

| |||||

|

Benefit payments** |

|

1,041 |

|

72 |

|

166 |

|

187 |

|

616 |

| |||||

|

Total contractual cash obligations |

|

$ |

2,231 |

|

$ |

360 |

|

$ |

479 |

|

$ |

514 |

|

$ |

878 |

|

* Interest on variable rate debt was calculated using the interest rate at year-end 2010.

** Benefit payments are estimated through 2020 and paid out of our pension and postretirement health care benefit plans.

In February 2011 we repaid our $150 million 6.875% notes when they became due. This amount is included in the long-term debt line of the preceding table due in less than one year.

As of December 31, 2010, our gross liability for uncertain tax positions was $66 million. We are not able to reasonably estimate the amount by which the liability will increase or decrease over an extended period of time or whether a cash settlement of the liability will be required. Therefore, these amounts have been excluded from the schedule of contractual obligations.

We are not required to make any contributions to our U.S. pension and postretirement healthcare benefit plans in 2011, based on plan asset values as of December 31, 2010. In January 2011 we made a $100 million voluntary contribution to our U.S. pension plan. We are in compliance with all funding requirements of our pension and postretirement health care plans. We are required to fund certain international pension benefit plans in accordance with local legal requirements. We estimate contributions to be made to our international plans will approximate $33 million in 2011. These amounts have been excluded from the schedule of contractual obligations.

We lease sales and administrative office facilities, distribution center facilities and other equipment under longer-term operating leases. Vehicle leases are generally shorter in duration. Vehicle leases have guaranteed residual value requirements that have historically been satisfied primarily by the proceeds on the sale of the vehicles.

Except for approximately $149 million of letters of credit ($56 million outstanding as of December 31, 2010) supporting domestic and international commercial relationships and transactions, primarily for our North America self-insurance program, we do not have significant unconditional purchase obligations, or significant other commercial commitments, such as commitments under lines of credit, standby letters of credit, guarantees, standby repurchase obligations or other commercial commitments.

Off-Balance Sheet Arrangements

Other than operating leases, we do not have any off-balance sheet financing arrangements. See Note 12 for information on our operating leases. We do not have relationships with unconsolidated entities or financial partnerships, such as entities often referred to as “special purposes entities”, which are sometimes established for the purpose of facilitating off-balance sheet financial arrangements or other contractually narrow or limited purposes. As such, we are not exposed to any financing, liquidity, market or credit risk that could arise if we had engaged in such relationships.

New Accounting Pronouncements

There were no new accounting pronouncements that were issued or became effective that have had or are expected to have a material impact on our consolidated financial statements.

Market Risk

We enter into contractual arrangements (derivatives) in the ordinary course of business to manage foreign currency exposure and interest rate risks. We do not enter into derivatives for trading purposes. Our use of derivatives is subject to internal policies that provide guidelines for control, counterparty risk and ongoing monitoring and reporting and is designed to reduce the volatility associated with movements in foreign exchange and interest rates on our income statement and cash flows.

We enter into foreign currency forward contracts to hedge certain intercompany financial arrangements, and to hedge against the effect of exchange rate fluctuations on transactions related to cash flows denominated in currencies other than U.S. dollars. See Note 8 for further information on our hedging activity.

We manage interest expense using a mix of fixed and floating rate debt. To help manage borrowing costs, we may enter into interest rate swap agreements. Under these arrangements, we agree to exchange, at specified intervals, the difference between fixed and floating interest amounts calculated by reference to an agreed-upon notional principal amount. As of December 31, 2010 and 2009, we did not have any interest rate swaps outstanding.

Based on a sensitivity analysis (assuming a 10% adverse change in market rates) of our foreign exchange and interest rate derivatives and other financial instruments, changes in exchange rates or interest rates would not materially affect our financial position and liquidity. The effect on our results of operations would be substantially offset by the impact of the hedged items.

Subsequent Events

In November 2010, we announced we had agreed to purchase the assets of O.R. Solutions, Inc., a privately-held developer and marketer of surgical fluid warming and cooling systems in the U.S. Annual sales of the business to be acquired are approximately $55 million, with more than 85% of O.R. Solutions’ sales from custom fit sterile drapes. The purchase price is approximately $260 million. As of the date of this report, the transaction had not closed. Completion of the transaction is subject to receipt of regulatory clearance and satisfaction of other customary closing conditions. We expect to fund the acquisition cost initially by issuing U.S. commercial paper which we will likely refinance by issuing long-term notes.

In December 2010, subsequent to our fiscal year end for international operations, we completed the purchase of the assets of the Cleantec business of Campbell Brothers Ltd., Brisbane, Queensland, Australia. Cleantec is a developer, manufacturer and marketer of cleaning and hygiene products principally within the Australian food and beverage processing, food service, hospitality and textile care markets. Annual sales of the business are approximately $55 million and will be included in our International reportable segment beginning in 2011.

In January 2011, we made a $100 million voluntary contribution to our U.S. pension plan.

In February 2011, we repaid our $150 million 6.875% notes when they became due.

Europe Transformation: Following the recent implementation of new business systems in Europe, in February 2011, we announced we have undertaken a comprehensive plan to substantially improve the efficiency and effectiveness of our Europe business, sharpen its competitiveness and accelerate its growth and profitability. As a part of this effort, we are developing plans for an accelerated restructure of our European operations in order to more quickly realize the benefits. We will work with our various works councils (worker representatives elected pursuant to local labor laws) in Europe to develop and finalize implementation plans in accordance with local labor laws and practices. As part of the restructuring, approximately 900 positions are expected to be eliminated.

The restructuring and other cost savings actions are expected to result in approximately $120 million ($100 million after tax) in annualized cost savings when fully realized, with approximately $4 million to $6 million ($3 million to $5 million after tax) realized in 2011. We expect to incur a pretax restructuring charge of approximately $150 million ($125 million after tax) over the next three years, beginning in the first quarter of 2011, as the restructuring is rolled out. Approximately $50 million to $70 million ($40 million to $60 million after tax) of that charge is expected to occur in 2011. We anticipate that approximately $125 million of the charge would represent cash expenditures.

It is foreseen that these actions will better align business and functional support by leveraging the new systems.

Major initiatives under development include:

· Supply chain - significant realignment of the supply chain, including repositioning of the warehousing networks, better leveraged purchasing capabilities, formula and packaging simplification, manufacturing consolidation and streamlined support functions.

· General and administrative (G&A) - shared and outsourced services, centralization of business functions, marketing channel optimization, simplification and automated manual tasks.

· Division - streamlined marketing, business simplification, channel optimization, sales productivity and office consolidation.

Non-GAAP Financial Measures

This MD&A includes financial measures that have not been calculated in accordance with accounting principles generally accepted in the U.S. (GAAP). These Non-GAAP measures include fixed currency sales and fixed currency operating income, adjusted operating income, adjusted fixed currency operating income, adjusted effective tax rate, adjusted net income attributable to Ecolab and adjusted diluted earnings per share amounts. We provide these measures as additional information regarding our operating results. We use these Non-GAAP measures internally to evaluate our performance and in making financial and operational decisions, including with respect to incentive compensation. We believe that our presentation of these measures provides investors with greater transparency with respect to our results of operations and that these measures are useful for period-to-period comparison of results.

We include in special gains and charges items that are unusual in nature, significant in amount and important to an understanding of underlying business performance. In order to better allow investors to compare underlying business performance period-to-period, we provide adjusted operating income, adjusted fixed currency operating income, adjusted net income attributable to Ecolab and adjusted diluted earnings per share, which exclude special gains and charges and discrete tax items.

The adjusted effective tax rate measure promotes period-to-period comparability of the underlying effective tax rate because the amount excludes the tax rate impact of special gains and charges and discrete tax items which do not necessarily reflect costs associated with historical trends or expected future costs.

We evaluate the performance of our international operations based on fixed currency rates of foreign exchange. Fixed currency sales and fixed currency operating income measures eliminate the impact of exchange rate fluctuations on our international sales and operating income, respectively, and promote a better understanding of our underlying sales and operating income trends. Fixed currency amounts are based on translation into U.S. dollars at fixed foreign currency exchange rates established by management at the beginning of 2010.

These measures are not in accordance with, or an alternative to GAAP, and may be different from Non-GAAP measures used by other companies. Investors should not rely on any single financial measure when evaluating our business. We recommend that investors view these measures in conjunction with the GAAP measures included in this MD&A and have provided reconciliations of reported GAAP amounts to the Non-GAAP amounts.

Forward-Looking Statements and Risk Factors

This MD&A and other portions of this Annual Report to Shareholders contain various “Forward-Looking Statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include expectations concerning items such as:

![]() economic trends and outlook

economic trends and outlook

![]() demographic trends and their impact on end-markets

demographic trends and their impact on end-markets

![]() focus areas in 2011

focus areas in 2011

![]() benefits from planned initiatives

benefits from planned initiatives

![]() benefits from new business systems

benefits from new business systems

![]() margin improvements

margin improvements

![]() outlook for growth

outlook for growth

![]() restructuring charges and cost savings

restructuring charges and cost savings

![]() bad debt and customer credit worthiness