Table of Contents

Index to Financial Statements

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE YEAR ENDED DECEMBER 31, 2009 |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

| Commission |

Registrant |

State of |

IRS Employer | |||

| 1-7810 | Energen Corporation | Alabama | 63-0757759 | |||

| 2-38960 | Alabama Gas Corporation | Alabama | 63-0022000 |

605 Richard Arrington Jr. Boulevard North, Birmingham, Alabama 35203-2707

Telephone Number 205/326-2700

http://www.energen.com

Securities Registered Pursuant to Section 12(b) of the Act:

| Title of Each Class |

Exchange on Which Registered | |

| Energen Corporation Common Stock, $0.01 par value | New York Stock Exchange |

Securities Registered Pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if the registrants are a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES x NO ¨

Indicate by check mark if the registrants are not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO x

Indicate by a check mark whether registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities and Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrants were required to file such reports) and (2) have been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Energen Corporation YES x NO ¨

Alabama Gas Corporation YES ¨ NO ¨

Indicate by a check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Energen Corporation |

Large accelerated filer x |

Accelerated filer ¨ |

Non-accelerated filer ¨ |

Smaller reporting company ¨ | ||||

| Alabama Gas Corporation |

Large accelerated filer ¨ |

Accelerated filer ¨ |

Non-accelerated filer x |

Smaller reporting company ¨ |

Indicate by check mark whether the registrants are a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ¨ NO x

Aggregate market value of the voting stock held by non-affiliates of the registrants as of June 30, 2009:

| Energen Corporation |

$2,839,294,000 |

Indicate number of shares outstanding of each of the registrant’s classes of common stock as of February 16, 2010:

| Energen Corporation |

71,861,637 shares | |

| Alabama Gas Corporation |

1,972,052 shares |

Alabama Gas Corporation meets the conditions set forth in General Instruction I(1) (a) and (b) of Form 10-K and is therefore filing this form with the reduced disclosure format pursuant to General Instruction I(2).

DOCUMENTS INCORPORATED BY REFERENCE

Energen Corporation Proxy Statement to be filed on or about March 24, 2010 (Part III, Item 10-14)

Table of Contents

Index to Financial Statements

INDUSTRY GLOSSARY

For a more complete definition of certain terms defined below, as well as other terms and concepts applicable to successful efforts accounting, please refer to Rule 4-10(a) of Regulation S-X, promulgated pursuant to the Securities Act of 1933 and the Securities Exchange Act of 1934, each as amended.

| Basis | The difference between the futures price for a commodity and the corresponding cash spot price. This commonly is related to factors such as product quality, location and contract pricing. | |

| Basin-Specific | A type of derivative contract whereby the contract’s settlement price is based on specific geographic basin indices. | |

| Behind Pipe Reserves | Oil or gas reserves located above or below the currently producing zone(s) that cannot be extracted until a recompletion or pay-add occurs. | |

| Cash Flow Hedge | The designation of a derivative instrument to reduce exposure to variability in cash flows from the forecasted sale of oil, gas or natural gas liquids production whereby the gains (losses) on the derivative transaction are anticipated to offset the losses (gains) on the forecasted sale. | |

| Collar | A financial arrangement that effectively establishes a price range between a floor and a ceiling for the underlying commodity. The purchaser bears the risk of fluctuation between the minimum (or floor) price and the maximum (or ceiling) price. | |

| Development Costs | Costs necessary to gain access to, prepare and equip development wells in areas of proved reserves. | |

| Development Well | A well drilled within the proved area of an oil or gas reservoir to the depth of a stratigraphic horizon known to be productive. | |

| Downspacing | An increase in the number of available drilling locations as a result of a regulatory commission order. | |

| Dry Well | An exploratory or a development well found to be incapable of producing either oil or gas in sufficient quantities to justify completion as an oil or gas well. | |

| Exploration Expenses | Costs primarily associated with drilling unsuccessful exploratory wells in undeveloped properties, exploratory geological and geophysical activities, and costs of impaired and expired leaseholds. | |

| Exploratory Well | A well drilled to find and produce oil or gas in an unproved area, to find a new reservoir in a field previously found to be productive of oil or gas in another reservoir, or to extend a known reservoir. | |

| Farmout | A contractual agreement with an owner who holds working interest in an oil and gas lease to assign all or part of that interest to another party in exchange for fulfilling contractually specified conditions. | |

| Futures Contract | An exchange-traded legal contract to buy or sell a standard quantity and quality of a commodity at a specified future date and price. Such contracts offer liquidity and minimal credit risk exposure but lack the flexibility of swap contracts. | |

| Hedging | The use of derivative commodity instruments such as futures, swaps and collars to help reduce financial exposure to commodity price volatility. | |

| Gross Revenues | Revenues reported after deduction of royalty interest payments. | |

| Gross Well or Acre | A well or acre in which a working interest is owned. | |

| Liquified Natural Gas (LNG) | Natural gas that is liquified by reducing the temperature to negative 260 degrees Fahrenheit. LNG typically is used to supplement traditional natural gas supplies during periods of peak demand. | |

| Long-Lived Reserves | Reserves generally considered to have a productive life of approximately 10 years or more, as measured by the reserves-to-production ratio. | |

Table of Contents

Index to Financial Statements

| Natural Gas Liquids (NGL) | Liquid hydrocarbons that are extracted and separated from the natural gas stream. NGL products include ethane, propane, butane, natural gasoline and other hydrocarbons. | |

| Net Well or Acre | A net well or acre is deemed to exist when the sum of fractional ownership working interests in gross wells or acres equals one. | |

| Odorization | The adding of odorant to natural gas which is a characteristic odor so that leaks can be readily detected by smell. | |

| Operational Enhancement | Any action undertaken to improve production efficiency of oil and gas wells and/or reduce well costs. | |

| Operator | The company responsible for exploration, development and production activities for a specific project. | |

| Pay-Add | An operation within a currently producing wellbore that attempts to access and complete an additional pay zone(s) while maintaining production from the existing completed zone(s). | |

| Pay Zone | The formation from which oil and gas is produced. | |

| Production (Lifting) Costs | Costs incurred to operate and maintain wells. | |

| Productive Well | An exploratory or a development well that is not a dry well. | |

| Proved Developed Reserves | The portion of proved reserves which can be expected to be recovered through existing wells with existing equipment and operating methods. | |

| Proved Reserves | Estimated quantities of crude oil, natural gas and natural gas liquids that geological and engineering data demonstrate with reasonable certainty to be recoverable in future years from known reservoirs under existing economic and operating conditions. | |

| Proved Undeveloped Reserves (PUD) | The portion of proved reserves which can be expected to be recovered from new wells on undrilled proved acreage or from existing wells where a relatively major expenditure is required for completion. | |

| Recompletion | An operation within an existing wellbore whereby a completion in one pay zone is abandoned in order to attempt a completion in a different pay zone. | |

| Reserves-to-Production Ratio | Ratio expressing years of supply determined by dividing the remaining recoverable reserves at year end by actual annual production volumes. The reserve-to-production ratio is a statistical indicator with certain limitations, including predictive value. The ratio varies over time as changes occur in production levels and remaining recoverable reserves. | |

| Secondary Recovery | The process of injecting water, gas, etc., into a formation in order to produce additional oil otherwise unobtainable by initial recovery efforts. | |

| Service Well | A well employed for the introduction into an underground stratum of water, gas or other fluid under pressure or disposal of salt water produced with oil or other waste. | |

| Sidetrack Well | A new section of wellbore drilled from an existing well. | |

| Swap | A contractual arrangement in which two parties, called counterparties, effectively agree to exchange or “swap” variable and fixed rate payment streams based on a specified commodity volume. The contracts allow for flexible terms such as specific quantities, settlement dates and location but also expose the parties to counterparty credit risk. | |

| Transportation | Moving gas through pipelines on a contract basis for others. | |

Table of Contents

Index to Financial Statements

| Throughput | Total volumes of natural gas sold or transported by the gas utility. | |

| Working Interest | Ownership interest in the oil and gas properties that is burdened with the cost of development and operation of the property. | |

| Workover | A major remedial operation on a completed well to restore, maintain, or improve the well’s production such as deepening the well or plugging back to produce from a shallow formation. | |

| -e | Following a unit of measure denotes that the oil and natural gas liquids components have been converted to cubic feet equivalents at a rate of 6 thousand cubic feet per barrel. | |

Table of Contents

Index to Financial Statements

2009 FORM 10-K ANNUAL REPORT

TABLE OF CONTENTS

| PART I | Page | |||

| Item 1. |

3 | |||

| Item 1A. |

11 | |||

| Item 1B. |

12 | |||

| Item 2. |

13 | |||

| Item 3. |

16 | |||

| Item 4. |

16 | |||

| PART II | ||||

| Item 5. |

19 | |||

| Item 6. |

21 | |||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

23 | ||

| Item 7A. |

39 | |||

| Item 8. |

40 | |||

| Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

91 | ||

| Item 9A. |

91 | |||

| PART III | ||||

| Item 10. |

94 | |||

| Item 11. |

94 | |||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

94 | ||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

94 | ||

| Item 14. |

94 | |||

| PART IV | ||||

| Item 15. |

95 | |||

| 99 | ||||

2

Table of Contents

Index to Financial Statements

This Form 10-K is filed on behalf of Energen Corporation (Energen or the Company)

and Alabama Gas Corporation (Alagasco).

Forward-Looking Statements: Certain statements in this report express expectations of future plans, objectives and performance of the Company and its subsidiaries and constitute forward-looking statements made pursuant to the Safe Harbor provision of the Private Securities Litigation Reform Act of 1995. Except as otherwise disclosed, the forward-looking statements do not reflect the impact of possible or pending acquisitions, investments, divestitures or restructurings. The absence of errors in input data, calculations and formulas used in estimates, assumptions and forecasts cannot be guaranteed. Neither the Company nor Alagasco undertakes any obligation to correct or update any forward-looking statements whether as a result of new information, future events or otherwise.

All statements based on future expectations rather than on historical facts are forward-looking statements that are dependent on certain events, risks and uncertainties that could cause actual results to differ materially from those anticipated. Some of these include, but are not limited to, economic and competitive conditions, inflation rates, legislative and regulatory changes, financial market conditions, the Company’s ability to access the capital markets, future business decisions, utility customer growth and retention and usage per customer, litigation results and other uncertainties, all of which are difficult to predict.

See Item 1A, Risk Factors, for a discussion of risk factors that may affect the Company and cause material variances from forward-looking statement expectations. The Item 1A, Risk Factors, discussion is incorporated by reference to this forward-looking statement disclosure.

| ITEM 1. | BUSINESS |

General

Energen Corporation, based in Birmingham, Alabama, is a diversified energy holding company engaged primarily in the development, acquisition, exploration and production of oil, natural gas and natural gas liquids in the continental United States and in the purchase, distribution and sale of natural gas in central and north Alabama. Its two principal subsidiaries are Energen Resources Corporation and Alabama Gas Corporation (Alagasco).

Alagasco was formed in 1948 by the merger of Alabama Gas Company into Birmingham Gas Company, the predecessors of which had been in existence since the mid-1800s. Alagasco became publicly traded in 1953. Energen Resources was formed in 1971 as a subsidiary of Alagasco. Energen was incorporated in 1978 in preparation for the 1979 corporate reorganization in which Alagasco and Energen Resources became subsidiaries of Energen.

The Company maintains a Web site with the address www.energen.com. The Company does not include the information contained on its Web site as part of this report nor is the information incorporated by reference into this report. The Company makes available free of charge through its Web site the annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to these reports. Also, these reports are available in print upon shareholder request. These reports are available as soon as reasonably practicable after being electronically filed with or furnished to the Securities and Exchange Commission. The Company’s Web site also includes its Code of Ethics, Corporate Governance Guidelines, Audit Committee Charter, Officers’ Review Committee Charter, Governance and Nominations Committee Charter and Finance Committee Charter, each of which is available in print upon shareholder request.

3

Table of Contents

Index to Financial Statements

Financial Information About Industry Segments

The information required by this item is provided in Note 18, Industry Segment Information, in the Notes to Financial Statements.

Narrative Description of Business

| • | Oil and Gas Operations |

General: Energen’s oil and gas operations focus on increasing production and adding proved reserves through the development and acquisition of oil and gas properties. In addition, Energen Resources explores for and develops new reservoirs, primarily in areas in which it has an operating presence. All gas, oil and natural gas liquids production is sold to third parties. Energen Resources also provides operating services in the Black Warrior, San Juan and Permian basins for its joint interest and third parties. These services include overall project management and day-to-day decision-making relative to project operations.

At the end of 2009, Energen Resources’ proved oil and gas reserves totaled 1,547 billion cubic feet equivalent (Bcfe). Substantially all of these reserves are located in the San Juan Basin in New Mexico and Colorado, the Permian Basin in west Texas and the Black Warrior Basin in Alabama. Approximately 83 percent of Energen Resources’ year-end reserves are proved developed reserves. Energen Resources’ reserves are long-lived, with a year-end reserves-to-production ratio of 14 years. Natural gas represents approximately 58 percent of Energen Resources’ proved reserves, with oil representing approximately 30 percent and natural gas liquids comprising the balance.

Growth Strategy: Energen has operated for nearly fifteen years under a strategy to grow its oil and gas operations. Since the end of fiscal year 1995, Energen Resources has invested approximately $1.4 billion in property acquisitions, $2 billion in related development, and $270 million in exploration and related development. Energen Resources’ capital investment in 2010 is currently expected to approximate $310 million primarily for existing properties. The Company also may allocate additional capital for other oil and gas activities such as property acquisitions, additional development of existing properties and the exploration and further development of potential shales acreage primarily in Alabama.

Energen Resources seeks to acquire onshore North American properties which offer proved undeveloped and behind-pipe reserves as well as operational enhancement potential. Energen Resources prefers properties with long-lived reserves and multiple pay-zone opportunities; however, Energen Resources will consider acquisitions of other types of properties which meet its investment requirements, including acquisitions with unproved properties. In addition, Energen Resources conducts exploration activities primarily in areas in which it has operations and remains open to exploration activities which complement its core expertise and meet its investment requirements. Following an acquisition, Energen Resources focuses on increasing production and reserves through development of the properties’ undeveloped reserves and behind-pipe reserve potential as well as engaging in other activities. These activities include development well drilling, exploration, behind-pipe recompletions, pay-adds, workovers, secondary recovery and operational enhancements. Energen Resources prefers to operate its properties in order to better control the nature and pace of development activities. Energen Resources operated approximately 92 percent of its proved reserves at December 31, 2009.

In October 2006, Energen Resources sold to Chesapeake Energy Corporation (Chesapeake) a 50 percent interest in its unproved lease position of approximately 200,000 gross acres in various shale plays in Alabama for $75 million plus certain net drilling costs (approximately $10.85 million). Currently, Energen Resources’ net acreage position in Alabama shales totals approximately 399,000 acres representing multiple shale opportunities. As of December 31, 2009, Energen Resources had approximately $39 million of unproved leasehold costs related to its lease position in Alabama shales.

Effective April 1, 2009, Chesapeake agreed to farmout its half-interest in Alabama shales to Energen Resources. Under this agreement, Energen Resources had 18 months to drill two wells; one earning the Chattanooga acreage and the other earning the Conasauga acreage. A well drilled in the fall of 2009 earned Chesapeake’s

4

Table of Contents

Index to Financial Statements

portion of the Chattanooga acreage. The farmout agreement was recently amended to extend the period to complete the Conasauga acreage until July 1, 2011. Chesapeake retains a net overriding royalty interest of approximately 1 to 2.5 percent convertible to a proportionately reduced working interest of 25 percent (net 12.5 percent) at 125 percent payout on a well-by-well basis.

During 2009 Energen Resources was unsuccessful in the completion of a Chattanooga shale well. The Company believes a casing leak rendered ineffective two small fracture stimulations in the Chattanooga shale formation. The costs related to this well of approximately $5.6 million pretax were expensed during the fourth quarter of 2009. Also expensed during the fourth quarter, was approximately $1.2 million pretax of costs associated with a well originally drilled by Chesapeake in an area of the Chattanooga shale which the Company no longer intends to pursue. The Company recognized unproved leasehold impairments of $2.1 million associated with these wells. Approximately $13 million of the remaining $39 million of unproved leasehold costs for Alabama shales mentioned above are associated with the Chattanooga shale formation with the remainder associated with the Conasauga shale formation. In the event further efforts are unsuccessful and the Company concludes no further activity is warranted, Energen Resources would expect to record a loss associated with well costs and the non-cash write-off on capitalized unproved leasehold. Energen Resources plans to drill a well during the spring of 2010 in order to determine economic viability of the Chattanooga shale formation and an additional well during the latter half of 2010 to determine economic viability of Conasauga shale formation.

Energen Resources’ development activities can result in the addition of new proved reserves and can serve to reclassify proved undeveloped reserves to proved developed reserves. Proved reserve disclosures are provided annually, although changes to reserve classifications occur throughout the year. Accordingly, additions of new reserves from development activities can occur throughout the year and may result from numerous factors including, but not limited to, regulatory approvals for drilling unit downspacing that increase the number of available drilling locations; changes in the economic or operating environments that allow previously uneconomic locations to be added; technological advances that make reserve locations available for development; successful development of existing proved undeveloped reserve locations that reclassify adjacent probable locations to proved undeveloped reserve locations; increased knowledge of field geology and engineering parameters relative to oil and gas reservoirs; and changes in management’s intent to develop certain opportunities.

During the three years ended December 31, 2009, the Company’s development efforts have added 358 Bcfe of proved reserves from the drilling of 995 gross development and service wells (including 36 sidetrack wells) and 228 well recompletions and pay-adds. In 2009, Energen Resources’ successful development wells and other activities added approximately 106 Bcfe of proved reserves; the Company drilled 222 gross development and service wells (including 3 sidetrack wells), performed some 91 well recompletions and pay-adds, and conducted other operational enhancements. Energen Resources’ production totaled 111.2 Bcfe in 2009 and is estimated to total 114 Bcfe in 2010, including 110 Bcfe of estimated production from proved reserves owned at December 31, 2009.

Drilling Activity: The following table sets forth the total number of net productive and dry exploratory and development wells drilled:

| Years ended December 31, | 2009 | 2008 | 2007 | |||

| Development: |

||||||

| Productive |

130.4 | 199.2 | 135.5 | |||

| Dry |

0.0 | 0.9 | 1.0 | |||

| Total |

130.4 | 200.1 | 136.5 | |||

| Exploratory: |

||||||

| Productive |

1.0 | 1.8 | 21.7 | |||

| Dry |

2.5 | 1.7 | 0.3 | |||

| Total |

3.5 | 3.5 | 22.0 |

As of December 31, 2009, the Company was participating in the drilling of 6 gross development and exploratory wells, with the Company’s interest equivalent to 5.1 wells. In addition to the development wells

5

Table of Contents

Index to Financial Statements

drilled, the Company drilled 32.5, 84.1 and 99.8 net service wells during 2009, 2008 and 2007, respectively. As of December 31, 2009, the Company was not participating in the drilling of any gross service wells.

Productive Wells and Acreage: The following table sets forth the total gross and net productive gas and oil wells as of December 31, 2009, and developed and undeveloped acreage as of the latest practicable date prior to year-end:

| Gross | Net | |||

| Gas wells |

4,390 | 2,420 | ||

| Oil wells |

3,757 | 2,176 | ||

| Developed acreage |

758,896 | 549,095 | ||

| Undeveloped acreage |

582,776 | 412,365 |

There were 9 wells with multiple completions in 2009. All wells and acreage are located onshore in the United States, with the majority of the net undeveloped acreage located in Alabama.

Risk Management: Energen Resources attempts to lower the commodity price risk associated with its oil and natural gas business through the use of futures, swaps and options. Energen Resources does not hedge more than 80 percent of its estimated annual production and generally does not hedge more than two fiscal years forward. Energen Resources recognized all derivatives on the balance sheet and measures all derivatives at fair value. If a derivative is designated as a cash flow hedge, the effectiveness of the hedge, or the degree that the gain (loss) for the hedging instrument offsets the loss (gain) on the hedged item, is measured at each reporting period. The effective portion of the gain or loss on the derivative instrument is recognized in other comprehensive income as a component of equity and subsequently reclassified to operating revenues when the forecasted transaction affects earnings. The ineffective portion of a derivative’s change in fair value is required to be recognized in operating revenues immediately.

The Company may also enter into derivative transactions that do not qualify for cash flow hedge accounting but are considered by management to represent valid economic hedges and are accounted for as mark-to-market transactions. These economic hedges may include, but are not limited to, basis hedges without a corresponding New York Mercantile Exchange hedge and hedges on non-operated or other properties for which all of the necessary information to qualify for cash flow hedge accounting is either not readily available or subject to change. Derivatives that do not qualify for hedge treatment are recorded at fair value with gains or losses recognized in operating revenues in the period of change.

In the case of an acquisition, Energen Resources may hedge more than two years forward to protect targeted returns. Energen Resources prefers long-lived reserves and primarily uses the then-current oil and gas futures prices in its evaluation models, the prevailing swap curve and, for the longer-term, its own pricing assumptions.

See the Forward-Looking Statements in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, and Item 1A, Risk Factors, for further discussion with respect to price and other risks.

| • | Natural Gas Distribution |

General: Alagasco is the largest natural gas distribution utility in the state of Alabama. Alagasco purchases natural gas through interstate and intrastate suppliers and distributes the purchased gas through its distribution facilities for sale to residential, commercial and industrial customers and other end-users of natural gas. Alagasco also provides transportation services to industrial and commercial customers located on its distribution system. These transportation customers, using Alagasco as their agent or acting on their own, purchase gas directly from marketers or suppliers and arrange for delivery of the gas into the Alagasco distribution system. Alagasco charges a fee to transport such customer-owned gas through its distribution system to the customers’ facilities.

Alagasco’s service territory is located in central and parts of north Alabama and includes 180 cities and communities in 28 counties. The aggregate population of the counties served by Alagasco is estimated to be 2.4

6

Table of Contents

Index to Financial Statements

million. Among the cities served by Alagasco are Birmingham, the center of the largest metropolitan area in Alabama, and Montgomery, the state capital. During 2009, Alagasco served an average of 409,214 residential customers and 33,264 commercial, industrial and transportation customers. The Alagasco distribution system includes approximately 10,400 miles of main and more than 11,950 miles of service lines, odorization and regulation facilities, and customer meters.

APSC Regulation: As an Alabama utility, Alagasco is subject to regulation by the Alabama Public Service Commission (APSC) which established the Rate Stabilization and Equalization (RSE) rate-setting process in 1983. RSE’s current extension is for a seven-year period through December 31, 2014. RSE will continue after December 31, 2014, unless, after notice to the Company and a hearing, the APSC votes to modify or discontinue the RSE methodology. Alagasco’s allowed range of return on average equity remains 13.15 percent to 13.65 percent throughout the term of the order. Alagasco is on a September 30 fiscal year for rate-setting purposes (rate year).

Under RSE, the APSC conducts quarterly reviews to determine, based on Alagasco’s projections and year-to-date performance, whether Alagasco’s return on average equity at the end of the rate year will be within the allowed range of return. Reductions in rates can be made quarterly to bring the projected return within the allowed range; increases, however, are allowed only once each rate year, effective December 1, and cannot exceed 4 percent of prior-year revenues. At September 30, 2009, RSE limited the utility’s equity upon which a return is permitted to 55 percent of total capitalization. Under the inflation-based Cost Control Measurement (CCM) established by the APSC, if the percentage change in O&M expense on an aggregate basis falls within a range of 0.75 points above or below the percentage change in the Consumer Price Index For All Urban Consumers (Index Range), no adjustment is required. If the change in O&M expense on an aggregate basis exceeds the Index Range, three-quarters of the difference is returned to customers. To the extent the change is less than the Index Range, the utility benefits by one-half of the difference through future rate adjustments. The O&M expense base for measurement purposes will be set at the prior year’s actual O&M expense amount unless the Company exceeds the top of the Index Range in two successive years, in which case the base for the following year will be set at the top of the Index Range. Certain items that fluctuate based on situations demonstrated to be beyond Alagasco’s control may be excluded for the CCM calculation.

Alagasco’s rate schedules for natural gas distribution charges contain a Gas Supply Adjustment (GSA) rider, established in 1993, which permits the pass-through to customers of changes in the cost of gas supply. Alagasco’s tariff provides a temperature adjustment mechanism, also included in the GSA, that is designed to moderate the impact of departures from normal temperatures on Alagasco’s earnings. The temperature adjustment applies primarily to residential, small commercial and small industrial customers. Other non-temperature weather related conditions that may affect customer usage are not included in the temperature adjustment.

The APSC approved an Enhanced Stability Reserve (ESR) beginning October 1997, with an approved maximum funding level of $4 million pre-tax, to which Alagasco may charge the full amount of: (1) extraordinary O&M expenses resulting from force majeure events when one or a combination of two such events results in more than $200,000 of additional O&M expense during a rate year; or (2) individual industrial and commercial customer revenue losses that exceed $250,000 during the rate year, if such losses cause Alagasco’s return on average equity to fall below 13.15 percent. Following a year in which a charge against the ESR is made, the APSC provides for accretions to the ESR of no more than $40,000 monthly until the maximum funding level is achieved. Under the terms of the current RSE extension, Alagasco will not have accretions against the ESR until December 31, 2010, unless Alagasco incurs a significant natural disaster during the three-year period ended December 31, 2010 and receives approval from the APSC to resume accretions under the ESR. Due to revenue losses from market-sensitive large commercial and industrial customers, Alagasco utilized the ESR of approximately $4.0 million pre-tax during the rate year ended September 30, 2008. Alagasco expects to utilize the ESR to recover certain manufactured gas plant site remediation costs through future rates and has recorded a corresponding amount to its Enhanced Stability Reserve regulatory account, as more fully described in Environmental Matters.

7

Table of Contents

Index to Financial Statements

Gas Supply: Alagasco’s distribution system is connected to two major interstate natural gas pipeline systems, Southern Natural Gas Company (Southern) and Transcontinental Gas Pipe Line Company (Transco). It is also connected to several intrastate natural gas pipeline systems and to Alagasco’s two liquified natural gas (LNG) facilities.

Alagasco purchases natural gas from various natural gas producers and marketers. Certain volumes are purchased under firm contractual commitments with other volumes purchased on a spot market basis. The purchased volumes are delivered to Alagasco’s system using a variety of firm transportation, interruptible transportation and storage capacity arrangements designed to meet the system’s varying levels of demand. Alagasco’s LNG facilities can provide the system with up to an additional 200,000 thousand cubic feet per day (Mcfd) of natural gas to meet peak day demand.

As of December 31, 2009, Alagasco had the following contracts in place for firm natural gas pipeline transportation and storage services:

| December 31, 2009 | ||

| (Mcfd) | ||

| Southern firm transportation |

112,933 | |

| Southern storage and no notice transportation |

251,679 | |

| Transco firm transportation |

70,000 | |

| Various intrastate transportation |

20,240 |

Competition: The price of natural gas is a significant competitive factor in Alagasco’s service territory, particularly among large commercial and industrial transportation customers. Propane, coal and fuel oil are readily available, and many industrial customers have the capability to switch to alternate fuels and alternate sources of gas. In the residential and small commercial and industrial markets, electricity is the principal competitor. With the support of the APSC, Alagasco has implemented a variety of programs to help it compete for gas load in all market segments. The Company has been effective at utilizing these programs to avoid load loss to competitive fuels.

Alagasco’s Transportation Tariff allows the Company to transport gas for large commercial and industrial customers rather than buy and resell it to them and is based on Alagasco’s sales profit margin so that operating margins are unaffected. During 2009, substantially all of Alagasco’s large commercial and industrial customer deliveries involved the transportation of customer-owned gas.

Natural gas service available to Alagasco customers falls into two broad categories: interruptible and firm. Interruptible service contractually is subject to interruption by Alagasco for various reasons; the most common occurrence is curtailment during periods of peak core market heating demand. Customers who contract for interruptible service can generally adjust production schedules or switch to alternate fuels during periods of service interruption or curtailment. More expensive firm service, on the other hand, generally is not subject to interruption and is provided to residential and small commercial and industrial customers. These core market customers depend on natural gas primarily for space heating.

Growth: Customer growth presents a major challenge for Alagasco, given its mature, slow-growth service area. Over the past several years, a higher price commodity environment and reduced economic activity have resulted in a decline in the utility’s customer base of approximately 1 percent annually. Recent lower commodity prices have not yet reversed this adverse trend at the utility. In 2009, Alagasco’s average number of customers decreased almost 1 percent. Alagasco will continue to concentrate on maintaining its current penetration levels and increasing residential saturation levels for all end-use applications. Alagasco will also continue to explore opportunities to increase revenue in the small and large commercial and industrial market segments.

Seasonality: Alagasco’s gas distribution business is highly seasonal since a material portion of the utility’s total sales and delivery volumes relate to space heating customers. Alagasco’s rate Tariff includes a Temperature Adjustment Rider primarily for residential, small commercial and small industrial customers that moderates the impact of departures from normal temperatures on Alagasco’s earnings. The adjustments are made through the GSA.

8

Table of Contents

Index to Financial Statements

| • | Environmental Matters and Climate Change |

Various federal, state and local environmental laws and regulations apply to the operations of Energen Resources and Alagasco. Historically, the cost of environmental compliance has not materially affected the Company’s financial position, results of operations or cash flows. New regulations, enforcement policies, claims for damages or other events could result in significant unanticipated costs. Remediation of the Huntsville, Alabama manufactured gas plant site, as discussed below, may also result in unanticipated costs.

Federal, state and local legislative bodies and agencies frequently exercise their respective authority to adopt new laws and regulations and to amend and interpret existing laws and regulations. Such law and regulation changes may occur with little prior notification, subject the Company to cost increases, and impose restrictions and limitations on the Company’s operations. Currently, there are various proposed law and regulatory changes with the potential to materially impact the Company. Such proposals include, but are not limited to, measures dealing with hydraulic fracturing, emission limits and reporting and the repeal of certain oil and gas tax incentives and deductions. Due to the nature of the political and regulatory processes and based on its consideration of existing proposals, the Company is unable to determine that such proposed laws and regulations are reasonably likely to occur or to determine that the potential impact would be material.

Existing federal, state and local environmental laws and regulations also have the potential to increase costs, reduce liquidity, delay operations and otherwise alter business operations. These existing laws and regulations include, but are not limited to, the Clean Air Act; the Clean Water Act; Oil Pollution Prevention: Spill Prevention Control and Countermeasure regulations; Toxic Substances Control Act; Resource Conservation and Recovery Act and the Federal Endangered Species Act. Compliance with these and other environmental laws and regulations is undertaken as part of the Company’s routine operations. The Company does not separately track costs associated with these routine compliance activities.

Climate change, whether arising through natural occurrences or through the impact of human activities, may have a significant impact upon the operations of Energen Resources and Alagasco. Volatile weather patterns and the resulting environmental impact may adversely impact the results of operations, financial position and cash flows of the Company. The Company is unable to predict the timing or manifestation of climate change or reliably estimate the impact to the Company. However, climate change could affect the operations of the Company as follows:

| • | sustained increases or decreases to the supply and demand of oil, natural gas and natural gas liquids; |

| • | positive or negative changes to usage and customer count at Alagasco from prolonged increases or decreases in average temperature due to the geographic concentration of Alagasco’s customers in central and north Alabama; |

| • | potential disruption to third party facilities to which Energen Resources delivers to and from which Alagasco is served. Such facilities include third party oil and gas gathering, transportation, processing and storage facilities and are typically limited in number and geographically concentrated. |

A discussion of certain litigation against Energen Resources in the state of Louisiana related to the restoration of oilfield properties is included in Item 3, Legal Proceedings of Part I in this Form 10-K.

Alagasco is in the chain of title of nine former manufactured gas plant sites (four of which it still owns) and five manufactured gas distribution sites (one of which it still owns). Subject to the following paragraph discussing the Huntsville, Alabama manufactured gas plant site, an investigation of the sites does not indicate the present need for remediation activities and management expects that, should remediation of any such sites be required in the future, Alagasco’s share, if any, of such costs will not materially affect the financial position of Alagasco.

9

Table of Contents

Index to Financial Statements

In June 2009, Alagasco received a General Notice Letter from the United States Environmental Protection Agency (EPA) identifying Alagasco as a responsible party for a former manufactured gas plant (MGP) site located in Huntsville, Alabama, and inviting Alagasco to enter an Administrative Settlement Agreement and Order on Consent to perform a removal action at that site. The Huntsville MGP, along with the Huntsville gas distribution system, was sold by Alagasco to the City of Huntsville in 1949. While Alagasco no longer owns the Huntsville site, the Company and the current site owner have agreed to enter into a Consent Order and develop an action plan for the site. Based on the limited information available at this time, Alagasco preliminarily estimates that it may incur costs associated with the site ranging from $3 million to $6.1 million. At the present time, the Company cannot conclude that any amount within this range is a better estimate than any other. During the year ended December 31, 2009, the Company incurred costs of $0.2 million associated with the site. As of December 31, 2009, the Company has accrued a contingent liability of $2.8 million in addition to the costs previously incurred. The estimate assumes an action plan for excavation of affected soil and sediment only. If it is determined that a greater scope of work is appropriate, then actual costs will likely exceed the preliminary estimate. Alagasco expects to recover such costs through insurance recovery and future rates and has recorded a corresponding amount to its Enhanced Stability Reserve regulatory asset account.

| • | Employees |

The Company has approximately 1,515 employees, of which Alagasco employs 1,100 and Energen Resources employs 415. The Company believes that its relations with employees are good.

10

Table of Contents

Index to Financial Statements

| ITEM 1A. | RISK FACTORS |

The future success and continued viability of Energen and its businesses, like any venture, is subject to many recognized and unrecognized risks and uncertainties. Such risks and uncertainties could cause actual results to differ materially from those contained in forward-looking statements made in this report and presented elsewhere by management. The following list identifies and briefly summarizes certain risk factors, and should not be viewed as complete or comprehensive. The Company undertakes no obligation to correct or update such risk factors whether as a result of new information, future events or otherwise. These risk factors should be read in conjunction with the Company’s disclosure specific to Forward-Looking Statements made elsewhere in this report.

Commodity Prices: The Company and Alagasco are significantly influenced by commodity prices. Historical markets for natural gas, oil and natural gas liquids have been volatile. Energen Resources’ revenues, operating results, profitability and cash flows depend primarily upon the prices realized for its oil, gas and natural gas liquid production. Alagasco’s competitive position and customer demand is significantly influenced by prices for natural gas which are passed-through to customers.

Access to Credit Markets: The Company and its subsidiaries rely on access to credit markets. The availability and cost of credit market access is significantly influenced by market events and rating agency evaluations for both lenders and the Company. Recent market volatility and credit market disruption have demonstrated that credit availability and issuer credit ratings can change rapidly. Events negatively affecting credit ratings and credit market liquidity could increase borrowing costs or limit availability of funds to the Company.

Energen Resources’ Hedging: Although Energen Resources makes use of futures, swaps, options and fixed-price contracts to mitigate price risk, fluctuations in future oil, gas and natural gas liquids prices could materially affect the Company’s financial position, results of operations and cash flows; furthermore, such risk mitigation activities may cause the Company’s financial position and results of operations to be materially different from results that would have been obtained had such risk mitigation activities not occurred. The effectiveness of such risk mitigation assumes that counterparties maintain satisfactory credit quality. The effectiveness of such risk mitigation also assumes that actual sales volumes will generally meet or exceed the volumes subject to the futures, swaps, options and fixed- price contracts. A substantial failure to meet sales volume targets, whether caused by miscalculations, weather events, natural disaster, accident, mechanical failure, criminal act or otherwise, could leave Energen Resources financially exposed to its counterparties and result in material adverse financial consequences to Energen Resources and the Company. The adverse effect could be increased if the adverse event was widespread enough to move market prices against Energen Resources’ position.

Alagasco’s Hedging: Similarly, although Alagasco makes use of futures, swaps and fixed-price contracts to mitigate gas supply cost risk, fluctuations in future gas supply costs could materially affect its financial position and rates to customers. The effectiveness of Alagasco’s risk mitigation assumes that its counterparties in such activities maintain satisfactory credit quality. The effectiveness of such risk mitigation also assumes that Alagasco’s actual gas supply needs will generally meet or exceed the volumes subject to the futures, swaps and fixed-price contracts. A substantial failure to experience projected gas supply needs, whether caused by miscalculations, weather events, natural disaster, accident, mechanical failure, criminal act or otherwise, could leave Alagasco financially exposed to its counterparties and result in material adverse financial consequences to Alagasco and the Company. The adverse effect could be increased if the adverse event was widespread enough to move market prices against Alagasco’s position.

Energen Resources Customer Concentration: Revenues and related accounts receivable from oil and gas operations primarily are generated from the sale of produced oil, natural gas and natural gas liquids to a small number of energy marketing companies. Such sales are typically made on an unsecured credit basis with payment due the month following delivery. This concentration of sales to a limited number of customers in the energy marketing industry has the potential to affect the Company’s overall exposure to credit risk, either positively or negatively, based on changes in economic, industry or other conditions specific to a single customer or to the energy marketing industry generally. Energen Resources considers the credit quality of its customers and, in certain instances, may require credit assurances such as a deposit, letter of credit or parent guarantee. The three

11

Table of Contents

Index to Financial Statements

largest oil, natural gas and natural gas liquids purchasers are expected to account for approximately 21 percent, 17 percent and 13 percent, respectively, of Energen Resources’ estimated 2010 production. Energen Resources’ other purchasers are each expected to purchase less than 8 percent of estimated 2010 production.

Third Party Facilities: Energen Resources delivers to and Alagasco is served by third party facilities. These facilities include third party oil and gas gathering, transportation, processing and storage facilities. Energen Resources relies upon such facilities for access to markets for its production. Alagasco relies upon such facilities for access to natural gas supplies. Such facilities are typically limited in number and geographically concentrated. An extended interruption of access to or service from these facilities, whether caused by weather events, natural disaster, accident, mechanical failure, criminal act or otherwise could result in material adverse financial consequences to Energen Resources, Alagasco and the Company.

Energen Resources’ Production and Drilling: There are numerous uncertainties inherent in estimating quantities of proved oil and gas reserves and in projecting future rates of production and timing of development expenditures. The total amount or timing of actual future production may vary significantly from reserve and production estimates. In the event Energen Resources is unable to fully invest its planned development, acquisition and exploratory expenditures, future operating revenues, production, and proved reserves could be negatively affected. The drilling of development and exploratory wells can involve significant risks, including those related to timing, success rates and cost overruns, and these risks can be affected by lease and rig availability, complex geology and other factors. Anticipated drilling plans and capital expenditures may also change due to weather, manpower and equipment availability, changing emphasis by management and a variety of other factors which could result in actual drilling and capital expenditures being substantially different than currently planned.

Operations: Inherent in the gas distribution activities of Alagasco and the oil and gas production activities of Energen Resources are a variety of hazards and operation risks, such as leaks, explosions and mechanical problems that could cause substantial financial losses. In addition, these risks could result in loss of human life, significant damage to property, environmental pollution, impairment of operations and substantial losses to the Company. In accordance with customary industry practices, the Company maintains insurance against some, but not all, of these risks and losses. Further, the Company’s insurance retention levels are such that significant events could adversely affect Energen Resources’, Alagasco’s and the Company’s financial position, results of operations and cash flows. The location of pipeline and storage facilities near populated areas, including residential areas, commercial business centers and industrial sites, could increase the level of damages resulting from these risks. The occurrence of any of these events could adversely affect Alagasco’s, Energen Resources’ and the Company’s financial position, results of operations and cash flows.

Alagasco’s Service Territory: Alagasco’s utility customers are geographically concentrated in central and north Alabama. Significant economic, weather, natural disaster, criminal act or other events that adversely affect this region could adversely affect Alagasco and the Company.

Federal, State and Local Laws and Regulations: Energen and Alagasco are subject to extensive federal, state and local regulation which significantly influences operations. Although the Company believes that operations generally comply with applicable laws and regulations, failure to comply could result in the suspension or termination of operations and subject the Company to administrative, civil and criminal penalties. Federal, state and local legislative bodies and agencies frequently exercise their respective authority to adopt new laws and regulations and to amend, modify and interpret existing laws and regulations. Such changes can subject the Company to significant tax or cost increases and can impose significant restrictions and limitations on the Company’s operations.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None

12

Table of Contents

Index to Financial Statements

| ITEM 2. | PROPERTIES |

The corporate headquarters of Energen, Energen Resources and Alagasco are located in leased office space in Birmingham, Alabama. See the discussion under Item 1, Business for further information related to Energen Resources’ and Alagasco’s business operations. Information concerning Energen Resources’ production and reserves is summarized in the table below and included in Note 17, Oil and Gas Operations (Unaudited), in the Notes to Financial Statements. See Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations for a discussion of the future outlook and expectations for Energen Resources and Alagasco.

Oil and Gas Operations

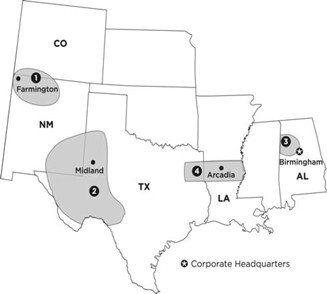

Energen Resources focuses on increasing its production and proved reserves through the acquisition and development of onshore North American producing oil and gas properties. Energen Resources maintains offices in Arcadia, Louisiana; in Farmington, New Mexico; and in Midland, Texas. The Company also maintains offices in Lehman, Seminole, Westbrook and Penwell, Texas; and in Brookwood and Tuscaloosa, Alabama.

The major areas of operations include (1) the San Juan Basin, (2) the Permian Basin, (3) the Black Warrior Basin and (4) North Louisiana/East Texas as highlighted on the above map.

The following table sets forth the production volumes for the year ended December 31, 2009, and proved reserves and reserves-to-production ratio by area as of December 31, 2009:

| Year ended December 31, 2009 | December 31, 2009 | December 31, 2009 | ||||

| Production Volumes (MMcfe) |

Proved Reserves (MMcfe) |

Reserves-to- Production Ratio | ||||

| San Juan Basin |

54,887 | 788,815 | 14.37 years | |||

| Permian Basin |

33,799 | 553,894 | 16.39 years | |||

| Black Warrior Basin |

14,313 | 156,009 | 10.90 years | |||

| North Louisiana/East Texas |

7,786 | 43,520 | 5.59 years | |||

| Other |

439 | 4,628 | 10.54 years | |||

| Total |

111,224 | 1,546,866 | 13.91 years |

13

Table of Contents

Index to Financial Statements

The following table sets forth proved reserves by area as of December 31, 2009:

| Gas MMcf | Oil MBbl | NGL MBbl | ||||

| San Juan Basin |

638,173 | 1,039 | 24,068 | |||

| Permian Basin |

56,386 | 76,729 | 6,189 | |||

| Black Warrior Basin |

156,009 | - | - | |||

| North Louisiana/East Texas |

43,040 | 80 | - | |||

| Other |

3,938 | 115 | - | |||

| Total |

897,546 | 77,963 | 30,257 |

The following table sets forth proved developed reserves by area as of December 31, 2009:

| Gas MMcf | Oil MBbl | NGL MBbl | ||||

| San Juan Basin |

494,486 | 986 | 20,164 | |||

| Permian Basin |

50,192 | 64,898 | 4,821 | |||

| Black Warrior Basin |

154,827 | - | - | |||

| North Louisiana/East Texas |

40,416 | 79 | - | |||

| Other |

3,938 | 115 | - | |||

| Total |

743,859 | 66,078 | 24,985 |

The following table sets forth proved undeveloped reserves by area as of December 31, 2009:

| Gas MMcf | Oil MBbl | NGL MBbl | ||||

| San Juan Basin |

143,687 | 53 | 3,904 | |||

| Permian Basin |

6,194 | 11,831 | 1,368 | |||

| Black Warrior Basin |

1,182 | - | - | |||

| North Louisiana/East Texas |

2,624 | 1 | - | |||

| Total |

153,687 | 11,885 | 5,272 |

The following table sets forth the reconciliation of proved undeveloped reserves:

| Bcfe | Year ended December 31, 2009 |

||

| Balance at beginning of period |

254.7 | ||

| Undeveloped reserves transferred to developed reserves* |

(69.3 | ) | |

| Revisions |

(39.2 | ) | |

| Extensions, discoveries and acquisitions |

110.4 | ||

| Balance at end of period |

256.6 |

| * | Approximately $103 million in capital was spent in the year ended December 31, 2009 related to undeveloped reserves that were moved to developed |

Energen Resources files Form EIA-23 with the Department of Energy which reports gross proved reserves, including the working interest share of other owners, for properties operated by the Company. The proved reserves reported in the table above represent our share of proved reserves for all properties, based on our ownership interest in each property. For properties operated by Energen Resources, the difference between the proved reserves reported on Form EIA-23 and the gross reserves associated with the Company-owned proved reserves reported in the table above does not exceed five percent. Estimated proved reserves as of December 31, 2009 are based upon studies for each of our properties prepared by Company engineers and audited by Ryder Scott Company, L.P. (Ryder Scott) and T. Scott Hickman and Associates, Inc. (T. Scott Hickman), independent oil and gas reservoir engineers. Calculations were prepared using standard geological and engineering methods generally accepted by the petroleum industry and in accordance with Securities and Exchange Commission (SEC) guidelines.

A Senior Vice President at Ryder Scott is the technical person primarily responsible for overseeing the audit of the reserves. The Senior Vice President has a Bachelor of Science degree in Mechanical Engineering and is a member of the Society of Petroleum Engineers and the Society of Petroleum Evaluation Engineers. He has been an employee of Ryder Scott since 1982 and also serves as chief technical advisor of unconventional reserves

14

Table of Contents

Index to Financial Statements

evaluation. A Petroleum Consultant at T. Scott Hickman is the technical person primarily responsible for overseeing the audit of the reserves. He has a Bachelor of Science degree in Petroleum Engineering and is a member of the Society of Petroleum Engineers and the Society of Petroleum Evaluation Engineers. He has been employed by T. Scott Hickman since 1983. The General Manager of Acquisitions and Engineering is the technical person primarily responsible for overseeing reserves on behalf of Energen Resources. His background includes a Bachelor of Science degree in Mechanical Engineering and membership in the Society of Petroleum Engineers. He is a registered Professional Engineer in the State of Alabama with more than 30-years experience evaluating oil and natural gas properties and estimating reserves.

The Company relies upon certain internal controls when preparing its reserve estimations. These internal controls include review by the reservoir engineering managers to ensure the correct reserve methodology has been applied for each specific property and that the reserves are properly categorized in accordance with SEC guidelines. They also affirm the accuracy of the data used in the reserve and associated rate forecast, provide a review of the procedures used to input pricing data and a review of the working and net interest factors to ensure that factors are adequately reflected in the engineering analysis.

Net production forecasts are compared to historical sales volumes to check for reasonableness and operating costs and severance taxes calculated in the reserve report are compared to historical accounting data to ensure proper cost estimates are used. A reserve table is generated comparing previous years reserves to current year reserve estimates to determine variances. This table is reviewed by the General Manager of Engineering and Acquisitions and the Chief Operating Officer of Energen Resources. Revisions and additions are investigated and explained.

Reserve estimates of proved reserves are sent to independent reservoir engineers for audit and verification. For 2009, approximately 99 percent of all proved reserves were audited by the independent reservoir engineers which audit engineering procedures, check the reserve estimates for reasonableness and check that the reserves are properly classified.

The following table sets forth the standard pressure base in pounds-force per square inch absolute (psia) for each state in which Energen Resources has wells:

| Alabama, Texas |

14.65 psia | |

| Colorado |

14.73 psia | |

| Louisiana, New Mexico |

15.025 psia |

The following table sets forth the total net productive gas and oil wells by area as of December 31, 2009, and developed and undeveloped acreage as of the latest practicable date prior to year-end:

| Net Wells | Net Developed Acreage |

Net Undeveloped Acreage | ||||

| San Juan Basin |

1,443 | 277,507 | 9,595 | |||

| Permian Basin |

2,163 | 97,281 | 1,807 | |||

| Black Warrior Basin |

801 | 147,106 | 602 | |||

| North Louisiana/East Texas |

178 | 20,824 | 952 | |||

| Alabama Shales and Other |

11 | 6,377 | 399,409 | |||

| Total |

4,596 | 549,095 | 412,365 |

Energen Resources sells oil, natural gas, and natural gas liquids under a variety of contractual arrangements, some of which specify the delivery of a fixed and determinable quantity. Energen Resources is contractually committed to deliver approximately 53 Bcf (net) of natural gas through March 2011. The Company expects to fulfill delivery commitments through production of existing proved reserves.

15

Table of Contents

Index to Financial Statements

Natural Gas Distribution

The properties of Alagasco consist primarily of its gas distribution system, which includes approximately 10,400 miles of main and more than 11,950 miles of service lines, odorization and regulation facilities, and customer meters. Alagasco also has two LNG facilities, four division commercial offices, three division business centers, one district office, seven service centers, and other related property and equipment, some of which are leased by Alagasco.

| ITEM 3. | LEGAL PROCEEDINGS |

Energen and its affiliates are, from time to time, parties to various pending or threatened legal proceedings. Certain of these lawsuits include claims for punitive damages in addition to other specific relief. Based upon information presently available, and in light of available legal and other defenses, contingent liabilities arising from threatened and pending litigation are not considered material in relation to the respective financial positions of Energen and its affiliates. It should be noted, however, that Energen and its affiliates conduct business in Alabama and other jurisdictions in which the magnitude and frequency of punitive or other damage awards may bear little or no relation to culpability or actual damages, thus making it difficult to predict litigation results.

Legacy Litigation

During recent years, numerous lawsuits have been filed against oil production companies in Louisiana for restoration of oilfield properties. These suits are referred to in the industry as “legacy litigation” because they usually involve operations that were conducted on the affected properties many years earlier. Energen Resources is or has been a party to several legacy litigation lawsuits, most of which result from the operations of predecessor companies. Based upon information presently available, and in light of available legal and other defenses, contingent liabilities arising from legacy litigation in excess of the Company’s accrued provision for estimated liability are not considered material to the Company’s financial position.

Other

Various other pending or threatened legal proceedings are in progress currently, and the Company has accrued a provision for the estimated liability.

| ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

No matters were submitted to a vote of security holders during the fourth quarter of 2009.

16

Table of Contents

Index to Financial Statements

EXECUTIVE OFFICERS OF THE REGISTRANTS

Energen Corporation

| Name |

Age | Position (1) | ||

| James T. McManus, II |

51 |

Chairman, Chief Executive Officer and President of Energen and Chairman and Chief Executive Officer of Alagasco (2) | ||

| Charles W. Porter, Jr. |

45 |

Vice President, Chief Financial Officer and Treasurer of Energen and Alagasco (3) | ||

| John S. Richardson |

52 |

President and Chief Operating Officer of Energen Resources (4) | ||

| Dudley C. Reynolds |

57 |

President and Chief Operating Officer of Alagasco (5) | ||

| J. David Woodruff, Jr. |

53 |

General Counsel and Secretary of Energen and Alagasco and Vice President-Corporate Development of Energen (6) | ||

| Russell E. Lynch, Jr. |

36 |

Vice President and Controller of Energen (7) | ||

| Notes: |

(1) All executive officers of Energen have been employed by Energen or a subsidiary for the past five years. Officers serve at the pleasure of the Board of Directors.

(2) Mr. McManus has been employed by the Company in various capacities since 1986. He was elected Executive Vice President and Chief Operating Officer of Energen Resources in October 1995 and President of Energen Resources in April 1997. He was elected President and Chief Operating Officer of Energen effective January 1, 2006 and Chief Executive Officer of Energen and each of its subsidiaries effective July 1, 2007. He was elected Chairman of the Board of Energen and each of its subsidiaries effective January 1, 2008. Mr. McManus serves as a Director of Energen and each of its subsidiaries.

(3) Mr. Porter has been employed by the Company in various financial capacities since 1989. He was elected Controller of Energen Resources in 1998. In 2001, he was elected Vice President – Finance of Energen Resources. He was elected Vice President, Chief Financial Officer and Treasurer of Energen and each of its subsidiaries effective January 1, 2007.

(4) Mr. Richardson has been employed by the Company in various capacities since 1985. He was elected Vice President – Acquisitions and Engineering of Energen Resources in 1997. He was elected Executive Vice President and Chief Operating Officer of Energen Resources effective January 1, 2006. He was elected President and Chief Operating Officer of Energen Resources effective January 23, 2008.

(5) Mr. Reynolds has been employed by the Company in various capacities since 1980. He was elected General Counsel and Secretary of Energen and each of its subsidiaries in April 1991. He was elected President and Chief Operating Officer of Alagasco effective January 1, 2003. |

17

Table of Contents

Index to Financial Statements

| (6) Mr. Woodruff has been employed by the Company in various capacities since 1986. He was elected Vice President-Legal and Assistant Secretary of Energen and each of its subsidiaries in April 1991 and Vice President-Corporate Development of Energen in October 1995. He was elected General Counsel and Secretary of Energen and each of its subsidiaries effective January 1, 2003.

(7) Mr. Lynch has been employed by the Company in various capacities since 2001. He became Energen’s Manager of Financial Accounting and Treasury in 2004 and Director of Financial Accounting in 2007. He was elected Vice President and Controller of Energen effective January 1, 2009. |

18

Table of Contents

Index to Financial Statements

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

| Quarterly Market Prices and Dividends Paid Per Share | ||||||||

| Quarter ended (in dollars) | High | Low | Close | Dividends Paid | ||||

| March 31, 2008 |

66.88 | 57.61 | 62.30 | .12 | ||||

| June 30, 2008 |

79.57 | 61.97 | 78.03 | .12 | ||||

| September 30, 2008 |

79.33 | 41.03 | 45.28 | .12 | ||||

| December 31, 2008 |

45.50 | 23.00 | 29.33 | .12 | ||||

| March 31, 2009 |

33.91 | 23.18 | 29.13 | .125 | ||||

| June 30, 2009 |

41.62 | 28.21 | 39.90 | .125 | ||||

| September 30, 2009 |

45.78 | 35.38 | 43.10 | .125 | ||||

| December 31, 2009 |

48.89 | 41.20 | 46.80 | .125 | ||||

Energen’s common stock is listed on the New York Stock Exchange under the symbol EGN. On February 16, 2010, there were 6,708 holders of record of Energen’s common stock. At the date of this filing, Energen Corporation owned all the issued and outstanding common stock of Alabama Gas Corporation. Energen expects to pay annual cash dividends of $0.52 per share on the Company’s common stock in 2010. The amount and timing of all dividend payments is subject to the discretion of the Board of Directors and is based upon business conditions, results of operations, financial conditions and other factors.

The following table summarizes information concerning securities authorized for issuance under equity compensation plans:

| Plan Category | Number of Securities to be Issued for Outstanding Options and Performance Share Awards |

Weighted Average Exercise Price |

Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans | ||||

| Equity compensation plans approved by security holders* |

1,107,809 | $ | 36.83 | 2,272,910 | |||

| Equity compensation plans not approved by security holders |

- | - | - | ||||

| Total |

1,107,809 | $ | 36.83 | 2,272,910 | |||

| * | These plans include 1,369,514 shares associated with the Company’s 1997 Stock Incentive Plan, 190,724 shares associated with the 1992 Energen Corporation Directors Stock Plan and 712,672 shares associated with the 1997 Deferred Compensation Plan. |

The following table summarizes information concerning purchases of equity securities by the issuer:

| Period | Total Number of Shares Purchased |

Average Price Paid per Share |

Total Number of Shares Purchased as Part of Publicly Announced Plans |

Maximum Number of Shares that May Yet Be Purchased Under the Plans** | ||||||

| October 1, 2009 through October 31, 2009 |

4,529 | * | $ | 47.07 | - | 8,992,700 | ||||

| November 1, 2009 through November 30, 2009 |

- | - | - | 8,992,700 | ||||||

| December 1, 2009 through December 31, 2009 |

- | - | - | 8,992,700 | ||||||

| Total |

4,529 | $ | 47.07 | - | 8,992,700 | |||||

| * | Acquired in connection with tax withholdings and payment of exercise price on stock compensation plans. |

| ** | By resolution adopted May 24, 1994, and supplemented by resolutions adopted April 26, 2000 and June 24, 2006, the Board of Directors authorized the Company to repurchase up to 12,564,400 shares of the Company’s common stock. The resolutions do not have an expiration date. |

19

Table of Contents

Index to Financial Statements

PERFORMANCE GRAPH

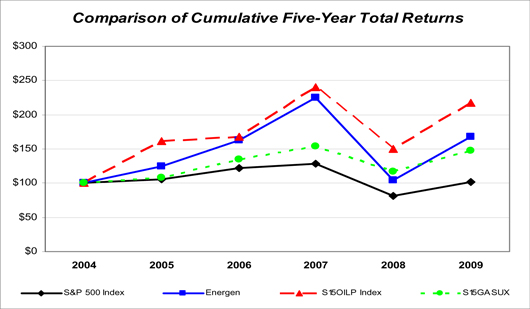

Energen Corporation — Comparison of Five-Year Cumulative Shareholder Returns

This graph compares the total shareholder returns of Energen, the Standard & Poor’s Composite Stock Index (S&P 500), the Standard & Poor’s Supercomposite Oil & Gas Exploration & Production Index (S15OILP), and the Standard & Poor’s Supercomposite Gas Utilities Index (S15GASUX). The graph assumes $100 invested at the per-share closing price of the common stock on the New York Exchange Composite Tape on December 31, 2004, in the Company and each of the indices. Total shareholder return includes reinvested dividends.

| As of December 31, | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | ||||||||||||

| S&P 500 Index |

$ | 100 | $ | 105 | $ | 121 | $ | 128 | $ | 81 | $ | 102 | ||||||

| Energen |

$ | 100 | $ | 125 | $ | 163 | $ | 225 | $ | 104 | $ | 168 | ||||||

| S15OILP Index |

$ | 100 | $ | 162 | $ | 168 | $ | 240 | $ | 150 | $ | 218 | ||||||

| S15GASUX |

$ | 100 | $ | 108 | $ | 135 | $ | 154 | $ | 117 | $ | 147 | ||||||

20

Table of Contents

Index to Financial Statements

| ITEM 6. | SELECTED FINANCIAL DATA |

The selected financial data as set forth below should be read in conjunction with the Consolidated Financial Statements and the Notes to Financial Statements included in this Form 10-K.

SELECTED FINANCIAL AND COMMON STOCK DATA

Energen Corporation

| Years ended December 31, (dollars in thousands, except per share amounts) |

2009 | 2008 | 2007 | 2006 | 2005 | |||||||||||

| INCOME STATEMENT |

||||||||||||||||

| Operating revenues |

$ | 1,440,420 | $ | 1,568,910 | $ | 1,435,060 | $ | 1,393,986 | * | $ | 1,128,394 | |||||

| Income from continuing operations |

$ | 256,325 | $ | 321,915 | $ | 309,212 | $ | 273,523 | * | $ | 172,886 | |||||

| Net income |

$ | 256,325 | $ | 321,915 | $ | 309,233 | $ | 273,570 | * | $ | 173,012 | |||||

| Diluted earnings per average common share from continuing operations |

$ | 3.57 | $ | 4.47 | $ | 4.28 | $ | 3.73 | * | $ | 2.35 | |||||

| Diluted earnings per average common share |

$ | 3.57 | $ | 4.47 | $ | 4.28 | $ | 3.73 | * | $ | 2.35 | |||||

| BALANCE SHEET |

||||||||||||||||

| Total property, plant and equipment, net |

$ | 3,144,469 | $ | 2,867,648 | $ | 2,538,243 | $ | 2,252,414 | $ | 2,068,011 | ||||||

| Total assets |

$ | 3,803,118 | $ | 3,775,404 | $ | 3,079,653 | $ | 2,836,887 | $ | 2,618,226 | ||||||

| Long-term debt |

$ | 410,786 | $ | 561,361 | $ | 562,365 | $ | 582,490 | $ | 683,236 | ||||||

| Total shareholders’ equity |

$ | 1,988,243 | $ | 1,913,920 | $ | 1,378,658 | $ | 1,202,069 | $ | 892,678 | ||||||

| COMMON STOCK DATA |

||||||||||||||||

| Annual dividend rate at period-end |

$ | 0.50 | $ | 0.48 | $ | 0.46 | $ | 0.44 | $ | 0.40 | ||||||

| Cash dividends paid per common share |

$ | 0.50 | $ | 0.48 | $ | 0.46 | $ | 0.44 | $ | 0.40 | ||||||

| Diluted average common shares outstanding (000) |

71,885 | 72,030 | 72,181 | 73,278 | 73,715 | |||||||||||

| Price range: |

||||||||||||||||

| High |

$ | 48.89 | $ | 79.57 | $ | 70.41 | $ | 47.60 | $ | 44.31 | ||||||

| Low |

$ | 23.18 | $ | 23.00 | $ | 43.78 | $ | 32.16 | $ | 27.06 | ||||||

| Close |

$ | 46.80 | $ | 29.33 | $ | 64.23 | $ | 46.94 | $ | 36.32 | ||||||

| * | Includes an after-tax gain of $34.5 million, or $0.47 per diluted share, on the sale of a 50 percent interest in Energen Resources’ acreage position in Alabama shales to Chesapeake Energy Corporation. |

21

Table of Contents

Index to Financial Statements

SELECTED BUSINESS SEGMENT DATA

Energen Corporation

| Years ended December 31, (dollars in thousands) |

2009 | 2008 | 2007 | 2006 | 2005 | ||||||||||

| OIL AND GAS OPERATIONS |

|||||||||||||||

| Operating revenues from continuing operations |

|||||||||||||||

| Natural gas |

$ | 460,370 | $ | 536,283 | $ | 499,406 | $ | 437,560 | $ | 365,635 | |||||

| Oil |

284,750 | 292,908 | 251,497 | 181,459 | 116,651 | ||||||||||

| Natural gas liquids |

67,254 | 68,216 | 68,623 | 50,258 | 38,455 | ||||||||||

| Other |

10,172 | 16,725 | 6,066 | 61,265 | 6,953 | ||||||||||

| Total |

$ | 822,546 | $ | 914,132 | $ | 825,592 | $ | 730,542 | $ | 527,694 | |||||

| Production volumes from continuing operations |

|||||||||||||||

| Natural gas (MMcf) |

72,337 | 67,573 | 64,300 | 62,824 | 61,048 | ||||||||||

| Oil (MBbl) |

4,690 | 4,114 | 3,879 | 3,645 | 3,316 | ||||||||||

| Natural gas liquids (MMgal) |

75.2 | 70.7 | 77.2 | 76.3 | 70.5 | ||||||||||