UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Amendment No.1)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended | |

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from to | |

Commission file number

(Name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

(Address of principal executive offices) | (Zip Code) |

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | |

Non-accelerated filer ☐ | Smaller reporting company |

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C 7262 (b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

As of June 30, 2021 (the last business day of the registrant’s second fiscal quarter), the aggregate market value of the registrant’s voting and non-voting common equity held by non-affiliates of the registrant was $

DOCUMENTS INCORPORATED BY REFERENCE: Portions of the registrant’s Proxy Statement for the 2022 Annual Meeting of Shareholders are incorporated into Part III, Items 10 through 14 of this report.

Explanatory Note

McEwen Mining Inc. (the “Company”) is filing this Amendment No. 1 on Form 10-K/A (this “Amendment”) to its Annual Report on Form 10-K for the year ended December 31, 2021 filed with the U.S. Securities and Exchange Commission (“SEC”) on March 7, 2022 (the “Original Filing”) to correct a scrivener’s error in the Gold and Silver Reserves and Resources tables presented in Item 1 of the Original Filing. Specifically, many of the total gold and silver grades in the tables were incorrectly disclosed in the Original Filing. The Company has also corrected some clerical errors in the exhibit list included in Item 15.

The Gold and Silver Reserves and Resources tables included in Item 1 of the Amendment, as well as the exhibit list, have been restated to correct the errors. The remainder of the Original Filing, in addition to the tables referenced in the preceding sentence, is included for the convenience of the reader.

No attempt has been made in this Amendment to modify or update the disclosures in the Original Filing except as required to reflect the effect of the revisions discussed herein. Except as otherwise noted herein, this Amendment continues to describe conditions as of the date of the Original Filing and the disclosures contained herein have not been updated to reflect events, results or developments that occurred after the date of the Original Filing, or to modify or update those disclosures affected by subsequent events. Among other things, forward-looking statements made in the Original Filing have not been revised to reflect events, results or developments that occurred or facts that became known to us after the date of the Original Filing, and such forward-looking statements should be read in conjunction with our filings with the SEC subsequent to the filing of the Original Filing. Accordingly, this Amendment should be read in conjunction with the Company’s other filings with the SEC subsequent to March 7, 2022.

1

TABLE OF CONTENTS

ADDITIONAL INFORMATION

Descriptions of agreements or other documents in this report are intended as summaries and are not necessarily complete. Please refer to the agreements or other documents filed or incorporated herein by reference as exhibits. Please see Item 15, Exhibits and Financial Statement Schedules in this report for a complete list of those exhibits.

2

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Please see the note under “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations,” for a description of special factors potentially affecting forward-looking statements included in this report.

CAUTIONARY NOTE REGARDING DISCLOSURE OF MINERAL PROPERTIES

Mineral Reserves and Resources

We are subject to the reporting requirements of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”) and applicable Canadian securities laws, and as a result, we have reported our mineral reserves and mineral resources according to two different standards. U.S. reporting requirements are governed by Item 1300 of Regulation S-K (“S-K 1300”), as issued by the U.S. Securities and Exchange Commission (“SEC”). Canadian reporting requirements for disclosure of mineral properties are governed by National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”), as adopted from the definitions provided by the Canadian Institute of Mining, Metallurgy and Petroleum. Both sets of reporting standards have similar goals in terms of conveying an appropriate level of confidence in the disclosures being reported, but the standards embody slightly different approaches and definitions. All disclosure of mineral resources and mineral reserves in this report are reported in accordance with S-K 1300.

Investors should be aware that the estimation of measured resources and indicated resources involve greater uncertainty as to their existence and economic feasibility than the estimation of proven and probable reserves, and therefore investors are cautioned not to assume that all or any part of measured or indicated resources will ever be converted into S-K 1300-compliant reserves. The estimation of inferred resources involves far greater uncertainty as to their existence and economic viability than the estimation of other categories of resources, and therefore it cannot be assumed that all or any part of inferred resources will ever be upgraded to a higher category. Therefore, investors are cautioned not to assume that all or any part of inferred resources exist, or that they can be mined legally or economically.

Technical Report Summaries and Qualified Persons

The technical information concerning our mineral projects in this Form 10-K have been reviewed and approved by Peter Mah, P.Eng., Chief Operating Officer, and Luke Willis, Director, Resource Modeling, each a “qualified person” under S-K 1300. For a description of the key assumptions, parameters and methods used to estimate mineral reserves and mineral resources included in this Form 10-K, as well as data verification procedures and a general discussion of the extent to which the estimates may be affected by any known environmental, permitting, legal, title, taxation, sociopolitical, marketing or other relevant factors, please review the Technical Report Summaries for each of our material properties which are included as exhibits to this Report.

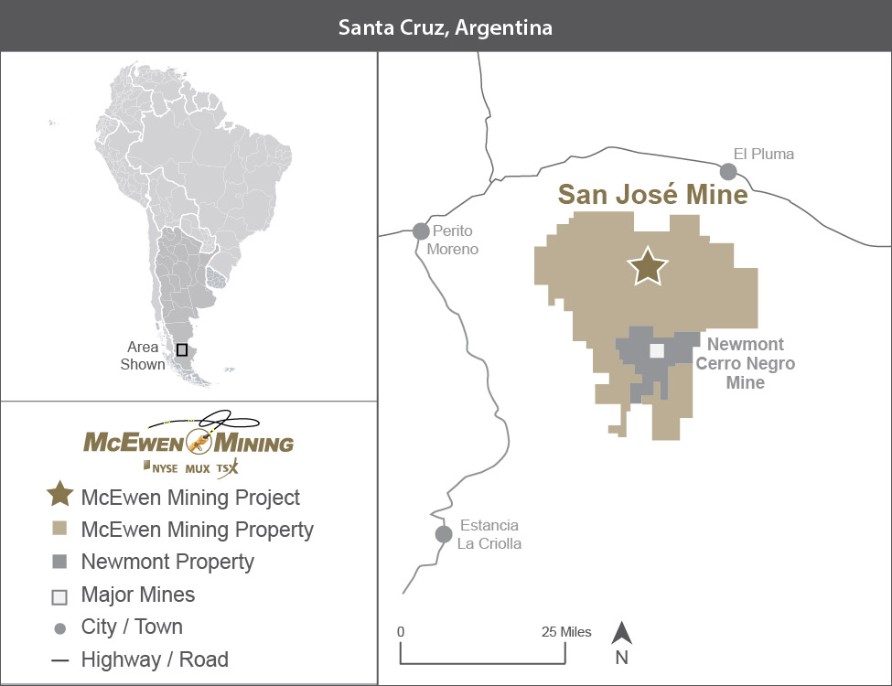

RELIABILITY OF INFORMATION

Minera Santa Cruz S.A. (“MSC”), the owner of the San José mine, is responsible for and has supplied to us all reported results from the San José mine. The technical information contained herein with regard to the San José mine is, with few exceptions as noted, based entirely on information provided to us by MSC. Our joint venture partner, a subsidiary of Hochschild Mining plc, and its affiliates other than MSC do not accept responsibility for the use of project data or the adequacy or accuracy of this information.

3

PART I

ITEM 1. BUSINESS

History and Organization

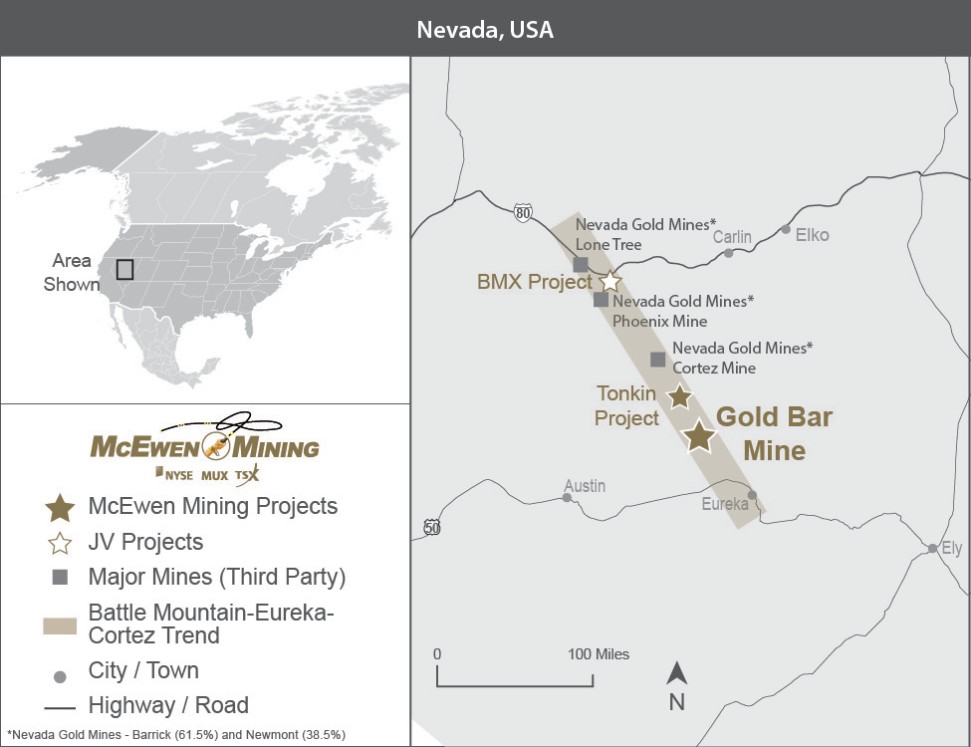

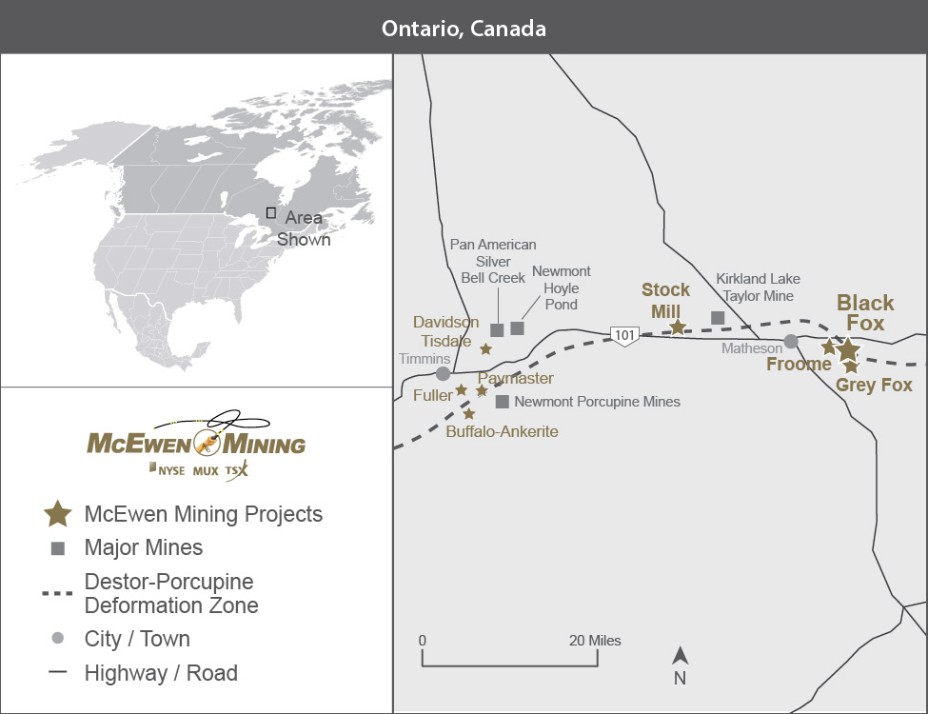

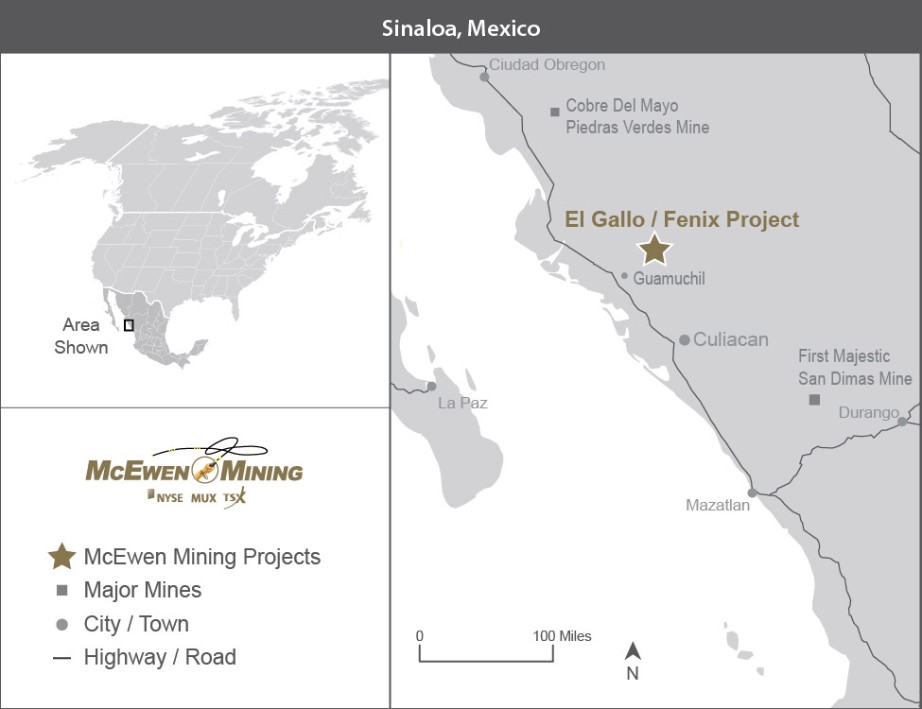

We are a mining and minerals production and exploration company focused on precious and base metals in the United States, Canada, Mexico and Argentina. We were incorporated under the laws of the state of Colorado in 1979. We own 100% of the Black Fox mine and Stock mill in Ontario, Canada, a 100% interest in the Gold Bar mine in Nevada, 100% of the formerly-producing El Gallo Project in Sinaloa, Mexico, 81.4% of McEwen Copper, the owner of the Los Azules copper deposit in San Juan, Argentina, and a 49% interest in MSC, the owner and operator of the San José mine in Santa Cruz, Argentina. MSC is controlled by the majority owner of the joint venture, Hochschild Mining plc (“Hochschild”). Since we own less than a 50% interest in MSC, we account for our interest as an unconsolidated subsidiary using the equity method of accounting. In addition to our operating properties, we hold interests in advanced-stage and exploration-stage properties and projects in the United States, Canada, Mexico and Argentina, including the Los Azules copper project (“Los Azules”) in Argentina.

Our commencement of Canadian operations in 2017 was facilitated by the acquisition of Lexam VG Gold Inc. (“Lexam”) in April 2017 and the acquisition of the Black Fox mine and Stock mill in October 2017. These two acquisitions provided us with an operating mine, mill and significant land interests in the historic Timmins mining district of Ontario. On September 19, 2021, the Froome deposit at the Black Fox mine achieved commercial production.

Our 100% owned Gold Bar mine in Nevada poured its first gold ingot on February 16, 2019 and achieved commercial production on May 23, 2019. Construction activities started in late 2017 following the receipt of the final permit on November 8, 2017. At the El Gallo Project, mining and crushing activities ceased during the second quarter of 2018, with production activities since that time limited to residual leaching.

During 2021, we re-organized our subsidiary, McEwen Copper Inc. (“McEwen Copper”), through which we historically held an indirect 100% interest in the Los Azules copper project in the province of San Juan, Argentina and Nevada Creek property. During the year ended December 31, 2021, we closed the first tranche of a private placement, a $40 million investment by an affiliate of our Chairman and CEO, Rob McEwen, in exchange for a 18.6% interest in McEwen Copper. McEwen Copper is included for the period August 19 to December 31, 2021, which is reported at 81.4% non-controlling interest. For further information, see Item 8. Financial Statements and Supplementary Data, Note 20 Non-Controlling Interests.

Our objective is to increase shareholder value through the exploration for and economic extraction of gold, silver and other valuable minerals. Other than the San José mine in Argentina, we generally conduct our activities as the sole operator, but we may enter into arrangements with other companies through joint venture or similar agreements in an effort to achieve our strategic objectives. We hold our mineral property interests and operate our business through various subsidiary companies, each of which is owned directly, or indirectly, by us.

Our principal executive office is located at 150 King Street West, Suite 2800, Toronto, Ontario, Canada M5H 1J9 and our telephone number is (866) 441-0690. We also maintain offices in Elko, Nevada (U.S.), Matheson, Canada, Guamuchil, Mexico, and San Juan, Argentina. Our website is www.mcewenmining.com. We make available at no cost our periodic reports including Forms 10-K, 10-Q and 8-K, and news releases and certain of our corporate governance documents, including our Code of Ethics, on our website. Our common stock is listed on the New York Stock Exchange (“NYSE”) and on the Toronto Stock Exchange (“TSX”) under the symbol “MUX.”

In this report, unless otherwise noted, “Au” represents gold; “Ag” represents silver; “Cu” represents copper, “oz” represents troy ounce; “gpt” represents grams per metric tonne; “ft.” represents feet; “m” represents meter; “sq.” represents square, and C$ refers to Canadian dollars. All our financial information is reported in United States (U.S.) dollars, unless otherwise noted.

4

Segment Information

Our operating segments include USA, Canada, Mexico, MSC and Los Azules. Financial information for each of our reportable segments can be found under Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and Item 8. Financial Statements and Supplementary Data, Note 3, Operating Segment Reporting.

Products

The end product at our gold and silver operations is either in the form of doré or concentrate. Doré is an alloy consisting primarily of gold and silver but also containing other impurity metals. Doré is sent to third party refiners to produce bullion that meets the required market standard of 99.95% gold and 99.9% silver. Ore concentrate, or simply concentrate, is raw mineralized material that has been ground finely to a powdery product from which gangue (waste) is removed, thus concentrating the metal component. Concentrate, as well as slag and fine carbons (by-products of the gold production process), are sent to third party smelters for further recovery of gold and silver.

During 2021, production consisted of 100% doré from the Gold Bar mine, 99% doré and 1% slag and fine carbon from the Black Fox mine was and approximately 92% doré and 8% slag and fine carbon from the El Gallo Project. Production from the San José mine consisted of approximately 40% doré and 60% concentrate.

During 2021, we reported the following consolidated production attributable to us:

| Gold |

| Silver |

| Gold equivalent | |

Consolidated Production | ounces | ounces | ounces(1) | |||

Gold Bar mine | 43,881 | 1,142 | 43,894 | |||

Black Fox mine |

| 30,016 |

| — |

| 30,016 |

El Gallo Project | 3,543 | 7,045 | 3,643 | |||

San José mine (on 49% basis) |

| 40,971 |

| 2,572,286 |

| 76,839 |

Total Production | 118,411 | 2,580,473 | 154,392 |

| (1) | Calculated using an average silver to gold ratio of 72:1 at the 100% owned operations and at the San José mine. |

Gold and silver bullion obtained from the doré produced in USA, Canada, Mexico and the San José mine are sold at the prevailing spot market price. Concentrates produced by the San José mine are provisionally priced, whereby the selling price is subject to final adjustments at the end of a period ranging from 30 to 90 days after delivery to the customer. The final price is based on the market price at the relevant quotation period stipulated in the contract. Due to the time elapsed between shipment and the final settlement with the buyer, MSC estimates the prices at which sales of metals will be settled. At the end of each financial reporting period, previously recorded provisional sales are adjusted to estimated settlement metals prices based on relevant forward market prices until final settlement with the buyer.

During 2021, revenues from gold and silver sales were $79.2 million from the Gold Bar mine, $50.7 million from the Black Fox mine, $6.6 million from the El Gallo Project, and $133.2 million from the San José mine on a 49% basis. Revenue from the San José mine is not included in our Consolidated Statements of Operations and Comprehensive (Loss) as we use the equity method of accounting for MSC. See Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations for additional information regarding production and operating results for our properties, and Item 8. Financial Statements and Supplementary Data, Note 2, Summary of Significant Accounting Policies—Investments and Note 9, Investment in Minera Santa Cruz S.A. (“MSC”) – San José Mine for additional information regarding the equity method of accounting.

5

Like all metal producers, our operations are affected by fluctuations in metal prices. The following table presents the annual high, low and average daily London P.M. Fix prices per ounce for gold and London Fix prices per ounce for silver over the past three years and 2022 to the most recent practical date on the London Bullion Market:

Gold | Silver |

| |||||||||||||||||

Year | High | Low | Average | High | Low | Average |

| ||||||||||||

(in dollars per ounce) |

| ||||||||||||||||||

2019 |

| 1,546 |

| 1,270 |

| 1,393 |

| 19.31 |

| 14.38 | 16.21 | ||||||||

2020 |

| 2,067 | 1,474 | 1,770 | 28.90 | 12.00 | 20.50 | ||||||||||||

2021 | 1,943 | 1,684 | 1,799 | 29.59 | 21.53 | 25.14 | |||||||||||||

2022 (through March 4, 2022) | 1,945 | 1,788 | 1,845 | 25.32 | 22.24 | 23.46 | |||||||||||||

On March 4, 2022, the London P.M. Fix for gold was $1,945 per ounce and the London Fix for silver was $25.15 per ounce.

Mineralized Material Processing Methods

Gold and silver are extracted from mineralized material by either milling or heap leaching depending on, among other things, the amount of gold and silver contained in the material, whether the material is naturally oxidized or not, and the amenability of the material to treatment.

At the Gold Bar mine and the El Gallo Project, both open pit operations, the mineralized material is processed using heap leaching methods. Heap leaching consists of stacking crushed, oxidized material on impermeable pads, where a weak cyanide solution is applied to the surface of the heap to dissolve and leach the gold and silver. The gold and silver-bearing solution is then collected and processed into doré bars.

At Black Fox, mineralized material from the underground mine is transported to the mill site and fed to the mill’s crushing circuit. Following additional processing and refining, the operation produces doré bars.

At San José, mineralized material from the underground mine is processed at a mill site, producing a concentrate and doré product.

Hedging Activities

Our strategy is to provide shareholders with exposure to gold and silver prices by selling our gold and silver ounces at spot market prices and consequently, we do not hedge our gold or silver sales. We may, however, from time to time, manage certain risks associated with fluctuations in foreign currencies using the derivatives market.

Gold and Silver Reserves

We have established gold and/or silver reserves at two of our properties: Gold Bar and San José. In 2020, through consultations with field experts, we completed work around the Gold Bar mineral reserve to revise the previous estimate. The work included drilling and metallurgical testing, geological and structural modelling and a 110,500 feet (33,700 m) drill program. On January 7, 2021, we announced the updated Indicated Resource and Probable Reserve Estimates of the Gold Bar mine and subsequently filed the 43-101 Technical Report on February 22, 2021.

6

The following tables summarize the mineral resources, exclusive of reserves, for gold, silver and other metals attributable for all our properties for the last two fiscal years.

Canada

Mineral resources, exclusive of reserves, as at December 31, 2021:

Gold | Measured | Indicated | Measured & Indicated | Inferred | ||||||||||

Tonnes (000s) | Au Grade (g/t) | Contained Au (000s oz) | Tonnes (000s) | Au Grade (g/t) | Contained Au (000s oz) | Tonnes (000s) | Au Grade (g/t) | Contained Au (000s oz) | Tonnes (000s) | Au Grade (g/t) | Contained Au (000s oz) | COG Au gpt | Met Rec % | |

Froome | 790 | 4.47 | 113 | 641 | 3.92 | 81 | 1,432 | 4.22 | 194 | 276 | 3.32 | 29 | 2.35 | 87 |

Grey Fox | - | - | - | 7,566 | 4.80 | 1,168 | 7,566 | 4.80 | 1,168 | 1,685 | 4.35 | 236 | 2.30 | 85 |

Stock West | - | - | - | 1,171 | 3.83 | 144 | 1,171 | 3.82 | 144 | 1,049 | 3.30 | 111 | 1.95 | 94 |

Fuller | - | - | - | 1,149 | 4.25 | 157 | 1,149 | 4.25 | 157 | 693 | 3.41 | 76 | 2.30 | 88 |

Stock East | - | - | - | 1,232 | 2.41 | 95 | 1,232 | 2.40 | 95 | 21 | 2.32 | 2 | 1.67 | 94 |

Others | 484 | 6.30 | 98 | 1,227 | 2.18 | 86 | 1,711 | 3.34 | 184 | 309 | 5.13 | 51 | ||

Total | 1,274 | 5.15 | 211 | 12,986 | 4.15 | 1731 | 14,261 | 4.24 | 1942 | 4,033 | 3.89 | 505 | ||

Mineral resources, exclusive of reserves, as at December 31, 2020:

Gold | Measured | Indicated | Measured & Indicated | Inferred | ||||||||

Tonnes (000s) | Au Grade (g/t) | Contained Au (000s oz) | Tonnes (000s) | Au Grade (g/t) | Contained Au (000s oz) | Tonnes (000s) | Au Grade (g/t) | Contained Au (000s oz) | Tonnes (000s) | Au Grade (g/t) | Contained Au (000s oz) | |

Froome | - | - | - | 1,104 | 5.09 | 181 | 1,104 | 5.09 | 181 | 52 | 4.13 | 7 |

Grey Fox | - | - | - | 3,917 | 7.05 | 888 | 3,917 | 7.05 | 888 | 818 | 6.58 | 173 |

Stock West | - | - | - | - | - | - | - | - | - | - | - | - |

Fuller | - | - | - | 5,660 | 1.92 | 351 | 5,660 | 1.92 | 351 | 3,548 | 2.16 | 247 |

Stock East | - | - | - | 2,417 | 1.55 | 121 | 2,417 | 1.55 | 121 | 262 | 0.91 | 8 |

Others | 1,149 | 4.30 | 159 | 1,453 | 2.91 | 136 | 2,603 | 3.54 | 296 | 705 | 4.81 | 109 |

Total | 1,149 | 4.30 | 159 | 14,551 | 3.58 | 1677 | 15,701 | 3.64 | 1837 | 5,385 | 3.14 | 544 |

United States

Mineral resources, exclusive of reserves, as at December 31, 2021:

Gold | Measured | Indicated | Measured & Indicated | Inferred | ||||||||||

Tonnes (000s) | Au Grade (opt) | Contained Au (000s oz) | Tonnes (000s) | Au Grade (opt) | Contained Au (000s oz) | Tonnes (000s) | Au Grade (opt) | Contained Au (000s oz) | Tonnes (000s) | Au Grade (opt) | Contained Au (000s oz) | COG Au opt | Met Rec % | |

Gold Bar, Nevada | - | - | - | 1,342 | 1.92 | 82.4 | 1,342 | 1.92 | 82.4 | 1,774 | 0.79 | 44.4 | 0.0065 - 0.0121 | var* |

Total | - | - | - | 1,342 | 1.92 | 82.4 | 1,342 | 1.92 | 82.4 | 1,774 | 0.79 | 44.4 | ||

*78% crushed oxide recovery at Pick & Ridge, 50% mid-carbon recovery at Pick & Ridge, 72% ROM oxide recovery at Pick & Ridge, 61% ROM oxide recovery at GBS, 0% ROM mid-carbon recovery

Mineral resources, exclusive of reserves, as at December 31, 2020:

Gold | Measured | Indicated | Measured & Indicated | Inferred | ||||||||||

Tons (000s) | Au Grade (opt) | Contained Au (000s oz) | Tonnes (000s) | Au Grade (opt) | Contained Au (000s oz) | Tons (000s) | Au Grade (opt) | Contained Au (000s oz) | Tons (000s) | Au Grade (opt) | Contained Au (000s oz) | COG Au opt | Met Rec % | |

Gold Bar, Nevada | - | - | - | 1,129 | 1.95 | 71.2 | 1,129 | 1.95 | 71.2 | 1,982 | 0.82 | 52 | 0.0065 - 0.0121 | var* |

Total | - | - | - | 1,129 | 1.95 | 71.2 | 1,129 | 1.95 | 71.2 | 1,982 | 0.82 | 52 | ||

*78% crushed oxide recovery at Pick & Ridge, 50% mid-carbon recovery at Pick & Ridge, 72% ROM oxide recovery at Pick & Ridge, 61% ROM oxide recovery at GBS, 0% ROM mid-carbon recovery

7

Argentina

Mineral resources, exclusive of reserves, as at December 31, 2021:

Gold | Measured | Indicated | Measured & Indicated | Inferred | ||||||||||

Tonnes (000s) | Au Grade (g/t) | Contained Au (000s oz) | Tonnes (000s) | Au Grade (g/t) | Contained Au (000s oz) | Tonnes (000s) | Au Grade (g/t) | Contained Au (000s oz) | Tonnes (000s) | Au Grade (g/t) | Contained Au (000s oz) | COG | Met Rec % | |

Los Azules (82% attrib.) | - | - | - | 788,800 | 0.06 | 1,394 | 788,800 | 0.06 | 1,394 | 2,186,000 | 0.04 | 3,116 | 0.2%Cu | 90 |

San Jose (49% attrib.) | 56 | 5.09 | 9.2 | 49 | 2.41 | 4 | 106 | 3.84 | 4 | 901 | 5.22 | 151.1 | 240gpt AgEq | 90 |

Total | 56 | 5.09 | 9.2 | 788,849 | 0.06 | 1,398 | 788,906 | 0.06 | 1,398 | 2,186,901 | 0.05 | 3,267.1 | ||

Silver | Tonnes (000s) | Ag Grade (g/t) | Contained Ag (Moz) | Tonnes (000s) | Ag Grade (g/t) | Contained Ag (Moz) | Tonnes (000s) | Ag Grade (g/t) | Contained Ag (Moz) | Tonnes (000s) | Ag Grade (g/t) | Contained Ag (Moz) | COG | Met Rec % |

Los Azules (82% attrib.) | - | - | - | 788,840 | 1.80 | 45.7 | 788,800 | 1.80 | 45.7 | 2,186,000 | 1.60 | 111 | 0.2%Cu | 90 |

San Jose (49% attrib.) | 56 | 310 | 0.6 | 49 | 204 | 0.3 | 106 | 260 | 0.9 | 901 | 332 | 9.6 | 240gpt AgEq | 90 |

Total | 56 | 310 | 0.6 | 788,889 | 1.80 | 46 | 788,906 | 1.80 | 46.6 | 2,186,901 | 1.72 | 120.6 |

Copper | Tonnes (000s) | Cu Grade (%) | Contained Cu (Blbs) | Tonnes (000s) | Cu Grade (%) | Contained Cu (Blbs) | Tonnes (000s) | Cu Grade (%) | Contained Cu (Blbs) | Tonnes (000s) | Cu Grade (%) | Contained Cu (Blbs) | COG | Met Rec % |

Los Azules (82% attrib.) | - | - | - | 788,800 | 0.48 | 8.4 | 788,800 | 0.48 | 8.4 | 2,186,000 | 0.33 | 15.8 | 0.2% Cu | 90 |

Total | - | - | - | 788,800 | 0.48 | 8.4 | 788,800 | 0.48 | 8.4 | 2,186,000 | 0.33 | 15.8 |

Molybdenum | Tonnes (000s) | Mo Grade (%) | Contained Mo (Mlbs) | Tonnes (000s) | Mo Grade (%) | Contained Mo (Mlbs) | Tonnes (000s) | Mo Grade (%) | Contained Mo (Mlbs) | Tonnes (000s) | Mo Grade (%) | Contained Mo (Mlbs) | COG | Met Rec % |

Los Azules (82% attrib.) | - | - | - | 788,800 | 0.003 | 47 | 788,800 | 0.003 | 47 | 2,186,000 | 0.003 | 159.1 | 0.2%Cu | 90 |

Total | - | - | - | 788,800 | 0.003 | 47 | 788,800 | 0.003 | 47 | 2,186,000 | 0.003 | 159.1 |

Mineral resources, inclusive* of reserves, as at December 31, 2020:

Gold | Measured | Indicated | Measured & Indicated | Inferred | ||||||||

Tonnes (000s) | Au Grade (g/t) | Contained Au (000s oz) | Tonnes (000s) | Au Grade (g/t) | Contained Au (000s oz) | Tonnes (000s) | Au Grade (g/t) | Contained Au (000s oz) | Tonnes (000s) | Au Grade (g/t) | Contained Au (000s oz) | |

Los Azules (100%) | - | - | - | 962,000 | 0.06 | 1,700 | 962,000 | 0.06 | 1,700 | 2,666,000 | 0.04 | 3,800 |

San Jose (49% attrib.)* | 858 | 7.89 | 218 | 490 | 5.68 | 89 | 1,348 | 7.09 | 307 | 912 | 5.58 | 164 |

Total | 858 | 7.89 | 218.0 | 962,490 | 0.06 | 1,398 | 963,348 | 0.06 | 2,007 | 2,666,912 | 0.05 | 3,964 |

Silver | Tonnes (000s) | Ag Grade (g/t) | Contained Ag (Moz) | Tonnes (000s) | Ag Grade (g/t) | Contained Ag (Moz) | Tonnes (000s) | Ag Grade (g/t) | Contained Ag (Moz) | Tonnes (000s) | Ag Grade (g/t) | Contained Ag (Moz) |

Los Azules (100%) | - | - | - | 962,000 | 1.80 | 55.7 | 962,000 | 1.80 | 55.7 | 2,666,000 | 1.60 | 135.4 |

San Jose (49% attrib.)* | 858 | 484 | 13.4 | 490 | 335 | 5 | 1,348 | 429 | 19 | 912 | 345 | 10.1 |

Total | 858 | 484 | 13.4 | 962,490 | 1.97 | 1,398 | 963,348 | 2.40 | 74.7 | 2,666,912 | 1.70 | 146 |

Copper | Tonnes (000s) | Cu Grade (%) | Contained Cu (Blbs) | Tonnes (000s) | Cu Grade (%) | Contained Cu (Blbs) | Tonnes (000s) | Cu Grade (%) | Contained Cu (Blbs) | Tonnes (000s) | Cu Grade (%) | Contained Cu (Blbs) |

Los Azules (100%) | - | - | - | 962,000 | 0.48 | 10.2 | 962,000 | 0.48 | 10.2 | 2,666,000 | 0.33 | 19.3 |

Total | - | - | - | 962,000 | 0.48 | 10.2 | 962,000 | 0.48 | 10.2 | 2,666,000 | 0.33 | 19.3 |

Molybdenum | Tonnes (000s) | Mo Grade (%) | Contained Mo (Mlbs) | Tonnes (000s) | Mo Grade (%) | Contained Mo (Mlbs) | Tonnes (000s) | Mo Grade (%) | Contained Mo (Mlbs) | Tonnes (000s) | Mo Grade (%) | Contained Mo (Mlbs) |

Los Azules (100%) | - | - | - | 962,000 | 0.003 | 57.3 | 962,000 | 0.003 | 57.3 | 2,666,000 | 0.003 | 194 |

Total | - | - | - | 962,000 | 0.003 | 57.3 | 962,000 | 0.003 | 57.3 | 2,666,000 | 0.003 | 194 |

*2020 Resources exclusive of Reserves not calculated under Industry Guide 7 in 2020 by JV partners. There are no reserves at Los Azules

8

Mexico

Mineral resources, exclusive of reserves, as at December 31, 2021:

Gold | Measured | Indicated | Measured & Indicated | Inferred | ||||||||||

Tonnes (Mt) | Au Grade (g/t) | Contained Au (koz) | Tonnes (Mt) | Au Grade (g/t) | Contained Au (koz) | Tonnes (Mt) | Au Grade (g/t) | Contained Au (koz) | Tonnes (Mt) | Au Grade (g/t) | Contained Au (koz) | COG | Met Rec % | |

Fenix | 9.8 | 0.46 | 146 | 5 | 0.23 | 35 | 14.5 | 0.39 | 182 | 0.2 | 0.31 | 2 | var** | var** |

Total | 9.8 | 0.46 | 146 | 5 | 0.23 | 35 | 14.5 | 0.39 | 182 | 0.2 | 0.31 | 2 | ||

Silver | Tonnes (Mt) | Ag Grade (g/t) | Contained Ag (koz) | Tonnes (Mt) | Ag Grade (g/t) | Contained Ag (koz) | Tonnes (Mt) | Ag Grade (g/t) | Contained Ag (koz) | Tonnes (Mt) | Ag Grade (g/t) | Contained Ag (koz) | COG | Met Rec % |

Fenix | 9.8 | 17 | 5,236 | 5 | 95 | 14,294 | 14.5 | 42 | 19,530 | 0.2 | 46 | 293 | var* | var** |

Total | 9.8 | 17 | 5,236 | 5 | 95 | 14294 | 14.5 | 42 | 19,530 | 0.2 | 46 | 293 |

* Heap Leach has no COG as the entire heap is processed with zero selectivity; El Gallo Silver COG 58gpt Ag;

** Recoveries HLP 85% Au, 60% Ag; EGS 86% Au, 75% Ag

Mineral resources, exclusive of reserves, as at December 31, 2020:

Gold | Measured | Indicated | Measured & Indicated | Inferred | ||||||||

Tonnes (Mt) | Au Grade (g/t) | Contained Au (koz) | Tonnes (Mt) | Au Grade (g/t) | Contained Au (koz) | Tonnes (Mt) | Au Grade (g/t) | Contained Au (koz) | Tonnes (Mt) | Au Grade (g/t) | Contained Au (koz) | |

Fenix | 9.8 | 0.48 | 150 | 5 | 0.23 | 35 | 14.5 | 0.39 | 186 | 0.2 | 0.31 | 2 |

Total | 9.8 | 0.48 | 150 | 5 | 0.23 | 35 | 14.5 | 0.39 | 186 | 0.2 | 0.31 | 2 |

Silver | Tonnes (Mt) | Ag Grade (g/t) | Contained Ag (koz) | Tonnes (Mt) | Ag Grade (g/t) | Contained Ag (koz) | Tonnes (Mt) | Ag Grade (g/t) | Contained Ag (koz) | Tonnes (Mt) | Ag Grade (g/t) | Contained Ag (koz) |

Fenix | 9.8 | 17 | 5,242 | 5 | 95.00 | 14,295 | 14.5 | 41 | 19,537 | 0.2 | 46 | 293 |

Total | 9.8 | 17 | 5,242 | 5 | 95.00 | 14295 | 14.5 | 41 | 19,537 | 0.2 | 46 | 293 |

The following table is a variance of the mineral resources from December 31, 2020 and December 31, 2021:

Property | Measured | Indicated | Measured & Indicated | Inferred | ||||||||

Mass % | Grade % | Metal % | Mass % | Grade % | Metal % | Mass % | Grade % | Metal % | Mass % | Grade % | Metal % | |

Froome | 100 | 100 | 100 | -42 | -23 | -55 | 30 | -17 | 7 | 431 | -20 | 314 |

Grey Fox | - | - | - | 93 | -32 | 32 | 93 | -32 | 32 | 106 | -34 | 36 |

Stock West | - | - | - | - | - | - | - | - | - | - | - | - |

Stock East | - | - | - | -49 | 55 | -21 | -49 | 55 | -21 | -92 | 155 | -75 |

Fuller | - | - | - | -80 | 121 | -55 | -80 | 121 | -55 | -80 | 58 | -69 |

Gold Bar | - | - | - | 16 | -2 | 14 | 16 | -2 | 14 | -12 | -6 | -17 |

Los Azules | - | - | - | -18 | - | -18 | -18 | - | -18 | -18 | - | -18 |

Mexico | - | -4 | -3 | - | - | - | - | - | -2 | - | - | - |

*Mexico, no change in Resources exclusive of Reserves; San Jose, calculation not made.

Technical Report Summaries and Qualified Persons

The technical information concerning our mineral projects in this Form 10-K have been reviewed and approved by Peter Mah, P.Eng., Chief Operating Officer, and Luke Willis, Director, Resource Modeling, each a “qualified person” under S-K 1300. For a description of the key assumptions, parameters and methods used to estimate mineral reserves and mineral resources included in this Form 10-K, as well as data verification procedures and a general discussion of the extent to which the estimates may be affected by any known environmental, permitting, legal, title, taxation, sociopolitical, marketing or other relevant factors, please review the Technical Report Summaries for each of our material properties which are included as exhibits to this Report.

9

The following table summarizes the estimated portion of proven and probable gold and silver reserves attributable to us for the Gold Bar mine and San José mine as of December 31, 2021.

Gold Reserves at December 31, 2021 | |||||||||||

Proven | Probable | Proven and Probable | |||||||||

Tonnes | Gold | Gold | Tonnes | Gold | Gold | Tonnes | Gold | Gold | |||

(kt) | (gpt) | (koz) | (kt) | (gpt) | (koz) | (kt) | (gpt) | (koz) | |||

Gold Bar mine (1) | - | - | - | 14,053 | 0.82 | 370 | 14,053 | 0.82 | 370 | ||

San José mine (2) | 381 | 5.69 | 70 | 351 | 5.68 | 64 | 733 | 5.69 | 134 | ||

Silver Reserves at December 31, 2021 | |||||||||||

Proven | Probable | Proven and Probable | |||||||||

Tonnes | Silver | Silver | Tonnes | Silver | Silver | Tonnes | Silver | Silver | |||

(kt) | (gpt) | (moz) | (kt) | (gpt) | (moz) | (kt) | (gpt) | (moz) | |||

San José mine (2) | 381 | 368 | 4.5 | 351 | 314 | 3.5 | 733 | 342 | 8.1 | ||

| (1) | The reserve estimate for the Gold Bar mine as at December 31, 2021 was prepared by Joseph McNaughton, P.E., Senior Mining Engineers, Partner, Independent Mining Consultants |

| (2) | The reserve estimate for the San José mine as at December 31, 2021, presented on a 49% basis, was prepared by Hochschild and audited by P&E Mining Consultants Inc. (“P&E”). |

The following table summarizes the estimated portion of proven and probable gold and silver reserves attributable to us for the Gold Bar mine San José mine as of December 31, 2020.

Gold Reserves at December 31, 2020 | |||||||||||

Proven | Probable | Proven and Probable | |||||||||

Tonnes | Gold | Gold | Tonnes | Gold | Gold | Tonnes | Gold | Gold | |||

(kt) | (gpt) | (koz) | (kt) | (gpt) | (koz) | (kt) | (gpt) | (koz) | |||

Gold Bar mine | - | - | - | 15,570 | 0.84 | 420 | 15,570 | 0.84 | 420 | ||

San José mine | 399 | 6.73 | 86 | 92 | 5.46 | 16 | 491 | 6.49 | 102 | ||

Silver Reserves at December 31, 2020 | |||||||||||

Proven | Probable | Proven and Probable | |||||||||

Tonnes | Silver | Silver | Tonnes | Silver | Silver | Tonnes | Silver | Silver | |||

(kt) | (gpt) | (moz) | (kt) | (gpt) | (moz) | (kt) | (gpt) | (moz) | |||

San José mine | 399 | 409 | 5.3 | 92 | 354 | 1.0 | 491 | 399 | 6.3 | ||

Footnotes to 2021 Mineral Resource and Mineral Reserves

Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that any part of the Mineral Resources estimated will be converted into a Mineral Reserves estimate. The numbers in the tables have been rounded to reflect the accuracy of the estimates and may not sum due to rounding. The Inferred Mineral Resource in these estimates has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration; Quantity and grade of reported Inferred resources are uncertain in nature and there has been insufficient exploration to classify these Inferred resources as Measured or Indicated.

UG Mineral Resources include the ‘must take’ minor material below cut-off grade within the mineable shape optimizer stopes that are generated by above-cut-off grade blocks.

The Mineral Resources in this report were estimated and reporting using the regulation S-K 1300 of the United States Securities and Exchange Commission (“SEC”).

10

Fox Complex

Mineral Resources for Froome are reported above an economic cut-off grade of 2.35 g/t gold assuming underground extraction methods and based on a mining cost of C$80/t, process cost of C$24.34/t, G&A cost of C$10.50/t, haulage cost of C$4.70/t, refining cost of C$1.82/oz, metallurgical recovery of 87%, royalty buyout of C$1.21/t, dilution of 15%, and realized gold price of US$1,632/oz (after Sandstorm Stream).

Mineral Resources for Grey Fox are reported above an economic cut-off grade of 2.30 g/t gold assuming underground extraction methods and based on a mining cost of C$80/t, process cost of C$24.34/t, G&A cost of C$10.50/t, haulage cost of C$5.64/t, refining cost of C$1.82/oz, metallurgical recovery of 85%, royalty NSR of 2.65%, dilution of 15%, and gold price of US$1,725/oz.

Mineral Resources for Stock West are reported above an economic cut-off grade of 1.95 g/t gold assuming underground extraction methods and based on a mining cost of C$80/t, process cost of C$24.34/t, G&A cost of C$10.50/t, refining cost of C$1.82/oz, metallurgical recovery of 94%, dilution of 15%, and gold price of US$1,725/oz.

Mineral Resources for Fuller are reported above an economic cut-off grade of 2.30 g/t gold assuming underground extraction methods and based on a mining cost of C$90/t, process cost of C$24.55/t, G&A cost of C$10.50/t, haulage cost of C$6.64/t, metallurgical recovery of 88%, 10% Net Profits Interest (NPI) royalty, dilution of 10% and gold price of US$1,725/oz.

Mineral Resources for Stock East are reported above an economic cut-off grade of 1.67 g/t gold assuming underground extraction methods and based on a mining cost of $60.61/t, process cost of $18.60/t, G&A cost of $7.95/t, metallurgical recovery of 94%, and gold price of US$1,725/oz.

Resources were calculated using a gold price of U$1725 based on industry consensus on long-term metal prices in late 2020. Resources are stated as in-situ. There are no Mineral Reserves stated in 2021 - Black Fox Mine reserves were depleted in 2021 when mining ceased in May. For all properties, a change in commodity price led to a change (generally lower) in the COG used to calculate resources. In addition, the use of UG constraining shapes to better define reasonable prospects for economic extraction were used. Some of the deposits used improvements to modelling and estimation methodology and updates based on drilling results. Black Fox Mine and Froome included changes due to mining depletion.

Gold Bar

Mineral reserves equal the total ore planned for processing from the mine plan based on a $1,650/oz gold price. Mineral reserves are based on the following economic input parameters: $3.80/ avg. ore ton mining cost, $2.88/ avg. waste ton mining cost, $4.91/ore ton crushed process cost, $3.77/ore ton ROM process cost, $3.22/ore ton G&A cost, $0.475/oz gold refining charge, $1.538/oz transport & sales cost, 99.95% payable gold, 1% royalty at GBS only.

The stated Reserves are based on a variable cut-off grade based on rock type, mining area, carbon content, clay content and process response. The grades reported from Pick and Ridge include a mining dilution based on the surrounding block grades. Reserves are contained within an engineered pit design between the $1,250/oz and $1,400 gold sales price Lerchs-Grossman pit shells, based on end of December 2021 topography.

Mineral resources are based on the following economic input parameters: $3.19/ore ton mining cost, $1.99/waste ton mining cost, $4.91/ore ton crushed process cost, $3.77/ore ton ROM process cost, $3.16/ore ton G&A cost, $0.475/oz gold refining charge, $1.538/oz transport & sales cost, 99.95% payable gold, 1% royalty at Gold Bar South (GBS) only. Resources stated are contained within a $1,725/oz Gold sales price Lerchs-Grossmann (LG) pits based on end of December 2021 topography

The Metal price used (U$1725) for resources is based on the consensus pricing forecasts based on Q4 2020 data. Resources are reported as in-situ. Recoveries are variable and as follows: 78% crushed oxide recovery at Pick & Ridge, 50% mid-carbon recovery at Pick & Ridge, 72% ROM oxide recovery at Pick & Ridge, 61% ROM oxide recovery at GBS, 0% ROM mid-carbon recovery. Cut-off grades are variable and based on the presence or not of clay content, carbon content and recoveries.

11

The metal price used (U$1650) for reserves reflects a conservative combination of a recent trailing average sourced from Kitco’s Historic Price data and a consensus forecast via Bloomberg. Recoveries are variable and as follows: 78% crushed oxide recovery at Pick & Ridge, 50% mid-carbon recovery at Pick & Ridge, 72% ROM oxide recovery at Pick & Ridge, 61% ROM oxide recovery at GBS, 0% ROM mid-carbon recovery. Cut-off grades are variable and based on the presence or not of clay content, carbon content and recoveries and range from 0.0065opt to 0.0121opt. The reference point for the Mineral Reserves is at the primary crusher.

Changes in Mineral Resources are due to mining depletion during 2021. The following changes have impacted the project Reserves: Mining depletion at Pick; the Gold Price has increased from $1500/toz to $1650/toz; the operating costs increased largely driven by an increase in mining costs; project costs were re-estimated based on current mining activity and new contractor quotes; the schedule has been updated based on the revised metal prices and costs.

San Jose

Reported resources and reserves are McEwen’s 49% attributable interest. Hochschild has a 51% interest in San José.

Metal equivalent used AgEq = (Au x 72) + Ag

Resources reporting Cut-off: 240 g/t AgEq; For Reserves AgEq Cut-offs: cut & fill 269 g/t AgEq., long hole 191 g/t AgEq.

Resources are in situ. Reserves as presented are in place and include average internal dilution of 5%, average mining and geotechnical dilution of 46%, and mine extraction of 37%, but do not include allowances for mill or smelter recoveries. For the 2021 Mineral Reserve Estimate, inaccessible Mineral Resources that contained insufficient tonnages to permit the development of local infrastructure, Mineral Resources in mined out/ isolated areas, Mineral Resources located in sill and rib pillars and operationally lost Mineral Resources were not included in the Mineral Reserve Estimate.

Metal prices of U$1800/oz Au and U$26/oz Ag were used for Resources based on a long-term consensus forecast for reserve prices with ~15% increase for resource prices. Metal prices of U$1600/oz Au and U$23/oz Ag were used based on long term consensus forecast for reserve prices. Ongoing definition, delineation and mine exploration drilling leads to better definition of existing resources or extensions of known veins that will be reflected on the year-on-year comparison of both mineral resources and reserves. Mine depletion, commodity price changes and equivalents leading to COG changes will also have an effect on the comparative data.

It should be noted that the San José Mine has a history of increasing Mineral Reserves over time, both from upgrading Inferred Mineral Resources to Indicated Mineral Resources, and from exploration success. Changes to internal and external dilution and ore loss rates will affect the Reserve balance

Los Azules

Mineral Resource is reported inside of a pitshell, the parameters assumed are a copper price of $2.75/lb, operating costs of $1.70/t mining, $5.00/t for processing and $1.00/t for G&A, and Copper metallurgical recovery of 90%. Mineral Resource is reported with a cut-off grade of 0.20% Cu.

Mexico

Gold and Silver Resources were calculated using metal prices of U$1300/oz and U$16/oz respectively. These prices were based off the 3-year trailing average of the London Closing Fix for 2017-2019 ($1306 and $16.32) sourced from Kitco’s Historical Data charts.

Resources are stated as in situ for El Gallo Silver and as crushed and stacked ready for hauling and processing at the El Gallo Gold HLP.

El Gallo Silver: Milling recovery assumptions of 86% (sulfide) and 75% (oxide) for silver and 86% gold. Mining costs of $1.95/t, processing and G&A costs of $26.15/t milled were used. Resources are stated within an optimized pitshell indicating prospects for eventual economic extraction.

12

Heap Leach Pad: Because of the unconsolidated nature of the heap leach material, the mine schedule plans to mine the entire heap without the benefit of selectivity. Sub-cut-off leach pad material will inherently have potential acid generating sulfide liabilities if placed in our waste dumps and so it will be prudent to process the entire leach pad and place tailings in a previously mined pit at an overall environmental and economic benefit.

Recovery assumptions of 85% Au and 60% Ag.

The differences in annual Resources at El Gallo Gold are attributed to the Heap Leach operation. Residual leaching continued in 2021 and continues into 2022. There was a minor amount of metal recovered (c.3.6koz Au and 7.0koz Ag) at the operation in 2021.

Competitive Business Conditions

We compete with many companies in the mining and mineral exploration and production industry, including large, established mining companies with substantial capabilities, personnel, and financial resources. There is a limited supply of desirable mineral lands available for claim-staking, lease, or acquisition in the United States, Canada, Mexico, Argentina, and other areas where we may conduct our mining or exploration activities. We may be at a competitive disadvantage in acquiring mineral properties, since we compete with these individuals and companies, many of which have significantly greater financial resources and larger technical staffs than we do. From time to time, specific properties or areas that would otherwise be attractive to us for exploration or acquisition may be unavailable due to their previous acquisition by other companies or our lack of financial resources.

Competition in the industry is not limited to the acquisition of mineral properties, but also extends to the technical expertise to find, advance, and operate such properties; the labor to operate the properties; and the capital for the purpose of funding such exploration and development. Many competitors not only explore for and mine precious and base metals but conduct refining and marketing operations on a world-wide basis. Such competition may result in our company not only being unable to acquire desired properties, but to recruit or retain qualified employees or to acquire the capital necessary to fund our operation and advance our properties. Our inability to compete with other companies for these resources would have a material adverse effect on our results of operation, financial condition and cash flows.

General Government Regulations

In the United States, Canada, Mexico and Argentina, we are subject to various governmental laws and regulations, including environmental regulations. Other than operating licenses for our mining and processing facilities and concessions granted under contracts with the host government, there are no third-party patents, licenses or franchises material to our business. The applicable laws and regulations applicable to us include but are not limited to:

| ● | mineral concession rights. |

| ● | surface rights. |

| ● | water rights. |

| ● | mining royalties. |

| ● | environmental laws. |

| ● | mining permits. |

| ● | mining and income taxes. |

| ● | health and safety laws and regulations. |

| ● | labor laws and regulations. |

| ● | export regulations. |

We believe that all of our properties are operated in compliance with all applicable governmental laws and regulations.

13

Reclamation Obligations

Under applicable laws in the jurisdictions where our properties are located, we are required to reclaim disturbances caused by our mining activities. Accordingly, we have recorded estimates in our financial statements for our reclamation obligations, in accordance with United States Generally Accepted Accounting Principles (“US GAAP” or “GAAP”) the most significant of which are related to our properties in the U.S., Canada and Mexico.

Estimated future reclamation costs are based primarily on legal and regulatory requirements. At December 31, 2021, we accrued $35.5 million for reclamation costs relating to currently developed and producing properties. These amounts are included in Asset Retirement Obligation on the Consolidated Balance Sheets.

U.S. Environmental Laws

We are subject to extensive environmental regulation under the laws of the U.S. and the state of Nevada, where our U.S. operations are conducted. For example, certain mining wastes resulting from the extraction and processing of ores would be considered hazardous waste under the Resource Conservation and Recovery Act (“RCRA”) and state law equivalents, but we are currently exempt from the extensive set of Environmental Protection Agency (“EPA”) regulations governing hazardous waste. If our mine wastes were treated as hazardous waste under RCRA or such wastes resulted in operations being designated as “Superfund” sites under the Comprehensive Environmental Response, Compensation, and Liability Act (“CERCLA”) or state law equivalents for cleanup, significant expenditures could be required for the construction of additional waste disposal facilities, for other remediation expenditures, or for natural resource damages. Under CERCLA, any present or past owners or operators of a Superfund site generally may be held liable and may be forced to undertake remedial cleanup action or to pay for the government’s cleanup efforts. Such owners or operators may also be liable to governmental entities for the cost of damages to natural resources, which may be substantial. Additional regulations or requirements may also be imposed upon our operations, tailings, and waste disposal areas, as well as upon mine closure under federal and state environmental laws and regulations, including, without limitation, CERCLA, the Clean Water Act, Clean Air Act, the Endangered Species Act and state law equivalents. See Note 12 to our consolidation financial statements, Reclamation and Remediation Liabilities, for information on reclamation obligations under governmental environmental laws.

We have reviewed and considered current federal legislation relating to climate change and do not believe it to have a material effect on our operations. Future changes in U.S. federal or state laws or regulations could have a material adverse effect upon us and our results of operations.

Foreign Government Regulations

Canada, where the Black Fox mine, Stock mill and other exploration and development projects are located, and Mexico, where the El Gallo Project and Fenix Project are located, have both adopted laws and guidelines for environmental permitting that are similar to those in effect in the U.S. The permitting process requires a thorough study to determine the baseline condition of the mining site and surrounding area, an environmental impact analysis, and proposed mitigation measures to minimize and offset the environmental impact of exploration and mining operation activities. We have received all permits required to operate our current activities in Canada and Mexico and have received all permits necessary for the exploration activities being conducted at our non-U.S. properties.

Customers

Production from Gold Bar, Black Fox, and the El Gallo Project is sold as refined metal on the spot market or doré under the terms set out in doré purchase agreements.

We have doré purchase agreements with Canadian financial institutions, Asahi Refining (“Asahi”), our refiner, and with metals trading companies. Under the terms of our doré purchase agreements, we have the option to sell approximately 90% of the gold and silver contained in doré bars produced at Gold Bar, Black Fox and the El Gallo Project prior to the completion of refining. During the year ended December 31, 2021, 97% of our consolidated sales were made to Asahi, with 38% of the sales made through the doré purchase agreement.

14

During the year ended December 31, 2021, 92% of the total sales from the San José mine were made to three companies: Aurubis AG, a German company, accounted for 15% of the total sales, LS Nikko, a Korean Company, accounted for 35% of the total sales and Argo-Heraeus, a Swiss company, accounted for 42% of the total sales. MSC has sales agreements with each of these purchasers.

In the event that our customer relationships or MSC’s customer relationships were interrupted for any reason, we believe that we or MSC could locate other purchasers for our products. However, any interruption may temporarily disrupt the sale of our products and may affect our operating results.

Human Capital Resources

As of December 31, 2021, we had 430 employees, including 83 in the United States, 27 in Toronto, Ontario, Canada, 189 in Timmins, Ontario, Canada, 96 in Mexico, and 35 in Argentina. All our employees based in Toronto work in an executive, technical or administrative position, while our employees in the United States, Timmins, Mexico, and Argentina include management, laborers, craftsmen, mining, geologist environmental specialists, information technologists, and various other support roles. As of December 31, 2021, MSC had 1,462 employees in Argentina. We also frequently engage independent contractors in connection with certain administrative matters and the exploration of our properties, such as drillers, geophysicists, geologists, and other specialty technical disciplines. For Canada and United States, we also engage independent contractors for technical and professional expertise as well as extractive and exploration activities such as drilling, geophysics, hauling and crushing. Of our employees in Mexico, 48 are covered by union labor contracts and we believe we have good relations with them.

As part of our fundamental need to attract and retain talent, we regularly evaluate our compensation, benefits and employee wellness offerings. We have determined that our compensation arrangements are competitive in the industry. Over 93% of U.S. employees are enrolled in our medical benefit plan, and over 90% of U.S. employees contribute to our 401(k) plan and 94% of employees in Canada contribute to our Deferred Profit Share Plan. Supplemental healthcare is provided above government requirements in both Canada and Mexico.

ITEM 1A. RISK FACTORS

Our operations and financial condition are subject to significant risks, including those described below. You should carefully consider these risks. If any of these risks actually occurs, our business, financial condition, and/or results of operation could be adversely affected. This report, including Management’s Discussion and Analysis of Financial Condition and Results of Operations, contains forward looking statements that may be affected by several risk factors, including those set forth below. The following information summarizes all material risks known to us as of the date of filing this report:

Risks Relating to Our Financial Condition, Results of Operation and Cash Flows

Our results of operations, cash flows and the value of our properties are highly dependent on the market prices of gold, silver, and copper and these prices can be volatile.

The profitability of our gold and silver mining operations and the value of our mining properties are directly related to the market price of gold, silver and copper. The price of gold, silver and copper may also have a significant influence on the market price of our common stock. Historically, the market price of gold and silver has fluctuated significantly and is affected by numerous factors beyond our control. These factors include supply and demand fundamentals, global or national political or economic conditions, expectations with respect to the rate of inflation, the relative strength of the U.S. dollar and other currencies, interest rates, gold and silver sales and loans by central banks, forward sales by metal producers, accumulation and divestiture by exchange traded funds, and a number of other factors such as industrial and commercial demand. The volatility of mineral prices represents a substantial risk which no amount of planning or technical expertise can fully eliminate. This is especially true since we do not hedge any of our sales.

We derive all of our revenue from the sale of gold and silver and our results of operations will fluctuate as the prices of these metals change. A period of significant and sustained lower gold and silver prices would materially and adversely

15

affect our results of operations and cash flows. In the event metal prices decline or remain low for prolonged periods of time, our existing producing properties may become uneconomic, and we might be unable to develop our undeveloped properties, which may further adversely affect our results of operations, financial performance and cash flows. An asset impairment charge may also result from the occurrence of unexpected adverse events that impact our estimates of expected cash flows generated from our producing properties or the market value of our non-producing properties, including a material diminution in the price of gold and/or silver.

Our results of operations have been and could in the future be materially and adversely affected by the impairment of assets.

During 2021, the price of gold, as measured by the London PM fix, fluctuated between $1,684 and $1,943 per ounce, while the price of silver fluctuated between $21.53 and $29.59 per ounce. As at March 4, 2022, gold, silver and copper prices were $1,945 per ounce, $25.15 per ounce, and $4.82 per pound, respectively.

We have incurred substantial losses in recent years and may never return to profitability.

During the three years ended December 31, 2021, we have incurred pre-tax losses on an annual basis of $64.2 million $153.7 million and $63.6 million. As of December 31, 2021, our accumulated deficit, which includes noncash impairment charges, was $1.2 billion. In the future, our ability to become profitable will depend on the profitability of the Gold Bar, Black Fox, including the Froome mine, and San José mines, our ability to generate revenue sufficient to cover our costs and expenses, and our ability to advance, sell or otherwise monetize our other properties and our interest in the Los Azules copper project. In pursuit of profitability, we will seek to identify additional mineralization that can be extracted economically at operating and exploration properties. For our non-operating properties that we believe demonstrate economic potential, we need to either develop our properties, locate and enter into agreements with third party operators, or sell the properties. We may suffer significant additional losses in the future and may not be profitable again. Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis.

Our business requires substantial capital investment from outside sources, and we may be unable to raise additional funding on favorable terms to develop additional mining operations. In addition, our ongoing reliance on equity funding will result in continued dilution to our existing shareholders.

We have in the past and will likely in the future require significant capital to develop our exploration projects. A significant portion of that funding in the past has come in the form of sales of our common stock. We continue to evaluate capital and development expenditure requirements as well as other options to monetize certain assets in the Company’s portfolio including Los Azules, Grey Fox, Stock and the Fenix Project. If we make a positive decision to develop one or more of these initiatives, the expenditures incurred may significantly exceed our working capital. Our ability to obtain necessary funding, in turn, depends upon a number of factors, including the state of the economy, our operating results and applicable commodity prices. We may not be successful in obtaining the required financing to advance our projects or for other purposes, on terms that are favorable to us or at all, in which case, our ability to replace reserves and continue operating would be adversely affected. Failure to obtain such additional financing could result in delay or indefinite postponement of further exploration or potential development and in the possible partial or total loss of our interest in certain properties. Even if we are successful in obtaining additional equity capital, it will result in dilution to existing shareholders.

Our indebtedness adversely affects our cash flow and may adversely affect our ability to operate our business.

As of December 31, 2021, we had an outstanding long term, secured debt with a principal amount of $50.0 million. Repayment of the loan is secured by a lien on certain of our and our subsidiaries’ assets. This debt requires us to make monthly interest payments, to begin making monthly principal payments of $2 million August 2022 for 12 months and a final $26 million payment on August 31, 2023. During 2021, the Company entered into negotiations with the lenders to defer the repayment of the debt and also change the terms that will be favorable to the Company. As of March 4, 2022, discussions are ongoing to extend debt repayments and more favorable terms.

We cannot be certain that our cash flow from operations will be sufficient to allow us to pay the principal and interest on our debt and meet our other obligations. Even if we have sufficient cash flow to retire the debt, those payments will affect

16

the amount of cash we have available for capital investment, exploration, ongoing operations and other purposes. Payments on our debt may also inhibit our ability to react to changing business conditions.

Any failure to meet our debt obligations could harm our business and financial condition and may require us to sell assets or take other steps to satisfy the debt.

Our ability to make payments on and/or to refinance our indebtedness and to fund planned capital expenditures will depend on our ability to generate sufficient cash flow from operations in the future. We cannot assure you that our business will generate sufficient cash flow from operations or that future borrowings, or other financing will be available to us in an amount sufficient to enable us to pay principal and interest on our indebtedness or to fund our other liquidity needs. Decreases in precious metal prices, in addition to our ability to execute our mine plans at existing operations, may adversely affect our ability to generate cash flow from operations. If our cash flow and existing capital resources are insufficient to fund our debt obligations, we may be forced to reduce our planned capital expenditures, sell assets, seek additional equity or debt capital, or restructure our debt, and any of these actions, if completed, could adversely affect our business and/or the holders of our securities. We cannot assure you that any of these remedies could, if necessary, be completed on commercially reasonable terms, in a timely manner or at all. In addition, any failure to make scheduled payments of interest and principal on our outstanding indebtedness could result in the immediate acceleration of the debt and foreclosure of our assets.

Restrictive debt covenants could limit our growth and our ability to finance our operations, fund our capital needs, respond to changing conditions, and engage in other business activities that may be in our best interests.

Our credit facility contains covenants that restrict or limit our ability to:

| ● | Pay dividends or distributions on our capital stock; |

| ● | Borrow additional funds; |

| ● | Repurchase, redeem, or retire our capital stock; |

| ● | Make certain loans and investments; |

| ● | Sell assets; |

| ● | Enter into certain transactions with affiliates; |

| ● | Create or assume certain liens on our assets; |

| ● | Make certain acquisitions; or |

| ● | Engage in certain other corporate activities. |

As part of our facility, the debt can be called in certain circumstances, including on demand in the event of a material adverse change in our business or our inability to satisfy certain financial tests on an ongoing basis. Our ability to comply with these requirements may be affected by events beyond our control, and we cannot assure you that we will satisfy them in the future. In addition, these requirements could limit our ability to obtain future financings, make needed capital expenditures, withstand a future downturn in our business or the economy in general, or otherwise conduct necessary corporate activities. We may also be prevented from taking advantage of potential business opportunities that arise because of the restrictive covenants under our debt agreement. A breach of any of the covenants in our debt agreements could result in a default under the agreement.

Increased operating and capital costs could adversely affect our results of operations.

Costs at any particular mining location are subject to variation due to a number of factors, such as variable ore grade, changing metallurgy and revisions to mine plans in response to the physical shape and location of the ore body, as well as the age and utilization rates for the mining and processing- related facilities and equipment. In addition, costs are affected by the price and availability of input commodities, such as fuel, electricity, labor, chemical reagents, explosives, steel, concrete and mining and processing related equipment and facilities. Commodity costs are, at times, subject to volatile price movements, including increases that could make production at certain operations less profitable. Further, changes in laws and regulations can affect commodity prices, uses and transport. Reported costs may also be affected by changes in

17

accounting standards. A material increase in costs at any significant location could have a significant adverse effect on our results of operation and operating cash flow.

We could have significant increases in capital and operating costs over the next several years in connection with the development of new projects in challenging jurisdictions and in the sustaining and/or expansion of existing mining and processing operations. Costs associated with capital expenditures may increase in the future as a result of factors beyond our control. Increased capital expenditures may have an adverse effect on the results of operation and cash flow generated from existing operations, as well as the economic returns anticipated from new projects.

If we do not hedge our exposure to reductions in gold and silver prices, we may be subject to significant reductions in price.

We do not use hedging transactions with respect to any of our gold and silver production and we do not expect to do so in the future. Accordingly, we may be exposed to more significant price fluctuations if gold and/or silver prices decline. While the use of hedging transactions limits the downside risk of price declines, their use also may limit future revenues from price increases. Hedging transactions also involve the risk that the counterparty may be unable to satisfy its obligations.

Estimates relating to new development projects and mine plans of existing operations are uncertain and we may incur higher costs and lower economic returns than estimated.

Our decision to develop a project is typically based on the results of feasibility studies, which estimate the anticipated economic returns of a project. However, the actual project profitability or economic feasibility may differ from such estimates as a result of any of the following factors, among others:

| ● | Changes in tonnage, grades and metallurgical characteristics of mineralized material to be mined and processed; |

| ● | Changes in input commodity and labor costs; |

| ● | The quality of the data on which engineering assumptions were made; |

| ● | Adverse geotechnical conditions; |

| ● | Availability of an adequate and skilled labor force; |

| ● | Availability, supply and cost of utilities such as water and power; |

| ● | Fluctuations in inflation and currency exchange rates; |

| ● | Changes in metals prices; or |

| ● | Changes in tax laws, the laws and/or regulations around royalties and other taxes due to the regional and national governments and royalty agreements. |

Our recent development activities, including Gold Bar and Black Fox, may not result in the expansion or replacement of past production with new production, or one or more of these new production sites or facilities may be less profitable than currently anticipated or may not be profitable at all, any of which could have a material adverse effect on our results of operations and financial position.

For our existing operations, we base our mine plans on geological, metallurgical and engineering assumptions, financial projections and commodity price estimates. These estimates are periodically updated to reflect changes in our operations, including modifications to our proven and probable reserves and mineralized material, revisions to environmental obligations, changes in legislation and/or our political or economic environment, and other significant events associated with mining operations. There are numerous uncertainties inherent in estimating quantities and qualities of gold, silver and copper and costs to mine recoverable reserves, including many factors beyond our control, that could cause actual results to differ materially from expected financial and operating results or result in future impairment charges.

18

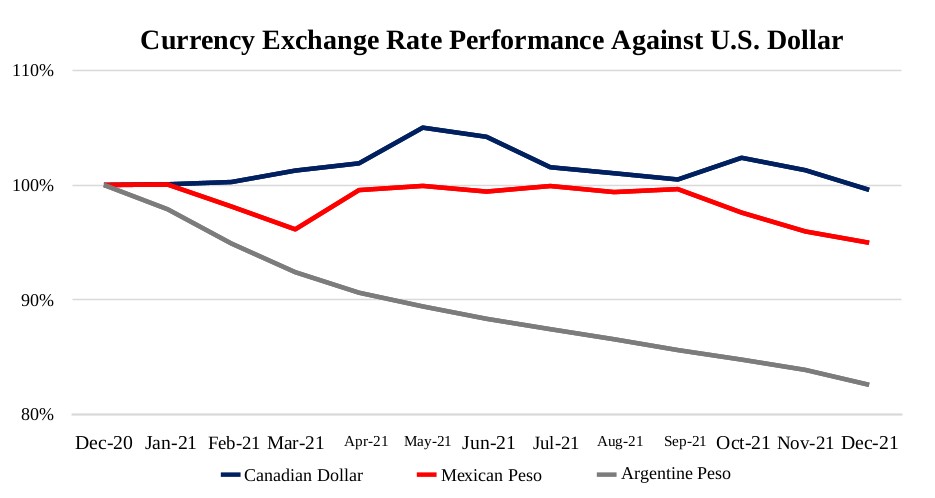

We are subject to foreign currency risks which may increase our costs and affect our results of operation.

While we transact most of our business in U.S. dollars, certain expenses, such as labor, operating supplies, and property and equipment, may be denominated in Canadian dollars, Mexican pesos or Argentine pesos. As a result, currency exchange fluctuations and foreign exchange regulations may impact our operating costs. The appreciation of non-U.S. dollar currencies against the U.S. dollar increases costs and the cost of purchasing property and equipment in U.S. dollar terms in Canada, Mexico and Argentina, which can adversely impact our operating results and cash flows.

The value of cash and cash equivalents denominated in foreign currencies also fluctuates with changes in currency exchange rates. Appreciation of non-U.S. dollar currencies results in a foreign currency gain on such investments and a depreciation in non-U.S. dollar currencies results in a loss. We have not utilized market risk sensitive instruments to manage our exposure to foreign currency exchange rates but may do so in the future. We also hold portions of our cash reserves in Canadian, Mexican and Argentine currency.

Our continuing reclamation obligations at Tonkin, Gold Bar, Black Fox and other Timmins properties, El Gallo, and other properties could require significant additional expenditures.

We are responsible for the reclamation obligations related to disturbances on all our properties. In Canada and the United States, we are required to post bonds to ensure performance of our reclamation obligations. As of December 31, 2021, we have accrued $29.7 million in estimated reclamation costs for our properties, including $37.7 million covered by surety bonds for projects in the United States and Canada. We have not posted a bond in Mexico as none is required by the current legislation; however, we have recorded a liability based on the estimated amount of our reclamation obligations in that jurisdiction.

There is a risk that any surety bond or recorded liability, even if increased based on the analysis and work performed to update the reclamation obligations, could be inadequate to cover the actual costs of reclamation when actually carried out. The satisfaction of bonding requirements and continuing reclamation obligations will require a significant amount of capital. Further, it is possible that the United States Bureau of Land Management (“BLM”) may request that we provide additional long-term financing supported by a long-term trust for an amount that cannot be determined at present. There is a risk that we will be unable to fund any additional bonding requirements or that the surety bonds may no longer be accepted by the governmental agencies as satisfactory reclamation coverage, in which case we would be required to replace the surety bonding with cash, and further, that the regulatory authorities may increase reclamation and bonding requirements to such a degree that it would not be commercially reasonable to continue exploration activities, which may adversely affect our results of operations, financial performance and cash flows.

There is no guarantee that we will declare distributions to shareholders.

From June 2015 to September 2018, we paid a distribution to holders of our common stock on a semi-annual basis. Those distributions were suspended in March 2019. Any determination to reinstate this distribution on our common stock will be based primarily upon covenants in outstanding debt instruments, our financial condition, results of operations and capital requirements, including for capital expenditures and acquisitions, and our Board of Directors’ determination that the distribution to shareholders is in the best interest of our shareholders and in compliance with all laws and agreements applicable to the Company.

Risks Relating to Our Operations as a Mining Company

Our estimates of proven and probable reserves and mineralized material are based on interpretation and assumptions and, under actual conditions, may yield less mineral production than is currently estimated or may result in additional impairment charges to our operations.

Unless otherwise disclosed, proven and probable reserves and mineralization figures presented in our filings with securities regulatory authorities, including the SEC, in our news releases and other public statements that may be made from time to time, are based upon estimates made by both independent and our own internal professionals. Estimates of proven and probable reserves and mineralized material are subject to considerable uncertainty and are based, to a large extent, on the

19

prices of gold and silver and interpretations of geologic data obtained from drill holes and other exploration techniques. These prices and interpretations are subject to change. If we determine that certain of our estimated reserves or mineralized material have become uneconomic, we may be forced to reduce our estimates. Actual production may be significantly less than we expect and such reductions may result in impairment charges such as we experienced in 2020.

When making determinations about whether to advance any of our projects to development, we rely upon such estimated calculations as to the mineralized material and grades of mineralization on our properties. Until ore is mined and processed, mineralized material and grades of mineralization must be considered as estimates only. We cannot ensure that these estimates will be accurate, or this mineralization can be mined or processed profitably.

Any material changes in mineral estimates and grades of mineralization may affect the economic viability of placing a property into production and such property’s return on capital. There can be no assurance that minerals recovered in small scale tests will be recovered in large-scale tests under on-site conditions or in production scale. Extended declines in market prices for gold and/or silver may render portions of our mineralization estimates uneconomic and result in reduced reported mineralization or adversely affect the commercial viability of one or more of our properties. Any material reductions in estimates of mineralization, or of our ability to extract this mineralization, could have a material adverse effect on our results of operations or financial condition.

Investors should also be aware that calculations of “reserves” differ under SEC reporting standards and those under other international standards, such as Canada. Investors should also be aware that mineralized material may not be converted into reserves. Please also see, CAUTIONARY NOTE TO UNITED STATES INVESTORS-INFORMATION CONCERNING PREPARATION OF RESOURCE AND RESERVE ESTIMATES.

We may be unable to replace gold and silver reserves as they become depleted.

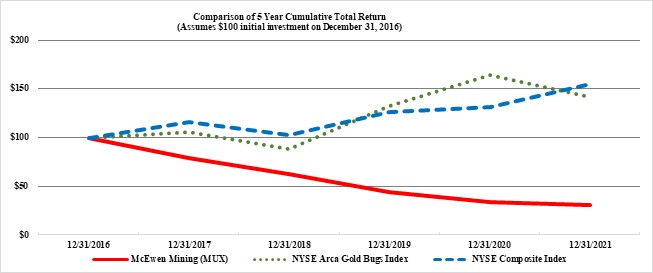

Like all metal producers, we must continually replace reserves depleted by production to maintain production levels over the long term and provide a return on invested capital. Depleted reserves can be replaced in several ways, including expanding known ore bodies, locating new deposits or acquiring interests in reserves from third parties. Exploration is highly speculative in nature, involves many risks and uncertainties and is frequently unsuccessful in discovering significant mineralization. Accordingly, our current or future exploration programs may not result in new mineral producing operations. Even if significant mineralization is discovered, it will likely take many years from the initial phases of exploration to commencement of production, during which time the economic feasibility of production may change.