Use these links to rapidly review the document

TABLE OF CONTENTS

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2013 |

||

o |

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission file number 001-33190

MCEWEN MINING INC.

(Name of registrant as specified in its charter)

| Colorado (State or other jurisdiction of incorporation or organization) |

84-0796160 (I.R.S. Employer Identification No.) |

|

181 Bay Street, Suite 4750, Toronto, Ontario Canada (Address of principal executive offices) |

M5J 2T3 (Zip Code) |

(866) 441-0690

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Common Stock, no par value | NYSE | |

|---|---|---|

| Title of each class | Name of each exchange on which registered |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

As of June 28, 2013 (the last business day of the registrant's second fiscal quarter), the aggregate market value of the registrant's voting and non-voting common equity held by non-affiliates of the registrant was $374,960,500 based on the closing price of $1.68 per share as reported on the NYSE. There were 265,176,527 shares of common stock outstanding (and 31,982,832 exchangeable shares exchangeable into McEwen Mining Inc. common stock on a one-for-one basis) on March 3, 2014.

DOCUMENTS INCORPORATED BY REFERENCE: Portions of the Proxy Statement for the 2014 Annual Meeting of Shareholders are incorporated into Part III, Items 10 through 14 of this report.

Descriptions of agreements or other documents in this report are intended as summaries and are not necessarily complete. Please refer to the agreements or other documents filed or incorporated herein by reference as exhibits. Please see the Exhibit Index at the end of this report for a complete list of those exhibits.

1

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Please see the note under "ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS," for a description of special factors potentially affecting forward-looking statements included in this report.

CAUTIONARY NOTE TO UNITED STATES INVESTORS—INFORMATION CONCERNING PREPARATION OF RESOURCE AND RESERVE ESTIMATES

McEwen Mining Inc. ("McEwen Mining," "we", "our", "us" or the "Company") is required to prepare reports under the Canadian Securities Administrators' National Instrument 43-101 "Standards of Disclosure for Mineral Projects" ("NI 43-101"), under the Canadian securities laws because we are listed on the Toronto Stock Exchange ("TSX") and subject to Canadian securities laws. These standards are materially different from the standards generally permitted in reports filed with the United States ("U.S.") Securities and Exchange Commission ("SEC").

Definitions of terms under NI 43-101 differ materially from the definitions of those and related terms in Industry Guide 7 ("Guide 7") promulgated by the SEC. Under U.S. standards, mineralization may not be classified as a "reserve" unless a determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. Under Guide 7 standards, a "Final" or "Bankable" feasibility study is required to report reserves, the three-year historical average precious metals prices are used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate government authority. One consequence of these differences is that "reserves" calculated in accordance with Canadian standards may not be "reserves" under Guide 7 standards. U.S. investors should be aware that McEwen Mining's properties located in Argentina (with the exception of the San José mine), Mexico and the United States do not have "reserves" as defined by Guide 7 and are cautioned not to assume that any part or all of the disclosed mineralized material will be confirmed or converted into Guide 7 compliant "reserves".

Under NI 43-101, we report measured, indicated and inferred resources, which are measurements that are generally not permitted in filings made with the SEC. The estimation of measured resources and indicated resources involve greater uncertainty as to their existence and economic feasibility than the estimation of proven and probable reserves under Guide 7. U.S. investors are cautioned not to assume that any part of measured or indicated resources will ever be converted into economically mineable reserves. The estimation of inferred resources involves far greater uncertainty as to their existence and economic viability than the estimation of other categories of resources. It cannot be assumed that all or any part of inferred resources will ever be upgraded to a higher category. Therefore, U.S. investors are also cautioned not to assume that all or any part of inferred resources exist, or that they can be mined legally or economically.

Canadian regulations permit the disclosure of resources in terms of "contained ounces" provided that the tonnes and grade for each resource are also disclosed; however, the SEC only permits issuers to report "mineralized material" in tonnage and average grade without reference to contained ounces. Under U.S. regulations, the tonnage and average grade described herein would be characterized as mineralized material. We provide such disclosure about our properties to allow a means of comparing our projects to those of other companies in the mining industry, many of which are Canadian and report pursuant to NI 43-101, and to comply with applicable disclosure requirements.

We also note that drill results are not indicative of mineralized material in other areas where we have mining interests. Furthermore, mineralized material identified on our properties does not and may never have demonstrated economic or legal viability.

2

Minera Santa Cruz S.A., the owner of the San José mine, is responsible for and has supplied to us all reported results from the San José mine. The technical information contained herein is, with few exceptions as noted, based entirely on information provided to us by Minera Santa Cruz S.A. Our joint venture partner, a subsidiary of Hochschild Mining plc, and its affiliates other than MSC do not accept responsibility for the use of project data or the adequacy or accuracy of this information.

3

History and Organization

We are a mining and minerals exploration company focused on precious and base metals in Argentina, Mexico and the United States. We were organized under the laws of the State of Colorado on July 24, 1979 under the name Silver State Mining Corporation. On June 21, 1988, we changed our name to U.S. Gold Corporation and on March 16, 2007, we changed our name to US Gold Corporation. On January 24, 2012, we changed our name to McEwen Mining Inc. after the completion of the acquisition of Minera Andes Inc. ("Minera Andes") by way of a statutory plan of arrangement under the laws of the Province of Alberta, Canada.

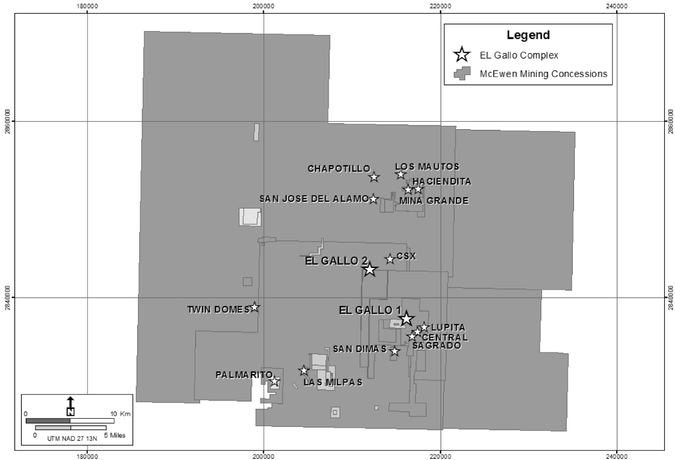

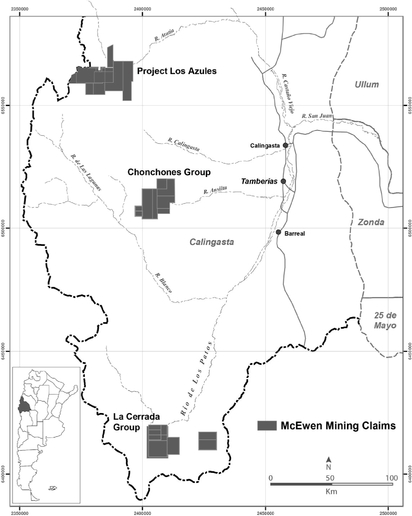

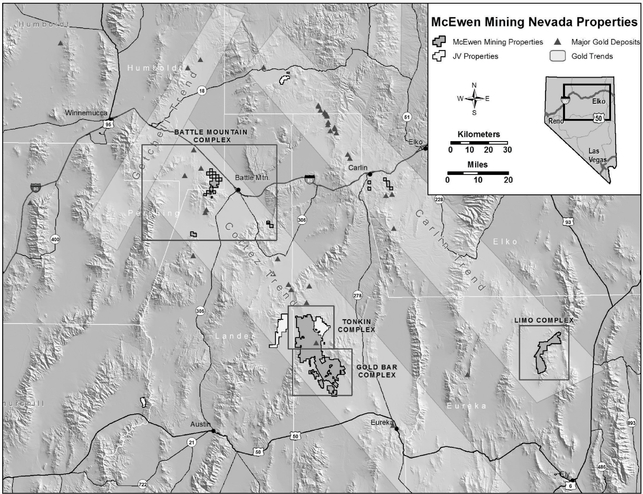

We operate in Argentina, Mexico and the United States. At December 31, 2013, we had an aggregate land position consisting primarily of mining claims, leases of mining claims or concessions of approximately 1,534 square miles (3,973 square kilometers). We own a 49% interest in Minera Santa Cruz S.A. ("MSC"), owner and operator of the producing San José mine in Santa Cruz, Argentina, which is controlled by the majority owner of the joint venture, Hochschild Mining plc ("Hochschild"). We also own the El Gallo 1 gold mine in Sinaloa, Mexico, where production resumed in 2012. In addition to our operating properties, we also hold interests in numerous exploration stage properties and projects in Argentina, Mexico and the United States. Prior to the acquisition of Minera Andes and commencement of production at El Gallo 1 in 2012, we had not generated revenue from operations since 1990.

Our objective is to increase the value of our shares through the exploration, development, and extraction of gold, silver and other valuable minerals. Other than the San José mine in Argentina, we generally conduct our exploration activities as sole operator, but we may enter into arrangements with other companies through joint venture or similar agreements in an effort to achieve our strategic objectives. We own our mineral interests and property and operate our business through various subsidiary companies, each of which is owned entirely, directly, or indirectly, by us.

Our principal executive office is located at 181 Bay Street, Suite 4750, Toronto, Ontario, Canada M5J 2T3 and our telephone number is (866) 441-0690. We also maintain offices in San Juan, Argentina; Guamuchil, Mexico; Elko and Reno, Nevada. Our website is www.mcewenmining.com. We make available our periodic reports and news releases on our website. Our common stock is listed on the New York Stock Exchange ("NYSE") and on the Toronto Stock Exchange ("TSX"), in each case under the symbol "MUX". Exchangeable shares of McEwen Mining—Minera Andes Acquisition Corp. are listed on the TSX under the symbol "MAQ".

In this report, "McEwen Mining", the "Company", "our" and "we" refer to McEwen Mining Inc. together with our subsidiaries, unless otherwise noted. "Au" represents gold; "Ag" represents silver; "oz" represents ounce; "gpt" represents grams per metric tonne; "ft." represents feet; "m" represents meter; "km" represents kilometer; and "sq." represents square. All of our financial information is reported in United States (U.S.) dollars, unless otherwise noted. C$ refers to Canadian dollars.

Segment Information

Our operating segments include Argentina, Mexico and the United States. See Note 16 to the Consolidated Financial Statements for the year ended December 31, 2013 for information relating to our operating segments.

4

Products

The end product at our gold and silver operations is either in the form of doré or concentrate. Doré is an alloy consisting primarily of gold and silver but also containing other metals. Doré is sent to refiners to produce bullion that meets the required market standard of 99.95% gold and 99.9% silver. Under the terms of our refining agreements, the doré bars are refined for a fee, and our share of the refined gold and silver is credited to our account. All of our production from El Gallo 1 is in the form of doré while production at the San José mine is generally a 45/55 ratio between doré and concentrates. Ore concentrate, or simply concentrate, is raw ore that has been ground finely to a powdery product where gangue (waste) is removed, thus concentrating the metal component. The concentrate is then transported to smelters where it is used to produce useful metals. Concentrates from the San José mine are shipped to third-party smelters and refineries for further processing.

During 2013, we reported consolidated production attributable to us of 79,158 gold ounces and 3,135,468 silver ounces, for a total of 139,455 gold equivalent ounces (using a silver to gold ratio of 52:1). Of our consolidated gold and silver production, approximately 61% and 99%, respectively, came from the San José mine in Argentina and 39% and 1%, respectively, came from our El Gallo 1 mine in Mexico.

Gold and silver doré produced in Argentina is sold at the prevailing spot market price based on the London A.M. fix, while concentrates are sold at the prevailing spot market price based on either the London P.M. fix or average of the London A.M. and London P.M fix depending on the sales contract. Concentrates are provisionally priced, whereby the selling price is subject to final adjustments at the end of a period ranging from 30 to 90 days after delivery to the customer. The final price is based on the market price at the relevant quotation point stipulated in the contract. Due to the time elapsed between shipment and the final settlement with the buyer, MSC must estimate the prices at which sales of metals will be settled. At the end of each financial reporting period, previously recorded provisional sales are adjusted to estimated settlement metals prices based on relevant forward market prices until final settlement with the buyer.

Gold and silver produced in Mexico are generally sold at the prevailing spot market price.

During 2013, total gold and silver sales for the San José mine were $240.7 million. However, we only report net income and loss, as applicable, from the San José mine on a 49% equity basis, which amounted to a net income of $0.8 million for 2013, after amortization of the fair value increments from the purchase price allocation based on the estimated fair value of assets acquired and liabilities assumed as of the acquisition date of January 24, 2012. Total gold and silver sales for Mexico were $46.0 million during 2013. See Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations for additional information regarding production and operating results for our properties.

The following table presents the annual high, low and average daily London P.M. fix prices per ounce for gold and silver over the past three years and 2014 to the most recent practical date on the London Bullion Market:

| |

Gold | Silver | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Year

|

High | Low | Average | High | Low | Average | |||||||||||||

2011 |

$ | 1,895 | $ | 1,319 | $ | 1,572 | $ | 48.70 | $ | 26.16 | $ | 35.12 | |||||||

2012 |

1,792 | 1,540 | 1,669 | 37.23 | 26.67 | 31.15 | |||||||||||||

2013 |

1,694 | 1,192 | 1,411 | 32.23 | 18.61 | 23.79 | |||||||||||||

2014 (through March 3, 2014) |

1,350 | 1,221 | 1,273 | 22.05 | 19.27 | 20.37 | |||||||||||||

On March 3, 2014, the London P.M. fix for gold was $1,350 per ounce and silver was $21.46 per ounce.

5

Gold and Silver Processing Methods

Gold and silver are extracted from mineralized material, by either milling or heap leaching, depending on, among other things, the amount of gold and silver contained in the material, whether the material is naturally oxidized or not oxidized, the accessibility of the mineralized material, the amenability of the material to treatment and related capital and operating costs. The mineralized material is extracted by underground (San José mine) and open pit (El Gallo 1 mine) mining methods.

The San José processing plant is composed of conventional crushing, grinding and flotation circuits. Approximately half of the silver-gold flotation concentrate is processed in an intensive cyanide leaching circuit with the dissolved gold and silver recovered by electrowinning of a clarified solution followed by smelting to produce doré. The balance of the flotation concentrate is filtered and shipped to a smelter. Flotation and leached tailings are stored in side-by-side engineered, zero discharge facilities. A Merrill Crowe circuit recovers small amounts of gold and silver from the electrowinning discharge solution. In 2012, the crushing circuit was modified to accommodate a 10% increase in mill throughput, from 1,500 to 1,650 metric tonnes per day. The modifications were completed in 2013.

At the El Gallo 1 mine, mineralized material is processed using heap leaching. Heap leaching consists of stacking crushed material on impermeable pads, where a weak cyanide solution is applied to the surface of the heap to dissolve the gold. The gold and silver-bearing solution is then collected and pumped to an ADR process facility consisting of carbon columns, stripping circuits and a precious metal refinery to process gold and silver into doré bars. Doré bars are then shipped from the mine to a third party refiner to obtain a purer, final product.

Gold and Silver Reserves

At December 31, 2012, we had 180,000 and 13.1 million ounces of proven and probable gold and silver reserves, respectively, attributable to McEwen Mining from our 49% equity interest in the San José mine. The 2012 information is the most recent available to us and does not account for 2013 production or reserves delineated during 2013. We expect that Hochschild Mining plc. will report updated reserves as at December 31, 2013 by the first quarter of 2014. See Item 2. Properties—San José Mine, Argentina, for additional information about our reserves on this property. There are no proven and probable reserves at El Gallo 1 in Mexico or any of our other properties.

Competitive Business Conditions

We compete with many companies in the mining and mineral exploration industry, including large, established mining companies with substantial capabilities, personnel, and financial resources. There is a limited supply of desirable mineral lands available for claim-staking, lease, or acquisition in Argentina, Mexico, or the United States, and other areas where we may conduct exploration activities. We may be at a competitive disadvantage in acquiring mineral properties, since we compete with these individuals and companies, many of which have greater financial resources and larger technical staffs than we do. From time to time, specific properties or areas which would otherwise be attractive to us for exploration or acquisition may be unavailable due to their previous acquisition by other companies or our lack of financial resources.

Competition in the industry is not limited to the acquisition of mineral properties, but also extends to the technical expertise to find, advance, and operate such properties; the labor to operate the properties; and the capital for the purpose of funding such exploration and development. Many competitors not only explore for and mine precious and base metals, but conduct refining and marketing operations on a world-wide basis. Such competition may result in our company being unable not only to acquire desired properties, but to recruit or retain qualified employees or to acquire the capital necessary to fund our operation and advance our properties. Our inability to compete with

6

other companies for these resources would have a material adverse effect on our results of operation, financial condition and cash flows.

General Government Regulations

Argentina

Mining in Argentina is subject to numerous federal, provincial and local laws, regulations and ordinances governing mineral rights, operations and environmental protection.

Mineral Concession Rights. Under Argentine Law, mining concessions are real property, which can be transferred freely and can also be pledged. Concessions are granted by provincial governments for unlimited periods of time, subject to the following conditions:

- (a)

- the

payment twice a year of a mining fee or canón of 800 Argentine pesos per unit, or pertenencia; and

- (b)

- the filing of a minimum investment plan and compliance with a minimum investment in the concession equal to 300 times the relevant canón over a five year period.

Failure to comply with these conditions may result in the termination of the concession.

Surface Rights. A mining license alone is not sufficient to permit mining operations. An agreement for access and occupation of the surface land is also required from the surface owner and occupier before mining may commence. Surface rights in Argentina are not automatically granted with title to either a mining lease or a claim and must be negotiated with the landowner.

Water Rights. Water rights are granted for the land or industry they have been applied for. Water rights cannot be separately seized or expropriated from the land or mining concession for which the use of water has been granted as long as the use for the mining concession is required and the obligations by the title holder are complied with.

Mining Royalties. As legal owners of the mineral resources, provinces are entitled to request royalties from mine operators. Regulations vary from province to province. Under a Mining Tax Stability Agreement between the Province of Santa Cruz where the San José mine is located and MSC, the mining royalty was fixed at 1.85% of the mine-site value per year when the final product is doré and 2.55% when the final products are concentrates or precipitates. Starting in November 2012, the Province increased the royalty to the legal maximum of 3% for all products. Royalties are paid monthly.

Reserve Tax Law. In June 2013, the Province of Santa Cruz passed amendments to the Provincial Tax Code and Provincial Tax Law, which imposes a new tax on mining reserves in the Province. The law came into effect on July 5, 2013. The tax will amount to 1% of the value of mine reserves reported in feasibility studies and financial statements inclusive of variations resulting from ongoing operations. Regulations require that the tax be calculated on "measured" reserves, and MSC has interpreted this to mean "proven" reserves. The Province has disputed this interpretation but has not provided further clarification on the definition of "measured" reserves, and the outcome is not clear at the time. MSC has filed a legal claim disputing the legality of the new tax and has paid the initial installment under protest.

Environmental Law. The Environmental Protection Section of the National Mining Code of Argentina, enacted in 1995, requires that each Provincial government monitor and enforce the laws pertaining to prescribed development and protection of the environment. The Argentine Constitution establishes that the Federal Government is required to set the minimum standards. In 2002, the National Congress established such minimum standards for the protection of the sustainable

7

environmental management and the protection of biodiversity, which are applicable throughout Argentina. Provinces are entitled to strengthen those standards. Further, the Argentine Constitution, as amended in 1994, allows any individual who believes a third party may be damaging the environment to initiate an action against such party. Existing and proposed legislation at both the federal and state levels in Argentina governing the protection of glaciers and the management of natural resources, including mining activity, in the vicinity of glaciers, may impact the Company's ability to develop its projects.

Mining Permits. Prior to conducting mining operations, companies must submit an Environmental Impact Report ("EIR") to the provincial government. The EIR must describe the proposed operation and the methods that will be used to prevent undue environmental damage and must be updated biennially. Mine operators are liable for environmental damage and violators of environmental standards may be required to shut down mining operations. An EIR must be submitted every two years in accordance with Argentine Law.

Mexico

Mining in Mexico is also subject to numerous federal, state and local laws, regulations and ordinances governing mineral rights, operations and environmental protection.

Mineral Concession Rights. Exploration and exploitation of minerals in Mexico may be carried out through Mexican companies incorporated under Mexican law by means of obtaining mining concessions. Mining concessions are granted by the Mexican government for a period of fifty years from the date of their recording in the Public Registry of Mining and are renewable for a further period of fifty years upon application within five years prior to the expiration of such concession in accordance with the Mining Law and its regulations.

Mining concessions are subject to annual work requirements and payment of annual surface taxes which are assessed and levied on a semi-annual basis. Such concessions may be transferred or assigned by their holders, but such transfers or assignments must be registered with the Public Registry of Mining in order to be valid against third parties.

The holder of a concession must pay semi-annual duties in January and July of each year on a per hectare basis and in accordance with the amounts provided by the Federal Fees Law.

During the month of May of each year, the concessionaire must file with the General Bureau of Mines, the work assessment reports made on each concession or group of concessions for the preceding calendar year. The regulations of the Mining Law provide tables containing the minimum investment amounts that must be made on a concession. This amount is updated annually in accordance with the changes in the Consumer Price Index.

Surface Rights. In Mexico, while mineral rights are administered by the federal government through federally issued mining concession, ejidos (communal owners of land recognized by the federal laws in Mexico) control surface access rights to the land. An ejido may sell or lease lands directly to a private entity. While the Company has agreements or is in the process of negotiating agreements with the ejidos that impact all of its projects in Mexico, some of these agreements may be subject to renegotiations.

Water Rights. Water rights are managed by the Comisión Nacional del Agua ("CONAGUA"). According to the Mexican water rights legislation, industrial users such as mining companies must pay for the right to use national waters regardless of how their rights were obtained, with the rates being determined by the availability of water and the method of extraction. We are not required to obtain water rights. According to CONAGUA, the El Gallo Complex is located in the Sinaloa River Aquifer

8

and is termed Zona de Libre Alumbramiento, meaning a free zone because of excess capacity. However, water usage costs $0.40 per cubic meter consumed.

Mining Royalties. In October 2013, the Mexican lower house passed a bill levying a tax-deductible mining royalty of 7.5% on earnings before the deduction of interest, taxes, depreciation and amortization, along with an additional 0.5% on precious metals revenue for mining companies. The effective date of the law was January 1, 2014. The new tax reforms are applicable on a prospective basis and would therefore affect future earnings from the Company's mining operations in Mexico. Although there are a number of uncertainties surrounding the scope, calculation and enforcement of the royalty, based on the Company's current interpretation of the bill, we do not expect the royalty to be material for 2014. Further, the Company has filed an Amparo, a legal recourse seeking remedy for the protection of constitutional rights.

Environmental Law. The Environmental Law in Mexico, called the "General Law of Ecological Balance and Protection to the Environment" ("General Law"), provides for general environmental policies, with specific requirements for certain activities such as exploration set forth in regulations called "Mexican official norms". Responsibility for enforcement of the General Law, the regulations and the Mexican official norms is with the Ministry of Environment and Natural Resources, which regulate all environmental matters with the assistance of Procuraduría Federal de Protección al Ambiente ("PROFEPA").

The primary laws and regulations used by the State of Sinaloa where our El Gallo property is located in order to govern environmental protection for mining and exploration are: the General Law, Forestry Law, Residues Law, as well as their specific regulations on air, water and residues, and the Mexican official norms ("NOM-120"). In order to comply with the environmental regulations, a concessionaire must obtain a series of permits during the exploitation and exploration stage. The time required to obtain the required permits is dependent on a number of factors including the type of vegetation and trees impacted by proposed activities.

Mining Permits. The Secretariat of Environmental and Natural Resources, the Mexican Government environmental authority ("SEMARNAT"), is responsible for issuing environmental permits associated with mining. Three main permits required before construction can begin are: Environmental Impact Statement (known in Mexico as Manifesto Impacto Ambiental) ("MIA"), Land Use Change (known in Mexico as Estudio Justificativo Para Cambio Uso Sueldo) ("ETJ"), and Risk Analysis (known in Mexico as Analisis de Riesgo) ("RA"). A construction permit is required from the local municipality and an archaeological release letter from the National Institute of Anthropology and History ("INAH"). An explosives permit is required from the ministry of defense before construction can begin. The MIA is required to be prepared by a third-party contractor and submitted to SEMARNAT and must include a detailed analysis of climate, air quality, water, soil, vegetation, wildlife, cultural resources and socio-economic impacts. The RA study (which is included into the MIA and submitted as one complete document) identifies potential environmental releases of hazardous substances and evaluates the risks in order to establish methods to prevent, respond to, and control environmental emergencies. The ETJ requires that an evaluation be made of the existing conditions of the land, including a plant and wildlife study, an evaluation of the current and proposed use of the land, impacts to naturally occurring resources, and an evaluation of reclamation/re-vegetation plans.

United States

Mining in the United States is also subject to numerous federal, state and local laws. Three types of laws are of particular importance to our U.S. mineral properties: those affecting land ownership and mining rights; those regulating mining operations; and those dealing with the environment.

9

Land Ownership and Mining Rights. Our Nevada properties are primarily located on lands owned by the United States (Federal Lands) and are governed by the General Mining Law of 1872 ("General Mining Law") as amended. The General Mining Law allows the location of mining claims on certain Federal Lands upon the discovery of a valuable mineral deposit and proper compliance with claim location requirements. A valid mining claim provides the holder with the right to conduct mining operations for the removal of minerals, subject to compliance with the General Mining Law and state law governing the staking and registration of mining claims, as well as compliance with various federal, state and local operating and environmental laws, regulations and ordinances. As the owner or lessee of the unpatented mining claims, we have the right to conduct mining operations on the lands subject to the prior procurement of required operating permits and approvals, compliance with the terms and conditions of any applicable mining lease, and compliance with applicable federal, state, and local laws, regulations and ordinances.

Mining Operations. The exploration of mining properties and development and operation of mines are governed by federal, state and local laws. Our Nevada properties are primarily administered by the United States Department of the Interior, Bureau of Land Management, which we refer to as the U.S. Bureau of Land Management ("BLM"). In general, the federal laws that govern mining claim location and maintenance and mining operations on Federal Lands are administered by the BLM. Additional federal laws, such as those governing the purchase, transport or storage of explosives, and those governing mine safety and health, also apply.

The State of Nevada likewise requires various permits and approvals before mining operations can begin, although the state and federal regulatory agencies usually cooperate to minimize duplication of permitting efforts. Among other things, a detailed reclamation plan must be prepared and approved, with bonding in the amount of projected reclamation costs. The bond is used to ensure that proper reclamation takes place, and the bond will not be released until this is completed. The Nevada Department of Environmental Protection ("NDEP") is the state agency that administers the reclamation permits, mine permits and related closure plans on our Nevada properties. Local jurisdictions (such as county governments) may also impose permitting requirements (such as conditional use permits or zoning approvals).

Environmental Law. The development, operation, closure, and reclamation of mining projects in the United States requires numerous notifications, permits, authorizations, and public agency decisions. Compliance with environmental and related laws and regulations requires us to obtain permits from regulatory agencies, and to file various reports and keep records of our operations. Certain of these permits require periodic renewal or review of their conditions and may be subject to a public review process during which opposition to our proposed operations may be encountered. We are currently operating under various permits for activities connected to mineral exploration, reclamation, and environmental requirements.

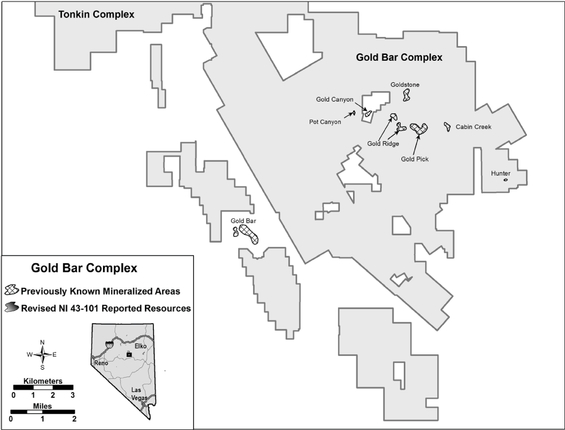

Proposed mineral processing at our Gold Bar property will require additional permitting prior to production. Various federal agencies and departments within the State of Nevada and local governments will be cooperating to review applications for any mining development and process facilities at the site. Although not expected, potential external events such as public or cooperating agency opposition could lengthen the schedule for permit acquisition. Because of previously permitted mining activity at the site, we currently have no reason to believe that permits to mine the mineral resources at Gold Bar could not be obtained from local, state and Federal regulatory agencies without unreasonable effort and expense. We also believe that production water for the Gold Bar property can be appropriated pursuant to regulations implemented by the State of Nevada.

10

Customers

During the year ended December 31, 2013, 79% of total sales from the San José mine were made to Argor-Heraeus S.A., LS-Nikko Copper Inc., and Corsorcio Minero S.A. Argor-Heraeus S.A., a Swiss company, is a purchaser of doré, which accounted for 34% of total sales. LS-Nikko Copper Inc., a Korean company, is a purchaser of concentrate, which accounted for 23% of total sales. Consorcio Minero S.A., a Peruvian company, is a purchaser of concentrate and accounted for 22% of total sales.

MSC has sales agreement with each of these purchasers. MSC has already allocated all of their 2014 concentrate production to their existing customers and is currently in negotiation with Argor-Heraeus S.A. for their 2014 doré production. However, any interruption of production could temporarily disrupt the sale of metals and adversely affect its operating results.

At our El Gallo 1 mine, we either sell doré under the terms set out in the doré purchase agreement of July 2012 or refined metal on the spot market. During the year ended December 31, 2013, 90% of total sales from El Gallo 1 in Mexico were sold on the spot market through The Bank of Nova Scotia, a Canadian financial institution. We also have an agreement to sell refined metal with a second Canadian financial institution.

Employees

As of March 3, 2014, we had 265 employees including 231 employees based in Mexico, 5 in Argentina, 8 in the United States, and 21 in Canada. All of our employees based in Canada work in an executive, technical or administrative position, while our employees in Mexico, Argentina and the United States include laborers, engineers, geologists, permitting specialists, information technologists, and office administrators. Some of our employees in Mexico are covered by union labor contracts and the Company believes we have good relations with our employees and their unions. We also frequently engage independent contractors in connection with certain administrative matters and the exploration of our properties, such as drillers, geophysicists, geologists, and other technical disciplines. As of March 3, 2014, MSC had 1,147 employees in Argentina.

This report, including Management's Discussion and Analysis of Financial Condition and Results of Operations, contains forward-looking statements that may be affected by several risk factors. The following information summarizes all material risks known to us as of the date of filing this report:

Risks Relating to Our Company

We have incurred substantial losses since our inception in 1979 and may never be profitable.

Since our inception in 1979, we have never been profitable. As of December 31, 2013, our accumulated deficit was $607.6 million, including a net loss of $147.7 million in 2013. In the future, our ability to become profitable will depend on the profitability of the San José and El Gallo 1 mines, our ability to bring the El Gallo 2 and Gold Bar projects into production and generate revenue sufficient to cover our costs and expenses, and our ability to advance or sell our other properties, including the Los Azules copper project. In pursuit of that objective, we will seek to identify additional mineralization that can be extracted economically at operating and exploration properties. For our non-operating properties that we believe demonstrate economic potential, we need to either develop our properties, locate and enter into agreements with third party operators, or sell the properties. We may suffer significant additional losses in the future and may never be profitable. Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis.

11

The feasibility of mining at our El Gallo Complex and Gold Bar properties has not been established in accordance with SEC Guide 7, and any funds spent by us on exploration and development could be lost.

We have no proven or probable reserves on our properties as defined by U.S. law, except for our 49% interest in the San José mine. A "reserve," as defined by regulation of the SEC, is that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. A reserve requires a SEC compliant feasibility study demonstrating with reasonable certainty that the deposit can be economically extracted and produced. Since we have not received a SEC compliant feasibility study on any of our properties, we currently have no reserves as defined by SEC Guide 7, except for our 49% interest in the San José mine, and there are no assurances that we will be able to prove that there are reserves on our properties.

The mineralized material identified on our properties, including El Gallo 1 where we are currently in production, does not and may never demonstrate economic viability. Substantial expenditures are required to establish reserves through drilling and additional study and there is no assurance that reserves will be established. The feasibility of mining at our El Gallo Complex, Gold Bar properties, or any other property has not been, and may never be, established. Whether a mineral deposit can be commercially viable depends upon a number of factors, including the particular attributes of the deposit, including size, grade, metallurgical recoveries and proximity to infrastructure; metal prices, which can be highly variable; and government regulations, including environmental and reclamation obligations. If we are unable to establish some or all of our mineralized material as proven or probable reserves in sufficient quantities to justify commercial operations, our investment in that property may be lost, and the market value of our securities may suffer.

We are required to prepare and file with the Canadian securities regulators estimates of mineralized material in accordance with NI 43-101. These standards are substantially different from the standards generally permitted to report reserve and other estimates in reports and other materials filed with the SEC. Under NI 43-101, we report measured, indicated and inferred resources, measurements which are generally not permitted in filings made with the SEC. U.S. investors are cautioned not to assume that all or any part of measured or indicated resources reported in our Canadian filings will ever be converted into SEC Guide 7 compliant reserves.

There are significant risks and uncertainty associated with construction, commencing or expanding production or changing production plans without a current feasibility, pre-feasibility or scoping study. As such, the El Gallo Complex and Gold Bar properties may ultimately be determined to lack one or more geological, engineering, legal, operating, economic, social, environmental, and other relevant factors reasonably required to serve as the basis for a final decision to successfully complete all or part of these projects.

The figures for our estimated mineralized material are based on interpretation and assumptions and may yield less mineral production under actual conditions than is currently estimated.

Unless otherwise indicated, mineralization figures presented in our filings with securities regulatory authorities including the SEC, news releases and other public statements that may be made from time to time are based upon estimates made by independent geologists and our internal geologists. When making determinations about whether to advance any of our projects to development, we must rely upon such estimated calculations as to the mineralized material and grades of mineralization on our properties. Until ore is actually mined and processed, mineralized material and grades of mineralization must be considered as estimates only.

12

These estimates are imprecise and depend upon geological interpretation and statistical inferences drawn from drilling and sampling analysis, which may prove to be unreliable. We cannot ensure that:

- •

- these estimates will be accurate;

- •

- mineralization estimates will be accurate; or

- •

- this mineralization can be mined or processed profitably.

Any material changes in mineral estimates and grades of mineralization will affect the economic viability of placing a property into production and such property's return on capital. There can be no assurance that minerals recovered in small scale tests will be recovered in large-scale tests under on-site conditions or in production scale. The estimates contained in our public filings have been determined and valued based on assumed future prices, cut-off grades and operating costs that may prove to be inaccurate. Extended declines in market prices for gold and/or silver may render portions of our mineralization estimates uneconomic and result in reduced reported mineralization or adversely affect the commercial viability of one or more of our properties. Any material reductions in estimates of mineralization, or of our ability to extract this mineralization, could have a material adverse effect on our results of operations or financial condition.

We own our 49% interest in the San José mine and the other 51% is owned Hochschild Mining plc., under the terms of an option and joint venture agreement, and therefore we are unable to control all aspects of the development and exploration of, and production from this property.

Our interest in the San José mine is subject to the risks normally associated with the conduct of joint ventures. A disagreement between joint venture partners on how to conduct business efficiently, the inability of joint venture partners to meet their obligations to the joint venture or third parties, or litigation arising between joint venture partners regarding joint venture matters could have a material adverse effect on the viability of our interests held through the joint venture.

Our operations in Argentina and Mexico are subject to changes in political conditions, regulations and crime.

Although all of our operations are subject to changes in political conditions, regulations and crime, the Company has substantial investments in Argentina and Mexico and is therefore subject to risks normally associated with the conduct of business in foreign countries. Further, both Argentina and Mexico have undergone significant government regulations with respect to, but not limited to, restrictions on production, price controls, export controls, currency remittance, importation of parts and supplies, income and other taxes, expropriation of property, foreign investment, maintenance of claims, environmental legislation, land use, land claims of local people, water use and mine safety. Changes, if any, in mining or investment policies or shifts in political attitude in any of the jurisdictions in which the Company operates may adversely affect the Company's operations or profitability. There also is the risk of political violence and increased social tension in both Mexico and Argentina as these countries have experienced periods of crime, and civil and labor unrest. Certain political and economic events such as acts, or failures to act, by a government authorities in Argentina and Mexico, and acts of political violence could have a material adverse effect on our ability to operate in the country.

With respect to our San José mine, there are risks relating to an uncertain or unpredictable political and economic environment in Argentina. For instance, during an economic crisis in 2002 and 2003, Argentina defaulted on foreign debt repayments and on the repayment on a number of official loans to multinational organizations. In addition, the Argentine government has renegotiated or defaulted on contractual arrangements.

In January 2008, the Argentine government reassessed its policy and practice in respect of export duties and began levying export duties on mining companies operating in the country. Although this

13

particular change did not affect the San José mine as its fiscal stability agreement explicitly fixes export duties at 5% for doré bars and 10% for concentrates, there can be no assurance that the Argentine government will not unilaterally take other action which could have a material adverse effect on our projects in the country or that Argentina will continue to honor, this or other fiscal agreements.

In April 2012, Argentina's President announced the nationalization of the majority stake of Yacimientos Petrolíferos Fiscales (YPF), Argentina's largest oil company. There can be no assurances that further nationalization of other industries are not forthcoming.

In September 2013, Argentina's federal Income Tax Statute was amended to include a 10% income tax withholding on dividend distributions by Argentine corporations. The impact of the new withholding tax on MSC is still unclear, as tax stability rights provided to mining projects by Mining Investment Law No. 24,196 MIL would generally allow mining projects to pay the new withholding tax under protest and request a refund or tax credit for the excess of the overall tax burden. In addition to this amendment, the capital gains exception for non-resident taxpayers was repealed. Transfers of Argentine stock by non-residents are subject to a tax rate of 15%.

There also exist current restrictions to imports and provisions relating to local sourcing of transports and substitution of imports of goods and services. These measures may impact the quality and supply of products and services required for our Argentine operations, including specifically the San José mine. Other unanticipated changes by the Argentine government could adversely impact the profitability of the San José mine or affect our ability to explore or develop all or part of our Los Azules project or other exploration properties in Argentina. Political and economic events such as acts, or failures to act, by a government authority in Argentina, and acts of political violence in Argentina, could have a material adverse effect on our ability to operate.

With respect to our El Gallo Complex in Mexico, in recent years, there has been a marked increase in the level of violence and crime relating to drug cartels in Sinaloa state, where we operate, and in other regions of Mexico. This may disrupt our ability to carry out exploration and mining activities and affect the safety and security of our employees and contractors. Our exploration and mining activities may be adversely affected in varying degrees by changing government regulations relating to the mining industry or shifts in political conditions, including as a result of periodic elections, that could increase the costs related to our activities or maintaining our properties.

Legislation has been enacted that significantly and adversely affects the mining industry.

In Argentina, in June 2013, the Province of Santa Cruz passed amendments to the Provincial Tax Code and Provincial Tax Law, which imposed a new tax on mine reserves in the Province. The tax will amount to 1% of the value of the mine reserves reported in feasibility studies and financial statements inclusive of variations resulting from ongoing exploration. Regulations require that the tax be calculated on "measured" reserve, less certain deductions. It is expected that the law will be onerous and may impact future exploration activities in the province unless repealed or otherwise modified.

In Mexico, in October 2013, the Mexican lower house passed a bill proposing a tax-deductible mining royalty of 7.5% on earnings before the deduction of interest, taxes, depreciation and amortization, along with an additional 0.5% on precious metals revenue for precious metals mining companies. In addition the long term corporate tax rate is expected to remain at 30% rather than being reduced to 28% as originally planned. The Mexican Senate approved the provisions of the Tax Reform on October 31, 2013. The effective date of the law was effective January 1, 2014. The new tax reforms are applicable on a prospective basis and would therefore affect future earnings from the Company's mining operations in Mexico.

Periodically, members of the U.S. Congress have introduced bills which would supplant or alter the provisions of the General Mining Law of 1872, which governs the unpatented claims that we control

14

with respect to our U.S. properties. One such amendment has become law and has imposed a moratorium on the patenting of mining claims, which reduced the security of title provided by unpatented claims such as those on our U.S. properties. If additional legislation is enacted, it could substantially increase the cost of holding unpatented mining claims by requiring payment of royalties, and could significantly impair our ability to develop mineral estimates on unpatented mining claims. Such bills have proposed, among other things, to make permanent the patent moratorium, to impose a federal royalty on production from unpatented mining claims and to declare certain lands as unsuitable for mining. Although it is impossible to predict at this time what royalties may be imposed in the future, the imposition of such royalties could adversely affect the potential for development of such mining claims, and the economics of existing operating mines on federal unpatented mining claims. Passage of such legislation could adversely affect our business.

Recent Argentine foreign exchange regulations and export repatriation requirements could adversely affect our liquidity and operations.

In October 2011, Argentina announced a decree requiring mining companies to repatriate mining revenues to Argentine currency before distributing revenue either locally or overseas. Fluctuation in the value of the Argentine peso as a result of the repatriation requirement and the repatriation requirement may create inefficiencies in our ability to transfer our revenue from Argentina and result in substantial transaction costs. Further, there are additional transaction costs imposed by the central bank for transferring funds from and within Argentina.

In April 2012, Argentina announced further rules which initially reduced the number of days mining companies have to repatriate funds relating to exports sales to 15 days and then subsequently in July 2012, relaxed the repatriation requirement to 79 days on the export of doré and 180 days on the sale of concentrates for certain mining companies including MSC which operates the San José mine. During this interim period of uncertainty, there was a disruption to MSC's exports, especially concentrate sales which take significantly longer than doré to process. This resulted in a disruption to their cash flows and ultimately, to the timing and amount of dividends that MSC paid to us in 2012.

Further, under current regulations, Argentine residents, including MSC, are not allowed to purchase in the foreign exchange market foreign currency without a specific purpose, which includes foreign currency to be held in Argentina and other cross-border transfers; and as such, though Argentine companies may freely acquire and transfer foreign currency abroad to pay profits and dividends to foreign shareholders (provided that they relate to final and audited financial statements), in an attempt to stop capital flight and control the dollar, the government has kept restricting, by means of a "de facto" measure, the transfer of dividends abroad.

These restrictions and any additional restrictions on the Argentine foreign exchange regime or export repatriation requirements could affect our liquidity and operations in Argentina, and our ability to access such funds.

Our business is subject to U.S. Foreign Corrupt Practices Act and similar worldwide anti-bribery laws, a breach or violation of which could lead to civil and criminal fines and penalties, loss of licenses or permits and reputational harm.

We operate in certain jurisdictions that have experienced governmental and private sector corruption to some degree, and, in certain circumstances, strict compliance with anti-bribery laws may conflict with certain local customs and practices. For example, the U.S. Foreign Corrupt Practices Act and anti-bribery laws in other jurisdictions, generally prohibit companies and their intermediaries from making improper payments for the purpose of obtaining or retaining business or other commercial advantage, and often carry substantial penalties. There can be no assurance that our internal control policies and procedures always will protect it from recklessness, fraudulent behavior, dishonesty or

15

other inappropriate acts committed by the Company's affiliates, employees or agents. As such, our corporate policies and processes may not prevent all potential breaches of law or other governance practices. Violations of these laws, or allegations of such violations, could lead to civil and criminal fines and penalties, litigation, and loss of operating licenses or permits, and may damage the Company's reputation, which could have a material adverse effect on our business, financial position and results of operations or cause the market value of our common shares to decline.

We are subject to foreign currency risk.

While we transact most of our business in U.S. dollars, expenses, such as labor, operating supplies and property and equipment are denominated in Canadian dollars, Mexican pesos or Argentine pesos. As a result, currency exchange fluctuations may impact our operating costs. The appreciation of non-U.S. dollar currencies against the U.S. dollar increases costs and the cost of purchasing property and equipment in U.S. dollar terms in Mexico, Argentina and Canada, which can adversely impact our operating results and cash flows. Conversely, a depreciation of non-U.S. dollar currencies usually decreases operating costs and property and equipment purchases in U.S. dollar terms in foreign countries.

The value of cash and cash equivalents denominated in foreign currencies also fluctuates with changes in currency exchange rates. Appreciation of non-U.S. dollar currencies results in a foreign currency gain on such investments and a depreciation in non-U.S. dollar currencies results in a loss. We have not utilized market risk sensitive instruments to manage our exposure to foreign currency exchange rates but may in the future actively manage our exposure to foreign currency exchange rate risk. We also hold a majority of our cash reserves in non-U.S. dollar currencies.

Fluctuating precious metals and copper prices could negatively impact our business.

The potential for profitability of our gold and silver mining operations and the value of our mining properties are directly related to the market price of gold, silver and copper. The price of gold, silver and copper may also have a significant influence on the market price of our common stock. The market price of gold and silver historically has fluctuated significantly and is affected by numerous factors beyond our control. These factors include supply and demand fundamentals, expectations with respect to the rate of inflation, the relative strength of the U.S. dollar and other currencies, interest rates, gold and silver sales and loans by central banks, forward sales by metal producers, accumulation and divestiture by exchange traded funds, global or regional political, economic or banking crises, and a number of other factors. The market price of silver is also affected by industrial demand. The selection of a property for exploration or development, the determination to construct a mine and place it into production, and the dedication of funds necessary to achieve such purposes are decisions that must be made long before the first revenues, if any, from production will be received. Price fluctuations between the time that such decisions are made and the commencement of production can have a material adverse effect on the economics of a mine.

The volatility in gold, silver and copper prices is illustrated by the following table, which sets forth, for the periods indicated, the average market prices in U.S. dollars per ounce of gold and silver, based on the daily London P.M. fix, and per pound of copper based on the London Metal Exchange Grade A copper settlement price.

Average Annual Market Price of Gold and Silver (per oz.) and Copper (per lb.)

Metal

|

2009 | 2010 | 2011 | 2012 | 2013 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Gold |

$ | 972 | $ | 1,224 | $ | 1,572 | $ | 1,669 | $ | 1,411 | ||||||

Silver |

14.67 | 20.19 | 35.12 | 31.15 | 23.79 | |||||||||||

Copper |

2.34 | 3.42 | 4.00 | 3.61 | 3.32 | |||||||||||

16

The volatility of mineral prices represents a substantial risk which no amount of planning or technical expertise can fully eliminate. In the event gold and silver prices decline and remain low for prolonged periods of time, we might be unable to develop our properties, which may adversely affect our results of operations, financial performance and cash flows.

Increased operating and capital costs could affect our profitability.

Costs at any particular mining location are subject to variation due to a number of factors, such as variable ore grade, changing metallurgy and revisions to mine plans in response to the physical shape and location of the ore body, as well as the age and utilization rates for the mining and processing related facilities and equipment. In addition, costs are affected by the price and availability of input commodities, such as fuel, electricity, labor, chemical reagents, explosives, steel and concrete and mining and processing related equipment and facilities. Commodity costs are, at times, subject to volatile price movements, including increases that could make production at certain operations less profitable. Further, changes in laws and regulations can affect commodity prices, uses and transport. Reported costs may also be affected by changes in accounting standards. A material increase in costs at any significant location could have a significant effect on our profitability and operating cash flow.

We could have significant increases in capital and operating costs over the next several years in connection with the development of new projects in challenging jurisdictions and in the sustaining and/or expansion of existing mining and processing operations. Costs associated with capital expenditures have escalated on an industry-wide basis over the last several years, as a result of factors beyond our control, including the prices of oil, steel and other commodities and labor, as well as the demand for certain mining and processing equipment. Increased capital expenditures may have an adverse effect on the profitability of and cash flow generated from existing operations, as well as the economic returns anticipated from new projects.

Our business requires substantial capital investment and we may be unable to raise additional funding on favorable terms to develop additional mining operations.

We may need to obtain additional financing, either in the form of debt or equity financing, to fund development of additional mining operations such as the El Gallo 2 or Gold Bar projects and to continue our administrative activities. Our working capital balance, along with expected cash generated from mining operations at El Gallo 1 and dividends received from MSC during 2013, is not expected to be sufficient to allow us to develop El Gallo 2, the next mine project, or to continue our operations indefinitely. Our ability to obtain necessary funding, in turn, depends upon a number of factors, including the state of the economy and applicable commodity prices. We may not be successful in obtaining the required financing for El Gallo 2 or other purposes, on terms that are favorable to us or at all, in which case, our ability to continue operating would be adversely affected. Failure to obtain such additional financing could result in delay or indefinite postponement of further exploration or potential development and the possible partial or total loss of our interest in certain properties.

Our estimated timetables to achieve production for the El Gallo 2 and Gold Bar properties may not be accurate.

The final decision to proceed with the construction of our El Gallo 2 project, for which a feasibility study was completed in 2012, has not been made. The Company plans to complete its cost savings studies and review financing alternatives. Any decision to proceed would be based on silver prices and securing financing on terms that we believe are more favorable to us than those that were available to us at the time of filing this report. The Company believes receiving the final permit for El Gallo 2 will help facilitate this process. All significant permits required for the construction of El Gallo 2 have now been received. With respect to the Gold Bar project, based on the 2012 preliminary feasibility study, we believe production may be achieved in 2016. However, the Gold Bar preliminary

17

feasibility study is preliminary in nature and is subject to change due to factors within and outside of our control. There is no certainty that the economics estimated in the preliminary feasibility study will be realized or that we will be able to begin production within the timelines estimated, if at all.

We will require significant amounts of capital through debt or equity to place one or both of these properties into production, and our ability to obtain this necessary funding will depend on a number of factors, including the status of the national and worldwide economy and the price of silver, gold, and other precious and base metals. Fluctuations in production costs, material changes in the mineral estimates and grades of mineralization or changes in the political conditions or regulations in Mexico or Nevada may make placing these properties into production uneconomic. Further, we may also be unable to obtain the necessary permits in a timely manner, on reasonable terms or on terms that provide us sufficient resources to develop our properties. These and other factors may cause us to delay production at El Gallo 2 and our Gold Bar properties beyond our current expectations, or cancel our plans entirely.

Development at the Los Azules copper project presents development challenges that may negatively affect, if not completely negate, the feasibility of development of the property.

The Los Azules property is located in a remote location that is accessed by 75 miles (120 kilometers) of unimproved dirt road with eight river crossings and two mountain passes both above 13,451 feet (4,100 meters). Even assuming that technical difficulties associated with this remote location can be overcome, the capital costs may make the project uneconomical. According to a new NI 43-101 Preliminary Economic Assessment ("PEA") filed on November 7, 2013 with an effective date of August 1, 2013, capital costs were estimated to be $3.9 billion initially and $5.5 billion over the life of the mine with an accuracy target of plus or minus 35%. In order for the Los Azules property to be economically feasible for development, the price of copper would have to remain high enough to justify the high capital costs estimated for the project. There can be no assurance that these capital cost estimates are accurate; given the inflationary pressure in the mining industry and in Argentina in particular. If the long term price of copper were to decrease significantly below the current price or capital cost estimates increase significantly, the Los Azules property may not be feasible for development, and we may have to write-off the carrying value of the asset. Furthermore, the project's economic feasibility has not yet been demonstrated through a full feasibility study. The PEA is preliminary in nature, includes NI 43-101 mineral resources that are considered too speculative geologically to have economic considerations applied to them that would allow them to be categorized as mineral reserves either under Guide 7 or NI 43-101, and there is no certainty that the PEA will be realized. Finally, we may not be able to raise sufficient capital to develop the property; we may not receive the required permits or environmental approvals; we may not be able to construct the necessary power and infrastructure assets; and, we may not be able to attract qualified workers to build such a project, any of which could result in the delay or indefinite postponement of development at the property. Such a result would have a material adverse effect on our Company.

We may acquire additional exploration stage properties and we may face negative reactions if reserves are not located on acquired properties.

We have in the past and may in the future acquire additional exploration stage properties. There can be no assurance that we have or will be able to complete the acquisition of such properties at reasonable prices or on favorable terms and that reserves will be identified on any properties that we acquire. We may also experience negative reactions from the financial markets if we are unable to successfully complete acquisitions of additional properties or if reserves are not located on acquired properties. These factors may adversely affect the trading price of our common stock or our financial condition or results of operations.

18

The nature of mineral exploration and production activities involves a high degree of risk and the possibility of uninsured losses that could materially and adversely affect our operations.

Exploration for and production of minerals is highly speculative and involves greater risk than many other businesses. Many exploration programs do not result in the discovery of mineralization, and any mineralization discovered may not be of sufficient quantity or quality to be profitably mined. Few properties that are explored are ultimately advanced to production. Our current exploration efforts are, and future development and mining operations we conduct will be, subject to all of the operating hazards and risks normally incident to exploring for and developing mineral properties, such as, but not limited to:

- •

- economically insufficient mineralized material;

- •

- fluctuations in production costs that may make mining uneconomical;

- •

- availability of labor, contractors, engineers, power, transportation and infrastructure;

- •

- labor disputes;

- •

- potential delays related to social, public health, and community issues;

- •

- unanticipated variations in grade and other geologic problems;

- •

- environmental hazards;

- •

- water conditions;

- •

- difficult surface or underground conditions;

- •

- industrial accidents;

- •

- metallurgical and other processing problems;

- •

- mechanical and equipment performance problems;

- •

- failure of pit walls or dams;

- •

- unusual or unexpected rock formations;

- •

- personal injury, fire, flooding, cave-ins and landslides; and

- •

- decrease in reserves or mineralized material due to a lower silver, gold or copper price.

Any of these risks can materially and adversely affect, among other things, the development of properties, production quantities and rates, costs and expenditures, potential revenues and production dates. We currently have no insurance to guard against any of these risks, except in very limited circumstances. If we determine that capitalized costs associated with any of our mineral interests are not likely to be recovered, we would incur a write-down of our investment in these interests. All of these factors may result in losses in relation to amounts spent which are not recoverable.

We do not insure against all risks to which we may be subject in our operations.

While we currently maintain insurance to insure against general commercial liability claims and physical assets at our properties in Argentina, Mexico, and the United States, we do not maintain insurance to cover all of the potential risks associated with our operations. Our other exploration projects have no existing infrastructure for which we insure. We may also be unable to obtain insurance to cover other risks at economically feasible premiums or at all. Insurance coverage may not continue to be available, or may not be adequate to cover liabilities. We might also become subject to liability for environmental, pollution or other hazards associated with mineral exploration and production which may not be insured against, which may exceed the limits of our insurance coverage or which we may

19

elect not to insure against because of premium costs or other reasons. Losses from these events may cause us to incur significant costs that could materially adversely affect our financial condition and our ability to fund activities on our property. A significant loss could force us to reduce or terminate our operations.

Shortages of critical parts and equipment may adversely affect our operations and development projects.

The mining industry has been impacted, from time to time, by increased demand for critical resources such as input commodities, drilling equipment, trucks, shovels and tires. These shortages have, at times, impacted the efficiency of our operations, and resulted in cost increases and delays in construction of projects; thereby impacting operating costs, capital expenditures and production and construction schedules.

Our operations are subject to permitting requirements which could require us to delay, suspend or terminate our operations on our mining properties.

Our mining operations, including ongoing exploration drilling programs, require permits from the state and federal governments, including permits for the use of water and for drilling wells for water. We may be unable to obtain these permits in a timely manner, on reasonable terms or on terms that provide us sufficient resources to develop our properties, or at all. Even if we are able to obtain such permits, the time required by the permitting process can be significant. If we cannot obtain or maintain the necessary permits, or if there is a delay in receiving these permits, our timetable and business plan for exploration of our properties will be adversely affected, which may in turn adversely affect our results of operations, financial condition, cash flows and market price of our securities.

Title to mineral properties can be uncertain, and we are at risk of loss of ownership of one or more of our properties.

Our ability to explore and operate our properties depends on the validity of our title to that property. Our U.S. mineral properties include leases of unpatented mining claims, as well as unpatented mining and millsite claims which we control directly. Unpatented mining claims provide only possessory title and their validity is often subject to contest by third parties or the federal government, which makes the validity of unpatented mining claims uncertain and generally more risky. Our Mexico concessions are granted by the Mexican government for a period of up to 50 years from the date of their recording in the Public Registry of Mining and are renewable for a further period of up to 50 years upon application within five years of expiration of such concession in accordance with the Mining Law and its Regulations. Failure to do so prior to expiration of the term of the exploration concession will result in termination of the concession. Under Argentine Law, concessions are granted by provincial governments for unlimited periods of time, subject to a mining fee and the filing of a minimum investment plan and compliance with a one-off minimum investment in the concession equal to 300 times the relevant mining fee over a five year period. Failure to comply with these conditions may result in the termination of the concession. Uncertainties inherent in mineral properties relate to such things as the sufficiency of mineral discovery, proper posting and marking of boundaries, assessment work and possible conflicts with other claims not determinable from public record. We have not obtained title opinions covering our entire property, with the attendant risk that title to some claims, particularly title to undeveloped property, may be defective. There may be valid challenges to the title to our property which, if successful, could impair development and/or operations.

We remain at risk in that the mining claims may be forfeited either due to failure to comply with statutory requirements as to location and maintenance of the claims or challenges to whether a discovery of a valuable mineral exists on every claim.

20

We cannot ensure that we will have an adequate supply of water to complete desired exploration or development of our mining properties.

Our mining operations require significant quantities of water for mining, ore processing and related support facilities. Our operations in Argentina, Mexico and the United States are in areas where water is scarce and competition among users for continuing access to water is significant. Continuous production at our mines is dependent on our ability to maintain our water rights and claims and to defeat claims adverse to our current water uses in legal proceedings. Although each of our operations currently has sufficient water rights and claims to cover its operational demands, we cannot predict the potential outcome of pending or future legal proceedings relating to our water rights, claims and uses. Water shortages may also result from weather or environmental and climate impacts out of the Company's control.

Our continuing reclamation obligations at the Tonkin Complex, El Gallo Complex and our other properties could require significant additional expenditures.