UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [X] | Preliminary Proxy Statement |

| [ ] | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [ ] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to §240.14a-12 |

ECHELON CORPORATION

|

|

(Name of Registrant as Specified In Its Charter)

|

|

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

|

|

| (2) | Aggregate number of securities to which transaction applies: |

|

|

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it is determined) |

|

|

| (4) | Proposed maximum aggregate value of transaction: |

|

|

| (5) | Total fee paid: |

|

|

| [ ] | Fee paid previously with preliminary proxy materials. |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount previously paid: |

|

|

| (2) | Form, Schedule or Registration Statement no.: |

|

|

| (3) | Filing Party: |

|

|

| (4) | Date Filed: |

PRELIMINARY PROXY STATEMENT—SUBJECT TO COMPLETION

[Company Logo]

[•], 2015

Dear Stockholder:

You are cordially invited to attend a special meeting of the stockholders of Echelon Corporation (“Echelon”), which will be held at Echelon’s offices located at 550 Meridian Avenue, San Jose, California 95126 on November 17, 2015, at 10:00 a.m. Pacific Time.

The purpose of the meeting is to approve an amendment to Echelon’s amended and restated certificate of incorporation to effect (i) a reverse stock split of all of the outstanding shares of our common stock and those shares held by Echelon in treasury stock, at a ratio of 1-for-10, and (ii) a corresponding reduction in the total number of authorized shares of our common stock from 100,000,000 to 10,000,000. Upon obtaining the requisite approval of our stockholders, the Board of Directors will have the discretion to cause the amendment to the amended and restated certificate of incorporation to be filed with the Secretary of State of the State of Delaware to effect the reverse stock split.

As you know, our common stock is currently listed on The Nasdaq Global Market (“Nasdaq”). In order to remain listed on Nasdaq, our common stock must meet certain listing standards, including a minimum closing bid price of at least $1.00 per share. Through the date of this letter, our common stock has not satisfied the minimum closing bid requirement since May 12, 2015. As a result, on June 25, 2015, we received a notice of deficiency from Nasdaq indicating that if we do not comply with the minimum bid price rules by December 22, 2015, Nasdaq may delist our stock. The Board of Directors has determined that, absent an increase in the price of our common stock, our common stock likely will be delisted from Nasdaq.

The Board of Directors, with input from senior management, regularly reviews and evaluates Echelon’s business and prospects, including the performance of our common stock, with the goal of maximizing stockholder value. On August 6, 2015, we announced that the Board of Directors has authorized its strategic committee of independent directors to identify, evaluate and pursue the feasibility and relative merits of various financial strategies. The Company has not set a definitive timetable for completing this strategic review process and the Board of Directors has determined that the Company should simultaneously proceed with the actions necessary to continue Echelon as a standalone entity. In so doing, the Board of Directors has determined that the proposed reverse stock split is necessary for execution of Echelon’s standalone business plan, including the continued listing of our common stock on Nasdaq, and to enhance the desirability and marketability of our common stock to the financial community and investing public.

We believe that the delisting of our common stock would adversely affect Echelon and its stockholders. Among other things, we believe delisting may negatively impact the liquidity, marketability and trading price of our common stock. The Board of Directors has determined that a reverse stock split would help regain compliance with Nasdaq’s minimum bid price requirement and potentially provide a number of benefits to Echelon and its existing stockholders, including, but not limited to, increasing interest by brokers and institutional investors and decreasing transaction costs. For these reasons and as described in greater detail in the enclosed proxy statement, the Board of Directors is seeking your approval of the reverse stock split and reduction in the total number of authorized shares of our common stock. You should carefully review the information contained in the proxy statement before making a decision whether to grant proxies to vote your shares in favor of the proposals set forth in the proxy statement.

On behalf of the Board of Directors of Echelon, I would like to express our appreciation for your continued interest in Echelon.

| Sincerely, | ||

| Ronald A. Sege | ||

| President and Chief Executive Officer | ||

| Echelon Corporation | ||

Enclosure

PRELIMINARY PROXY STATEMENT—SUBJECT TO COMPLETION

[Company Logo]

[•], 2015

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON NOVEMBER 17, 2015

TO THE STOCKHOLDERS OF ECHELON CORPORATION:

NOTICE IS HEREBY GIVEN that a Special Meeting of Stockholders (the “Special Meeting”) of Echelon Corporation, a Delaware corporation (“Echelon” or the “Company”), will be held on November 17, 2015, at 10:00 a.m. Pacific Time, at our principal executive offices, located at 550 Meridian Avenue in San Jose, California 95126, for the following purposes, as more fully described in the proxy statement accompanying this notice:

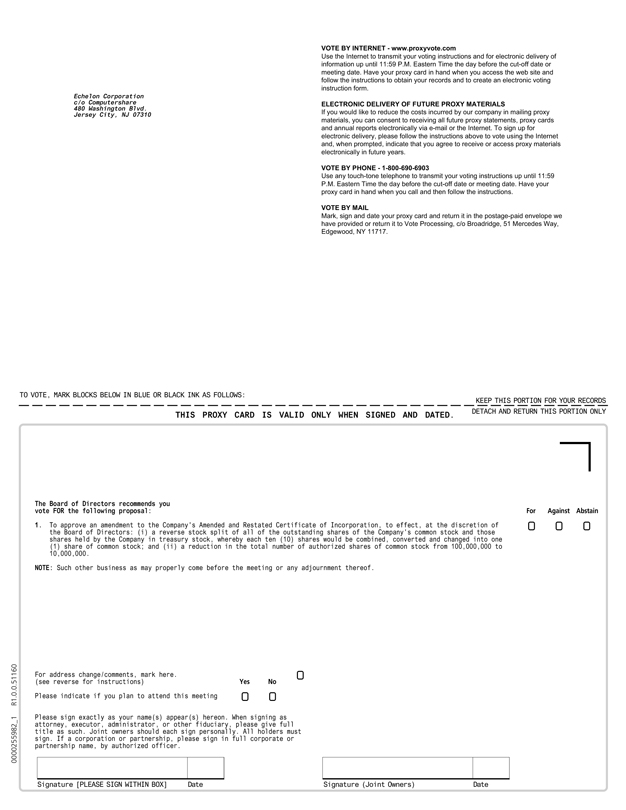

| 1. | To approve an amendment to the Company’s Amended and Restated Certificate of Incorporation, to effect, at the discretion of the Board of Directors: |

| (i) | a reverse stock split of all of the outstanding shares of the Company’s common stock and those shares held by the Company in treasury stock, whereby each ten (10) shares would be combined, converted and changed into one (1) share of common stock, and |

| (ii) | a reduction in the total number of authorized shares of common stock from 100,000,000 to 10,000,000, |

with the effectiveness or abandonment of such amendment to be determined by the Board of Directors as permitted under Section 242(c) of the Delaware General Corporation Law; and

| 2. | To transact such other business as may properly come before the meeting or any adjournment or adjournments thereof. |

The items of business are more fully described in the proxy statement accompanying this Notice of Special Meeting.

Only stockholders of record at the close of business on September 24, 2015 are entitled to vote at the Special Meeting. A list of stockholders entitled to vote at the Special Meeting will be available for inspection at our principal executive offices.

All stockholders are cordially invited to attend the meeting in person. Whether or not you plan to attend, please sign and return the proxy in the envelope enclosed for your convenience, or vote your shares by telephone or by the Internet as promptly as possible. Telephone and Internet voting instructions can be found on the attached proxy. Should you receive more than one proxy because your shares are registered in different names and addresses, each proxy should be signed and returned to assure that all your shares will be voted. You may revoke your proxy at any time prior to the Special Meeting. If you attend the Special Meeting and vote, your proxy will be revoked automatically and only your vote at the Special Meeting will be counted.

| Sincerely, |

| Alicia J. Moore Senior Vice President, General Counsel and Secretary, Chief Administrative Officer |

| San Jose, California |

| [•], 2015 |

YOUR VOTE IS VERY IMPORTANT, REGARDLESS OF THE NUMBER OF SHARES YOU OWN. PLEASE READ THE ATTACHED PROXY STATEMENT CAREFULLY, AND VOTE YOUR SHARES BY TELEPHONE, BY THE INTERNET OR BY COMPLETING, SIGNING AND DATING THE ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE AND RETURNING IT IN THE ENCLOSED ENVELOPE.

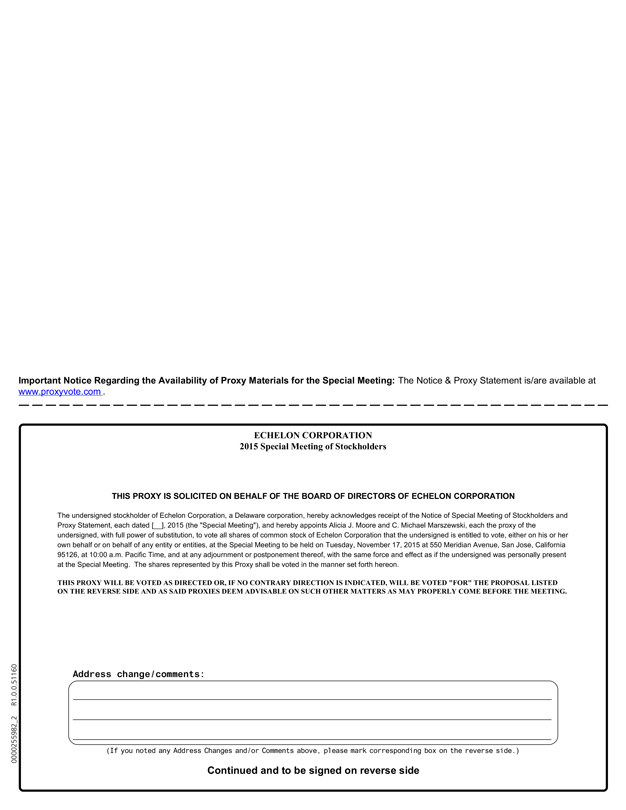

ECHELON CORPORATION

550 Meridian Avenue

San Jose, CA 95126

PROXY STATEMENT

FOR THE SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON NOVEMBER 17, 2015

The Board of Directors of Echelon Corporation is soliciting proxies for the 2015 Special Meeting of Stockholders. This proxy statement contains important information for you to consider when deciding how to vote on the matters brought before the meeting. Please read it carefully.

Our Board of Directors has set September 24, 2015 as the record date for the meeting. Stockholders who owned our common stock at the close of business on September 24, 2015 are entitled to vote at and attend the meeting, with each share entitled to one vote. On the record date, there were [•] shares of our common stock outstanding and [•] shares held by the Company in treasury stock. On the record date, the closing sale price of our common stock on The Nasdaq Global Market was $[•] per share.

General

The enclosed proxy is solicited on behalf of the Board of Directors of Echelon Corporation, a Delaware corporation (“Echelon” or the “Company”), for use at the Special Meeting of Stockholders to be held on Tuesday, November 17, 2015 (the “Special Meeting”). The Special Meeting will be held at 10:00 a.m. Pacific Time at our principal executive offices, located at 550 Meridian Avenue, San Jose, California 95126. These proxy solicitation materials are first being sent or made available on or about [•], 2015, to all stockholders entitled to vote at our Special Meeting.

Voting

The specific proposals to be considered and acted upon at our Special Meeting are to approve an amendment to the Company’s Amended and Restated Certificate of Incorporation (the “Amended and Restated Certificate”) to effect, at the discretion of the Board of Directors, (i) a reverse stock split of all of the outstanding shares of the Company’s common stock and those shares held by the Company in treasury stock, whereby each ten (10) shares would be combined, converted and changed into one (1) share of common stock, and (ii) a reduction in the total number of authorized shares of common stock from 100,000,000 to 10,000,000, with the effectiveness or abandonment of such amendment to be determined by the Board of Directors as permitted under Section 242(c) of the Delaware General Corporation Law. On September 24, 2015, the record date for determination of stockholders entitled to notice of, and to vote at, the Special Meeting (the “Record Date”), there were [•] shares of our common stock outstanding, [•] shares held by the Company in treasury stock, and no shares of our preferred stock outstanding.

Each stockholder is entitled to one (1) vote for each share of common stock held by such stockholder on the Record Date. The presence, in person or by proxy, of holders of a majority of our shares entitled to vote is necessary to constitute a quorum at the Special Meeting. The affirmative vote of a majority of the shares outstanding and entitled to vote as of the Record Date is required to approve amendments to the Amended and Restated Certificate to effect the reverse stock split and reduce the number of authorized shares of common stock. As a result, abstentions, broker non-votes and the failure to submit a proxy or vote in person at the Special Meeting will have the same effect as a vote against the proposal.

All votes will be tabulated by the inspector of election appointed for the Special Meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes. Abstentions and broker non-votes are counted for purposes of determining the presence or absence of a quorum for the transaction of business.

Notice of Internet Availability of Proxy Materials

Pursuant to rules adopted by the Securities and Exchange Commission, or the SEC, we have chosen to provide access to our proxy materials over the Internet. We are sending a Notice of Internet Availability of Proxy Materials (the “Notice”) to our stockholders of record and our beneficial owners. All stockholders will have the option to access the proxy materials on a website referred to in the Notice, or to request a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy of the proxy materials are included in the Notice. You may also request to receive proxy materials in printed form by mail or electronically by e-mail on an ongoing basis.

Proxies

If the form of proxy card is properly signed and returned or if you properly follow the instructions for telephone or Internet voting, the shares represented thereby will be voted at the Special Meeting in accordance with the instructions specified thereon. If you sign and return your proxy without specifying how the shares represented thereby are to be voted, the proxy will be voted as recommended by the Board of Directors. You may revoke or change your proxy at any time before the Special Meeting by filing with our Corporate Secretary at our principal executive offices at 550 Meridian Avenue, San Jose, CA 95126, a notice of revocation or another signed proxy with a later date. You may also revoke your proxy by attending the Special Meeting and voting in person.

Costs of Proxy Solicitation

We will pay the costs and expenses of soliciting proxies from stockholders. We have engaged The Proxy Advisory Group, LLC® to assist in the solicitation of proxies and provide related advice and informational support, for a services fee and the reimbursement of customary disbursements that are not expected to exceed $15,000 in the aggregate. Certain of our directors, officers, employees, and representatives may solicit proxies from the Company’s stockholders in person or by telephone, email, or other means of communication. Our directors, officers, employees, and representatives will not be additionally compensated for any such solicitation, but may be reimbursed for reasonable out-of-pocket expenses they incur. Arrangements will be made with brokerage houses, custodians, and other nominees for forwarding of proxy materials to beneficial owners of shares of our common stock held of record by such nominees and for reimbursement of reasonable expenses they incur.

Deadline for Receipt of Stockholder Proposals for 2016 Annual Meeting

Requirements for stockholder proposals to be considered for inclusion in the Company’s proxy materials.

Pursuant to Rule 14a-8 of the Securities Exchange Act of 1934, as amended, proposals of our stockholders that are intended to be presented by such stockholders at our 2016 annual meeting and that such stockholders desire to have included in our proxy materials relating to such meeting must be received by us at our offices at 550 Meridian Avenue in San Jose, California 95126, Attn: Corporate Secretary, no later than December 10, 2015, which is 120 calendar days prior to the anniversary of the mail date of the proxy statement relating to our 2015 annual meeting. Such proposals must be in compliance with applicable laws and regulations in order to be considered for possible inclusion in the proxy statement and form of proxy for that meeting.

2

Requirements for stockholder proposals to be brought before an annual meeting.

The Company’s bylaws establish an advance notice procedure with regard to specified matters to be brought before an annual meeting of stockholders. In general, written notice must be received by the Secretary of the Company not less than twenty (20) days nor more than sixty (60) days prior to an annual meeting and must contain specified information concerning the matters to be brought before such meeting and concerning the stockholder proposing such matters. Therefore, to be presented at the Company’s 2016 annual meeting, such a proposal must be received by the Company no earlier than sixty (60) days nor later than twenty (20) days prior to the 2016 annual meeting of stockholders. If less than thirty (30) days’ notice or prior public disclosure of the date of the annual meeting is given or made to stockholders, notice by the stockholder, in order to be timely, must be so received not later than the close of business on the tenth (10th) day following the day on which such notice of the date of the annual meeting was mailed or such public disclosure was made. Our Amended and Restated Bylaws also specify requirements as to the form and content of a stockholder’s notice.

The chairman of the annual meeting may refuse to acknowledge the introduction of any stockholder proposal if it is not made in compliance with the applicable notice provisions.

3

QUESTIONS AND ANSWERS

Although we encourage you to read the enclosed proxy statement in its entirety, we include this Question and Answer section to provide some background information and brief answers to several questions you might have about the Special Meeting.

Q: When and where is the Special Meeting of Stockholders?

A: The Special Meeting of Stockholders is being held on November 17, 2015 at 10:00 a.m., Pacific Time, at our headquarters, located at 550 Meridian Avenue, San Jose, California 95126.

Q: Why am I receiving this proxy statement?

A: This proxy statement describes the proposal on which we would like you, as a stockholder, to vote. It also gives you information on this issue so that you can make an informed decision.

Q: What is the Notice of Internet Availability?

A: In accordance with rules and regulations adopted by the SEC, instead of mailing a printed copy of our proxy materials to all stockholders entitled to vote at the Special Meeting, we are furnishing the proxy materials to our stockholders over the Internet. If you received a Notice by mail, you will not receive a printed copy of the proxy materials. Instead, the Notice will instruct you as to how you may access and review the proxy materials and submit your vote via the Internet. If you received a Notice by mail and would like to receive a printed copy of the proxy materials, please follow the instructions included in the Notice for requesting such materials.

We mailed the Notice on or about [•], 2015, to all stockholders entitled to vote at the Special Meeting. On the date of mailing of the Notice, all stockholders and beneficial owners will have the ability to access all of our proxy materials on a website referred to in the Notice. These proxy materials will be available free of charge.

Q: What proposal am I being asked to consider at the upcoming Special Meeting of Stockholders?

A. We are seeking approval of one proposal: the approval of an amendment to our Amended and Restated Certificate of Incorporation to effect (i) a reverse stock split of all of the outstanding shares of our common stock and those shares held by us in treasury stock, whereby each ten (10) shares would be combined, converted and changed into one (1) share of common stock, and (ii) a reduction in the total number of authorized shares of common stock from 100,000,000 to 10,000,000, with the effectiveness or abandonment of such amendment to be determined by the Board of Directors as permitted under Section 242(c) of the Delaware General Corporation Law. Approval of the proposal would give the Board of Directors discretionary authority to implement the reverse stock split.

We will also transact any other business that properly comes before the meeting.

Q. If the stockholders approve this proposal, when would the Company implement the reverse stock split?

A. We currently expect that the reverse stock split will be implemented as soon as practicable after the receipt of the requisite stockholder approval. However, our Board of Directors will have the discretion to abandon the reverse stock split if it does not believe it to be in the best interests of Echelon and our stockholders.

Q. Why is Echelon seeking to implement a reverse stock split?

A. The reverse stock split is being proposed to increase the market price of our common stock to satisfy the $1.00 minimum closing bid price required to avoid the delisting of our common stock from The Nasdaq Global Market. In addition, a higher stock price may, among other things, increase the attractiveness of our common stock to the investment community.

4

Q. What are the consequences of being delisted from The Nasdaq Global Market?

A. If we do not effect the reverse stock split, it is likely that we will not be able to meet the $1.00 minimum closing bid price continued listing requirement of The Nasdaq Global Market and, consequently, our common stock would be delisted from The Nasdaq Global Market. If we are delisted from The Nasdaq Global Market, we may be forced to seek to be traded on the OTC Bulletin Board or the “pink sheets,” which would require our market makers to request that our common stock be so listed. There are a number of negative consequences that could result from our delisting from The Nasdaq Global Market, including, but not limited to, the following:

| ● | The liquidity and market price of our common stock may be negatively impacted and the spread between the “bid” and “asked” prices quoted by market makers may be increased. | |||

| ● | Our access to capital may be reduced, causing us to have less flexibility in responding to our capital requirements. | |||

| ● | Our institutional investors may be less interested or prohibited from investing in our common stock, which may cause the market price of our common stock to decline. | |||

| ● | We will no longer be deemed a “covered security” under Section 18 of the Securities Act of 1933, as amended, and, as a result, we will lose our exemption from state securities regulations. This means that granting stock options and other equity incentives to our employees will be more difficult. | |||

| ● | If our stock is traded as a “penny stock,” transactions in our stock would be more difficult and cumbersome. | |||

Q. What would be the principal effects of the reverse stock split?

A. The reverse stock split will have the following effects:

| ● | the market price of our common stock immediately upon effect of the reverse stock split will increase substantially over the market price of our common stock immediately prior to the reverse stock split; | |||

| ● | the number of outstanding shares of common stock will be reduced to one-tenth (1/10) of the number of shares currently outstanding (except for the effect of eliminating fractional shares); | |||

| ● | the number of shares held by us in treasury stock will be reduced to one-tenth (1/10) of the number of shares currently held in treasury stock; and | |||

| ● | the number of authorized shares of our common stock will be reduced to one-tenth (1/10) of the number of shares currently authorized from 100,000,000 to 10,000,000 shares. | |||

Q. Are my pre-split stock certificates still good after the reverse stock split? Do I need to exchange them for new stock certificates?

A. As of the effective date of the amendment to our Amended and Restated Certificate of Incorporation, each certificate representing pre-split shares of common stock will, until surrendered and exchanged, be deemed to represent only the relevant number of post-split shares of common stock and the right to receive the amount of cash for any fractional shares as a result and at the time of the reverse stock split. As soon as practicable after the effective date of the reverse stock split, our transfer agent, Computershare, will mail you a letter of transmittal. Upon receipt of your properly completed and executed letter of transmittal and your stock certificate(s), you will be issued the appropriate number of shares of the Company’s common stock either as stock certificates (including legends, if appropriate) or electronically in book-entry form, as determined by the Company.

5

Q. What if I hold some or all of my shares electronically in book-entry form? Do I need to take any action to receive post-split shares?

A. If you hold shares of our common stock in book-entry form (that is, you do not have stock certificates evidencing your ownership of our common stock but instead received a statement reflecting the number of shares registered in your account), you do not need to take any action to receive your post-split shares or, if applicable, your cash payment in lieu of any fractional share interest. If you are entitled to post-split shares, a transaction statement will be sent automatically to your address of record indicating the number of shares you hold. However, if you hold any shares in certificated form, you must still surrender and exchange your stock certificates for those shares and provide a properly completed and executed letter of transmittal.

Q. What happens to any fractional shares resulting from the reverse stock split?

A. If you would be entitled to receive fractional shares as a result of the reverse stock split because you hold a number of shares of common stock before the reverse stock split that is not evenly divisible (in other words, it would result in a fractional interest following the reverse split), you will be entitled, upon surrender of certificate(s) representing your shares, to a cash payment in lieu of the fractional shares without interest.

Q. What happens to equity awards under the Company’s 1997 Stock Plan as a result of the reverse stock split?

A. All shares of the Company’s common stock subject to the outstanding equity awards (including stock options, performance shares and stock appreciation rights) under the Company’s 1997 Stock Plan will be converted upon the effective date of the reverse stock split into one-tenth (1/10) of the number of such shares immediately preceding the reverse stock split (subject to adjustment for fractional interests). In addition, the exercise price of outstanding equity awards (including stock options and stock appreciation rights) will be adjusted to ten (10) times the exercise price specified before the reverse stock split. As a result, the approximate aggregate exercise price will remain the same following the reverse stock split. No fractional shares will be issued pursuant to the Company’s 1997 Stock Plan following the reverse stock split. Therefore, if the number of shares subject to the outstanding equity awards immediately before the reverse stock split is not evenly divisible (in other words, it would result in a fractional interest following the reverse stock split), the number of shares of common stock issuable pursuant to such equity awards (including upon exercise of stock options and stock appreciation rights) will be rounded up to the nearest whole number.

Q. Who can vote at the Special Meeting?

A. Our Board of Directors has set September 24, 2015 as the record date for the Special Meeting. All stockholders who owned Echelon common stock at the close of business on September 24, 2015 may attend and vote at the Special Meeting. Each stockholder is entitled to one vote for each share of common stock held as of the record date on all matters to be voted on. Stockholders do not have the right to cumulate votes. On September 24, 2015, there were [•] shares of our common stock outstanding. Shares held as of the record date include shares that are held directly in your name as the stockholder of record and those shares held for you as a beneficial owner through a broker, bank or other nominee.

Q. What is the difference between holding shares as a stockholder of record and as a beneficial owner?

A: Most stockholders of Echelon hold their shares through a broker, bank or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Stockholders of record — If your shares are registered directly in your name with Echelon’s transfer agent, Computershare, you are considered the stockholder of record with respect to those shares and the Notice has been sent directly to you. As the stockholder of record, you have the right to grant your voting proxy directly to Echelon or to vote in person at the Special Meeting.

6

Beneficial owners — If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in “street name,” and the Notice has been forwarded to you by your broker, bank or other nominee who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker, bank or other nominee on how to vote and are also invited to attend the Special Meeting. However, since you are not the stockholder of record, you may not vote these shares in person at the Special Meeting unless you request a “legal proxy” from the broker, bank or other nominee who holds your shares, giving you the right to vote the shares at the Special Meeting.

Q: Who counts the votes?

A: Voting results are tabulated and certified by Broadridge Financial Solutions, Inc.

Q. How can I vote my shares in person at the Special Meeting?

A. Shares held directly in your name as the stockholder of record may be voted in person at the Special Meeting. If you choose to vote in person, please bring your proxy card or proof of identification to the Special Meeting. Even if you plan to attend the Special Meeting, Echelon recommends that you vote your shares in advance as described below so that your vote will be counted if you later decide not to attend the Special Meeting. If you hold your shares in street name, you must request a legal proxy from your broker, bank or other nominee in order to vote in person at the Special Meeting.

Q: How can I vote my shares without attending the Special Meeting?

A: Whether you hold shares directly as the stockholder of record or beneficially in street name, you may direct how your shares are voted without attending the Special Meeting. If you are a stockholder of record, you may vote by submitting a proxy; please refer to the voting instructions in the Notice or below. If you hold shares beneficially in street name, you may vote by submitting voting instructions to your broker, bank or other nominee; please refer to the voting instructions provided to you by your broker, bank or other nominee.

| ● | Internet — Stockholders of record with Internet access may submit proxies by following the “Vote by Internet” instructions on the Notice until 11:59 p.m., Eastern Time, on November 16, 2015, or by following the instructions at www.proxyvote.com. Most of our stockholders who hold shares beneficially in street name may vote by accessing the website specified in the voting instructions provided by their brokers, banks or other nominees. A large number of banks and brokerage firms are participating in Broadridge Financial Solutions, Inc.’s online program. This program provides eligible stockholders the opportunity to vote over the Internet or by telephone. Voting forms will provide instructions for stockholders whose bank or brokerage firm is participating in Broadridge’s program. | |||

| ● | Telephone — If you request a printed set of the proxy materials, you will be eligible to submit your vote by telephone. | |||

| ● | Mail — If you request a printed set of the proxy materials, you may indicate your vote by completing, signing and dating the proxy card or voting instruction form where indicated and by returning it in the prepaid envelope that will be provided. | |||

Q. What happens if I do not cast a vote?

A. Stockholders of record — If you are a stockholder of record and you do not cast your vote, no votes will be cast on your behalf on any of the items of business at the Special Meeting. However, if you submit a signed proxy card with no further instructions, the shares represented by that proxy card will be voted as recommended by our Board of Directors.

Beneficial owners — If you hold your shares in street name and you do not cast your vote, your bank, broker or other nominee will have discretion to vote any uninstructed shares on the reverse stock split (Proposal One). We believe that Proposal One is considered a routine matter and, thus, we do not expect to receive any broker non-votes on this proposal.

7

Q. How can I change or revoke my vote?

A. Subject to any rules your broker, bank or other nominee may have, you may change your proxy instructions at any time before your proxy is voted at the Special Meeting.

Stockholders of record — If you are a stockholder of record, you may change your vote by (1) filing with our Senior Vice President, General Counsel and Secretary, prior to your shares being voted at the Special Meeting, a written notice of revocation or a duly executed proxy card, in either case dated later than the prior proxy relating to the same shares, or (2) attending the Special Meeting and voting in person (although attendance at the Special Meeting will not, by itself, revoke a proxy). Any written notice of revocation or subsequent proxy card must be received by our Senior Vice President, General Counsel and Secretary prior to the taking of the vote at the Special Meeting. Such written notice of revocation or subsequent proxy card should be hand delivered to our Senior Vice President, General Counsel and Secretary or should be sent so as to be delivered to our principal executive offices, Attention: General Counsel.

Beneficial owners — If you are a beneficial owner of shares held in street name, you may change your vote by (1) submitting new voting instructions to your broker, bank or other nominee, or (2) attending the Special Meeting and voting in person if you have obtained a legal proxy giving you the right to vote the shares from the broker, bank or other nominee who holds your shares.

In addition, a stockholder of record or a beneficial owner who has voted via the Internet or by telephone may also change his, her or its vote by making a timely and valid later Internet or telephone vote no later than 11:59 p.m., Eastern Time, on November 16, 2015.

Q: What is a proxy card?

A: The proxy card enables you to appoint Alicia J. Moore and C. Michael Marszewski, with full power of substitution, who we refer to as the proxyholders, as your representatives at the Special Meeting. By completing and returning the proxy card, you are authorizing the proxyholders to vote your shares at the meeting, as you have instructed them on the proxy card. Even if you plan to attend the meeting, it is a good idea to complete, sign and return your proxy card or vote by proxy via the Internet or telephone in advance of the meeting just in case your plans change. You can vote in person at the meeting even if you have already sent in your proxy card.

If a proposal comes up for vote at the meeting that is not on the proxy card, the proxyholders will vote your shares, under your proxy, according to their best judgment.

Q. What if I return my proxy card but do not provide voting instructions?

A. Proxies that are signed and returned but do not contain instructions will be voted “FOR” the proposal in this proxy statement.

Q. If I hold shares through a broker, how do I vote them?

A. Your broker should have forwarded instructions to you regarding the manner in which you can direct your broker as to how you would like your shares to be voted. If you have not received these instructions or have questions about them, you should contact your broker directly.

Q. What does it mean if I receive more than one proxy card?

A. It means that you have multiple accounts with brokers and/or our transfer agent, Computershare. Please vote all of these shares. We recommend that you contact your broker and/or our transfer agent to consolidate as many accounts as possible under the same name and address.

Q: How may I obtain a separate Notice or a separate set of proxy materials?

A: If you share an address with another stockholder, each stockholder may not receive a separate Notice or a separate copy of the proxy materials. Stockholders who do not receive a separate Notice or a separate copy of the proxy materials may request to receive a separate Notice or a separate copy of the proxy materials by contacting our Investor Relations department (i) by mail at 550 Meridian Avenue, San Jose, California 95126, (ii) by calling us at 408-938-5252, or (iii) by sending an email to mlarsen@echelon.com. Alternatively, stockholders who share an address and receive multiple Notices or multiple copies of our proxy materials may request to receive a single copy by following the instructions above.

8

Q: What is a “broker non-vote”?

A: A broker non-vote occurs when a broker holding shares in street name does not vote on a particular proposal because the broker does not have discretionary voting power with respect to that proposal and has not received instructions from the beneficial owner. In order to effect the reverse stock split, Delaware law requires the approval of the holders of a majority of Echelon’s outstanding shares of common stock, and not merely the approval of a majority of the shares represented in person and by proxy at the Special Meeting. Therefore, a broker non-vote will count as a vote against the proposal.

Q. How can I attend the meeting?

A. The Special Meeting is open to all holders of Echelon common stock. The meeting will be held at Echelon’s headquarters located at 550 Meridian Avenue, San Jose, CA 95126, and directions may be found on our website at www.echelon.com.

Q. How many votes must be present to hold the meeting?

A. Your shares are counted as present at the meeting if you attend the meeting and vote in person or if you properly return a proxy by Internet, telephone or mail. In order for us to conduct the meeting, a majority of our outstanding shares of common stock as of September 24, 2015 must be present in person or by proxy at the meeting. This is referred to as a quorum.

Q. How are different votes treated for purposes of establishing a quorum and determining whether the proposal has passed?

A. Shares that are voted “FOR,” “AGAINST” or “ABSTAIN” are treated as being present at the meeting for purposes of establishing a quorum and are also treated as shares entitled to vote at the meeting with respect to the proposal. Abstentions will have the same effect as a vote against the proposal. Broker non-votes are counted for the purpose of determining the presence or absence of a quorum, and will have the same effect as a vote against the proposal.

Q. Why is my vote important?

A. Your vote is important because the proposal must receive the affirmative vote of a majority of shares outstanding in order to pass. Also, unless a majority of the shares outstanding as of the Record Date are voted or present at the meeting, we will not have a quorum, and we will be unable to transact any business at the Special Meeting. In that event, we would need to adjourn the meeting until such time as a quorum can be obtained.

Q: Who is soliciting my vote?

A: We will pay the costs and expenses of soliciting proxies from stockholders. Broadridge Financial Solutions, Inc. will tabulate the votes and act as inspector of the election. We have engaged The Proxy Advisory Group, LLC® to assist in the solicitation of proxies and provide related advice and informational support, for a services fee and the reimbursement of customary disbursements that are not expected to exceed $15,000 in the aggregate. Certain of our directors, officers, employees, and representatives may solicit proxies from the Company’s stockholders in person or by telephone, email, or other means of communication. Our directors, officers, employees, and representatives will not be additionally compensated for any such solicitation, but may be reimbursed for reasonable out-of-pocket expenses they incur. Arrangements will be made with brokerage houses, custodians, and other nominees for forwarding of proxy materials to beneficial owners of shares of our common stock held of record by such nominees and for reimbursement of reasonable expenses they incur.

9

PROPOSAL ONE

APPROVAL OF A PROPOSED AMENDMENT TO

THE AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

TO EFFECT A REVERSE STOCK SPLIT AND REDUCE THE

TOTAL NUMBER OF AUTHORIZED SHARES OF COMMON STOCK

OVERVIEW

The Board of Directors of Echelon Corporation (“Echelon” or the “Company”) has unanimously adopted resolutions approving and recommending to the stockholders for their approval a proposed amendment to the Company’s Amended and Restated Certificate of Incorporation (the “Amended and Restated Certificate”) that would, at the discretion of the Board of Directors, effect:

| ● | a reverse stock split of all of the outstanding shares of the Company’s common stock and those shares held by the Company in treasury stock, whereby each ten (10) shares would be combined, converted and changed into one share of the Company’s common stock, and |

| ● | a reduction in the total number of authorized shares of the Company’s common stock from 100,000,000 to 10,000,000. |

Under the proposed amendment, each ten (10) shares of the Company’s common stock currently outstanding, reserved for issuance or held by the Company in treasury stock would be combined, converted and changed into one (1) share of common stock. At the same time, the total number of authorized shares of the Company’s common stock would be reduced from 100,000,000 to 10,000,000. The par value per share of the Company’s common stock would remain unchanged at $0.01 per share after the reverse stock split. Please see the table below under the section heading “Principal Effects of the Reverse Stock Split” for an illustration of the effects of the proposed amendment to the Company’s Amended and Restated Certificate (which is referred to in this proxy statement as the “reverse stock split”).

The text of the proposed form of Certificate of Amendment to the Amended and Restated Certificate to effect the reverse stock split and reduce the total number of authorized shares of common stock is attached to this proxy statement as Appendix A-1. However, such text is subject to amendment to include such changes as may be required by the office of the Secretary of State of the State of Delaware or as the Board of Directors deems necessary and advisable to effect the reverse stock split. The effectiveness or abandonment of such amendment will be determined by the Board of Directors.

The Board of Directors has recommended that the proposed amendment be presented to the Company’s stockholders for approval. Upon receiving stockholder approval of the proposed amendment, the Board of Directors will have the sole discretion, until the 2016 Annual Meeting, to elect, as it determines to be in the best interests of the Company and its stockholders, whether to effect the reverse stock split. As described in greater detail below, the reverse stock split is proposed to be effected to increase the price of the Company’s common stock to, among other things, meet the $1.00 minimum closing bid price requirement for continued listing on The Nasdaq Global Market. The reduction in the total number of shares of the Company’s authorized common stock is designed to maintain approximately the same proportion of the total number of authorized shares that are not issued or outstanding following the reverse stock split.

If the Board of Directors determines to effect the reverse stock split by causing the amendment to the Amended and Restated Certificate to be filed with the Secretary of State of the State of Delaware, the Amended and Restated Certificate would be amended accordingly. Approval of the reverse stock split will authorize the Board of Directors in its discretion to effectuate the reverse stock split and the reduction in authorized common stock as described above, or not to effect the reverse stock split. As noted, the Board of Directors will have the discretion to abandon the reverse stock split if it no longer believes it to be in the best interests of the Company and its stockholders, including if the Board of Directors determines that the reverse stock split will not impact the Company’s ability to meet the continued listing requirements of The Nasdaq Global Market or if such objective is no longer necessary or desirable, or for any other reason in the business judgment and discretion of the Board of Directors. The Company currently expects that the Board of Directors will cause the Company to effect the reverse stock split as soon as practicable after the receipt of the requisite stockholder approval.

If the Board of Directors elects to effect the reverse stock split following stockholder approval, the number of issued and outstanding shares of the Company’s common stock and those shares held by the Company in treasury stock would be

10

reduced in accordance with the reverse stock split ratio. Except for adjustments that may result from the treatment of fractional shares, each stockholder will hold the same percentage of the outstanding common stock immediately following the reverse stock split as such stockholder held immediately prior to the reverse stock split. As described in greater detail below, as a result of the reverse stock split, stockholders who hold less than ten (10) shares of the Company’s common stock will no longer be stockholders of the Company on a post-split basis.

The Board of Directors, with input from senior management, regularly reviews and evaluates the Company’s business, strategic plans and prospects, including the performance of the Company’s common stock, with the goal of maximizing stockholder value. On August 6, 2015, the Company announced that the Board of Directors has authorized its strategic committee of independent directors to identify, evaluate and pursue the feasibility and relative merits of various financial strategies. The strategic committee plans to consider a wide range of available options, including, among other things, partnerships, strategic business model alternatives, recapitalization, disposition of one or more corporate assets, or a possible business combination or sale of Echelon, in addition to continued pursuit of the Company as a standalone entity. The Company has engaged Goldman Sachs as the Company’s financial advisor in support of these activities.

The Company has not set a definitive timetable for completing the strategic review process, which is ongoing and could result in a variety of outcomes including a sale or a merger of the Company or a determination by the Board of Directors that Echelon remain an independent company. Therefore, the Board of Directors has determined that the Company should simultaneously proceed with the actions necessary to continue Echelon as a standalone entity. In so doing, the Board of Directors has determined that the proposed reverse stock split is necessary for execution of the Company’s standalone business plan, including the continued listing of Echelon’s common stock on The Nasdaq Global Market. In addition, the Board of Directors believes the reverse stock split will provide a number of other benefits to the Company and its stockholders, including enhancing the desirability and marketability of the Company’s common stock to the financial community and the investing public.

The Board of Directors does not intend for this transaction to be the first step in a series of plans or proposals of a “going private transaction” within the meaning of Rule 13e-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

REASONS FOR THE REVERSE STOCK SPLIT

Nasdaq Listing. The Company’s common stock is currently listed on The Nasdaq Global Market under the symbol “ELON.” Among other requirements, the listing maintenance standards established by The Nasdaq Stock Market LLC (“Nasdaq”) require the Company’s common stock to have a minimum closing bid price of at least $1.00 per share. Pursuant to the Nasdaq Marketplace Rules, if the closing bid price of the Company’s common stock is not equal to or greater than $1.00 for thirty (30) consecutive business days, Nasdaq will send a deficiency notice to the Company. Thereafter, if the Company’s common stock does not close at a minimum bid price of $1.00 or more for ten (10) consecutive trading days within 180 calendar days of the deficiency notice, Nasdaq may determine to delist the Company’s common stock.

Through the date of filing this proxy statement, the last date the closing bid price of the Company’s common stock satisfied the $1.00 minimum closing bid price requirement was May 12, 2015. As a result, on June 25, 2015, the Company received a notice of deficiency from Nasdaq indicating that if the Company does not comply with the minimum bid price rules by December 22, 2015, Nasdaq may delist the Company’s common stock. Consequently, the Board of Directors has determined that, absent approval by the Company’s stockholders of the reverse stock split, the Company will likely be unable to meet the $1.00 minimum closing bid price requirement for continued listing on The Nasdaq Global Market.

If the stockholders do not approve the reverse stock split proposal and the closing price of the Company’s common stock does not otherwise meet the $1.00 minimum closing bid price requirement, the Board of Directors expects that the Company’s common stock will be delisted from The Nasdaq Global Market. If, however, the Company’s common stock satisfies applicable listing criteria for listing on The Nasdaq Capital Market (other than compliance with the minimum closing bid price requirement), the Company’s common stock might be eligible for transfer to The Nasdaq Capital Market. Because the Nasdaq Marketplace Rules also require a $1.00 minimum closing bid price for continued listing on The Nasdaq Capital Market, in the event the Company’s common stock is transferred to The Nasdaq Capital Market, the Company will be afforded an additional 180 calendar days to comply with the minimum bid price requirement.

11

In the event the Company’s common stock is no longer eligible for continued listing on either The Nasdaq Global Market or The Nasdaq Capital Market, the Company would be forced to seek to be traded on the OTC Bulletin Board or in the “pink sheets.” These alternative markets are generally considered to be less efficient than, and not as broad as, The Nasdaq Global Market or The Nasdaq Capital Market, and therefore less desirable. Accordingly, the Board of Directors believes delisting of the Company’s common stock would likely have a negative impact on the liquidity and market price of the Company’s common stock and may increase the spread between the “bid” and “asked” prices quoted by market makers.

The Board of Directors has considered the potential harm to the Company of a delisting from The Nasdaq Global Market and believes that delisting could, among other things, adversely affect (i) the trading price of the Company’s common stock and (ii) the liquidity and marketability of shares of the Company’s common stock, reducing the ability of holders of the Company’s common stock to purchase or sell shares of the Company’s common stock as quickly and as inexpensively as they have done historically. Delisting could also adversely affect the Company’s relationships with vendors and customers who may perceive the Company’s business less favorably, which would have a detrimental effect on the Company’s relationships with these entities.

Furthermore, if the Company’s common stock was no longer listed on The Nasdaq Global Market, it may reduce the Company’s access to capital and cause the Company to have less flexibility in responding to the Company’s capital requirements. Certain institutional investors may also be less interested or prohibited from investing in the Company’s common stock, which may cause the market price of the Company’s common stock to decline.

In addition, the Company would no longer be deemed a “covered security” under Section 18 of the Securities Act of 1933, as amended, and therefore would lose its exemption from state securities regulations. As a result, the Company would need to comply with various state securities laws with respect to issuances of its securities, including equity award grants to employees. As a public company, Echelon, however, would not have the benefit of certain exemptions applicable to privately held entities, which would make granting equity awards to the Company’s employees more difficult.

Potential Increased Investor Interest. The Board of Directors believes that the reverse stock split will provide a number of benefits to the Company and its existing stockholders, which may lead to an increase in investor interest, including:

| 1. | Reduced Short-Term Risk of Illiquidity. The Board of Directors understands that a higher stock price may increase investor confidence by reducing the short-term risk of illiquidity and lack of marketability of the Company’s common stock that may result from the delisting of the Company’s common stock from The Nasdaq Global Market. |

| 2. | Decreasing Transaction Costs. Investors may also be dissuaded from purchasing stocks below certain prices because the brokerage commissions, as a percentage of the total transaction value, tend to be higher for such low-priced stocks. |

| 3. | Stock Price Requirements. The Board of Directors understands that some brokerage houses and institutional investors may have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers or by restricting or limiting the ability to purchase such stocks on margin. In addition, analysts at brokerage firms may not monitor the trading activity or otherwise provide coverage of lower priced stocks. |

Other Potential Benefits. The Board of Directors believes that a higher stock price would help Echelon attract and retain employees and other service providers. It is the view of the Board of Directors that some potential employees and service providers are less likely to work for a company with a low stock price, regardless of the size of the company’s market capitalization. Accordingly, if the reverse stock split successfully increases the per share price of the Company’s common stock, the Board of Directors believes this increase will enhance the Company’s ability to attract and retain employees and service providers.

12

REASONS FOR THE REDUCTION IN THE TOTAL NUMBER OF AUTHORIZED SHARES OF COMMON STOCK

As a matter of Delaware law, implementation of the reverse stock split does not require a change in the total number of shares of the Company’s common stock authorized under the Amended and Restated Certificate. However, the proposed reduction in the total number of authorized shares of the Company’s common stock is designed to maintain approximately the same proportion of the total number of authorized shares that are not issued or outstanding following the reverse stock split. The proposed reduction from 100,000,000 to 10,000,000 authorized shares of the Company’s common stock is intended to conform to the requirements of certain entities that make recommendations to stockholders regarding proposals submitted by the Company and to ensure that the Company does not have what some stockholders might view as an unreasonably high number of authorized but unissued shares of common stock. In addition, the Board of Directors believes that the reduction in the number of authorized shares of the Company’s common stock may also reduce certain of the Company’s costs, such as annual franchise taxes paid to the State of Delaware.

THE REVERSE STOCK SPLIT MAY NOT RESULT IN AN INCREASE IN THE PER SHARE PRICE OF THE COMPANY’S COMMON STOCK; THERE ARE OTHER RISKS ASSOCIATED WITH THE REVERSE STOCK SPLIT

The Board of Directors expects that a reverse stock split of the outstanding common stock will increase the market price of the Company’s common stock. However, the Company cannot be certain whether the reverse stock split would lead to a sustained increase in the trading price or the trading market for the Company’s common stock. The history of similar stock split combinations for companies in like circumstances is varied. There is no assurance that:

| ● | the market price per share of the Company’s common stock after the reverse stock split will rise in proportion to the reduction in the number of pre-split shares of common stock outstanding before the reverse stock split; |

| ● | the reverse stock split will result in a per share price that will attract brokers and investors, including institutional investors, who do not trade in lower priced stocks; |

| ● | the reverse stock split will result in a per share price that will increase the Company’s ability to attract and retain employees and other service providers; |

| ● | the market price per post-split share will remain in excess of the $1.00 minimum closing bid price as required by the Nasdaq Marketplace Rules or that the Company would otherwise meet the requirements of Nasdaq for continued inclusion for trading on The Nasdaq Global Market (or The Nasdaq Capital Market); and |

| ● | the reverse stock split will increase the trading market for the Company’s common stock, particularly if the stock price does not increase as a result of the reduction in the number of shares of common stock available in the public market. |

The market price of the Company’s common stock will also be based on the Company’s performance and other factors, some of which are unrelated to the number of shares outstanding. If the reverse stock split is consummated and the trading price of the Company’s common stock declines, the percentage decline as an absolute number and as a percentage of the Company’s overall market capitalization may be greater than would occur in the absence of the reverse stock split. Furthermore, the liquidity of the Company’s common stock could be adversely affected by the reduced number of shares that would be outstanding after the reverse stock split and this could have an adverse effect on the price of the Company’s common stock. If the market price of the Company’s shares of common stock declines subsequent to the effectiveness of the reverse stock split, this will detrimentally impact the Company’s market capitalization and the market value of the Company’s public float.

13

EFFECTIVE DATE

Assuming the Board of Directors exercises its discretion to effect the reverse stock split, the reverse stock split and the reduction in the total number of authorized shares of the Company’s common stock will become effective as of the date and time (the “Effective Date”) that the certificate of amendment to the Amended and Restated Certificate to effect the foregoing is filed with the Secretary of State of the State of Delaware in accordance with the Delaware General Corporation Law (the “DGCL”), without any further action on the part of the Company’s stockholders and without regard to the date that any stockholder physically surrenders the stockholder’s certificates representing pre-split shares of common stock for certificates representing post-split shares. The Board of Directors, in its discretion, may delay or decide against effecting the reverse stock split and the filing of the certificate of amendment to the Amended and Restated Certificate to effect the reverse stock split without resoliciting stockholder approval. It is currently anticipated that if stockholder approval is obtained for the reverse stock split and reduction in the total number of authorized shares of the Company’s common stock described in this proposal, the Board of Directors would cause the Company to effect the foregoing as soon as practicable after obtaining such stockholder approval.

PRINCIPAL EFFECTS OF THE REVERSE STOCK SPLIT

After the Effective Date, each stockholder will own a reduced number of shares of the Company’s common stock. However, the Company expects that the market price of the Company’s common stock immediately after the reverse stock split will increase substantially above the market price of the Company’s common stock immediately prior to the reverse stock split. The proposed reverse stock split will be effected simultaneously for all of the Company’s common stock and shares held in treasury stock, and the ratio for the reverse stock split will be the same for all of the Company’s common stock and shares held in treasury stock. The reverse stock split will affect all of the Company’s stockholders uniformly and will not affect any stockholder’s percentage ownership interest in the Company (except to the extent that the reverse stock split would result in any of the stockholders owning a fractional share as described below). Likewise, the reverse stock split will affect all holders of outstanding equity awards under the Company’s 1997 Stock Plan (including stock options, performance shares and stock appreciation rights) substantially the same (except to the extent that the reverse stock split would result in a fractional interest as described below). Proportionate voting rights and other rights and preferences of the holders of common stock will not be affected by the proposed reverse stock split (except to the extent that the reverse stock split would result in any stockholders owning a fractional share as described below). For example, a holder of 2% of the voting power of the outstanding shares of common stock immediately prior to the reverse stock split would continue to hold approximately 2% of the voting power of the outstanding shares of common stock immediately after the reverse stock split. The number of stockholders of record also will not be affected by the proposed reverse stock split (except to the extent that the reverse stock split would result in any stockholders owning only a fractional share as described below).

On the Effective Date, the total number of authorized shares of the Company’s common stock will be reduced from 100,000,000 to 10,000,000. The par value per share of the Company’s common stock would remain unchanged at $0.01 per share after the reverse stock split. Based on the number of shares of the Company’s common stock issued or reserved for issuance under the Company’s 1997 Stock Plan as of September 24, 2015, approximately [•] shares of common stock will be issued or reserved for issuance following the reverse stock split, leaving approximately [•] shares unissued and unreserved for issuance. The Company will continue to have 5,000,000 million shares of authorized but unissued preferred stock.

The proposed reverse stock split will reduce the number of shares of common stock available for issuance under the Company’s 1997 Stock Plan. All shares of the Company’s common stock subject to outstanding equity awards (including stock options, performance shares and stock appreciation rights) under the Company’s 1997 Stock Plan and the number of shares of common stock which have been authorized for issuance under the Company’s 1997 Stock Plan but as to which no equity awards have yet been granted or which have been returned to the Company’s 1997 Stock Plan upon cancellation or expiration of such equity awards will be converted on the Effective Date into one-tenth (1/10) of the number of such shares immediately preceding the reverse stock split (subject to adjustment for fractional interests). In addition, the exercise price of outstanding stock options and stock appreciation rights will be adjusted to ten (10) times the exercise price specified before the reverse stock split. This will result in approximately the same aggregate price being required to be paid as immediately preceding the reverse stock split. No fractional shares with respect to the shares subject to the outstanding equity awards (including stock options, performance shares and stock appreciation rights) under the Company’s 1997 Stock Plan will be issued following the reverse stock split. Therefore, if the number of shares subject to any outstanding equity award under the Company’s 1997 Stock Plan immediately before the reverse stock split is not evenly divisible (in other words, it would result in a fractional interest following the reverse stock split), the number of shares of common stock subject to such equity award

14

(including upon exercise of stock options and stock appreciation rights) will be rounded up to the nearest whole number. For additional information on the treatment of any fractional interest that may arise as a result of the reverse stock split relating to equity awards under the Company’s 1997 Stock Plan, please see the section below under the heading “Effect of the Reverse Stock Split on Equity Awards.”

The effects of the proposed amendment to the Amended and Restated Certificate are illustrated in the below table as of September 24, 2015, including (A) the approximate percentage reduction in the outstanding number of shares of common stock, (B) the approximate number of shares of common stock that would be (i) authorized, (ii) issued and outstanding, (iii) issued but held by the Company in treasury stock, (iv) authorized but reserved for issuance upon exercise of outstanding equity awards pursuant to the Company’s 1997 Stock Plan, (v) authorized but reserved for issuance under the Company’s 1997 Stock Plan (but not subject to outstanding equity awards), and (vi) authorized but not issued or outstanding, or reserved for issuance under the Company’s 1997 Stock Plan, and (C) the approximate percentage of authorized shares not issued or outstanding, or reserved for issuance under the Company’s 1997 Stock Plan:

| Pre-Reverse Stock Split | Amendment (see Appendix A-1) | |||

| Reverse Stock Split Ratio | -- | 1:10 | ||

| Percentage Reduction of Shares Outstanding Post-Reverse Stock Split | -- | 90.0% | ||

| Authorized Shares of Common Stock | 100,000,000 | 10,000,000 | ||

| Shares Outstanding | [•] | [•] | ||

| Issued But Not Outstanding (Held by the Company in Treasury Stock) | [•] | [•] | ||

| Reserved for Issuance Upon Exercise of Outstanding Equity Awards Under the 1997 Stock Plan | [•] | [•] | ||

| Reserved for Issuance Under the 1997 Stock Plan (but not Subject to Outstanding Equity Awards) | [•] | [•] | ||

| Authorized but not Issued or Outstanding, or Reserved for Issuance Under the 1997 Stock Plan | [•] | [•] | ||

| Percentage of Authorized Shares not Issued or Outstanding, or Reserved for Issuance Under the 1997 Stock Plan | [•]% | [•]% | ||

As illustrated in the above table, the proposed reduction in the total number of shares of the Company’s authorized common stock for the 1-for-10 reverse stock split is designed to maintain approximately the same proportion of the total number of authorized shares that are not issued or outstanding, or reserved for issuance under the Company’s 1997 Stock Plan, following the reverse stock split. However, the rounding up to the nearest whole number of fractional interests that would otherwise result from those equity awards that are not evenly divisible immediately prior to the reverse stock split will increase the proportion of shares reserved for issuance under the Company’s 1997 Stock Plan to the number of authorized shares of common stock following the reverse stock split. For example, as of September 24, 2015, there were [•] shares of common stock issued or reserved for issuance under the Company’s 1997 Stock Plan, leaving [•] shares unissued (or [•]% of the 100,000,000 shares of Common Stock authorized for issuance under the Company’s Amended and Restated Certificate). If the Board of Directors determines to effect the reverse stock split, then, based on the number of shares issued or reserved for issuance as of September 24, 2015, approximately [•] shares of common stock would be issued or reserved for issuance under the Company’s 1997 Stock Plan following the reverse stock split, leaving [•] shares unissued (or [•]% of the 10,000,000 shares of Common Stock authorized for issuance on a post-split basis).

In addition, on the Effective Date, those shares held by the Company in treasury stock will be combined and converted automatically from [•] to [•] shares of treasury stock.

If the proposed reverse stock split is implemented, it may increase the number of stockholders of the Company who own “odd lots” of less than 100 shares of common stock. Brokerage commissions and other costs of transactions in odd lots may be higher than the costs of transactions of more than 100 shares of common stock.

15

The Company’s common stock is currently registered under Section 12(b) of the Exchange Act, and the Company is subject to the periodic reporting and other requirements of the Exchange Act. The proposed reverse stock split will not affect the registration of the Company’s common stock under the Exchange Act. If the proposed reverse stock split is implemented, the Company’s common stock will continue to be reported on The Nasdaq Global Market under the symbol “ELON” (although Nasdaq will add the letter “D” to the end of the trading symbol for a period of twenty (20) trading days to indicate that the reverse stock split has occurred). After the end of this period, the Company’s ticker symbol will revert to “ELON.”

The proposed amendment to the Company’s Amended and Restated Certificate will not change the terms of the Company’s common stock. After the reverse stock split, the shares of the Company’s common stock will have the same voting rights and rights to dividends and distributions and will be identical in all other respects to the common stock now authorized. Each stockholder’s percentage ownership of the new common stock will not be altered except for the effect of eliminating fractional shares (which is discussed in more detail below). The Company’s common stock issued pursuant to the reverse stock split will remain fully paid and non-assessable. Following the reverse stock split, the Company will continue to be subject to the periodic reporting requirements of the Exchange Act.

TREATMENT OF FRACTIONAL SHARES

No scrip or fractional shares would be issued if, as a result of the reverse stock split, a registered stockholder would otherwise become entitled to a fractional share. Instead, the Company would pay to the registered stockholder, in cash, the value of any fractional share interest arising from the reverse stock split. The cash payment would equal the fraction to which the stockholder would otherwise be entitled multiplied by the closing sales price of the Company’s common stock as reported on The Nasdaq Global Market, as of the Effective Date. No transaction costs would be assessed to stockholders for the cash payment. Stockholders would not be entitled to receive interest for the period of time between the Effective Date and the date payment is made for their fractional shares. The ownership of a fractional interest will not give the holder thereof any voting, dividend or other rights except to receive payment as described herein. This cash payment merely represents a mechanical rounding off of the fractions in the exchange. For a discussion of the treatment of any fractional interest that may arise as a result of the reverse stock split relating to equity awards under the Company’s 1997 Stock Plan, please see the section below under the heading “Effect of the Reverse Stock Split on Equity Awards.”

As a result of the reverse stock split, stockholders who hold less than ten (10) shares of the Company’s common stock will no longer be stockholders of Echelon on a post-split basis. In other words, any holder of nine (9) or fewer shares of the Company’s common stock prior to the effectiveness of the reverse stock split would only be entitled to receive cash for the fractional share of common stock such stockholder would hold on a post-split basis. The actual number of stockholders that will be eliminated will be dependent upon the actual number of stockholders holding less than ten (10) shares of the Company’s common stock on the Effective Date. Reducing the number of post-split stockholders, however, is not the purpose of this proposal or the reverse stock split.

If you do not hold sufficient shares of pre-split common stock to receive at least one post-split share of common stock and you want to hold common stock after the reverse stock split, you may do so by taking either of the following actions far enough in advance so that it is completed before the reverse stock split is effected:

| ● | purchase a sufficient number of shares of the Company’s common stock so that you would hold at least ten (10) shares of common stock in your account prior to the implementation of the reverse stock split that would entitle you to receive at least one (1) share of common stock on a post-split basis; or |

| ● | if applicable, consolidate your accounts so that you hold at least ten (10) shares of the Company’s common stock in one account prior to the reverse stock split that would entitle you to at least one (1) share of common stock on a post-split basis. The Company’s common stock held in registered form (that is, shares held by you in your own name on the Company’s share register maintained by its transfer agent) and common stock held in “street name” (that is, shares held by you through a bank, broker or other nominee) for the same investor would be considered held in separate accounts and would not be aggregated when implementing the reverse stock split. Also, shares of common stock held in registered form but in separate accounts by the same investor would not be aggregated when implementing the reverse stock split. |

Stockholders should be aware that, under the escheat laws of the various jurisdictions where stockholders reside, where the Company is domiciled and where the funds for fractional shares would be deposited, sums due to stockholders in

16

payment for fractional shares that are not timely claimed after the effective time may be required to be paid to the designated agent for each such jurisdiction. Thereafter, stockholders otherwise entitled to receive such funds may have to seek to obtain them directly from the state to which they were paid.

EFFECT OF THE REVERSE STOCK SPLIT ON EQUITY AWARDS

On the Effective Date, the proposed reverse stock split will reduce the number of shares of common stock available for issuance under the Company’s 1997 Stock Plan. All shares of the Company’s common stock subject to outstanding equity awards (including stock options, performance shares and stock appreciation rights) under the Company’s 1997 Stock Plan and the number of shares of common stock which have been authorized for issuance under the Company’s 1997 Stock Plan but as to which no equity awards have yet been granted or which have been returned to the Company’s 1997 Stock Plan upon cancellation or expiration of such equity awards will be converted on the Effective Date into one-tenth (1/10) of the number of such shares immediately preceding the reverse stock split (subject to adjustment for fractional interests). In addition, the exercise price of outstanding equity awards will be adjusted to ten (10) times the exercise price specified before the reverse stock split. This will result in approximately the same aggregate price being required to be paid as immediately preceding the reverse stock split. No fractional shares with respect to the shares subject to the outstanding equity awards (including stock options, performance shares and stock appreciation rights) under the Company’s 1997 Stock Plan will be issued following the reverse stock split. Therefore, if the number of shares subject to any outstanding equity award under the Company’s 1997 Stock Plan immediately before the reverse stock split is not evenly divisible (in other words, it would result in a fractional interest following the reverse stock split), the number of shares of common stock subject to such equity award (including upon exercise of stock options and stock appreciation rights) will be rounded up to the nearest whole number. This will result in an increase to the proportion of shares reserved for issuance under the Company’s 1997 Stock Plan to the number of authorized shares of common stock following the reverse stock split.

AUTHORIZED SHARES

On the Effective Date, the total number of authorized shares of the Company’s common stock will be reduced from 100,000,000 to 10,000,000. The par value per share of the Company’s common stock would remain unchanged at $0.01 per share after the reverse stock split. Please see the table above under the heading “Principal Effects of the Reverse Stock Split” for more information regarding the effects on the Company’s common stock of the proposed amendment to the Company’s Amended and Restated Certificate.

BOARD DISCRETION TO IMPLEMENT THE REVERSE STOCK SPLIT