|

|

|

Registration Nos. 002-65539/811-2958

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-1A

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 /X/

Post-Effective Amendment No. 200 /X/

and/or

REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940 /X/

Amendment No. 182 /X/

Exact Name of Registrant as Specified in Charter

100 East Pratt Street, Baltimore,

Maryland 21202

Address of Principal Executive Offices

410-345-2000

Registrant’s Telephone Number,

Including Area Code

David Oestreicher

100 East Pratt Street, Baltimore, Maryland 21202

Name and

Address of Agent for Service

Approximate Date of Proposed Public Offering March 1, 2021

It is proposed that this filing will become effective (check appropriate box):

// Immediately upon filing pursuant to paragraph (b)

/X/ On March 1, 2021 pursuant to paragraph (b)

// 60 days after filing pursuant to paragraph (a)(1)

// On (date) pursuant to paragraph (a)(1)

// 75 days after filing pursuant to paragraph (a)(2)

// On pursuant to paragraph (a)(2) of Rule 485

If appropriate, check the following box:

// This post-effective amendment designates a new effective date for a previously filed post-effective amendment.

|

|

|

|||

|

PROSPECTUS

|

||||

|

T. ROWE PRICE |

||||

|

International Disciplined Equity Fund |

||||

|

PRCNX RICIX PRNCX |

Investor Class I Class Advisor Class |

|||

|

The Securities and Exchange Commission (SEC) has not approved or disapproved these securities or passed upon the adequacy of this prospectus. Any representation to the contrary is a criminal offense. |

||||

|

|

||||

Table of Contents

|

1 |

SUMMARY |

||

|

2 |

MORE ABOUT THE FUND |

||

|

More Information About the Fund’s

|

|||

|

3 |

INFORMATION ABOUT ACCOUNTS |

||

|

Investing with T. Rowe Price 27

Distribution and Shareholder

Policies for Opening an Account 32 Pricing of Shares and Transactions 33 Investing Directly with T. Rowe Price 35

Investing Through a Financial

General Policies Relating to Transactions 43 |

|

SUMMARY |

1 |

|

The fund seeks long-term growth of capital through investments in stocks of non-U.S. companies.

This table describes the fees and expenses that you may pay if you buy, hold, and sell shares of the fund. You may also incur brokerage commissions and other charges when buying or selling shares of the Investor Class or I Class, which are not reflected in the table.

Fees and Expenses of the Fund

|

Investor |

I |

Advisor |

||||

|

Shareholder fees (fees paid directly from your investment) |

||||||

|

Maximum account fee |

$ |

a |

|

|

||

|

|

||||||

|

Management fees |

|

% |

|

% |

|

% |

|

Distribution and service (12b-1) fees |

|

|

|

|||

|

Other expenses |

|

|

c |

|

||

|

Total annual fund operating expenses |

|

|

|

|||

|

Fee waiver/expense reimbursement |

( |

) b |

( |

) c |

( |

) d |

|

Total annual fund operating expenses after fee waiver/expense reimbursement |

|

b |

|

c |

|

d |

a

b

|

T. ROWE PRICE |

2 |

c

d

|

1 year |

3 years |

5 years |

10 years |

|

|

Investor Class |

$ |

$ |

$ |

$ |

|

I Class |

|

|

|

|

|

Advisor Class |

|

|

|

|

Investments, Risks, and Performance

The fund expects to primarily invest in stocks of companies located outside the U.S. Under normal conditions, the fund will invest at least 80% of its net assets (including any borrowings for investment purposes) in stocks of non-U.S. companies and no more than 15% of its net

|

SUMMARY |

3 |

assets will be invested in stocks of companies in emerging markets. For purposes of determining whether the fund invests at least 80% of its net assets in non-U.S. stocks, the fund relies on the country assigned to a security by MSCI Inc. or another unaffiliated data provider. Because the fund focuses on developed markets outside the U.S., it typically has significant exposure to companies in Europe.

The fund is “nondiversified,” meaning it may invest a greater portion of its assets in a single company and own more of the company’s voting securities than is permissible for a “diversified” fund.

While the adviser invests with an awareness of the global economic backdrop and the adviser’s outlook for certain industries, sectors, and individual countries, the adviser’s decision-making process focuses on bottom-up stock selection. Country allocation is driven largely by stock selection, though the adviser may limit investments in markets or industries that appear to have poor overall prospects.

The fund may purchase the stocks of companies of any size, but typically focuses on larger companies, and does not emphasize either a growth or value bias in selecting investments. The adviser generally selects securities for the fund that the adviser believes have the most favorable combination of company fundamentals, earnings potential, and relative valuation.

The fund may sell securities for a variety of reasons, including to realize gains, limit losses, or redeploy assets into more promising opportunities.

As

with any fund, there is no guarantee that the fund will achieve its objective(s).

International investing Investing in the securities of non-U.S. issuers involves special risks not typically associated with investing in U.S. issuers. Non-U.S. securities tend to be more volatile and have lower overall liquidity than investments in U.S. securities and may lose value because of adverse local, political, social, or economic developments overseas, or due to changes in the exchange rates between foreign currencies and the U.S. dollar. In addition, investments outside the U.S. are subject to settlement practices and regulatory and financial reporting standards that differ from those of the U.S. The risks of investing outside the U.S. are heightened for any investments in emerging markets, which are susceptible to greater volatility than investments in developed markets.

Large-cap stocks Securities issued by large-cap companies tend to be less volatile than securities issued by smaller companies. However, larger companies may not be able to attain the high growth rates of successful smaller companies, especially during strong economic periods, and may be unable to respond as quickly to competitive challenges.

Market conditions The value of the fund’s investments may decrease, sometimes rapidly or unexpectedly, due to factors affecting an issuer held by the fund, particular industries, or the

|

T. ROWE PRICE |

4 |

overall securities markets. A variety of factors can increase the volatility of the fund’s holdings and markets generally, including political or regulatory developments, recessions, inflation, rapid interest rate changes, war or acts of terrorism, natural disasters, and outbreaks of infectious illnesses or other widespread public health issues such as the coronavirus pandemic and related governmental and public responses. Certain events may cause instability across global markets, including reduced liquidity and disruptions in trading markets, while some events may affect certain geographic regions, countries, sectors, and industries more significantly than others. Government intervention in markets may impact interest rates, market volatility, and security pricing. These adverse developments may cause broad declines in market value due to short-term market movements or for significantly longer periods during more prolonged market downturns.

Investing in Europe The European financial markets have been experiencing increased volatility due to concerns over rising government debt levels of several European countries, and these events may continue to significantly affect all of Europe. European economies could be significantly affected by, among other things, rising unemployment, the imposition or unexpected elimination of fiscal and monetary controls by member countries of the European Economic and Monetary Union, uncertainty surrounding the euro, the success of governmental actions to reduce budget deficits, and ongoing uncertainties surrounding Brexit, the formal withdrawal by the United Kingdom from the European Union.

Sector exposure At times, the fund may have a significant portion of its assets invested in securities of issuers conducting business in a broadly related group of industries within the same economic sector. Issuers in the same economic sector may be similarly affected by economic or market events, making the fund more vulnerable to unfavorable developments in that economic sector than funds that invest more broadly.

Emerging markets Investments in emerging market countries are subject to greater risk and overall volatility than investments in the U.S. and other developed markets. Emerging market countries tend to have economic structures that are less diverse and mature, less developed legal and regulatory regimes, and political systems that are less stable, than those of developed countries. In addition to the risks associated with investing outside the U.S., emerging markets are more susceptible to governmental interference, political and economic uncertainty, local taxes and restrictions on the fund’s investments, less efficient trading markets with lower overall liquidity, and more volatile currency exchange rates.

Stock investing Stocks generally fluctuate in value more than bonds and may decline significantly over short time periods. There is a chance that stock prices overall will decline because stock markets tend to move in cycles, with periods of rising and falling prices. The value of stocks held by the fund may decline due to general weakness or volatility in the stock markets in which the fund invests or because of factors that affect a particular company or industry.

Active management The fund’s overall investment program and holdings selected by the fund’s investment adviser may underperform the broad markets, relevant indices, or other funds with similar objectives and investment strategies.

|

SUMMARY |

5 |

Cybersecurity breaches The fund could be harmed by intentional cyberattacks and other cybersecurity breaches, including unauthorized access to the fund’s assets, customer data and confidential shareholder information, or other proprietary information. In addition, a cybersecurity breach could cause one of the fund’s service providers or financial intermediaries to suffer unauthorized data access, data corruption, or loss of operational functionality.

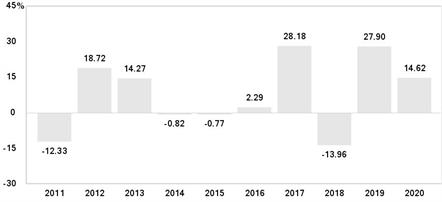

The following bar chart illustrates how much returns can differ from year to year by showing calendar year returns and the best and worst calendar quarter returns during those years for the fund’s Investor Class. Returns for other share classes vary since they have different expenses.

|

INTERNATIONAL DISCIPLINED EQUITY FUND |

|

Quarter Ended |

Total Return |

Quarter Ended |

Total Return |

|||||

|

|

|

|

|

|

- |

The following table shows the average annual total returns for each class of the fund that has been in operation for at least one full calendar year, and also compares the returns with the returns of a relevant broad-based market index, as well as with the returns of one or more comparative indexes that have investment characteristics similar to those of the fund, if applicable.

|

T. ROWE PRICE |

6 |

In

addition, the table shows hypothetical after-tax returns to demonstrate how taxes paid by a shareholder

may influence returns.

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

Periods ended |

|

||||||||||

|

|

|

|

December 31, 2020 |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Since |

Inception |

|

||

|

|

|

|

1 Year |

|

|

5 Years |

|

|

|

inception |

date |

|

||

|

|

Investor Class |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Returns before taxes |

|

% |

|

|

% |

|

|

|

% |

|

|

|

|

|

|

Returns after taxes on distributions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Returns after taxes on distributions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and sale of fund shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I Class |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Returns before taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Advisor Class |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Returns before taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b |

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

c |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

a

b

c

d

Management

Investment Adviser T. Rowe Price Associates, Inc. (T. Rowe Price or Price Associates)

Investment Subadviser T. Rowe Price International Ltd (T. Rowe Price International)

|

Portfolio Manager |

Title |

Managed |

Joined |

|

Federico Santilli |

Chair of Investment Advisory Committee |

2014 |

2001 |

|

SUMMARY |

7 |

Purchase and Sale of Fund Shares

The Investor Class and Advisor Class generally require a $2,500 minimum initial investment ($1,000 minimum initial investment if opening an IRA, a custodial account for a minor, or a small business retirement plan account). Additional purchases generally require a $100 minimum. These investment minimums generally are waived for financial intermediaries and certain employer-sponsored retirement plans submitting orders on behalf of their customers. Advisor Class shares may generally only be purchased through a financial intermediary or retirement plan.

The I Class requires a $1 million minimum initial investment and there is no minimum for additional purchases, although the initial investment minimum generally is waived for financial intermediaries, retirement plans, and certain client accounts for which T. Rowe Price or its affiliate has discretionary investment authority.

For investors holding shares of the fund directly with T. Rowe Price, you may purchase, redeem, or exchange fund shares by mail; by telephone (1-800-225-5132 for IRAs and nonretirement accounts; 1-800-492-7670 for small business retirement plans; and 1-800-638-8790 for institutional investors and financial intermediaries); or, for certain accounts, by accessing your account online through troweprice.com.

If you hold shares through a financial intermediary or retirement plan, you must purchase, redeem, and exchange shares of the fund through your intermediary or retirement plan. You should check with your intermediary or retirement plan to determine the investment minimums that apply to your account.

Tax Information

Any dividends or capital gains are declared and paid annually, usually in December. Redemptions or exchanges of fund shares and distributions by the fund, whether or not you reinvest these amounts in additional fund shares, generally may be taxed as ordinary income or capital gains unless you invest through a tax-deferred account (in which case you will be taxed upon withdrawal from such account).

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the fund through a broker-dealer or other financial intermediary (such as a bank), the fund and its related companies may pay the intermediary for the sale of fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

|

MORE ABOUT THE FUND |

2 |

|

Investment Adviser(s)

T. Rowe Price is the fund’s investment adviser and oversees the selection of the fund’s investments and management of the fund’s portfolio pursuant to an investment management agreement between the investment adviser and the fund. T. Rowe Price is the investment adviser for all mutual funds sponsored and managed by T. Rowe Price (T. Rowe Price Funds); is an SEC-registered investment adviser that provides investment management services to individual and institutional investors and sponsors; and serves as adviser and subadviser to registered investment companies, institutional separate accounts, and common trust funds. The address for T. Rowe Price is 100 East Pratt Street, Baltimore, Maryland 21202. As of December 31, 2020, T. Rowe Price and its affiliates (Firm) had approximately $1.47 trillion in assets under management and provided investment management services for more than 6.6 million individual and institutional investor accounts.

T. Rowe Price has entered into a subadvisory agreement with T. Rowe Price International under which T. Rowe Price International is authorized to trade securities and make discretionary investment decisions on behalf of the fund. T. Rowe Price International is registered with the SEC as an investment adviser, and is authorized or licensed by the United Kingdom Financial Conduct Authority and other global regulators. T. Rowe Price International sponsors and serves as adviser to foreign collective investment schemes and provides investment management services to registered investment companies and other institutional investors. T. Rowe Price International is headquartered in London and has several branch offices around the world. T. Rowe Price International is a direct subsidiary of T. Rowe Price and its address is 60 Queen Victoria Street, London EC4N 4TZ, United Kingdom.

Portfolio Management

T. Rowe Price has established an Investment Advisory Committee with respect to the fund. The committee chair is ultimately responsible for the day-to-day management of the fund’s portfolio and works with the committee in developing and executing the fund’s investment program. The members of the committee are as follows: Federico Santilli, Chair, R. Scott Berg, Steve Boothe, Anh Lu, Raymond A. Mills, Tobias F. Mueller, and Ernest C. Yeung. The following information provides the year that the chair (portfolio manager) first joined the Firm and the chair’s specific business experience during the past five years (although the chair may have had portfolio management responsibilities for a longer period). Mr. Santilli has been chair of the committee since the fund’s inception in 2014. He joined the Firm in 2001 and his investment experience dates from that time. He has served as a portfolio manager with the Firm throughout the past five years. The Statement of Additional Information provides additional information about the portfolio manager’s compensation, other accounts managed by the portfolio manager, and the portfolio manager’s ownership of the fund’s shares.

|

MORE ABOUT THE FUND |

9 |

The Management Fee

The management fee consists of two components—an “individual fund fee,” which reflects the fund’s particular characteristics, and a “group fee.” The group fee, which is designed to reflect the benefits of the shared resources of the Firm, is calculated daily based on the combined net assets of all T. Rowe Price Funds (except the funds-of-funds, TRP Reserve Funds, Multi-Sector Account Portfolios, and any index or private-label mutual funds). The group fee schedule (in the following table) is graduated, declining as the combined assets of the T. Rowe Price Funds rise, so shareholders benefit from the overall growth in mutual fund assets.

Group Fee Schedule

|

0.334%* |

First $50 billion |

|

0.305% |

Next $30 billion |

|

0.300% |

Next $40 billion |

|

0.295% |

Next $40 billion |

|

0.290% |

Next $60 billion |

|

0.285% |

Next $80 billion |

|

0.280% |

Next $100 billion |

|

0.275% |

Next $100 billion |

|

0.270% |

Next $150 billion |

|

0.265% |

Next $195 billion |

|

0.260% |

Thereafter |

* Represents a blended group fee rate containing various breakpoints.

The fund’s group fee is determined by applying the group fee rate to the fund’s average daily net assets. On October 31, 2020, the effective annual group fee rate was 0.29%. The individual fund fee, also applied to the fund’s average daily net assets, is 0.35%.

A discussion about the factors considered by the fund’s Board of Directors (Board) and its conclusions in approving the fund’s investment management agreement (and any subadvisory agreement, if applicable) appear in the fund’s semiannual report to shareholders for the period ended April 30.

Investment Objective(s)

The fund seeks long-term growth of capital through investments in stocks of non-U.S. companies.

Principal Investment Strategies

The fund expects to primarily invest in stocks of companies located outside the U.S. Under normal conditions, the fund will invest at least 80% of its net assets (including any borrowings for investment purposes) in stocks of non-U.S. companies and no more than 15% of its net

|

T. ROWE PRICE |

10 |

assets will be invested in stocks of companies in emerging markets. Shareholders will receive at least 60 days’ prior notice of a change in the fund’s policy requiring it to normally invest at least 80% of its net assets in stocks of non-U.S. companies.

The fund relies on the country assigned to a security by MSCI Inc., a third-party provider of benchmark indexes and data services, or another unaffiliated data provider. The fund also relies on MSCI Inc. or another unaffiliated data provider to determine which countries are considered emerging markets. The data providers use various criteria to determine the country to which a security is economically tied. Examples include the following: (1) the country under which the issuer is organized; (2) the location of the issuer’s principal place of business or principal office; (3) where the issuer’s securities are listed or traded principally on an exchange or over-the-counter market; and (4) where the issuer conducts the predominant part of its business activities or derives a significant portion (e.g., at least 50%) of its revenues or profits.

The fund is “nondiversified,” meaning it may invest a greater portion of its assets in a single company and own more of the company’s voting securities than is permissible for a “diversified” fund.

While the adviser invests with an awareness of the global economic backdrop and the adviser’s outlook for certain industries, sectors, and individual countries, the adviser’s decision-making process focuses on bottom-up stock selection. Country allocation is driven largely by stock selection, though the adviser may limit investments in markets or industries that appear to have poor overall prospects.

The fund seeks stocks of larger companies that the adviser believes have the most favorable combination of company fundamentals, earnings potential, and relative valuation. As a result, the fund will be exposed at times to both growth- and value-oriented stocks.

The market may reward growth stocks with price increases when earnings expectations are met or exceeded. Funds that employ a growth-oriented approach to stock selection rely on the premise that by investing in companies that increase their earnings faster than both inflation and the overall economy, the market will eventually reward those companies with a higher stock price. The fund’s successful implementation of a growth-oriented strategy may lead to long-term growth of capital over time.

Funds that employ a value-oriented approach to stock selection seek to invest in companies whose stock prices are low in relation to the value of their assets or future prospects. By identifying companies whose stocks are currently out of favor or undervalued, value funds attempt to realize significant appreciation as other investors recognize the stock’s intrinsic value and the price rises accordingly. Generally, careful selection of stocks having value characteristics can, over time, limit the downside risk of a value-oriented portfolio compared with the broad market. In addition, stocks whose prices are below a company’s intrinsic value may offer the potential for substantial capital appreciation.

Investing a portion of your overall portfolio in stock funds with foreign holdings can enhance your diversification and increase your available investment opportunities.

|

MORE ABOUT THE FUND |

11 |

The fund typically focuses its investments more on developed foreign countries than on emerging market countries. As a result, the fund may at times have significant investments in the United Kingdom and other developed European countries, as well as Japan.

The fund’s investments, as well as political and economic trends in the countries and regions in which the fund invests, and holdings are adjusted according to the portfolio manager’s analysis and outlook. The impact of unfavorable developments in a particular country may be reduced when investments are spread among many countries. However, the economies and financial markets of countries in a certain region may be heavily influenced by one another.

The fund may sell securities for a variety of reasons, including to realize gains, limit losses, or redeploy assets into more promising opportunities.

The Firm integrates pecuniary environmental, social, and governance (ESG) factors into its investment research process. We focus on the ESG factors we consider most likely to have a material impact on the performance of the holdings in the fund’s portfolio.

Common and Preferred Stocks

Stocks represent shares of ownership in a company. Generally, preferred stocks have a specified dividend rate and rank after bonds and before common stocks in their claim on income for dividend payments and on assets should the company be liquidated. After other claims are satisfied, common stockholders participate in company profits on a pro-rata basis and profits may be paid out in dividends or reinvested in the company to help it grow. Increases and decreases in earnings are usually reflected in a company’s stock price, so common stocks generally have the greatest appreciation and depreciation potential of all corporate securities. Unlike common stock, preferred stock does not ordinarily carry voting rights. While most preferred stocks pay a dividend, the fund may decide to purchase preferred stock where the issuer has suspended, or is in danger of suspending, payment of its dividend.

Foreign Securities

Investments in foreign securities could include non-U.S. dollar-denominated securities traded outside the U.S. and U.S. dollar-denominated securities of foreign issuers traded in the U.S. The fund may purchase American Depositary Receipts and Global Depositary Receipts, which are certificates evidencing ownership of shares of a foreign issuer. American Depositary Receipts and Global Depositary Receipts trade on established markets and are alternatives to directly purchasing the underlying foreign securities in their local markets and currencies. Such investments are subject to many of the same risks associated with investing directly in foreign securities. For purposes of the fund’s investment policies, investments in depositary receipts are deemed to be investments in the underlying securities. For example, a depositary receipt representing ownership of common stock will be treated as common stock.

Principal Risks

Some of the principal tools the adviser uses to try to reduce overall risk include intensive research when evaluating a company’s prospects and limiting exposure to certain industries, asset classes, or investment styles when appropriate.

|

T. ROWE PRICE |

12 |

The principal risks associated with the fund’s principal investment strategies include the following:

International investing Investments outside the U.S. may lose value because of declining foreign currencies or adverse political or economic events overseas, among other things. Securities of non-U.S. issuers (including depositary receipts and other instruments that represent interests in a non-U.S. issuer) tend to be more volatile than U.S. securities and are subject to trading markets with lower overall liquidity, governmental interference, and regulatory and accounting standards and settlement practices that differ from the U.S. The fund could experience losses based solely on the weakness of foreign currencies in which the fund’s holdings are denominated versus the U.S. dollar, and changes in the exchange rates between such currencies and the U.S. dollar. Risks can result from differing regulatory environments, less stringent investor protections, uncertain tax laws, and higher transaction costs compared with U.S. markets. Investments outside the U.S. could be subject to governmental actions such as capital or currency controls, nationalization of a company or industry, expropriation of assets, or imposition of high taxes.

A trading market may close for national holidays or without warning for extended time periods, preventing the fund from buying or selling securities in that market. Trading securities in which the fund invests may take place in various foreign markets on certain days when the fund is not open for business and does not calculate its net asset value. For example, the fund may invest in securities that trade in various foreign markets that are open on weekends. As the securities trade, their value may substantially change. As a result, the fund’s net asset value may be significantly affected on days when shareholders cannot make transactions. In addition, market volatility may significantly limit the liquidity of securities of certain issuers in a particular country or geographic region, or of all companies in the country or region. The fund may be unable to liquidate its positions in such securities at any time, or at a favorable price, in order to meet the fund’s obligations.

Large-cap stocks Although stocks issued by larger companies tend to have less overall volatility than stocks issued by smaller companies, larger companies may not be able to attain the high growth rates of successful smaller companies, especially during strong economic periods. In addition, larger companies may be less capable of responding quickly to competitive challenges and industry changes, and may suffer sharper price declines as a result of earnings disappointments.

Market conditions The value of investments held by the fund may decline, sometimes rapidly or unpredictably, due to factors affecting certain issuers, particular industries or sectors, or the overall markets. Rapid or unexpected changes in market conditions could cause the fund to liquidate its holdings at inopportune times or at a loss or depressed value. The value of a particular holding may decrease due to developments related to that issuer, but also due to general market conditions, including real or perceived economic developments such as changes in interest rates, credit quality, inflation, or currency rates, or generally adverse investor sentiment. The value of a holding may also decline due to factors that negatively affect a particular industry or sector, such as labor shortages, increased production costs, or

|

MORE ABOUT THE FUND |

13 |

competitive conditions. In addition, local, regional, or global events such as war, acts of terrorism, political and social unrest, regulatory changes, recessions, shifts in monetary or trade policies, natural or environmental disasters, and the spread of infectious diseases or other public health issues could have a significant negative impact on securities markets and the fund’s investments. Unpredictable events such as natural disasters, pandemics, and widespread health crises, including the coronavirus pandemic and related governmental and public responses, may lead to unexpected suspensions or closures of securities exchanges, travel restrictions or quarantines, business disruptions and closures, inability to obtain raw materials, supplies and component parts, reduced or disrupted operations for the fund’s service providers or issuers in which the fund invests, and an extended adverse impact on global market conditions. Government intervention in markets may impact interest rates, market volatility, and security pricing. The occurrence, reoccurrence, and uncertainty of widespread diseases and health crises could adversely affect the economies (including through changes in business activity and increased unemployment) and financial markets of specific countries or worldwide.

Investing in Europe The Economic and Monetary Union of the European Union (EU) requires compliance with restrictions on inflation rates, deficits, interest rates, debt levels, and fiscal and monetary controls, each of which may significantly affect every country in Europe. Decreasing imports or exports, changes in governmental or EU regulations on trade, changes in the exchange rate of the euro (the common currency of certain EU countries), the default or threat of default by an EU member country on its sovereign debt, and/or an economic recession in an EU member country may have a significant adverse effect on the economies of EU member countries and their trading partners. The European financial markets have been experiencing volatility and adverse trends due to concerns about economic downturns, rising government debt levels, and public health pandemics in several European countries, including Greece, Ireland, Italy, Portugal, and Spain. These events have adversely affected the exchange rate of the euro and may continue to significantly affect every country in Europe, including countries that do not use the euro. Responses to the financial problems by European governments, central banks, and others, including austerity measures and reforms, may not produce the desired results, may result in social unrest, and may limit future growth and economic recovery or have other unintended consequences. Further defaults or restructurings by governments and other entities of their debt could have additional adverse effects on economies, financial markets, and asset valuations around the world.

The risks of investing in Europe have been heightened as a result of Brexit. The United Kingdom’s decision to leave the EU has resulted in increased volatility and illiquidity in economies throughout Europe, as well as the broader global economy. In addition, uncertainty remains regarding the consequences of Brexit that may lead to instability in the foreign exchange markets, including volatility in the value of the euro. If one or more additional countries chooses to withdraw from the EU and/or abandon use of the euro as a currency, the impact of these actions, especially if they occur in a disorderly fashion, could be significant and far-reaching.

|

T. ROWE PRICE |

14 |

Sector exposure At times, the fund may have a significant portion of its assets invested in securities of issuers conducting business in a related group of industries within the same economic sector. Issuers within the same economic sector may be similarly affected by specific market events impacting that sector. As a result, the fund is more susceptible to adverse developments affecting an economic sector in which the fund has significant investments and may perform poorly during a downturn in one or more of the industries within that economic sector.

Emerging markets Investments in emerging markets are subject to the risk of abrupt and severe price declines. The economic and political structures of emerging market countries, in most cases, do not compare favorably with the U.S. or other developed countries in terms of wealth and stability, and their financial markets often lack liquidity. These economies are less developed, can be overly reliant on particular industries, and are more vulnerable to the ebb and flow of international trade, trade barriers, and other protectionist or retaliatory measures. Governments in many emerging market countries participate to a significant degree in their economies and securities markets. As a result, foreign investments may be restricted and subject to greater government control, including repatriation of sales proceeds. Emerging market securities exchanges are more likely to experience problems with the clearing and settling of trades, as well as the custody of holdings by local banks, agents, and depositories. In addition, the accounting standards in emerging market countries may be unreliable and could present an inaccurate picture of a company’s finances. Some countries have histories of instability and upheaval that could cause their governments to act in a detrimental or hostile manner toward private enterprise or foreign investment. Investments in countries or regions that have recently begun moving away from central planning and state-owned industries toward free markets should be regarded as speculative.

While some countries have made progress in economic growth, liberalization, fiscal discipline, and political and social stability, there is no assurance these trends will continue. Significant risks, such as war and terrorism, currently affect some emerging market countries. The fund’s performance will likely be hurt by exposure to nations in the midst of hyperinflation, currency devaluation, trade disagreements, sudden political upheaval, or interventionist government policies. The volatility of emerging markets may be heightened by the actions (such as significant buying or selling) of a few major investors. For example, substantial increases or decreases in cash flows of mutual funds investing in these markets could significantly affect local securities prices and, therefore, could cause fund share prices to decline.

Stock investing The fund’s share price can fall because of weakness in the overall stock markets, a particular industry, or specific holdings. Stock markets as a whole can be volatile and decline for many reasons, such as adverse local, political, regulatory, or economic developments; changes in investor psychology; or heavy institutional selling at the same time by major institutional investors in the market, such as mutual funds, pension funds, and banks. The prospects for an industry or company may deteriorate because of a variety of factors, including disappointing earnings or changes in the competitive environment. In addition, the adviser’s assessment of companies whose stocks are held by the fund may prove incorrect, resulting in losses or poor performance, even in rising markets. In the event an issuer is

|

MORE ABOUT THE FUND |

15 |

liquidated or declares bankruptcy, the claims of owners of the issuer’s bonds and preferred stock take precedence over the claims of those who own common stock.

Active management The investment adviser’s judgments about the attractiveness, value, or potential appreciation of the fund’s investments may prove to be incorrect. The fund could underperform other funds with a similar benchmark or similar investment program if the fund’s investment selections or overall strategies fail to produce the intended results. Regulatory, tax, or other developments may affect the investment strategies available to a portfolio manager, which could adversely affect the ability to implement the fund’s overall investment program and achieve the fund’s investment objective(s).

Nondiversification Because the fund is nondiversified and thus can invest more of its assets in a smaller number of issuers, it is more exposed to the risks associated with an individual issuer than a fund that invests more broadly across many issuers. For example, poor performance by a single large holding of the fund would adversely affect the fund’s performance more than if the fund were invested in a larger number of issuers.

Cybersecurity breaches The fund may be subject to operational and information security risks resulting from breaches in cybersecurity. Cybersecurity breaches may involve deliberate attacks and unauthorized access to the digital information systems (for example, through “hacking” or malicious software coding) used by the fund or its third-party service providers but may also result from outside attacks such as denial-of-service attacks, which are efforts to make network services unavailable to intended users. These breaches may, among other things, result in financial losses to the fund and its shareholders, cause the fund to lose proprietary information, disrupt business operations, or result in the unauthorized release of confidential information. Further, cybersecurity breaches involving the fund’s third-party service providers, financial intermediaries, trading counterparties, or issuers in which the fund invests could subject the fund to many of the same risks associated with direct breaches.

Additional Strategies, Risks, and Investment Management Practices

In addition to the principal investment strategies and principal risks previously described, the fund may employ other investment strategies and may be subject to other risks, which include the following:

Derivatives

The fund may, to a limited extent, use derivatives such as futures contracts and forward currency exchange contracts. Any investments in futures would typically serve as an efficient means of gaining exposure to certain markets or as a cash management tool to maintain liquidity while being invested in the market. Forward currency exchange contracts would primarily be used to settle trades in a foreign currency or to help protect the fund’s holdings from unfavorable changes in foreign currency exchange rates, although other currency hedging techniques may be used from time to time. To the extent the fund uses futures and forward currency exchange contracts, it is exposed to potential volatility and losses greater than direct investments in the contracts’ underlying assets, and the risk that anticipated currency movements will not be accurately predicted.

|

T. ROWE PRICE |

16 |

Futures Futures are often used to establish exposures, or manage or hedge risk, because they enable the investor to buy or sell an asset in the future at an agreed-upon price. Futures contracts may be bought or sold for any number of reasons, including to manage exposure to changes in interest rates, securities prices and indexes, currency exchange rates, and credit quality; as an efficient means of increasing or decreasing the fund’s exposure to certain markets; in an effort to enhance income; to improve risk-adjusted returns; to protect the value of portfolio securities; and to serve as a cash management tool. The fund may choose to continue a futures contract by “rolling over” an expiring futures contract into an identical contract with a later maturity date. This could increase the fund’s transaction costs and portfolio turnover rate. Futures contracts may not be successful investments or hedges, their prices can be highly volatile and their use could lower the fund’s total return, and the potential loss from the use of futures can exceed the fund’s initial investment in such contracts.

Currency Derivatives The fund will normally conduct any foreign currency exchange transactions either on a spot (i.e., cash) basis at the spot rate prevailing in the foreign currency exchange market, or through entering into forward contracts to purchase or sell foreign currencies. The fund will generally not enter into a forward contract with a term greater than one year. The fund may enter into forward currency exchange contracts to “lock in” the U.S. dollar price of a security when it enters into a contract for the purchase or sale of a security denominated in a foreign currency, and when the fund believes that the currency of a particular foreign country may move substantially against another currency, it may enter into a forward contract to sell or buy the former foreign currency.

A fund that invests in foreign securities may attempt to hedge its exposure to potentially unfavorable currency changes. The primary means of doing this is through the use of forward currency exchange contracts, which are contracts between two counterparties to exchange one currency for another on a future date at a specified exchange rate. The fund may also use these instruments to create a synthetic bond, which is issued in one currency with the currency component transformed into another currency. However, futures, swaps, and options on foreign currencies may also be used. In certain circumstances, the fund may use currency derivatives to substitute a different currency for the currency in which the investment is denominated, a strategy known as proxy hedging. If the fund were to engage in any of these foreign currency transactions, it could serve to protect its foreign securities from adverse currency movements relative to the U.S. dollar, although the fund may also use currency derivatives in an effort to gain exposure to a currency expected to appreciate in value versus other currencies. As a result, the fund could be invested in a currency without holding any securities denominated in that currency. Such transactions involve, among other risks, the risk that anticipated currency movements will not occur, which could reduce the fund’s total return. There are certain markets, including many emerging markets, where it is not possible to engage in effective foreign currency hedging.

Hedging may result in the application of the mark-to-market and straddle provisions of the Internal Revenue Code. These provisions could result in an increase (or decrease) in the amount of taxable dividends paid by the fund and could affect whether dividends paid by the fund are classified as capital gains or ordinary income.

|

MORE ABOUT THE FUND |

17 |

Derivatives typically involve risks different from, and possibly greater than, the risks associated with investing directly in the assets on which the derivative is based. Certain derivatives can be highly volatile, lack liquidity, and be difficult to value. Changes in the value of a derivative may not properly correlate with changes in the value of the underlying asset, reference rate, or index. The fund could be exposed to significant losses if it is unable to close a derivative position due to the lack of a liquid trading market. Derivatives involve the risk that a counterparty to the derivatives agreement will fail to make required payments or comply with the terms of the agreement. There is also the possibility that limitations or trading restrictions may be imposed by an exchange or government regulation, which could adversely impact the value and liquidity of a derivatives contract subject to such regulation. Recent regulations have changed the requirements related to the use of certain derivatives. Some of these new regulations have limited the availability of certain derivatives and made their use by funds more costly. It is expected that additional changes to the regulatory framework will occur, but the extent and impact of additional new regulations are not certain at this time.

Convertible Securities and Warrants

The fund may invest in debt instruments or preferred equity securities that are convertible into, or exchangeable for, equity securities at specified times in the future and according to a certain exchange ratio. Convertible bonds are typically callable by the issuer, which could in effect force conversion before the holder would otherwise choose. Traditionally, convertible securities have paid dividends or interest at rates higher than common stocks but lower than nonconvertible securities. They generally participate in the appreciation or depreciation of the underlying stock into which they are convertible, but to a lesser degree than common stock. Some convertible securities combine higher or lower current income with options and other features. Warrants are options to buy, directly from the issuer, a stated number of shares of common stock at a specified price anytime during the life of the warrants (generally, two or more years). Warrants have no voting rights, pay no dividends, and can be highly volatile. In some cases, the redemption value of a warrant could be zero.

Participation Notes (P-notes)

The fund may gain exposure to securities traded in foreign markets through investments in P-notes. P-notes are generally issued by banks or broker-dealers and are designed to offer a return linked to an underlying common stock or other security. An investment in a P-note involves additional risks beyond the risks normally associated with a direct investment in the underlying security. While the holder of a P-note is entitled to receive from the broker-dealer or bank any dividends paid by the underlying security, the holder is not entitled to the same rights (e.g., voting rights) as a direct owner of the underlying security. P-notes are considered general unsecured contractual obligations of the banks or broker-dealers that issue them as the counterparty. As such, the fund must rely on the creditworthiness of the counterparty for its investment returns on the P-notes, and could lose the entire value of its investment in the event of default by a counterparty. Additionally, there is no assurance that there will be a secondary trading market for a P-note or that the trading price of a P-note will equal the value of the underlying security.

|

T. ROWE PRICE |

18 |

Fixed Income Securities

From time to time, the fund may invest in corporate and government fixed income securities as well as below investment-grade bonds, commonly referred to as “junk” bonds. Corporate fixed income securities would be purchased in companies that meet the fund’s investment criteria. The price of a fixed income security fluctuates with changes in interest rates, generally rising when interest rates fall and falling when interest rates rise. Below investment-grade bonds, or “junk” bonds, can be more volatile and have greater risk of default than investment-grade bonds, and should be considered speculative.

Investments in Other Investment Companies

The fund may invest in other investment companies, including open-end funds, closed-end funds, and exchange-traded funds.

The fund may purchase the securities of another investment company to temporarily gain exposure to a portion of the market while awaiting the purchase of securities or as an efficient means of gaining exposure to a particular asset class. The fund might also purchase shares of another investment company, including shares of other T. Rowe Price Funds, to gain exposure to the securities in the investment company’s portfolio at times when the fund may not be able to buy those securities directly, or as a means of gaining efficient and cost-effective exposure to certain asset classes. Any investment in another investment company would be consistent with the fund’s objective(s) and investment program.

The risks of owning another investment company are generally similar to the risks of investing directly in the securities in which that investment company invests. However, an investment company may not achieve its investment objective or execute its investment strategy effectively, which may adversely affect the fund’s performance. In addition, because closed-end funds and exchange-traded funds trade on a secondary market, their shares may trade at a premium or discount to the actual net asset value of their portfolio securities, and their shares may have greater volatility if an active trading market does not exist.

As a shareholder of another investment company, the fund must pay its pro-rata share of that investment company’s fees and expenses. The fund’s investments in non-T. Rowe Price investment companies are subject to the limits that apply to investments in other funds under the Investment Company Act of 1940 or under any applicable exemptive order.

Investments in other investment companies could allow the fund to obtain the benefits of a more diversified portfolio than might otherwise be available through direct investments in a particular asset class, and will subject the fund to the risks associated with the particular asset class or asset classes in which an underlying fund invests. Examples of asset classes in which other mutual funds (including T. Rowe Price Funds) focus their investments include high yield bonds, inflation-linked securities, floating rate loans, international bonds, emerging market bonds, stocks of companies involved in activities related to real assets, stocks of companies that focus on a particular industry or sector, and emerging market stocks. If the fund invests in another T. Rowe Price Fund, the management fee paid by the fund will be reduced to ensure that the fund does not incur duplicate management fees as a result of its investment.

|

MORE ABOUT THE FUND |

19 |

Illiquid Investments

Some of the fund’s holdings may be considered illiquid because they are subject to legal or contractual restrictions on resale or because they cannot reasonably be expected to be sold or disposed of in current market conditions in seven calendar days or less without the sale or disposition significantly changing the market value of the investment. The determination of liquidity involves a variety of factors. Illiquid investments may include private placements that are sold directly to a small number of investors, usually institutions. Unlike public offerings, such securities are not registered with the SEC. Although certain of these securities may be readily sold (for example, pursuant to Rule 144A under the Securities Act of 1933) and therefore deemed liquid, others may have resale restrictions and be considered illiquid. The sale of illiquid investments may involve substantial delays and additional costs, and the fund may only be able to sell such investments at prices substantially lower than what it believes they are worth. In addition, the fund’s investments in illiquid investments may reduce the returns of the fund because it may be unable to sell such investments at an advantageous time, which could prevent the fund from taking advantage of other investment opportunities.

Reserve Position

A certain portion of the fund’s assets may be held in reserves. The fund’s reserve positions will primarily consist of: (1) shares of a T. Rowe Price internal money market fund or short-term bond fund (which do not charge any management fees and are not available for public purchase); (2) short-term, high-quality U.S. and non-U.S. dollar-denominated money market securities, including repurchase agreements; and (3) U.S. dollar or non-U.S. dollar currencies. In order to respond to adverse market, economic, or political conditions, or to provide flexibility in meeting redemptions, paying expenses, managing cash flows into the fund, and responding to periods of unusual market volatility, the fund may assume a temporary defensive position that is inconsistent with its principal investment objective(s) and/or strategies and may invest, without limitation, in reserves. If the fund has significant holdings in reserves, it could compromise its ability to achieve its objective(s). Non-U.S. dollar reserves are subject to currency risk.

Borrowing Money and Transferring Assets

The fund may borrow from banks, other persons, and other T. Rowe Price Funds for temporary or emergency purposes, to facilitate redemption requests, or for other purposes consistent with the fund’s policies as set forth in this prospectus and the Statement of Additional Information. Such borrowings may be collateralized with the fund’s assets, subject to certain restrictions.

Borrowings may not exceed 331/3% of the fund’s total assets. This limitation includes any borrowings for temporary or emergency purposes, applies at the time of the transaction, and continues to the extent required by the Investment Company Act of 1940.

Meeting Redemption Requests

We expect that the fund will hold cash or cash equivalents to meet redemption requests. The fund may also use the proceeds from the sale of portfolio securities to meet redemption requests if consistent with the management of the fund. These redemption methods will be

|

T. ROWE PRICE |

20 |

used regularly and may also be used in deteriorating or stressed market conditions. The fund reserves the right to pay redemption proceeds with securities from the fund’s portfolio rather than in cash (redemptions in-kind), as described under “Large Redemptions.” Redemptions in-kind are typically used to meet redemption requests that represent a large percentage of the fund’s net assets in order to minimize the effect of large redemptions on the fund and its remaining shareholders. In general, any redemptions in-kind will represent a pro-rata distribution of the fund’s securities, subject to certain limited exceptions. Redemptions in-kind may be used regularly in circumstances as described above (generally if the shareholder is able to accept securities in-kind) and may also be used in stressed market conditions.

The fund, along with other T. Rowe Price Funds, is a party to an interfund lending exemptive order received from the SEC that permits the T. Rowe Price Funds to borrow money from and/or lend money to other T. Rowe Price Funds to help the funds meet short-term redemptions and liquidity needs.

During periods of deteriorating or stressed market conditions, when an increased portion of the fund’s portfolio may be composed of holdings with reduced liquidity or lengthy settlement periods, or during extraordinary or emergency circumstances, the fund may be more likely to pay redemption proceeds with cash obtained through interfund lending or short-term borrowing arrangements (if available) or by redeeming a large redemption request in-kind.

Lending of Portfolio Securities

The fund may lend its securities to broker-dealers, other institutions, or other persons to earn additional income. Risks include the potential insolvency of the broker-dealer or other borrower that could result in delays in recovering securities and capital losses. Additionally, losses could result from the reinvestment of collateral received on loaned securities in investments that decline in value, default, or do not perform as well as expected. Cash collateral from securities lending is invested in the T. Rowe Price Short-Term Fund.

The Statement of Additional Information contains more detailed information about the fund and its investments, operations, and expenses. The fund’s investments may be subject to further restrictions and risks described in the Statement of Additional Information.

Turnover is an indication of frequency of trading. Each time the fund purchases or sells a security, it incurs a cost. This cost is reflected in the fund’s net asset value but not in its operating expenses. The higher the turnover rate, the higher the transaction costs and the greater the impact on the fund’s total return. Higher turnover can also increase the possibility of taxable capital gain distributions. The fund’s portfolio turnover rates are shown in the Financial Highlights tables.

|

MORE ABOUT THE FUND |

21 |

The Financial Highlights tables, which provide information about each class’ financial history, are based on a single share outstanding throughout the periods shown. The tables are part of the fund’s financial statements, which are included in its annual report and are incorporated by reference into the Statement of Additional Information (available upon request). The financial statements in the annual report were audited by the fund’s independent registered public accounting firm, PricewaterhouseCoopers LLP.

|

FINANCIAL HIGHLIGHTS |

For a share outstanding throughout each period |

|

Investor Class |

||||||||||||||||||||

|

|

Year |

|

10/31/19 |

|

10/31/18 |

|

10/31/17 |

|

10/31/16 |

|||||||||||

|

NET ASSET VALUE |

||||||||||||||||||||

|

Beginning of period |

$ |

10.74 |

$ |

9.81 |

$ |

11.08 |

$ |

9.42 |

$ |

9.40 |

||||||||||

|

|

||||||||||||||||||||

|

Investment activities |

||||||||||||||||||||

|

Net investment |

0.19 |

0.21 |

0.24 |

0.17 |

0.18 |

|||||||||||||||

|

Net realized and |

(1.18 |

) |

1.09 |

(0.99 |

) |

1.65 |

0.06 |

|||||||||||||

|

Total

from investment |

(0.99 |

) |

1.30 |

(0.75 |

) |

1.82 |

0.24 |

|||||||||||||

|

|

||||||||||||||||||||

|

Distributions |

||||||||||||||||||||

|

Net investment income |

(0.27 |

) |

(0.15 |

) |

(0.15 |

) |

(0.15 |

) |

(0.17 |

) |

||||||||||

|

Net realized gain |

(0.15 |

) |

(0.22 |

) |

(0.38 |

) |

(0.01 |

) |

(0.05 |

) |

||||||||||

|

Total distributions |

(0.42 |

) |

(0.37 |

) |

(0.53 |

) |

(0.16 |

) |

(0.22 |

) |

||||||||||

|

Redemption fees added |

– |

– |

(3) |

0.01 |

– |

(3) |

– |

(3) |

||||||||||||

|

|

||||||||||||||||||||

|

NET

ASSET VALUE

|

$ |

9.33 |

$ |

10.74 |

$ |

9.81 |

$ |

11.08 |

$ |

9.42 |

||||||||||

|

T. ROWE PRICE |

22 |

|

FINANCIAL HIGHLIGHTS |

For a share outstanding throughout each period |

|

Investor Class |

||||||||||||||||||||

|

|

Year |

|

10/31/19 |

|

10/31/18 |

|

10/31/17 |

|

10/31/16 |

|||||||||||

|

Ratios/Supplemental Data |

||||||||||||||||||||

|

|

||||||||||||||||||||

|

Total return(2)(5) |

(9.73 |

)% |

13.88 |

% |

(7.04 |

)% |

19.69 |

% |

2.67 |

% |

||||||||||

|

|

||||||||||||||||||||

|

Ratios

to average net |

||||||||||||||||||||

|

Gross expenses before |

0.92 |

% |

1.24 |

% |

1.22 |

% |

2.35 |

% |

3.27 |

% |

||||||||||

|

Net

expenses after |

0.90 |

% |

0.90 |

% |

0.90 |

% |

0.90 |

% |

0.90 |

% |

||||||||||

|

Net investment income |

1.96 |

% |

2.08 |

% |

2.28 |

% |

1.68 |

% |

1.92 |

% |

||||||||||

|

|

||||||||||||||||||||

|

Portfolio turnover rate |

69.1 |

% |

128.4 |

% |

153.2 |

% |

118.0 |

% |

147.8 |

% |

||||||||||

|

Net

assets, end of period |

$ |

113,097 |

$ |

21,838 |

$ |

15,275 |

$ |

21,569 |

$ |

12,368 |

||||||||||

(1) Per share amounts calculated using average shares outstanding method.

(2) Includes the impact of expense-related arrangements with Price Associates.

(3) Amounts round to less than $0.01 per share.

(4) The fund charged redemption fees through March 31, 2019.

(5) Total return reflects the rate that an investor would have earned on an investment in the fund during each period, assuming reinvestment of all distributions, and payment of no redemption or account fees, if applicable.

|

MORE ABOUT THE FUND |

23 |

|

FINANCIAL HIGHLIGHTS |

For a share outstanding throughout each period |

|

I Class |

||||||||||||||||||||

|

|

Year |

|

10/31/19 |

|

10/31/18 |

|

3/6/17(1) |

|||||||||||||

|

NET ASSET VALUE |

||||||||||||||||||||

|

Beginning of period |

$ |

10.71 |

$ |

9.83 |

$ |

11.09 |

$ |

9.63 |

||||||||||||

|

|

||||||||||||||||||||

|

Investment activities |

||||||||||||||||||||

|

Net investment income(2)(3) |

0.21 |

0.22 |

0.21 |

0.10 |

||||||||||||||||

|

Net realized and unrealized |

(1.18 |

) |

1.10 |

(0.93 |

) |

1.36 |

||||||||||||||

|

Total from investment activities |

(0.97 |

) |

1.32 |

(0.72 |

) |

1.46 |

||||||||||||||

|

|

||||||||||||||||||||

|

Distributions |

||||||||||||||||||||

|

Net investment income |

(0.27 |

) |

(0.22 |

) |

(0.16 |

) |

– |

|||||||||||||

|

Net realized gain |

(0.15 |

) |

(0.22 |

) |

(0.38 |

) |

– |

|||||||||||||

|

Total distributions |

(0.42 |

) |

(0.44 |

) |

(0.54 |

) |

– |

|||||||||||||

|

|

||||||||||||||||||||

|

NET ASSET VALUE

|

$ |

9.32 |

$ |

10.71 |

$ |

9.83 |

$ |

11.09 |

||||||||||||

|

T. ROWE PRICE |

24 |

|

FINANCIAL HIGHLIGHTS |

For a share outstanding throughout each period |

|

I Class |

||||||||||||||||||||

|

|

Year |

|

10/31/19 |

|

10/31/18 |

|

3/6/17(1) |

|

||||||||||||

|

Ratios/Supplemental Data |

||||||||||||||||||||

|

|

||||||||||||||||||||

|

Total return(3)(4) |

(9.57 |

)% |

14.19 |

% |

(6.85 |

)% |

15.16 |

% |

||||||||||||

|

|

||||||||||||||||||||

|

Ratios to average net assets:(3) |

||||||||||||||||||||

|

Gross expenses before |

0.75 |

% |

0.91 |

% |

0.92 |

% |

1.92 |

%(5) |

||||||||||||

|

Net

expenses after |

0.68 |

% |

0.69 |

% |

0.69 |

% |

0.70 |

%(5) |

||||||||||||

|

Net investment income |

2.13 |

% |

2.23 |

% |

2.07 |

% |

1.44 |

%(5) |

||||||||||||

|

|

||||||||||||||||||||

|

Portfolio turnover rate |

69.1 |

% |

128.4 |

% |

153.2 |

% |

118.0 |

% |

||||||||||||

|

Net

assets, end of period (in |

$ |

404,394 |

$ |

79,768 |

$ |

96,975 |

$ |

2,086 |

||||||||||||

(1) Inception date

(2) Per share amounts calculated using average shares outstanding method.

(3) Includes the impact of expense-related arrangements with Price Associates.

(4) Total return reflects the rate that an investor would have earned on an investment in the fund during each period, assuming reinvestment of all distributions, and payment of no redemption or account fees, if applicable. Total return is not annualized for periods less than one year.

(5) Annualized

|

MORE ABOUT THE FUND |

25 |

|

FINANCIAL HIGHLIGHTS |

For a share outstanding throughout each period |

|

Advisor Class |

|||||||||||||||||||||||

|

|

Year |

|

10/31/19 |

|

10/31/18 |

|

10/31/17 |

|

10/31/16 |

||||||||||||||

|

NET ASSET VALUE |

|||||||||||||||||||||||

|

Beginning of period |

$ |

10.68 |

$ |

9.80 |

$ |

11.06 |

$ |

9.43 |

$ |

9.40 |

|||||||||||||

|

|

|||||||||||||||||||||||

|

Investment activities |

|||||||||||||||||||||||

|

Net investment |

0.17 |

0.25 |

0.19 |

0.17 |

0.13 |

||||||||||||||||||

|

Net realized and |

(1.16 |

) |

1.03 |

(0.94 |

) |

1.63 |

0.11 |

||||||||||||||||

|

Total

from investment |

(0.99 |

) |

1.28 |

(0.75 |

) |

1.80 |

0.24 |

||||||||||||||||

|

|

|||||||||||||||||||||||

|

Distributions |

|||||||||||||||||||||||

|

Net investment income |

(0.27 |

) |

(0.18 |

) |

(0.13 |

) |

(0.16 |

) |

(0.16 |

) |

|||||||||||||

|

Net realized gain |

(0.15 |

) |

(0.22 |

) |

(0.38 |

) |

(0.01 |

) |

(0.05 |

) |

|||||||||||||

|

Total distributions |

(0.42 |

) |

(0.40 |

) |

(0.51 |

) |

(0.17 |

) |

(0.21 |

) |

|||||||||||||

|

Redemption fees added |

– |

– |

(3) |

– |

(3) |

– |

(3) |

– |

(3) |

||||||||||||||

|

|

|||||||||||||||||||||||

|

NET ASSET VALUE

|

$ |

9.27 |

$ |

10.68 |

$ |

9.80 |

$ |

11.06 |

$ |

9.43 |

|||||||||||||

|

T. ROWE PRICE |

26 |

|

FINANCIAL HIGHLIGHTS |

For a share outstanding throughout each period |

|

Advisor Class |

||||||||||||||||||||

|

|

Year |

|

10/31/19 |

|

10/31/18 |

|

10/31/17 |

|

10/31/16 |

|||||||||||

|

Ratios/Supplemental Data |

||||||||||||||||||||

|

|

||||||||||||||||||||

|

Total return(2)(5) |

(9.79 |

)% |

13.74 |

% |

(7.13 |

)% |

19.47 |

% |

2.66 |

% |

||||||||||

|

|

||||||||||||||||||||

|

Ratios

to average net |

||||||||||||||||||||

|

Gross expenses before |

1.21 |

% |

1.32 |

% |

1.61 |

% |

2.66 |

% |

3.62 |

% |

||||||||||

|

Net

expenses after |

1.00 |

% |

1.00 |

% |

1.00 |

% |

1.00 |

% |

1.00 |

% |

||||||||||

|

Net investment income |

1.70 |

% |

2.48 |

% |

1.77 |

% |

1.66 |

% |

1.39 |

% |

||||||||||

|

|

||||||||||||||||||||

|

Portfolio turnover rate |

69.1 |

% |

128.4 |

% |

153.2 |

% |

118.0 |

% |

147.8 |

% |

||||||||||

|

Net

assets, end of period |

$ |

4,120 |

$ |

1,560 |

$ |

1,128 |

$ |

1,872 |

$ |

1,354 |

||||||||||

(1) Per share amounts calculated using average shares outstanding method.

(2) Includes the impact of expense-related arrangements with Price Associates.

(3) Amounts round to less than $0.01 per share.

(4) The fund charged redemption fees through March 31, 2019.

(5) Total return reflects the rate that an investor would have earned on an investment in the fund during each period, assuming reinvestment of all distributions, and payment of no redemption or account fees, if applicable.

Most T. Rowe Price Funds disclose their calendar quarter-end portfolio holdings on troweprice.com 15 calendar days after each quarter. At the discretion of the investment adviser, these holdings reports may exclude the issuer name and other information relating to a holding in order to protect the fund’s interests and to prevent harm to the fund or its shareholders. In addition, most T. Rowe Price Funds disclose their 10 largest holdings, along with the percentage of the relevant fund’s total assets that each of the 10 holdings represents, on troweprice.com on the seventh business day after each month-end. These holdings are listed in numerical order based on such percentages of the fund’s assets. A description of T. Rowe Price’s policies and procedures with respect to the disclosure of portfolio information is available in the Statement of Additional Information.

|

INFORMATION ABOUT ACCOUNTS IN T. ROWE PRICE FUNDS |

3 |

|

The following policies and procedures generally apply to Investor Class, I Class, Advisor Class, R Class, and Z Class accounts in the T. Rowe Price Funds. The front cover and Section 1 of this prospectus indicate which share classes are available for the fund.

This section of the prospectus explains the basics of investing with T. Rowe Price and describes some of the different share classes that may be available. Certain share classes can be held directly with T. Rowe Price, while other share classes must typically be held through a financial intermediary, such as broker-dealers, banks, insurance companies, retirement plan recordkeepers, and registered investment advisers. The Z Class is only available to funds managed by T. Rowe Price and other advisory clients of T. Rowe Price or its affiliates that are subject to a contractual fee for investment management services.

Each class of a fund’s shares represents an interest in the same fund with the same investment program and investment policies. However, each class is designed for a different type of investor and has a different cost structure primarily due to shareholder services or distribution arrangements that may apply only to that class. For example, certain classes may make payments to financial intermediaries for various administrative services they provide (commonly referred to as administrative fee payments, or AFP) and/or make payments to certain financial intermediaries for distribution of the fund’s shares (commonly referred to as 12b-1 fee payments). Determining the most appropriate share class depends on many factors, including how much you plan to invest, whether you are investing directly in the fund or through a financial intermediary, and whether you are investing on behalf of a person or an organization.

This section generally describes the differences between Investor Class, I Class, Advisor Class, R Class, and Z Class shares. This section does not describe the policies that apply to accounts in T. Rowe Price institutional funds and certain other types of funds. Policies for these other funds are described in their respective prospectuses, and all available share classes for the T. Rowe Price Funds are described more fully in the funds’ Statement of Additional Information. While many T. Rowe Price Funds are offered in more than one share class, not all funds offer all of the share classes described in this section.

Investor Class

A T. Rowe Price Fund that does not include the term “institutional” or indicate a specific share class as part of its name is considered to be the Investor Class of that fund. The Investor Class is

|

T. ROWE PRICE |

28 |