|

| ||

SUMMARY PROSPECTUS December 15, 2020 | |||

T. ROWE PRICE | |||

Emerging Europe Fund | |||

TREMX TTEEX TRZEX | Investor Class I Class Z Class | ||

The Securities and Exchange Commission (SEC) has not approved or disapproved these securities or passed upon the adequacy of this prospectus. Any representation to the contrary is a criminal offense. Before you invest, you may want to review the fund’s prospectus, which contains more information about the fund and its risks. You can find the fund’s prospectus, shareholder reports, and other information about the fund online at troweprice.com/prospectus. You can also get this information at no cost by calling 1-800-638-5660, by sending an e-mail request to info@troweprice.com, or by contacting your financial intermediary. This Summary Prospectus incorporates by reference the fund’s prospectus, dated December 15, 2020, as amended or supplemented, and Statement of Additional Information, dated December 15, 2020, as amended or supplemented. Beginning on January 1, 2021, as permitted by SEC regulations, paper copies of the T. Rowe Price funds’ annual and semiannual shareholder reports will no longer be mailed, unless you specifically request them. Instead, shareholder reports will be made available on the funds’ website (troweprice.com/prospectus), and you will be notified by mail with a website link to access the reports each time a report is posted to the site. If you already elected to receive reports electronically, you will not be affected by this change and need not take any action. At any time, shareholders who invest directly in T. Rowe Price funds may generally elect to receive reports or other communications electronically by enrolling at troweprice.com/paperless or, if you are a retirement plan sponsor or invest in the funds through a financial intermediary (such as an investment advisor, broker-dealer, insurance company, or bank), by contacting your representative or your financial intermediary. You may elect to continue receiving paper copies of future shareholder reports free

of charge. To do so, if you invest directly with T. Rowe Price, please call T. Rowe Price as follows:

IRA, nonretirement account holders, and institutional investors, 1-800-225-5132; small business retirement accounts, | |||

| |||

SUMMARY | 1 |

Investment Objective(s)

The fund seeks long-term growth of capital through investments primarily in the common stocks of companies located (or with primary operations) in the emerging market countries of Europe.

Fees and Expenses

This table describes the fees and expenses that you may pay if you buy, hold, and sell shares of the fund. The fees and expenses set forth below are annualized based on the fees and expenses for the six-month period ended April 30, 2020. You may also incur brokerage commissions and other charges when buying or selling shares of the Investor Class or I Class, which are not reflected in the table.

Fees and Expenses of the Fund

Investor | I | Z | ||||

Shareholder fees (fees paid directly from your investment) | ||||||

Maximum account fee | $20 | a | — | — | ||

Annual

fund operating expenses | ||||||

Management fees | 1.04 | % | 1.04 | % | 1.04 | % |

Distribution and service (12b-1) fees | — | — | — | |||

Other expenses | 0.49 | 0.21 | d | 0.21 | e | |

Total annual fund operating expenses | 1.53 | 1.25 | 1.25 | |||

Fee waiver/expense reimbursement | (0.12 | )b,c | (0.16 | )d | (1.25 | )e |

Total annual fund operating expenses after fee waiver/expense reimbursement | 1.41 | b,c | 1.09 | d | 0.00 | e |

a Subject to certain exceptions, accounts with a balance of less than $10,000 are charged an annual $20 fee.

b T. Rowe Price Associates, Inc., has contractually agreed (through February 28, 2022) to waive its fees and/or bear any expenses (excluding interest; expenses related to borrowings, taxes, and brokerage; nonrecurring, extraordinary expenses; and acquired fund fees and expenses) that would cause the class’ ratio of expenses to average daily net assets to exceed 1.41%. The agreement may only be terminated at any time after February 28, 2022, with approval by the fund’s Board of Directors. Fees waived and expenses paid under this agreement are subject to reimbursement to T. Rowe Price Associates, Inc., by the fund whenever the class’ expense ratio is below 1.41%. However, no reimbursement will be made more than three years from the date such amounts were initially waived or reimbursed. The fund may only make repayments to T. Rowe Price Associates, Inc., if such repayment does not cause the class’ expense ratio (after the repayment is taken into account) to exceed the lesser of: (1) the expense limitation in place at the time such amounts were waived; or (2) the class’ current expense limitation.

c Restated to reflect current fees.

T. ROWE PRICE | 2 |

d T. Rowe Price Associates, Inc., has contractually agreed (through February 28, 2022) to pay the operating expenses of the fund’s I Class excluding management fees; interest; expenses related to borrowings, taxes, and brokerage; nonrecurring, extraordinary expenses; and acquired fund fees and expenses (“I Class Operating Expenses”), to the extent the I Class Operating Expenses exceed 0.05% of the class’ average daily net assets. The agreement may only be terminated at any time after February 28, 2022, with approval by the fund’s Board of Directors. Any expenses paid under this agreement (and a previous limitation of 0.05%) are subject to reimbursement to T. Rowe Price Associates, Inc., by the fund whenever the fund’s I Class Operating Expenses are below 0.05%. However, no reimbursement will be made more than three years from the date such amounts were initially waived or reimbursed. The fund may only make repayments to T. Rowe Price Associates, Inc., if such repayment does not cause the I Class Operating Expenses (after the repayment is taken into account) to exceed the lesser of: (1) the limitation on I Class Operating Expenses in place at the time such amounts were waived; or (2) the current expense limitation on I Class Operating Expenses.

e T. Rowe Price Associates, Inc., has contractually agreed to waive and/or bear all the Z Class’ expenses (excluding interest; expenses related to borrowings, taxes, and brokerage; nonrecurring, extraordinary expenses; and acquired fund fees and expenses) in their entirety. T. Rowe Price Associates, Inc. expects this fee waiver and/or expense reimbursement arrangement to remain in place indefinitely, and the agreement may only be amended or terminated with approval by the fund’s Board of Directors.

Example This example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the fund for the time periods indicated and then redeem all of your shares at the end of those periods, that your investment has a 5% return each year, and that the fund’s operating expenses remain the same. The example also assumes that any current expense limitation arrangement remains in place for the period noted in the table above; therefore, the figures have been adjusted to reflect fee waivers or expense reimbursements only in the periods for which the expense limitation arrangement is expected to continue. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

1 year | 3 years | 5 years | 10 years | |

Investor Class | $144 | $469 | $820 | $1,811 |

I Class | 111 | 377 | 668 | 1,494 |

Z Class | 0 | 0 | 0 | 0 |

Portfolio Turnover The fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when the fund’s shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the fund’s performance. During the most recent 6-month period ended April 30, 2020, the fund’s portfolio turnover rate was 21.3% of the average value of its portfolio.

Investments, Risks, and Performance

Principal Investment Strategies

The fund normally invests at least 80% of its net assets (including any borrowings for investment purposes) in the emerging markets of Europe, including Eastern Europe and the former Soviet Union. For purposes of determining whether the fund invests at least 80% of its net assets in emerging European countries, the fund relies on MSCI Inc. to determine which countries are considered emerging markets and relies on the country assigned to a security by MSCI Inc. or another unaffiliated data provider. The fund considers frontier markets to be a subset of emerging markets, and any investments in frontier markets will be counted toward

SUMMARY | 3 |

the fund’s 80% investment policy. The fund expects to primarily invest in common stocks of companies located (or with primary operations) in emerging markets of Europe. The countries in which the fund normally invests include, but are not limited to, the following:

· Primary Emphasis: Czech Republic, Greece, Hungary, Kazakhstan, Poland, Romania, Russia, and Turkey.

· Others: Bulgaria, Croatia, Estonia, Georgia, Latvia, Lithuania, Slovakia, Slovenia, and Ukraine.

The emerging European investable universe, due to its limited geographic scope and less developed markets, tends to rely heavily on the success of certain industries and sectors. As a result, the fund may invest up to 35% of its net assets in any industry that accounts for more than 20% of the emerging European market as a whole, as measured by an index determined by T. Rowe Price to be an appropriate measure of the emerging European market (currently the MSCI Emerging Markets Europe Index).

The fund is “nondiversified,” meaning it may invest a greater portion of its assets in a single company and own more of the company’s voting securities than is permissible for a “diversified” fund. The fund may purchase the stocks of companies of any size.

While the adviser invests with an awareness of the outlook for certain industry sectors and individual countries within the region, the adviser’s decision-making process focuses on bottom-up stock selection. The fund may invest significantly in the banking industry and energy sector. Country allocation is driven largely by stock selection, though the adviser may limit investments in markets or industries that appear to have poor overall prospects.

Security selection reflects a growth style. The adviser relies on a global team of investment analysts dedicated to in-depth fundamental research in an effort to identify companies capable of achieving and sustaining above-average, long-term earnings growth. The adviser seeks to purchase stocks of companies at reasonable prices in relation to present or anticipated earnings, cash flow, or book value.

In selecting investments, the adviser generally favors companies with one or more of the following characteristics:

· leading or improving market position;

· attractive business niche;

· attractive or improving franchise or industry position;

· seasoned management;

· stable or improving earnings and/or cash flow; and

· sound or improving balance sheet.

The fund may sell securities for a variety of reasons, including to realize gains, limit losses, or redeploy assets into more promising opportunities.

Principal Risks

As with any fund, there is no guarantee that the fund will achieve its objective(s). The fund’s share price fluctuates, which means you could lose money by investing in the fund. The

T. ROWE PRICE | 4 |

principal risks of investing in this fund, which may be even greater during periods of market disruption or volatility, are summarized as follows:

Investing in Emerging Europe The European financial markets have been experiencing increased volatility due to concerns over rising government debt levels of several European countries, and these events may continue to significantly affect all of Europe. European economies could be significantly affected by, among other things, rising unemployment, the imposition or unexpected elimination of fiscal and monetary controls by member countries of the European Economic and Monetary Union, uncertainty surrounding the euro, the success of governmental actions to reduce budget deficits, and ongoing uncertainties surrounding Brexit, the formal withdrawal by the United Kingdom from the European Union. Emerging European countries are more susceptible to political turmoil, recession, varying market reforms, and adverse currency fluctuations as their economies continue to develop. In addition, there tends to be less information available about issuers in emerging Europe and their markets may experience limited trading volumes and reduced liquidity.

Emerging markets Investments in emerging market countries are subject to greater risk and overall volatility than investments in the U.S. and developed markets. Emerging market countries tend to have economic structures that are less diverse and mature, and political systems that are less stable, than those of developed countries. In addition to the risks associated with investing outside the U.S., emerging markets are more susceptible to governmental interference, political and economic uncertainty, local taxes and restrictions on the fund’s investments, less efficient trading markets with lower overall liquidity, and more volatile currency exchange rates.

Geographic concentration Because the fund focuses its investments on a particular geographic area, the fund’s performance is closely tied to the social, political, and economic conditions of that area. Political developments and changes in regulatory, tax, or economic policy could significantly affect the markets in which the fund invests. As a result, the fund is likely to be more volatile than more geographically diverse international funds.

Investing in Russia The Russian economy is susceptible to declines in the production and sales of oil, government intervention, corruption, and geopolitical tensions. Investing in Russia also involves risks relating to the settlement and ownership rights associated with holding Russian securities and the threat that sanctions could significantly impact the Russian economy. Military and political actions undertaken by Russia have prompted the U.S. and the regulatory bodies of certain other countries, as well as the European Union, to impose economic sanctions on certain Russian individuals and Russian companies. These sanctions can consist of prohibiting certain securities trades, certain private transactions in the energy sector, asset freezes and prohibition of all business, against certain Russian individuals and Russian companies. Such sanctions and the threat of additional sanctions could severely disrupt the Russian economy and limit the liquidity of the fund’s investments in Russia.

Industry concentration Because the fund may invest significantly in any industry that accounts for more than 20% of the emerging European market, the fund is more susceptible to adverse developments affecting such industries and may perform poorly during a downturn in

SUMMARY | 5 |

one of the industries that are heavily represented in emerging Europe. For example, the fund may invest significantly in banks and financial companies or in energy-related companies. Banks can be adversely affected by, among other things, regulatory changes, interest rate movements, the availability of capital and cost to borrow, and the rate of debt defaults. The oversight of banks in emerging markets may be ineffective and underdeveloped relative to more mature markets. In particular for emerging markets, the impact of future regulation on any individual bank, or on the financial services sector as a whole, can be very difficult to predict. In addition, companies in the energy sector can be adversely affected by political, regulatory, and economic factors including fluctuations in energy prices and the supply-and-demand of energy fuels. Such companies are also at risk of being negatively impacted by natural disasters or becoming subject to environmental damage claims.

Frontier markets Frontier markets generally have smaller economies and less mature capital markets than emerging markets. As a result, the risks associated with investing in emerging market countries are magnified in frontier market countries. Frontier markets are more susceptible to abrupt changes in currency values, have less mature markets and settlement practices, and can have lower trading volumes that could lead to greater price volatility and illiquidity. Investor protections in frontier market countries may be limited and settlement procedures and custody services may prove inadequate in certain markets.

International investing Investing in the securities of non-U.S. issuers involves special risks not typically associated with investing in U.S. issuers. Non-U.S. securities tend to be more volatile and have lower overall liquidity than investments in U.S. securities and may lose value because of adverse local, political, social, or economic developments overseas, or due to changes in the exchange rates between foreign currencies and the U.S. dollar. In addition, investments outside the U.S. are subject to settlement practices and regulatory and financial reporting standards that differ from those of the U.S. The risks of investing outside the U.S. are heightened for any investments in emerging markets, which are susceptible to greater volatility than investments in developed markets.

Liquidity A particular investment or an entire market segment may become less liquid or even illiquid, sometimes abruptly, which could limit the fund’s ability to purchase or sell holdings in a timely manner at a desired price. An inability to sell a portfolio holding can adversely affect the fund’s overall value or prevent the fund from being able to take advantage of other investment opportunities. Liquidity risk may be magnified during periods of substantial market volatility and unexpected episodes of illiquidity may limit the fund’s ability to pay redemption proceeds without selling holdings at an unfavorable time or at a suitable price. Large redemptions may also have a negative impact on the fund’s overall liquidity.

Nondiversification As a nondiversified fund, the fund has the ability to invest a larger percentage of its assets in the securities of a smaller number of issuers than a diversified fund. As a result, poor performance by a single issuer could adversely affect fund performance more than if the fund were invested in a larger number of issuers. The fund’s share price can be expected to fluctuate more than that of a similar fund that is more broadly diversified.

T. ROWE PRICE | 6 |

Growth investing The fund’s growth approach to investing could cause it to underperform other stock funds that employ a different investment style. Growth stocks tend to be more volatile than certain other types of stocks, and their prices may fluctuate more dramatically than the overall stock market. A stock with growth characteristics can have sharp price declines due to decreases in current or expected earnings and may lack dividends that can help cushion its share price in a declining market.

Stock investing Stocks generally fluctuate in value more than bonds and may decline significantly over short time periods. There is a chance that stock prices overall will decline because stock markets tend to move in cycles, with periods of rising and falling prices. The value of stocks held by the fund may decline due to general weakness or volatility in the stock markets in which the fund invests or because of factors that affect a particular company or industry.

Active management The fund’s overall investment program and holdings selected by the fund’s investment adviser may underperform the broad markets, relevant indices, or other funds with similar objectives and investment strategies.

Performance

The following performance information provides some indication of the risks of investing in the fund. The fund’s performance information represents only past performance (before and after taxes) and is not necessarily an indication of future results.

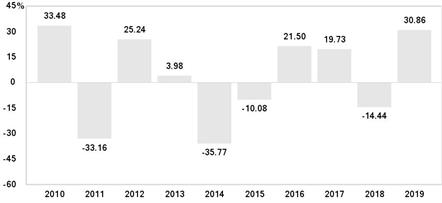

The following bar chart illustrates how much returns can differ from year to year by showing calendar year returns and the best and worst calendar quarter returns during those years for the fund’s Investor Class. Returns for other share classes vary since they have different expenses.

EMERGING EUROPE FUND |

Calendar Year Returns

Quarter Ended | Total Return | Quarter Ended | Total Return | |||||

Best Quarter | 03/31/2012 | 20.63% | Worst Quarter | 09/30/2011 | -30.99% |

The fund’s return for the nine months ended 9/30/20 was -26.55%.

SUMMARY | 7 |

The following table shows the average annual total returns for each class of the fund that has been in operation for at least one full calendar year, and also compares the returns with the returns of a relevant broad-based market index, as well as with the returns of one or more comparative indexes that have investment characteristics similar to those of the fund, if applicable.

In addition, the table shows hypothetical after-tax returns to demonstrate how taxes paid by a shareholder may influence returns. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements, such as a 401(k) account or an IRA. After-tax returns are shown only for the Investor Class and will differ for other share classes.

T. ROWE PRICE | 8 |

Average Annual Total Returns |

|

|

|

|

|

|

| |||||||||

|

|

| Periods ended |

| ||||||||||||

|

|

| December 31, 2019 |

| ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

|

|

| Since | Inception |

| ||

|

|

| 1 Year |

|

| 5 Years |

|

| 10 Years |

|

| inception | date |

| ||

| Investor Class |

|

|

|

|

|

|

|

|

|

|

| 08/31/2000 |

|

| |

|

| Returns before taxes | 30.86 | % |

| 7.93 | % |

| 0.89 | % |

| — | % |

|

| |

|

| Returns after taxes on distributions | 30.36 |

|

| 7.65 |

|

| 0.79 |

|

| — |

|

|

| |

|

| Returns after taxes on distributions |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

| and sale of fund shares | 19.48 |

|

| 6.45 |

|

| 0.90 |

|

| — |

|

|

| |

| I Class |

|

|

|

|

|

|

|

|

|

|

| 03/06/2017 |

|

| |

|

| Returns before taxes | 31.25 |

|

| — |

|

| — |

|

| 11.37 |

|

|

|

|

Z Class | 02/22/2021 | |||||||||||||||

|

| Returns before taxes | — |

|

| — |

|

| — |

|

| — |

|

|

|

|

| MSCI Emerging Markets Europe Index Net (reflects no deduction for fees or expenses) |

|

|

| ||||||||||||

|

| 32.32 |

|

| 8.50 |

|

| 1.08 |

|

| 12.37 | a |

|

|

| |

| Lipper Emerging Markets Funds Average |

|

|

| ||||||||||||

|

| 20.54 |

|

| 5.02 |

|

| 3.89 |

|

| 8.55 | b |

|

|

| |

a Return since 3/6/17.

b Return since 2/28/17.

Updated performance information is available through troweprice.com.

Management

Investment Adviser T. Rowe Price Associates, Inc. (T. Rowe Price or Price Associates)

Investment Subadviser T. Rowe Price International Ltd (T. Rowe Price International)

Portfolio Manager | Title | Managed | Joined |

Ulle Adamson | Chair of Investment Advisory Committee | 2015 | 2002 |

Purchase and Sale of Fund Shares

The Investor Class generally requires a $2,500 minimum initial investment ($1,000 minimum initial investment if opening an IRA, a custodial account for a minor, or a small business retirement plan account). Additional purchases generally require a $100 minimum. These investment minimums generally are waived for financial intermediaries and certain employer-sponsored retirement plans submitting orders on behalf of their customers.

The I Class requires a $1 million minimum initial investment and there is no minimum for additional purchases, although the initial investment minimum generally is waived for financial intermediaries, retirement plans, and certain client accounts for which T. Rowe Price or its affiliate has discretionary investment authority.

SUMMARY | 9 |

The Z Class is only available to funds managed by T. Rowe Price and other advisory clients of T. Rowe Price or its affiliates that are subject to a contractual fee for investment management services. There is no minimum initial investment and no minimum for additional purchases.

For investors holding shares of the fund directly with T. Rowe Price, you may purchase, redeem, or exchange fund shares by mail; by telephone (1-800-225-5132 for IRAs and nonretirement accounts; 1-800-492-7670 for small business retirement plans; and 1-800-638-8790 for institutional investors and financial intermediaries); or, for certain accounts, by accessing your account online through troweprice.com.

If you hold shares through a financial intermediary or retirement plan, you must purchase, redeem, and exchange shares of the fund through your intermediary or retirement plan. You should check with your intermediary or retirement plan to determine the investment minimums that apply to your account.

Tax Information

Any dividends or capital gains are declared and paid annually, usually in December. Redemptions or exchanges of fund shares and distributions by the fund, whether or not you reinvest these amounts in additional fund shares, generally may be taxed as ordinary income or capital gains unless you invest through a tax-deferred account (in which case you will be taxed upon withdrawal from such account).

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the fund through a broker-dealer or other financial intermediary (such as a bank), the fund and its related companies may pay the intermediary for the sale of fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

| |

T. Rowe Price Associates, Inc. | F131-045 12/15/20 |