UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-2958

| T. Rowe Price International Funds, Inc. |

|

|

| (Exact name of registrant as specified in charter) |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

|

| (Address of principal executive offices) |

| David Oestreicher |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

|

| (Name and address of agent for service) |

Registrant’s telephone number, including area

code: (410) 345-2000

Date of fiscal year end: December

31

Date of reporting period: December 31, 2011

Item 1. Report to Shareholders

|

|

Emerging

Markets Bond Fund |

December

31, 2011 |

The views and opinions in this report were current as of December 31, 2011. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors, and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of the fund’s future investment intent. The report is certified under the Sarbanes-Oxley Act, which requires mutual funds and other public companies to affirm that, to the best of their knowledge, the information in their financial reports is fairly and accurately stated in all material respects.

REPORTS ON THE WEB

Sign up for our E-mail Program, and you can begin to receive updated fund reports and prospectuses online rather than through the mail. Log in to your account at troweprice.com for more information.

Manager’s Letter

Fellow Shareholders

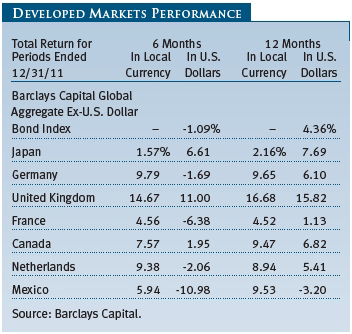

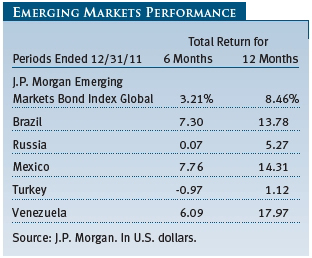

Returns for international bonds were mixed in 2011 against a background of heightened volatility. The latter half of the year was particularly challenging as the ongoing European debt crisis and signs of slower global economic growth caused investors to shed risk in favor of safe-haven assets. Government bonds issued by non-U.S. developed markets rose on the whole, but Europe was an obvious exception as returns were held back by the failure of policymakers to adequately address the Continent’s long-term debt problems. Emerging markets bonds outpaced developed market debt—a testament to their generally healthy fiscal positions and better growth prospects relative to developed markets. Strong performance in local currency bond markets was offset by the depreciation of most emerging market currencies versus the U.S. dollar.

MARKET ENVIRONMENT

The global economic recovery continued to unfold in 2011, although the pace of growth slowed overall. Among developed markets, U.S. growth was less than robust but proved far more resilient than many experts had expected. The domestic recovery continued despite multiple shocks, including the acrimonious political debate over the U.S. debt ceiling, the ongoing European debt crisis, political and social unrest in key oil-producing nations in the Middle East and North Africa, and slowing growth in China and other key emerging markets. The eurozone edged toward recession as policymakers failed to resolve or even effectively contain the Continental debt crises. However, German government bonds benefited from their status as the premium lower-risk asset in Europe and performed well, as did highly rated non-eurozone sovereigns from the UK, Denmark, Sweden, and Norway. Except for the Japanese yen, all major developed market currencies depreciated against the U.S. dollar over the year, eroding returns in dollar terms. Investment-grade corporate bonds were volatile, rising steadily in the first half of the year before experiencing a broad third-quarter sell-off as the eurozone debt crisis intensified. They recovered somewhat in the fourth quarter and closed the year with modest gains. European high yield bonds lost ground for the year amid widespread negative investor sentiment.

Dollar-denominated emerging markets bonds outpaced developed market debt by a wide margin as investors were attracted to the superior fundamentals of the asset class versus developed markets. Emerging markets debt denominated in local currencies performed well in local currency terms. However, this strong performance was offset by broad-based currency depreciation against the U.S. dollar as investors favored the relative safety of dollar-denominated assets.

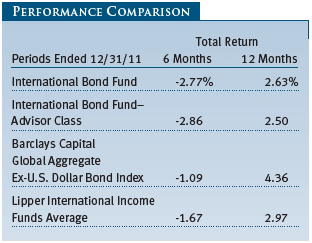

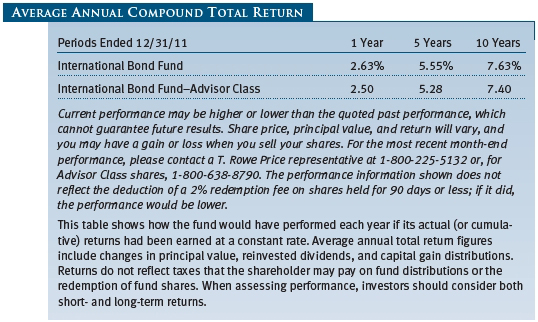

INTERNATIONAL BOND FUND

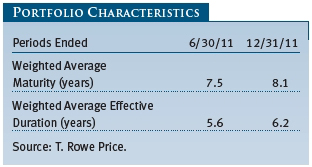

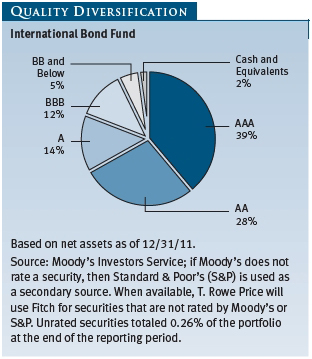

As shown in the Performance Comparison table, the International Bond Fund gained 2.63% for the 12 months ended December 31, 2011, but declined 2.77% over the closing six months. The fund narrowly trailed its Lipper peer group average over both periods and lagged the Barclays Capital Global Aggregate Ex-U.S. Dollar Bond Index by a slightly wider margin. Country and duration selection added modestly to results over the year, but this was not enough to overcome weakness in our active currency selection, sector and security selection, and allocations to below investment-grade securities. (Returns for the fund’s Advisor Class shares varied slightly due to their different fee structure.)

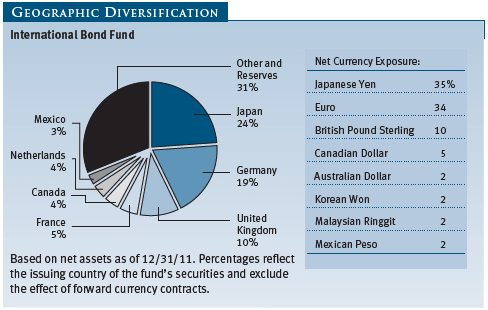

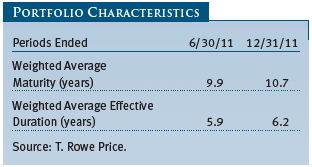

Underweight duration positions in peripheral European government debt helped performance as these securities mostly lagged German government bonds, in which we have an overweight relative to the benchmark. An underweight allocation to Canadian government bonds weighed on results as these bonds closely tracked the strong performance of U.S. Treasuries, particularly in the second half of the year as risk aversion increased. Overall, we expect low yields and negative real yields in some regions to persist for some time, and we recently lengthened our duration—making it more sensitive to changes in interest rates—but remain shorter than our benchmark. We reduced our exposure to peripheral European debt by eliminating our lone Irish government bond and we trimmed our Spanish and Italian debt. We currently have no exposure to Ireland or Portugal and have significant underweights to Italy and Spain. Government bonds currently appear expensive, and we have underweight allocations to Canada and the eurozone. Among Asian markets, we are underweight Japan and overweight Malaysia. We like longer-dated bonds in Brazil and Mexico as part of our broader focus on the relative health of emerging markets over the long term.

Active currency selection weighed on returns. An underweight exposure to the euro and an overweight allocation to the Norwegian krone enhanced returns for the year. However, these benefits were not enough to overcome weakness from the Mexican peso and other emerging market local currencies, whose value declined sharply in September as investors once again grew cautious. We reduced risk in our currency allocations late in the period, trimming exposure to the British pound and Swedish krona. We retained a focus on the Norwegian krone, funded by our lack of exposure to the euro. We favor the Mexican peso over a weakening U.S. dollar. Over the long term, emerging market currencies should continue to strengthen versus the U.S. dollar and euro as developed markets struggle with burdensome debt challenges.

Sector and security selection also hampered results during the year. An overweight allocation and adverse security selection in investment-grade European corporate bonds detracted significantly amid heightened uncertainty surrounding the European debt crisis, particularly over the second half of the year. However, an underweight to European securitized and government-related bonds was modestly positive. We reduced our focus on European investment-grade corporate bonds in light of widening yield spreads—the difference between yields of higher- and lower-quality bonds—but remain overweight. Within financials, we continue to favor U.S. and UK banks over European banks as they are more likely to be insulated somewhat from the European debt crisis.

Allocations to sub-investment-grade emerging markets local currency government bonds modestly benefited results. European high yield and emerging markets U.S. dollar-denominated corporate bonds detracted significantly in the second half of the year as riskier assets came under pressure. As part of a risk reduction strategy, we trimmed our exposure to European high yield bonds over the quarter. However, we maintain allocations to both European high yield and dollar-denominated emerging markets corporate bonds, where we see a mismatch between fundamentals and current yields.

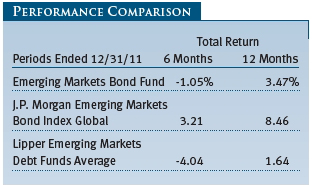

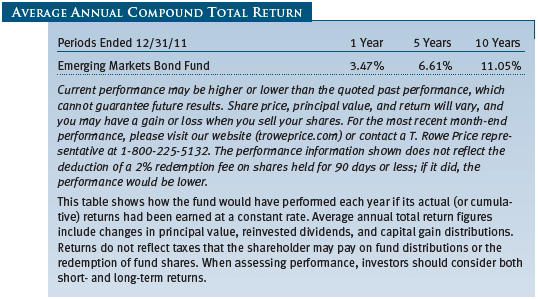

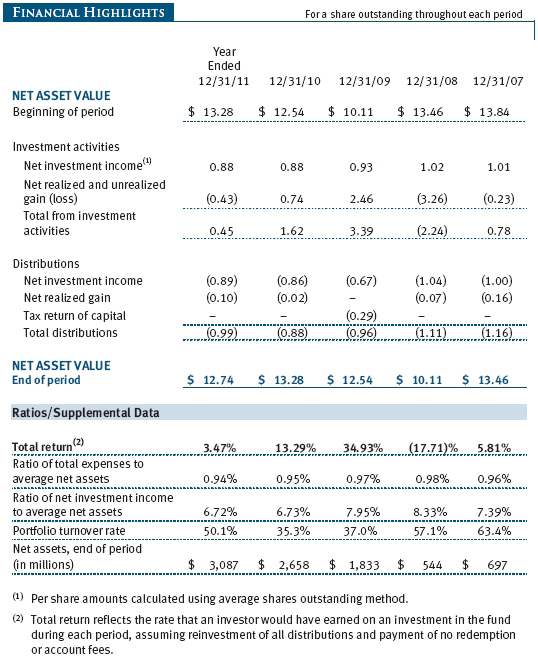

EMERGING MARKETS BOND FUND

As shown in the Performance Comparison table, strong performance in the first half of the year helped the Emerging Markets Bond Fund gain 3.47% for the 12 months ended December 31, 2011. The fund outpaced its Lipper peer group average but lagged the J.P. Morgan Emerging Markets Bond Index Global. Our exposure to emerging market corporate debt weighed heavily on returns over the second half of the year as risk appetite declined amid concerns over the broader impact of the European debt crisis and slowing global economic growth. Investors rotated into the perceived safety of larger sovereign issuers such as Brazil and Mexico, where our underweight allocation also hurt returns. On a positive note, our relative lack of exposure to several troubled countries, including Belarus and Egypt, benefited returns. Our exposure to Venezuelan sovereign bonds also aided results as elevated oil prices and improved prospects for regime change contributed to heightened investor interest.

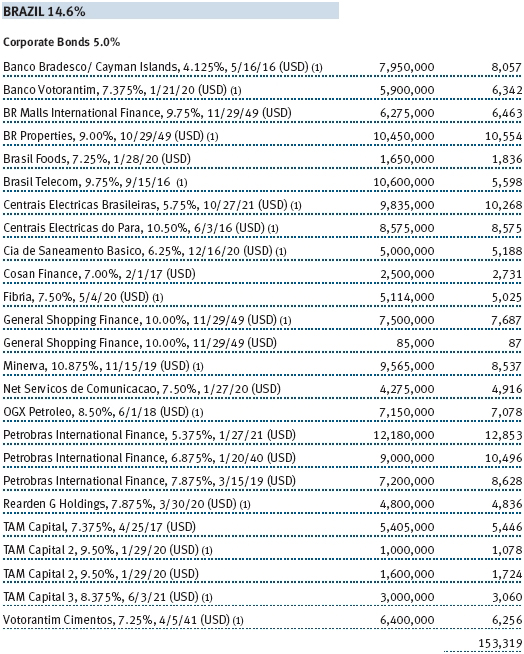

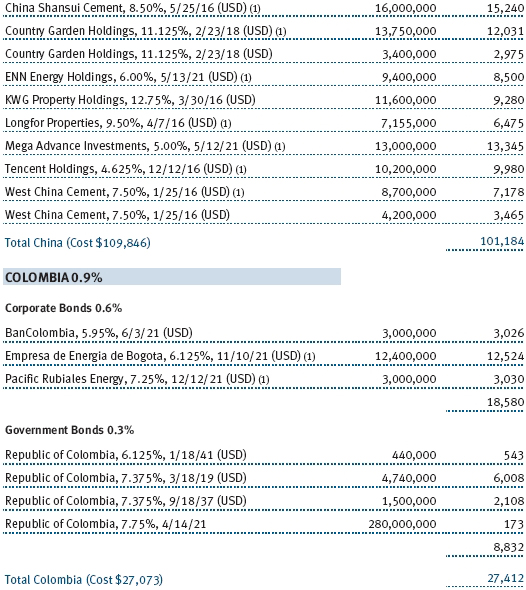

We trimmed our allocation to corporate debt after a December rally in many of our positions, including the Chinese property sector, which benefited from improved prospects for a soft economic landing. Despite recent volatility, our long-term conviction in the sector remains firm given favorable urbanization trends and a high savings rate. The remainder of our corporate allocation is spread across companies that stand to benefit from growing domestic demand from the emerging market consumer, particularly in Brazil, Russia, China, India, and Mexico. We recently added to our position in General Shopping, a Brazilian shopping mall operator that stands to benefit from rising local consumption trends and low vacancy rates. Given heightened tensions in major oil producers such as Iran, Russia, Kazakhstan, and Iraq, we also recently added to select western oil-related companies that enjoy strong government support, including Petroleos de Venezuela, Petroleos Mexicanos (Pemex), and Petrobras in Brazil. These companies are removed from the unrest in the Middle East and North Africa but stand to benefit from potential oil price increases. Despite the recent volatility, the fundamentals of emerging market corporate debt compare favorably to developed market companies, and we believe strongly that it will outperform over the coming years. (Please refer to the fund’s portfolio of investments for a complete list of holdings and the amount each represents in the portfolio.)

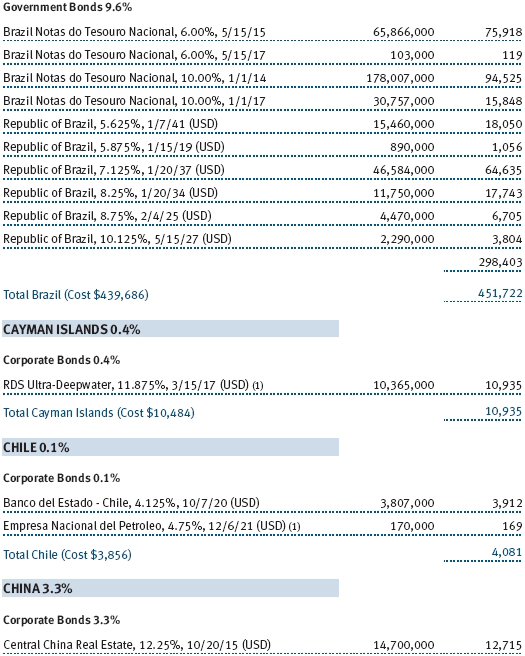

We continued to reduce our local markets allocation during the period. Inflationary pressures have eased, and many emerging markets have started to cut interest rates in order to safeguard economic growth. However, weakening currencies versus the U.S. dollar have muted the return potential. We continue to maintain conviction in select markets, however, most notably in Mexico and Brazil. Mexico continues to enjoy relatively benign inflation expectations, while Brazil offers the highest real interest rates in the world.

The choice to invest in local debt and the respective currency in which that debt is issued are separate and distinct decisions made by the portfolio manager. Although bouts of risk aversion are likely in the first half of 2012, we expect risk appetite to increase in the second half of the year as global headwinds abate or become priced into the market, and we may add to select currencies on weakness, such as the Colombian peso and Chilean peso.

In terms of region and country positions, our overweight in Eastern Europe stems largely from our focus on Russia. The country maintains a robust growth outlook, led by consumer activity, lower inflation, and an ongoing resumption in lending activity. Additionally, Russia stands to benefit from its upcoming membership in the World Trade Organization, which should boost long-term growth prospects and improve regulatory discipline. We further anticipate that this major oil exporter will continue to benefit from elevated oil prices. We also favor the Ukraine, where our exposure is spread across sovereign, quasi-sovereign, and corporate debt markets. Importantly, we are significantly underweight troubled Eastern European countries exposed to high contagion risks from the deteriorating eurozone economy, including Belarus, Croatia, and Hungary.

Our exposure to inflation-linked debt in Latin America helped relative performance in the fourth quarter. Despite reduced inflationary pressure in the latter part of 2011, we expect current inflation levels to persist and that inflation is likely to rise again in 2012. Brazil continues to be the largest overweight position in our portfolio, and our holdings include external, local, and corporate debt. Brazil has a healthy reserve position, a diverse mix of commodity exports, and strong domestic demand. We continue to find value in corporations that stand to profit from Brazil’s growing middle class.

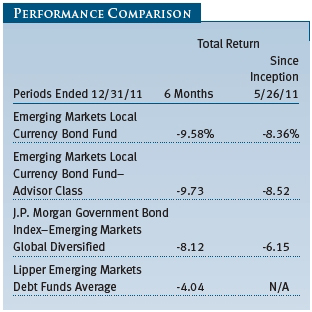

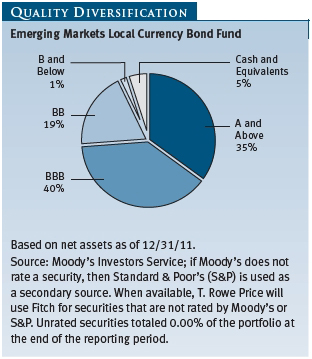

EMERGING MARKETS LOCAL CURRENCY BOND FUND

The Emerging Markets Local Currency Bond Fund fell 9.58% over the six-month period ended December 31, 2011, and returned -8.36% since its inception on May 26, 2011. (Returns for the fund’s Advisor Class shares varied slightly due to a different fee structure.) The fund trailed its Lipper peer group average for the closing six months, and lagged the J.P. Morgan Government Bond Index–Emerging Markets Global Diversified over both periods. The fund underperformed the benchmark since inception in May. Currency selection, country and duration positioning, and sector and security selection detracted from returns versus the index.

| Strategy Review |

Profound structural reforms have bought greater political and economic stability to many emerging markets. Heightened monetary and fiscal discipline has helped tame inflation, lessening the need to issue bonds in hard foreign currencies like the U.S. dollar, euro, and yen. As a result, an increasing number of countries now issue debt denominated in their local currencies, offering high credit quality and broad geographic diversification.

The asset class offers several benefits. Since interest rates vary from country to country depending on local economic conditions and monetary and fiscal policies, U.S. investors can benefit from potentially higher yields than those available in the domestic market. Additionally, investors are frequently attracted by the ability to diversify their portfolio’s currency exposure away from the U.S. dollar, yen, and euro into currencies that benefit from stronger economic growth rates.

Leveraging the knowledge and experience gained through 25 years of managing non-U.S. bond portfolios, our team of investment professionals has adopted a multi-step management process for the Emerging Markets Local Currency Bond Fund:

- A rigorous analysis of valuation measures,

trading conditions, and the economic and political environment helps to develop a deep understanding of local

markets.

- An in-depth risk/return profile of countries

and currencies helps to identify the most attractive investment opportunities.

- A detailed asset allocation model includes

the calibration of country and currency positions based on market opportunities and the need for

diversification.

- Individual securities are carefully screened and selected, with close consideration given to the execution of best-price trades and compliance with established risk parameters.

Investing in emerging local market debt is certainly not without risk, including the currency and political risks unique to international investing. However, we believe the Emerging Markets Local Currency Bond Fund offers an attractive investment opportunity for investors seeking a combination of current income, capital appreciation, and greater diversification for their fixed income investments and who can accept the volatility inherent in the asset class.

Currency selection weighed on results, with the largest detractor being an overweight allocation to the South Korean won versus the Japanese yen as the latter benefited from its safe-haven status. Our preference for the Mexican peso over the U.S. dollar also hurt results. Currency selection in the Europe, Middle East, and Africa (EMEA) region was beneficial, however, and was driven by an off-benchmark allocation to the U.S. dollar funded by a short position in the euro. An overweight allocation to the euro versus the Hungarian forint, which was particularly weak over the closing three months, also helped performance.

Country and duration positions also detracted from results. Much of the negative impact stemmed from implementation costs, particularly from taxes imposed on foreign bond investments in a number of emerging markets. Country selection in Latin America hindered returns overall, but overweight allocations to Brazil, Peru, and Mexico helped performance. In Asia, performance detraction came from underweight allocations to Thailand and Indonesia as these markets experienced strong performance. In the EMEA region, an overweight allocation to Turkey and an underweight to Poland were the largest detractors. An underweight to Hungary proved beneficial as Hungary was the only bond market to decline over the period.

Sector and security selection were also negative. Exposure to Brazilian real-denominated supranational bonds and U.S. dollar-denominated emerging markets corporate bonds were the two largest detractors.

OUTLOOK

Among developed markets, the U.S. economy has shown surprising resilience in the face of macroeconomic uncertainty stemming from the eurozone debt crisis and decelerating growth in major emerging markets. Nonetheless, we continue to expect a recession and financial strains in the eurozone to contribute to a slowdown in the U.S. in the months ahead. The European economy is likely to deteriorate due to stress in the banking system and ongoing fiscal tightening, with expected gross domestic product growth between -0.5% and -1.0% for 2012. The outlook for growth in the second half of 2012 depends largely on whether or not policymakers take decisive action to resolve the Continent’s long-term debt problems. The Japanese economy continues to recover from the impact of the earthquake and tsunami last March. Domestic demand and exports have improved, though capital expenditures are still weak, and recent export data to Europe have been somewhat disappointing.

Short-term weakness emanating from global growth concerns may provide an attractive entry point into emerging market bonds, as emerging markets debt remains well supported by solid fundamental and technical characteristics. Although the asset class remains vulnerable to global macroeconomic instability stemming from developed markets in the near term, longer-term drivers remain very supportive of emerging markets debt. More specifically, we expect risks will begin to ease in the second half of the year as a modest U.S. recovery and soft economic landing in China become more entrenched. Capital inflows have been reinforced by the continued fundamental deterioration of developed markets, most notably in Europe, combined with improved credit profiles among emerging countries. We believe this convergence is precipitating a long-term shift in investor preference toward emerging markets debt.

Overall, the global growth outlook has become modestly more positive, helped by better-than-expected data from the U.S. While a recession in Europe is now fully priced into bond markets, investors remain uncertain when it comes to China. Decreased commodity prices, coupled with erosion in exports to regions like Europe, have led many forecasters to downgrade inflation expectations in emerging market countries. While this supports local currency emerging market bonds, it may restrict the appreciation potential of emerging market currencies in the short term. In below investment-grade bonds, default rate forecasts for 2012 remain around historical averages, and the asset class remains attractively valued. By contrast, the market remains cautious on investment-grade corporate bonds, where the financials sector remains vulnerable to further deleveraging and large exposure to European periphery debt.

Effective security selection is becoming increasingly important as the international bond market grows in size, complexity, and maturity. We believe that the extended reach of T. Rowe Price’s global credit and equity research platforms, combined with our emphasis on cross-functional collaboration, gives our portfolio managers a critical edge in evaluating opportunities and risks in the global bond market.

Respectfully submitted,

Ian Kelson

President of the International Fixed Income Division,

portfolio manager of the International Bond Fund, and chairman of the fund’s

Investment Advisory Committee

Michael J.

Conelius

Portfolio manager of the

Emerging Markets Bond Fund and chairman of the fund’s Investment Advisory

Committee

Christopher J.

Rothery

Co-portfolio manager of the

Emerging Markets Local Currency Bond Fund and cochairman of the fund’s

Investment Advisory Committee

Andrew J. Keirle

Co-portfolio manager of the Emerging Markets Local

Currency Bond Fund and cochairman of the fund’s Investment Advisory

Committee

January 23, 2012

The committee chairmen have day-to-day responsibility for the portfolios and work with committee members in developing and executing the funds’ investment programs.

RISK OF INTERNATIONAL BOND INVESTING

Funds that invest overseas generally carry more risk than funds that invest strictly in U.S. assets, including unpredictable changes in currency values. Investments in emerging markets are subject to abrupt and severe price declines and should be regarded as speculative. The economic and political structures of developing nations, in most cases, do not compare favorably with the U.S. or other developed countries in terms of wealth and stability, and their financial markets often lack liquidity. Some countries also have legacies of hyperinflation, currency devaluations, and government interference in markets.

International investments are subject to currency risk, a decline in the value of a foreign currency versus the U.S. dollar, which reduces the dollar value of securities denominated in that currency. The overall impact on a fund’s holdings can be significant and long-lasting, depending on the currencies represented in the portfolio, how each one appreciates or depreciates in relation to the U.S. dollar, and whether currency positions are hedged. Further, exchange rate movements are unpredictable, and it is not possible to effectively hedge the currency risks of many developing countries.

Bonds are also subject to interest rate risk, the decline in bond prices that usually accompanies a rise in interest rates, and credit risk, the chance that any fund holding could have its credit rating downgraded or that a bond issuer will default (fail to make timely payments of interest or principal), potentially reducing the fund’s income level and share price.

GLOSSARY

Barclays Capital Global Aggregate Ex-U.S. Dollar Bond Index: Tracks the performance of government, corporate, agency, and mortgage-backed bonds in Europe, the Asia-Pacific region, and Canada.

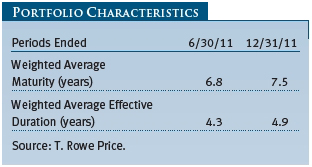

Duration: A measure of a bond’s or bond fund’s sensitivity to changes in interest rates. For example, a fund with a duration of five years would fall about 5% in response to a one-percentage-point rise in rates, and vice versa.

J.P. Morgan Emerging Markets Bond Index Global: Tracks U.S. dollar government bonds of 31 foreign countries.

J.P. Morgan Government Bond Index–Emerging Markets Global Diversified: A capitalization-weighted index tracking emerging market government bonds denominated in local currencies.

Lipper averages: The average of available mutual fund performance for specified time periods in categories defined by Lipper Inc.

Quasi-sovereign debt: Debt issued by a corporation and backed by the respective government, typically offering the higher yields of corporate debt with the added benefit of government support.

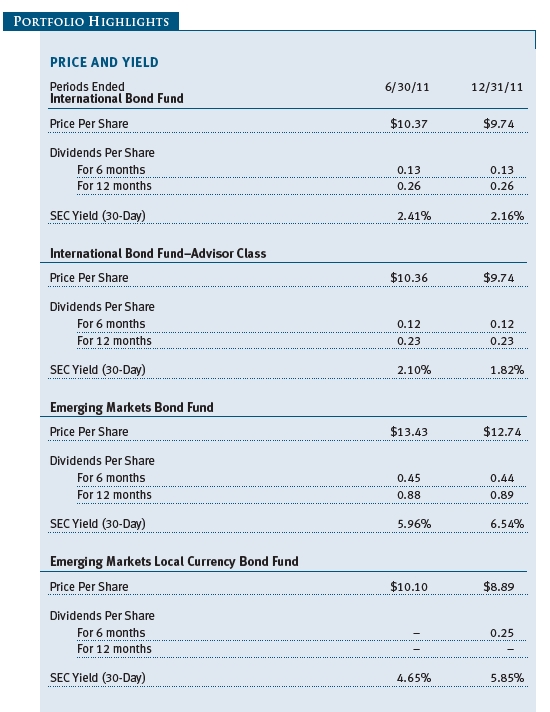

SEC yield (30-day): The 30-day SEC yield represents net investment income earned by a fund over a 30-day period, expressed as an annual percentage rate based on the fund’s share price at the end of the 30-day period.

Weighted average maturity: A measure of a fund’s sensitivity to interest rates. In general, the longer the average maturity, the greater the fund’s sensitivity to interest rate changes. The weighted average maturity may take into account the interest rate readjustment dates for certain securities. Money funds must maintain a weighted average maturity of less than 60 days.

Yield curve: A graphic depicting the relationship between yields and maturity dates for a set of similar securities. These curves are in constant flux. One of the key activities in managing any fixed income portfolio is to study the trends reflected by yield curves.

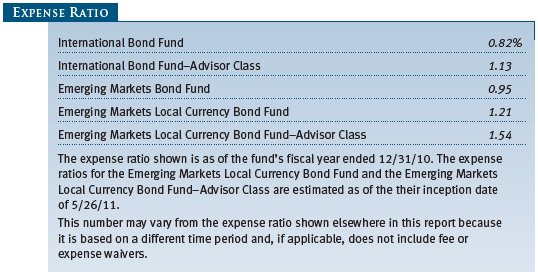

Performance and Expenses

| Growth of $10,000 |

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

| Growth of $10,000 |

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

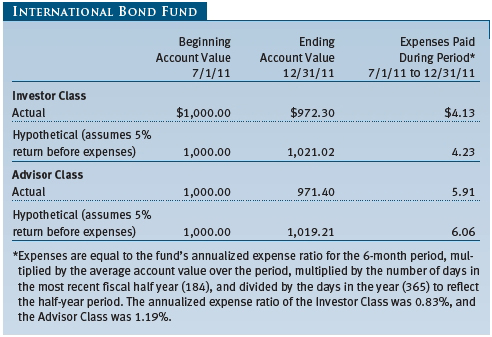

| Fund Expense Example |

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs, such as redemption fees or sales loads, and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Please note that the International Bond Fund has two share classes: The original share class (“Investor Class”) charges no distribution and service (12b-1) fee, and the Advisor Class shares are offered only through unaffiliated brokers and other financial intermediaries and charge a 0.25% 12b-1 fee. Each share class is presented separately in the table.

Actual

Expenses

The first line of the

following table (“Actual”) provides information about actual account values and

expenses based on the fund’s actual returns. You may use the information on this

line, together with your account balance, to estimate the expenses that you paid

over the period. Simply divide your account value by $1,000 (for example, an

$8,600 account value divided by $1,000 = 8.6), then multiply the result by the

number on the first line under the heading “Expenses Paid During Period” to

estimate the expenses you paid on your account during this period.

Hypothetical Example for

Comparison Purposes

The information

on the second line of the table (“Hypothetical”) is based on hypothetical

account values and expenses derived from the fund’s actual expense ratio and an

assumed 5% per year rate of return before expenses (not the fund’s actual

return). You may compare the ongoing costs of investing in the fund with other

funds by contrasting this 5% hypothetical example and the 5% hypothetical

examples that appear in the shareholder reports of the other funds. The

hypothetical account values and expenses may not be used to estimate the actual

ending account balance or expenses you paid for the

period.

Note: T. Rowe Price charges an annual account service fee of $20, generally for accounts with less than $10,000 ($1,000 for UGMA/UTMA). The fee is waived for any investor whose T. Rowe Price mutual fund accounts total $50,000 or more; accounts employing automatic investing; accounts electing to receive electronic delivery of account statements, transaction confirmations, prospectuses, and shareholder reports; accounts of an investor who is a T. Rowe Price Preferred Services, Personal Services, or Enhanced Personal Services client (enrollment in these programs generally requires T. Rowe Price assets of at least $100,000); and IRAs and other retirement plan accounts that utilize a prototype plan sponsored by T. Rowe Price (although a separate custodial or administrative fee may apply to such accounts). This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

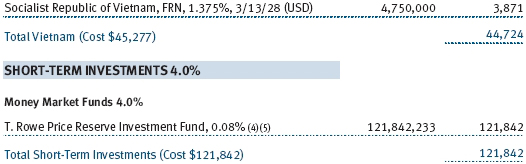

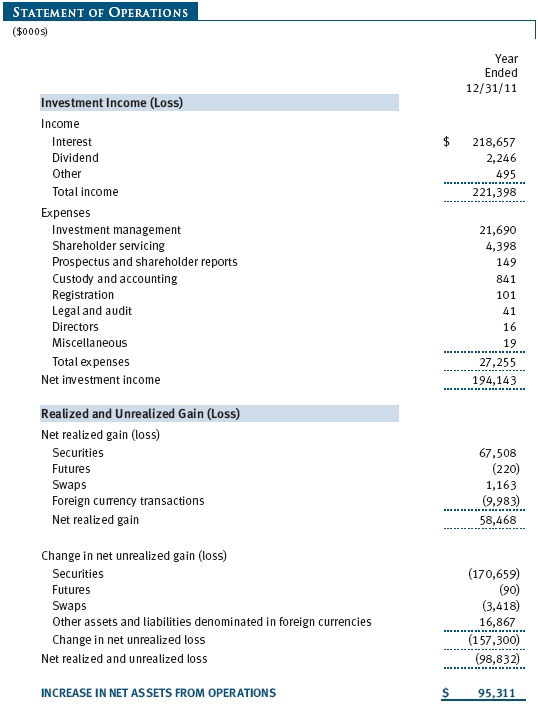

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

| Notes to Financial Statements |

T. Rowe Price International Funds, Inc. (the corporation), is registered under the Investment Company Act of 1940 (the 1940 Act). The Emerging Markets Bond Fund (the fund), a nondiversified, open-end management investment company, is one portfolio established by the corporation. The fund commenced operations on December 30, 1994. The fund seeks to provide high income and capital appreciation.

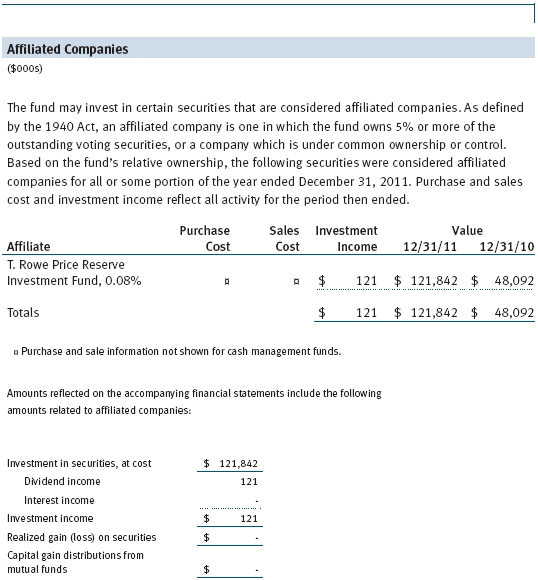

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (GAAP), which require the use of estimates made by management. Management believes that estimates and valuations are appropriate; however, actual results may differ from those estimates, and the valuations reflected in the accompanying financial statements may differ from the value ultimately realized upon sale or maturity.

Investment Transactions, Investment Income, and Distributions Income and expenses are recorded on the accrual basis. Premiums and discounts on debt securities are amortized for financial reporting purposes. Paydown gains and losses are recorded as an adjustment to interest income. Dividends received from mutual fund investments are reflected as dividend income; capital gain distributions are reflected as realized gain/loss. Dividend income and capital gain distributions are recorded on the ex-dividend date. Income tax-related interest and penalties, if incurred, would be recorded as income tax expense. Investment transactions are accounted for on the trade date. Realized gains and losses are reported on the identified cost basis. Distributions to shareholders are recorded on the ex-dividend date. Income distributions are declared daily and paid monthly. Capital gain distributions, if any, are generally declared and paid by the fund annually.

Currency Translation Assets, including investments, and liabilities denominated in foreign currencies are translated into U.S. dollar values each day at the prevailing exchange rate, using the mean of the bid and asked prices of such currencies against U.S. dollars as quoted by a major bank. Purchases and sales of securities, income, and expenses are translated into U.S. dollars at the prevailing exchange rate on the date of the transaction. The effect of changes in foreign currency exchange rates on realized and unrealized security gains and losses is reflected as a component of security gains and losses.

Credits The fund earns credits on temporarily uninvested cash balances held at the custodian, which reduce the fund’s custody charges. Custody expense in the accompanying financial statements is presented before reduction for credits.

Redemption Fees A 2% fee is assessed on redemptions of fund shares held for 90 days or less to deter short-term trading and to protect the interests of long-term shareholders. Redemption fees are withheld from proceeds that shareholders receive from the sale or exchange of fund shares. The fees are paid to the fund and are recorded as an increase to paid-in capital. The fees may cause the redemption price per share to differ from the net asset value per share.

New Accounting Pronouncements In December 2011, the Financial Accounting Standards Board issued amended guidance to enhance disclosure for offsetting assets and liabilities. The guidance is effective for fiscal years and interim periods beginning on or after January 1, 2013; adoption will have no effect on the fund’s net assets or results of operations.

NOTE 2 - VALUATION

The fund’s financial instruments are reported at fair value as defined by GAAP. The fund determines the values of its assets and liabilities and computes net asset value per share at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day that the NYSE is open for business. Values in the accompanying Portfolio of Investments are as of December 30, 2011 the last business day in the fund’s fiscal year ended December 31, 2011. Some foreign markets were open between December 30 and the close of the fund’s reporting period on December 31, but any differences in values and foreign exchange rates subsequent to December 30 through December 31 were immaterial to the fund’s financial statements.

Valuation Methods Debt securities are generally traded in the over-the-counter (OTC) market. Securities with remaining maturities of one year or more at the time of acquisition are valued at prices furnished by dealers who make markets in such securities or by an independent pricing service, which considers the yield or price of bonds of comparable quality, coupon, maturity, and type, as well as prices quoted by dealers who make markets in such securities. Securities with remaining maturities of less than one year at the time of acquisition generally use amortized cost in local currency to approximate fair value. However, if amortized cost is deemed not to reflect fair value or the fund holds a significant amount of such securities with remaining maturities of more than 60 days, the securities are valued at prices furnished by dealers who make markets in such securities or by an independent pricing service.

Equity securities listed or regularly traded on a securities exchange or in the OTC market are valued at the last quoted sale price or, for certain markets, the official closing price at the time the valuations are made, except for OTC Bulletin Board securities, which are valued at the mean of the latest bid and asked prices. A security that is listed or traded on more than one exchange is valued at the quotation on the exchange determined to be the primary market for such security. Listed securities not traded on a particular day are valued at the mean of the latest bid and asked prices for domestic securities and the last quoted sale price for international securities.

Investments in mutual funds are valued at the mutual fund’s closing net asset value per share on the day of valuation. Forward currency exchange contracts are valued using the prevailing forward exchange rate. Swaps are valued at prices furnished by independent swap dealers or by an independent pricing service.

Other investments, including restricted securities and private placements, and those financial instruments for which the above valuation procedures are inappropriate or are deemed not to reflect fair value, are stated at fair value as determined in good faith by the T. Rowe Price Valuation Committee, established by the fund’s Board of Directors (the Board). Subject to oversight by the Board, the Valuation Committee develops pricing-related policies and procedures and approves all fair-value determinations. The Valuation Committee regularly makes good faith judgments, using a wide variety of sources and information, to establish and adjust valuations of certain securities as events occur and circumstances warrant. For instance, in determining the fair value of private-equity instruments, the Valuation Committee considers a variety of factors, including the company’s business prospects, its financial performance, strategic events impacting the company, relevant valuations of similar companies, new rounds of financing, and any negotiated transactions of significant size between other investors in the company. Because any fair-value determination involves a significant amount of judgment, there is a degree of subjectivity inherent in such pricing decisions.

Valuation Inputs Various inputs are used to determine the value of the fund’s financial instruments. These inputs are summarized in the three broad levels listed below:

Level 1 – quoted prices in active markets for identical financial instruments

Level 2 – observable inputs other than Level 1 quoted prices (including, but not limited to, quoted prices for similar financial instruments, interest rates, prepayment speeds, and credit risk)

Level 3 – unobservable inputs

Observable inputs are those based on market data obtained from sources independent of the fund, and unobservable inputs reflect the fund’s own assumptions based on the best information available. The input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level. The following table summarizes the fund’s financial instruments, based on the inputs used to determine their values on December 31, 2011:

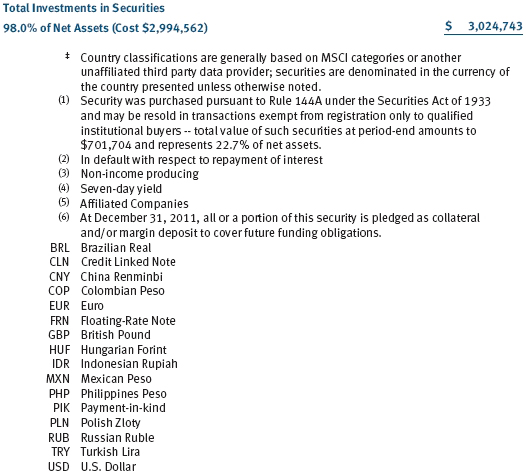

NOTE 3 - DERIVATIVE INSTRUMENTS

During the year ended December 31, 2011, the fund invested in derivative instruments. As defined by GAAP, a derivative is a financial instrument whose value is derived from an underlying security price, foreign exchange rate, interest rate, index of prices or rates, or other variable; it requires little or no initial investment and permits or requires net settlement. The fund invests in derivatives only if the expected risks and rewards are consistent with its investment objectives, policies, and overall risk profile, as described in its prospectus and Statement of Additional Information. The fund may use derivatives for a variety of purposes, such as seeking to hedge against declines in principal value, increase yield, invest in an asset with greater efficiency and at a lower cost than is possible through direct investment, or to adjust portfolio duration and credit exposure. The risks associated with the use of derivatives are different from, and potentially much greater than, the risks associated with investing directly in the instruments on which the derivatives are based. Investments in derivatives can magnify returns positively or negatively; however, the fund at all times maintains sufficient cash reserves, liquid assets, or other SEC-permitted asset types to cover the settlement obligations under its open derivative contracts.

The fund values its derivatives at fair value, as described below and in Note 2, and recognizes changes in fair value currently in its results of operations. Accordingly, the fund does not follow hedge accounting, even for derivatives employed as economic hedges. The fund does not offset the fair value of derivative instruments against the right to reclaim or obligation to return collateral. The following table summarizes the fair value of the fund’s derivative instruments held as of December 31, 2011, and the related location on the accompanying Statement of Assets and Liabilities, presented by primary underlying risk exposure:

Additionally, the amount of gains and losses on derivative instruments recognized in fund earnings during the year ended December 31, 2011, and the related location on the accompanying Statement of Operations is summarized in the following table by primary underlying risk exposure:

Forward Currency Exchange Contracts The fund is subject to foreign currency exchange rate risk in the normal course of pursuing its investment objectives. It uses forward currency exchange contracts (forwards) primarily to protect its non-U.S. dollar-denominated holdings from adverse currency movements and to gain exposure to currencies for the purposes of risk management or enhanced return. A forward involves an obligation to purchase or sell a fixed amount of a specific currency on a future date at a price set at the time of the contract. Although certain forwards may be settled by exchanging only the net gain or loss on the contract, most forwards are settled with the exchange of the underlying currencies in accordance with the specified terms. Forwards are valued at the unrealized gain or loss on the contract, which reflects the net amount the fund either is entitled to receive or obligated to deliver, as measured by the difference between the forward exchange rates at the date of entry into the contract and the forward rates at the reporting date. Appreciated forwards are reflected as assets, and depreciated forwards are reflected as liabilities on the accompanying Statement of Assets and Liabilities. Risks related to the use of forwards include the possible failure of counterparties to meet the terms of the agreements; that anticipated currency movements will not occur, thereby reducing the fund’s total return; and the potential for losses in excess of the fund’s initial investment. During the year ended December 31, 2011, the fund’s exposure to forwards, based on underlying notional amounts, was generally between 9% and 13% of net assets.

Futures Contracts The fund is subject to interest rate risk in the normal course of pursuing its investment objectives and uses futures contracts to help manage such risk. The fund may enter into futures contracts to manage exposure to interest rate and yield curve movements, security prices, foreign currencies, credit quality, and mortgage prepayments; as an efficient means of adjusting exposure to all or part of a target market; to enhance income; as a cash management tool; and/or to adjust portfolio duration and credit exposure. A futures contract provides for the future sale by one party and purchase by another of a specified amount of a particular underlying financial instrument at an agreed-upon price, date, time, and place. The fund currently invests only in exchange-traded futures, which generally are standardized as to maturity date, underlying financial instrument, and other contract terms. Upon entering into a futures contract, the fund is required to deposit with the broker cash or securities in an amount equal to a certain percentage of the contract value (initial margin deposit); the margin deposit must then be maintained at the established level over the life of the contract. Subsequent payments are made or received by the fund each day to settle daily fluctuations in the value of the contract (variation margin), which reflect changes in the value of the underlying financial instrument. At its election, the fund may also hold additional U.S. dollars and foreign currencies in an account with the broker to settle future variation margin obligations. All cash and currencies held by the broker for initial margin or future settlements are reflected as deposits on futures contracts on the accompanying Statement of Assets and Liabilities. Variation margin is recorded as unrealized gain or loss until the contract is closed. The value of a futures contract included in net assets is the amount of unsettled variation margin, if any. Risks related to the use of futures contracts include possible illiquidity of the futures markets, contract prices that can be highly volatile and imperfectly correlated to movements in hedged security values and/or interest rates, and potential losses in excess of the fund’s initial investment. During the year ended December 31, 2011, the fund’s exposure to futures, based on underlying notional amounts, was generally less than 1% of net assets.

Credit Default Swaps The fund is subject to credit risk in the normal course of pursuing its investment objectives and uses swap contracts to help manage such risk. The fund may use swaps in an effort to manage exposure to changes in interest rates, inflation rates, and credit quality; to adjust overall exposure to certain markets; to enhance total return or protect the value of portfolio securities; to serve as a cash management tool; and/or to adjust portfolio duration or credit exposure. Credit default swaps are agreements where one party (the protection buyer) agrees to make periodic payments to another party (the protection seller) in exchange for protection against specified credit events, such as certain defaults and bankruptcies related to an underlying credit instrument, or issuer or index of such instruments. Upon occurrence of a specified credit event, the protection seller is required to pay the buyer the difference between the notional amount of the swap and the value of the underlying credit, either in the form of a net cash settlement or by paying the gross notional amount and accepting delivery of the relevant underlying credit. For credit default swaps where the underlying credit is an index, a specified credit event may affect all or individual underlying securities included in the index and will be settled based upon the relative weighting of the affected underlying security(s) within the index. Generally, the payment risk for the seller of protection is inversely related to the current market price of the underlying credit; or, in the case of an index swap, the market value of the contract relative to the notional amount. Therefore, the payment risk increases as the price of the relevant underlying credit, or market value of the index swap, declines due to market valuations of credit quality. As of December 31, 2011, the notional amount of protection sold by the fund totaled $79,500,000 (2.6% of net assets), which reflects the maximum potential amount the fund could be required to pay under such contracts. The value of a swap included in net assets is the unrealized gain or loss on the contract plus or minus any unamortized premiums paid or received, respectively. Appreciated swaps and premiums paid are reflected as assets, and depreciated swaps and premiums received are reflected as liabilities on the accompanying Statement of Assets and Liabilities. Net periodic receipts or payments required by swaps are accrued daily and are recorded as realized gain or loss for financial reporting purposes when settled; fluctuations in the fair value of swaps are reflected in the change in net unrealized gain or loss and are reclassified to realized gain or loss upon termination prior to maturity or cash settlement. Risks related to the use of credit default swaps include the possible inability of the fund to accurately assess the current and future creditworthiness of underlying issuers, the possible failure of a counterparty to perform in accordance with the terms of the swap agreements, potential government regulation that could adversely affect the fund’s swap investments, and potential losses in excess of the fund’s initial investment During the year ended December 31, 2011, the fund’s exposure to swaps, based on underlying notional amounts, was generally between 1% and 3% of net assets.

NOTE 4 - OTHER INVESTMENT TRANSACTIONS

Consistent with its investment objective, the fund engages in the following practices to manage exposure to certain risks and/or to enhance performance. The investment objective, policies, program, and risk factors of the fund are described more fully in the fund’s prospectus and Statement of Additional Information.

Emerging Markets At December 31, 2011, approximately 91% of the fund’s net assets were invested, either directly or through investments in T. Rowe Price institutional funds, in securities of companies located in emerging markets, securities issued by governments of emerging market countries, and/or securities denominated in or linked to the currencies of emerging market countries. Emerging market securities are often subject to greater price volatility, less liquidity, and higher rates of inflation than U.S. securities. In addition, emerging markets may be subject to greater political, economic, and social uncertainty, and differing regulatory environments that may potentially impact the fund’s ability to buy or sell certain securities or repatriate proceeds to U.S. dollars.

Noninvestment-Grade Debt Securities At December 31, 2011, approximately 47% of the fund’s net assets were invested, either directly or through its investment in T. Rowe Price institutional funds, in noninvestment-grade debt securities, commonly referred to as “high yield” or “junk” bonds. The noninvestment-grade bond market may experience sudden and sharp price swings due to a variety of factors, including changes in economic forecasts, stock market activity, large sustained sales by major investors, a high-profile default, or a change in the market’s psychology. These events may decrease the ability of issuers to make principal and interest payments and adversely affect the liquidity or value, or both, of such securities.

Restricted Securities The fund may invest in securities that are subject to legal or contractual restrictions on resale. Prompt sale of such securities at an acceptable price may be difficult and may involve substantial delays and additional costs.

Counterparty Risk and Collateral The fund has entered into collateral agreements with certain counterparties to mitigate counterparty risk associated with certain over-the-counter (OTC) financial instruments, including swaps, forward currency exchange contracts, TBA purchase commitments, and OTC options (collectively, covered OTC instruments). Subject to certain minimum exposure requirements (which typically range from $100,000 to $500,000), collateral requirements generally are determined and transfers made based on the net aggregate unrealized gain or loss on all OTC instruments covered by a particular collateral agreement with a specified counterparty. Collateral, both pledged by the fund to a counterparty and pledged by a counterparty to the fund, is held in a segregated account by a third-party agent and can be in the form of cash or debt securities issued by the U.S. government or related agencies. Securities posted as collateral by the fund to a counterparty are so noted in the accompanying Portfolio of Investments and remain in the fund’s net assets. As of December 31, 2011, securities valued at $7,058,000 had been posted by the fund to counterparties. In accordance with GAAP, cash pledged by counterparties to the fund is included in the fund’s net assets; however, securities pledged by counterparties to the fund are not recorded by the fund. As of December 31, 2011, collateral pledged by counterparties to the fund consisted of securities valued at $11,150,000.

At any point in time, the fund’s risk of loss from counterparty credit risk on covered OTC instruments is the aggregate unrealized gain on appreciated covered OTC instruments in excess of collateral, if any, pledged by the counterparty to the fund. Counterparty risk related to exchange-traded futures and options contracts is minimal because the exchange’s clearinghouse provides protection against counterparty defaults. Generally, for exchange-traded derivatives such as futures and options, each broker, in its sole discretion, may change margin requirements applicable to the fund. In accordance with the terms of the relevant derivatives agreements, counterparties to OTC derivatives may be able to terminate derivative contracts prior to maturity after the occurrence of certain stated events, such as a decline in net assets above a certain percentage or a failure by the fund to perform its obligations under the contract. Upon termination, all transactions would typically be liquidated and a net amount would be owed by or payable to the fund.

Other Purchases and sales of portfolio securities other than short-term securities aggregated $1,830,562,000 and $1,379,378,000, respectively, for the year ended December 31, 2011.

NOTE 5 - FEDERAL INCOME TAXES

No provision for federal income taxes is required since the fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its taxable income and gains. Distributions determined in accordance with federal income tax regulations may differ in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences.

The fund files U.S. federal, state, and local tax returns as required. The fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations, which is generally three years after the filing of the tax return but which can be extended to six years in certain circumstances. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

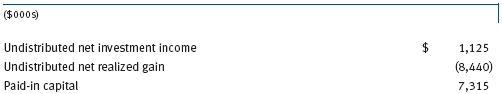

Reclassifications to paid-in capital relate primarily to a tax practice that treats a portion of the proceeds from each redemption of capital shares as a distribution of taxable net investment income and/or realized capital gain. Reclassifications between income and gain relate primarily to the recharacterization of distributions. For the year ended December 31, 2011, the following reclassifications were recorded to reflect tax character (there was no impact on results of operations or net assets):

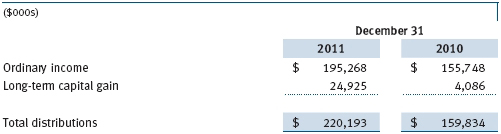

Distributions during the years ended December 31, 2011 and December 31, 2010 were characterized for tax purposes as follows:

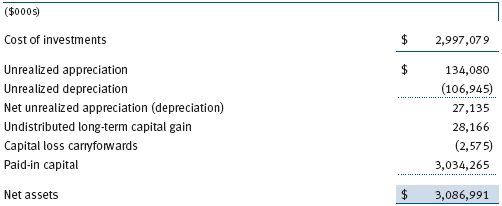

At December 31, 2011, the tax-basis cost of investments and components of net assets were as follows:

The difference between book-basis and tax-basis net unrealized appreciation (depreciation) is attributable to the realization of gains/losses on certain open derivative contracts for tax purposes. Net realized capital losses may be carried forward indefinitely to offset future realized capital gains. All or a portion of the capital loss carryforwards may be from losses realized between November 1 and the fund’s fiscal year-end, which are deferred for tax purposes until the subsequent year but recognized for financial reporting purposes in the year realized. The fund intends to retain realized gains to the extent of available capital loss carryforwards. The fund’s available capital loss carryforwards as of December 31, 2011, have no expiration.

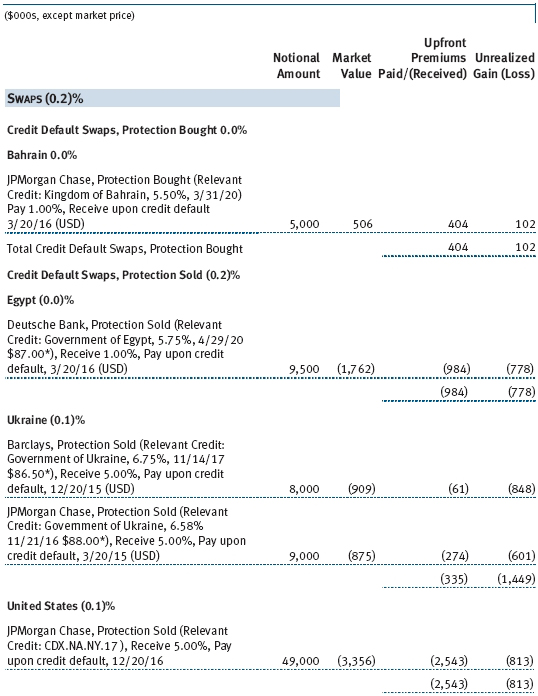

NOTE 6 - RELATED PARTY TRANSACTIONS

The fund is managed by T. Rowe Price Associates, Inc. (Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. (Price Group). The fund is managed by T. Rowe Price Associates, Inc. (Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. (Price Group). The fund was previously managed by T. Rowe Price International, Inc. (Price International), which was merged into its parent company, Price Associates, effective at the close of business on December 31, 2010. Thereafter, Price Associates assumed responsibility for all of Price International’s existing investment management contracts, and Price International ceased all further operations. The corporate reorganization was designed to simplify Price Group’s corporate structure related to its international business and was intended to result in no material changes in the nature, quality, level, or cost of services provided to the T. Rowe Price funds. The investment management agreement between the fund and Price Associates provides for an annual investment management fee, which is computed daily and paid monthly. The fee consists of an individual fund fee, equal to 0.45% of the fund’s average daily net assets, and a group fee. The group fee rate is calculated based on the combined net assets of certain mutual funds sponsored by Price Associates (the group) applied to a graduated fee schedule, with rates ranging from 0.48% for the first $1 billion of assets to 0.28% for assets in excess of $300 billion. The fund’s group fee is determined by applying the group fee rate to the fund’s average daily net assets. At December 31, 2011, the effective annual group fee rate was 0.30%.

In addition, the fund has entered into service agreements with Price Associates and two wholly owned subsidiaries of Price Associates (collectively, Price). Price Associates computes the daily share price and provides certain other administrative services to the fund. T. Rowe Price Services, Inc., provides shareholder and administrative services in its capacity as the fund’s transfer and dividend disbursing agent. T. Rowe Price Retirement Plan Services, Inc., provides subaccounting and recordkeeping services for certain retirement accounts invested in the fund. For the year ended December 31, 2011, expenses incurred pursuant to these service agreements were $193,000 for Price Associates; $615,000 for T. Rowe Price Services, Inc.; and $43,000 for T. Rowe Price Retirement Plan Services, Inc. The total amount payable at period-end pursuant to these service agreements is reflected as Due to Affiliates in the accompanying financial statements.

The fund is also one of several mutual funds sponsored by Price Associates (underlying Price funds) in which the T. Rowe Price Spectrum Funds (Spectrum Funds) and T. Rowe Price Retirement Funds (Retirement Funds) may invest. Neither the Spectrum Funds nor the Retirement Funds invest in the underlying Price funds for the purpose of exercising management or control. Pursuant to separate special servicing agreements, expenses associated with the operation of the Spectrum and Retirement Funds are borne by each underlying Price fund to the extent of estimated savings to it and in proportion to the average daily value of its shares owned by the Spectrum and Retirement Funds, respectively. Expenses allocated under these agreements are reflected as shareholder servicing expenses in the accompanying financial statements. For the year ended December 31, 2011, the fund was allocated $717,000 of Spectrum Funds’ expenses and $2,416,000 of Retirement Funds’ expenses. Of these amounts, $1,874,000 related to services provided by Price. The amount payable at period-end pursuant to this agreement is reflected as Due to Affiliates in the accompanying financial statements. At December 31, 2011, approximately 18% of the outstanding shares of the fund were held by the Spectrum Funds and 47% were held by the Retirement Funds.

The fund may invest in the T. Rowe Price Reserve Investment Fund and the T. Rowe Price Government Reserve Investment Fund (collectively, the T. Rowe Price Reserve Investment Funds), open-end management investment companies managed by Price Associates and considered affiliates of the fund. The T. Rowe Price Reserve Investment Funds are offered as cash management options to mutual funds, trusts, and other accounts managed by Price Associates and/or its affiliates and are not available for direct purchase by members of the public. The T. Rowe Price Reserve Investment Funds pay no investment management fees.

As of December 31, 2011, T. Rowe Price Group, Inc., and/or its wholly owned subsidiaries owned 119,458 shares of the fund, representing less than 1% of the fund’s net assets.

| Report of Independent Registered Public Accounting Firm |

To the

Board of Directors

of T. Rowe Price

International Funds, Inc.

and

Shareholders of

T. Rowe Price Emerging

Markets Bond Fund

In our opinion, the accompanying statement of assets and liabilities, including the portfolio of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of T. Rowe Price Emerging Markets Bond Fund (one of the portfolios comprising T. Rowe Price International Funds, Inc., hereafter referred to as the “Fund”) at December 31, 2011, and the results of its operations, the changes in its net assets and the financial highlights for each of the periods indicated therein, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2011 by correspondence with the custodian and brokers, and confirmation of the underlying funds by correspondence with the transfer agent, provide a reasonable basis for our opinion.

PricewaterhouseCoopers

LLP

Baltimore, Maryland

February 17, 2012

| Tax Information (Unaudited) for the Tax Year Ended 12/31/11 |

We are providing this information as required by the Internal Revenue Code. The amounts shown may differ from those elsewhere in this report because of differences between tax and financial reporting requirements.

- $1,543,000 from short-term capital

gains,

- $32,240,000 from long-term capital gains, subject to the 15% rate gains category.

| Information on Proxy Voting Policies, Procedures, and Records |

A description of the policies and procedures used by T. Rowe Price funds and portfolios to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information, which you may request by calling 1-800-225-5132 or by accessing the SEC’s website, sec.gov. The description of our proxy voting policies and procedures is also available on our website, troweprice.com. To access it, click on the words “Our Company” at the top of our corporate homepage. Then, when the next page appears, click on the words “Proxy Voting Policies” on the left side of the page.

Each fund’s most recent annual proxy voting record is available on our website and through the SEC’s website. To access it through our website, follow the directions above, then click on the words “Proxy Voting Records” on the right side of the Proxy Voting Policies page.

| How to Obtain Quarterly Portfolio Holdings |

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q is available electronically on the SEC’s website (sec.gov); hard copies may be reviewed and copied at the SEC’s Public Reference Room, 450 Fifth St. N.W., Washington, DC 20549. For more information on the Public Reference Room, call 1-800-SEC-0330.

| About the Fund’s Directors and Officers |

Your fund is overseen by a Board of Directors (Board) that meets regularly to review a wide variety of matters affecting the fund, including performance, investment programs, compliance matters, advisory fees and expenses, service providers, and other business affairs. The Board elects the fund’s officers, who are listed in the final table. At least 75% of the Board’s members are independent of T. Rowe Price Associates, Inc. (T. Rowe Price), and its affiliates; “inside” or “interested” directors are employees or officers of T. Rowe Price. The business address of each director and officer is 100 East Pratt Street, Baltimore, Maryland 21202. The Statement of Additional Information includes additional information about the fund directors and is available without charge by calling a T. Rowe Price representative at 1-800-638-5660.

| Independent Directors | ||

| Name | ||

| (Year of Birth) | Principal Occupation(s) and Directorships of Public Companies and | |

| Year Elected* | Other Investment Companies During the Past Five Years | |

| William R. Brody | President and Trustee, Salk Institute for Biological Studies (2009 | |

| (1944) | to present); Director, Novartis, Inc. (2009 to present); Director, IBM | |

| 2009 | (2007 to present); President and Trustee, Johns Hopkins University | |

| (1996 to 2009); Chairman of Executive Committee and Trustee, | ||

| Johns Hopkins Health System (1996 to 2009) | ||

| Jeremiah E. Casey | Retired | |

| (1940) | ||

| 2006 | ||

| Anthony W. Deering | Chairman, Exeter Capital, LLC, a private investment firm (2004 | |

| (1945) | to present); Director, Under Armour (2008 to present); Director, | |

| 1991 | Vornado Real Estate Investment Trust (2004 to present); Director, | |

| Mercantile Bankshares (2002 to 2007); Director and Member of the | ||

| Advisory Board, Deutsche Bank North America (2004 to present) | ||

| Donald W. Dick, Jr. | Principal, EuroCapital Partners, LLC, an acquisition and management | |

| (1943) | advisory firm (1995 to present) | |

| 1988 | ||

| Karen N. Horn | Senior Managing Director, Brock Capital Group, an advisory and | |

| (1943) | investment banking firm (2004 to present); Director, Eli Lilly and | |

| 2003 | Company (1987 to present); Director, Simon Property Group (2004 | |

| to present); Director, Norfolk Southern (2008 to present); Director, | ||

| Fannie Mae (2006 to 2008) | ||

| Theo C. Rodgers | President, A&R Development Corporation (1977 to present) | |

| (1941) | ||

| 2006 | ||

| John G. Schreiber | Owner/President, Centaur Capital Partners, Inc., a real estate | |

| (1946) | investment company (1991 to present); Cofounder and Partner, | |

| 2001 | Blackstone Real Estate Advisors, L.P. (1992 to present); Director, | |

| General Growth Properties, Inc. (2010 to present) | ||

| Mark R. Tercek | President and Chief Executive Officer, The Nature Conservancy (2008 | |

| (1957) | to present); Managing Director, The Goldman Sachs Group, Inc. | |

| 2009 | (1984 to 2008) | |

| *Each independent director oversees 130 T. Rowe Price portfolios and serves until retirement, resignation, or election of a successor. | ||

| Inside Directors | ||

| Name | ||

| (Year of Birth) | ||

| Year Elected* | ||

| [Number of T. Rowe Price | Principal Occupation(s) and Directorships of Public Companies and | |

| Portfolios Overseen] | Other Investment Companies During the Past Five Years | |

| Edward C. Bernard | Director and Vice President, T. Rowe Price; Vice Chairman of the | |

| (1956) | Board, Director, and Vice President, T. Rowe Price Group, Inc.; | |

| 2006 | Chairman of the Board, Director, and President, T. Rowe Price | |

| [130] | Investment Services, Inc.; Chairman of the Board and Director, | |

| T. Rowe Price Retirement Plan Services, Inc., T. Rowe Price Savings | ||

| Bank, and T. Rowe Price Services, Inc.; Chairman of the Board, Chief | ||

| Executive Officer, and Director, T. Rowe Price International; Chief | ||

| Executive Officer, Chairman of the Board, Director, and President, | ||

| T. Rowe Price Trust Company; Chairman of the Board, all funds | ||

| Brian C. Rogers, CFA, CIC | Chief Investment Officer, Director, and Vice President, T. Rowe Price; | |

| (1955) | Chairman of the Board, Chief Investment Officer, Director, and Vice | |

| 2006 | President, T. Rowe Price Group, Inc.; Vice President, T. Rowe Price | |

| [74] | Trust Company | |

| *Each inside director serves until retirement, resignation, or election of a successor. | ||

| Officers | ||

| Name (Year of Birth) | ||

| Position Held With International Funds | Principal Occupation(s) | |

| Ulle Adamson, CFA (1979) | Vice President, T. Rowe Price Group, Inc., and | |

| Vice President | T. Rowe Price International | |

| Christopher D. Alderson (1962) | Director and President–International Equity, | |

| President | T. Rowe Price International; Company’s | |

| Representative, Director, and Vice President, | ||

| Price Hong Kong; Director and Vice President, | ||

| Price Singapore; Vice President, T. Rowe Price | ||

| Group, Inc. | ||

| Haider Ali (1970) | Vice President, Price Singapore and T. Rowe | |

| Vice President | Price Group, Inc.; formerly Research Analyst, | |

| Credit Suisse Securities (to 2010) | ||

| Paulina Amieva (1981) | Vice President, T. Rowe Price Group, Inc., and | |

| Vice President | T. Rowe Price International | |

| Peter J. Bates, CFA (1974) | Vice President, T. Rowe Price and T. Rowe Price | |

| Vice President | Group, Inc. | |

| Oliver Bell, IMC (1969) | Vice President, T. Rowe Price International; | |

| Executive Vice President | formerly Head of Global Emerging Markets | |

| Research, Pictet Asset Management Ltd. (to | ||

| 2011); Portfolio Manager of Africa and Middle | ||

| East portfolios and other emerging markets | ||

| strategies, Pictet Asset Management Ltd. | ||

| (to 2009) | ||

| R. Scott Berg, CFA (1972) | Vice President, T. Rowe Price and T. Rowe Price | |

| Executive Vice President | Group, Inc. | |

| Mark C.J. Bickford-Smith (1962) | Vice President, T. Rowe Price Group, Inc., and | |

| Executive Vice President | T. Rowe Price International | |

| Brian J. Brennan, CFA (1964) | Vice President, T. Rowe Price, T. Rowe Price | |

| Vice President | Group, Inc., T. Rowe Price International, and | |

| T. Rowe Price Trust Company | ||

| Jose Costa Buck (1972) | Vice President, T. Rowe Price Group, Inc., and | |

| Executive Vice President | T. Rowe Price International | |

| Ryan Burgess, CFA (1974) | Vice President, T. Rowe Price and T. Rowe Price | |

| Vice President | Group, Inc. | |

| Tak Yiu Cheng, CFA, CPA (1974) | Vice President, Price Hong Kong and T. Rowe | |

| Vice President | Price Group, Inc.; formerly Analyst, CLS, BNP | |

| Paribas, and Deutsche Bank (to 2008) | ||

| Archibald A. Ciganer, CFA (1976) | Vice President, T. Rowe Price Group, Inc., and | |

| Vice President | T. Rowe Price International | |

| Richard N. Clattenburg, CFA (1979) | Vice President, T. Rowe Price, T. Rowe Price | |

| Executive Vice President | Group, Inc., and T. Rowe Price International | |

| Michael J. Conelius, CFA (1964) | Vice President, T. Rowe Price, T. Rowe Price | |

| Executive Vice President | Group, Inc., T. Rowe Price International, and | |

| T. Rowe Price Trust Company | ||

| Richard de los Reyes (1975) | Vice President, T. Rowe Price and T. Rowe Price | |

| Vice President | Group, Inc. | |

| Jessie Q. Ding (1981) | Employee, T. Rowe Price; formerly Associate, | |

| Vice President | TPG Capital (to 2008) | |

| Shawn T. Driscoll (1975) | Vice President, T. Rowe Price Group, Inc. | |

| Vice President | ||

| Mark J.T. Edwards (1957) | Vice President, T. Rowe Price Group, Inc., and | |

| Executive Vice President | T. Rowe Price International | |

| David J. Eiswert, CFA (1972) | Vice President, T. Rowe Price, T. Rowe Price | |

| Vice President | Group, Inc., and T. Rowe Price International | |

| Henry M. Ellenbogen (1973) | Vice President, T. Rowe Price, T. Rowe Price | |

| Vice President | Group, Inc., and T. Rowe Price Trust Company | |

| Roger L. Fiery III, CPA (1959) | Vice President, Price Hong Kong, Price | |

| Vice President | Singapore, T. Rowe Price, T. Rowe Price Group, | |

| Inc., T. Rowe Price International, and T. Rowe | ||

| Price Trust Company | ||

| Melissa C. Gallagher (1974) | Vice President, T. Rowe Price Group, Inc., and | |

| Vice President | T. Rowe Price International; formerly European | |

| Pharmaceuticals and Biotech Analyst, Bear | ||

| Stearns International Ltd. (to 2008) | ||

| Robert N. Gensler (1957) | Vice President, T. Rowe Price, T. Rowe Price | |

| Executive Vice President | Group, Inc., and T. Rowe Price International | |

| John R. Gilner (1961) | Chief Compliance Officer and Vice President, | |

| Chief Compliance Officer | T. Rowe Price; Vice President, T. Rowe Price | |

| Group, Inc., and T. Rowe Price Investment | ||

| Services, Inc. | ||

| Gregory S. Golczewski (1966) | Vice President, T. Rowe Price and T. Rowe Price | |

| Vice President | Trust Company | |

| Benjamin Griffiths, CFA (1977) | Vice President, T. Rowe Price Group, Inc., and | |

| Vice President | T. Rowe Price International | |

| M. Campbell Gunn (1956) | Vice President, T. Rowe Price Group, Inc., and | |

| Executive Vice President | T. Rowe Price International | |

| Gregory K. Hinkle, CPA (1958) | Vice President, T. Rowe Price, T. Rowe Price | |

| Treasurer | Group, Inc., and T. Rowe Price Trust Company; | |

| formerly Partner, PricewaterhouseCoopers LLP | ||

| (to 2007) | ||

| Leigh Innes, CFA (1976) | Vice President, T. Rowe Price Group, Inc., and | |

| Executive Vice President | T. Rowe Price International | |

| Randal Spero Jenneke (1971) | Vice President, T. Rowe Price Group, Inc., and | |

| Vice President | T. Rowe Price International; formerly Senior | |

| Portfolio Manager, Australian Equities (to 2010) | ||

| Kris H. Jenner, M.D., D.Phil. (1962) | Vice President, T. Rowe Price, T. Rowe Price | |

| Vice President | Group, Inc., and T. Rowe Price International | |

| Yoichiro Kai (1973) | Vice President, T. Rowe Price Group, Inc., and | |

| Vice President | T. Rowe Price International; formerly Japanese | |

| Financial/Real Estate Sector Analyst/Portfolio | ||

| Manager, Citadel Investment Group, Asia | ||

| Limited (to 2009); Research Analyst, Japanese | ||

| Equities & Sector Fund Portfolio Manager, | ||

| Fidelity Investments Japan Limited (to 2007) | ||

| Andrew J. Keirle (1974) | Vice President, T. Rowe Price Group, Inc., and | |

| Executive Vice President | T. Rowe Price International | |

| Ian D. Kelson (1956) | Director and President–International Fixed | |

| Executive Vice President | Income, T. Rowe Price International; Vice | |

| President, T. Rowe Price and T. Rowe Price | ||

| Group, Inc. | ||

| Mark J. Lawrence (1970) | Vice President, T. Rowe Price Group, Inc., and | |

| Vice President | T. Rowe Price International | |

| David M. Lee, CFA (1962) | Vice President, T. Rowe Price and T. Rowe Price | |

| Vice President | Group, Inc. | |

| Patricia B. Lippert (1953) | Assistant Vice President, T. Rowe Price and | |

| Secretary | T. Rowe Price Investment Services, Inc. | |

| Anh Lu (1968) | Vice President, Price Hong Kong and T. Rowe | |

| Executive Vice President | Price Group, Inc. | |

| Sebastien Mallet (1974) | Vice President, T. Rowe Price Group, Inc., and | |

| Vice President | T. Rowe Price International | |

| Daniel Martino, CFA (1974) | Vice President, T. Rowe Price and T. Rowe Price | |

| Vice President | Group, Inc. | |

| Jonathan H.W. Matthews, CFA (1975) | Vice President, T. Rowe Price Group, Inc., and | |

| Executive Vice President | T. Rowe Price International; formerly Analyst, | |

| Pioneer Investments (to 2008) | ||

| Susanta Mazumdar (1968) | Vice President, Price Singapore and T. Rowe | |

| Executive Vice President | Price Group, Inc. | |

| Raymond A. Mills, Ph.D., CFA (1960) | Vice President, T. Rowe Price, T. Rowe Price | |

| Executive Vice President | Group, Inc., T. Rowe Price International, and | |

| T. Rowe Price Trust Company | ||

| Eric C. Moffett (1974) | Vice President, Price Hong Kong and T. Rowe | |

| Vice President | Price Group, Inc.; formerly Analyst, Fayez | |

| Sarofim & Company (to 2007) | ||

| Joshua Nelson (1977) | Vice President, T. Rowe Price and T. Rowe Price | |

| Executive Vice President | Group, Inc. | |

| Philip A. Nestico (1976) | Vice President, T. Rowe Price and T. Rowe Price | |

| Vice President | Group, Inc. | |

| Hwee Jan Ng, CFA (1966) | Vice President, Price Singapore and T. Rowe | |

| Vice President | Price Group, Inc. | |

| Sridhar Nishtala (1975) | Vice President, Price Singapore and T. Rowe | |

| Vice President | Price Group, Inc. | |

| Jason Nogueira, CFA (1974) | Vice President, T. Rowe Price and T. Rowe Price | |

| Executive Vice President | Group, Inc. | |